The Daily Shot: 18-Nov-22

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

Administrative Update

1. The Daily Shot will not be published on November 24th and 25th (Thursday and Friday of next week).

2. If you have trouble viewing images or experience navigation issues (such as “[Message clipped] View entire message” in Gmail), try clicking on “View in your browser” at the very top of the email.

3. If you are looking for a particular Daily Shot post or a specific image, try searching the archive using the search tool on TheDailyShot.com (it allows image as well as text search). Here is an overview.

Back to Index

The United States

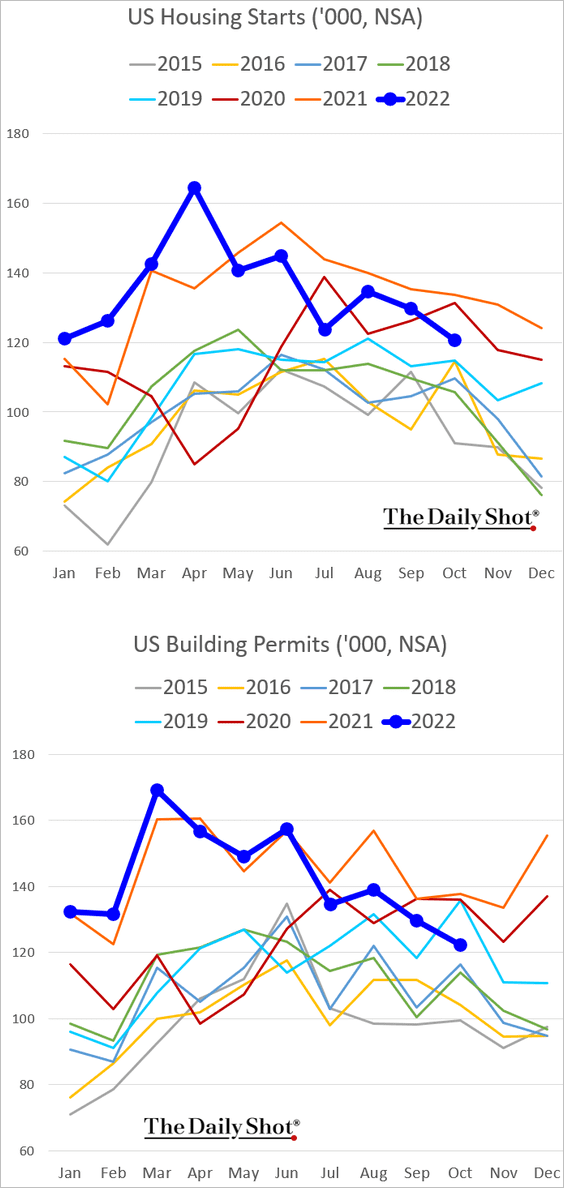

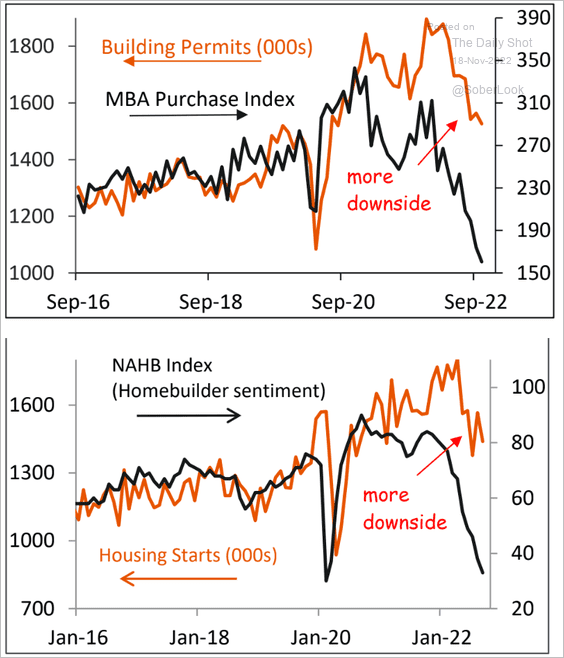

1. Residential construction was softer last month, but it’s not collapsing yet.

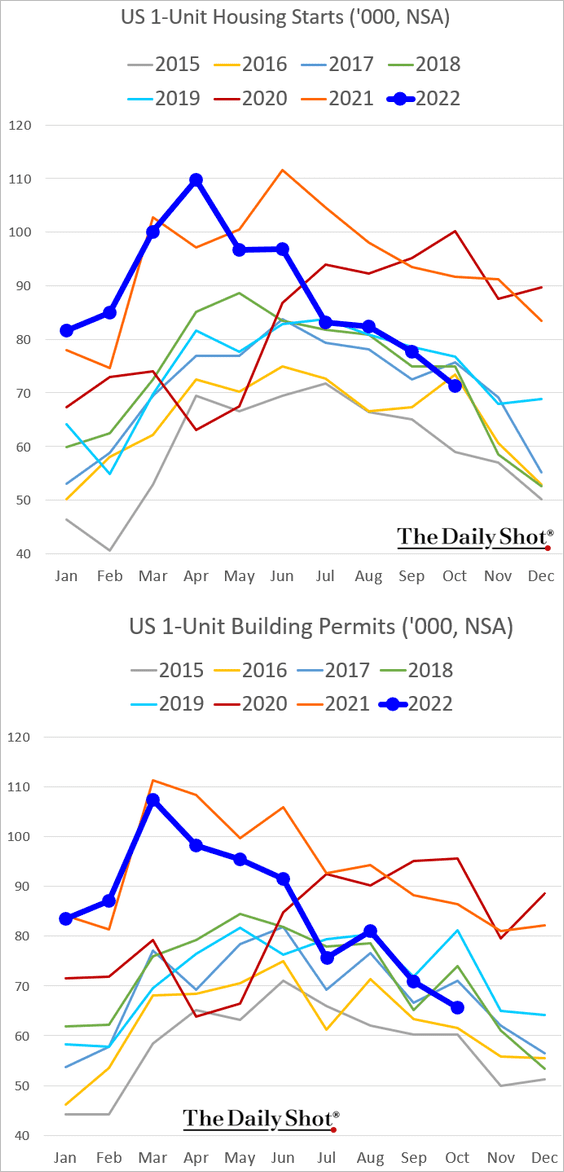

• The weakness was in single-family housing.

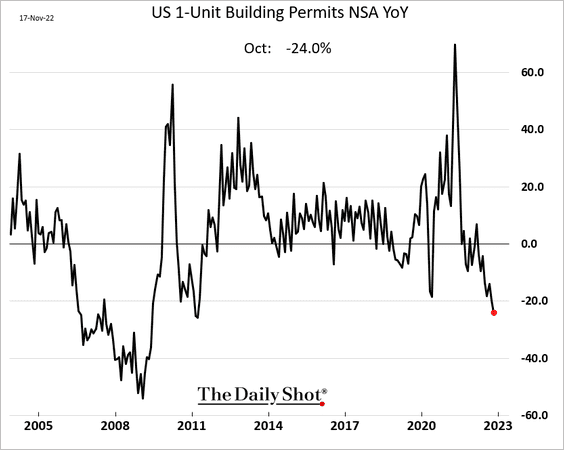

Single-family permits are down 24% versus the same time a year ago.

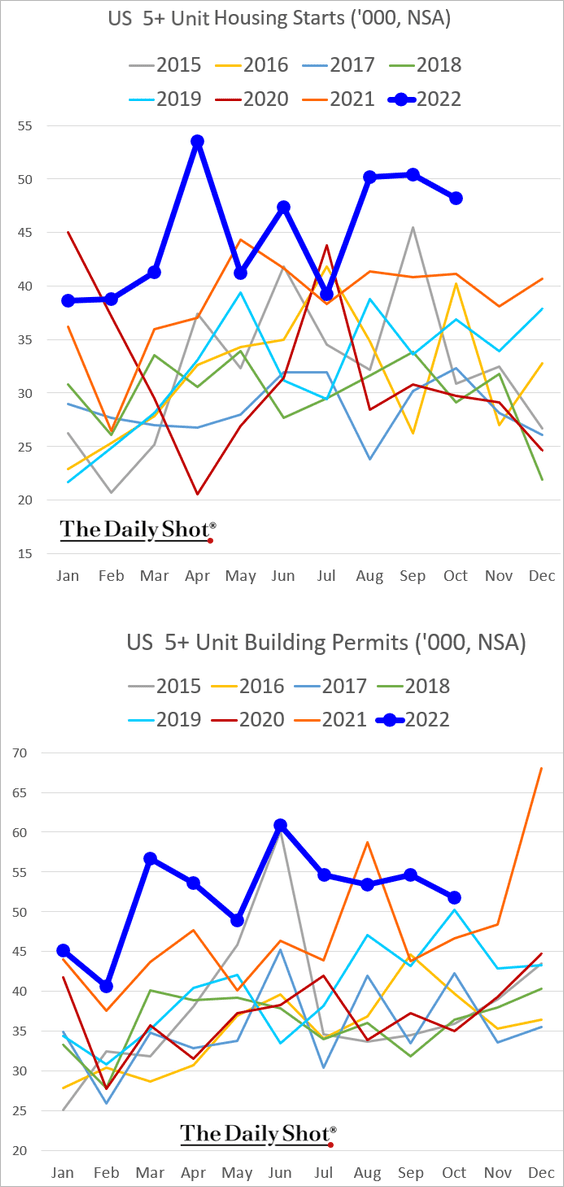

• Multi-family construction remains robust.

• But there is trouble ahead for construction activity.

Source: Piper Sandler

Source: Piper Sandler

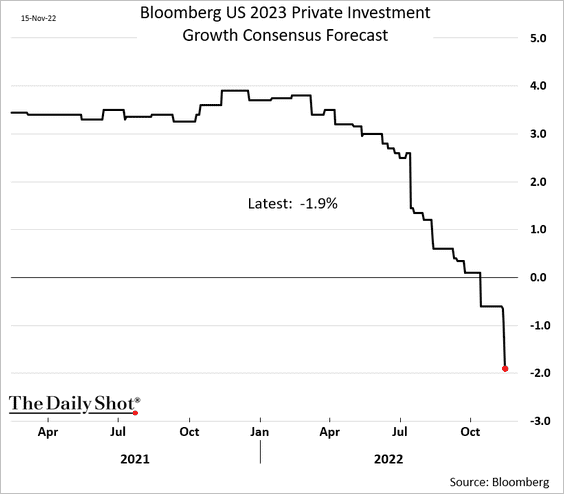

US private investment is expected to tumble next year, driven mostly by stalling residential construction (and, to a lesser extent, slower business investment).

——————–

2. Next, we have some updates on the labor market.

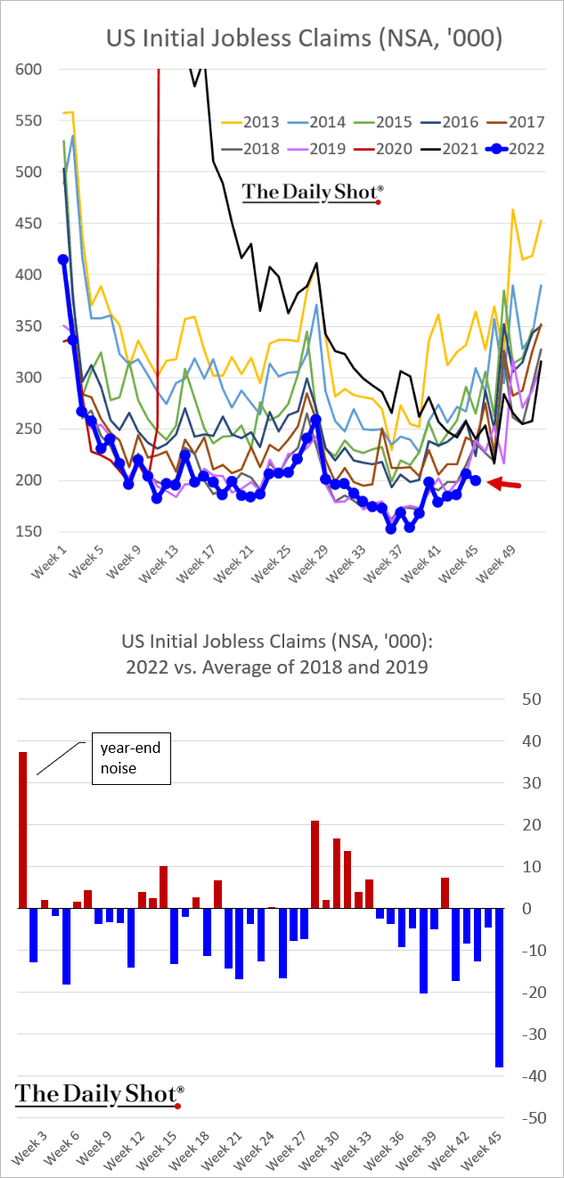

• Initial jobless claims hit a multi-year low, dipping well under pre-COVID levels. Despite the layoff headlines, the job market remains tight.

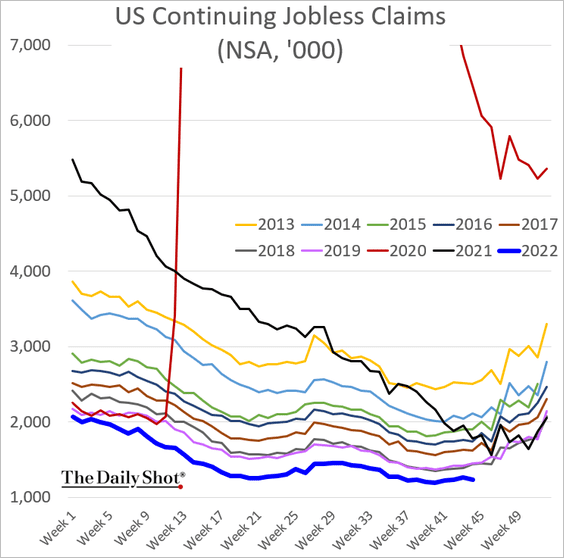

Continuing claims are also at multi-year lows.

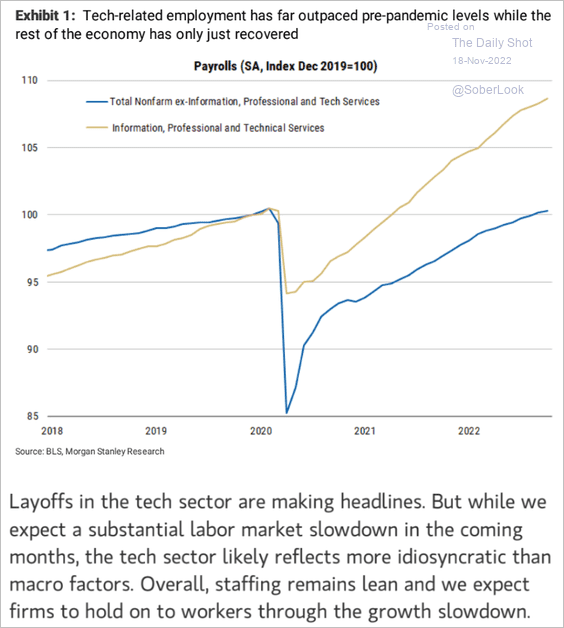

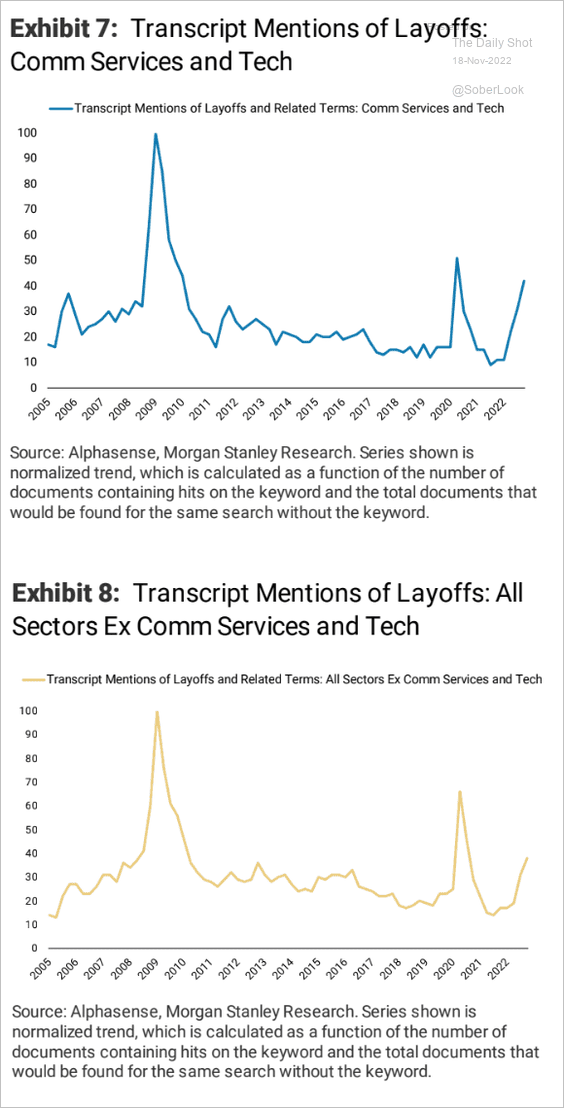

• Given the strength of US tech employment, tech layoffs are not a signal of stress in the labor market. The stock market has been rewarding companies that cut costs in recent months, incentivizing tech firms to announce layoffs (more in the equities section). See the comment below from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

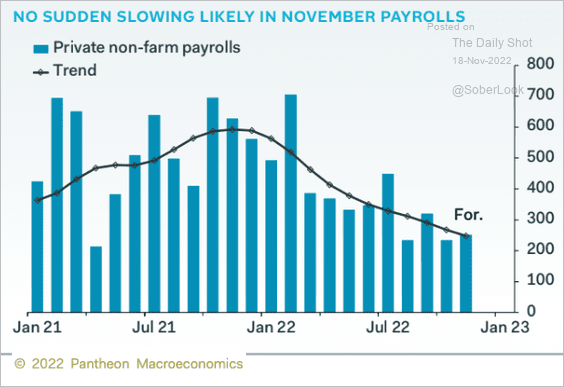

• Pantheon Macroeconomics expects a strong payrolls gain this month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

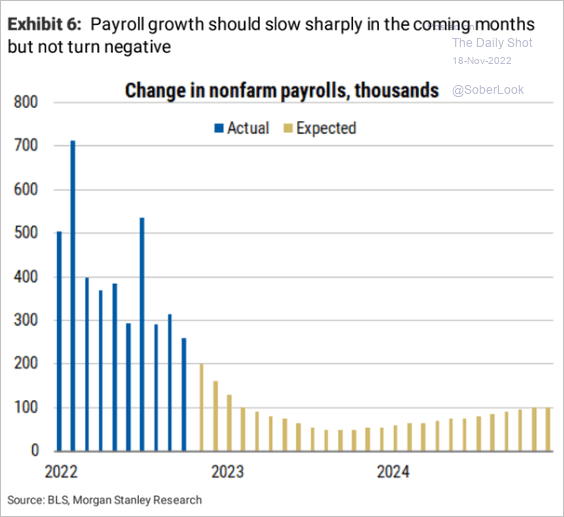

• Morgan Stanley expects payrolls growth to remain positive next year, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

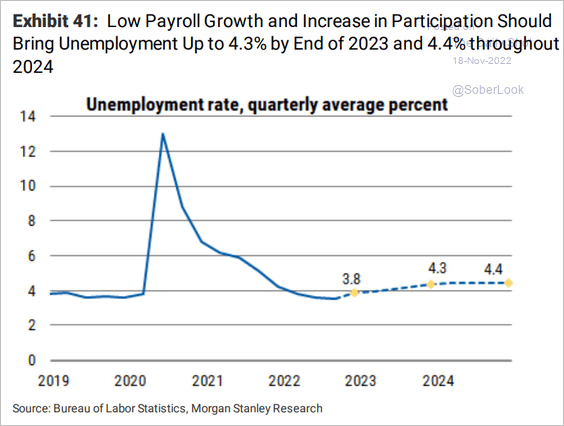

… with the unemployment rate rising to 4.3% by the end of 2023.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

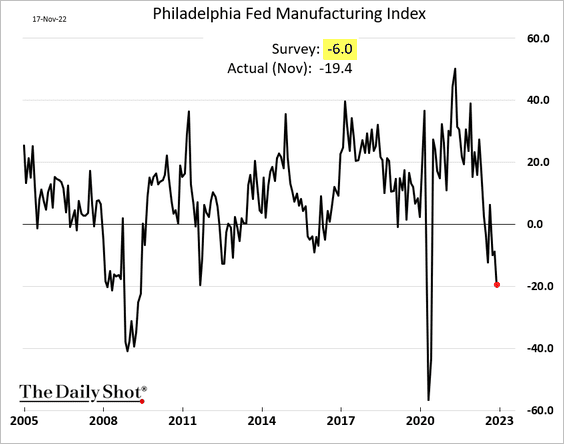

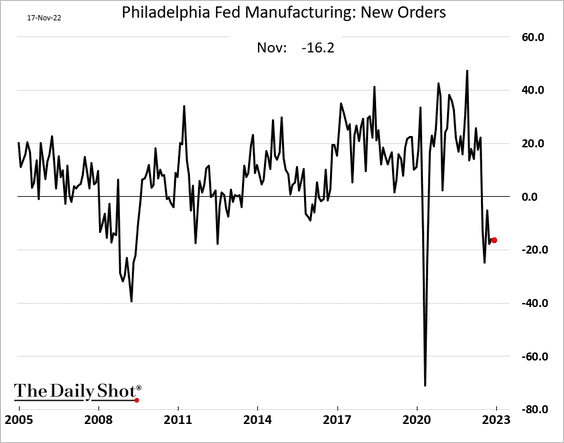

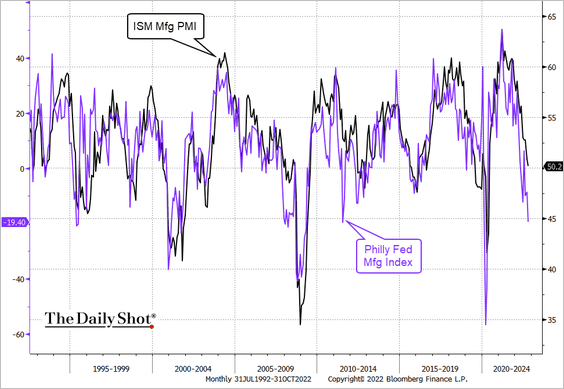

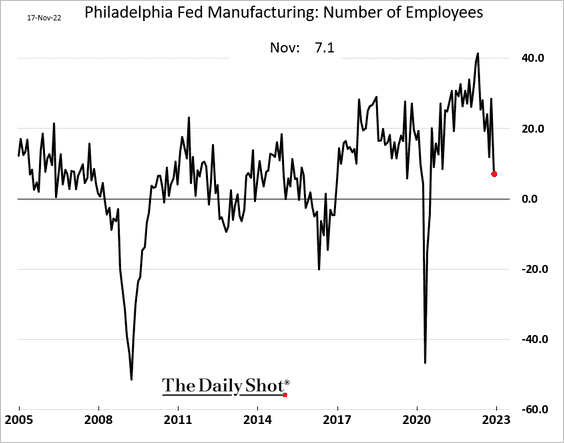

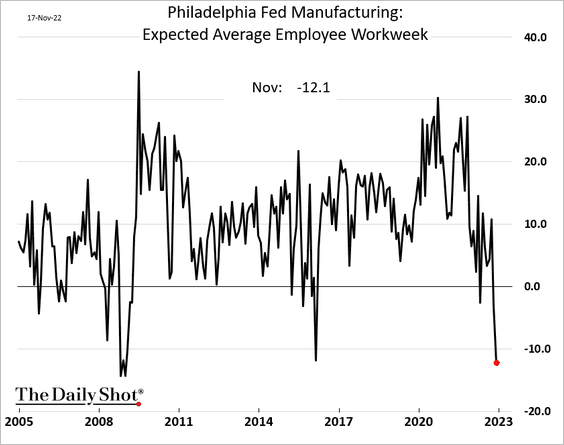

3. The Philly Fed’s regional manufacturing index showed further deterioration in factory activity this month (worse than expected).

• The Philly Fed’s report does not bode well for manufacturing at the national level.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Hiring is slowing.

Manufacturers increasingly expect to be cutting workers’ hours as demand slumps.

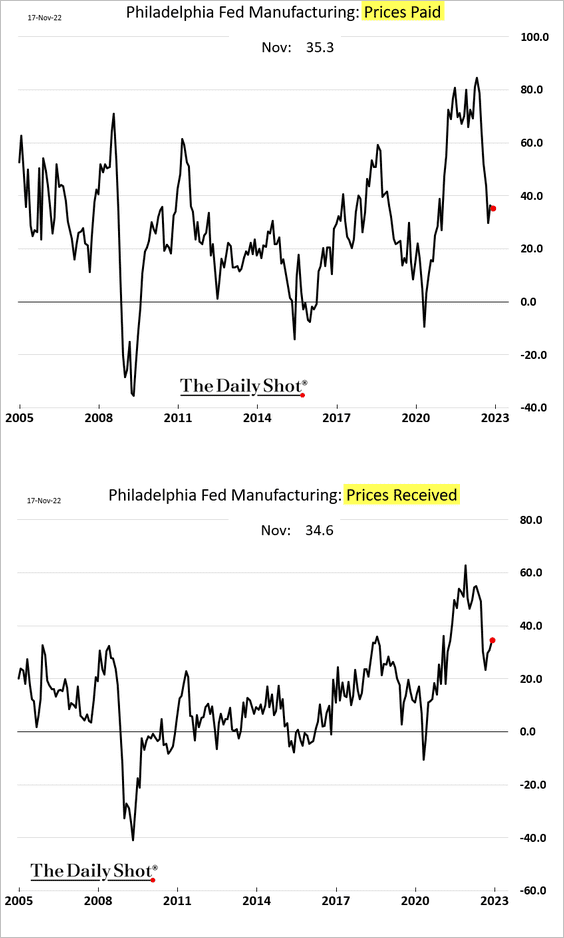

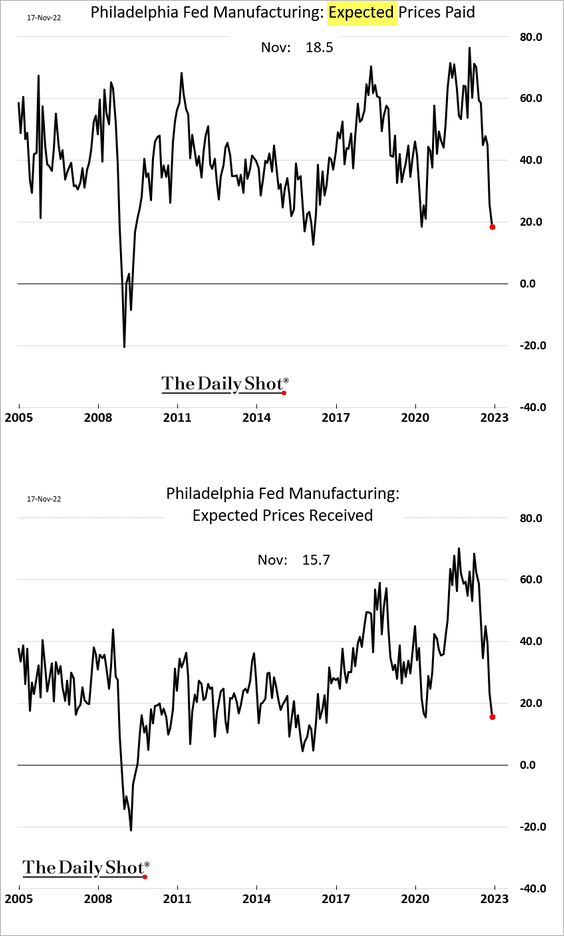

• Price pressures have moderated, but they are not gone.

Businesses expect price gains to keep slowing in the months ahead.

——————–

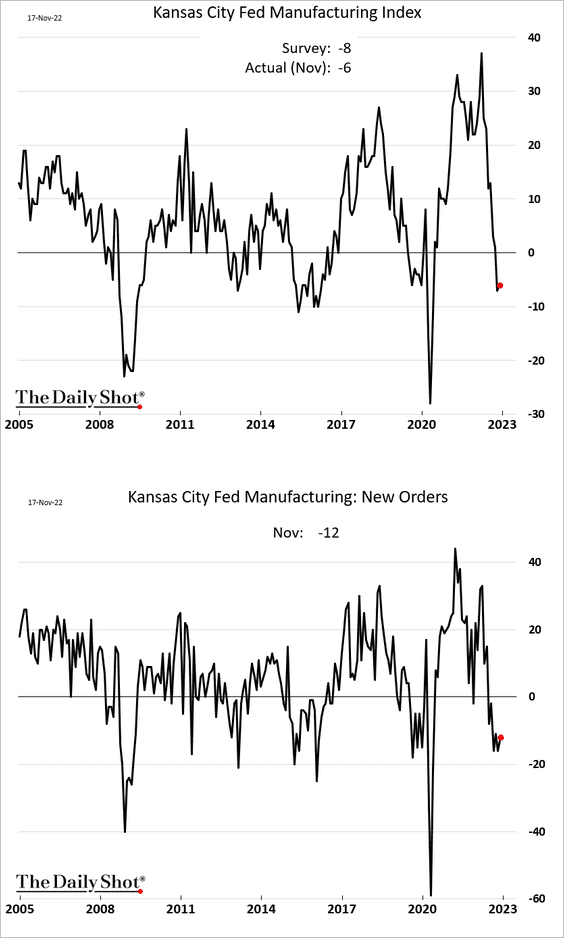

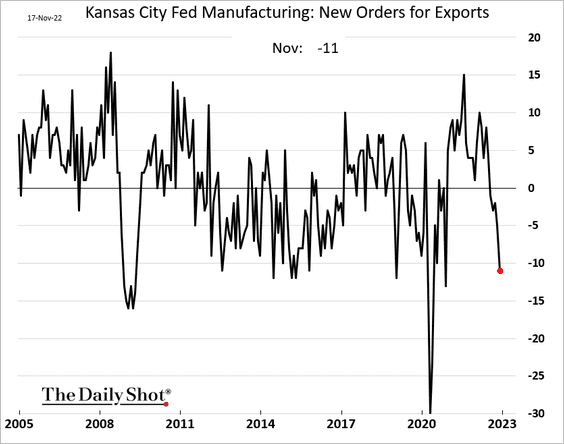

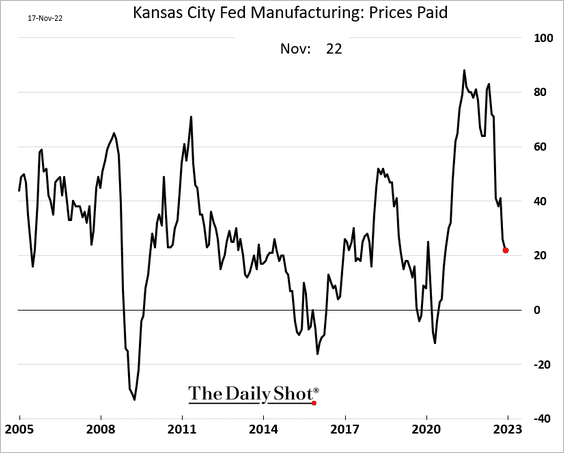

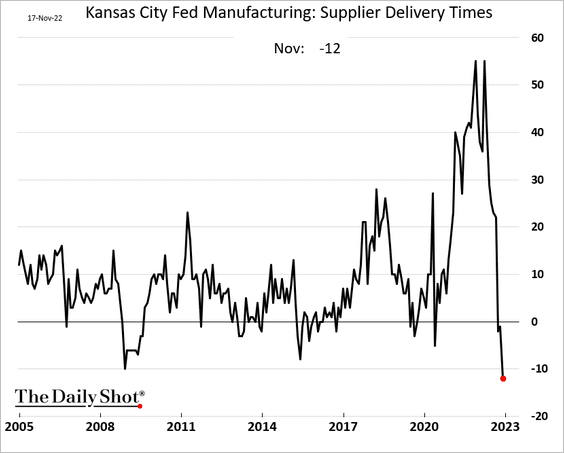

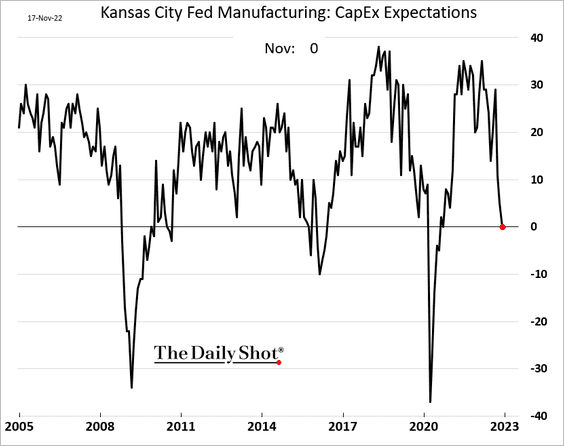

4. The Kansas City Fed’s manufacturing index remains in contraction territory.

• Export orders are sinking.

• Price pressures are moderating, …

… as supply bottlenecks rapidly disappear.

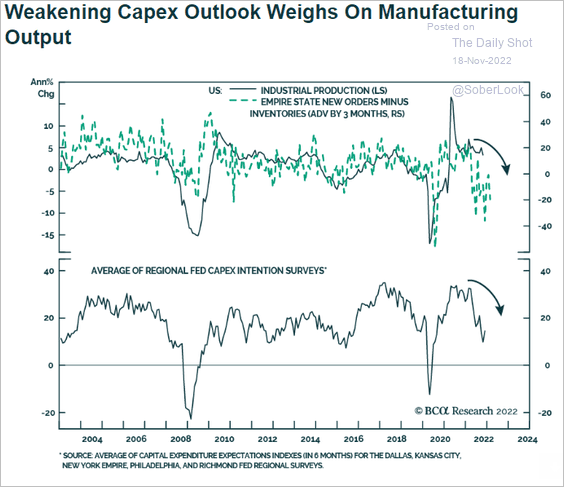

• CapEx plans are evaporating.

The CapEx slowdown is a national trend.

Source: BCA Research

Source: BCA Research

——————–

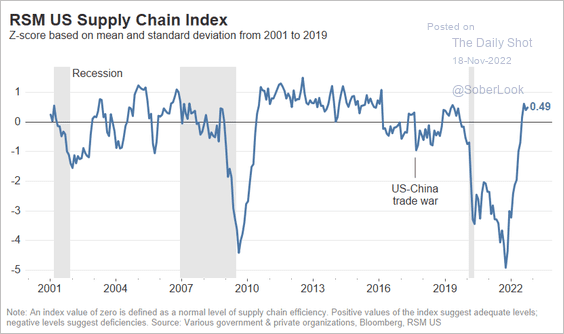

5. Supply chain stress levels are returning to pre-COVID levels.

Source: RSM, @tuannguyen0709

Source: RSM, @tuannguyen0709

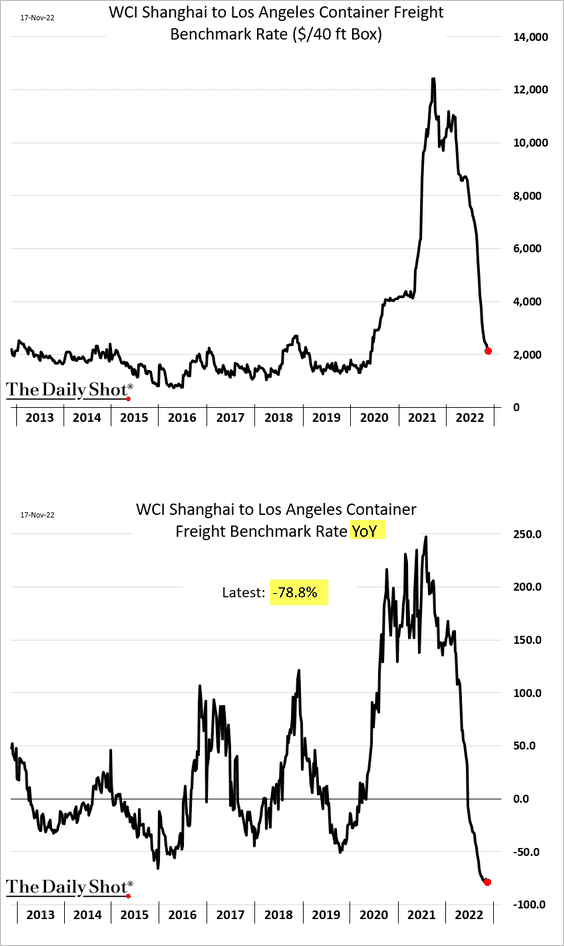

Container shipping costs are down nearly 80% from a year ago.

——————–

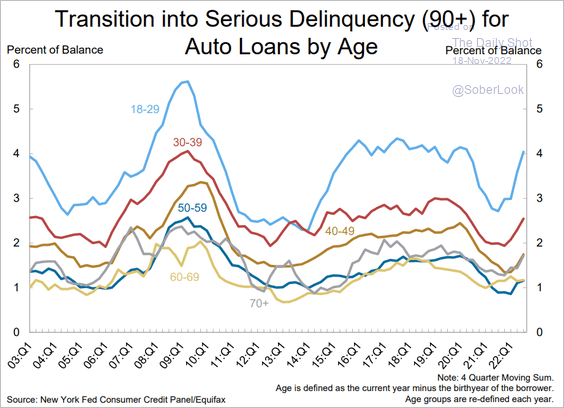

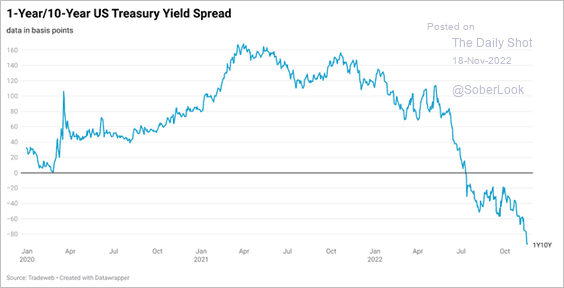

6. Auto loan delinquencies are rebounding from the pandemic-era lows.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

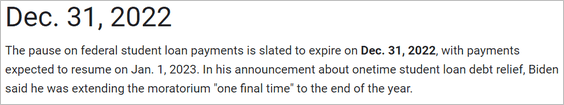

• Student loan delinquencies are about to jump as payments become due again.

Source: CNET Read full article

Source: CNET Read full article

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

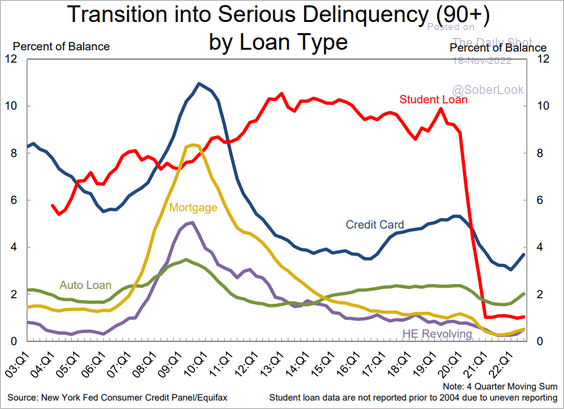

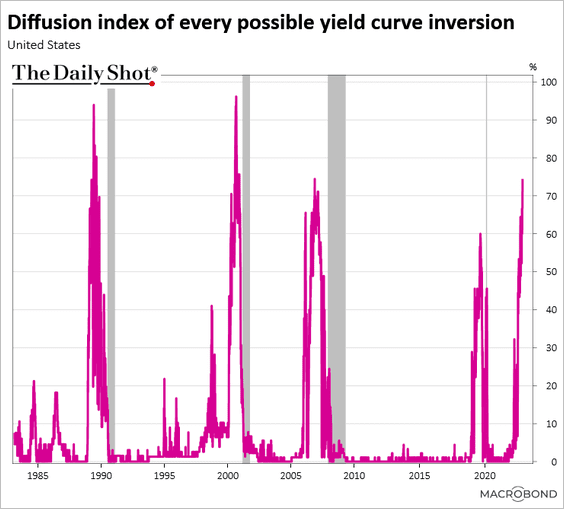

7. Much of the Treasury curve is now inverted.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: Tradeweb

Source: Tradeweb

Back to Index

The United Kingdom

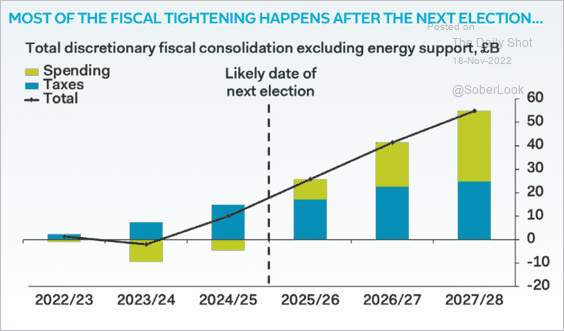

1. The austerity 2.0 “can” has been kicked down the road.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

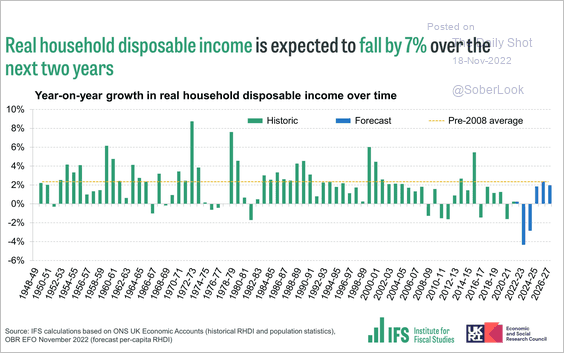

2. The UK standards of living are taking a hit.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @TheIFS

Source: @TheIFS

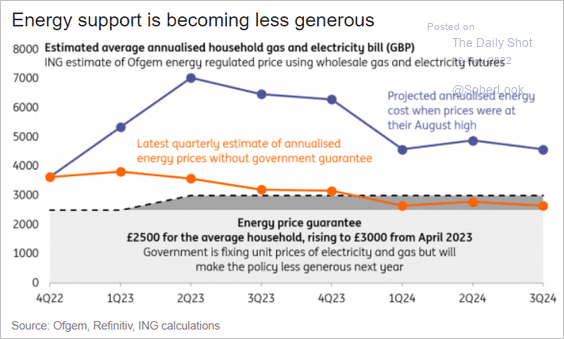

Government support to cap household energy bills is becoming less generous.

Source: ING

Source: ING

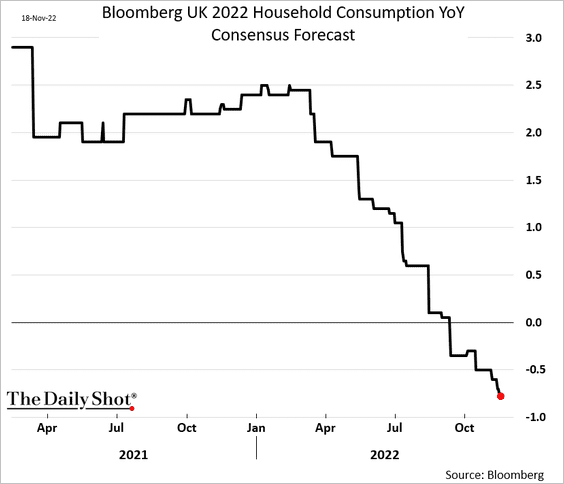

Here is what economists think will happen to household consumption next year.

——————–

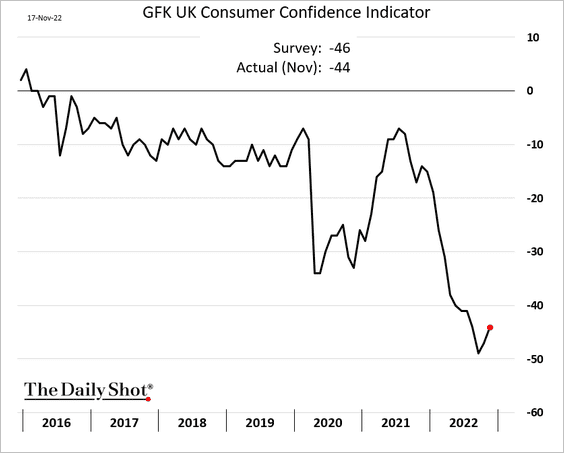

3. Consumer confidence edged higher this month but remains depressed.

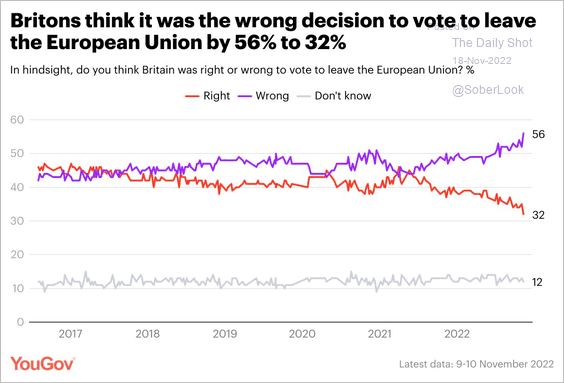

4. Brexit regrets are on the rise.

Source: @YouGov Read full article

Source: @YouGov Read full article

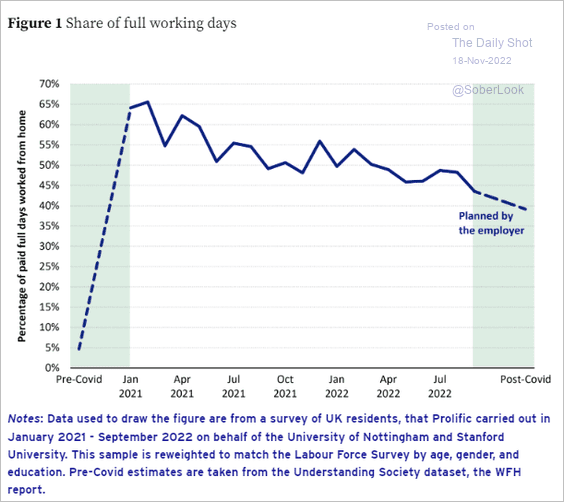

5. Remote work share remains elevated.

Source: VoxEU Read full article

Source: VoxEU Read full article

Back to Index

The Eurozone

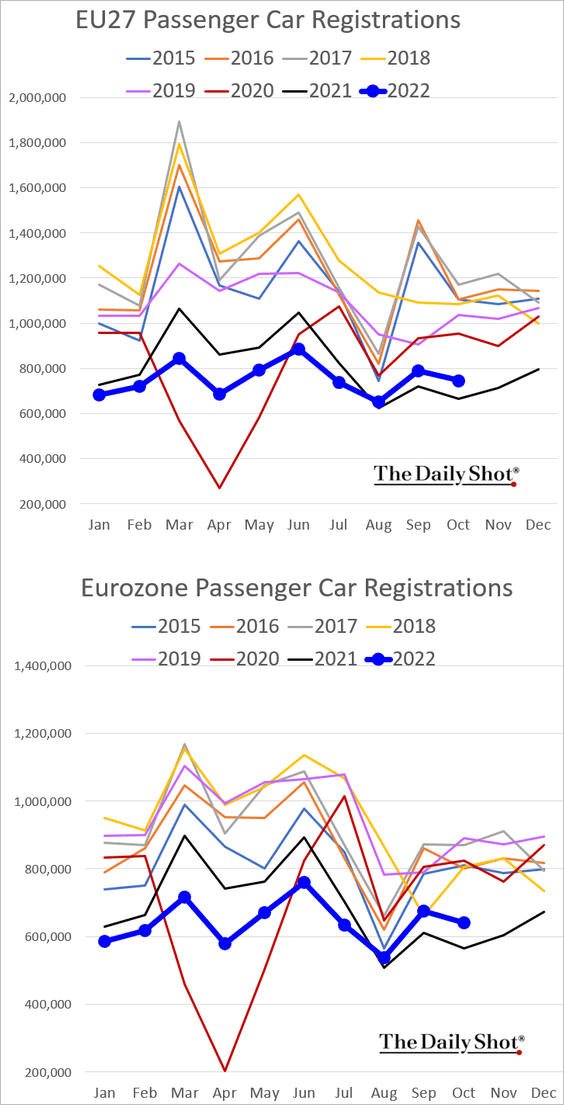

1. Car registrations are above last year’s levels, but that’s not a good benchmark.

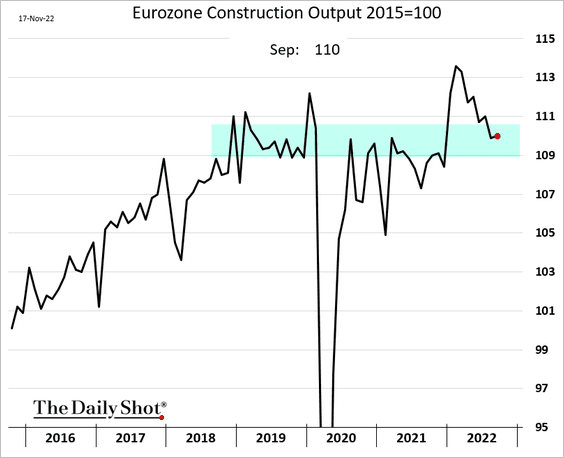

2. Construction output is holding at pre-COVID levels.

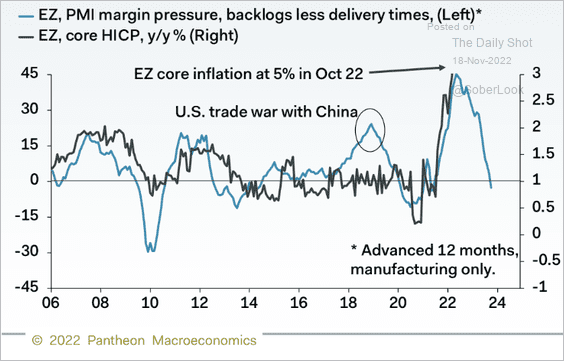

3. Inflation should be moderating as margin pressures ease.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

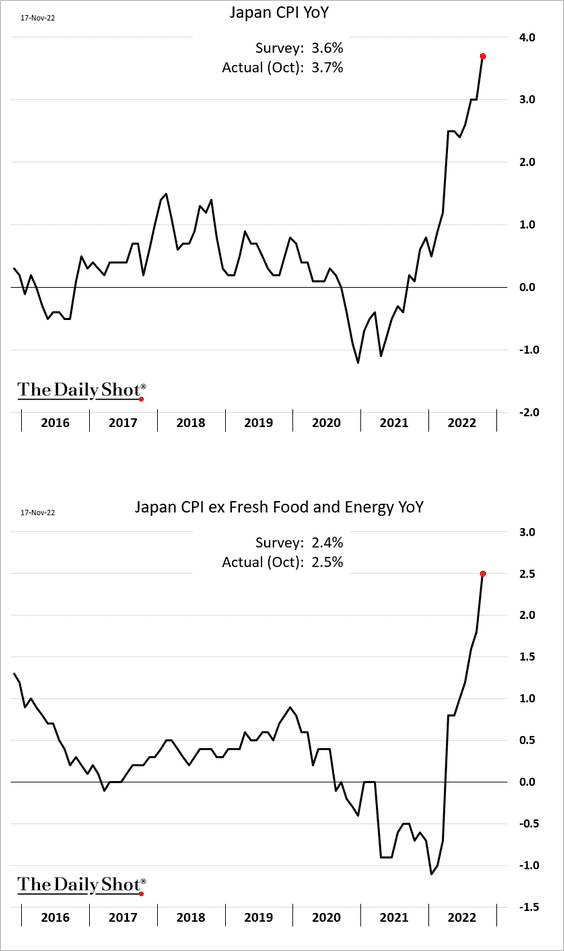

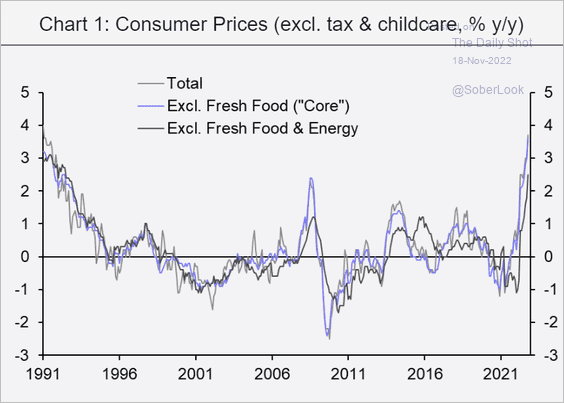

Inflation continues to surge.

Excluding the impact of consumption tax hikes, inflation is at a three-decade high.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

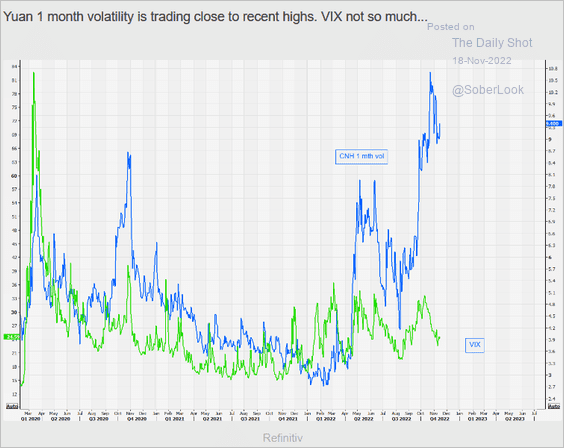

1. Renminbi implied volatility remains elevated.

Source: @themarketear

Source: @themarketear

2. Short-term bond yields surged this month.

Source: @markets Read full article

Source: @markets Read full article

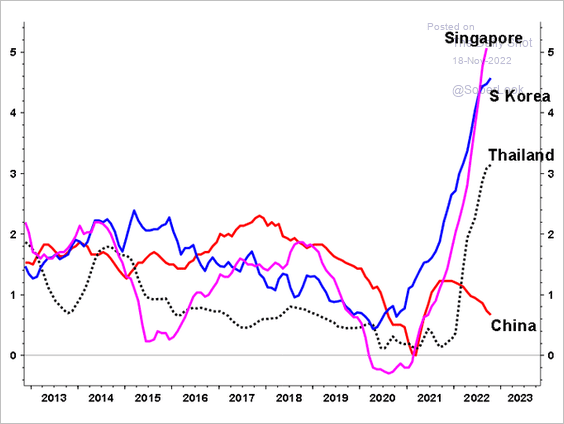

3. China’s inflation has been much lower than in other Asian economies.

Source: @albertedwards99

Source: @albertedwards99

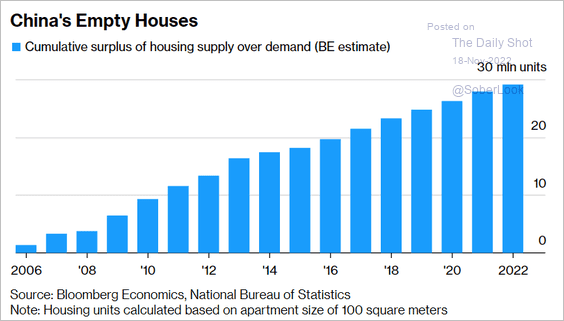

4. The housing surplus is massive.

Source: @business Read full article

Source: @business Read full article

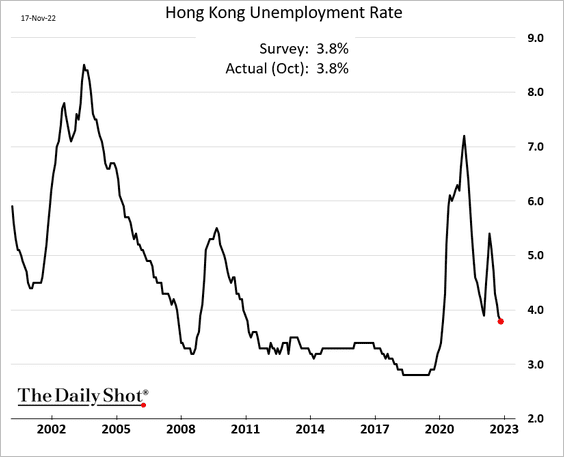

5. Hong Kong’s unemployment continues to ease.

Back to Index

Emerging Markets

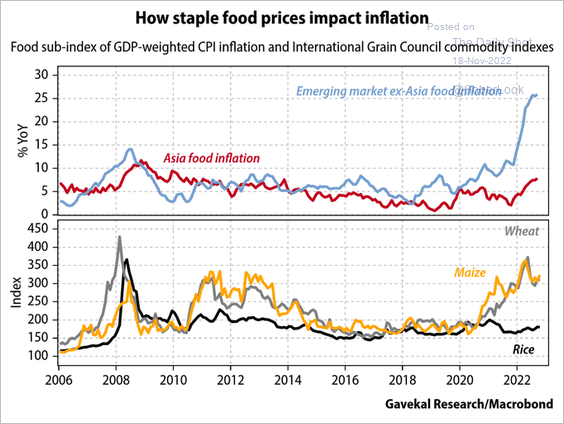

1. Stable rice prices helped some EM Asia economies contain food inflation.

Source: Gavekal Research

Source: Gavekal Research

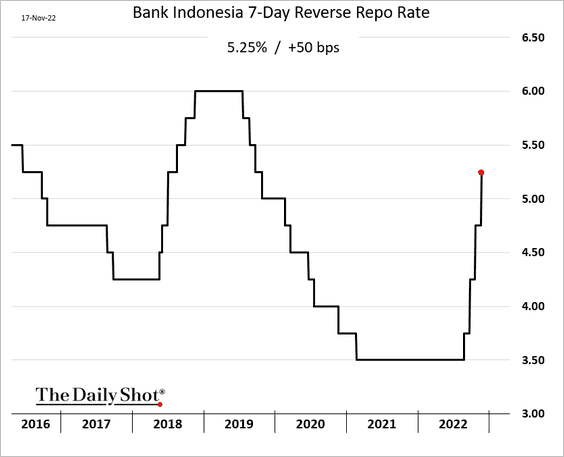

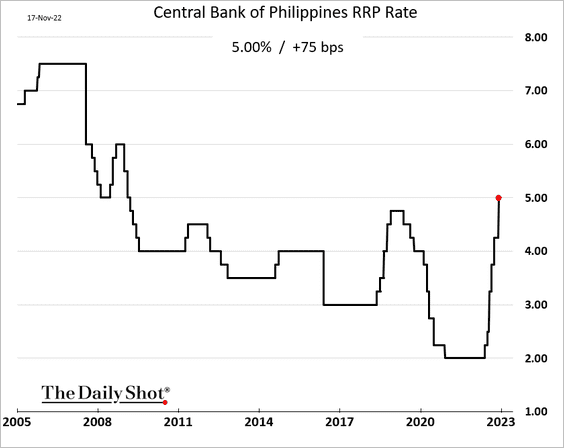

Nonetheless, many Asian central banks continue to hike rates.

• Indonesia:

• The Philippines:

——————–

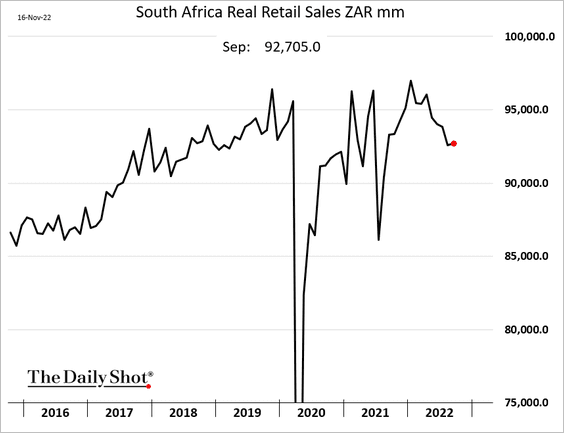

2. After months of declines, South Africa’s retail sales ticked higher in September.

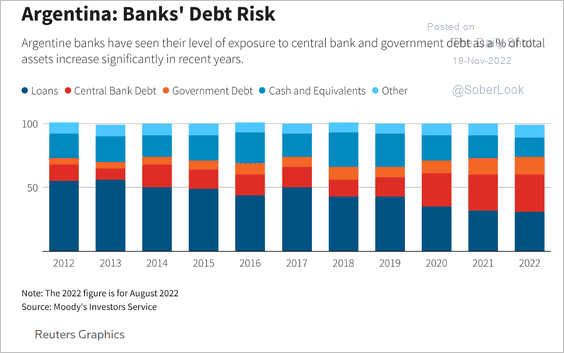

3. Argentina’s banking system is increasingly financing the public sector, particularly via central bank debt.

Source: Reuters Read full article

Source: Reuters Read full article

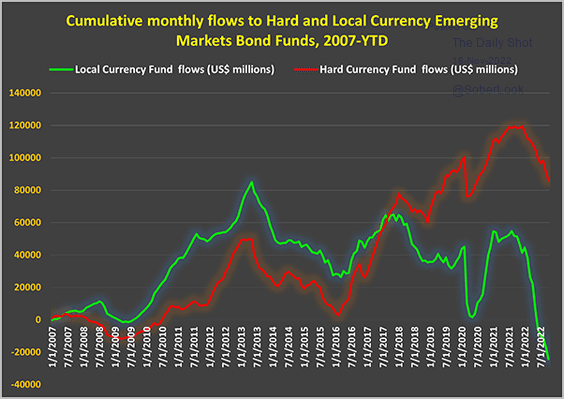

4. Bond fund outflows have been most severe in local-currency debt.

Source: EPFR Global Navigato

Source: EPFR Global Navigato

Back to Index

Cryptocurrency

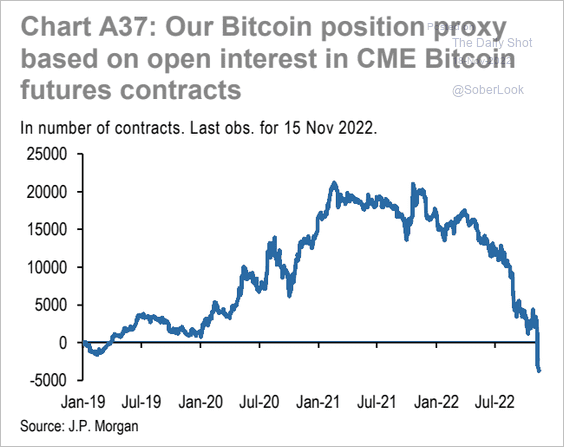

1. Bitcoin positioning has been increasingly bearish.

Source: JP Morgan Research; @themarketear

Source: JP Morgan Research; @themarketear

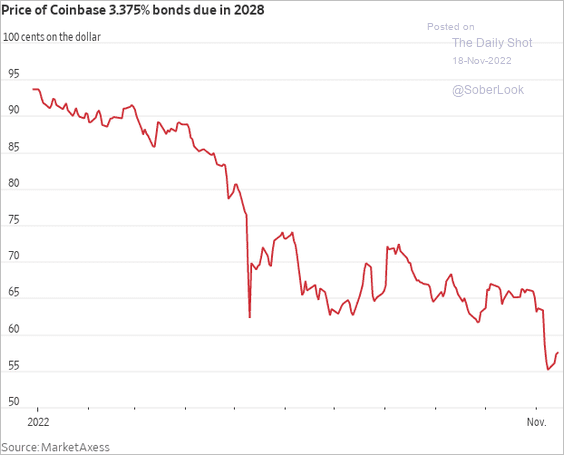

2. Coinbase bonds are under pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

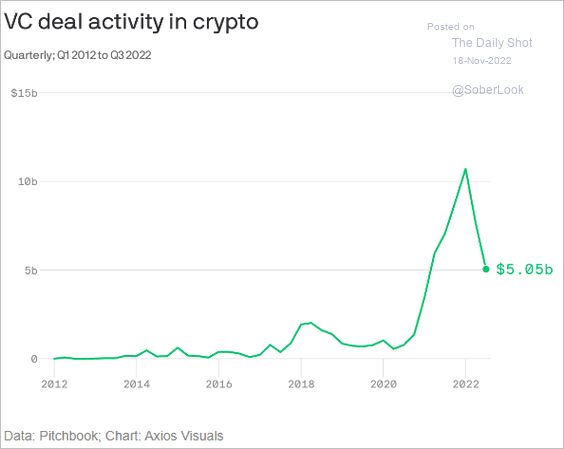

3. VC deal activity in crypto has slowed, with declines likely to continue.

Source: @axios

Source: @axios

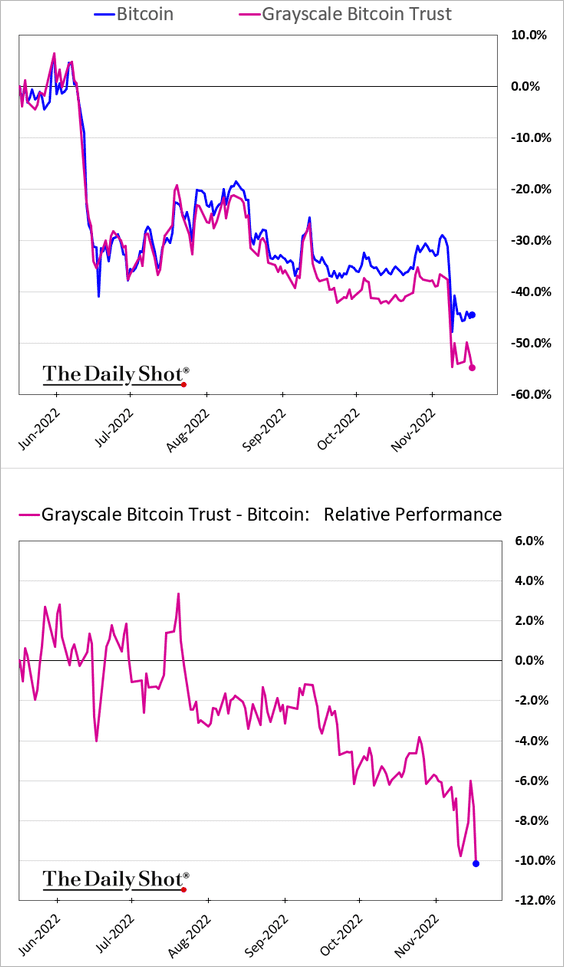

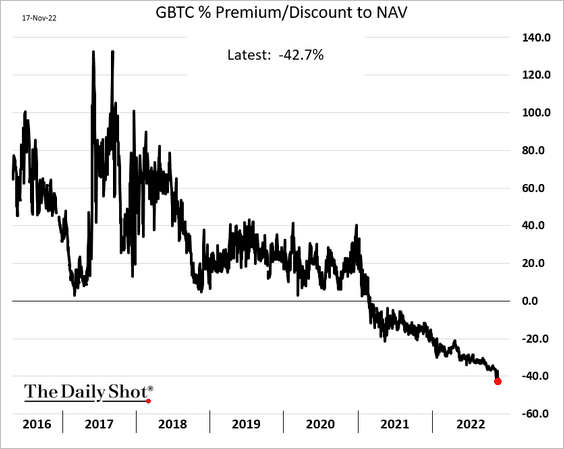

4. Grayscale Bitcoin Trust (GBTC) has diverged sharply from bitcoin, …

.. as the discount to NAV exceeds 40%. Blocked by the SEC, Grayscale has been unable to unlock the fund’s value by converting it to an ETF.

Back to Index

Commodities

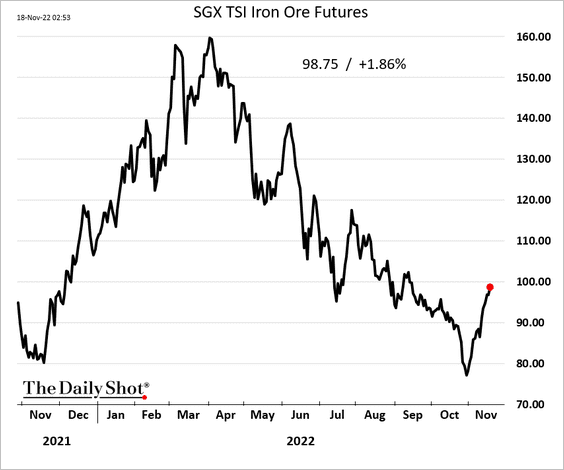

1. Iron ore is rebounding on hopes of China’s “reopening” and property developer bailout.

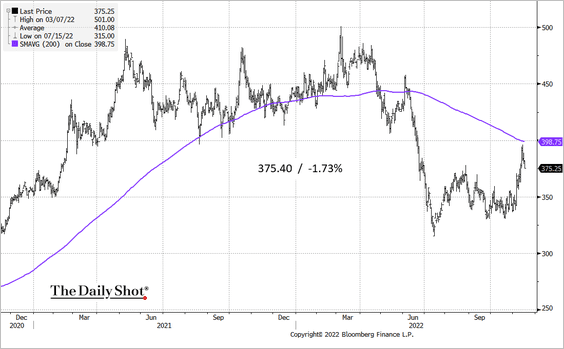

2. Copper held resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

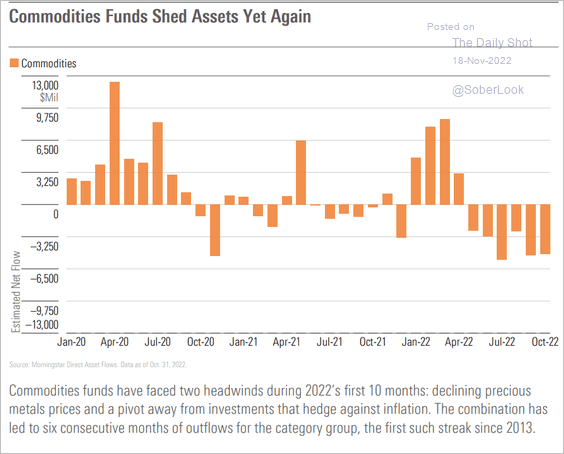

3. Commodity funds continue to see outflows.

Source: Morningstar

Source: Morningstar

Back to Index

Energy

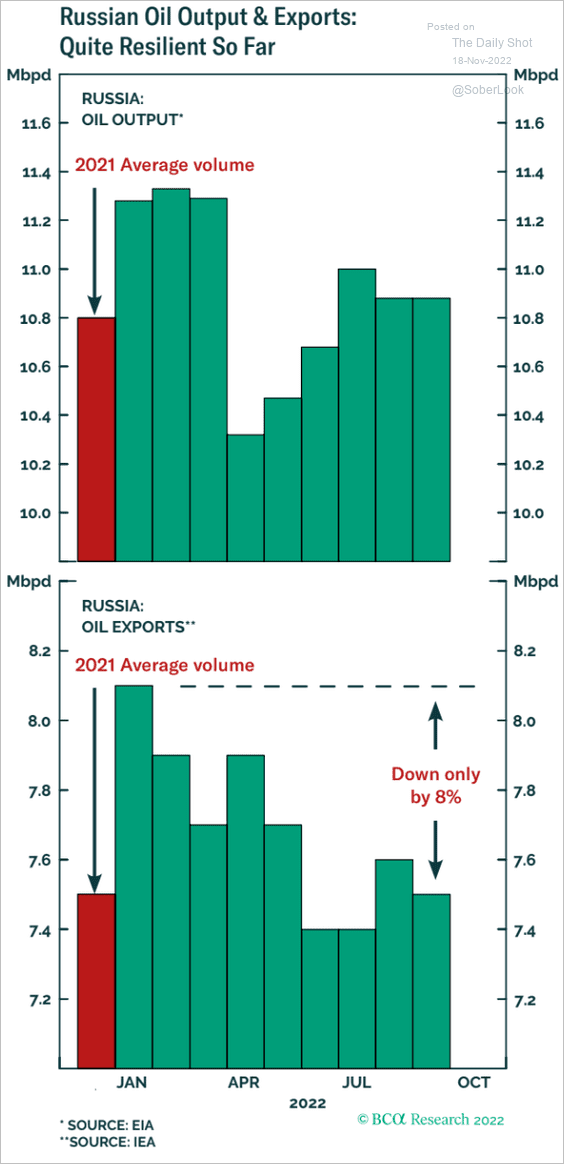

1. Russian oil output has been resilient.

Source: BCA Research

Source: BCA Research

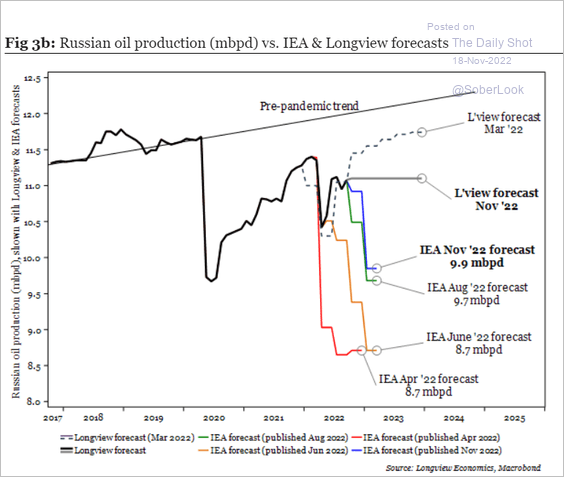

But there is a great deal of uncertainty around Russia’s oil production next year.

Source: Longview Economics

Source: Longview Economics

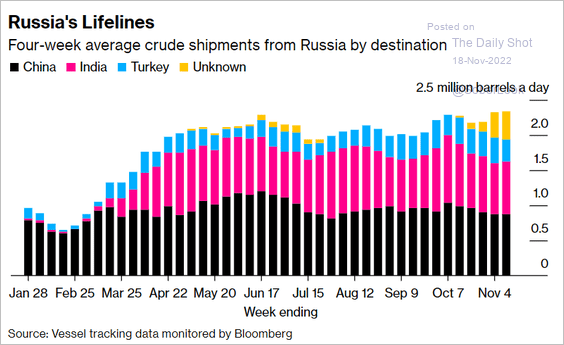

This chart shows crude shipments by destination.

Source: @business, @JLeeEnergy Read full article

Source: @business, @JLeeEnergy Read full article

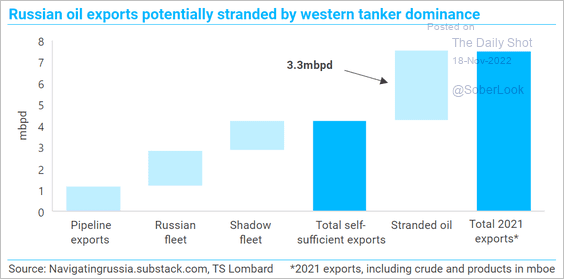

Will exports be stranded by the western dominance of tankers?

Source: TS Lombard

Source: TS Lombard

——————–

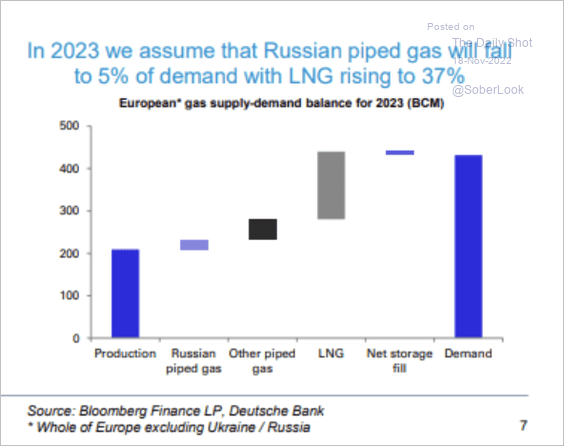

2. LNG will help fill the gas supply/demand imbalance next year, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

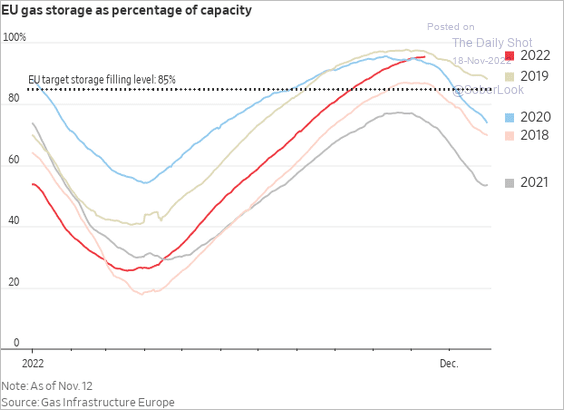

EU gas storage is nearing 2019 levels, but much will depend on the weather this winter.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

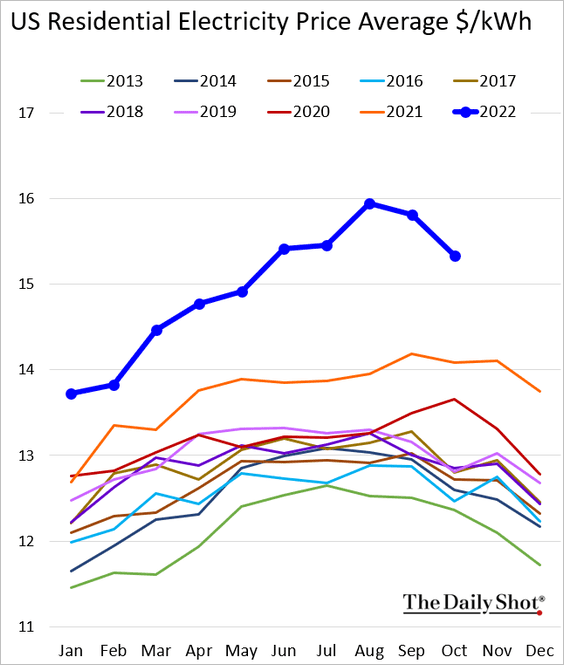

3. US residential electricity prices are very high.

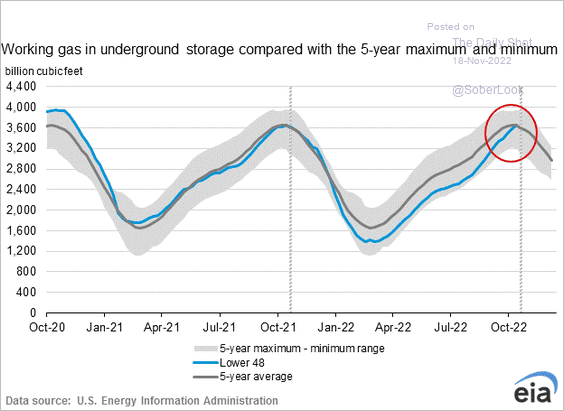

4. US natural gas in storage has reached the 5-year average.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

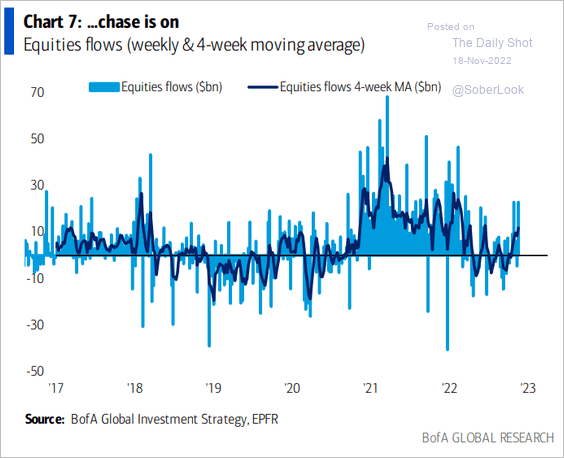

1. Equity funds are seeing inflows.

Source: BofA Global Research

Source: BofA Global Research

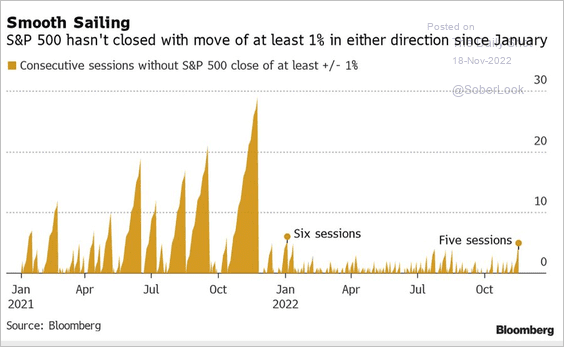

2. A pause in volatility?

Source: @JessicaMenton, @Matt_Turnerr

Source: @JessicaMenton, @Matt_Turnerr

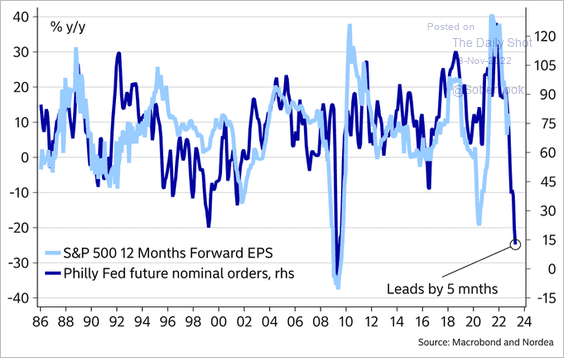

3. The Philly Fed’s manufacturing index is signaling a sharp decline in earnings expectations.

Source: @MikaelSarwe

Source: @MikaelSarwe

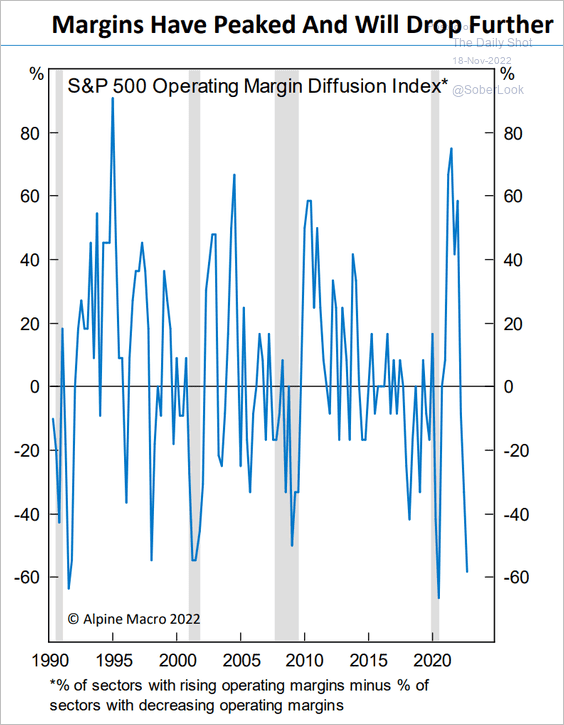

4. Margins are going lower.

Source: Alpine Macro

Source: Alpine Macro

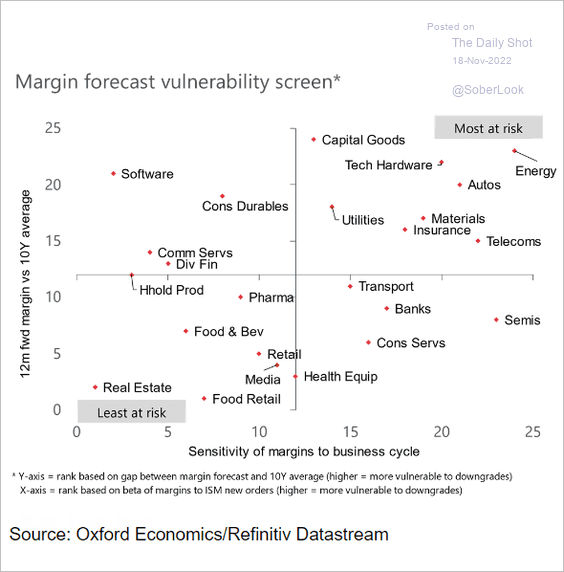

Here is a look at margin contraction risk by sector.

Source: Oxford Economics

Source: Oxford Economics

——————–

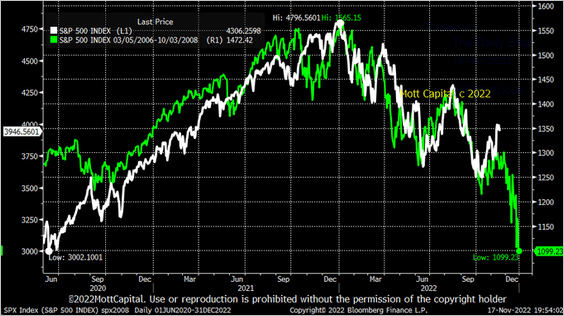

5. The 2008 analog is not dead.

Source: @MichaelMOTTCM

Source: @MichaelMOTTCM

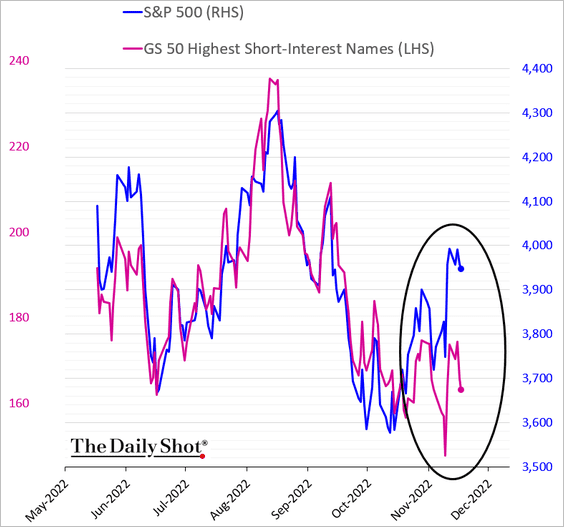

6. Short-covering hasn’t been prominent in this rebound.

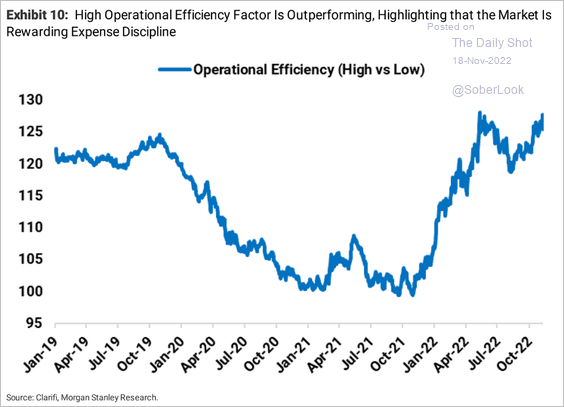

7. The market has been rewarding companies for cutting costs this year as the operational efficiency factor outperforms.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

As a result, tech companies have been incentivized to announce job cuts.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

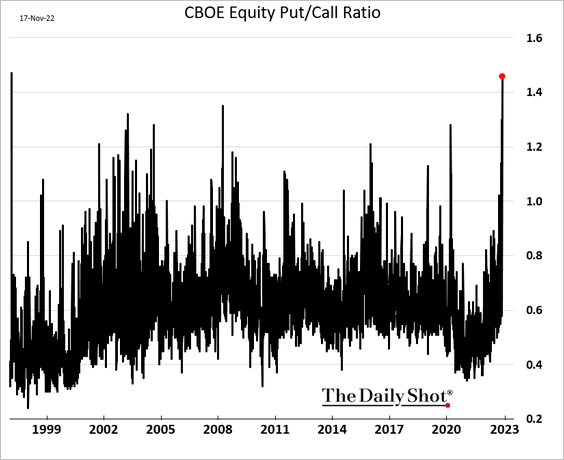

8. Next, we have some updates on the options market.

• The put/call ratio hit the highest level since 1997.

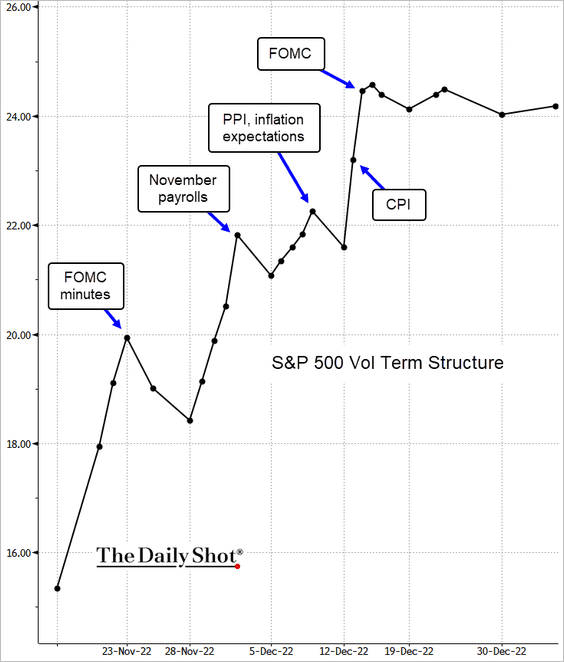

• What’s keeping index options traders awake at night? Here is the vol term structure.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

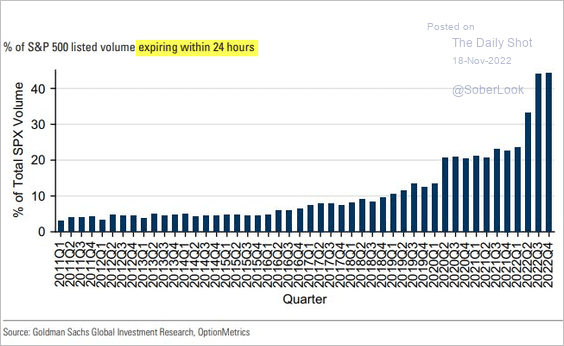

• Short-term options volume share has exploded.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

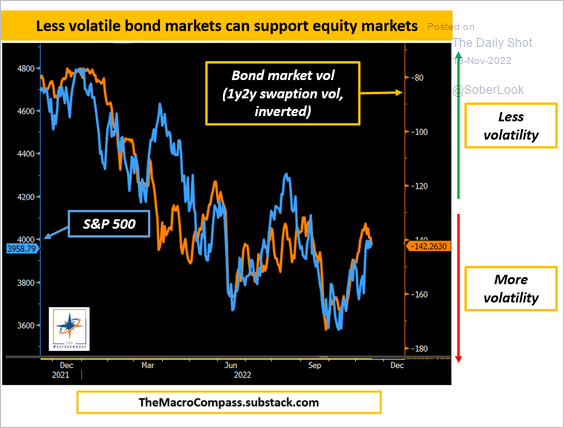

• Lower interest rate volatility is a tailwind for stocks.

Source: @MacroAlf

Source: @MacroAlf

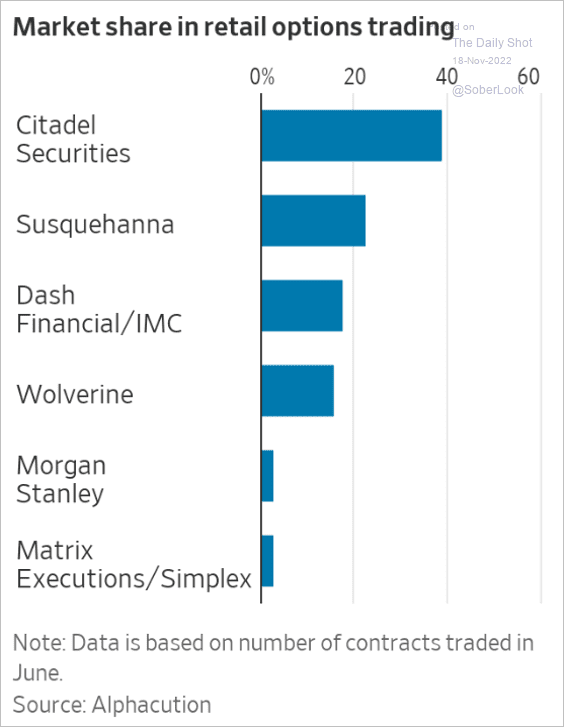

• This chart shows the retail options trading market share.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Alternatives

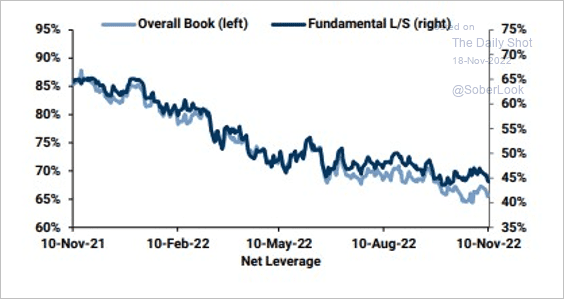

1. Equity hedge funds’ leverage remains relatively low.

Source: Goldman Sachs; @markets, @luwangnyc Read full article

Source: Goldman Sachs; @markets, @luwangnyc Read full article

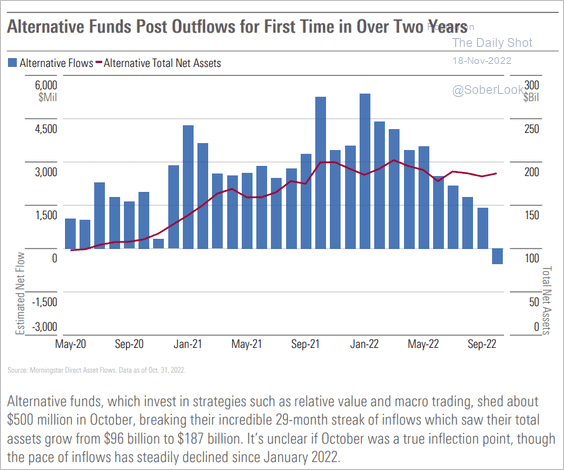

2. Publicly-listed alternative funds experienced outflows last month.

Source: Morningstar

Source: Morningstar

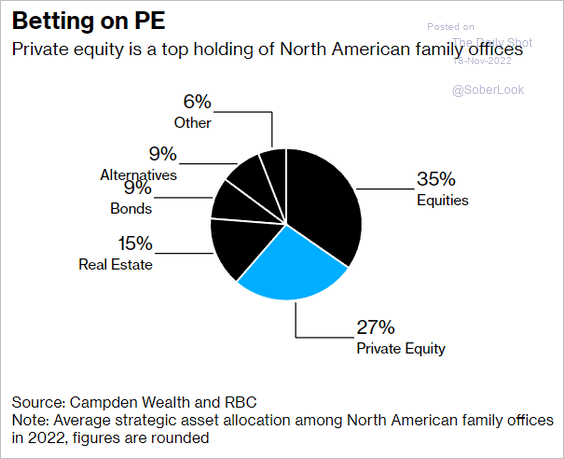

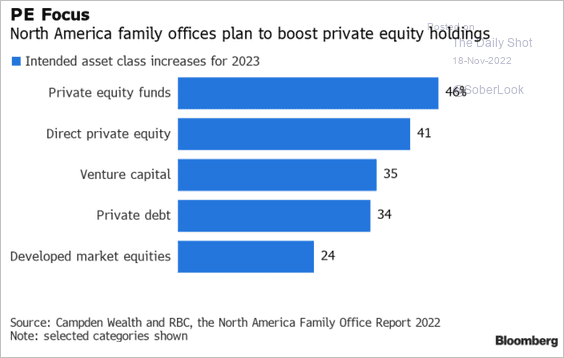

3. Family offices have been boosting private equity holdings (2 charts).

Source: @wealth, @BenStupples, @amanda_albright Read full article

Source: @wealth, @BenStupples, @amanda_albright Read full article

Source: @wealth, @BenStupples, @amanda_albright Read full article

Source: @wealth, @BenStupples, @amanda_albright Read full article

Back to Index

Credit

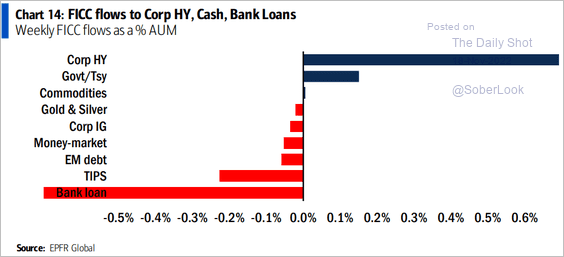

1. Fund flows point to a rotation from leveraged loans to high-yield bonds.

Source: BofA Global Research

Source: BofA Global Research

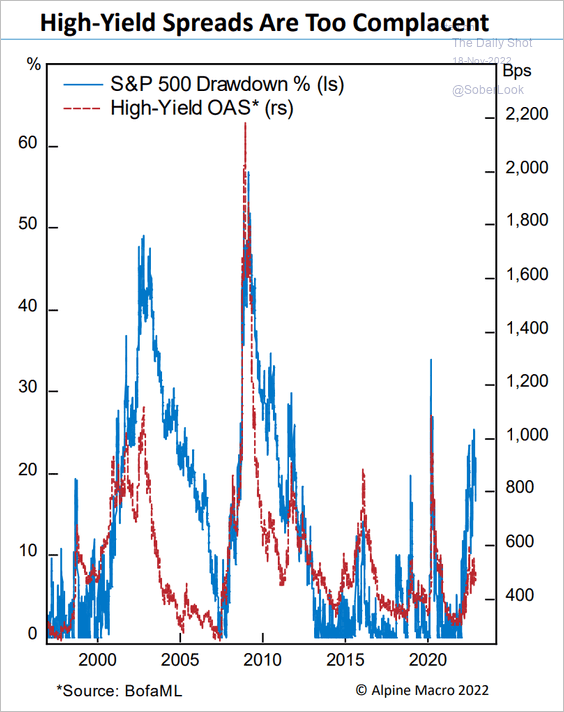

2. The equity market signals pain ahead for corporate credit.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Global Developments

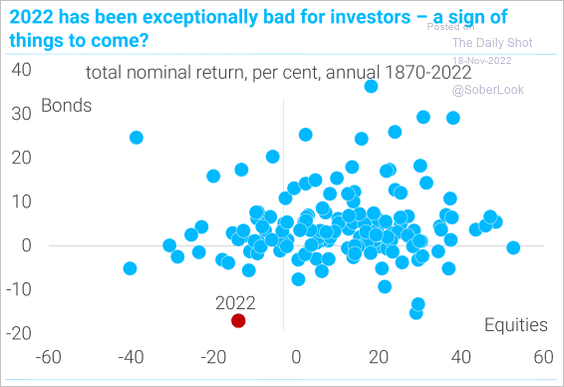

1. It’s been a rough year for investors.

Source: TS Lombard

Source: TS Lombard

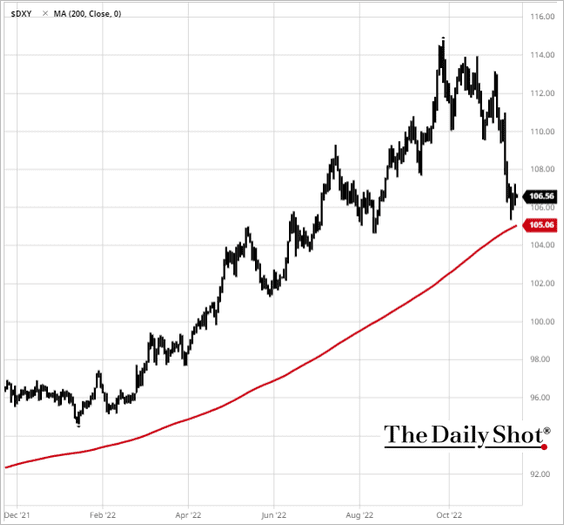

2. The dollar index (DXY) held above the 200-day moving average.

Source: barchart.com

Source: barchart.com

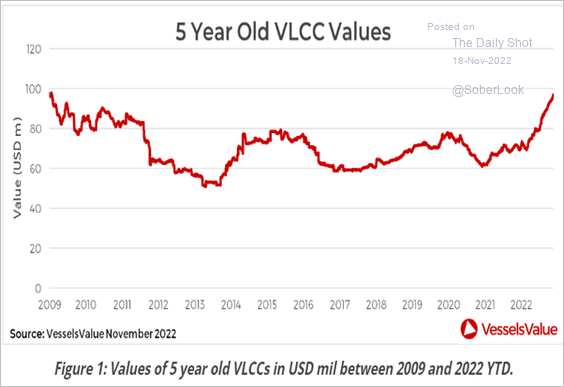

3. Tanker values are at a 13-year high.

Source: VesselsValue data Read full article

Source: VesselsValue data Read full article

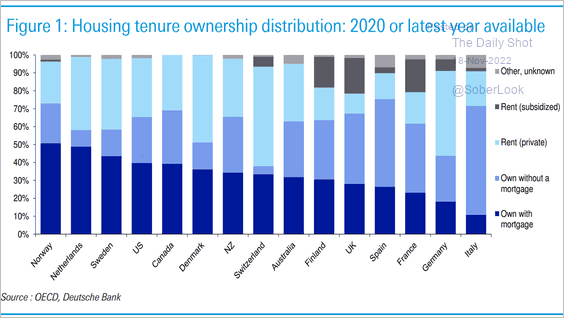

4. Here is a look at housing ownership and rentals in advanced economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

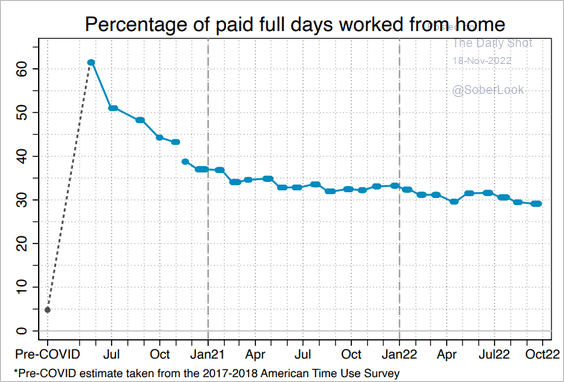

1. Full days worked from home (stabilizing at 30%):

Source: WFH Research Read full article

Source: WFH Research Read full article

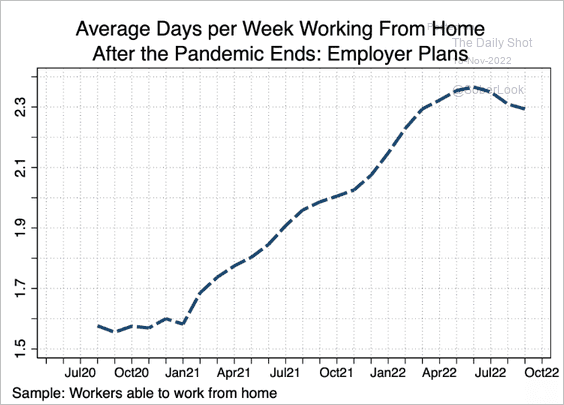

• Employer plans for remote work:

Source: WFH Research Read full article

Source: WFH Research Read full article

——————–

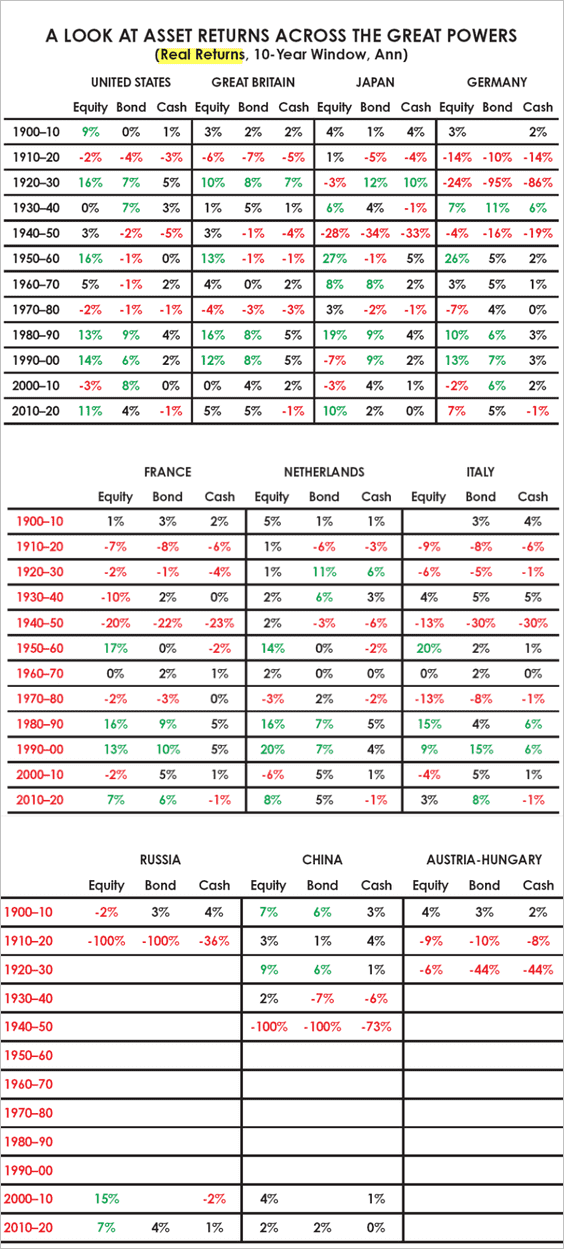

2. Asset returns across the great powers:

Source: Principled Perspectives

Source: Principled Perspectives

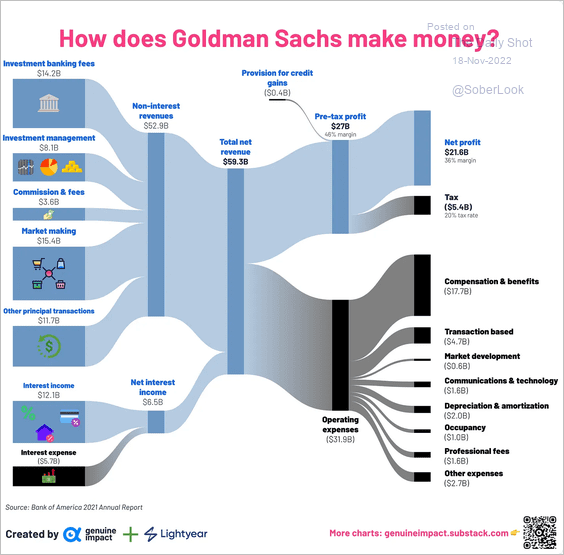

3. How does Goldman Sachs make money?

Source: @genuine_impact, h/t @MattGarrett3

Source: @genuine_impact, h/t @MattGarrett3

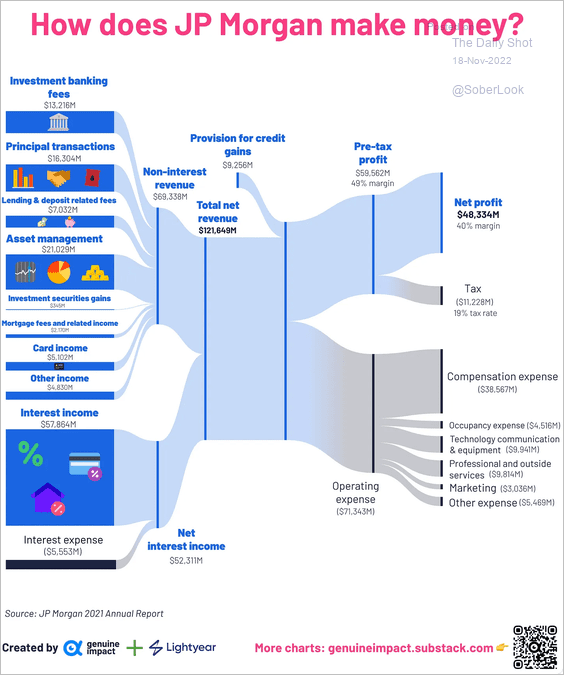

• How does JP Morgan make money?

Source: @genuine_impact, h/t @MattGarrett3

Source: @genuine_impact, h/t @MattGarrett3

——————–

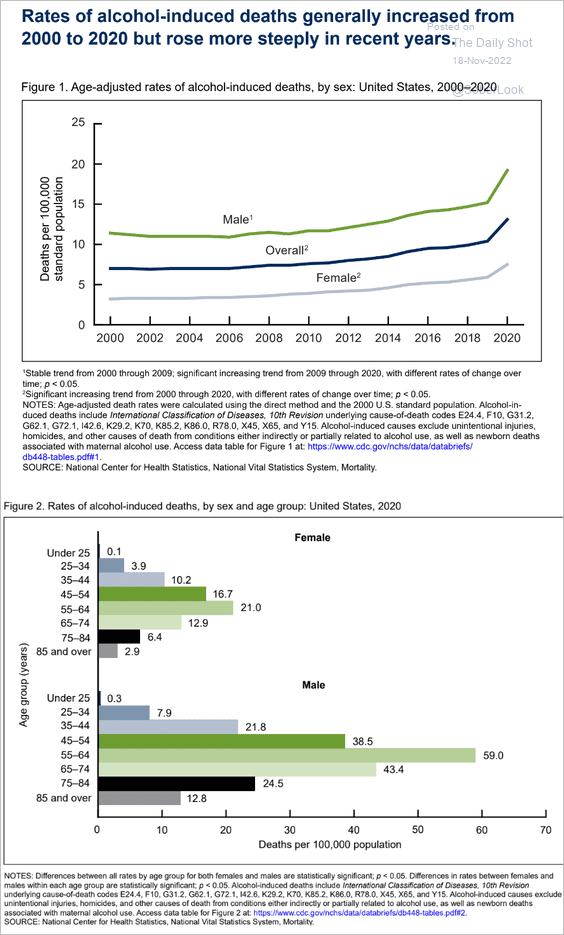

4. Alcohol-induced deaths in 2020:

Source: CDC

Source: CDC

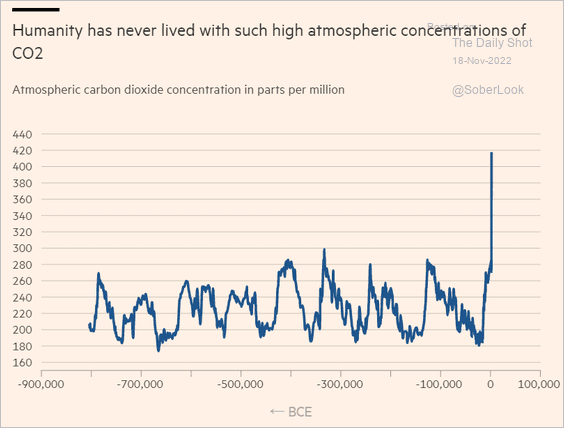

5. Atmospheric CO2 concentration:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

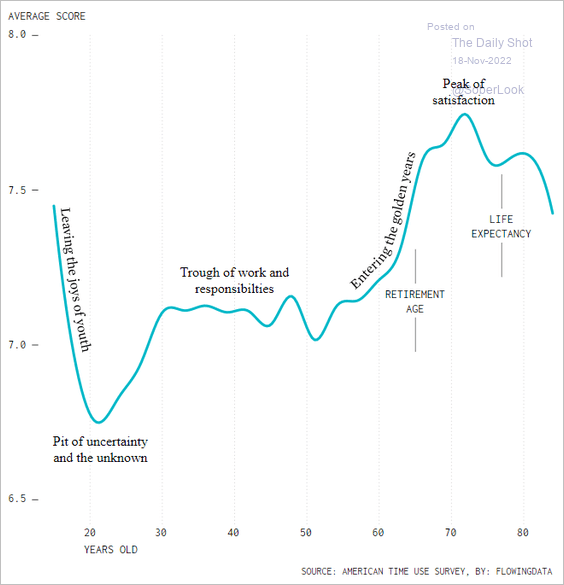

6. Life satisfaction by age:

Source: FlowingData Read full article

Source: FlowingData Read full article

——————–

Have a great weekend!

Back to Index