The Daily Shot: 01-Feb-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

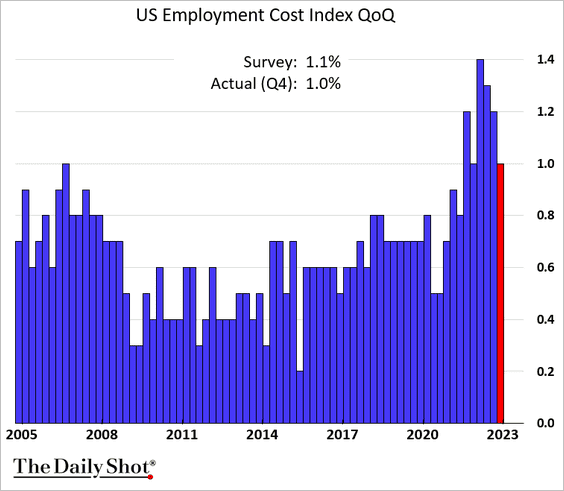

1. Gains in the employment cost index slowed last quarter, …

… which should help cool inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Here are the year-over-year changes in total compensation by industry.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• This chart from Pantheon Macroeconomics shows the Phillips Curve returning to pre-COVID levels.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. The Conference Board’s consumer confidence index edged lower in January.

The labor market strength has been keeping this index from deteriorating.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

3. The MNI Chicago PMI moved deeper into contraction territory this month, highlighting softening business activity in the Midwest.

4. Home prices declined less than expected in November.

• These are the year-over-year changes.

• The FHFA index shows only a modest drop in prices.

• High-frequency indicators point to further declines in December.

Source: Calculated Risk

Source: Calculated Risk

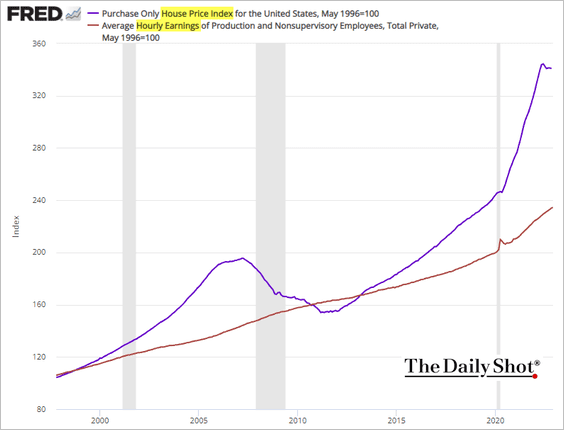

• The gap between home prices and wages remains elevated.

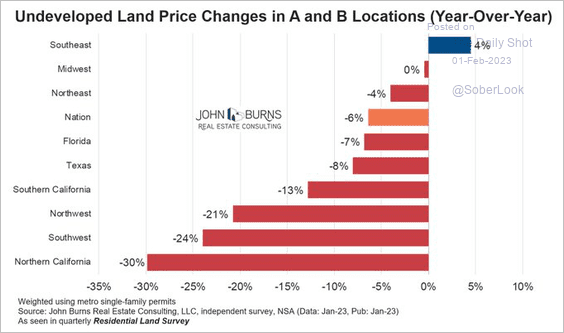

• Undeveloped land prices have been falling in most regions.

Source: @RickPalaciosJr

Source: @RickPalaciosJr

——————–

5. Next, we have some updates on the debt ceiling impasse.

• The Treasury bill market expects the X-date by early August.

Source: Piper Sandler

Source: Piper Sandler

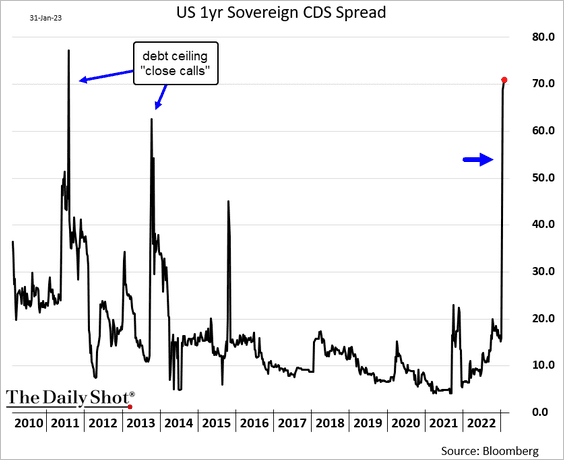

• The 1-year US sovereign credit default swap spread signals market fears similar to 2011. The market expects the government to take the debt ceiling fight to the brink.

• Here is what happened to financial conditions in 2011.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

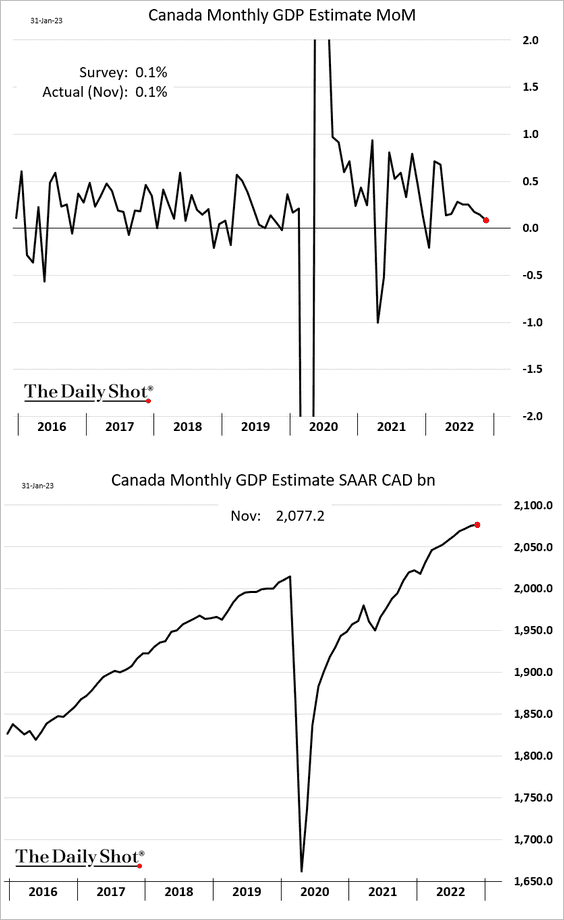

Canada

1. Economic growth slowed in November but remained in positive territory.

2. Real retail sales are turning lower.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

3. This chart shows housing exposure by province.

Source: Desjardins

Source: Desjardins

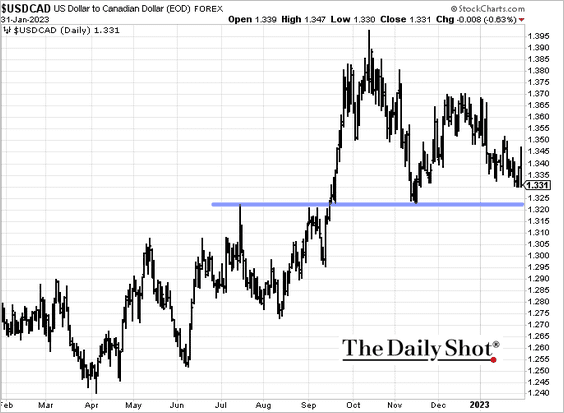

4. Will USD/CAD test support around 1.323?

Back to Index

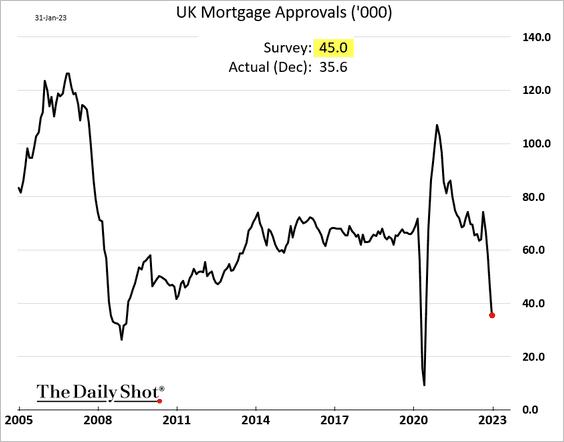

The United Kingdom

1. Housing credit is deteriorating rapidly.

• Mortgage lending:

• Mortgage approvals:

Source: @LucyGJWhite, @economics Read full article

Source: @LucyGJWhite, @economics Read full article

2. The broad money supply growth is slowing.

3. Next, we have the CPI forecast from BCA Research.

Source: BCA Research

Source: BCA Research

4. Below is the history of GBP/USD exchange rate since 1800.

Source: Credit Suisse

Source: Credit Suisse

5. Bregret has become widespread.

Source: UnHerd Britain, h/t Walter

Source: UnHerd Britain, h/t Walter

Back to Index

The Eurozone

1. Let’s begin with Germany.

• Retail sales tumbled in December

• The labor market remains resilient.

– Changes in the number of unemployed workers:

– The unemployment rate:

• Import price inflation slowed less than expected in December.

• This chart shows naturalizations in Germany over time.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

2. French consumer spending on goods deteriorated further in December.

Inflation remains elevated.

Source: Arcano Economics

Source: Arcano Economics

——————–

3. Italian unemployment held steady in December.

4. Spain’s current account surplus has been surging.

The nation’s labor productivity has been lagging behind the Eurozone.

Source: Arcano Economics

Source: Arcano Economics

——————–

5. The euro-area GDP expanded last quarter, topping expectations.

Here is the quarterly breakdown (where available).

Source: @OliverRakau

Source: @OliverRakau

——————–

6. Below is Commerzbank’s ECB “hawk-o-meter.”

Source: Commerzbank Research

Source: Commerzbank Research

7. The currency market isn’t too concerned about the ECB and the Fed this week. Here is the EUR/USD risk reversal.

Back to Index

Europe

1. Sweden’s GDP unexpectedly declined last quarter.

• Sweden’s house prices are sharply lower, diverging from Greece.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Sweden has one of the highest private debt levels as a percent of GDP in the developed world.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

2. The Norwegian krone underperformed in January.

3. Swiss retail sales slowed sharply in December.

4. Youth unemployment has been trending lower.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

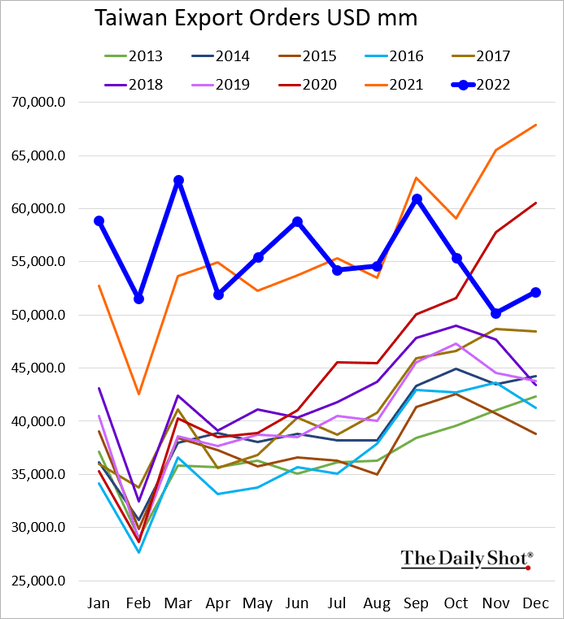

Asia – Pacific

1. Japan’s consumer confidence edged higher in January.

2. Taiwan’s export orders were down sharply last year relative to 2021.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

• Taiwan’s manufacturing activity continued to contract in January.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

3. South Korea’s exports tumbled further in January, …

… exacerbated by soft demand from China.

The trade deficit widened to a record.

• Manufacturing activity is declining.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

4. Next, we have some updates on New Zealand.

• Wage growth:

• Unemployment:

• Home prices:

Back to Index

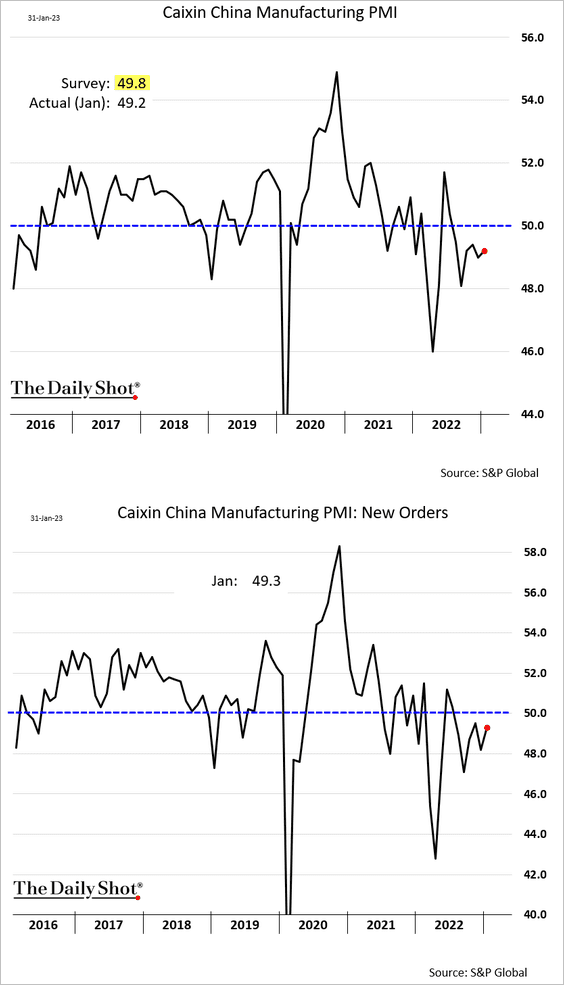

China

1. The manufacturing PMI data from S&P Global was less upbeat than the official report. Factory activity remains in contraction mode.

2. Revenue growth improved in January.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

1. Let’s run through Asian PMIs for January.

• Indonesia (back to growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Thailand (robust expansion):

Source: S&P Global PMI

Source: S&P Global PMI

• The Philippines (accelerating growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Malaysia (further deterioration):

Source: S&P Global PMI

Source: S&P Global PMI

• Vietnam (continuing contraction):

Source: S&P Global PMI

Source: S&P Global PMI

• ASEAN (improved growth):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

2. Adani shares remain under pressure.

India’s key industries expanded rapidly in December.

Source: India TV News Read full article

Source: India TV News Read full article

——————–

3. Next, we have some performance data for January.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

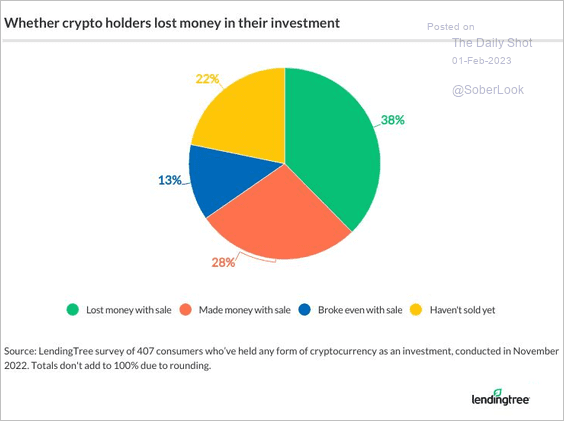

Cryptocurrency

1. $22,500 is now a support level for bitcoin.

2. Next, we have some performance data for January.

3. Who lost money on crypto?

Source: LendingTree Read full article

Source: LendingTree Read full article

What makes Americans fearful of crypto?

Source: LendingTree Read full article

Source: LendingTree Read full article

Back to Index

Commodities

1. Platinum’s short-term price trend is improving, while palladium remains in a downtrend. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

The platinum/palladium price ratio is improving.

——————–

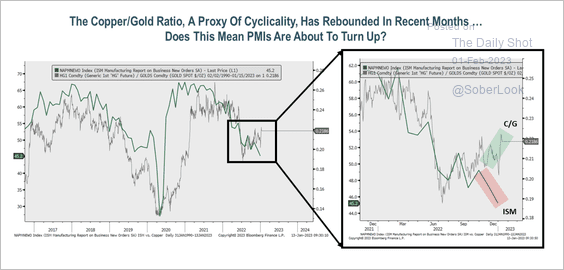

2. The copper/gold ratio diverged from the US ISM manufacturing new orders index. The market is likely pricing in global growth divergence, driven by China’s reopening.

Source: Piper Sandler

Source: Piper Sandler

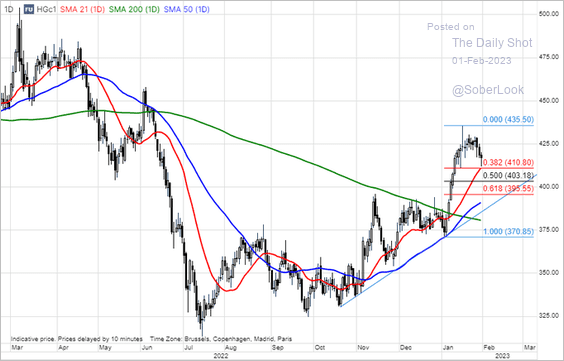

• Copper is at support.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

——————–

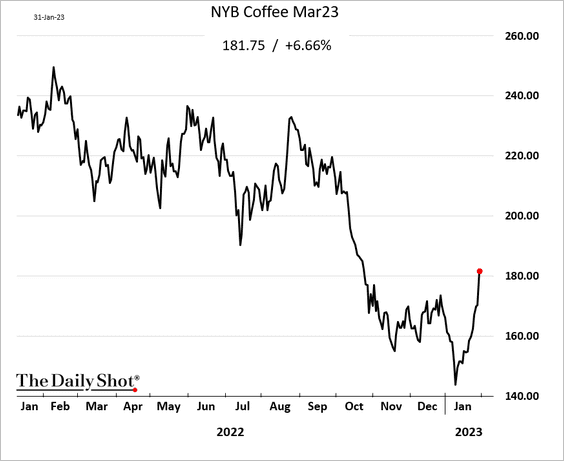

3. Coffee futures are rebounding.

4. Next, we have some performance data for January.

Back to Index

Energy

1. Arab Light crude is trading at a higher discount to Brent.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Demand for second-hand oil tankers (to ship Russian oil) surged last year.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

1. Let’s begin with some attribution data.

• S&P 500:

• S&P 600 (small caps):

——————–

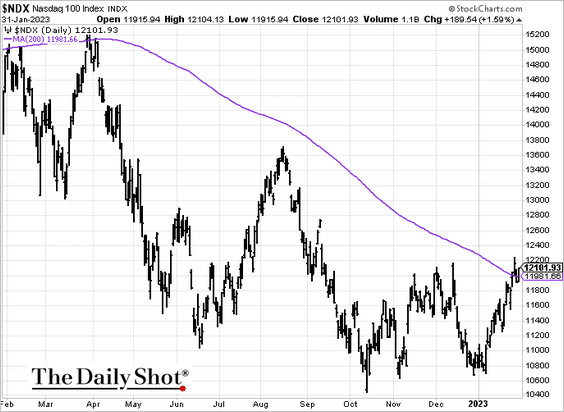

2. The Nasdaq 100 closed above its 200-day moving average again.

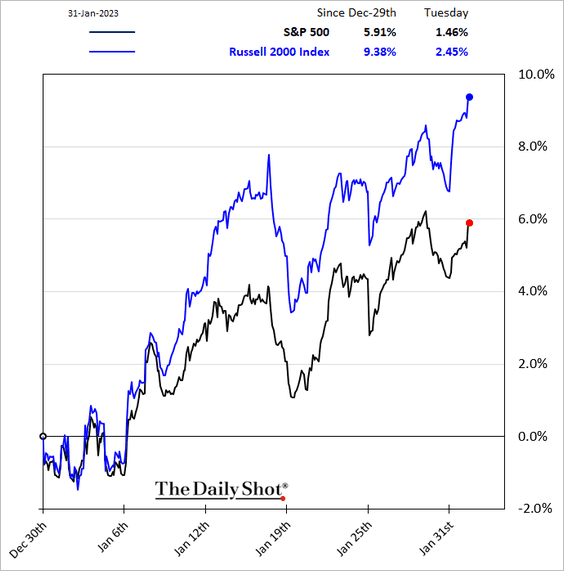

3. Small caps have been outperforming.

4. Should we be concerned about the divergence between the S&P 500 and Fed liquidity (reserves)?

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

5. US corporate profits typically decline by at least 15%-20% during recessions, which is out of line with current analyst expectations.

Source: TS Lombard

Source: TS Lombard

6. Q4 earnings reports have been disappointing relative to historical surprises.

Source: @lisaabramowicz1, @bloomberg

Source: @lisaabramowicz1, @bloomberg

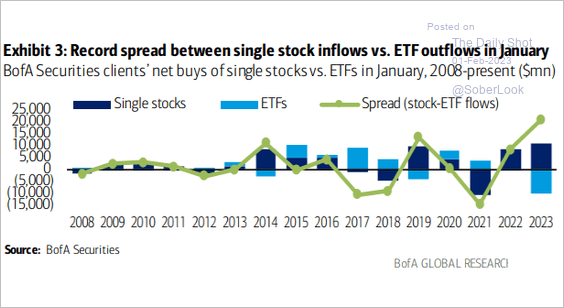

7. Single stock and ETF flows diverged in January.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

8. Risk-off conditions could continue as earnings and market prices have not fully reflected the rapid rise in rates.

Source: Piper Sandler

Source: Piper Sandler

9. Money managers have been spending quite a bit on downside protection recently.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

10. Next, we have some performance data for January.

• Sectors:

• Equity factors:

• Basket pairs:

• Thematic ETFs:

• Largest US tech stocks:

Back to Index

Credit

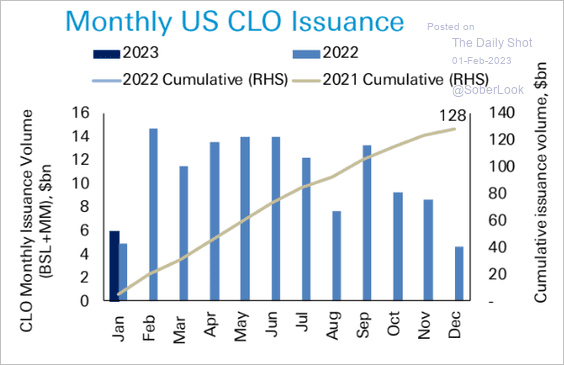

1. CLO issuance picked up in January.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. High-yield credit spreads have not risen to the same extent as the 10-year Treasury yield.

Source: Piper Sandler

Source: Piper Sandler

3. Next, we have the returns by asset class in January.

Back to Index

Rates

1. Let’s begin with the Treasury yield decline attribution for January.

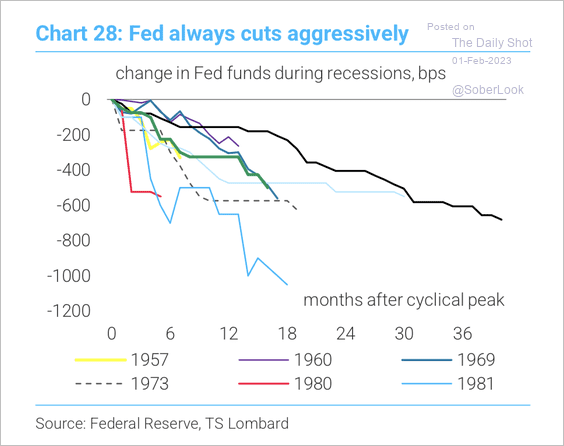

2. Here is a look at Fed rate cuts in past recessions. This time, inflation would need to move sharply lower to encourage a pivot.

Source: TS Lombard

Source: TS Lombard

3. SOFR market share is rising in the loan market.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

Back to Index

Global Developments

1. Broad money supply growth is correlated with inflation and inflation forecast errors.

Source: BIS, h/t Torsten Slok, Apollo Read full article

Source: BIS, h/t Torsten Slok, Apollo Read full article

2. China and India will drive global growth in 2023, according to the IMF.

Source: IMF Read full article

Source: IMF Read full article

Oxford Economics is less optimistic about global growth this year than the IMF.

Source: Oxford Economics

Source: Oxford Economics

——————–

3. Financial conditions in developed markets have eased in recent months, almost back to their long-run average.

Source: Capital Economics

Source: Capital Economics

4. Next, we have some DM performance data for January.

• Currency indices:

• Bond yields:

——————–

Food for Thought

1. Countries by share of the global economy:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

2. Living paycheck-to-paycheck:

Source: @atanzi, @bbgequality Read full article

Source: @atanzi, @bbgequality Read full article

3. A minute on the internet:

Source: @genuine_impact

Source: @genuine_impact

4. Fastest internet speeds:

Source: @genuine_impact

Source: @genuine_impact

5. Podcast platform preferences:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

6. Legal abortions in the US over time:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

7. Human names for dogs:

Source: @andrewvandam, @alyssafowers, @chrisalcantara Read full article

Source: @andrewvandam, @alyssafowers, @chrisalcantara Read full article

——————–

Back to Index