The Daily Shot: 13-Jan-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

As a reminder, The Daily Shot will not be published on Monday, January 16th.

The United States

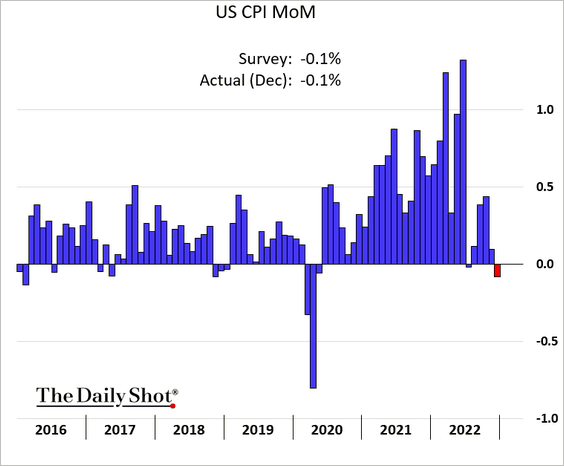

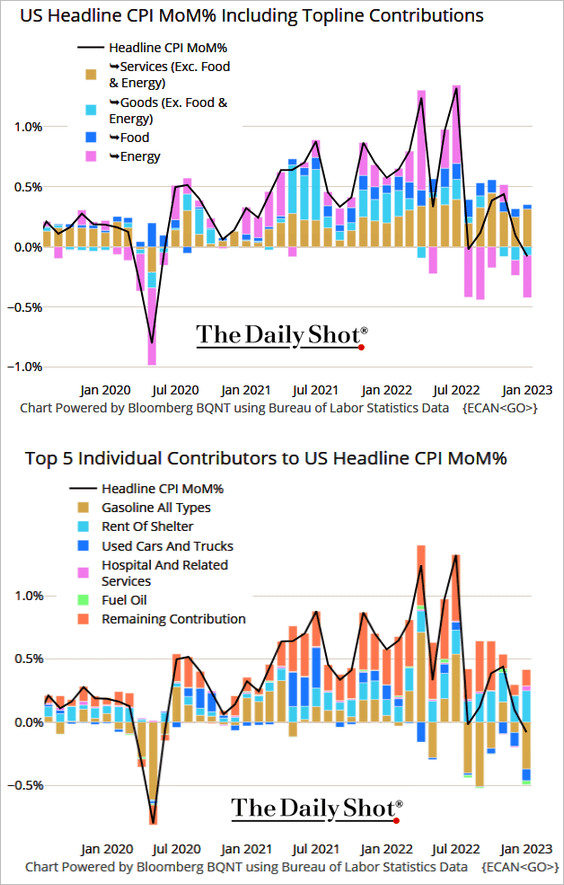

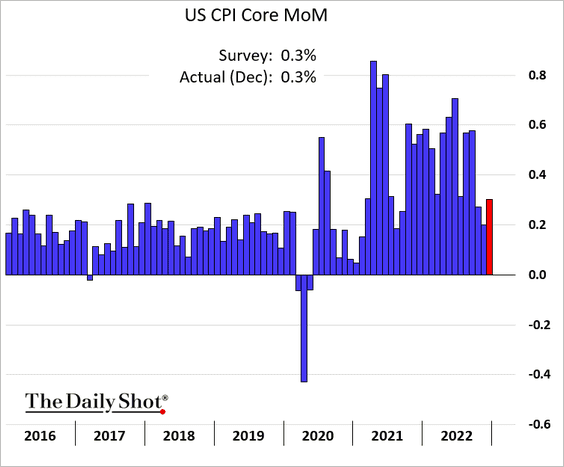

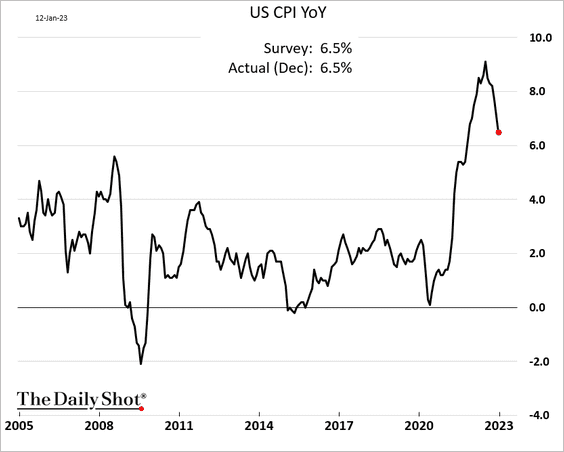

1. The CPI report was in line with expectations.

• The headline CPI declined in December.

Here are the contributions.

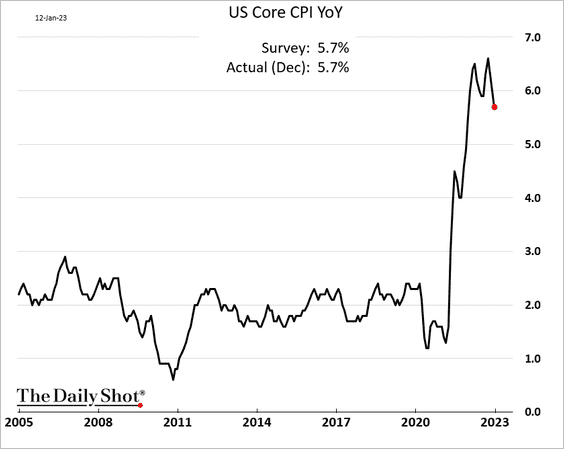

• The core CPI rose faster than in November.

• Inflation slowed on a year-over-year basis.

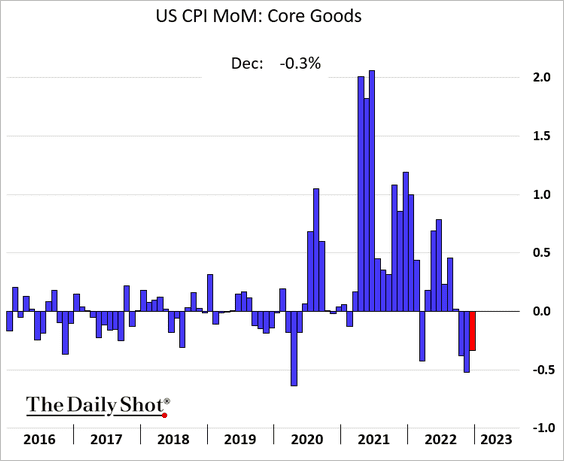

• The core goods CPI was down for the third month in a row.

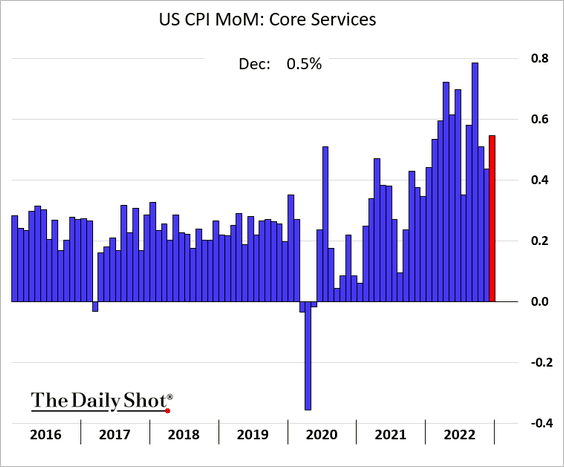

But the core services CPI continues to surge.

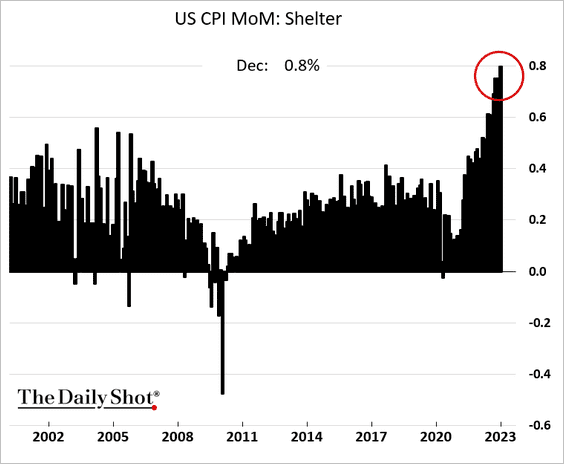

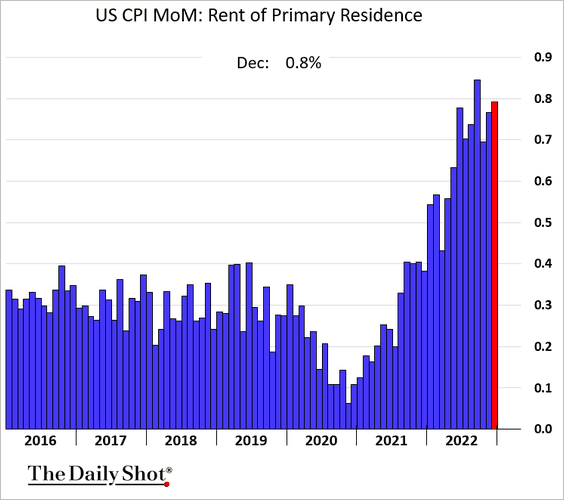

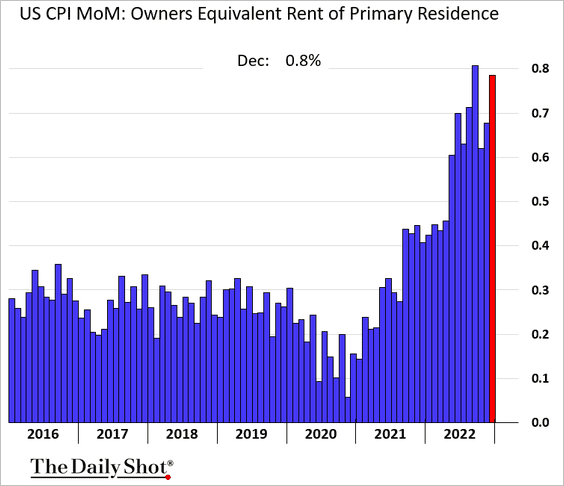

• Housing is driving the core services CPI, with shelter inflation hitting a multi-decade high.

– Rent:

– Owners’ equivalent rent:

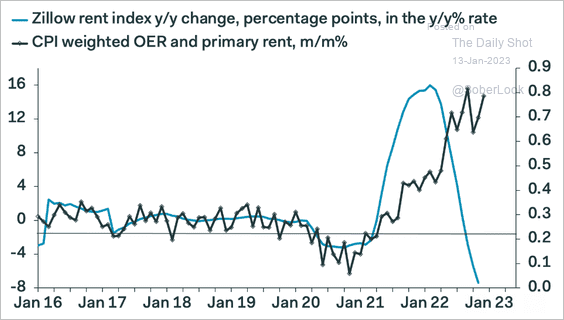

However, leading indicators tell us that shelter inflation should moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

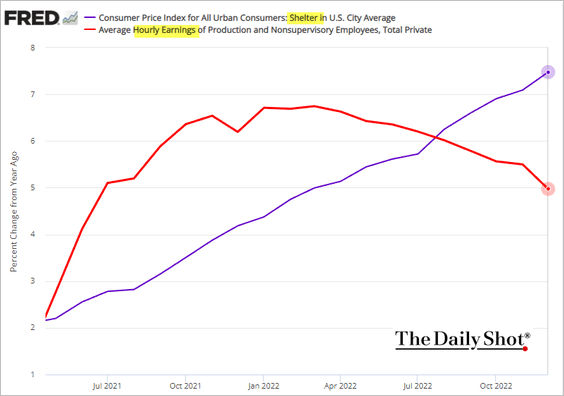

With wage growth now lagging shelter inflation, demand should ease.

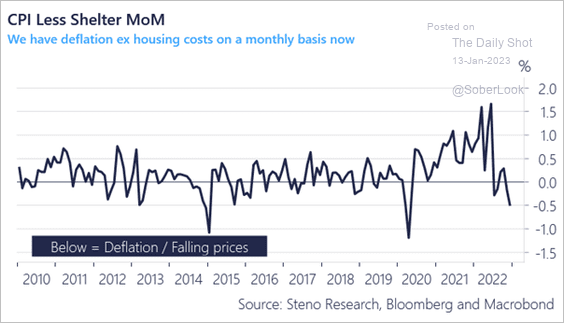

By the way, here is the CPI excluding shelter.

Source: @AndreasSteno Read full article

Source: @AndreasSteno Read full article

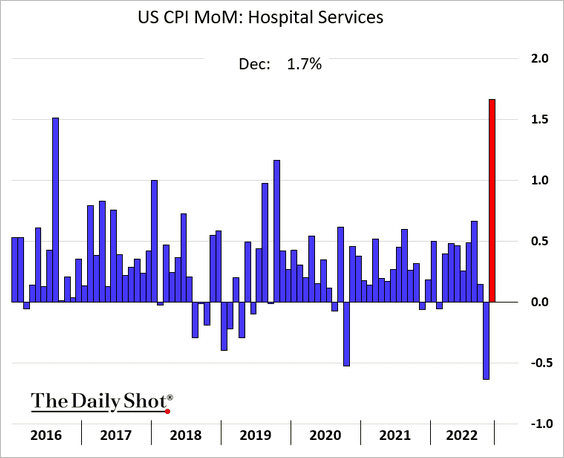

• Hospital services costs surged last month, but this increase is expected to be a “one-off” event.

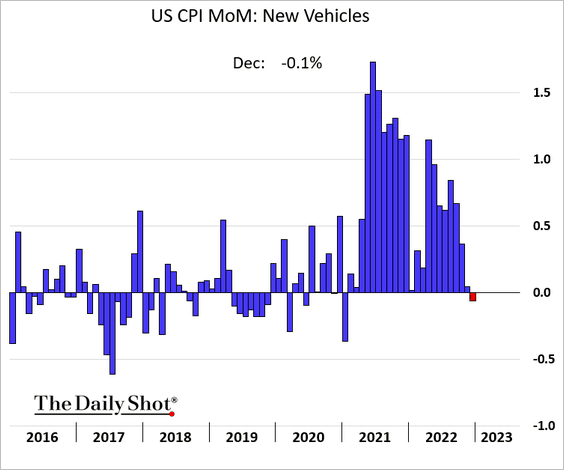

• New vehicle prices declined for the first time in two years.

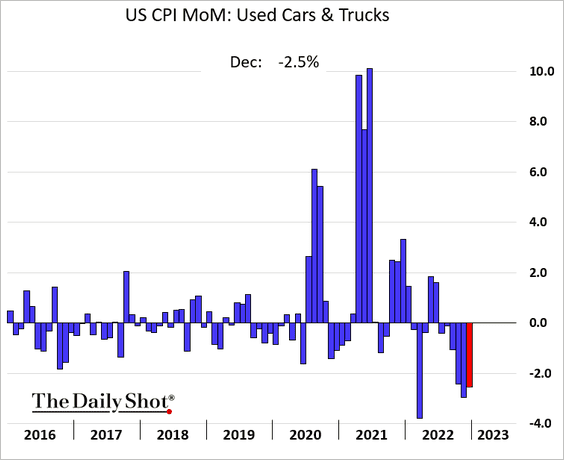

Used car prices fell again.

• We will have more inflation-related data next week.

——————–

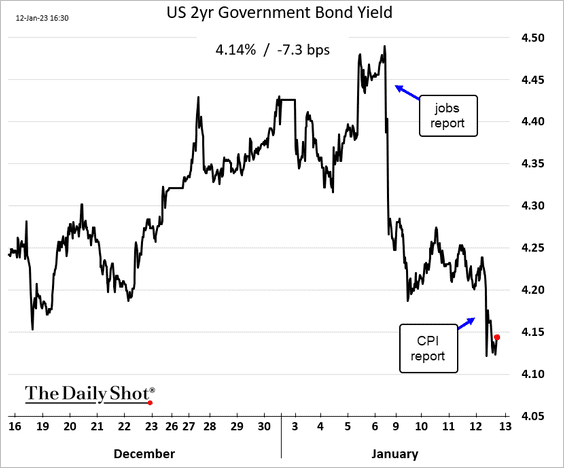

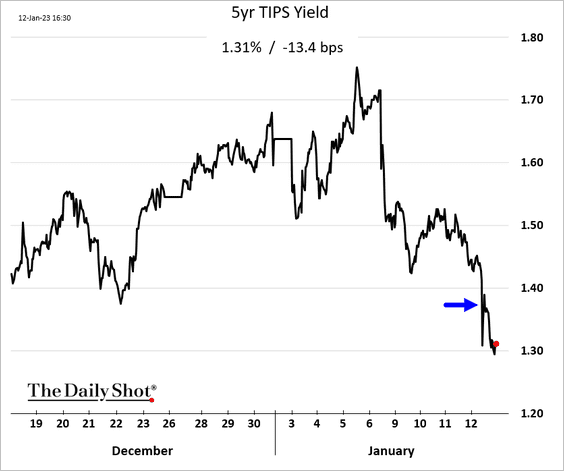

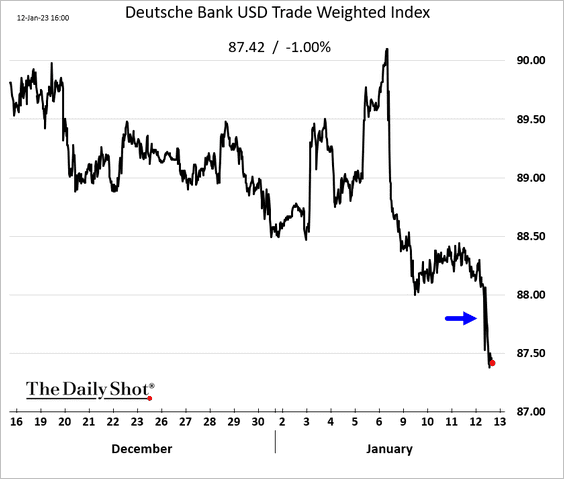

2. Markets cheered the softening headline inflation, with bonds and commodities surging while the dollar weakened further.

• 2yr yield:

• 5yr TIPS yield (real rate):

• The dollar index:

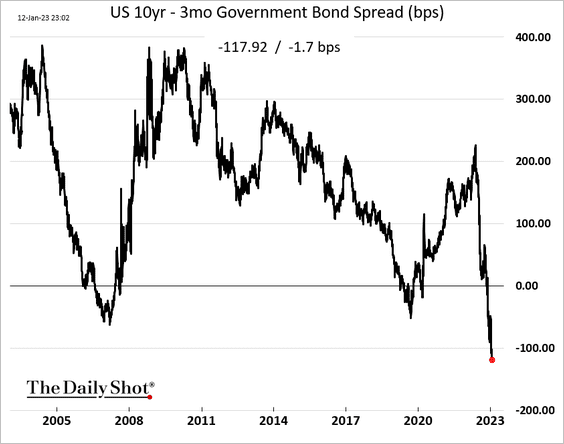

The 10-year/3-month portion of the Treasury curve inverted further.

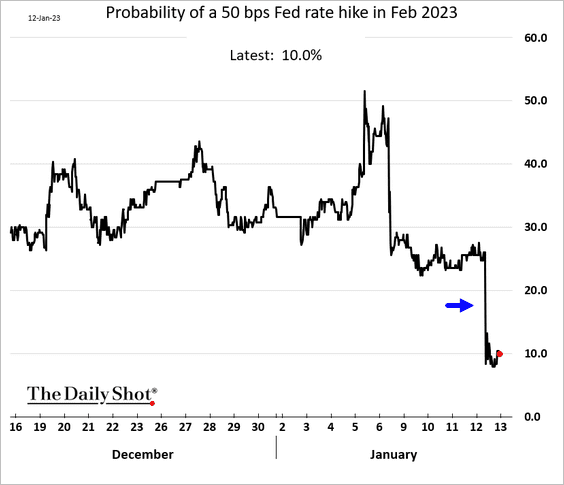

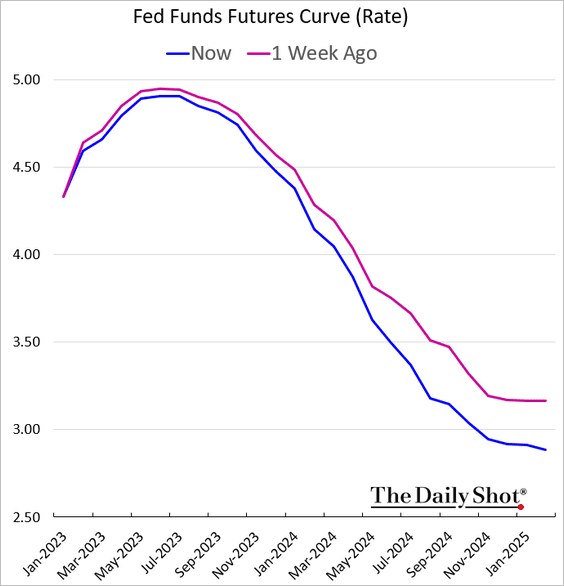

3. The market now expects a 25 bps rate hike next month, with the probability of a 50 bps increase dipping to 10%.

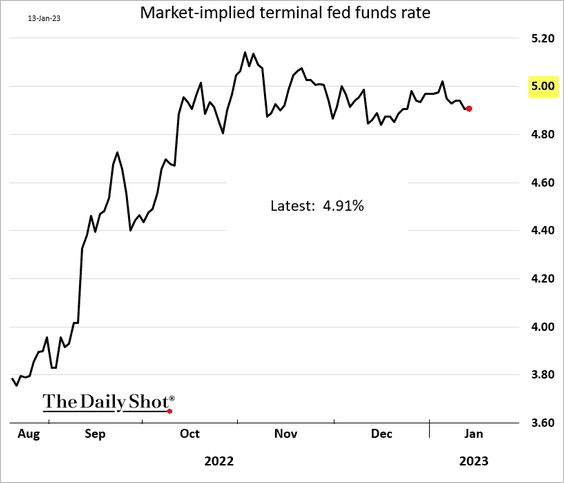

• The terminal rate edged lower. The market doesn’t see it going to 5%, …

… but Fed officials still do.

Source: @SteveMatthews12, @Jonnelle, @economics Read full article

Source: @SteveMatthews12, @Jonnelle, @economics Read full article

Source: MarketWatch Read full article

Source: MarketWatch Read full article

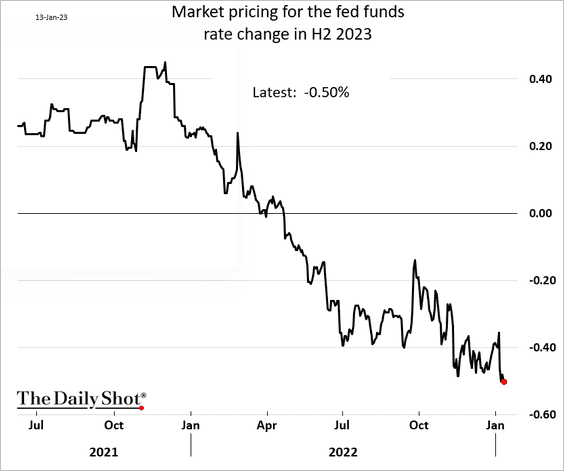

• The market still sees a 50 bps rate cut later this year.

——————–

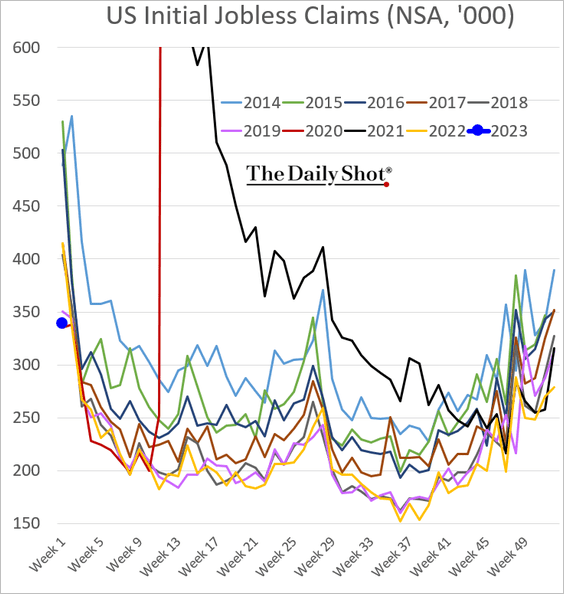

4. Initial jobless claims remain very low for this time of the year.

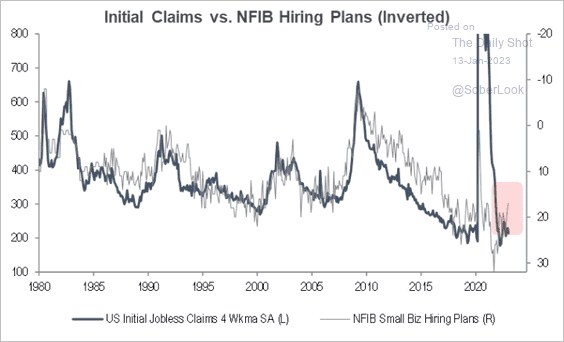

But small business hiring plans suggest that unemployment applications will start rising.

Source: Piper Sandler

Source: Piper Sandler

Back to Index

The United Kingdom

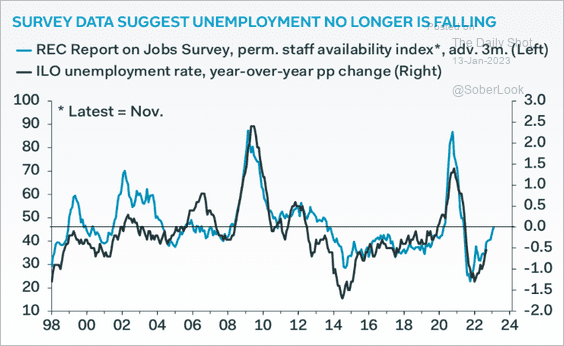

1. Unemployment is heading higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

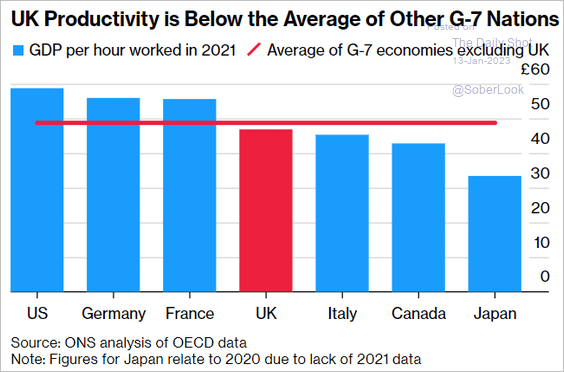

2. Here is how UK labor productivity compares to other advanced economies.

Source: @LucyGJWhite, @economics Read full article

Source: @LucyGJWhite, @economics Read full article

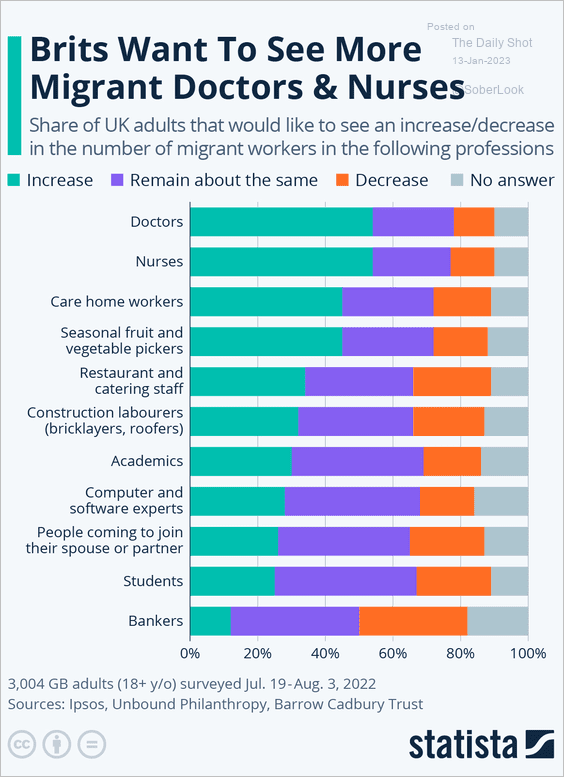

3. More doctors and nurses, please, but no students or bankers (way too scary).

Source: Statista

Source: Statista

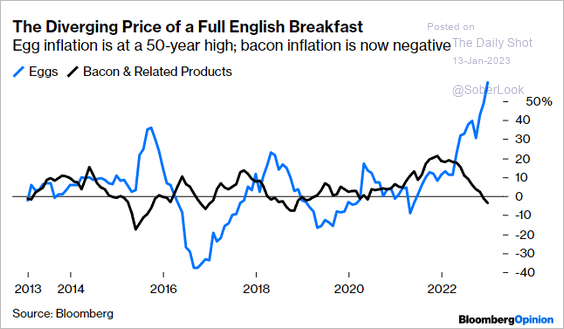

4. The diverging English breakfast costs …

Source: @johnauthers

Source: @johnauthers

Back to Index

The Eurozone

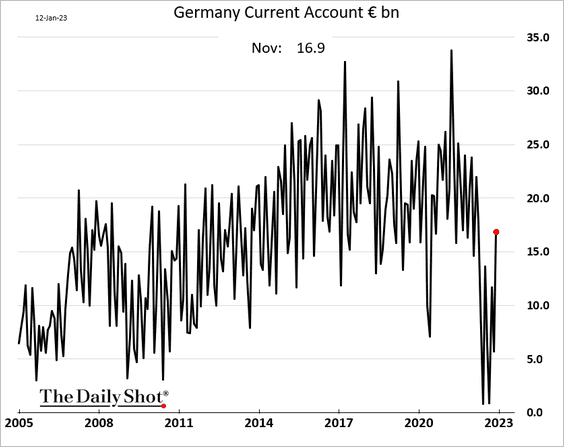

1. Germany’s current account is rebounding.

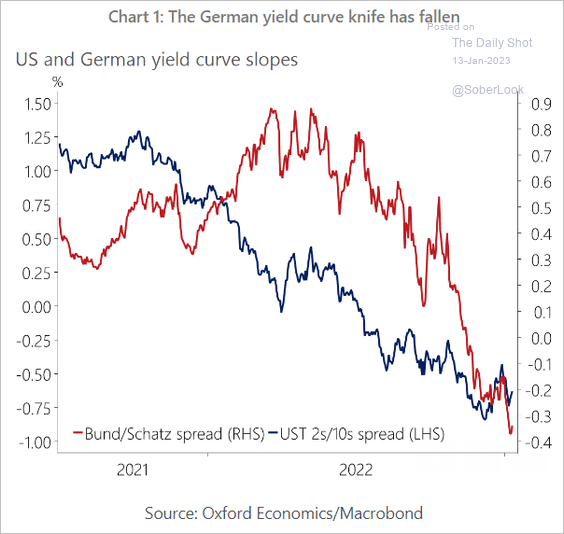

2. Based on the 2/10yr spread, Germany’s yield curve is more inverted than the US.

Source: Oxford Economics

Source: Oxford Economics

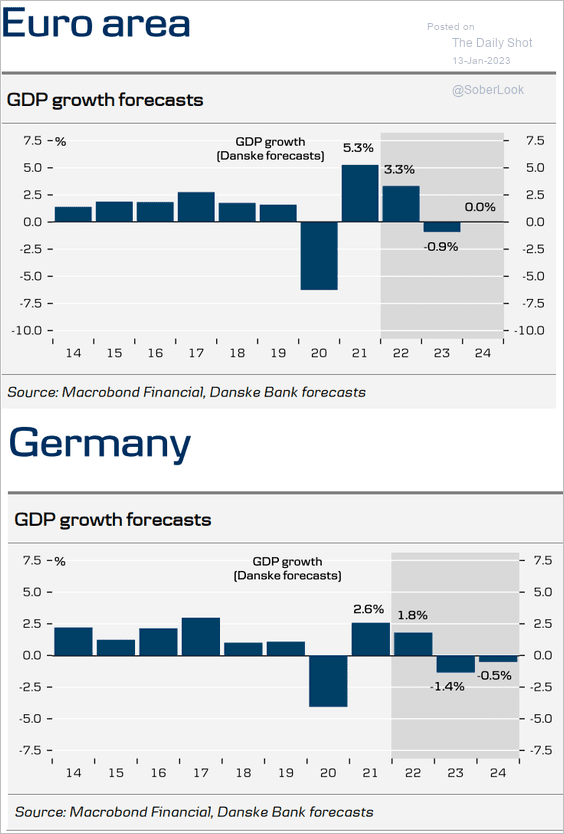

3. Here is the GDP forecast from Danske Bank.

Source: Danske Bank

Source: Danske Bank

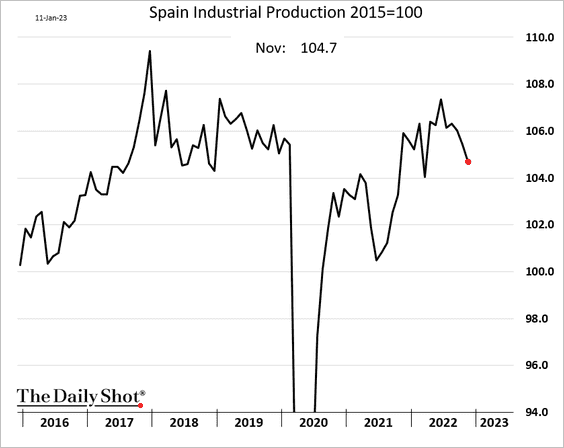

4. Spain’s industrial production is rolling over.

Back to Index

Japan

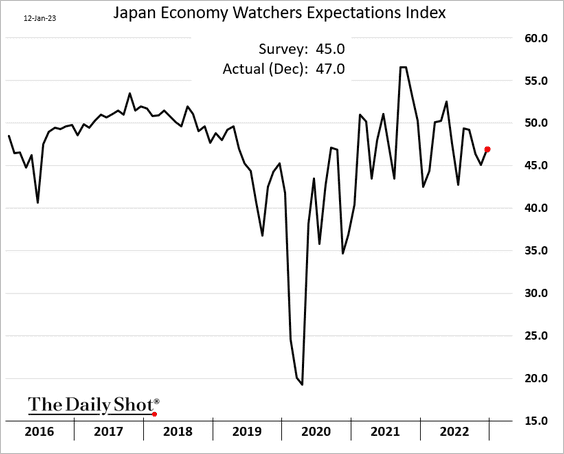

1. The Economy Watchers Expectations index edged higher.

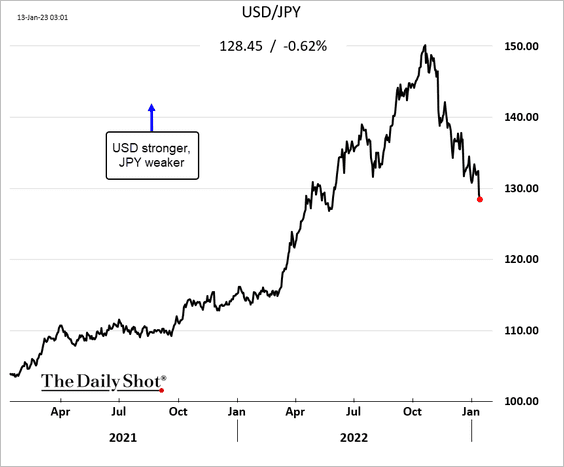

2. The yen continues to rally.

Back to Index

Asia – Pacific

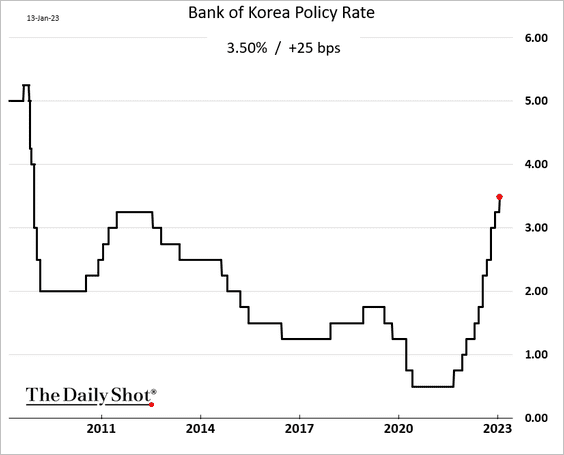

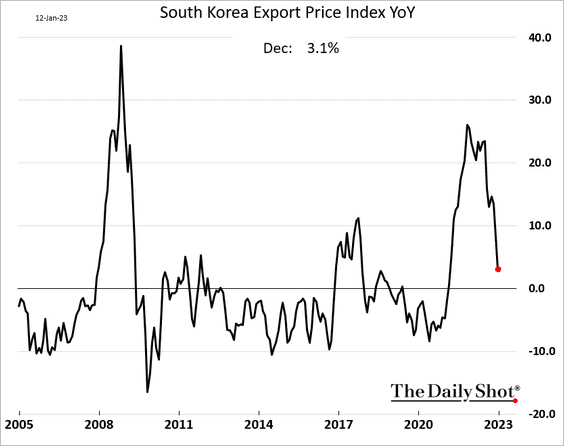

1. South Korea’s central bank hiked rates again.

Export price gains are moderating rapidly.

——————–

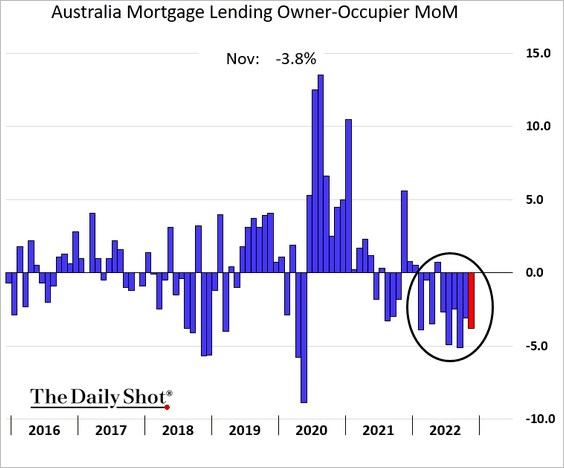

2. Australia’s mortgage lending saw its 6th monthly decline in a row.

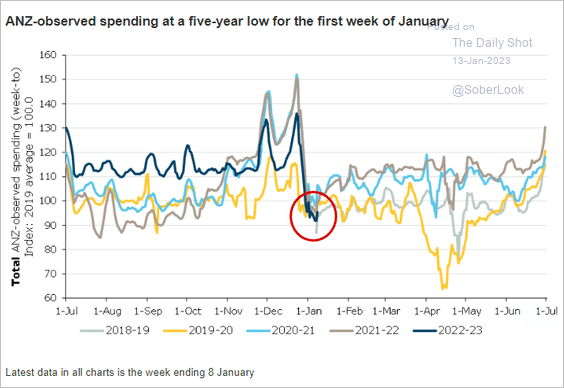

Consumer spending is slowing.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

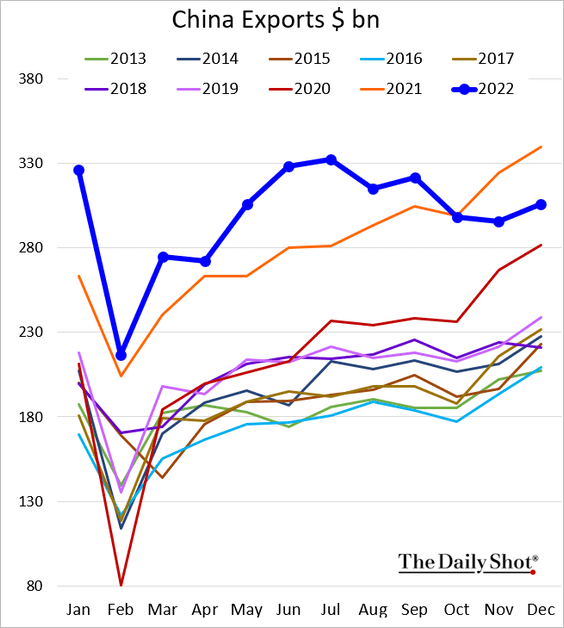

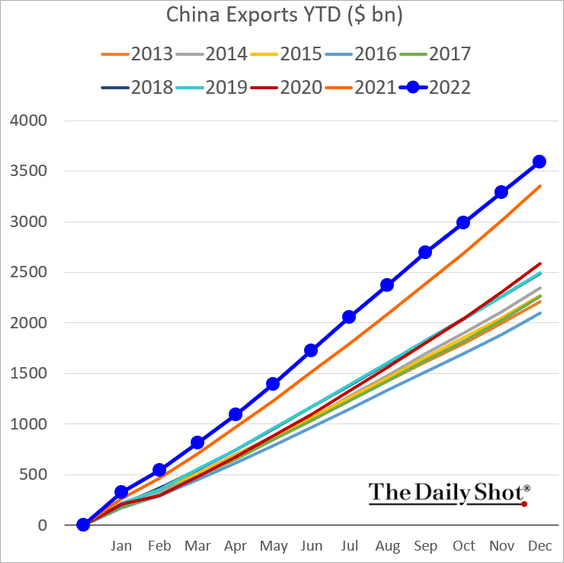

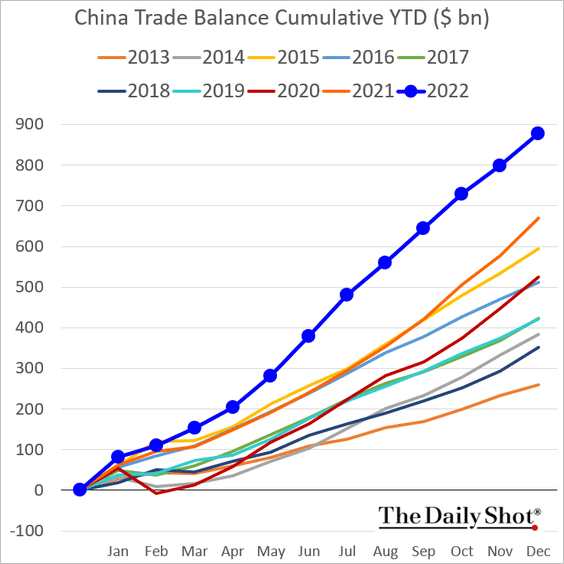

1. The December trade balance and exports were a bit stronger than expected.

——————–

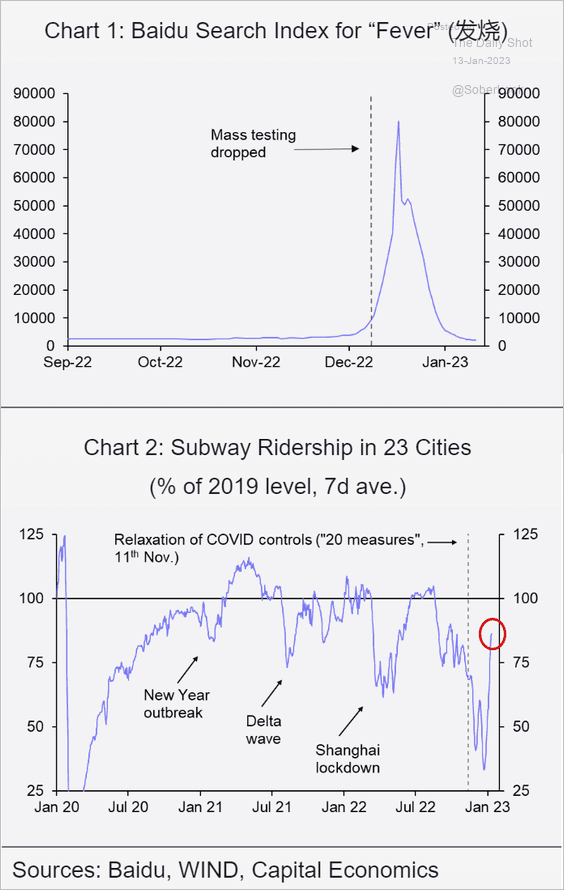

2. Herd immunity?

Source: Capital Economics

Source: Capital Economics

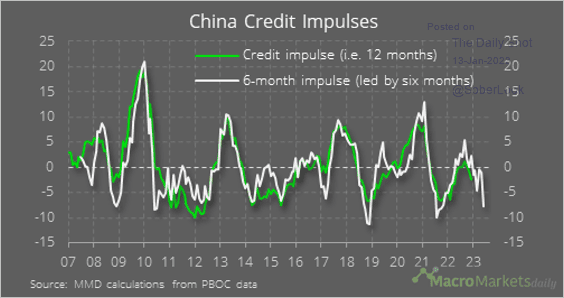

3. The 6-month credit impulse dropped sharply in December.

Source: @macro_daily

Source: @macro_daily

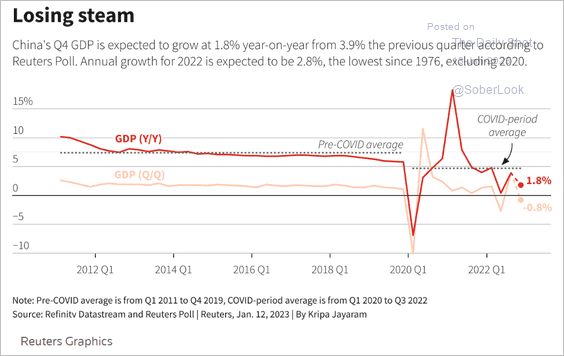

4. Here is the Q4 GDP forecast based on a survey from Reuters.

Source: Reuters Read full article

Source: Reuters Read full article

5. Semiconductor demand is slowing.

![]() Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

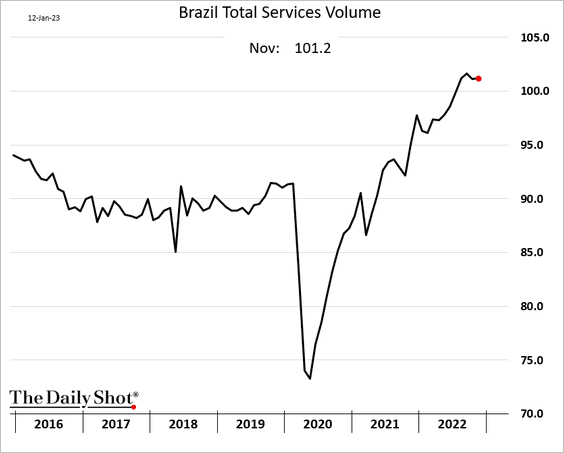

1. Brazil’s services output is holding up well.

Source: To share this content, please use the link https://brazilian.report/liveblog/2023/01/12/services-stable-boom/ or the tools offered on the page. Read full article

Source: To share this content, please use the link https://brazilian.report/liveblog/2023/01/12/services-stable-boom/ or the tools offered on the page. Read full article

——————–

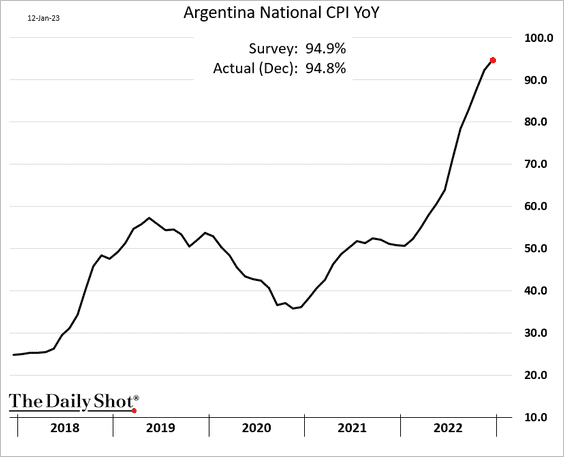

2. Argentina’s CPI is nearing 100%.

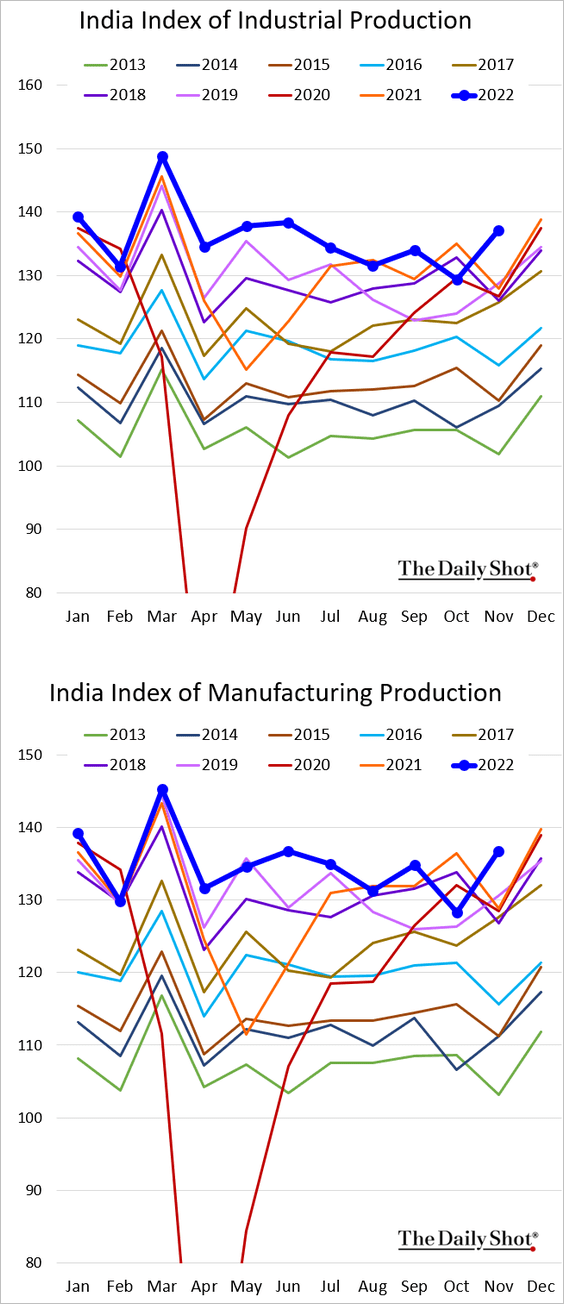

3. India’s industrial production hit a multi-year high in November.

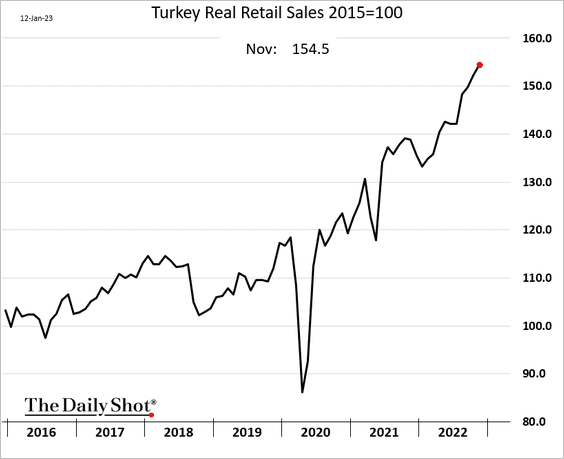

4. Turkey’s retail sales continue to surge.

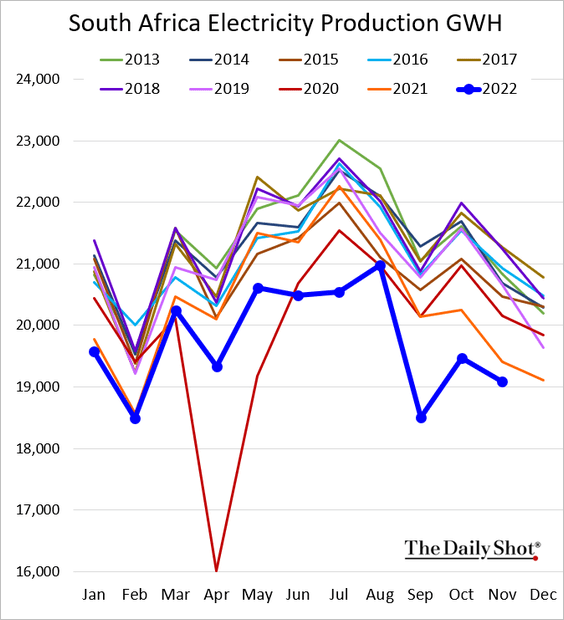

5. South Africa’s electricity production remains at multi-year lows.

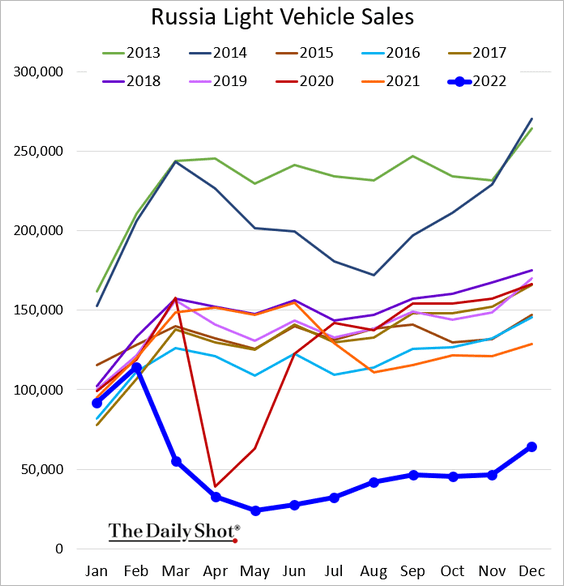

6. Russian car sales climbed above 50k last month.

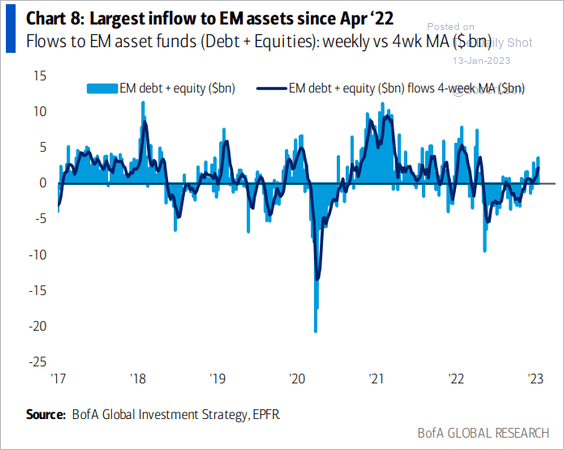

7. EM fund flows have turned positive.

Source: BofA Global Research

Source: BofA Global Research

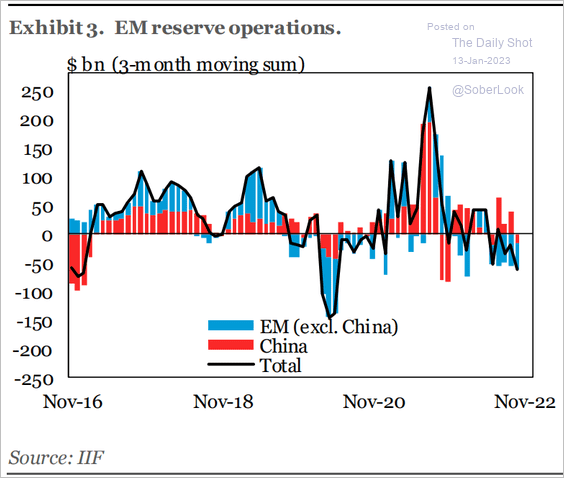

8. FX reserves continue to fall.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

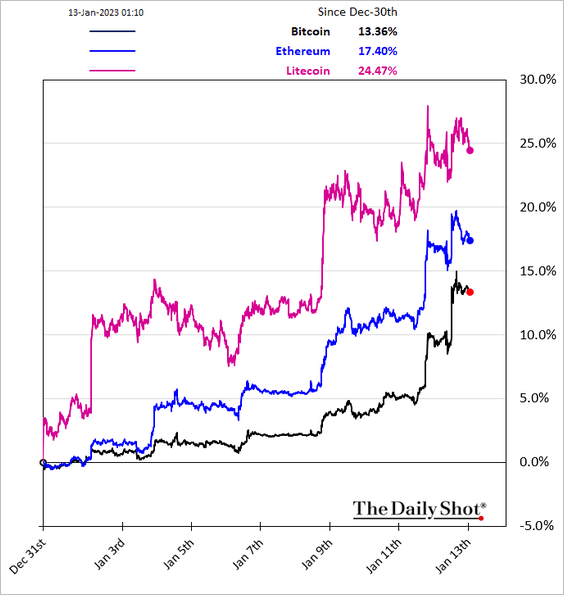

1. Cryptos started the year on a strong note.

Source: @isabelletanlee, @crypto Read full article

Source: @isabelletanlee, @crypto Read full article

——————–

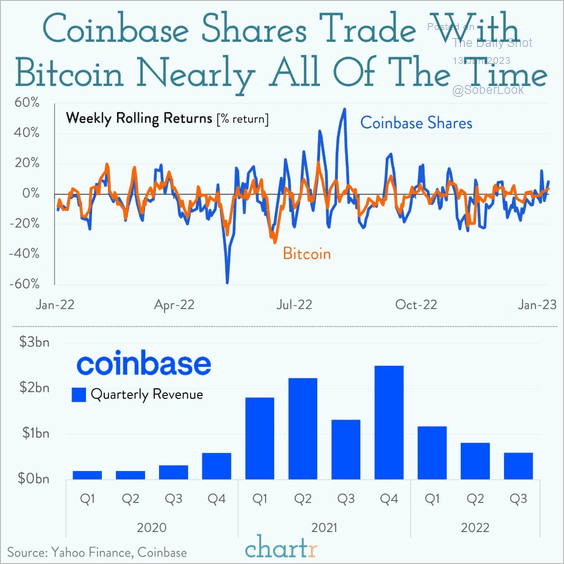

2. Coinbase share prices are highly correlated to bitcoin.

Source: @chartrdaily

Source: @chartrdaily

Back to Index

Commodities

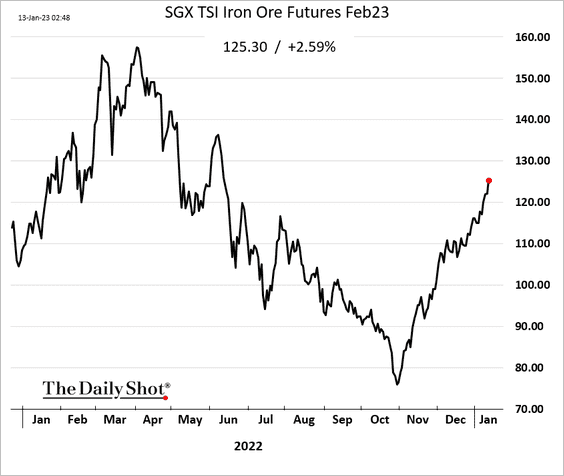

1. Iron ore continues to surge on China’s reopening.

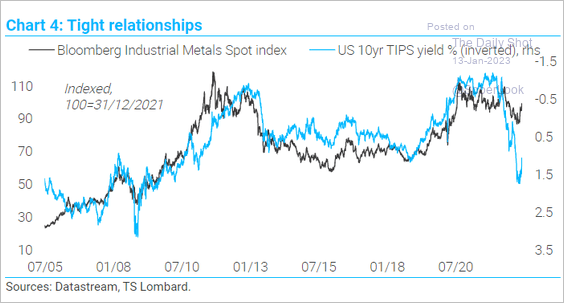

2. This chart shows the disconnect between base metals and US real yields.

Source: TS Lombard

Source: TS Lombard

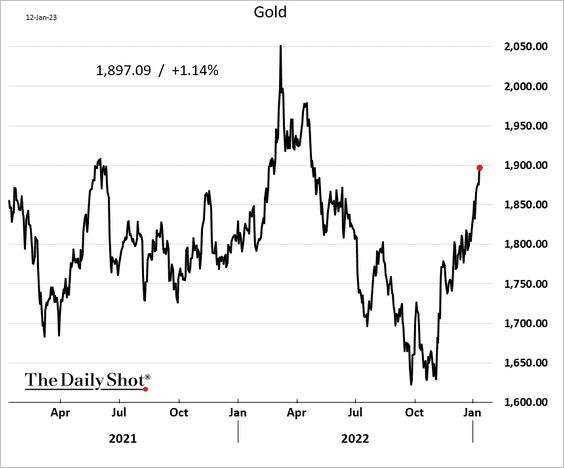

3. Gold prices are nearing $1900/oz as the dollar weakens and US real yields decline.

Back to Index

Energy

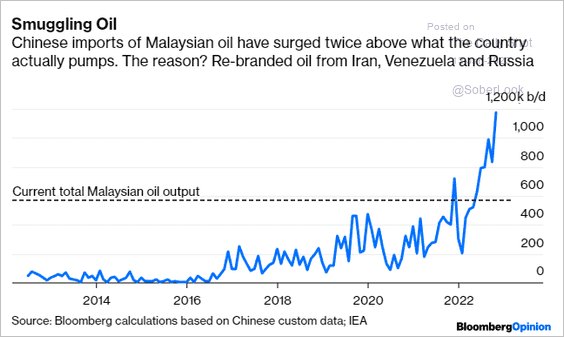

1. China is importing “rebranded” Russian oil.

Source: @JavierBlas

Source: @JavierBlas

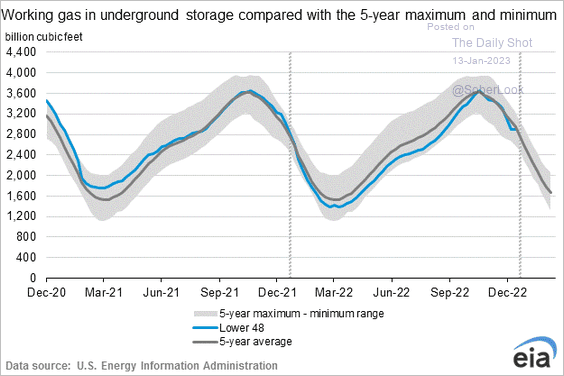

2. Despite the pre-Christmas cold blast, US natural gas in storage is at its 5-year average.

Back to Index

Equities

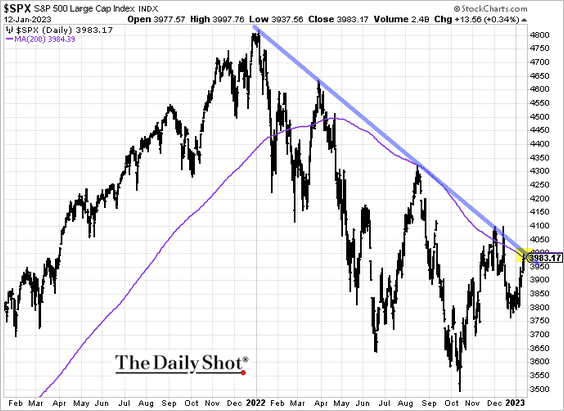

1. The S&P 500 is at resistance.

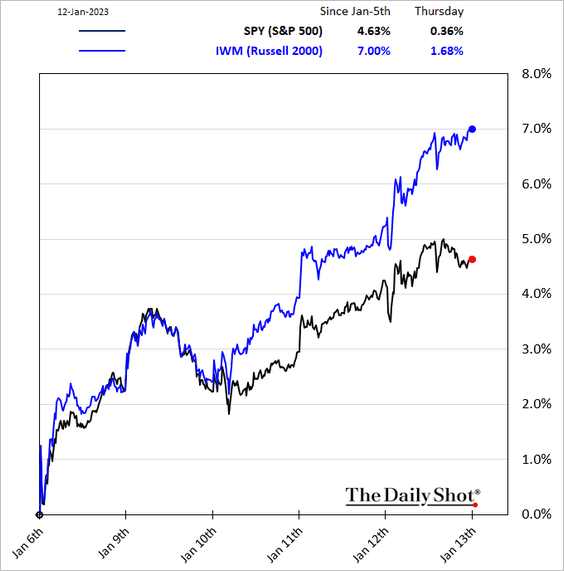

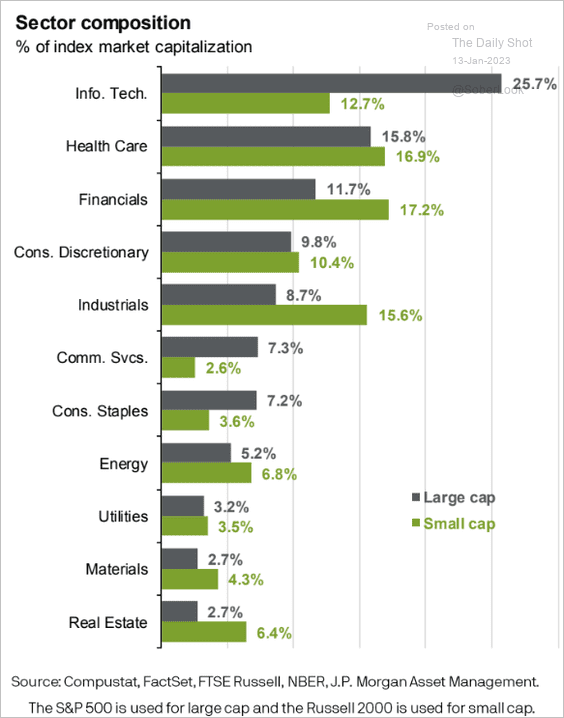

2. Small caps are outperforming.

Here are the differences in sector composition between the S&P 500 and the Russell 2000.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

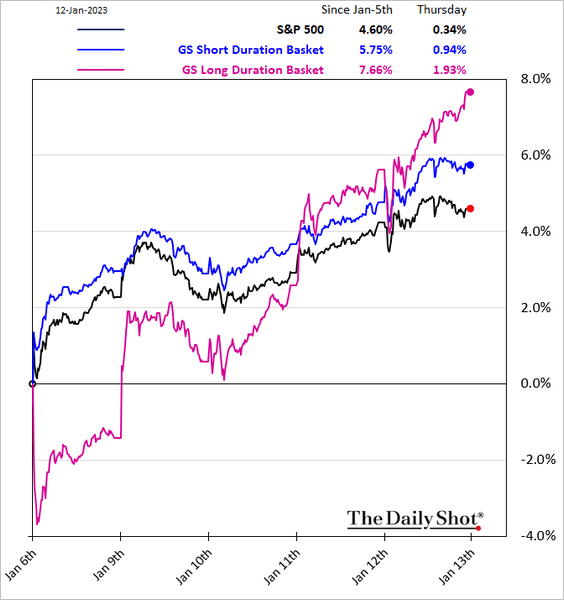

3. Long-duration stocks are surging as bond yields (including real yields) decline.

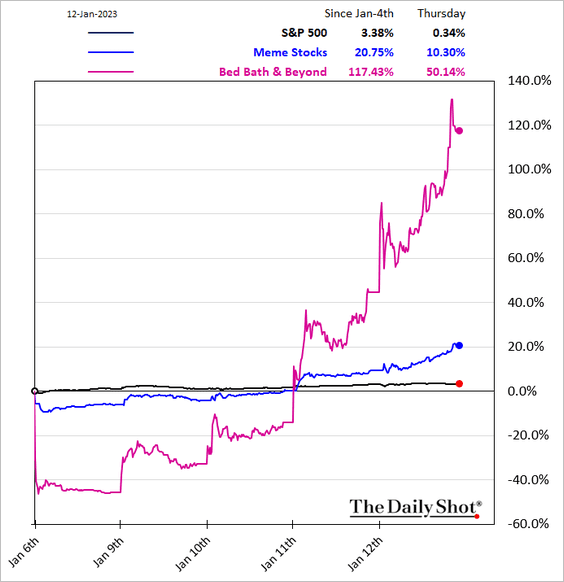

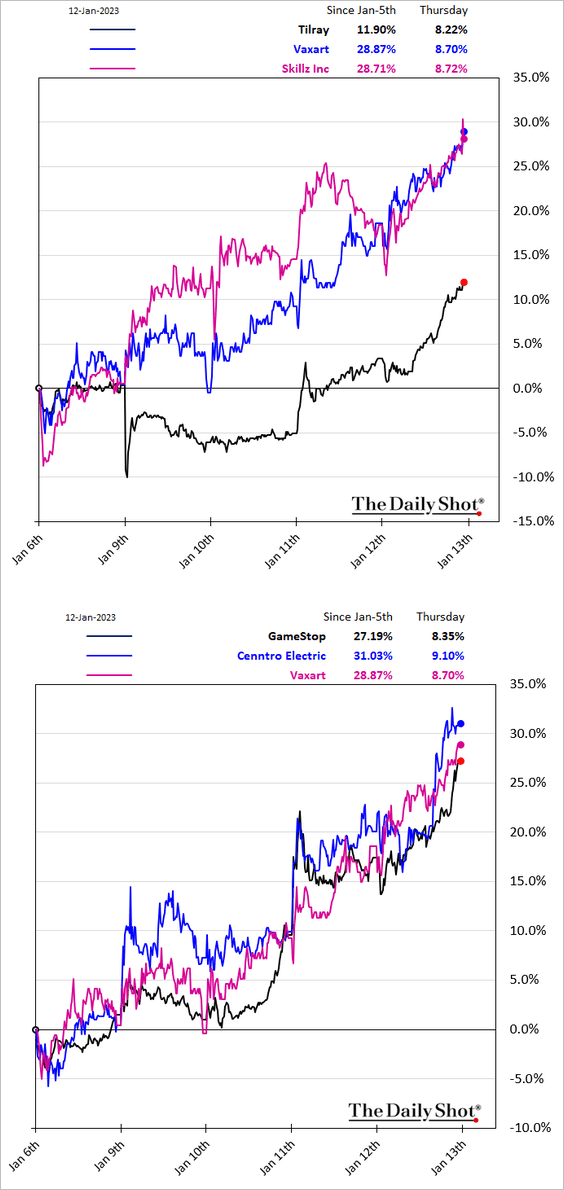

4. Meme stocks are soaring (2 charts).

——————–

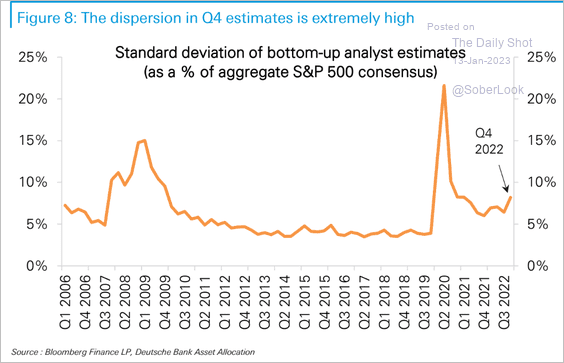

5. The Q4 earnings estimates dispersion is very high.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

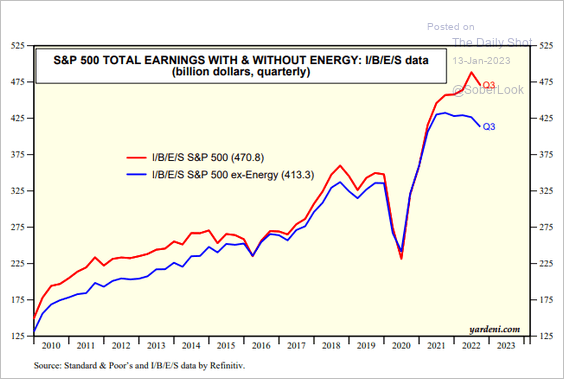

• This chart shows the S&P 500 earnings with and without the energy sector.

Source: Yardeni Research

Source: Yardeni Research

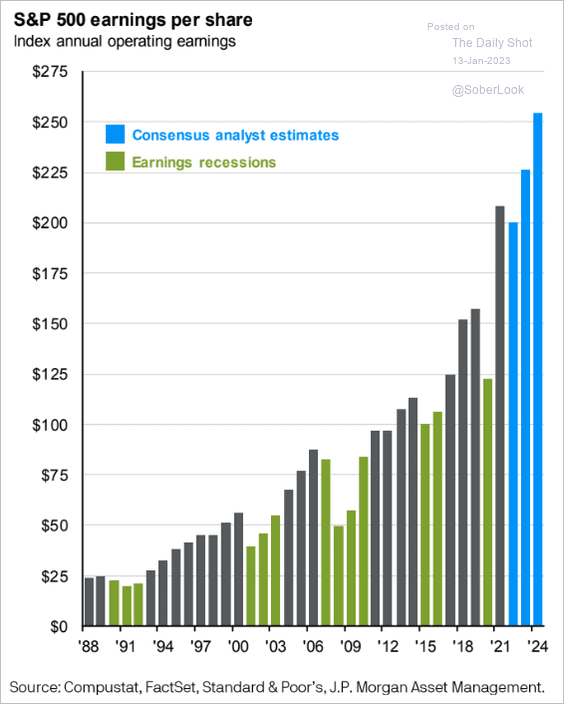

• Are earnings estimates for 2023 and 2024 too optimistic?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

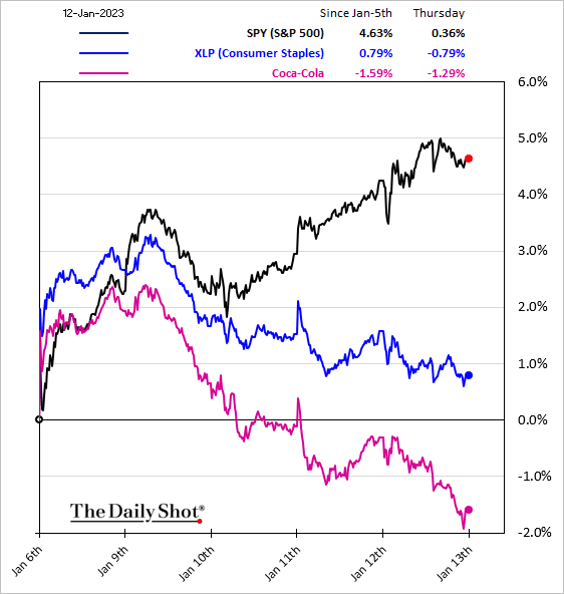

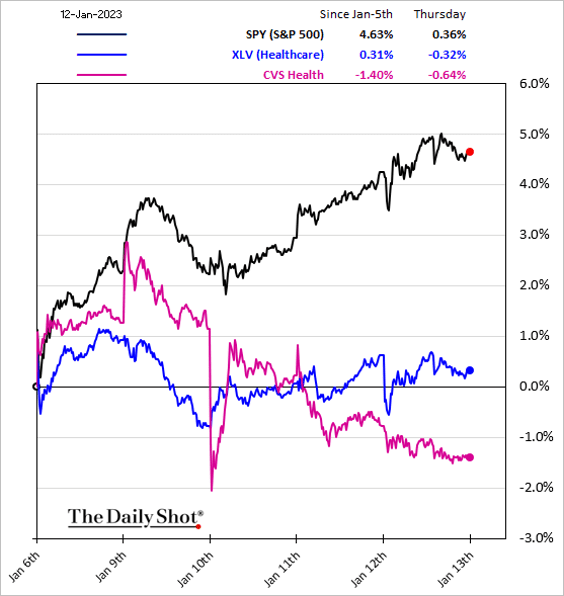

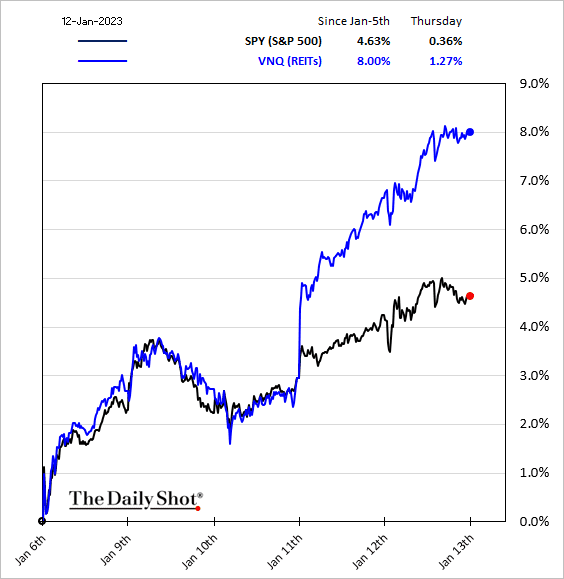

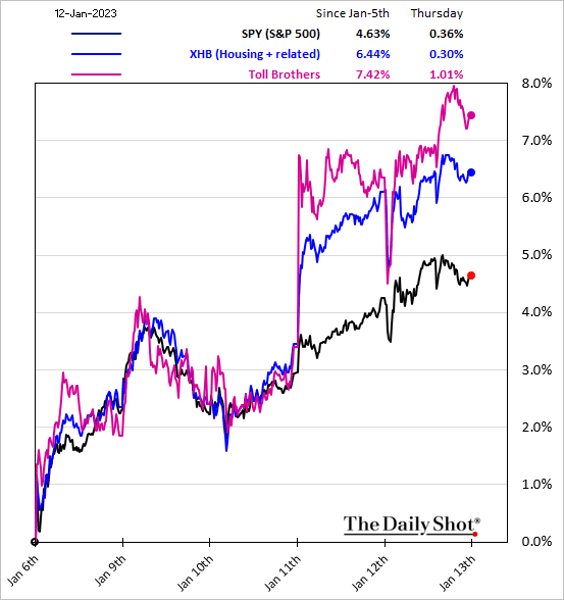

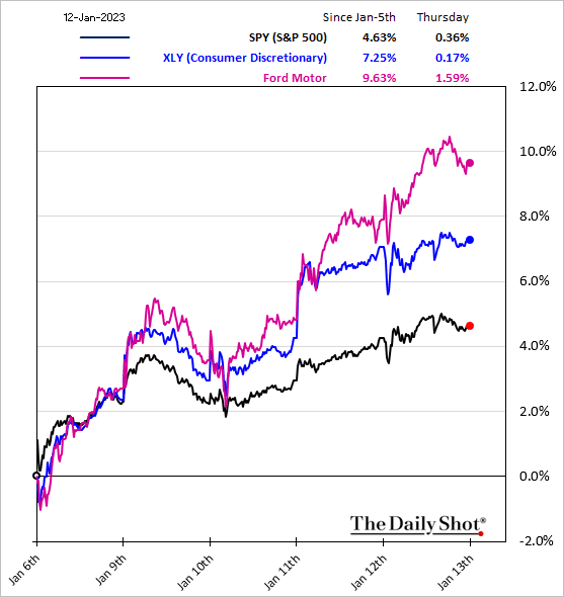

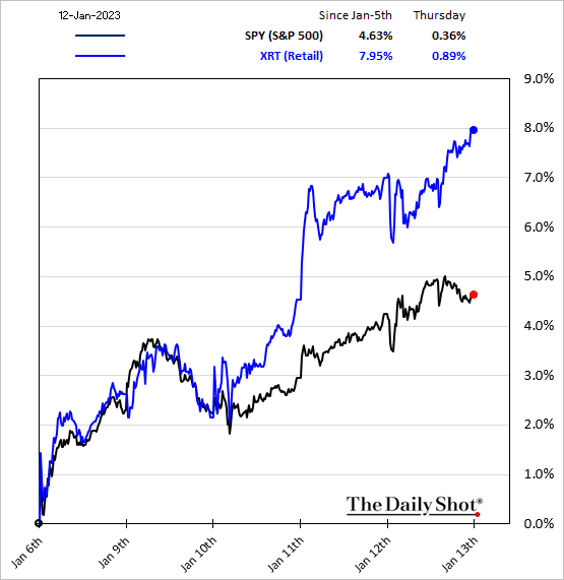

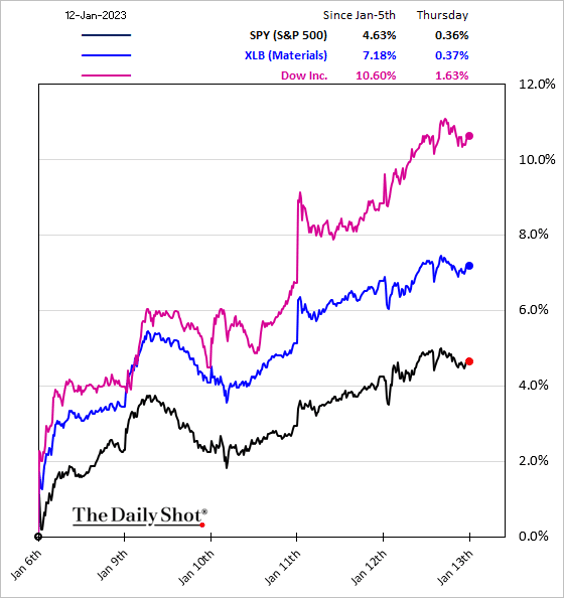

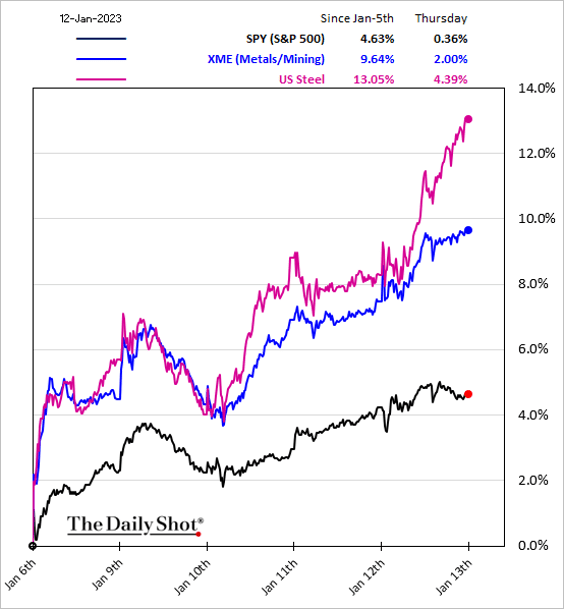

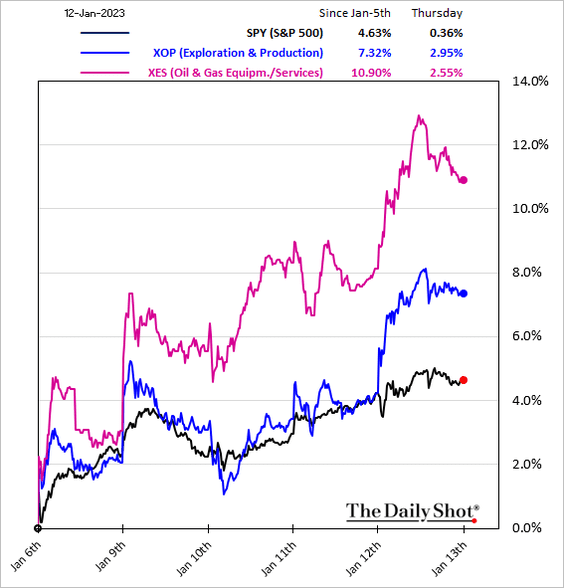

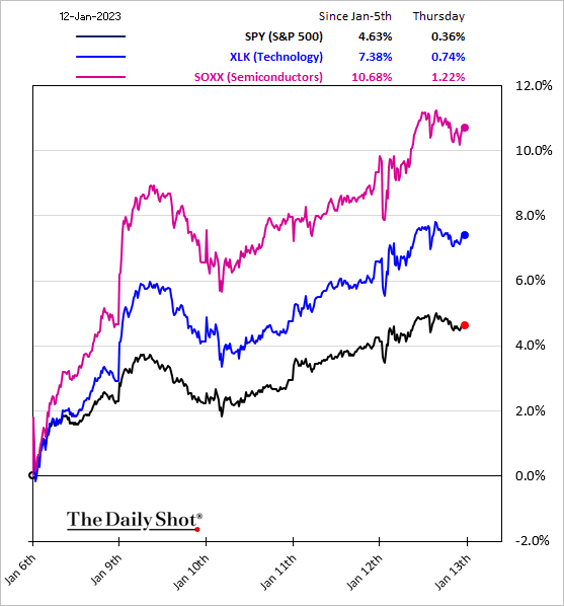

6. Next, we have some sector performance updates.

• Defensive sectors are underperforming, …

– Consumer Staples:

– Healthcare:

• … but property stocks are doing well as bond yields fall.

Lower bond yields are also helping housing stocks.

• Consumer discretionary and retail stocks are surging.

• Falling US dollar and China reopening are helping materials, mining, and energy shares.

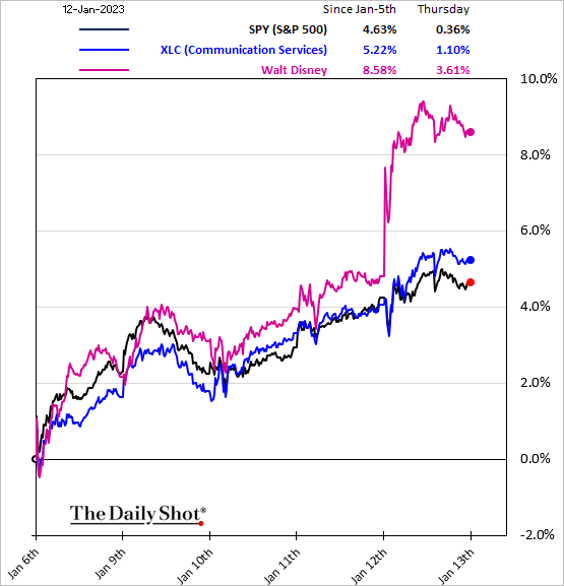

• Tech, semiconductor, and communication services shares are rebounding.

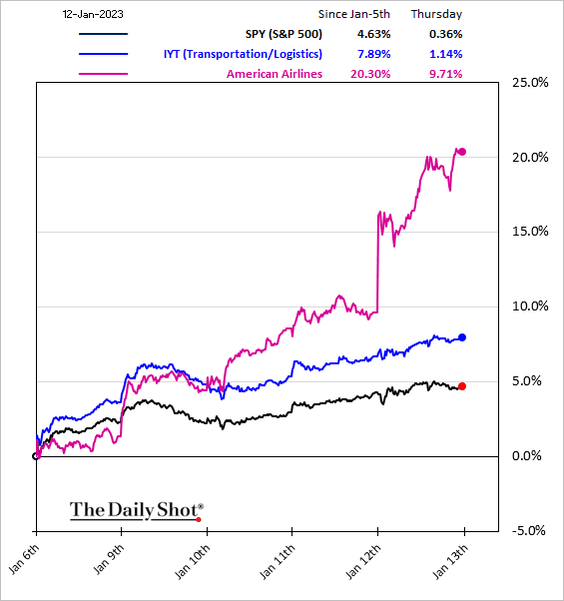

• Transport shares are outperforming as well.

Back to Index

Credit

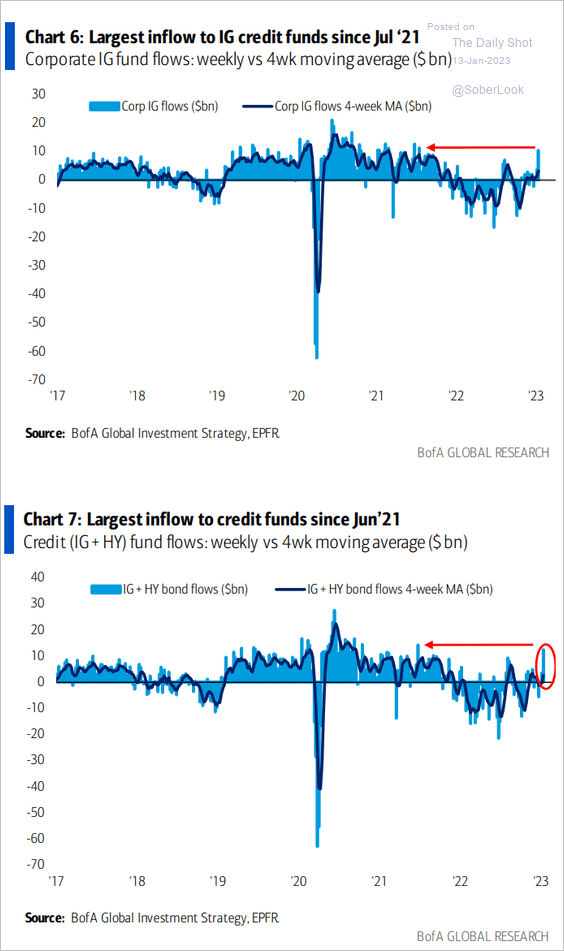

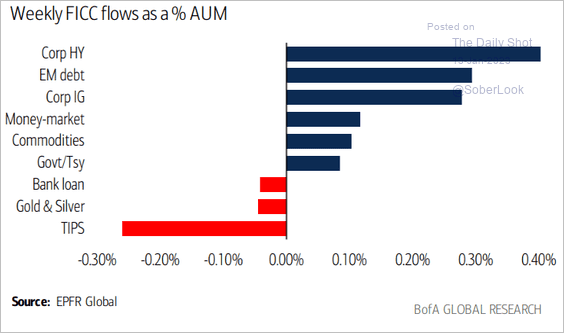

1. Investors are jumping into corporate credit, with fund inflows picking up speed.

Source: Reuters Read full article

Source: Reuters Read full article

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

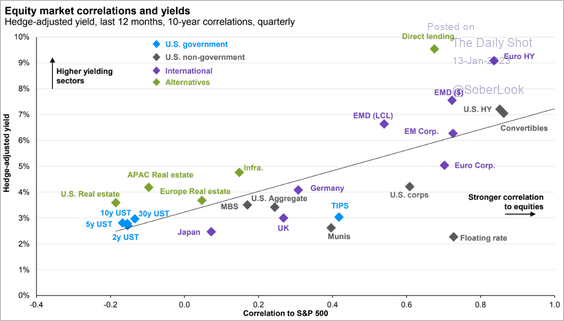

2. This scatterplot shows the fixed-income universe risk/reward profile (risk = correlation to the S&P 500, reward = yield).

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Rates

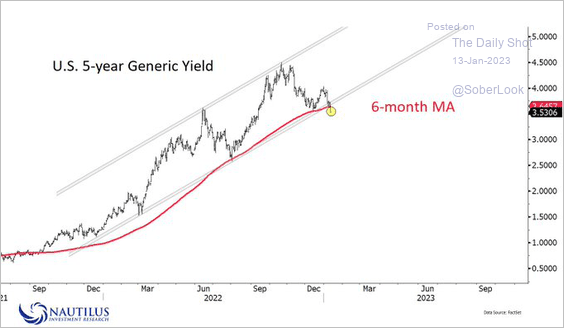

1. The 5-year Treasury yield is at support.

Source: @NautilusCap

Source: @NautilusCap

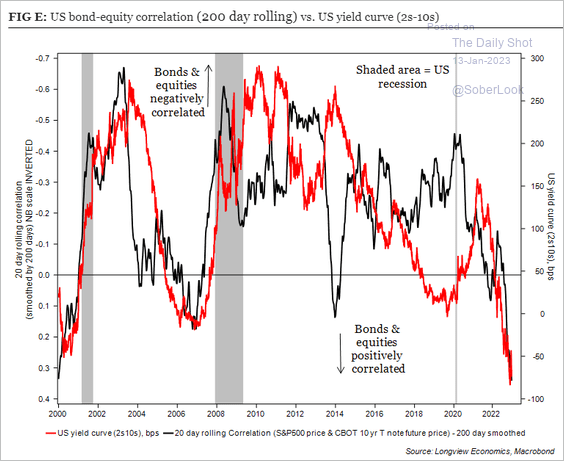

2. The yield curve slope and the bond-equity correlation tend to move in tandem.

Source: Longview Economics

Source: Longview Economics

——————–

Food for Thought

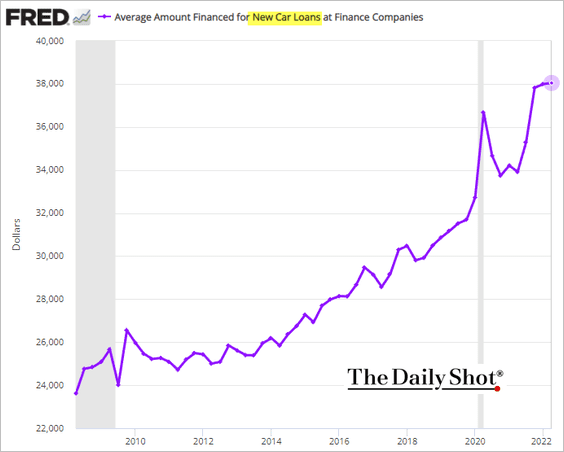

1. Average new car loan in the US:

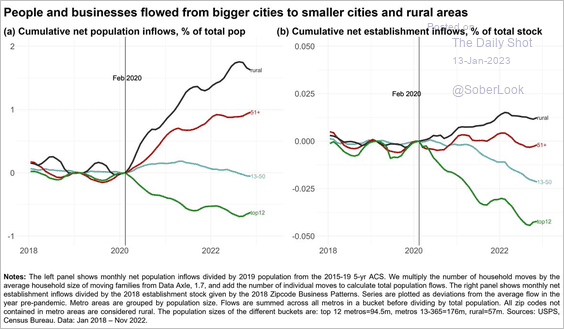

2. Migration to smaller cities:

Source: @I_Am_NickBloom, Raman and Bloom Read full article

Source: @I_Am_NickBloom, Raman and Bloom Read full article

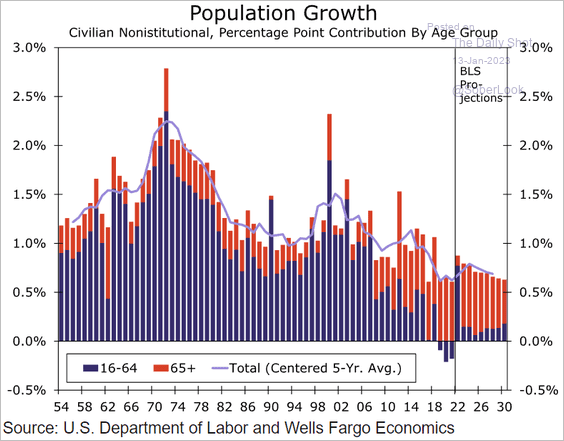

3. US population growth by age group:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

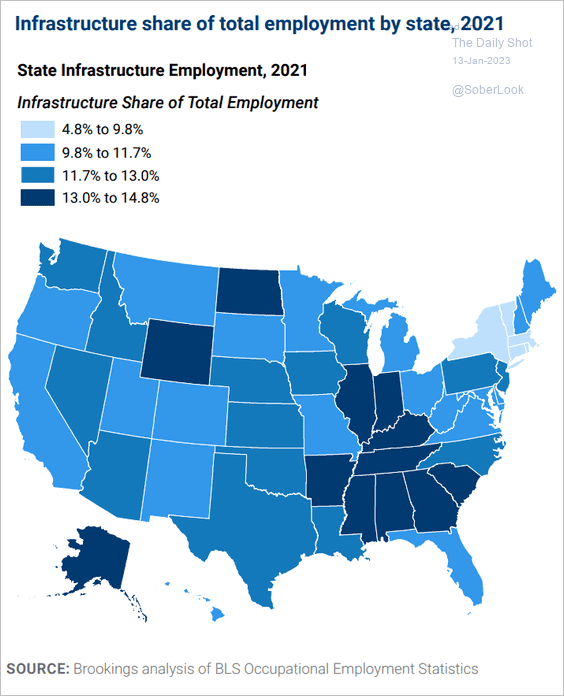

4. Infrastructure employment:

Source: Brookings Read full article

Source: Brookings Read full article

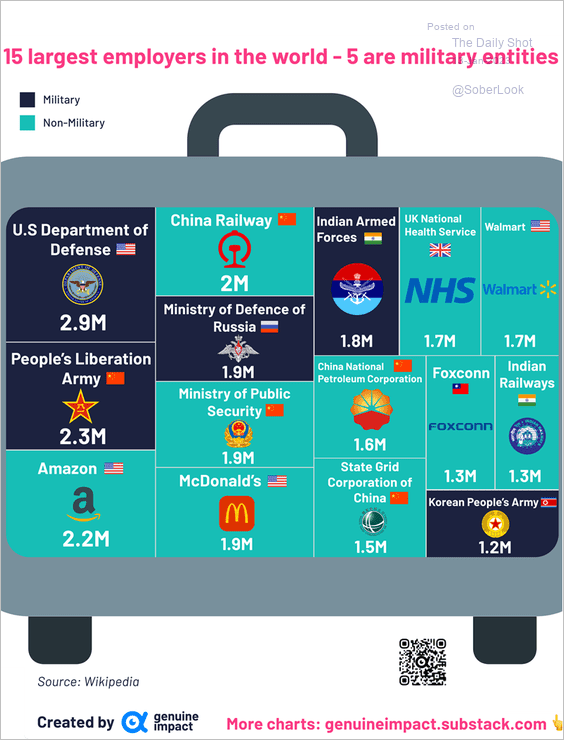

5. 15 largest employers in the world:

Source: @genuine_impact

Source: @genuine_impact

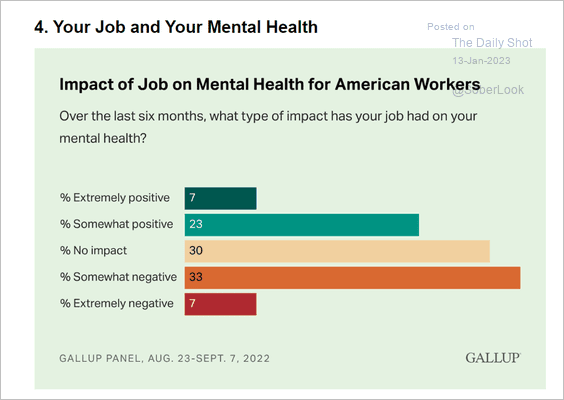

6. The impact of your job on your mental health:

Source: Gallup Read full article

Source: Gallup Read full article

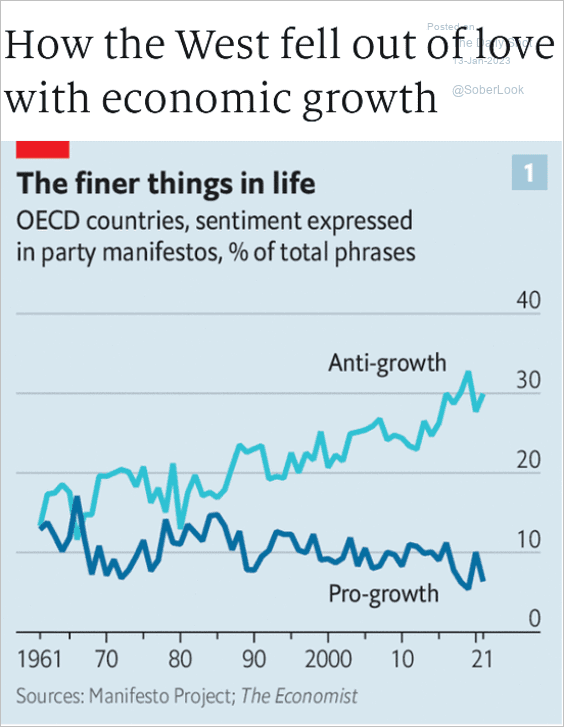

7. Declining interest in economic growth:

Source: The Economist Read full article

Source: The Economist Read full article

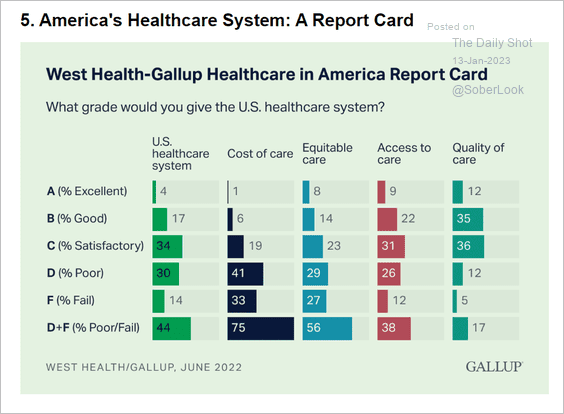

8. Rating the US healthcare system:

Source: Gallup Read full article

Source: Gallup Read full article

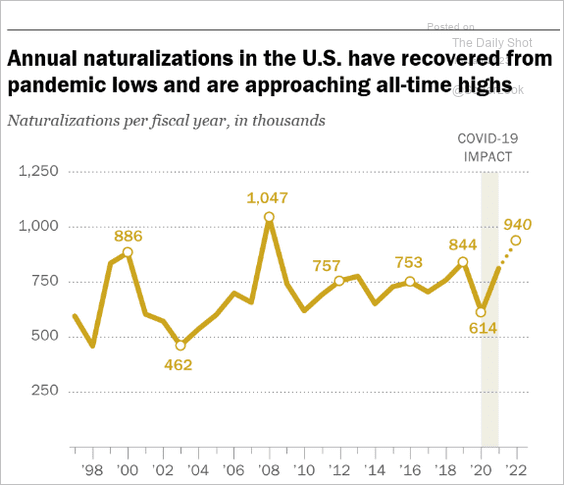

9. US naturalizations:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

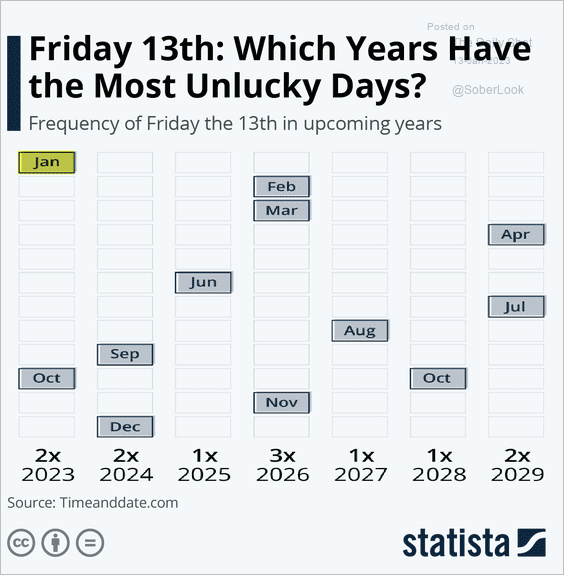

10. Frequency of Friday the 13th by year:

Source: Statista

Source: Statista

——————–

The next Daily Shot will be out on Tuesday, January 17th.

Have a great weekend!

Back to Index