The Daily Shot: 21-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

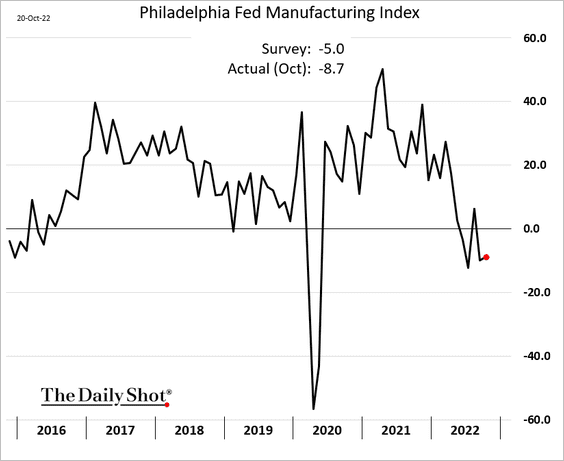

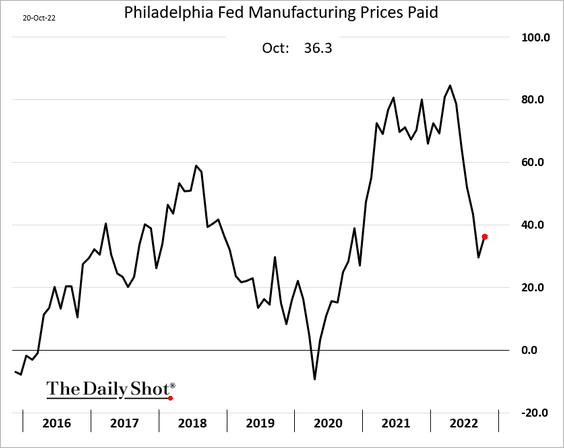

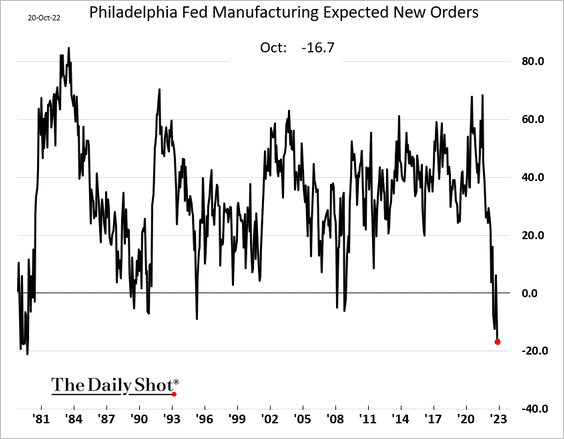

1. The Philly Fed’s manufacturing index held in negative territory this month, pointing to soft factory activity in the region, …

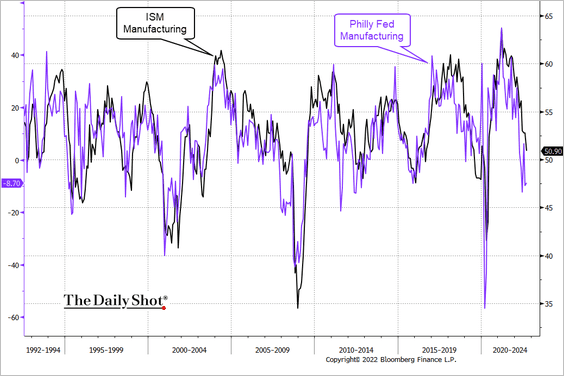

… and signaling manufacturing weakness at the national level.

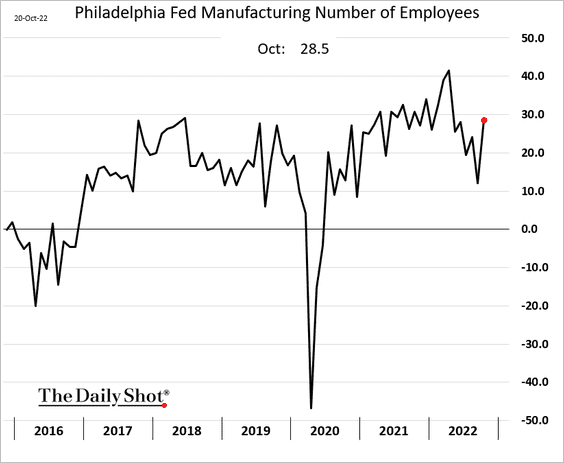

• Hiring improved.

• More firms reported paying higher prices.

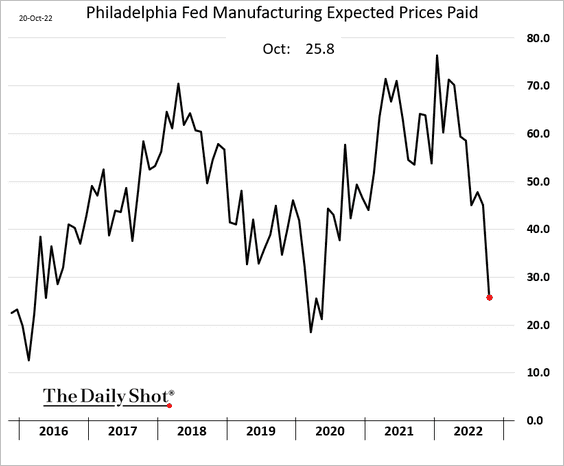

However, fewer companies expect input prices to keep climbing.

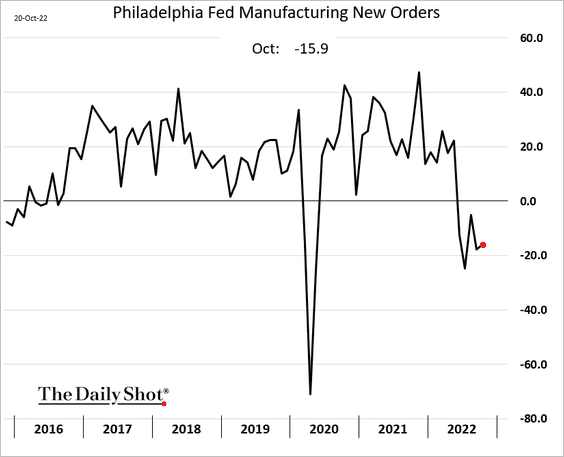

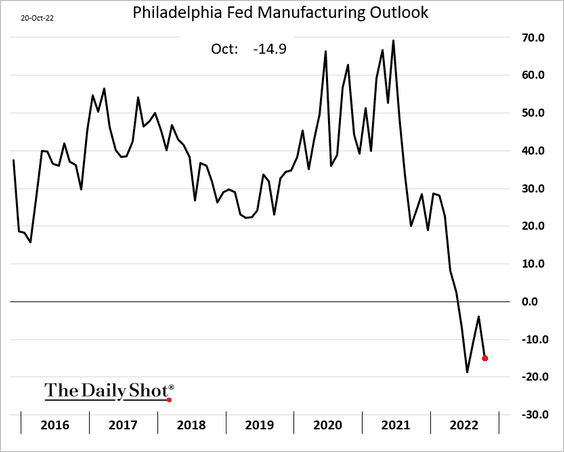

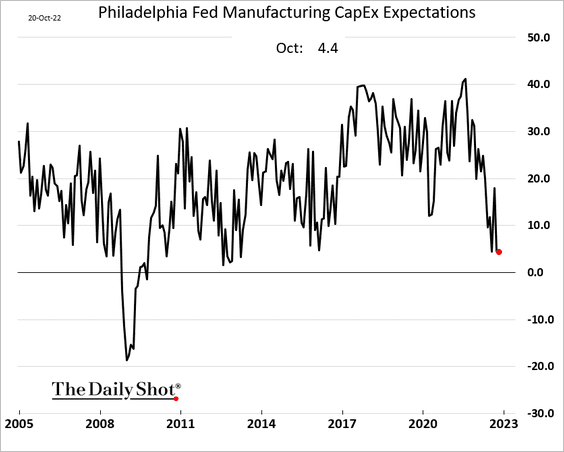

• Forward-looking indicators are particularly weak.

– Outlook:

– CapEx expectations:

– Expected new orders (lowest since 1979):

——————–

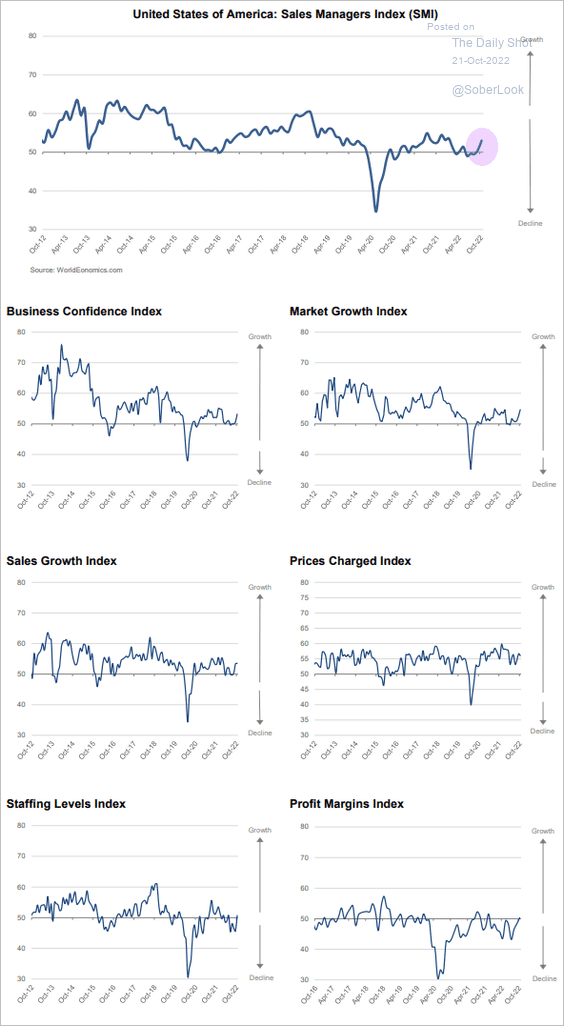

2. On the other hand, the World Economics SMI report showed faster US business activity growth this month (services and manufacturing).

Source: World Economics

Source: World Economics

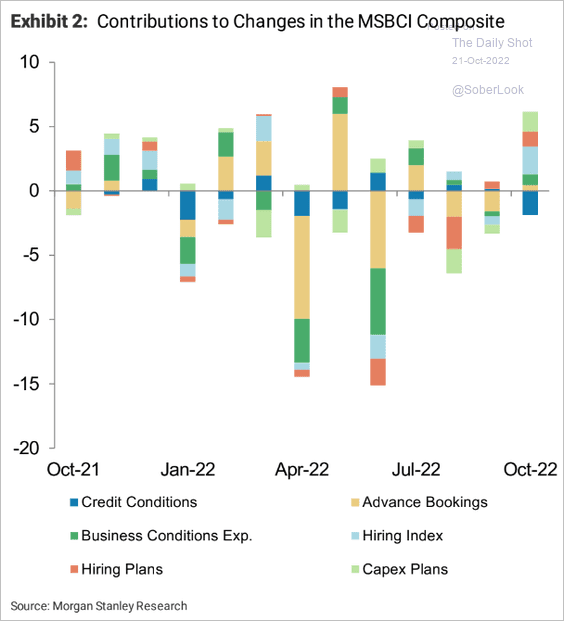

There was also a bounce in the Morgan Stanley Business Conditions Index.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

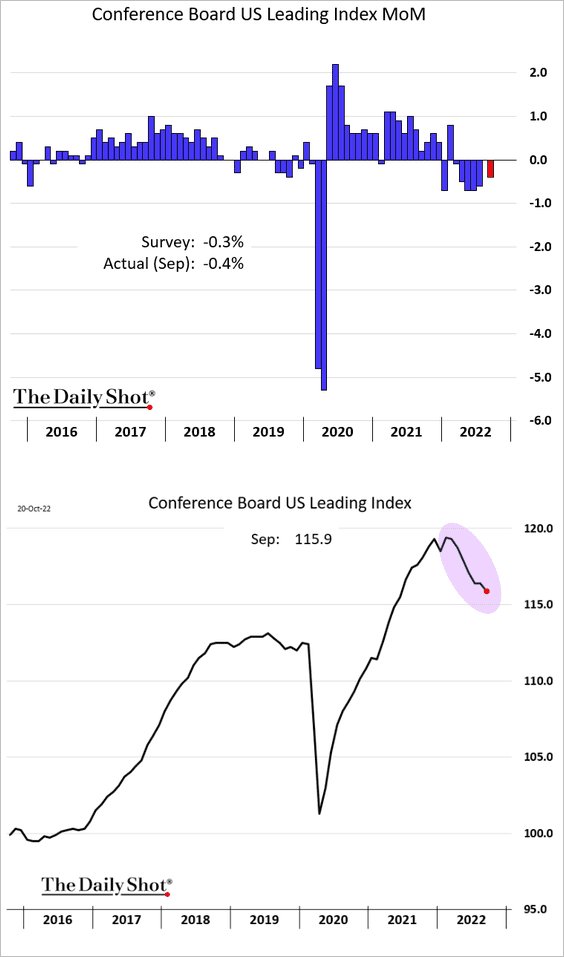

3. The Conference Board’s index of leading economic indicators declined again in September.

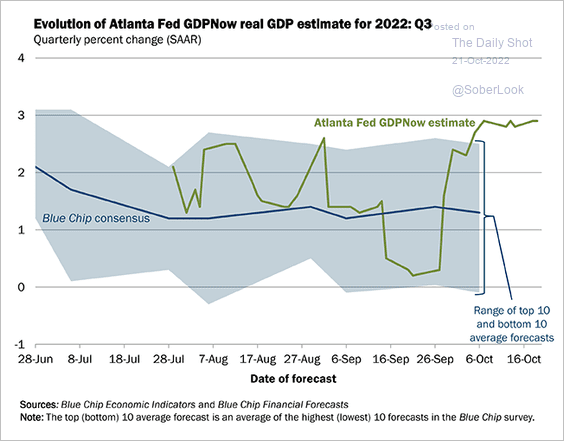

4. The Atlanta Fed’s GDPNow Q3 growth estimate is holding near 3% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

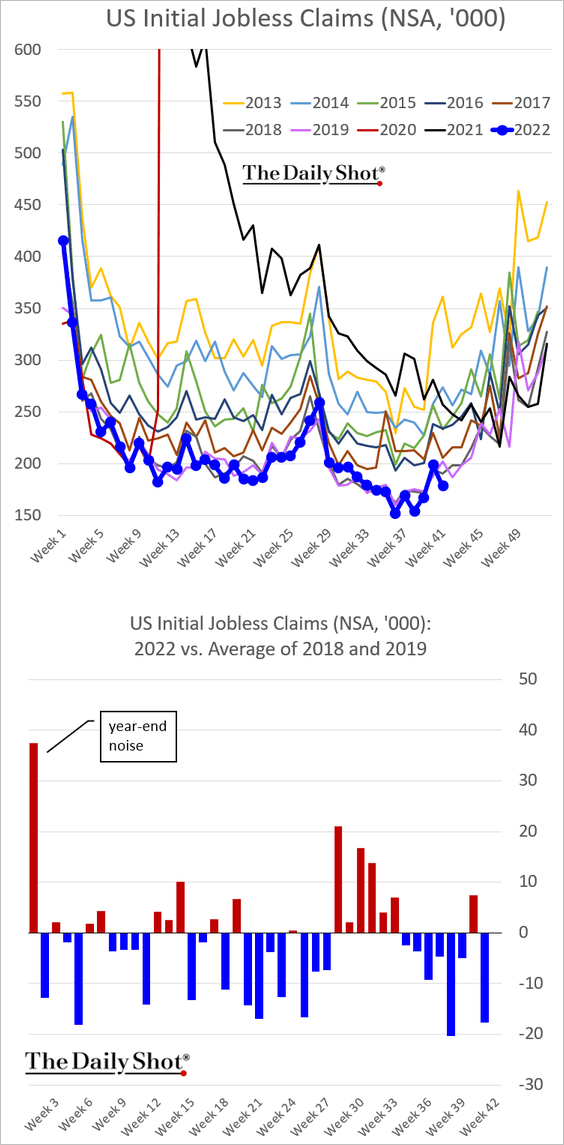

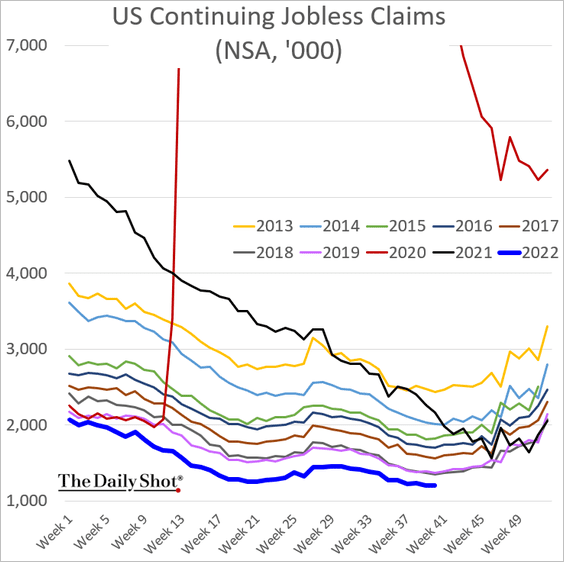

5. Initial jobless claims are back at multi-year lows, pointing to persistent strength in the labor market.

——————–

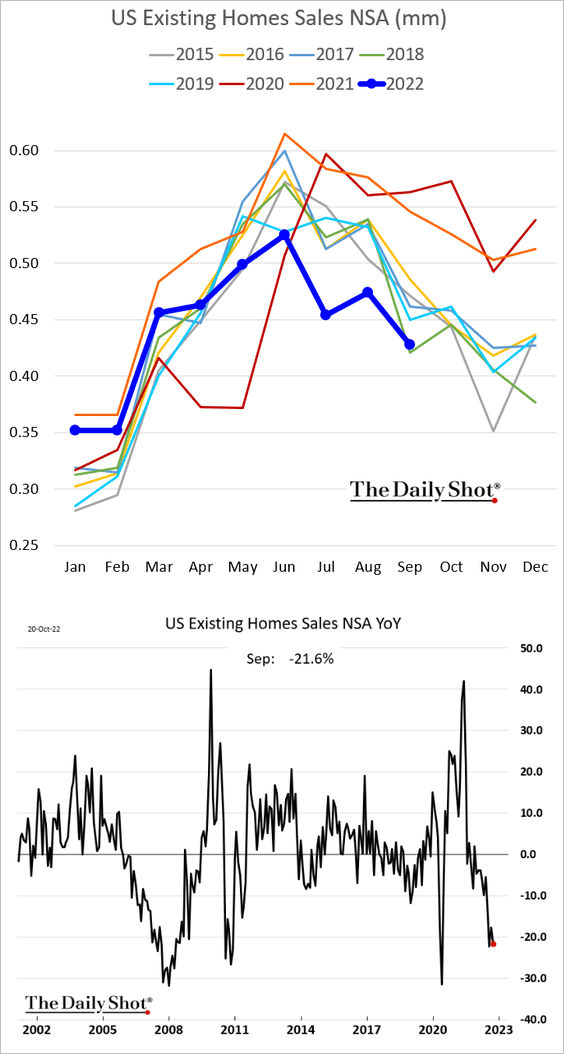

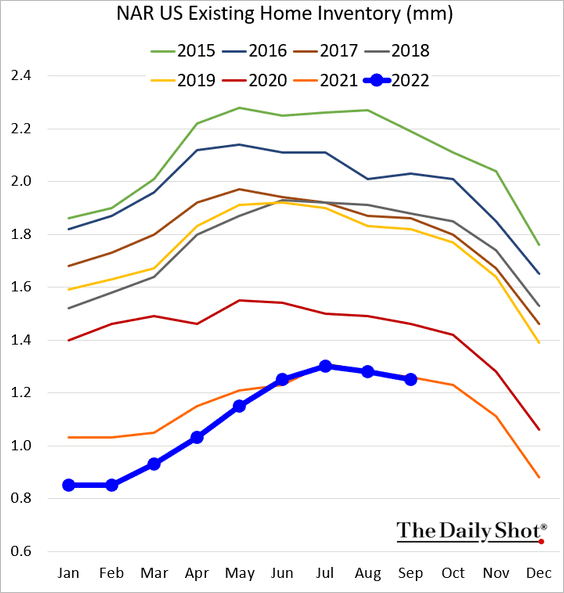

6. Existing home sales remain soft.

• Inventories (number of units) are in line with last year’s levels.

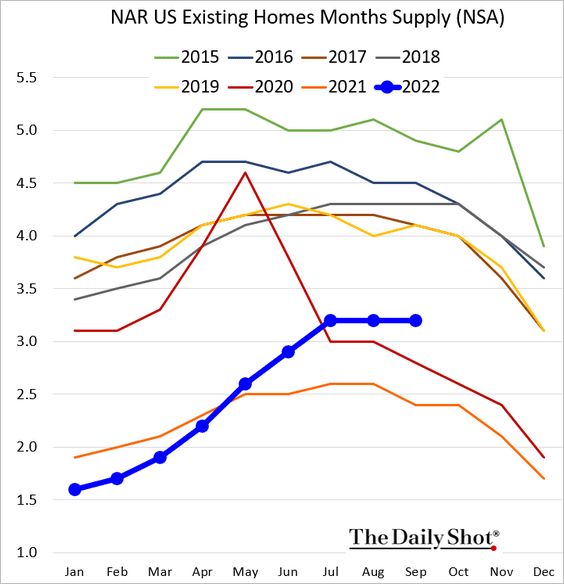

But they are higher when measured in months of supply.

——————–

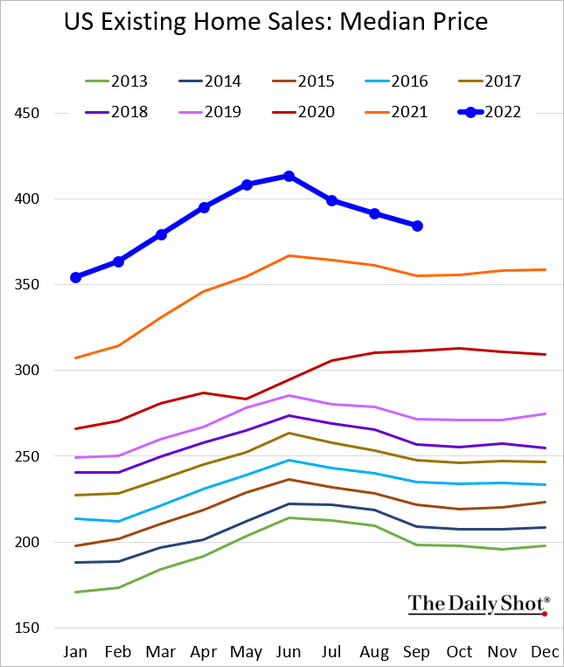

• The median sale price is still well above last year’s levels.

——————–

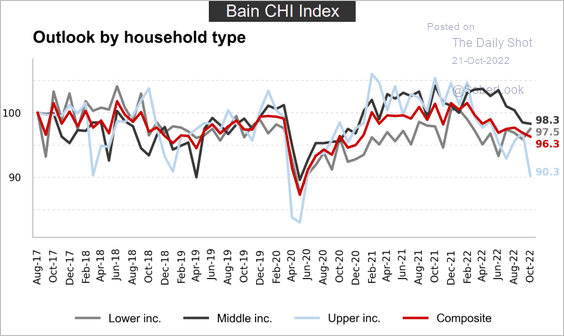

7. The Bain Consumer Health Index signals slower spending ahead, driven by the negative wealth effect.

Source: Bain & Company

Source: Bain & Company

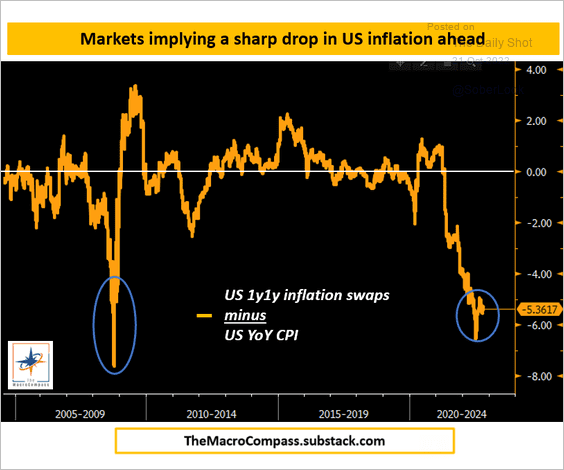

8. The market expects a sharp decline in inflation over the next couple of years.

Source: @MacroAlf

Source: @MacroAlf

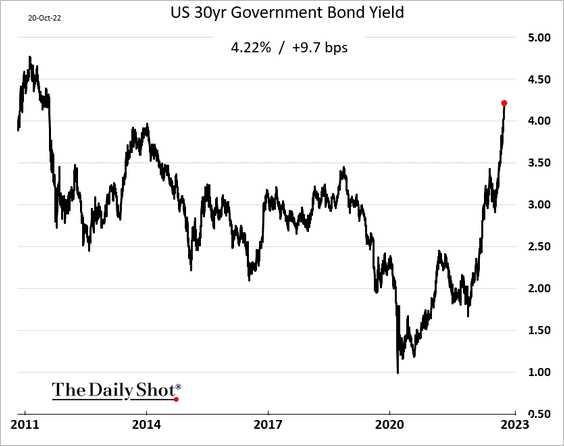

9. Treasury yields continue to surge.

Back to Index

Canada

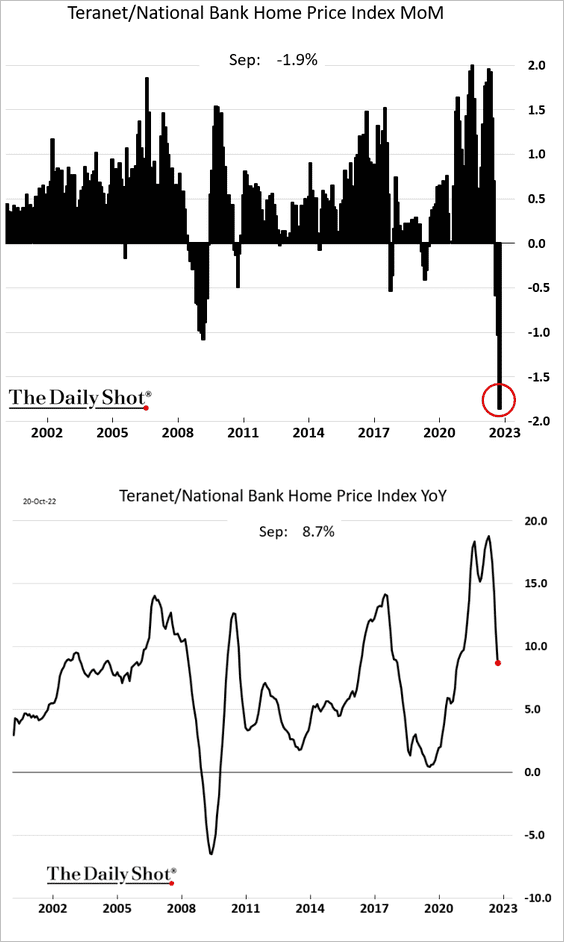

1. Home prices tumbled last month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

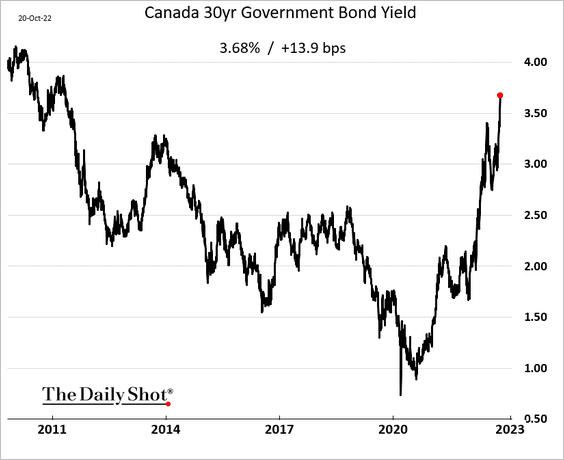

2. Bond yields keep climbing.

Back to Index

The United Kingdom

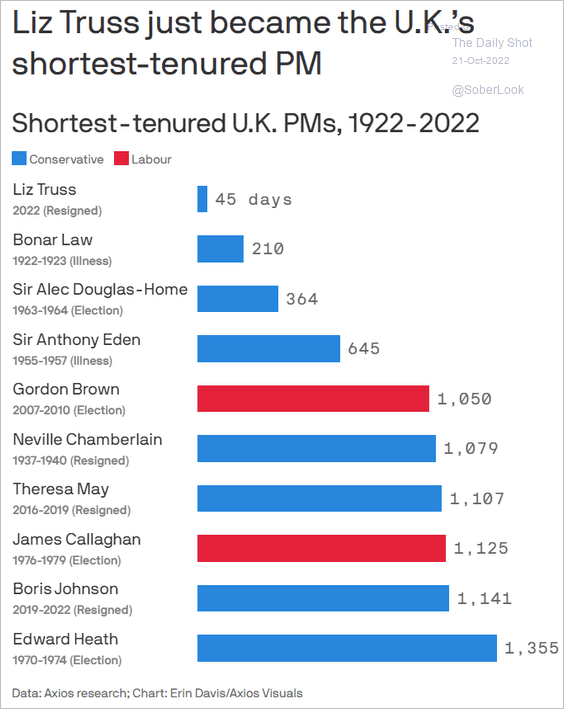

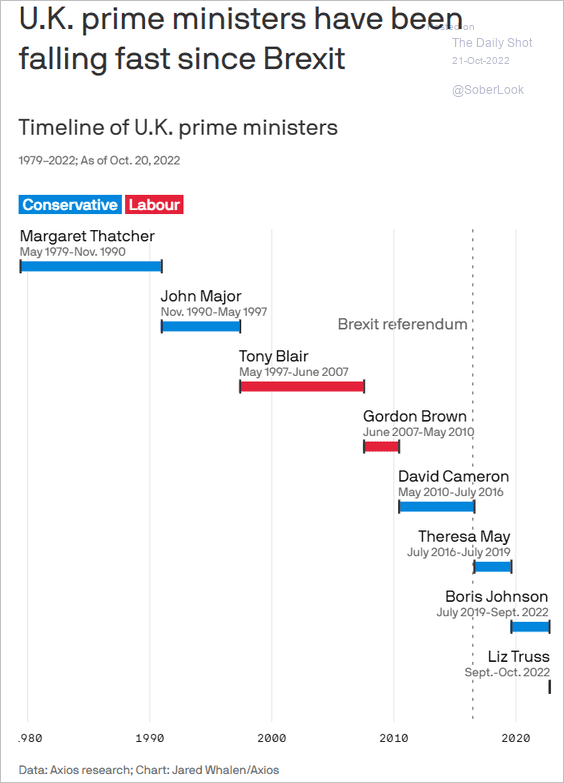

1. The UK’s political turmoil continues.

Source: @axios Read full article

Source: @axios Read full article

Source: @axios Read full article

Source: @axios Read full article

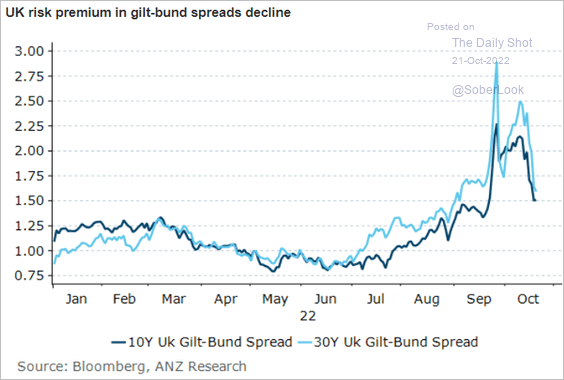

• The gilt-bund spread is lower but remains elevated.

Source: @ANZ_Research

Source: @ANZ_Research

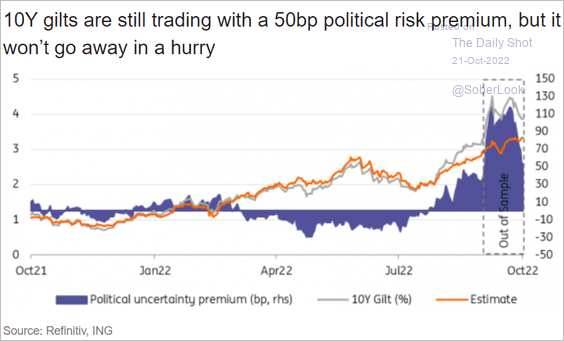

There is still a great deal of risk premium priced into gilts.

Source: ING

Source: ING

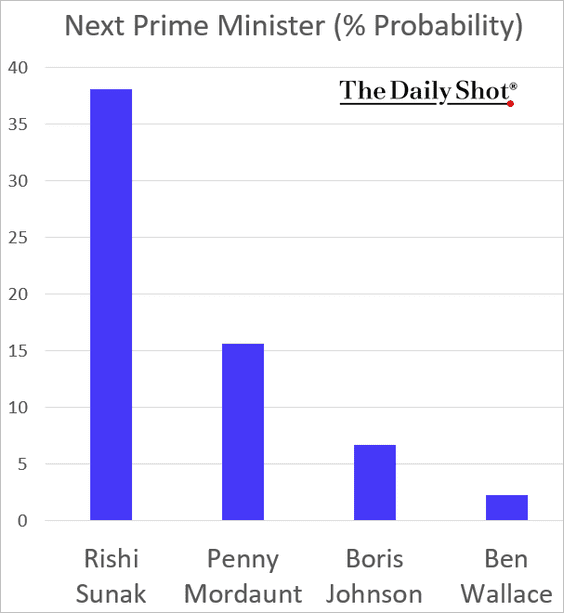

• What are the betting markets telling us about the next prime minister?

Source: oddschecker.com

Source: oddschecker.com

——————–

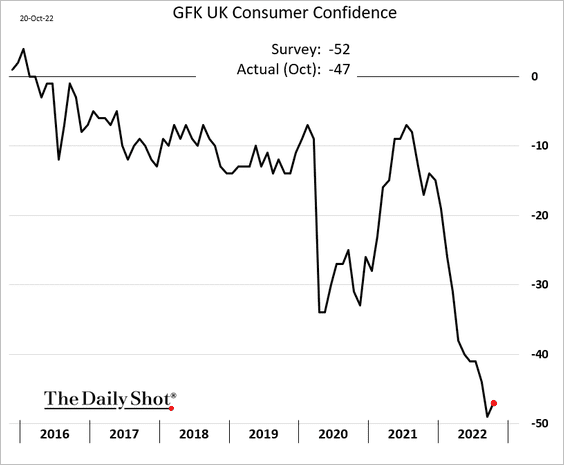

2. Consumer confidence ticked up this month.

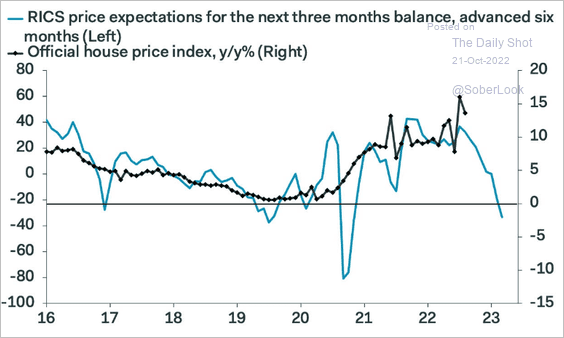

3. The housing market is facing some headwinds.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

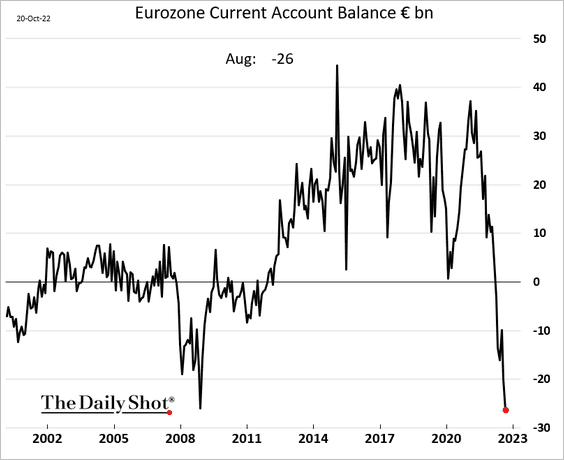

The Eurozone

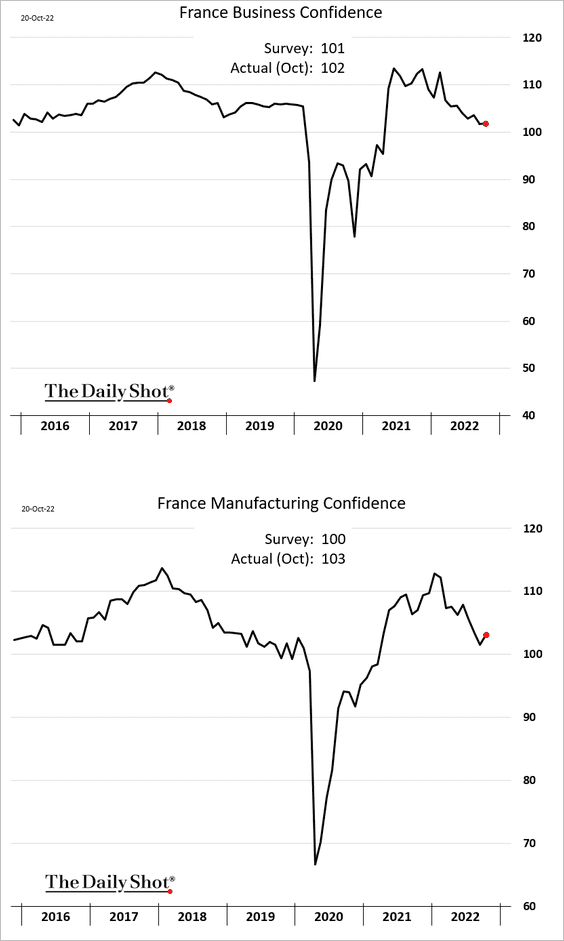

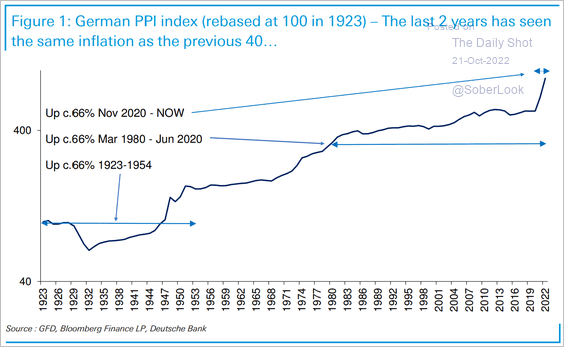

1. French business confidence was resilient this month.

2. German producer prices have accelerated at the fastest pace in about 40 years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Here is the euro-area current account balance.

Back to Index

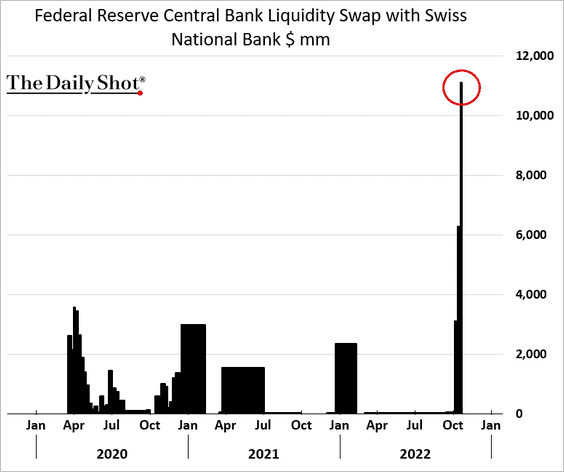

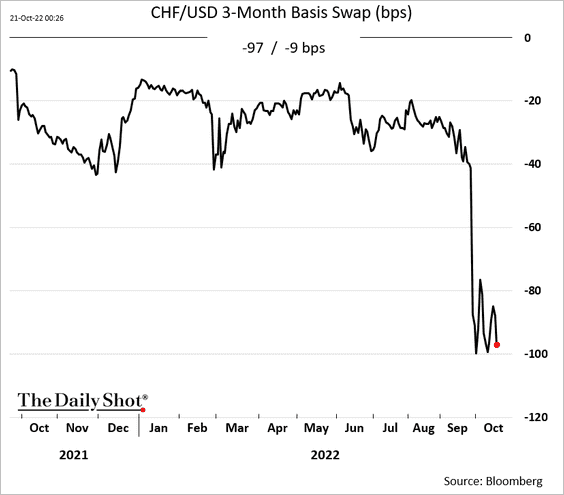

Europe

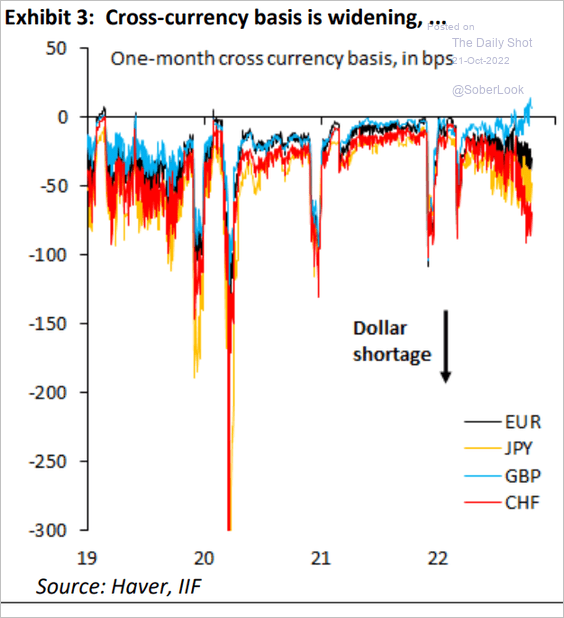

1. The SNB continues to draw more dollars from the Fed’s swap facility amid funding jitters.

Source: Reuters Read full article

Source: Reuters Read full article

The CHF/USD basis swap has blown out …

… more than other markets.

Source: IIF

Source: IIF

——————–

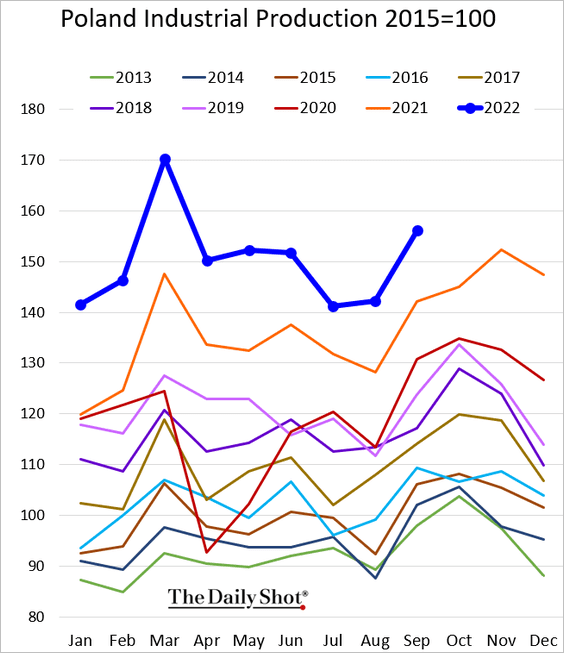

2. Poland’s industrial production remains robust despite the energy headwinds.

Back to Index

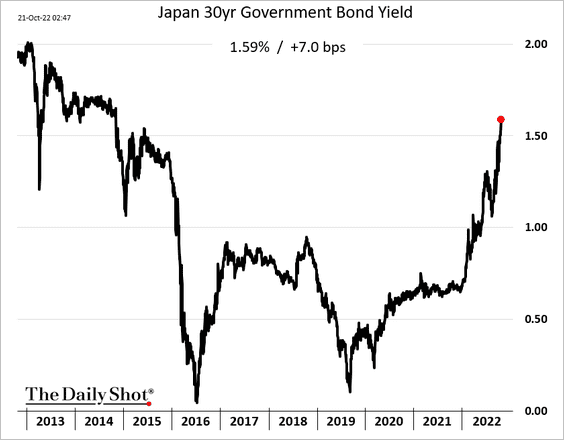

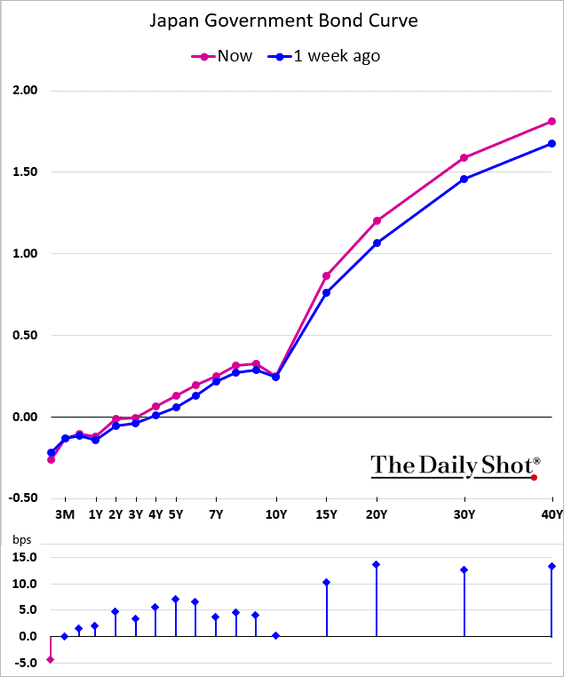

Japan

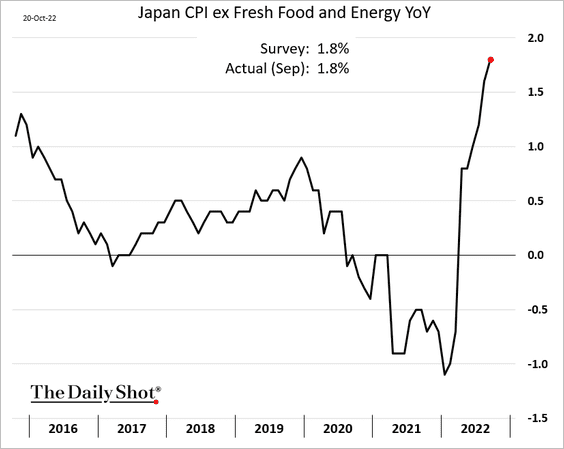

1. Core inflation is nearing 2%.

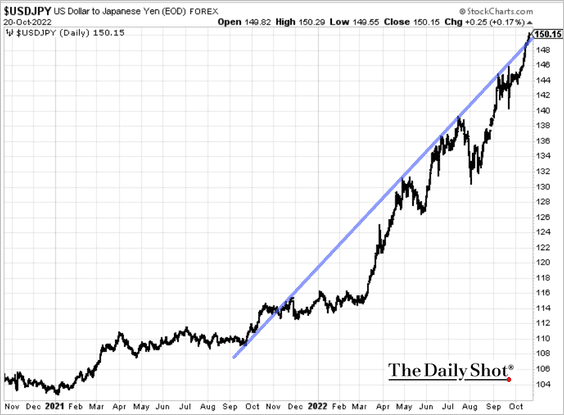

2. Dollar-yen has breached 150.

3. The market is putting more pressure on the BoJ as JGB yields (excluding the 10-year) surge.

How long will the central bank keep the 10yr pinned down?

Back to Index

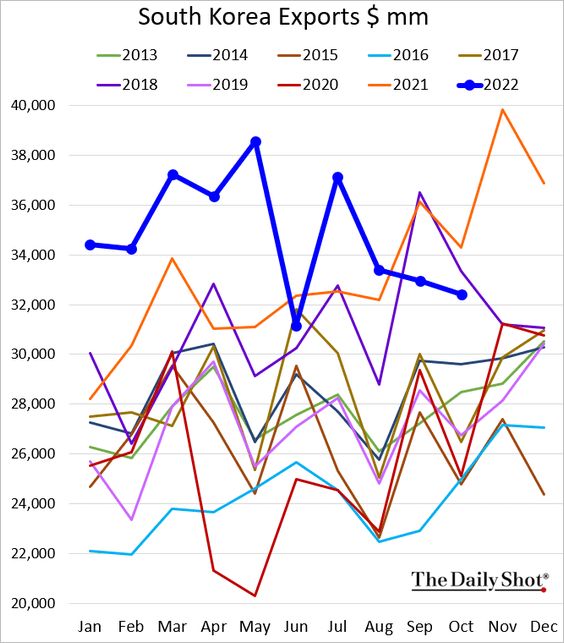

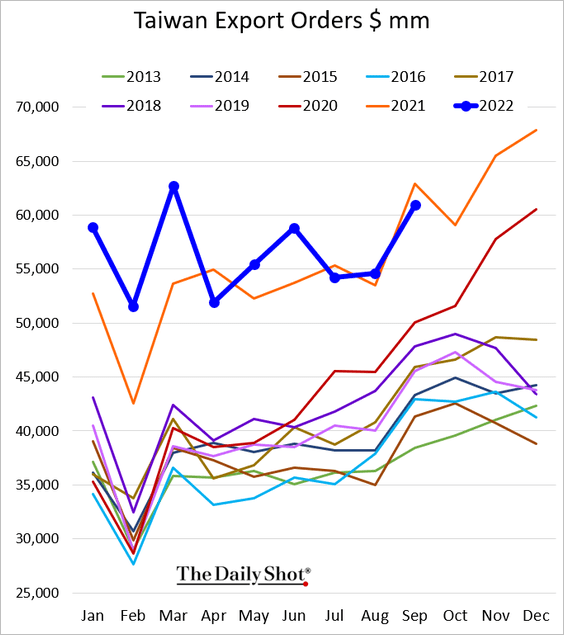

Asia – Pacific

1. South Korea’s exports are softer but are not crashing.

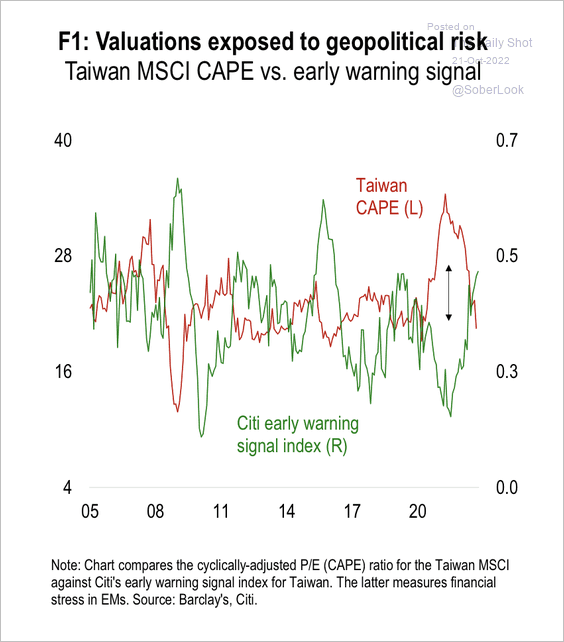

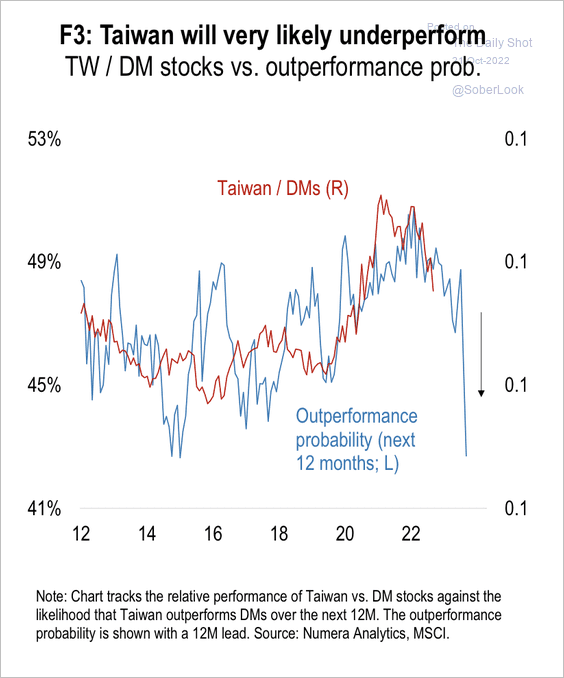

2. Taiwan’s export orders are slightly below last year’s level.

Although valuations have normalized, Taiwanese equities remain vulnerable to sharp earnings contraction and geopolitical risks, according to Numera Analytics. (2 charts)

Source: Numera Analytics

Source: Numera Analytics

Source: Numera Analytics

Source: Numera Analytics

——————–

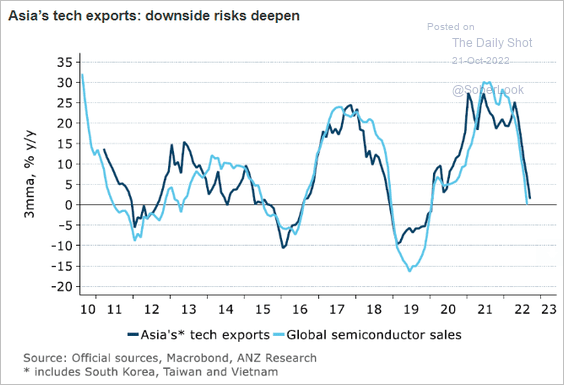

3. Asian tech exports face downside risks.

Source: @ANZ_Research

Source: @ANZ_Research

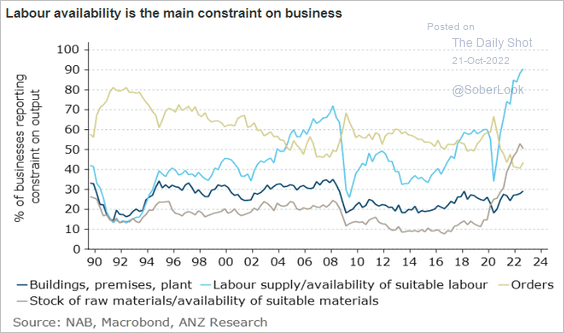

4. Australia continues to face labor shortages.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

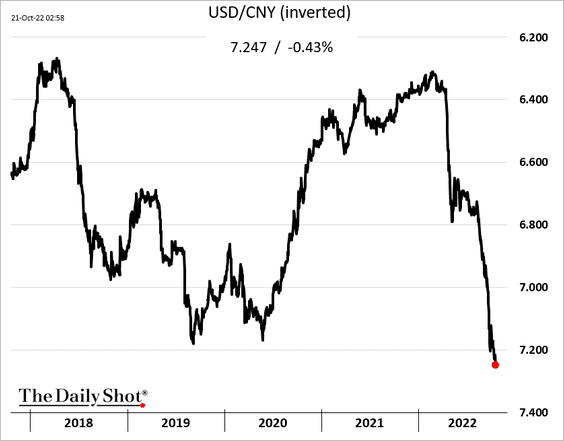

1. The renminbi keeps hitting multi-year lows against the dollar.

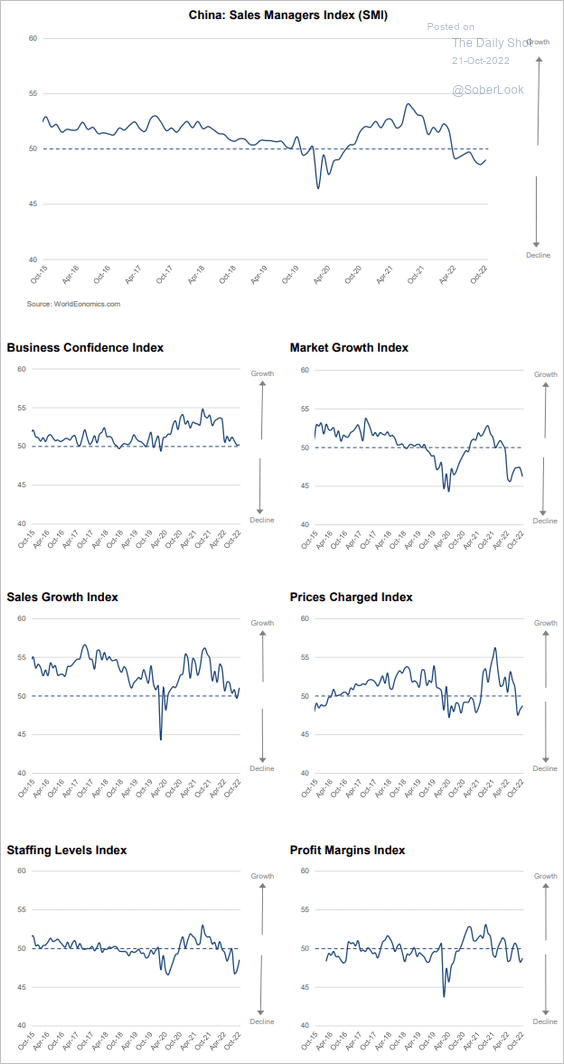

2. The World Economics SMI report shows China’s business activity remaining in contraction territory this month.

Source: World Economics

Source: World Economics

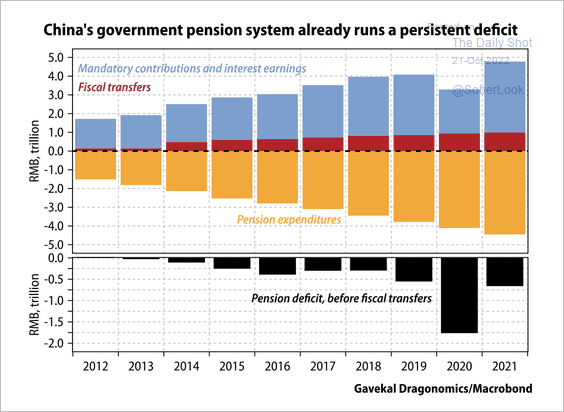

3. Funding the public pension program will be a burden on government finances, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

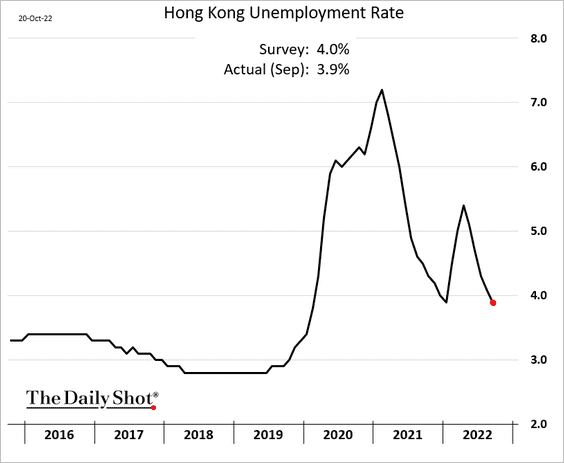

4. Hong Kong’s unemployment rate is back below 4%.

Back to Index

Emerging Markets

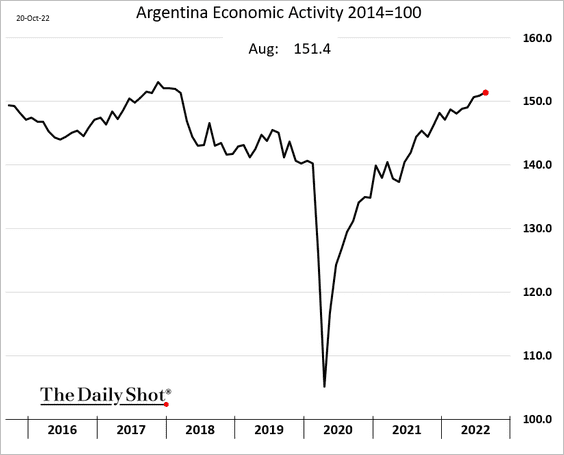

1. Argentina’s COVID-era economic recovery has been relatively strong.

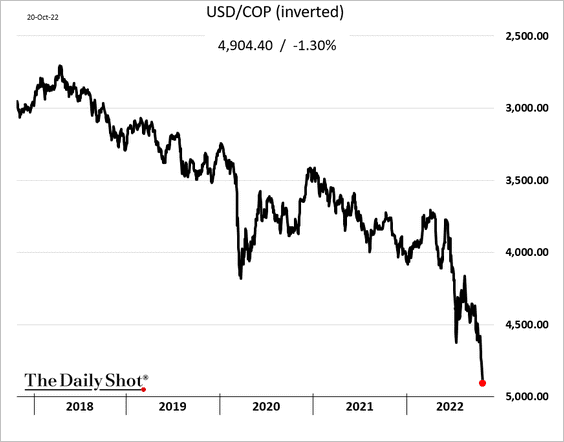

2. Colombia’s currency continues to sink, …

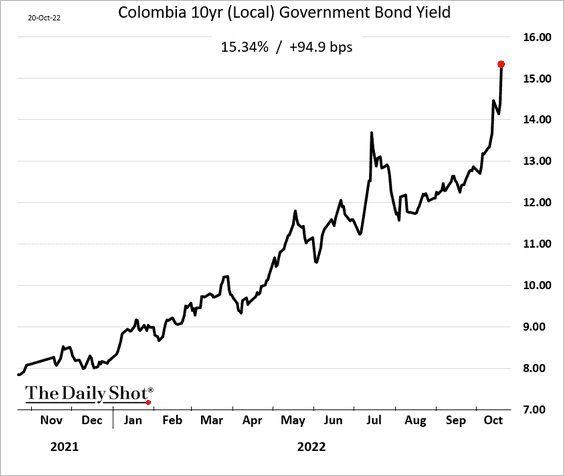

… as domestic bond yields surge.

——————–

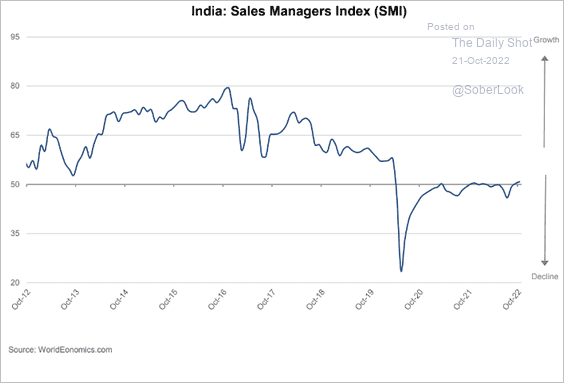

3. India’s business activity is back in growth territory according to World Economics.

Source: World Economics

Source: World Economics

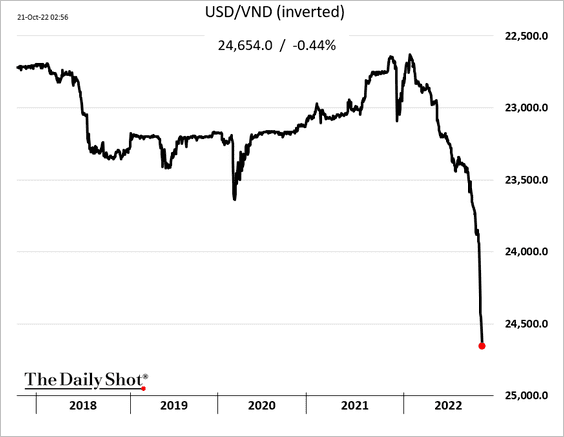

4. The Vietnamese dong keeps falling vs. USD.

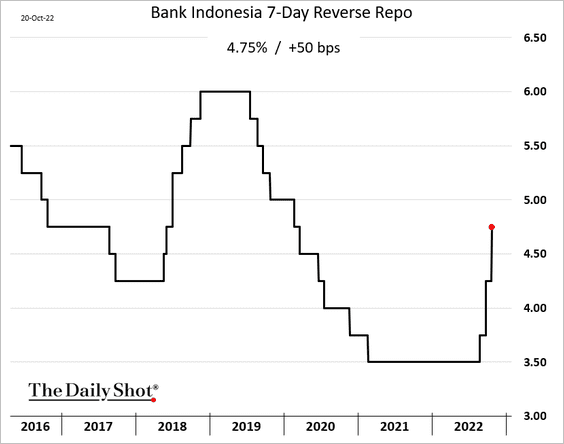

5. Indonesia’s central bank hiked rates again.

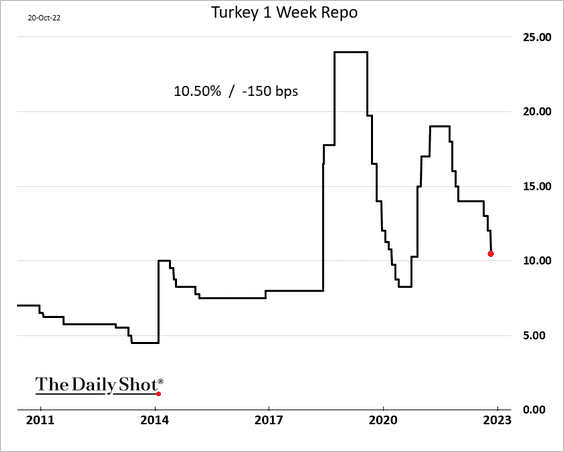

6. On the other hand. Turkey’s central bank cut rates by 150 bps. It’s all good – the core CPI is only 68%.

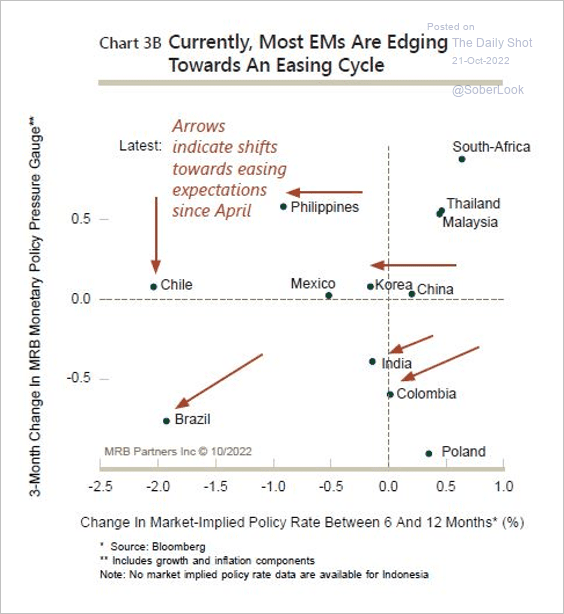

7. EM central banks are poised to deliver rate cuts and better growth prospects (versus developed markets) over the next 6-12 months, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

Back to Index

Energy

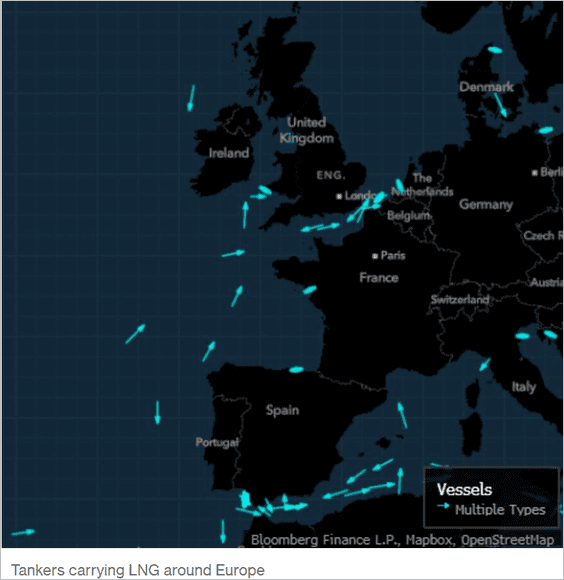

1. European natural gas import facilities are struggling to keep up with the incoming LNG tankers.

Source: @MaznevaElena, @Thomgua Read full article

Source: @MaznevaElena, @Thomgua Read full article

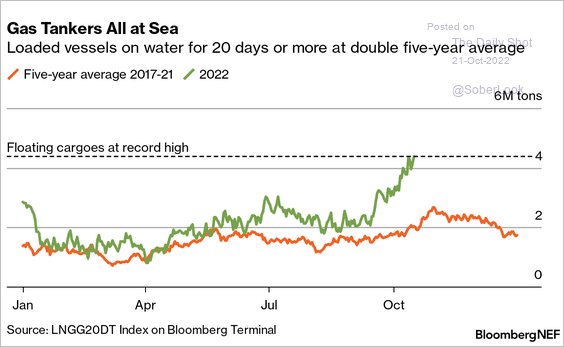

This chart shows the loaded vessels that have been on the water for 20 days or more.

Source: @BloombergNEF Read full article Further reading

Source: @BloombergNEF Read full article Further reading

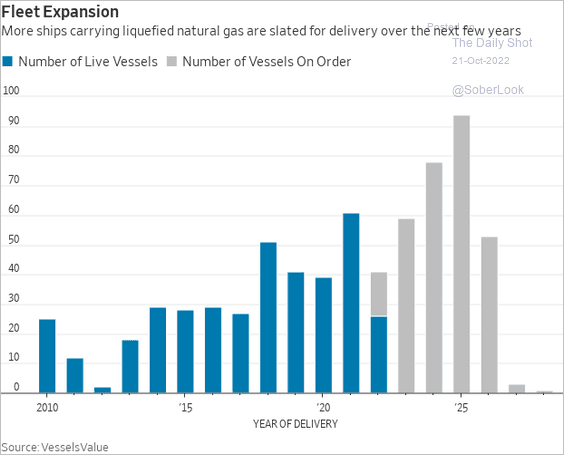

• There are many more LNG vessels being built.

Source: @WSJ Read full article

Source: @WSJ Read full article

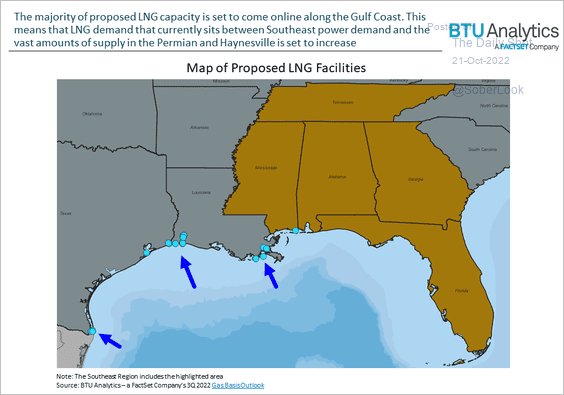

• And the US is building a lot of LNG export terminals. Europe will need to build the infrastructure to keep up.

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

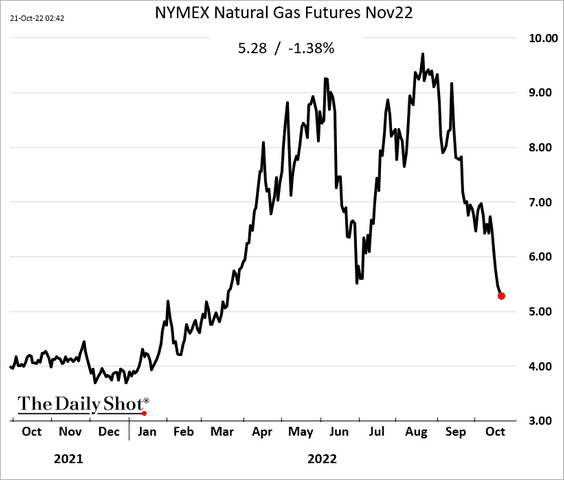

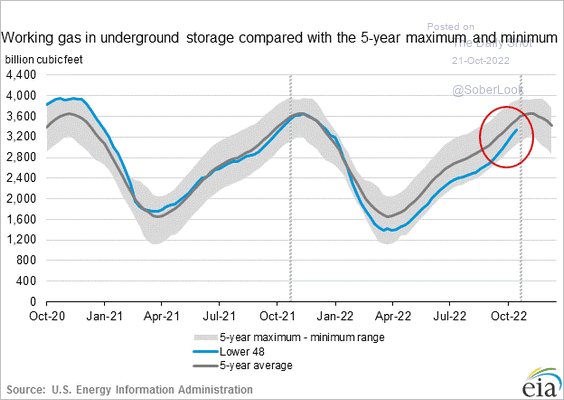

2. US natural gas prices continue to fall …

… as gas in storage climbs faster than the normal seasonal pattern.

Back to Index

Equities

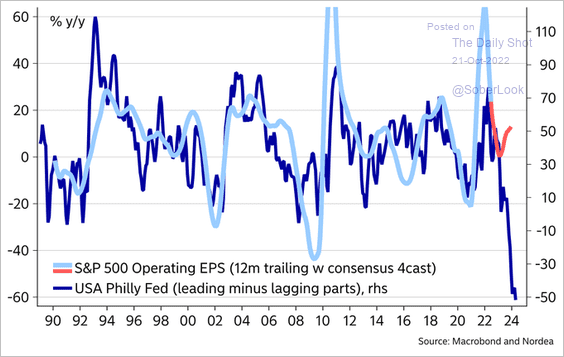

1. The Philly Fed’s manufacturing index (forward-looking vs. lagging components) points to a crash in corporate earnings.

Source: @MikaelSarwe

Source: @MikaelSarwe

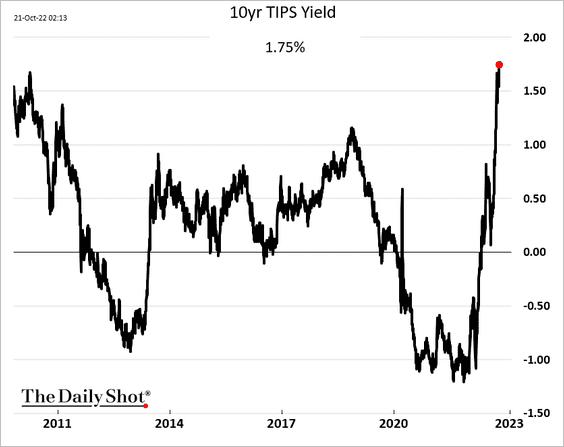

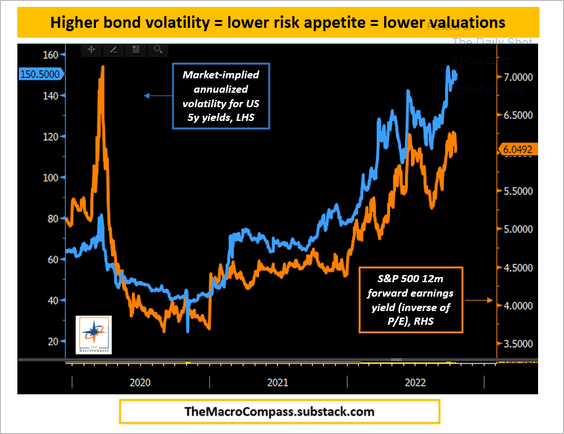

2. Rising real yields will continue to pressure stock valuations.

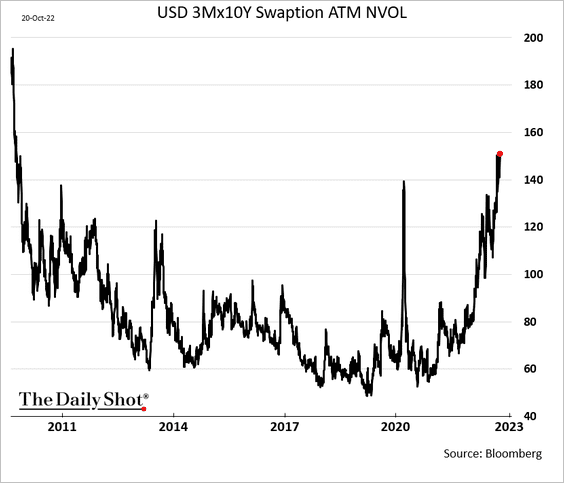

• Surging rates volatility …

… will also take a toll on equity valuations.

Source: @MacroAlf

Source: @MacroAlf

——————–

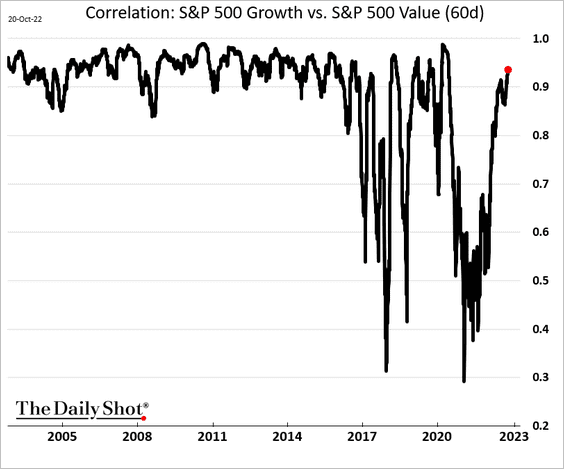

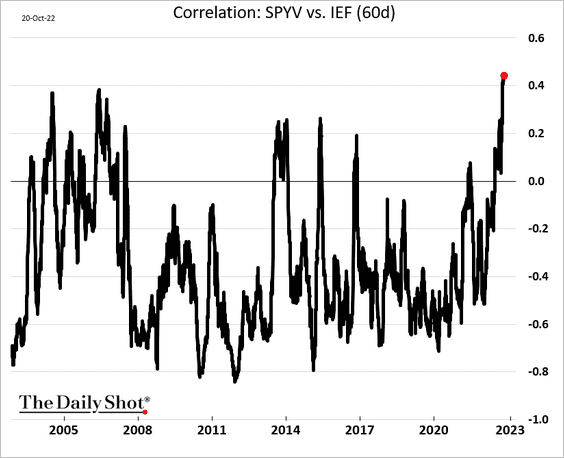

3. The correlation between value and growth stocks has rebounded, …

… as value becomes correlated to Treasuries (similar to growth).

——————–

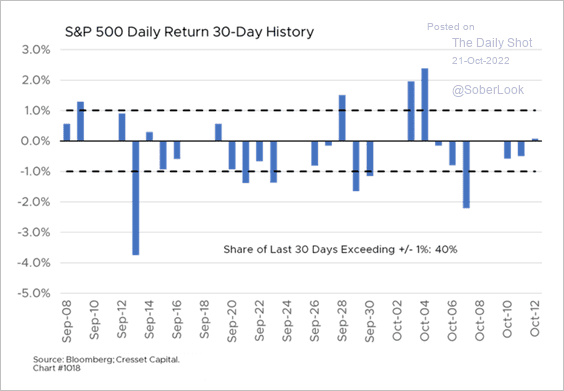

4. Over the last month, the S&P 500’s daily return volatility exceeded 1% nearly half the time.

Source: Cresset Capital

Source: Cresset Capital

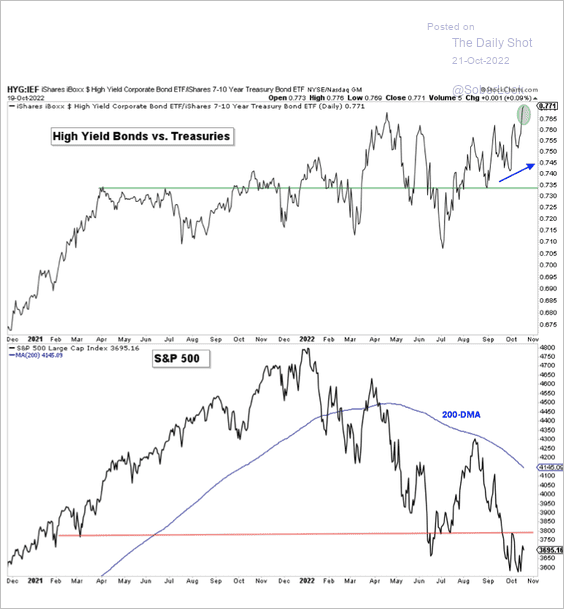

5. There has been a divergence between the high yield/Treasury bond ETF price ratio and the S&P 500 over the past few months. That could support a short-term risk-on environment.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

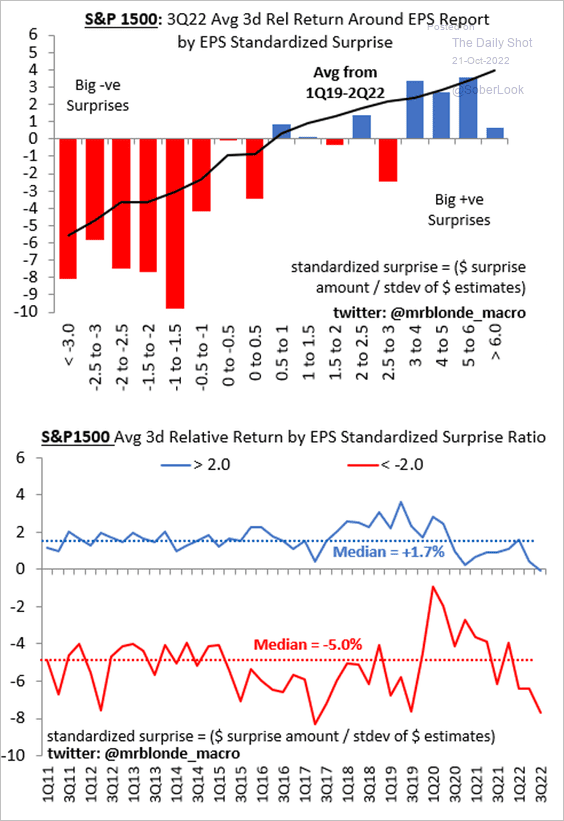

6. The market is not very forgiving of negative surprises.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

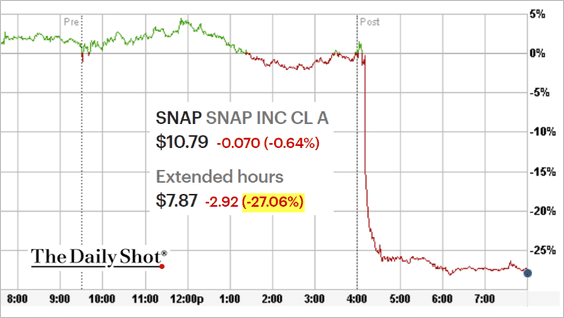

7. SNAP was down 27% after the close as advertisers pull back (which could impact the whole sector).

8. Next, let’s take a look at some sector performance data over the past five business days.

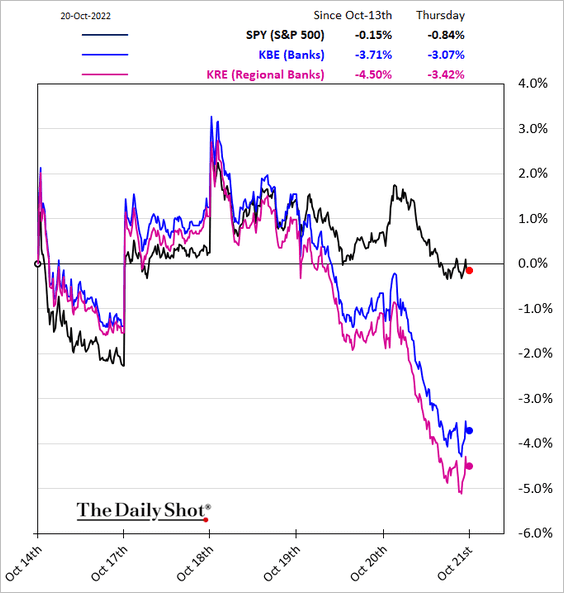

• Banks:

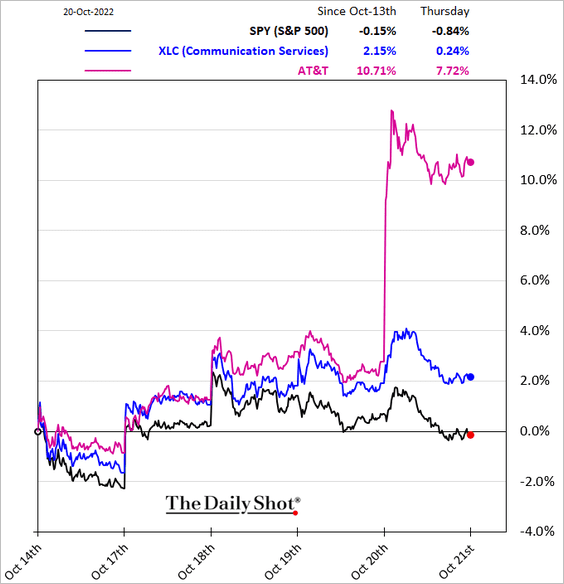

• Communication Services:

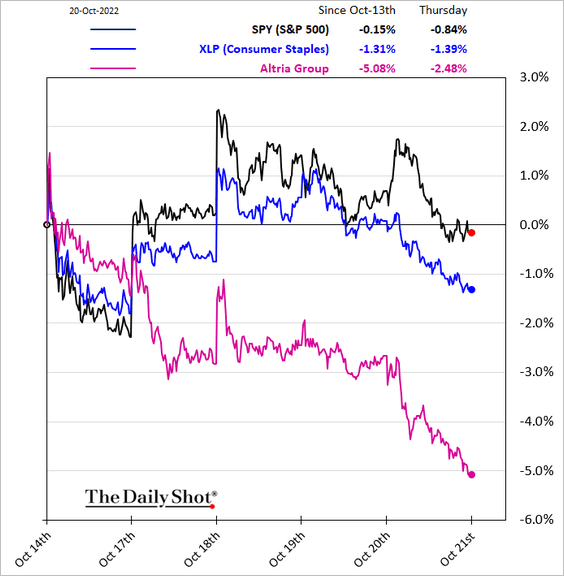

• Consumer Staples:

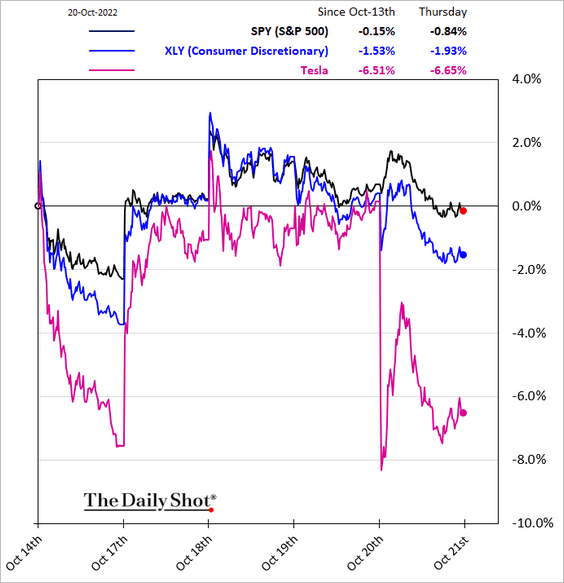

• Consumer Discretionary:

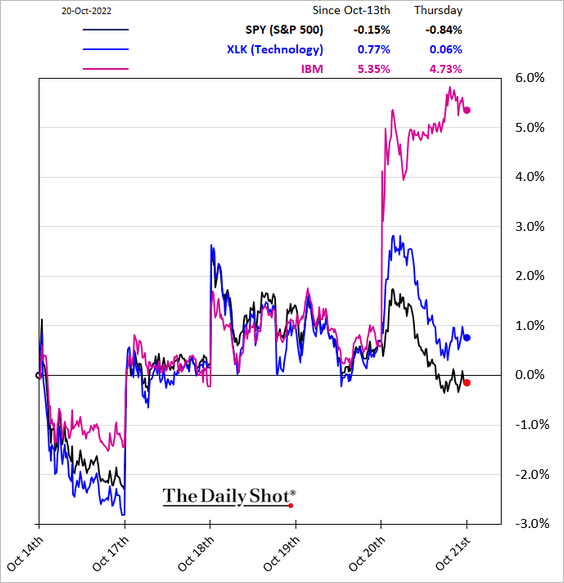

• Tech:

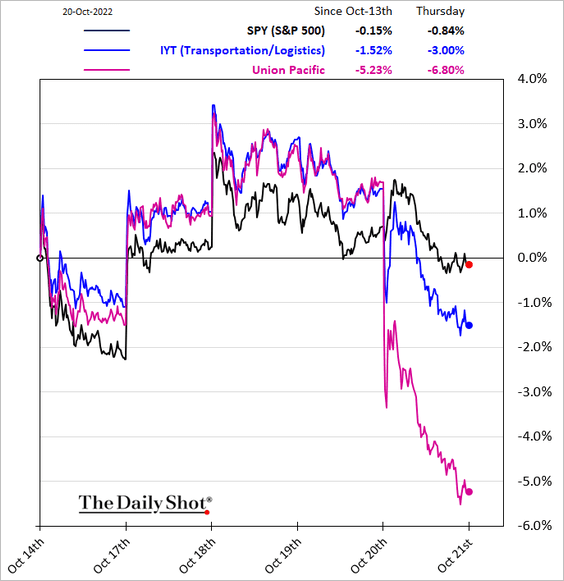

• Transportation:

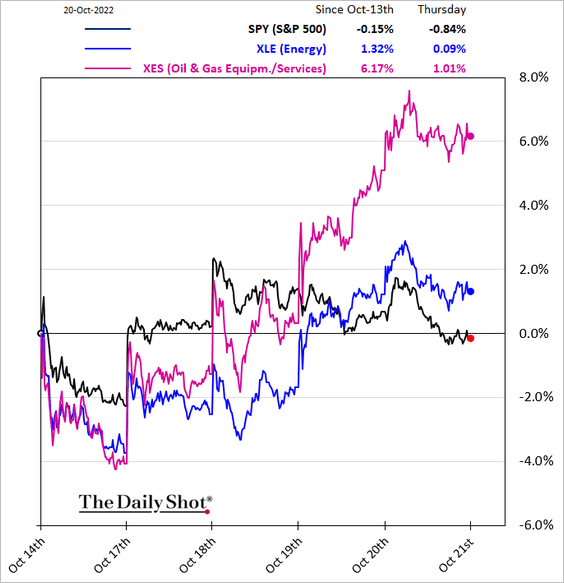

• Energy:

Back to Index

Rates

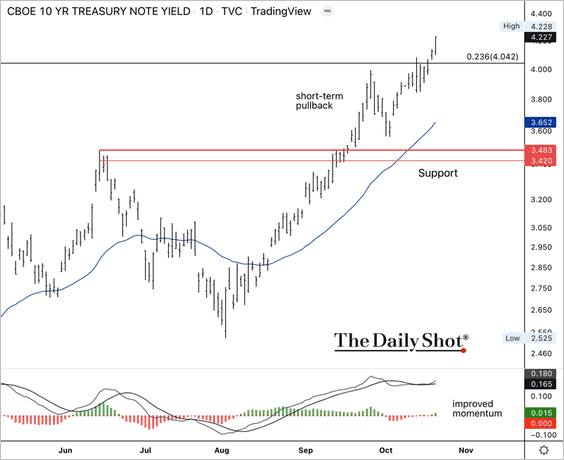

1. The 10-year Treasury yield broke above the 4% resistance level.

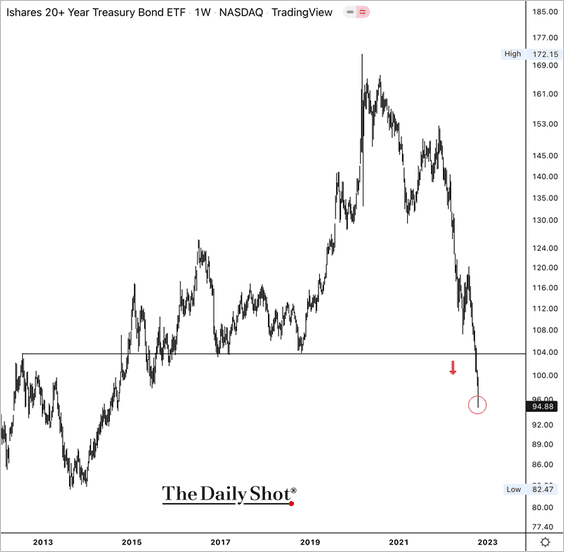

The iShares 20+ Year Treasury Bond ETF (TLT) continues to break down.

——————–

2. The Simplify Interest Rate Hedge ETF (PFIX) surged to new highs. The ETF holds interest rate options that benefit from large increases in rates and rate volatility.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

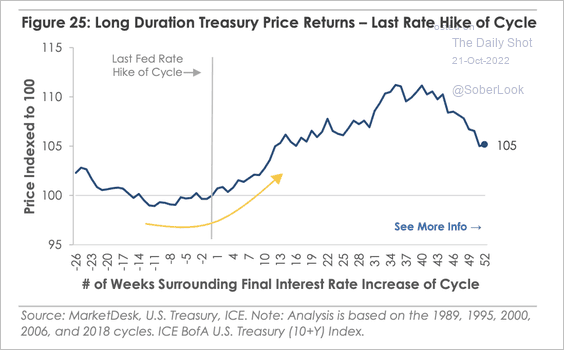

3. Long-duration Treasury bonds historically outperform after the final rate hike of the cycle.

Source: MarketDesk Research

Source: MarketDesk Research

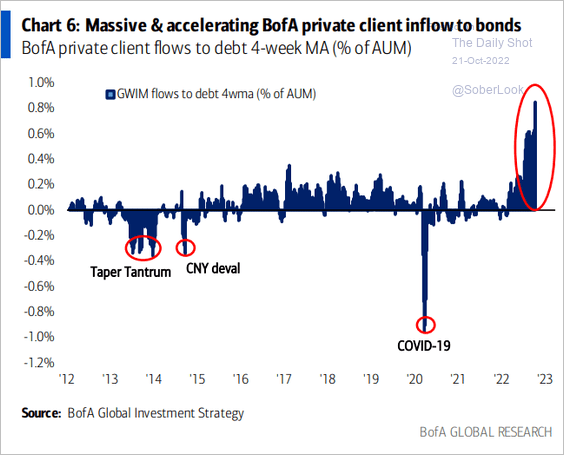

4. BofA private client flows into bonds have accelerated.

Source: BofA Global Research

Source: BofA Global Research

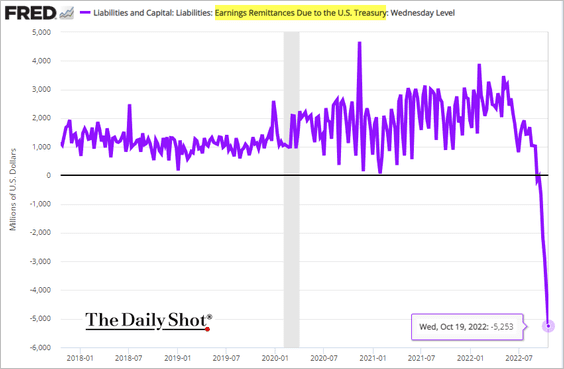

5. There will be no cash remittances from the Fed to the US Treasury for a while.

Back to Index

Global Developments

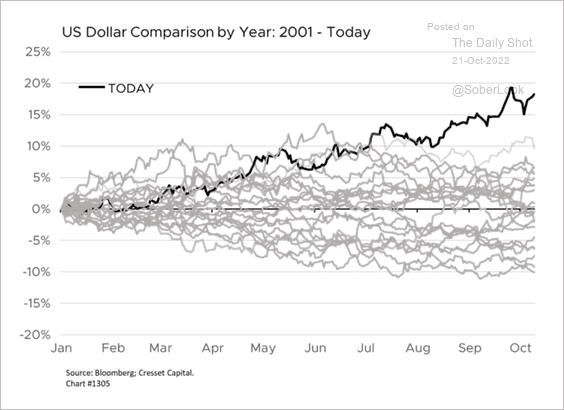

1. The dollar has surged to its strongest level in about a decade, partly due to the Fed’s aggressive rate hikes.

Source: Cresset Capital

Source: Cresset Capital

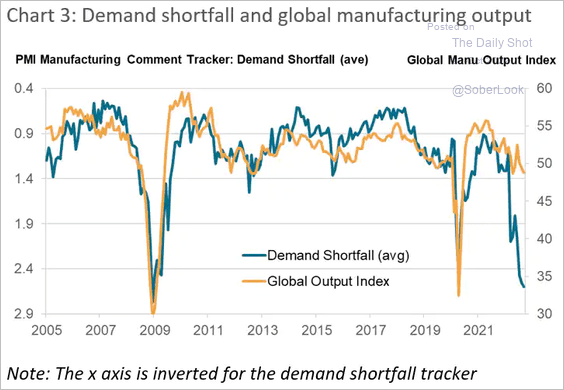

2. Deteriorating demand points to weakness in manufacturing output ahead.

Source: S&P Global PMI; {ht] @dailychartbook

Source: S&P Global PMI; {ht] @dailychartbook

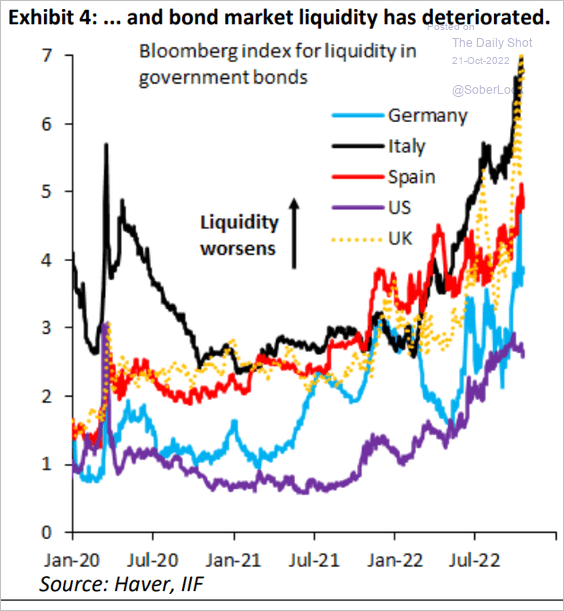

3. Global bond liquidity has deteriorated.

Source: IIF

Source: IIF

——————–

Food for Thought

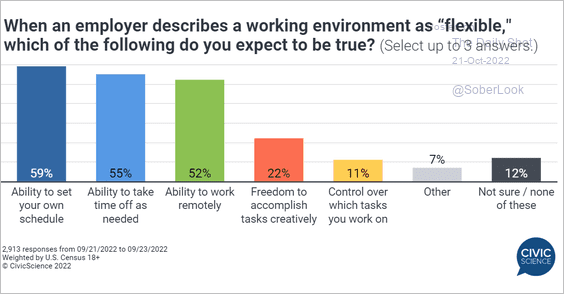

1. What does a “flexible” working environment mean?

Source: @CivicScience

Source: @CivicScience

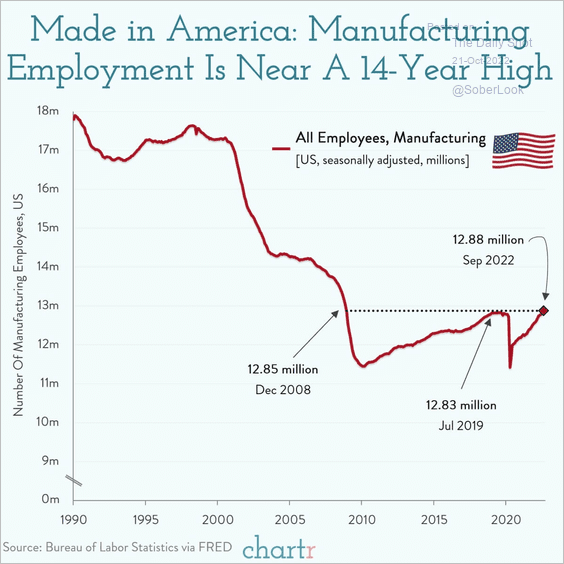

2. US manufacturing employment:

Source: @chartrdaily

Source: @chartrdaily

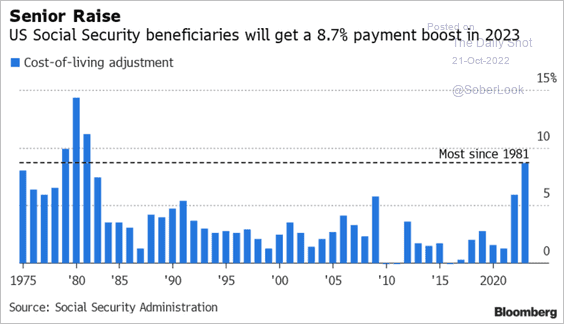

3. Social Security cost-of-living adjustment:

Source: @business Read full article

Source: @business Read full article

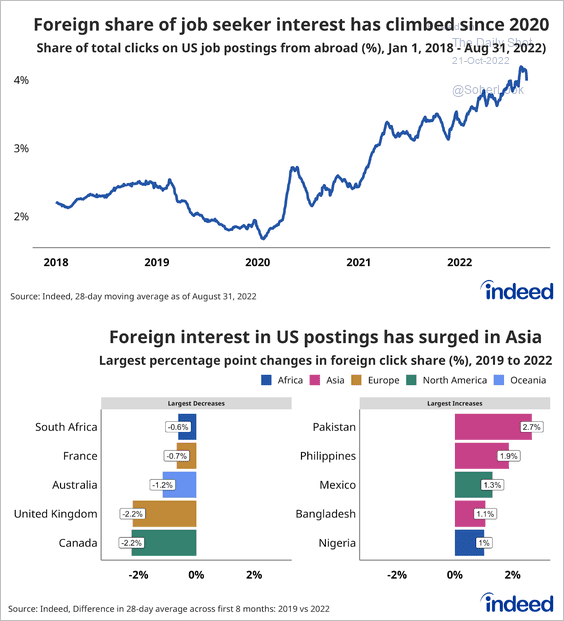

4. Foreign interest in US jobs:

Source: @indeed

Source: @indeed

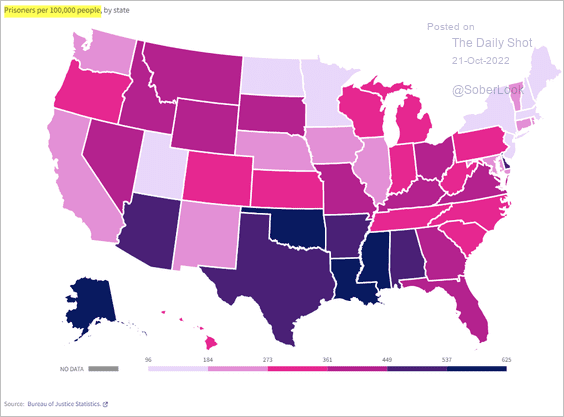

5. Incarceration rates:

Source: USAFacts Read full article

Source: USAFacts Read full article

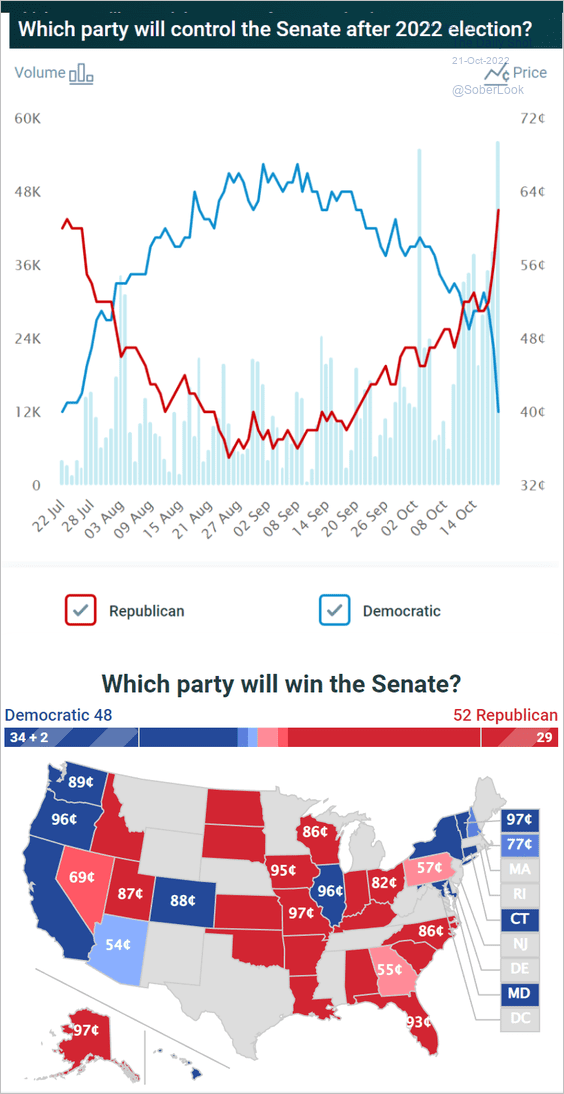

6. Betting markets’ probability of which party will control the US Senate:

Source: @PredictIt

Source: @PredictIt

——————–

Have a great weekend!

Back to Index