The Daily Shot: 20-Dec-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

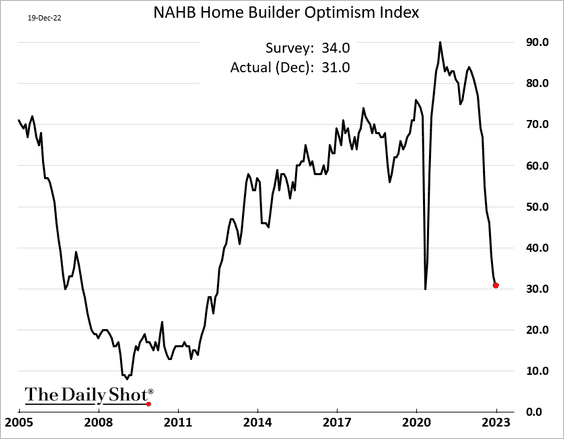

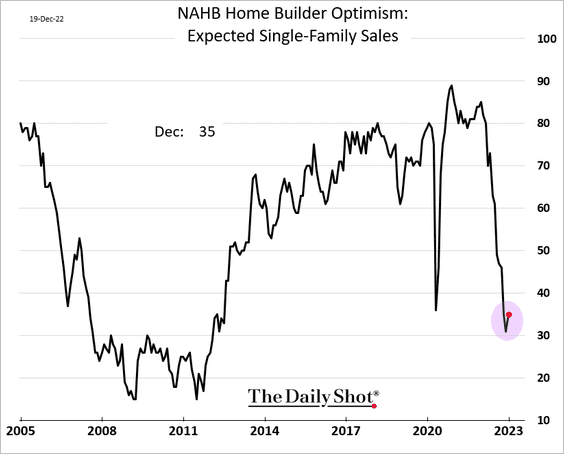

1. Let’s begin with the housing market.

• Homebuilder sentiment came close to the COVID-shock lows this month.

But sales expectations edged higher.

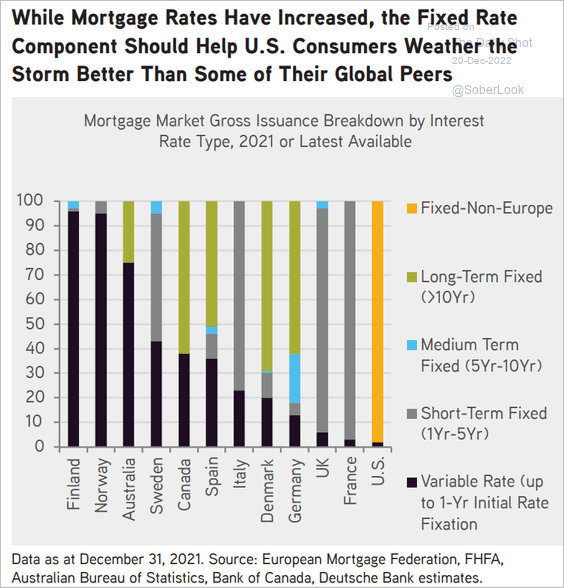

• US homeowners have relatively low exposure to interest rates.

Source: KKR Global Institute

Source: KKR Global Institute

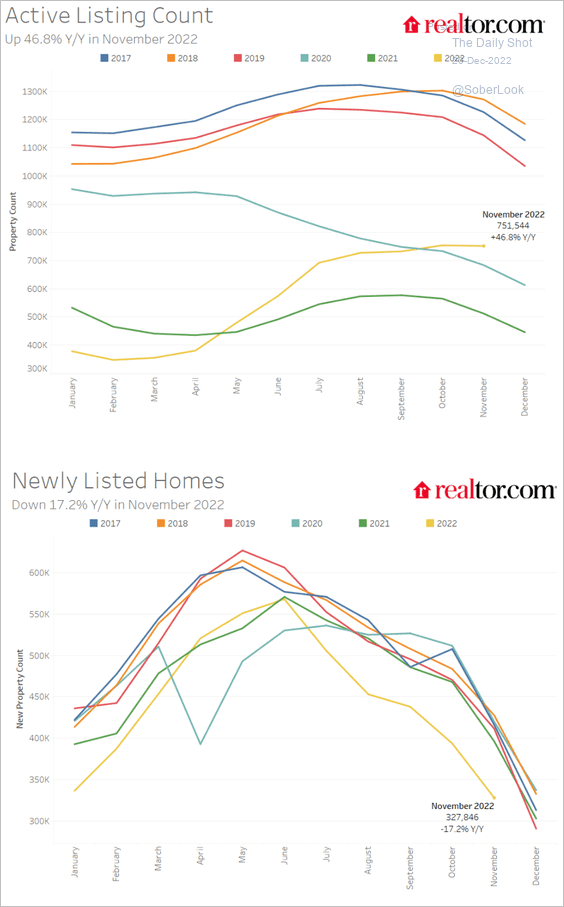

• Housing inventories are still tight.

Source: realtor.com

Source: realtor.com

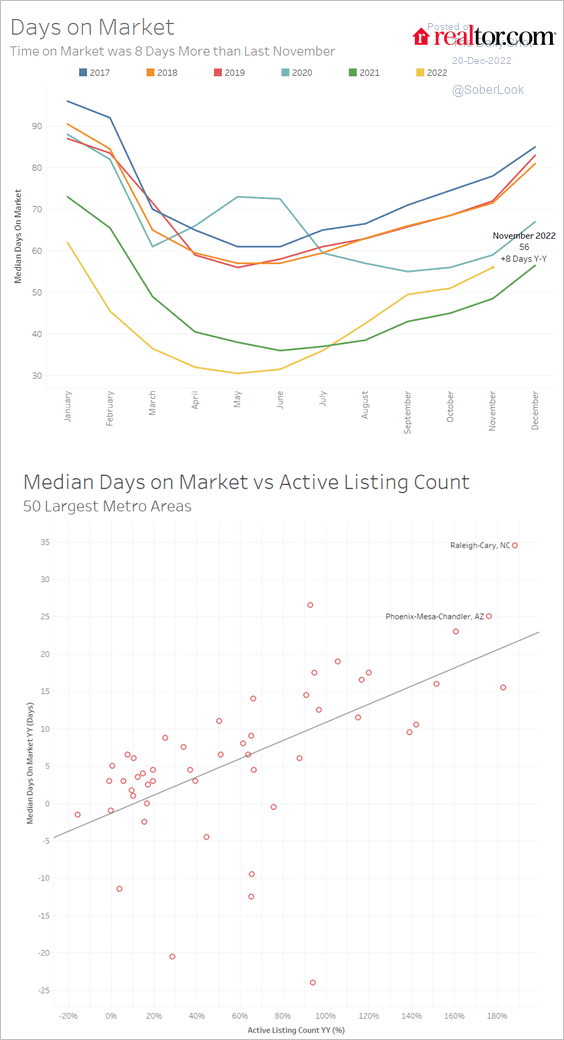

• It takes a bit longer to sell a house than last year, but the number of days on the market depends on local inventories.

Source: realtor.com

Source: realtor.com

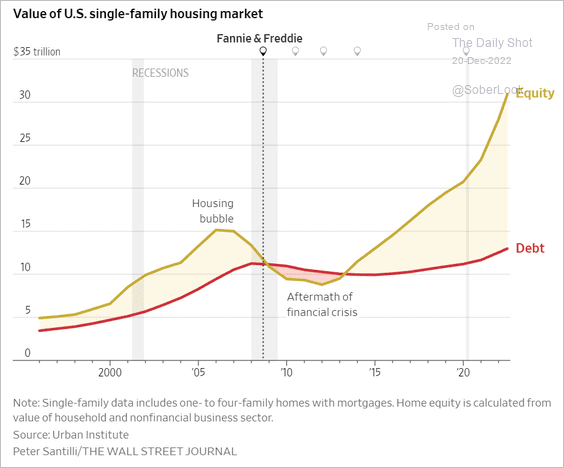

• Underwater mortgages will be less likely in the current housing downturn.

Source: @WSJ Read full article

Source: @WSJ Read full article

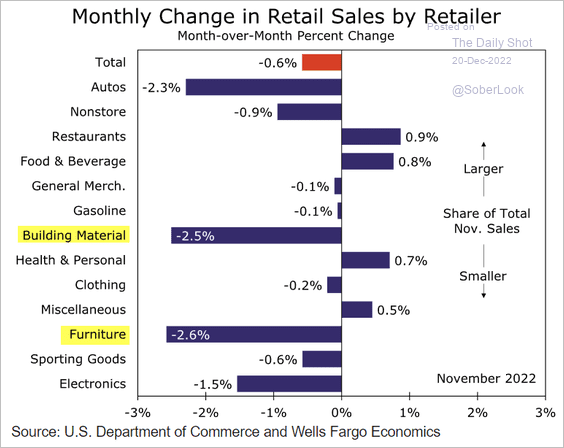

• Housing market pain was visible in last month’s retail sales.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

2. Next, we have some updates on inflation.

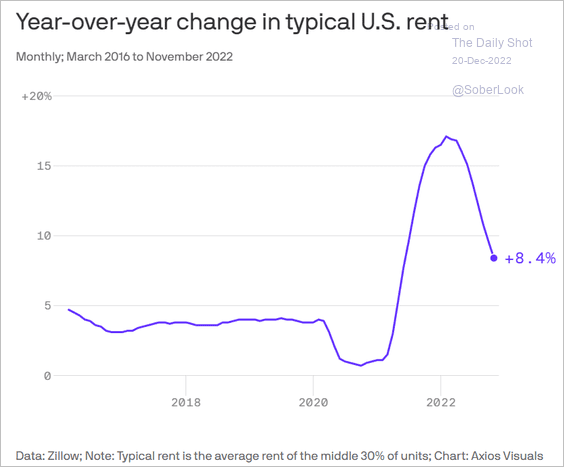

• Rent inflation continues to moderate.

Source: @axios Read full article

Source: @axios Read full article

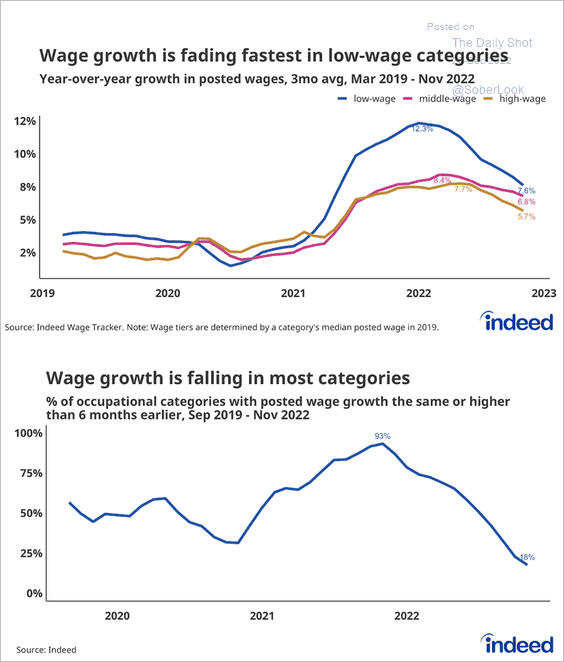

• Wage growth is slowing.

Source: Hiring Lab Read full article

Source: Hiring Lab Read full article

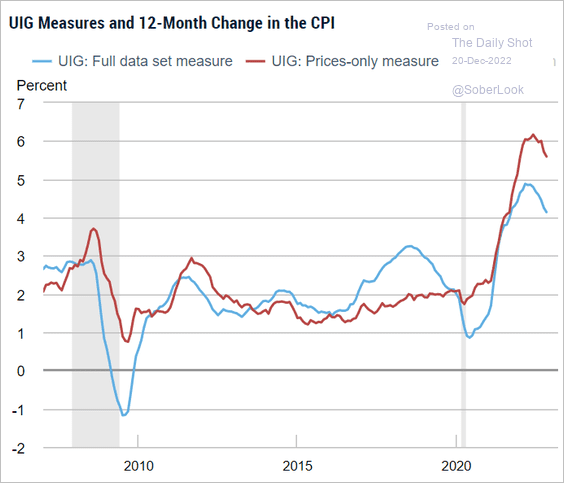

• This chart shows the NY Fed’s UIG inflation measures.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

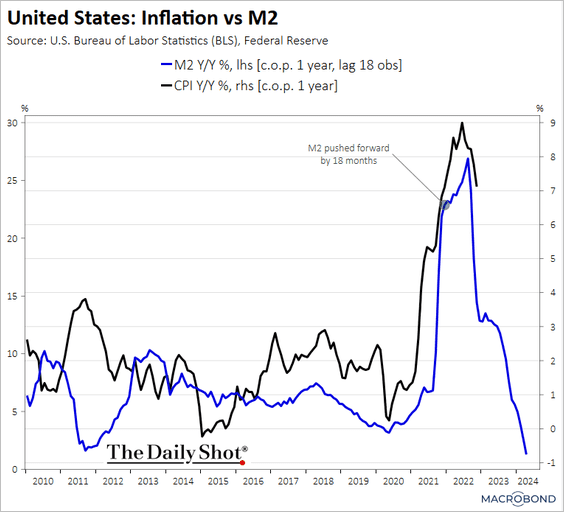

• Slower growth in the broad money supply could signal softer inflation ahead.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

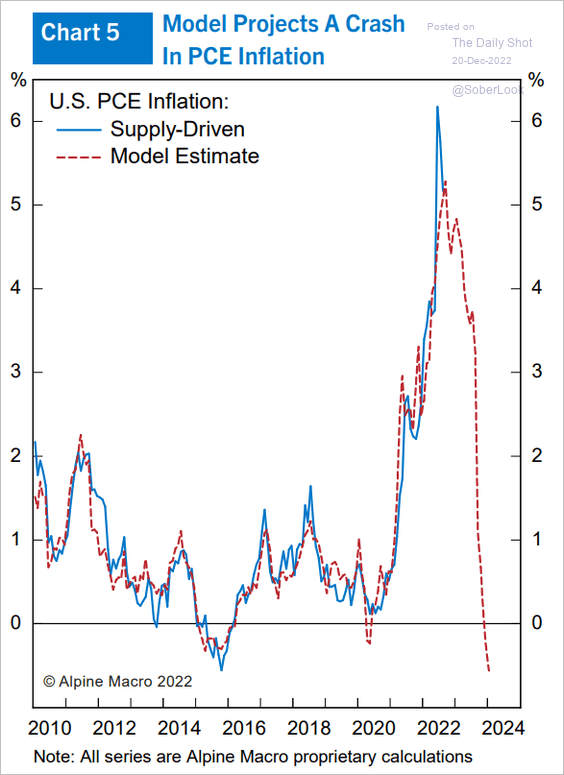

• Supply-driven components of inflation will be in negative territory in 2023 (on a year-over-year basis), according to a model from Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

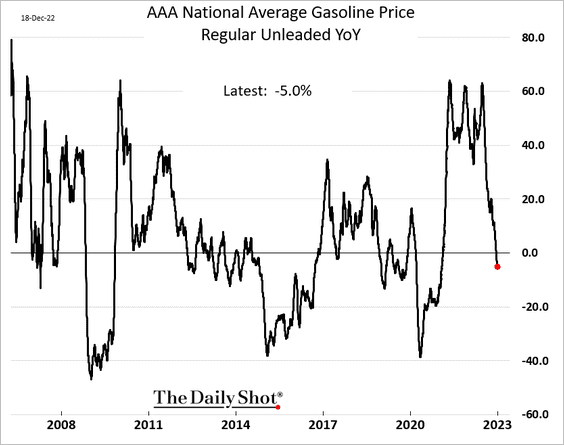

• Retail gasoline prices are 5% below the levels we saw 12 months ago.

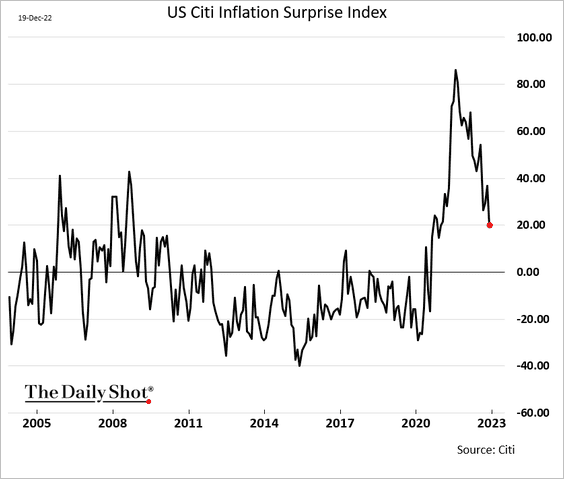

• Here is the Citi Inflation Surprise Index.

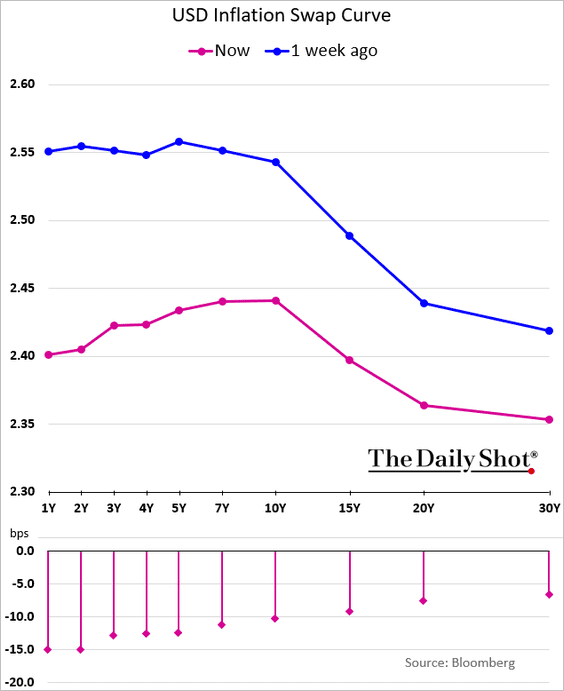

• The US inflation swap curve (market-based inflation expectations) continues to flatten.

——————–

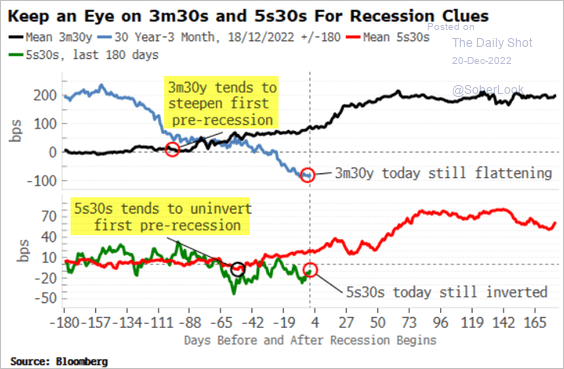

3. What signals will we get from the yield curve as the economy enters a recession?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

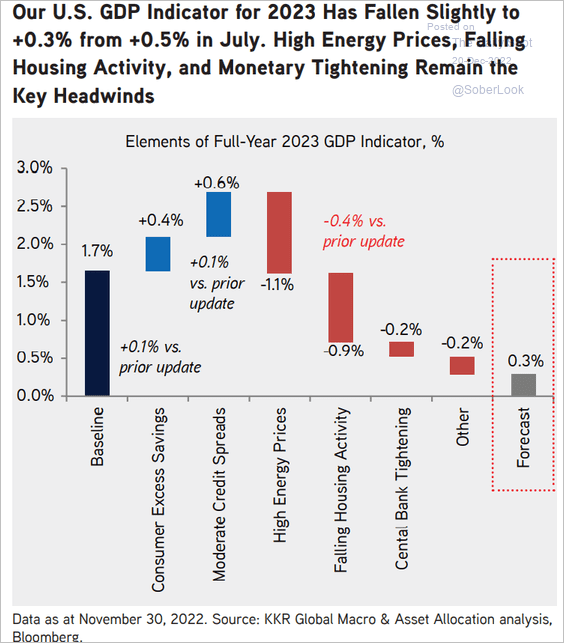

4. This chart shows the drivers of slower growth in 2023, according to KKR.

Source: KKR Global Institute

Source: KKR Global Institute

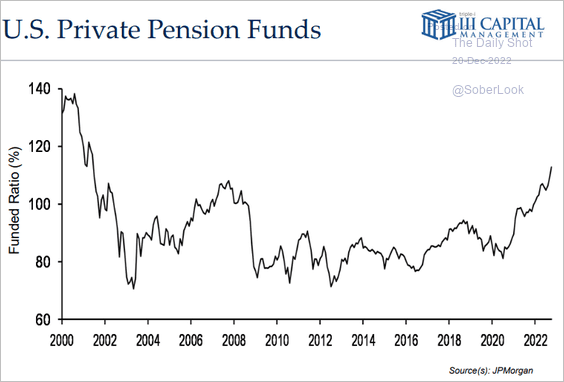

5. Funded ratios for private defined benefit pension funds have improved markedly in the pandemic era.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

Back to Index

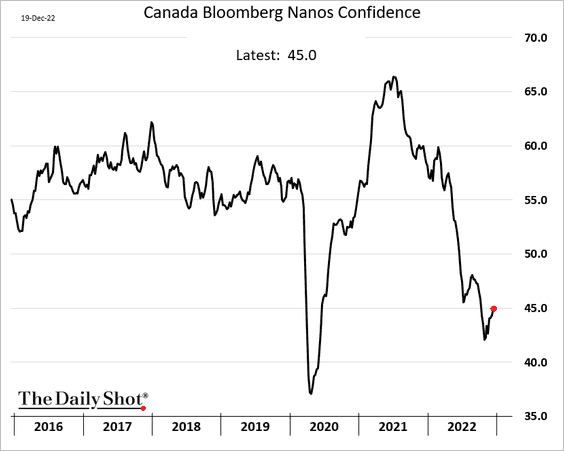

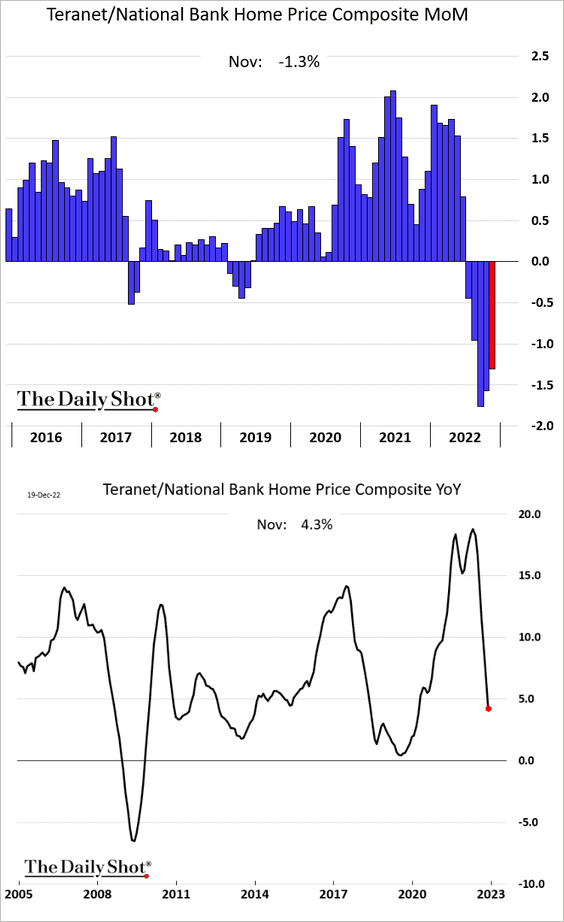

Canada

1. Consumer confidence edged higher again last week.

2. Home prices have been down for five months in a row.

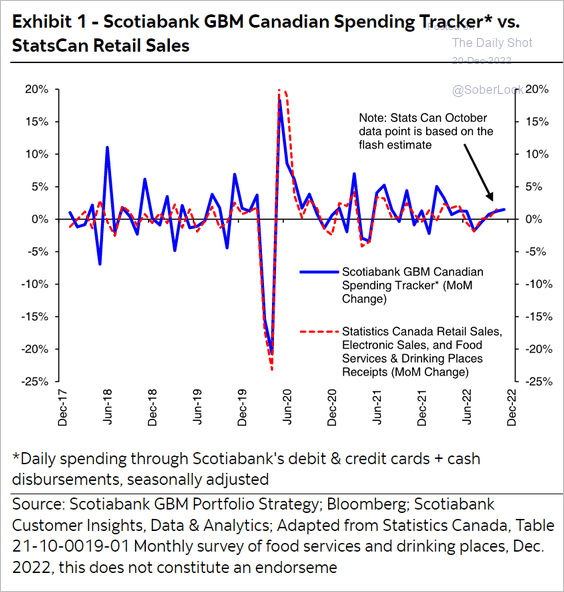

3. Retail sales kept improving last month, according to Scotiabank.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

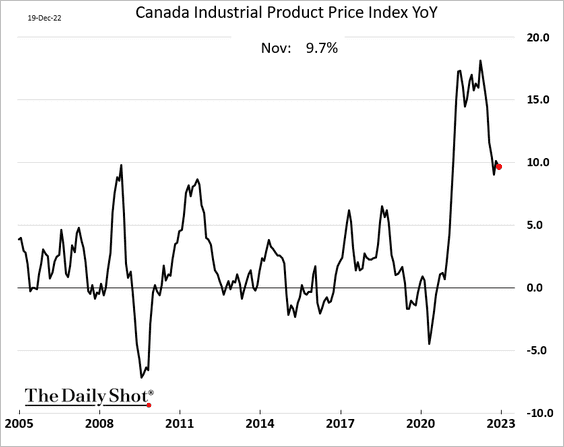

4. Producer price inflation is off the highs but remains elevated.

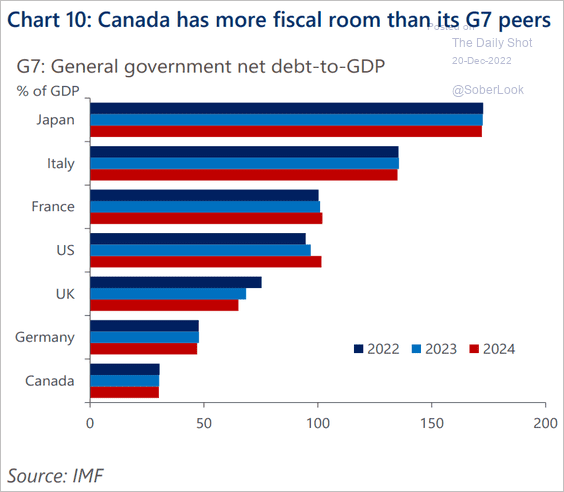

5. Canada has more fiscal room than other advanced economies.

Source: Oxford Economics

Source: Oxford Economics

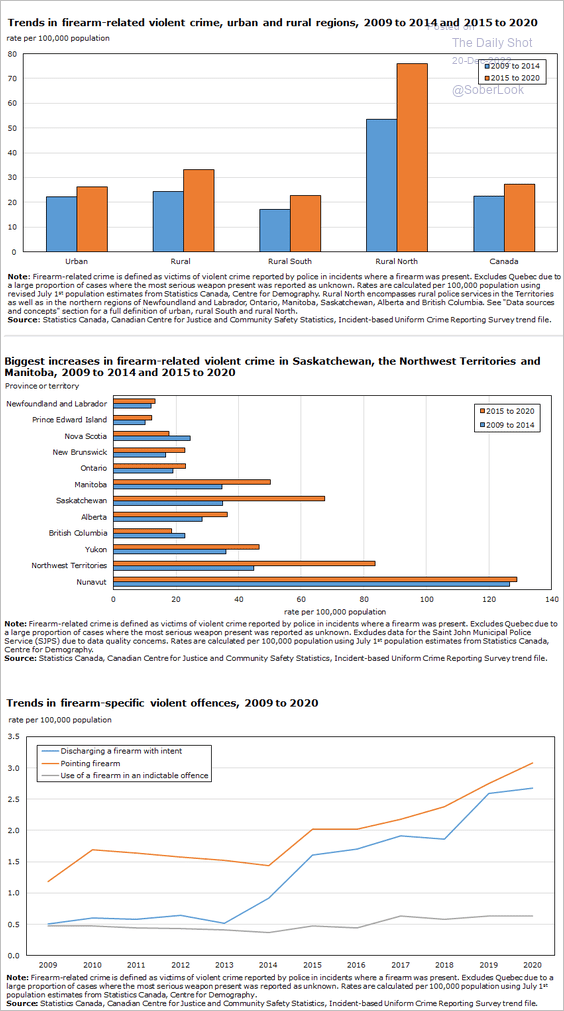

6. Finally, we have some data on Canada’s firearm-related violent crime.

Source: Statistics Canada Read full article

Source: Statistics Canada Read full article

Back to Index

The United Kingdom

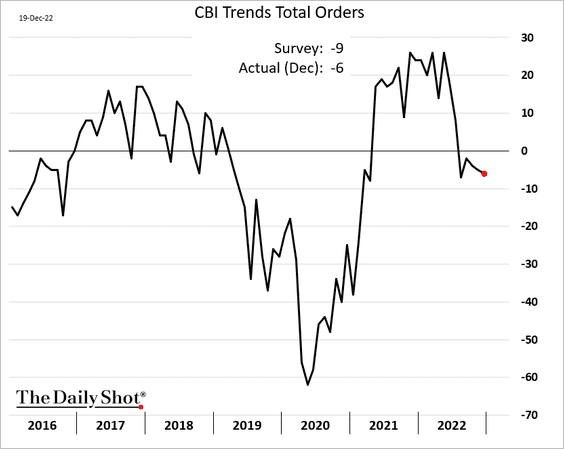

1. The CBI industrial orders report was a bit better than expected.

Price gains remain elevated.

——————–

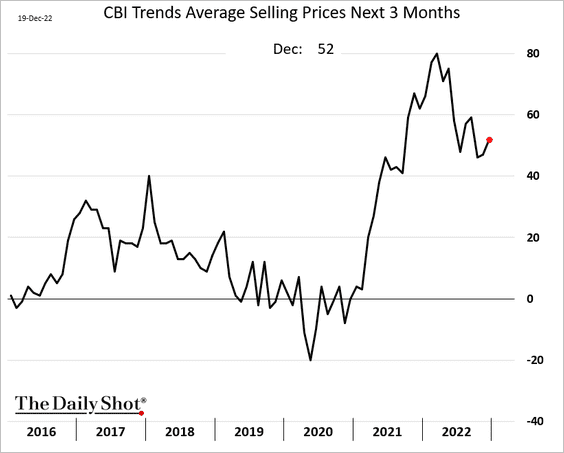

2. Gilt yields have been rising.

Source: Tradeweb

Source: Tradeweb

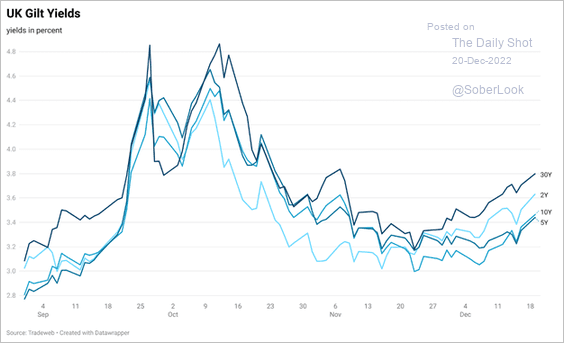

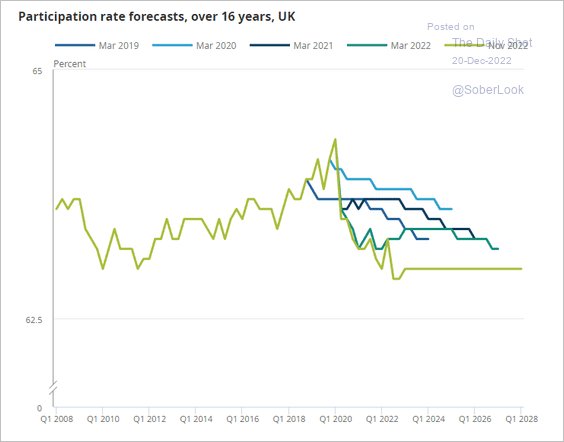

3. Economists continue to downgrade UK’s labor force participation forecasts.

Source: ONS Read full article

Source: ONS Read full article

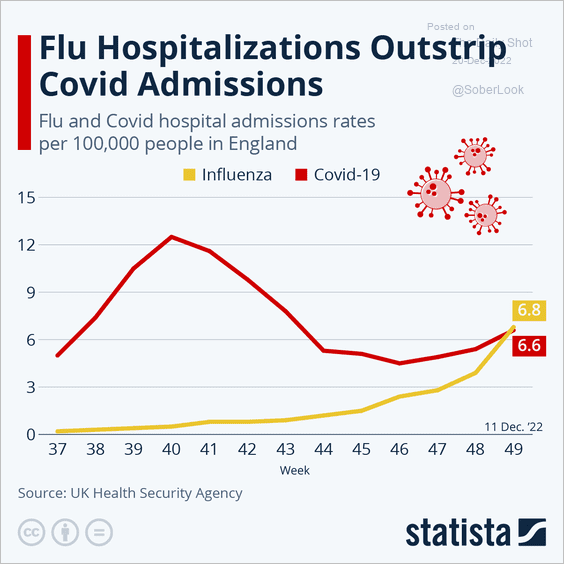

4. Flu-related hospitalizations have exceeded COVID.

Source: Statista

Source: Statista

Back to Index

The Eurozone

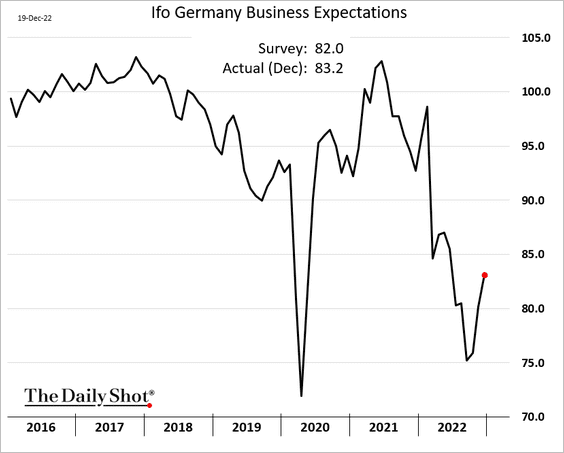

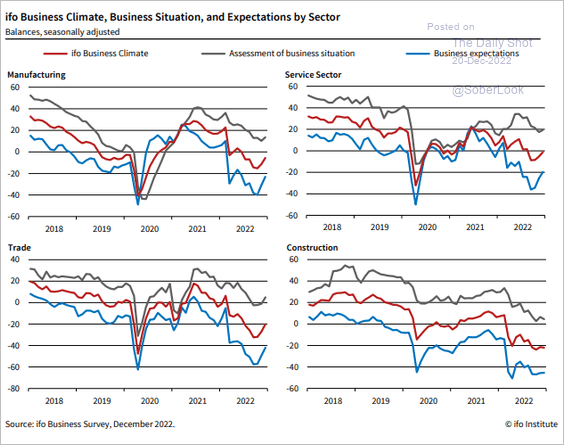

1. Let’s begin with Germany.

• The Ifo expectations index improved again this month.

Source: ifo Institute

Source: ifo Institute

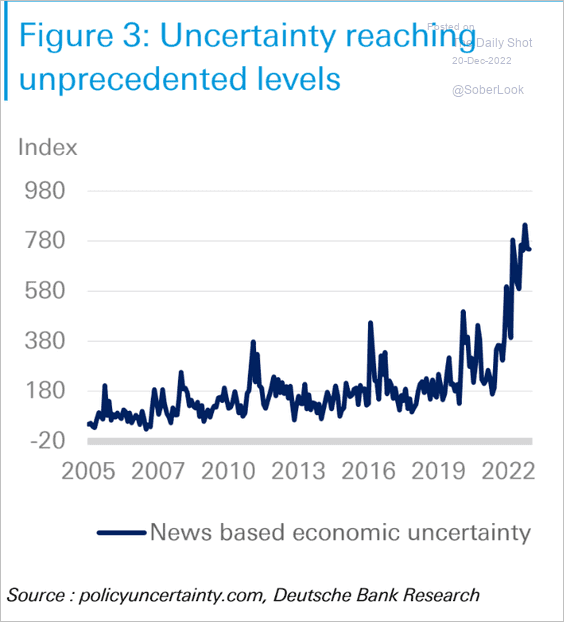

• Uncertainty remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

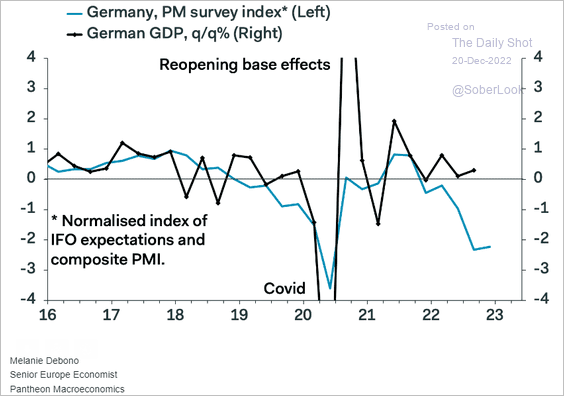

• The PMI data continues to signal a recession.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

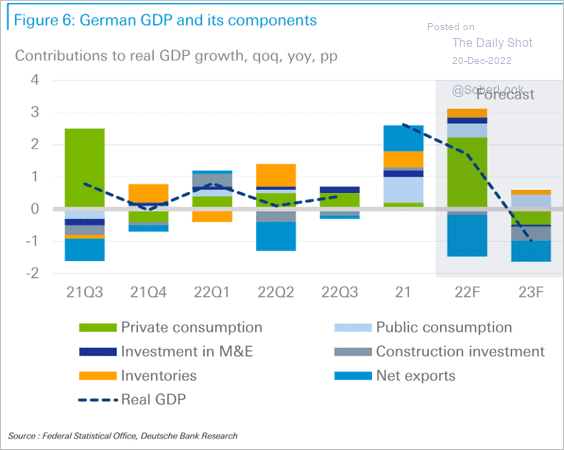

Here is a forecast from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

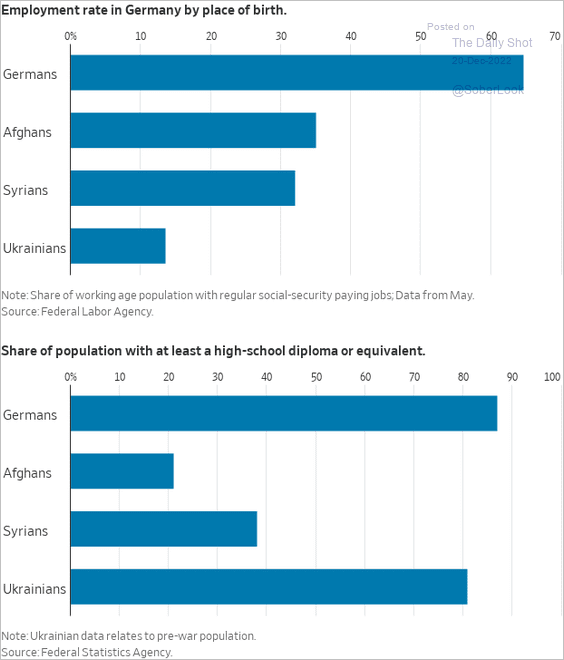

• Germany has a tough time assimilating migrants into the labor force.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

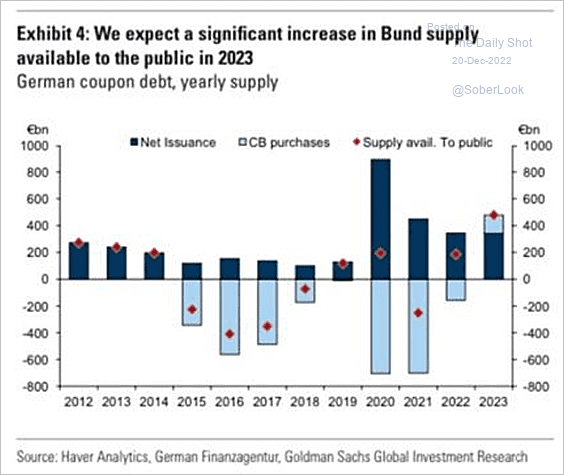

2. Bund supply is expected to increase next year.

Source: Goldman Sachs

Source: Goldman Sachs

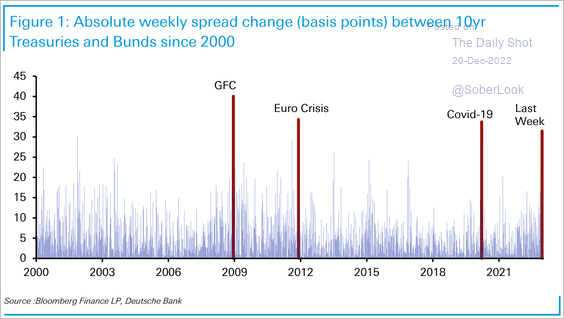

• Last week saw the fourth-largest absolute spread change between 10-year Treasuries and Bunds. Deutsche Bank expects the spread to compress as the Fed is closer to a pivot than the ECB.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

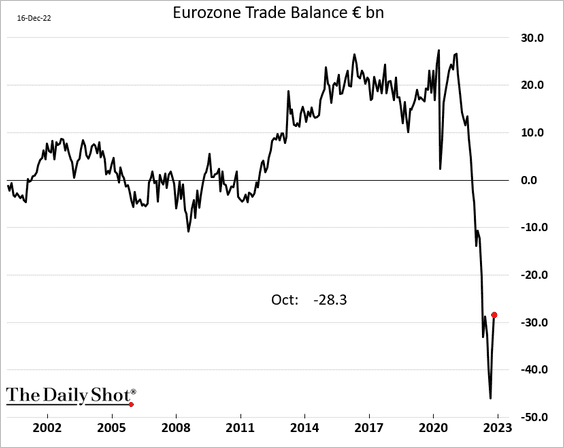

3. The euro-area trade deficit narrowed as energy prices fell.

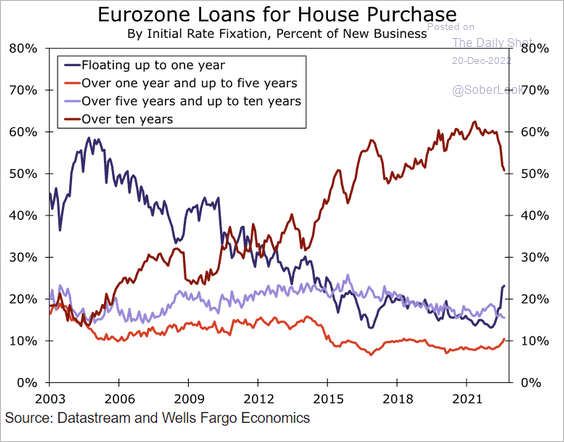

4. How exposed are euro-area homeowners to higher rates?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

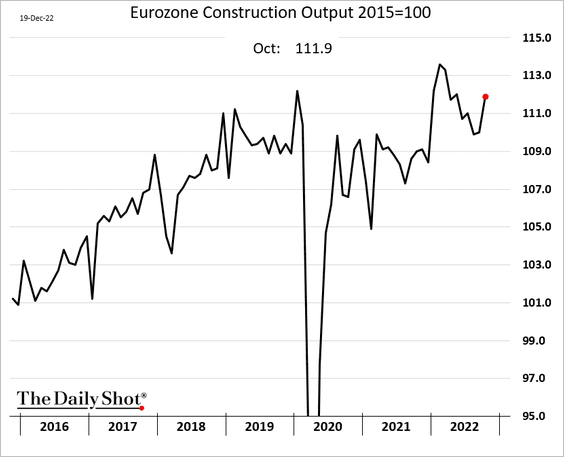

5. Construction output remained elevated in October.

Back to Index

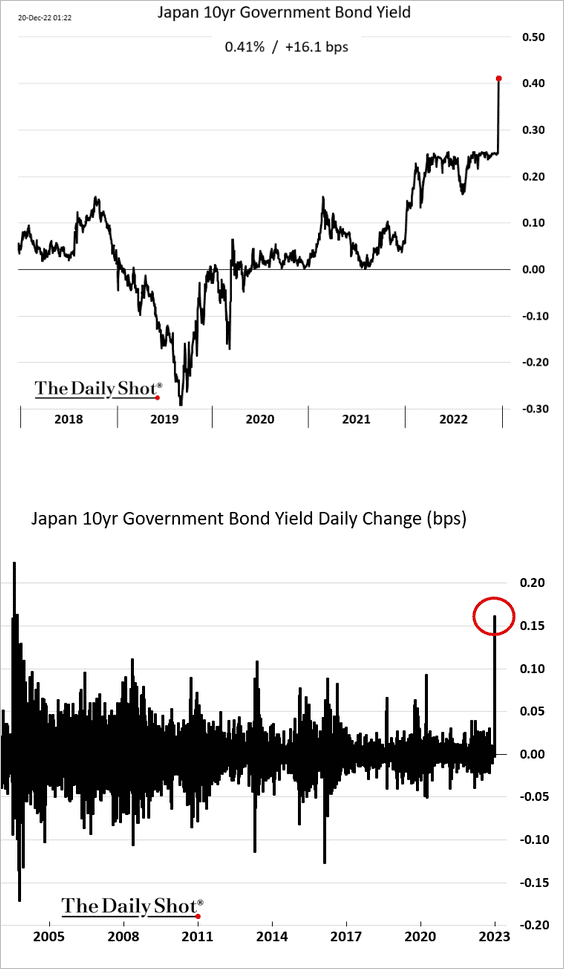

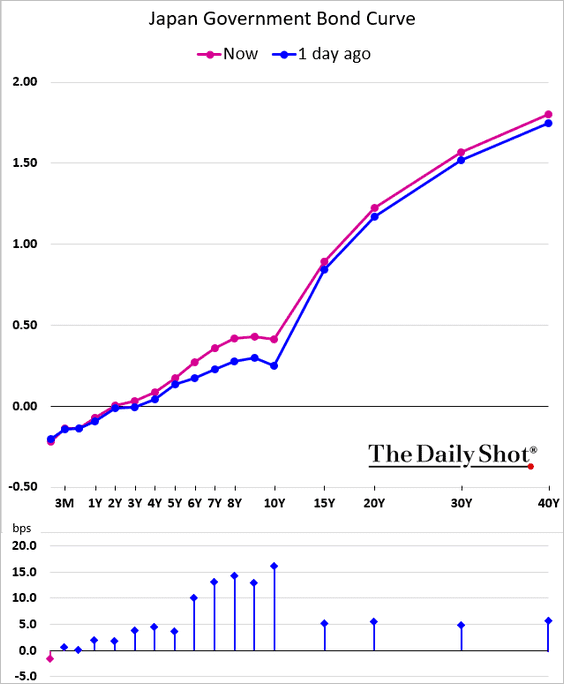

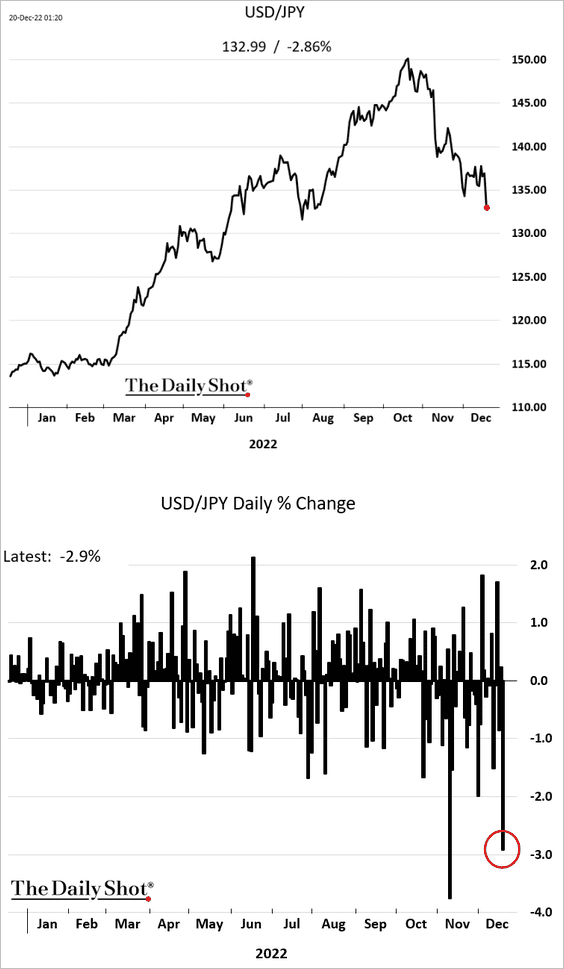

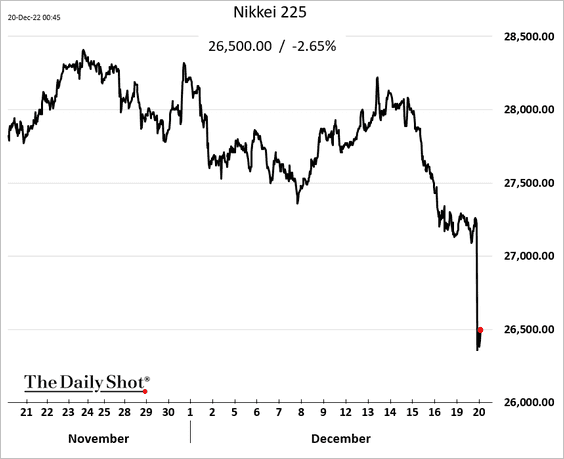

Japan

The BoJ shocked the markets by widening the 10-year JGB yield band to 50 bps from 25 bps. This is a form of monetary tightening.

Source: Reuters Read full article

Source: Reuters Read full article

• The 10yr JGB yield jumped by most in nearly two decades.

• Here is the yield curve.

• The yen rallied (chart shows USD falling vs. JPY).

• Stocks fell in Japan and globally.

Back to Index

Asia – Pacific

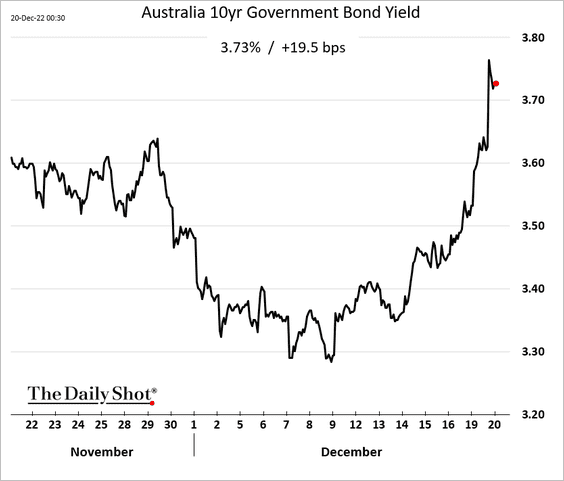

1. Australian yields jumped with JGBs.

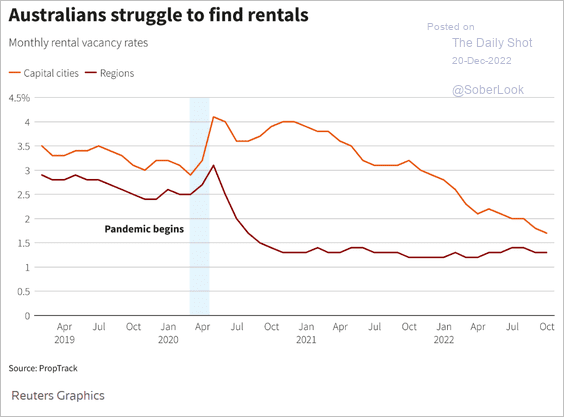

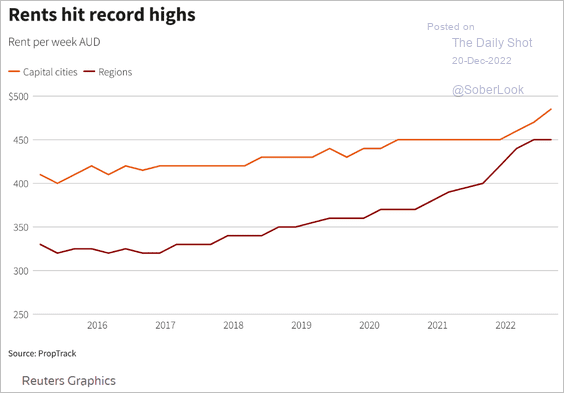

2. Australia faces housing shortages (2 charts).

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

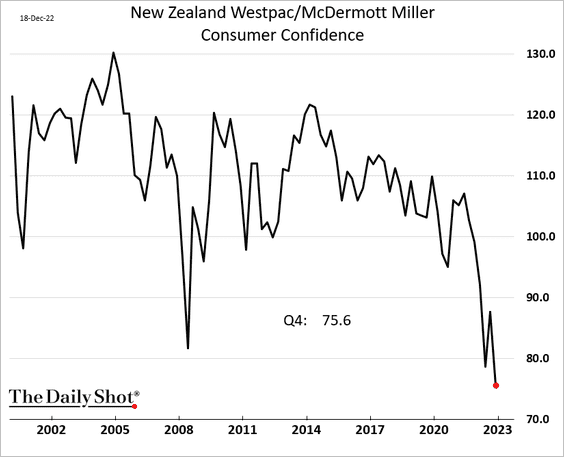

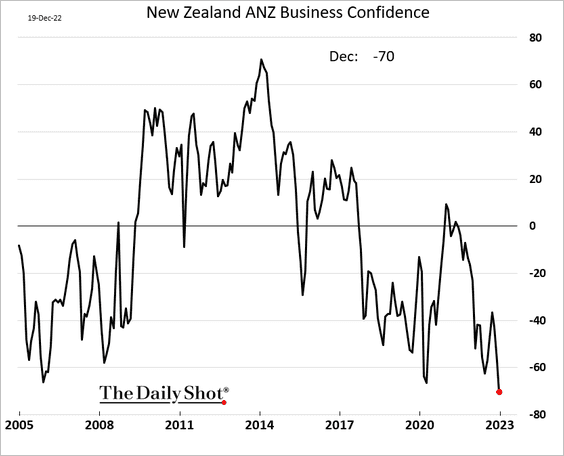

3. New Zealand’s consumer and business confidence has collapsed.

Source: @tracywwithers, @markets Read full article

Source: @tracywwithers, @markets Read full article

Back to Index

China

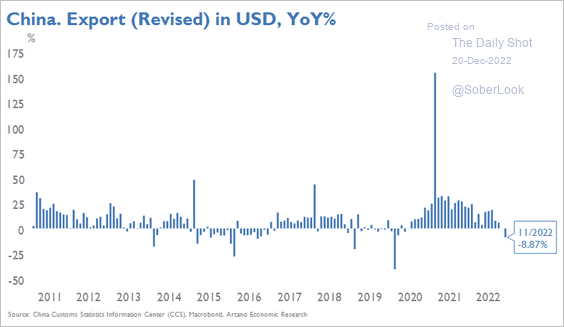

1. China’s exports have been revised lower.

Source: Arcano Economics

Source: Arcano Economics

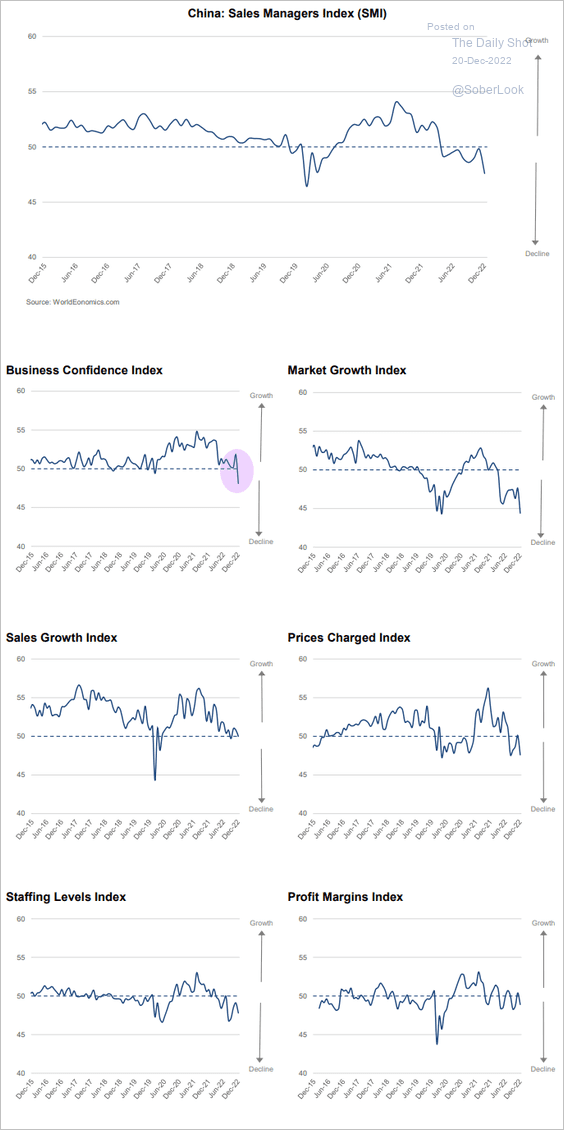

2. The World Economics SMI report showed an accelerating contraction in China’s business activity this month as confidence slumps.

Source: World Economics

Source: World Economics

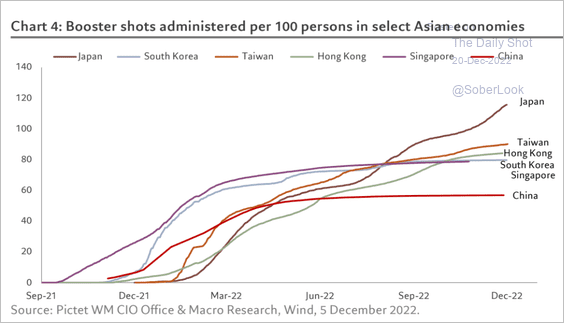

3. China lags behind other Asian countries in COVID booster shots.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

Back to Index

Emerging Markets

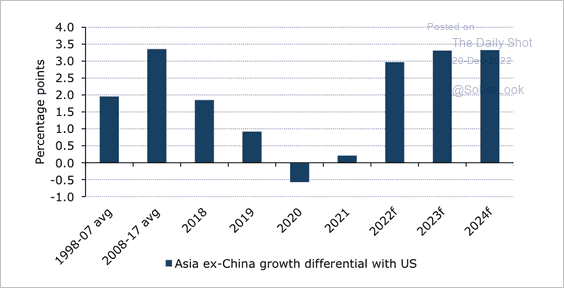

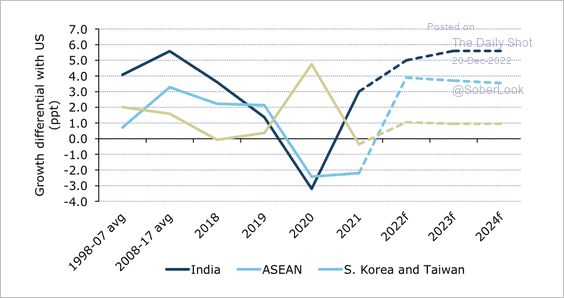

1. ANZ Research expects Asia ex-China growth differentials to rise, led by India and ASEAN countries. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

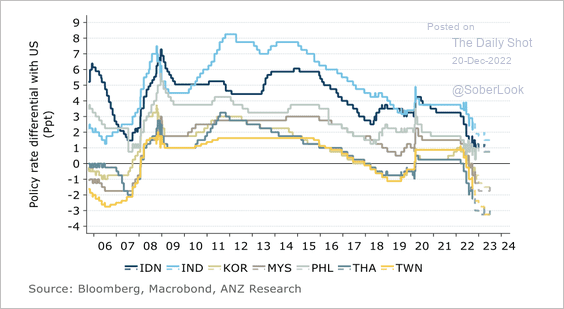

Interest rate differentials in most Asian countries are at their narrowest level in more than a decade.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

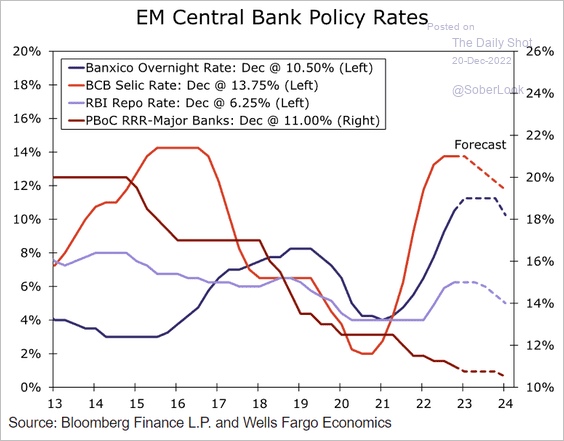

2. Below are Wells Fargo’s forecasts for EM policy rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

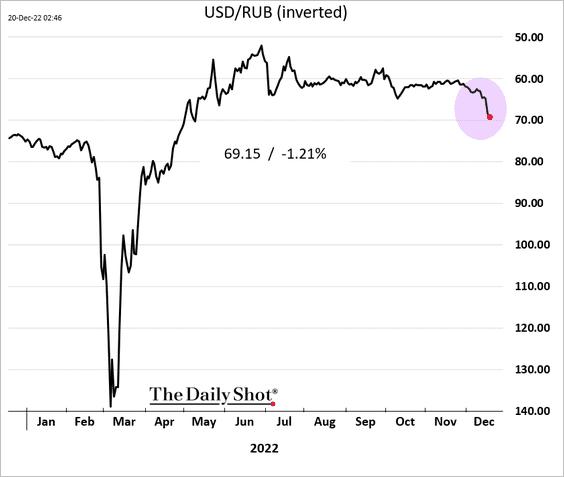

3. The ruble hit the lowest level since May.

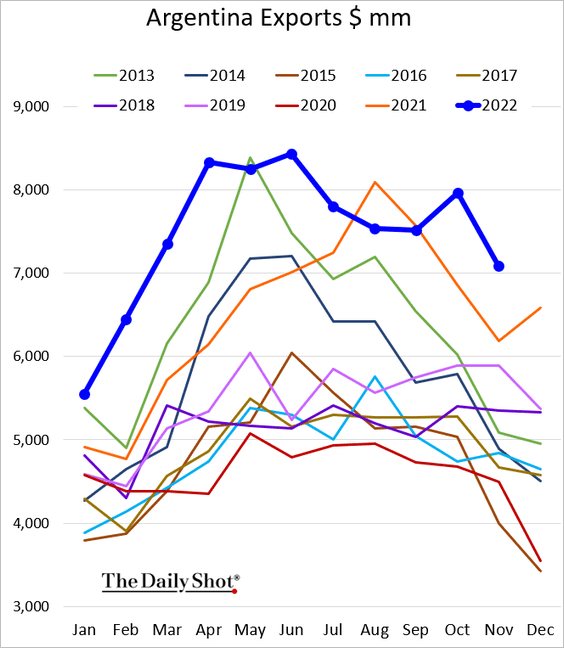

4. Argentina’s exports remain at multi-year highs.

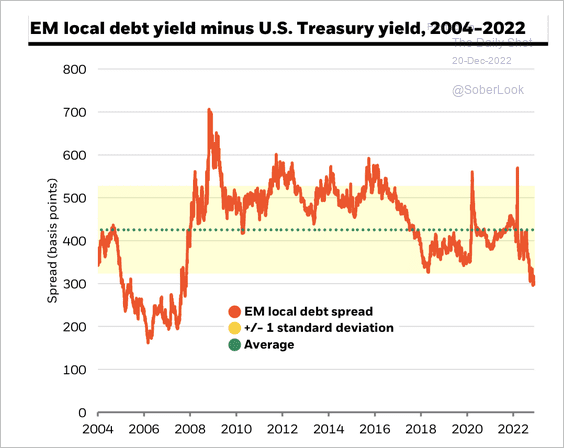

5. EM local debt spreads are narrowing.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

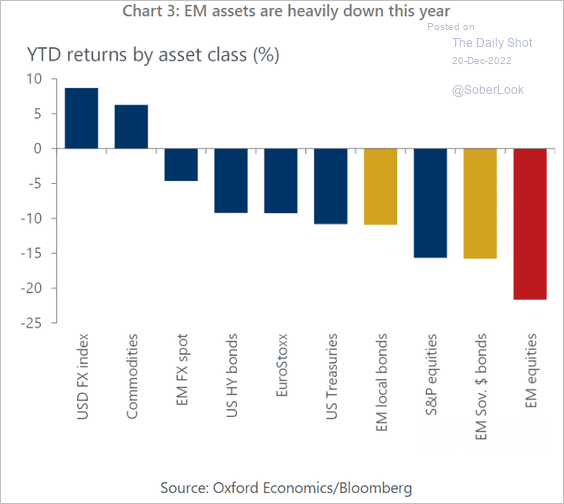

6. EM equities have underperformed year-to-date.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

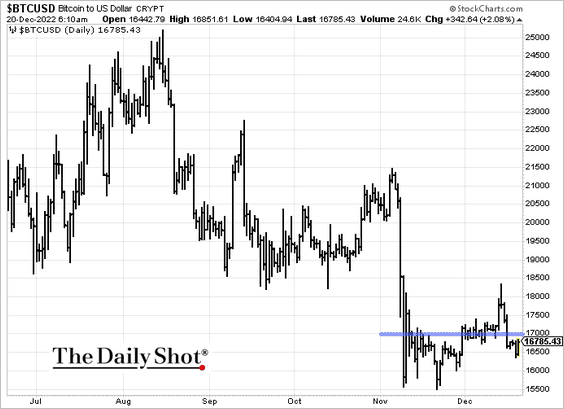

1. Bitcoin could not sustain the move above $17k.

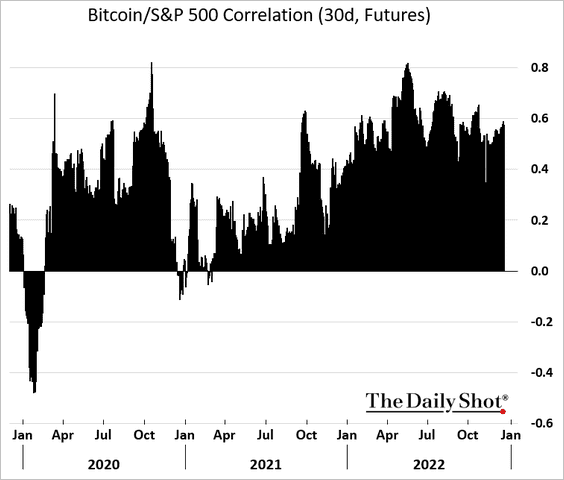

But much will depend on the stock market.

——————–

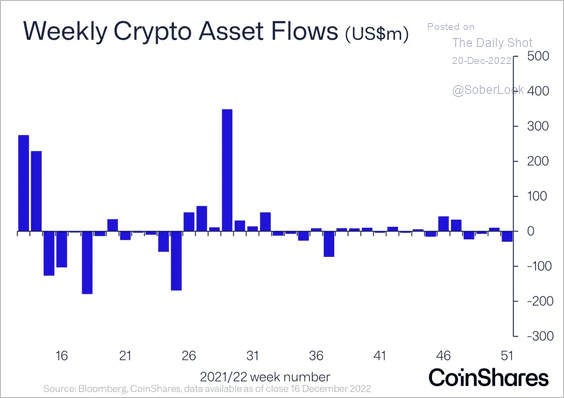

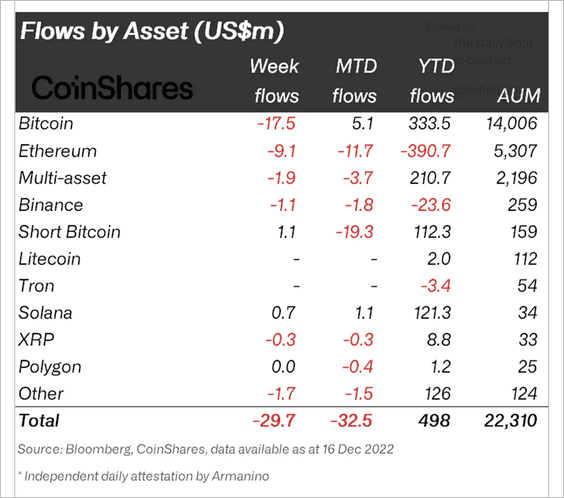

2. Crypto funds saw outflows last year, driven by bitcoin products (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

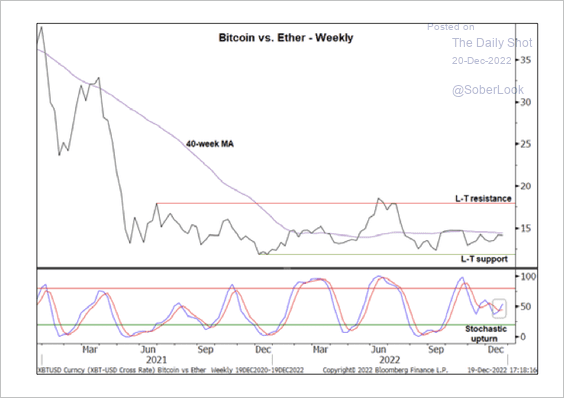

3. The BTC/ETH price ratio is holding long-term support. A breakout could signal risk-off conditions.

Source: @StocktonKatie

Source: @StocktonKatie

4. Binance’s net outflows hit around $6 billion last week.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Commodities

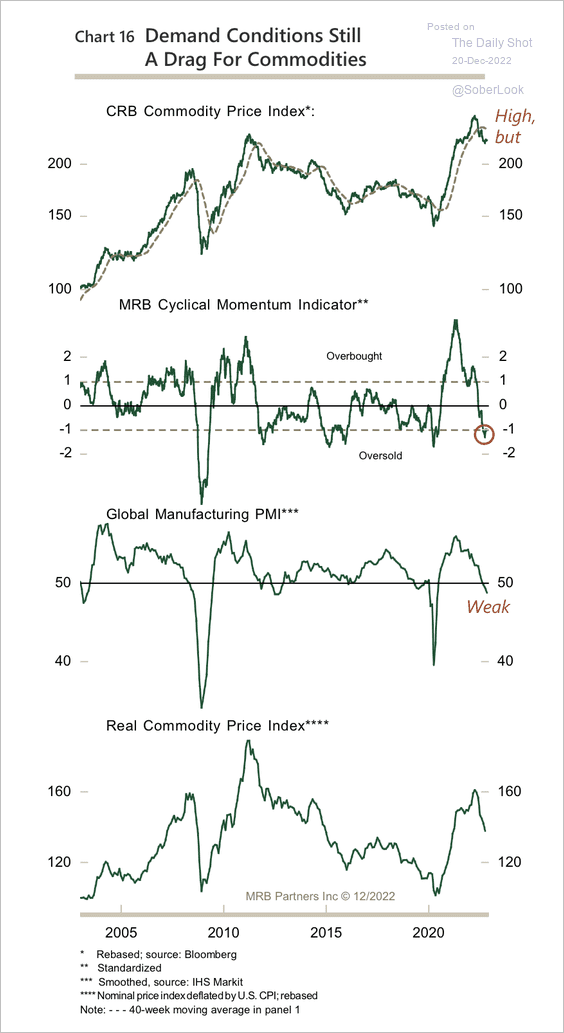

1. The slowdown in global demand points to weaker commodity prices.

Source: MRB Partners

Source: MRB Partners

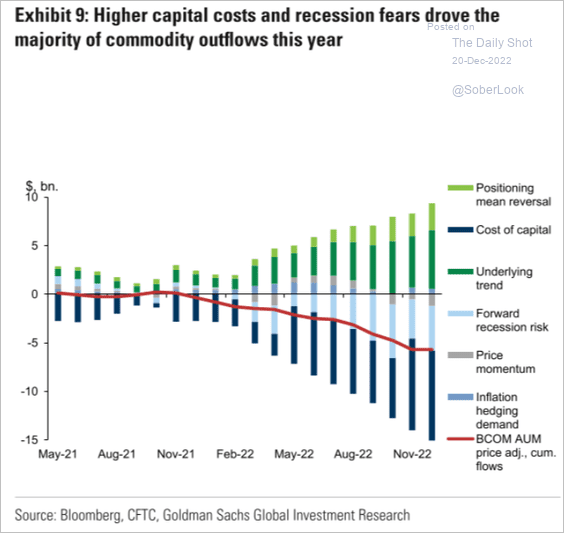

2. What drove commodity outflows this year?

Source: Goldman Sachs

Source: Goldman Sachs

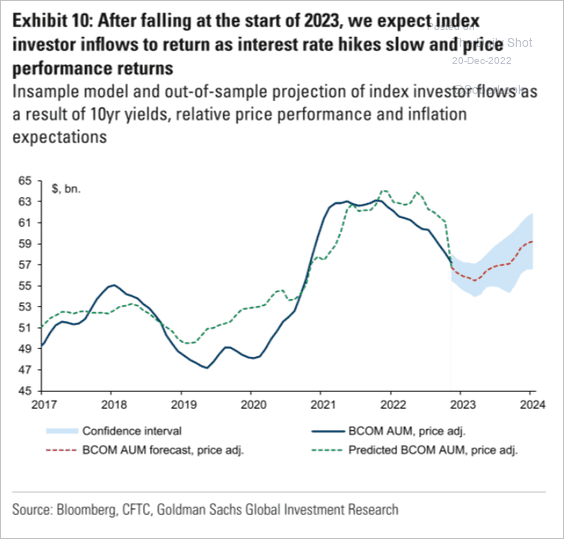

According to Goldman, capital is expected to return to commodity funds next year.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

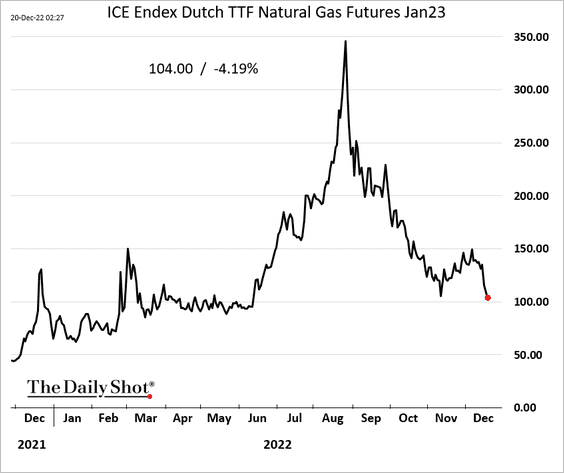

Energy

1. European natural gas prices declined sharply in recent days amid ample supplies.

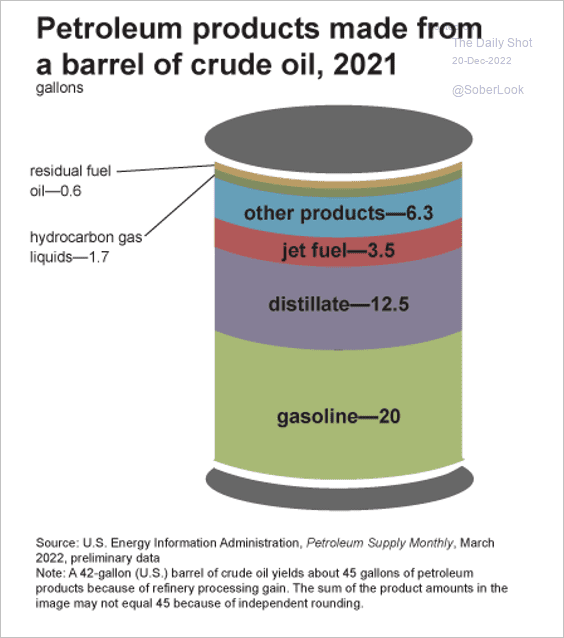

2. This infographic shows petroleum products made from a barrel of crude.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

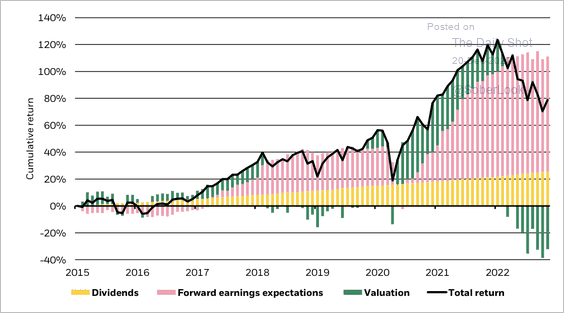

Equities

1. Earnings expectations are not fully pricing in the recession risk.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

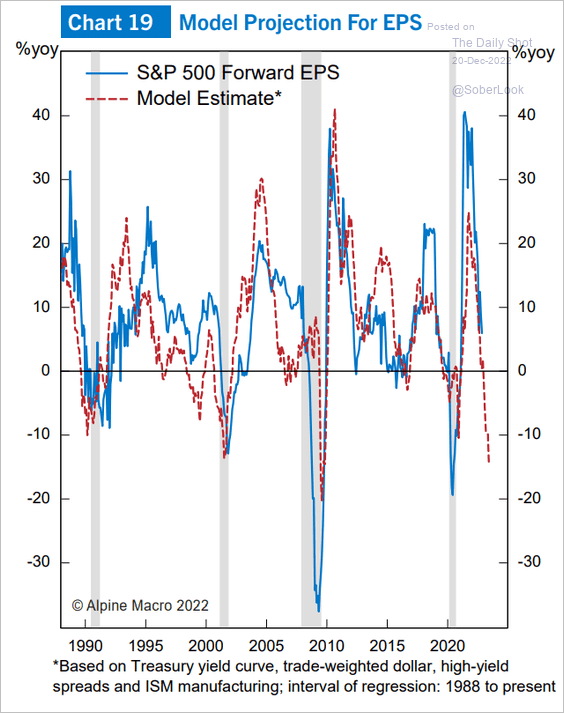

Here is Alpine Macro’s model estimate for S&P 500 earnings per share.

Source: Alpine Macro

Source: Alpine Macro

——————–

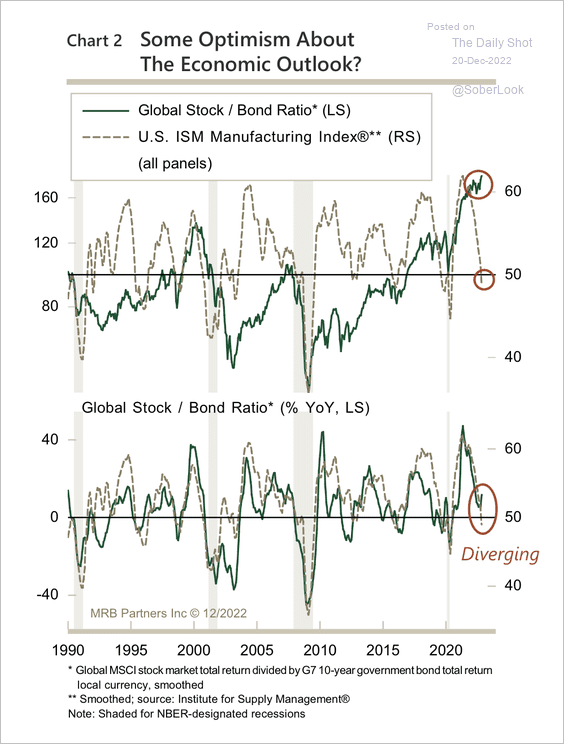

2. There is downside risk to the global stock/bond ratio as economic growth weakens.

Source: MRB Partners

Source: MRB Partners

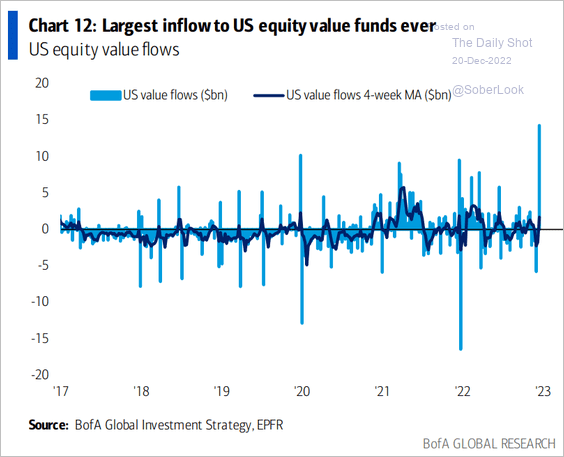

3. Value funds saw substantial inflows last week.

Source: BofA Global Research

Source: BofA Global Research

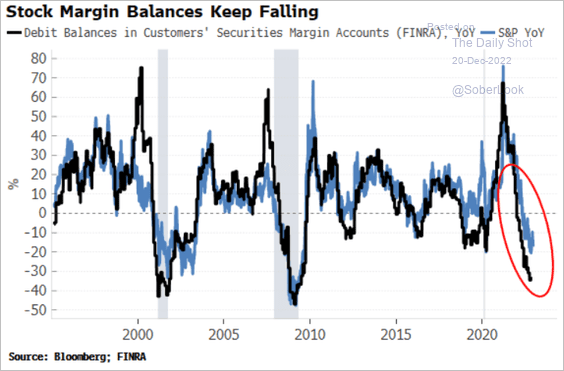

4. Margin debt has declined markedly this year.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

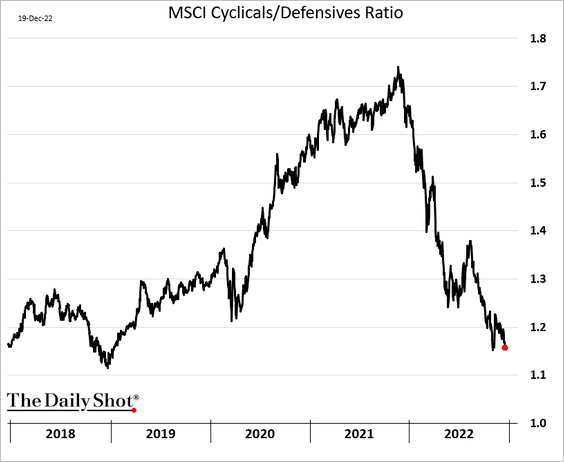

5. Cyclicals continue to lag defensives as the market braces for a recession.

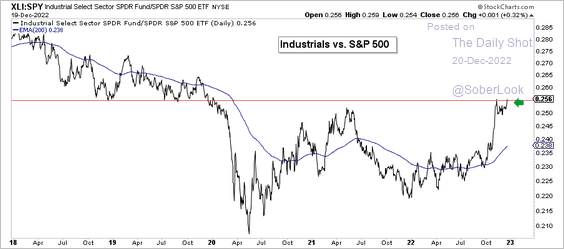

6. The SPDR Industrial sector ETF (XLI) is outperforming the S&P 500.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

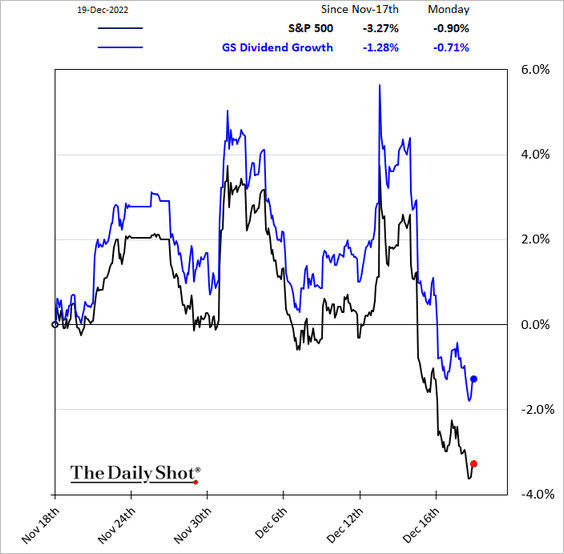

7. Dividend growers are holding on to their outperformance.

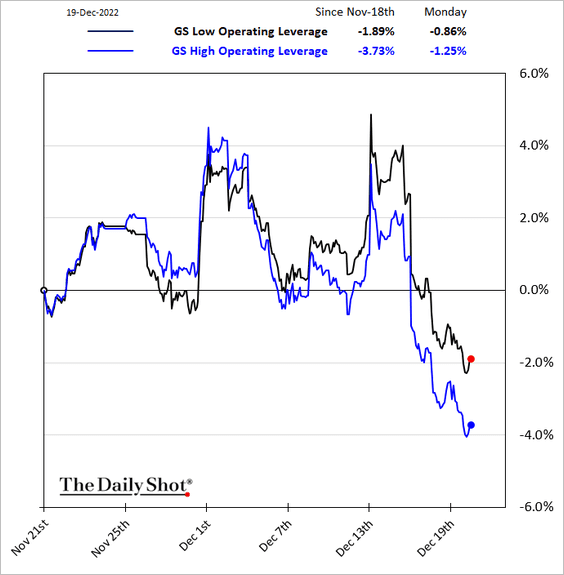

8. Companies with high operating leverage underperformed in recent days.

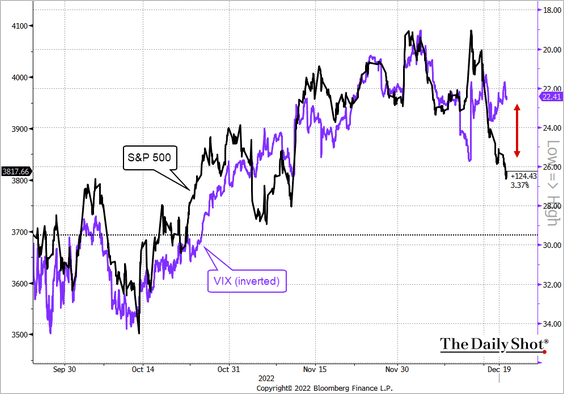

9. The S&P 500 has diverged from VIX.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

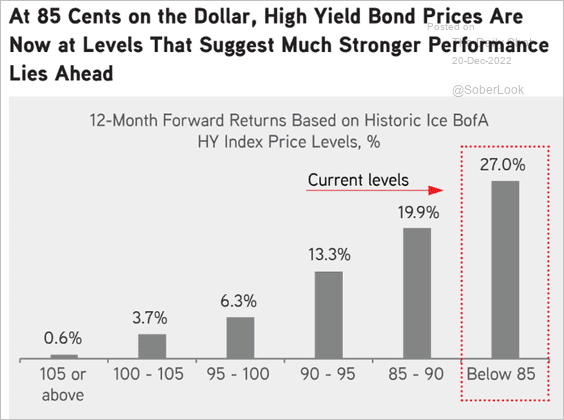

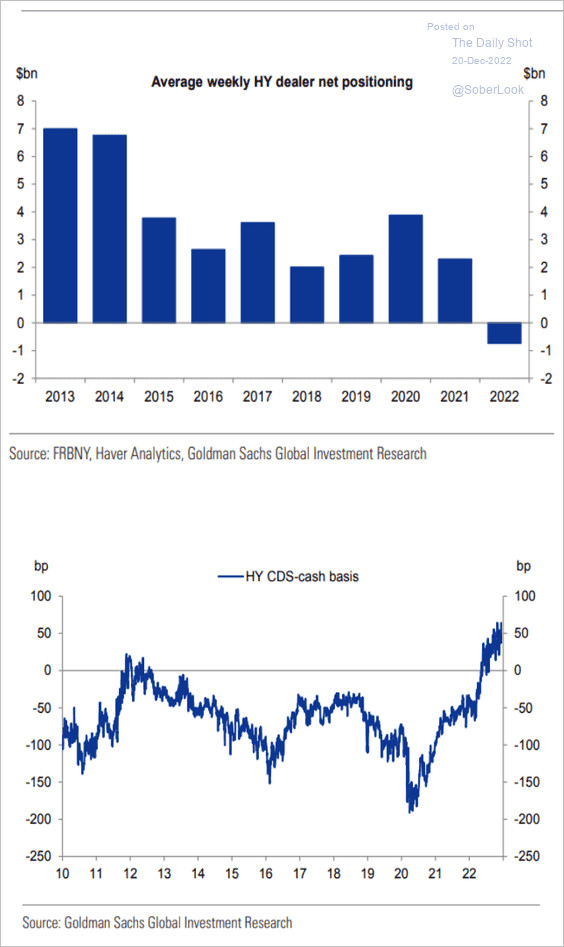

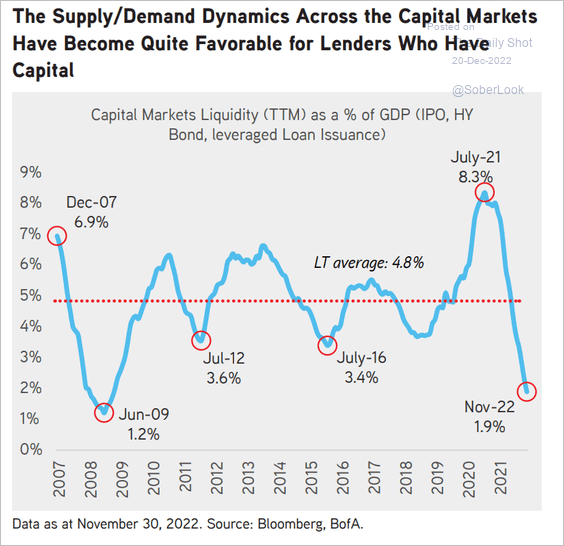

1. Are HY bonds attractive?

Source: KKR Global Institute

Source: KKR Global Institute

The market for HY bonds is undersupplied.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

——————–

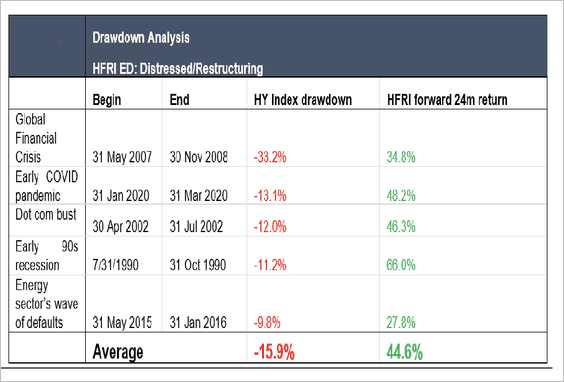

2. Here is a look at distressed hedge fund performance after difficult periods for high-yield bonds.

Source: Citi Private Bank

Source: Citi Private Bank

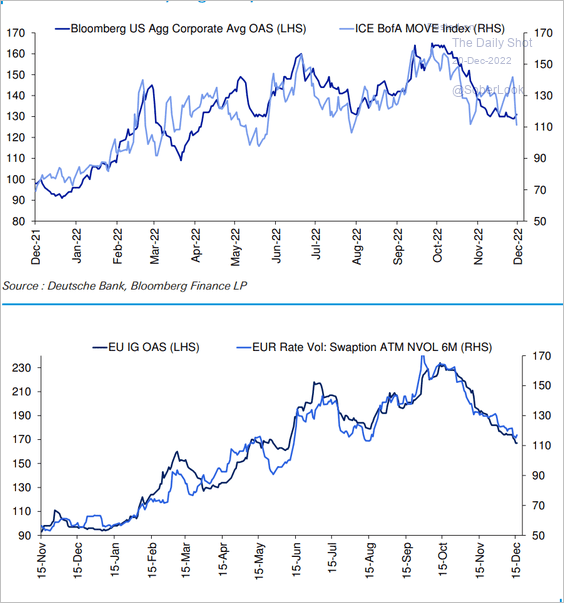

3. Credit spreads have been highly correlated to rate vol.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

4. Someone has been using the Fed’s discount window. Interbank liquidity could be getting tight going into the year end.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

Back to Index

Global Developments

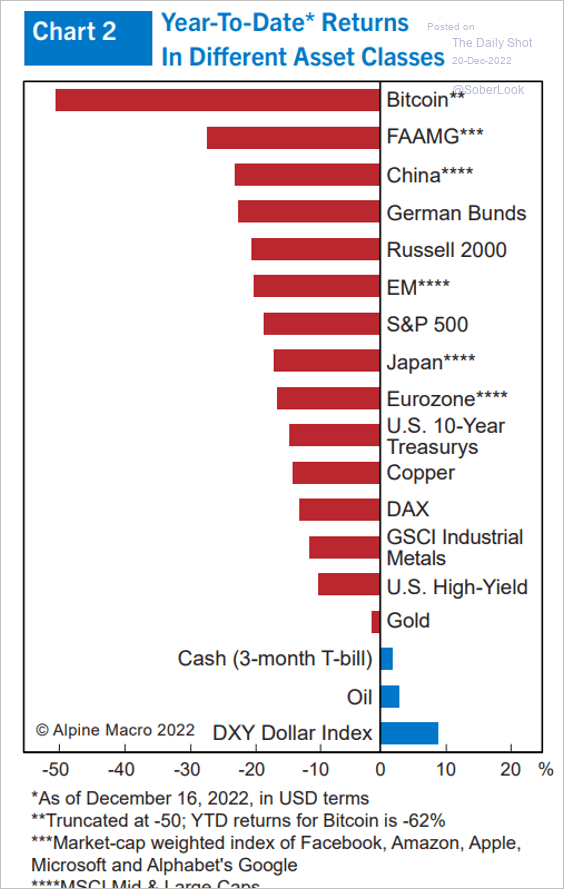

1. This chart shows year-to-date returns across select asset classes.

Source: Alpine Macro

Source: Alpine Macro

2. Corporate debt and equity capital raising slowed sharply this year.

Source: KKR Global Institute

Source: KKR Global Institute

——————–

Food for Thought

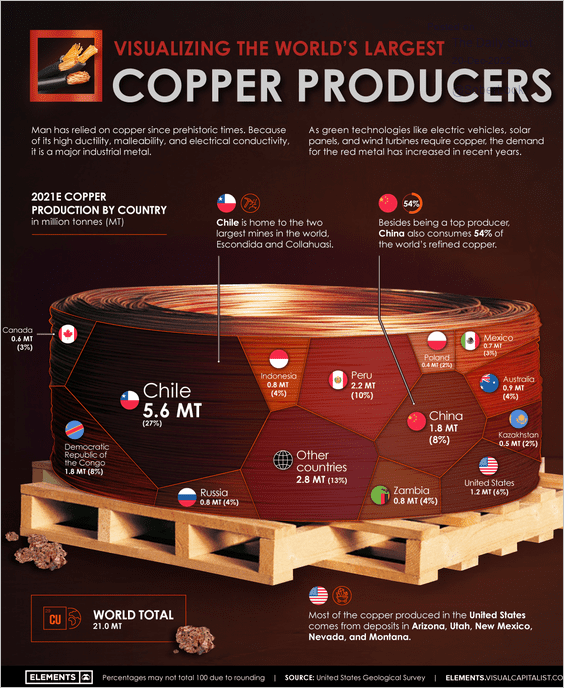

1. Largest copper producers:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

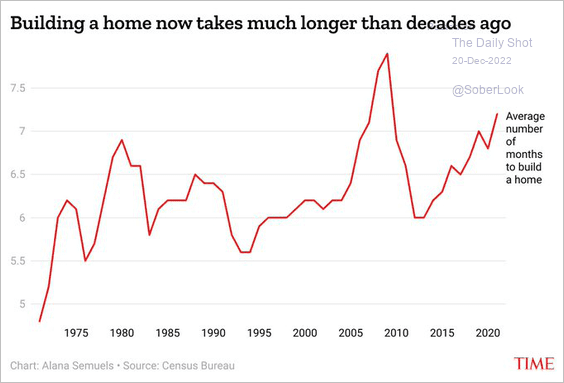

2. Number of months to build a home in the US:

Source: @TIME

Source: @TIME

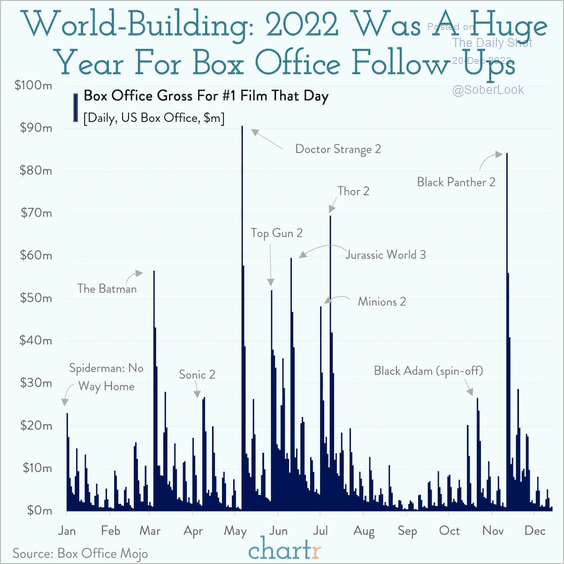

3. The year of follow-ups at the box office:

Source: @chartrdaily

Source: @chartrdaily

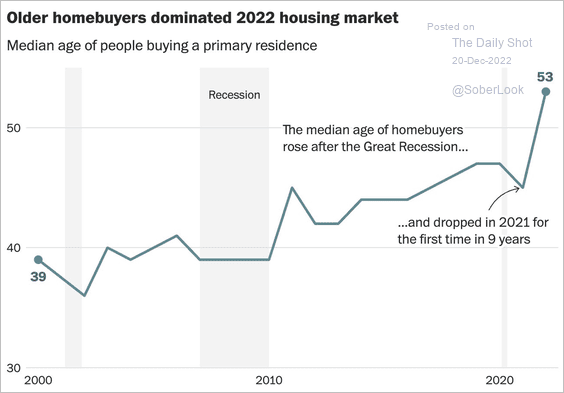

4. Median age of Americans buying a primary residence:

Source: @PostGraphics Read full article

Source: @PostGraphics Read full article

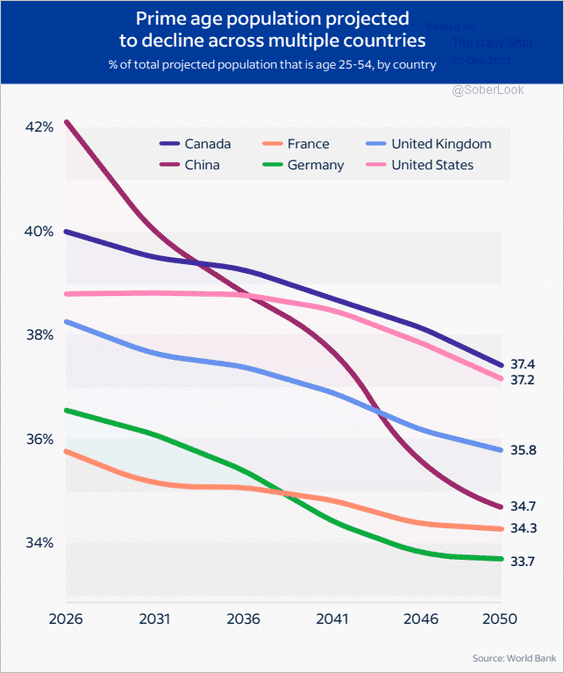

5. Projections for prime-age population:

Source: @indeed, @Glassdoor

Source: @indeed, @Glassdoor

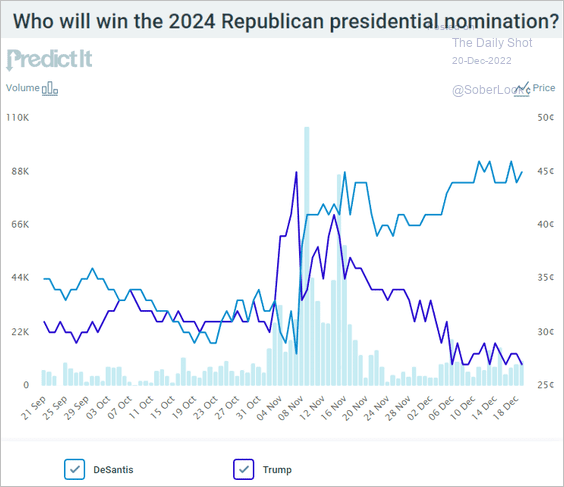

6. 2024 GOP presidential nomination probabilities in the betting markets:

Source: @PredictIt

Source: @PredictIt

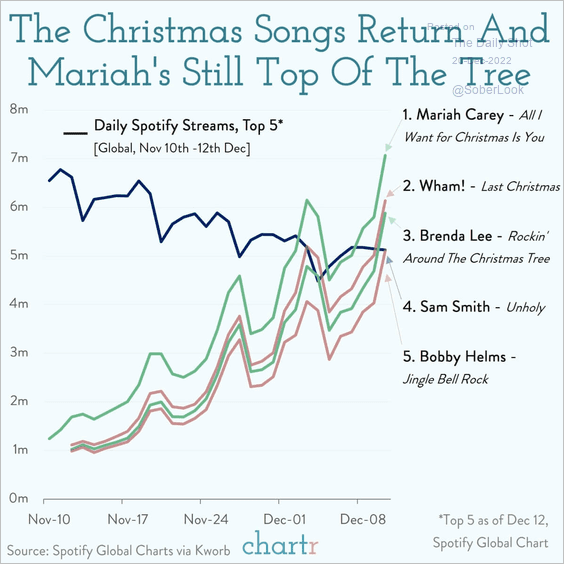

7. Christmas songs on Spotify:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index