The Daily Shot: 10-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Food for Thought

The United States

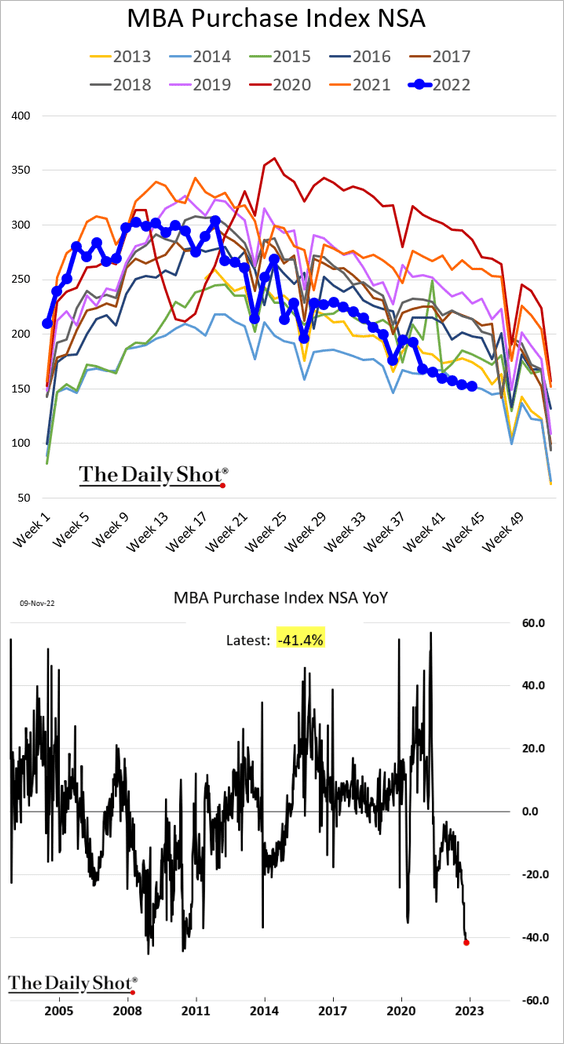

1. Let’s begin with the housing market.

• Mortgage applications are running at 2014 levels, down over 41% from a year ago.

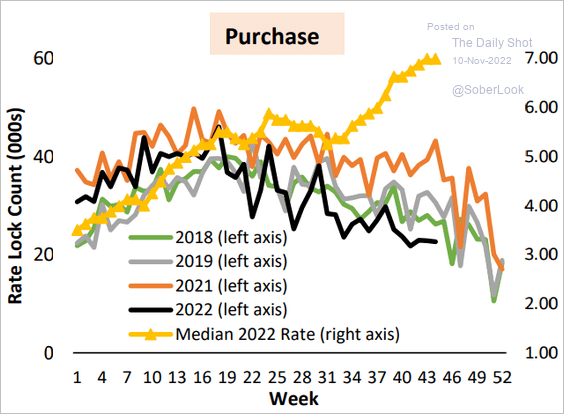

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

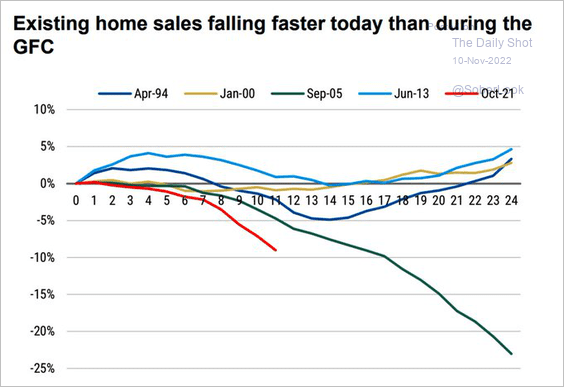

• The decline in existing home sales has been rapid, …

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

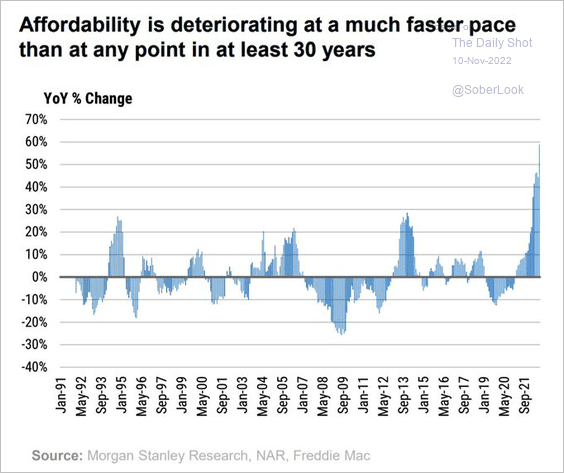

… as housing affordability deteriorated.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

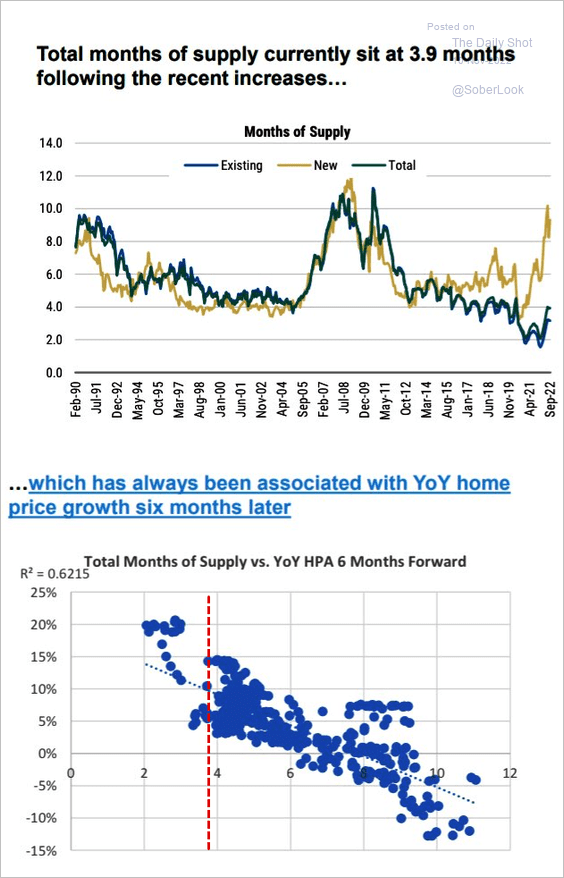

• Low housing inventories point to positive home price appreciation on a year-over-year basis.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

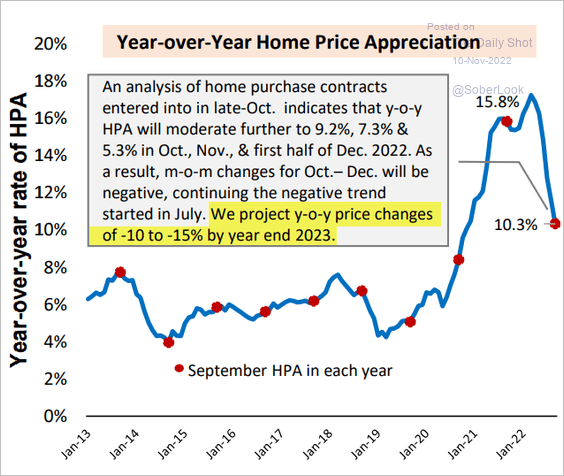

• However, the AEI Housing Center sees a steep year-over-year decline in home prices by the end of next year.

Source: AEI Housing Center

Source: AEI Housing Center

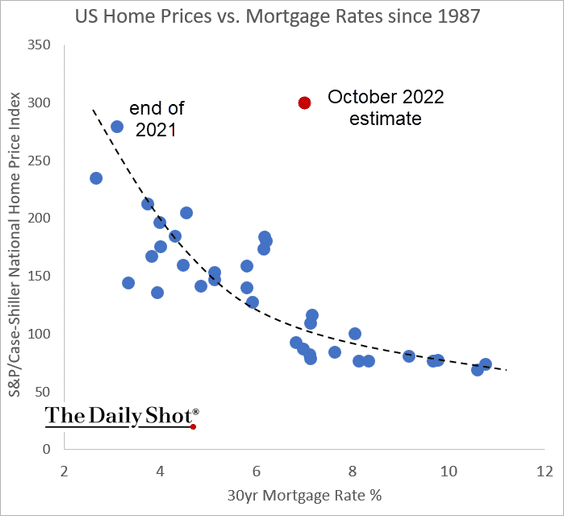

• The mortgage rate spike also signals lower prices ahead (note that this chart shows nominal home prices).

h/t @MacroAlf

h/t @MacroAlf

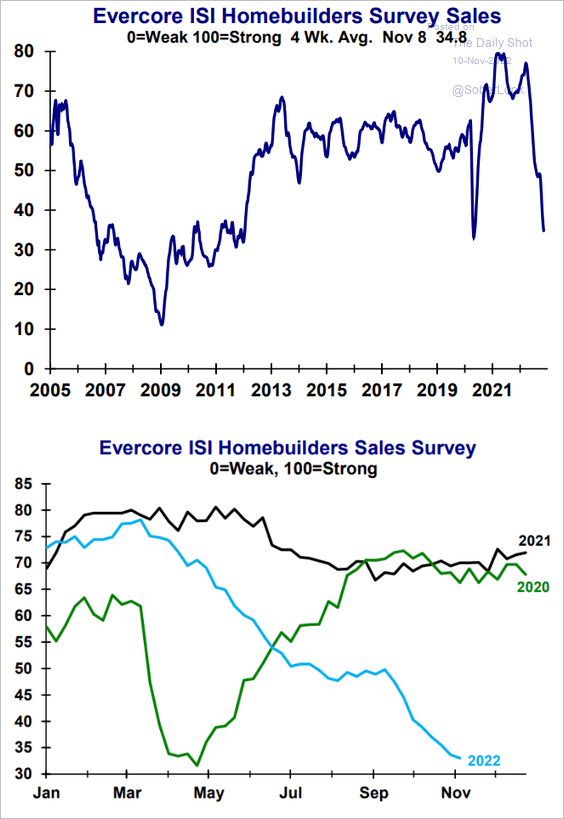

• The Evercore ISI homebuilder sales index continues to deteriorate.

Source: Evercore ISI Research

Source: Evercore ISI Research

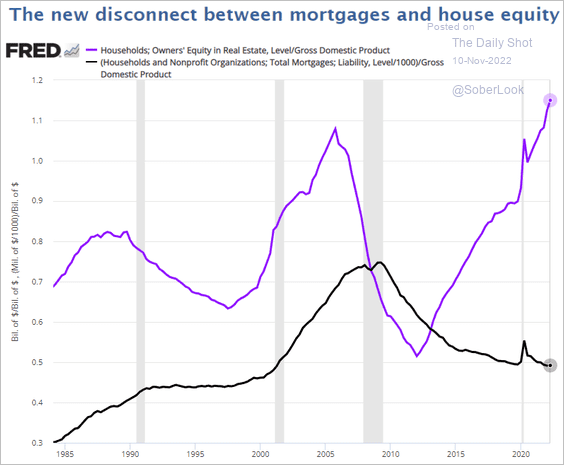

• This chart shows homeowners’ equity and mortgage balances as a share of GDP.

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

——————–

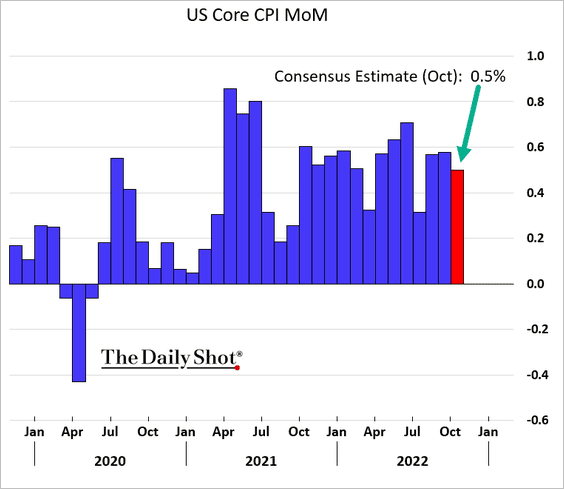

2. Next, we have some updates on inflation.

• What should we expect from the CPI report today? Here is the consensus estimate for the core CPI (monthly changes).

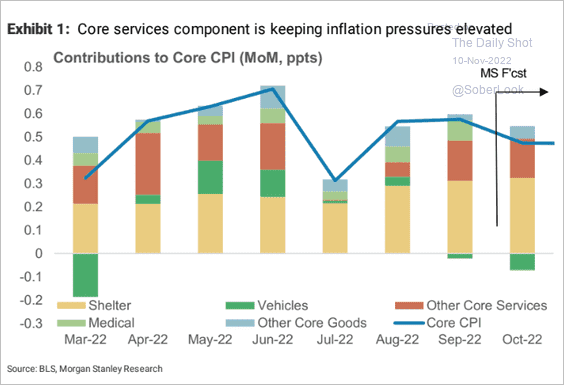

• Morgan Stanley’s estimate is in line with the consensus, showing that core services kept inflation elevated.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

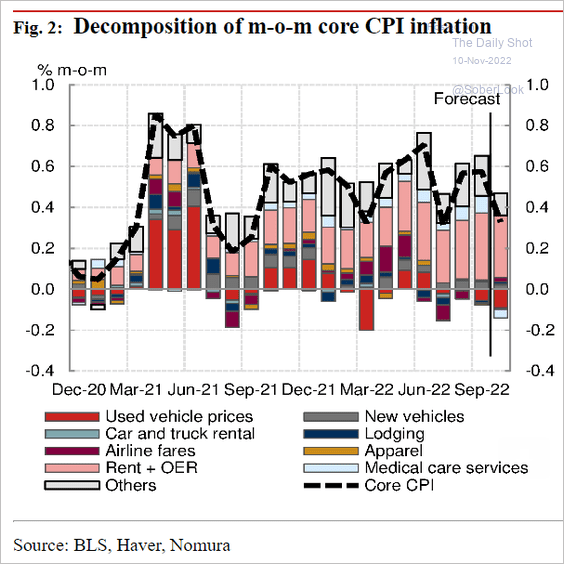

• Nomura’s estimate is below consensus. Used vehicles, other core goods, and health insurance are expected to be a drag on core inflation.

Source: Nomura Securities

Source: Nomura Securities

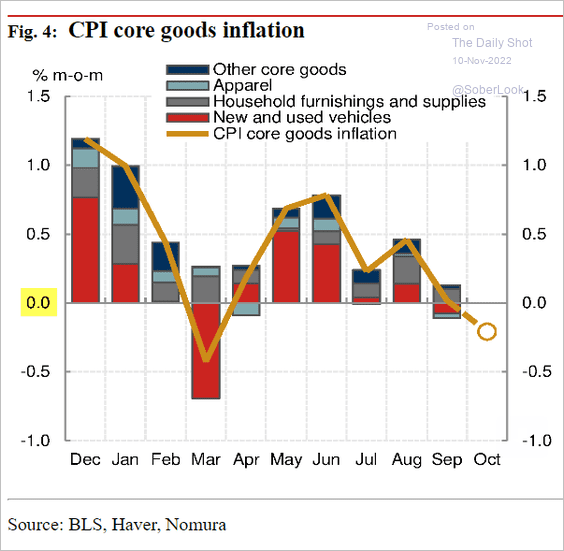

– Here is Nomura’s core goods CPI forecast:

Source: Nomura Securities

Source: Nomura Securities

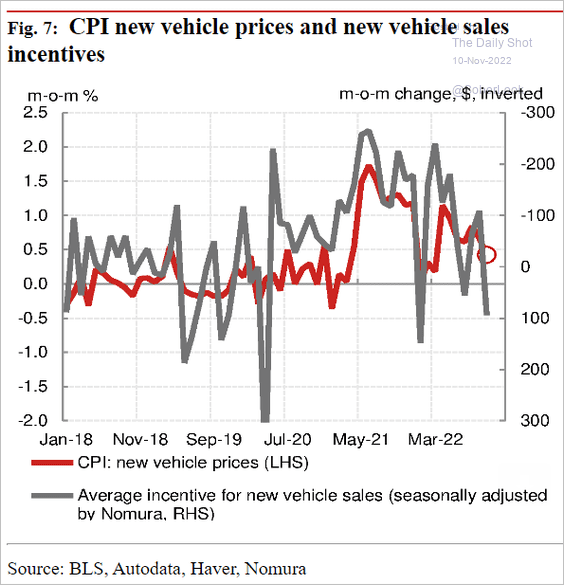

– Increased incentives for new vehicles point to slower price gains.

Source: Nomura Securities

Source: Nomura Securities

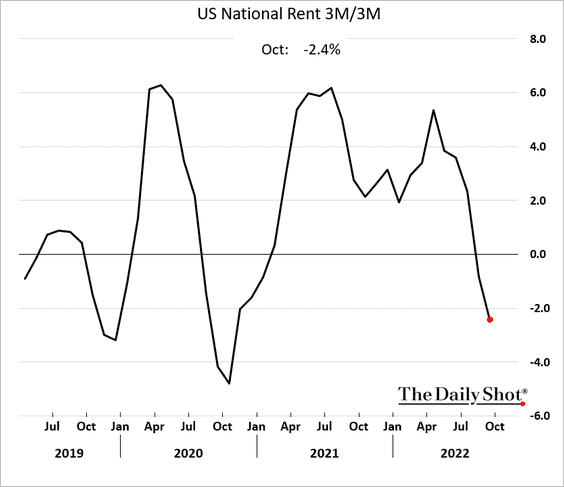

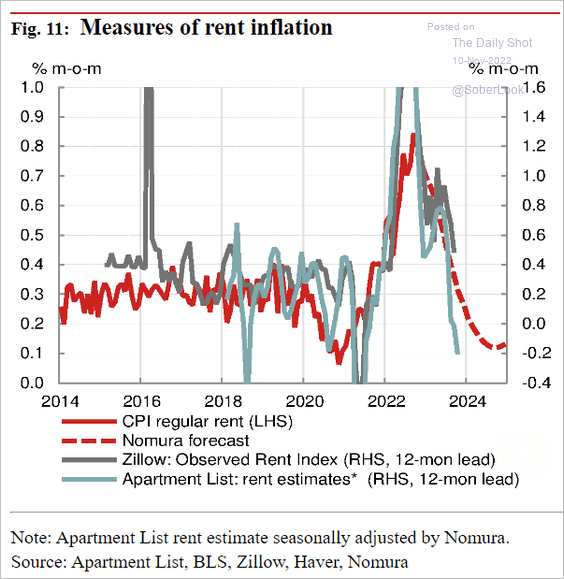

• Rent inflation is negative on a 3-month rolling basis, according to Rent.

Source: Rent. Read full article

Source: Rent. Read full article

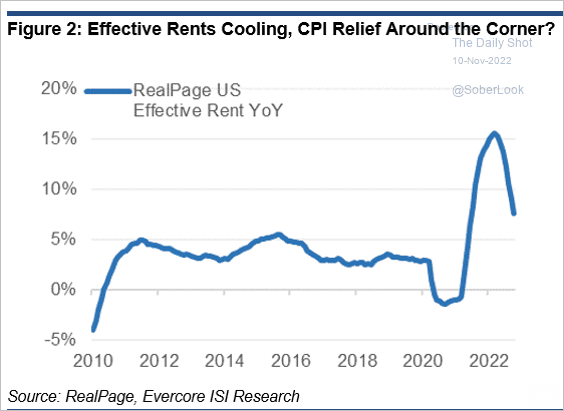

– Here is the RealPage rent index (year-over-year).

Source: Evercore ISI Research

Source: Evercore ISI Research

– Nomura sees rent inflation moderating slowly.

Source: Nomura Securities

Source: Nomura Securities

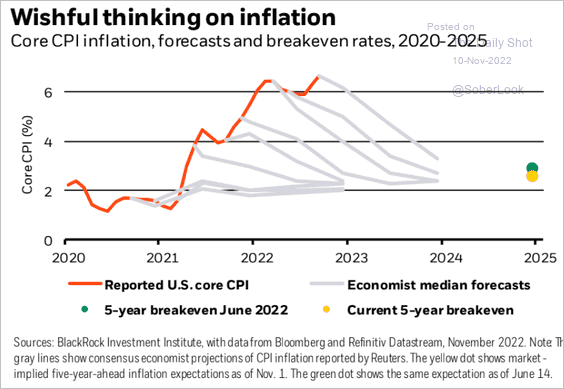

• Is it different this time?

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

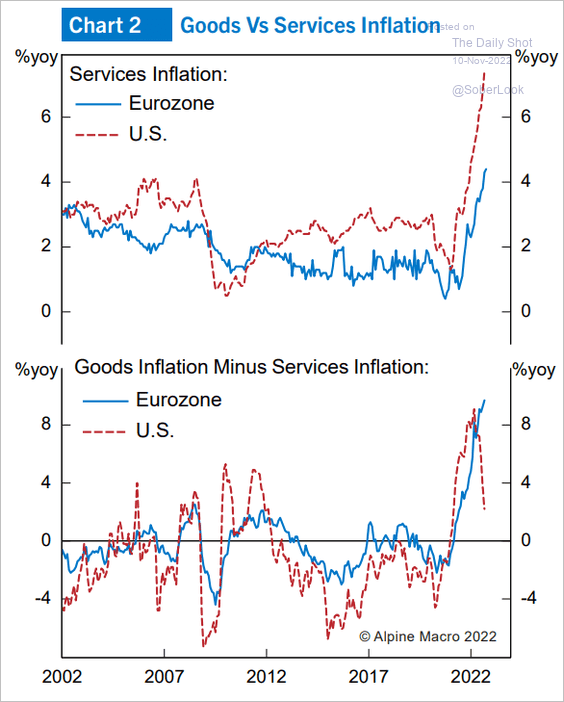

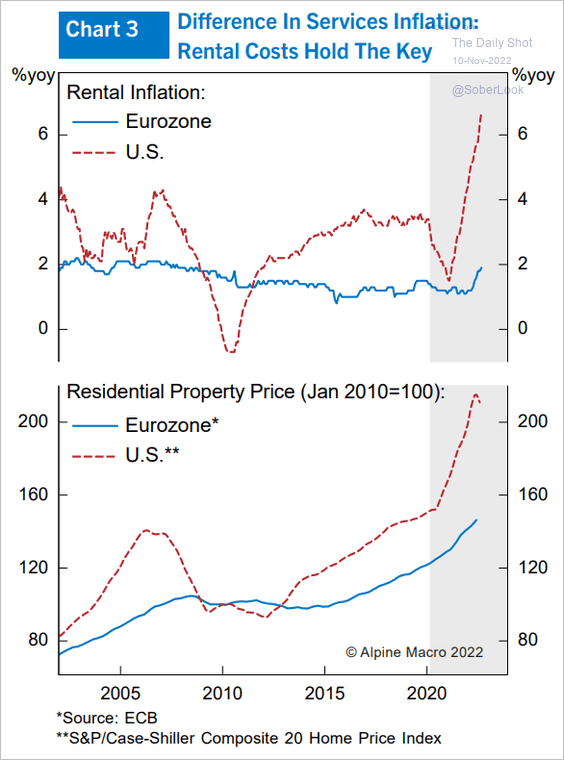

• Inflation in the US and the Eurozone is driven by different factors (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

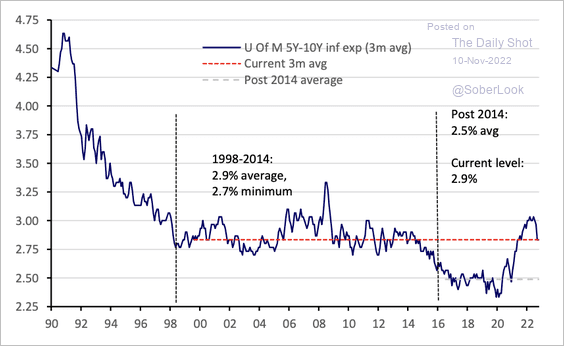

• Long-term consumer inflation expectations are back at pre-2014 levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

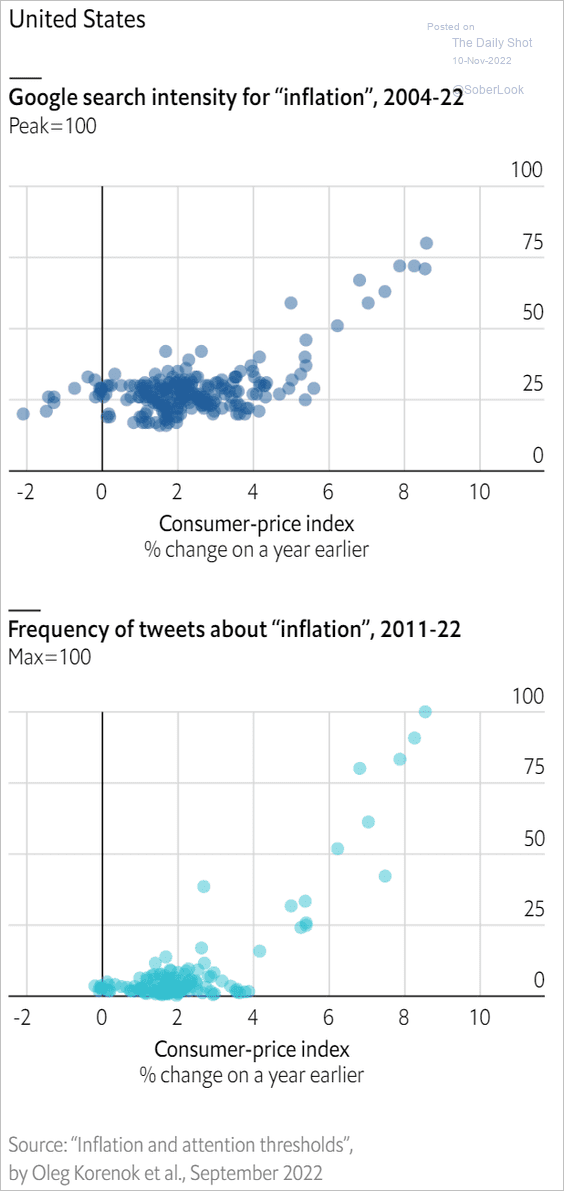

• The public starts noticing inflation when the CPI hits 4-5%.

Source: The Economist, h/t @jessefelder Read full article

Source: The Economist, h/t @jessefelder Read full article

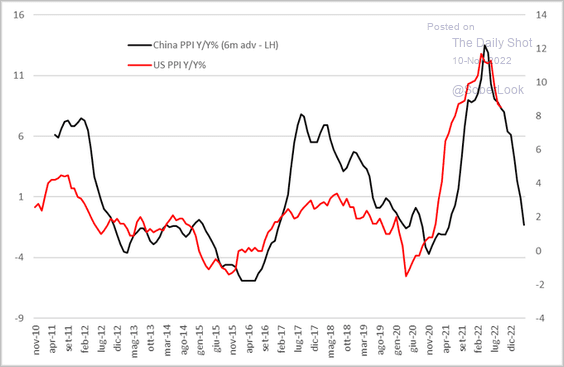

• China’s PPI is in negative territory, which signals slower gains in US producer prices.

Source: @CavaggioniMario

Source: @CavaggioniMario

——————–

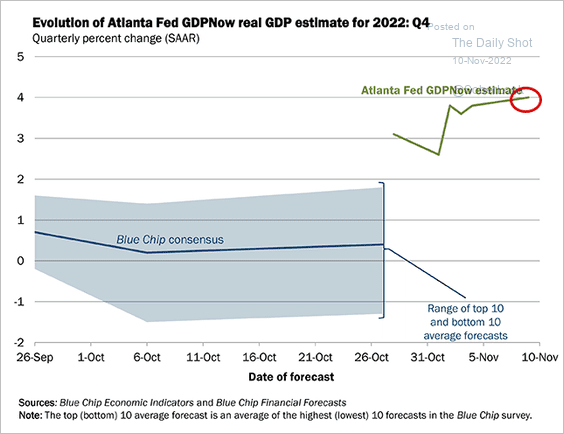

3. The Atlanta Fed’s GDPNow model now has the Q4 GDP growth at 4%, well above consensus.

Source: @AtlantaFed

Source: @AtlantaFed

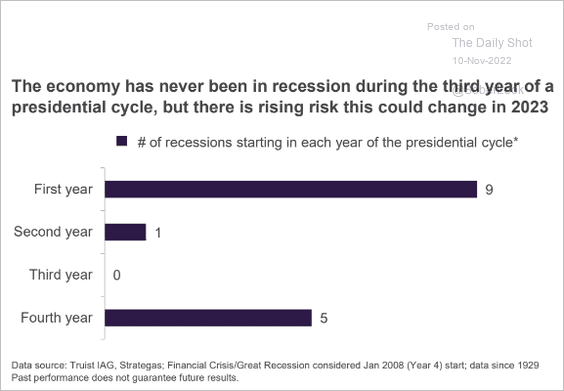

A recession during the third year of a presidential cycle? There is a first time for everything.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Canada

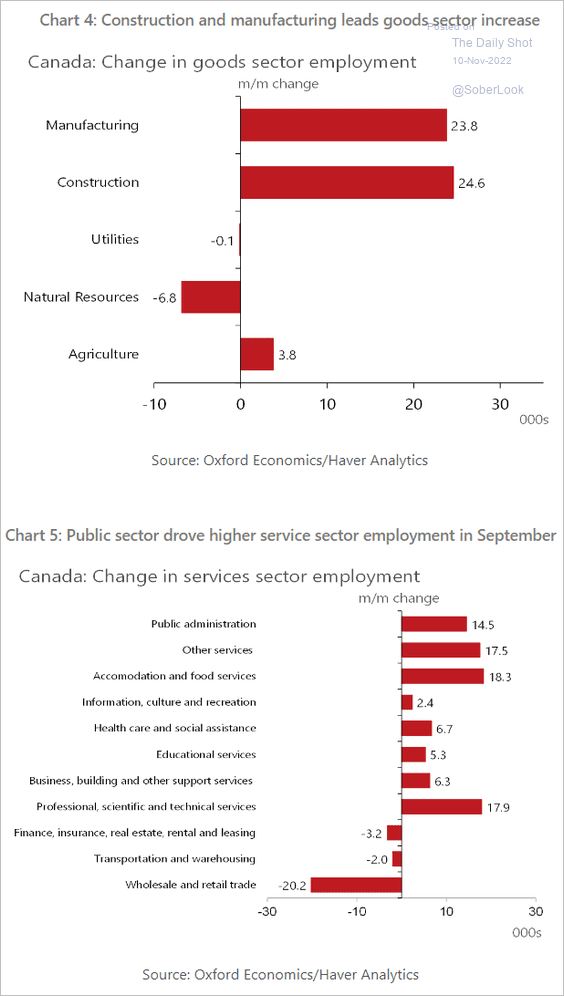

1. Here is a look at the spectacular October employment report by sector.

Source: Oxford Economics

Source: Oxford Economics

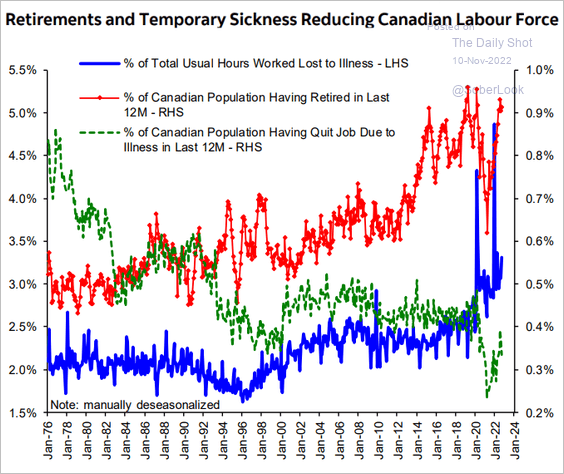

2. Retirements and sickness are keeping the labor market tight.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

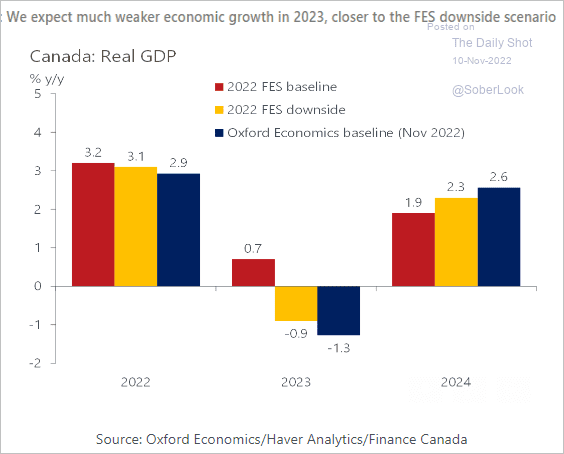

3. Oxford Economics sees a rough year ahead for Canada’s economy.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

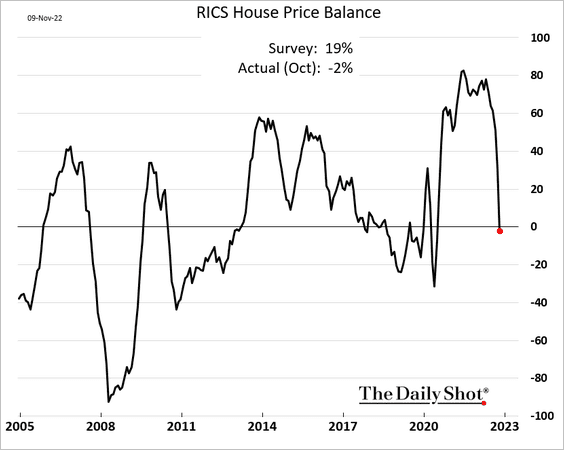

The United Kingdom

The housing market is under pressure.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

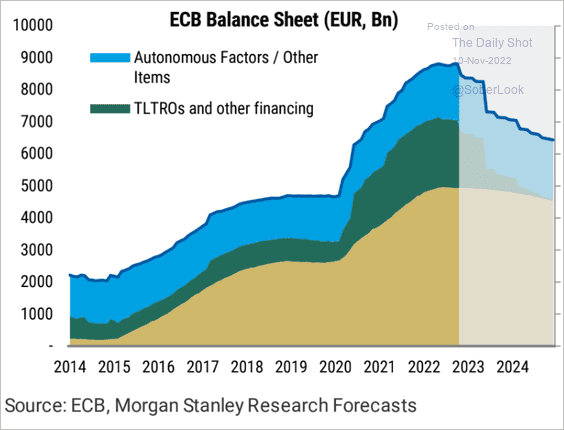

1. The TLTRO runoff will keep reducing the ECB’s (Eurosystem’s) balance sheet.

Source: BCA Research

Source: BCA Research

Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

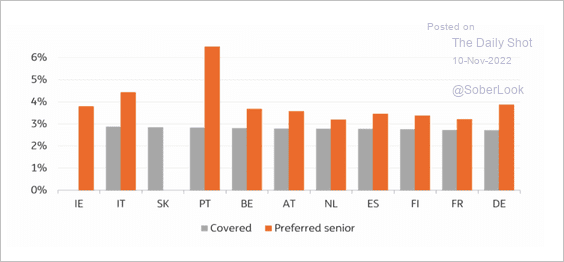

• The cost for TLTRO tranches for certain banks will move to at least 1.5% later this month, which is still attractive given the substantial repricing of interest rates this year. The chart below shows covered and preferred senior unsecured bond yields for 2024 maturities.

Source: ING

Source: ING

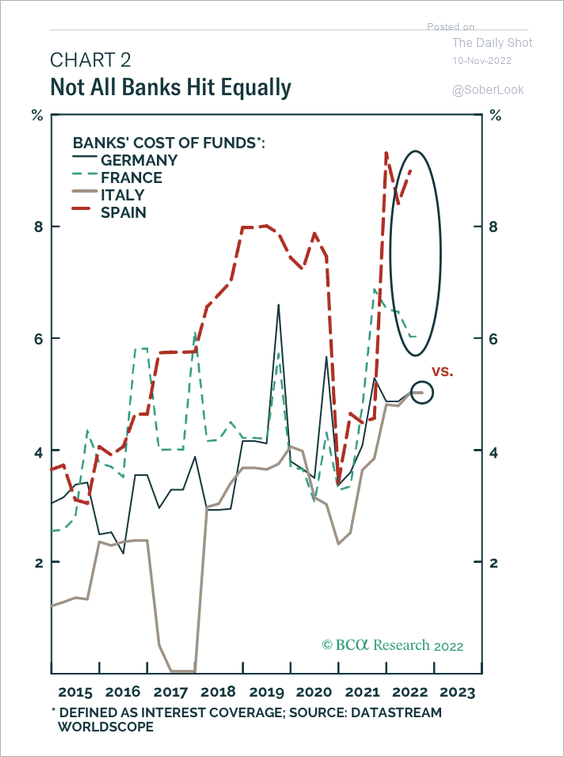

The TLTRO cost increase is more relevant for banks in core Eurozone countries, which have access to less expensive market funding, according to BCA Research.

Source: BCA Research

Source: BCA Research

——————–

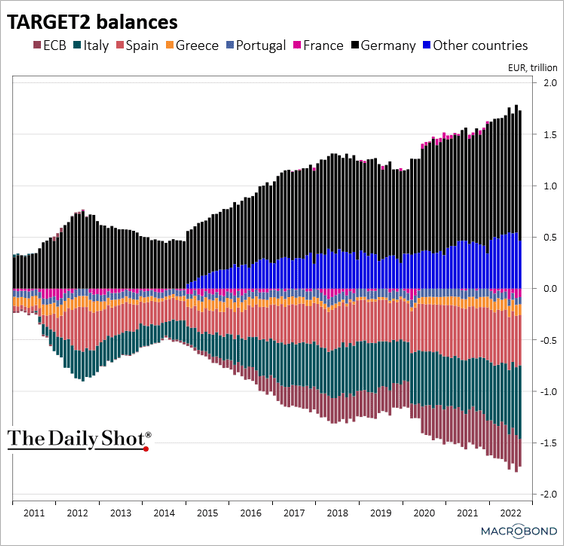

2. The TARGET2 imbalances keep widening.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

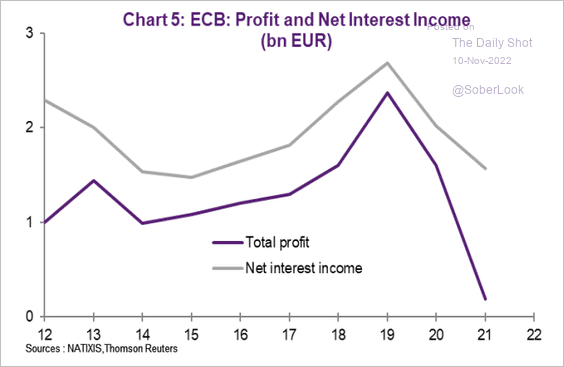

3. The ECB’s “profit” is deteriorating as interest rates surge.

Source: Natixis

Source: Natixis

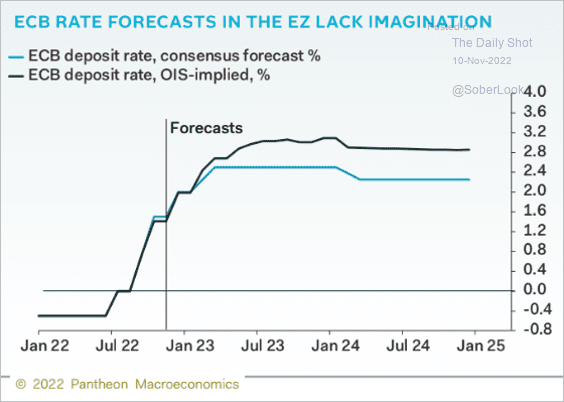

4. The consensus ECB rate trajectory has diverged from the market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

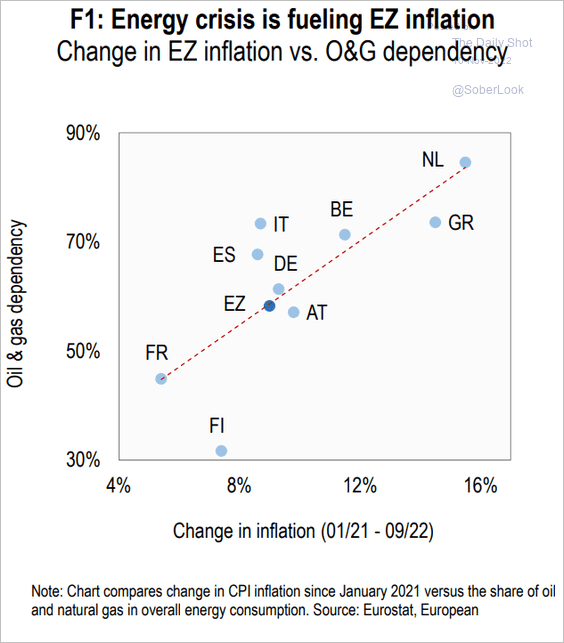

5. Energy dependency is fueling inflation.

Source: Numera Analytics

Source: Numera Analytics

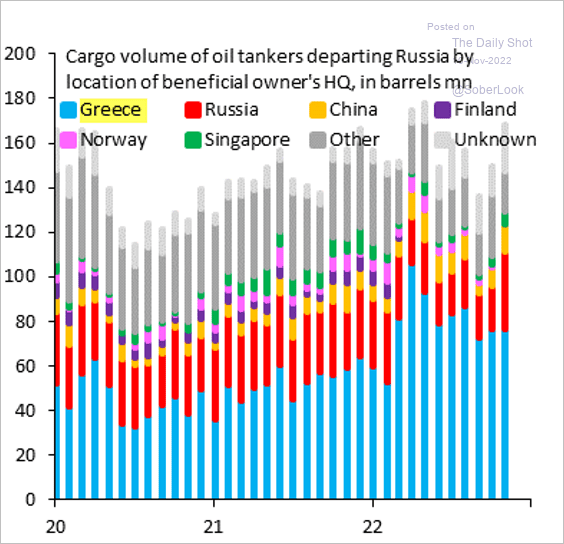

6. Who owns oil tankers moving Russian oil?

Source: @RobinBrooksIIF, @JonathanPingle

Source: @RobinBrooksIIF, @JonathanPingle

Back to Index

Japan

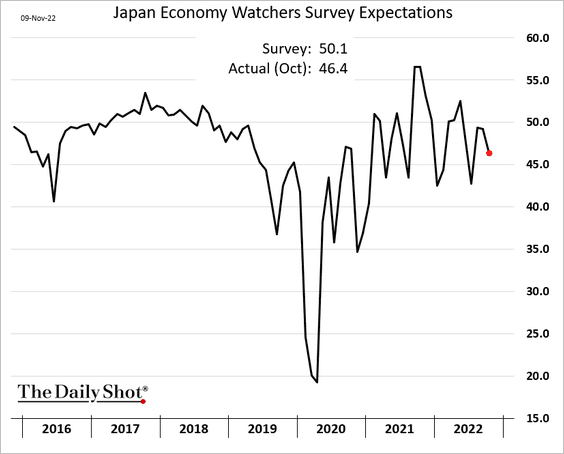

1. The October Economy Watchers Expectations indicator surprised to the downside. Notice how volatile the index has been since the start of the pandemic.

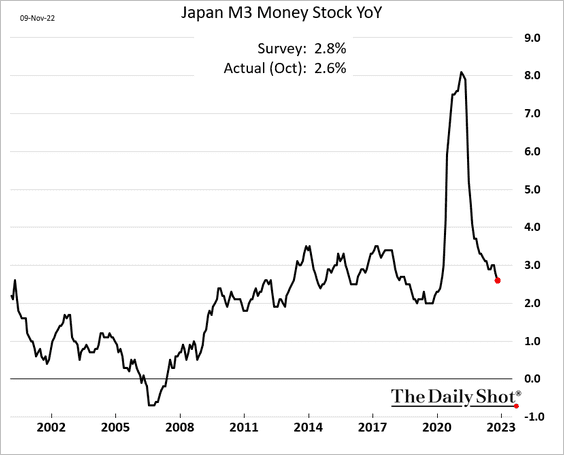

2. Growth in Japan’s broad money supply continues to moderate.

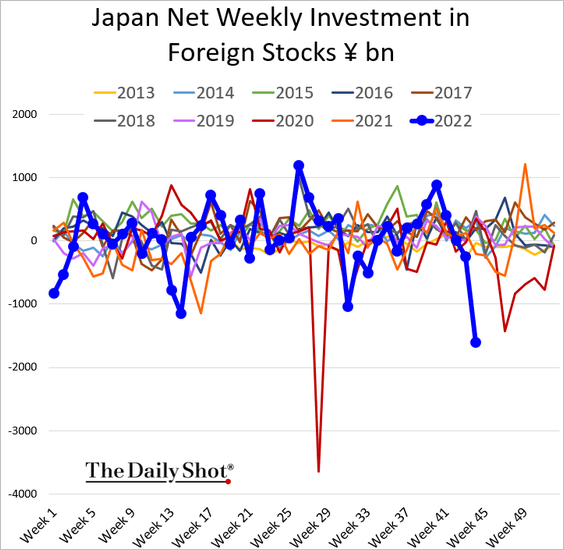

3. Japanese investors have been dumping foreign stocks.

Back to Index

Asia – Pacific

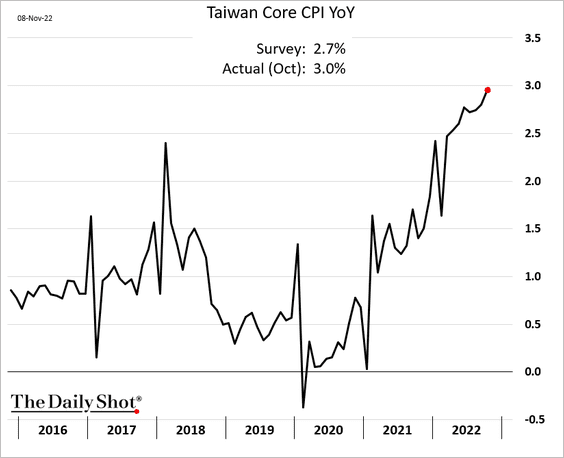

1. Taiwan’s inflation continues to climb.

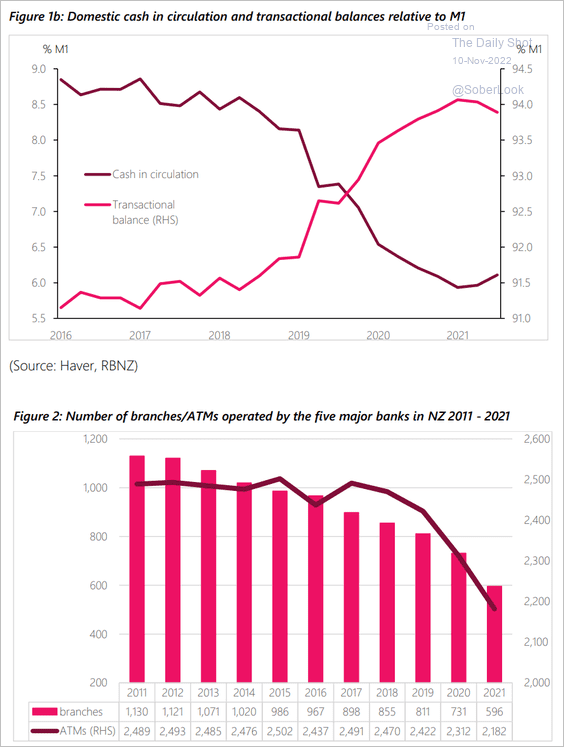

2. New Zealand is moving toward a cashless economy.

Source: BIS Read full article

Source: BIS Read full article

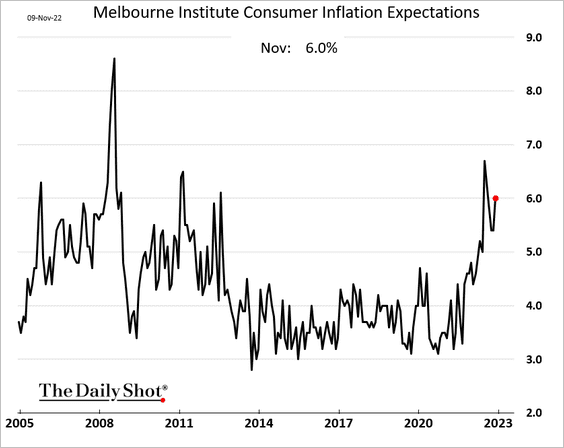

3. Australian inflation expectations are back at 6% this month.

Back to Index

Emerging Markets

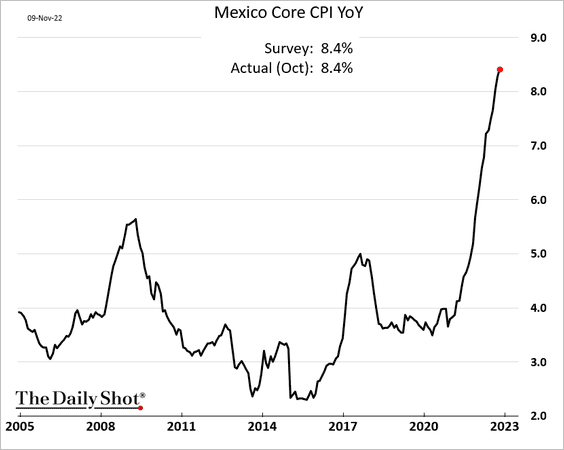

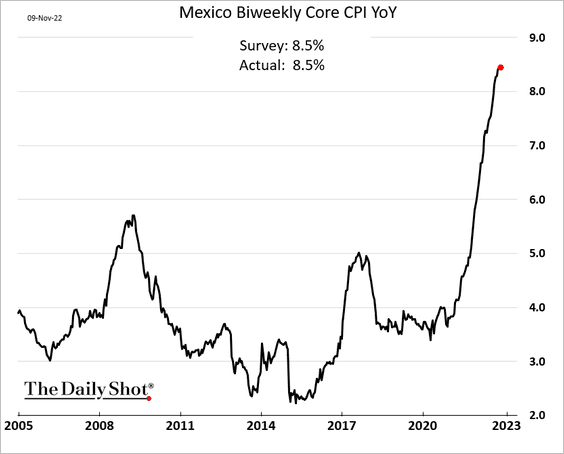

1. Mexico’s inflation keeps surging.

However, the biweekly index shows signs of peaking.

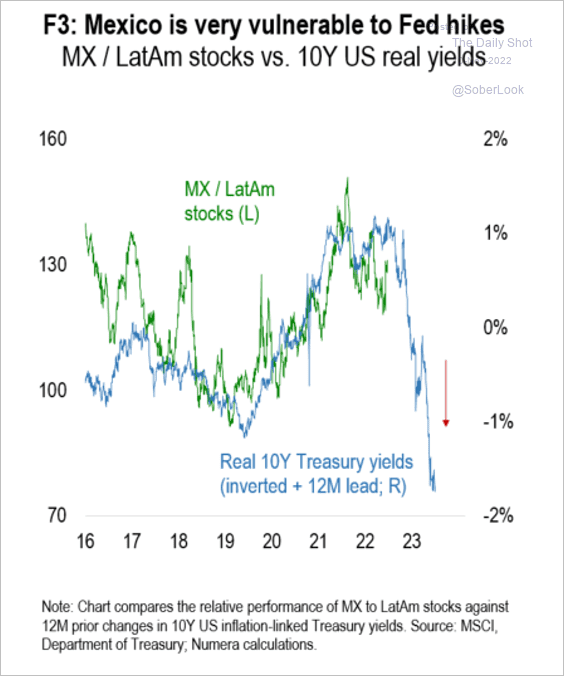

Separately, Mexico is highly exposed to the US economy and rates.

Source: Numera Analytics

Source: Numera Analytics

——————–

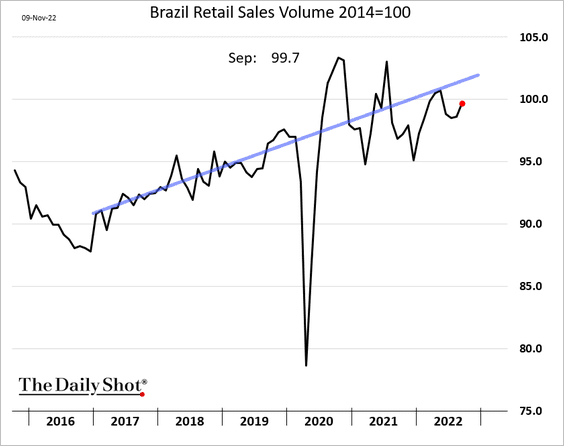

2. Brazil’s retail sales climbed more than expected in September.

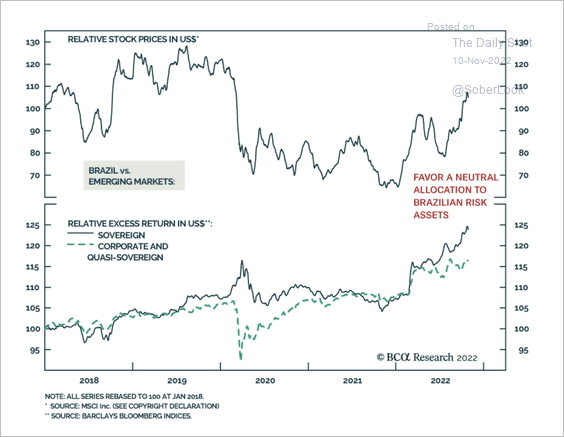

Brazilian assets have outperformed this year but could experience volatility if Bolsonaro contests election results, according to BCA Research.

Source: BCA Research

Source: BCA Research

——————–

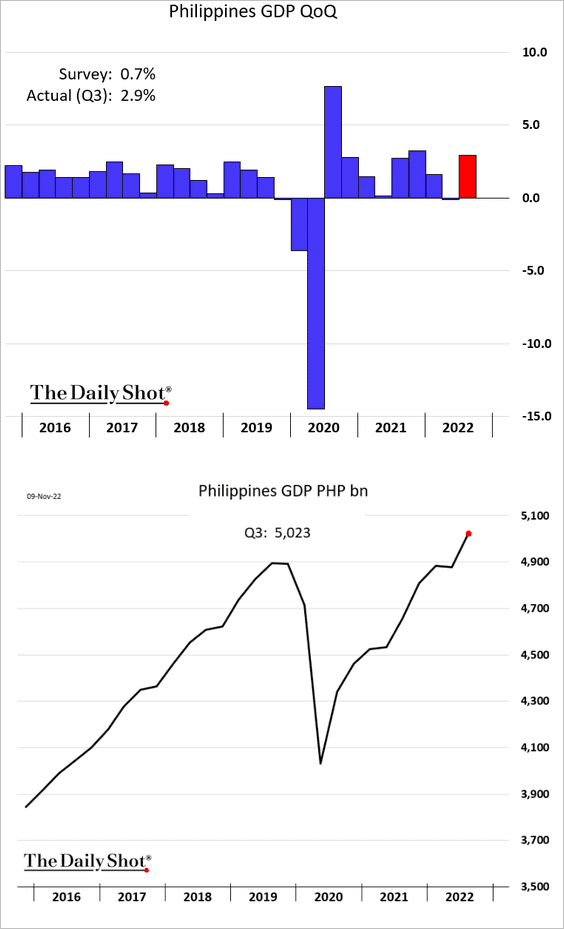

3. The Philippine third-quarter GDP growth surprised to the upside.

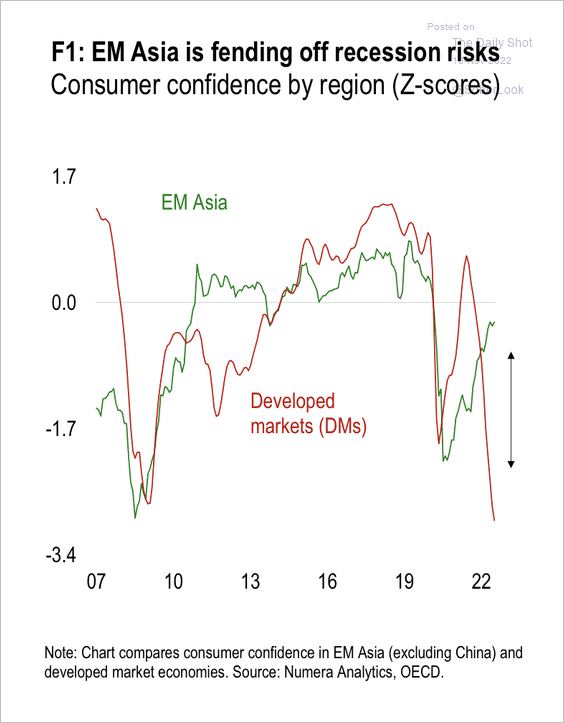

4. Consumer confidence in EM Asia is holding up versus developed markets.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Cryptocurrency

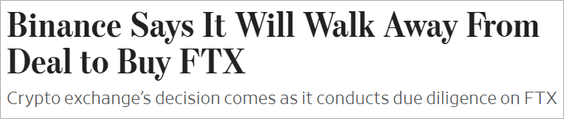

1. Binance will not acquire FTX after all, which triggered another round of selling in crypto market.

Source: @WSJ Read full article

Source: @WSJ Read full article

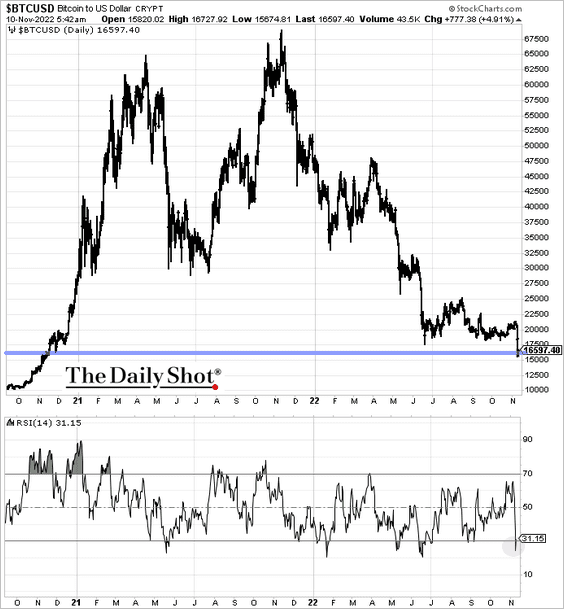

• Bitcoin appears to have found support near 16k.

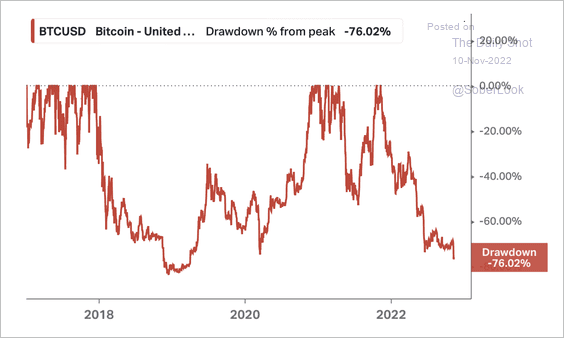

• Bitcoin is down about 76% from its peak, compared with an 83% max drawdown during the 2018 bear market.

Source: Koyfin

Source: Koyfin

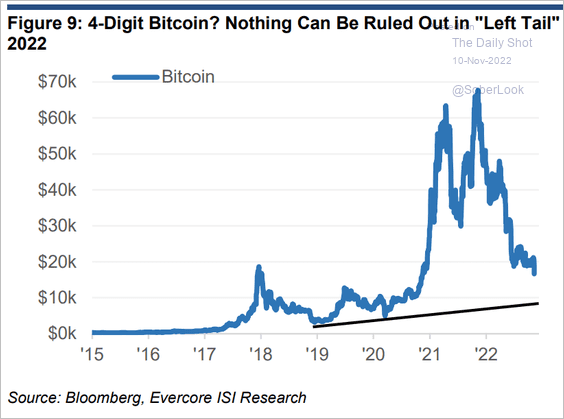

• More room to fall?

Source: Evercore ISI Research

Source: Evercore ISI Research

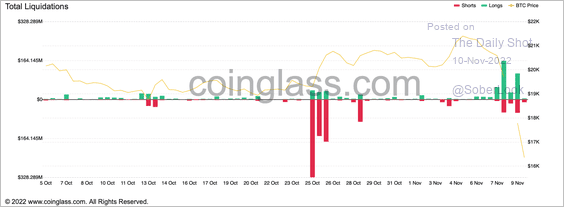

2. Long BTC liquidations increased over the past two days.

Source: Coinglass

Source: Coinglass

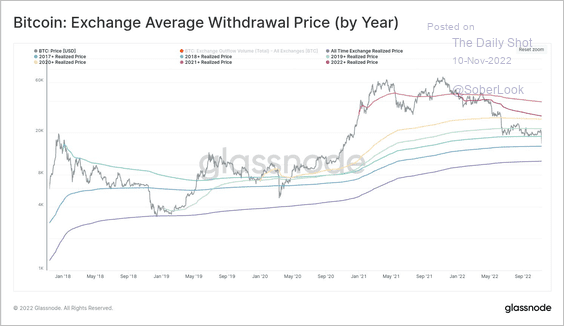

3. Only investors who acquired bitcoin in 2017 and earlier are in profit, based on the average exchange withdrawal price analyzed by Glassnode.

Source: @glassnode

Source: @glassnode

4. Bitcoin’s implied volatility keeps surging.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

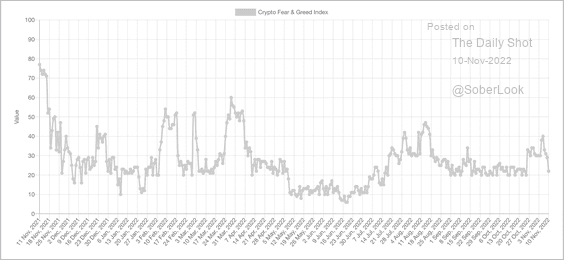

5. The Crypto Fear & Greed Index returned to “extreme fear” territory.

Source: Alternative.me

Source: Alternative.me

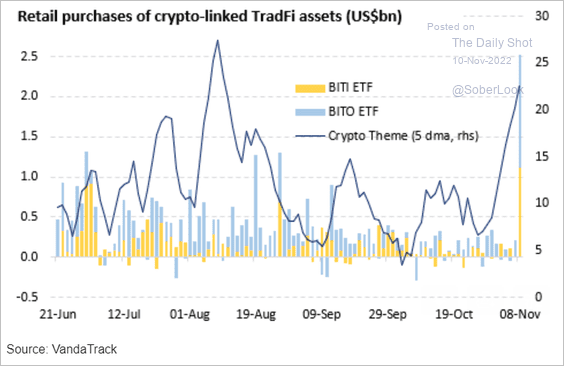

6. Retail investors bought crypto-linked products going into the crash.

Source: Vanda Research

Source: Vanda Research

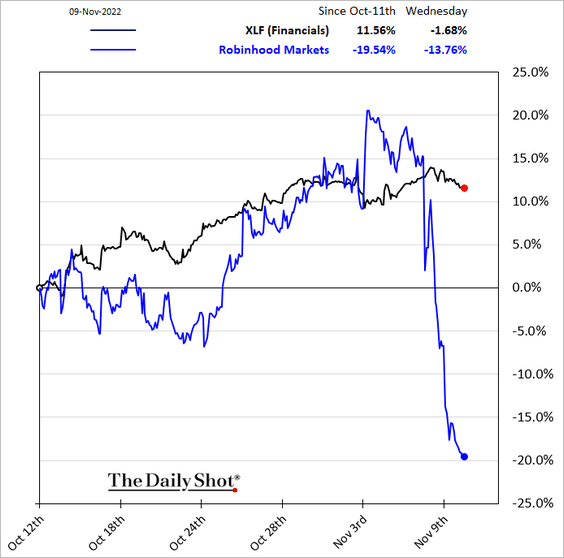

7. Robinhood shares took a hit this week, driven by the crypto rout.

Back to Index

Energy

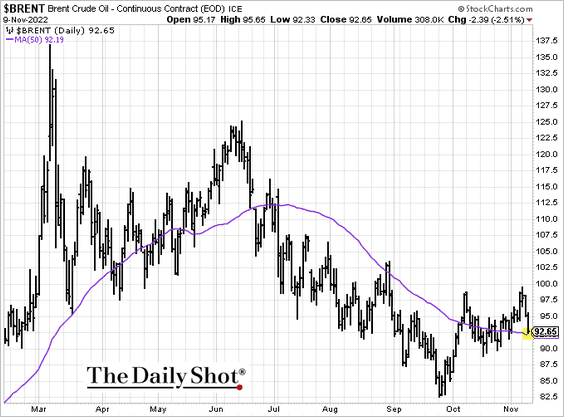

1. Brent is at the 50-day moving average.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

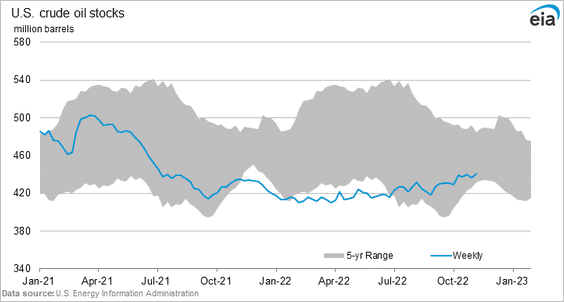

2. US oil inventories increased last week.

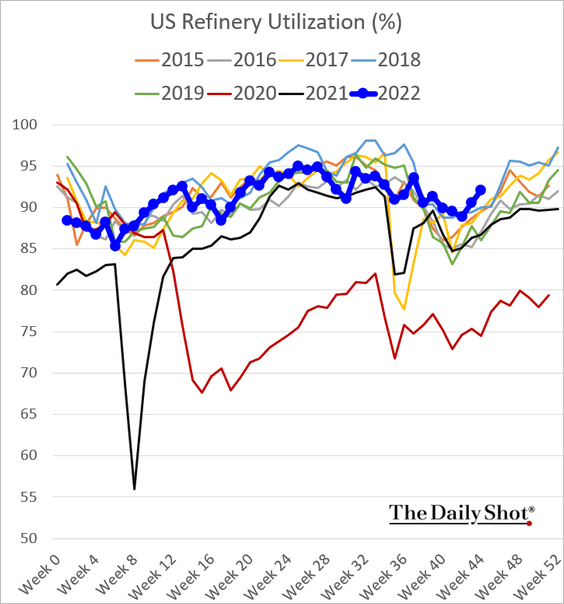

3. US refinery utilization is at a multi-year high for this time of the year.

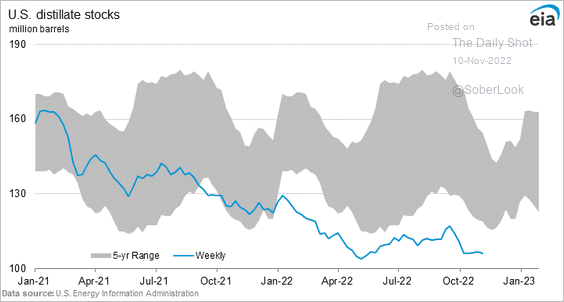

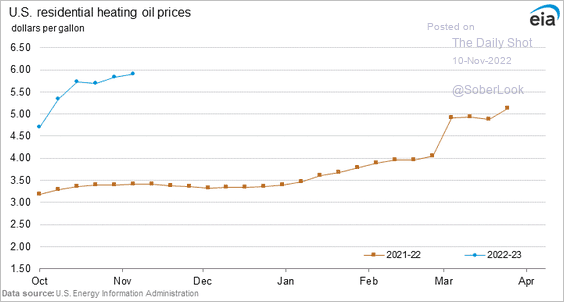

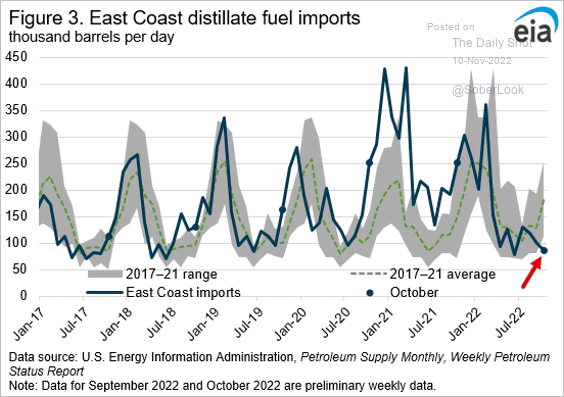

4. Distillates inventories remain very low, …

… driving up diesel and heating oil prices.

Source: @EIAgov

Source: @EIAgov

This chart shows US East Coast distillates imports.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

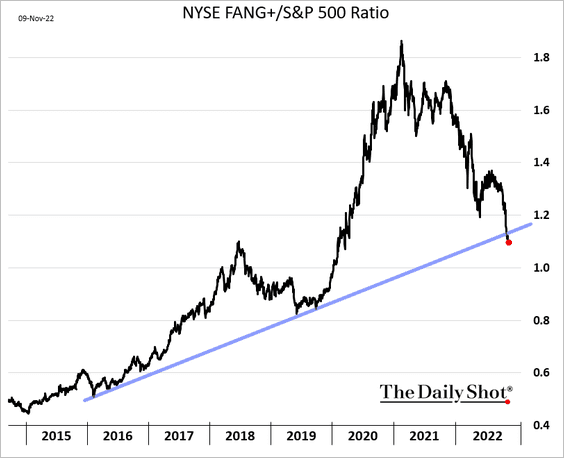

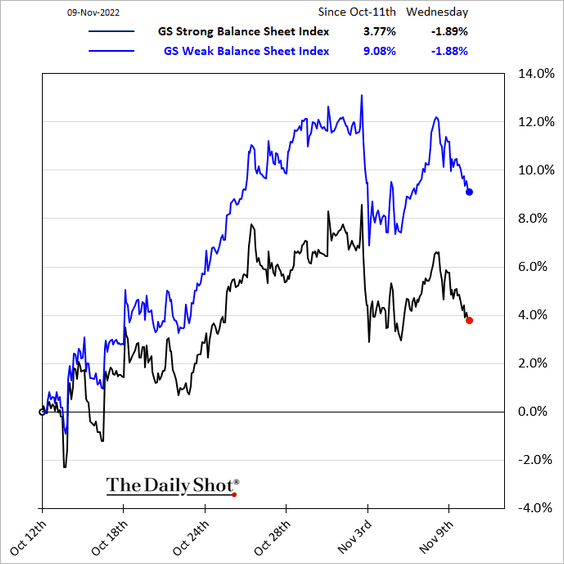

1. Tech mega-caps continue to underperform.

2. Related to the trend above, companies with weak balance sheets have been outperforming.

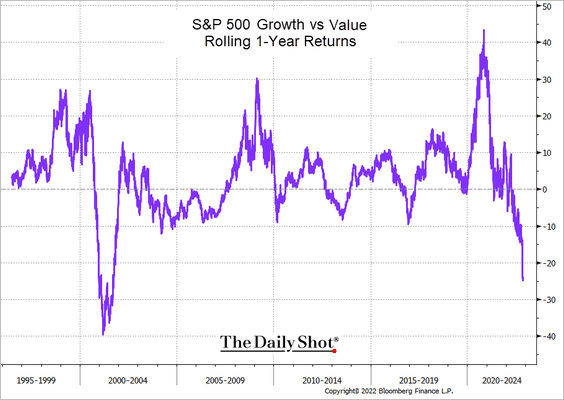

3. Growth stocks are down almost 25% vs. value over the past 12 months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

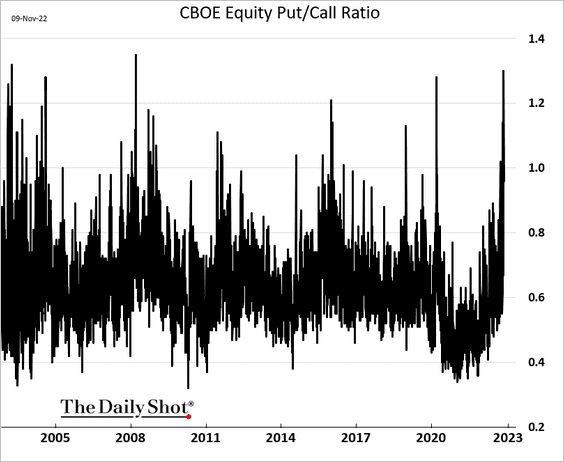

3. The put/call ratio surged this week.

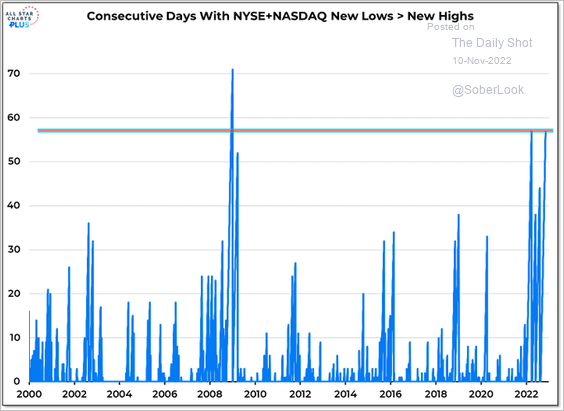

4. New lows continue to exceed new highs.

Source: @WillieDelwiche

Source: @WillieDelwiche

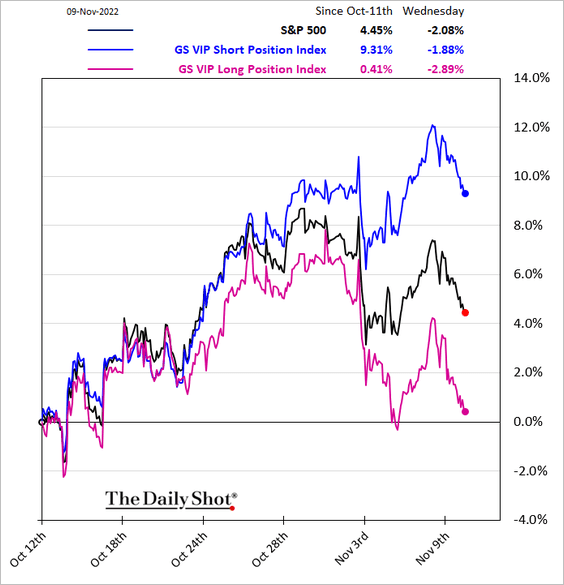

5. Hedge funds’ most loved stocks have massively underperformed their preferred short positions.

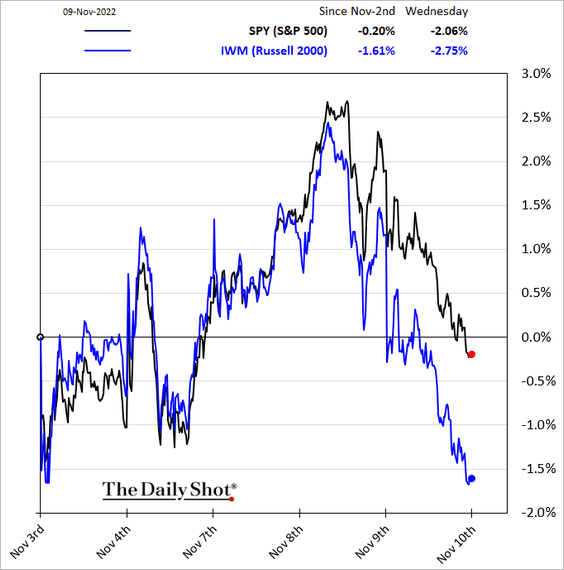

6. Small caps are underperforming again.

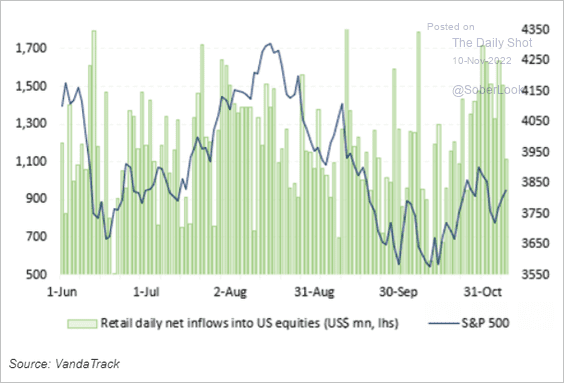

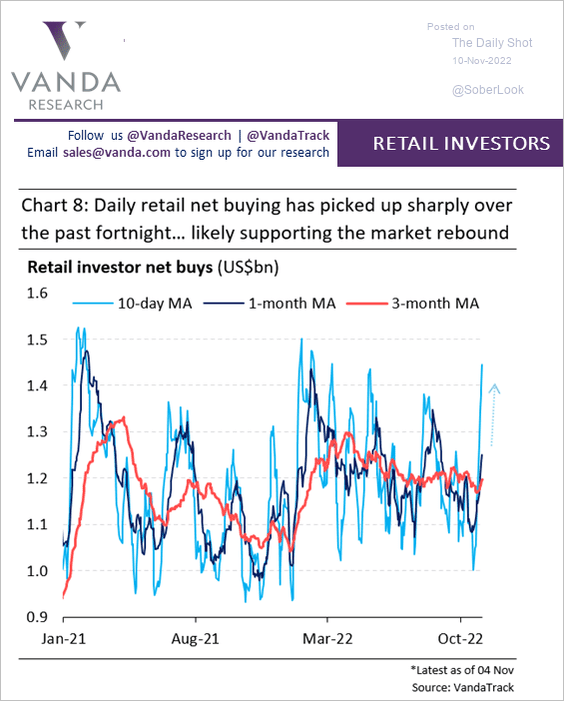

7. Retail investors have been buying equities in recent days (2 charts).

Source: Vanda Research

Source: Vanda Research

Source: Vanda Research

Source: Vanda Research

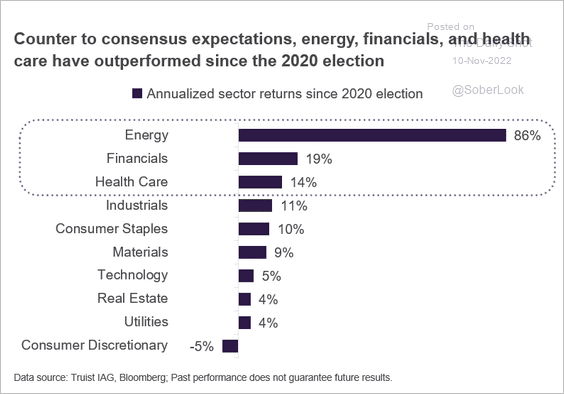

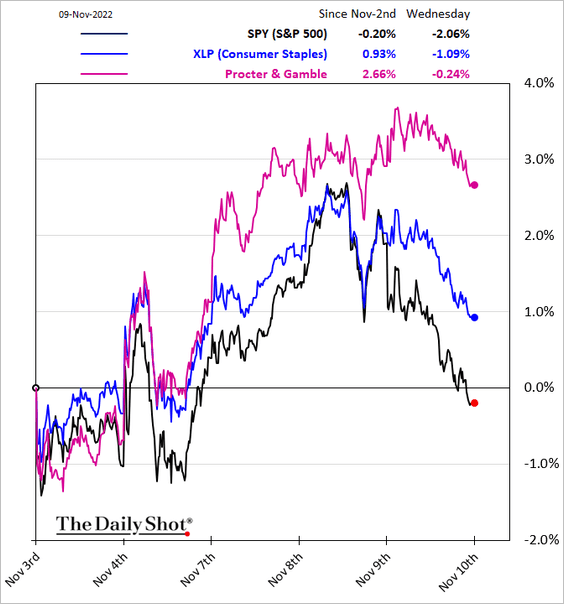

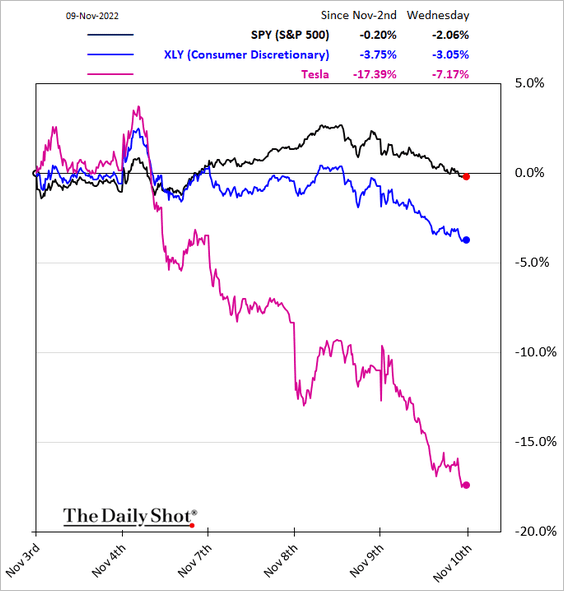

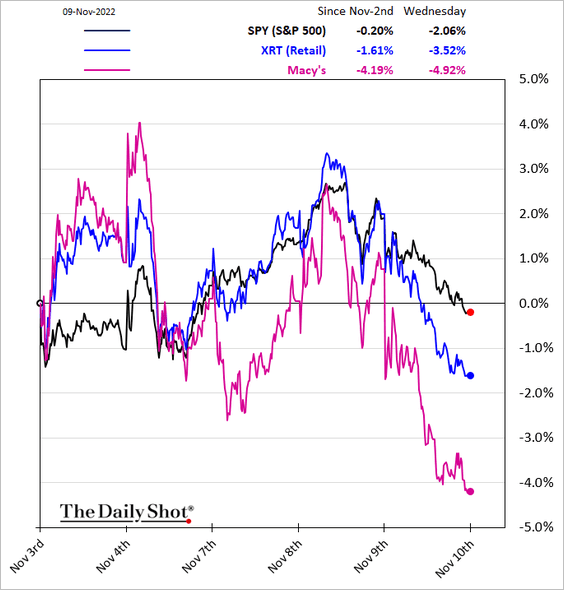

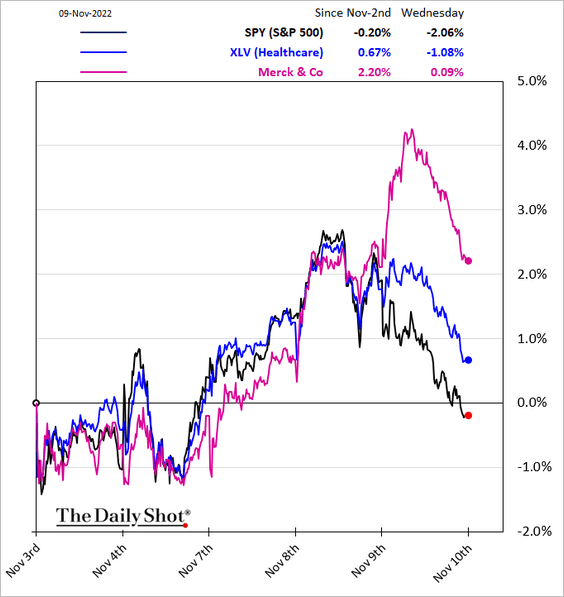

8. Next, we have some sector updates.

• Sector performance since the 2020 election:

Source: Truist Advisory Services

Source: Truist Advisory Services

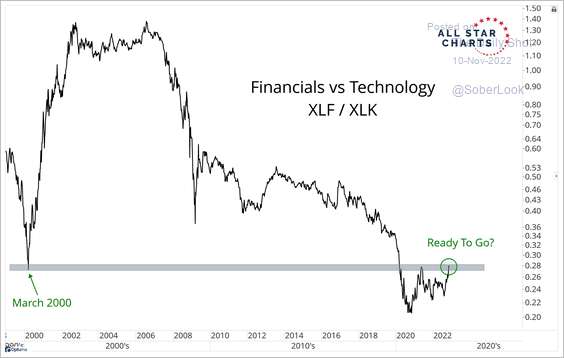

• Financials vs. tech:

Source: @allstarcharts

Source: @allstarcharts

• Sector performance over the past five business days:

– Consumer Staples:

– Consumer Discretionary:

– Retail:

– Healthcare:

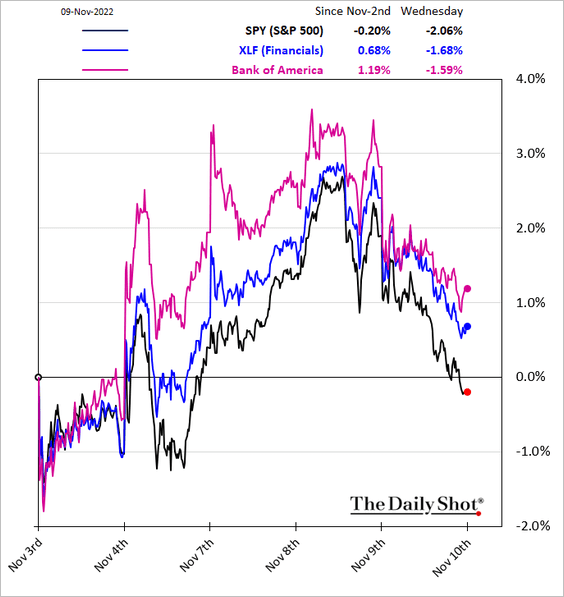

– Financials:

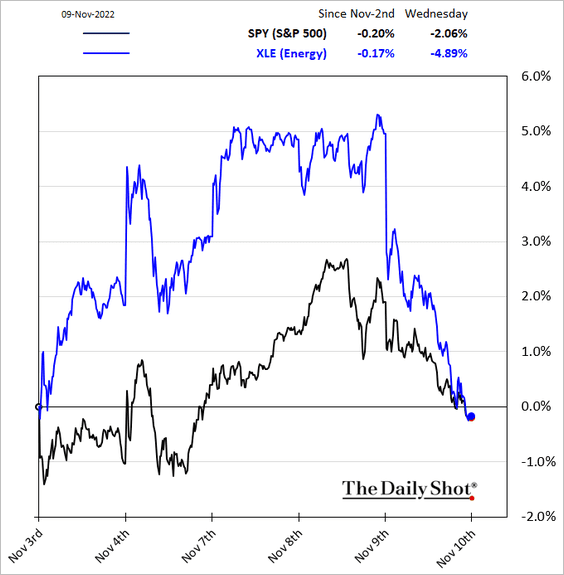

– Energy:

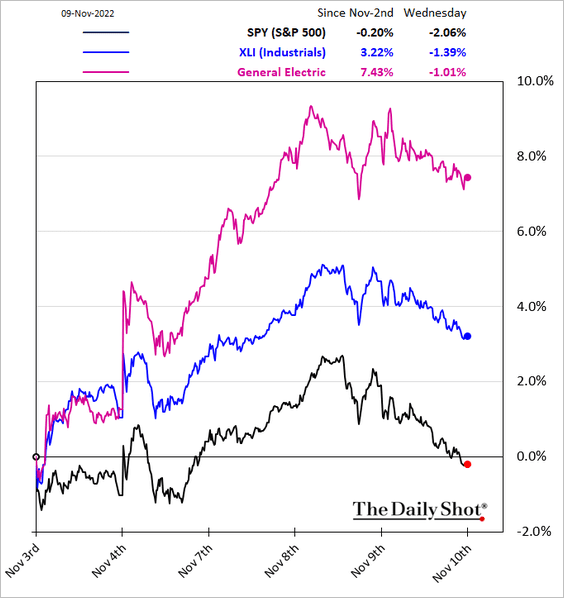

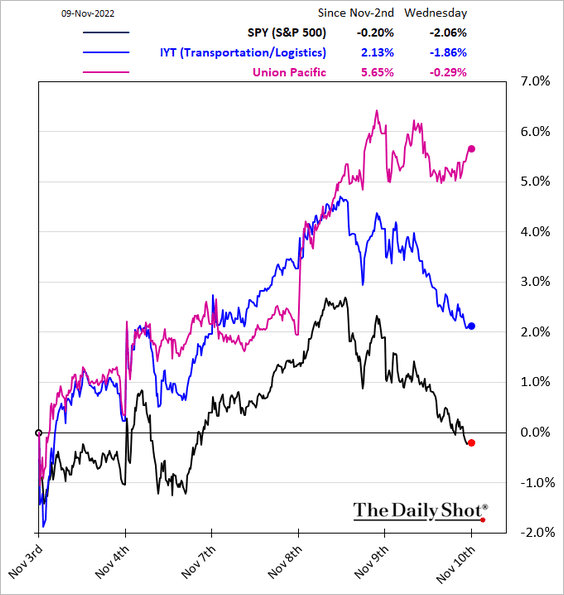

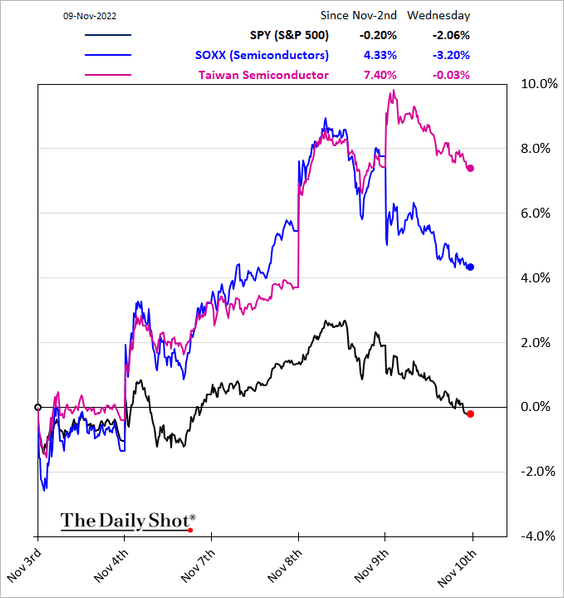

– Industrials (2 charts):

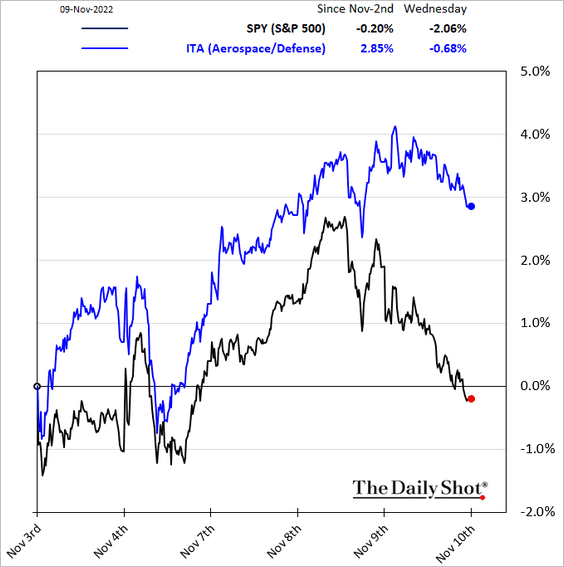

– Transportation:

– Semiconductors:

Back to Index

Credit

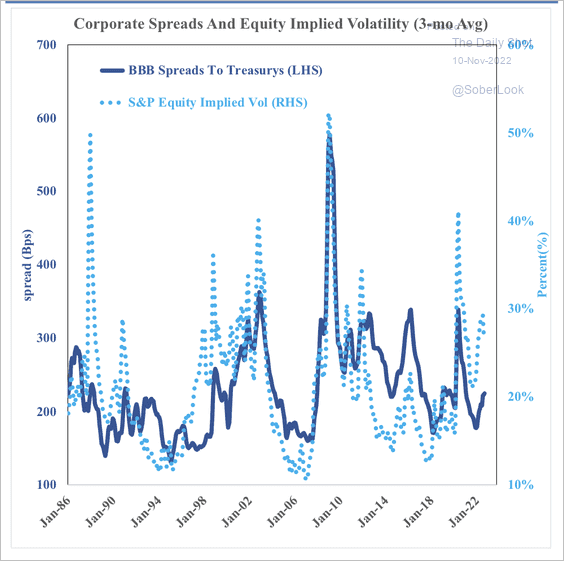

1. The rise in equity volatility points to wider US investment-grade credit spreads.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

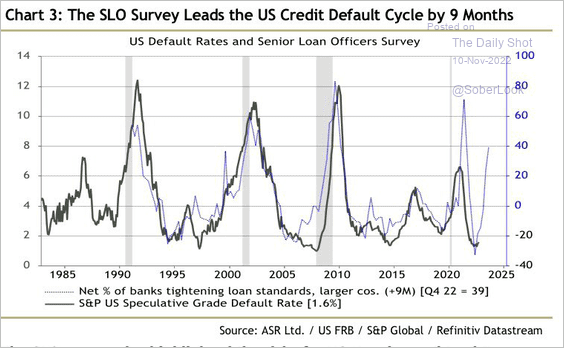

2. Tighter credit conditions signal higher default rates ahead.

Source: @IanRHarnett

Source: @IanRHarnett

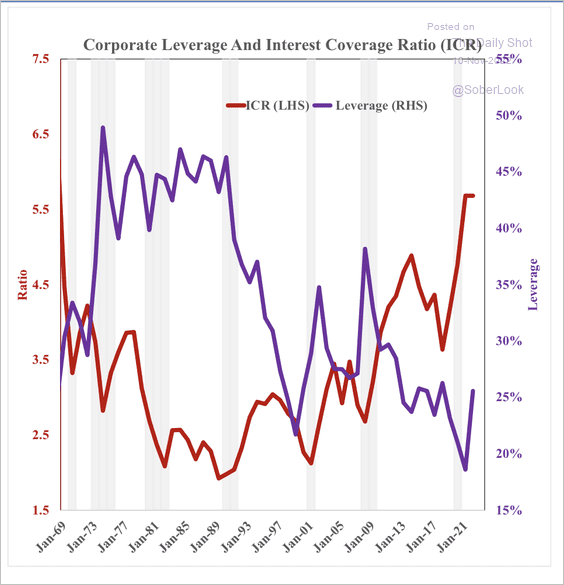

3. Interest coverage has increased as leverage has fallen.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

——————–

Food for Thought

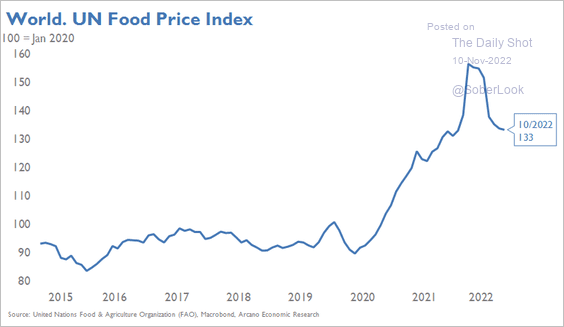

1. Global food prices:

Source: Arcano Economics

Source: Arcano Economics

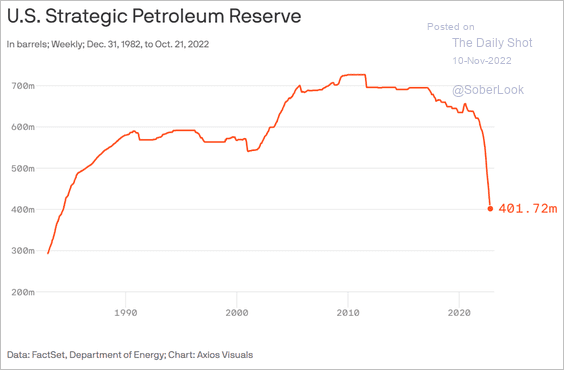

2. The US Strategic Petroleum Reserve:

Source: @axios Read full article

Source: @axios Read full article

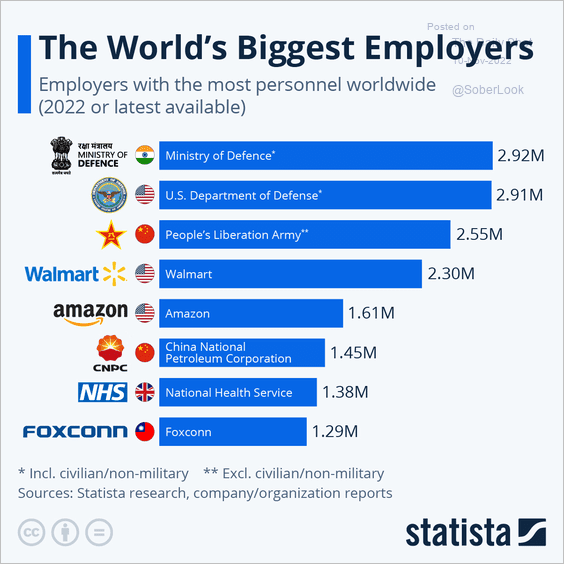

3. The world’s biggest employers:

Source: Statista

Source: Statista

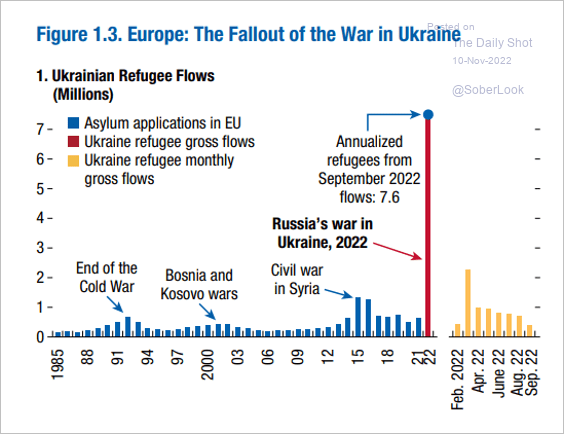

4. Ukrainian refugees in Europe:

Source: IMF Read full article

Source: IMF Read full article

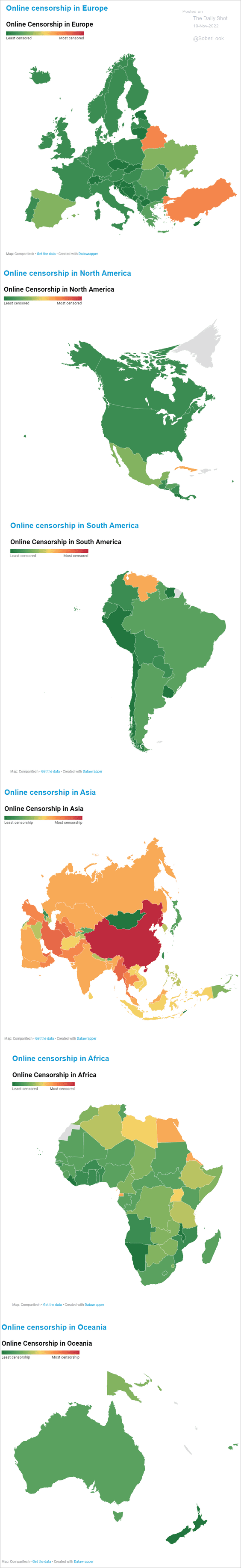

5. Internet censorship around the world:

Source: Comparitech Read full article

Source: Comparitech Read full article

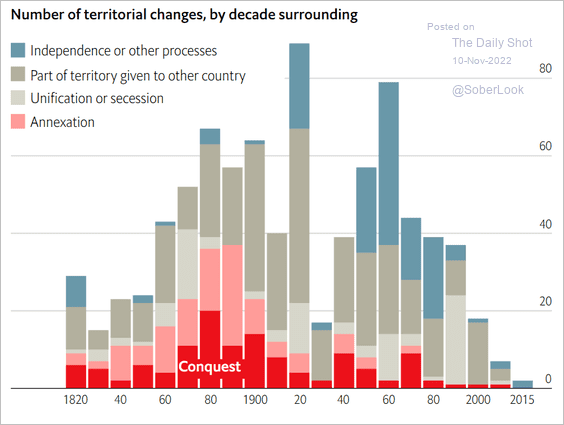

6. The number of territorial changes over time:

Source: The Economist Read full article

Source: The Economist Read full article

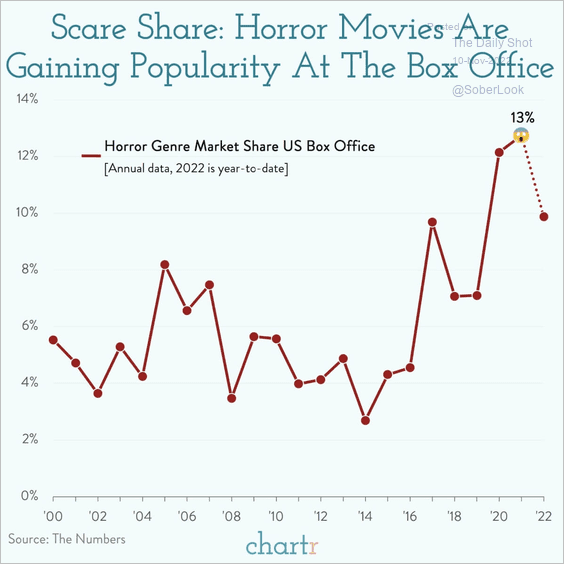

7. Horror movies’ market share:

Source: @chartrdaily

Source: @chartrdaily

——————–

.

Back to Index