The Daily Shot: 14-Nov-22

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

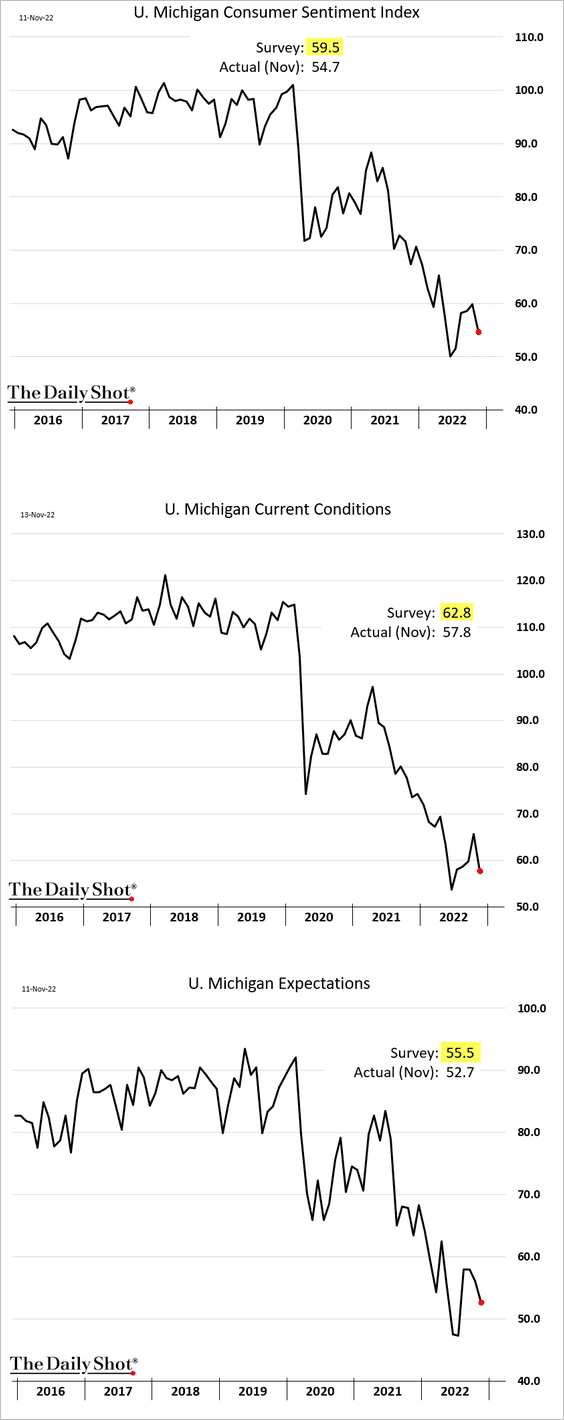

1. The U. Michigan Consumer Sentiment Index softened this month (coming in below forecasts), with both the current conditions and expectations indices registering declines.

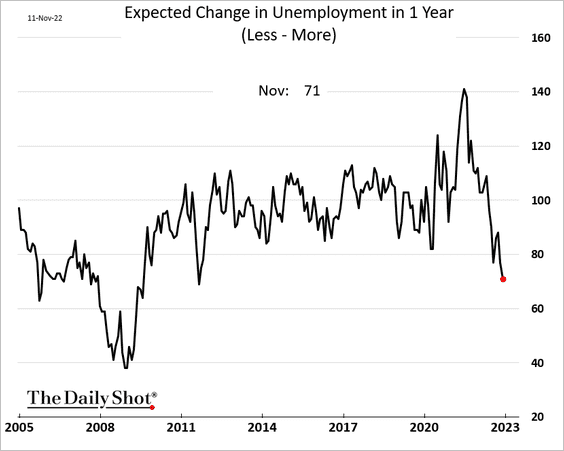

• Consumers increasingly expect a weaker job market.

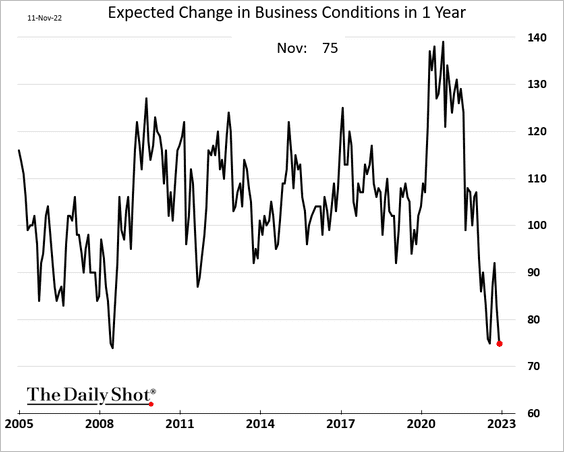

• Expected changes in business conditions are similar to the GFC lows.

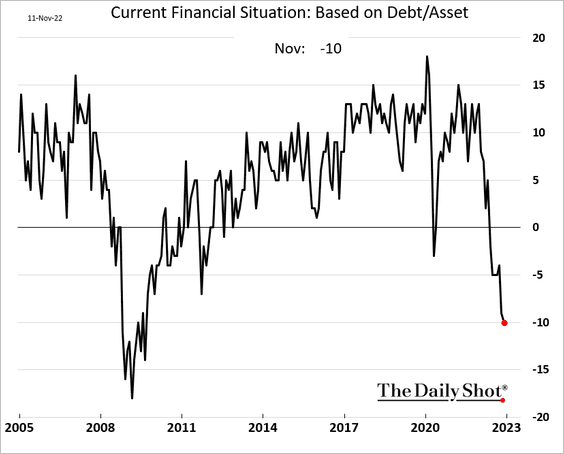

• Households see a deterioration in their balance sheets.

——————–

2. Next, we have some updates on inflation.

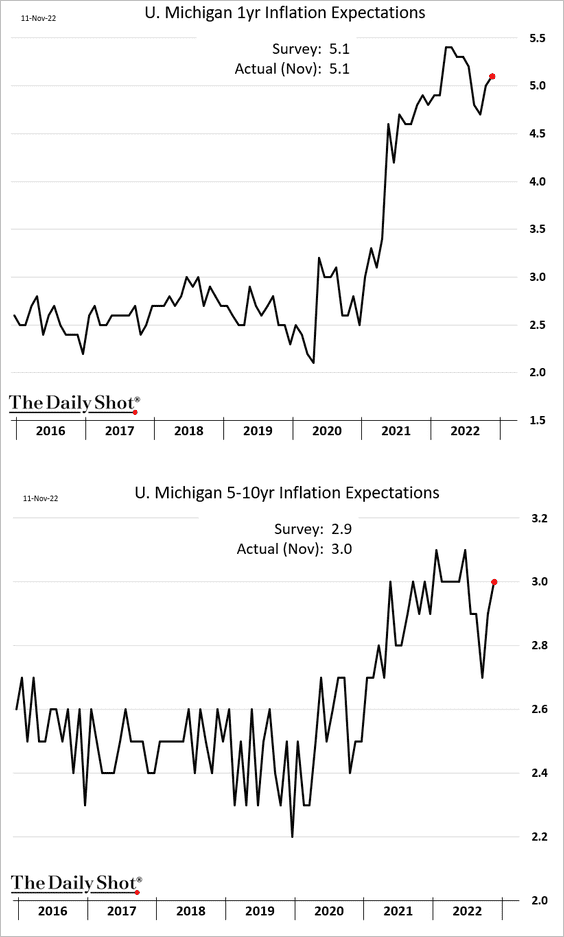

• Inflation expectations climbed again this month, raising concerns about price expectations becoming unanchored.

Compounding these concerns, households expect higher incomes ahead.

——————–

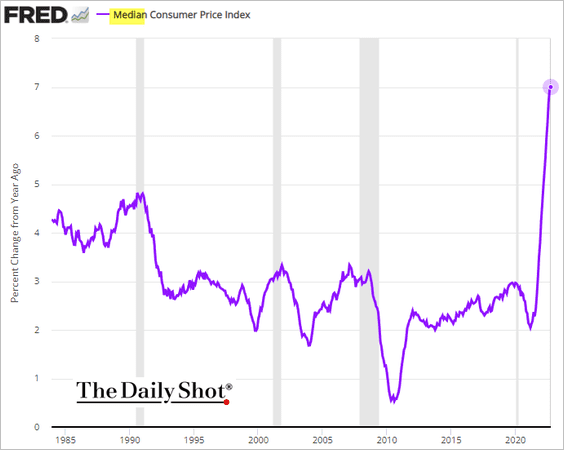

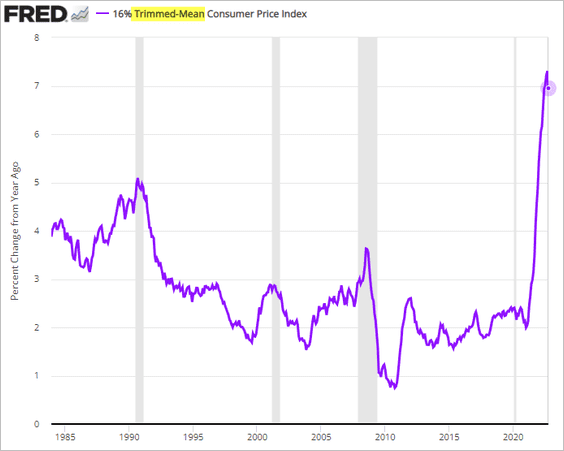

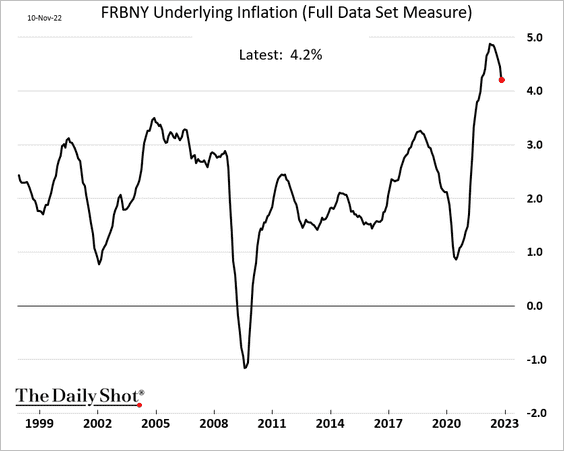

• Here are some alternative CPI measures.

– Median CPI:

– Trimmed-mean:

– The NY Fed’s UIG:

——————–

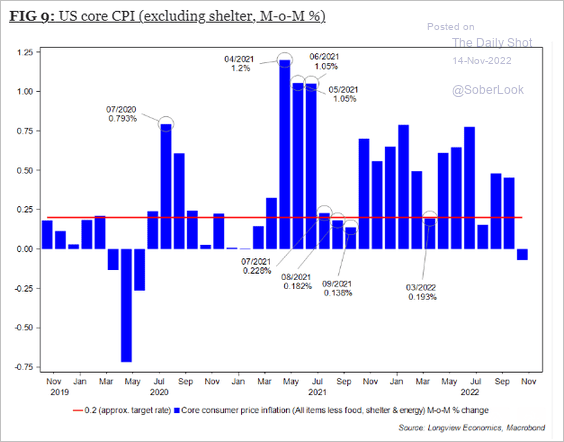

• The core CPI ex-shelter declined last month.

Source: Longview Economics

Source: Longview Economics

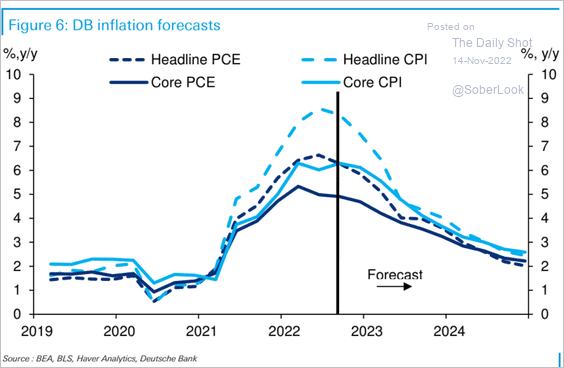

• Has the core CPI peaked?

– Forecast from Deutsche Bank:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

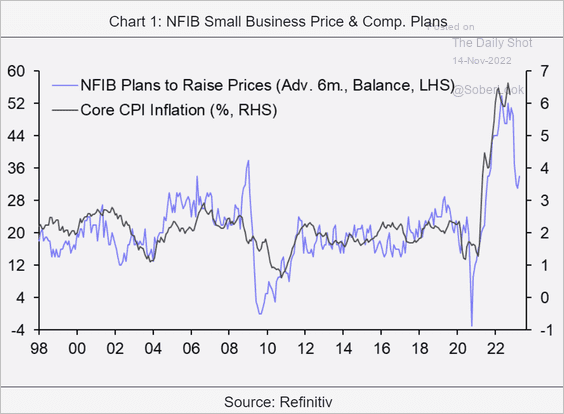

– Core CPI vs. small-business price plans:

Source: Capital Economics

Source: Capital Economics

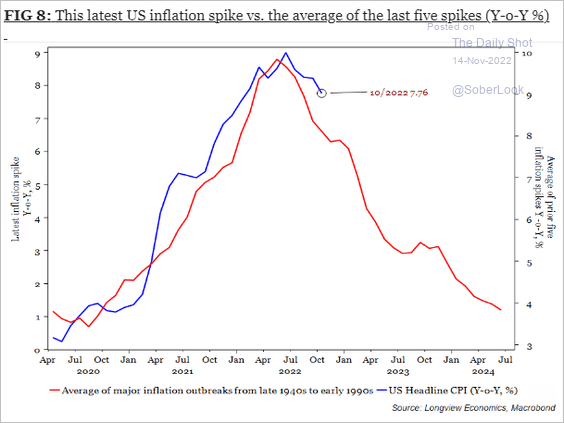

This chart shows the headline CPI relative to historical cycles.

Source: Longview Economics

Source: Longview Economics

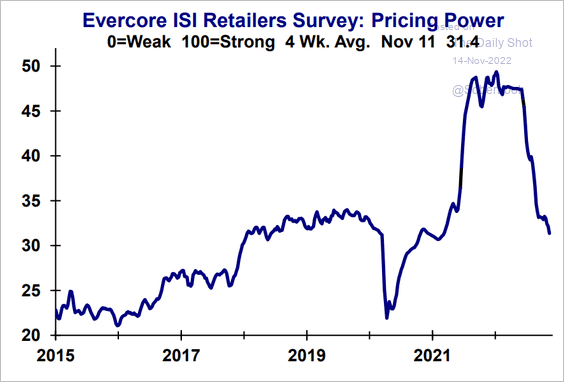

• Retailers’ pricing power continues to weaken as inventories climb.

Source: Evercore ISI Research

Source: Evercore ISI Research

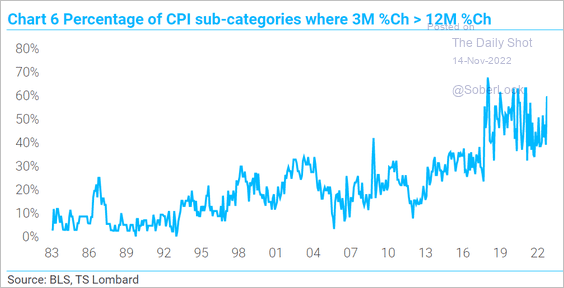

• How many CPI sub-categories have increased more in the past three months than in the past 12 months?

Source: TS Lombard

Source: TS Lombard

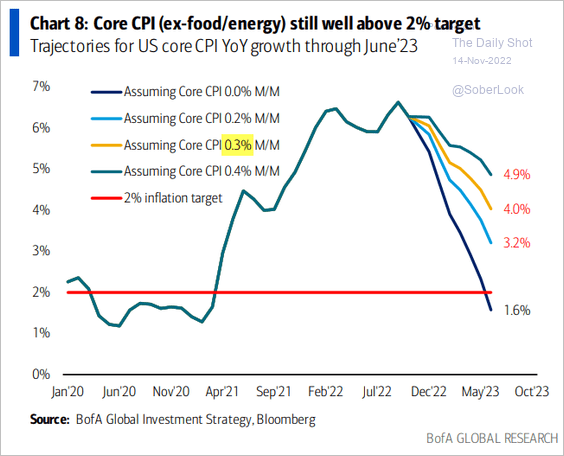

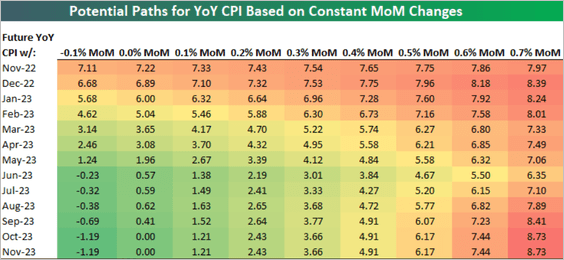

• The charts below show how fast the CPI will decline on a year-over-year basis given different monthly CPI assumptions.

Source: BofA Global Research

Source: BofA Global Research

Source: @bespokeinvest

Source: @bespokeinvest

——————–

3. Mortgage rates declined sharply last week.

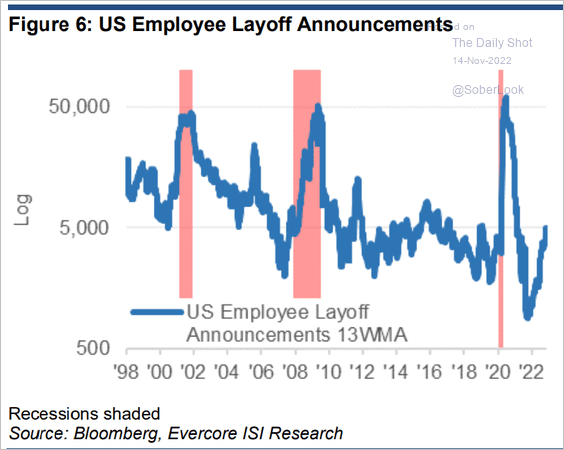

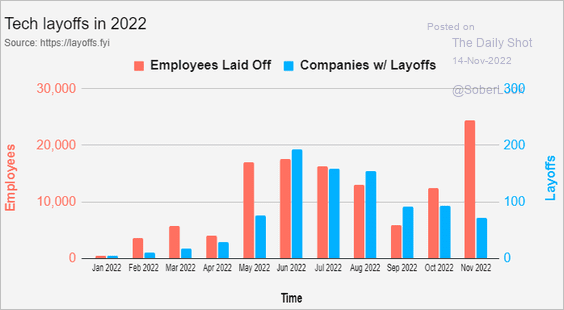

4. Layoff announcements are still relatively low but are trending up.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

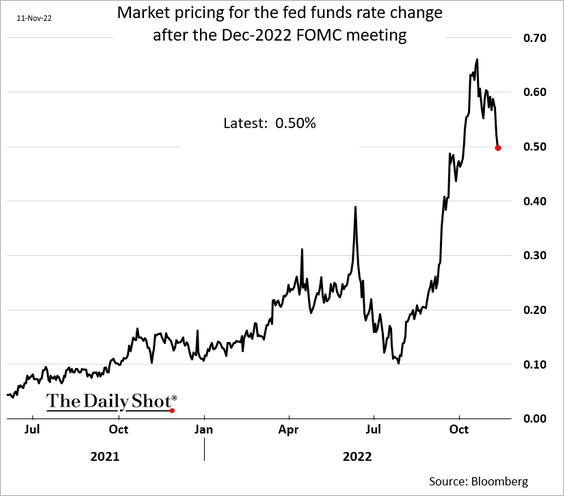

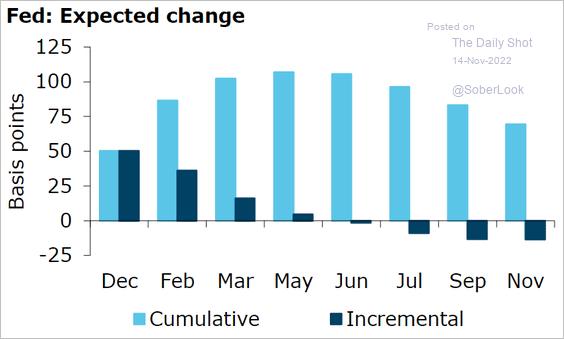

5. The markets have taken the possibility of a 75 bps rate hike in December off the table.

Expectations for February are somewhere between 25 and 50 bps.

Source: @ANZ_Research

Source: @ANZ_Research

Did the markets get ahead of themselves last week based on a single CPI report?

Source: @markets, @Swatisays Read full article

Source: @markets, @Swatisays Read full article

——————–

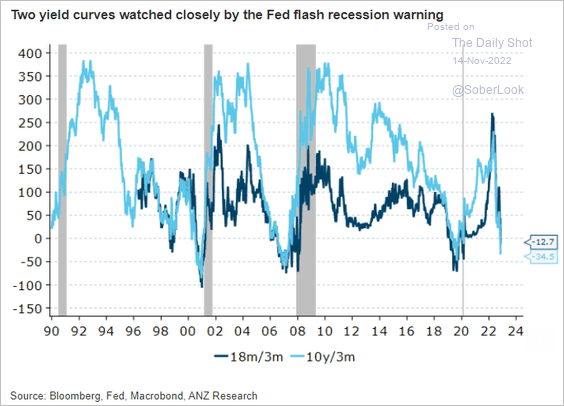

6. The portions of the Treasury curve tracked closely by the Fed remain inverted.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

The United Kingdom

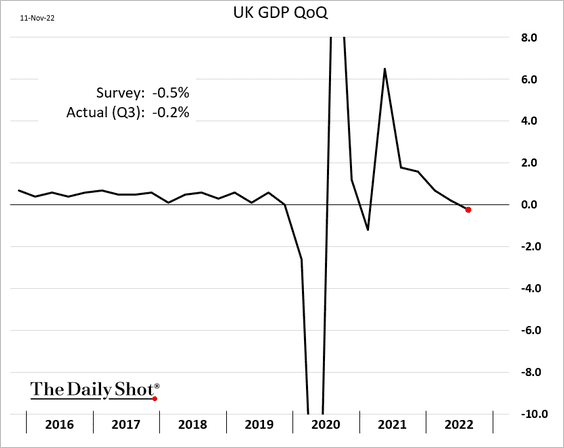

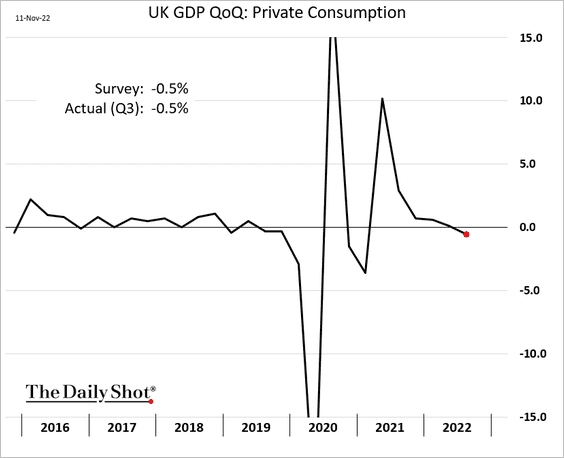

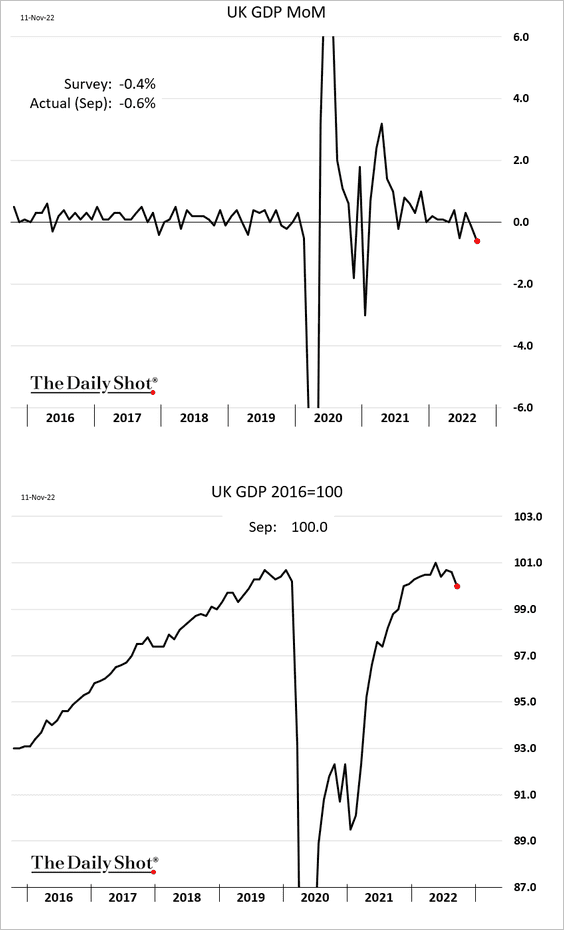

1. The GDP declined less than expected last quarter, …

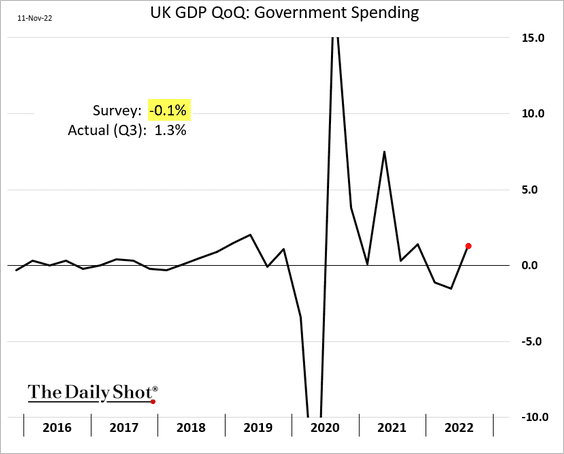

… supported by government spending …

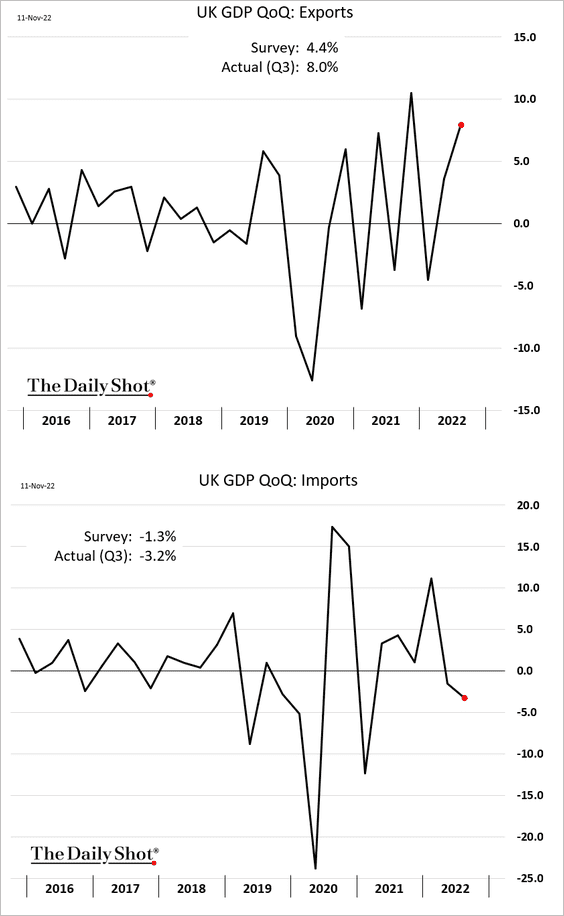

… and improved net exports.

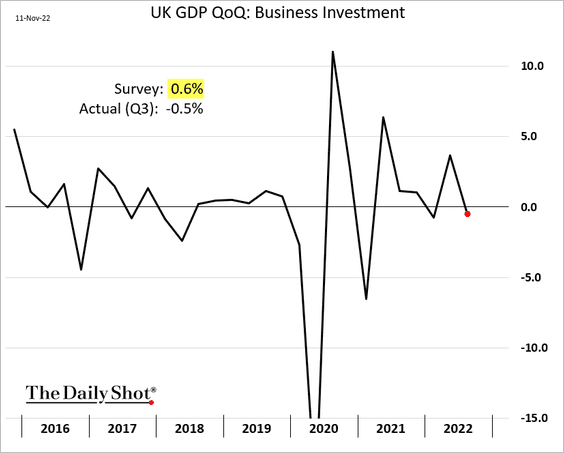

But consumer spending and business investment were down.

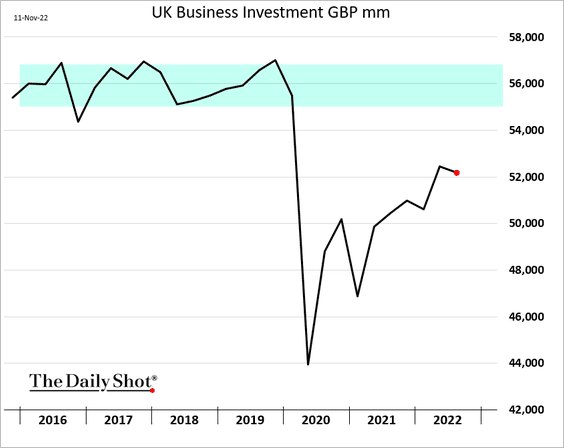

Business investment remains well below pre-COVID levels.

• Moreover, growth deteriorated in the last month of the quarter.

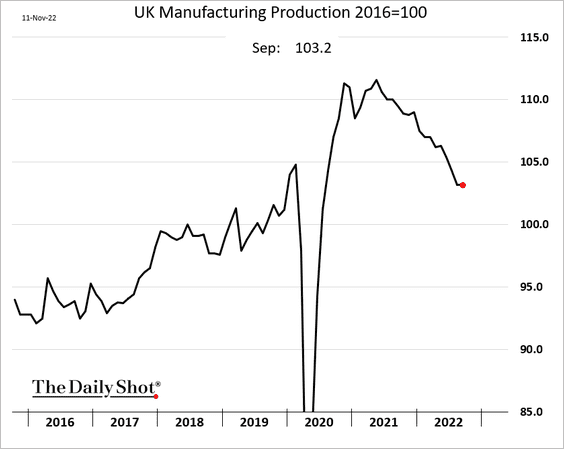

Manufacturing production held steady in September, …

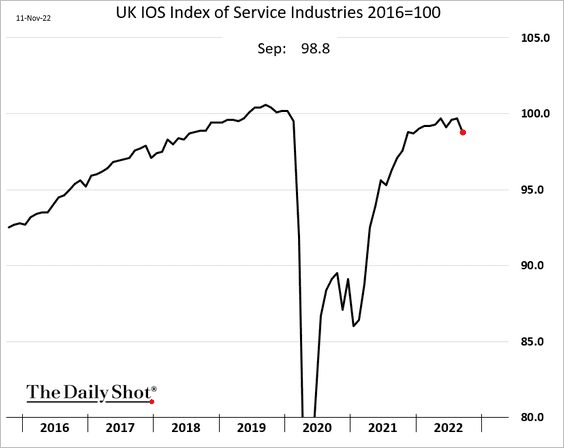

But services output declined.

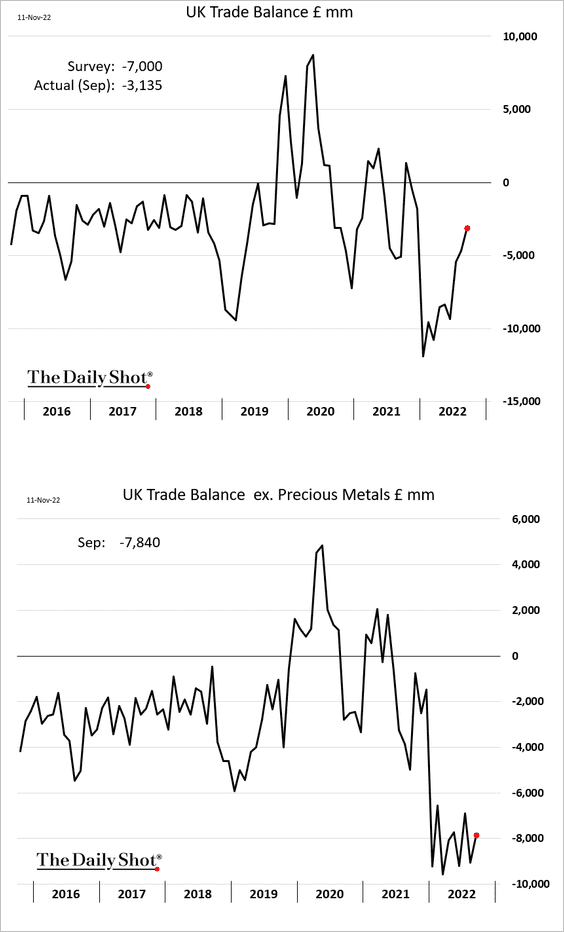

• The trade deficit narrowed, but the improvement was minimal when precious metals are excluded.

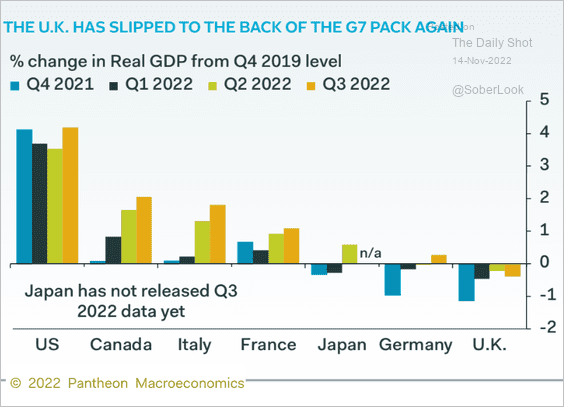

• The COVID-era GDP recovery still lags other advanced economies.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

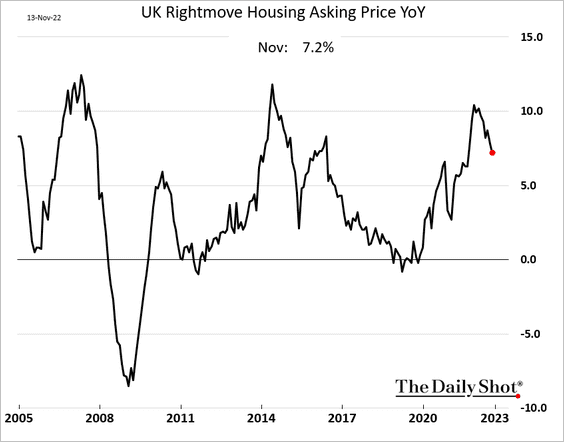

2. Home price appreciation continues to ease.

Back to Index

Europe

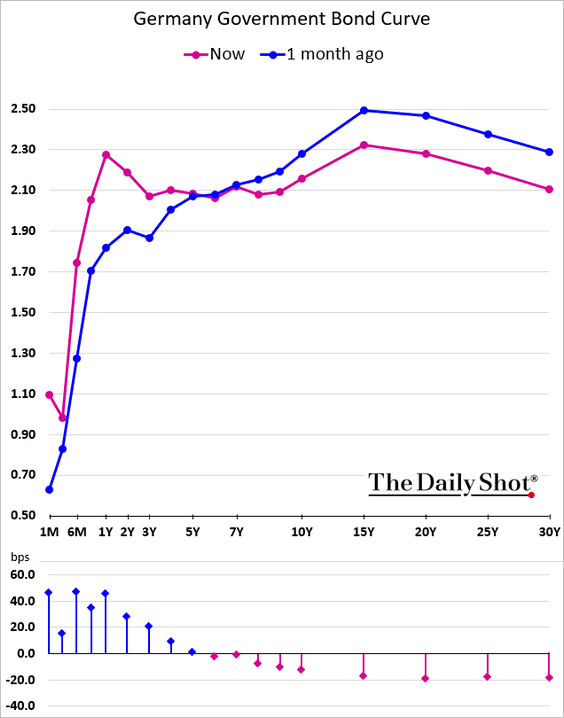

1. Germany’s yield curve remains inverted.

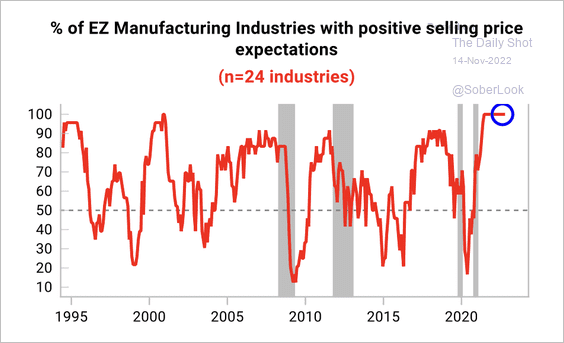

2. Manufacturing surveys show confidence in the ability to pass on high producer prices.

Source: Variant Perception

Source: Variant Perception

3. How did European currencies perform relative to the euro last week?

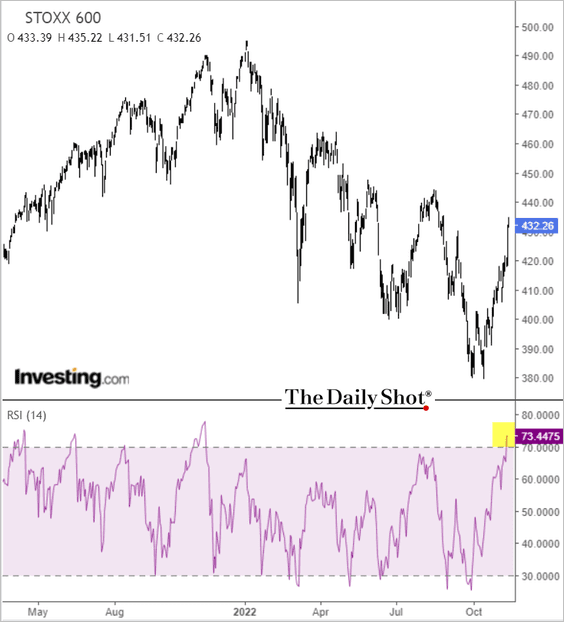

4. European shares are in overbought territory.

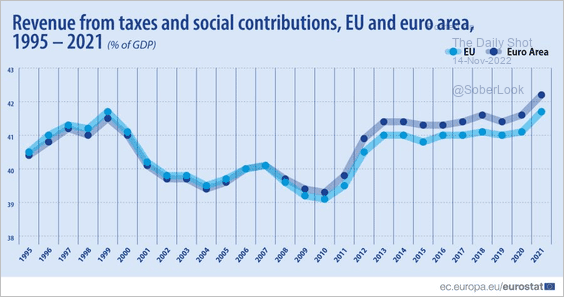

5. This chart shows EU tax collections as a share of GDP.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

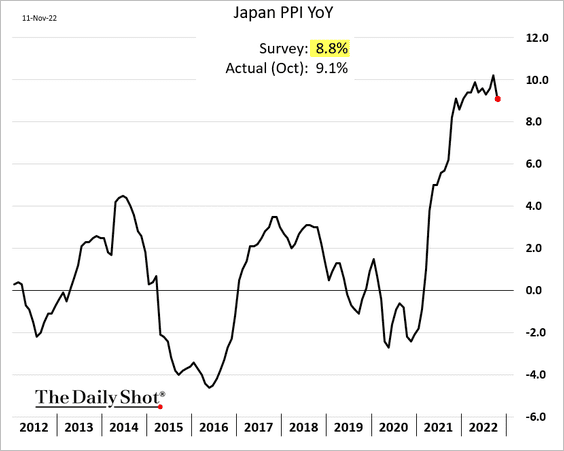

1. Japan’s PPI surprised to the upside last week.

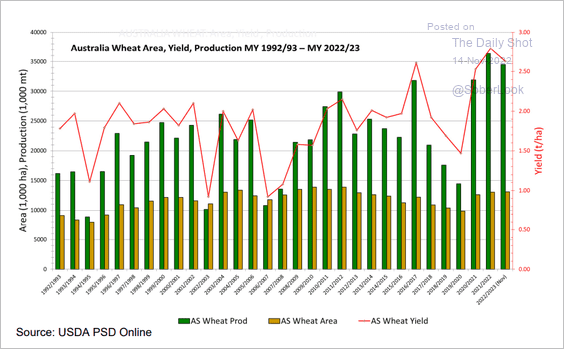

2. Australian wheat yields have been climbing.

Source: USDA Read full article

Source: USDA Read full article

Back to Index

China

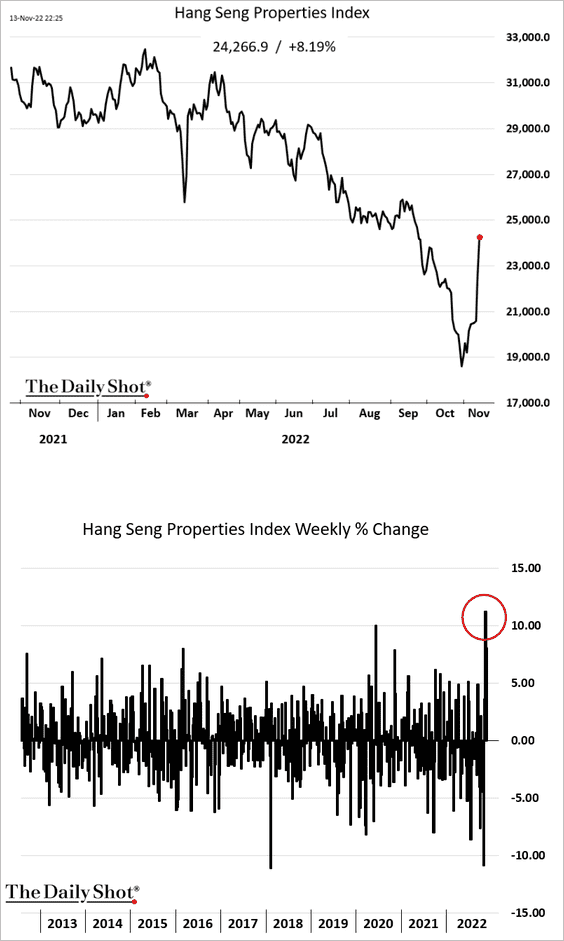

1. Beijing wants the banking system to support property developers.

Source: Reuters Read full article

Source: Reuters Read full article

Property stocks are surging.

——————–

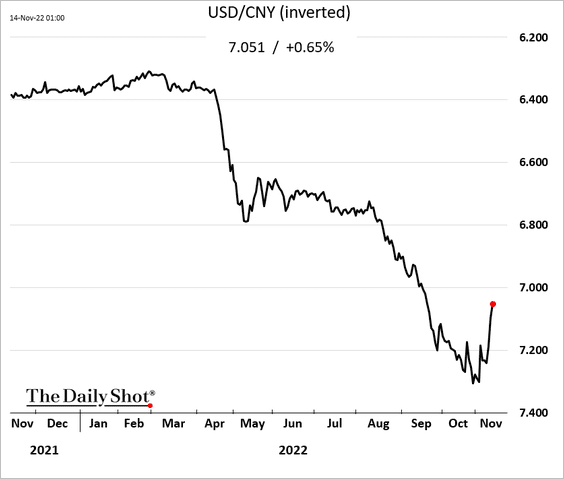

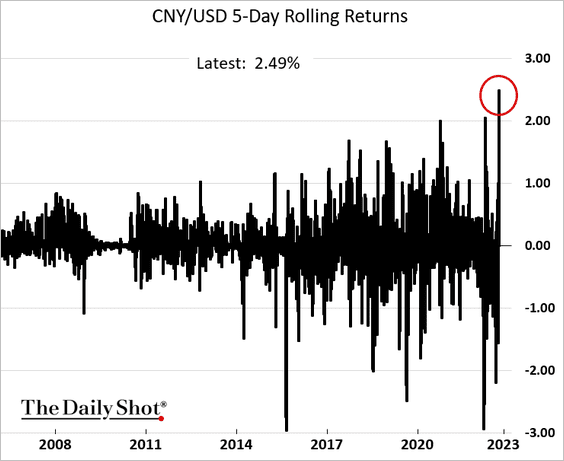

2. The renminbi had the best five days vs. USD in years.

——————–

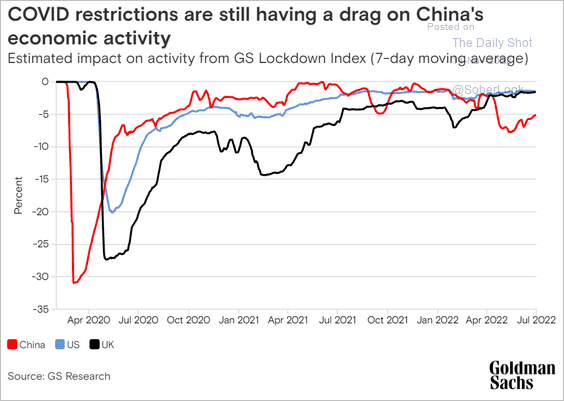

3. COVID remains a drag on economic activity.

Source: Goldman Sachs

Source: Goldman Sachs

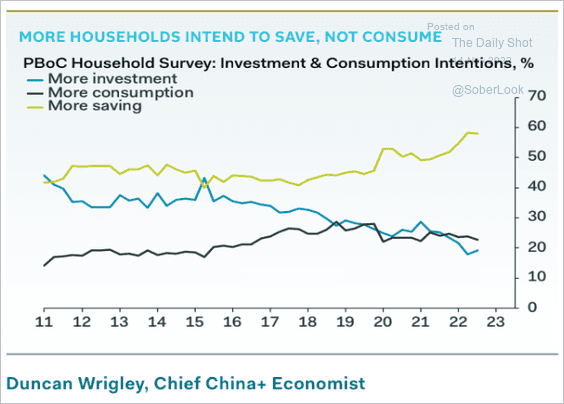

4. Consumers are not keen on spending.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

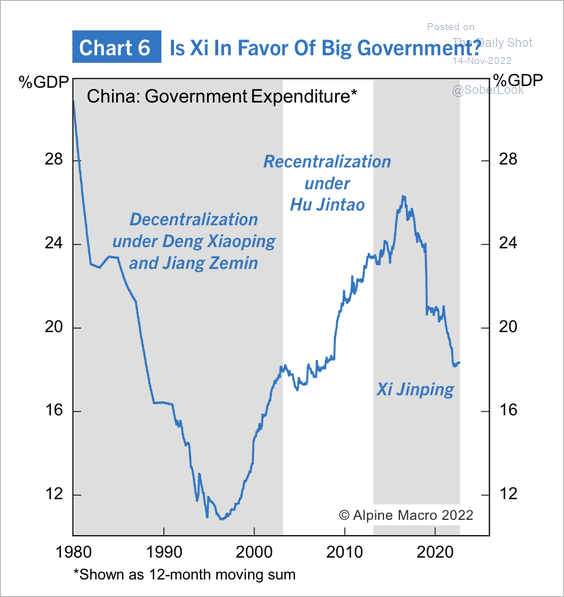

5. Government spending has declined under Xi Jinping’s leadership.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

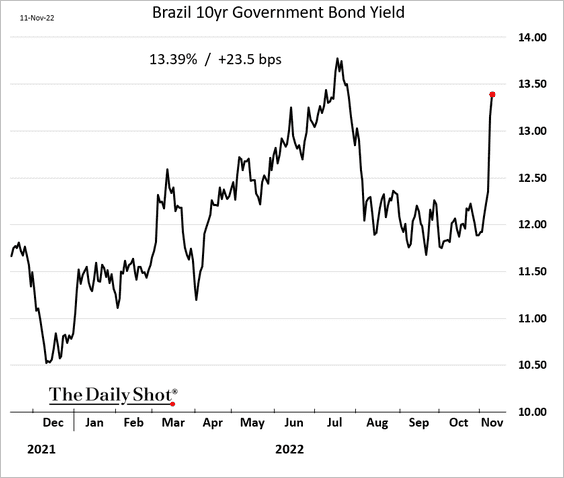

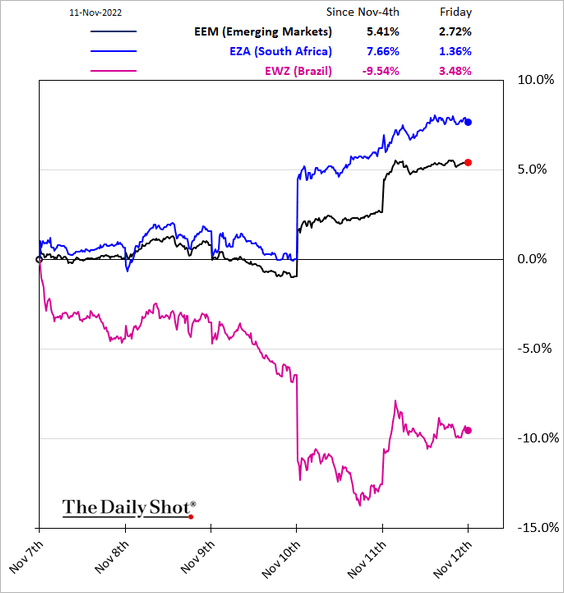

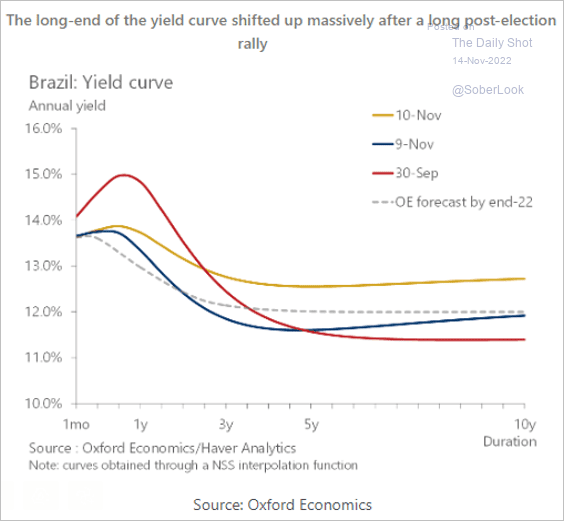

Emerging Markets

1. It was a challenging week for Brazilian assets (2 charts).

• Here is the evolution of Brazil’s yield curve.

Source: Oxford Economics

Source: Oxford Economics

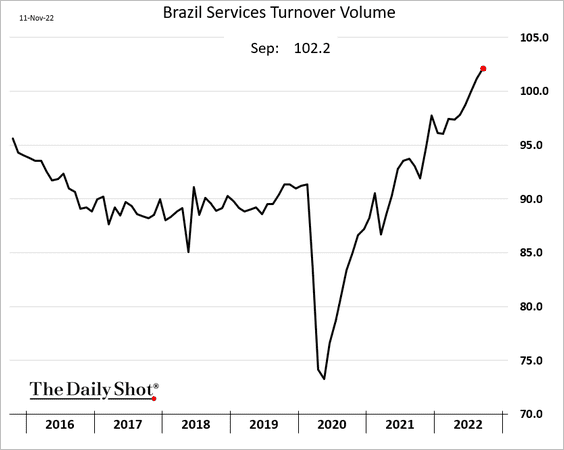

• Service sector activity has been strong.

——————–

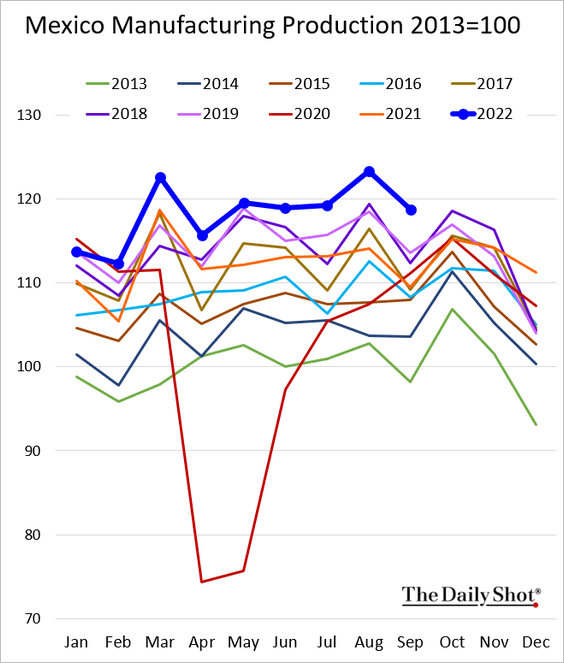

2. Mexico’s factory output remains robust.

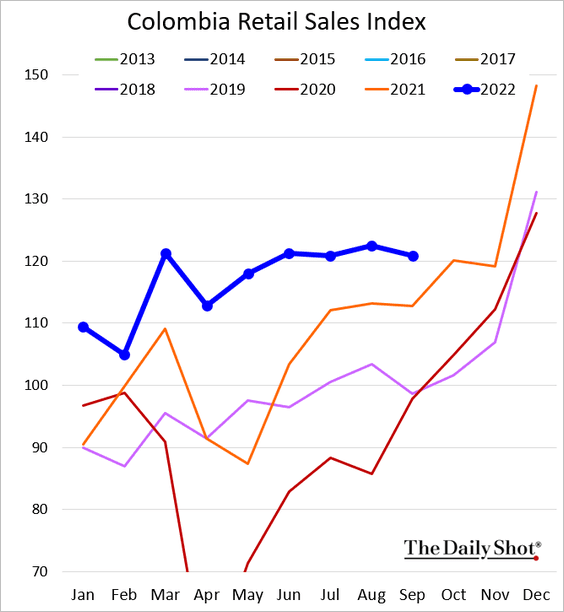

3. Colombia’s retail sales have leveled off.

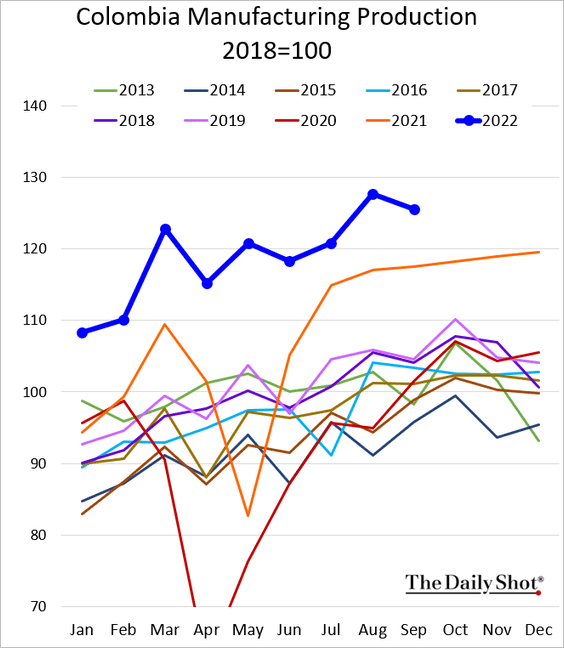

Manufacturing output is still quite strong.

——————–

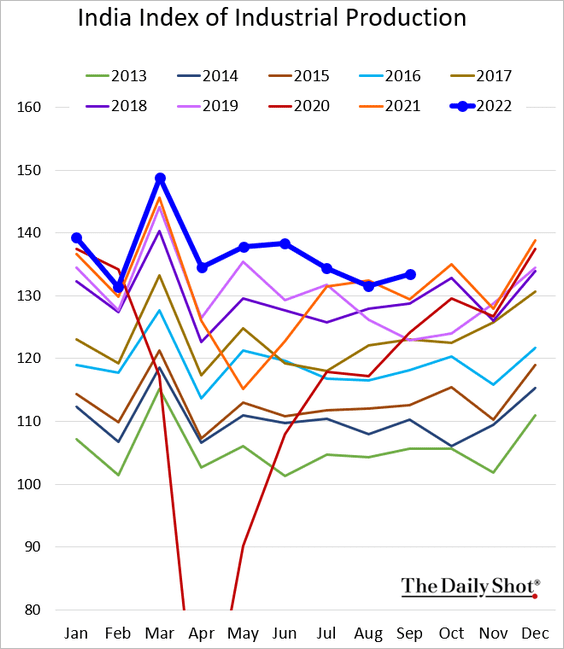

4. India’s industrial production is back above last year’s levels.

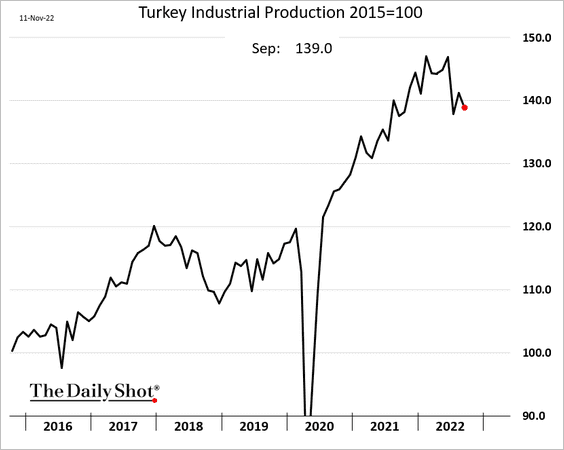

5 Turkey’s industrial production has been rolling over (driven by weakness in the Eurozone).

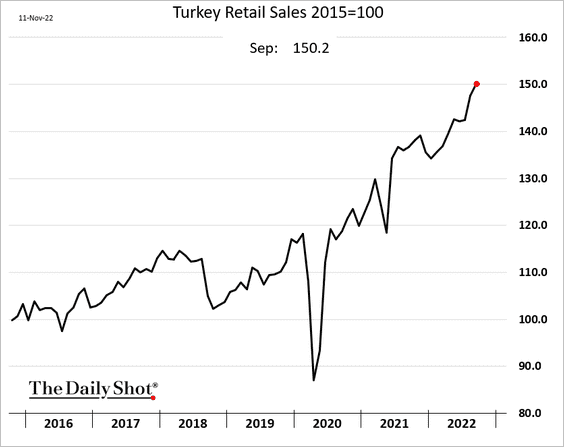

But the nation’s retail sales continue to climb.

——————–

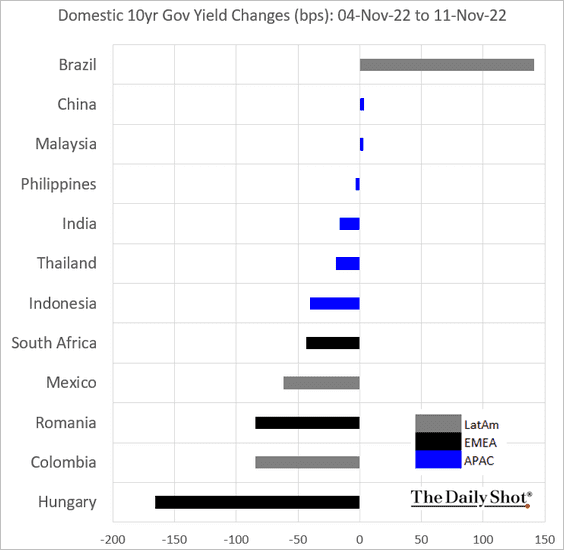

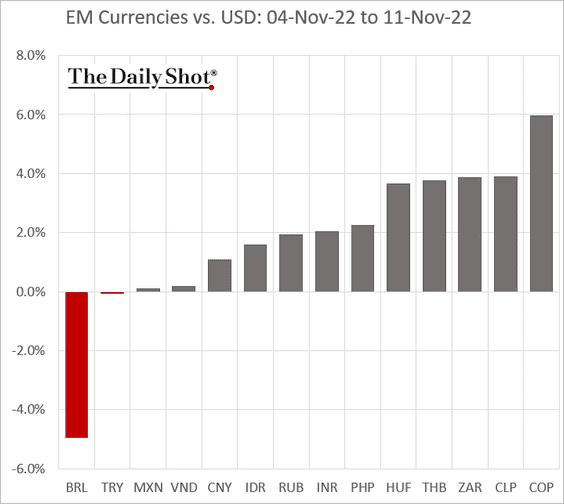

6. Next, we have some performance data from last week.

• Bond yields:

• Currencies:

• Equity ETFs:

Back to Index

Cryptocurrency

1. Concerns about the Crypto.com platform spread over the weekend (after the FTX collapse).

Source: @WSJ Read full article

Source: @WSJ Read full article

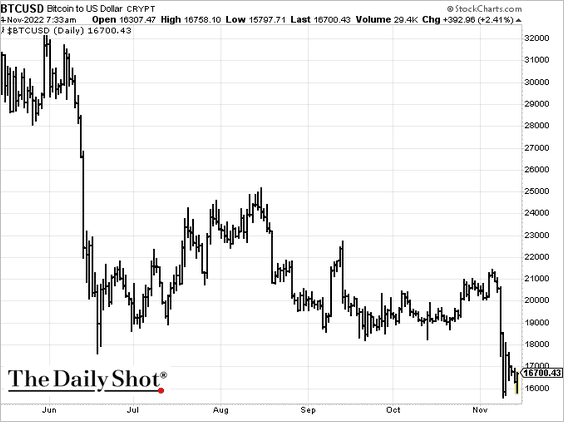

But bitcoin once again held support just below $16k.

——————–

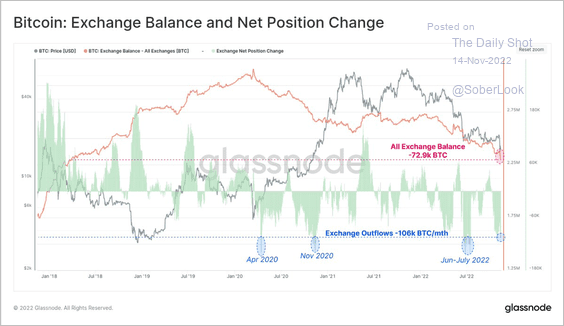

2. Bitcoin investors have been withdrawing tokens off exchanges, either cashing out or moving to self-custody.

Source: @glassnode

Source: @glassnode

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

——————–

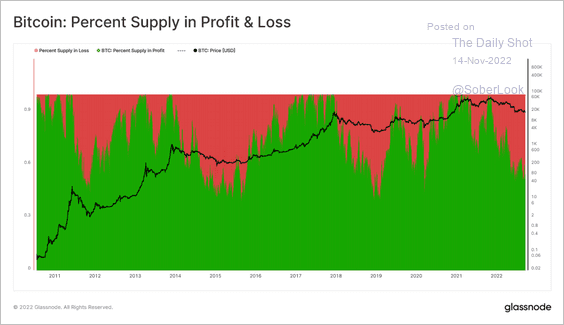

3. This chart shows the relative share of bitcoin supply in profit and loss, based on the average cost basis among holders.

Source: @glassnode

Source: @glassnode

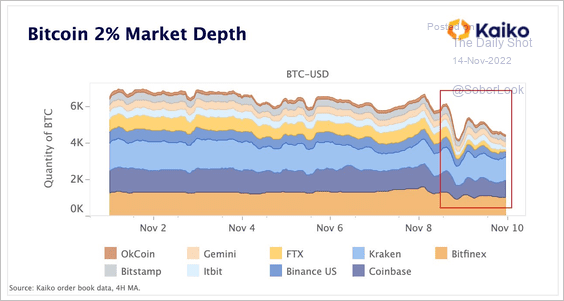

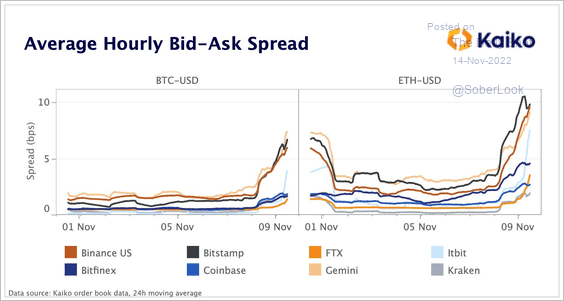

4. BTC and ETH market liquidity has deteriorated. (2 charts)

Source: @KaikoData

Source: @KaikoData

Source: @KaikoData

Source: @KaikoData

——————–

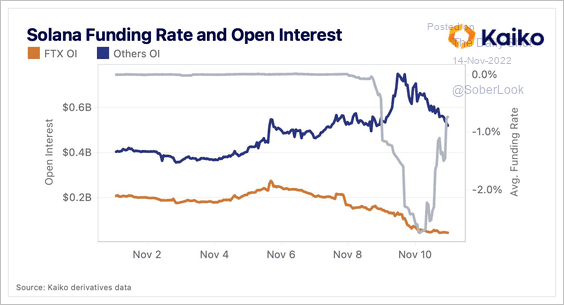

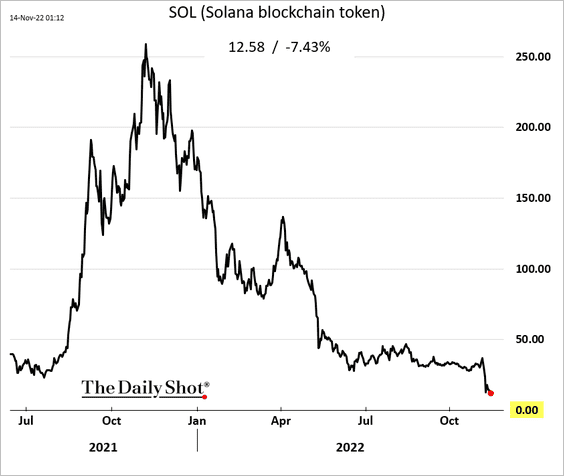

5. Solana’s (SOL) open interest on FTX and other exchanges declined during the recent sell-off. Meanwhile, funding rates (the cost to fund long/short positions in the perpetual futures market) have improved.

Source: @KaikoData

Source: @KaikoData

The token price is collapsing.

Back to Index

Commodities

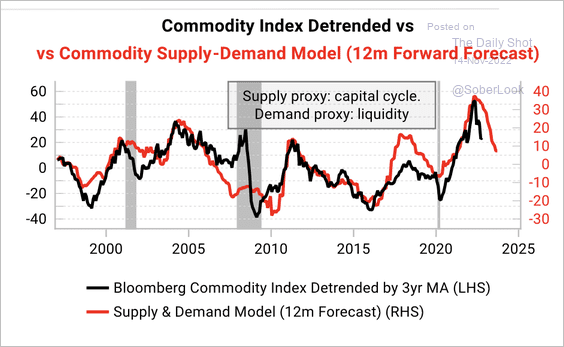

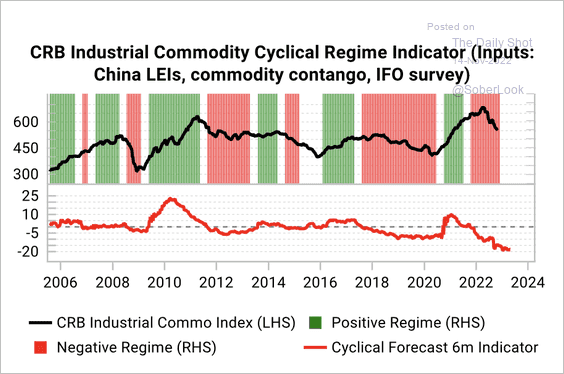

1. Variant Perception expects further weakness for industrial metal prices because of cyclical demand headwinds. (2 charts)

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

——————–

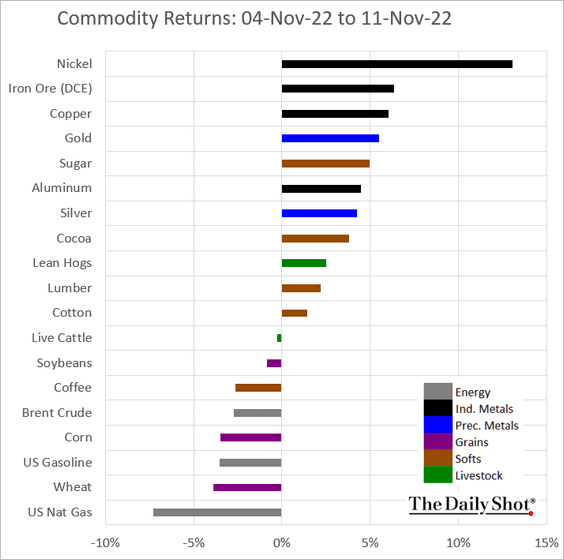

2. Here is last week’s performance across key markets.

Back to Index

Equities

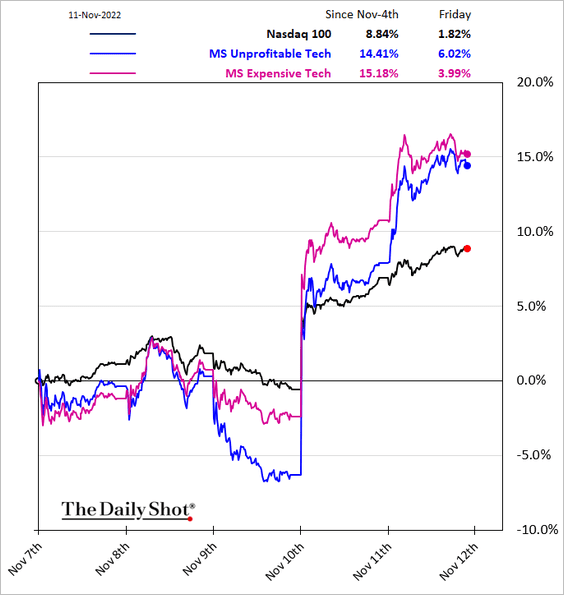

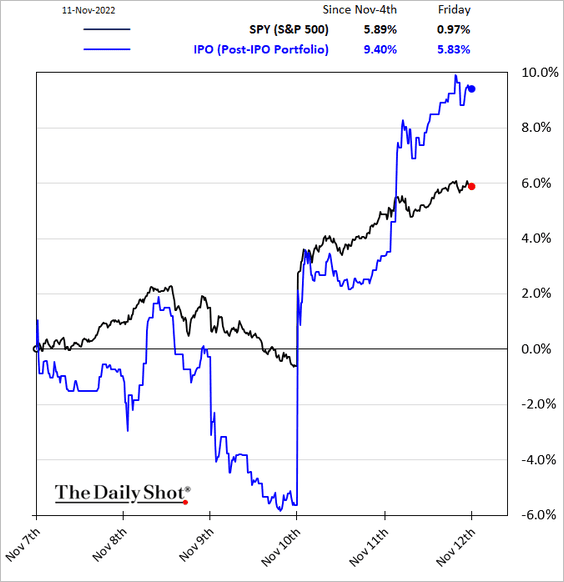

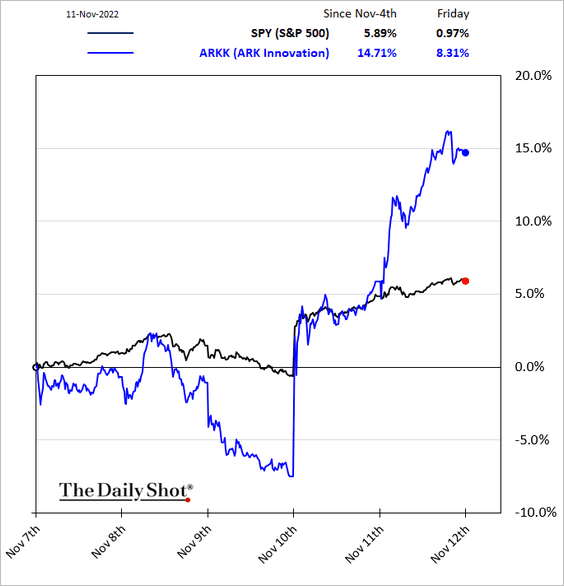

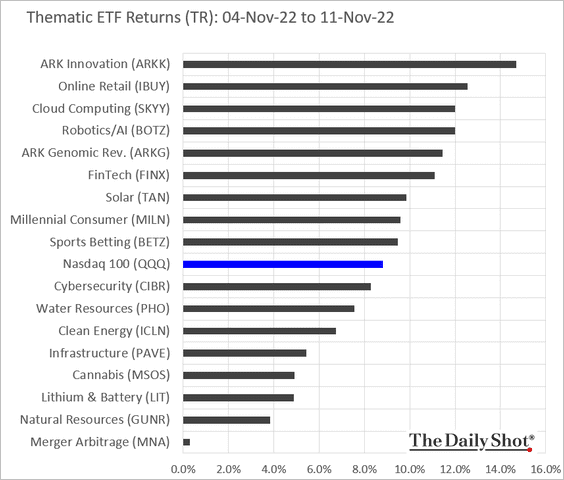

1. Speculative tech shares surged last week (3 charts).

——————–

2. Dow index futures broke above their short-term downtrend.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

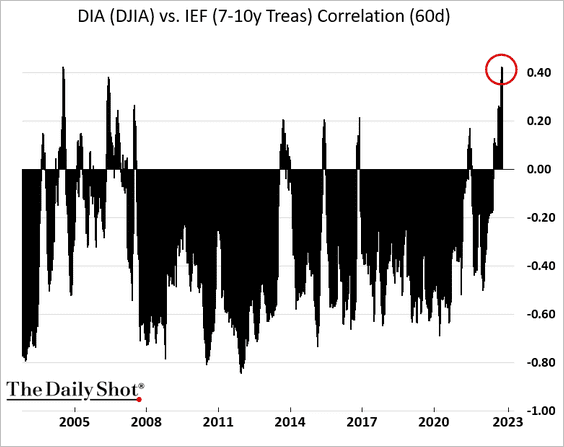

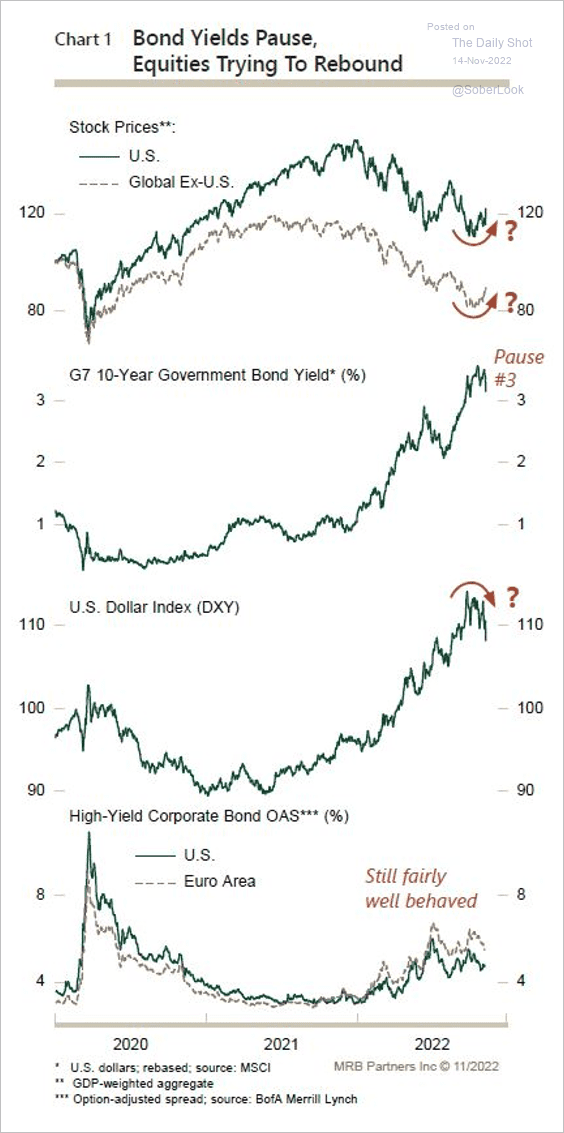

3. Stock/bond correlations remain elevated.

Stocks moved higher as the rally in bond yields and the dollar paused.

Source: MRB Partners

Source: MRB Partners

——————–

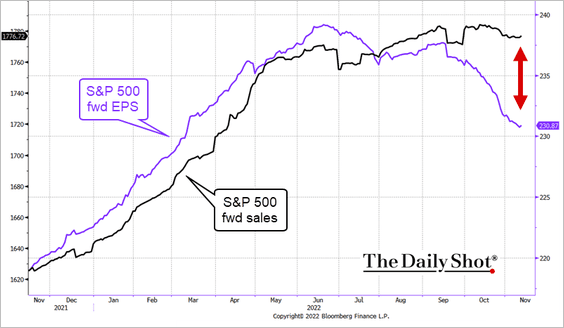

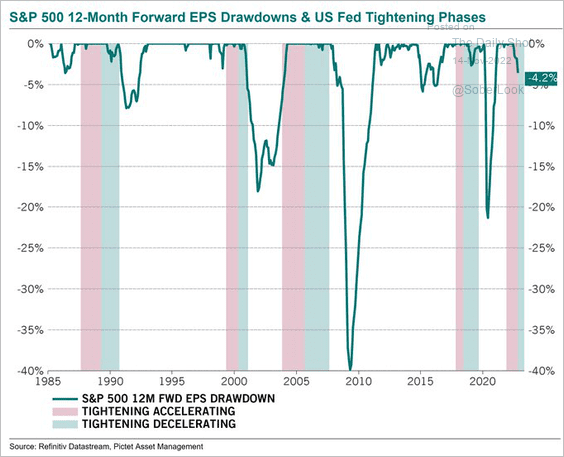

4. The divergence between earnings and sales expectations signals shrinking margins ahead.

The looming recession will put further pressure on earnings.

Source: @steve_donze

Source: @steve_donze

——————–

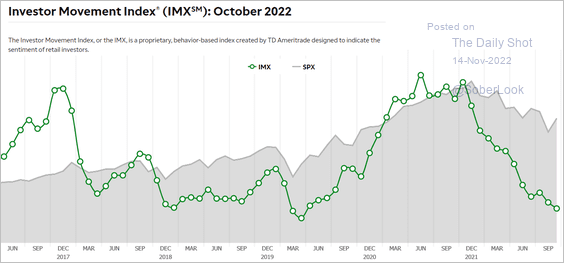

5. Retail investors were very risk-averse going into November.

Source: TD Ameritrade

Source: TD Ameritrade

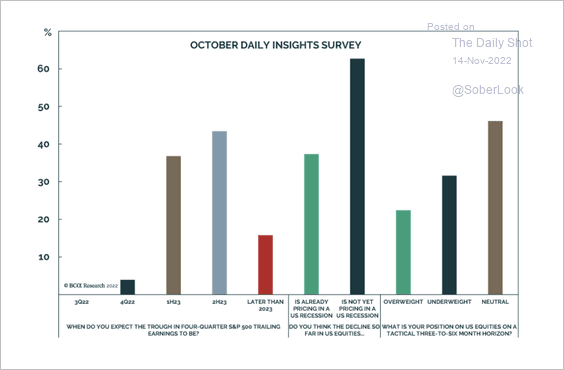

6. Stocks are not pricing in a US recession, which could be a few quarters away, according to an investor survey by BCA Research.

Source: BCA Research

Source: BCA Research

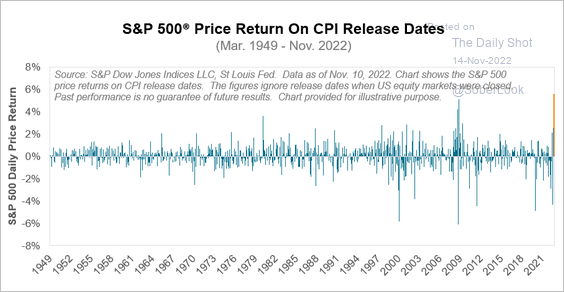

7. This chart shows the S&P 500 returns on CPI release days.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

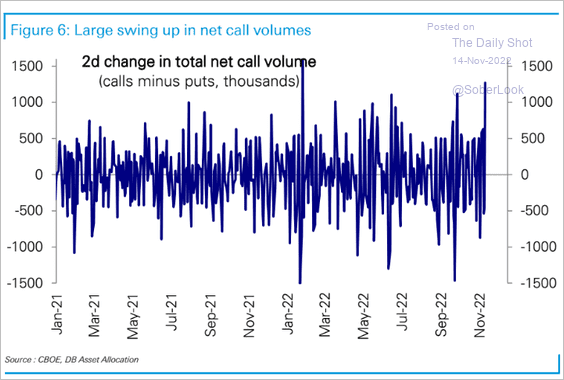

8. Net call option volume surged after the CPI report.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

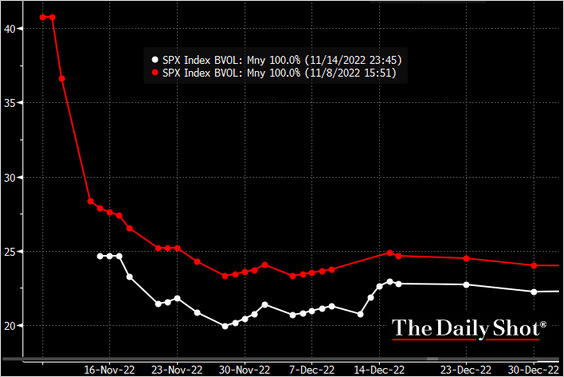

• Here is the change in the S&P 500 implied vol term structure after last week’s CPI report.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

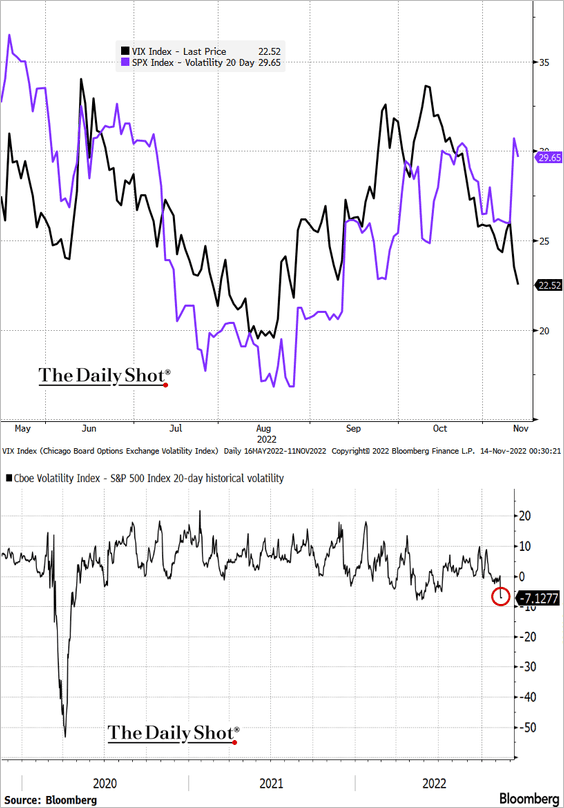

• Realized and implied volatility diverged last week.

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

——————–

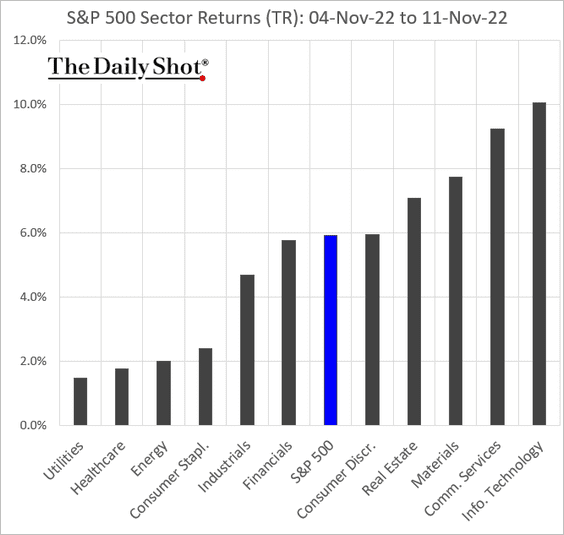

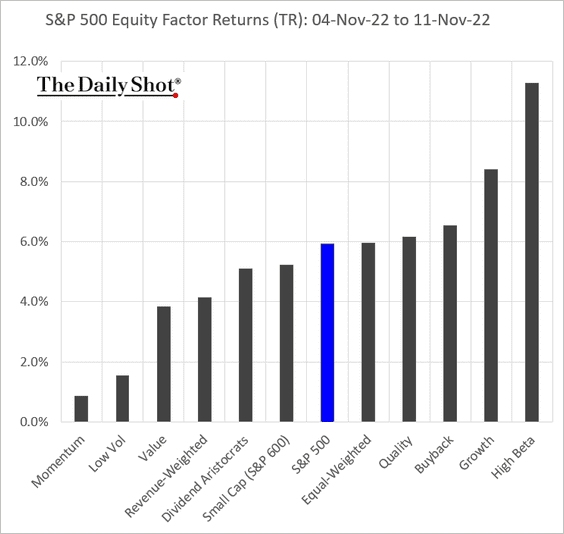

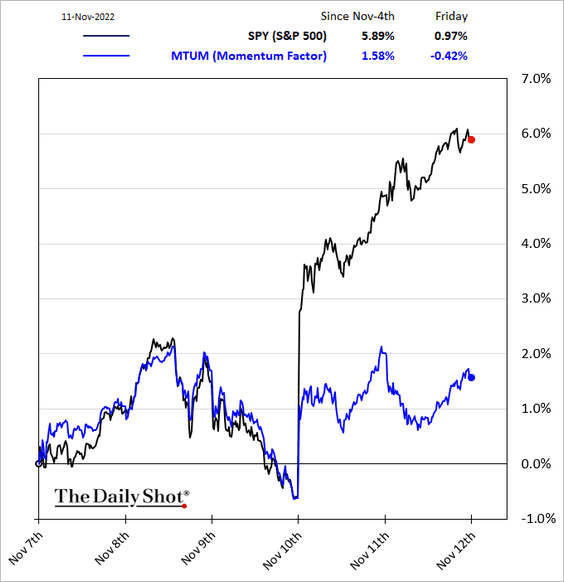

9. Next, we have some performance data from last week.

• Sectors:

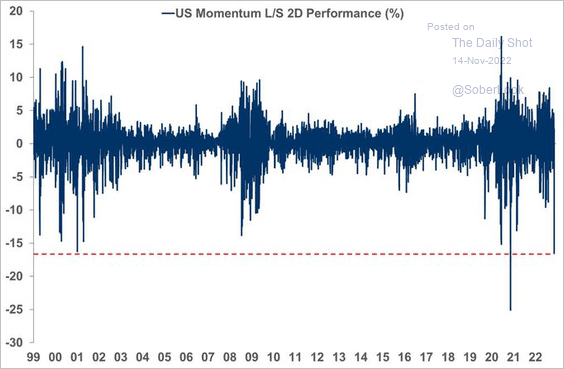

• Equity factors:

It was a rough week for momentum stocks (on a relative basis).

Source: Morgan Stanley Research; @fkronawitter1

Source: Morgan Stanley Research; @fkronawitter1

• Thematic ETFs:

• Largest tech firms:

Back to Index

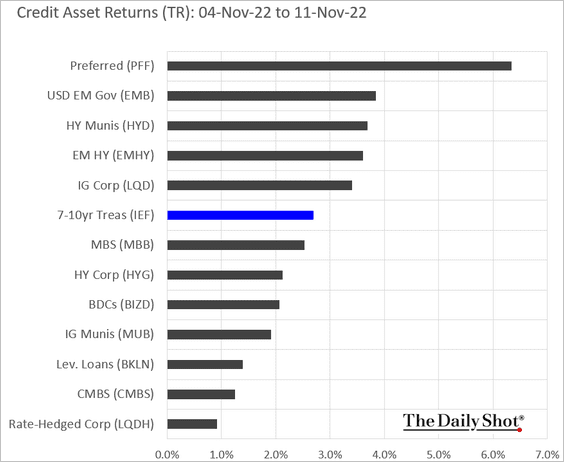

Credit

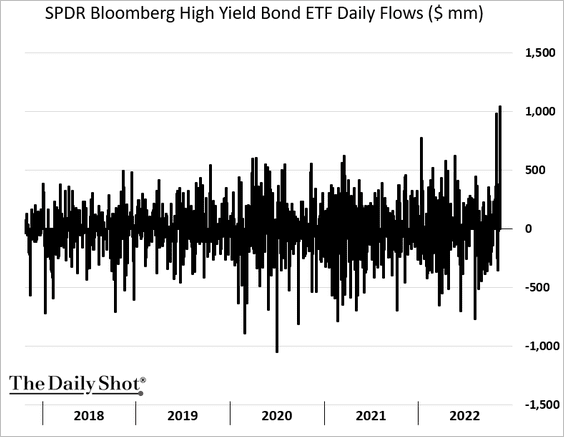

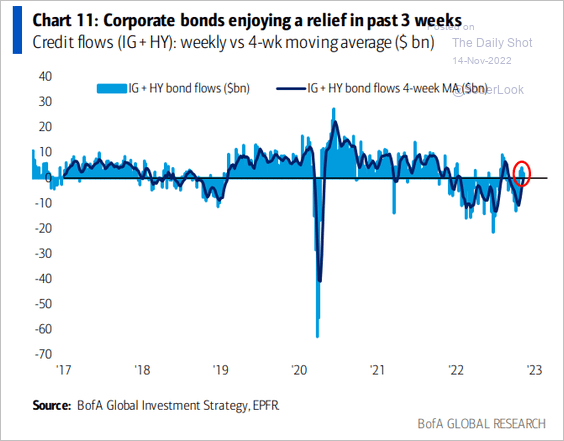

1. High-yield funds saw some inflows last week.

Here are the high-yield and investment-grade net flows.

Source: BofA Global Research

Source: BofA Global Research

——————–

2. This chart shows last week’s performance by asset class.

Back to Index

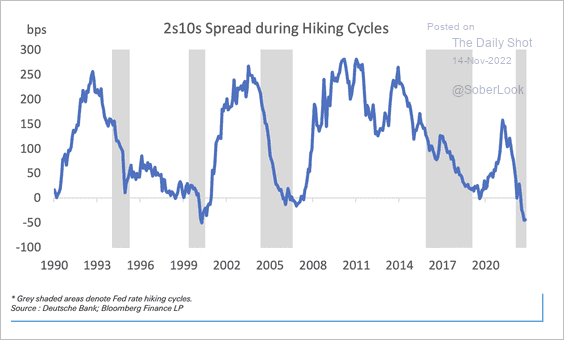

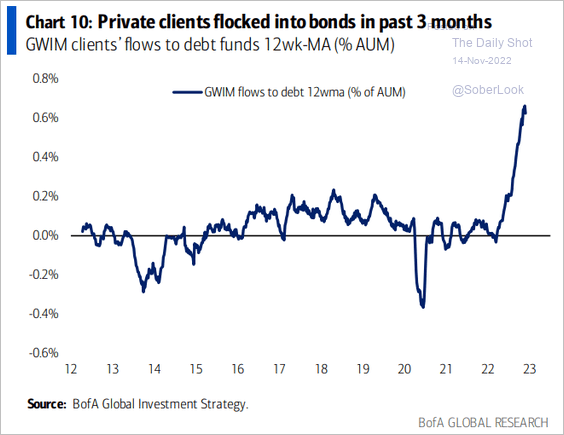

Rates

1. The Treasury yield curve inverted earlier and more sharply during this hiking cycle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. BofA’s private clients flocked into bonds recently.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

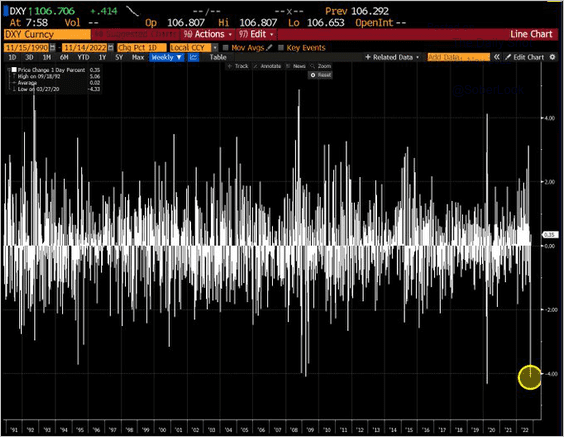

Global Developments

1. It was a difficult week for the US dollar.

Source: @DavidInglesTV

Source: @DavidInglesTV

Is the next stop the 200-day moving average (for DXY)?

——————–

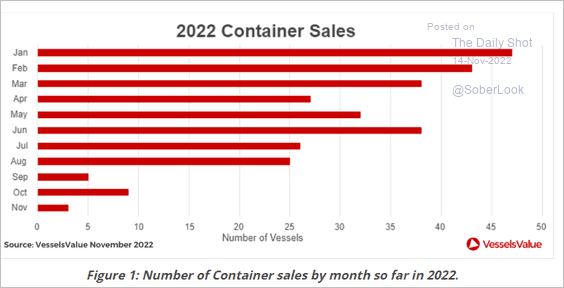

2. Shipping container sales have slowed in recent months.

Source: VesselsValue Read full article

Source: VesselsValue Read full article

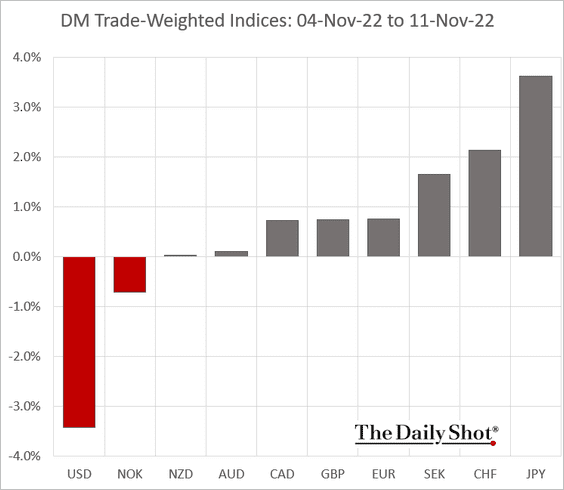

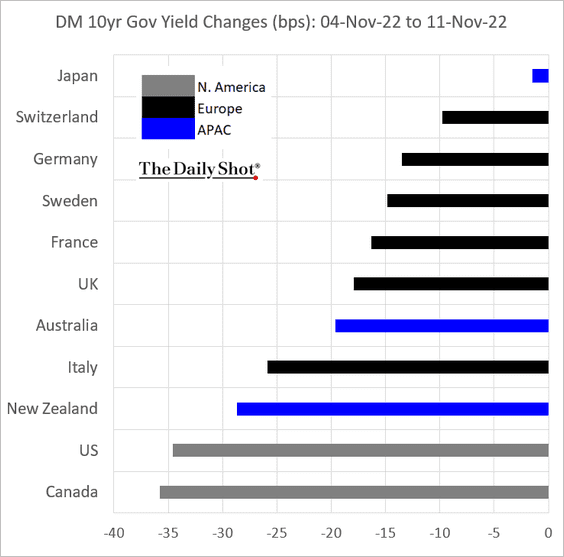

3. Next, we have some performance data from last week.

• Trade-weighted DM currency indices:

• DM yield changes:

——————–

Food for Thought

1. Global semiconductor demand:

![]() Source: Natixis

Source: Natixis

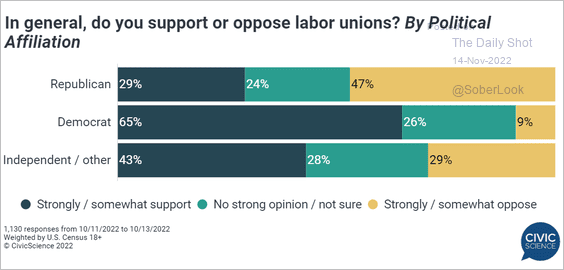

2. Support for labor unions in the US:

Source: @CivicScience

Source: @CivicScience

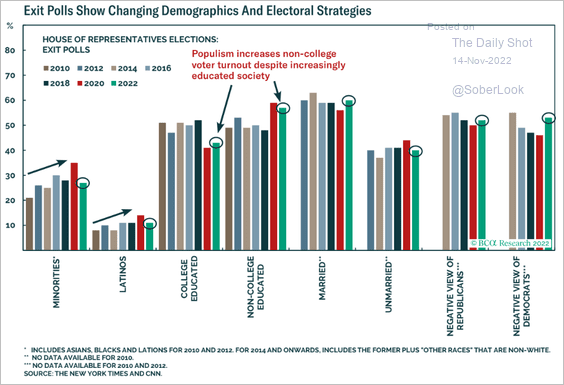

3. Changing demographics in US exit polls:

Source: BCA Research

Source: BCA Research

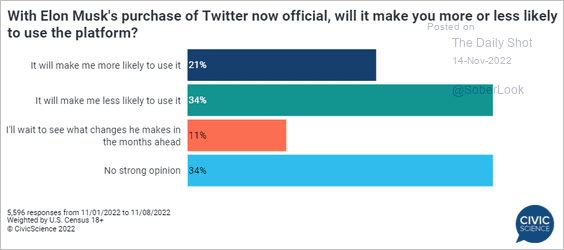

4. The likelihood of using Twitter since the takeover:

Source: @CivicScience

Source: @CivicScience

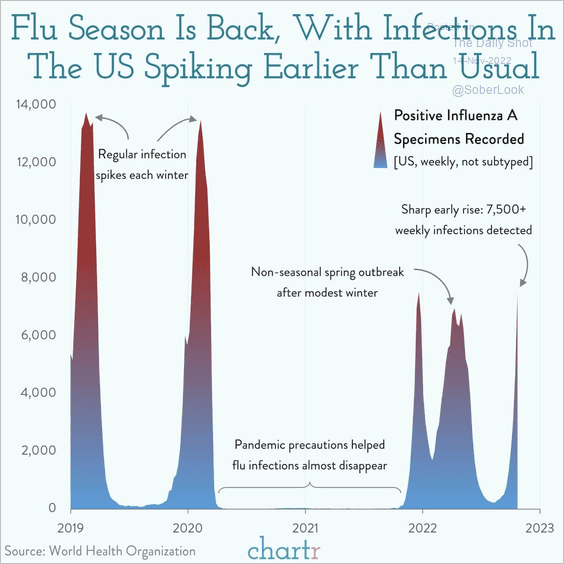

5. The flu season is back:

Source: @chartrdaily

Source: @chartrdaily

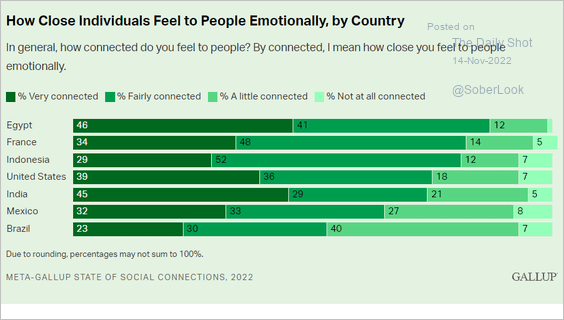

6. Being connected to others:

Source: Gallup Read full article

Source: Gallup Read full article

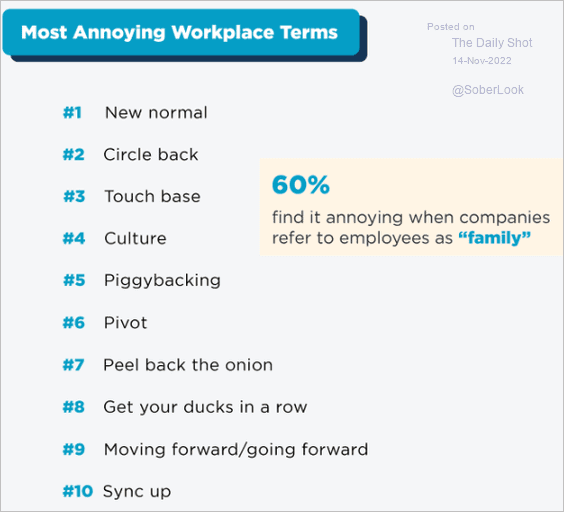

7. Annoying workplace terminology:

Source: LLC.ORG Read full article

Source: LLC.ORG Read full article

——————–

Back to Index