The Daily Shot: 07-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

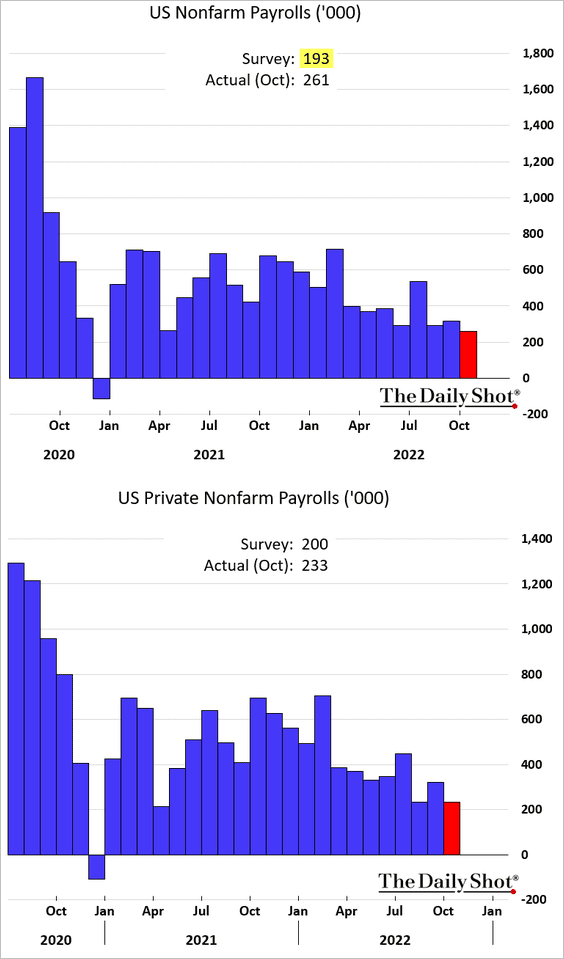

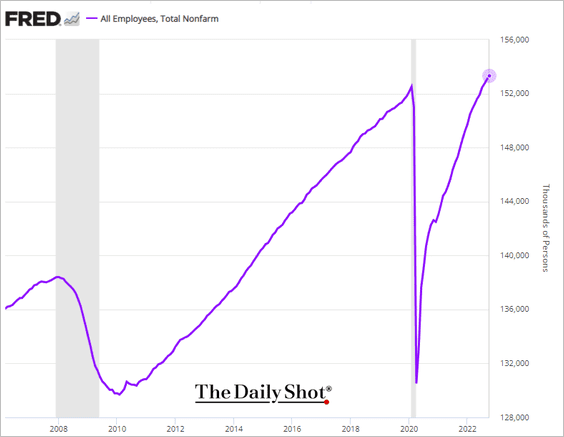

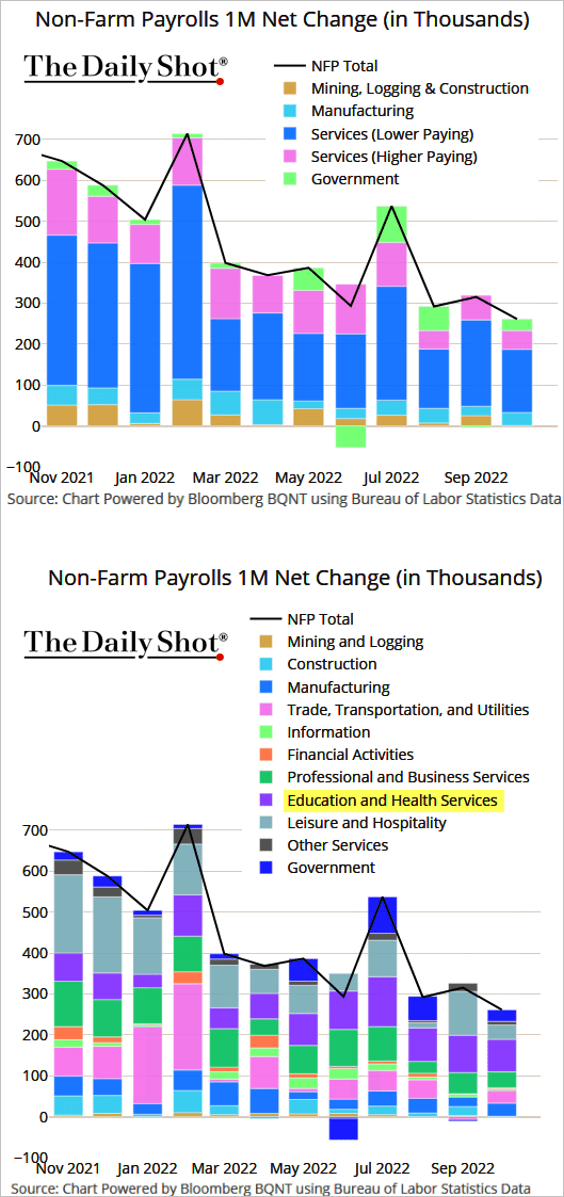

1. The October payrolls report topped expectations, once again pointing to resilience in the labor market.

Source: @WSJ Read full article

Source: @WSJ Read full article

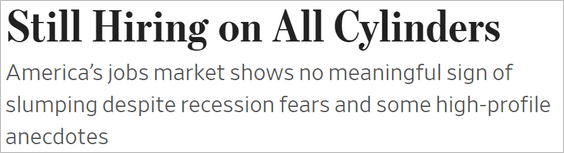

Here is the total level of payrolls.

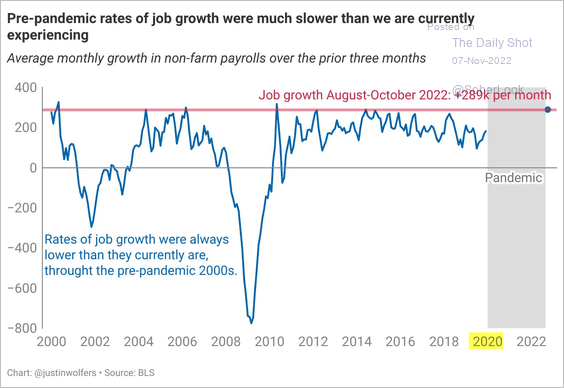

While the media was quick to point out that job creation is trending lower, it’s important to note that at 261k, the pace of labor market growth continues to exceed pre-COVID levels.

Source: @JustinWolfers

Source: @JustinWolfers

• The chart below shows the key drivers of job gains during the past 12 months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

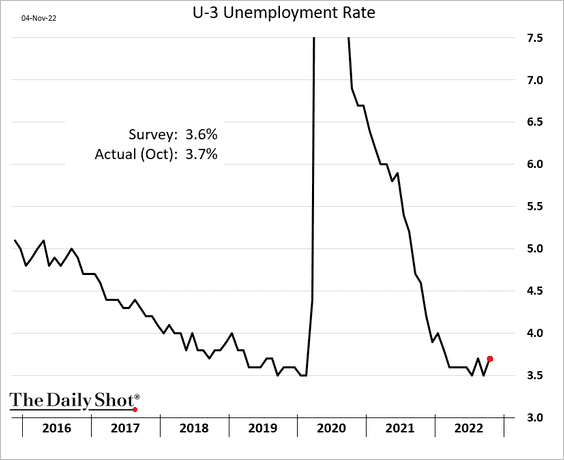

• The unemployment rate edged higher but remains low relative to historical levels.

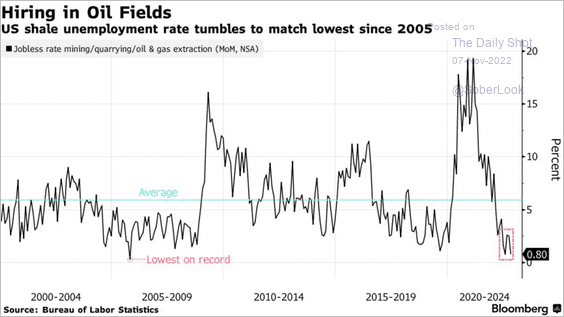

– Oil & gas unemployment is near record lows.

Source: @DavidWethe, @catarinasaraiva, @business Read full article

Source: @DavidWethe, @catarinasaraiva, @business Read full article

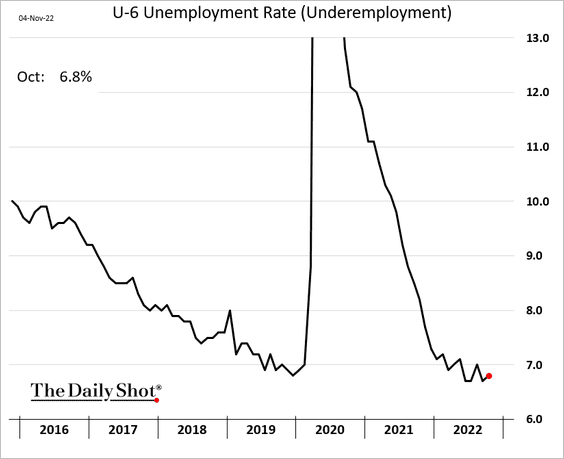

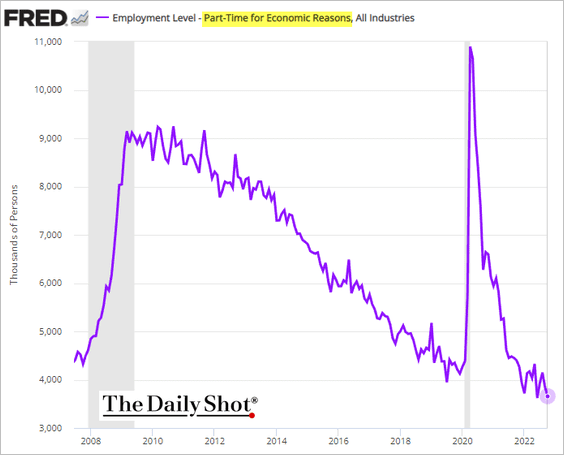

• Underemployment is also very low.

– Part-time employment for “economic reasons” is signaling very little slack in the labor market.

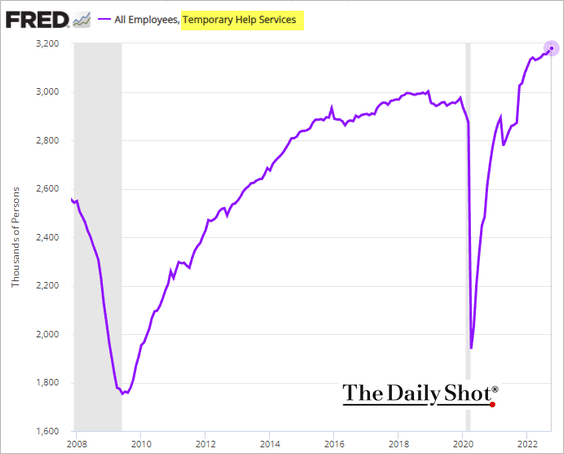

• Temp help levels hit a record high. Temp workers are often the first to be cut.

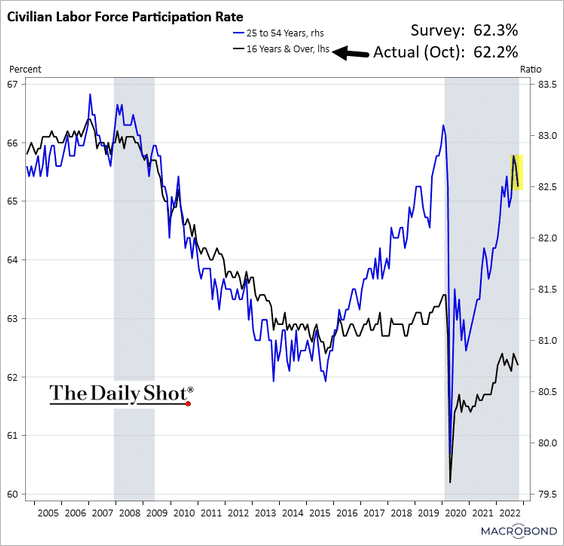

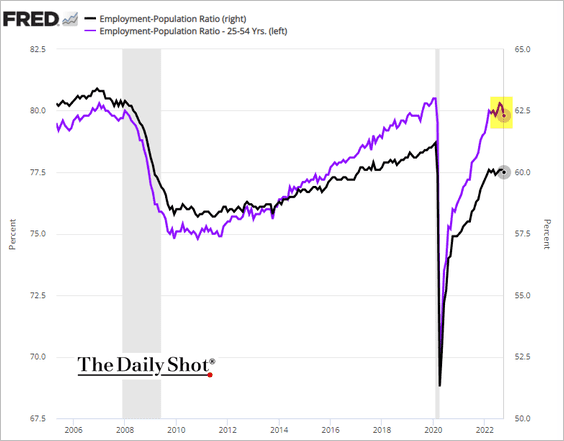

• Prime-age labor force participation declined again, keeping the labor market tight.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

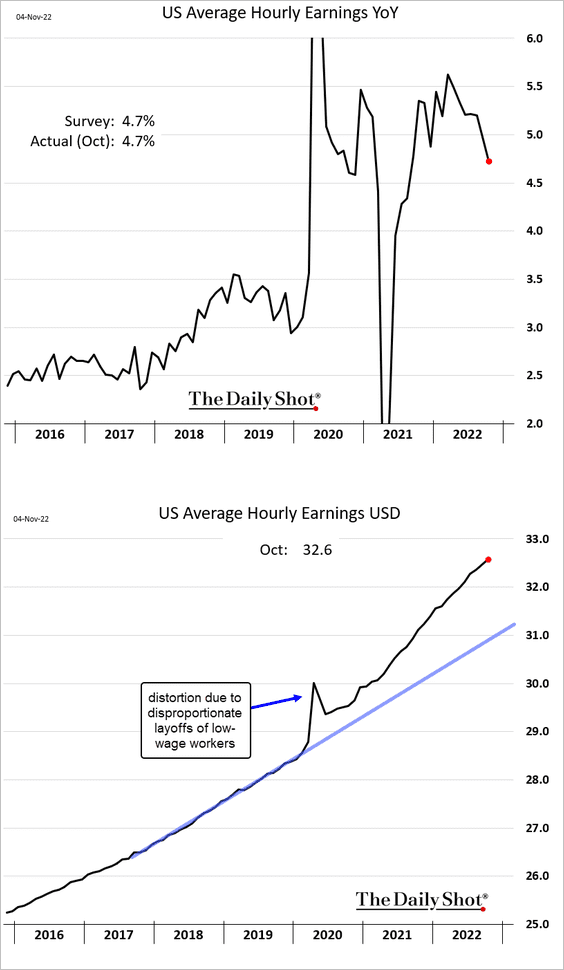

• Wage growth has slowed some but remains well above pre-COVID levels.

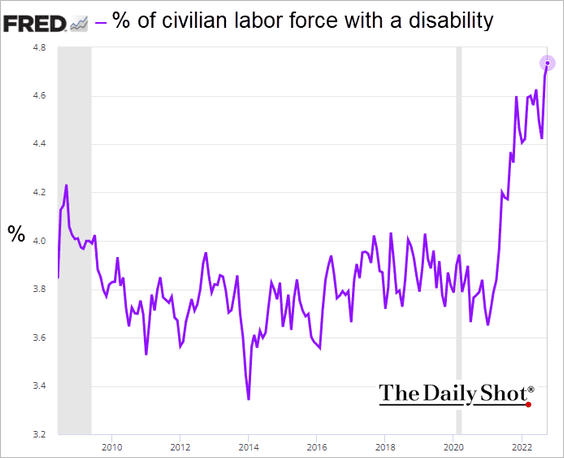

• The percentage of workers with a disability who are in the labor force surged since the start of last year.

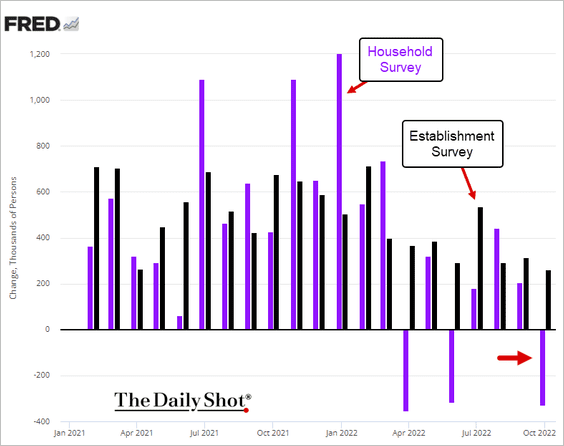

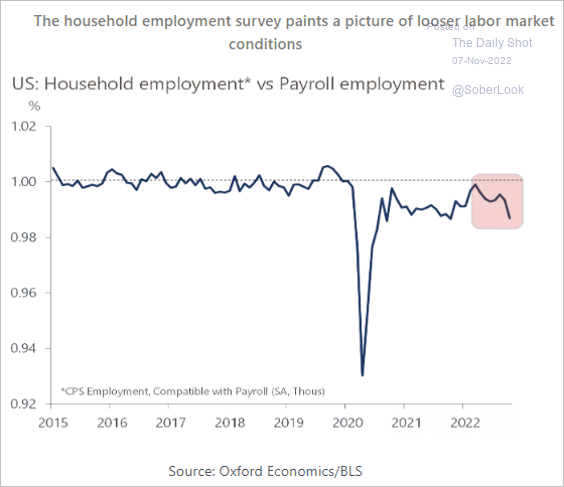

• One signal of potential weakness in the labor market is the decline in payrolls as measured by the household survey (which includes self-employment) (2 charts).

Source: Oxford Economics

Source: Oxford Economics

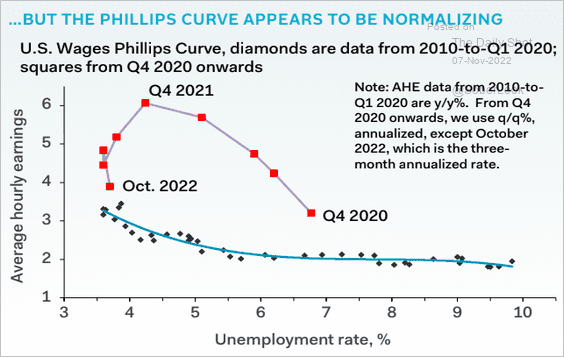

• The Phillips Curve is starting to normalize.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

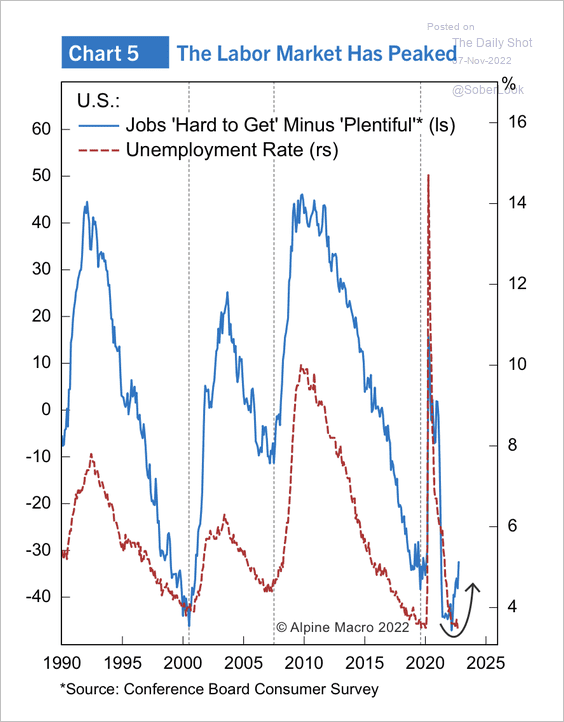

• The labor market is expected to cool from here. This chart compares the unemployment rate with the Conference Board’s labor differential.

Source: Alpine Macro

Source: Alpine Macro

——————–

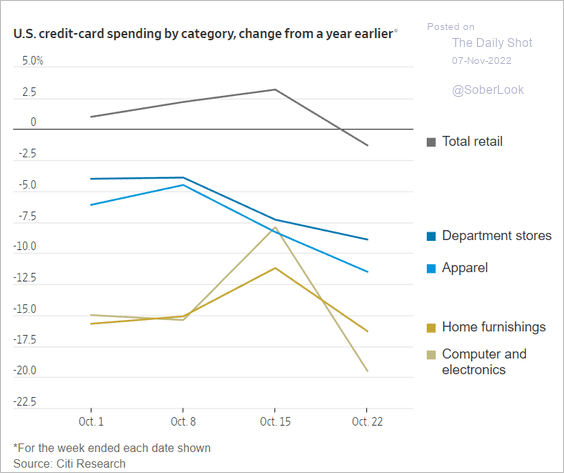

2. Credit card spending has been moderating.

Source: @WSJ Read full article

Source: @WSJ Read full article

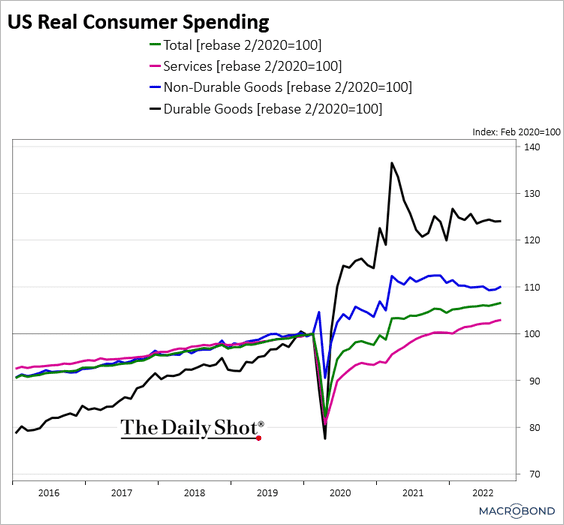

But real consumer spending is yet to show a meaningful slowdown.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

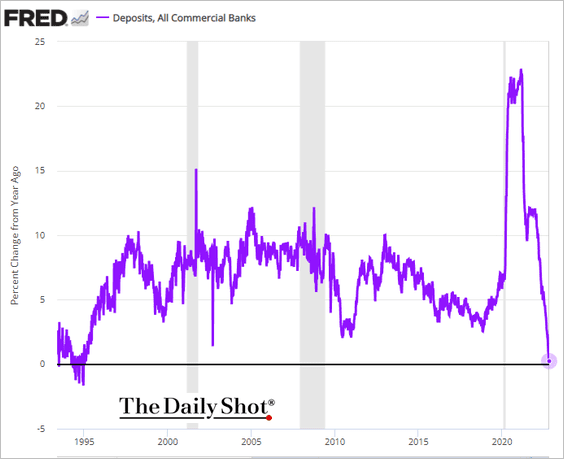

3. Bank deposits are almost flat vs. a year ago despite robust bank lending (see the credit section). Quantitative tightening has been reducing private-sector deposits (see discussion in the rates section here).

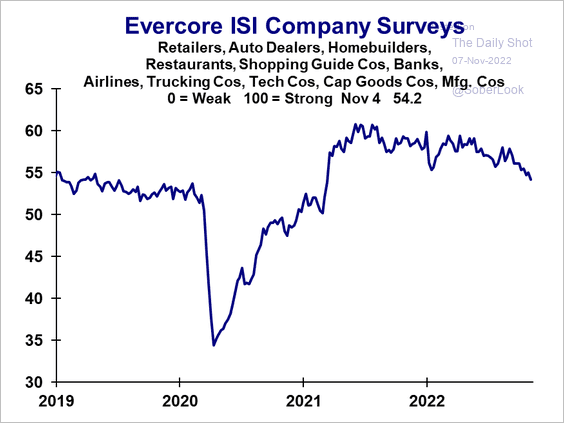

4. The Evercore ISI index of company surveys is still strong but is starting to roll over.

Source: Evercore ISI Research

Source: Evercore ISI Research

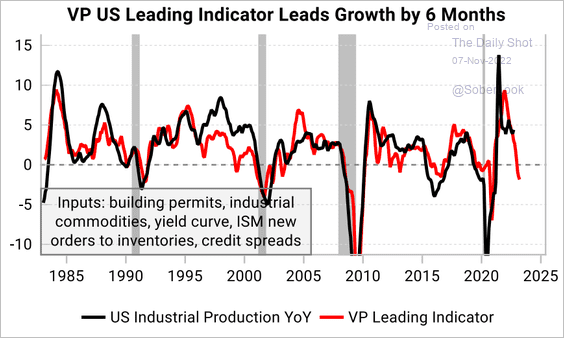

• The leading indicator from Variant Perception points to weakness ahead in industrial production.

Source: Variant Perception

Source: Variant Perception

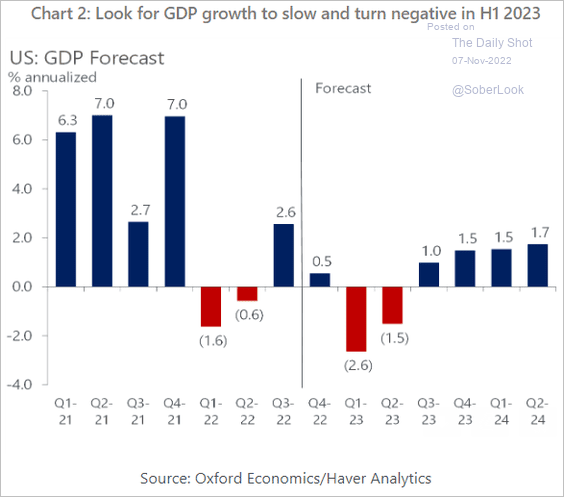

• The economy will contract in the first half of next year, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Canada

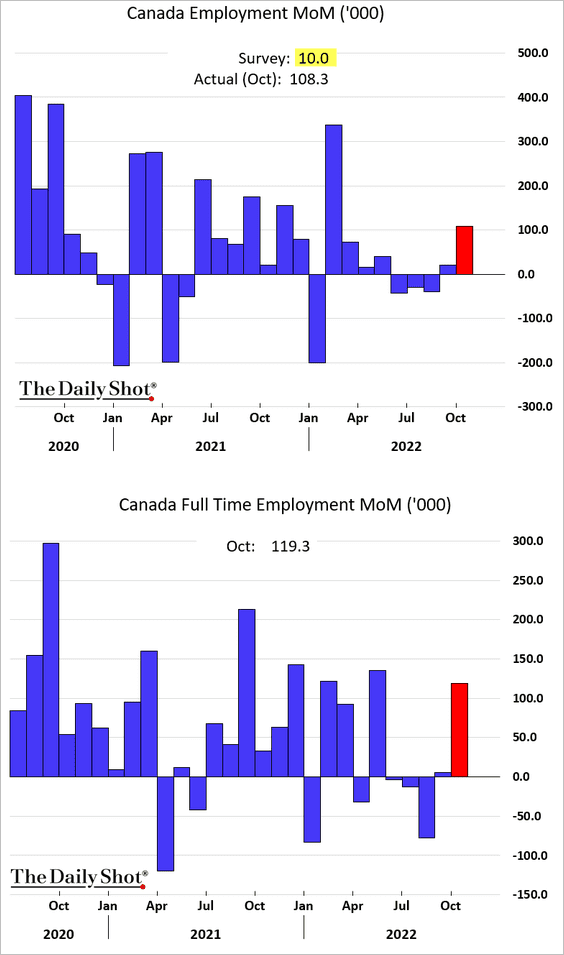

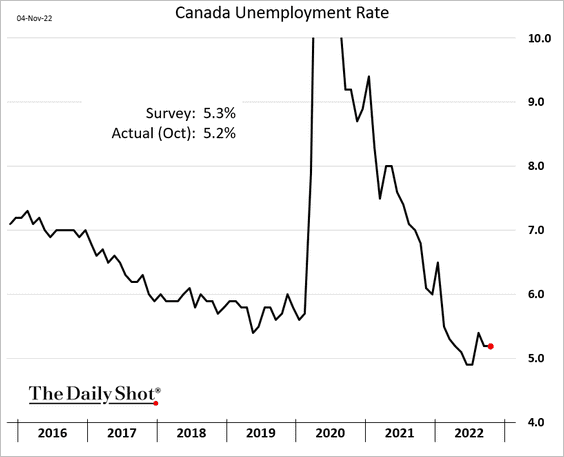

1. The employment report was shockingly strong.

• The unemployment rate held steady, …

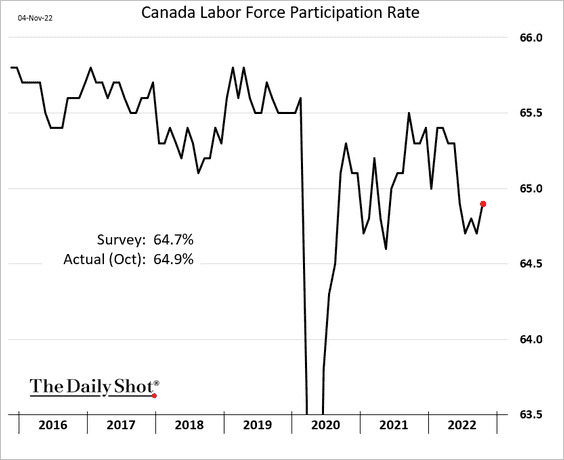

… and labor force participation jumped.

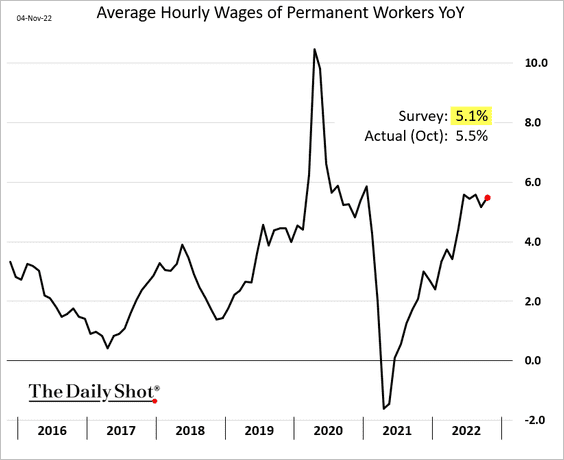

• Wage growth surprised to the upside.

——————–

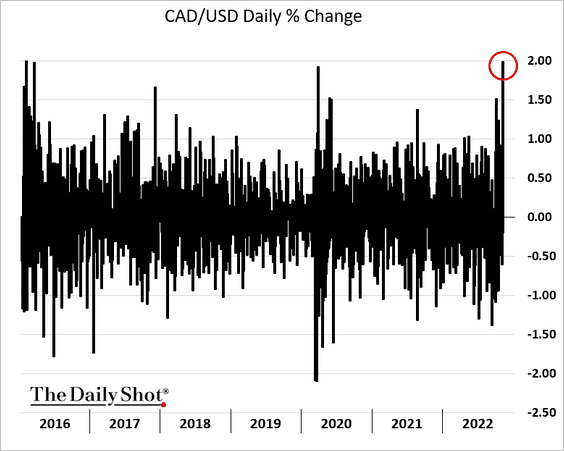

2. The loonie jumped 2% vs. USD on Friday – mostly driven by the US dollar’s weakness.

Back to Index

The United Kingdom

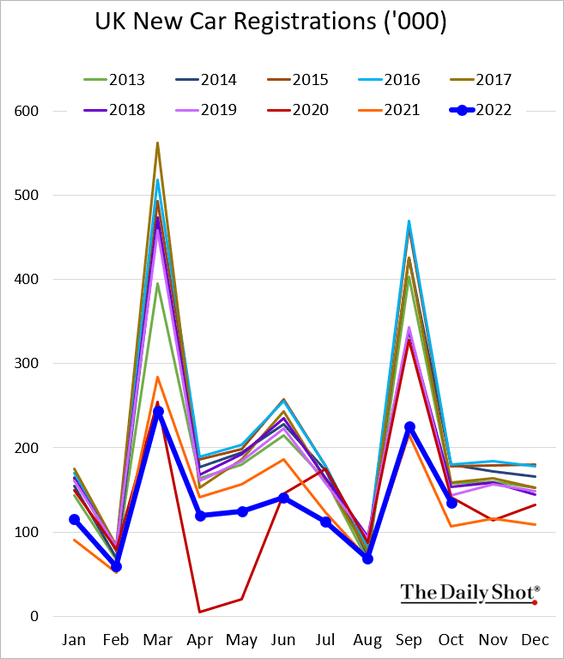

1. New car registrations are finally above last year’s levels, but still very weak.

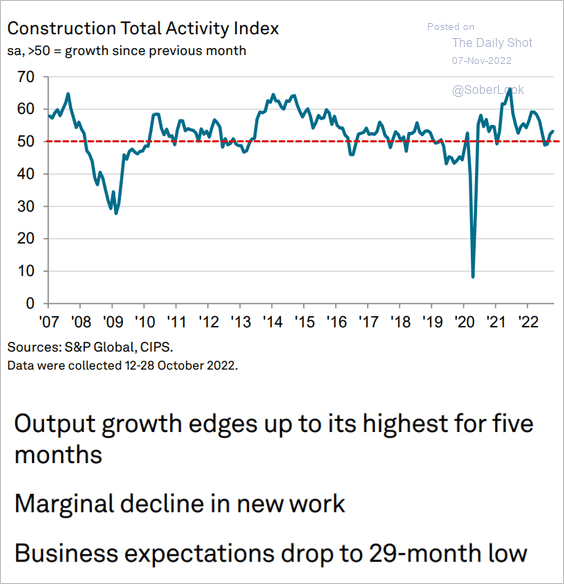

2. Construction activity accelerated in October.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

The Eurozone

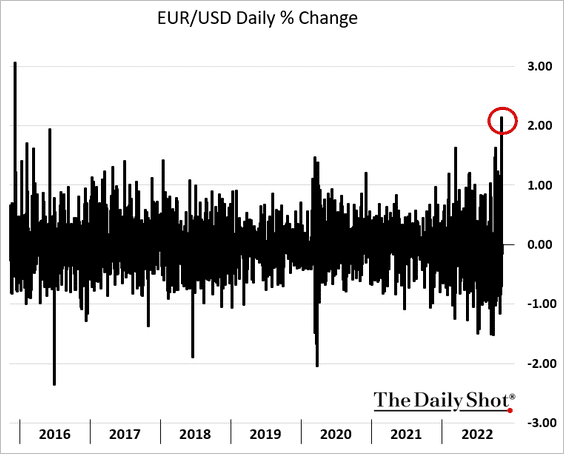

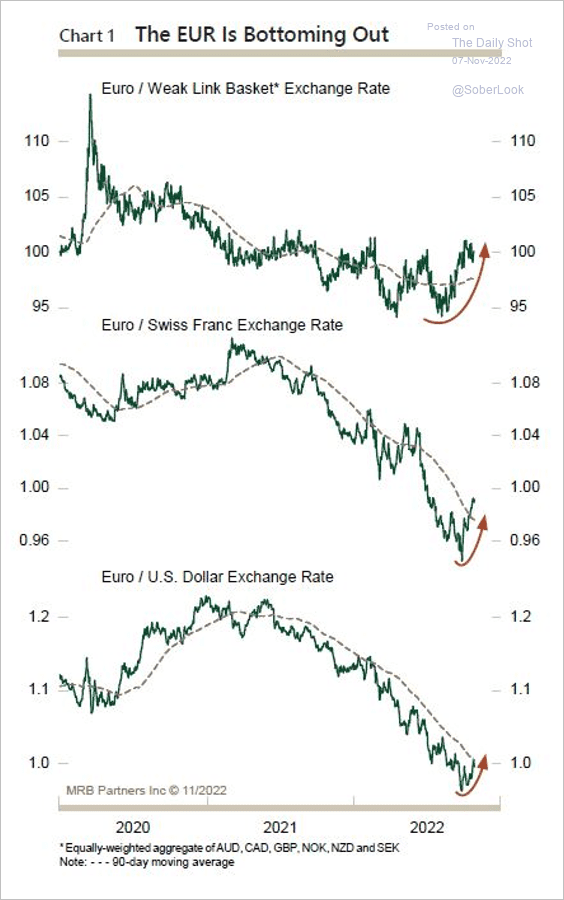

1. The euro surged vs. the dollar on Friday, driven by the US dollar’s weakness.

• The euro is starting to recover.

Source: MRB Partners

Source: MRB Partners

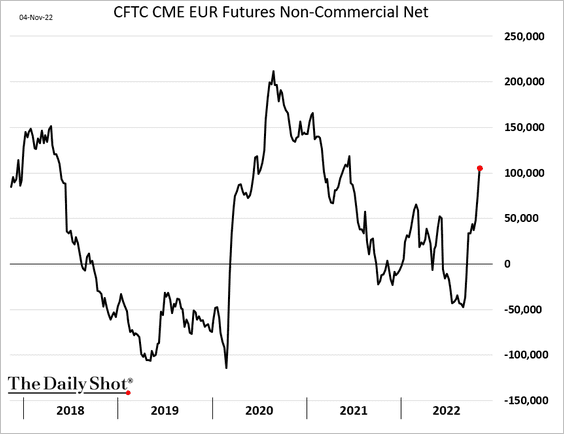

• Speculative accounts are boosting their bets on the euro.

——————–

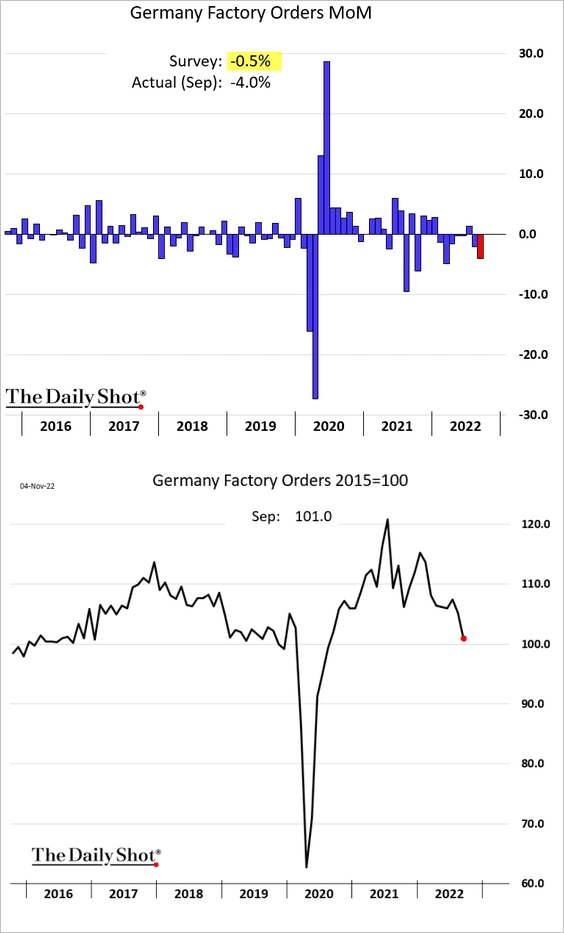

2. Germany’s factory orders declined sharply in September.

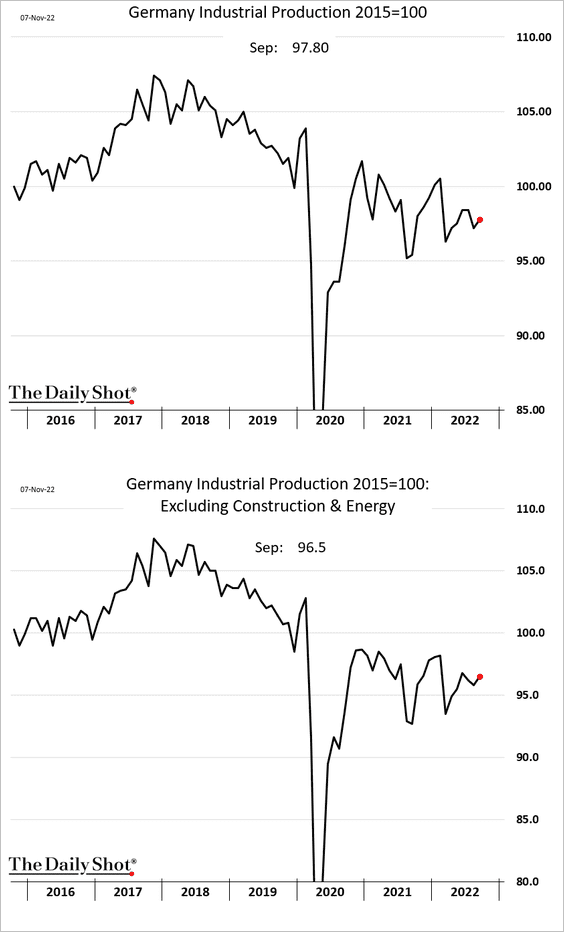

But industrial production held up better than expected.

——————–

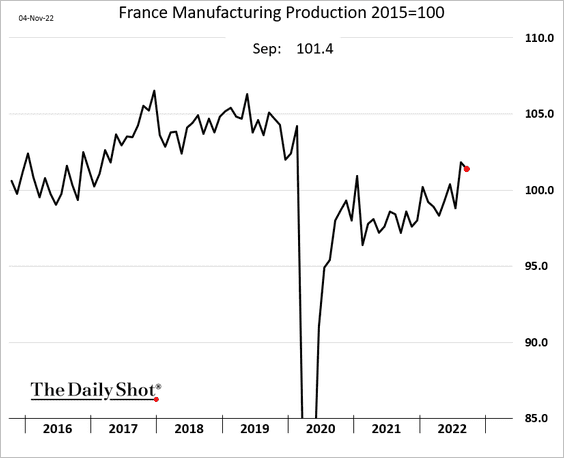

3. French manufacturing production edged lower in September, but it too held up well.

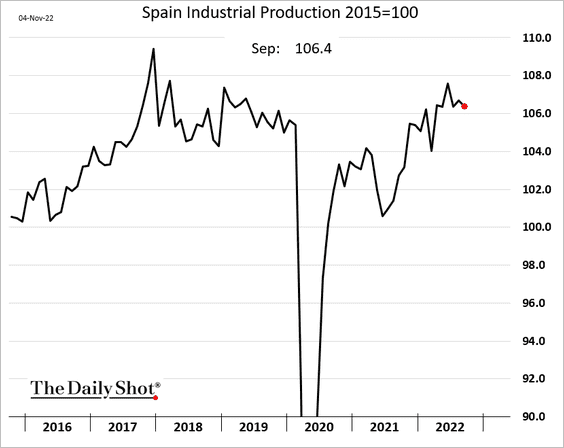

Here is Spain’s industrial production.

——————–

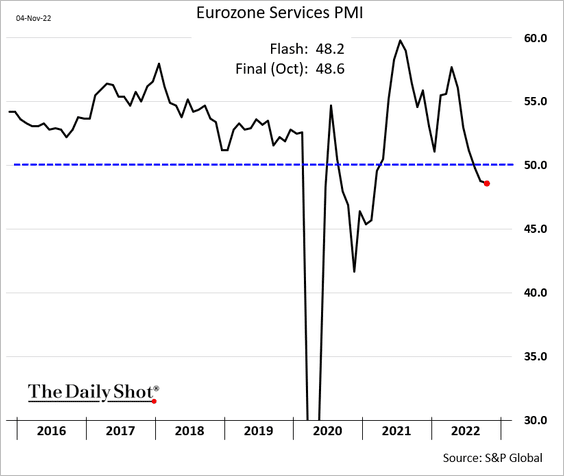

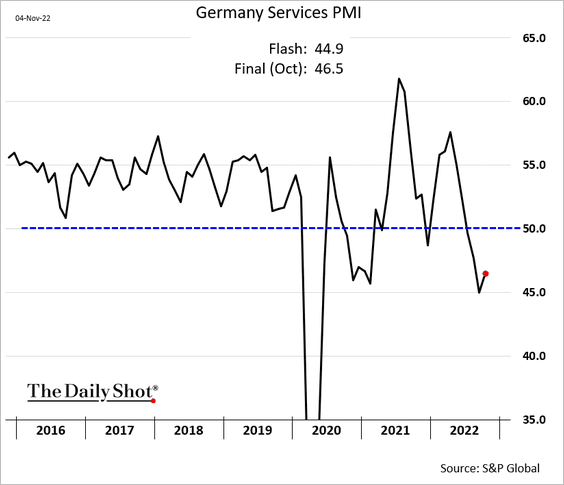

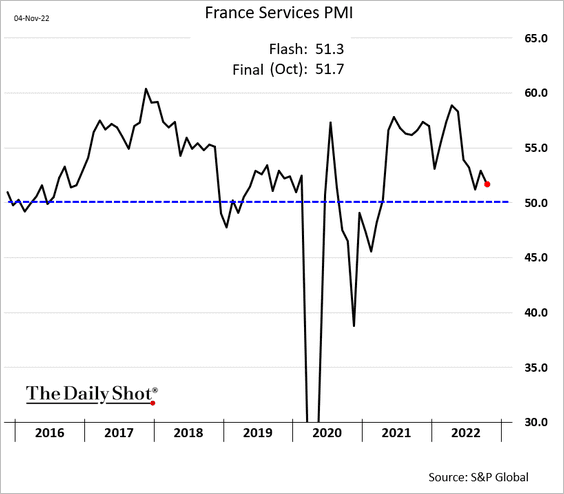

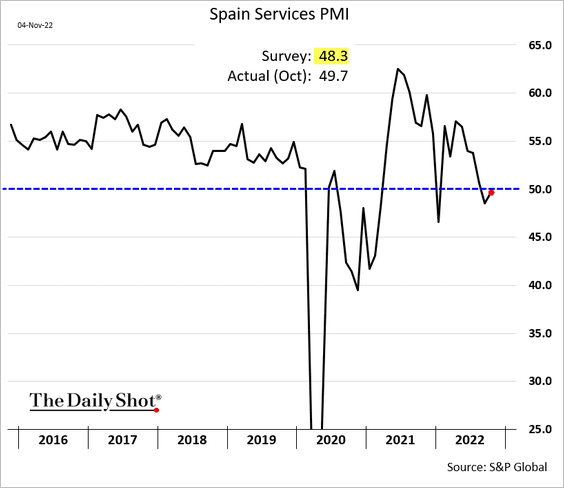

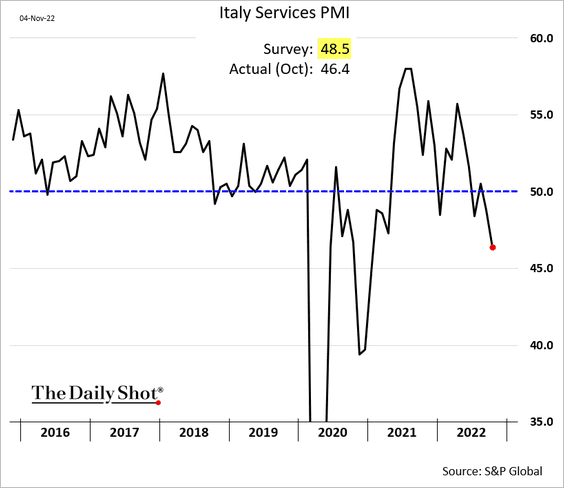

4. Final services PMI indicators were a bit stronger than the flash report.

• The Eurozone:

• Germany:

• France:

• Spanish service sector is almost back in growth mode.

• But Italian service companies are struggling.

Back to Index

China

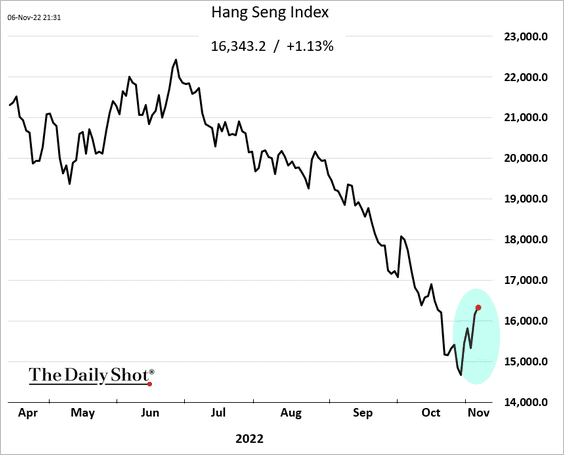

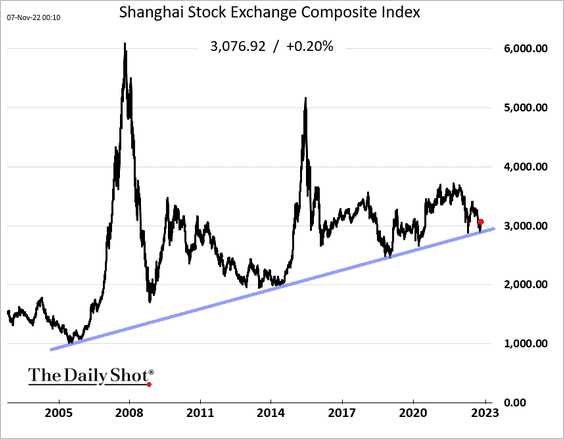

1. The reopening-driven equity rebound continues.

The Shanghai Composite held its long-term support.

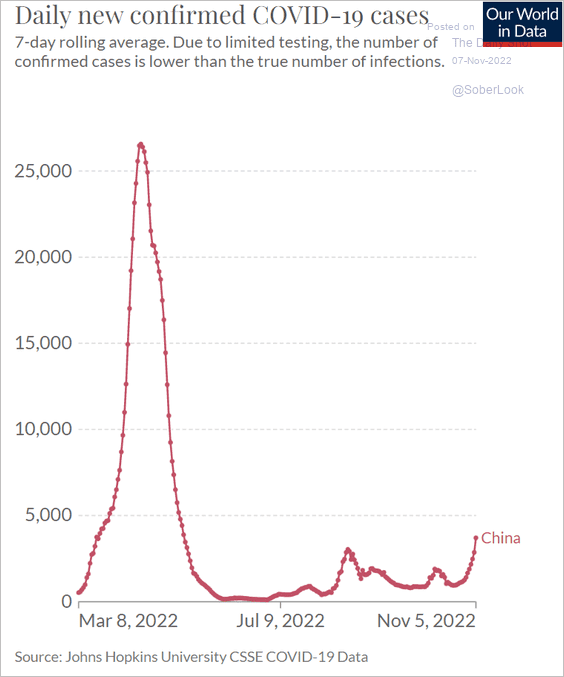

But Beijing doesn’t seem to be revising its policy right now.

Source: Reuters Read full article

Source: Reuters Read full article

And COVID cases are climbing again.

Source: Our World In Data

Source: Our World In Data

——————–

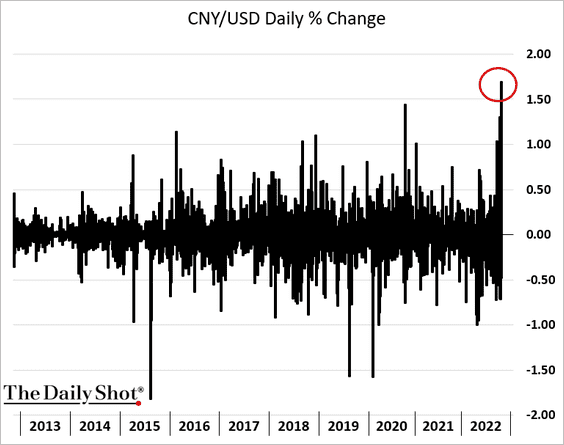

2. The renminbi surged 1.69% vs. USD on Friday – driven by the dollar’s weakness.

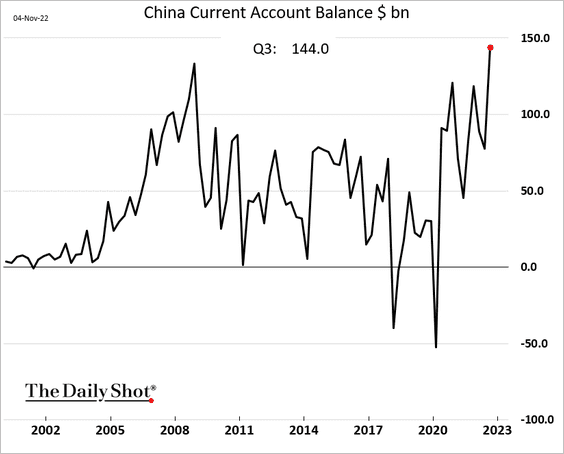

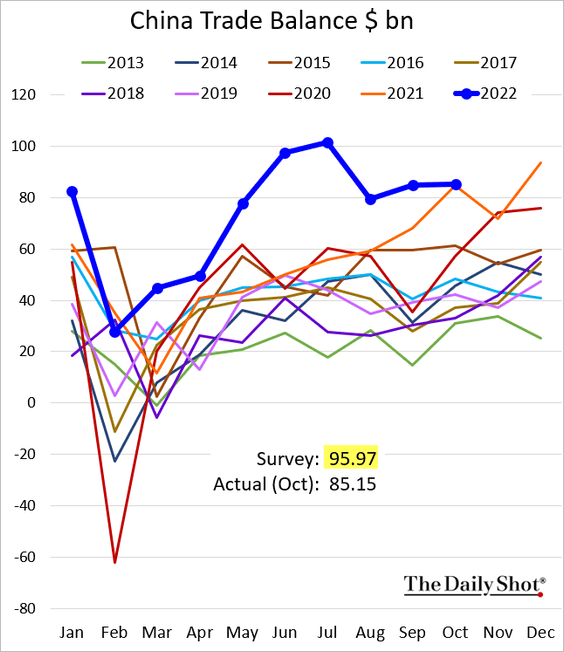

3. China’s current account surplus hit a record last quarter.

But the nation’s trade surplus was softer than expected in October.

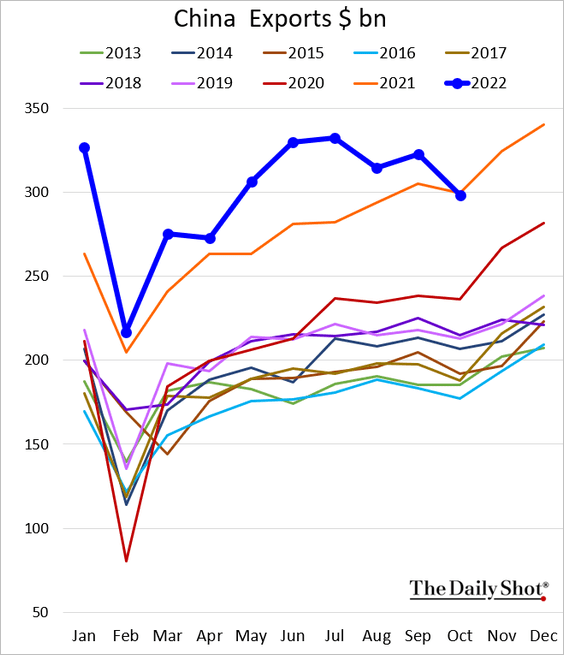

Exports dipped below last year’s level.

Back to Index

Emerging Markets

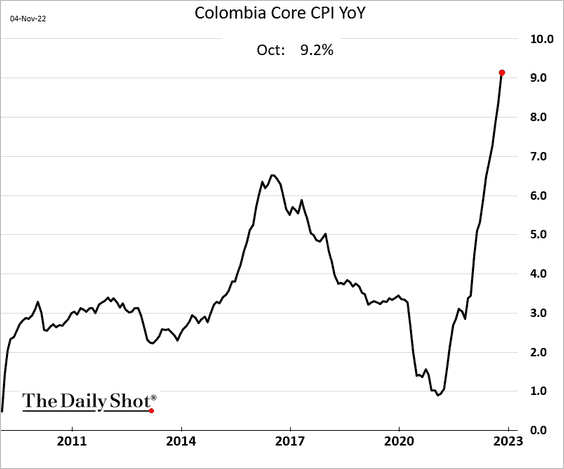

1. Colombia’s core CPI continues to surge.

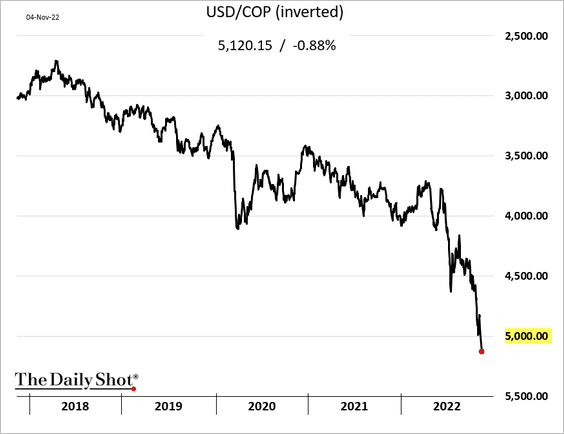

The peso hit a record low last week.

——————–

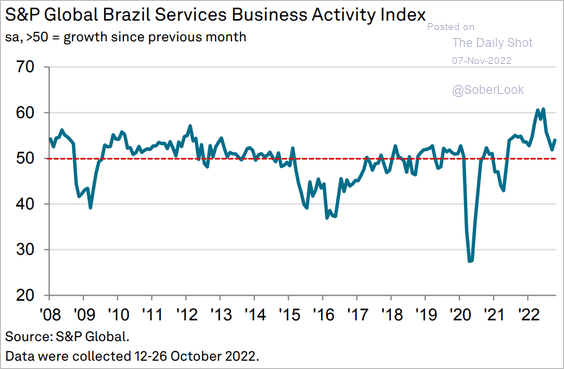

2. Brazil’s service sector growth improved in October.

Source: S&P Global PMI

Source: S&P Global PMI

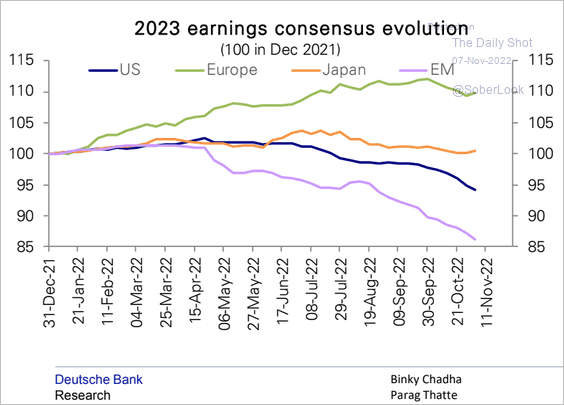

3. EM companies are outpacing the US in earnings downgrades.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

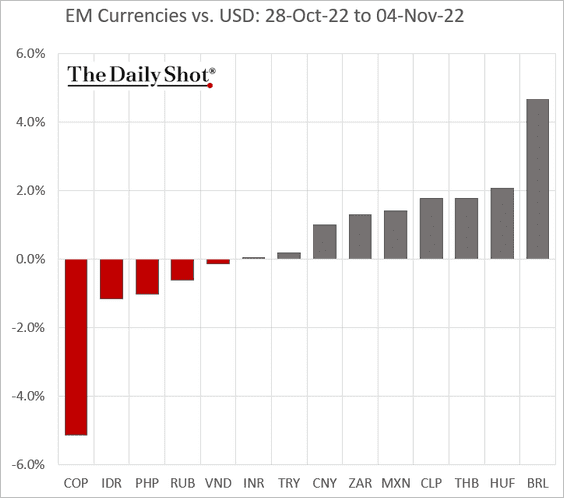

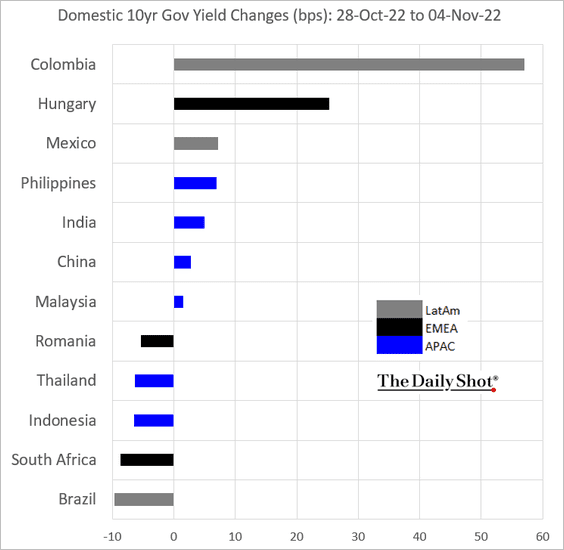

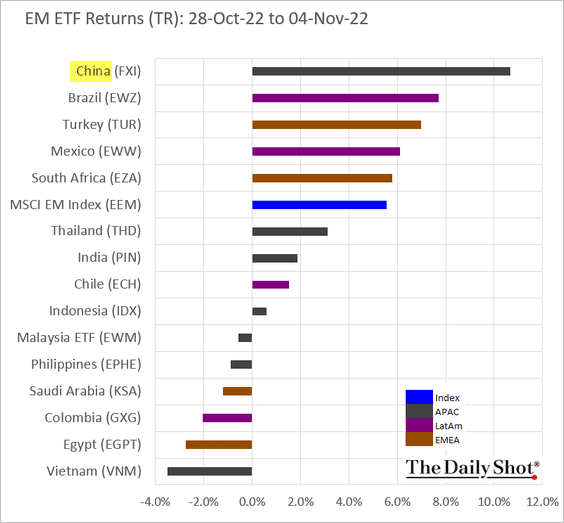

4. Next, we have some performance data from last week.

• Currencies:

• Local bond yields:

• Equity ETFs:

Back to Index

Commodities

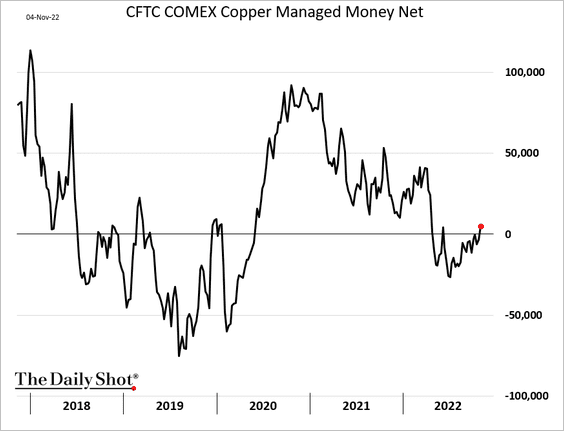

1. Fund managers are becoming more upbeat on copper.

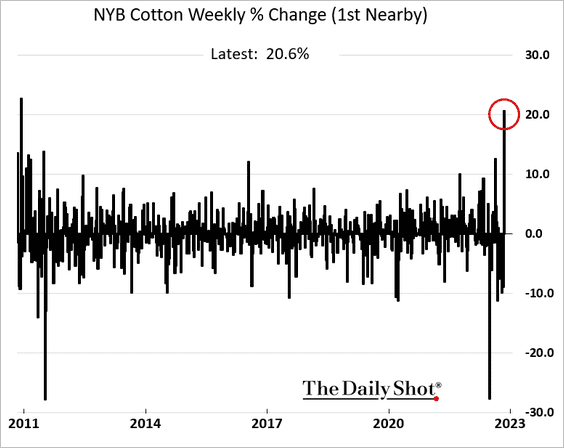

2. Cotton surged last week amid hopes for stronger demand from China.

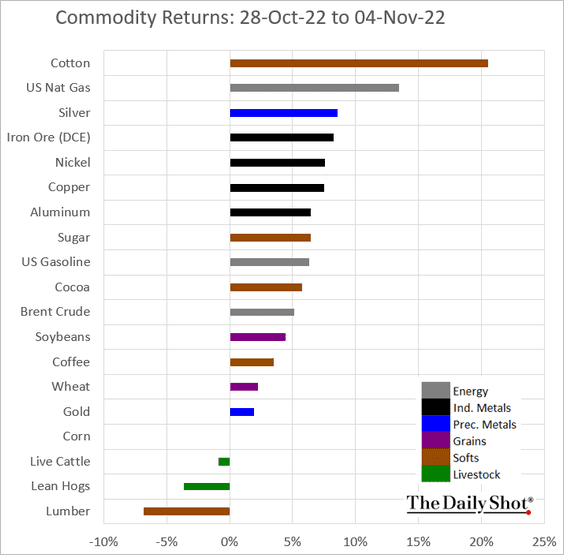

3. Here is last week’s performance across key commodity markets.

Back to Index

Equities

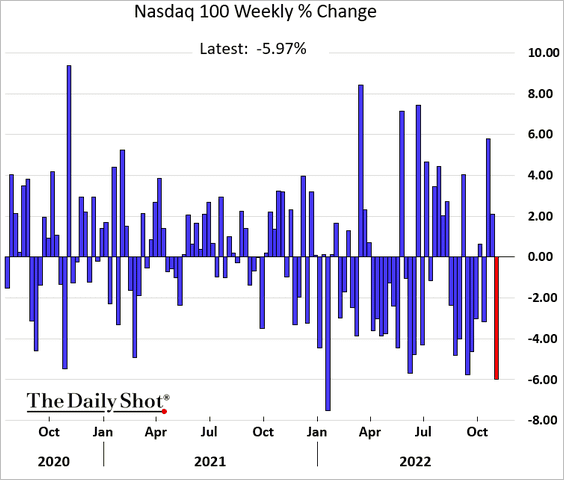

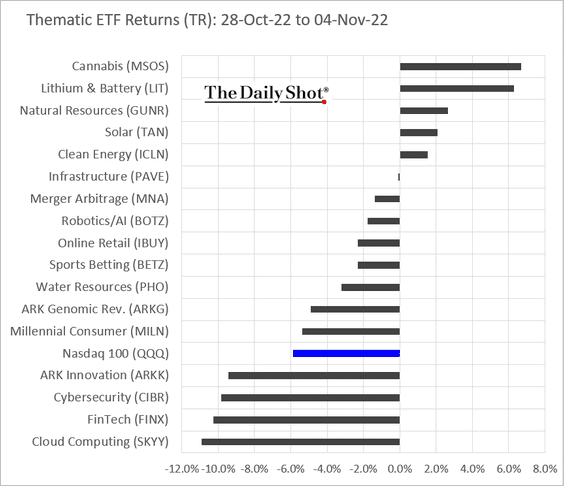

1. Despite the rebound on Friday, the Nasdaq 100 was still down 6% last week.

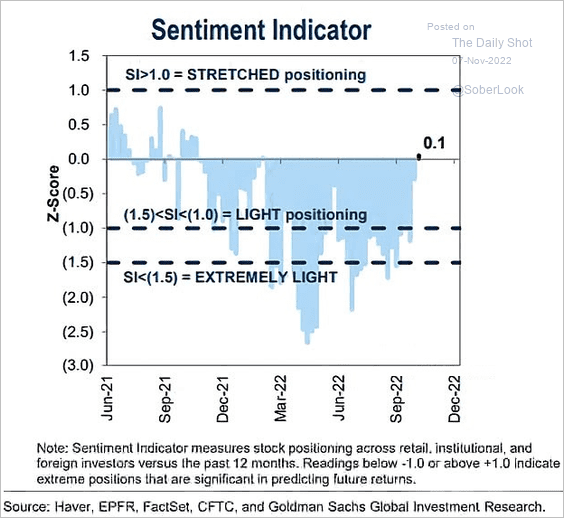

2. Goldman’s sentiment indicator has turned positive.

Source: Goldman Sachs

Source: Goldman Sachs

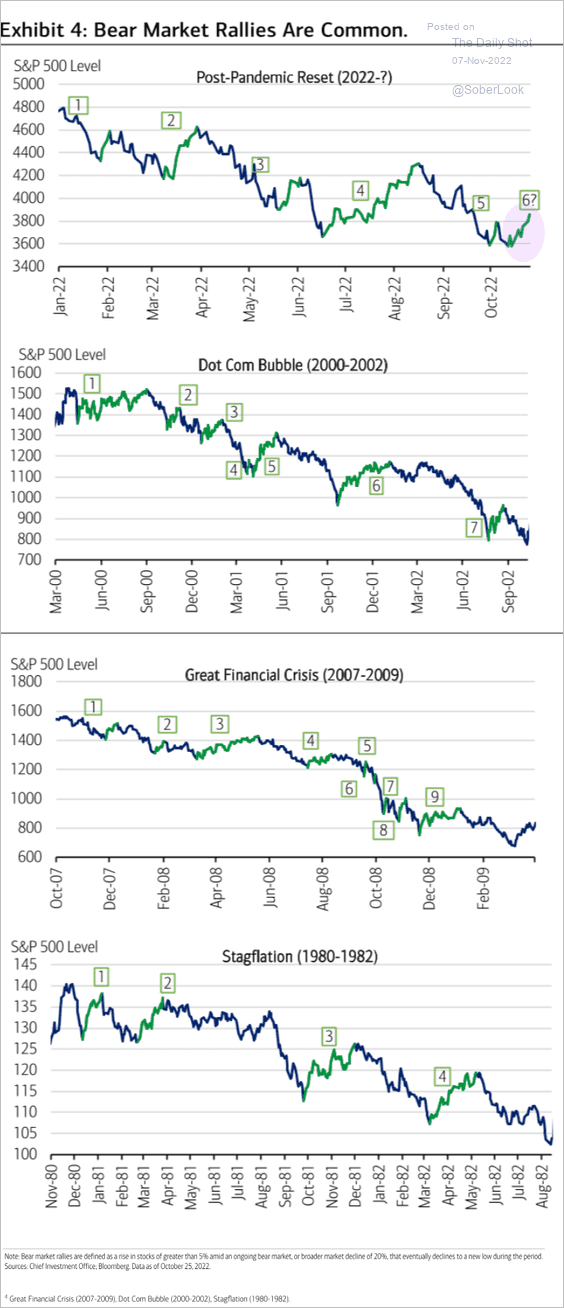

3. Are we in the midst of another bear-market rally?

Source: Merrill Lynch

Source: Merrill Lynch

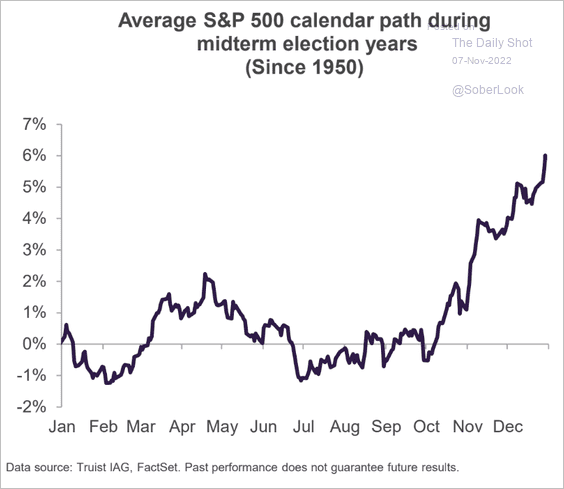

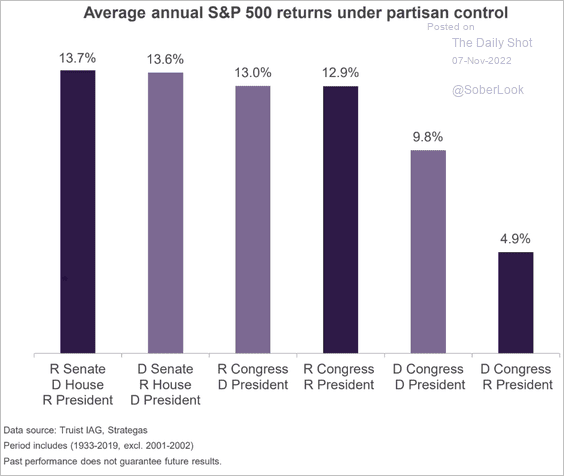

4. Stocks tend to rally after midterm elections, …

Source: Truist Advisory Services

Source: Truist Advisory Services

… and a split government tends to be good for the market.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

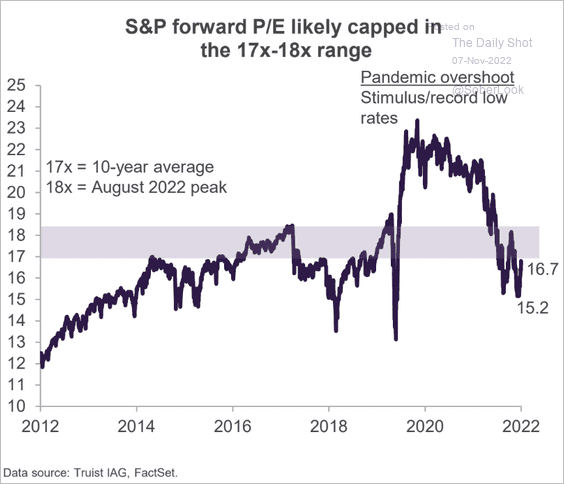

5. Valuations are likely capped for a while.

Source: Truist Advisory Services

Source: Truist Advisory Services

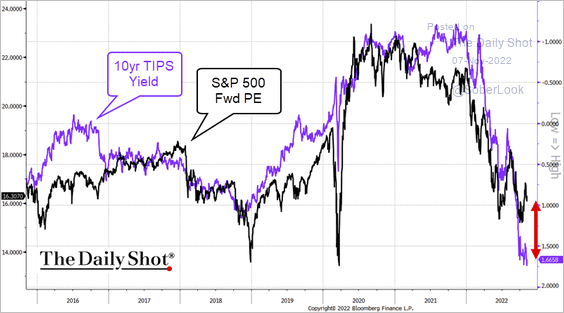

Elevated real yields point to further declines in valuations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

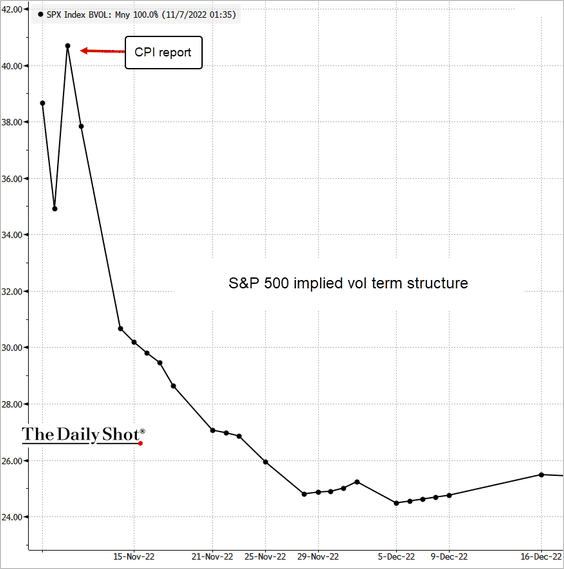

6. The S&P 500 implied volatility term structure signals concerns about the October CPI report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

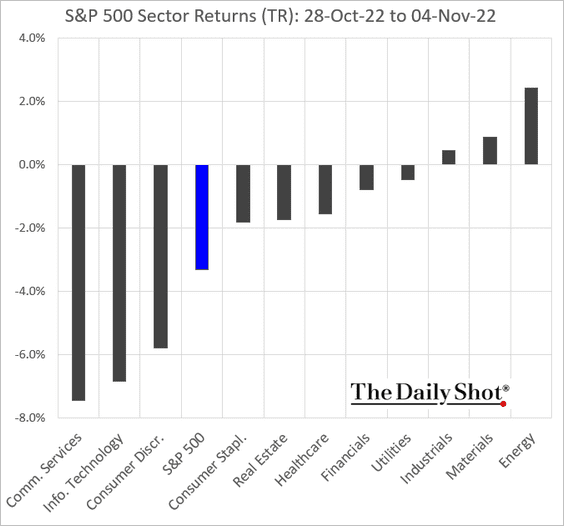

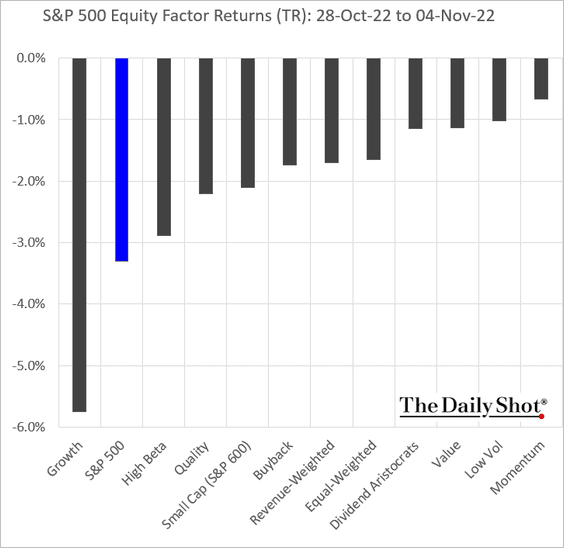

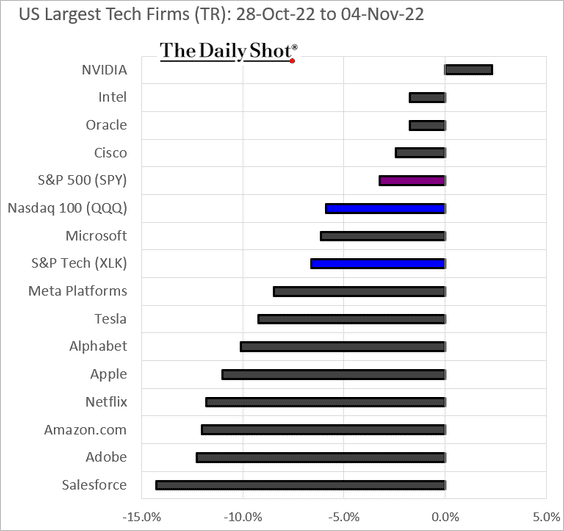

7. Finally, we have some performance data from last week.

• Sectors:

• Factors:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

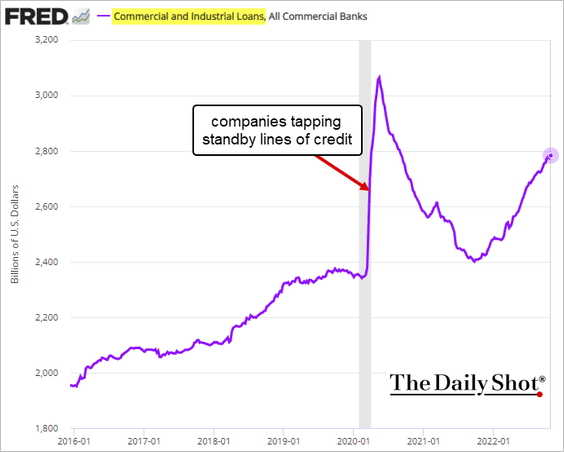

Credit

1. Growth in business loan balances at commercial banks has been robust despite the economic headwinds.

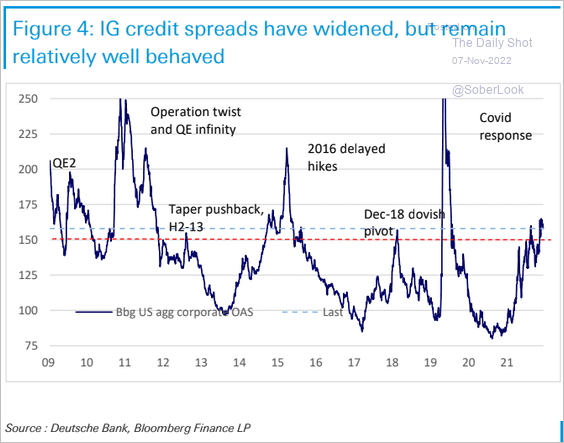

2. IG spreads are wider but have not blown out.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

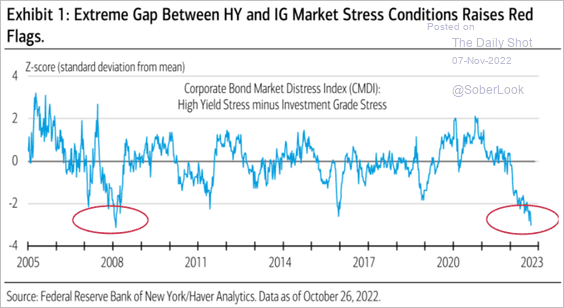

However, the HY/IG stress differential is raising red flags.

Source: Merrill Lynch

Source: Merrill Lynch

——————–

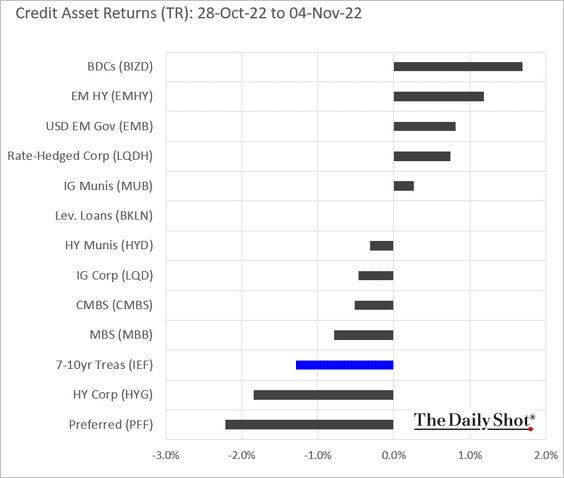

3. Here is last week’s performance across different credit asset classes.

Back to Index

Rates

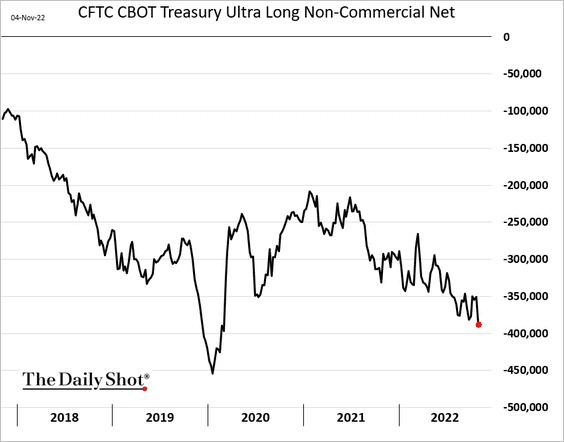

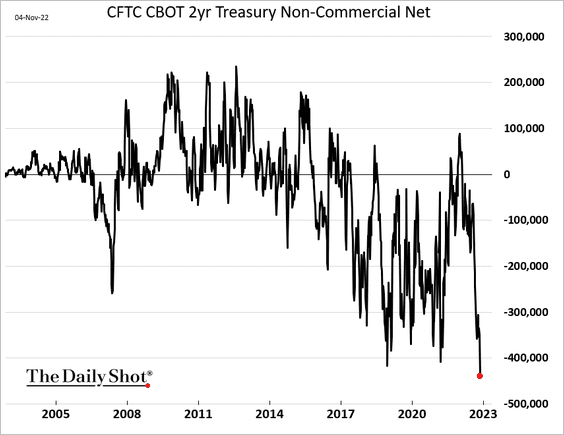

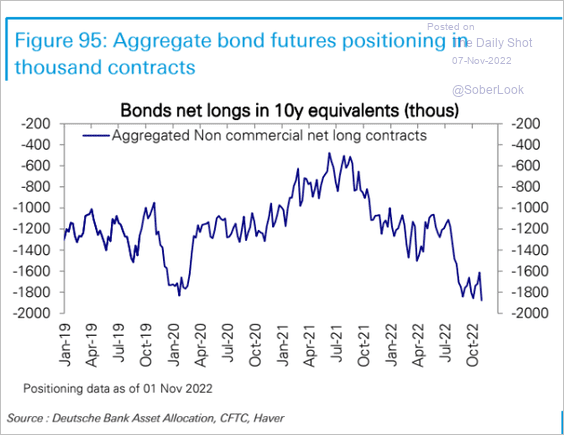

Speculative accounts keep boosting their bets against Treasuries.

• Ultra-long Treasury futures:

• 2-year note futures (record short):

• Aggregate positioning:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

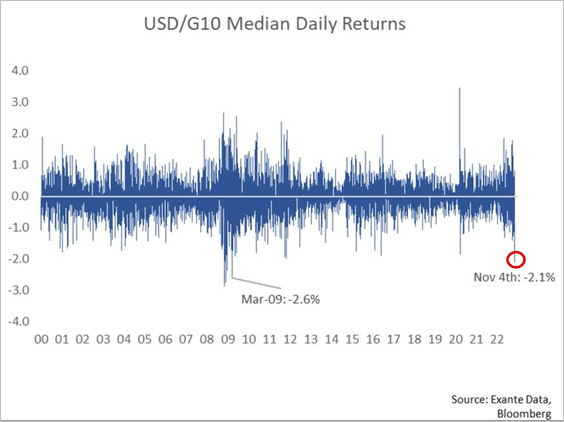

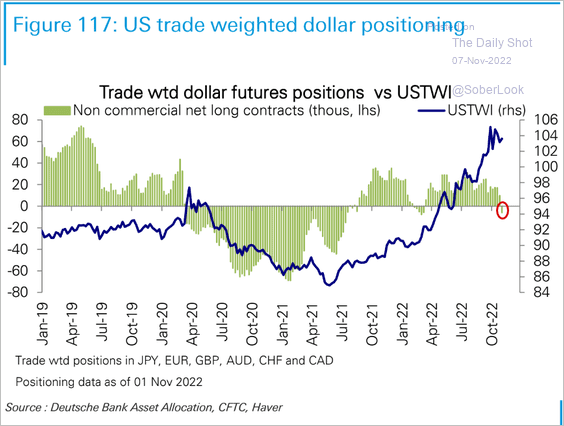

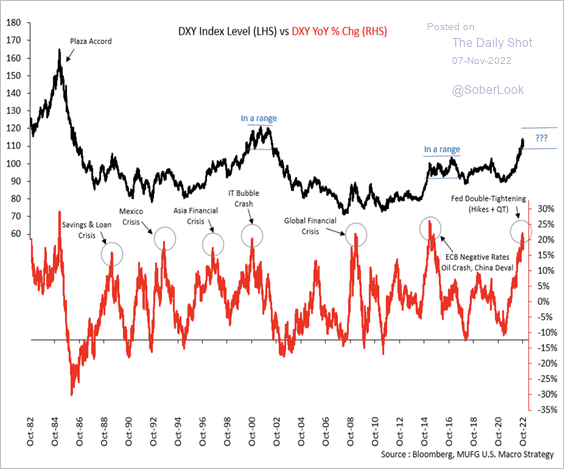

1. The dollar tumbled on Friday.

• Speculative accounts are now net short the US dollar in the futures markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Here is a look at key events that impacted the dollar.

Source: MUFG Securities

Source: MUFG Securities

——————–

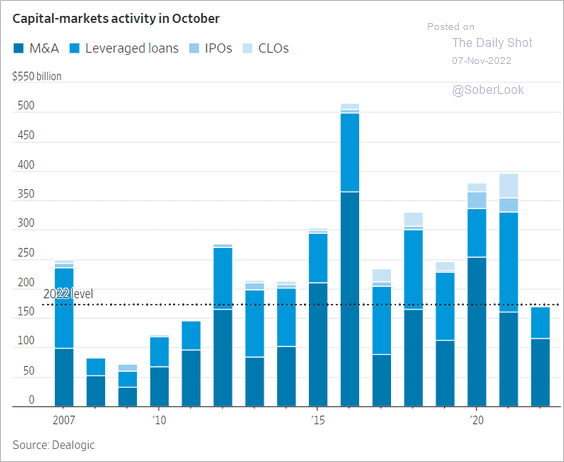

2. Capital markets activity slowed in October.

Source: @WSJ Read full article

Source: @WSJ Read full article

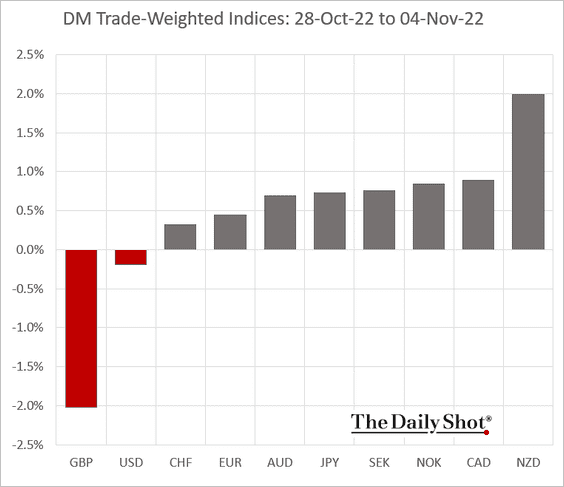

3. Next, we have some performance data from last week.

• DM currencies:

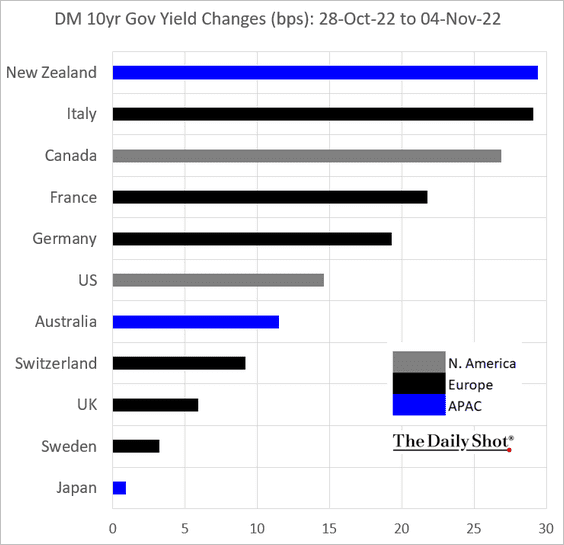

• DM bond yields:

——————–

Food for Thought

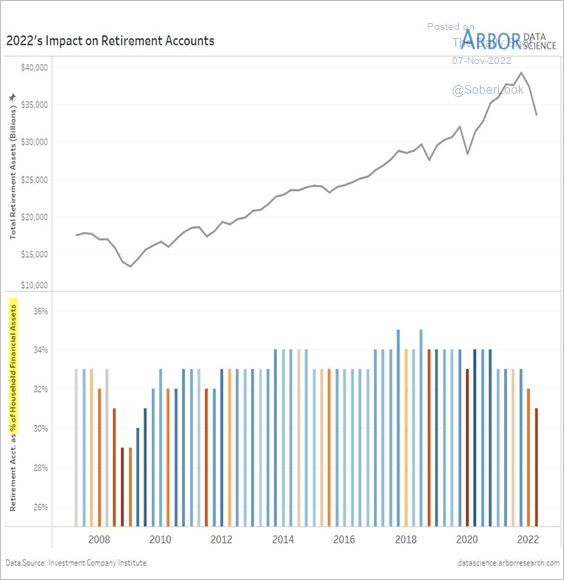

1. Retirement accounts under pressure:

Source: @LizAnnSonders, @DataArbor

Source: @LizAnnSonders, @DataArbor

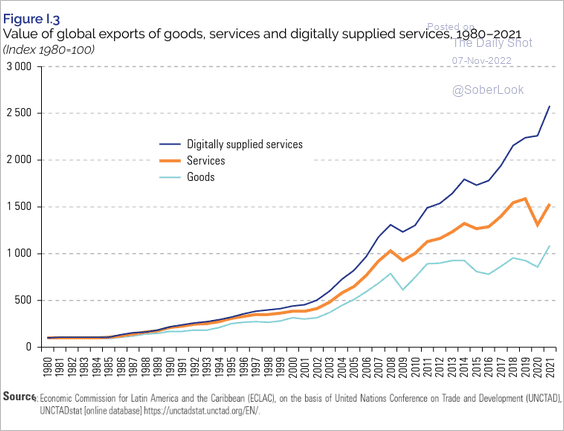

2. Growth in LatAm exports:

Source: UN/ECLAC Read full article

Source: UN/ECLAC Read full article

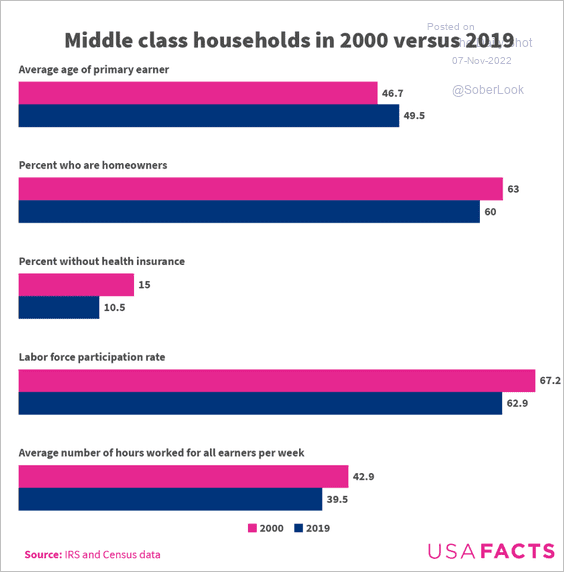

3. Middle-class households in 2000 and 2019:

Source: USAFacts

Source: USAFacts

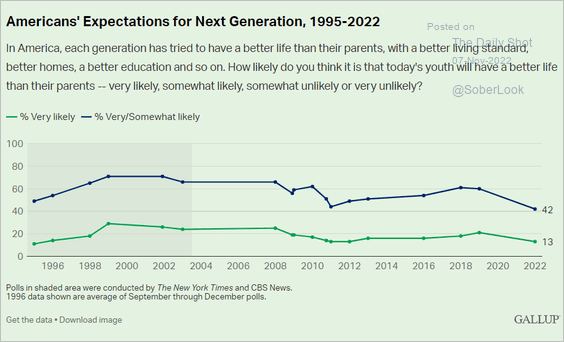

4. Pessimism about the next generation’s future:

Source: Gallup Read full article

Source: Gallup Read full article

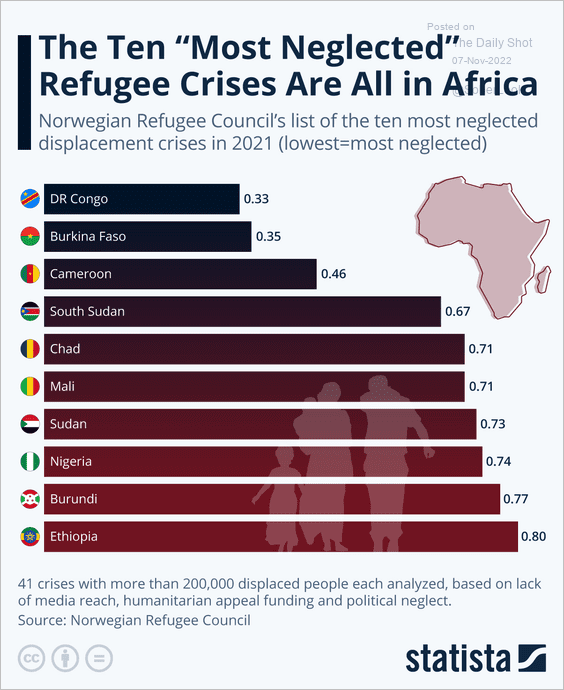

5. Neglected refugee crises in Africa:

Source: Statista

Source: Statista

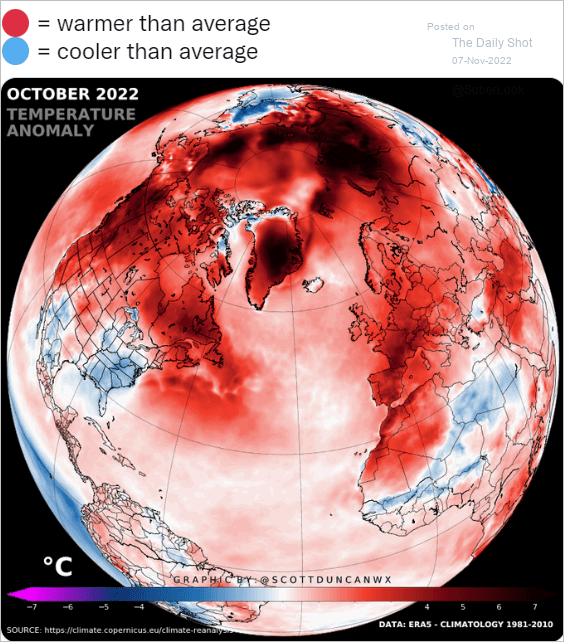

6. A warm October:

Source: @ScottDuncanWX

Source: @ScottDuncanWX

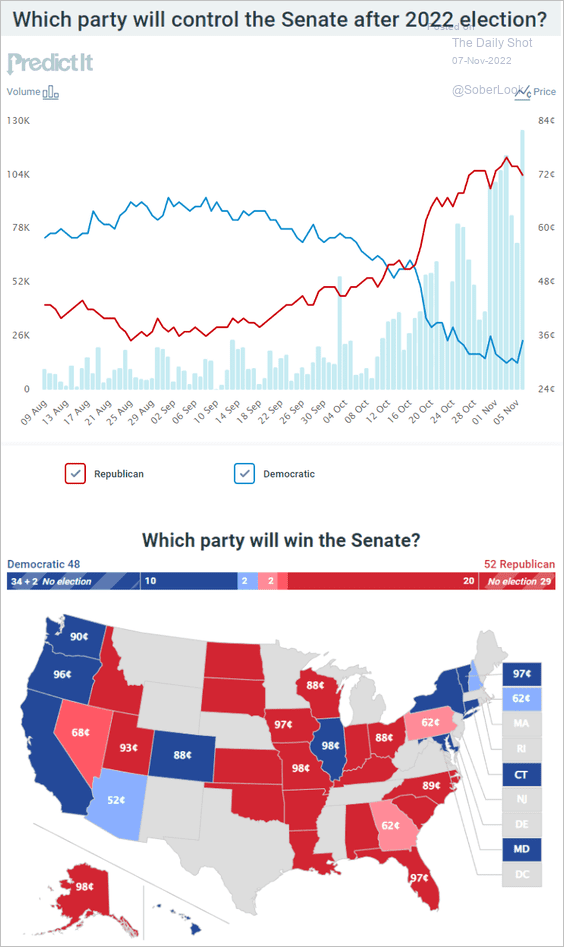

7. Betting markets’ odds on Senate control after the 2022 election:

Source: @PredictIt

Source: @PredictIt

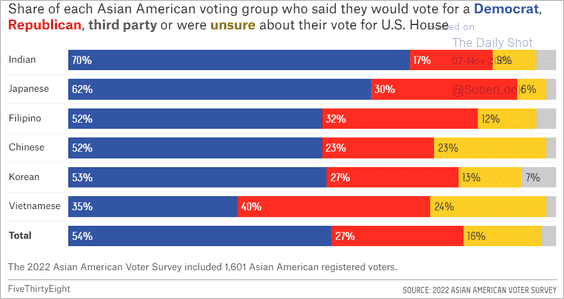

8. Asian Americans’ voting intentions:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

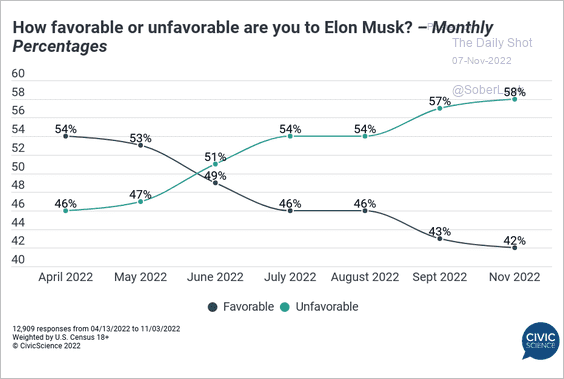

9. Elon Musk’s favorability ratings:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

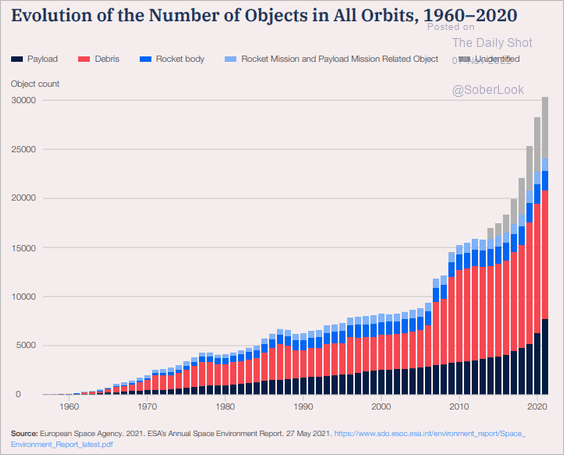

10. Number of objects in orbit:

Source: WEF Read full article

Source: WEF Read full article

——————–

Back to Index