The Daily Shot: 20-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

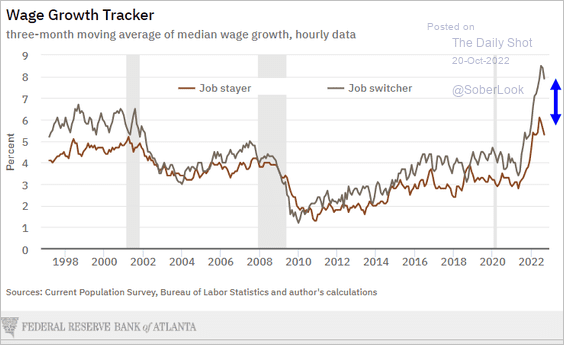

1. The Fed’s Beige Book continues to signal tight labor markets despite some signs of easing.

Wage growth remained widespread, though an easing was reported in several Districts. Some businesses said elevated inflation and higher costs of living were pushing wages up, coupled with upward pressure from labor market tightness. Contacts expect wage growth to continue as higher pay remains essential for retaining talent in the current environment.

The massive gap between wage growth for job stayers and job switchers illustrates the persistent bid for labor. It may take a recession to ease labor market imbalances.

Source: @AtlantaFed

Source: @AtlantaFed

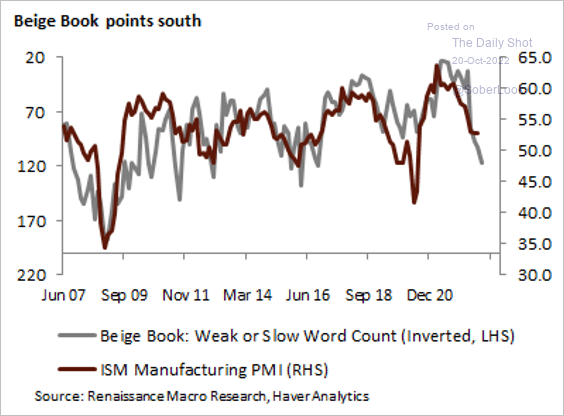

The Beige Book’s “weak” or “slow” word count points to a sharp slowdown ahead.

Source: @RenMacLLC

Source: @RenMacLLC

——————–

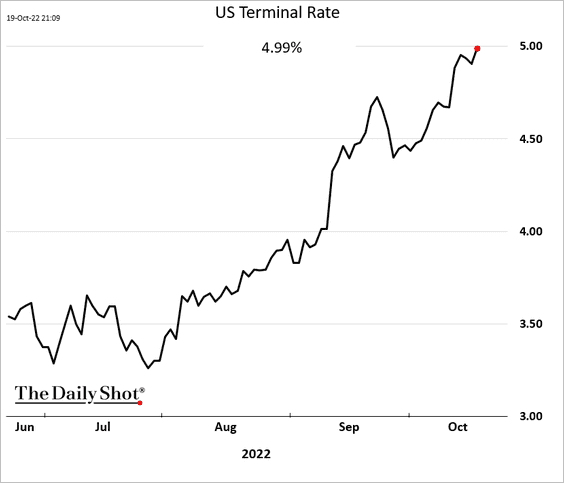

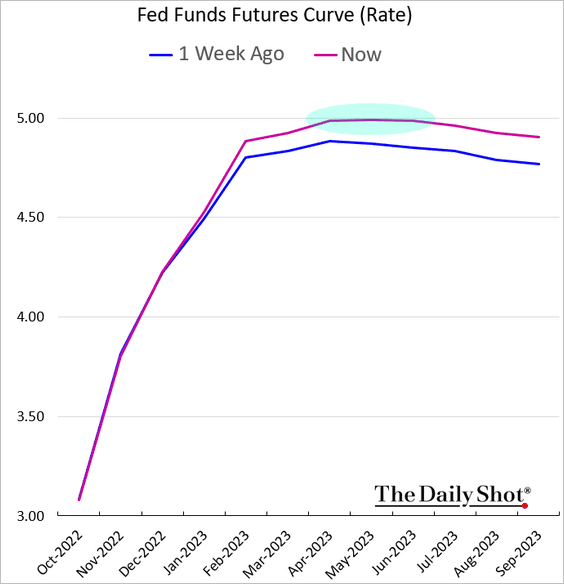

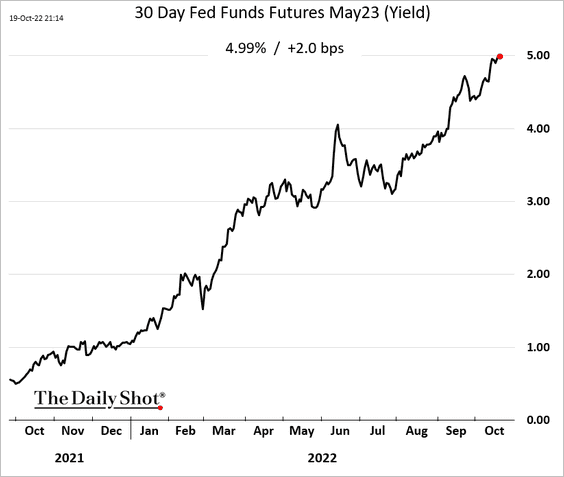

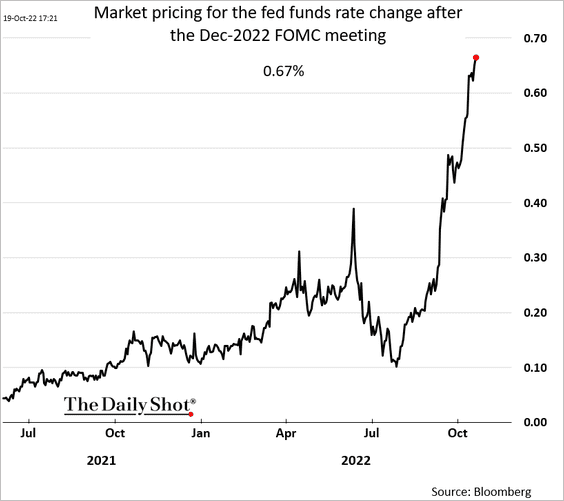

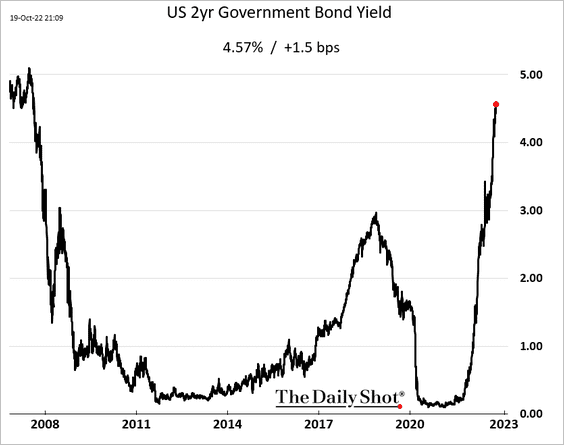

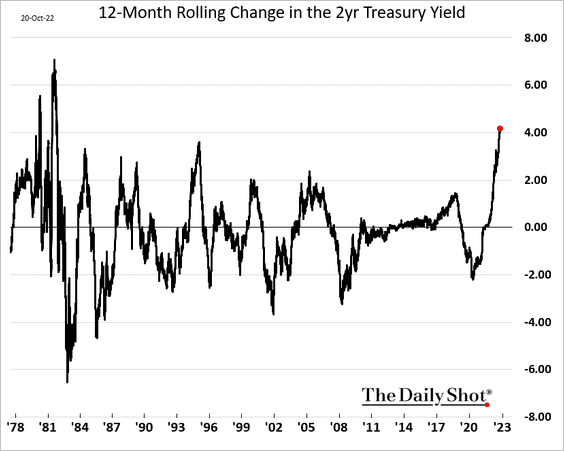

2. The market now sees the terminal rate at 5%.

• Here is the May fed funds futures contract.

• The market increasingly sees a 75 bps rate hike in December.

• The 2-year Treasury yield keeps climbing.

We haven’t seen such a massive 12-month move in the 2yr yield since the early 1980s.

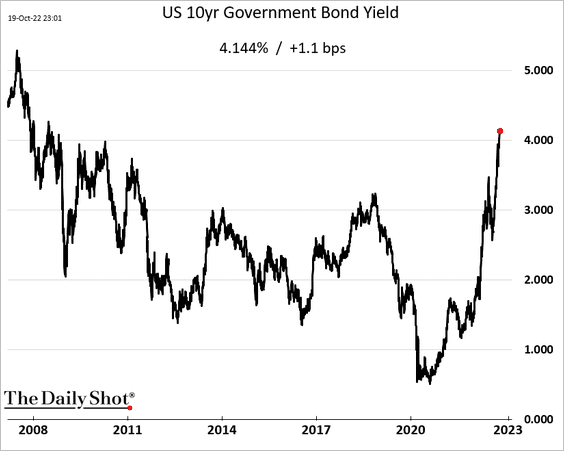

• The 10yr yield keeps rising as well.

——————–

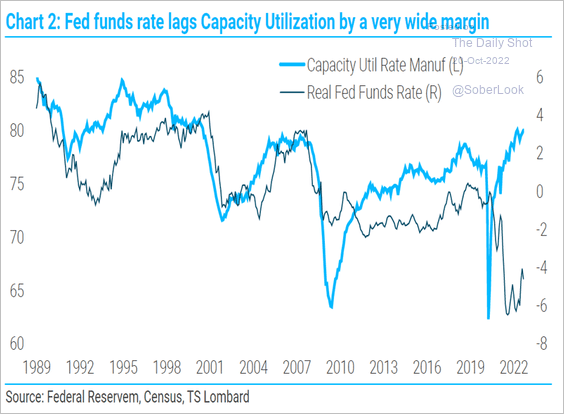

2. Strong capacity utilization suggests that real rates should be higher.

Source: TS Lombard

Source: TS Lombard

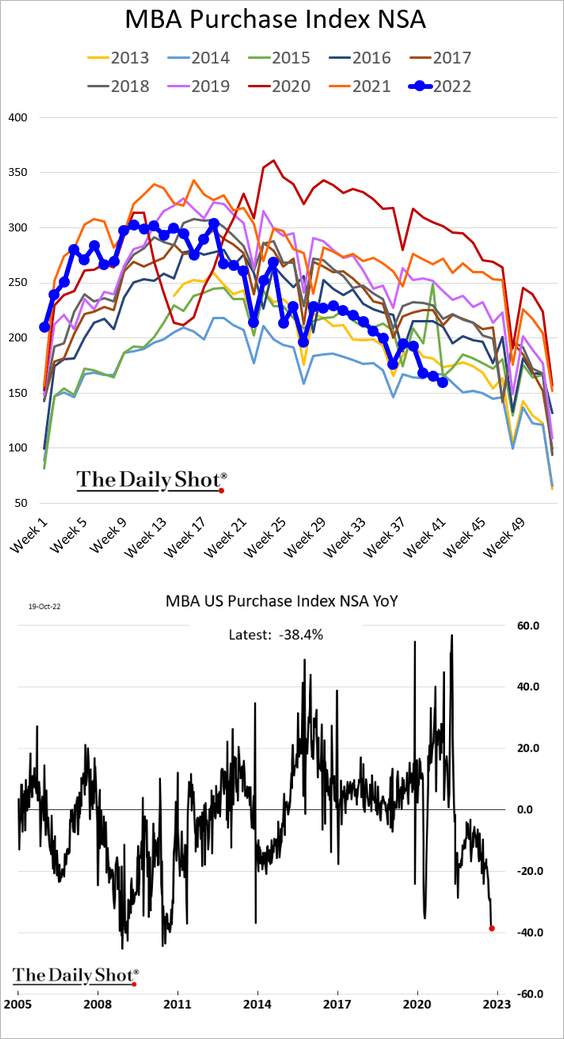

3. Mortgage applications are at multi-year lows.

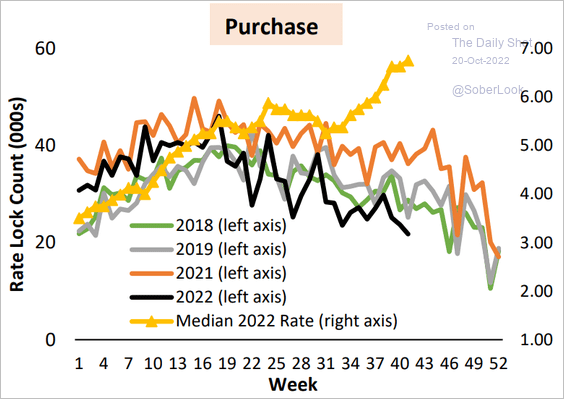

Here is the rate lock count.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

——————–

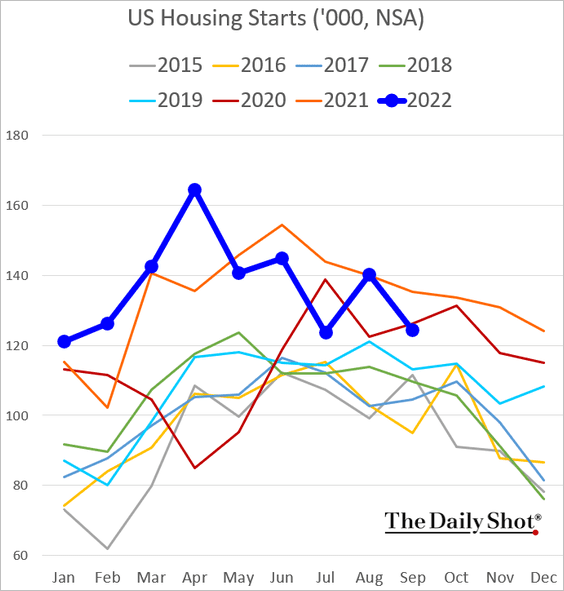

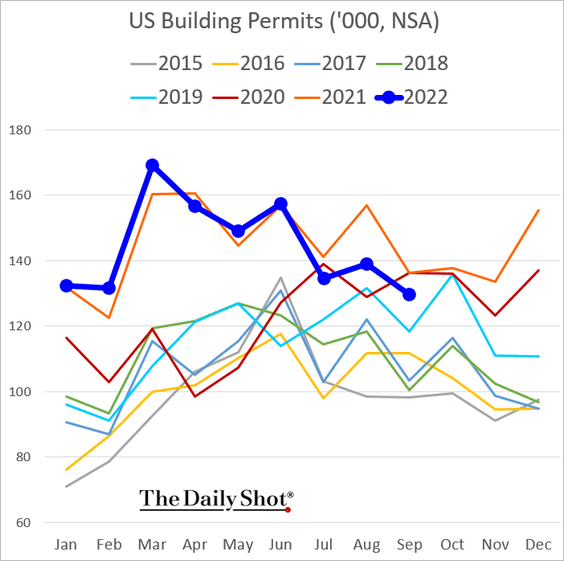

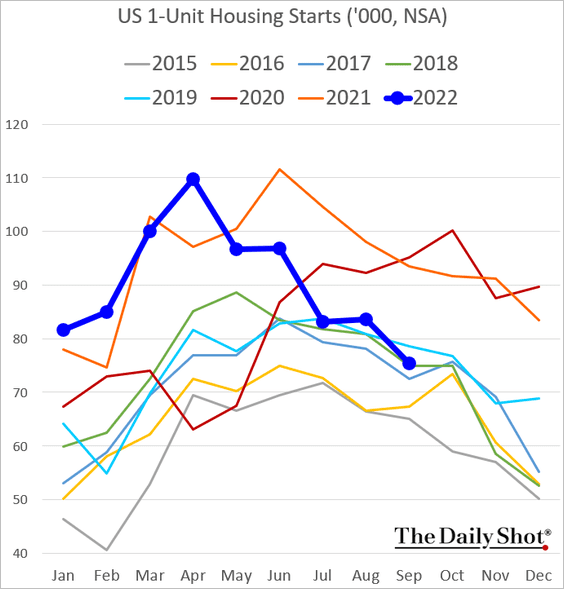

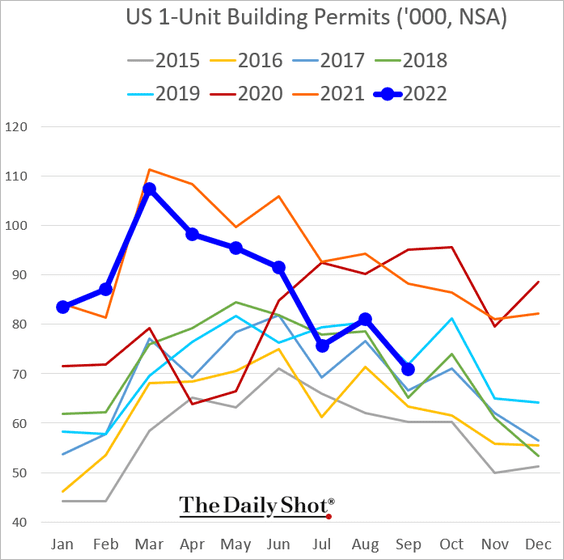

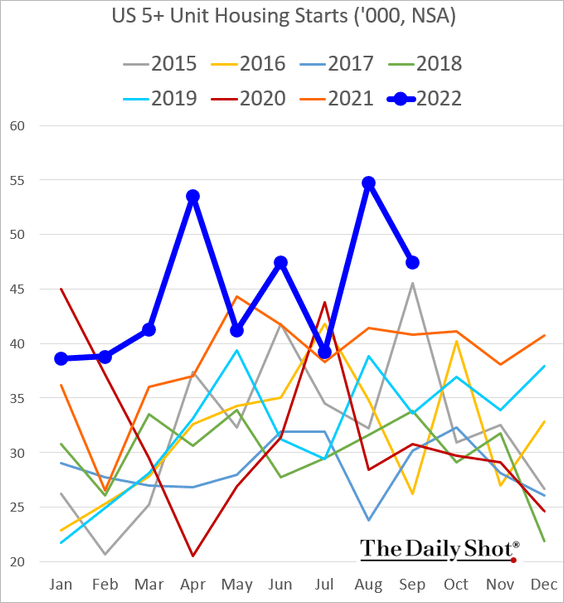

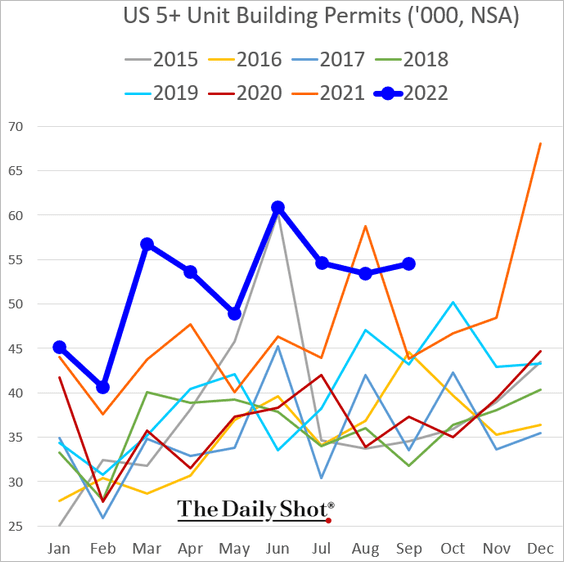

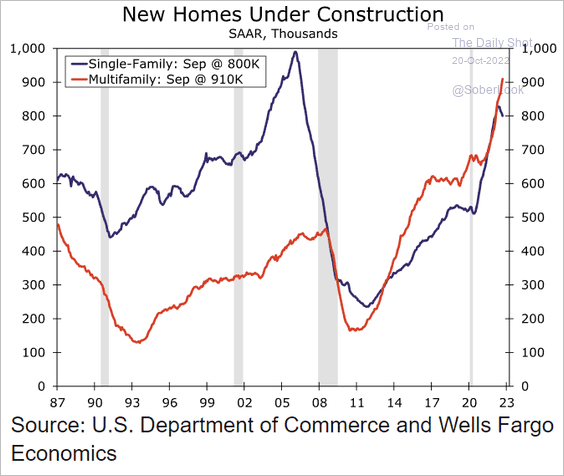

4. Housing starts and permits were softer in September, but they are not collapsing.

• The weakness has been in single-family housing.

• Multi-family construction activity remains at a multi-year highs.

• But leading indicators point to severe weakness in residential construction going forward.

Source: Piper Sandler

Source: Piper Sandler

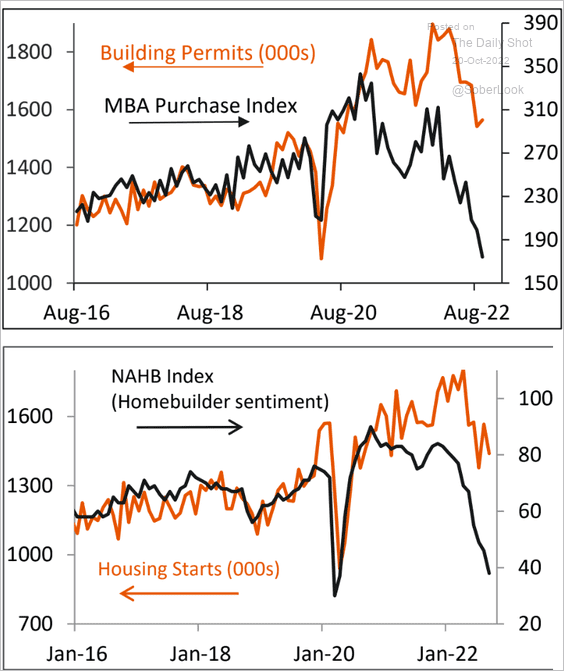

• There are a lot of homes under construction, especially multi-family projects.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

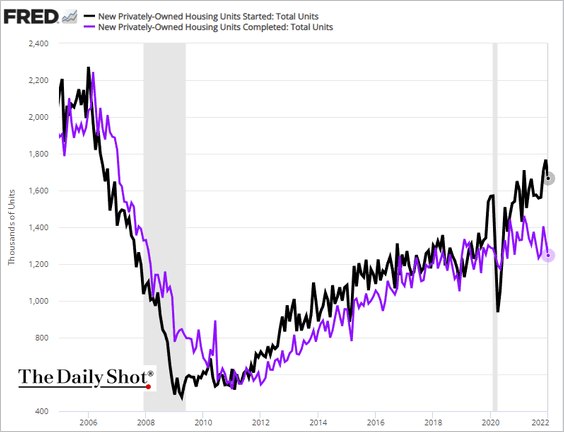

• Housing starts and completions continue to diverge.

——————–

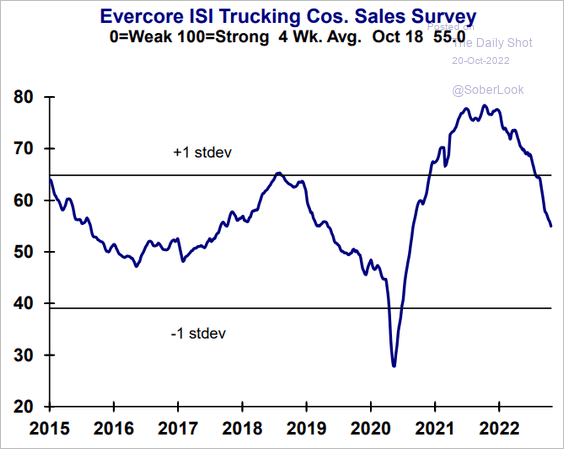

5. The Evercore ISI trucking company sales index continues to ease.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

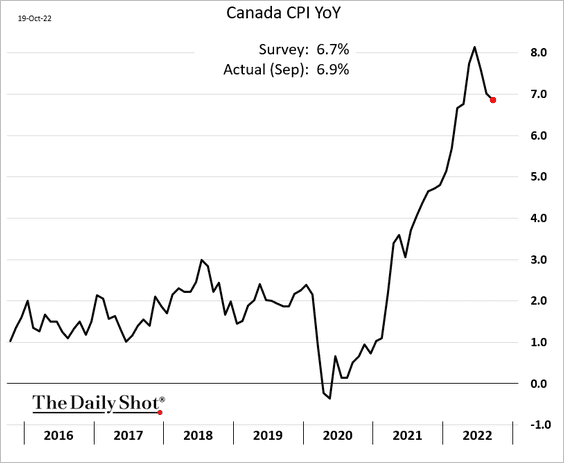

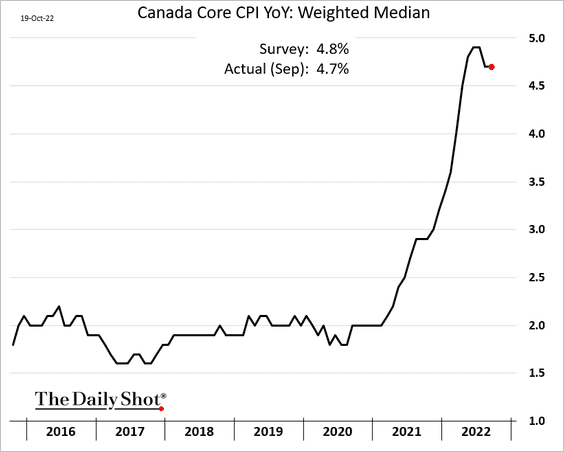

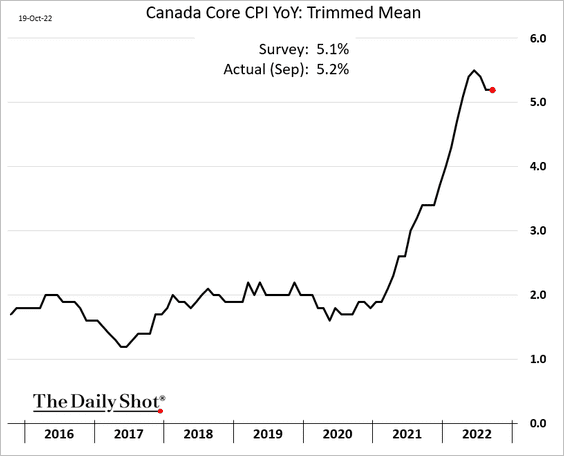

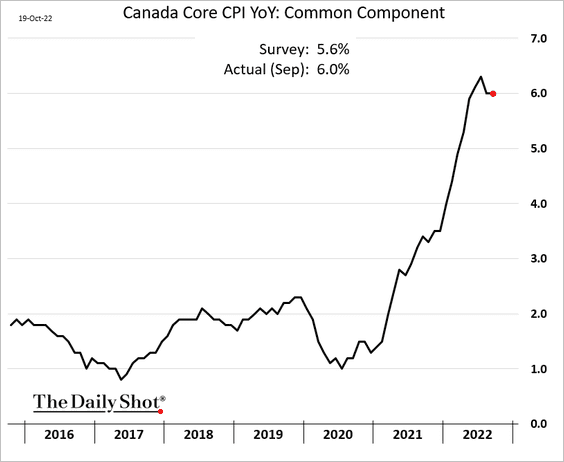

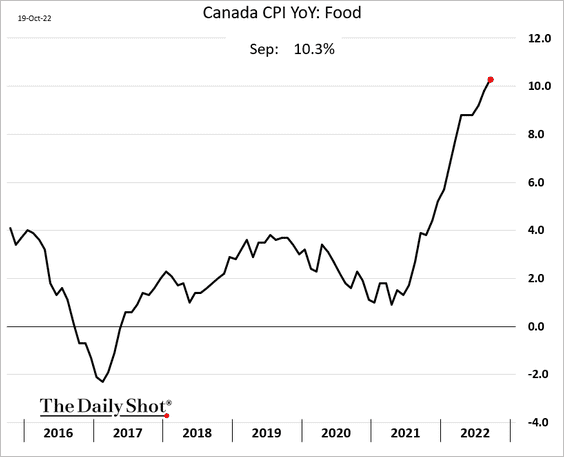

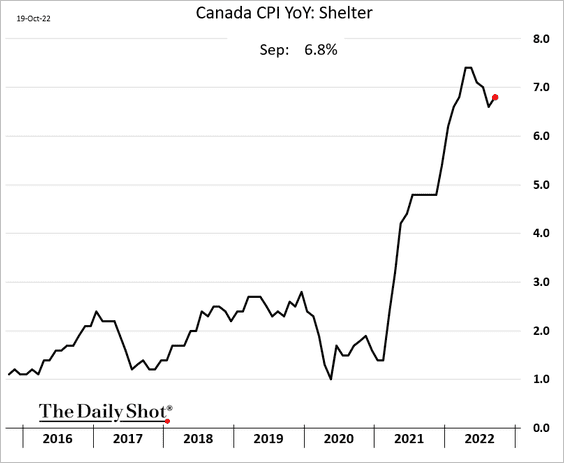

1. The CPI edged lower but was above forecasts. Inflation is still running hot in Canada.

Below are the core CPI measures.

– Median:

– Trimmed mean:

– Common Component:

• Food inflation continues to surge.

• Shelter inflation accelerated last month.

——————–

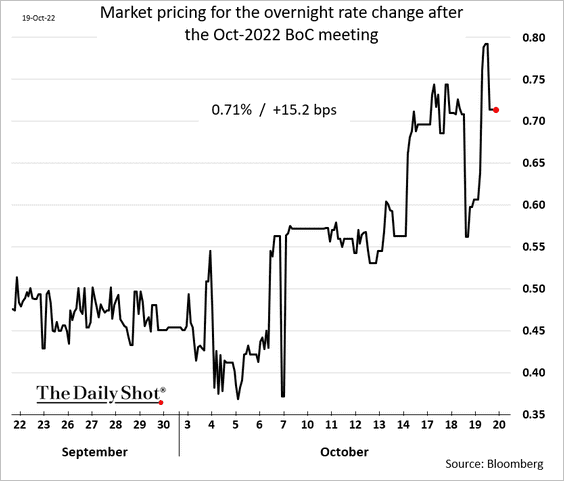

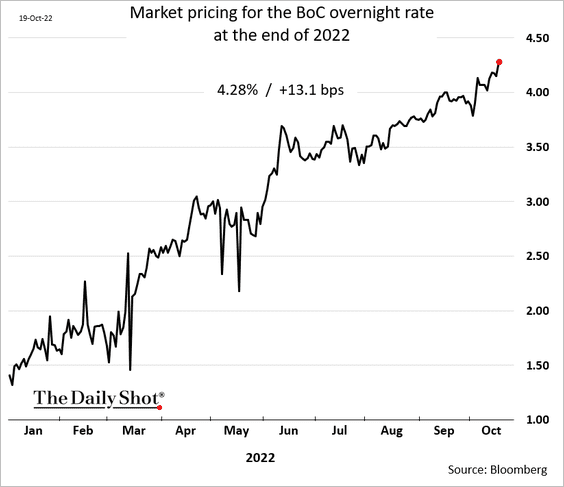

2. A 75 bps rate hike looks like a certainty this month.

Source: Reuters Read full article

Source: Reuters Read full article

The market now sees the overnight rate ending the year at 4.3%.

——————–

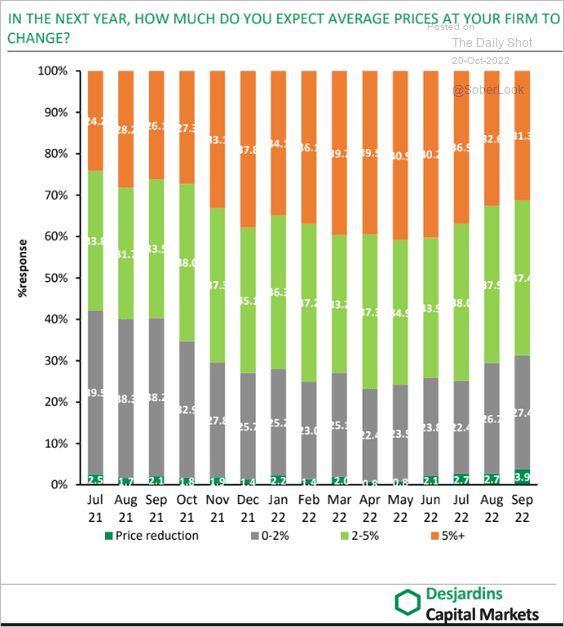

3. Small business price expectations are moderating.

Source: Desjardins

Source: Desjardins

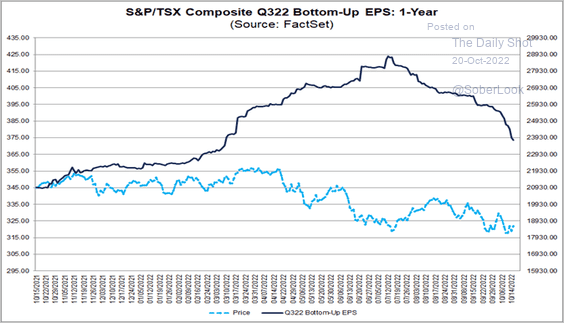

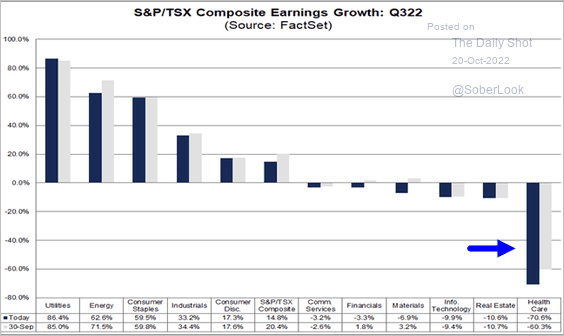

4. Analysts have been rapidly downgrading Q3 earnings estimates.

Source: @FactSet Read full article

Source: @FactSet Read full article

Cannabis companies’ earnings are under pressure.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

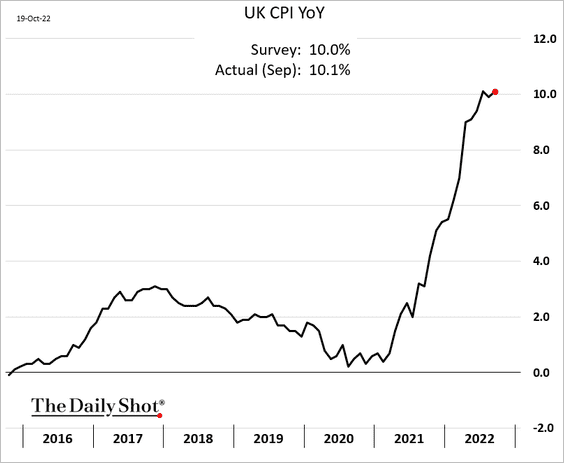

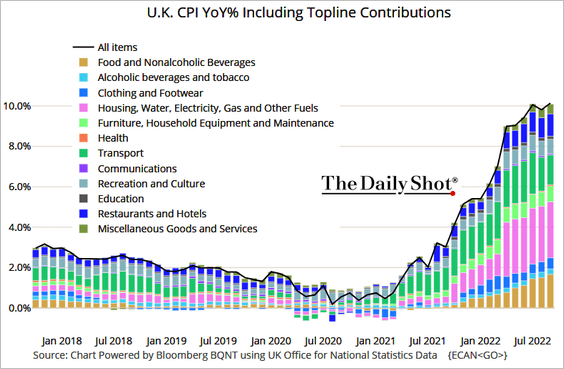

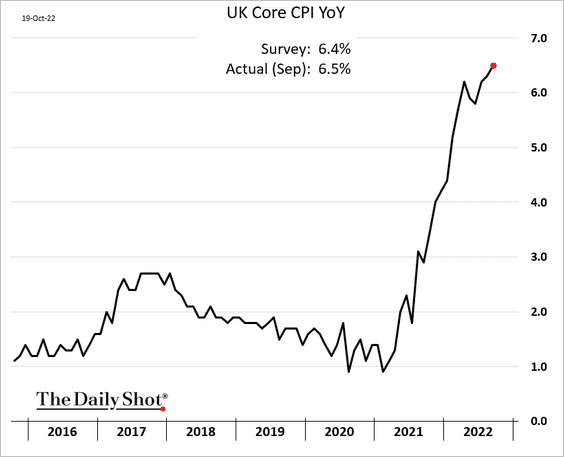

The United Kingdom

1. The CPI is back above 10%.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Core inflation continues to surge.

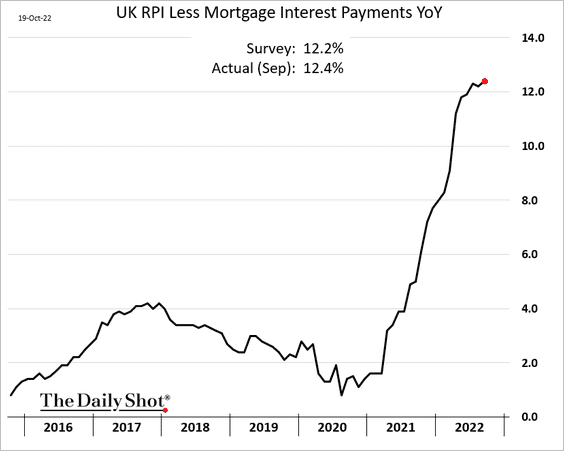

• The retail price index surprised to the upside.

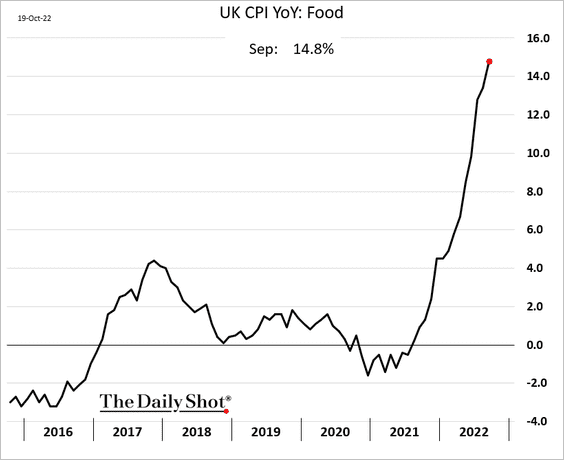

• Food inflation is nearing 15%.

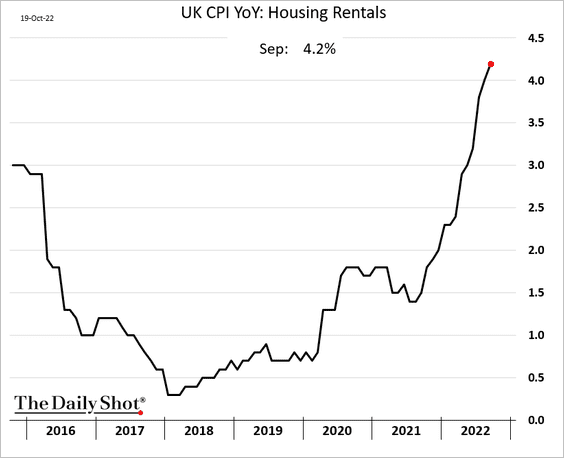

• Rent inflation keeps climbing.

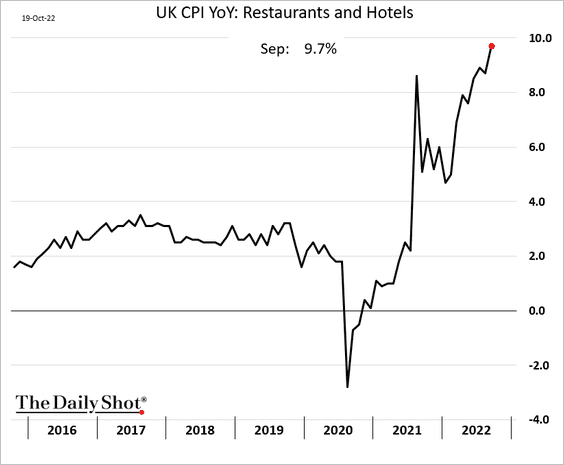

• Here is the CPI for restaurants and hotels.

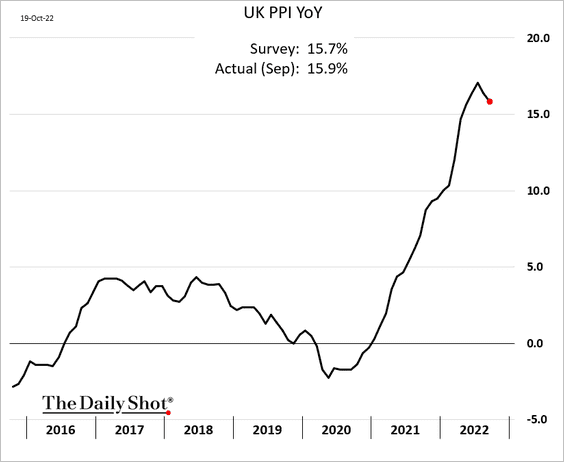

• The PPI edged lower but was above consensus estimates.

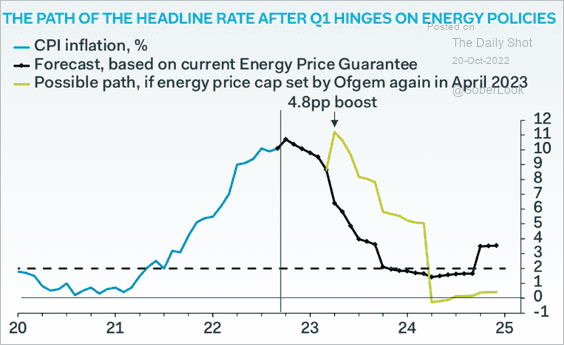

• The evolution of the UK’s CPI hinges on energy price guarantees.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

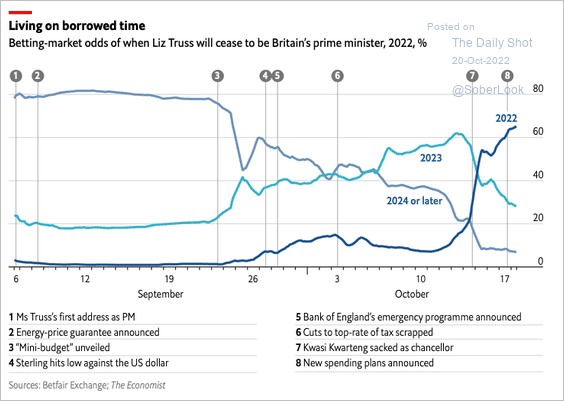

2. The betting markets expect Liz Truss to be out by the end of the year.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

The Eurozone

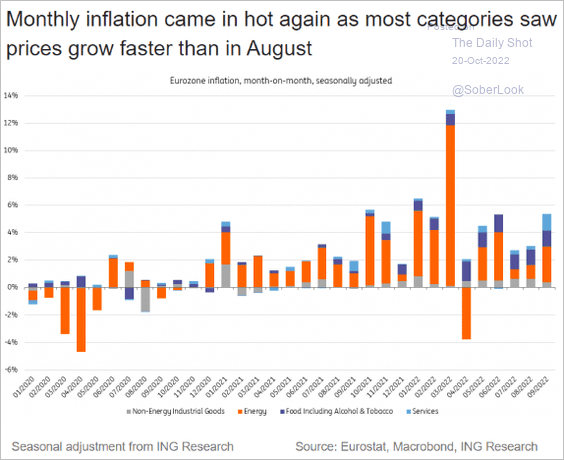

1. Inflation ran hot in September.

Source: ING

Source: ING

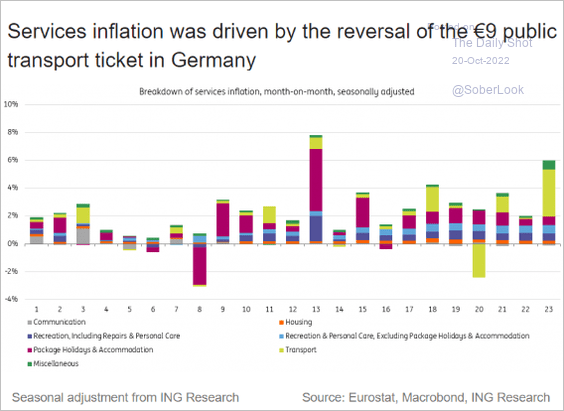

• Here are the drivers of services CPI.

Source: ING

Source: ING

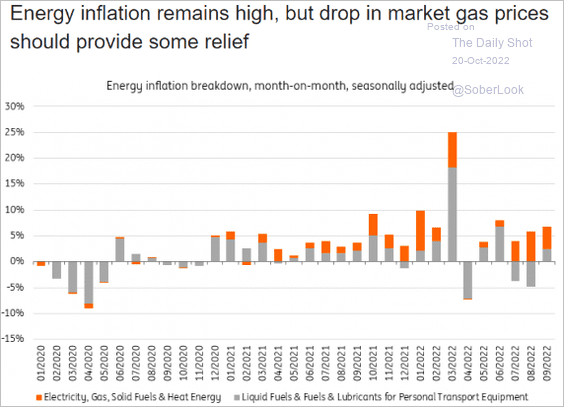

• Energy inflation has been massive but falling natural gas prices should help.

Source: ING

Source: ING

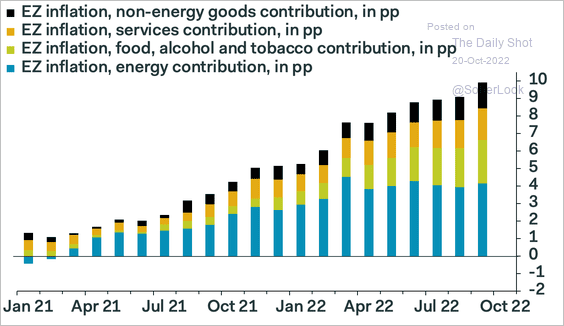

• Here are the year-over-year contributions (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Capital Economics

Source: Capital Economics

——————–

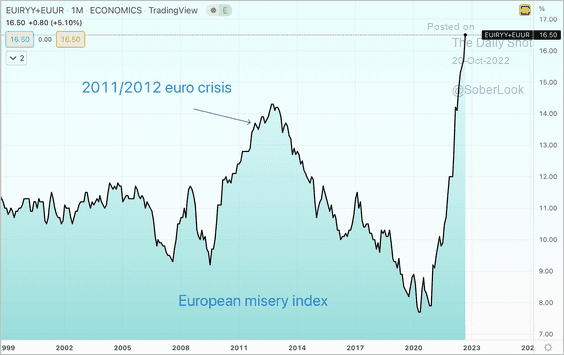

2. The misery index is the highest in decades.

Source: @AlessioUrban

Source: @AlessioUrban

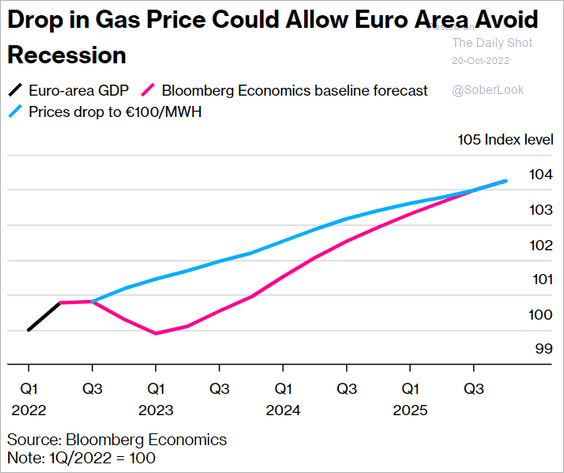

3. Can the Eurozone avoid a recession if natural gas prices keep falling?

Source: @business, @MaevaDebarge, @JMurray804 Read full article

Source: @business, @MaevaDebarge, @JMurray804 Read full article

Back to Index

Europe

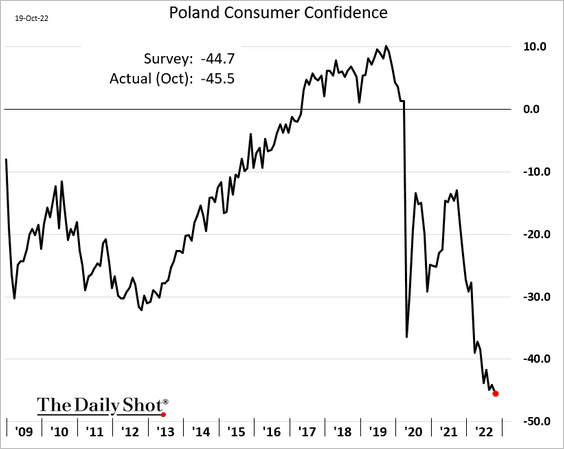

1. Poland’s consumer confidence reached a new low.

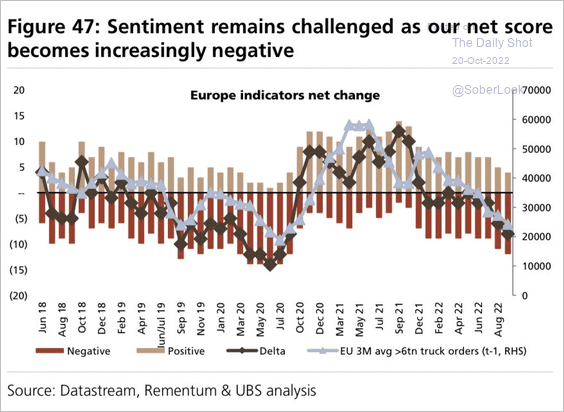

2. Macro indicators continue to deteriorate in the EU.

Source: UBS Research

Source: UBS Research

3. This chart shows inflation rates across the EU.

Source: Eurostat

Source: Eurostat

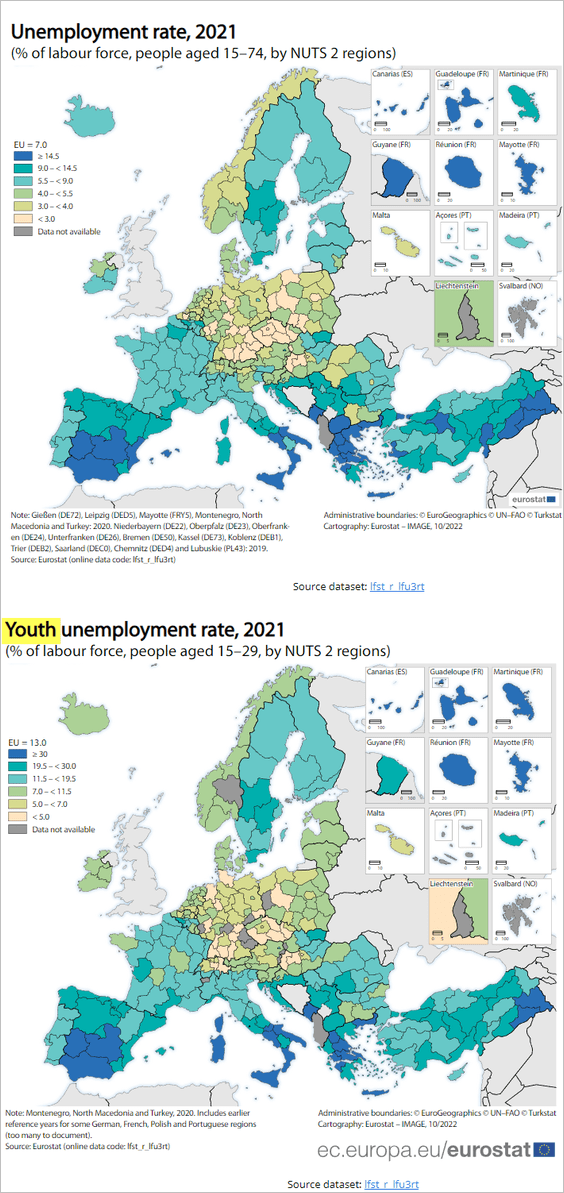

4. Here is the unemployment rate map, including youth joblessness.

Source: Eurostat

Source: Eurostat

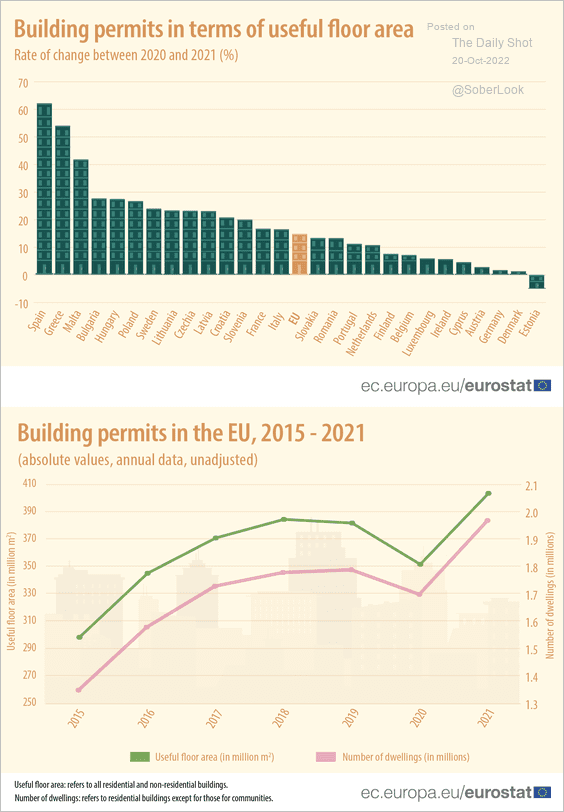

5. Finally, we have data on building permits in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

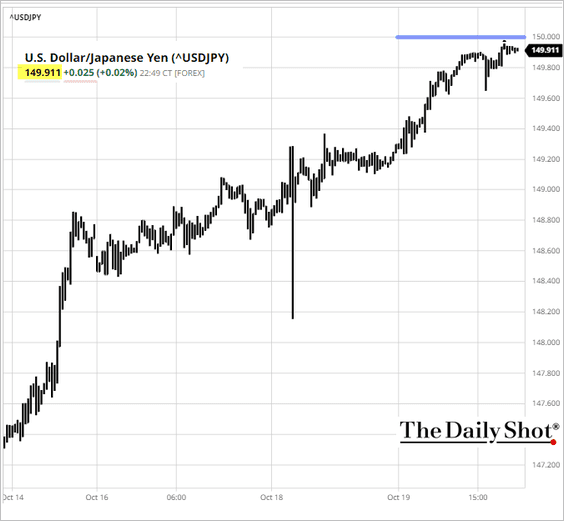

1. Dollar-yen is testing resistance at 150.

Source: barchart.com

Source: barchart.com

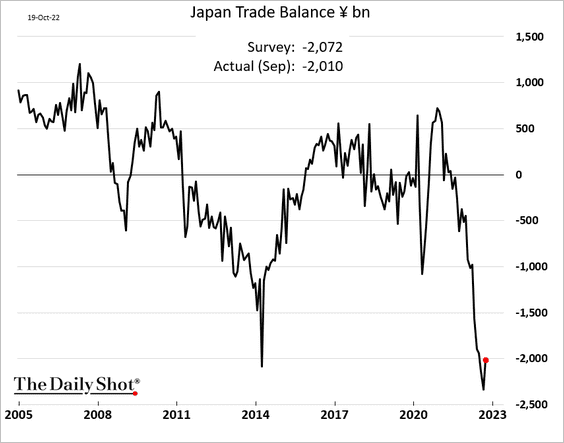

2. Japan’s trade deficit eased a bit last month.

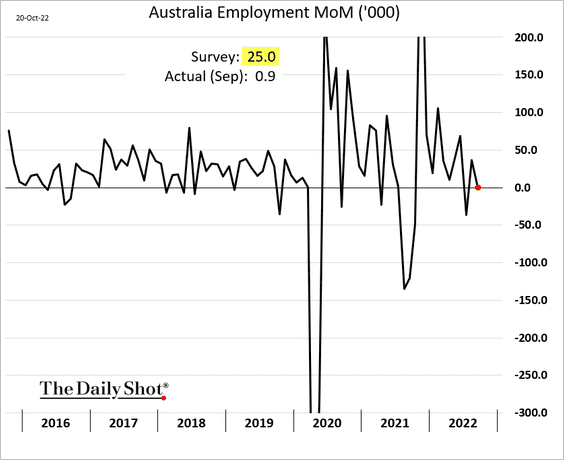

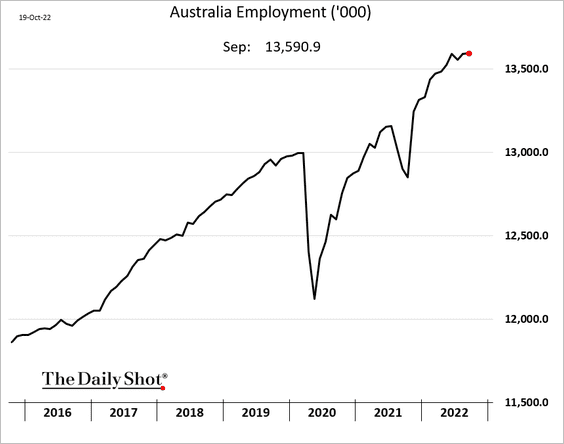

3. Australia’s employment report was much softer than expected …

… as job growth stalls.

Source: Reuters Read full article

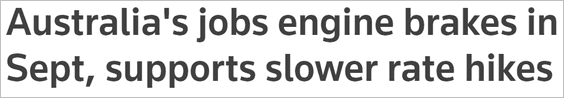

Source: Reuters Read full article

The unemployment rate edged up but is still extremely low.

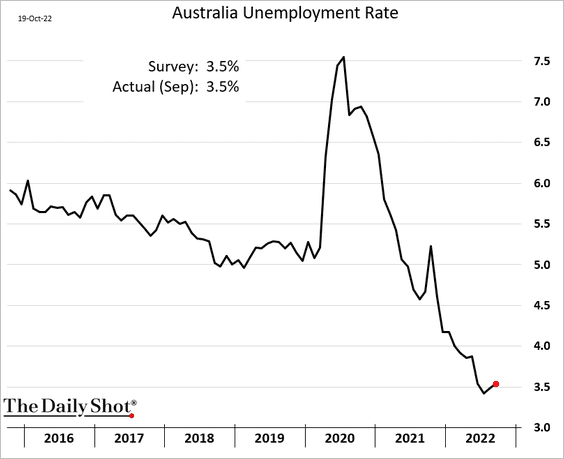

Labor force participation remains elevated.

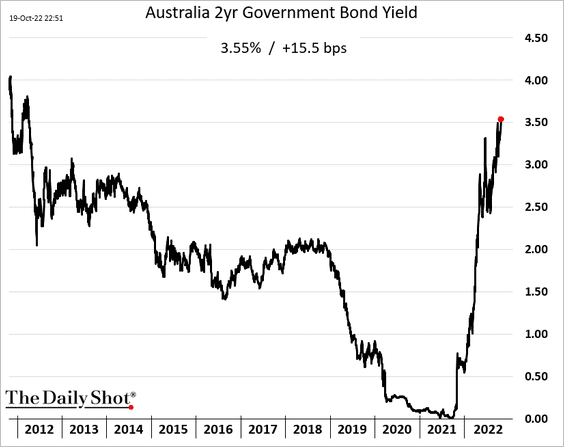

• Australia’s 2yr yield breached 3.5%.

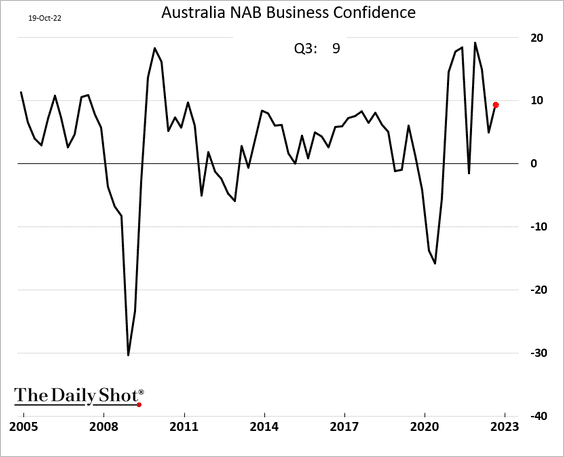

• Business confidence improved last quarter.

——————–

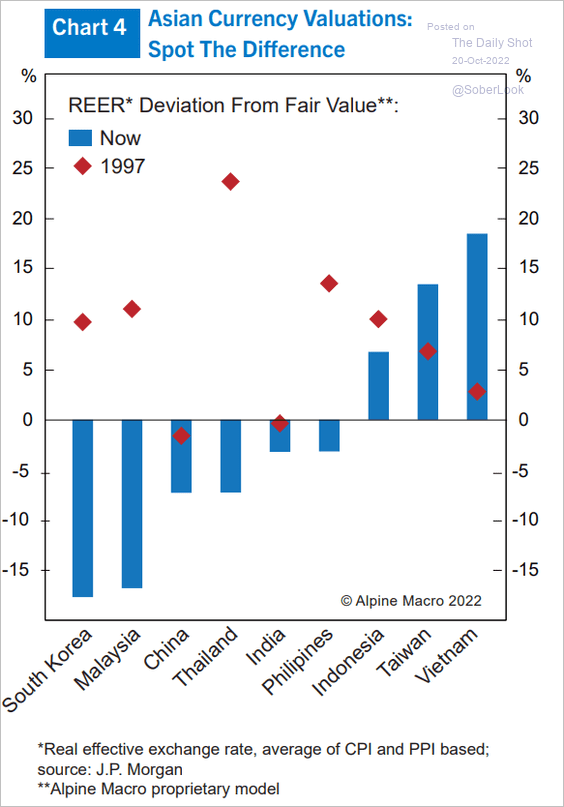

3. How far are Asian currencies from their fair value?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

China

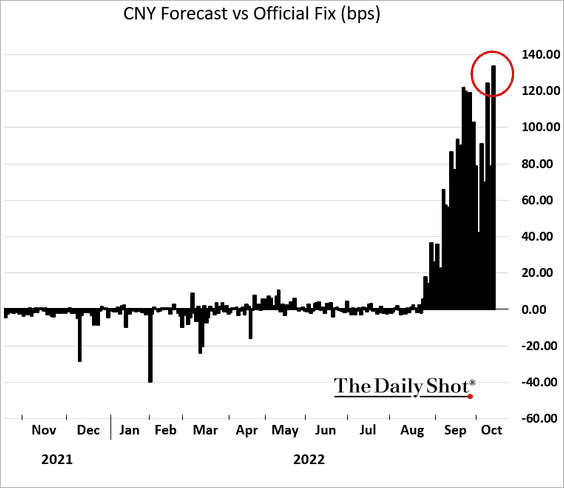

1. The PBoC is struggling to stabilize the renminbi.

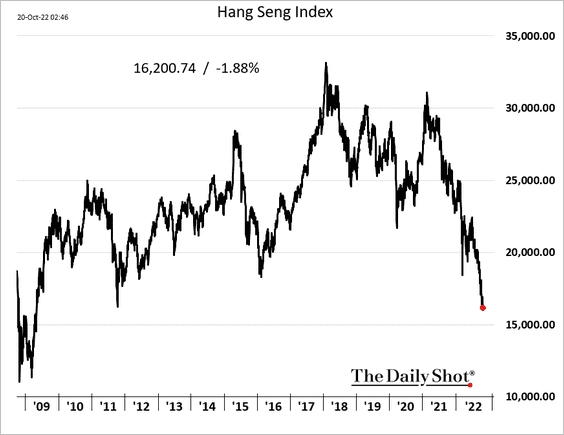

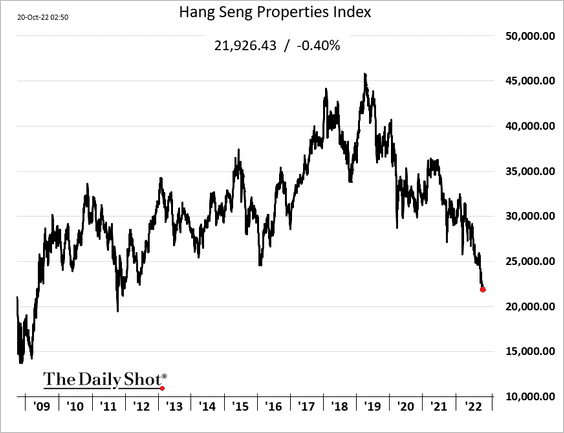

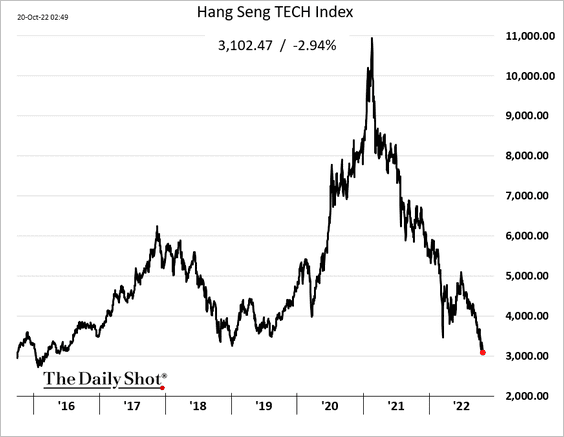

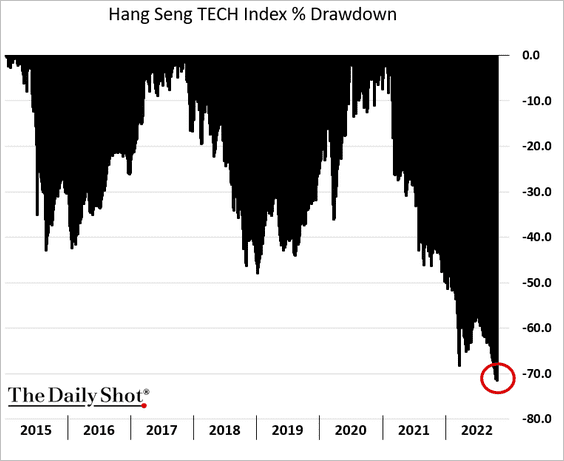

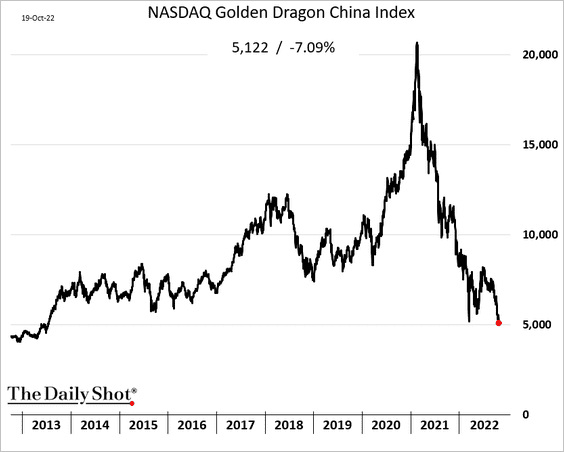

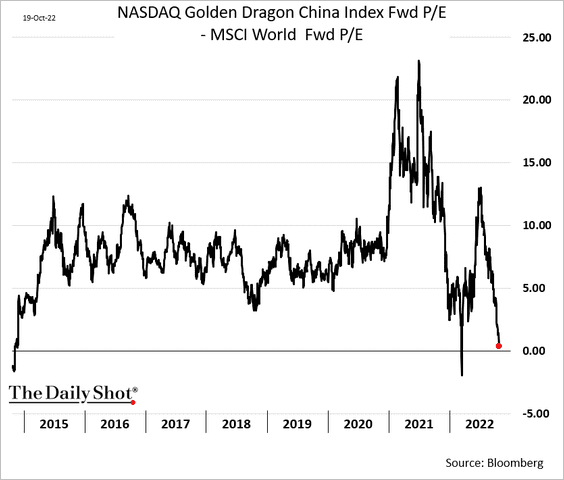

2. Stocks remain under pressure.

• Hang Seng Index

• Property stocks:

• Tech:

• Tech drawdown (> 70%):

• US-listed Chinese firms:

• Premium on US-listed Chinese firms:

h/t Cormac Mullen, Bloomberg

h/t Cormac Mullen, Bloomberg

——————–

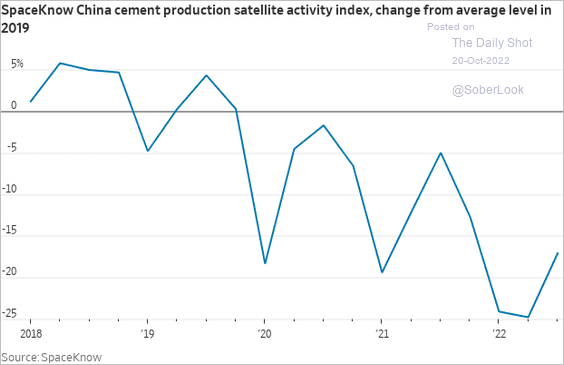

3. Cement production has been depressed.

Source: @WSJ Read full article

Source: @WSJ Read full article

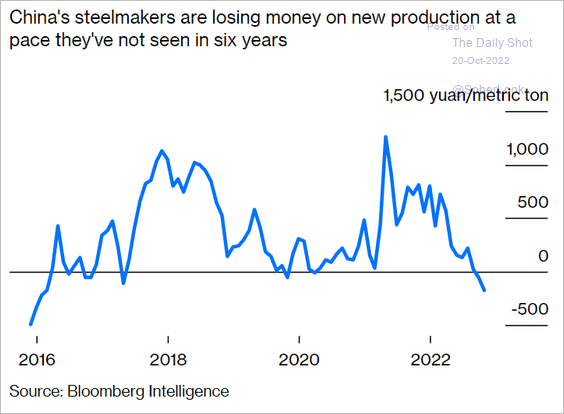

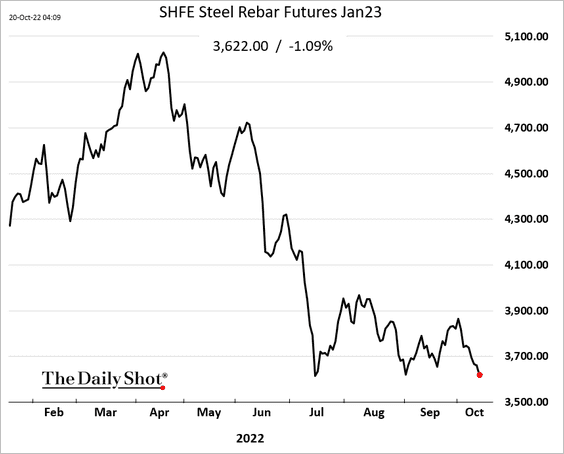

4. Steelmakers are losing money.

Source: @opinion, @davidfickling Read full article

Source: @opinion, @davidfickling Read full article

Steel prices are down sharply this year.

——————–

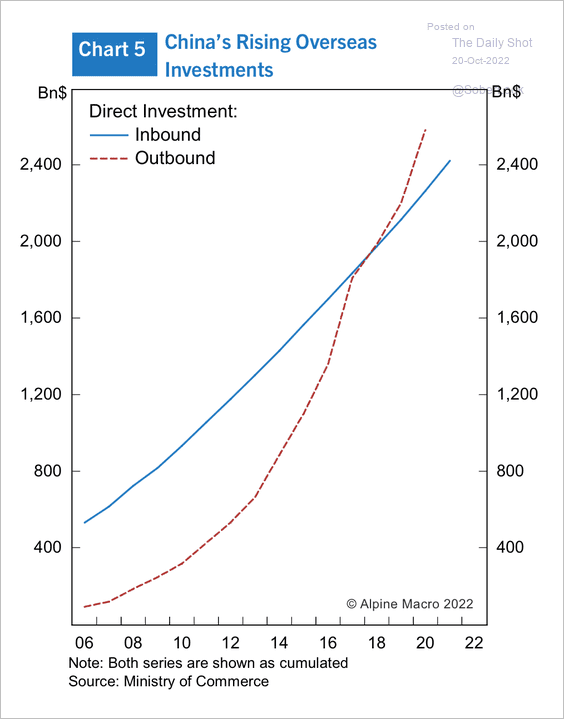

5. Outbound investments have exceeded inward investments in recent years.

Source: Alpine Macro

Source: Alpine Macro

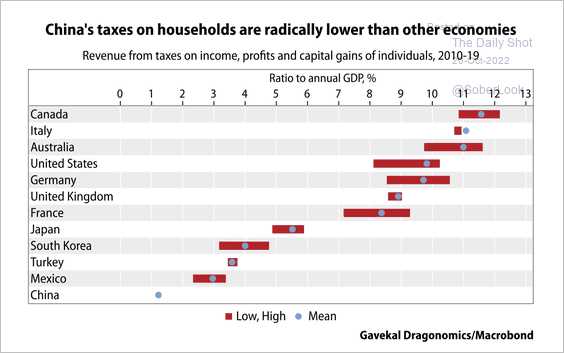

6. China’s taxes on households are lower than other major economies.

Source: Gavekal Research

Source: Gavekal Research

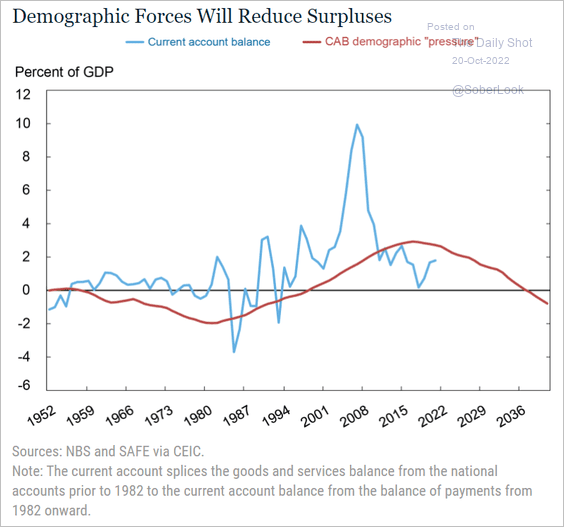

7. Demographic pressures will reduce China’s surpluses.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

Back to Index

Emerging Markets

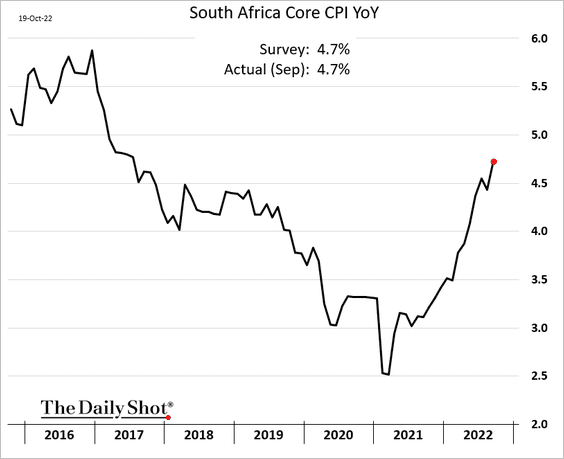

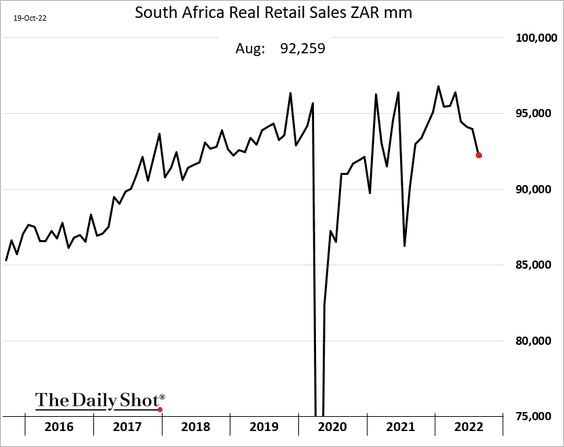

1. South Africa’s core CPI continues to climb.

Retail sales rolled over in August.

——————–

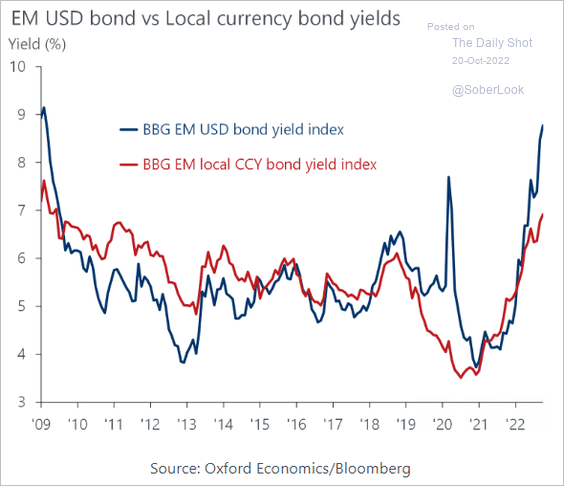

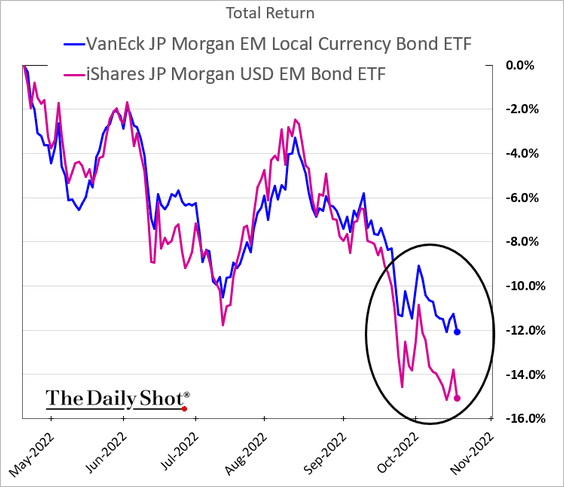

2. Dollar-denominated bonds have sold off much more than local-currency debt (2 charts).

Source: Oxford Economics

Source: Oxford Economics

——————–

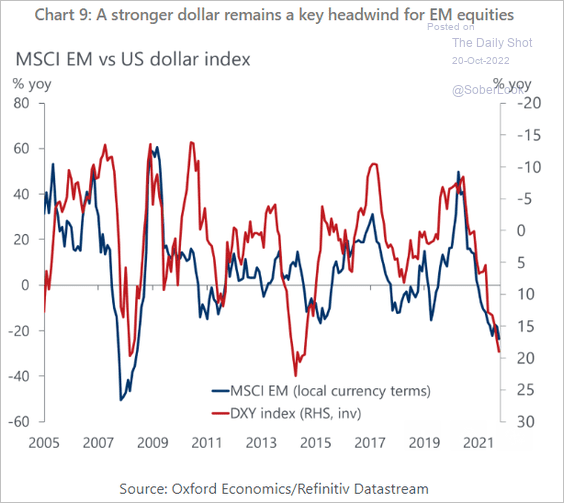

3. A strong dollar is a headwind for EM stocks.

Source: Oxford Economics

Source: Oxford Economics

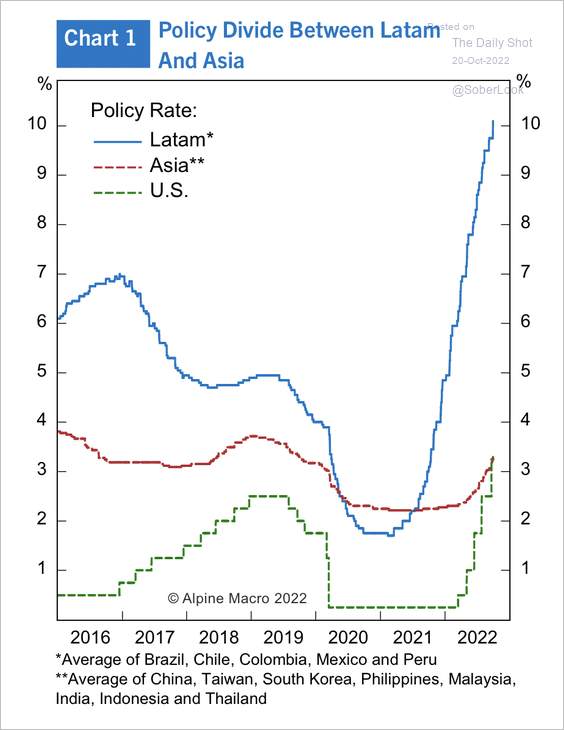

4. Most EM countries have tightened preemptively, and only some EM Asian central banks are playing catch up with the Fed.

Source: Alpine Macro

Source: Alpine Macro

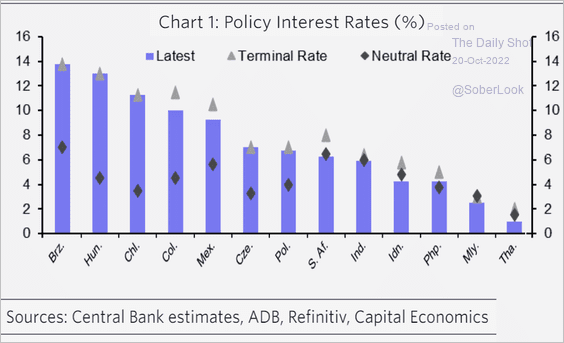

There isn’t much more tightening left, according to Capital Economics, with most countries nearing or having reached the terminal rate. This chart also shows how restrictive central bank policies are based on the neutral rate.

Source: Capital Economics

Source: Capital Economics

——————–

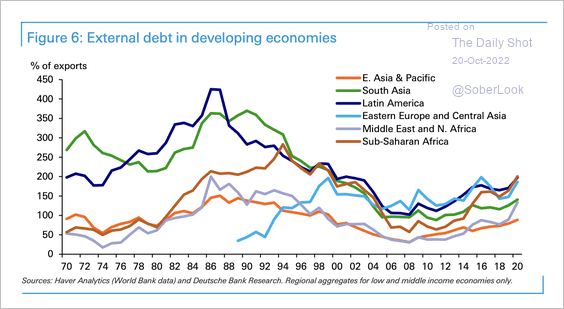

5. External debt levels across EM countries are slightly higher than pre-1980s debt crisis levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Cryptocurrency

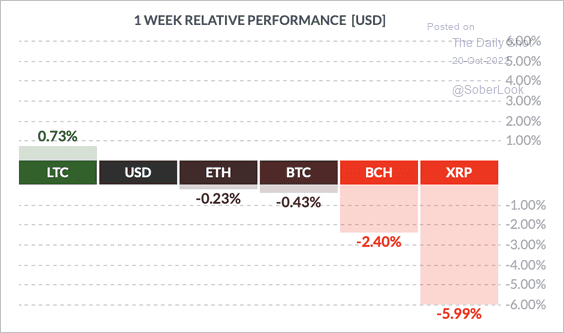

1. It’s been a flat week for BTC so far, while Litecoin (LTC) has outperformed and XRP underperformed

Source: FinViz

Source: FinViz

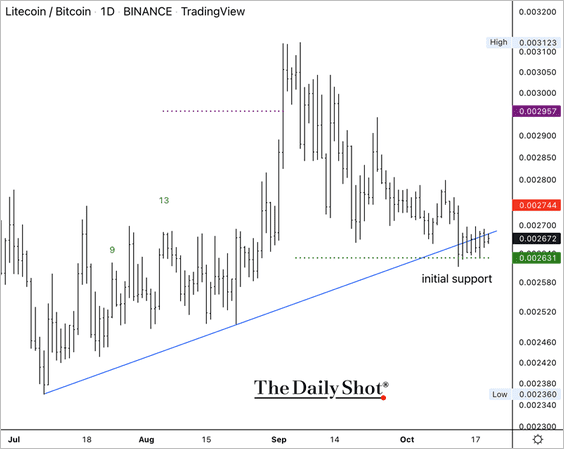

2. Will LTC hold short-term support?

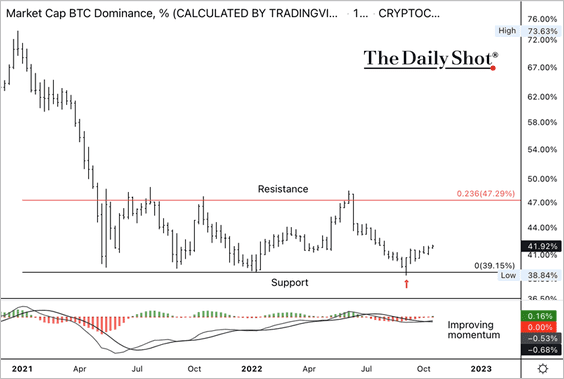

3. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) continues to hold support. A rising dominance ratio is typically associated with risk-off conditions.

Back to Index

Energy

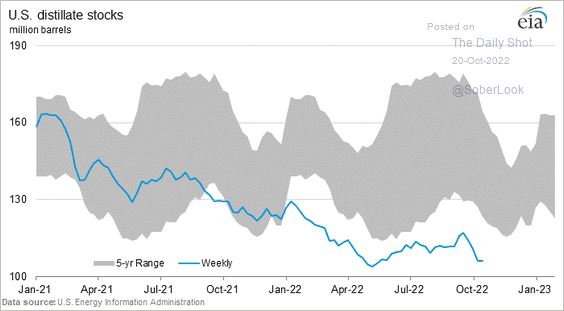

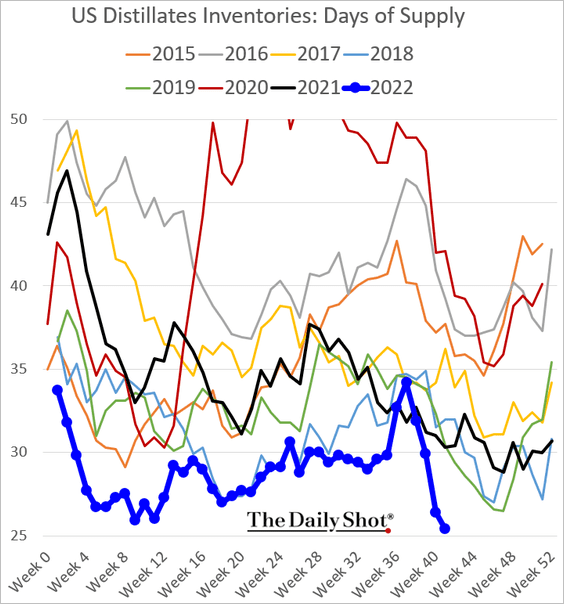

1. US diesel inventories remain extremely tight.

• Barrels:

Source: @EIAgov

Source: @EIAgov

• Days of supply:

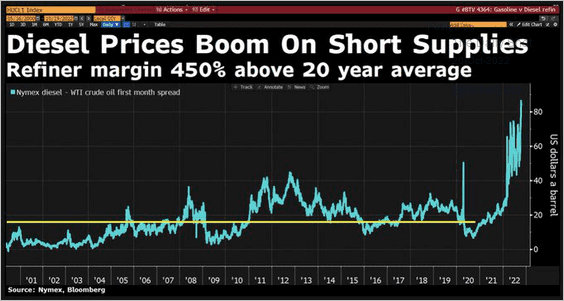

Crack spreads have blown out.

Source: @ValerieTytel, @JavierBlas Read full article

Source: @ValerieTytel, @JavierBlas Read full article

——————–

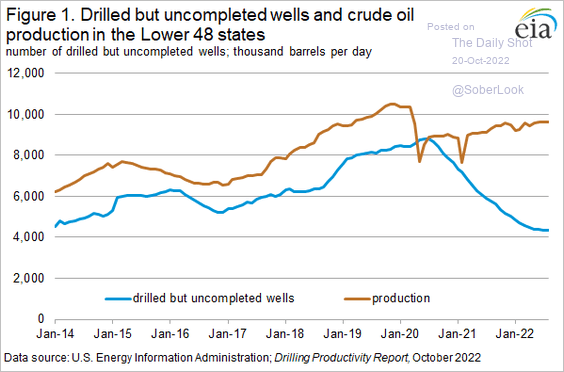

2. Substantial investment will be needed to keep US oil production growing.

Source: @EIAgov

Source: @EIAgov

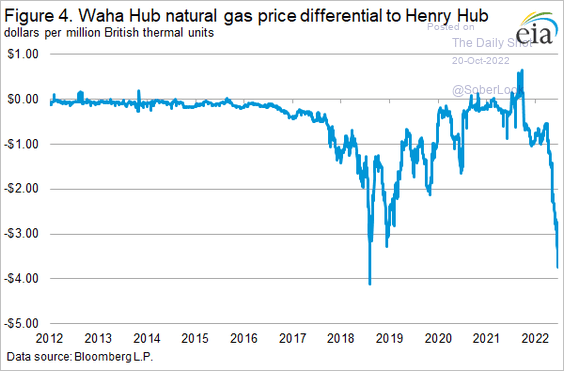

3. The Permian region is once again challenged by natural gas pipeline takeaway capacity constraints.

Source: @EIAgov

Source: @EIAgov

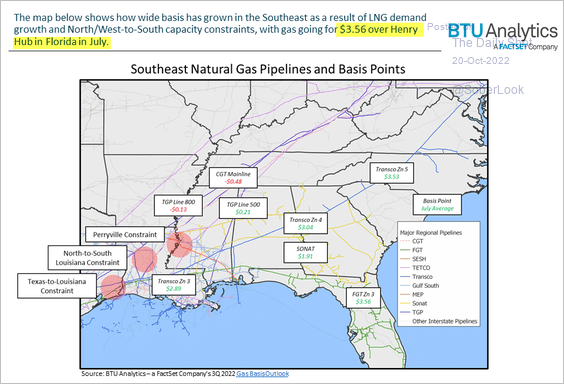

4. LNG demand has boosted natural gas prices in some parts of the US Southeast well above the benchmark Henry Hub levels.

Source: @FactSet Read full article

Source: @FactSet Read full article

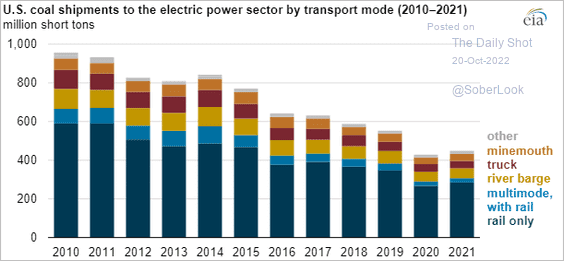

5. Coal shipments to US power plants have been trending lower.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

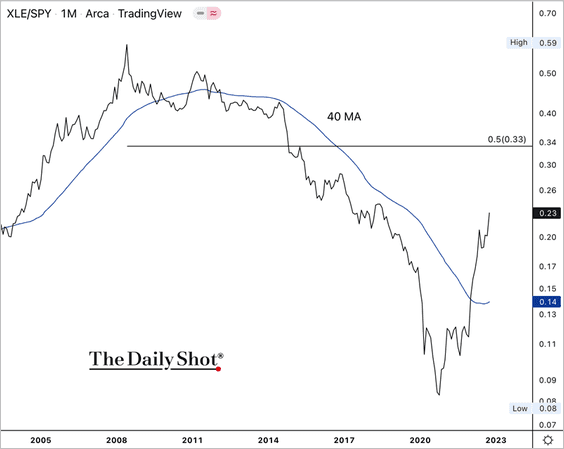

6. The SPDR Energy Sector ETF (XLE) is well above its decade-long downtrend versus the S&P 500.

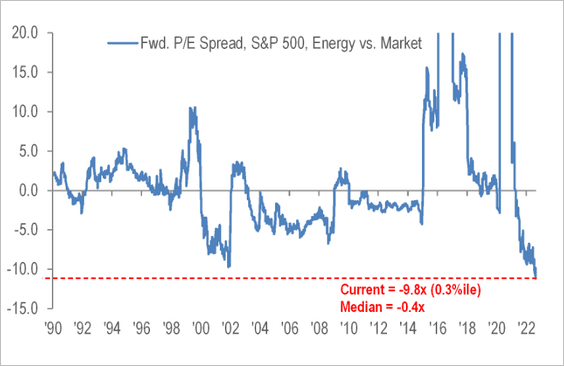

Nonetheless, energy companies are extremely cheap relative to the overall market.

Back to Index

Equities

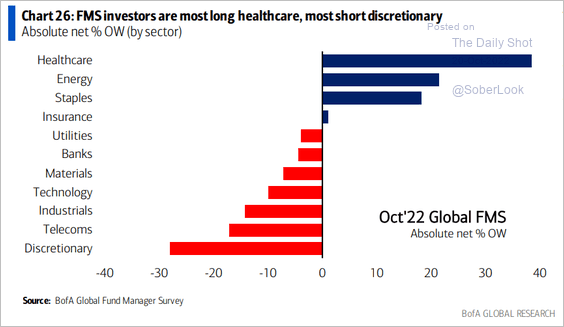

1. Let’s begin with some sector updates.

• Fund managers’ allocations:

Source: BofA Global Research

Source: BofA Global Research

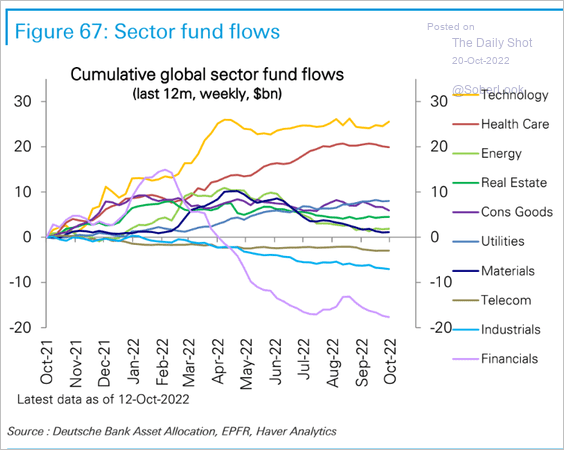

• Fund flows by sector:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

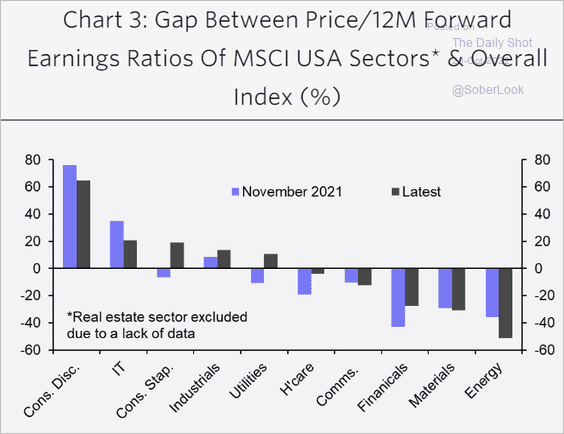

• The gap between sectors’ forward P/E ratios and the overall index (relative valuations):

Source: Capital Economics

Source: Capital Economics

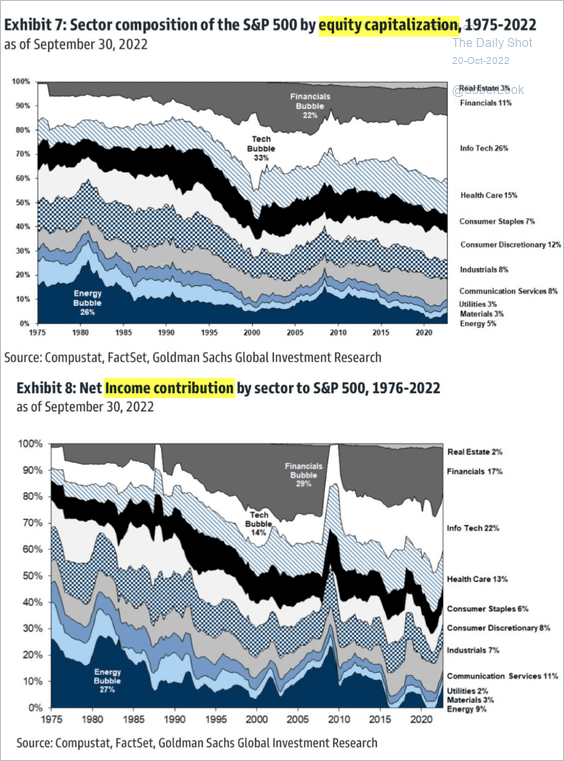

• Sector capitalization distribution and sector income contributions over time:

Source: Goldman Sachs

Source: Goldman Sachs

• Which sectors are most vulnerable to US dollar strength?

Source: Oxford Economics

Source: Oxford Economics

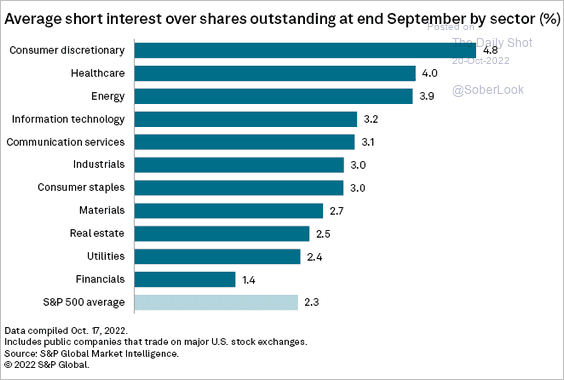

• Short Interest by sector:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

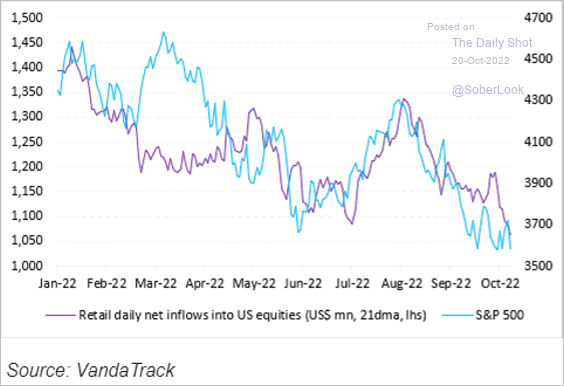

2. Net retail buying continues to slow.

Source: Vanda Research

Source: Vanda Research

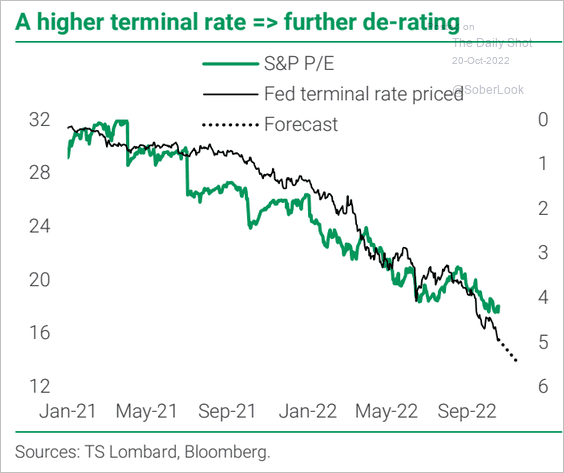

3. A higher terminal rate (see the US section) means lower PE multiples.

Source: TS Lombard

Source: TS Lombard

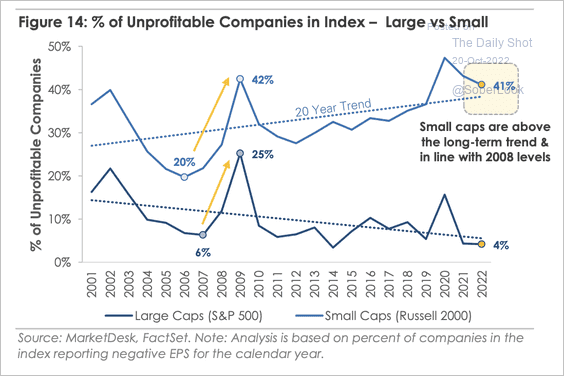

4. The Russell 2,000 small-cap index is more exposed to unprofitable companies versus the S&P 500.

Source: MarketDesk Research

Source: MarketDesk Research

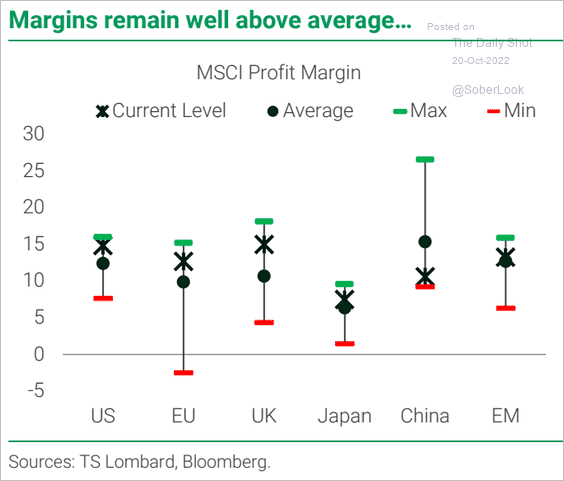

5. Corporate margins remain above average across advanced economies.

Source: TS Lombard

Source: TS Lombard

Back to Index

Rates

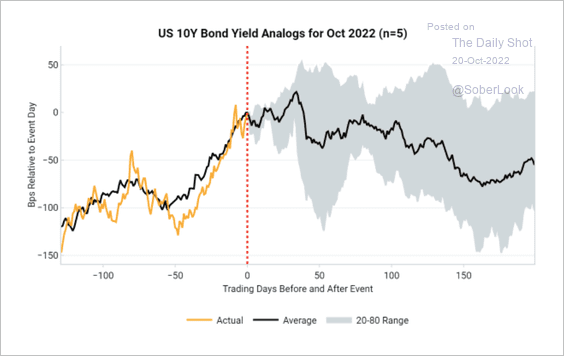

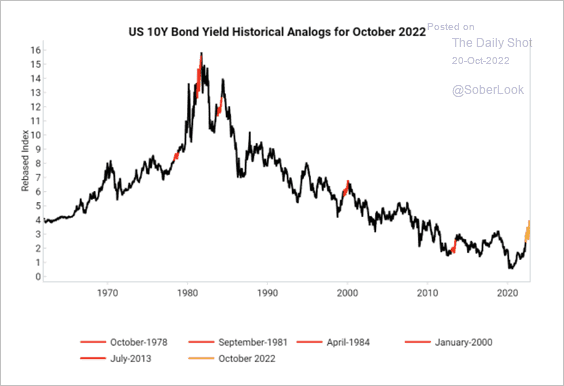

Some analogs point to a peak in yields very soon, according to Variant Perception (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Back to Index

Global Developments

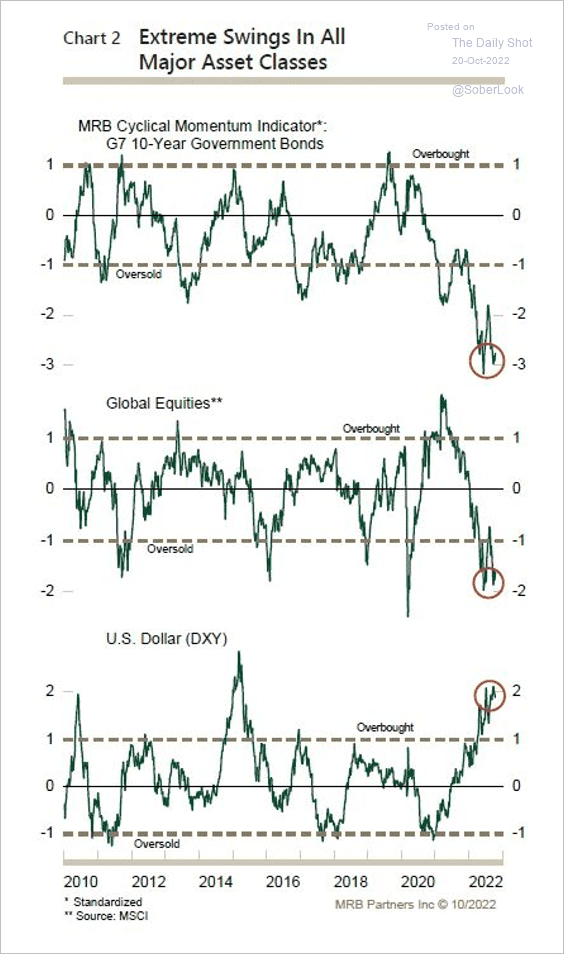

1. A sustained risk-on phase requires a pause/downward move in bond yields and the dollar.

Source: MRB Partners

Source: MRB Partners

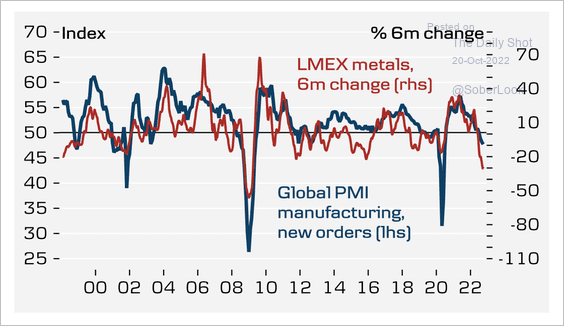

2. The decline in metal prices points to weaker manufacturing conditions.

Source: Danske Bank

Source: Danske Bank

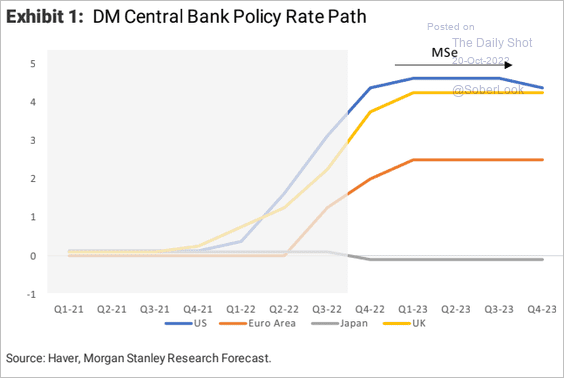

3. Next we have Morgan Stanley’s forecast for policy rate trajectories in advanced economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

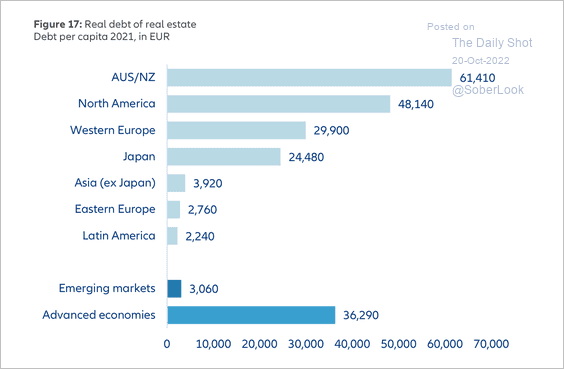

4. Advanced economies, particularly Australia and New Zealand, have high amounts of real estate debt per capita.

Source: Allianz Research

Source: Allianz Research

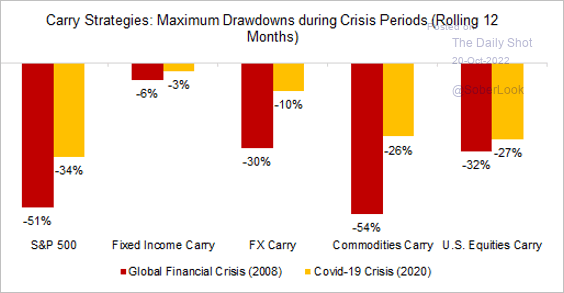

5. This chart shows maximum drawdowns across carry strategies.

Source: Finominal

Source: Finominal

——————–

Food for Thought

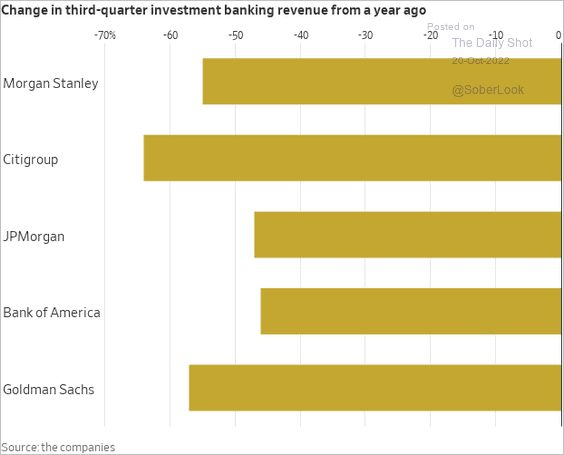

1. Investment banking revenues:

Source: @WSJ Read full article

Source: @WSJ Read full article

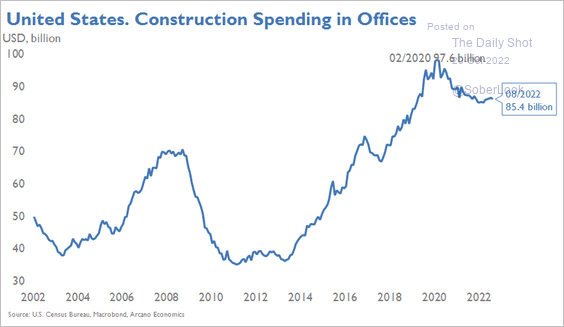

2. Office construction spending:

Source: Arcano Economics

Source: Arcano Economics

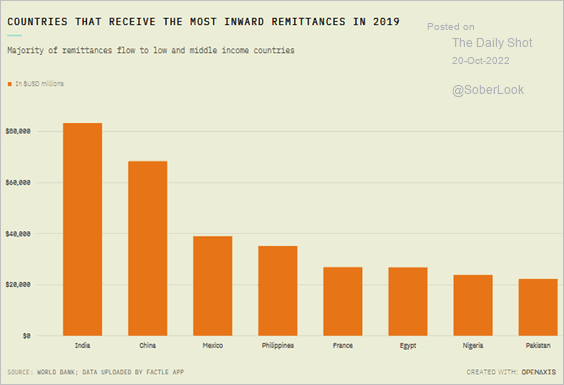

3. Remittances:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

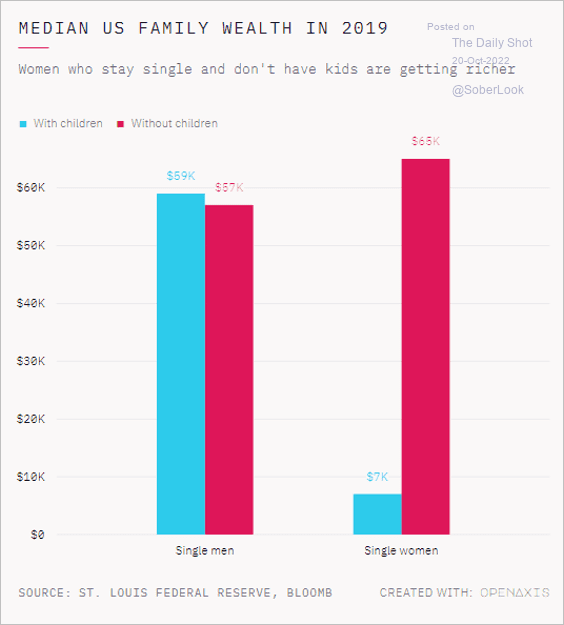

4. Wealth of single US adults with and without children:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

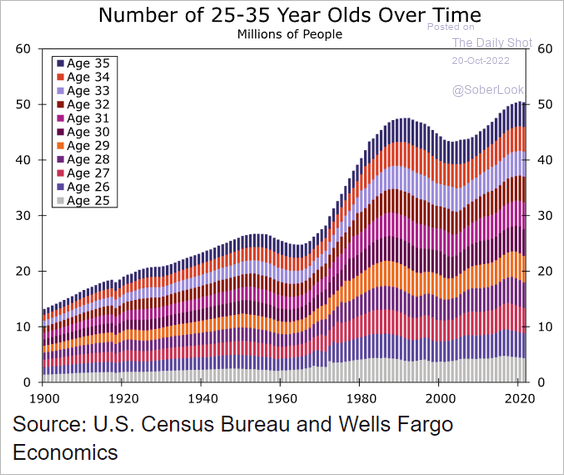

5. The number of 25-35 year-olds in the US:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

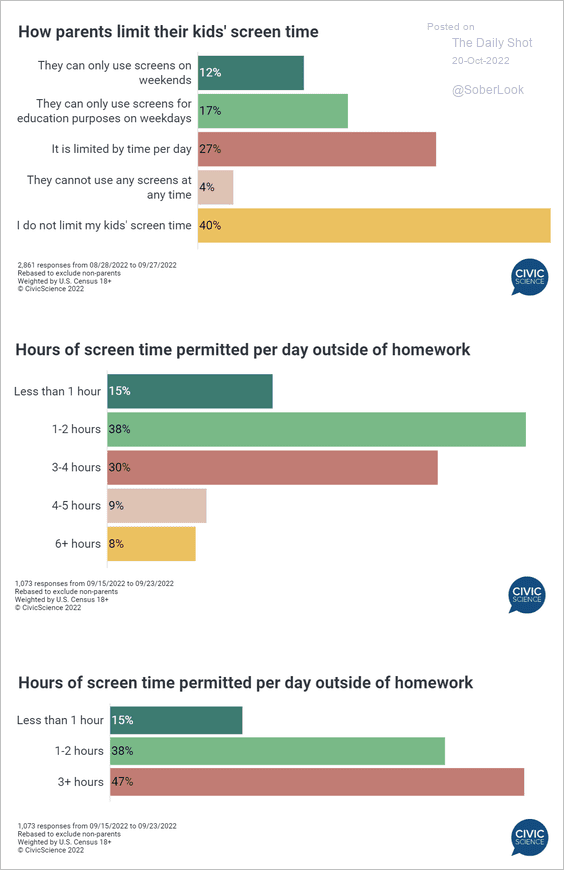

6. Limiting kids’ screen time:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

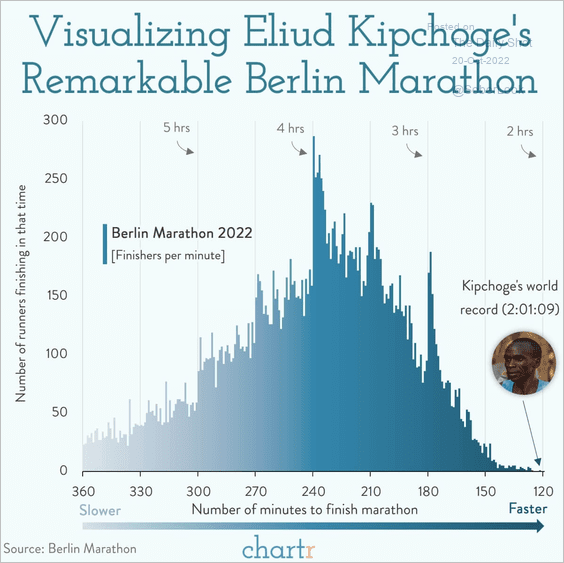

7. The Berlin Marathon finishers’ time distribution:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index