The Daily Shot: 17-Jan-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

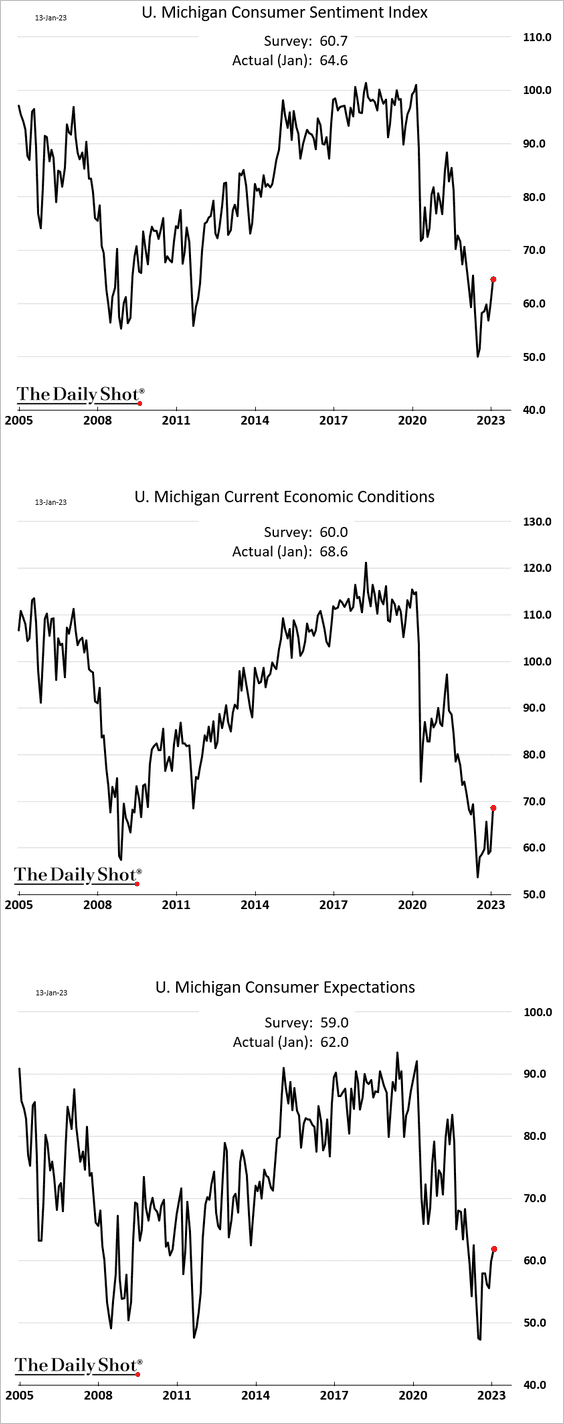

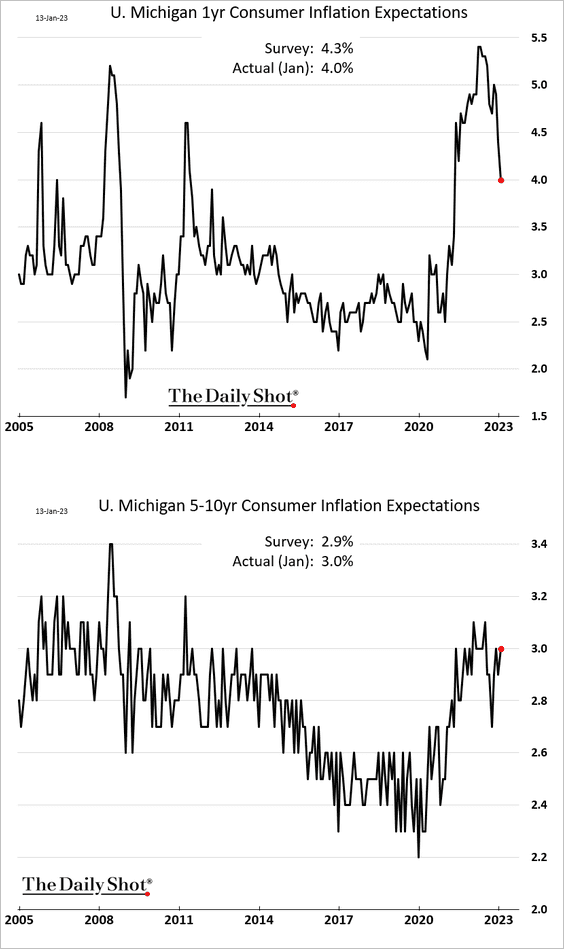

1. The U. Michigan consumer sentiment index improved this month, topping expectations.

Indicators of buying conditions moved higher.

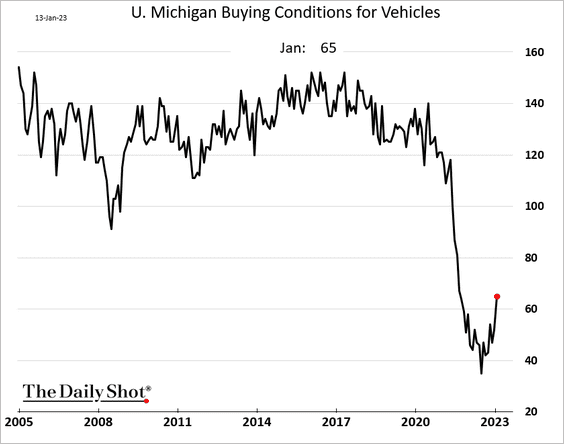

Goldman’s Twitter sentiment index points to further gains in consumer confidence.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

2. Next, we have some updates on inflation.

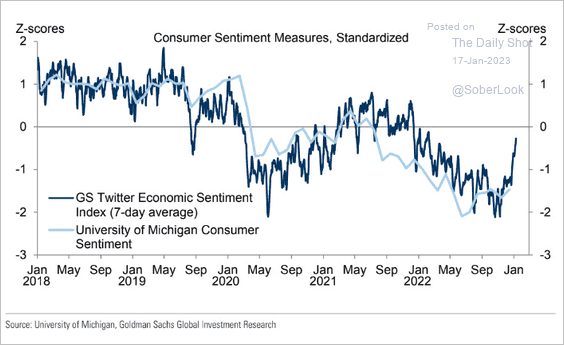

• The U. Michigan’s 1-year consumer inflation expectations declined further, but longer-term inflation projections edged up.

Source: Reuters Read full article

Source: Reuters Read full article

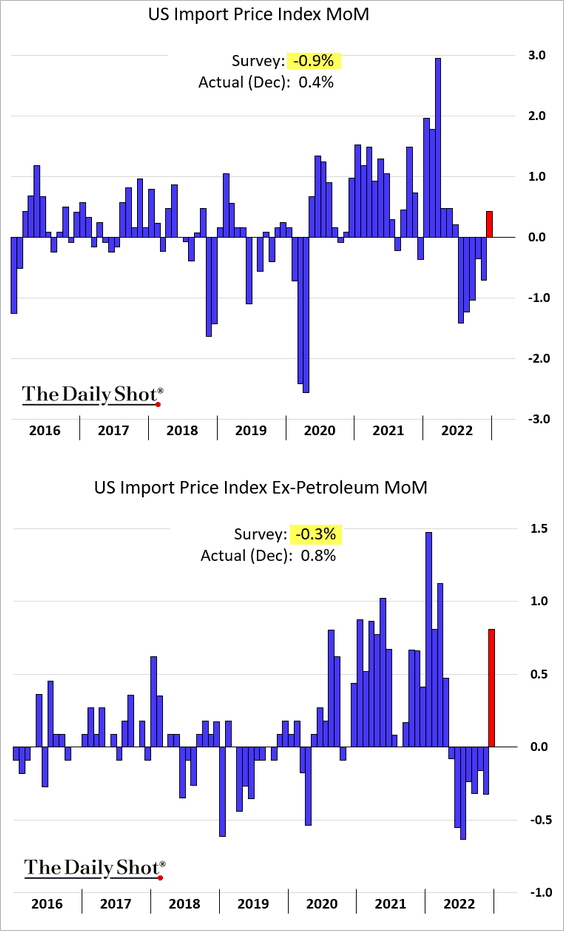

• Import prices unexpectedly jumped in December.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

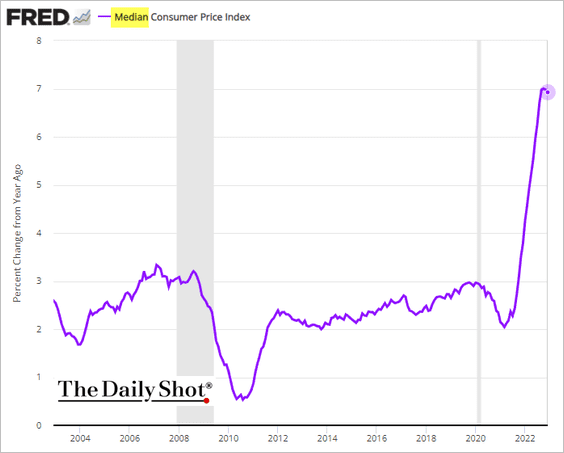

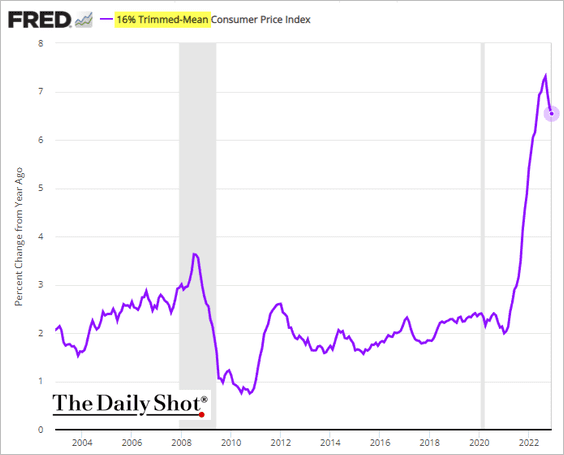

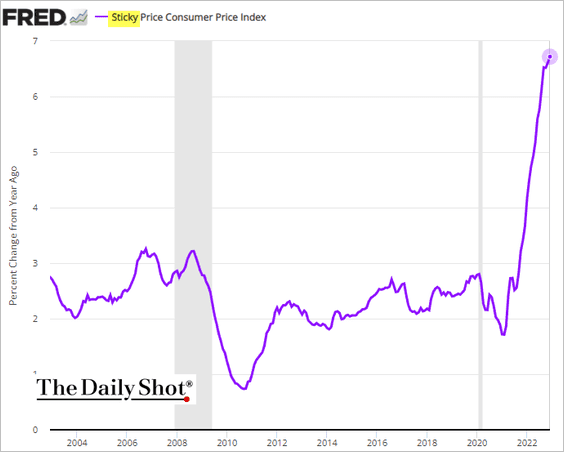

• Next, we have the alternative measures of core inflation (year-over-year).

– Median CPI:

– Trimmed-mean CPI:

– Sticky CPI:

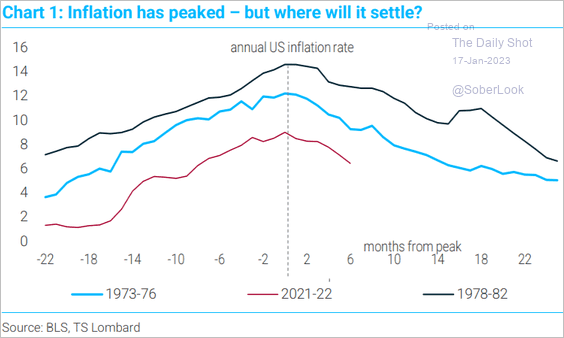

• How does the current inflationary spike compare to the 1970s?

Source: TS Lombard

Source: TS Lombard

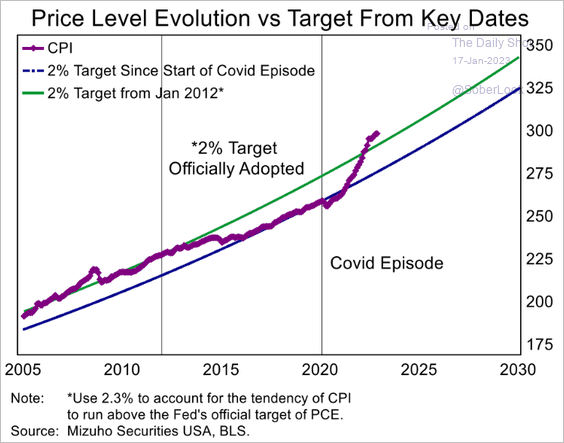

• Here is the CPI price level versus the 2% target trends.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

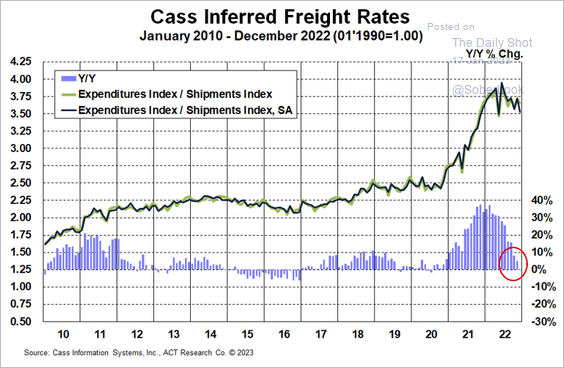

• Freight inflation and warehousing costs continue to ease.

Source: Cass Information Systems

Source: Cass Information Systems

Source: Quill Intelligence

Source: Quill Intelligence

——————–

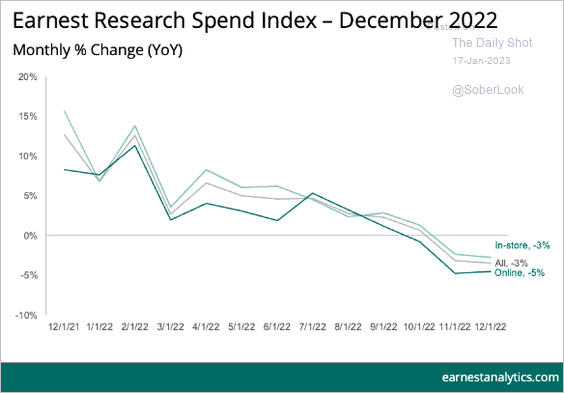

3. According to the Earnest Analytics Spend Index, retail sales softened in December.

Source: Earnest Analytics

Source: Earnest Analytics

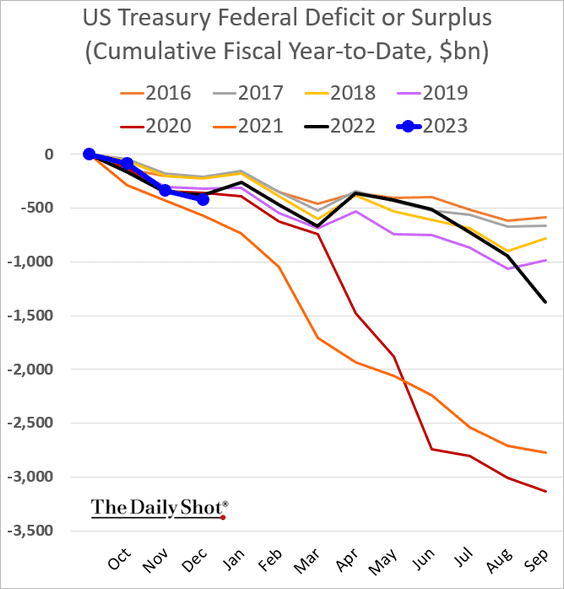

4. The budget deficit exceeded fiscal 2022 levels in December.

5. Next, let’s take a look at recession risks.

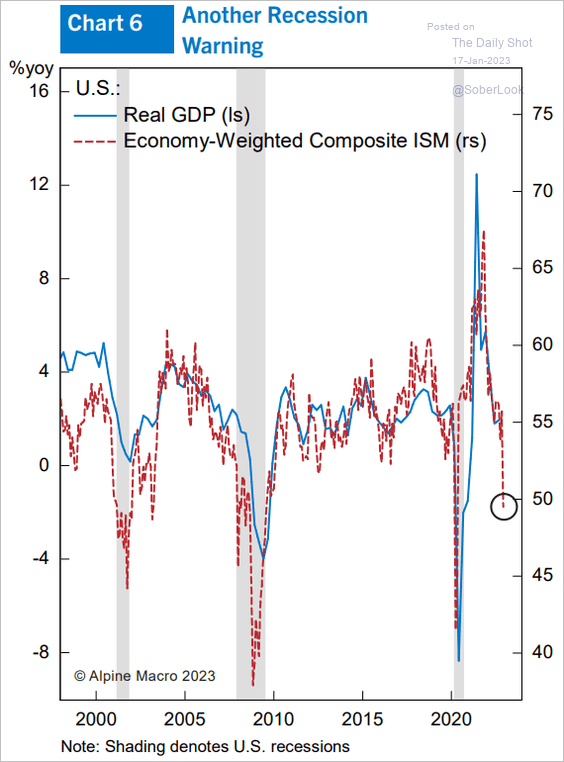

• Leading indicators continue to point to a substantial GDP contraction.

Source: Alpine Macro

Source: Alpine Macro

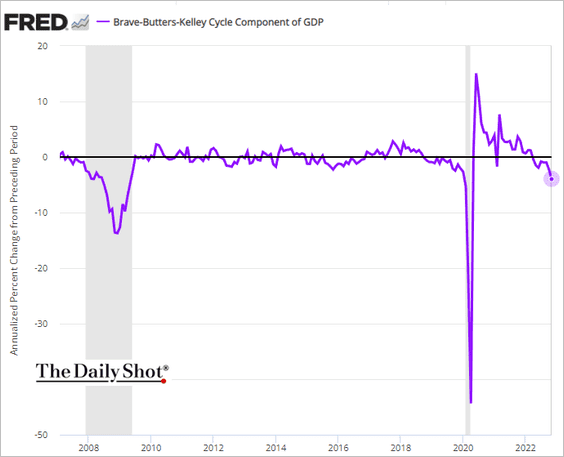

The cycle component of the Brave-Butters-Kelley Indexes reflects “movements that are likely to govern the direction of growth going forward,” picking up the “turning points in the business cycle.”

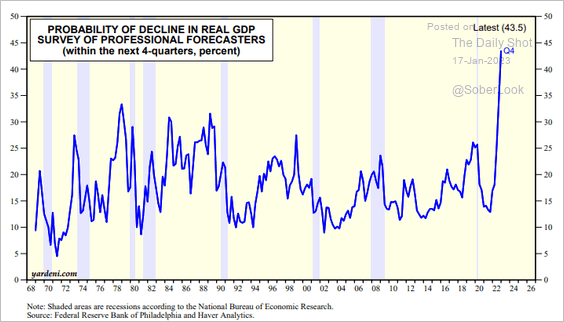

• This will be the most anticipated recession in history as forecasters boost their downturn expectations.

Source: Yardeni Research

Source: Yardeni Research

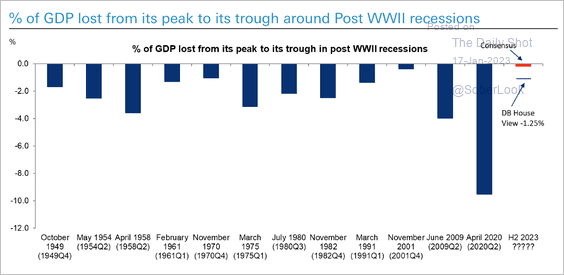

– Deutsche Bank expects a deeper recession than the consensus.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

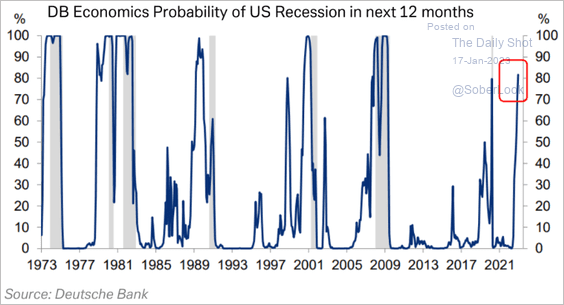

Here is the DB recession probability model.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

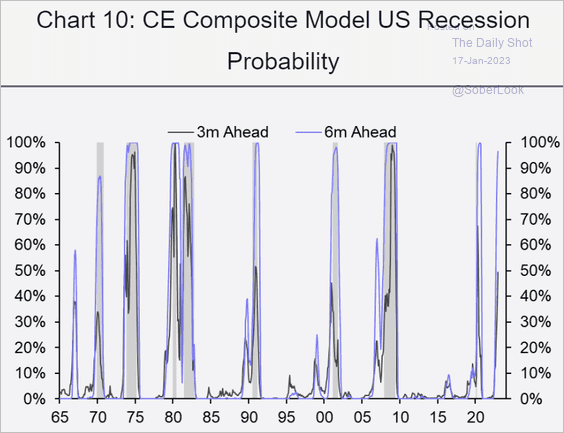

– Below is a model from Capital Economics.

Source: Capital Economics

Source: Capital Economics

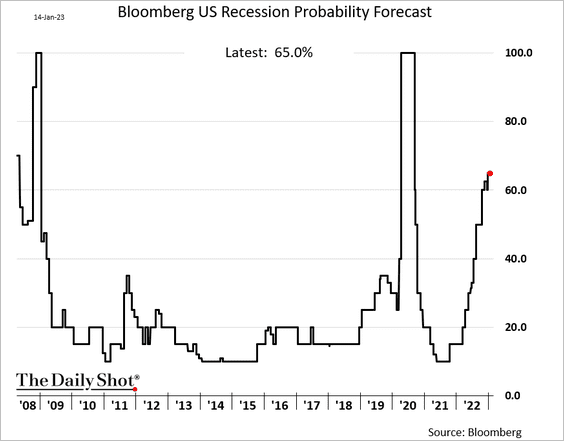

– And this is Bloomberg’s recession probability index.

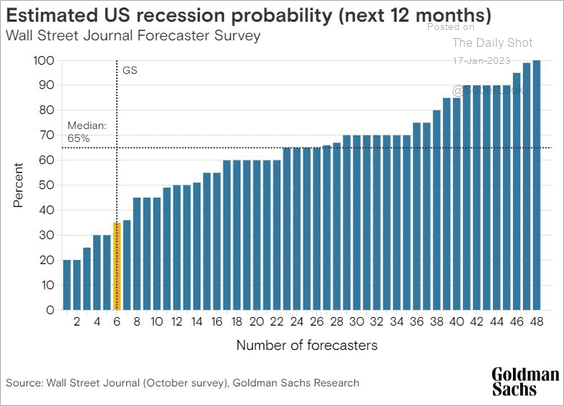

• But not everyone sees a recession this year. Here is Goldman’s recession probability vs. other forecasters.

Source: Goldman Sachs

Source: Goldman Sachs

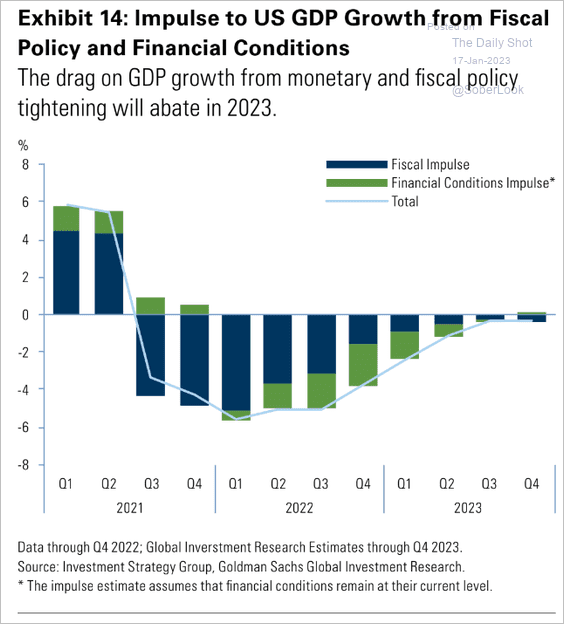

– The fiscal and financial conditions drag on growth will ease this year.

Source: Goldman Sachs

Source: Goldman Sachs

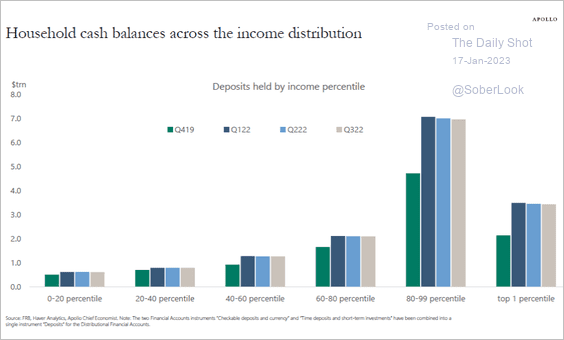

– As of Q3, household cash balances remained well above pre-COVID levels, which will be a tailwind for consumer spending.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

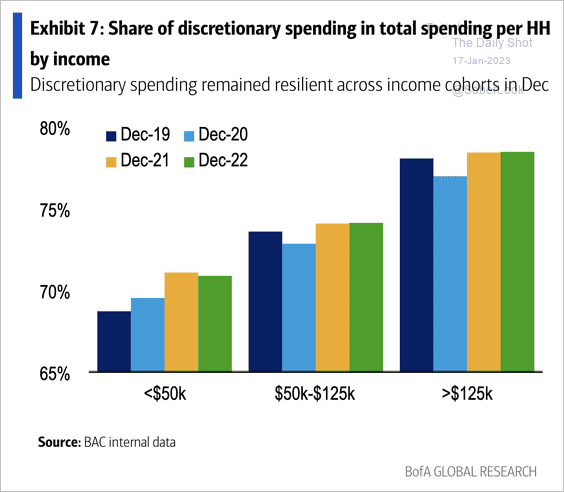

And discretionary spending remains robust.

Source: BofA Global Research; @SamRo, h/t @dailychartbook

Source: BofA Global Research; @SamRo, h/t @dailychartbook

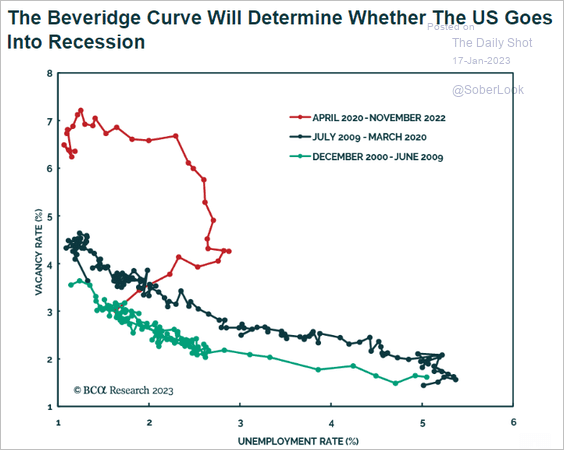

• The outcome will hinge on whether labor market imbalances diminish, allowing the Fed to stop raising rates.

Source: BCA Research

Source: BCA Research

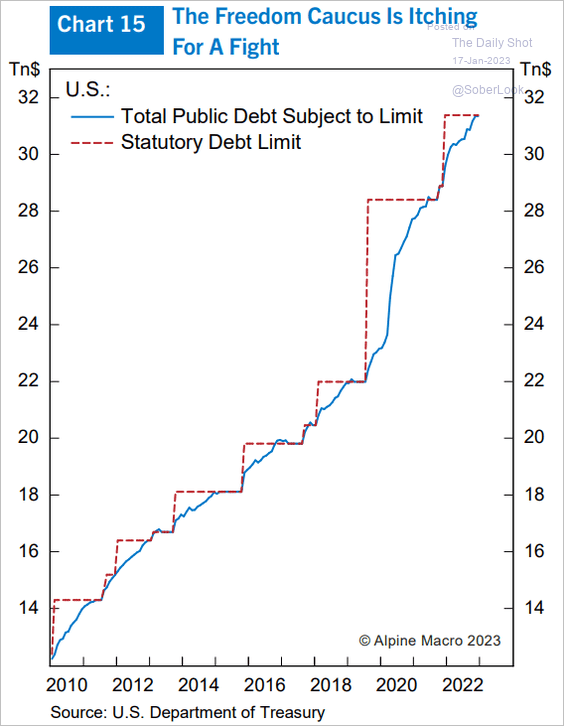

• One sure way to get a recession is a debt crisis, with 2023 increasingly looking like 2011.

Source: Alpine Macro

Source: Alpine Macro

——————–

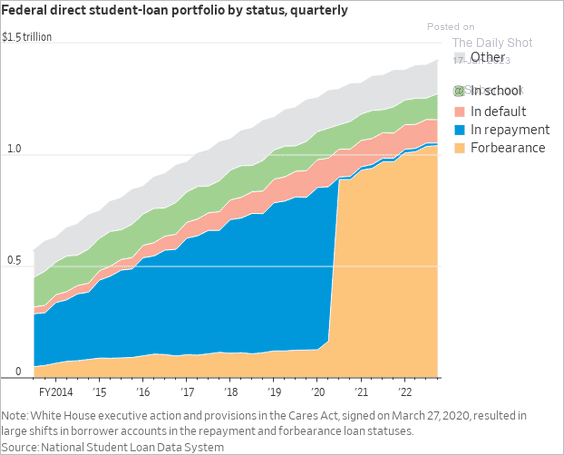

6. Over $1 trillion of student debt is in forbearance (and rising). At some point (perhaps this summer), payments will become due.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Canada

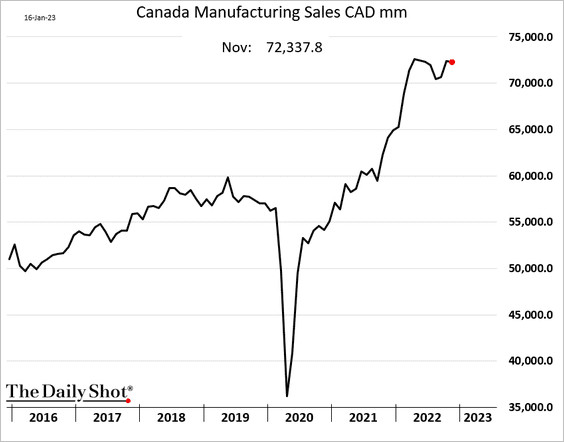

1. Manufacturing sales held up in November.

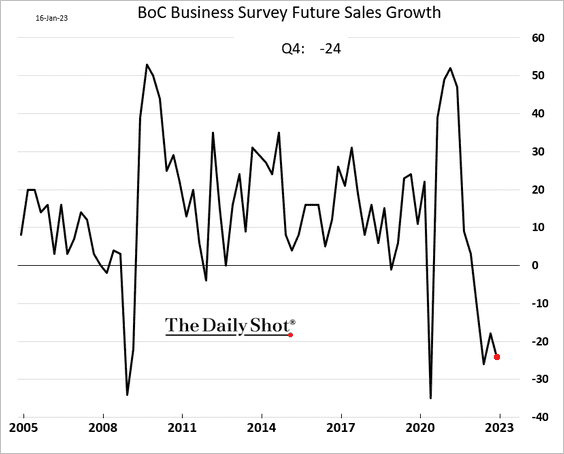

2. According to the BoC’s business survey, companies are gloomy about future sales.

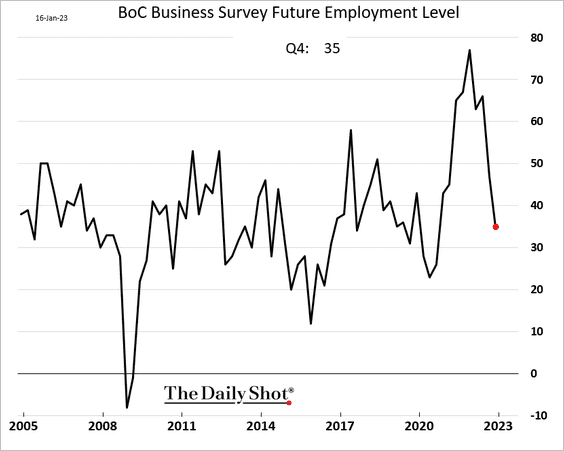

• Firms have pared back hiring plans.

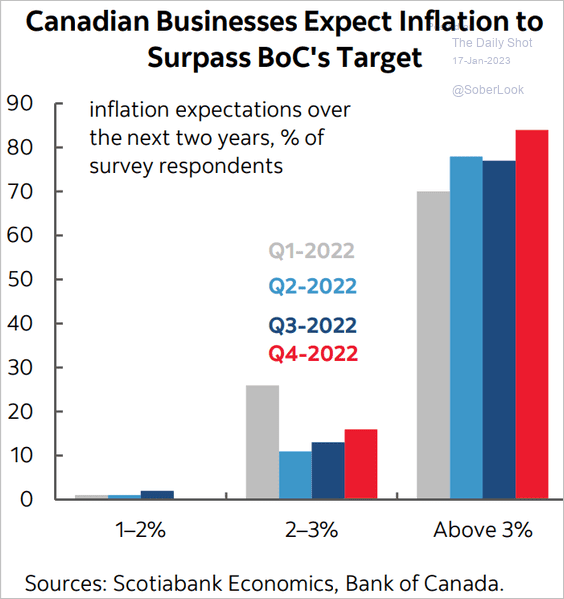

• Businesses see inflation surpassing the BoC’s target.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

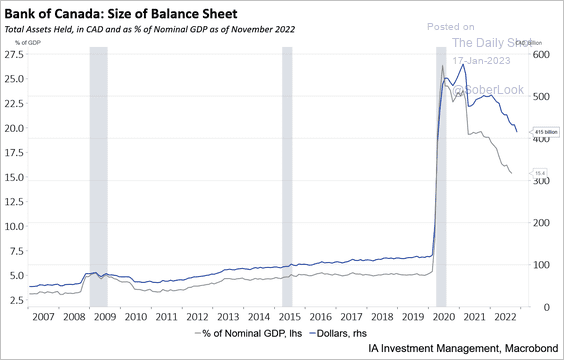

3. The BoC’s balance sheet continues to shrink.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

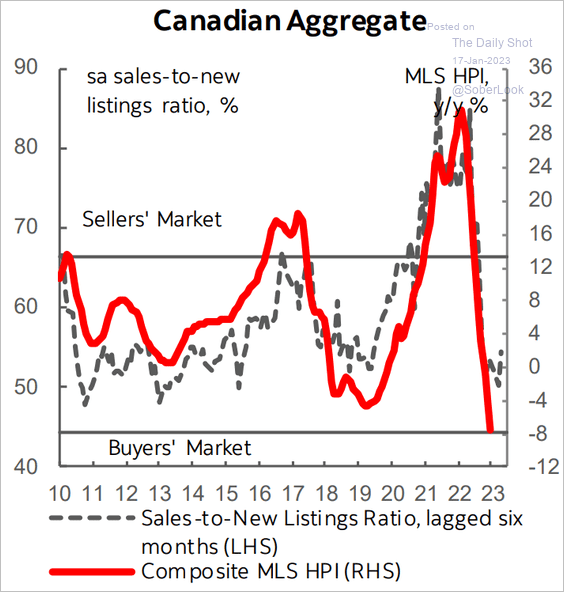

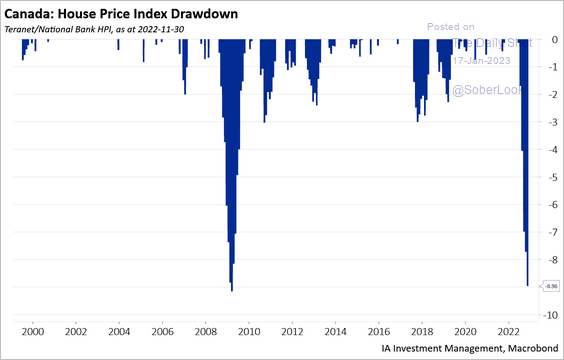

4. Home price declines have been severe (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

Back to Index

The United Kingdom

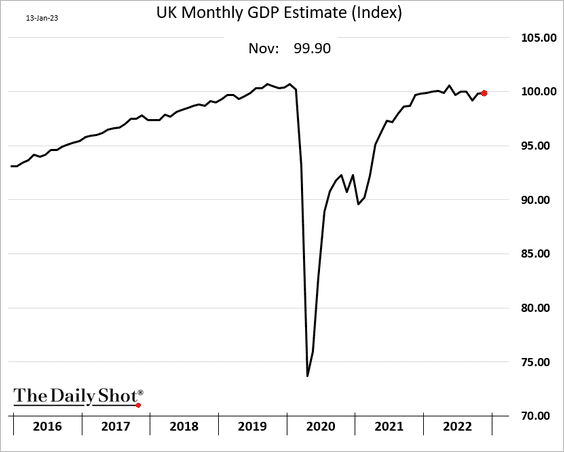

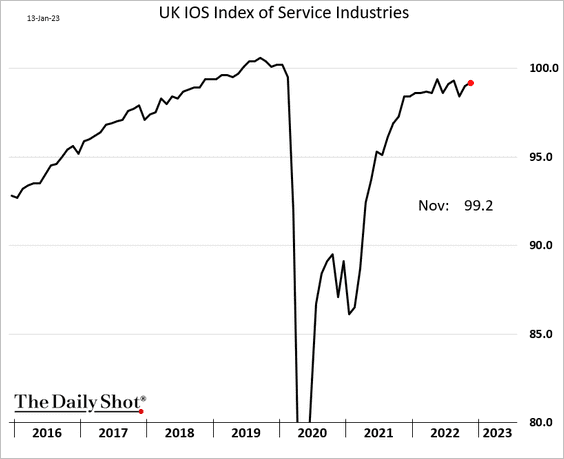

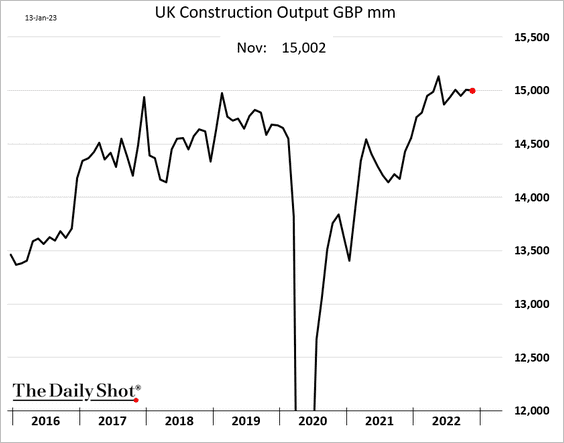

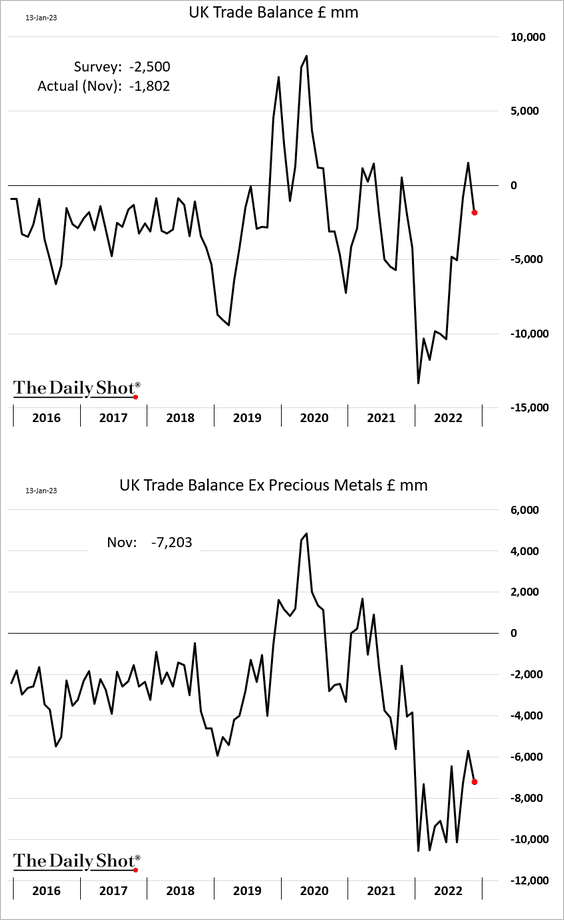

1. The monthly GDP edged higher in November, topping estimates.

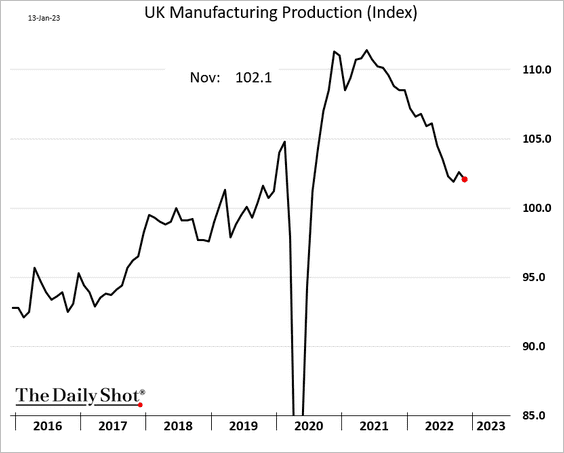

• Manufacturing production shrunk, …

… but service sector output improved.

• Construction was flat.

• The trade balance is back in deficit.

——————–

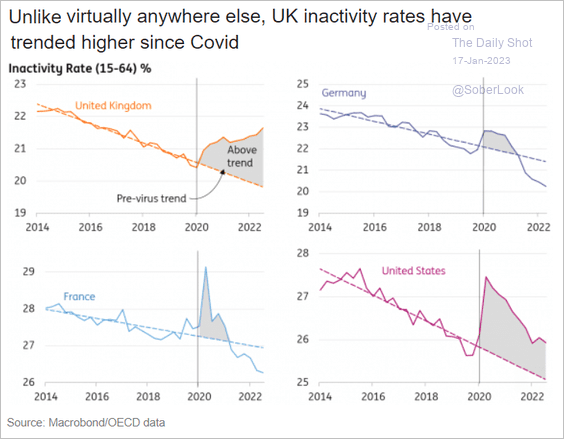

2. UK labor inactivity rates have been trending higher.

Source: ING

Source: ING

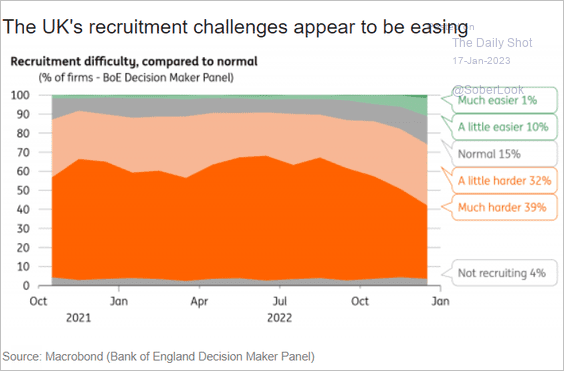

But hiring challenges are easing.

Source: ING

Source: ING

Back to Index

The Eurozone

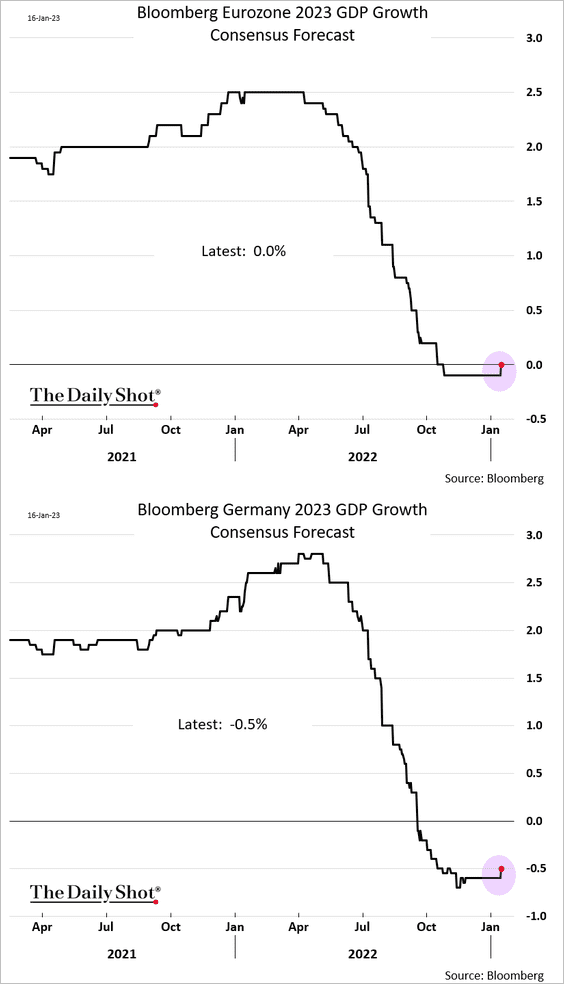

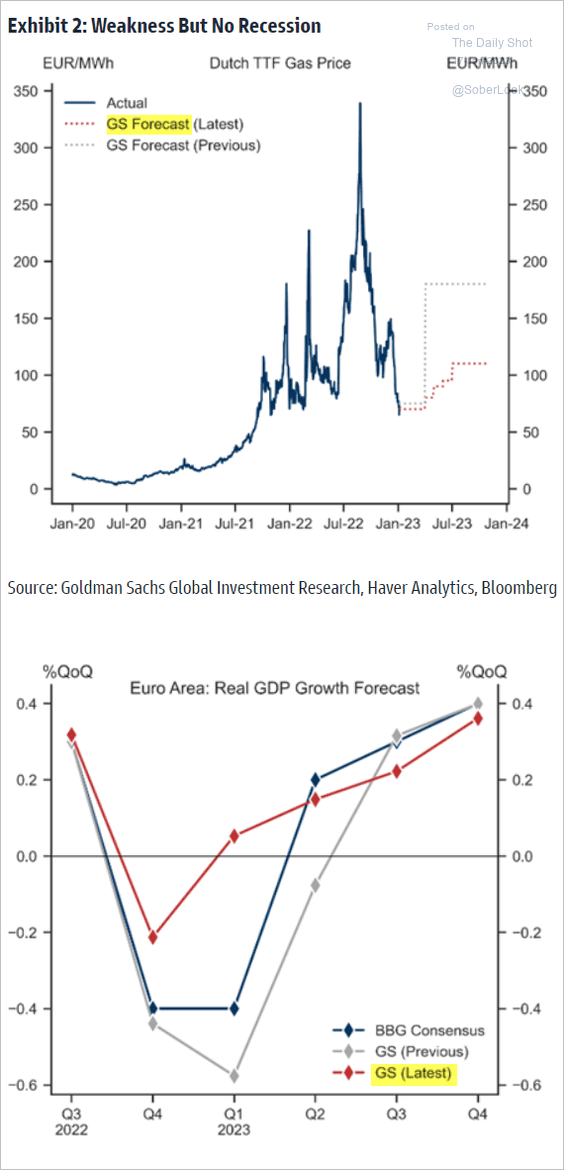

1. For the first time in a year, economists upgraded the Eurozone GDP forecast as the energy crisis eases (see the energy section).

• Goldman no longer sees a recession.

Source: Goldman Sachs

Source: Goldman Sachs

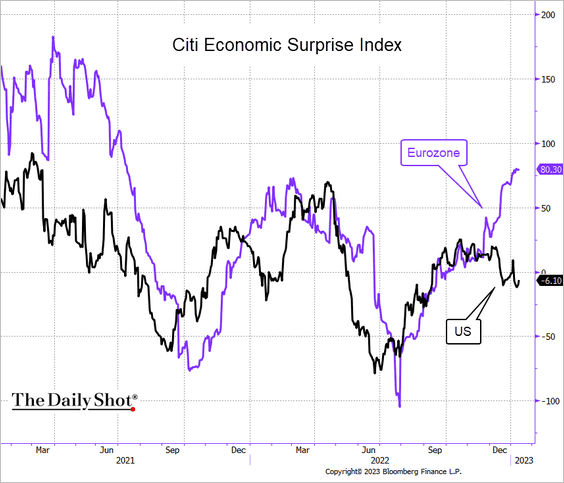

• The Citi Economic Surprise Index continues to outpace the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

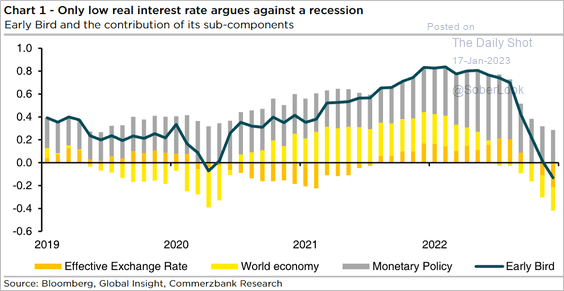

• However, the Commerzbank leading indicator for Germany has deteriorated.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

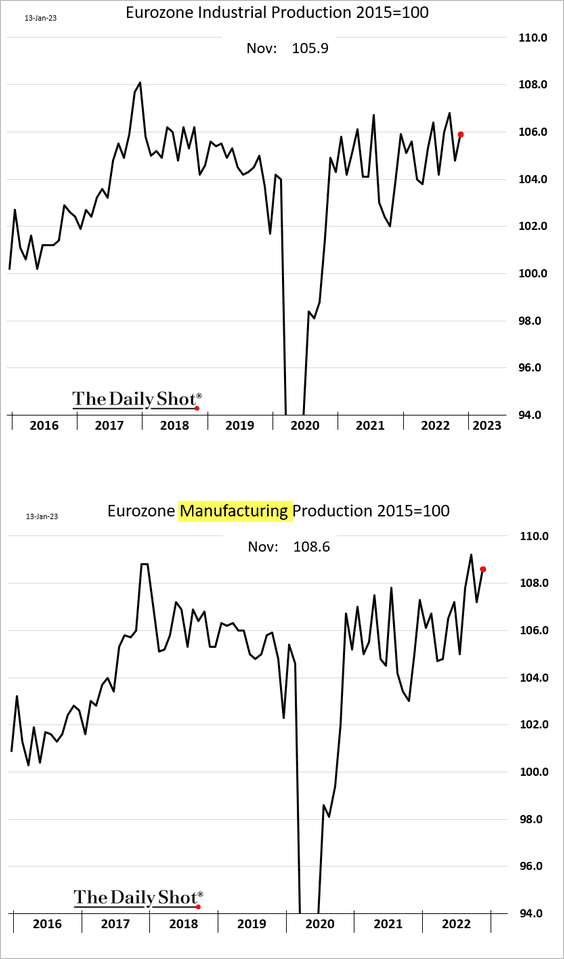

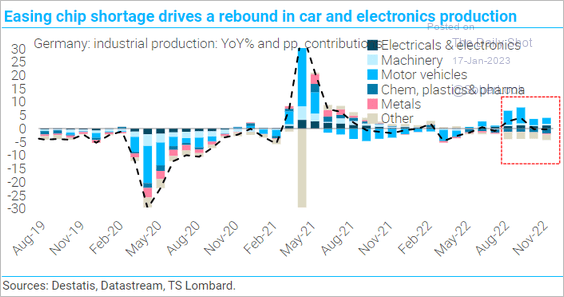

2. Industrial production improved in November, despite soft manufacturing PMI figures.

Auto production has picked up.

Source: TS Lombard

Source: TS Lombard

——————–

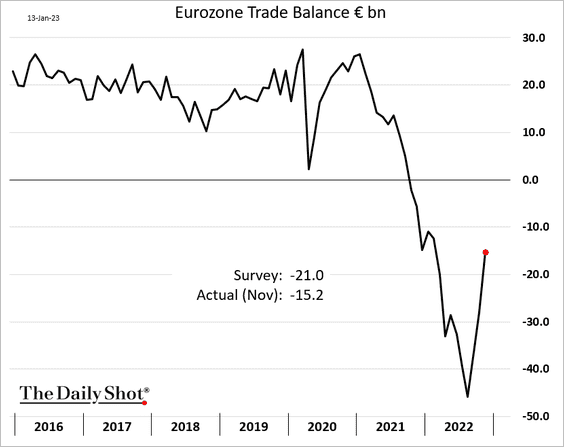

3. The trade gap is narrowing rapidly.

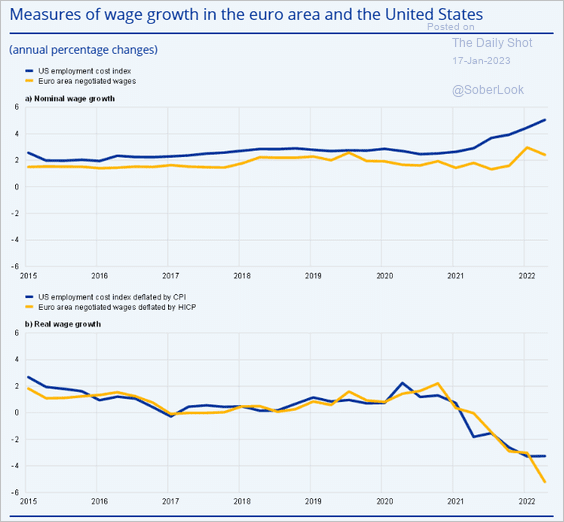

4. Real wage growth is now below the rate we see in the US.

Source: ECB Read full article

Source: ECB Read full article

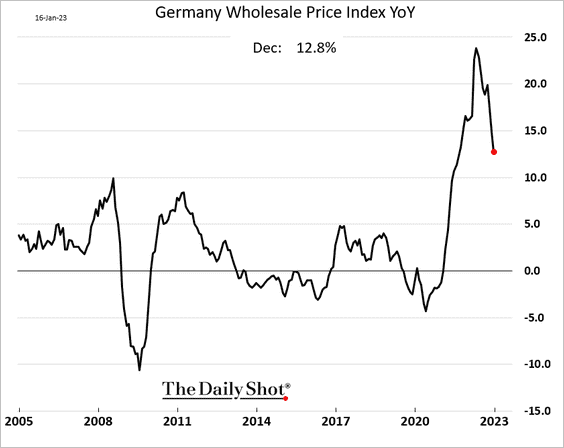

5. Germany’s wholesale inflation is easing.

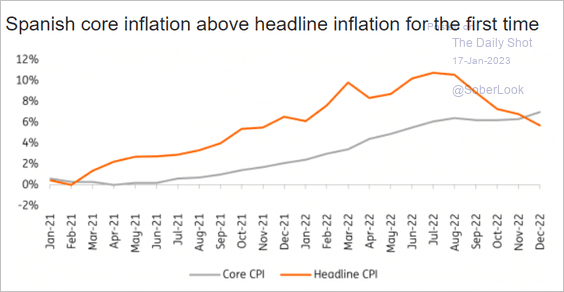

• Spain’s core CPI is now above the headline index.

Source: ING

Source: ING

Back to Index

Europe

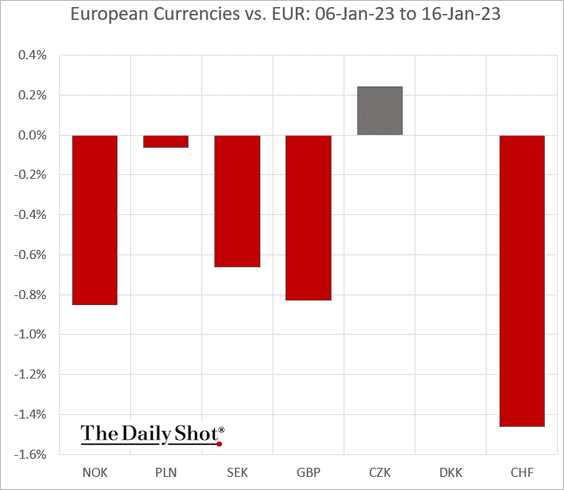

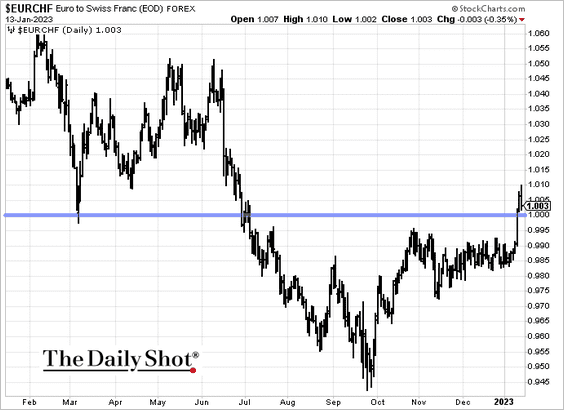

1. The Swiss franc tumbled last week.

Will the euro hold above parity versus the Swiss franc?

——————–

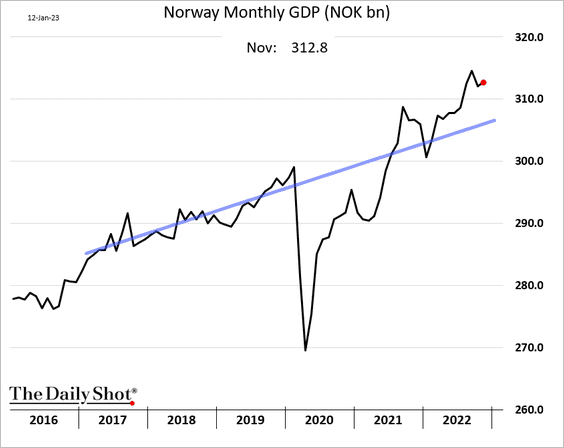

2. Norway’s economic growth remains above the pre-COVID trend.

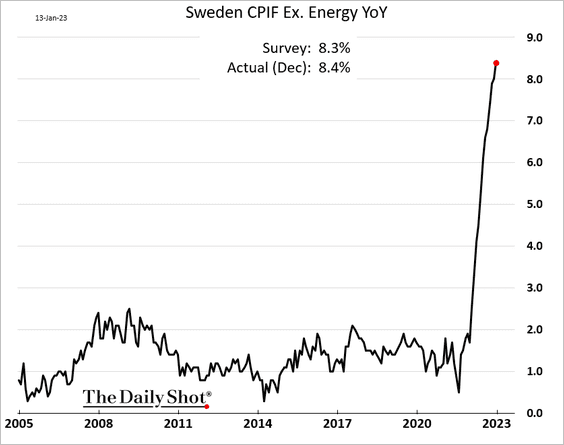

3. Sweden’s core CPI continues to surge.

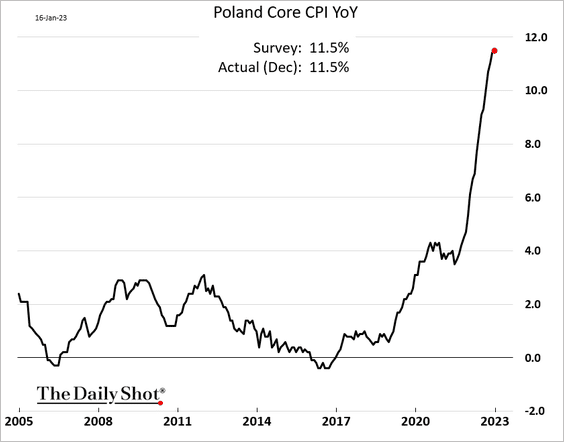

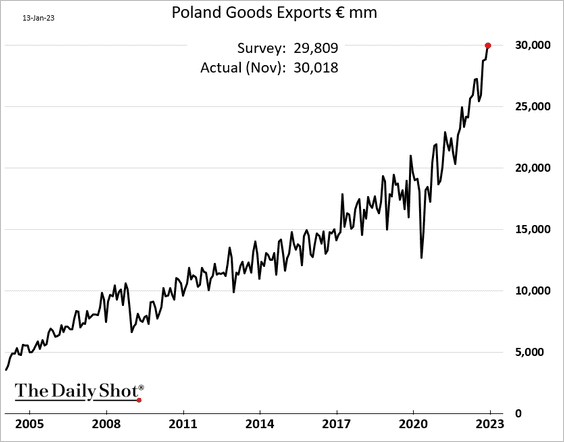

4. Poland’s inflation shows signs of peaking.

The nation’s exports hit a record high in November.

——————–

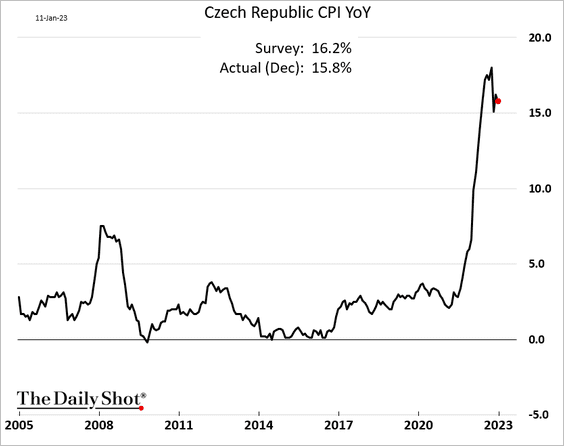

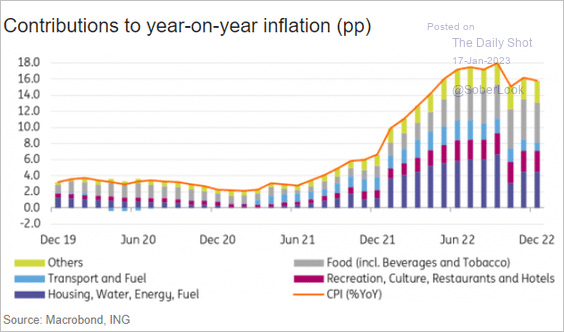

5. Czech inflation is off the highs.

Source: ING

Source: ING

——————–

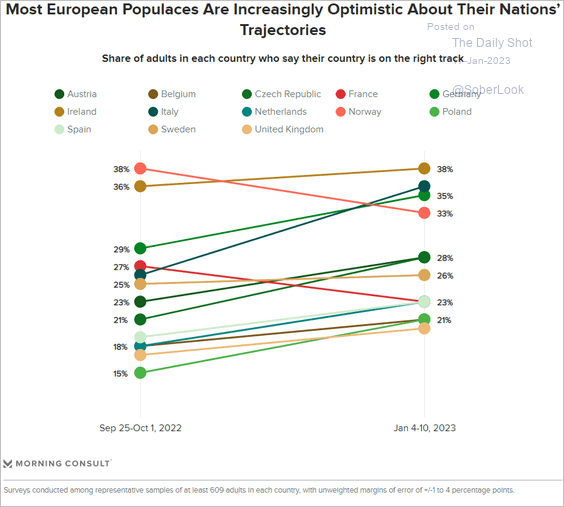

6. Citizens of Western European nations increasingly perceive their country as making progress, with the exception of France and Norway.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Japan

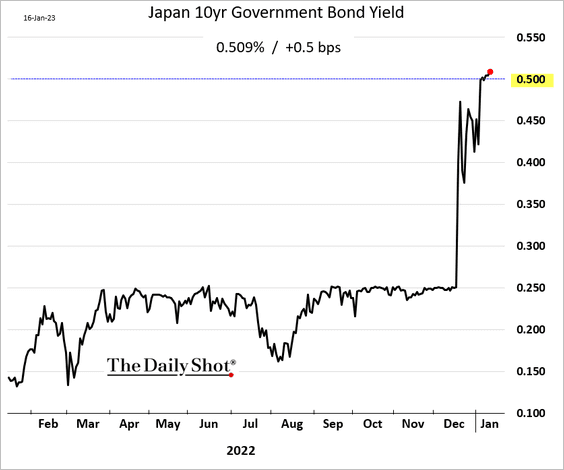

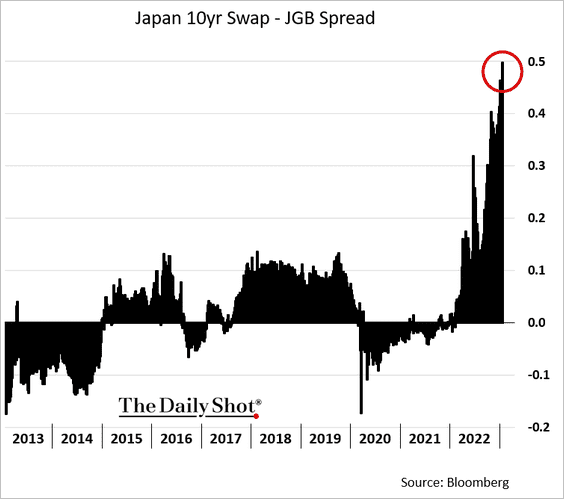

1. Traders continue to play the game of chicken with the BoJ, with the 10-year JGB yield edging above 0.5%. At some point, the central bank will run out of bonds to buy.

The 10-year swap spread has blown out (traders express their short bets via the rates swap market).

——————–

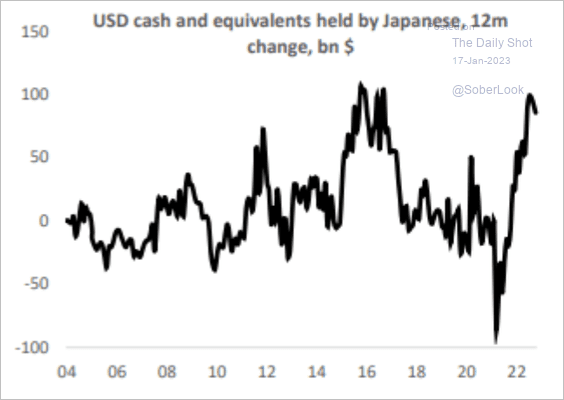

2. Japanese investors built up large dollar cash positions. This could be deployed in Japanese government bonds once the BoJ’s yield curve control adjustment is complete, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

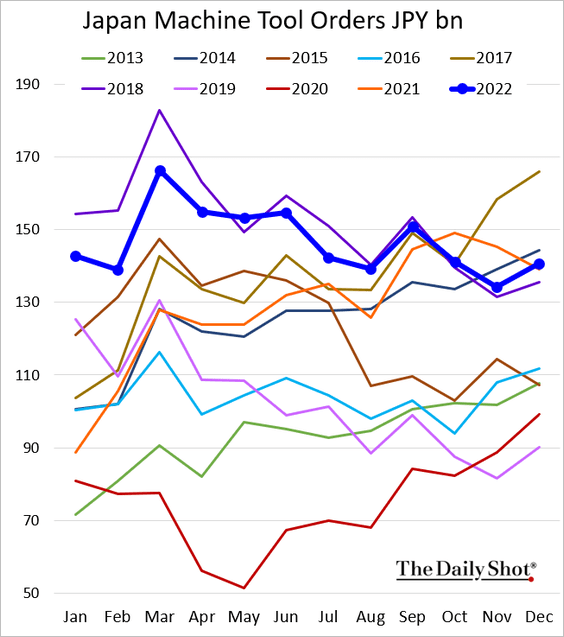

3. Machine tool orders climbed above 2021 levels in December.

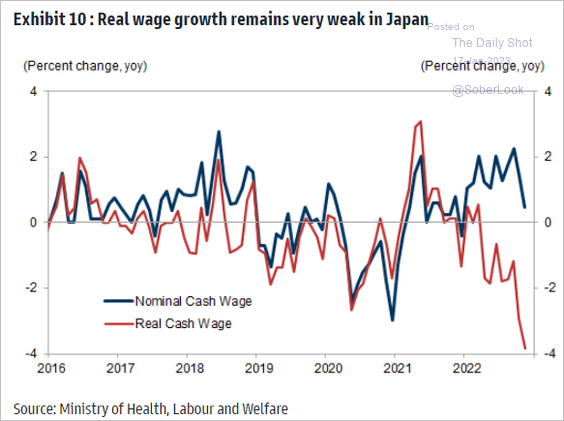

4. Real wage growth is deeply negative.

Source: Goldman Sachs

Source: Goldman Sachs

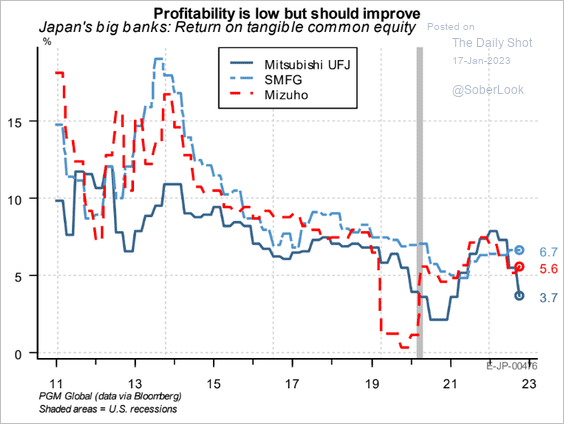

5. Banks’ profitability will improve once the Bank of Japan discontinues its negative rate policy.

Source: PGM Global

Source: PGM Global

Back to Index

Asia – Pacific

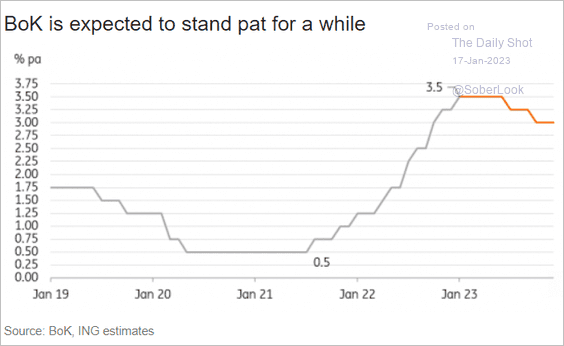

1. The BoK is on hold for now.

Source: ING

Source: ING

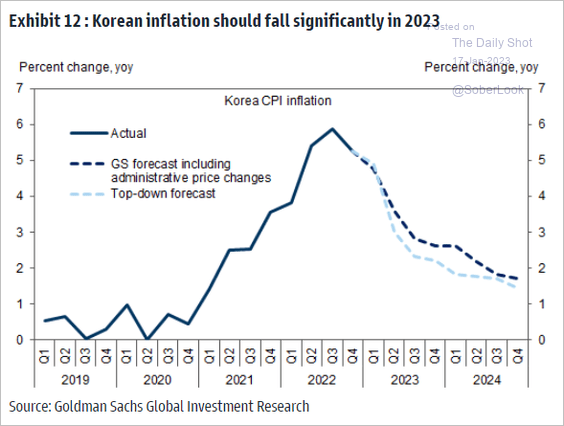

South Korean inflation should decline rapidly this year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

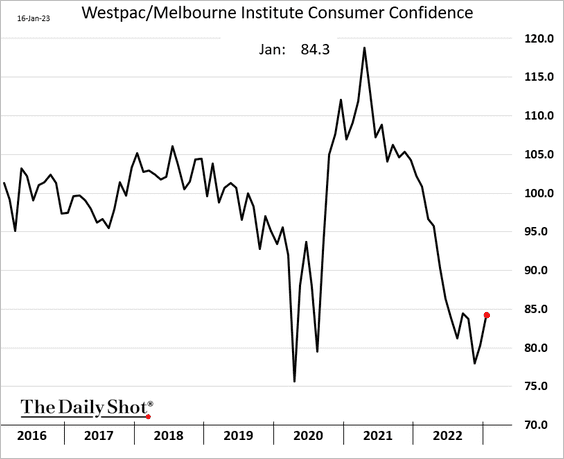

2. Australia’s consumer confidence improved this month but remains near extreme lows.

Back to Index

China

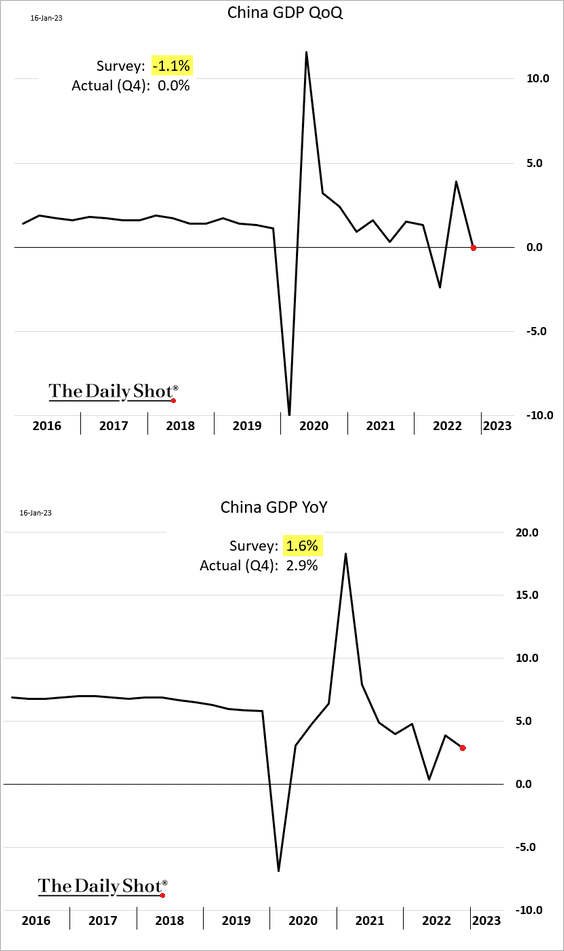

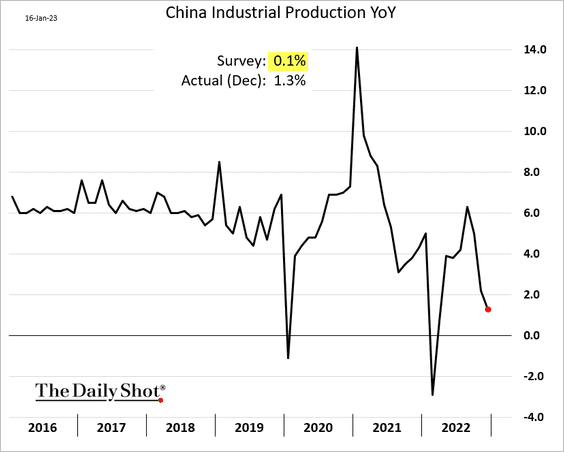

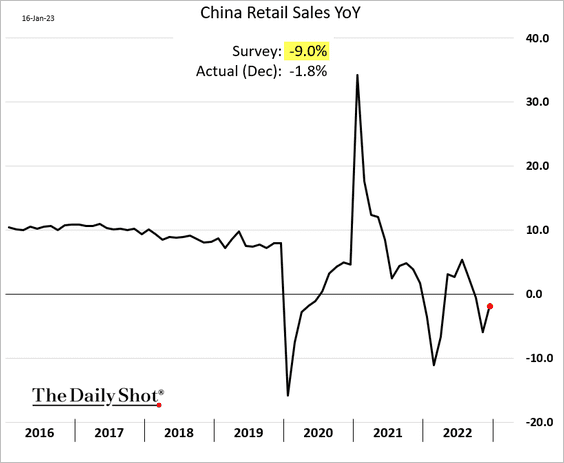

1. The economic growth report topped forecasts, with the Q4 GDP change coming in at zero rather than negative.

December economic activity indicators were stronger than expected.

• Industrial production:

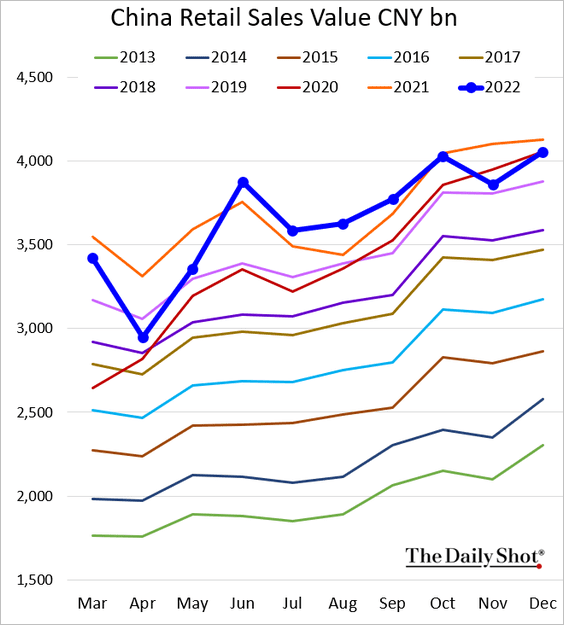

• Retail sales:

Here is the retail sales value (back at the 2020 level).

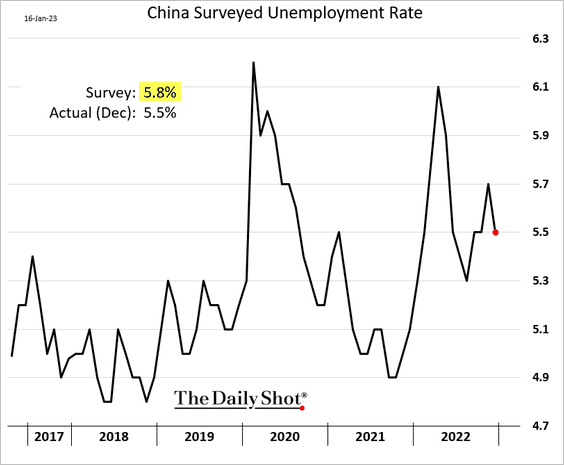

• Unemployment:

——————–

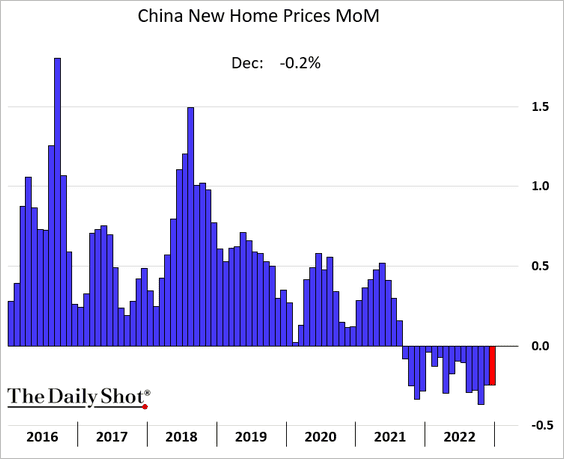

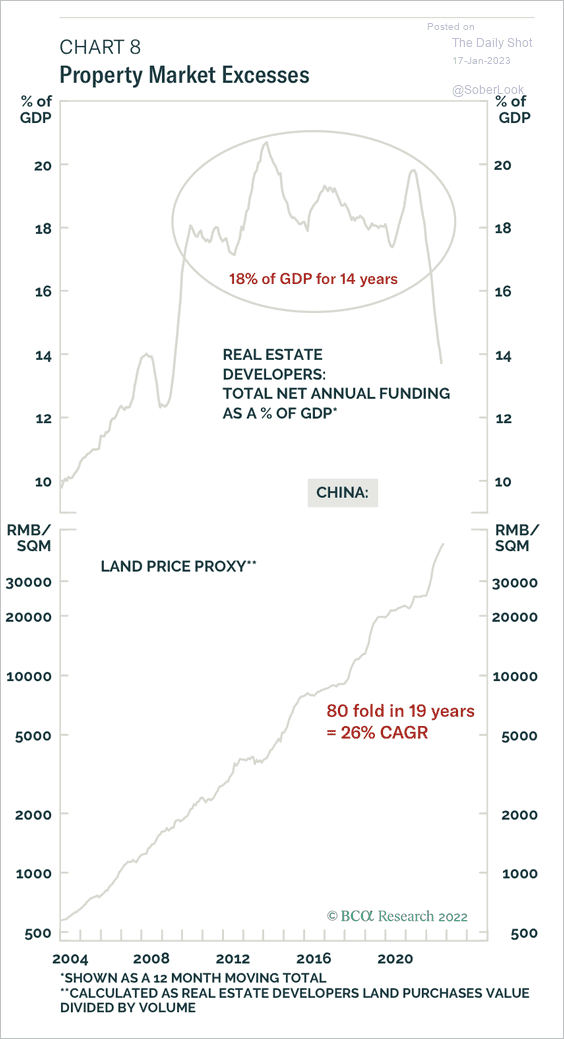

2. New home prices have declined for 16 months in a row.

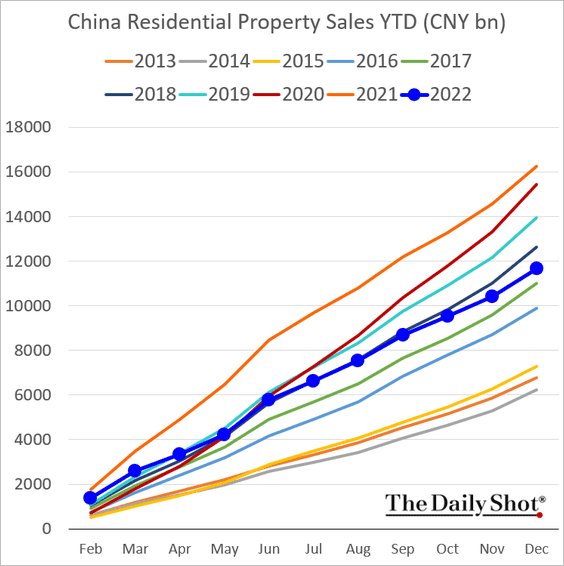

Residential property sales were below the 2018 level in 2022.

Property market excess remains large.

Source: BCA Research

Source: BCA Research

——————–

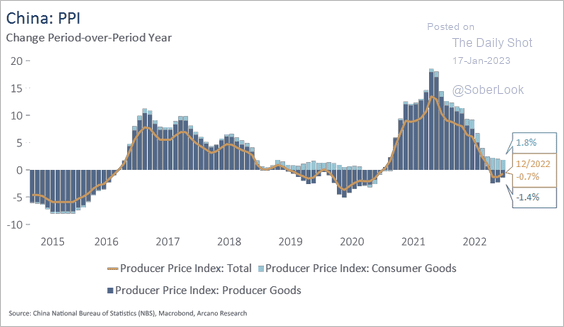

3. This chart shows China’s PPI components.

Source: Arcano Economics

Source: Arcano Economics

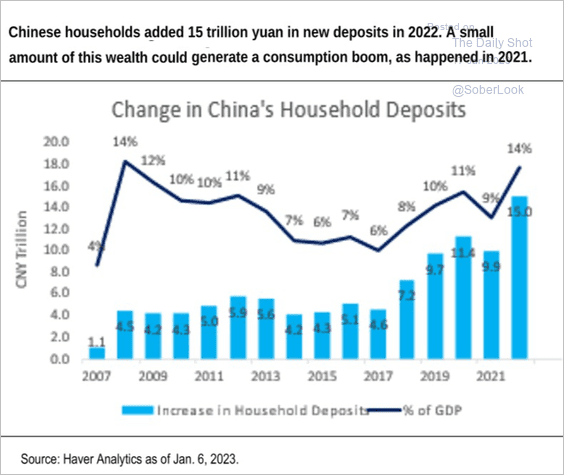

4. Elevated savings could generate a spending boom this year.

Source: Citi Private Bank

Source: Citi Private Bank

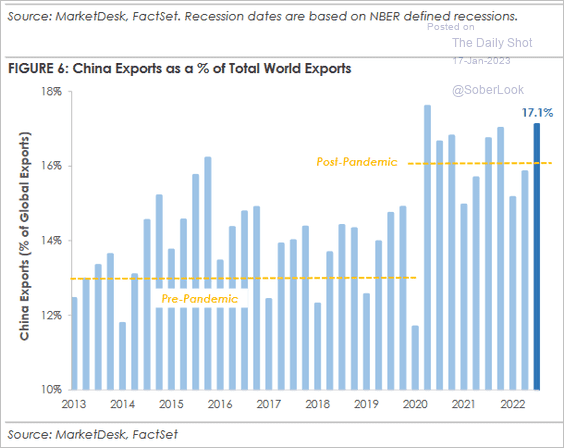

5. China accounts for 17% of worldwide exports.

Source: MarketDesk Research

Source: MarketDesk Research

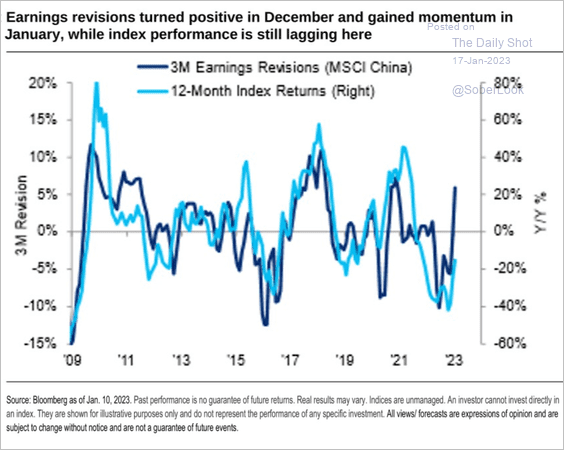

6. Corporate earnings revisions have turned positive as reopening takes hold.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Emerging Markets

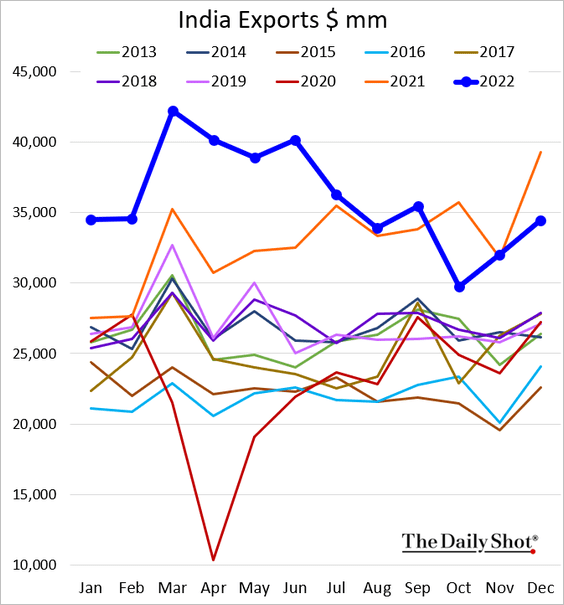

1. India’s exports remain below last year’s levels.

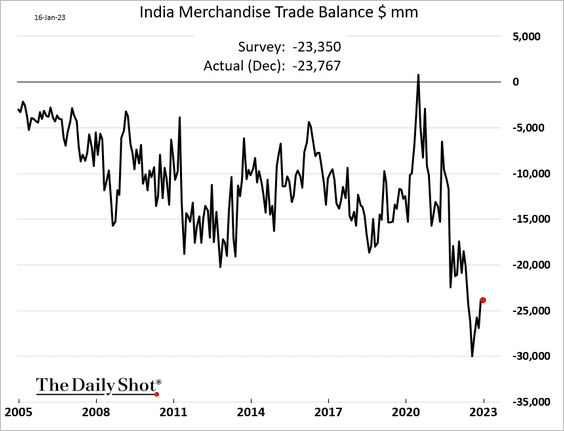

The December trade gap was a bit wider than expected.

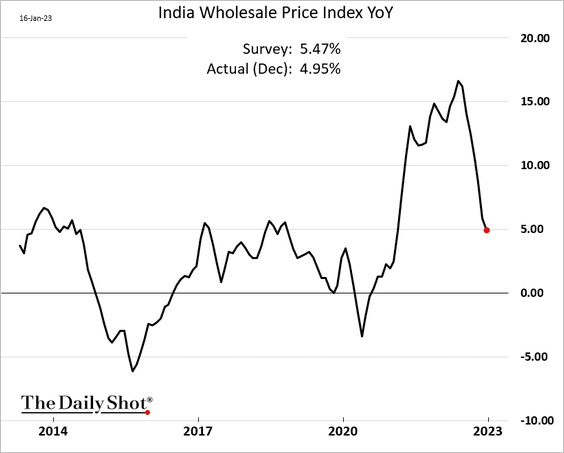

• India’s wholesale price inflation continues to moderate.

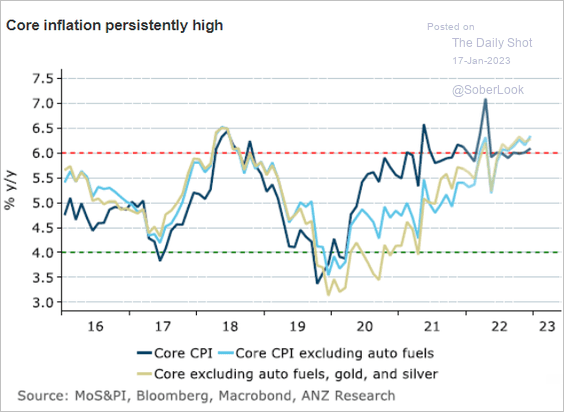

But the core CPI has been persistently high.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

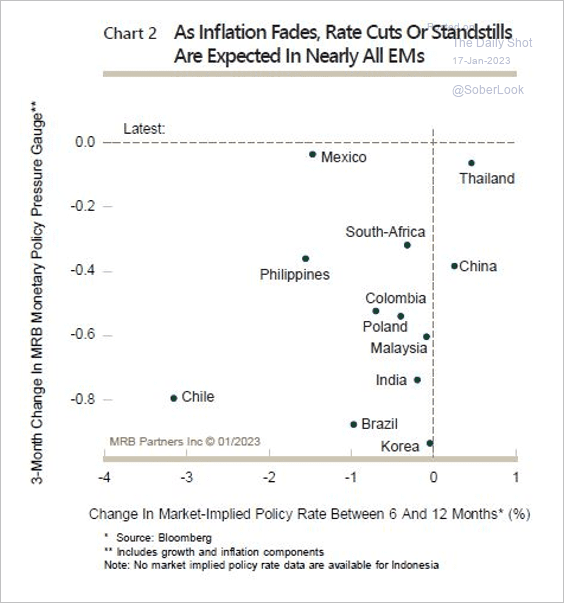

2. Falling inflation could permit eventual rate cuts across EM.

Source: MRB Partners

Source: MRB Partners

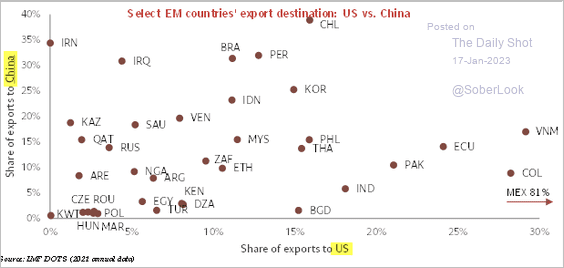

3. This scatterplot shows EM exposure to China vs. the US.

Source: @TCosterg

Source: @TCosterg

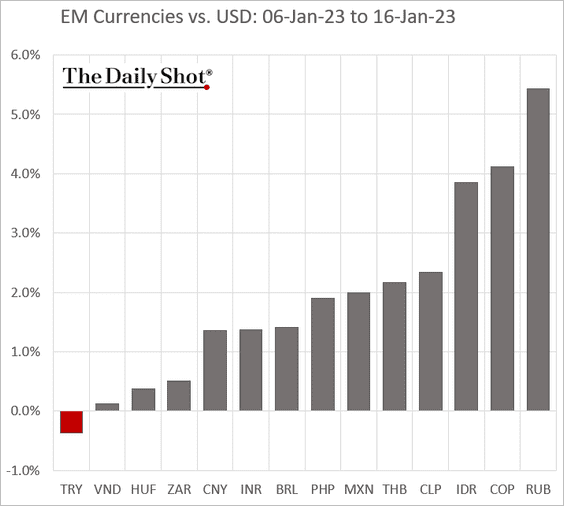

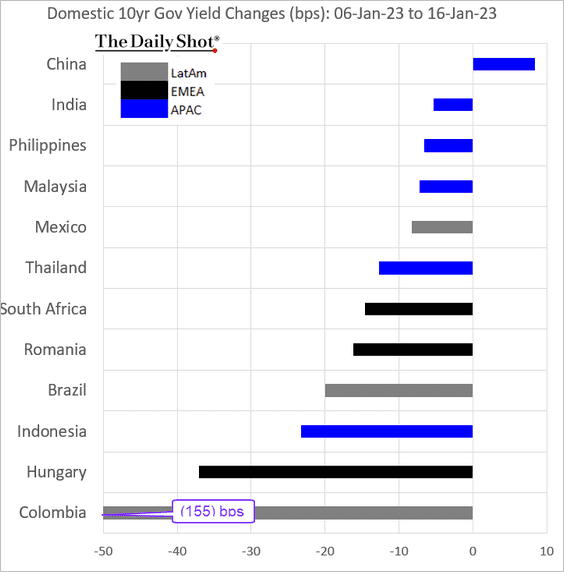

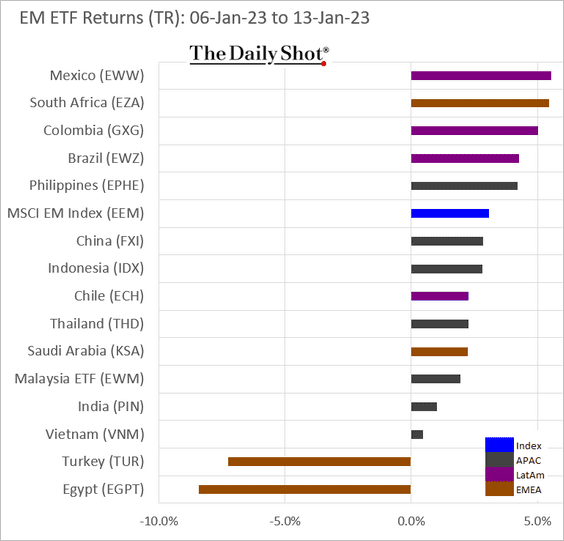

4. Next, we have some performance data since January 6th.

• Currencies:

• Bond yields (Colombia’s yield is down 155 bps):

• Equity ETFs:

Back to Index

Cryptocurrency

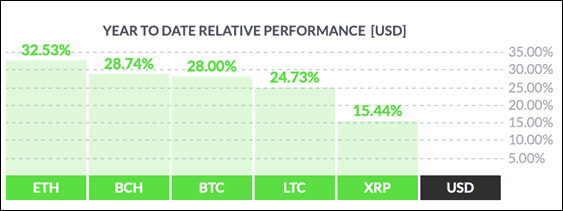

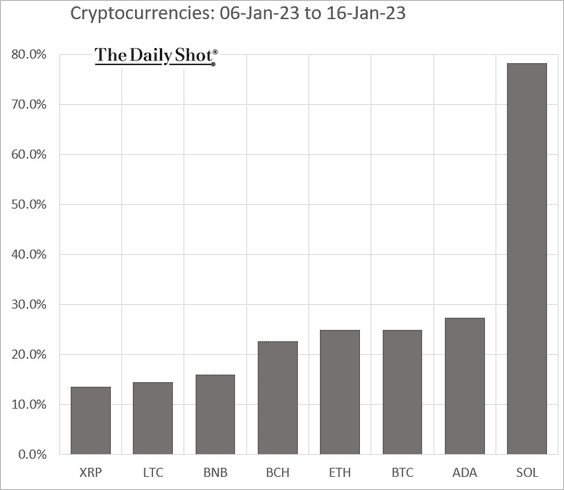

1. Cryptos are off to a strong start this year, with ether (ETH) leading other large tokens.

Source: FinViz

Source: FinViz

SOL has been surging.

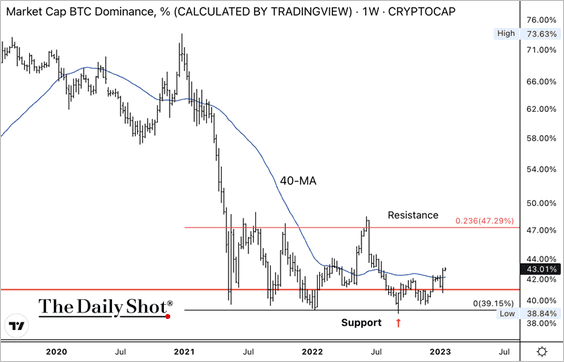

However, over the past week, bitcoin’s market cap relative to the total crypto market cap (dominance ratio) ticked higher. A sustained rise in the dominance ratio typically signals risk-off conditions.

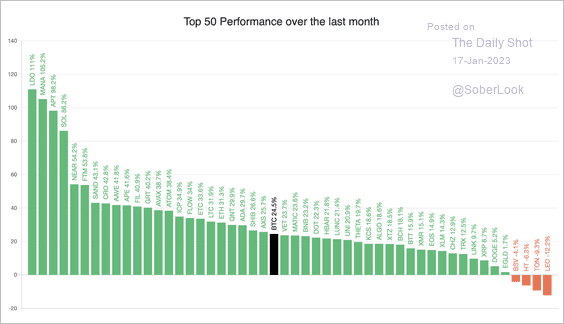

Roughly half of the top 50 tokens have outperformed BTC over the past month.

Source: Blockchain Center

Source: Blockchain Center

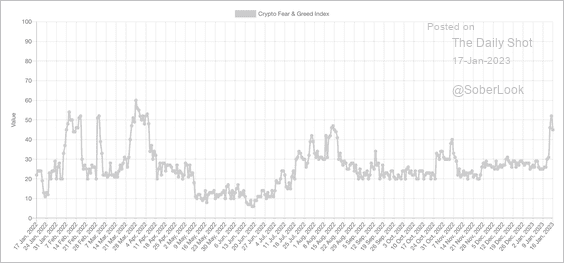

2. The Crypto Fear & Greed Index escaped “extreme fear” territory.

Source: Alternative.me

Source: Alternative.me

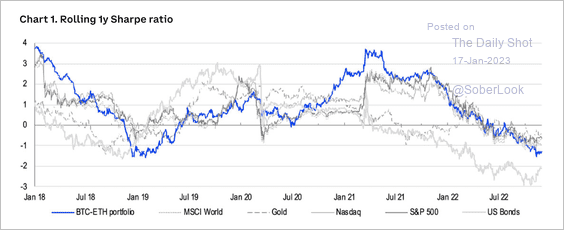

3. In risk-adjusted terms, an equal-weight basket of BTC and ETH in line with global stock indices last year.

Source: Coinbase Institutional

Source: Coinbase Institutional

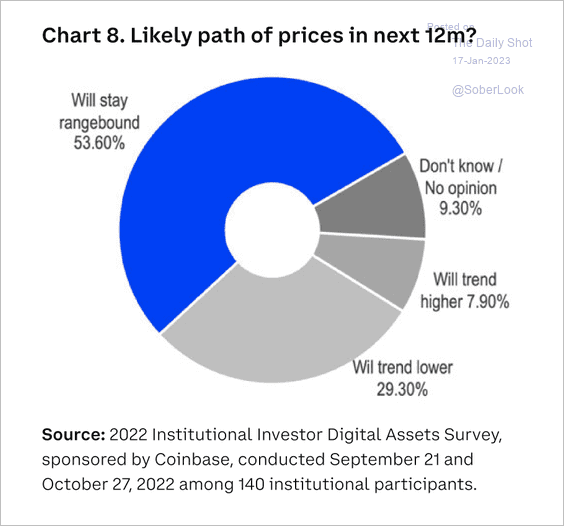

Most institutional investors expect crypto prices to stay range-bound or trend lower over the next 12 months, according to a survey by Coinbase.

Source: Coinbase Institutional

Source: Coinbase Institutional

——————–

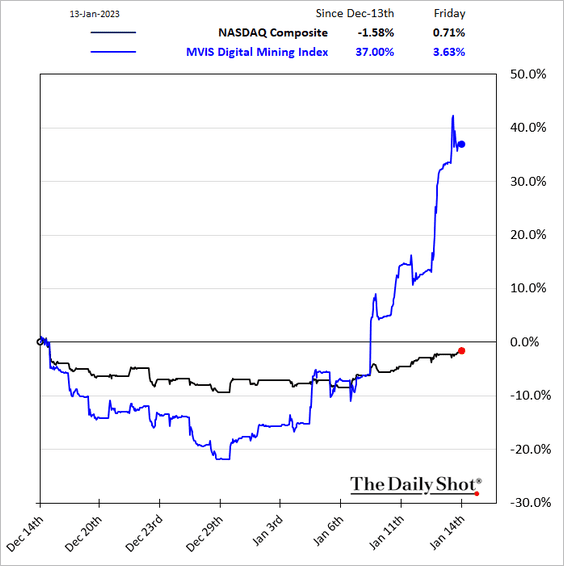

4. Shares of crypto mining companies have been surging.

5. The end of magical thinking?

Source: @jessefelder, @ttmygh, The New York Times Read full article

Source: @jessefelder, @ttmygh, The New York Times Read full article

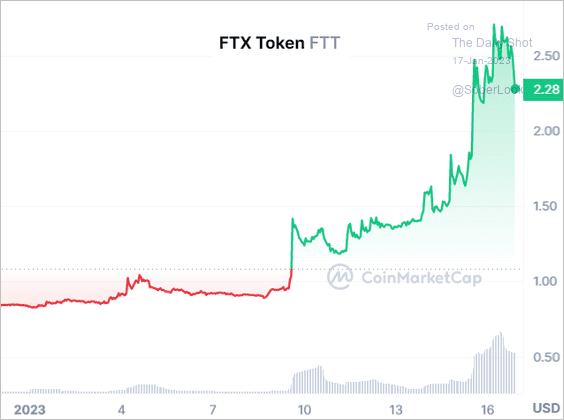

Not quite …

Source: CoinMarketCap

Source: CoinMarketCap

Back to Index

Commodities

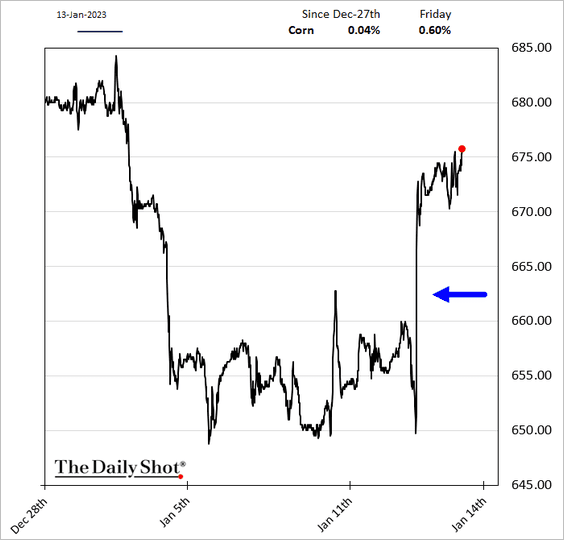

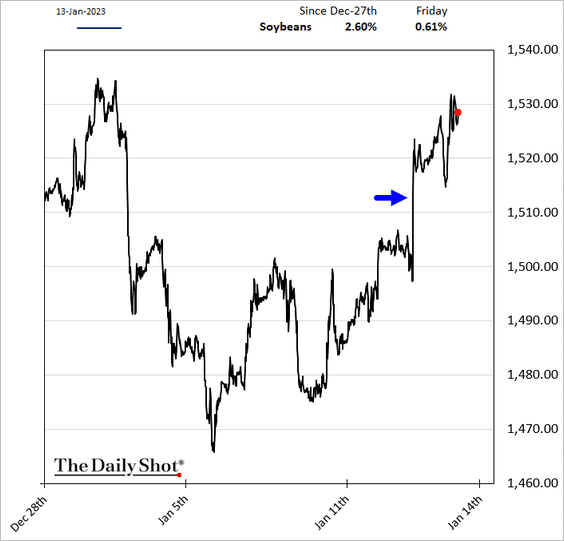

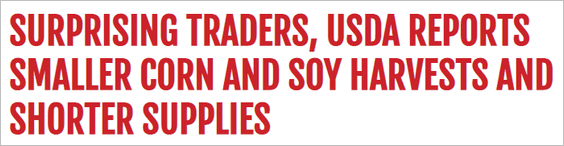

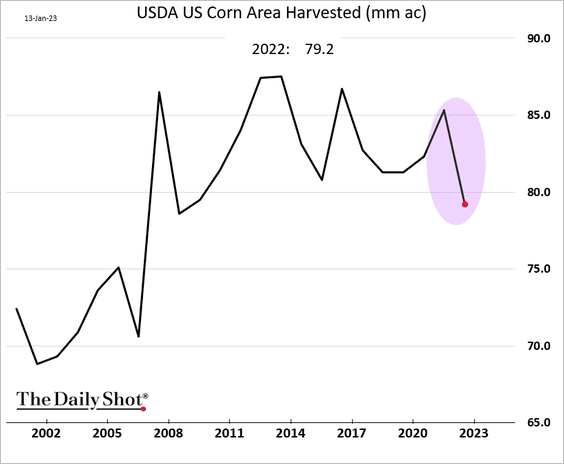

1. Corn and soybean futures jumped on last week’s USDA report.

Source: Successful Farming

Source: Successful Farming

——————–

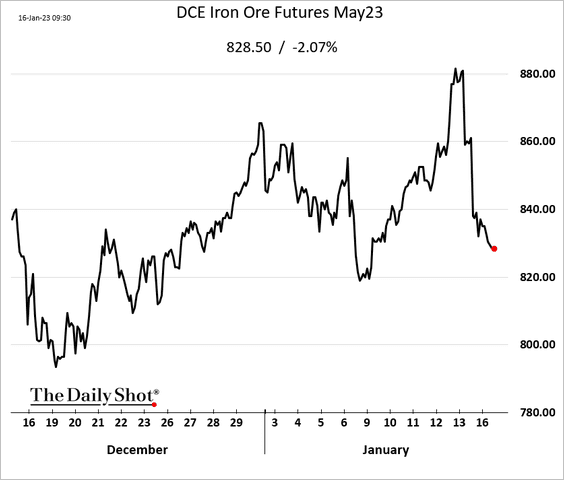

2. Iron ore futures declined as Beijing cracks down on rising prices.

Source: @markets Read full article

Source: @markets Read full article

——————–

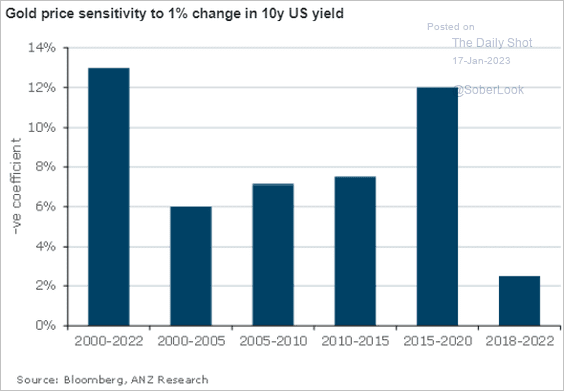

3. Gold has been less sensitive to Treasury yields in recent years.

Source: @ANZ_Research

Source: @ANZ_Research

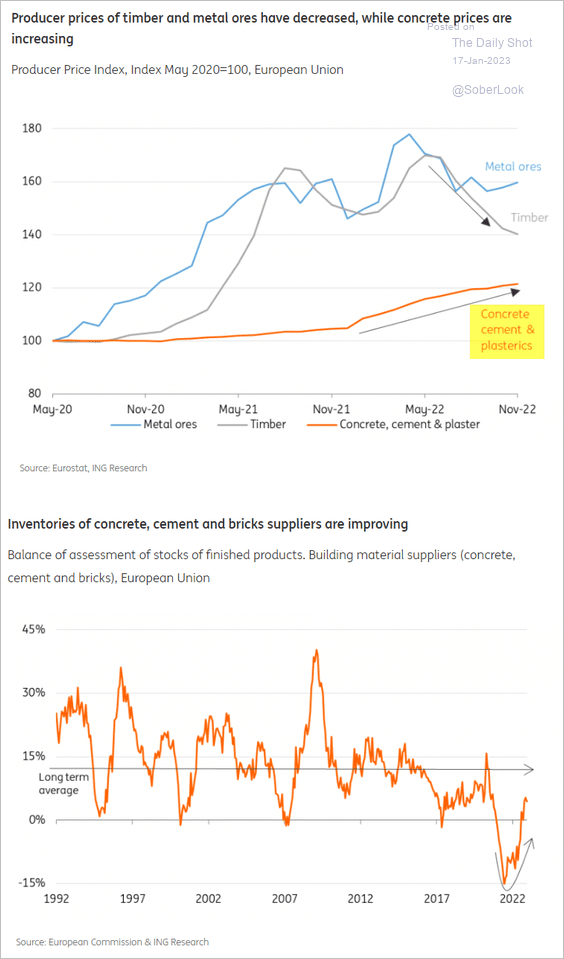

4. Will improving supplies stabilize concrete prices?

Source: ING

Source: ING

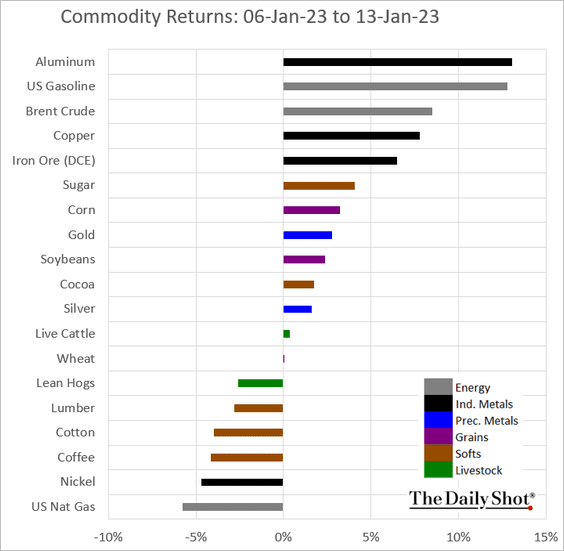

5. Finally, we have last week’s performance across key commodity markets.

Back to Index

Energy

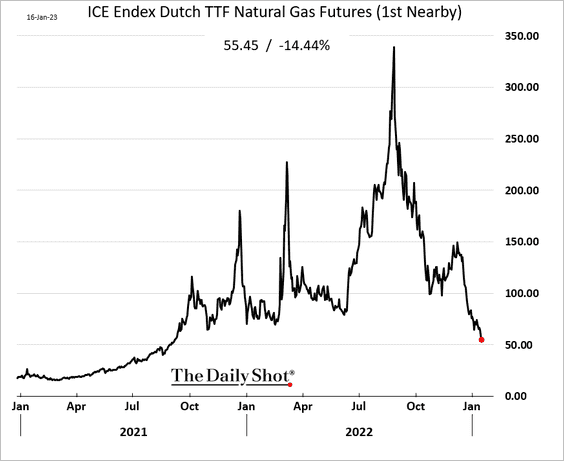

1. European natural gas prices continue to tumble …

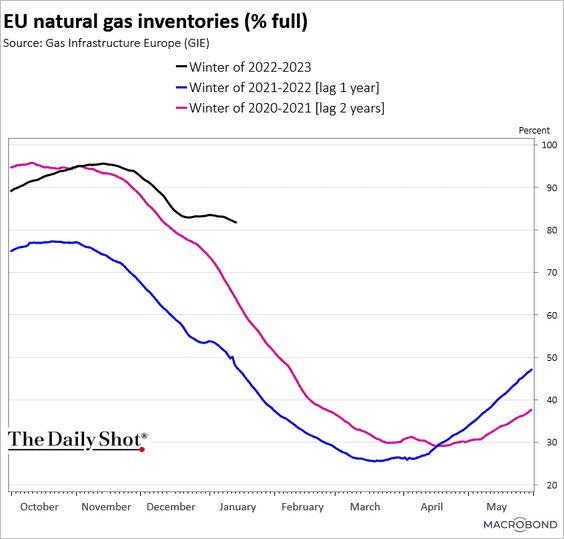

… amid elevated inventories.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

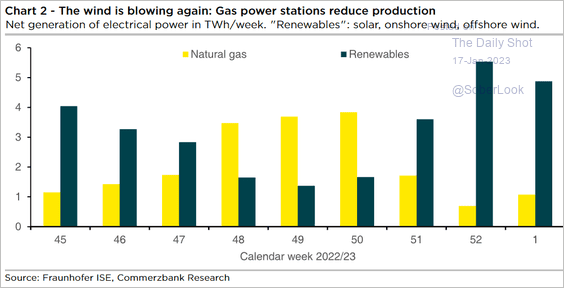

• Moreover, winds have been blowing across Europe, boosting renewables’ contribution to electricity production.

Source: Commerzbank Research

Source: Commerzbank Research

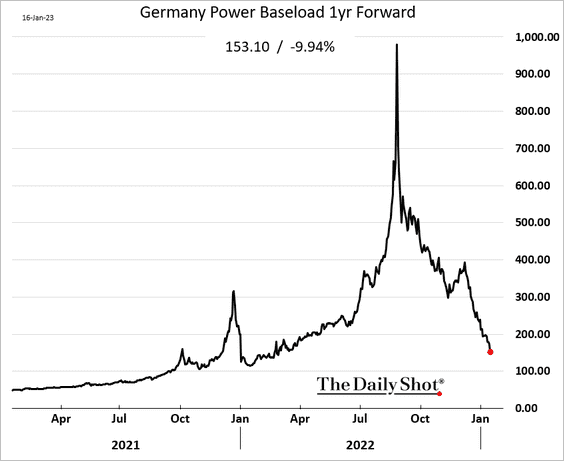

• German forward power prices continue to ease.

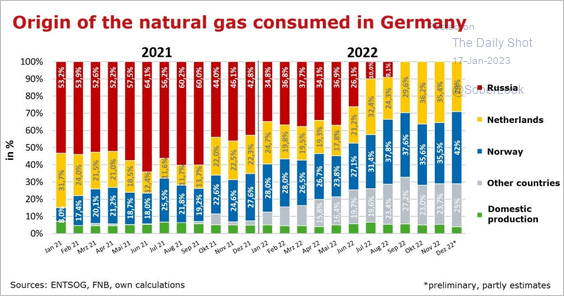

• This chart shows Germany’s shift from Russian natural gas.

Source: @janrosenow Read full article

Source: @janrosenow Read full article

——————–

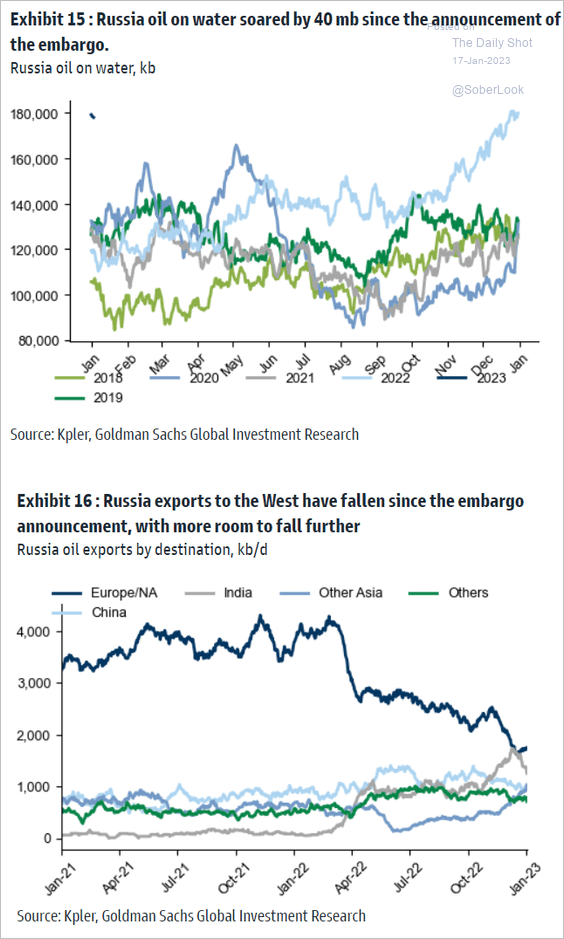

2. There is a lot of Russian crude oil on water these days (headed for Asia).

Source: Goldman Sachs

Source: Goldman Sachs

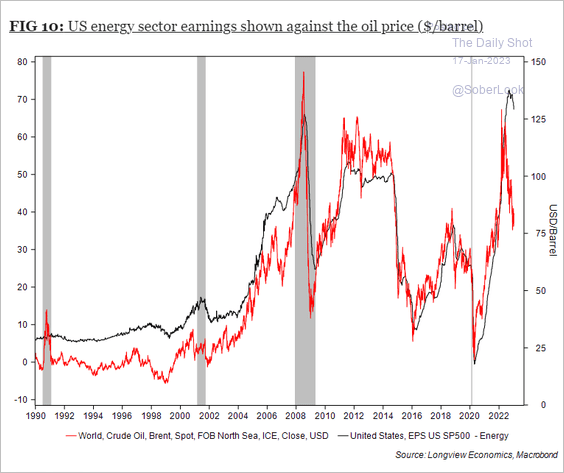

3. Are energy sector earnings about to slow?

Source: Longview Economics

Source: Longview Economics

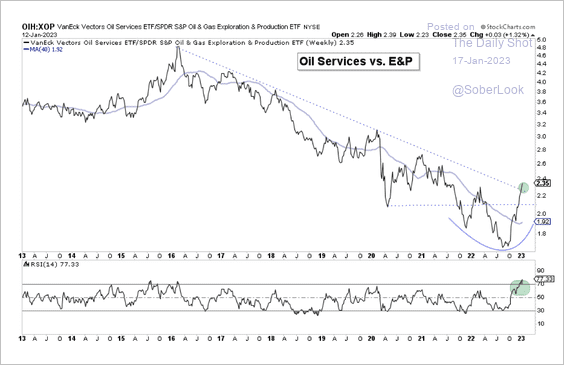

4. Oil services stocks are breaking out relative to exploration and production stocks.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Equities

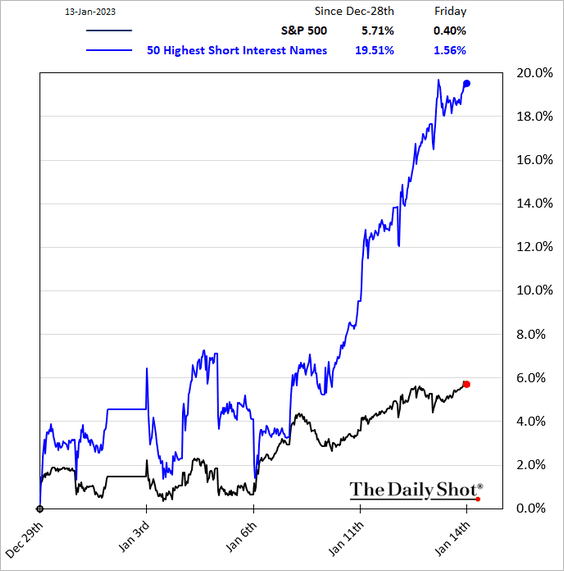

1. Last week saw some short covering.

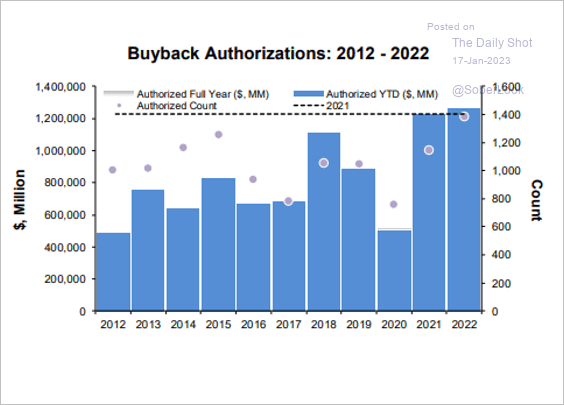

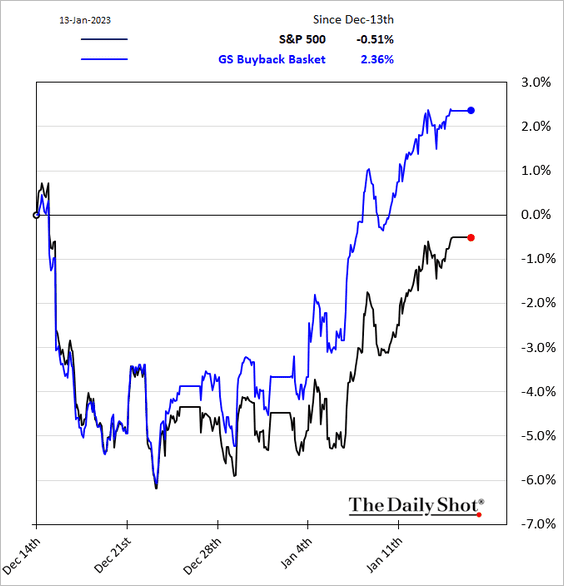

2. In spite of the market challenges, companies set a new record in 2022 for repurchasing their own shares.

Source: Birinyi Associates; @luwangnyc, @markets Read full article

Source: Birinyi Associates; @luwangnyc, @markets Read full article

Companies known for share buybacks have been outperforming.

——————–

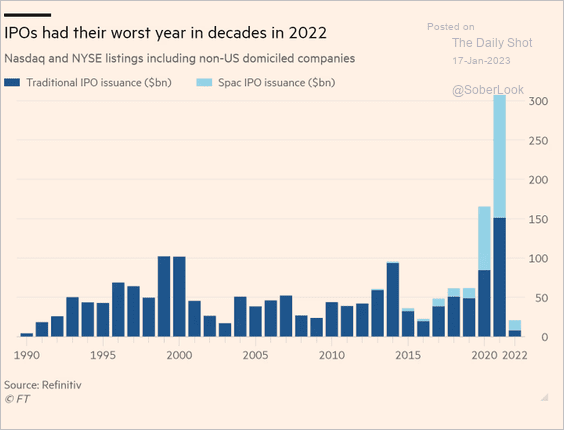

3. 2022 was a rough year for IPOs.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. A break from the 2008 analog?

Source: @NautilusCap

Source: @NautilusCap

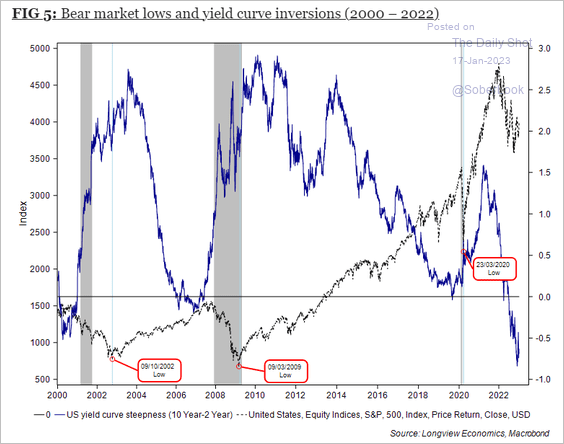

5. In recent years, bear-market lows occurred after the yield curve has been steepening for some time.

Source: Longview Economics

Source: Longview Economics

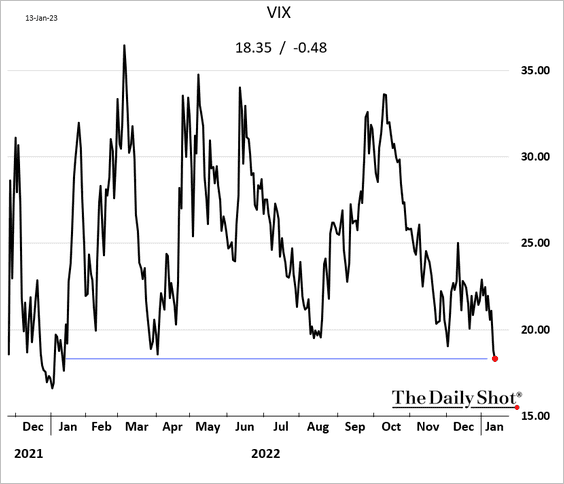

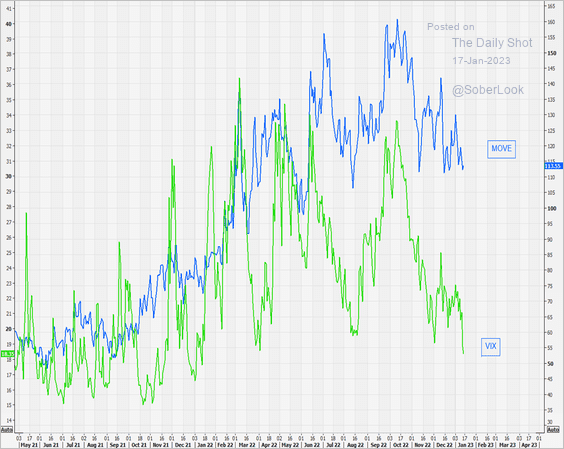

6. VIX closed at the lowest level in over 12 months, …

… diverging from rates vol (MOVE).

Source: @themarketear

Source: @themarketear

——————–

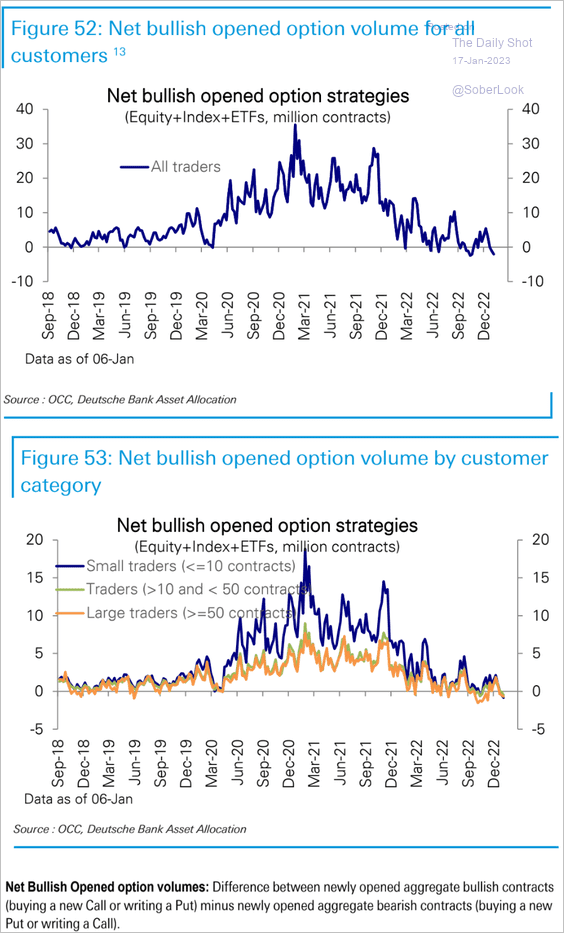

7. Net bullish options volume remains depressed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

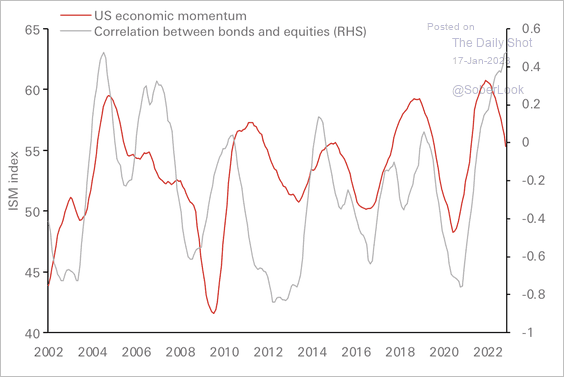

8. Historically, equities and bonds become less correlated when the economic cycle slows.

Source: HSBC

Source: HSBC

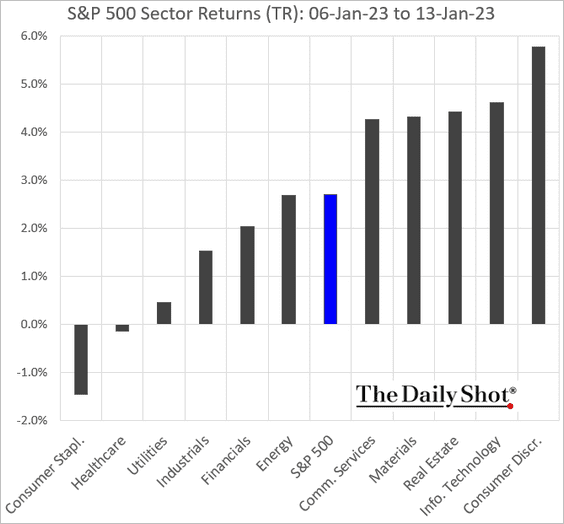

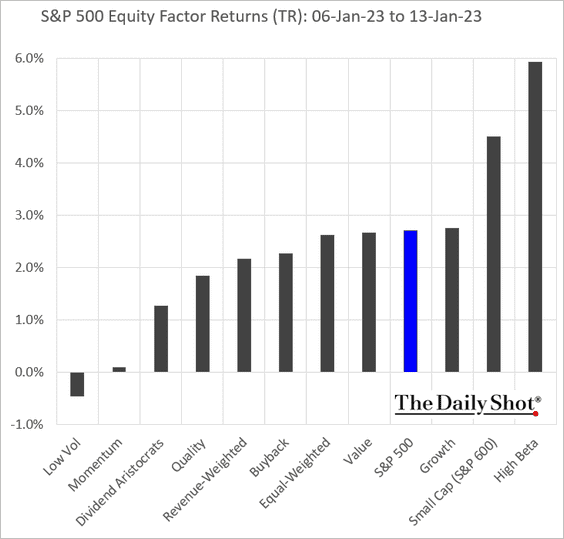

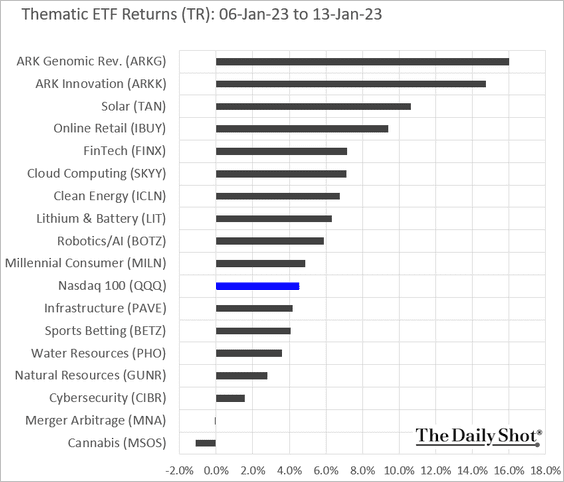

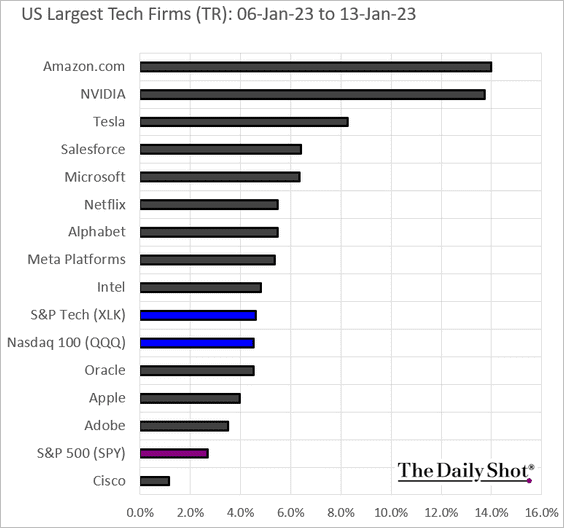

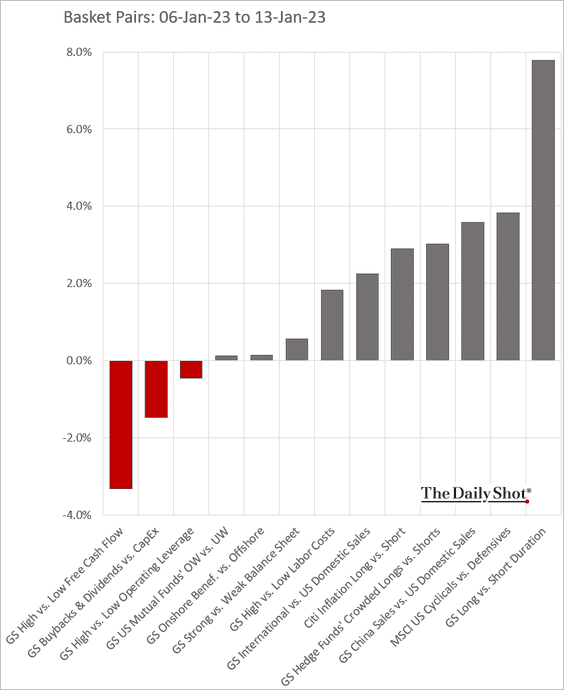

9. Finally, we have some performance data from last week.

• Sectors:

• Equity factors:

• Thematic ETFs:

• Largest US tech firms:

Also, this chart shows the relative performance of various thematic basket pairs.

– Long-duration shares have been outperforming as Treasury yields ease.

– Companies with sales in China have benefitted from the reopening trend.

Back to Index

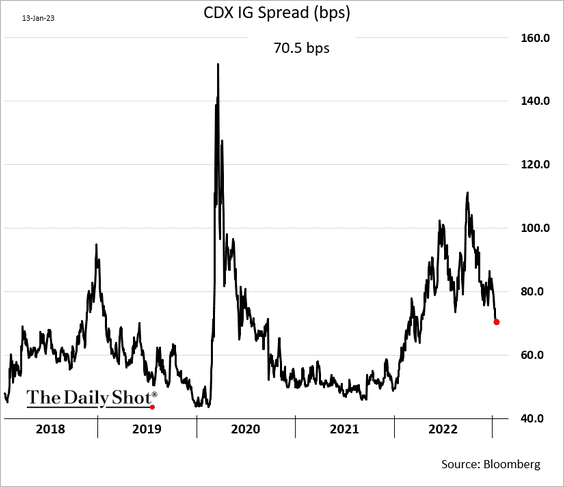

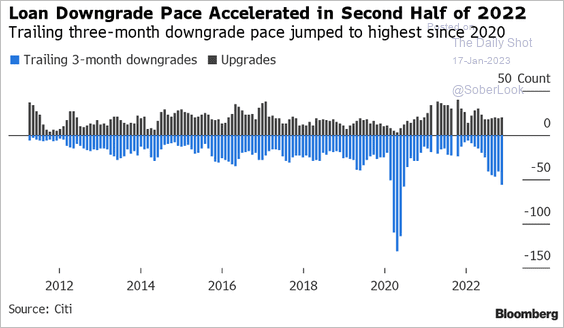

Credit

1. Corporate credit default swap spreads have been tightening since the start of the year.

2. Leveraged loan ratings downgrades continue.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

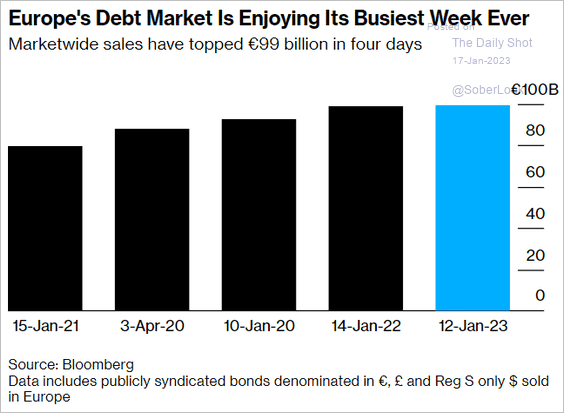

3. It’s been a good few days for Europen corporate bond sales.

Source: @priazrocha, @markets Read full article

Source: @priazrocha, @markets Read full article

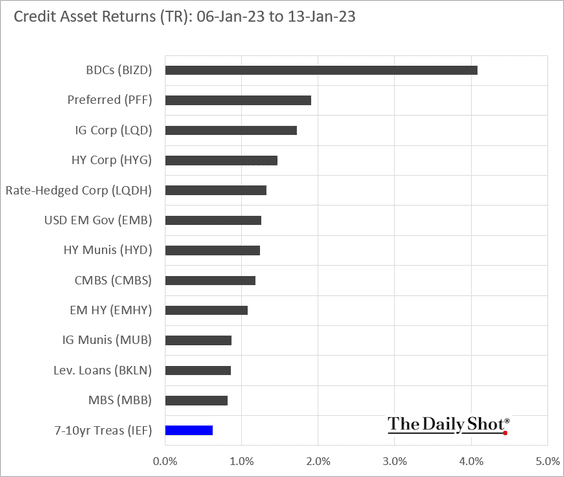

4. Next, we have last week’s performance by asset class.

Back to Index

Global Developments

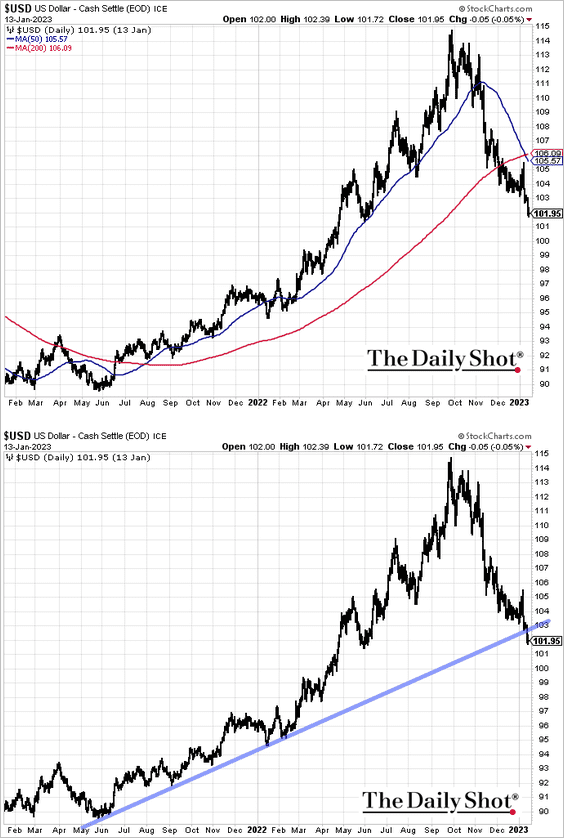

1. The dollar index (DXY) has entered a death cross and broke below the near-term uptrend support.

Source: @Ruth_Liew10, @markets Read full article

Source: @Ruth_Liew10, @markets Read full article

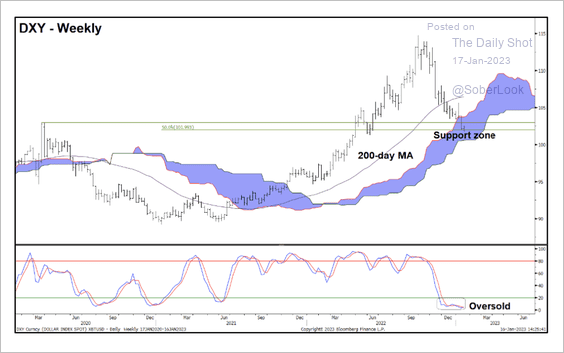

• But the dollar appears to be oversold.

Source: @StocktonKatie

Source: @StocktonKatie

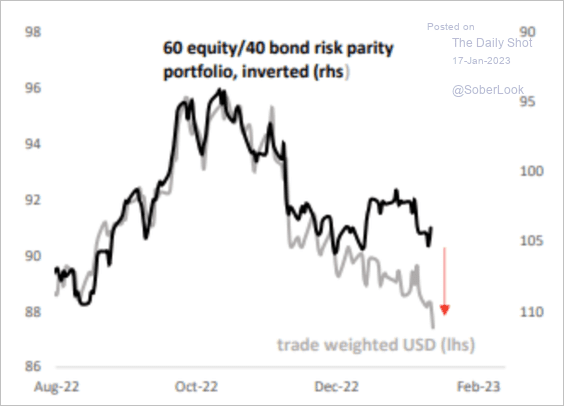

• The inverse correlation between the dollar and a long equity/bond risk parity basket is starting to break. Is the dollar losing its safe-haven appeal?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

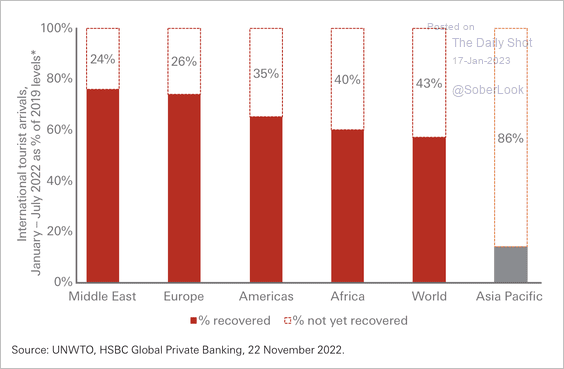

2. Asia has the largest potential upside in reopening.

Source: HSBC

Source: HSBC

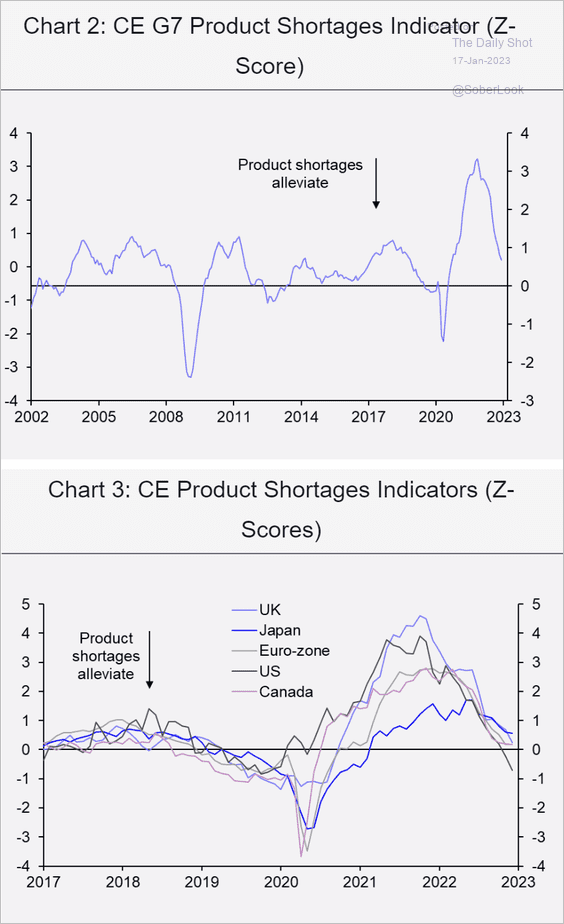

3. Product shortages continue to ease.

Source: Capital Economics

Source: Capital Economics

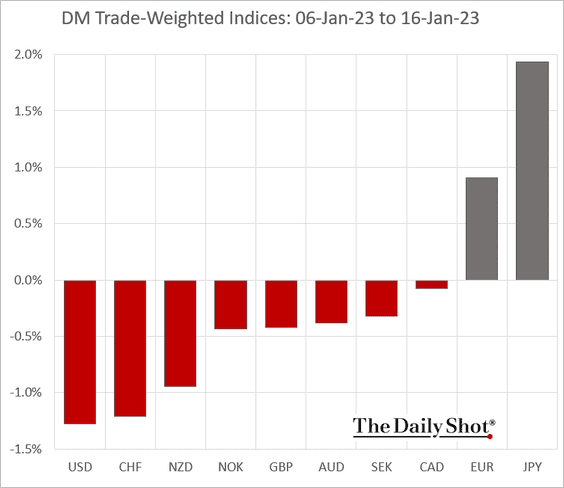

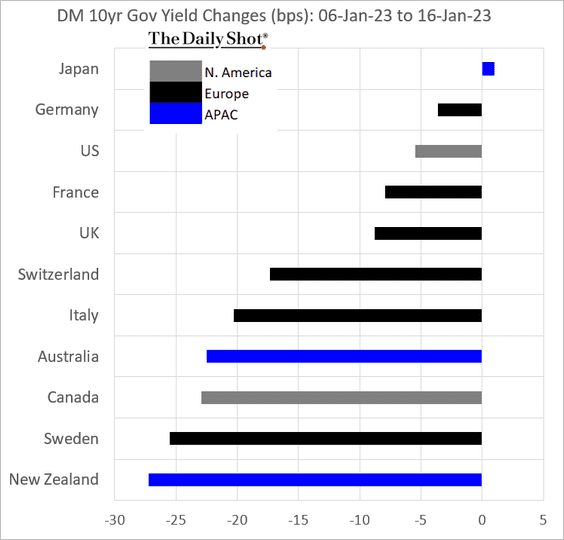

4. Next, we have some performance data since January 6th.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

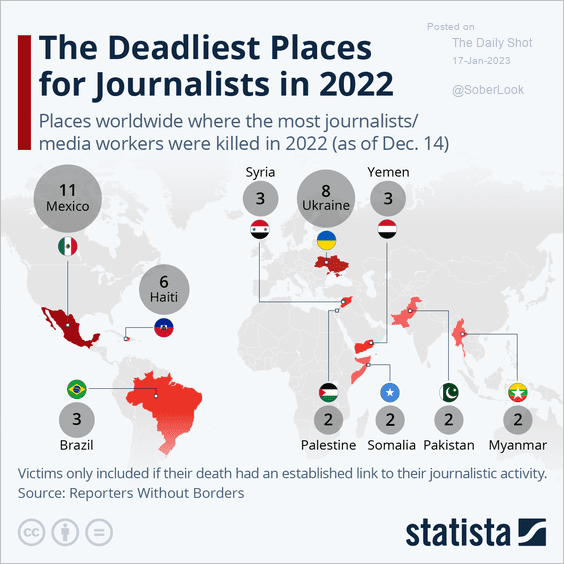

1. Deadliest places for journalists:

Source: Statista

Source: Statista

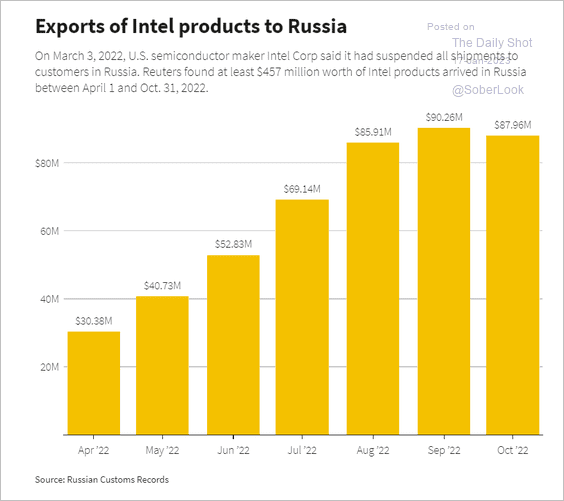

2. Exports of Intel products to Russia:

Source: Reuters Read full article

Source: Reuters Read full article

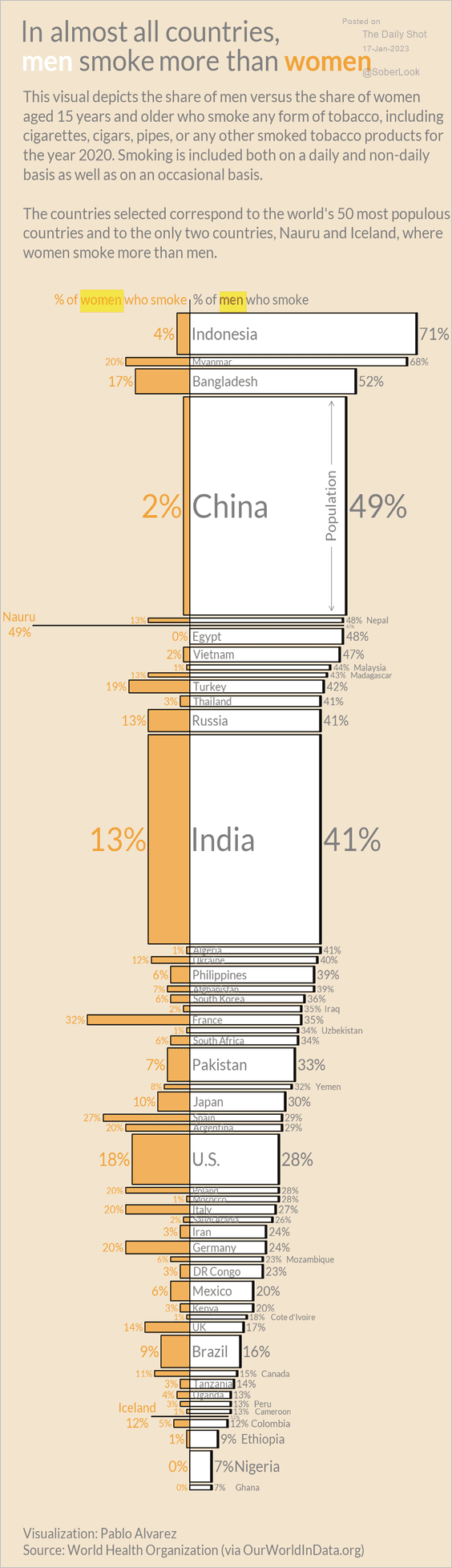

3. Smoking among women and men globally:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

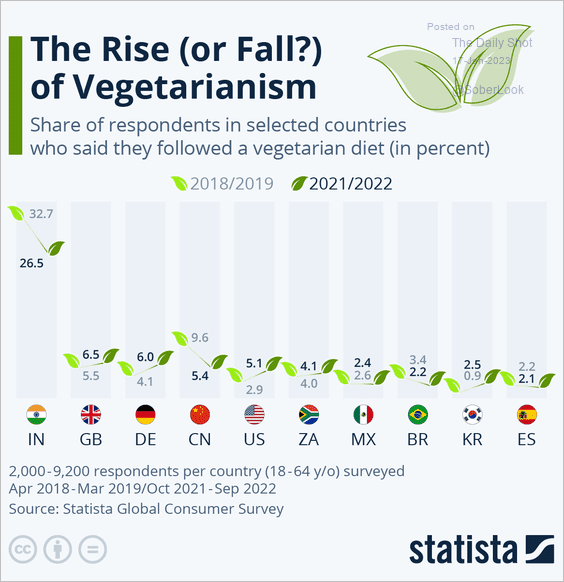

4. Vegetarian diet (changes in recent years):

Source: Statista

Source: Statista

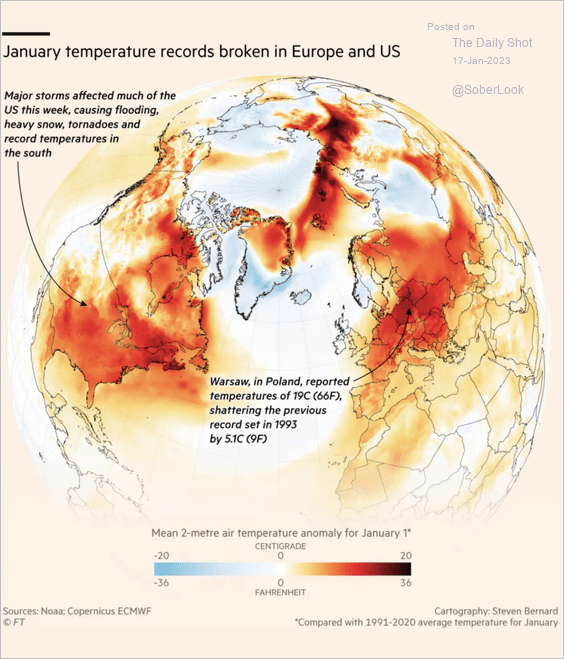

5. Broken January temperature records:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

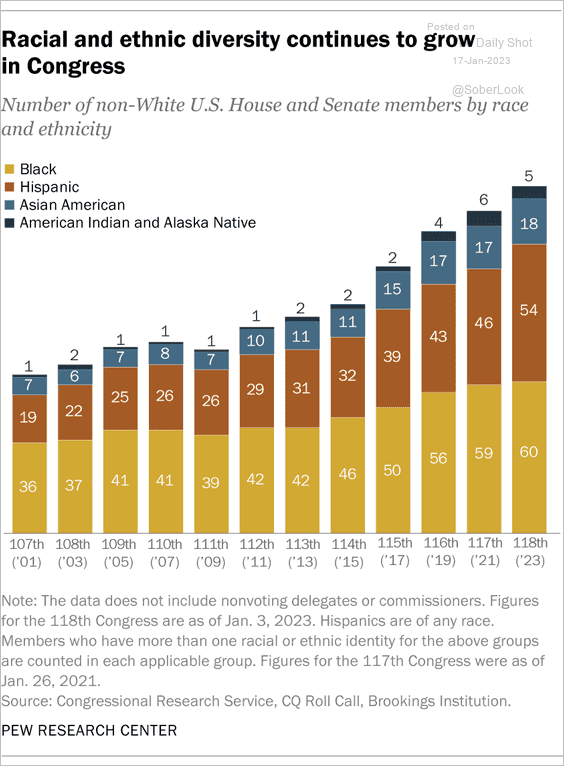

6. Racial and ethnic diversity in the US Congress:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

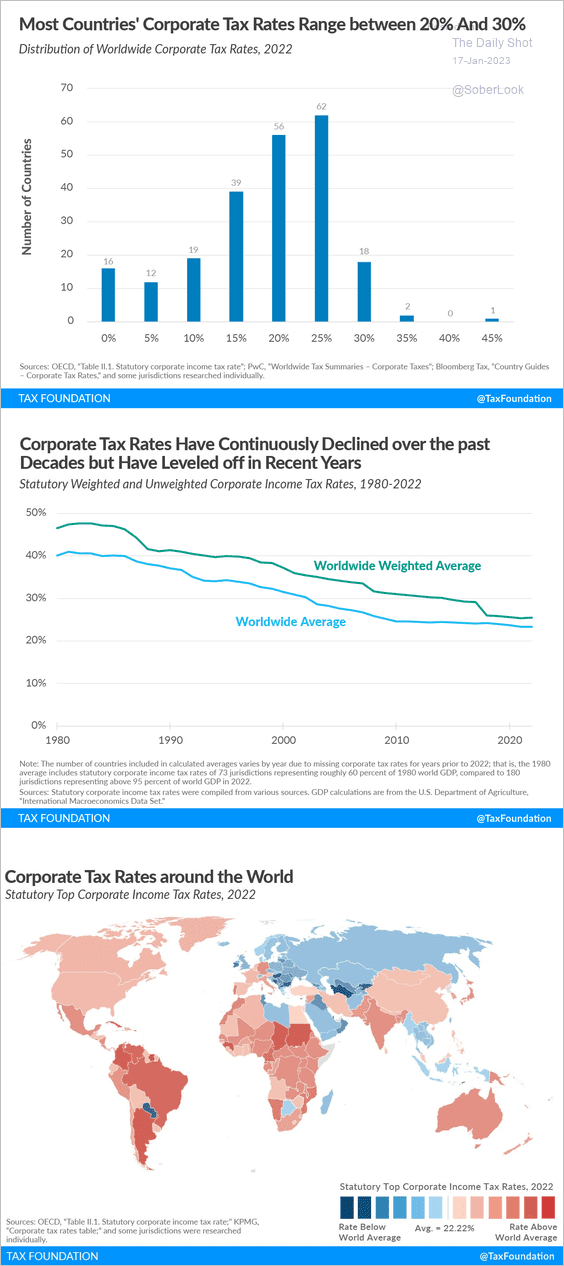

7. Corporate tax rates around the world:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

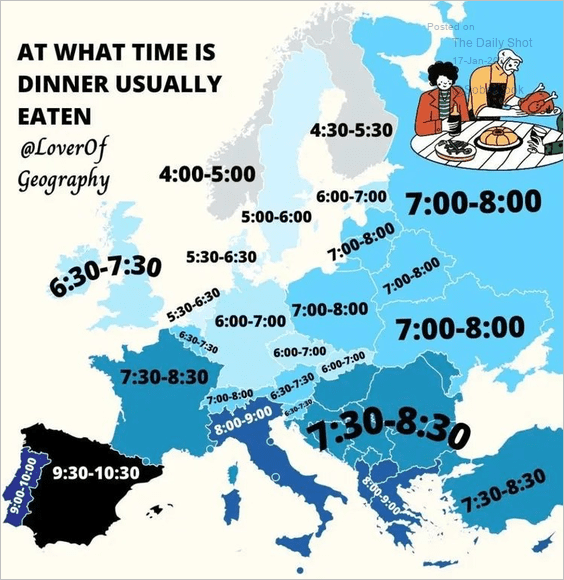

8. Dinner time across Europe:

Source: @conradhackett

Source: @conradhackett

——————–

Back to Index