The Daily Shot: 19-Dec-22

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published next week (the week of December 26th). We will, however, publish the Food for Thought special edition next Wednesday.

Back to Index

The United States

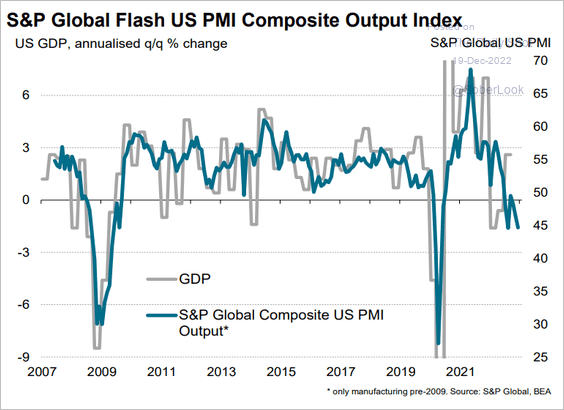

1. The PMI report from S&P Global increasingly looks recessionary.

Source: S&P Global PMI

Source: S&P Global PMI

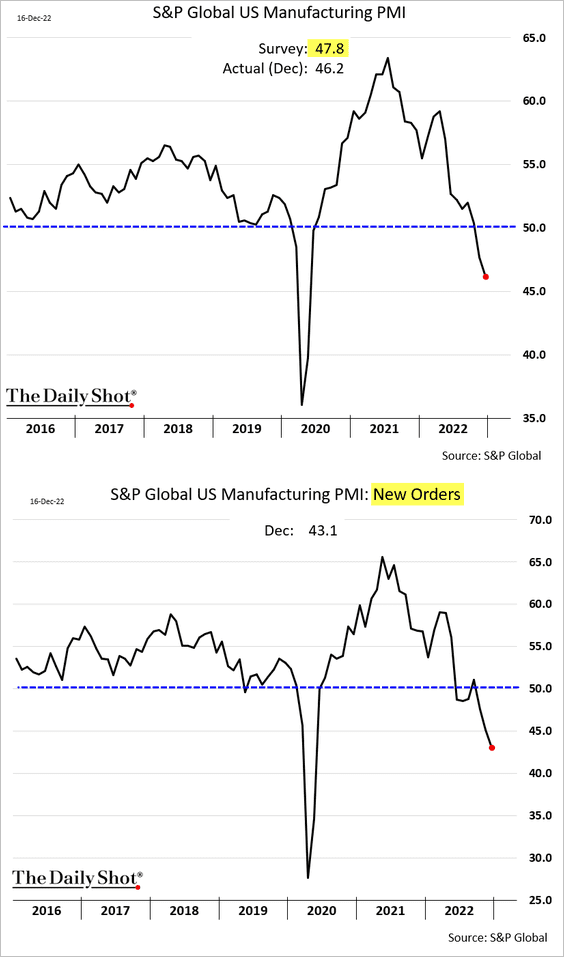

• Manufacturing activity shifted deeper into contraction territory this month as demand plummets (2nd panel).

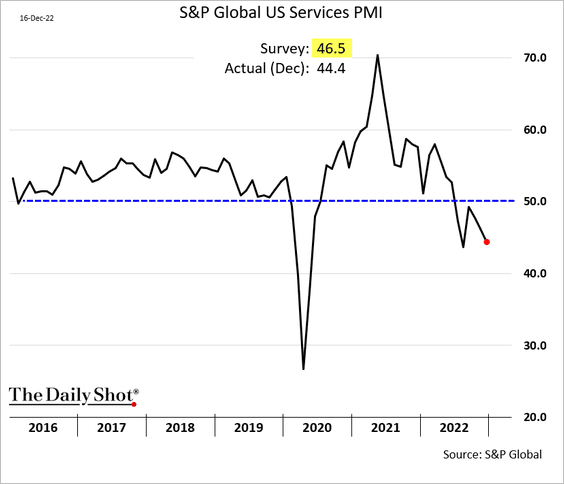

• Declines in service firms’ activity also accelerated.

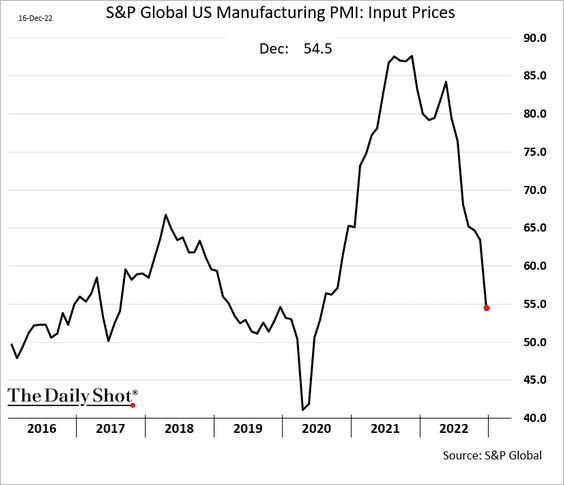

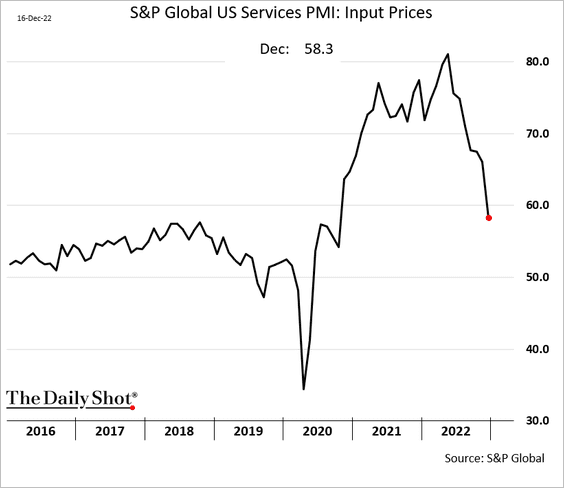

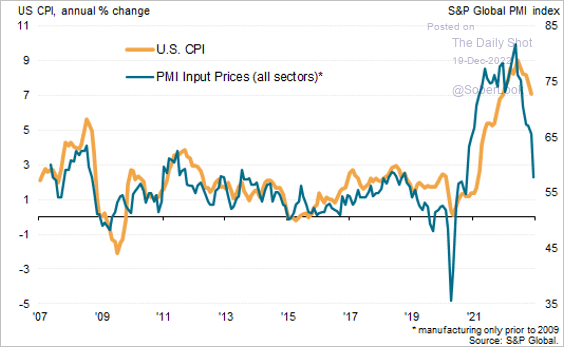

• Input price gains continue to slow, …

– Manufacturing:

– Services:

… signaling softer inflation ahead.

Source: @WilliamsonChris, @SPGlobalPMI

Source: @WilliamsonChris, @SPGlobalPMI

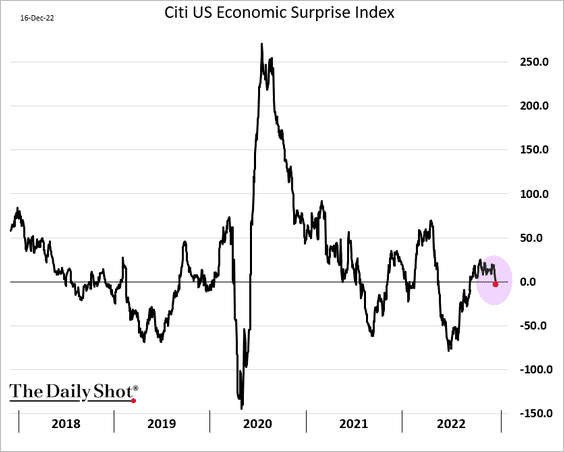

• The Citi Economic Surprise Index dipped back into negative territory in response to the PMI report.

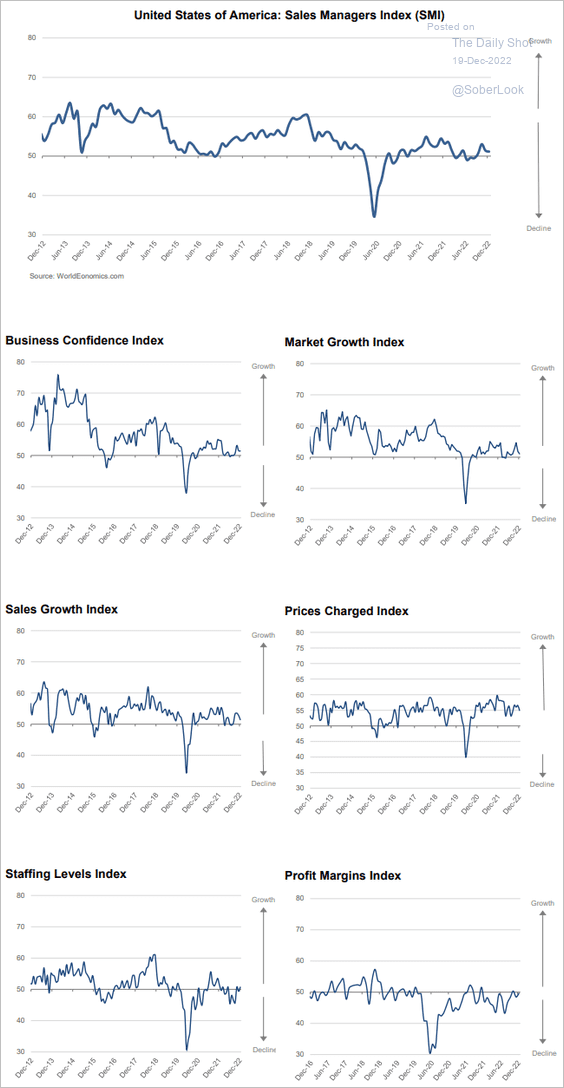

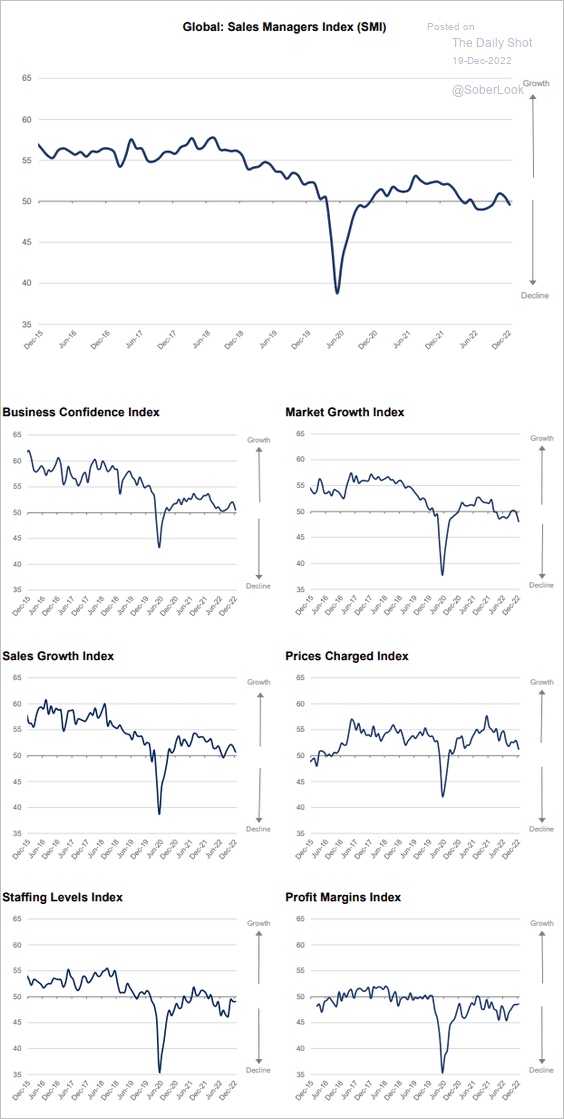

2. On the other hand, the World Economics SMI report still shows modest growth.

Source: World Economics

Source: World Economics

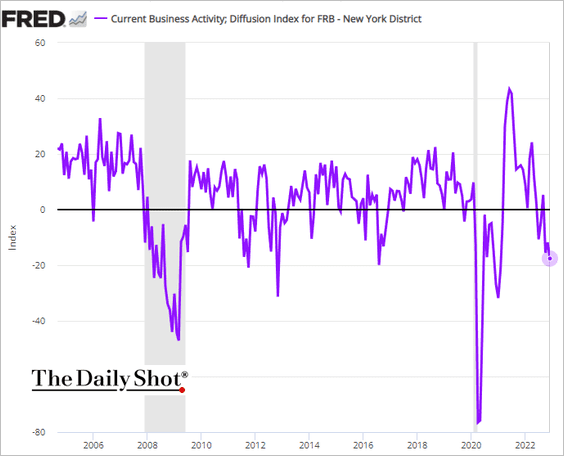

3. The NY Fed’s Business Leaders Survey indicates that the region’s service firms are struggling.

——————–

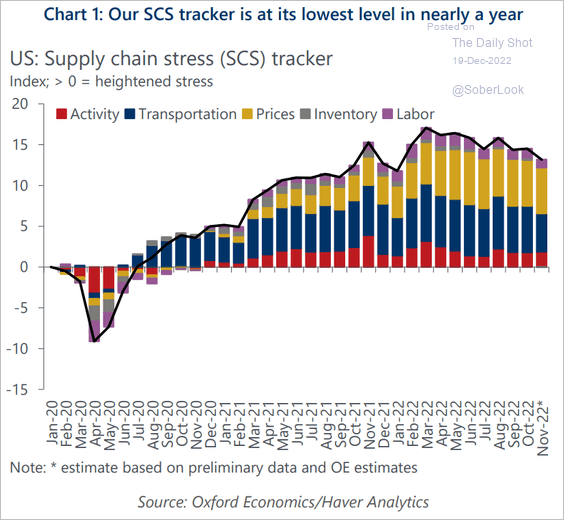

4. The Oxford Economics supply chain stress index continues to ease gradually.

Source: Oxford Economics

Source: Oxford Economics

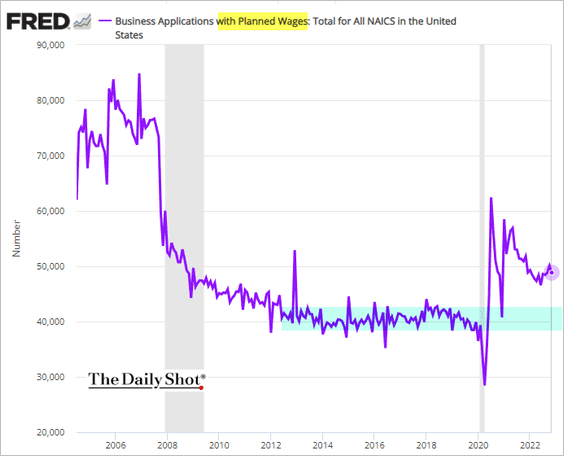

5. Business applications remain well above pre-COVID levels.

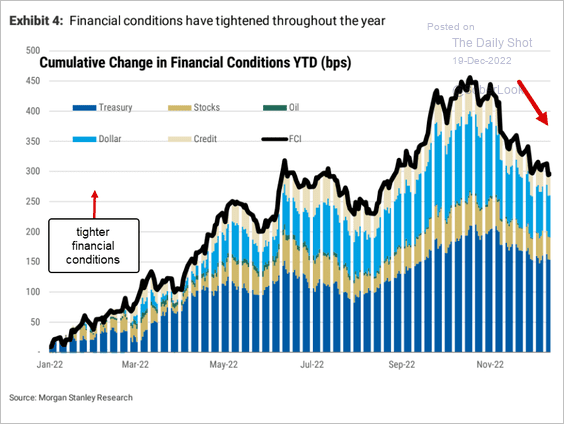

6. What are the drivers of easier financial conditions in the US?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

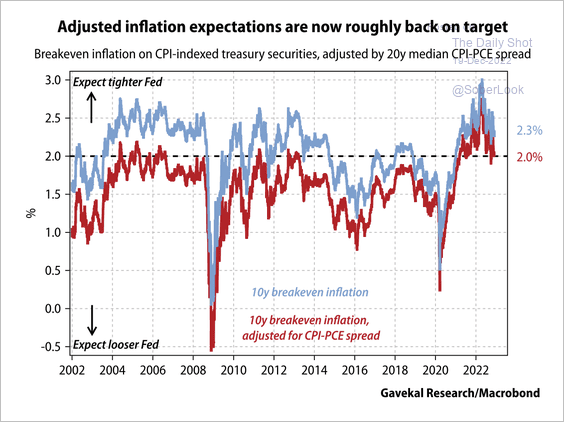

7. Long-term market-based inflation expectations are back near target levels.

Source: Gavekal Research

Source: Gavekal Research

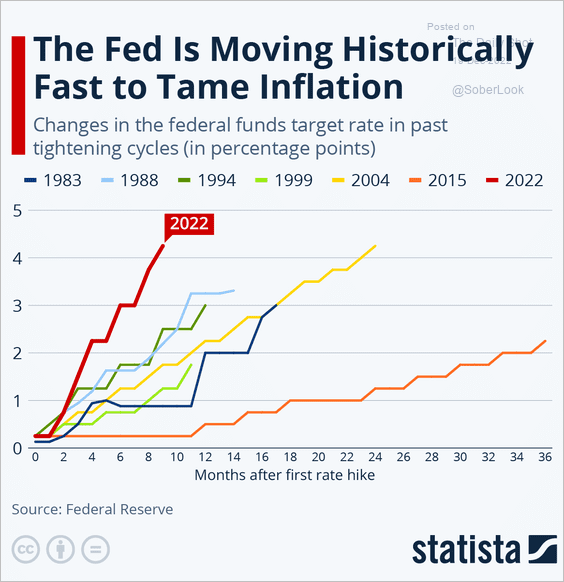

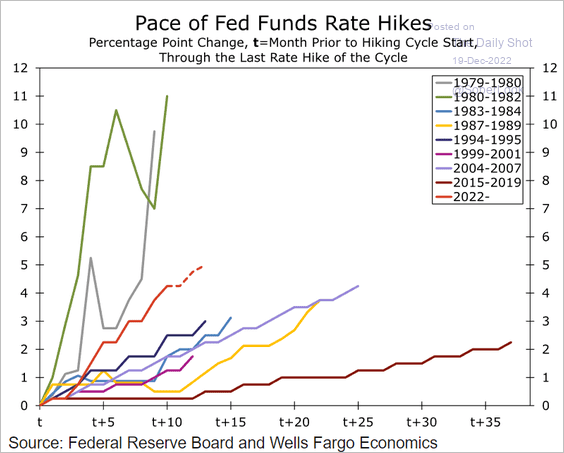

8. How does the current Fed tightening cycle compare to previous ones?

Source: Statista

Source: Statista

This chart includes Wells Fargo’s forecast.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

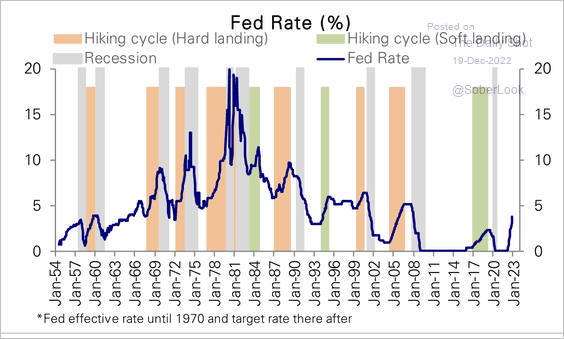

• Three of the last eleven hiking cycles preceded a soft landing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

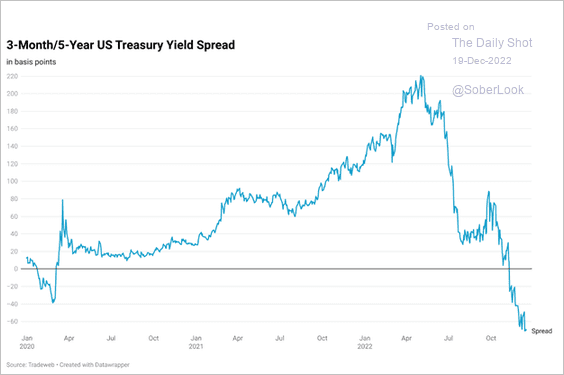

• The yield curve remains heavily inverted.

Source: Tradeweb

Source: Tradeweb

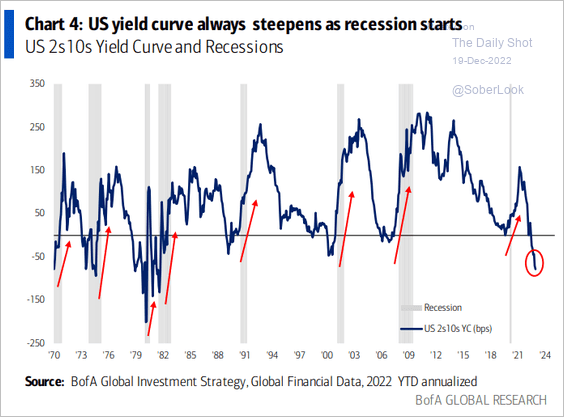

The yield curve steepening will signal the onset of a recession.

Source: BofA Global Research

Source: BofA Global Research

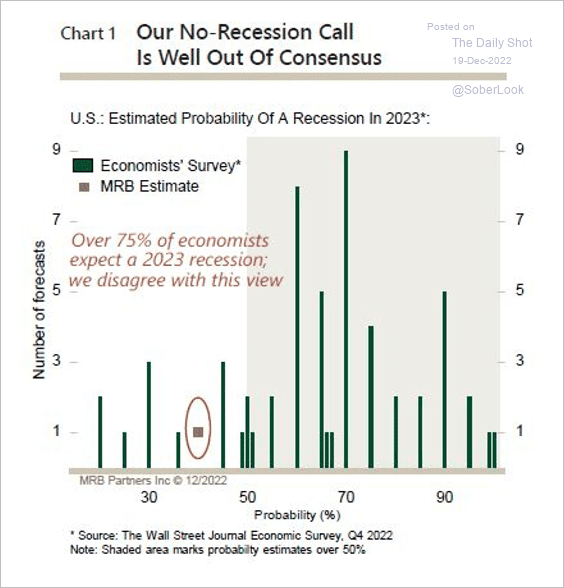

• MRB Partners expects the economy to expand at a decent rate in 2023.

Source: MRB Partners

Source: MRB Partners

Back to Index

Canada

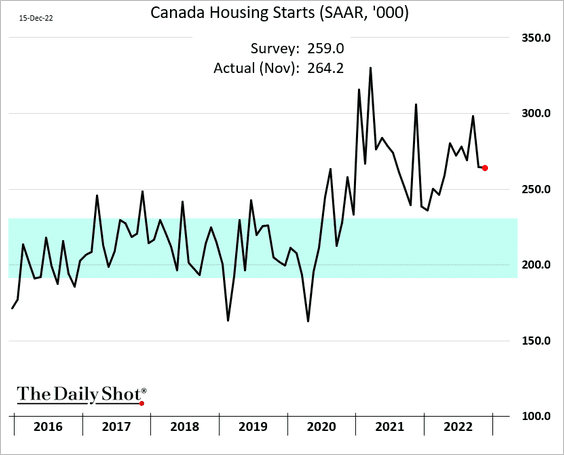

1. Housing starts remain well above pre-COVID levels.

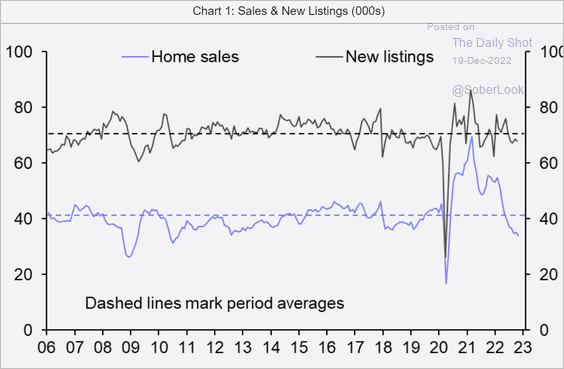

• But home sales have declined sharply.

Source: Capital Economics

Source: Capital Economics

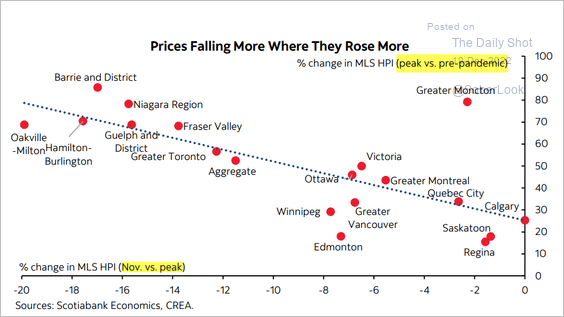

• Home prices are falling faster in areas with higher recent gains.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

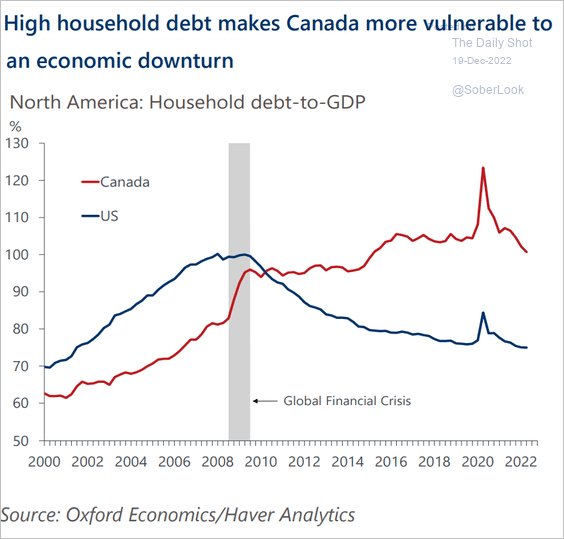

2. Canada’s elevated household leverage makes the economy more vulnerable to a downturn, …

Source: Oxford Economics

Source: Oxford Economics

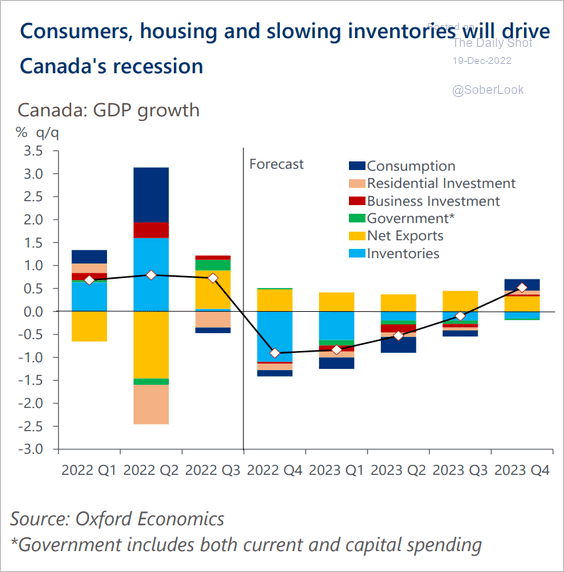

… which is already here, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

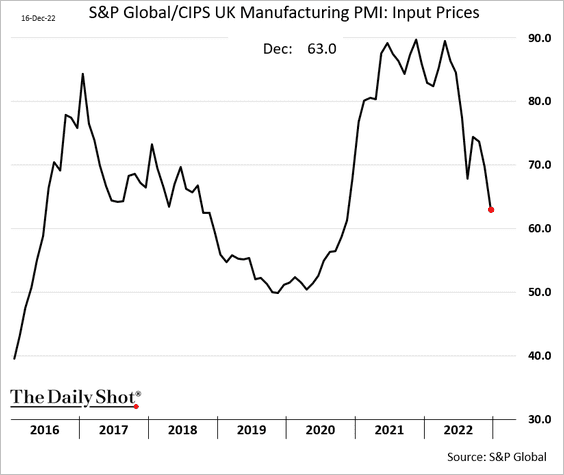

The United Kingdom

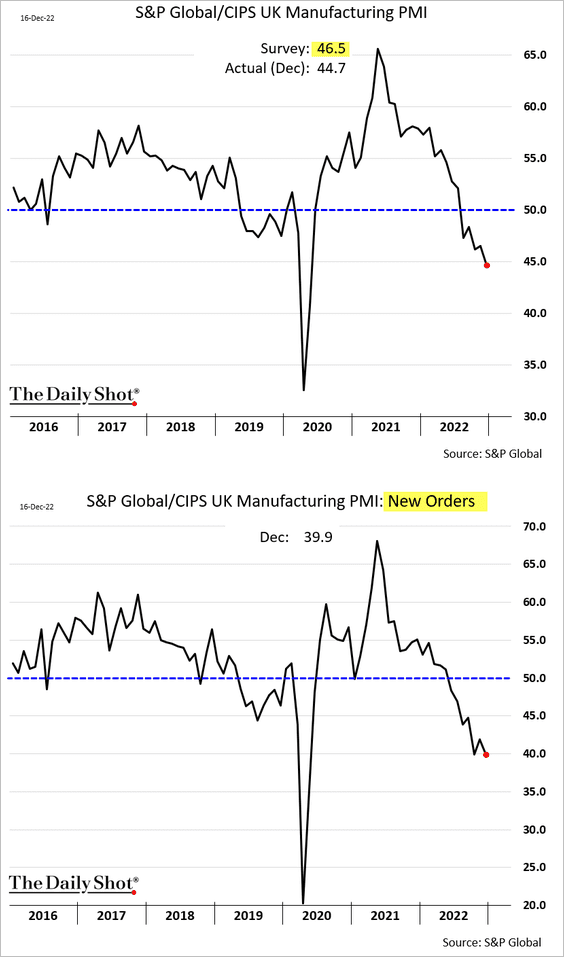

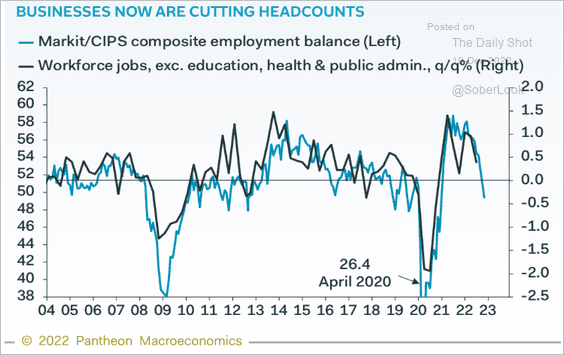

1. The manufacturing PMI report showed an accelerating contraction this month as demand crashes.

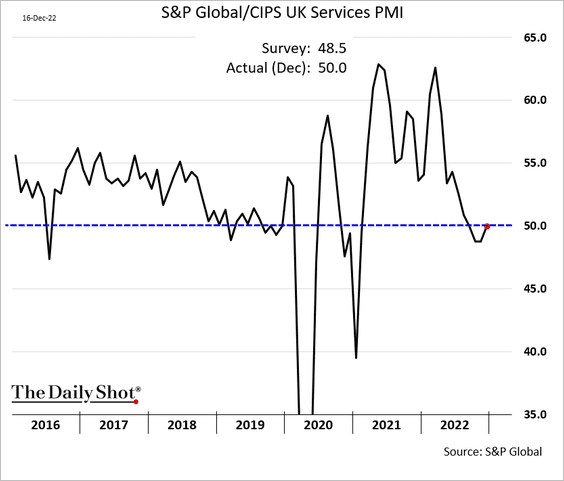

• However, service-sector activity stabilized in December.

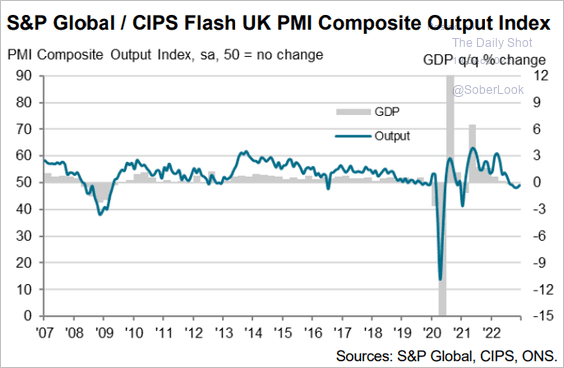

• Here is the composite PMI.

Source: S&P Global PMI

Source: S&P Global PMI

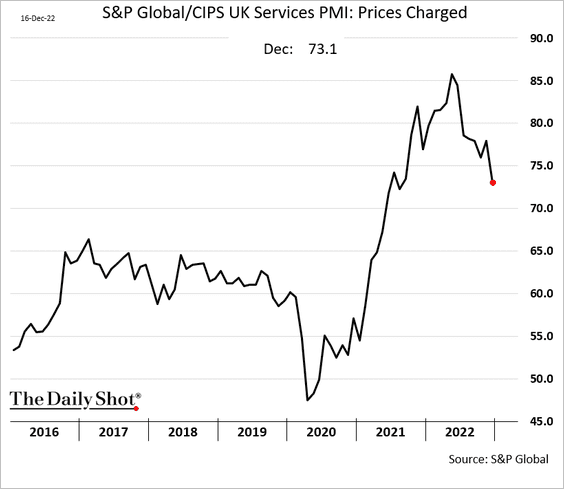

• Price pressures remain elevated, but signs point to moderating inflation.

• The PMI report is signaling job cuts.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

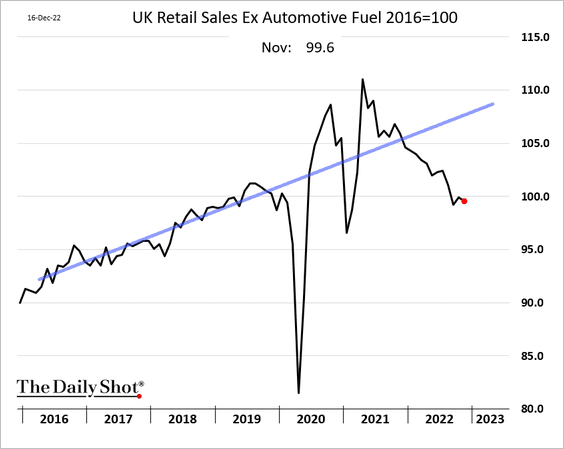

2. Retail sales softened in November.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

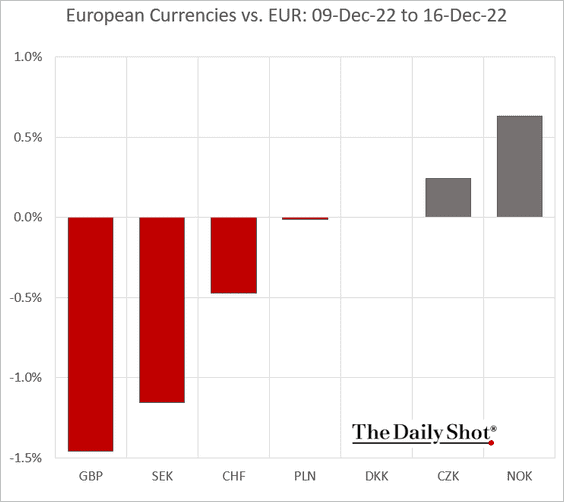

3. The pound underperformed other European currencies (vs. EUR) on dovish signals from the MPC.

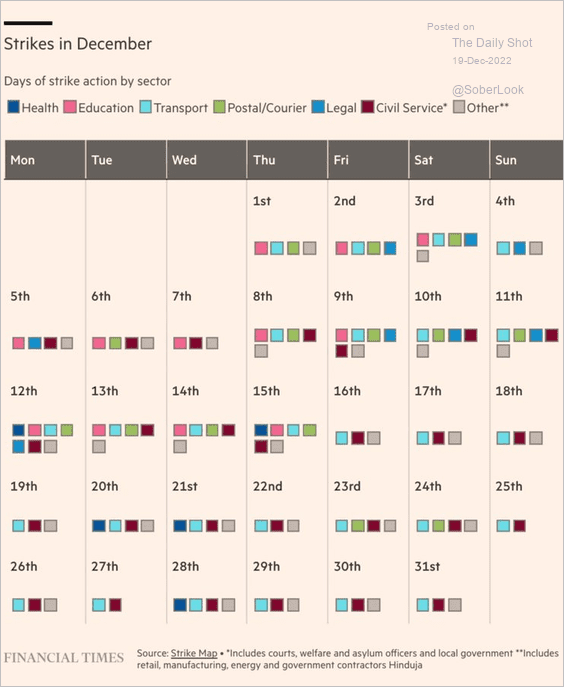

4. Who is on strike this month?

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

Back to Index

The Eurozone

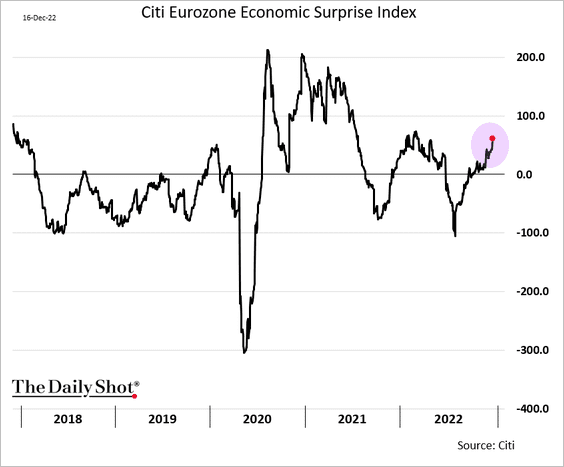

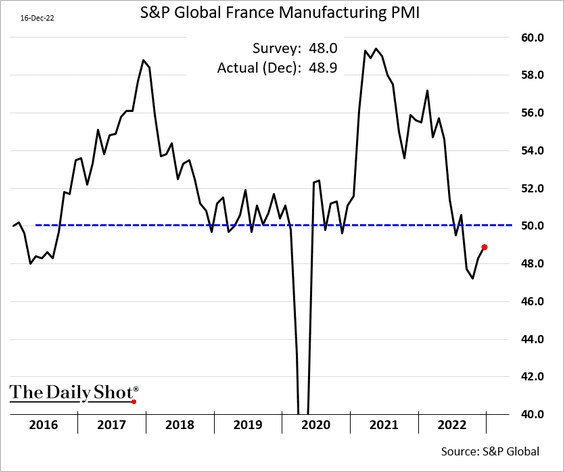

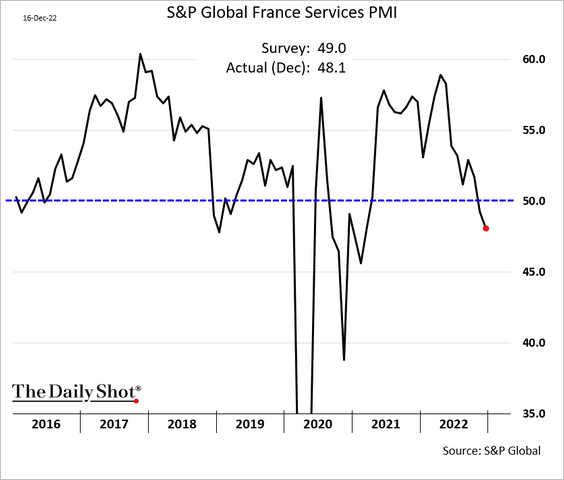

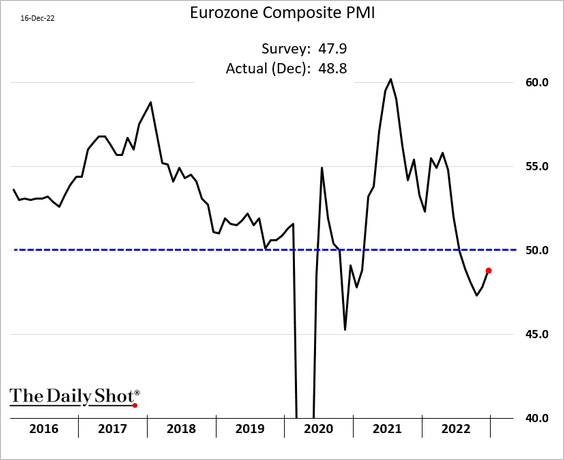

1. As we saw last week, the PMI reports topped expectations. The Citi Economic Surprise Index jumped.

• France:

– Manufacturing:

– Services:

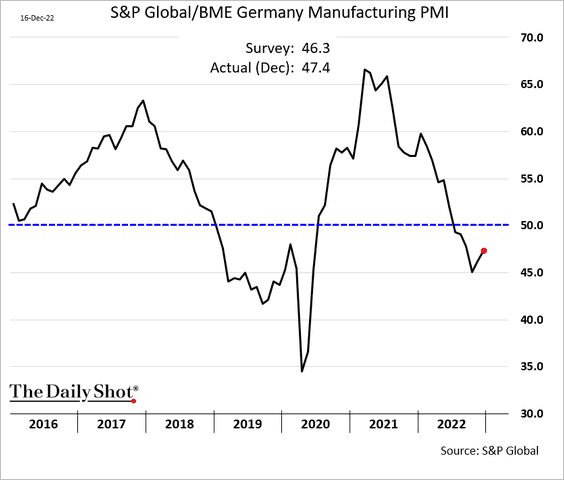

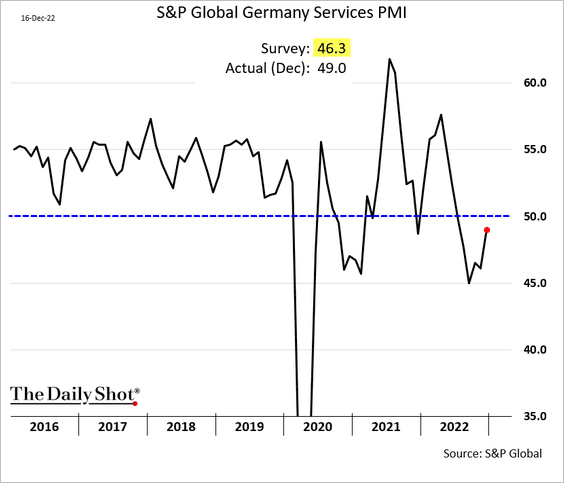

• Germany:

Source: Reuters Read full article

Source: Reuters Read full article

– Manufacturing:

– Services:

• The Eurozone Composite PMI:

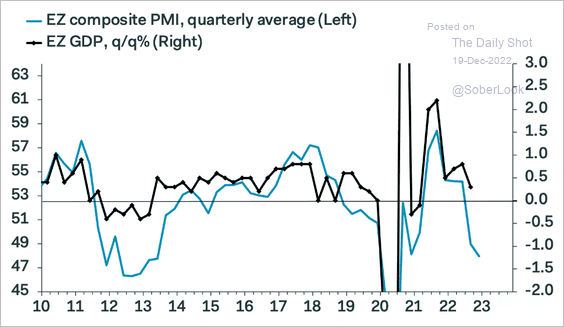

• Nonetheless, the quarterly average PMI still signals a recession.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

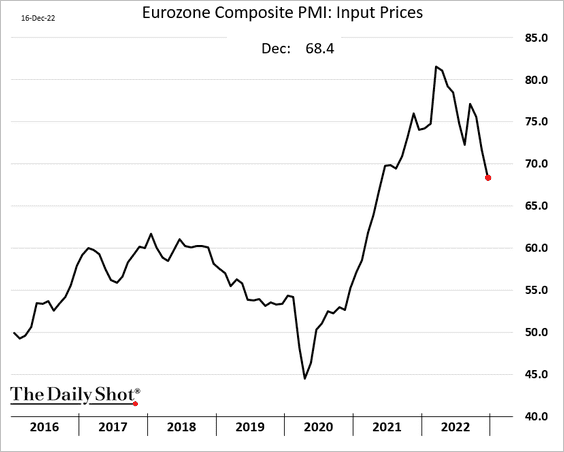

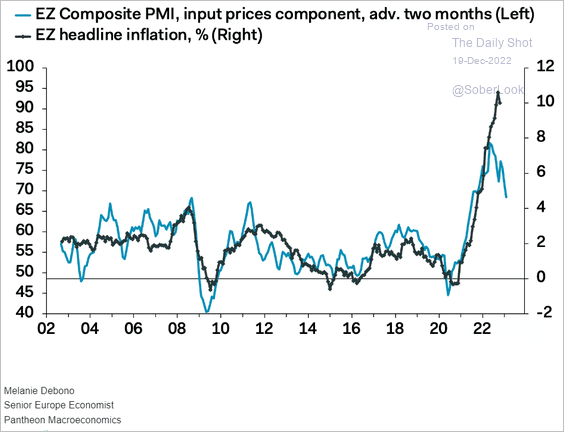

• Price gains are moderating, …

… pointing to lower inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

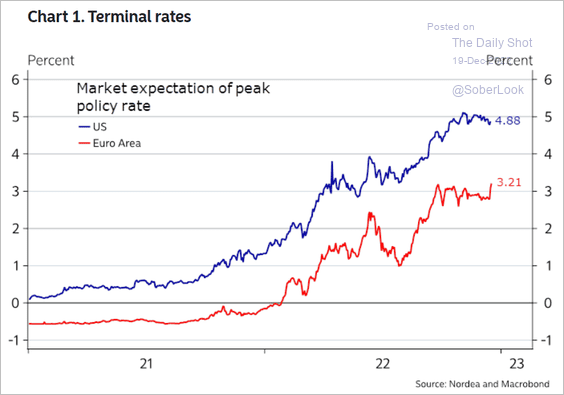

2. The market expectation for the euro-area terminal rate is above 3%.

Source: Nordea Markets

Source: Nordea Markets

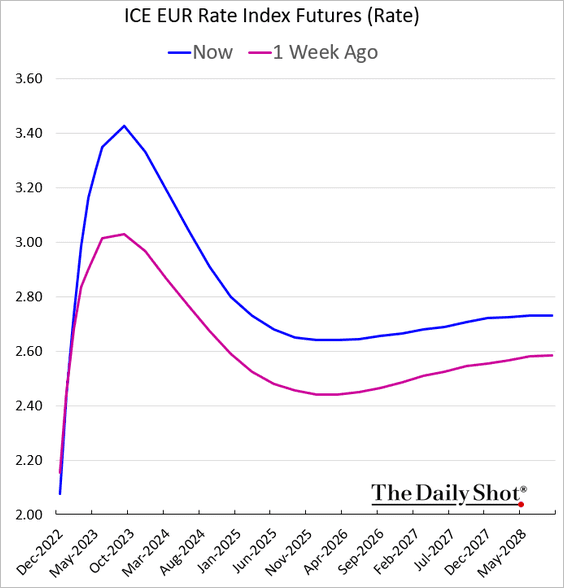

• The ECB rate trajectory has been repriced sharply.

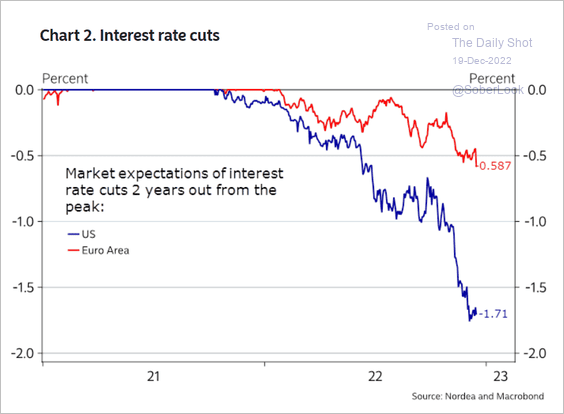

• This chart shows the expected rate cuts two years out from the peak (compared to the US).

Source: Nordea Markets

Source: Nordea Markets

——————–

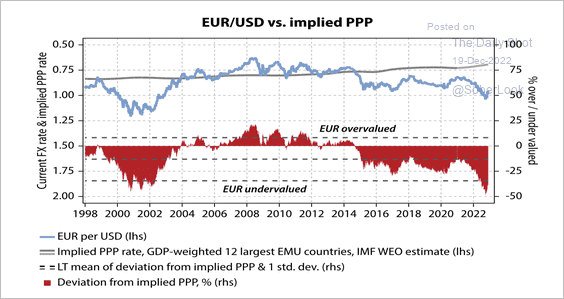

3. EUR/USD has deviated far below fair value, similar to what occurred during the early 2000s. During that time, the cross rate traded sideways for about two years before a meaningful recovery took place.

Source: Gavekal Research

Source: Gavekal Research

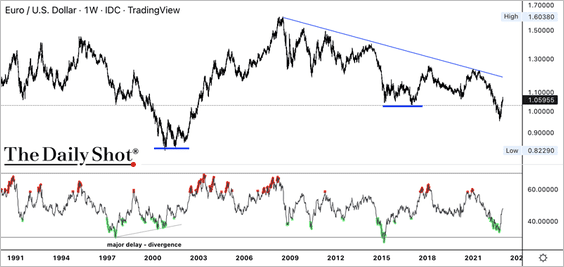

• Previous oversold conditions in EUR/USD also resulted in a basing phase before a rebound.

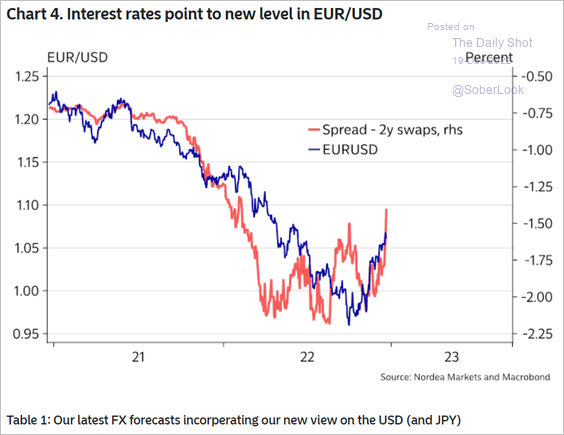

• Rate differentials suggest more gains for the euro in the near term.

Source: Nordea Markets

Source: Nordea Markets

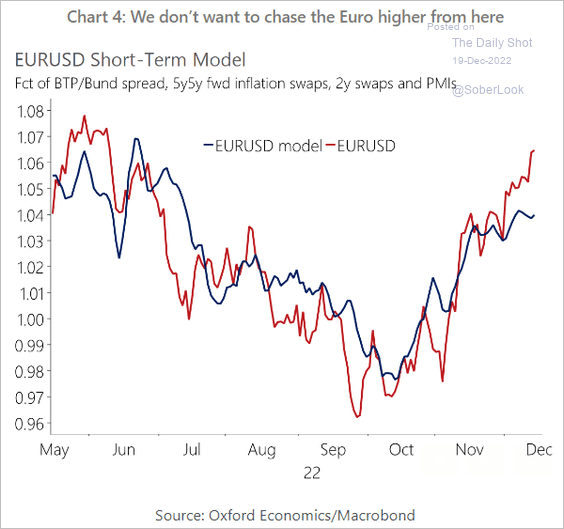

• The Oxford Economics model, however, shows that the euro may be overvalued in the short term.

Source: Oxford Economics

Source: Oxford Economics

——————–

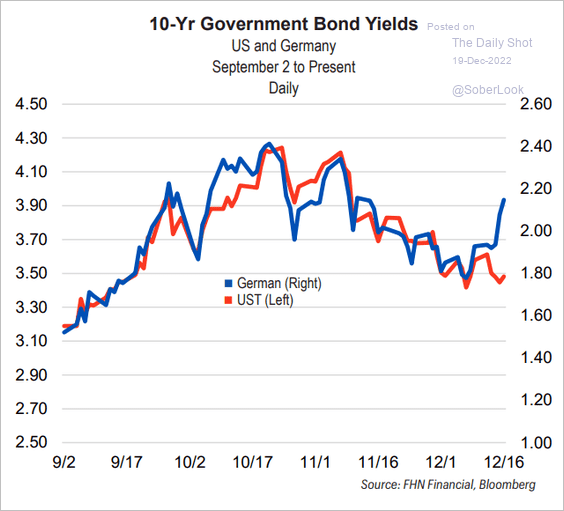

4. Bunds have diverged from Treasuries as the ECB signals more tightening and QT ahead.

Source: FHN Financial

Source: FHN Financial

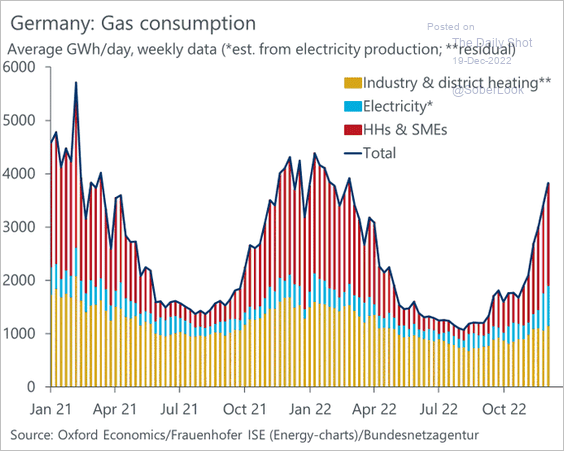

5. The jump in Germany’s natural gas consumption has been mostly driven by households, …

Source: @OliverRakau

Source: @OliverRakau

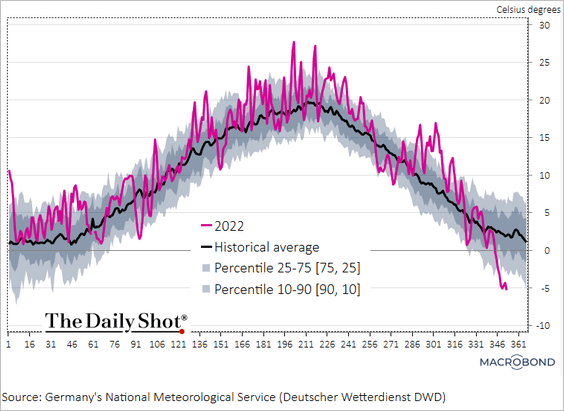

… as temperatures plummet.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Back to Index

Emerging Markets

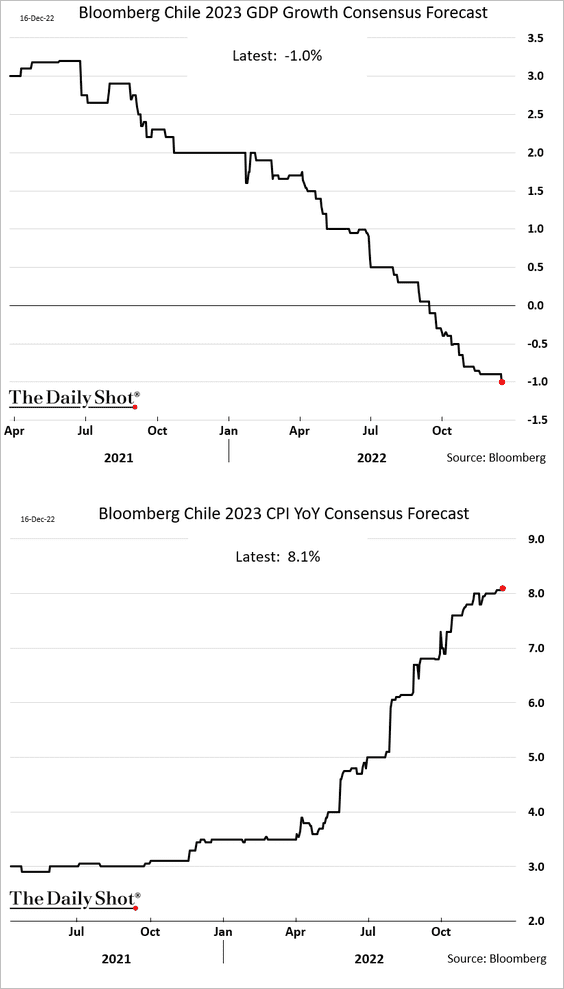

1. Economists see a painful onset of stagflation in Chile next year.

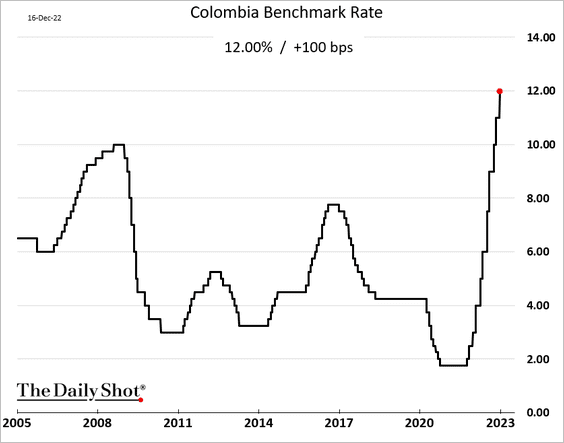

2. Colombia’s central bank delivered another 100 bps rate hike.

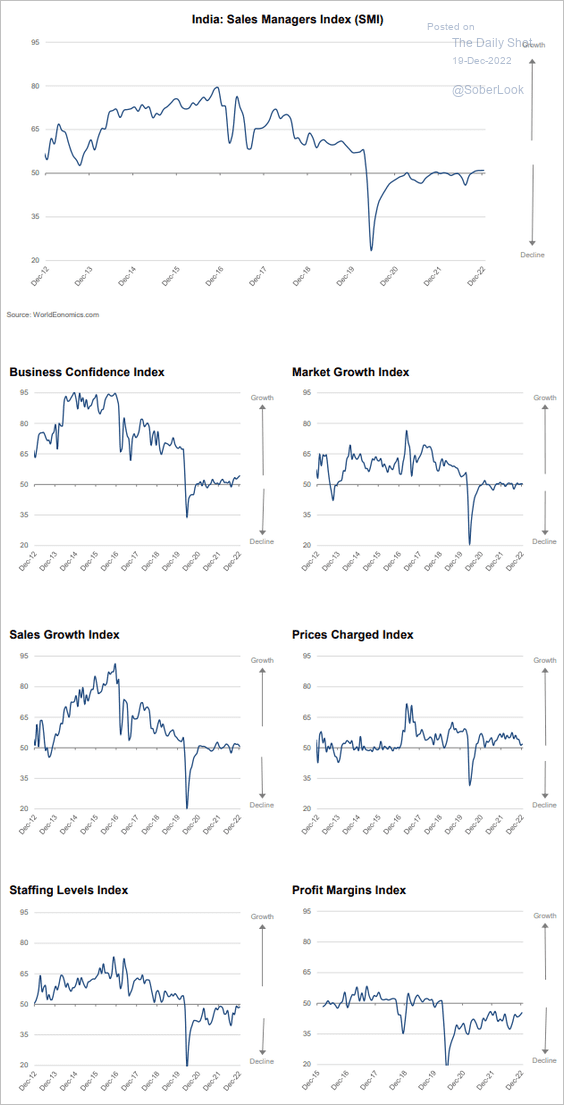

3. India’s business activity is maintaining modest expansion, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

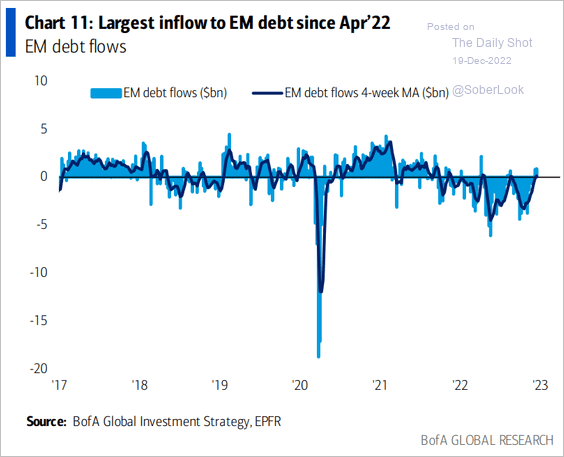

4. EM debt flows have turned positive.

Source: BofA Global Research

Source: BofA Global Research

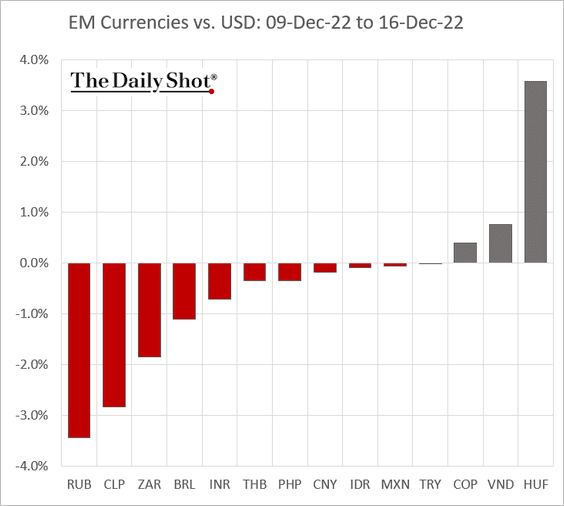

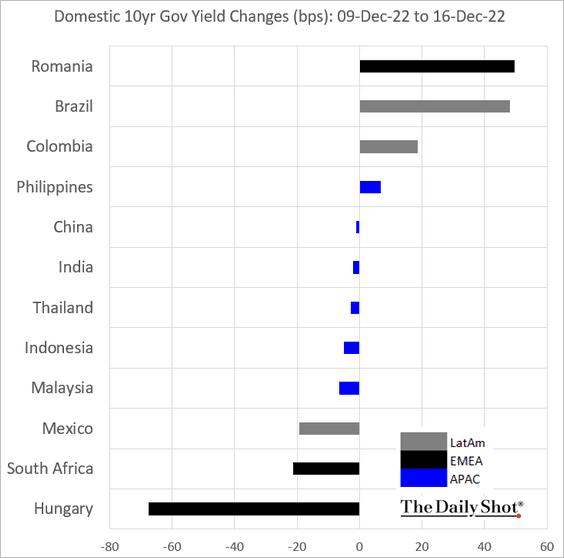

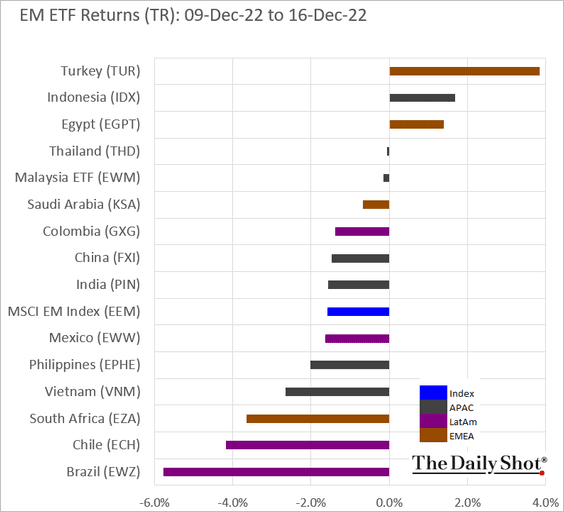

5. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

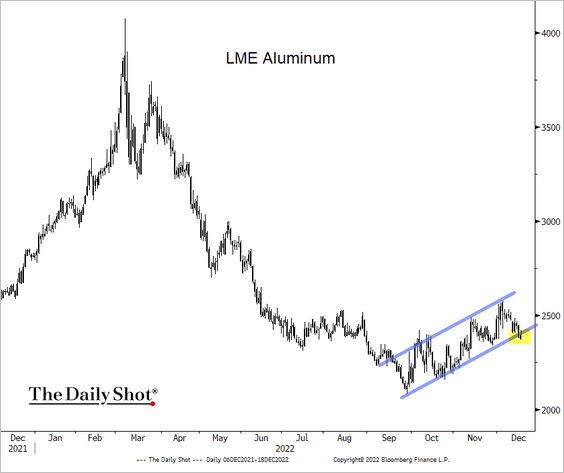

1. Aluminum is testing the lower end of its uptrend channel amid demand concerns.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

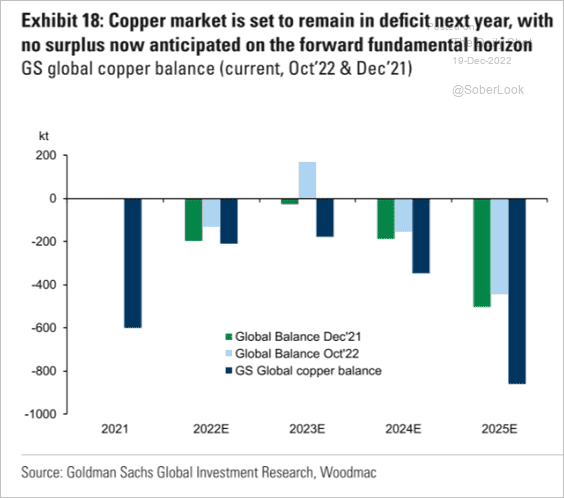

2. According to Goldman, copper markets will be in deficit over the next few years.

Source: Goldman Sachs

Source: Goldman Sachs

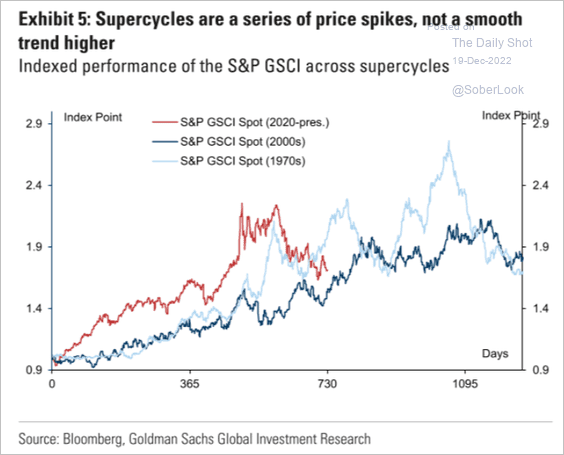

3. Is the supercycle thesis still intact?

Source: Goldman Sachs

Source: Goldman Sachs

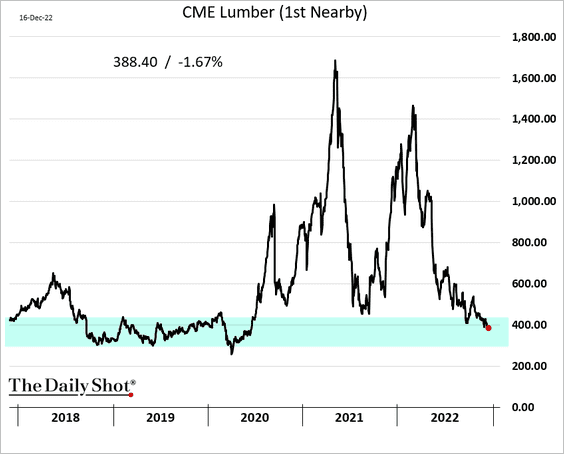

4. US lumber futures continue to weaken amid the housing rout.

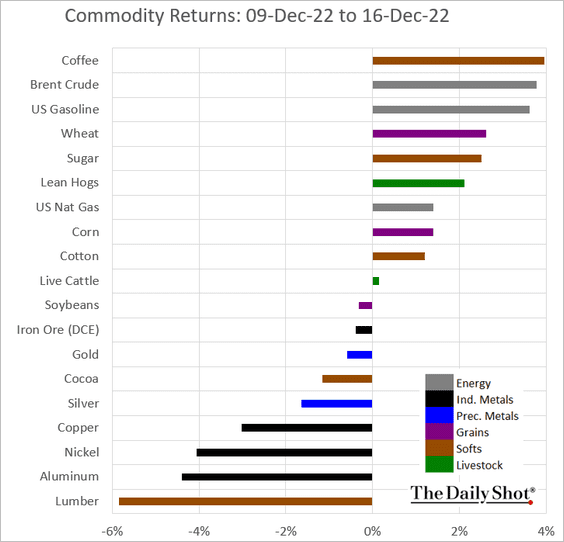

5. Finally, we have last week’s performance across key commodity markets.

Back to Index

Energy

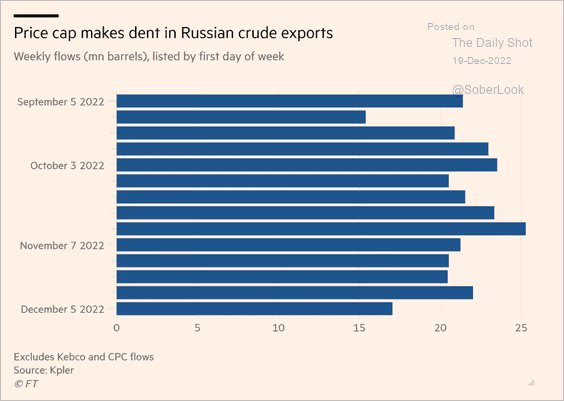

1. Are price caps having an impact on Russia’s crude exports?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

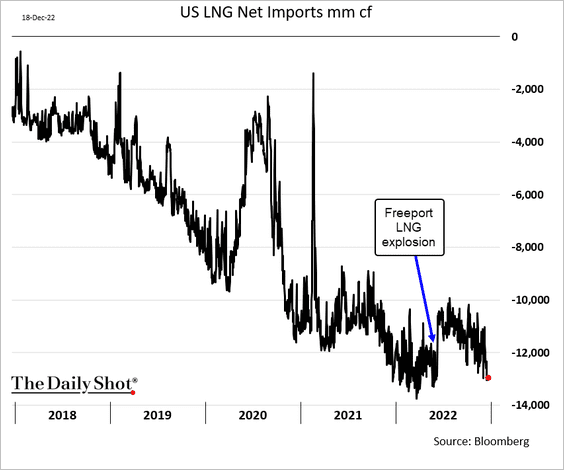

2. US LNG exports are rebounding after the Freeport explosion (chart shows net imports).

Source: Reuters Read full article

Source: Reuters Read full article

——————–

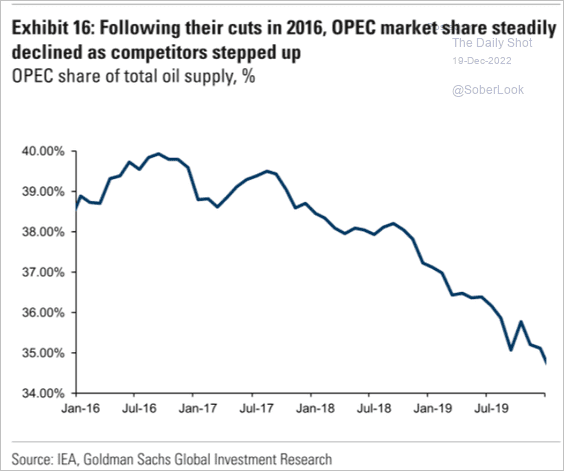

3. This chart shows OPEC’s market share over time.

Source: Goldman Sachs

Source: Goldman Sachs

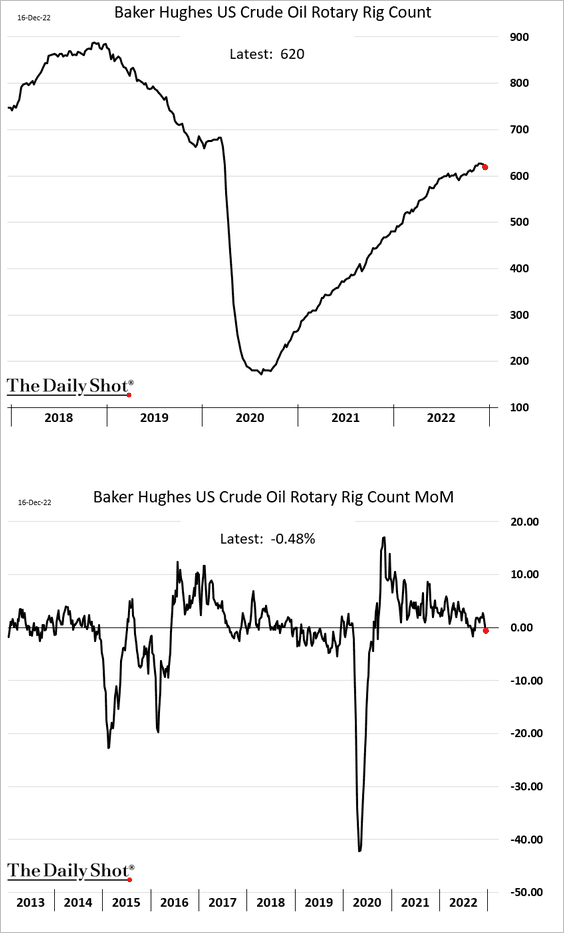

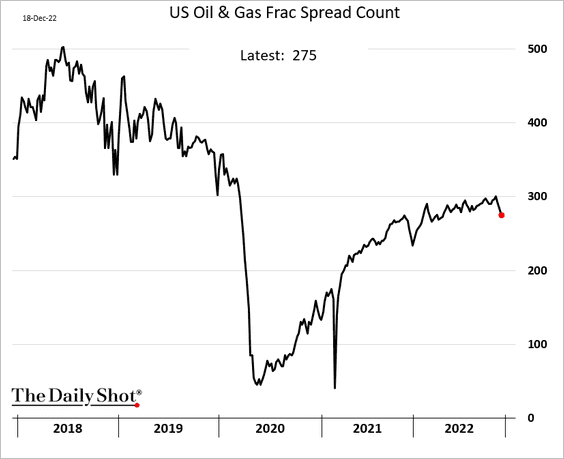

4. US rig count and frac spread declined last week.

Back to Index

Equities

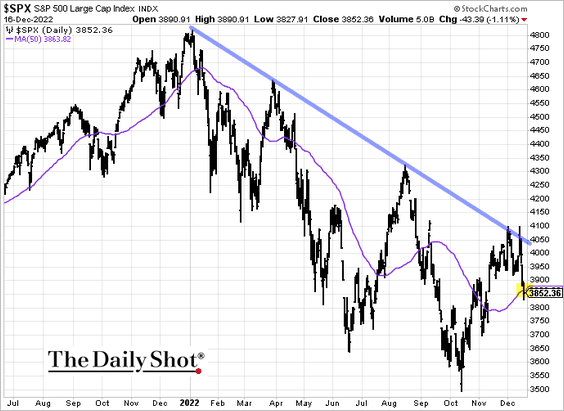

1. Will the S&P 500 hold support at the 50-day moving average?

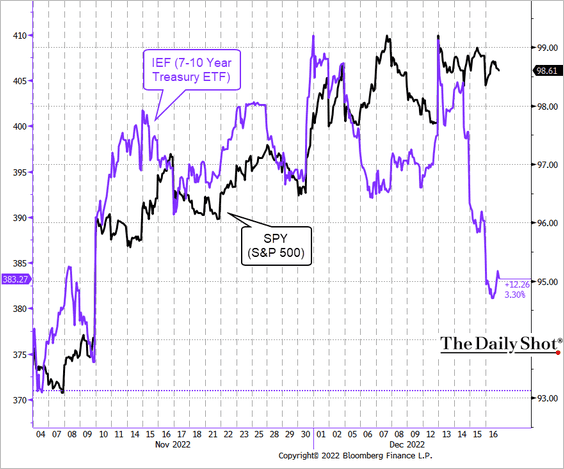

2. Stocks decoupled from bonds last week as recession worries grow.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

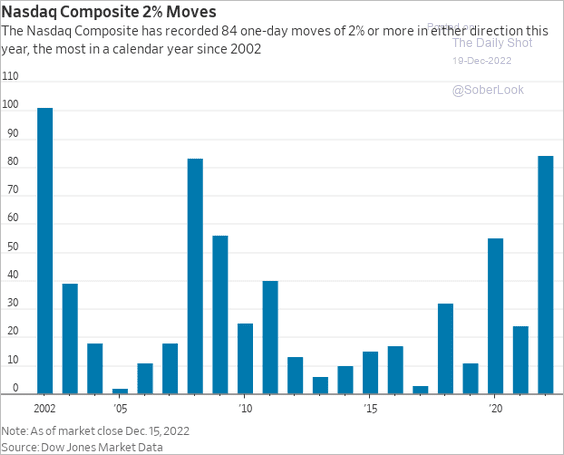

3. It’s been a volatile year for the Nasdaq Composite.

Source: @WSJ Read full article

Source: @WSJ Read full article

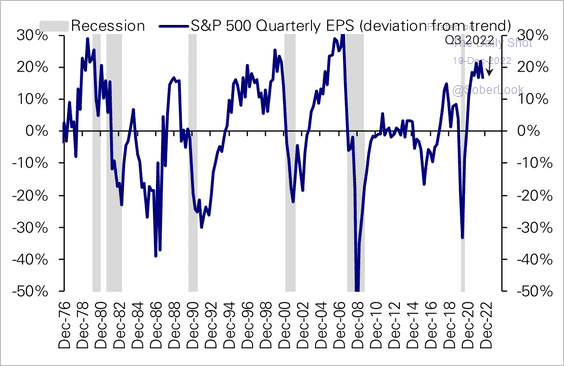

4. S&P 500 earnings are nearly 20% above their long-term trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

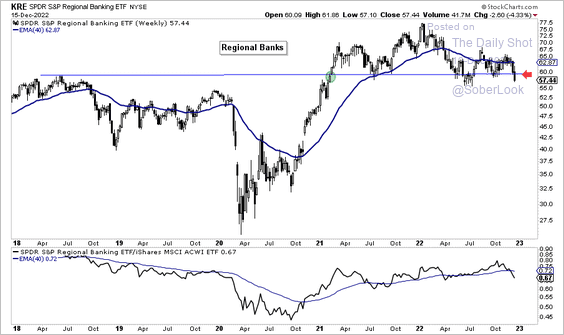

5. The SPDR Regional Bank ETF (KRE) broke through a key support zone in absolute and relative terms.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

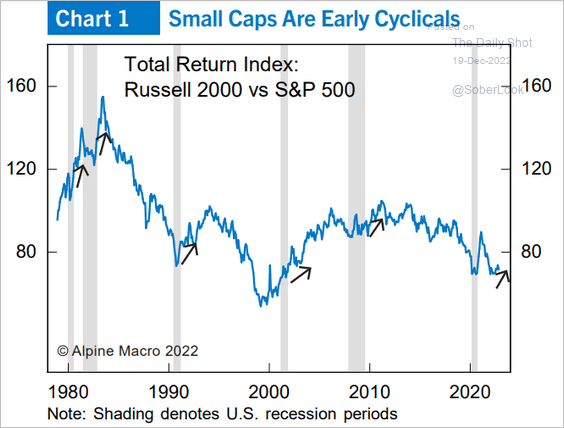

6. Will small caps outperform as the economy bottoms?

Source: Alpine Macro

Source: Alpine Macro

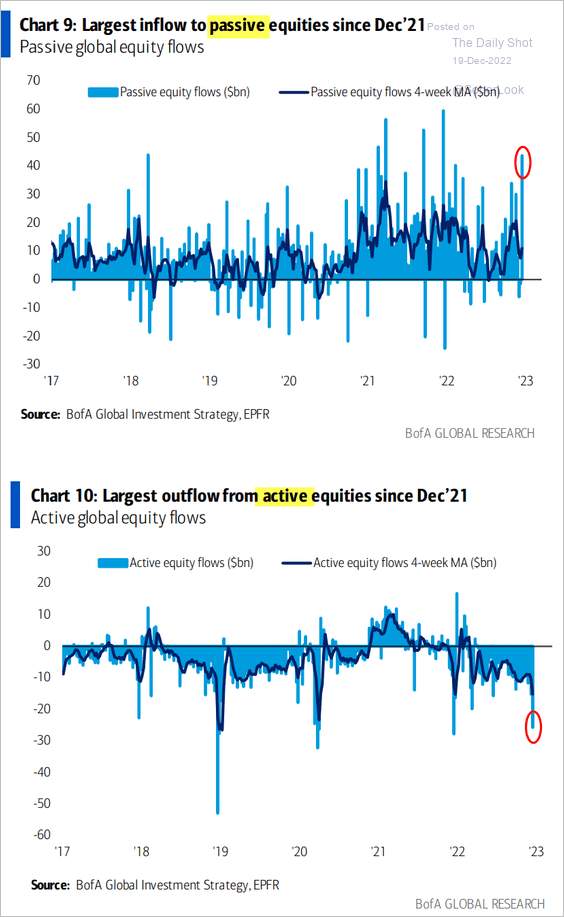

7. Rotation from active to passive funds accelerated in recent days.

Source: BofA Global Research

Source: BofA Global Research

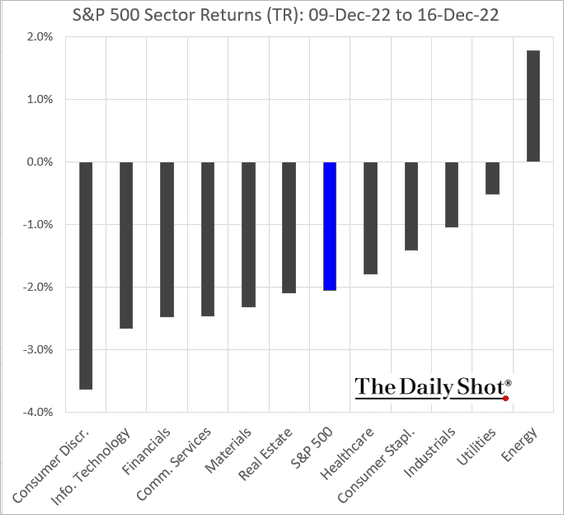

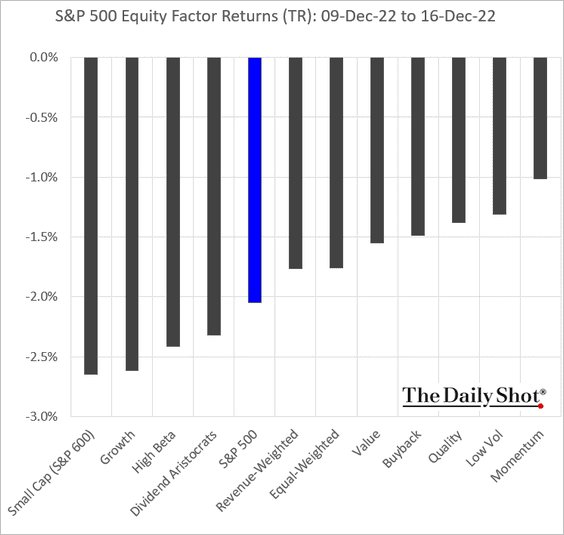

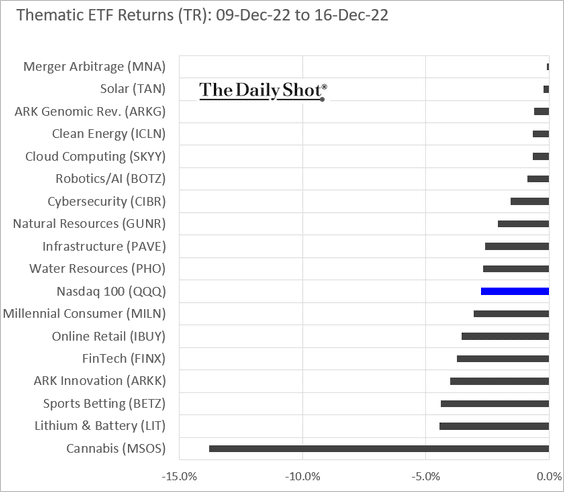

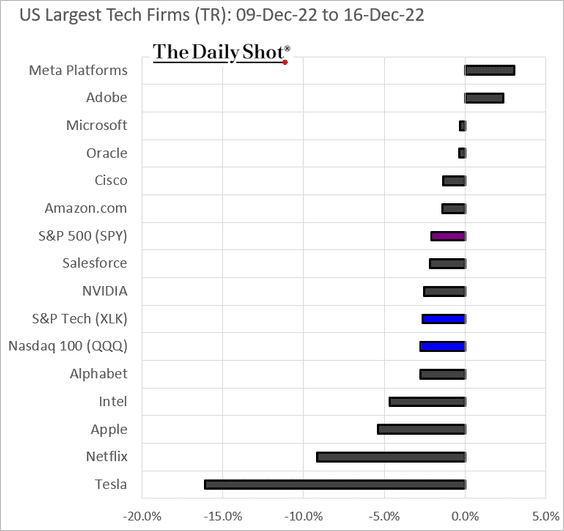

8. Finally, we have some performance data from last week.

• Sectors:

• Factors:

• Thematic strategies:

• Largest US tech firms:

Back to Index

Credit

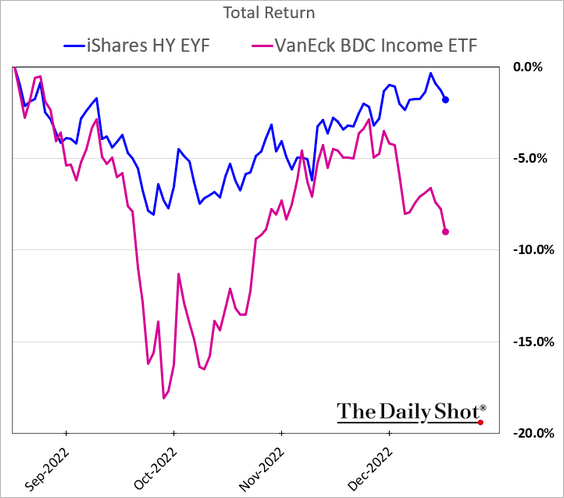

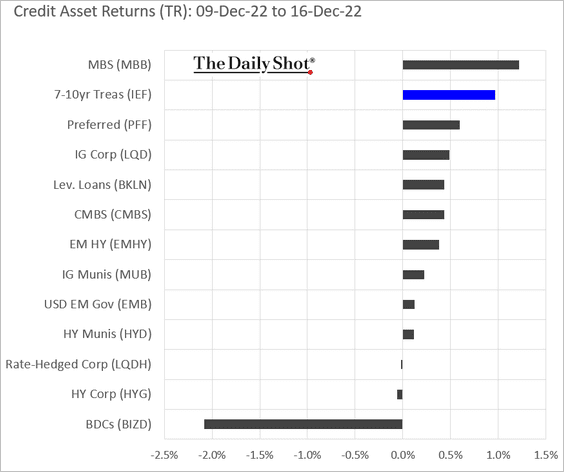

1. BDCs are underperforming again.

Here is last week’s performance by asset class.

——————–

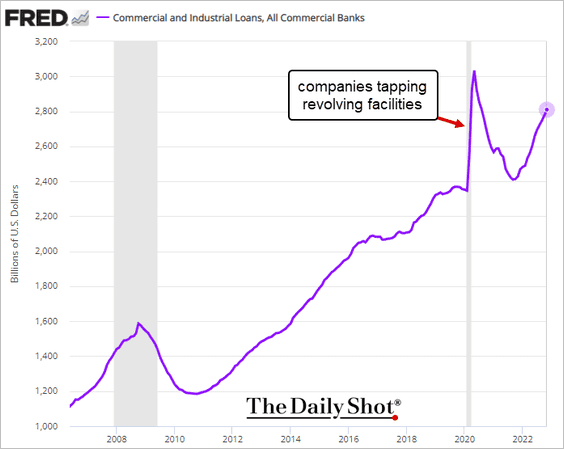

2. Business loans on US banks’ balance sheets continue to grow at a healthy pace.

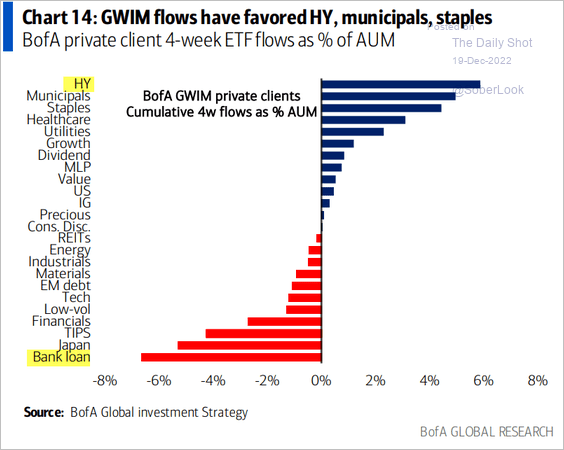

3. BofA’s private clients are rotating from leveraged loans to HY bonds to lock in yields (signaling that bond yields may have peaked).

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Rates

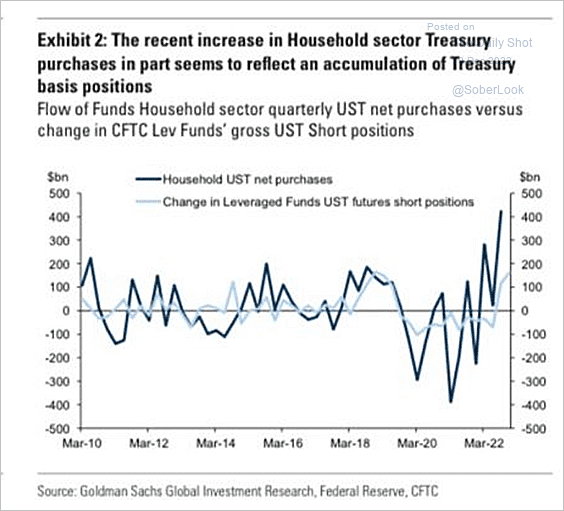

1. Households have been buying Treasuries.

Source: Goldman Sachs

Source: Goldman Sachs

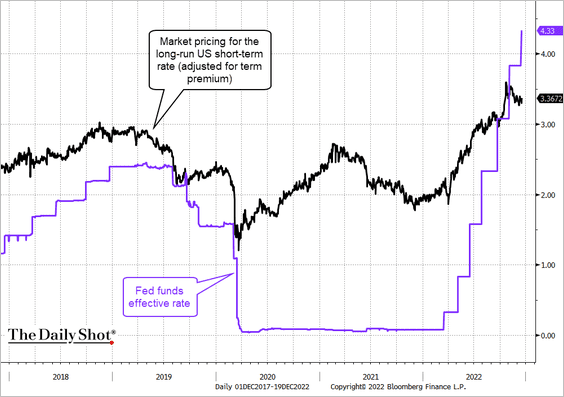

2. The fed funds rate is now in restrictive territory based on market expectations of short-term rates in the future.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

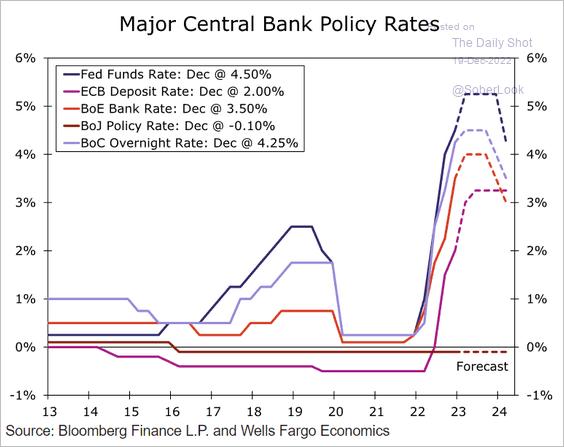

1. Below are Wells Fargo’s forecasts for advanced economies’ policy rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

2. The World Economics SMI report shows global business activity back in contraction mode this month.

Source: World Economics

Source: World Economics

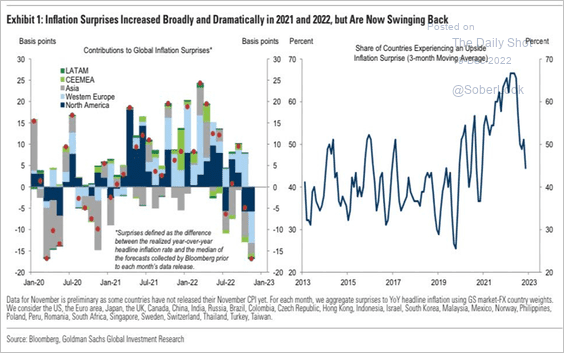

3. Inflation reports have been surprising to the downside.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

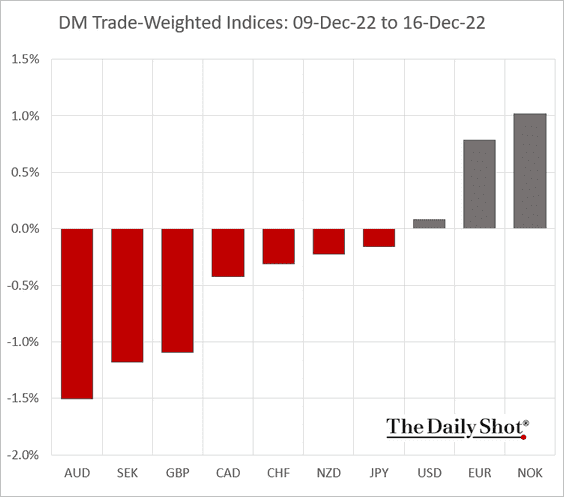

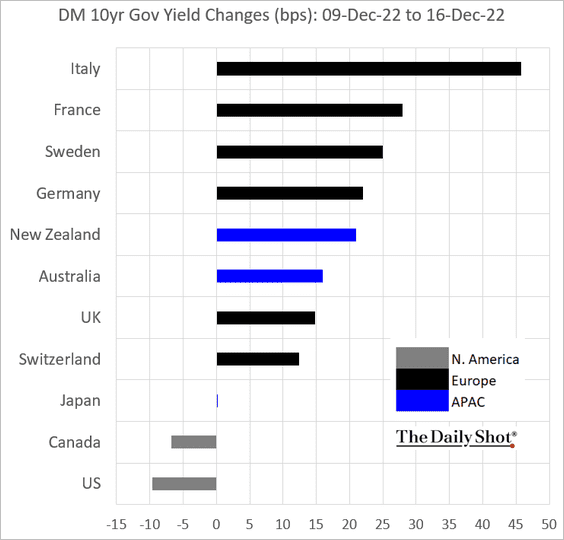

4. Next, we have some performance data from last week.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

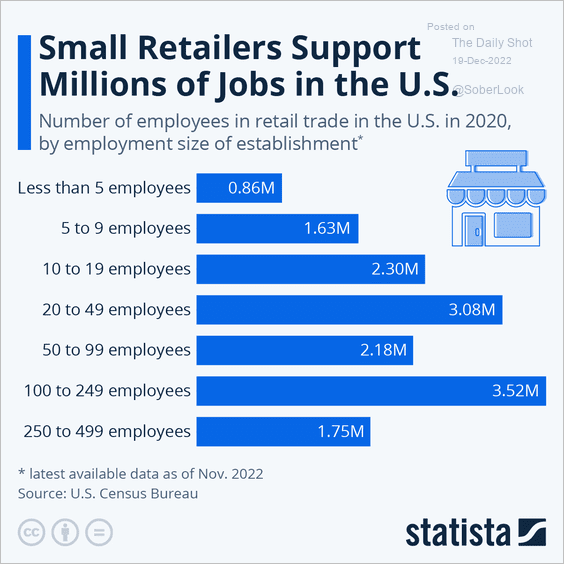

1. Employment at small US retailers:

Source: Statista

Source: Statista

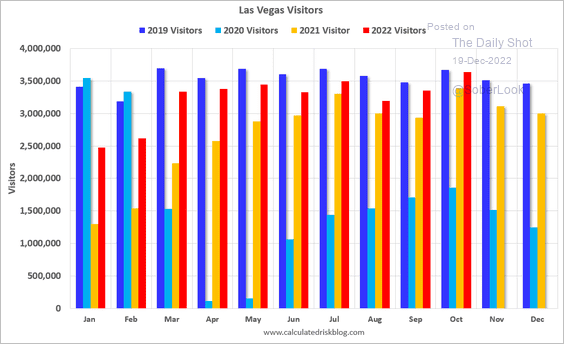

2. Las Vegas visitors:

Source: Calculated Risk

Source: Calculated Risk

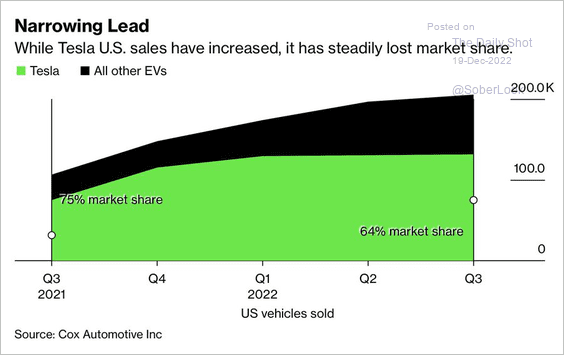

3. Tesla’s market share:

Source: @jessefelder, @business, @KyleStock, @iboudway Read full article

Source: @jessefelder, @business, @KyleStock, @iboudway Read full article

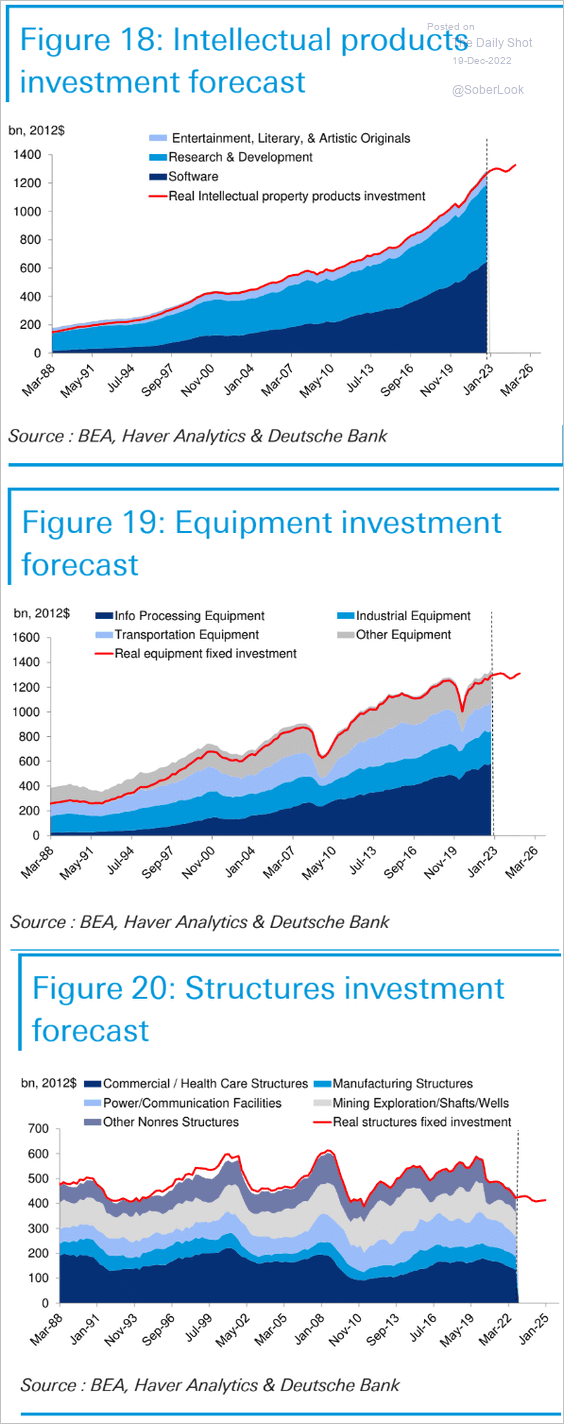

4. US business investment trends and projections from Deutsche Bank:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

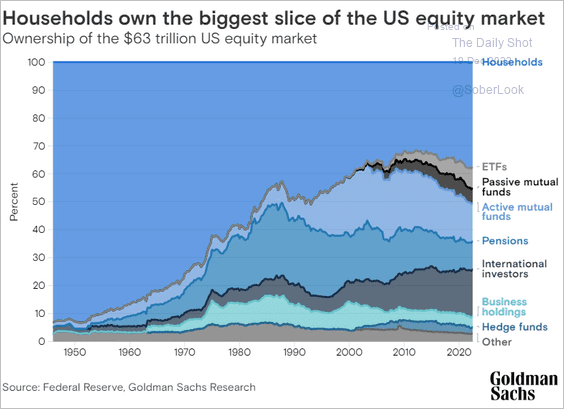

5. Who owns the US stock market?

Source: Goldman Sachs

Source: Goldman Sachs

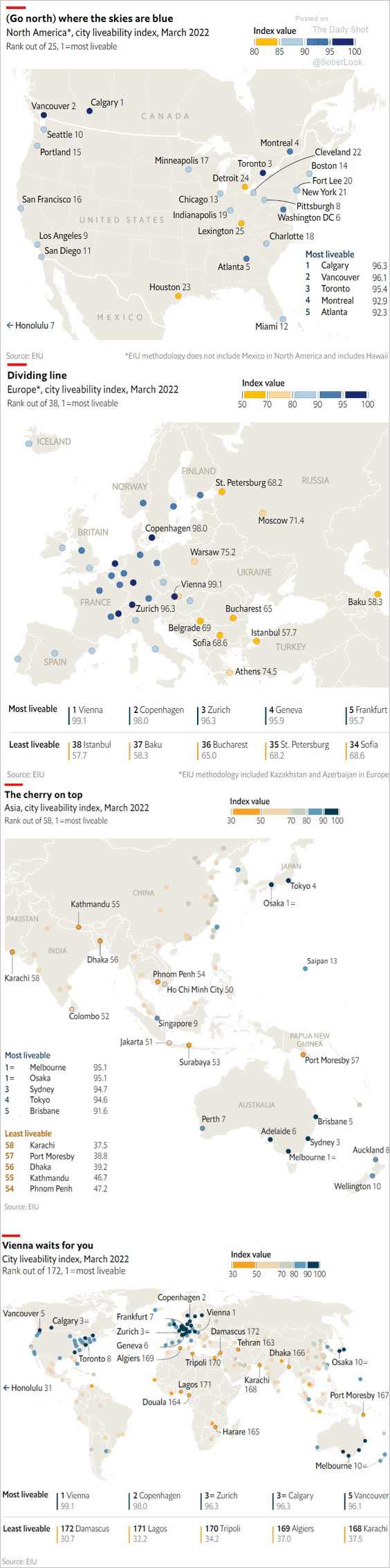

6. City liveability index:

Source: The Economist Read full article

Source: The Economist Read full article

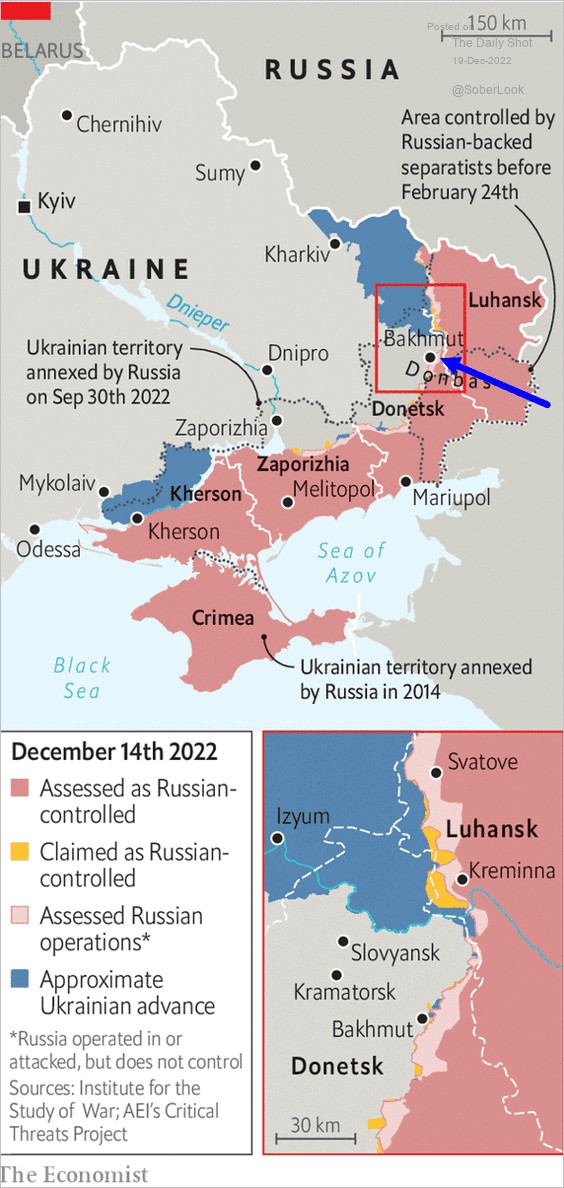

7. Russia’s latest offensive:

Source: The Economist Read full article

Source: The Economist Read full article

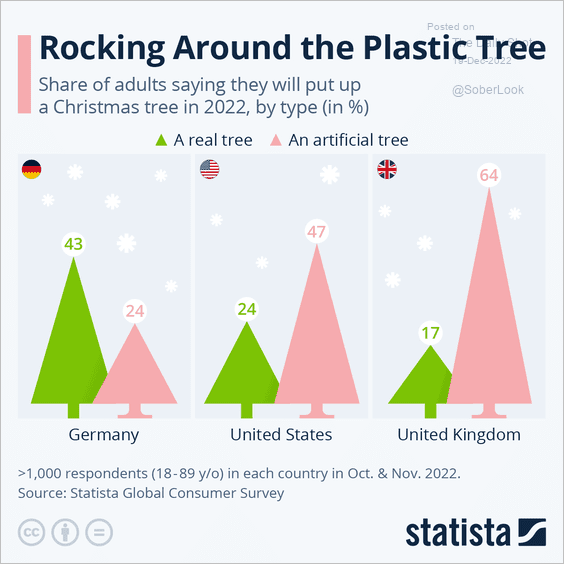

8. Plastic trees:

Source: Statista

Source: Statista

——————–

Back to Index