The Daily Shot: 17-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Australia

• China

• Cryptocurrency

• Energy

• Equities

• Rates

• Food for Thought

The United States

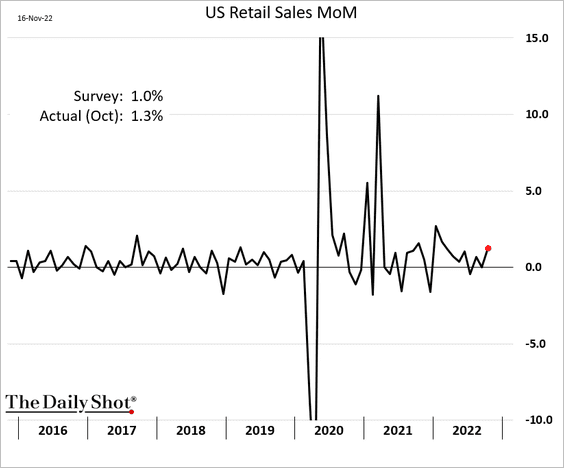

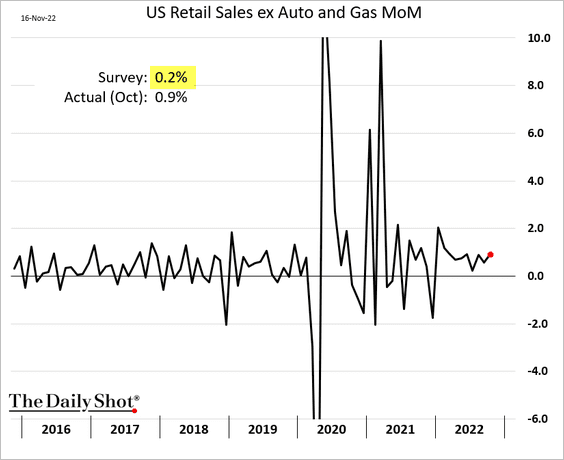

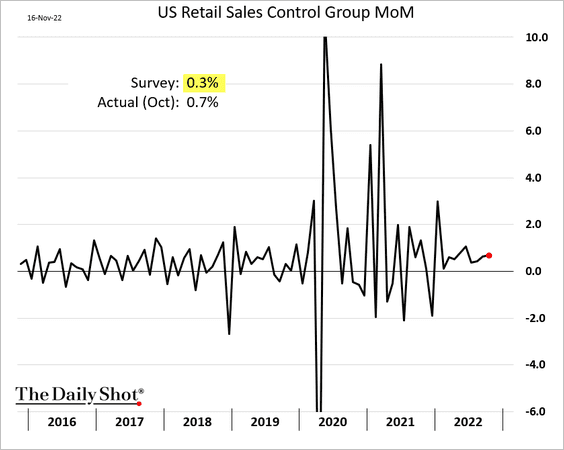

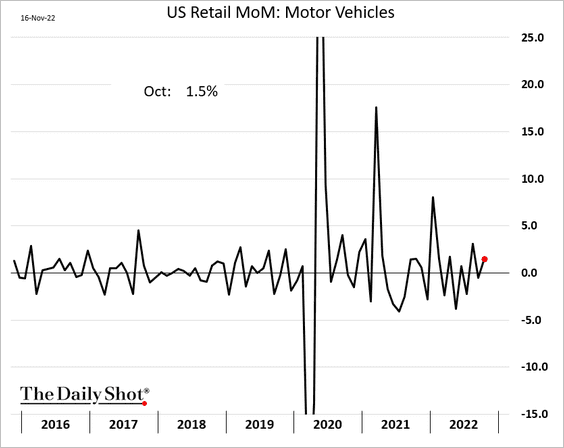

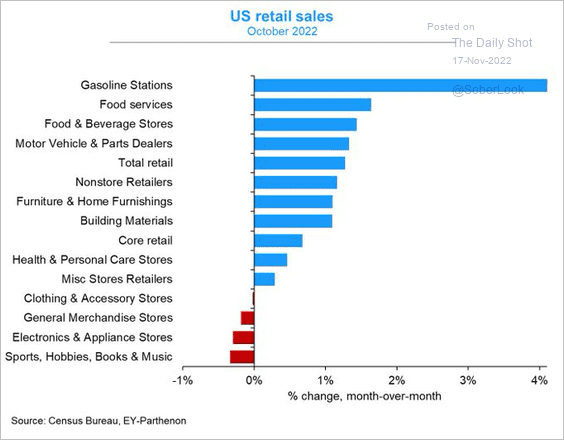

1. Retail sales topped expectations, suggesting that consumers are willing to spend despite the surge in prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

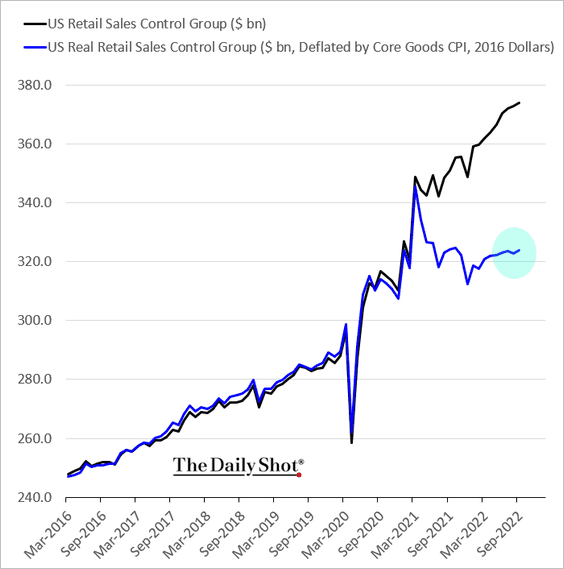

• Core retail sales were particularly strong.

• Vehicle sales also increased.

• Here are the October changes by category.

Source: @GregDaco

Source: @GregDaco

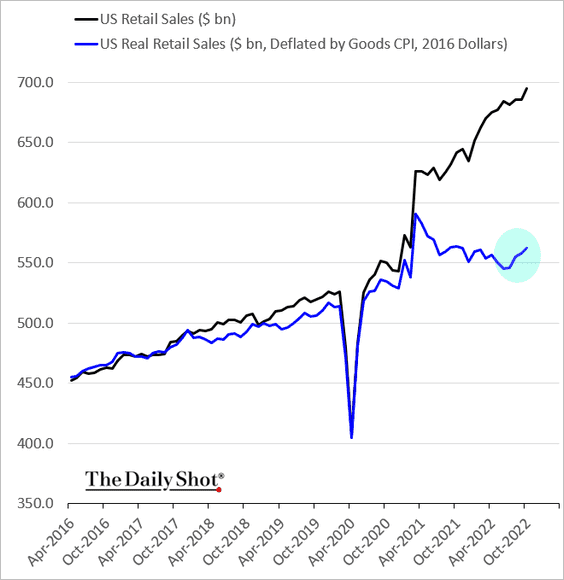

• The charts below show the levels of retail sales in nominal and real terms.

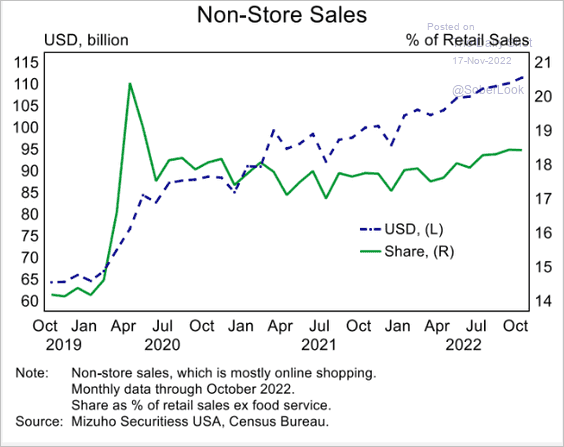

• The nonstore (online) share of retail sales remains well above pre-COVID levels.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

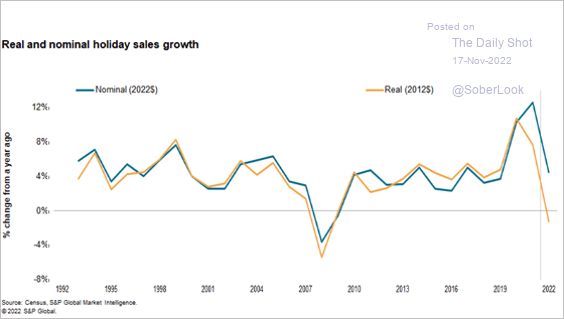

• Despite strong retail sales in October, real holiday spending is expected to be down this year for the first time since the GFC.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

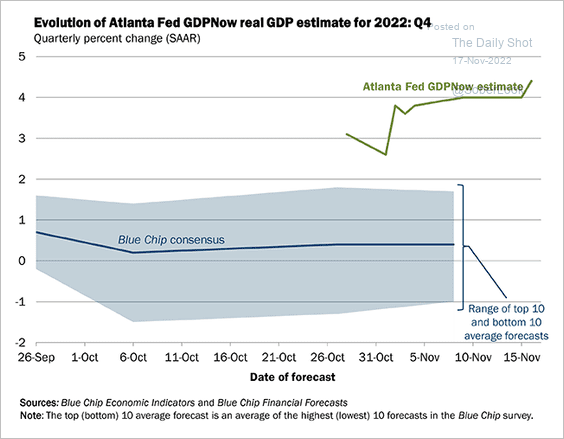

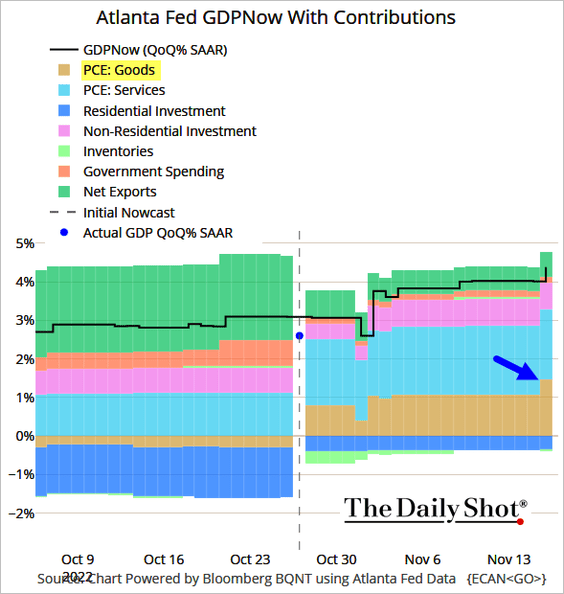

2. The Atlanta Fed’s GDPNow model estimate for the Q4 GDP growth jumped to 4.4% (annualized) in response to stronger-than-expected retail sales.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

The bump came from expected goods spending this quarter.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

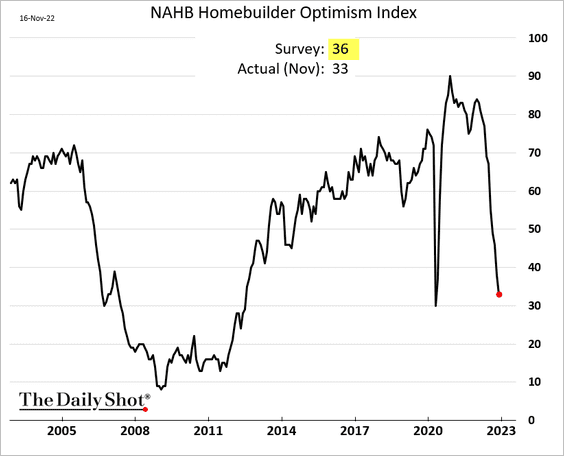

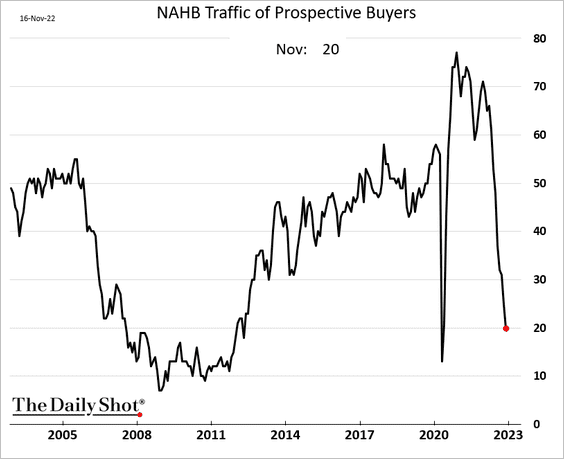

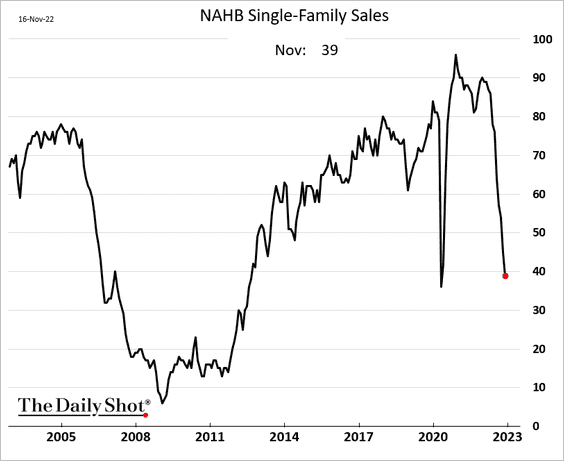

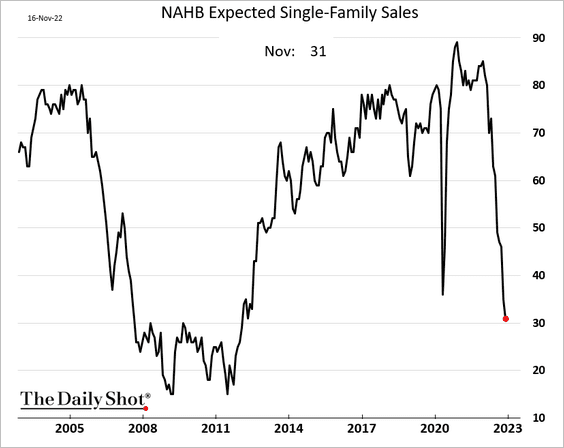

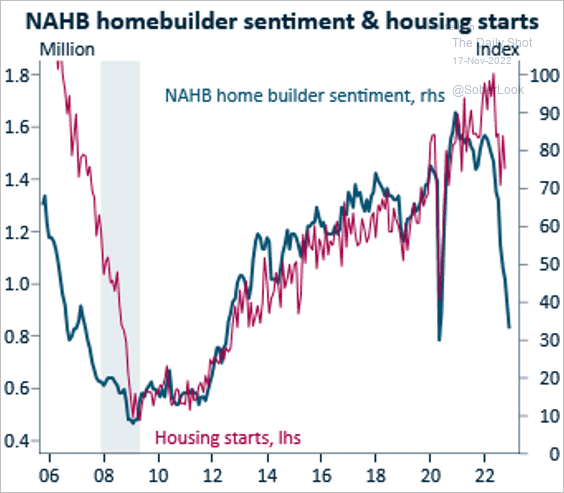

3. Homebuilder sentiment is crashing.

• Buyer traffic:

• Sales index:

• Expected sales:

What does it mean for residential construction?

Source: @IFM_Economist

Source: @IFM_Economist

——————–

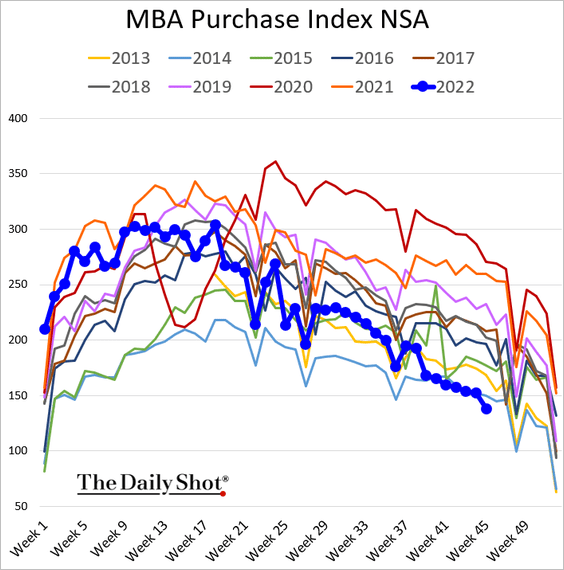

4. Mortgage applications hit the lowest level in a decade, …

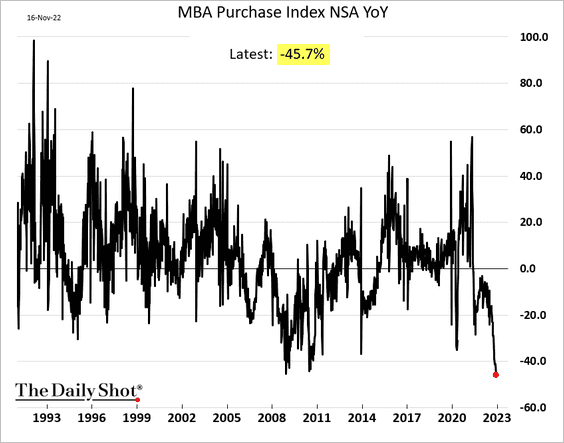

… with the biggest year-over-year decline on record.

——————–

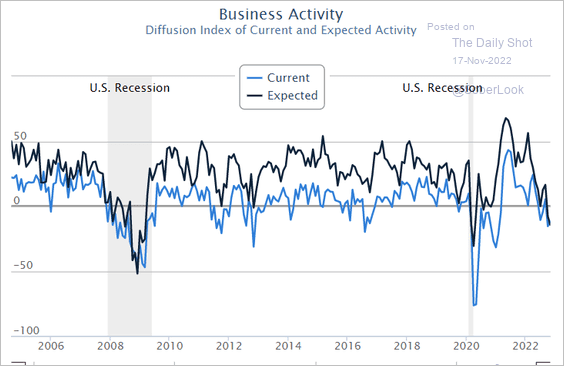

5. The NY Fed’s index of service firms (in New York State, northern New Jersey, and southwestern Connecticut) points to a deterioration in business activity.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

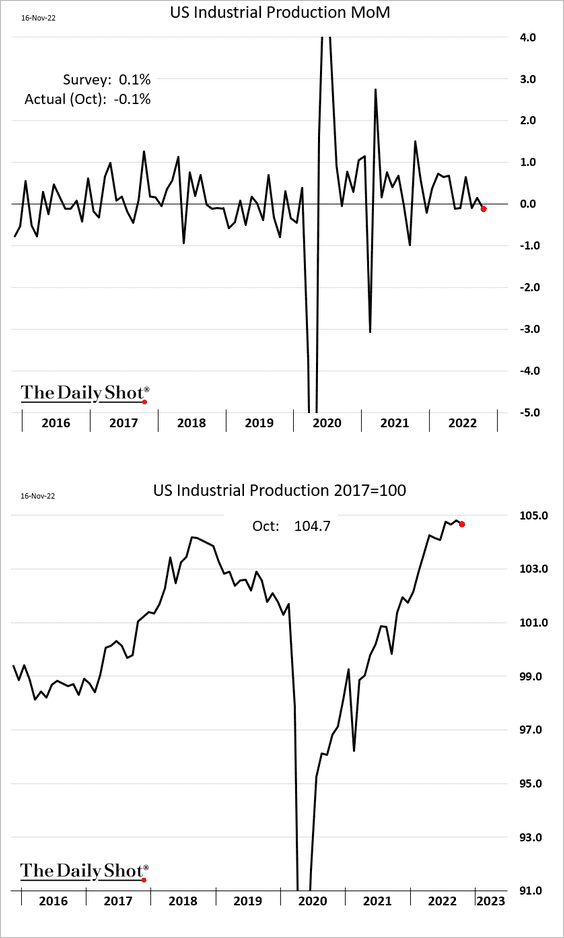

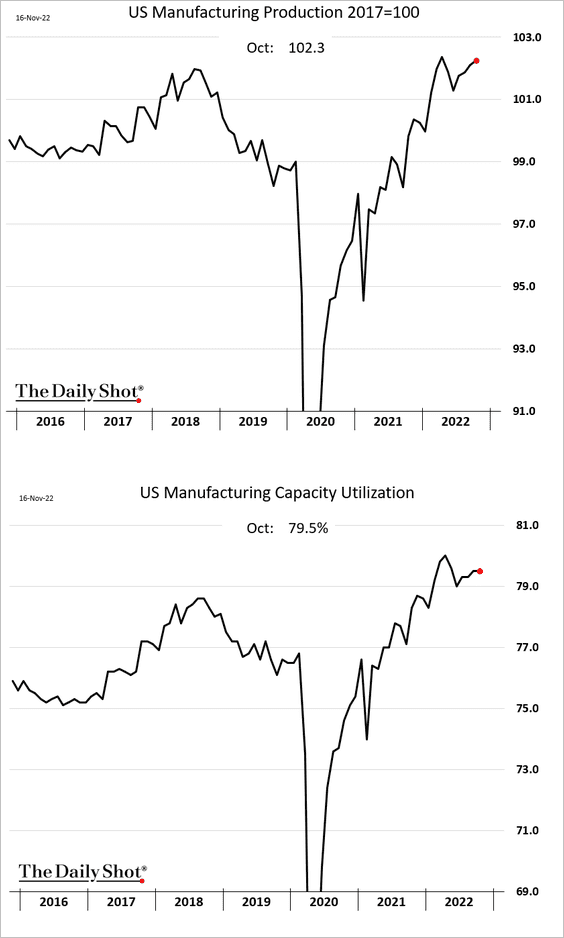

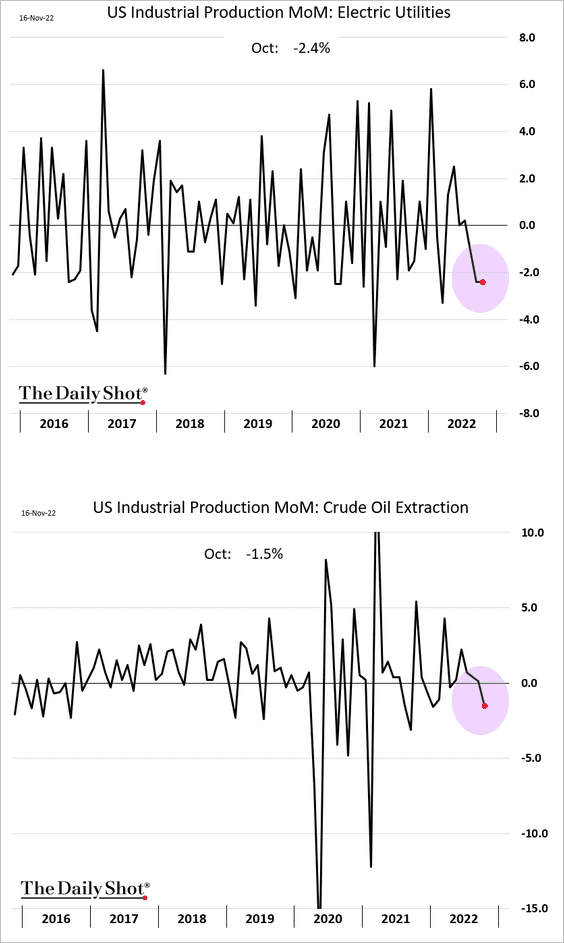

6. Industrial production edged lower last month.

However, manufacturing output kept rising.

The weakness in industrial production was driven by utilities (warmer than usual weather) and softer oil production.

——————–

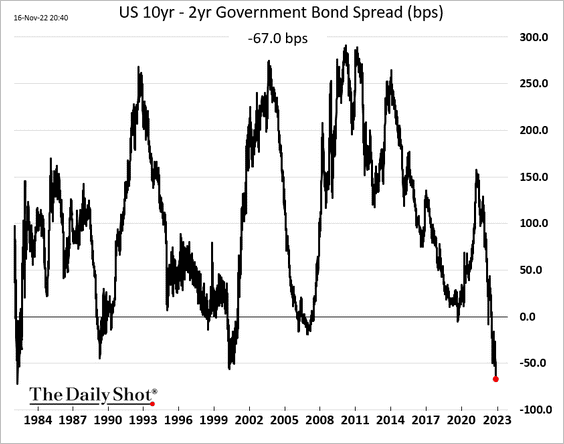

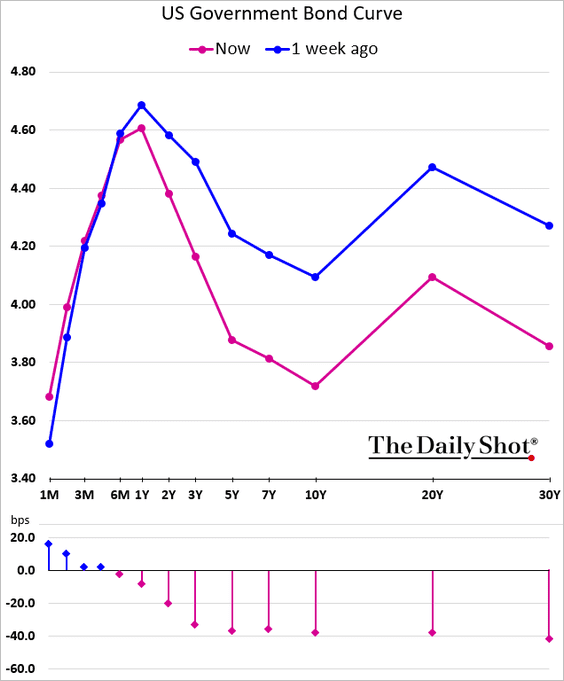

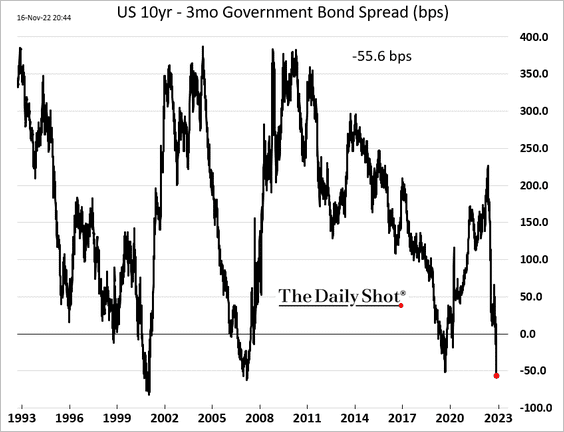

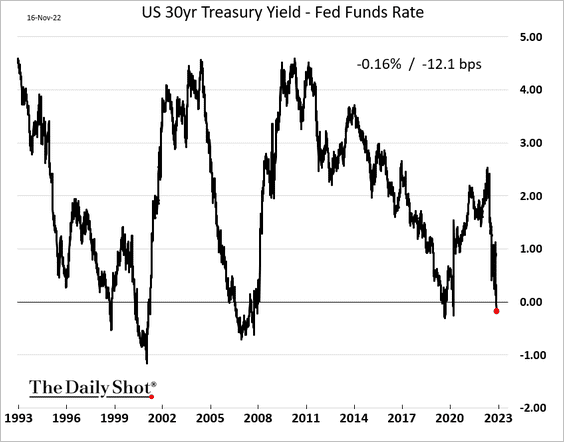

7. The last time the Treasury curve was this inverted was in early 1982.

• 10yr vs. 3-month T-bill:

• 30yr vs. the fed funds rate:

——————–

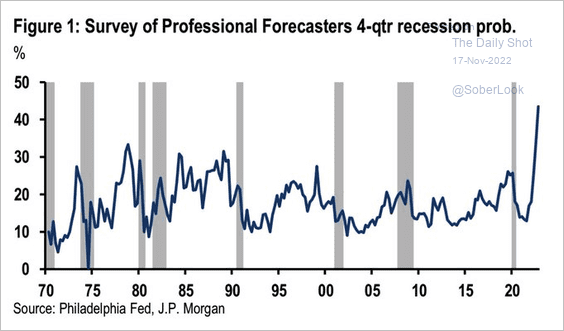

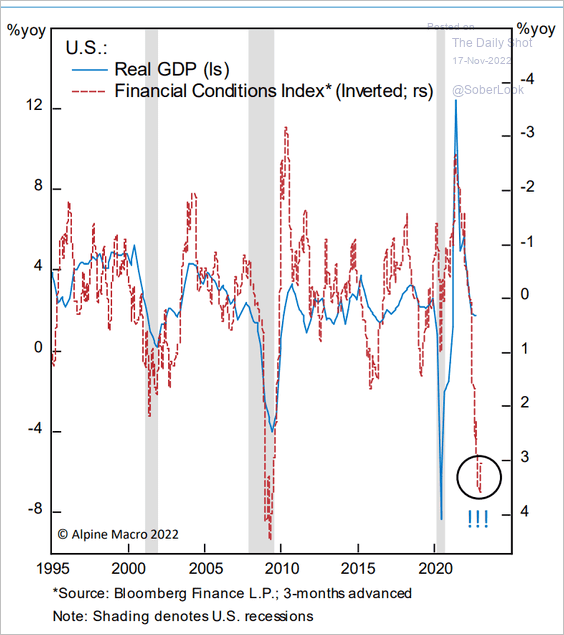

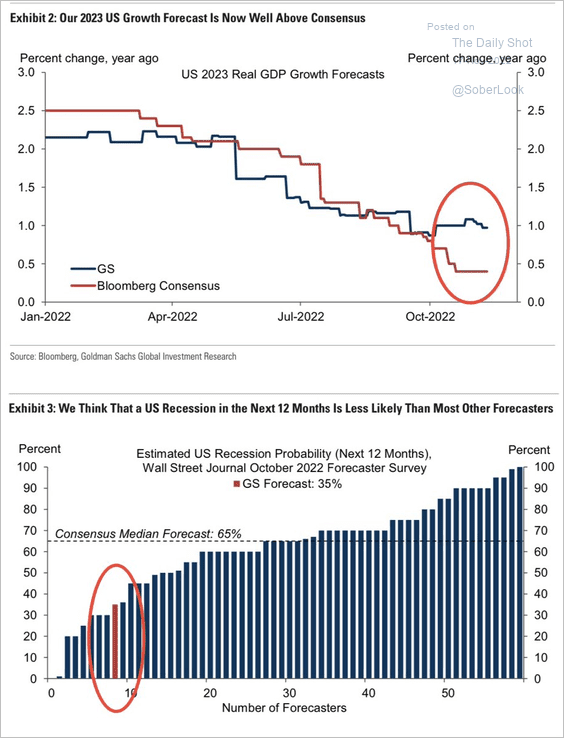

8. The yield curve inversion signals an impending recession, which we also see in the survey of professional forecasters.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

Tight financial conditions also signal a sharp economic downturn.

Source: Alpine Macro

Source: Alpine Macro

Not everyone agrees. As we saw earlier (chart here), Morgan Stanley expects slower growth but not a recession. Goldman also sees a much lower chance of a recession than consensus estimates.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

Back to Index

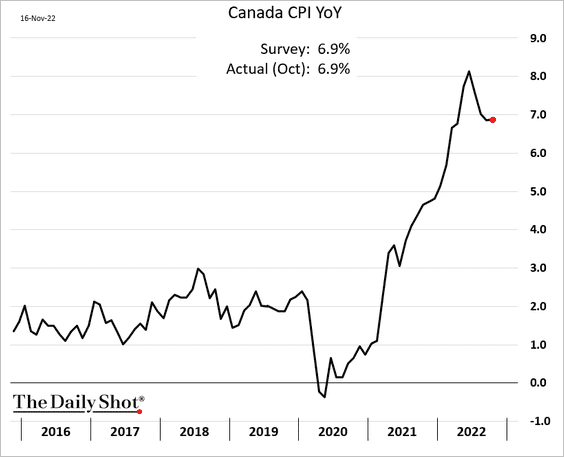

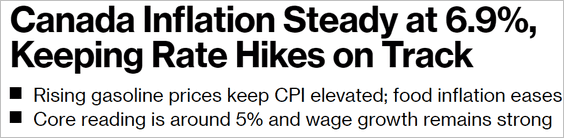

Canada

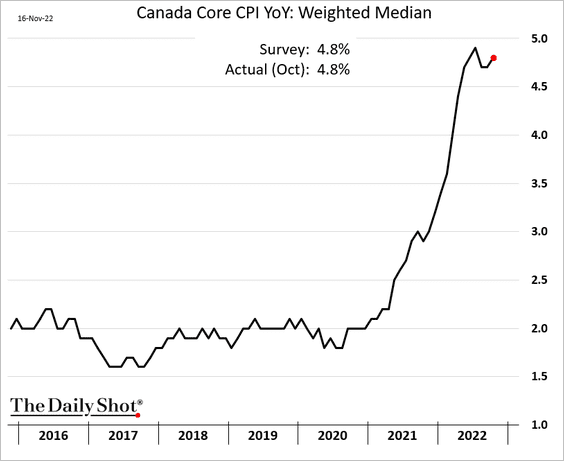

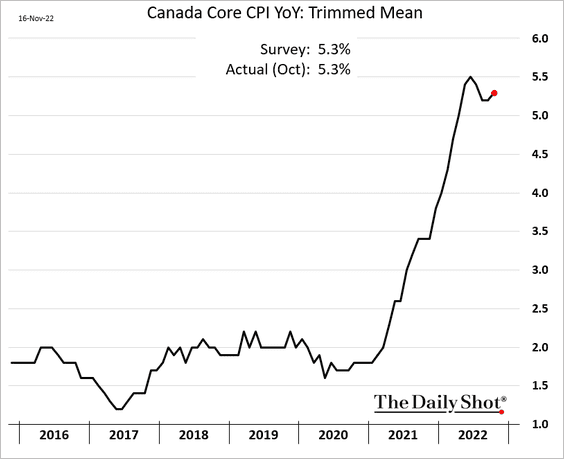

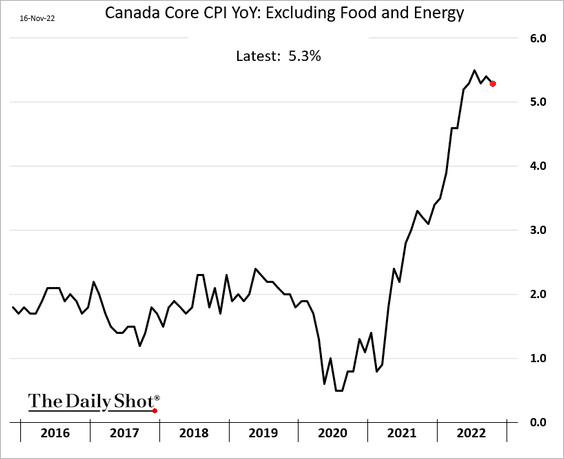

1. The inflation report was roughly in line with forecasts.

Source: @business, @rtkwrites Read full article

Source: @business, @rtkwrites Read full article

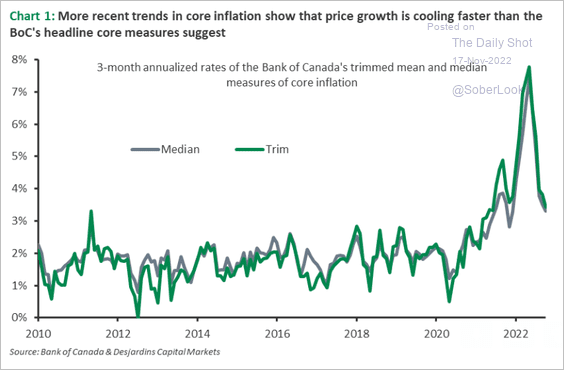

Core inflation remains sticky (4 charts).

However, the three-month chart looks promising.

Source: Desjardins

Source: Desjardins

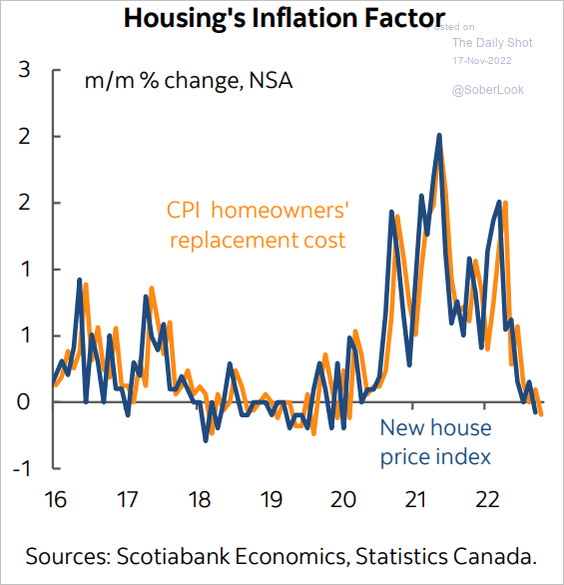

Housing-related inflation has slowed.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

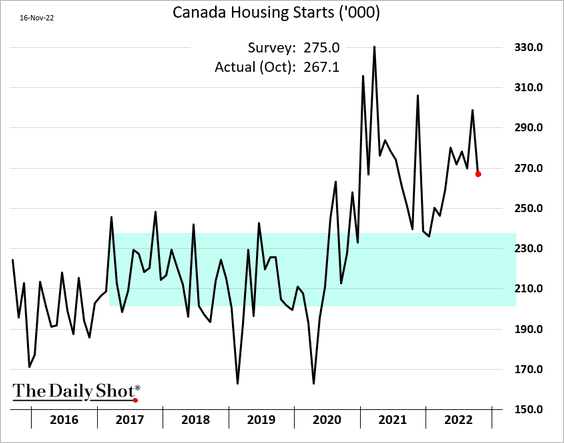

2. Housing starts remain well above pre-COVID levels.

Back to Index

The United Kingdom

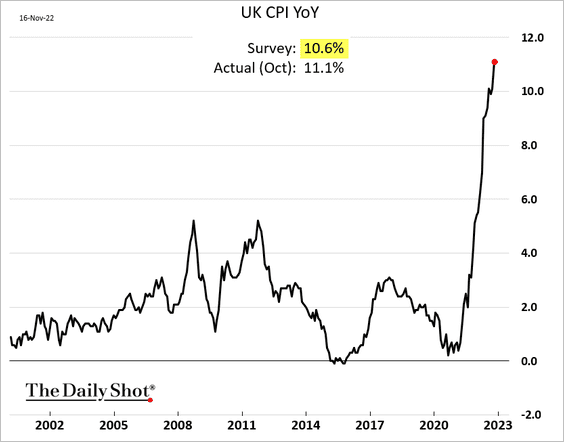

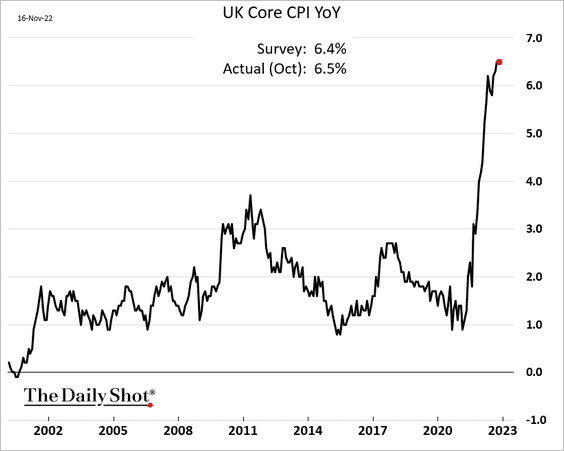

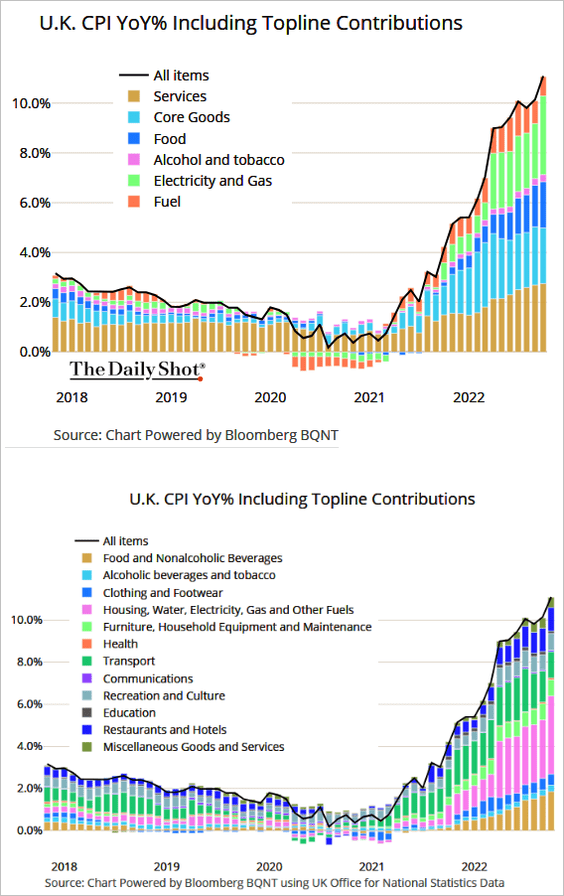

1. The headline inflation blasted past 11%, topping expectations.

Source: Reuters Read full article

Source: Reuters Read full article

• The core inflation held steady.

• Here are the contributions to the year-over-year CPI index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

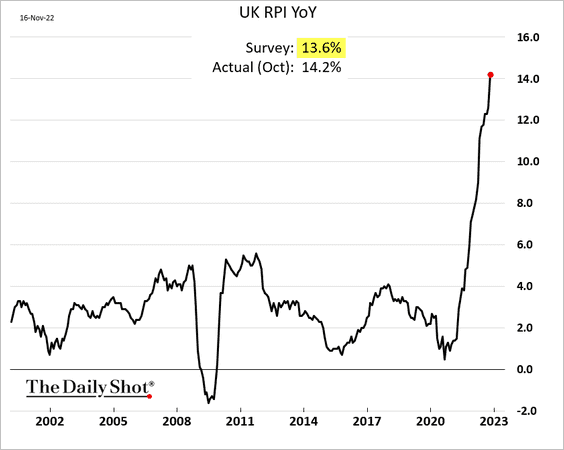

• Retail inflation also surprised to the upside, exceeding 14%.

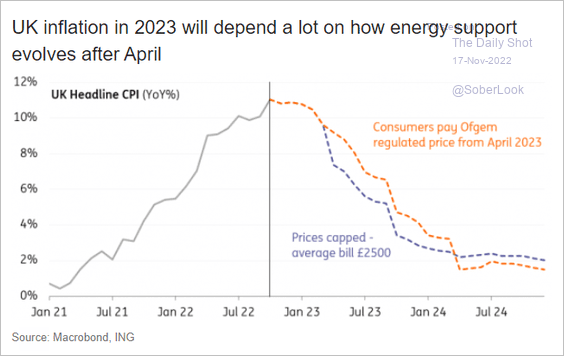

• Here is a forecast from ING.

Source: ING

Source: ING

——————–

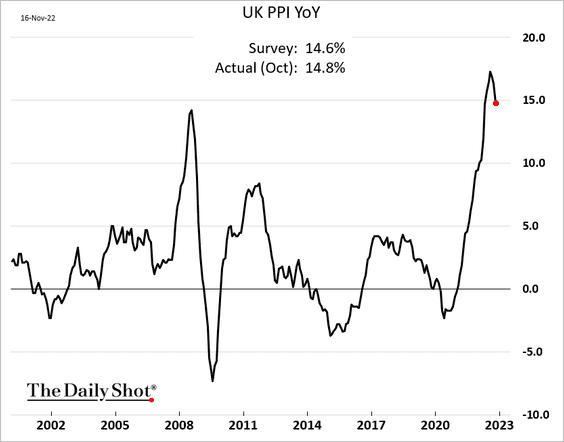

2. The PPI has peaked but was also above consensus estimates.

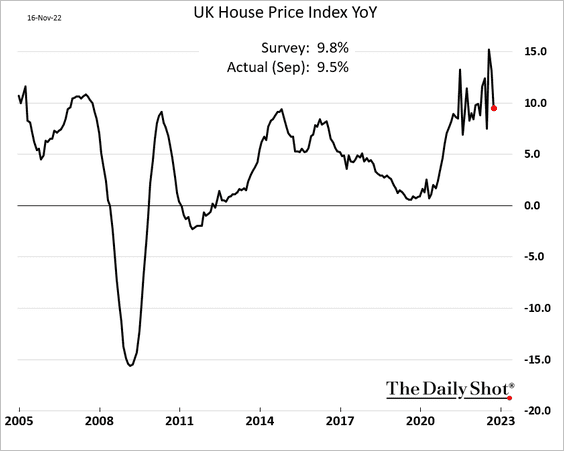

3. The official index of home prices was below estimates (for September). But this is old news – more timely indicators point to worsening housing market conditions last month.

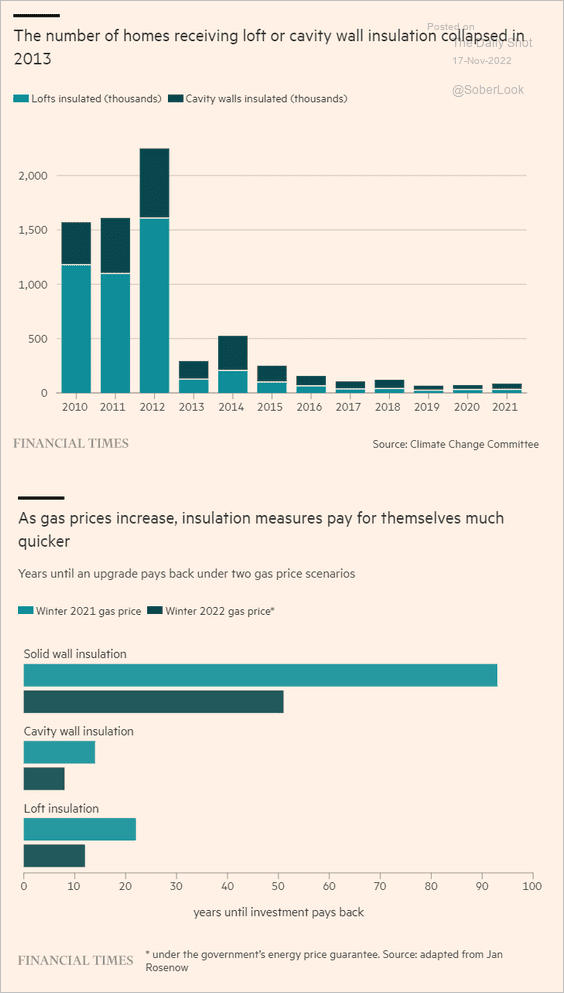

4. Time for insulation measures?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

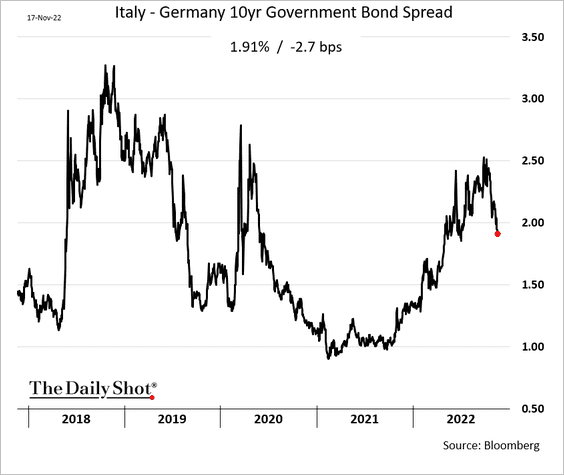

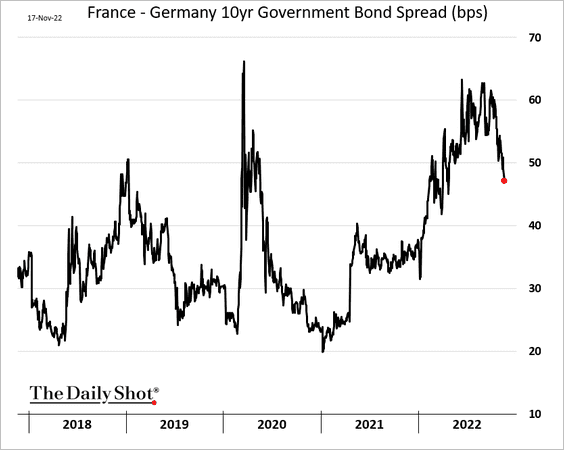

1. Spreads to Bunds have been falling.

• Italy:

• France:

——————–

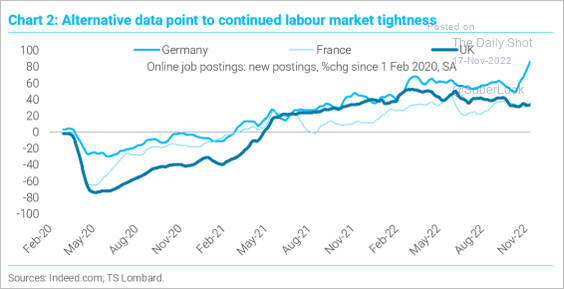

2. Germany’s labor market has been tightening.

Source: TS Lombard

Source: TS Lombard

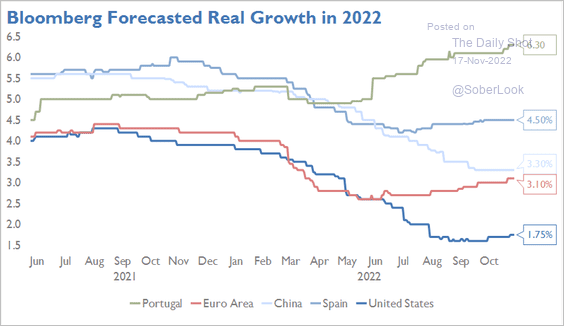

3. Portugal’s economy has outperformed this year.

Source: Arcano Economics

Source: Arcano Economics

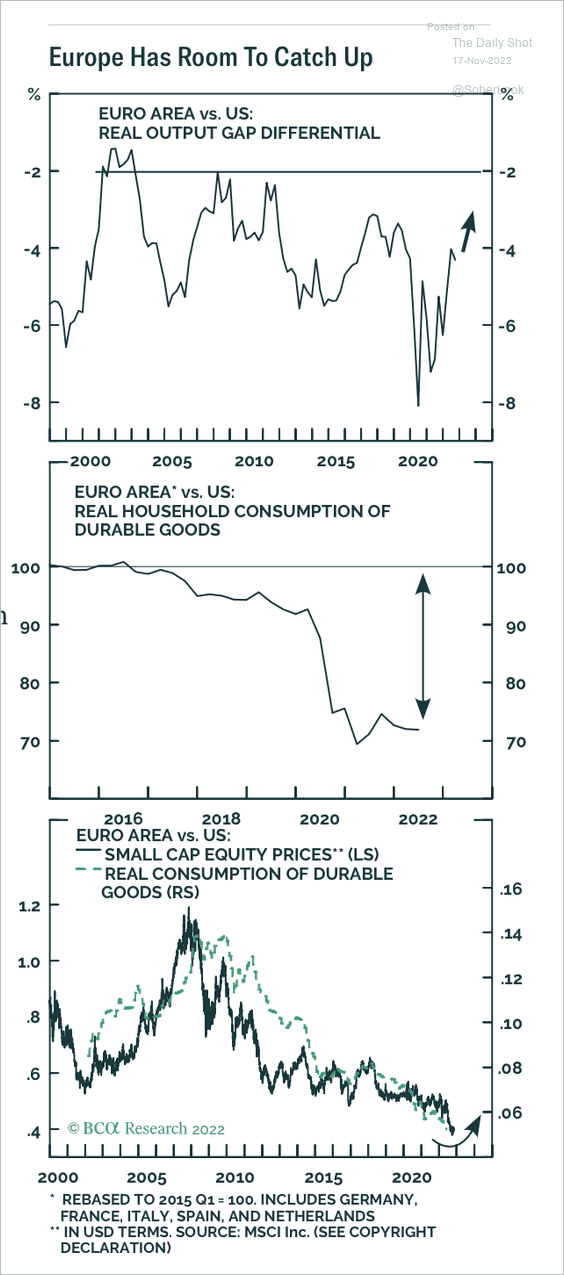

4. The euro area economy and markets have lagged behind the US. Is the underperformance over?

Source: BCA Research

Source: BCA Research

Back to Index

Europe

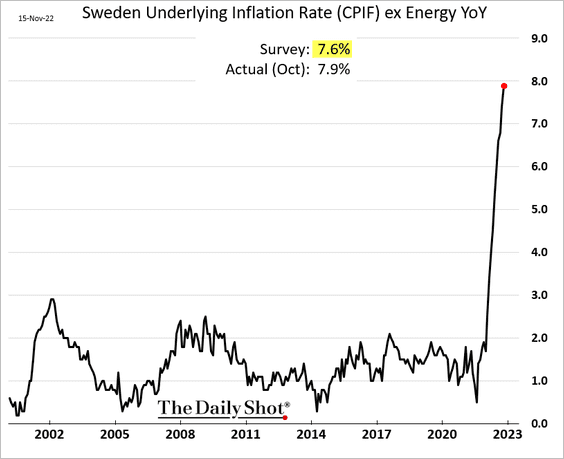

1. Sweden’s core inflation continues to surge.

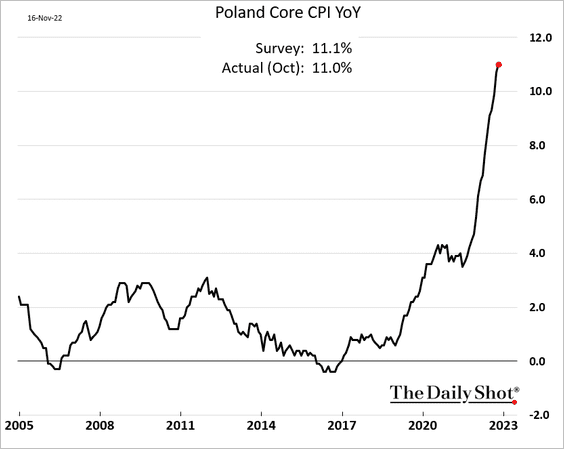

2. Poland’s core CPI hit 11%.

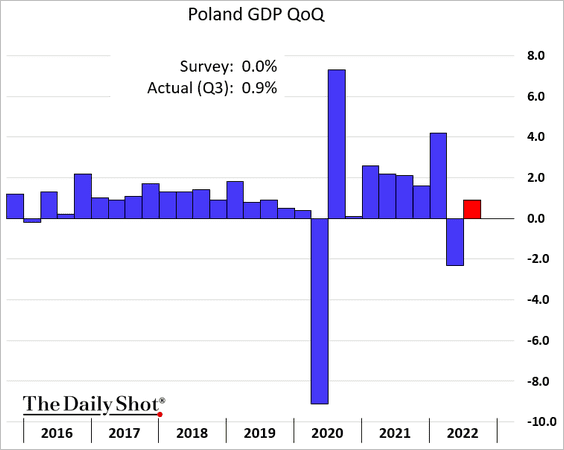

Poland’s GDP growth rebounded last quarter, avoiding a technical recession.

——————–

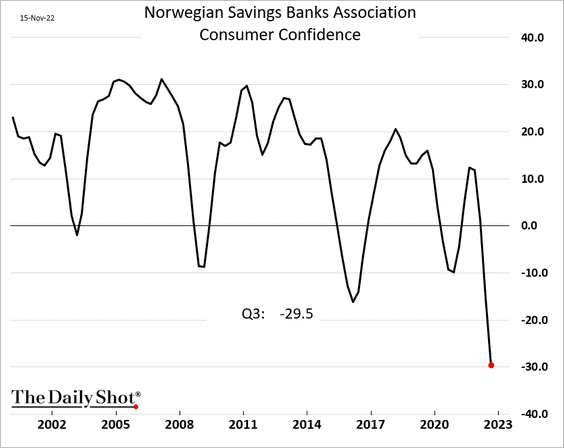

3. Norway’s consumer confidence has collapsed.

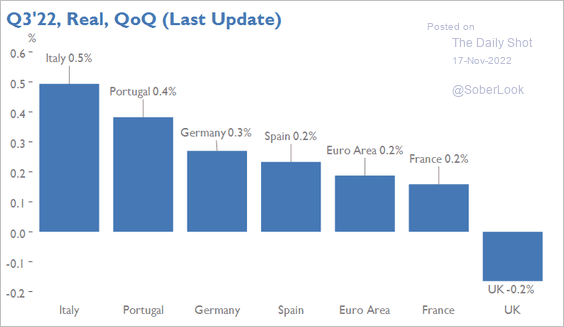

4. Here is a look at Q3 GDP growth in select economies.

Source: Arcano Economics

Source: Arcano Economics

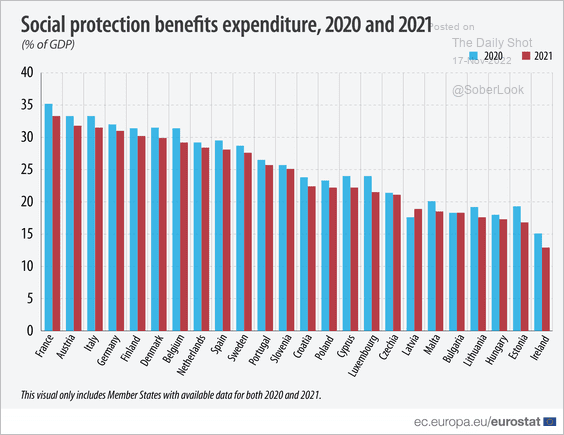

5. Finally, we have social protection benefits expenditures in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

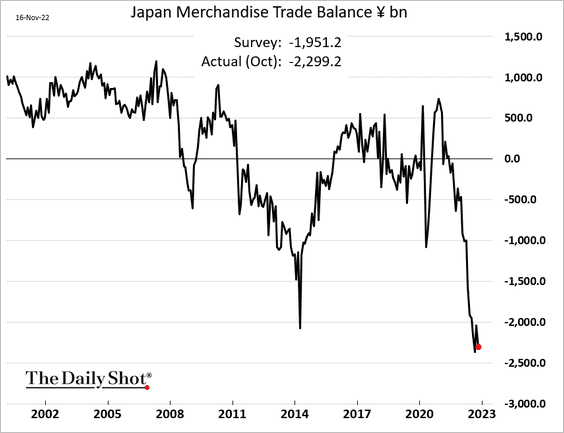

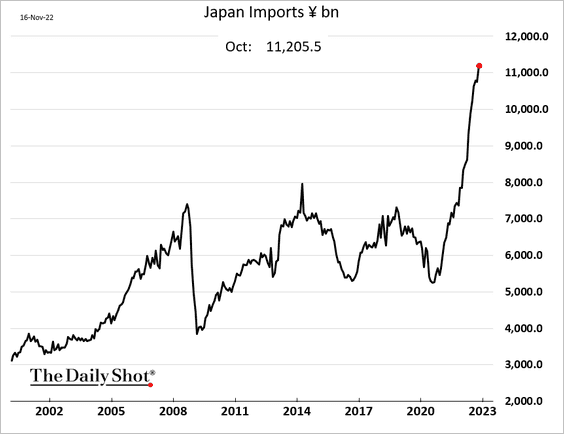

1. Japan’s trade deficit is holding near record levels, …

… as imports hit a new high.

——————–

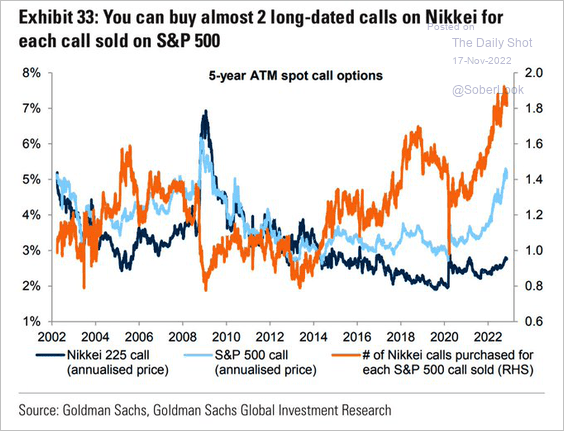

2. The Nikkei long-dated call options are cheap relative to the SP 500 equivalents.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

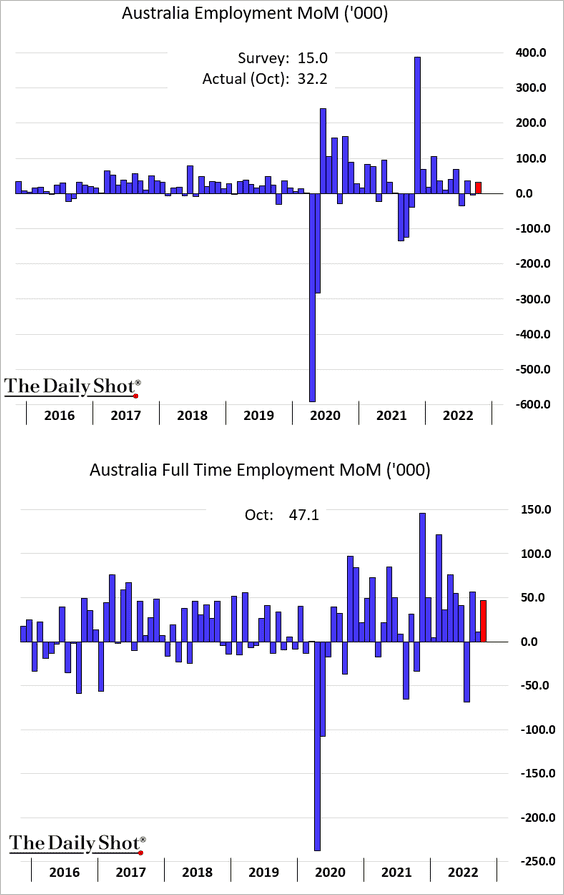

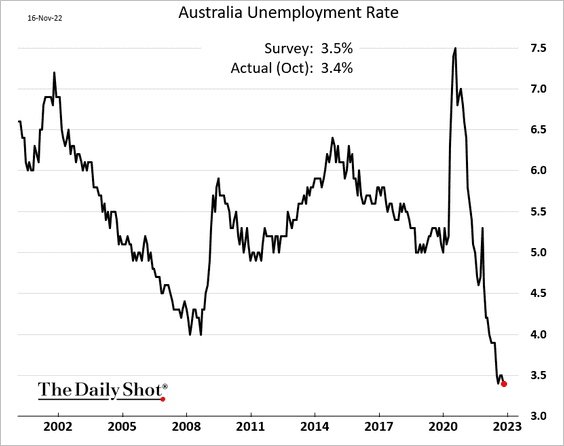

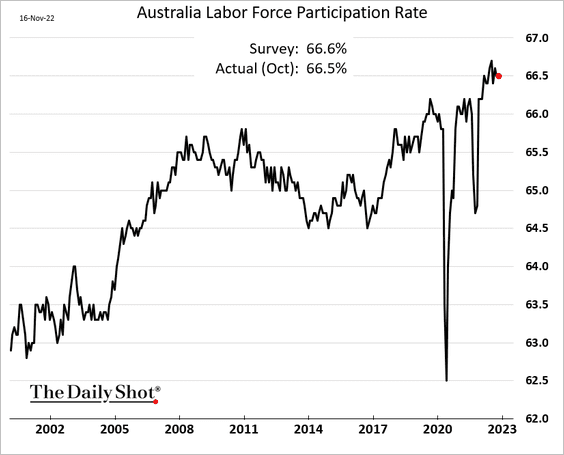

Australia

The labor market remains remarkably strong.

• The unemployment rate hit a multi-decade low.

Source: Reuters Read full article

Source: Reuters Read full article

• Labor force participation remains well above pre-COVID levels.

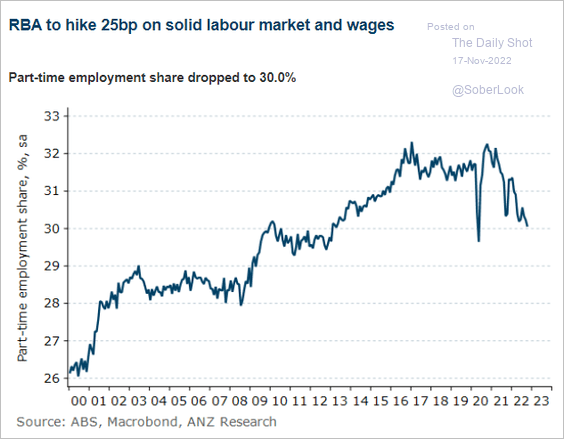

• Here is the share of part-time employment.

Source: @ANZ_Research

Source: @ANZ_Research

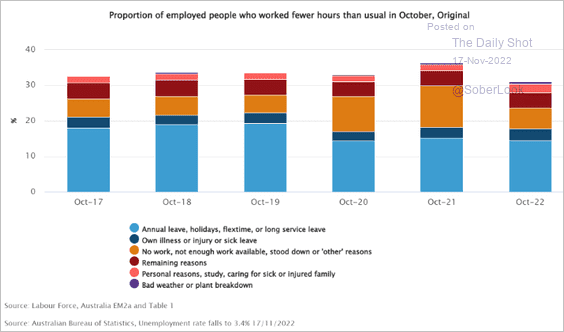

• Why did some Australians work fewer hours than usual?

Source: ABC NEWS Read full article

Source: ABC NEWS Read full article

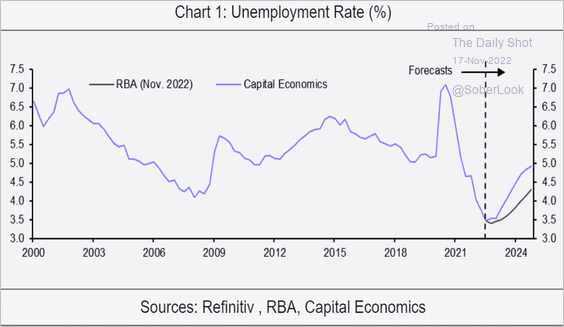

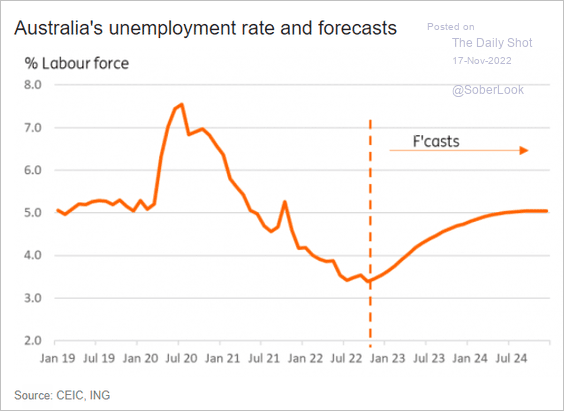

The unemployment rate is expected to start climbing. Here are a couple of forecasts.

– Capital Economics:

Source: Capital Economics

Source: Capital Economics

– ING:

Source: ING

Source: ING

Back to Index

China

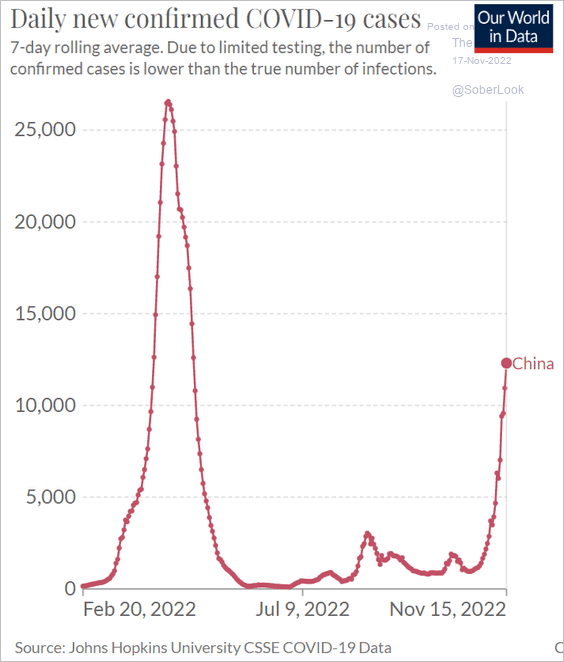

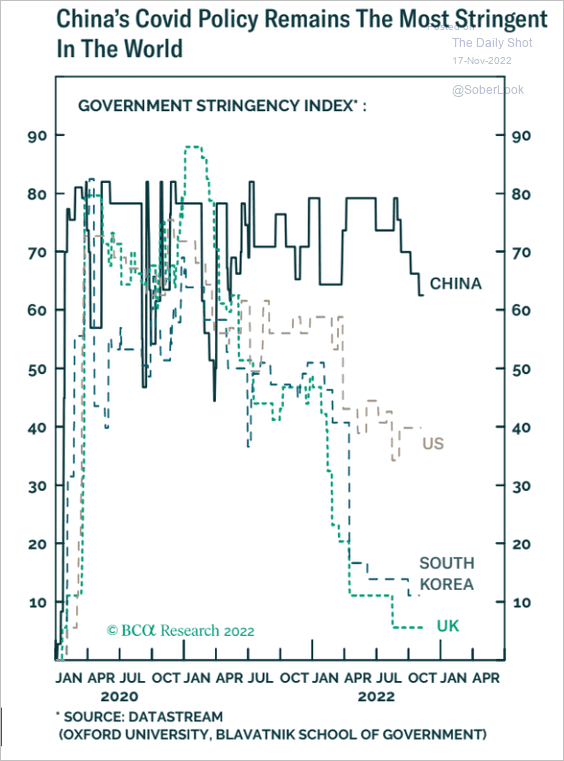

1. The COVID situation continues to pose a risk to economic activity.

Source: AP Read full article

Source: AP Read full article

• COVID cases:

Source: Our World in Data

Source: Our World in Data

• Restrictions:

Source: BCA Research

Source: BCA Research

——————–

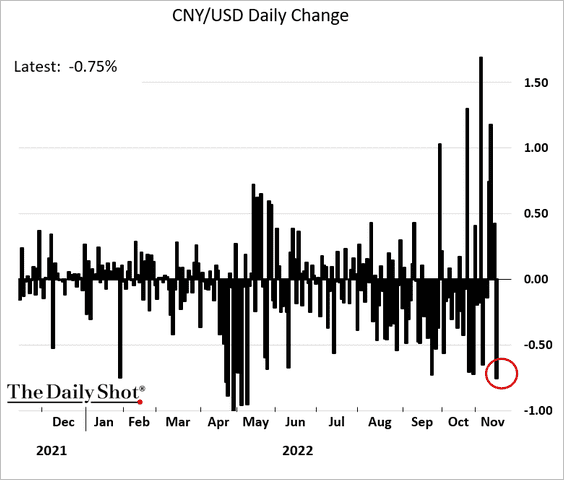

2. The renminbi declined.

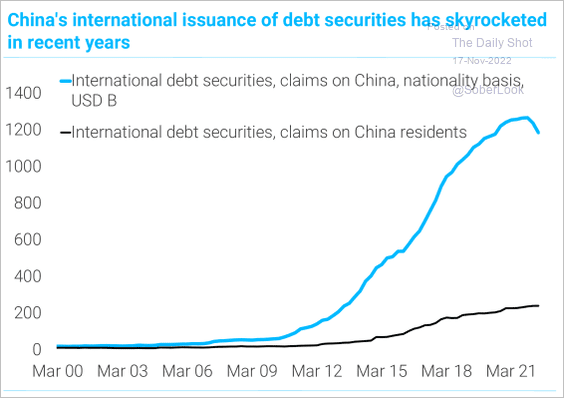

3. China’s international debt issuance has grown massively over the past decade.

Source: TS Lombard

Source: TS Lombard

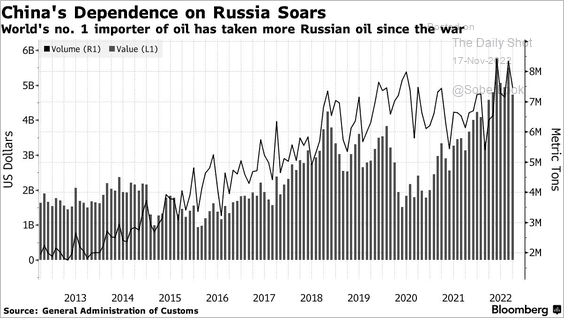

4. Oil imports from Russia keep rising.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Cryptocurrency

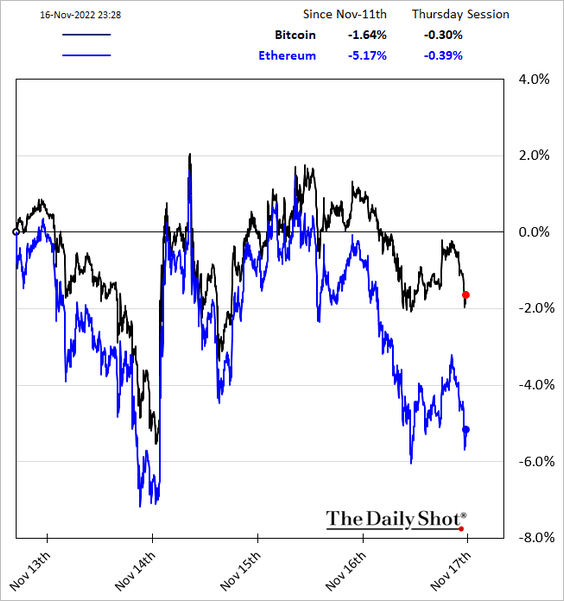

1. Ether has been underperforming.

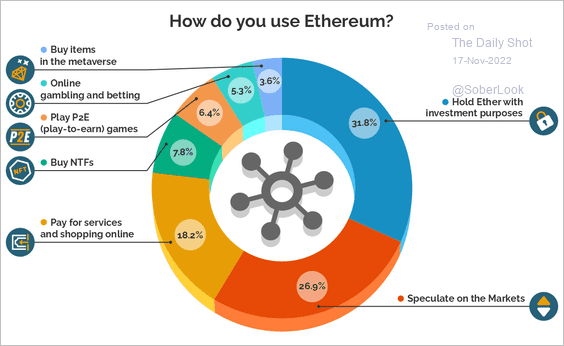

By the way, here is a survey on how the Ethereum platform is used.

Source: BonusInsider Read full article

Source: BonusInsider Read full article

——————–

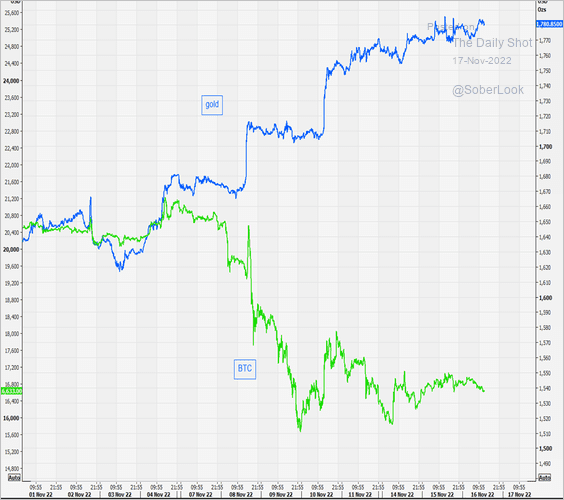

2. Bitcoin and gold have diverged sharply.

Source: @themarketear

Source: @themarketear

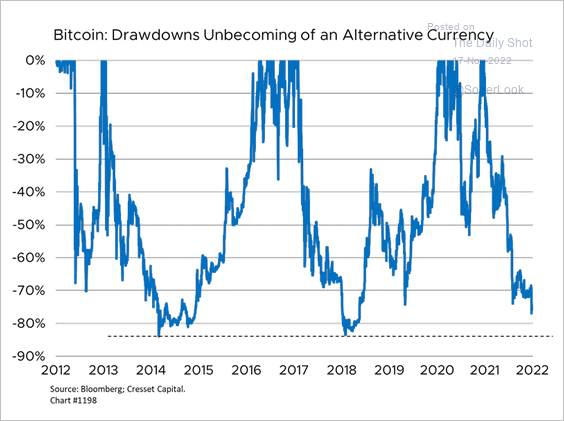

3. Bitcoin’s drawdown is nearing 80%.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

Back to Index

Energy

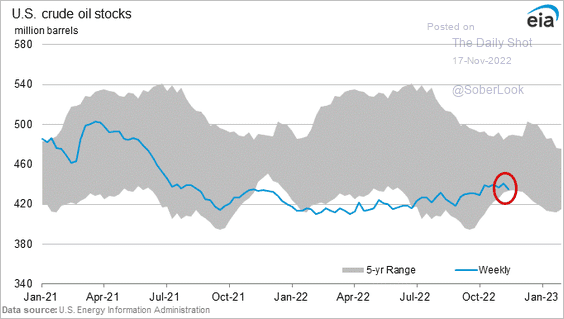

1. US oil inventories declined sharply last week.

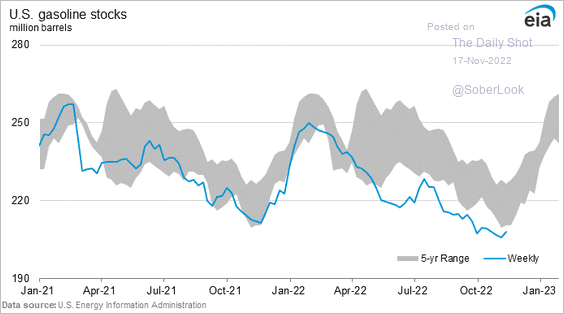

But gasoline inventories increased.

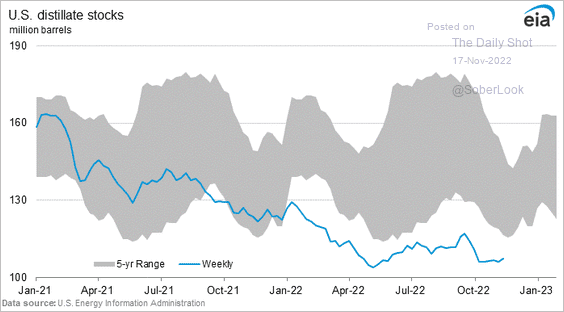

Distillates inventories remain at extreme lows, …

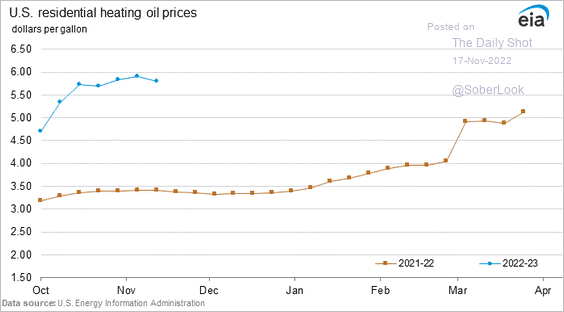

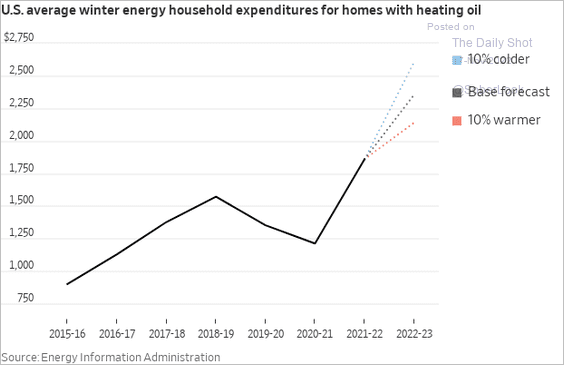

… driving up diesel and heating oil prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

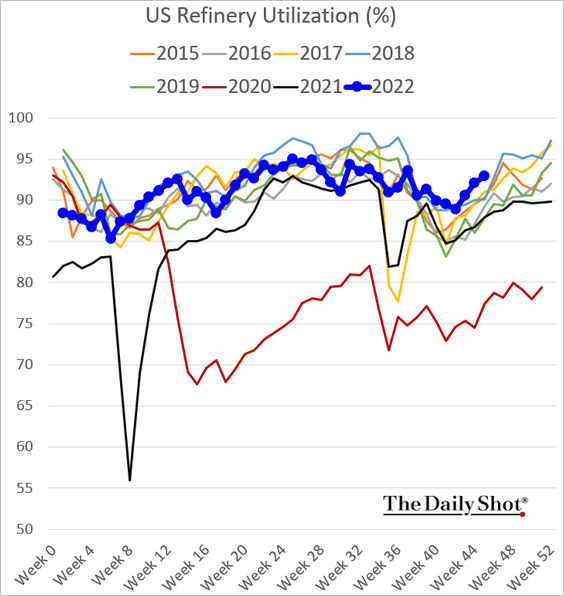

2. Refinery utilization remains elevated for this time of the year.

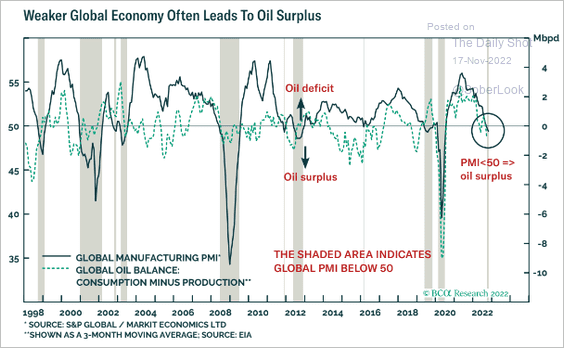

3. Will the looming economic slump lead to crude oil surpluses?

Source: BCA Research

Source: BCA Research

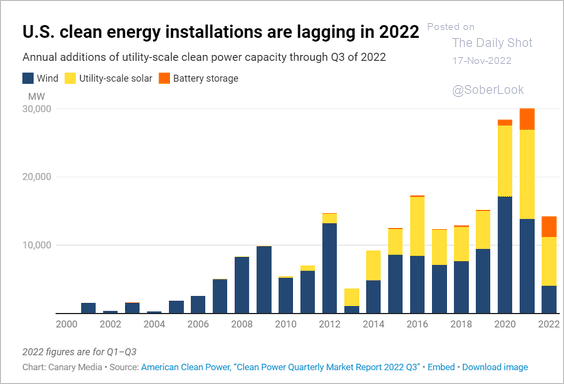

4. This chart shows US clean energy installations.

Source: Canary Media Read full article

Source: Canary Media Read full article

Back to Index

Equities

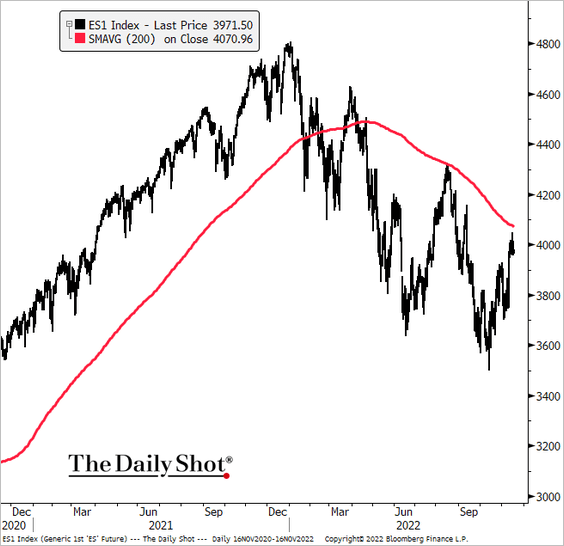

1. The S&P 500 futures held resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

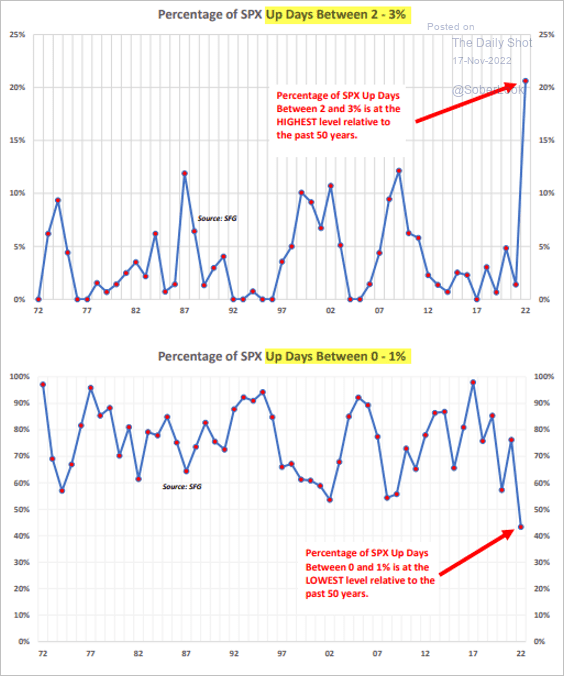

2. We’ve had some sharp upswings this year.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

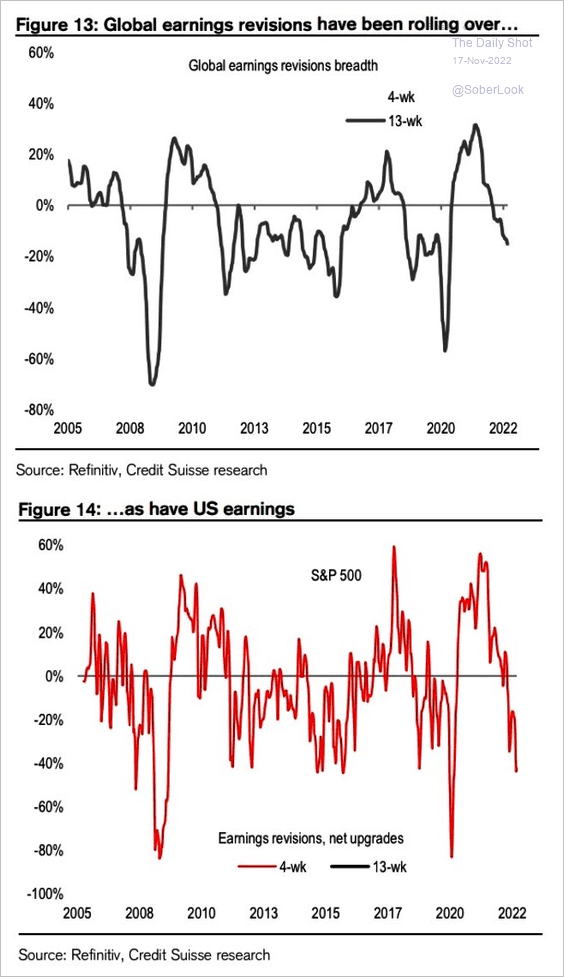

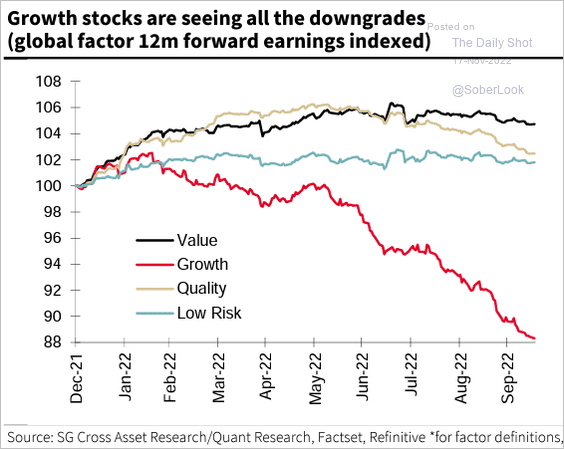

3. Net earnings revisions continue to trend lower.

Source: Credit Suisse; @WallStJesus

Source: Credit Suisse; @WallStJesus

Growth stocks continue to take the brunt of earnings downgrades.

Source: Societe Generale Cross Asset Research; @MikeZaccardi, @TheTranscript_

Source: Societe Generale Cross Asset Research; @MikeZaccardi, @TheTranscript_

——————–

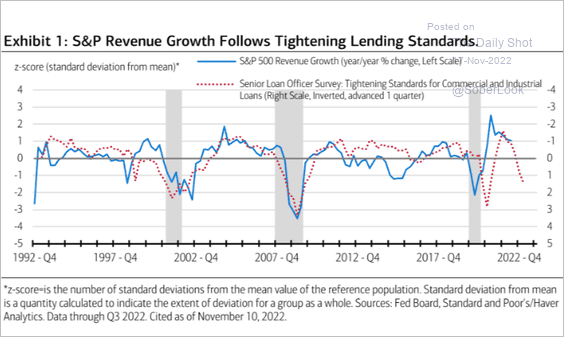

4. Tighter credit conditions signal weaker revenue growth ahead.

Source: Merrill Lynch

Source: Merrill Lynch

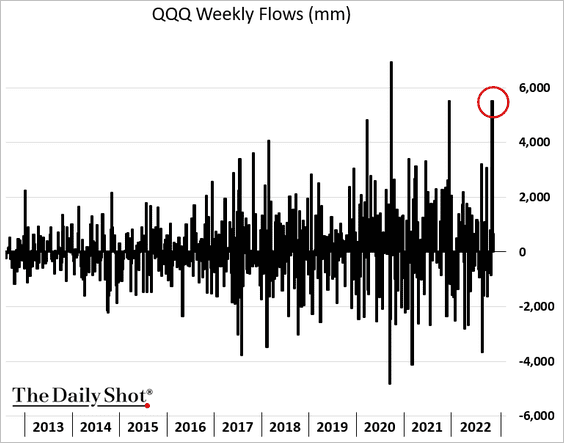

5. QQQ (NASDAQ 100 ETF) saw robust inflows recently.

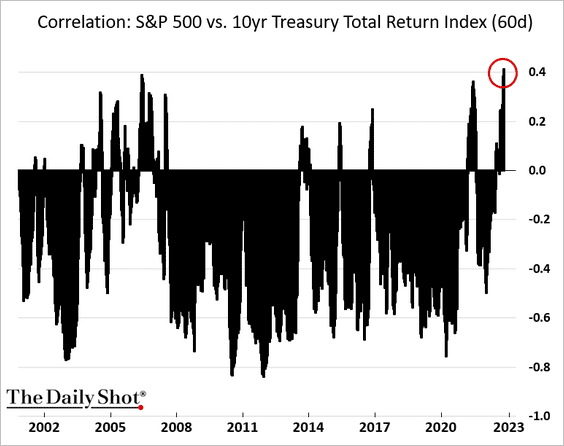

6. The correlation between stocks and bonds is hitting multi-year highs.

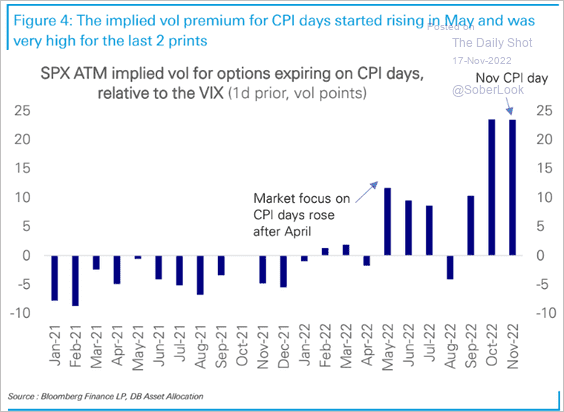

7. Options traders have been paying up for CPI-day protection.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

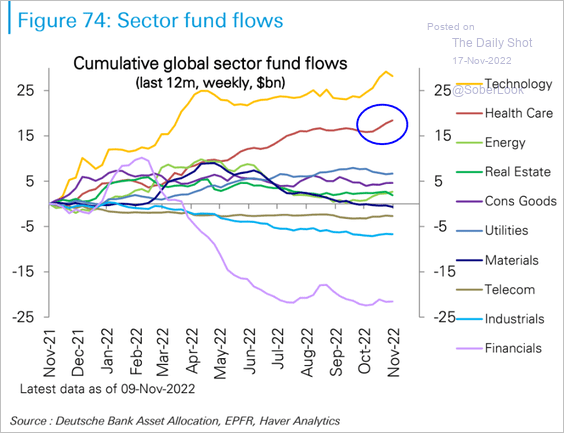

8. Next, we have some sector updates.

• Fund flows by sector:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

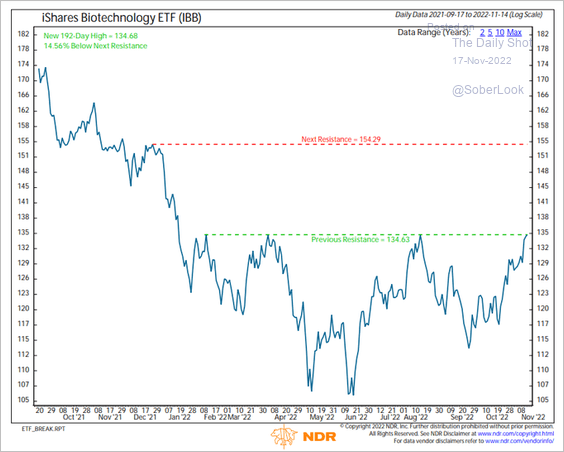

• The iShares Biotech ETF (at resistance):

Source: @rob_anderson314

Source: @rob_anderson314

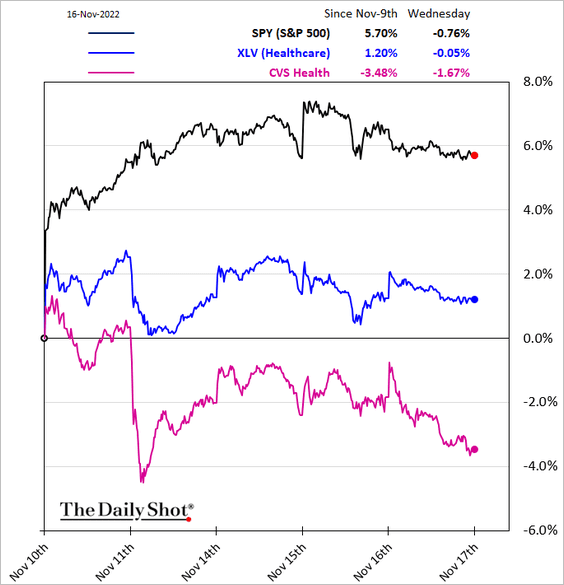

• Performance over the past five business days:

– Healthcare:

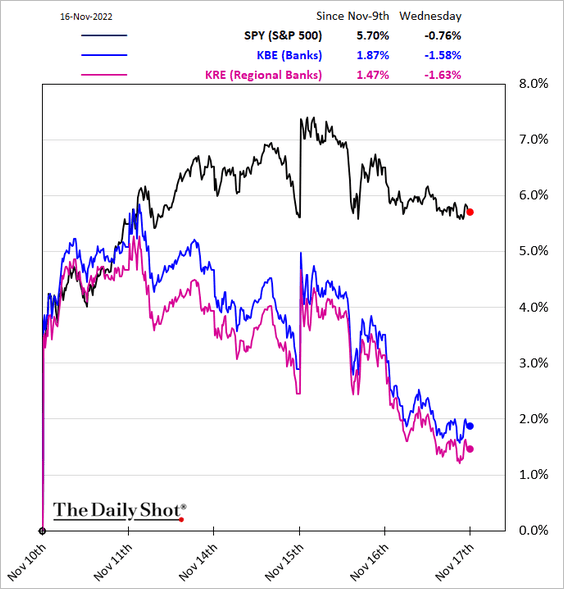

– Banks:

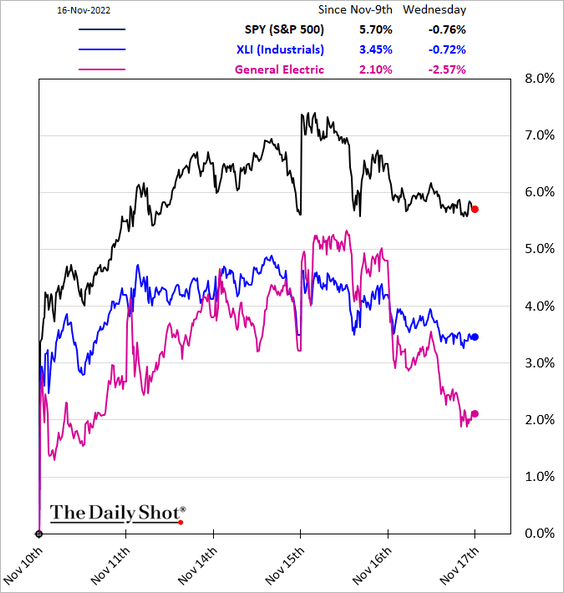

– Industrials:

– Semiconductors:

![]()

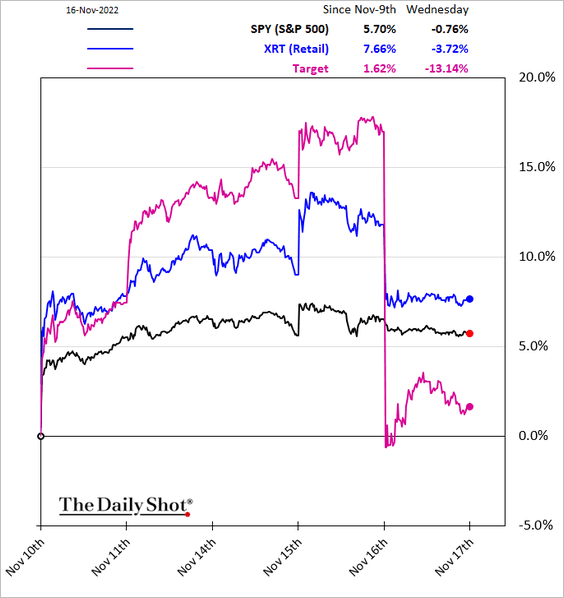

– Retail:

Back to Index

Rates

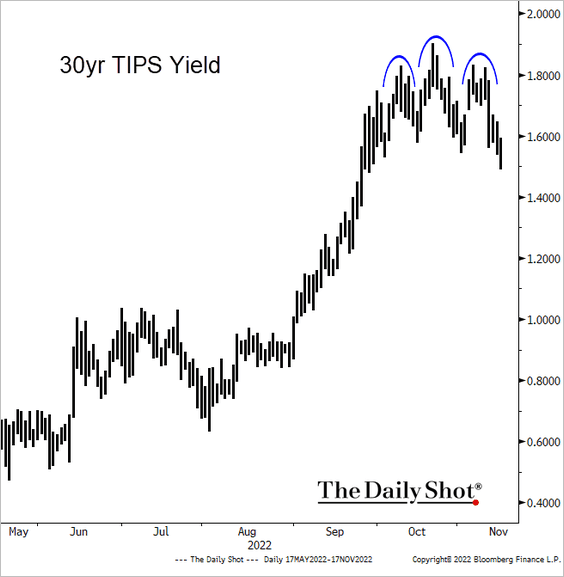

1. The 30-year TIPS yield (real yield) appears to be rolling over.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

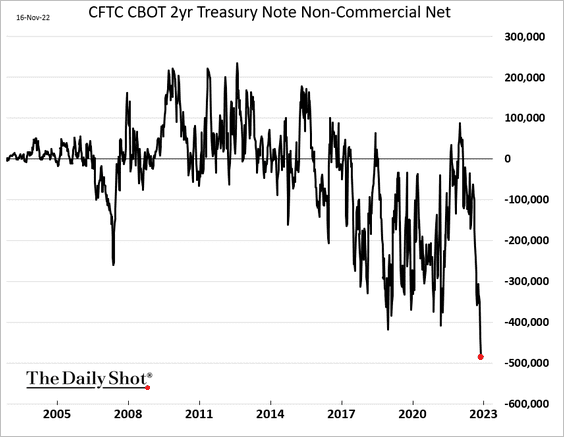

2. Speculative accounts are running massive bets against the 2-year Treasury note.

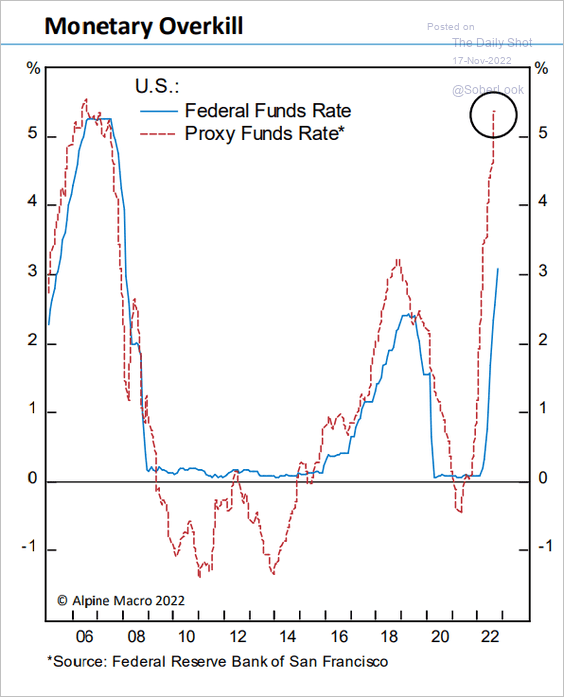

3. Monetary conditions are tighter than the fed funds rate indicates.

Source: Alpine Macro

Source: Alpine Macro

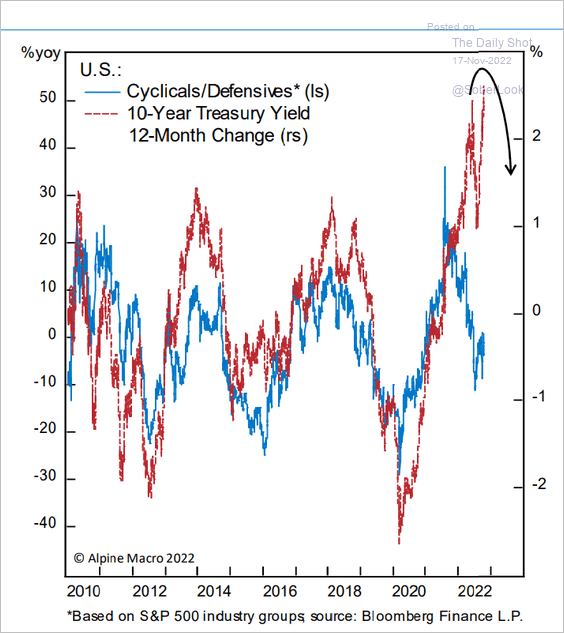

4. The stock market is signaling lower Treasury yields ahead.

Source: Alpine Macro

Source: Alpine Macro

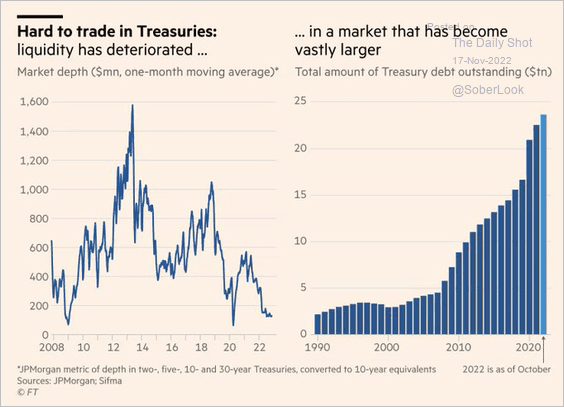

5. Treasury market liquidity has been awful.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

Back to Index

Food for Thought

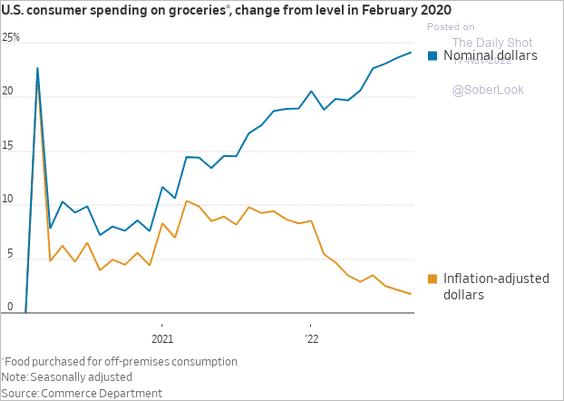

1. Nominal and real spending on groceries in the US:

Source: @WSJ

Source: @WSJ

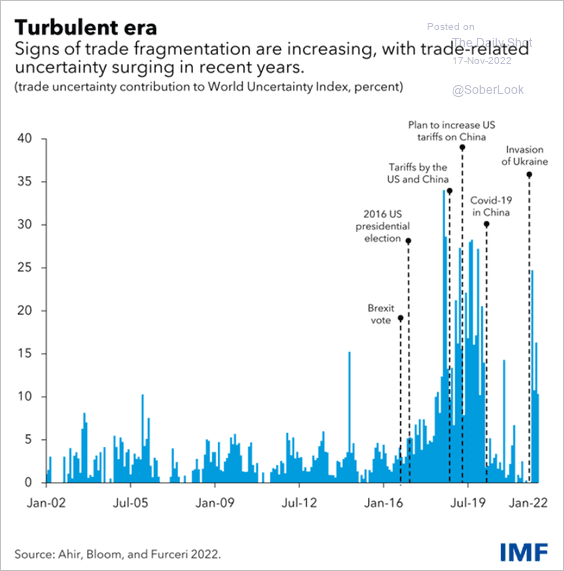

2. Rising trade fragmentation risks:

Source: IMF Read full article

Source: IMF Read full article

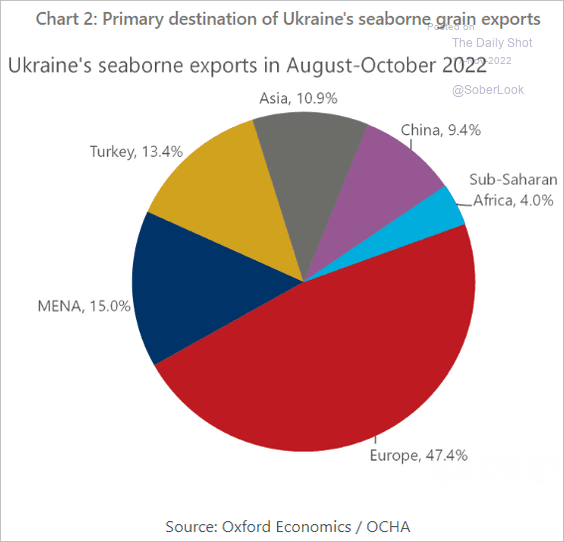

3. Ukrainian seaborne grain exports:

Source: @axios

Source: @axios

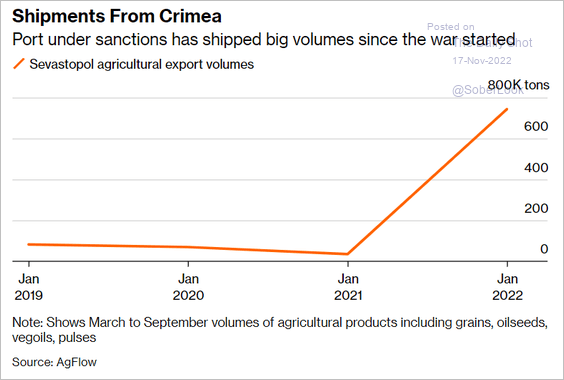

4. Russia smuggling stolen Ukrainian grain:

Source: @business Read full article

Source: @business Read full article

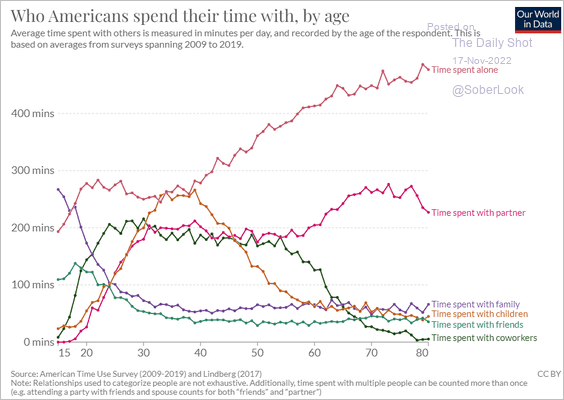

5. Who Americans spend their time with, by age:

Source: Our World in Data

Source: Our World in Data

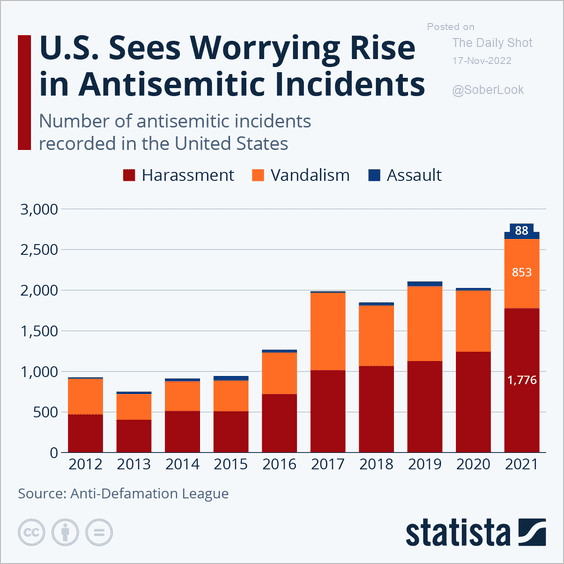

6. Antisemitic incidents:

Source: Statista

Source: Statista

7. Countries with the most golf courses:

Source: Statista

Source: Statista

——————–

Back to Index