The Daily Shot: 16-Dec-22

• The Eurozone

• The United Kingdom

• Europe

• The United States

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Food for Thought

The Eurozone

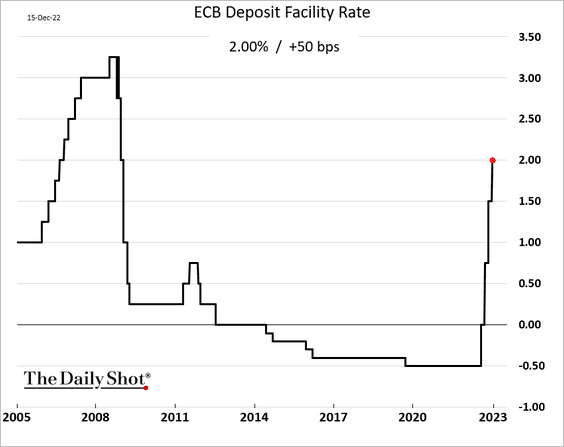

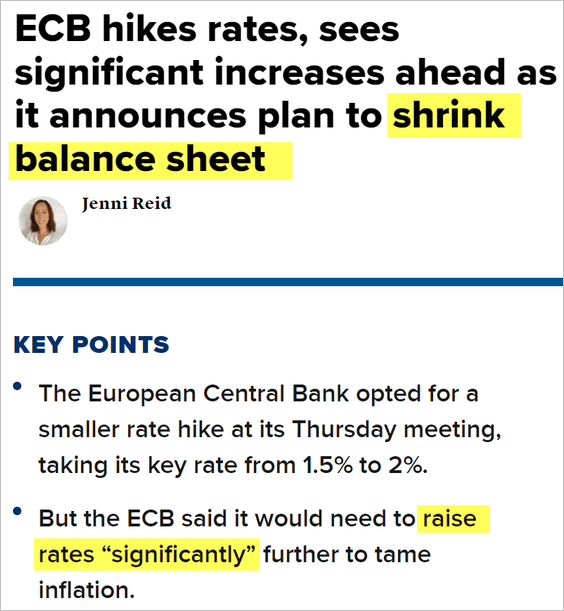

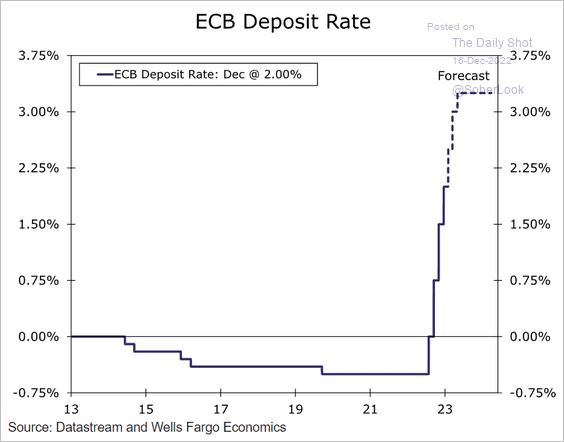

1. The ECB hiked rates by 50 bps and struck a hawkish tone.

Source: CNBC Read full article

Source: CNBC Read full article

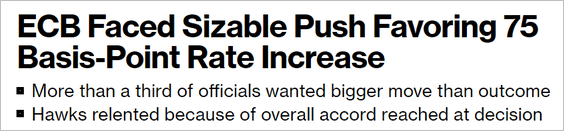

The hawks on the Governing Council wanted to go with 75 bps, but a compromise was struck to deliver hawkish guidance on rates and quantitative tightening.

Source: @WeberAlexander, @jrandow, @business Read full article

Source: @WeberAlexander, @jrandow, @business Read full article

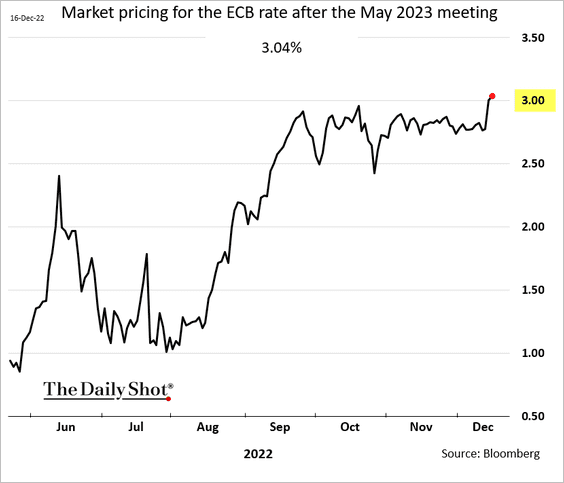

The market now sees the terminal rate above 3%. Here is the pricing for May.

Below is Wells Fargo’s forecast.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

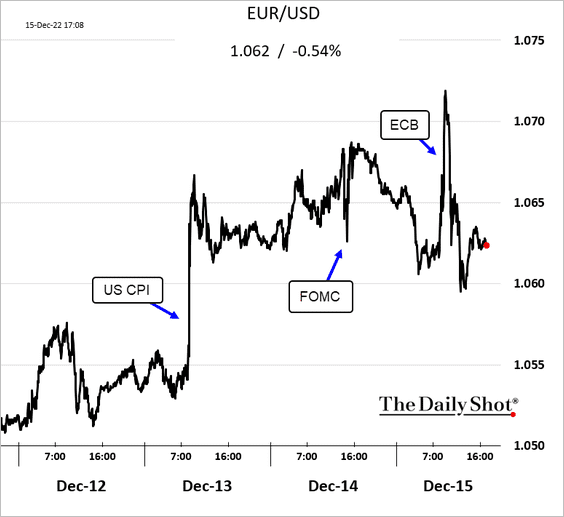

2. The euro surged on the ECB announcement but then retreated amid global risk-off sentiment.

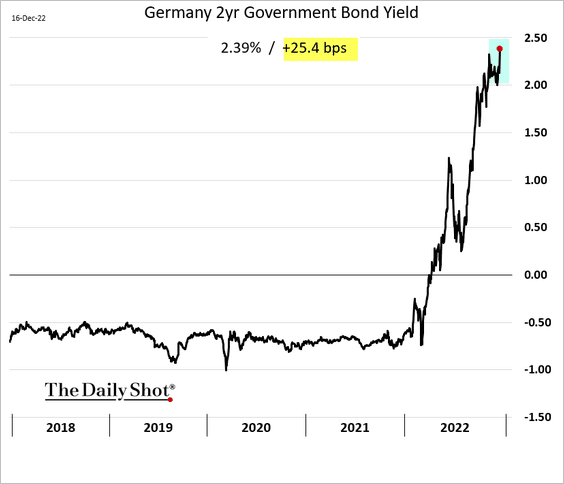

Short-term bond yields jumped, …

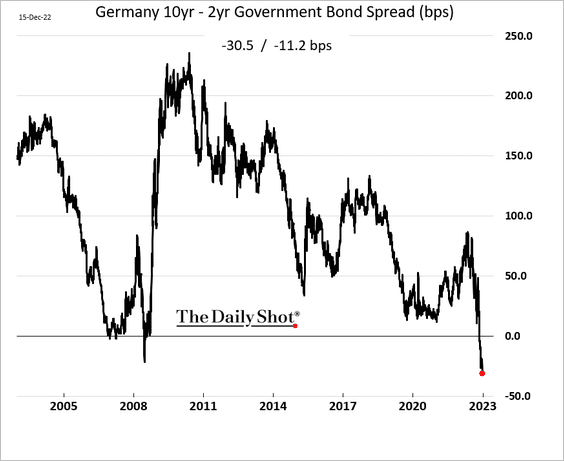

… and the Bund curve inverted further, signaling recession.

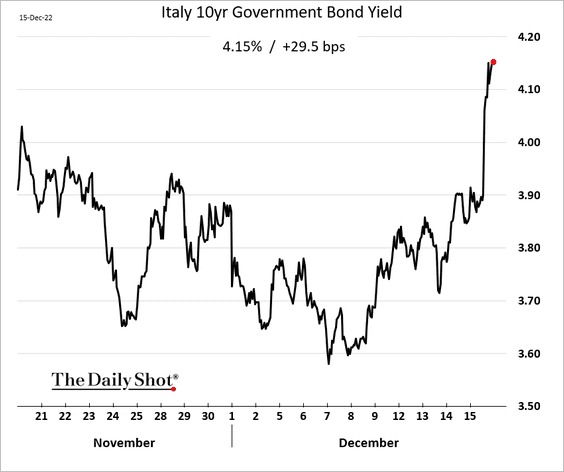

Italian yields spiked as the ECB focuses on balance sheet reduction.

——————–

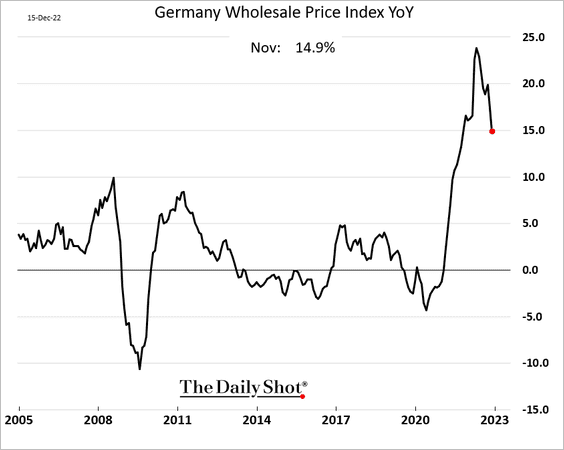

3. Germany’s wholesale prices are moderating.

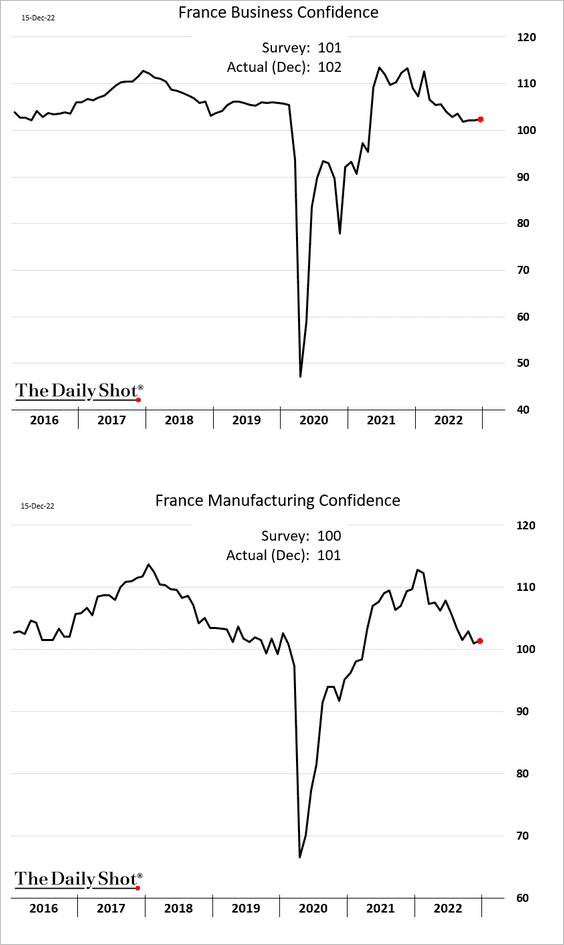

4. French business confidence is holding up relatively well.

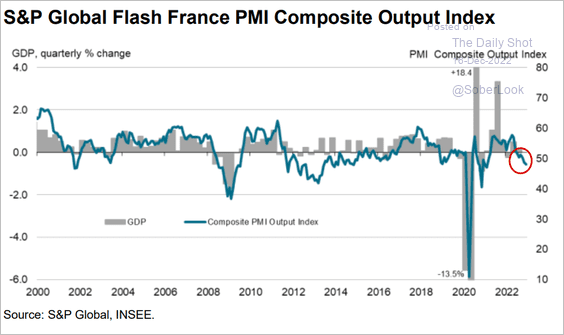

However, the December PMI report showed further contraction in business activity.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

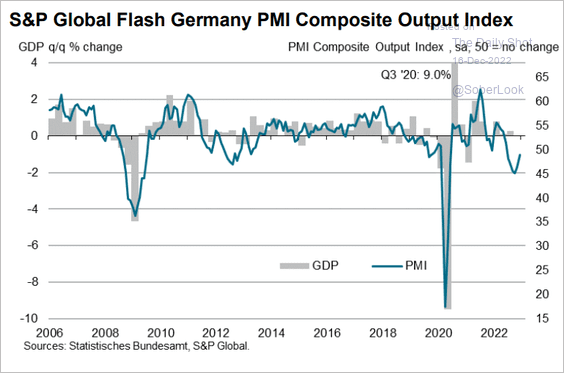

5. Germany’s business activity declined at a slower pace this month, according to the flash PMI report. More on this next week.

Source: S&P Global PMI

Source: S&P Global PMI

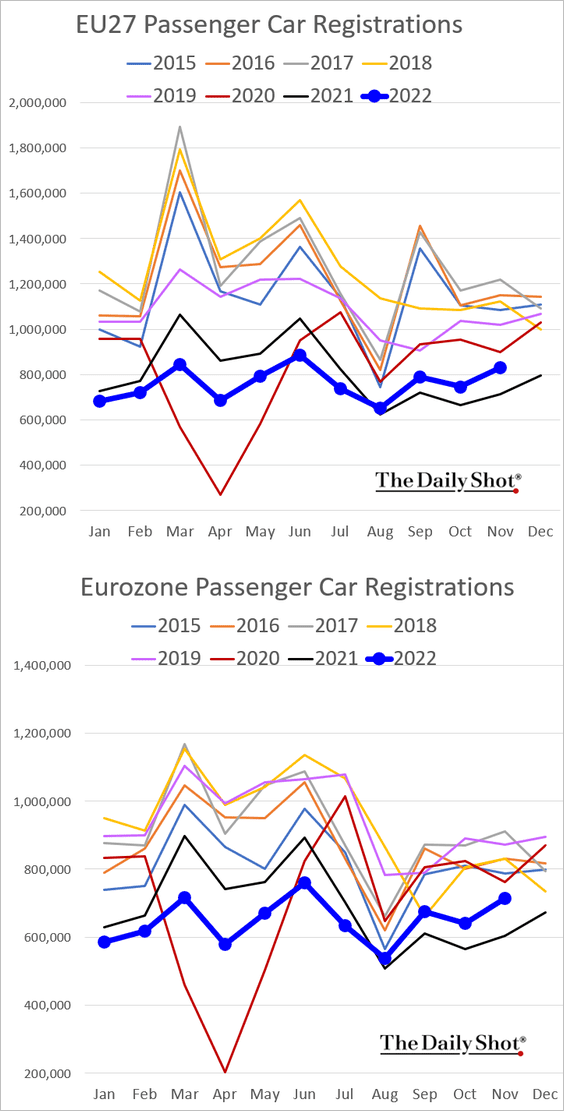

6. Car sales improved in November but remain below 2020 levels.

Back to Index

The United Kingdom

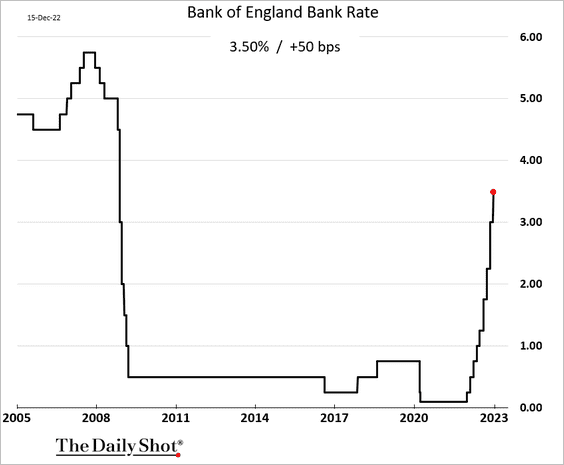

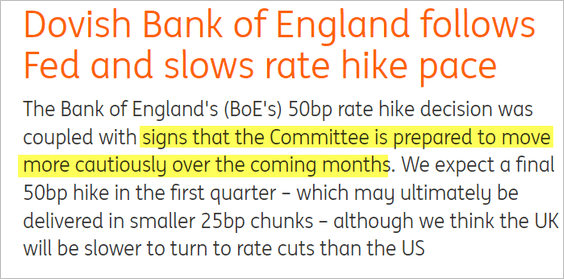

1. The BoE delivered a dovish 50 bps hike.

Source: ING Read full article

Source: ING Read full article

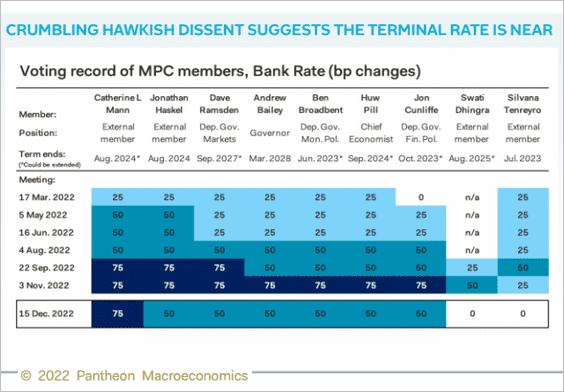

The MPC vote was more dovish than expected. According to Dan Hanson of Bloomberg Economics, “The vote split was 1-6-0-2 with Catherine Mann preferring a 75-bps hike. Swati Dhingra and Silvana Tenreyro favored no increase.” Here is the MPC’s voting history from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

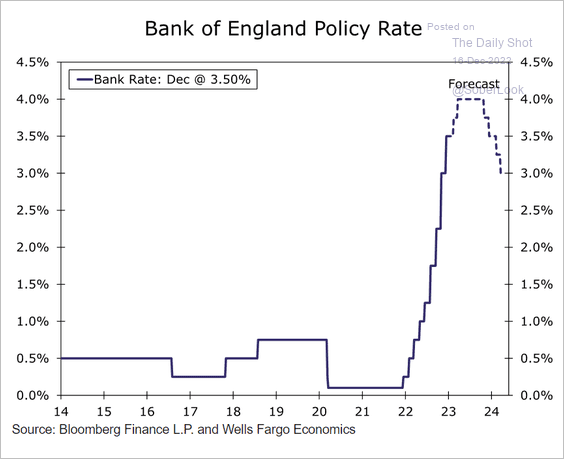

Below is Wells Fargo’s forecast for the BoE rate.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

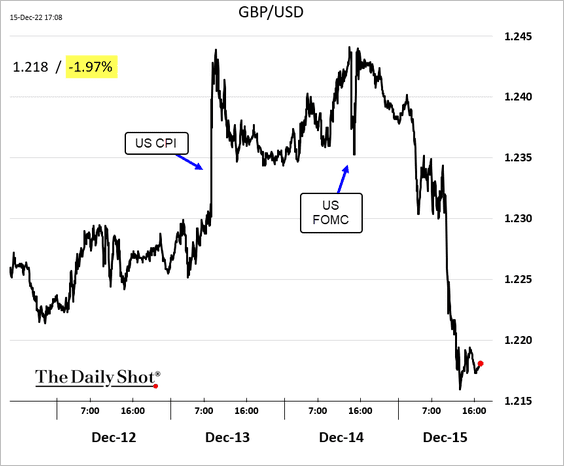

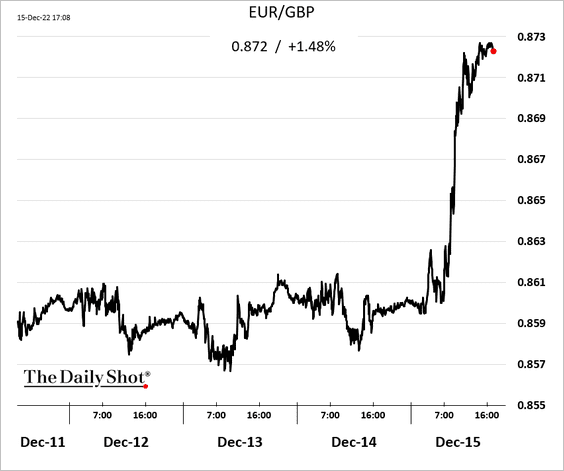

2. The pound tumbled (2 charts).

——————–

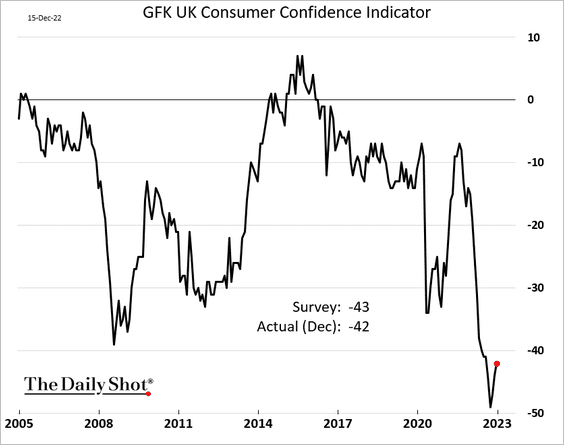

3. UK consumer confidence bounced from the lows this month.

Back to Index

Europe

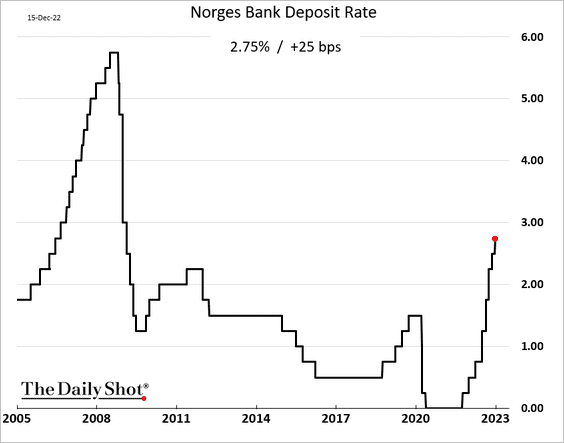

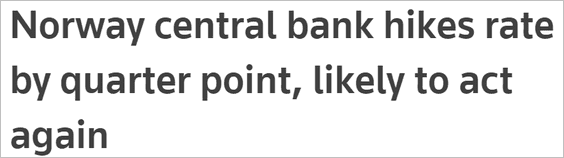

1. Three other European central banks raised rates on Thursday.

• Norway:

Source: Reuters Read full article

Source: Reuters Read full article

• Denmark:

Source: Nordea Markets

Source: Nordea Markets

Source: Reuters Read full article

Source: Reuters Read full article

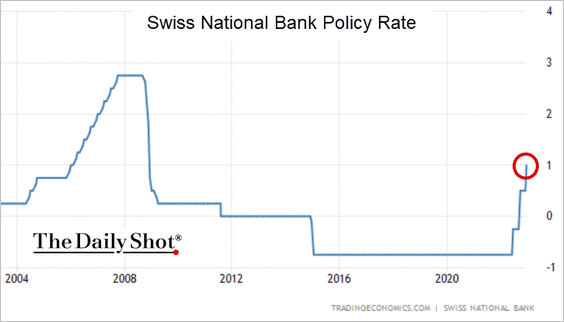

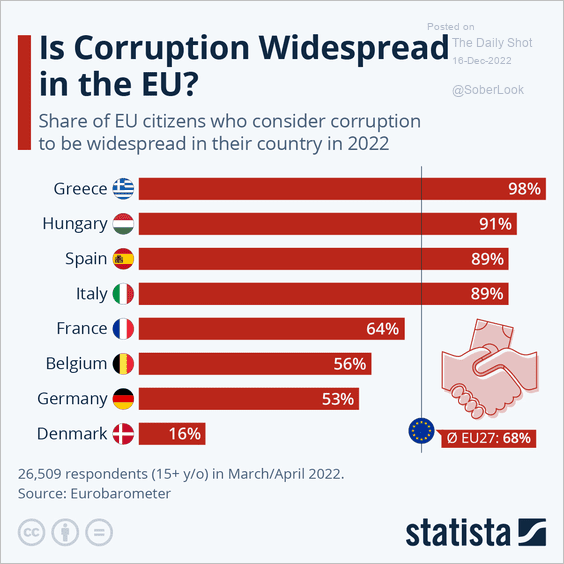

• Switzerland:

Source: Tradingeconomics.com

Source: Tradingeconomics.com

Source: Reuters Read full article

Source: Reuters Read full article

——————–

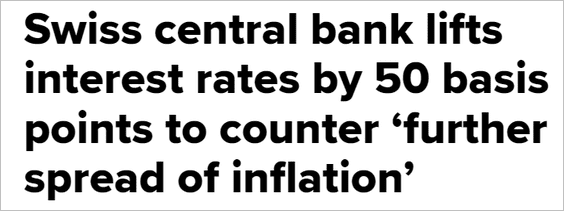

2. Sweden’s unemployment rate remains very low.

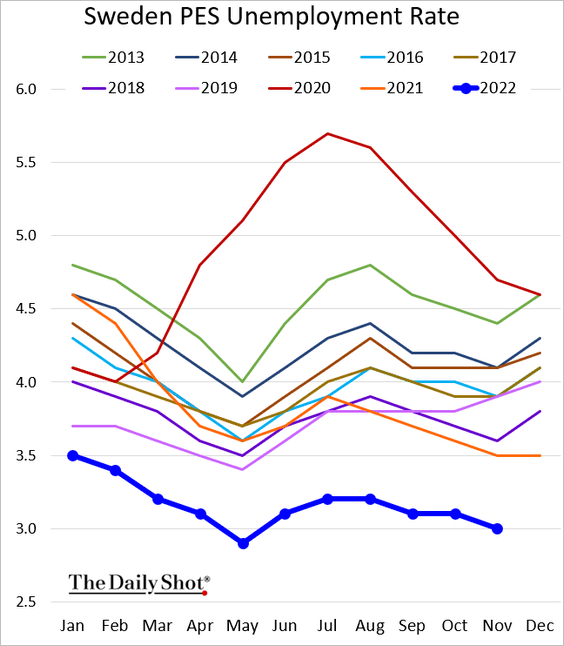

3. Next, we have some data on corruption concerns in the EU.

Source: Statista

Source: Statista

Back to Index

The United States

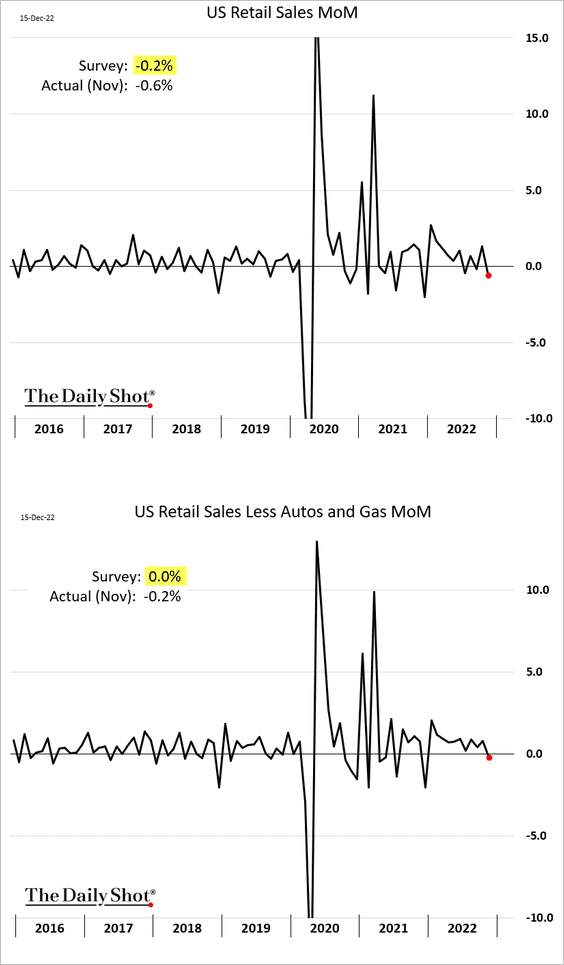

1. Retail sales declined last month.

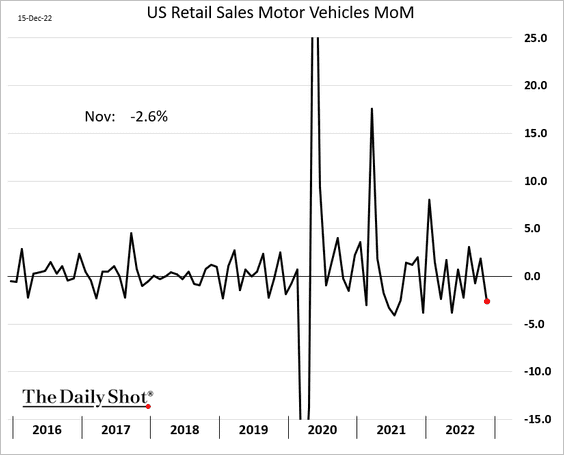

Vehicle sales dropped sharply.

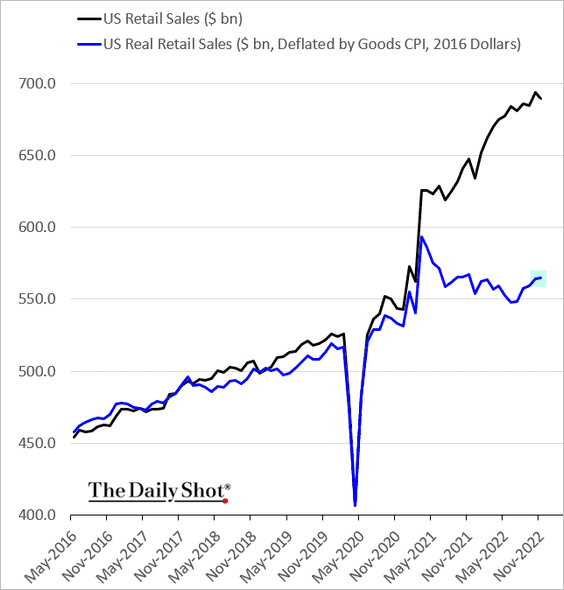

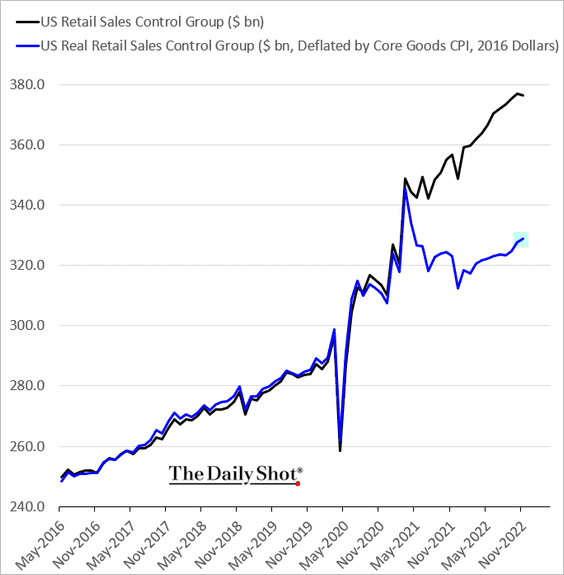

However, when adjusting for inflation, retail sales held steady or improved.

• Total sales:

• “Core” retail sales:

——————–

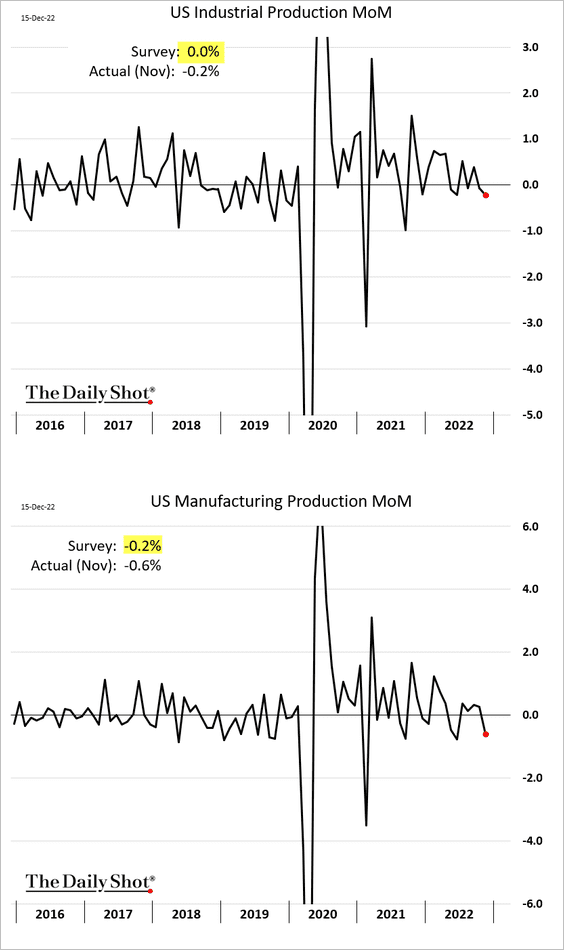

2. Industrial production and manufacturing output also declined in November.

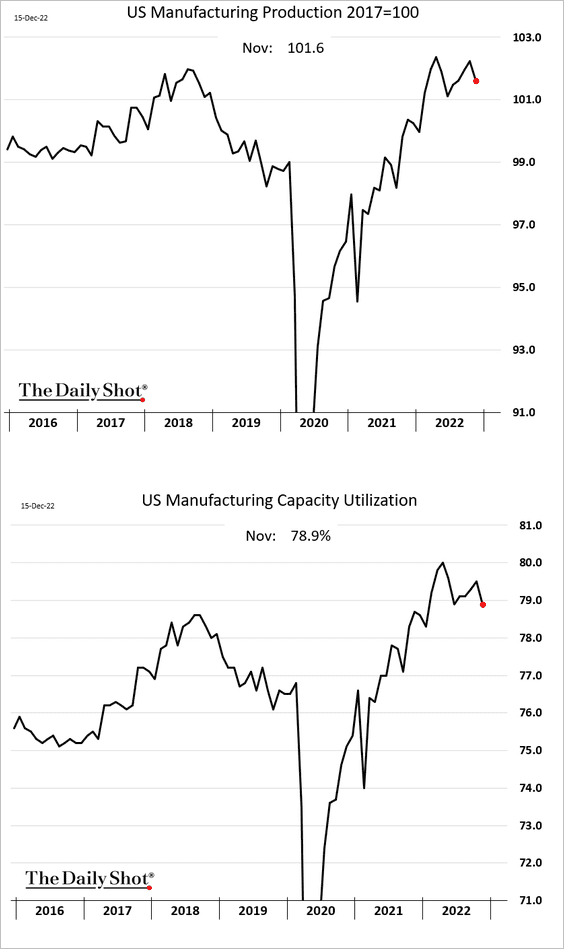

These charts show the manufacturing production level and capacity utilization.

——————–

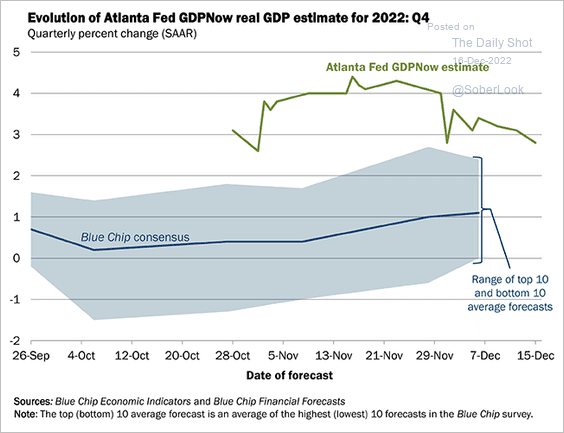

3. Slower retail sales and industrial production signal softer economic growth.

Source: @WSJ Read full article

Source: @WSJ Read full article

The Q4 GDPNow model estimate declined to 2.8% (annualized). Forecasters see growth at around 1%.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

——————–

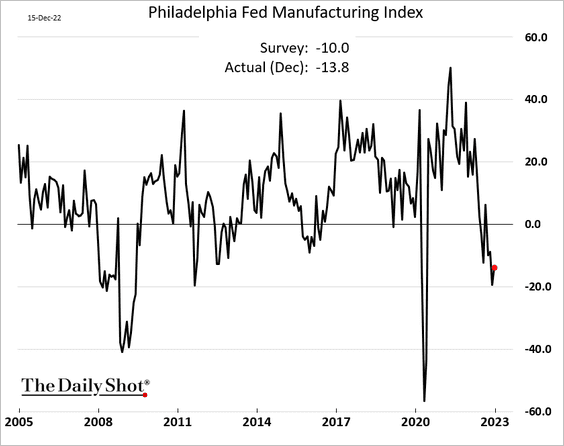

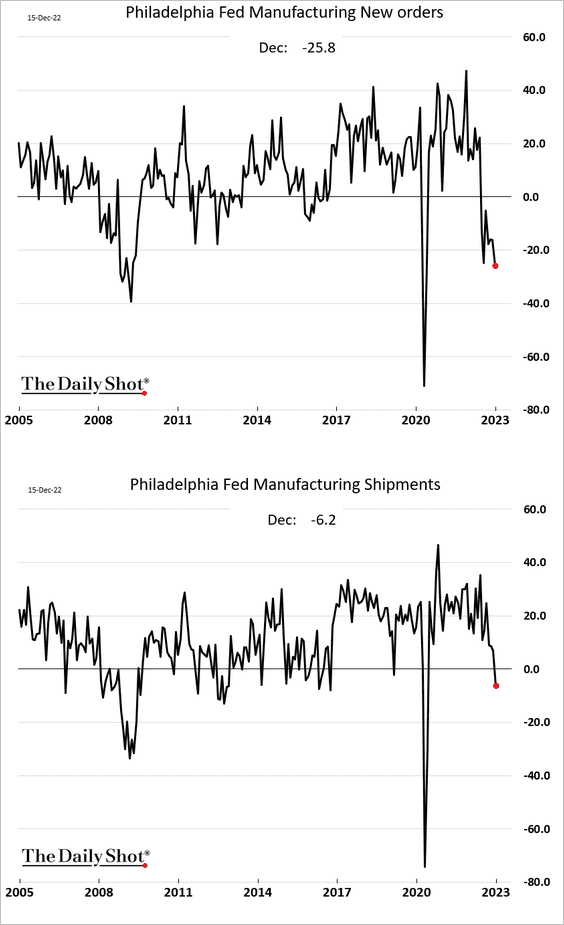

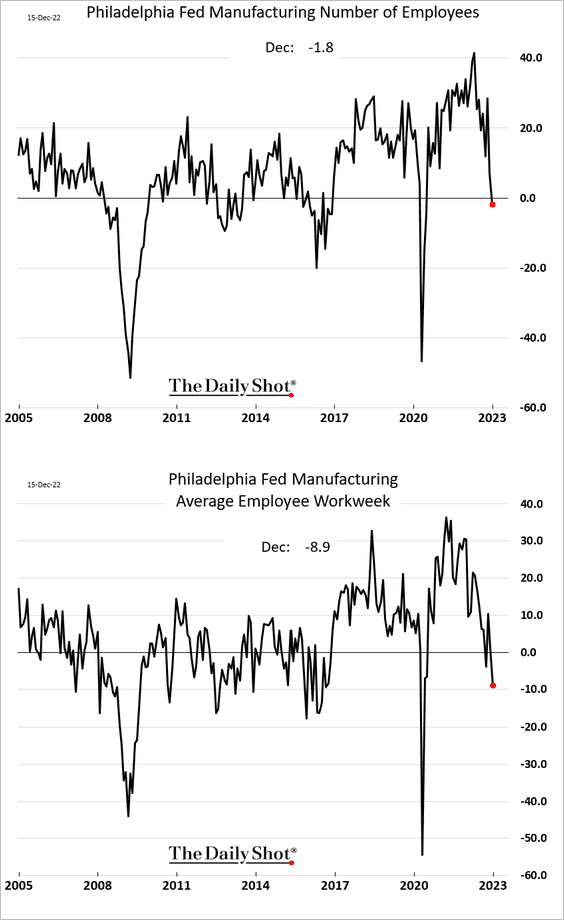

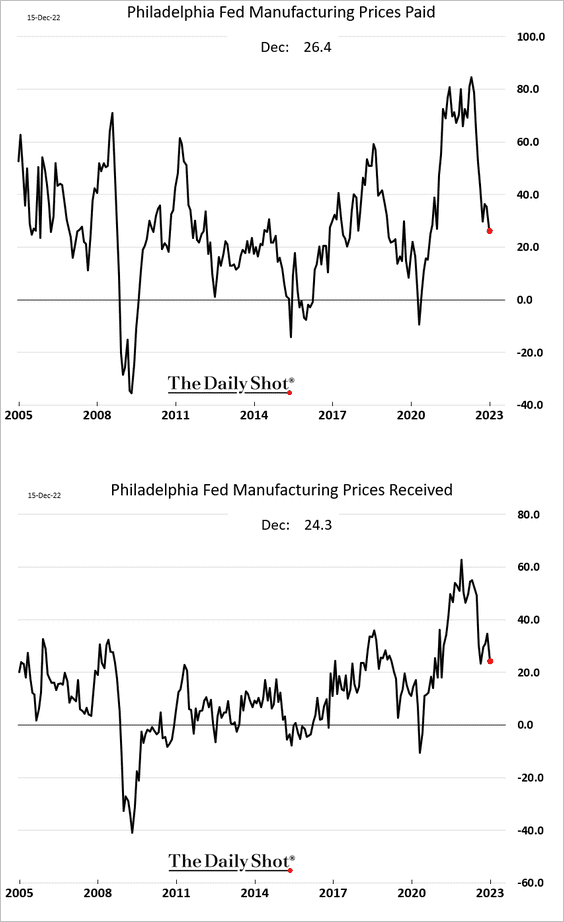

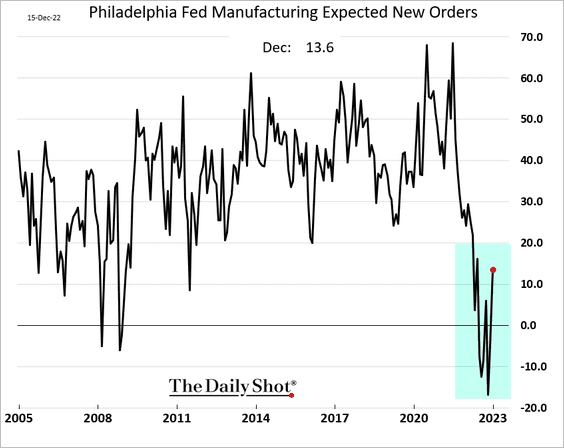

4. Regional manufacturing reports from the NY Fed and the Philly Fed show soft factory activity in December.

• Philly Fed:

– Orders and shipments:

– Employment and workers’ hours:

– Price indicators:

The index of expected orders bounced from the lows this month.

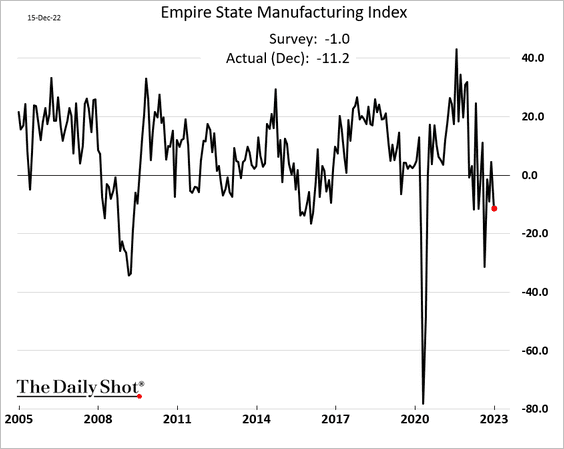

• NY Fed:

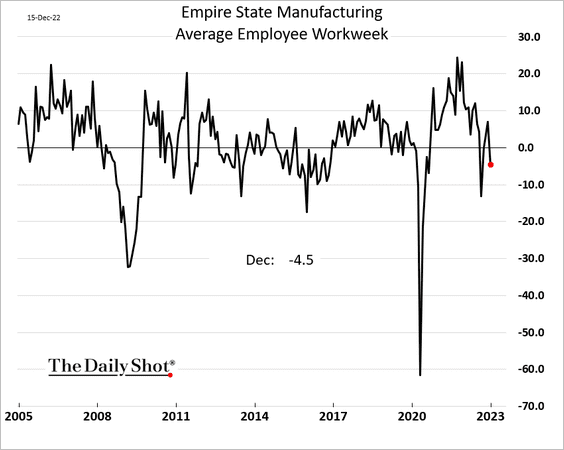

– Employee hours:

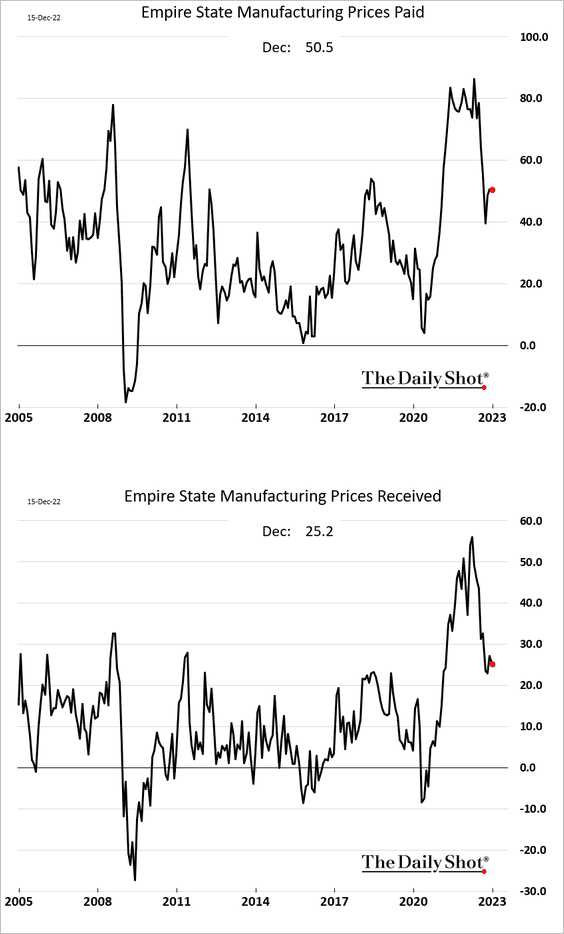

– Price indices:

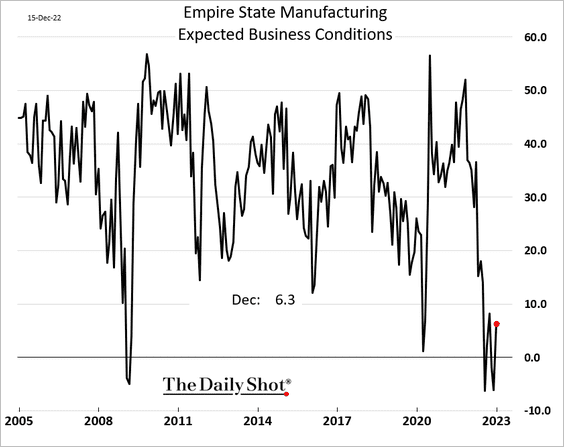

The index of expected business conditions showed an improvement (from extreme lows).

——————–

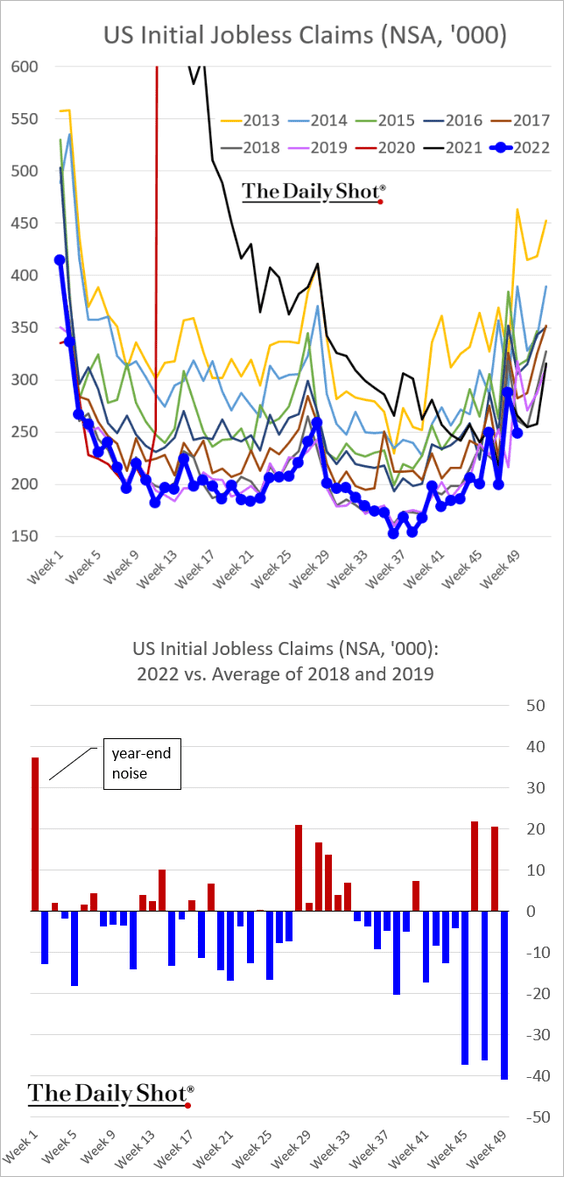

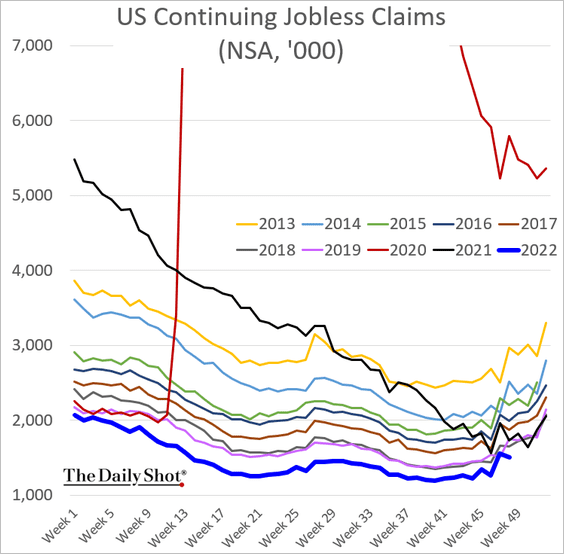

5. The job market remains tight, with unemployment claims hitting multi-year lows for this time of the year. Initial claims were well below pre-COVID levels last week.

——————–

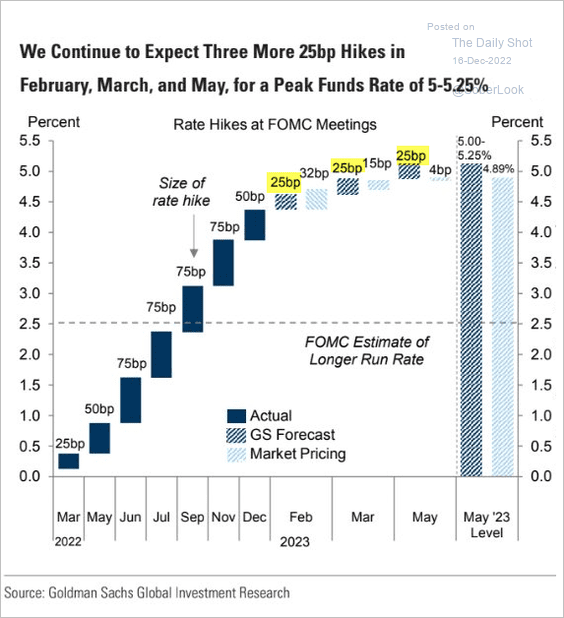

6. Goldman sees the Fed hiking another 75 bps next year.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

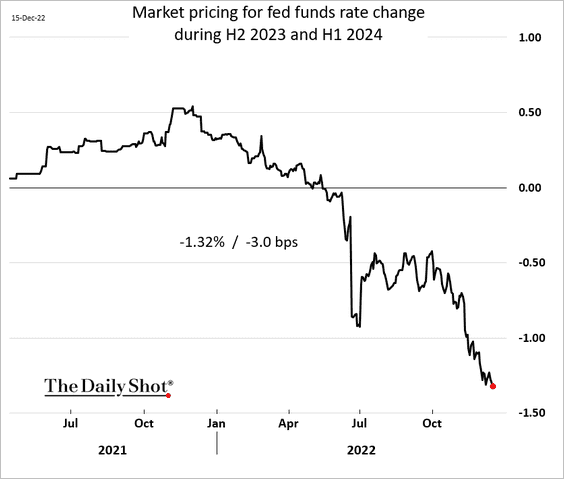

The market is now pricing about 130 bps of rate cuts in the second half of next year and the first half of 2024.

Back to Index

Japan

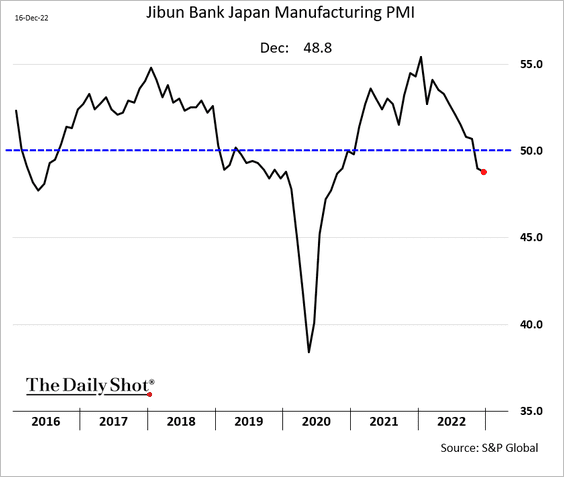

1. Manufacturing contraction worsened in December.

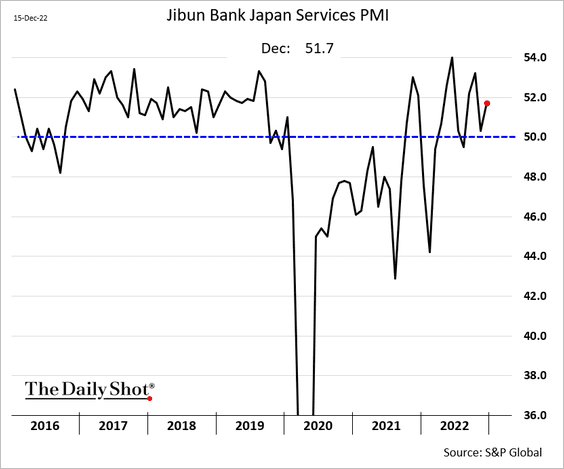

But service firms’ activity continues to expand.

——————–

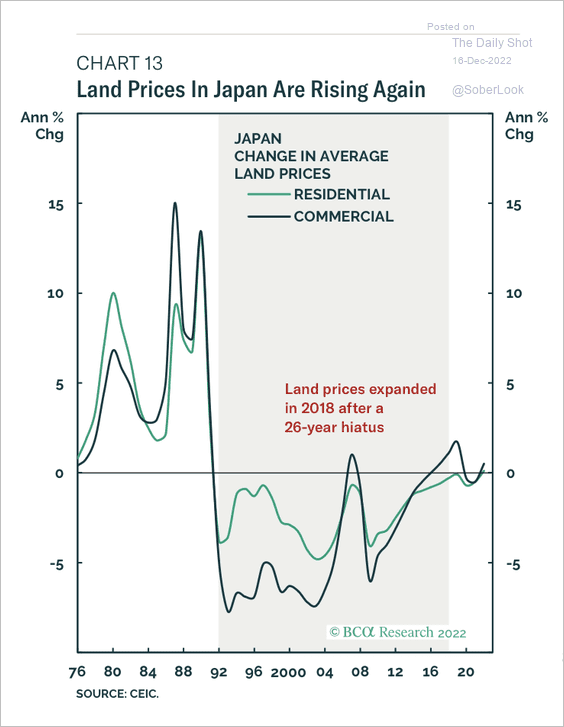

2. Land prices have started to rise.

Source: BCA Research

Source: BCA Research

Back to Index

Asia – Pacific

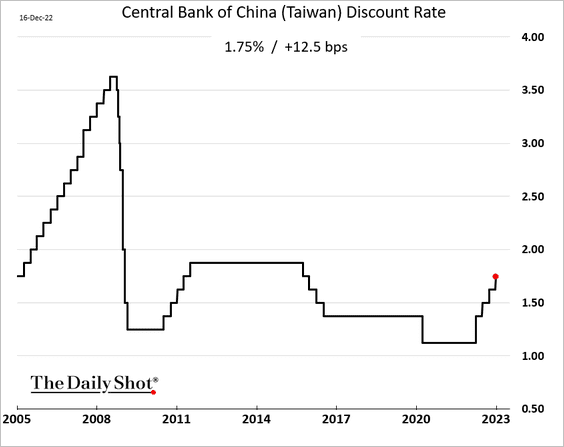

1. Taiwan’s central bank hiked rates again.

Source: ING Read full article

Source: ING Read full article

——————–

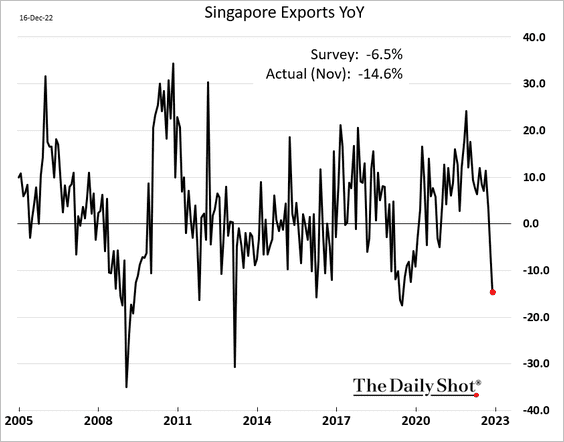

2. Singapore’s exports slowed in November.

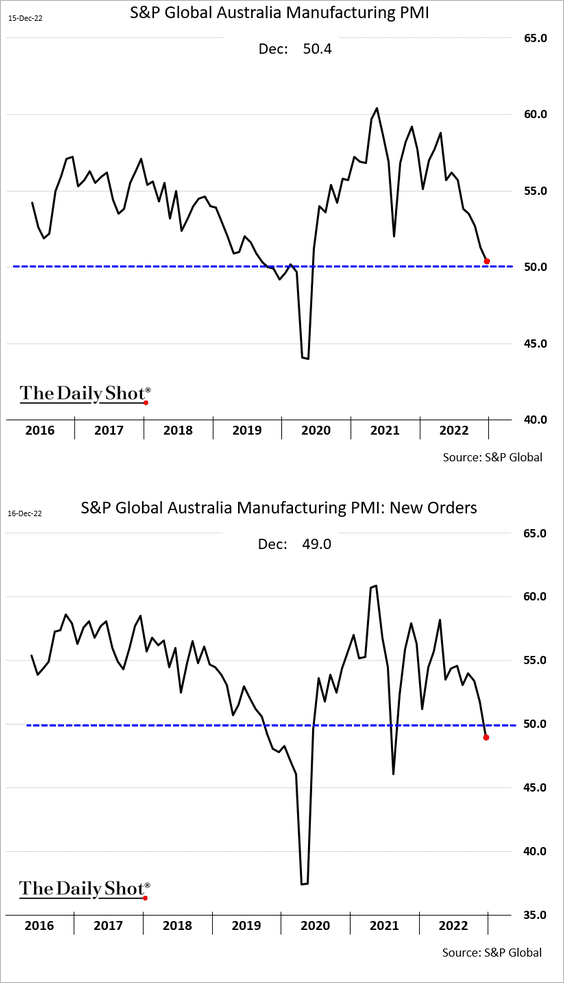

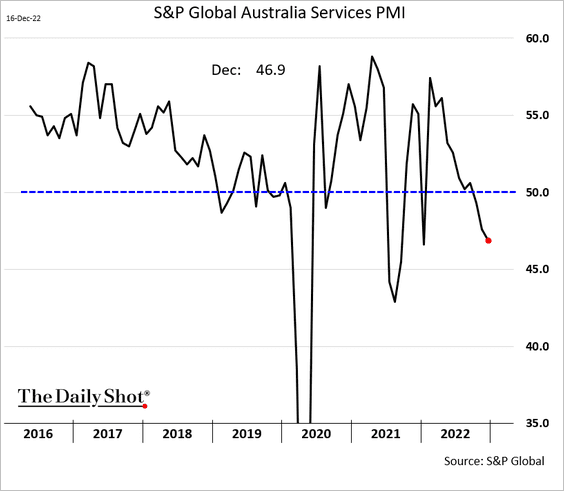

3. Australia’s business activity softened further.

• Manufacturing:

• Services:

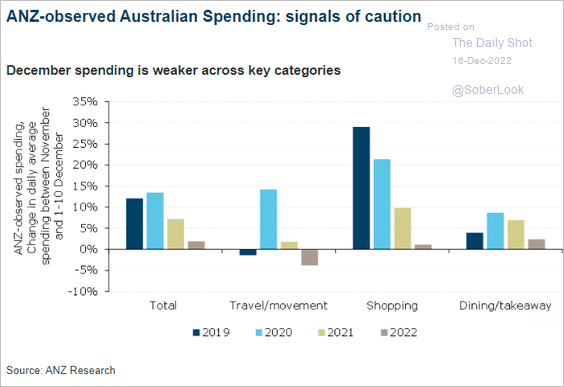

Australian household spending shows more caution.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

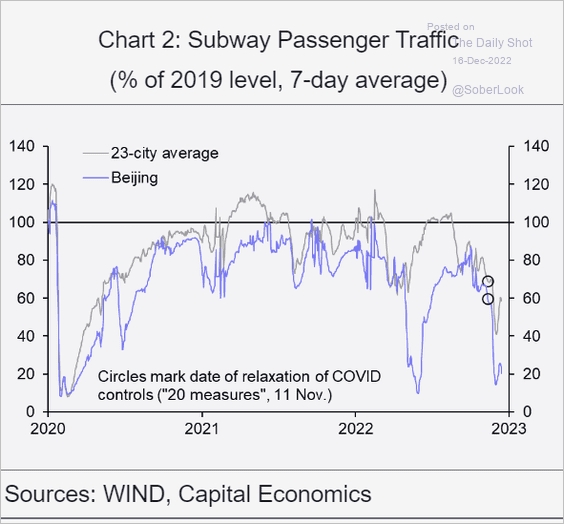

1. The spreading pandemic is pressuring mobility.

Source: Capital Economics

Source: Capital Economics

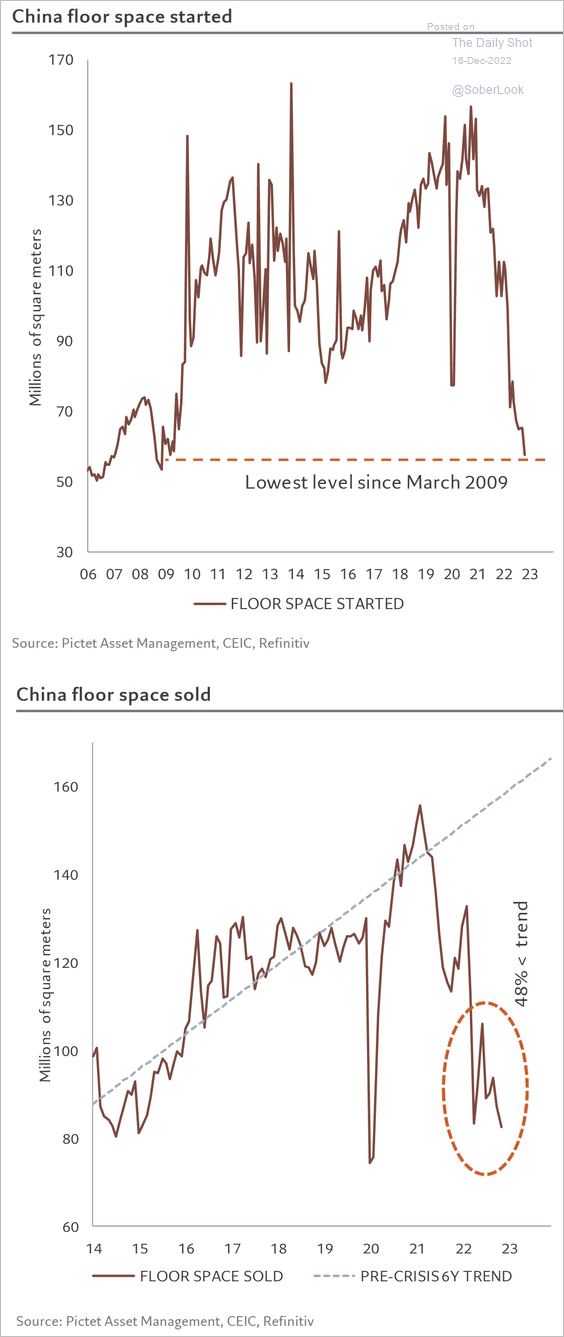

2. The housing market continues to struggle.

Source: @PkZweifel

Source: @PkZweifel

Back to Index

Emerging Markets

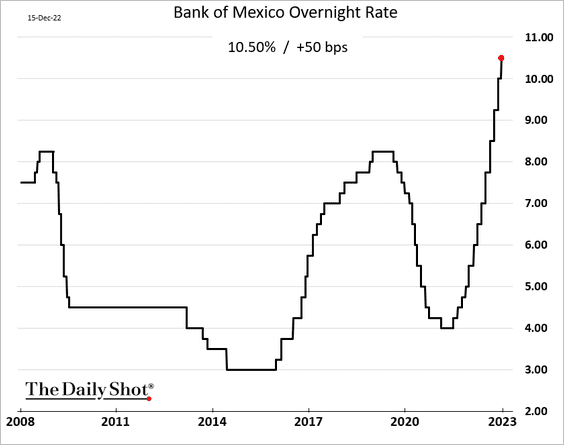

1. Banxico followed the Fed with a 50 bps rate hike.

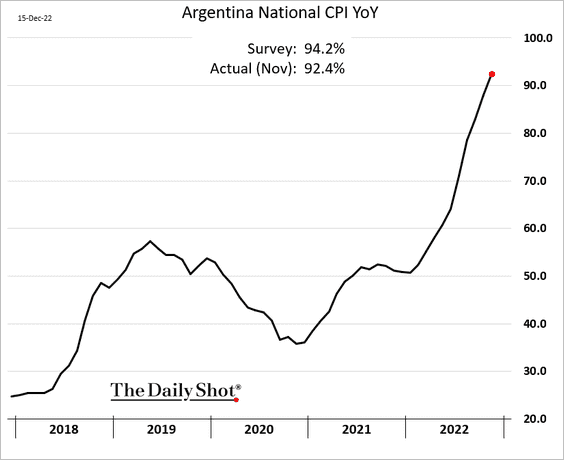

2. Argentina’s inflation breached 90% last month.

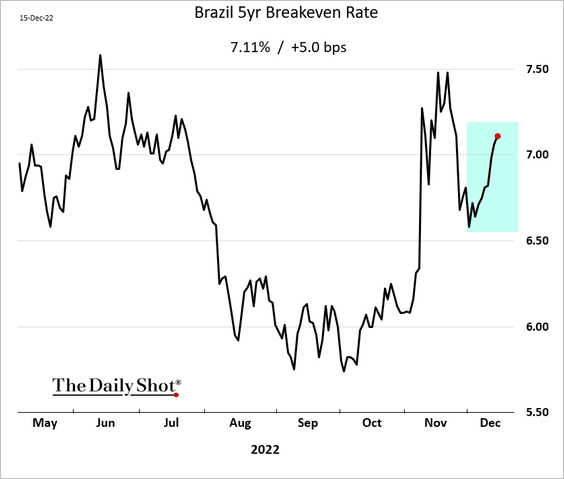

3. Brazil’s market-based inflation expectations are rising, even as inflation eases.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

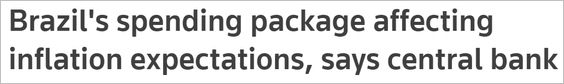

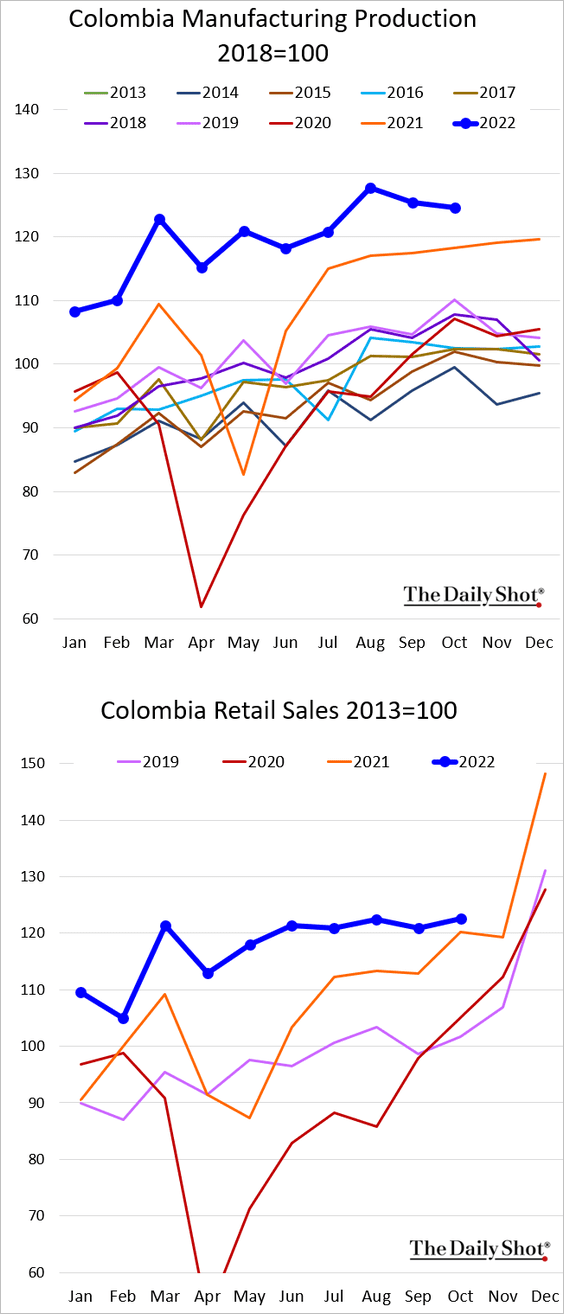

4. Colombia’s economic activity is losing momentum.

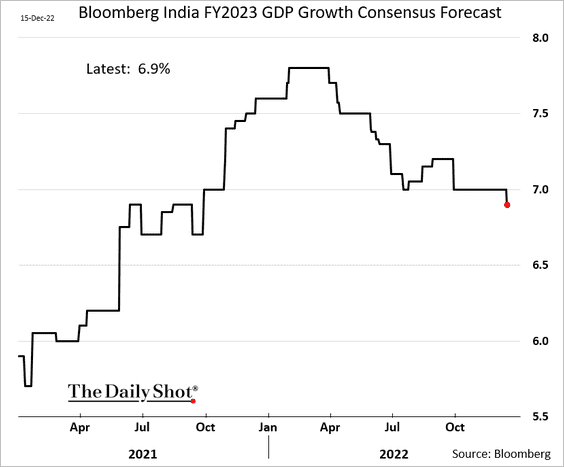

5. Economists downgraded India’s FY 2023 GDP, but the nation’s growth is expected to outpace most other countries.

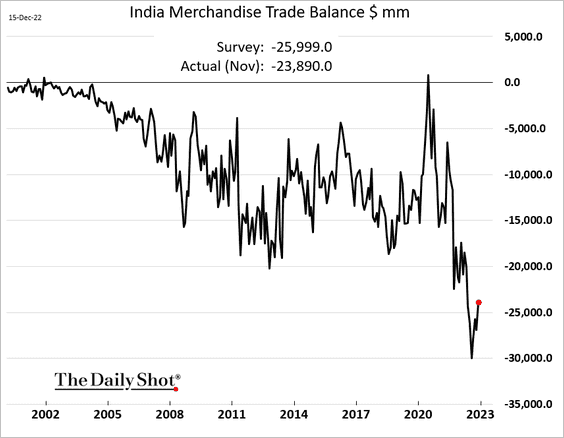

India’s trade gap eased in November.

——————–

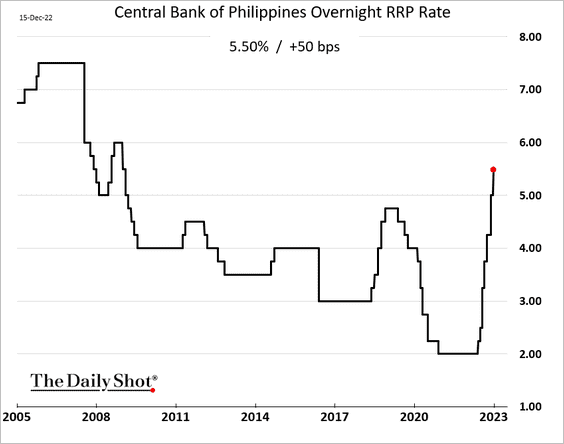

6. The Philippine central bank hiked rates on Thursday.

Source: @SiegfridAlegado, @iamditaslopez, @dreocalonzo, @business Read full article

Source: @SiegfridAlegado, @iamditaslopez, @dreocalonzo, @business Read full article

——————–

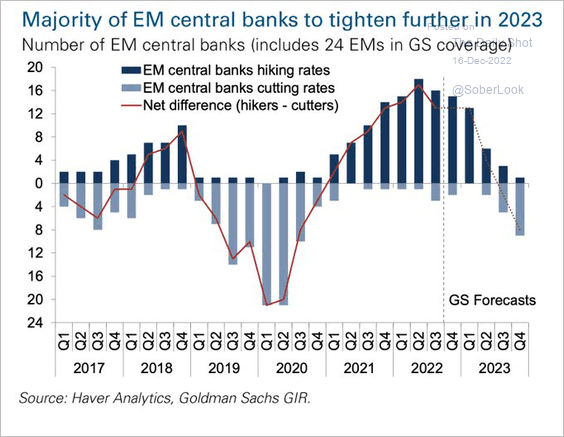

7. There is more EM policy tightening in 2023, according to Goldman.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

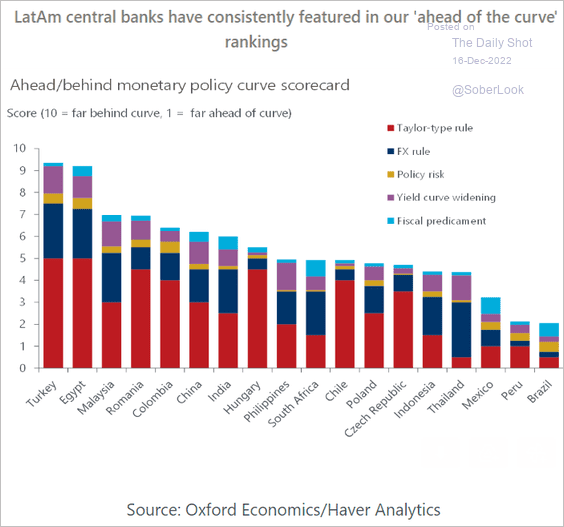

Which central banks are behind the curve? Here are the rankings from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Energy

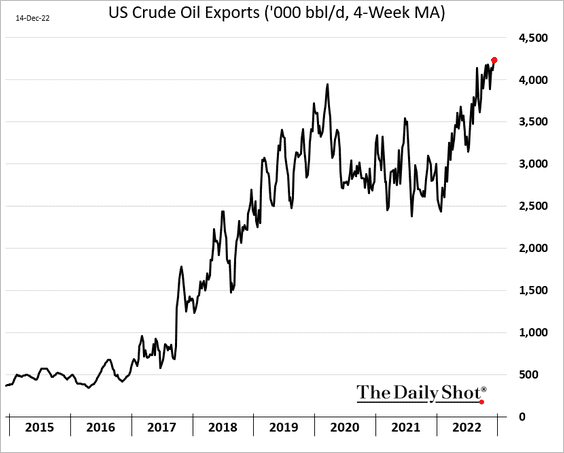

1. US gross crude oil exports remain near record levels.

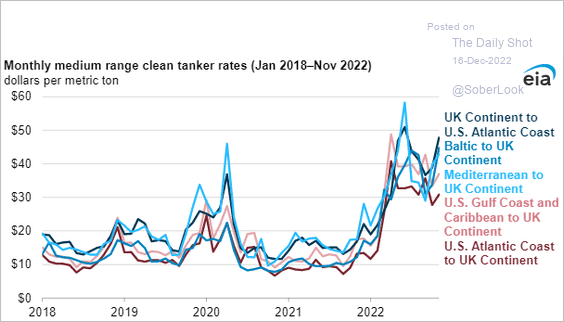

2. Tanker rates are still elevated.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

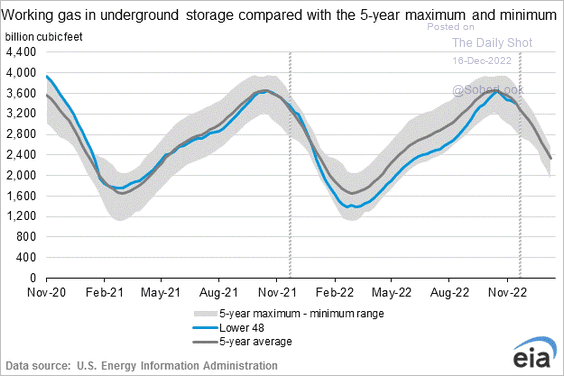

3. US natural gas in storage is holding at the 5-year average. But there will be a sharp drawdown amid frigid weather over the next few days.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

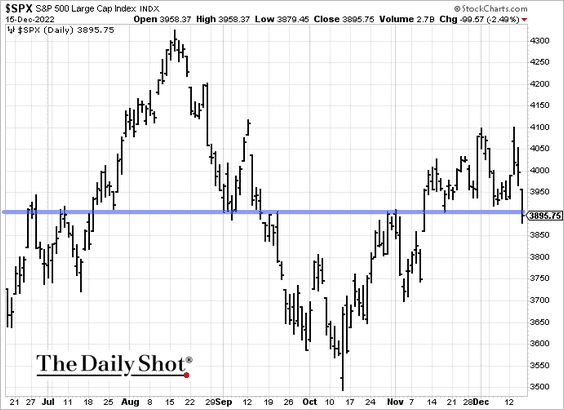

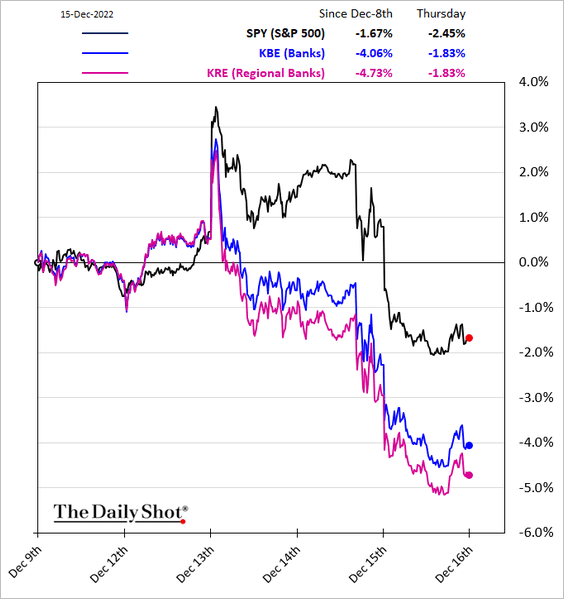

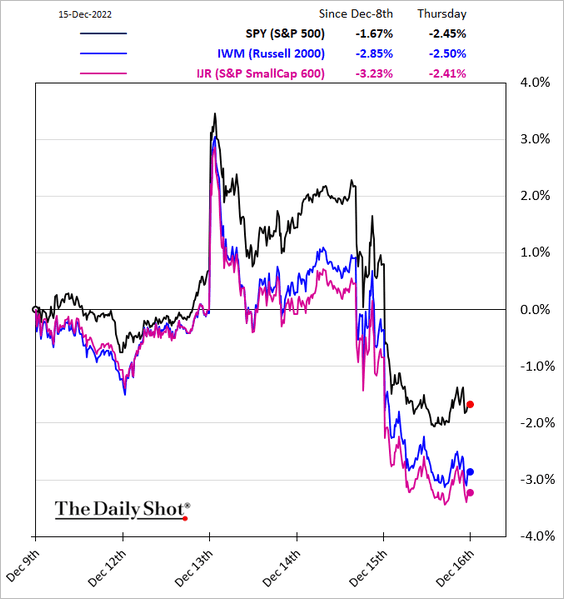

1. Stocks tumbled on Thursday in response to the hawkish Fed. The S&P 500 is at the low end of its recent trading range.

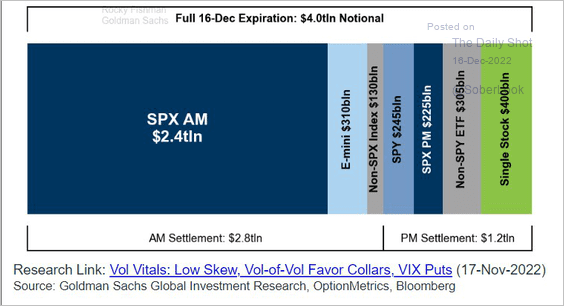

2. $4 trillion worth of options contracts expire today.

Source: Goldman Sachs, @luwangnyc, @markets Read full article

Source: Goldman Sachs, @luwangnyc, @markets Read full article

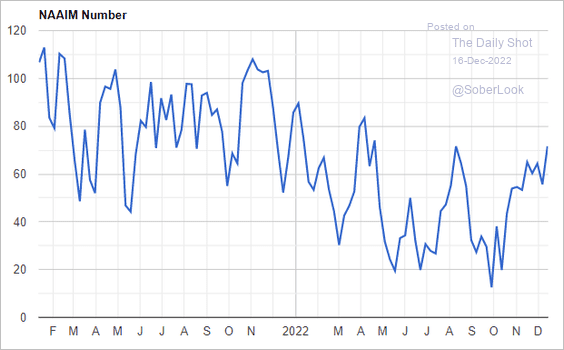

3. Investment managers have been increasing their exposure to stocks.

Source: NAAIM

Source: NAAIM

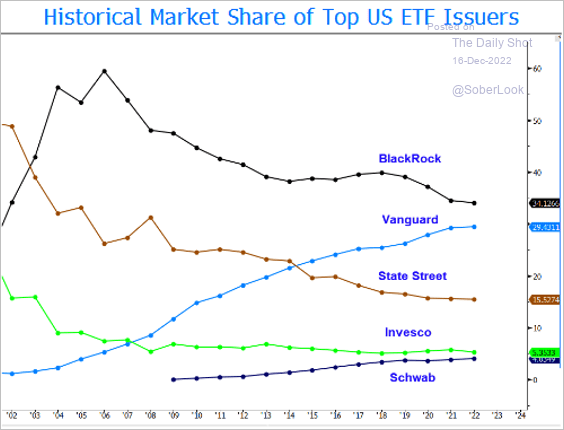

4. This chart shows the ETF market share over time.

Source: @EricBalchunas

Source: @EricBalchunas

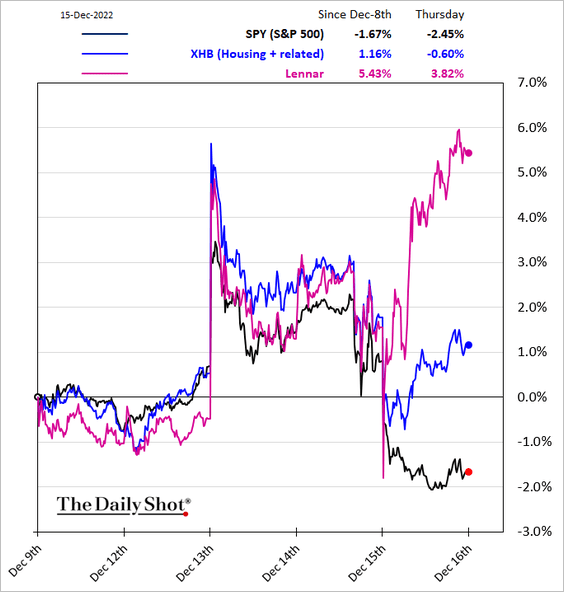

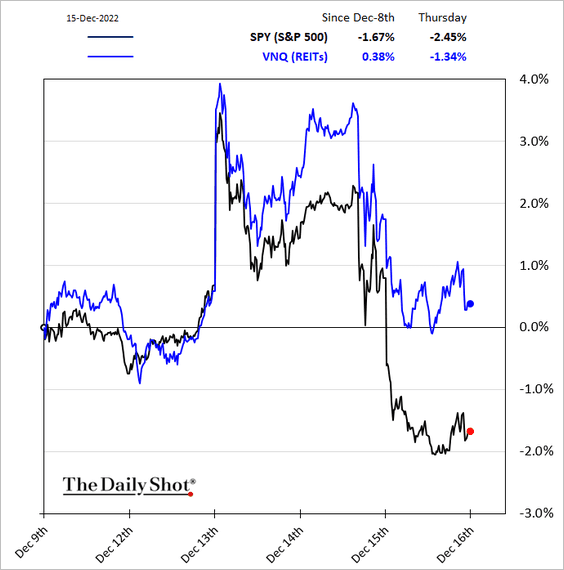

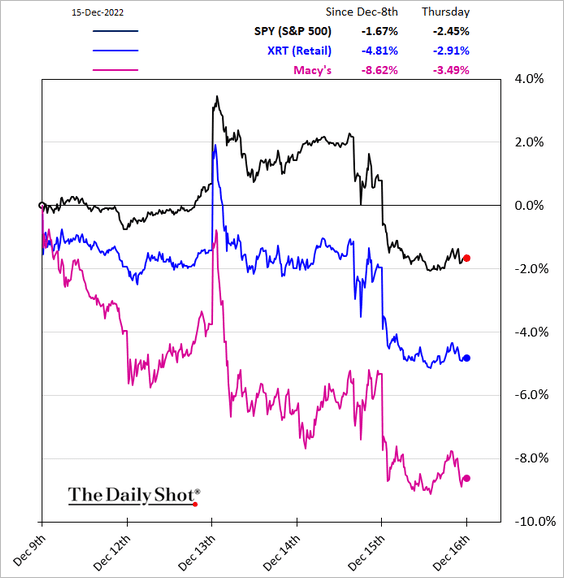

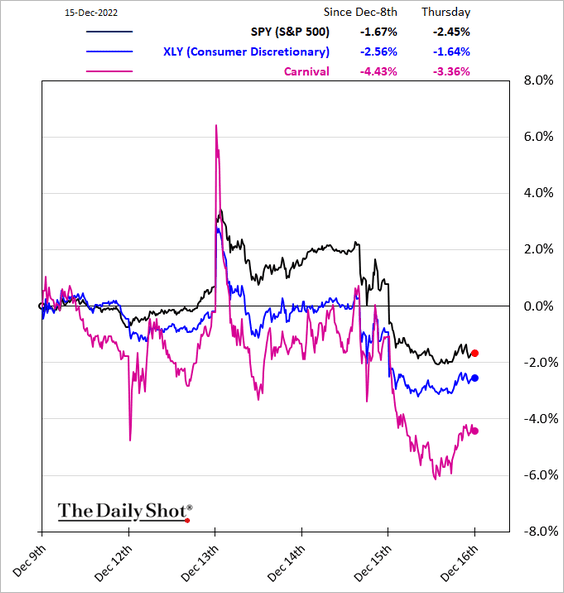

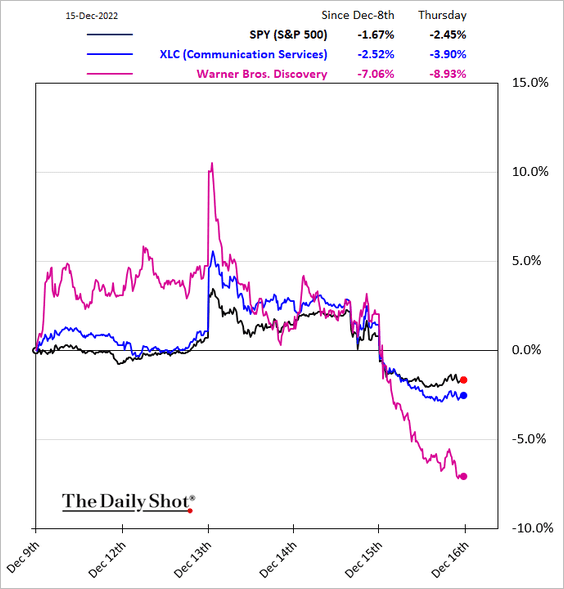

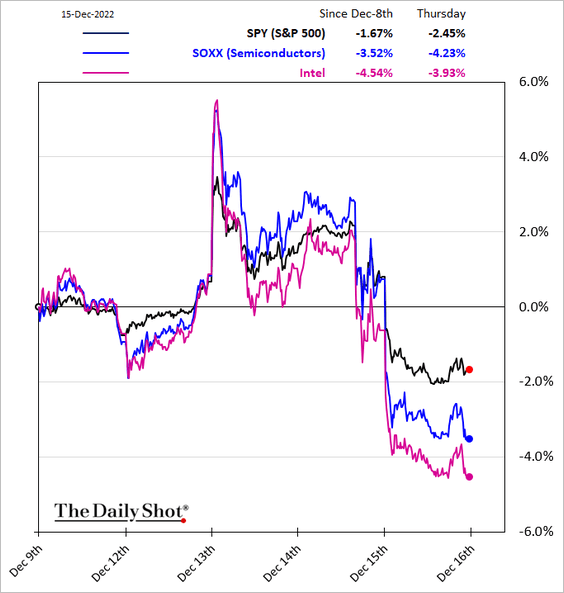

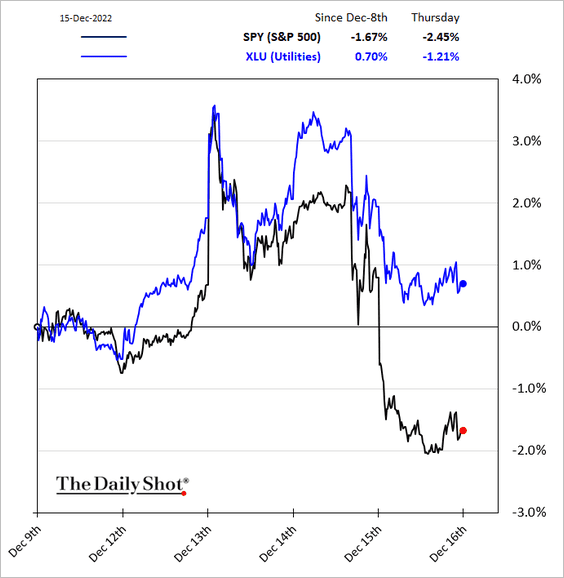

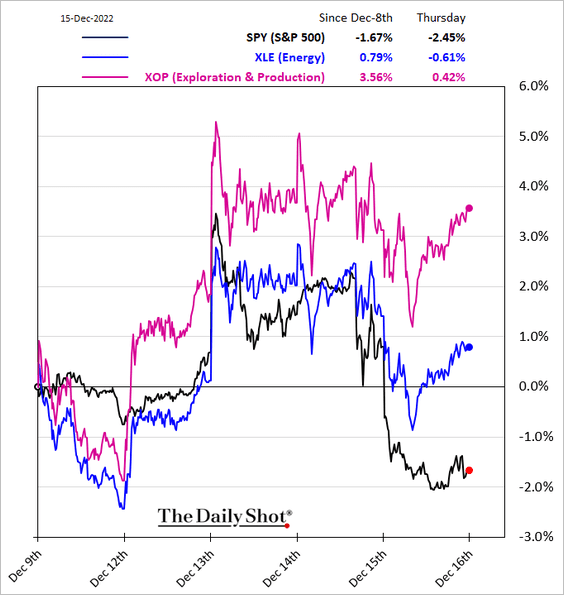

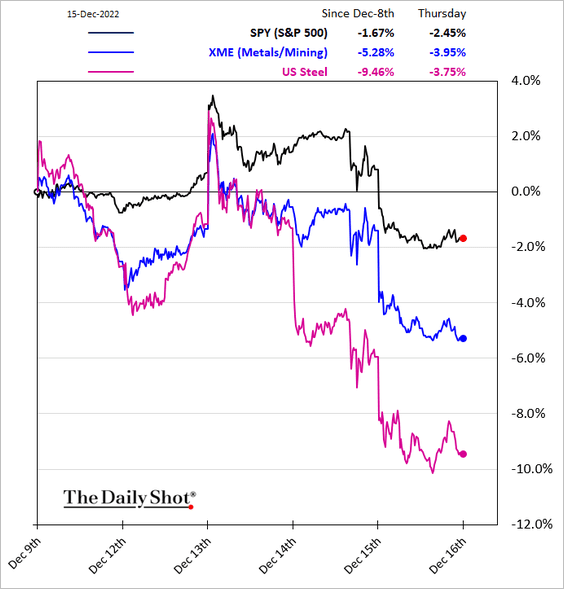

5. Next, we have some sector performance data (over the past five business days).

• Banks:

• Housing:

• REITs:

• Retail:

• Consumer Discretionary:

• Communication Services:

• Semiconductors:

• Utilities:

• Energy:

• Metals & Mining:

——————–

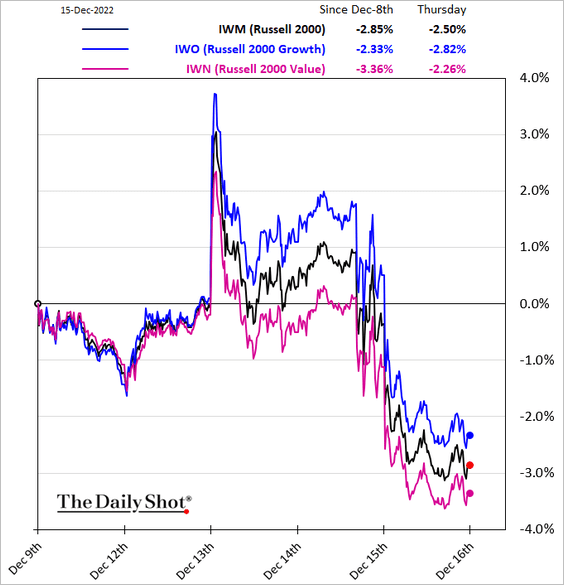

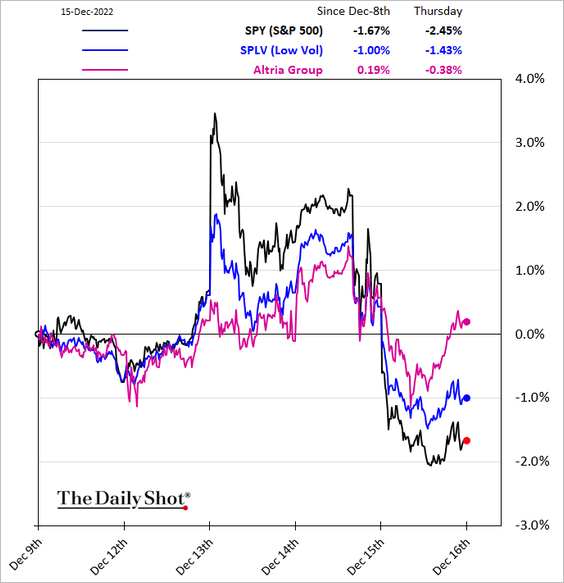

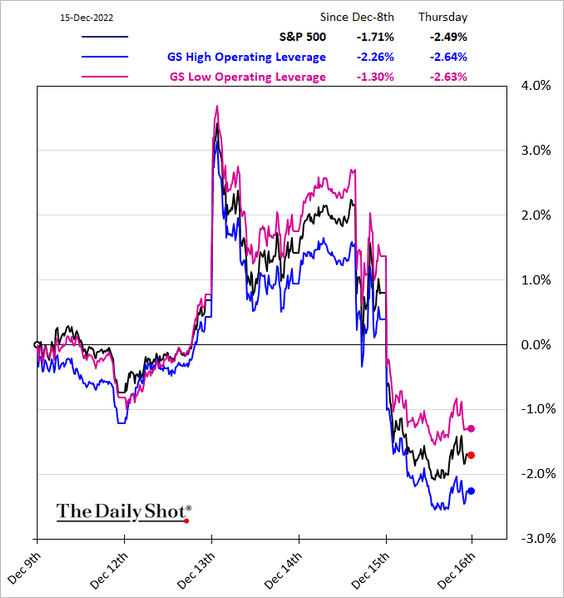

6. Finally, we have some equity factor performance charts.

• Small caps:

• Small-cap growth vs. value (value is underperforming):

• Low-vol:

• High vs. low operating leverage:

Back to Index

Rates

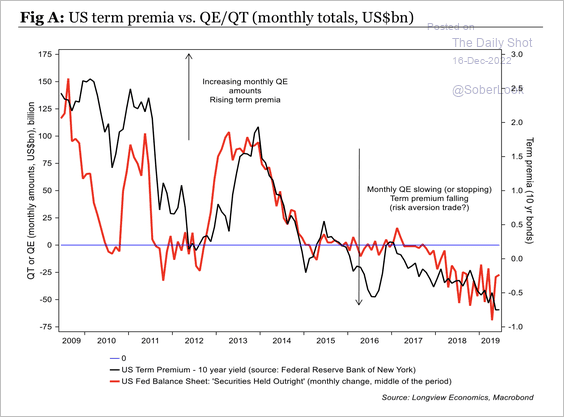

1. The 10-year Treasury note’s term premium is correlated with changes in the Fed’s balance sheet.

Source: Longview Economics

Source: Longview Economics

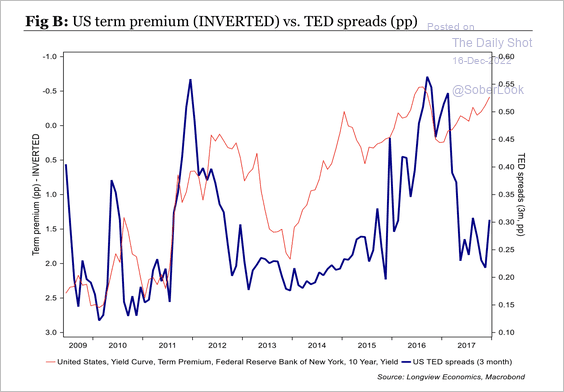

The term premium and TED spreads have also been somewhat correlated.

Source: Longview Economics

Source: Longview Economics

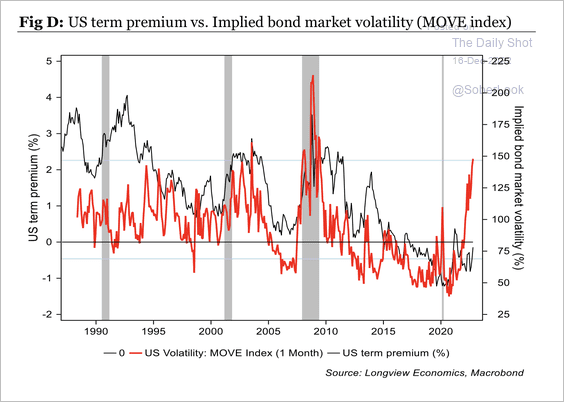

Higher bond volatility points to a higher term premium.

Source: Longview Economics

Source: Longview Economics

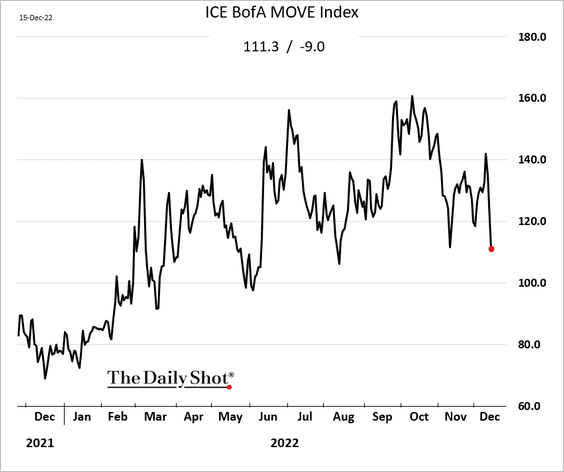

2. But Treasury implied vol declined this week.

——————–

Food for Thought

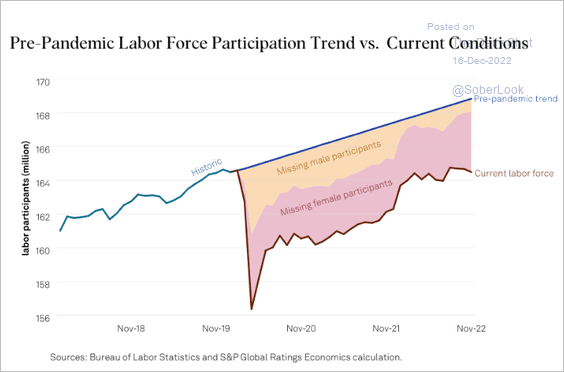

1. US labor force participation gap:

Source: S&P Global Ratings

Source: S&P Global Ratings

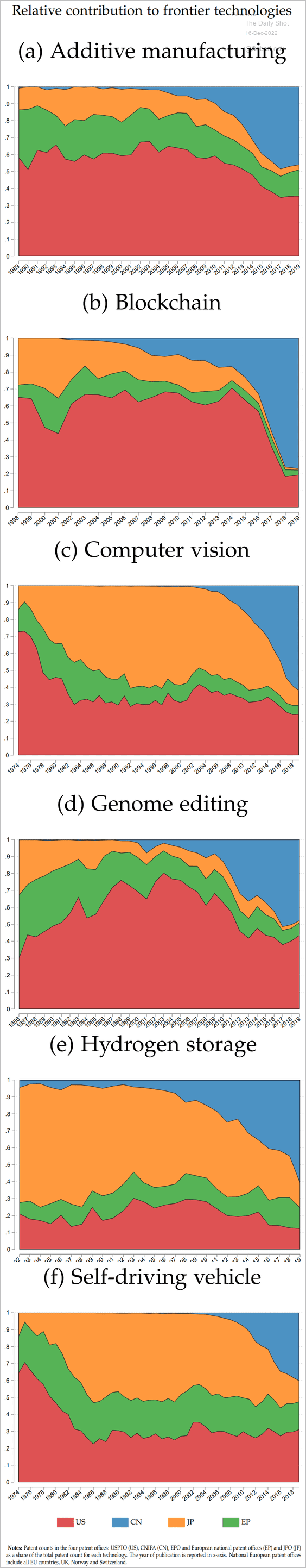

2. Relative contributions to frontier technologies:

Source: CEP Read full article

Source: CEP Read full article

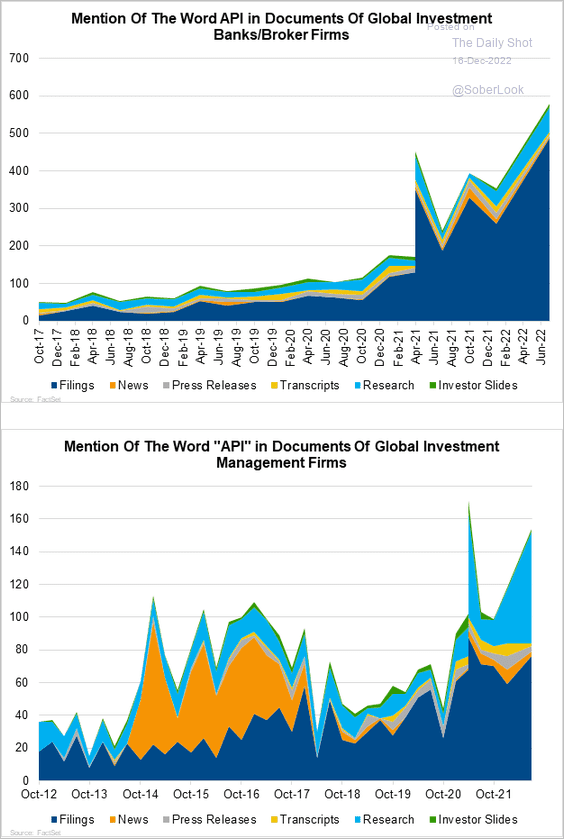

3. Popularity of APIs in financial services:

Source: @FactSet Read full article

Source: @FactSet Read full article

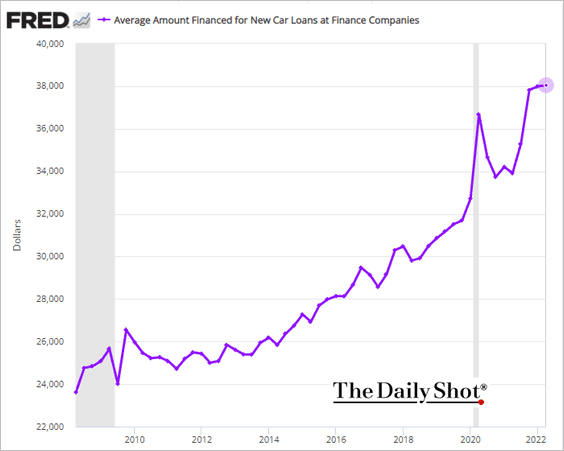

4. Average US car loan size:

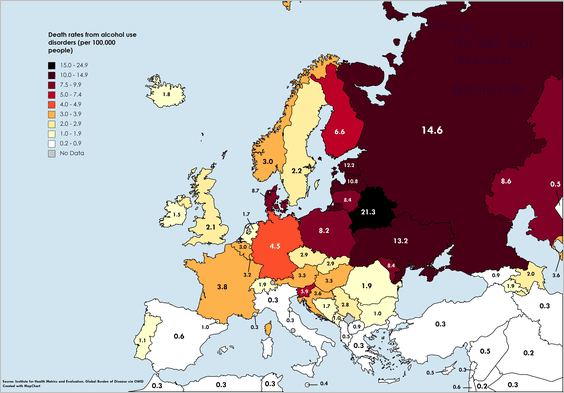

5. Alcohol-related death rates in Europe:

Source: @conradhackett Read full article

Source: @conradhackett Read full article

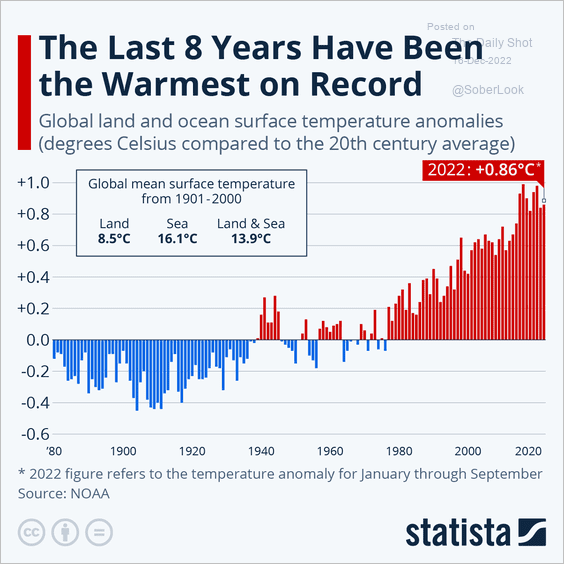

6. The global warming trend:

Source: Statista

Source: Statista

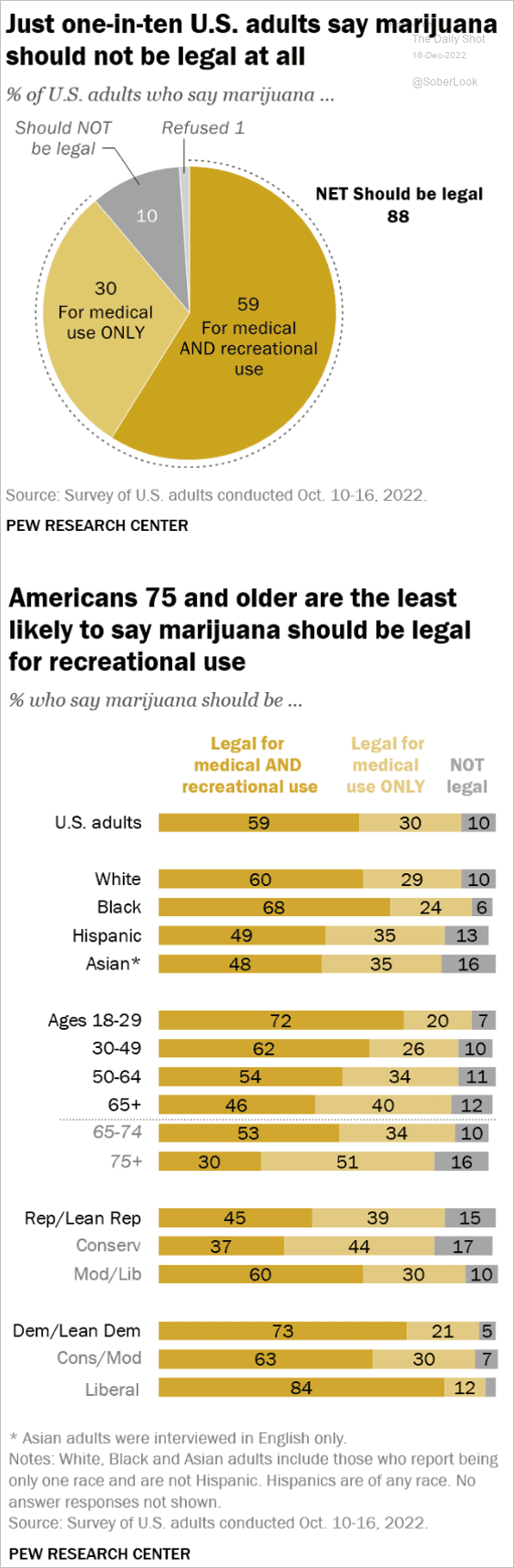

7. Views on marijuana legalization:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

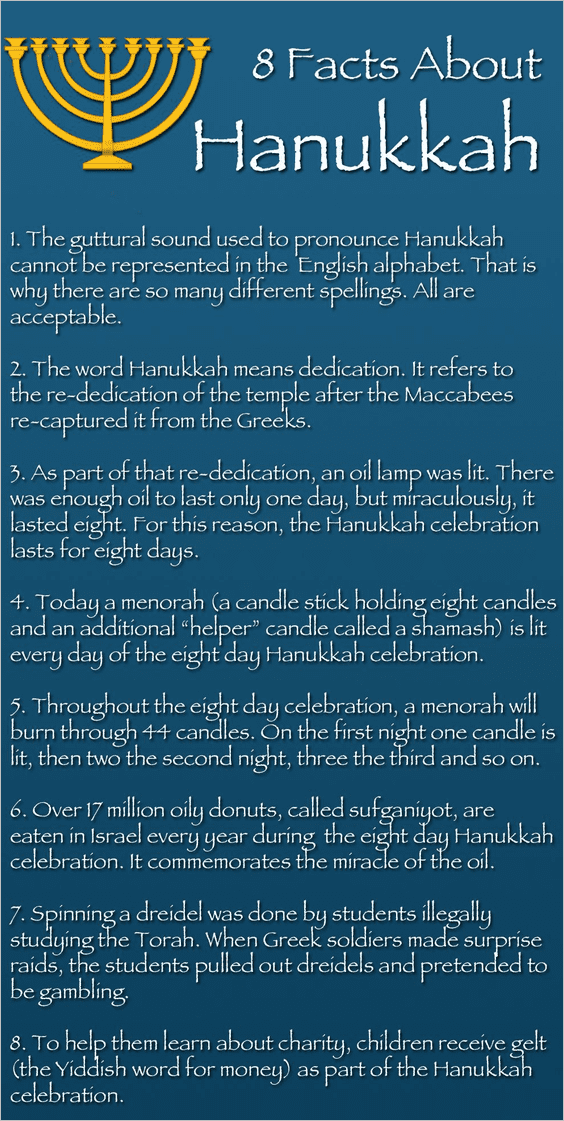

8. Happy Hanukkah!

——————–

Have a great weekend!

Back to Index