The Daily Shot: 12-Dec-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

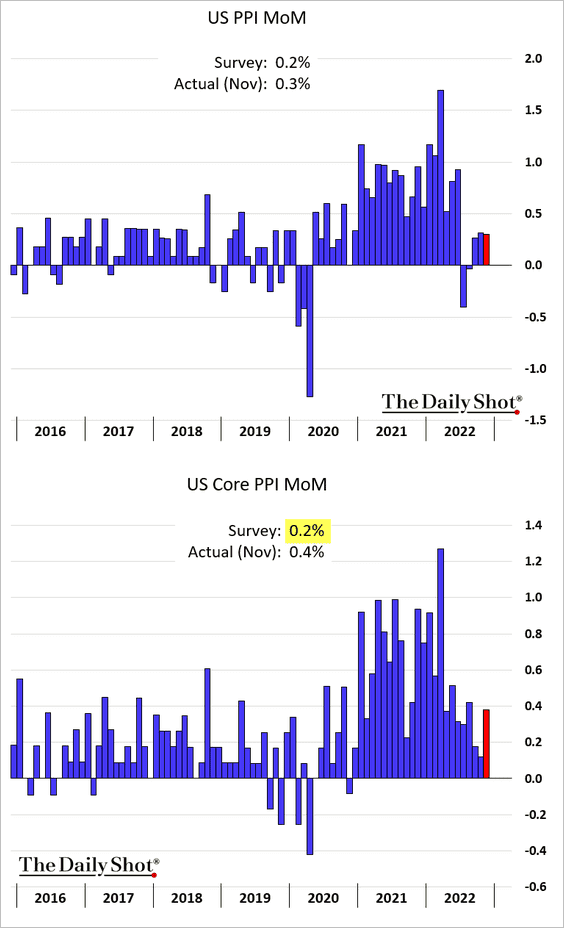

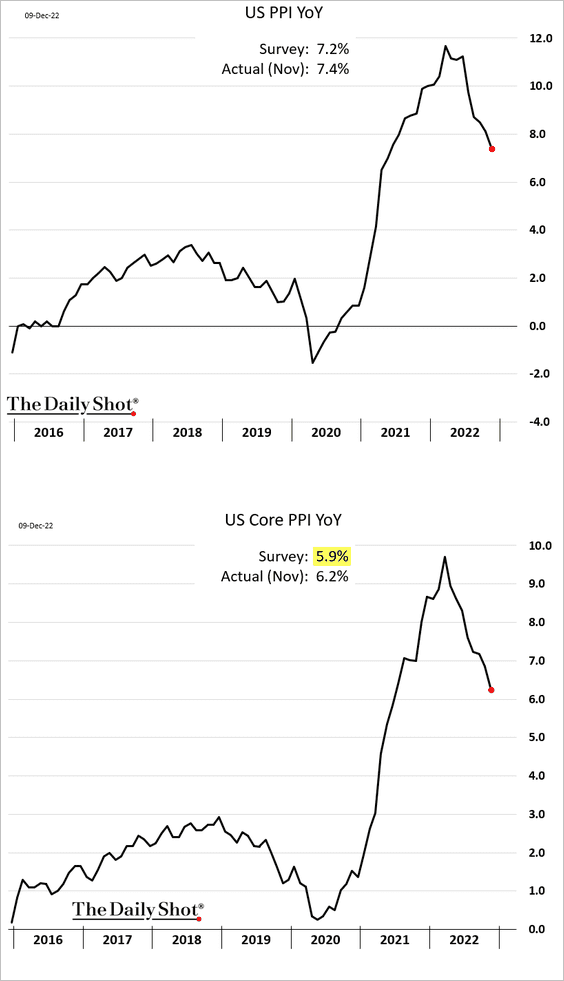

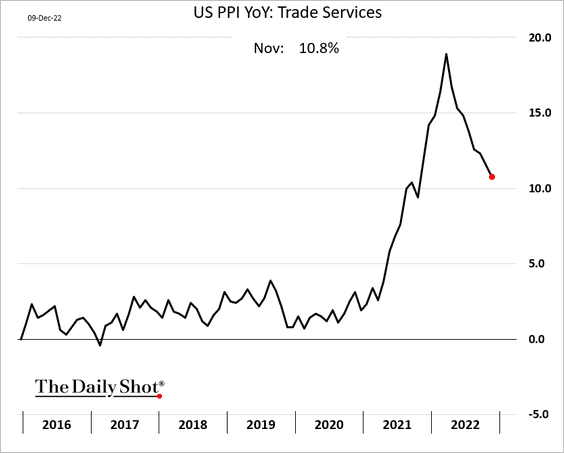

1. Let’s begin with some updates on inflation.

• The November PPI report surprised to the upside, with the core PPI climbing by 0.4% last month.

On a year-over-year basis, the PPI growth is trending lower.

The “trade services” PPI continues to moderate, signaling lower corporate margins.

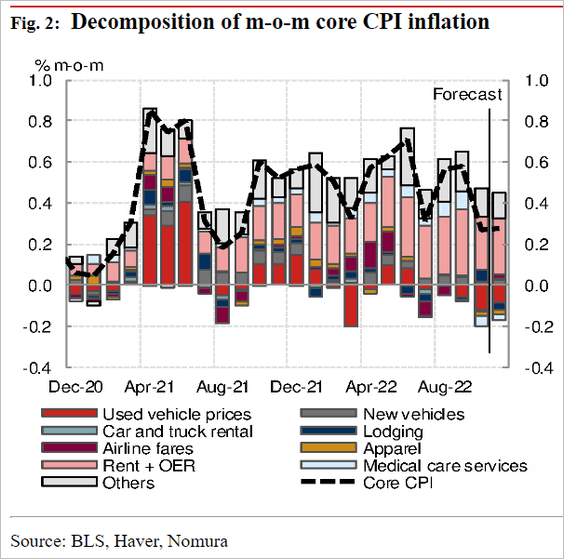

• What should we expect from the CPI report this week? Nomura estimates a similar monthly gain to what we saw in October, once again driven by housing.

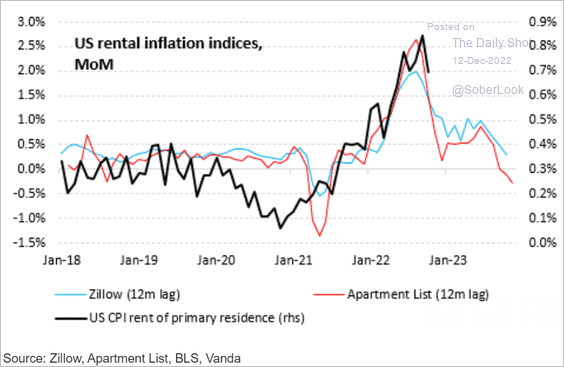

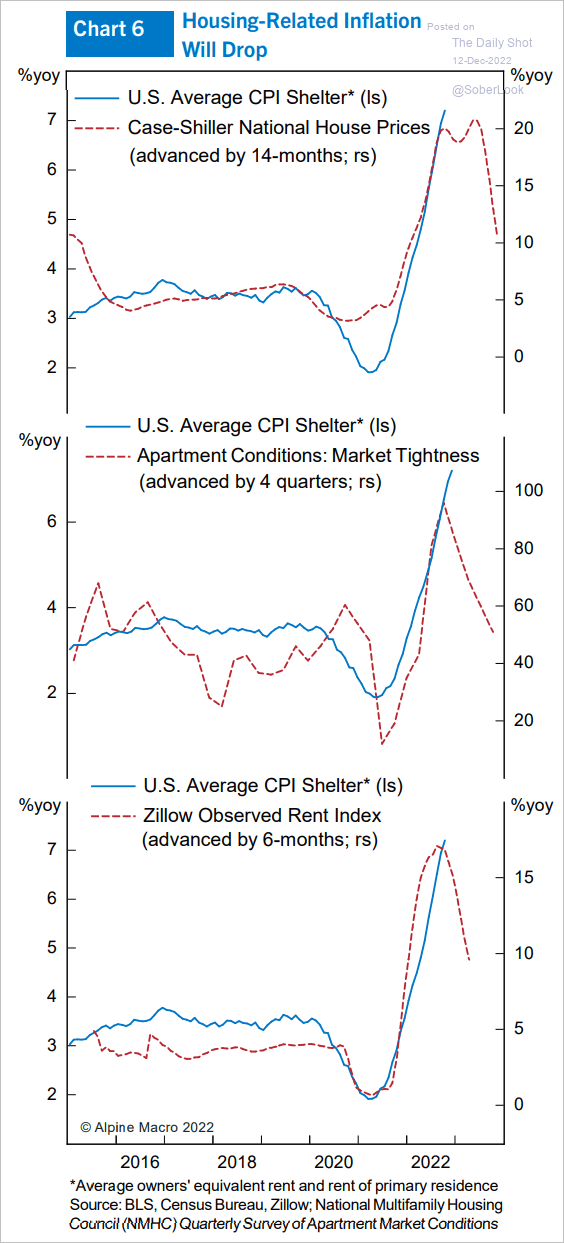

• Rent inflation is expected to moderate next year (2 charts).

Source: Vanda Research

Source: Vanda Research

Source: Alpine Macro

Source: Alpine Macro

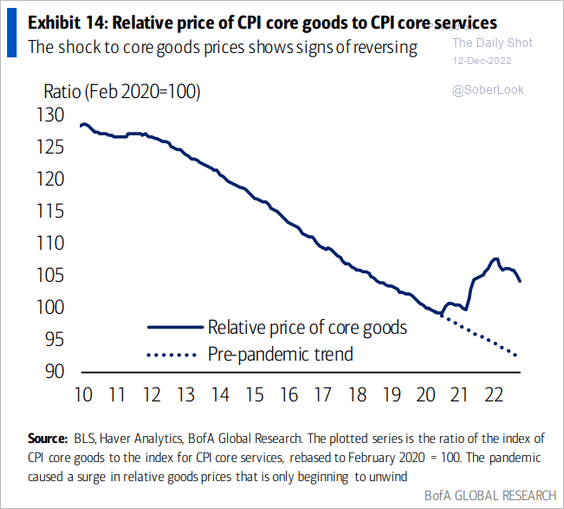

• Here is the price ratio of core goods to core services CPI.

Source: BofA Global Research

Source: BofA Global Research

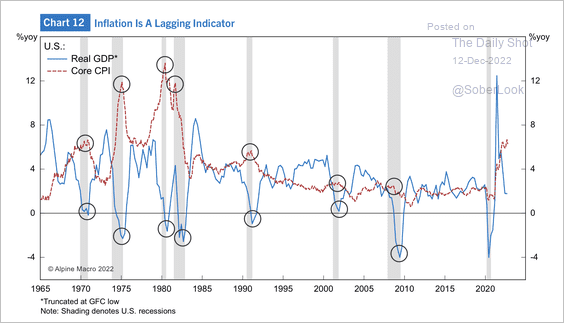

• Inflation typically peaks during recessions and decelerates afterward, lagging the GDP.

Source: Alpine Macro

Source: Alpine Macro

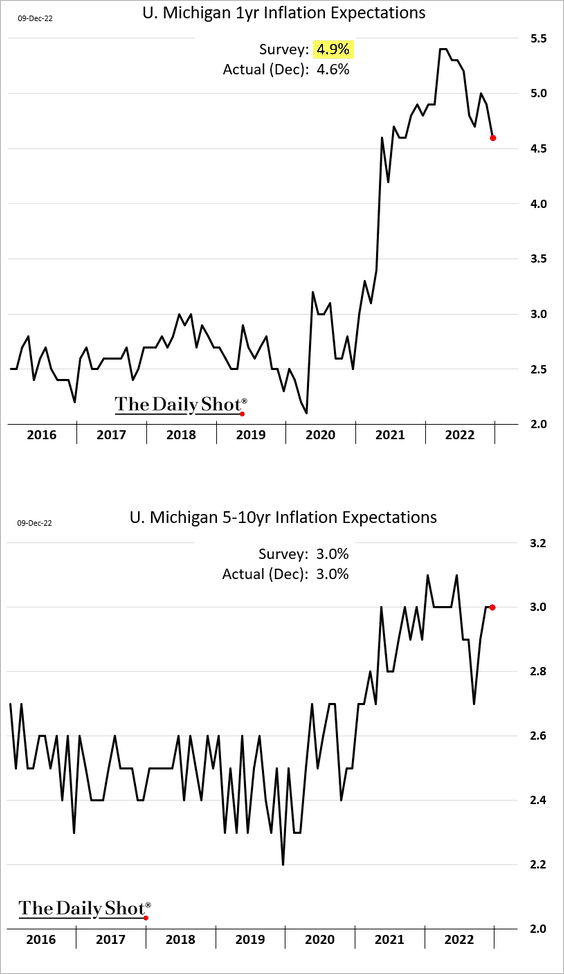

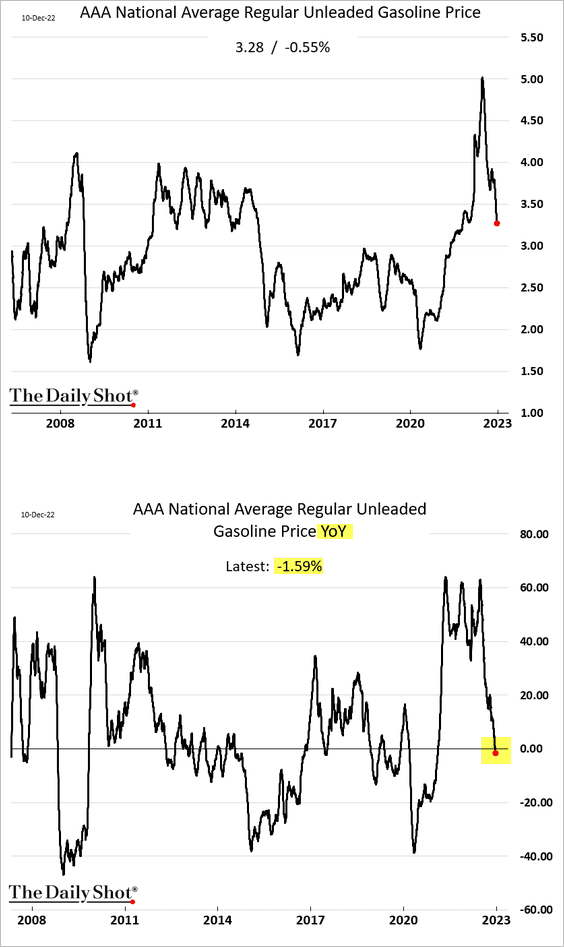

• Short-term inflation expectations eased this month, …

… as gasoline prices decline. A gallon of unleaded is now cheaper than it was 12 months ago.

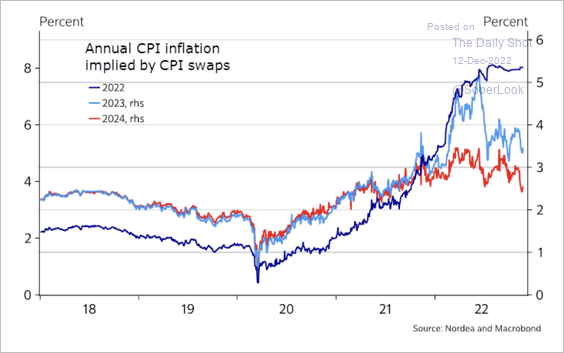

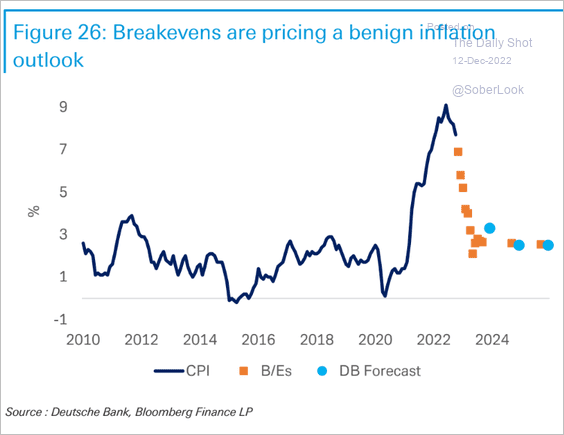

• The market expects inflation to ease rapidly, with longer-term inflation expectations remaining at manageable levels (2 charts).

Source: Nordea Markets

Source: Nordea Markets

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

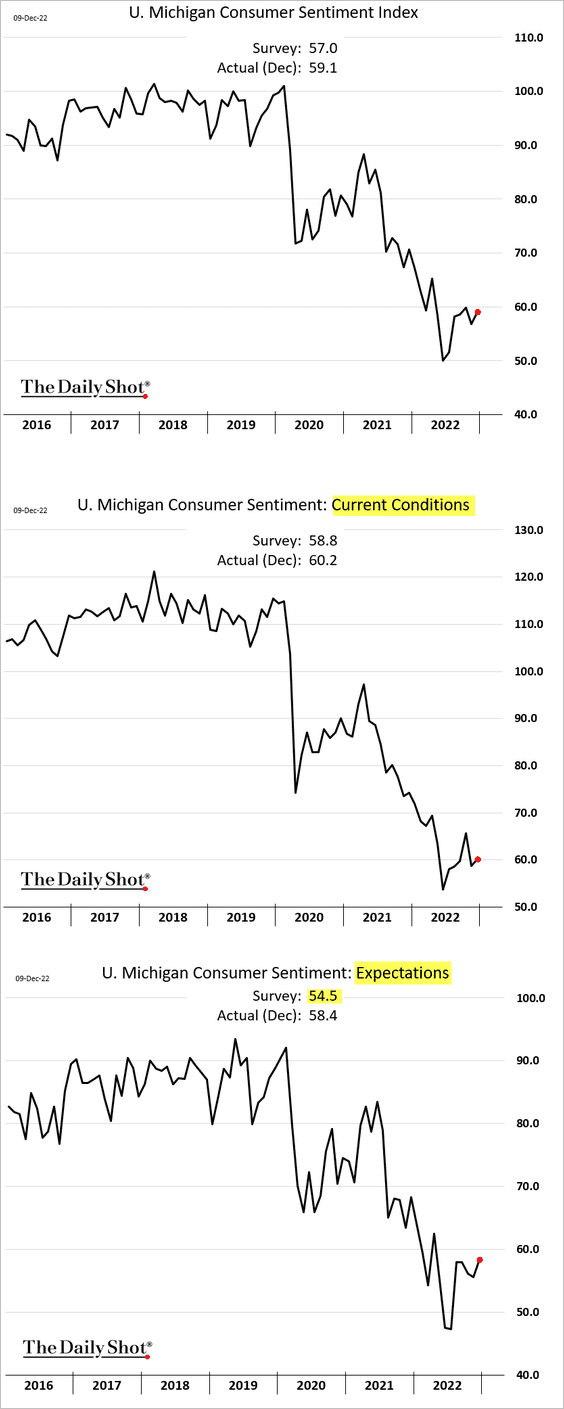

2. Consumer sentiment benefitted from lower gasoline prices this month, with the U. Michigan index topping forecasts.

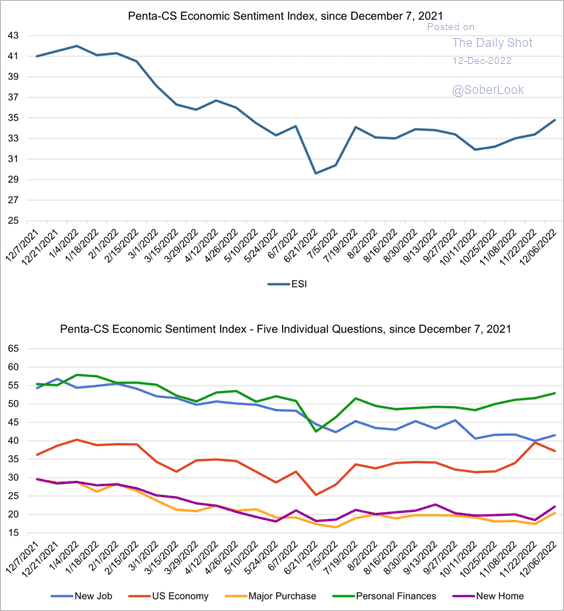

• The Penta-CivicScience Economic Sentiment Index also showed an improvement.

Source: @CivicScience Read full article

Source: @CivicScience Read full article

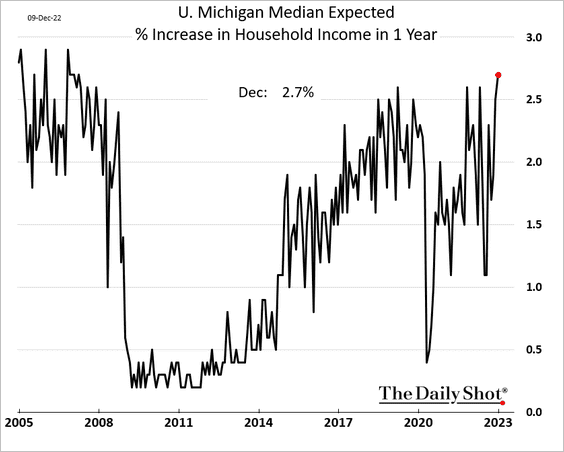

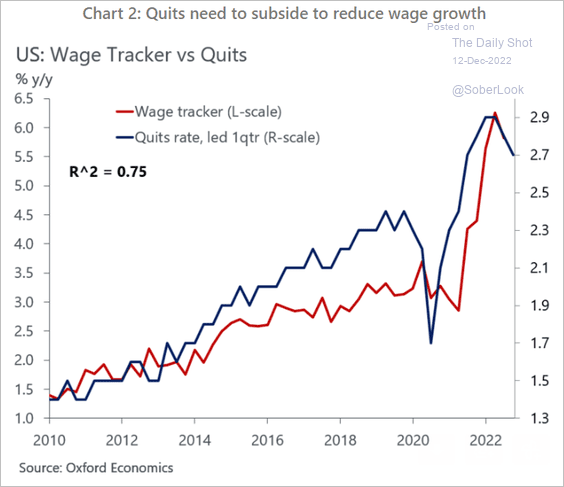

• Households expect a relatively robust increase in nominal income (higher wage expectations) …

… as they take advantage of tight labor markets.

Source: Oxford Economics

Source: Oxford Economics

——————–

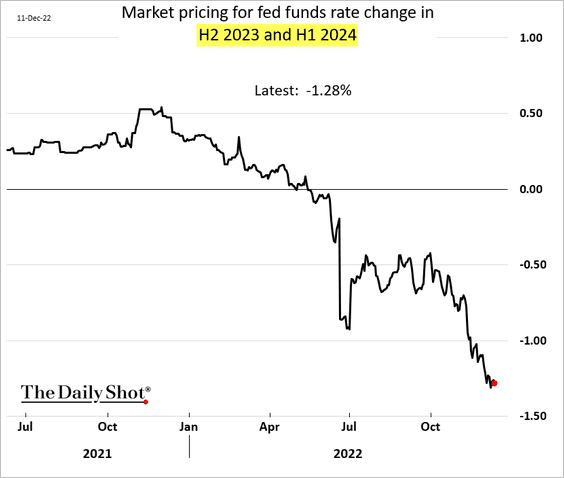

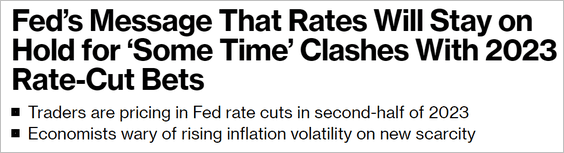

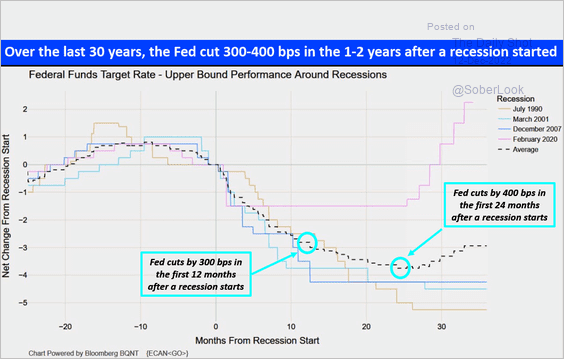

3. The market expects substantial Fed rate cuts over the 12-month period starting next July. Too much enthusiasm, perhaps?

Source: @business, @ctorresreporter, @mccormickliz Read full article

Source: @business, @ctorresreporter, @mccormickliz Read full article

Here is what happened in previous recessions.

Source: @MacroAlf

Source: @MacroAlf

——————–

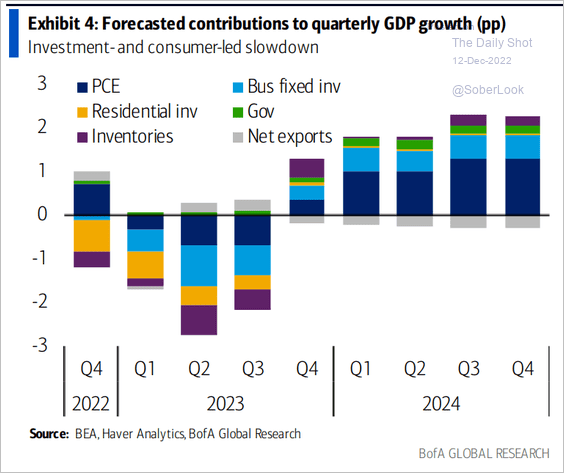

4. BofA expects a recession next year as demand crumbles.

Source: BofA Global Research

Source: BofA Global Research

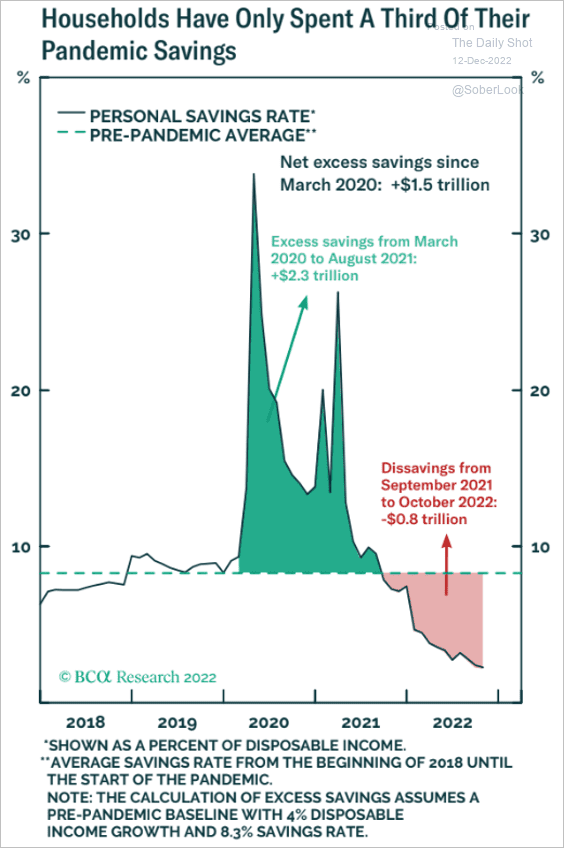

It’s worth noting that households spent only about a third of their pandemic-era excess savings.

Source: BCA Research

Source: BCA Research

Back to Index

The United Kingdom

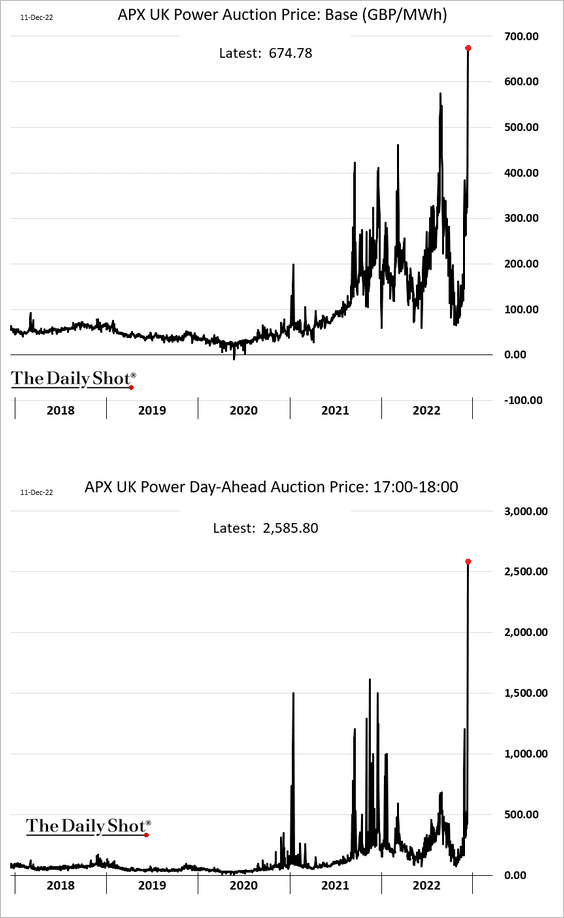

1. Electricity prices surged last week as temperatures plunge.

Source: The Independent Read full article

Source: The Independent Read full article

——————–

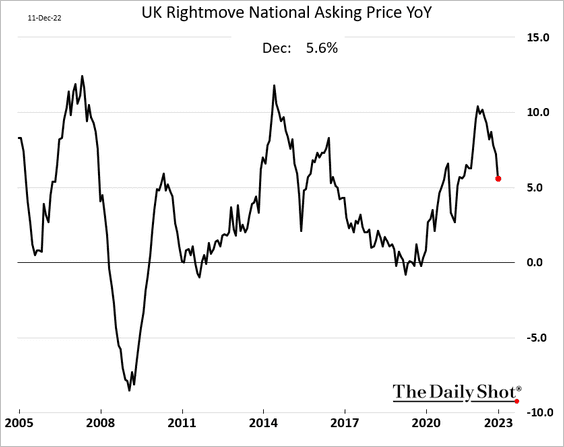

2. Home prices continue to ease.

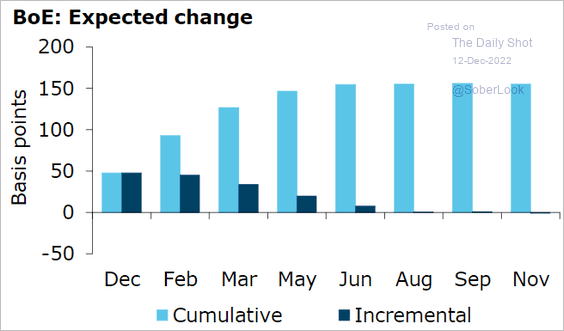

3. The market is pricing in a 50 bps BoE rate hike this week and another one in February.

Source: @ANZ_Research

Source: @ANZ_Research

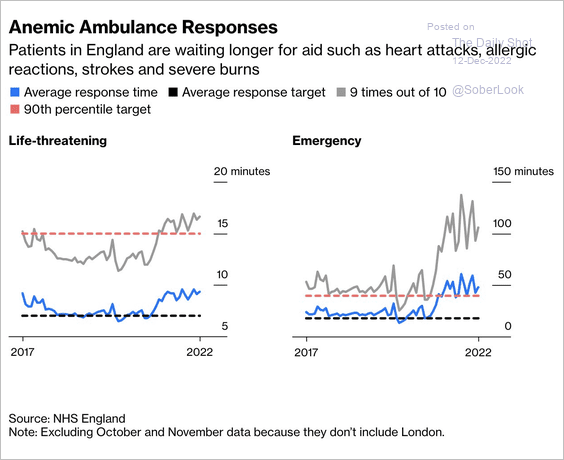

4. Ambulance response times in England have risen substantially.

Source: @opinion Read full article

Source: @opinion Read full article

Back to Index

The Eurozone

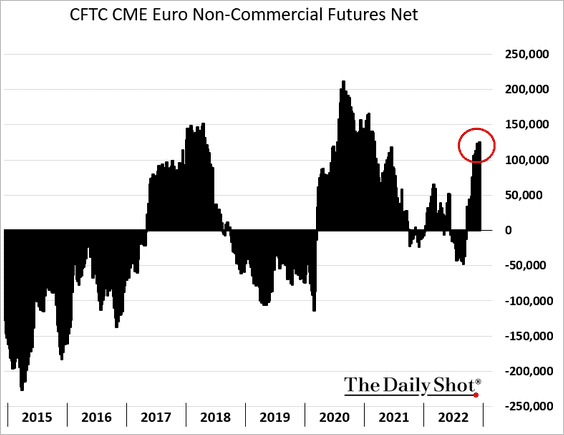

1. Speculative accounts continue to bet on further gains in the euro.

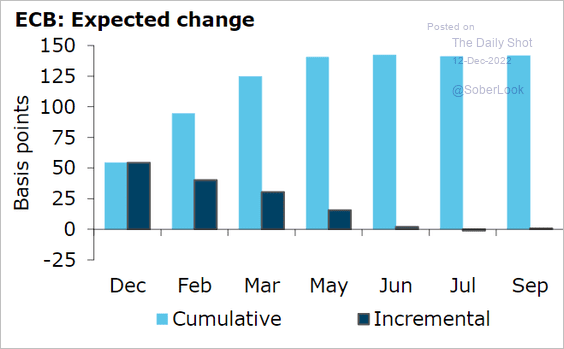

2. The market sees a 50 bps ECB rate hike this week.

Source: @ANZ_Research

Source: @ANZ_Research

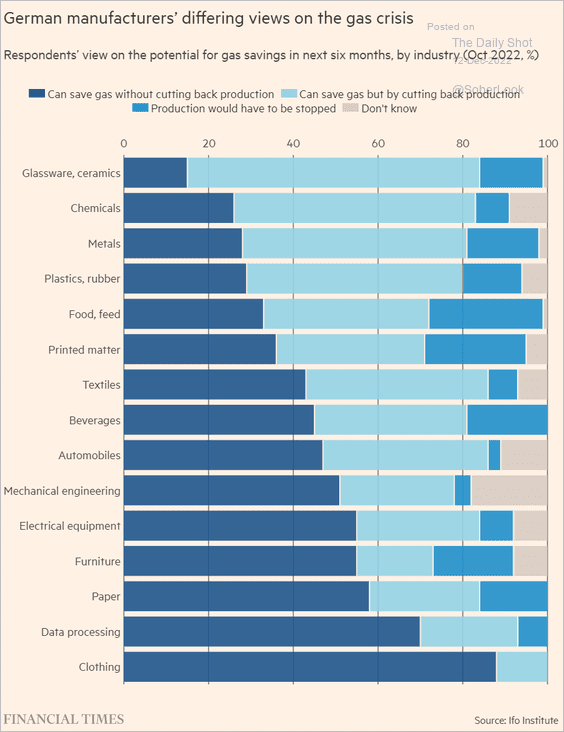

3. Which German manufacturing sectors are most affected by the energy crisis?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

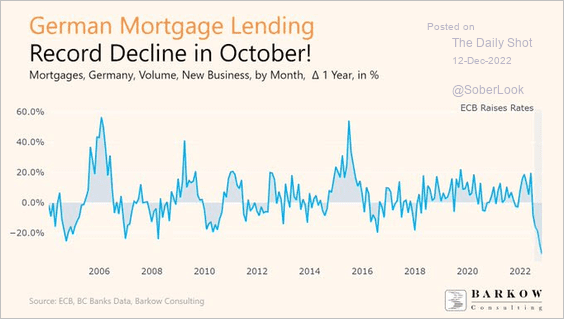

Separately, mortgage lending has declined sharply in Germany.

Source: @BarkowConsult Read full article

Source: @BarkowConsult Read full article

——————–

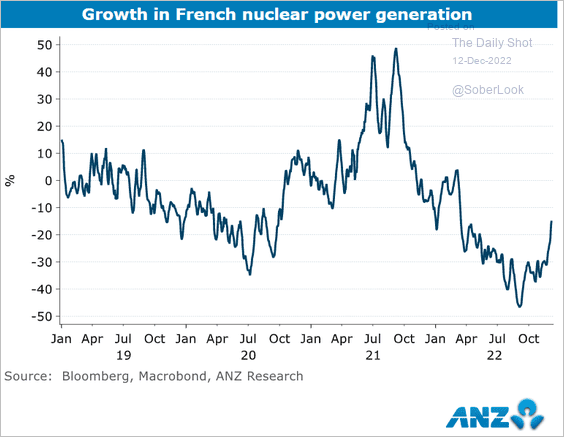

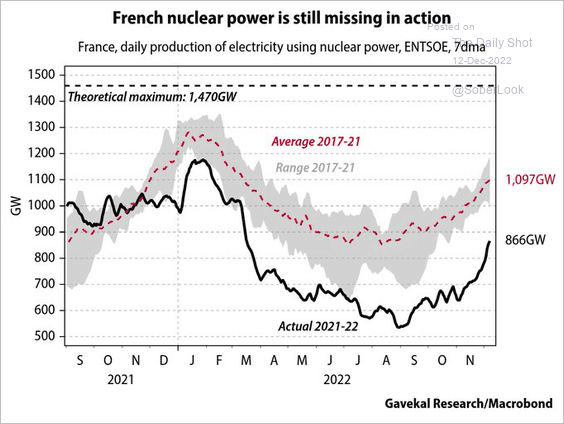

4. Nuclear power generation bounced from the lows in France but remains well below the typical levels for this time of the year.

Source: @ANZ_Research

Source: @ANZ_Research

Source: @Gavekal

Source: @Gavekal

Back to Index

Europe

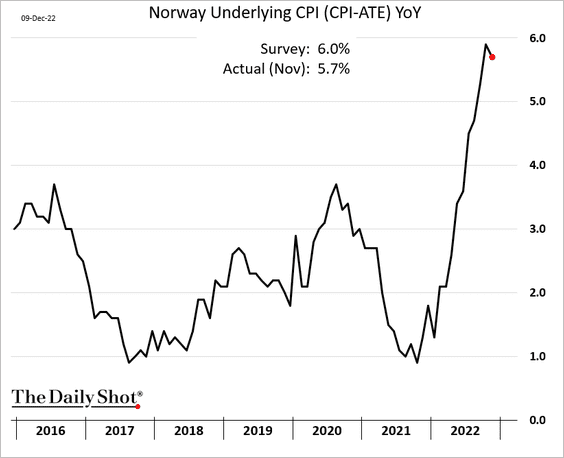

1. Norway’s inflation appears to have finally peaked.

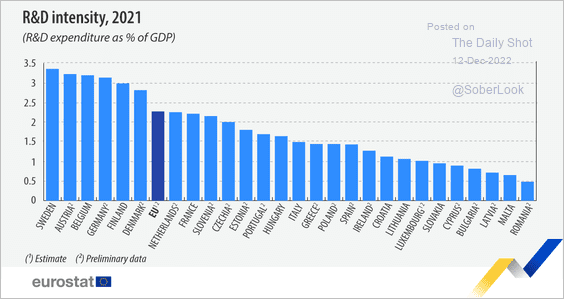

2. This chart shows R&D spending across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

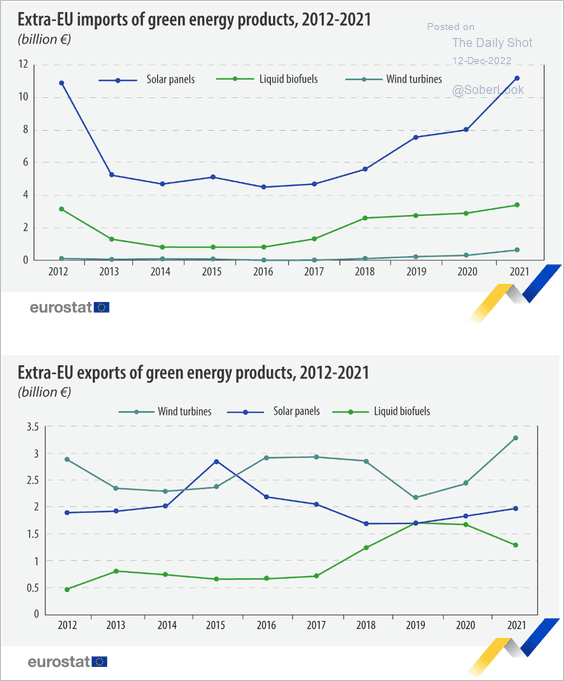

3. Here is the EU’s trade in green energy products.

Source: Eurostat Read full article

Source: Eurostat Read full article

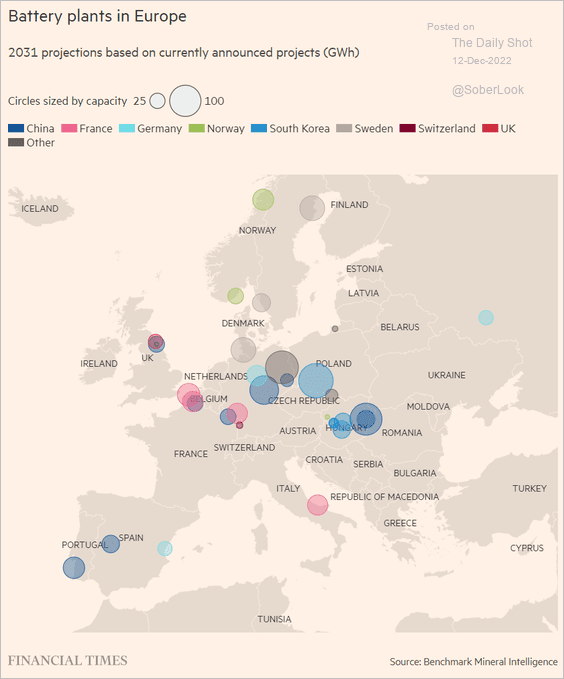

4. The map below shows battery plants across Europe.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Japan

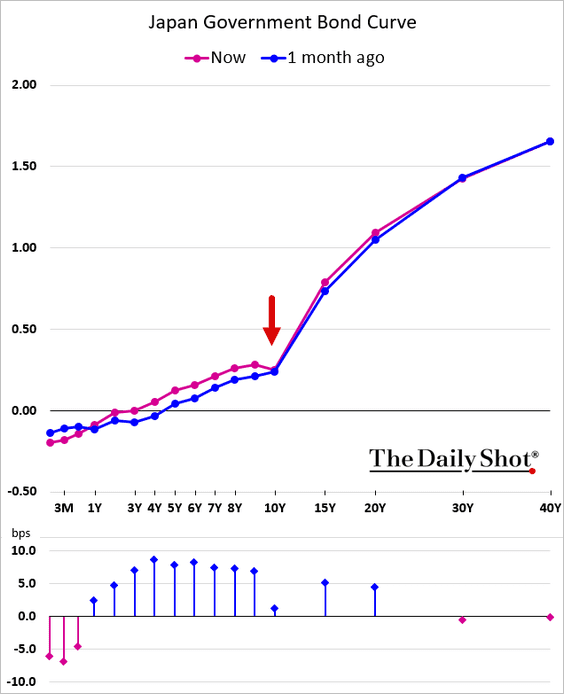

1. The BoJ is sticking with its yield control policy (distorting the yield curve).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

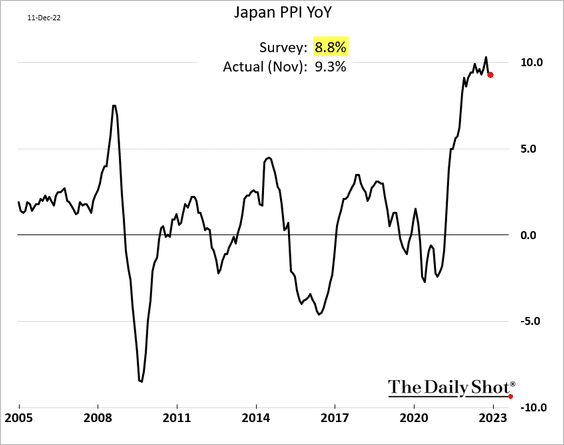

2. The PPI surprised to the upside.

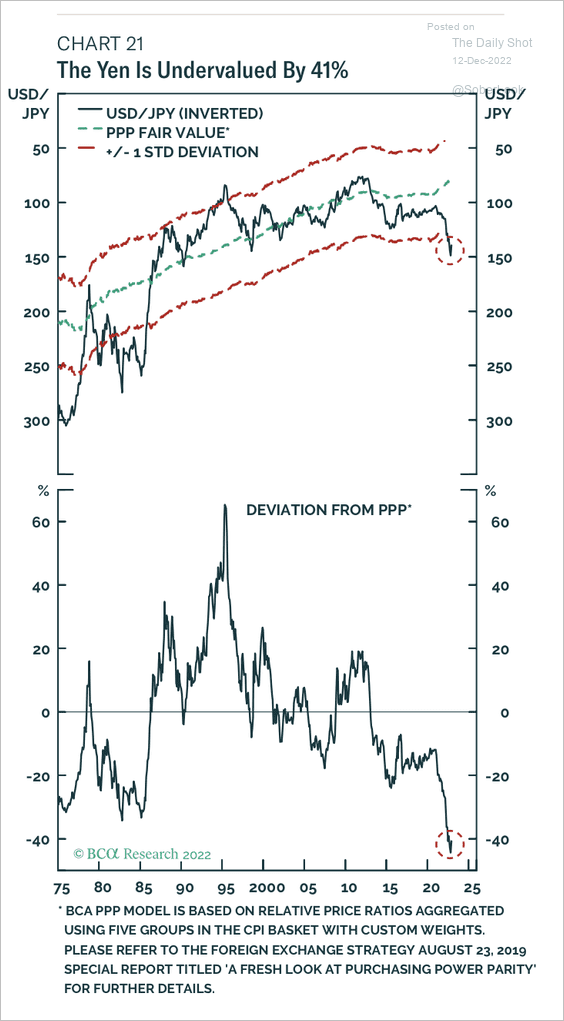

3. The yen has deviated far from fair value.

Source: BCA Research

Source: BCA Research

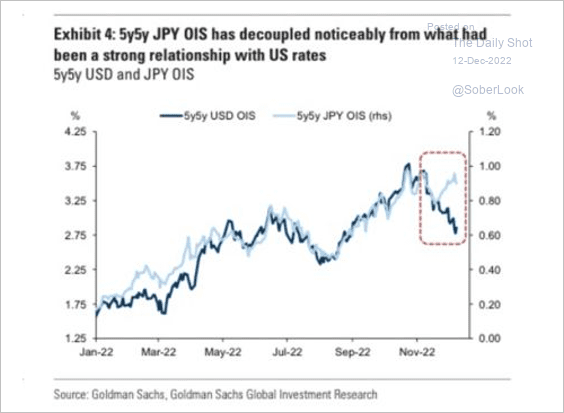

4. Japan’s longer-term rate expectations have decoupled from the US.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

China

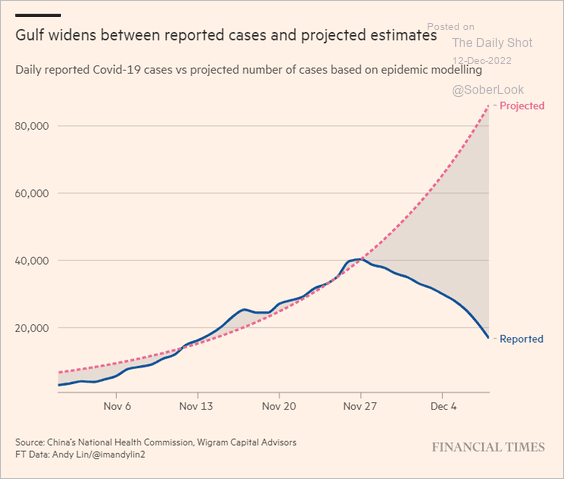

1. Beijing has pulled back on COVID testing, resulting in lower reported cases.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

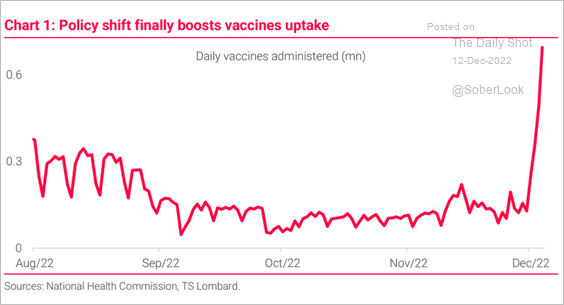

Vaccinations have picked up.

Source: TS Lombard

Source: TS Lombard

——————–

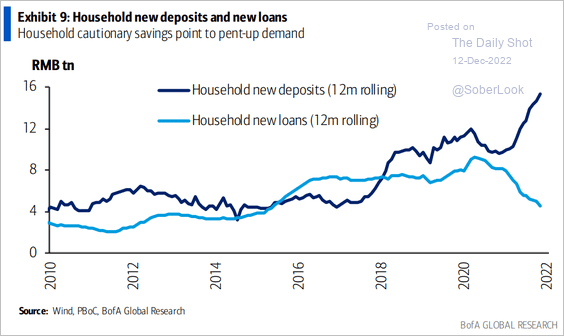

2. Households remain cautious.

Source: BofA Global Research

Source: BofA Global Research

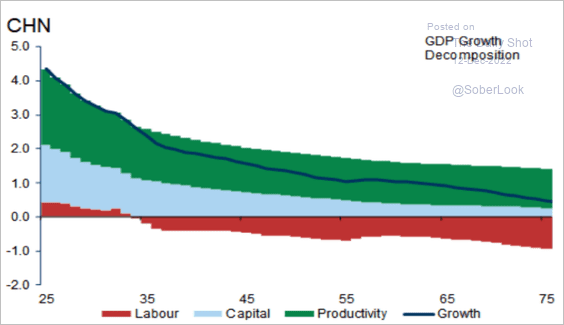

3. China’s shrinking labor force will increasingly become a drag on GDP growth in the decades ahead.

Source: Goldman Sachs

Source: Goldman Sachs

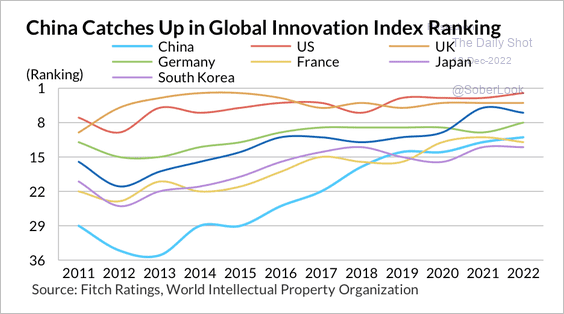

4. China’s ranking in the Global Innovation Index significantly improved over the past decade.

Source: Fitch Ratings

Source: Fitch Ratings

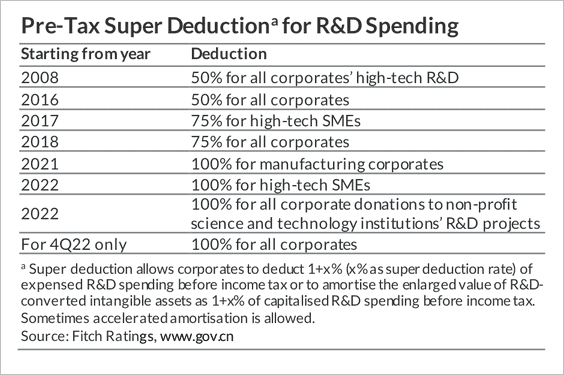

Policy initiatives such as tax deductions have incentivized research and development spending.

Source: Fitch Ratings

Source: Fitch Ratings

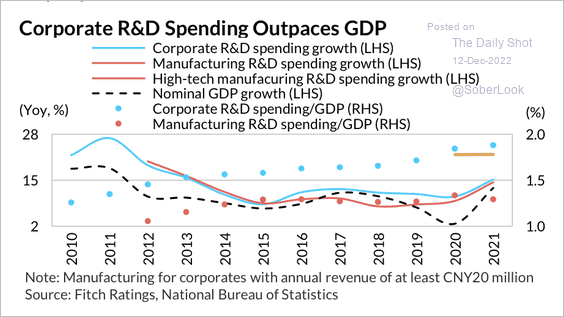

Corporate research and development spending has outpaced GDP growth in recent years.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

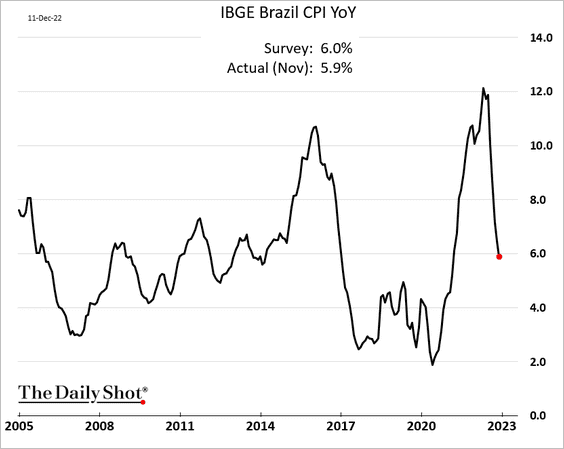

1. Brazil’s inflation continues to moderate.

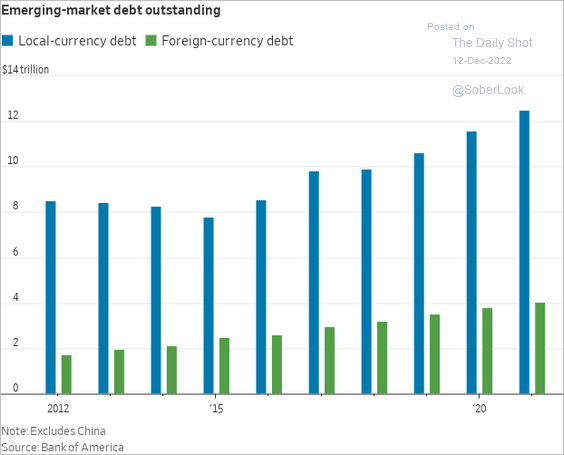

2. This chart shows EM growth in local- and hard-currency debt outstanding.

Source: @WSJ Read full article

Source: @WSJ Read full article

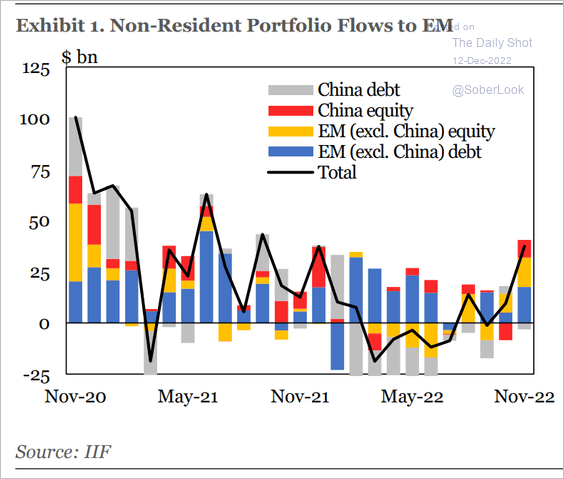

3. EM portfolio flows jumped last month.

Source: IIF

Source: IIF

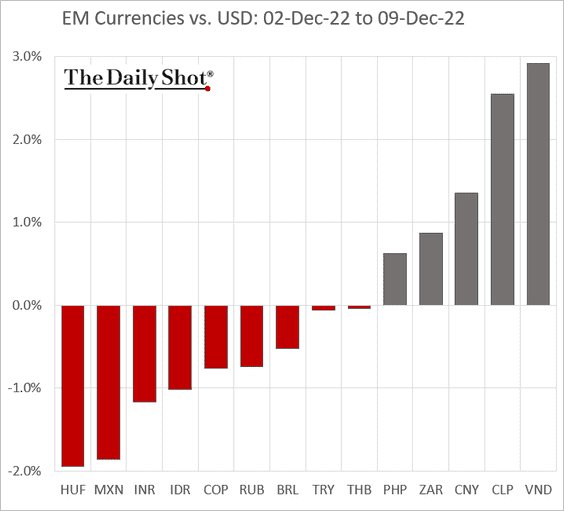

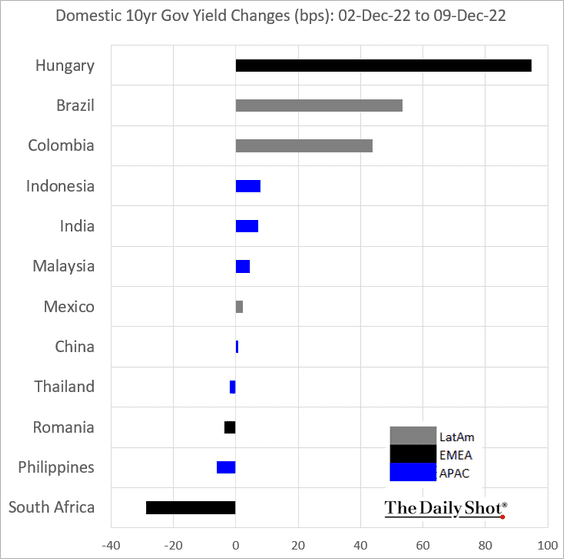

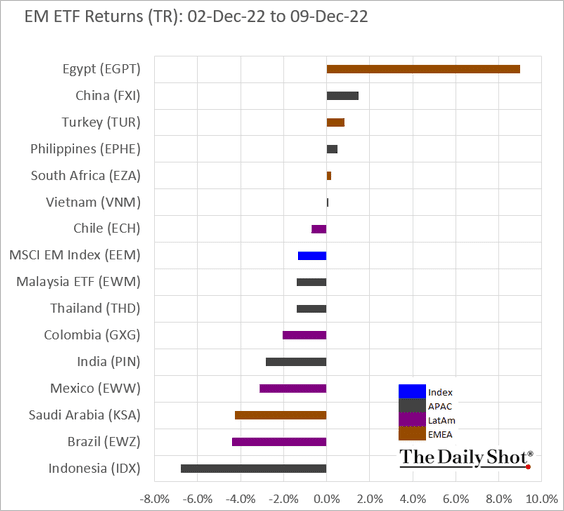

4. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

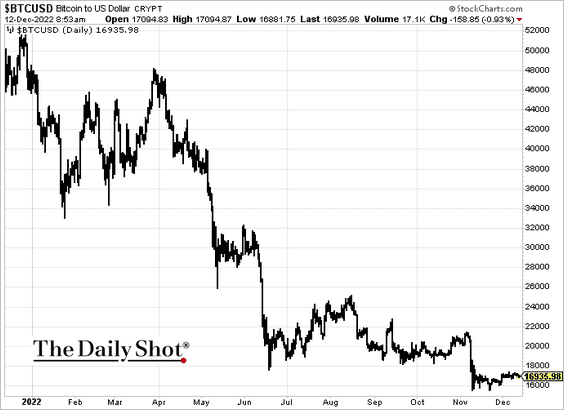

Cryptocurrency

1. Bitcoin is struggling to hold above $17k.

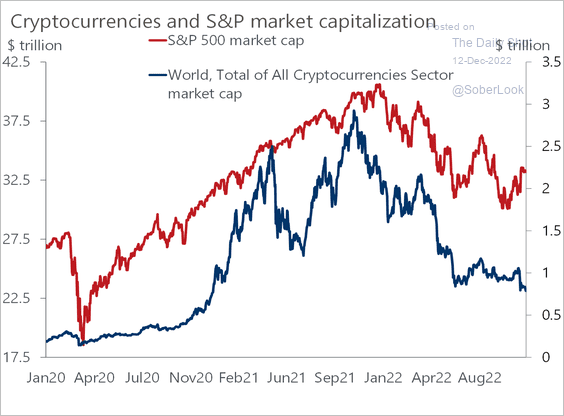

2. Here is a look at the crypto market cap versus the S&P 500’s.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

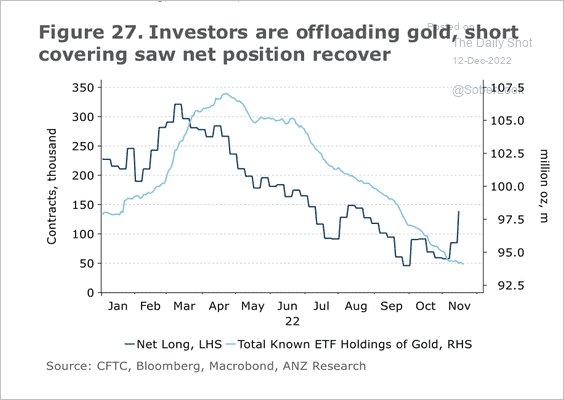

Commodities

1. Speculators started to cover their net short gold positions.

Source: @ANZ_Research

Source: @ANZ_Research

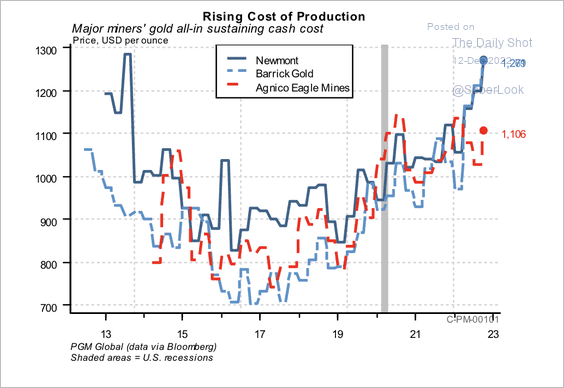

2. Gold miners have experienced rising production costs, …

Source: PGM Global

Source: PGM Global

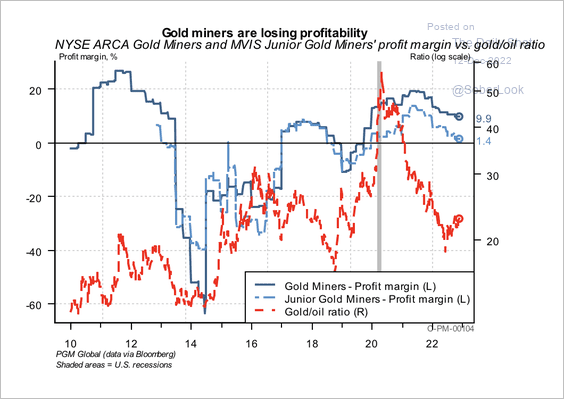

… with profit margins rolling over.

Source: PGM Global

Source: PGM Global

——————–

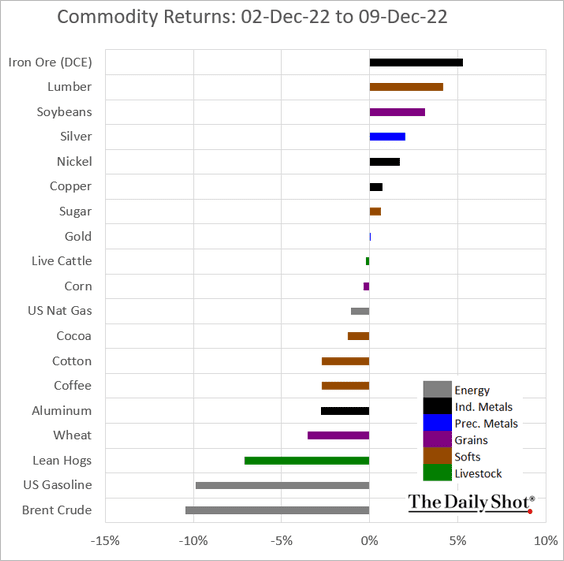

3. Here is last week’s performance across key commodity markets.

Back to Index

Energy

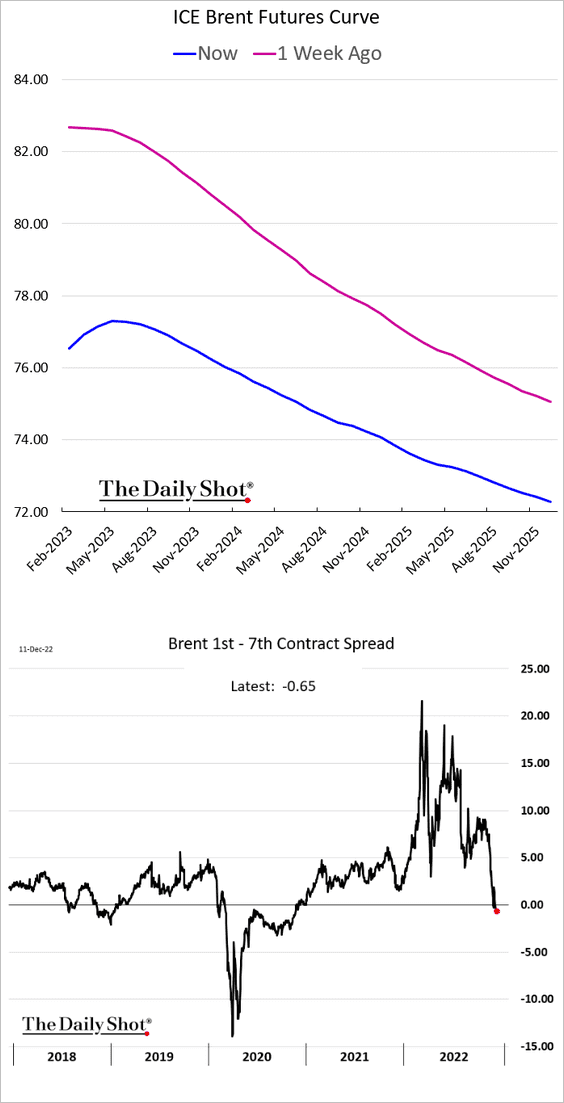

1. The front end of the Brent curve remains in contango.

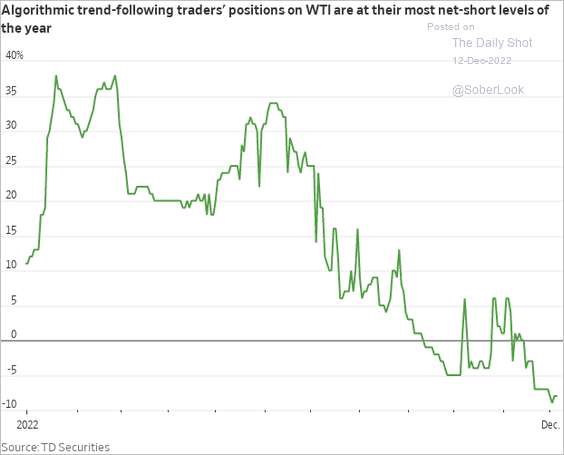

2. Trend followers are shorting crude oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

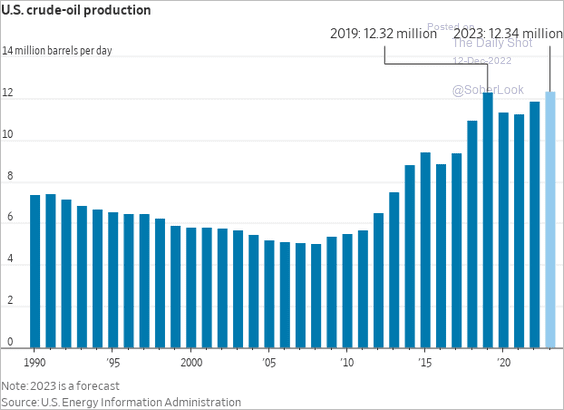

3. Will US crude oil production hit a record high next year?

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

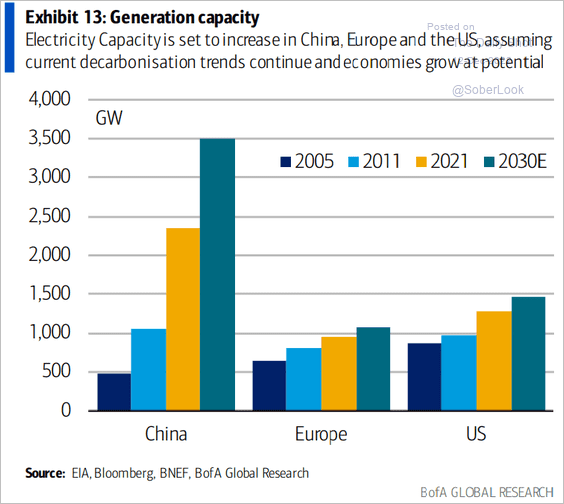

4. Here is a look at growth in electricity capacity, including projections.

Source: BofA Global Research

Source: BofA Global Research

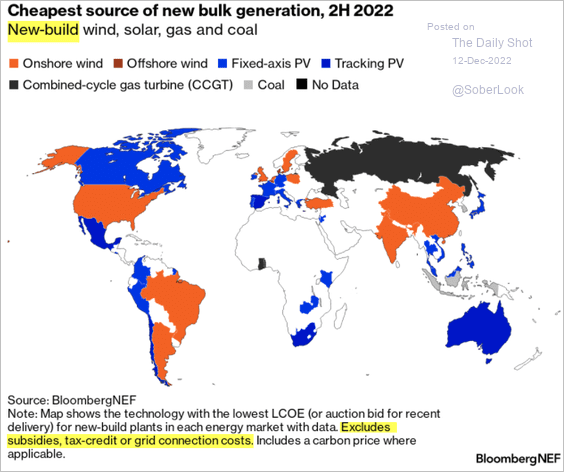

And this map shows the cheapest source of new electricity generation capacity.

Source: @BloombergNEF, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @BloombergNEF, @TheTerminal, Bloomberg Finance L.P. Read full article

Back to Index

Equities

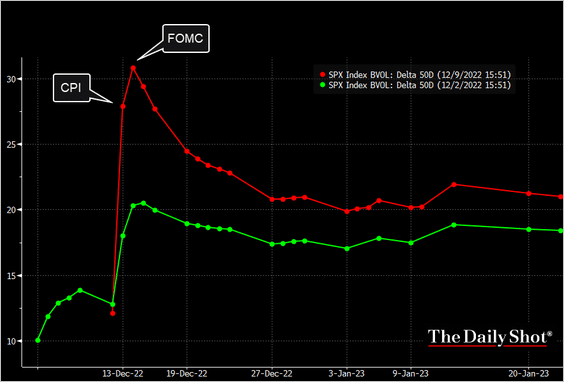

1. The market expects a volatile week. Here is the S&P 500 vol term structure (now vs. a week ago).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

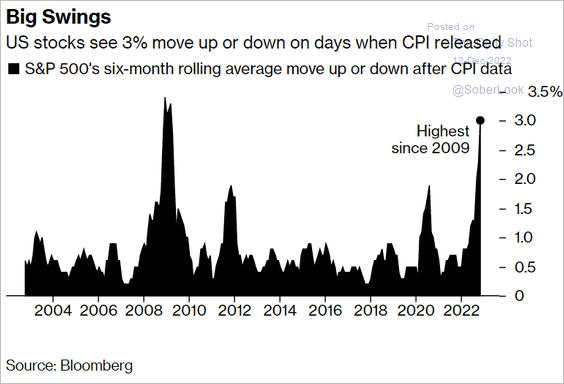

The CPI release days saw sharp market swings in recent months.

Source: @markets, @JessicaMenton, @lena_popina, @Matt_Turnerr Read full article

Source: @markets, @JessicaMenton, @lena_popina, @Matt_Turnerr Read full article

——————–

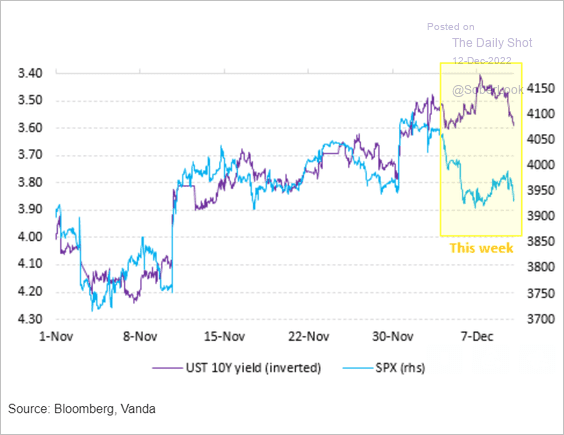

2. Last week’s stock/bond divergence is signaling recession concerns.

Source: Vanda Research

Source: Vanda Research

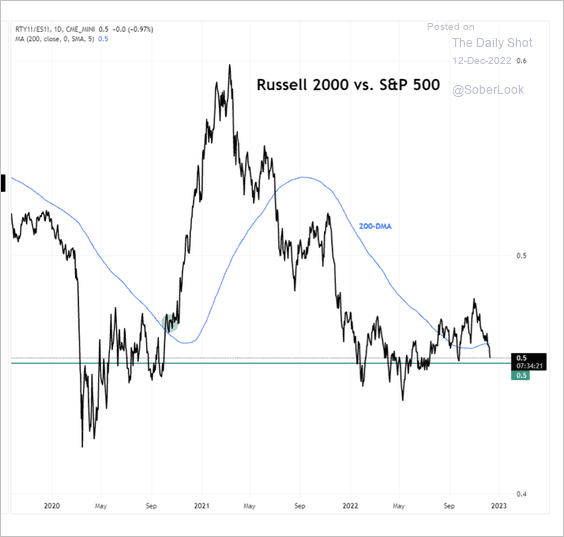

3. The Russell 2000 small-cap index/S&P 500 price ratio is back below its 200-day moving average.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

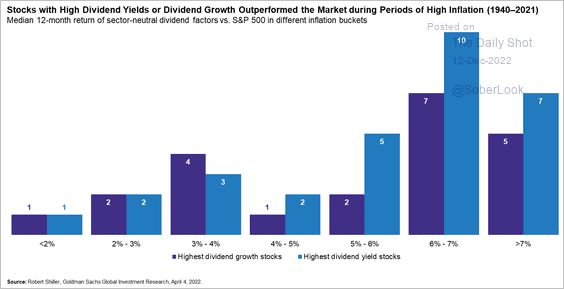

4. Dividend stocks typically outperform during inflationary periods.

Source: Newton Investment Management Read full article

Source: Newton Investment Management Read full article

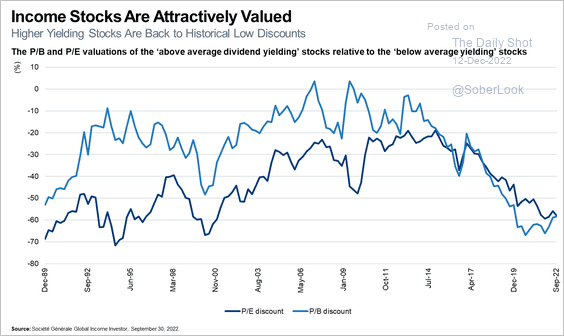

High dividend yield stocks are trading at a discount versus low dividend yield stocks.

Source: Newton Investment Management Read full article

Source: Newton Investment Management Read full article

——————–

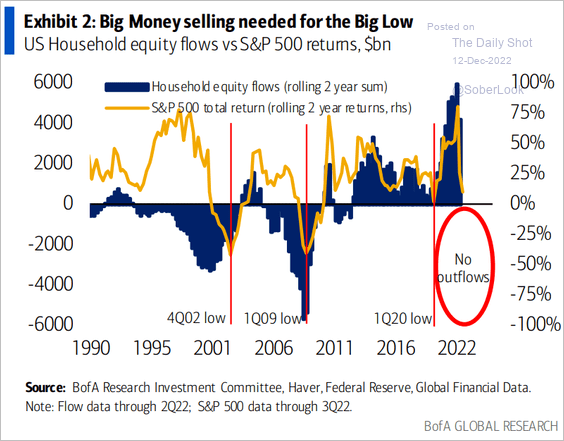

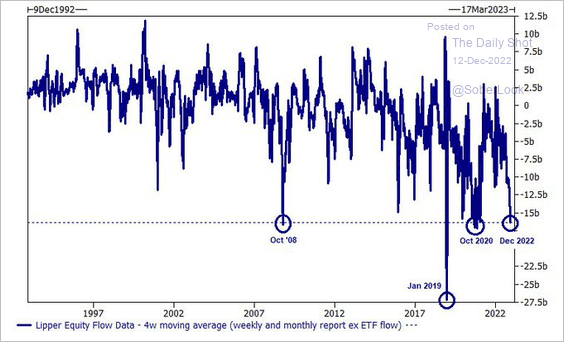

5. Fund flows showed no signs of capitulation in this year’s selloff.

Source: BofA Global Research

Source: BofA Global Research

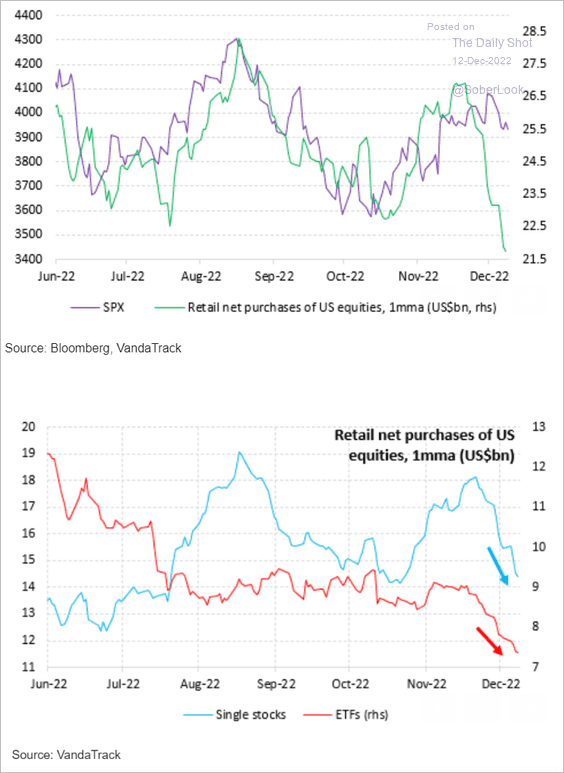

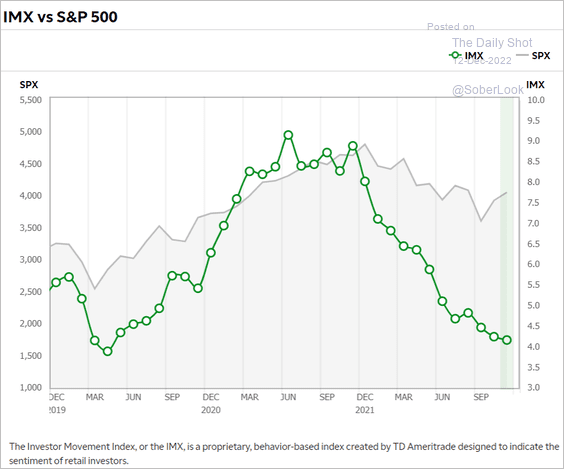

6. Retail investors have pulled back on stock purchases in recent weeks.

Source: Vanda Research

Source: Vanda Research

• Retail fund flows have turned sharply negative.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

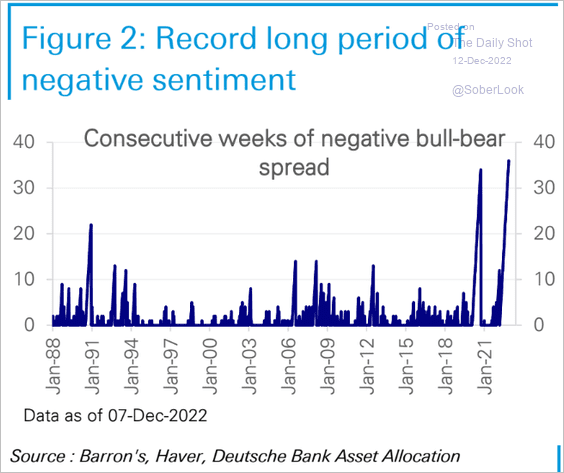

• Retail investor positioning …

Source: TD Ameritrade

Source: TD Ameritrade

… and sentiment remain depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

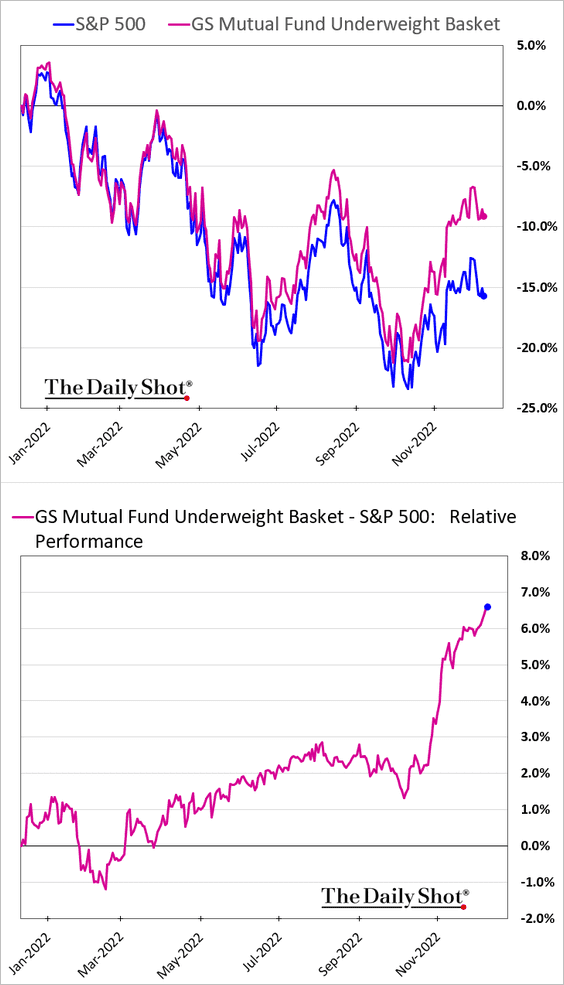

7. Stocks shunned by mutual funds have been outperforming.

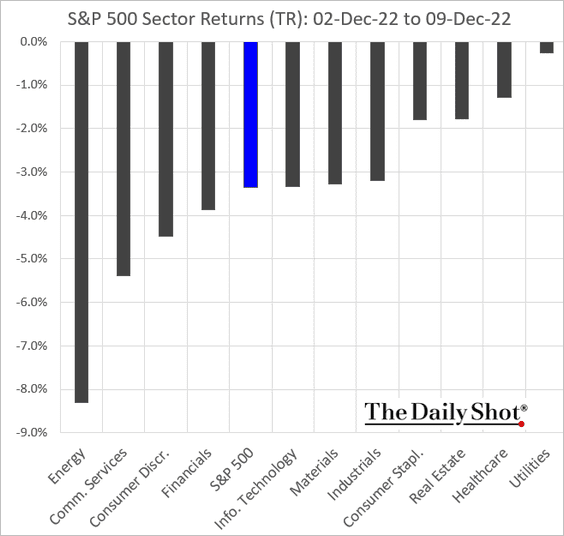

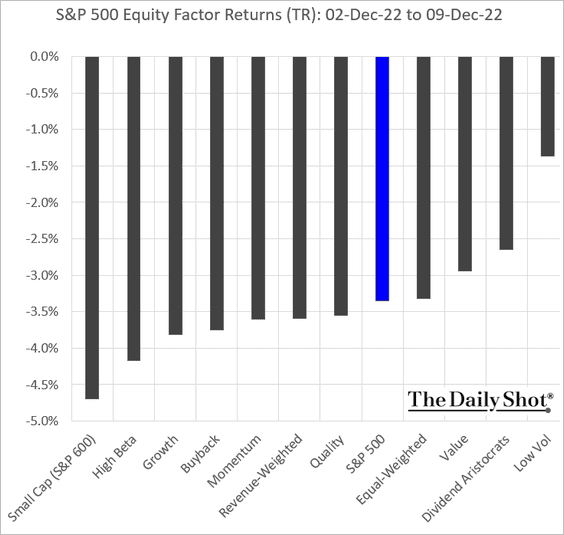

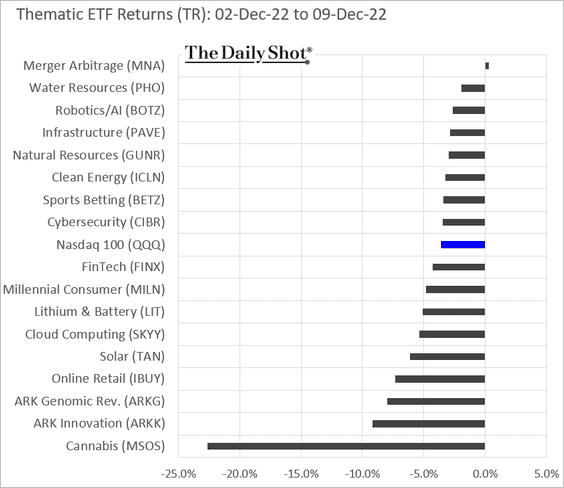

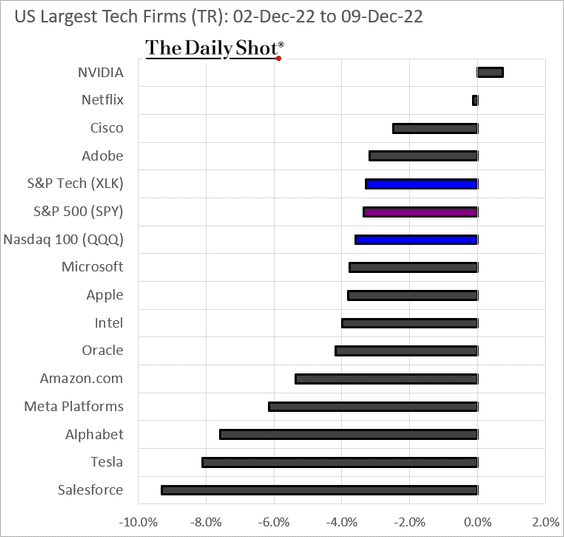

8. Finally, we have last week’s performance data.

• Sectors:

• Equity factors:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

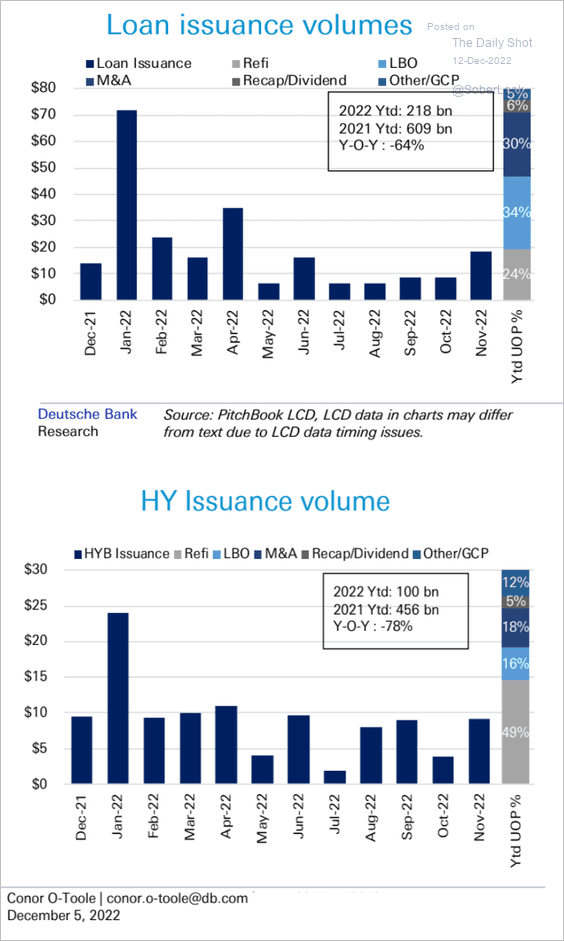

1. Leveraged finance issuance picked up in November. This chart also shows the year-to-date use of proceeds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

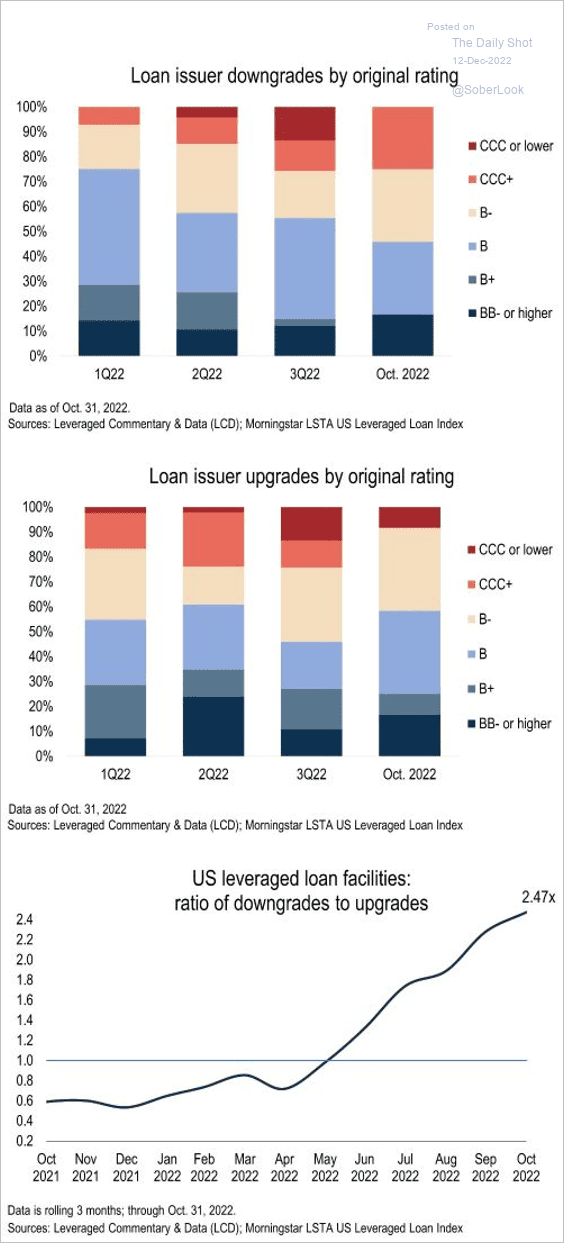

2. Next, we have leveraged loan downgrades and upgrades.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

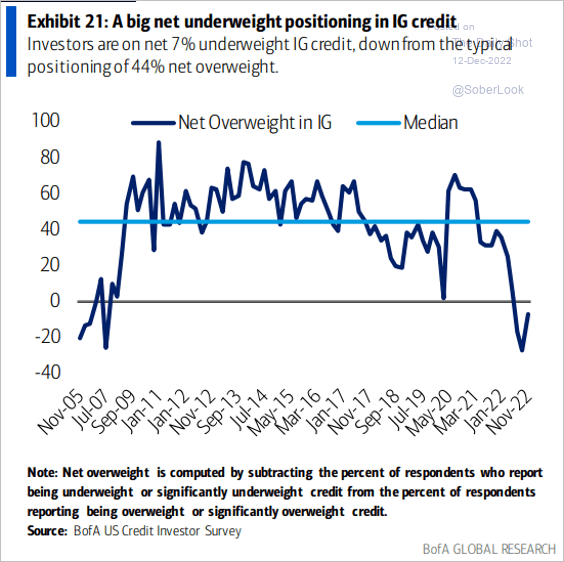

3. Investors are underweight in IG credit.

Source: BofA Global Research

Source: BofA Global Research

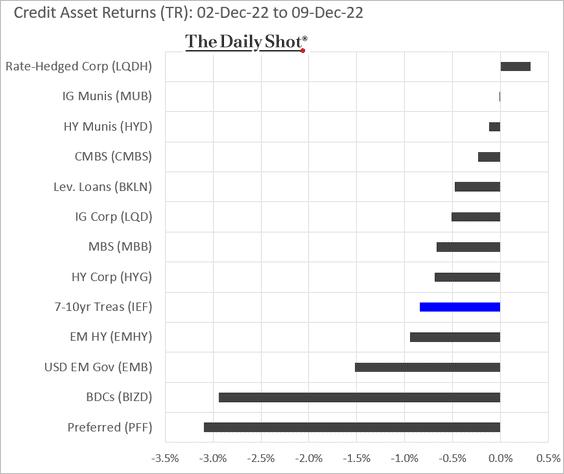

4. Here is last week’s performance by asset class.

Back to Index

Rates

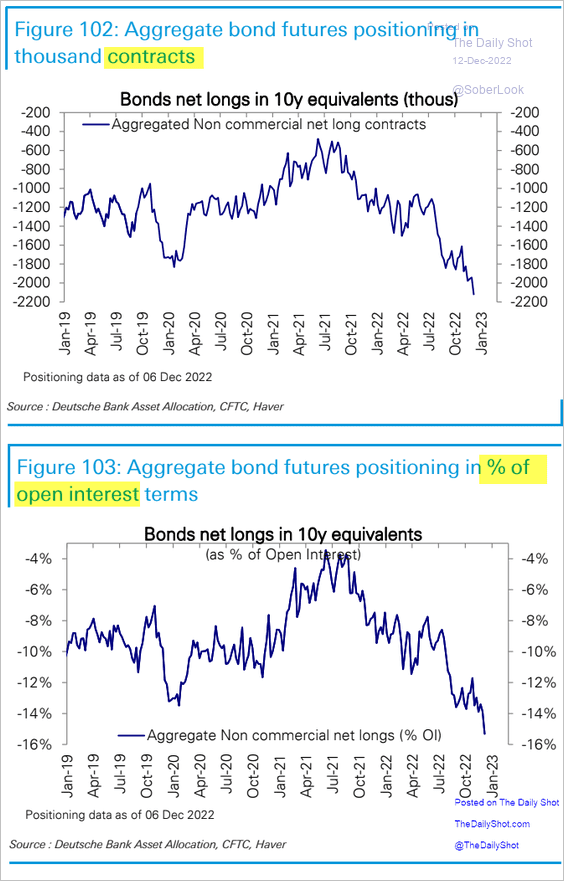

1. Speculative bets against Treasury futures are hitting extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

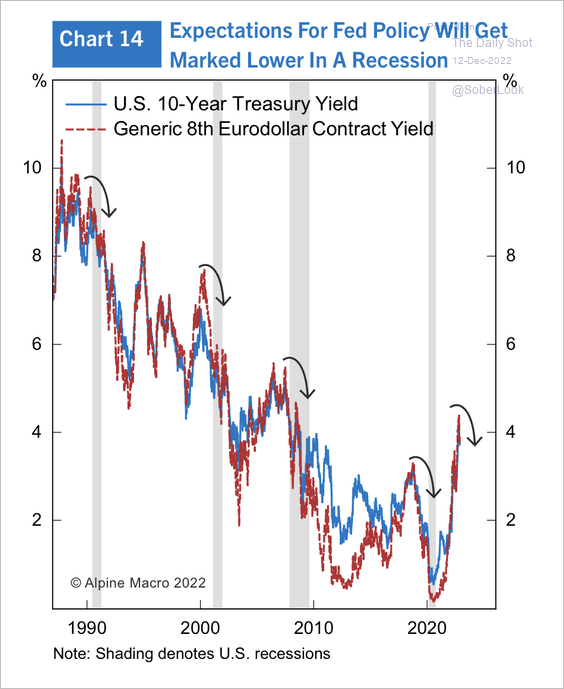

2. The 10-year Treasury yield is closely correlated with the yield on the eighth eurodollar contract. Alpine Macro expects lower yields as the market has fully discounted the tightening cycle.

Source: Alpine Macro

Source: Alpine Macro

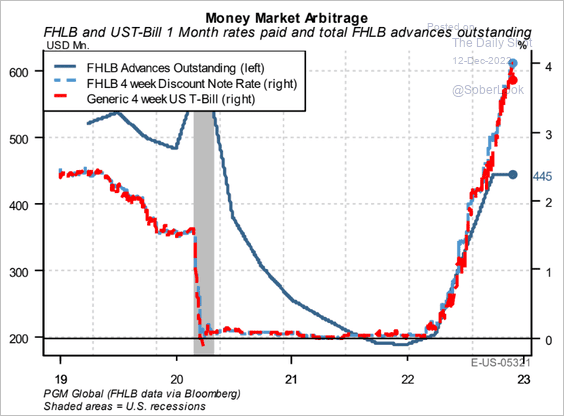

3. FHLB notes have become an attractive alternative to T-bills.

Source: PGM Global

Source: PGM Global

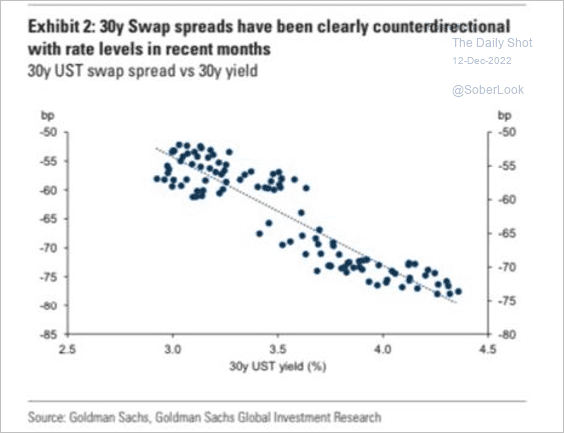

4. Longer-dated swap spreads have been inversely correlated to Treasury yields.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Global Developments

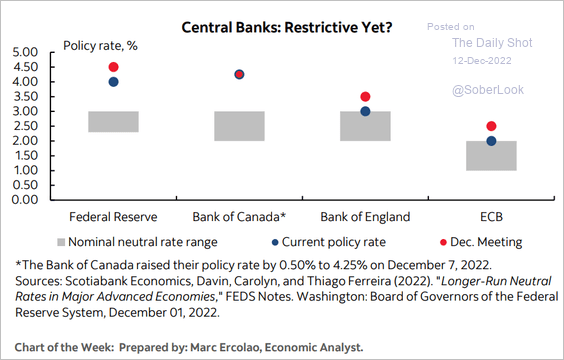

1. DM central banks are moving rates into restrictive territory.

Source: Scotiabank Economics

Source: Scotiabank Economics

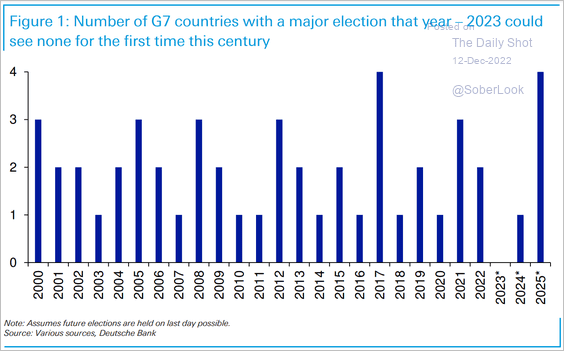

2. 2023 could be the first year of the 21st century without a major election in any G7 country.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

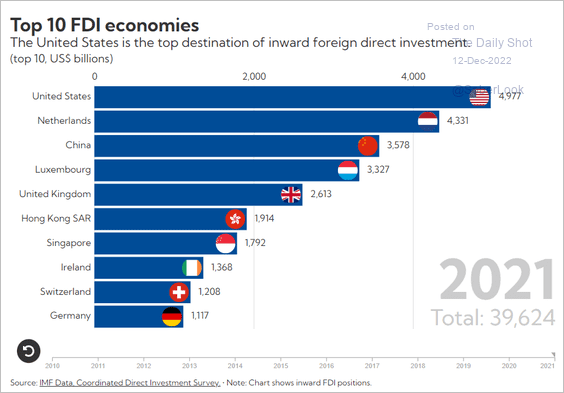

3. Here are the top destinations for foreign direct investment.

Source: IMF Read full article

Source: IMF Read full article

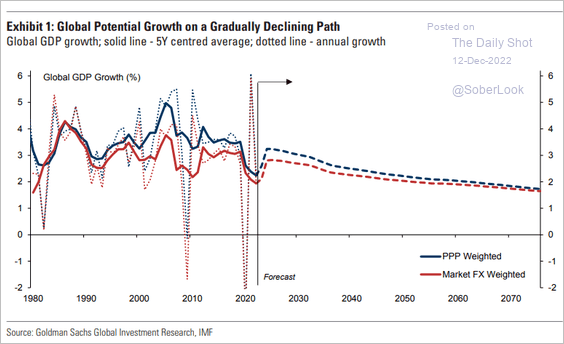

4. Global potential GDP expansion will continue to soften as population growth slows.

Source: Goldman Sachs

Source: Goldman Sachs

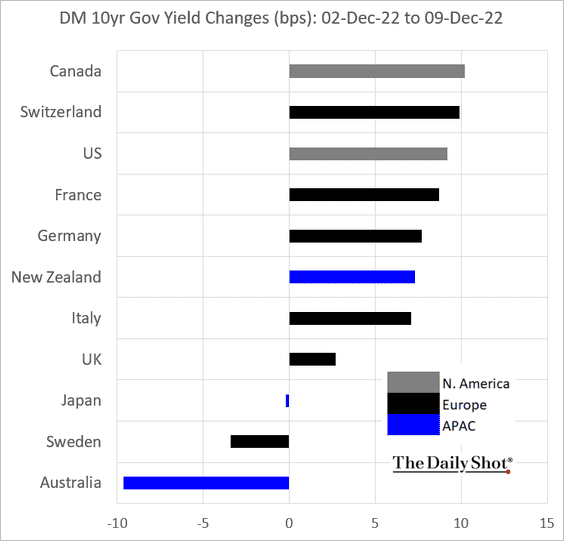

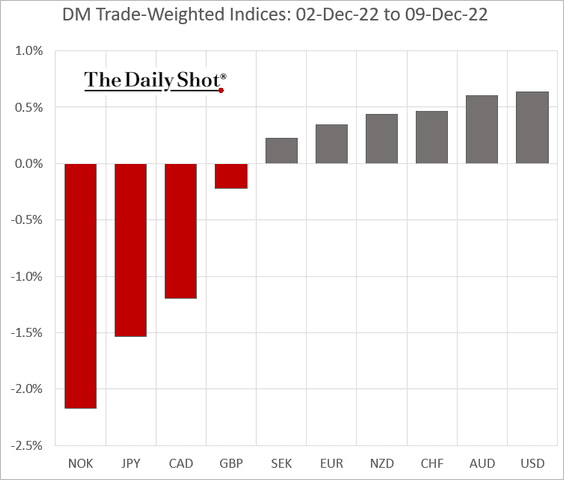

5. Next, we have some performance data from last week.

• Bond yields:

• Trade-weighted currency indices:

——————–

Food for Thought

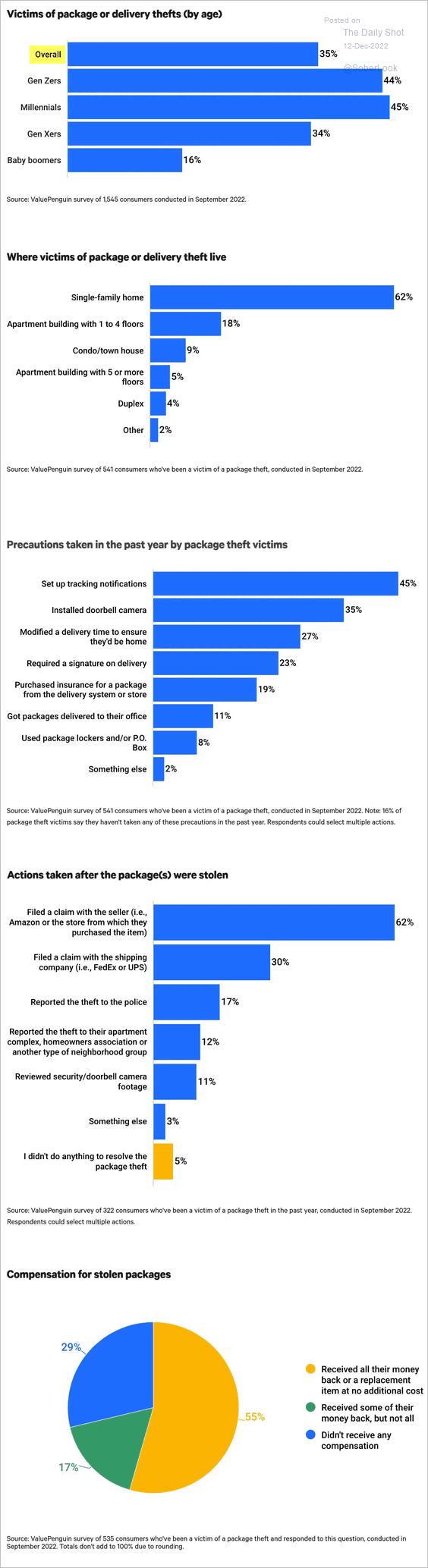

1. Stolen packages:

Source: ValuePenguin Read full article

Source: ValuePenguin Read full article

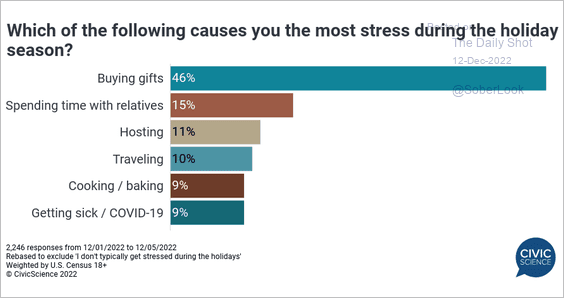

2. Stress during the holiday season:

Source: @CivicScience

Source: @CivicScience

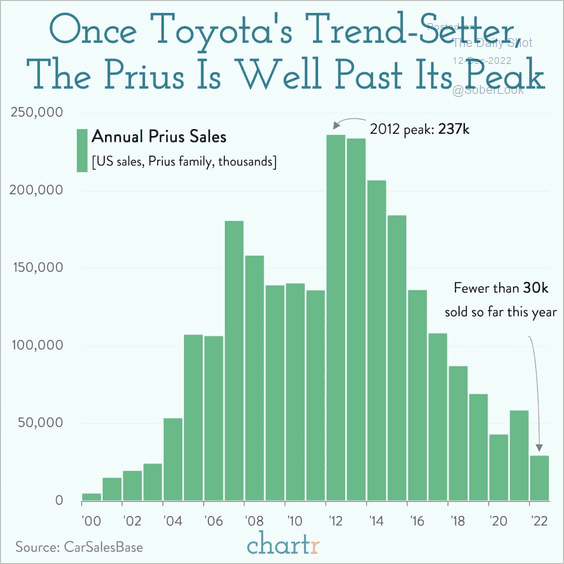

3. Toyota Prius sales:

Source: @chartrdaily

Source: @chartrdaily

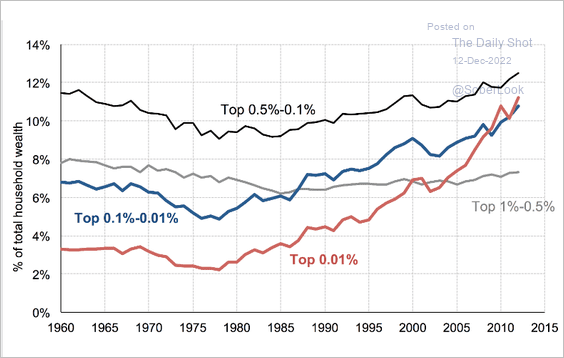

4. Top wealth shares in the United States:

Source: @gabriel_zucman

Source: @gabriel_zucman

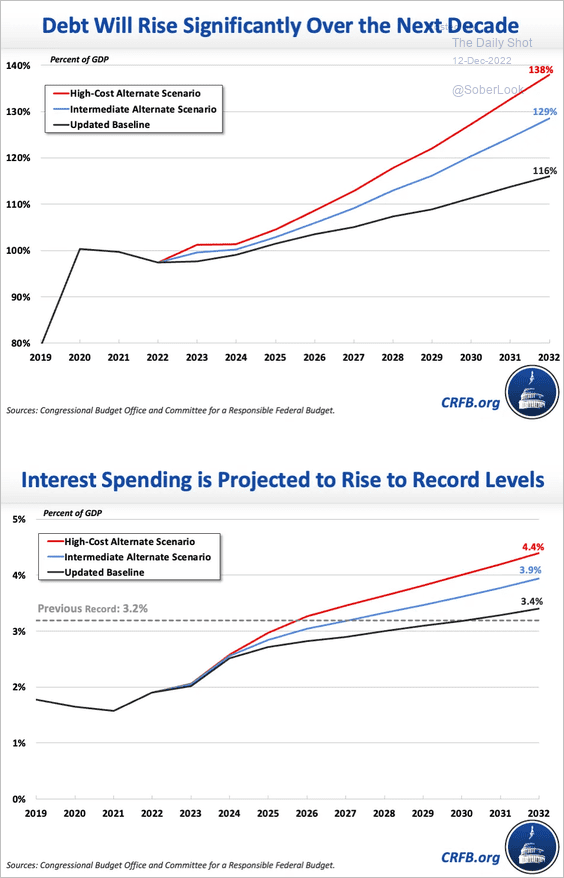

6. US debt scenarios:

Source: Committee for a Responsible Federal Budget

Source: Committee for a Responsible Federal Budget

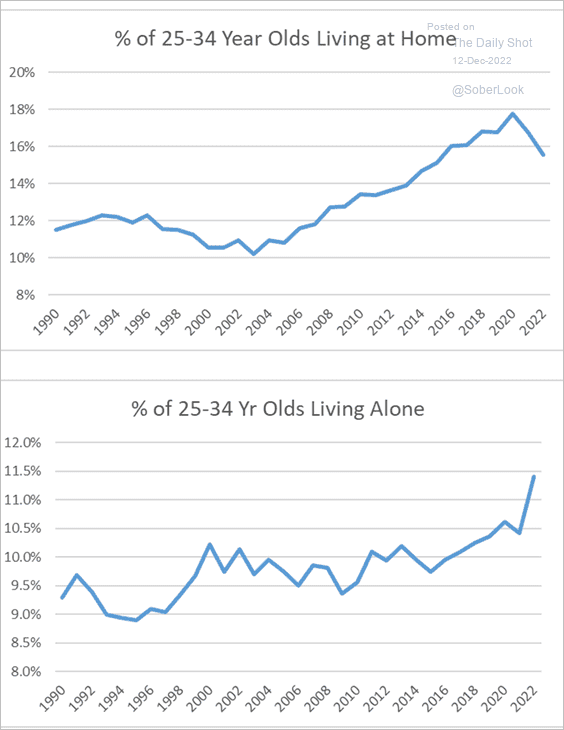

6. Share of US 25-34-year-olds living with parents vs. living alone:

Source: Calculated Risk

Source: Calculated Risk

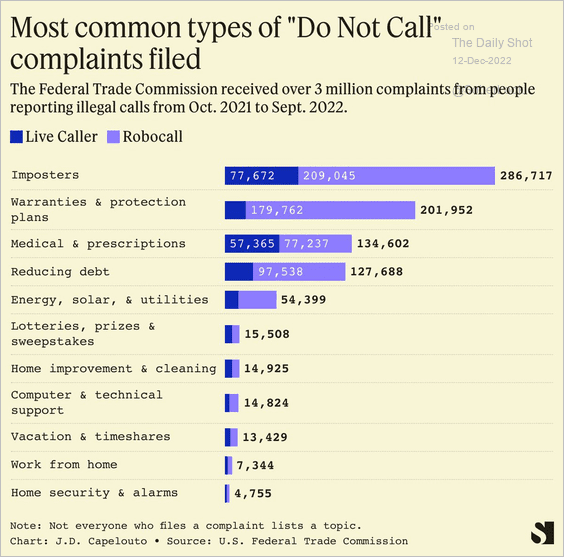

7. “Do not call” complaints:

Source: @semafor Read full article

Source: @semafor Read full article

——————–

Back to Index