The Daily Shot: 21-Nov-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrencies

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

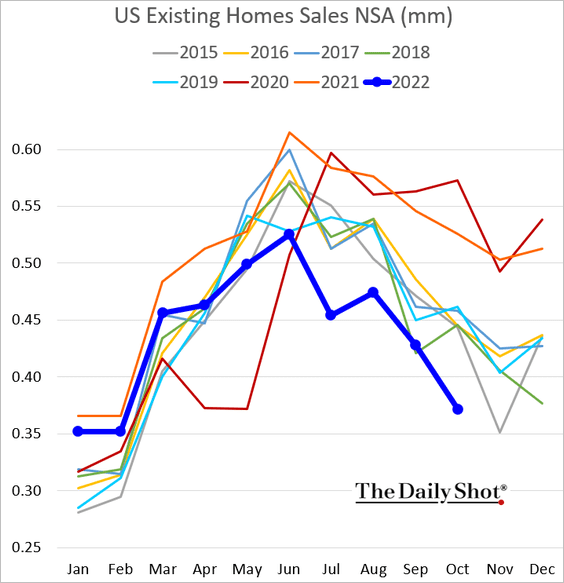

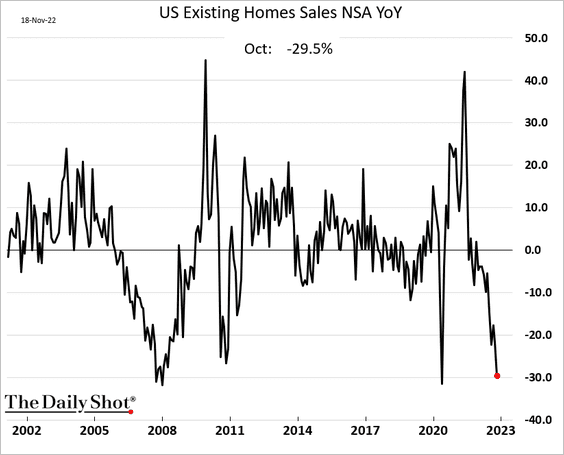

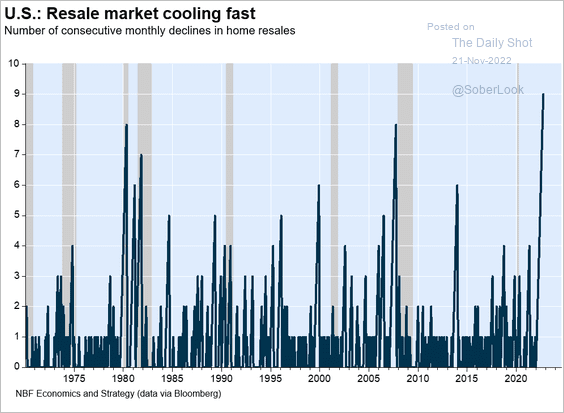

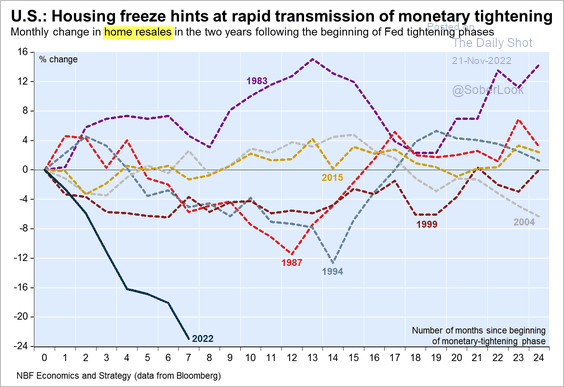

1. Let’s begin with the housing market.

• Existing home sales were down almost 30% last month on a year-over-year basis.

– Here is the number of consecutive monthly declines.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

– This chart shows the evolution of home sales across rate hiking cycles.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

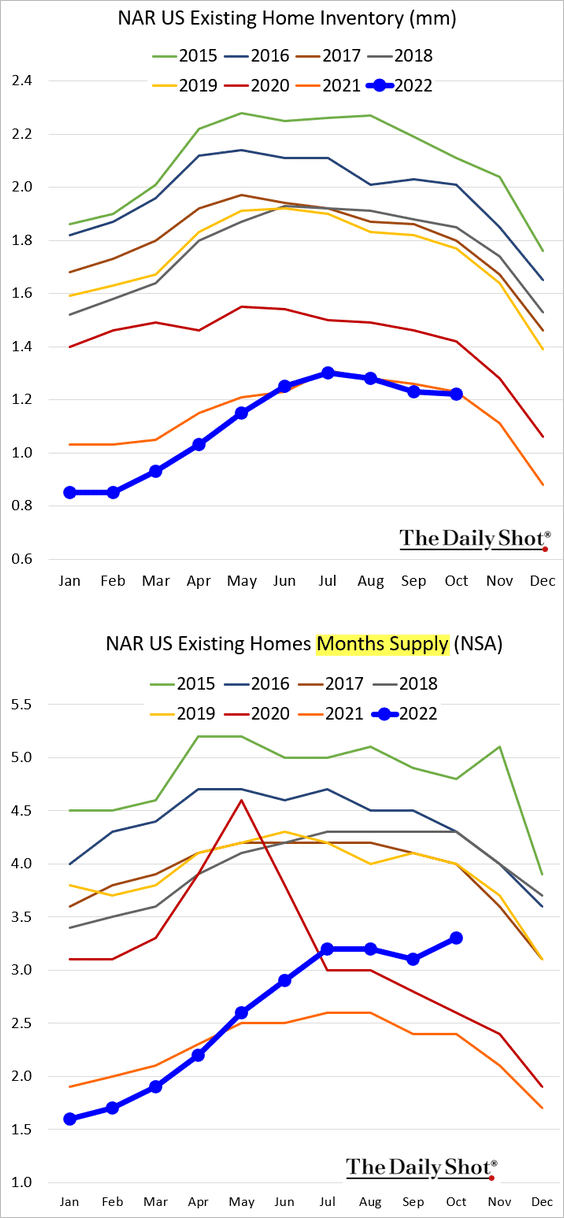

– Inventories are running at last year’s levels, but with slower sales, the months-of-supply indicator keeps climbing (2nd panel).

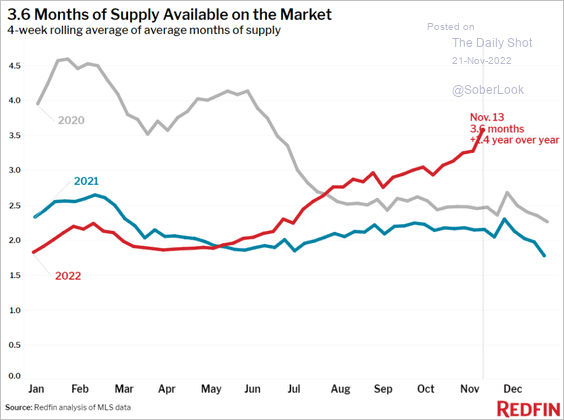

Here is a similar index from Redfin.

Source: Redfin

Source: Redfin

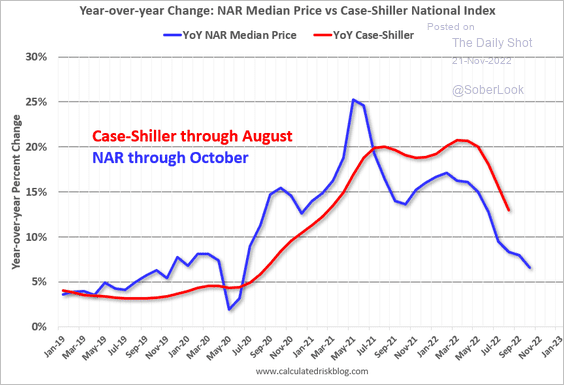

– The median price trend signals further weakness in home price appreciation.

Source: Calculated Risk

Source: Calculated Risk

——————–

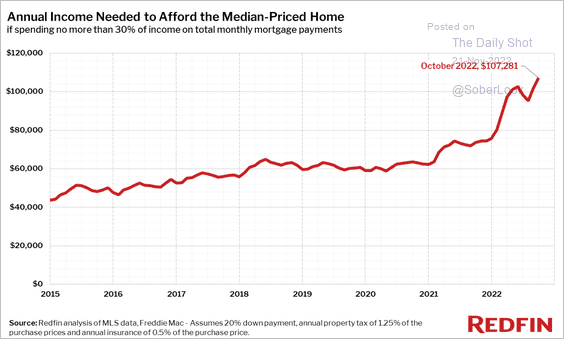

• This chart shows how much income is needed to afford the median-priced home.

Source: Redfin

Source: Redfin

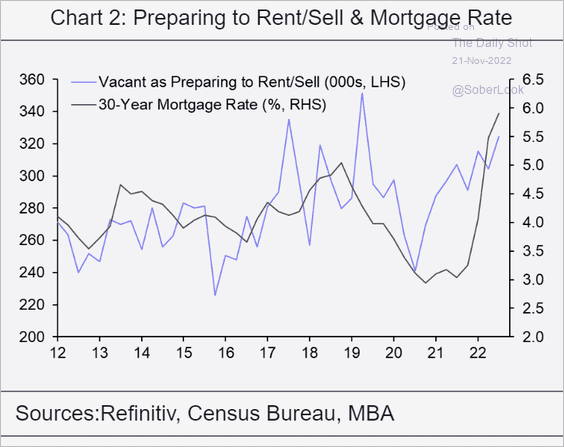

• More homeowners will be renting rather than selling their houses as homebuyer demand crashes.

Source: Capital Economics

Source: Capital Economics

——————–

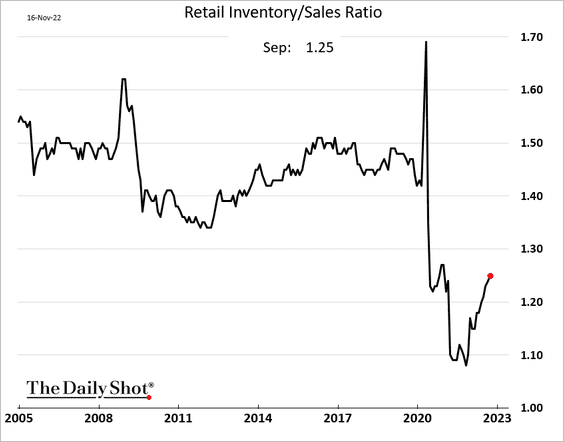

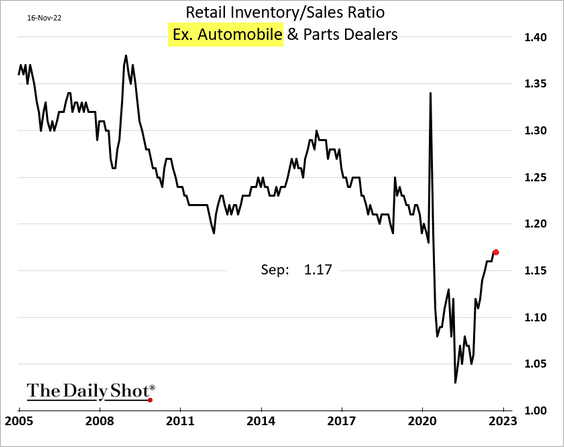

2. As of September, the retail inventories-to-sales ratio remained well below pre-COVID levels.

But the ratio has been nearing 2019 levels when vehicles are excluded.

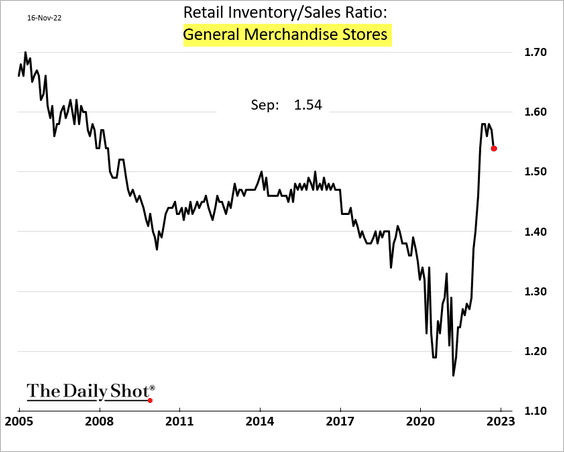

Here is the ratio for general merchandise stores.

——————–

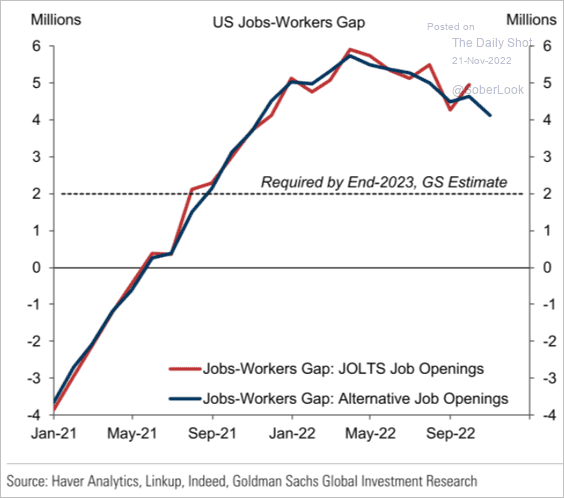

3. “Real-time” indicators suggest that job openings continue to moderate, albeit slowly.

Source: Goldman Sachs

Source: Goldman Sachs

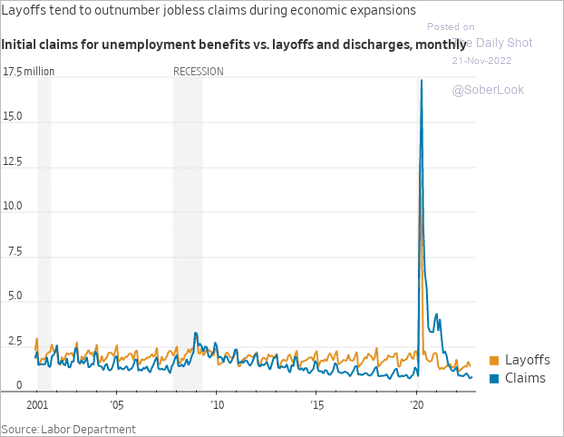

Layoff levels are not particularly high relative to initial unemployment claims.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

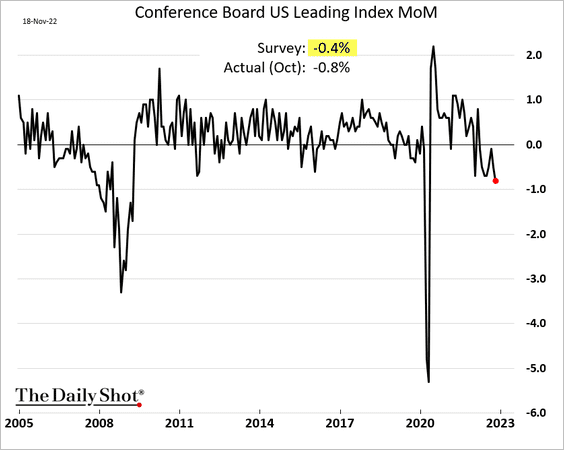

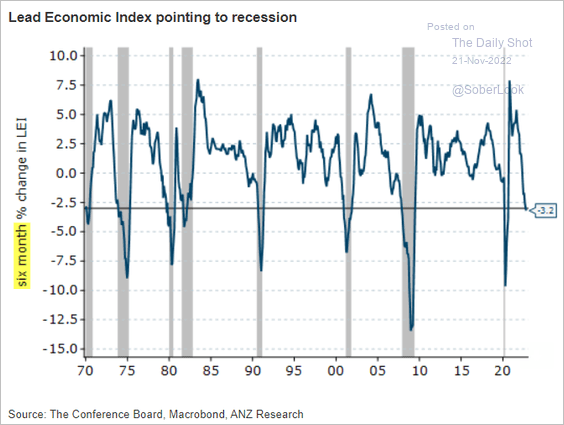

4. The Conference Board’s index of leading economic indicators has been down for eight months in a row.

The six-month rolling changes in the leading index are signaling a recession.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

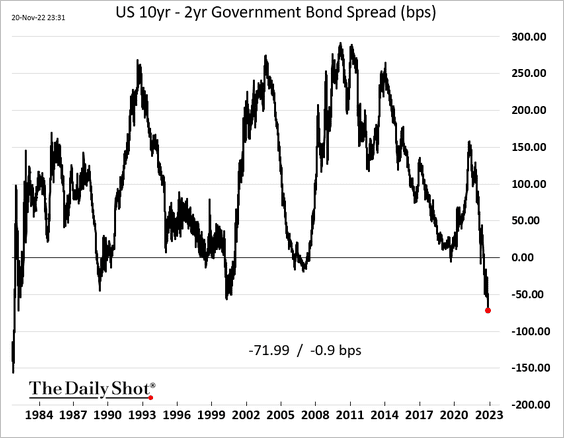

5. The Treasury curve inversion takes us back to 1981.

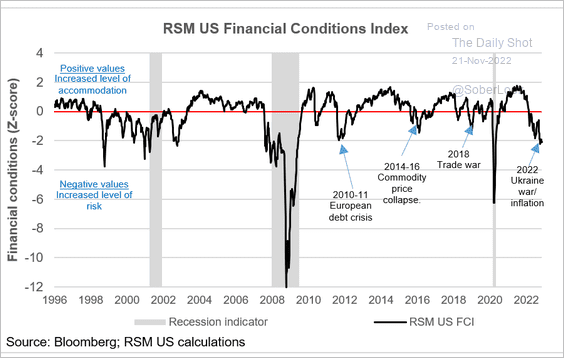

The RSM financial conditions index looks increasingly recessionary.

Source: RSM, @JoeBrusuelas

Source: RSM, @JoeBrusuelas

——————–

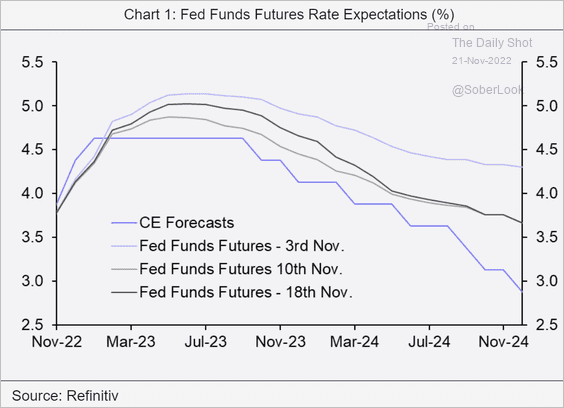

6. Goldman now sees rate hikes in February, March, and May, and no rate cuts in 2023.

Source: Goldman Sachs

Source: Goldman Sachs

• ANZ also does not expect rate cuts next year.

Source: @ANZ_Research

Source: @ANZ_Research

• But Capital Economics projects Fed rate cuts in the 2nd half of next year as the US enters a recession.

Source: Capital Economics

Source: Capital Economics

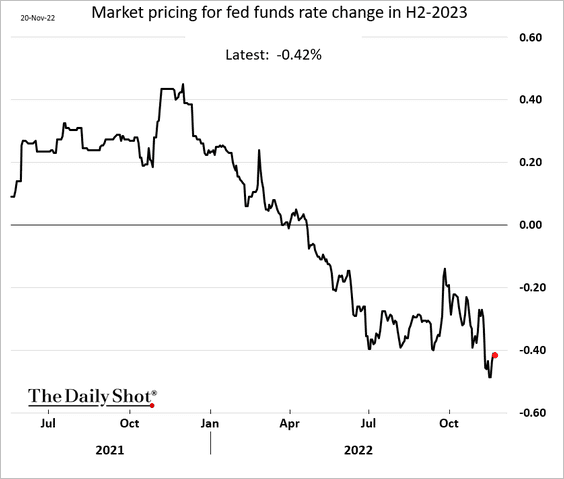

• The market is pricing in about 40 bps of rate hikes in the second half of 2023.

Back to Index

Canada

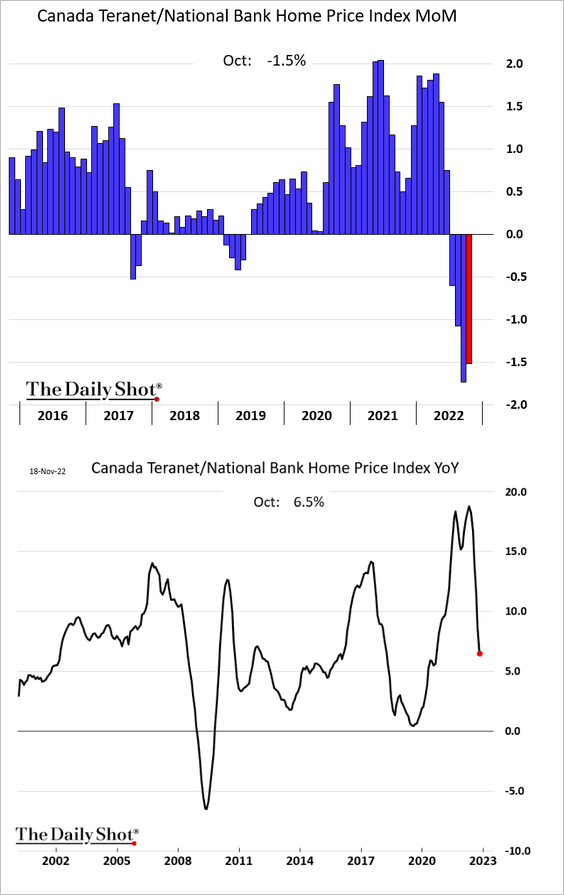

1. Home prices declined again last month.

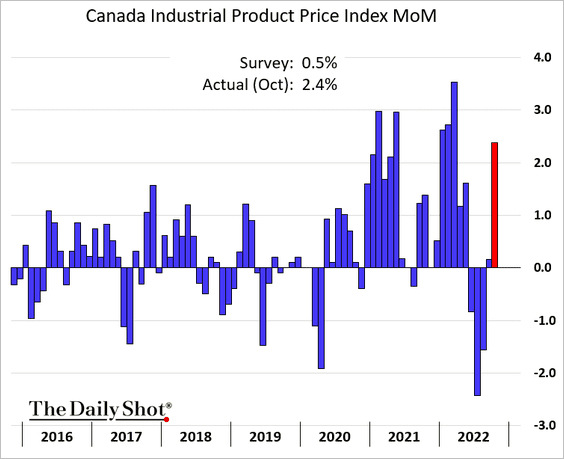

2. Industrial output prices increased sharply in October.

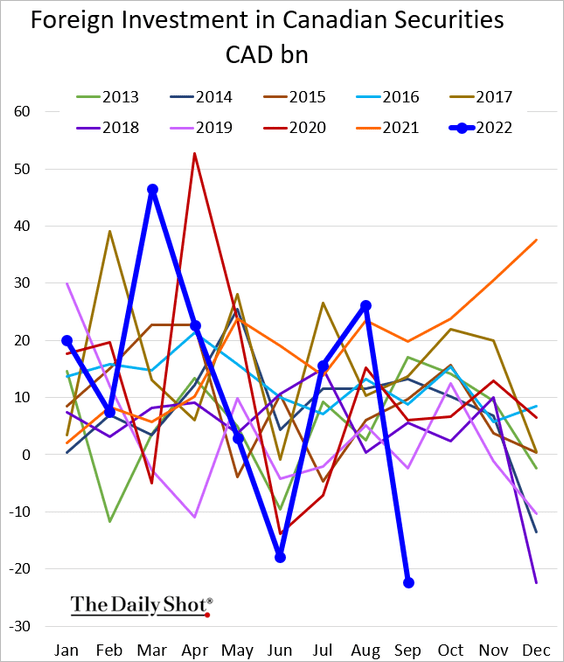

3. Foreigners pulled quite a bit of capital out of Canadian securities markets in September.

Back to Index

The United Kingdom

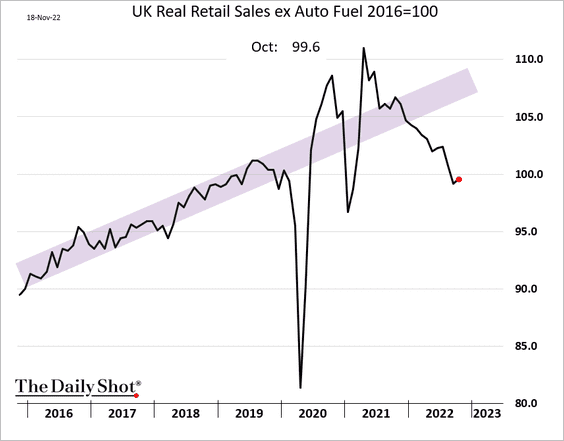

1. Retail sales ticked higher in October, but the trend doesn’t look promising.

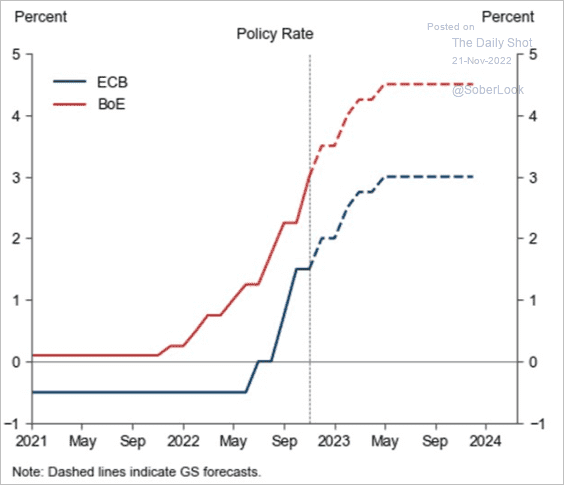

2. The BoE has another 150 bps to go, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

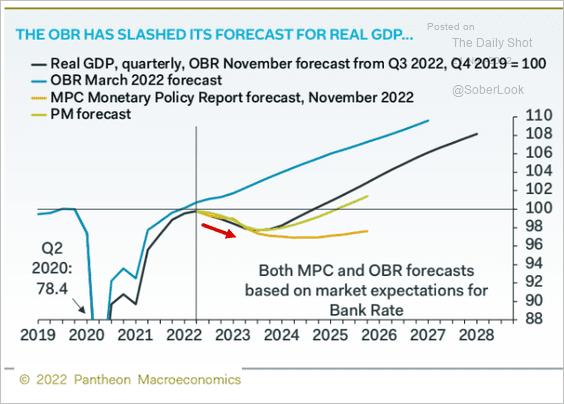

3. While the recovery trajectory is uncertain, forecasters agree on an economic downturn next year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

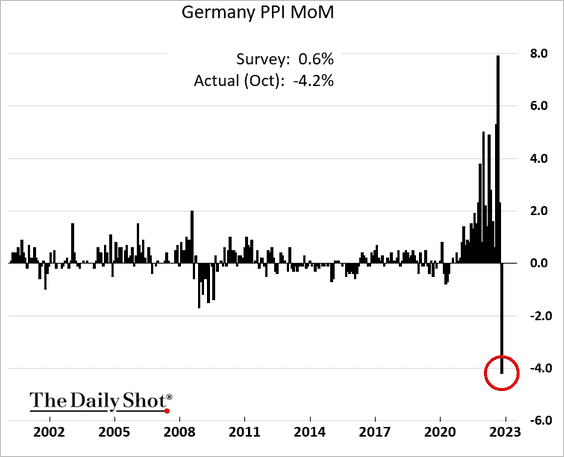

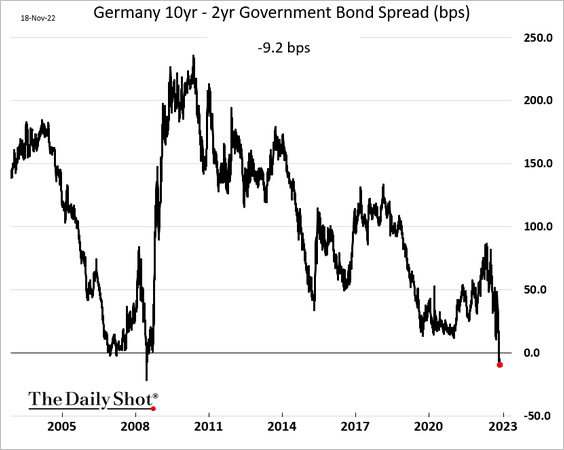

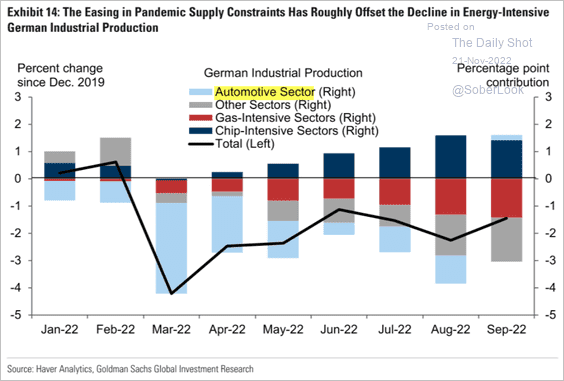

1. Let’s begin with Germany.

• The PPI tumbled last month, signaling a peak in Germany’s inflation.

• Germany’s yield curve remains inverted.

• The auto sector output grew in September for the first time this year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

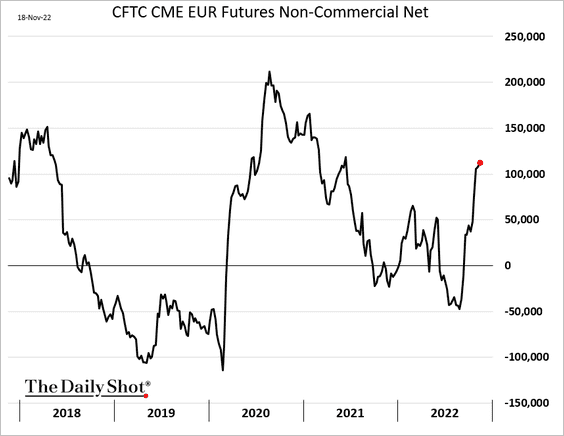

2. Speculative accounts continue to boost their bets on the euro.

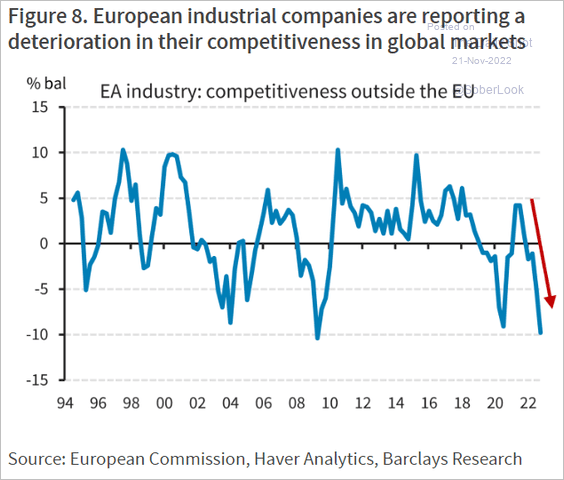

3. Elevated energy prices make the euro area less competitive.

Source: Barclays Research

Source: Barclays Research

4. What are the drivers of lower housing demand?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

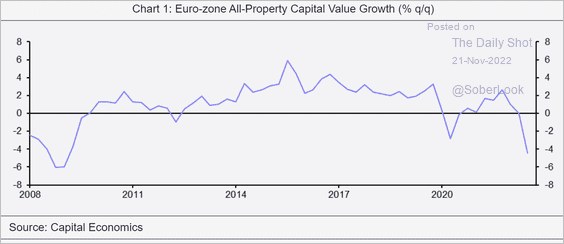

5. Commercial property markets are under pressure.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia – Pacific

1. Japan’s housing market has been oversupplied for decades.

Source: @opinion Read full article

Source: @opinion Read full article

2. South Korea’s exports are well below last year’s levels but are not crashing.

Back to Index

China

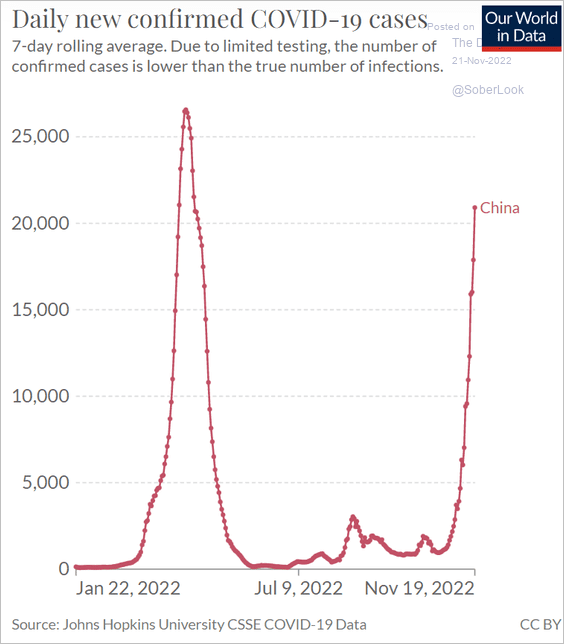

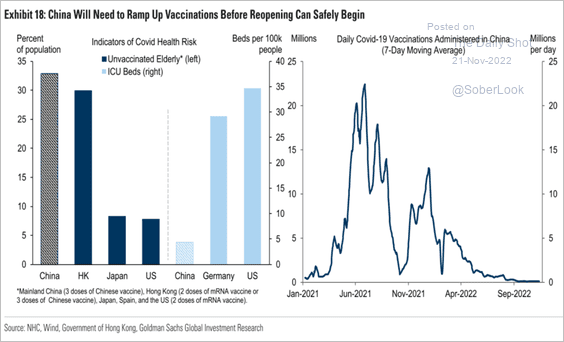

1. COVID-related concerns persist, …

Source: AP Read full article

Source: AP Read full article

… as new cases surge, …

Source: Our World in Data

Source: Our World in Data

… and vaccinations grind to a halt.

Source: Goldman Sachs

Source: Goldman Sachs

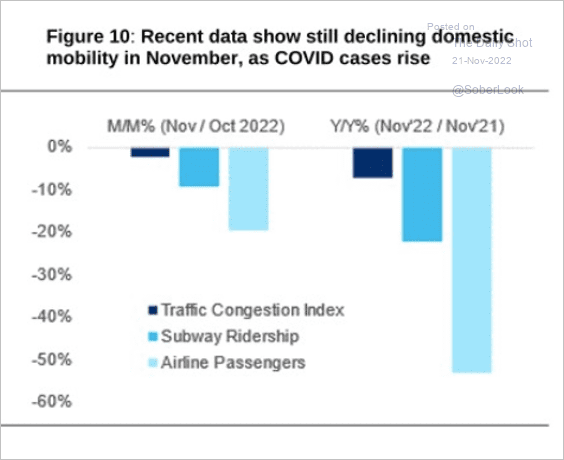

Mobility continues to deteriorate.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

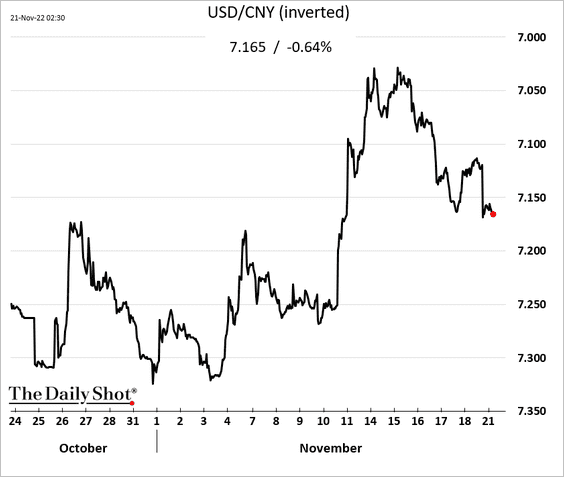

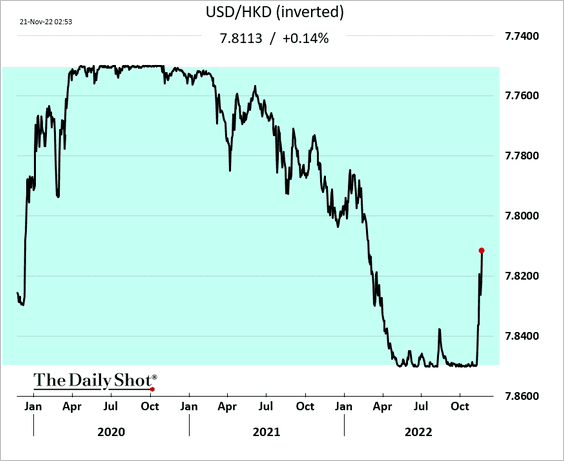

2. The renminbi is reversing recent gains.

3. On the other hand, the Hong Kong dollar is rebounding as foreign capital flows back in.

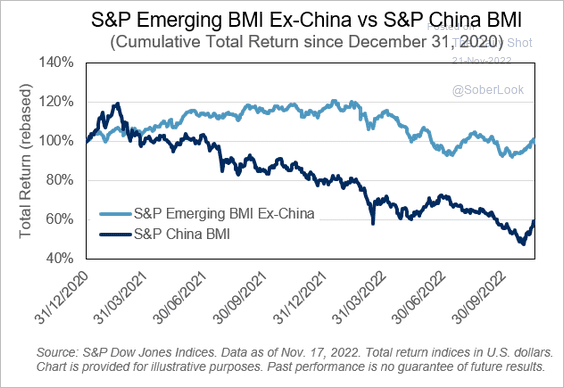

4. Despite the recent bounce, China’s stocks still lag the broad EM index.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

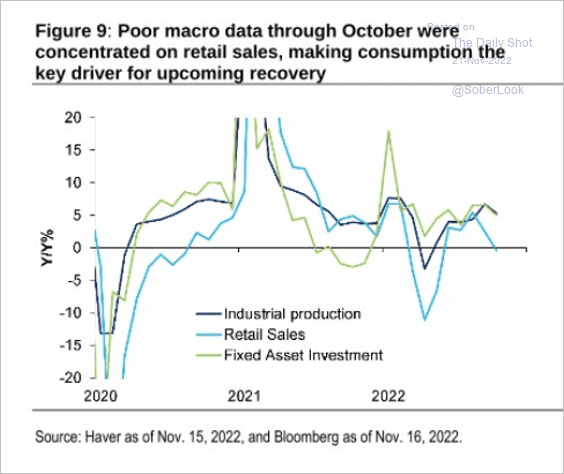

5. Consumption has been a drag on economic growth over the past two months.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Emerging Markets

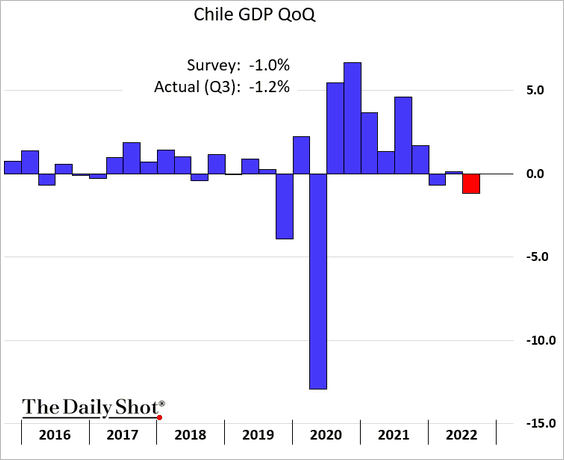

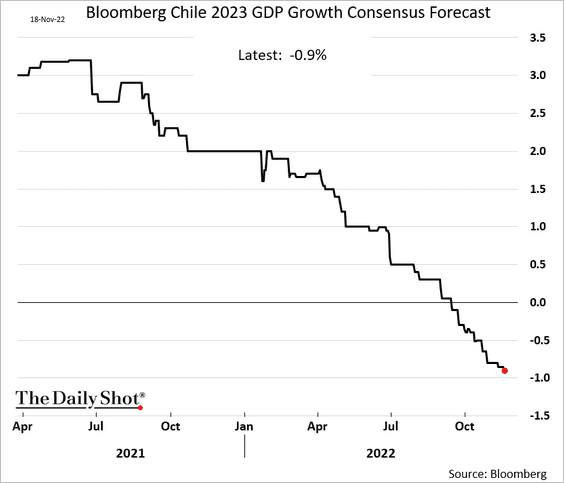

1. Chile’s GDP declined last quarter.

Economists expect a recession next year.

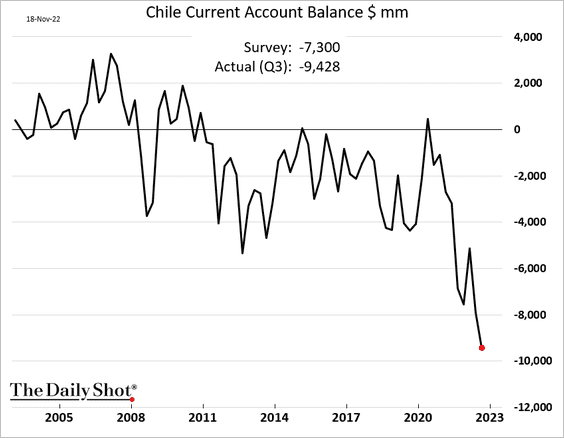

The current account deficit hit a new record.

——————–

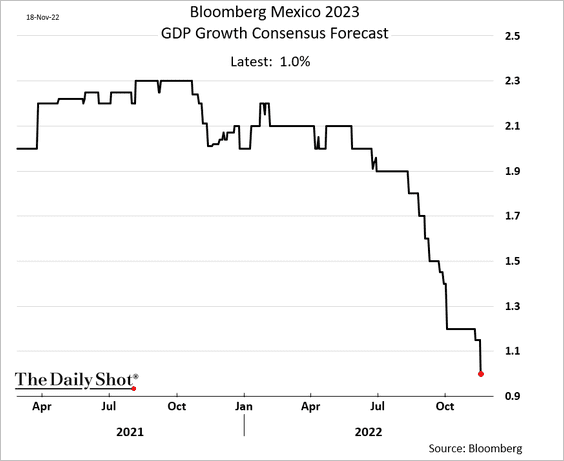

2. Mexico’s 2023 growth forecasts continue to move lower.

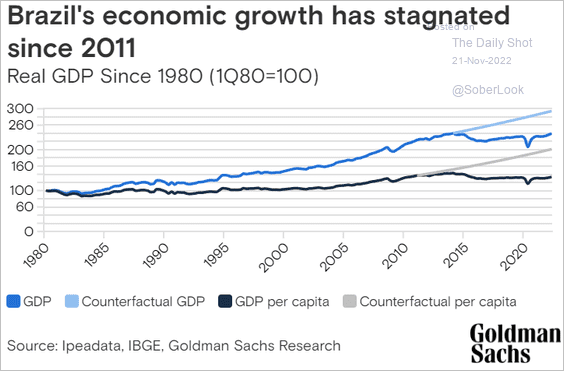

3. A lost decade for Brazil …

Source: Goldman Sachs

Source: Goldman Sachs

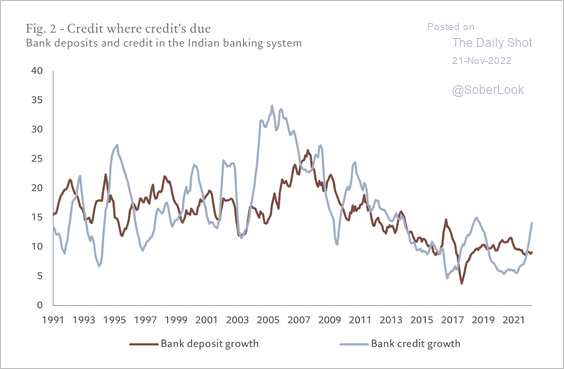

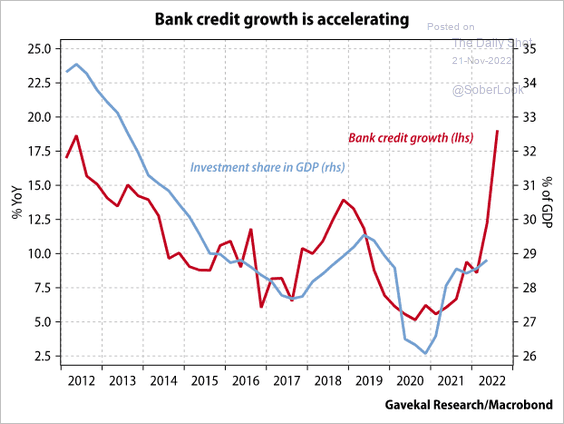

4. Credit growth in India increased this year, …

Source: Pictet Wealth Management Read full article

Source: Pictet Wealth Management Read full article

… which points to stronger CapEx growth ahead.

Source: Gavekal Research

Source: Gavekal Research

——————–

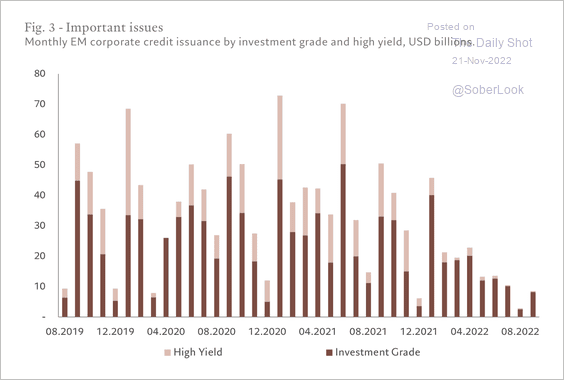

5. Many EM firms took advantage of historically low rates to extend debt maturities. As a result, there is not much in the near-term financing wall, especially in high-yield, according to Pictet.

Source: Pictet Wealth Management Read full article

Source: Pictet Wealth Management Read full article

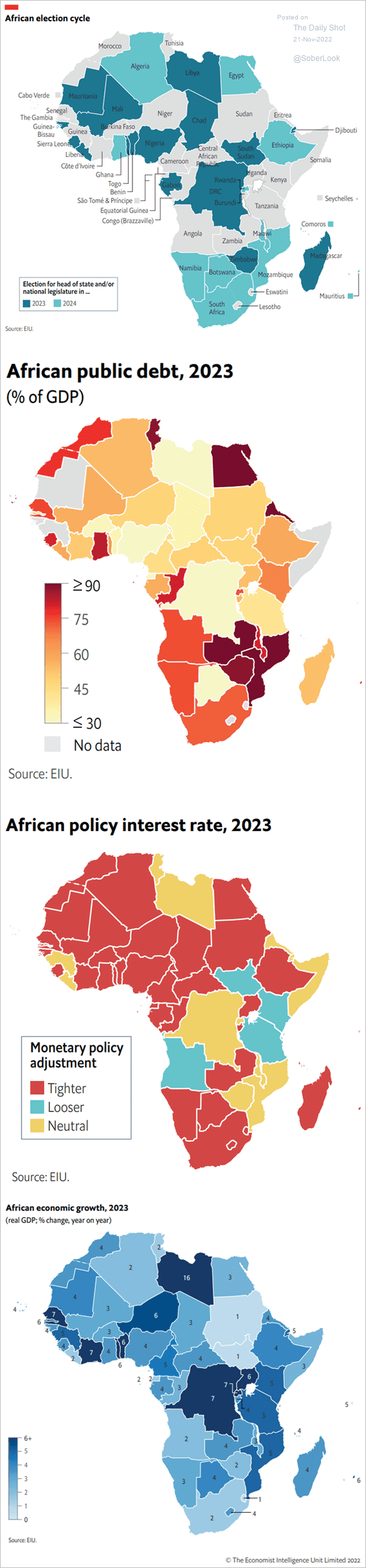

6. The maps below show Africa’s election cycle, public debt, policy rates, and economic growth.

Source: The Economist Intelligence Unit

Source: The Economist Intelligence Unit

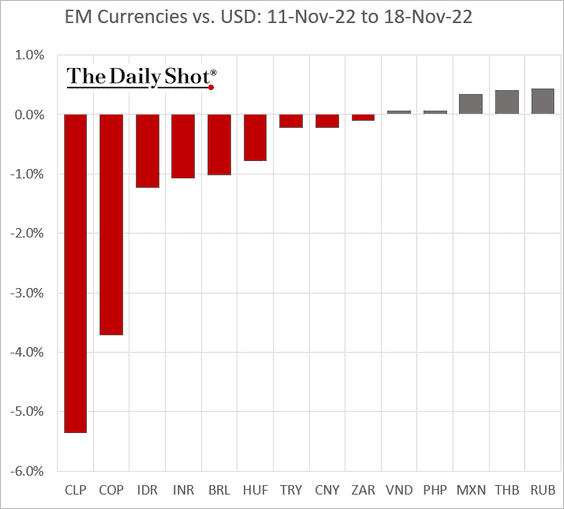

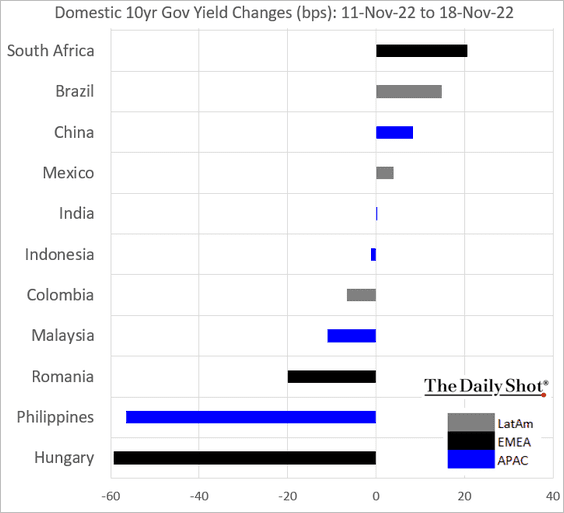

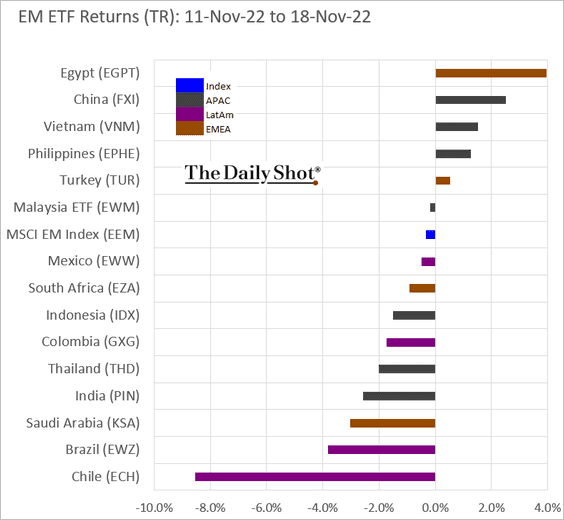

7. Next, we have some performance metrics from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

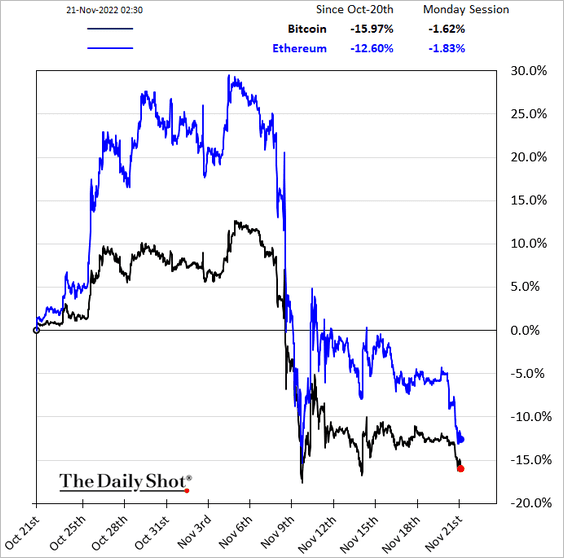

Cryptocurrencies

1. Bitcoin is back below 16k, …

… as cryptos come under pressure again.

Source: @business, @SKJagtiani Read full article

Source: @business, @SKJagtiani Read full article

——————–

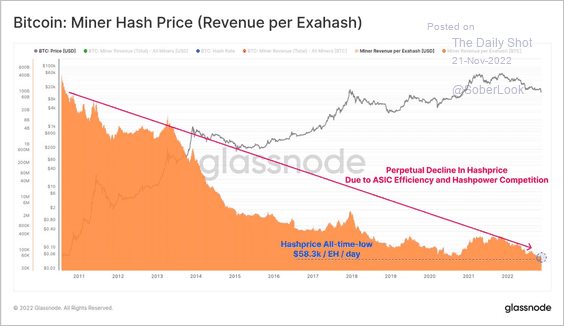

2. The BTC “hash price” (market value per unit of computing power) plunged to an all-time low, down 76% from its peak. The bitcoin mining industry is under pressure.

Source: @glassnode

Source: @glassnode

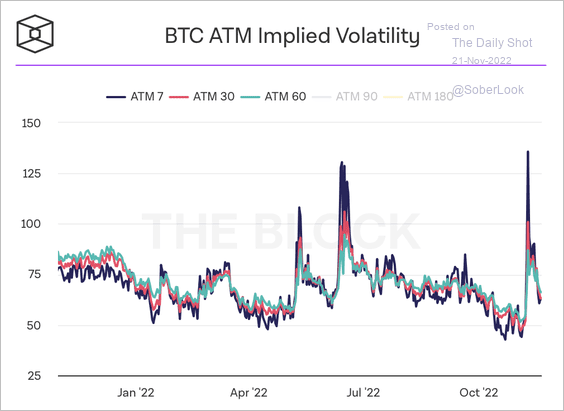

3. Bitcoin’s implied volatility is starting to decline.

Source: The Block

Source: The Block

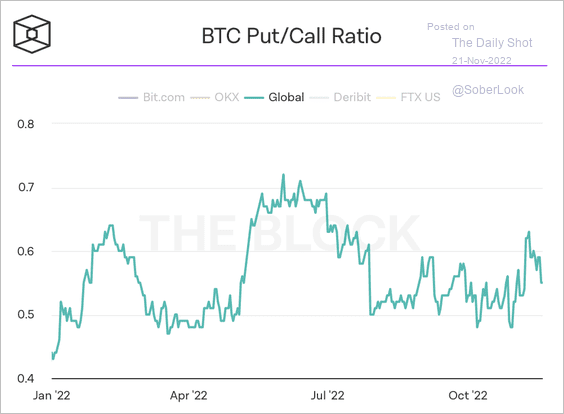

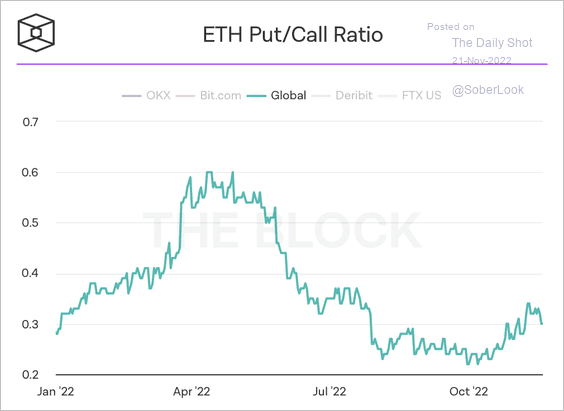

4. Bitcoin and Ether’s put/call ratio has stabilized after the latest sell-off. (2 charts)

Source: The Block

Source: The Block

Source: The Block

Source: The Block

——————–

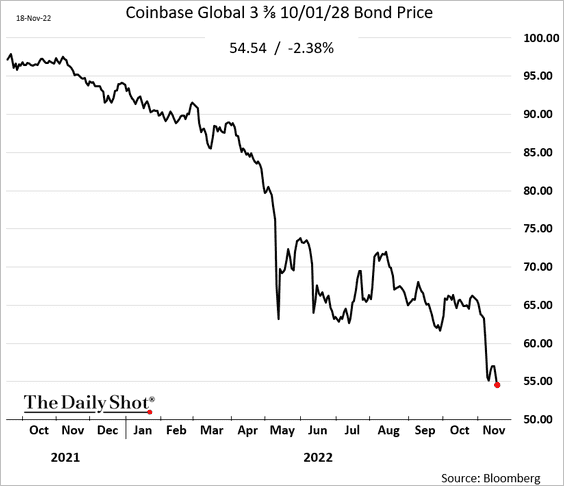

5. Coinbase debt price is nearing 50 cents on the dollar.

Back to Index

Commodities

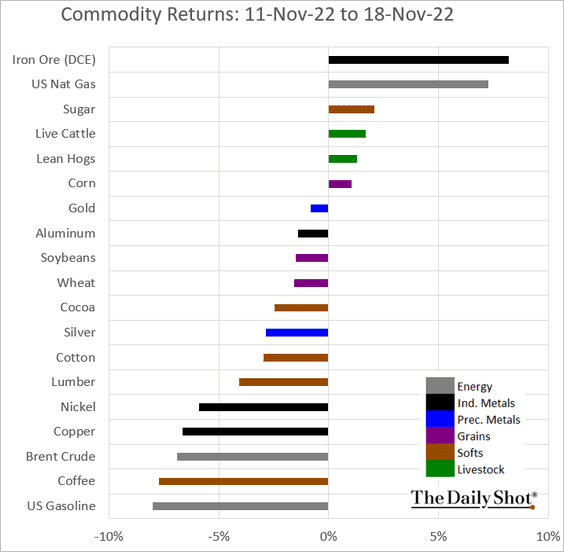

Here is last week’s performance across key markets.

Back to Index

Energy

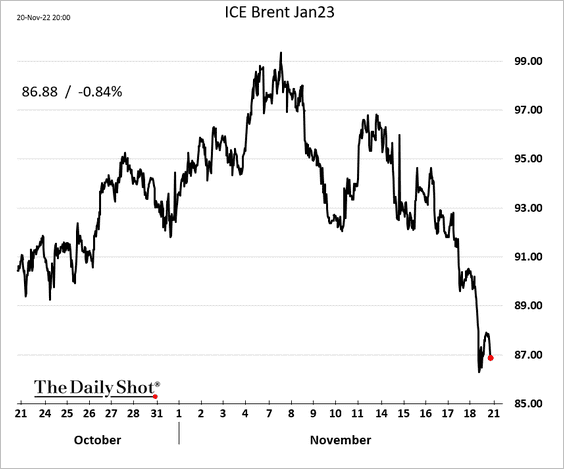

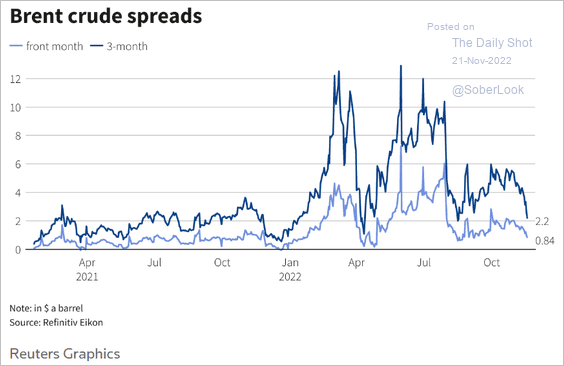

1. Brent crude is back below $90/bbl.

Source: Reuters Read full article

Source: Reuters Read full article

Backwardation is shrinking.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

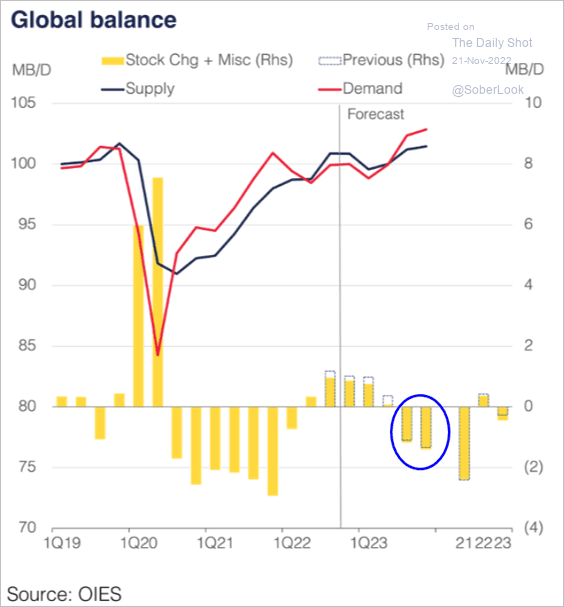

2. Will oil markets swing back into deficit in the second half of next year?

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

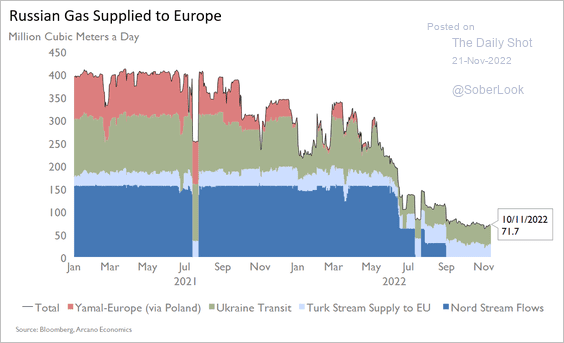

3. This chart shows the Russian gas supply to Europe.

Source: Arcano Economics

Source: Arcano Economics

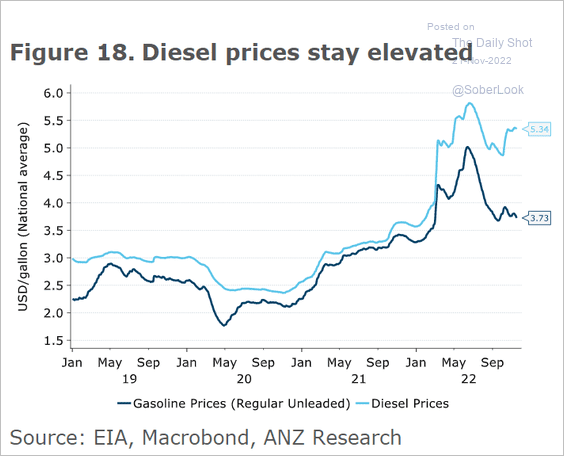

4. US diesel-gasoline spreads keep widening due to distillates shortages.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

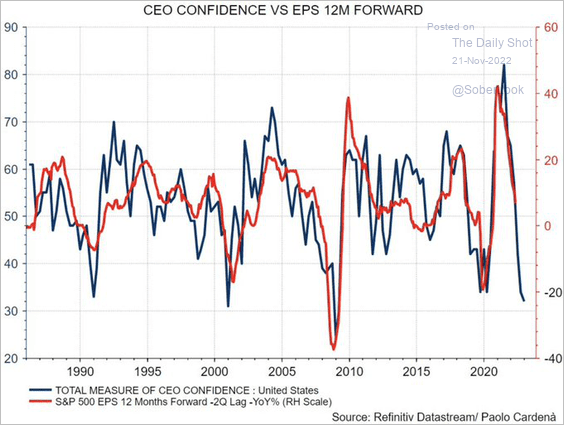

1. CEO sentiment points to deeper reductions in earnings.

Source: @paolocardena

Source: @paolocardena

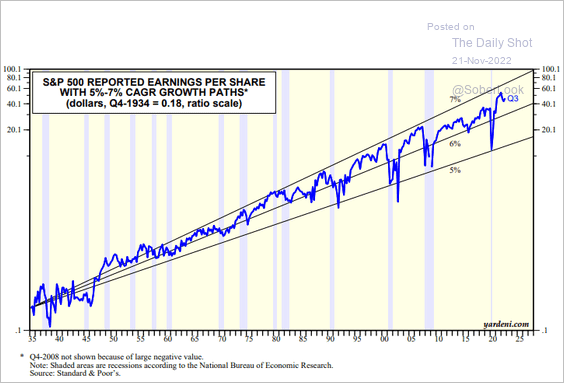

2. This chart shows long-term earnings growth in the S&P 500 (log scale).

Source: Yardeni Research

Source: Yardeni Research

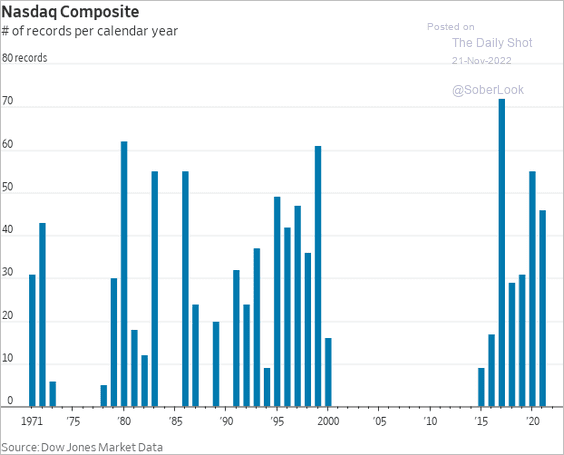

3. How long before the next record high for Nasdaq?

Source: @WSJ Read full article

Source: @WSJ Read full article

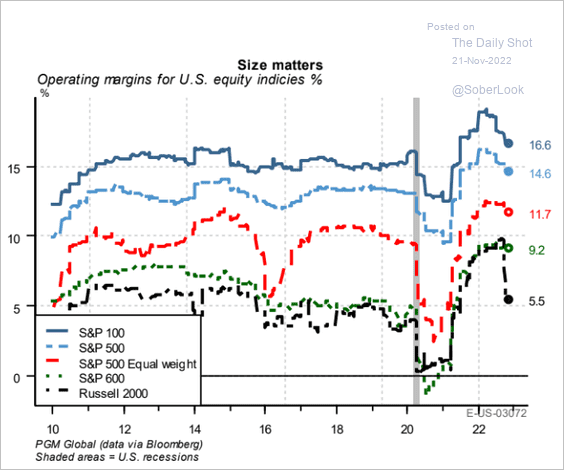

4. Larger companies tend to have higher operating margins.

Source: PGM Global

Source: PGM Global

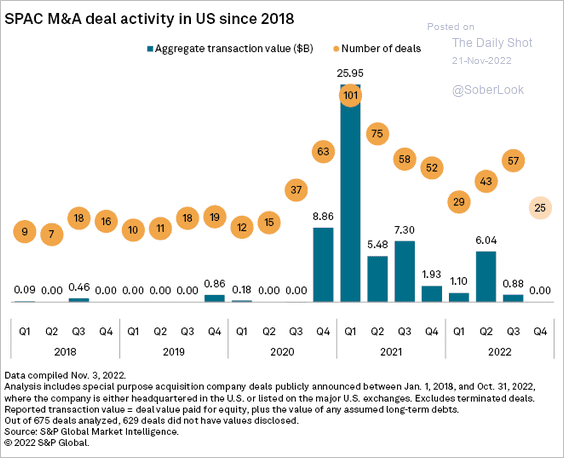

5. This chart shows SPAC M&A activity over time.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

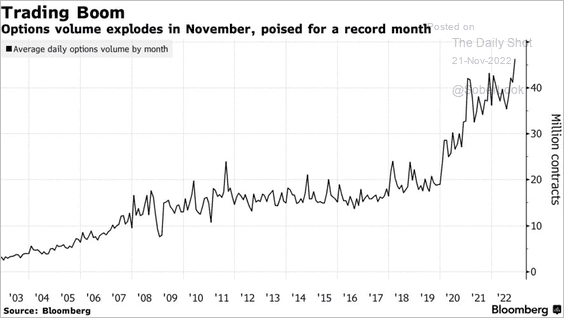

6. Options volume hit a new record this month.

Source: @markets, @luwangnyc Read full article

Source: @markets, @luwangnyc Read full article

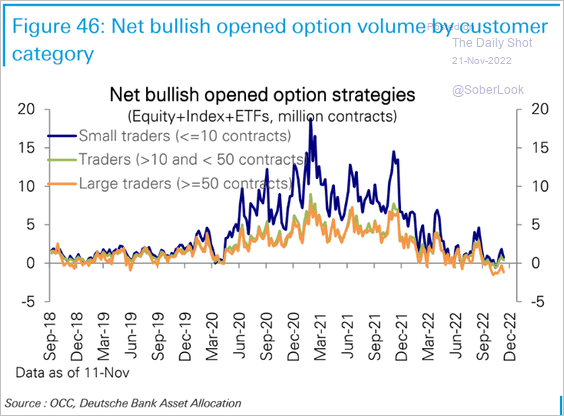

But the net bullish opened options volume remains depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

7. Semiconductor shares have been outperforming.

![]()

![]() Source: @technology, @jwittenstein Read full article

Source: @technology, @jwittenstein Read full article

——————–

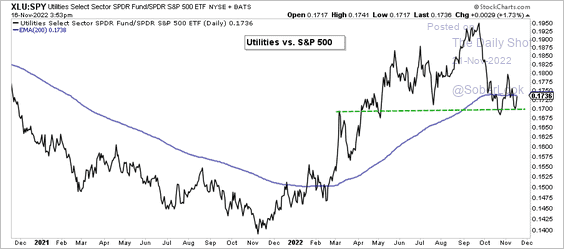

8. The utilities sector is holding support relative to the S&P 500, although upside has weakened over the past few months.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

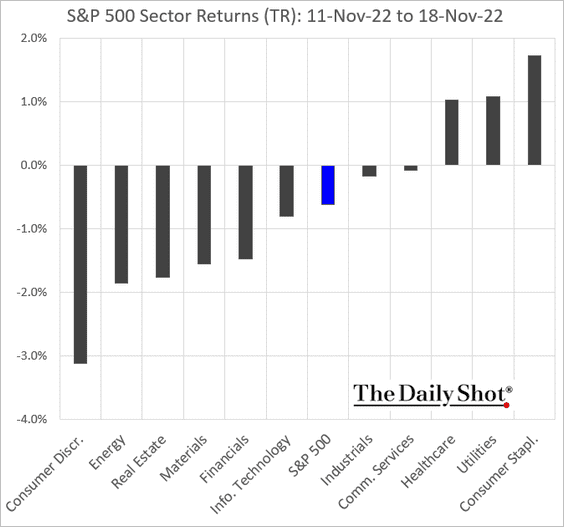

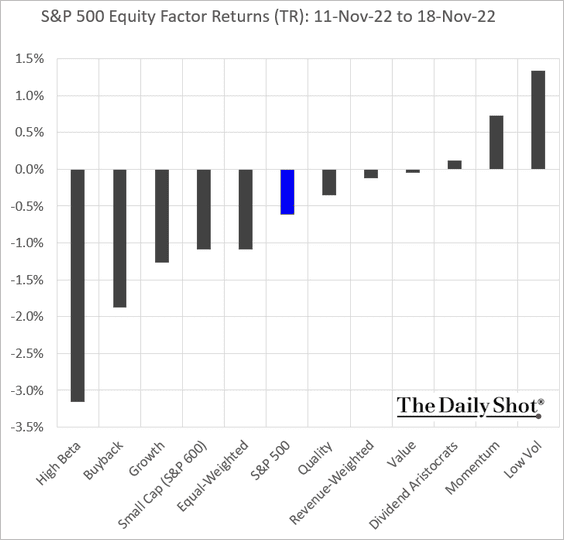

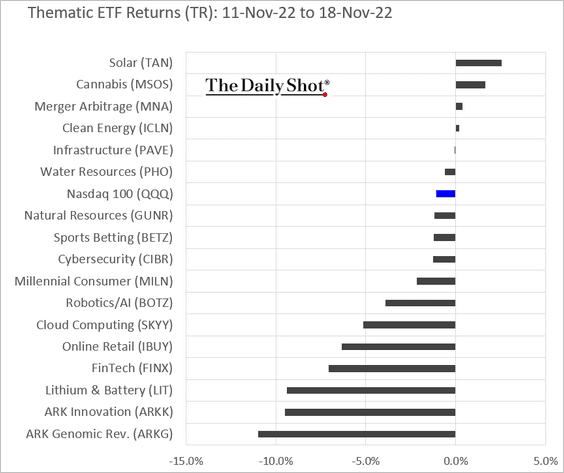

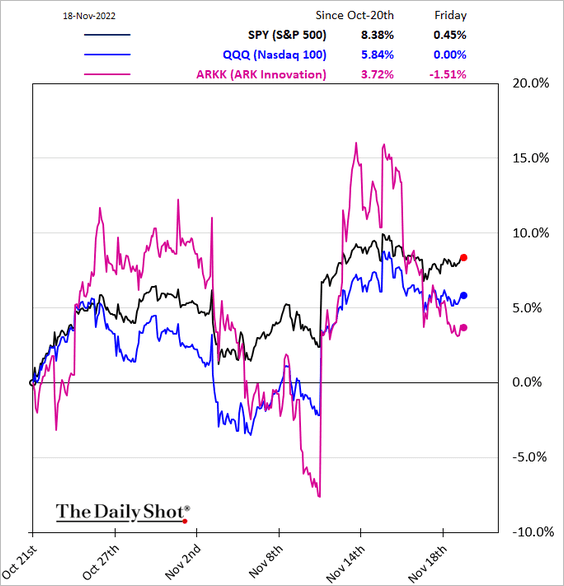

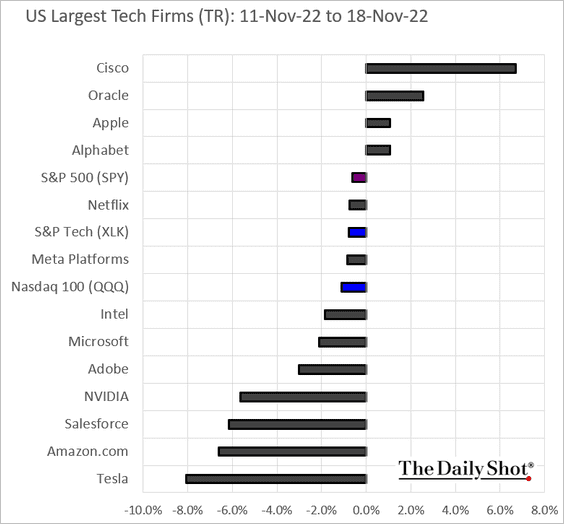

9. Next we have some performance data from last week.

• Sectors:

• Factors:

• Thematic ETFs:

• Largest tech firms:

Back to Index

Credit

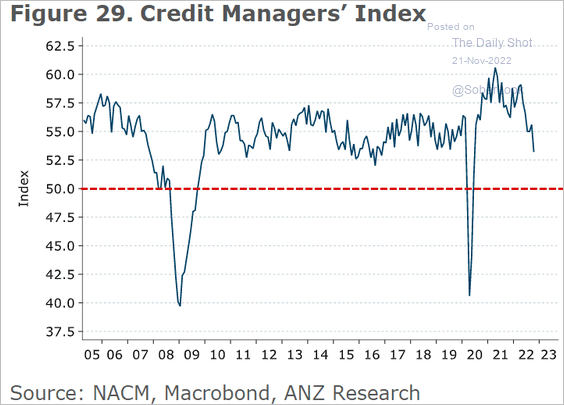

1. Credit Managers’ Index (based on commercial transactions) signals slowing credit growth.

Source: @ANZ_Research

Source: @ANZ_Research

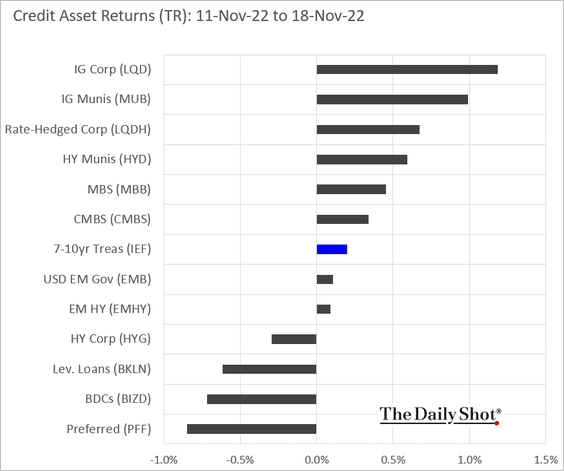

2. Here is last week’s performance by asset class.

Back to Index

Rates

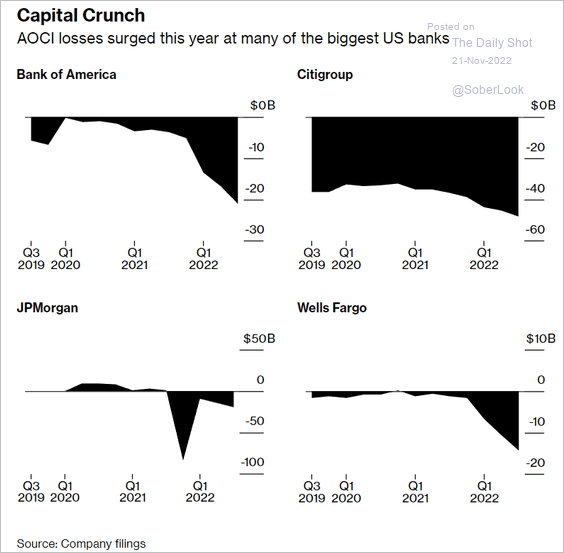

1. Banks now have substantial unrealized losses on their bond holdings.

Source: @wealth, @jennysurane, @hannahlevitt Read full article

Source: @wealth, @jennysurane, @hannahlevitt Read full article

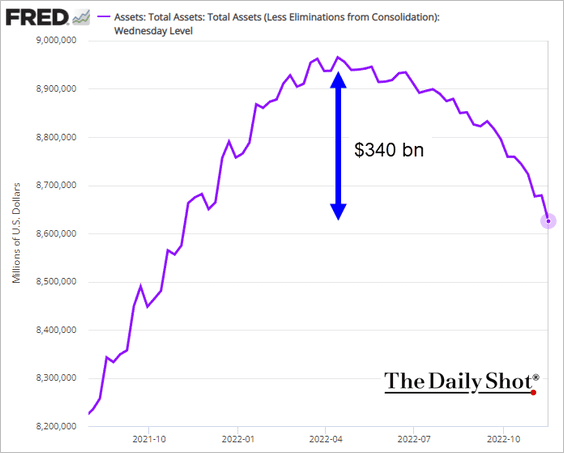

2. The Fed’s balance sheet is now down roughly $340 billion from the peak …

… driven mostly by the reduction in Treasury holdings.

Back to Index

Global Developments

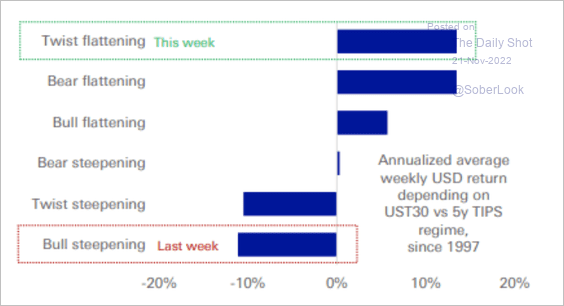

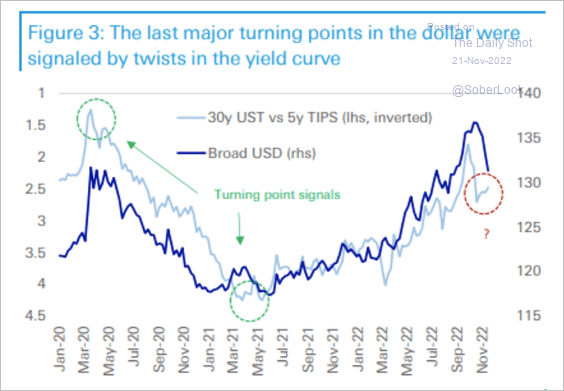

1. The dollar tends to do well when the Treasury yield curve is flattening. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

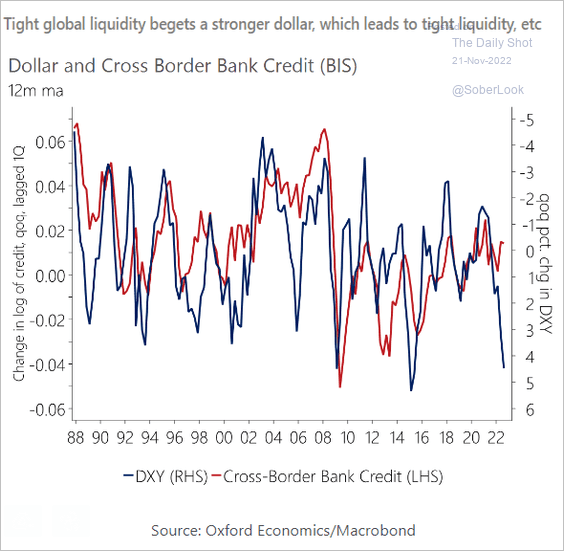

Tight liquidity is also a tailwind for the dollar.

Source: Oxford Economics

Source: Oxford Economics

——————–

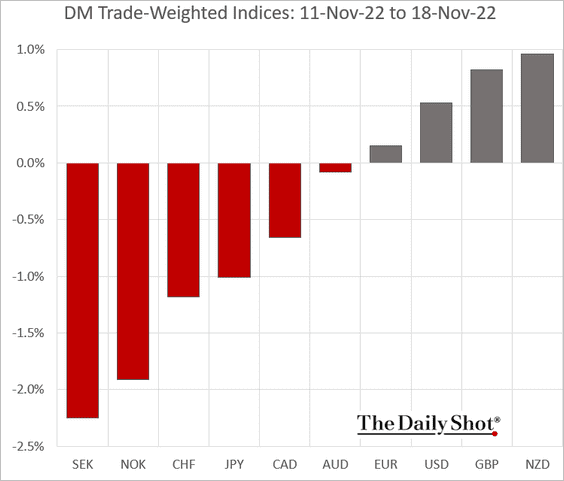

2. Next, we have some performance data from last week.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

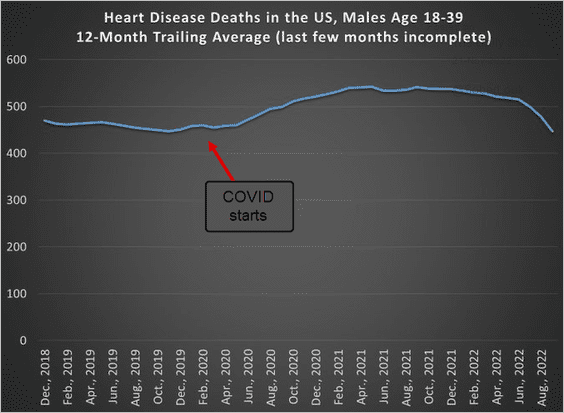

1. Heart disease deaths among US males aged 18-39:

Source: @jmhorp

Source: @jmhorp

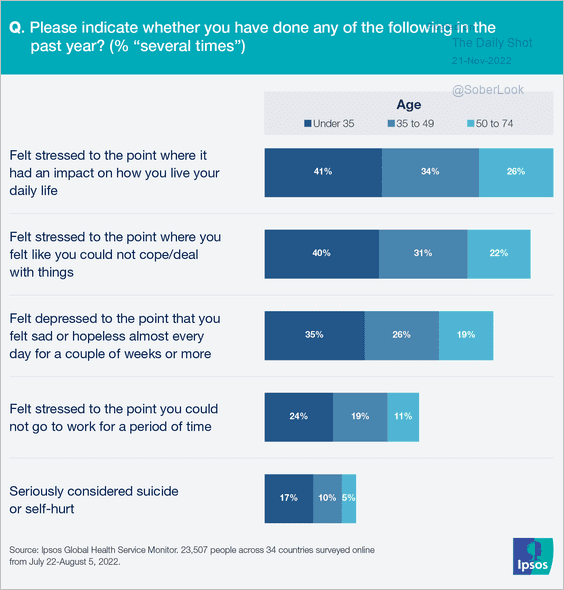

2. Global mental health survey:

Source: Ipsos Read full article

Source: Ipsos Read full article

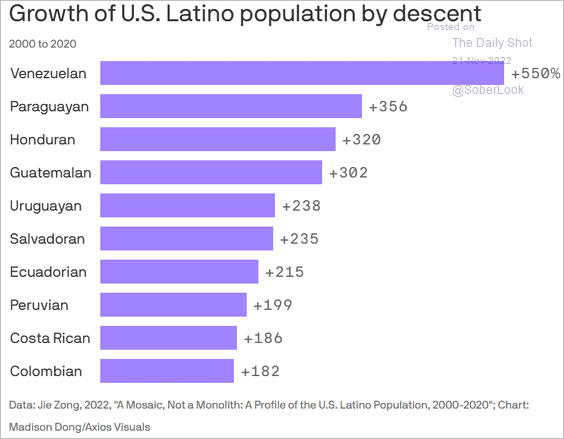

3. US Latino population growth:

Source: @axios Read full article

Source: @axios Read full article

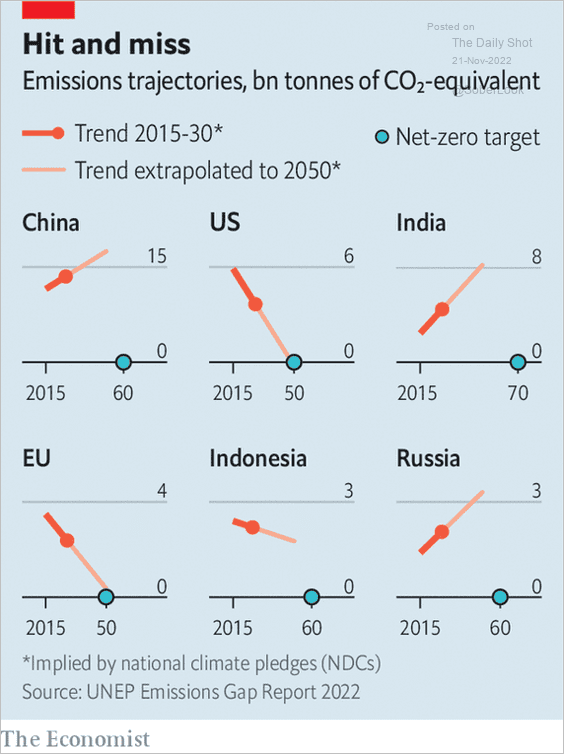

4. Emissions trajectories:

Source: The Economist Read full article

Source: The Economist Read full article

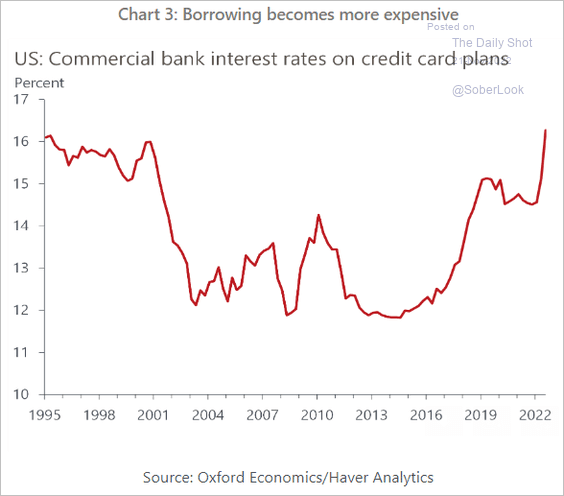

5. Credit card rates in the US:

Source: Oxford Economics

Source: Oxford Economics

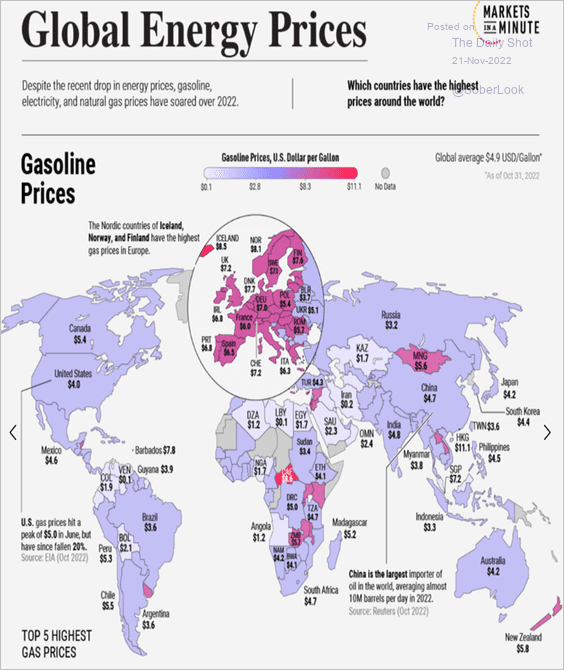

6. Gasoline prices globally:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

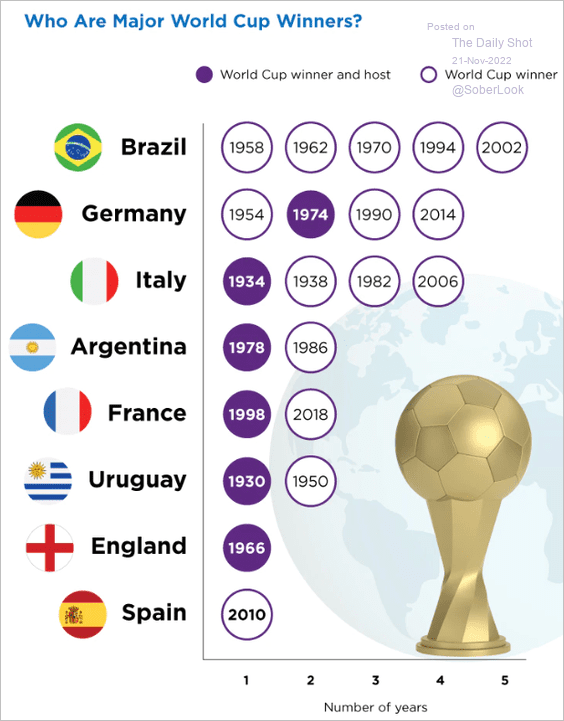

7. Past World Cup winners:

Source: The Census Bureau Read full article

Source: The Census Bureau Read full article

——————–

Back to Index