The Daily Shot: 03-Nov-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

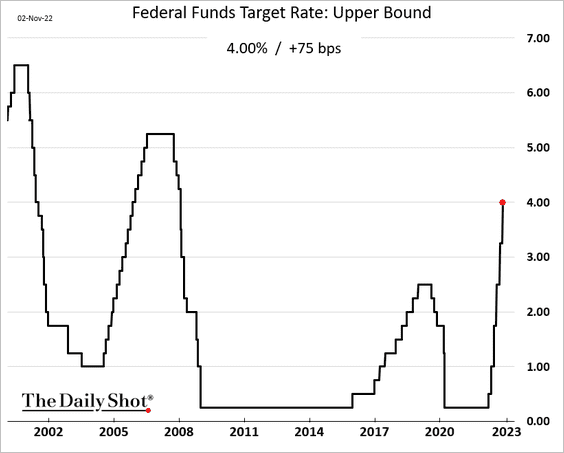

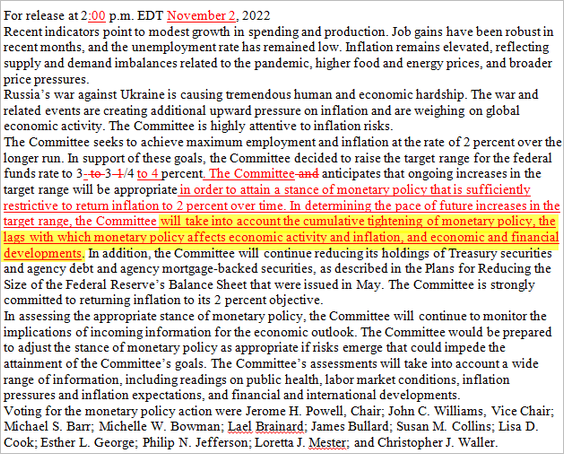

1. The Fed hiked rates by 75 bps as expected.

The FOMC statement hints at smaller rate increases ahead. The wording “cumulative tightening” suggests a focus on the terminal rate rather than individual rate increases. The market initially saw the reference to monetary policy “lags” and “economic and financial developments” as a bit dovish.

Source: @NickTimiraos

Source: @NickTimiraos

But then we got this comment at the press conference.

Fed Chair Jerome Powell: – … we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.

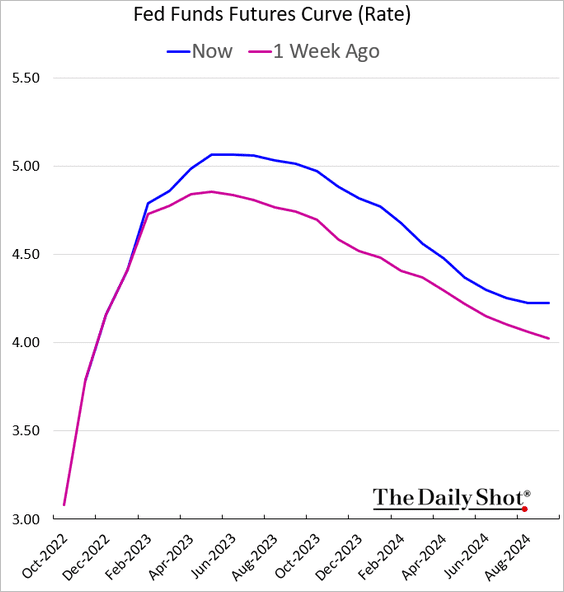

A slower pace of rate hikes but a higher peak? This is not the “pivot” the markets were hoping for.

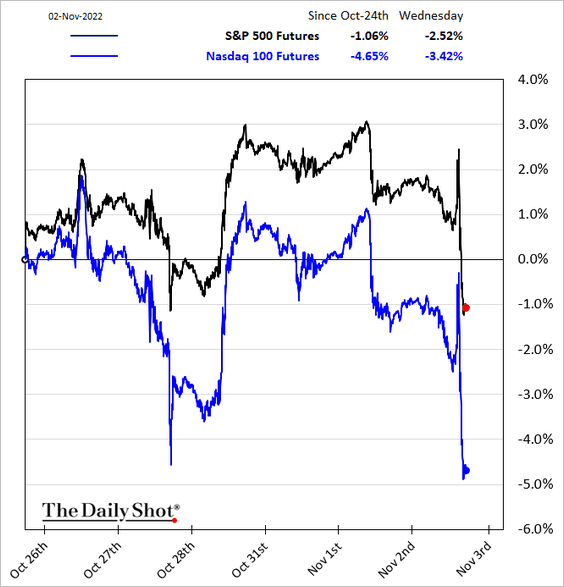

2. Stocks tumbled, …

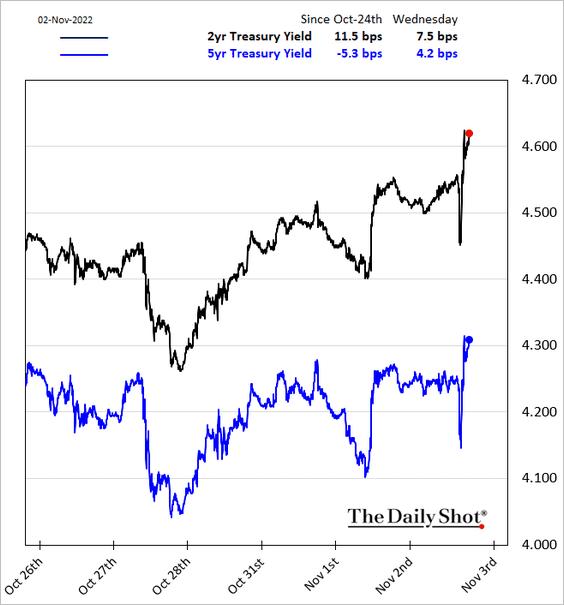

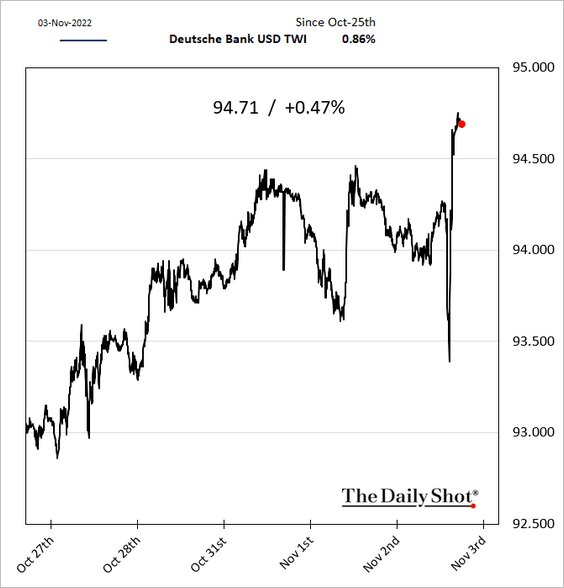

… and treasury yields and the dollar rose, …

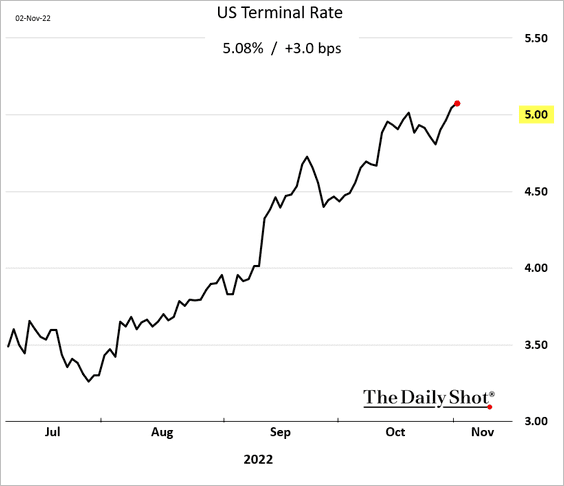

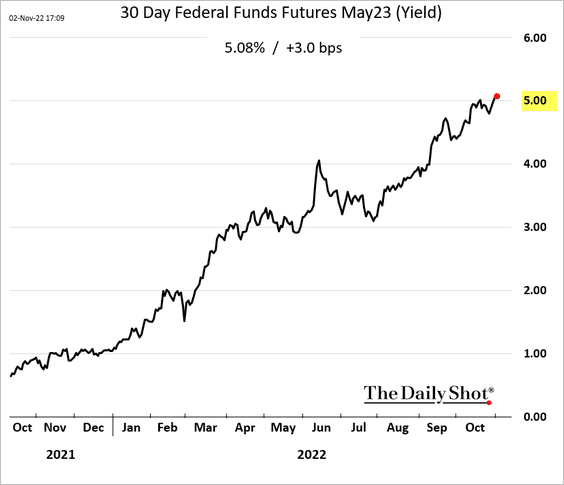

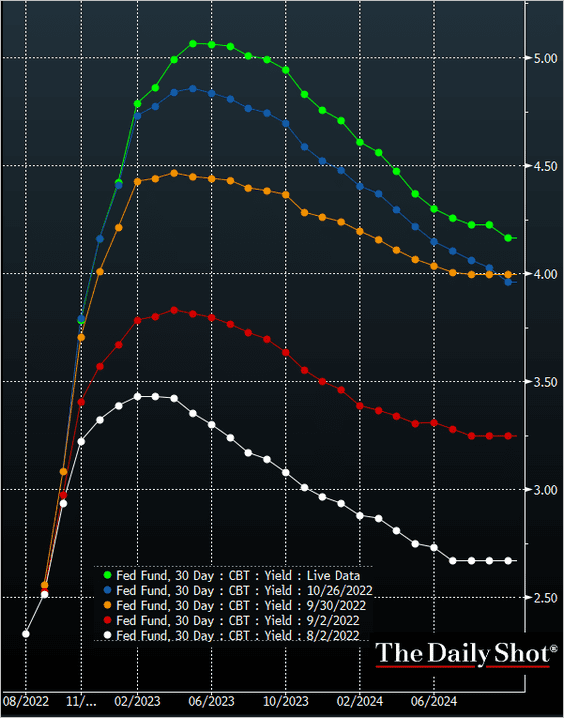

… as the terminal rate moved past 5%.

• The fed funds rate peak is now expected to be in May, …

… as it keeps moving further out.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

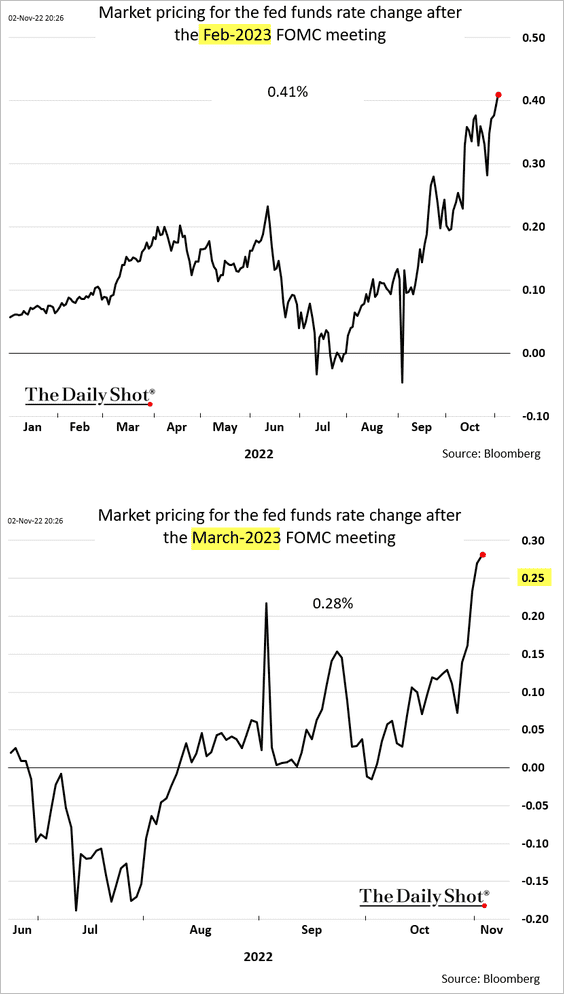

• So we get a 50 bps increase in December and then what? Another 50 bps in February and 25 or 50 bps in March? Another hike in May? Here is what the market sees in February and March.

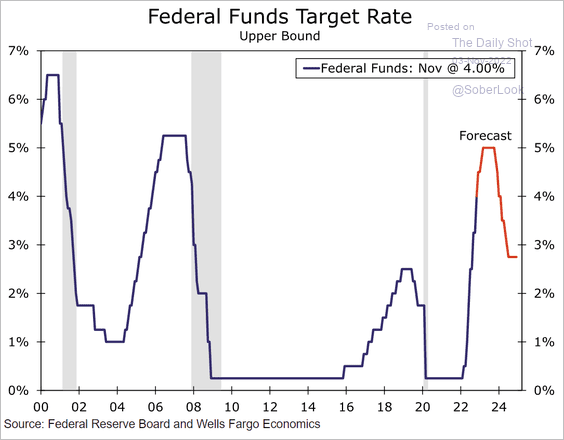

• Will we see rapid rate cuts in 2024? Here is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

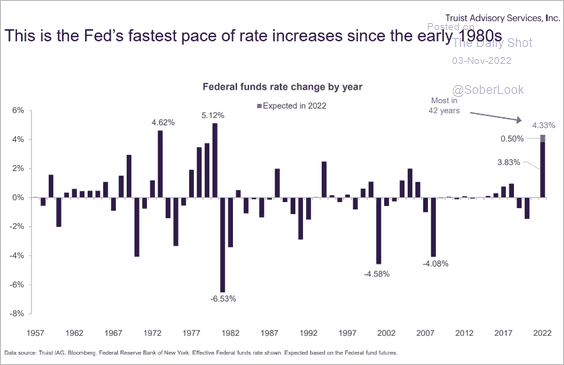

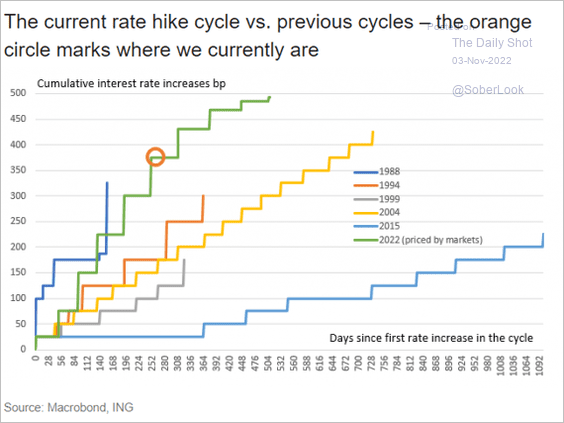

• The pace of policy tightening has been remarkably fast (2 charts).

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: ING

Source: ING

——————–

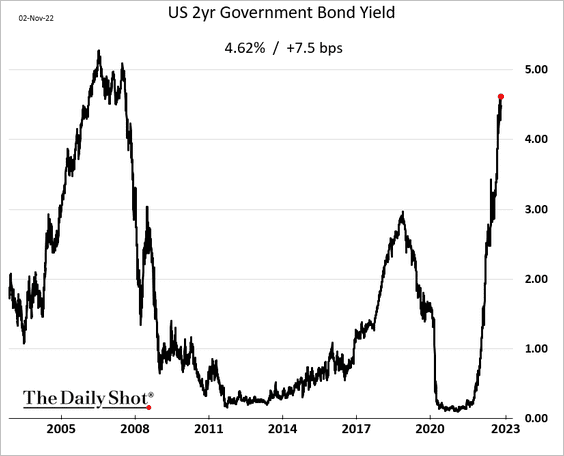

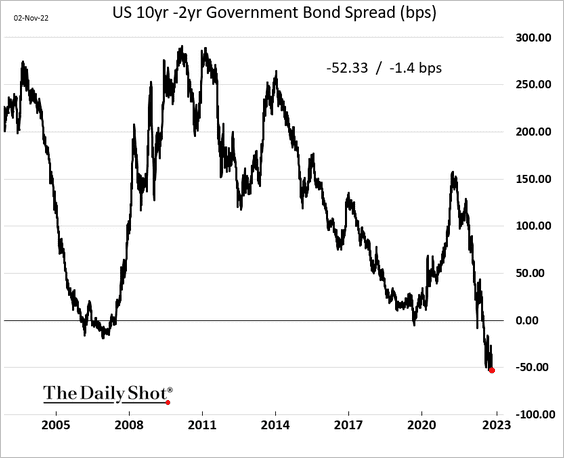

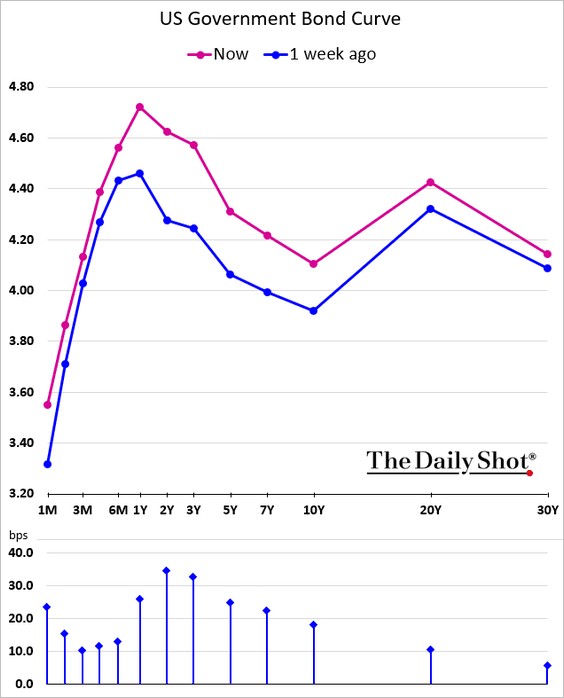

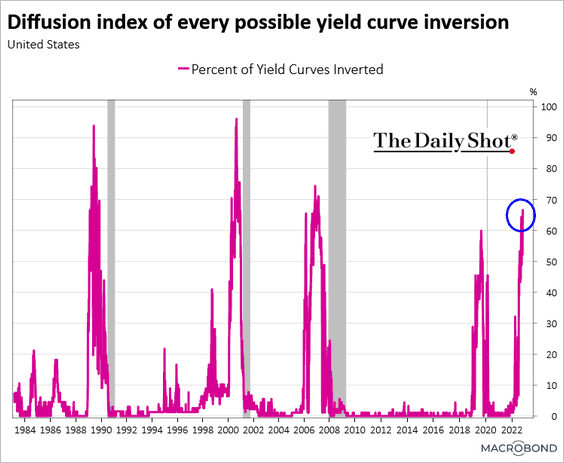

3. The 2-year Treasury yield reached another cycle high, …

… as the curve inverts further (2 charts).

The market doesn’t see much room for a soft landing.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

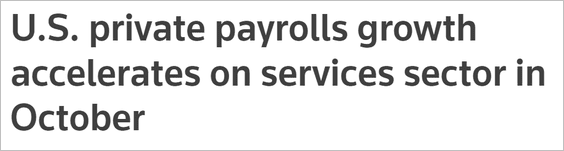

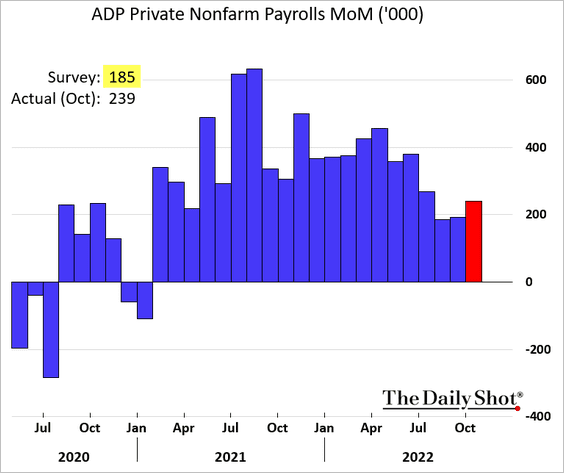

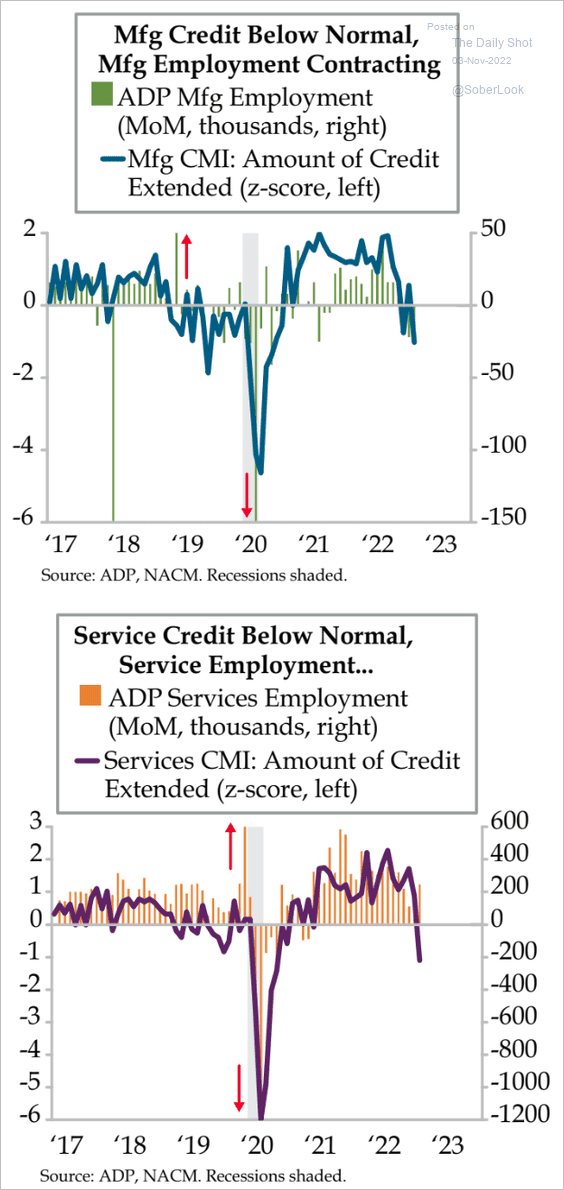

4. The October gains in the ADP private payrolls report topped forecasts.

Source: Reuters Read full article

Source: Reuters Read full article

The breadth of job gains was not great.

And tighter credit conditions point to a deterioration in the labor market ahead.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

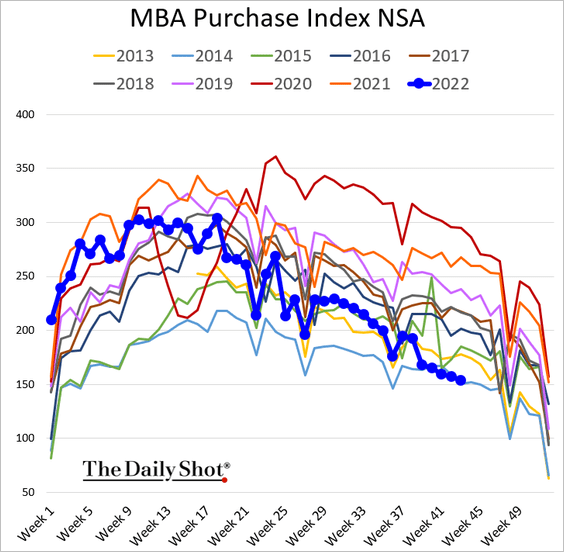

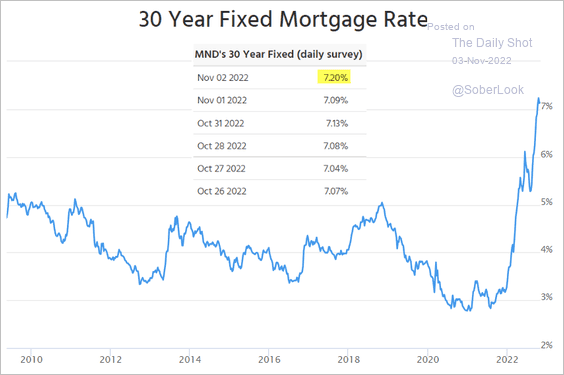

5. Mortgage applications are running at 2014 levels, …

… as mortgage rates hold above 7%.

Source: @mortgagenewsmnd

Source: @mortgagenewsmnd

——————–

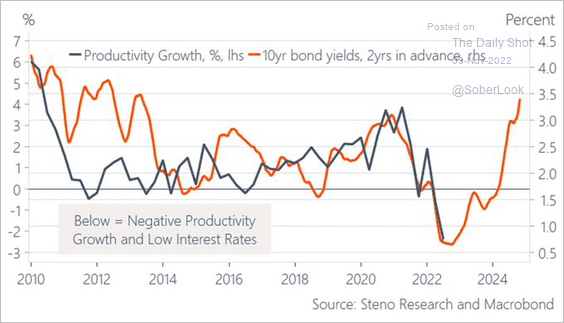

6. Will higher rates boost US productivity?

Source: @AndreasSteno

Source: @AndreasSteno

Back to Index

The United Kingdom

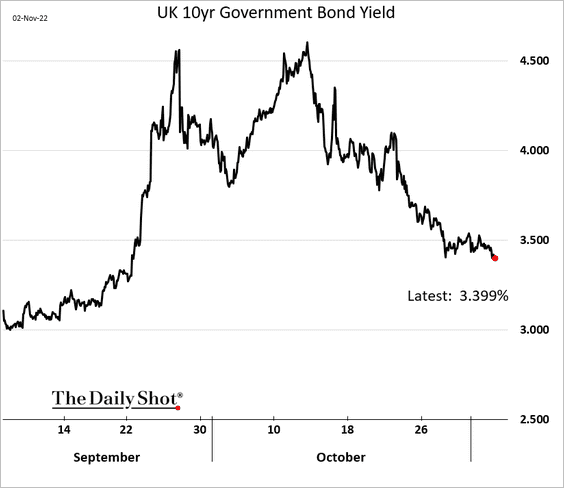

1. Gilt yields are moving lower as the “Truss premium” dissipates.

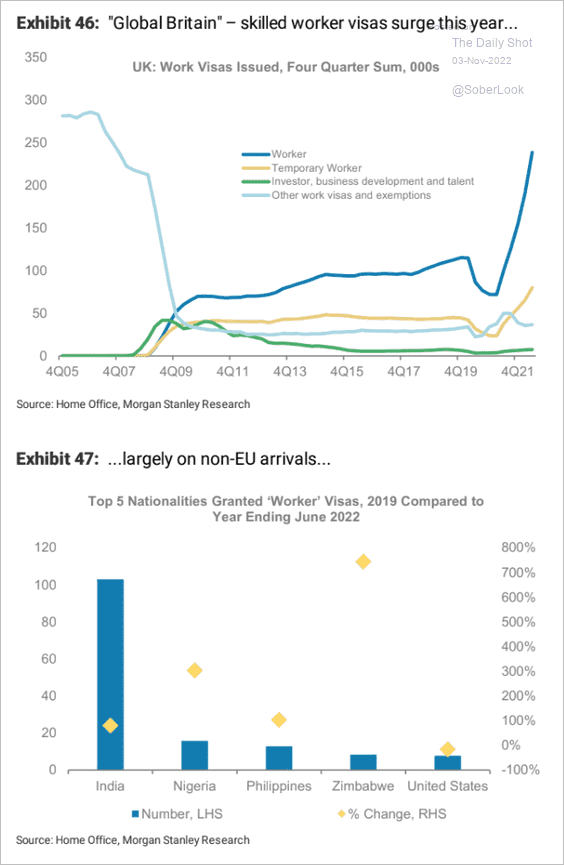

2. Visas to skilled workers surged this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

The Eurozone

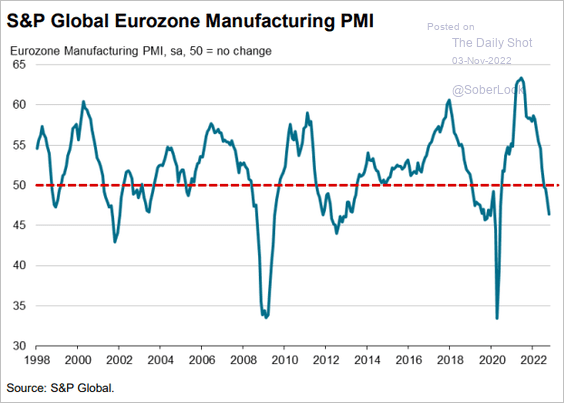

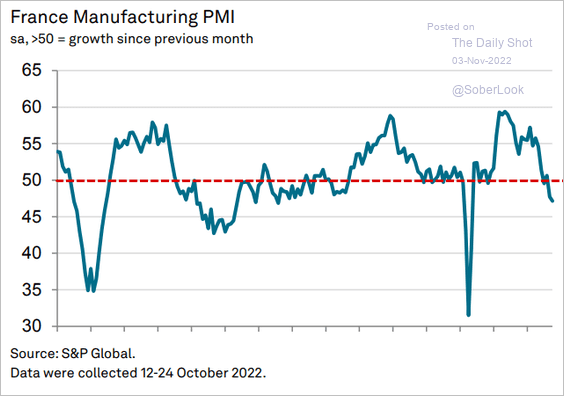

1. The final manufacturing PMI reports were worse than the October flash figures.

Source: S&P Global PMI

Source: S&P Global PMI

• France:

Source: S&P Global PMI

Source: S&P Global PMI

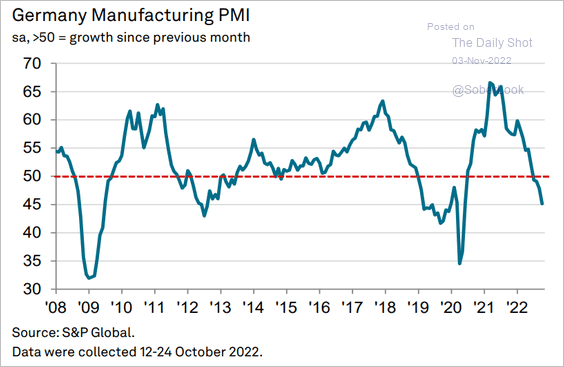

• Germany:

Source: S&P Global PMI

Source: S&P Global PMI

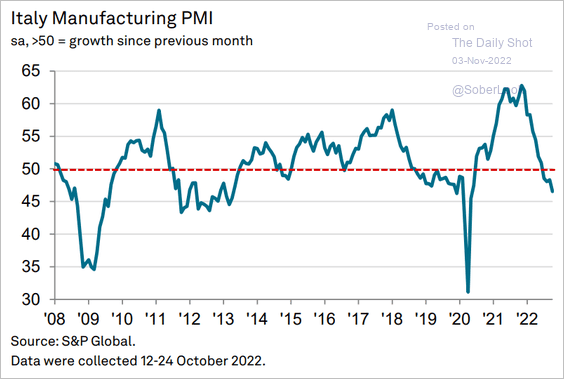

• Italy:

Source: S&P Global PMI

Source: S&P Global PMI

• The Netherlands:

Source: S&P Global PMI

Source: S&P Global PMI

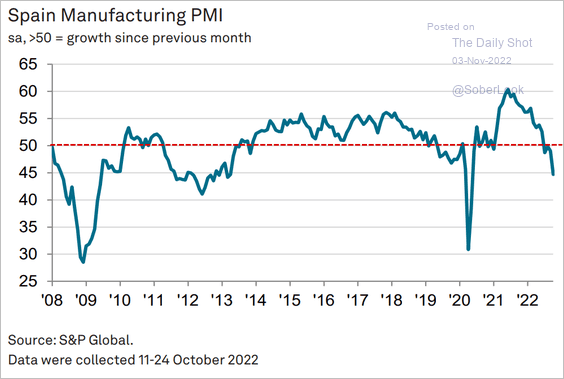

• Spain:

Source: S&P Global PMI

Source: S&P Global PMI

——————–

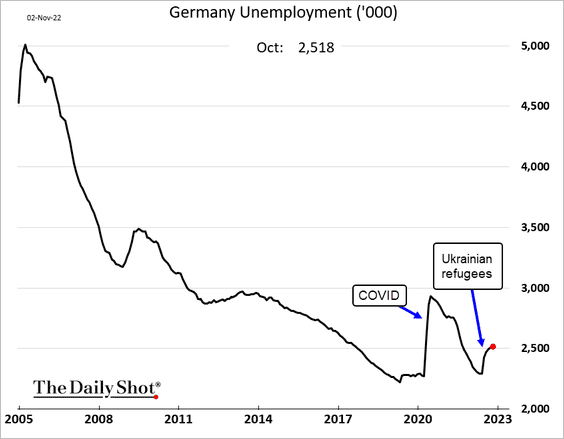

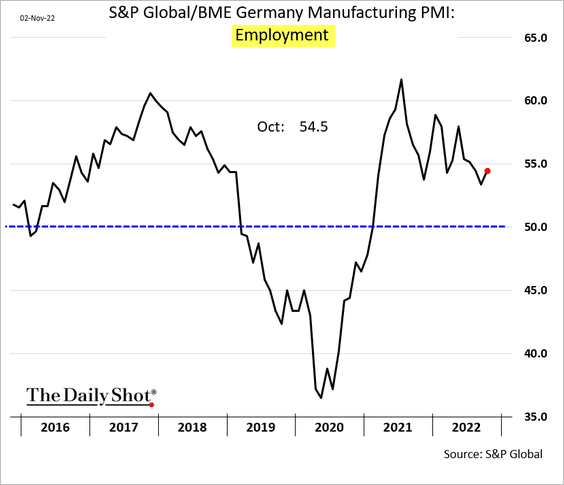

2. Despite the headwinds, German unemployment remains relatively low.

Here is the Manufacturing PMI employment index:

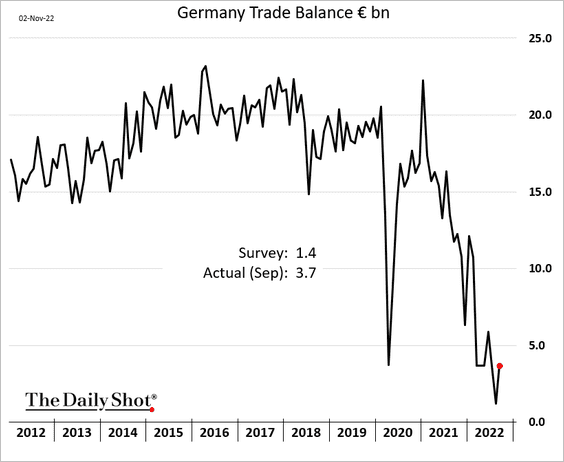

Separately, Germany’s trade surplus edged higher in September.

——————–

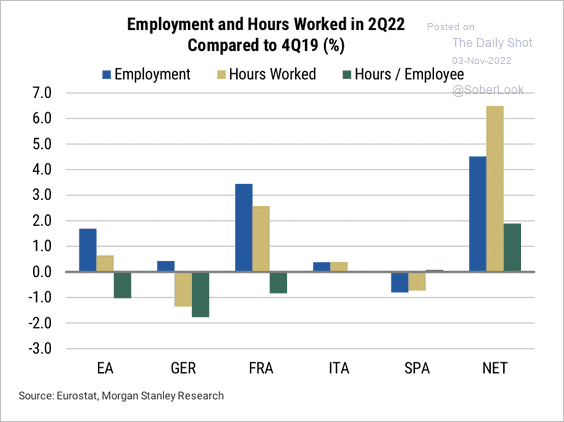

3. This chart shows total employment and hours worked vs. pre-COVID levels across the Eurozone.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

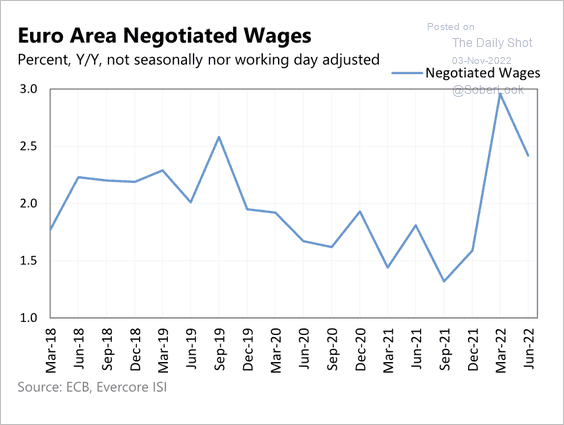

4. Negotiated wages are starting to decline.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Europe

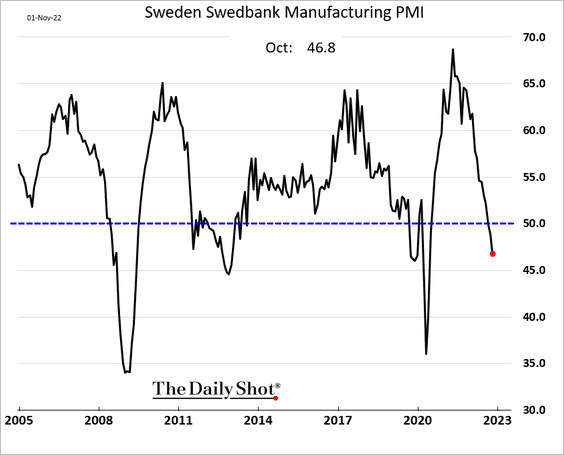

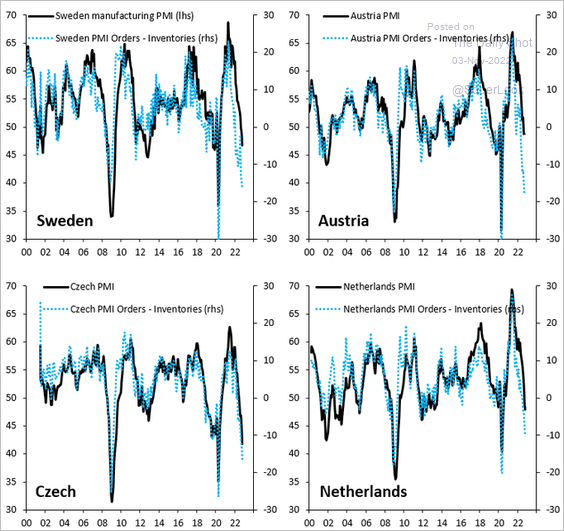

1. Sweden’s manufacturing activity is contracting.

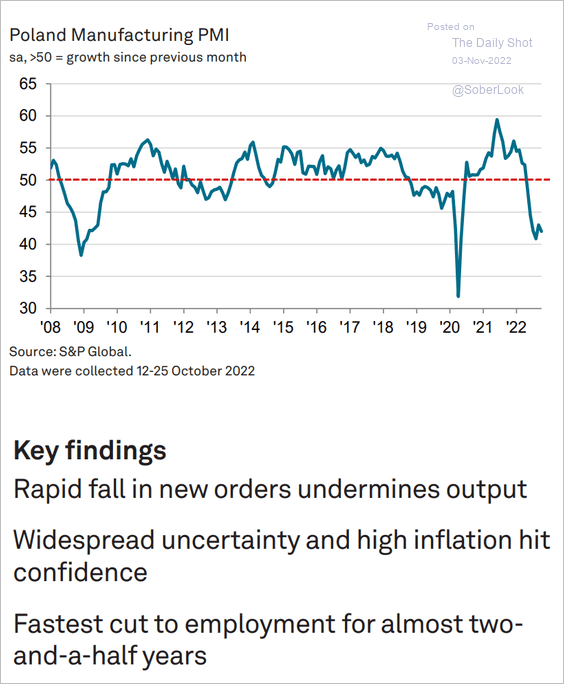

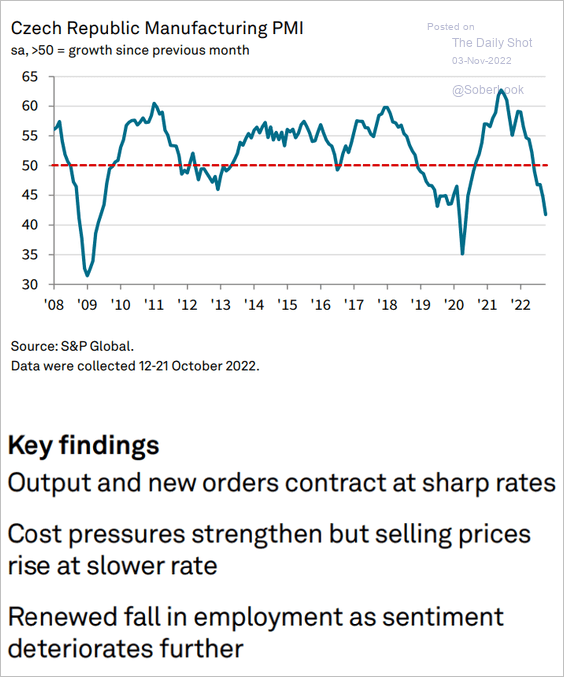

2. Manufacturing is also in trouble in central Europe.

• Poland:

Source: S&P Global PMI

Source: S&P Global PMI

• The Czech Republic:

Source: S&P Global PMI

Source: S&P Global PMI

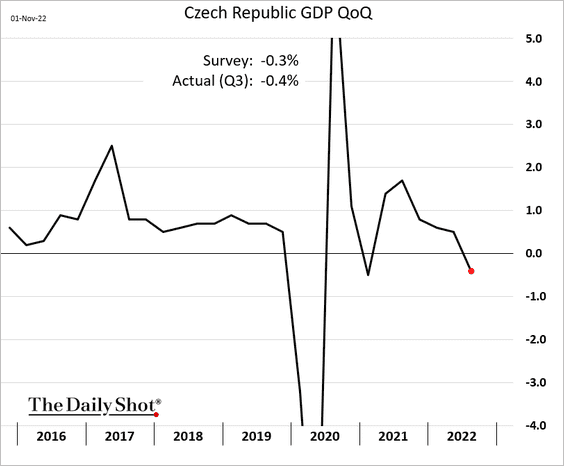

Separately, the Czech GDP contracted last quarter.

——————–

3. A deep European recession is coming.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Asia – Pacific

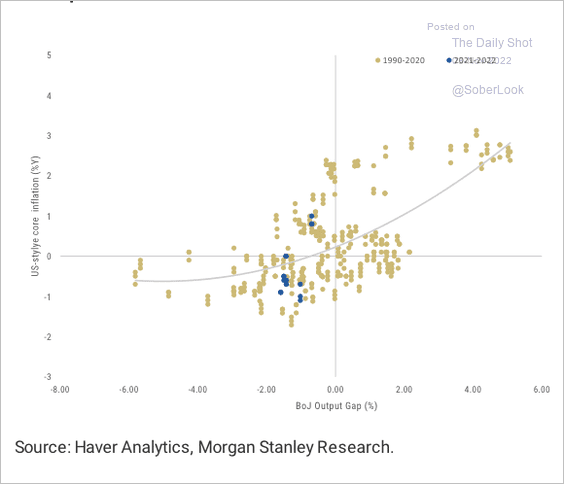

1. Japan’s core inflation has been aligned with the historical Phillips Curve.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

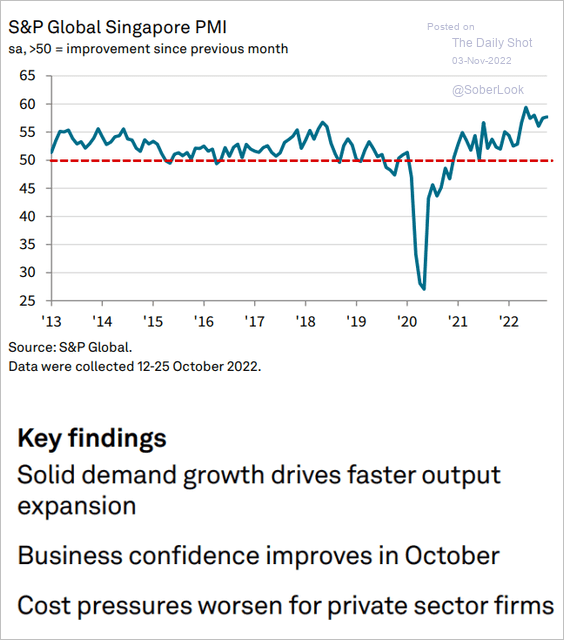

2. Singapore’s business activity remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

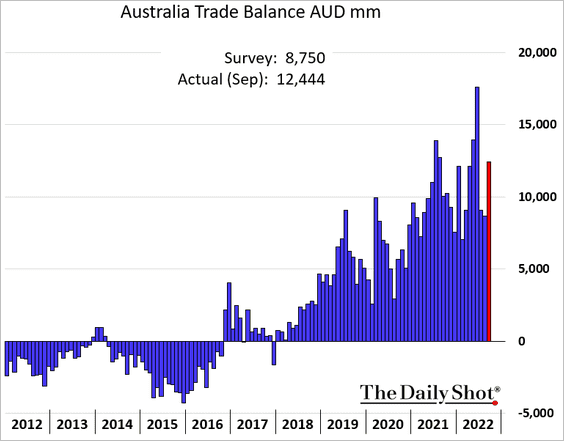

3. Australia’s trade surplus topped expectations on strong exports.

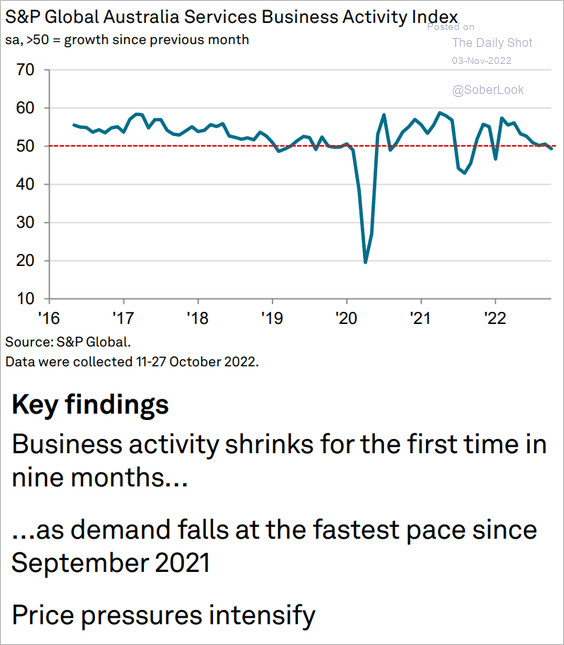

However, Australia’s service sector growth has stalled.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

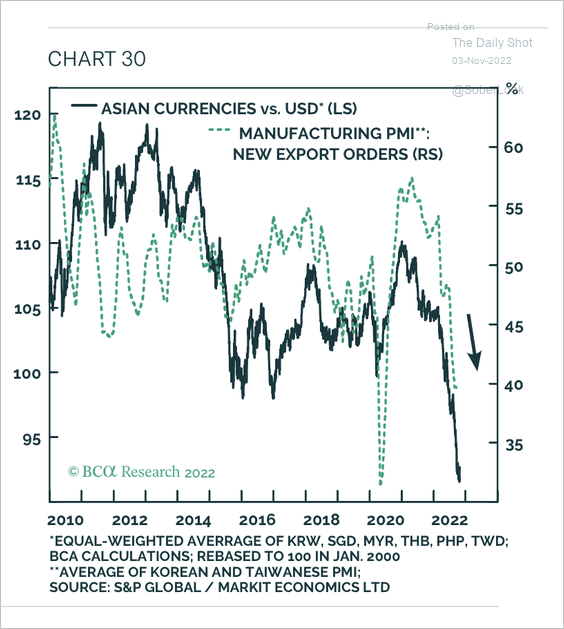

4. Asian currencies are pricing in weaker regional manufacturing growth.

Source: BCA Research

Source: BCA Research

Back to Index

China

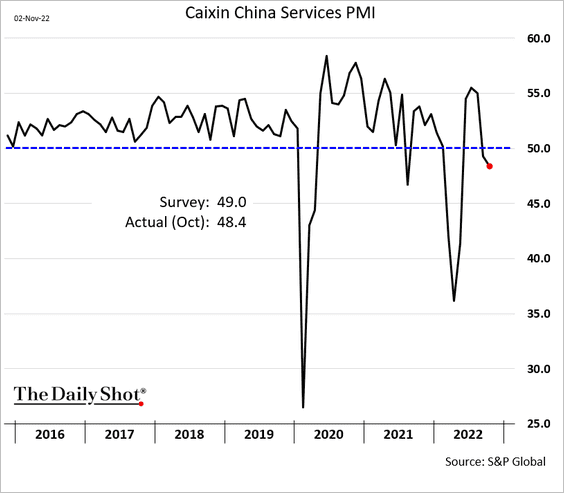

1. The S&P Global Services PMI moved deeper into contraction territory amid lockdowns.

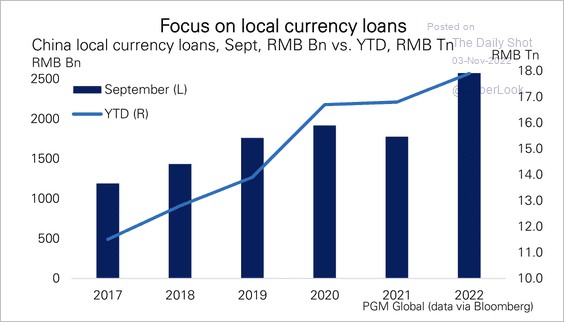

2. Local currency bank loans had their largest reading in September in about 30 years. Some banks are inflating loan volumes to meet government targets amid weak credit demand, according to PGM Global.

Source: PGM Global

Source: PGM Global

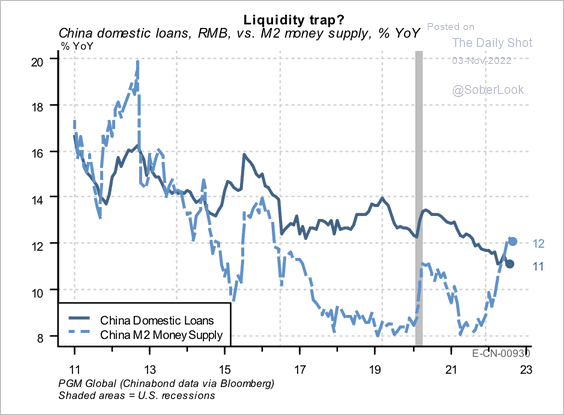

• Domestic loan demand is falling while the money supply is rising, which means banks are sitting on plenty of cash.

Source: PGM Global

Source: PGM Global

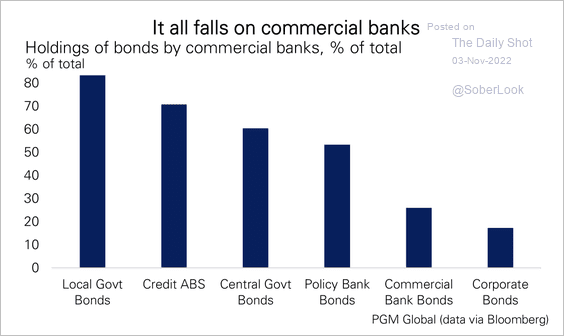

• Credit risk is concentrated in the banking sector, which owns over 80% of local government bonds (also tied to the property sector).

Source: PGM Global

Source: PGM Global

——————–

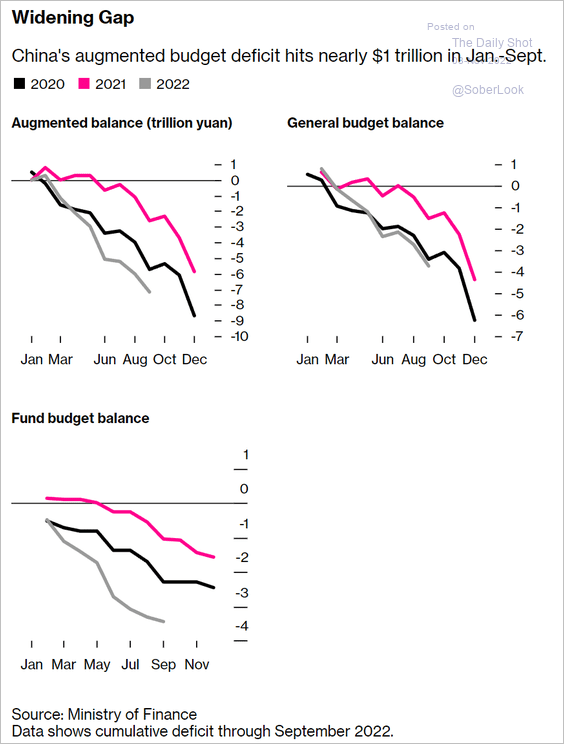

3. The budget deficit is massive.

Source: @MollySmithNews, @business Read full article

Source: @MollySmithNews, @business Read full article

Back to Index

Emerging Markets

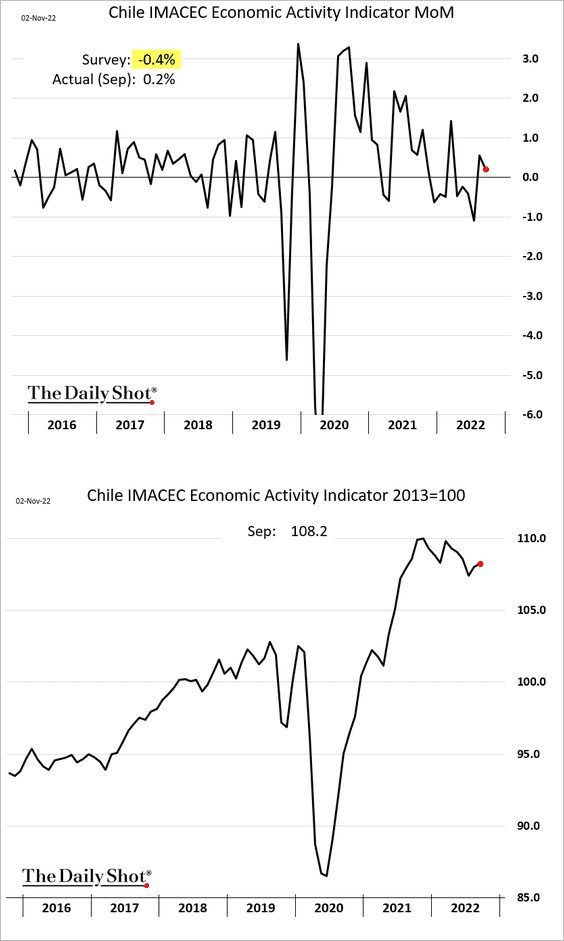

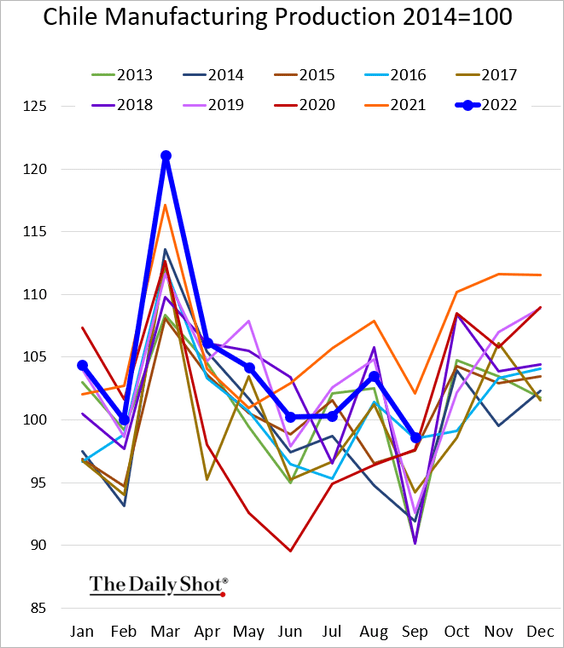

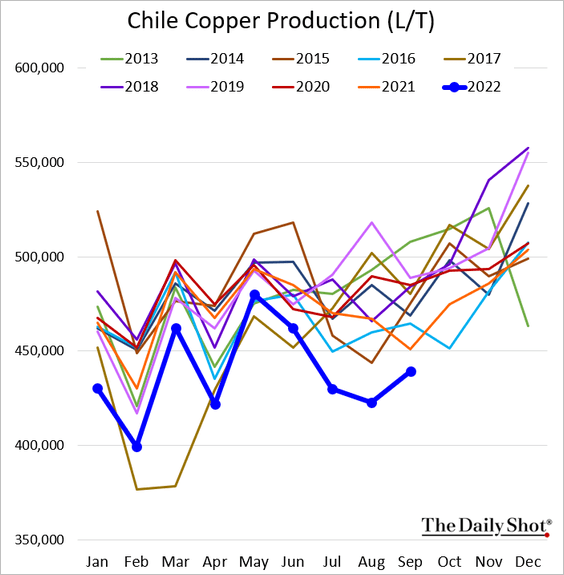

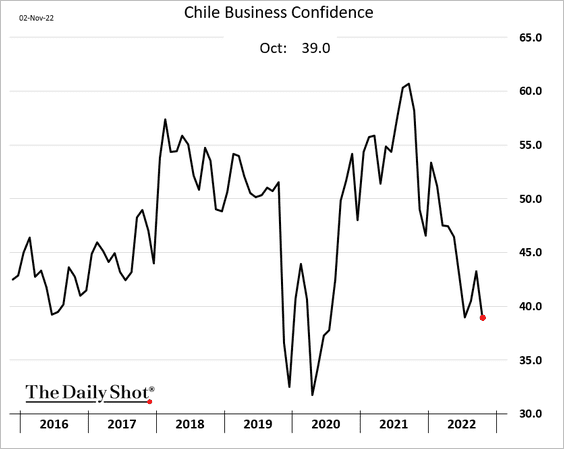

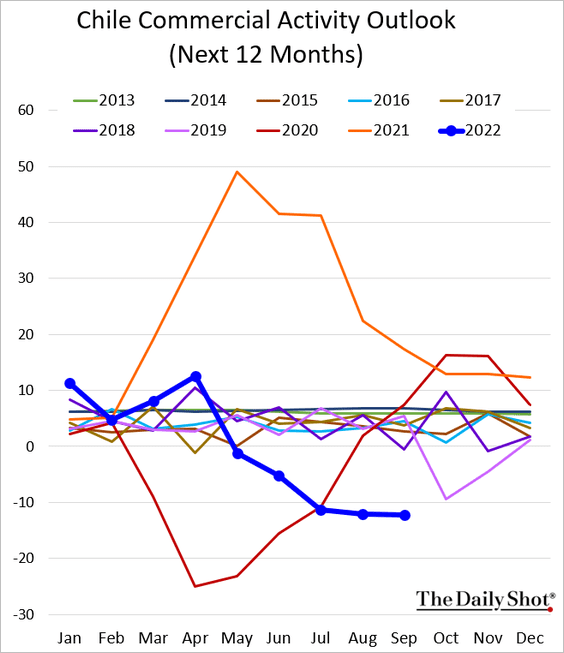

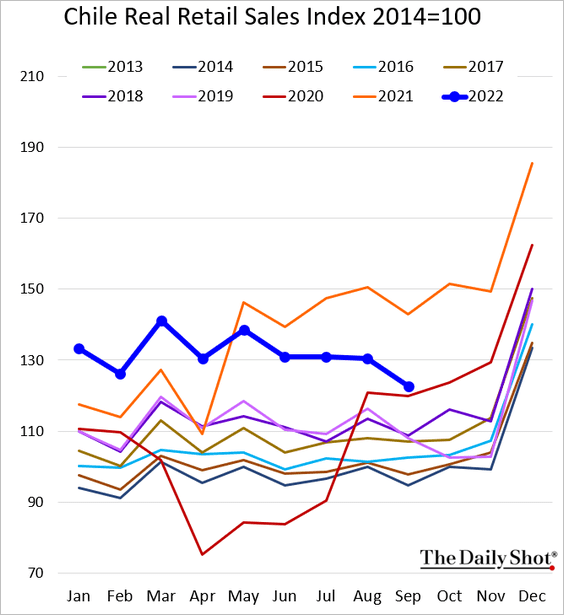

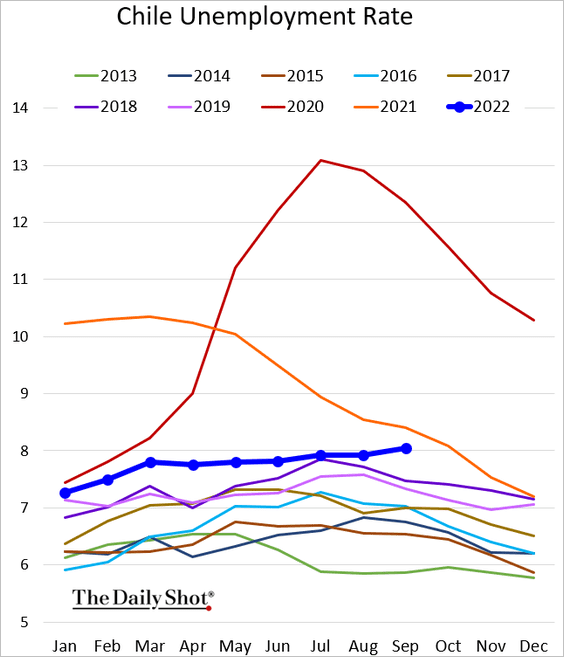

1. Let’s begin with some updates on Chile.

• Economic activity (topped expectations):

• Industrial production (running at 2016 levels):

• Copper output (soft):

• Business confidence …

… and business outlook (weak):

• Retail sales (deteriorating):

• Unemployment (grinding higher):

——————–

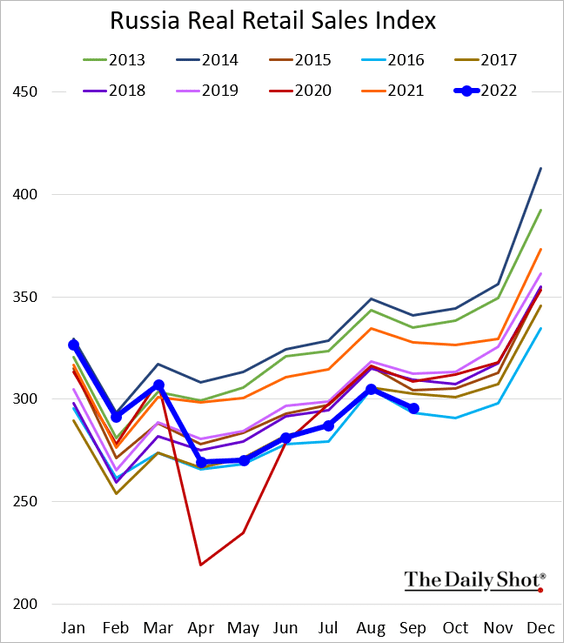

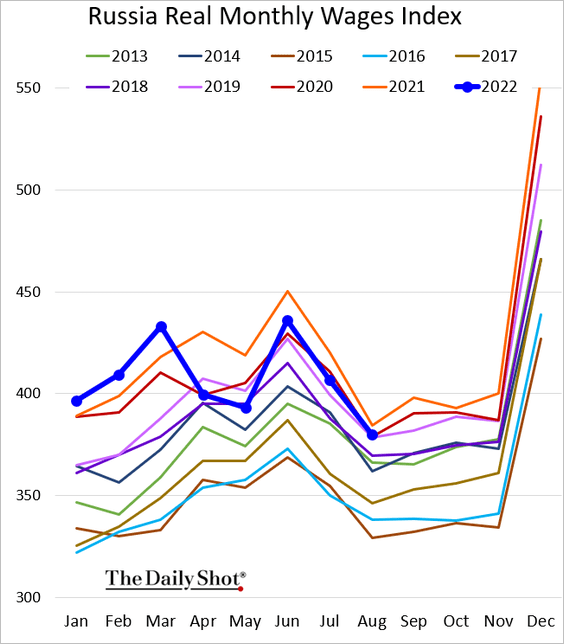

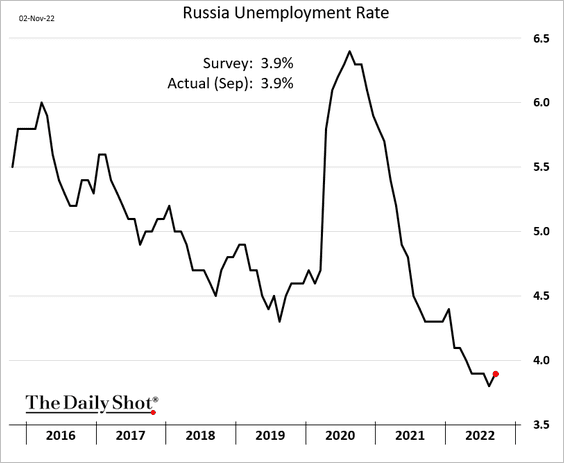

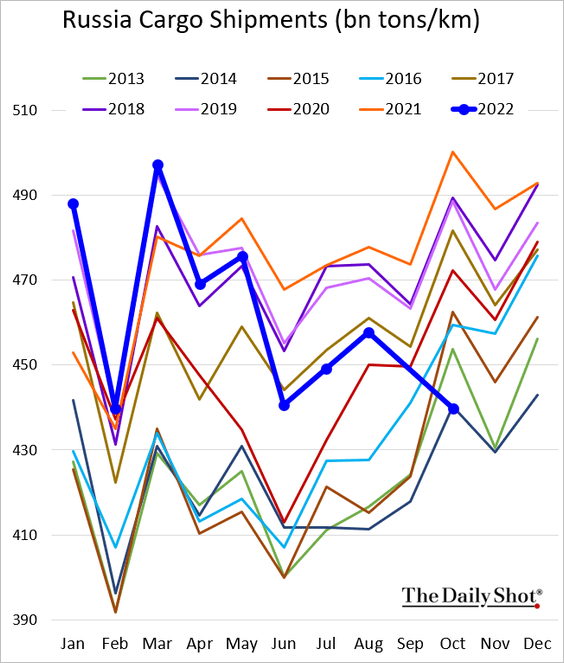

2. Next, we have some updates on Russia. Once again, it’s important to keep in mind that these figures are reported by the Russian government and should be taken with a grain of salt.

• Retail sales:

• Real wages:

• Unemployment:

• Cargo shipments:

——————–

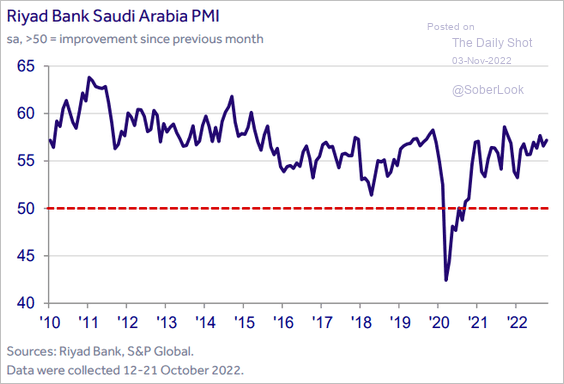

3. Saudi business growth remains robust as oil proceeds roll in.

Source: S&P Global PMI

Source: S&P Global PMI

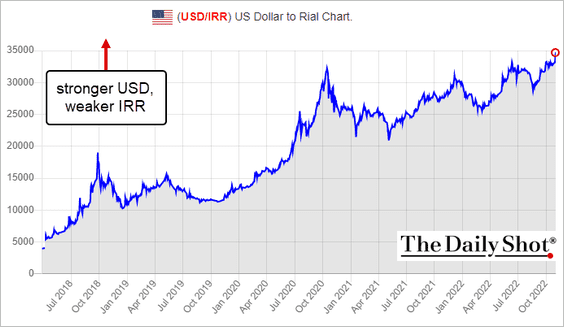

4. The Iranian rial hit a record low vs. USD, …

Source: @BonbastEx

Source: @BonbastEx

… as protests persist.

Back to Index

Cryptocurrency

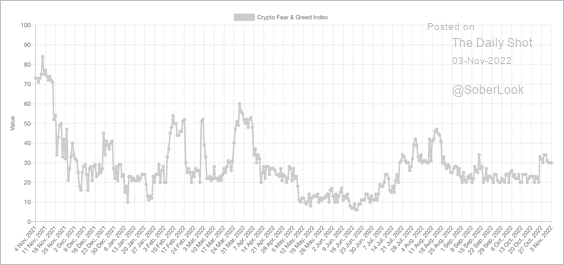

1. The Crypto Fear & Greed Index moved out of “extreme fear” territory last week.

Source: Alternative.me

Source: Alternative.me

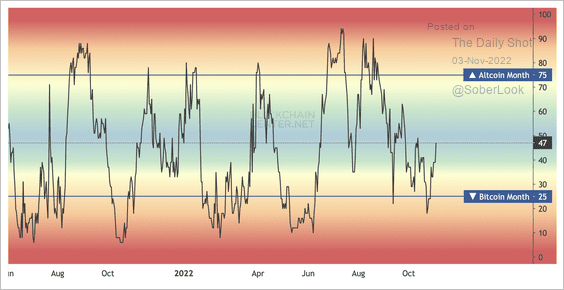

2. 47% of the top 50 altcoins have outperformed bitcoin over the past month, indicating a neutral stance among crypto traders.

Source: Blockchain Center

Source: Blockchain Center

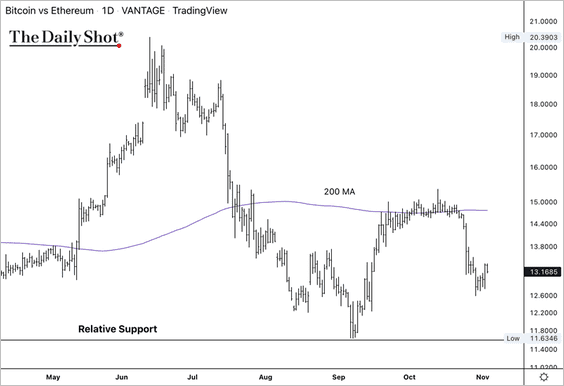

3. The BTC/ETH price ratio declined from its 200-day moving average, reflecting a risk-on tone in crypto markets.

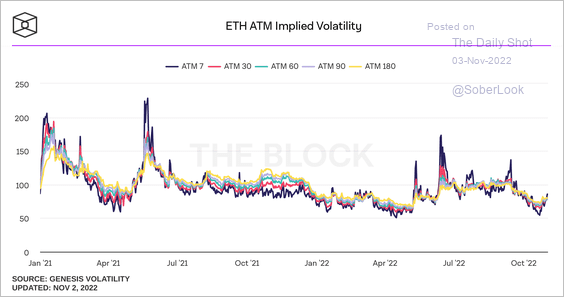

4. Ether’s implied volatility ticked higher over the past week.

Source: The Block

Source: The Block

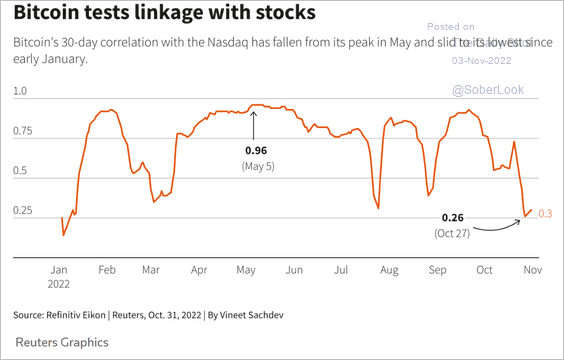

5. Bitcoin’s correlation with stocks declined last month.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

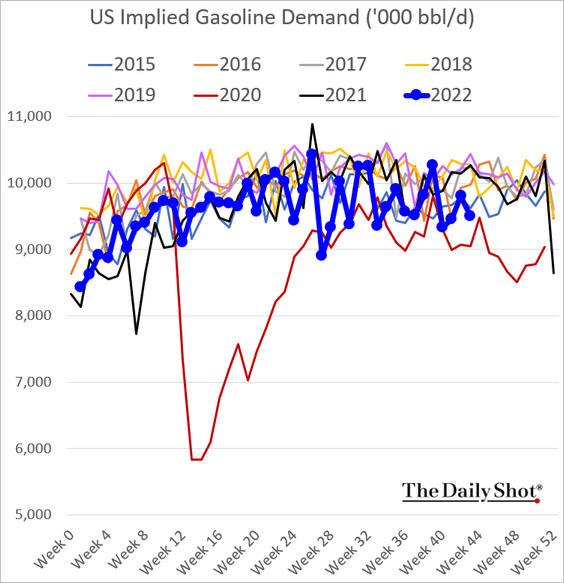

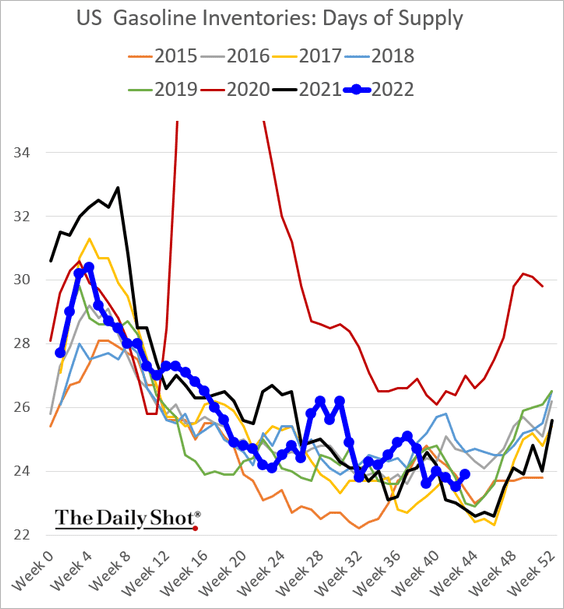

1. US gasoline demand remains relatively soft, …

… boosting inventories – as measured in days of supply.

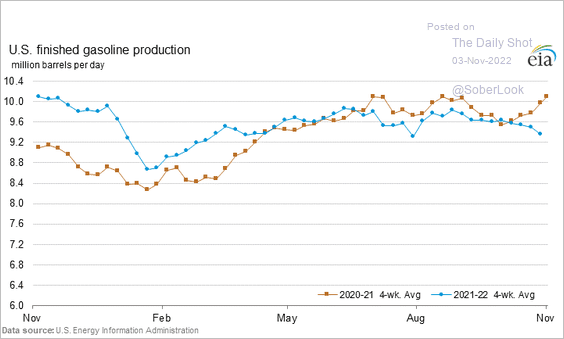

US gasoline production is now well below last year’s levels.

——————–

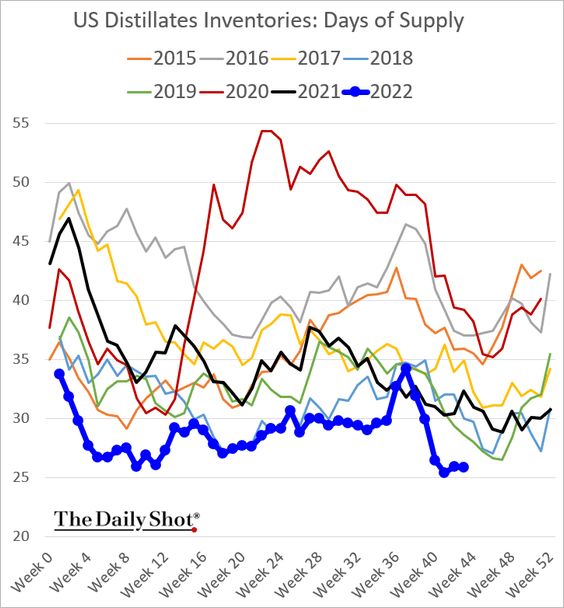

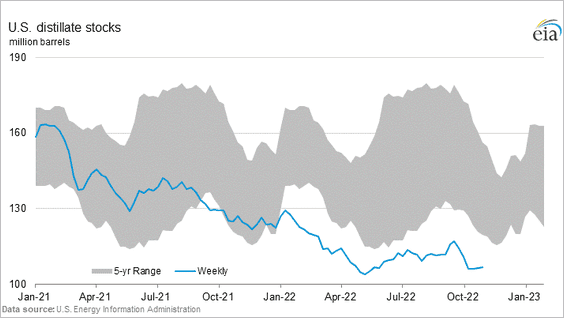

2. US diesel inventories remain exceptionally low.

• Days of supply:

• Barrels:

——————–

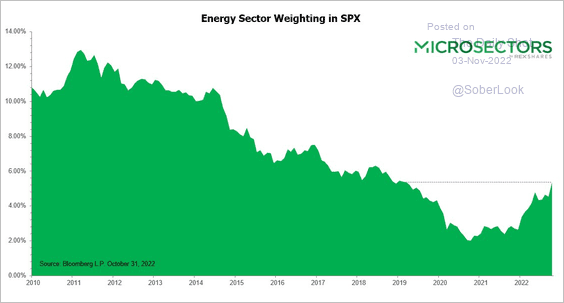

3. The energy sector closed October with its highest weighting in the S&P 500 since March 2019.

Source: @msectors

Source: @msectors

Back to Index

Equities

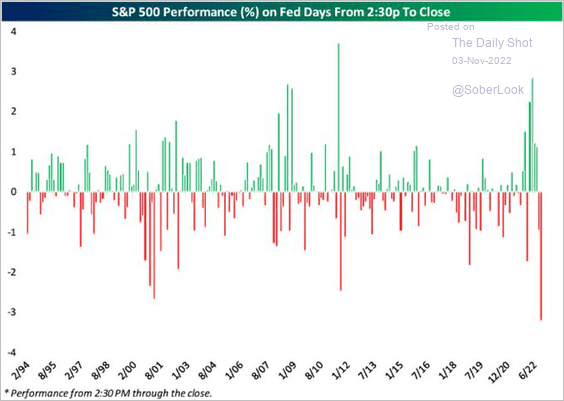

1. The market reaction to Chair Powell’s press conference was severe. It was not the “pivot” markets wanted to see.

Source: @bespokeinvest

Source: @bespokeinvest

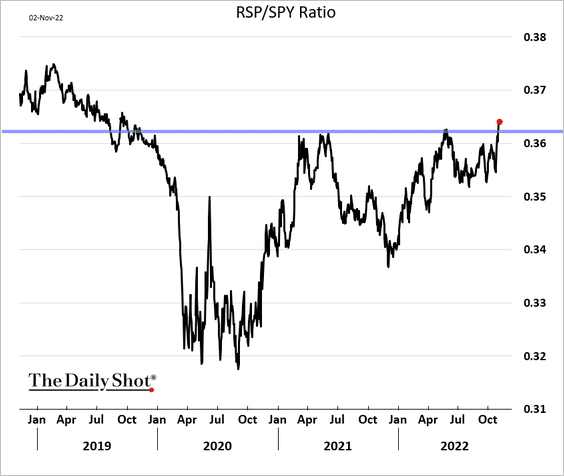

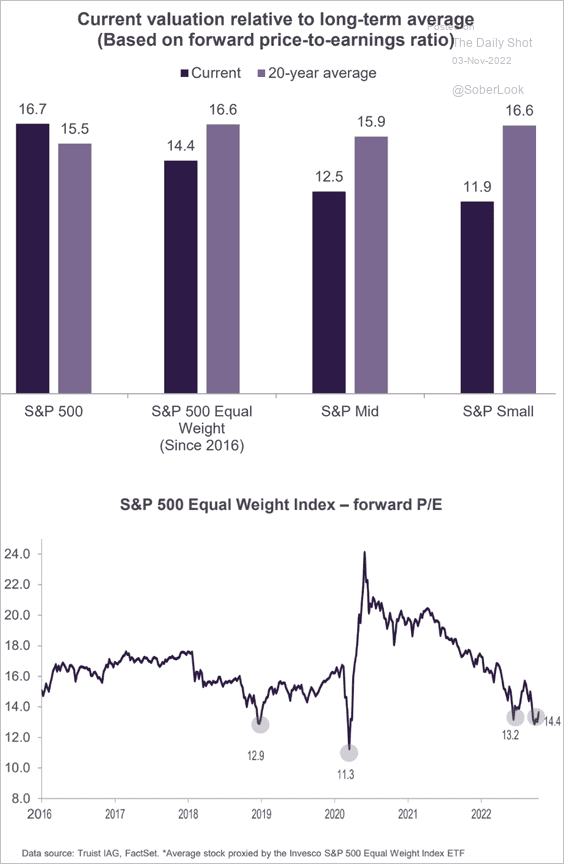

2. The equal-weight S&P 500 continues to outperform, …

… as tech mega-caps make the overall index too expensive.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

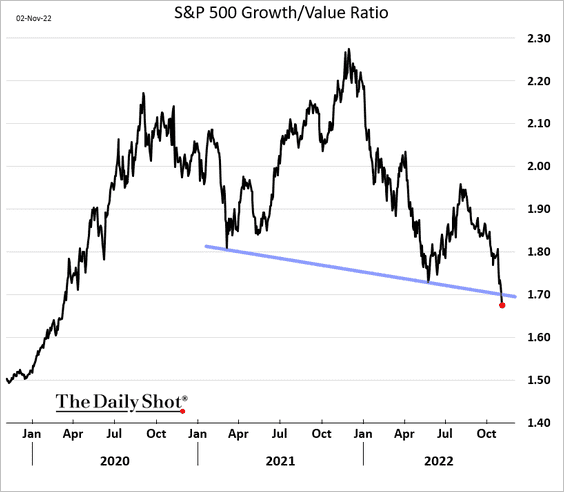

3. Growth stocks’ underperformance deepens.

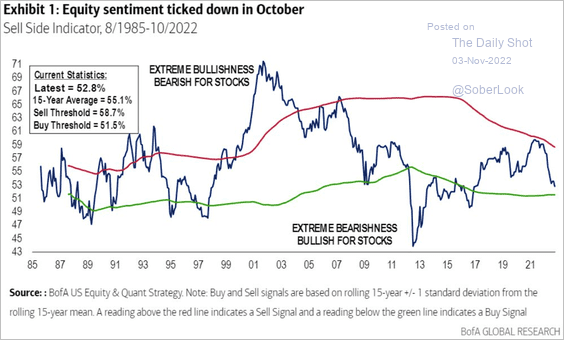

4. The BoA’s sentiment indicator is nearing the “buy signal.”

Source: BofA Global Research; @markets Read full article

Source: BofA Global Research; @markets Read full article

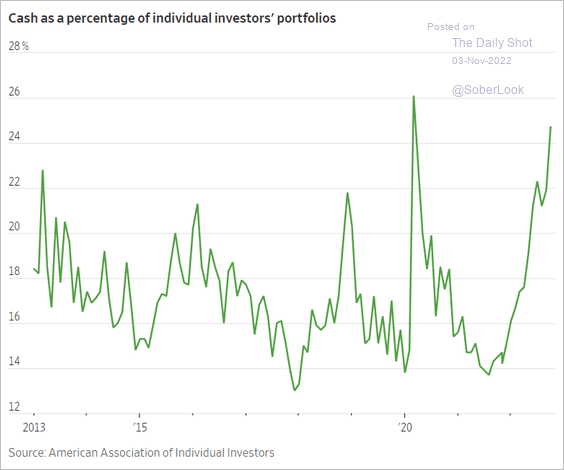

5. Individual investors are sitting on a lot of cash

Source: @WSJ Read full article

Source: @WSJ Read full article

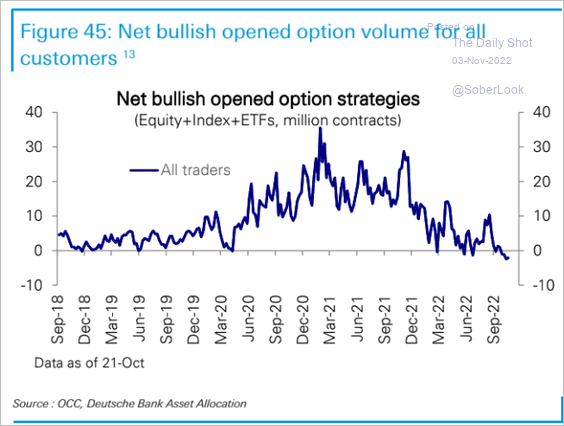

6. Net bullish options volumes remain depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

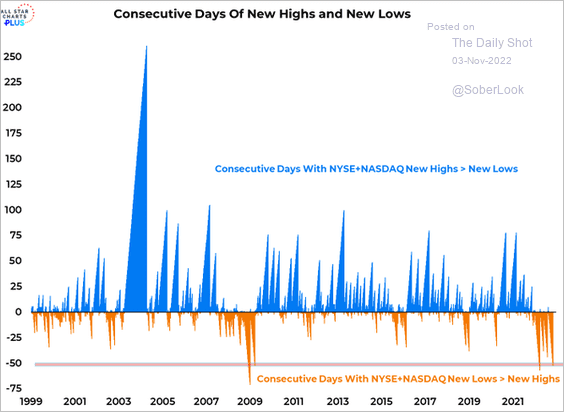

7. New lows continue to outpace new highs.

Source: @WillieDelwiche

Source: @WillieDelwiche

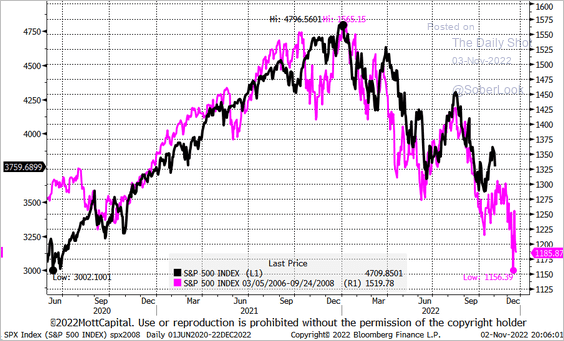

8. Back to the 2008 analog?

Source: @MichaelMOTTCM

Source: @MichaelMOTTCM

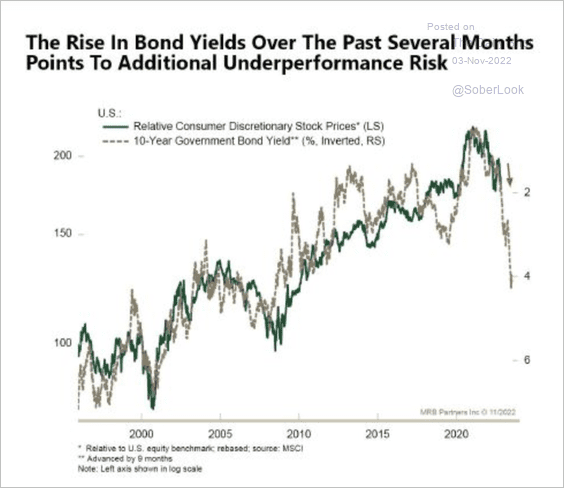

9. The rapid rise in Treasury yields implies further underperformance for consumer discretionary stocks.

Source: MRB Partners

Source: MRB Partners

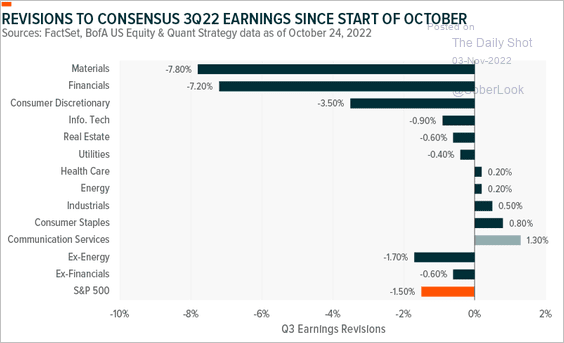

10. Materials, financials, and consumer discretionary sectors have seen the largest downward revisions to earnings estimates. Communication services had the largest increase in earnings expectations, which contributed to recent disappointments.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

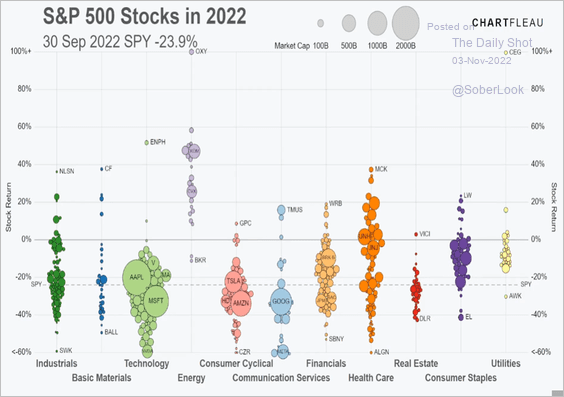

11. This video is a visualization of the S&P 500 performance by sector since the beginning of the year.

Source: Visual Capitalist, h/t Walter Read full article

Source: Visual Capitalist, h/t Walter Read full article

Back to Index

Rates

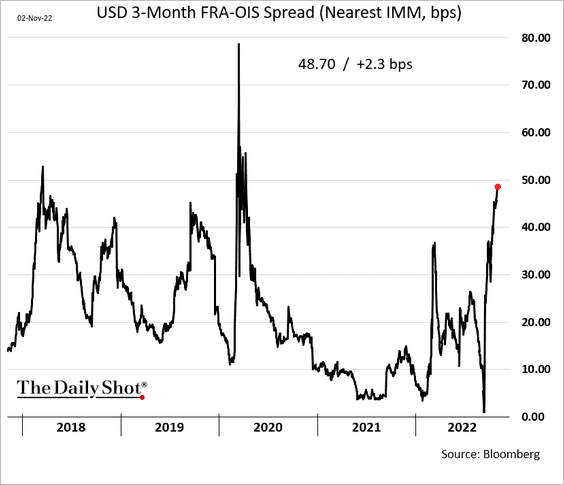

Markets remain concerned about year-end US dollar liquidity. Here is the FRA-OIS spread.

Back to Index

Global Developments

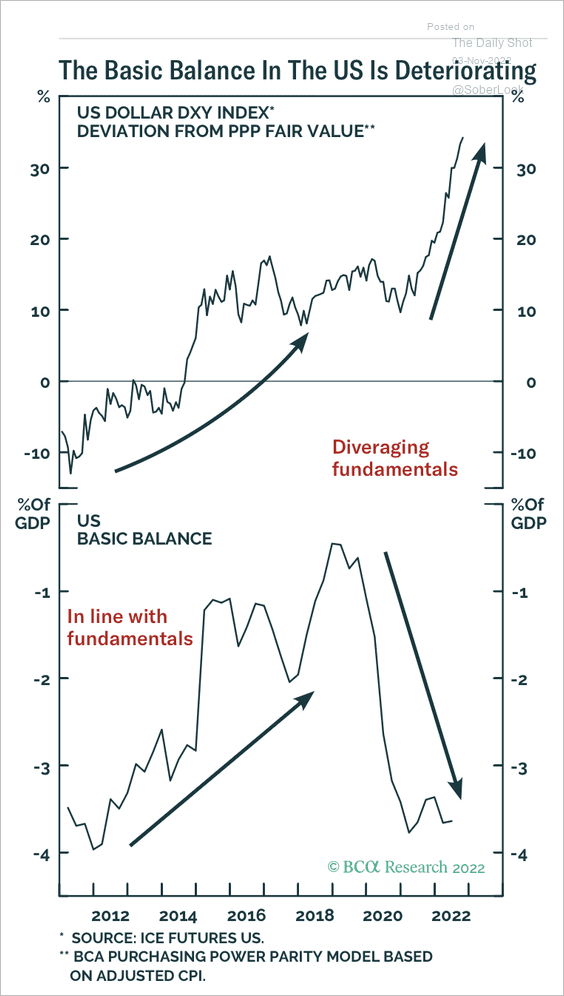

1. The dollar is trading at high valuations while the US trade deficit has been widening.

Source: BCA Research

Source: BCA Research

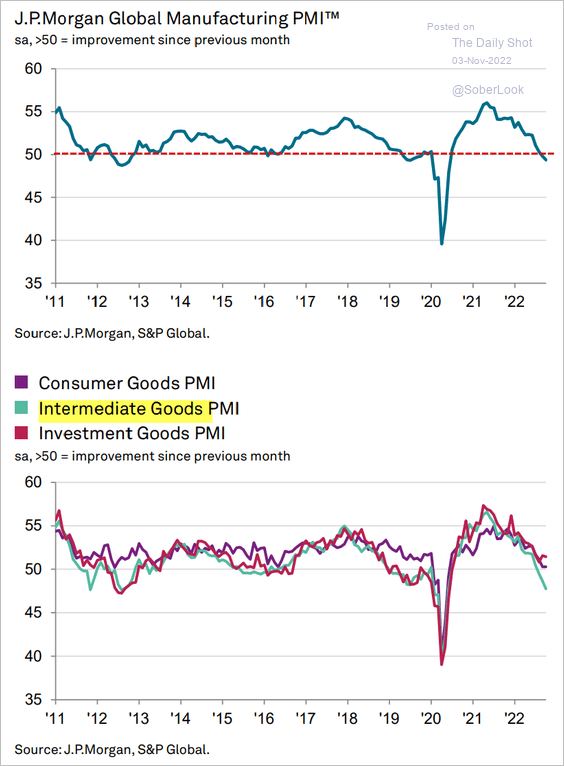

2. Global manufacturing contraction in October was driven by falling intermediate goods production.

Source: S&P Global PMI

Source: S&P Global PMI

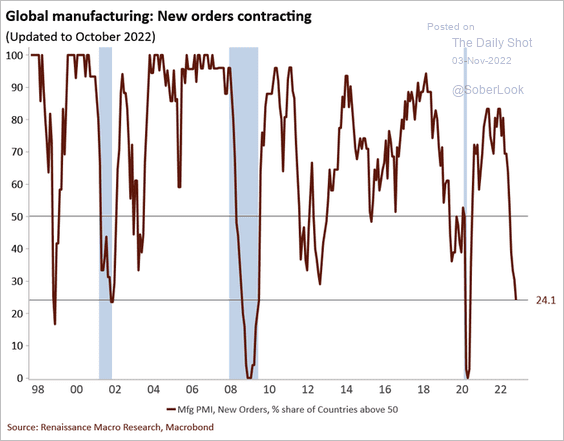

• Manufacturers face shrinking demand:

Source: @RenMacLLC

Source: @RenMacLLC

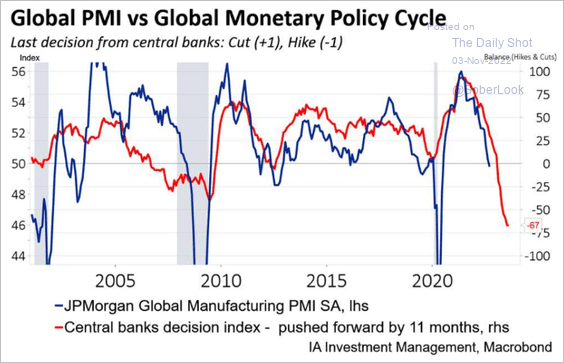

• Tight monetary policy points to further weakness in manufacturing.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

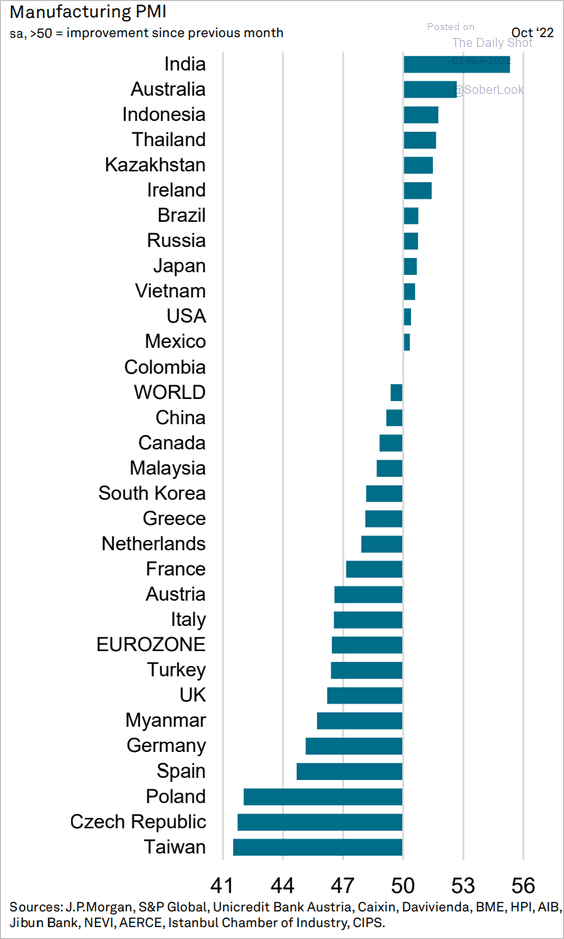

• Here are the manufacturing PMI indicators by country.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

Food for Thought

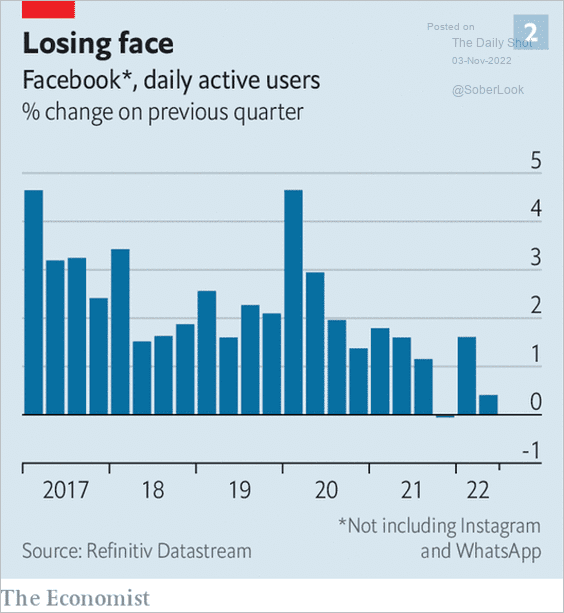

1. Quarterly growth in Facebook’s active users:

Source: The Economist Read full article

Source: The Economist Read full article

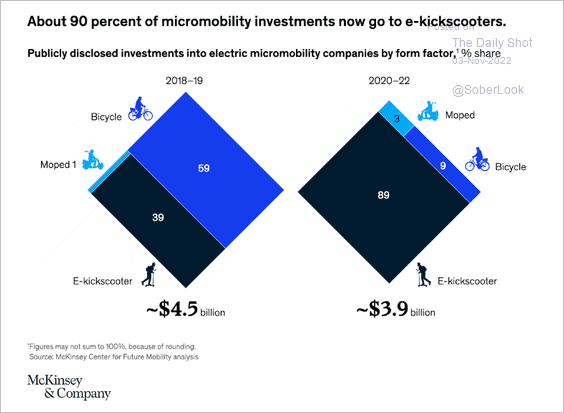

2. Micromobility investments:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

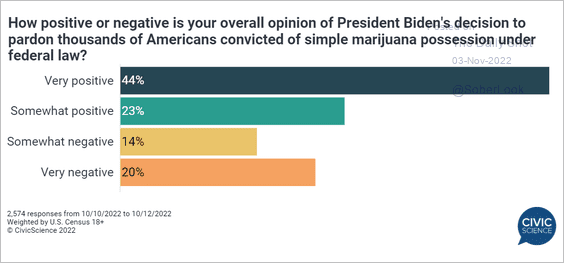

3. Views on pardoning Americans convicted of simple marijuana possession:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

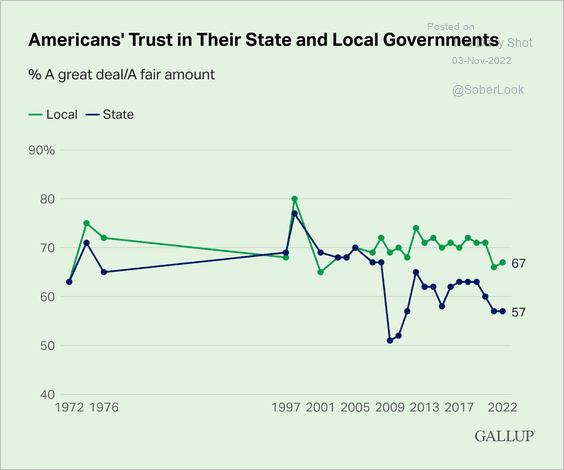

4. Trust in state and local governments:

Source: Gallup Read full article

Source: Gallup Read full article

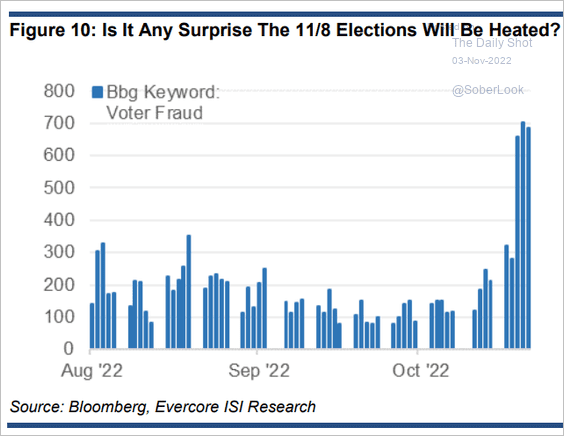

5. Bloomberg articles containing the phrase “voter fraud”:

Source: Evercore ISI Research

Source: Evercore ISI Research

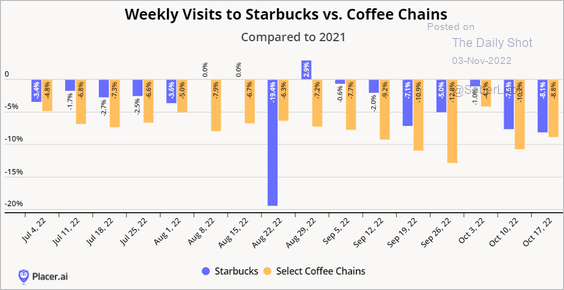

6. Coffee shop visits vs. 2021:

Source: Placer.ai

Source: Placer.ai

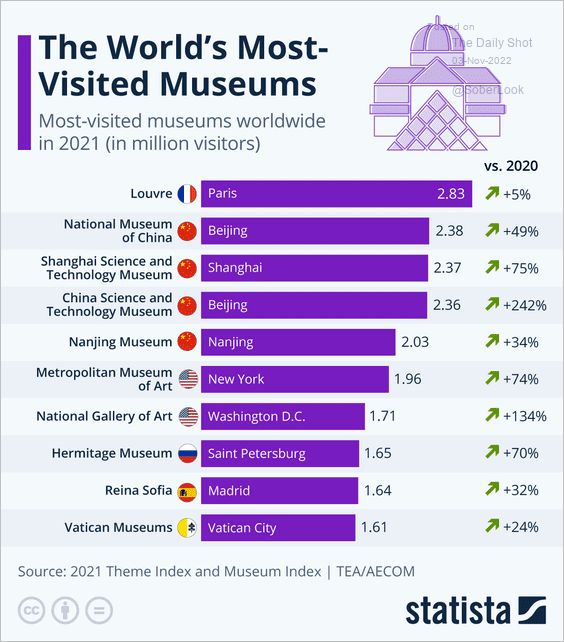

7. Most visited museums:

Source: Statista

Source: Statista

——————–

Back to Index