The Daily Shot: 14-Dec-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

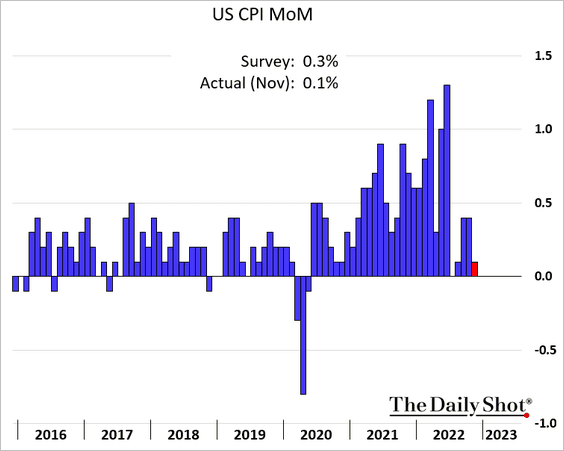

1. The November CPI report came in below expectation as inflation moderates.

Here are the contributions to the monthly CPI changes.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Gains in the core CPI were the lowest since August 2021, …

… and were negative when shelter is excluded.

Source: Calculated Risk

Source: Calculated Risk

• The core goods CPI was negative again.

The core services CPI remains elevated, …

… driven by housing (2 charts).

• Below is the CPI on a year-over-year basis.

Source: Oxford Economics

Source: Oxford Economics

• Next, we have some additional trends from the CPI report.

– Vehicles:

– Hospital services:

– Airline fares vs. jet fuel inflation:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• While the CPI slowdown is good news, absolute price levels have risen massively over the past couple of years, putting pressure on US households.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• We will have more data on inflation tomorrow.

——————–

2. Next, let’s take a look at market reactions to the CPI report.

• Bond yields:

– The Treasury curve:

– By the way, was the CPI report leaked?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @readep, @gardnerakayla, @markets Read full article

Source: @readep, @gardnerakayla, @markets Read full article

• Equities:

• The dollar:

• Gold:

• Copper:

• Cryptocurrencies:

——————–

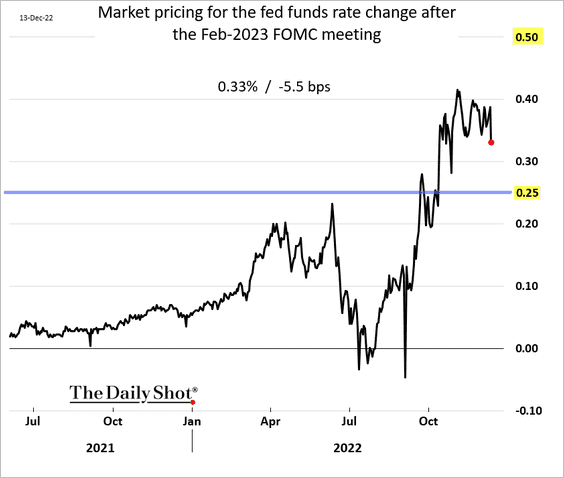

3. The implied terminal rate declined, with the market expecting the Fed to ease up on rate hikes (2 charts). Are the markets too optimistic about the Fed’s intentions?

February is now looking more like 25 bps rather than 50 bps.

Source: @ANZ_Research

Source: @ANZ_Research

By the way, here is a survey result from Deutsche Bank on the terminal rate.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

4. The inflation curve has been flattening.

Source: Quill Intelligence

Source: Quill Intelligence

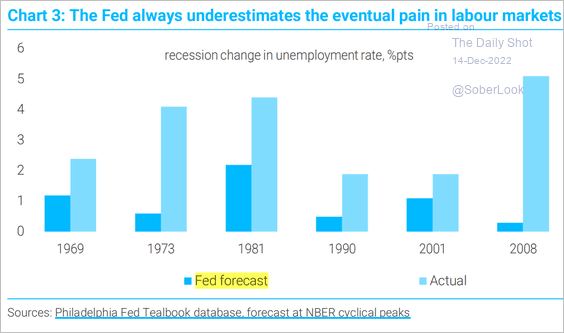

5. The FOMC is expected to boost its projections for unemployment. The forecast track record isn’t great.

Source: TS Lombard

Source: TS Lombard

——————–

6. The NFIB small business sentiment edged higher last month.

• Indicators of current earnings and sales expectations improved.

• Businesses are now trying to cut inventories.

• Compensation and compensation plans indicators remain elevated.

• Job openings are still hard to fill but getting easier, …

… which points to lower job openings ahead.

Source: Yardeni Research

Source: Yardeni Research

• Small businesses are cutting back on hiring plans.

Back to Index

The United Kingdom

1. The November payrolls growth topped expectations.

• The unemployment rate edged higher over the August – October period.

• Wage growth is above 6%.

• Vacancies are staring to moderate.

Source: Arcano Economics

Source: Arcano Economics

——————–

2. Danske Bank expects no rate cuts next year as inflation remains elevated.

Source: Danske Bank

Source: Danske Bank

3. Inflation expectations remain near multi-year highs.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

Back to Index

The Eurozone

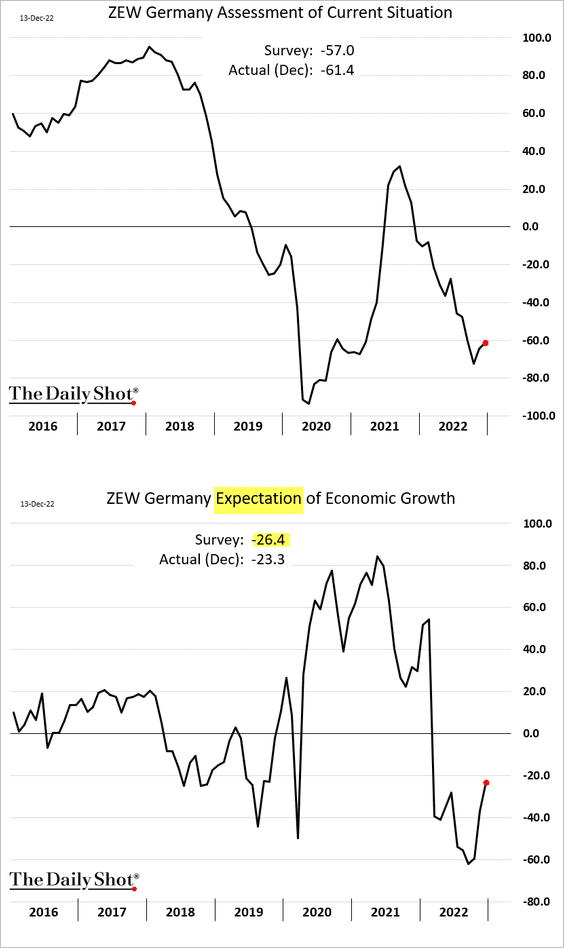

1. Germany’s ZEW expectations index climbed further this month as fears of an energy crisis this winter subside.

The EUR/USD one-month implied vol has been falling rapidly.

However, euro-area economic uncertainty remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

2. Italy’s industrial production declined again.

3. How will markets react to the ECB’s decision? Below are some scenarios from ING.

Source: ING

Source: ING

Here is the market pricing for the ECB terminal rate.

Source: ING

Source: ING

——————–

4. Inventories have been rising quickly.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

1. Norway’s GDP declined in October, but the economy remains robust.

2. How have real housing prices changed over the past few years?

Source: Gavekal Research

Source: Gavekal Research

This scatterplot shows housing valuation changes over the past decade.

Source: Gavekal Research

Source: Gavekal Research

——————–

3. Next, we have renewables capacity additions in the EU.

Source: Fitch Ratings

Source: Fitch Ratings

4. How important is manufacturing to each country’s economy?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

5. Finally, we have traffic fatalities by country.

Source: Datawrapper

Source: Datawrapper

Back to Index

Japan

1. The Tankan report showed manufacturing conditions and outlook moving lower.

Services activity remains strong, but the outlook is sputtering.

——————–

2. Banks are flush with cash, which could support lending.

Source: BCA Research

Source: BCA Research

Credit demand has been rising.

Source: BCA Research

Source: BCA Research

Back to Index

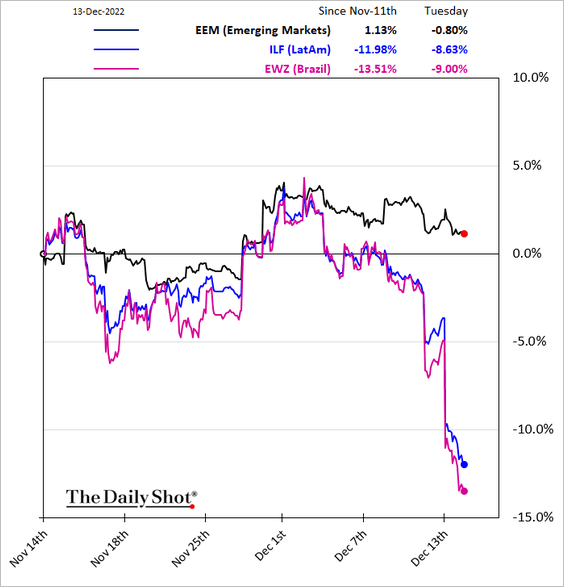

Emerging Markets

1. Brazil’s services output declined in October but remains well above pre-COVID levels.

Brazil’s stocks came under pressure in recent days.

——————–

2. LatAm fund managers are turning more gloomy, according to a survey from BofA.

Source: BofA Global Research

Source: BofA Global Research

3. Turkey’s industrial production improved in October.

4. South Africa’s mining output continues to deteriorate.

But business sentiment is holding up.

——————–

5. This chart shows distressed EM sovereigns’ debt composition.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

1. The ETH/BTC price ratio has stalled over the past month, capped below long-term resistance.

2. Crypto funds saw minor inflows last week led by long bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

Canadian crypto funds attracted the most capital last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

3. Total liquidity processed by Solana plummeted nearly 96% during the FTX fiasco.

Source: @DelphiDigital

Source: @DelphiDigital

The SOL/BTC price ratio collapsed to its lowest level since July 2021.

——————–

4. This chart shows the total number of crypto tokens with a value of over $1 billion (“unicorns”).

Source: Blockchain Center

Source: Blockchain Center

5. Binance, the largest crypto exchange, faces significant outflows.

Source: Reuters Read full article

Source: Reuters Read full article

The Binance token has underperformed.

Back to Index

Commodities

1. Fund managers are underweight commodities relative to bonds.

Source: BofA Global Research

Source: BofA Global Research

2. Brazil’s soybeans crop forecast signals an oversupplied market next year.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Back to Index

Energy

1. Slower economic activity could put further downward pressure on oil prices.

Source: Capital Economics

Source: Capital Economics

2. Falling oil prices could make it more challenging for Russia to keep financing its war.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

3. US natural gas demand is about to surge.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Source: NOAA

Source: NOAA

Prices have been rising.

Back to Index

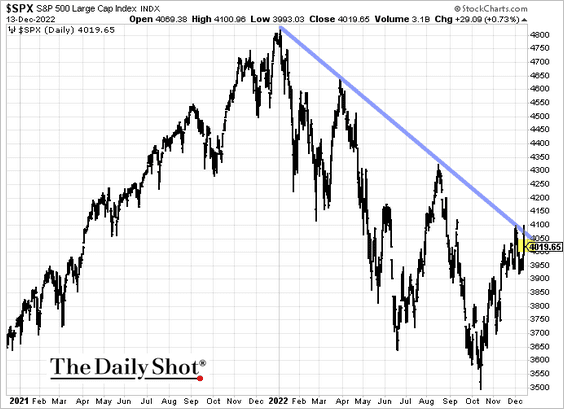

Equities

1. The S&P 500 downtrend resistance held after the CPI report.

2. Market swings around CPI reports have been getting larger.

Source: @WSJ Read full article

Source: @WSJ Read full article

4. A survey of US equity investors by S&P Global shows deteriorating risk appetite (diverging from the BofA fund manager survey).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

5. The correlation between stocks has moderated over the past month.

Source: Evercore ISI Research

Source: Evercore ISI Research

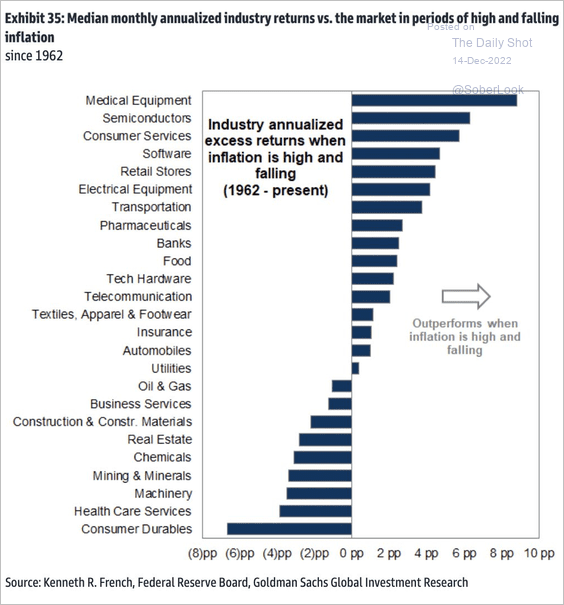

6. Next, we have some sector updates.

• Buyback announcements:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Fund flows:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Fund managers’ overweight/underweight levels by sector:

Source: BofA Global Research

Source: BofA Global Research

• Sector performance during periods of high and falling inflation:

Source: Goldman Sachs

Source: Goldman Sachs

• Sector outlook:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

7. The percentage of days with the S&P 500 down and VIX also down hit a multi-decade high this year.

Source: Tier1 Alpha

Source: Tier1 Alpha

8. The best-performing regions of the last decade often disappoint in the following decade.

Source: Taunus Trust

Source: Taunus Trust

Back to Index

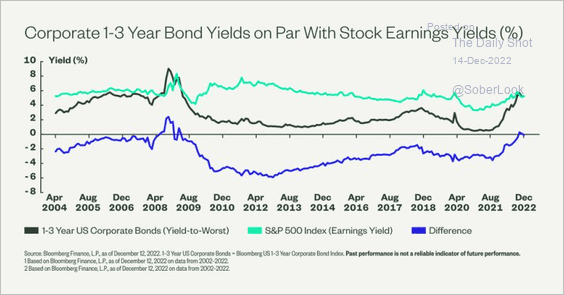

Credit

Short-term US corporate bond yields are on par with the S&P 500’s earnings yield for the first time since the financial crisis.

Source: State Street Global Advisors Read full article

Source: State Street Global Advisors Read full article

Back to Index

Rates

1. The 10-year Treasury yield is testing support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. The rates/equities implied vol gap remains wide.

Source: @themarketear

Source: @themarketear

Back to Index

Global Developments

1. The dollar index (DXY) is testing long-term support.

The upside appears limited, given overbought readings.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

2. Bloomberg article mentions of “recession” peaked earlier this year. That could signal a trough in global manufacturing PMIs …

Source: BCA Research

Source: BCA Research

… and maybe a peak in the dollar.

Source: BCA Research

Source: BCA Research

——————–

3. US CPI, FOMC, and ECB days have seen outsized market moves this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Labor markets remain very tight in advanced economies.

Source: JP Morgan Research; @SamRo

Source: JP Morgan Research; @SamRo

5. The Oxford Economics’ 2023 GDP forecasts are well below consensus.

Source: Oxford Economics

Source: Oxford Economics

This chart shows Barclays’ inflation forecasts for 2023.

Source: Barclays Research

Source: Barclays Research

——————–

Food for Thought

1. Falling real wages:

Source: Statista

Source: Statista

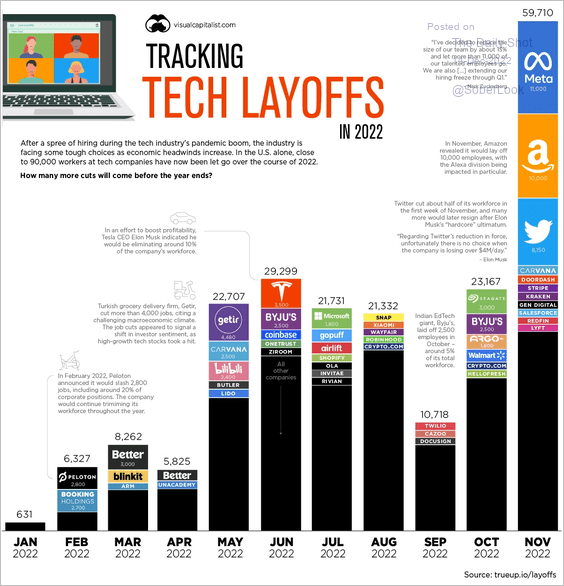

2. Tech layoffs:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

3. Real heating costs in the US:

Source: USAFacts

Source: USAFacts

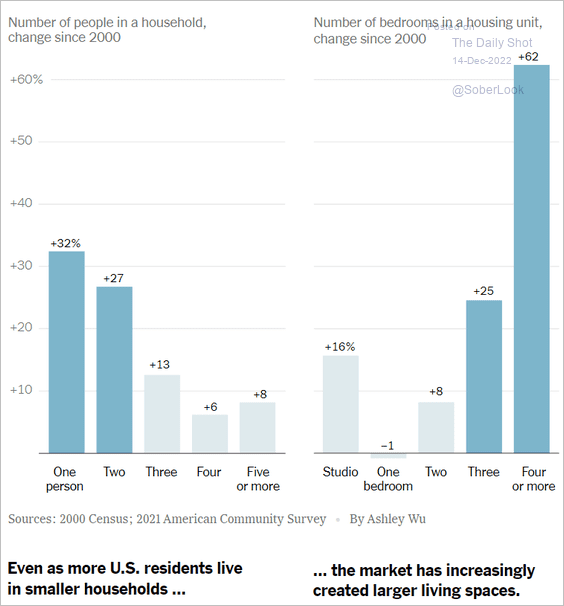

4. Smaller households, larger homes:

Source: The New York Times Read full article

Source: The New York Times Read full article

5. US population aged 50 and older by marital status:

Source: The New York Times Read full article

Source: The New York Times Read full article

6. Ukraine’s missile interception rates:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

7. Carbon reduction plans vs. goals (2 charts):

Source: Barclays Research

Source: Barclays Research

Source: Datawrapper

Source: Datawrapper

• Investment required for climate action by 2030:

Source: Oxford Economics

Source: Oxford Economics

——————–

8. Thunderstorm frequency across Europe:

Source: @loverofgeography

Source: @loverofgeography

——————–

Back to Index