The Daily Shot: 21-Dec-22

• Administrative Update

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• Emerging Markets

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

As a reminder, The Daily Shot will not be published next week (the week of December 26th).

Back to Index

The United States

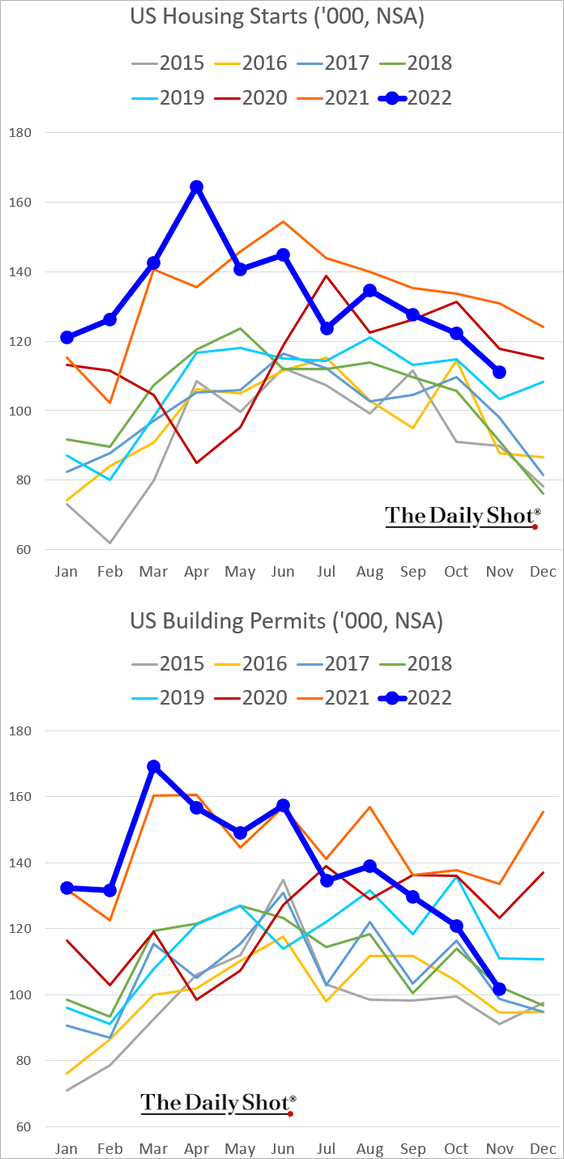

1. Housing starts held up well last month, but building permits declined more than expected.

Source: Reuters Read full article

Source: Reuters Read full article

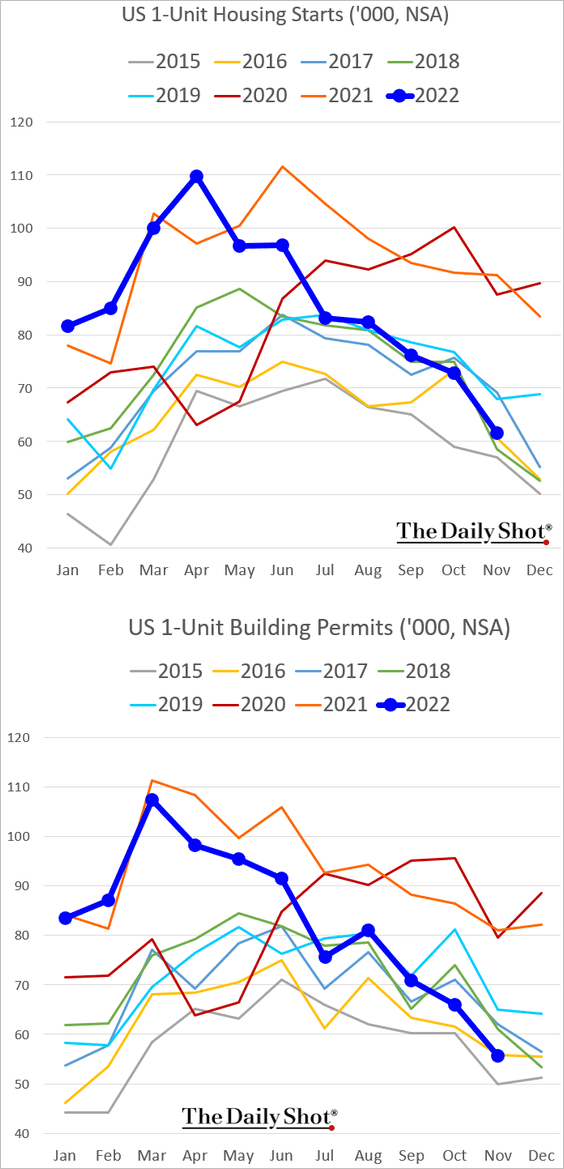

The weakness was in single-family housing, with permits dipping below 2016 levels, …

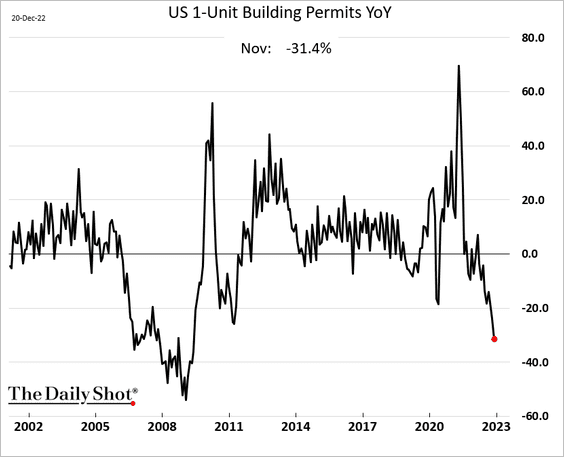

… down over 30% vs. November of 2021.

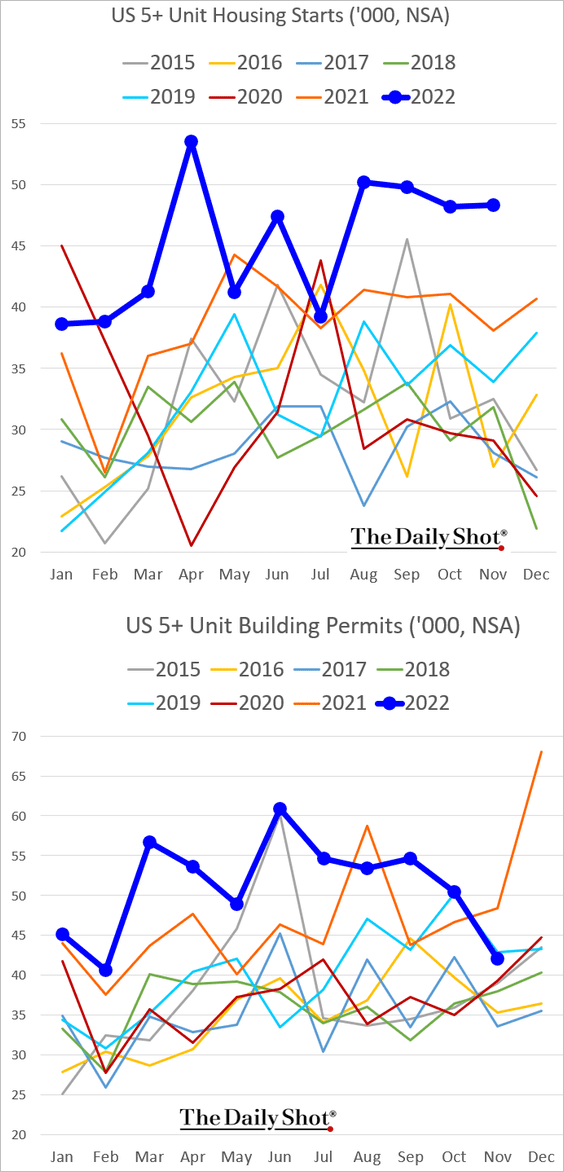

Multifamily starts remained very strong in November, but permits softened.

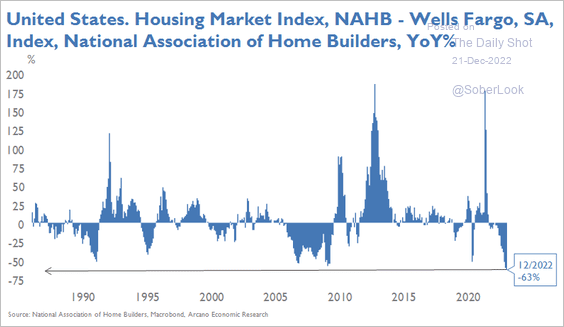

• The year-over-year decline in homebuilder sentiment has not been this severe in decades.

Source: Arcano Economics

Source: Arcano Economics

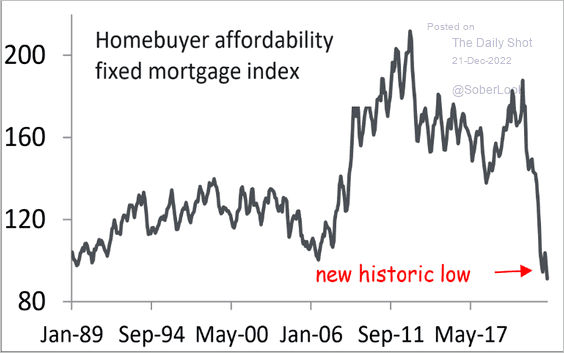

• Housing affordability hit a new low recently, …

Source: Piper Sandler

Source: Piper Sandler

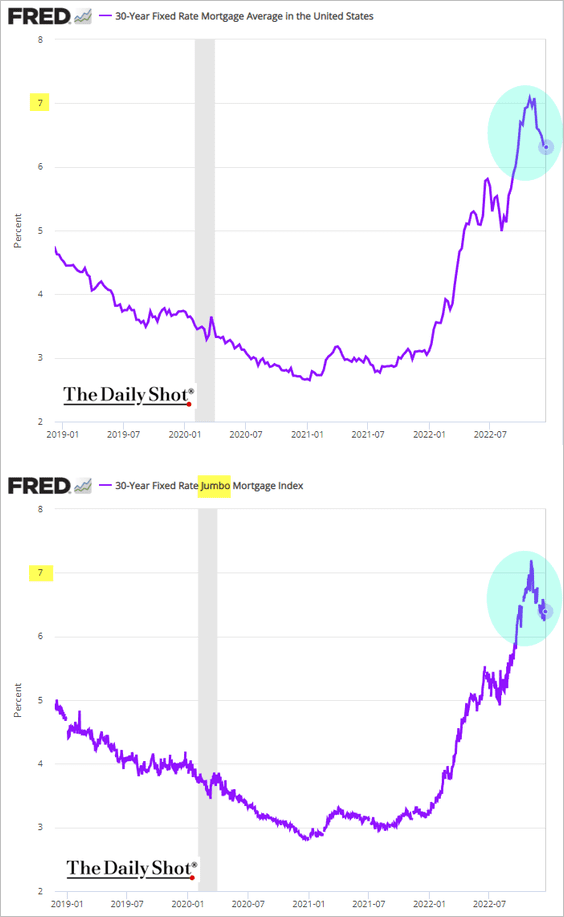

… but mortgage rates, including jumbo loans, are off the highs.

——————–

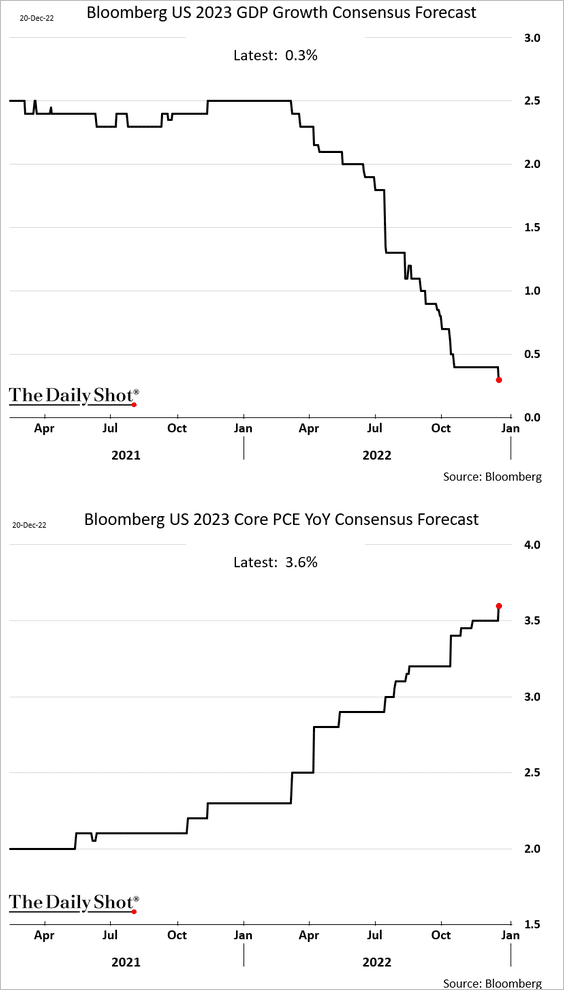

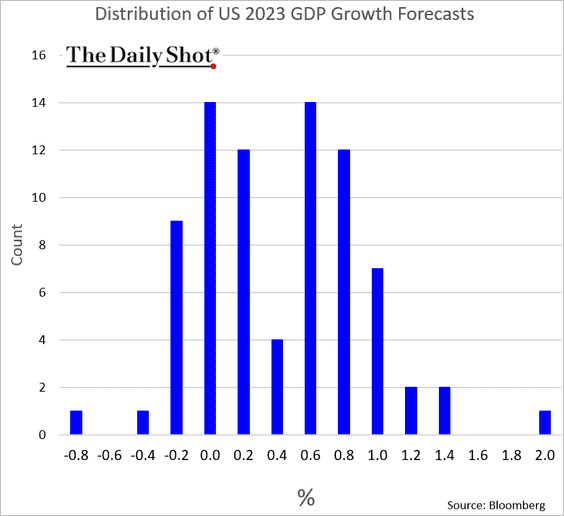

2. The consensus GDP growth forecast for 2023 (full year) hit 0.3%, while forecasts for the core PCE inflation were upgraded again (stagflation).

• The 2023 GDP growth forecast distribution is relatively wide.

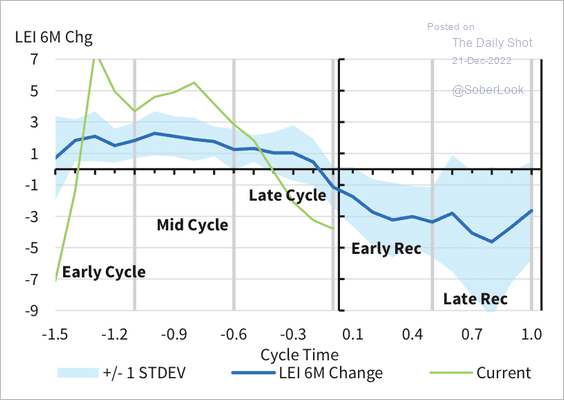

• The Conference Board’s Leading Economic Indicators Index (LEI) is around typical recessionary levels.

Source: Barclays Research

Source: Barclays Research

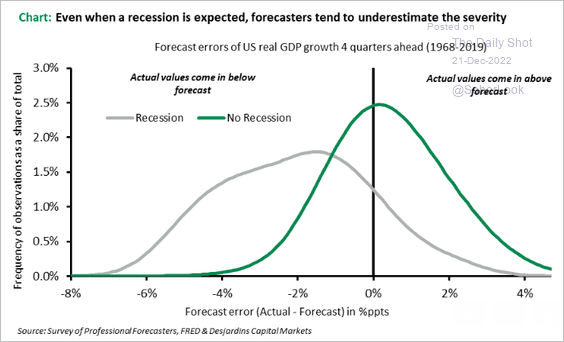

• In the past, recession predictions underestimated the severity of the downturn.

Source: Desjardins

Source: Desjardins

——————–

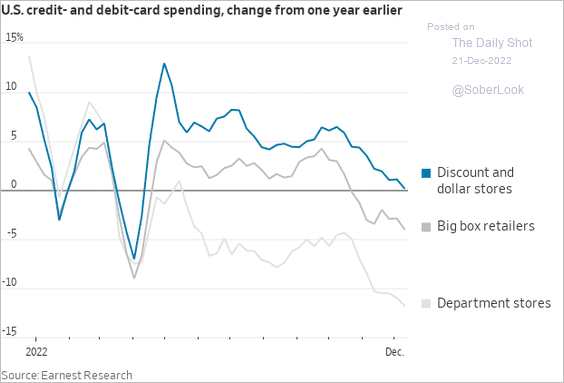

3. Card spending has been weakening relative to last year’s levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

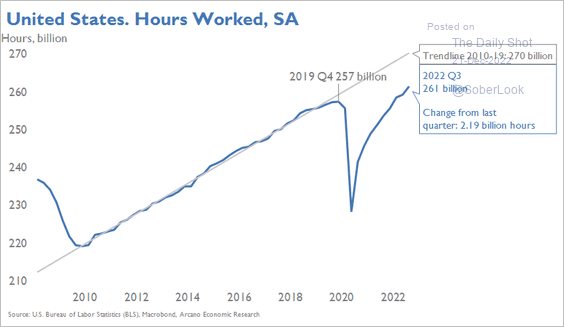

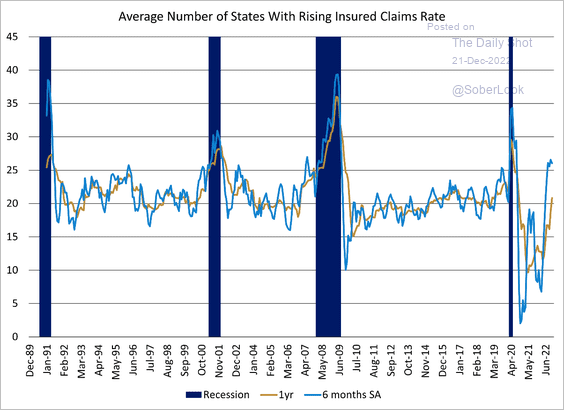

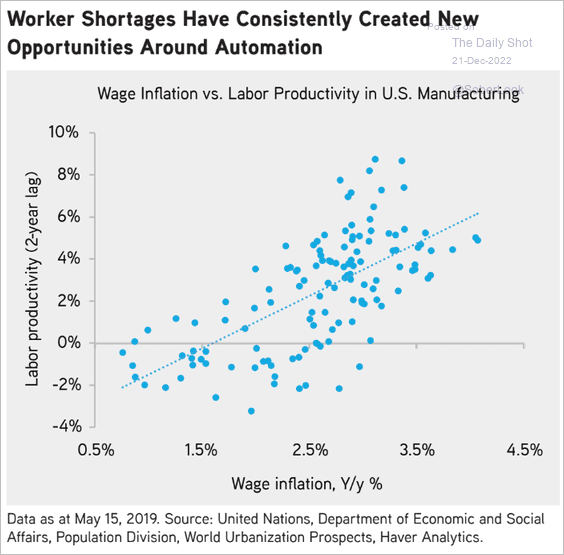

4. Next, we have some updates on the labor market.

• Hours worked remain below the pre-COVID trend.

Source: Arcano Economics

Source: Arcano Economics

• More states see increases in unemployment claims.

Source: Tier1 Alpha

Source: Tier1 Alpha

• Should we expect improvements in labor productivity amid elevated wage growth?

Source: KKR Global Institute

Source: KKR Global Institute

——————–

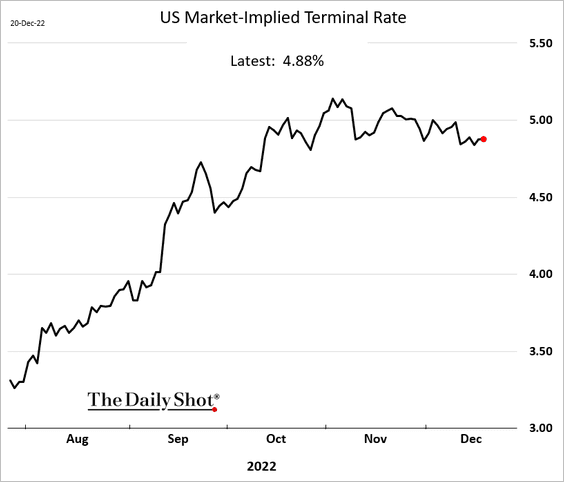

5. The market-implied terminal rate (maximum fed funds rate in this cycle) remains below 5%.

Back to Index

Canada

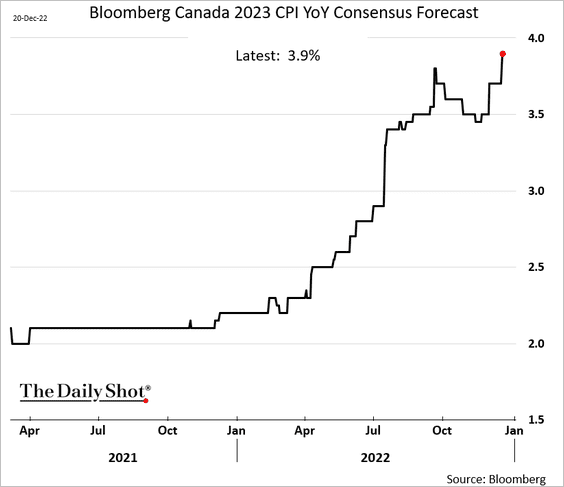

1. Economists continue to boost their forecasts for next year’s inflation.

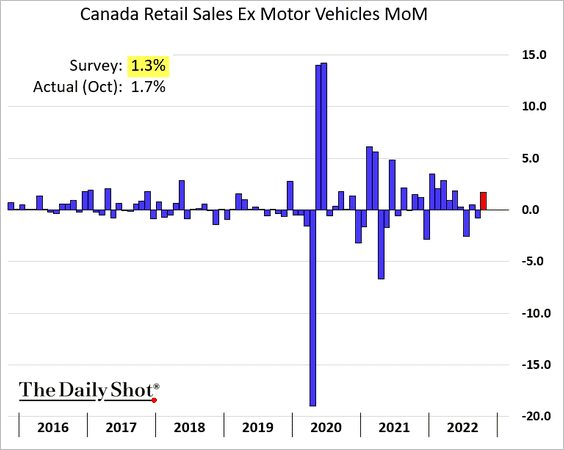

2. Retail sales rebounded in October.

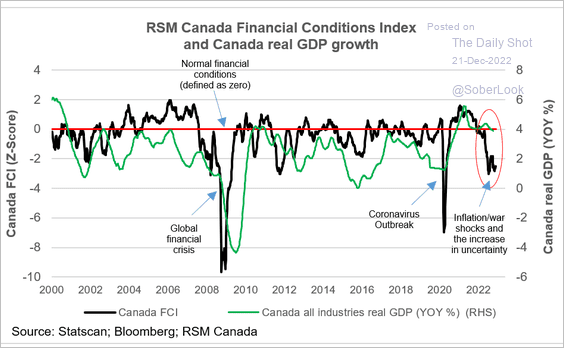

3. Tight financial conditions point to a GDP contraction next year.

Source: The Real Economy Blog Read full article

Source: The Real Economy Blog Read full article

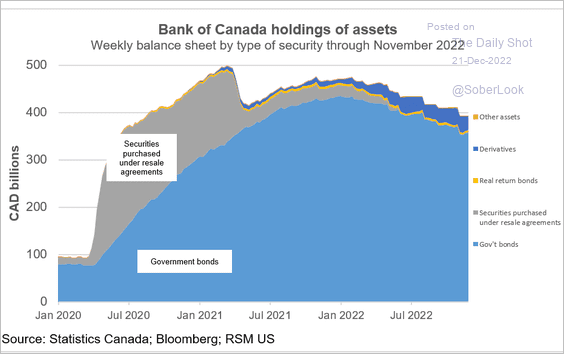

4. This chart shows the BoC’s balance sheet composition over time.

Source: The Real Economy Blog Read full article

Source: The Real Economy Blog Read full article

Back to Index

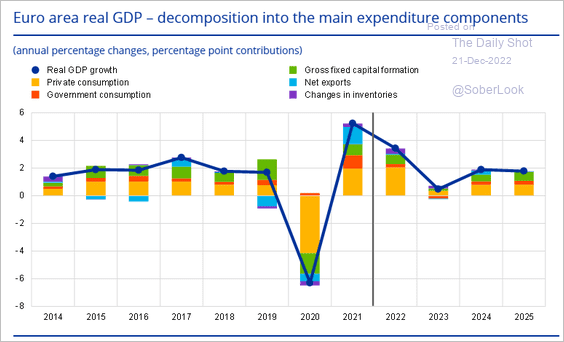

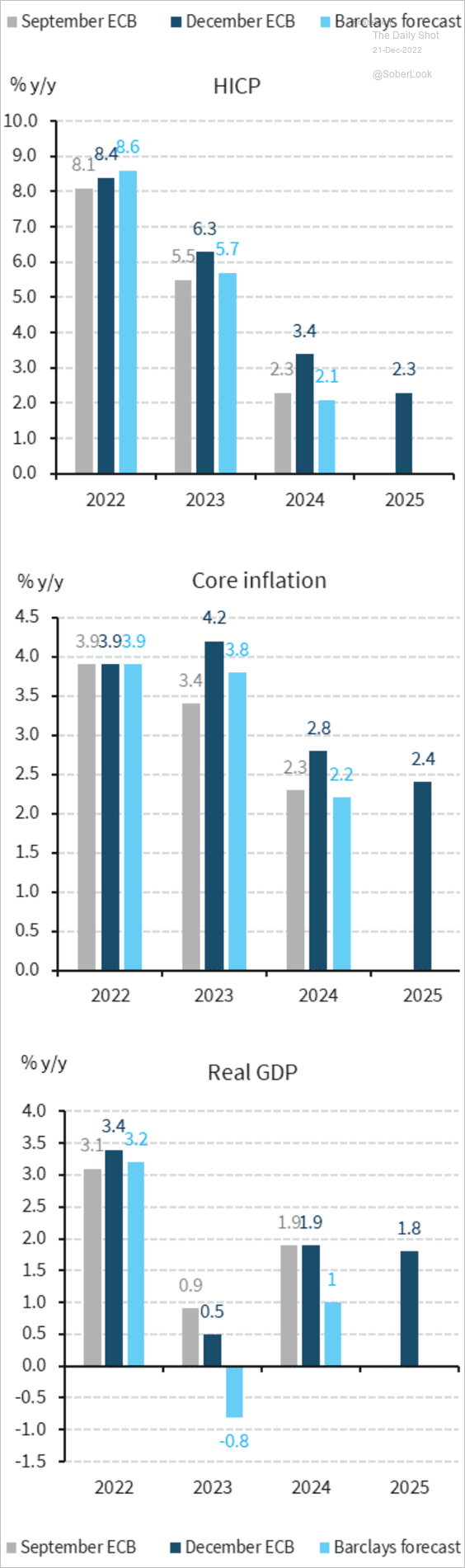

The Eurozone

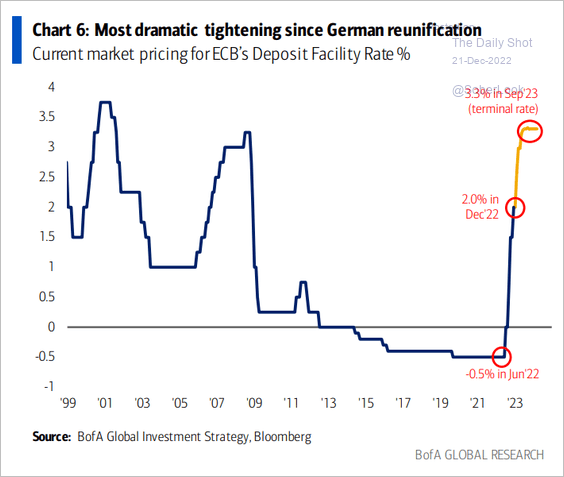

1. How much additional tightening should we expect from the ECB?

Source: BofA Global Research

Source: BofA Global Research

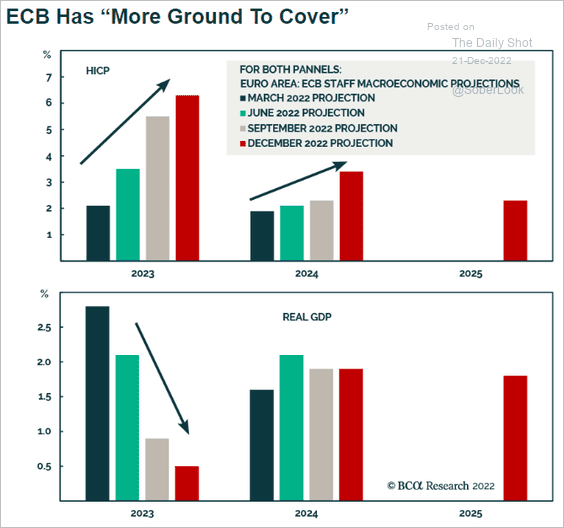

• Here are the latest economic forecasts from the ECB.

Source: BCA Research

Source: BCA Research

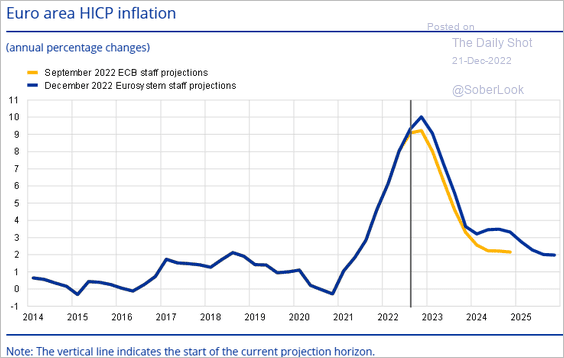

– Inflation (September and December forecasts):

Source: ECB Read full article

Source: ECB Read full article

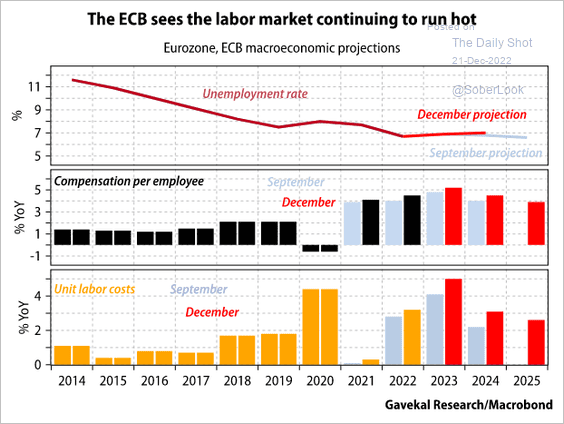

– Labor market:

Source: Gavekal Research

Source: Gavekal Research

– GDP growth:

Source: ECB Read full article

Source: ECB Read full article

– Barclays Research is skeptical about the ECB’s GDP forecast (3rd panel below).

Source: Barclays Research

Source: Barclays Research

——————–

2. Italy’s bond spread to Germany widened after the ECB’s emphasis on quantitative tightening.

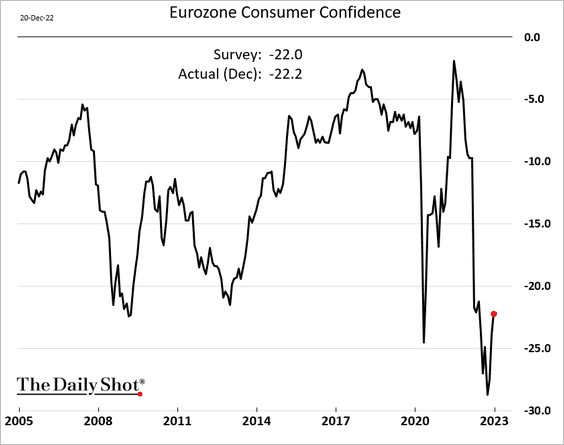

3. Consumer confidence is off the lows.

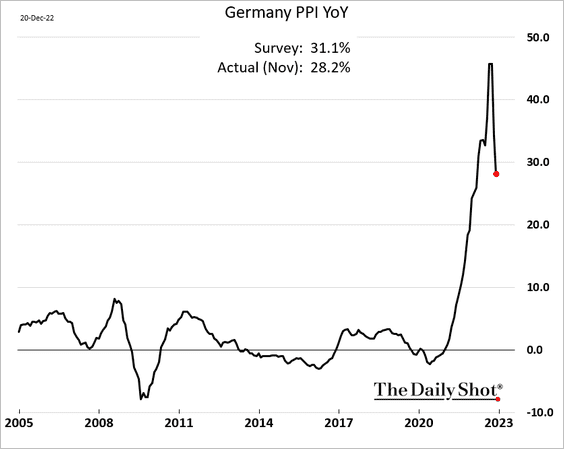

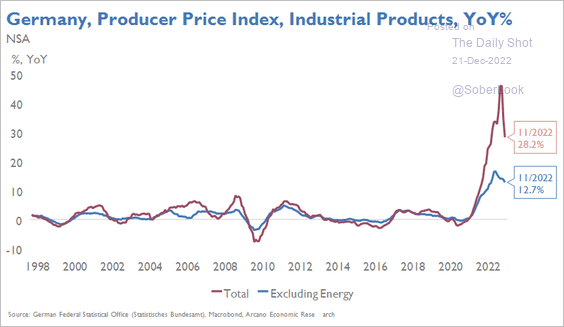

4. Germany’s PPI report came in below forecasts.

Here is the PPI excluding energy (blue).

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Europe

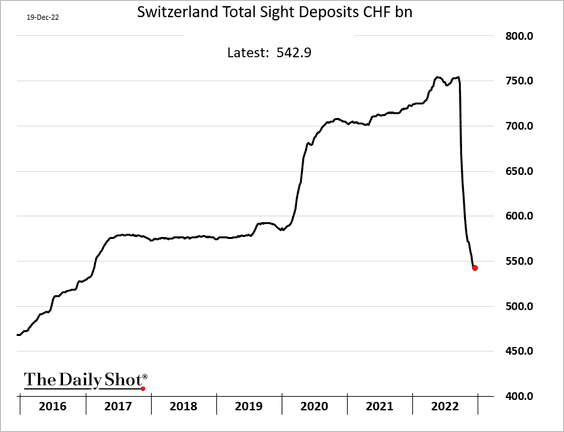

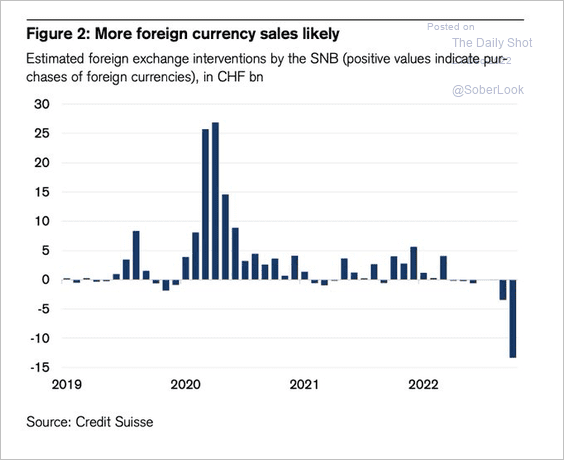

1. The Swiss central bank has been rapidly reducing its balance sheet by cutting FX reserves.

Source: @acemaxx, @csresearch

Source: @acemaxx, @csresearch

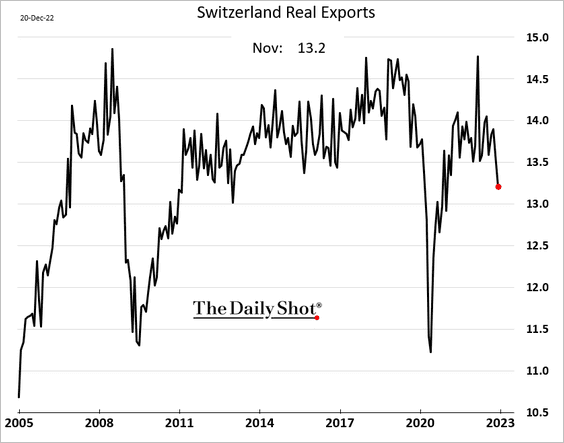

Separately, export volumes declined sharply in November.

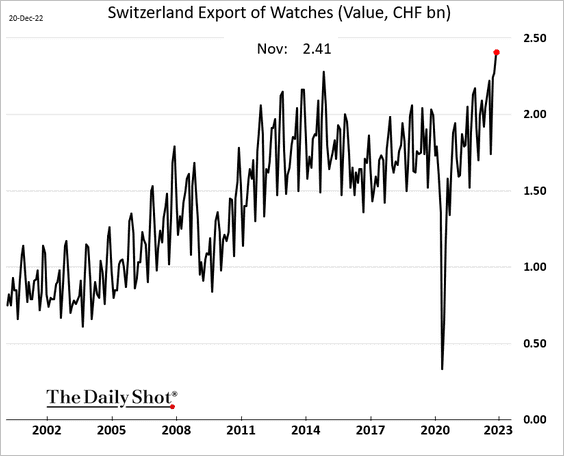

But nominal sales of watches hit a record high.

——————–

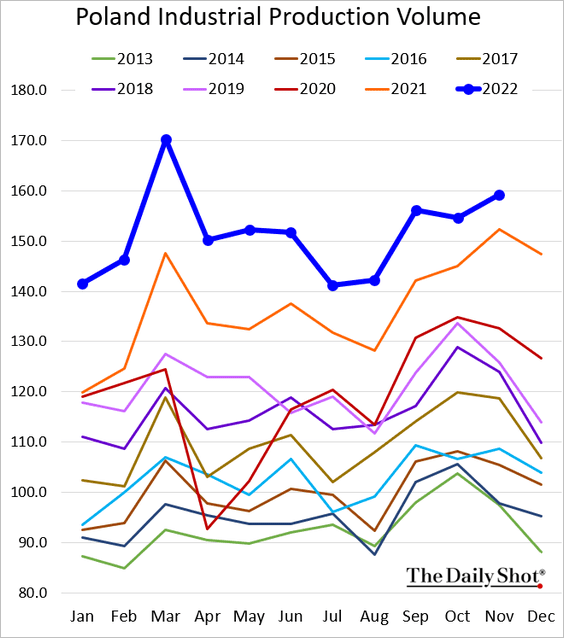

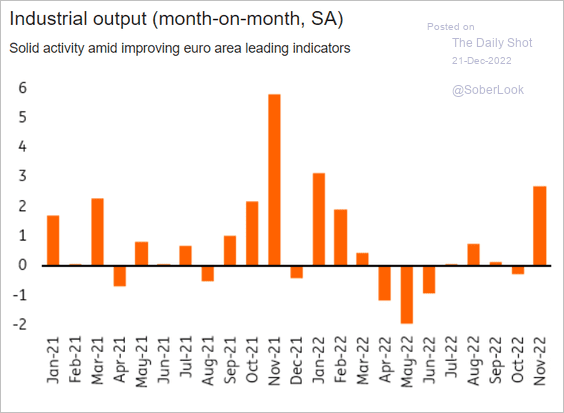

2. Poland’s industrial production remains robust despite dismal PMI data.

Source: ING

Source: ING

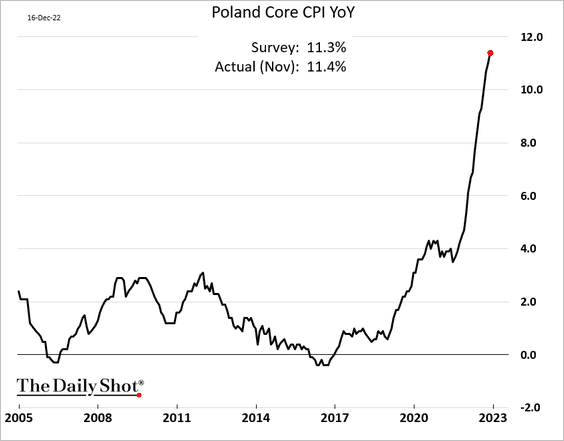

Poland’s core inflation continues to climb.

——————–

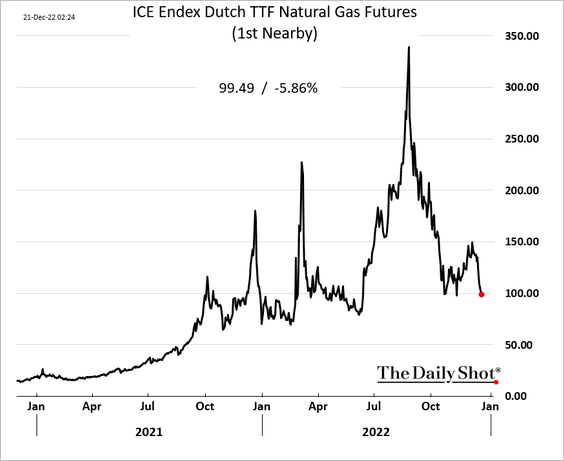

3. European natural gas futures dipped below €100/MWh.

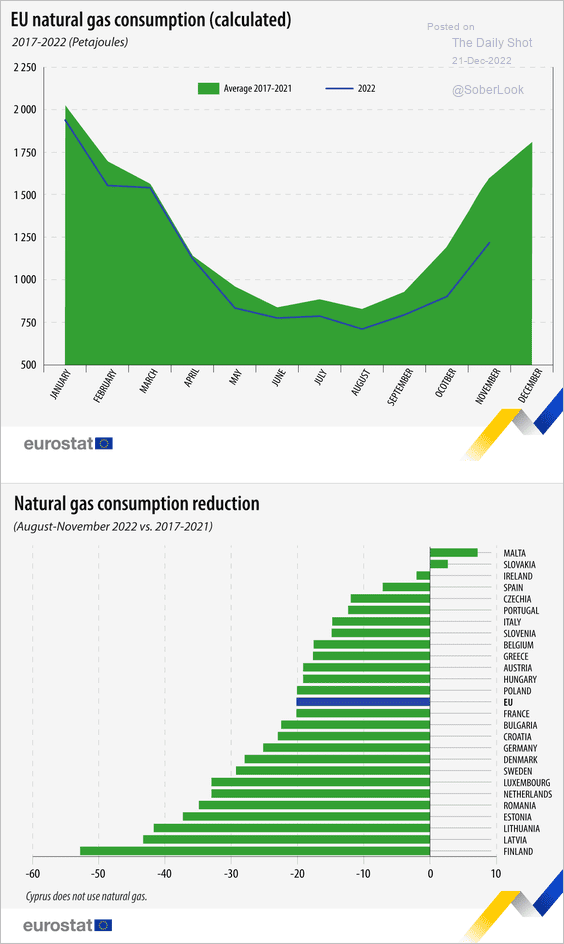

Gas consumption remains well below averages for this time of the year.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

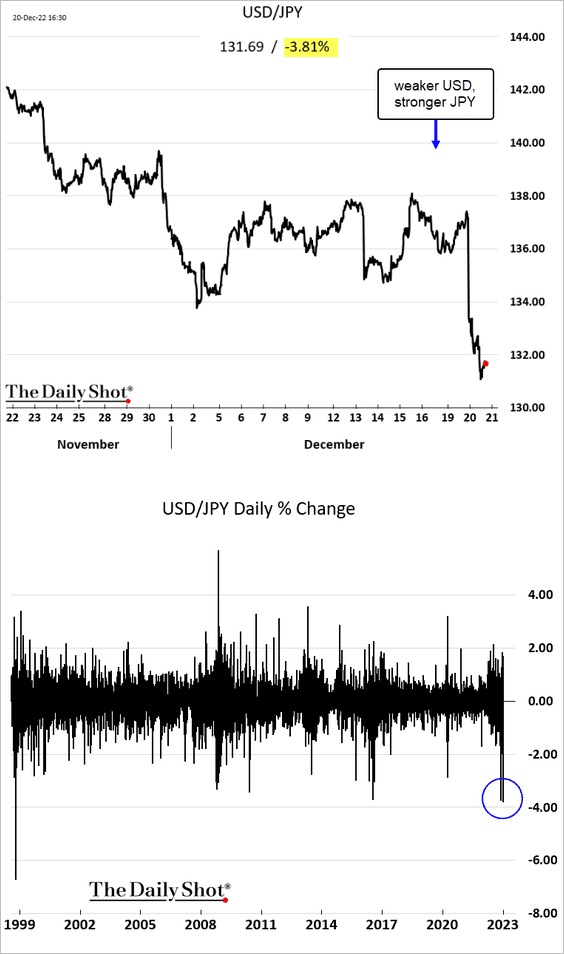

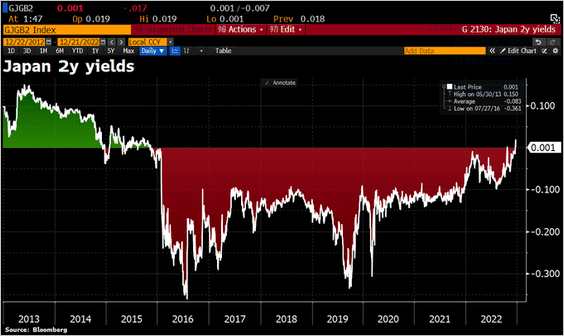

1. The one-day yen surge was the biggest since 1998 after the BoJ widened the trading band for the 10yr JGB.

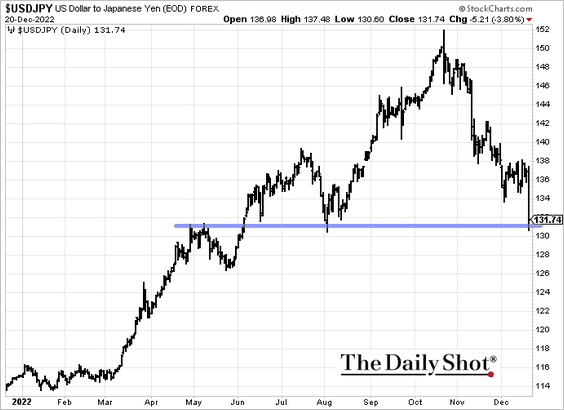

• USD/JPY is now at support.

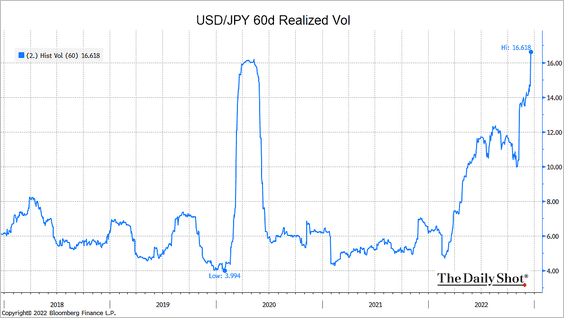

• USD/JPY volatility hit a multi-year high.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

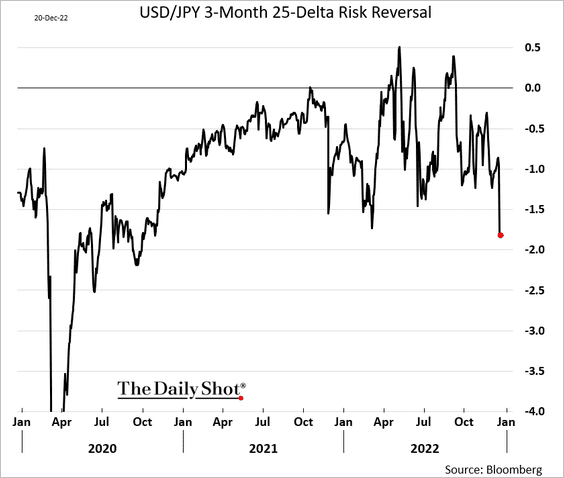

• Here is the USD/JPY risk reversal (increased bets on further gains in the yen).

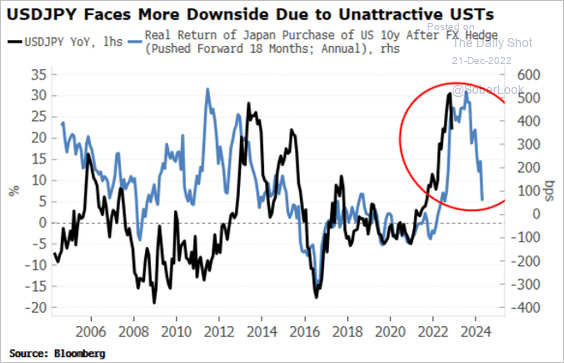

• Treasuries are not attractive when hedged into yen, which is a headwind for USD/JPY.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

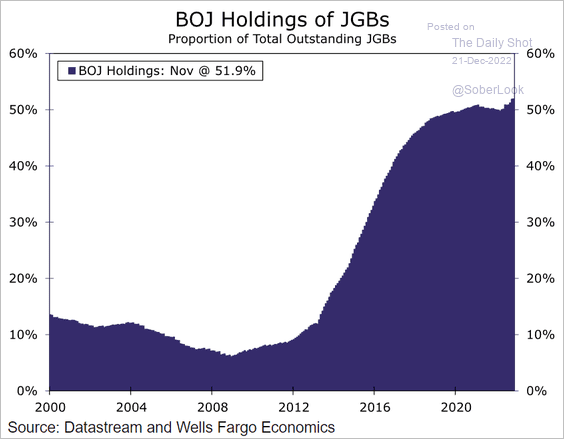

2. This chart shows the BoJ’s holdings of JGBs.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

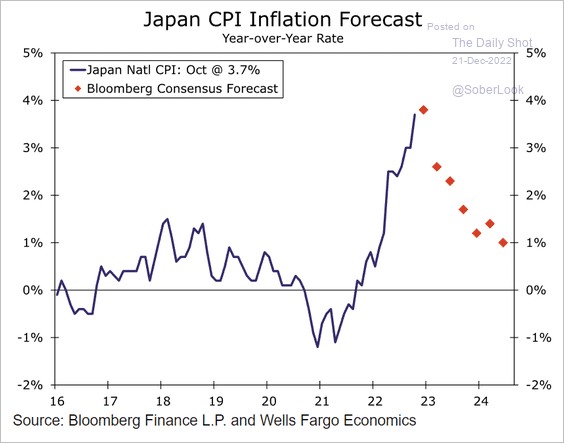

3. Here is the consensus forecast for Japan’s CPI.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Asia – Pacific

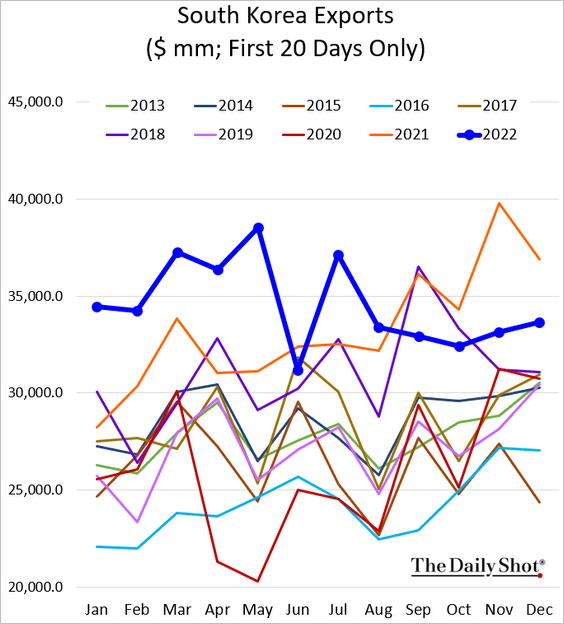

1. South Korea’s exports remain robust.

But the trade deficit widened this month.

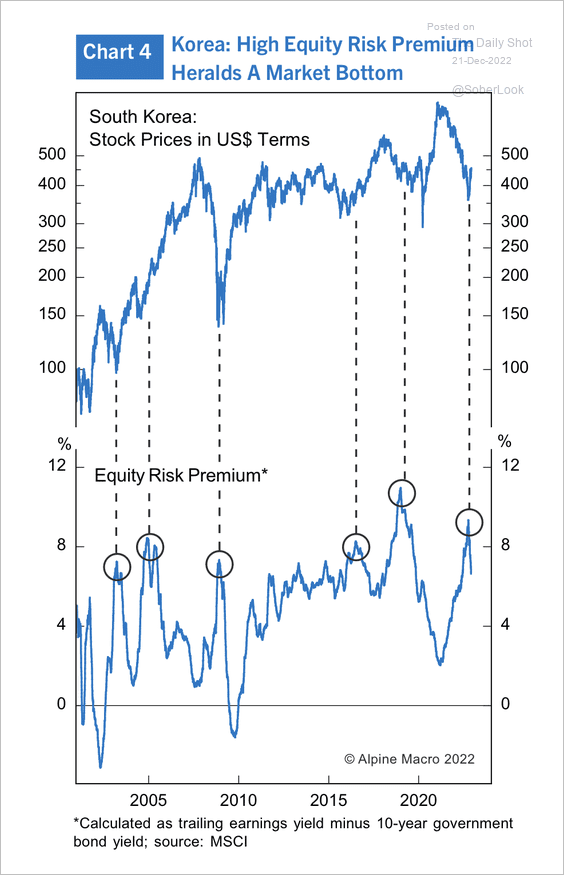

• The sell-off in South Korean stocks could stabilize, given the elevated equity risk premium.

Source: Alpine Macro

Source: Alpine Macro

——————–

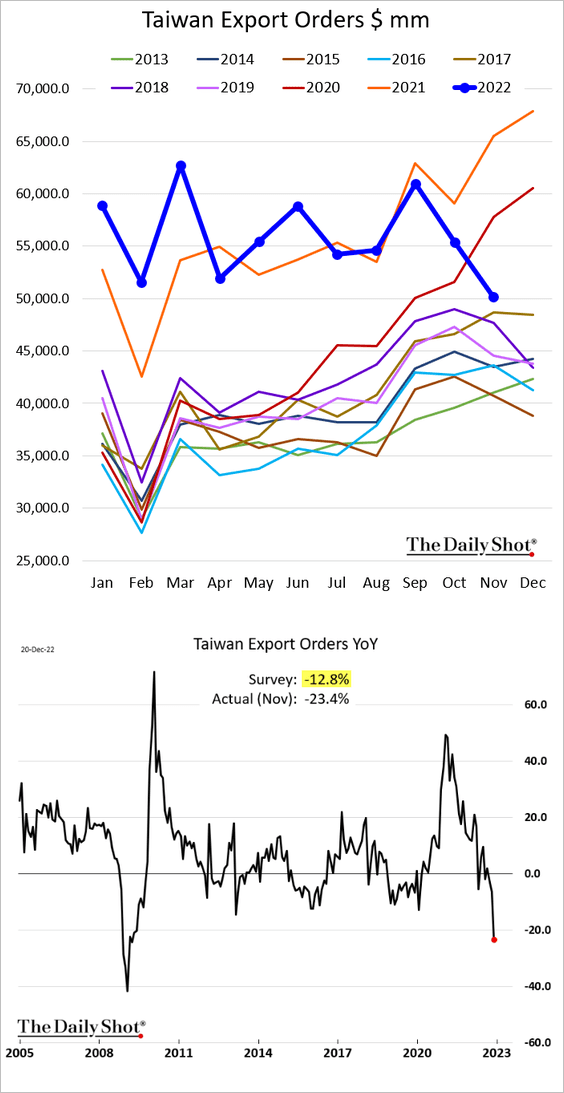

2. Taiwan’s export orders are tumbling.

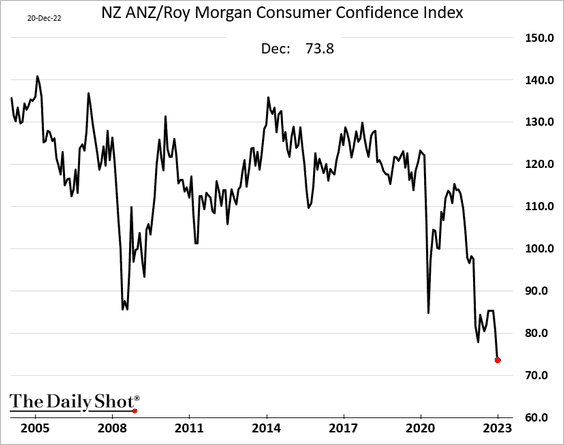

3. As we saw previously, New Zealand’s consumer confidence is hitting new lows. Here is an indicator from ANZ.

Source: @tracywwithers, @business Read full article

Source: @tracywwithers, @business Read full article

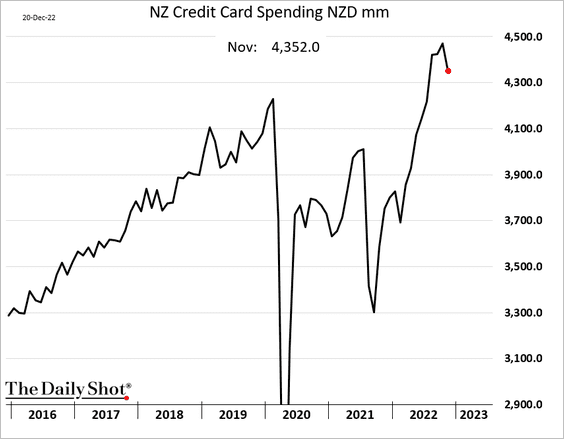

• Credit card spending came off the highs but remains strong.

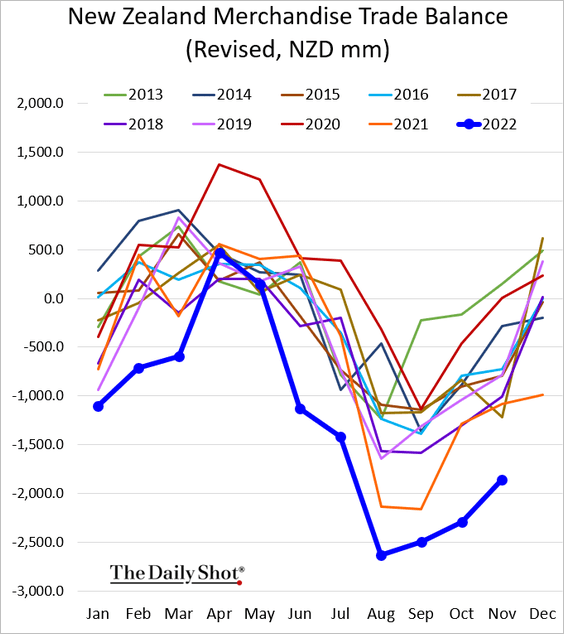

• The trade deficit hit a multi-year high for this time of the year.

Back to Index

Emerging Markets

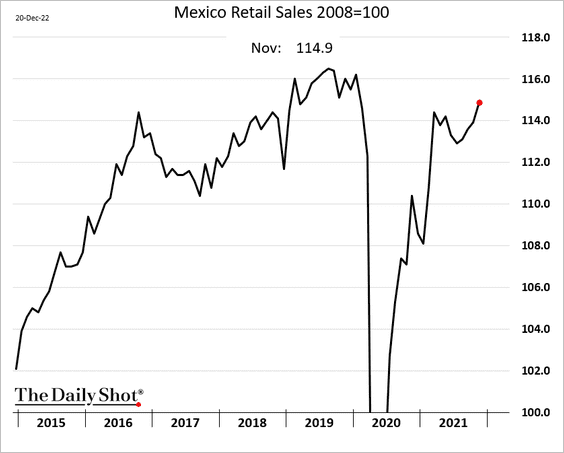

1. Mexican retail sales strengthened again last month.

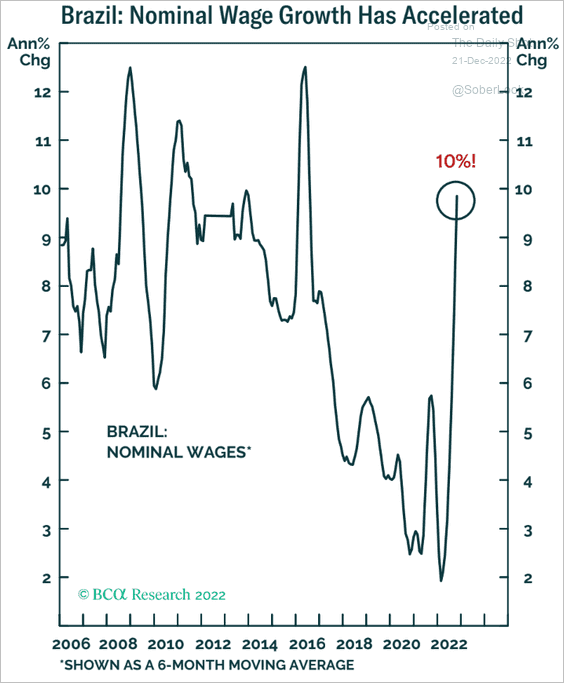

2. Brazil’s wage growth has accelerated.

Source: BCA Research

Source: BCA Research

3. India-related M&A fees have exceeded China’s.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

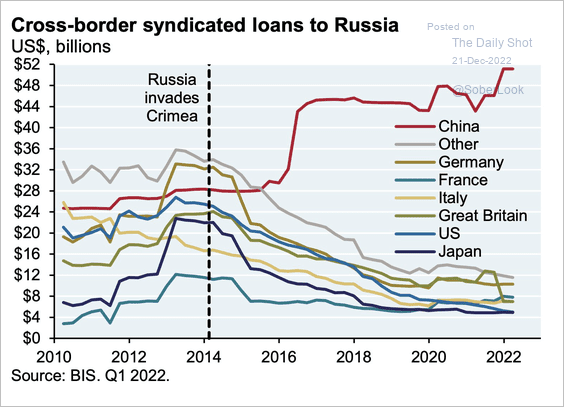

4. Russian companies are getting loans from China.

Source: @acemaxx, @JPMorganAM

Source: @acemaxx, @JPMorganAM

Back to Index

Energy

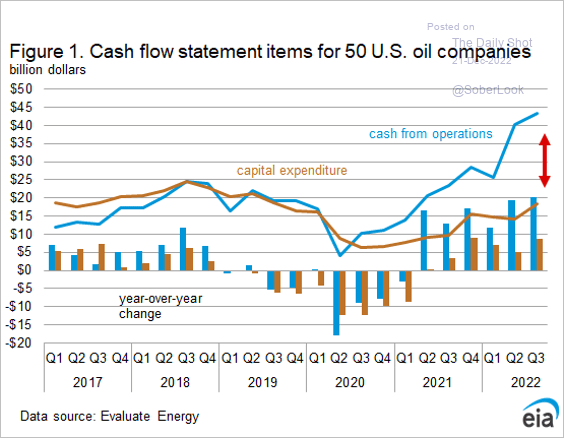

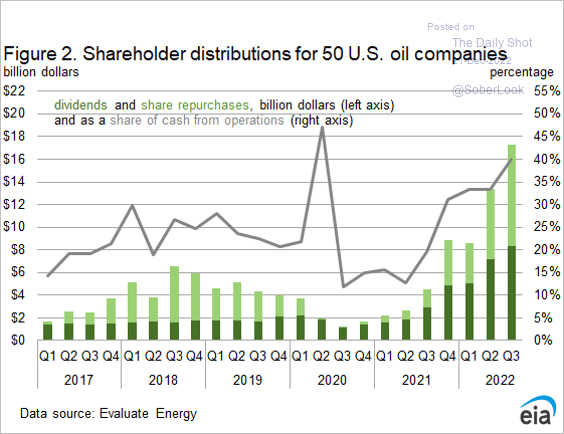

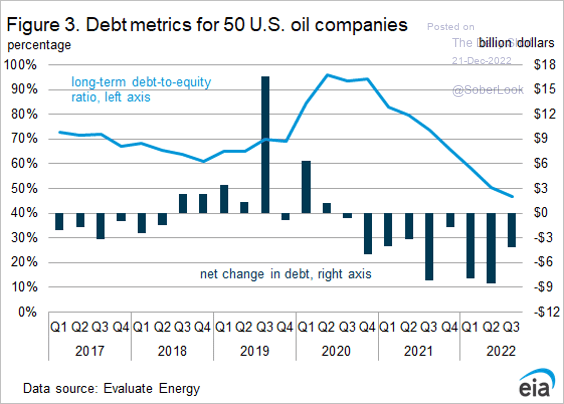

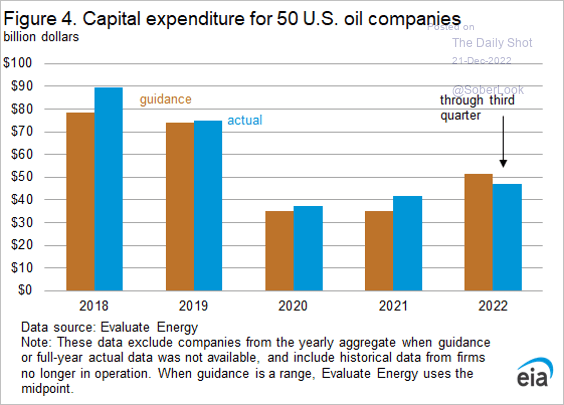

1. Despite higher prices, US energy companies are returning cash to shareholders rather than boosting CapEx.

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

• Energy firms are also deleveraging.

Source: @EIAgov

Source: @EIAgov

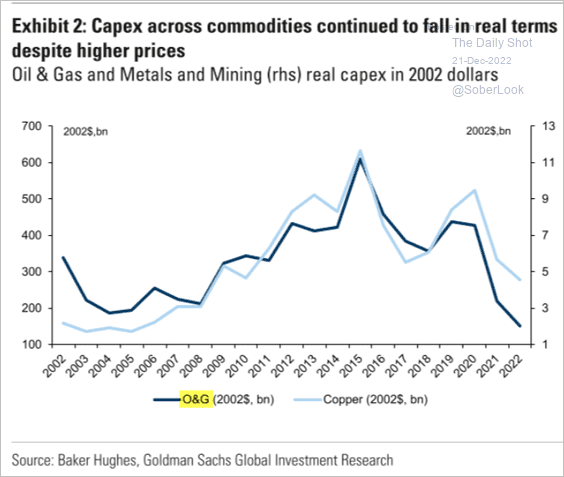

• Investment in production continues to lag pre-COVID levels (2 charts).

Source: @EIAgov

Source: @EIAgov

Source: Goldman Sachs

Source: Goldman Sachs

——————–

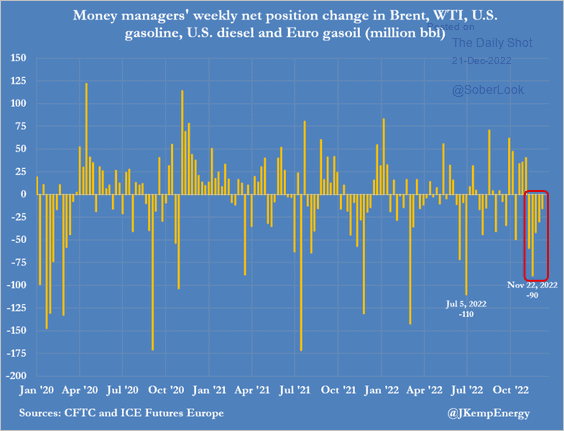

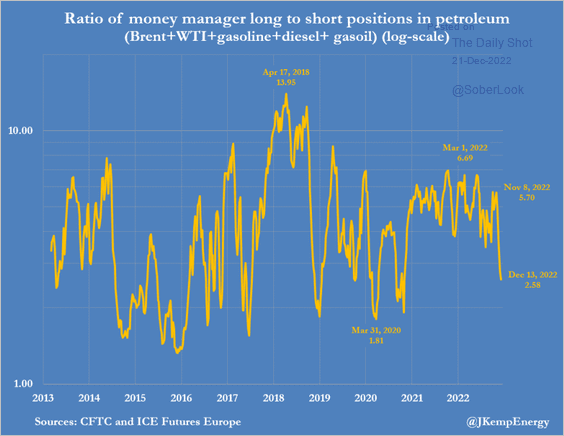

2. Hedge funds continue to reduce their positions in oil futures.

Source: @JKempEnergy, Reuters Read full article

Source: @JKempEnergy, Reuters Read full article

Bulls have been retreating.

Source: @JKempEnergy, Reuters Read full article

Source: @JKempEnergy, Reuters Read full article

——————–

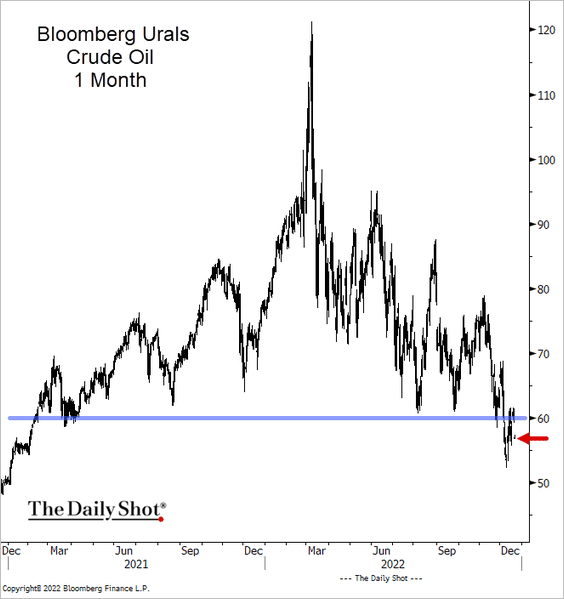

3. Russian oil prices are holding below $60/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

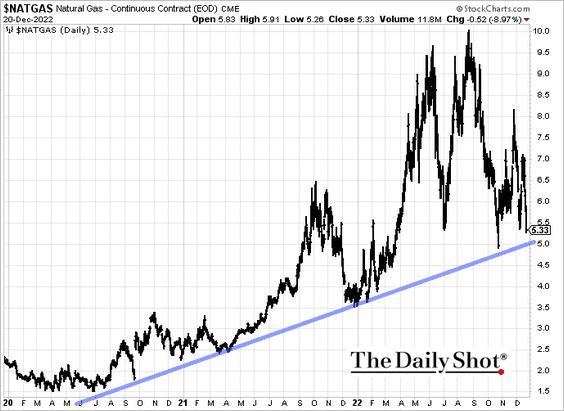

4. Despite the frigid weather in parts of the US, natural gas futures are well below $6/MMBtu.

Back to Index

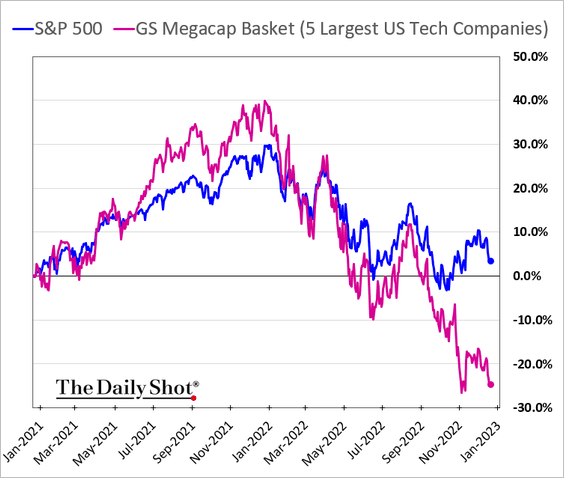

Equities

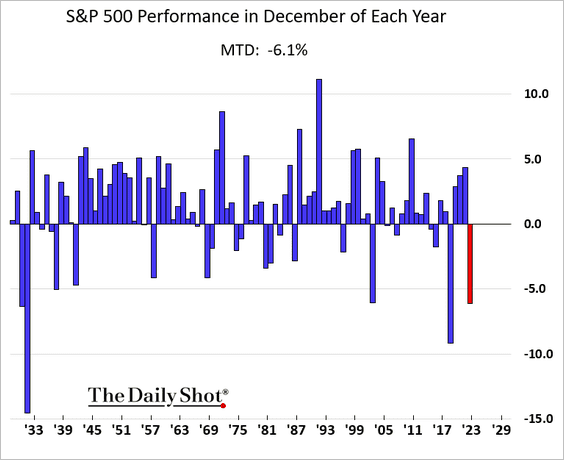

1. No Santa rally this year.

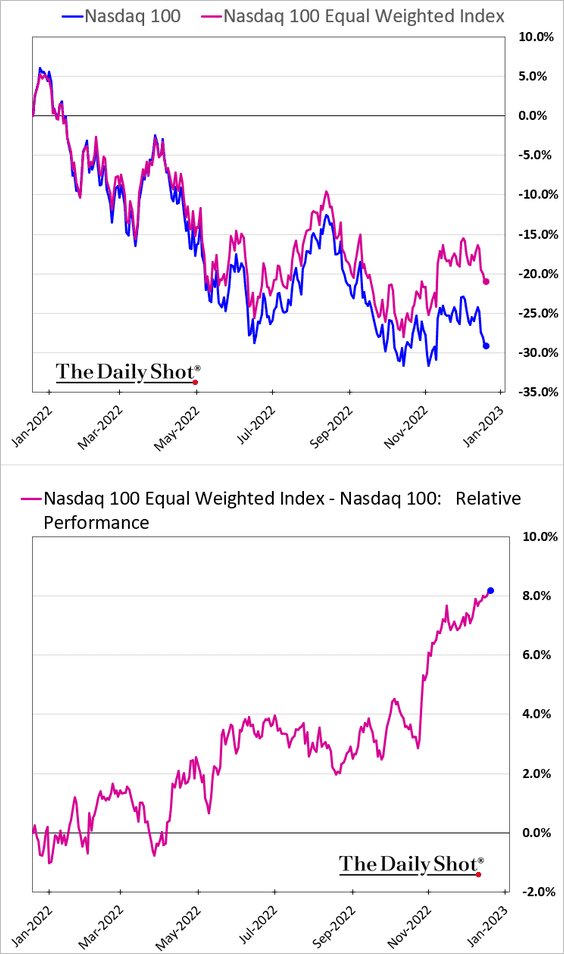

2. Mega-cap firms have underperformed sharply in recent months.

• That’s why the Nasdaq 100 equal-weight index has been outpacing the capitalization-weighted index.

h/t Heather Burke

h/t Heather Burke

——————–

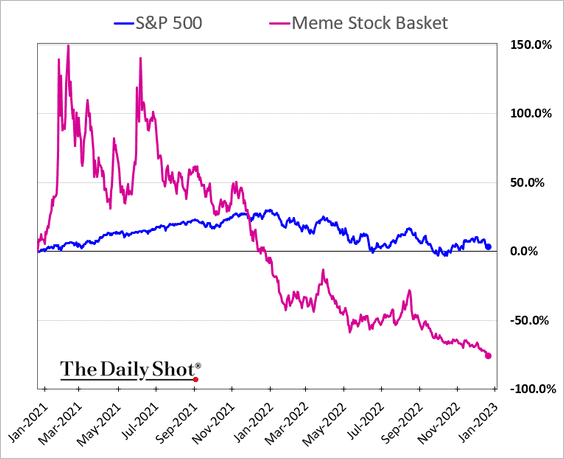

3. The meme bubble continues to deflate.

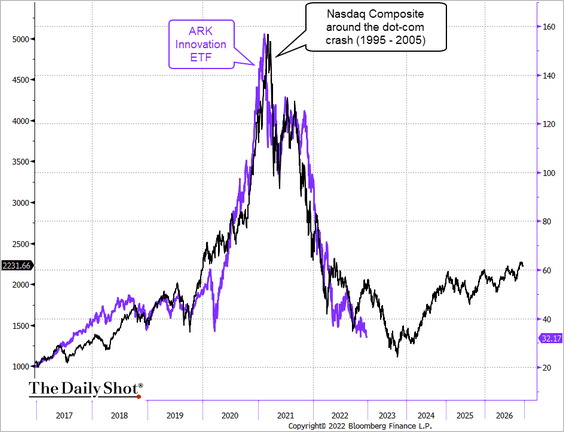

By the way, here is the ARK Innovation ETF overlaid on top of the Nasdaq Composite during the dot-com bubble/crash.

Source: @TheTerminal, Bloomberg Finance L.P., h/t Tier1 Alpha

Source: @TheTerminal, Bloomberg Finance L.P., h/t Tier1 Alpha

——————–

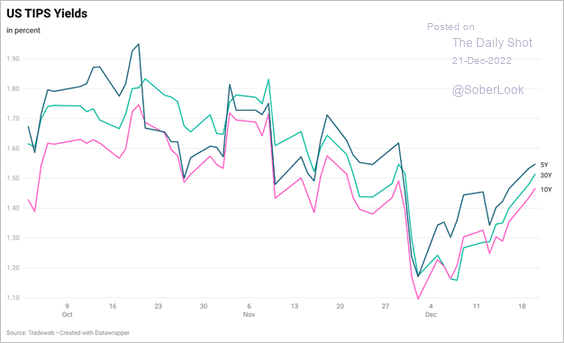

4. Recently, rising real yields have been a headwind for stocks with high multiples.

Source: Tradeweb

Source: Tradeweb

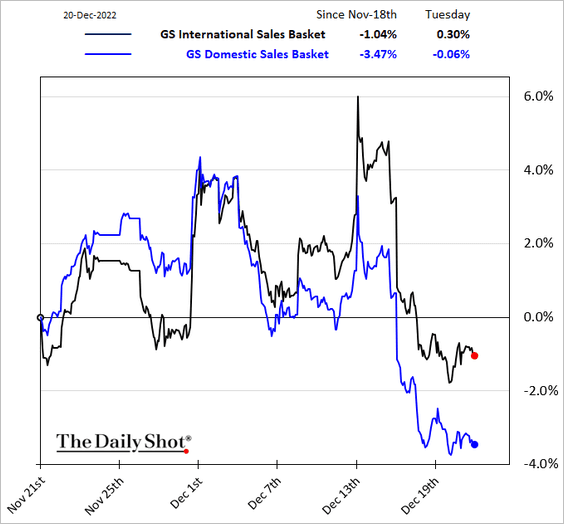

5. Companies with higher international sales have been outperforming as the dollar softens.

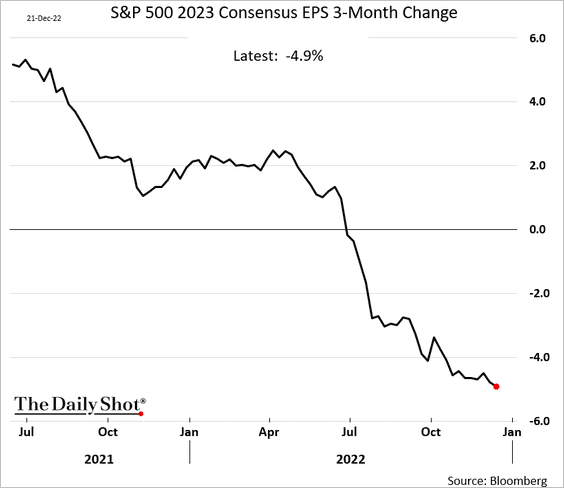

6. The consensus 2023 S&P 500 earnings forecast is down 5% over the past three months. Many analysts expect the trend to continue.

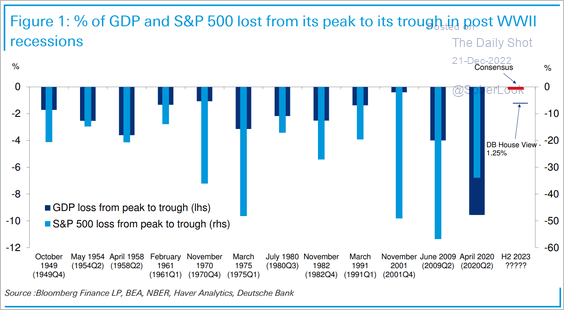

7. The depth of recessions is not massively correlated to the scale of S&P 500 declines.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

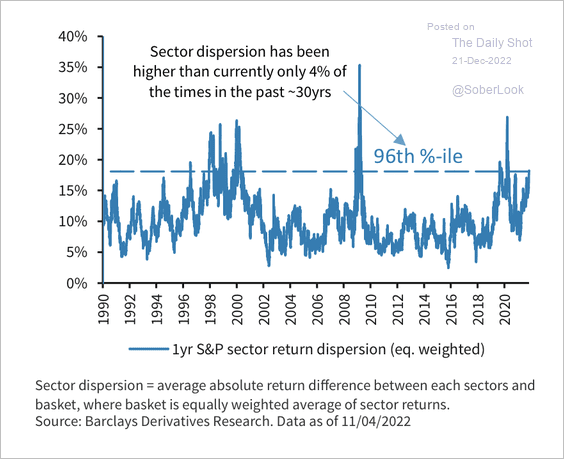

8. Sector return dispersion is among historic highs. According to Barclays, this tends to peak just before the onset of a recession.

Source: Barclays Research

Source: Barclays Research

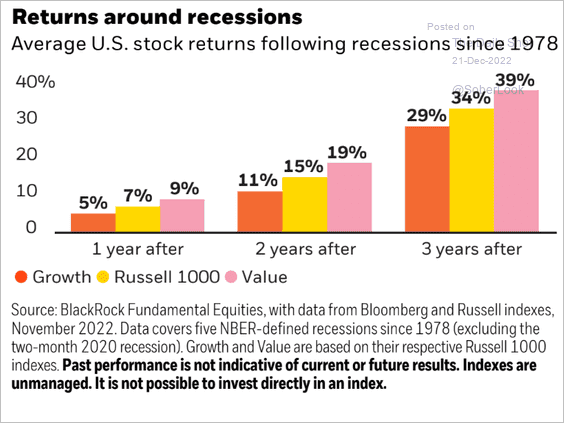

9. How do stocks perform after recessions?

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

Back to Index

Rates

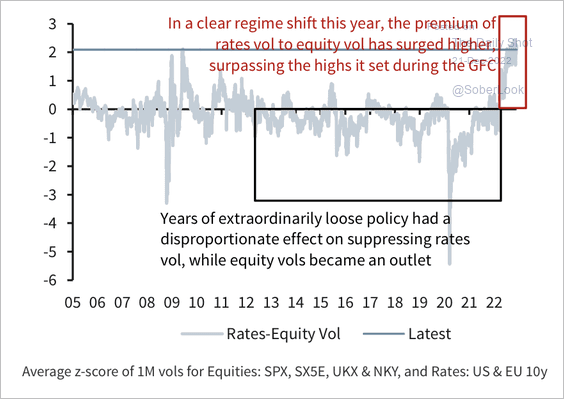

1. Rates vol is trading at the largest premium to equity vol since 2005, surpassing financial crisis highs.

Source: Barclays Research

Source: Barclays Research

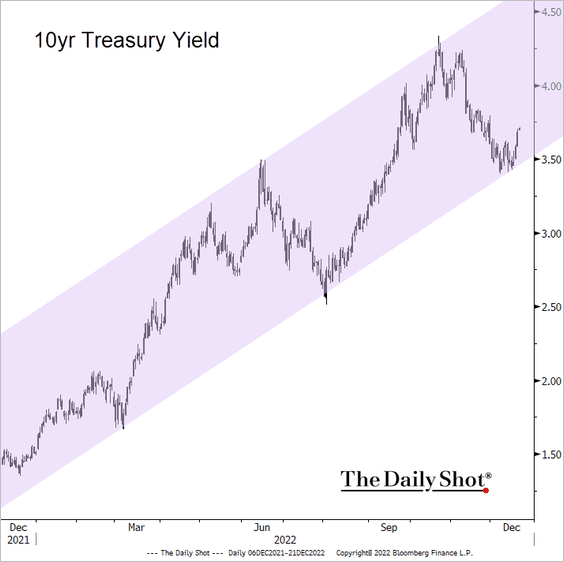

2. Higher Treasury yields ahead?

Source: @TheTerminal, h/t @marketnewsgirl

Source: @TheTerminal, h/t @marketnewsgirl

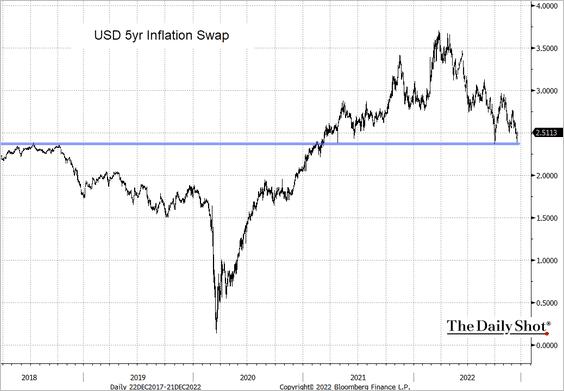

3. Have market-based inflation expectations found support?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

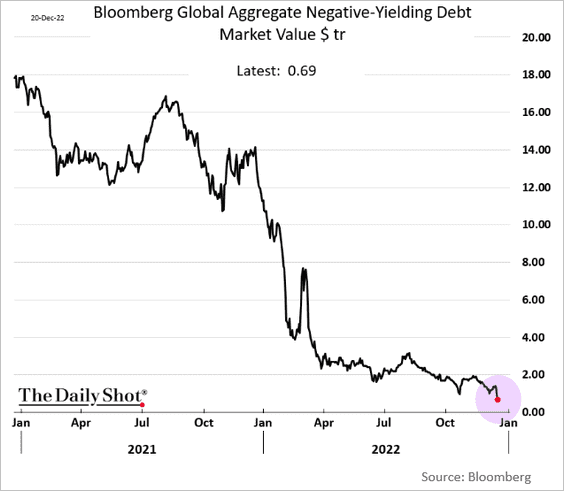

1. The amount of negative-yielding debt declined further as some short-term JGBs swung into positive territory.

Source: @Schuldensuehner

Source: @Schuldensuehner

——————–

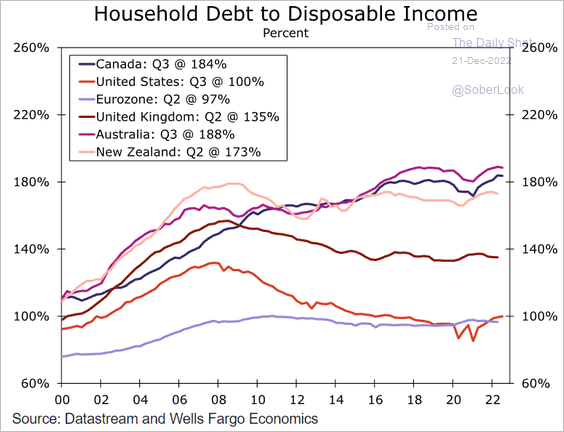

2. Here is the evolution of household leverage in advanced economies.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

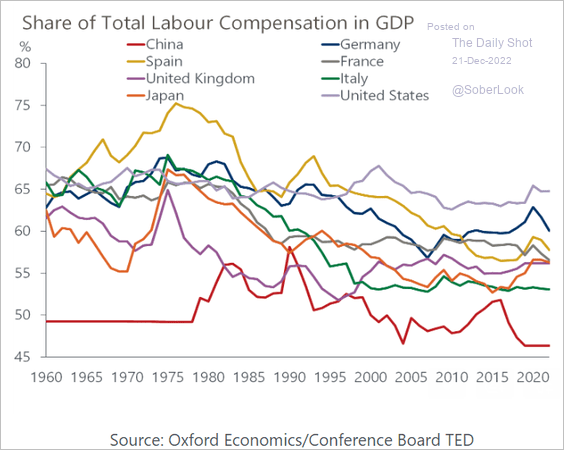

3. This chart shows labor compensation as a share of GDP.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

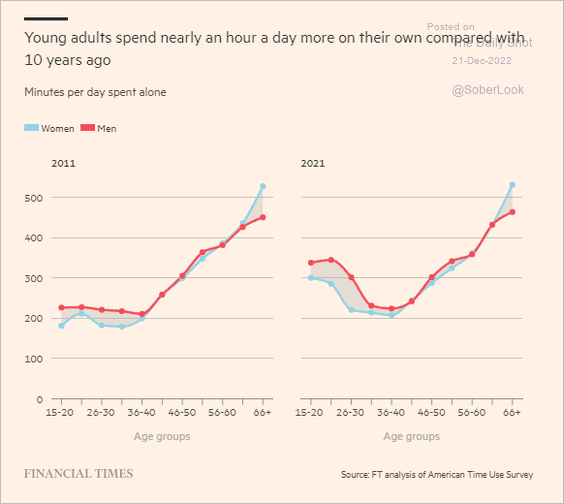

1. Time spent alone:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

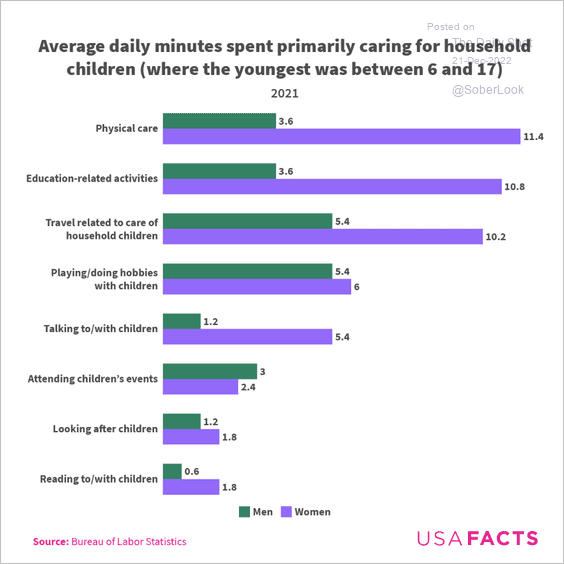

2. Time spent caring for children:

Source: USAFacts

Source: USAFacts

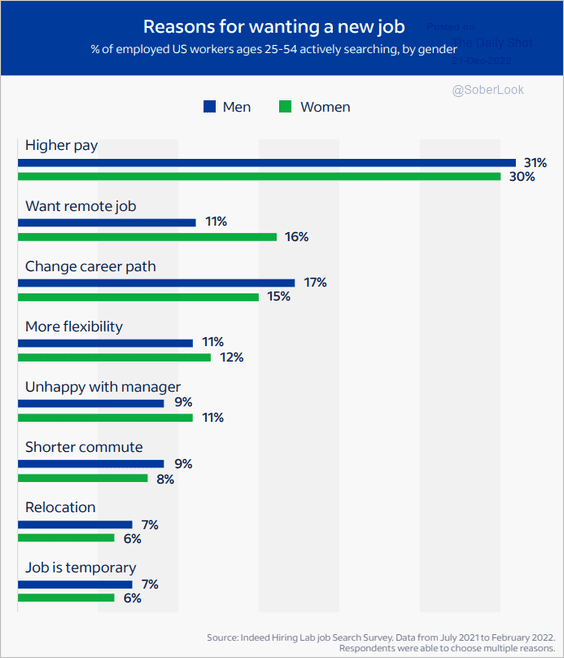

3. Reasons for wanting a new job:

Source: @indeed, @Glassdoor

Source: @indeed, @Glassdoor

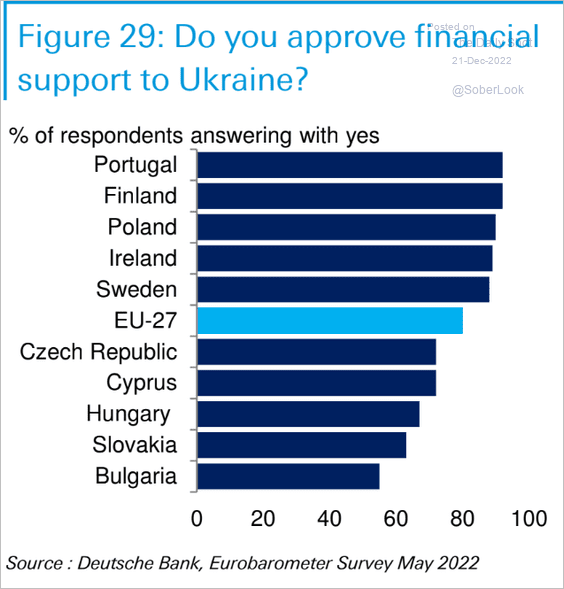

4. Views on financial support for Ukraine:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

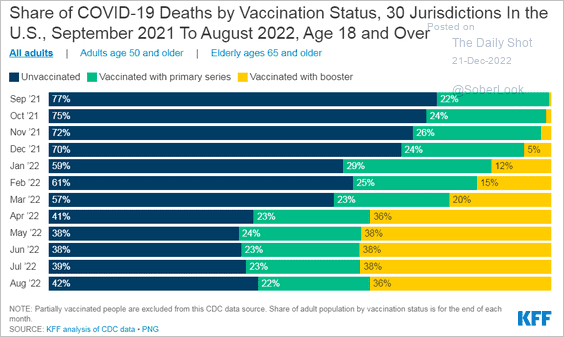

5. COVID deaths by vaccination status:

Source: KFF Read full article

Source: KFF Read full article

6. Marijuana smoking rates:

Source: Gallup Read full article

Source: Gallup Read full article

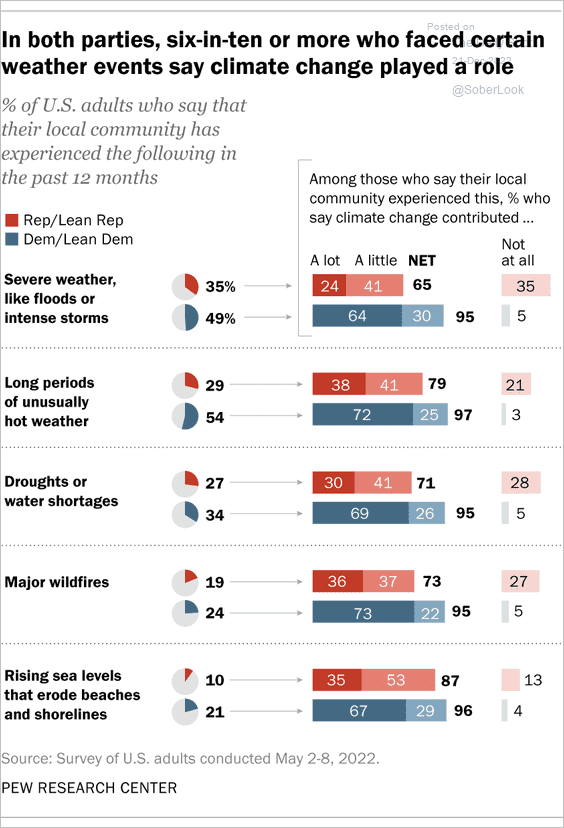

7. The role of climate change:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

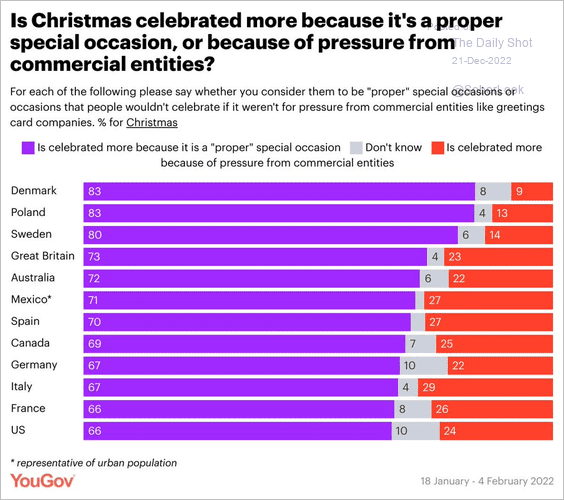

8. Reasons for Christmas celebrations:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

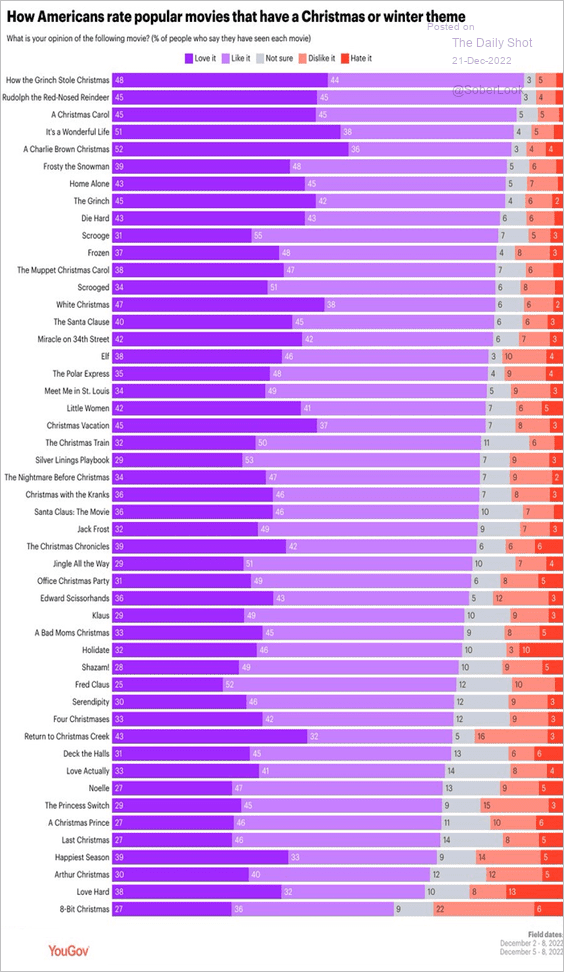

9. Americans’ top five Christmas movies:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

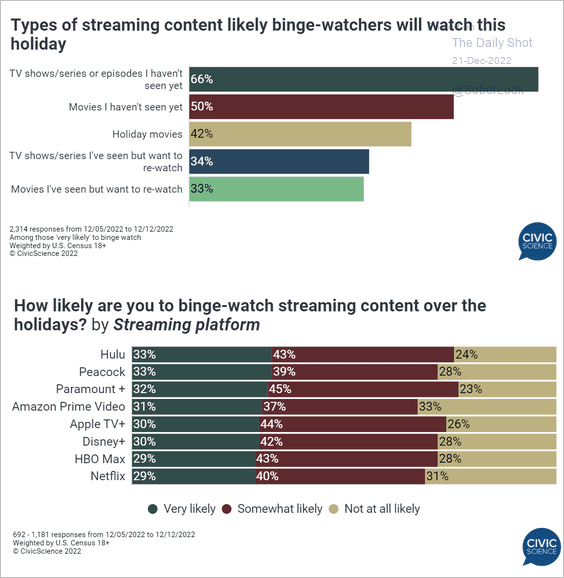

10. Holiday binge-watching preferences:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index