The Daily Shot: 11-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

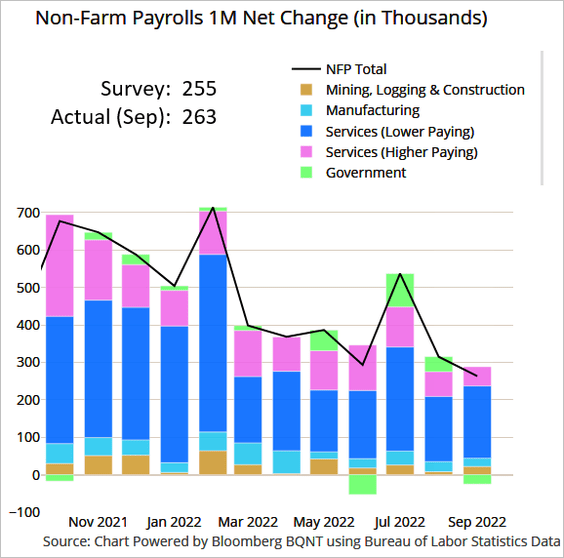

1. The September jobs report was stronger than expected, delivering another confirmation that the labor market remains tight.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

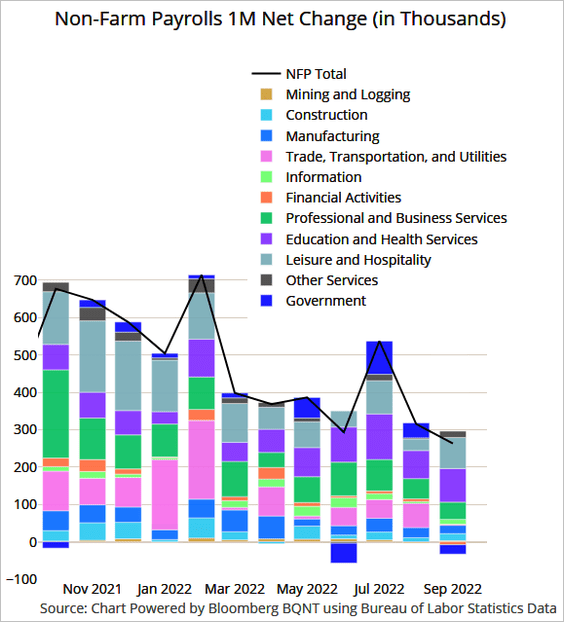

• Here are the contributions by sector.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

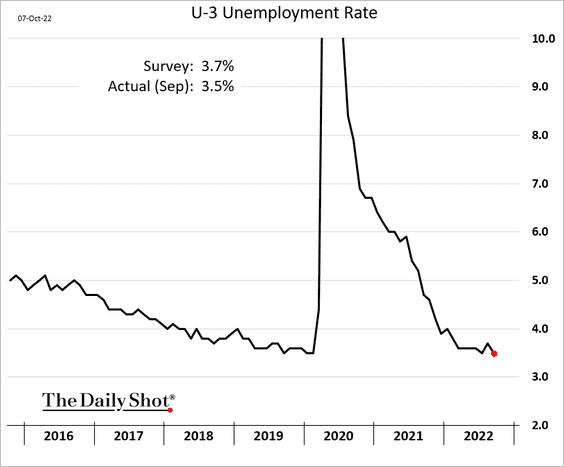

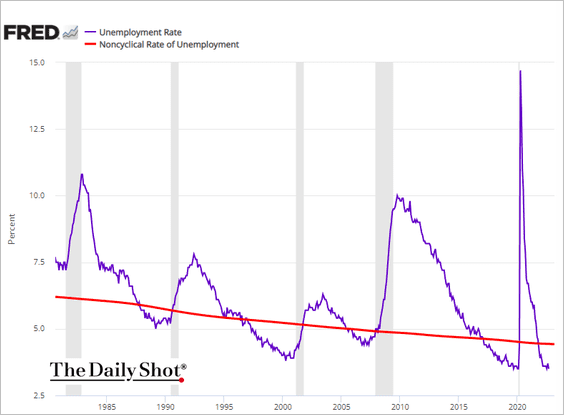

• The unemployment rate dipped back to pre-COVID lows. To see a meaningfully lower rate, one has to go back to 1969.

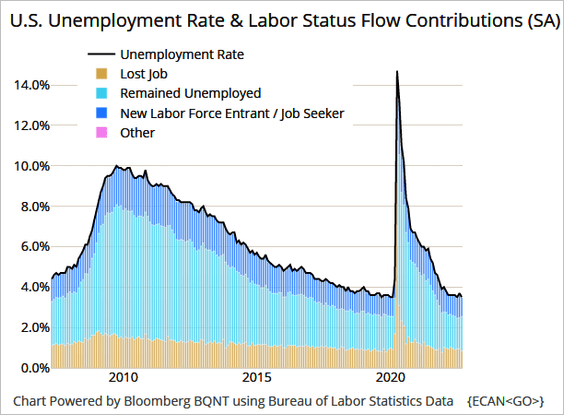

• Next, we have the drivers of the unemployment rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

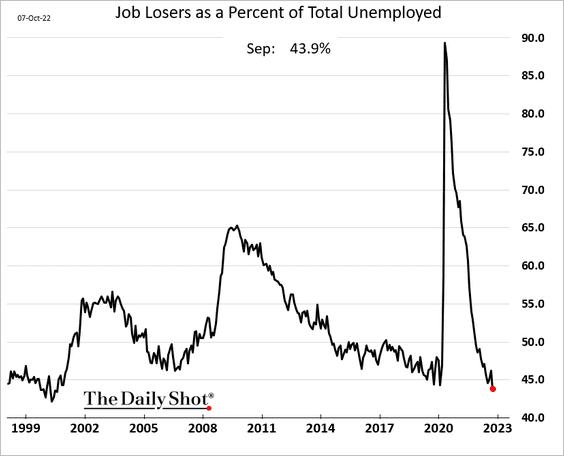

The contribution to the unemployment rate from job losses is at the lowest level in over two decades.

• The unemployment rate remains well below the Natural Rate of Unemployment (an indication of tight labor markets).

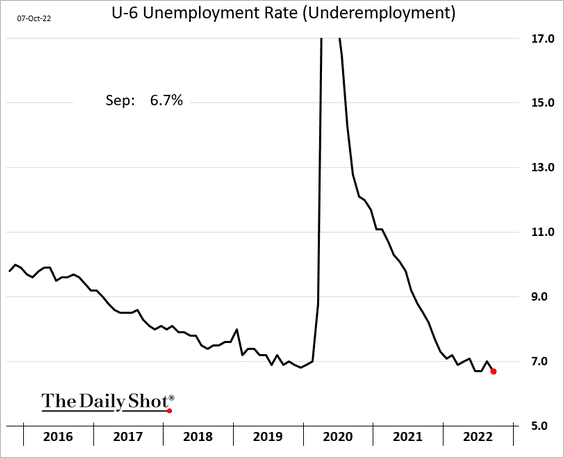

• Underemployment is also very low.

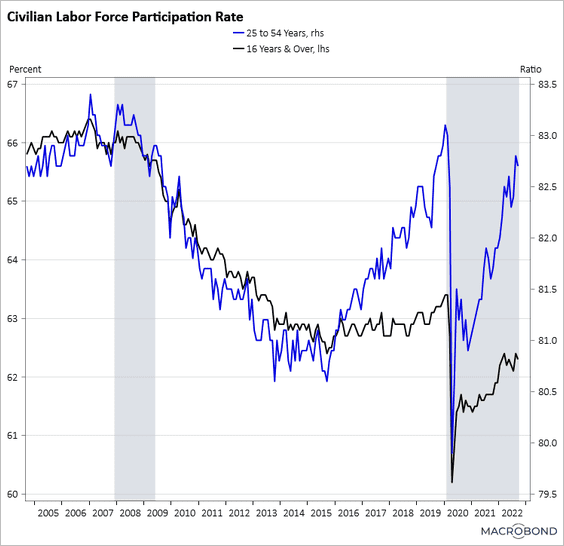

• The participation rate edged down, which adds to the concerns about the labor market’s imbalance. The Fed would like to see more people reentering the labor force.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

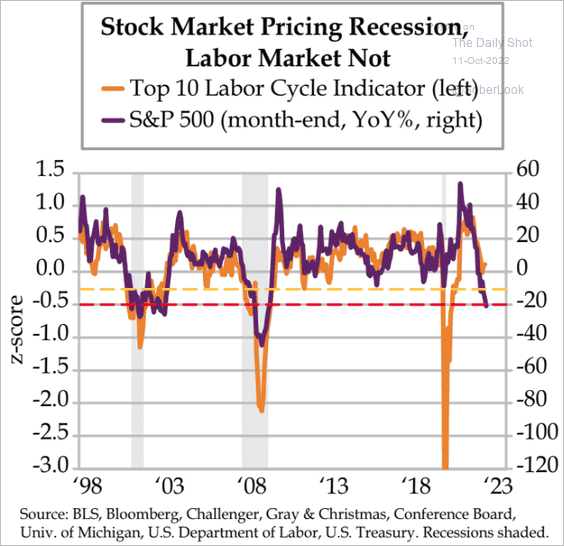

• Tight financial conditions have taken a toll on financial assets but are yet to visibly impact the labor market.

Source: Quill Intelligence

Source: Quill Intelligence

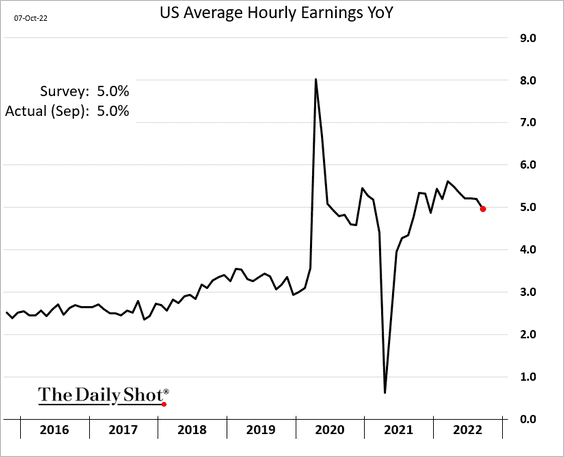

• Wage growth ticked lower but remains elevated.

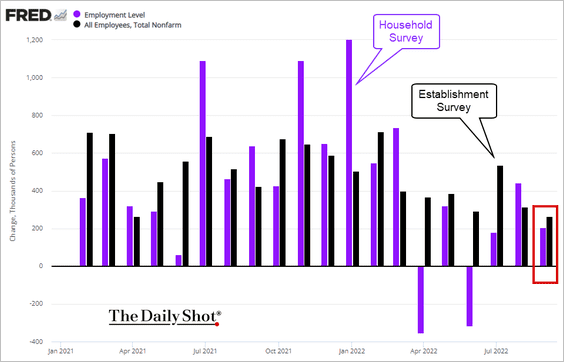

• The Household Survey payrolls figure was lower than the Establishment Survey (above).

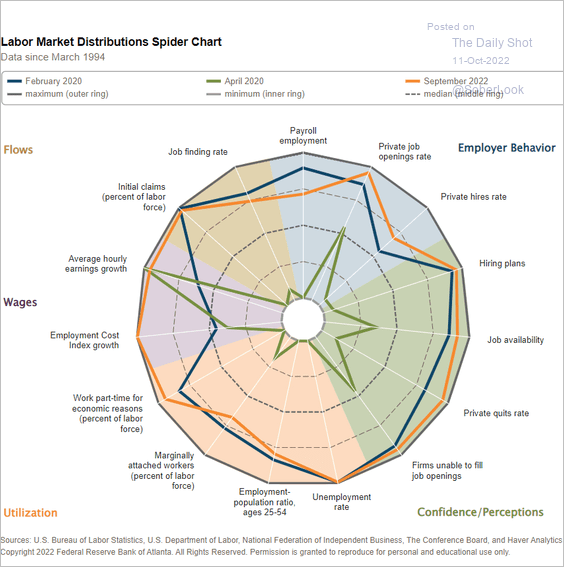

• Here is the Atlanta Fed’s labor market spider chart.

Source: @AtlantaFed

Source: @AtlantaFed

——————–

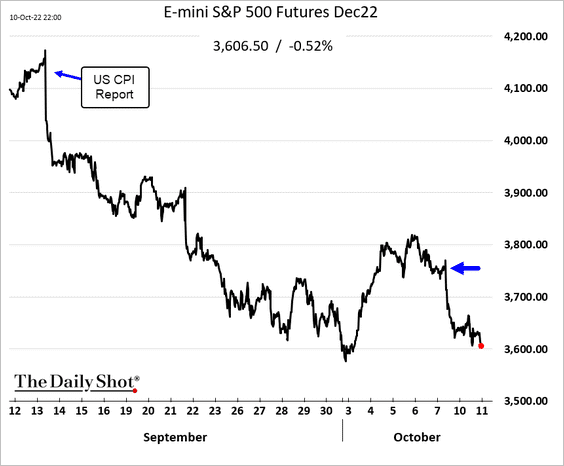

2. Stocks tumbled on the payrolls upside surprise (which removes the hopes of a near-term “Fed pivot”).

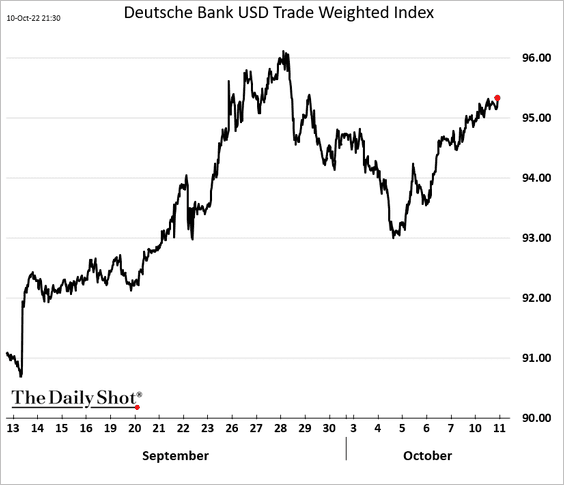

• The US dollar is rallying.

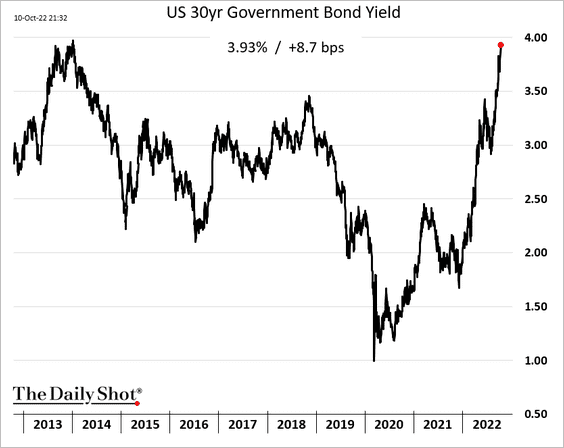

• The 30-year Treasury yield is nearing 4%.

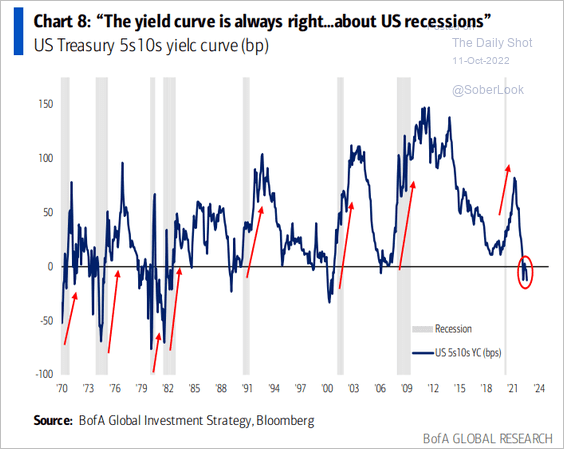

• The inverted yield curve has been signaling a recession ahead.

Source: BofA Global Research

Source: BofA Global Research

——————–

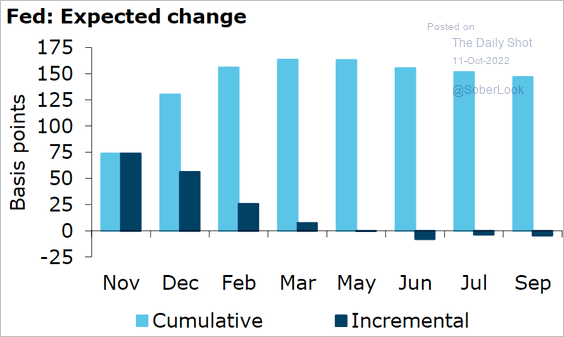

3. The market expects the Fed to hike rates by 75 bps in November, 50 bps in December, and 25 bps in February.

Source: @ANZ_Research

Source: @ANZ_Research

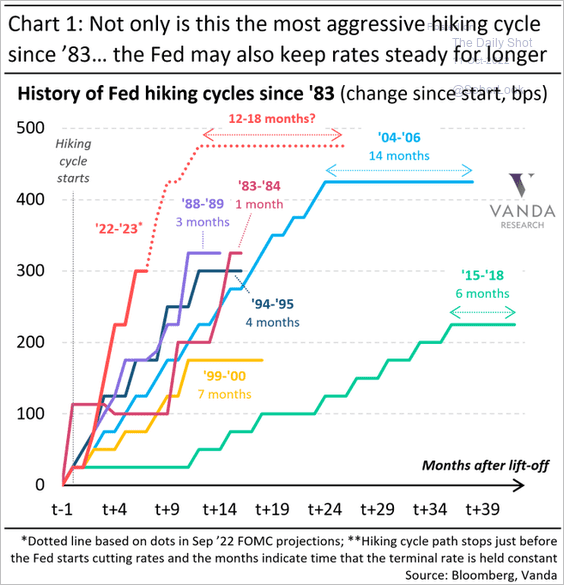

How long will the Fed hold rates at elevated levels?

Source: @VPatelFX

Source: @VPatelFX

——————–

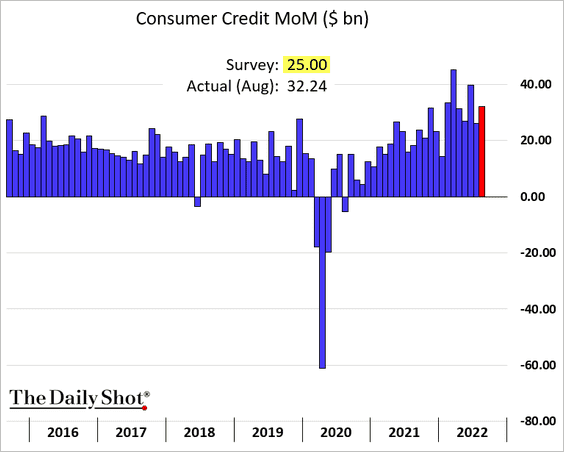

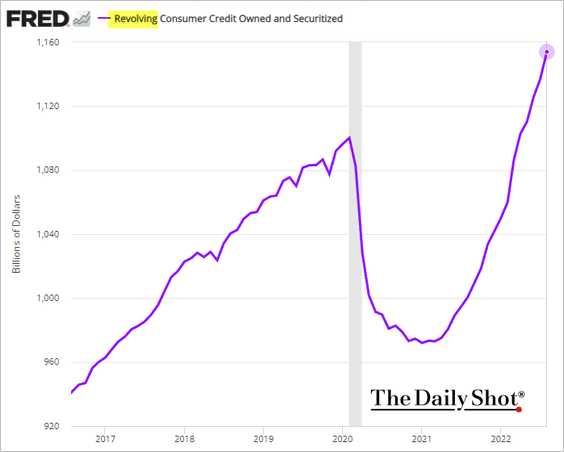

4. Consumer credit increased more than expected in August, driven by credit cards. Households continue to spend.

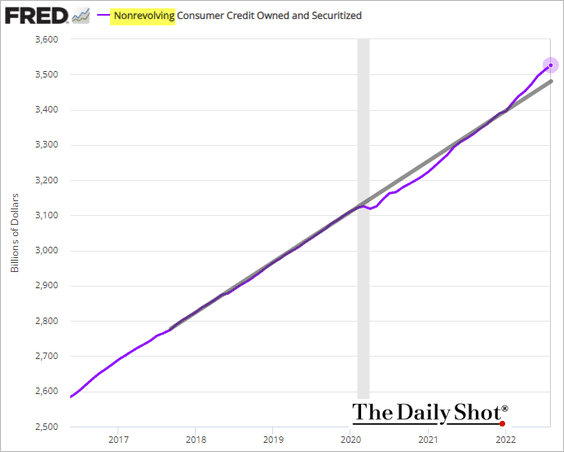

• Nonrevolving debt growth (auto loans and student debt) continues to outpace the pre-COVID trend.

• Much of the recent consumer credit growth came from credit card debt.

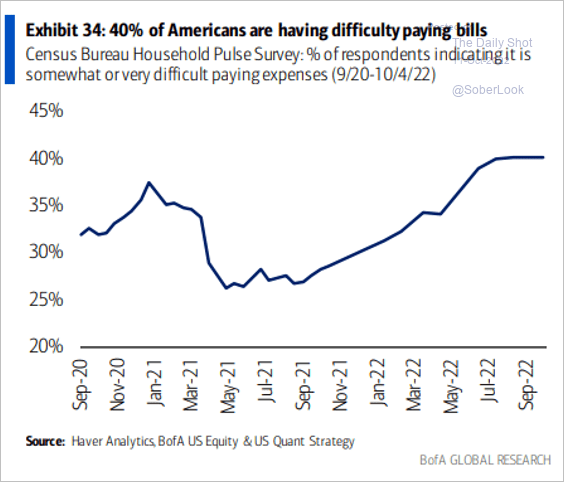

• Many consumers have been reporting difficulties paying bills.

Source: BofA Global Research

Source: BofA Global Research

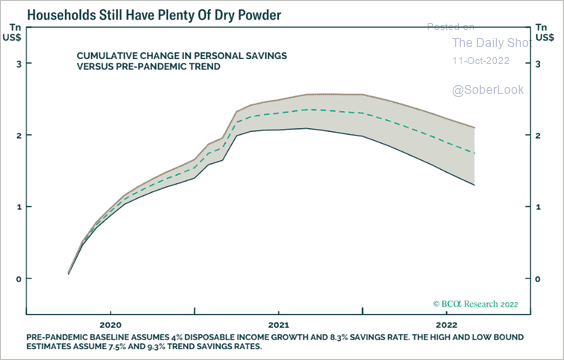

• However, excess savings remain elevated.

Source: BCA Research

Source: BCA Research

——————–

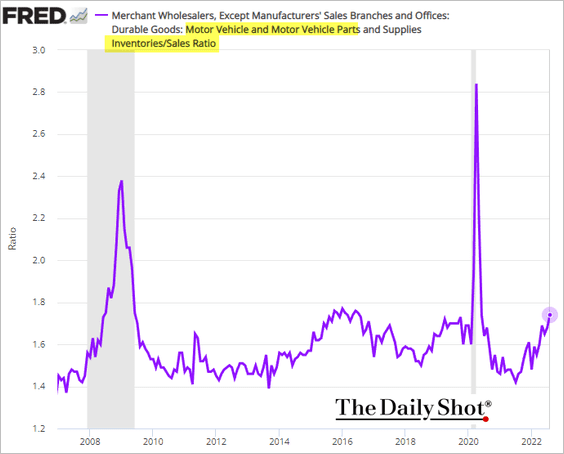

5. Vehicles’ inventories-to-sales ratio is now above pre-COVID levels as shortages ease.

Back to Index

Canada

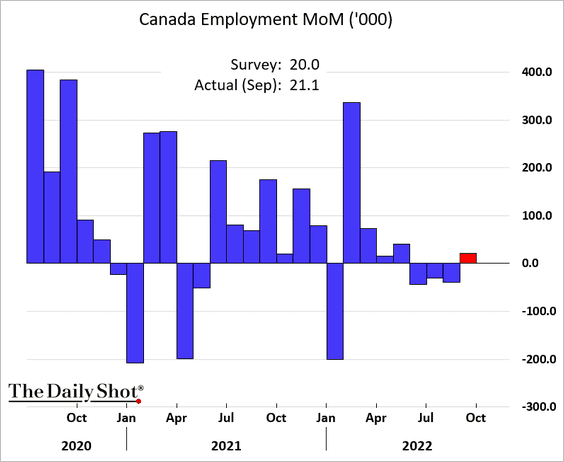

1. The September employment report was in line with expectations.

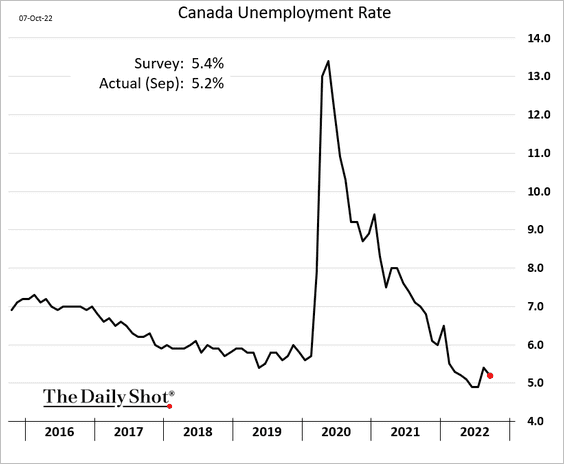

• The unemployment rate moved lower.

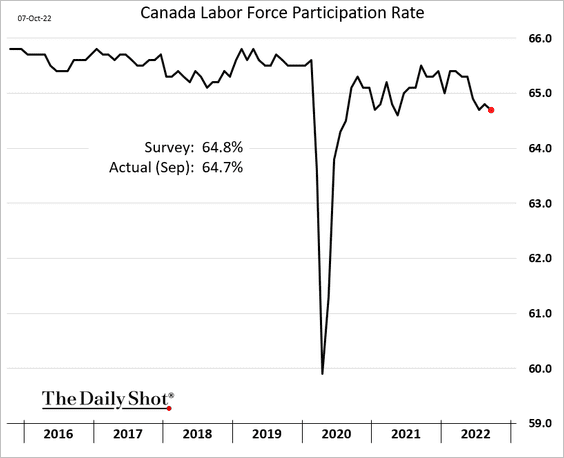

• Labor force participation continues to soften.

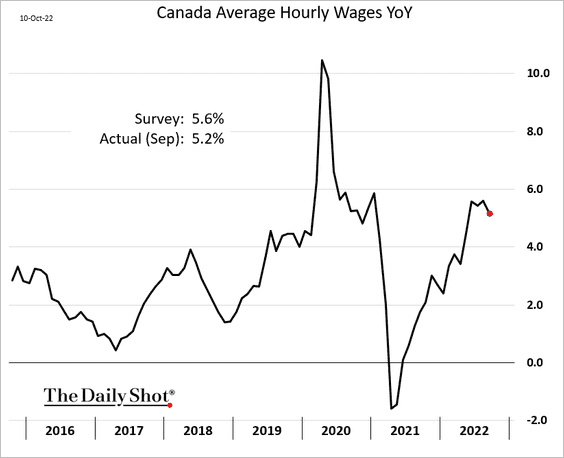

• Wage growth edged down.

——————–

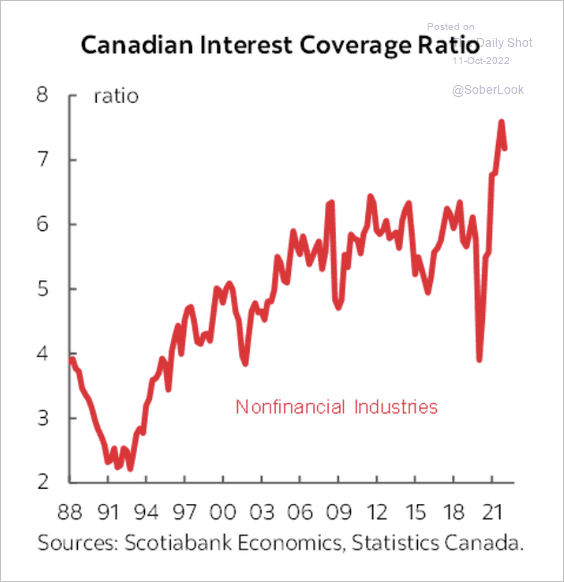

2. The interest coverage ratio among nonfinancial firms is near record highs.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

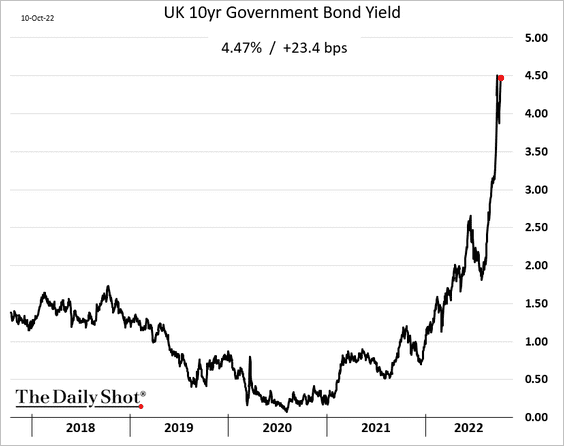

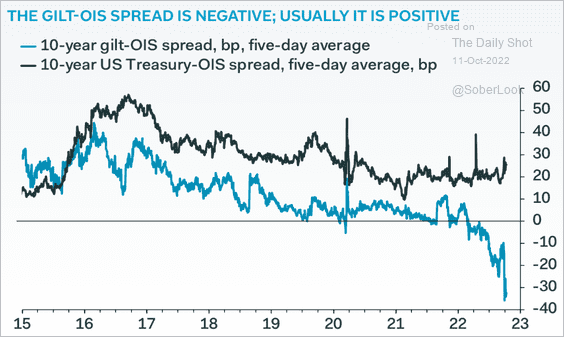

1. Gilt yields are nearing the recent highs.

• The gilt market is dislocated relative to rate expectations.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• In addition to the recent debt purchase announcement, the BoE now plans to buy inflation-linked bonds.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

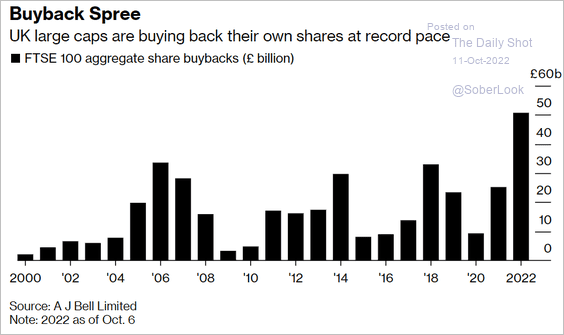

2. UK large-cap companies have been buying back shares.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

The Eurozone

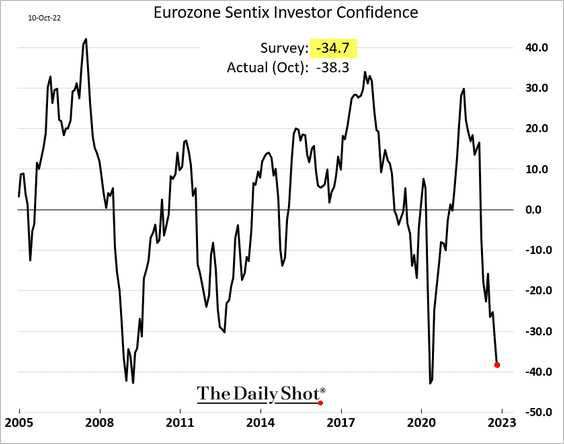

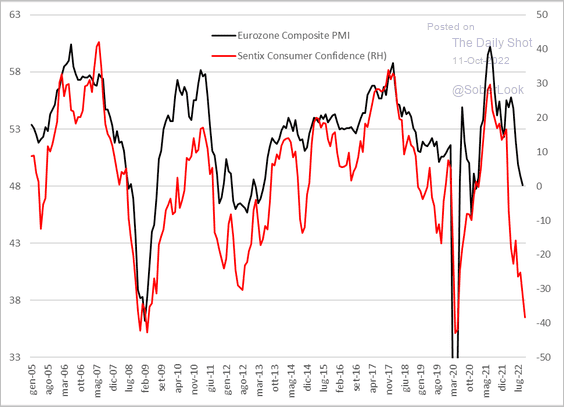

1. The Sentix investor confidence index tumbled this month, …

… signaling further economic pain ahead.

Source: @CavaggioniMario

Source: @CavaggioniMario

——————–

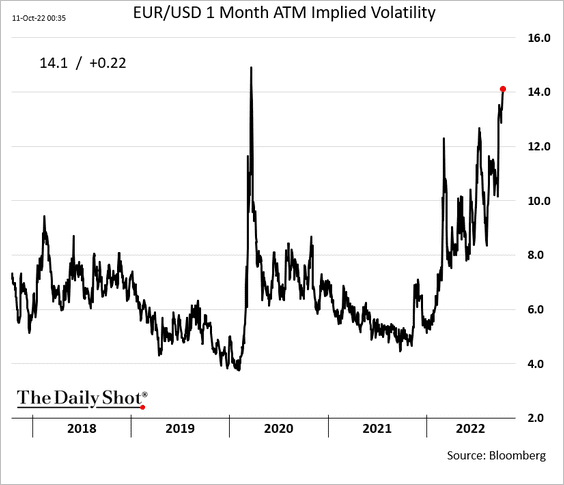

2. The EUR/USD implied volatility has been surging.

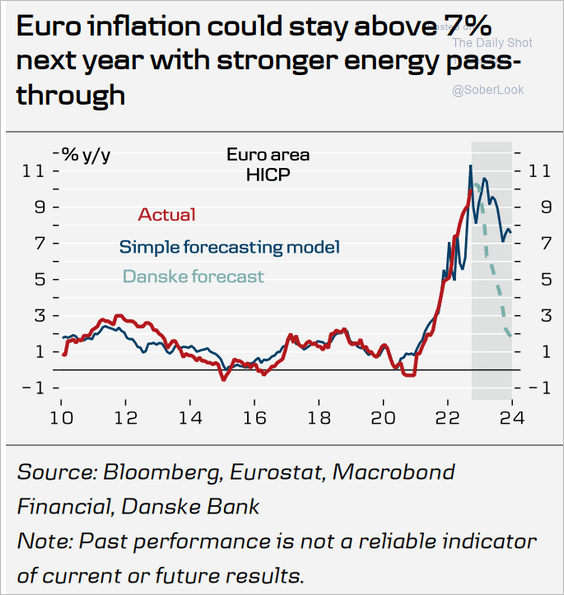

3. How long will extreme inflation linger?

Source: Danske Bank

Source: Danske Bank

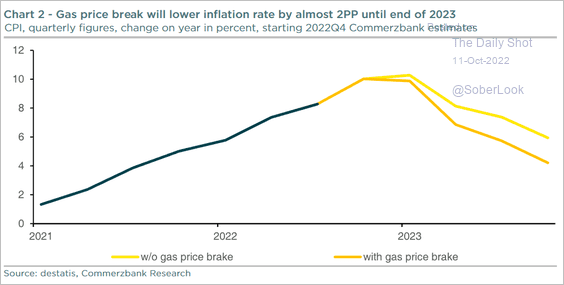

4. Germany’s effort to ease the energy burden should cut inflation.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Commerzbank Research

Source: Commerzbank Research

——————–

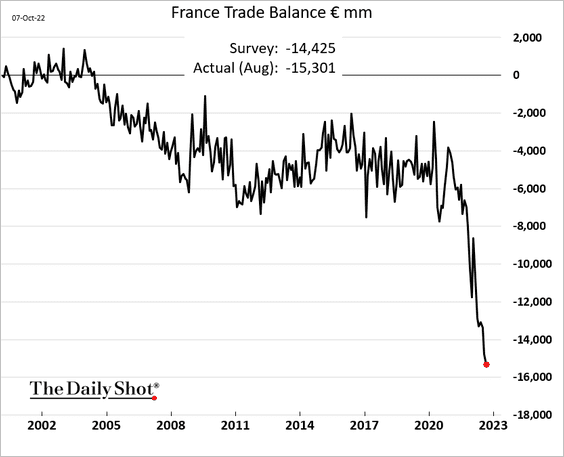

5. The French trade deficit hit another record.

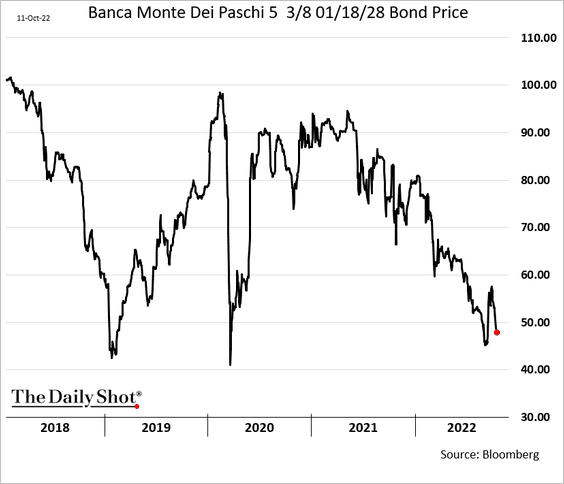

6. Will Italy succeed in its attempts to recapitalize Monte dei Paschi with private capital?

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Europe

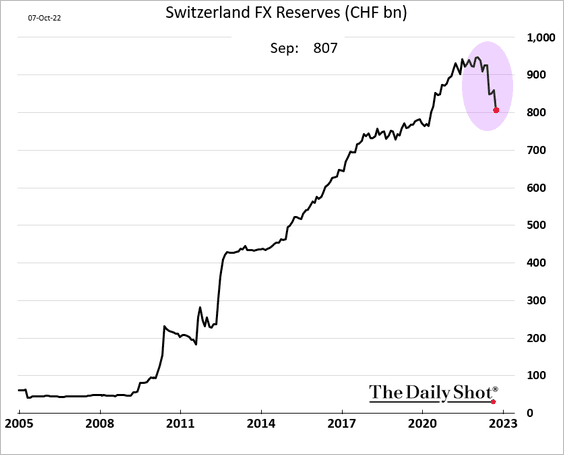

1. Swiss FX reserves tumbled in recent months as the central bank tightens policy.

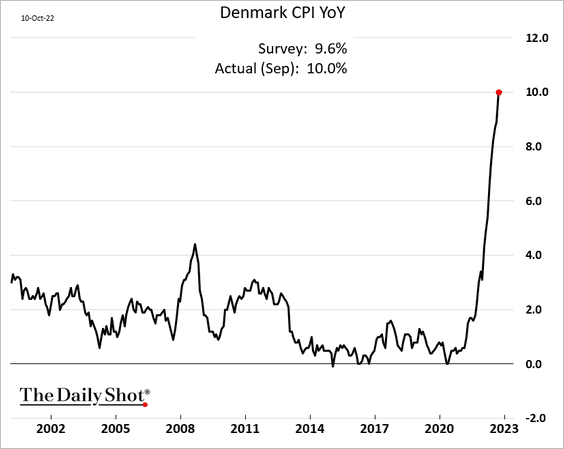

2. Denmark’s CPI hit 10%.

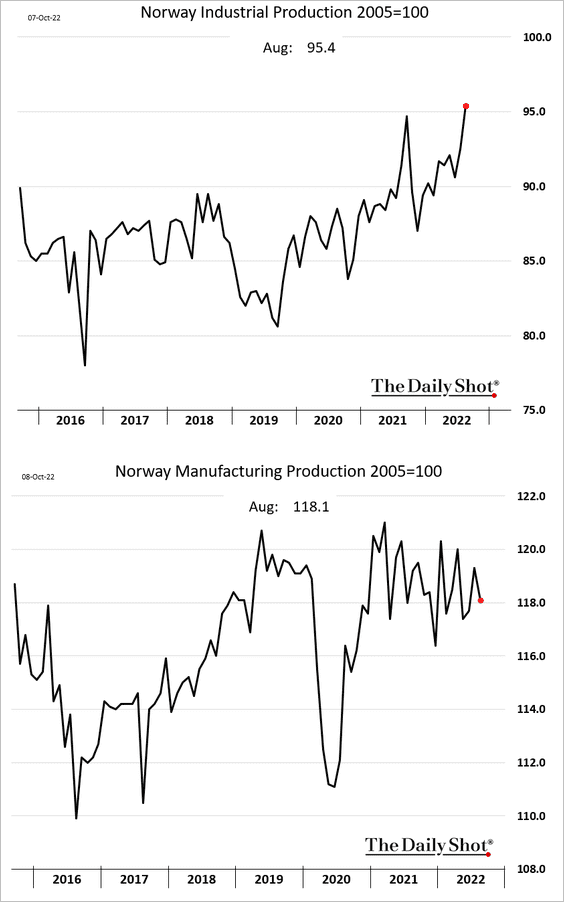

3. Norway’s industrial production has been surging due to the nation’s energy output. Manufacturing has been relatively flat (on average).

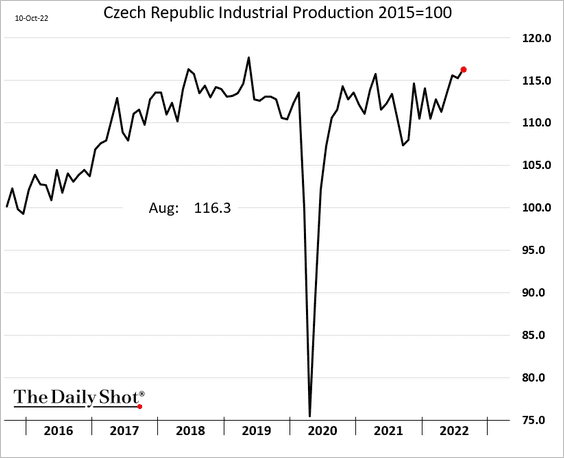

4. Czech industrial production has been strengthening.

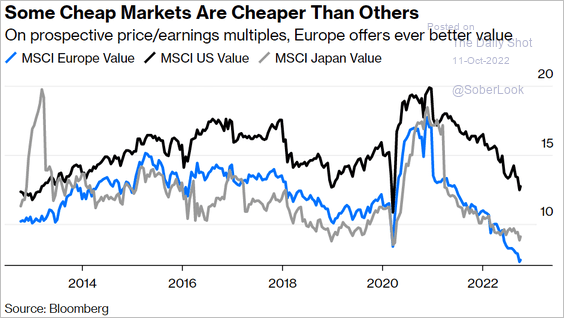

5. European value stocks are trading at a discount relative to global peers.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

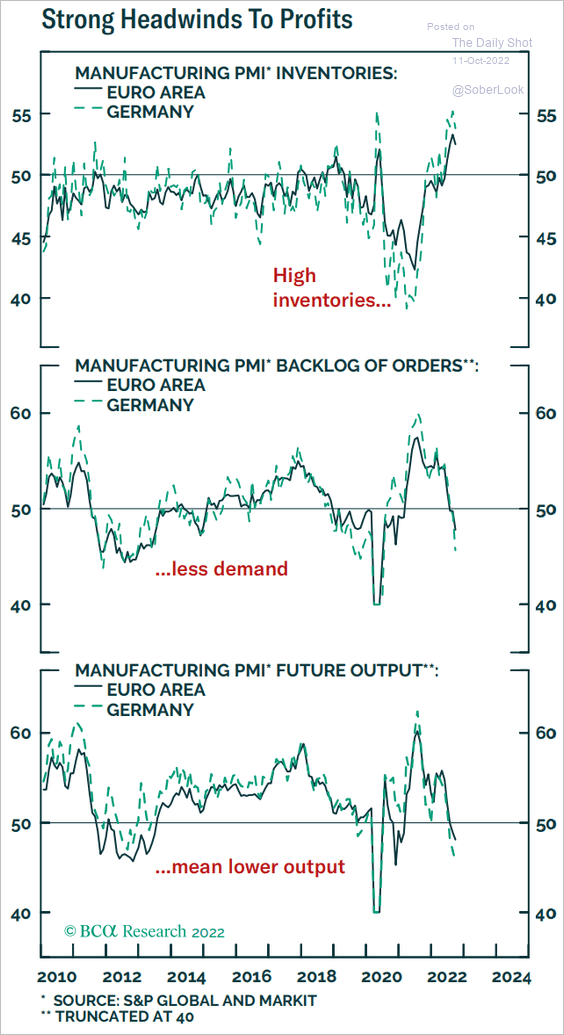

• European corporate profits face significant headwinds.

Source: BCA Research

Source: BCA Research

Back to Index

Asia – Pacific

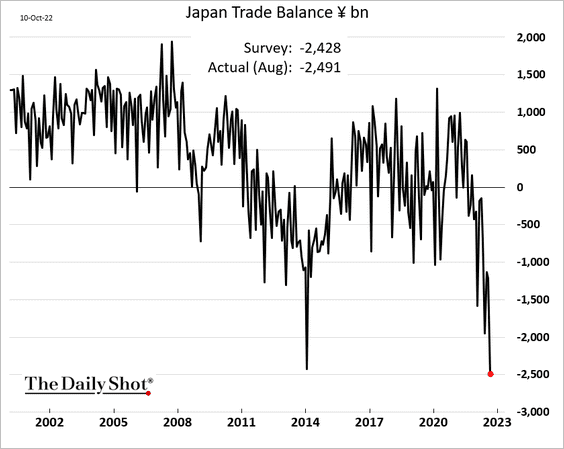

1. Japan’s trade deficit reached a new record.

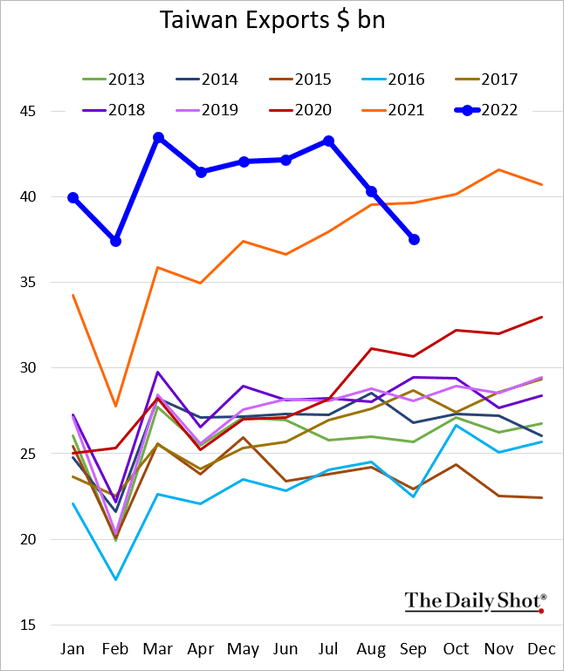

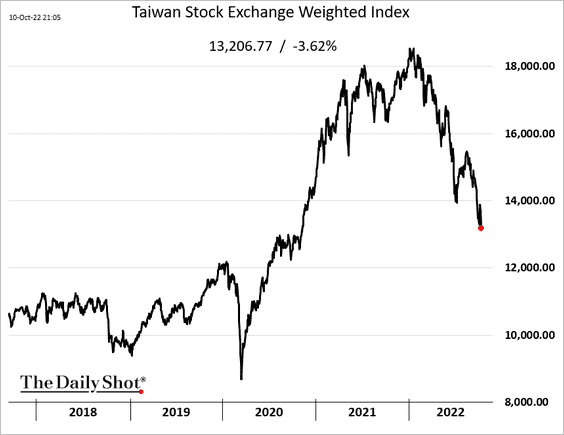

2. Taiwan’s exports are softening rapidly.

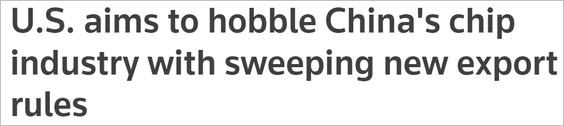

The US semiconductor restrictions on sales to China will be painful. Stocks are down.

——————–

3. Next, we have some updates on Australia.

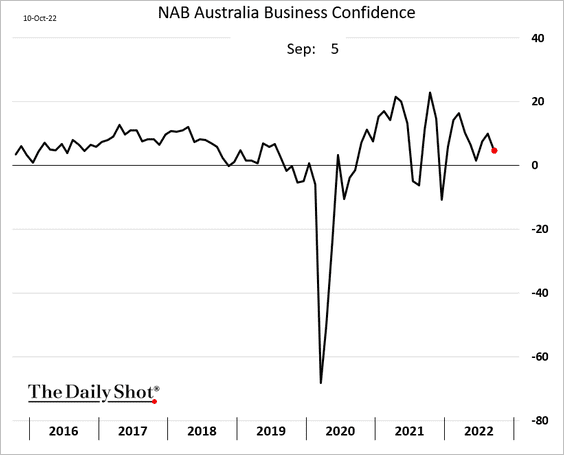

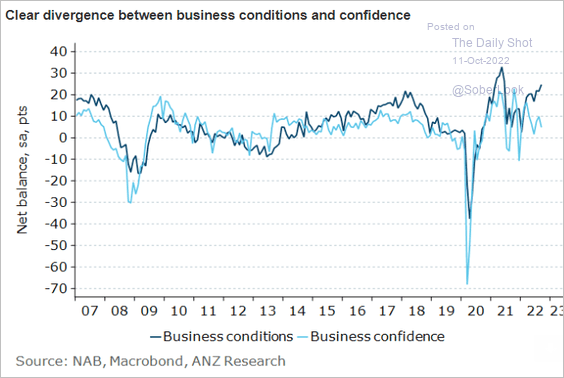

• Business confidence eased last month, …

… diverging from current conditions.

Source: @ANZ_Research

Source: @ANZ_Research

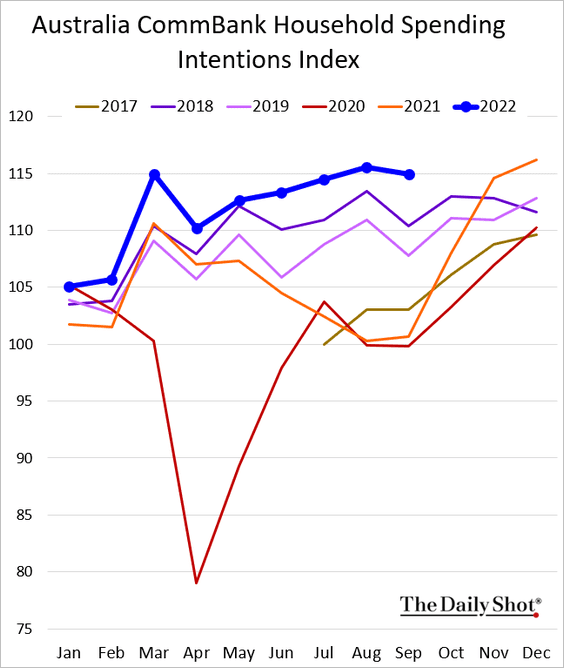

• Household spending intentions remain robust.

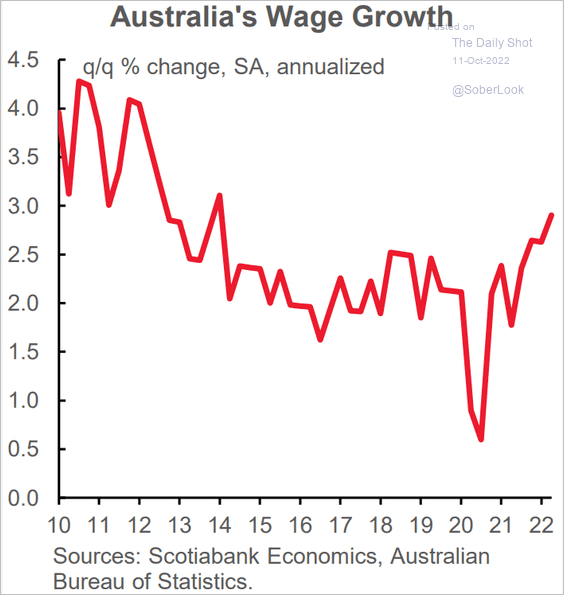

• Wage growth has been strong.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

China

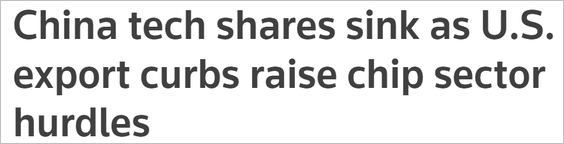

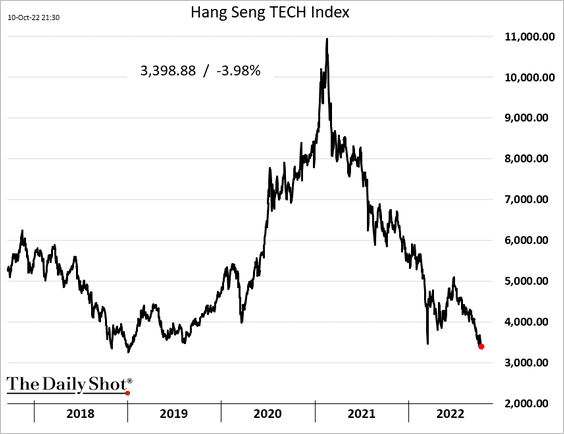

1. The US semiconductor sales curbs are putting pressure on the chip sector.

Source: Reuters Read full article

Source: Reuters Read full article

Tech stocks in Hong Kong continue to fall.

China’s key equity index is also sharply lower.

——————–

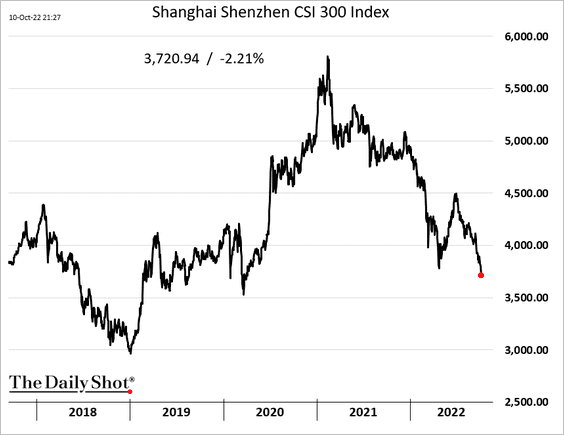

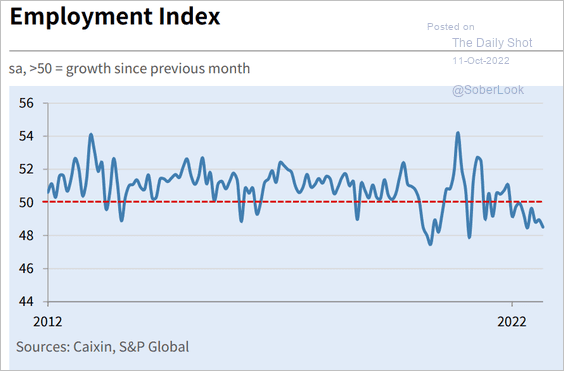

2. The S&P Global China Services PMI surprised to the downside, unexpectedly showing a contraction last month.

Services employment is shrinking.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

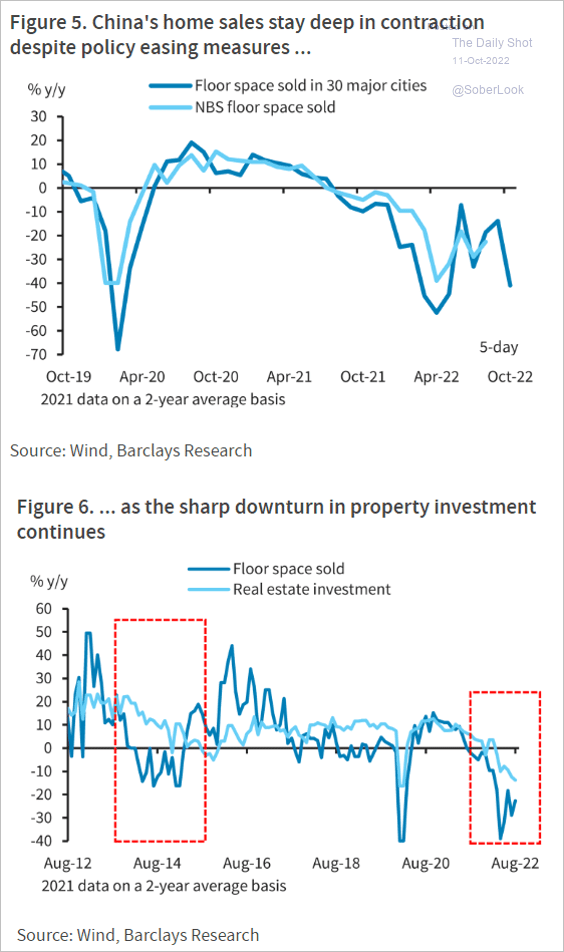

3. The downturn in property investment continues.

Source: Barclays Research

Source: Barclays Research

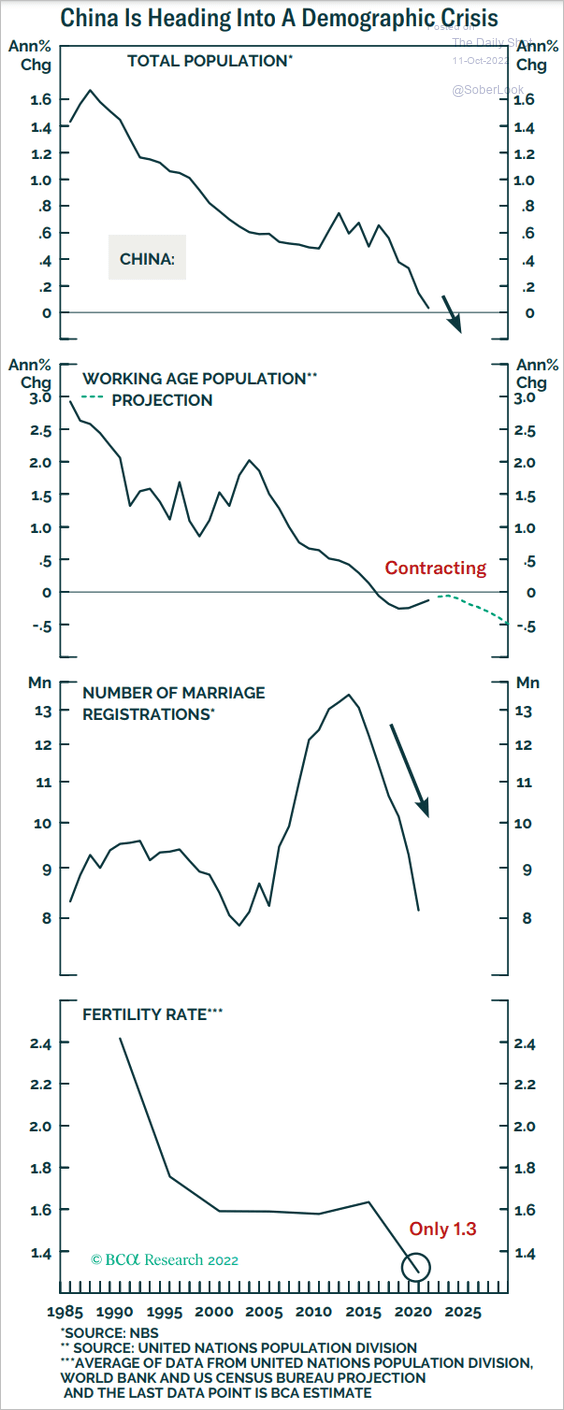

4. China is facing deteriorating demographics.

Source: BCA Research

Source: BCA Research

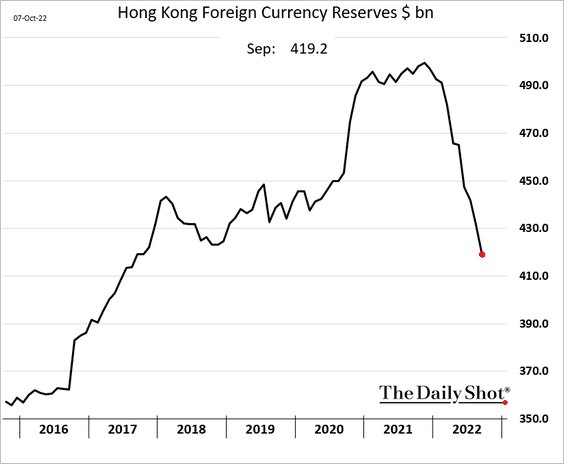

5. Hong Kong’s FX reserves continue to sink.

Back to Index

Emerging Markets

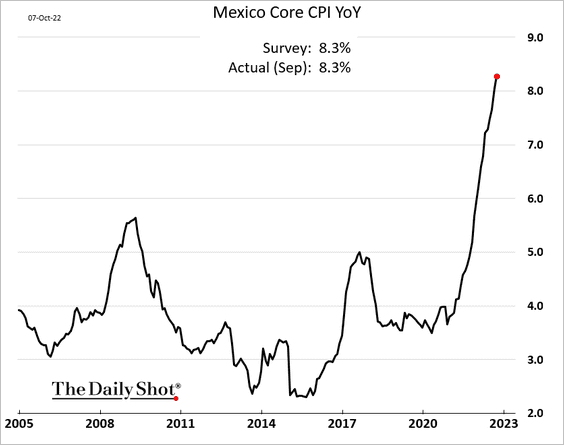

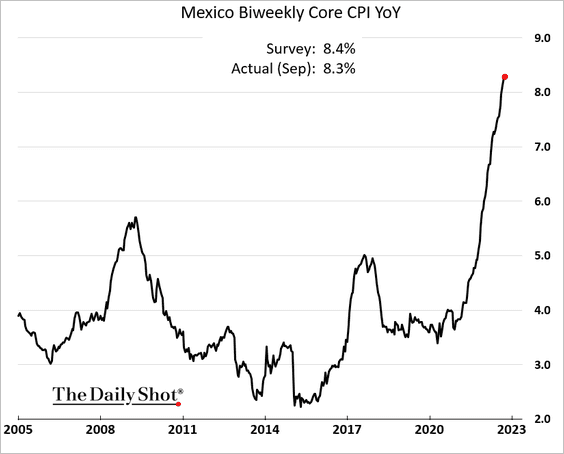

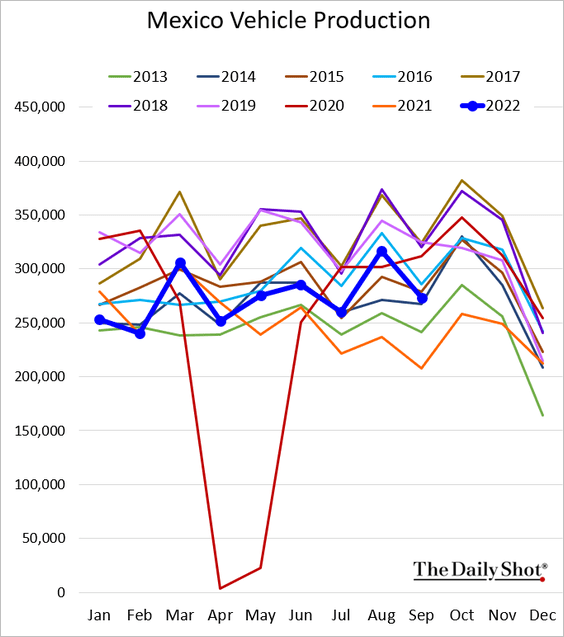

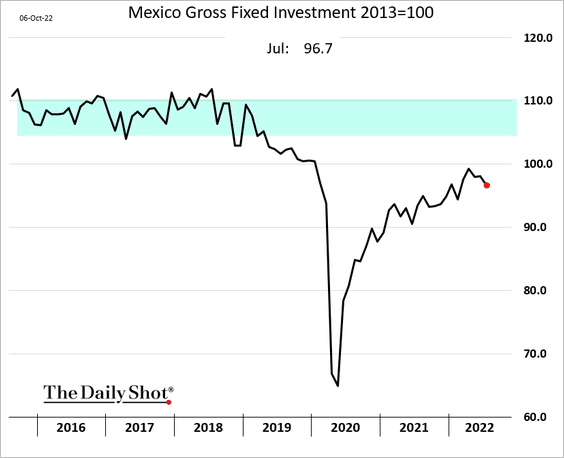

1. Let’s begin with Mexico.

• The CPI has been surging, but we should see a peak soon.

• Vehicle production softened last month but is holding above last year’s levels.

• Business investment has been slowing over the summer.

——————–

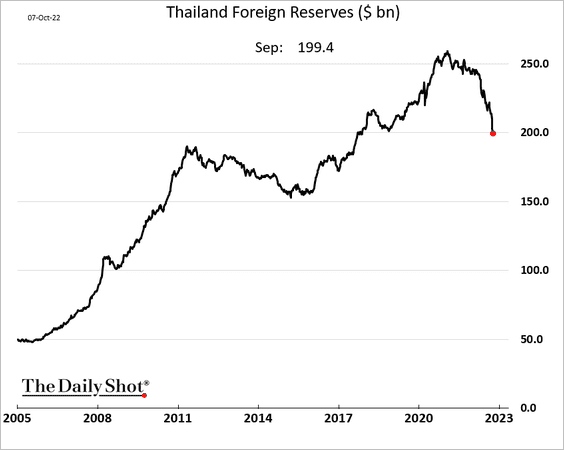

2. Thai FX reserves are tumbling amid capital outflows.

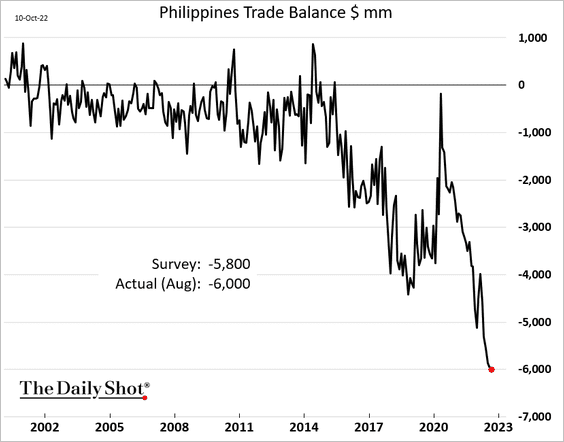

3. The Philippine trade deficit hit a new record.

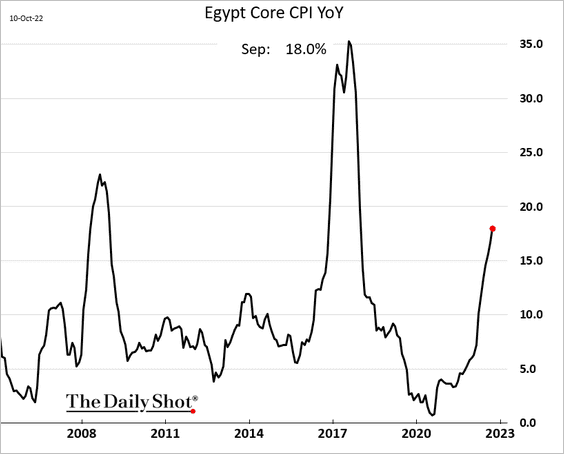

4. Egypt’s CPI continues to climb.

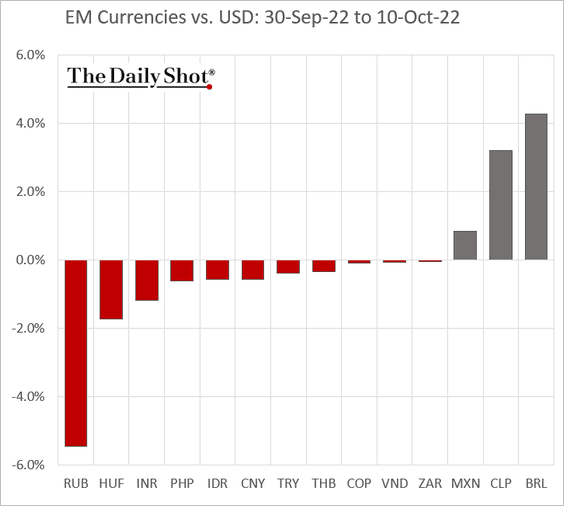

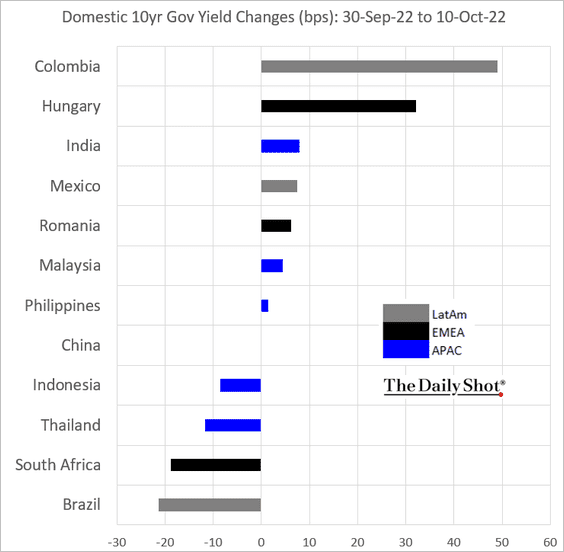

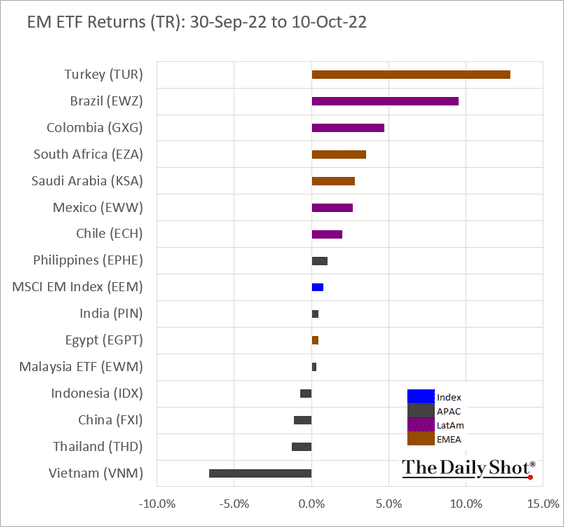

5. Next, we have some month-to-date performance data.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

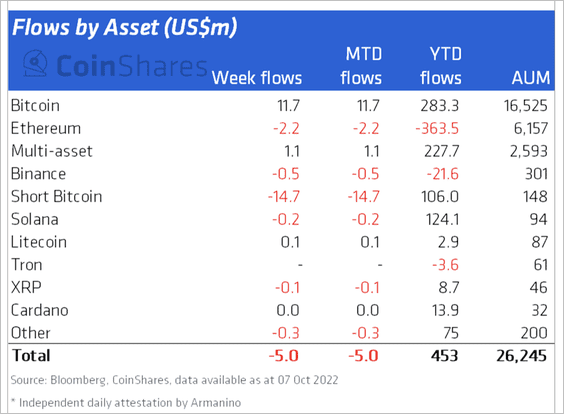

1. Crypto funds saw minor outflows last week, mostly in short-Bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

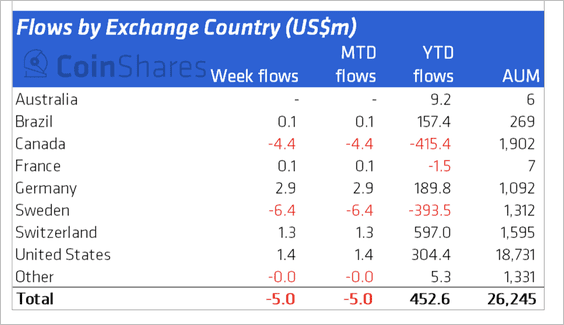

Funds in Canada and Sweden continued to see outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

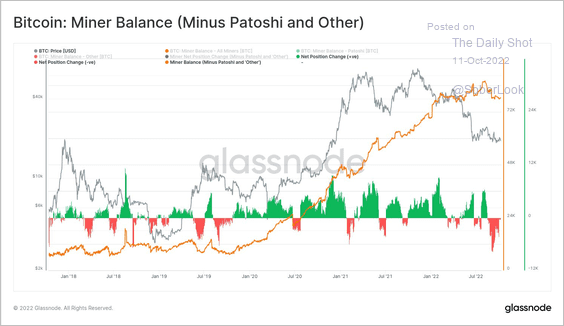

2. There has been a notable slowdown in bitcoin miner treasury growth over the past few months.

Source: @glassnode

Source: @glassnode

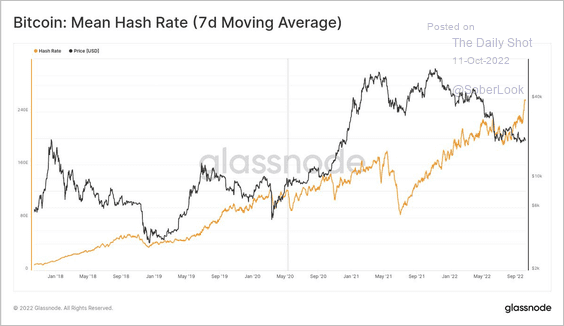

3. The rise in bitcoin’s hash rate, a measure of mining difficulty, increases the cost of production. Miners could face financial stress without a subsequent rise in price.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

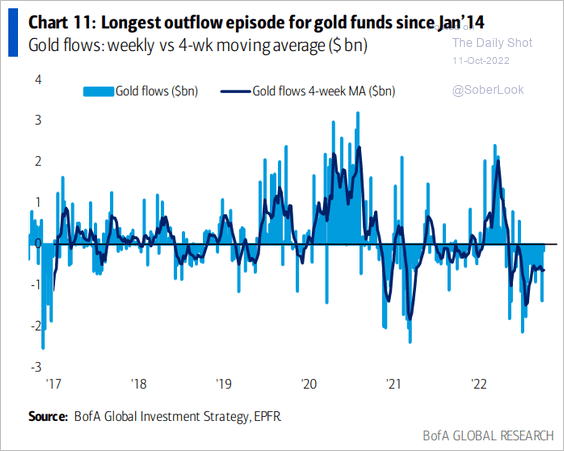

1. Gold funds continue to see outflows.

Source: BofA Global Research

Source: BofA Global Research

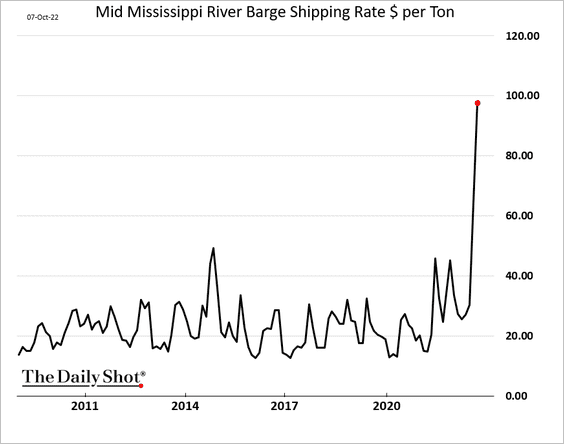

2. The US Midwest drought is taking a toll on the Mississippi River navigation. The cost to ship grain via barge has been surging.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

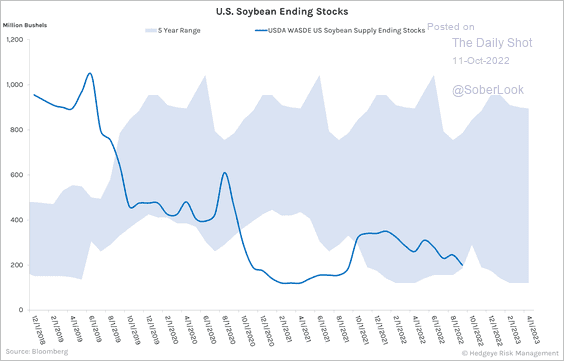

3. US soybean inventories are falling.

Source: @Hedgeye

Source: @Hedgeye

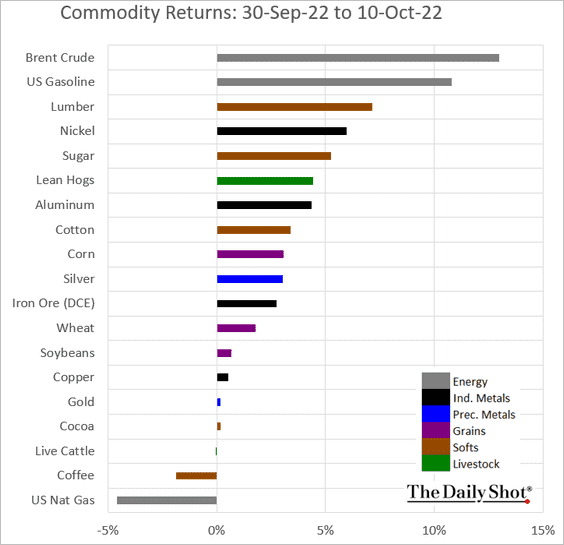

4. Here is the month-to-date performance across key commodity markets.

Back to Index

Energy

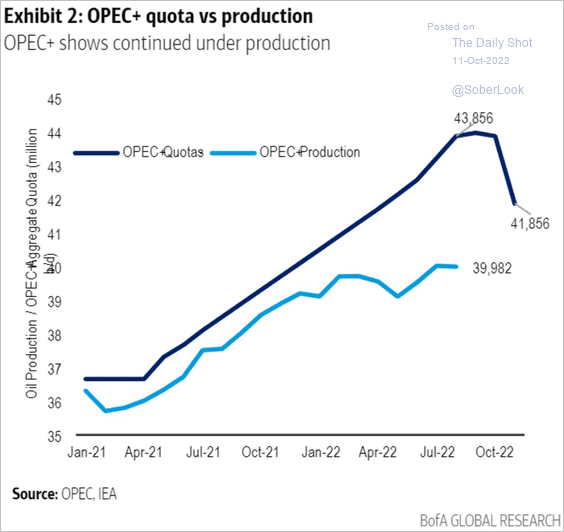

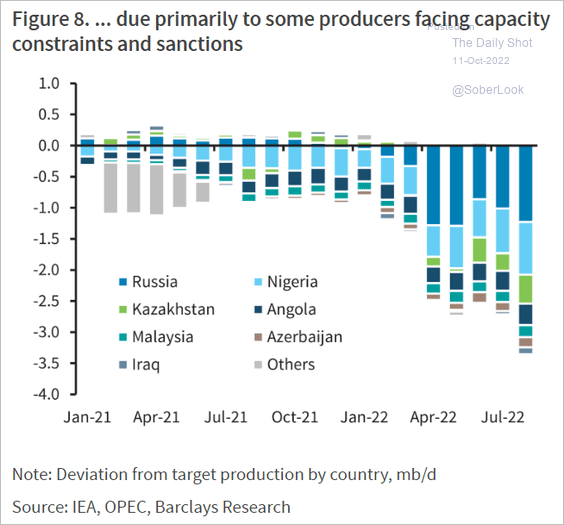

1. With OPEC+ production running well below caps, the massive quota reduction will not have an immediate impact on output (2 charts).

Source: BofA Global Research; @johnauthers, @opinion Read full article

Source: BofA Global Research; @johnauthers, @opinion Read full article

Source: Barclays Research

Source: Barclays Research

——————–

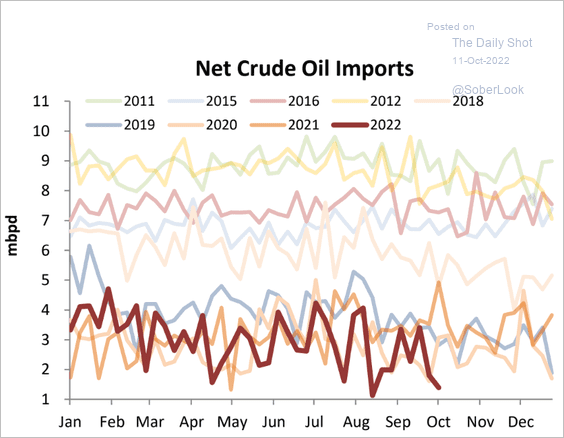

2. US net crude imports are at multi-year lows.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

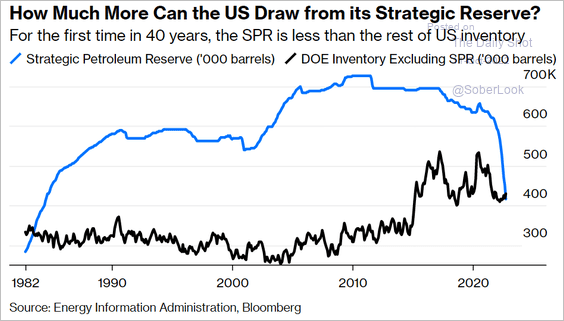

3. The US Strategic Petroleum Reserve is now below the nation’s commercial inventories.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

Back to Index

Equities

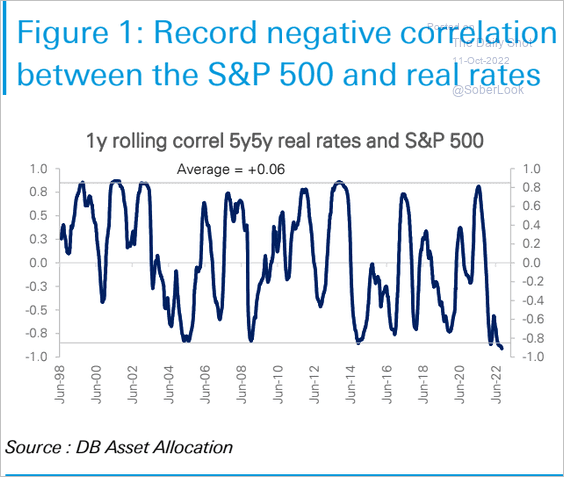

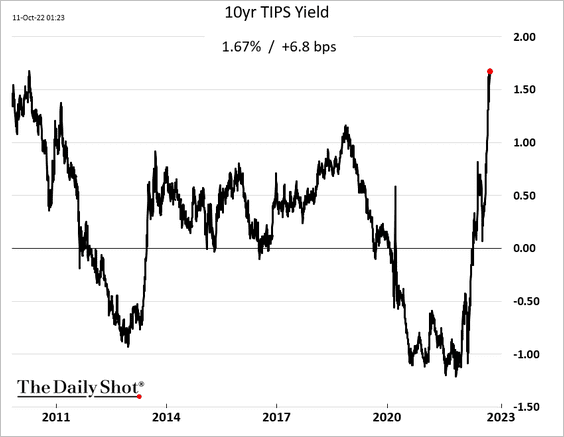

1. The stock market is extremely sensitive to real rates, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… which continue to surge.

——————–

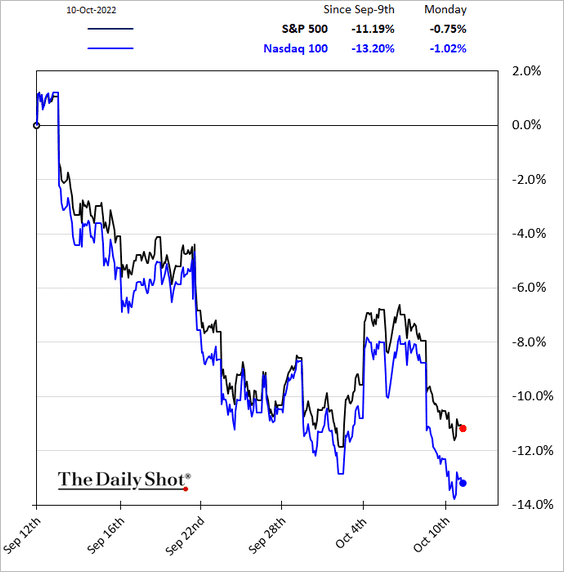

2. The Nasdaq 100 has underperformed …

… as chip stocks tumble.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

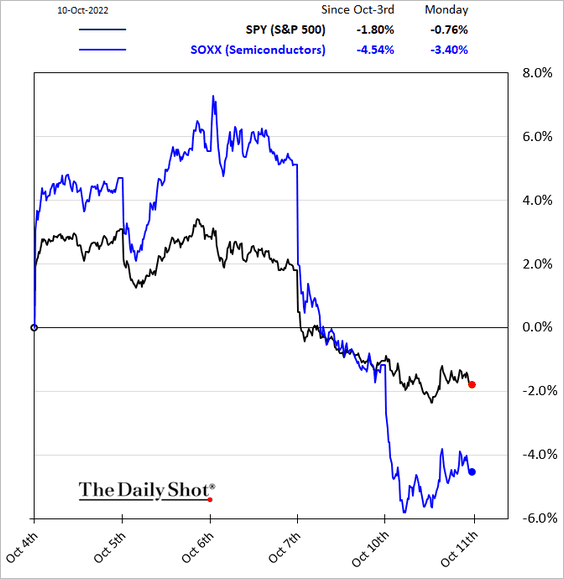

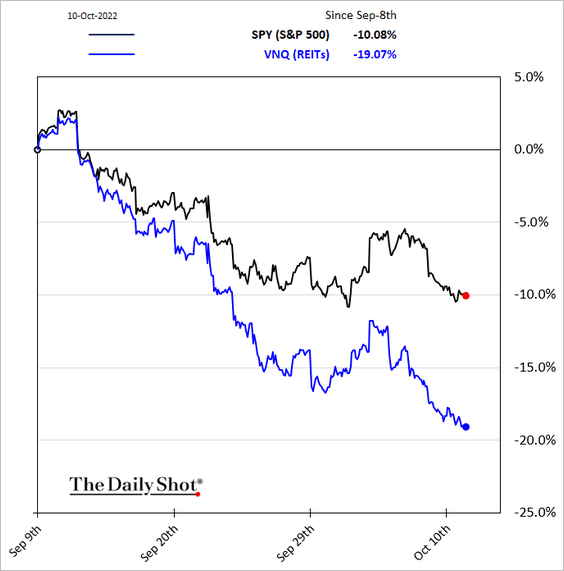

3. Many high-dividend defensive stocks have been under pressure as bond yields surge.

• Utilities:

• REITs:

——————–

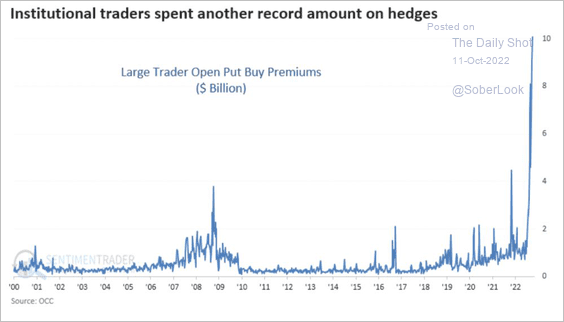

4. Put option buying activity surged in recent weeks.

Source: SentimenTrader; @markets Read full article

Source: SentimenTrader; @markets Read full article

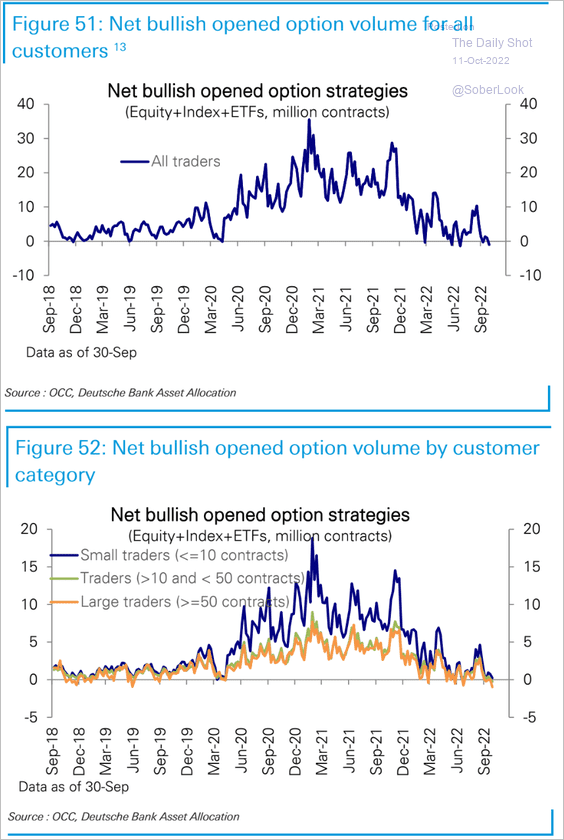

But bullish option strategies are not getting much love.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

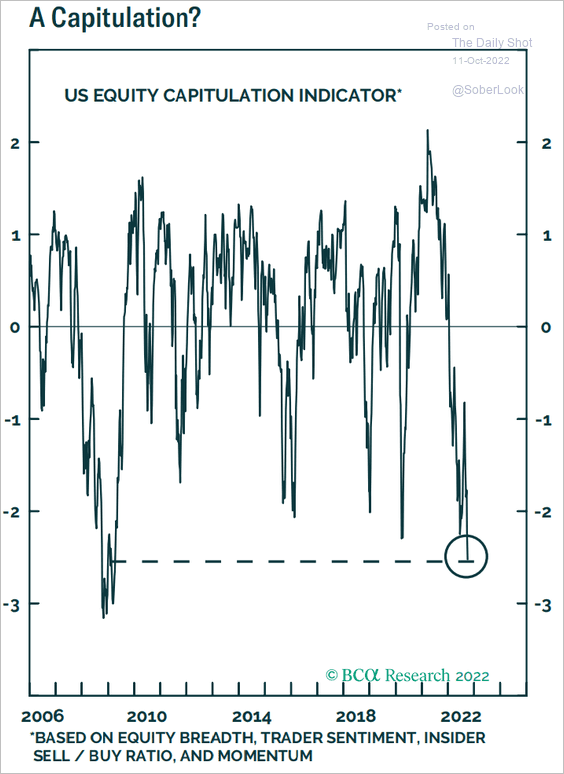

5. Too early to talk about capitulation?

Source: BCA Research

Source: BCA Research

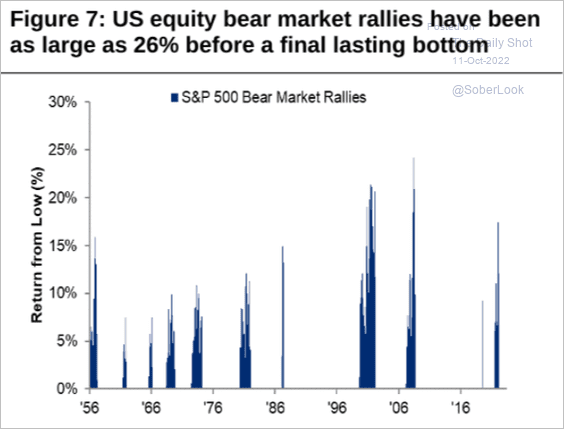

This chart shows bear-market rallies going back to 1956.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

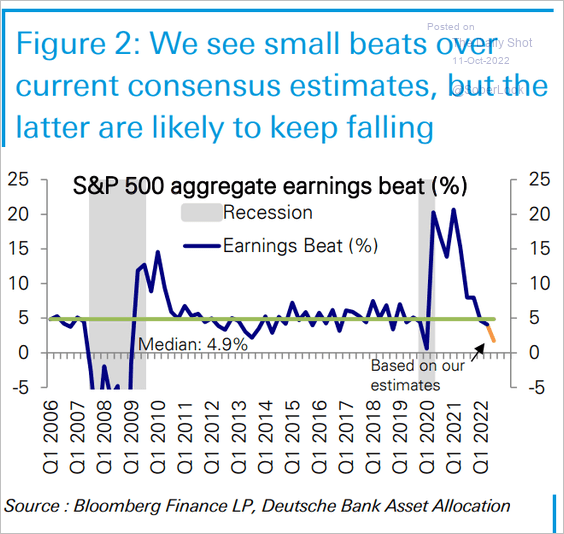

6. Deutsche Bank sees modest earnings beats (on average) in this earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

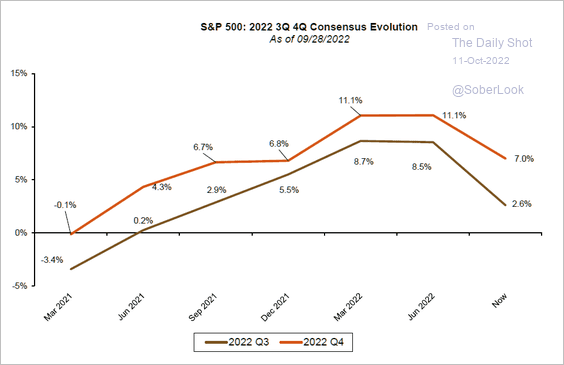

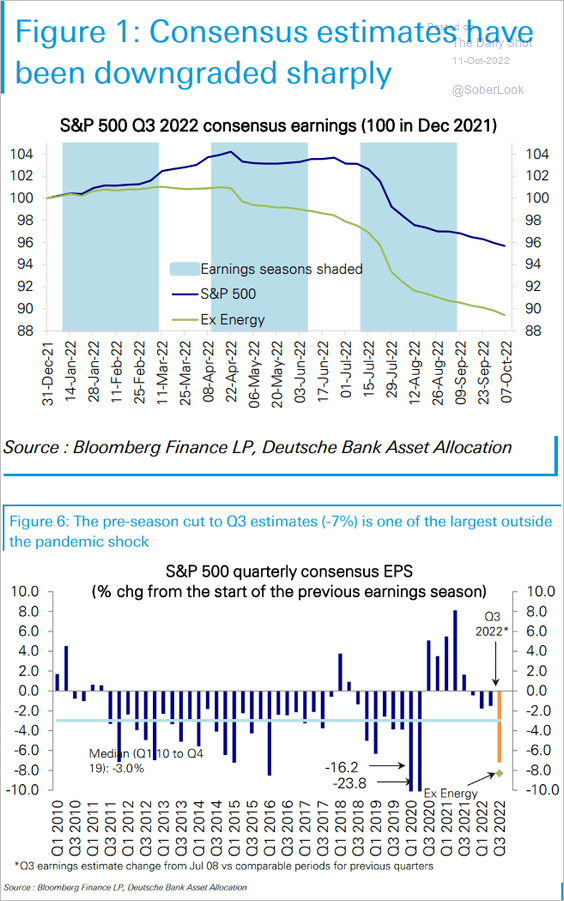

Q3 (and Q4) earnings expectations have been downgraded sharply.

Source: Bernstein; @themarketear

Source: Bernstein; @themarketear

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

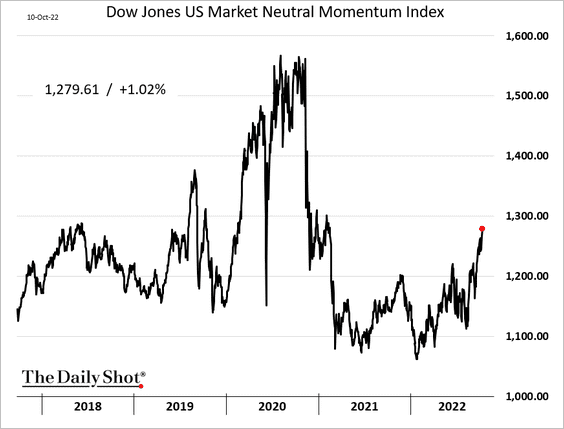

7. The momentum factor has been outperforming in recent weeks.

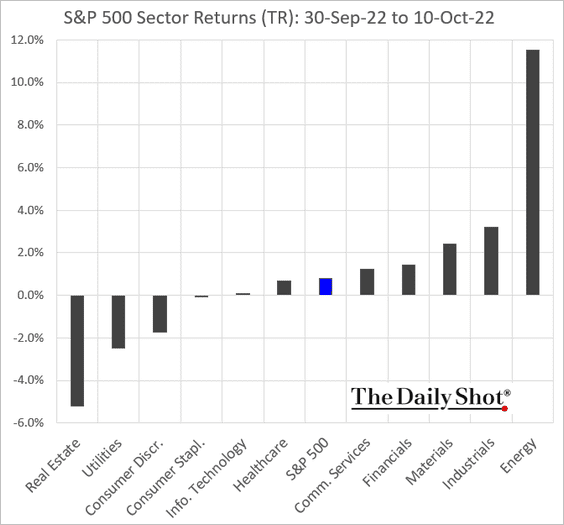

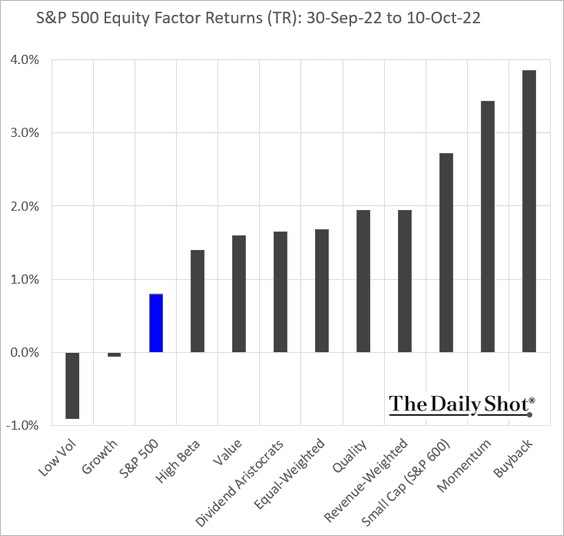

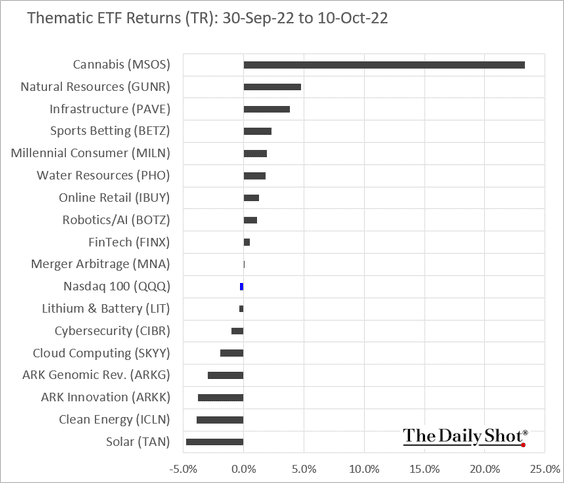

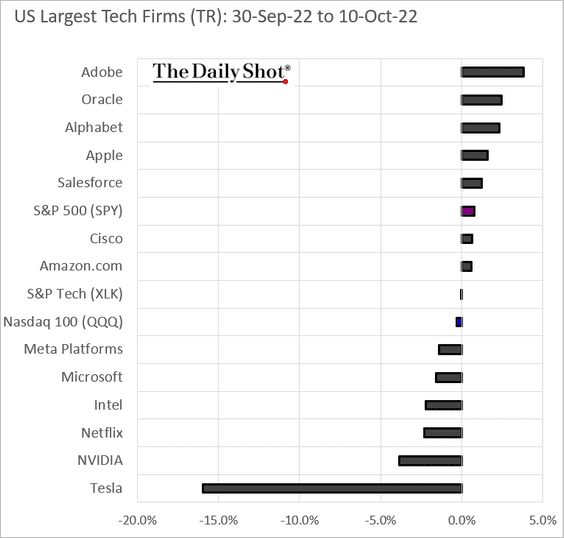

8. Finally, we have some month-to-date performance data.

• Sectors:

• Equity factors:

• Thematic ETFs:

• The largest US tech companies:

Back to Index

Credit

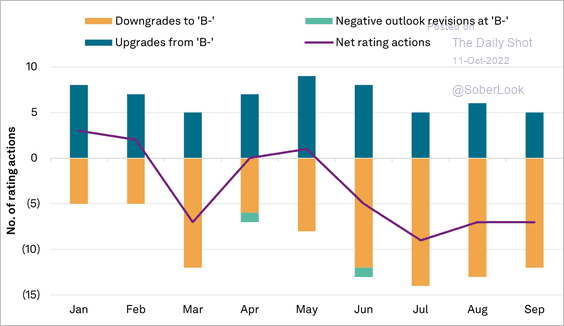

1. Downgrades to B- have been outpacing upgrades in recent months.

Source: S&P Global Ratings

Source: S&P Global Ratings

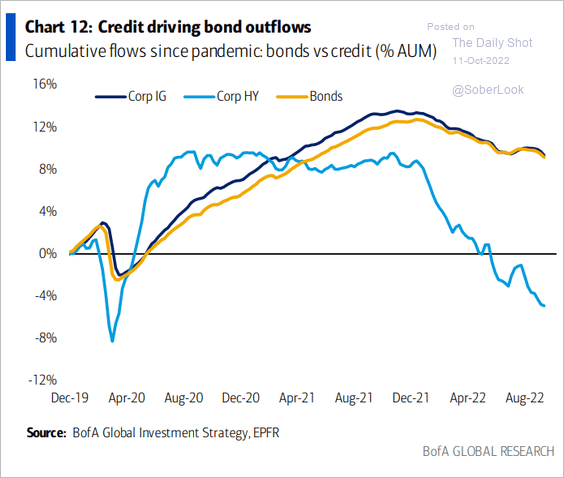

2. Credit has been driving bond fund outflows.

Source: BofA Global Research

Source: BofA Global Research

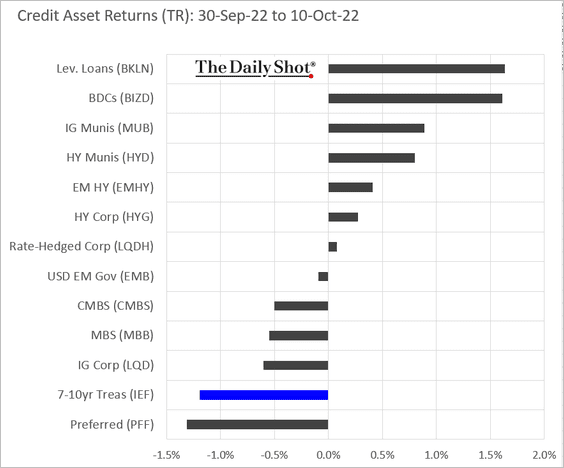

3. This chart shows month-to-date performance by credit asset class.

Back to Index

Rates

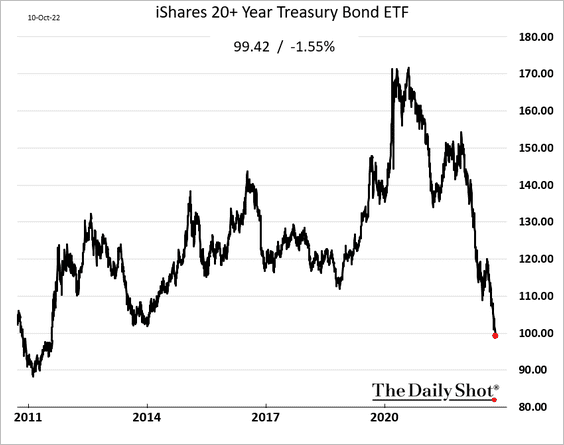

1. Long-term Treasuries have seen unprecedented losses this year.

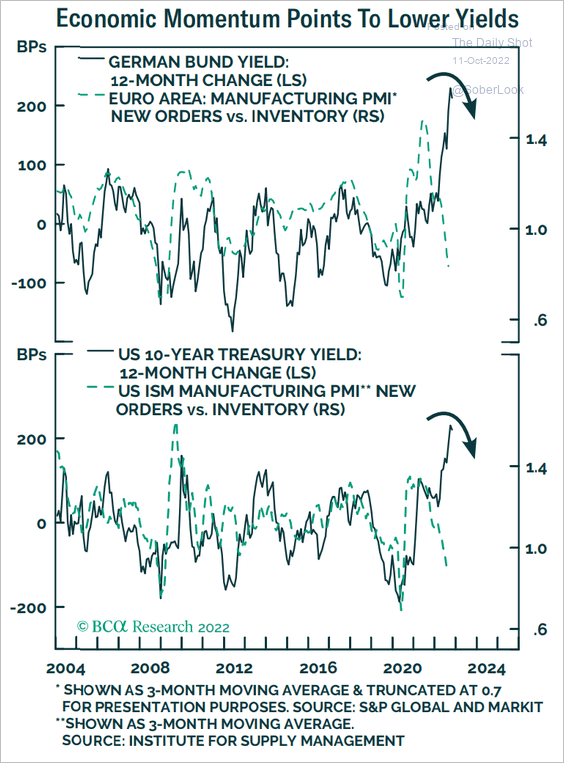

2. Economic momentum points to lower Treasury yields.

Source: BCA Research

Source: BCA Research

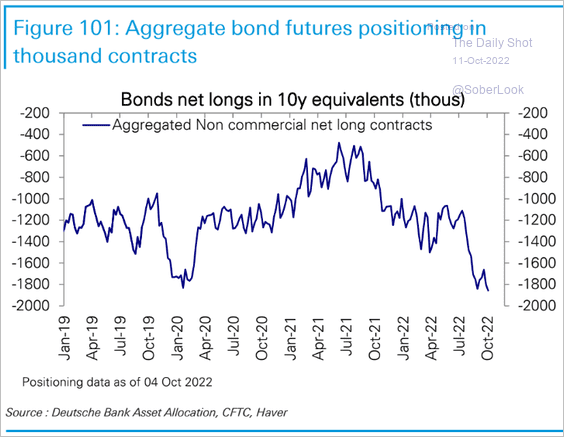

3. Speculative bets against Treasuries are at extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

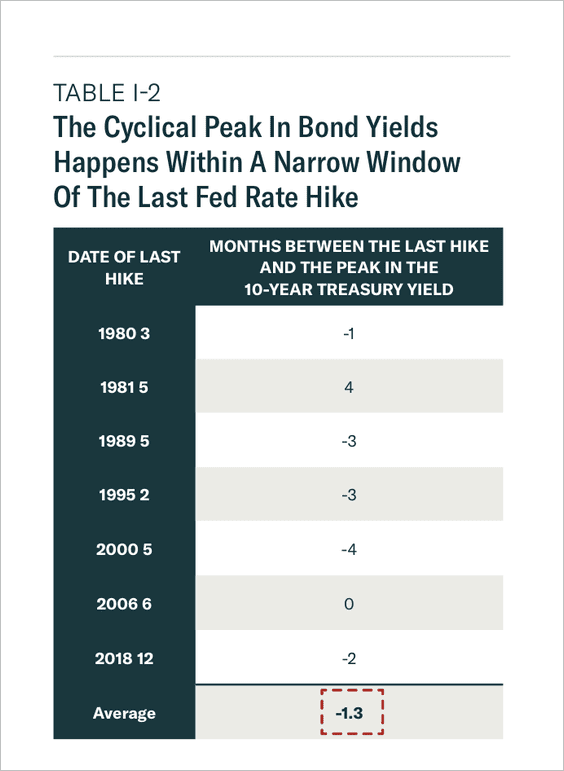

4. The 10-year Treasury yield has historically peaked within four months of the last Fed rate hike during tightening cycles.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

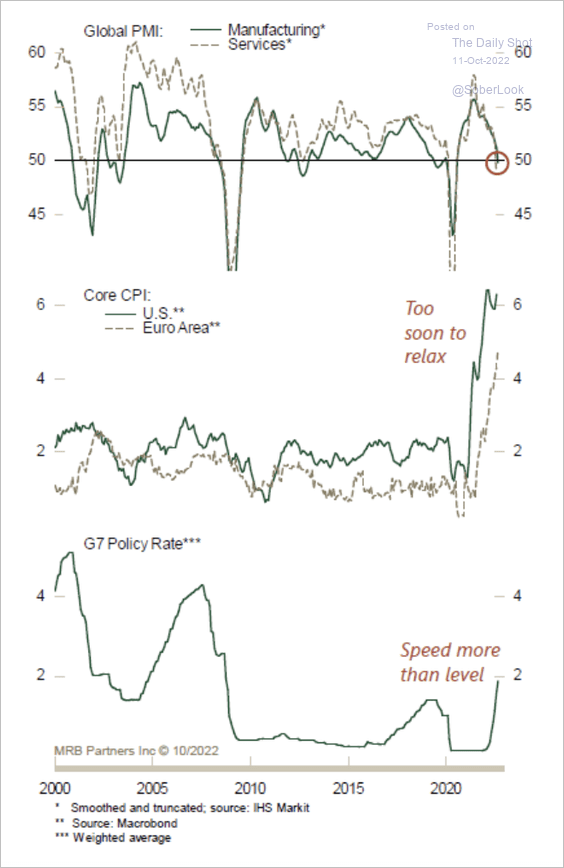

1. Global growth continues to slow amid elevated inflation and rising interest rates.

Source: MRB Partners

Source: MRB Partners

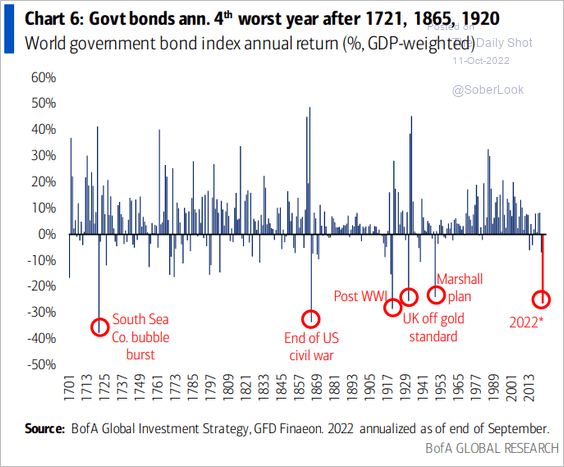

2. It’s been an ugly year for government bonds.

Source: BofA Global Research

Source: BofA Global Research

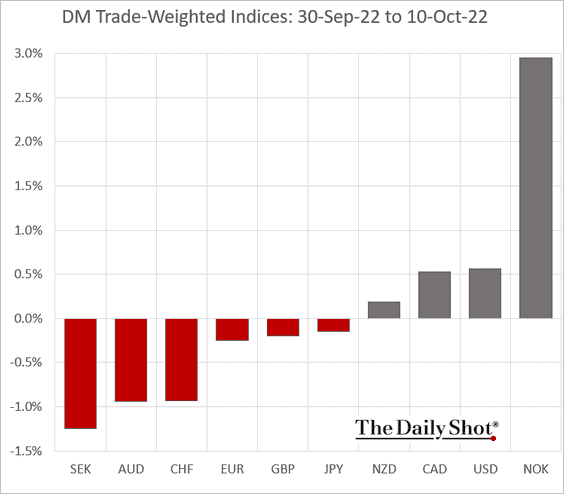

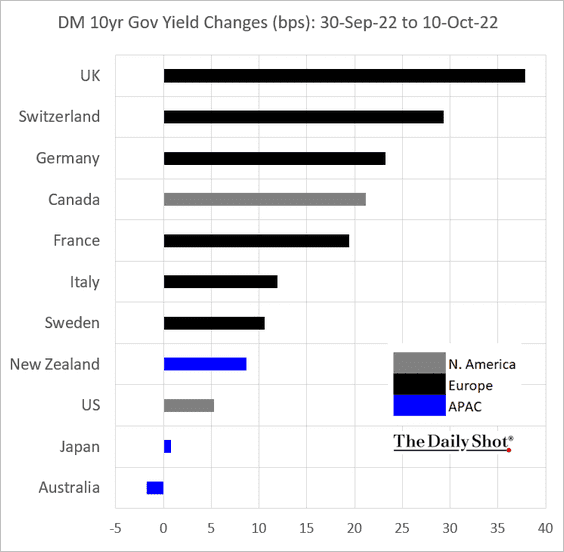

3. Next, we have some month-to-date performance data.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

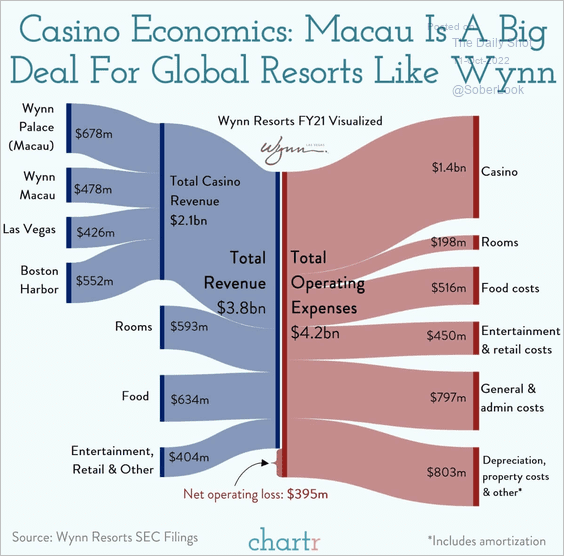

1. Casino economics:

Source: @chartrdaily

Source: @chartrdaily

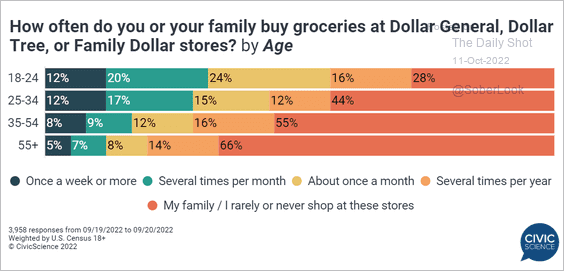

2. Grocery shopping at dollar stores:

Source: @CivicScience

Source: @CivicScience

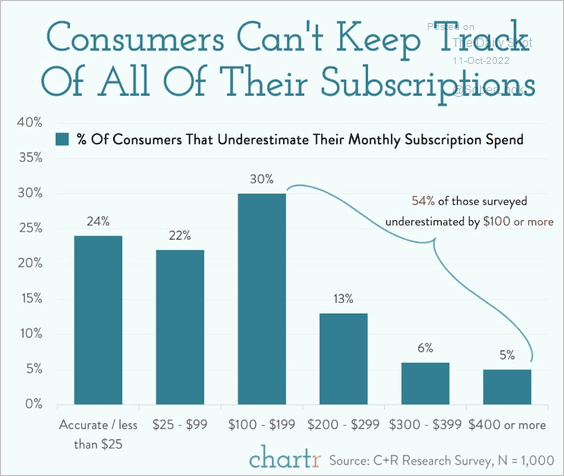

3. Consumers are underestimating the total cost of their subscriptions (streaming video/music, news services, coffee shops, software, razor subscriptions, etc.).

Source: @chartrdaily

Source: @chartrdaily

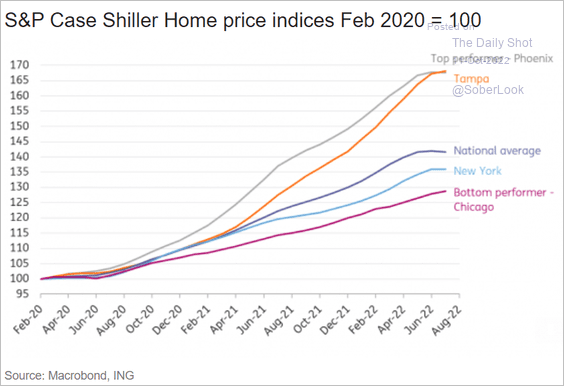

4. Home price trends in select cities:

Source: ING

Source: ING

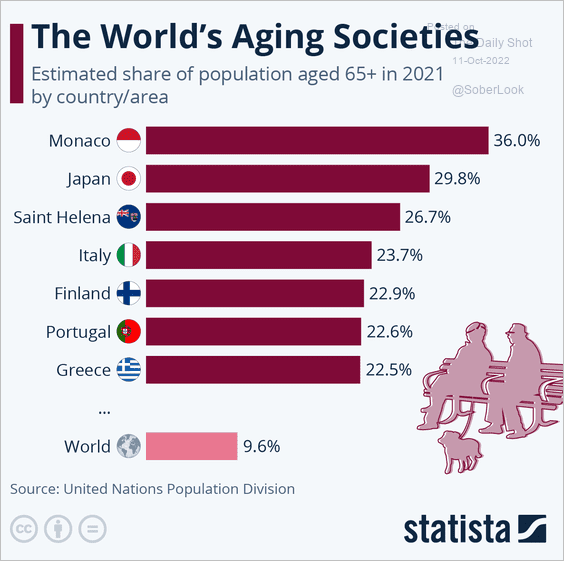

5. Share of the population aged 65 and older:

Source: Statista

Source: Statista

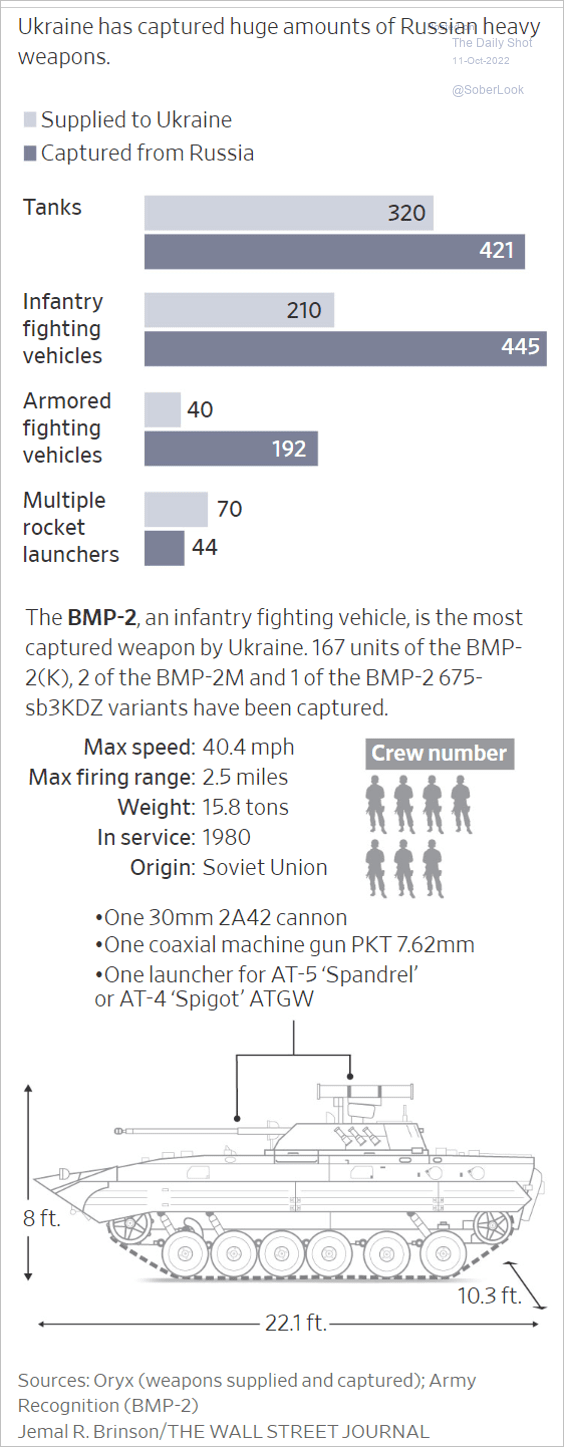

6. Russian weapons captured by Ukraine:

Source: @WSJ Read full article

Source: @WSJ Read full article

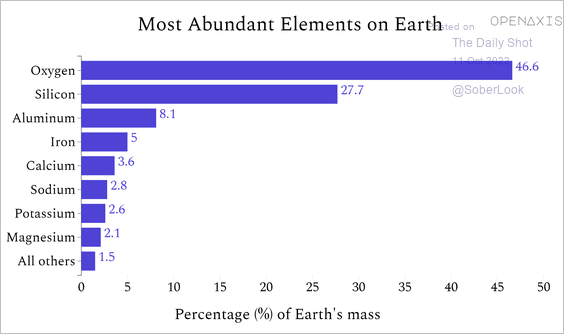

7. Most abundant elements on earth:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

——————–

Back to Index