The Daily Shot: 27-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

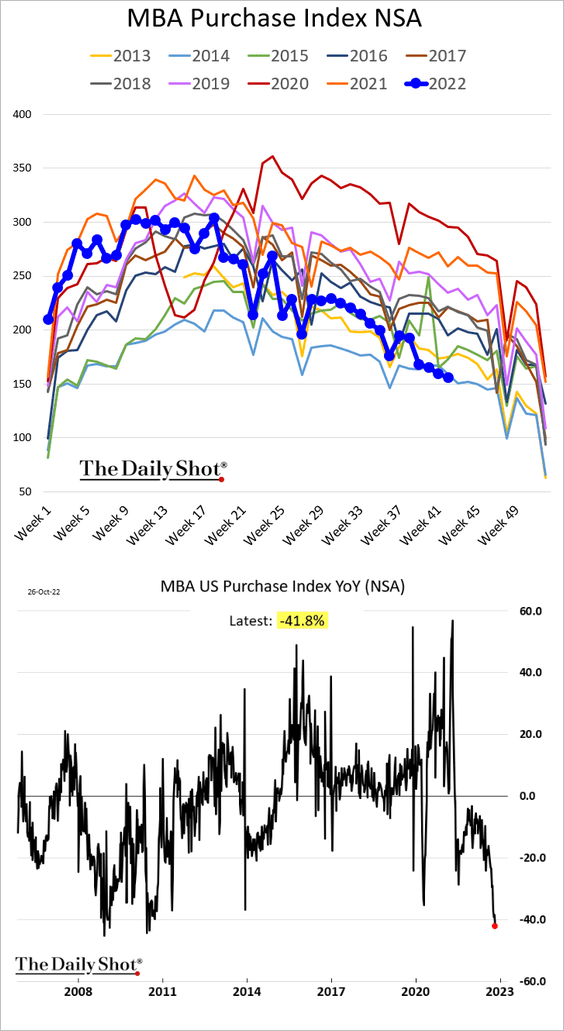

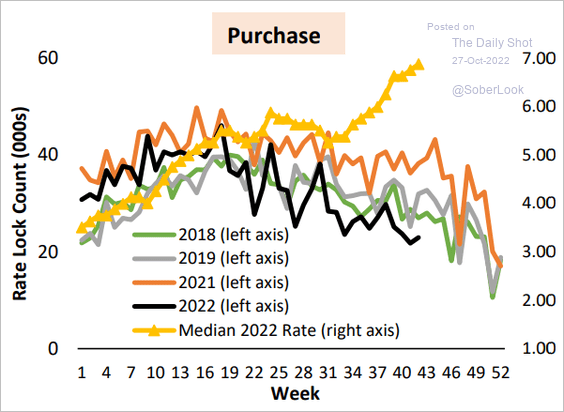

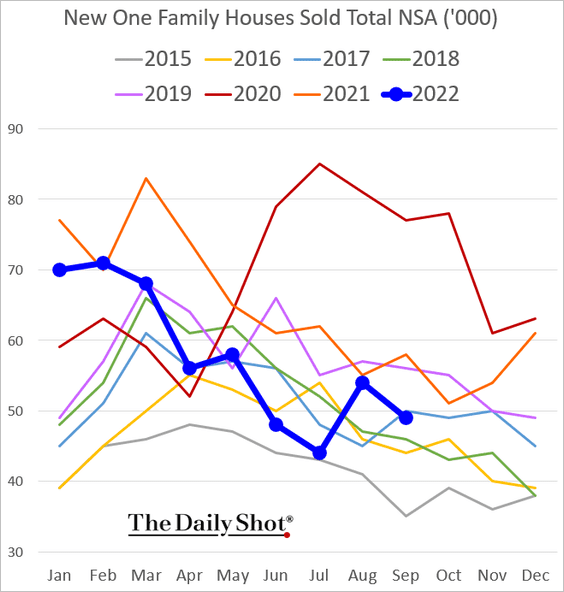

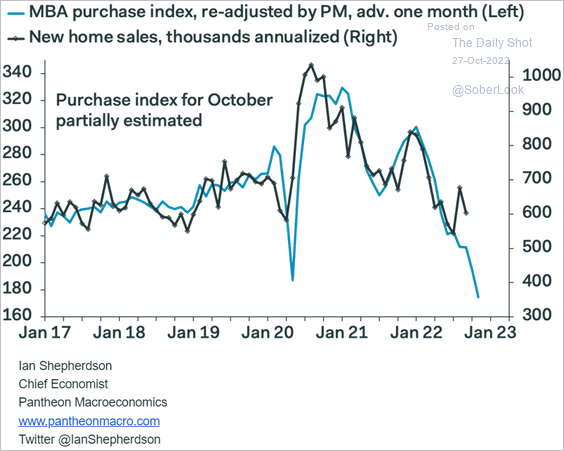

1. Let’s begin with the housing market.

• Mortgage applications are down 42% from a year ago.

This chart shows mortgage rate locks.

Source: AEI Housing Center

Source: AEI Housing Center

• New home sales have been weakening but not crashing.

But mortgage applications point to significant deterioration in sales in the near future.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

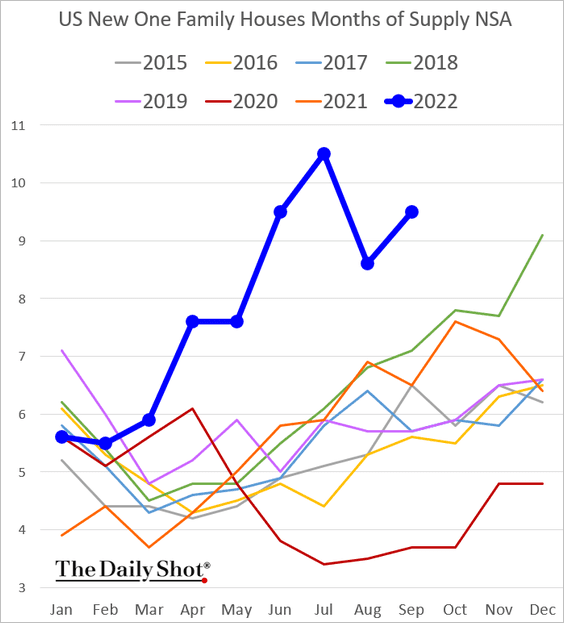

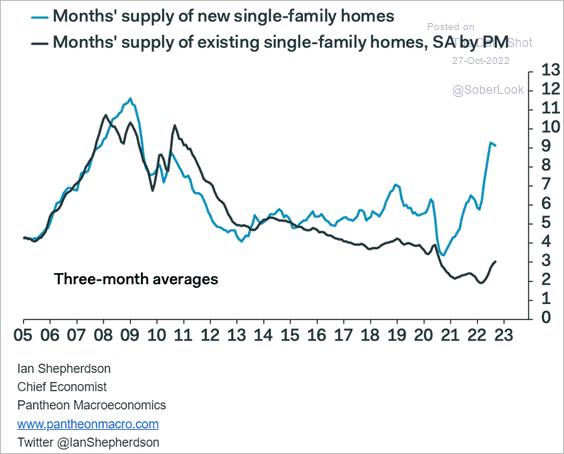

– New home inventories remain at multi-year highs, …

… diverging from existing home inventories.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

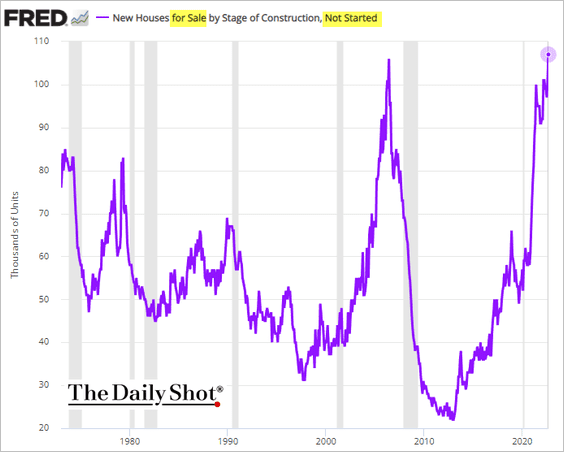

– The number of units for sale that haven’t been started hit a record high.

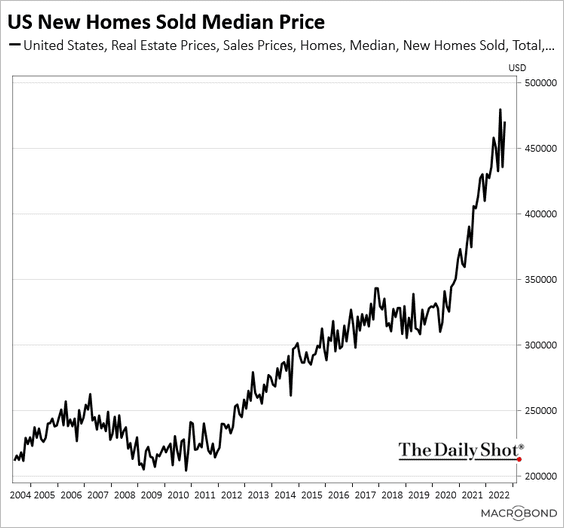

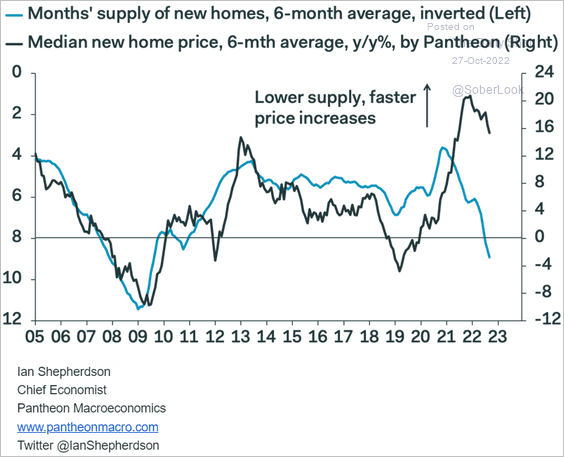

– The median price of new homes increased last month.

But rising inventories point to the median price moving lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

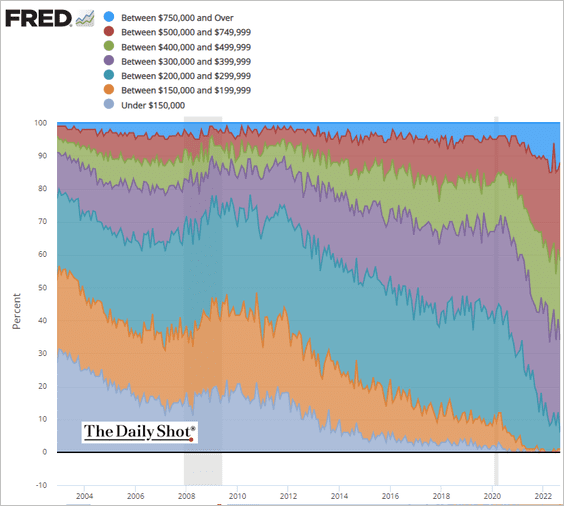

– Here is the distribution of new home sales by price range.

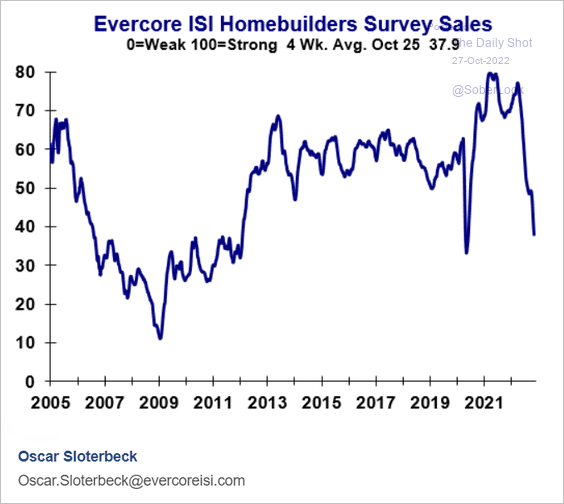

• The Evercore ISI homebuilder index continues to crater.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

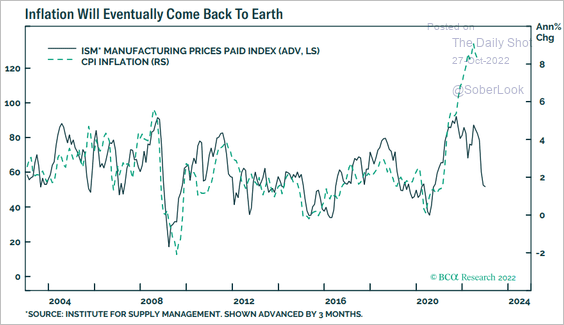

2. Next, we have some updates on inflation.

• Housing is among the factors driving this divergence between the CPI and the ISM manufacturing prices index.

Source: BCA Research

Source: BCA Research

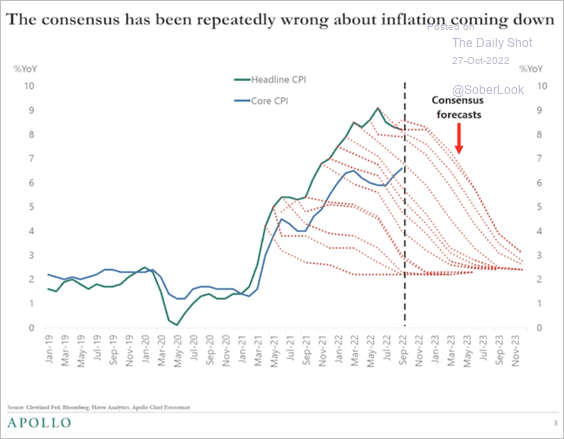

• Inflation forecasts have been persistently wrong.

Source: Torsten Slok, Apollo Read full article

Source: Torsten Slok, Apollo Read full article

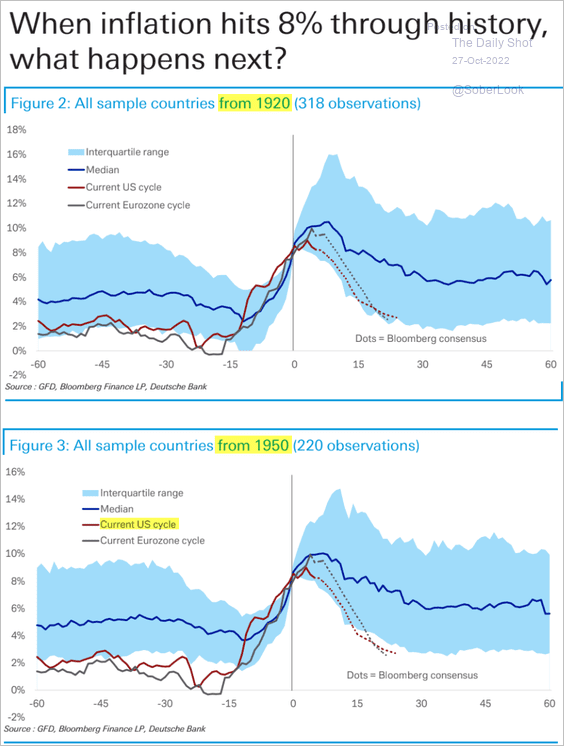

• Historically, once inflation spikes above 8%, median inflation takes about two years to fall beneath 6% before settling around that level out to five years. That is very different from consensus expectations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

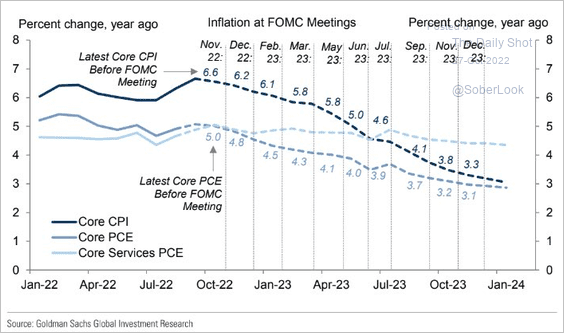

• Services inflation is expected to remain elevated for years.

Source: Goldman Sachs; @_____JustMe__

Source: Goldman Sachs; @_____JustMe__

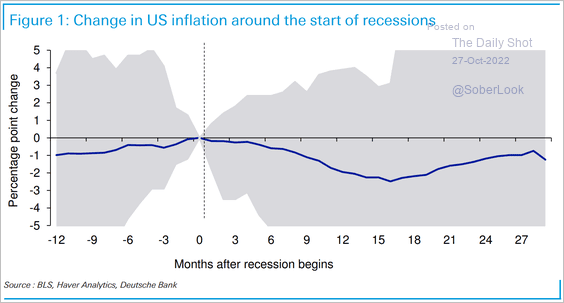

• On average, inflation needs a recession to fall.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

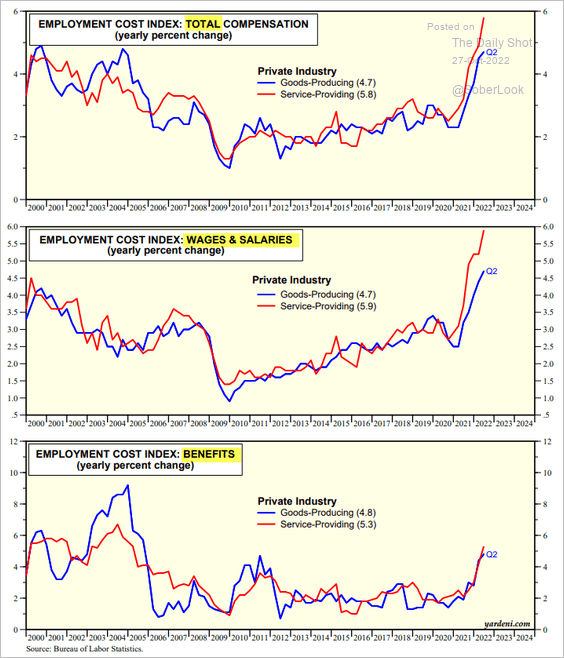

• Compensation costs have been surging.

Source: Yardeni Research

Source: Yardeni Research

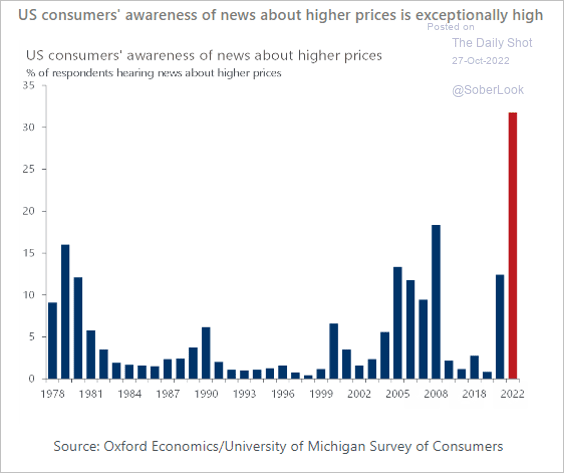

• Consumer awareness of inflation news is very high, which could keep inflation elevated, …

Source: Oxford Economics

Source: Oxford Economics

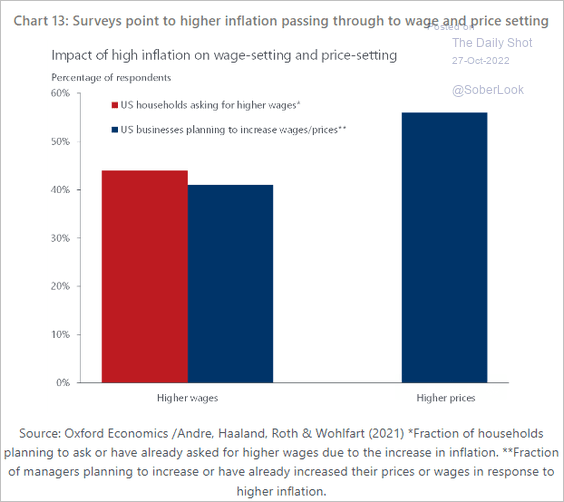

… passing through to wage-setting and price-setting trends.

Source: Oxford Economics

Source: Oxford Economics

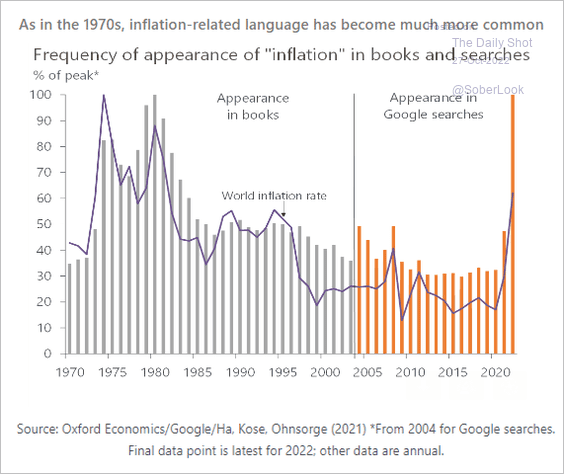

Inflation awareness is similar to the 1970s.

Source: Oxford Economics

Source: Oxford Economics

——————–

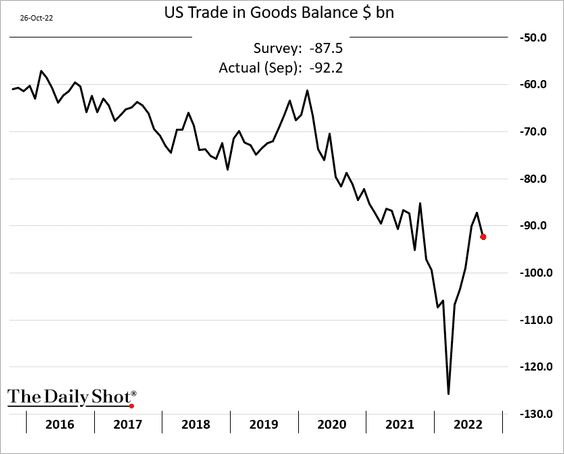

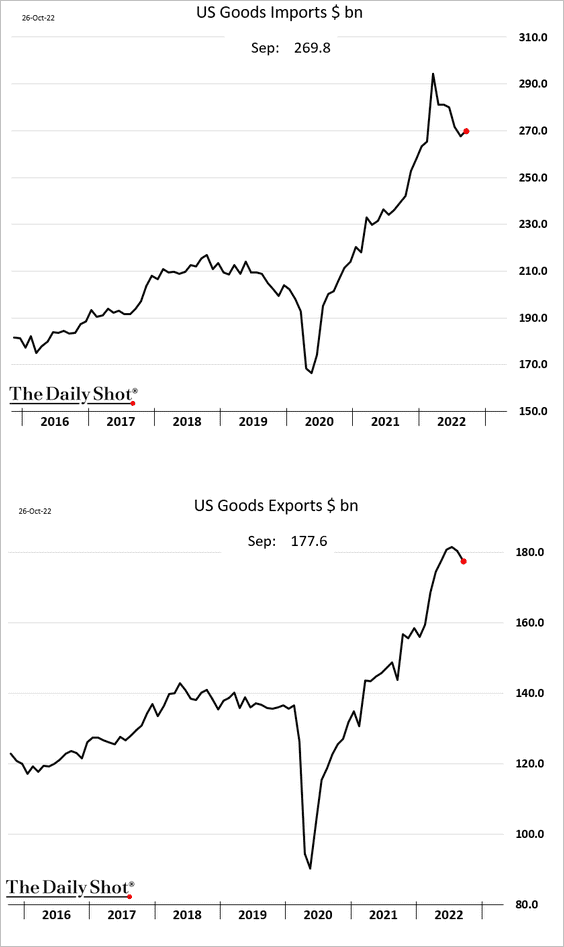

3. The trade gap unexpectedly widened last month.

Imports climbed while exports declined again

——————–

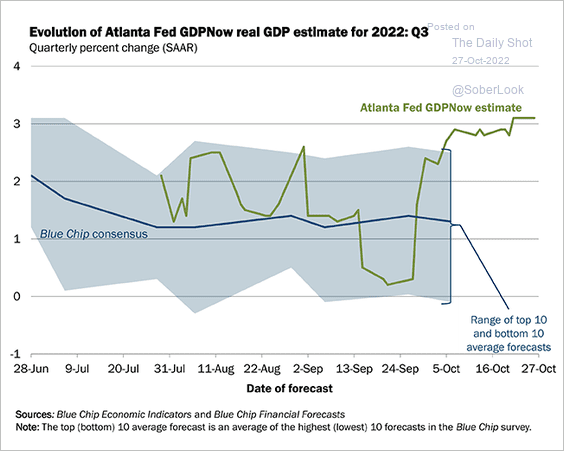

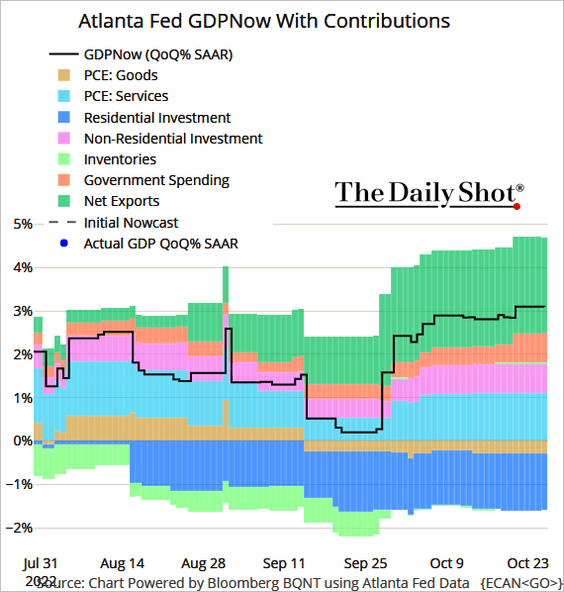

4. The GDPNow model now has the Q3 growth at 3.1% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

Here is the breakdown.

——————–

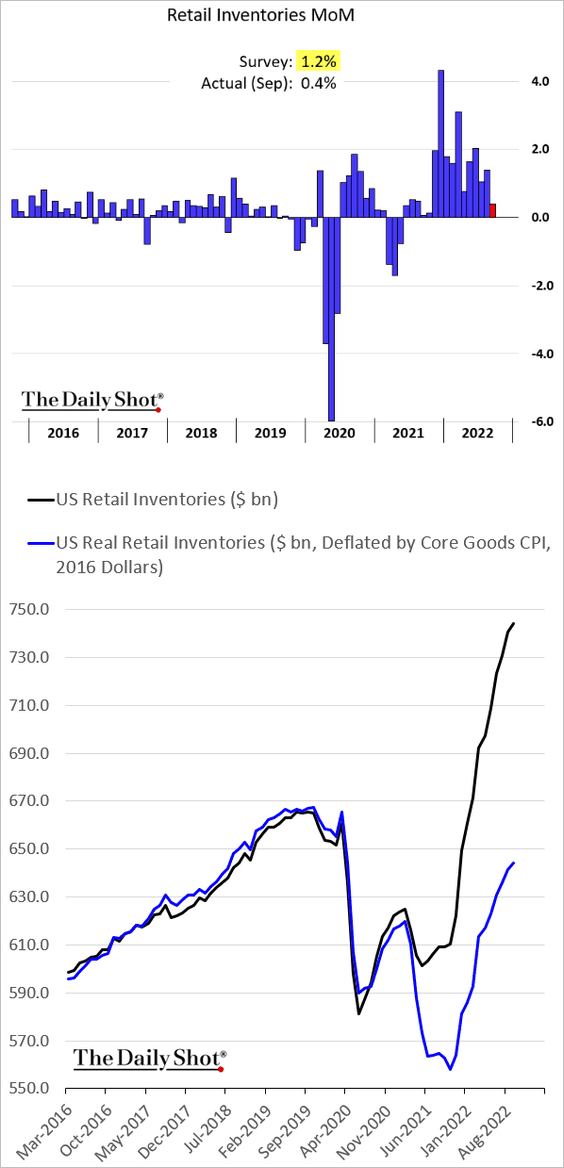

5. Growth in retail inventories has slowed.

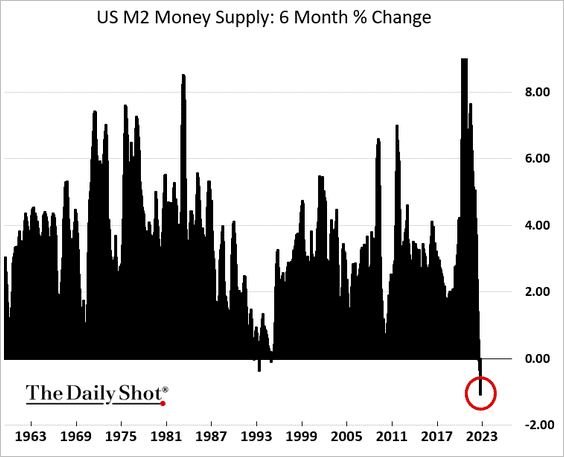

6. The broad money supply just had the biggest six-month decline on record, driven by quantitative tightening.

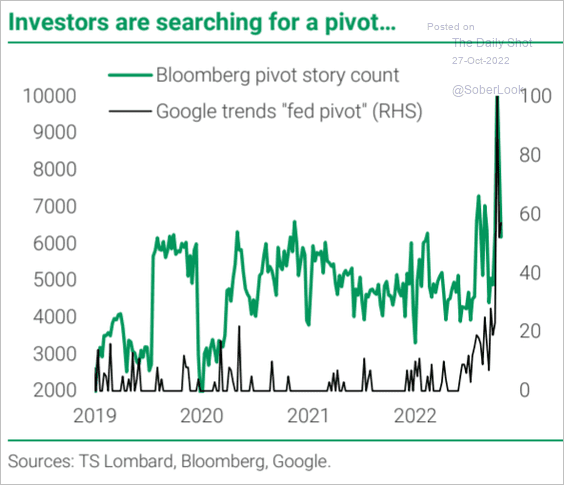

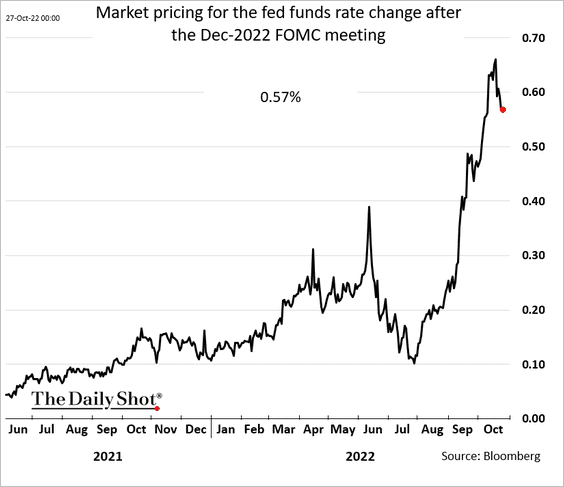

7. There is a lot of talk about the Fed’s “pivot” (especially after the BoC’s dovish hike).

Source: TS Lombard

Source: TS Lombard

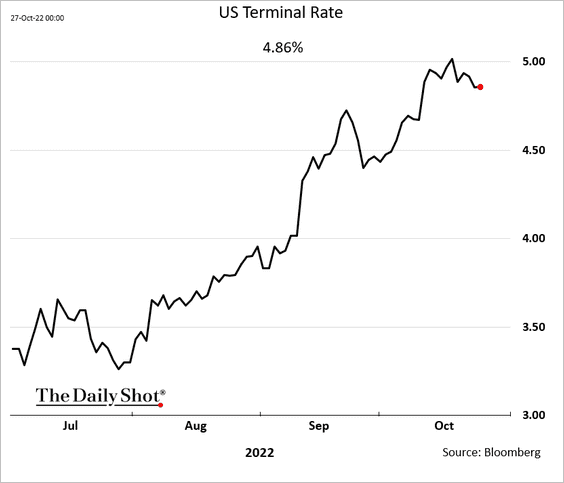

The terminal rate appears to have peaked just above 5%.

December increasingly looks like 50 bps rather than 75 bps.

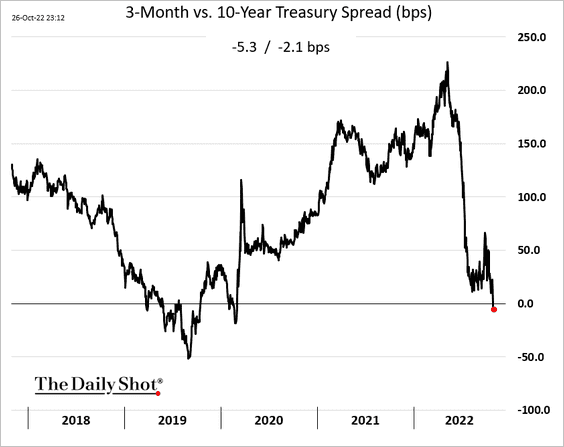

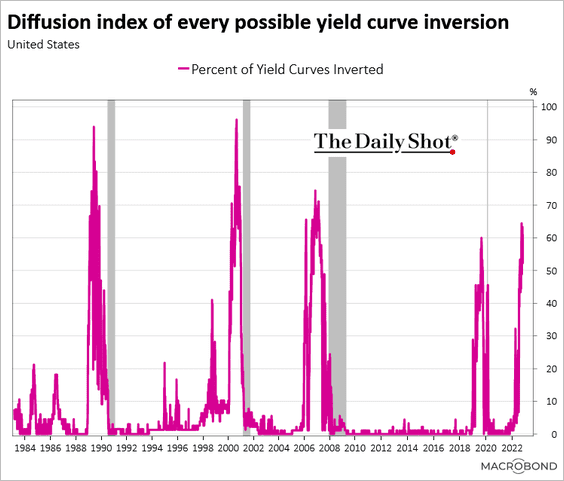

8. The 3-month/10-year portion of the Treasury curve finally inverted.

The percentage of the yield curve that is inverted signals a recession ahead.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Back to Index

Canada

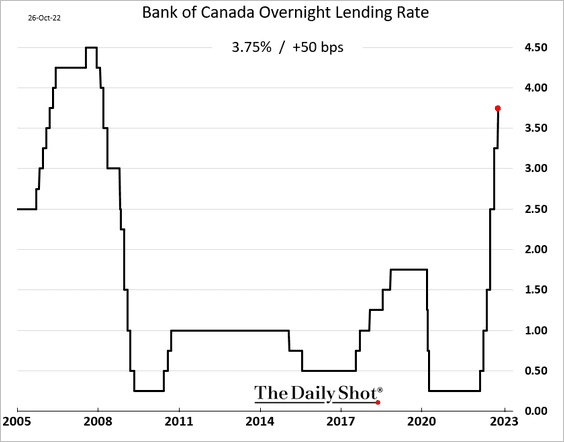

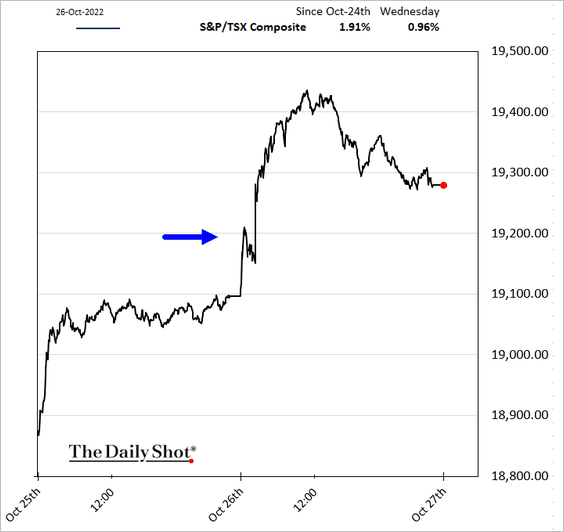

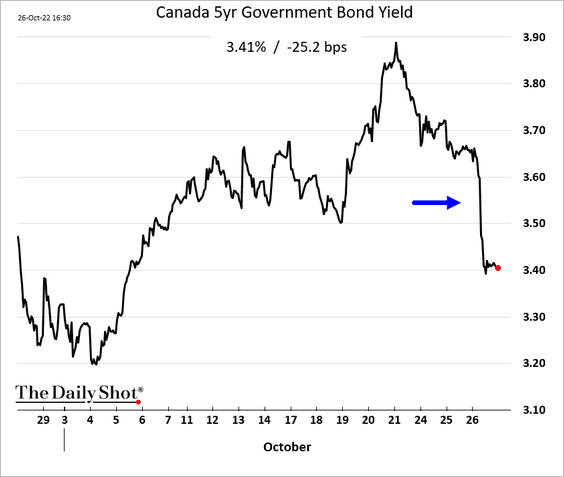

1. The BoC surprised with a 50 bps hike. Markets expected 75 bps.

Source: Reuters Read full article

Source: Reuters Read full article

Stocks and bonds jumped.

——————–

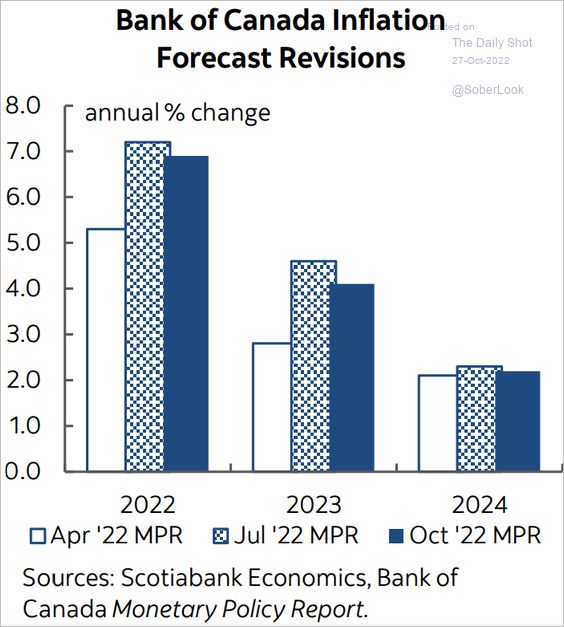

2. The BoC revised its inflation forecast lower, …

Source: Scotiabank Economics

Source: Scotiabank Economics

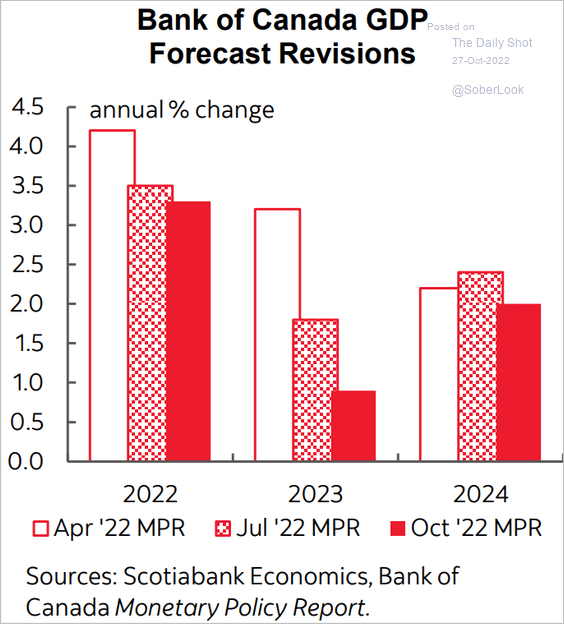

… and once again downgraded growth projections.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

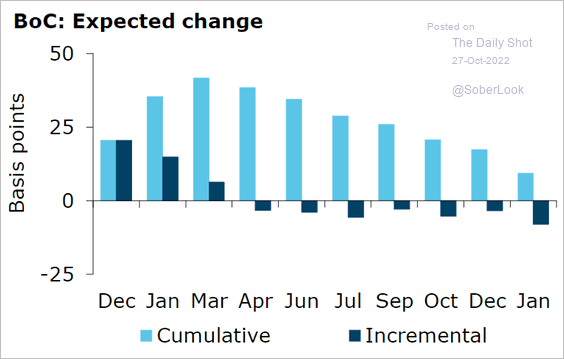

3. A 25 bps hike in December?

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

The United Kingdom

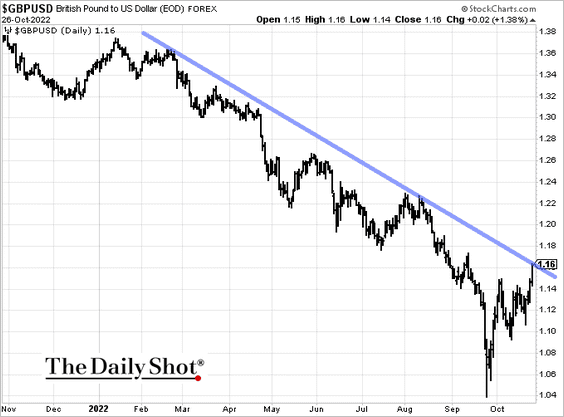

1. The pound is testing downtrend resistance.

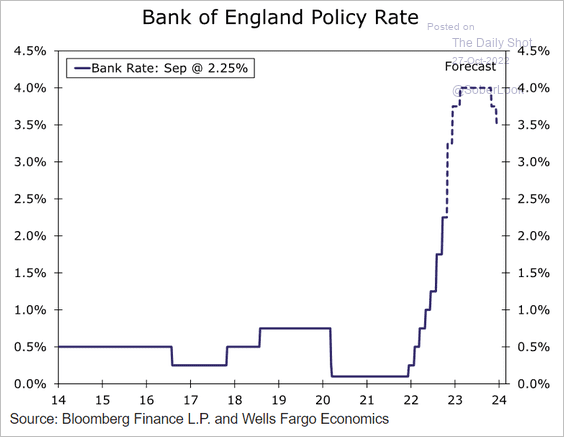

2. Here is Wells Fargo’s BoE rate forecast.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

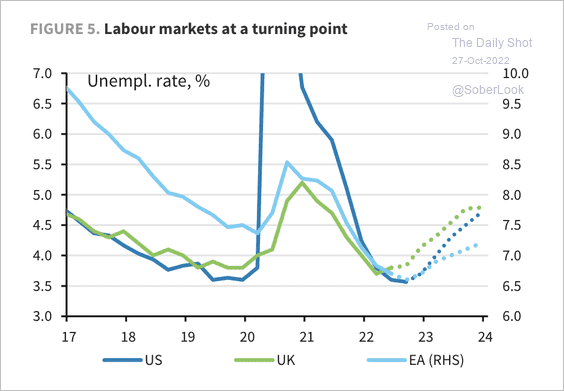

3. Barclays expects higher unemployment rates in the UK versus the US and euro area.

Source: Barclays Research

Source: Barclays Research

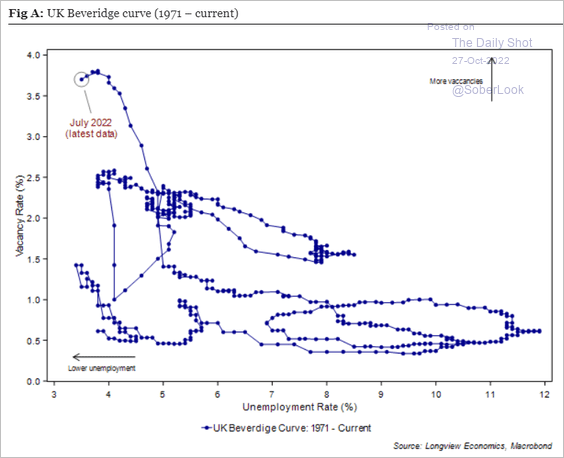

4. The UK’s labor market imbalance is severe.

Source: Longview Economics

Source: Longview Economics

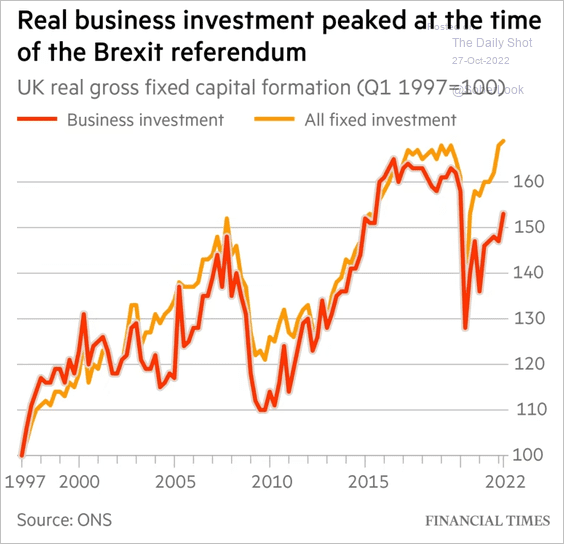

5. Business investment has lagged behind the total fixed investment.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

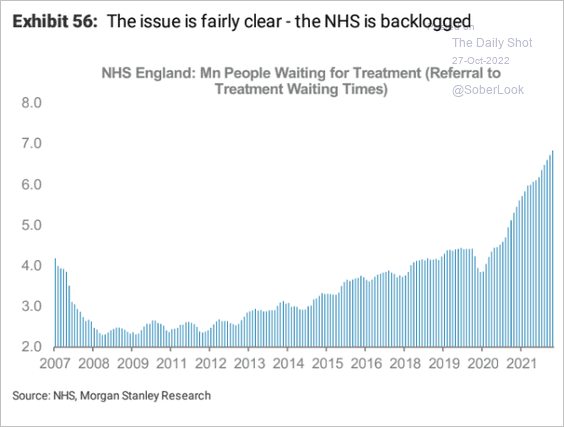

6. The healthcare system is backlogged.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

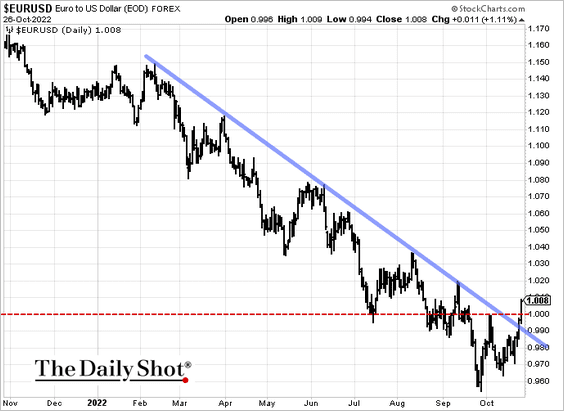

The Eurozone

1. EUR/USD broke above parity and the downtrend resistance.

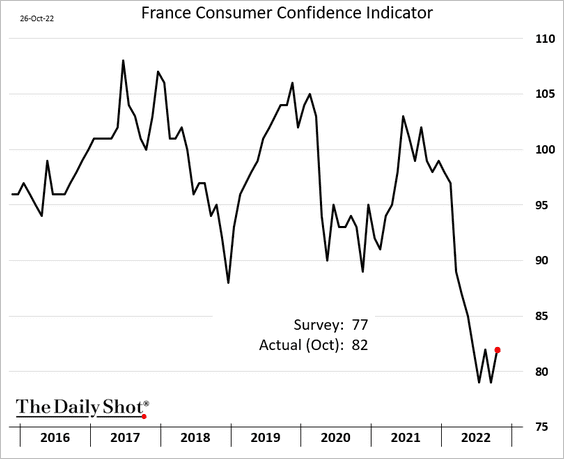

2. French consumer confidence edged higher this month.

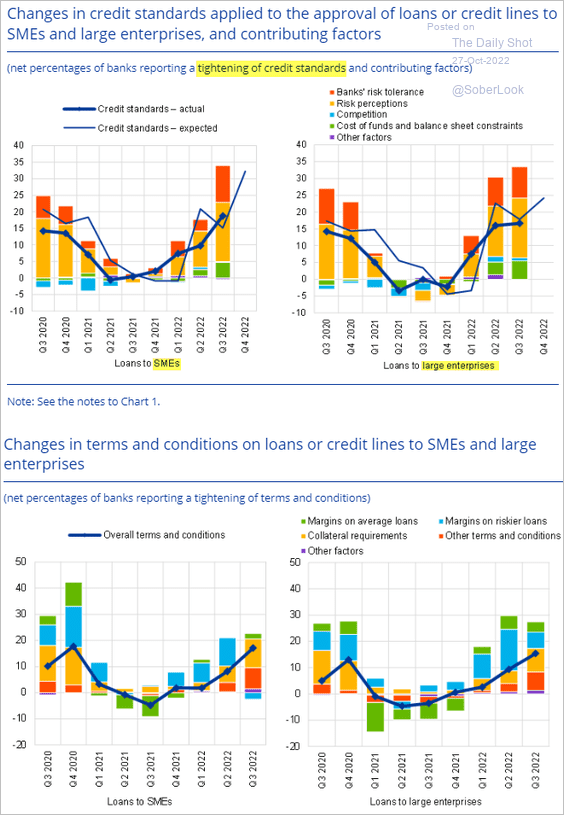

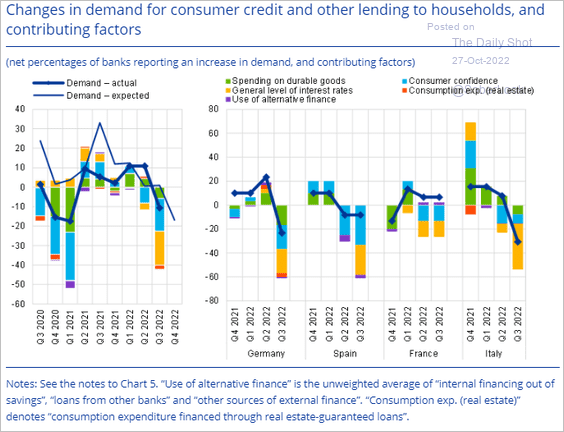

3. Credit Standards have tightened for businesses …

Source: ECB

Source: ECB

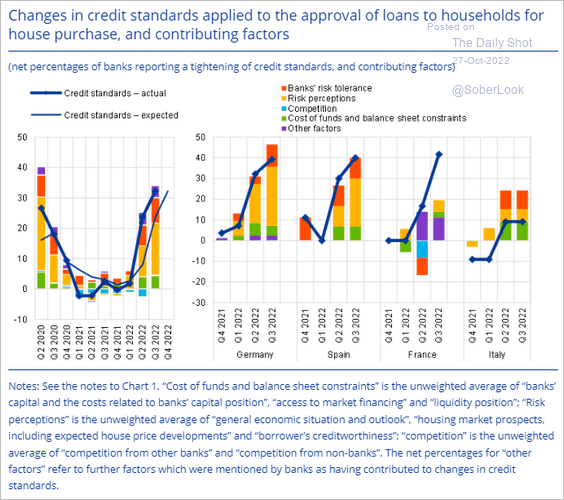

… and mortgages.

Source: ECB

Source: ECB

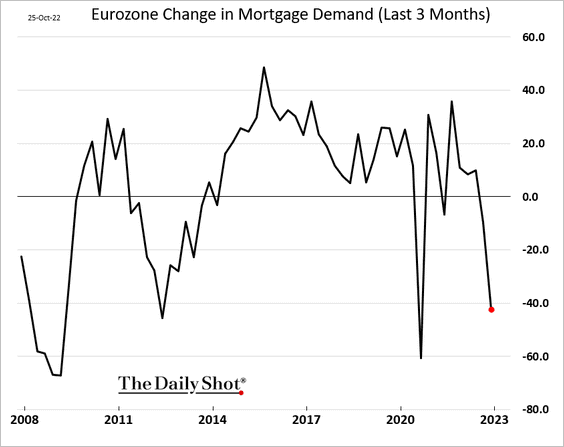

Demand for mortgages is sharply lower.

Source: ECB

Source: ECB

——————–

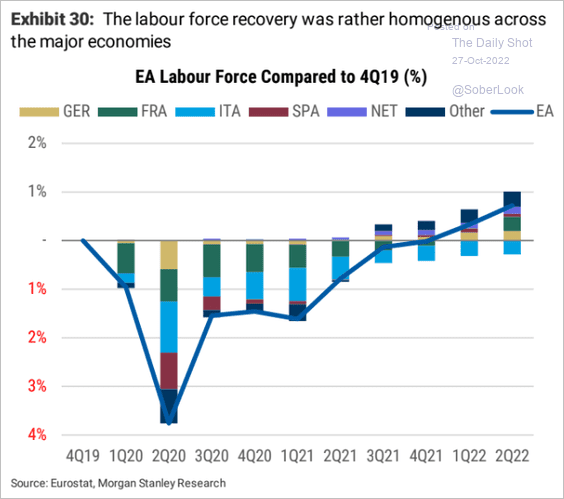

4. This chart shows the components of the euro-area labor force recovery.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

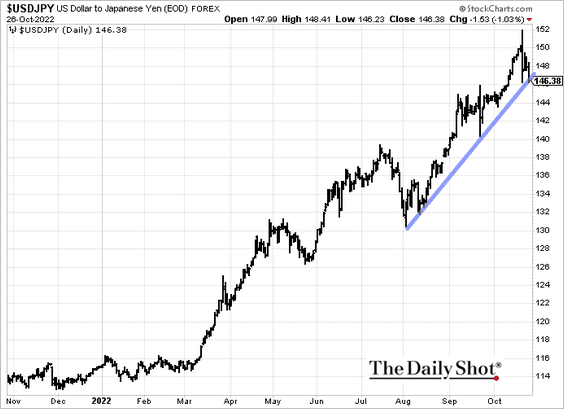

Asia – Pacific

1. Dollar-yen is testing short-term uptrend support.

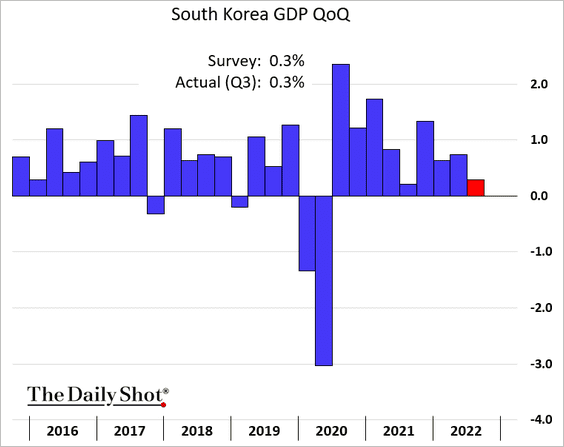

2. South Korea’s GDP growth has slowed, …

… driven by surging imports (due to energy costs) and softer exports (due to weaker demand from China).

Source: ING

Source: ING

Back to Index

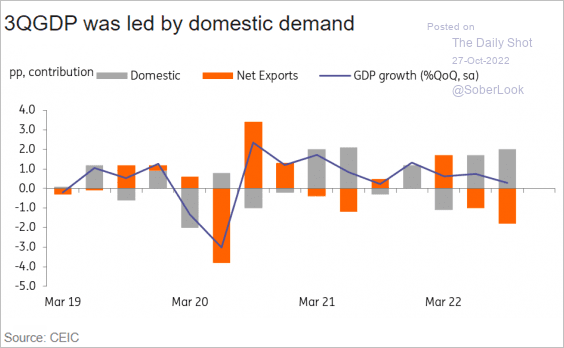

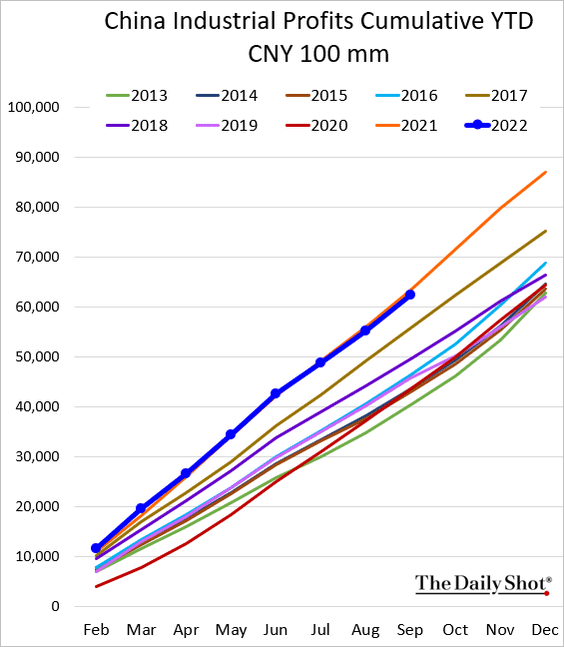

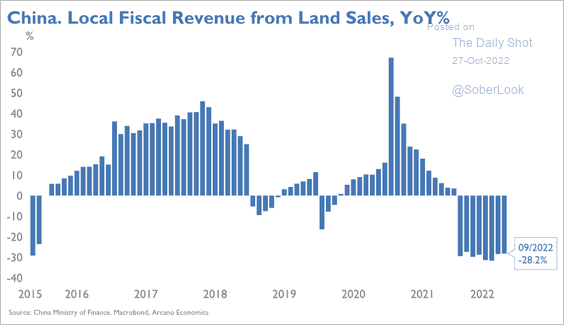

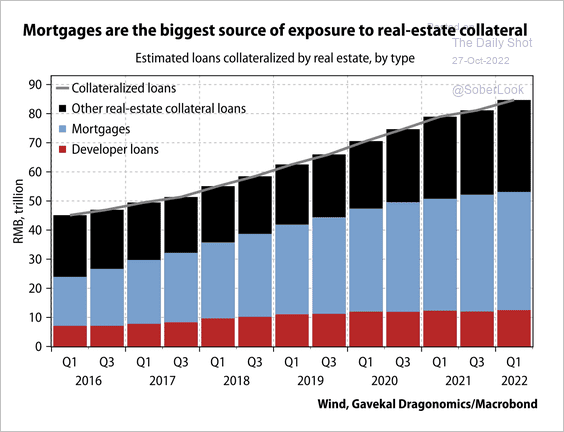

China

1. Industrial profits are now running below last year’s levels.

2. Land sales revenue has been depressed.

Source: Arcano Economics

Source: Arcano Economics

3. Mortgages make up roughly half of all collateralized loans.

Source: Gavekal Research

Source: Gavekal Research

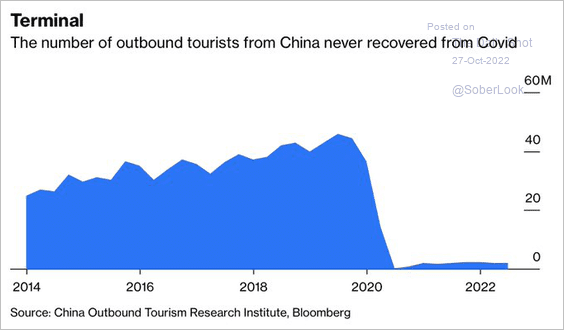

4. Outbound tourism remains depressed.

Source: @opinion Read full article

Source: @opinion Read full article

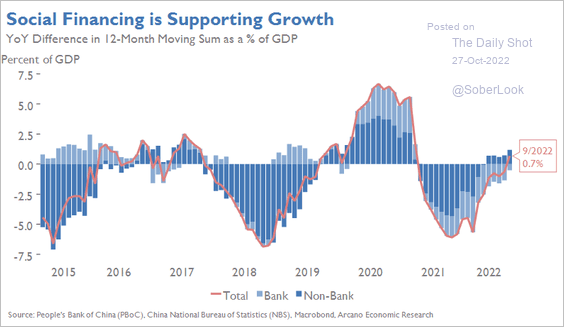

5. Beijing will prop up the economy through credit growth

Source: Arcano Economics

Source: Arcano Economics

6. Semiconductors are now China’s largest import.

![]() Source: Natixis

Source: Natixis

Back to Index

Emerging Markets

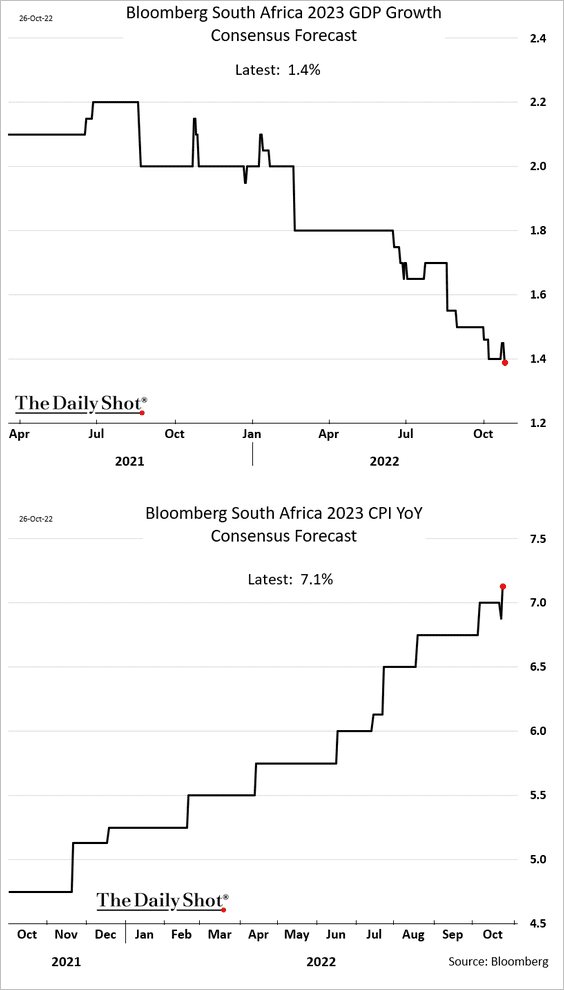

1. South Africa is headed for stagflation.

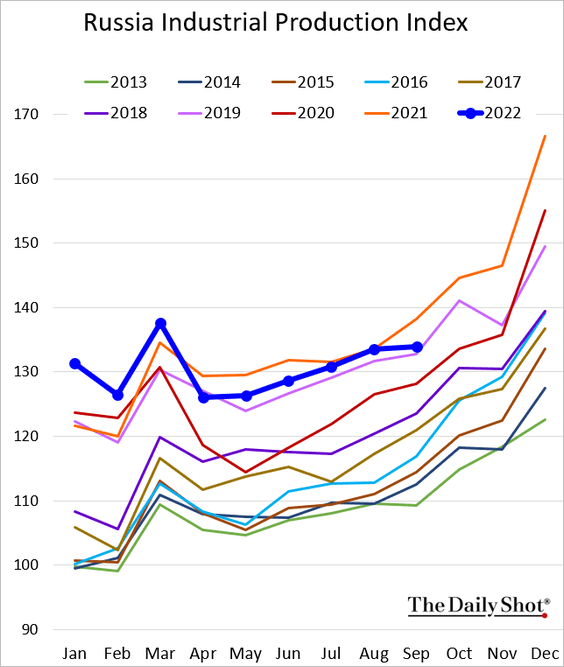

2. Here is Russia’s industrial production index (as reported by the government).

Back to Index

Cryptocurrency

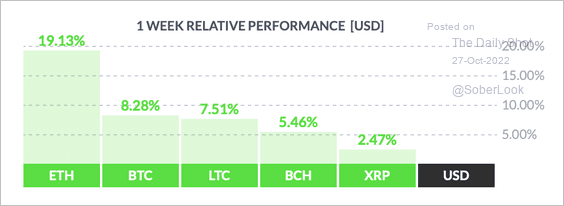

1. It’s been a good week for cryptos, with ethereum (ETH) outperforming other large tokens.

Source: FinViz

Source: FinViz

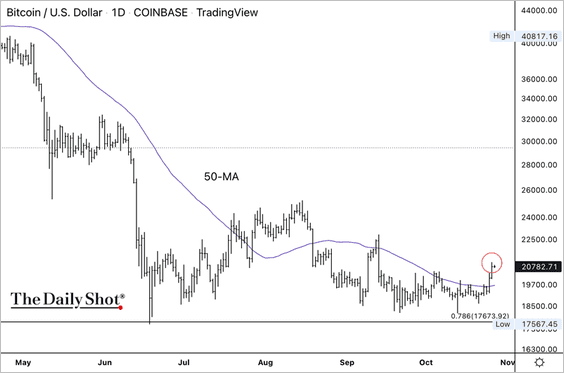

2. Bitcoin broke above its 50-day moving average.

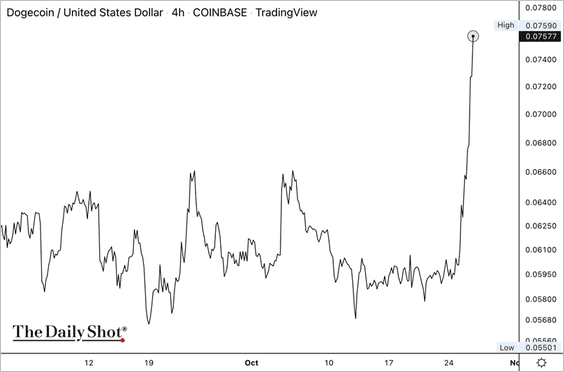

3. Dogecoin (DOGE) soared as much as 20% as Elon Musk’s Twitter deal nears completion.

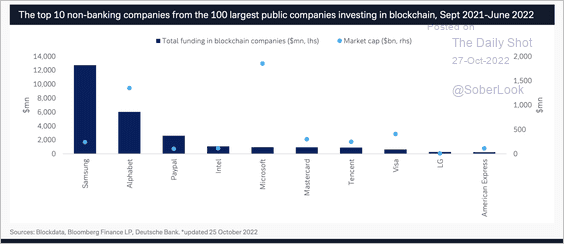

4. Large public companies have invested in blockchain technology over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

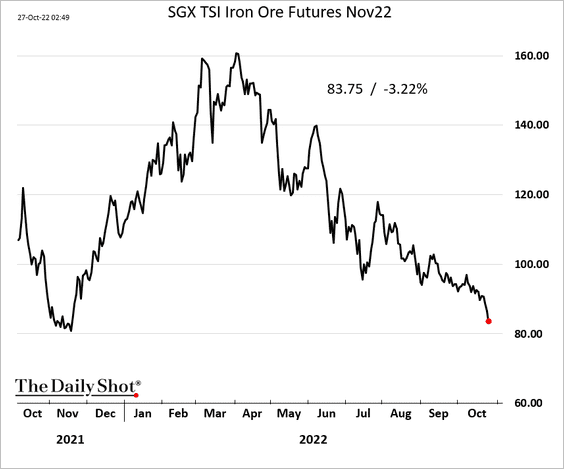

1. Iron ore futures continue to sink due to China’s falling demand for steel.

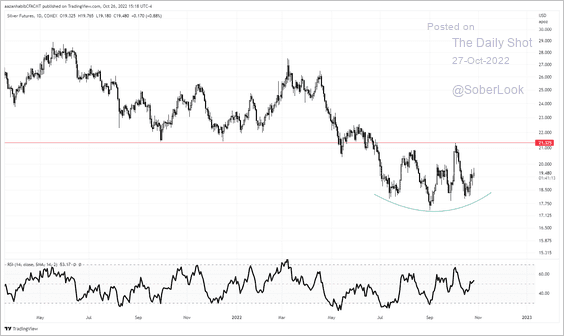

2. Silver futures are attempting to form a short-term bottom.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

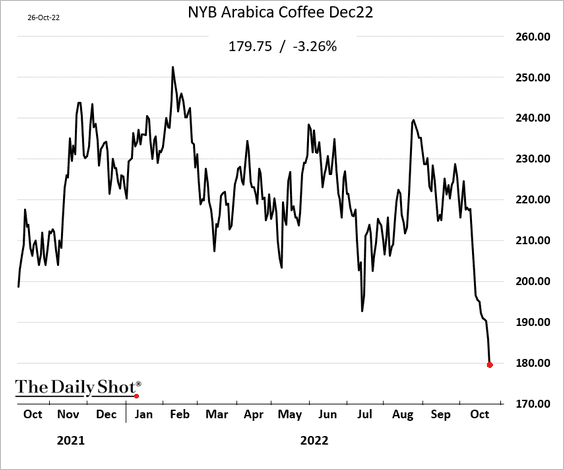

3. Coffee futures are down sharply this month.

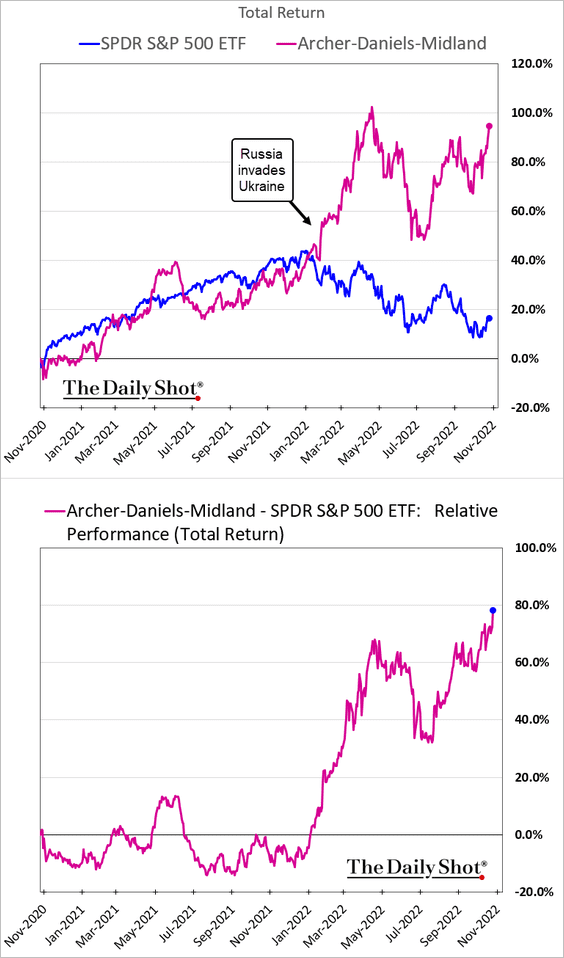

4. Large grain companies have posted better-than-expected profits and raised their financial outlooks for the year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

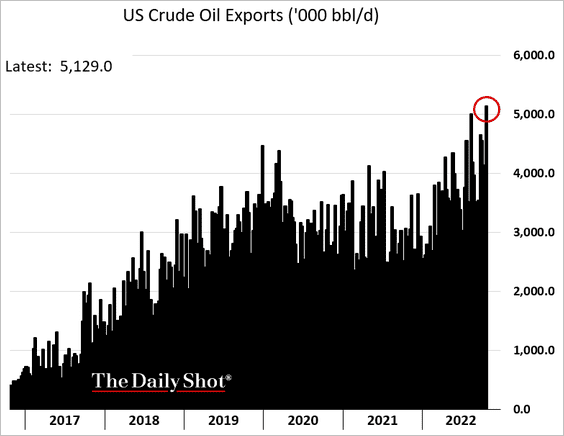

1. US crude oil gross exports hit a record high.

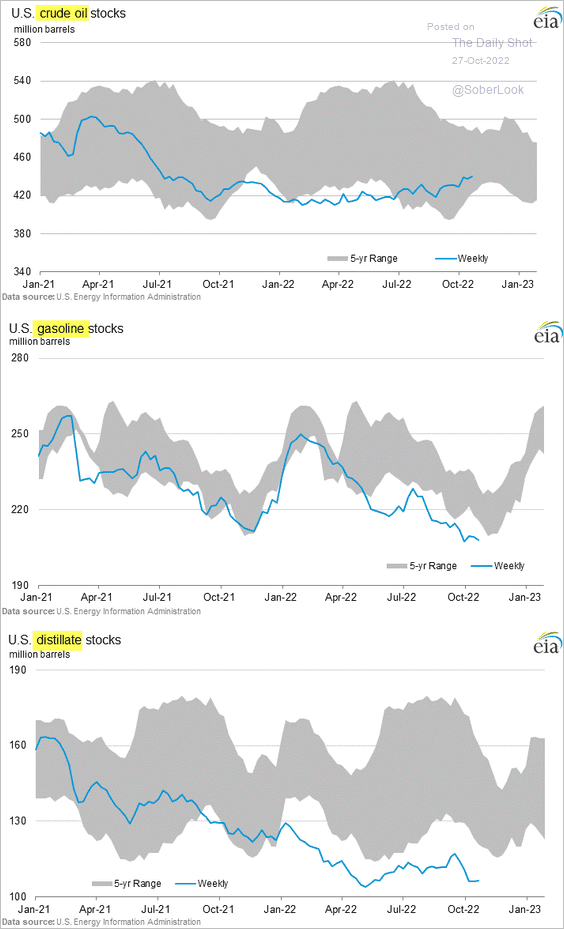

2. US oil inventories increased last week but product inventories remain depressed.

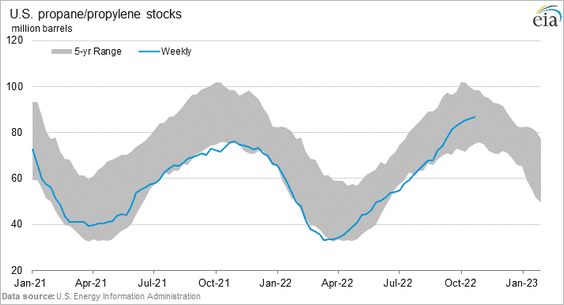

• Propane inventories are up sharply (good news for many rural US households who use it for heating).

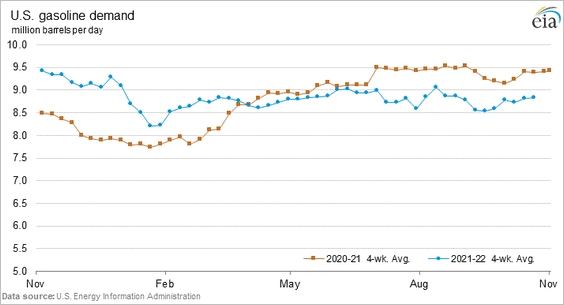

• Gasoline demand remains below last year’s levels.

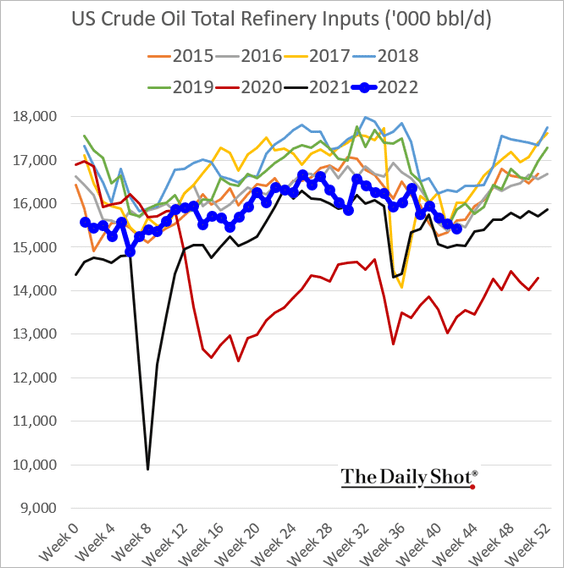

• Refinery runs moved lower again last week.

——————–

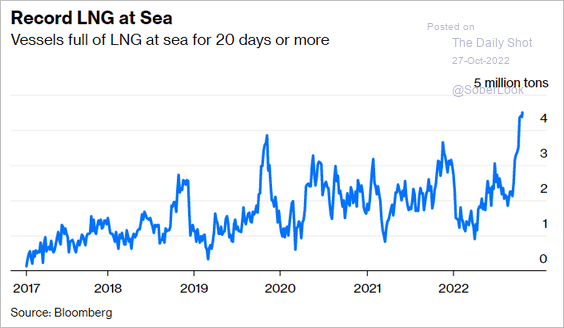

3. There are a lot of LNG vessels off the coast of Spain. Some are waiting for prices to move higher.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

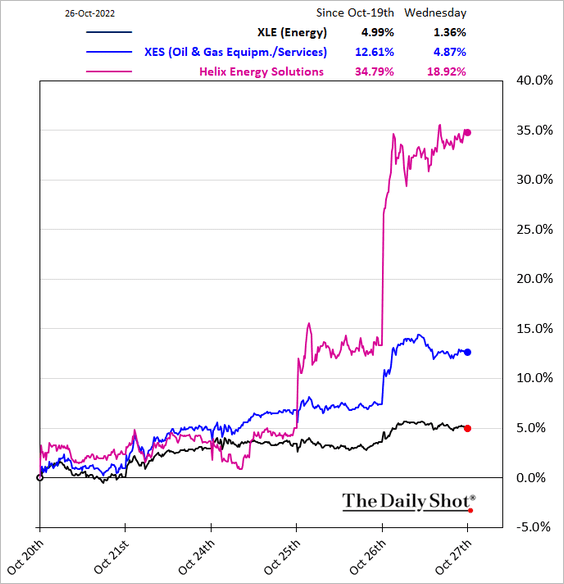

4. Shares of oil servicing companies surged this week.

h/t Walter

h/t Walter

Back to Index

Equities

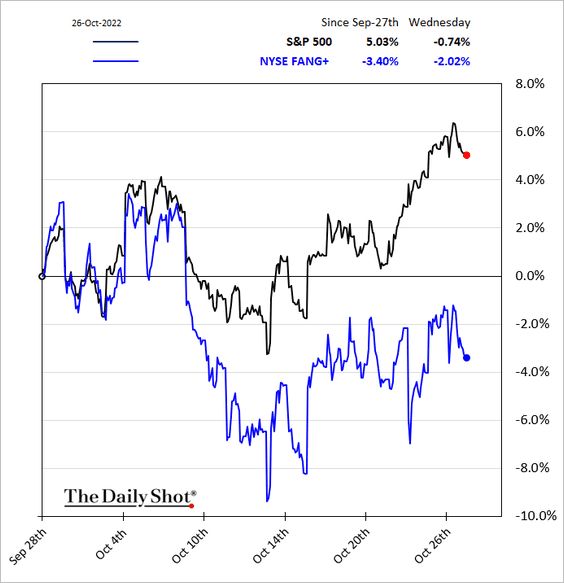

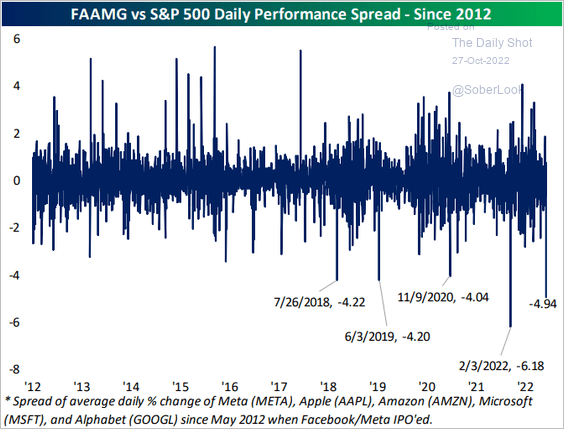

1. Tech mega-caps underperformed sharply in recent days.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

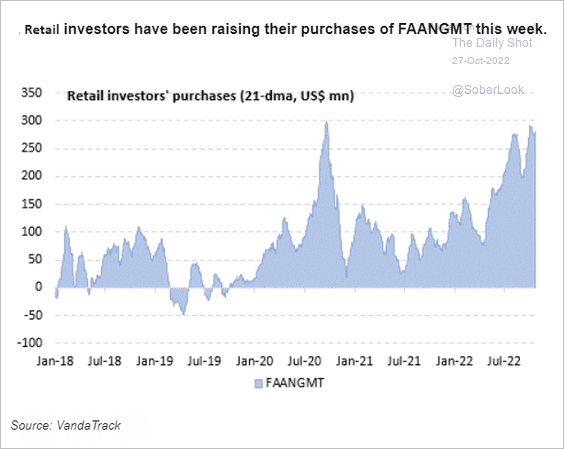

Retail investors have been buying tech mega-caps.

Source: Vanda Research

Source: Vanda Research

——————–

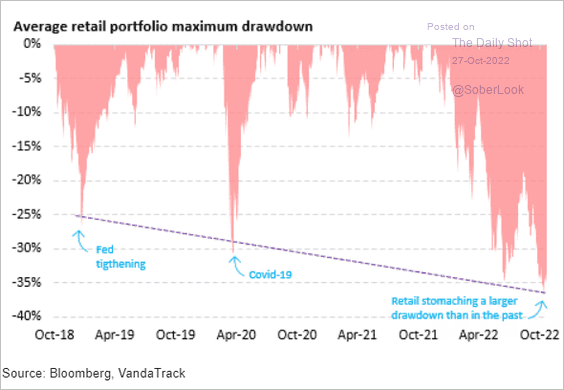

2. Large drawdowns have not triggered retail investors’ capitulation.

Source: Vanda Research

Source: Vanda Research

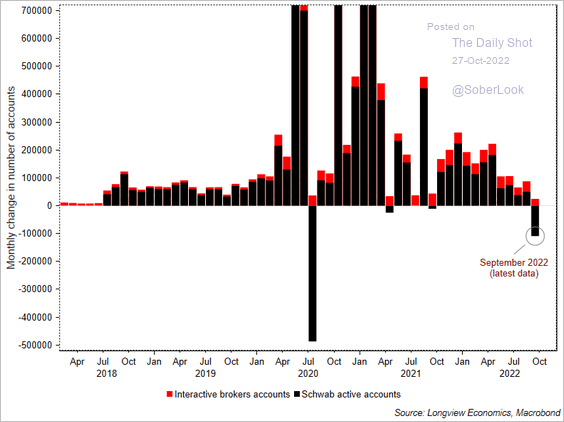

But Schwab saw a decline in brokerage accounts last month.

Source: Longview Economics

Source: Longview Economics

——————–

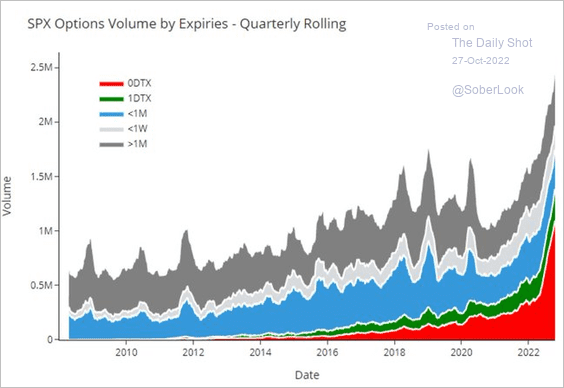

3. Short-term options activity has exploded, boosting gamma spikes and exacerbating market moves.

Source: @markets, @tracyalloway, h/t @jessefelder Read full article

Source: @markets, @tracyalloway, h/t @jessefelder Read full article

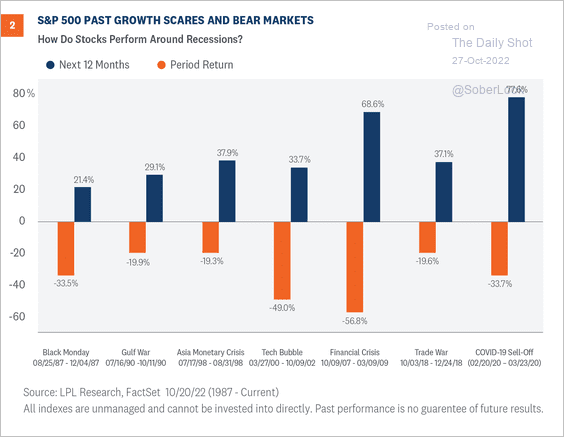

4. Here is the history of significant market downturns and performance over the following 12 months.

Source: LPL Research

Source: LPL Research

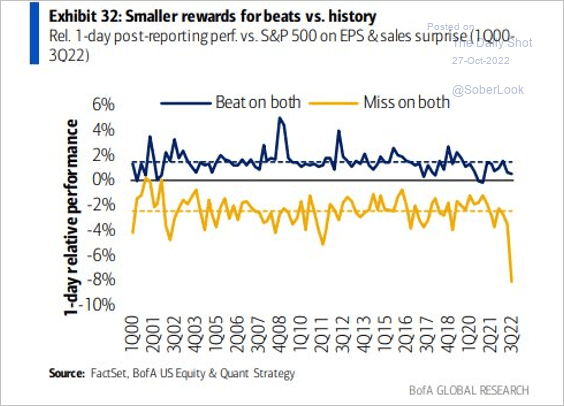

5. The market has been punishing companies for missing both earnings and sales forecasts.

Source: BofA Global Research

Source: BofA Global Research

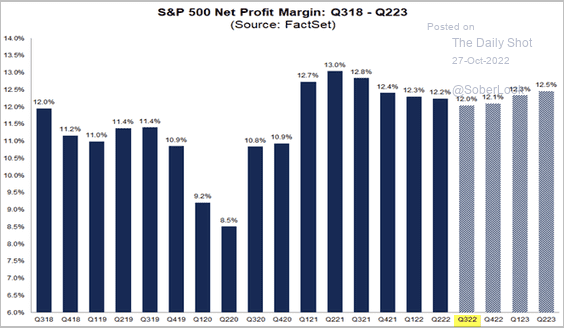

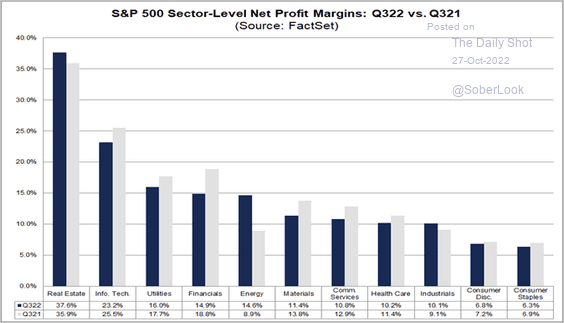

6. Profit margins are unlikely to have bottomed last quarter (which is the consensus).

Source: @FactSet Read full article

Source: @FactSet Read full article

Source: @FactSet

Source: @FactSet

——————–

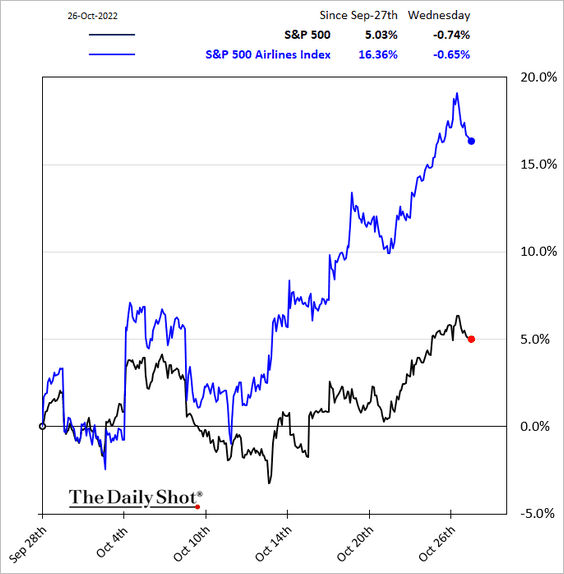

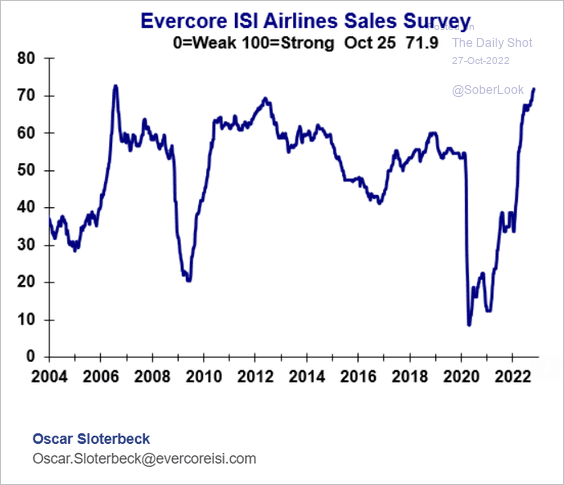

7. Shares of airlines have been outperforming …

… amid strong demand.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

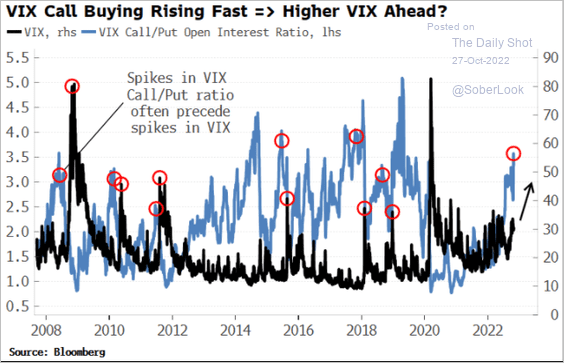

8. Demand for VIX call options has been strong.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Credit

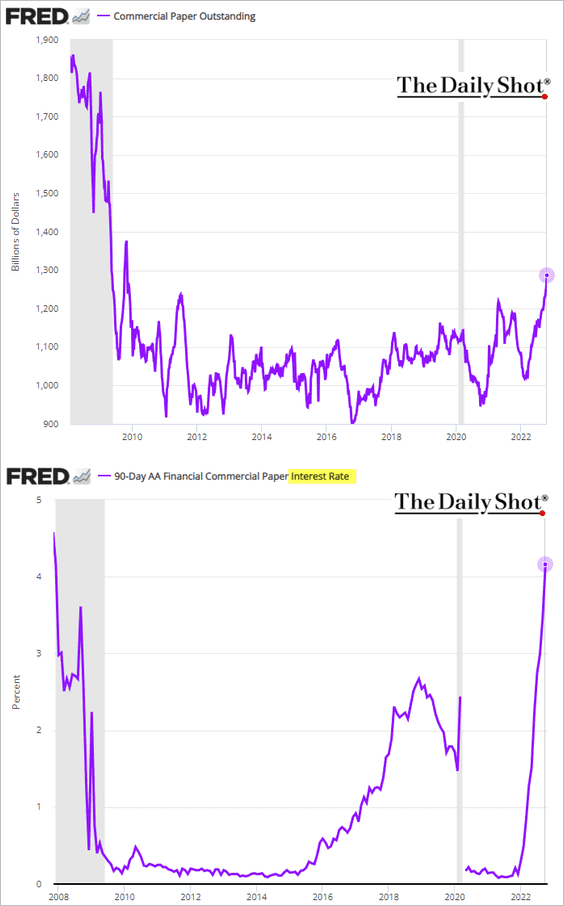

1. US commercial paper outstanding hit the highest level since 2010 as rates surge.

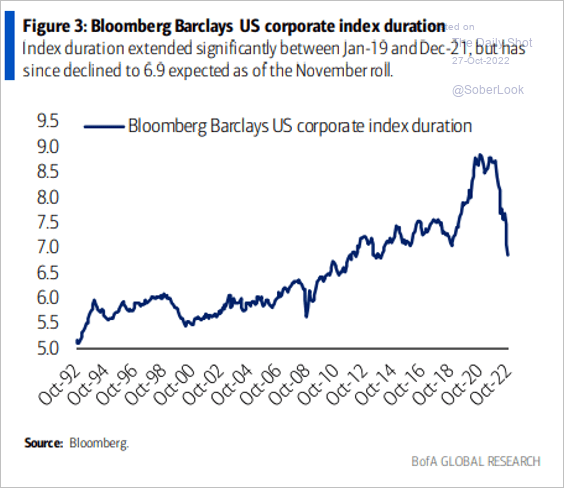

2. The investment-grade index duration has been falling quickly.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

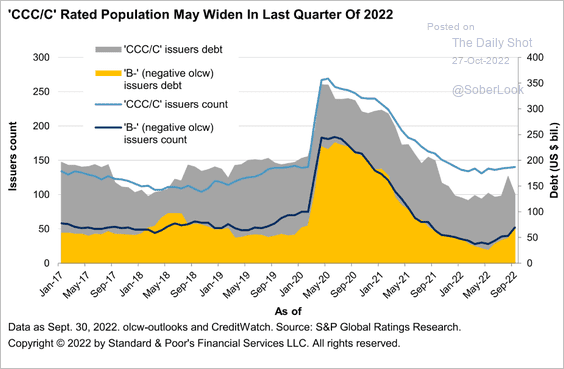

3. The number of stressed credits is expected to increase this quarter.

Source: S&P Global Ratings

Source: S&P Global Ratings

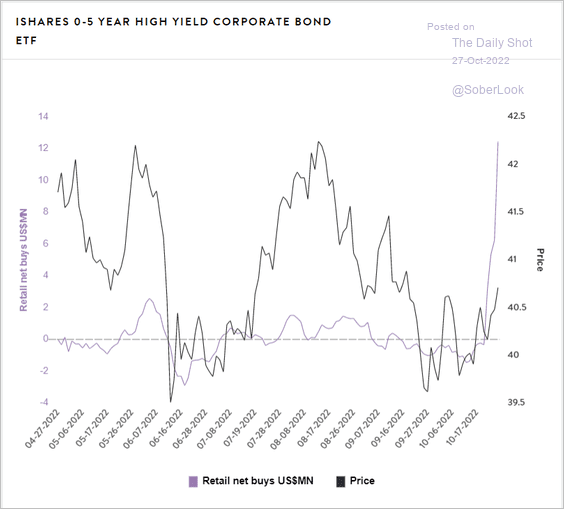

4. Retail investors have been buying SHYG (short-term high-yield debt ETF).

Source: Vanda Research

Source: Vanda Research

Back to Index

Rates

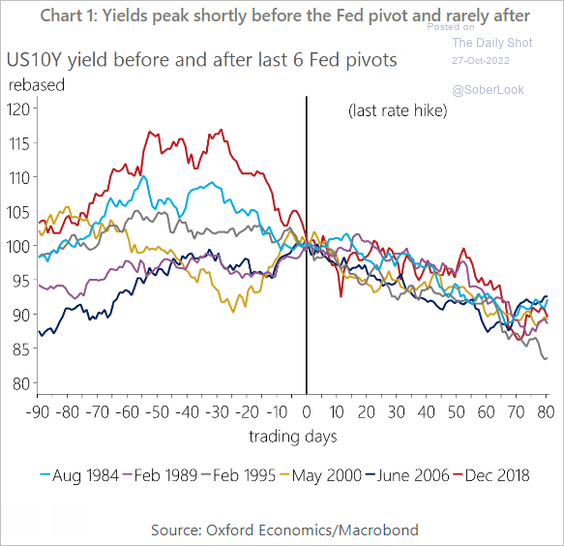

1. Treasury yields tend to peak before the Fed’s pivot.

Source: Oxford Economics

Source: Oxford Economics

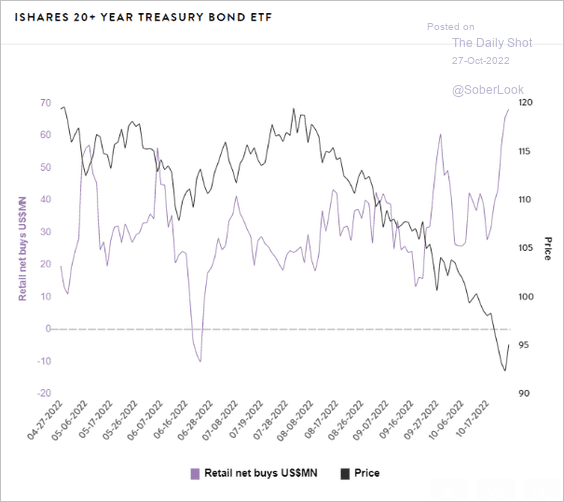

2. Retail investors have been buying TLT (long-term Treasury debt ETF).

Source: Vanda Research

Source: Vanda Research

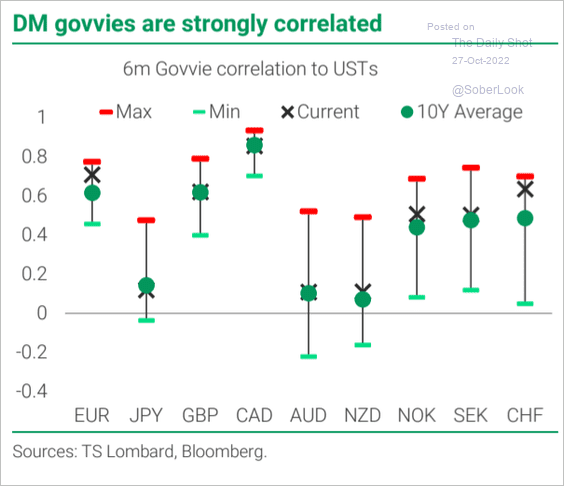

3. How correlated are DM government bonds to Treasuries?

Source: TS Lombard

Source: TS Lombard

Back to Index

Global Developments

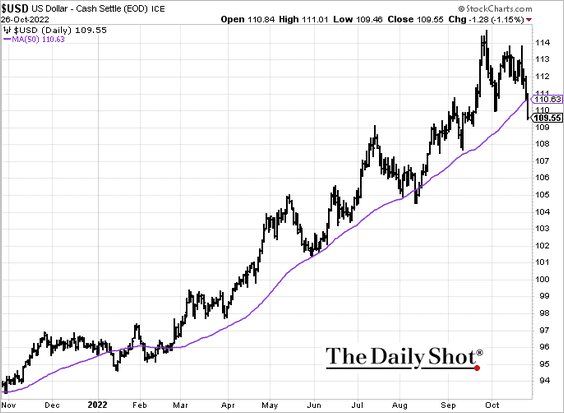

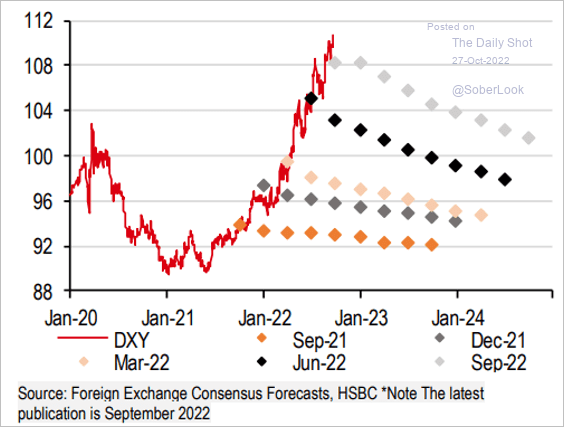

1. The US dollar declined sharply, breaking below the 50-day moving average.

Forecasts calling for the US dollar to weaken have been persistently wrong. Is it different this time?

Source: HSBC; @patrick_saner

Source: HSBC; @patrick_saner

——————–

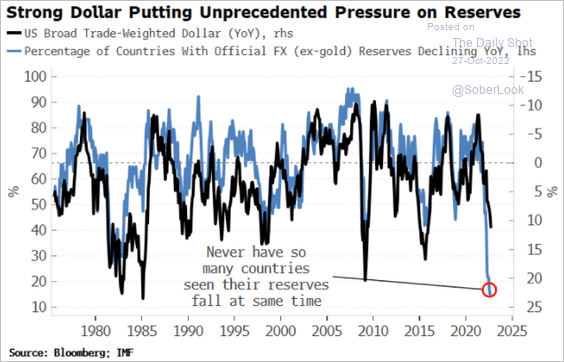

2. The US dollar’s strength is putting pressure on reserves.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

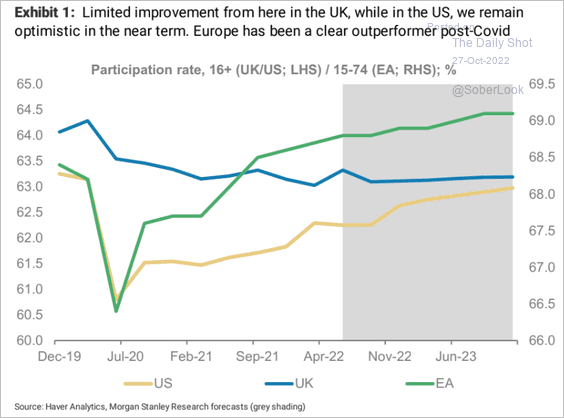

3. Next, we have Morgan Stanley’s projections for labor force participation rates in the US, UK, and Eurozone.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

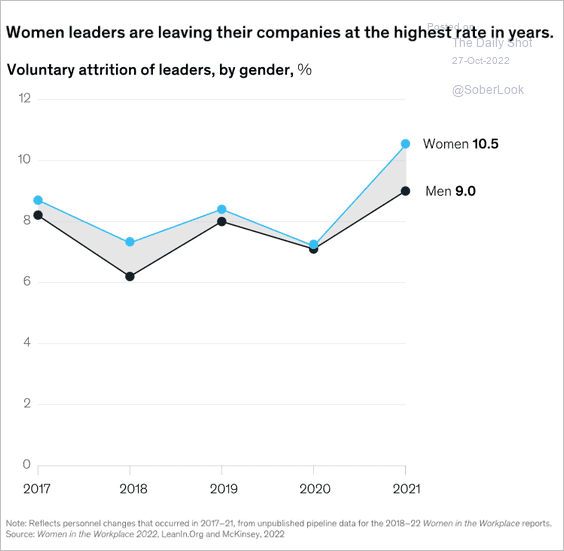

1. Women leaders leaving their companies:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

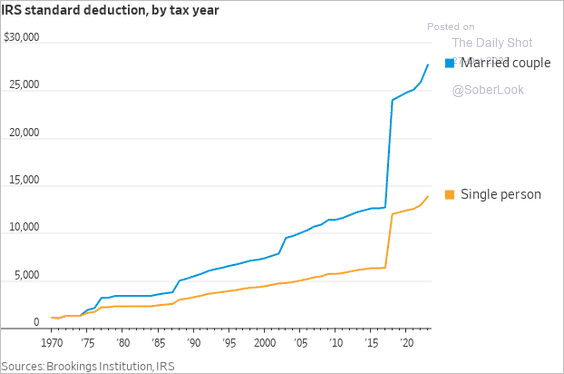

2. The IRS standard deduction over time:

Source: @WSJ Read full article

Source: @WSJ Read full article

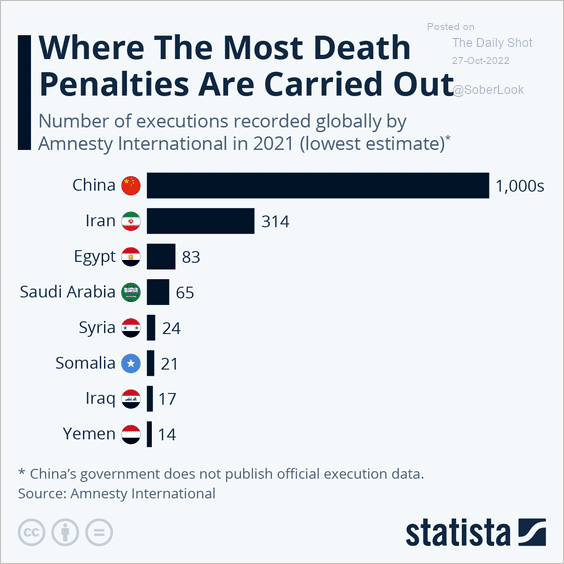

3. Death penalties:

Source: Statista

Source: Statista

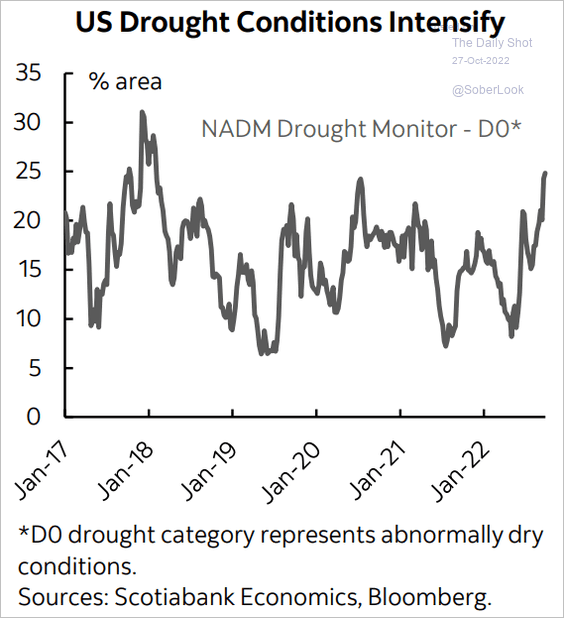

4. US drought conditions:

Source: Scotiabank Economics

Source: Scotiabank Economics

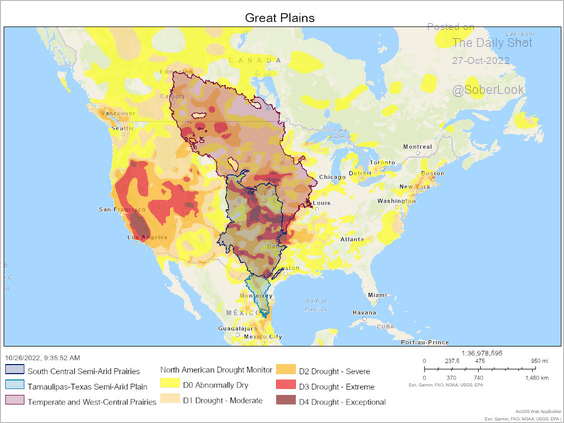

• Drought in the Great Plains:

Drought increased to cover 70.3% of the North American Great Plains region by the end of September 2022.

Source: @NOAANCEI Read full article

Source: @NOAANCEI Read full article

——————–

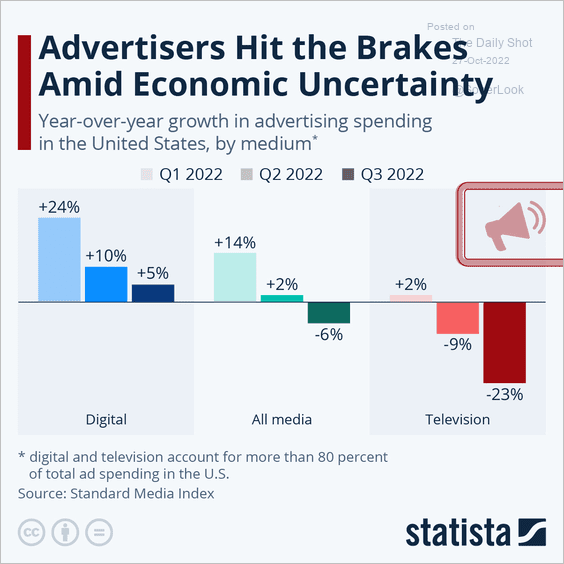

5. Advertising pullback:

Source: Statista

Source: Statista

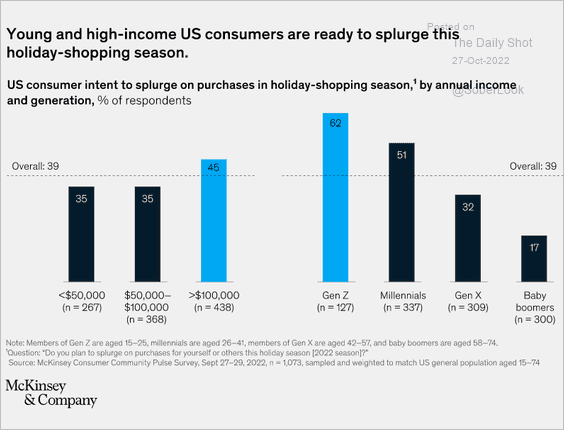

6. Willingness to splurge this holiday season:

Source: McKinsey & Company

Source: McKinsey & Company

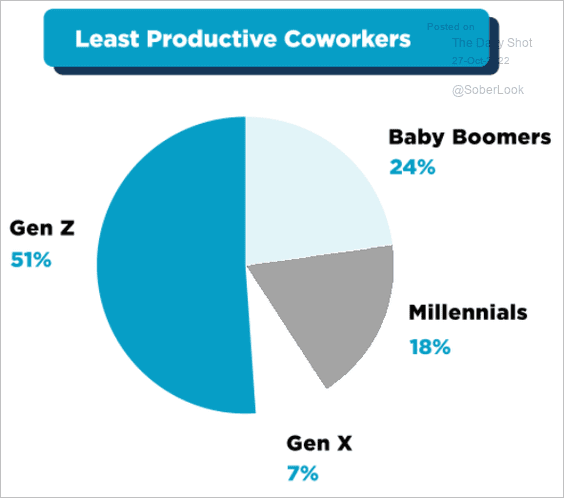

7. Least productive coworkers:

Source: LLC.ORG Read full article

Source: LLC.ORG Read full article

——————–

Back to Index