The Daily Shot: 24-Jan-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

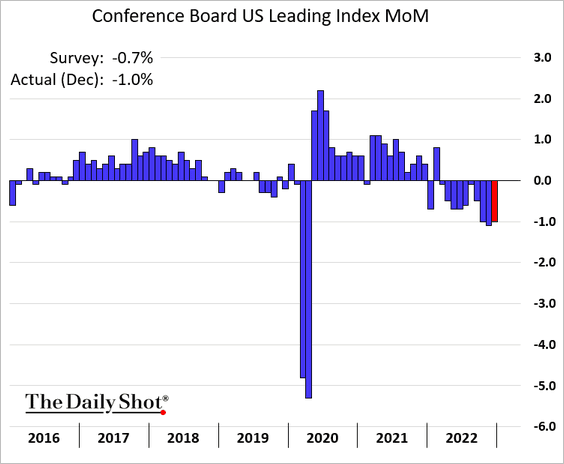

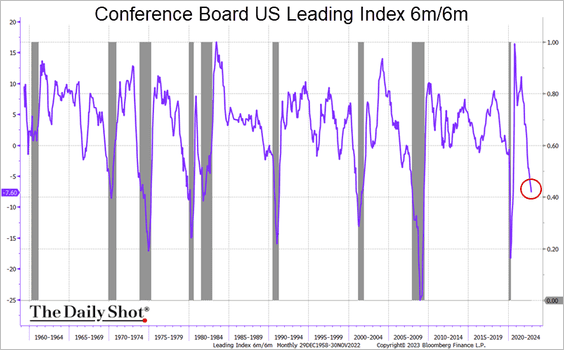

1. The Conference Board’s index of leading indicators worsened again last month.

This index has never declined this much in six months without a recession (the index goes back to the late 1950s).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

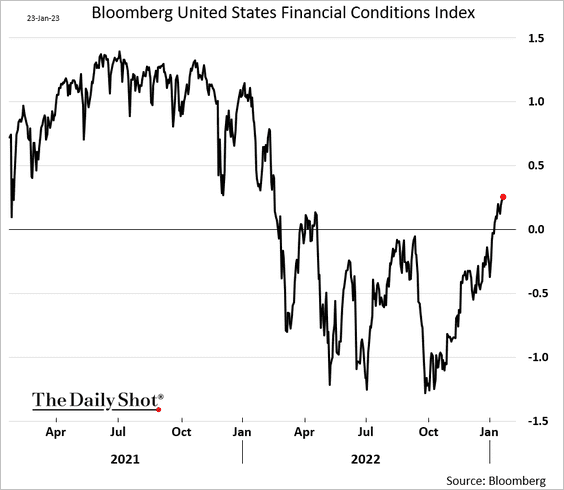

2. US financial conditions continue to ease.

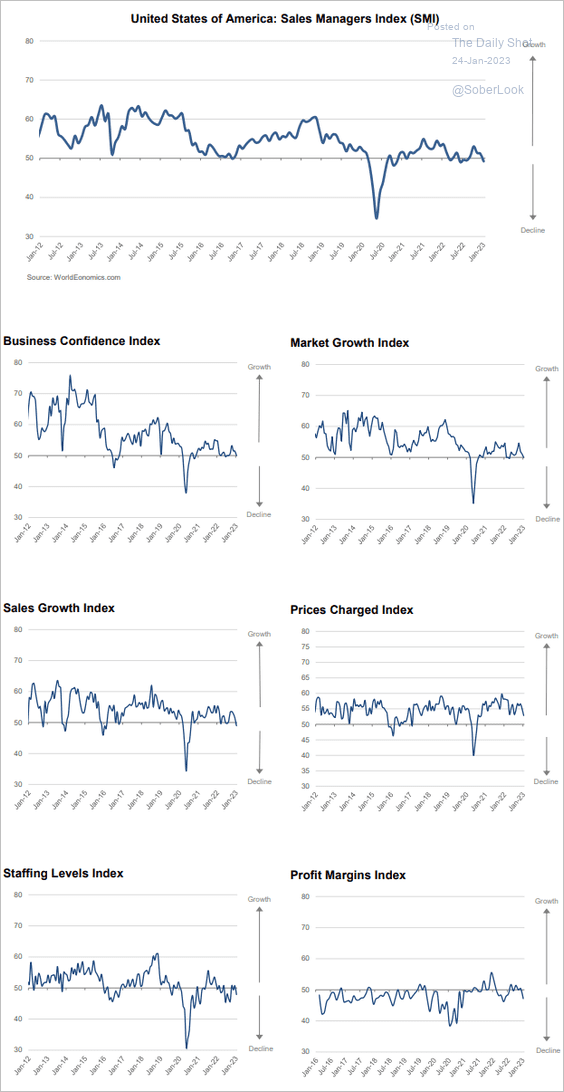

3. The World Economics SMI report shows this month’s US business activity in contraction territory.

Source: World Economics

Source: World Economics

4. Next, we have some updates on inflation.

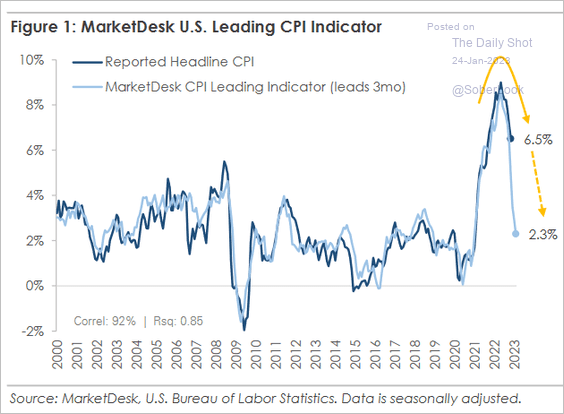

• Will the CPI approach 2% this year? This chart shows MarketDesk’s CPI leading index.

Source: MarketDesk Research

Source: MarketDesk Research

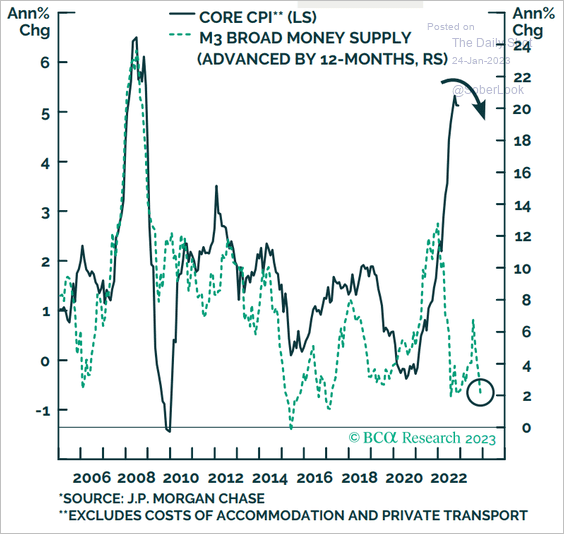

• The broad money supply signals weaker inflation ahead.

Source: BCA Research

Source: BCA Research

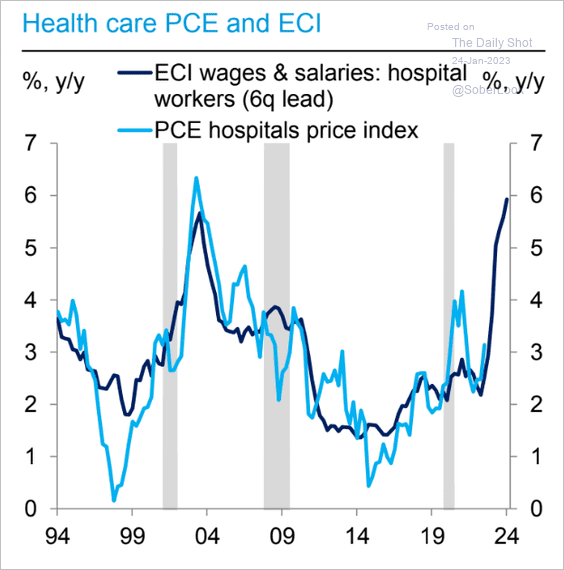

• Healthcare inflation is about to surge as wage growth in the sector accelerates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

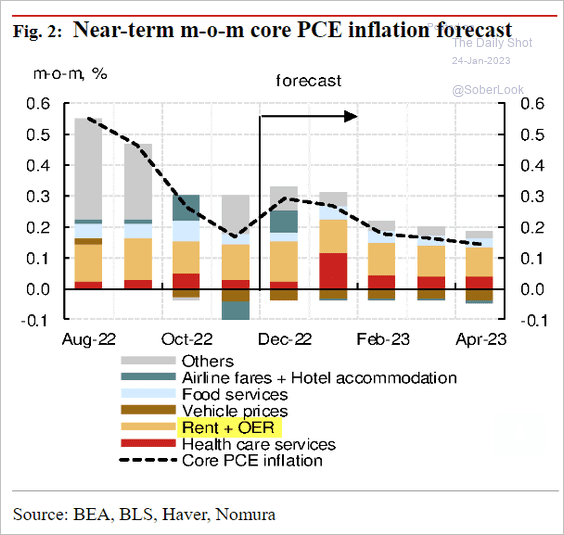

• According to Nomura, housing-related inflation is expected to remain stubbornly high.

Source: Nomura Securities

Source: Nomura Securities

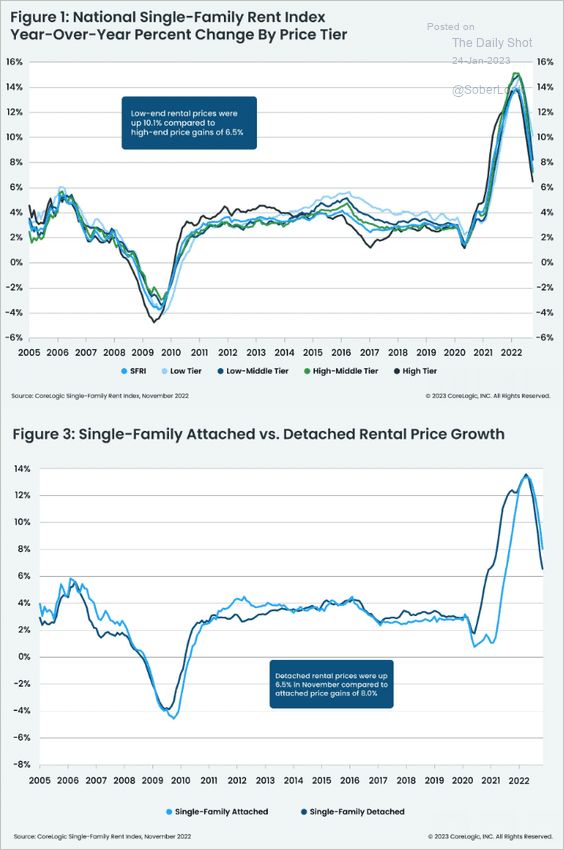

– Single-family rent inflation continues to ease.

Source: CoreLogic

Source: CoreLogic

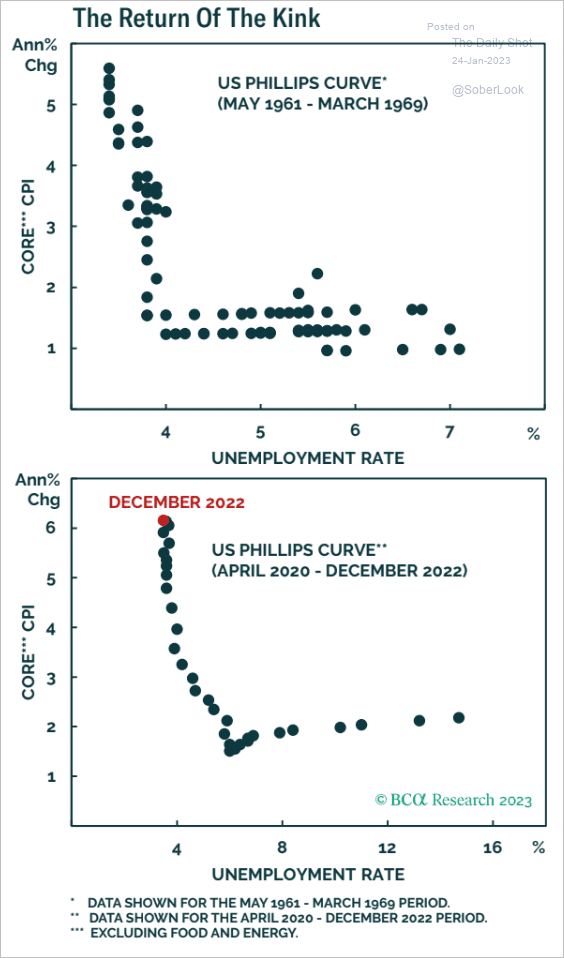

• The Phillips Curve “kink” is back.

Source: BCA Research

Source: BCA Research

——————–

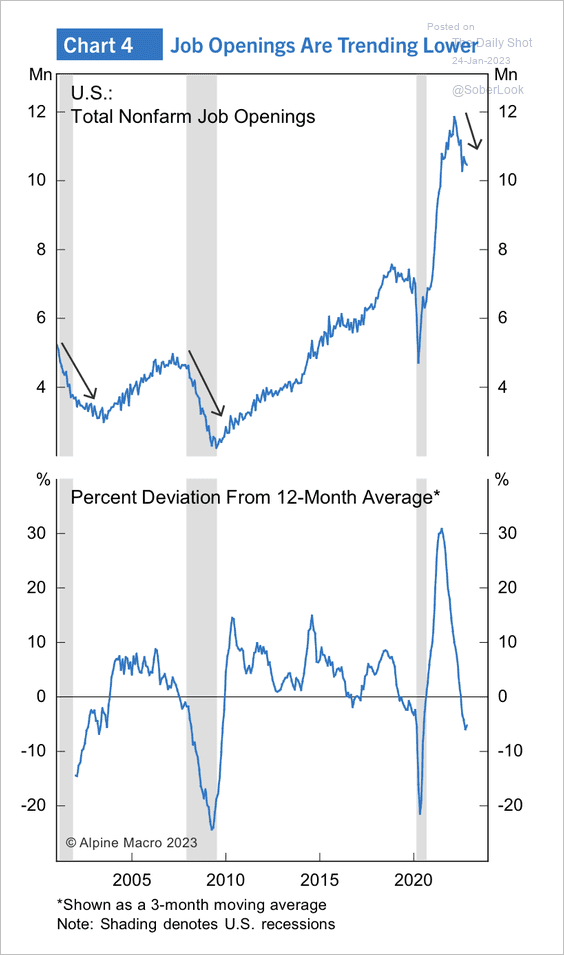

5. Next, let’s take a look at some labor market trends.

• The declining trend in total job openings is similar to what occurred in 2001 and 2008, albeit from a higher level.

Source: Alpine Macro

Source: Alpine Macro

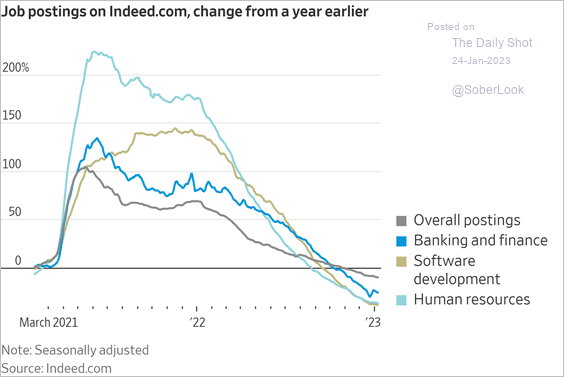

– This chart shows year-over-year growth in job openings on Indeed, by sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

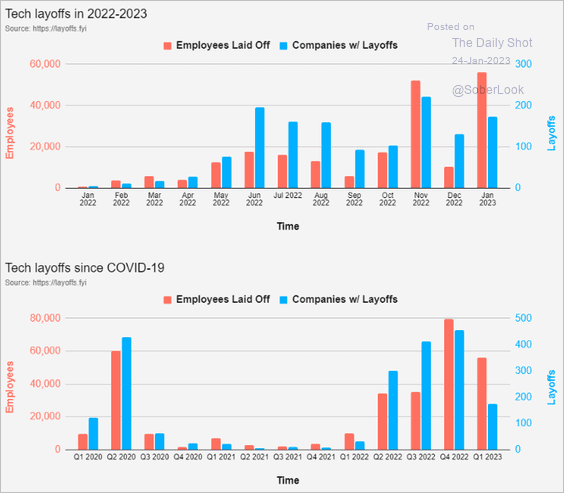

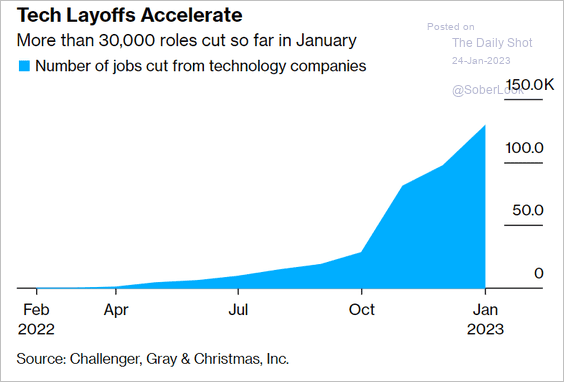

• Tech sector layoffs have been rising (2 charts).

Source: @roger_lee

Source: @roger_lee

Source: @lcrupp, @technology Read full article

Source: @lcrupp, @technology Read full article

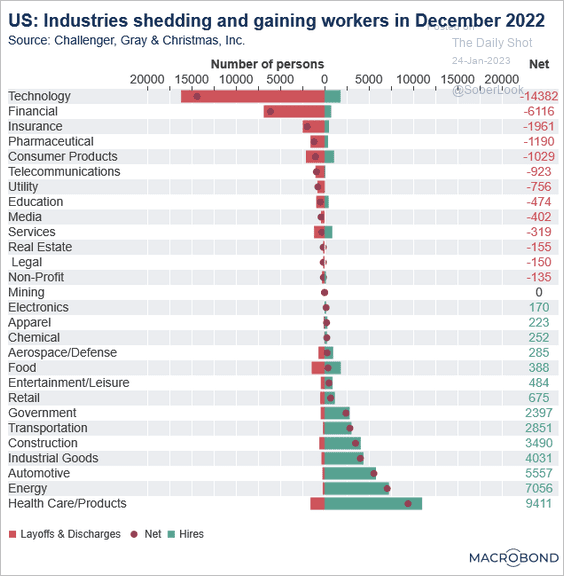

• Here is an estimate of layoffs and hires in December (a “rotation” from tech to other industries).

Source: Macrobond

Source: Macrobond

——————–

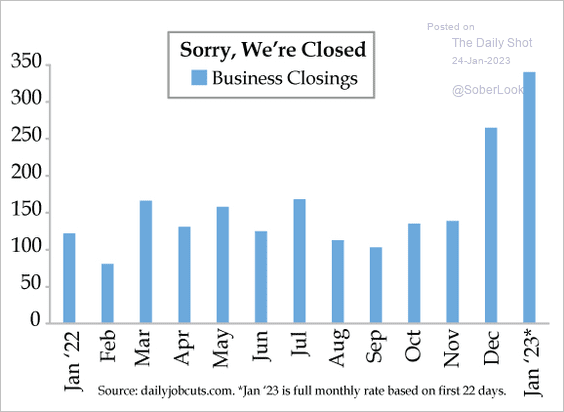

6. Business closings are on the rise.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Canada

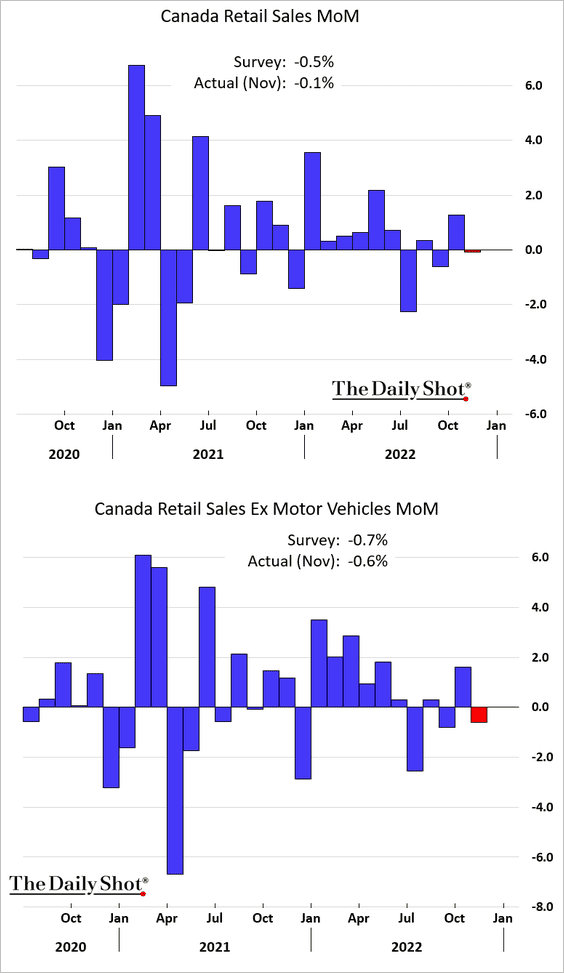

1. Retail sales saw a smaller decrease than anticipated in November due to stronger car sales.

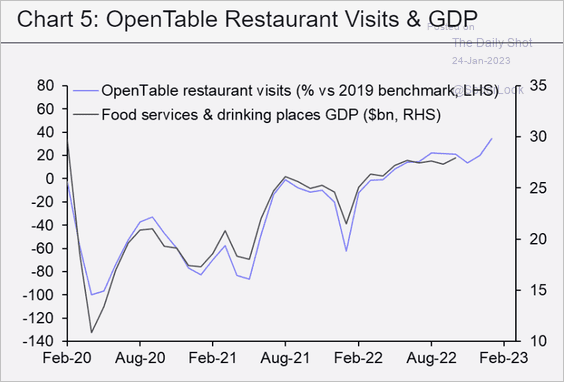

2. Canadians’ restaurant visits are well above pre-COVID levels.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

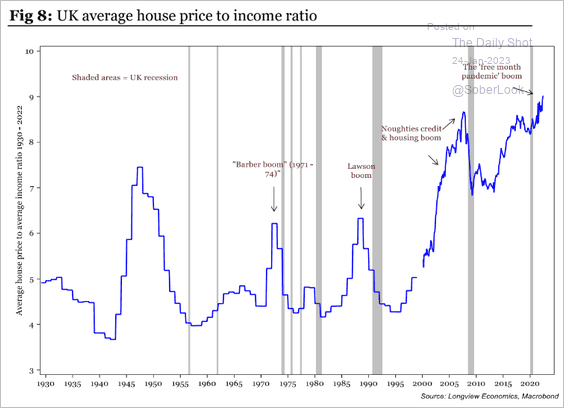

1. Housing market valuations have been stretched.

Source: Longview Economics

Source: Longview Economics

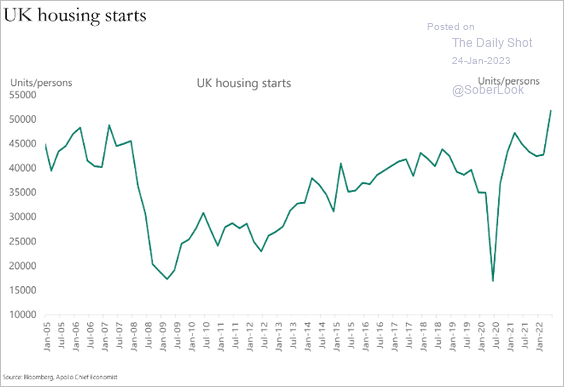

2. Housing starts climbed sharply last year.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

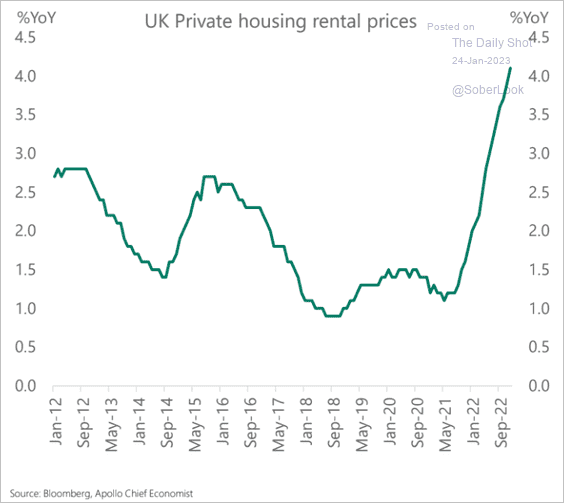

3. Rent inflation has been surging.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

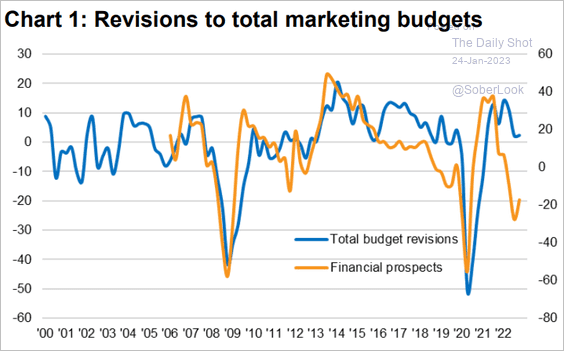

4. Marketing budgets keep growing despite recession risks.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

The Eurozone

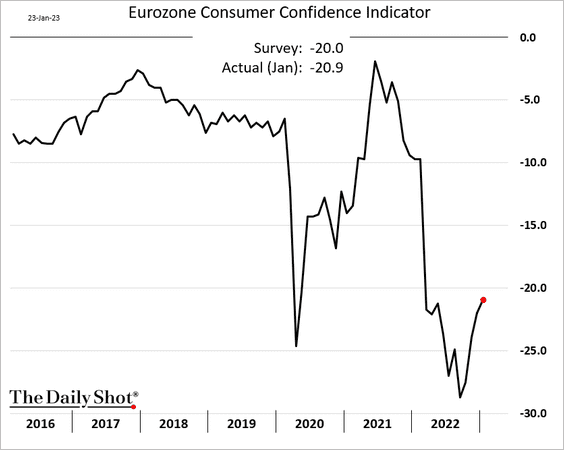

1. Consumer confidence has been recovering from extreme lows.

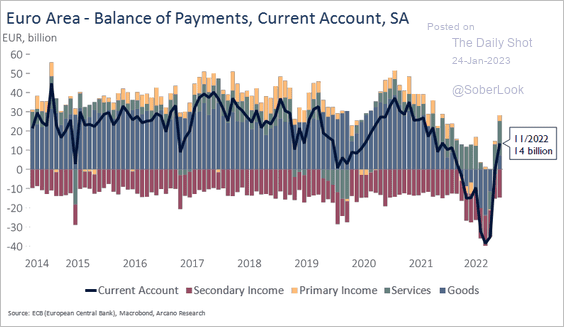

2. Here are the contributions to the euro-area current account balance.

Source: Arcano Economics

Source: Arcano Economics

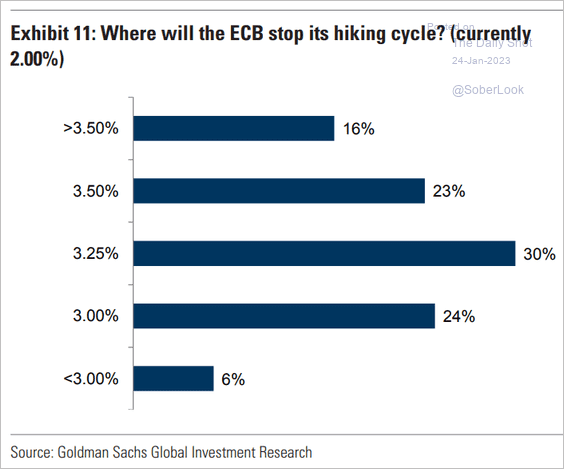

3. Where do investors see the ECB’s terminal rate?

Source: Goldman Sachs

Source: Goldman Sachs

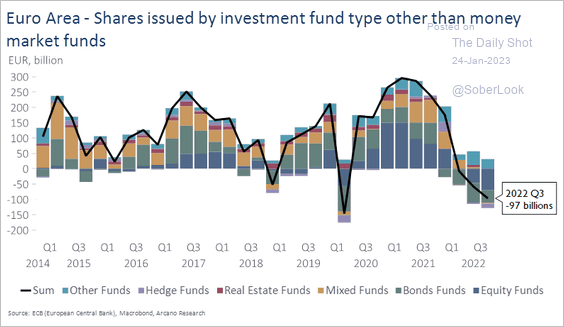

4. This chart shows euro-area fund issuance minus redemptions.

Source: Arcano Economics

Source: Arcano Economics

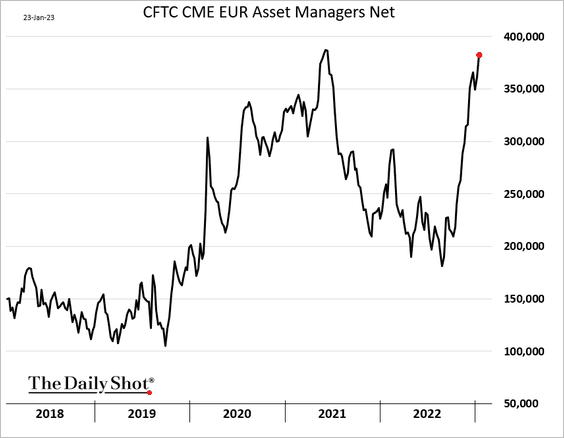

5. Asset managers have been boosting their bets on the euro (via CME futures).

Back to Index

Europe

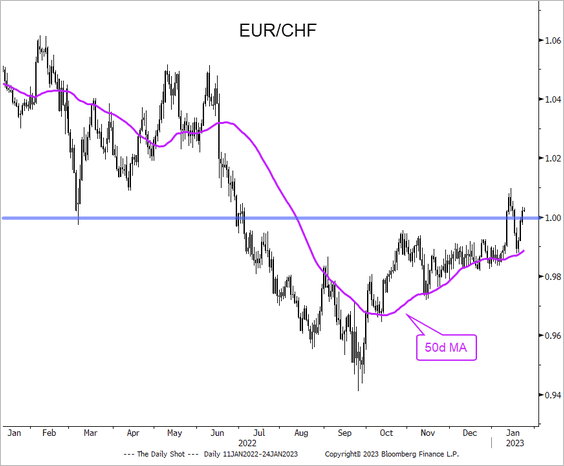

1. EUR/CHF is holding near parity.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

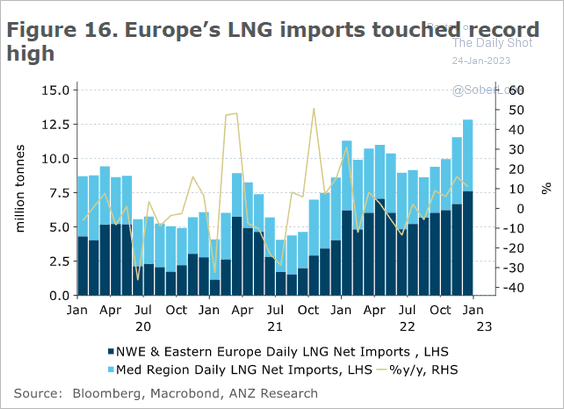

2. Europe continues to buy a lot of LNG.

Source: @ANZ_Research

Source: @ANZ_Research

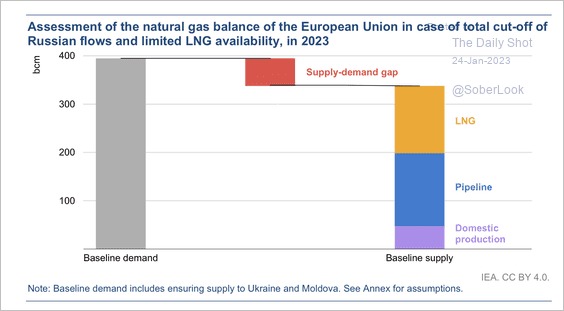

There is still potential for a supply/demand gap in European energy markets this year, according to the IEA.

Source: IEA

Source: IEA

——————–

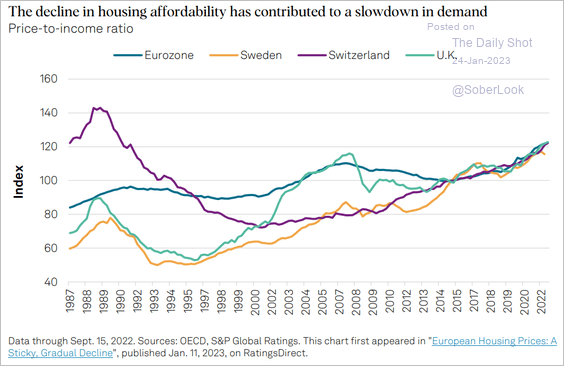

3. European housing valuations have been climbing over the past decade.

Source: S&P Global Ratings

Source: S&P Global Ratings

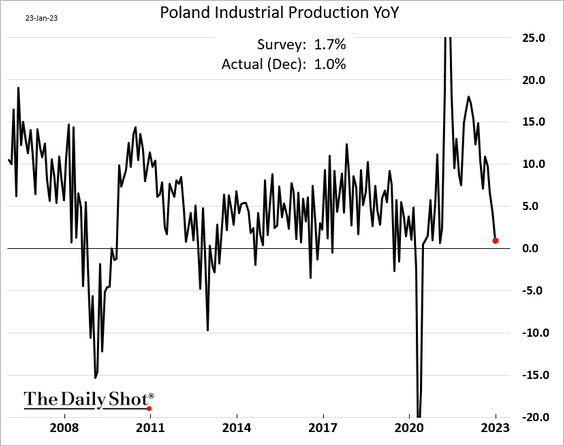

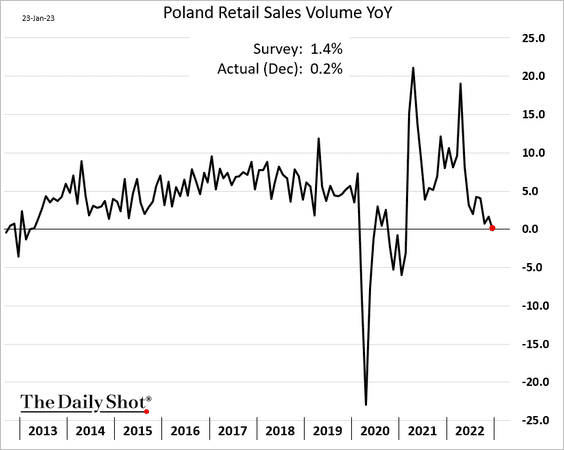

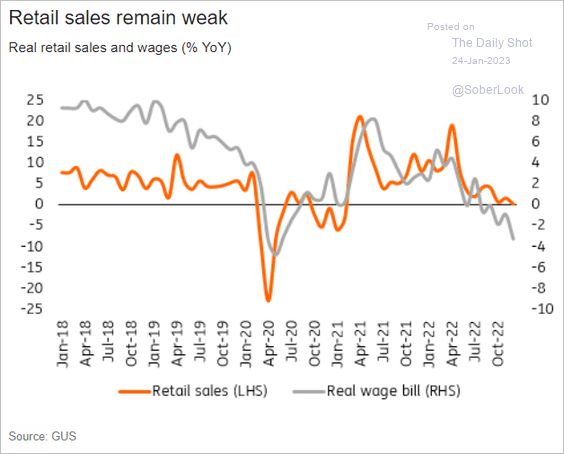

4. Poland’s economy is cooling.

• Industrial production (year-over-year):

• Retail sales:

• Real wages:

Source: ING

Source: ING

Back to Index

Japan

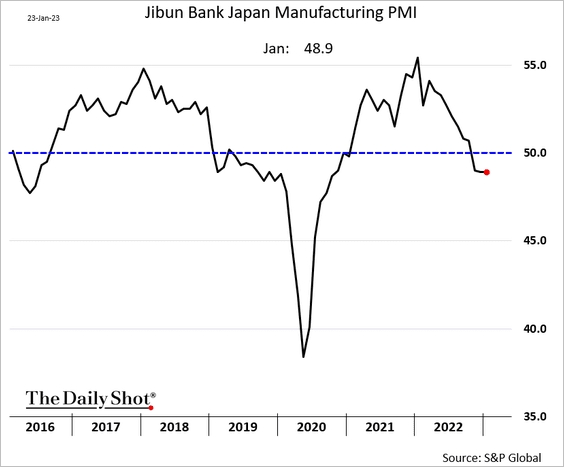

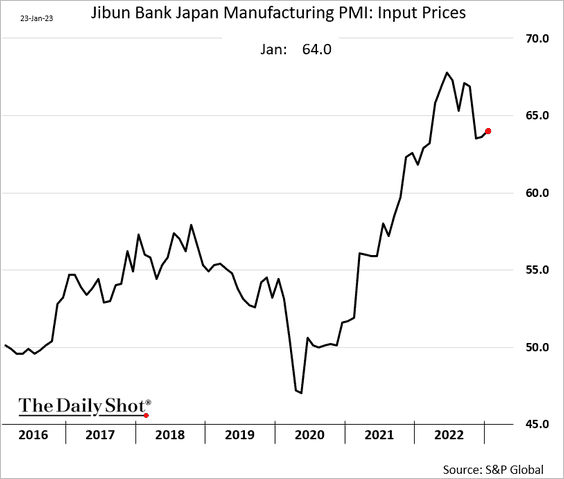

1. Manufacturing activity continues to contract, …

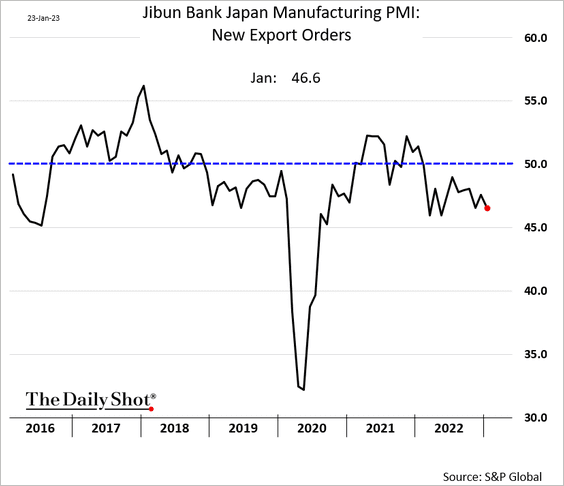

… as export orders sink.

Manufacturers continue to face price pressures.

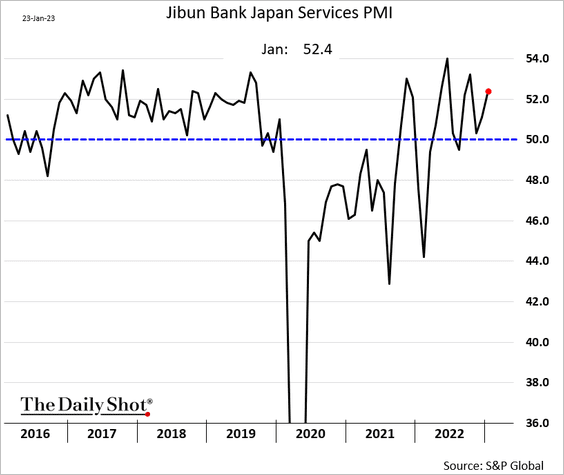

2. Service sector activity remains in growth territory.

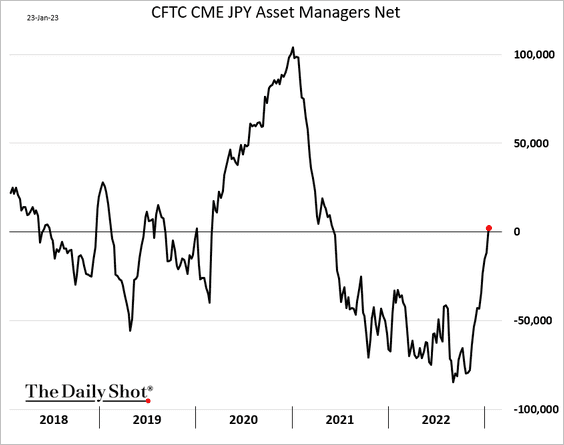

3. Asset managers have covered their short bets (or carry trades) against the yen.

Back to Index

China

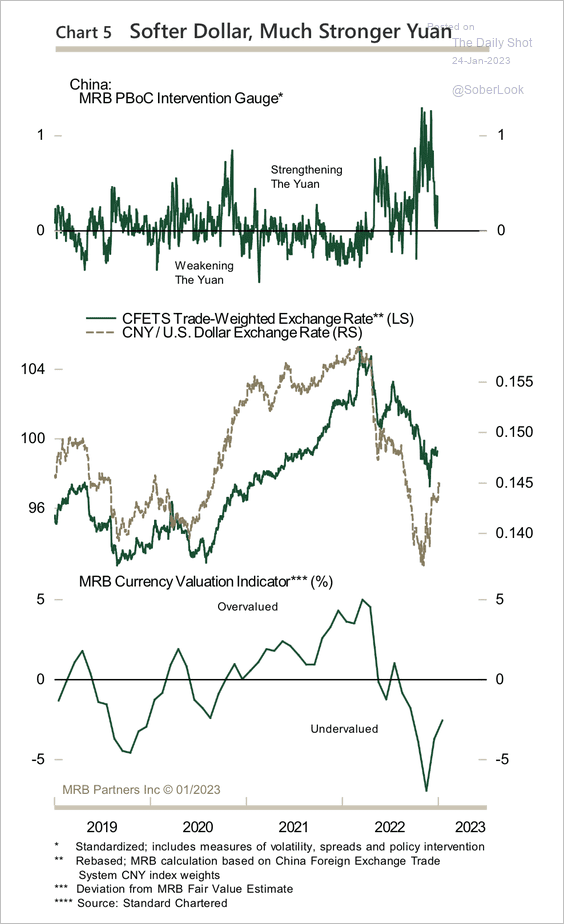

1. The yuan has recovered from some of its steep undervaluation versus the dollar.

Source: MRB Partners

Source: MRB Partners

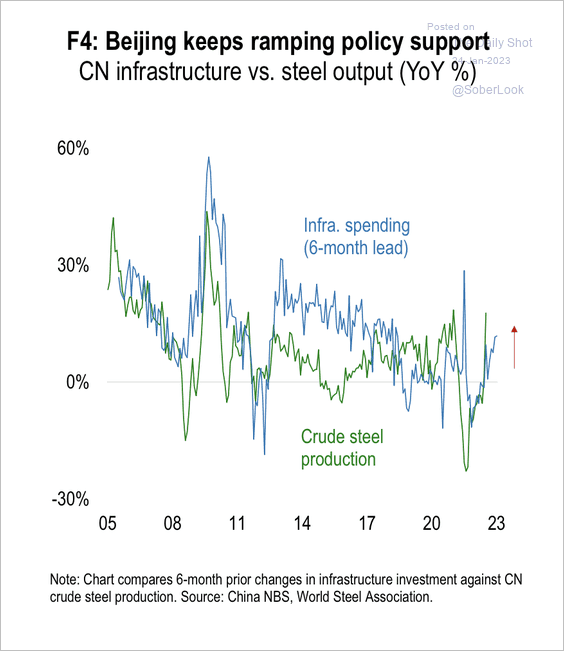

2. Steel production has increased, keeping up with rising infrastructure spending.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

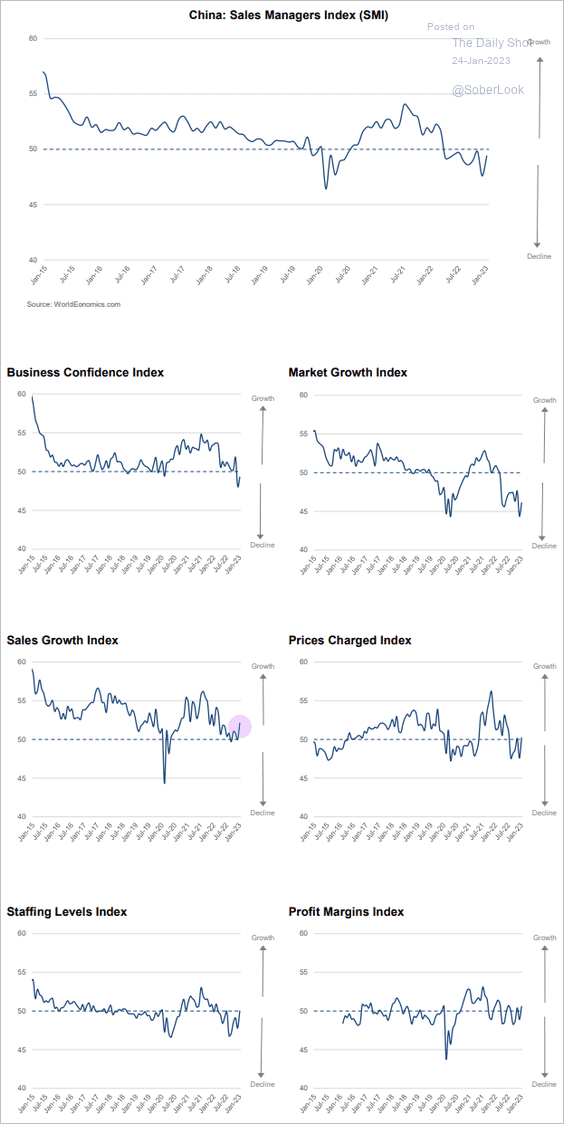

3. The World Economics SMI report shows slower declines in China’s business activity this month. Sales growth gained momentum.

Source: World Economics

Source: World Economics

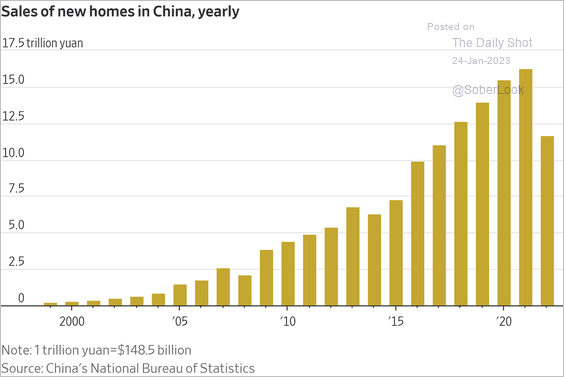

4. Next, let’s take a look at the property markets.

• New home sales by year:

Source: @WSJ Read full article

Source: @WSJ Read full article

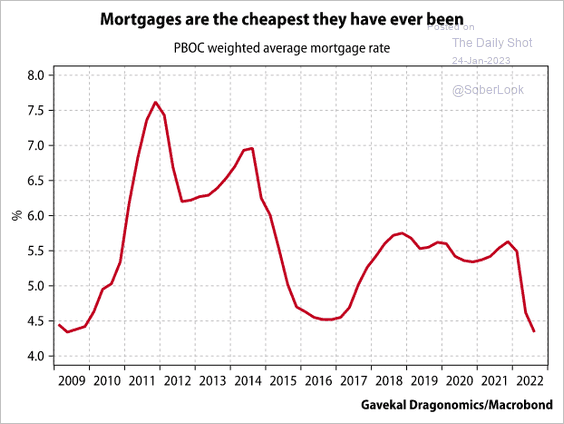

• Mortgage rates:

Source: Gavekal Research

Source: Gavekal Research

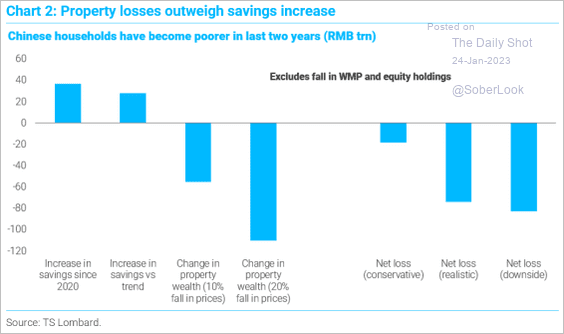

• Households’ property losses vs. higher savings:

Source: TS Lombard

Source: TS Lombard

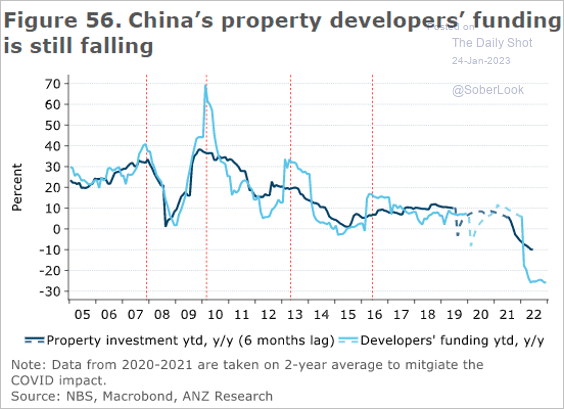

• Property developer funding (still depressed):

Source: @ANZ_Research

Source: @ANZ_Research

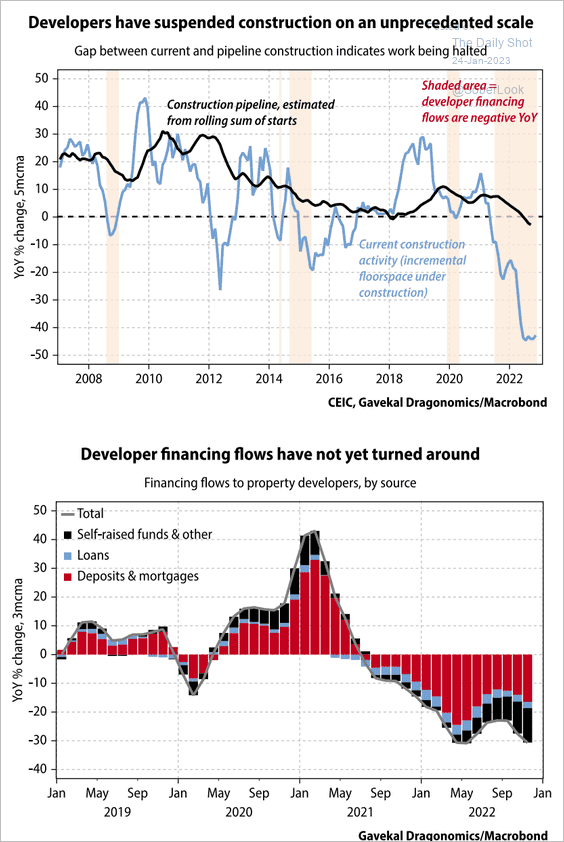

Developers are looking to Beijing for financing support to restart construction.

Source: Gavekal Research

Source: Gavekal Research

——————–

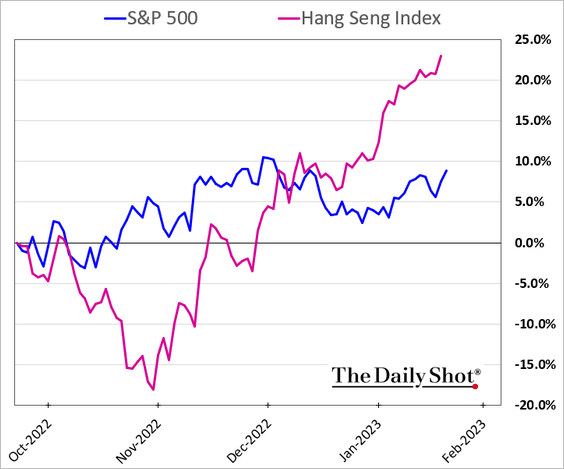

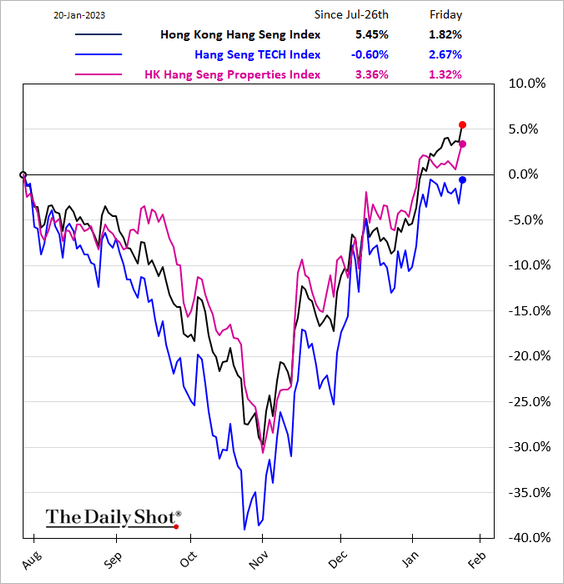

5. Hong Kong stocks continue to outperform.

Back to Index

Emerging Markets

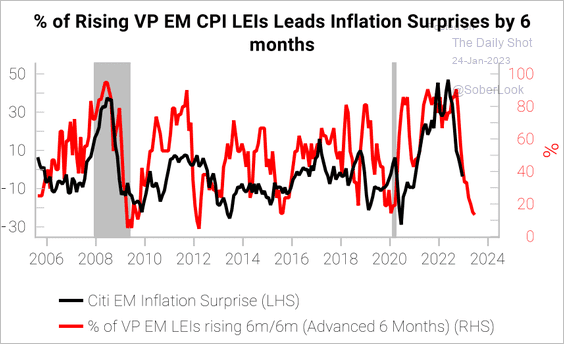

1. Inflation will surprise to the downside, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

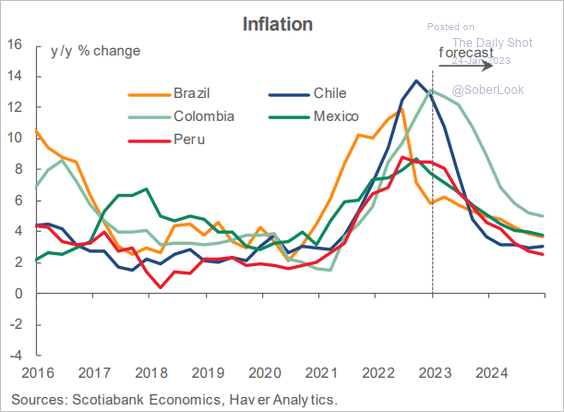

2. This chart shows Scotiabank’s forecasts for LatAm inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

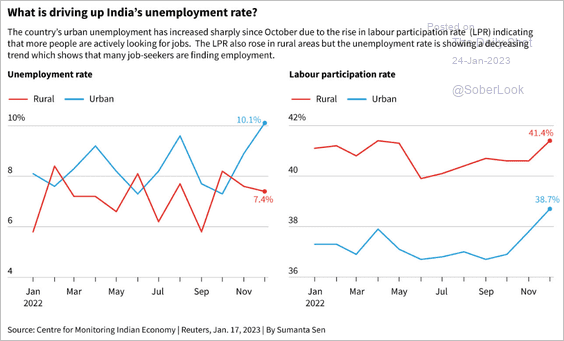

3. Next, we have India’s rural and urban unemployment rates and labor force participation rates.

Source: Reuters Read full article

Source: Reuters Read full article

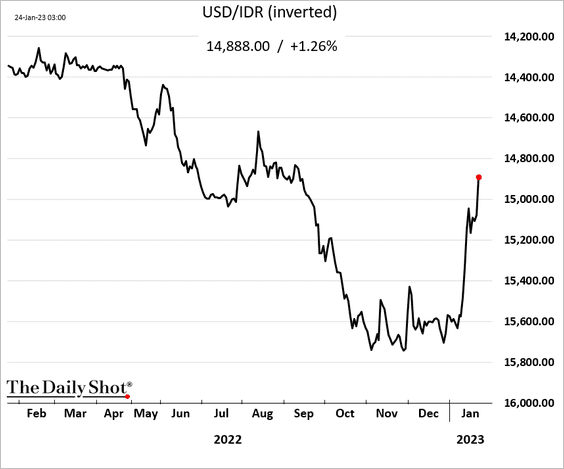

4. The Indonesian rupiah is rebounding rapidly.

Back to Index

Cryptocurrency

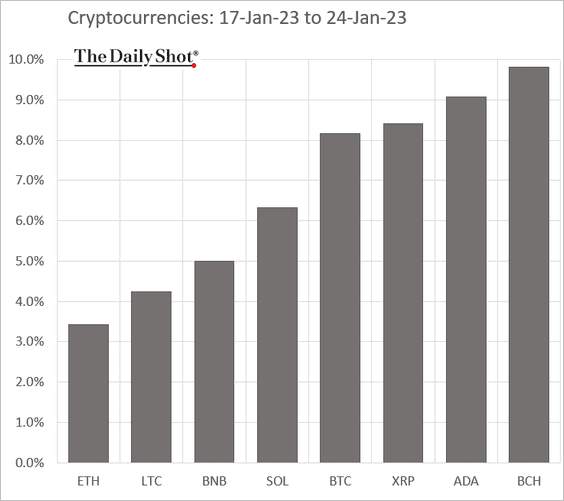

1. Cryptos continue to rally as bitcoin climbs above $23k.

Here is the performance over the past seven days.

——————–

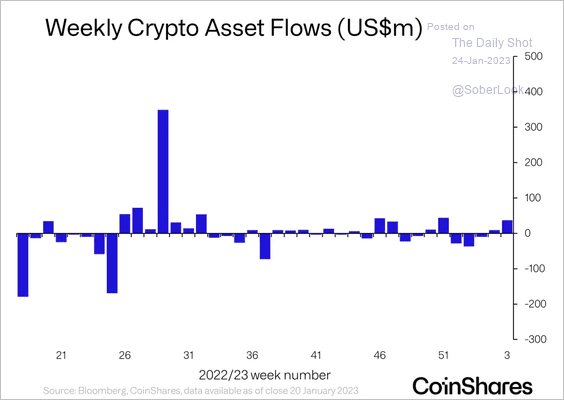

2. Crypto funds saw minor inflows last week, primarily in short-bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

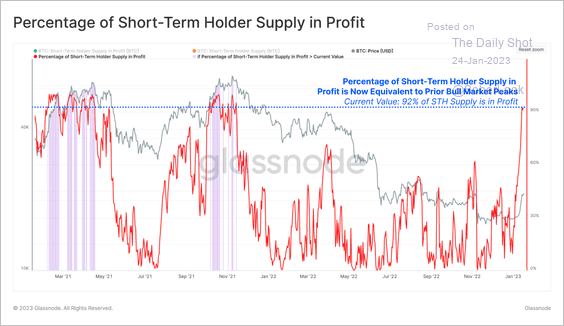

3. The recent rise in BTC’s price placed a majority of short-term holders in profit.

Source: Glassnode Read full article

Source: Glassnode Read full article

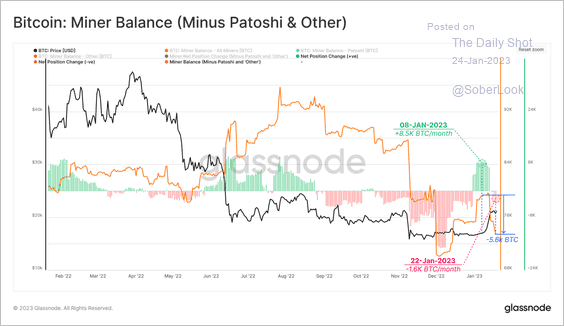

Meanwhile, bitcoin miners have been selling into the rally.

Source: Glassnode Read full article

Source: Glassnode Read full article

——————–

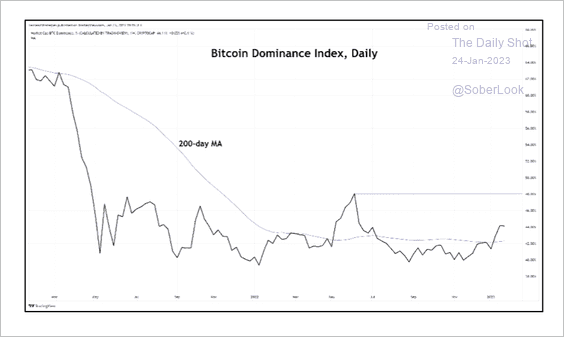

4. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) continued to tick higher. A sustained rise in the dominance ratio signals risk-off conditions. Could the crypto rally stall?

Source: @StocktonKatie

Source: @StocktonKatie

Back to Index

Commodities

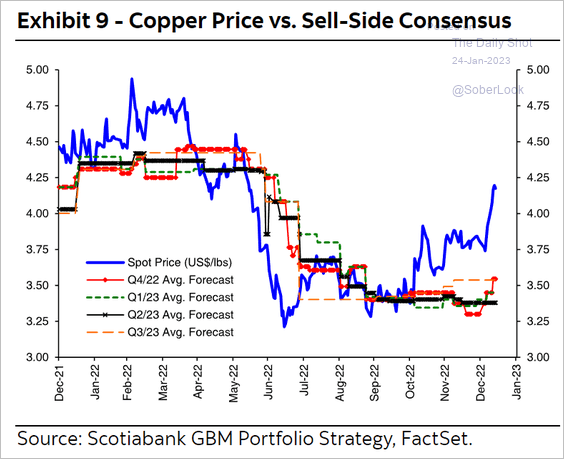

1. Copper prices have exceeded forecasts.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

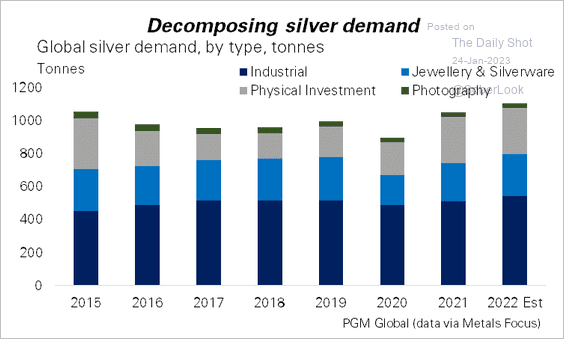

2. What are the drivers of silver demand?

Source: PGM Global

Source: PGM Global

Back to Index

Energy

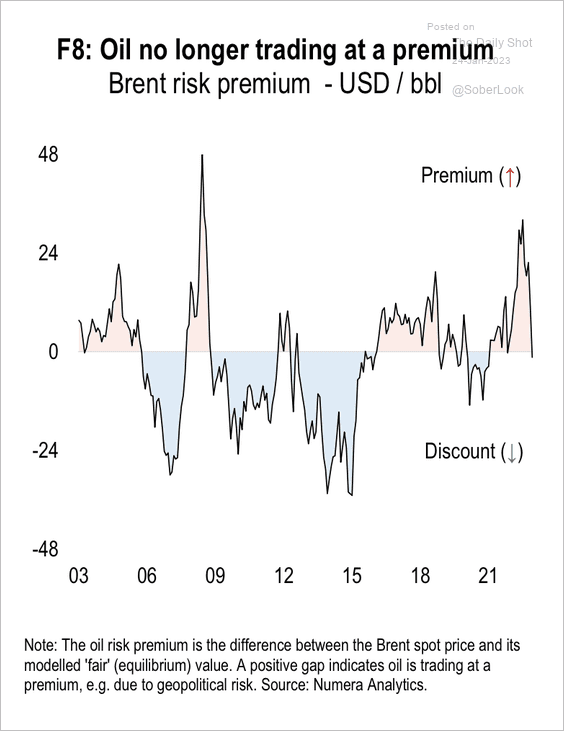

1. Brent oil is back to fair value, increasing the likelihood of higher prices this year, according to Numera Analytics.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

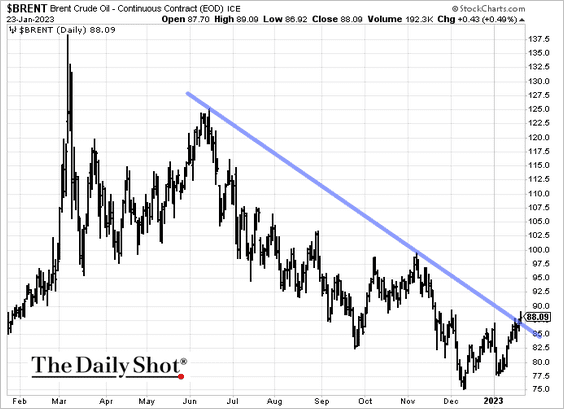

Brent has been rebounding from recent lows.

——————–

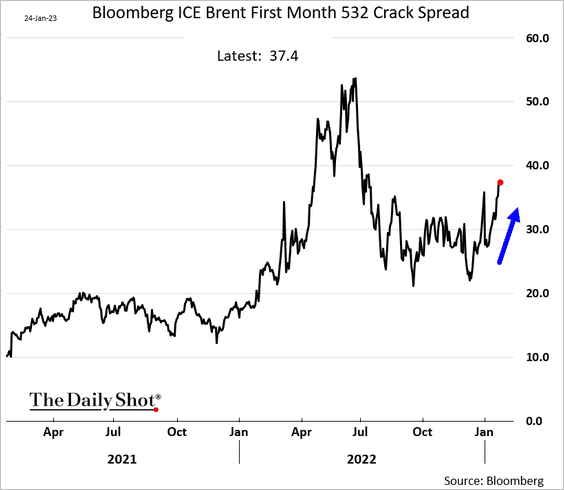

2. Crack spreads are rising again.

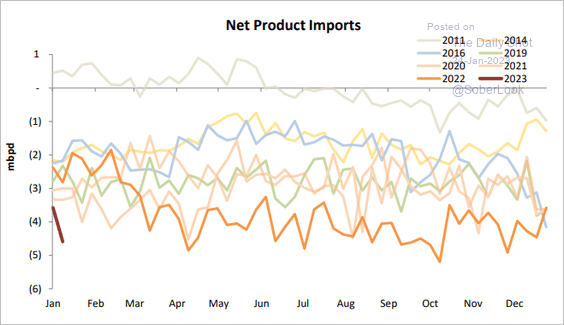

3. US refined product exports hit a multi-year high.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

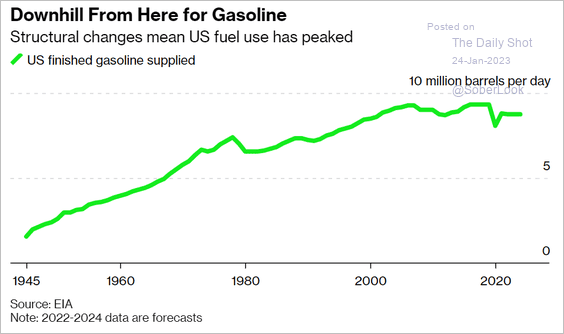

4. Peak gasoline demand in the US?

Source: @business Read full article

Source: @business Read full article

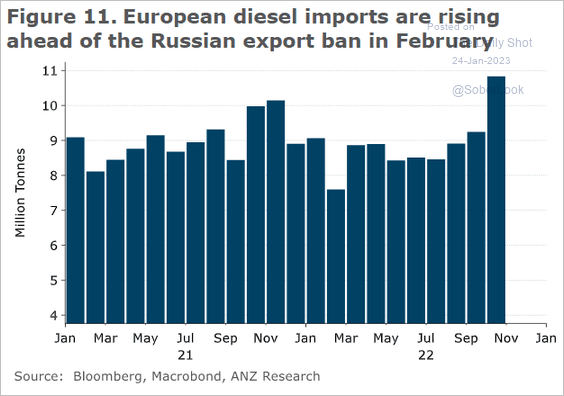

5. European firms are importing a lot of Russian diesel ahead of the upcoming restrictions next month.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

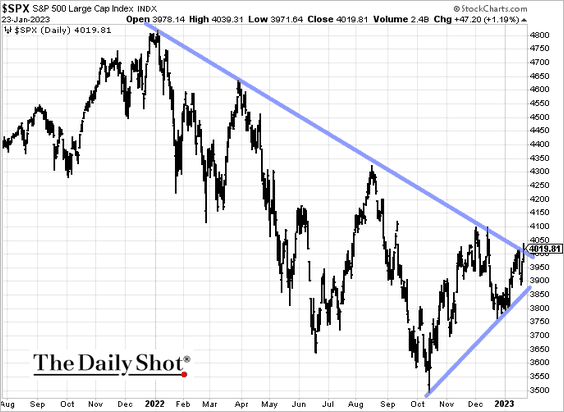

1. All eyes are on this chart of the S&P 500.

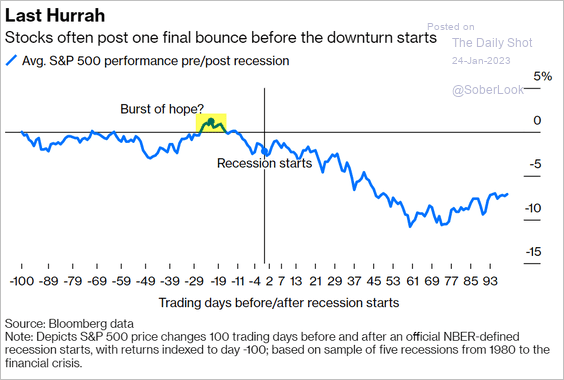

2. One final bounce before the recession?

Source: @JonathanJLevin, @opinion Read full article

Source: @JonathanJLevin, @opinion Read full article

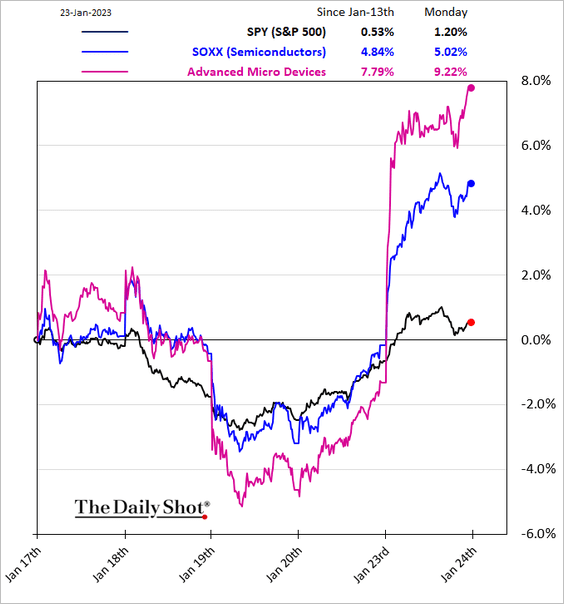

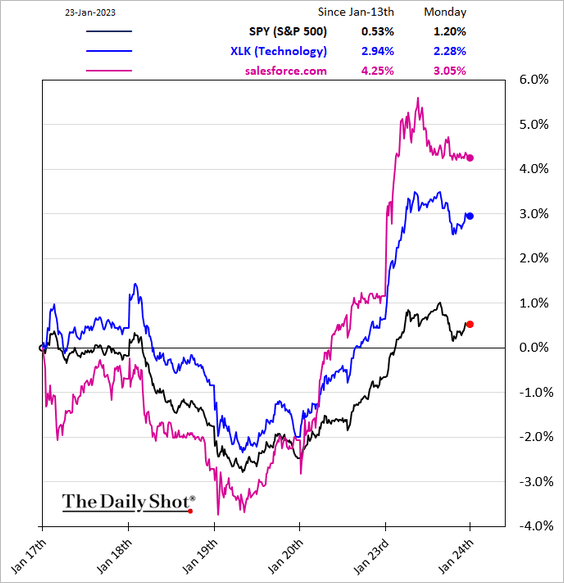

2. Tech/semiconductor shares led the rally on Monday.

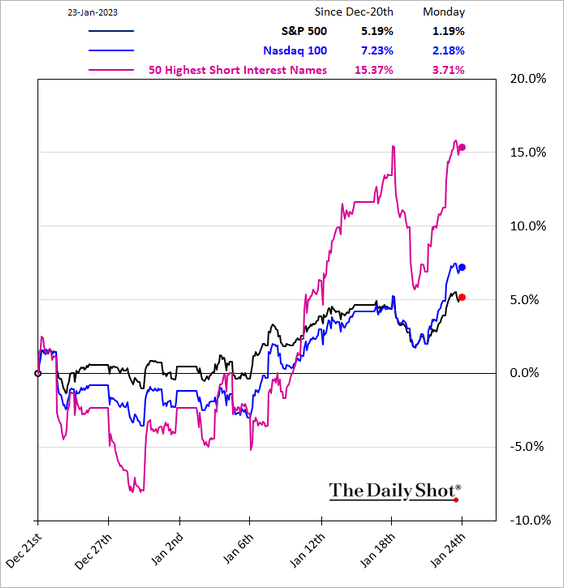

3. There has been some short-covering in recent days.

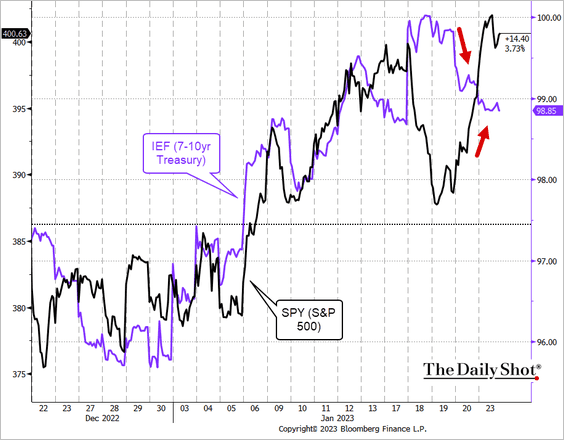

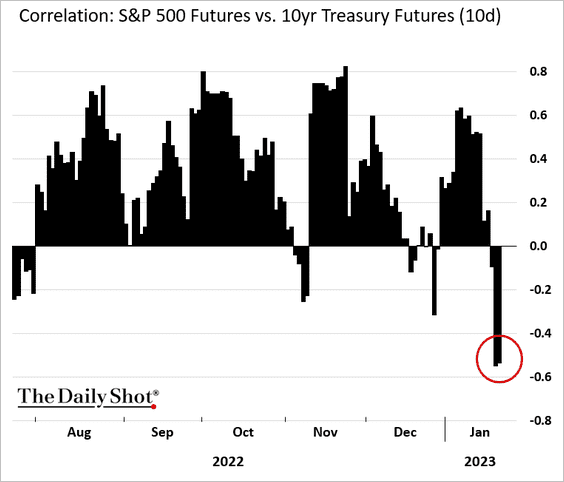

4. As market attention shifts from inflation, stocks and bonds are becoming negatively correlated (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

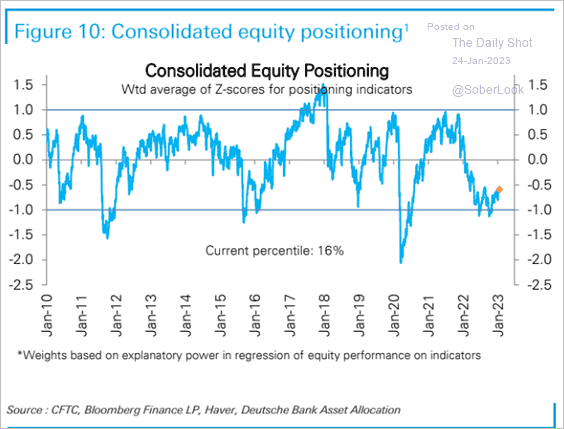

5. Positioning remains cautious, according to Deutsche Bank’s consolidated equity positioning indicator.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

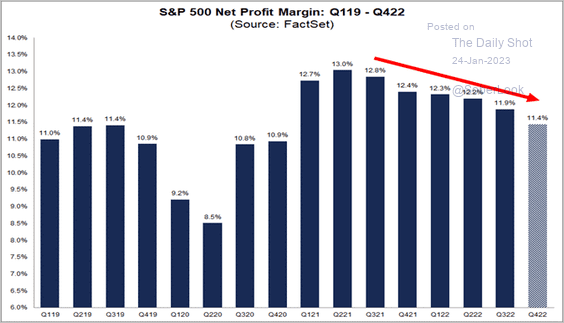

6. Profit margins continue to trend lower.

Source: @FactSet Read full article

Source: @FactSet Read full article

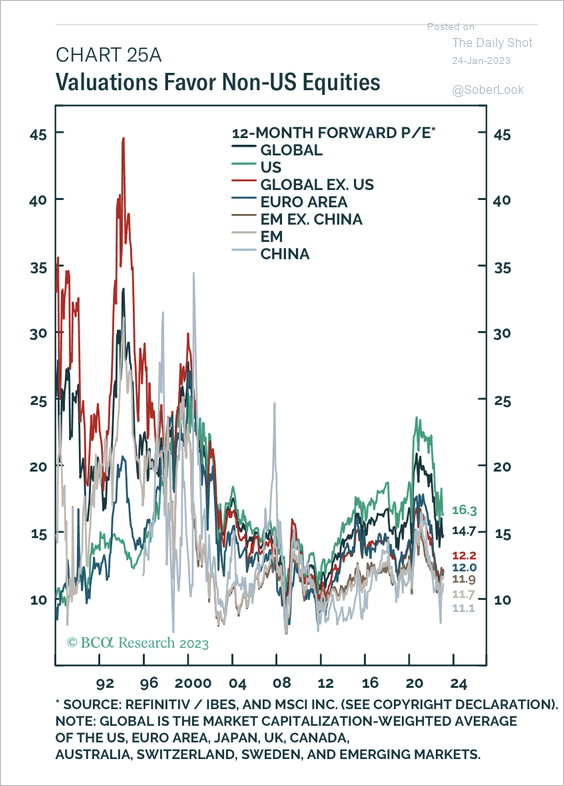

7. Low valuations and a weaker dollar benefit equities outside the US. (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

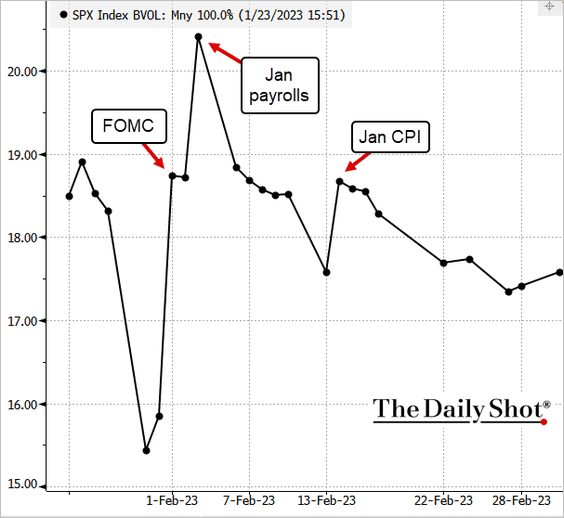

8. Volatility traders are focused on the first few days of February.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Alternatives

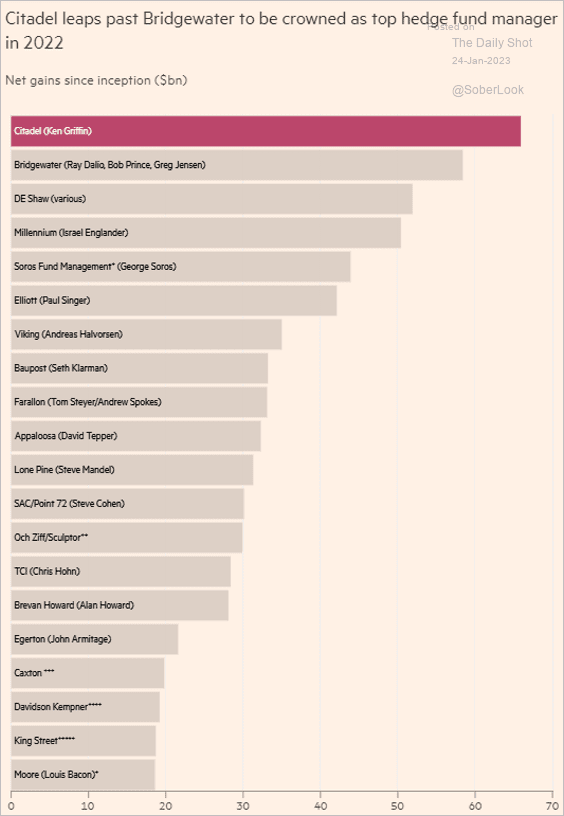

1. Let’s start with the top hedge fund managers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

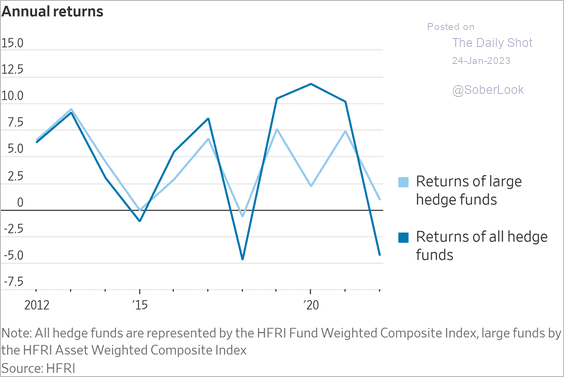

Large hedge funds outperformed last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

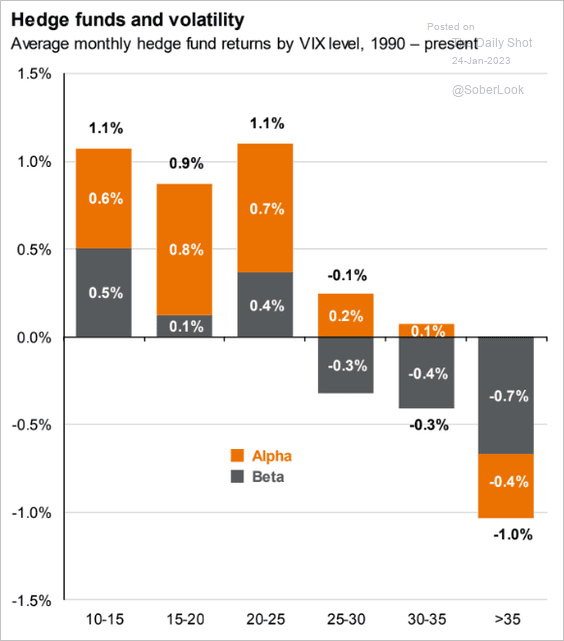

2. How do hedge funds perform in different volatility regimes?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

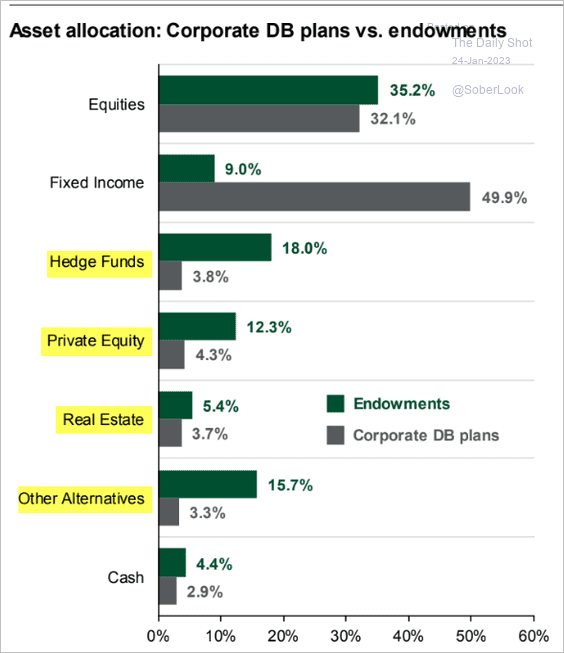

3. Endowments like alternatives.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

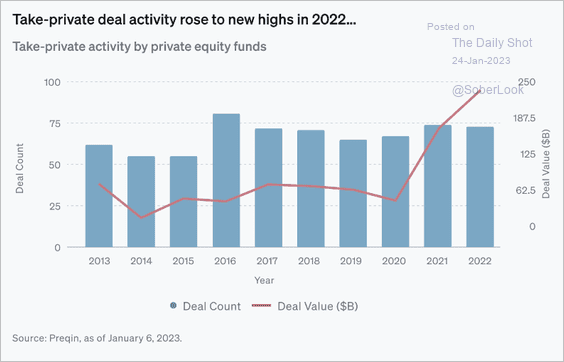

4. The value of deals involving taking companies private reached an all-time high last year.

Source: Opto Read full article

Source: Opto Read full article

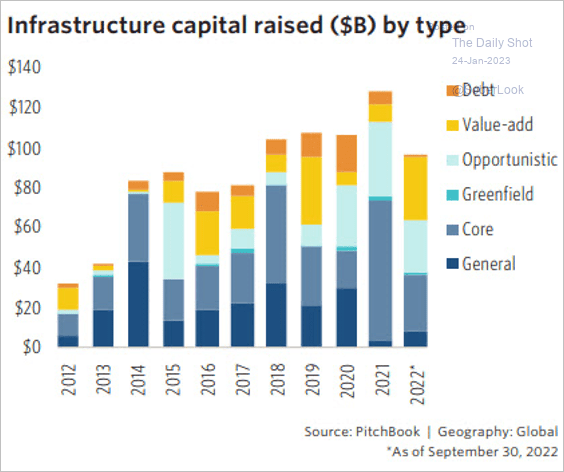

5. More capital has been raised in private infrastructure funds in the past few years than at any other point in history, according to PitchBook. This has been driven by energy security, climate change, and digital infrastructure.

Source: PitchBook

Source: PitchBook

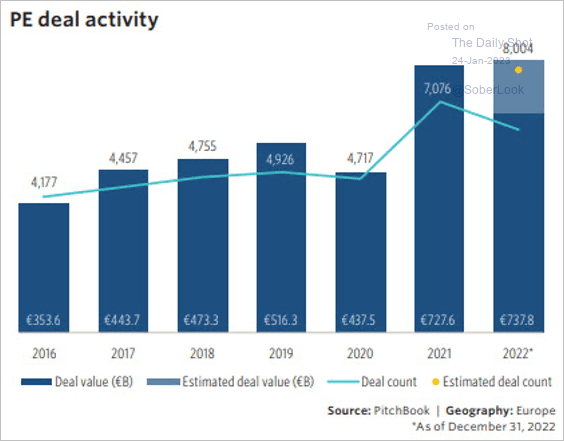

6. Private equity deal-making remained healthy in Europe last year.

Source: PitchBook

Source: PitchBook

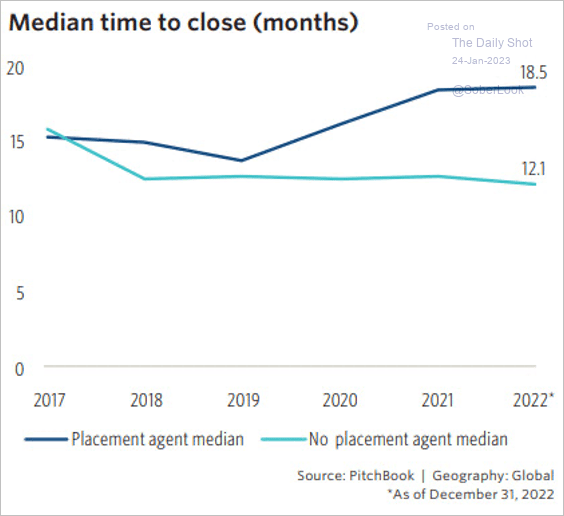

7. Working with placement agents does not necessarily mean a shorter time to close.

Source: PitchBook

Source: PitchBook

Back to Index

Rates

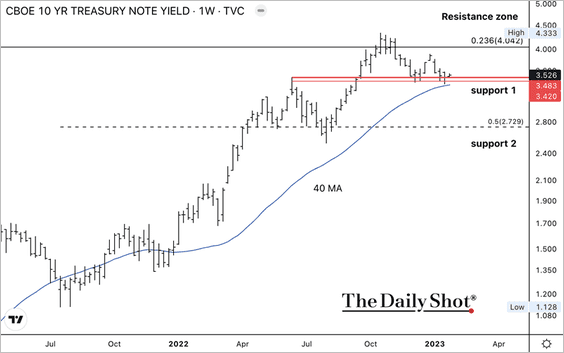

1. The 10-year Treasury yield is holding short-term support, although there is strong resistance ahead.

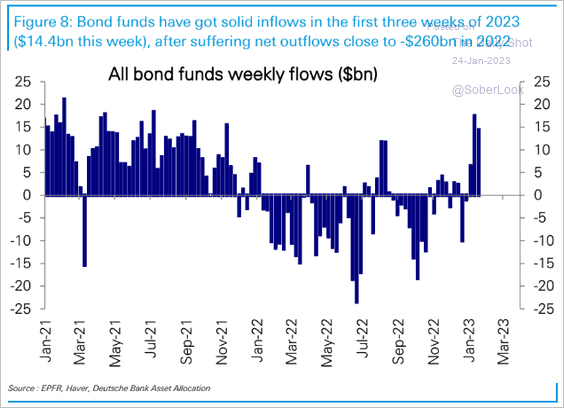

2. Bond funds continue to see inflows …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

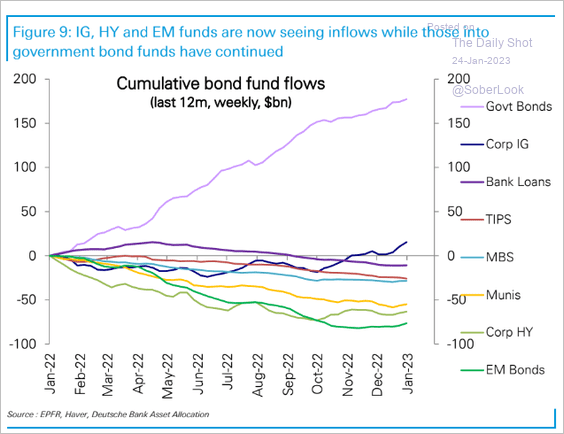

… driven by government debt and IG corporates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

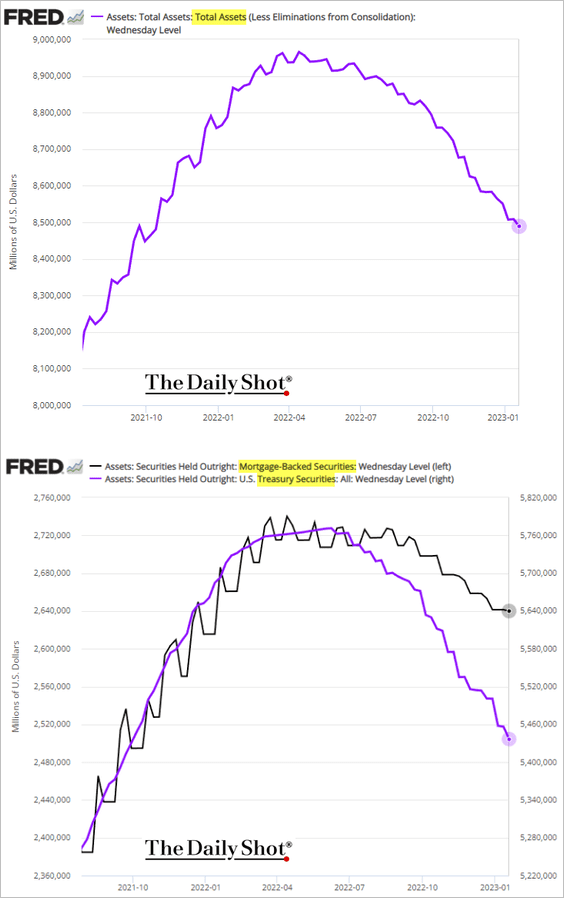

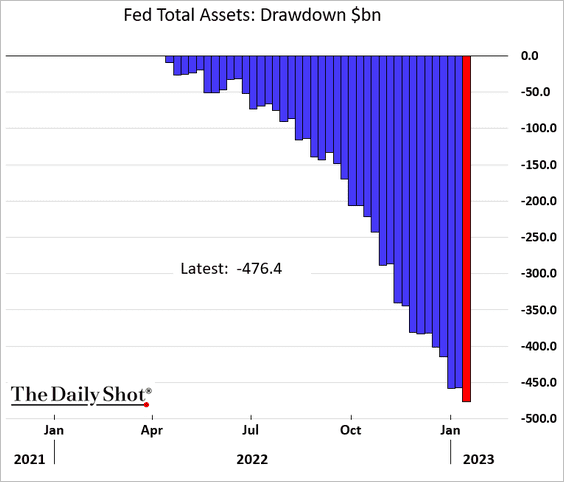

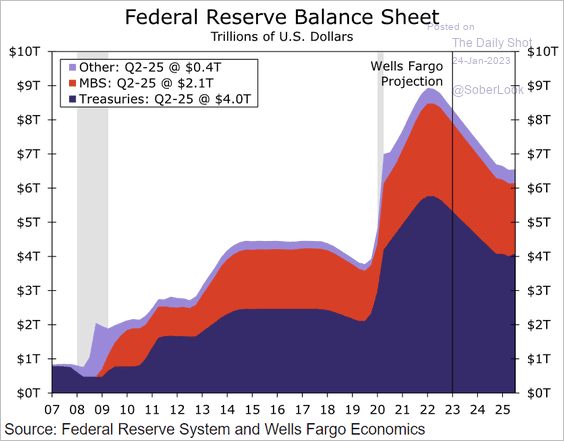

3. The Fed’s balance sheet is down nearly half a trillion dollars from the peak (2 charts).

Quantitative tightening will continue for another couple of years, according to Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

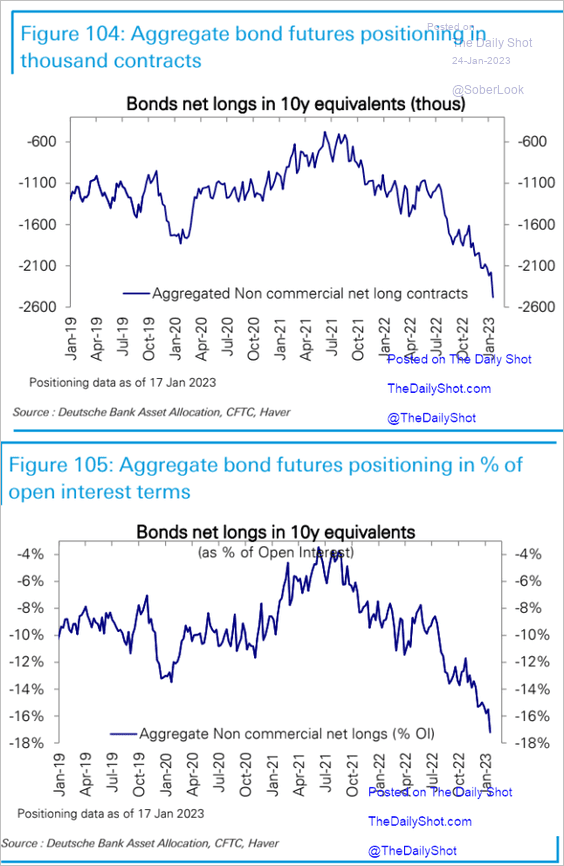

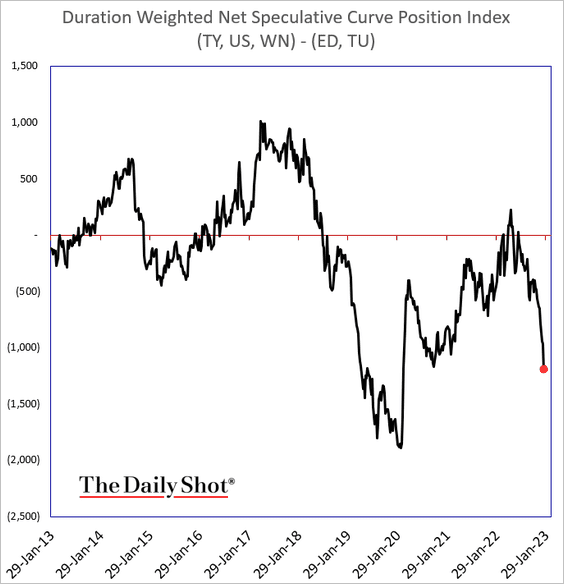

4. Net speculative bearish positioning in Treasuries appears stretched.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Traders are positioning for a steeper yield curve.

Back to Index

Global Developments

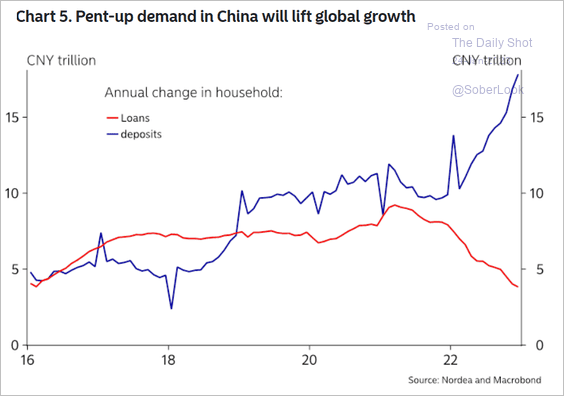

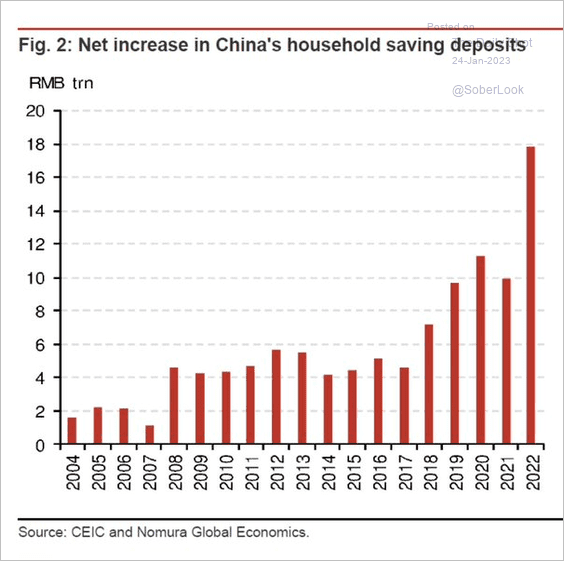

1. China’s pent-up consumer demand will be a tailwind for global growth (2 charts).

Source: Nordea Markets

Source: Nordea Markets

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

——————–

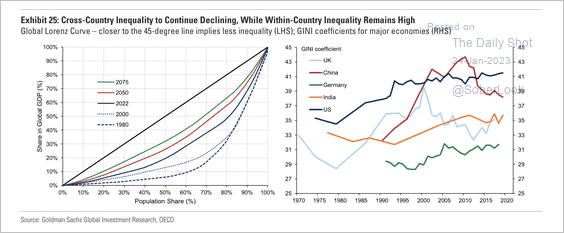

2. Income inequality between countries has fallen (left), while inequality within most economies has risen since the late 1970s (right).

Source: Goldman Sachs

Source: Goldman Sachs

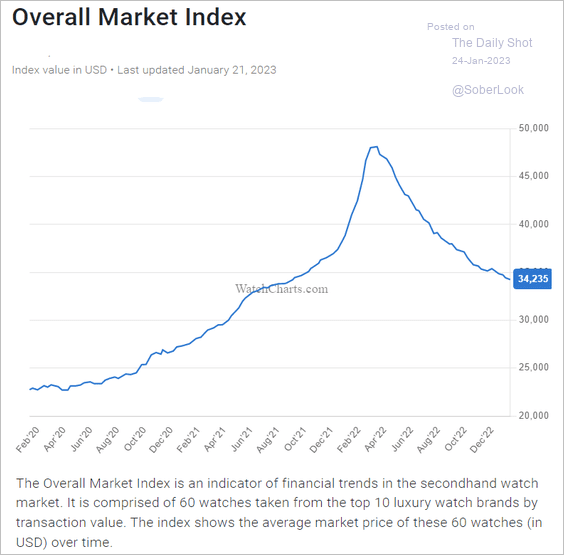

3. Luxury secondhand watch prices continue to trend lower.

Source: WatchEnthusiasts

Source: WatchEnthusiasts

——————–

Food for Thought

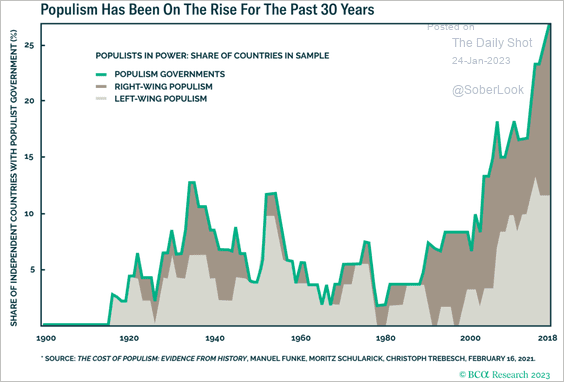

1. Rising populism around the world:

Source: BCA Research

Source: BCA Research

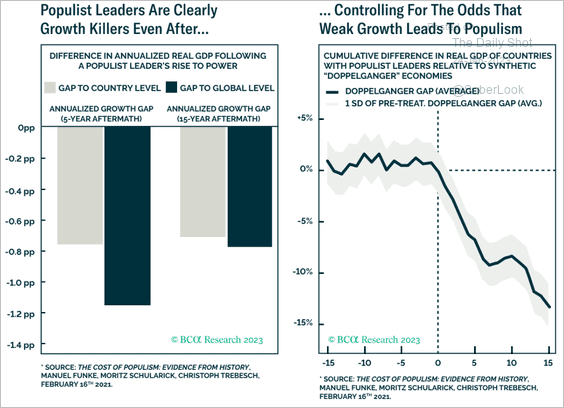

Populism tends to depress economic growth.

Source: BCA Research

Source: BCA Research

——————–

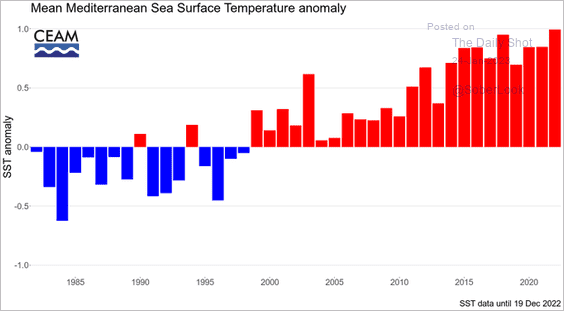

2. The Mediterranean Sea warming trend:

Source: @CEAM_Meteo

Source: @CEAM_Meteo

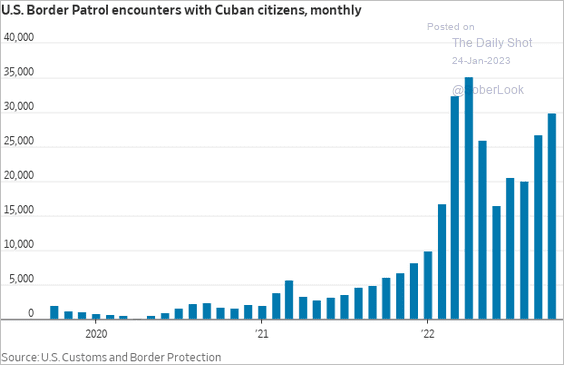

3. Cuban refugees in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

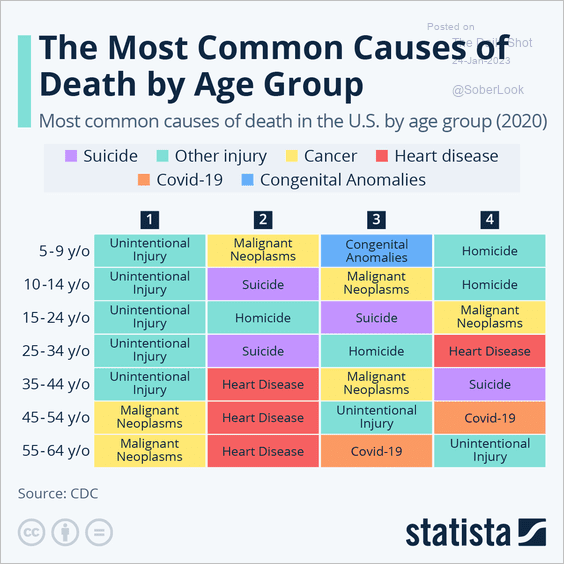

4. Most common causes of death by age group:

Source: Statista

Source: Statista

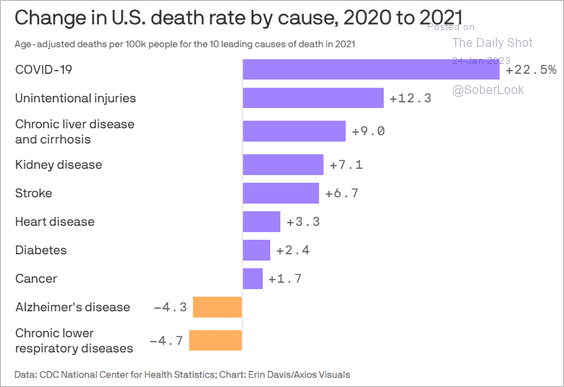

• Changes in US death rates by cause in 2021:

Source: @axios Read full article

Source: @axios Read full article

——————–

5. Government healthcare spending in select countries:

Source: The Economist Read full article

Source: The Economist Read full article

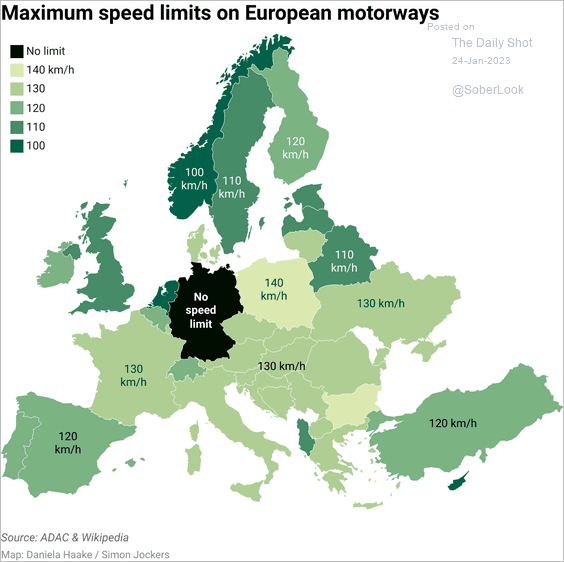

6. Maximum speed limit in Europe (100 km = 62 miles):

Source: Datawrapper

Source: Datawrapper

——————–

Back to Index