The Daily Shot: 11-Jan-23

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

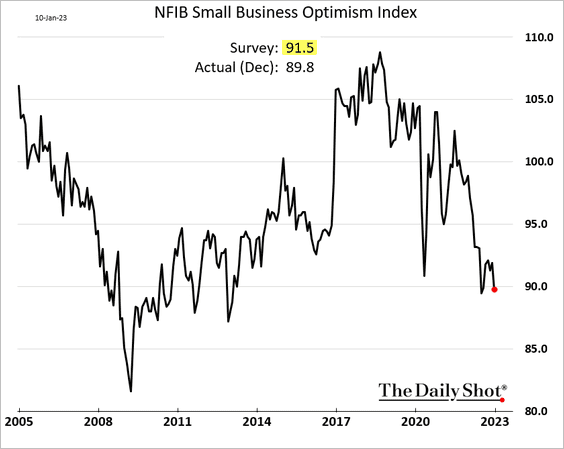

1. The NFIB small business index surprised to the downside in December.

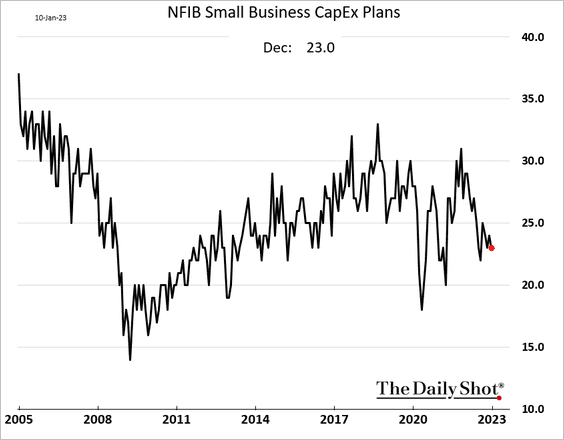

• CapEx plans are trending lower.

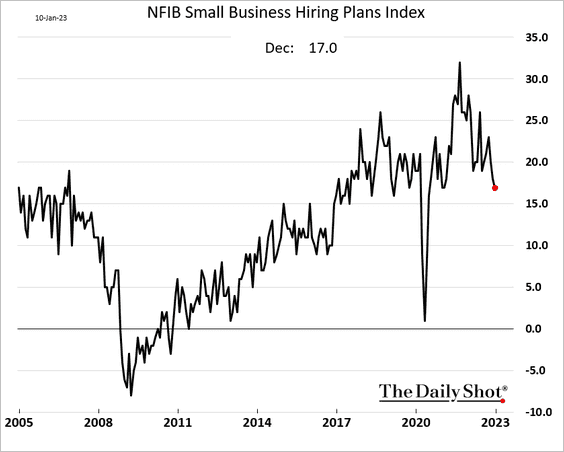

• Hiring plans sank further.

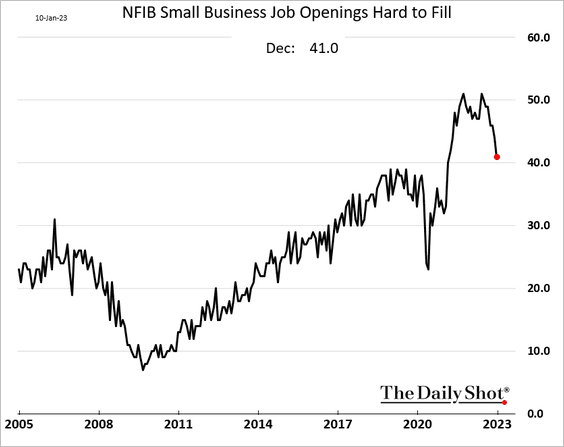

• Fewer firms had trouble filling job openings.

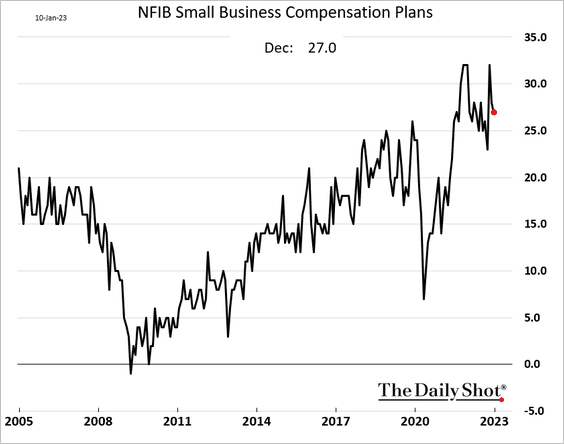

• The percentage of small businesses planning to boost compensation remains elevated.

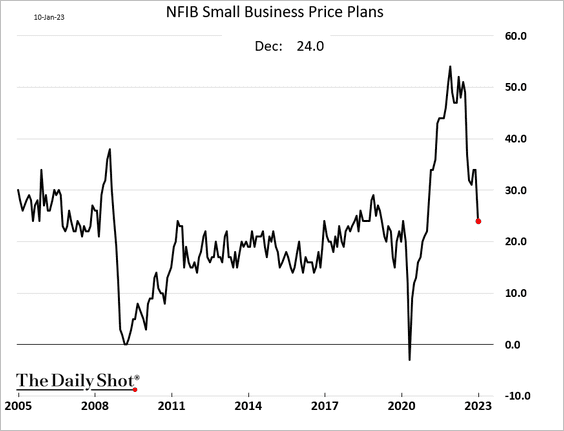

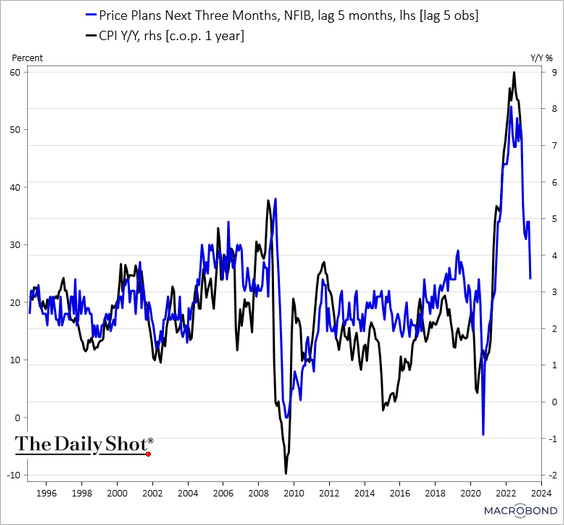

• The share of companies planning to increase prices is tumbling.

——————–

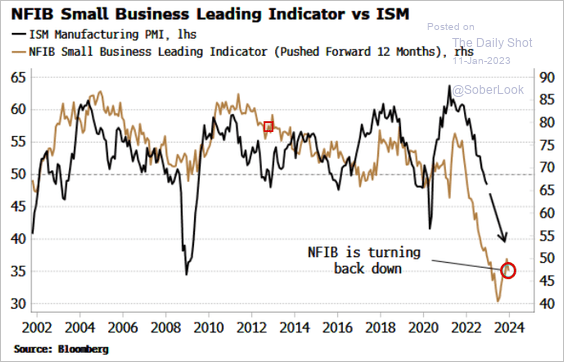

2. The NFIB report points to further weakness in US manufacturing activity, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

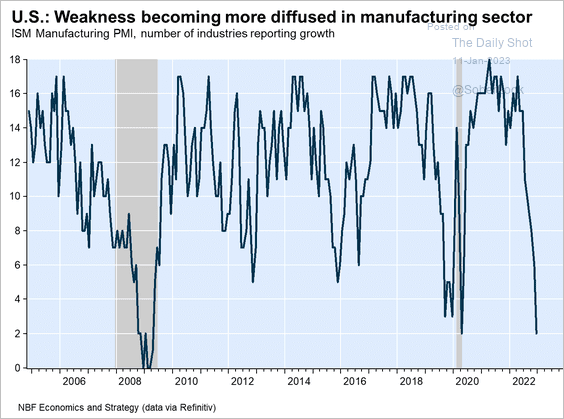

… as fewer industries experience growth, …

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

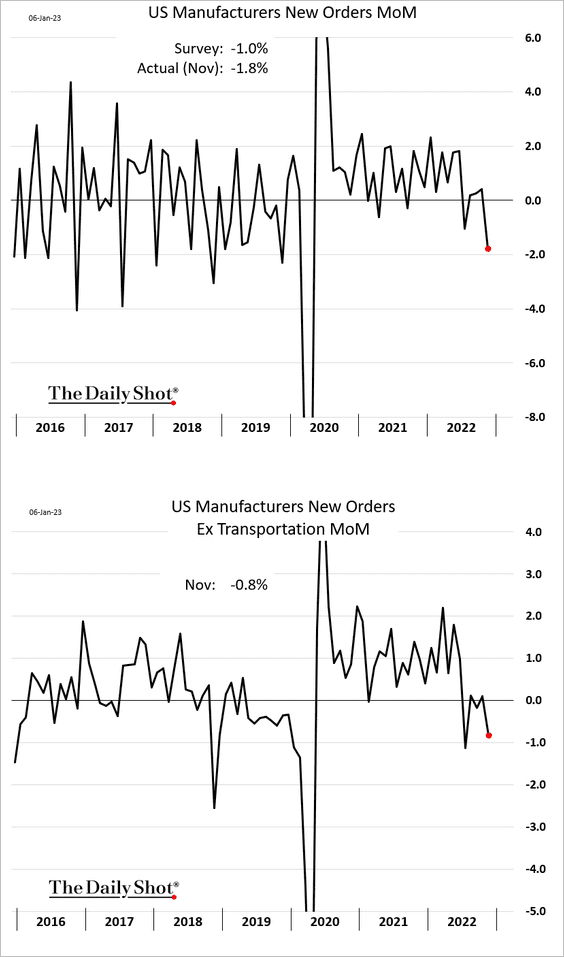

… and factory orders slow.

——————–

3. Next, we have some updates on inflation.

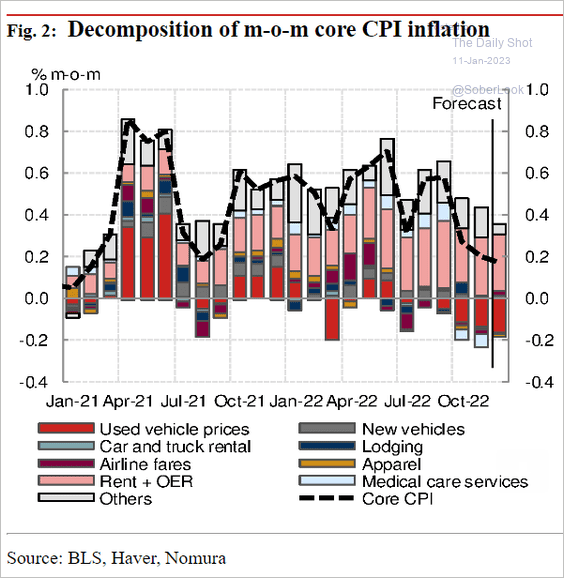

• Nomura expects a softer core CPI print for December, …

Source: Nomura Securities

Source: Nomura Securities

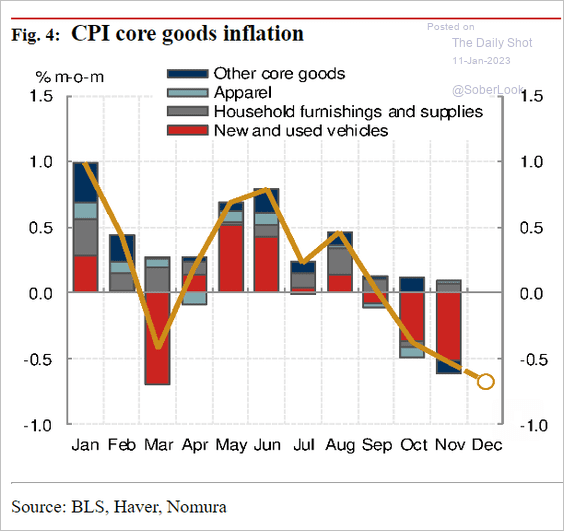

… dragged lower by core goods.

Source: Nomura Securities

Source: Nomura Securities

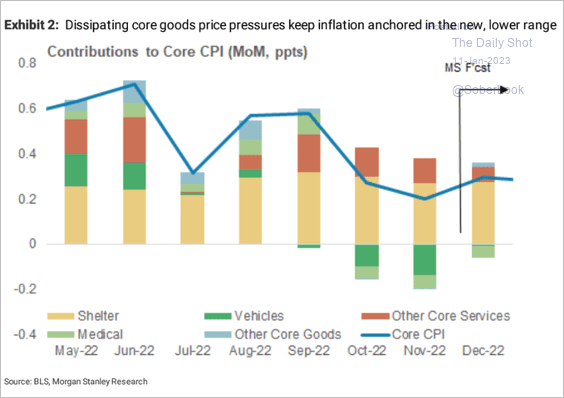

– Morgan Stanley, on the rather hand, sees an increase (similar to consensus).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• The NFIB price expectations index (above) points to rapid moderation in the CPI this year. Below are some additional indications.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

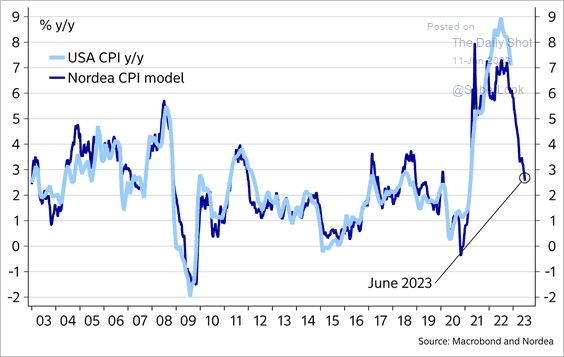

– Nordea’s CPI model:

Source: @MikaelSarwe

Source: @MikaelSarwe

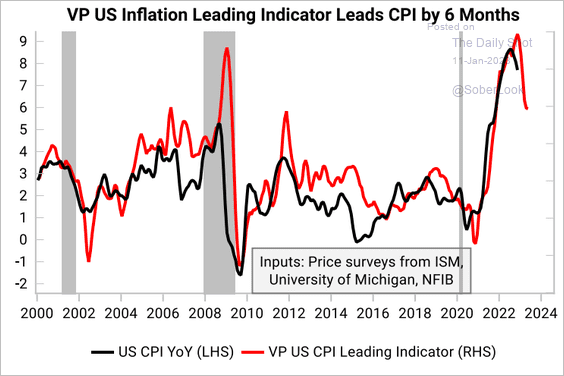

– Variant Perception’s model:

Source: Variant Perception

Source: Variant Perception

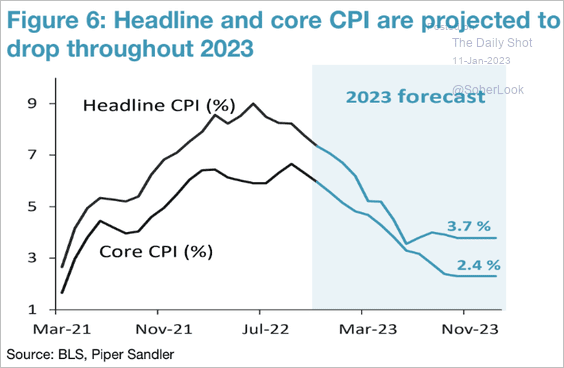

– Forecast from Piper Sandler:

Source: Piper Sandler

Source: Piper Sandler

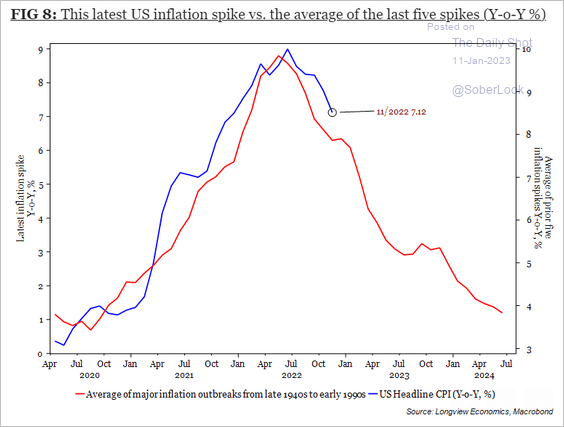

• Here is how the current CPI trend compares to previous spikes.

Source: Longview Economics

Source: Longview Economics

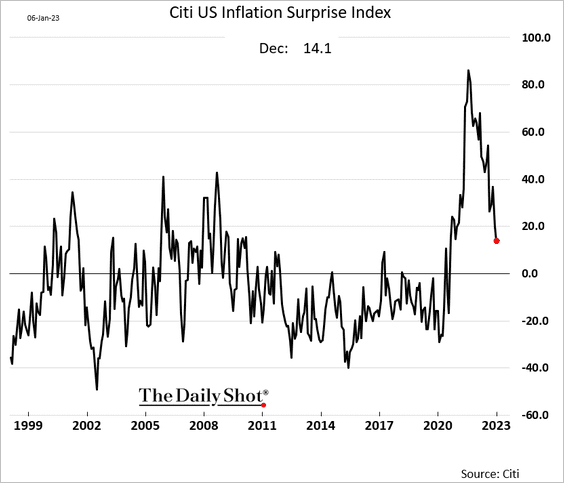

• Inflation reports have been surprising to the downside.

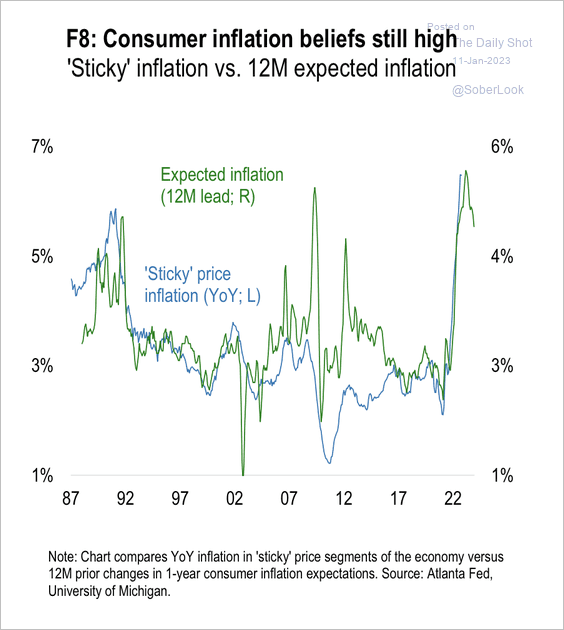

• The decline in sticky inflation could come at a lag.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

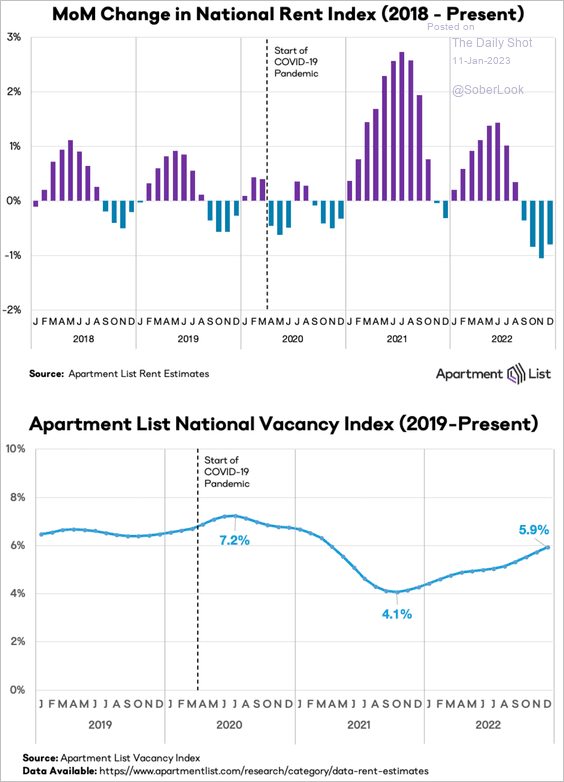

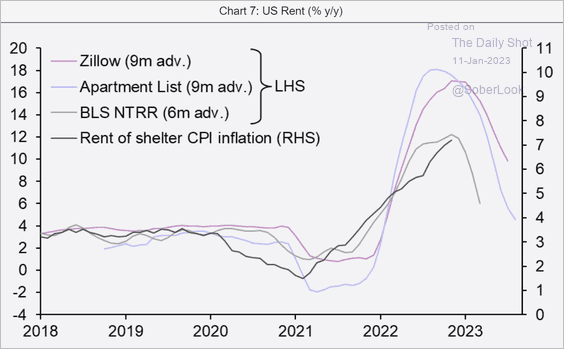

• Rent inflation continues to ease (2 charts).

Source: Apartment List

Source: Apartment List

Source: Capital Economics

Source: Capital Economics

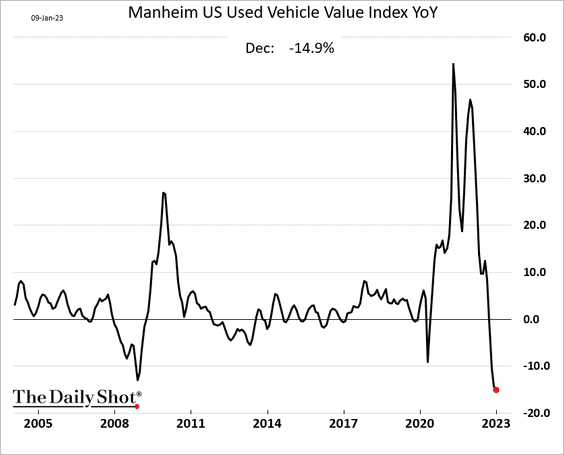

• Wholesale used vehicle prices are down almost 15% from a year ago.

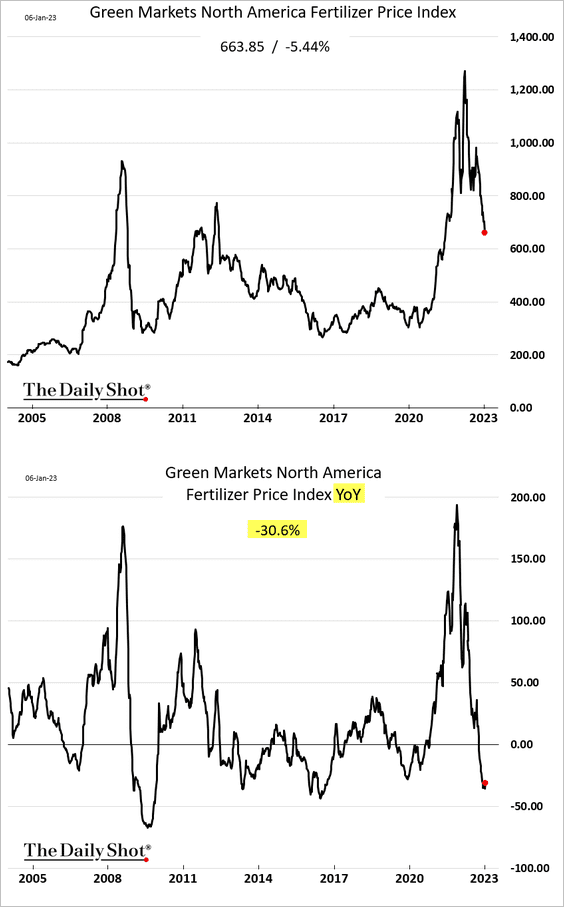

• Weaker fertilizer prices signal lower food inflation ahead.

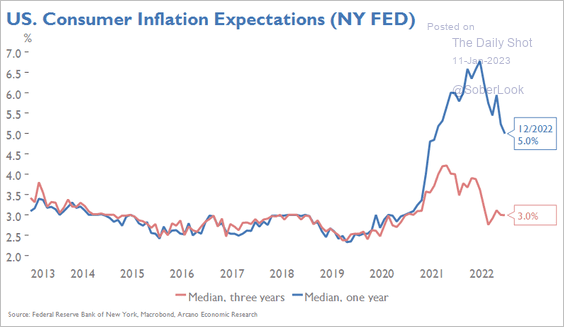

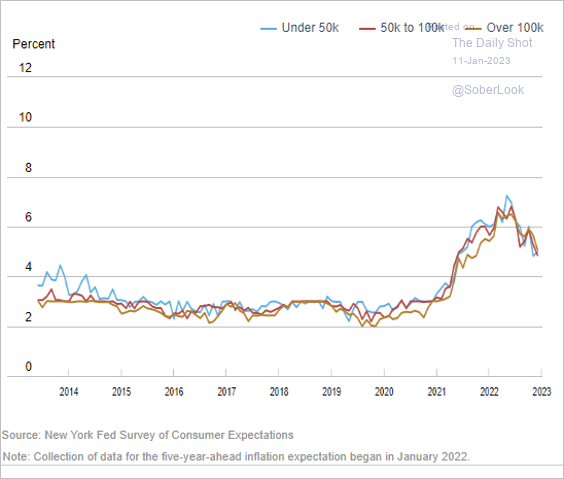

• Consumer inflation expectations have been easing, …

Source: Arcano Economics

Source: Arcano Economics

… with remarkably similar trends across income categories.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

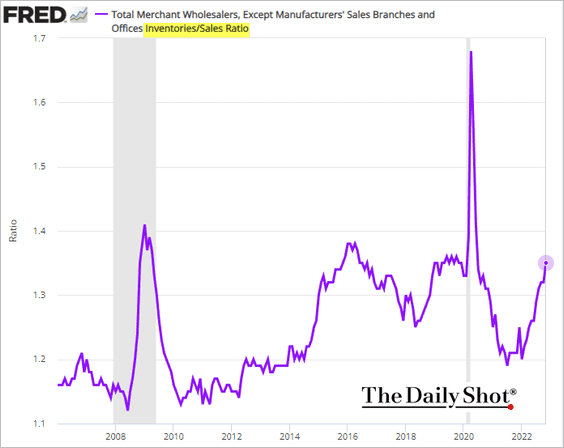

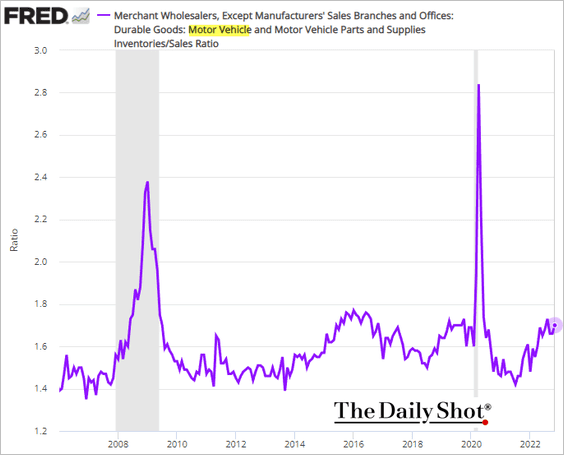

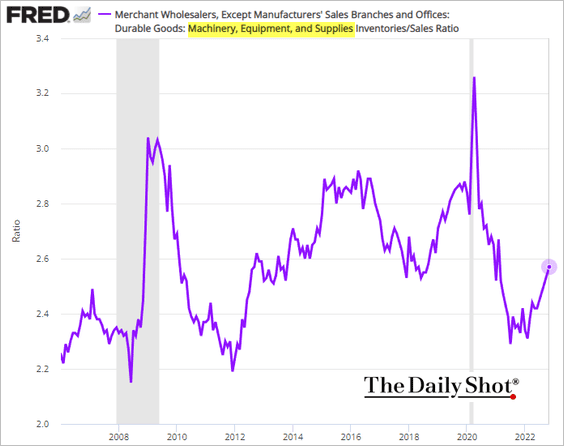

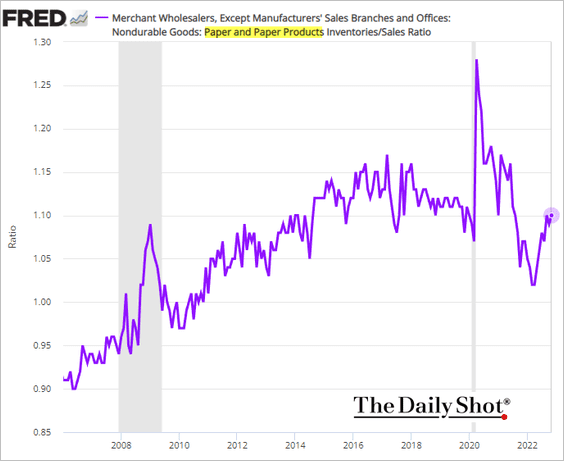

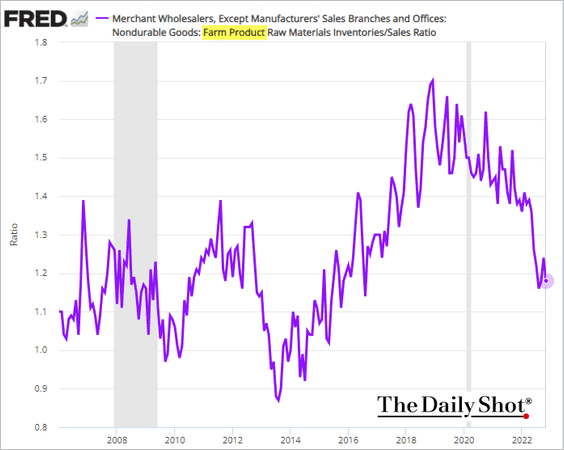

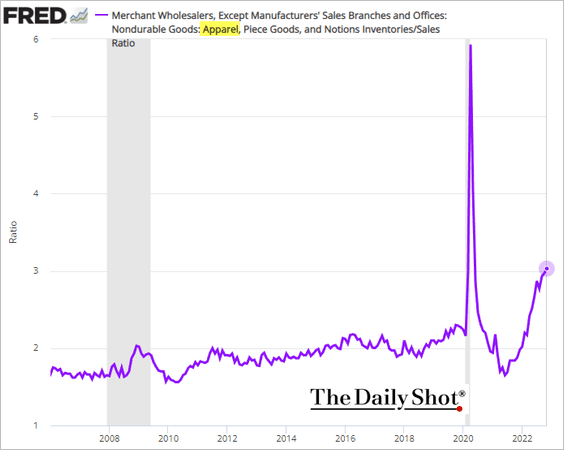

4. The inventories-to-sales ratio continues to rise.

Source: Reuters Read full article

Source: Reuters Read full article

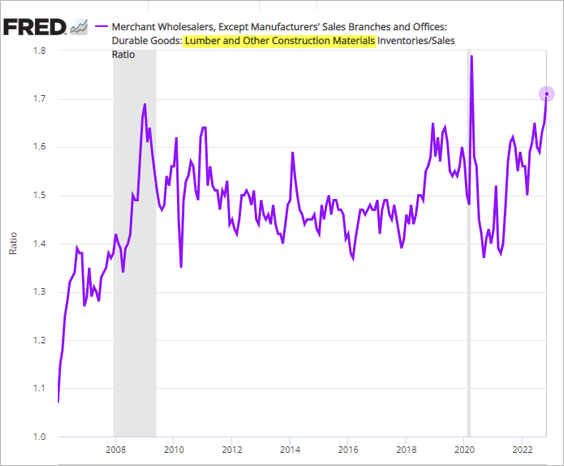

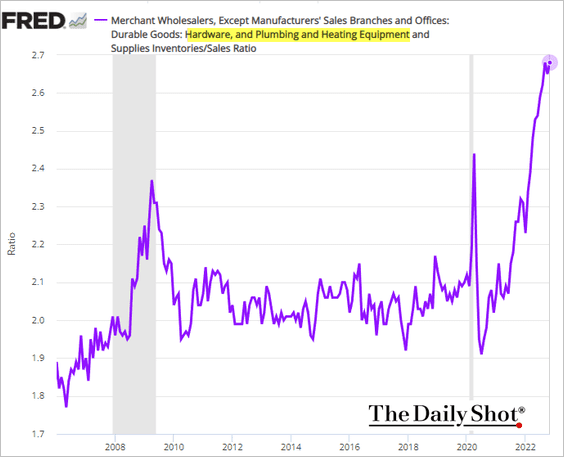

Below are some inventories-to-sales trends by sector.

• Housing-related:

– Lumber/construction materials:

– Hardware and plumbing/heating equipment:

• Vehicles:

• Machinery/equipment:

• Paper (no more toilet paper shortages?):

• Farm product:

• Apparel:

——————–

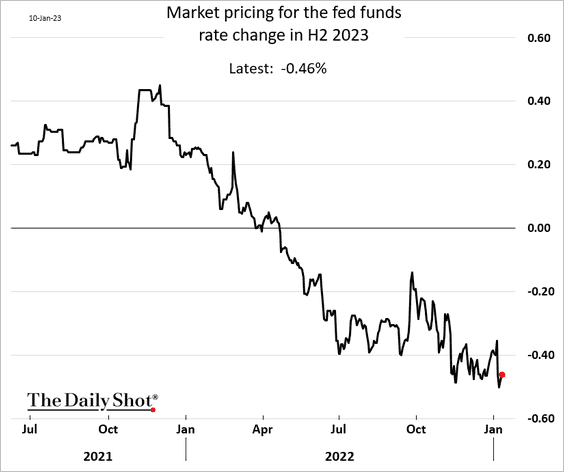

5. The market expects some 50 bps of Fed rate cuts in the second half of this year.

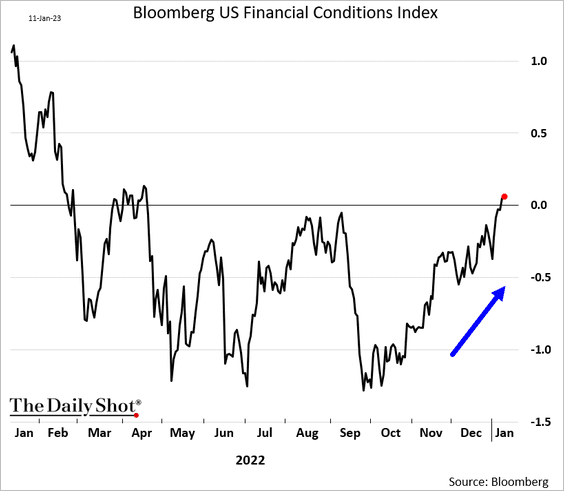

• Easing financial conditions is not what the Fed wants to see now.

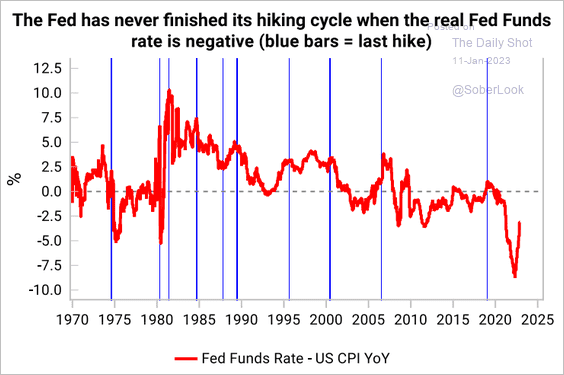

• The Fed has never completed its hiking cycle while the real fed funds rate was negative.

Source: Variant Perception

Source: Variant Perception

Back to Index

Canada

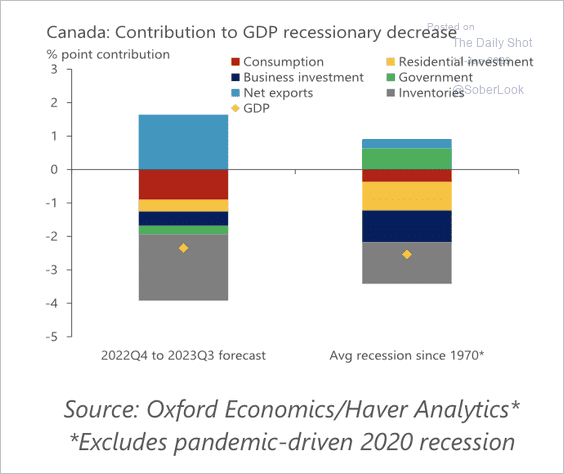

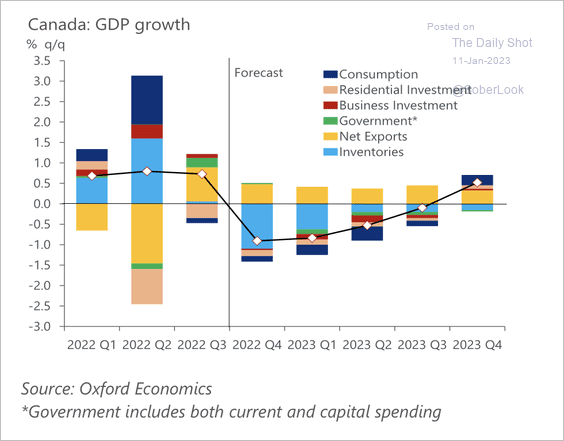

1. Oxford Economics expects the depth of this year’s recession to be similar to the average downturn.

Source: Oxford Economics

Source: Oxford Economics

Consumption, housing, and slowing inventories could drive this recession.

Source: Oxford Economics

Source: Oxford Economics

——————–

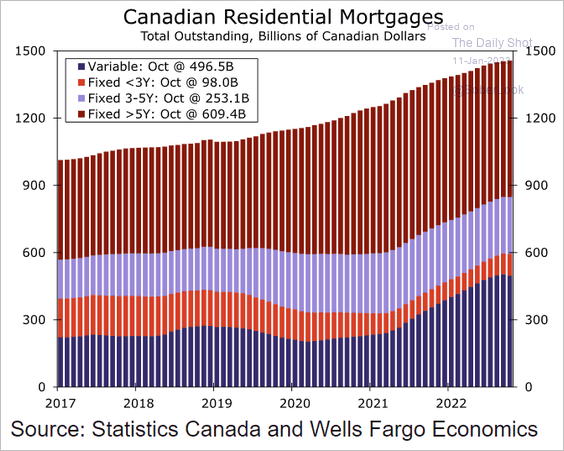

2. Resetting mortgages will sharply boost homeowners’ payments over the next few years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

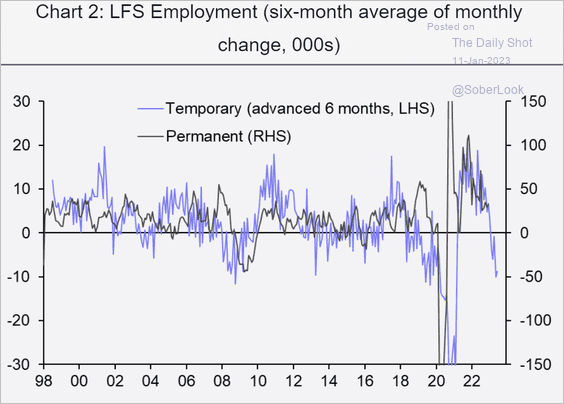

3. Soft temp employment signals weakness in permanent employment in the months ahead.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

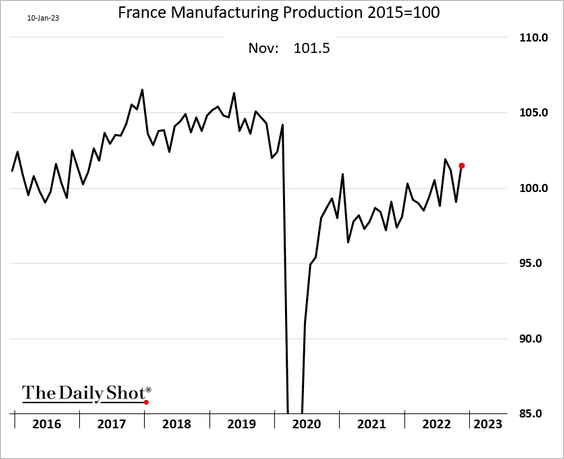

1. French manufacturing output has been holding up despite weakness in the PMI data.

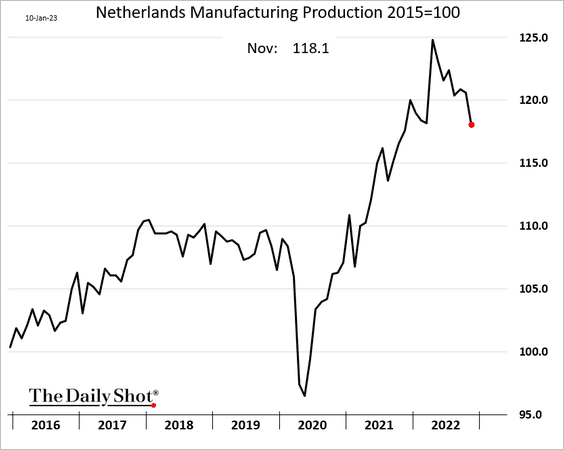

Dutch manufacturing production is rapidly coming off the highs.

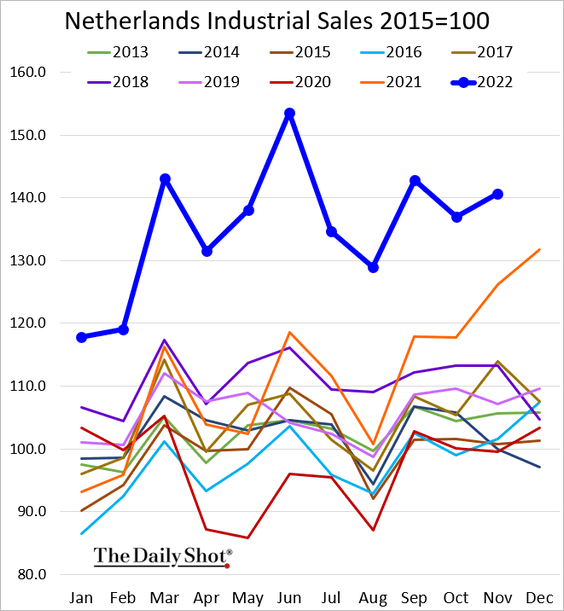

But industrial sales remain strong.

——————–

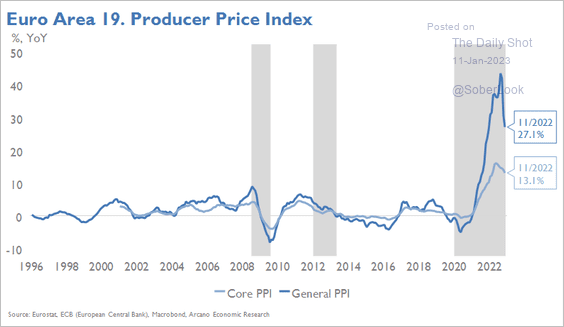

2. Gains in producer prices have been slowing.

Source: Arcano Economics

Source: Arcano Economics

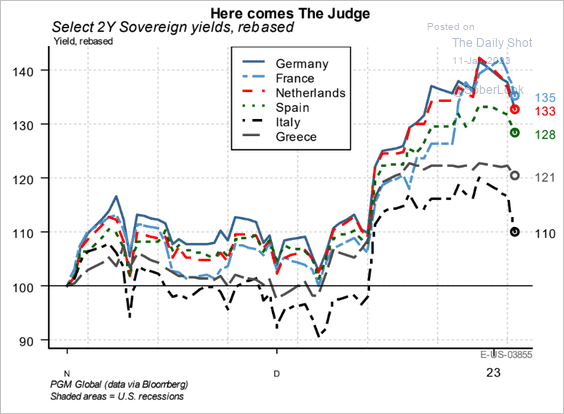

3. Short-term yields appear to have peaked.

Source: PGM Global

Source: PGM Global

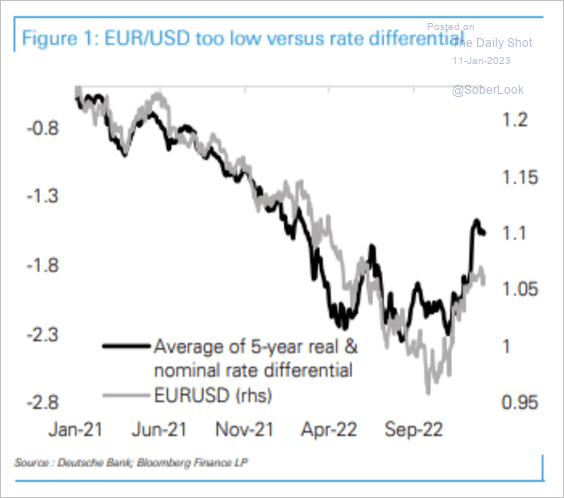

4. Rate differentials indicate a fair value for EUR/USD above 1.10, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

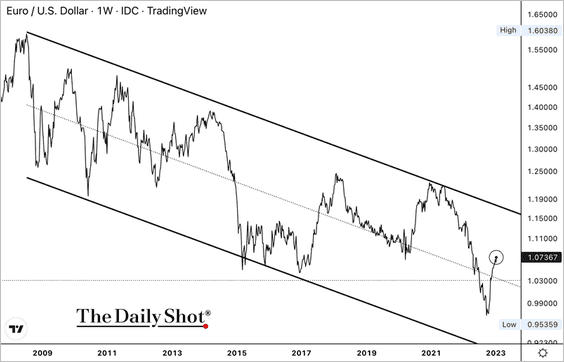

• This chart shows EUR/USD’s long-term downtrend channel. There is strong resistance around 1.15.

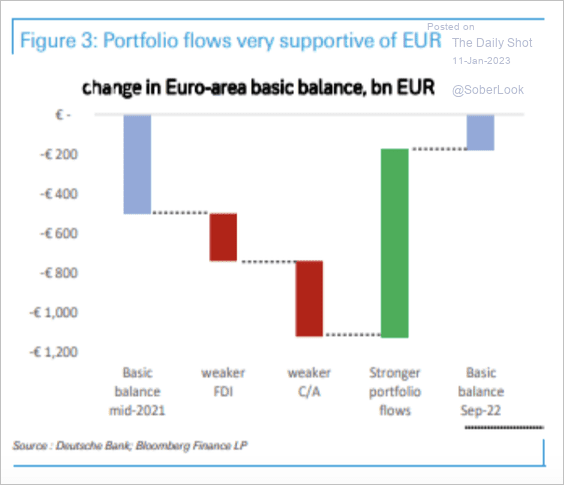

• The euro has benefitted from strong portfolio flows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

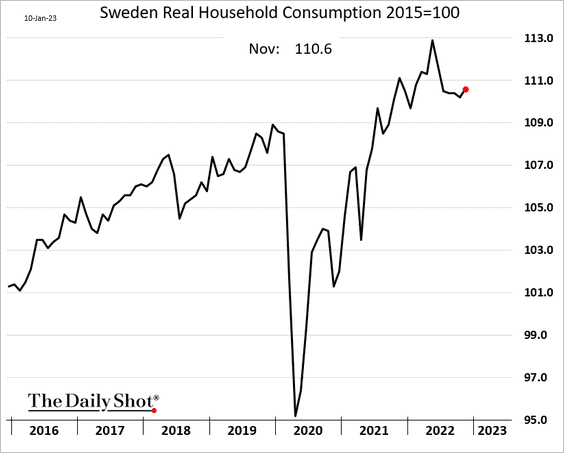

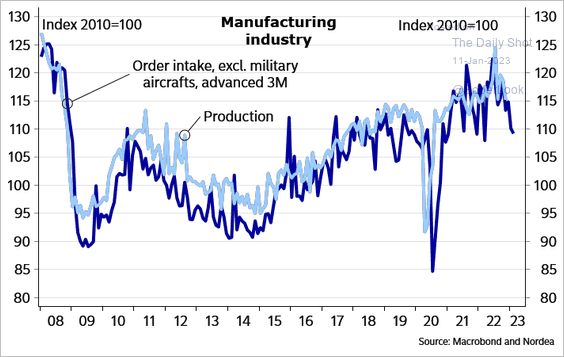

1. Sweden’s household consumption improved last month.

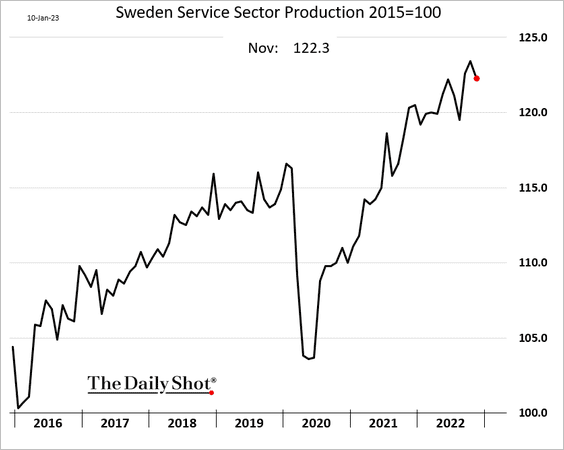

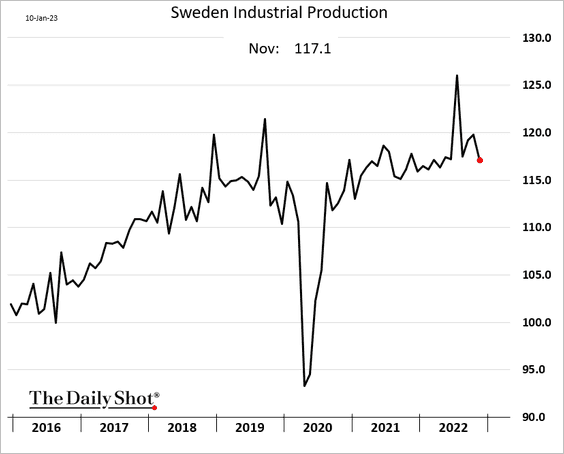

• Business activity eased in December, but the overall levels remained strong.

– Services:

– Industrial production:

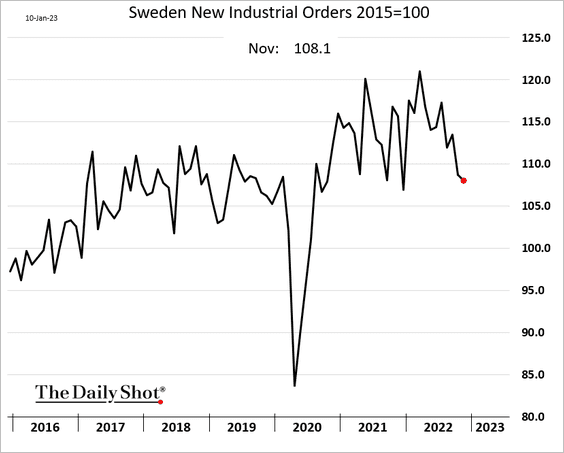

However, industrial orders have weakened (2 charts).

Source: Nordea Markets

Source: Nordea Markets

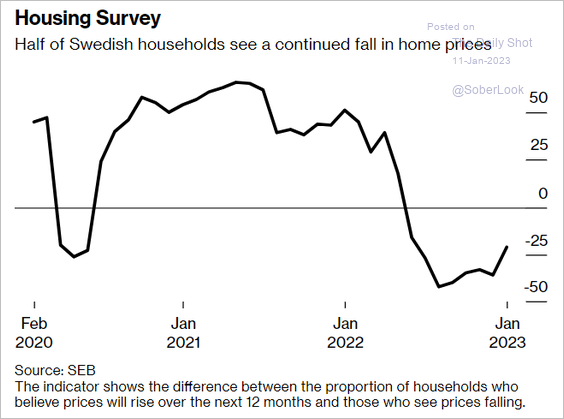

• Housing sentiment may have bottomed.

Source: @pohjanka, @economics Read full article

Source: @pohjanka, @economics Read full article

——————–

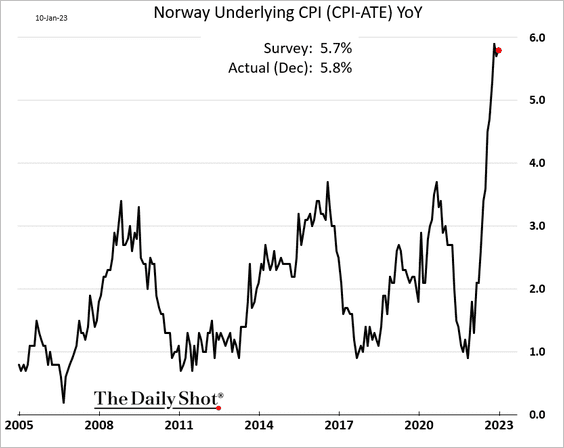

2. Norway’s inflation remains elevated.

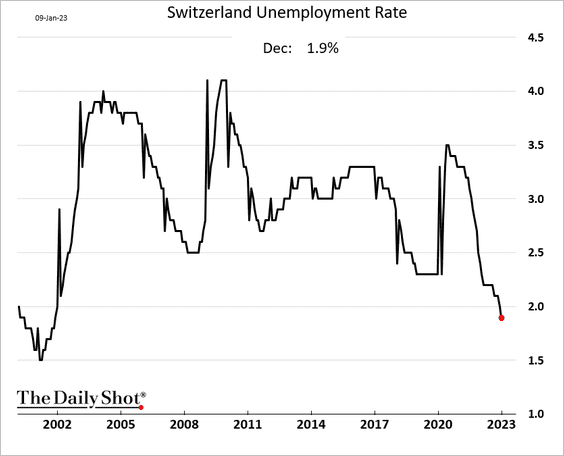

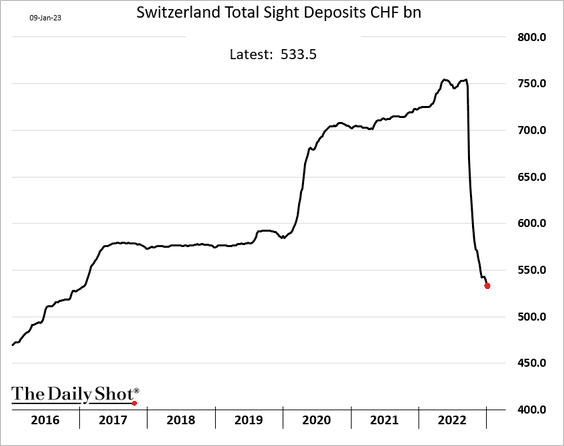

3. The Swiss unemployment rate dipped below 2%.

The central bank continues to pull liquidity from the market.

——————–

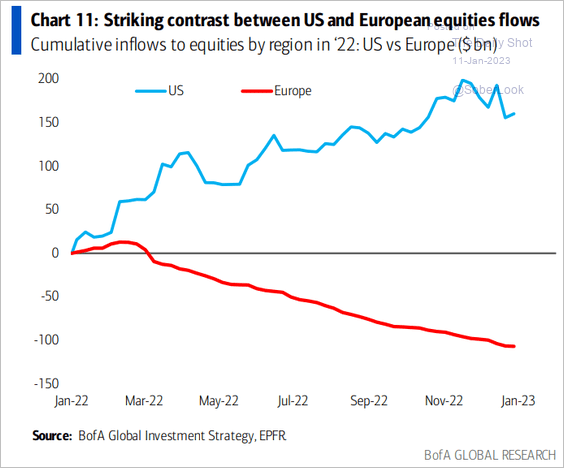

4. Are outflows from European equity funds over?

Source: BofA Global Research

Source: BofA Global Research

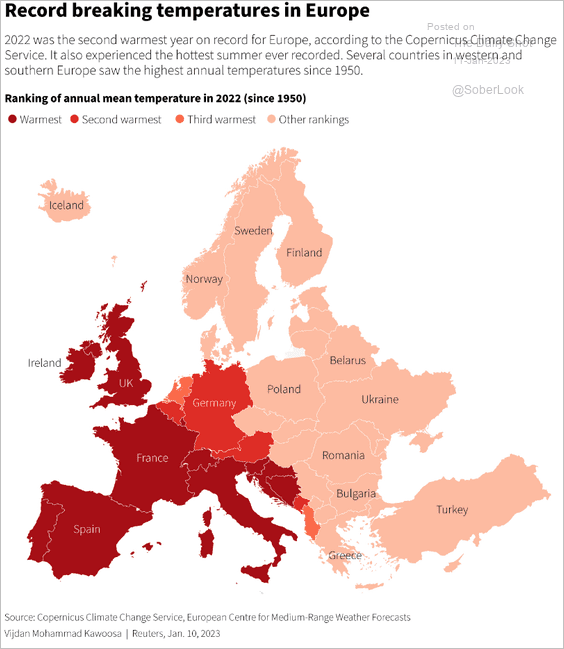

5. It was a warm year in Europe.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Asia – Pacific

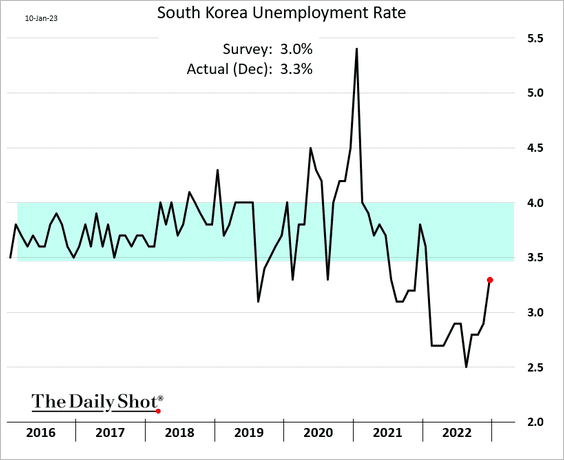

1. South Korea’s unemployment rate has been rebounding but remains below pre-COVID levels.

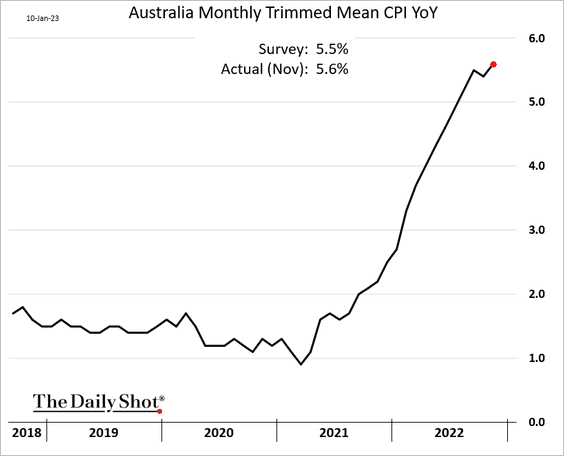

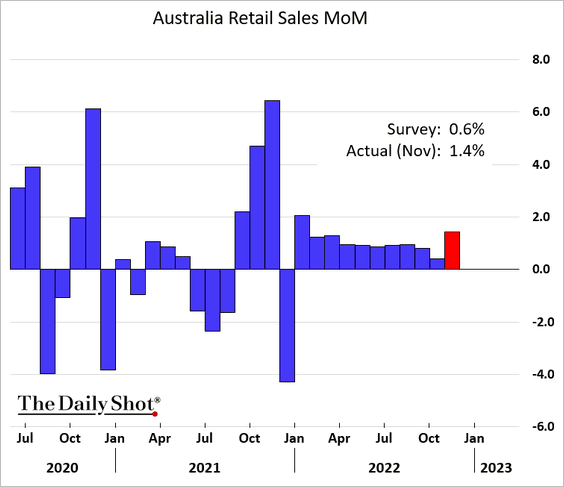

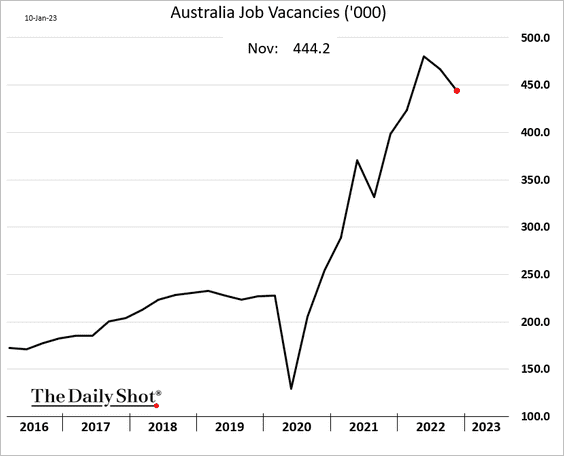

2. Next, we have some updates on Australia.

• Inflation remains stubbornly high.

• Retail sales jumped in November.

• Just like in the US, Australian job vacancies are off the peak but remain well above pre-COVID levels.

Back to Index

China

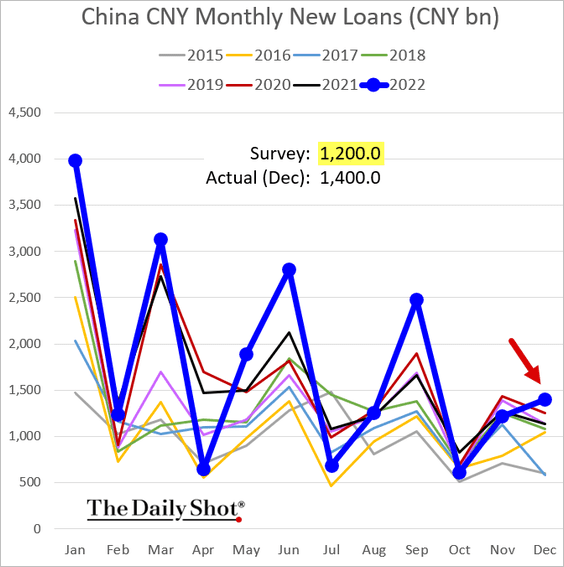

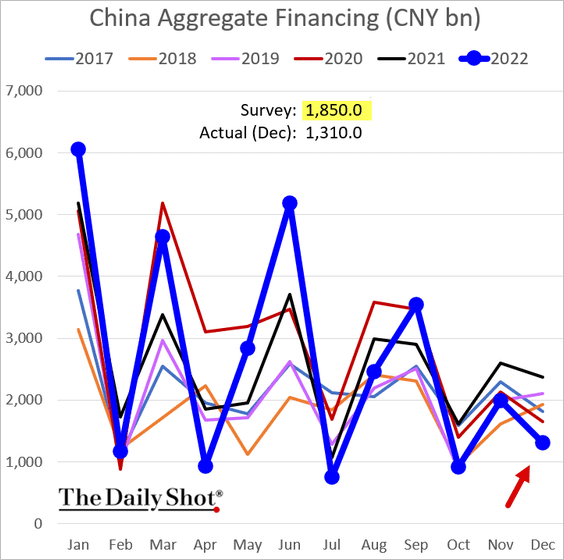

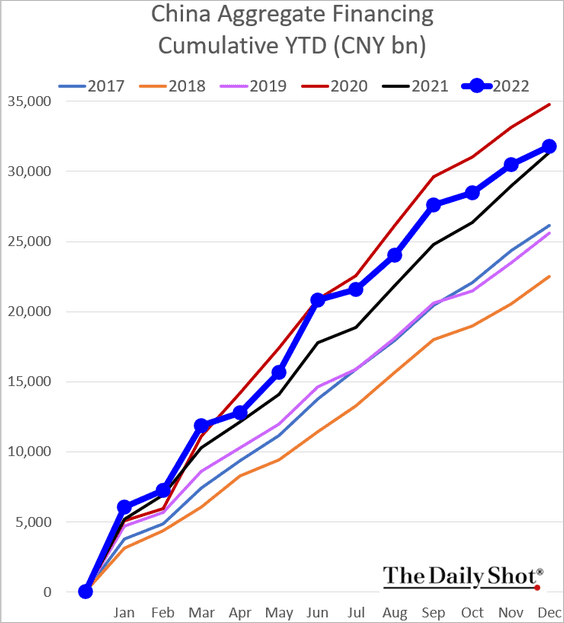

1. Loan growth was stronger than expected last month, …

… but aggregate financing was a disappointment.

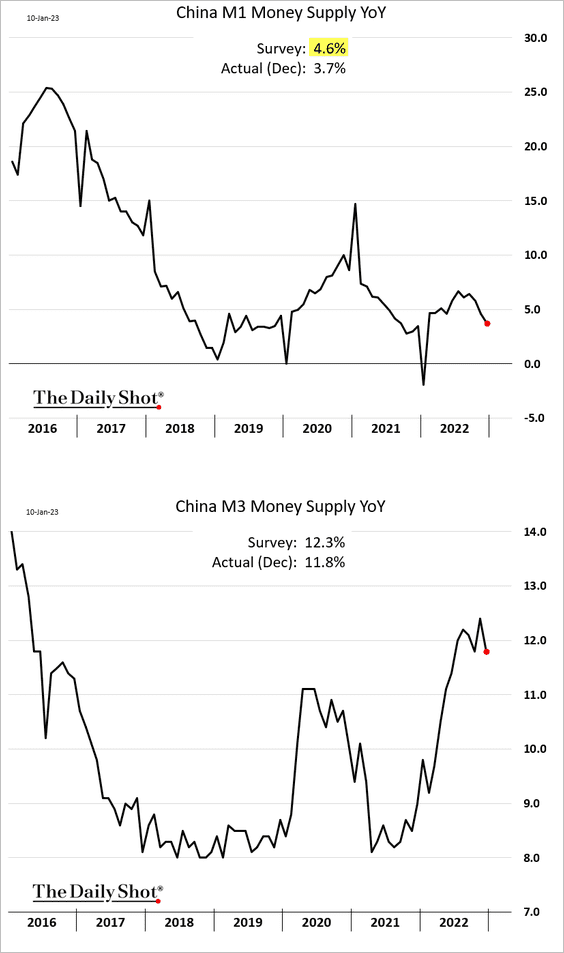

The money supply expansion slowed.

——————–

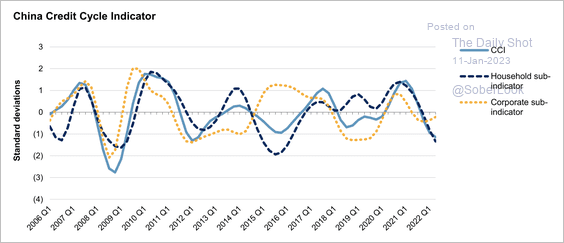

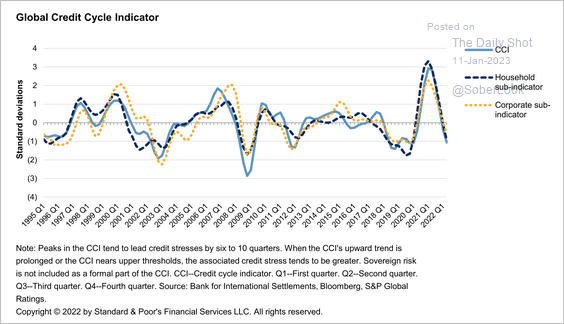

2. The downtrend in China’s credit cycle is driven by a slower pace of household borrowing. While credit conditions remain fragile, recent liquidity support to the property sector could lift sentiment, according to S&P.

Source: S&P Global Ratings

Source: S&P Global Ratings

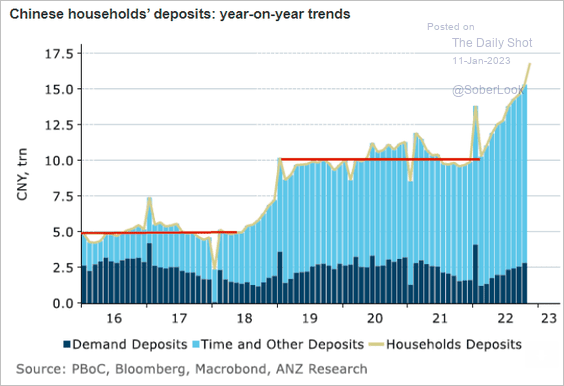

3. Household deposits have been surging.

Source: @ANZ_Research

Source: @ANZ_Research

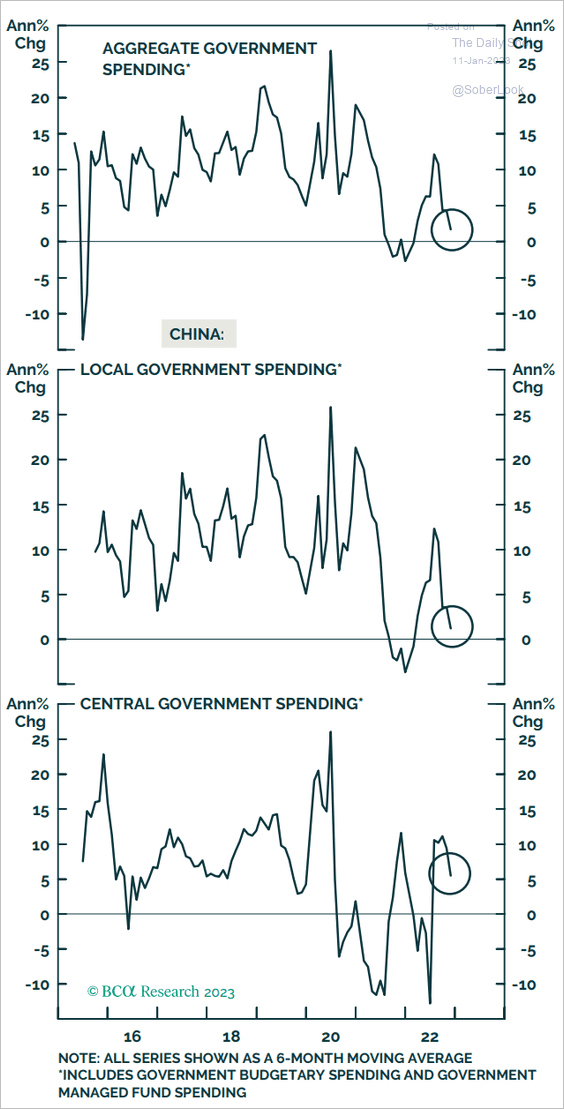

4. Government spending growth is slowing.

Source: BCA Research

Source: BCA Research

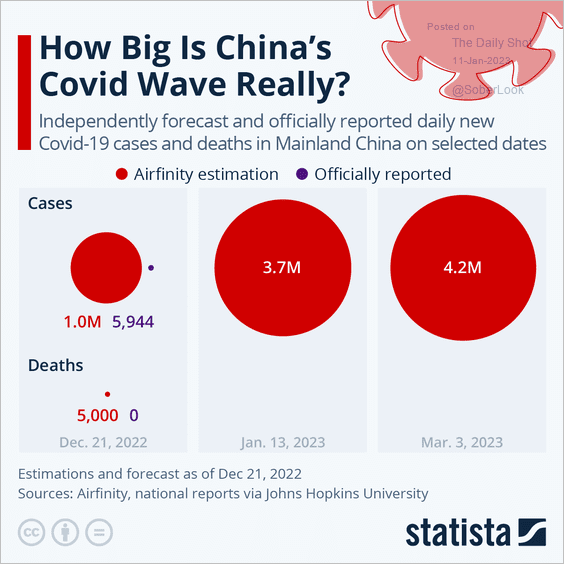

5. Here is an estimate of COVID cases in China.

Source: Statista

Source: Statista

Back to Index

Emerging Markets

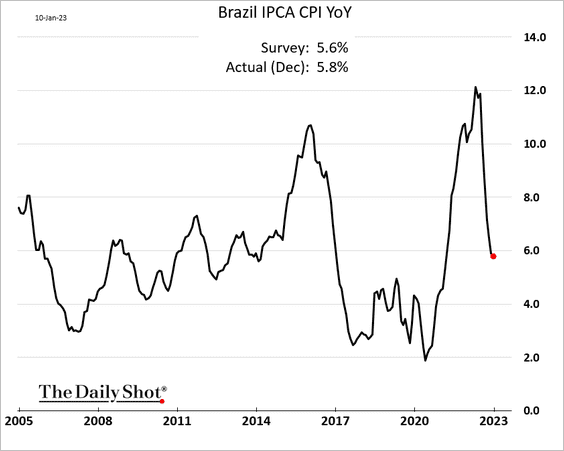

1. Brazil’s December CPI was higher than expected.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

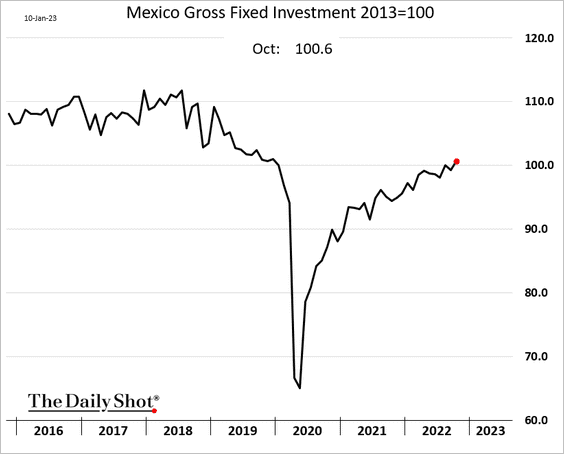

2. Mexico’s business investment is nearing 2019 levels.

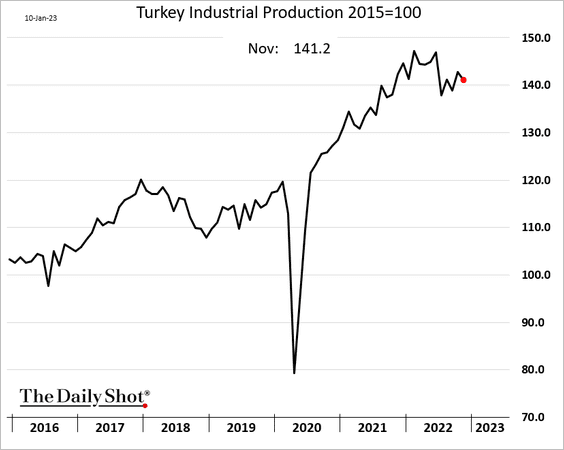

3. Turkey’s industrial production eased in November but remains robust.

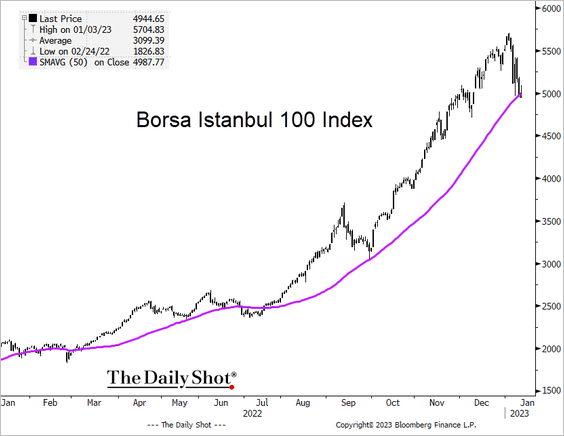

The stock market benchmark is testing support at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

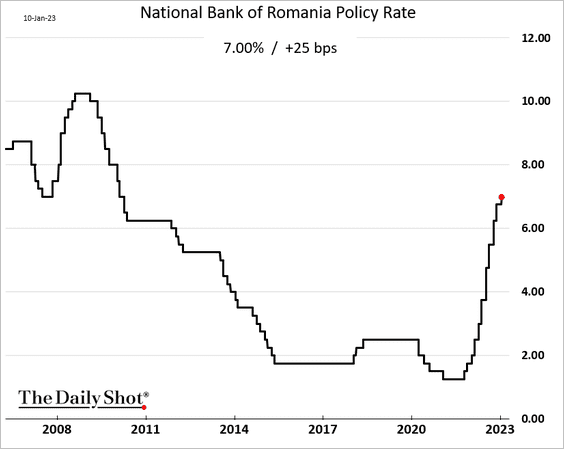

4. Romania’s central bank hiked rates to 7%. Is the cycle over?

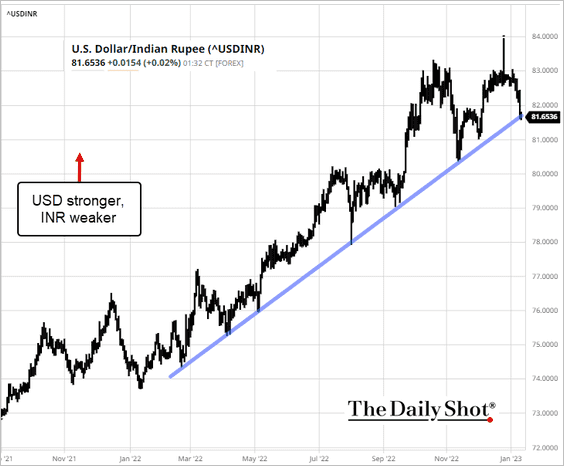

5. USD/INR is at the uptrend support as the rupee strengthens.

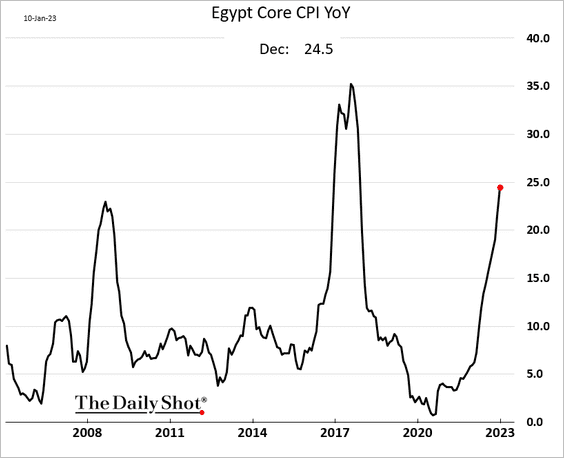

6. Egypt’s core CPI is nearing 25%.

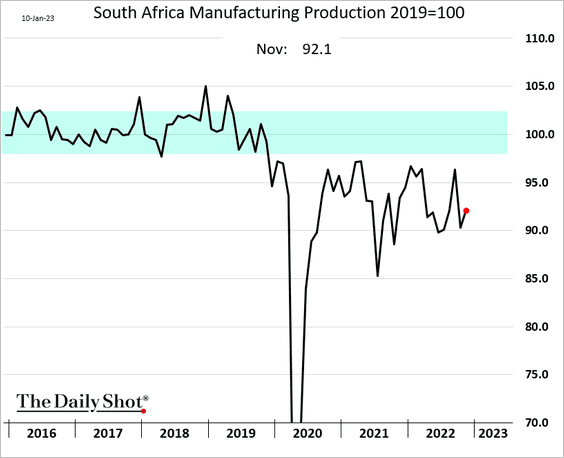

7. South Africa’s manufacturing production edged higher in November.

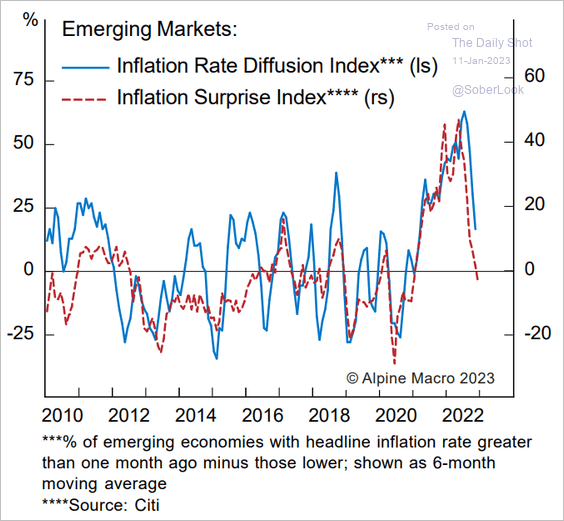

8. Disinflation is coming to EM economies.

Source: Alpine Macro

Source: Alpine Macro

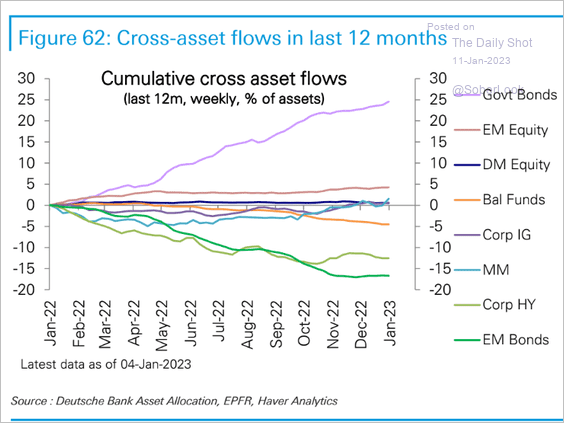

9. Have EM bond flows stabilized?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Cryptocurrency

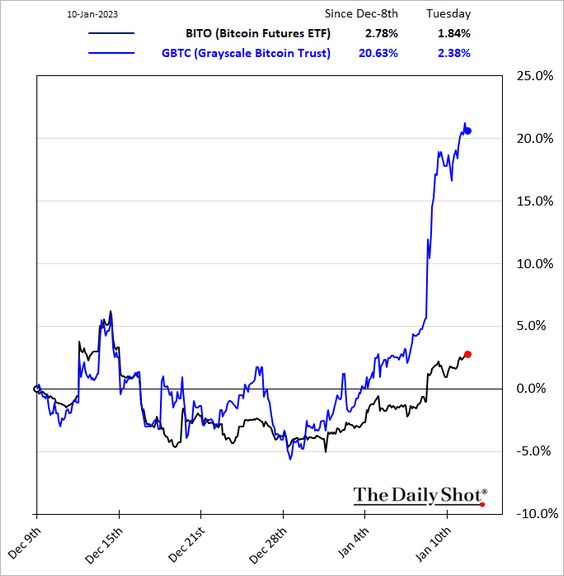

Investors are betting that the GBTC discount to NAV will narrow.

Source: @kgreifeld, @crypto Read full article

Source: @kgreifeld, @crypto Read full article

Back to Index

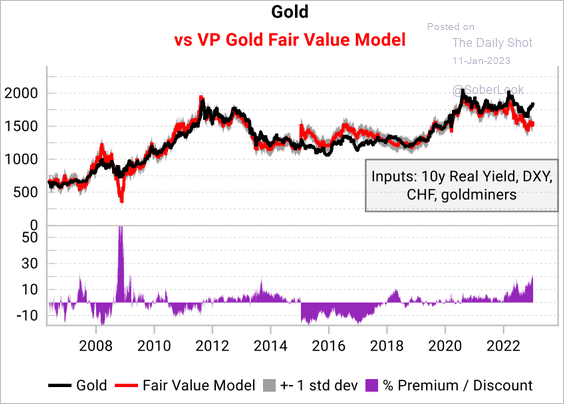

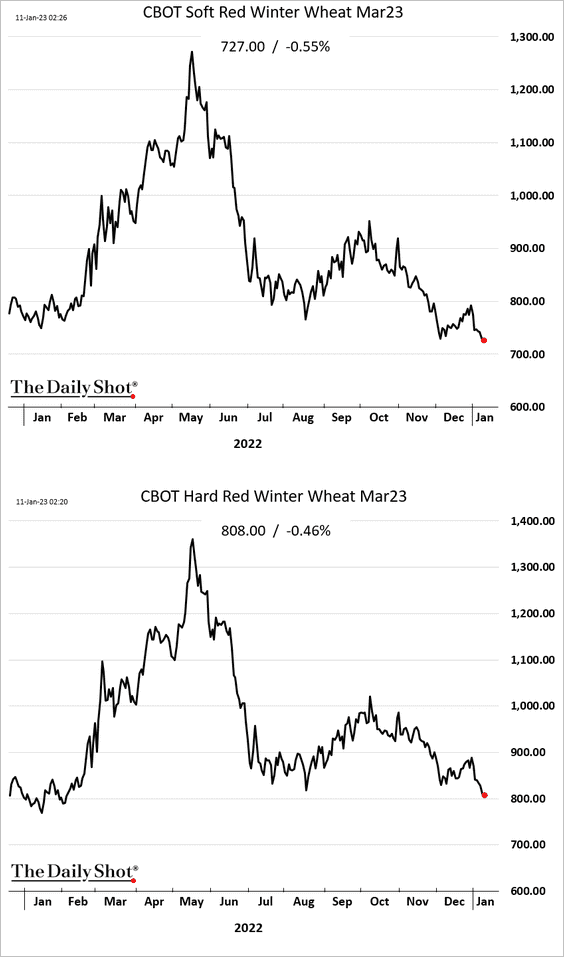

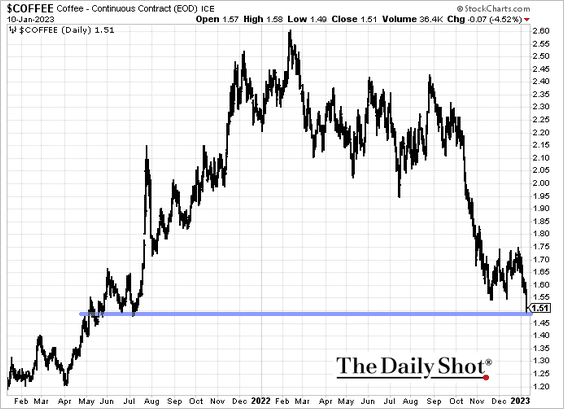

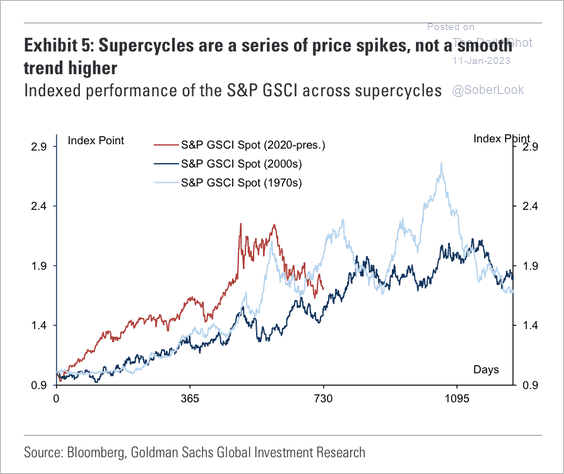

Commodities

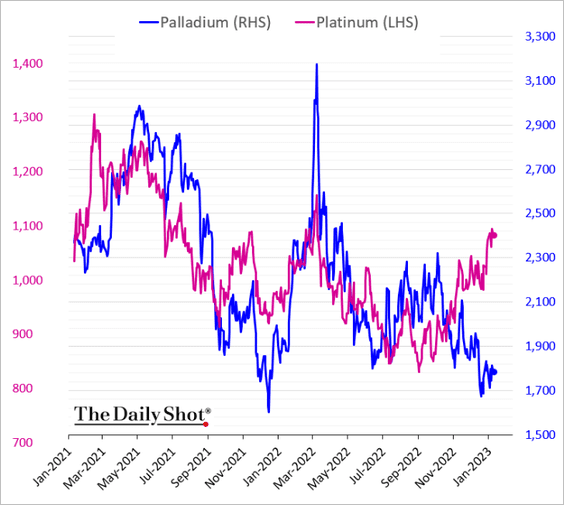

1. Palladium has not participated in the precious metals rally.

2. Gold is trading at a hefty premium for fair value, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

3. US wheat futures are struggling amid competition from abroad.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

4. Coffee futures are at support.

5. Commodity cycles tend to be choppy and sensitive to supply/demand swings.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Energy

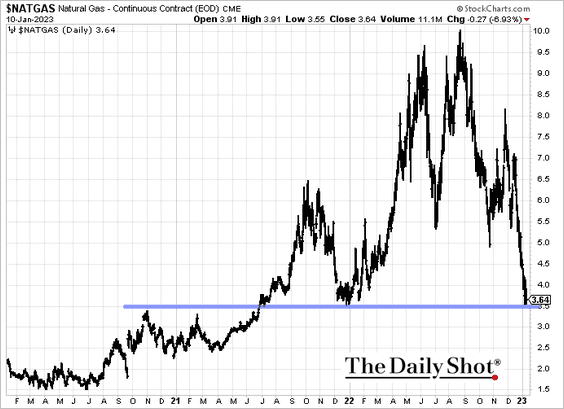

1. Will US natural gas hold support at $3.5/MMBtu?

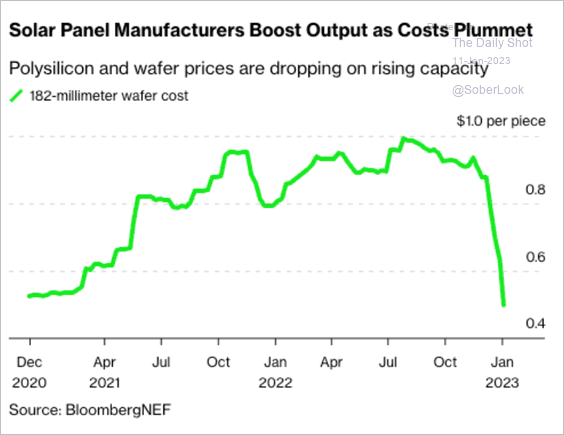

2. After rapid COVID-era gains, the cost of solar panel manufacturing is tumbling.

Source: @business Read full article

Source: @business Read full article

Back to Index

Equities

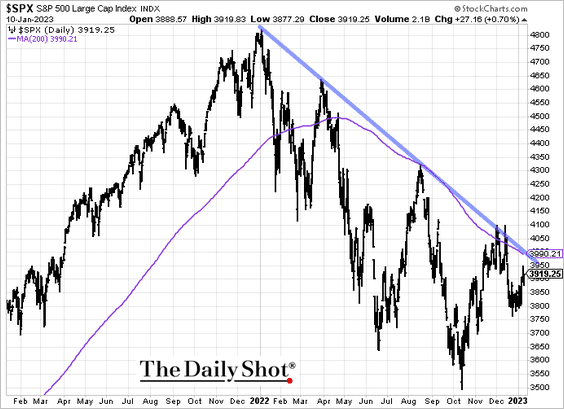

1. The S&P 500 will face resistance near 4,000.

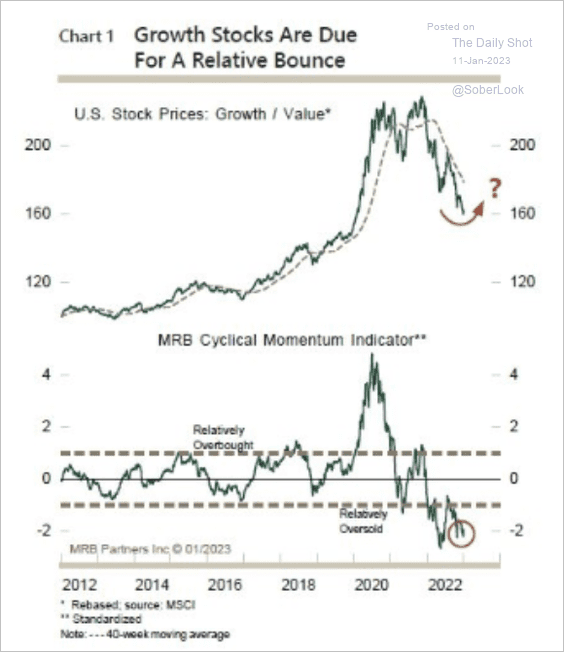

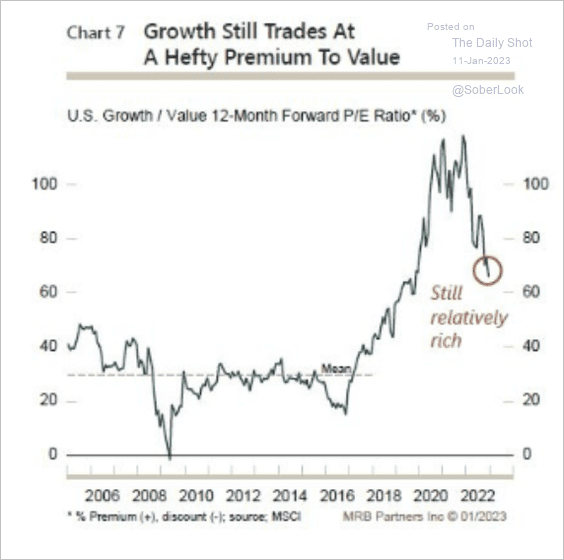

2. US growth stocks appear oversold relative to value stocks. However, in downtrends, oversold conditions can persist for some time.

Source: MRB Partners

Source: MRB Partners

Growth stocks still trade at a high premium relative to value stocks.

Source: MRB Partners

Source: MRB Partners

——————–

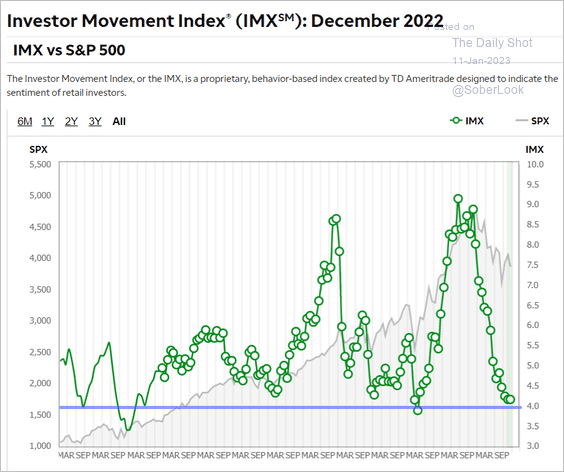

3. Is retail investor sentiment bottoming? Here is the positioning indicator from TD Ameritrade.

Source: TD Ameritrade

Source: TD Ameritrade

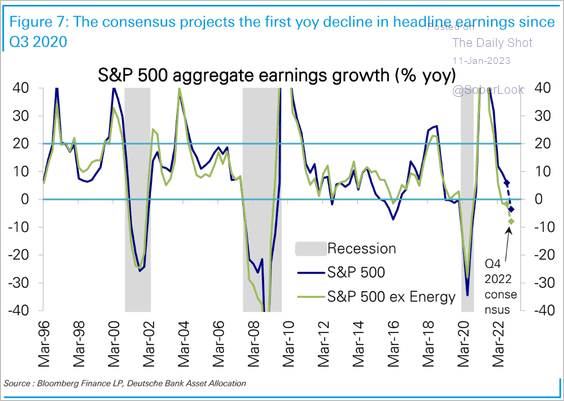

4. S&P 500 earnings face their first year-over-year decline since Q3 of 2020.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

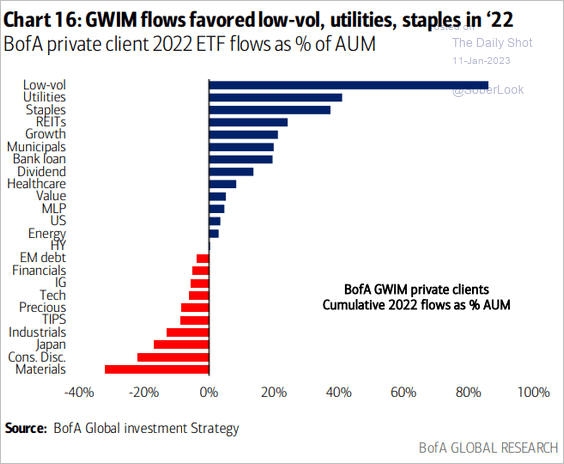

5. BofA private clients moved into defensive sectors last year.

Source: BofA Global Research

Source: BofA Global Research

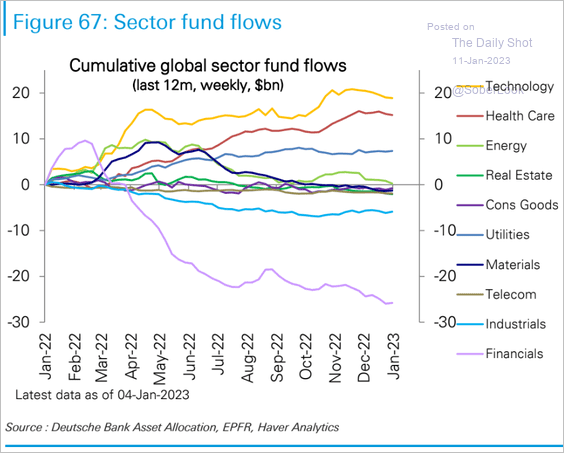

6. This chart shows sector fund flows over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

1. The global credit cycle is trending downward and could see a contraction this year (more nonperforming loans and defaults), according to S&P Global Ratings.

Source: S&P Global Ratings

Source: S&P Global Ratings

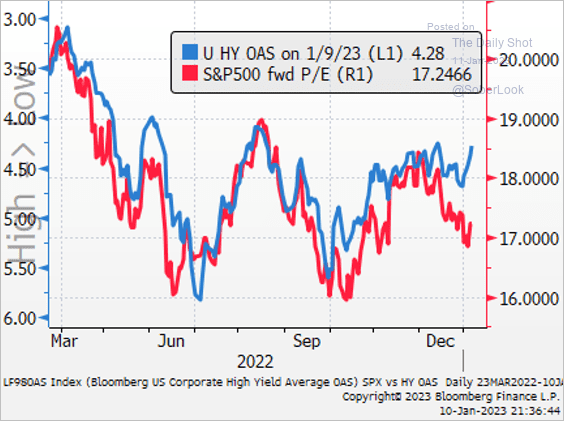

2. Given the decline in stock valuations, HY spreads should be wider.

Source: @PhilipJagd

Source: @PhilipJagd

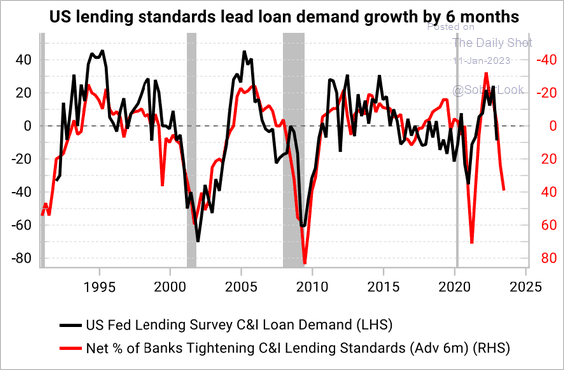

3. Loan demand is expected to slow.

Source: Variant Perception

Source: Variant Perception

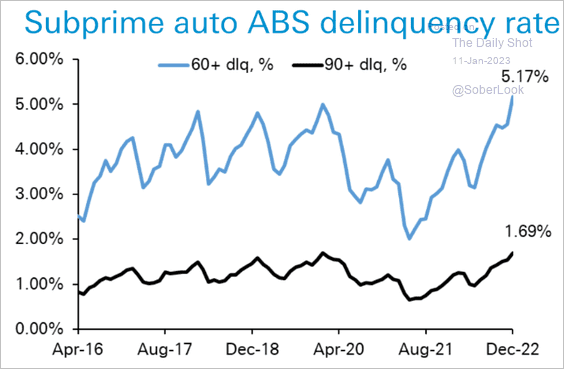

4. Subprime auto ABS delinquency rates continue to climb.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

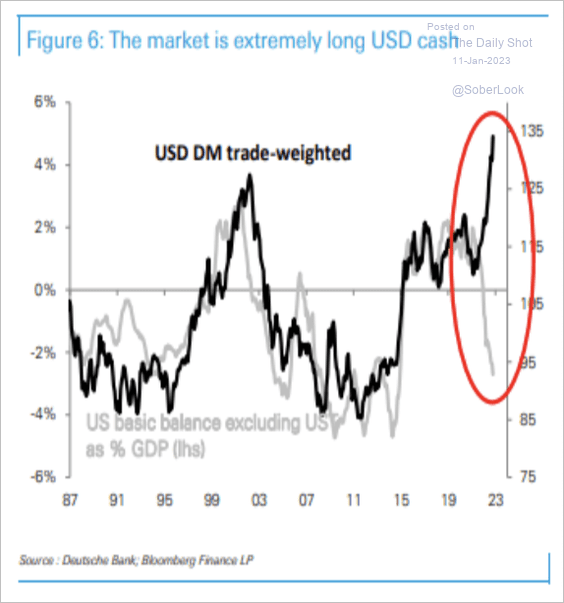

1. The market is sitting on significant USD cash exposure, which is vulnerable to further liquidation as the dollar’s safe-haven appeal declines, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

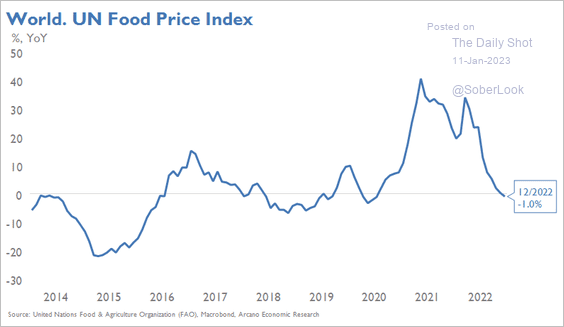

2. Food inflation is now negative on a year-over-year basis.

Source: Arcano Economics

Source: Arcano Economics

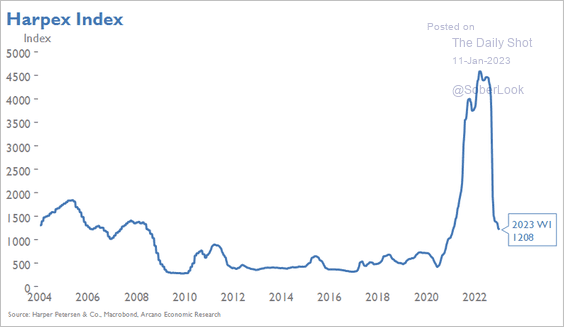

3. The cost of renting container ships is quickly reverting to more typical levels.

Source: Arcano Economics

Source: Arcano Economics

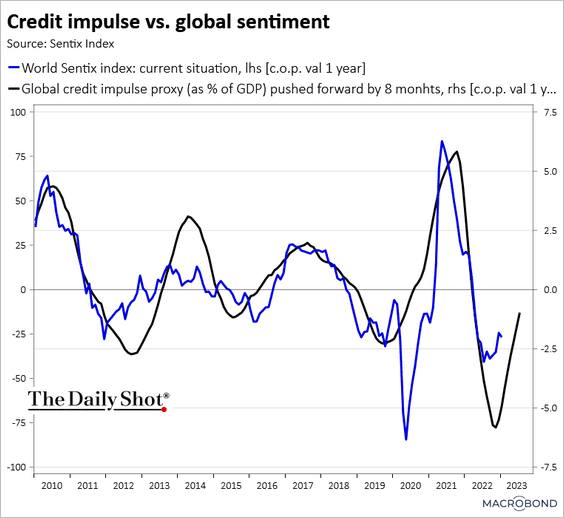

4. The global credit impulse is rebounding. Will sentiment follow?

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

Food for Thought

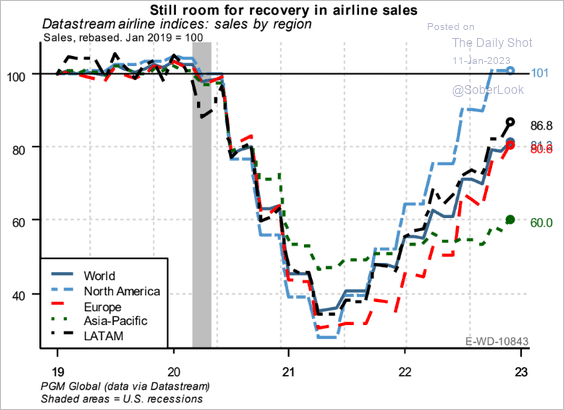

1. Airline sales recovery:

Source: PGM Global

Source: PGM Global

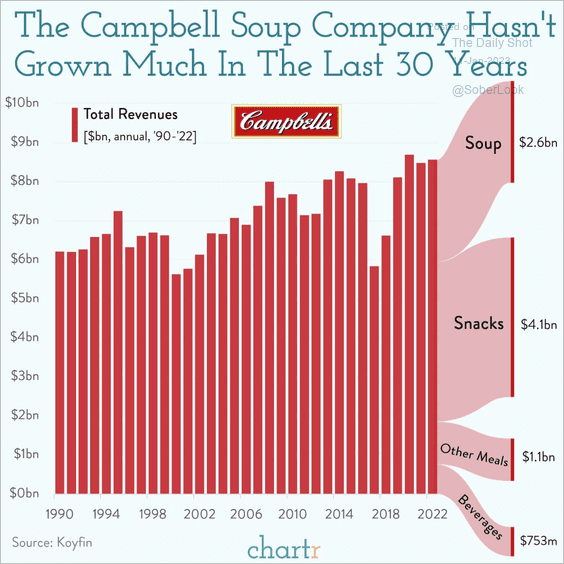

2. Campbell Soup revenues:

Source: @chartrdaily

Source: @chartrdaily

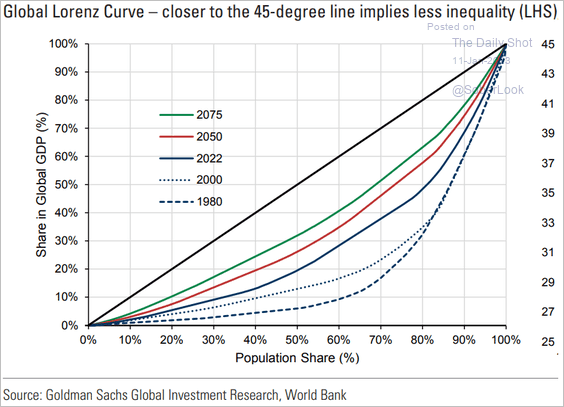

3. The global Lorenz Curve:

Source: Goldman Sachs

Source: Goldman Sachs

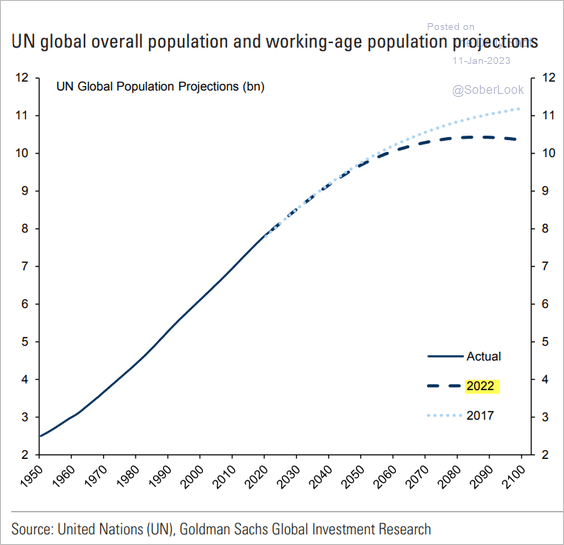

4. Adjusted global population projections:

Source: Goldman Sachs

Source: Goldman Sachs

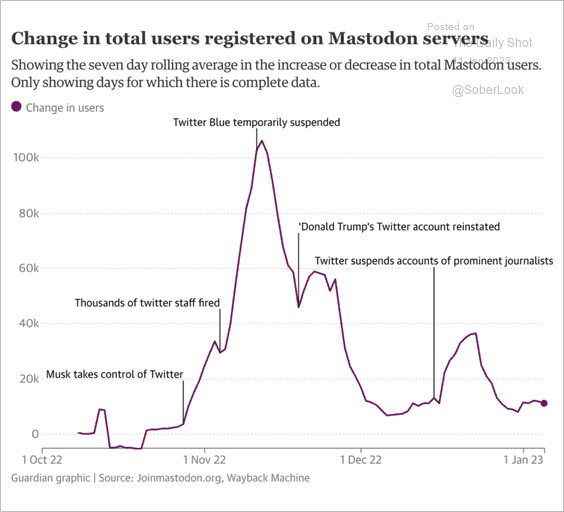

5. Mastodon new user registrations:

Source: The Guardian Read full article

Source: The Guardian Read full article

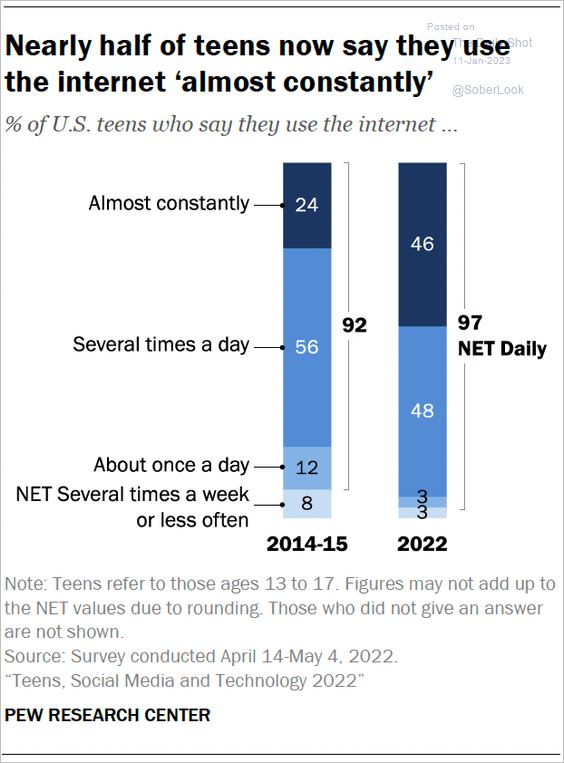

6. Teen internet usage:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

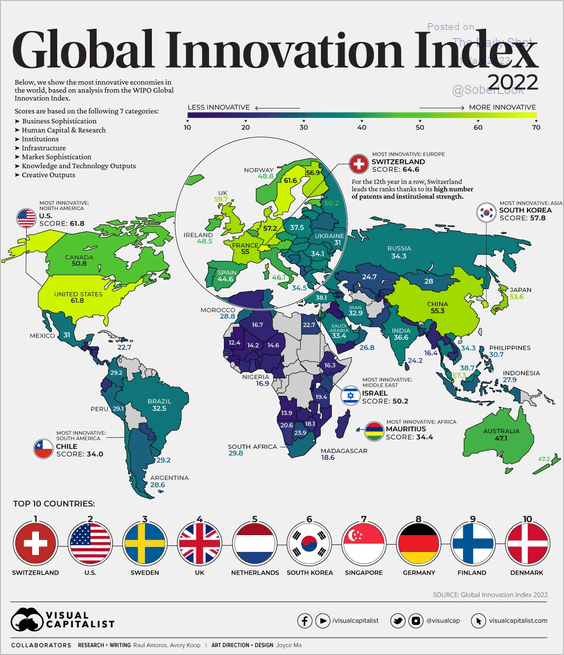

7. The global innovation index:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

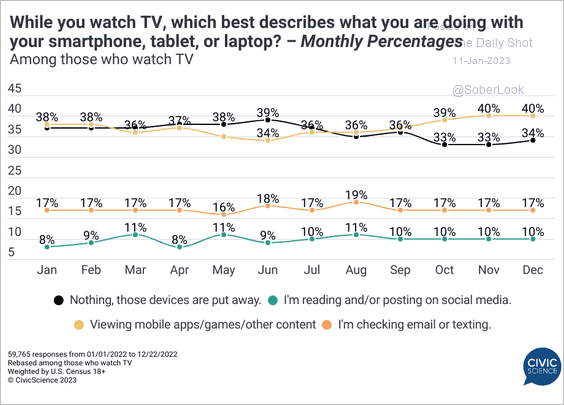

8. Do you play with your phone while watching TV?

Source: @CivicScience

Source: @CivicScience

——————–

Back to Index