The Daily Shot: 15-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

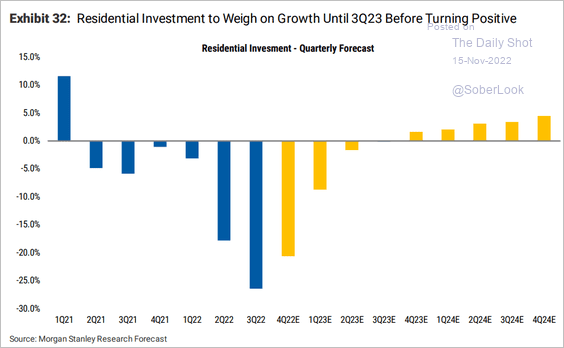

1. Let’s begin with the housing market.

• Residential investment will remain depressed next year, according to a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

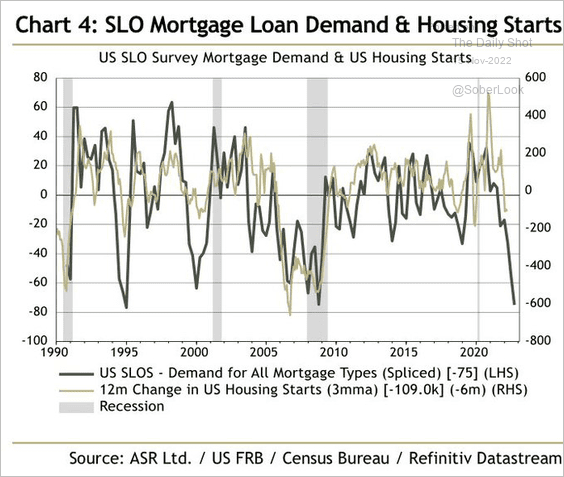

Declining mortgage demand points to more weakness in residential construction.

Source: @IanRHarnett

Source: @IanRHarnett

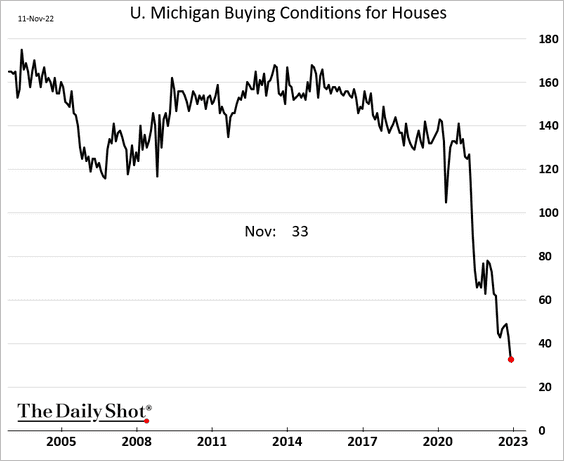

• The U. Michigan consumer survey report shows further deterioration in buying conditions for homes.

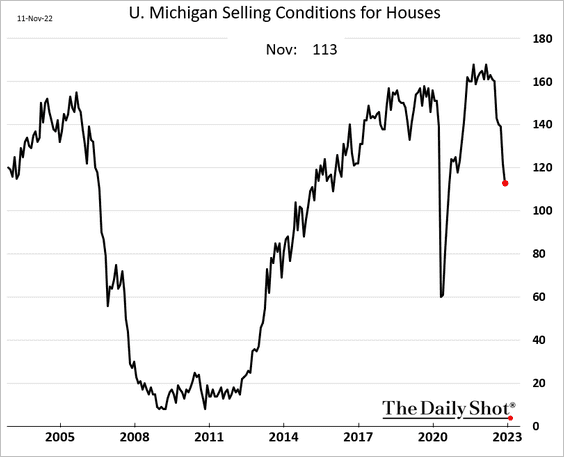

Selling conditions are also declining.

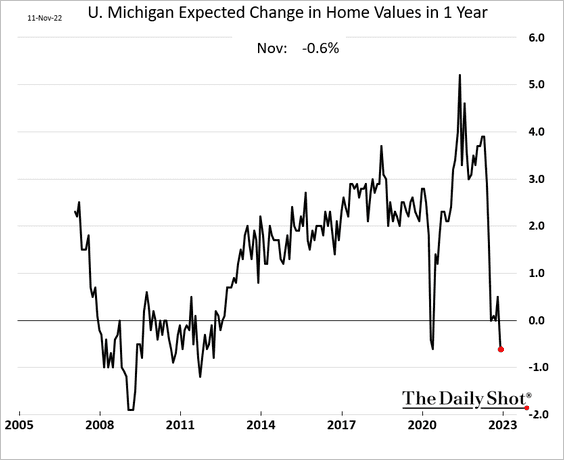

– Consumers expect home prices to be lower a year from now.

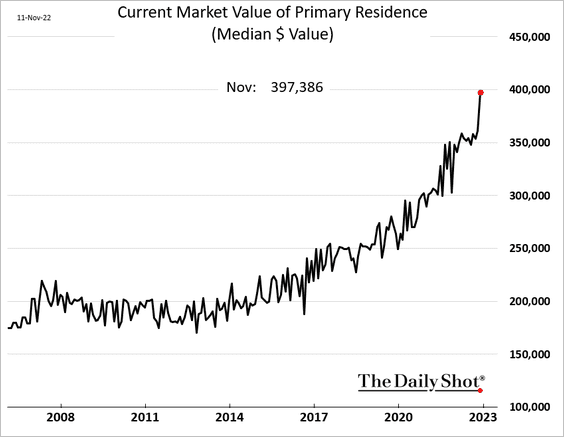

At the same time, homeowners keep inflating the perceived “market value” of their own houses.

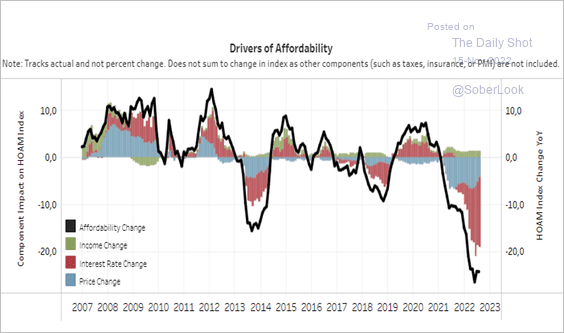

• What are the drivers of changes in housing affordability?

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

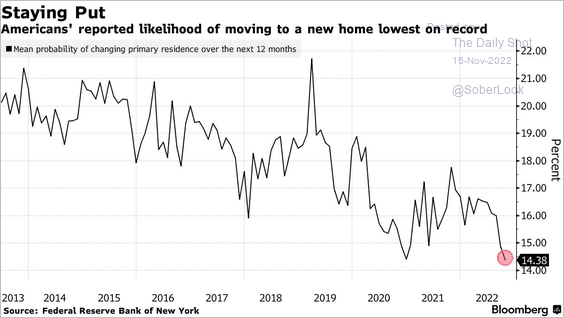

• Consumers don’t see themselves moving to a new home.

Source: @wealth, @jordan_yadoo Read full article

Source: @wealth, @jordan_yadoo Read full article

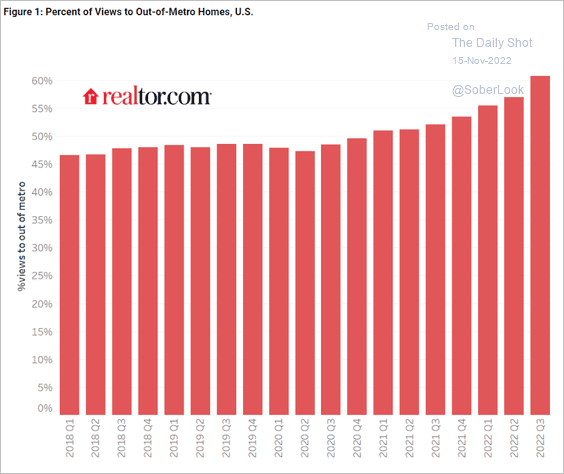

• Views of online listings increasingly come from outside the metropolitan area where the house is located.

Source: realtor.com

Source: realtor.com

——————–

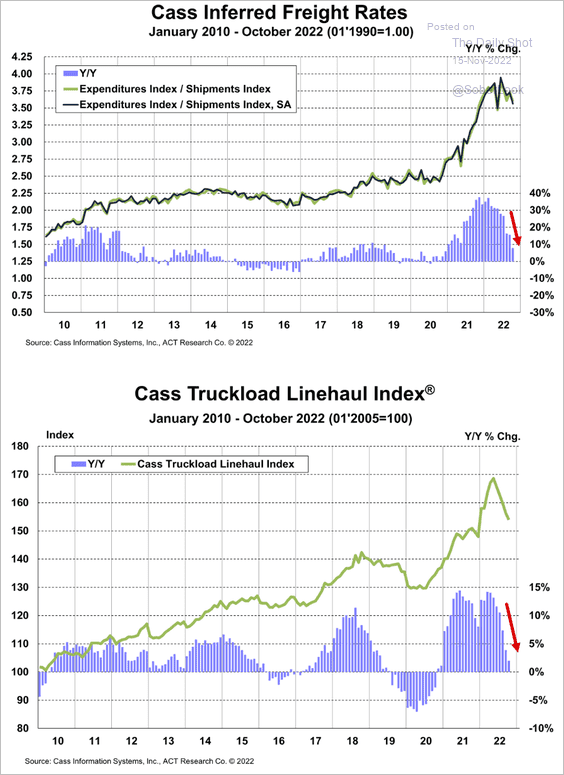

2. Freight rate inflation continues to ease …

Source: Cass Information Systems

Source: Cass Information Systems

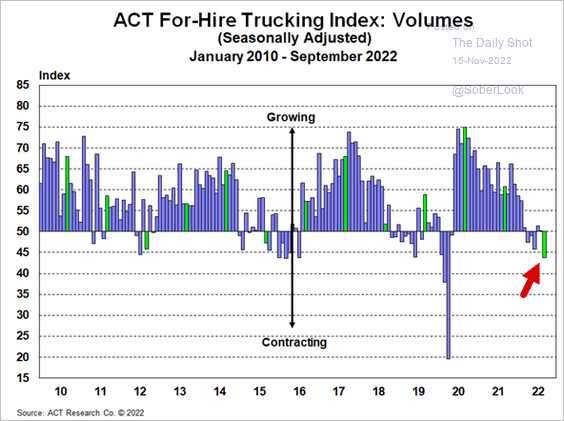

… as demand softens.

Source: Cass Information Systems

Source: Cass Information Systems

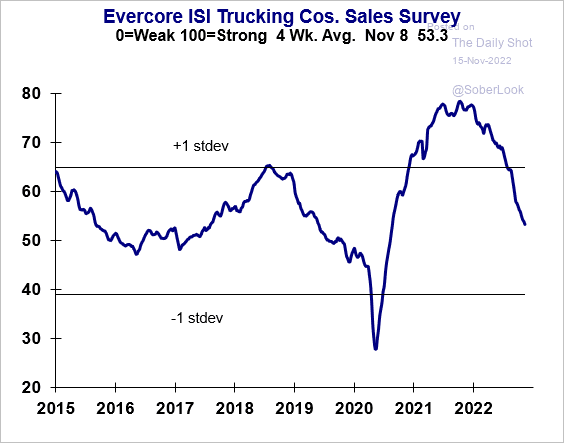

Here is the Evercore ISI trucking company sales index.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

3. Morgan Stanley sees very soft growth next year but not a recession.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

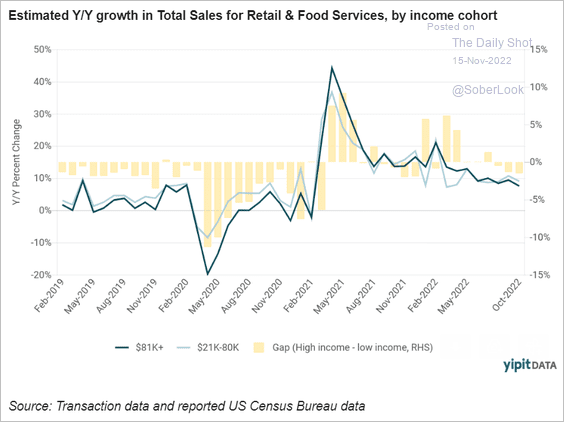

4. High-frequency indicators continue to signal a weak retail sales print in October. The YipitData indicator points to softer demand among higher-income households.

Source: YipitData

Source: YipitData

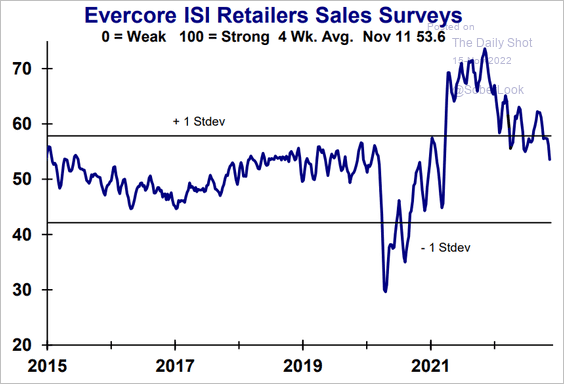

Below is the Evercore ISI retailers sales index.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

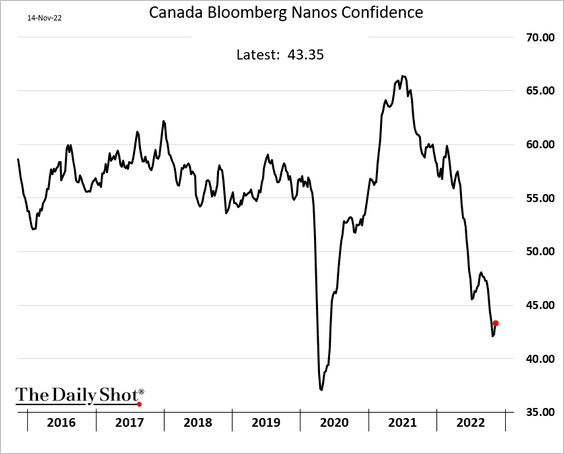

1. Consumer confidence appears to have finally stabilized.

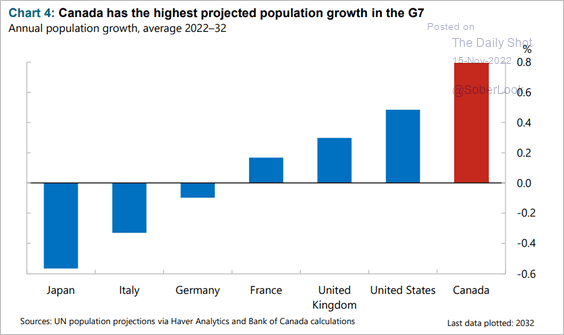

2. Strong population growth (driven by immigration) will allow Canada’s economy to outperform over the long run.

Source: BIS Read full article

Source: BIS Read full article

Back to Index

The United Kingdom

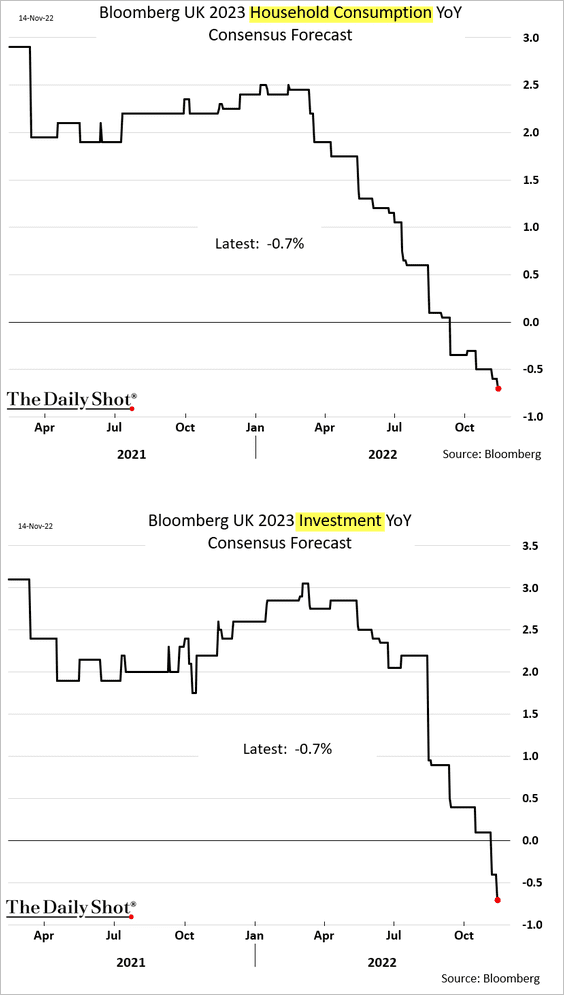

1. Economists are rushing to downgrade their forecasts for next year’s private domestic demand. Both consumer spending and business investment are now expected to contract next year.

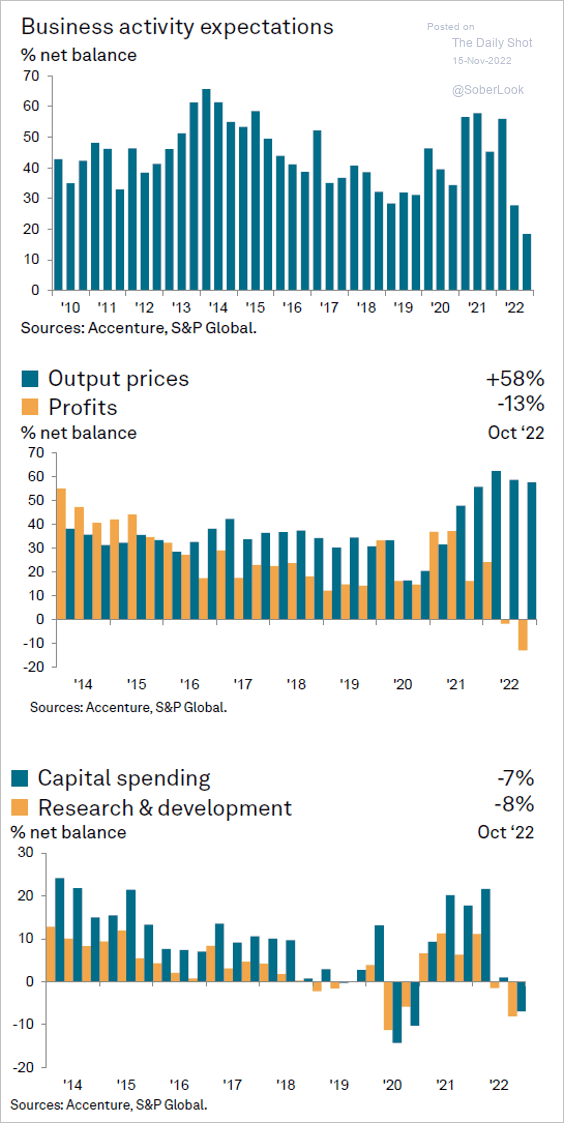

2. Business sentiment has been softening.

Source: @SPGlobalPMI, @AccentureUK

Source: @SPGlobalPMI, @AccentureUK

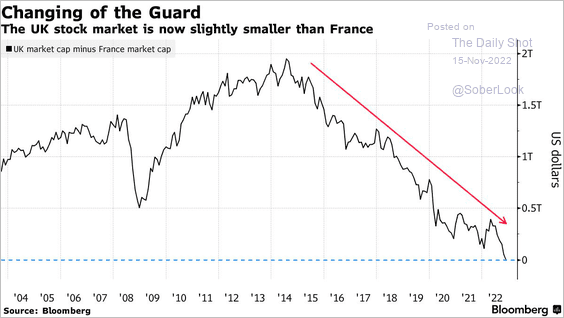

3. Paris overtook London as Europe’s most valuable stock market.

Source: @markets, @marketsjoe Read full article

Source: @markets, @marketsjoe Read full article

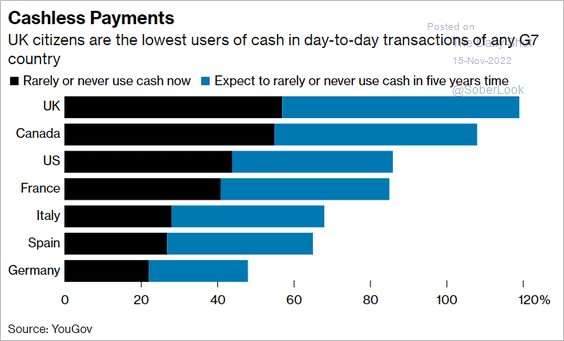

4. Cash usage in the UK has been declining faster than in other advanced economies.

Source: @wealth, @tetley_liza Read full article

Source: @wealth, @tetley_liza Read full article

Back to Index

The Eurozone

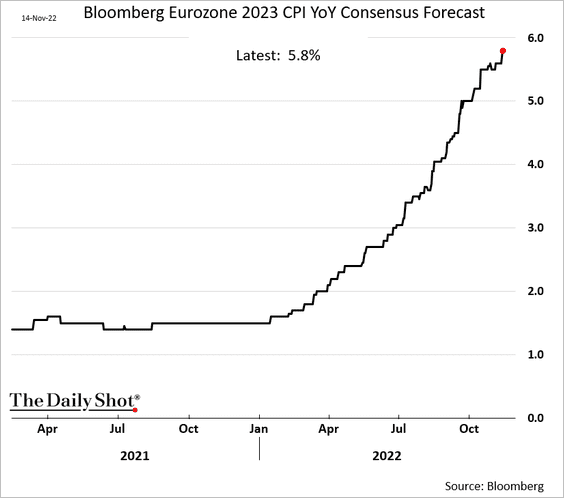

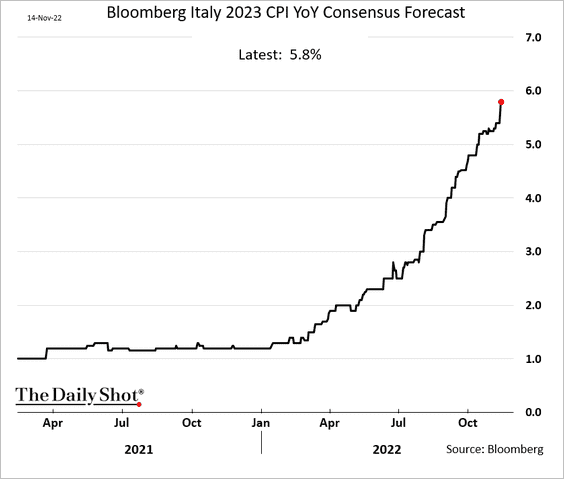

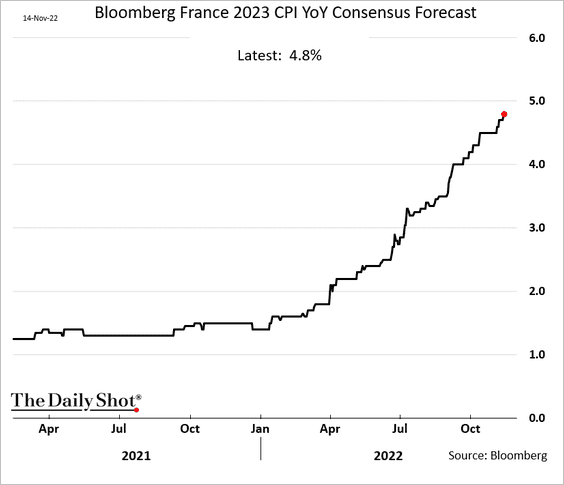

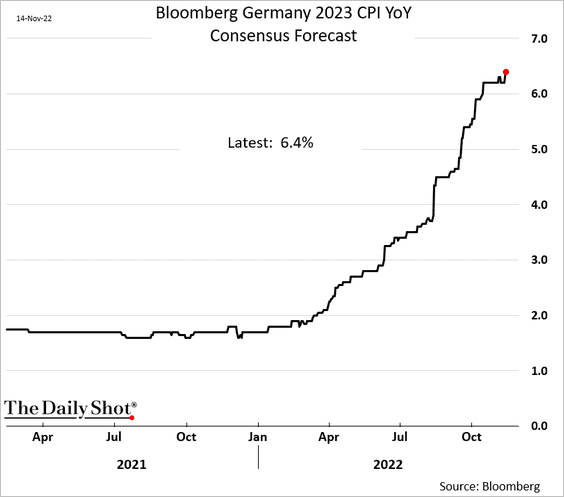

1. Economists keep raising their forecasts for the euro-area inflation next year.

• The Eurozone:

• Italy:

• France:

• Germany:

——————–

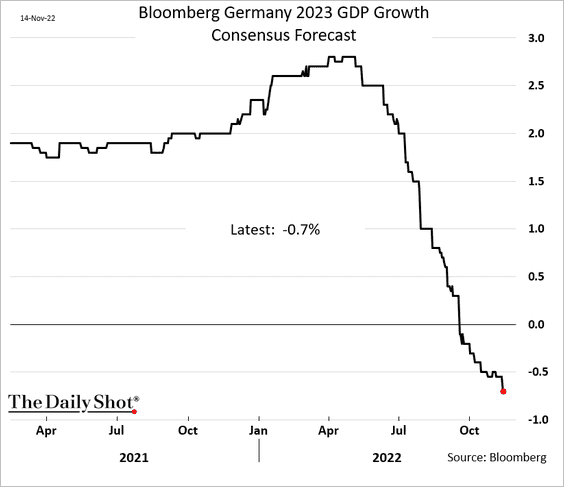

2. How bad will Germany’s recession get in 2023? Here is the consensus forecast for the full year.

Below are some additional updates on Germany.

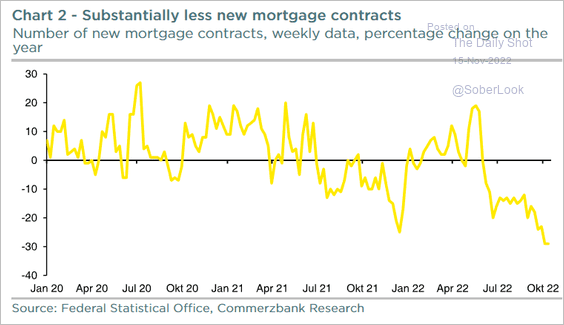

• Mortgage contracts:

Source: Commerzbank Research

Source: Commerzbank Research

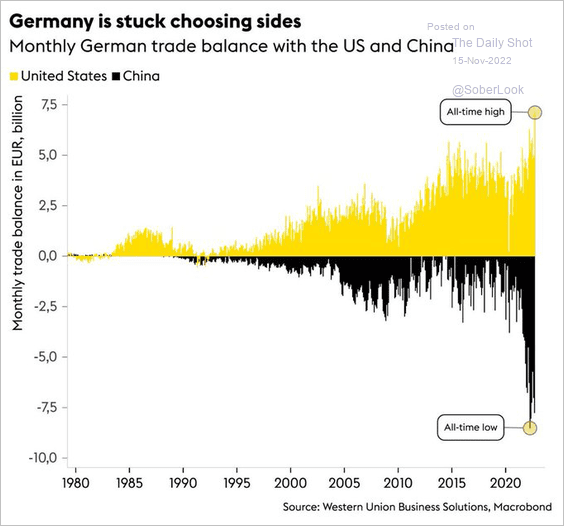

• Dependence on imports from China:

Source: @AndreasSteno

Source: @AndreasSteno

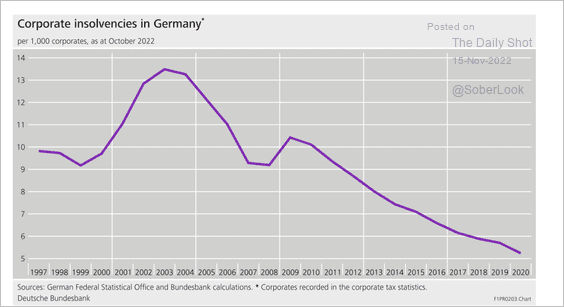

• Corporate insolvencies since 1997:

Source: BIS Read full article

Source: BIS Read full article

——————–

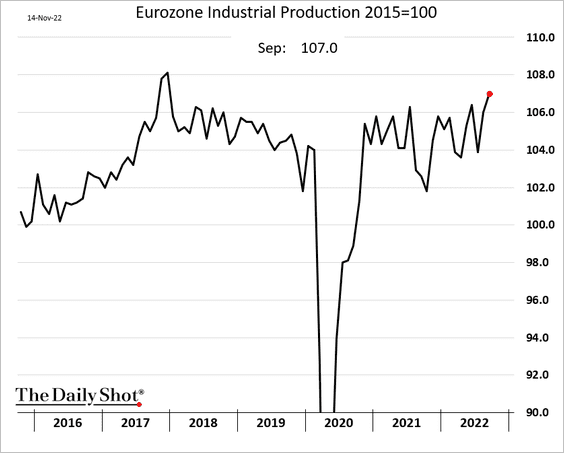

3. Euro-area industrial production was strong in September, but PMI indicators point to downside risks ahead.

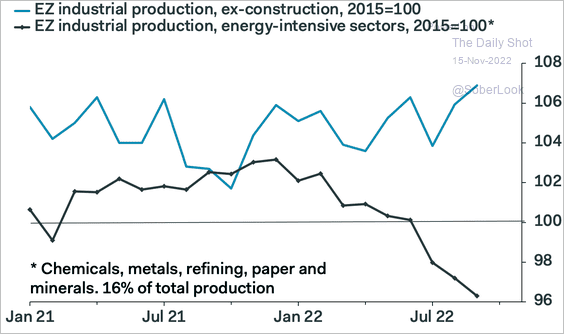

Energy-intensive sectors are struggling.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

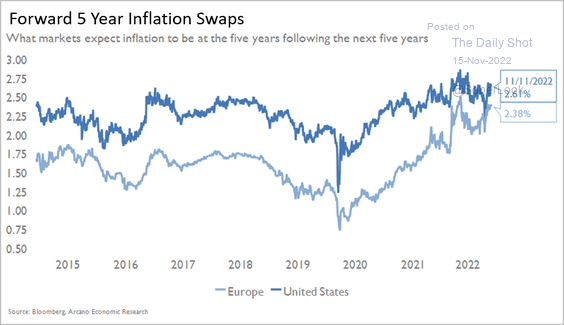

4. Market-based inflation expectations are converging with those in the US.

Source: Arcano Economics

Source: Arcano Economics

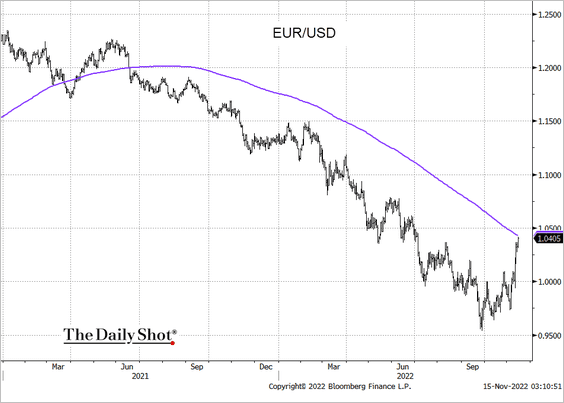

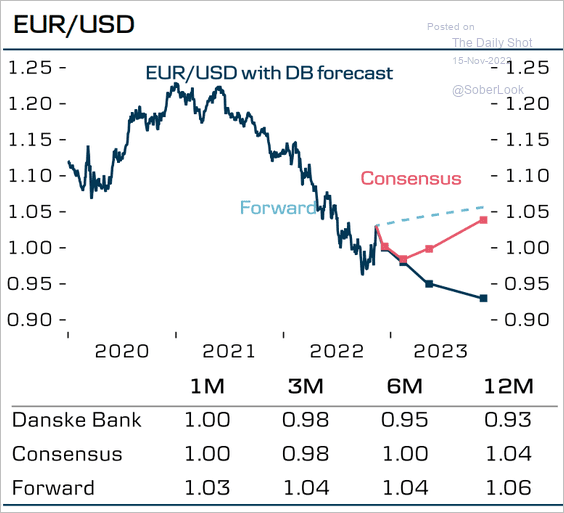

5. EUR/USD is at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

But Danske Bank expects the euro to resume its decline.

Source: Danske Bank

Source: Danske Bank

Back to Index

Europe

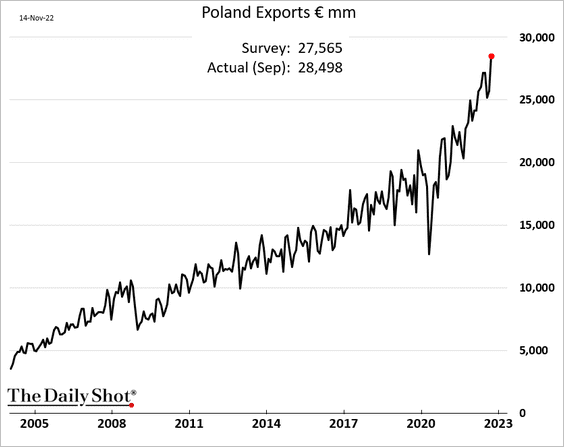

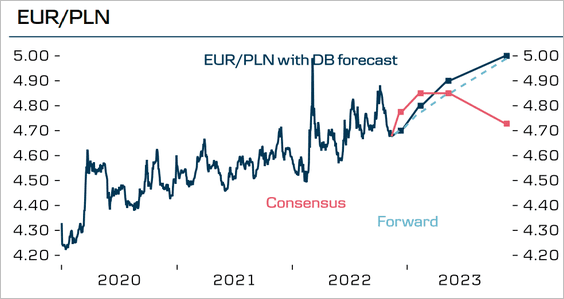

1. Poland’s exports hit a record high.

Danske Bank expects the Polish zloty to weaken further vs. the euro.

——————–

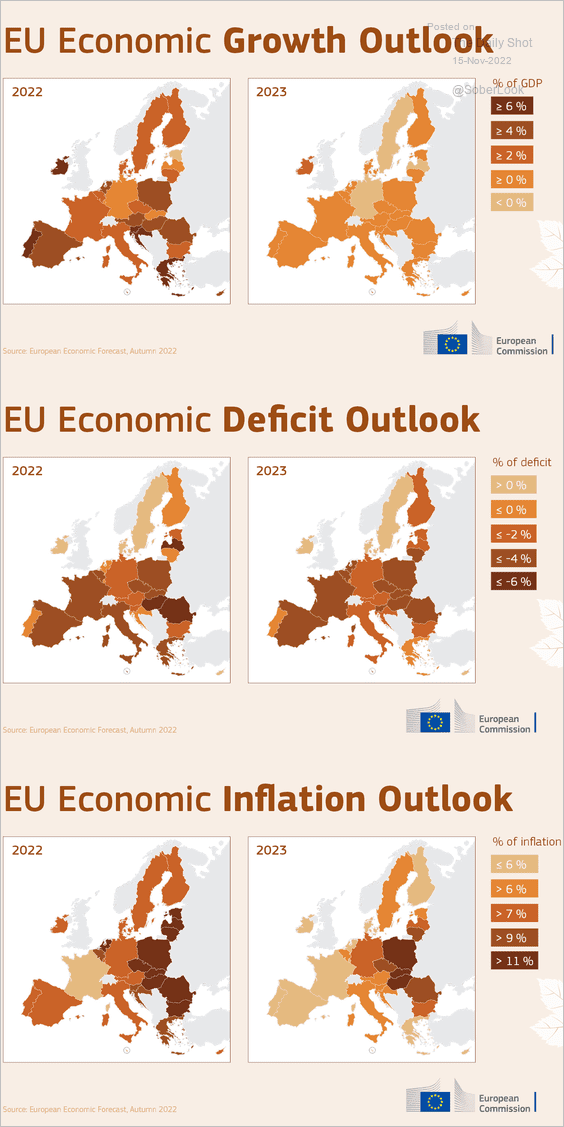

2. Next, we have projections for economic growth, budget deficit, and inflation.

Source: @ecfin Read full article

Source: @ecfin Read full article

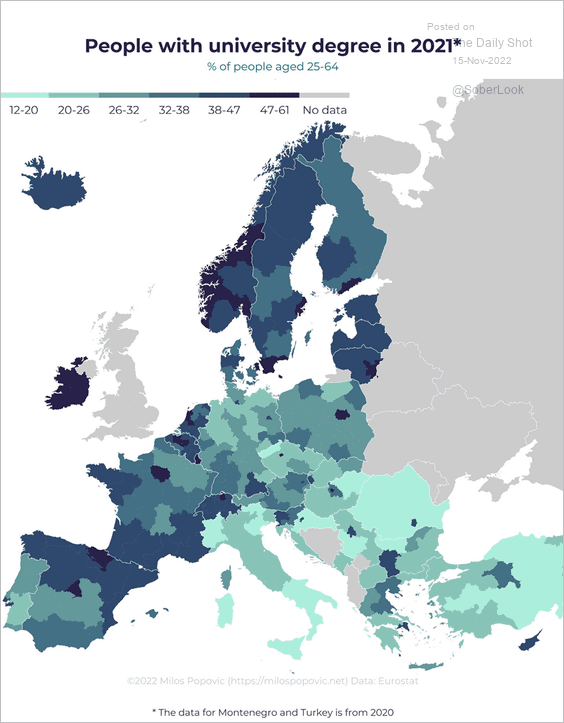

3. The map below shows the percentage of adults with a university degree.

Source: @milos_agathon

Source: @milos_agathon

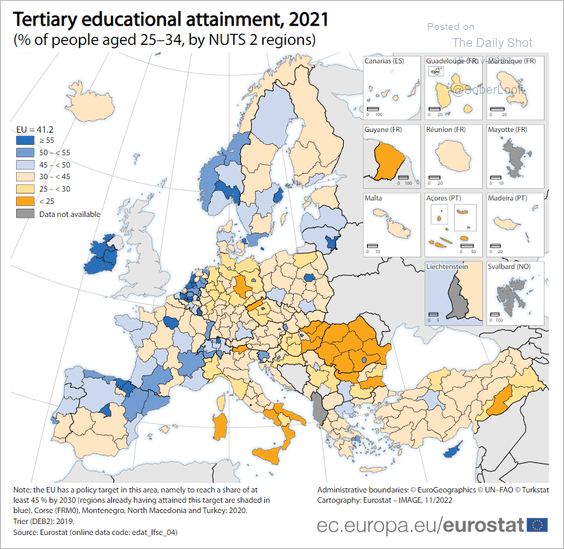

Here is the tertiary educational attainment (university/college and vocational training).

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

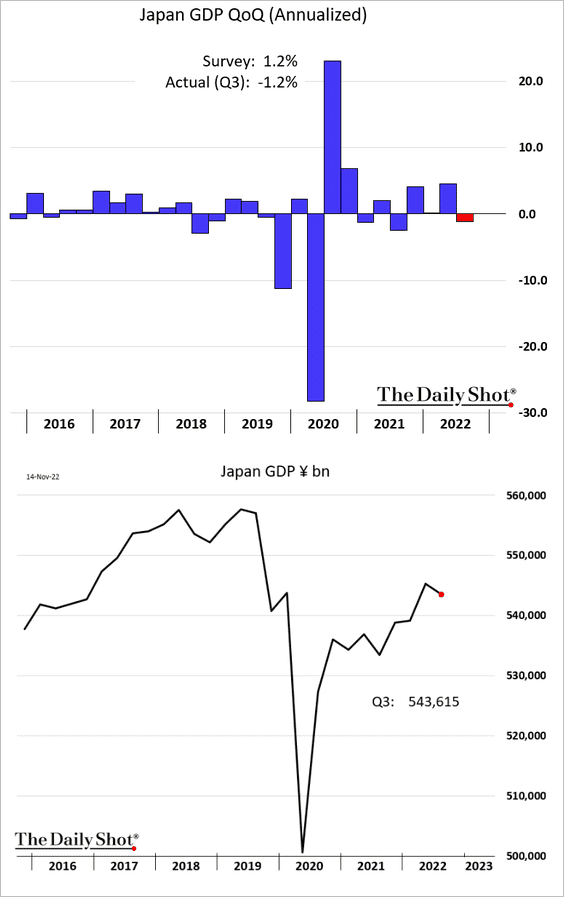

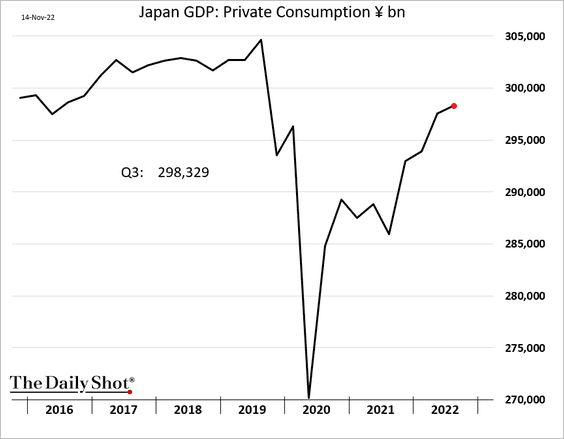

1. The economy unexpectedly contracted last quarter, …

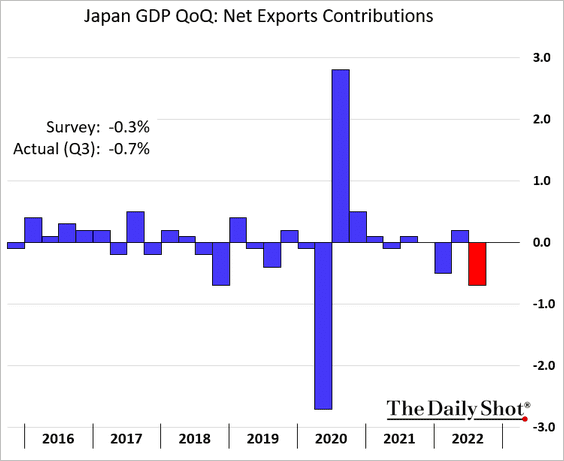

… as net exports tumbled (due to weak yen and soaring energy prices).

Consumer spending remains below pre-COVID levels.

——————–

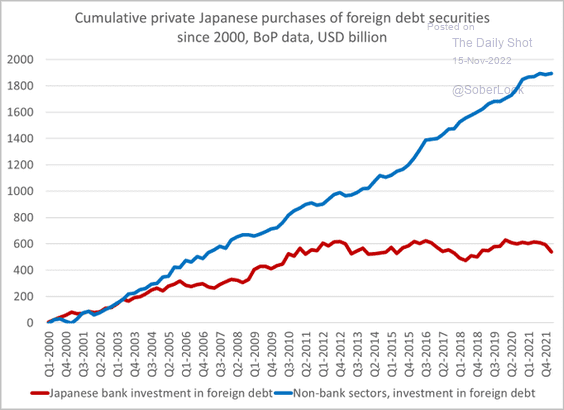

2. Japan has been a key player in global bond markets.

Source: @Brad_Setser

Source: @Brad_Setser

Back to Index

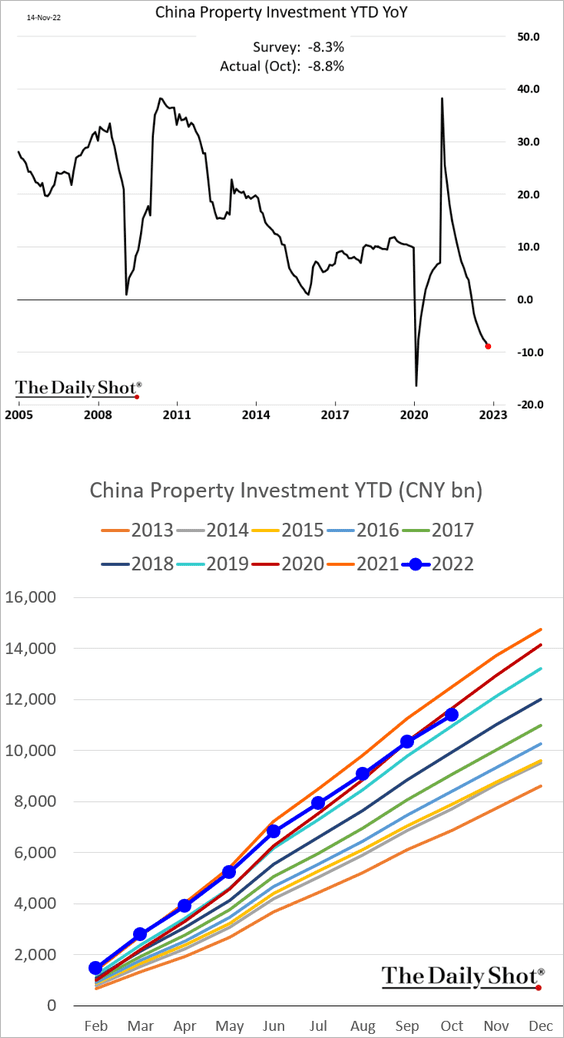

China

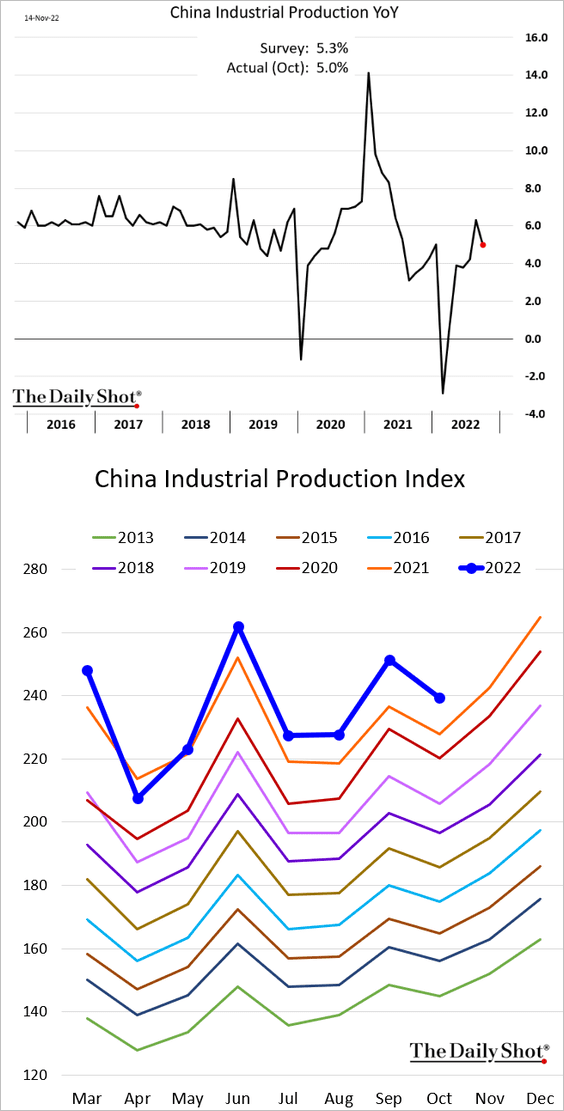

1. Industrial production was roughly in line with expectations last month.

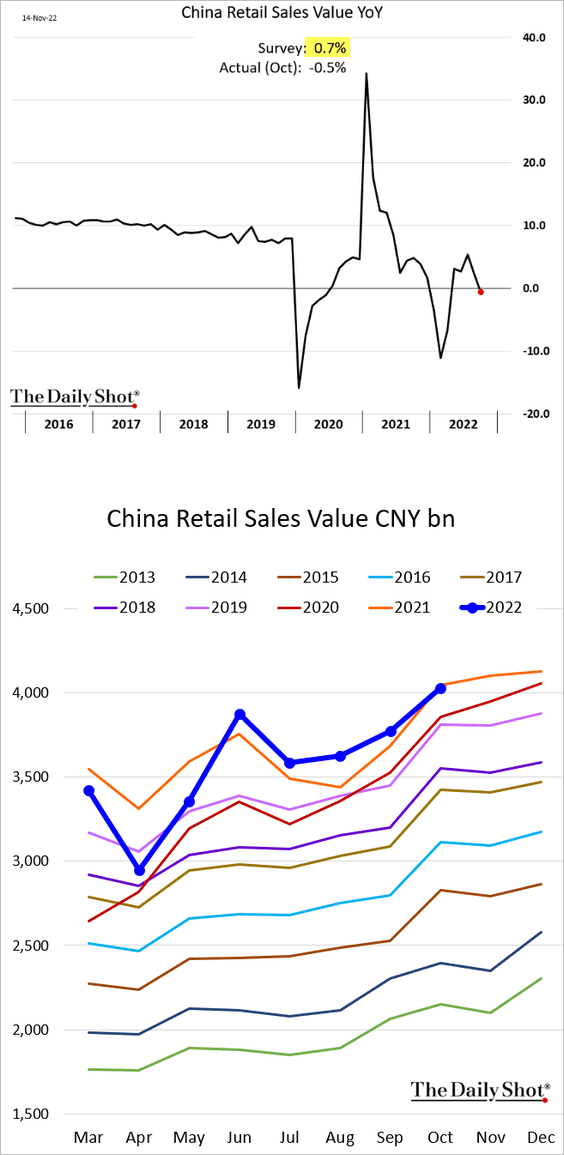

But retail sales unexpectedly declined on a year-over-year basis.

Property investment kept deteriorating in October.

——————–

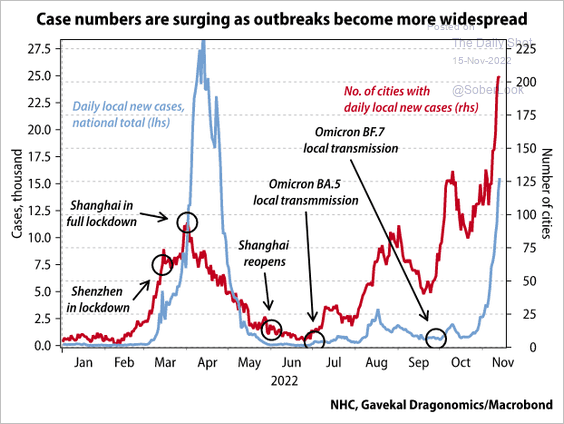

2. The COVID situation has been worsening.

Source: Gavekal Research

Source: Gavekal Research

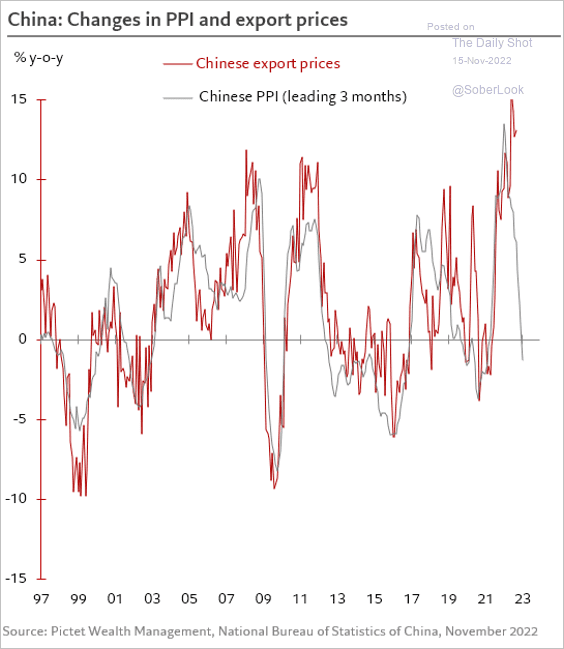

3. China will be exporting disinflation.

Source: @fwred

Source: @fwred

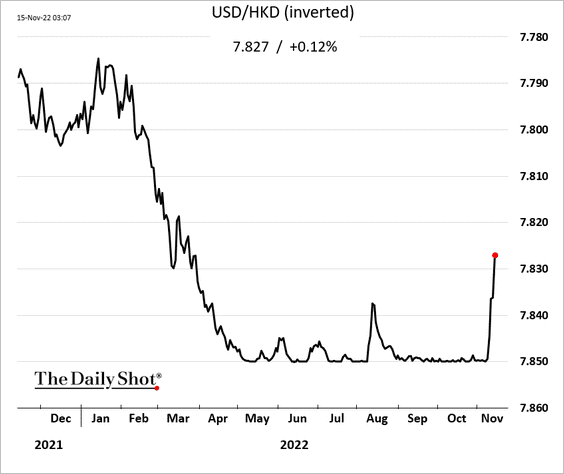

4. The Hong Kong dollar has been climbing in recent days as foreign capital returns.

Back to Index

Emerging Markets

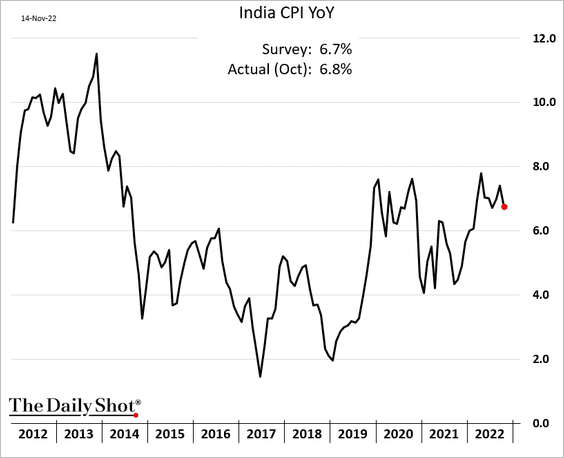

1. India’s CPI edged lower last month but was above expectations.

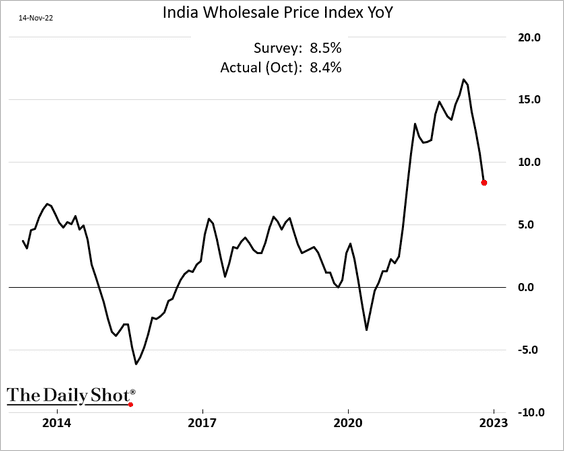

Wholesale price inflation continues to moderate.

——————–

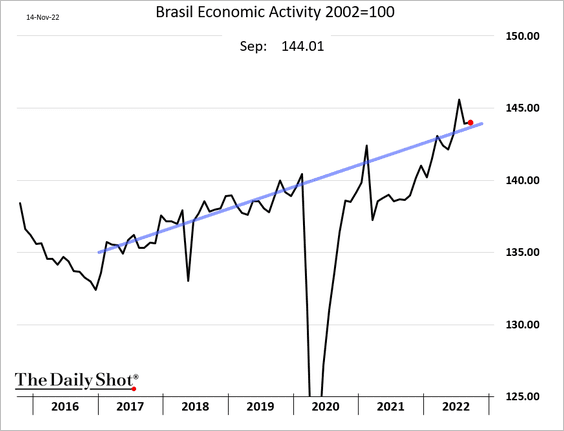

2. Brazil’s economic activity is holding near the pre-COVID trend.

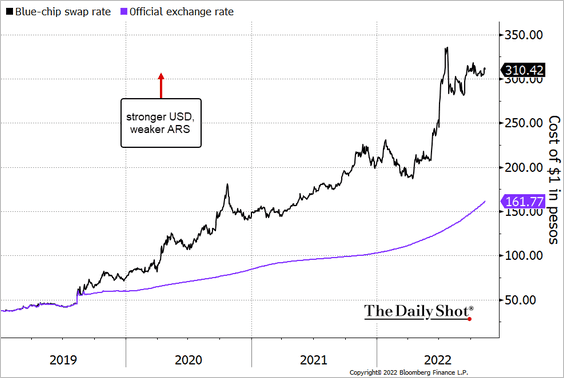

3. The gap between USD/ARS and the “unofficial” exchange rate in Argentina keeps widening.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

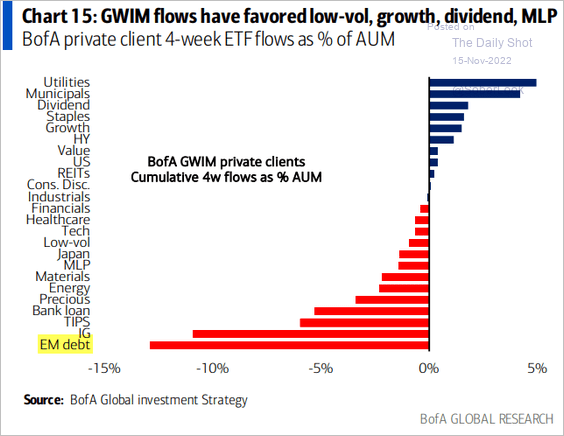

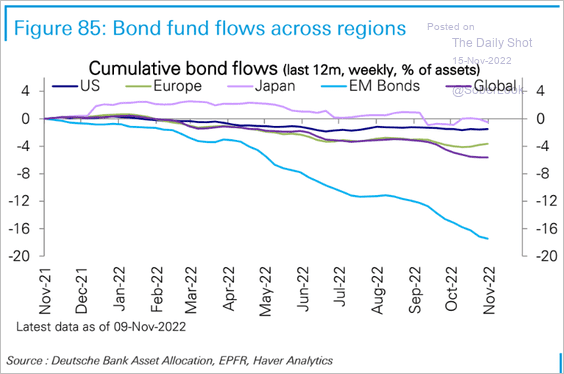

4. Outflows from EM debt funds have been relentless (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Source: @TheTerminal, Bloomberg Finance L.P., h/t Deutsche Bank Research

Back to Index

Cryptocurrency

1. Binance CEO announced a bailout fund for crypto projects, stabilizing markets.

Source: Barron’s Read full article

Source: Barron’s Read full article

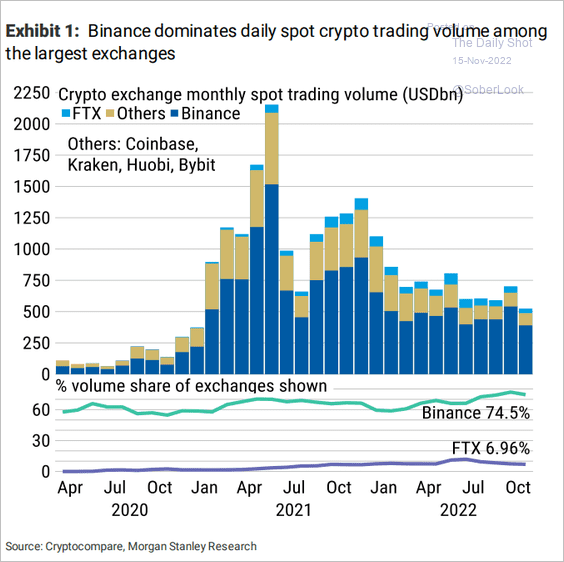

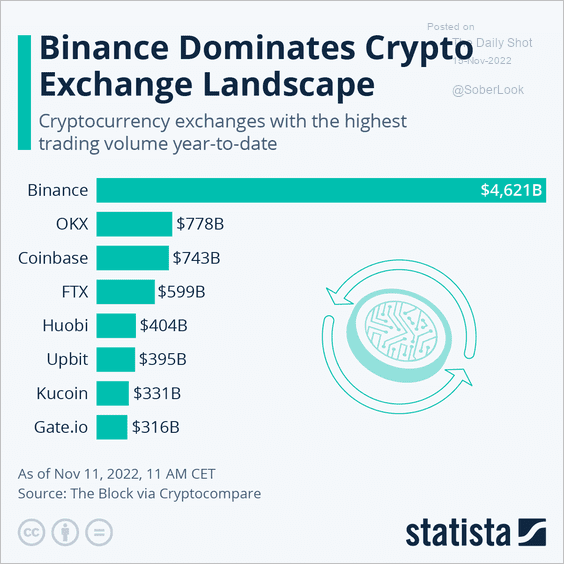

2. Binance dominates spot crypto trading (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Statista

Source: Statista

——————–

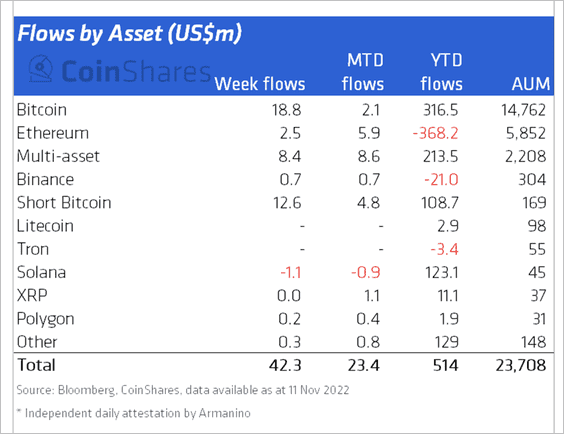

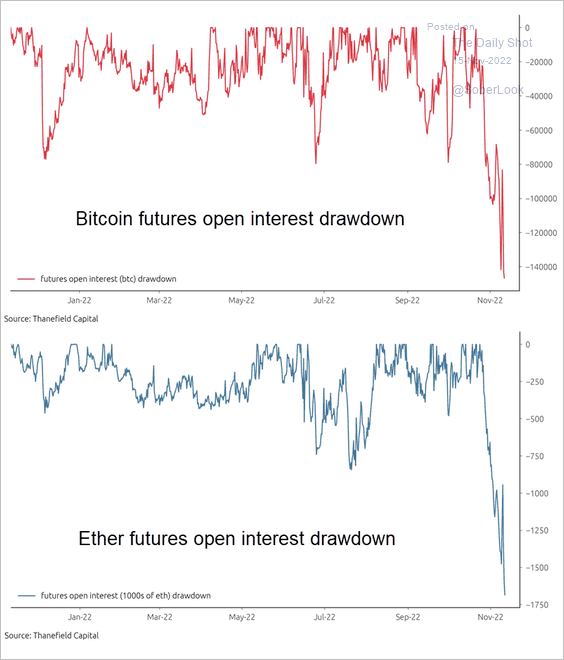

3. Crypto investment funds saw the largest inflows in 14 weeks in both long and short products. Solana-focused funds saw outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Crypto funds in the US and Brazil accounted for most inflows last week, while Switzerland-based funds saw outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

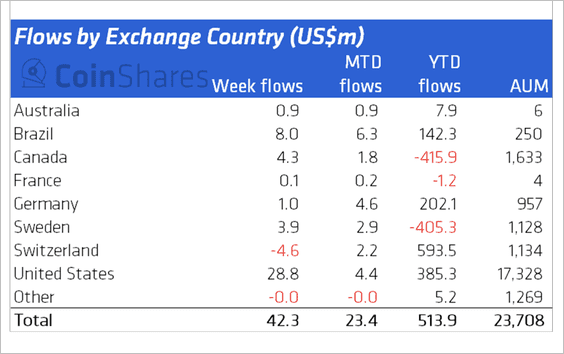

4. So far, only 30% of the top 50 coins outperformed bitcoin this year, reflecting the broader risk-off environment.

Source: Blockchain Center

Source: Blockchain Center

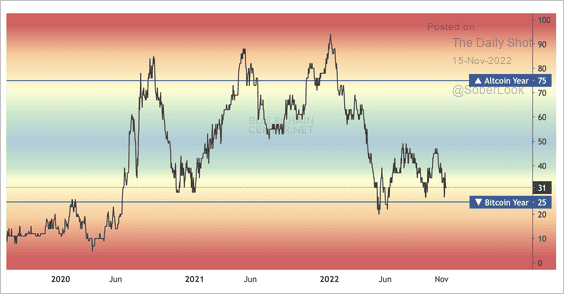

5. Crypto futures liquidity has been deteriorating.

Source: @ThanefieldCap

Source: @ThanefieldCap

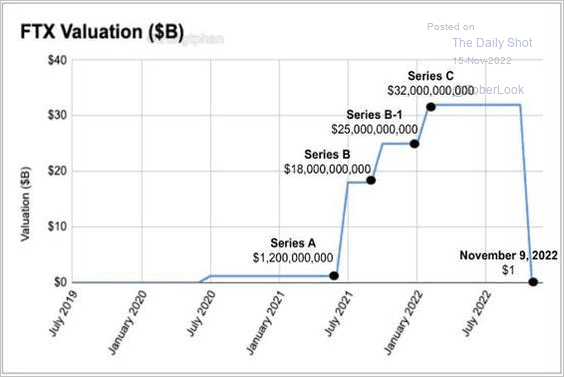

6. This chart shows the valuation trajectory of FTX.

Source: @carlquintanilla, @DougKass

Source: @carlquintanilla, @DougKass

Back to Index

Commodities

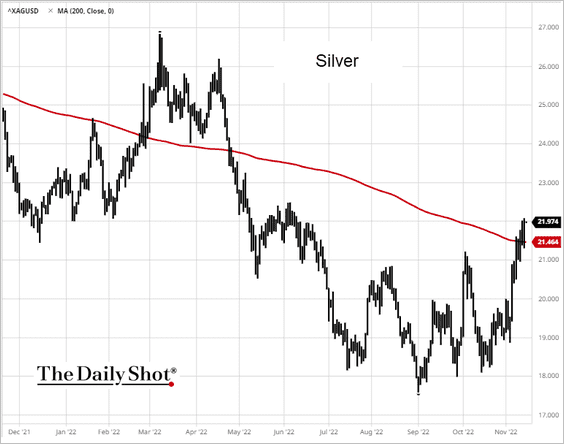

1. Silver broke above the 200-day moving average.

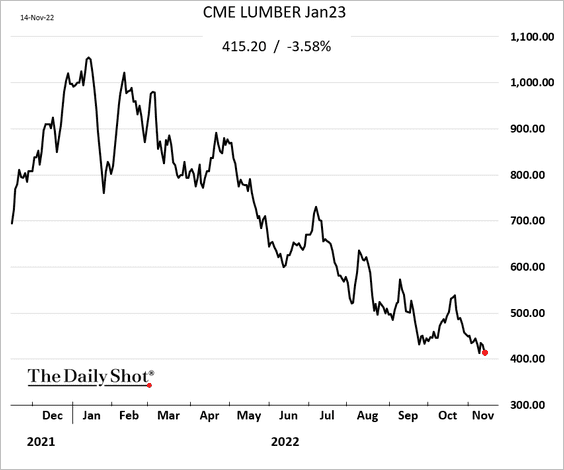

2. US lumber futures have been falling due to the housing market weakness.

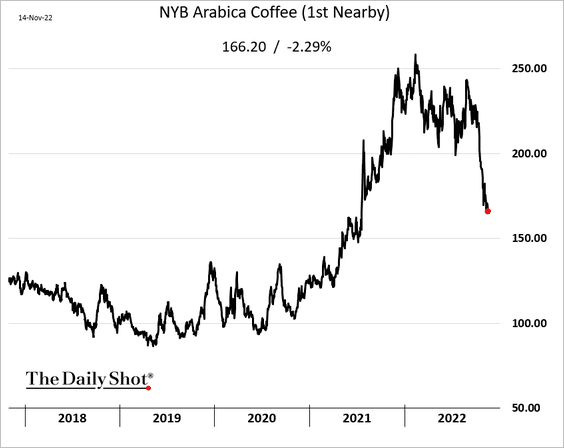

3. Coffee futures are tumbling.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

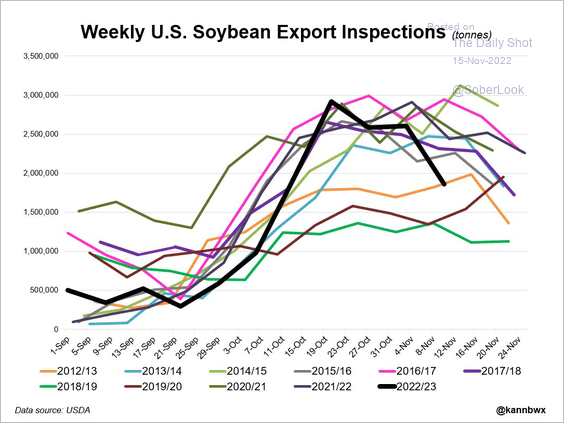

4. US soybean exports unexpectedly slowed.

Source: @kannbwx

Source: @kannbwx

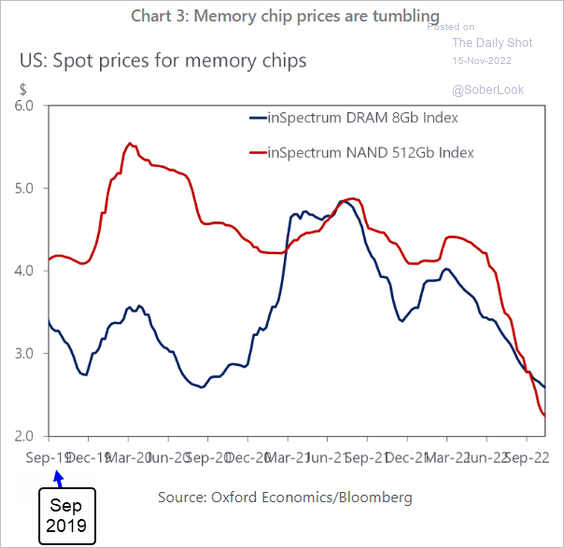

5. Memory chip prices are under pressure.

Source: Oxford Economics

Source: Oxford Economics

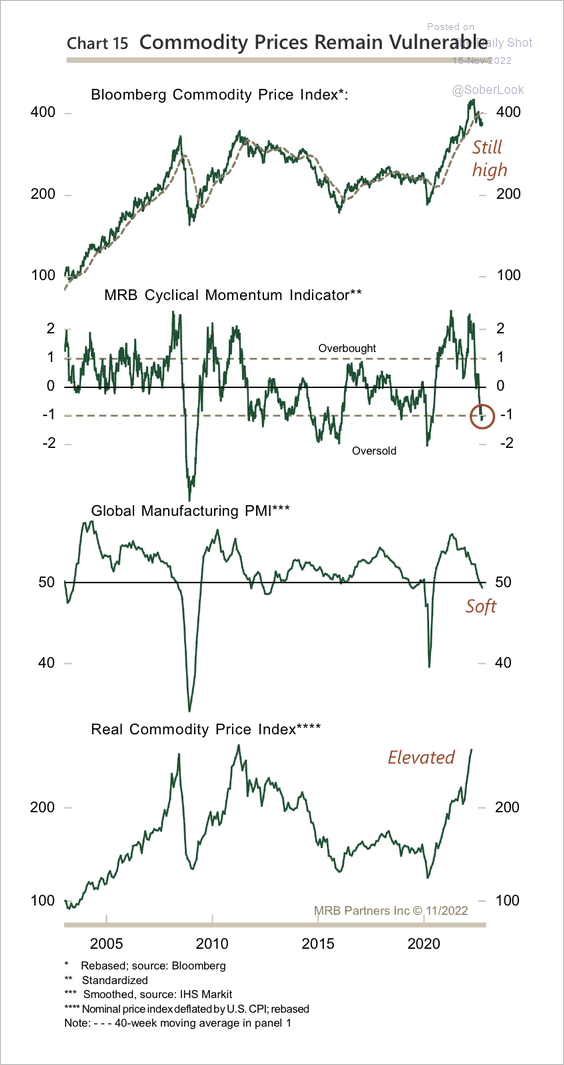

6. The decline in commodity prices is overdone, although weaker economic data could limit further upside from here.

Source: MRB Partners

Source: MRB Partners

Back to Index

Energy

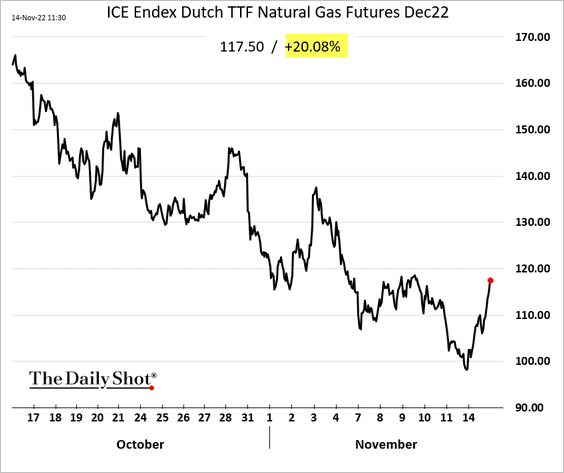

1. Freeport is delaying the restart of its LNG exports, …

Source: @markets, @SStapczynski, @a_shiryaevskaya Read full article

Source: @markets, @SStapczynski, @a_shiryaevskaya Read full article

… sending European gas prices higher.

——————–

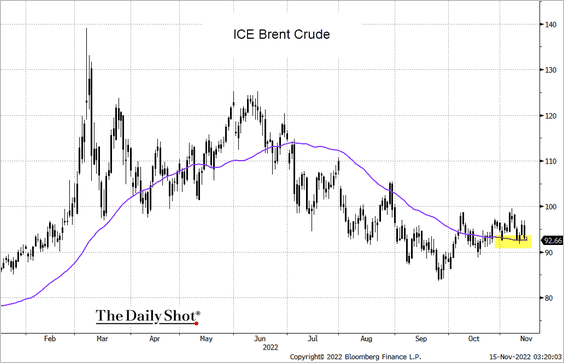

2. Brent crude is holding support at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

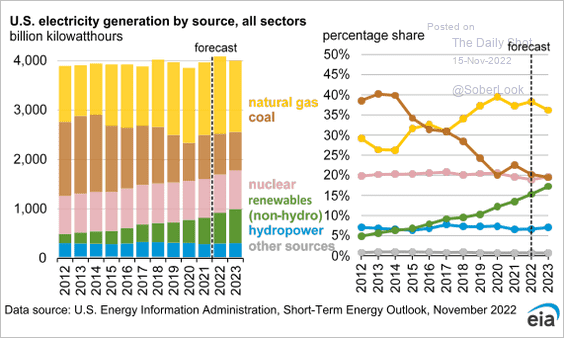

3. This chart shows US electricity generation by source.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

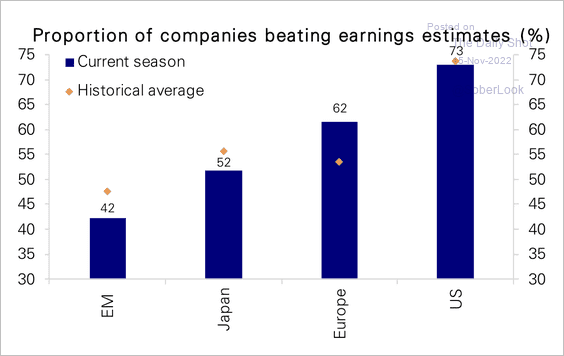

1. The breadth of earnings beats declined sharply below historical averages in all regions except Europe.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

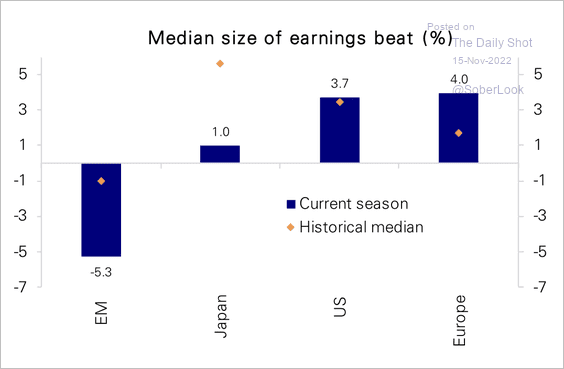

The median earnings beat in Europe is well above average (mainly because of energy), and significantly below average in emerging markets and Japan.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

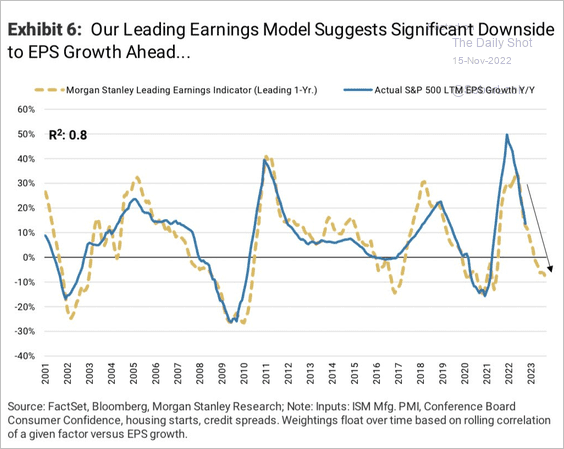

2. Many analysts expect an earnings recession ahead, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

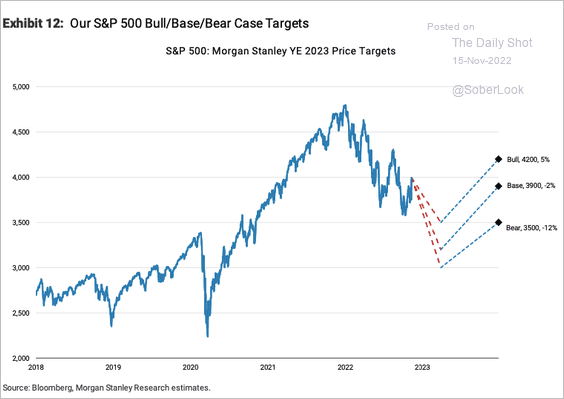

… posing downside risks to the market. Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

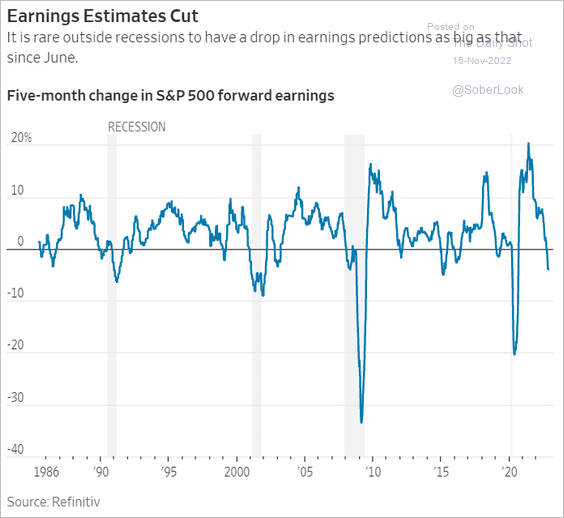

• Large forward earnings declines rarely happen outside economic recessions.

Source: @WSJ Read full article

Source: @WSJ Read full article

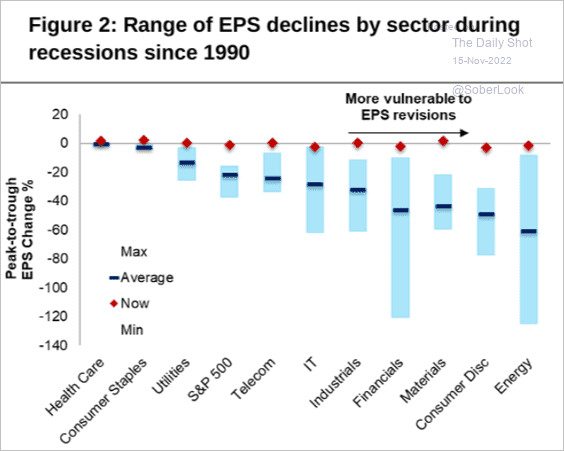

• Which sectors are most vulnerable to earnings revisions?

Source: Citi Private Bank

Source: Citi Private Bank

——————–

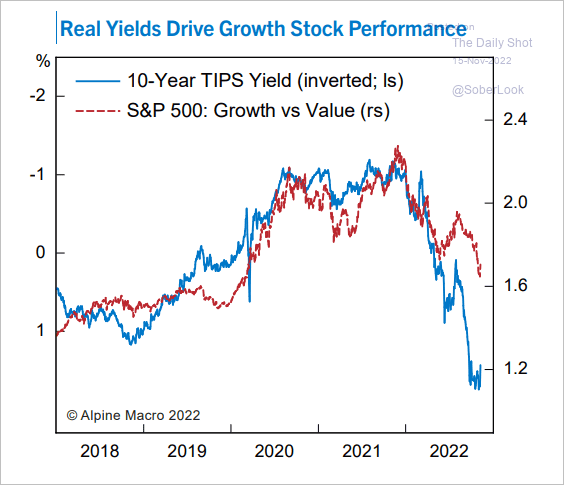

3. Growth stocks remain vulnerable amid elevated real yields.

Source: Alpine Macro

Source: Alpine Macro

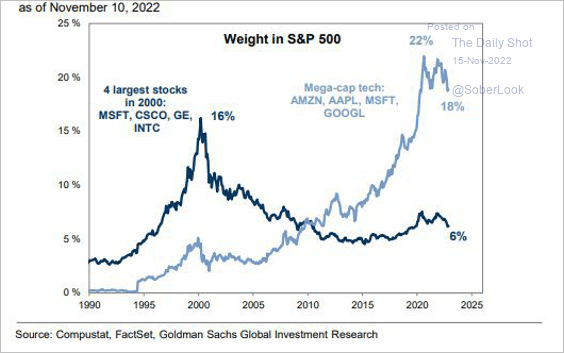

4. Tech mega-caps still represent an outsize portion of the S&P 500.

Source: Goldman Sachs; @MichaelAArouet

Source: Goldman Sachs; @MichaelAArouet

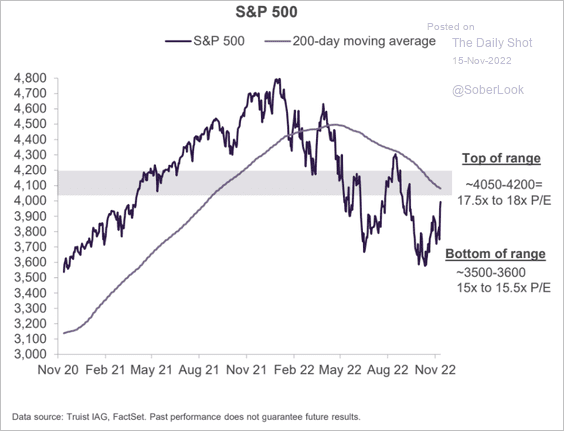

5. The market is capped in the near-term based on both fundamentals and technicals, according to Truist.

Source: Truist Advisory Services

Source: Truist Advisory Services

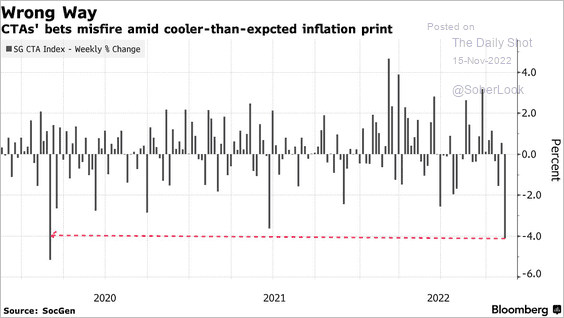

6. CTAs took a hit in recent days as the momentum factor stumbled.

Source: @markets, @luwangnyc, @denitsa_tsekova Read full article

Source: @markets, @luwangnyc, @denitsa_tsekova Read full article

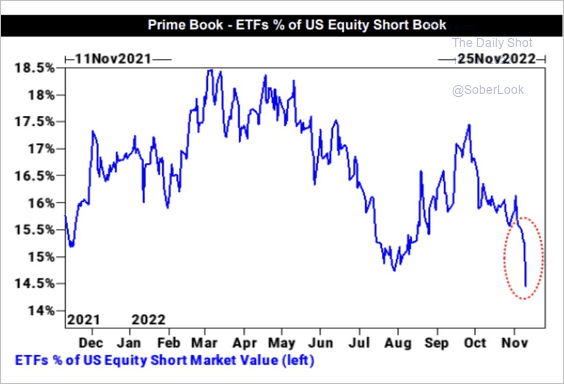

7. Short ETF positions have been forced out (based on data from GS prime brokerage clients).

Source: Goldman Sachs

Source: Goldman Sachs

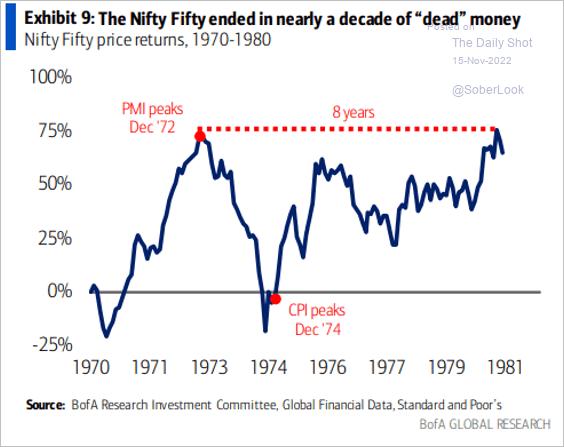

8. It took the market a while to recover after the 1970s inflation surge.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Alternatives

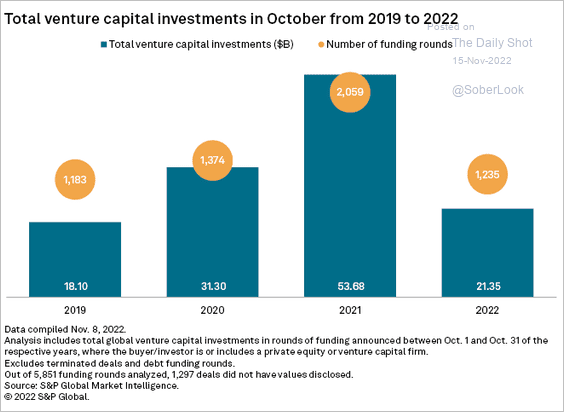

Let’s take a look at some trends in venture capital markets.

• VC activity slowed in October relative to previous years.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

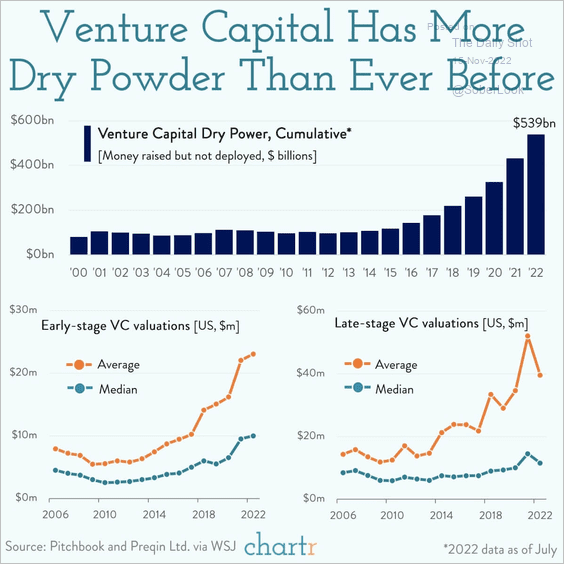

• Dry powder is at record levels.

Source: @chartrdaily

Source: @chartrdaily

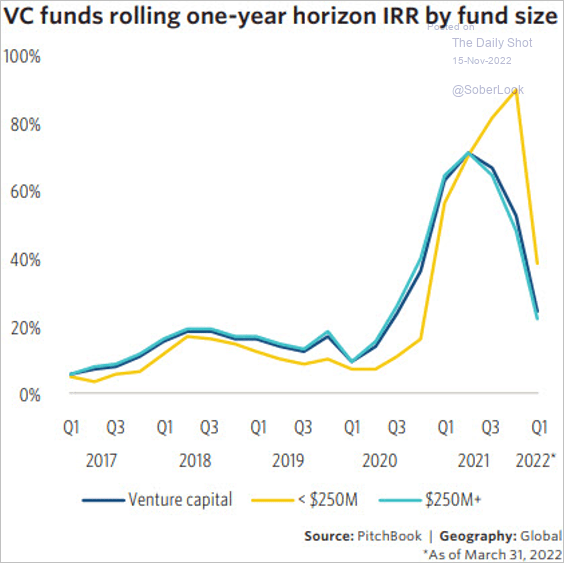

• Global venture capital fund performance is more in line with historical trends following extreme levels last year.

Source: PitchBook

Source: PitchBook

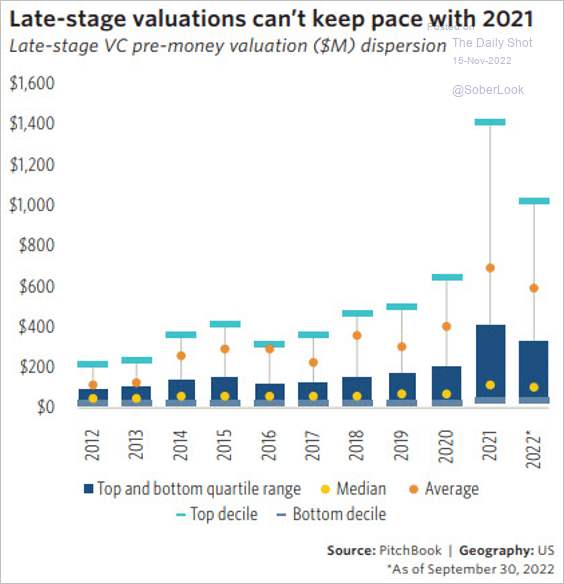

• Late-stage venture capital valuations are rapidly falling, while seed and early-stage valuations continue to surge, according to PitchBook. Investors are moving earlier in the venture lifecycle.

Source: PitchBook

Source: PitchBook

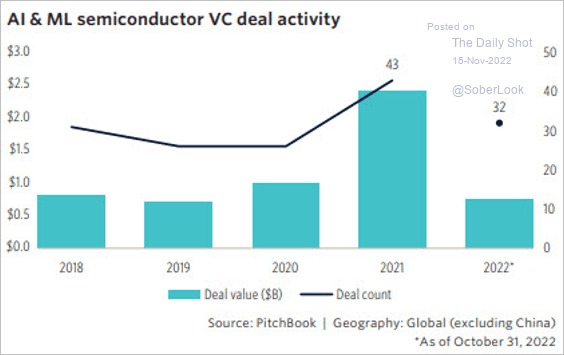

• Deal activity and valuations in artificial intelligence and machine learning semiconductor industries are down this year.

Source: PitchBook

Source: PitchBook

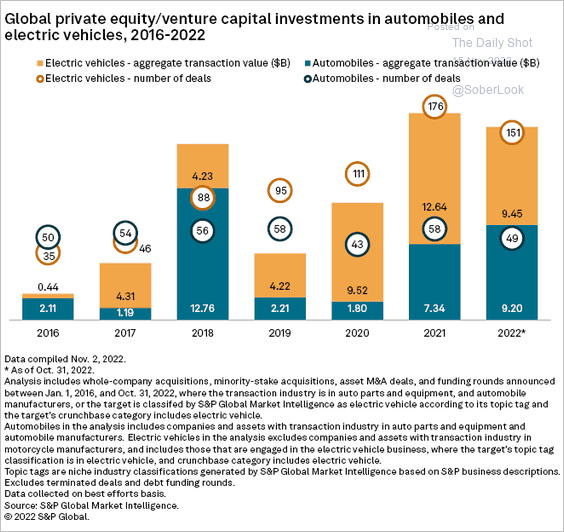

• Automotive sector investment has been robust for PE and VC funds.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

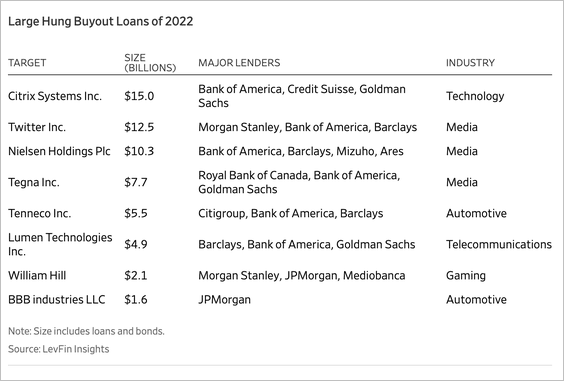

1. Here is a look at ‘hung’ buyout deals this year (when lenders keep debt rather than sell at a loss).

Source: @WSJ Read full article

Source: @WSJ Read full article

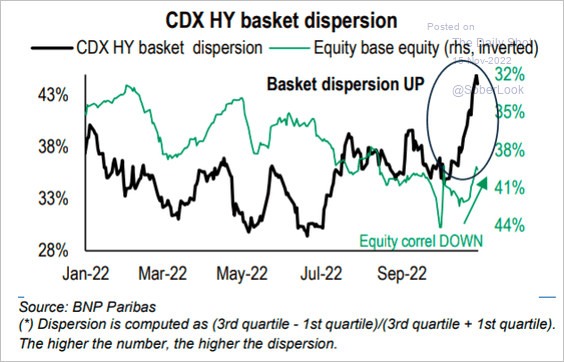

2. The HY spread dispersion has blown out in credit default swaps. What does it mean for equity vol?

Source: BNP Paribas; III Capital Management

Source: BNP Paribas; III Capital Management

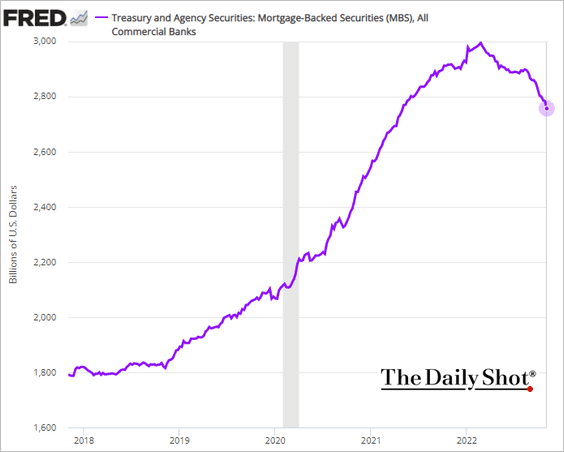

3. Banks continue to reduce their holdings of mortgage bonds.

Back to Index

Rates

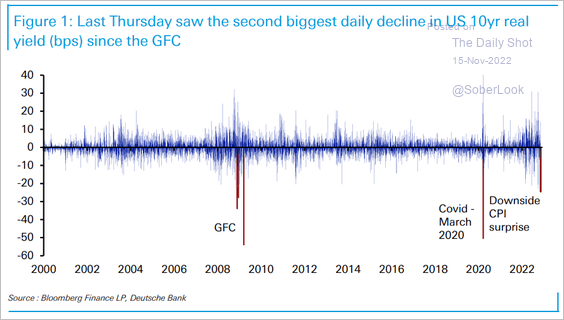

1. The decline in the 10-year real Treasury yield last week was the second-largest since the financial crisis and behind only the initial COVID-19 move in March 2020.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

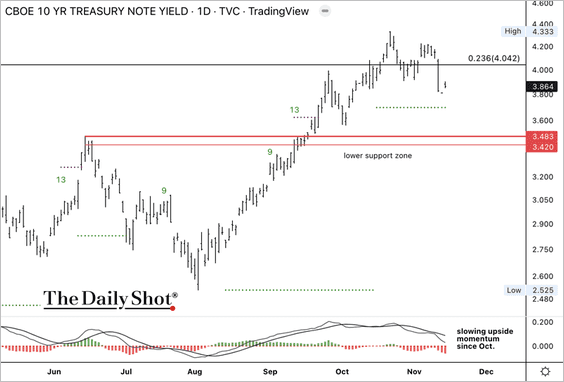

2. The 10-year Treasury yield could find support around 3.5%.

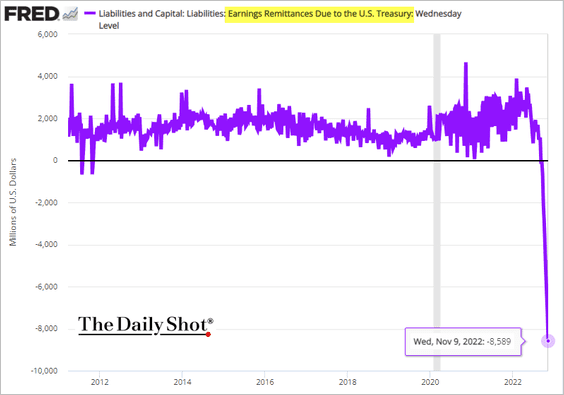

3. It will be a while before the Fed sends remittances to the US Treasury.

Back to Index

Global Developments

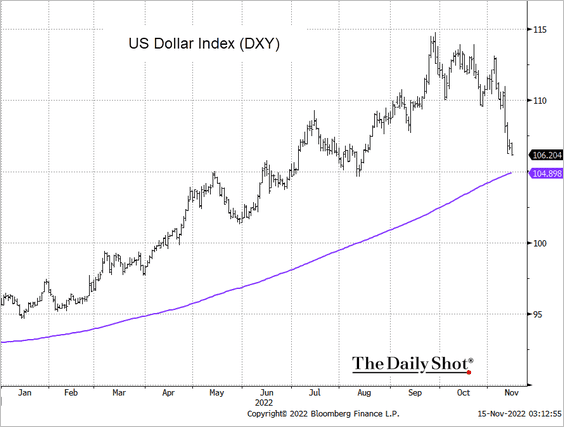

1. The dollar index (DXY) is nearing its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

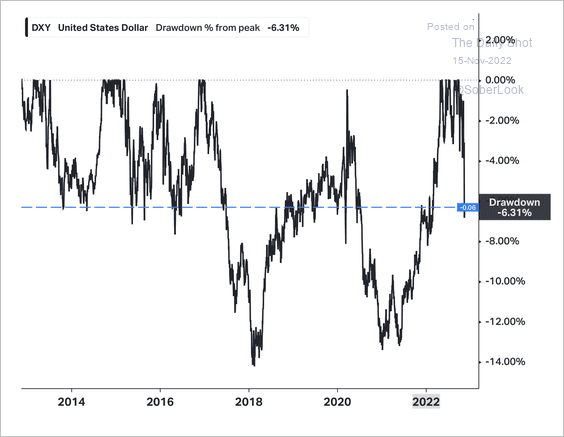

This has been the sharpest drawdown in DXY since 2020.

Source: Koyfin

Source: Koyfin

——————–

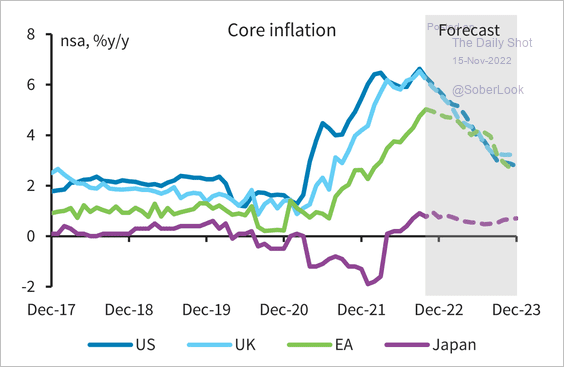

2. Here is the core inflation forecast for the US, UK, Eurozone, and Japan from Barclays Research.

Source: Barclays Research

Source: Barclays Research

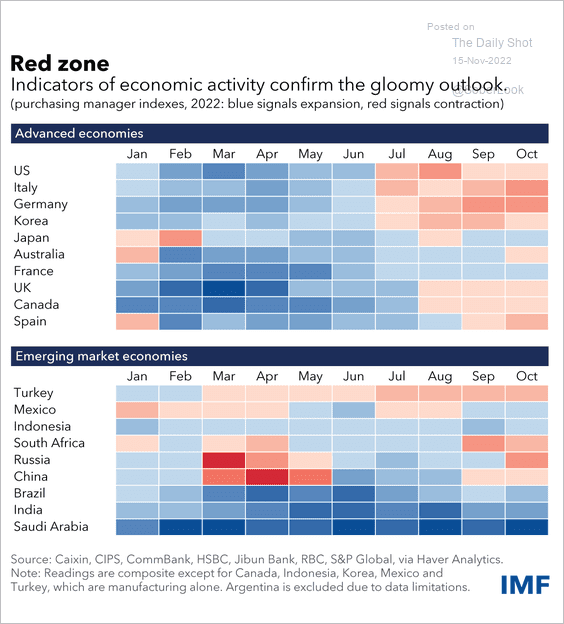

3. Finally, we have the IMF’s economic activity heat map.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

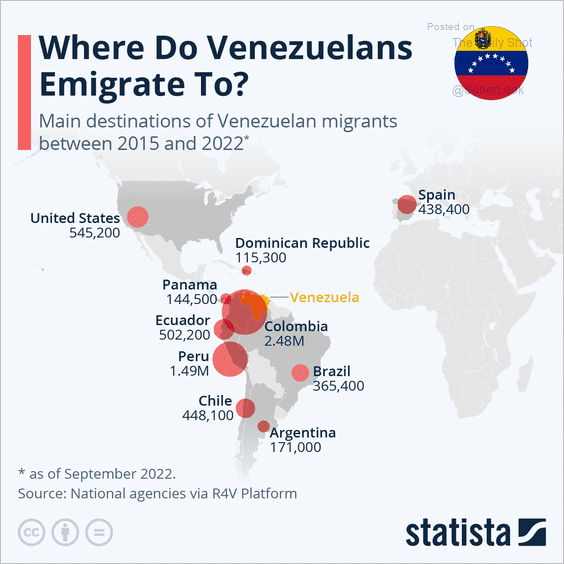

1. Immigrants from Venezuela:

Source: Statista

Source: Statista

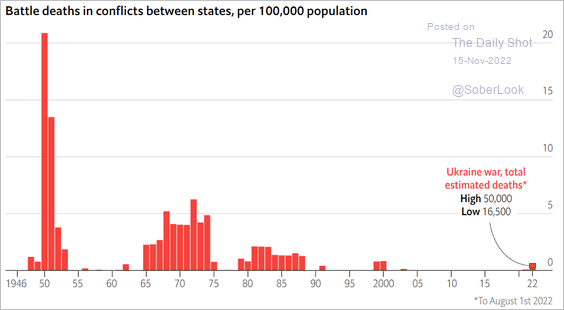

2. Population-adjusted battle deaths:

Source: The Economist Read full article

Source: The Economist Read full article

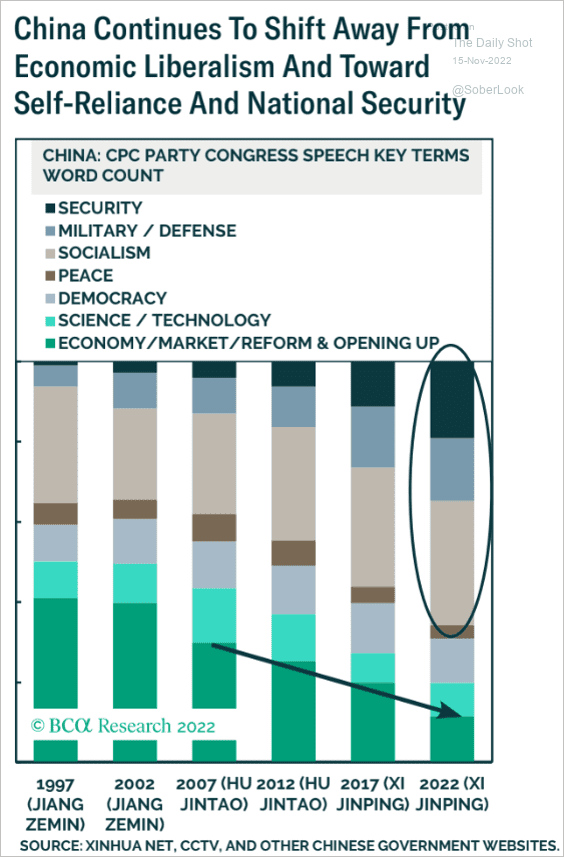

3. Key terms in CPC Party Congress speeches:

Source: BCA Research

Source: BCA Research

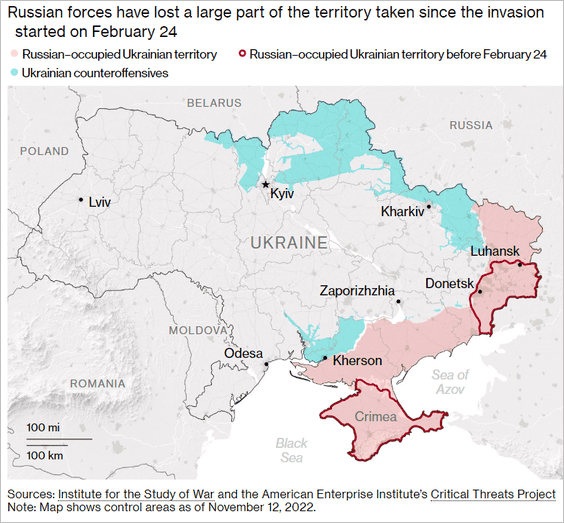

4. Ukraine’s counterattacks:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

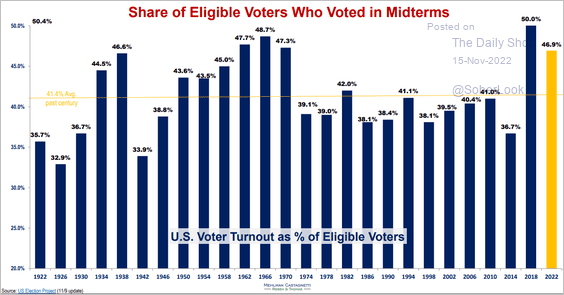

5. Midterms voter turnout in the US:

Source: Bruce Mehlman

Source: Bruce Mehlman

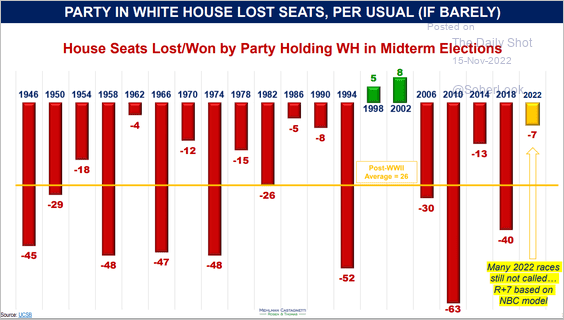

6. House seats lost by the party holding the White House:

Source: Bruce Mehlman

Source: Bruce Mehlman

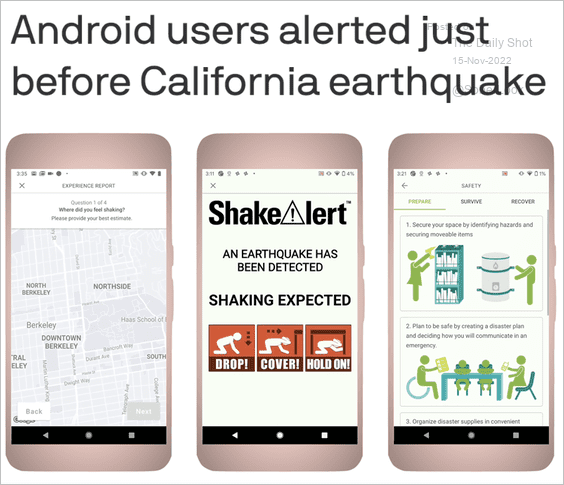

7. Smartphones providing earthquake alerts:

Source: @axios Read full article

Source: @axios Read full article

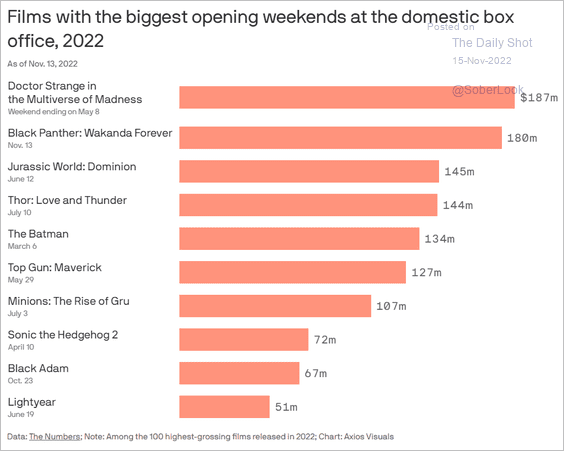

8. Films with the biggest opening weekends in 2022:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index