The Daily Shot: 07-Dec-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

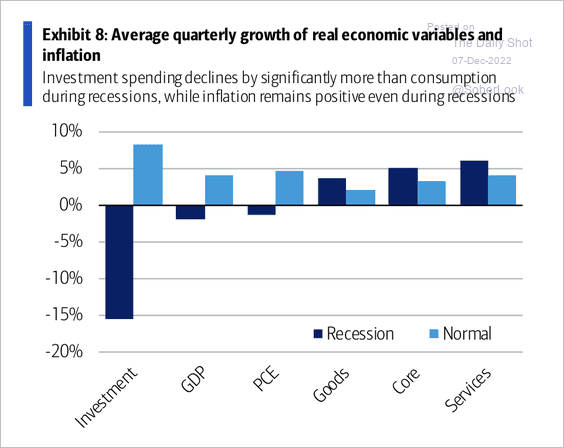

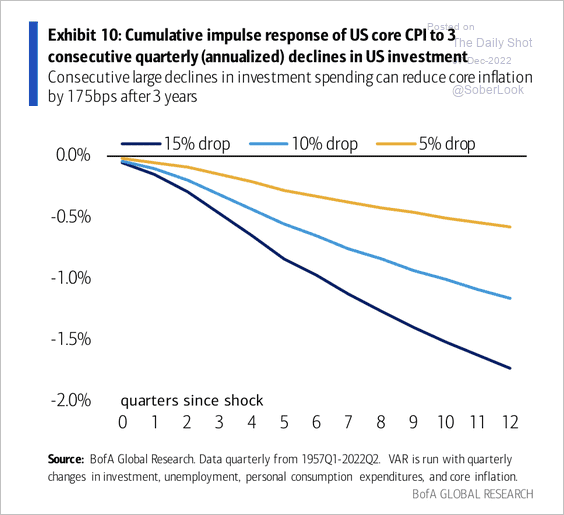

• Investment spending tends to decline well before consumer spending during recessions, which is needed to bring inflation down, according to BofA. (2 charts)

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

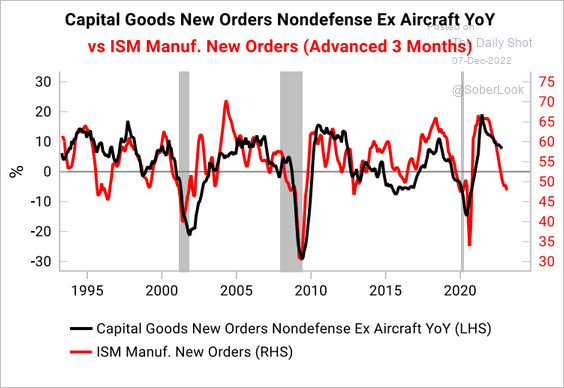

Survey data point to a sharp slowdown in CapEx.

Source: Variant Perception

Source: Variant Perception

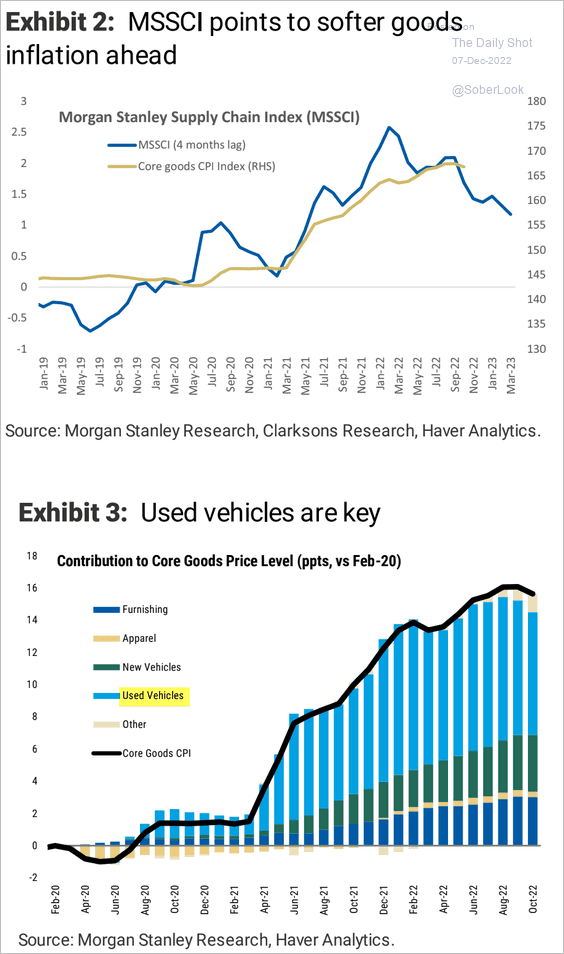

• Goods inflation is expected to soften further.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

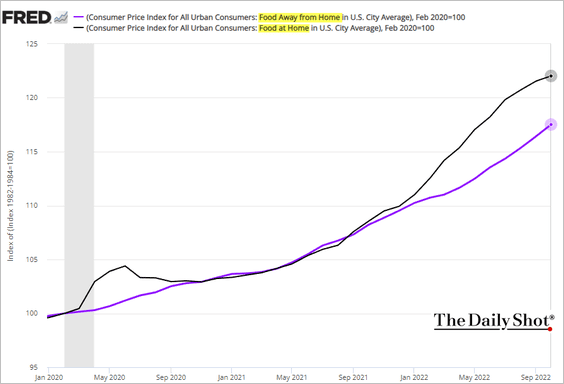

• Price gains at grocery stores have been outpacing inflation at restaurants.

——————–

2. Next, let’s take a look at some trends in the labor market.

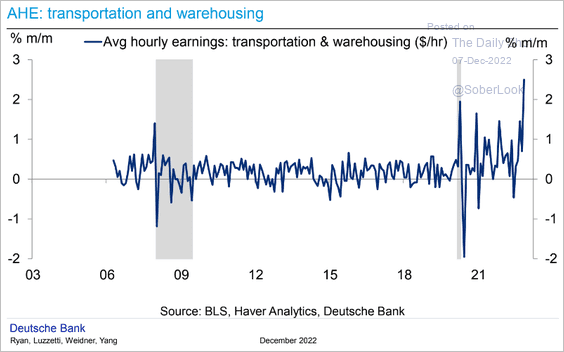

• Wage growth in the transportation and warehousing sectors has been surging.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

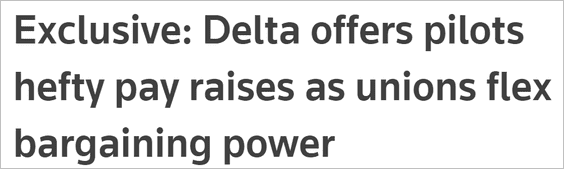

Source: Reuters Read full article

Source: Reuters Read full article

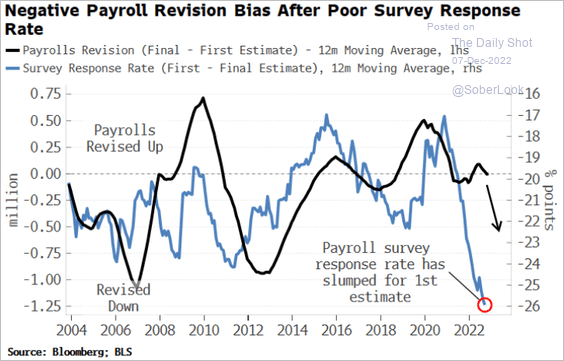

• Does the poor response to the payrolls survey signal a downward revision in the jobs number.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

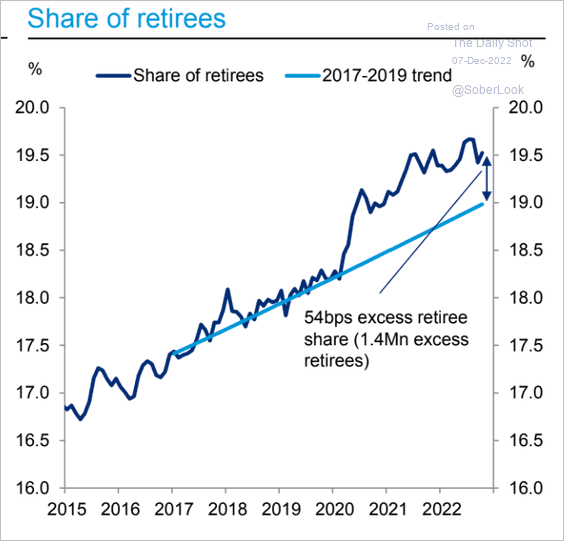

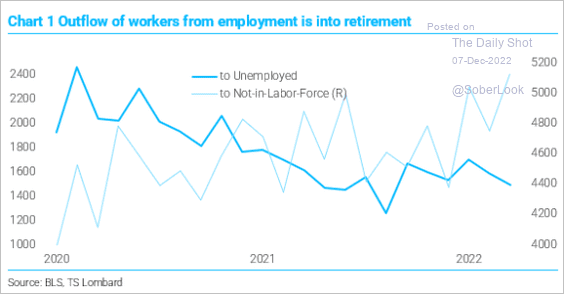

• “Excess” retirements remain elevated, contributing to the labor market imbalance (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: TS Lombard

Source: TS Lombard

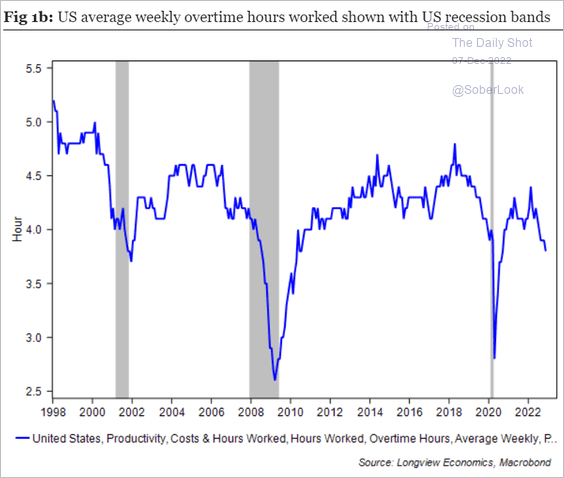

• Overtime hours continue to fall.

Source: Longview Economics

Source: Longview Economics

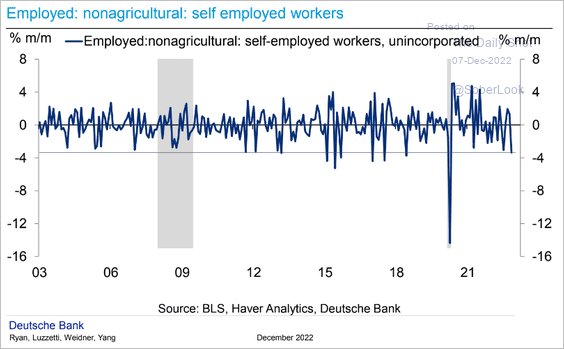

• Self-employment levels declined last month.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

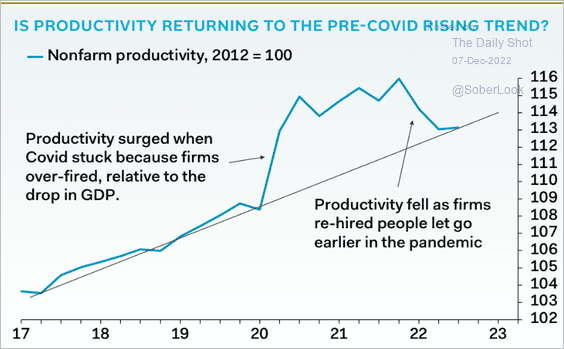

• Labor productivity is back on the pre-COVID trend.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

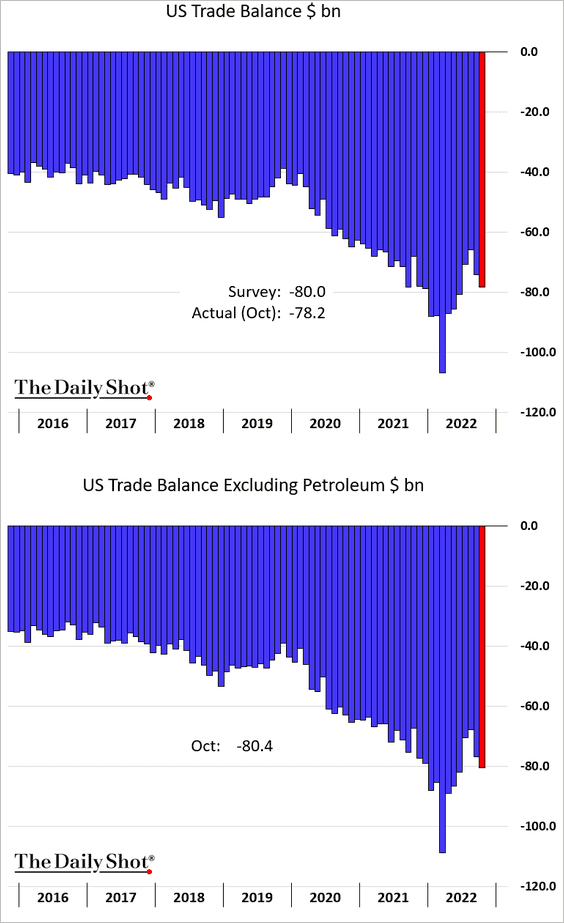

3. The trade gap (goods + services) widened last month.

• Below, imports and exports are shown on separate axis to illustrate the COVID-era divergence.

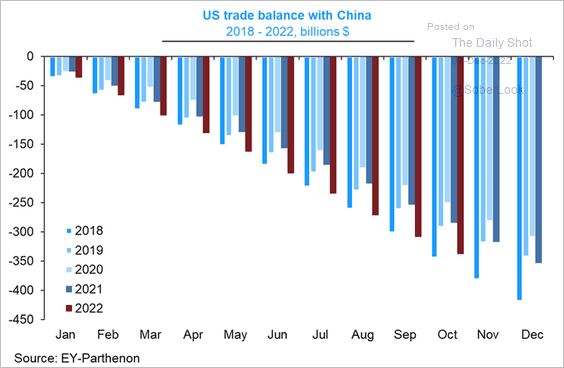

• Here is the cumulative trade deficit with China going back to 2018 (pre-trade-war).

Source: @GregDaco

Source: @GregDaco

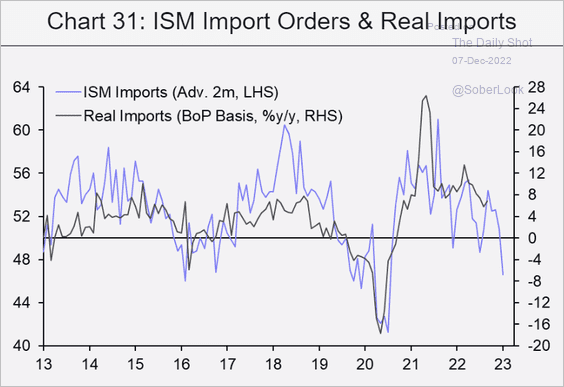

• US real imports are expected to decline sharply as demand slows.

Source: Capital Economics

Source: Capital Economics

Back to Index

Canada

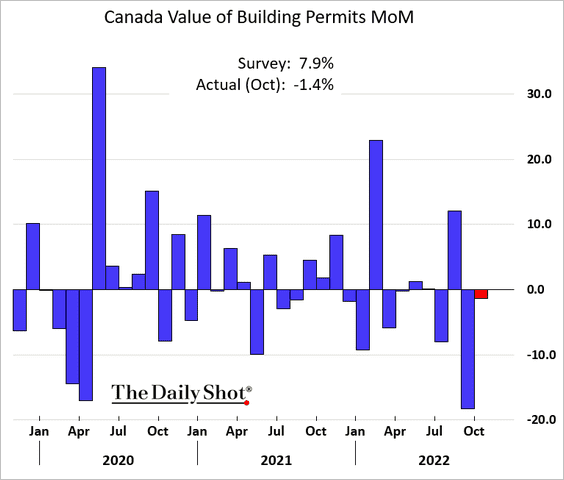

1. Building permits unexpectedly fell in October.

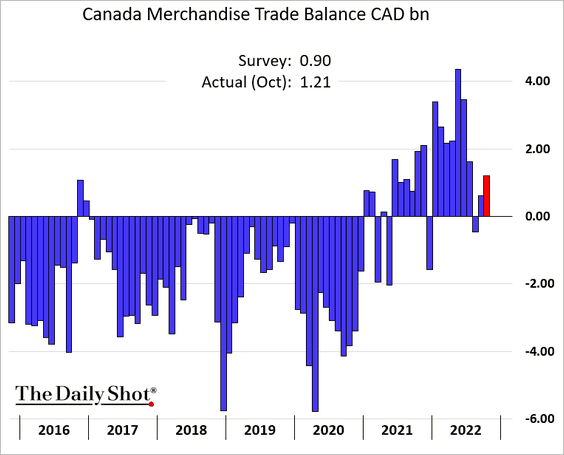

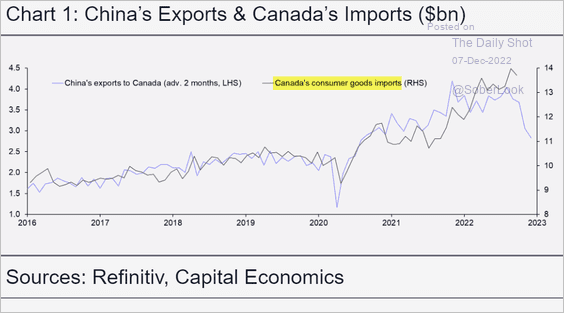

2. The trade surplus increased, …

… as domestic demand slows.

Source: Capital Economics

Source: Capital Economics

——————–

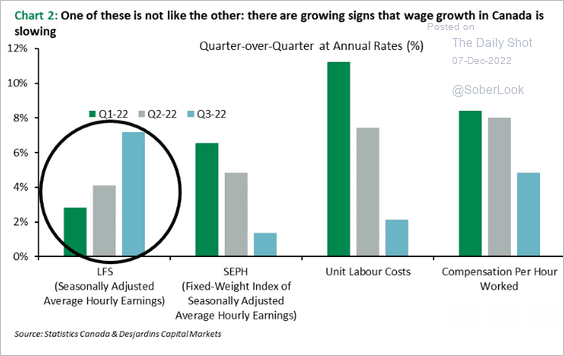

3. Wage growth is moderating.

Source: Desjardins

Source: Desjardins

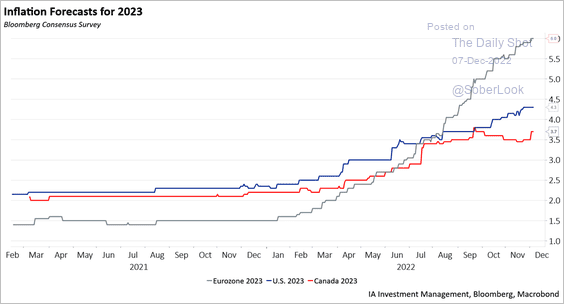

4. Inflation forecasts for 2023 are running below those in the US and the Eurozone.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

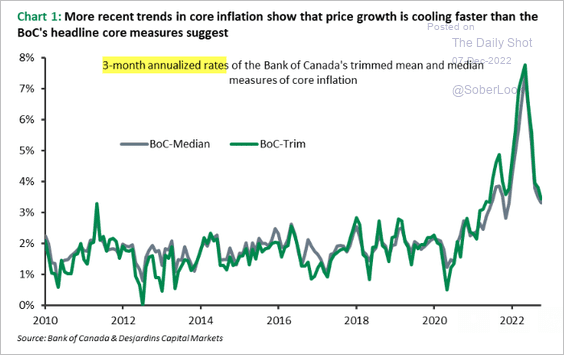

The core CPI may be slowing faster than the headline figures suggest.

Source: Desjardins

Source: Desjardins

——————–

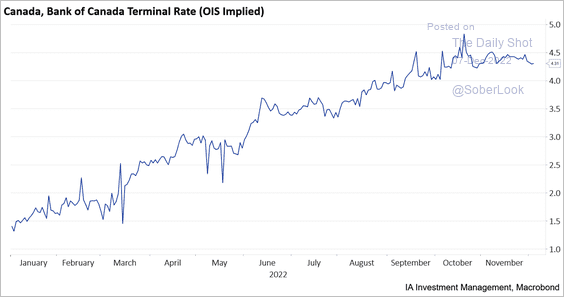

5. Market expectations for the BoC terminal rate are back below 4.5%.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

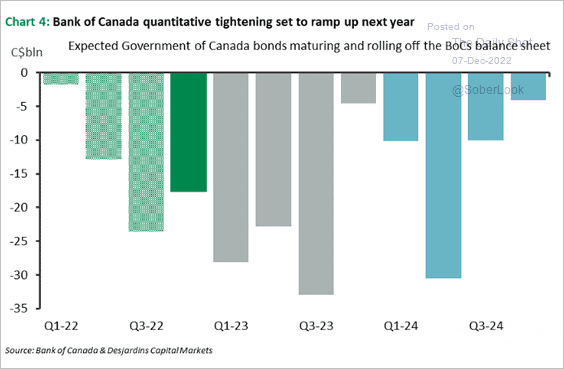

6. The BoC’s QT will ramp up next year.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

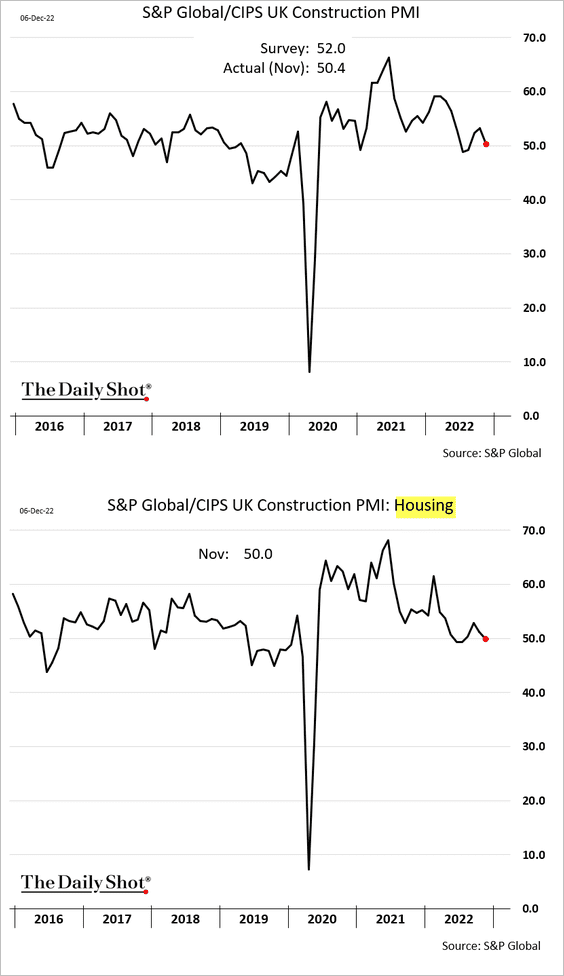

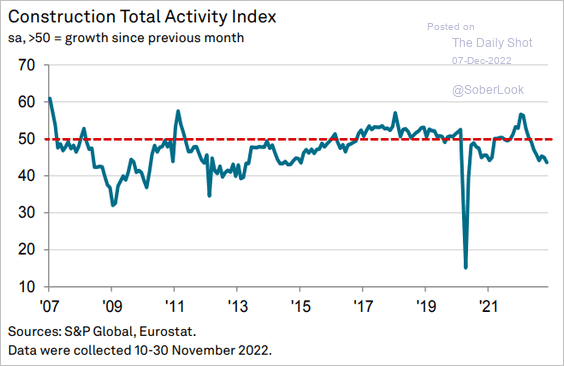

1. Construction activity is no longer growing.

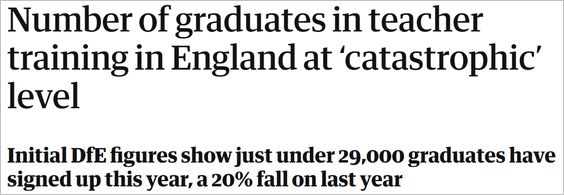

2. The UK is facing a shortage of teachers.

Source: The Guardian Read full article

Source: The Guardian Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

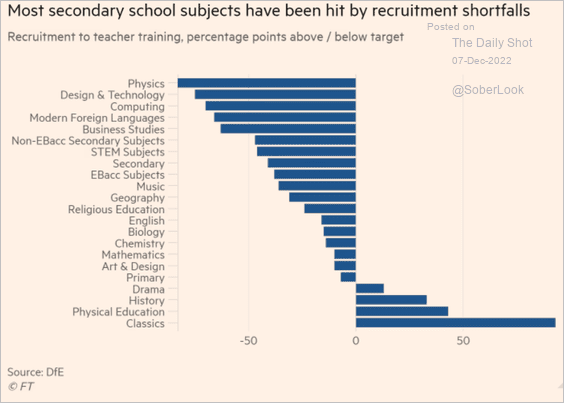

1. Let’s begin with Germany.

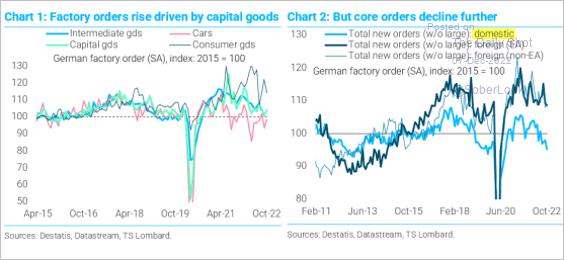

• New factory orders ticked higher in October.

Domestic orders are under pressure.

Source: TS Lombard

Source: TS Lombard

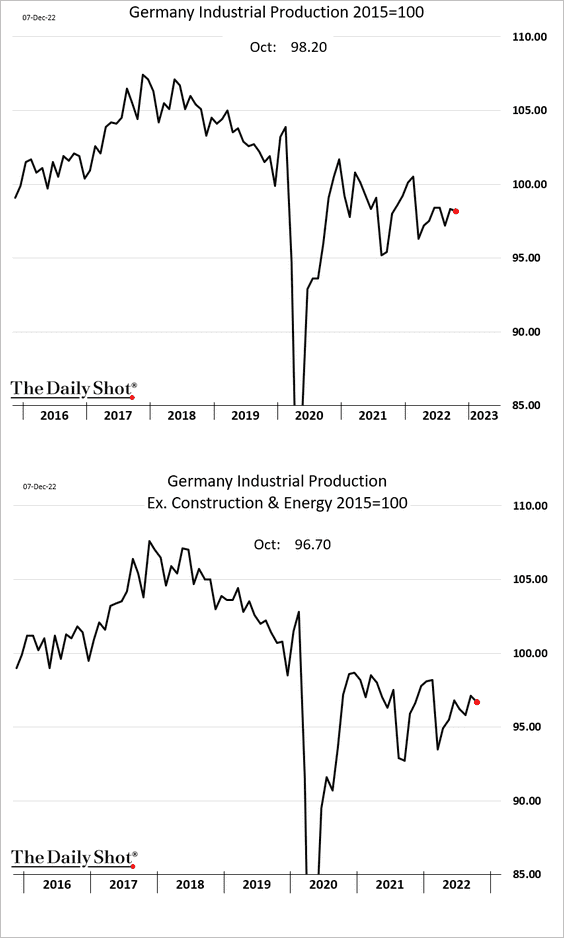

Industrial production edged lower but exceeded forecasts.

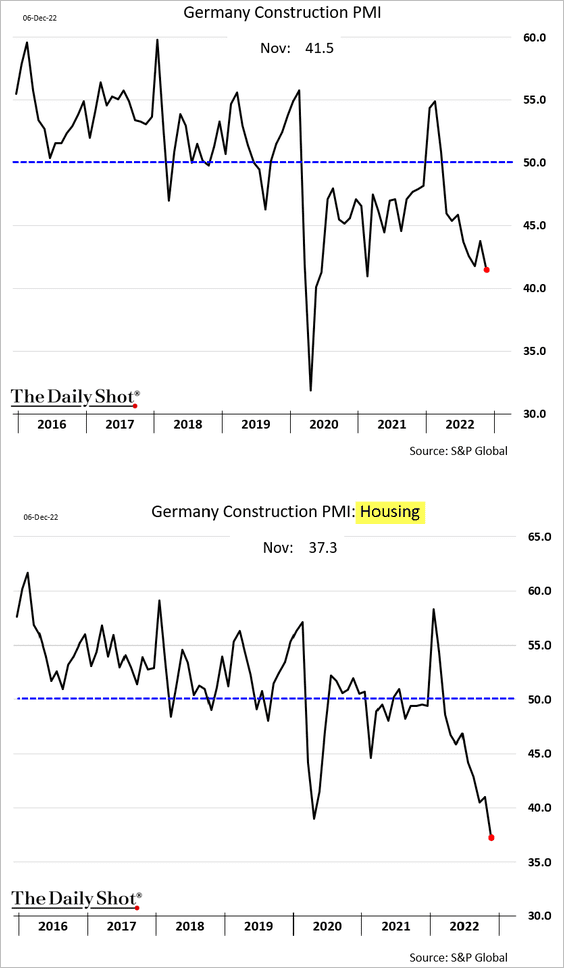

• Construction activity has been deteriorating.

Construction is also weakening at the Eurozone level.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

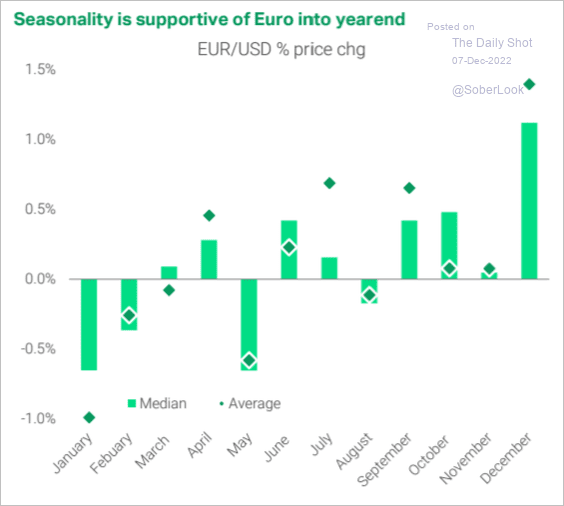

2. December tends to be a good month for the euro.

Source: TS Lombard

Source: TS Lombard

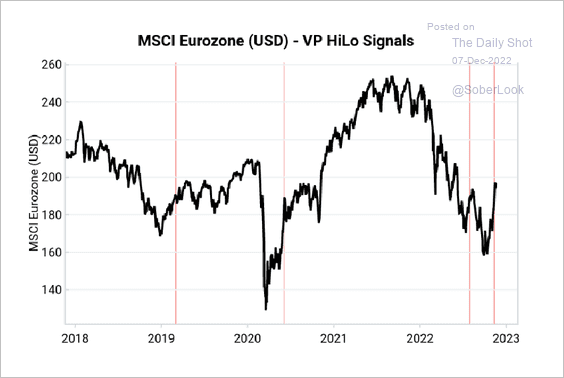

3. Technical signals appear overbought for Eurozone equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

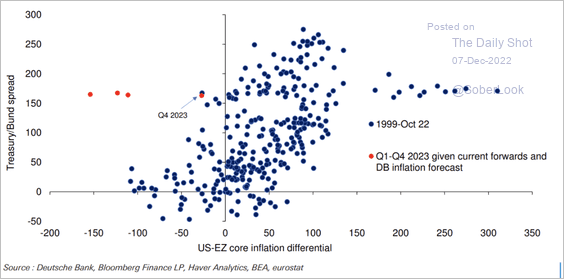

4. The negative US/Eurozone core inflation differential implies a much tighter Treasury/Bund spread than implied by forward rates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia – Pacific

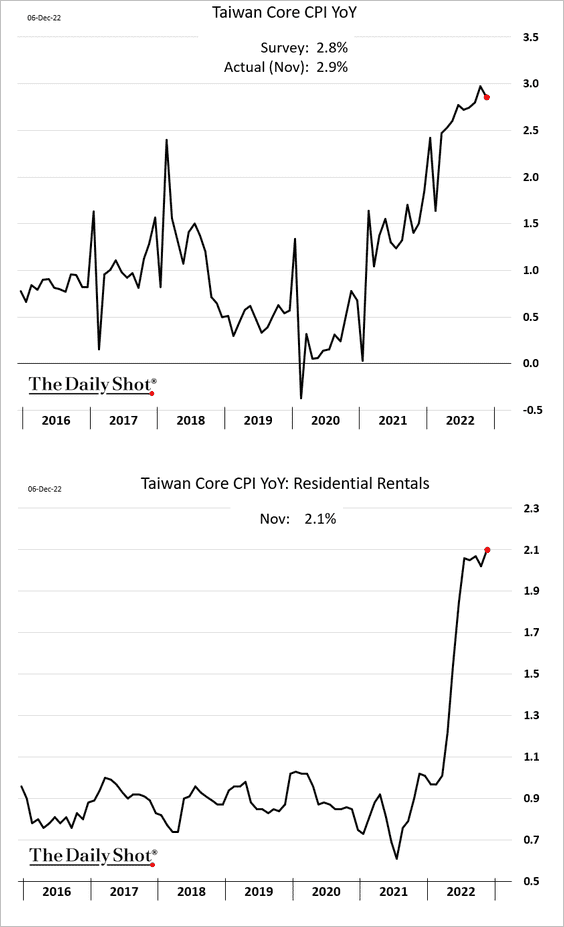

1. Taiwan’s core CPI topped expectations.

2. Next, we have some updates on Australia.

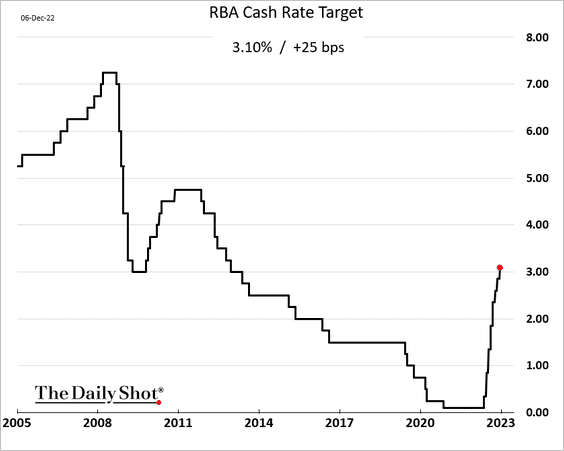

• The RBA hiked by 25 bps, as expected.

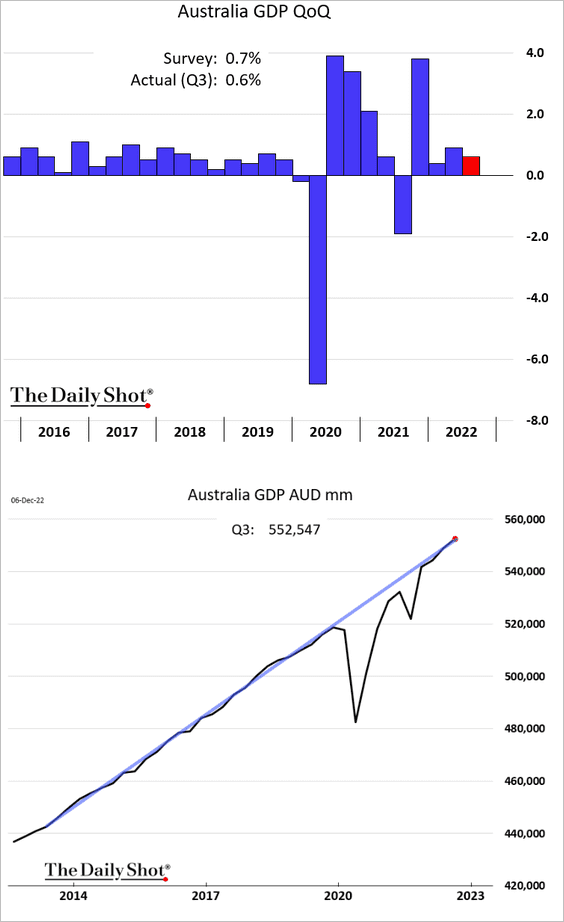

• The GDP growth remains on its pre-COVID trend.

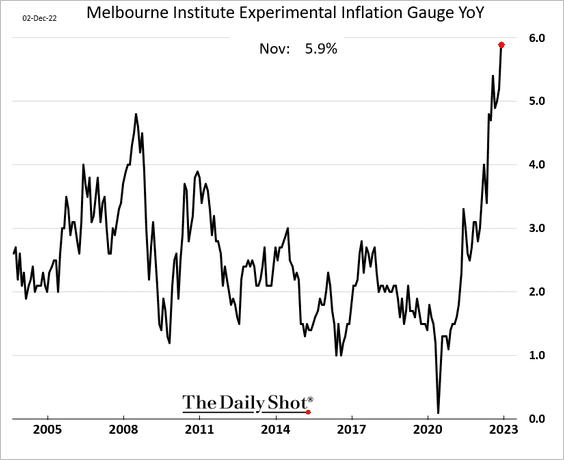

• Inflation remains elevated.

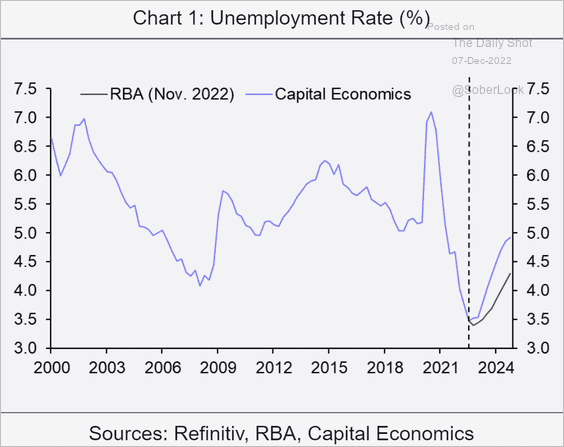

• Capital Economics sees unemployment rising faster than the RBA’s forecast.

Source: Capital Economics

Source: Capital Economics

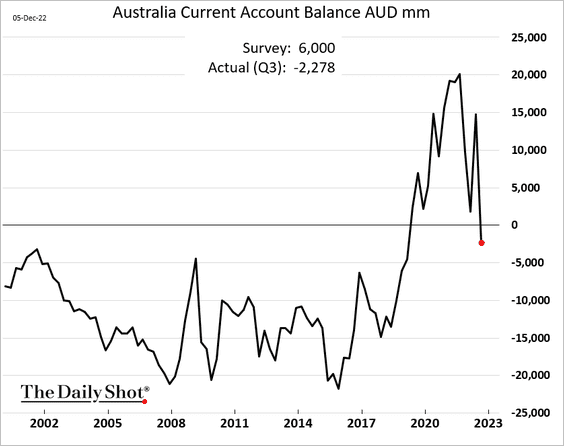

• The current account is back in deficit.

Back to Index

China

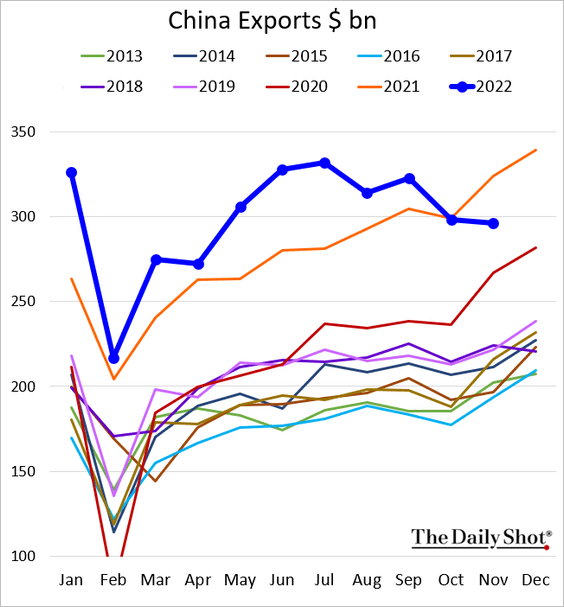

1. Exports surprised to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

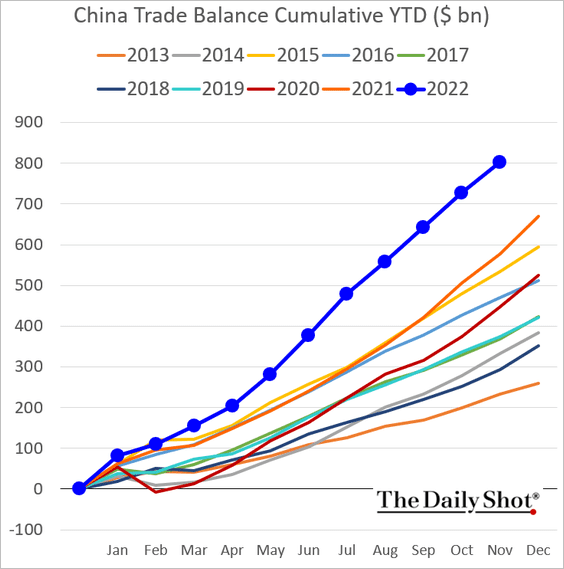

The trade surplus remains well above last year’s levels.

——————–

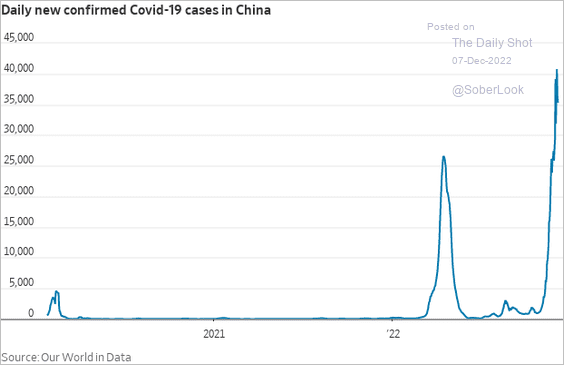

2. COVID cases are still elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

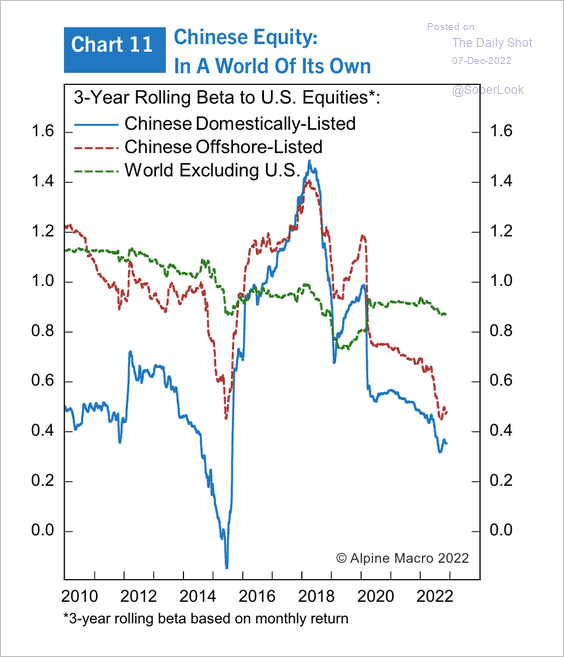

3. Chinese equities, both listed domestically and overseas, have a much lower beta to US stocks compared with other markets.

Source: Alpine Macro

Source: Alpine Macro

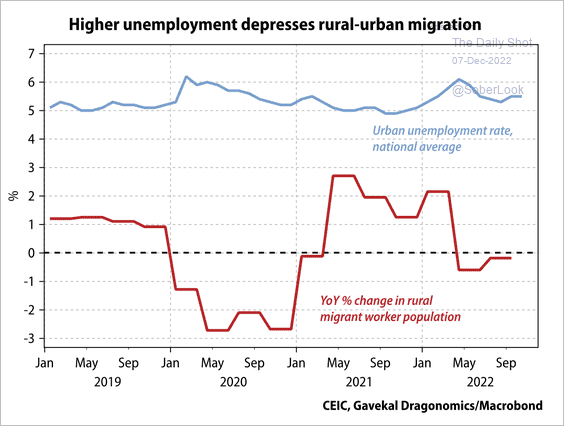

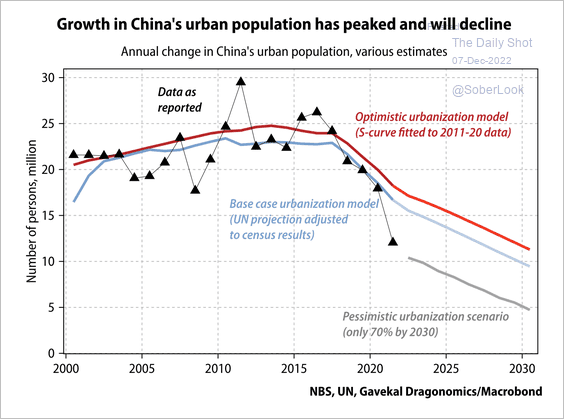

4. COVID-19 restrictions negatively impacted labor migration. That could be a setback for long-term housing demand. (2 charts)

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

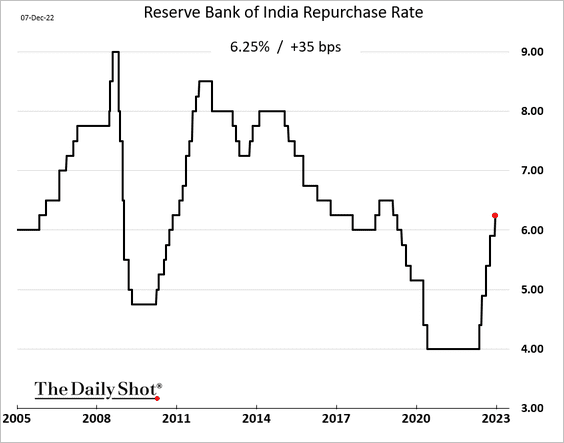

1. India’s central bank hiked rates, as expected.

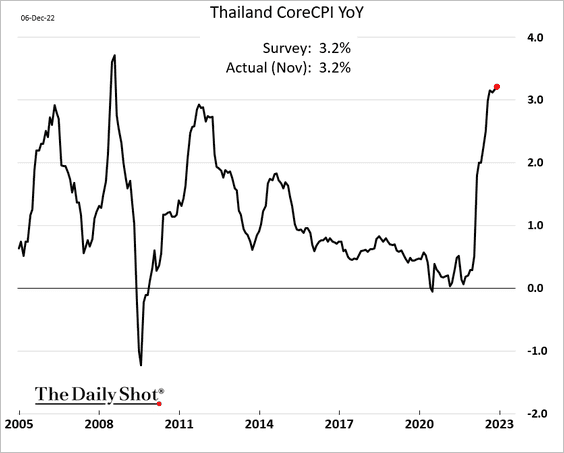

2. Thai core inflation keeps rising.

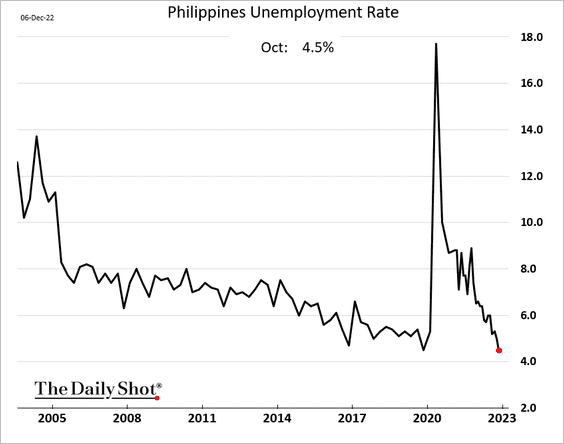

3. The Philippine unemployment rate dipped under the pre-COVID lows.

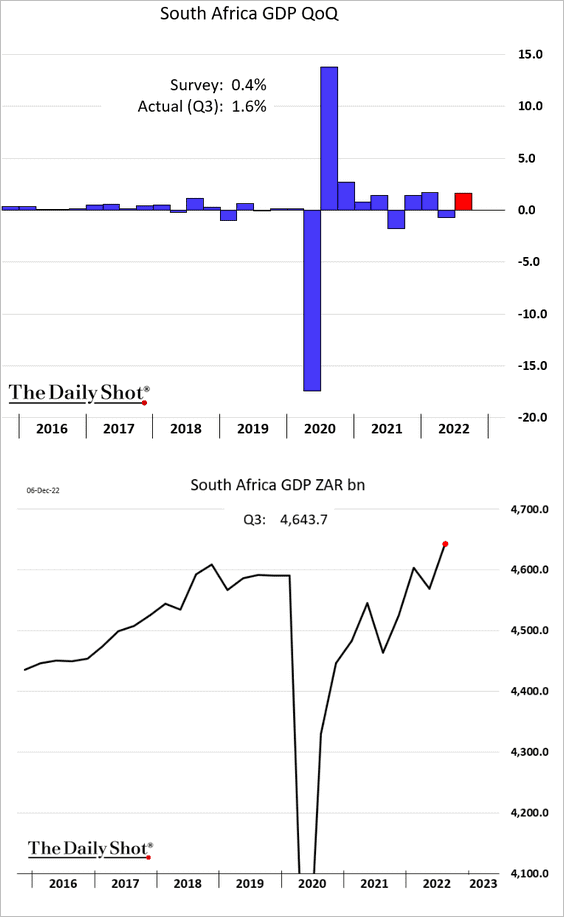

4. South Africa’s GDP growth surprised to the upside.

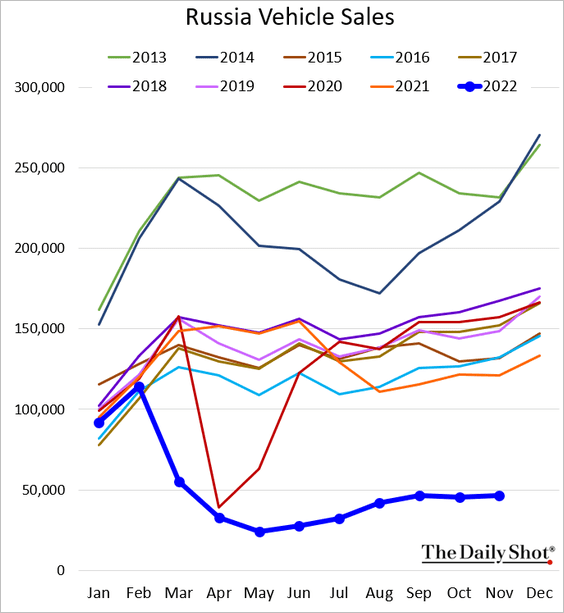

5. Russian vehicle sales remain depressed.

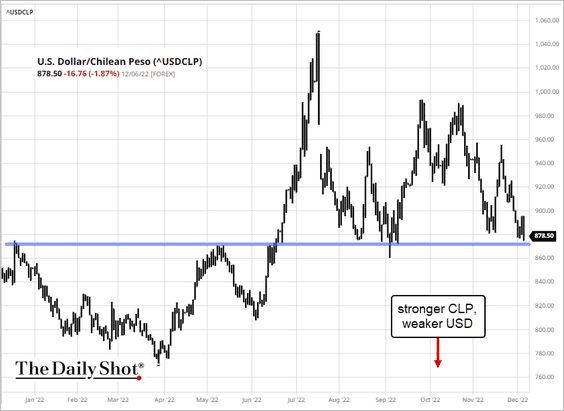

6. USD/CLP (Chilean peso) is at support.

Source: barchart.com

Source: barchart.com

7. EM equity valuations are depressed.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

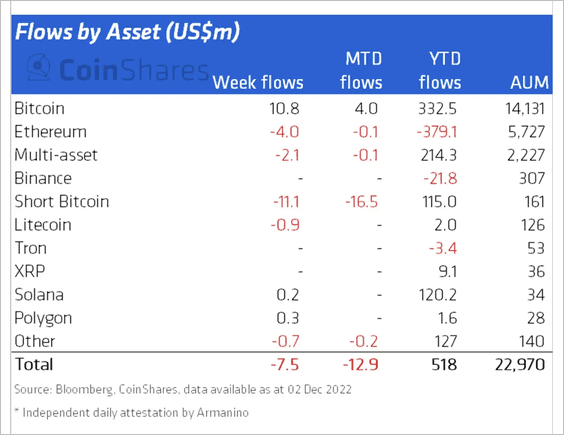

1. Crypto funds saw minor outflows last week, driven by short-Bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

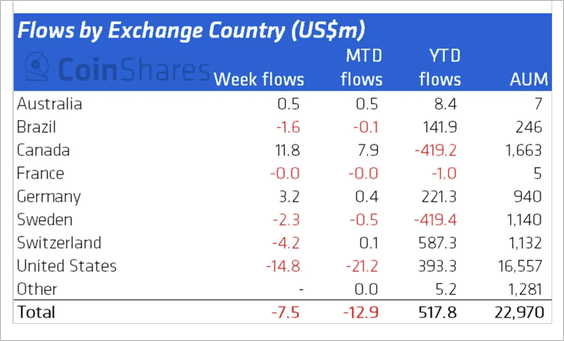

US funds accounted for a majority of outflows last week, while Canadian funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

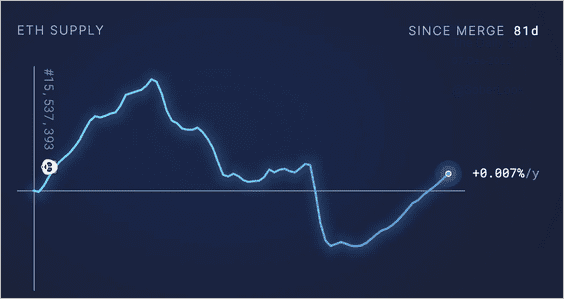

2. Ether turned inflationary as network activity slowed. That means the volume of ether being minted outpaces the amount “burned” (removed from circulation), which could be negative for ETH’s token price.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

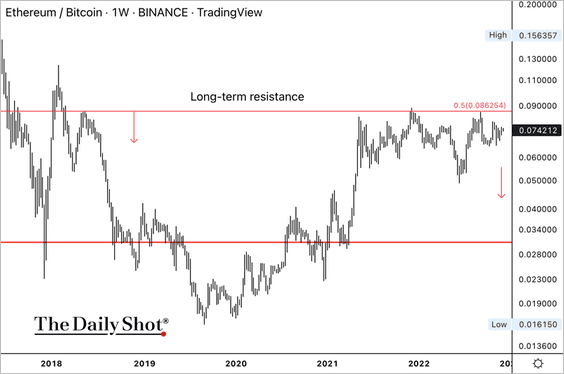

3. The ETH/BTC price ratio continues to stall near long-term resistance.

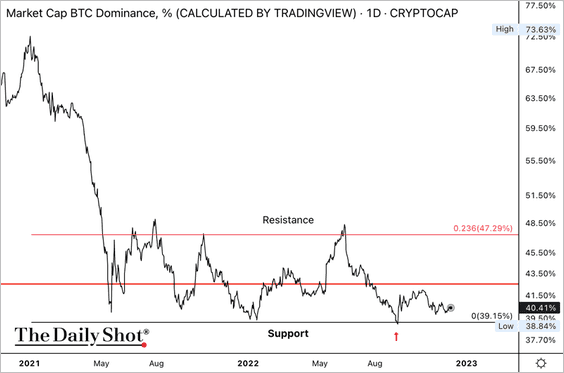

4. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) is testing support. A rise in the dominance ratio typically signals risk-off conditions.

5. The Grayscale Bitcoin Trust discount to NAV continues to widen.

Investors are getting impatient.

Source: @Burtonkathy, @markets Read full article

Source: @Burtonkathy, @markets Read full article

Back to Index

Commodities

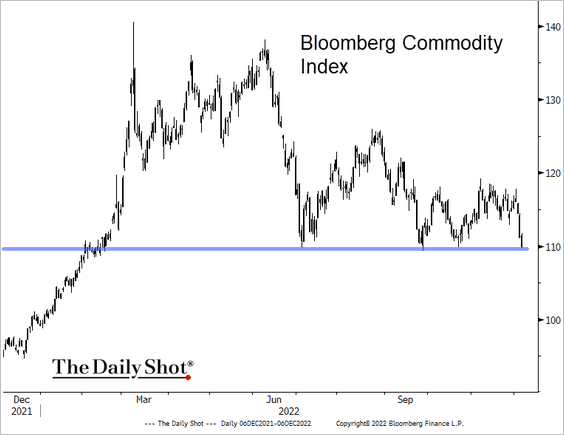

1. Bloomberg’s broad commodity Index is testing support again.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

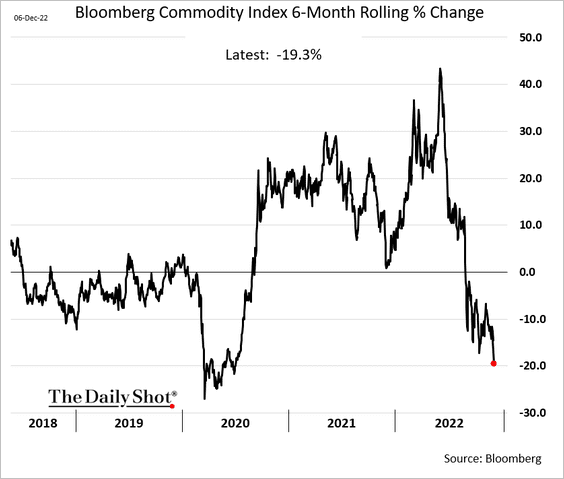

• The index is down 19% over the past six months.

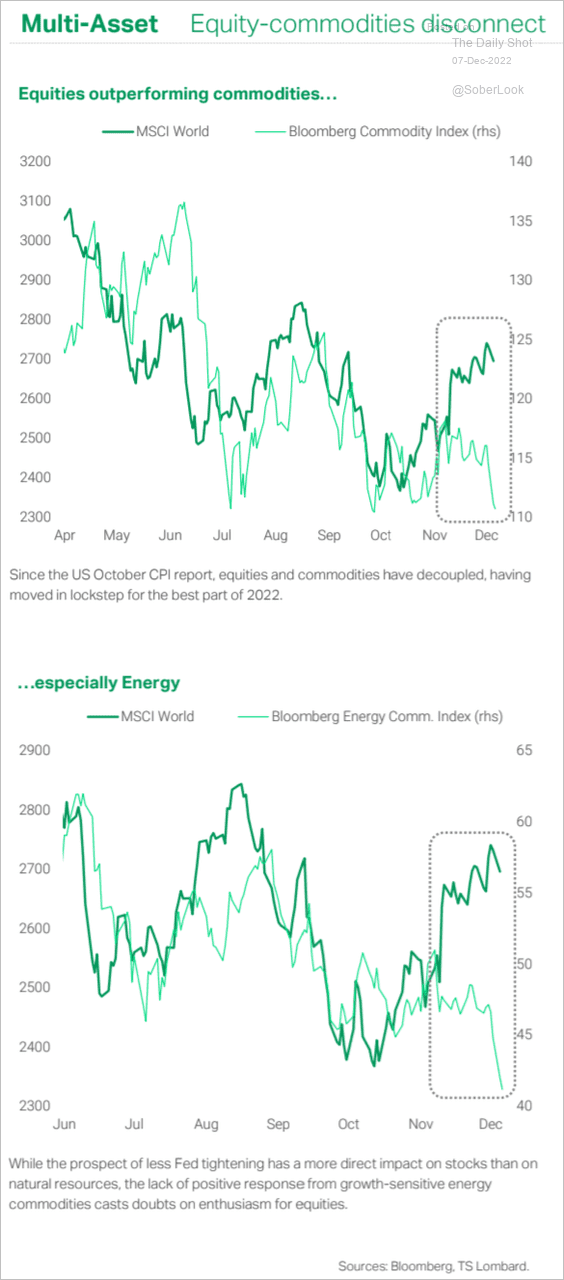

• Commodities have been underperforming equities.

Source: TS Lombard

Source: TS Lombard

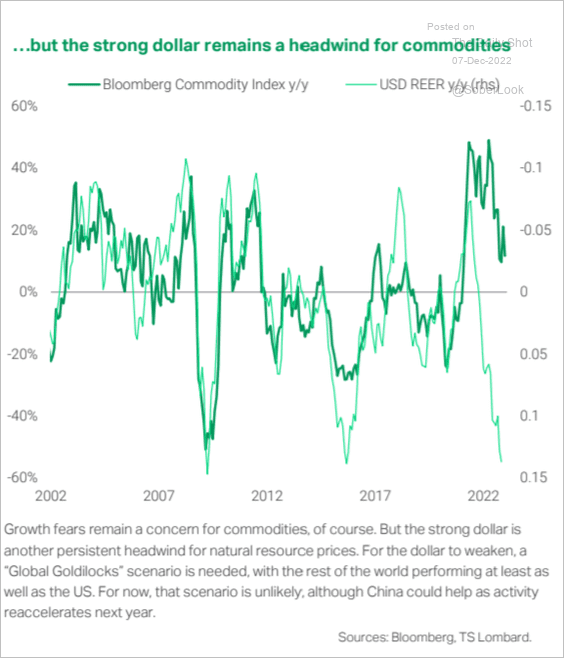

• The dollar’s strength remains a headwind for commodities.

Source: TS Lombard

Source: TS Lombard

——————–

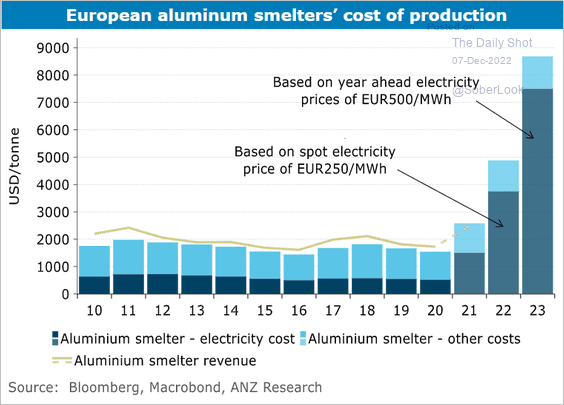

2. Industrial metals production costs have been surging.

Source: @ANZ_Research

Source: @ANZ_Research

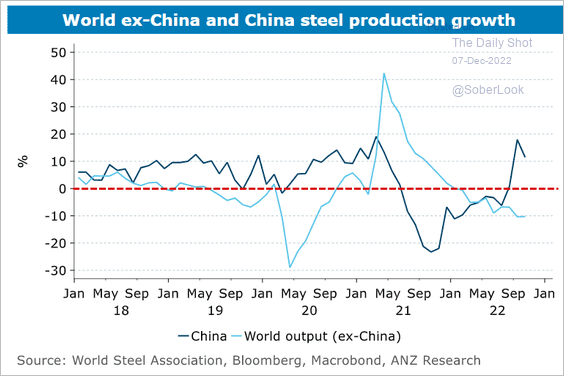

3. Here is the growth rate in global steel output.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

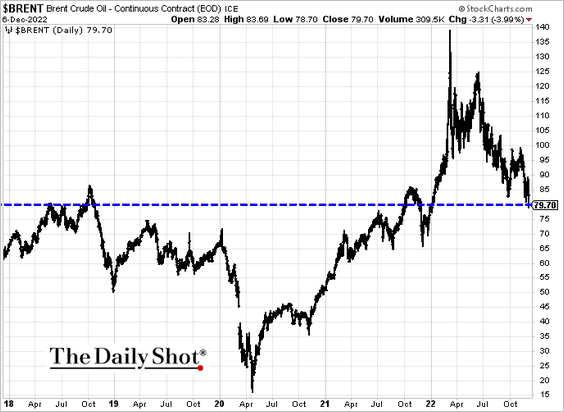

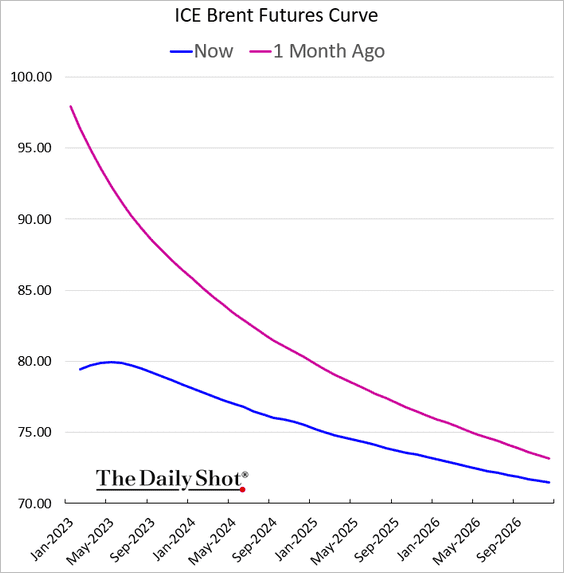

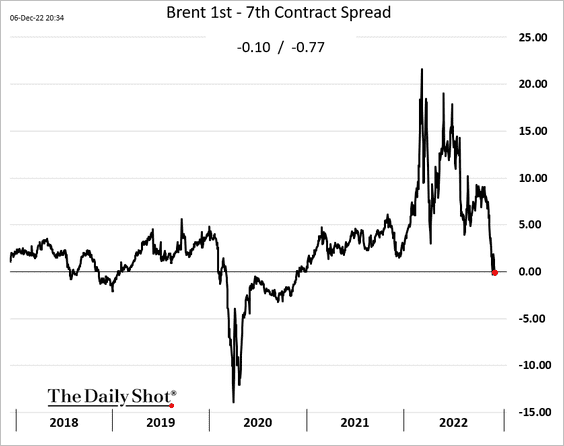

1. Brent is trading below $80/bbl.

The curve is in contango, signaling softer demand.

——————–

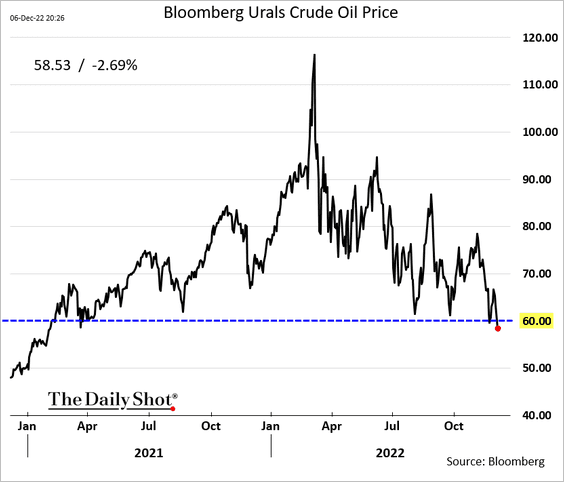

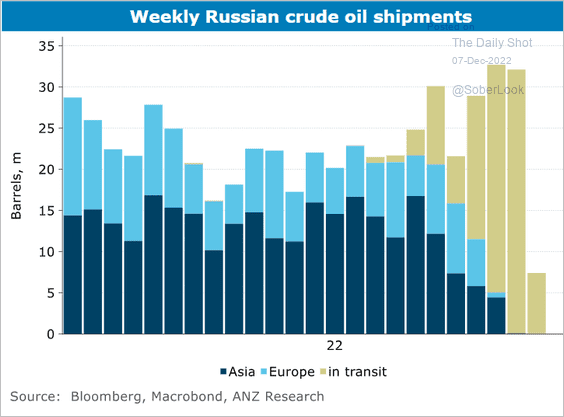

2. The G7’s $60 cap on Russian oil will have no immediate effect on sales …

Source: Reuters Read full article

Source: Reuters Read full article

… as prices dip below the cap.

Oil shipments remain robust.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

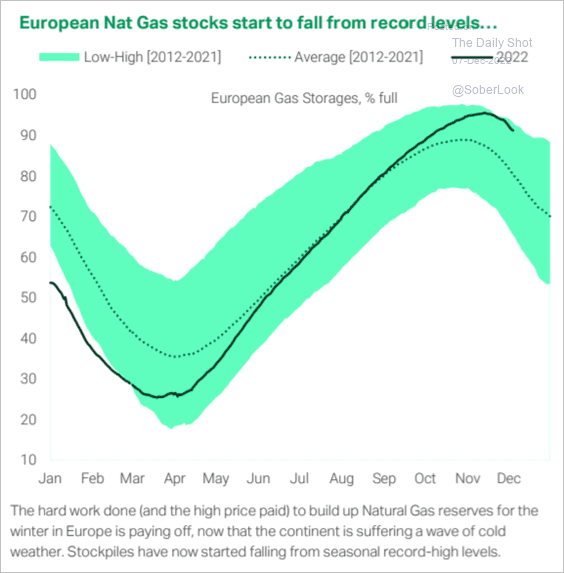

3. European natural gas inventories are off the highs, …

Source: TS Lombard

Source: TS Lombard

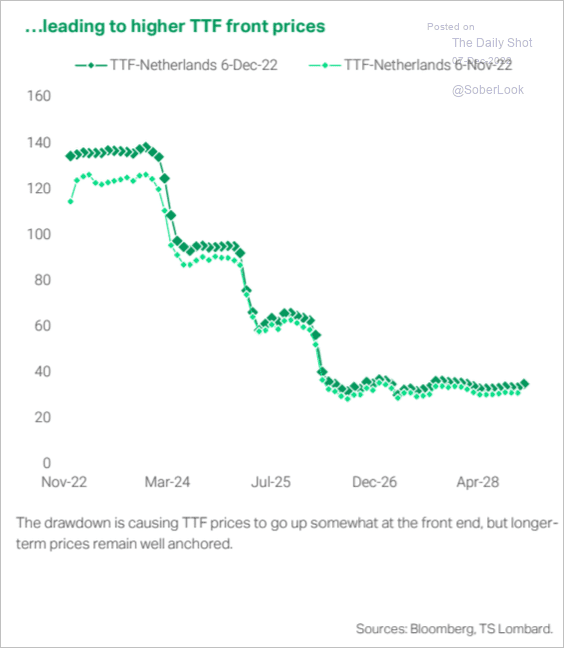

… pushing spot prices higher.

Source: TS Lombard

Source: TS Lombard

Back to Index

Equities

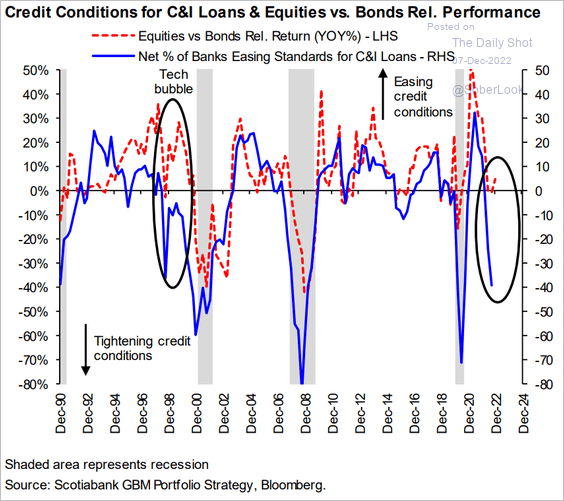

1. Given tighter credit conditions, there is room for equities to underperform bonds.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

2. Morgan Stanley’s leading earnings model points to trouble ahead for stocks.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

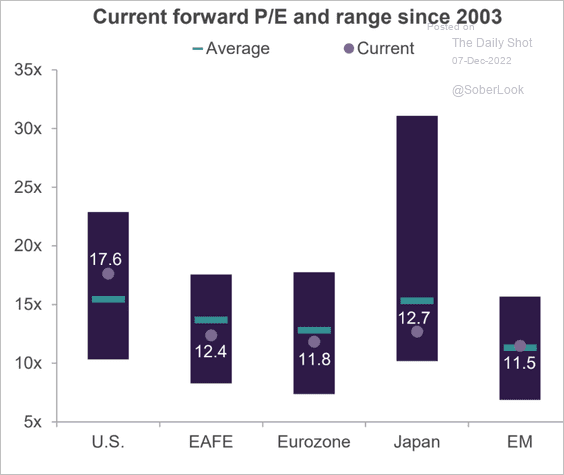

3. Here is the S&P 500 valuation vs. international markets …

Source: Truist Advisory Services

Source: Truist Advisory Services

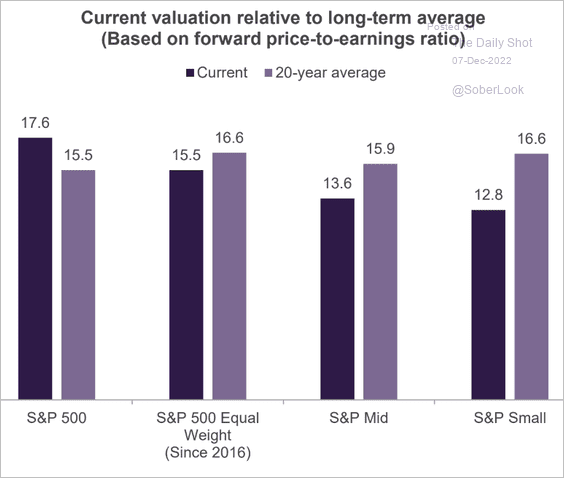

… and mid/small US companies.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

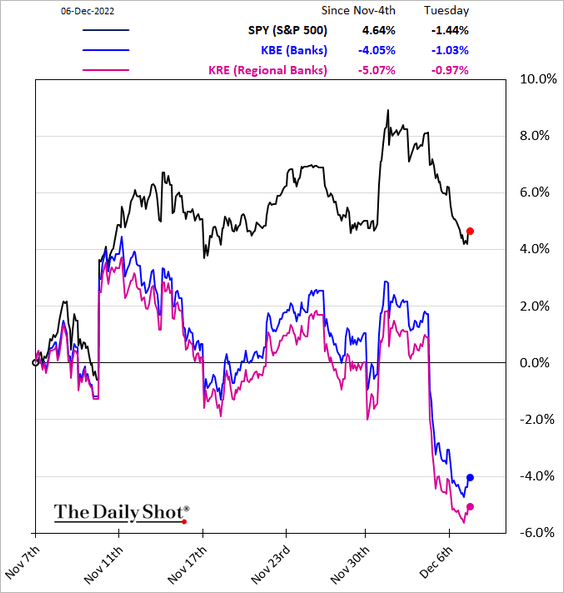

4. Next, we have some sector updates.

• Bank shares are under pressure amid recession concerns (especially regional banks).

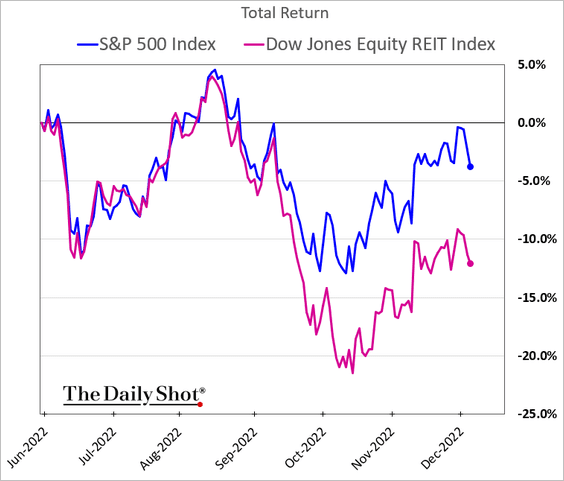

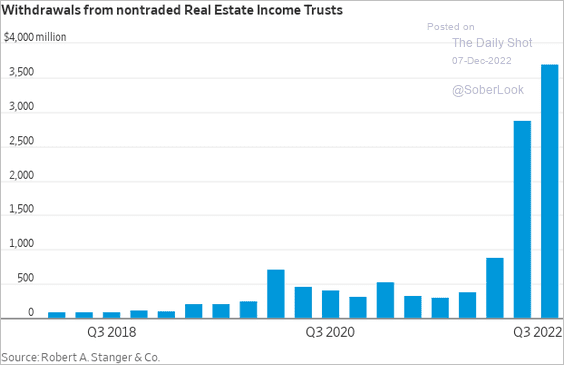

• REITs have been underperforming …

… as investors exit.

Source: @WSJ Read full article

Source: @WSJ Read full article

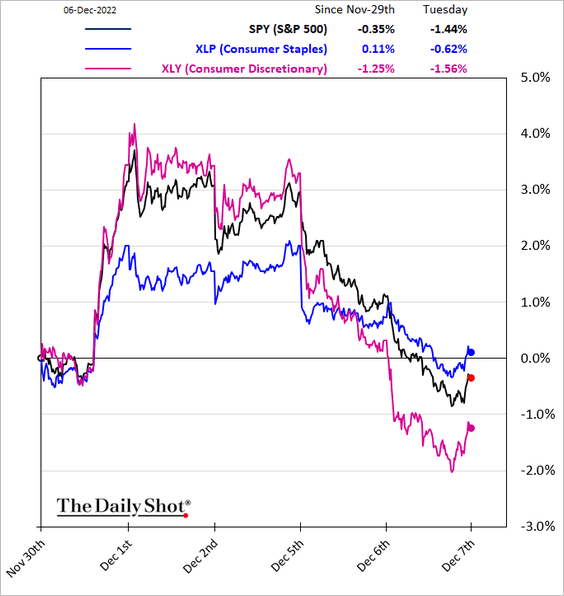

• Consumer discretionary shares are lagging staples again.

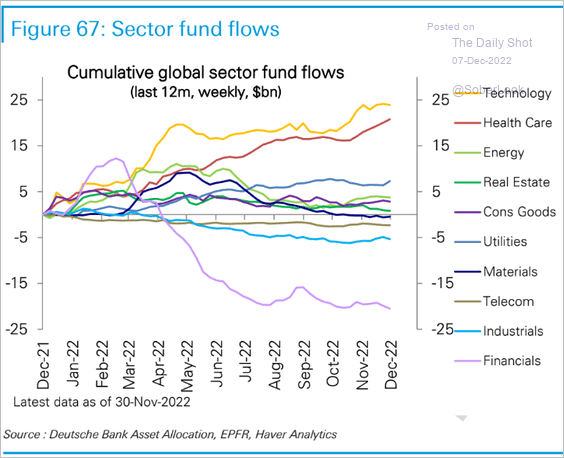

• This chart shows cumulative flows by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

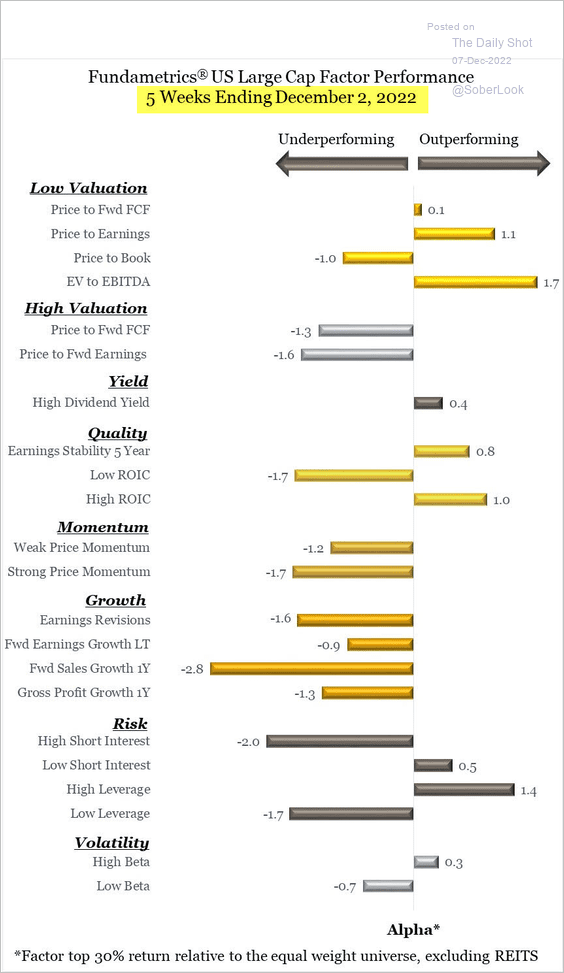

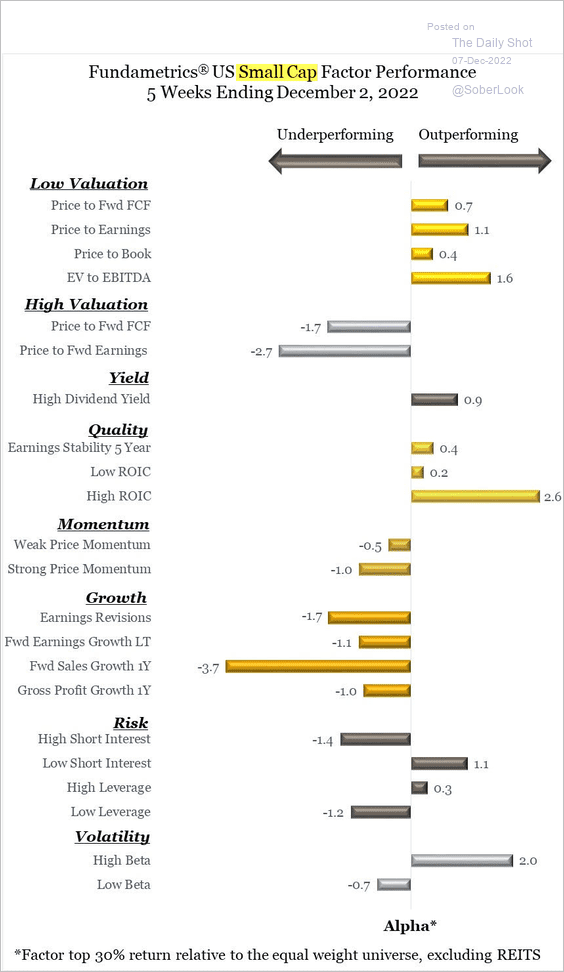

5. How did equity factors perform over the past five weeks?

• Large-caps:

Source: CornerCap Institutional

Source: CornerCap Institutional

• Small caps:

Source: CornerCap Institutional

Source: CornerCap Institutional

——————–

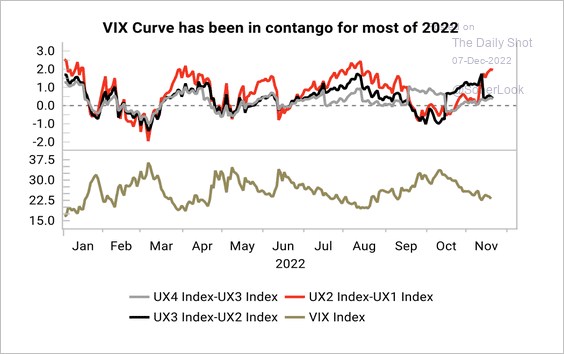

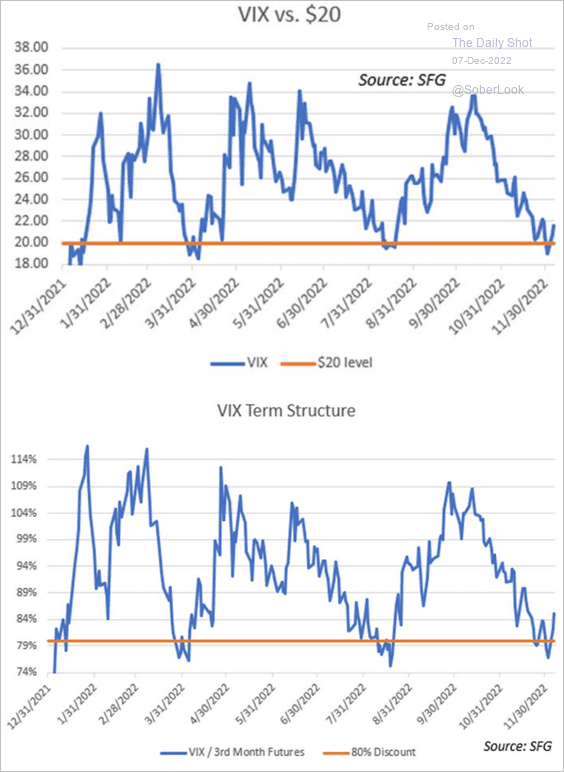

6. Next, we have some updates on volatility markets.

• The VIX curve has been below 40, and mostly in contango this year. Short-vol strategies benefitted from a positive roll effect (selling long-term and buying short-term), according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

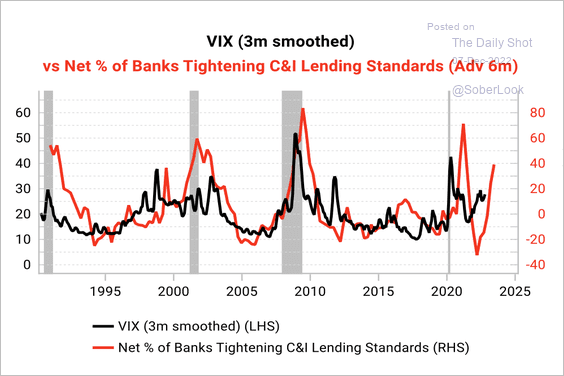

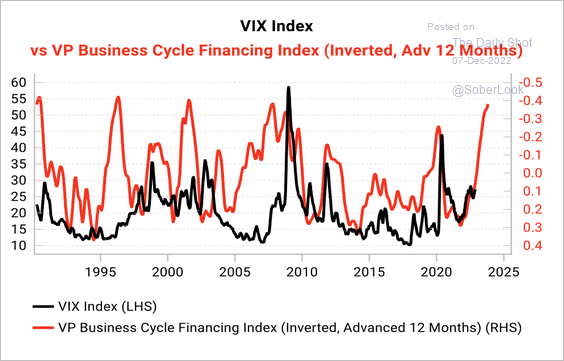

• However, a turn in the credit cycle could signal more volatility ahead. (2 charts)

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

• VIX and VIX curve are bouncing from support levels.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

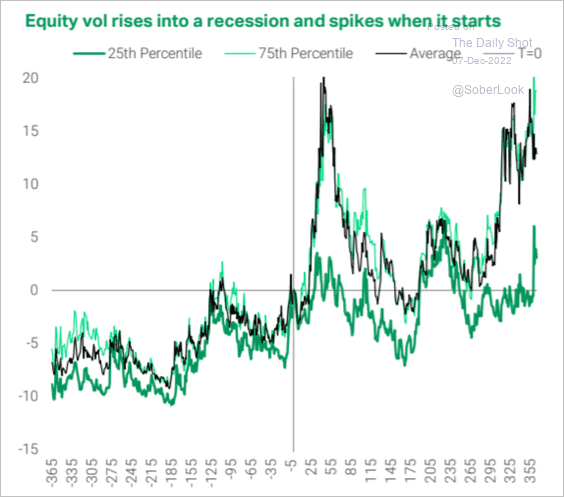

• Recession starts tend to boost volatility.

Source: TS Lombard

Source: TS Lombard

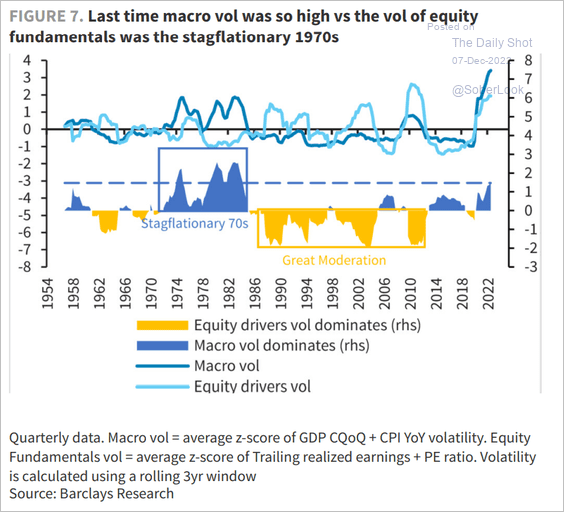

• Equity vol has been lagging macro volatility.

Source: Barclays Research

Source: Barclays Research

Back to Index

Credit

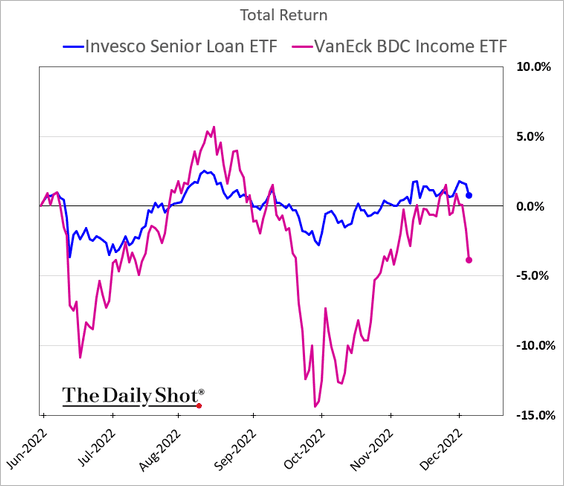

1. BDCs are under pressure again.

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

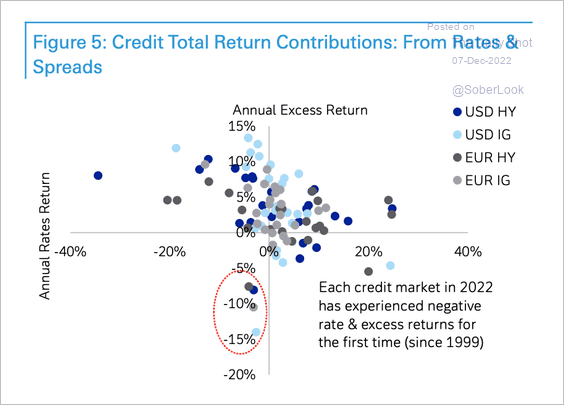

2. US and European credit markets experienced negative absolute and excess returns this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

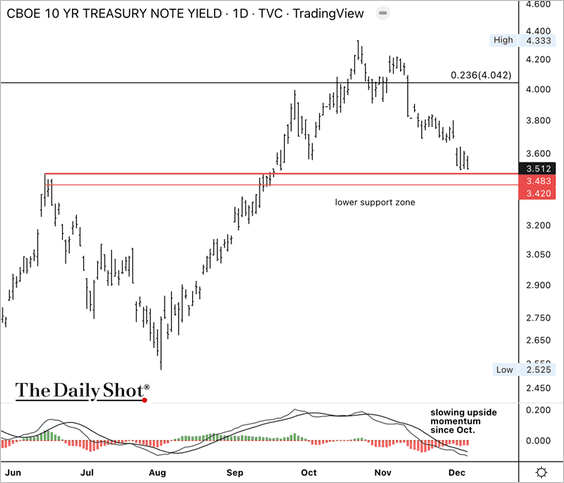

1. The 10-year Treasury yield is testing short-term support, but upside momentum has faded.

2. Central banks’ liability costs have been surging with rate hikes.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

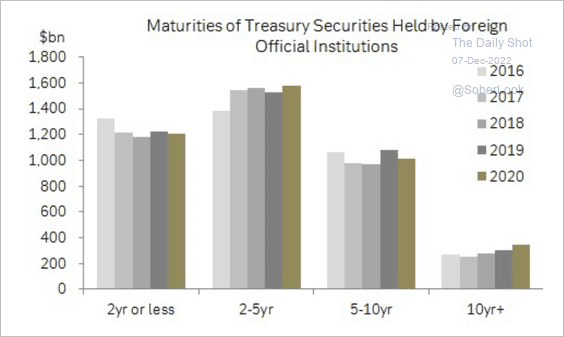

3. There is a concentration of Treasury holdings in two-to-five-year maturities among non-US institutions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

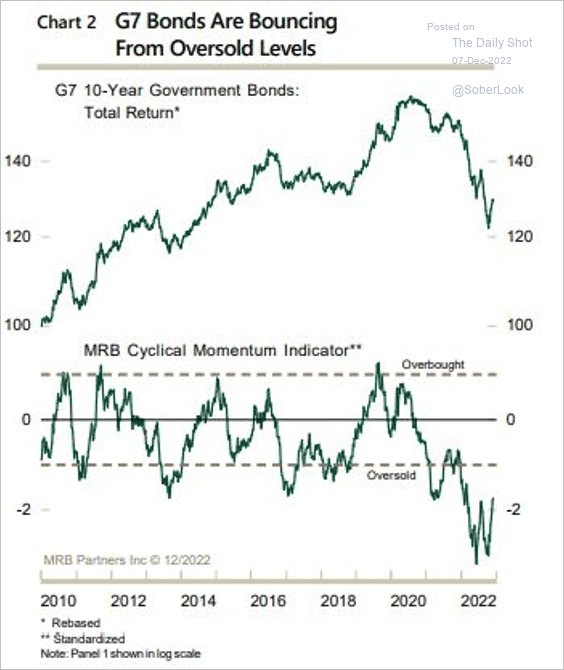

4. G7 sovereign bonds are rising from deeply oversold levels.

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

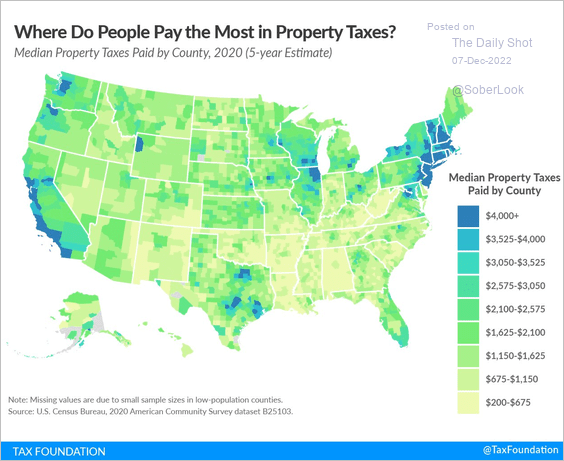

1. Property taxes by county:

Source: @TaxFoundation, @janellefritts Read full article

Source: @TaxFoundation, @janellefritts Read full article

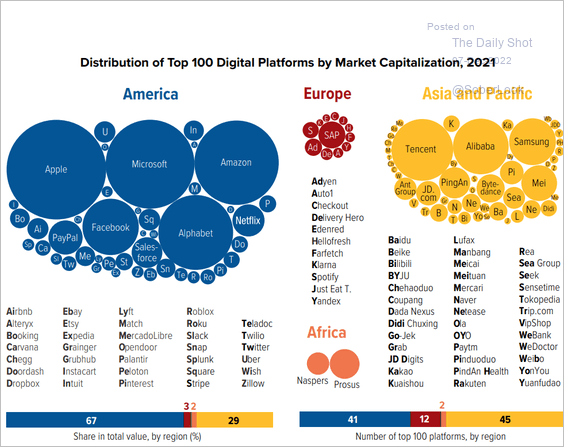

2. Digital platforms:

Source: Atlantic Council Read full article

Source: Atlantic Council Read full article

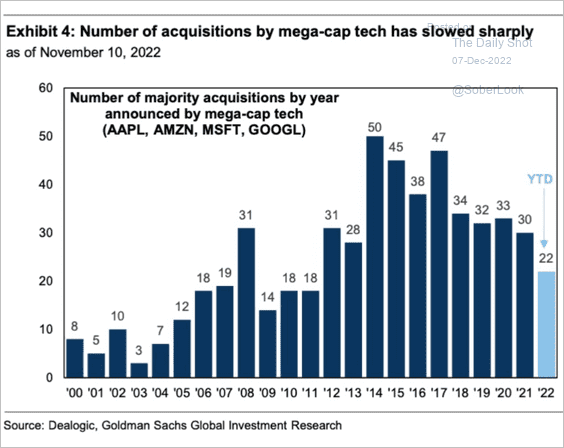

3. Acquisitions by tech mega-cap firms:

Source: @acemaxx, @GoldmanSachs, @YahooFinance Read full article

Source: @acemaxx, @GoldmanSachs, @YahooFinance Read full article

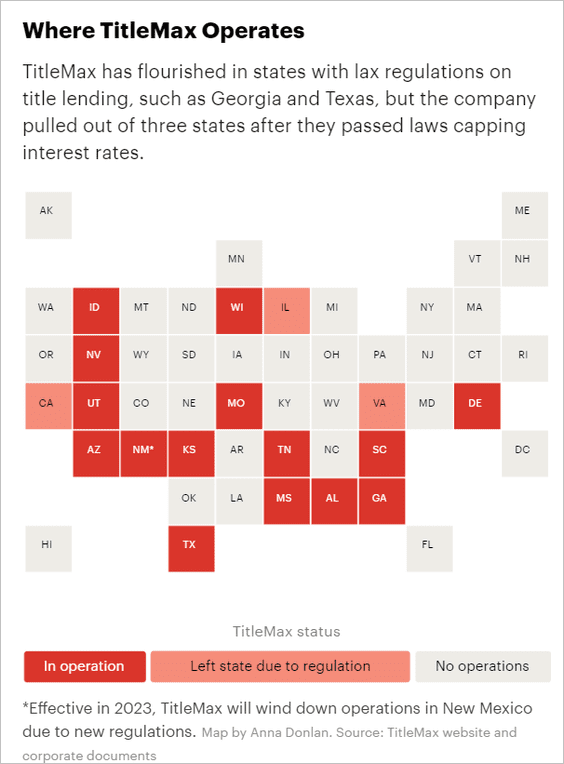

4. Title lending:

Source: Pro Publica Read full article

Source: Pro Publica Read full article

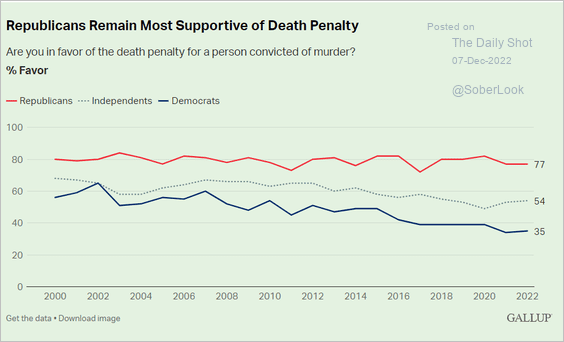

5. Support for the death penalty:

Source: Gallup Read full article

Source: Gallup Read full article

6. Voter turnout around the world:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

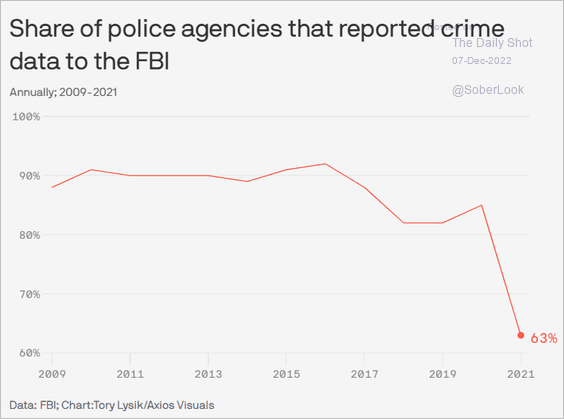

7. Reporting crime data to the FBI:

Source: @axios Read full article

Source: @axios Read full article

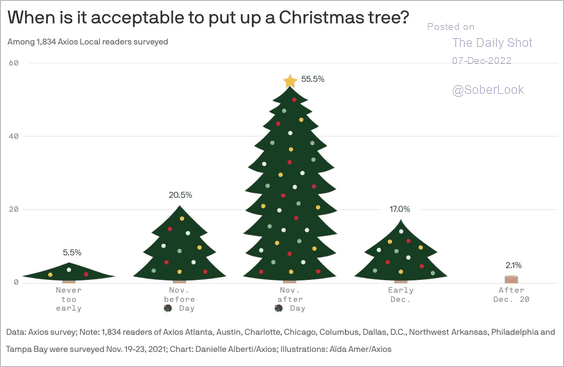

8. How early is too early to put up a Christmas tree?

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index