The Daily Shot: 14-Oct-22

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

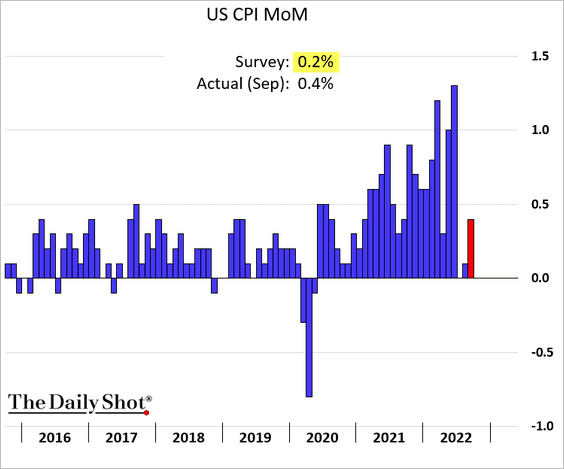

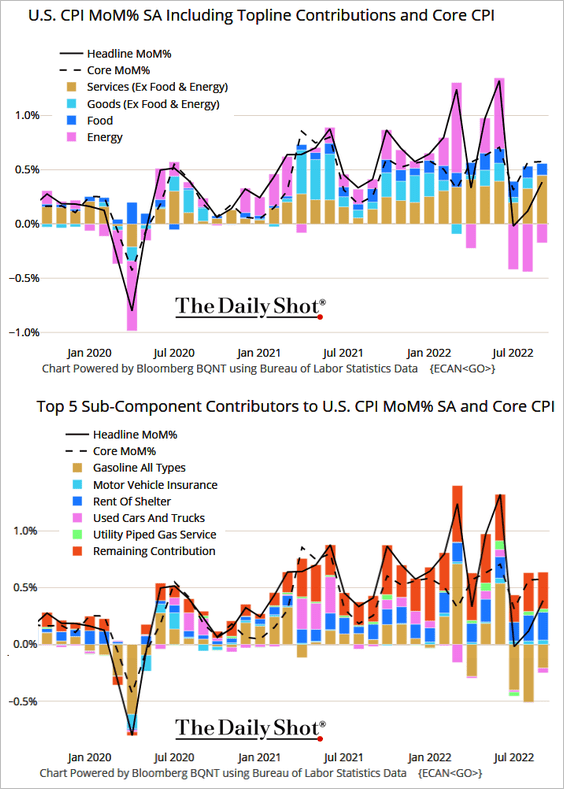

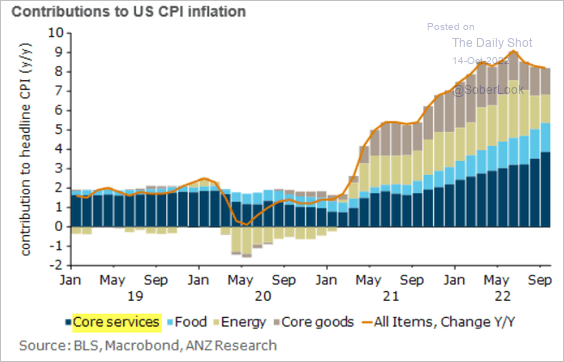

1. Once again, the CPI report surprised to the upside, pointing to entrenched inflation in the US.

Below are the contributions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

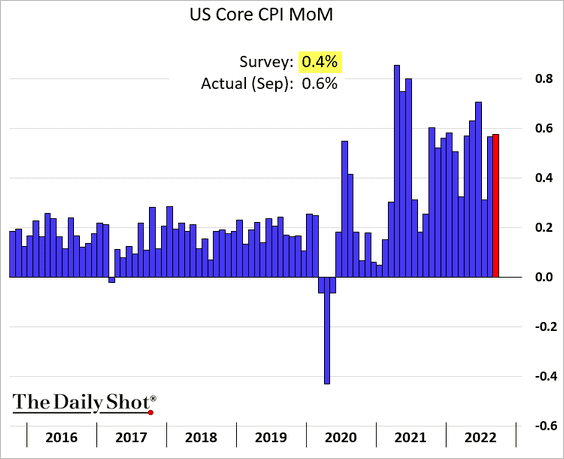

The core inflation climbed 0.6% in September, …

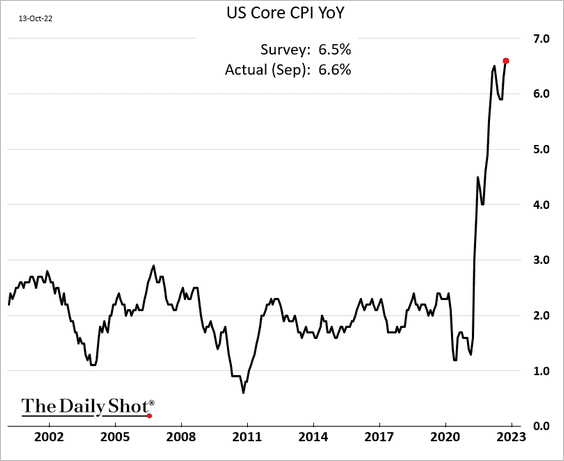

… hitting a multi-decade high on a year-over-year basis.

Here is a quote from Nomura.

… today’s report supports our long-held view that inflation is much more entrenched than the market consensus and the Fed’s expectations. As a result, we believe today’s data supports our above-consensus terminal rate forecast of 5.25-5.50%, including our call for 75bp hikes in both November and December.

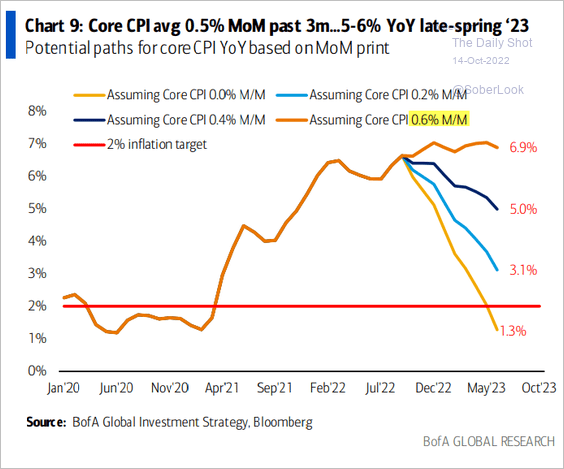

• At 0.6% per month, the yearly core CPI is not moving down any time soon.

Source: BofA Global Research

Source: BofA Global Research

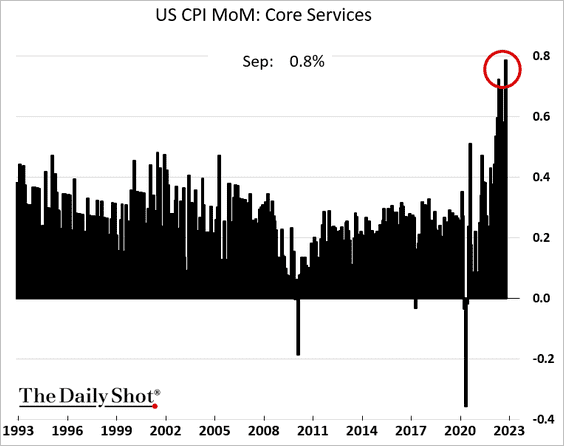

• The problem continues to be with the core services CPI, which hit a multi-decade high (month-over-month).

Here is the core services contribution on a year-over-year basis.

Source: @ANZ_Research

Source: @ANZ_Research

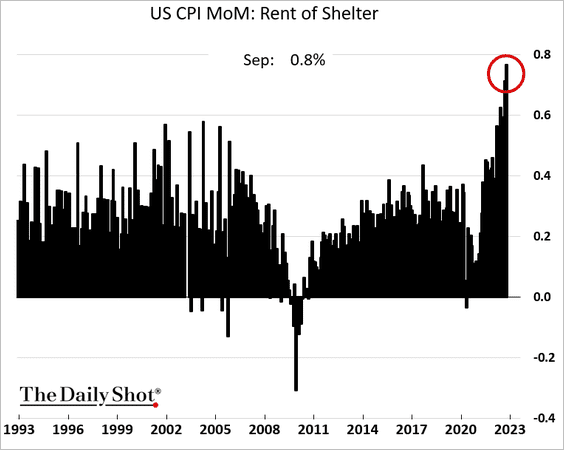

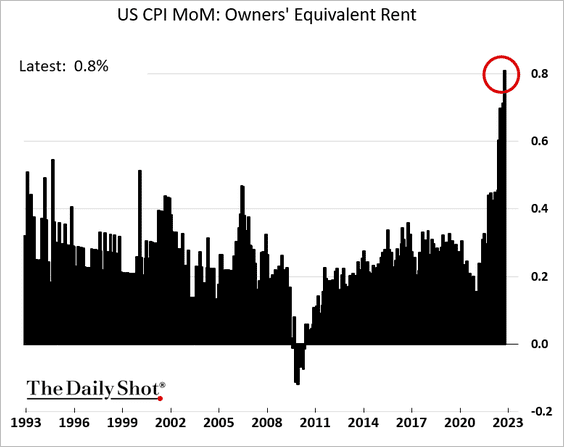

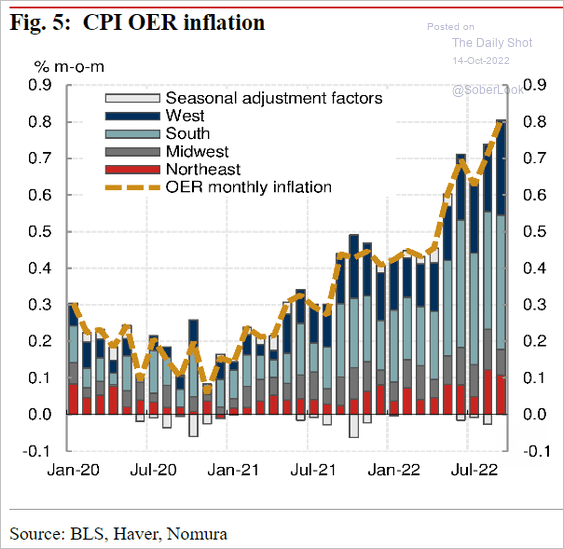

• Housing inflation continues to accelerate.

– Rent:

– Owners’ equivalent rent (2 charts):

Source: Nomura Securities

Source: Nomura Securities

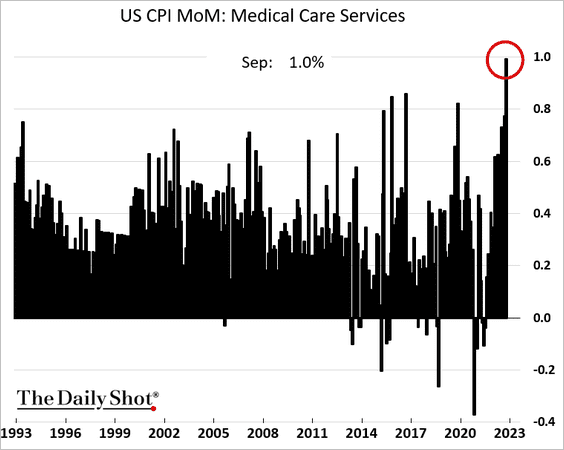

• And here is the CPI for medical care services.

Outside of the core CPI, food inflation remains elevated.

We will have more on the inflation report on Monday, including some forecasts.

——————–

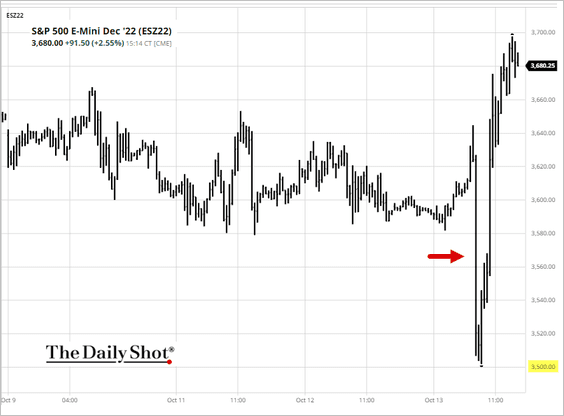

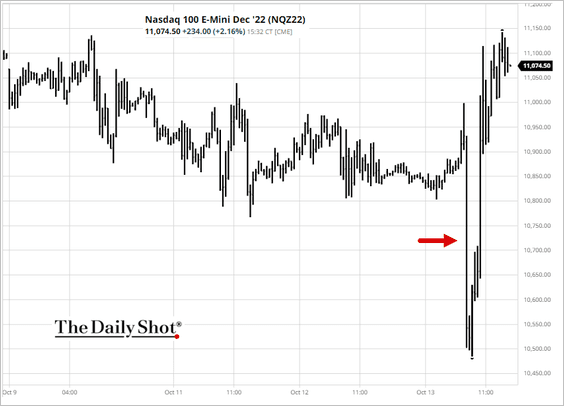

2. The market reaction was quite unexpected.

• Stocks tumbled and then rebounded, closing sharply higher. Investors were very short (or hedged) going into the CPI report. At 3,500 on the S&P 500 futures, short-covering ensued and continued for the rest of the day. We will likely see this rally reversed shortly.

Source: barchart.com

Source: barchart.com

Source: barchart.com

Source: barchart.com

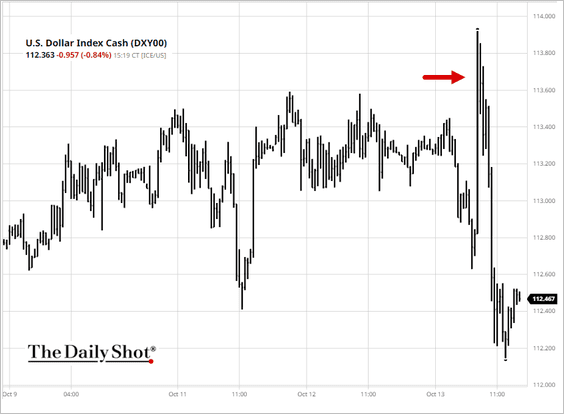

• The dollar ended lower.

Source: barchart.com

Source: barchart.com

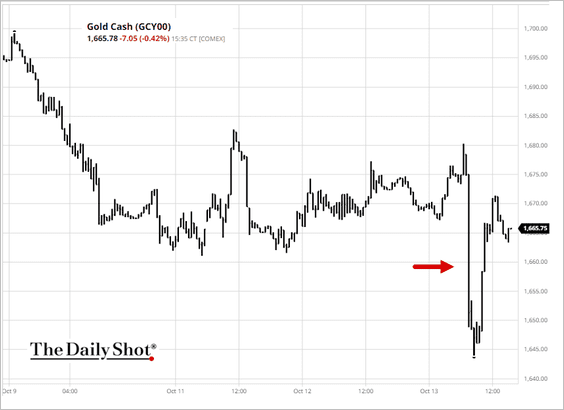

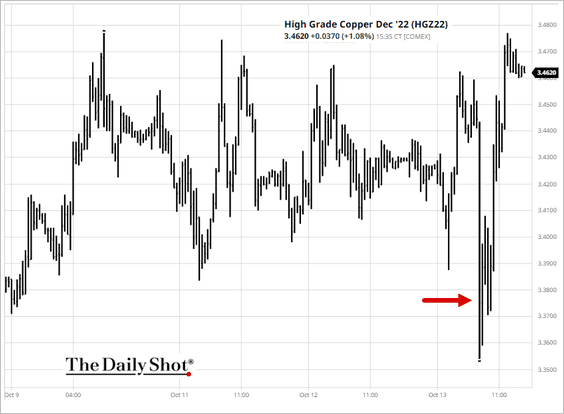

• Gold and copper rebounded.

Source: barchart.com

Source: barchart.com

Source: barchart.com

Source: barchart.com

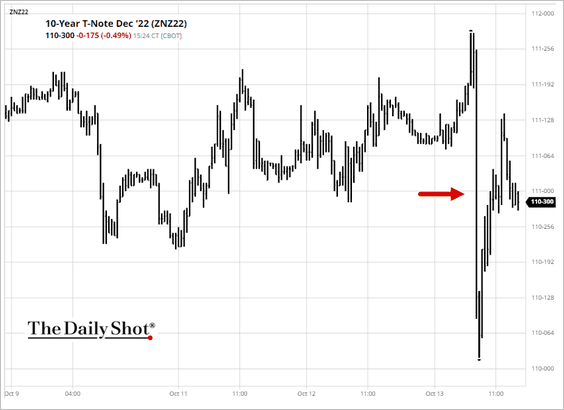

• Treasuries ended down, …

– 10yr note futures:

Source: barchart.com

Source: barchart.com

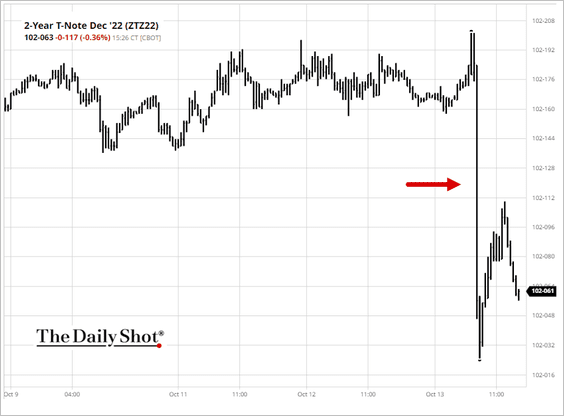

– 2yr note futures:

Source: barchart.com

Source: barchart.com

… with the 2-year yield nearing 4.5%.

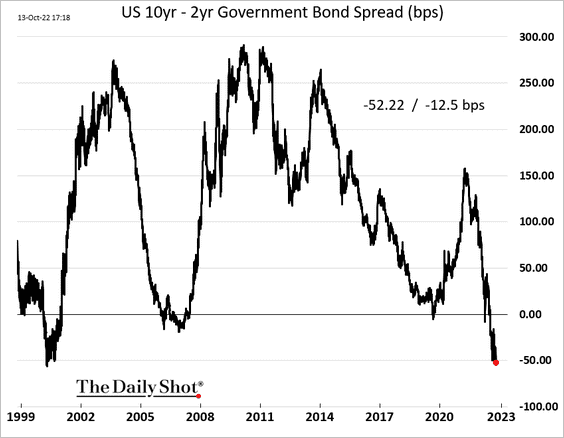

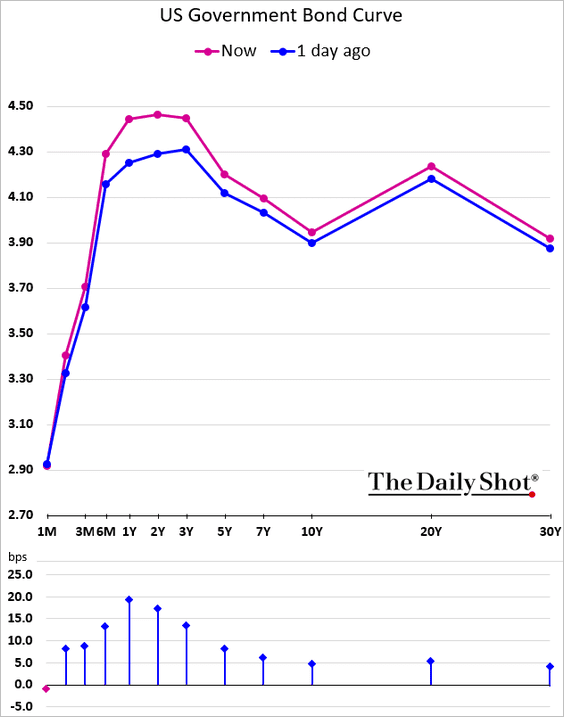

The yield curve inverted further as recession looms.

——————–

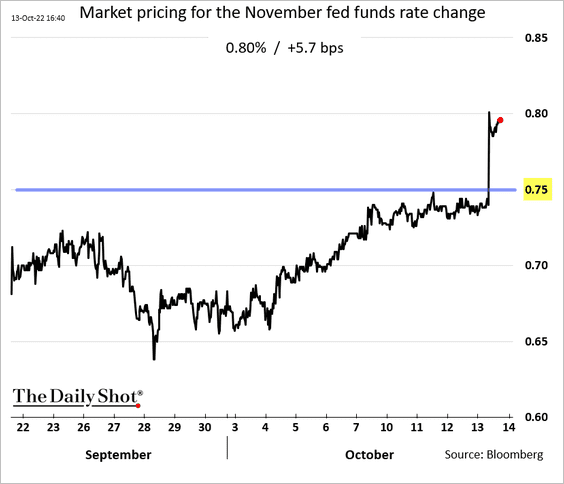

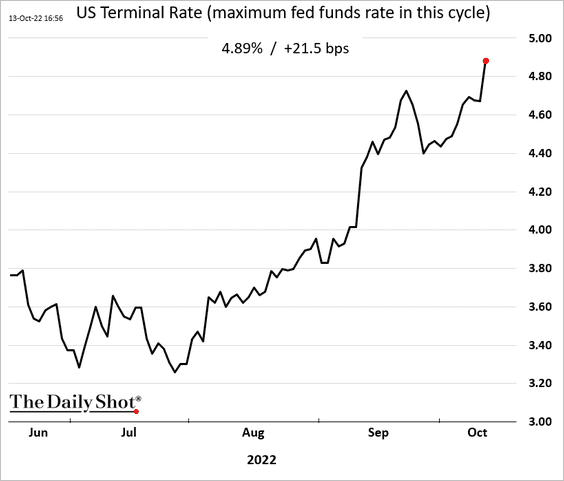

3. The market started pricing a chance of a 100 bps rate hike in November, …

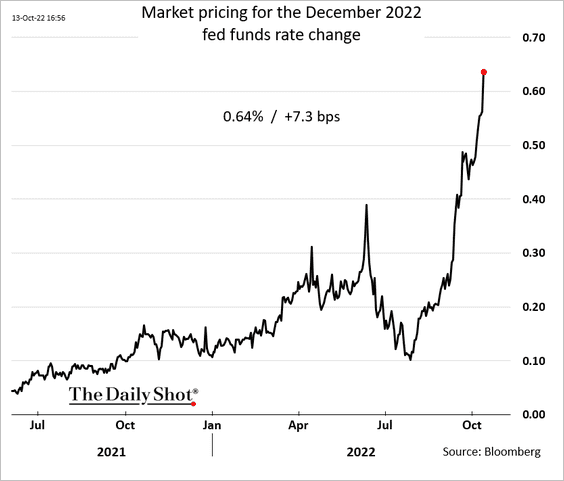

… and an increased likelihood of 75 bps in December.

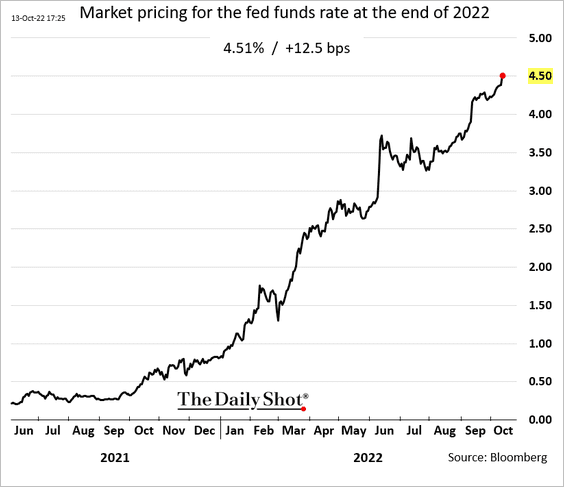

The year is expected to end with the fed funds rate at 4.5%, …

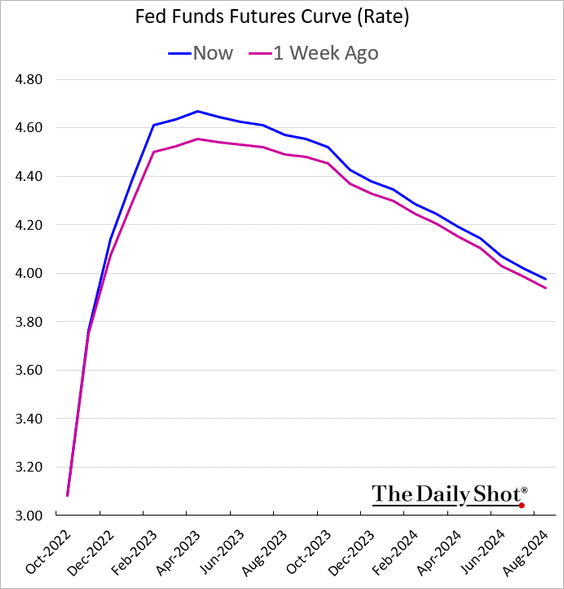

… with the terminal rate approaching 5% next year.

——————–

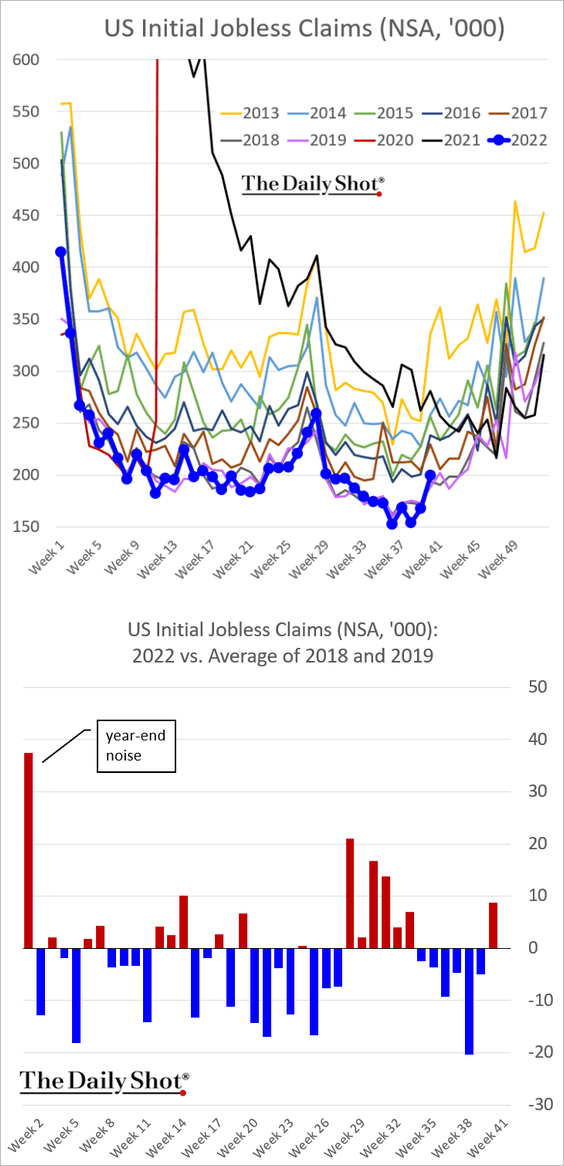

4. Jobless claims jumped last week, driven by storm-battered Florida.

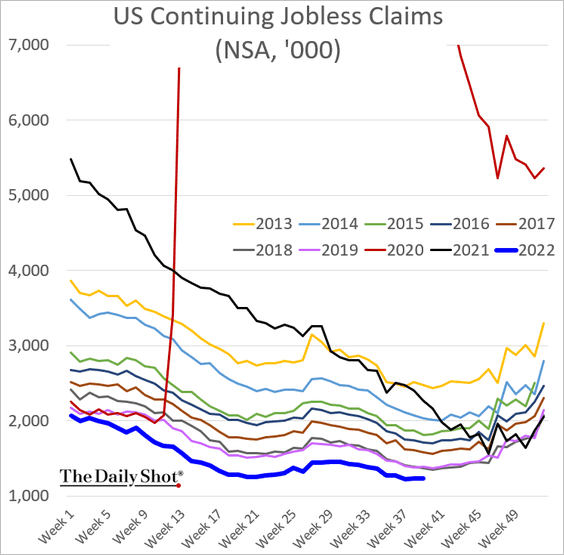

This chart shows continuing unemployment claims.

——————–

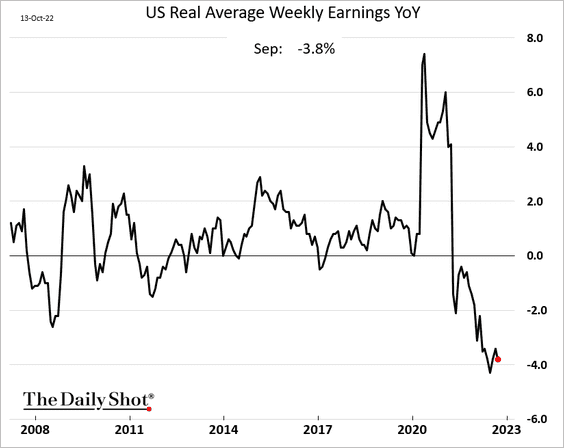

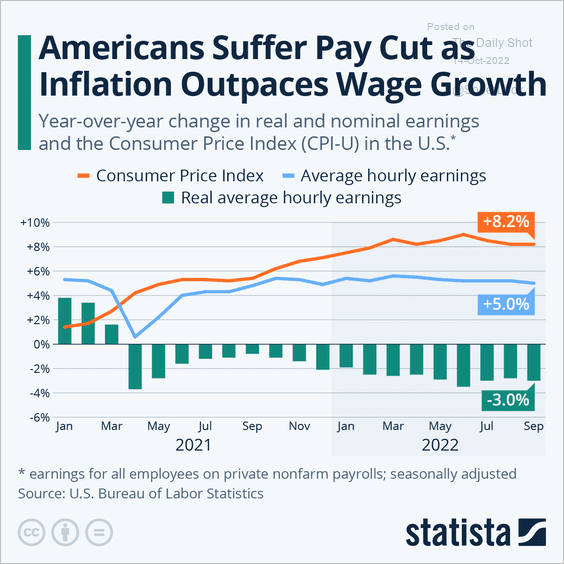

5. Real wage growth is holding deep in negative territory (2 charts).

Source: Statista

Source: Statista

——————–

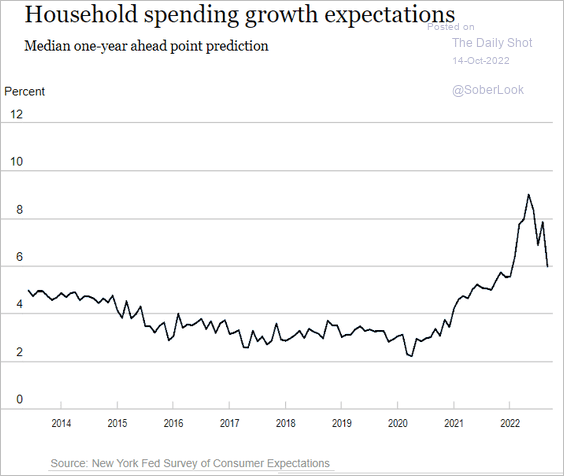

6. Household spending expectations have been moderating.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

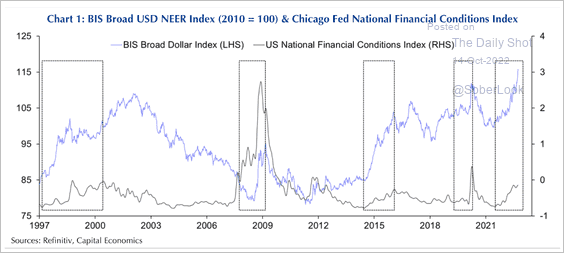

7. Dollar rallies are typically associated with tighter financial conditions.

Source: Capital Economics

Source: Capital Economics

Back to Index

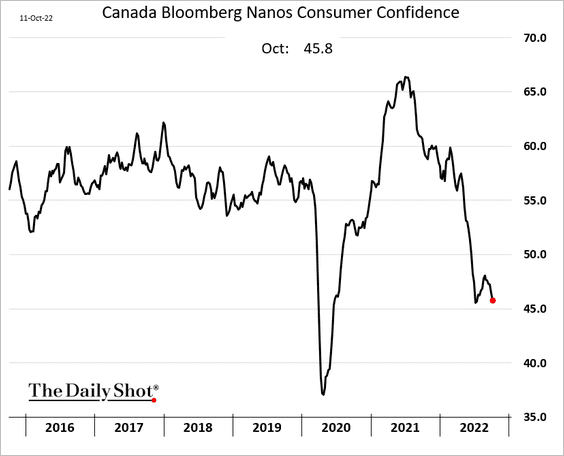

Canada

1. Consumer confidence is near the lowest levels since 2020.

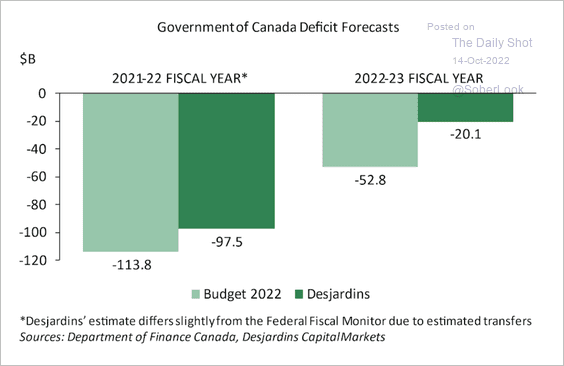

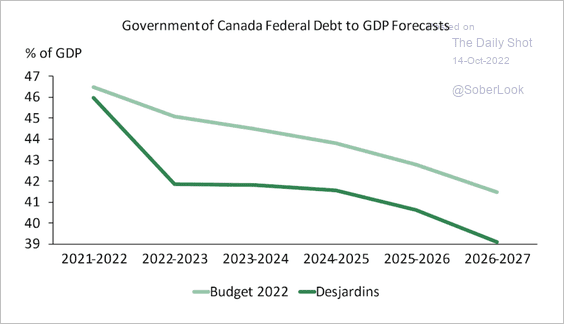

2. Desjardins expects an improvement in the forecasted government budget deficit this year. The tight labor market could reduce demand for income support, thereby lowering expenses (2 charts).

Source: Desjardins

Source: Desjardins

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

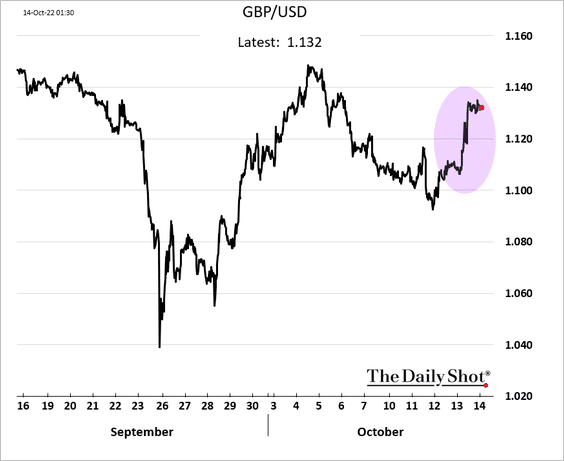

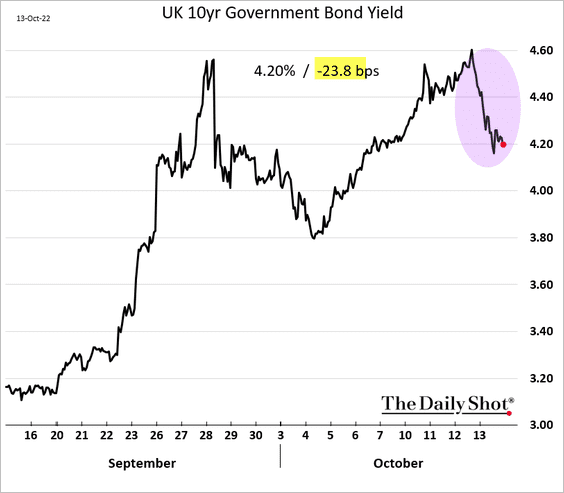

Rumors of a pullback in tax cuts sent gilts and the pound sharply higher.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Europe

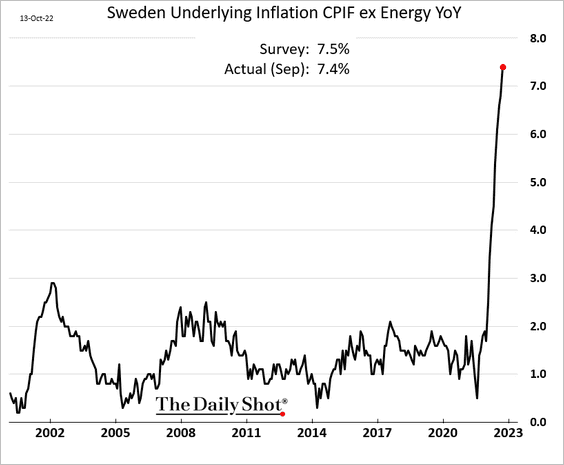

1. Sweden’s CPI continues to surge.

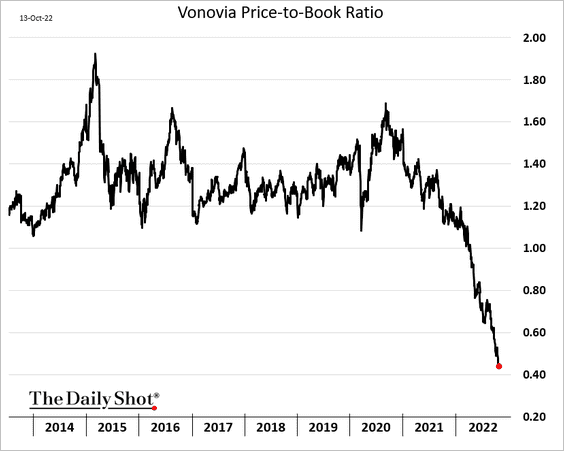

2. Germany’s largest landlord, Vonovia, will see many tenants under financial stress this winter (due to energy costs). Here is the company’s price-to-book ratio.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

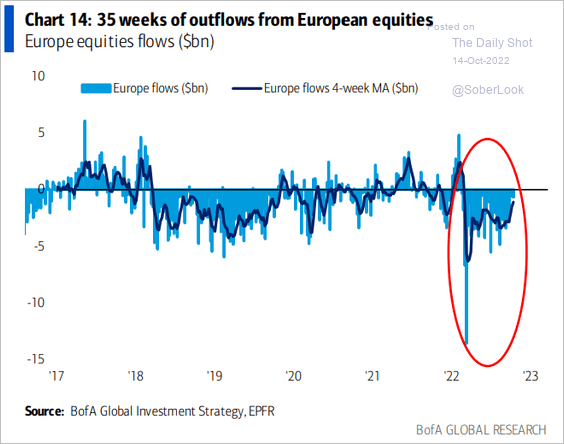

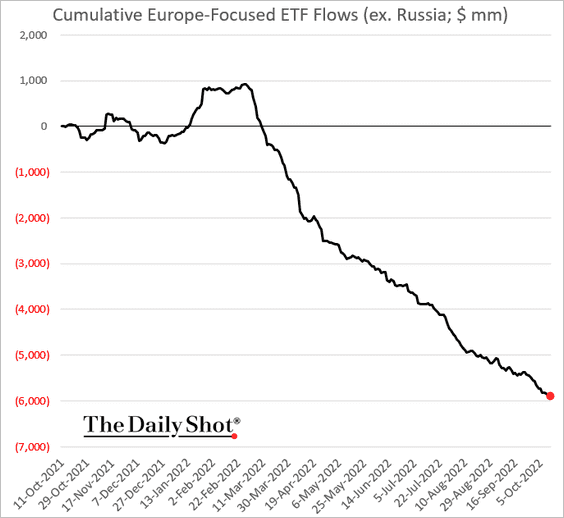

3. European equity funds continue to see outflows.

Source: BofA Global Research

Source: BofA Global Research

——————–

4. USD/CHF is testing long-term downtrend resistance.

Source: BofA Global Research

Source: BofA Global Research

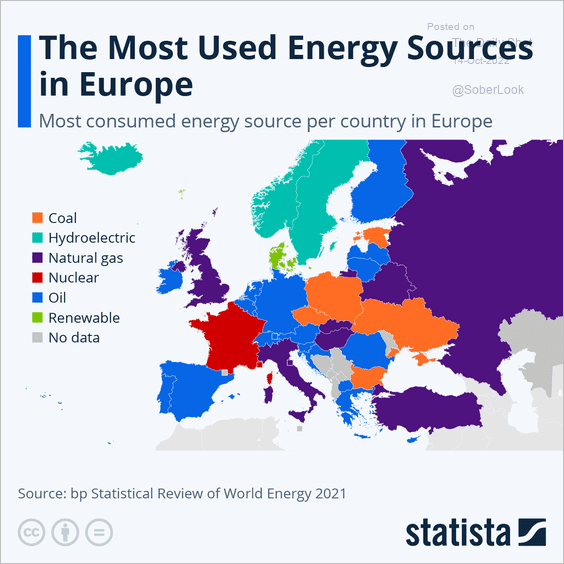

5. Here are the most consumed energy sources by country.

Source: Statista Read full article

Source: Statista Read full article

Back to Index

Asia – Pacific

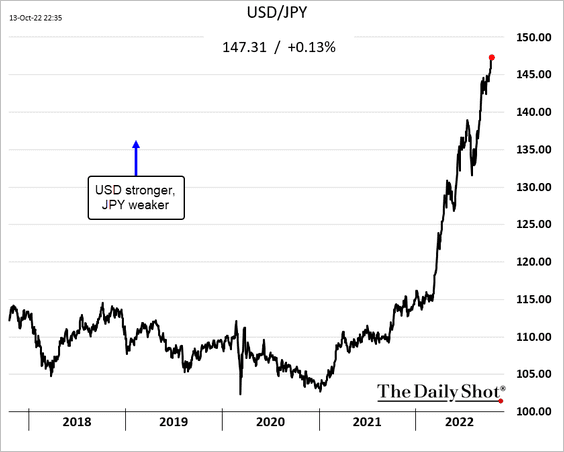

1. The yen continues to sink vs. USD.

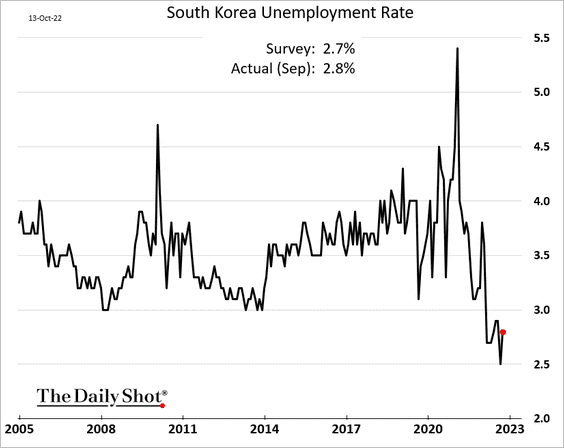

2. South Korea’s unemployment rate ticked higher but remains at historically low levels.

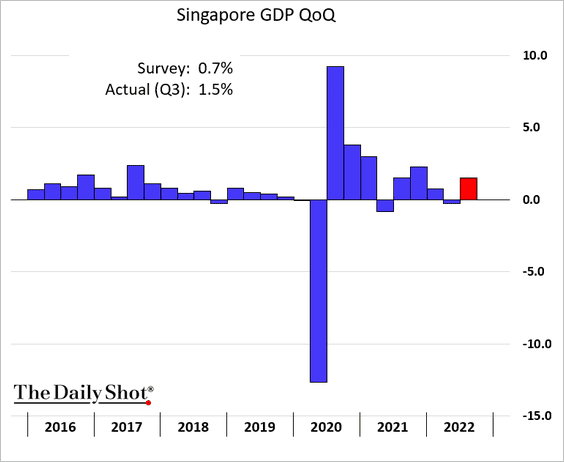

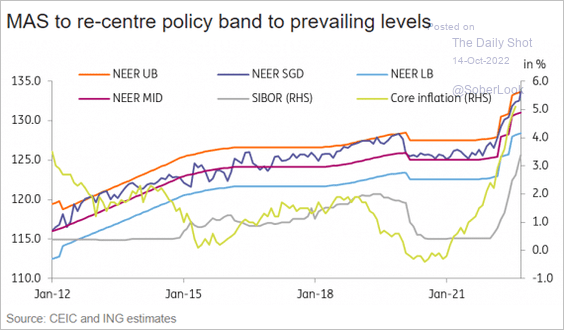

3. Singapore’s Q3 GDP growth surprised to the upside.

Singapore’s central bank continues to tighten monetary policy by guiding the currency higher.

Source: ING

Source: ING

——————–

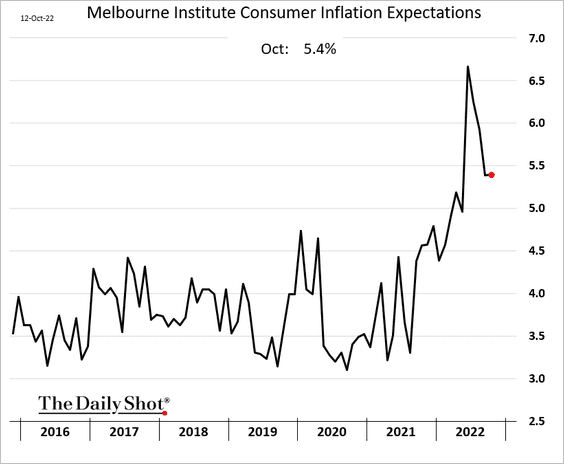

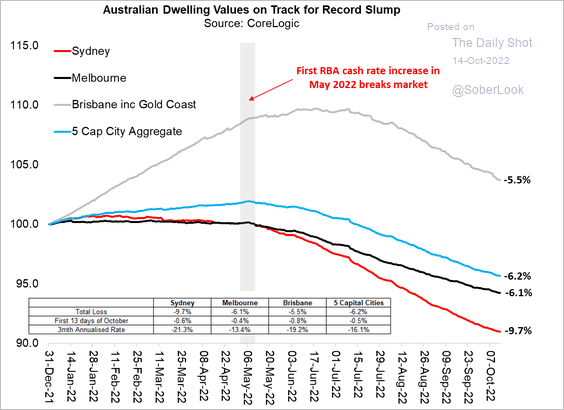

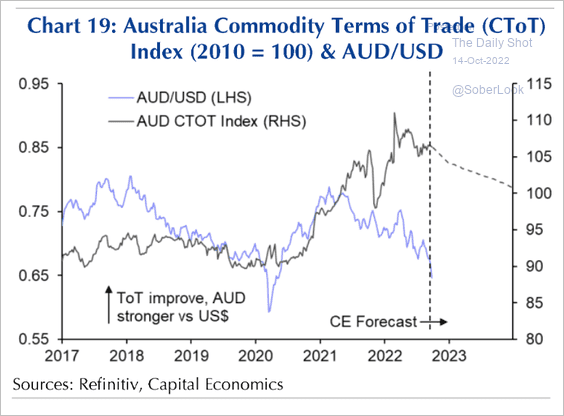

4. Next, we have some updates on Australia.

• Inflation expectations held steady this month.

• Home prices continue to slump.

Source: Coolabah Capital Read full article

Source: Coolabah Capital Read full article

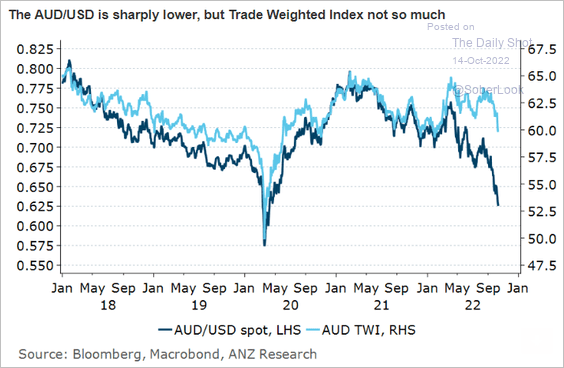

• Lower commodity prices and terms of trade could add further pressure on AUD/USD.

Source: Capital Economics

Source: Capital Economics

The Aussie dollar weakened massively vs. USD, but the trade-weighted index hasn’t declined much.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

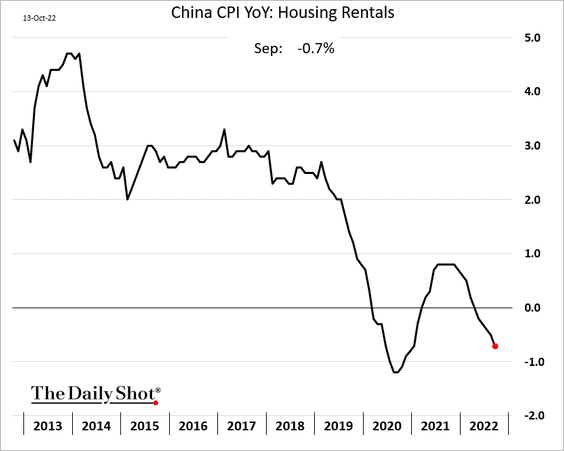

China

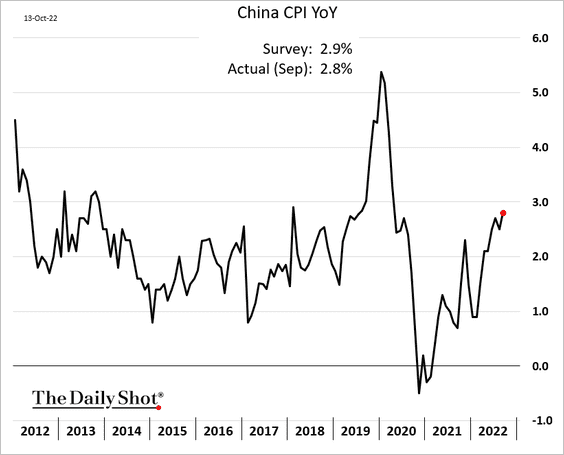

1. Inflation was a bit softer than expected in September.

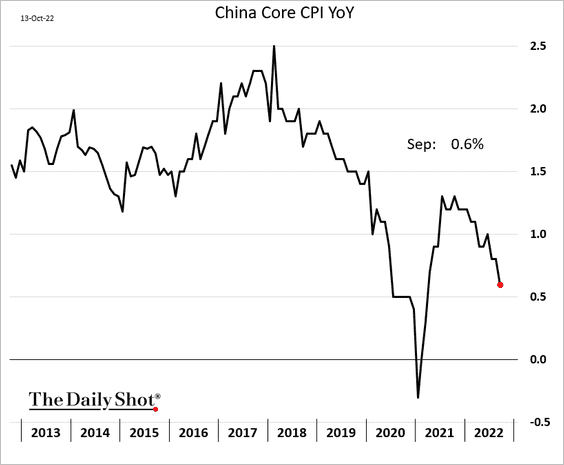

• The core CPI continues to move lower, in sharp contrast to the US.

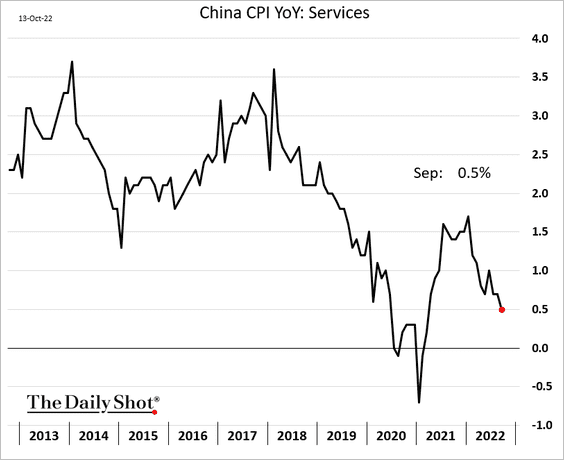

• Services inflation is easing.

• Here is rent inflation.

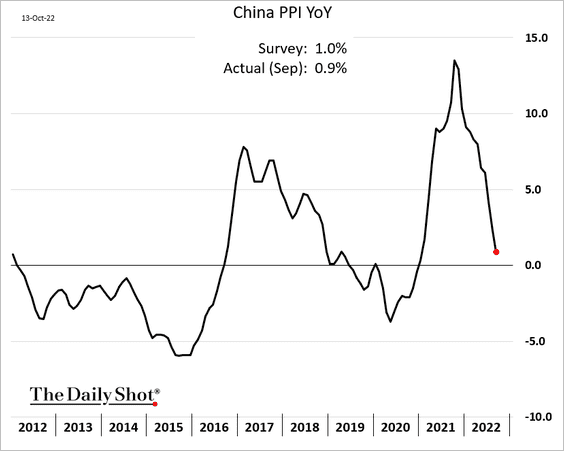

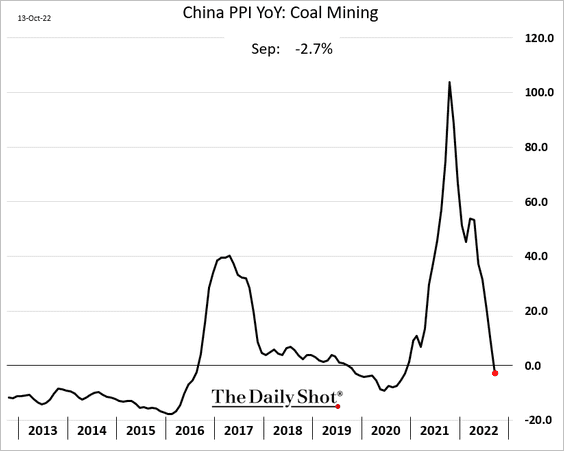

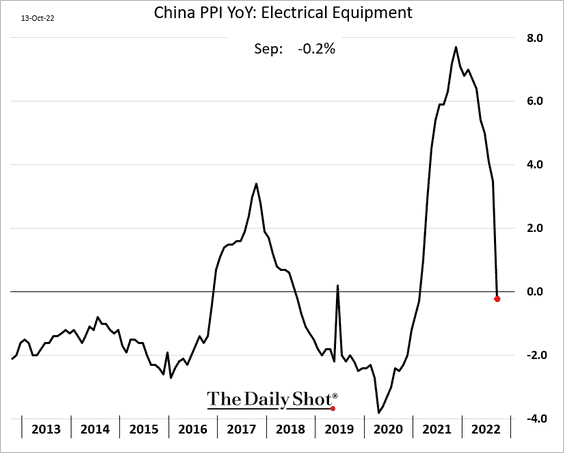

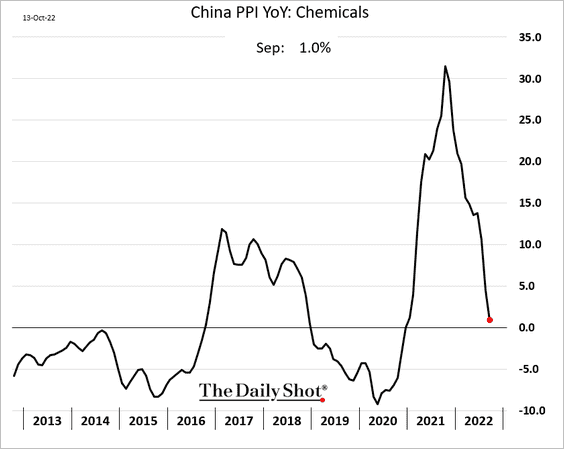

2. The PPI was also lower than expected.

Below are some of the PPI components.

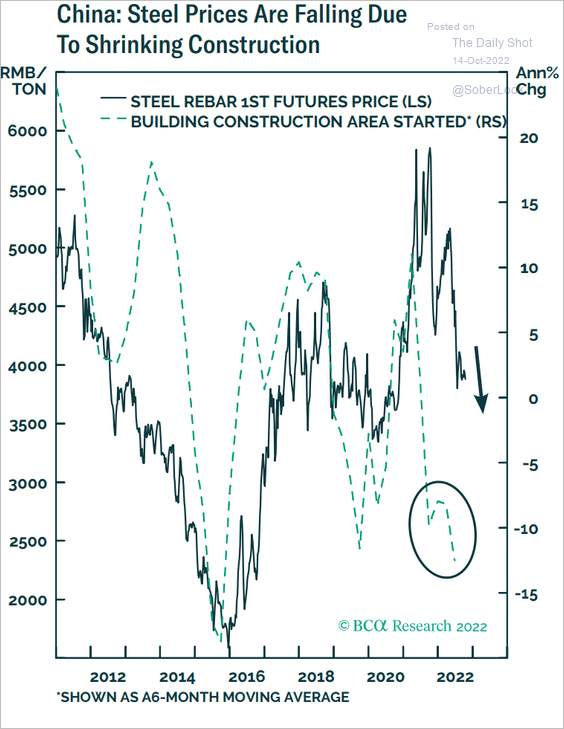

Steel prices keep moving lower.

Source: BCA Research

Source: BCA Research

——————–

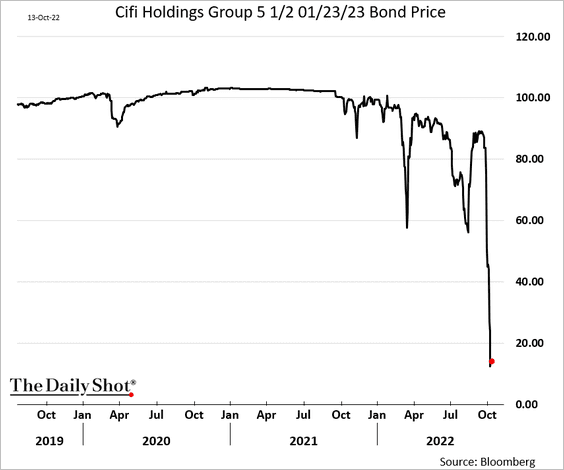

3. China’s property developers’ debt crisis continues.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

——————–

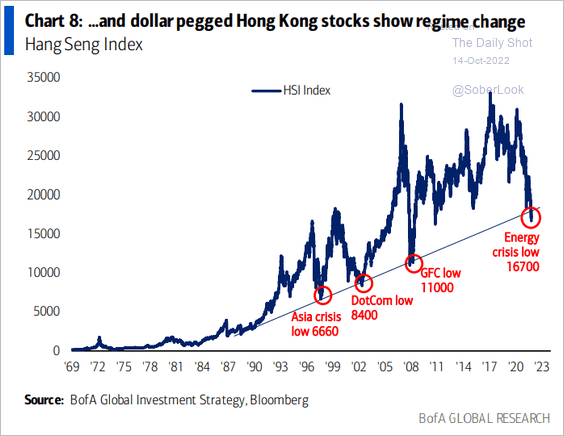

4. Hong Kong stocks are breaking below long-term uptrend support.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Emerging Markets

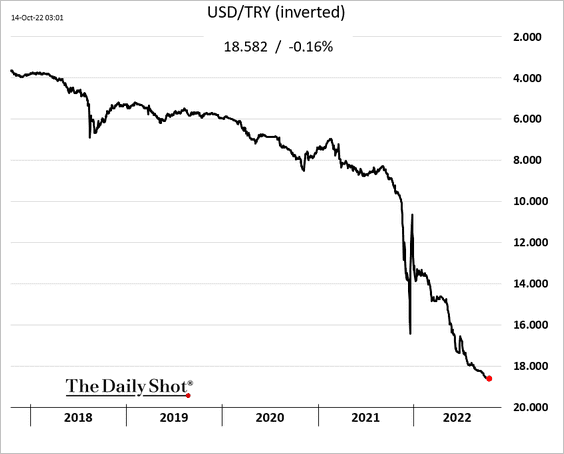

1. The Turkish lira continues to drift lower.

2. Mexican factory output has been holding up well.

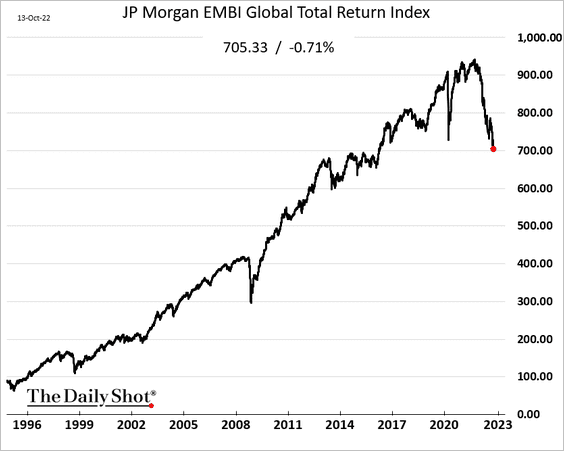

3. EM bond outflows have been severe, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… pressuring prices.

Back to Index

Commodities

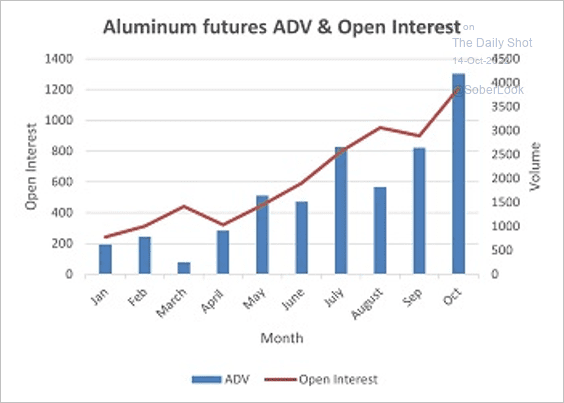

1. Average daily volume and open interest in aluminum futures have risen this year.

Source: CME Group

Source: CME Group

2. European steel futures have also seen an increase in volume and open interest, possibly due to hedging demand.

Source: CME Group

Source: CME Group

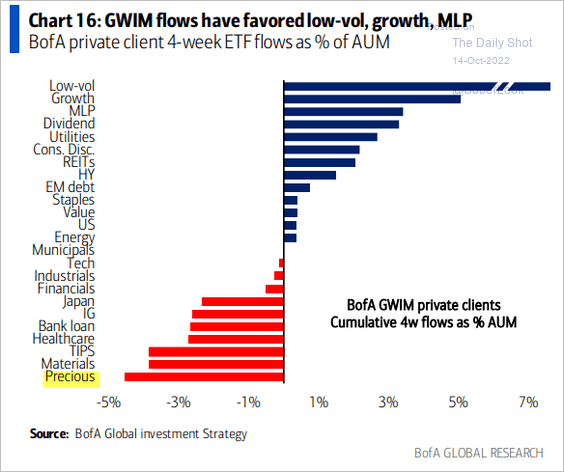

3. Merrill Lynch’s private clients have been cutting their precious metals exposure.

Source: BofA Global Research

Source: BofA Global Research

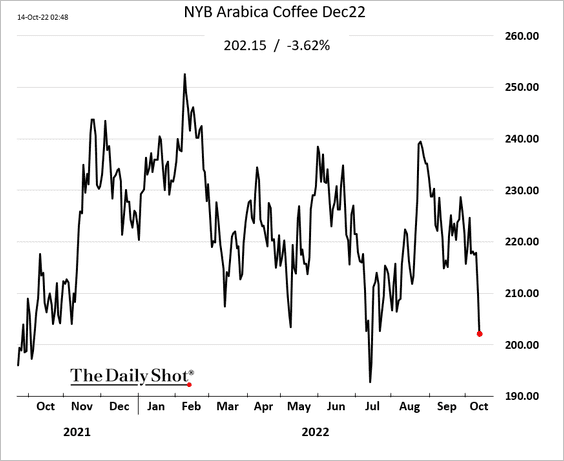

4. Coffee futures are tumbling.

Source: Nasdaq Read full article

Source: Nasdaq Read full article

Back to Index

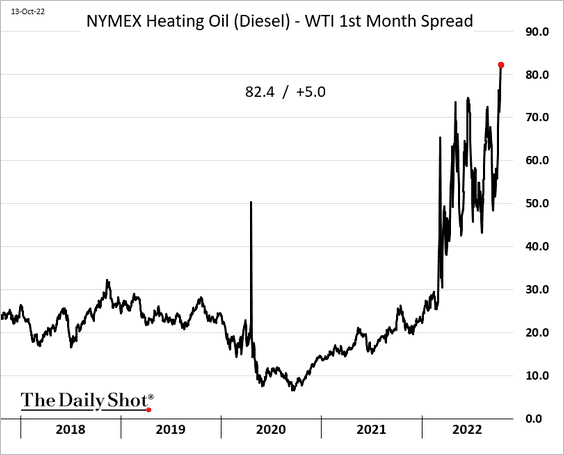

Energy

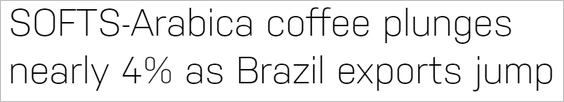

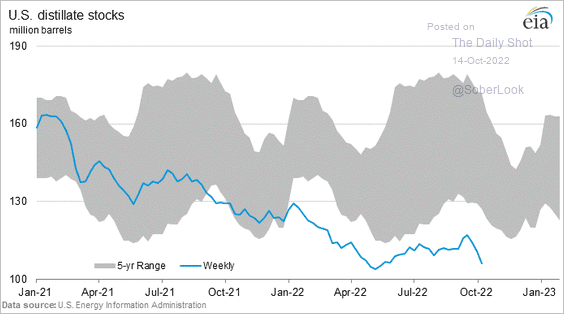

1. US diesel shortages are worsening.

• Inventory (in barrels):

• Days of supply:

Diesel crack spreads continue to widen.

——————–

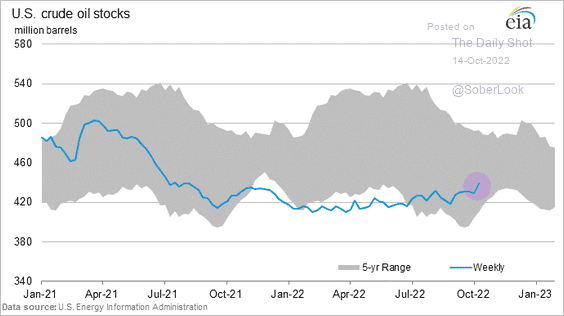

2. US oil inventories increased sharply last week.

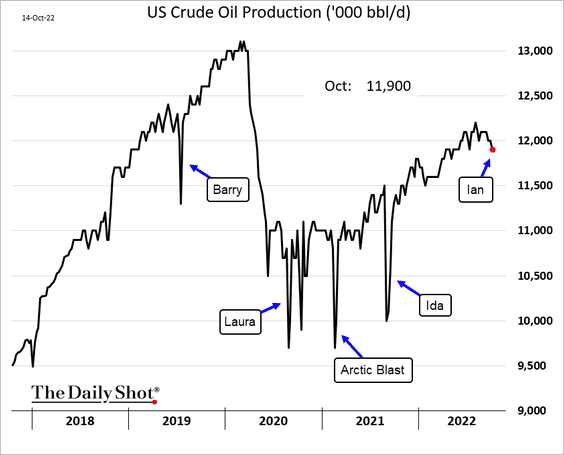

3. US oil production was lower due to Hurricane Ian.

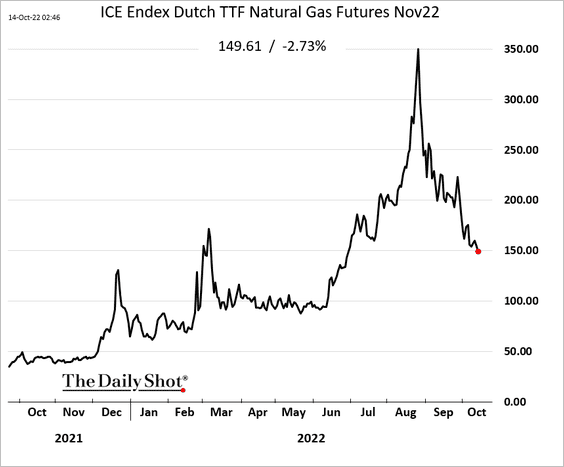

4. European natural gas prices continue to fall despite Russia’s attempts to squeeze the market.

Back to Index

Equities

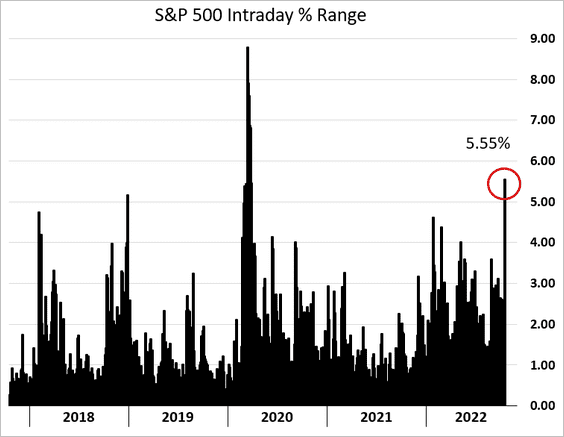

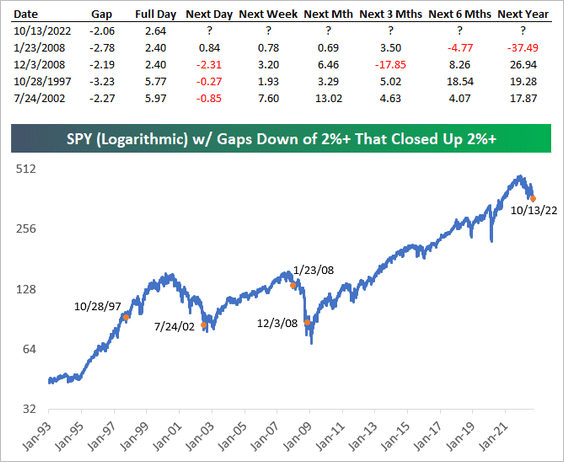

1. The intraday swing was massive on Thursday as the selloff turned into a rally amid short covering (which is likely to be short-lived).

Historically, the S&P 500 has pulled back before rallying after instances similar to yesterday.

Source: @bespokeinvest

Source: @bespokeinvest

——————–

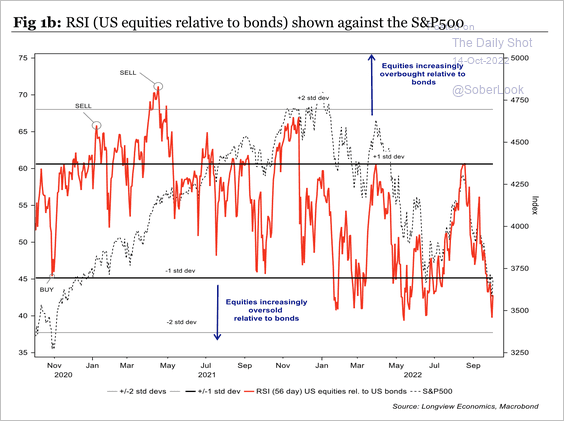

2. Stocks are oversold relative to bonds.

Source: Longview Economics

Source: Longview Economics

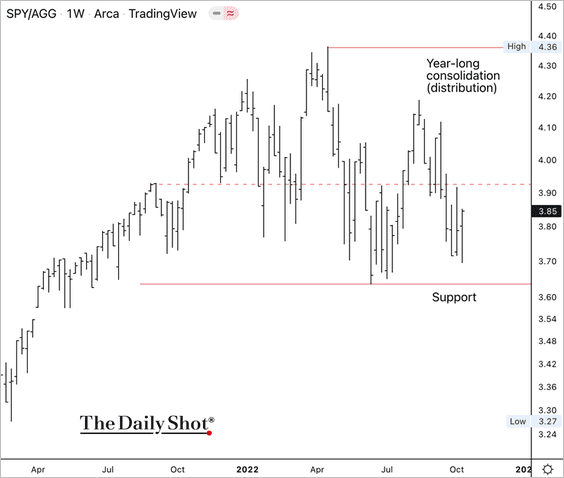

So far, the S&P 500 (SPY) is holding support relative to the US Aggregate Bond ETF (AGG), albeit within a year-long range.

——————–

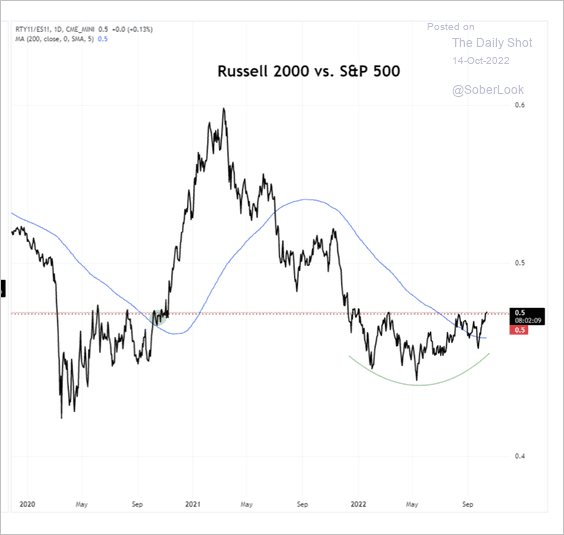

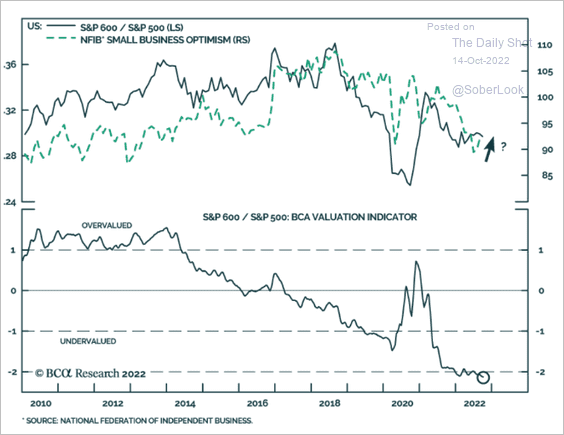

3. The Russell 2,000 small-cap index has been outperforming the S&P 500.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Small caps have been trading at significant discounts.

Source: BCA Research

Source: BCA Research

——————–

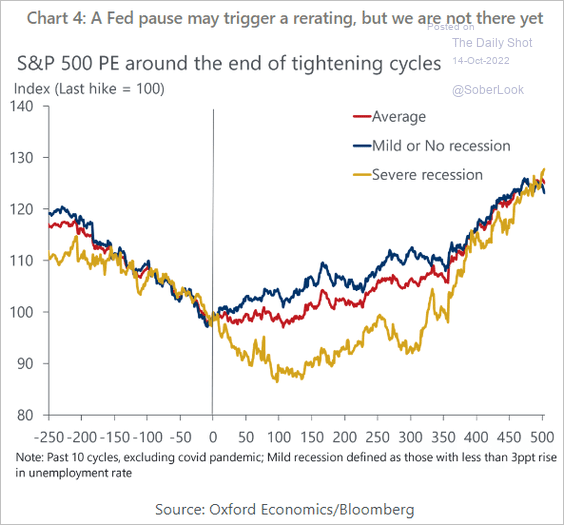

4. What happens at the end of tightening cycles? The end, of course, is months away.

Source: Oxford Economics

Source: Oxford Economics

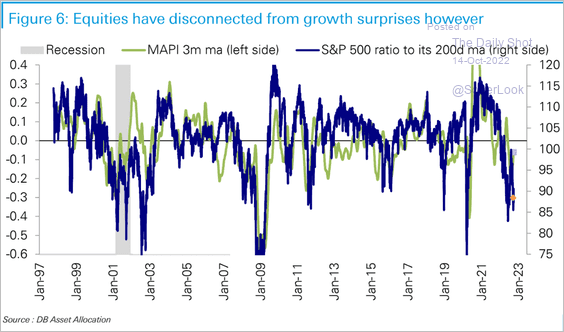

5. Stocks have decoupled from economic surprises (the market is pricing a recession).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

6. Global equity market sentiment is extremely bearish.

Source: Longview Economics

Source: Longview Economics

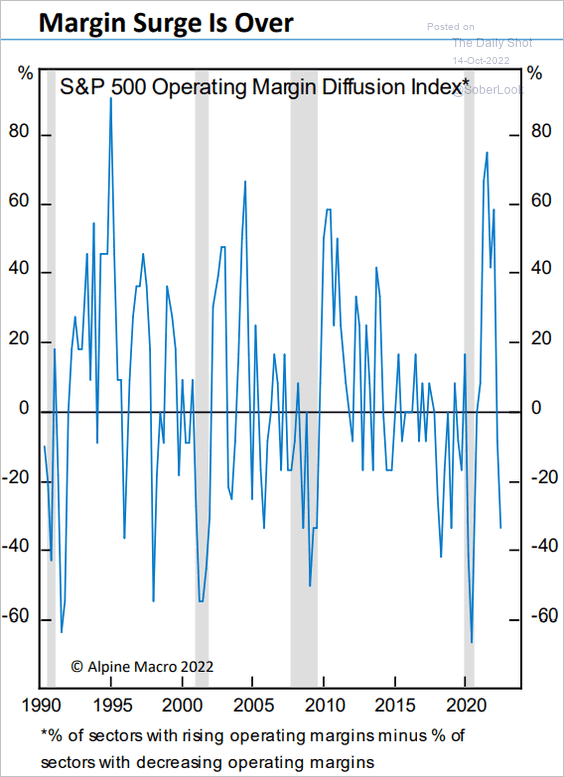

7. Profit margins are heading lower.

Source: Alpine Macro

Source: Alpine Macro

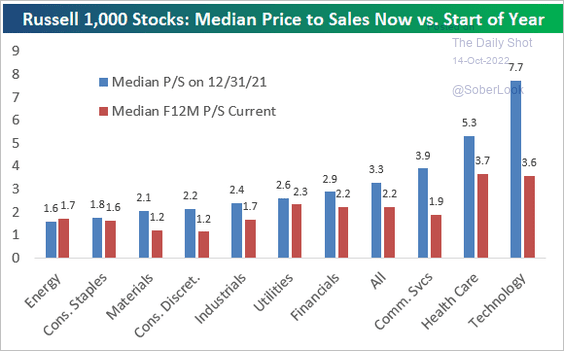

8. This chart shows large-cap price-to-sales ratio changes since the end of last year.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

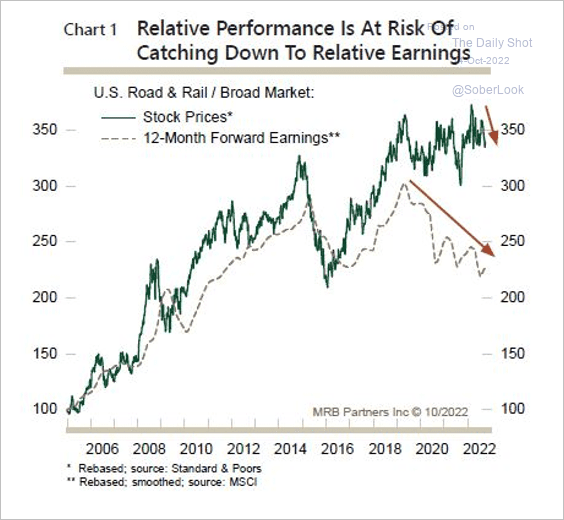

9. So far, the relative performance of US road and rail stocks has held up despite weakness in forward earnings.

Source: MRB Partners

Source: MRB Partners

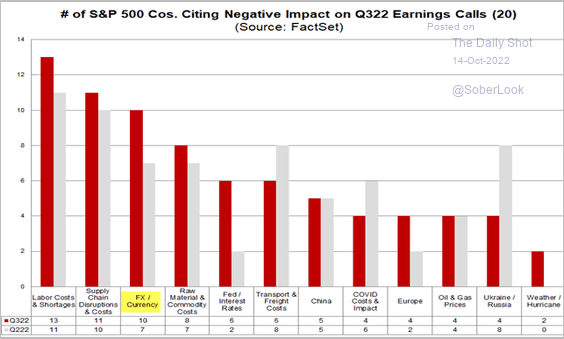

10. Which factors do companies report as having a negative impact on earnings?

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Rates

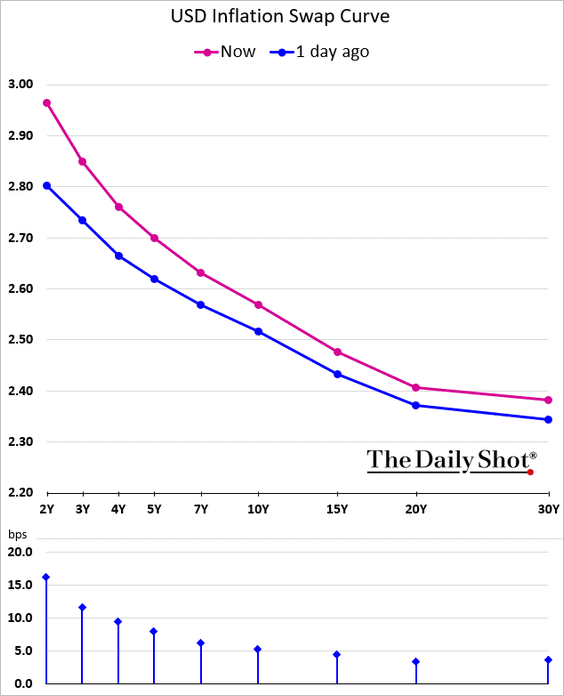

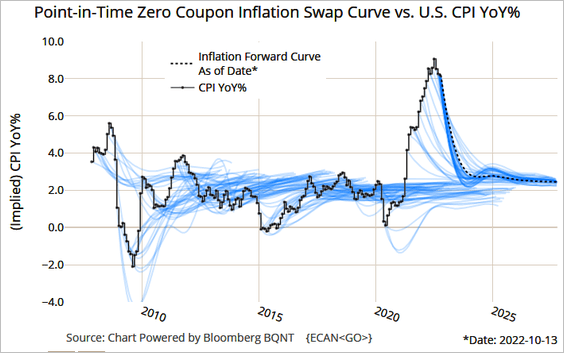

1. The US inflation curve is increasingly inverted …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

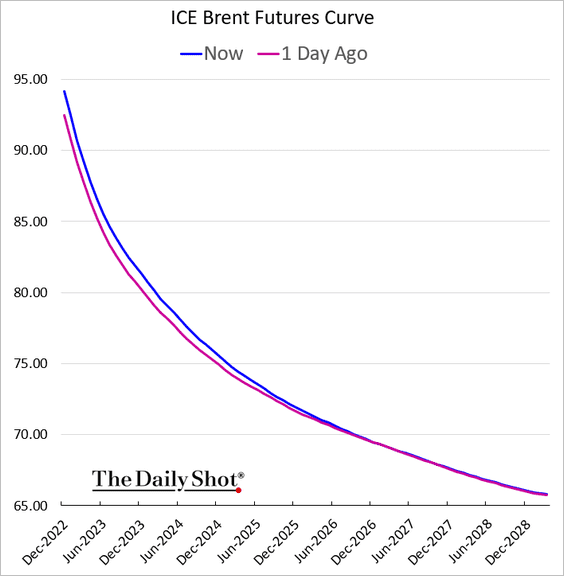

… partially driven by the oil curve backwardation.

——————–

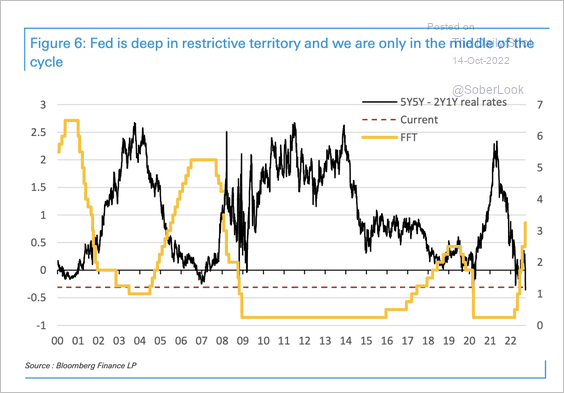

2. Typically, the real rates curve inverts around the end of a tightening cycle. This time, the market is pricing in a highly restrictive Fed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

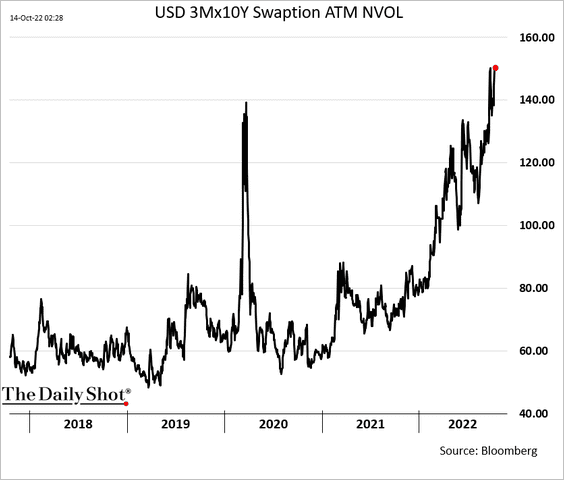

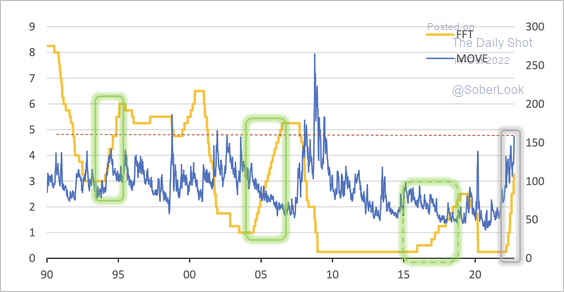

3. Rate markets implied volatility has been surging.

Treasury volatility used to decline during tightening cycles. Not anymore.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

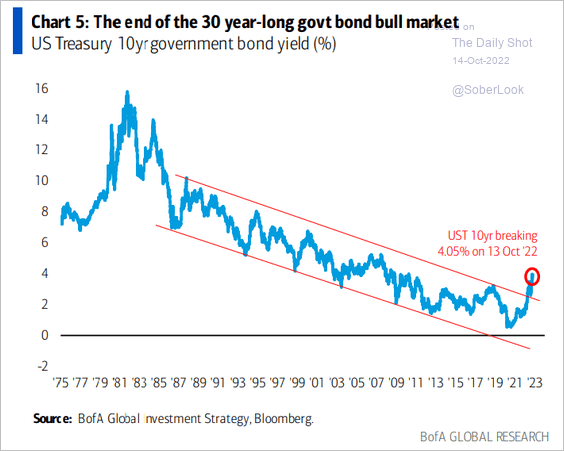

4. The 30-year bull market in government debt has ended.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

1. Cross-asset correlation surged this year.

Source: Barclays Research

Source: Barclays Research

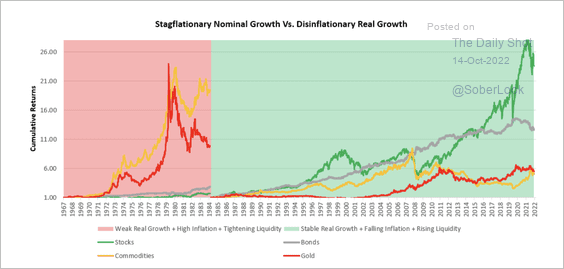

2. This chart shows asset class performance in stagflationary and disinflationary environments.

Source: Prometheus Research

Source: Prometheus Research

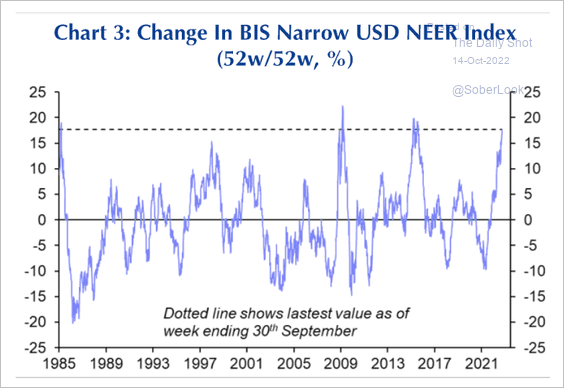

3. The pace of the dollar’s appreciation has hit record levels.

Source: Capital Economics

Source: Capital Economics

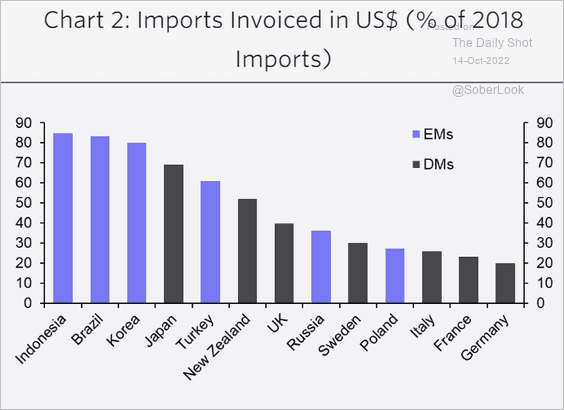

4. Which countries are most exposed to US dollar strength?

Source: Capital Economics

Source: Capital Economics

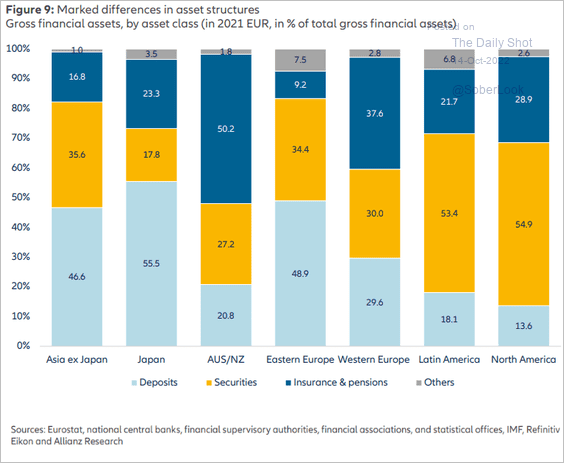

5. Next, we have the distribution of financial assets by region.

Source: Allianz Research

Source: Allianz Research

——————–

Food for Thought

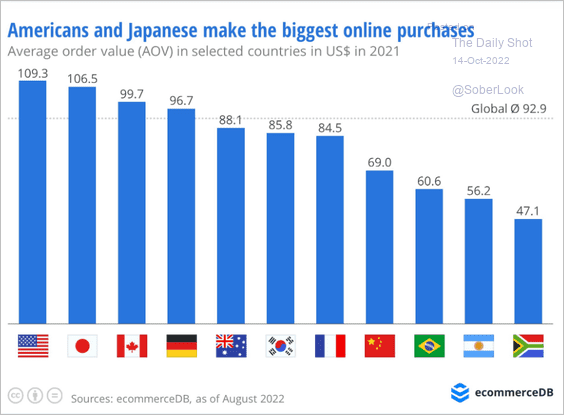

1. Average online order value:

Source: ecommerceDB

Source: ecommerceDB

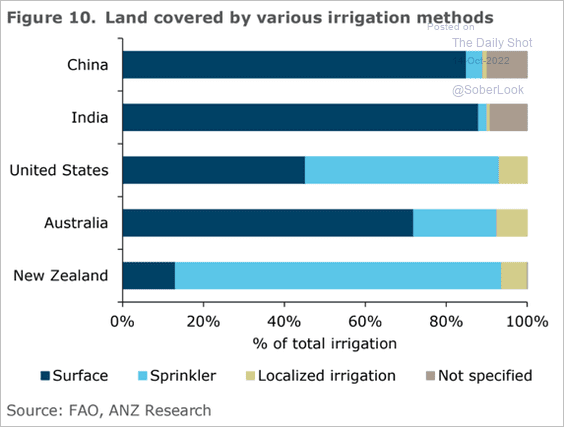

2. Water efficiency:

Source: @ANZ_Research

Source: @ANZ_Research

3. Gen-Z exercise preferences:

Source: @CivicScience

Source: @CivicScience

4. Impeachment resolutions:

Source: @axios Read full article

Source: @axios Read full article

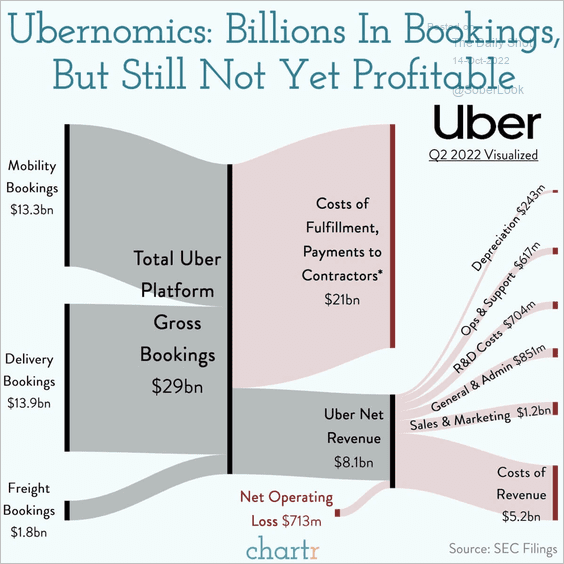

5. Uber’s second-quarter results:

Source: @chartrdaily

Source: @chartrdaily

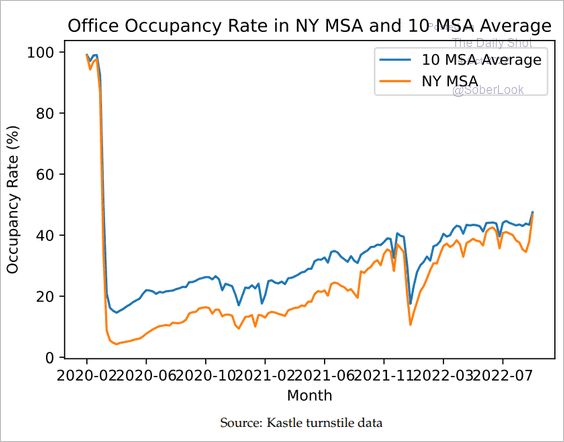

6. Physical office occupancy:

Source: NBER Read full article

Source: NBER Read full article

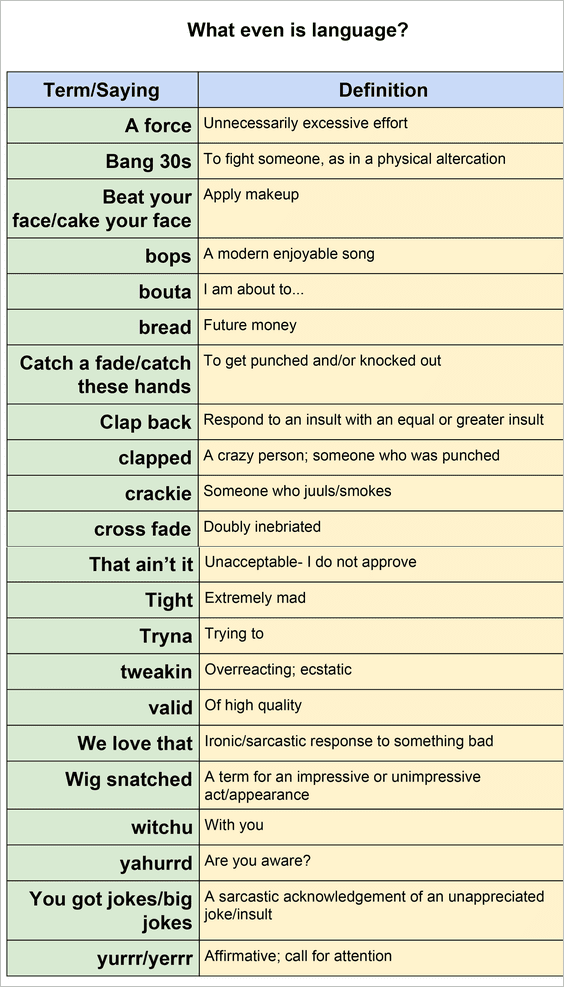

7. Gen-Z cheat sheet for teachers:

Source: James Callahan Read full article

Source: James Callahan Read full article

——————–

Have a great weekend!

Back to Index