The Daily Shot: 16-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

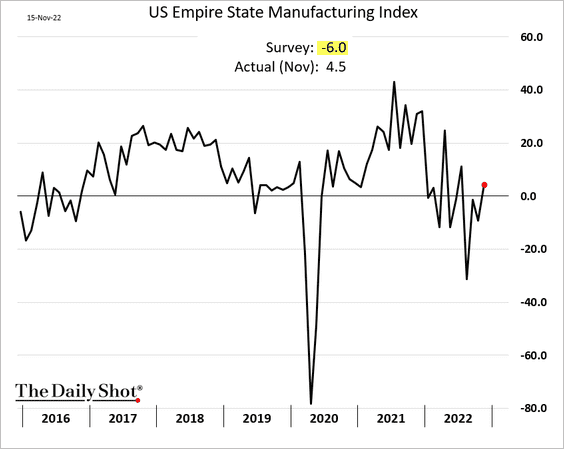

1. The NY Fed’s regional manufacturing index (the first such report for November) was stronger than expected.

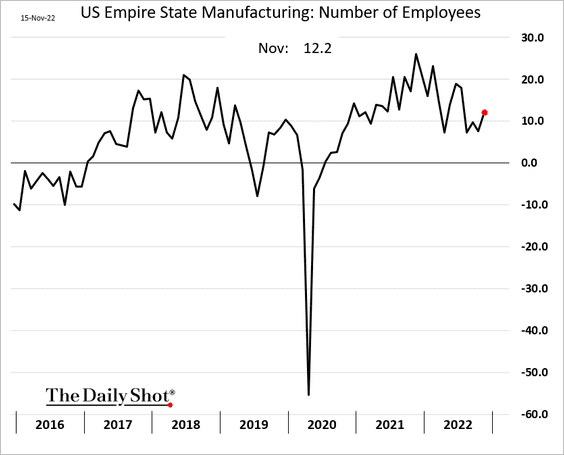

• Hiring picked up.

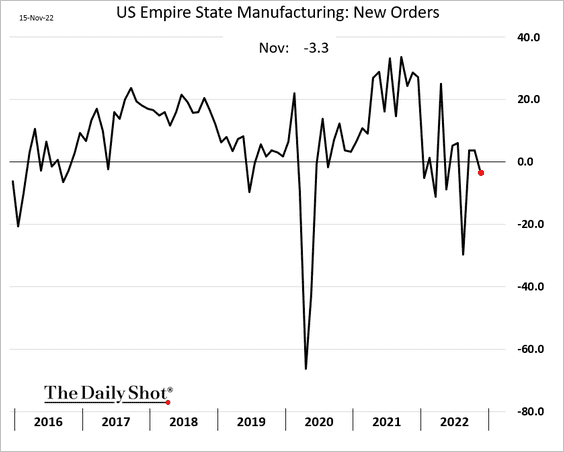

• But new orders remain lackluster.

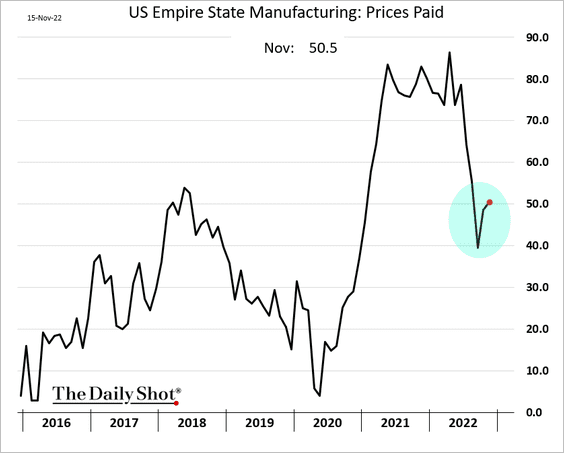

• The cost index has been moving higher, suggesting that manufacturers still face price pressures.

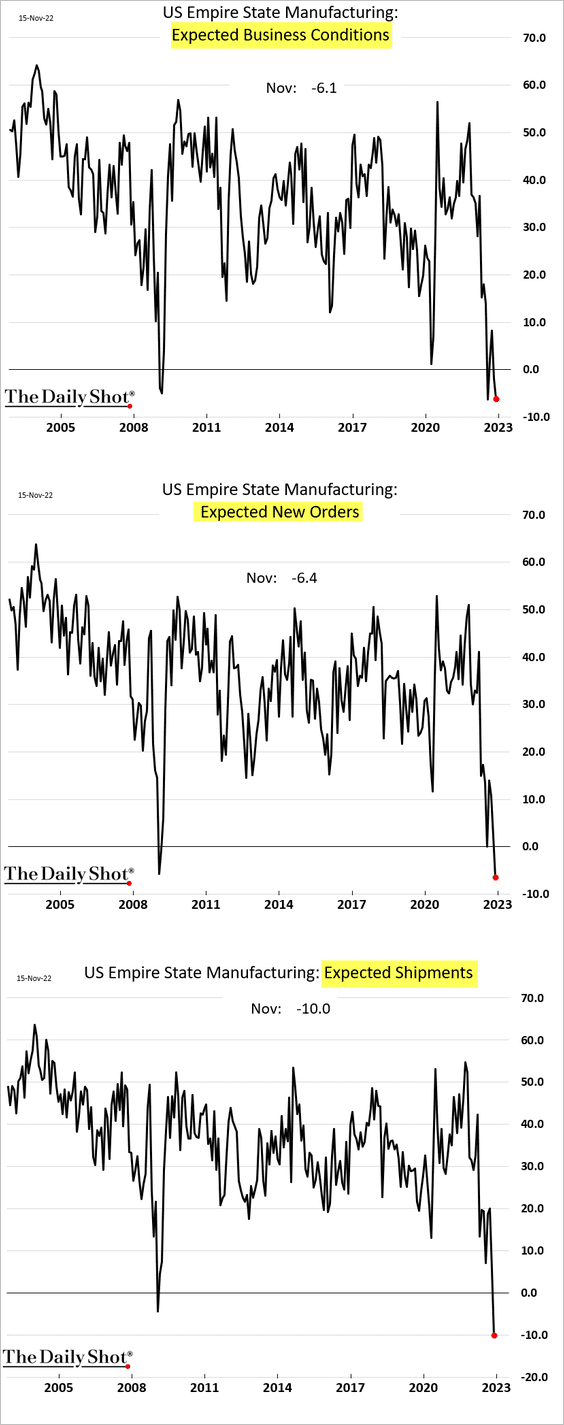

Despite a more upbeat headline figure, forward-looking indicators are crashing.

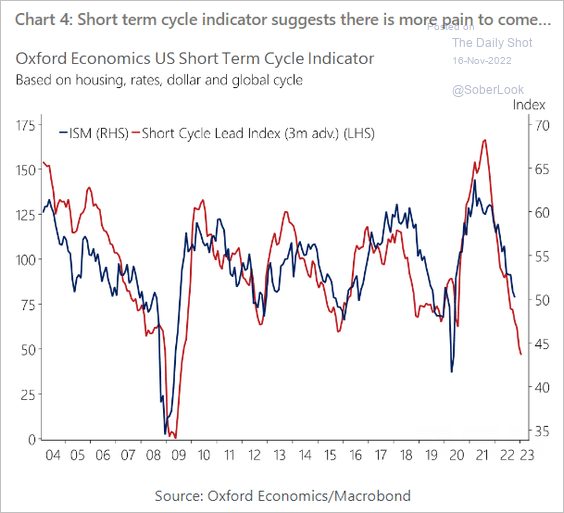

At the national level, the Oxford Economics leading index points to further weakness in US factory activity (and perhaps the overall economy).

Source: Oxford Economics

Source: Oxford Economics

——————–

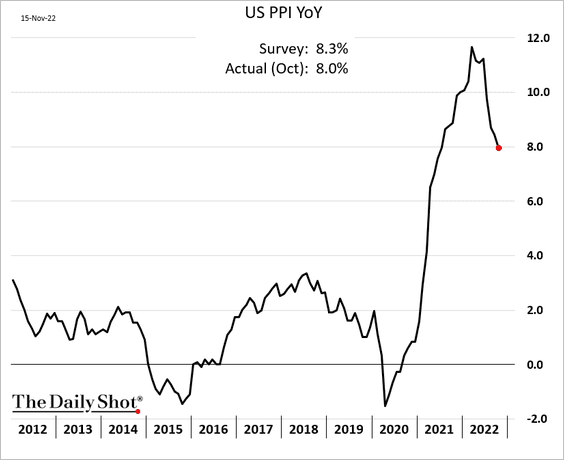

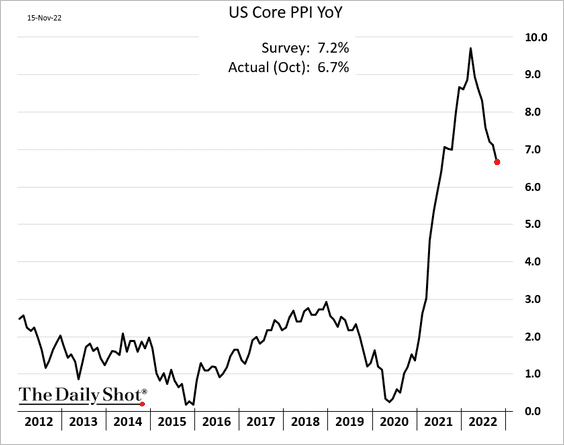

2. Next, we have some updates on inflation.

• Producer price inflation continues to moderate.

– The core PPI surprised to the downside, …

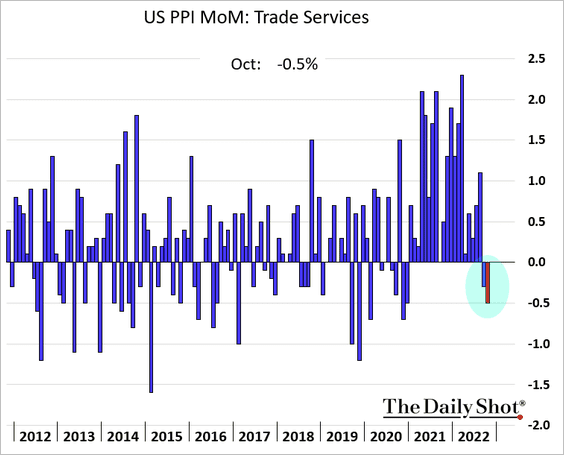

… as corporate margins (PPI trade services) decline.

Year-over-year:

Month-over-month:

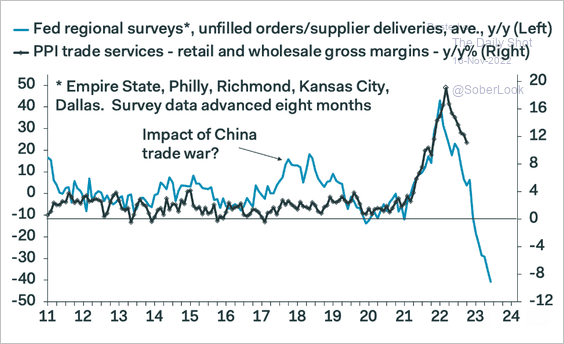

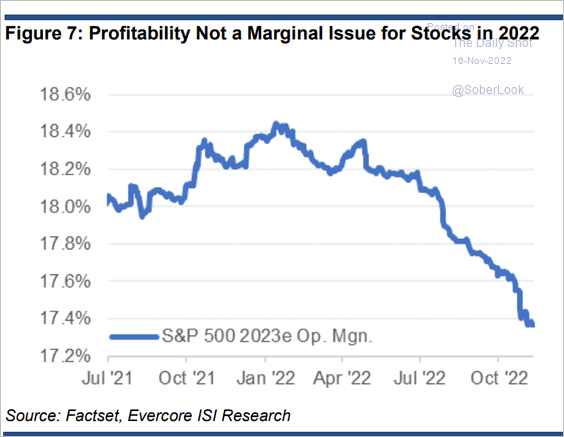

Margins are expected to keep falling (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Evercore ISI Research

Source: Evercore ISI Research

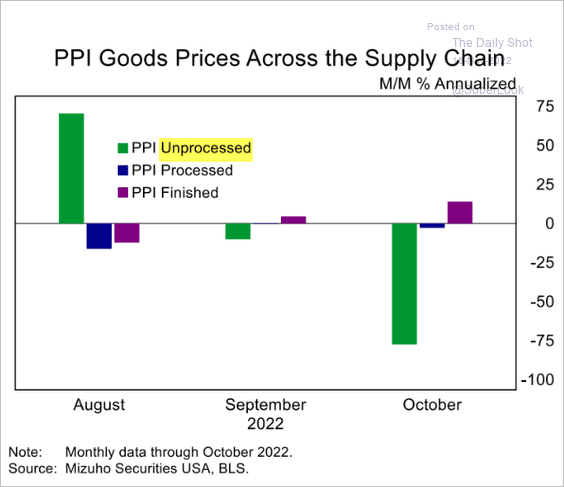

– Upstream price pressures are easing.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

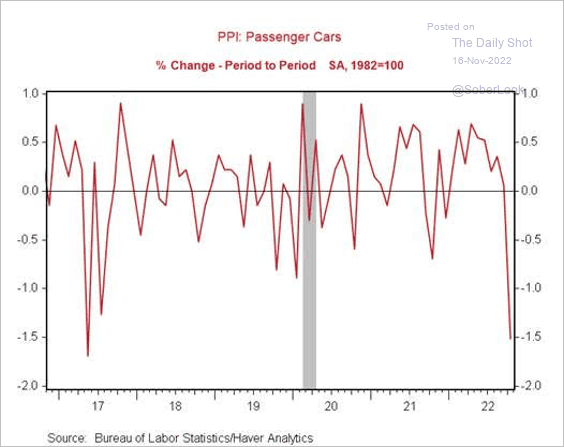

– Vehicle PPI declined sharply last month.

Source: LPL Research

Source: LPL Research

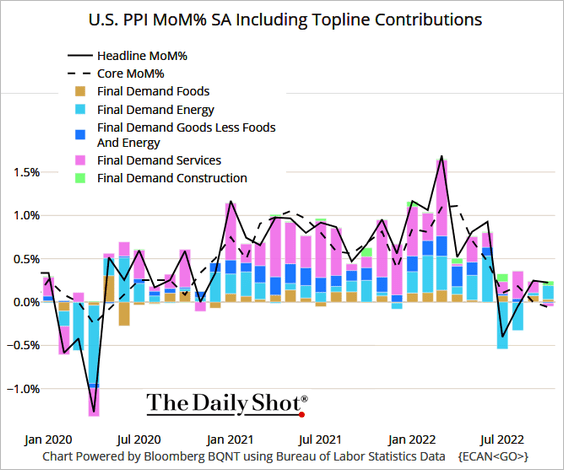

– Here are the monthly contributions to the PPI.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

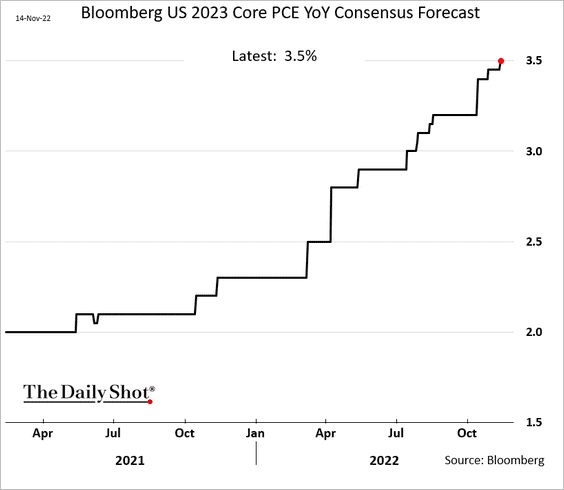

• Economists continue to boost their core PCE inflation forecasts (the Fed’s preferred indicator).

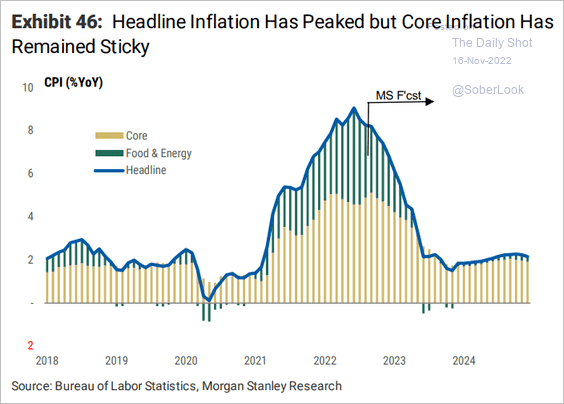

• Here is Morgan Stanley’s CPI forecast.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

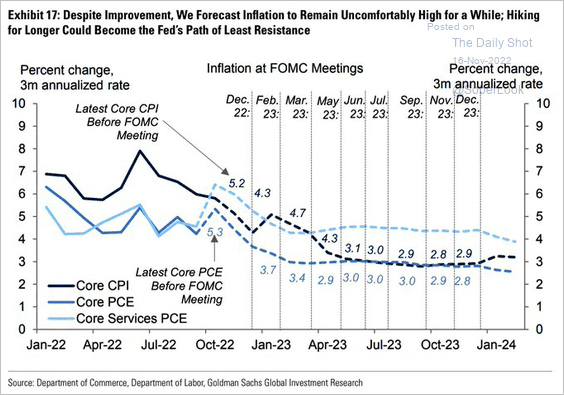

• Goldman expects the core services inflation to remain sticky.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

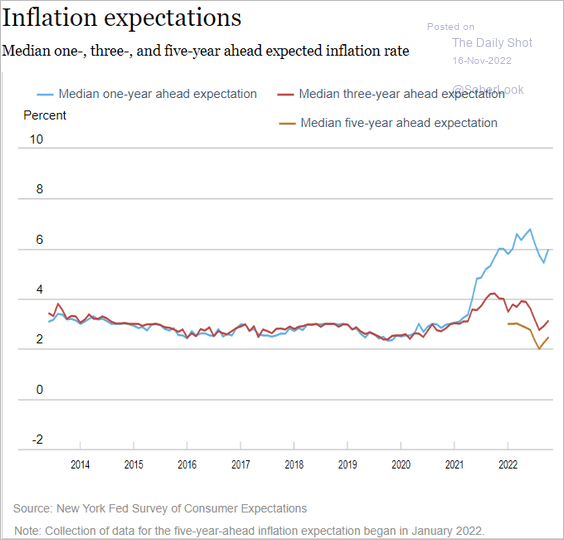

• The NY Fed’s survey of consumers showed an increase in inflation expectations.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

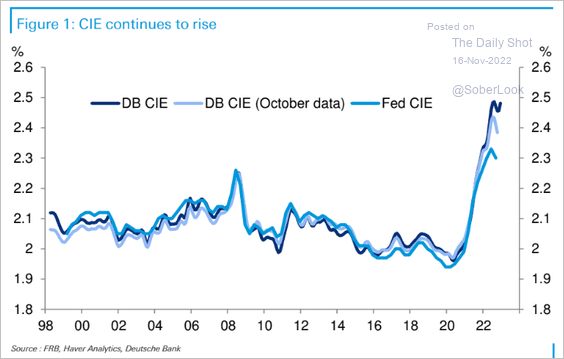

• Deutsche Bank’s index of common inflation expectations remains near the highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

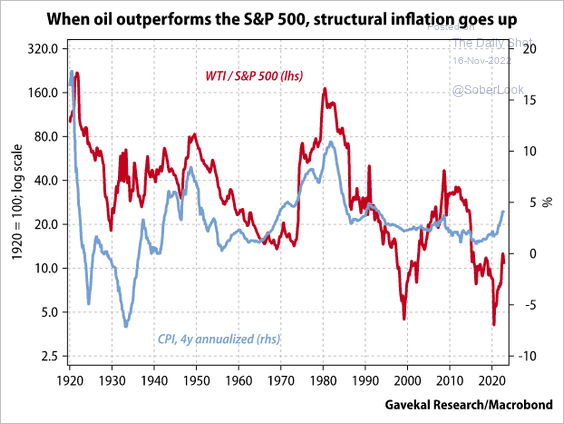

• Inflation tends to rise when oil outperforms stocks.

Source: Gavekal Research

Source: Gavekal Research

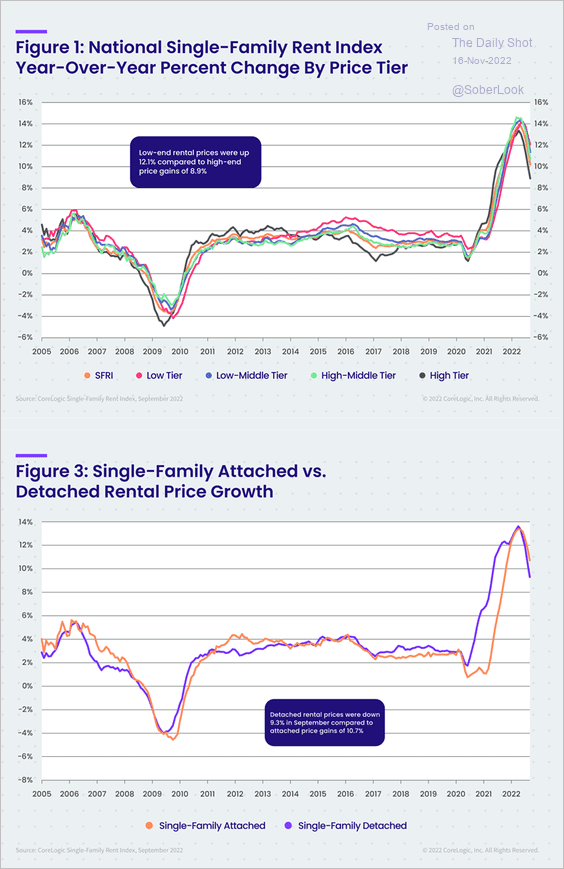

• Single-family rent inflation is moderating.

Source: CoreLogic

Source: CoreLogic

——————–

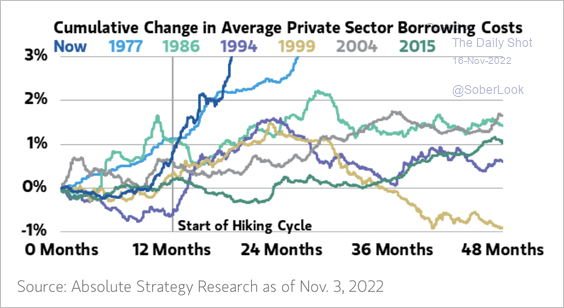

2. This year has seen the sharpest rise in borrowing costs during a hiking cycle.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

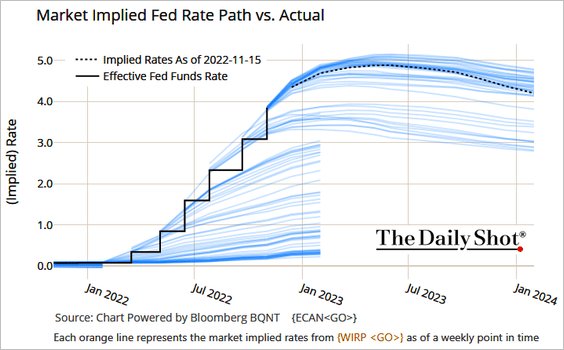

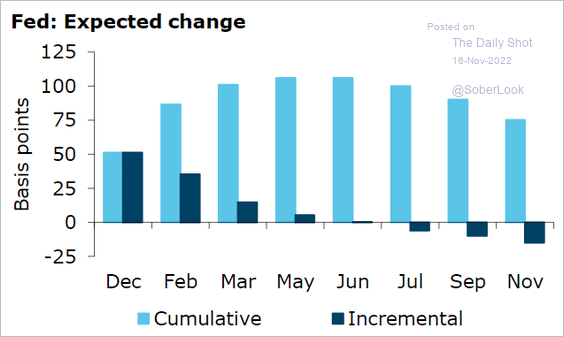

• Here is the evolution of market pricing for the fed funds rate trajectory.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

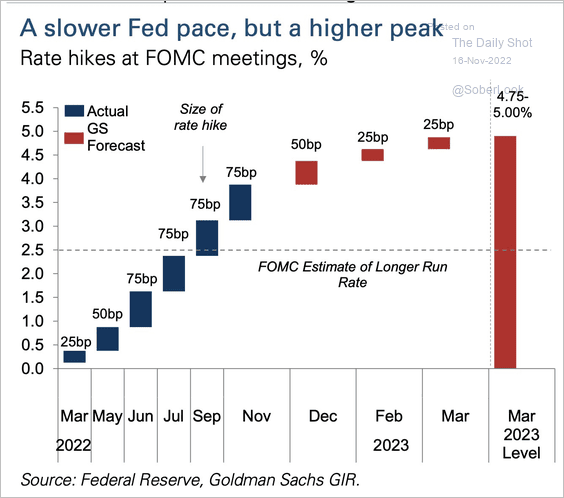

– Goldman sees a 50 bps hike in December and a 25 bps increase in February and March.

Source: Goldman Sachs

Source: Goldman Sachs

That’s not very different from market expectations.

Source: @ANZ_Research

Source: @ANZ_Research

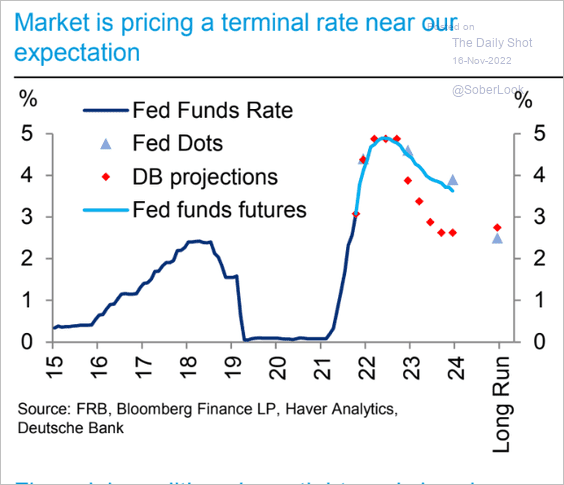

– Deutsche Bank sees sharper rate cuts than the market (starting next year).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

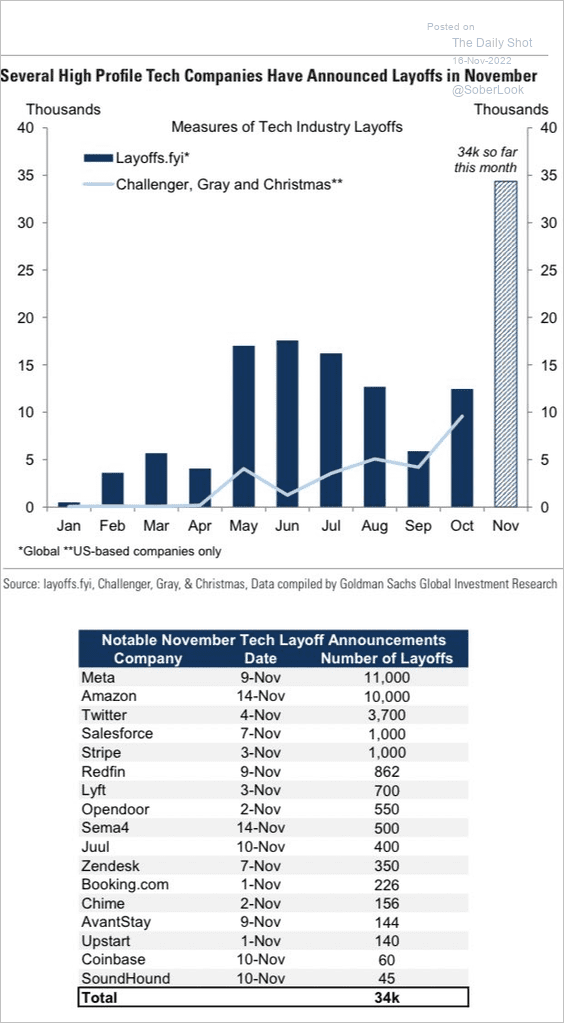

3. High-profile layoff announcements surged this month.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

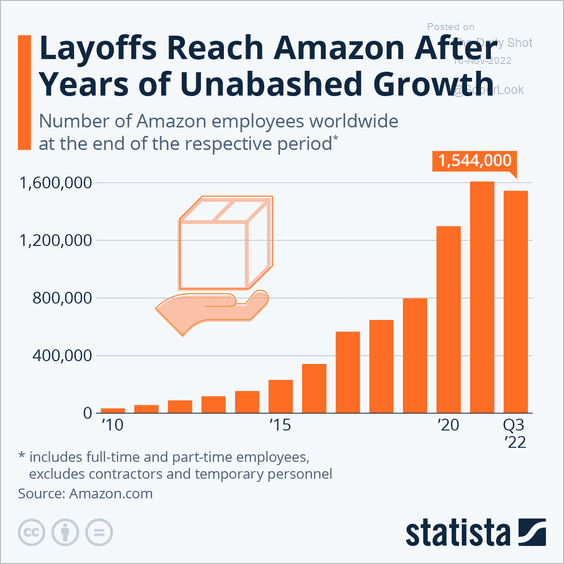

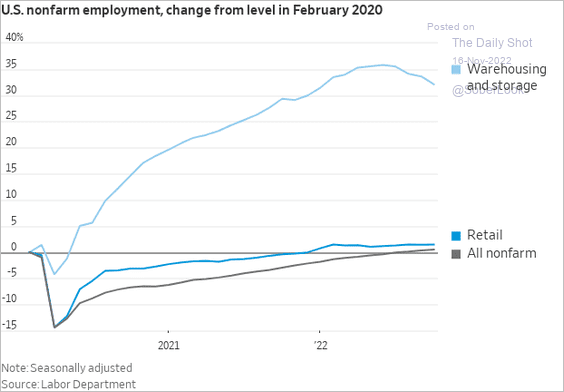

• After soaring during the pandemic era, warehouse employment is likely to decline in the months ahead.

Source: Statista

Source: Statista

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Canada

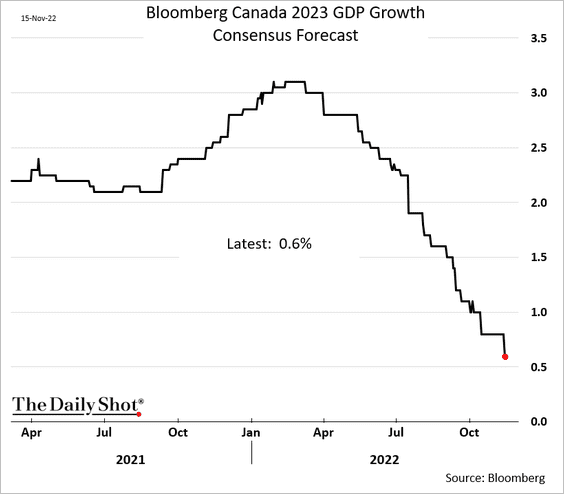

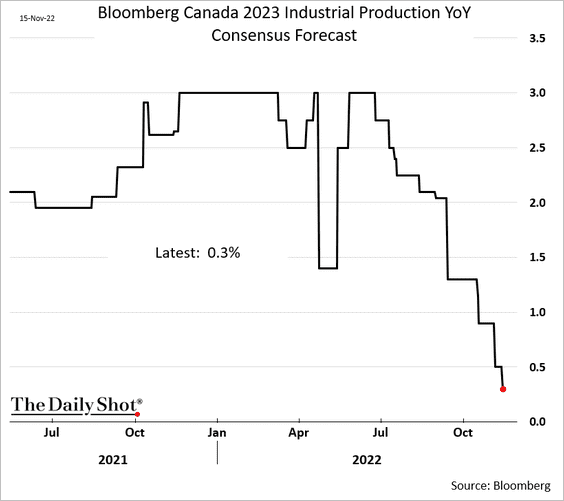

1. Economists have been downgrading Canada’s 2023 growth projections (2 charts).

——————–

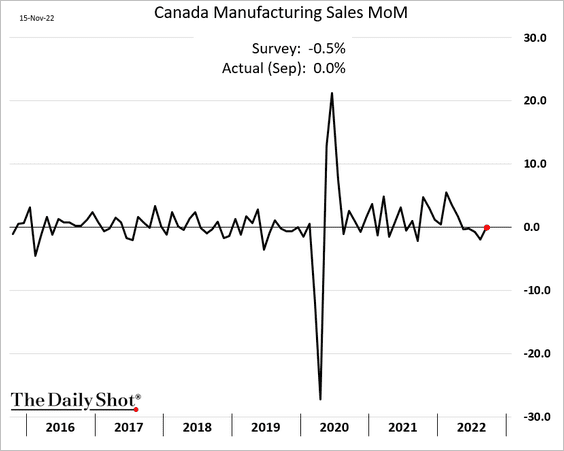

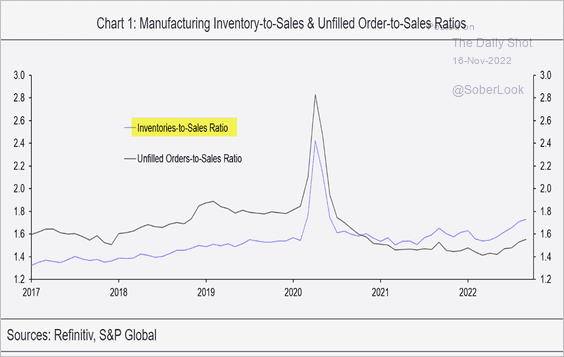

2. Manufacturing sales surprised to the upside.

But inventories have been rising quickly.

Source: Capital Economics

Source: Capital Economics

——————–

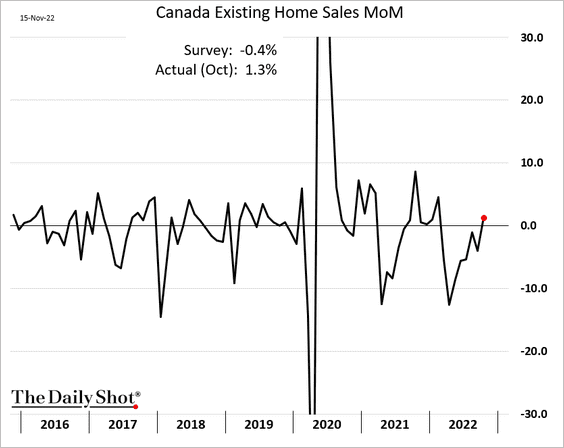

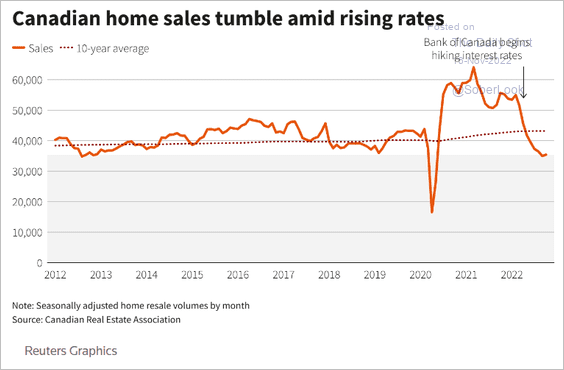

3. Existing home sales topped expectations.

However, sales are now well below the 10-year moving average.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

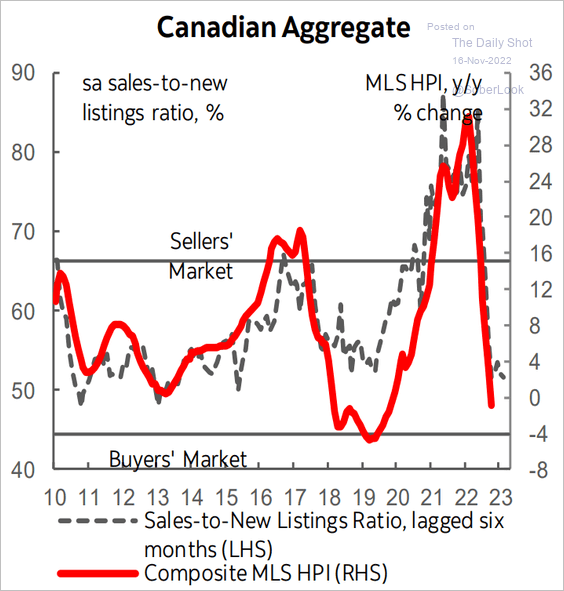

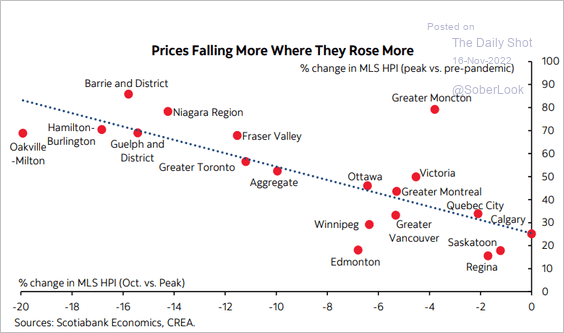

4. Home prices remain under pressure, …

Source: Scotiabank Economics

Source: Scotiabank Economics

… with prices falling faster in areas where they increased the most.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

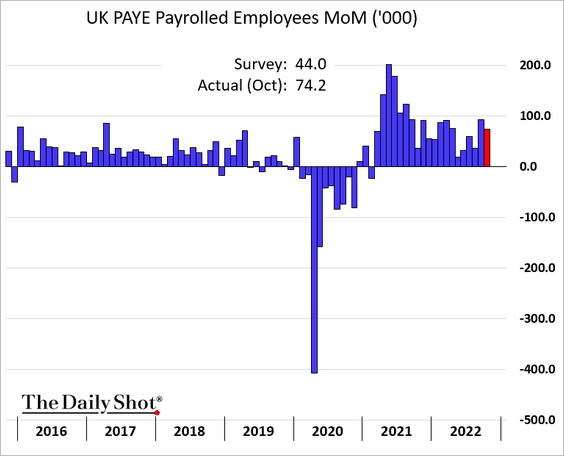

1. October payrolls were firmer than expected.

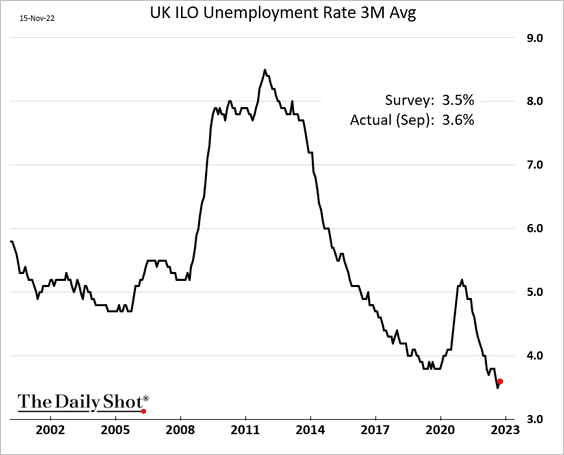

• The unemployment rate ticked higher.

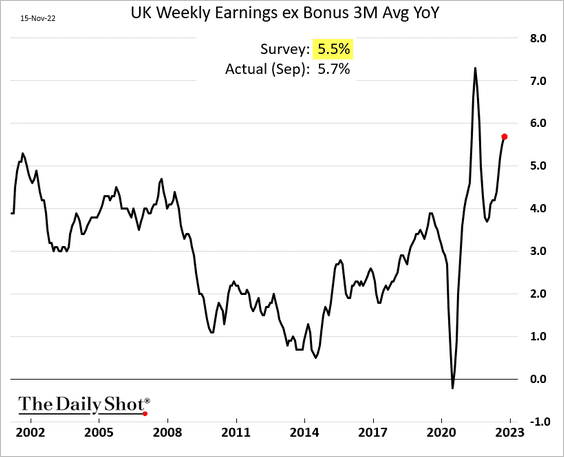

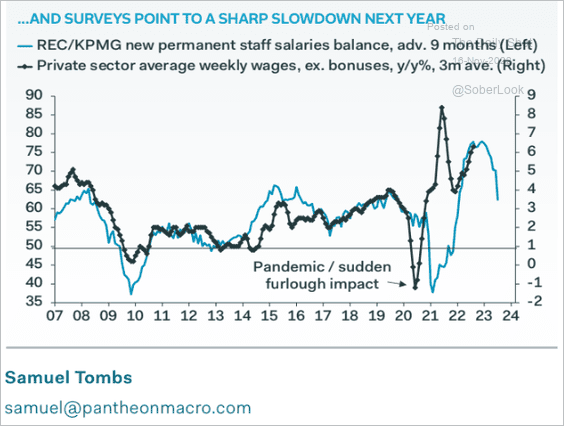

• Wages are surging, …

… but that’s not going to last.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

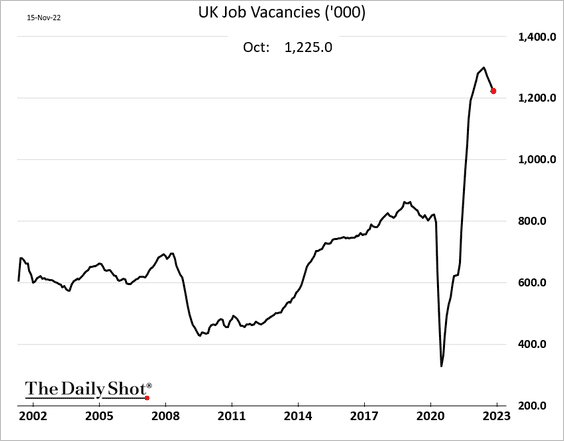

• Job vacancies have peaked.

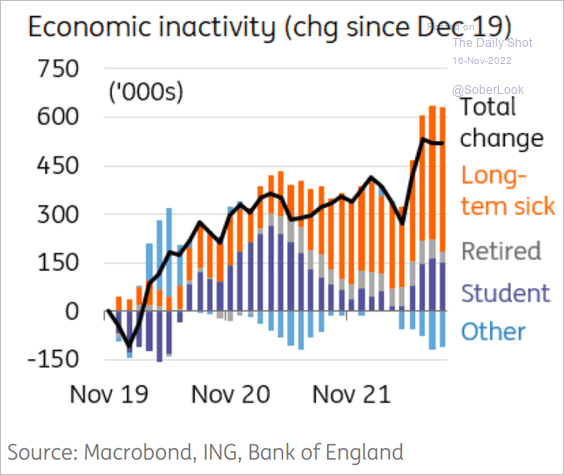

• Labor force inactivity remains elevated.

Source: ING

Source: ING

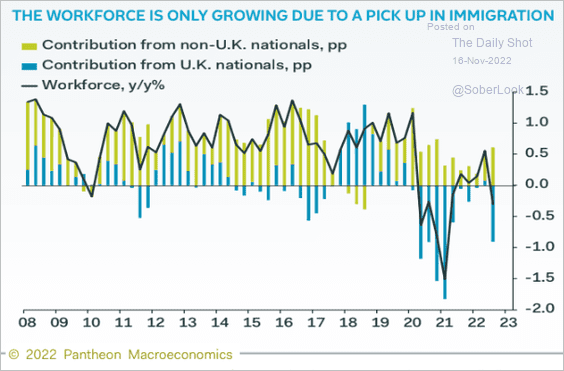

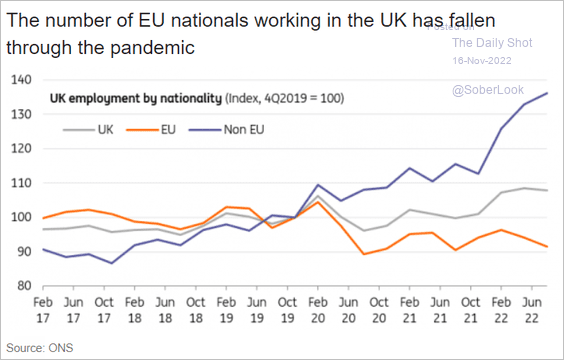

• Labor force growth has been driven by immigration (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: ING

Source: ING

——————–

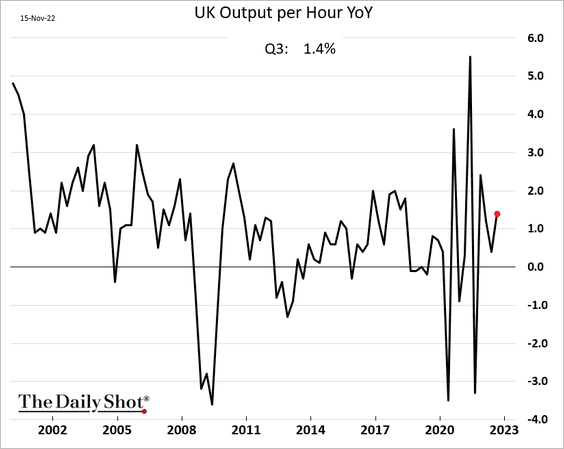

2. Productivity growth improved last quarter.

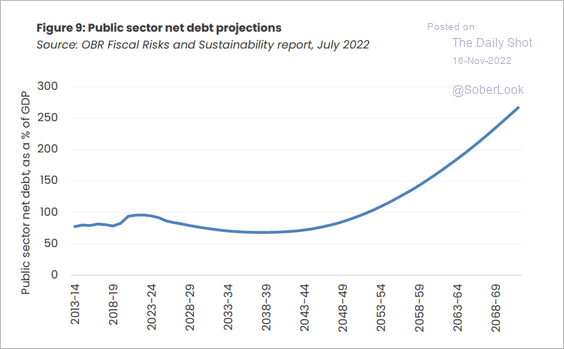

3. How much will the debt-to-GDP ratio rise over the next few decades?

Source: Onward Read full article

Source: Onward Read full article

Back to Index

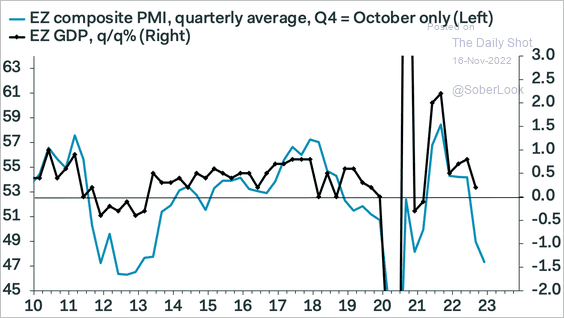

The Eurozone

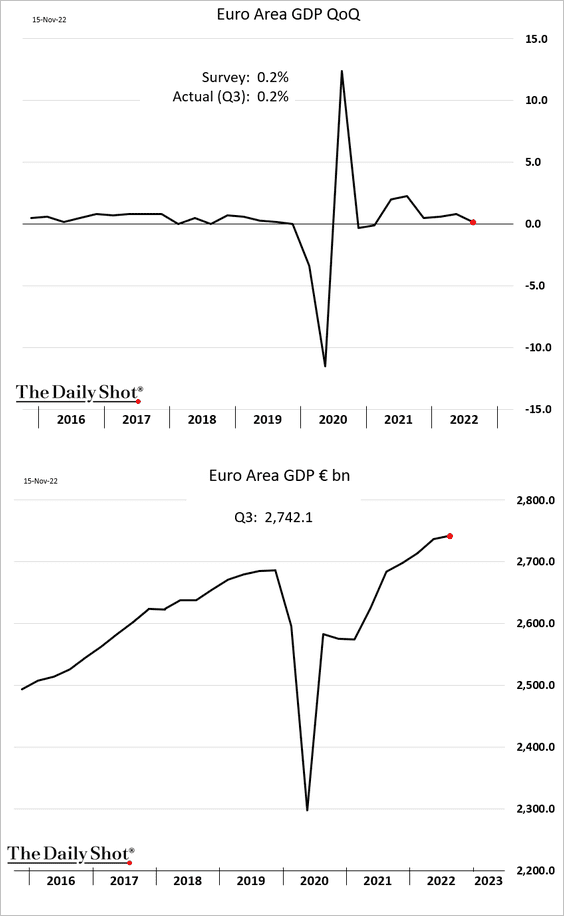

1. The Eurozone Q3 GDP was in line with forecasts.

But the economy faces significant headwinds.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

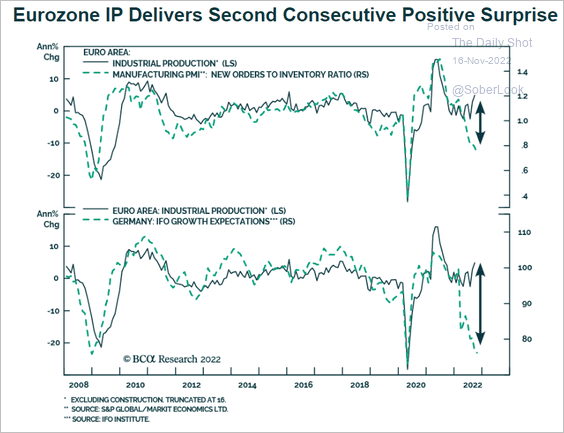

2. Industrial production has been surprising to the upside.

Source: BCA Research

Source: BCA Research

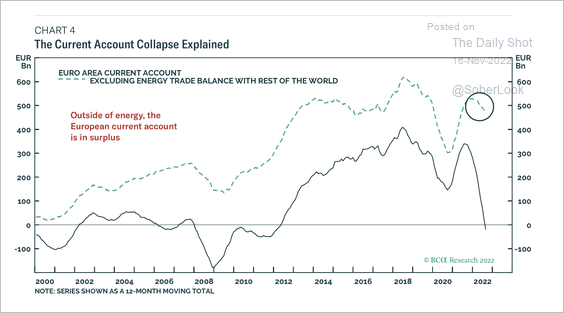

3. Outside of energy, the euro area’s current account is in surplus.

Source: BCA Research

Source: BCA Research

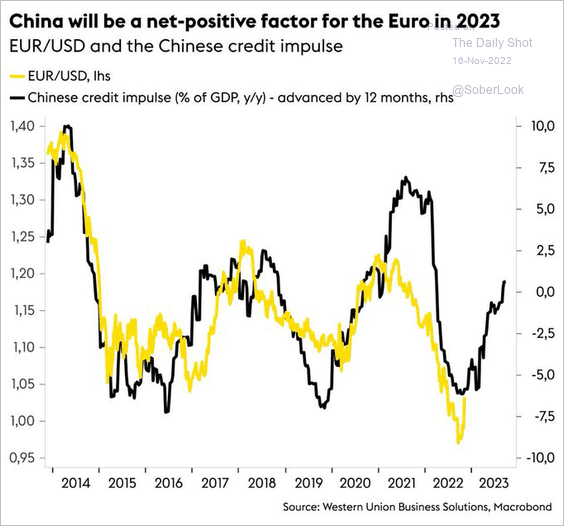

4. China’s rebound should be positive for the euro.

Source: @AndreasSteno

Source: @AndreasSteno

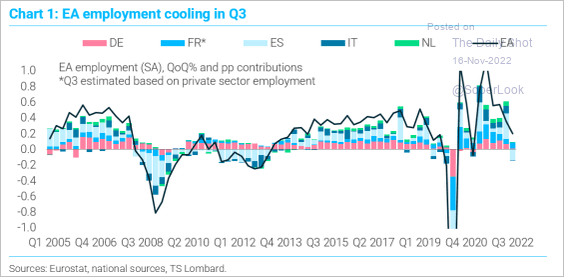

5. Employment is cooling.

Source: TS Lombard

Source: TS Lombard

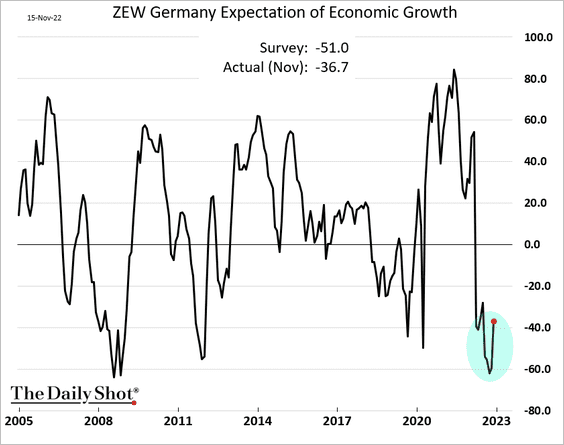

6. Germany’s ZEW expectations index surprised to the upside.

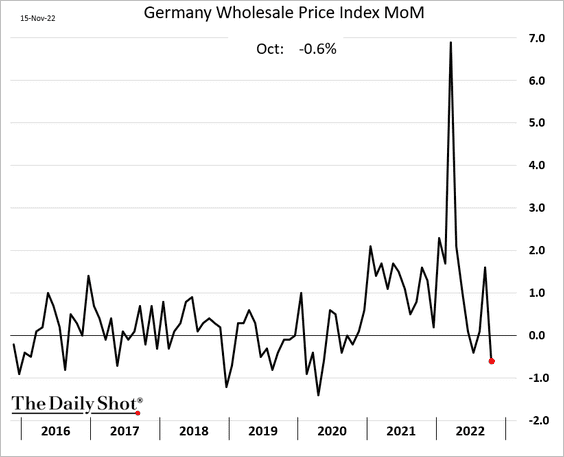

Wholesale prices in Germany are now decreasing.

——————–

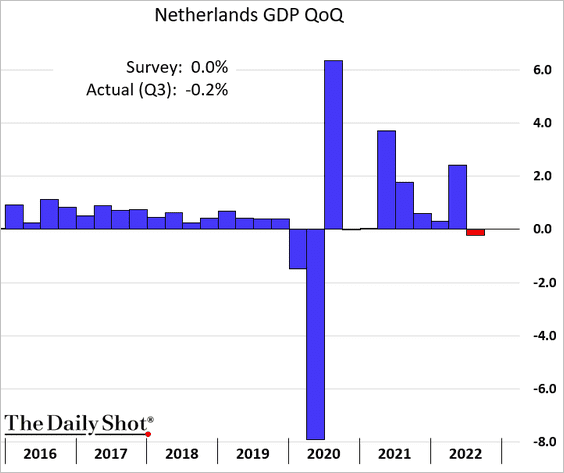

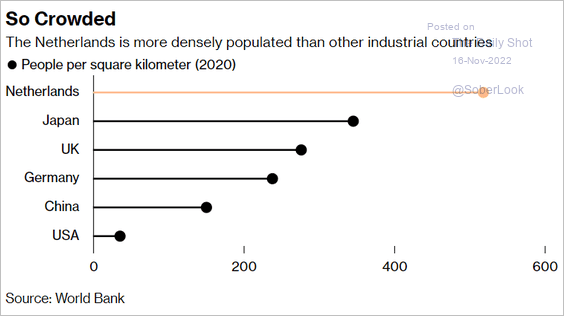

7. The Dutch GDP unexpectedly declined last quarter.

By the way, the population density in the Netherlands is much higher than in other countries.

Source: @citylab Read full article

Source: @citylab Read full article

Back to Index

Asia – Pacific

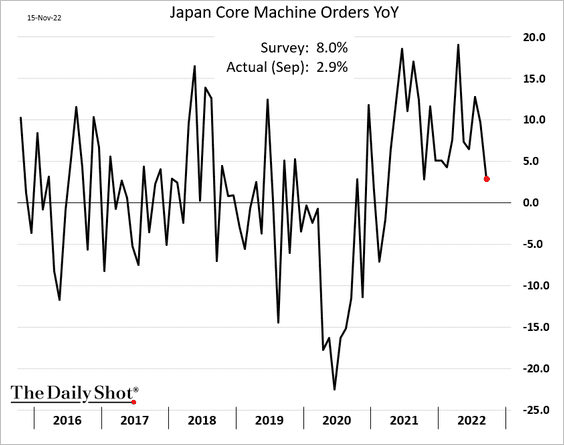

1. Japan’s core machine orders fell in September.

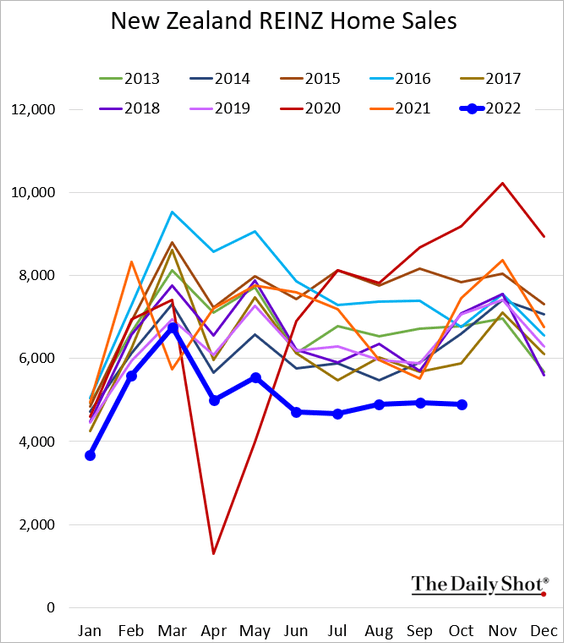

2. New Zealand’s home sales remain depressed.

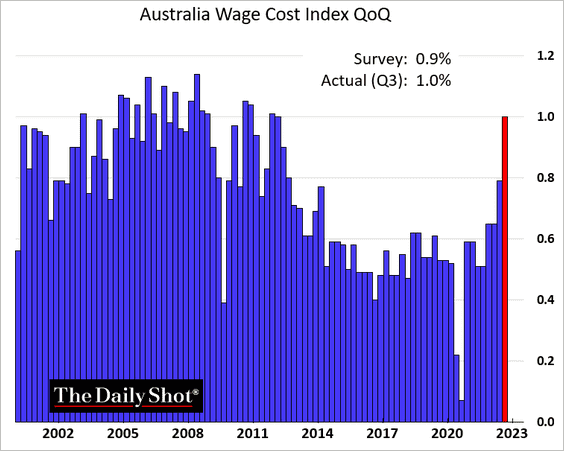

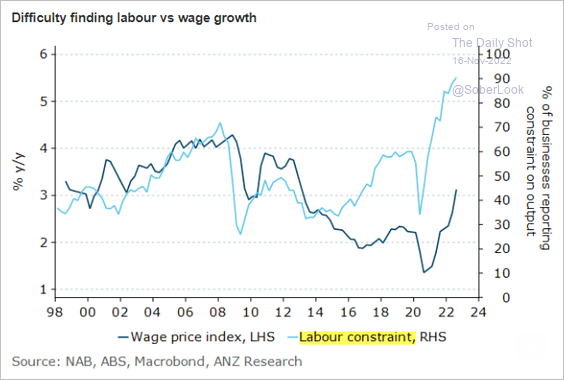

3. Australian wages surged last quarter, …

… amid tight labor markets.

Source: @ANZ_Research

Source: @ANZ_Research

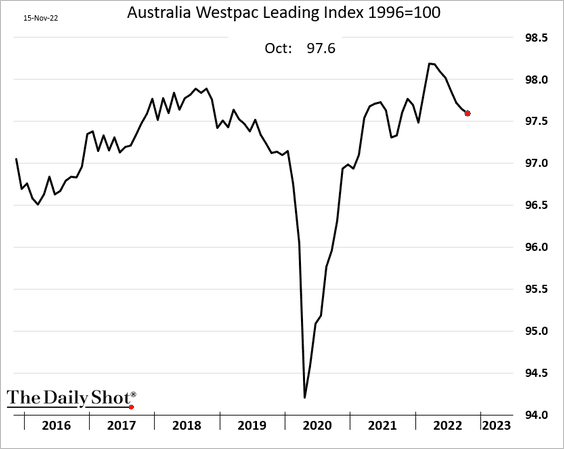

• The Westpac leading index has been moving lower.

• The Aussie dollar is testing resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

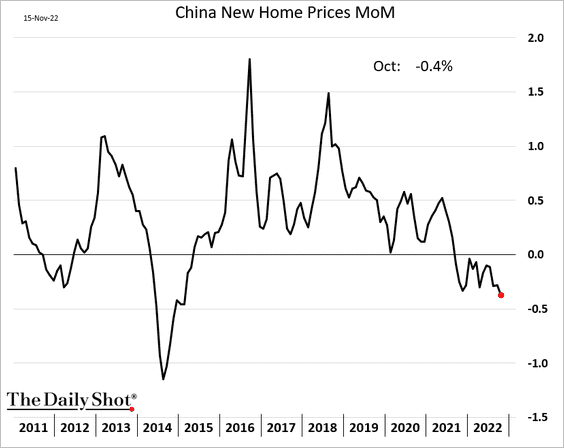

1. New home prices have now seen 14 months of consecutive declines.

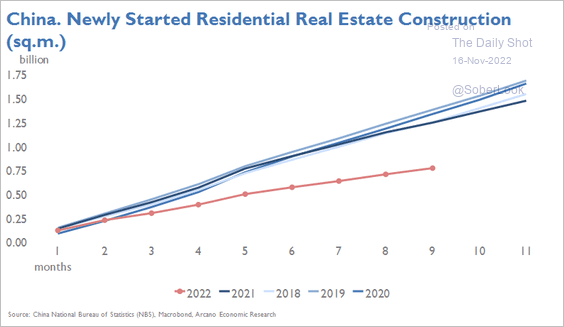

• Residential construction has been stalling.

Source: Arcano Economics

Source: Arcano Economics

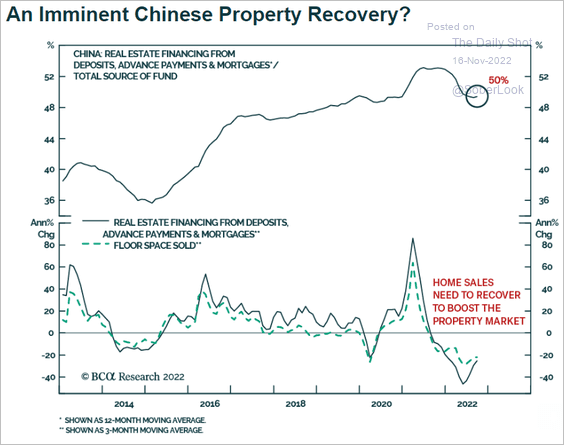

• Is China’s property recovery on the way?

Source: BCA Research

Source: BCA Research

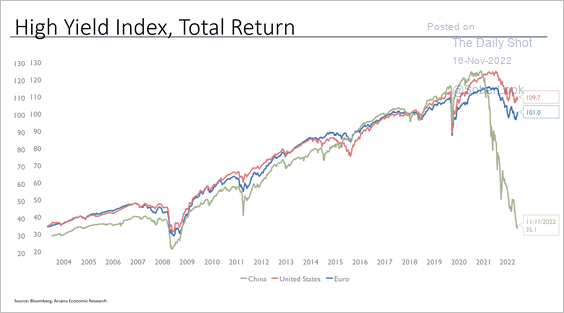

• China’s high-yield debt market has been hit by property developers’ woes.

Source: Arcano Economics

Source: Arcano Economics

——————–

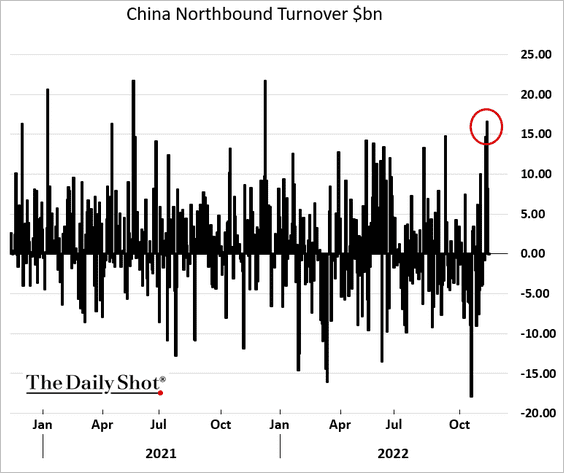

2. Hong Kong and foreign investors jumped into mainland shares in recent days.

Back to Index

Emerging Markets

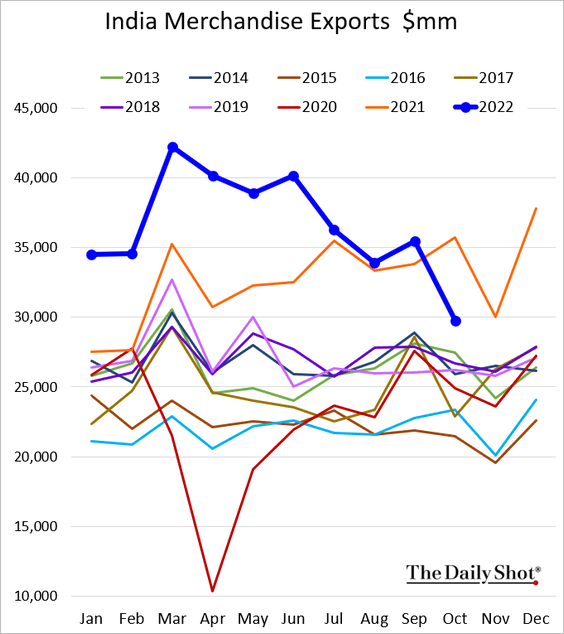

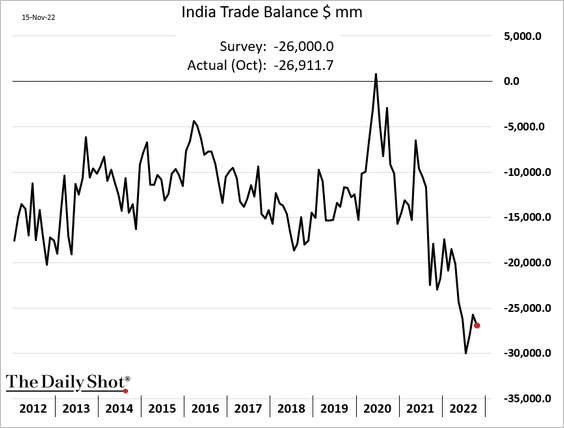

1. India’s exports have been slowing.

Elevated energy prices have massively widened the trade gap.

——————–

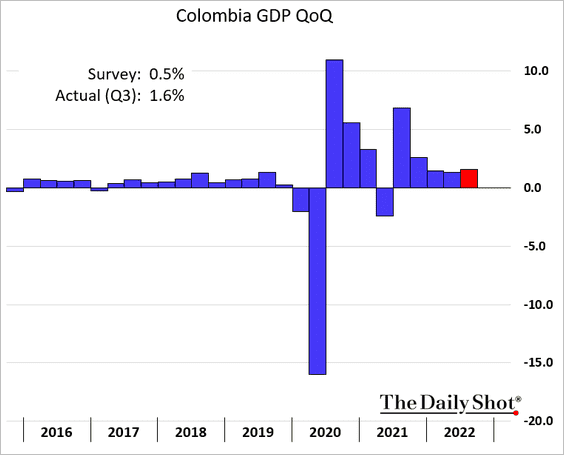

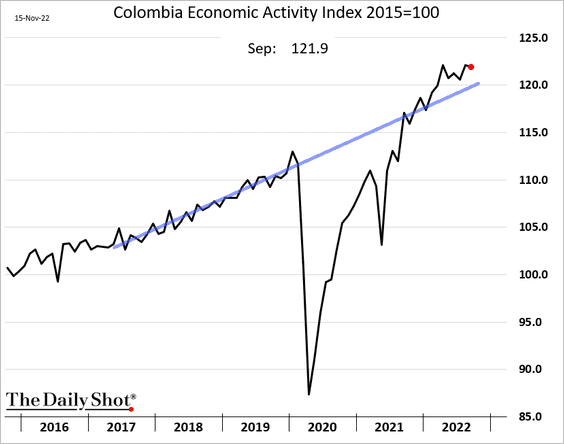

2. Colombia’s GDP topped expectations.

Is economic activity leveling off?

——————–

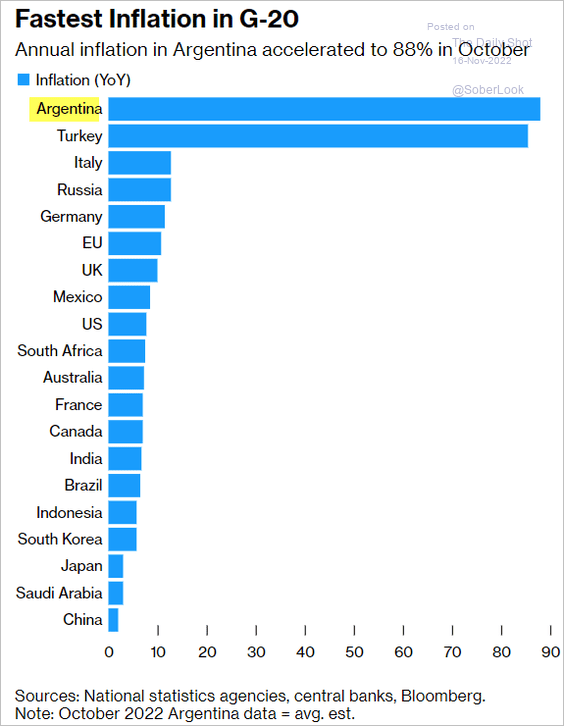

3. Argentina’s CPI could hit 100%.

Source: @business, @Pat_Gillespie Read full article

Source: @business, @Pat_Gillespie Read full article

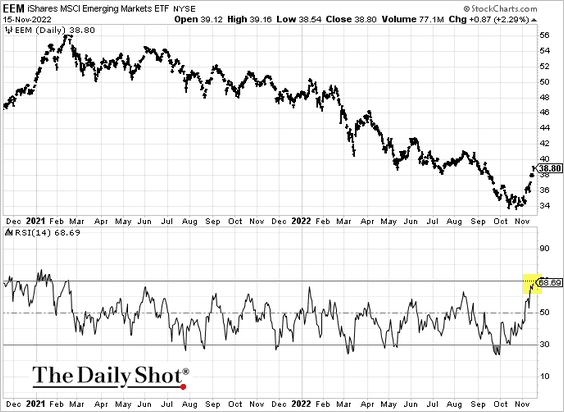

4. EM stocks are nearing overbought territory.

Back to Index

Cryptocurrency

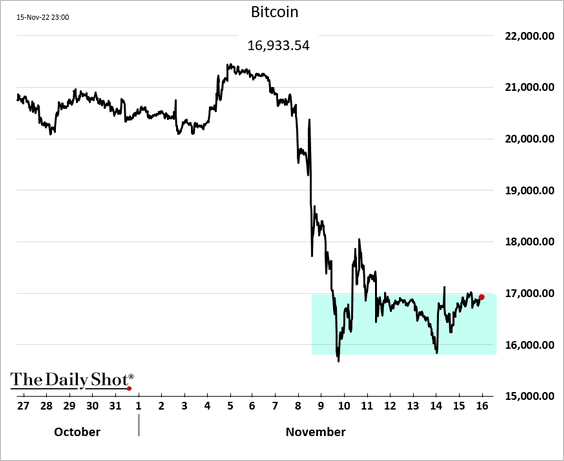

1. Bitcoin bounced from the lows but remains below 17k.

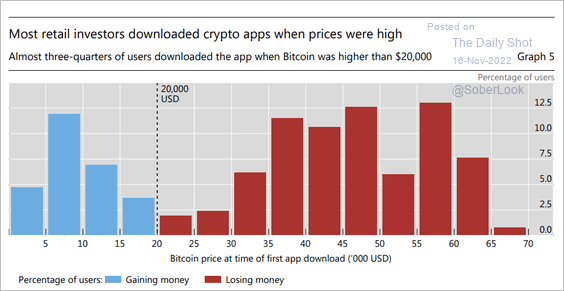

2. When did retail investors download their crypto apps?

Source: BIS

Source: BIS

Back to Index

Commodities

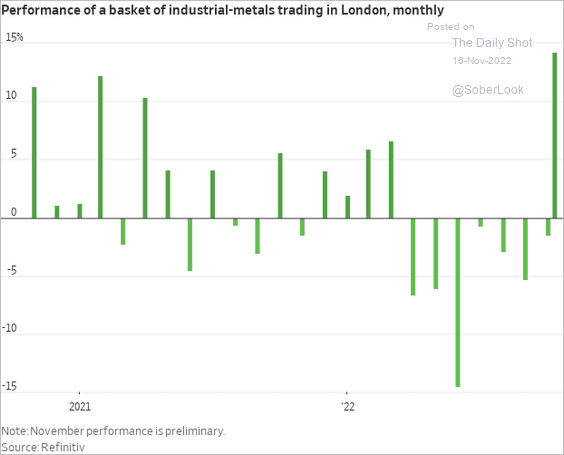

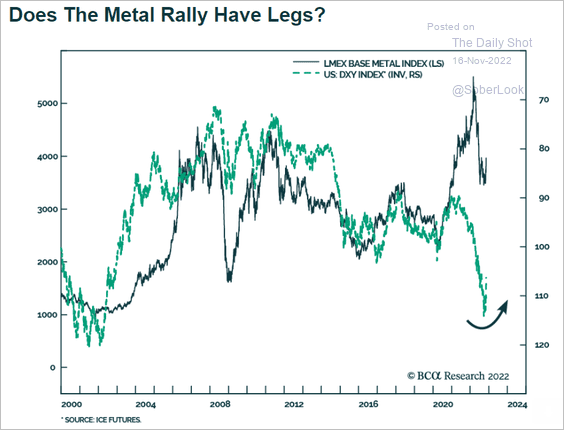

1. Industrial metals rebounded in recent weeks on China’s potential reopening.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: BCA Research

Source: BCA Research

——————–

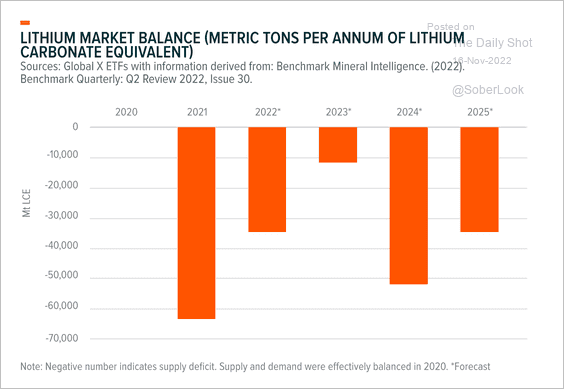

2. Lithium supply is expected to lag demand over the next few years, largely due to electric vehicle adoption.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

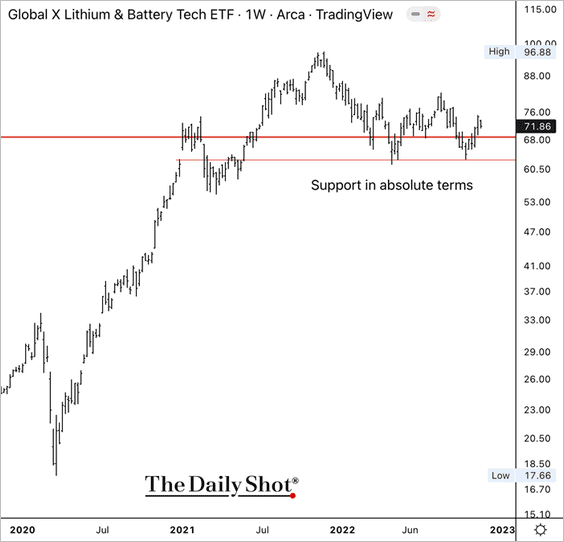

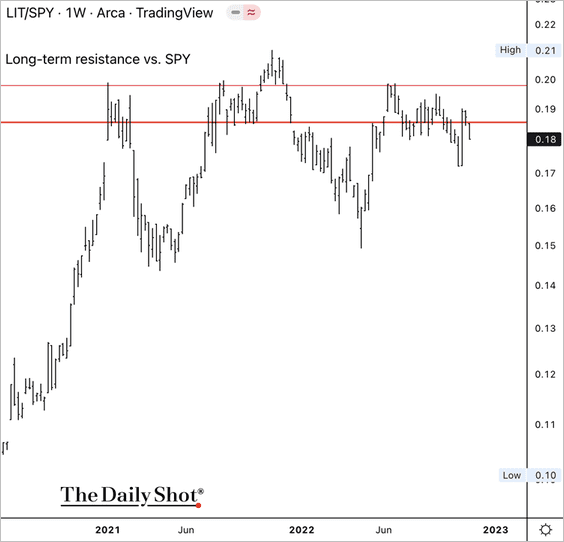

The Global X Lithium & Battery Tech ETF (LIT) is holding support but has weakened relative to the S&P 500. (2 charts)

——————–

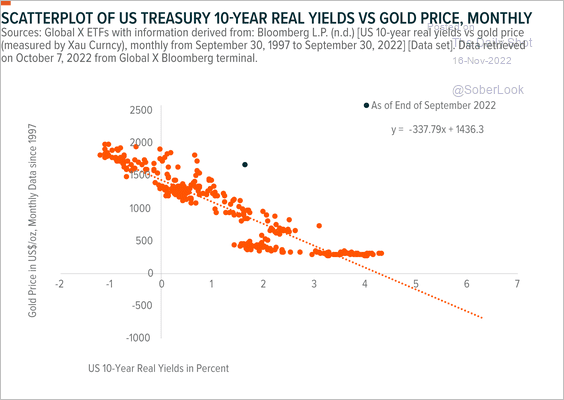

3. Gold has decoupled from US real yields this year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

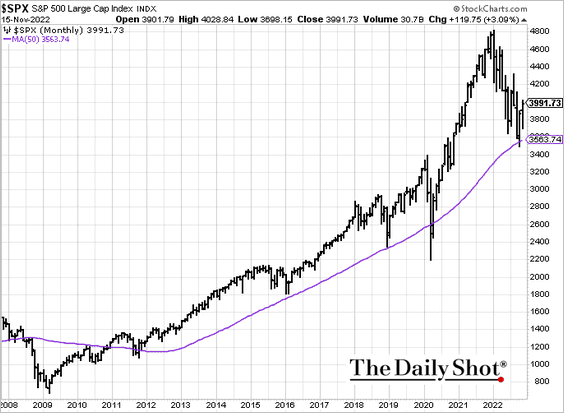

1. Did the 50-month moving average mark the bottom for this cycle?

h/t Evercore ISI Research

h/t Evercore ISI Research

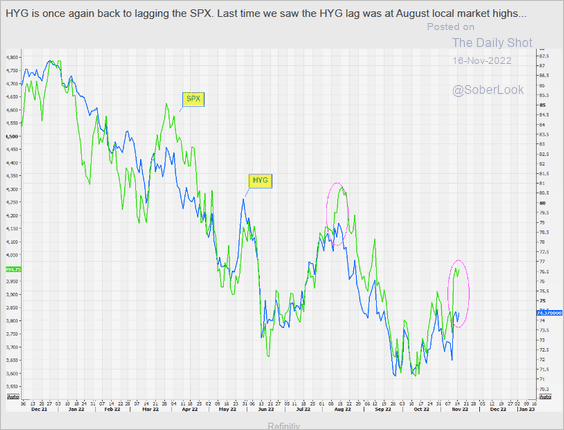

2. Stocks have outpaced credit in recent days.

Source: @themarketear

Source: @themarketear

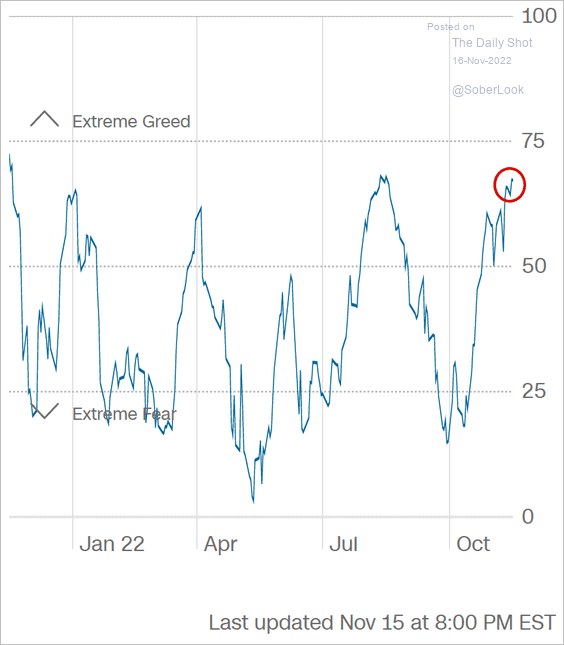

3. The fear & greed index is moving toward “extreme greed” territory.

Source: CNN Business

Source: CNN Business

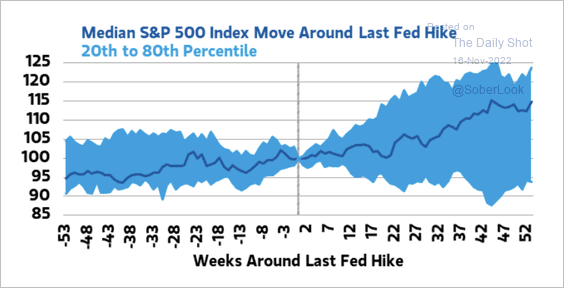

4. Historically, the S&P 500’s median return exceeds 5% after the fifth month following the last rate hike.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

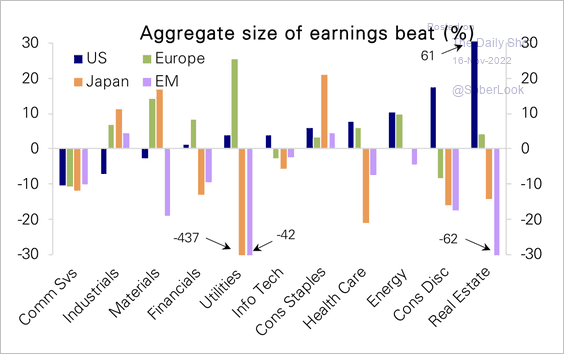

5. Communication services missed earnings estimates across all regions, while consumer staples beat.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

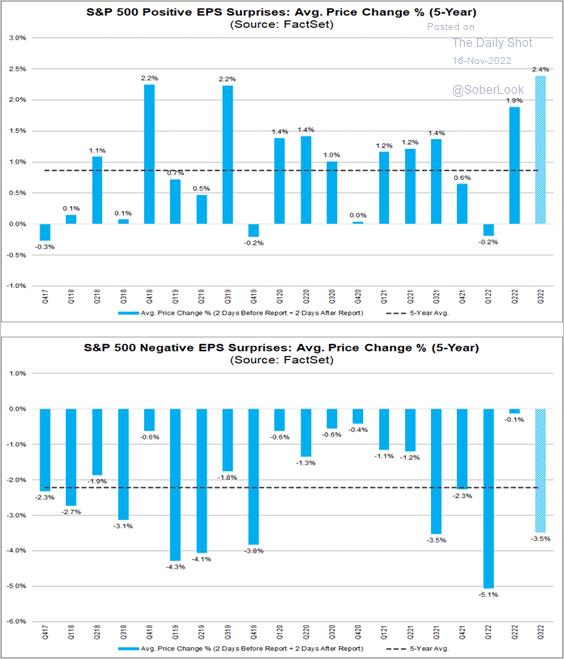

How has the market reacted to earnings reports?

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

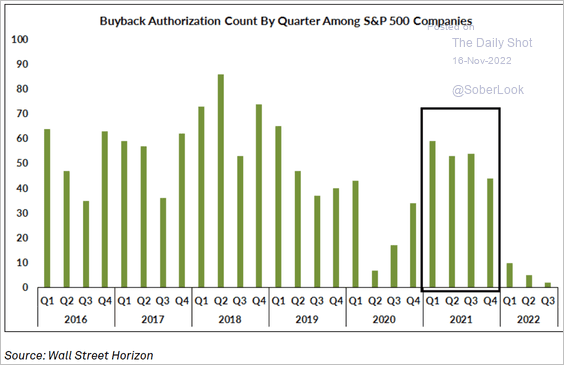

6. Share buyback authorizations have slowed.

Source: @FactSet Read full article

Source: @FactSet Read full article

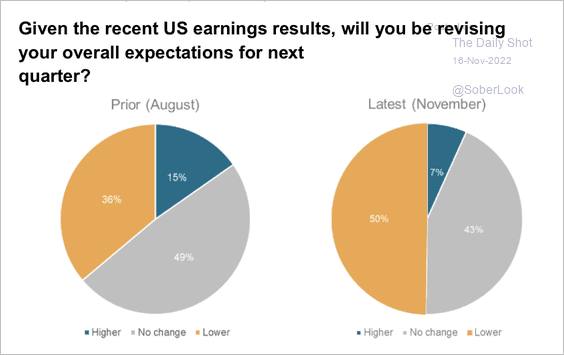

7. Half of the investors surveyed by S&P Global have lowered their market expectations for the next quarter.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

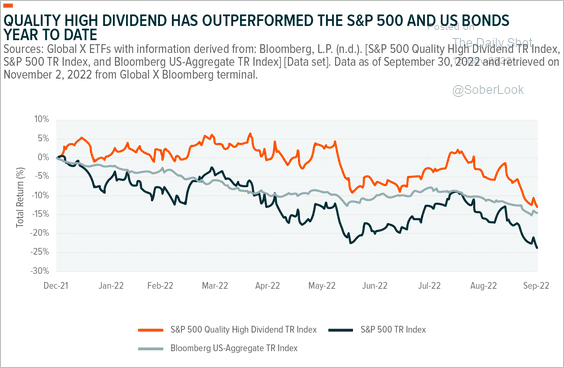

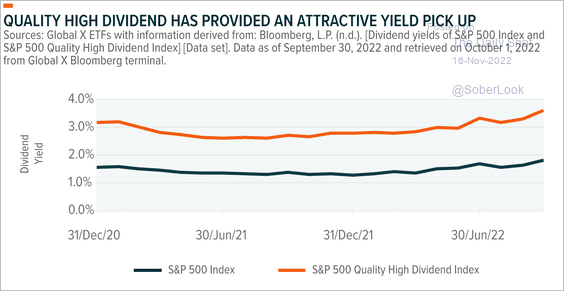

8. Quality high-dividend stocks have outperformed the S&P 500 and the US aggregate bond index this year while offering higher yields. (2 charts)

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

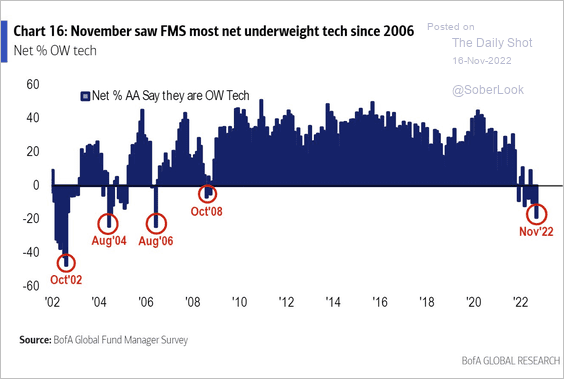

9. Fund managers remain underweight tech.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Rates

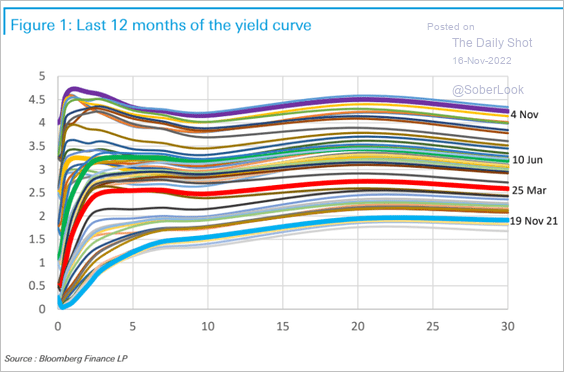

1. Here is the evolution of the Treasury curve over the past 12 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

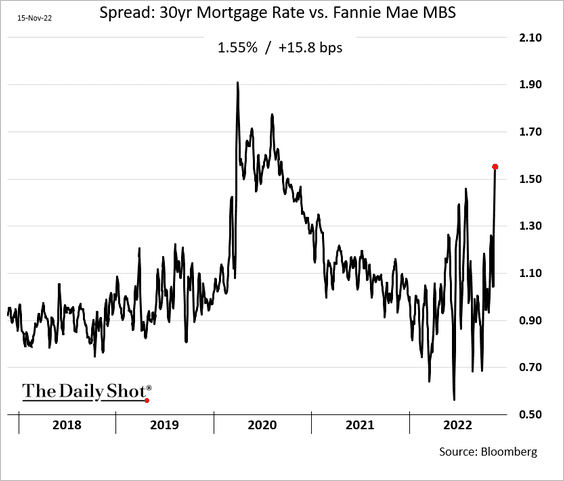

2. The spread between mortgage rates and MBS has been widening.

Back to Index

Global Developments

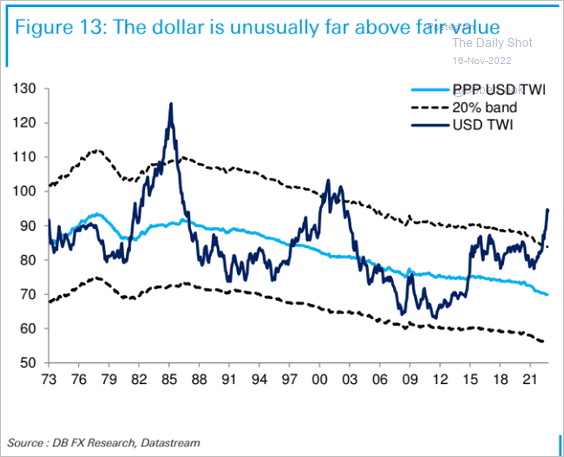

1. The dollar has been well above fair value this year, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

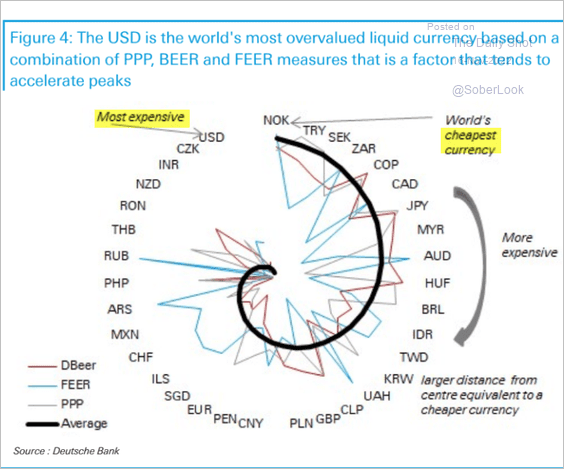

… and is now the most expensive currency, according to Deutsche Bank Research.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

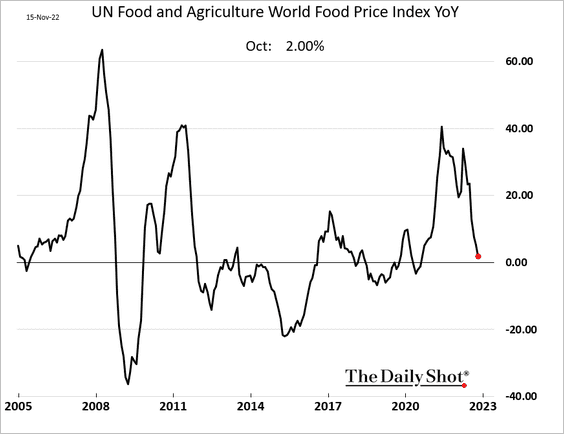

2. Global food inflation has been moderating.

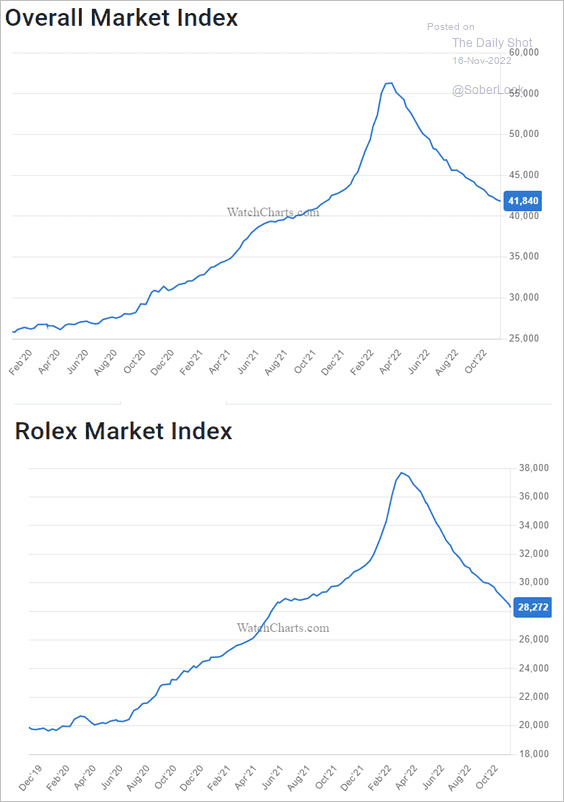

3. The secondhand watch market bubble continues to deflate.

Source: WatchCharts

Source: WatchCharts

——————–

Food for Thought

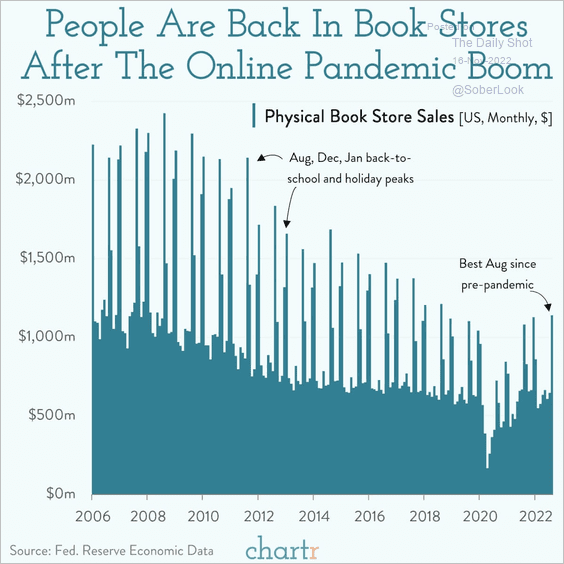

1. Physical bookstore sales:

Source: @chartrdaily

Source: @chartrdaily

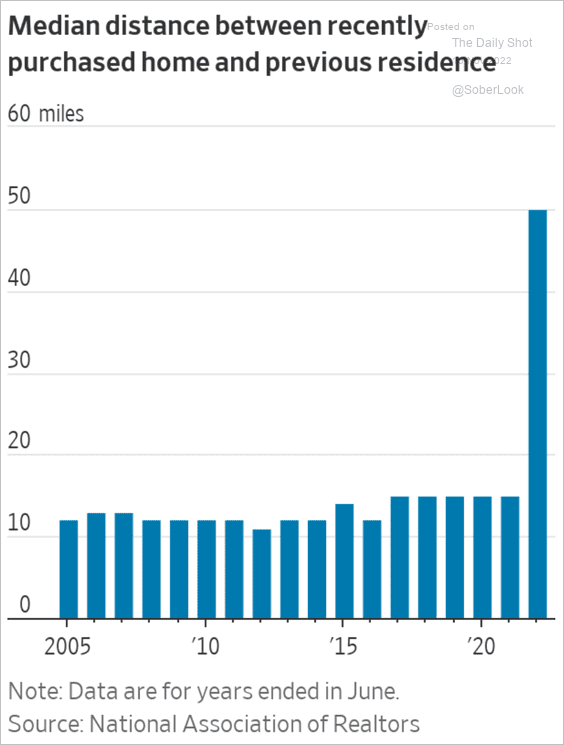

2. Moving farther away:

Source: @WSJ Read full article

Source: @WSJ Read full article

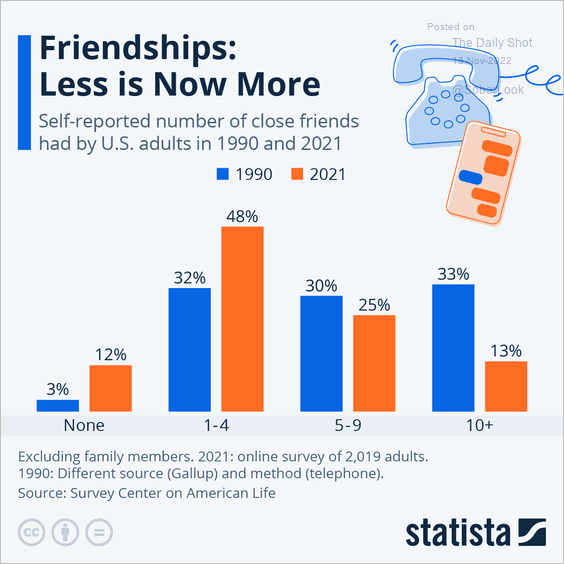

3. Number of close friendships:

Source: Statista

Source: Statista

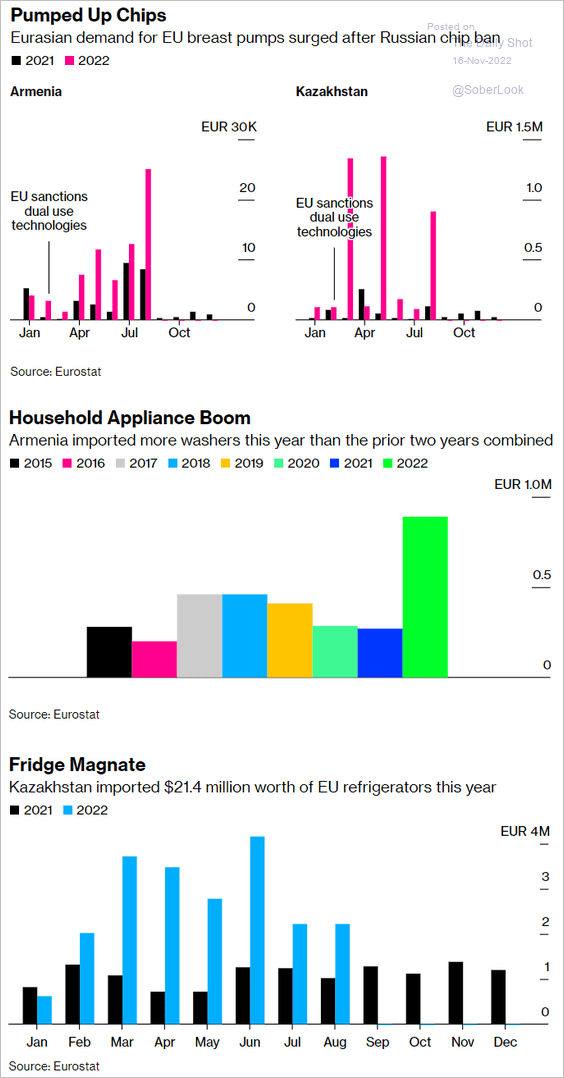

4. Some European consumer equipment exports to Russia’s allies have been repurposed by Russia for weapons production.

Source: @bpolitics, @albertonardelli, @bbaschuk, @MarcChampion1 Read full article

Source: @bpolitics, @albertonardelli, @bbaschuk, @MarcChampion1 Read full article

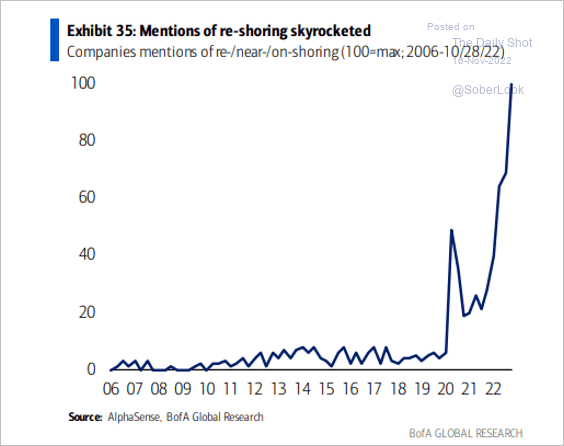

5. Mentions of re-shorting on corporate earnings calls:

Source: BofA Global Research

Source: BofA Global Research

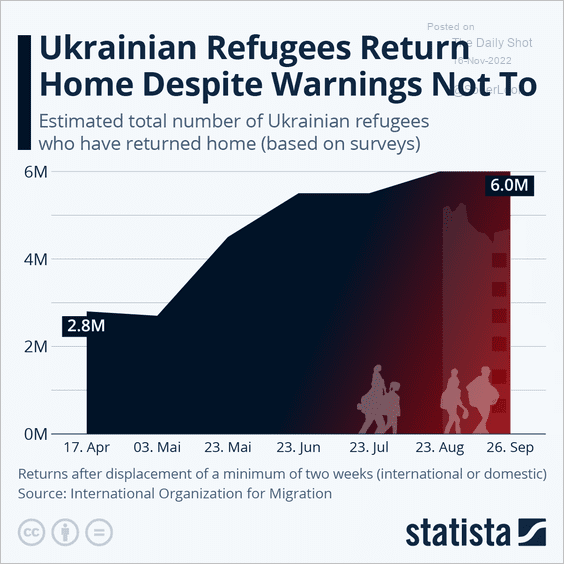

6. Ukrainian refugees returning home:

Source: Statista

Source: Statista

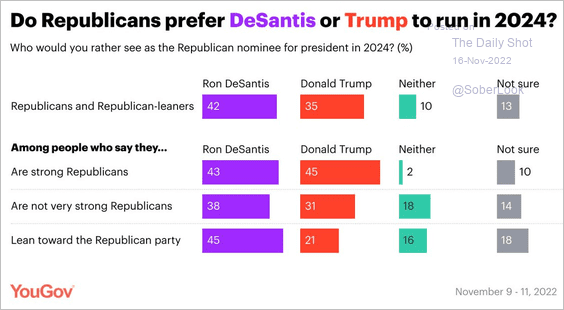

7. Preferences for Ron DeSantis vs. Donald Trump:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

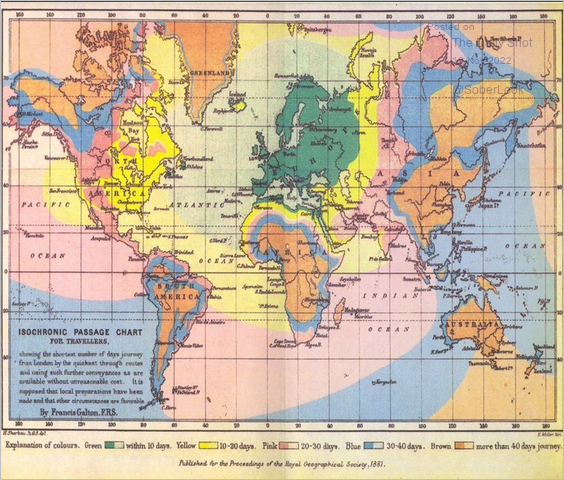

8. An old map showing travel times from London to the rest of the world in 1881:

Source: @conradhackett

Source: @conradhackett

——————–

Back to Index