The Daily Shot: 06-Jan-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

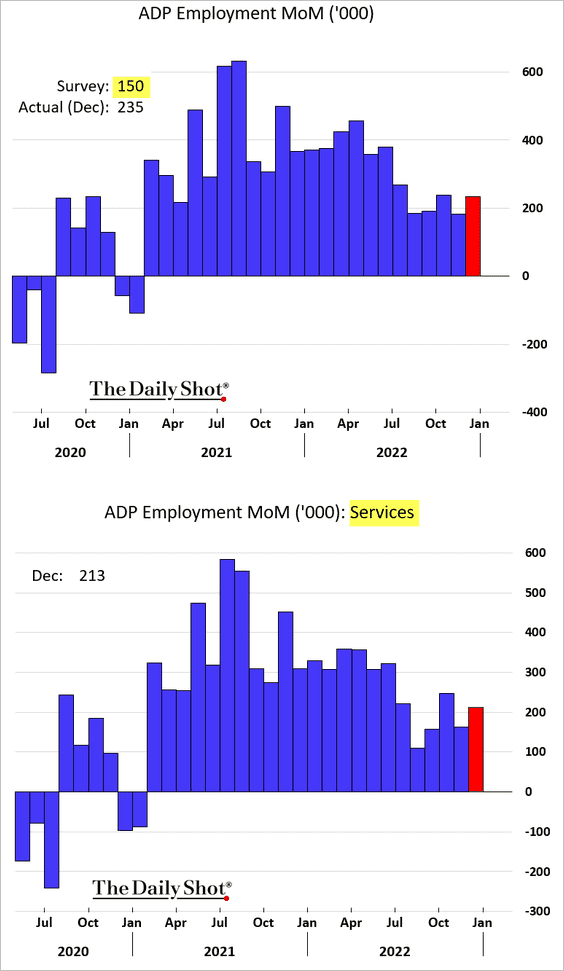

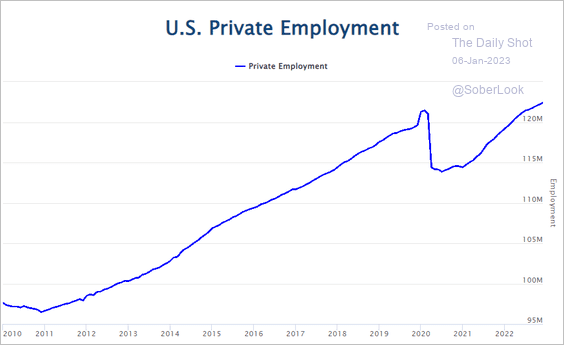

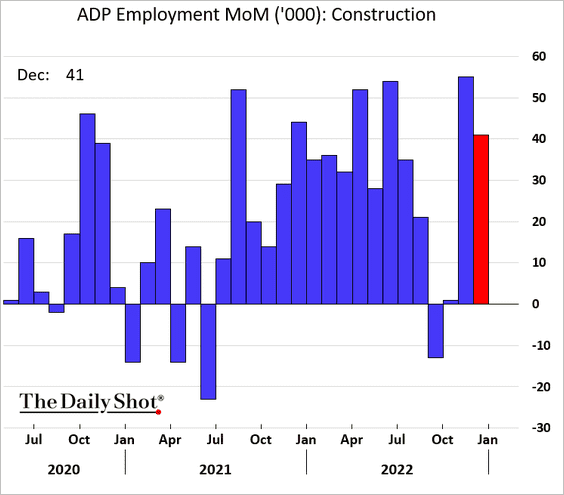

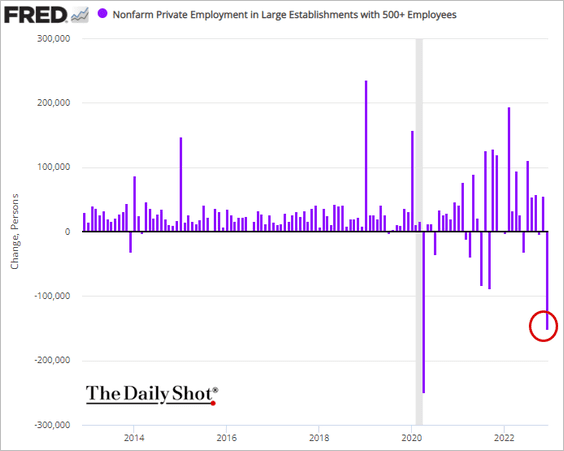

1. We continue to see persistent strength in the US labor market despite the most aggressive monetary policy tightening in years. The ADP report topped expectations.

Source: ADP Research Institute

Source: ADP Research Institute

Even gains in construction employment were robust.

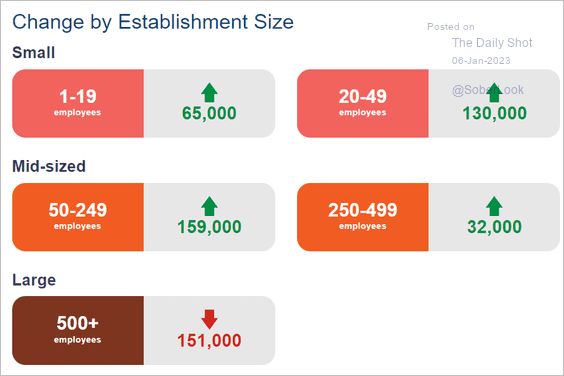

Some of the tech and other high-profile layoffs are showing up in “large company” employment data.

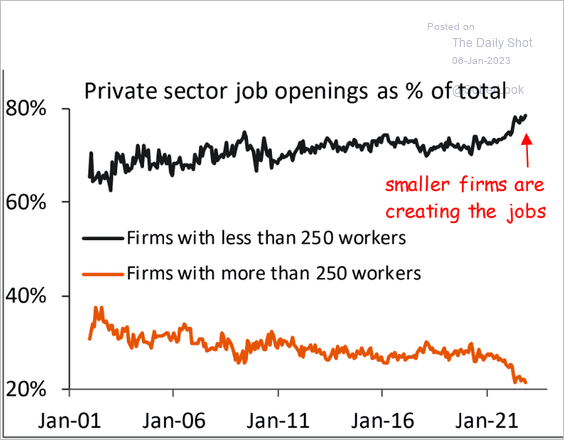

But smaller firms are picking up the slack (2 charts).

Source: ADP Research Institute

Source: ADP Research Institute

Source: Piper Sandler

Source: Piper Sandler

——————–

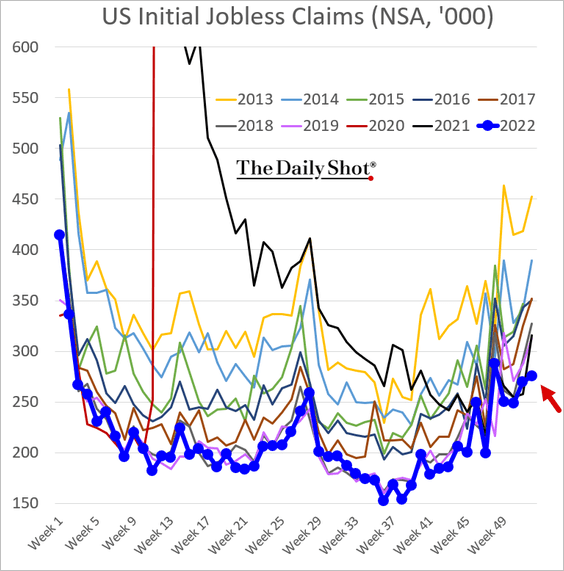

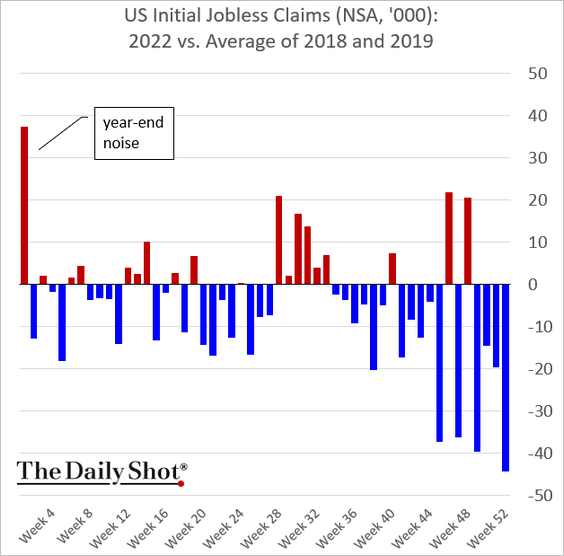

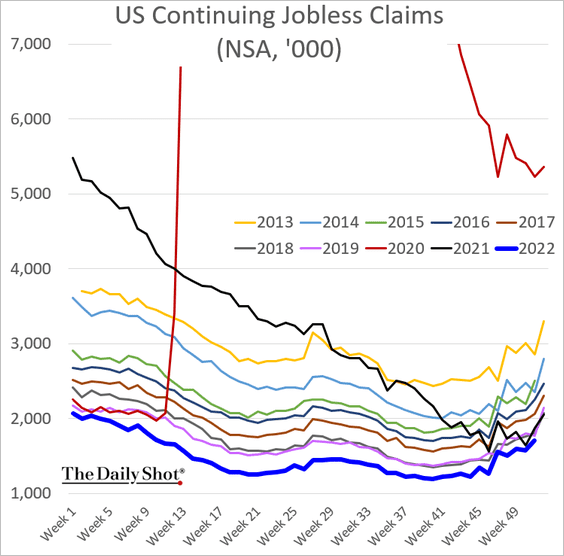

2. Initial jobless claims were exceptionally low for this time of the year (2 charts).

Continuing claims are moving closer to pre-COVID levels but are still very low.

——————–

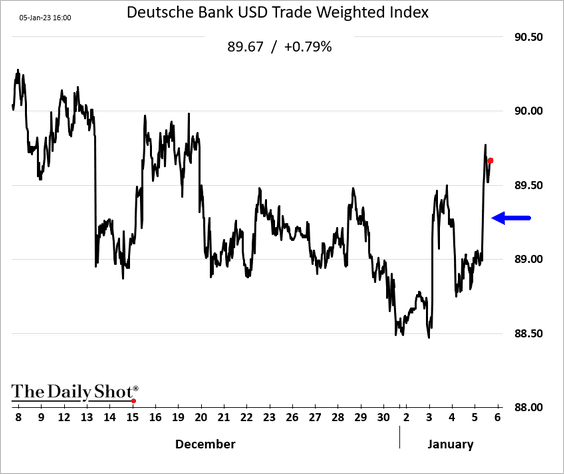

3. Strong employment data sent the dollar higher, …

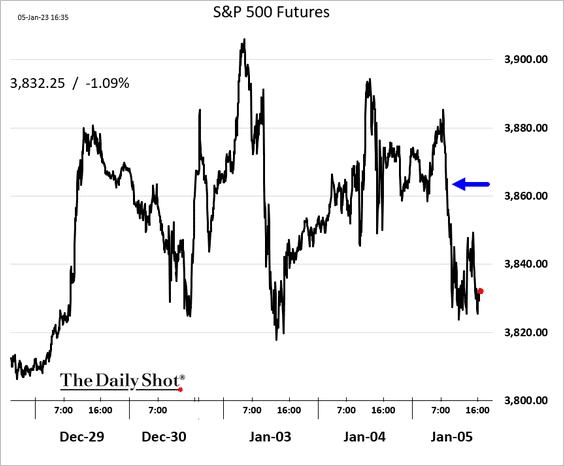

… while stocks tumbled.

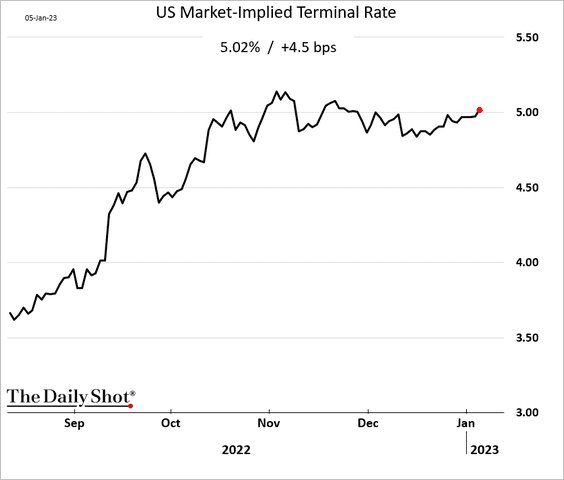

The terminal rate (the highest market-expected fed funds rate in this cycle) is back above 5%.

——————–

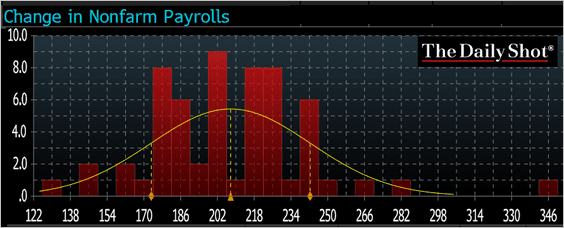

4. What is the market’s expectation for the December payrolls report? Here is the distribution of forecasts assembled by Bloomberg (median = 202k).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

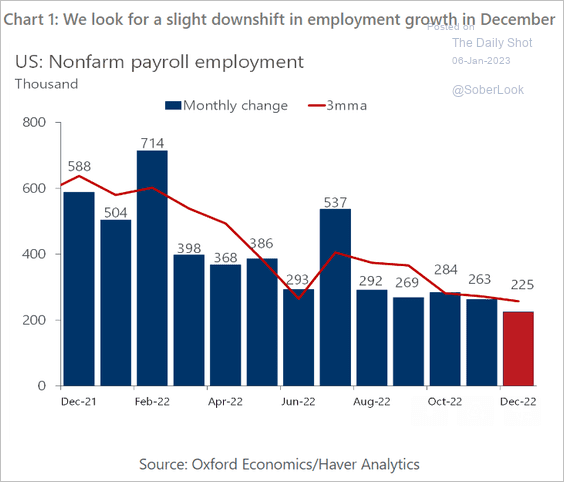

And this estimate is from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

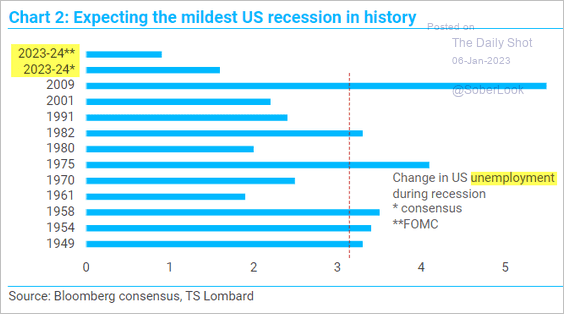

Economists don’t see significant increases in unemployment going forward.

Source: TS Lombard

Source: TS Lombard

——————–

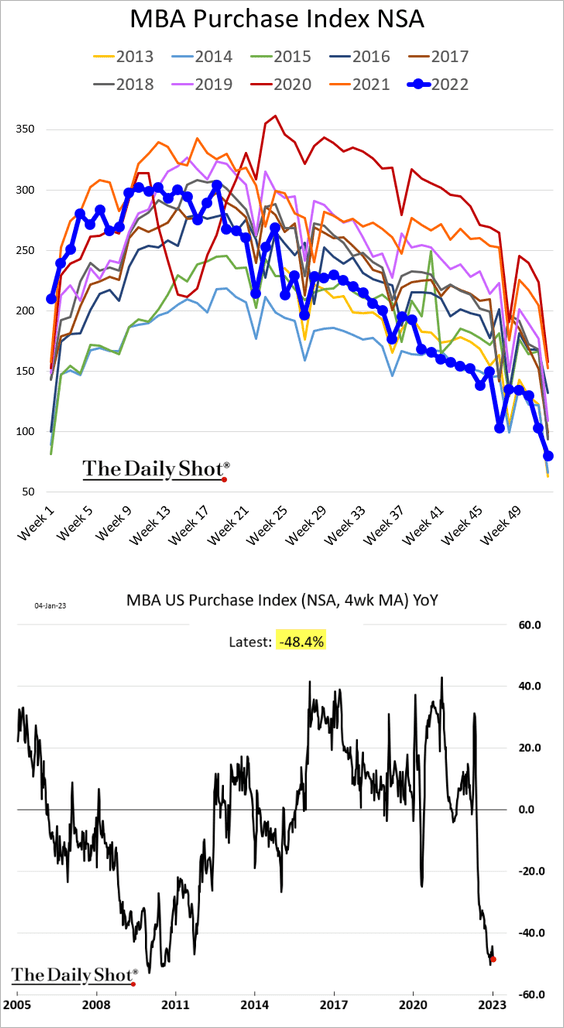

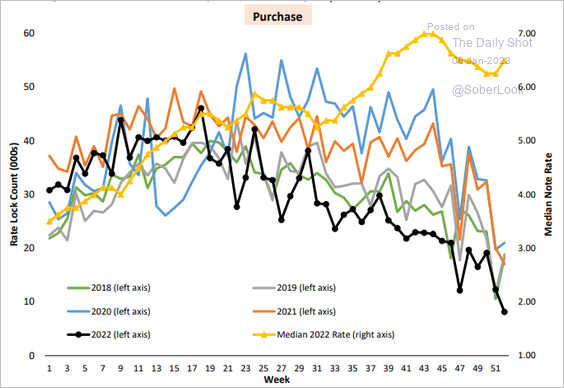

5. Next, we have some updates on the housing market.

• Mortgage applications are down 48% on a year-over-year basis.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

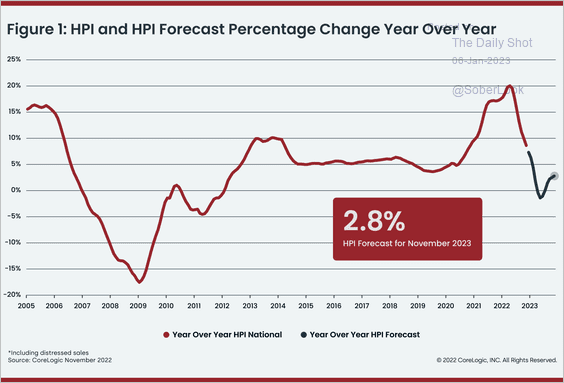

• Below is a forecast for home price appreciation from CoreLogic (barely dipping into negative territory on a year-over-year basis).

Source: CoreLogic

Source: CoreLogic

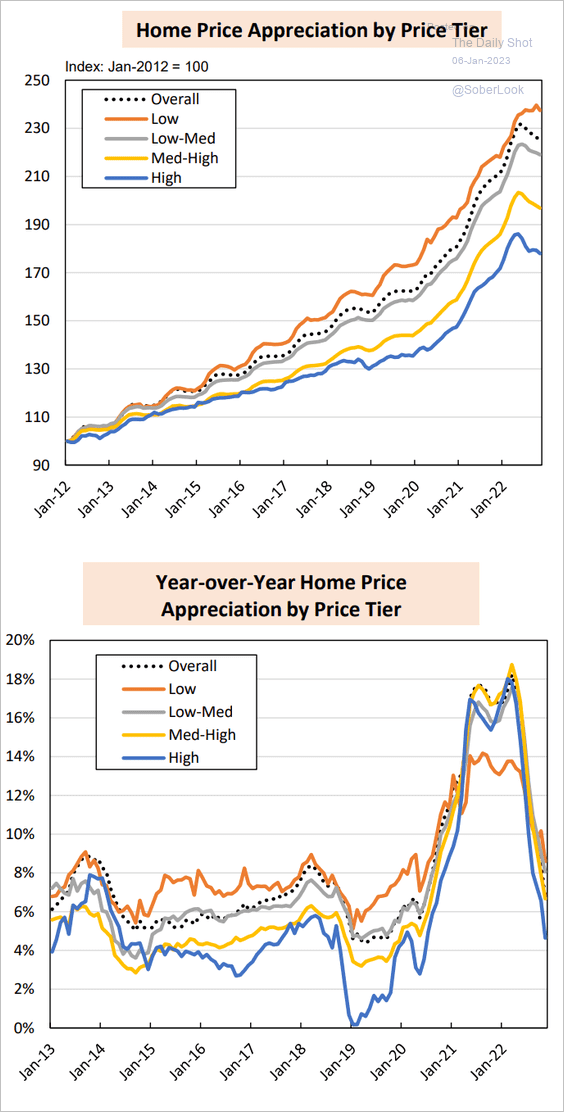

• This chart shows home price appreciation by price tier.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

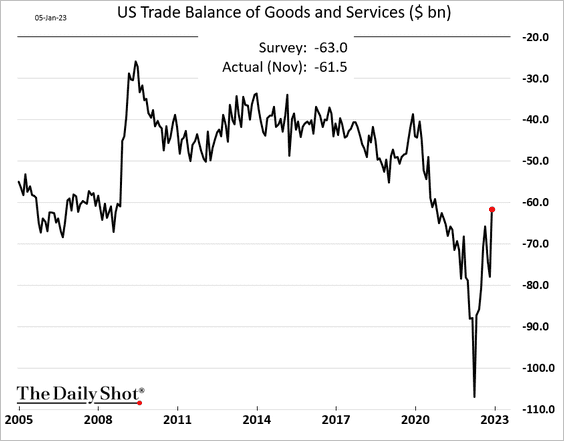

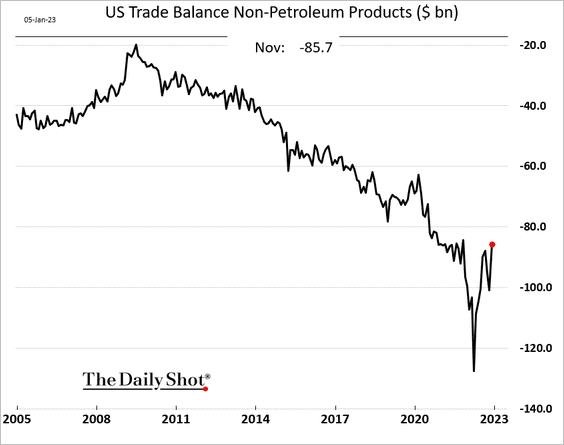

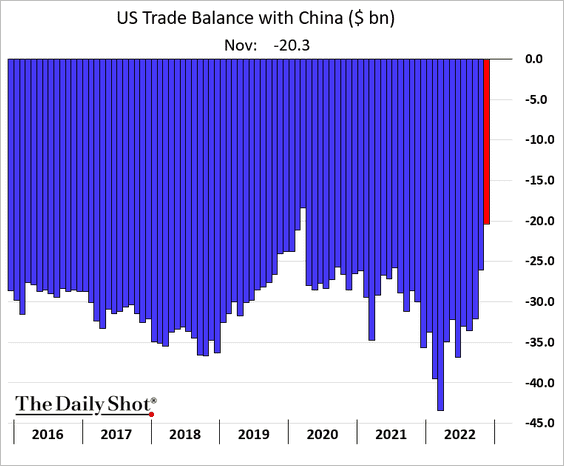

6. The trade deficit narrowed sharply in November as imports slowed.

The trade gap with China hit its lowest level since early 2020.

——————–

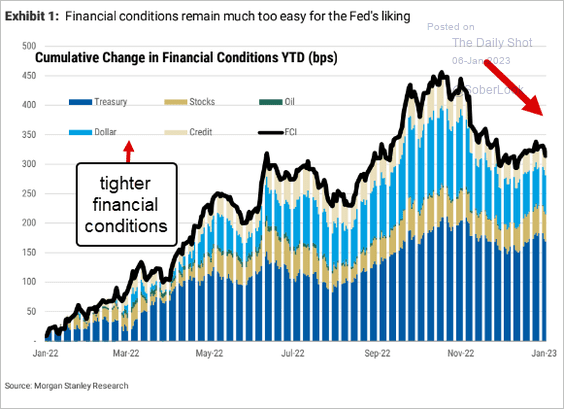

7. As we saw yesterday, financial conditions have been easing, frustrating the Fed. Here is the financial conditions index from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

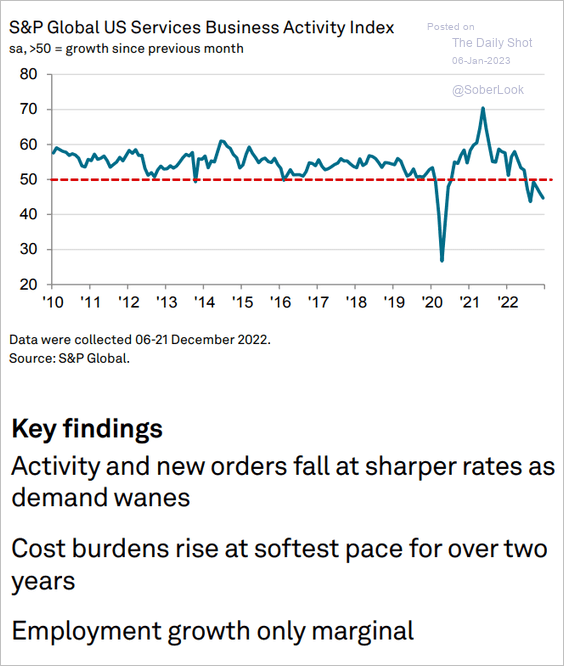

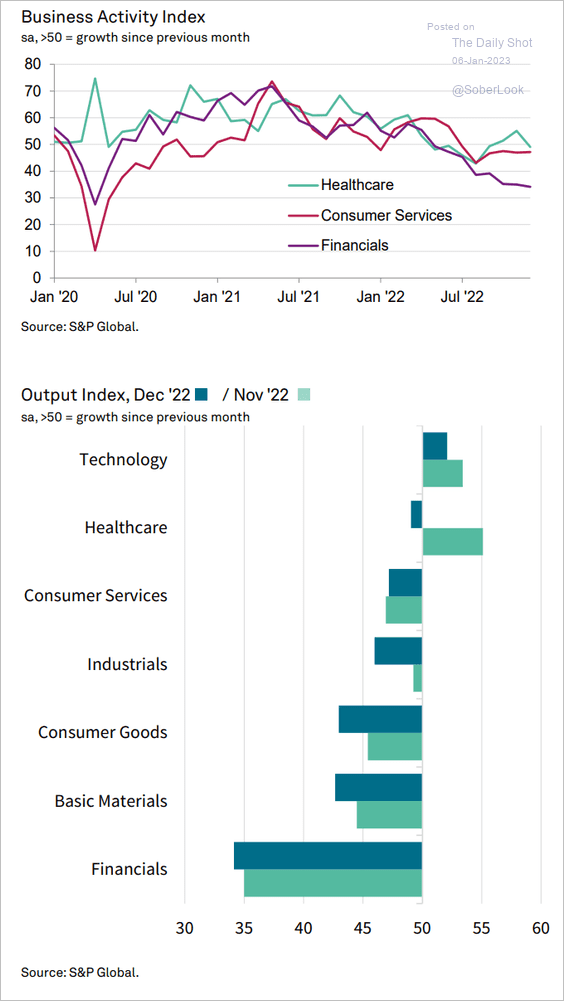

8. Activity at US service firms has been weakening, according to the S&P Global PMI report.

Source: S&P Global PMI

Source: S&P Global PMI

Financials continue to struggle. This chart shows the PMI by sector.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

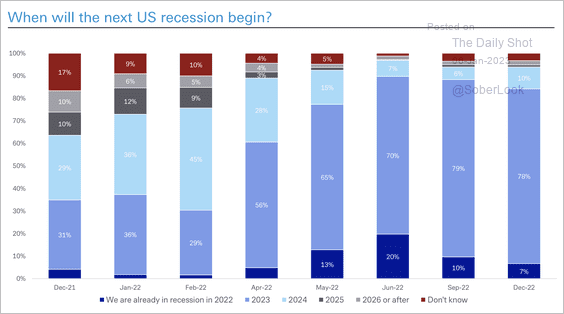

9. A recession is likely to occur around the second half of the year, according to an investor survey by Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

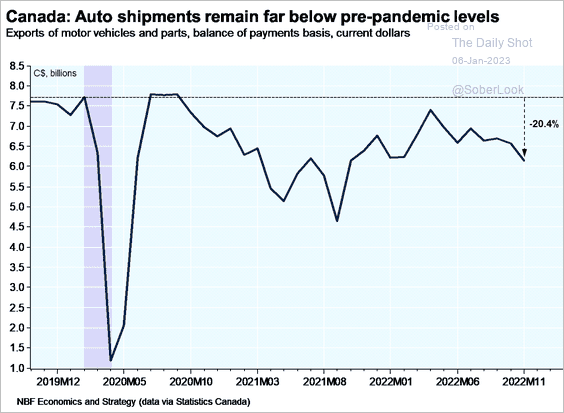

1. Auto shipments remain soft.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

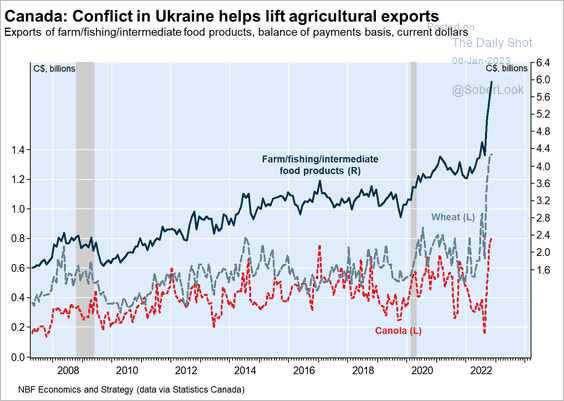

2. Agricultural exports surged last year.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

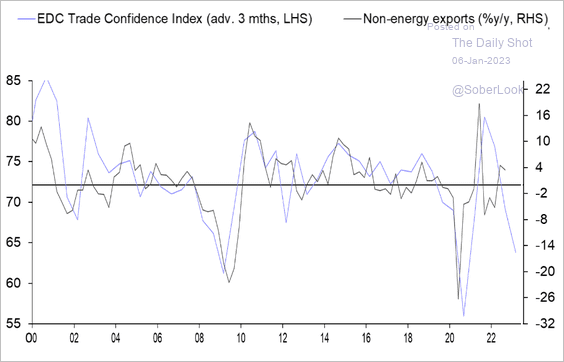

But total non-energy exports are probably heading lower.

Source: Capital Economics

Source: Capital Economics

——————–

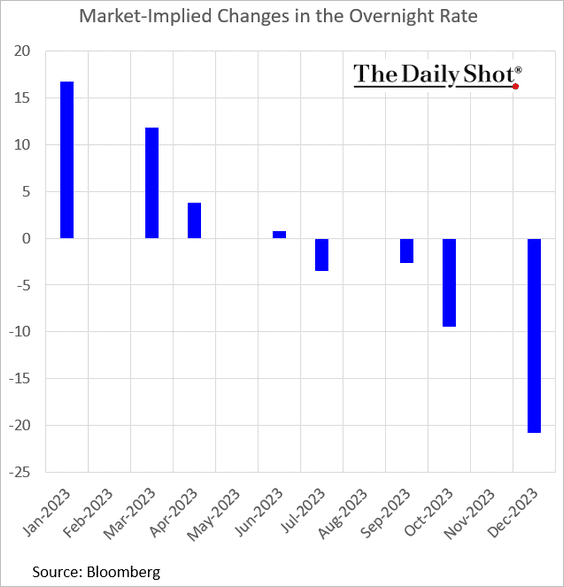

3. The market expects more BoC rate hikes ahead.

Back to Index

The United Kingdom

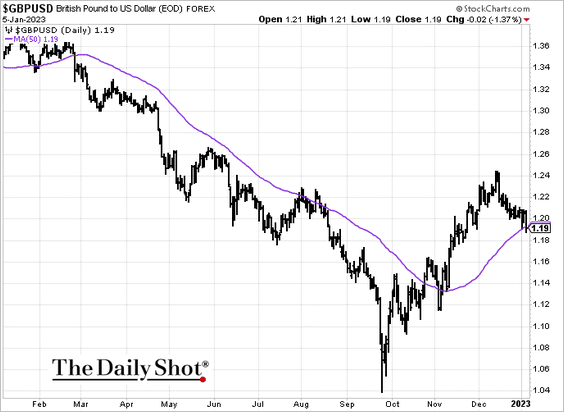

1. The pound is testing support at the 50-day moving average.

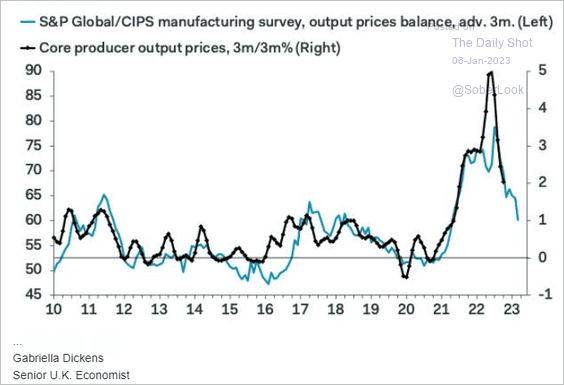

2. The PMI data point to a slower producer price inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

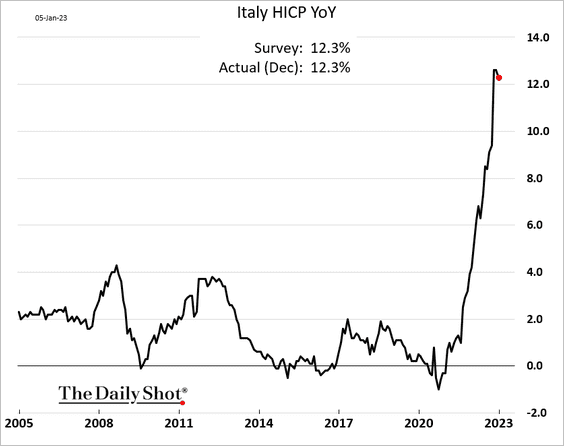

1. Italy’s CPI appears to have peaked.

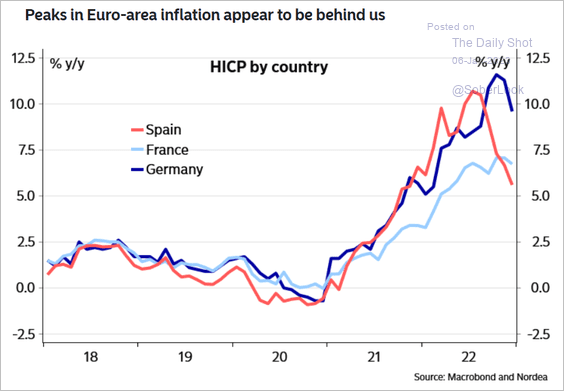

• Here are the CPI trends for Spain, France, and Germany.

Source: Nordea Markets

Source: Nordea Markets

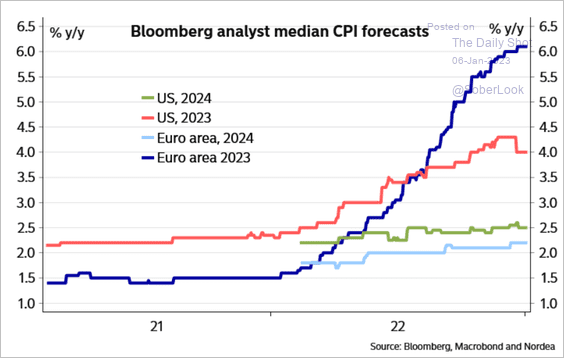

• Below are the consensus CPI forecasts for the Eurozone and the US.

Source: Nordea Markets

Source: Nordea Markets

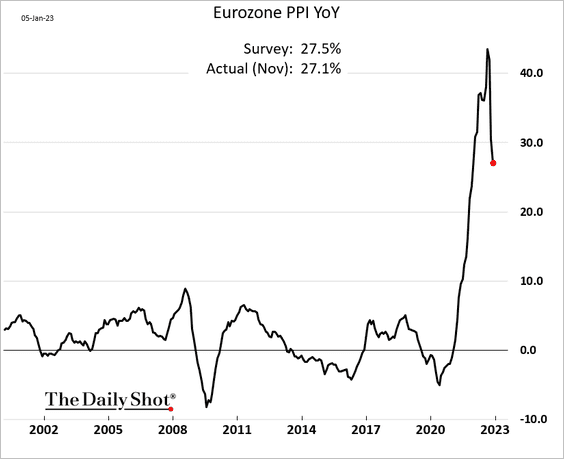

• The euro-area PPI has been moving lower as energy costs ease.

——————–

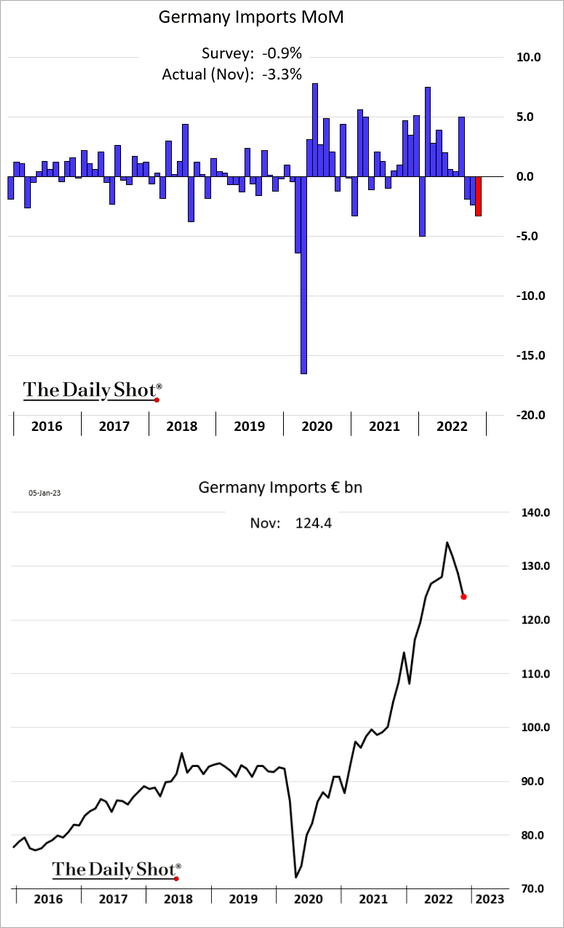

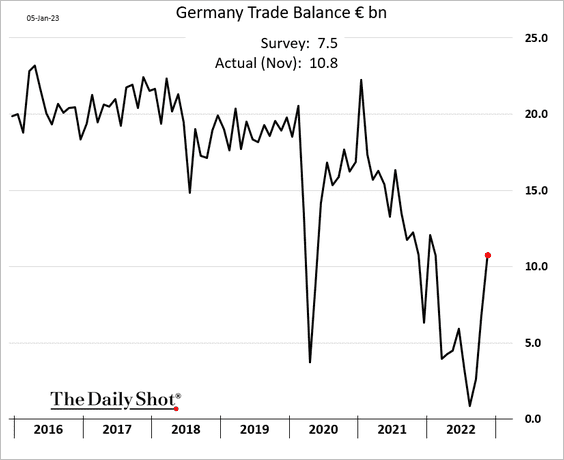

2. Germany’s imports have been falling with energy prices, …

… boosting the trade surplus.

——————–

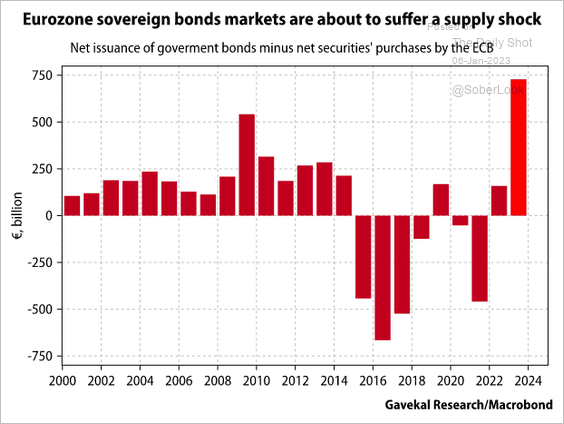

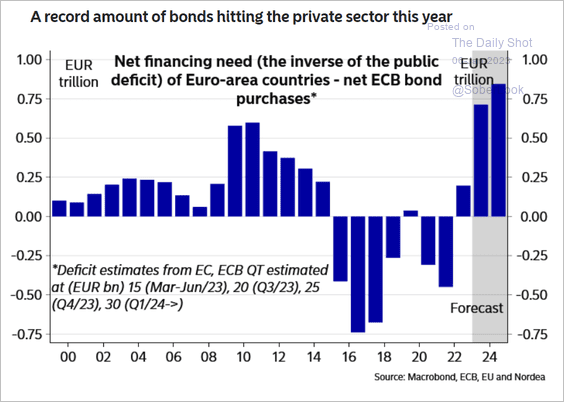

3. Sovereign bond supply will surge this year as the ECB steps back (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Japan

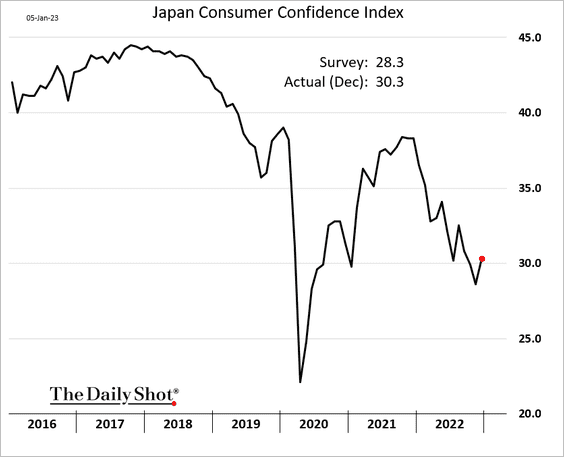

1. Consumer confidence bounced from recent lows in December.

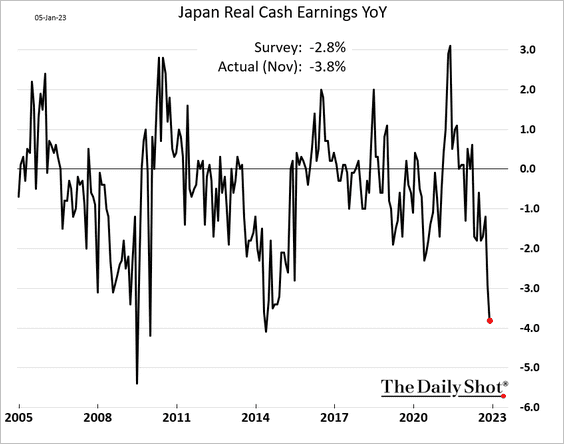

2. Real wages have fallen sharply in 2022.

Back to Index

China

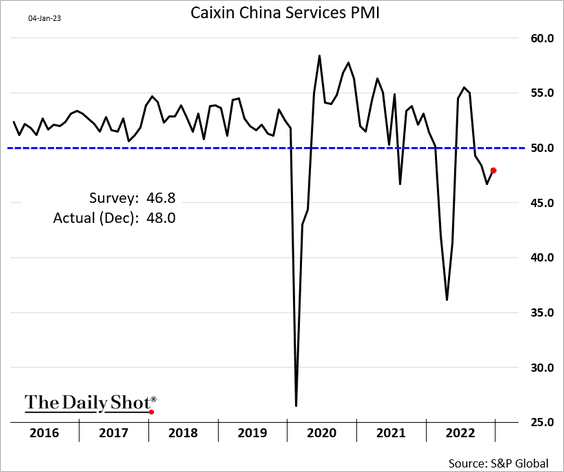

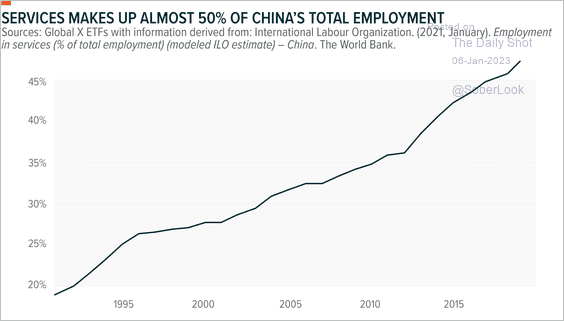

1. The S&P Global PMI indicator shows persistent weakness in China’s services sector.

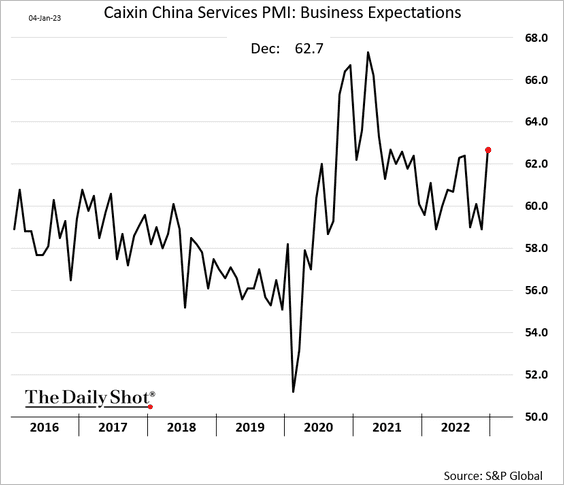

But businesses are upbeat about the future as lockdowns end.

By the way, the service sector accounts for a growing share of total employment.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

——————–

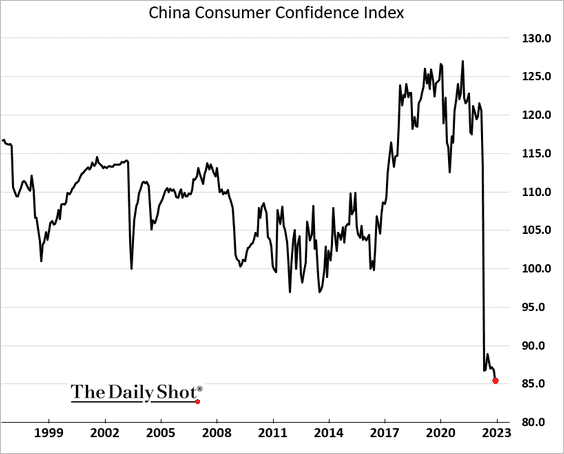

2. Consumer confidence remains depressed.

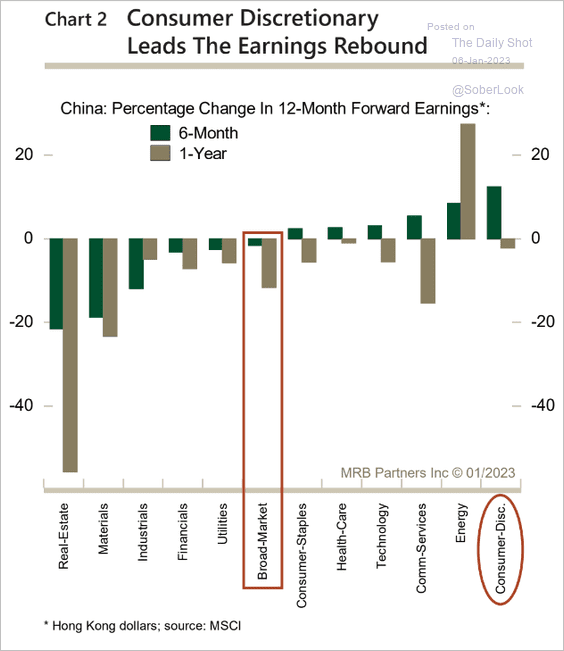

3. The Consumer Discretionary sector has seen the largest increase in 6-month forward earnings.

Source: MRB Partners

Source: MRB Partners

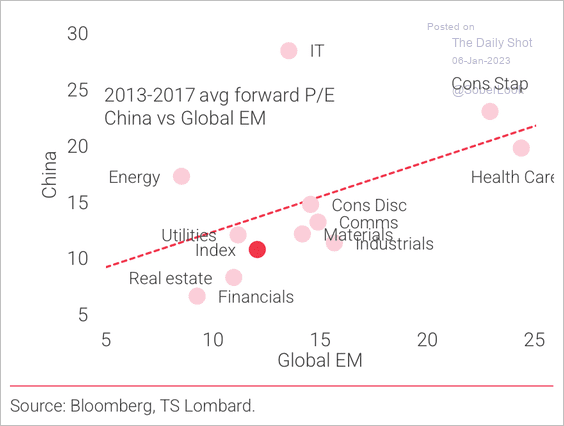

This chart shows Chinese sector valuations versus broader EM.

Source: TS Lombard

Source: TS Lombard

——————–

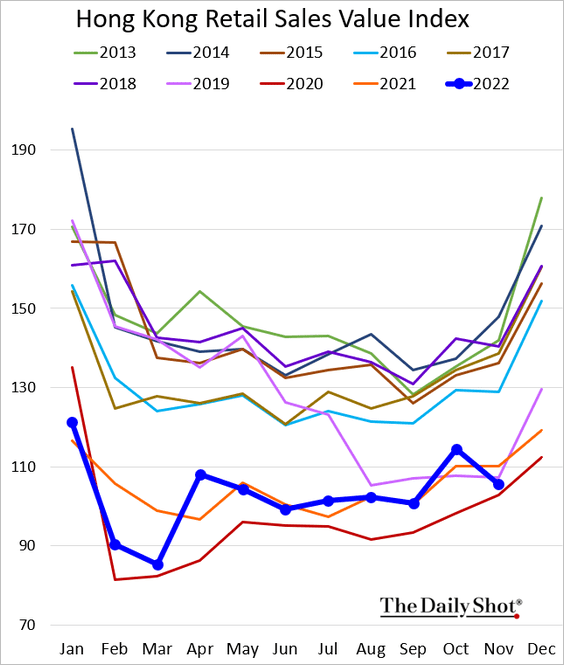

4. Hong Kong’s retail sales were soft in November.

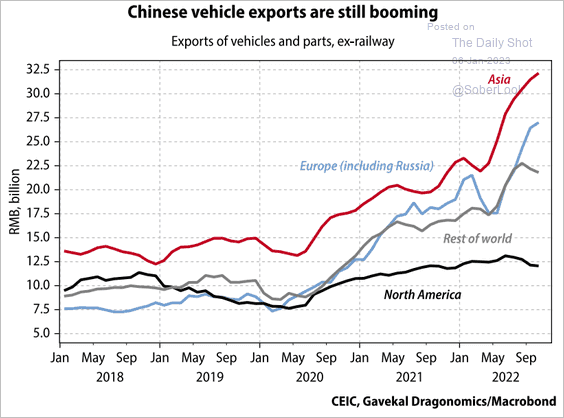

5. Vehicle exports have been booming.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

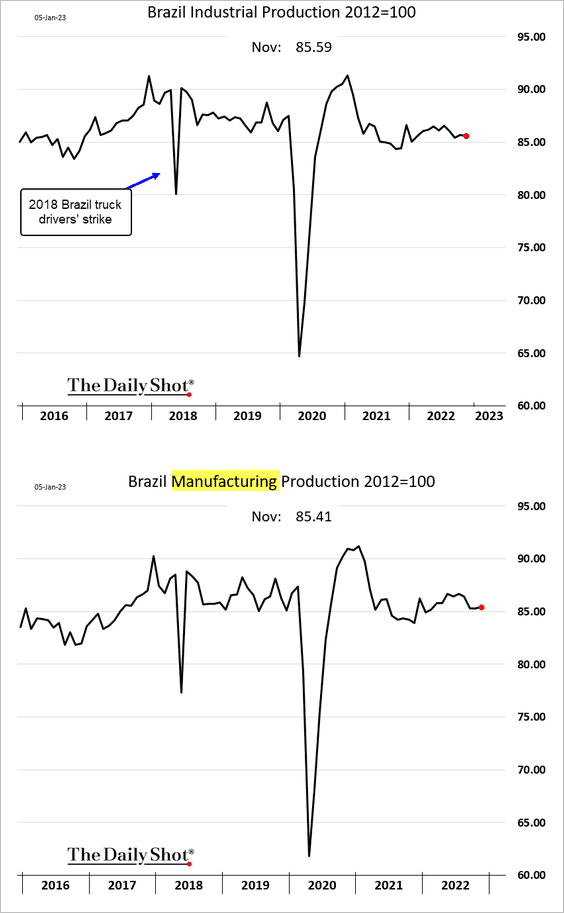

1. Brazil’s industrial production has been holding up well.

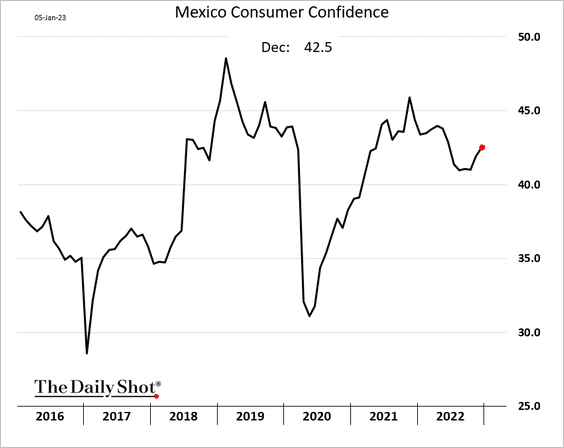

2. Mexico’s consumer confidence improved again last month.

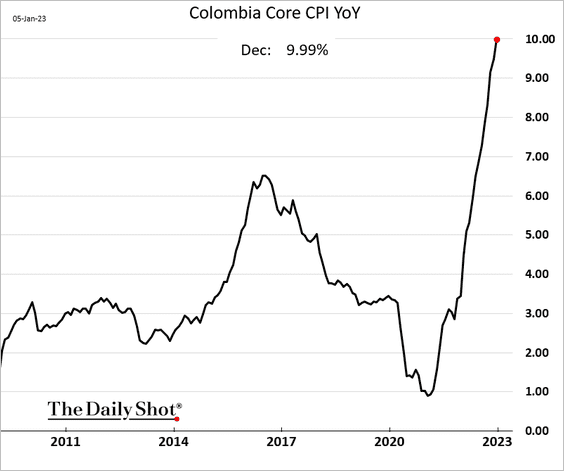

3. Colombia’s core CPI keeps rising.

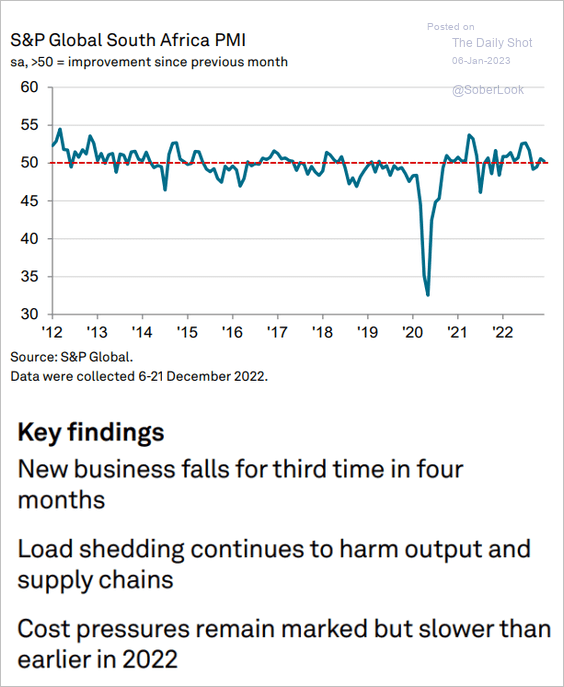

4. South Africa’s business activity has been slowing.

Source: S&P Global PMI

Source: S&P Global PMI

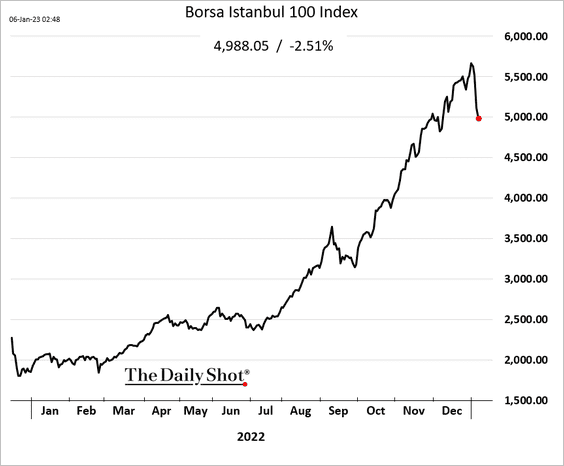

5. Turkish stocks were hit with profit-taking after reaching record highs.

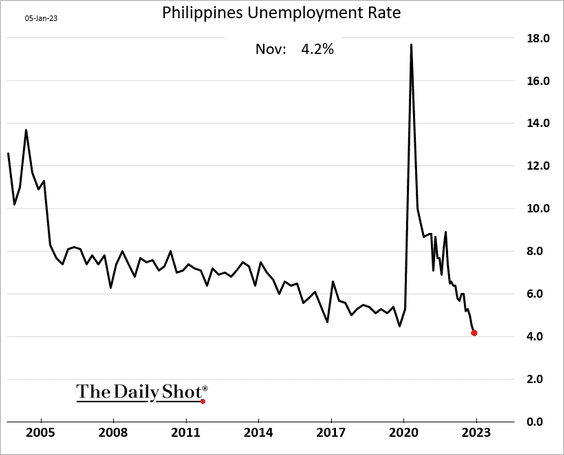

6. The Philippine unemployment rate is at multi-year lows.

Back to Index

Cryptocurrency

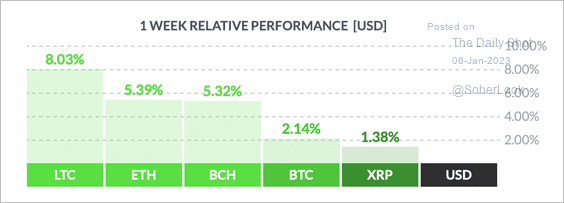

1. Cryptos had a good week, with Litecoin (LTC) outperforming other large tokens.

Source: FinViz

Source: FinViz

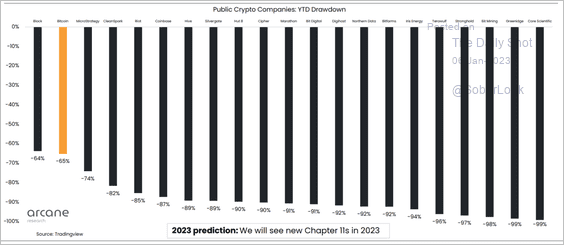

2. 2022 was a tough year for public crypto companies.

Source: @ArcaneResearch

Source: @ArcaneResearch

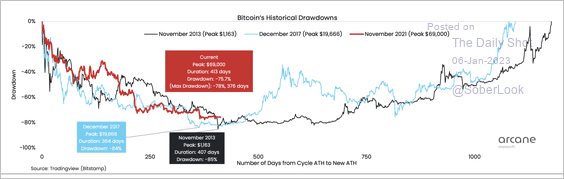

3. Bitcoin’s current drawdown resembles previous bear market cycles.

Source: @ArcaneResearch

Source: @ArcaneResearch

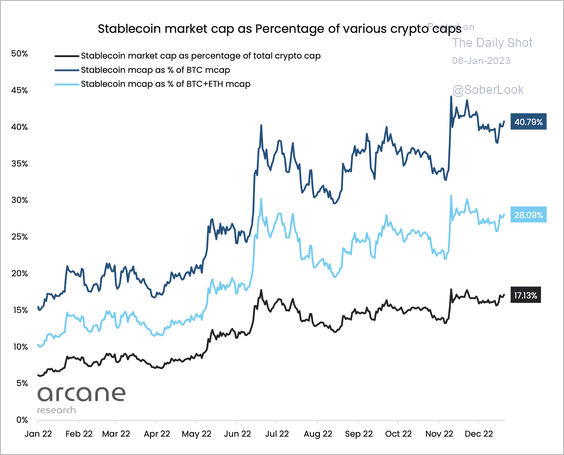

4. The total stablecoin market cap relative to bitcoin’s market cap accelerated in 2022.

Source: @ArcaneResearch

Source: @ArcaneResearch

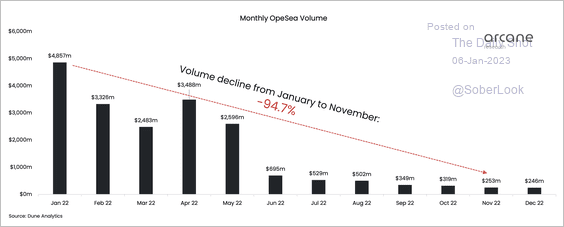

5. NFT trading volumes collapsed in 2022.

Source: @ArcaneResearch

Source: @ArcaneResearch

6. Genesis, an institutional crypto lender, is considering filing for bankruptcy.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

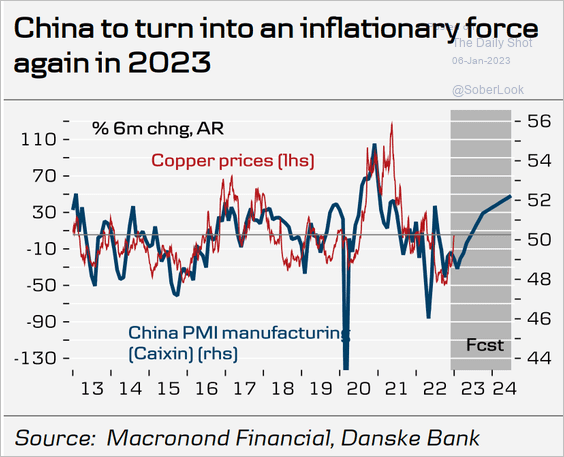

1. Will China’s reopening boost commodity prices?

Source: Danske Bank

Source: Danske Bank

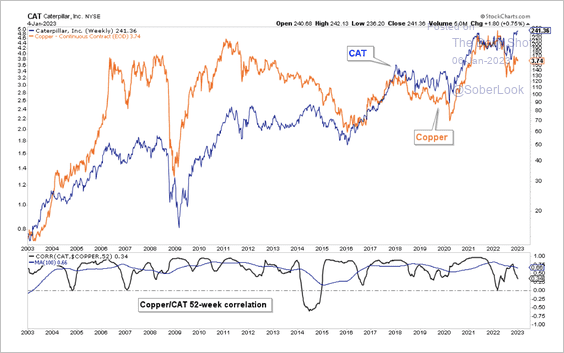

2. Caterpillar’s stock has diverged from the copper futures price.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

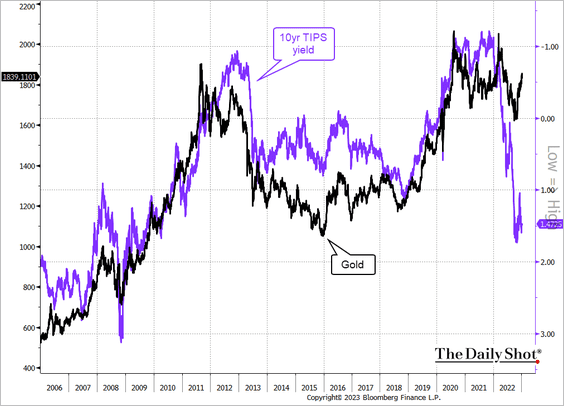

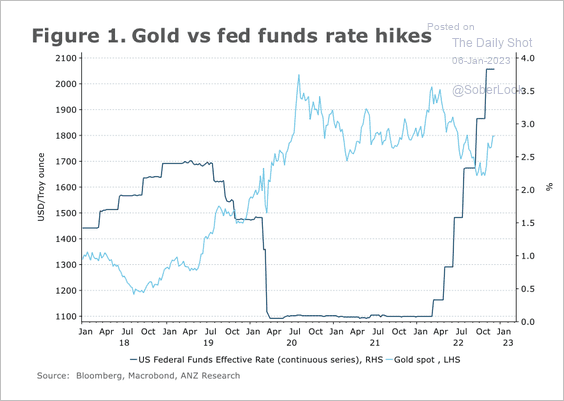

3. Elevated real rates pose downside risks for gold.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

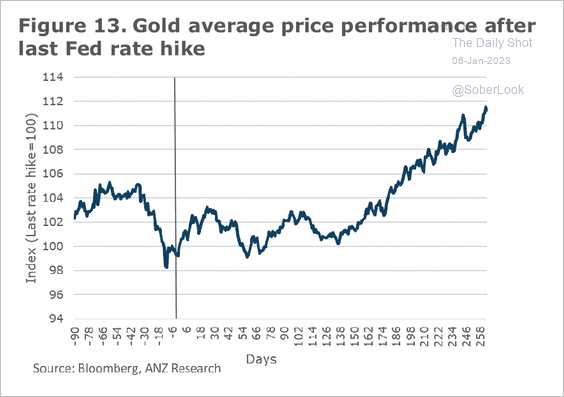

• Gold appears to be another pivot point toward the end of the Fed rate hike cycle. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

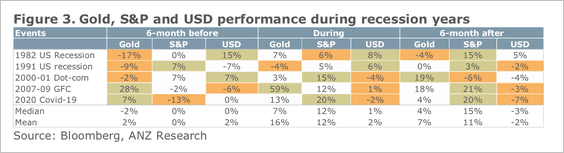

• Gold typically performs well during and after recessions.

Source: @ANZ_Research

Source: @ANZ_Research

• Gold and silver miners have been rallying.

Source: @TaviCosta

Source: @TaviCosta

Back to Index

Energy

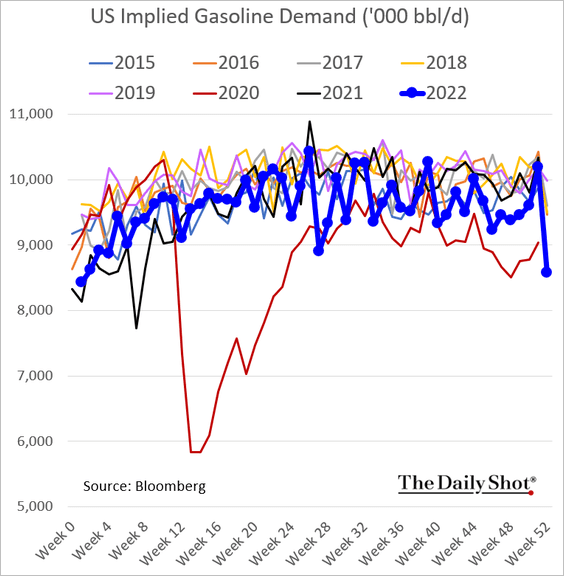

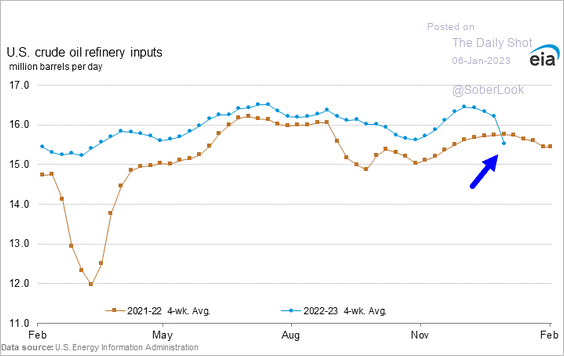

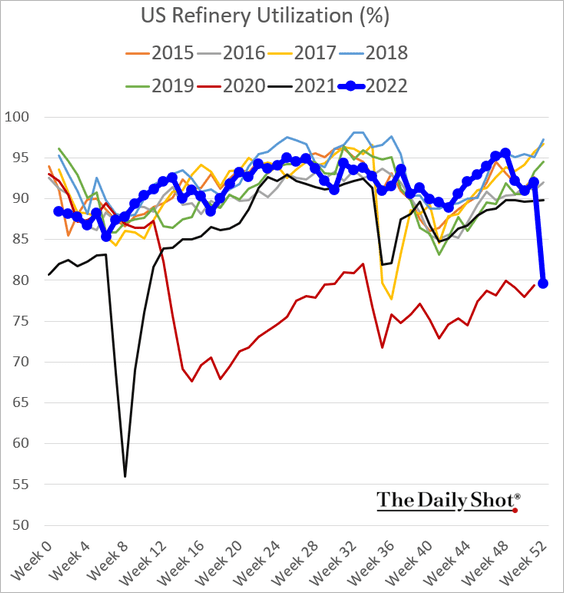

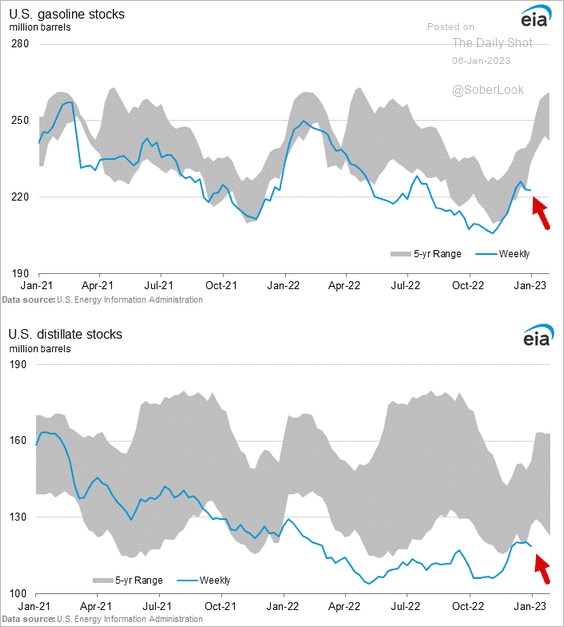

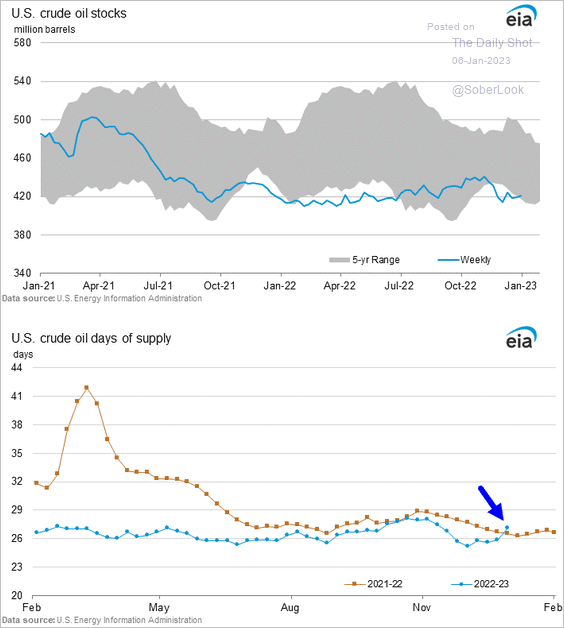

1. The pre-Christmas winter storm wreaked havoc on the US energy sector.

Source: Reuters Read full article

Source: Reuters Read full article

• Gasoline demand:

• Refinery inputs:

• Refinery utilization:

• Gasoline and distillates inventories:

Measured in days of supply, crude oil inventories climbed above last year’s level (2nd panel below).

——————–

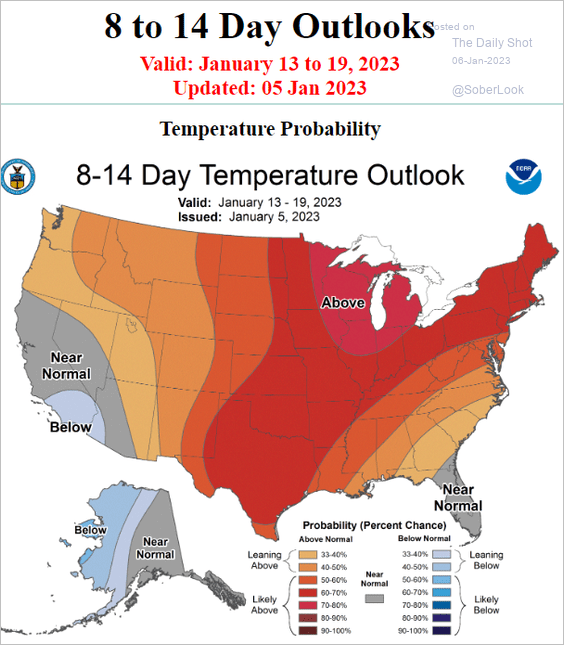

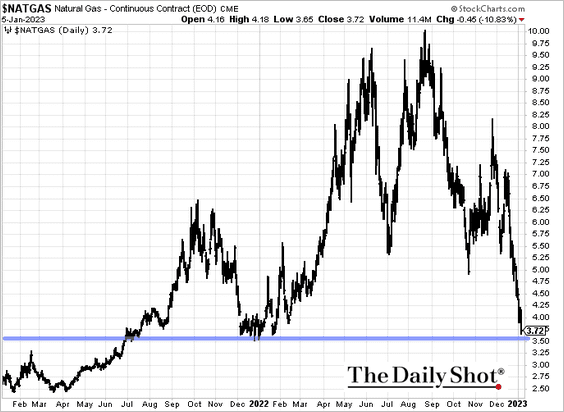

2. Warm weather continues to pressure US natural gas futures.

Source: NOAA

Source: NOAA

Back to Index

Equities

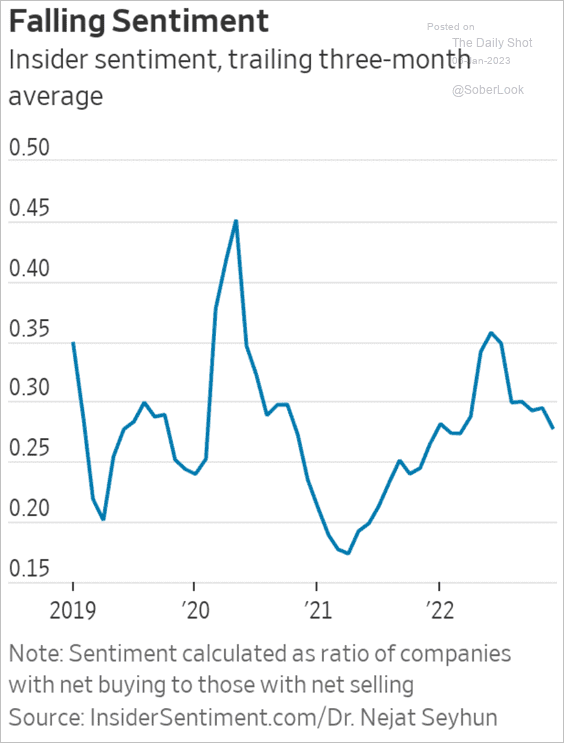

1. Insider sentiment has been deteriorating.

Source: @WSJ Read full article

Source: @WSJ Read full article

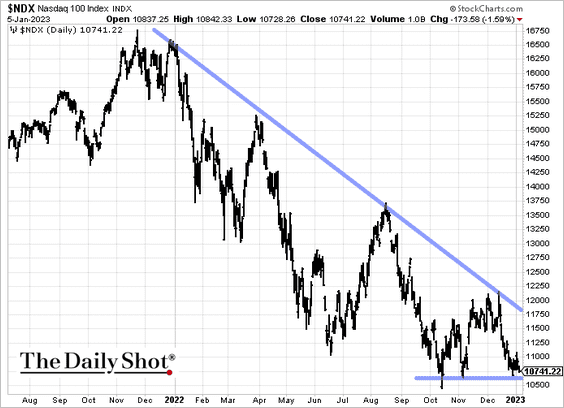

2. Decision time is coming up for the Nasdaq 100.

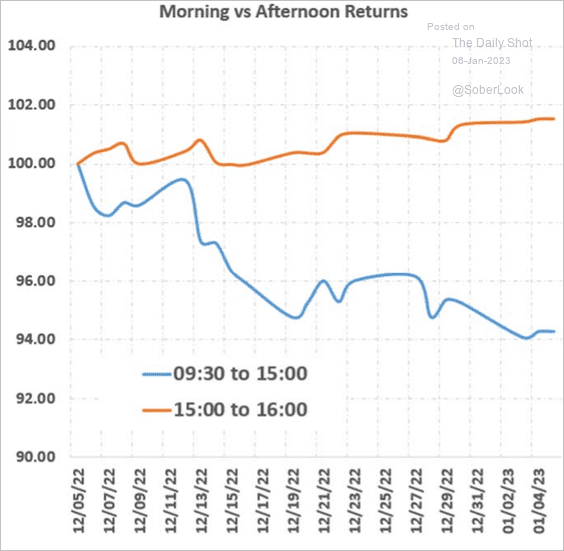

4. Mornings have been tough on stocks.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

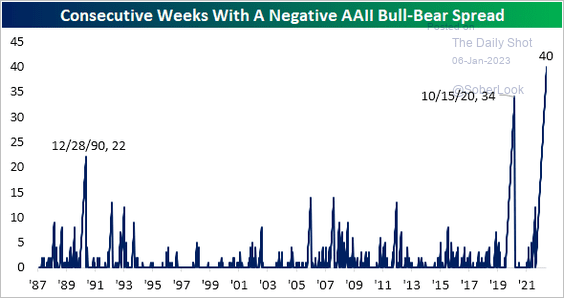

5. Investor pessimism has been persistent.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

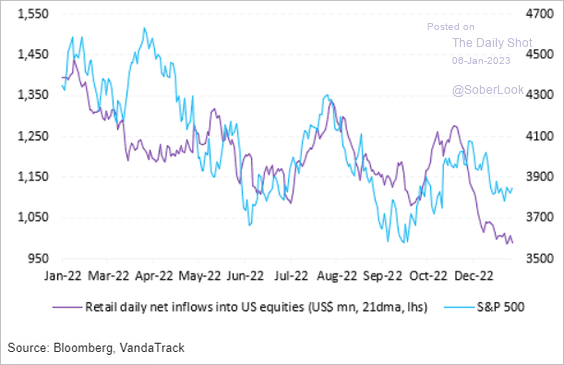

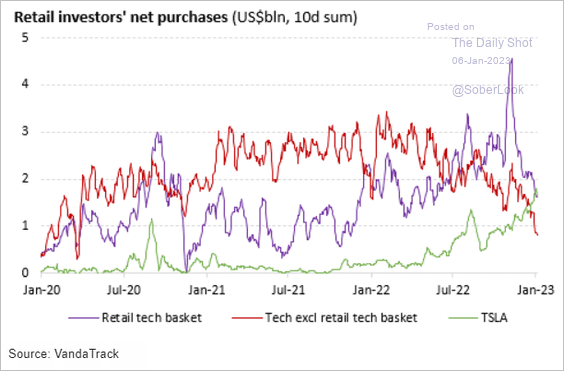

6. Retail flows have been weakening.

Source: Vanda Research

Source: Vanda Research

This chart shows investor purchases of tech stocks and Tesla.

Source: Vanda Research

Source: Vanda Research

——————–

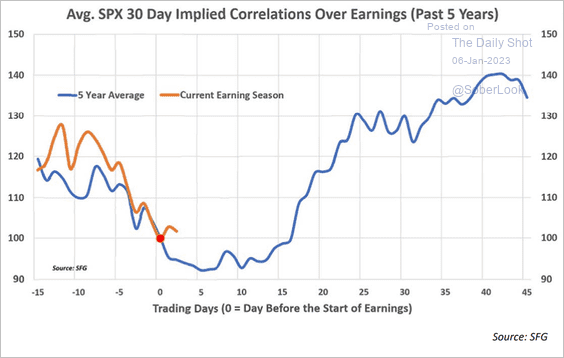

7. Stock correlations tend to drop going into earnings season.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

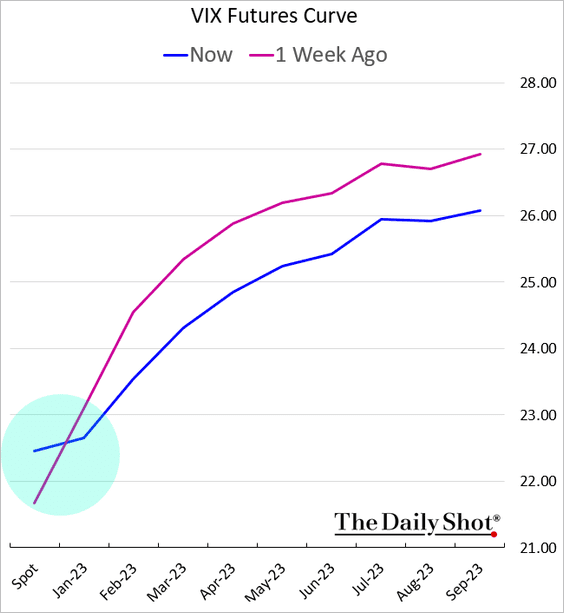

8. VIX is up, but the rest of the vol curve has moved lower.

h/t Chris Murphy, Susquehanna International Group

h/t Chris Murphy, Susquehanna International Group

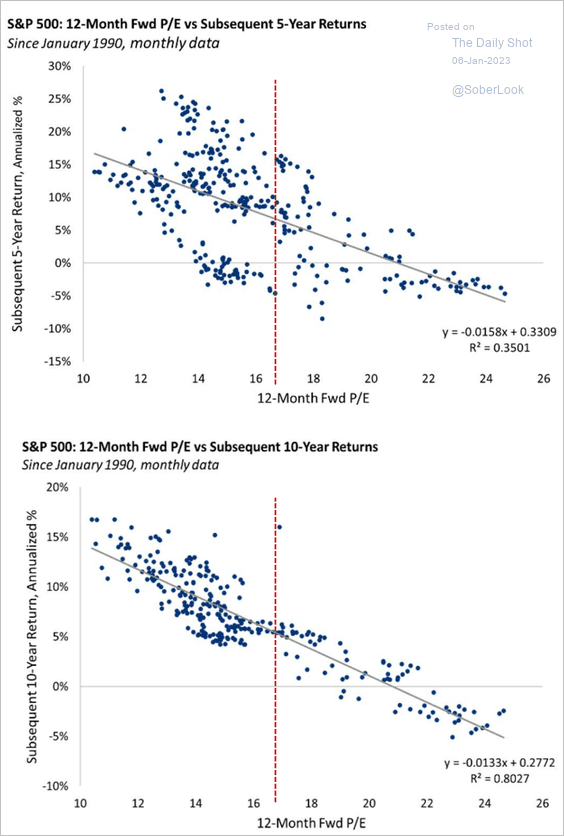

9. What returns should we expect over the next 5 and 10 years, given the current S&P 500 valuation (PE ~16.6x)?

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

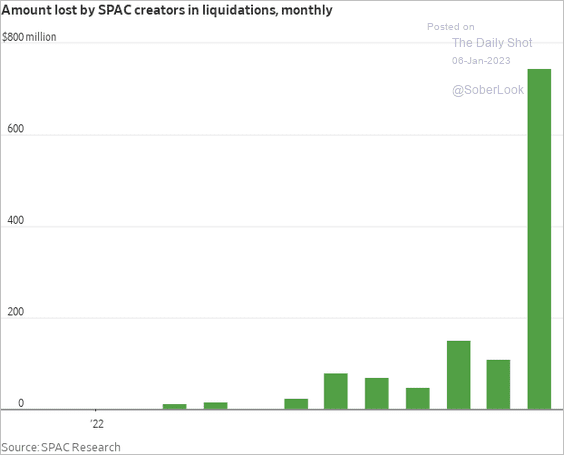

10. Unable to consummate acquisitions, many SPAC managers were forced to liquidate.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

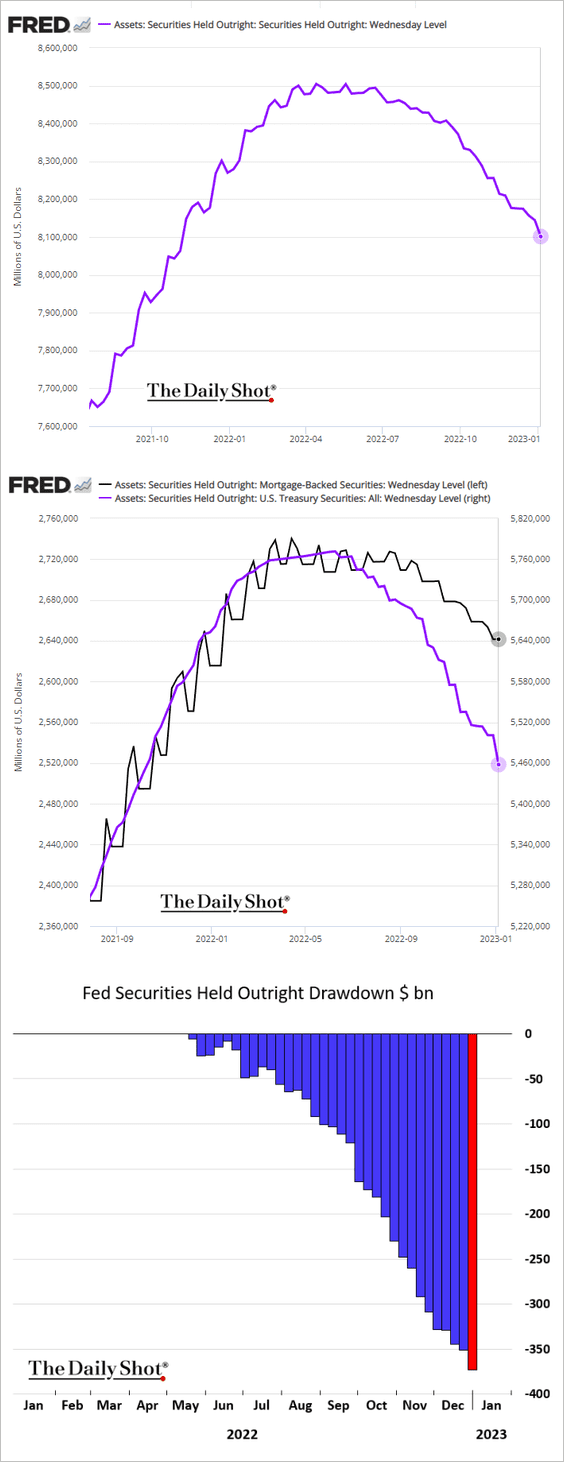

1. The Fed’s quantitative tightening has picked up momentum. But the MBS portfolio unwind has been slow due to collapsed mortgage refi activity.

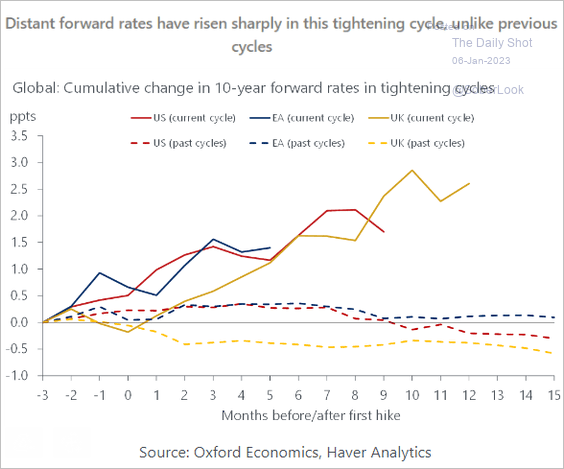

2. Market projections for short-term rates ten years out have risen sharply in this cycle. The market expects advanced economies to “face a persistently higher neutral level of interest rates in this decade than during the pre-pandemic period,” according to Oxford Economics. That means persistently higher central bank policy rates.

Source: Oxford Economics

Source: Oxford Economics

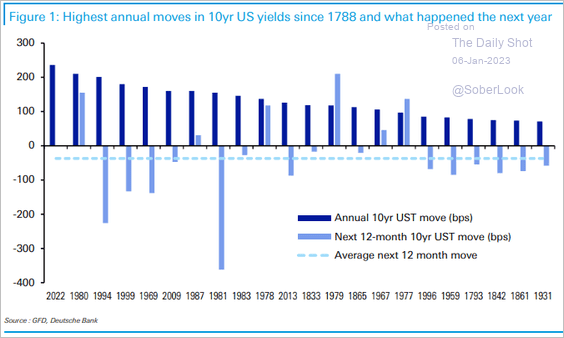

3. 2022 saw the largest increase in the 10-year Treasury yield since 1788. Historically, yields decline after a large annual rise.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

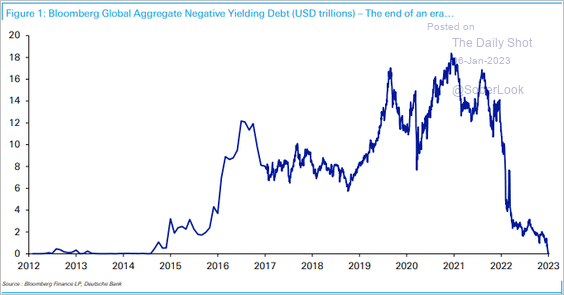

4. The era of negative yields is over.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

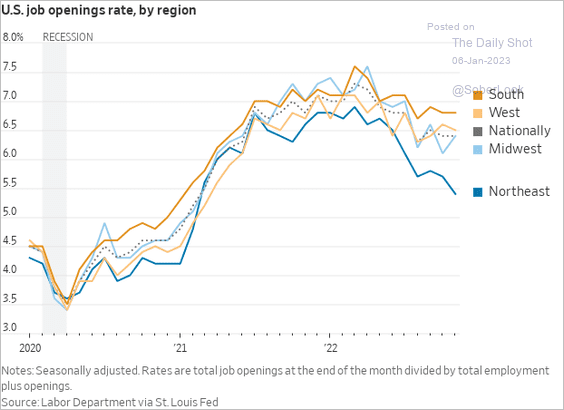

1. US job openings rate by region:

Source: @WSJ Read full article

Source: @WSJ Read full article

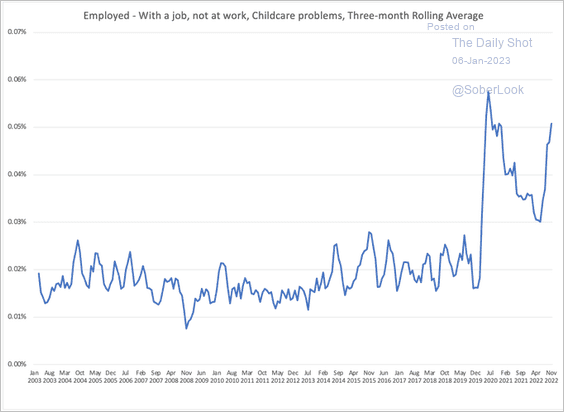

2. Not at work due to childcare issues:

Source: @keds_economist

Source: @keds_economist

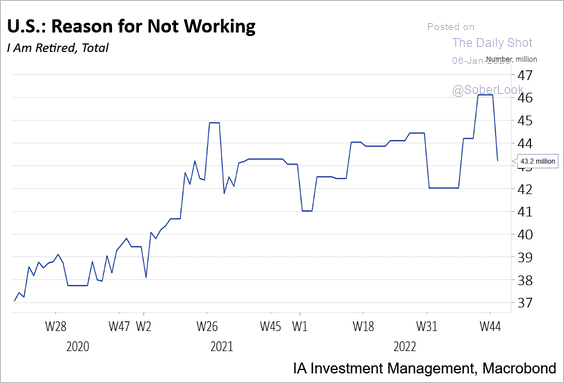

• Not working due to retirement:

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

——————–

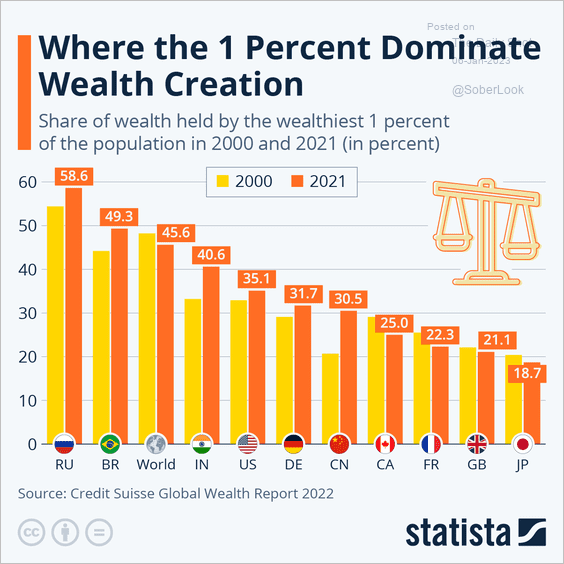

3. Share of wealth held by the top 1%:

Source: Statista

Source: Statista

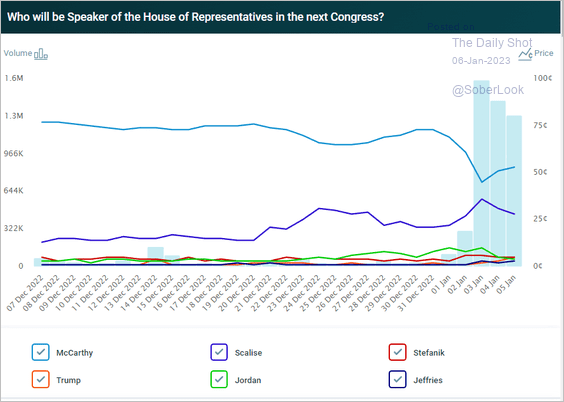

4. The next Speaker of the House, according to the betting markets:

Source: @PredictIt

Source: @PredictIt

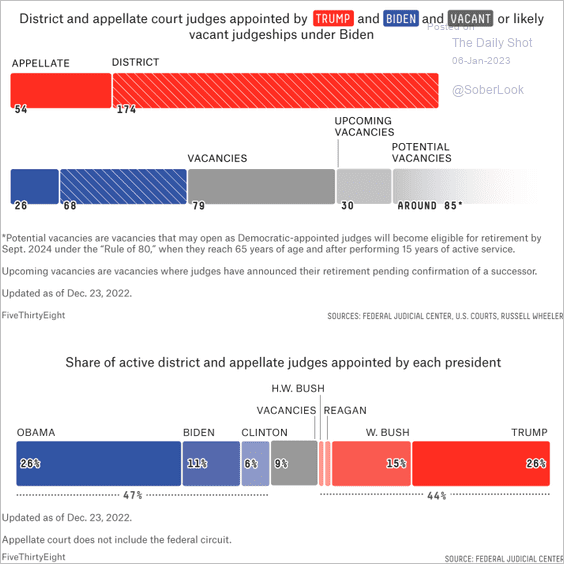

5. Appointments of district and appellate court judges:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

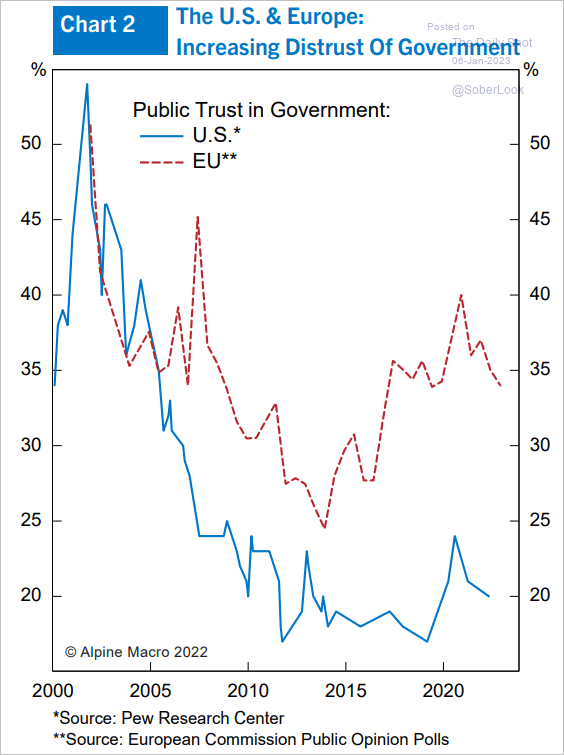

6. Public trust in government:

Source: Alpine Macro

Source: Alpine Macro

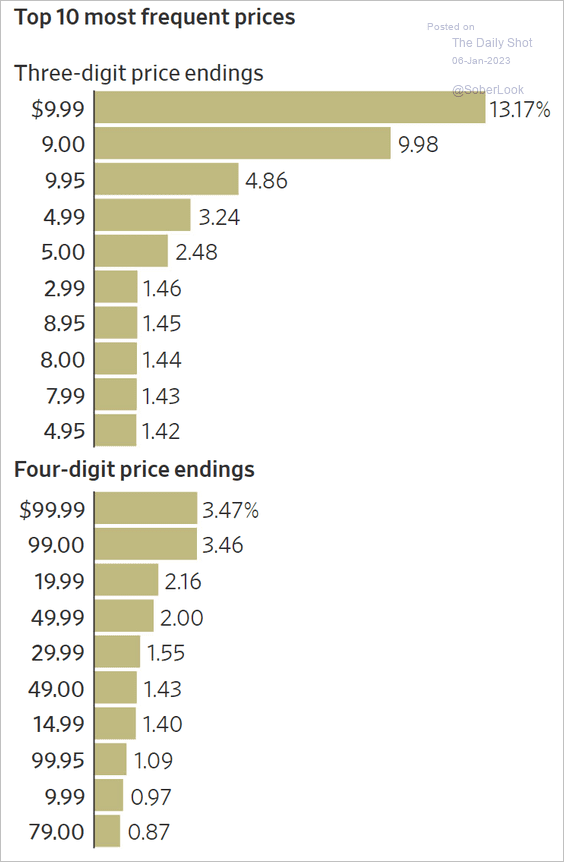

7. Most frequent store prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Have a great weekend!

Back to Index