The Daily Shot: 17-Oct-22

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

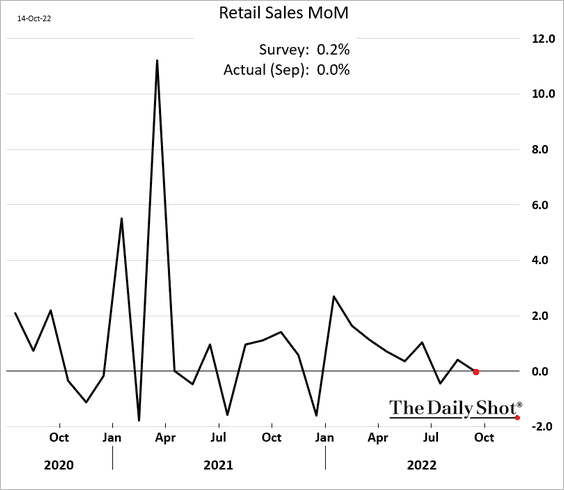

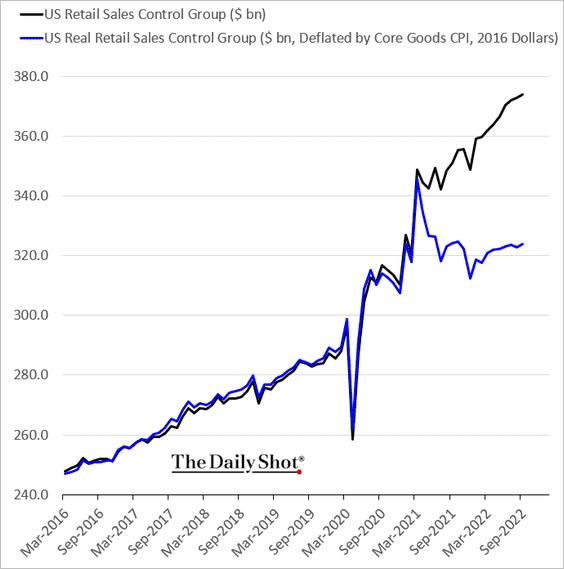

1. Nominal retail sales were flat last month.

Source: CNBC Read full article

Source: CNBC Read full article

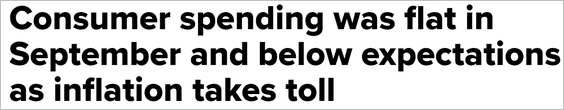

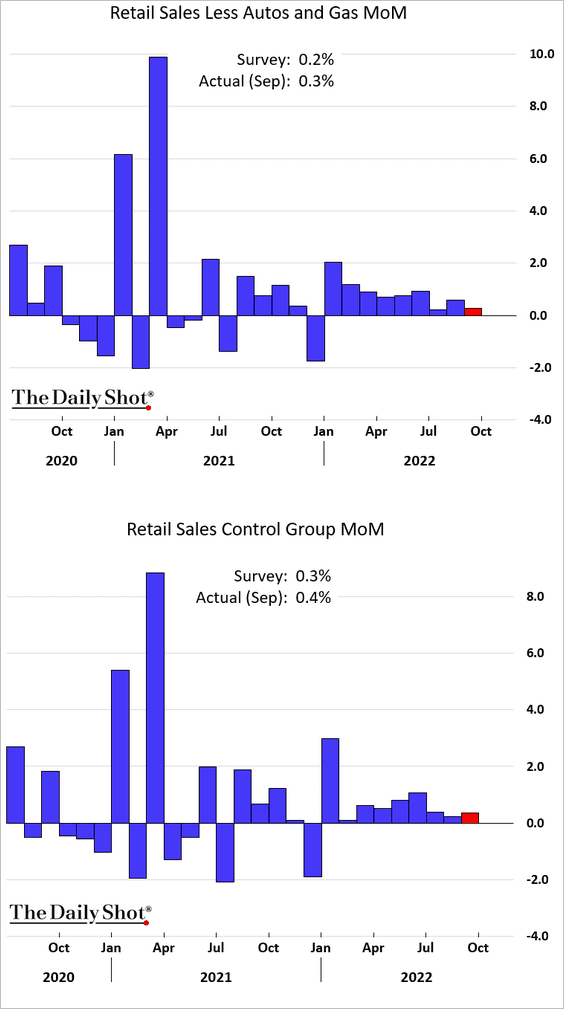

However, excluding autos and gasoline, retail sales continued to grow. The second panel shows the control group (“core”) sales.

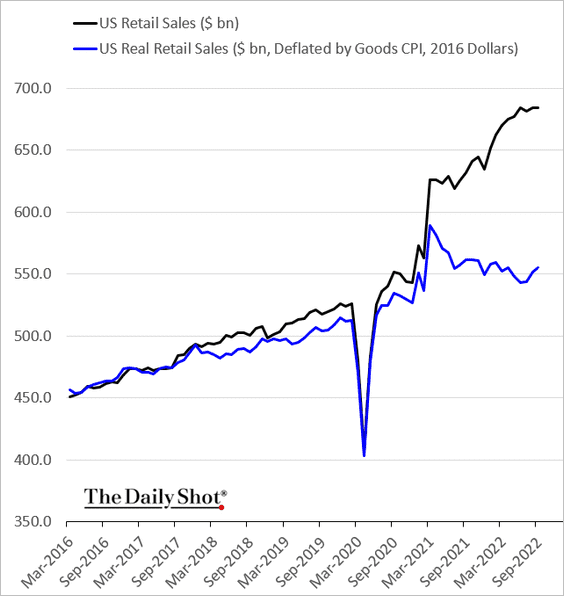

• In real terms, retail sales were also higher in September. Despite depressed sentiment and high inflation, consumers are spending.

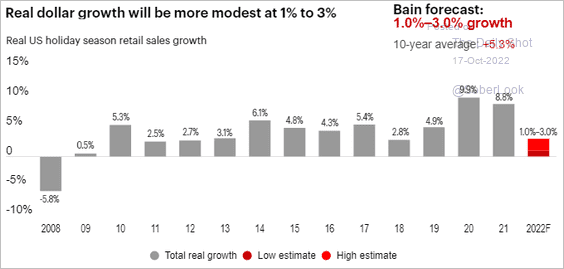

• Bain expects growth in holiday spending to moderate but remain positive this year.

Source: Bain & Company

Source: Bain & Company

——————–

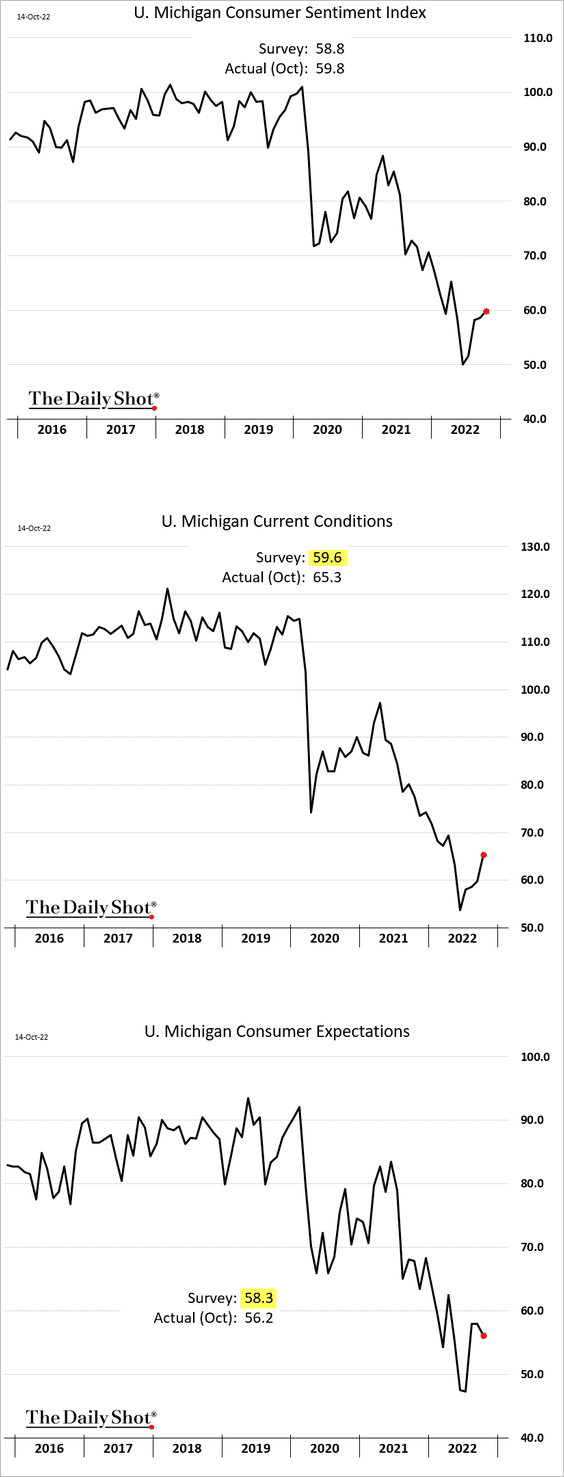

2. The U. Michigan consumer sentiment index edged higher this month, boosted by the current conditions indicator. Expectations dipped.

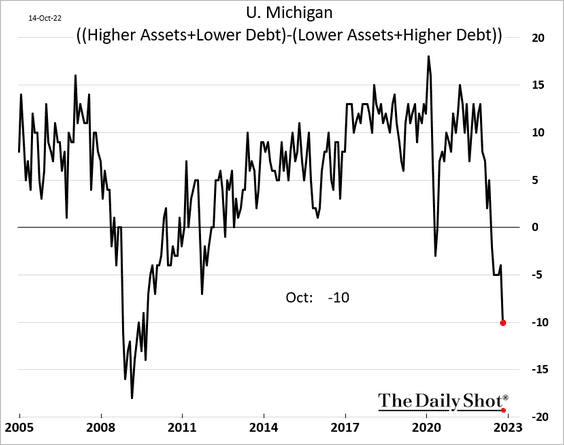

• Declining stock prices are taking a toll.

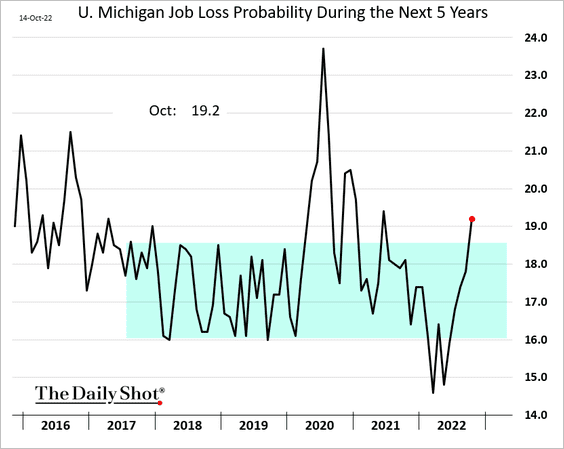

• There is more nervousness about the job market over the next five years.

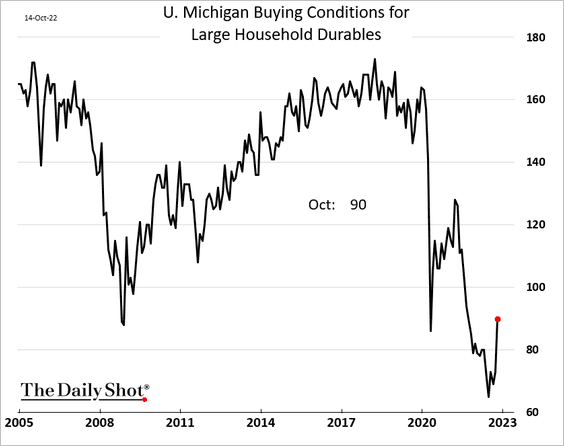

• But buying conditions for durables improved.

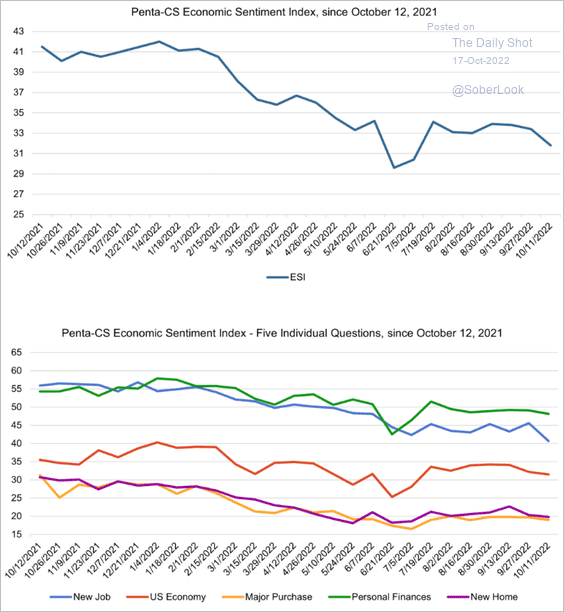

• A separate report (Penta-CS) showed softening consumer sentiment this month.

Source: @CS_Penta, @Pentagrp, @CivicScience

Source: @CS_Penta, @Pentagrp, @CivicScience

——————–

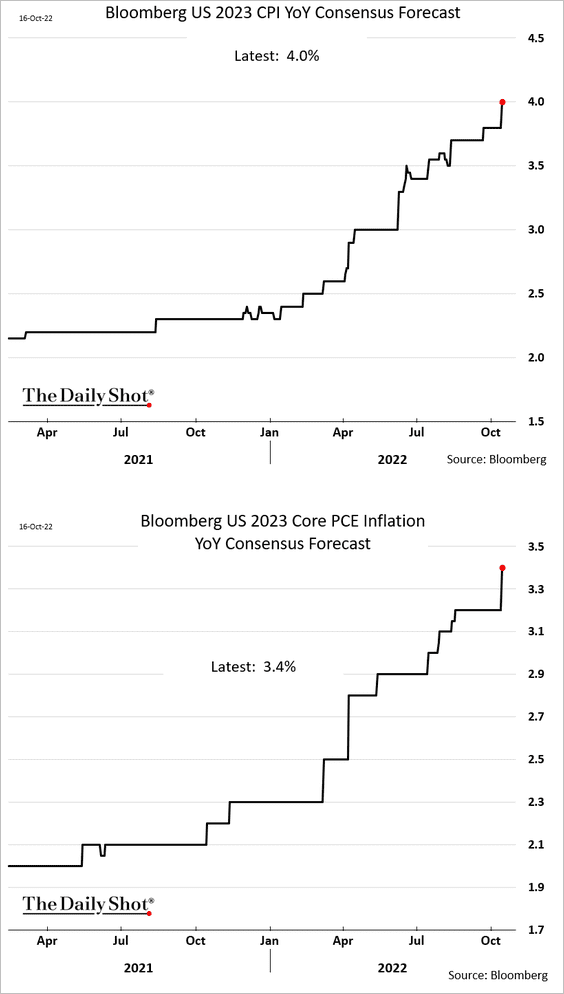

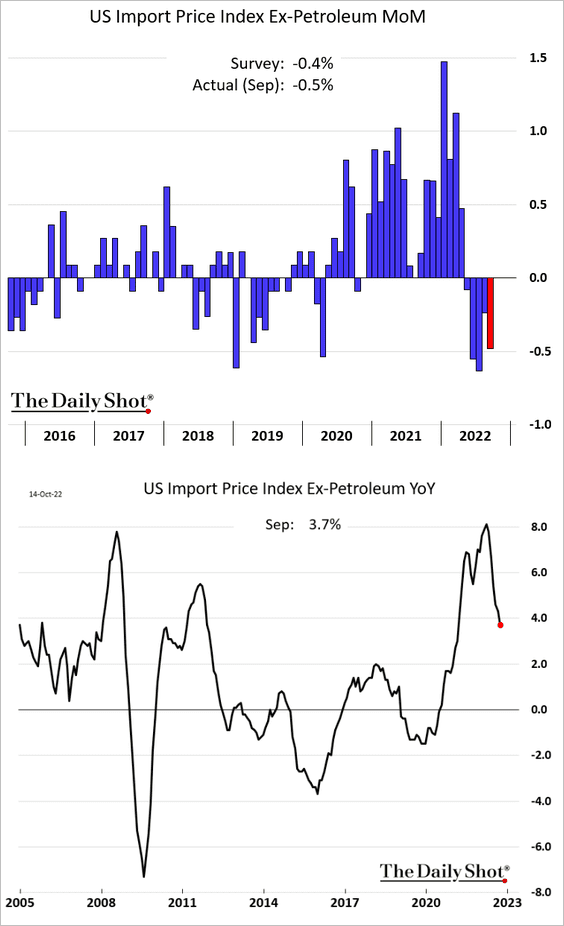

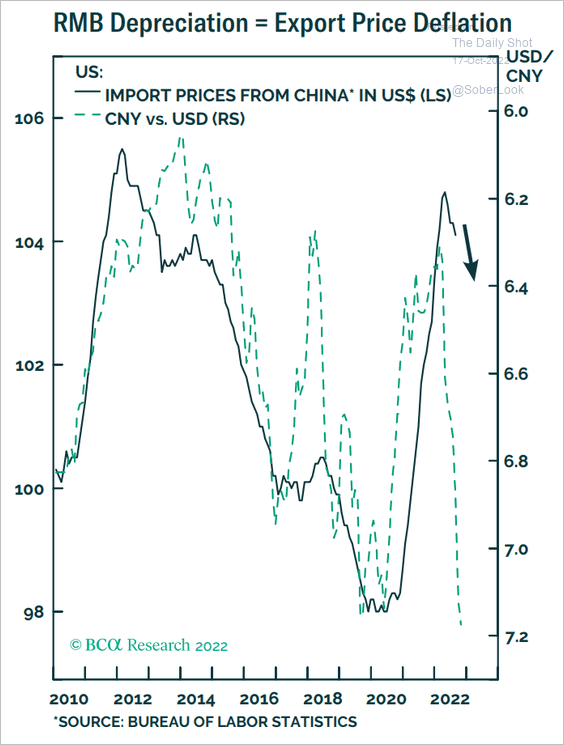

3. Next, we have some updates on inflation.

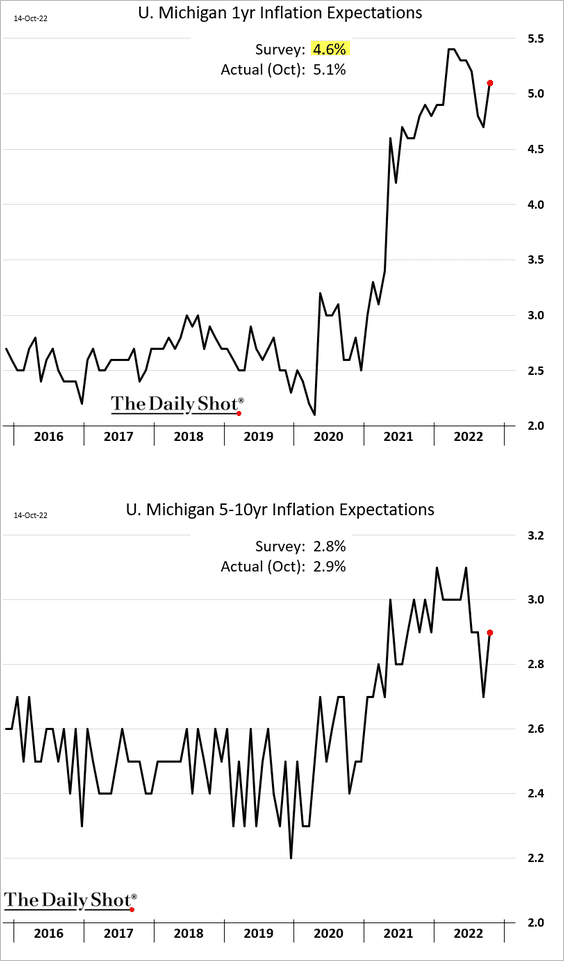

• Inflation expectations moved higher with gasoline prices this month.

• Economists keep boosting their inflation forecasts for 2023.

• Import prices continue to ease due to the US dollar strength and disinflationary trends in China.

And there is more price moderation ahead.

Source: BCA Research

Source: BCA Research

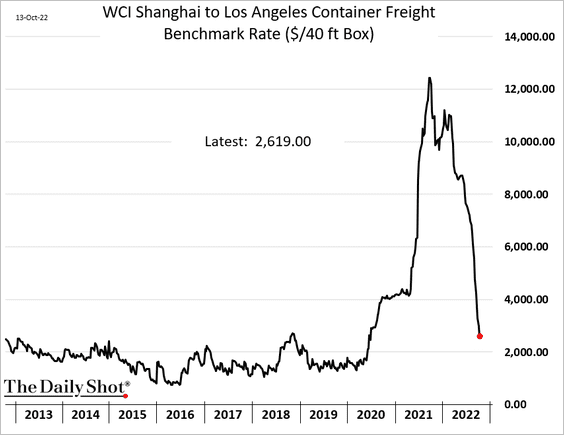

• Here is the Oxford Economics supply chain stress tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

– Container freight rates continue to fall.

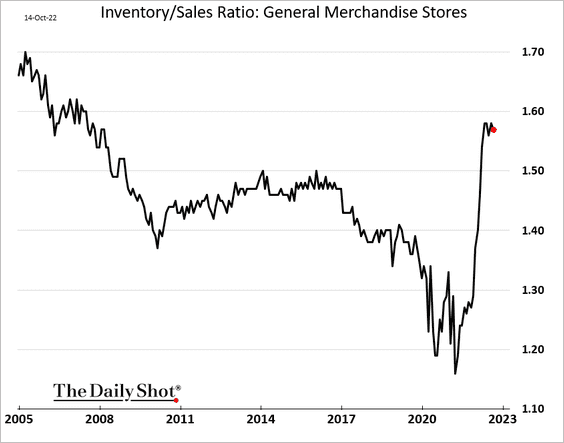

– Retail inventories remain elevated.

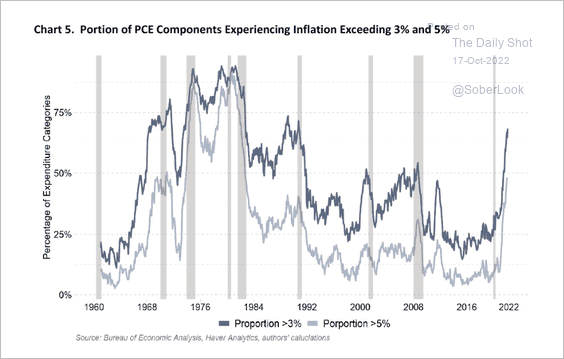

• Inflation has been broad, similar to the 1970s.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

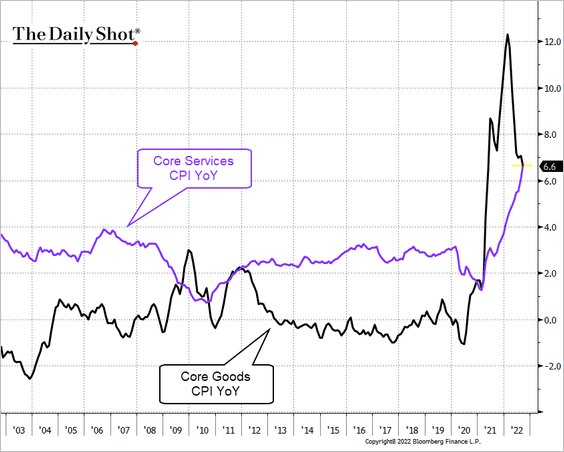

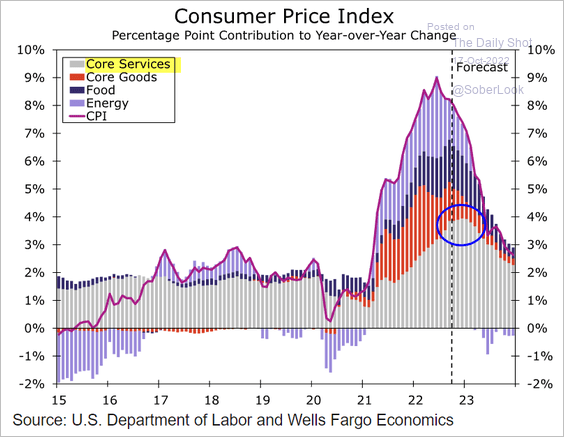

• Core services price gains caught up with core goods inflation.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

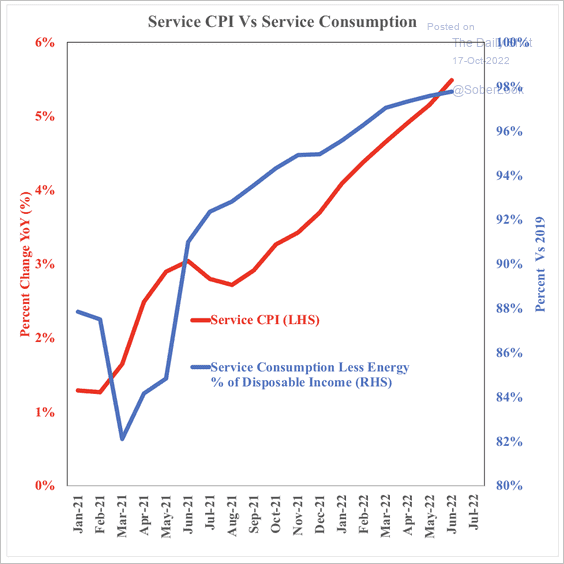

High service prices are starting to weigh on services consumption.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

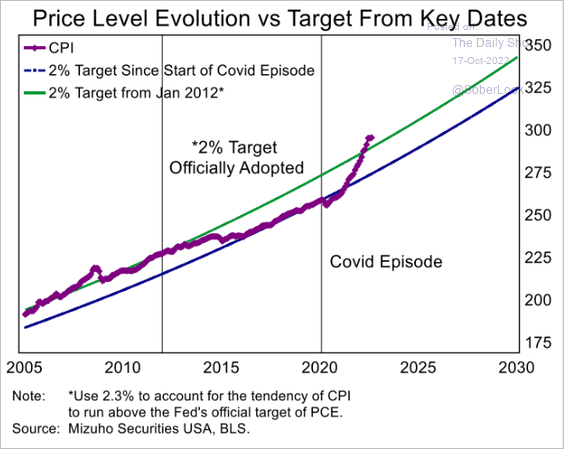

• Here is the CPI price index vs. the Fed’s 2% target.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

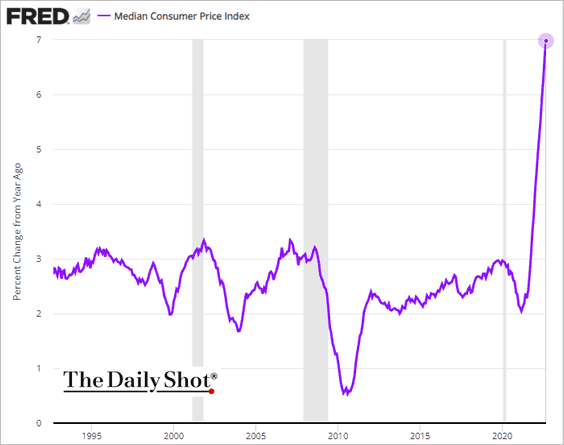

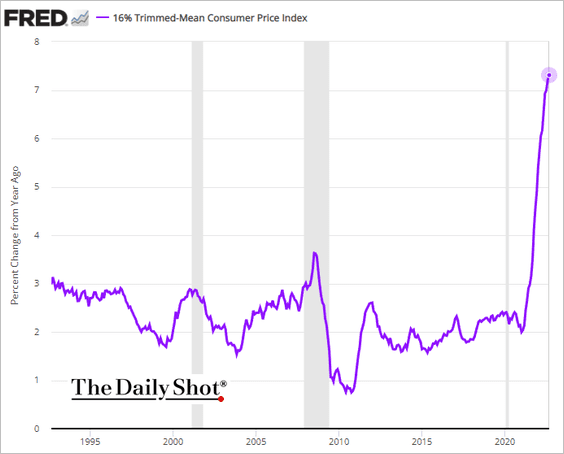

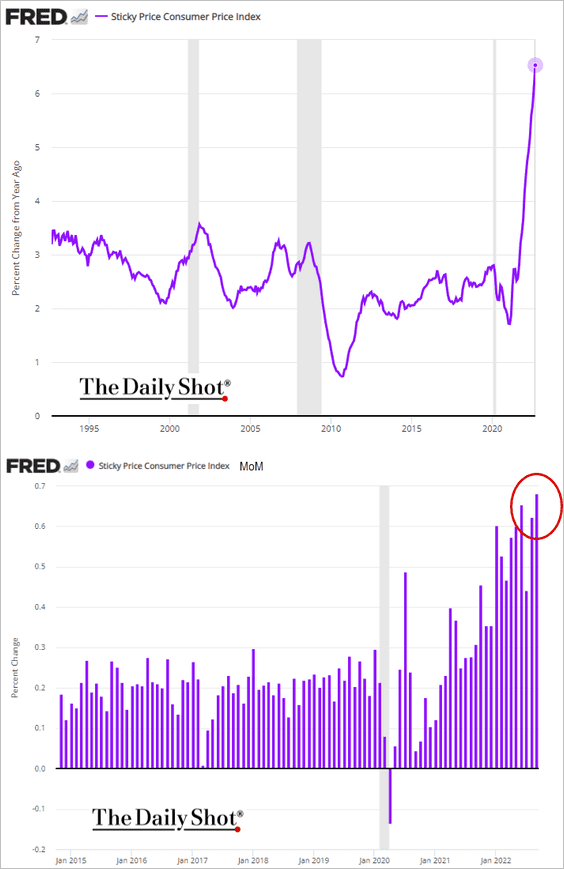

• Alternative core inflation measures showed broad price pressures persisting last month.

– Median CPI:

– Trimmed-mean CPI:

– Sticky CPI:

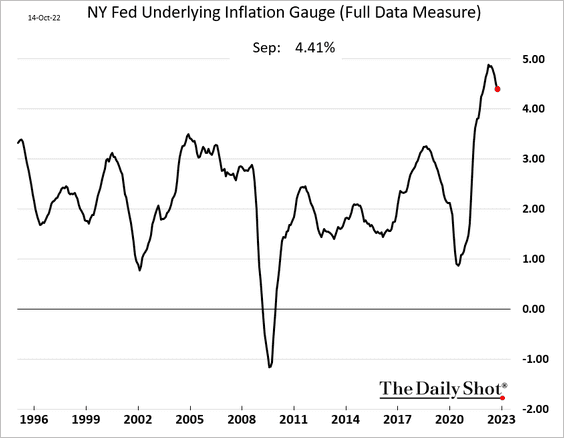

• The NY Fed’s UIG index appears to have peaked.

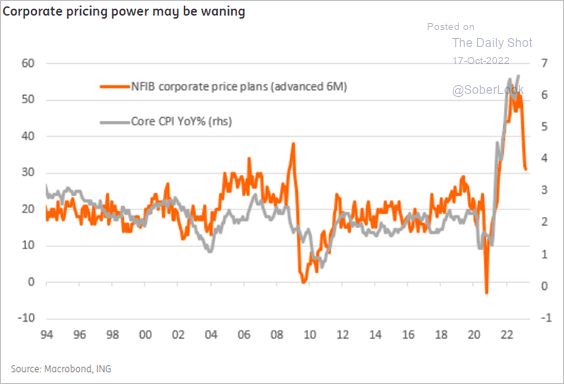

• Are companies losing pricing power?

Source: ING

Source: ING

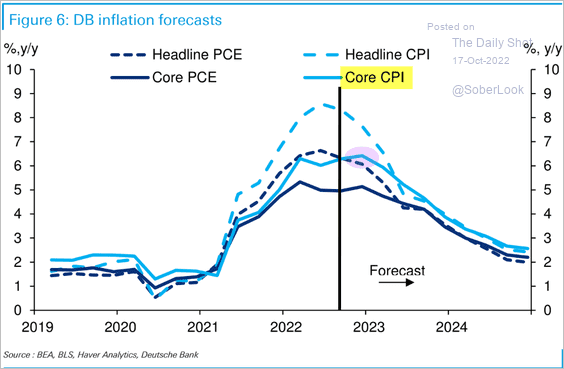

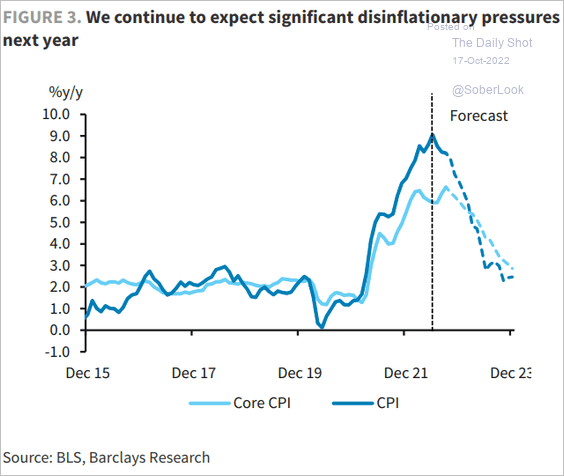

• Finally, we have some forecasts showing that inflation will slow next year, but the core CPI (particularly services) is yet to peak.

– Deutsche Bank:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Barclays:

Source: Barclays Research

Source: Barclays Research

– Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

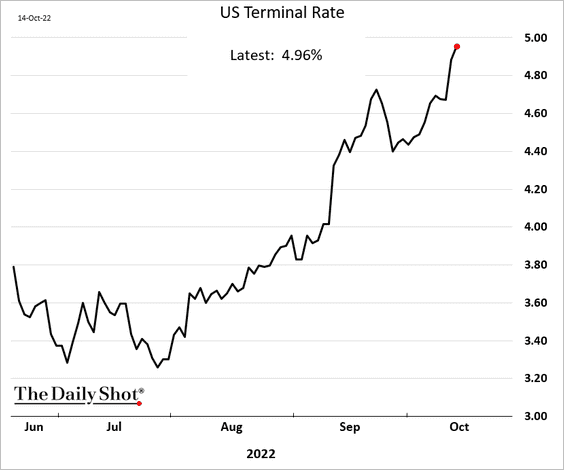

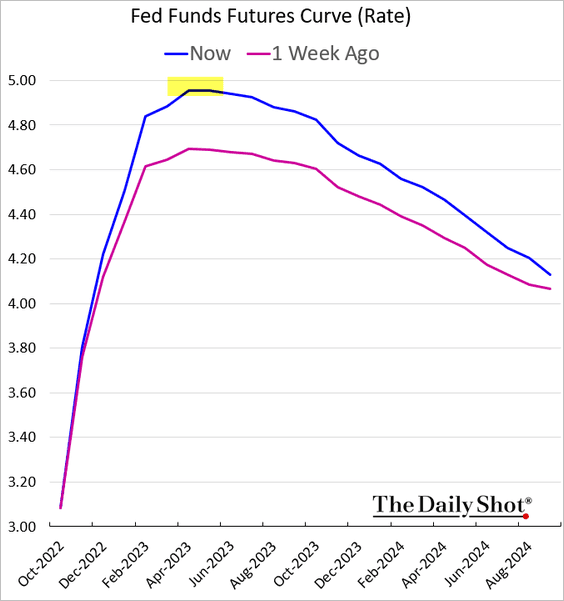

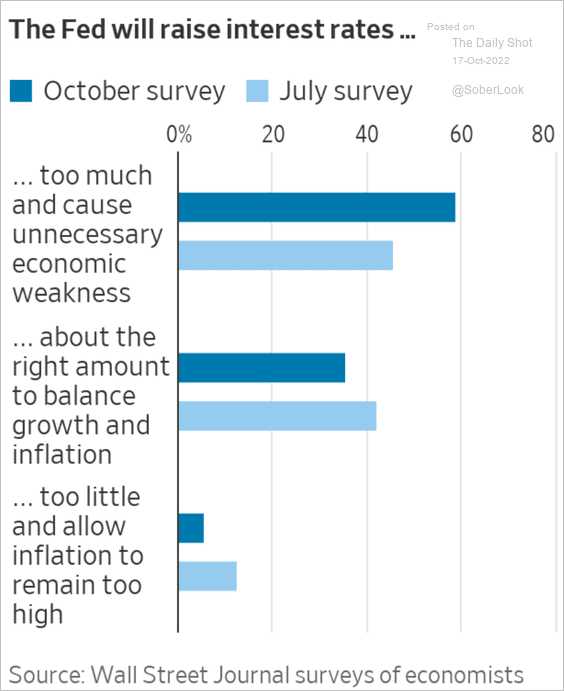

4. The terminal rate is nearing 5%.

A policy mistake?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

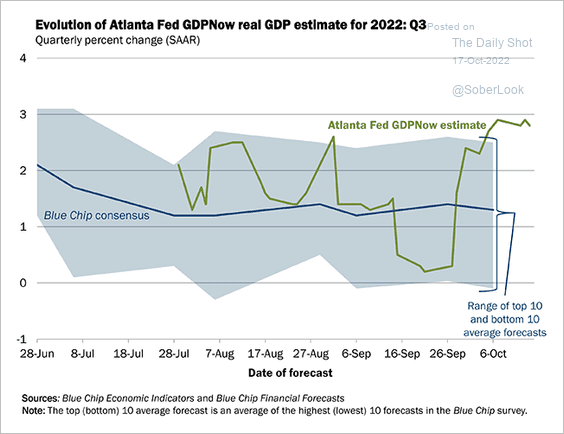

5. Next, we have some updates on economic growth.

• The GDPNow Q3 growth estimate is near 3% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

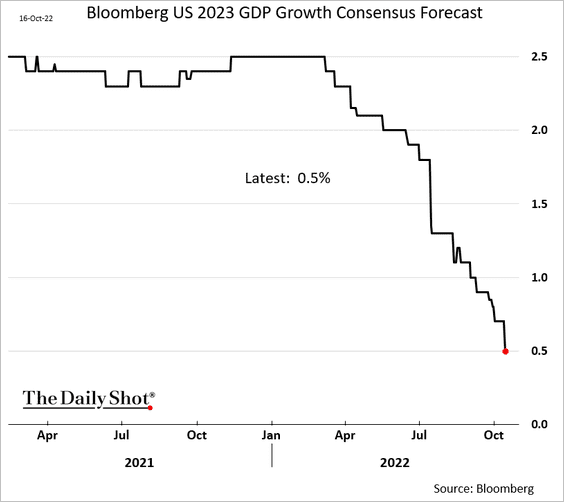

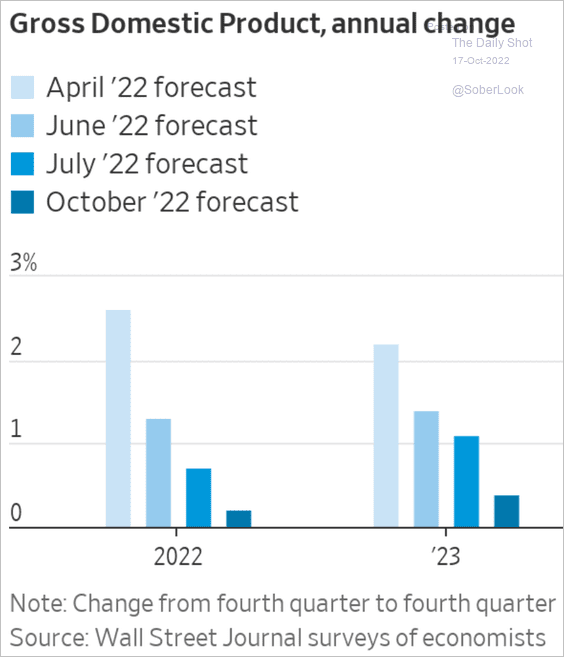

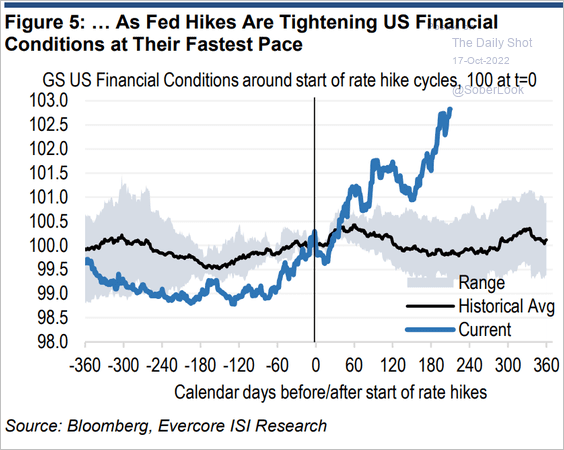

• Economists continue to downgrade next year’s GDP growth (2 charts), …

Source: @WSJ Read full article

Source: @WSJ Read full article

… as financial conditions tighten.

Source: Evercore ISI Research

Source: Evercore ISI Research

• Recession probability is rising.

Source: @WSJ Read full article

Source: @WSJ Read full article

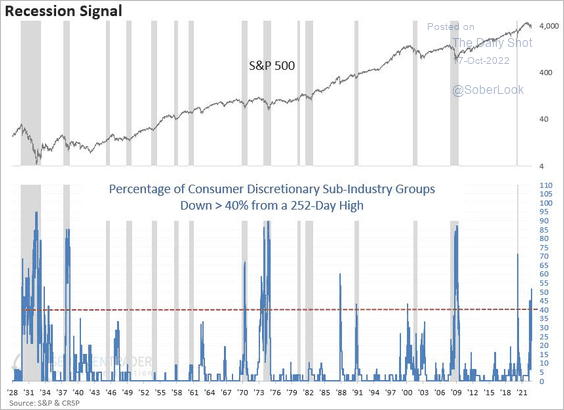

{*) The stock market has been signaling recession.

– The recent sell-off within consumer discretionary sub-industry groups is consistent with previous recession periods.

Source: SentimenTrader

Source: SentimenTrader

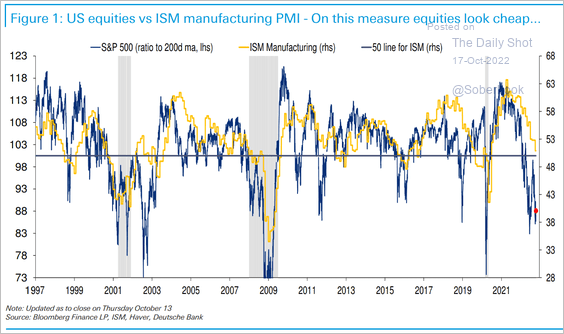

– The S&P 500 deviation from its 200-day moving average also suggests weakness in economic activity.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

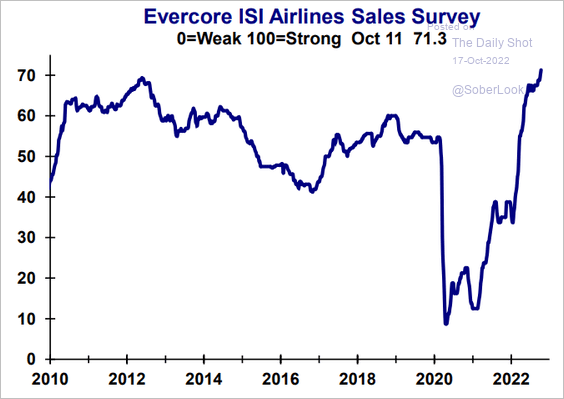

6. Airlines continue to see strong demand.

Source: Evercore ISI Research

Source: Evercore ISI Research

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Canada

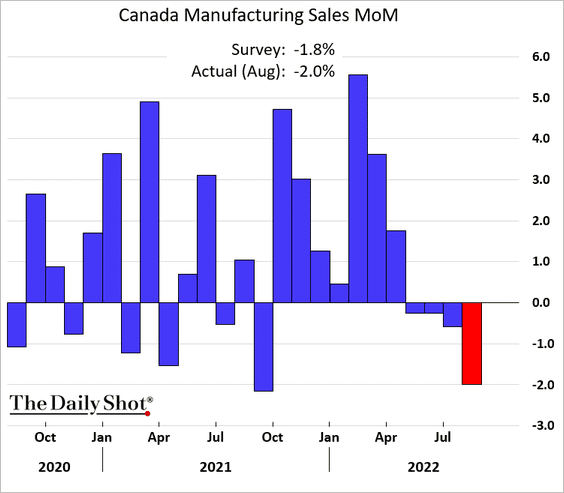

1. Manufacturing sales slumped in August.

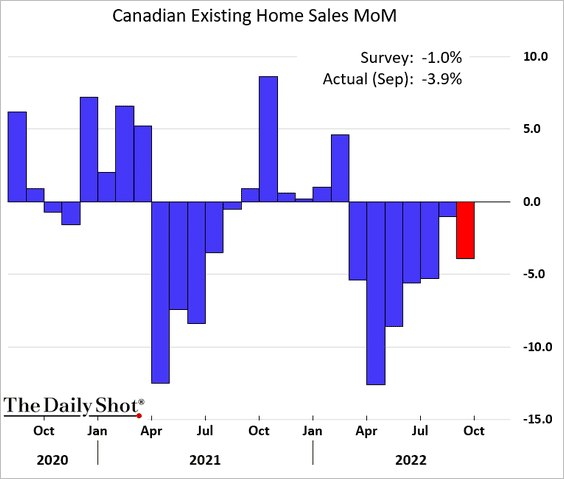

2. Existing home sales are down for seven months in a row.

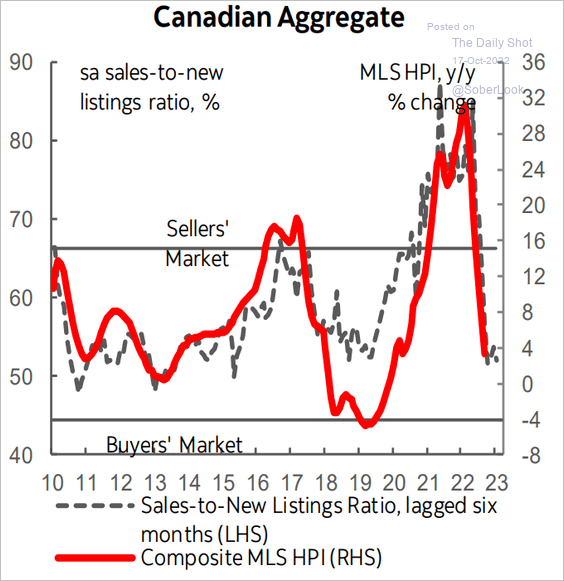

The housing market is struggling (the red line shows home price appreciation).

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

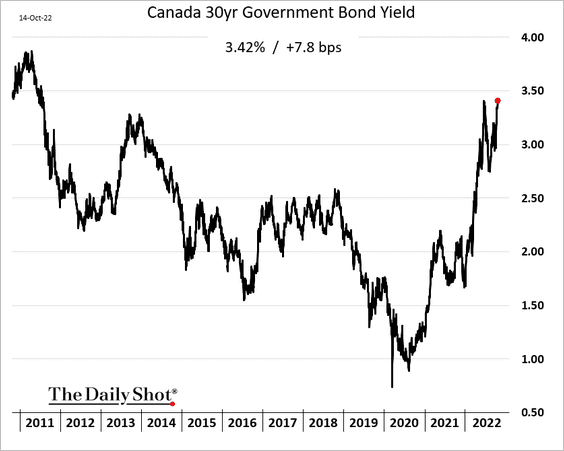

3. The 30yr bond yield hit the highest level in over a decade.

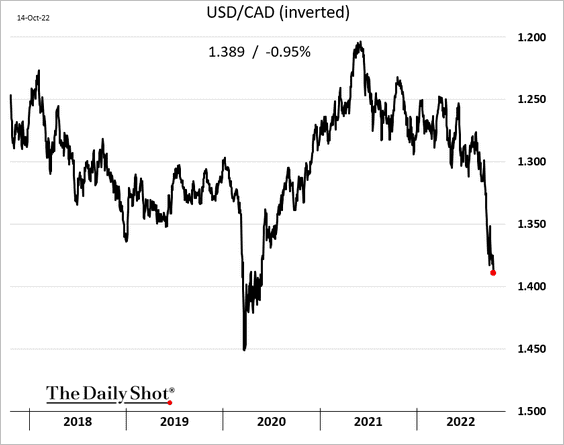

The loonie continues to move lower vs. USD.

Back to Index

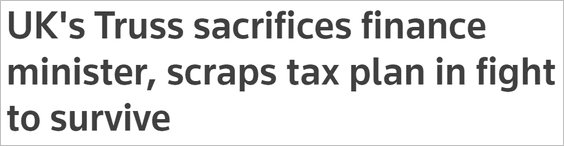

The United Kingdom

1. The government’s actions appear to be increasingly desperate.

Source: Reuters Read full article

Source: Reuters Read full article

Source: The Economist Read full article

Source: The Economist Read full article

——————–

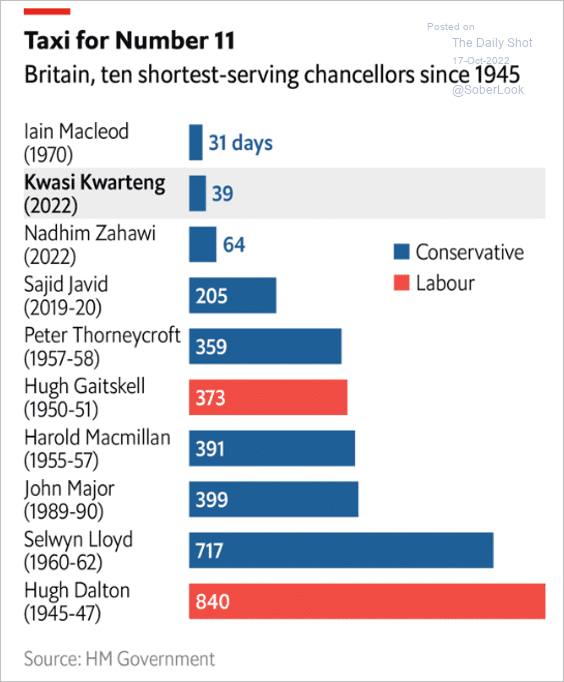

2. The drawdown in long-term gilts has been spectacular.

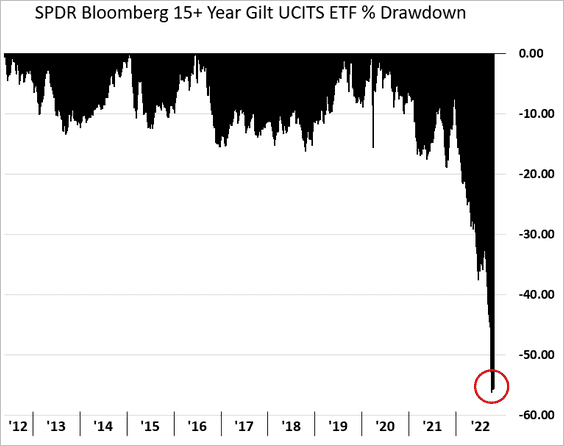

3. The price-to-income ratio suggests that the UK housing market is overpriced, …

Source: Longview Economics

Source: Longview Economics

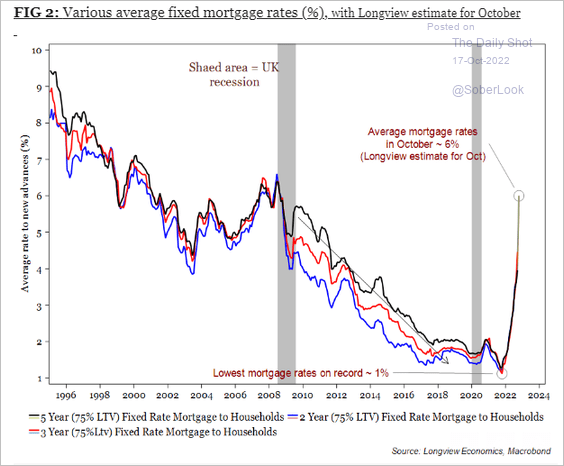

… while mortgage rates are climbing. This chart shows a forecast from Longview Economics.

Source: Longview Economics

Source: Longview Economics

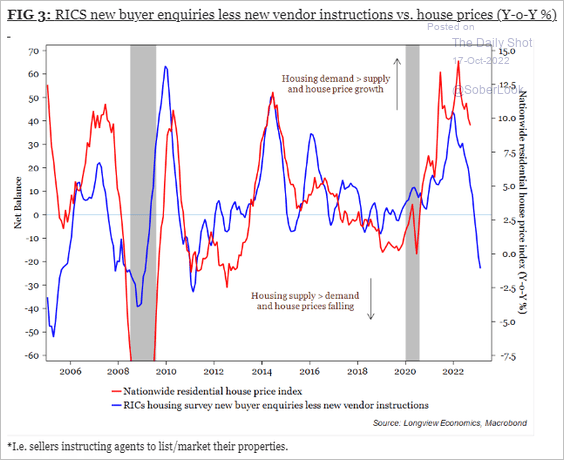

Home prices are likely to come under pressure in the months ahead.

Source: Longview Economics

Source: Longview Economics

——————–

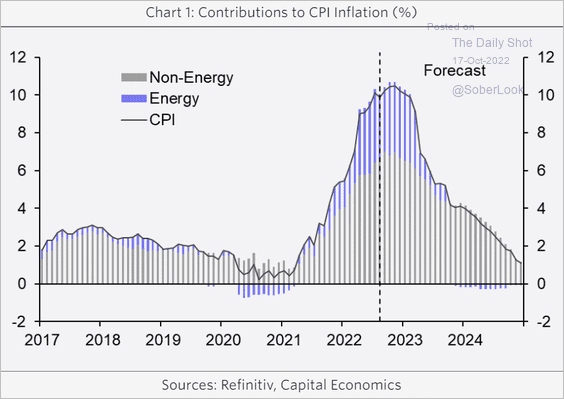

4. Inflation is yet to peak.

Source: Capital Economics

Source: Capital Economics

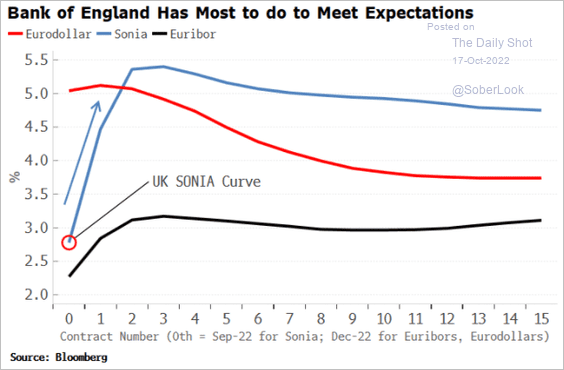

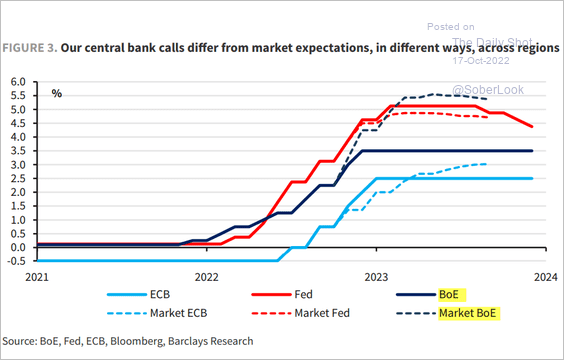

5. The BoE has a long way to go in hiking rates to meet market expectations.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Is the market too hawkish? Here is a forecast from Barclays.

Source: Barclays Research

Source: Barclays Research

Back to Index

Europe

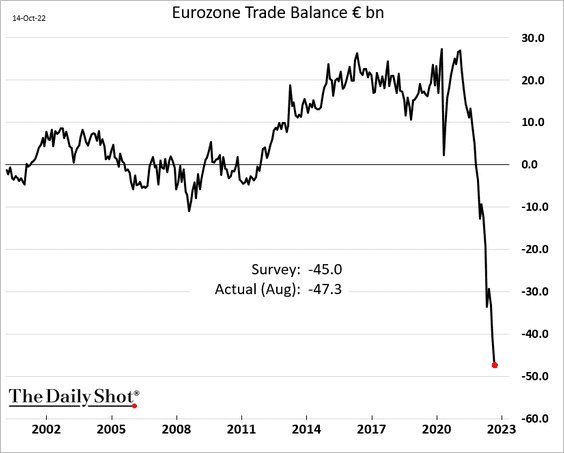

1. The trade deficit is hitting unprecedented levels.

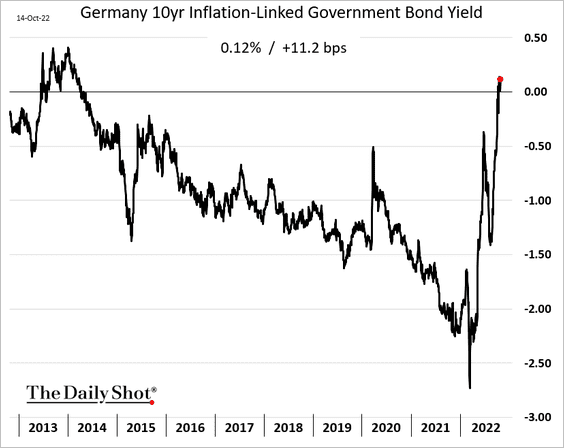

2. Germany’s 10yr inflation-linked bond yield is in positive territory for the first time since 2013.

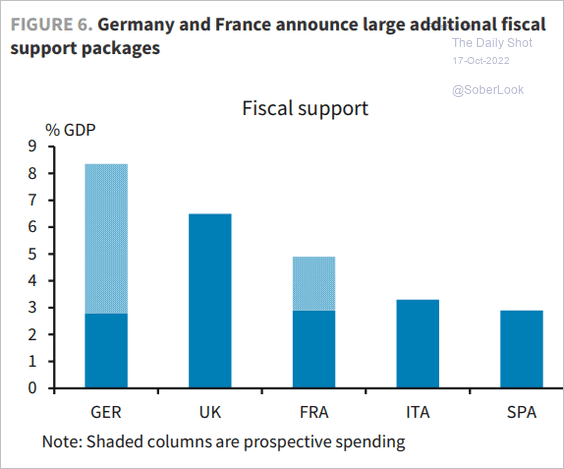

3. How much fiscal support are the largest economies getting?

Source: Barclays Research

Source: Barclays Research

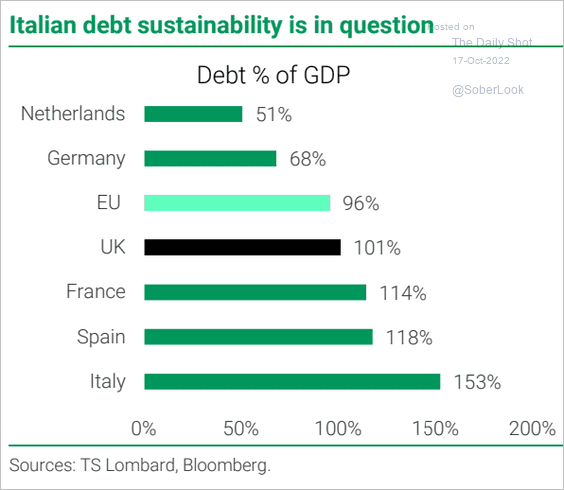

4. This chart shows debt-to-GDP ratios for Western Europe’s largest economies.

Source: TS Lombard

Source: TS Lombard

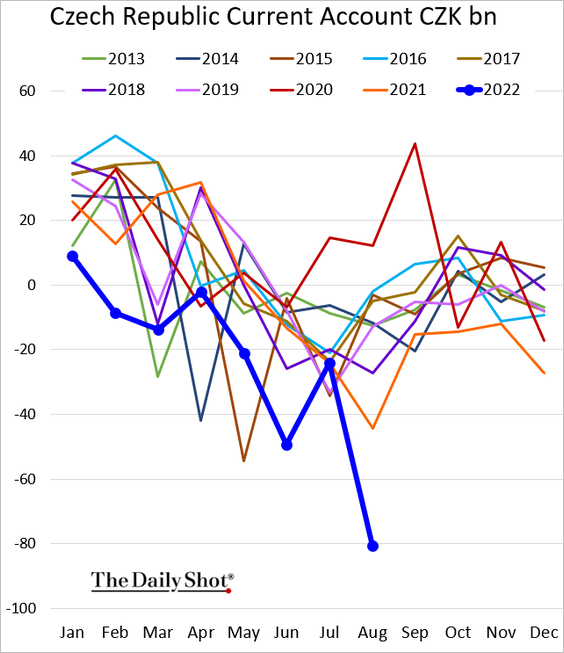

5. The Czech current account deficit has blown out.

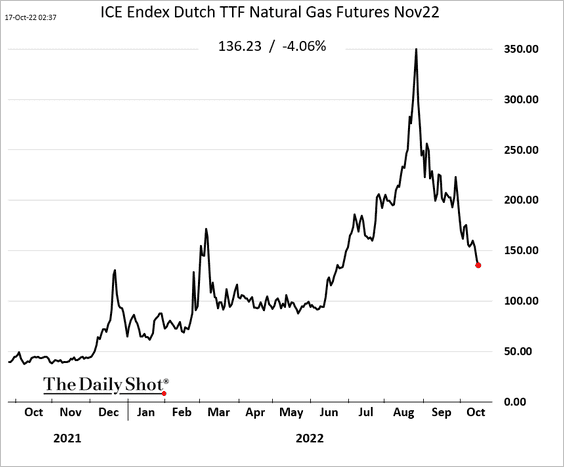

6. There is some good news on the energy front. Natural gas prices continue to ease as demand softens and storage fills up.

Back to Index

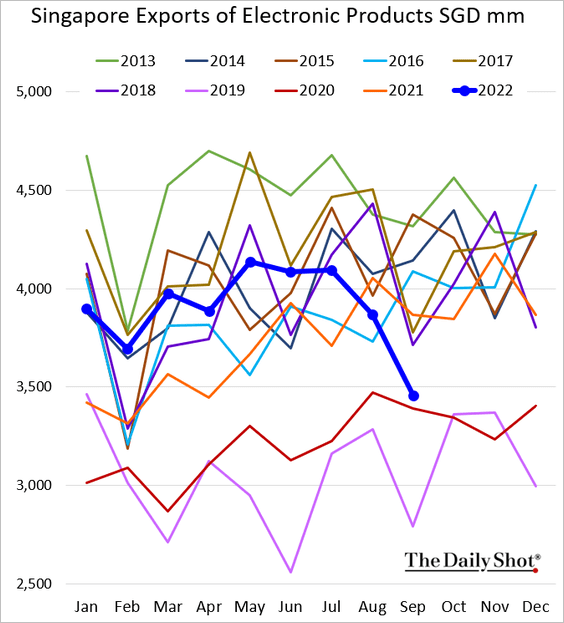

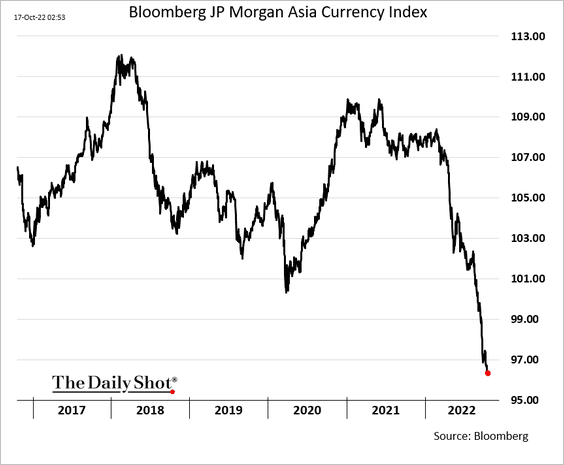

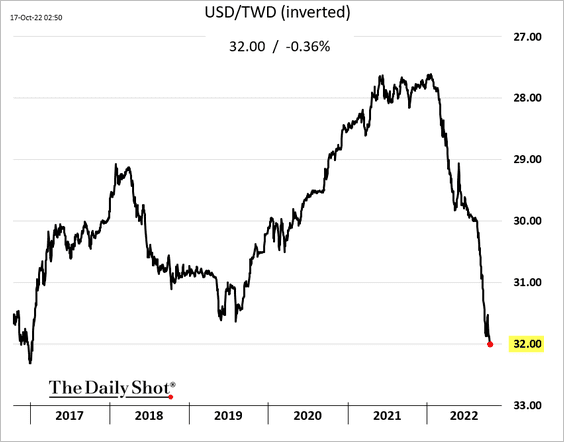

Asia – Pacific

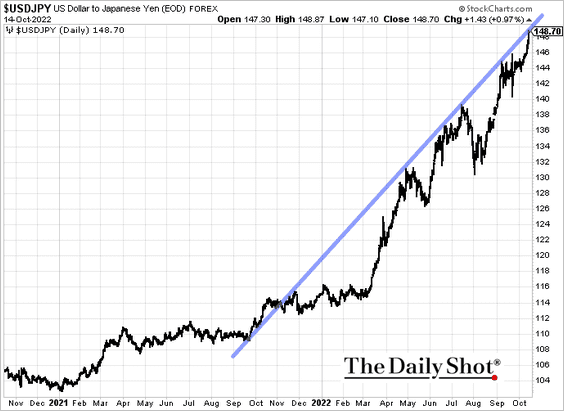

1. The yen continues to weaken vs. the dollar, with USD/JPY now testing the uptrend resistance.

2. This doesn’t look good …

3. Asian currencies remain under pressure.

Here is the Taiwan dollar.

Back to Index

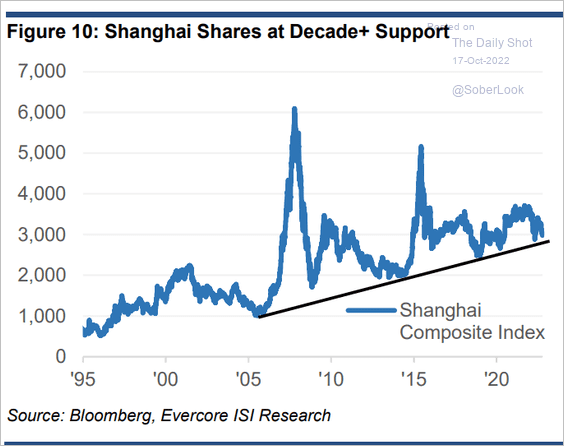

China

1. The Shanghai Composite is testing long-term support.

Source: Evercore ISI Research

Source: Evercore ISI Research

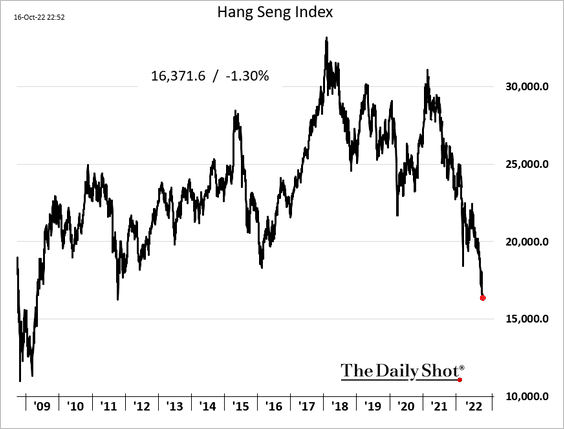

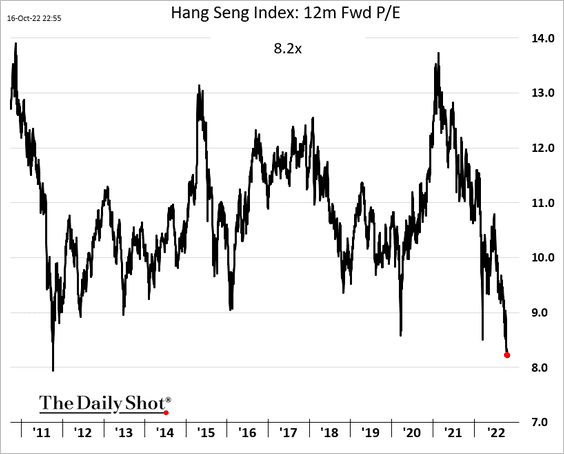

The selloff in Hong Kong continues. Is it overdone?

Hong Kong stocks haven’t been this cheap in over a decade.

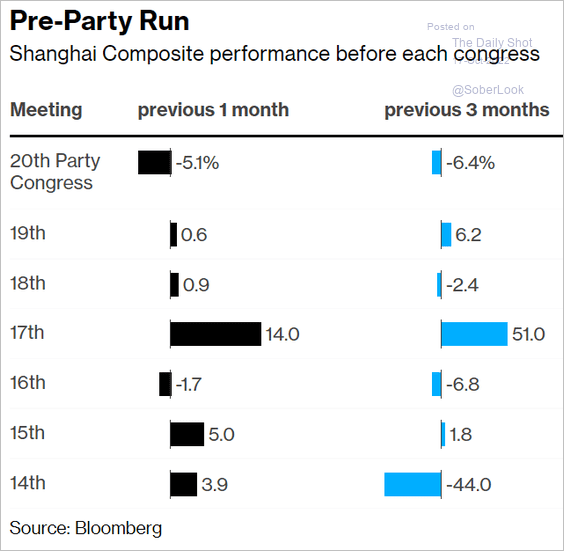

Stock market weakness is unusual going into the Party Congress

Source: @markets Read full article

Source: @markets Read full article

——————–

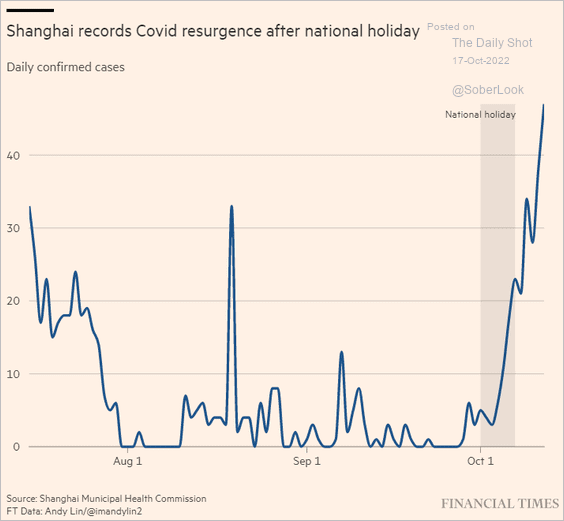

2. COVID cases have picked up in Shanghai.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

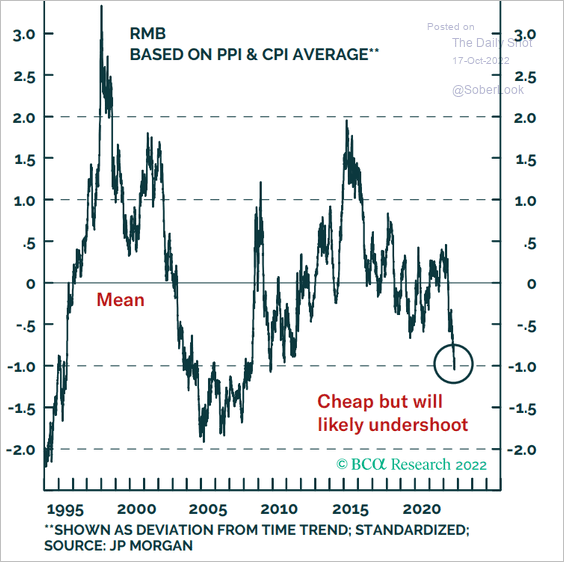

3. Is the renminbi oversold?

Source: BCA Research

Source: BCA Research

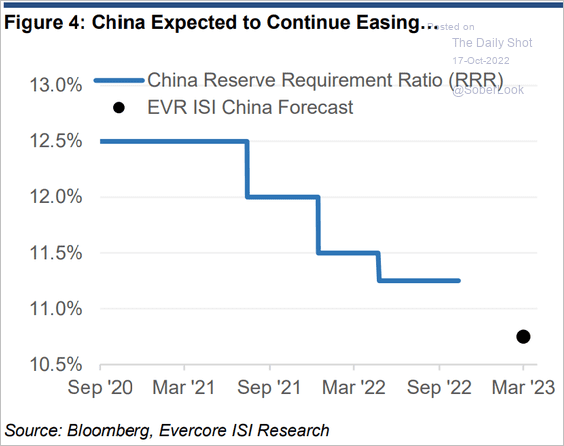

4. More monetary policy easing ahead? Here is a forecast from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

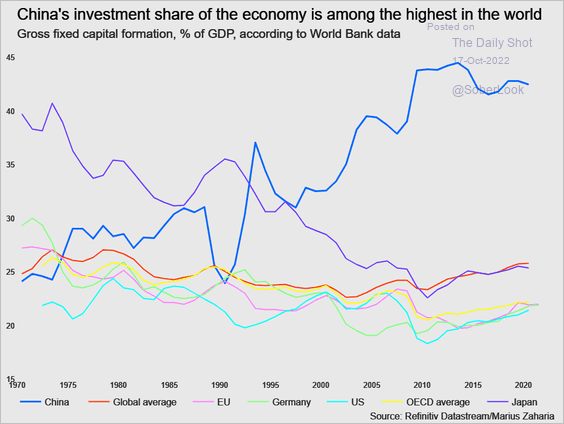

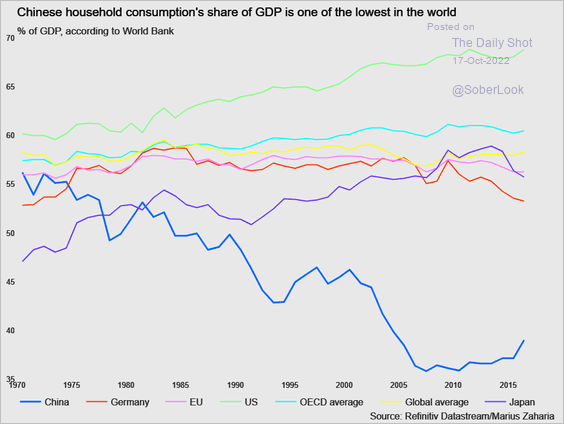

5. China’s economy is heavily reliant on investment.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

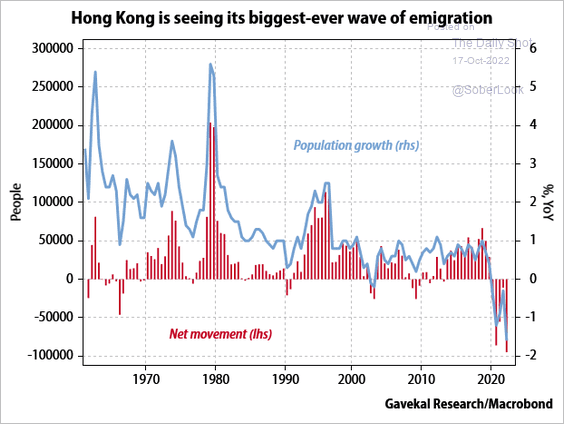

6. Hong Kong’s population is declining.

Source: @Gavekal

Source: @Gavekal

Back to Index

Emerging Markets

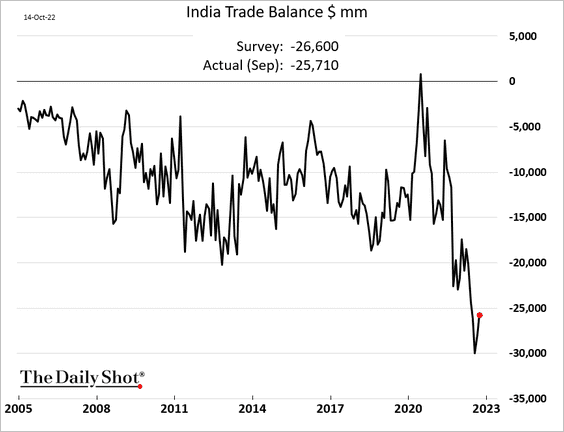

1. India’s trade deficit eased last month.

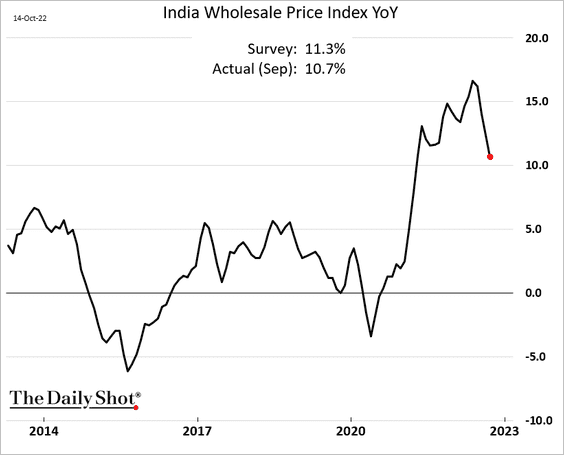

Wholesale inflation was lower than expected.

——————–

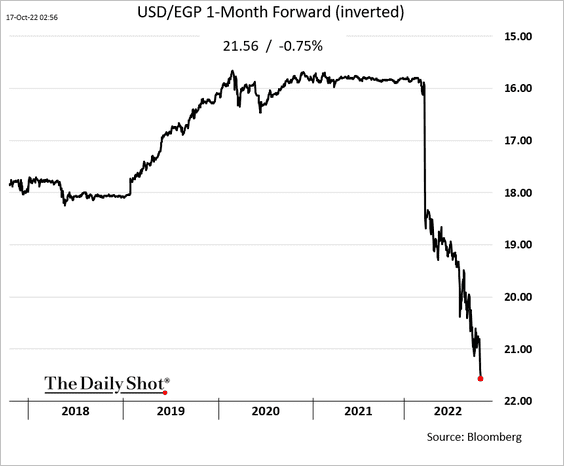

2. The Egyptian pound is under pressure, which will exacerbate inflation.

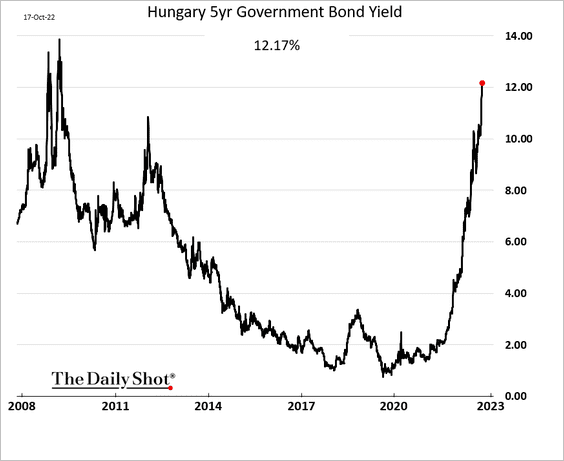

3. Hungary’s 5-year yield is above 12% for the first time since the financial crisis.

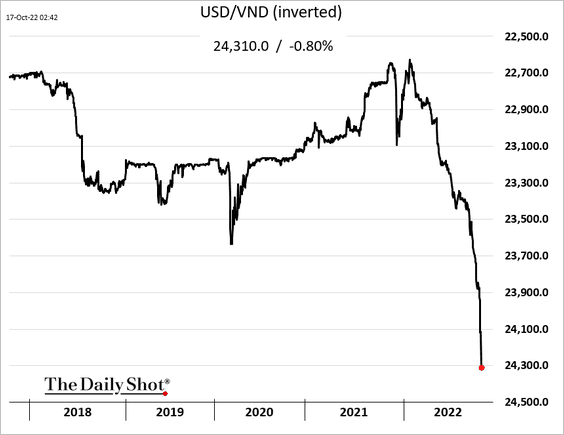

4. The Vietnamese dong continues to weaken vs. USD.

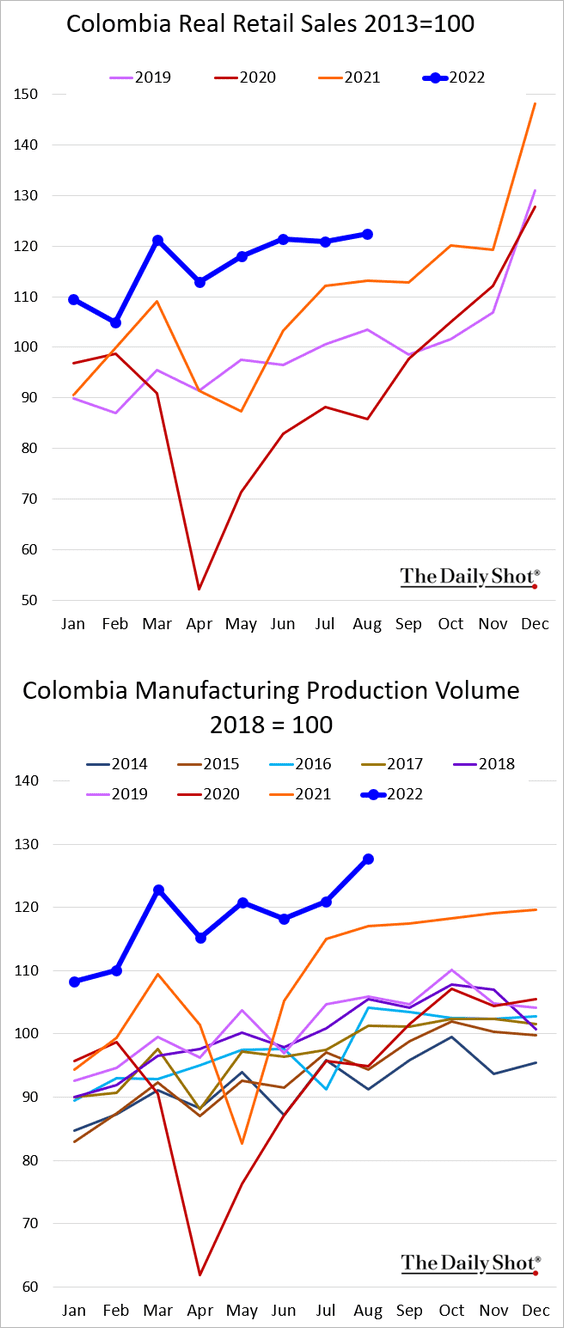

5. Colombia’s economic activity remains robust.

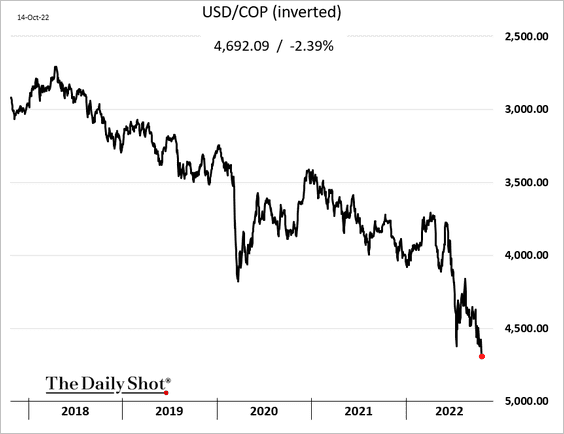

Nonetheless, the Colombian peso keeps sinking.

——————–

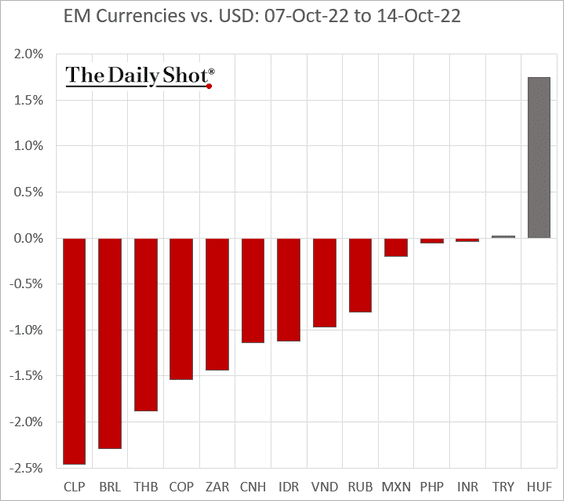

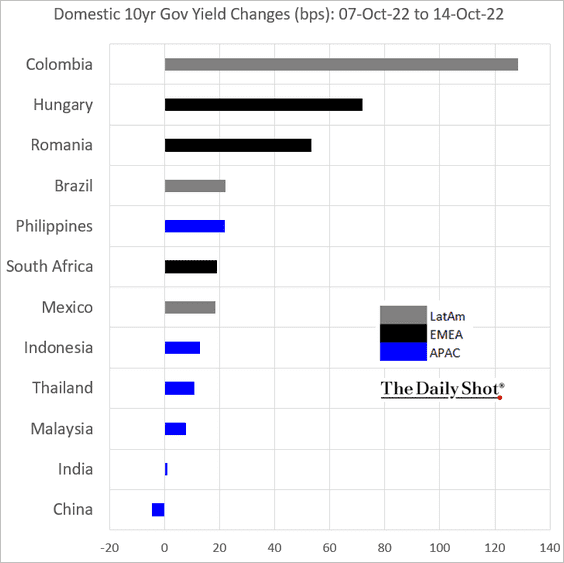

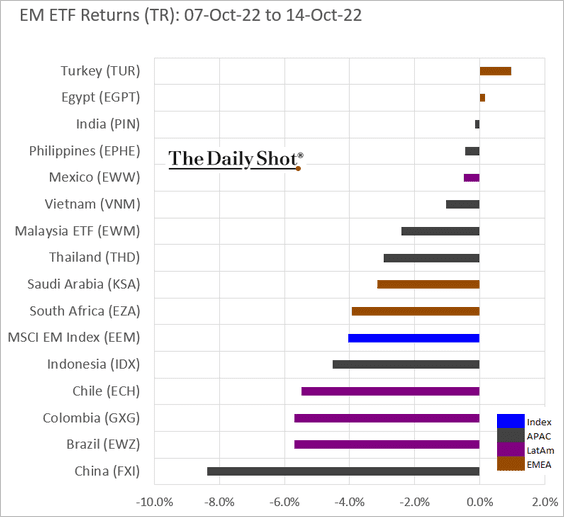

6. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Cryptocurrency

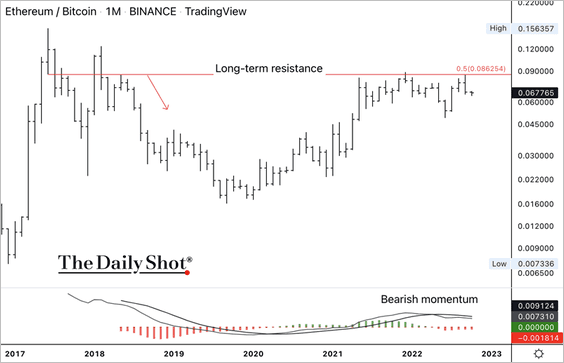

1. The ETH/BTC price ratio is hovering around long-term resistance, similar to what occurred in 2018.

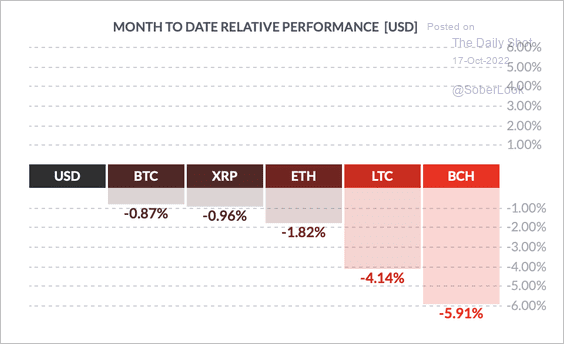

2. So far, BTC has declined less than other top cryptos this month.

Source: FinViz

Source: FinViz

Bitcoin continues to test downtrend resistance.

——————–

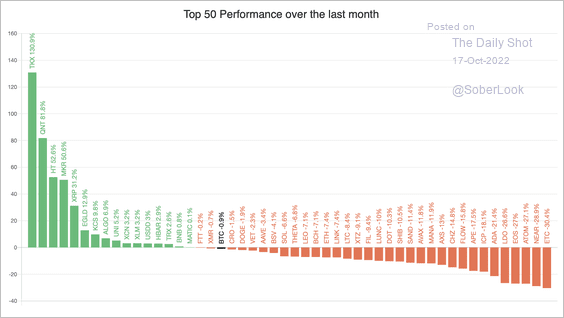

3. Only 37% of the top 50 altcoins have outperformed bitcoin over the past month, which reflects a lower appetite for risk among crypto traders.

Source: Blockchain Center

Source: Blockchain Center

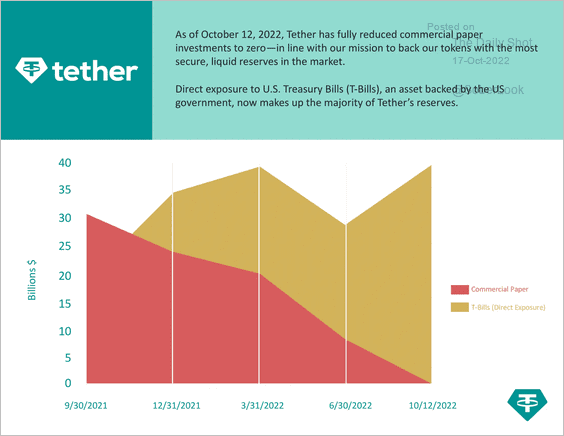

4. Tether, a major stablecoin, has fully reduced its commercial paper investments to zero. Treasury bills now make up a majority of Tether’s reserves.

Source: Tether Read full article

Source: Tether Read full article

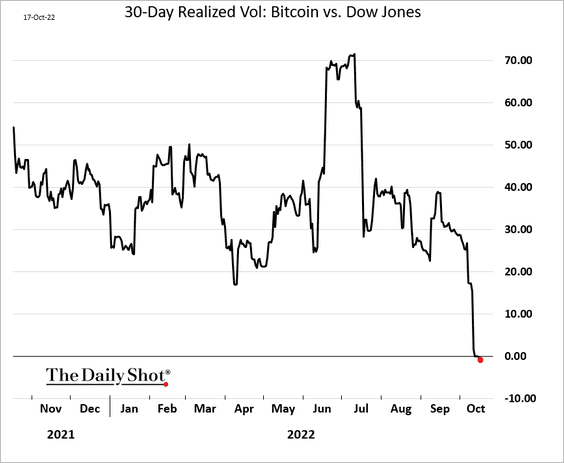

5. Bitcoin’s price swings are now below the Dow Jones realized volatility.

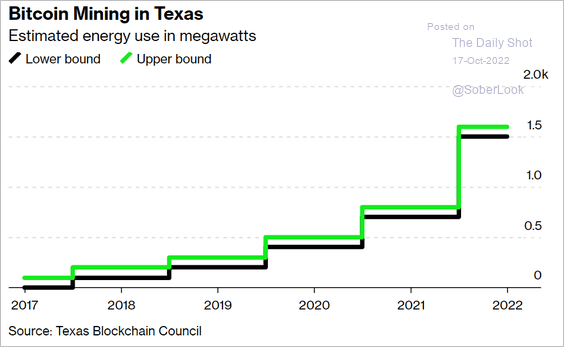

6. Texas bitcoin mining could put pressure on the ERCOT grid.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

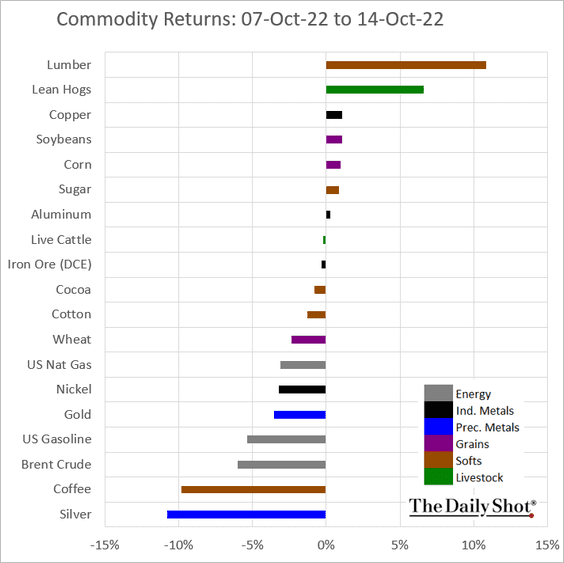

Here is last week’s performance across key commodity markets.

Back to Index

Equities

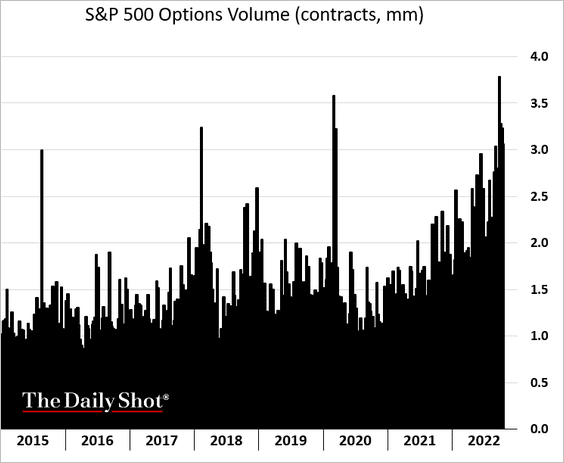

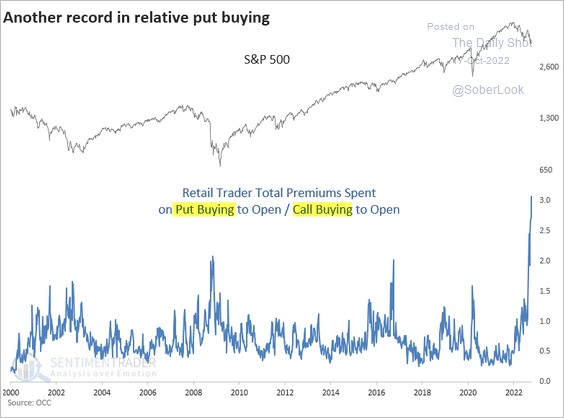

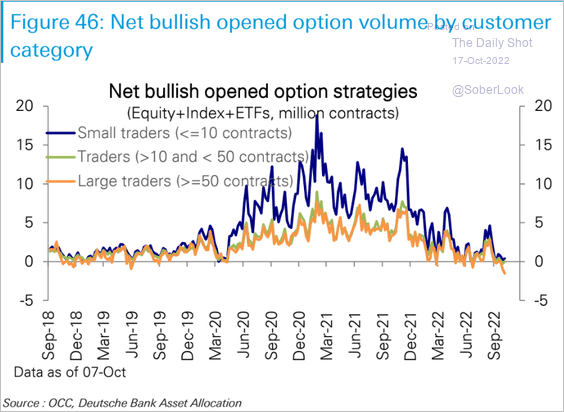

1. Options volume has been surging this year, …

… with put buying massively outpacing calls in recent weeks.

Source: SentimenTrader

Source: SentimenTrader

At the same time, volumes in bullish options strategies continue to soften.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

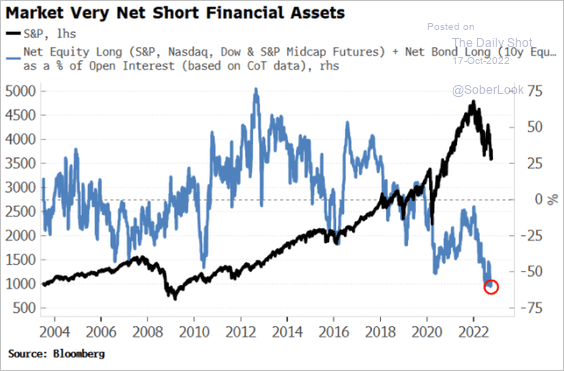

2. Positioning remains very bearish, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

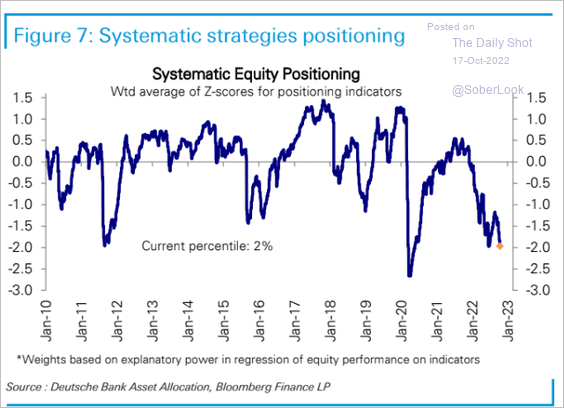

… with CTAs’ systematic strategies boosting bets against the market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

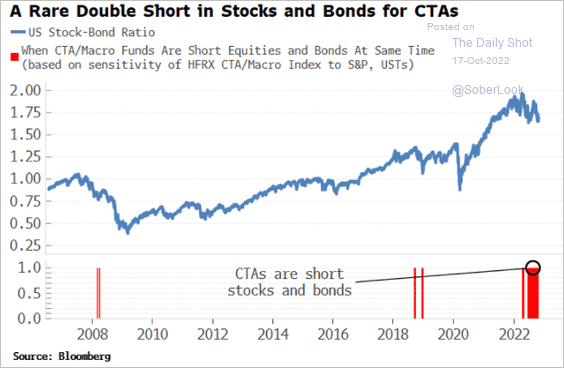

CTAs are short stocks and bonds.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

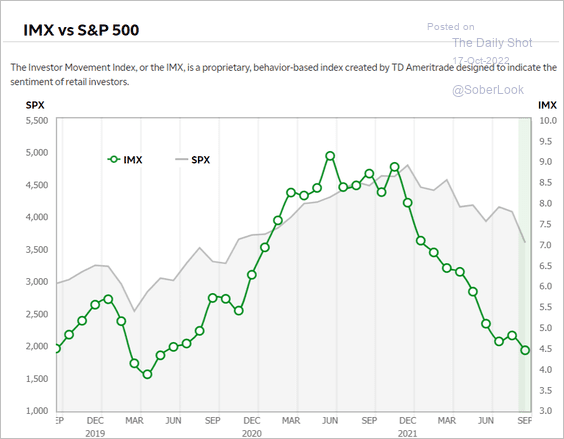

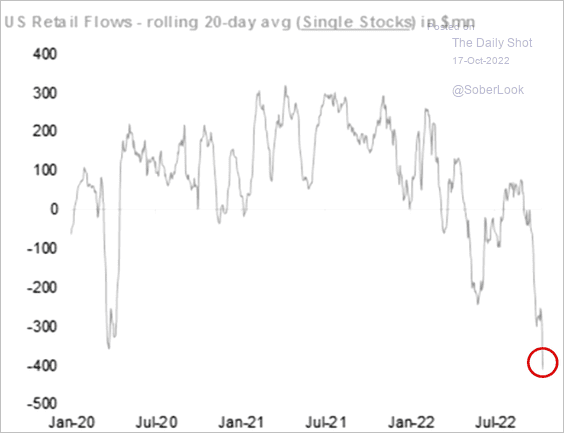

3. Retail investors are also quite bearish. The extreme negative sentiment suggests that we could see a market bounce.

• TD Ameritrade’s Investor Movement Index:

Source: TD Ameritrade

Source: TD Ameritrade

• Retail single-stock flows:

Source: JP Morgan Research; @themarketear

Source: JP Morgan Research; @themarketear

——————–

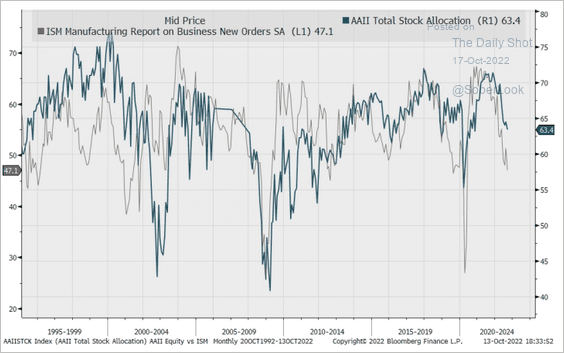

4. Equity allocations have room to shrink.

Source: Piper Sandler

Source: Piper Sandler

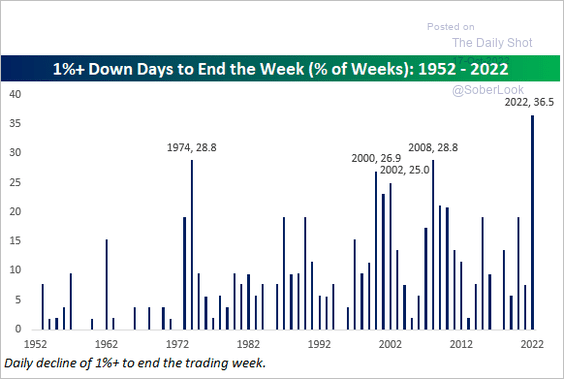

6. We’ve had many weeks that ended with 1%+ down days.

Source: @bespokeinvest

Source: @bespokeinvest

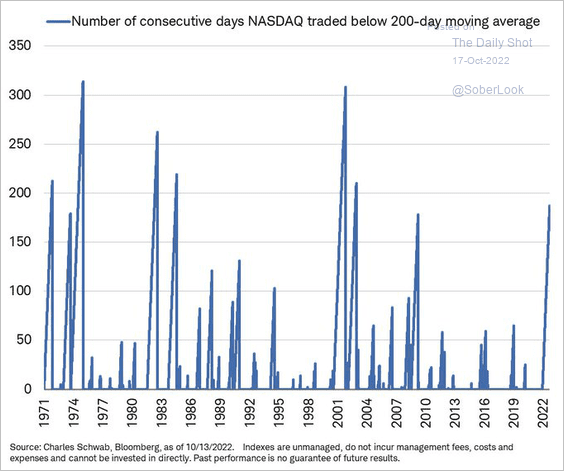

7. Nasdaq has been below its 200-day moving average for a while now.

Source: @LizAnnSonders

Source: @LizAnnSonders

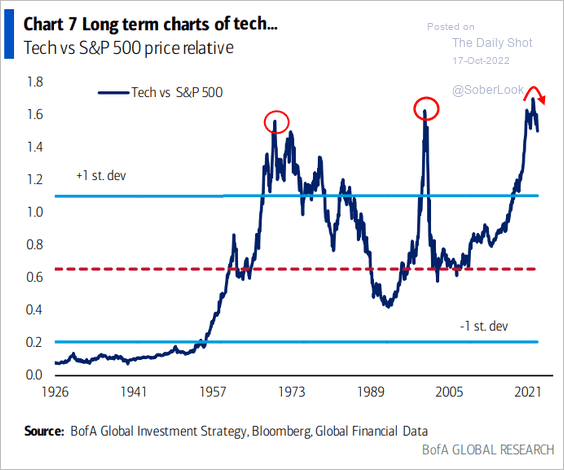

8. Has the tech outperformance cycle ended?

Source: BofA Global Research

Source: BofA Global Research

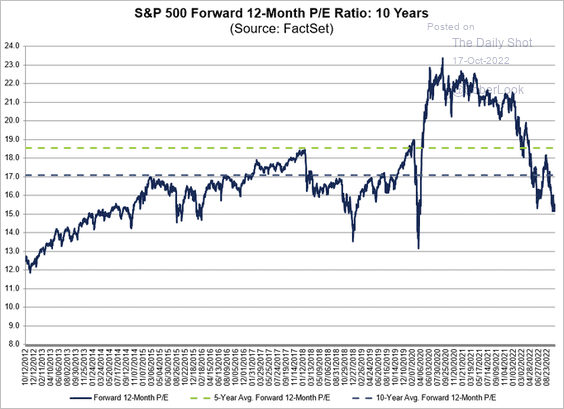

9. The S&P 500 forward P/E ratio is holding just above 15x.

Source: @FactSet Read full article

Source: @FactSet Read full article

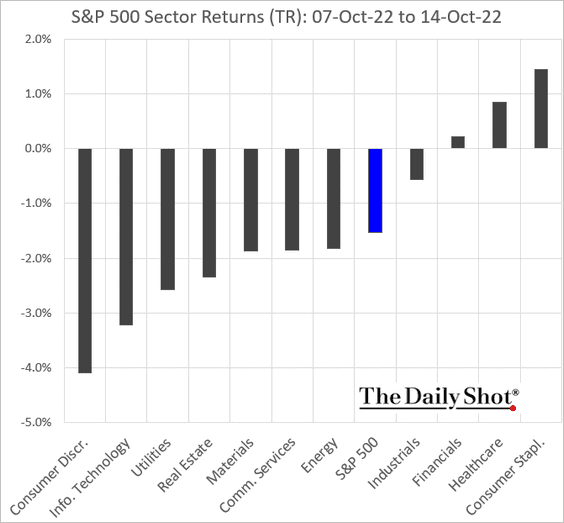

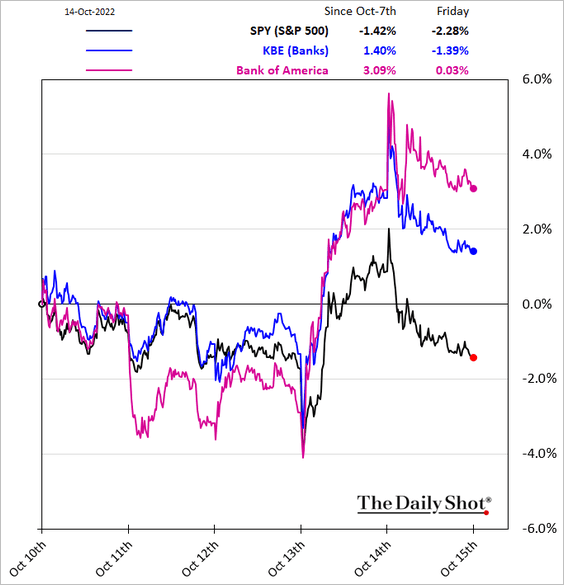

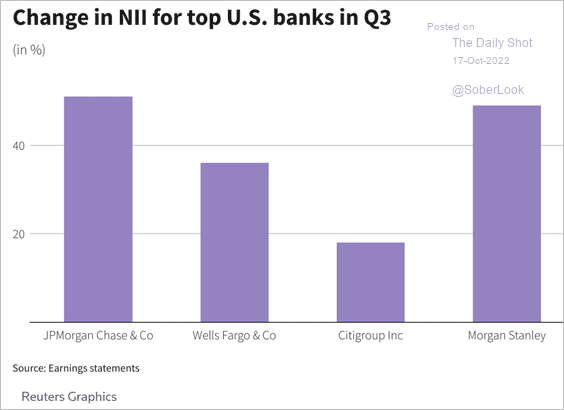

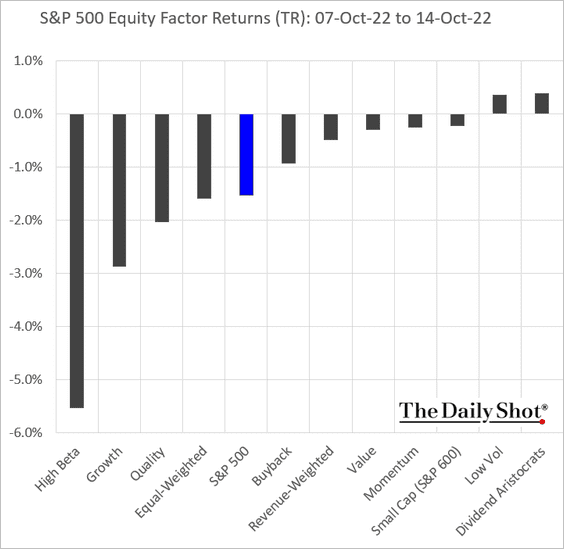

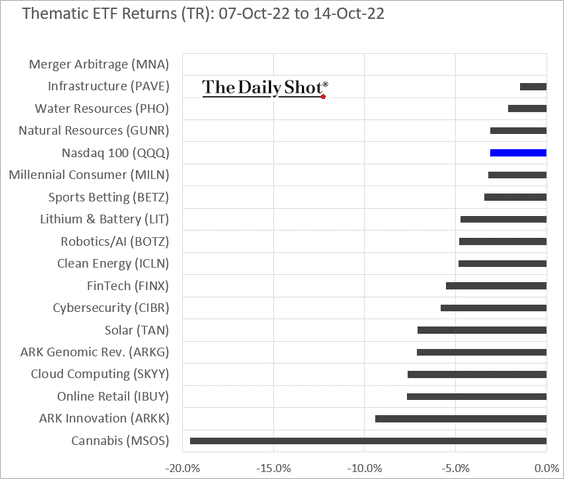

10. Next, we have some performance updates from last week.

• Sectors:

– Bank earnings were mostly better than expected, …

… amid rising net interest income.

Source: Reuters Read full article

Source: Reuters Read full article

• Equity factors:

• Thematic ETFs:

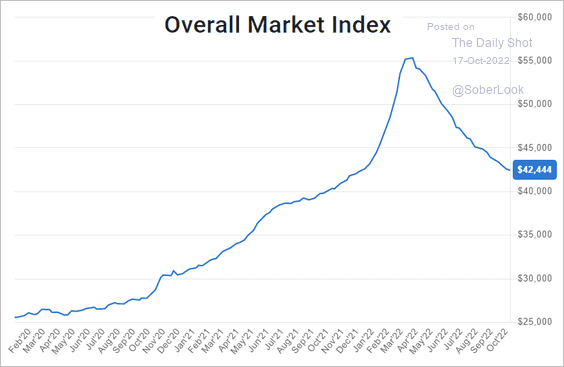

By the way, ARK Innovation is near multi-year lows.

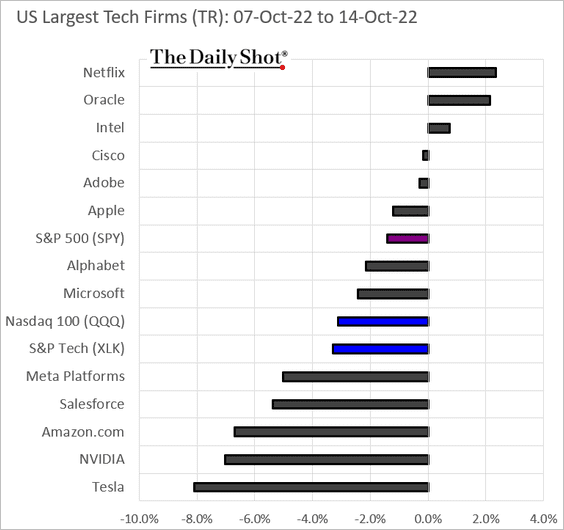

• Largest US tech firms:

Back to Index

Credit

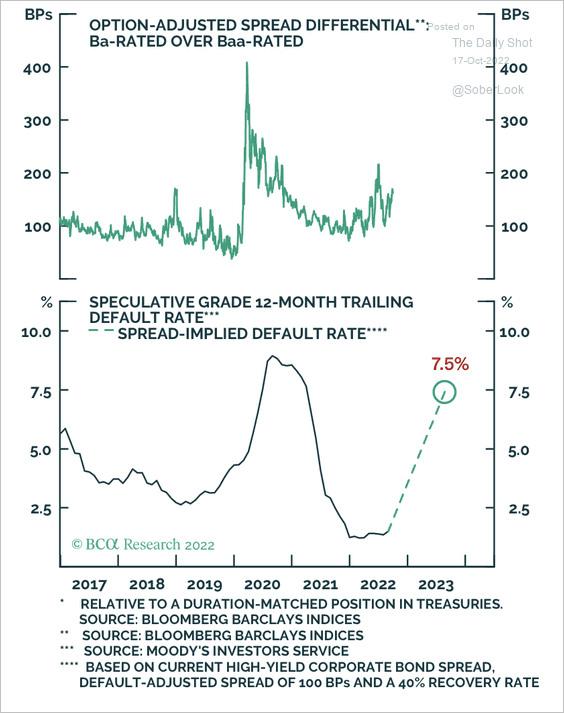

1. The default rate that is priced into the US junk bond index increased to 7.5% in September, which points to much wider spreads.

Source: BCA Research

Source: BCA Research

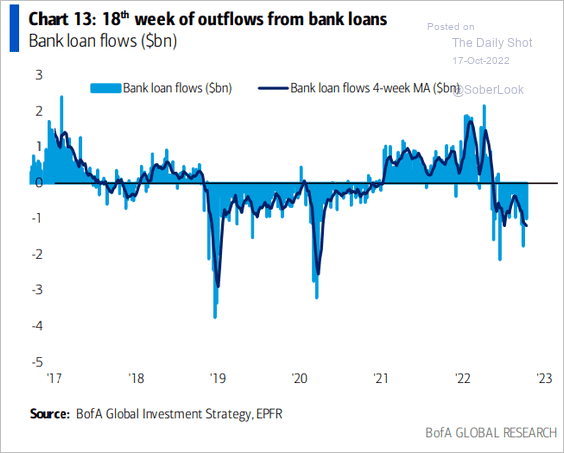

2. Leveraged loan outflows continue.

Source: BofA Global Research

Source: BofA Global Research

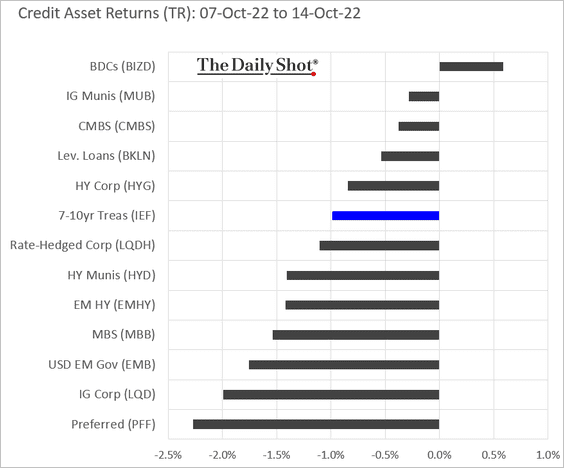

3. Here is last week’s performance by asset class.

Back to Index

Rates

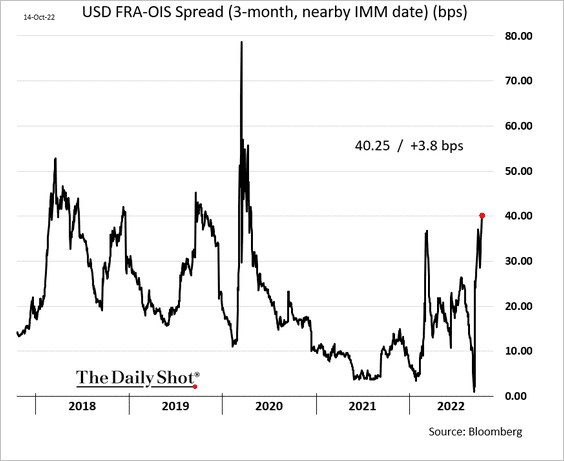

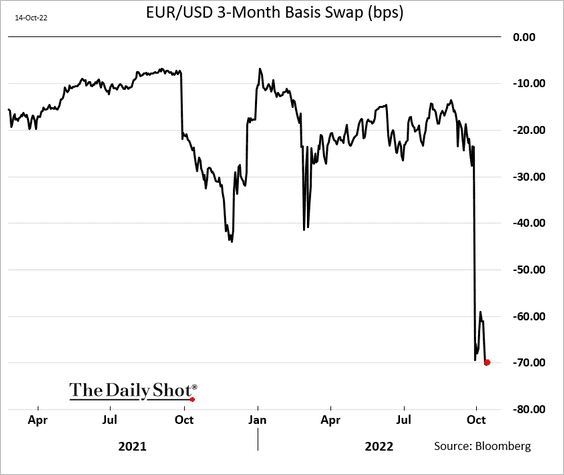

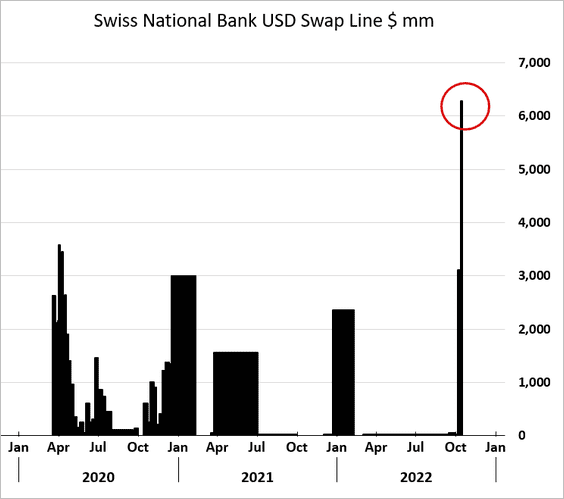

1. The market is nervous about US dollar funding availability at the end of the year.

• FRA-OIS spread:

• EUR/USD basis swap:

• SNB’s draw on the Fed’s swap facility:

Source: Reuters Read full article

Source: Reuters Read full article

By the way, part of the reason for Swiss banks demanding dollars could be due to arbitrage opportunities.

——————–

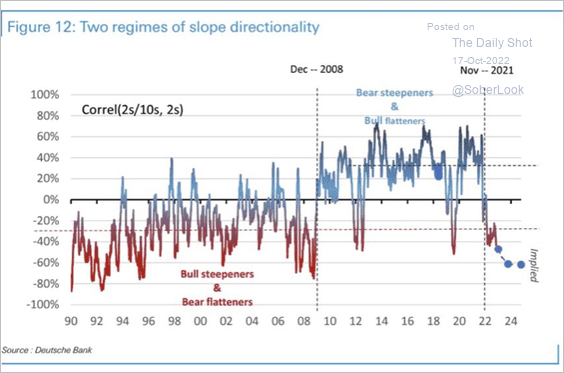

2. This chart shows the directionality of the 2s/10s Treasury yield slope in terms of its correlation with the short rate. The more the Fed moves into restrictive territory, the more the long-end will price in economic consequences of tighter policy, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

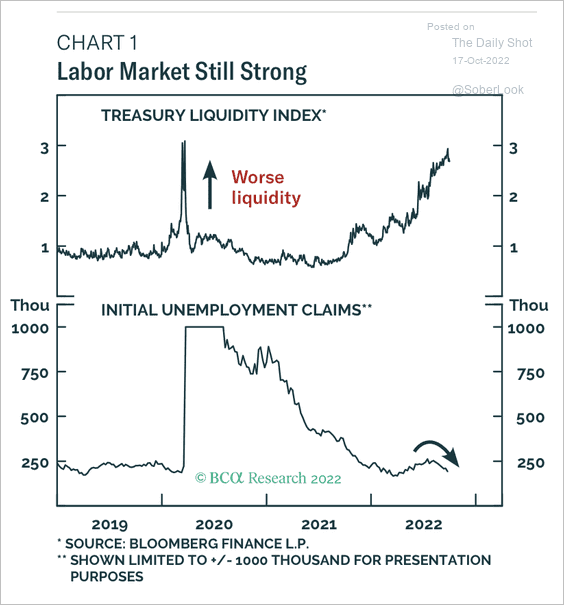

3. Treasury liquidity conditions are tight, which typically leads to near-term market dislocations. Will concerns about financial stability cause the Fed to reverse QT despite the strong labor market?

Source: BCA Research

Source: BCA Research

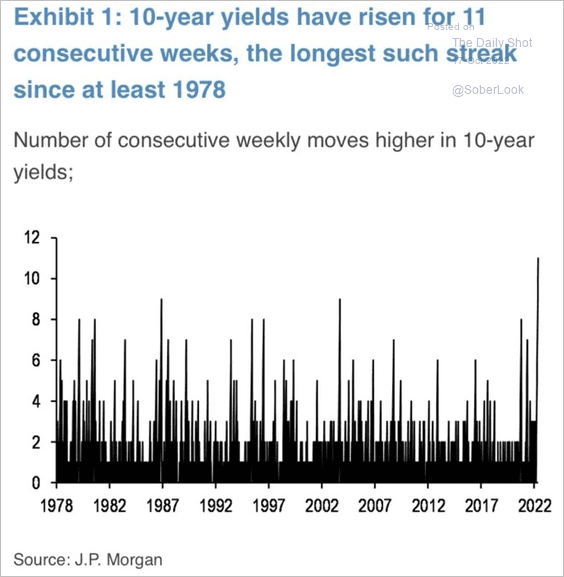

4. We’ve had 11 consecutive weeks of increases in the 10yr yield.

Source: JP Morgan Research; @MikeZaccardi

Source: JP Morgan Research; @MikeZaccardi

Back to Index

Global Developments

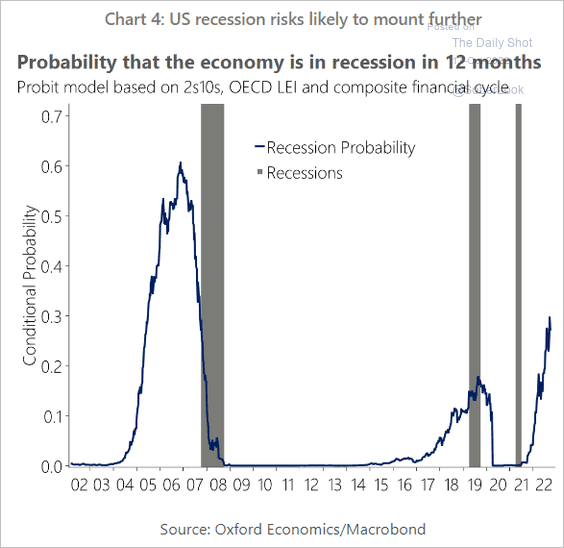

1. Recession probability continues to climb.

Source: Oxford Economics

Source: Oxford Economics

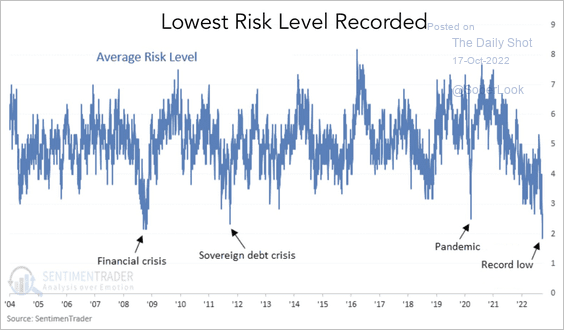

2. Risk appetite is extremely low.

Source: SentimenTrader

Source: SentimenTrader

3. Secondhand luxury watch prices continue to sink.

Source: WatchEnthusiasts

Source: WatchEnthusiasts

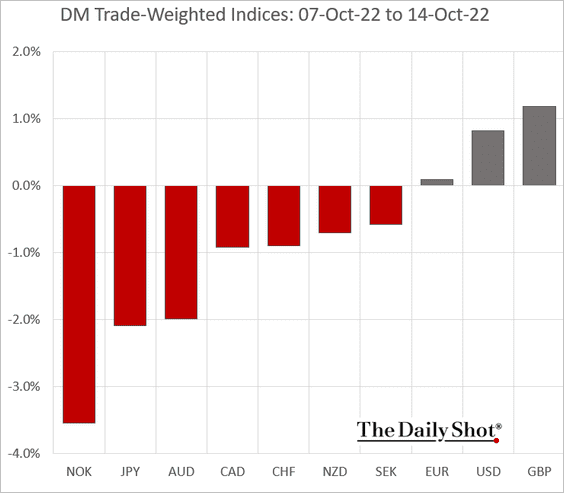

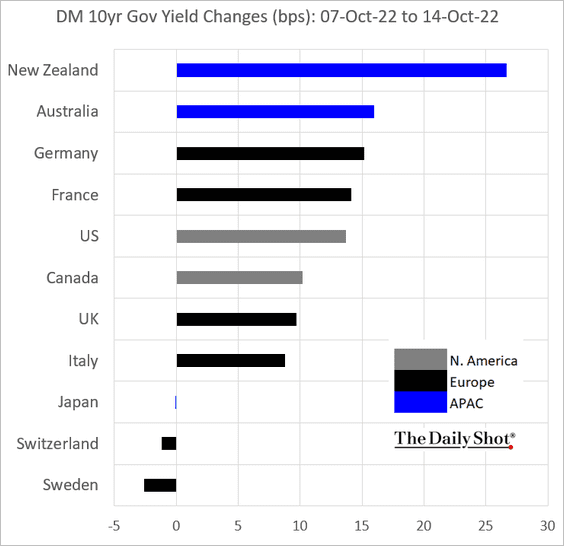

4. Next, we have last week’s performance data.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

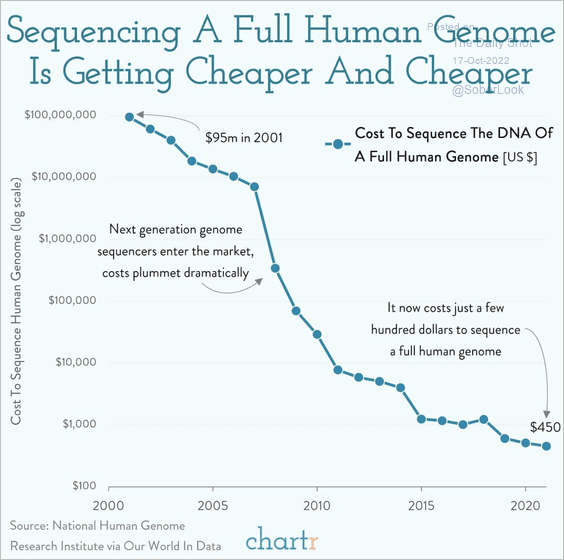

1. The cost to sequence a full human genome:

Source: @chartrdaily

Source: @chartrdaily

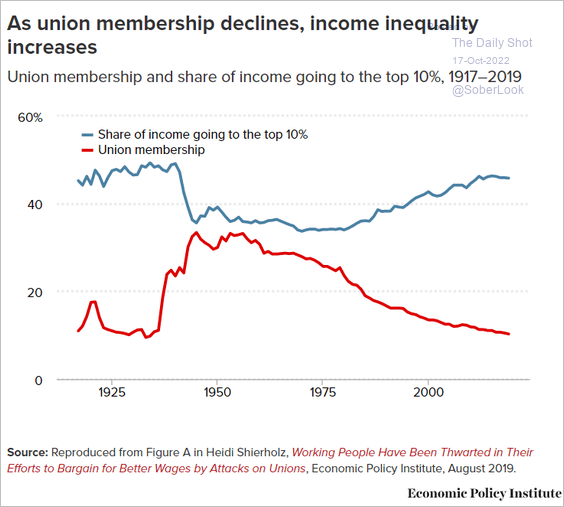

2. Union membership and income inequality:

Source: @EconomicPolicy

Source: @EconomicPolicy

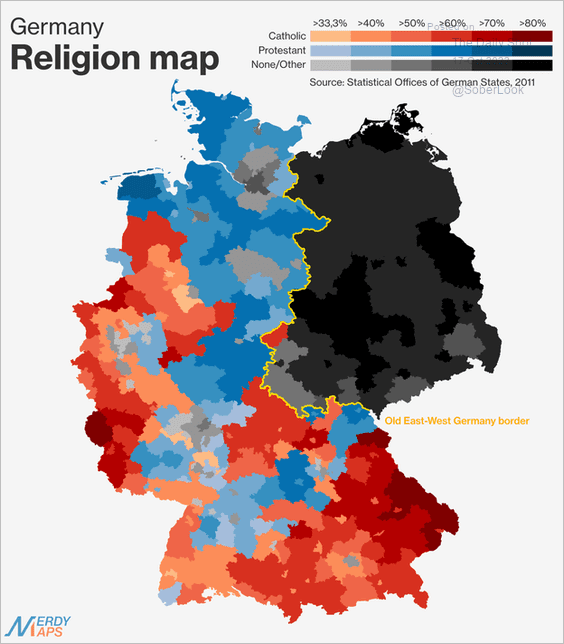

3. Religion in Germany:

Source: @xruiztru

Source: @xruiztru

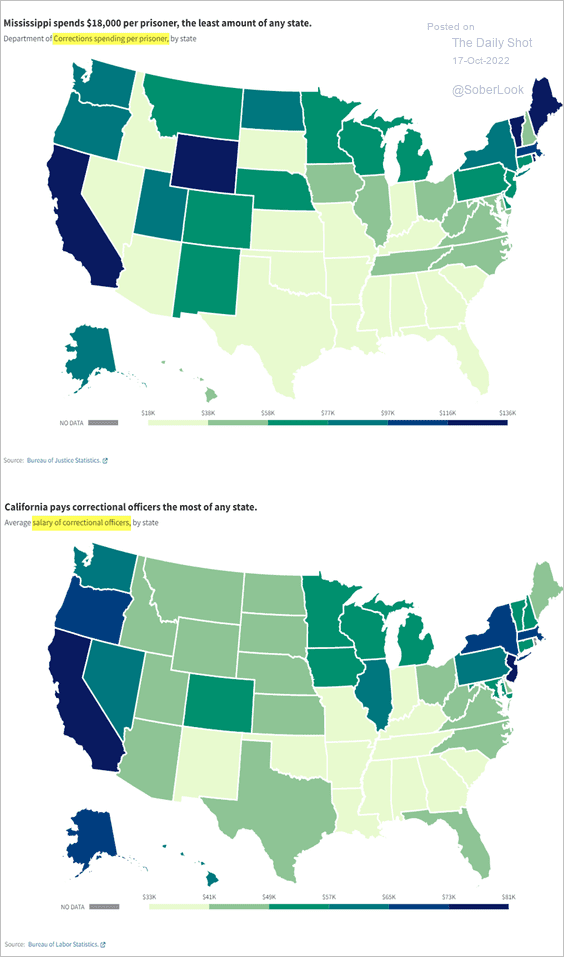

4. Spending on prisons:

Source: USAFacts Read full article

Source: USAFacts Read full article

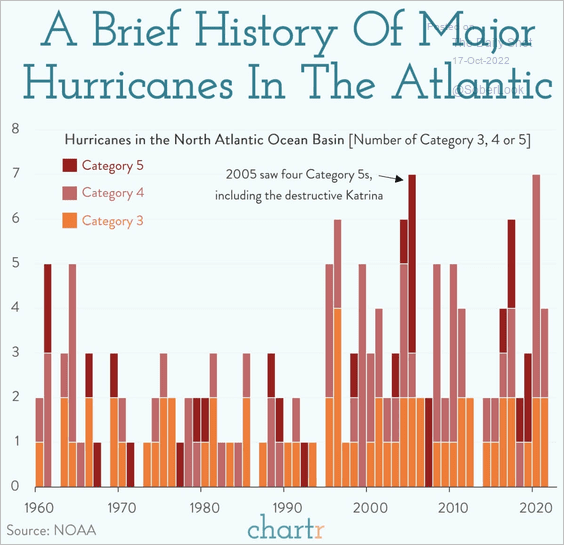

5. Hurricanes in the Atlantic:

Source: @chartrdaily

Source: @chartrdaily

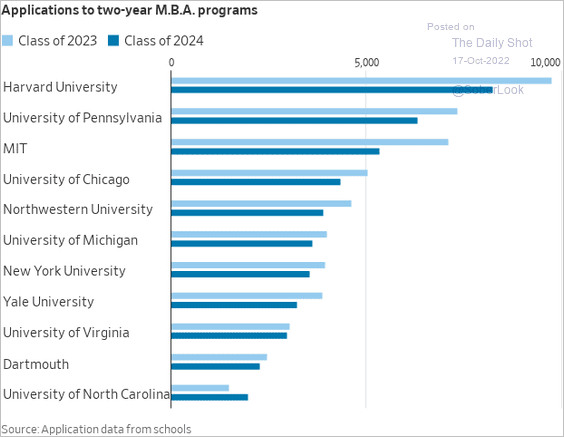

6. MBA program applicants:

Source: @WSJ Read full article

Source: @WSJ Read full article

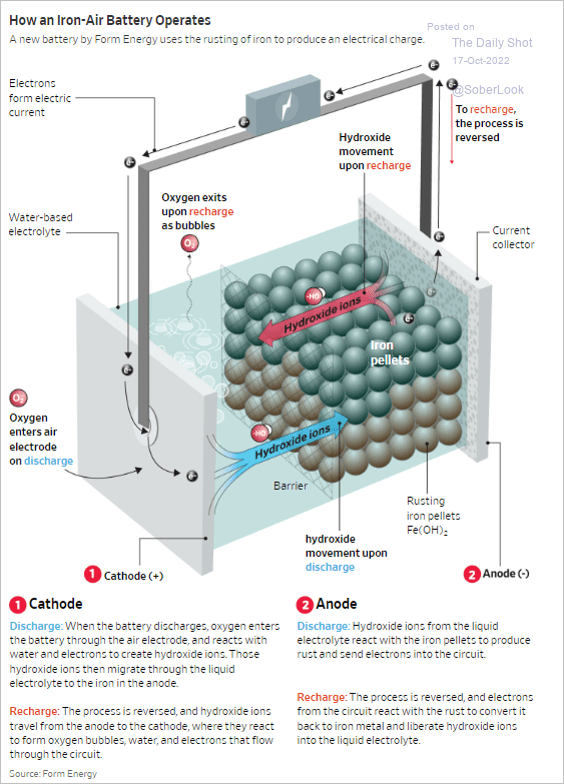

7. Iron-air battery:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index