The Daily Shot: 09-Dec-22

• The United States

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Food for Thought

The United States

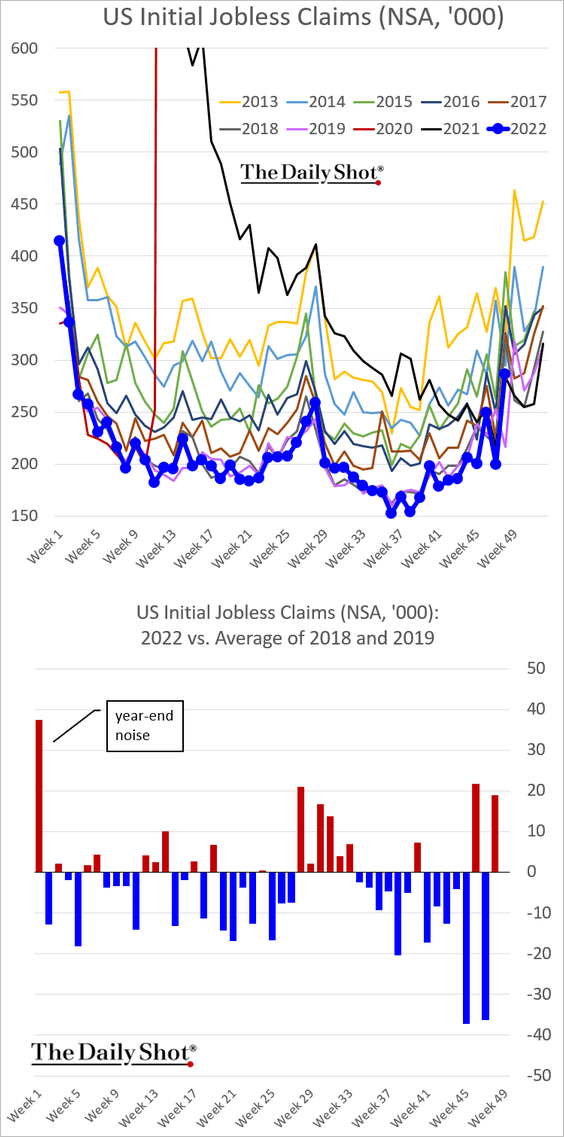

1. Let’s begin with the labor market.

• Initial jobless claims rose above the pre-COVID levels last week.

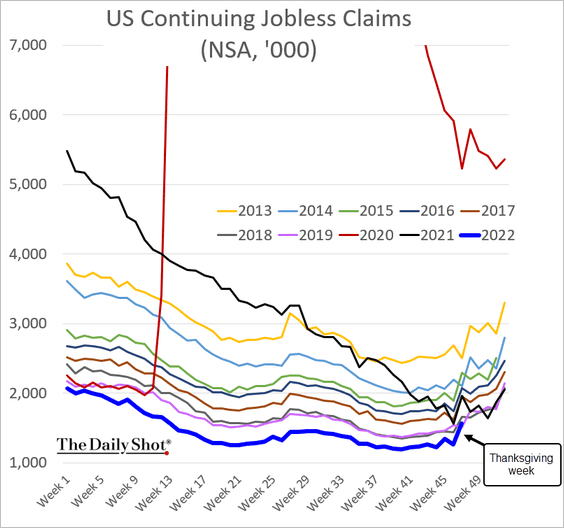

Continuing claims (which are on a one-week lag) moved sharply higher during the week of Thanksgiving (which tends to be noisy).

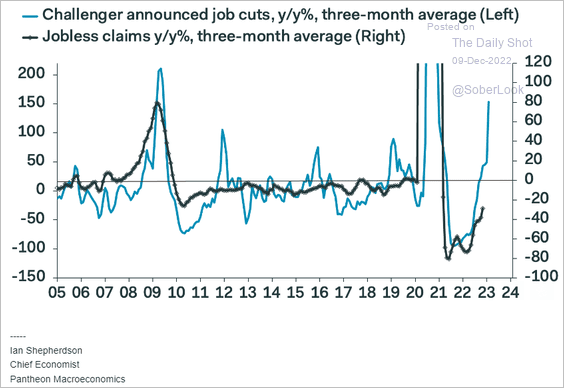

• Elevated layoffs point to higher jobless claims ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

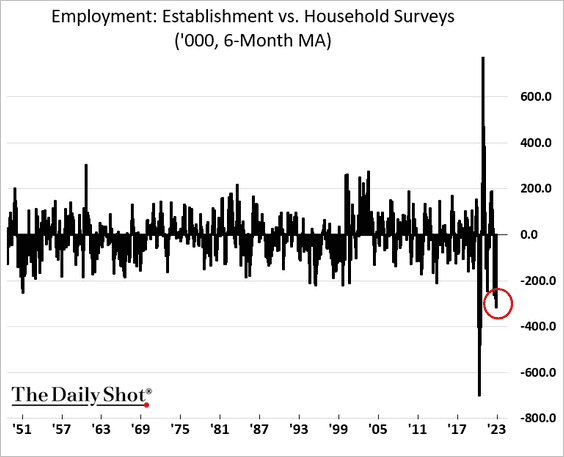

• The recent gap between the Establishment Survey (the official employment report) and the Household Survey has widened sharply. Some view this divergence as a signal of trouble in the labor market (link below).

Further reading

Further reading

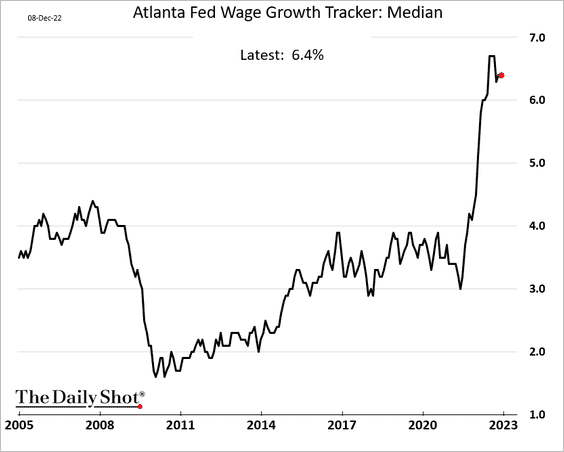

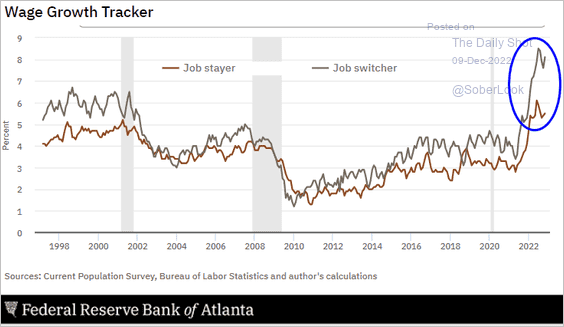

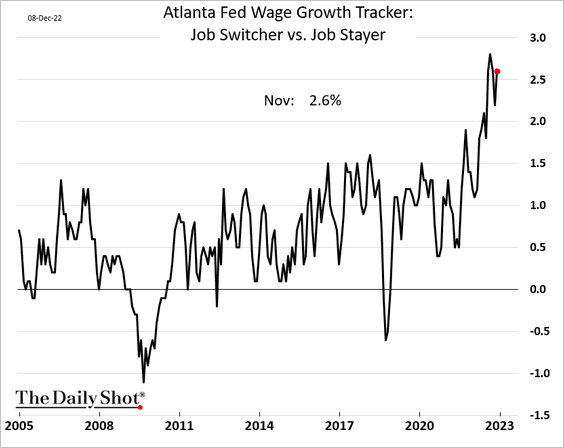

• Wage growth is holding near multi-decade highs.

The massive divergence between wage growth for job switchers and job stayers is troubling because it signals an imbalance in the labor market (2 charts). Demand for labor remains extreme, suggesting that the Fed may need to tighten policy more than expected.

Source: @AtlantaFed

Source: @AtlantaFed

——————–

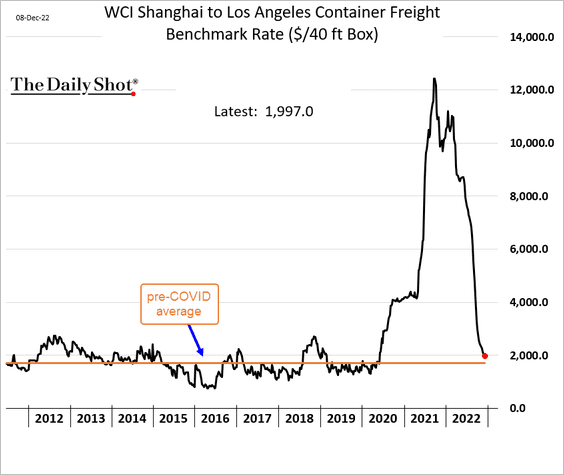

2. Container shipping costs are near the pre-COVID average.

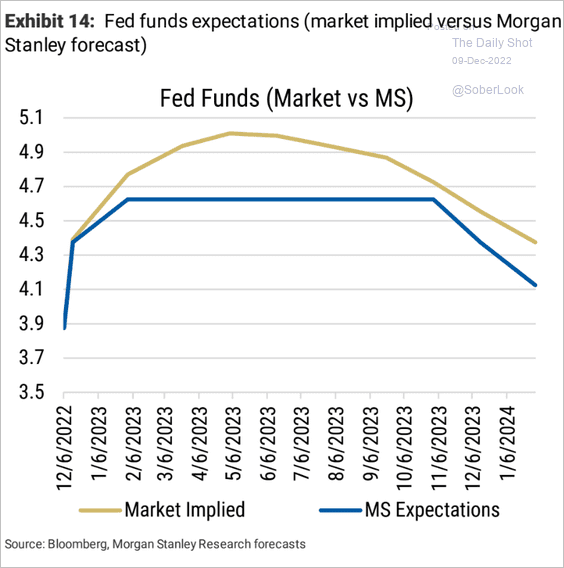

3. Morgan Stanley sees the Fed’s rate hiking cycle ending after 50 bps next week and another 25 bps in February.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

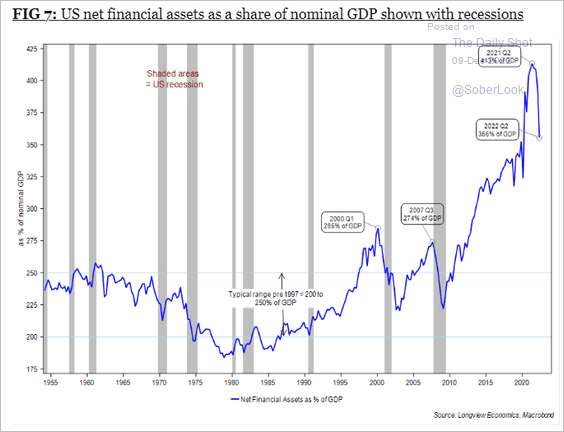

4. Financial assets as a share of GDP remain elevated.

Source: Longview Economics

Source: Longview Economics

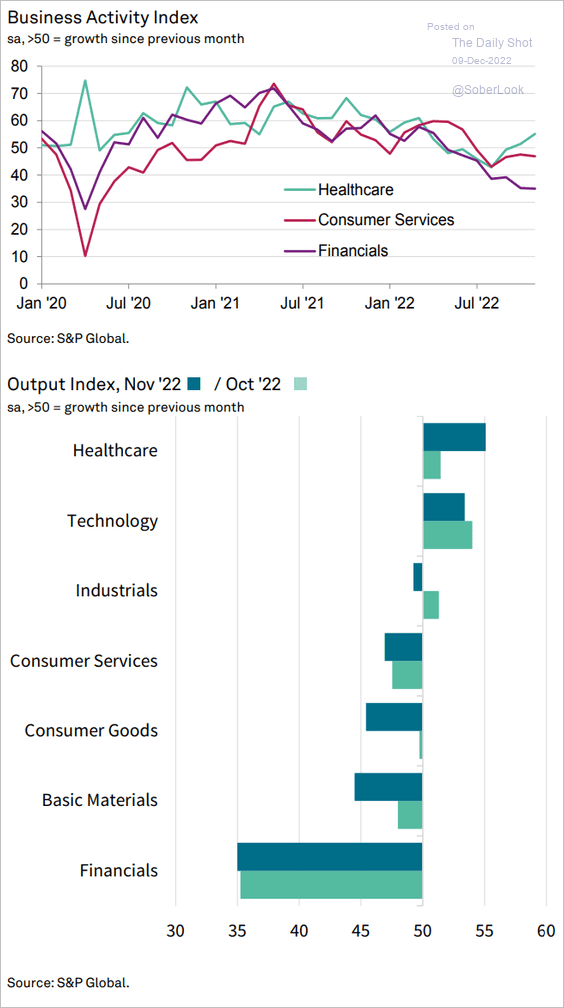

5. Which sectors saw declines in business activity last month?

Source: S&P Global PMI

Source: S&P Global PMI

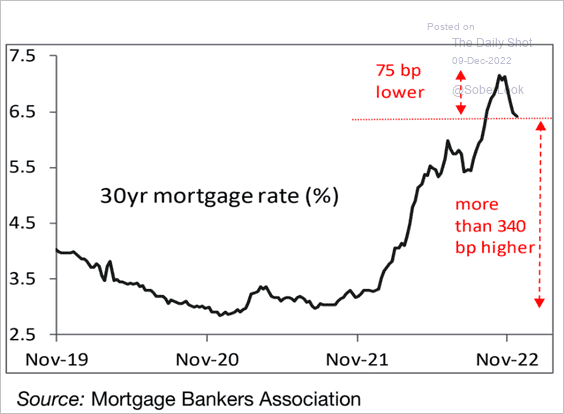

6. Finally, we have some updates on the housing market.

• Mortgage rates have been moving lower.

Source: Piper Sandler

Source: Piper Sandler

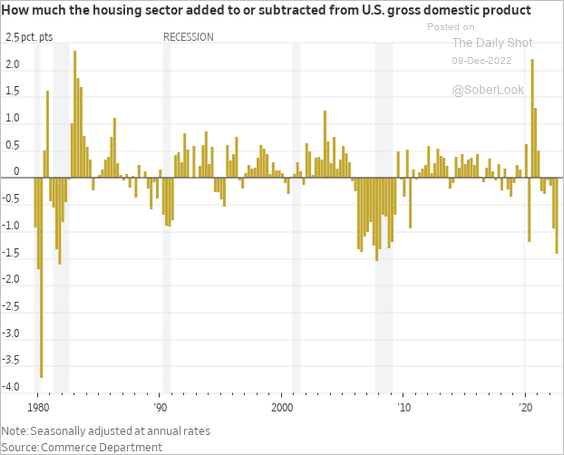

• The housing sector has been a substantial drag on the GDP.

Source: @WSJ Read full article

Source: @WSJ Read full article

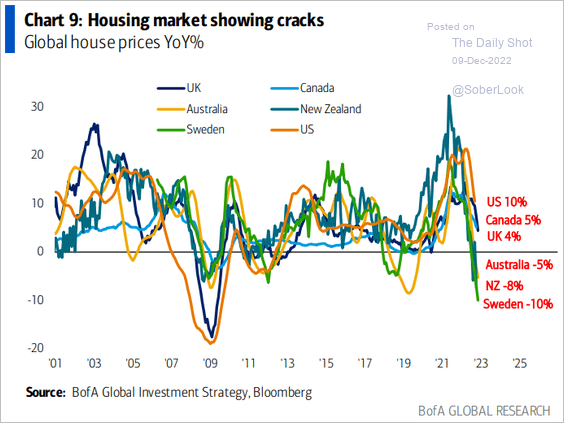

• The housing market has been holding up better in the US than in other advanced economies.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

The Eurozone

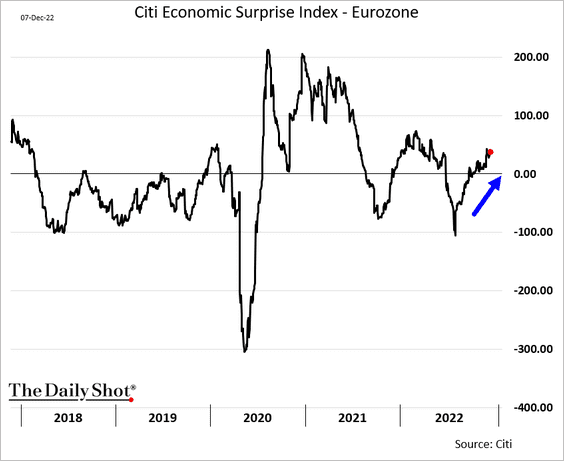

1. The Citi Economic Surprise Index has been recovering.

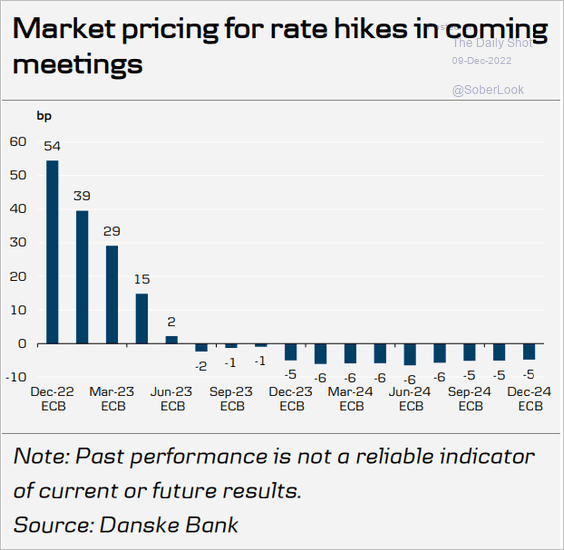

2. Here is what the market is pricing in for ECB rate changes.

Source: Danske Bank

Source: Danske Bank

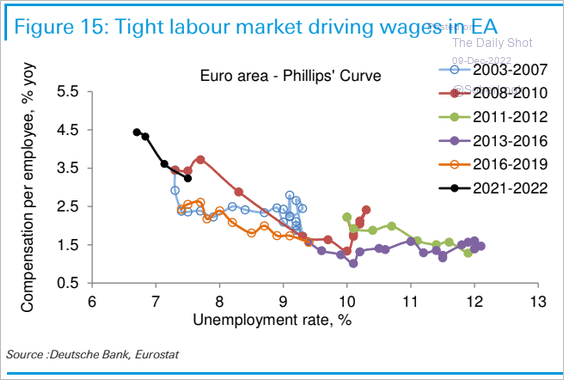

3. The Eurozone’s tight labor market has been pushing wages higher.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

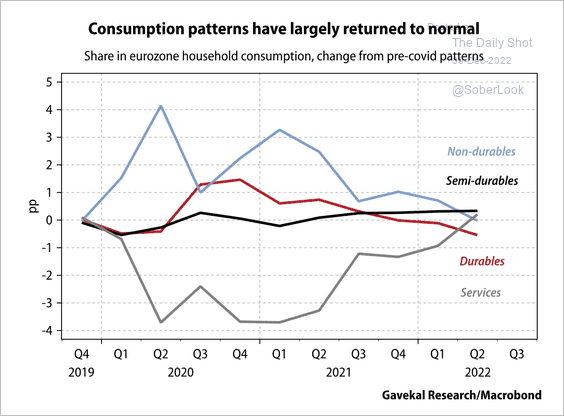

4. There has been a rebound in service spending over the past year.

Source: Gavekal Research

Source: Gavekal Research

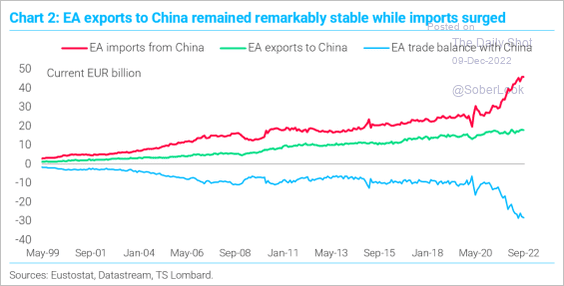

5. Here is the Eurozone’s trade with China.

Source: TS Lombard

Source: TS Lombard

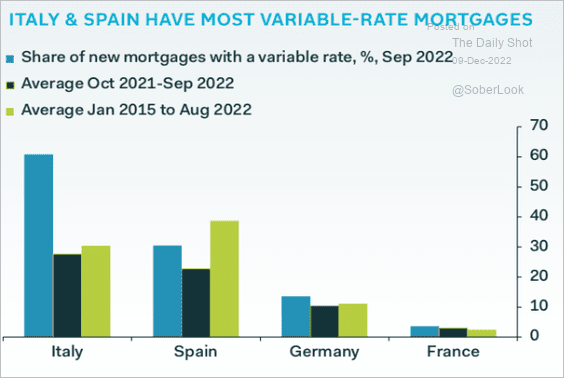

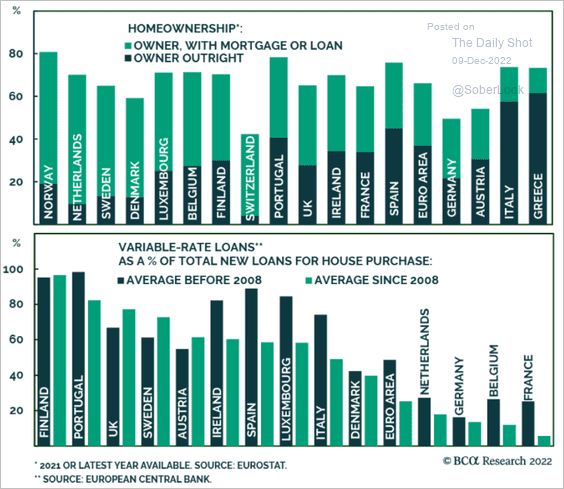

6. Spain has the highest percentage of variable-rate mortgages (exposure to higher rates).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

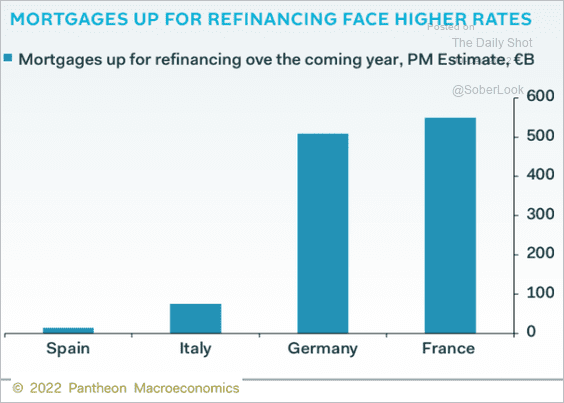

But there are a lot of mortgages coming up for refinancing in Germany and France.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

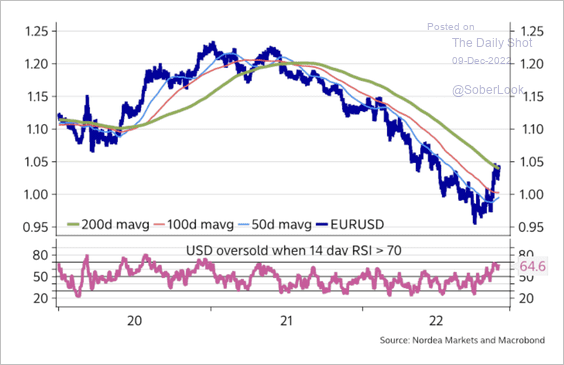

7. EUR/USD appears overbought at resistance.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Europe

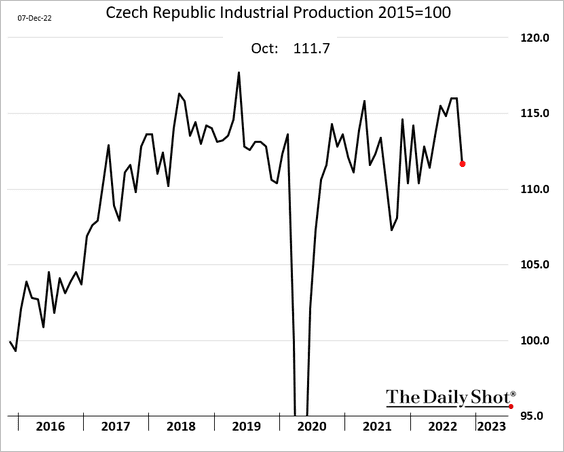

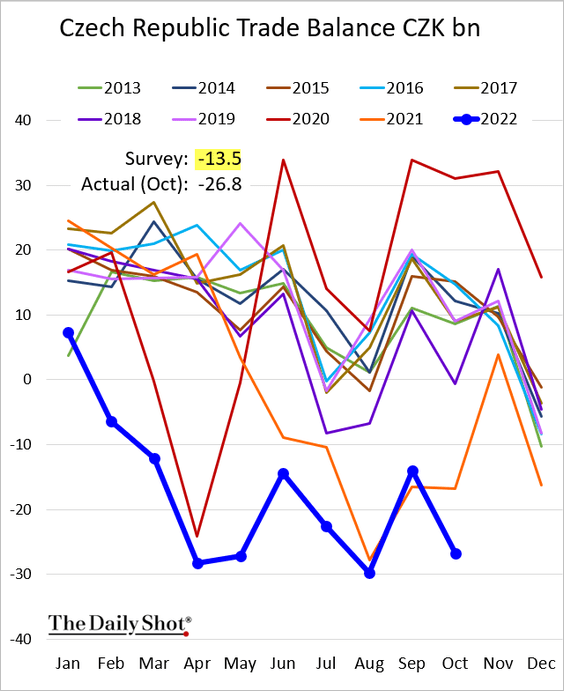

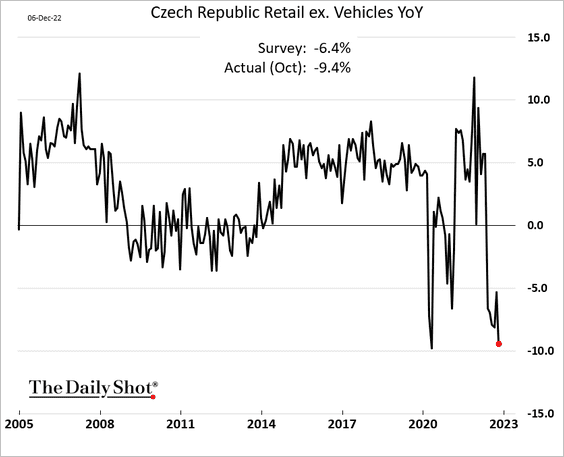

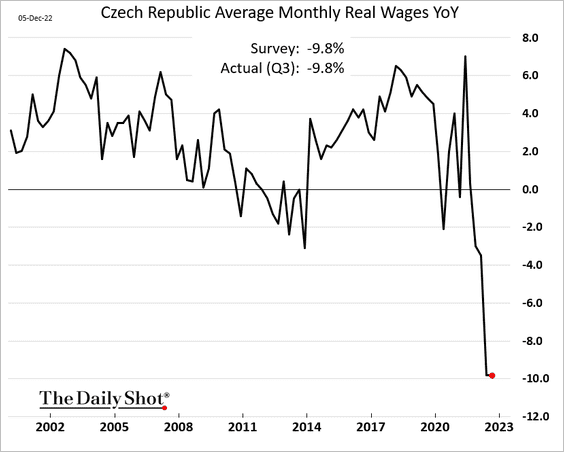

1. Let’s start with some updates on the Czech Republic.

• Industrial production:

• Trade balance:

• Retail sales:

• Real wages:

——————–

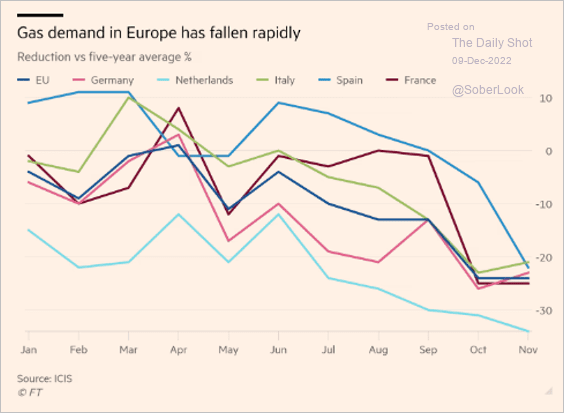

2. Europe’s natural gas demand has been falling.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

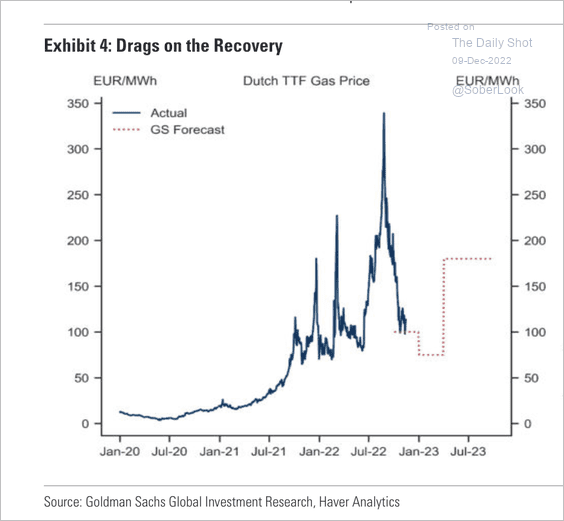

But Goldman expects tensions in the European gas market to re-intensify after winter, leading to higher prices.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

3. Here is more data on homeowners’ exposure to higher rates.

Source: BCA Research

Source: BCA Research

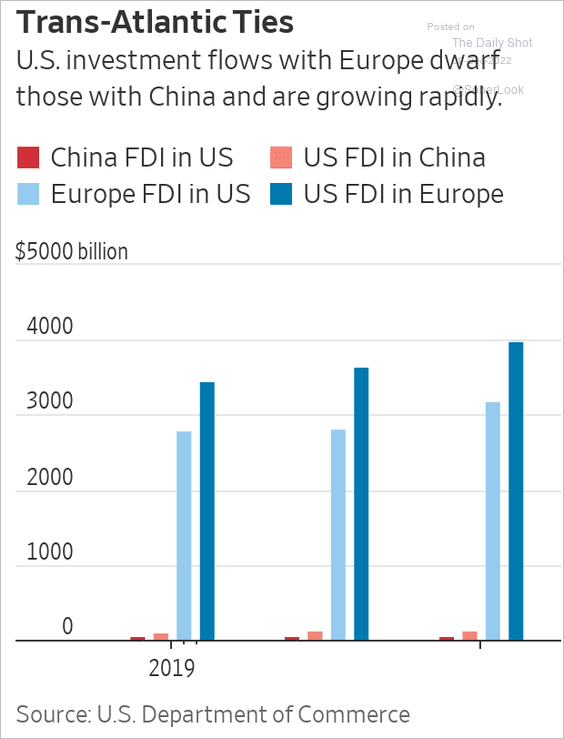

4. The US-Europe foreign direct investment has been rising.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Japan

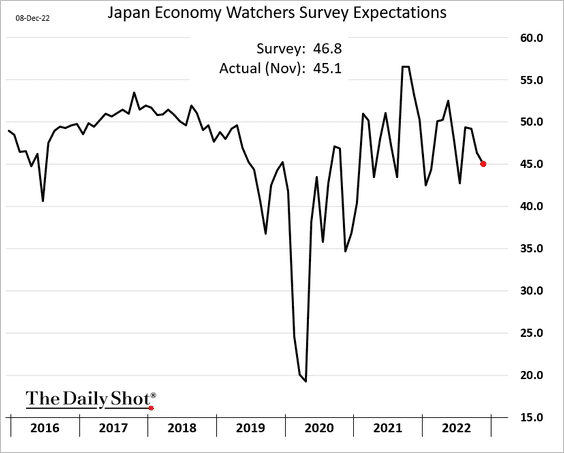

1. The Economy Watchers Expectations index declined again last month.

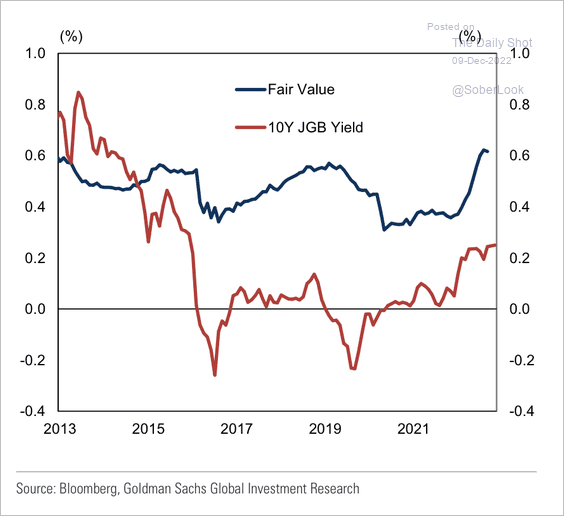

2. The Bank of Japan has suppressed the 10-year government bond yield far below fair value, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

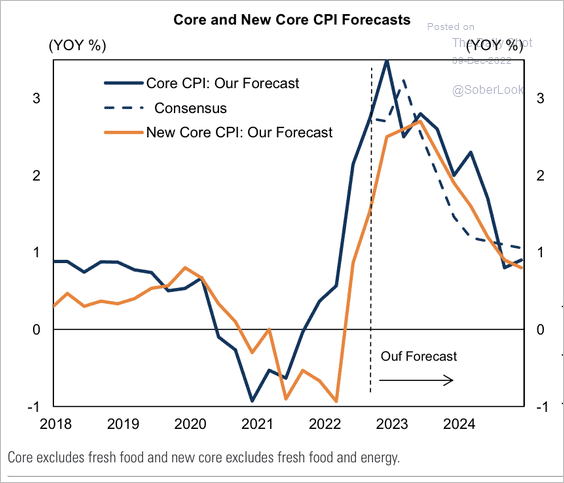

3. Goldman expects Inflation to decelerate.

Source: Goldman Sachs

Source: Goldman Sachs

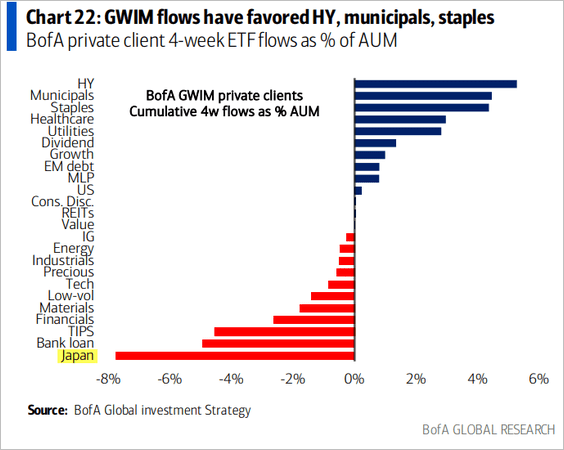

4. Merrill Lynch private clients have been exiting Japanese stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

China

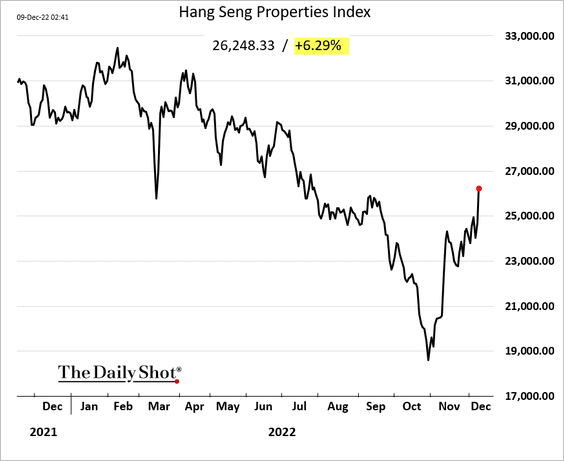

1. Property stocks are surging.

Source: @markets Read full article

Source: @markets Read full article

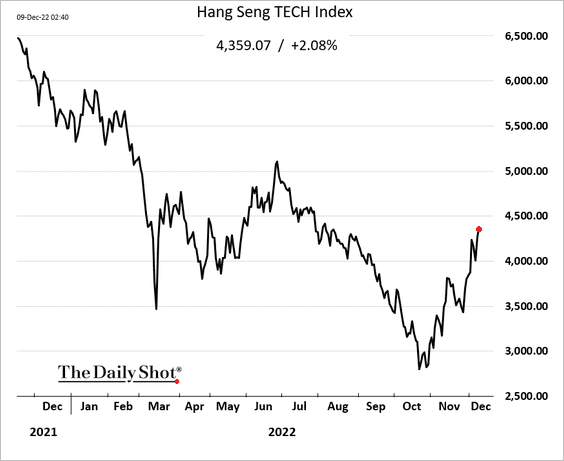

Tech shares continue to rebound.

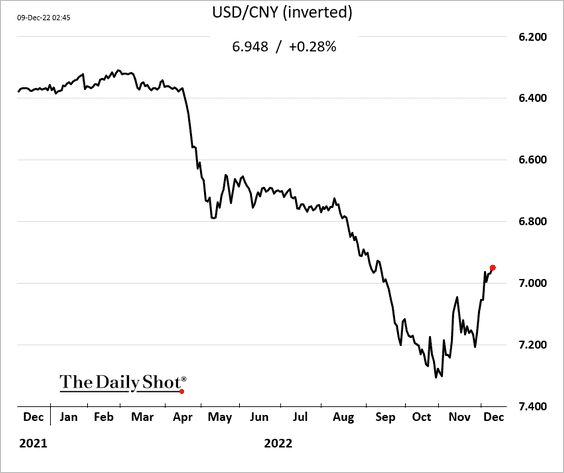

The renminbi is moving higher, …

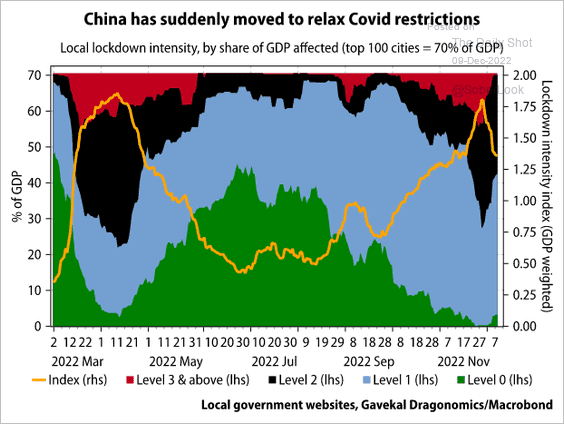

… as lockdowns start to ease.

Source: Gavekal Research

Source: Gavekal Research

——————–

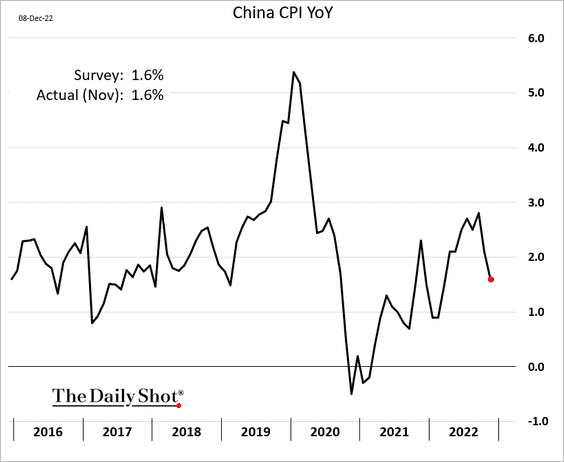

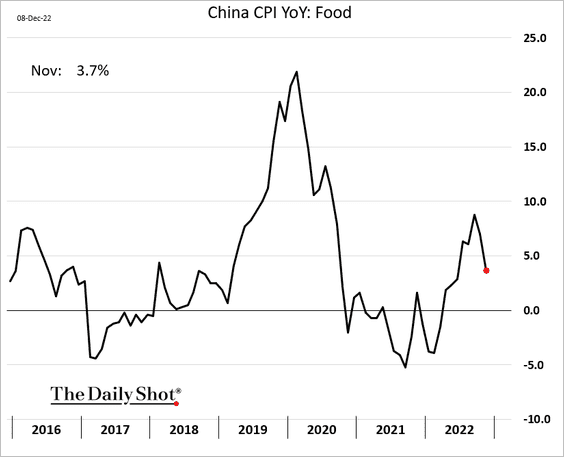

2. Inflation declined again, …

… driven by food CPI.

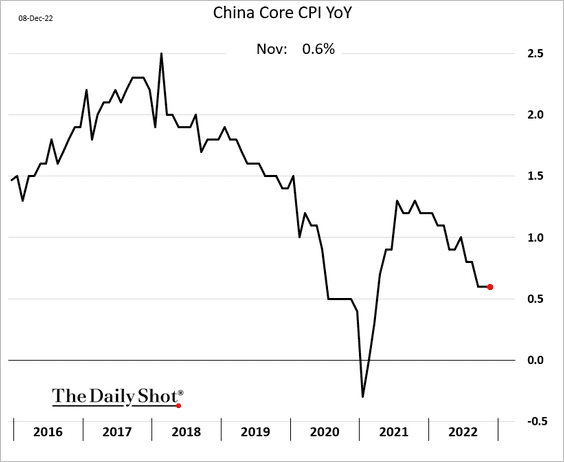

Core inflation held steady last month.

——————–

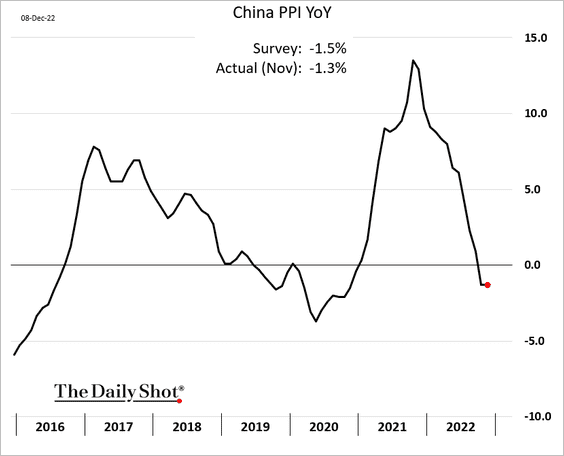

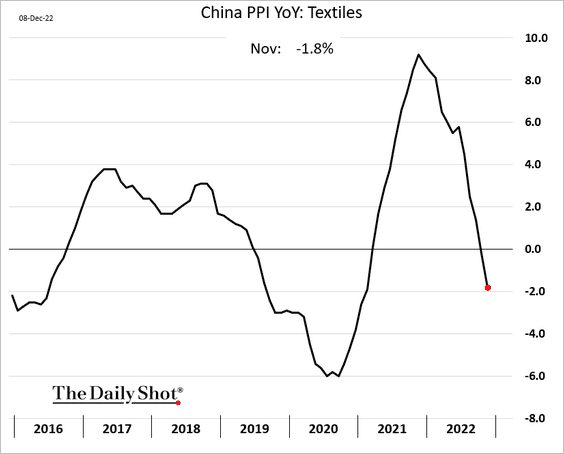

3. The PPI remains in negative territory.

——————–

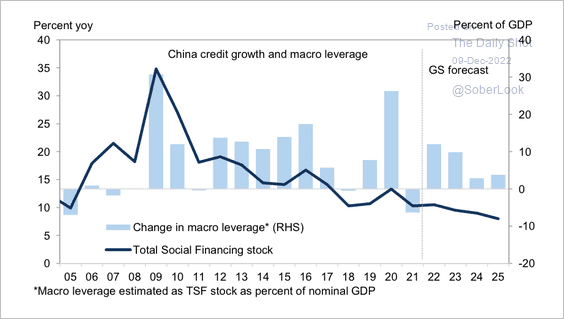

4. Goldman expects China’s monetary policy stance to normalize next year from very accommodative levels. That could weigh on credit growth.

Source: Goldman Sachs

Source: Goldman Sachs

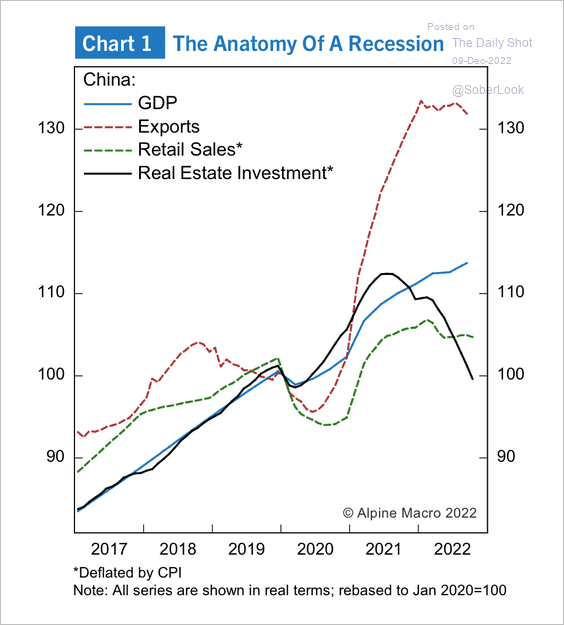

5. Real asset investment deteriorated over the past year.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

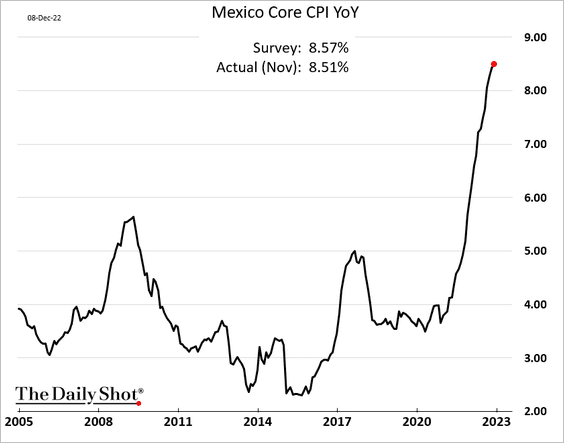

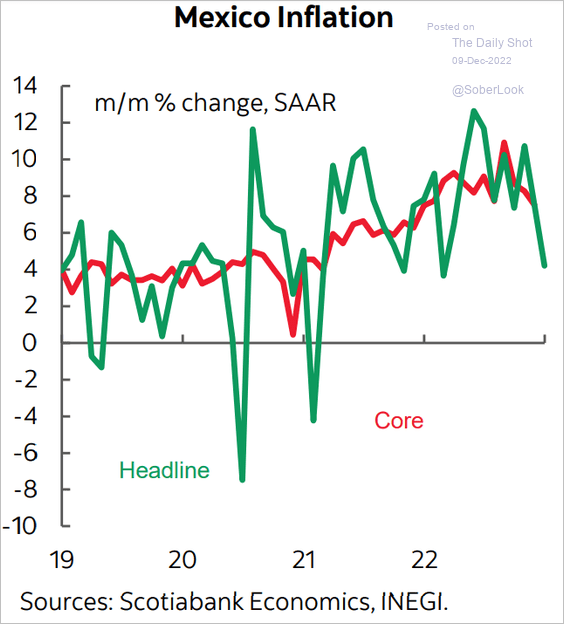

1. Mexican core inflation kept rising last month.

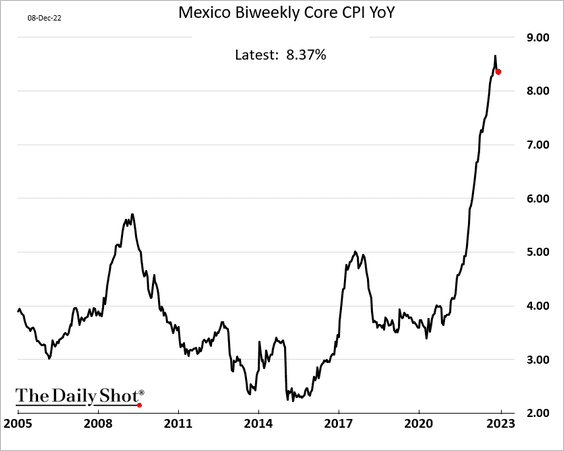

But there are signs inflation is peaking.

• Biweekly CPI:

• Month-over-month CPI:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

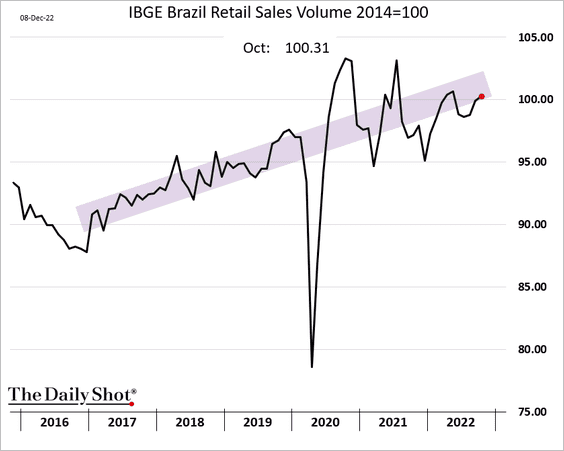

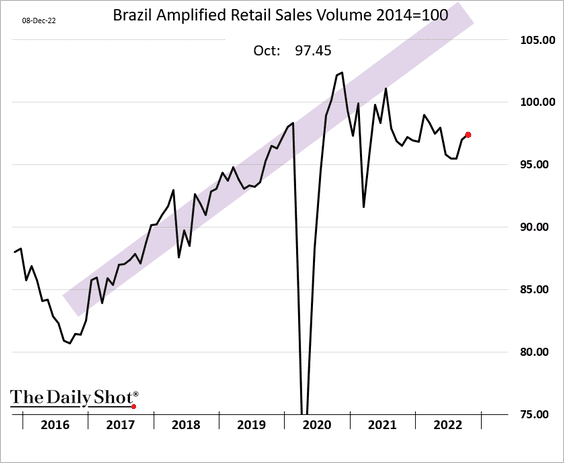

2. Brazil’s real retail sales have been moving higher.

The broad retail sales index is not as upbeat.

——————–

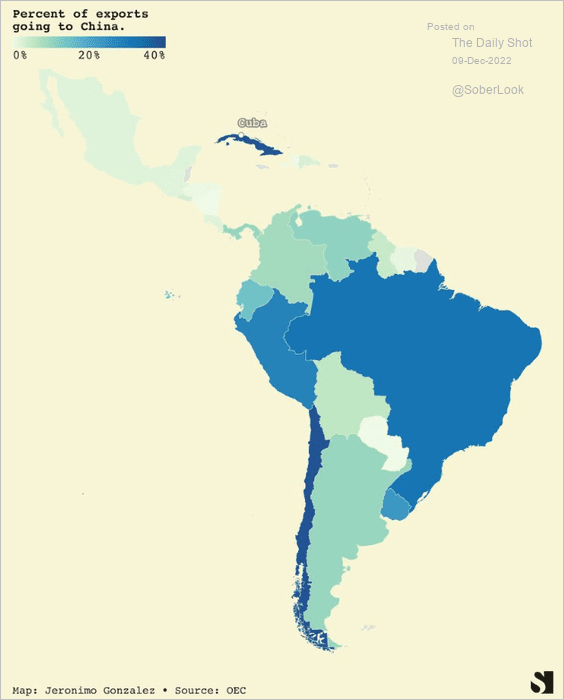

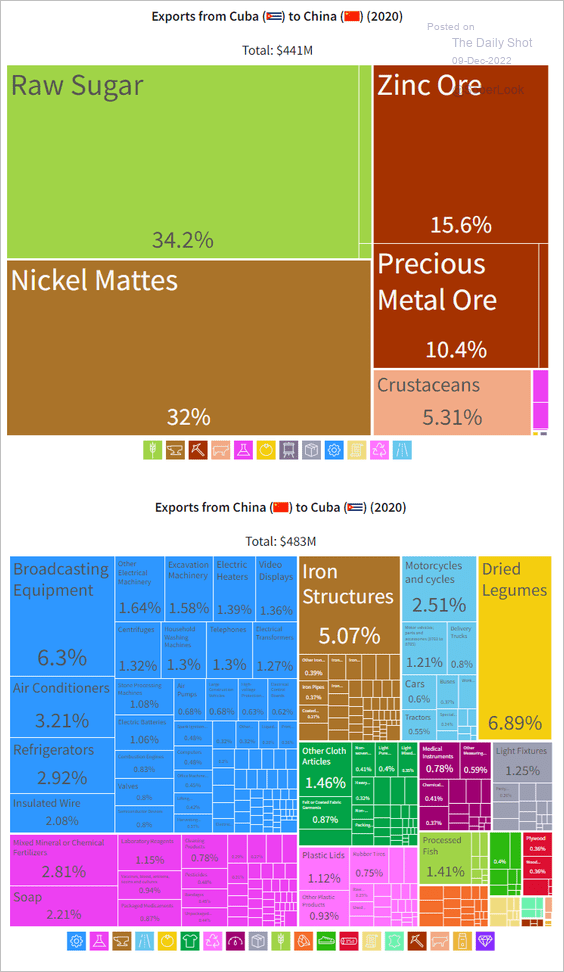

3. Almost 40% of Cuba’s exports go to China – the highest proportion of any LatAm country.

Source: @semafor

Source: @semafor

Here is Cuba’s trade with China.

Source: OECD Read full article

Source: OECD Read full article

——————–

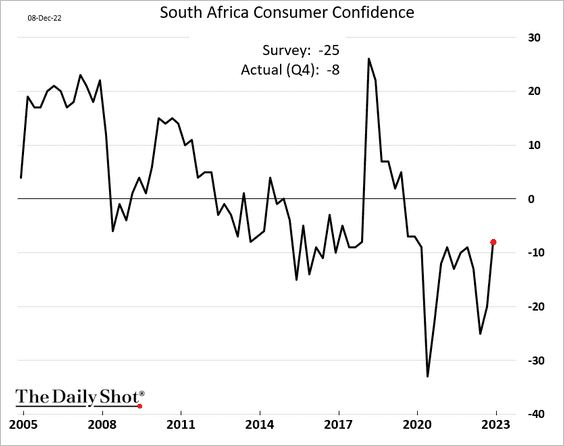

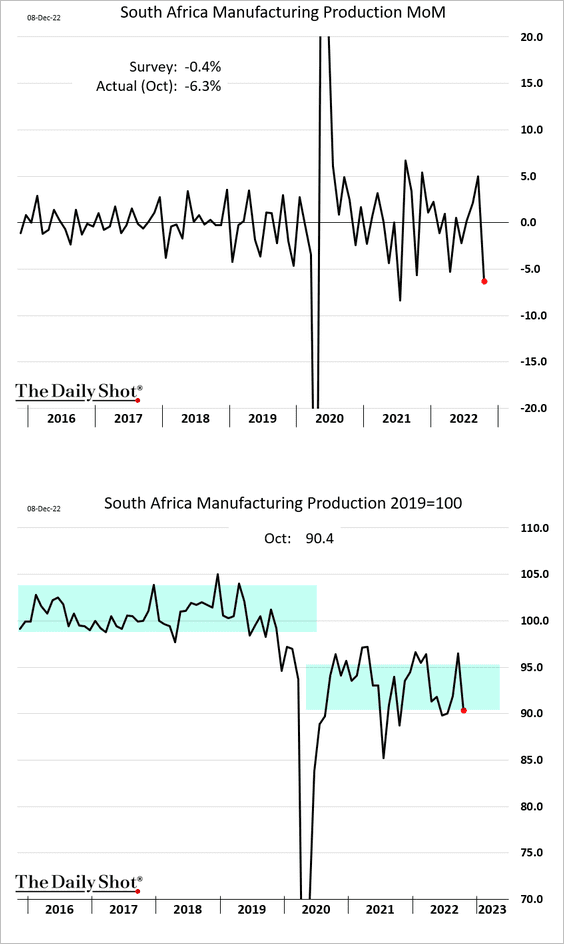

4. South Africa’s consumer confidence jumped this quarter.

Manufacturing production declined in October.

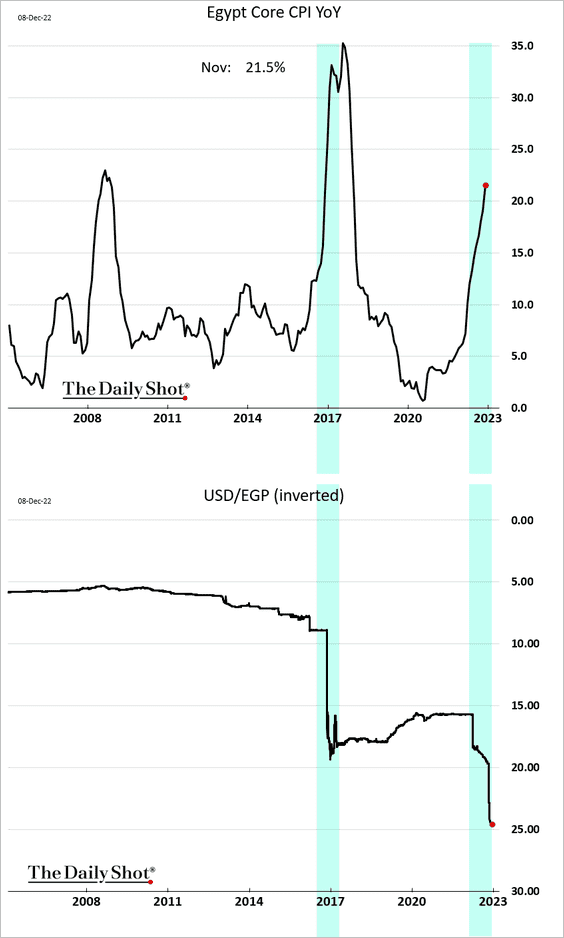

5. The currency devaluation is causing Egypt’s inflation to surge again.

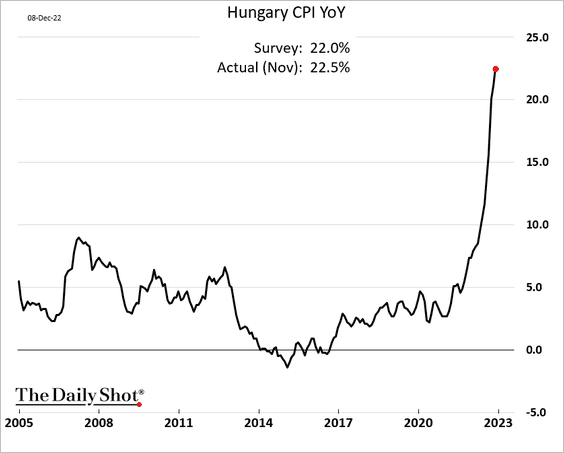

6. The Hungarian CPI is above 22%.

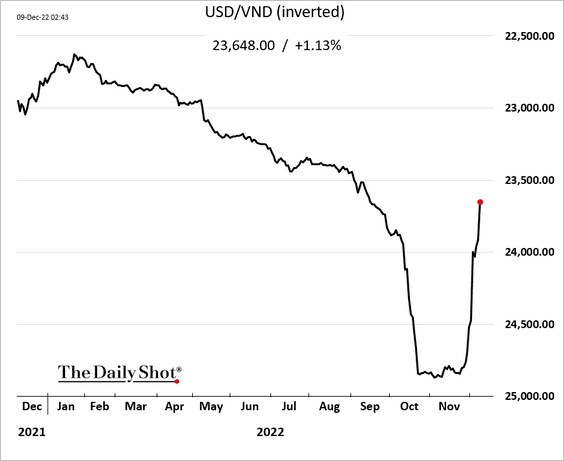

7. The Vietnamese dong is rebounding as foreign capital flows back in (an indirect bet on China’s reopening).

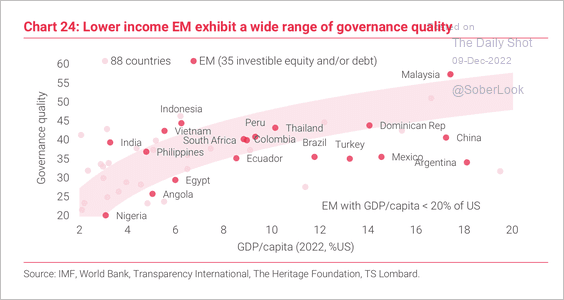

8. Here is a look at governance quality versus GDP per capita.

Source: TS Lombard

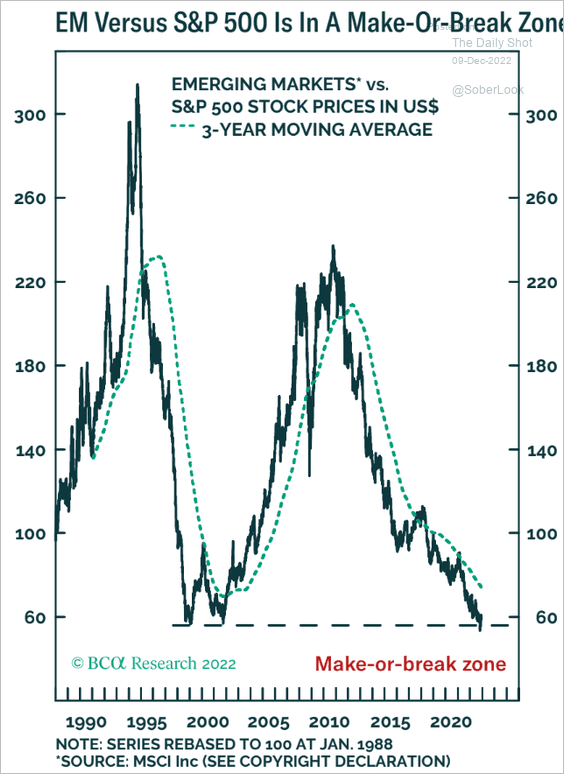

Source: TS Lombard 9. Is EM equity markets’ underperformance vs. the US over?

Source: BCA Research

Source: BCA Research

Back to Index

Cryptocurrency

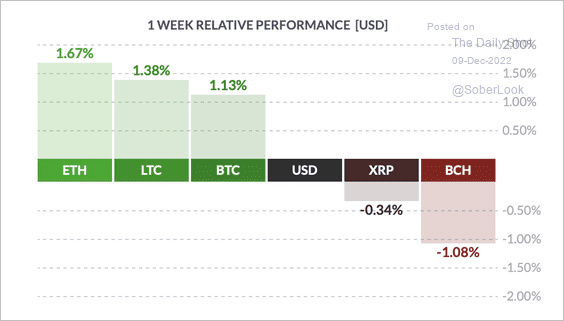

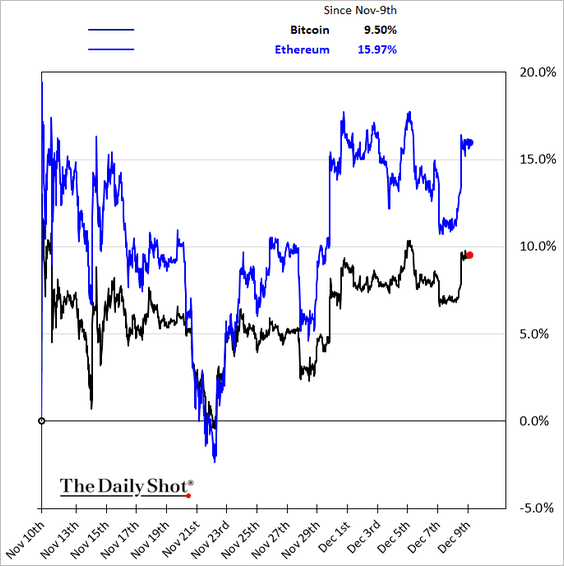

1. It has been a mixed week for cryptos, with ether outperforming other top tokens.

Source: FinViz

Source: FinViz

——————–

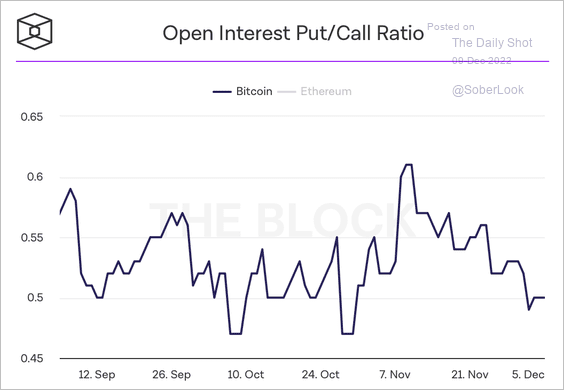

2. Bitcoin’s put/call ratio declined over the past month.

Source: The Block

Source: The Block

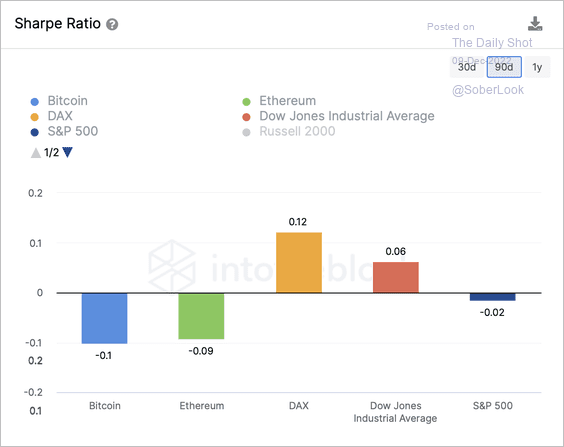

3. Here is a look at bitcoin and ether’s Sharpe ratios versus equity indices.

Source: IntoTheBlock

Source: IntoTheBlock

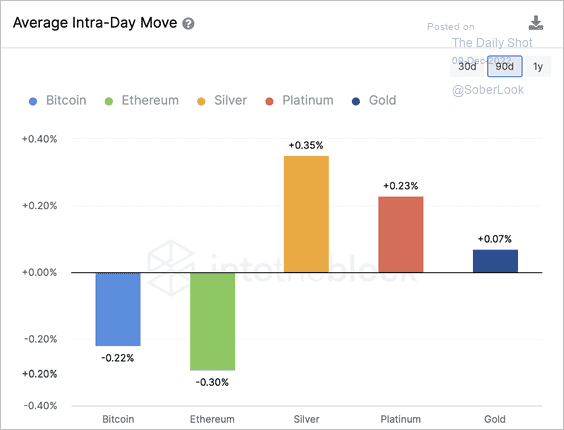

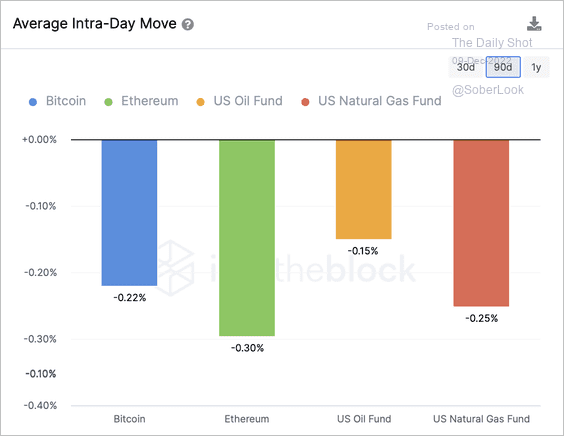

And the average intraday move versus precious metals and energy. (2 charts)

Source: IntoTheBlock

Source: IntoTheBlock

Source: IntoTheBlock

Source: IntoTheBlock

——————–

4. Get ready for more crypto disclosures among US public companies.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

5. Institutions are having second thoughts about crypto.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

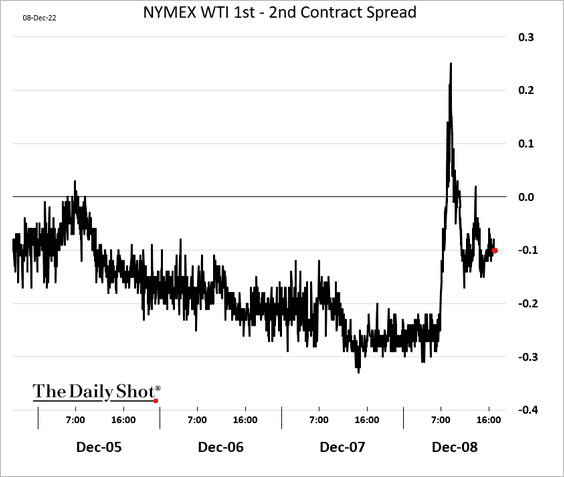

1. WTI temporarily moved back into backwardation on the Keystone news.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

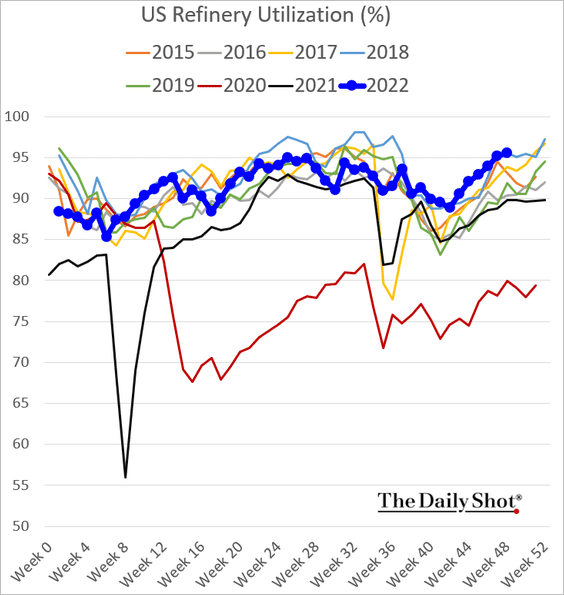

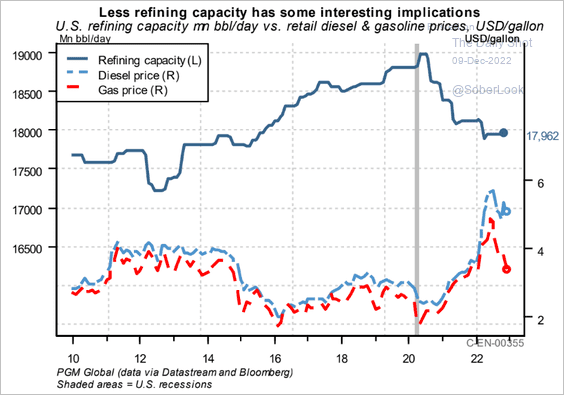

2. US refinery utilization remains elevated, …

… as capacity declined.

Source: PGM Global

Source: PGM Global

——————–

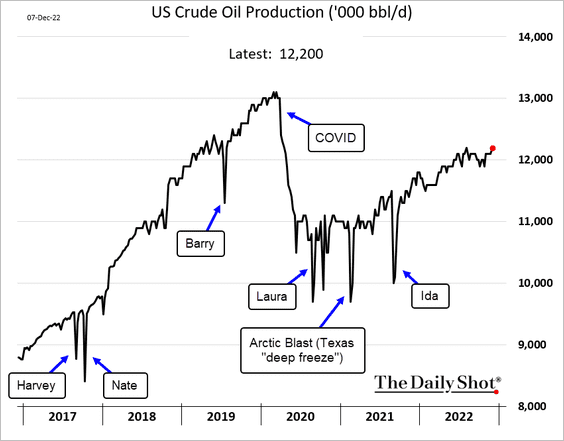

3. US oil production continues to recover, albeit very gradually.

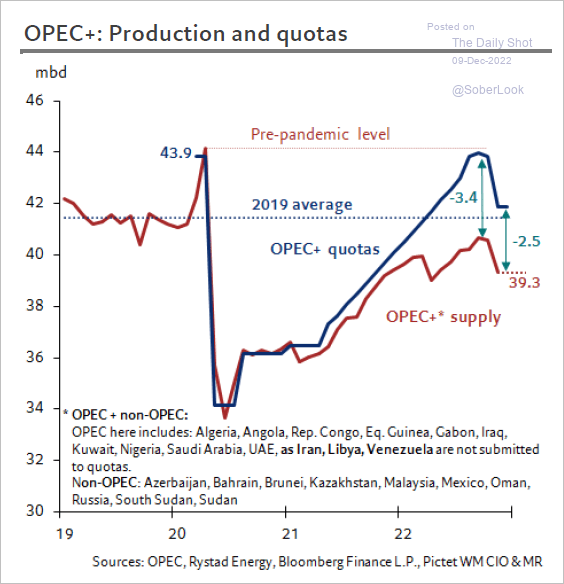

4. This chart shows OPEC+ production and quotas.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

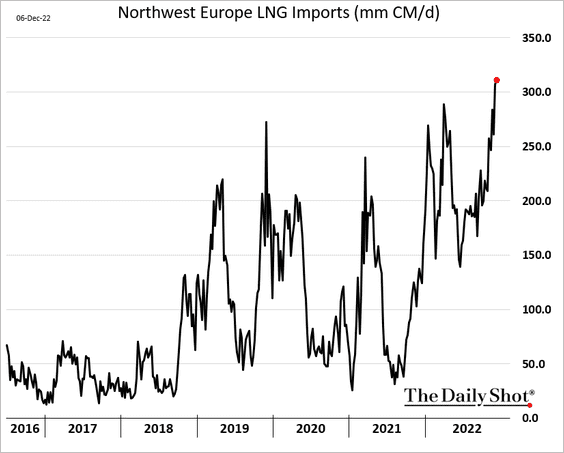

5. European LNG imports hit a record high.

Further reading

Further reading

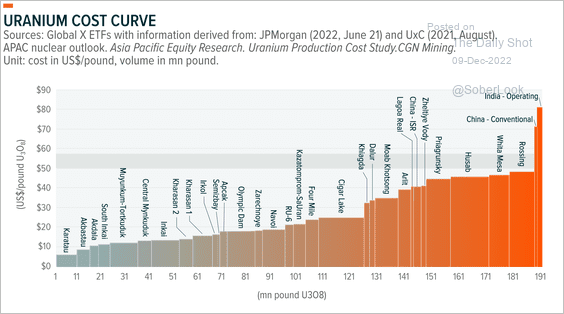

6. An increase in the uranium price to $50/pound may cause a global increase in capacity, according to the cost curve. Mines could find it profitable to resume operations.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

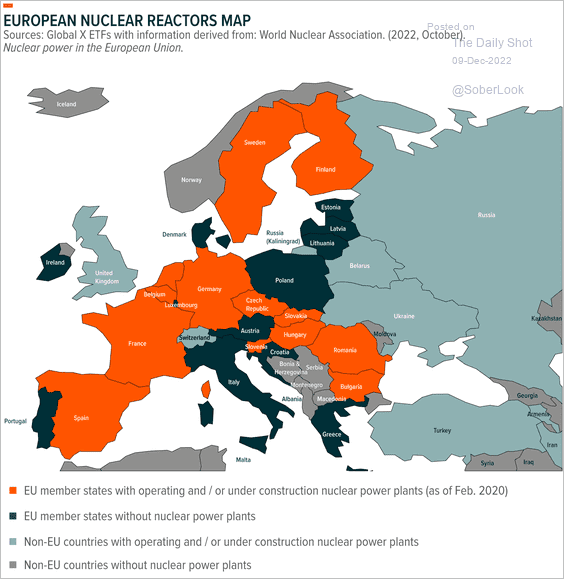

This map shows the status of nuclear power plants across Europe.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

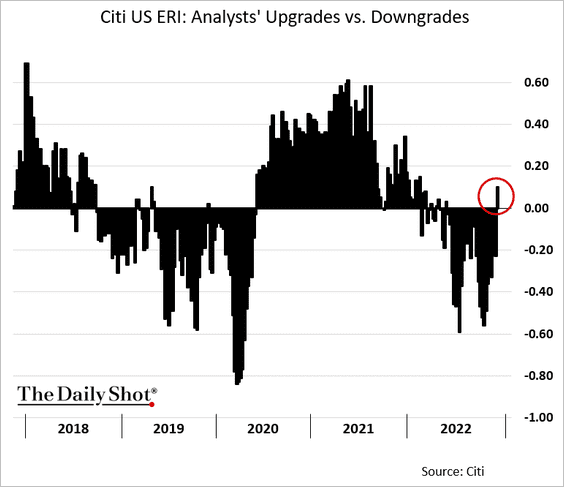

1. For the first time in 26 weeks, there were more earnings upgrades than downgrades.

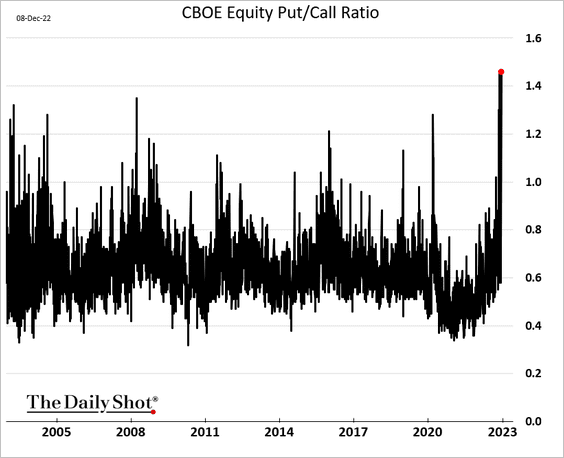

2. The put/call ratio is back at multi-year highs as demand for bullish option strategies wanes.

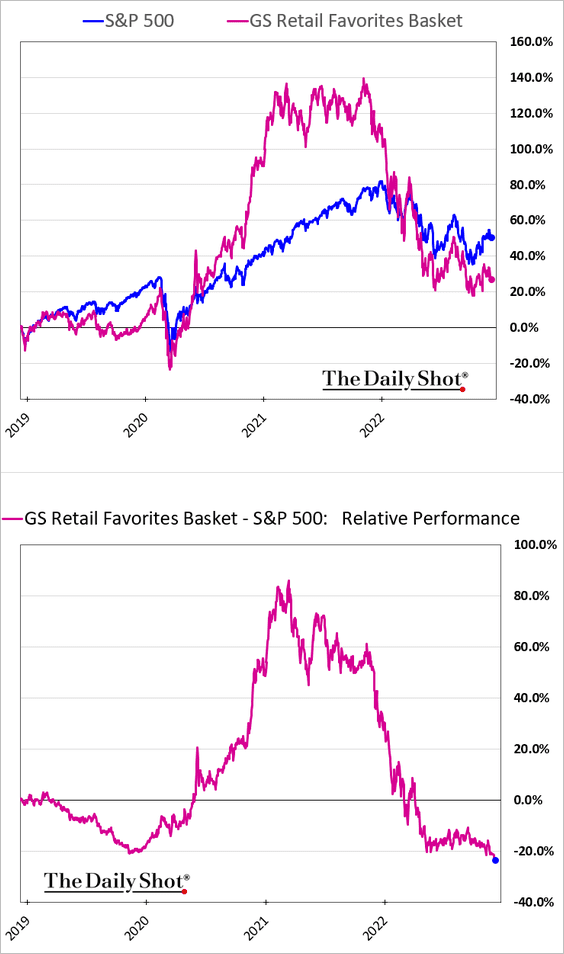

3. It’s been a painful year for retail investors.

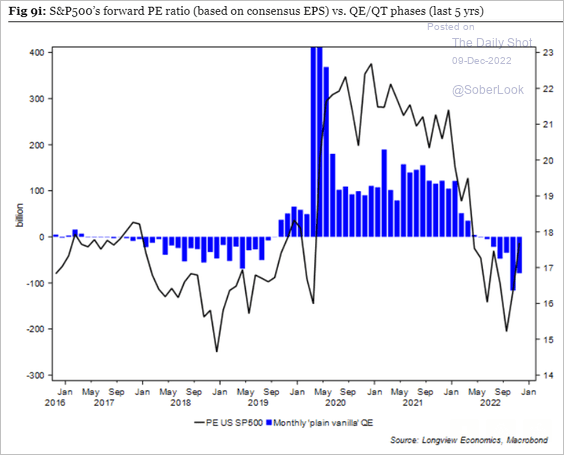

4. Stock valuations have been correlated with changes in the Fed’s balance sheet.

Source: Longview Economics

Source: Longview Economics

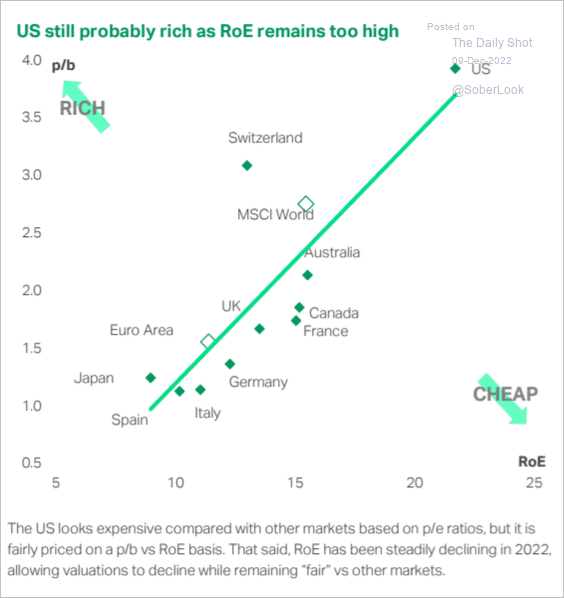

5. This scatterplot shows price-to-book ratios vs. RoE in advanced economies.

Source: TS Lombard

Source: TS Lombard

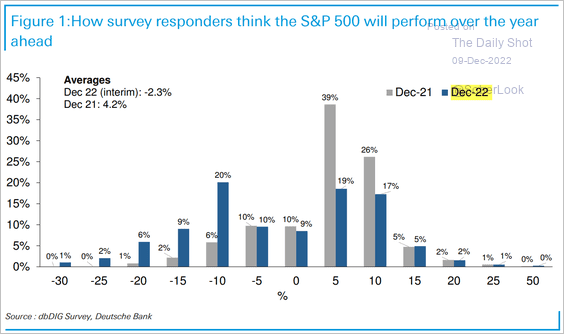

6. More investors expect negative S&P 500 returns next year, according to a Deutsche Bank survey. But there could be recency bias.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

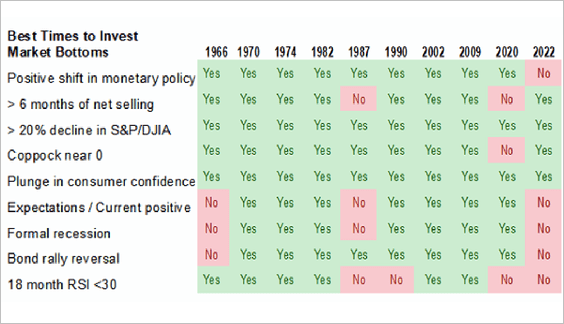

7. What could signal a market bottom?

Source: Variant Perception

Source: Variant Perception

Back to Index

Rates

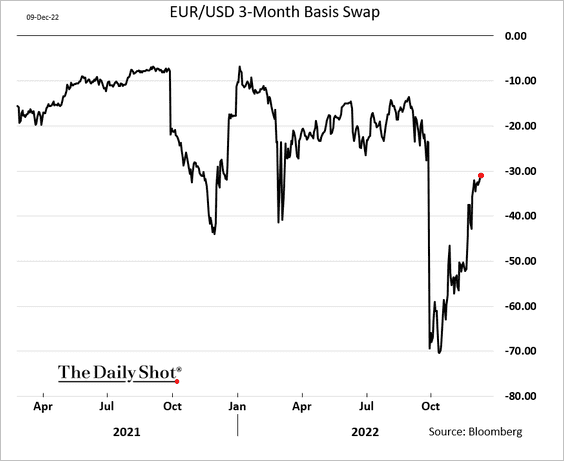

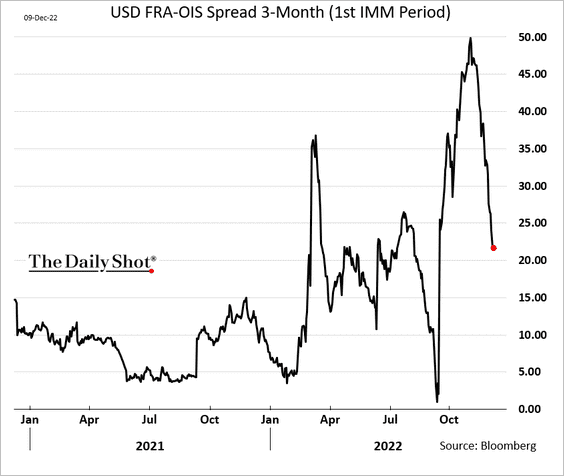

1. US dollar funding concerns are easing (2 charts).

——————–

2. The decline in reserve balances has been massive (due to the Fed’s QT and the RRP program).

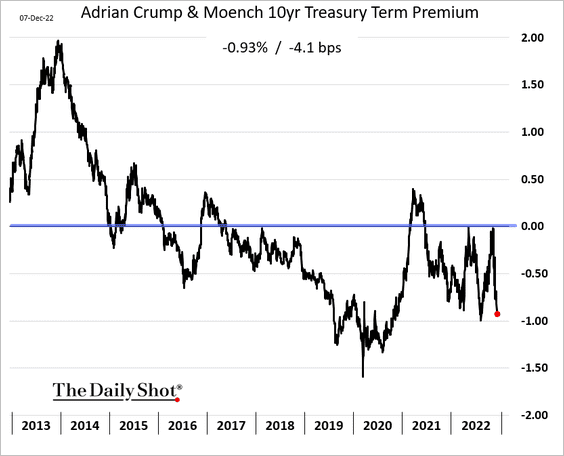

3. Treasury term premium is decreasing again.

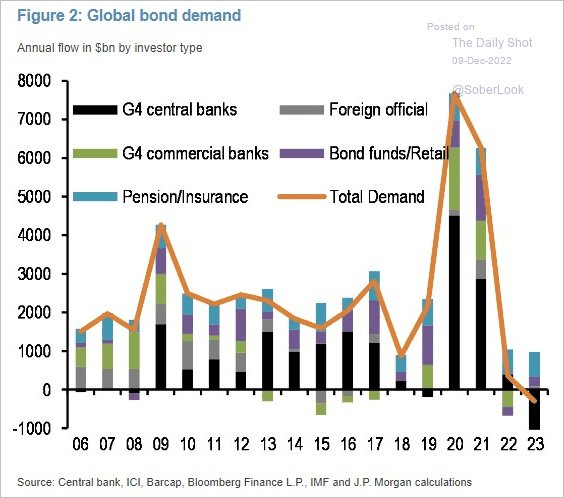

4. Finally, we have the breakdown of global bond demand.

Source: JP Morgan Research; @luwangnyc, @markets Read full article

Source: JP Morgan Research; @luwangnyc, @markets Read full article

——————–

Food for Thought

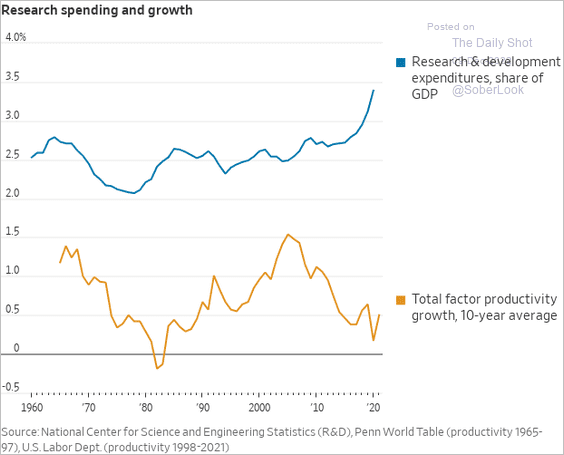

1. R&D spending vs. productivity growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

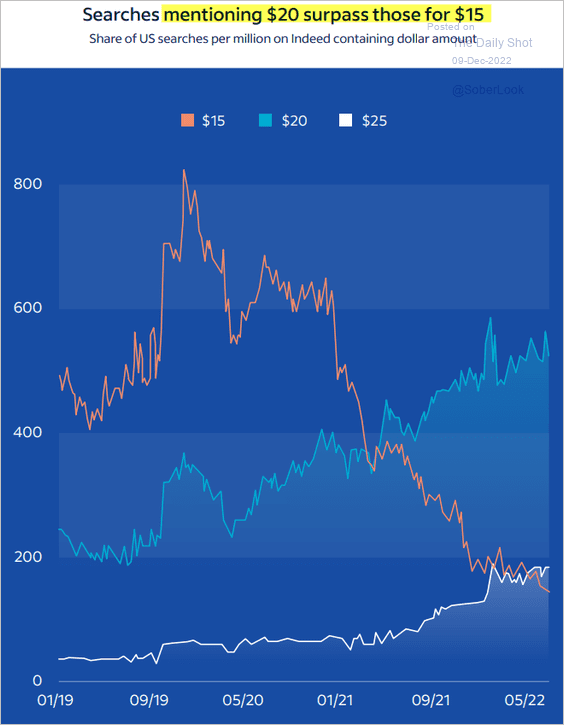

2. Job searches mentioning a specific hourly wage:

Source: @indeed, @Glassdoor

Source: @indeed, @Glassdoor

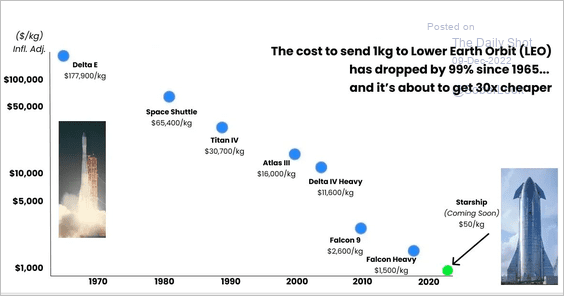

3. The cost to deliver cargo into orbit:

Source: @tomfgoodwin

Source: @tomfgoodwin

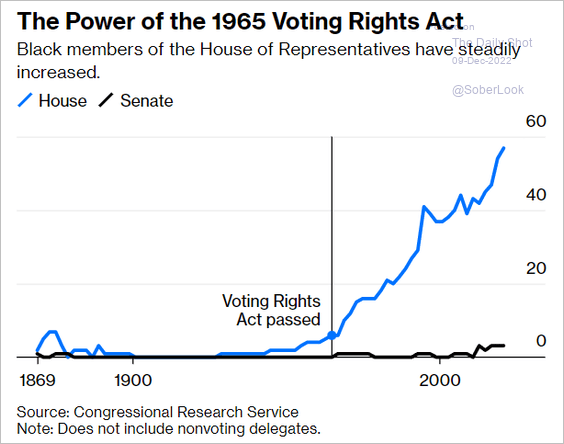

4. Black members of the House of Representatives:

Source: @opinion Read full article

Source: @opinion Read full article

5. Automatic voter registration:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

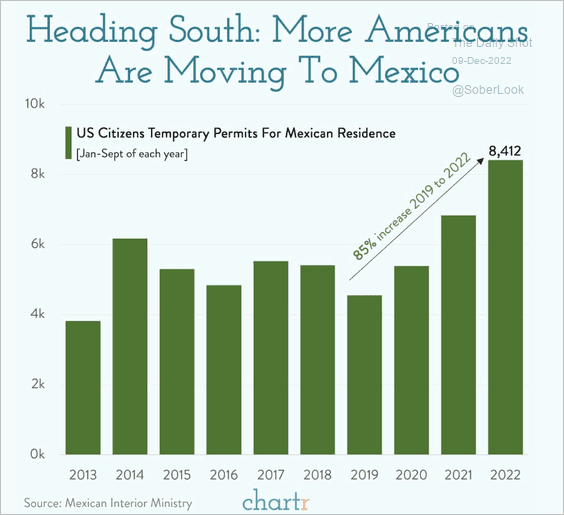

6. Moving to Mexico:

Source: @chartrdaily

Source: @chartrdaily

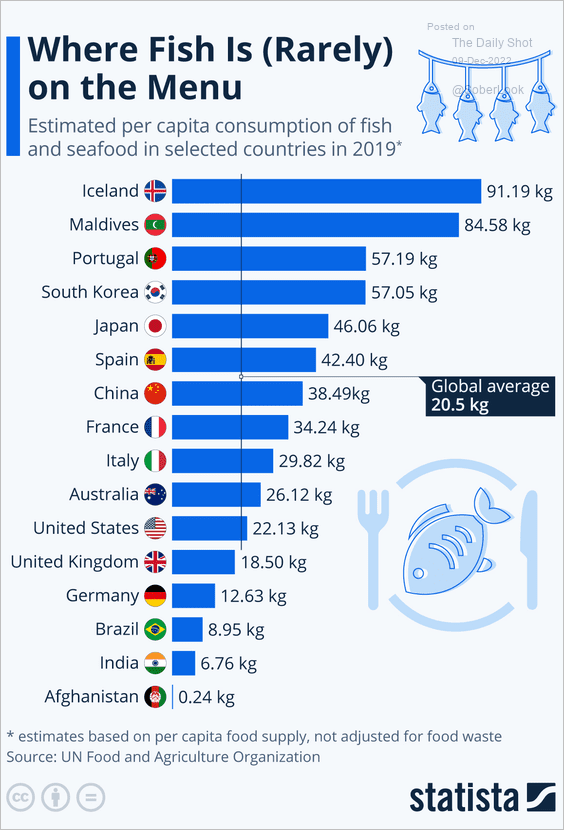

7. Fish consumption:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index