The Daily Shot: 19-Jan-23

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

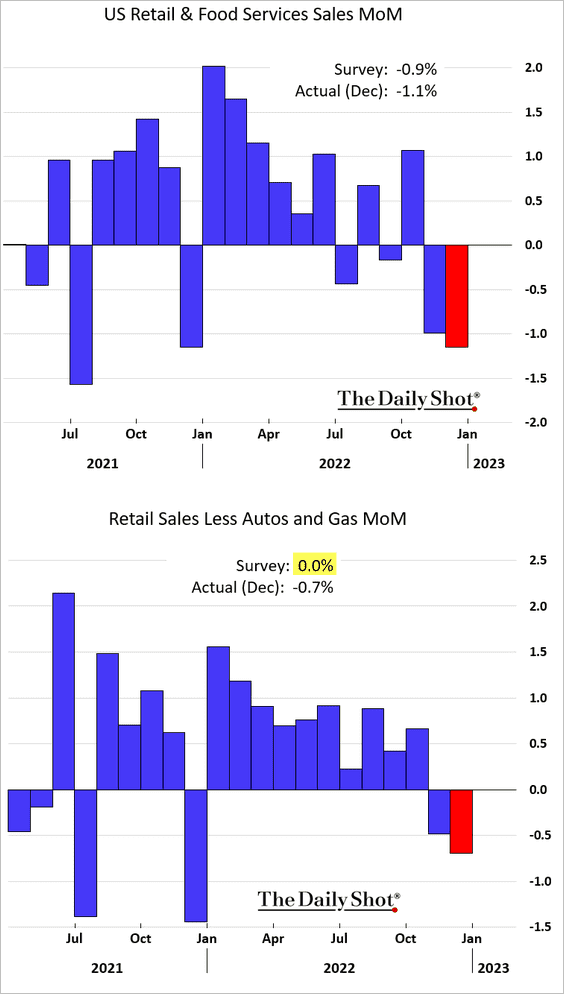

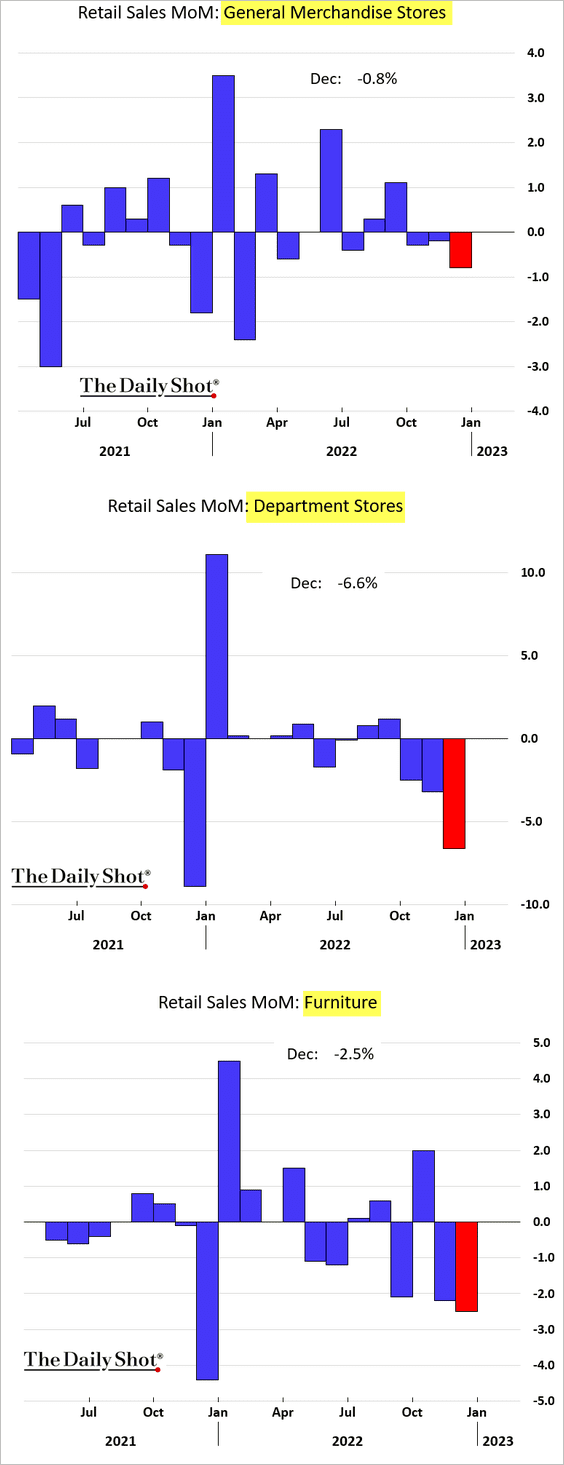

1. Economic activity in the US has taken a marked downturn. December retail sales surprised to the downside.

Source: CNBC Read full article

Source: CNBC Read full article

• Below are some examples.

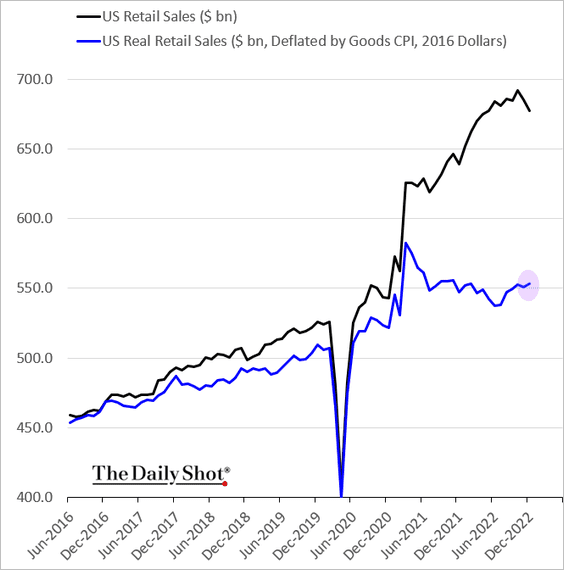

Adjusted for inflation, total retail sales showed a modest increase.

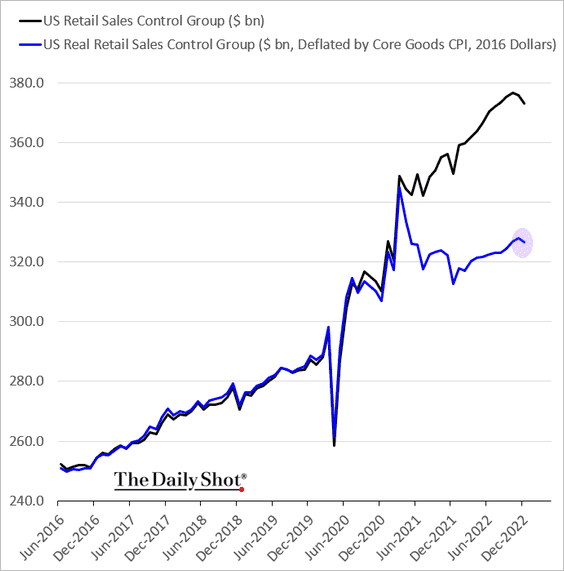

However, real “core” retail sales declined.

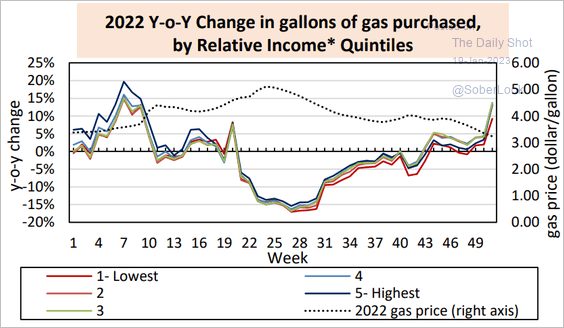

What’s the reason for this divergence? Americans bought a lot of gasoline leading up to the end of the year.

Source: AEI Housing Center

Source: AEI Housing Center

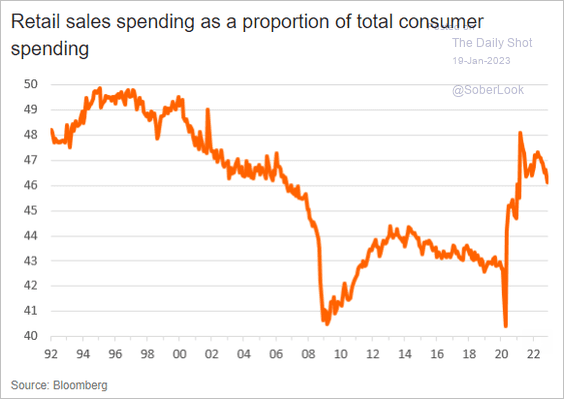

• Retail sales as a share of total consumption remain elevated.

Source: ING

Source: ING

——————–

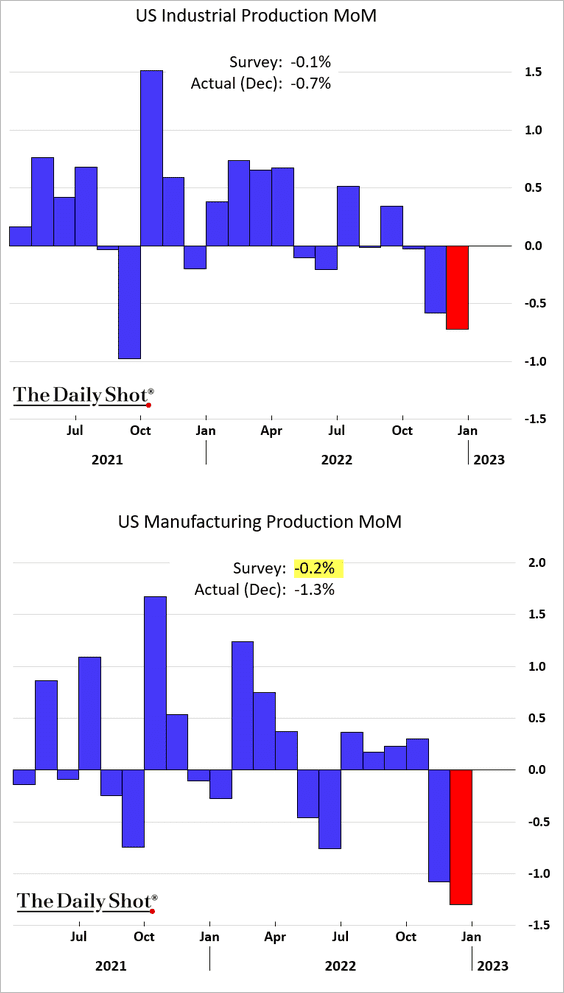

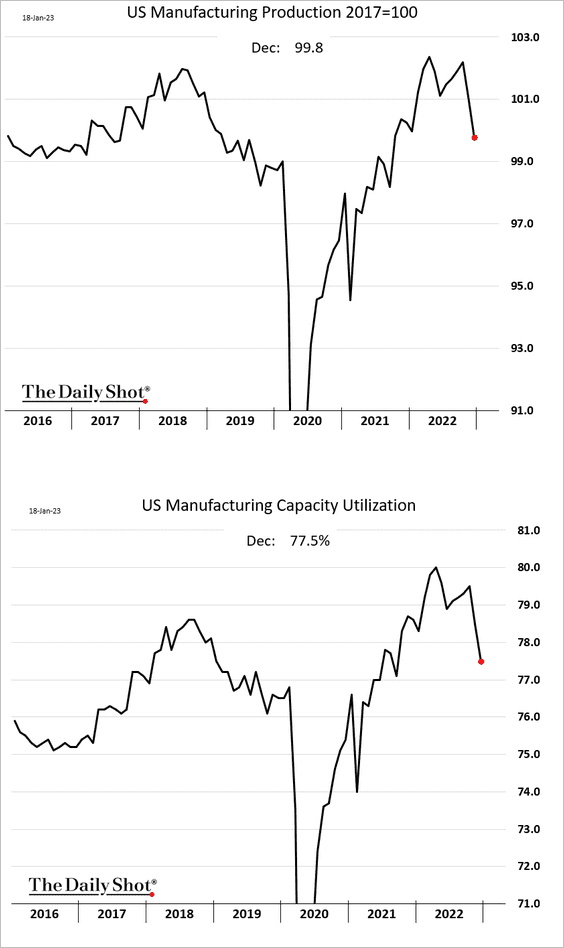

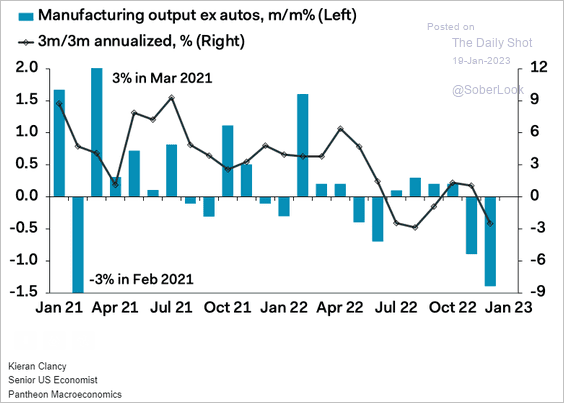

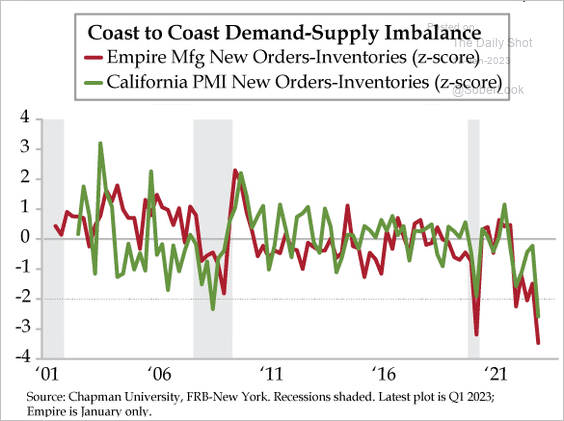

2. The nation’s manufacturing sector is in recession.

Source: Reuters Read full article

Source: Reuters Read full article

• Here is the US manufacturing output excluding autos.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Demand has been sagging relative to inventories.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

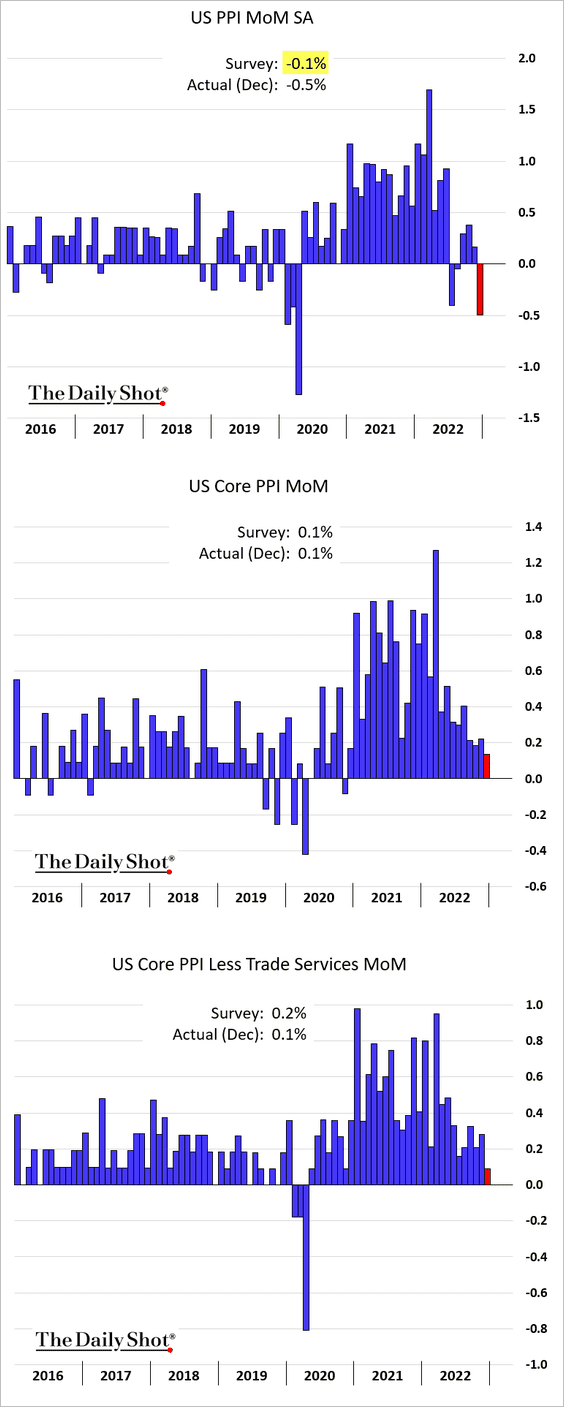

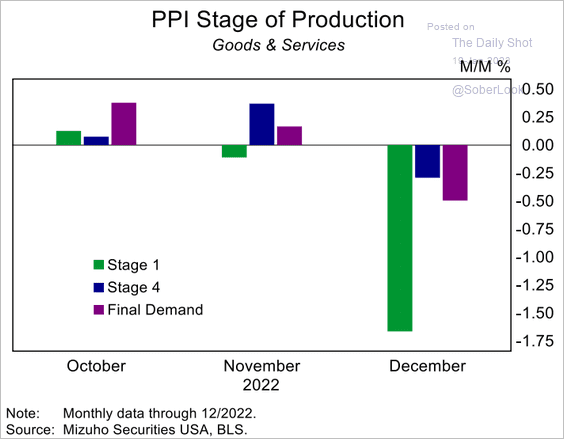

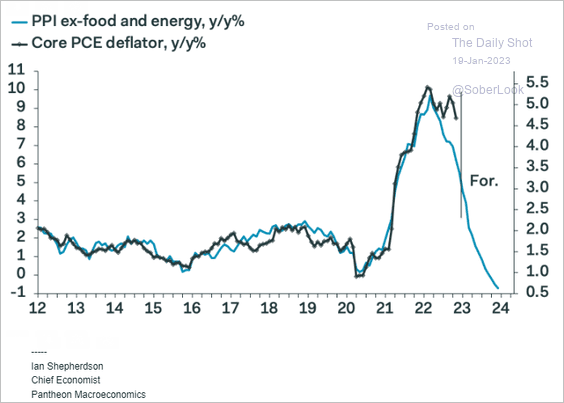

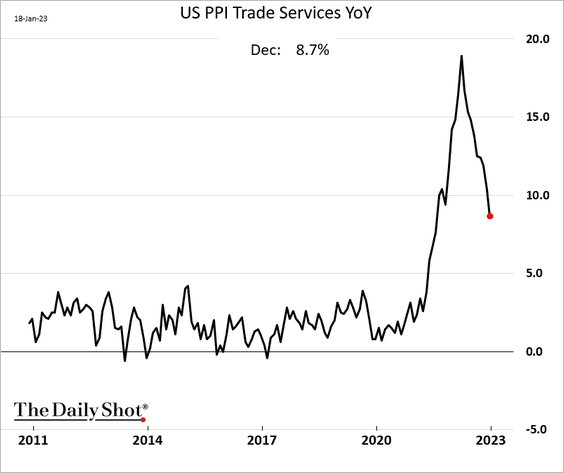

3. The December PPI report surprised to the downside. Gains in core producer prices continue to slow.

• Upstream producer prices fell sharply.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Falling core PPI is good news for consumer prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

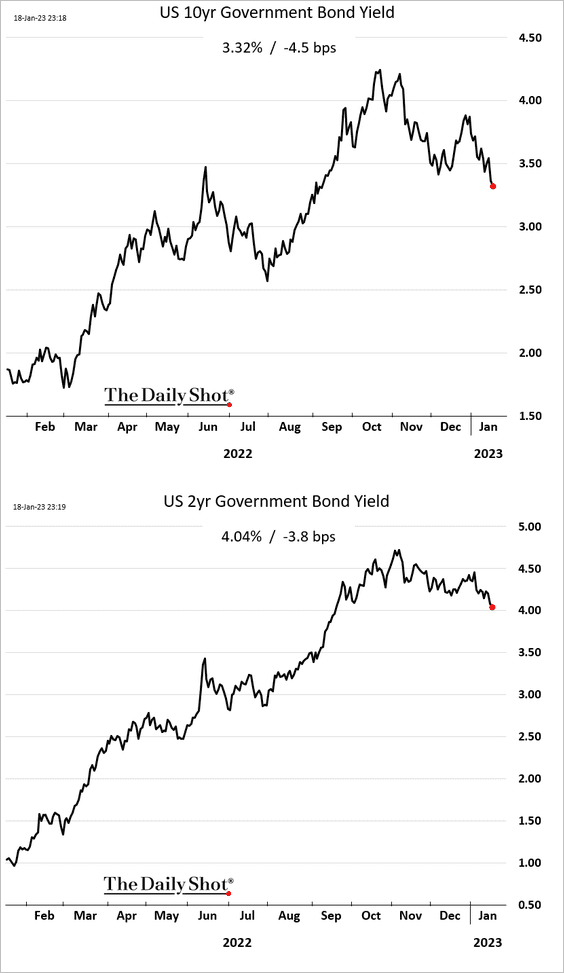

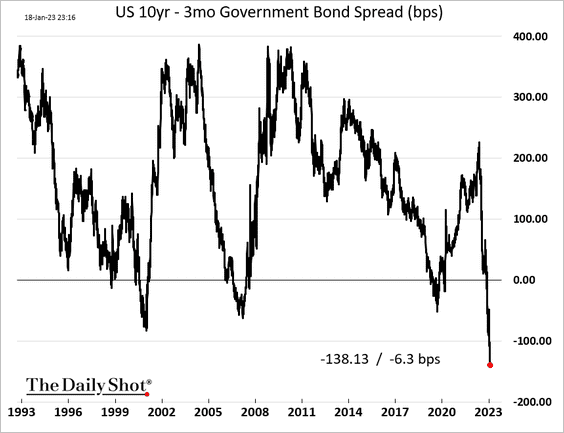

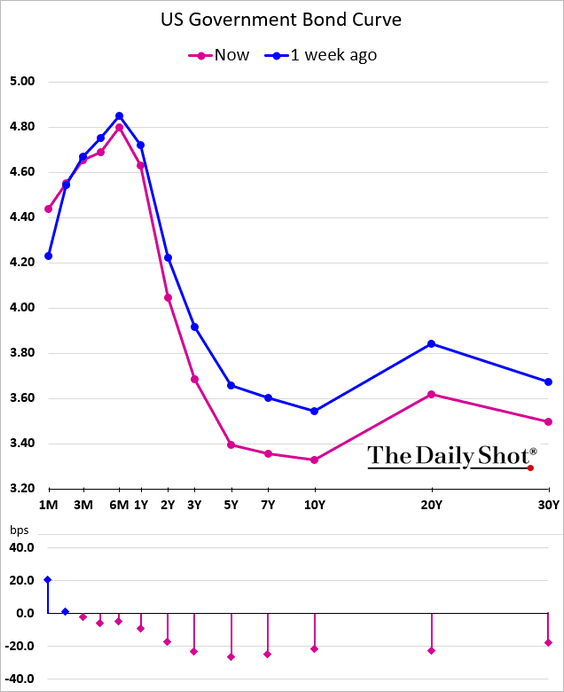

4. Treasury yields declined further amid recession concerns.

• The yield curve inversion (10-year vs. 3-month) deepened to record levels.

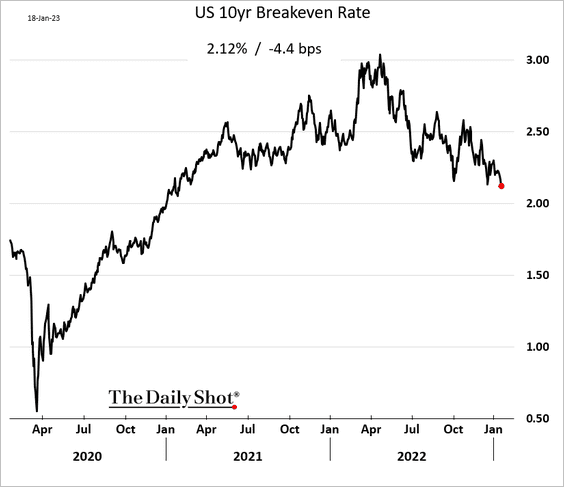

• Longer-term market-based inflation expectations hit a two-year low.

• Despite the protests from Fed officials, …

Source: Reuters Read full article

Source: Reuters Read full article

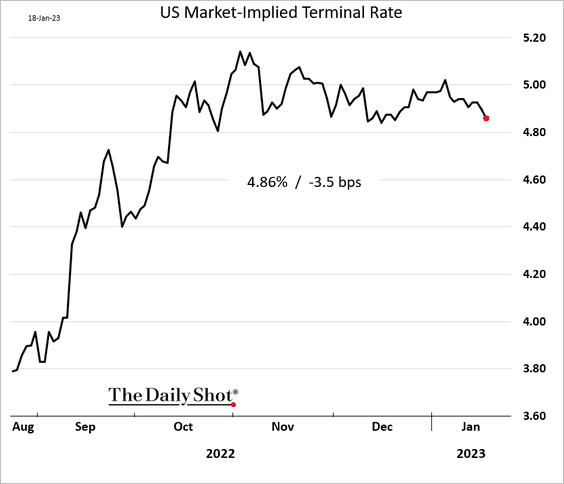

… the terminal rate continues to move away from the 5% level.

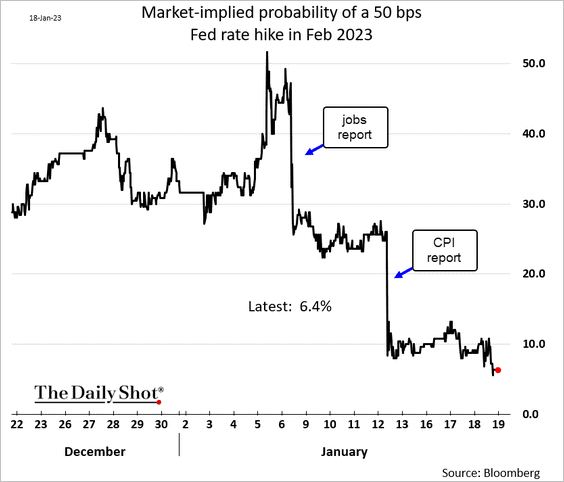

The market has almost completely discounted the possibility of a 50 bps rate hike next month.

——————–

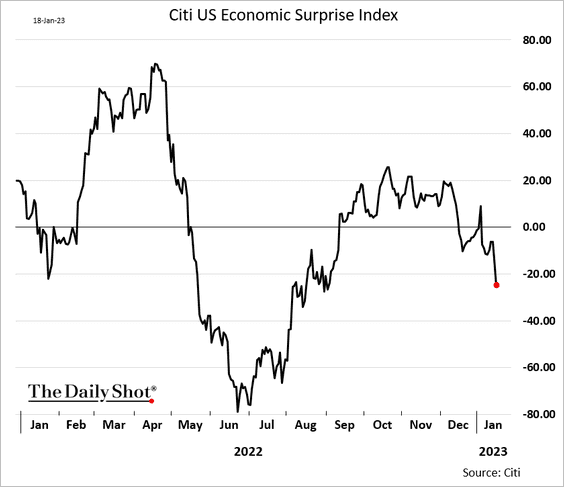

5. The Citi Economic Surprise Index tumbled after the retail sales and industrial production reports.

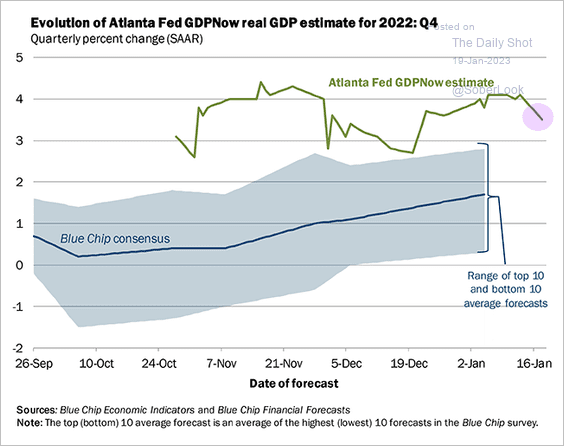

• The Atlanta Fed’s GDPNow model for Q4 growth declined but remains elevated relative to forecasts.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

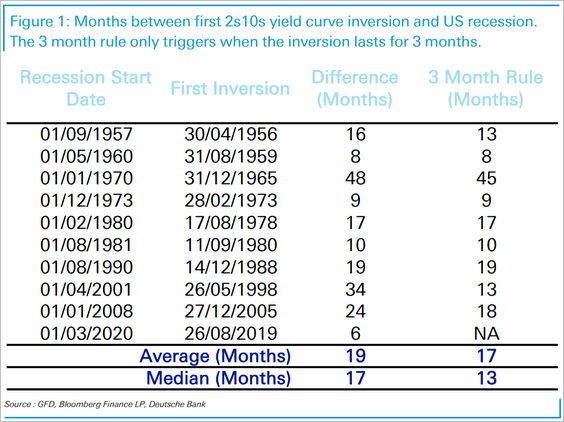

• Historically, recessions start about 17 months after the 2s/10s Treasury curve has inverted for three months. So far, we are roughly nine months away from that point.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

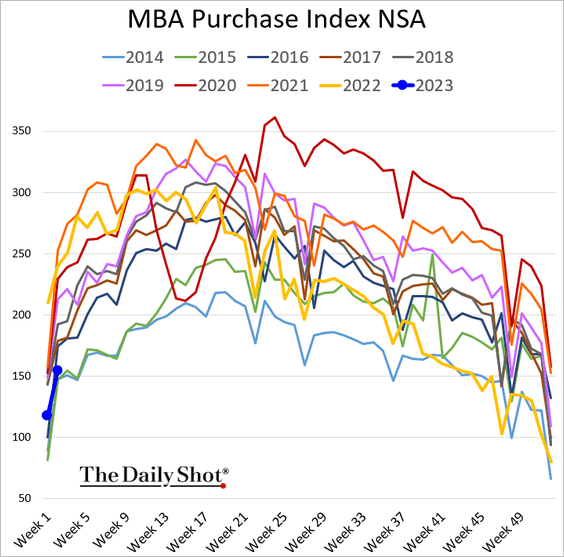

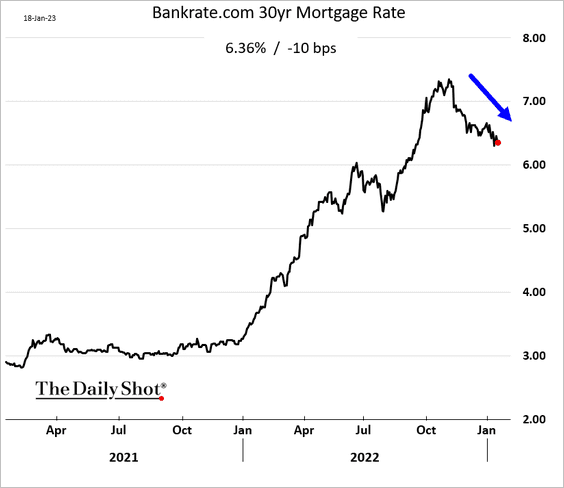

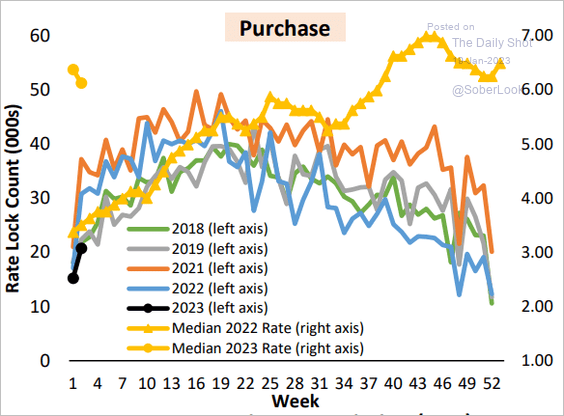

6. Mortgage applications showed a bit more vigor last week, …

… as mortgage rates ease.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

We will have more on the housing market tomorrow.

Back to Index

The United Kingdom

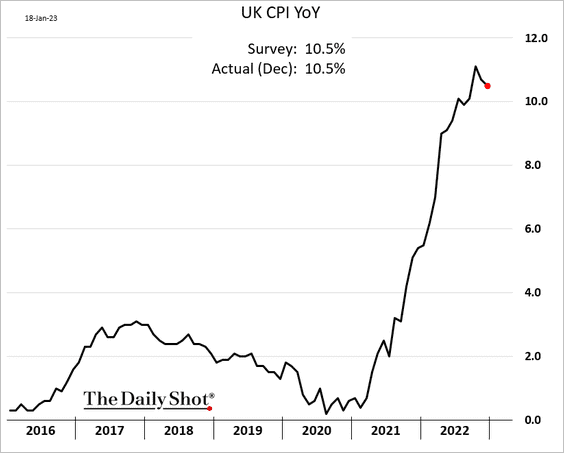

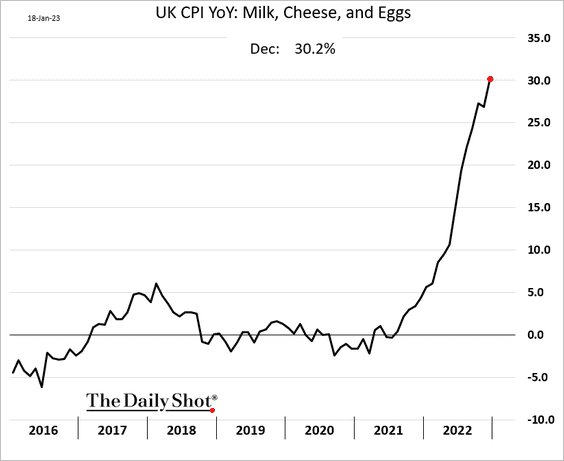

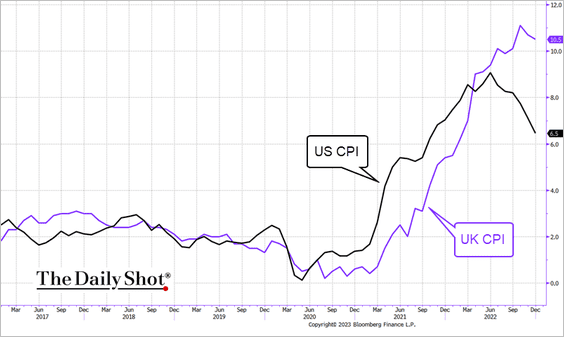

1. Inflation edged down in December, …

… bit food prices continue to surge.

Source: Reuters Read full article

Source: Reuters Read full article

• The UK inflation rate has widened the gap with the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

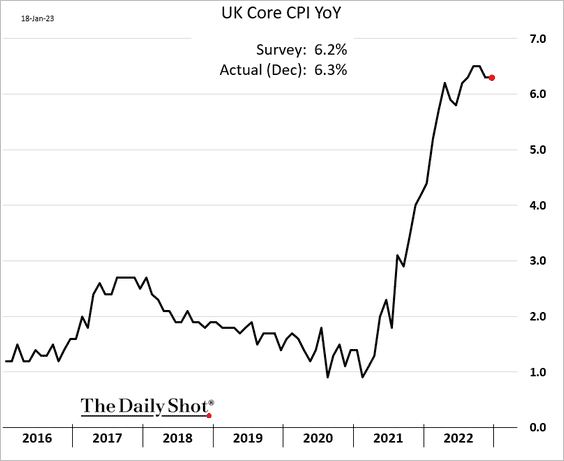

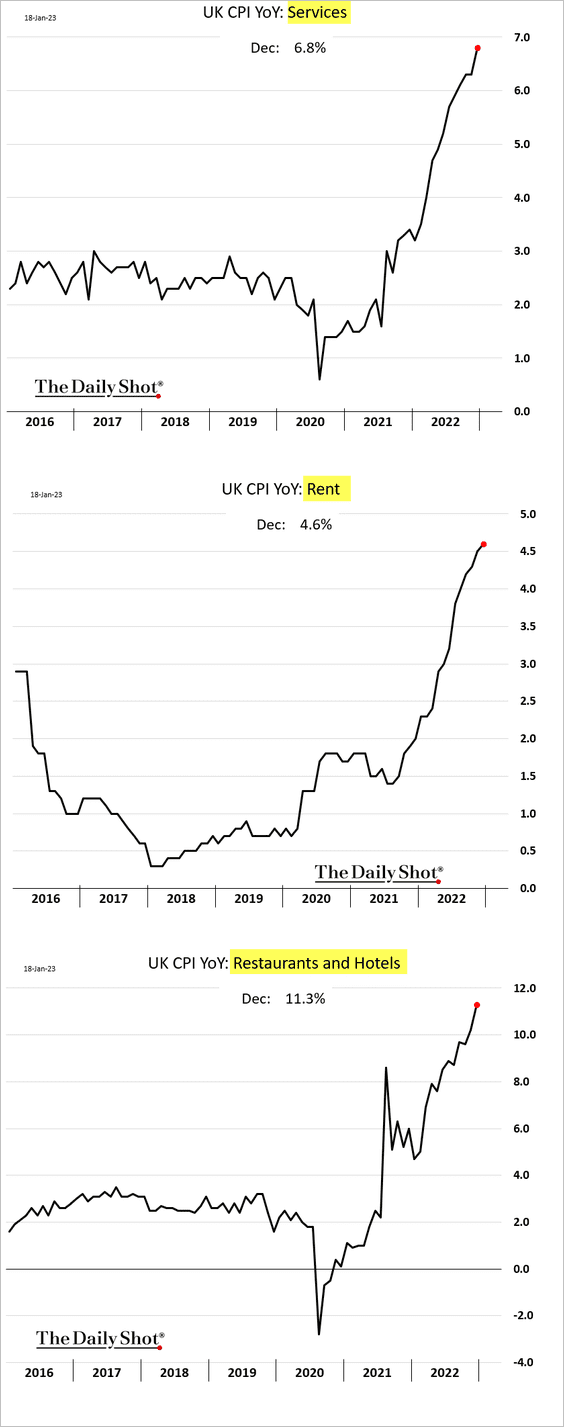

• Core inflation remains stubbornly high, …

… as services CPI hits a multi-year peak.

——————–

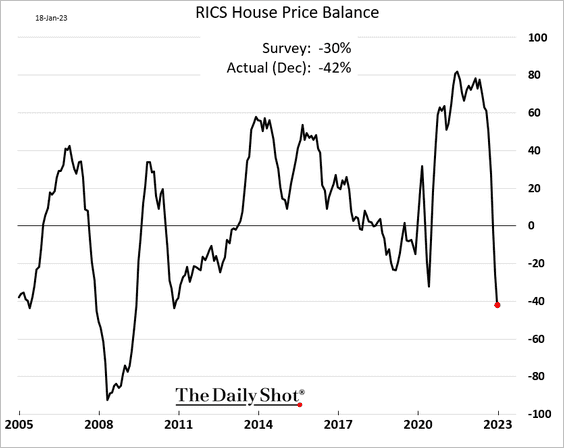

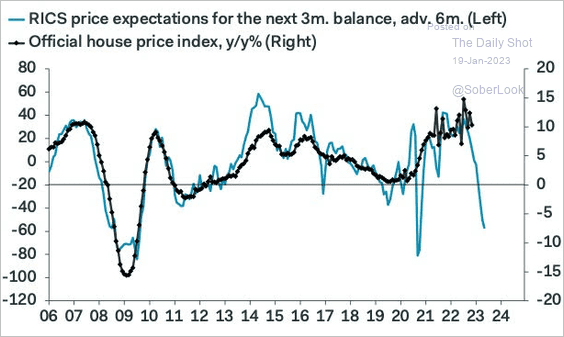

2. The RICS housing market index tumbled last month, surprising to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

The official home price index is about to dive.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

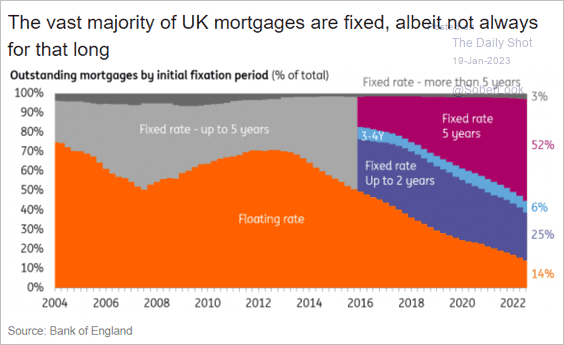

3. Here is the term structure of the nation’s mortgage market over time.

Source: ING

Source: ING

Back to Index

The Eurozone

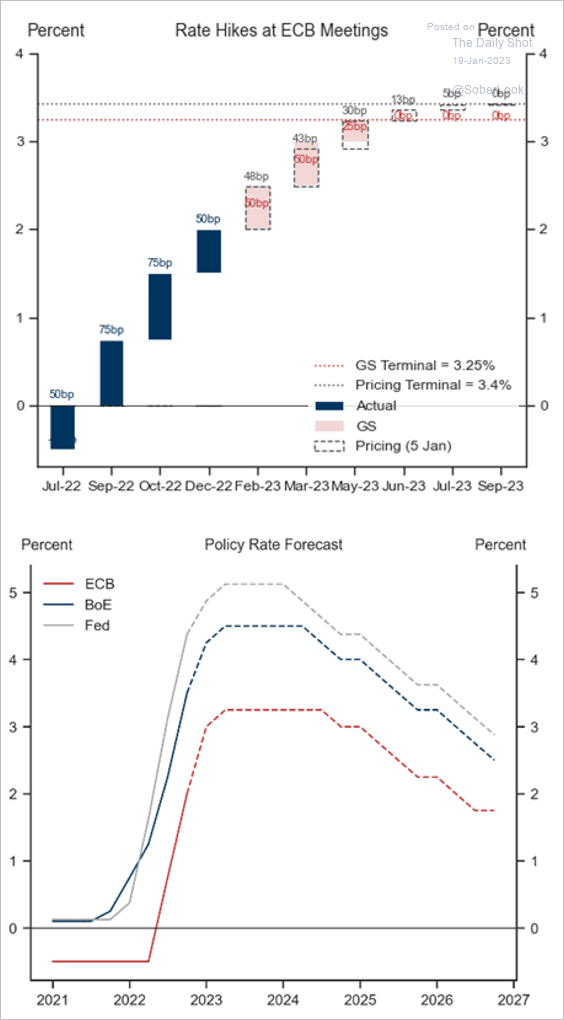

1. Goldman sees the ECB hiking rates three more times (50, 50, and 25 bps).

Source: Goldman Sachs

Source: Goldman Sachs

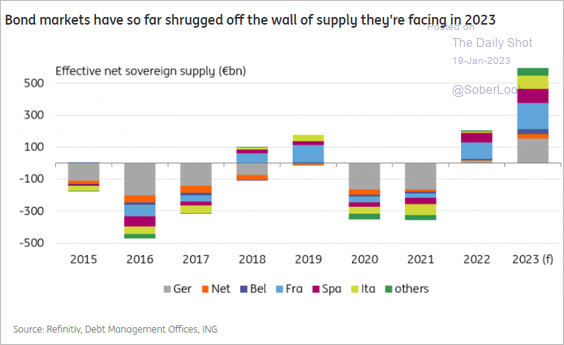

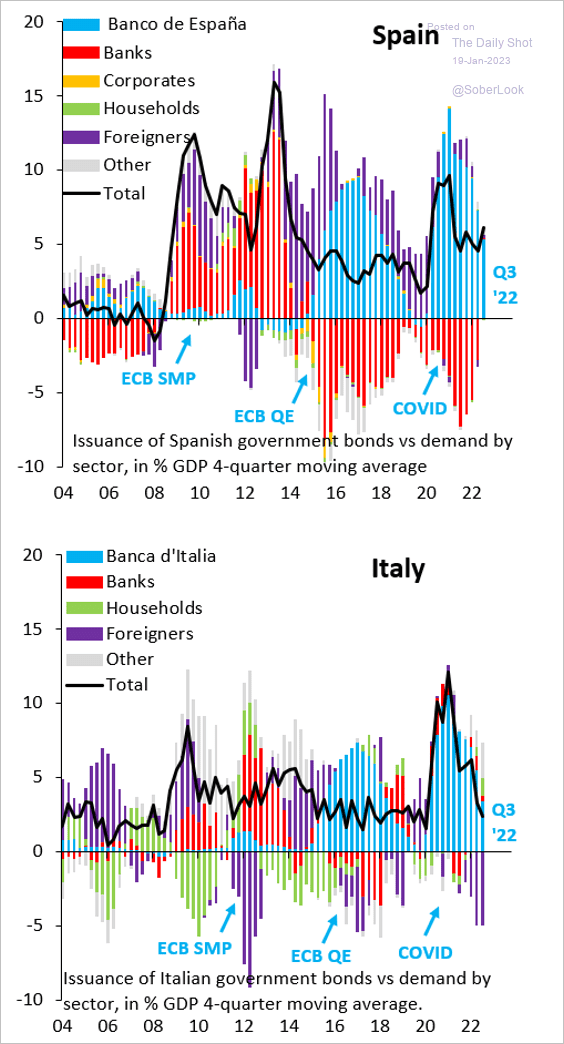

2. Debt supply is expected to surge this year.

Source: ING

Source: ING

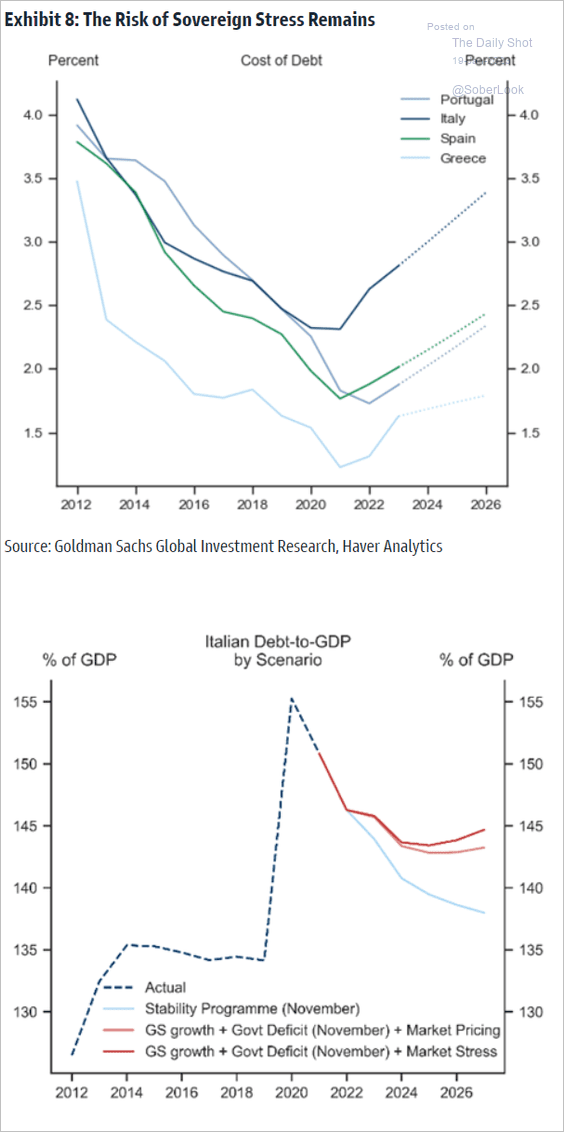

• Sovereign debt stress risks remain.

Source: Goldman Sachs

Source: Goldman Sachs

• Foreigners will need to step in as the ECB pulls out.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

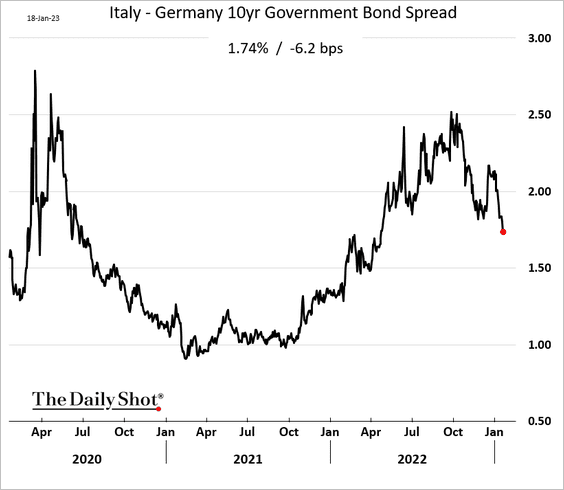

• Nonetheless, Italian spreads continue to tighten.

——————–

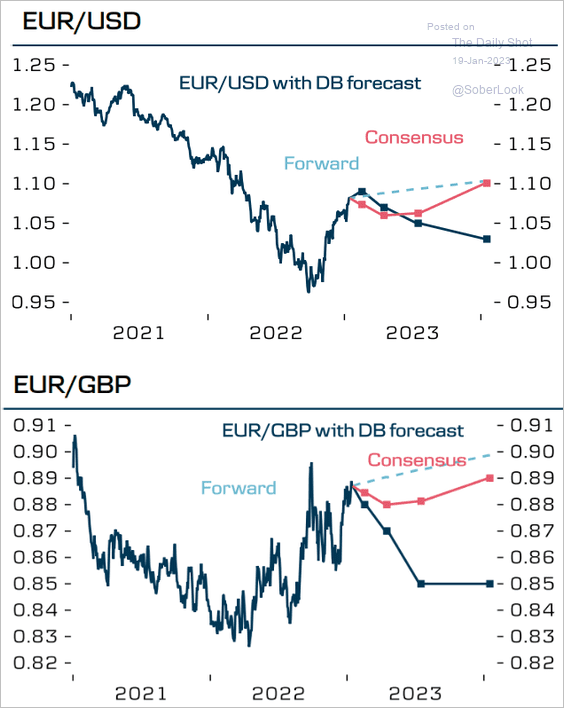

3. The euro will weaken this year, according to Danske Bank.

Source: Danske Bank

Source: Danske Bank

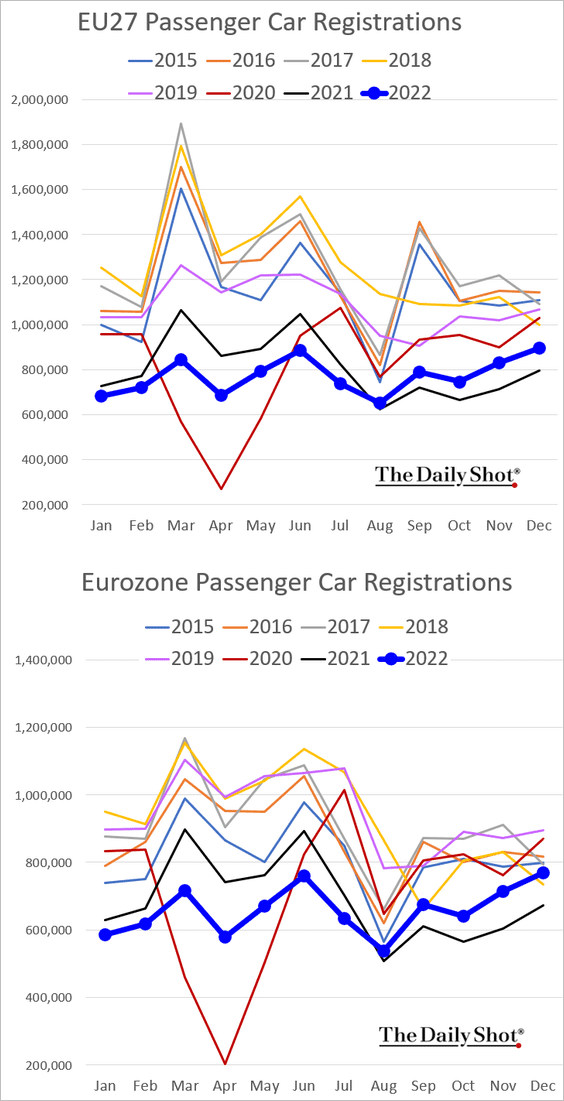

4. Euro-area car registrations climbed above 2018 levels.

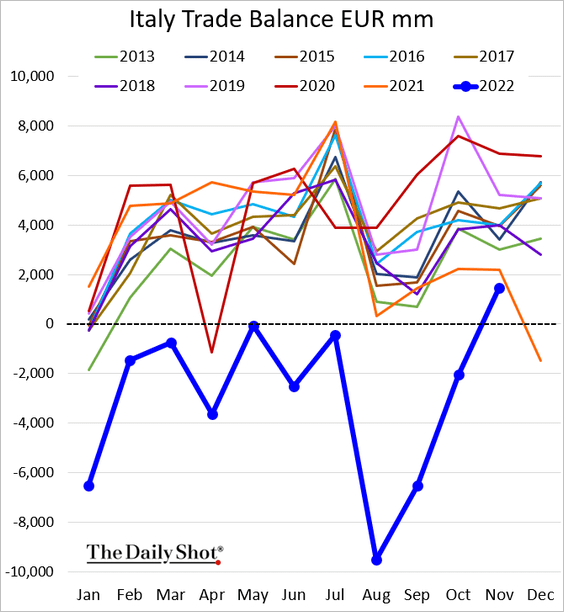

5. Italian trade balance is back in surplus.

Back to Index

Japan

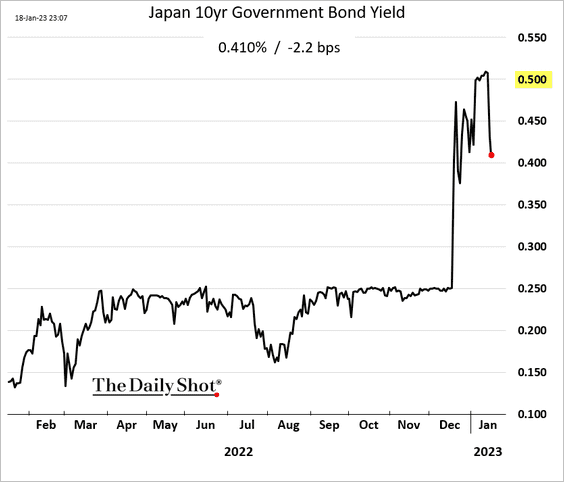

1. How long can the BoJ keep up its massive bond purchases to cap the 10-year yield? Here is a comment from Capital Economics.

… the policy looks increasingly unsustainable. The Bank bought a record amount of bonds in December and is on track to buy yet another record amount this month. Indeed, the aim of improving market functioning by widening the tolerance band hasn’t been met. Even if the government in early February appoints a continuity candidate to replace Governor Kuroda when his term ends in early April, we suspect he will be instructed to ditch Yield Curve Control at his first meeting in late April.

——————–

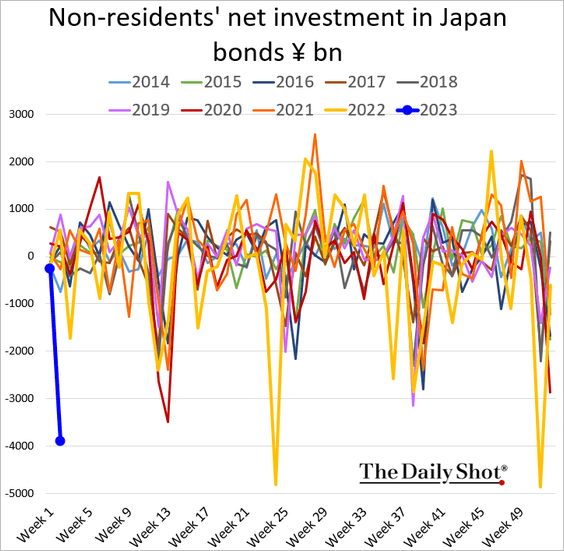

2. Foreigners have been dumping JGBs.

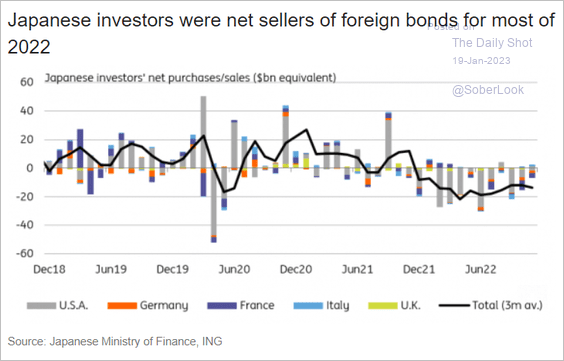

3. Japanese investors continue to sell foreign bonds.

Source: ING

Source: ING

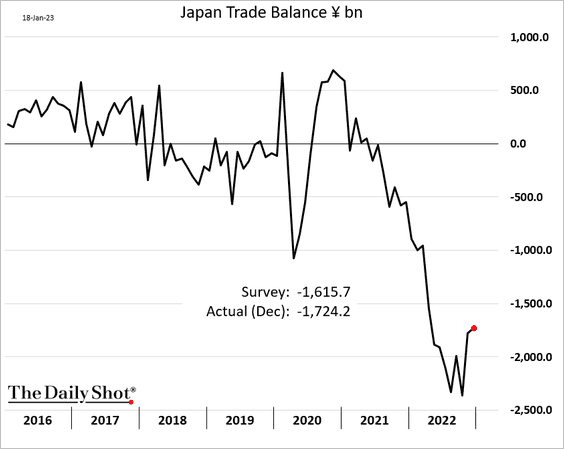

4. The trade gap was wider than expected last month.

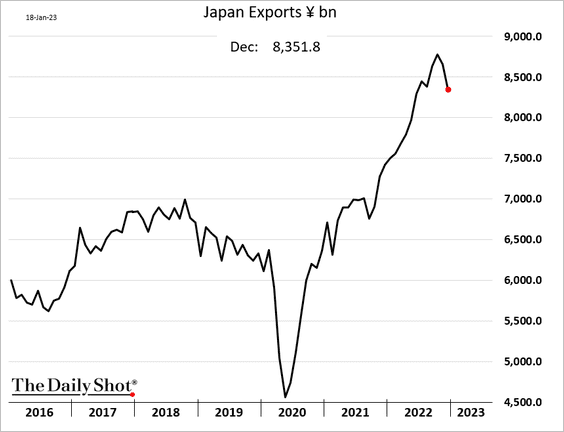

Exports continue to ease.

——————–

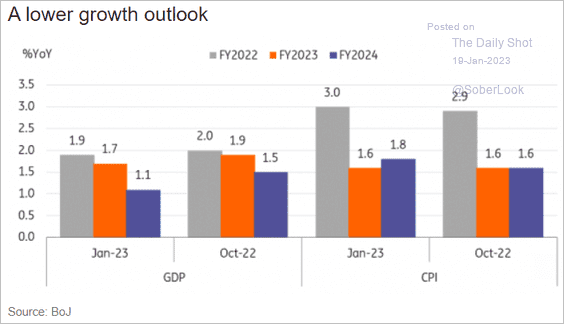

5. The BoJ downgraded its growth forecasts again.

Source: ING

Source: ING

Back to Index

Asia – Pacific

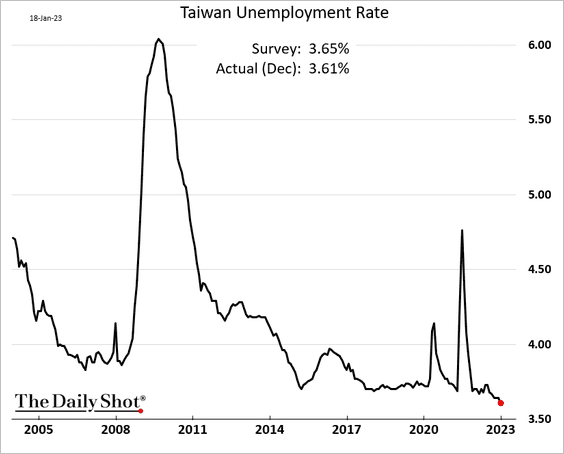

1. Taiwan’s unemployment rate hit its lowest level in 22 years.

Source: Taiwan News Read full article

Source: Taiwan News Read full article

——————–

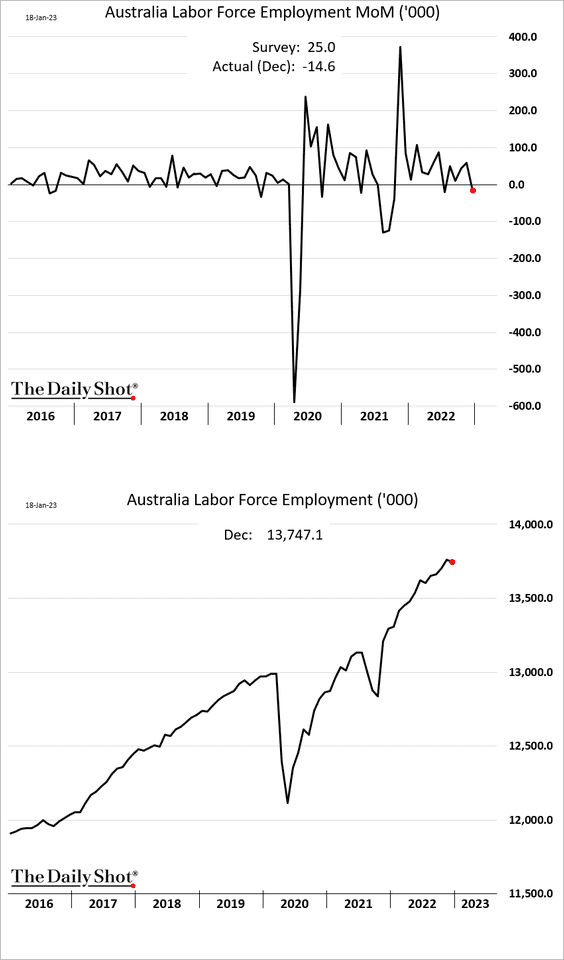

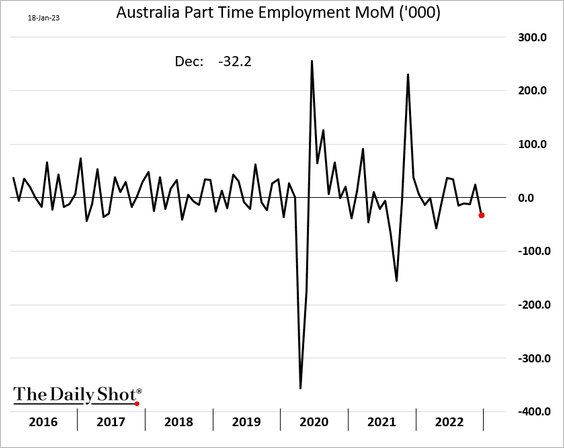

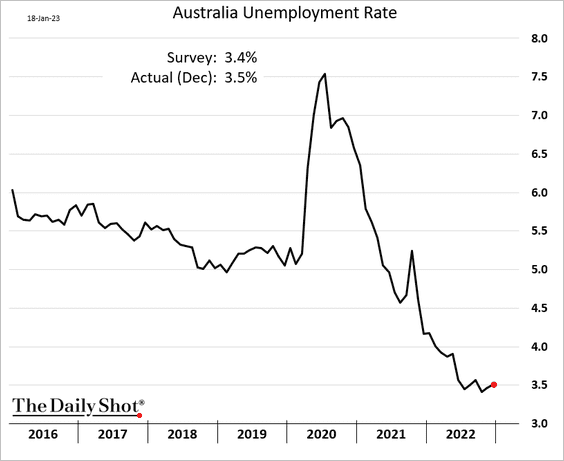

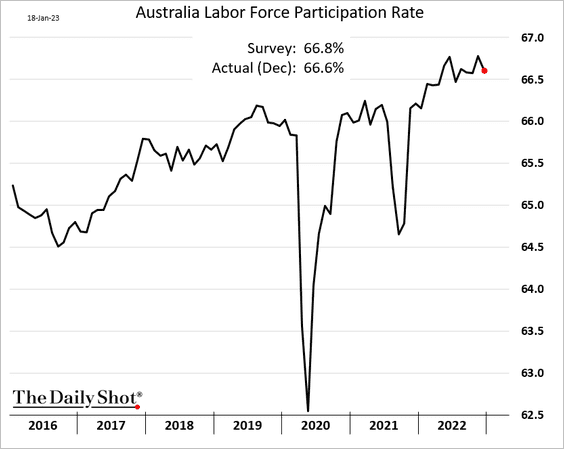

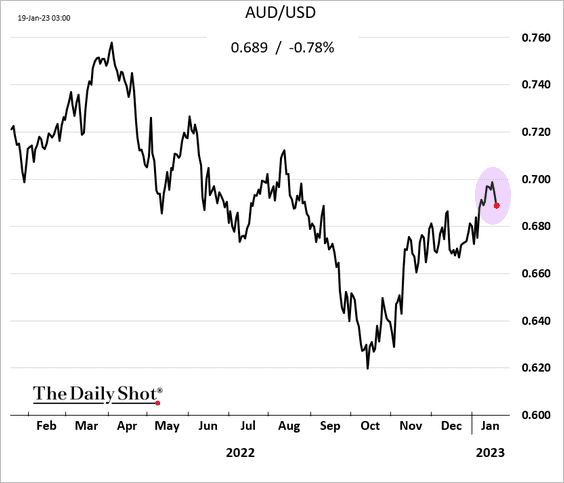

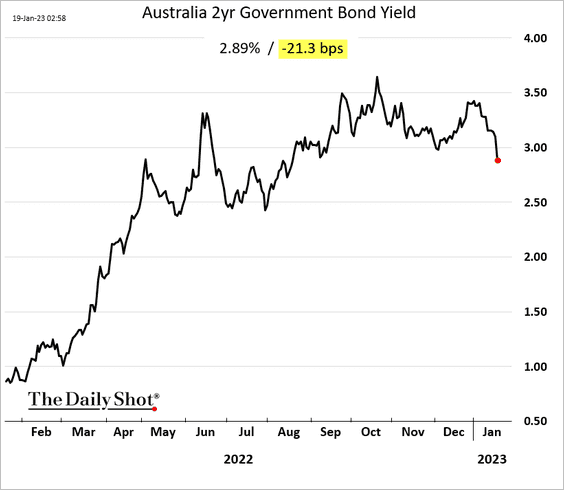

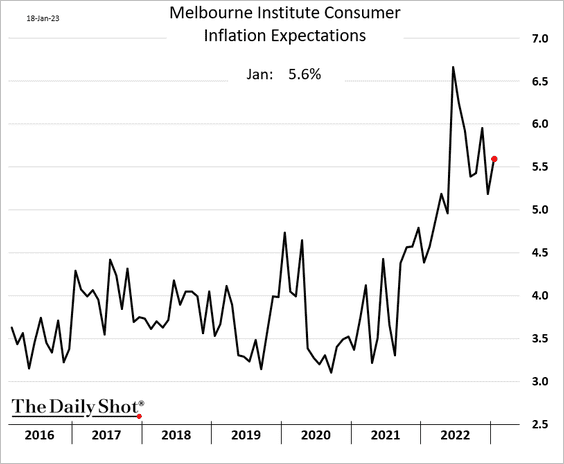

2. Next, we have some updates on Australia.

• The employment report fell short of expectations with a surprise decrease in job numbers.

The decline was driven by part-time jobs.

– The unemployment rate edged higher.

And the participation rate declined.

• The Aussie dollar rally stalled in response to the jobs report.

And bond yields tumbled.

• Inflation expectations remain elevated.

Back to Index

China

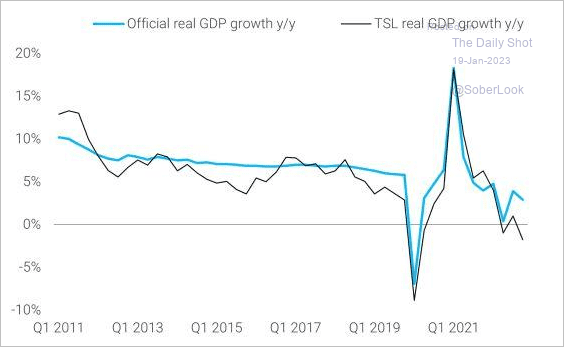

1. How much did Beijing “cook” China’s GDP figures? Here is an estimate from TS Lombard.

Source: TS Lombard

Source: TS Lombard

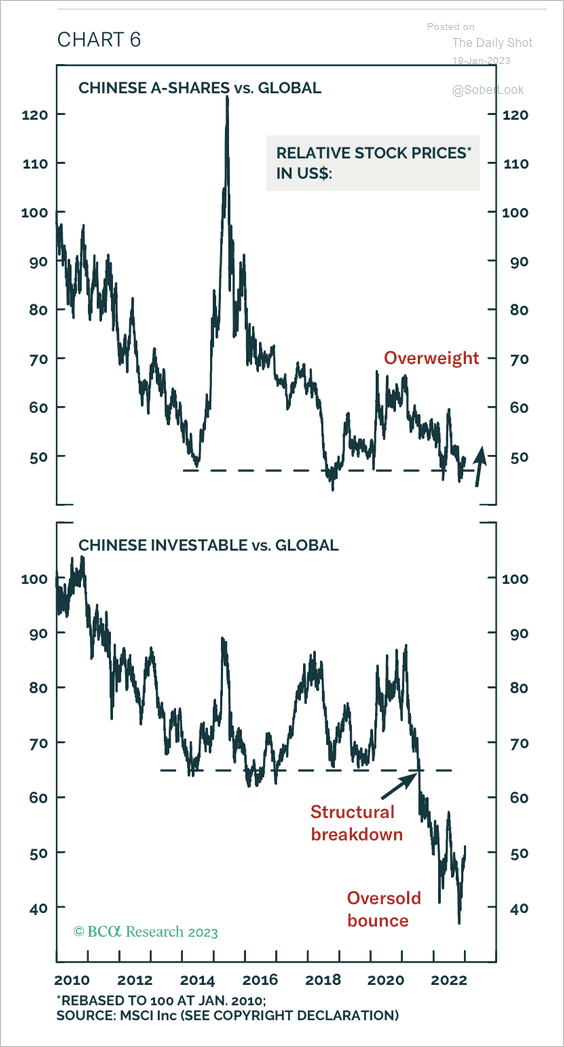

2. Is the rally in China just an oversold bounce? It’s worth noting that Chinese A-Shares are still holding support relative to global stocks.

Source: BCA Research

Source: BCA Research

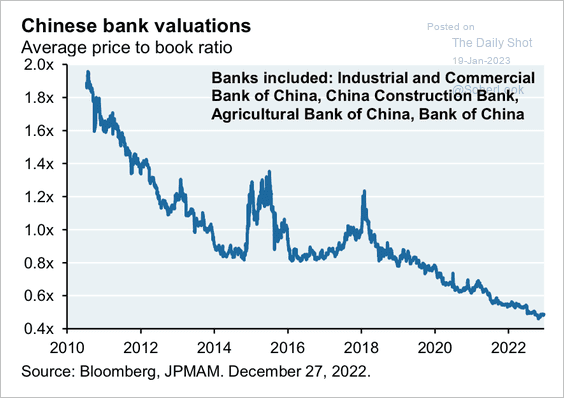

3. Chinese bank valuations are historically low.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

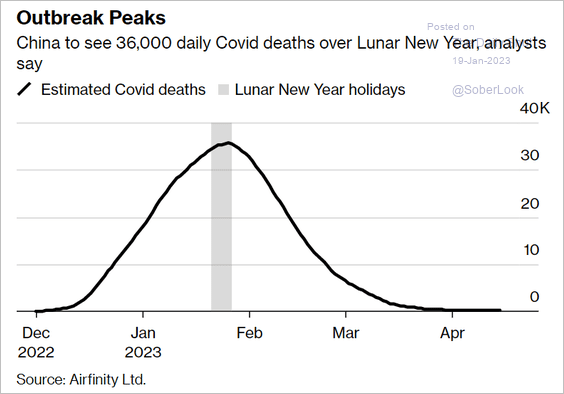

4. This chart shows estimated COVID deaths in China.

Source: @hongjinshan, @bpolitics Read full article

Source: @hongjinshan, @bpolitics Read full article

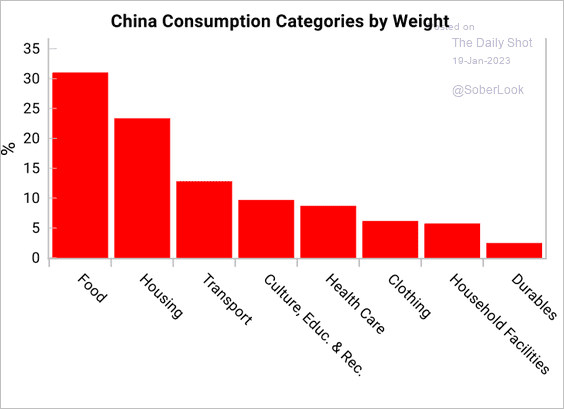

5. Finally, we have China’s consumer spending categories by weight.

Source: Variant Perception

Source: Variant Perception

Back to Index

Emerging Markets

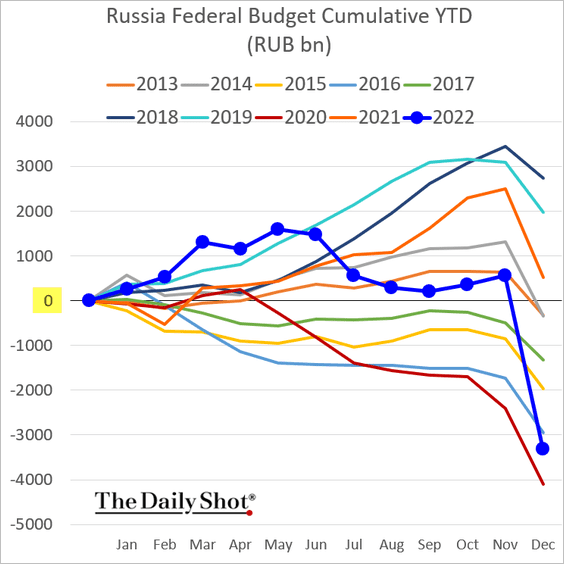

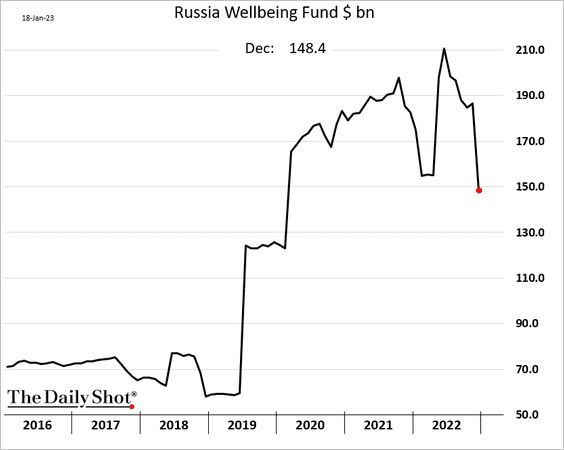

1. Russia’s federal budget deteriorated sharply at the end of the year.

The national wealth fund balances hit the lowest level in nearly two years.

——————–

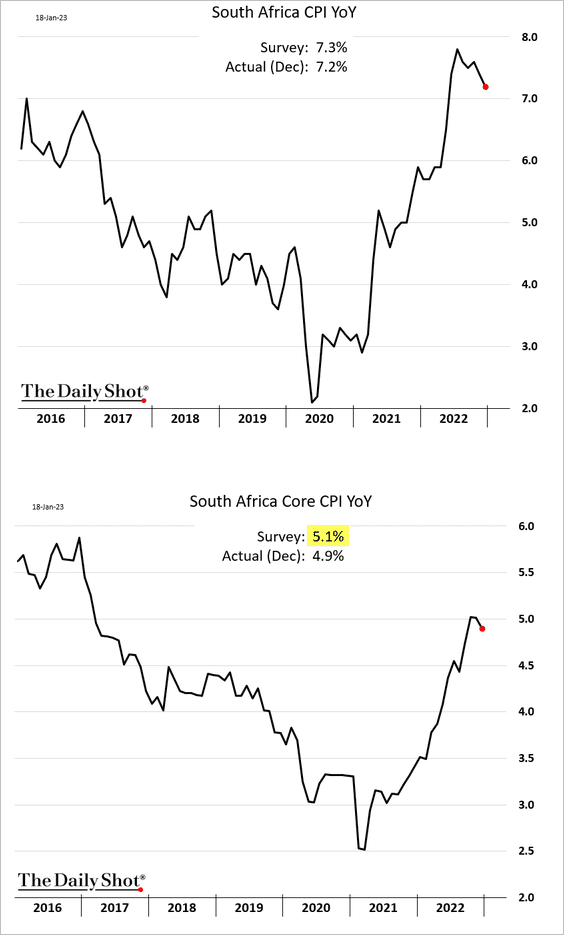

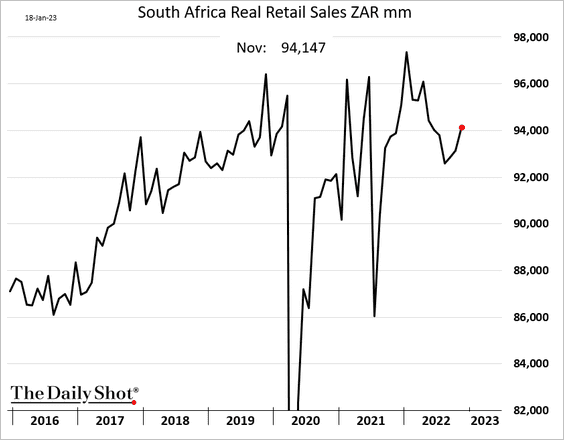

2. South Africa’s inflation declined again, with the core CPI coming in below forecasts.

Retail sales improved in November.

——————–

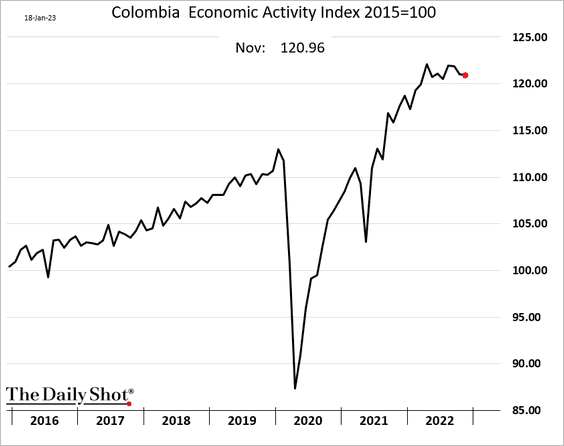

3. Colombia’s GDP is holding up for now.

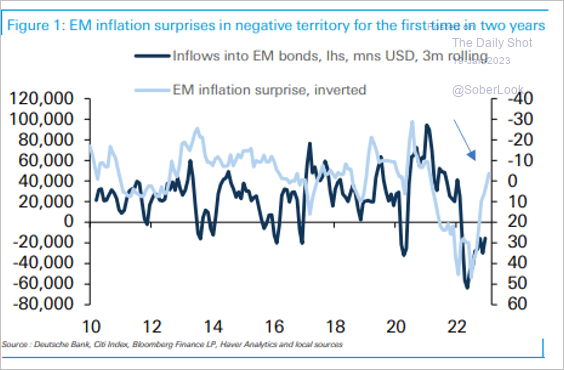

4. Negative EM inflation surprises could help drive bond inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

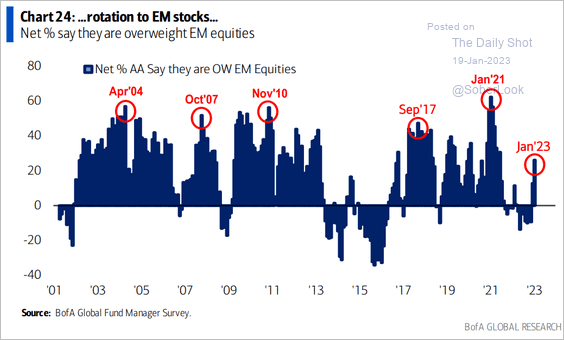

5. Global investors have been rotating into EM stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

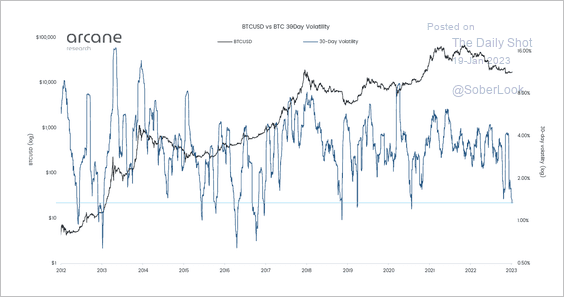

1. Bitcoin’s 30-day volatility returned toward long-term lows.

Source: @ArcaneResearch

Source: @ArcaneResearch

2. There was a large amount of BTC short liquidations during the latest rally.

Source: Coinglass

Source: Coinglass

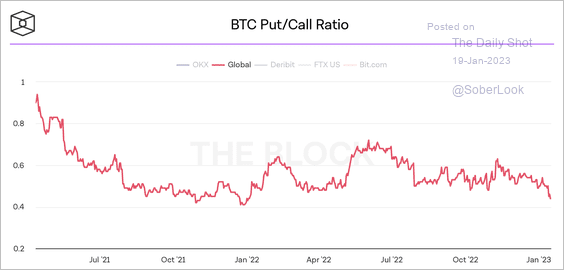

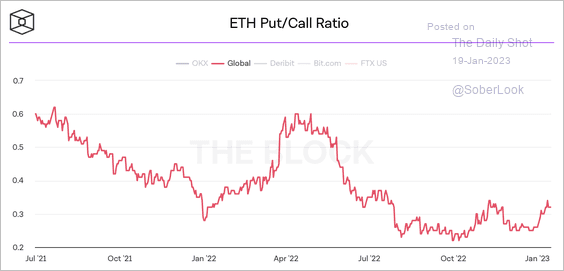

3. Bitcoin’s put/call ratio declined, although ether’s ratio is picking up. (2 charts)

Source: The Block

Source: The Block

Source: The Block

Source: The Block

——————–

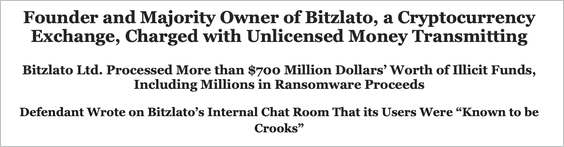

4. The US Justice Department and Treasury charged a Hong Kong-based platform with money laundering tied to Russian finance. This is seen as a significant international enforcement action on crypto.

Source: US Department of Justice Read full article

Source: US Department of Justice Read full article

5. CoinDesk, a major crypto-focused media company, is exploring a partial or full sale. The outlet’s parent company, Digital Currency Group, is a large crypto conglomerate that also owns Genesis – the institutional lender considering bankruptcy.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

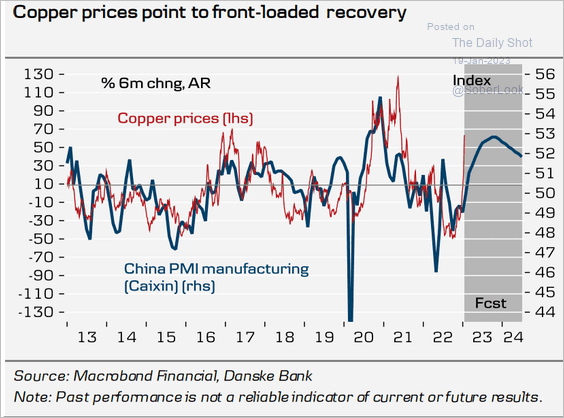

1. Copper prices have been signaling a sharp economic rebound in China.

Source: Danske Bank

Source: Danske Bank

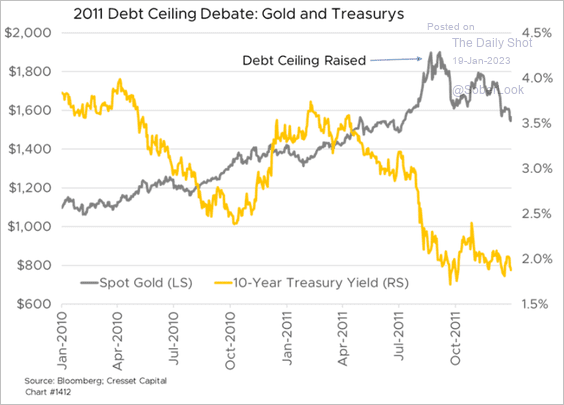

2. Gold and longer-dated Treasuries performed well during the 2011 debt ceiling crisis.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

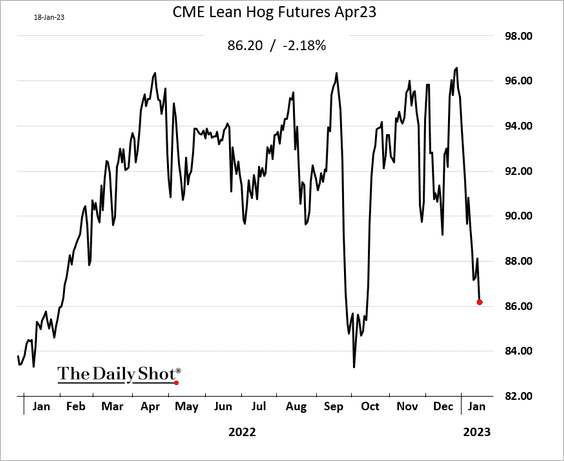

3. Chicago hog futures are under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

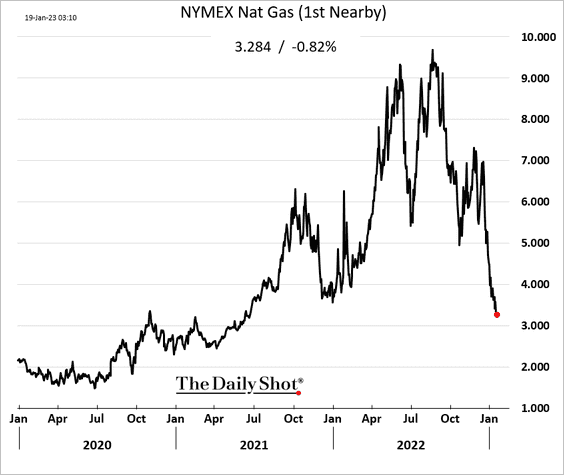

1. US natural gas prices continue to tumble.

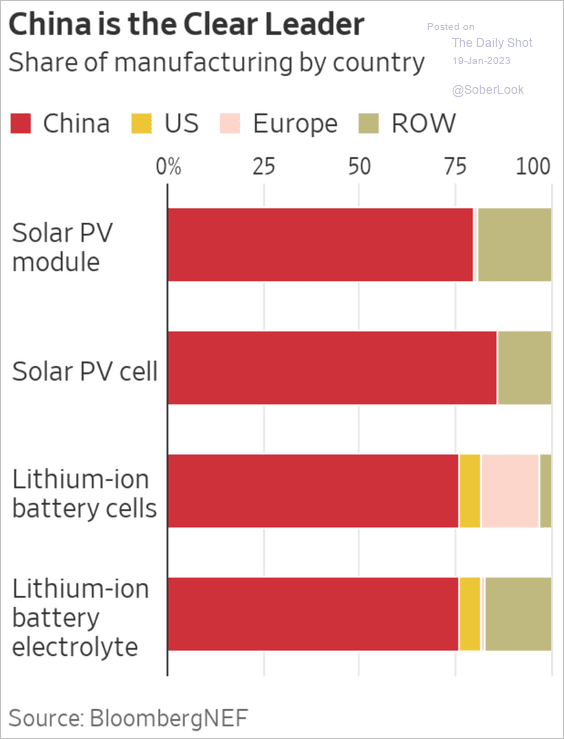

2. This chart illustrates China’s leading position in the production of renewable energy technology.

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

Back to Index

Equities

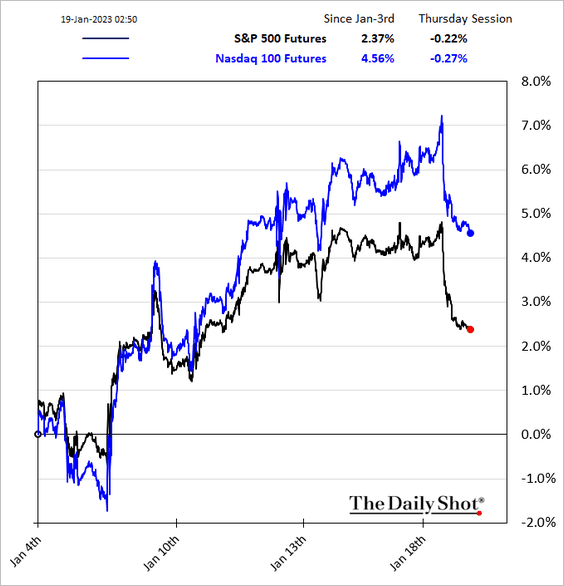

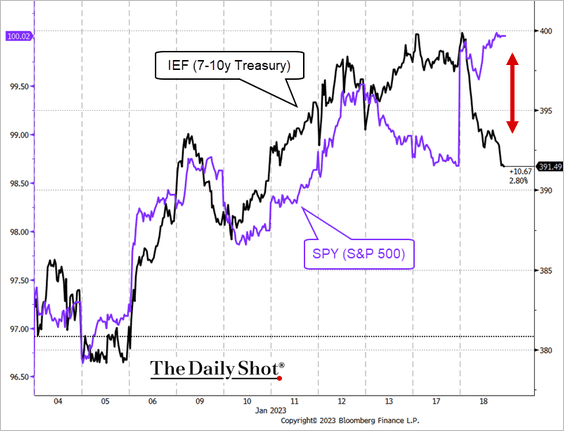

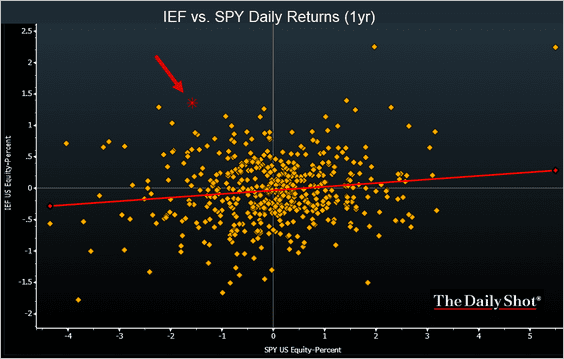

1. Stocks declined as US data point to a deepening economic slump, while Fed officials continue to signal more rate hikes.

Market focus has shifted from inflation to recession, with the stock-bond correlation turning negative.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. US producer prices point to tightening corporate margins.

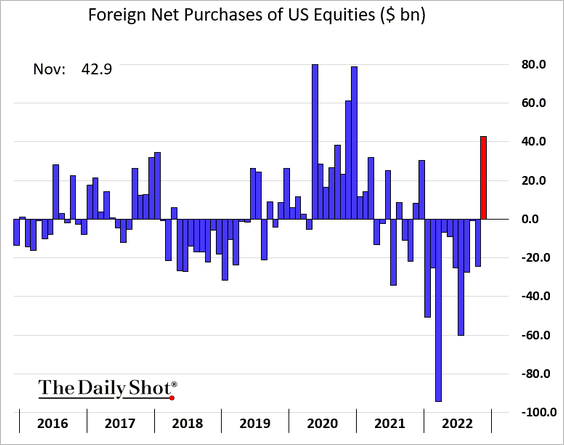

3. For the first time since the start of 2022, foreigners bought US stocks in November.

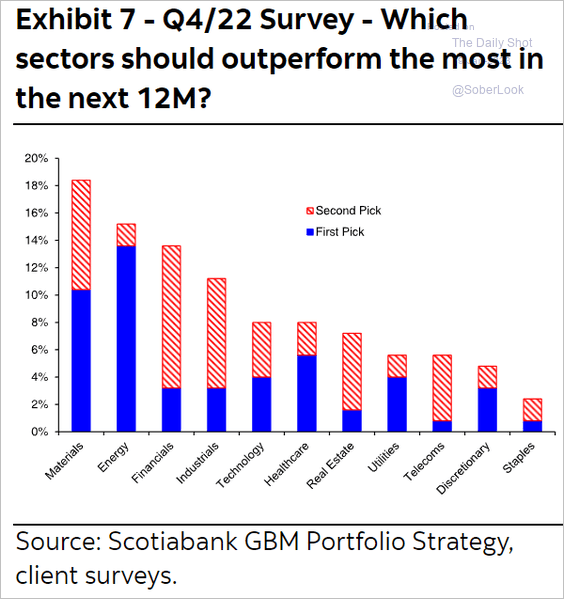

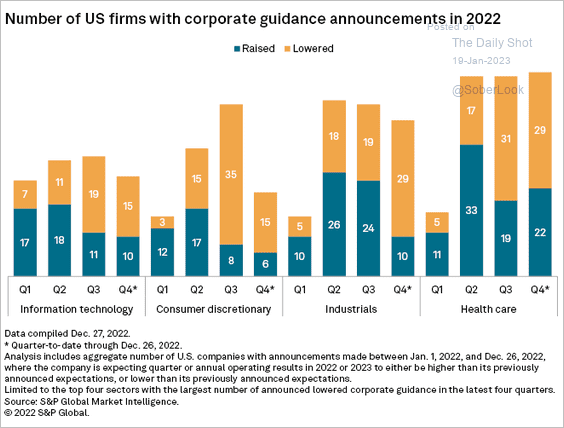

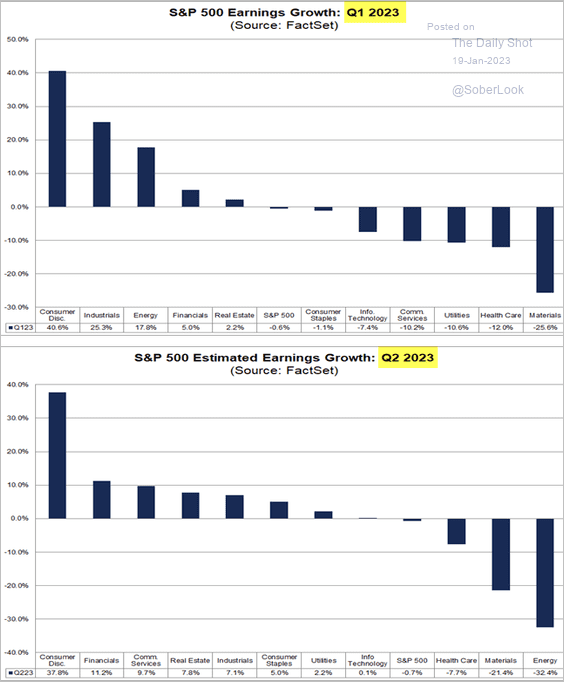

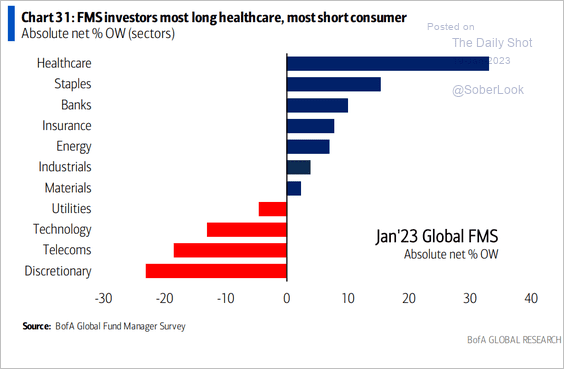

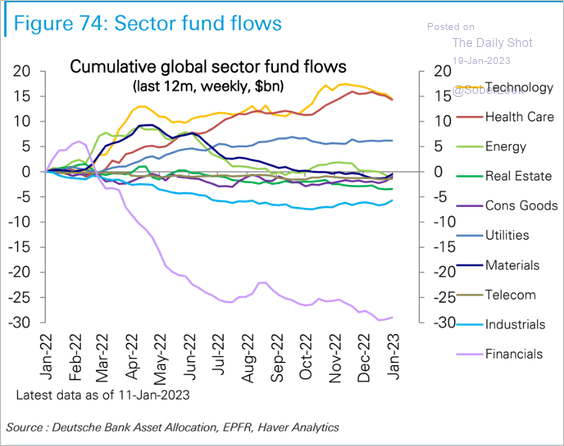

4. Next, we have some sector updates.

• Which sectors will outperform?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• Corporate guidance announcements:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Expected year-over-year earnings growth:

Source: @FactSet Read full article

Source: @FactSet Read full article

• Fund managers’ sector positioning:

Source: BofA Global Research

Source: BofA Global Research

• Fund flows by sector:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

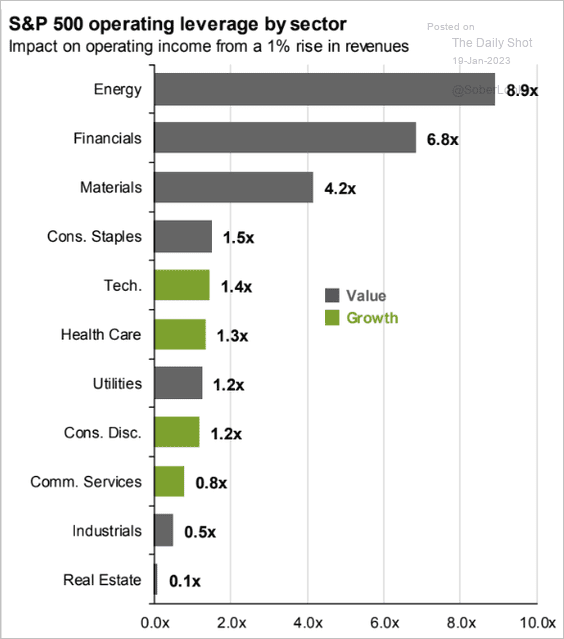

• Operating leverage by sector:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

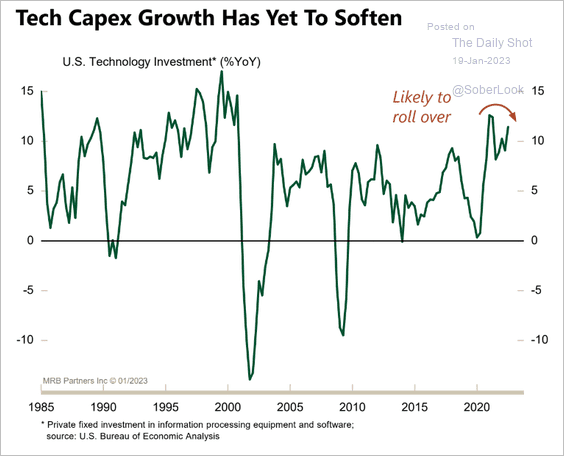

• Is tech CapEx about to roll over?

Source: MRB Partners

Source: MRB Partners

• The rise in semiconductor stocks has met resistance.

![]() Source: BCA Research

Source: BCA Research

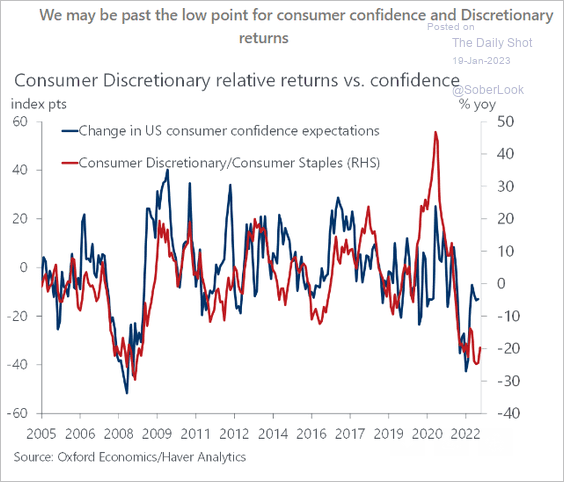

• More upside for consumer discretionary stocks?

Source: Oxford Economics

Source: Oxford Economics

——————–

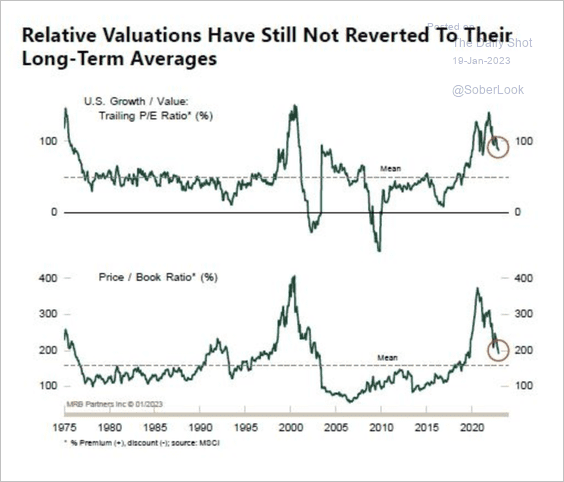

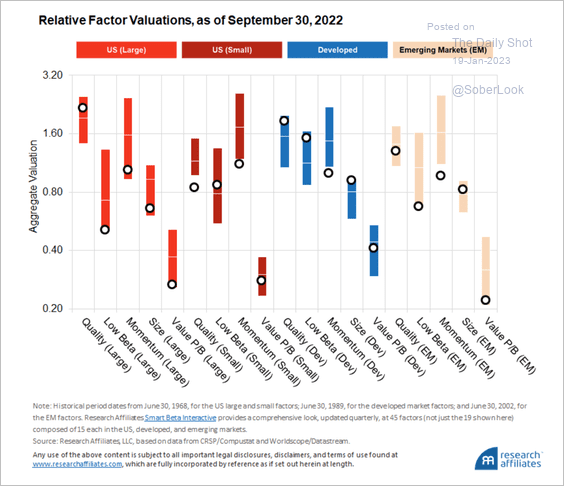

5. Growth stock valuations remain elevated relative to value stocks.

Source: MRB Partners

Source: MRB Partners

Here is a look at relative factor valuations.

Source: Research Affiliates Read full article

Source: Research Affiliates Read full article

Back to Index

Rates

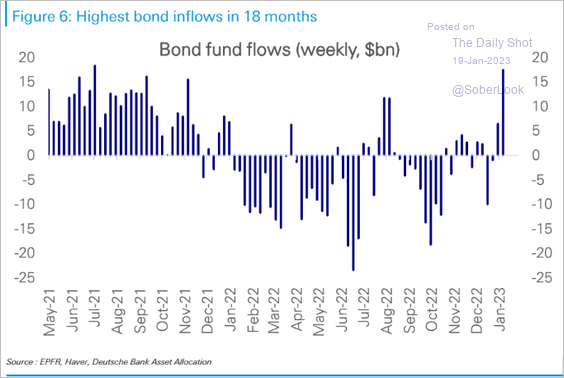

1. Bond fund inflows surged last week.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

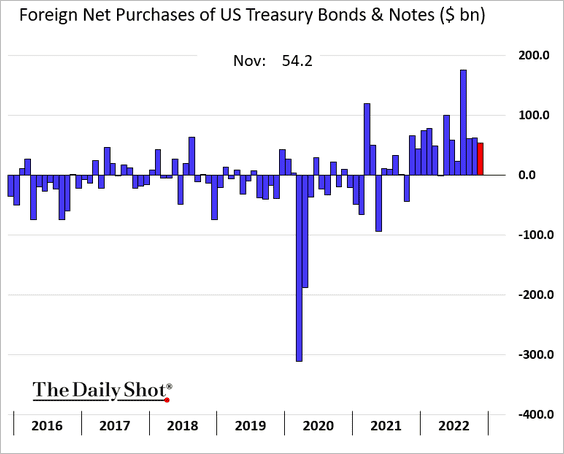

2. Foreigners continued to purchase coupon Treasuries in November.

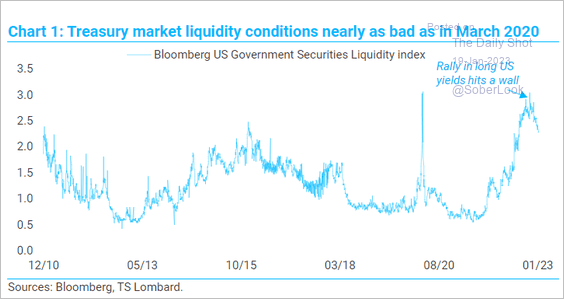

3. Treasury market liquidity remains poor.

Source: TS Lombard

Source: TS Lombard

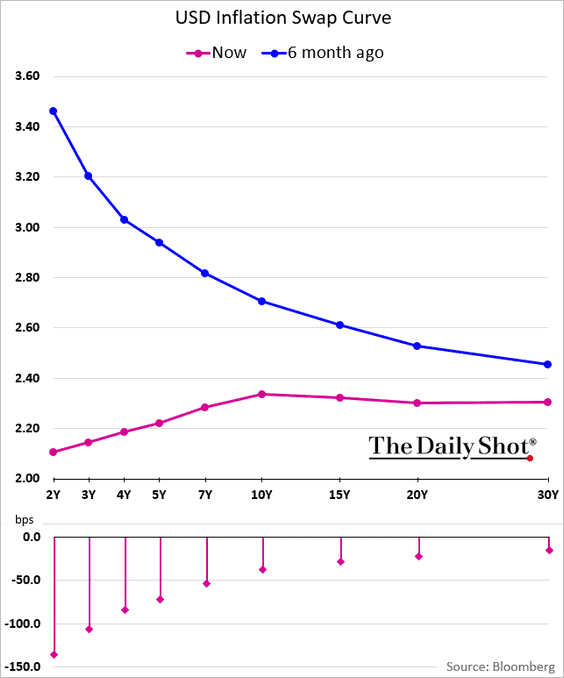

4. The reset in the US inflation expectations term structure over the past few months has been remarkable.

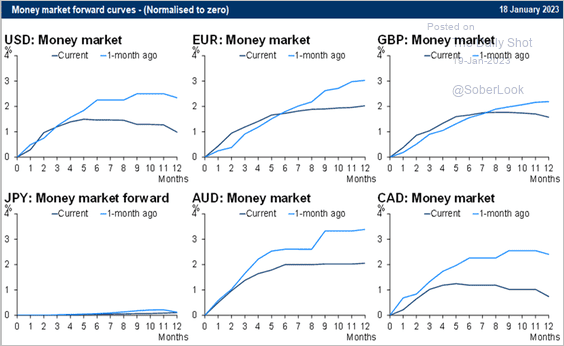

5. Market expectations for DM policy rate trajectories have downshifted sharply.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

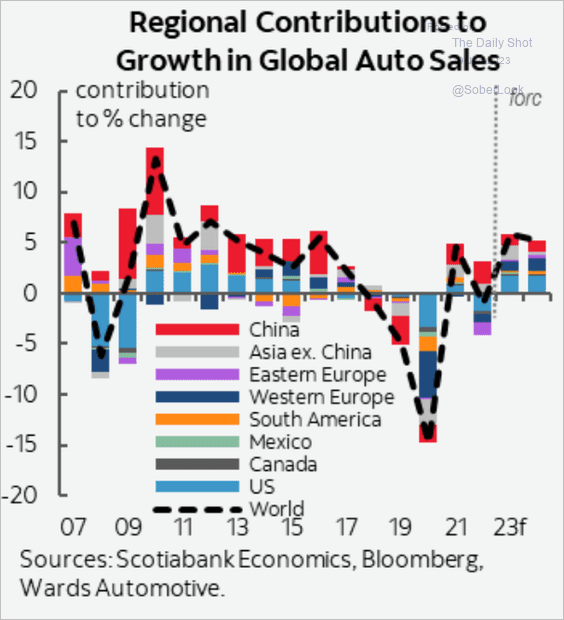

1. Auto sales growth should recover this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

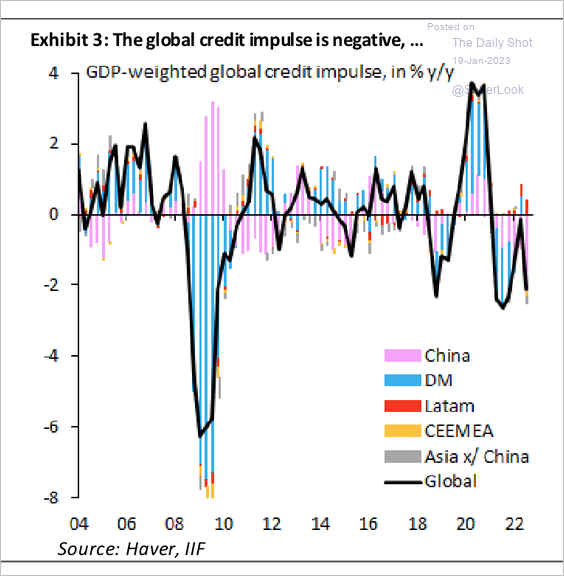

2. The global credit impulse has been negative, driven by China.

Source: IIF

Source: IIF

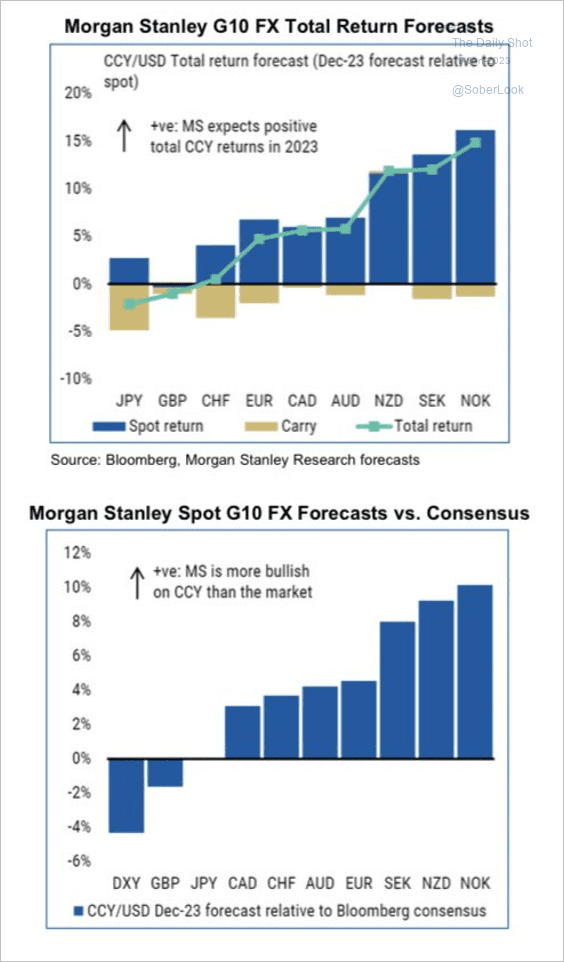

3. Morgan Stanley expects the dollar to weaken sharply this year.

Source: Morgan Stanley Research; @carlquintanilla

Source: Morgan Stanley Research; @carlquintanilla

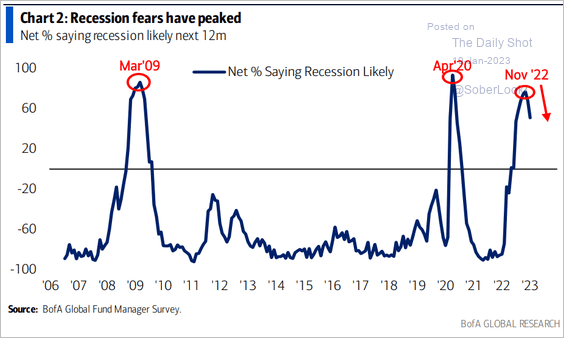

4. Recession concerns among global investors have peaked.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

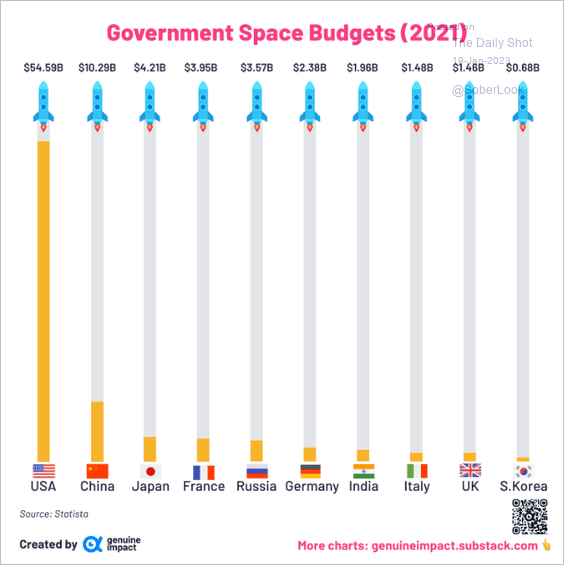

1. Government space budgets:

Source: @genuine_impact

Source: @genuine_impact

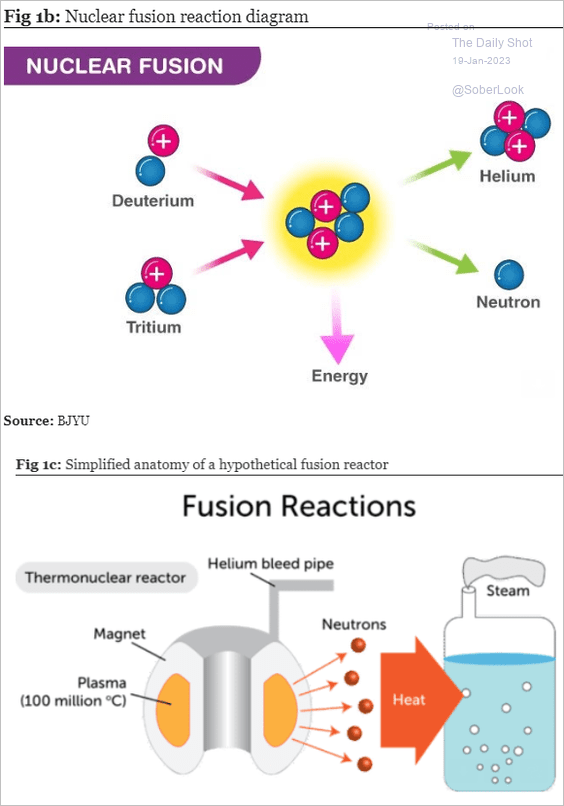

2. An illustration of nuclear fusion:

Source: Longview Economics

Source: Longview Economics

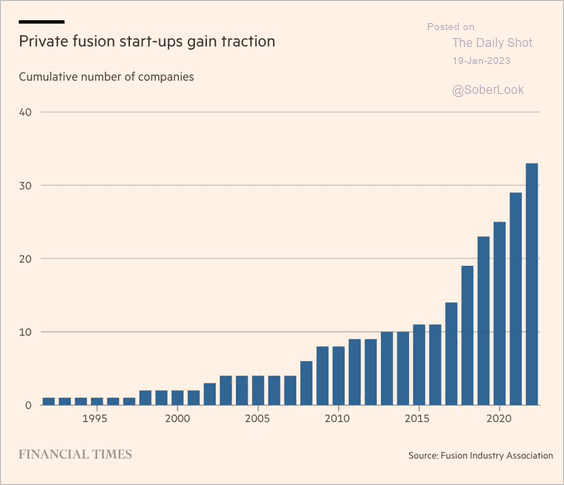

• Private fusion start-ups:

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

——————–

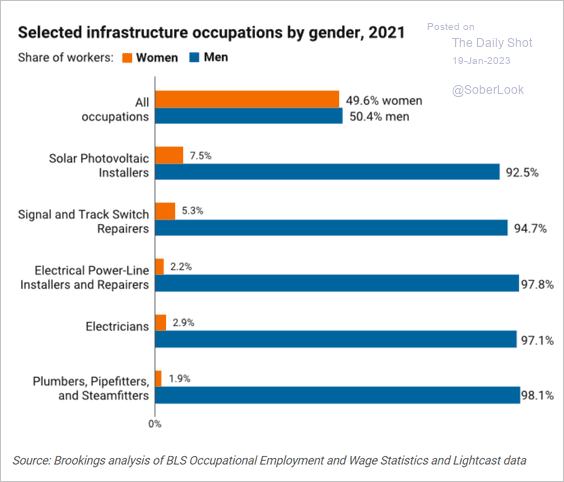

3. Infrastructure occupations by gender:

Source: Brookings Read full article

Source: Brookings Read full article

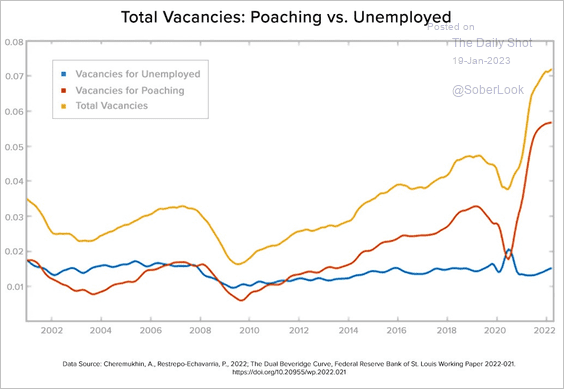

4. Job vacancies (poaching vs. hiring unemployed workers):

Source: Sunflower Bank, h/t Drew Read full article

Source: Sunflower Bank, h/t Drew Read full article

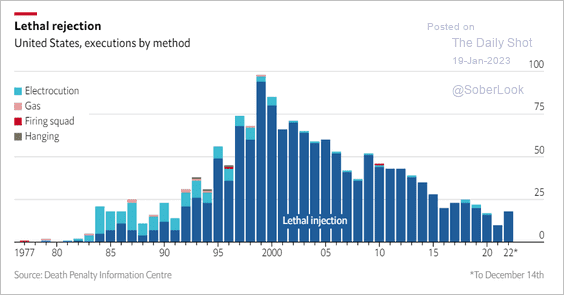

5. US executions:

Source: The Economist Read full article

Source: The Economist Read full article

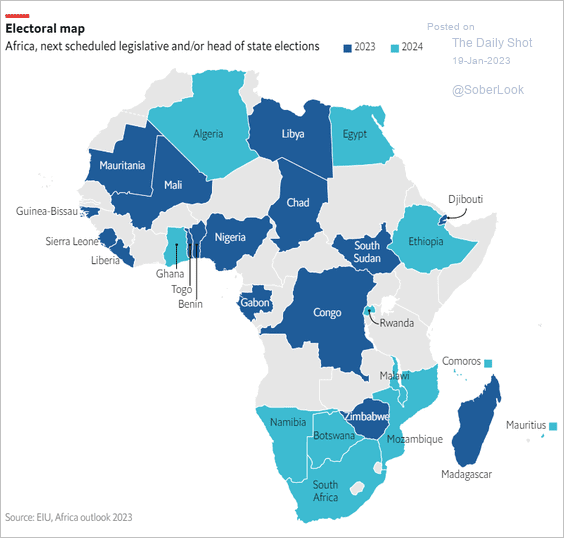

6. Upcoming elections in Africa:

Source: The Economist Read full article

Source: The Economist Read full article

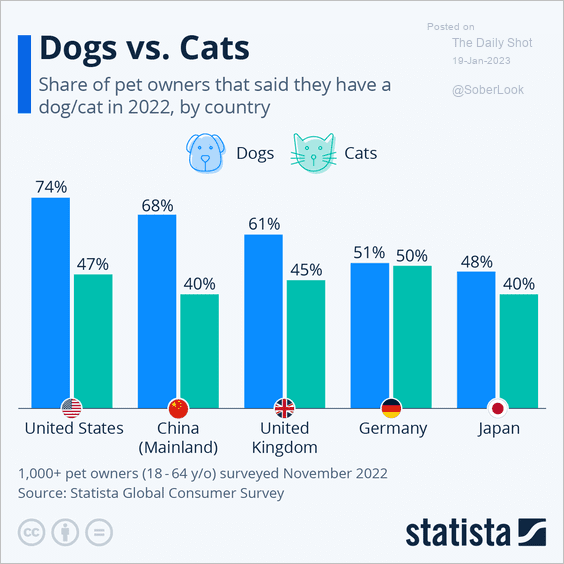

7. Dogs vs. cats:

Source: Statista

Source: Statista

——————–

Back to Index