The Daily Shot: 06-Feb-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

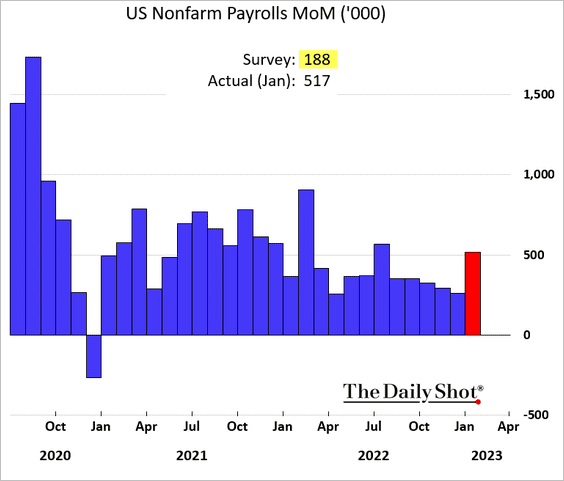

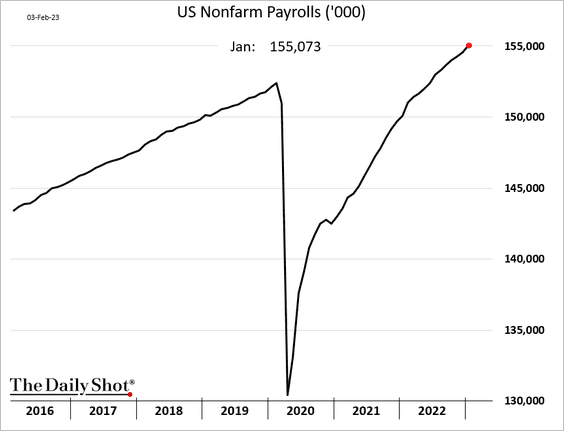

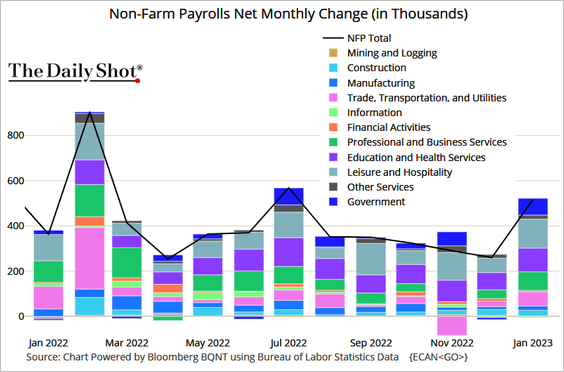

1. With over half a million jobs created, the January jobs report far surpassed economists’ expectations. The labor market is far from signaling a recession.

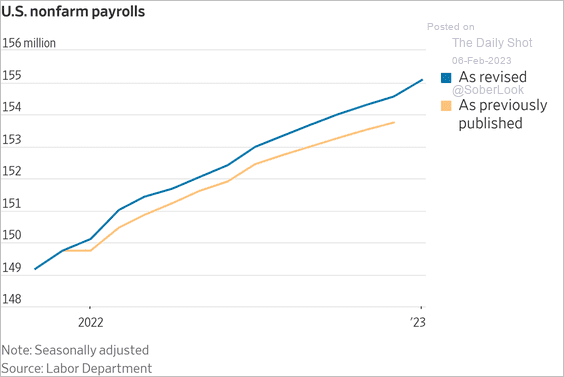

• Revisions remain positive.

Source: @WSJ Read full article

Source: @WSJ Read full article

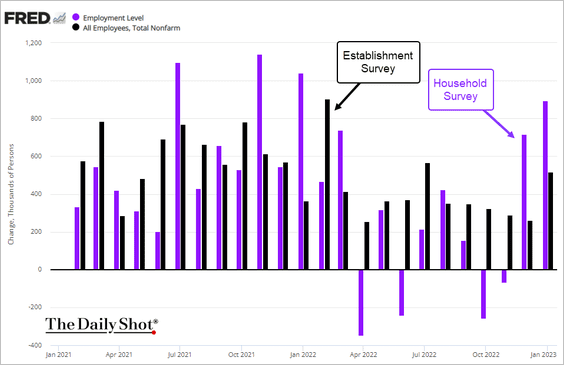

• Results from the household survey were even stronger.

• Job gains were broad.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

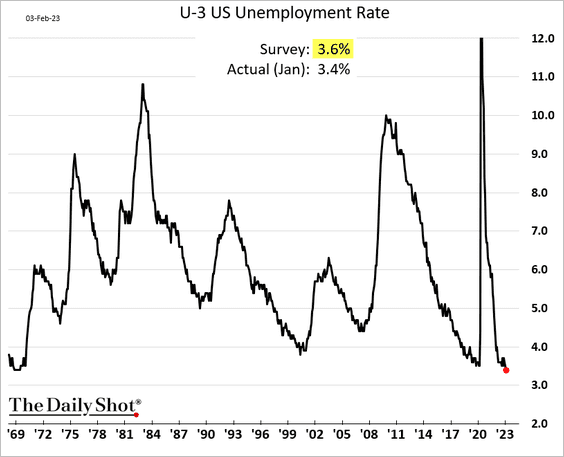

• The unemployment rate hit its lowest level since 1969.

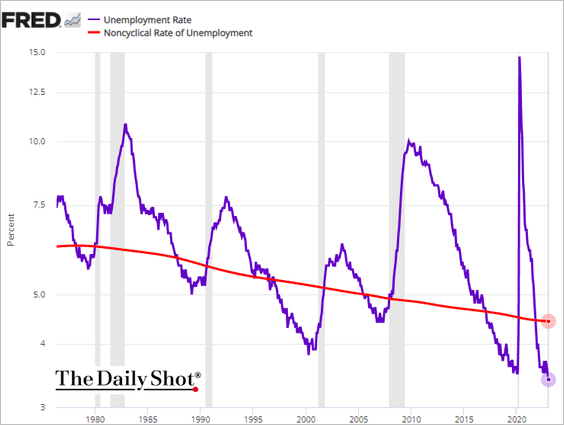

– The unemployment rate is now well below NAIRU, signaling tightness in the labor market.

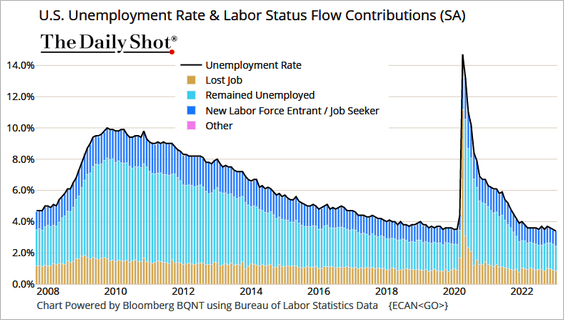

– This chart shows the contributions to the unemployment rate based on labor flows.

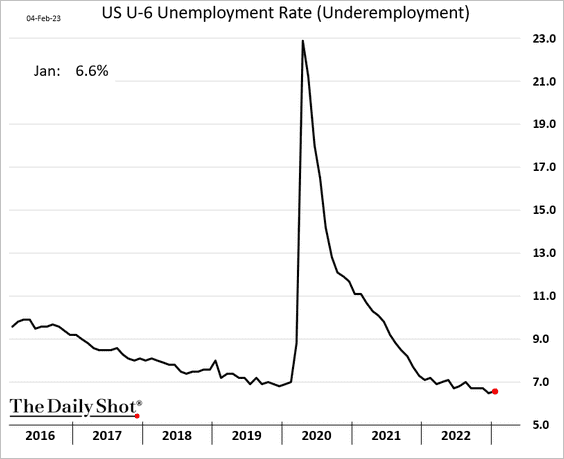

• Underemployment edged higher.

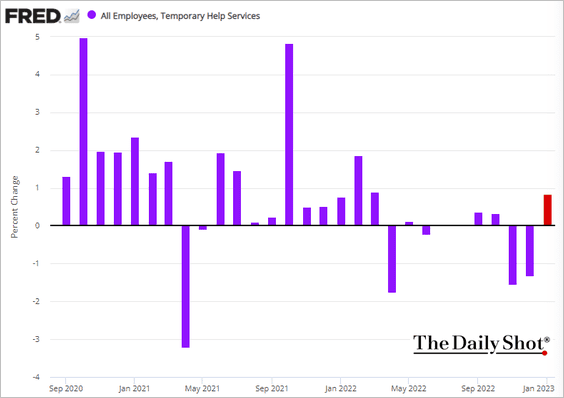

• After two months of declines, temp employment jumped.

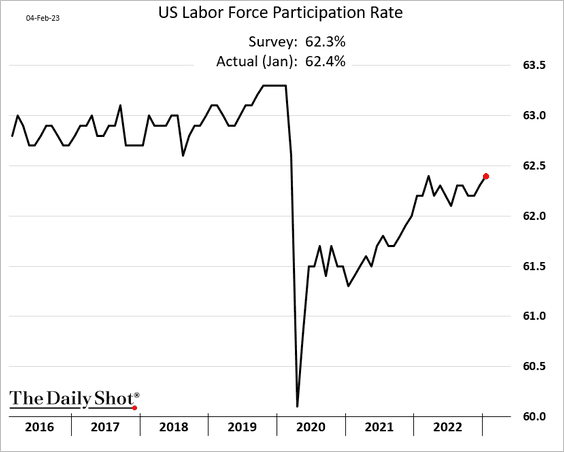

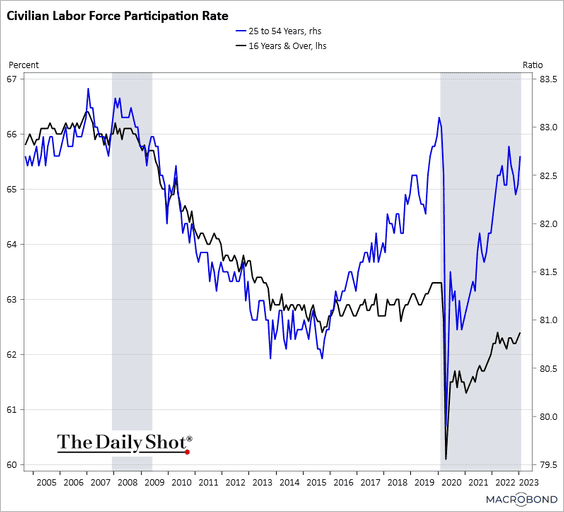

• Labor force participation improved.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

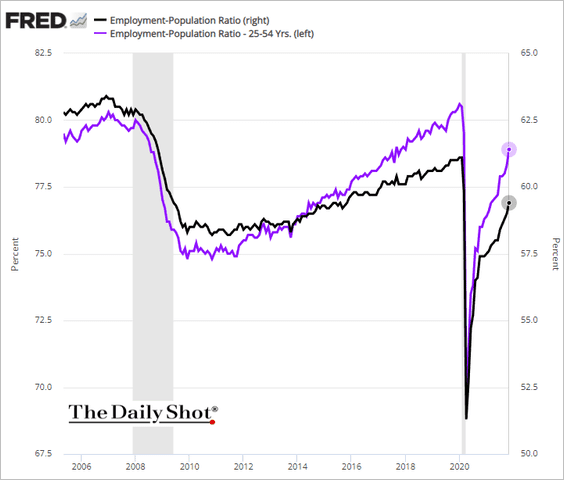

Here is the employment-to-population ratio.

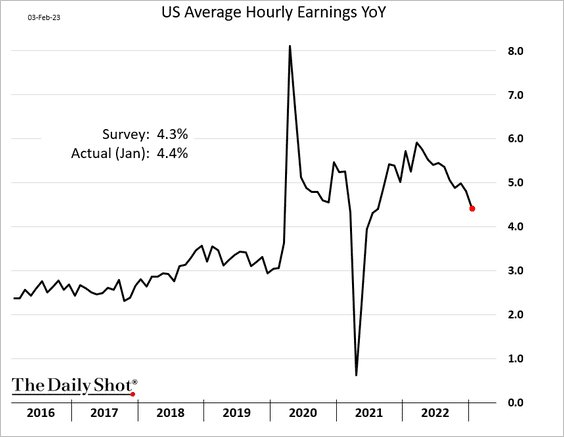

• Wage growth has been moderating but remains elevated.

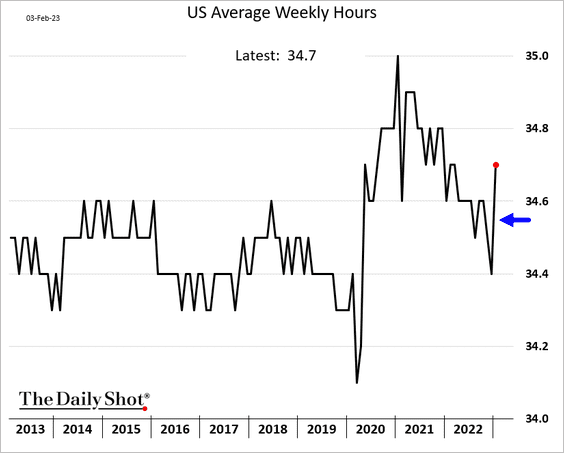

• Average weekly hours worked jumped in January.

• Below are some additional trends from the jobs report.

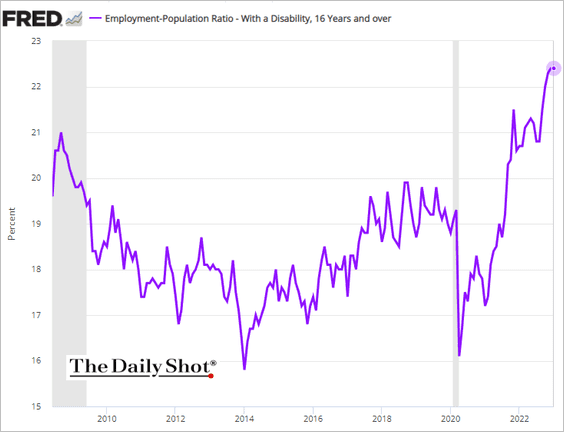

– Workers with a disability:

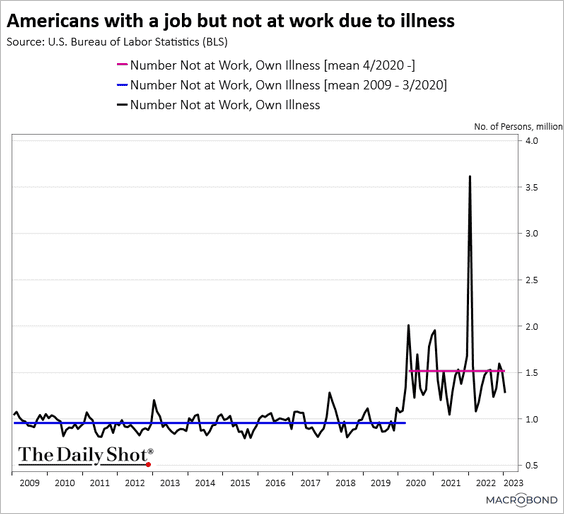

– Not at work due to illness:

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

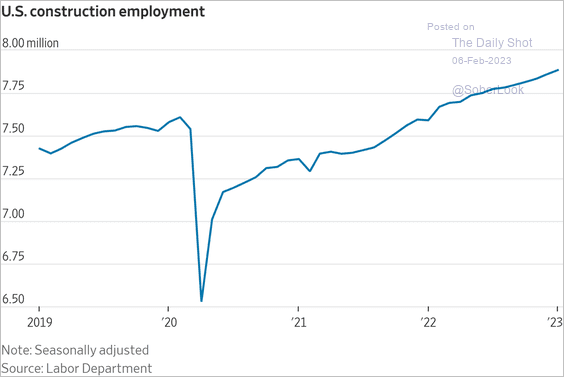

– Construction employment:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

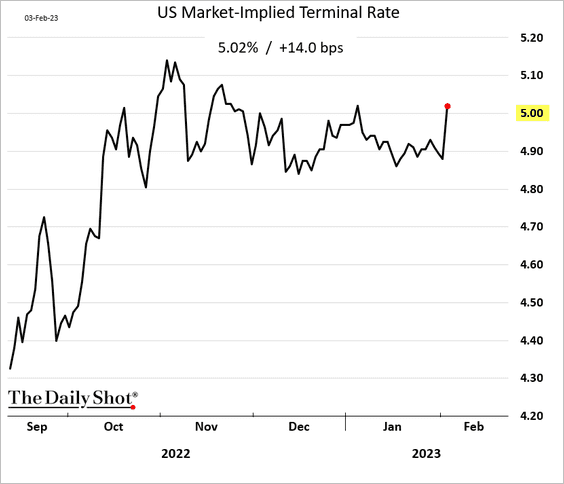

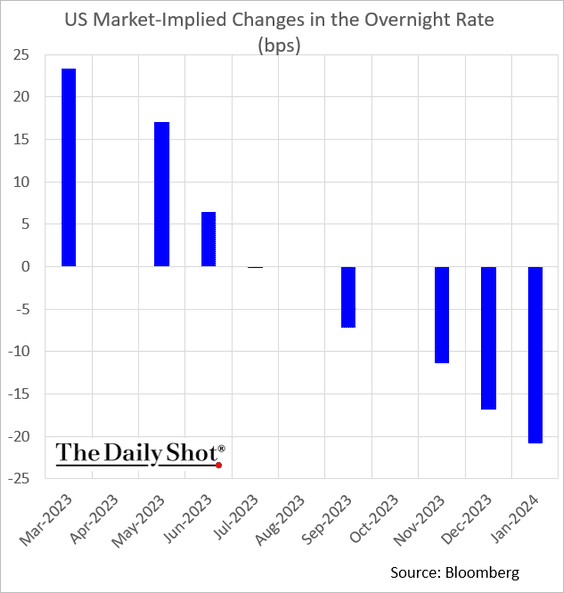

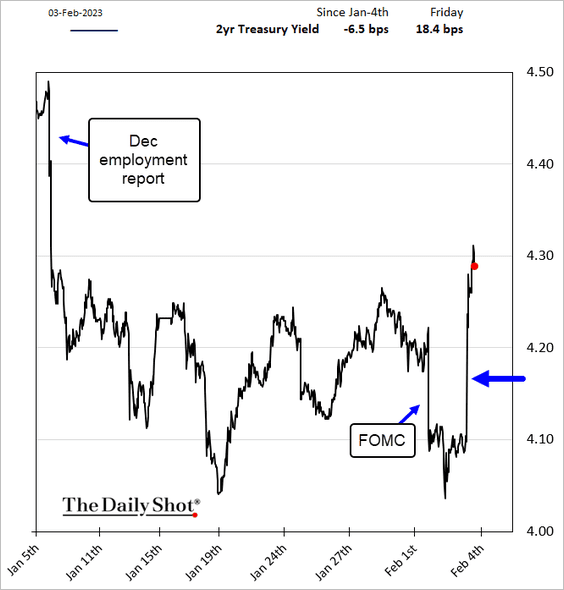

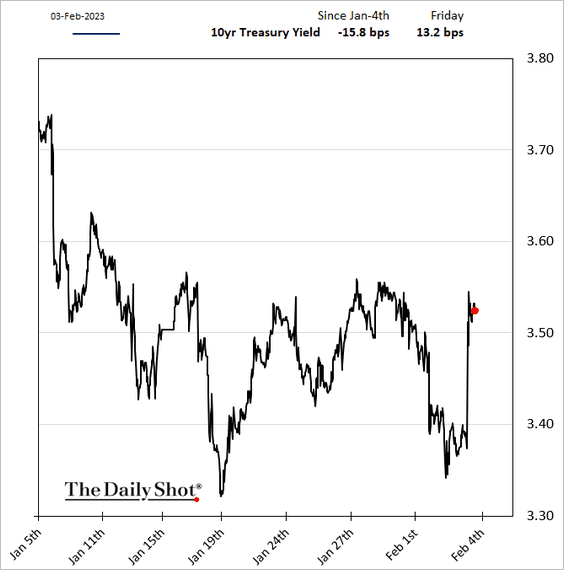

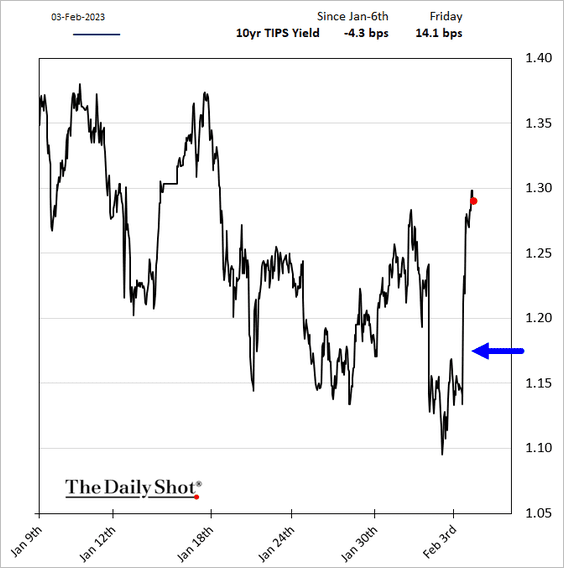

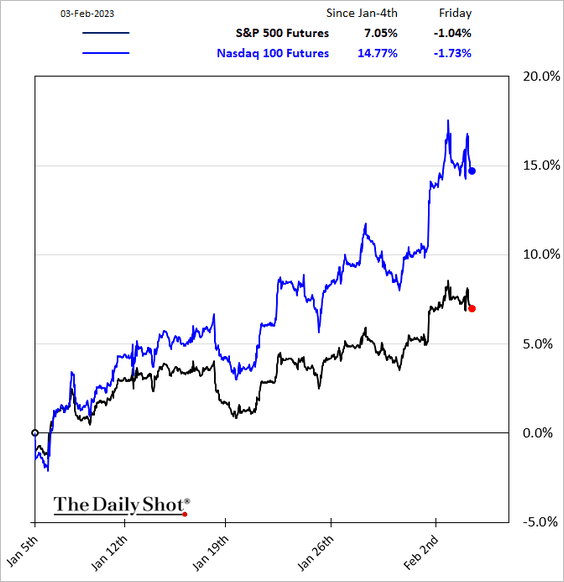

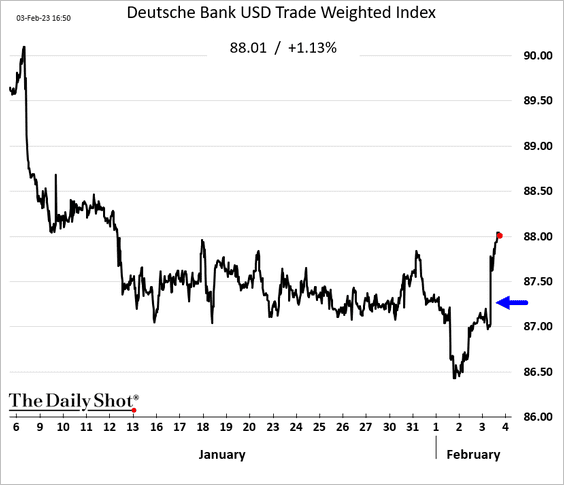

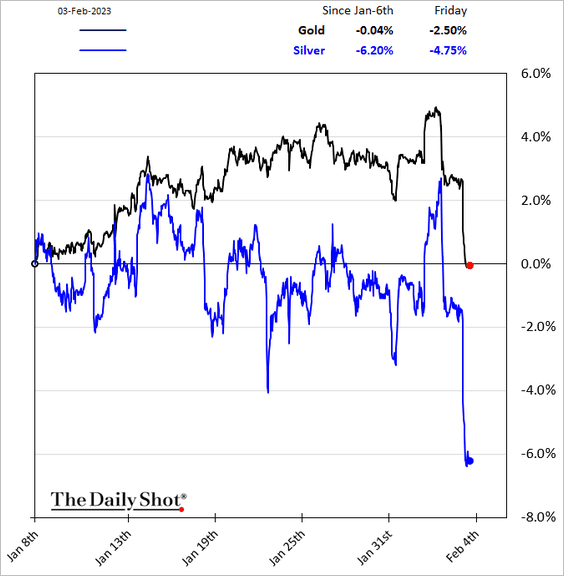

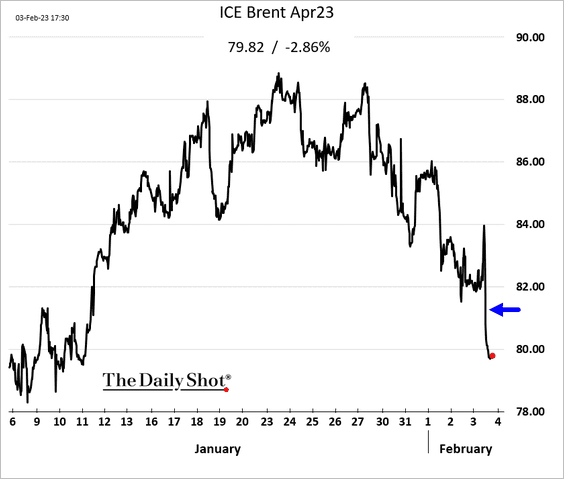

2. The jobs report shocker boosted rate hike expectations, with the terminal rate back above 5%.

Two more rate hikes?

Below, we have other market responses to the employment report.

• Treasury yields:

• Real yields:

• Stocks (remarkably stable):

• The US dollar:

• Precious metals:

• Crude oil:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

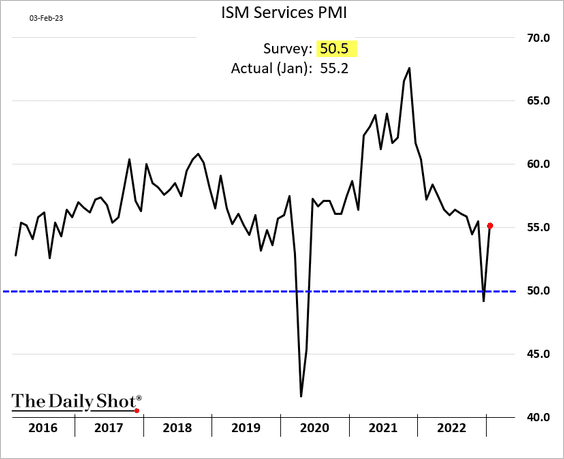

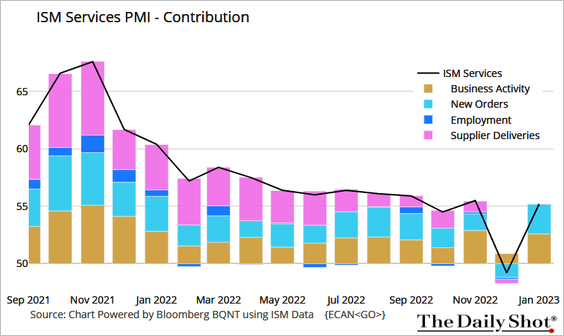

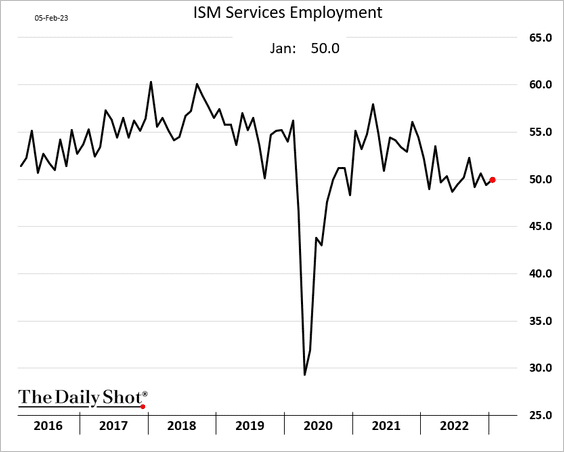

3. The ISM Services PMI jumped back into growth territory, also topping forecasts.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

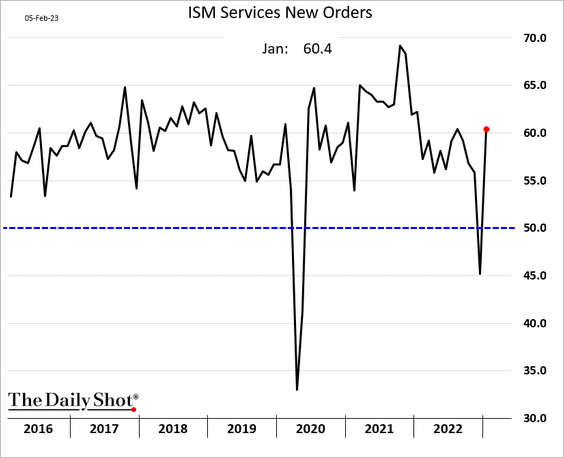

• New orders surged.

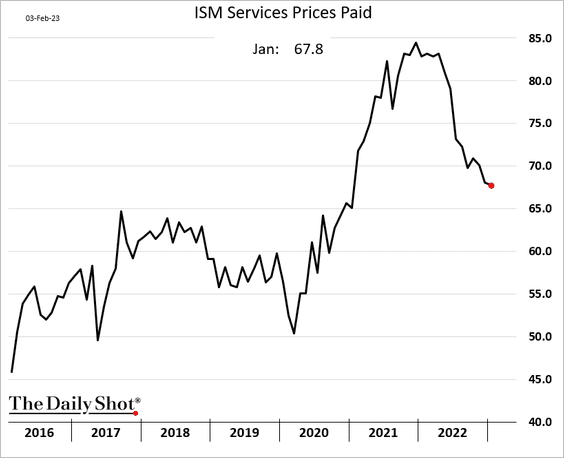

• Price pressures persist:

• Employment remains stable.

——————–

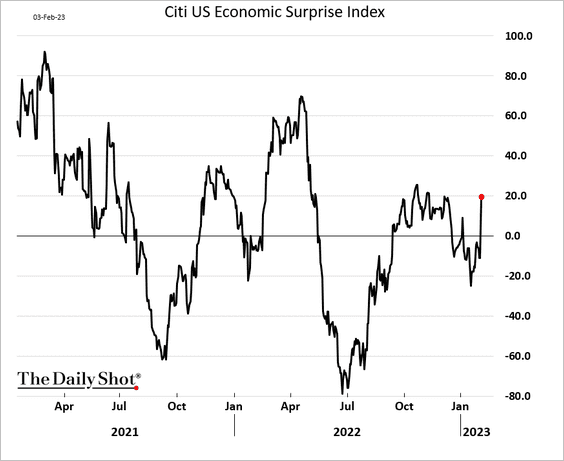

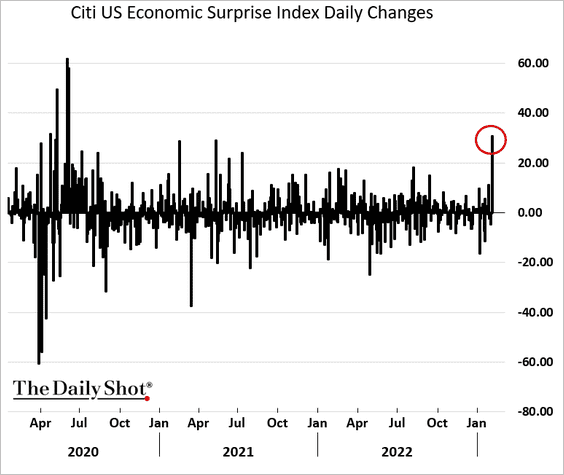

4. The Citi Economic Surprise Index rebounded sharply due to the employment and ISM reports.

——————–

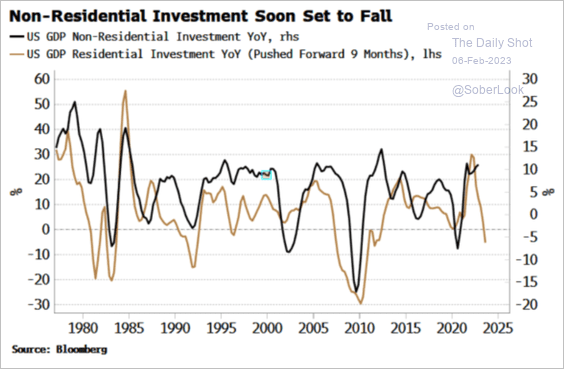

5. Is the crash in residential investment signaling weakness for broader CapEx?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

The United Kingdom

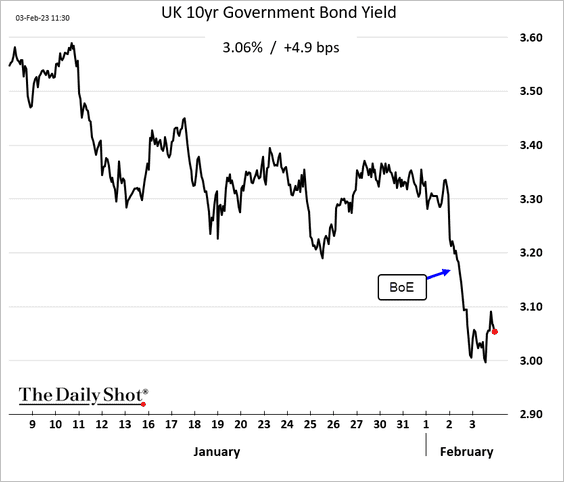

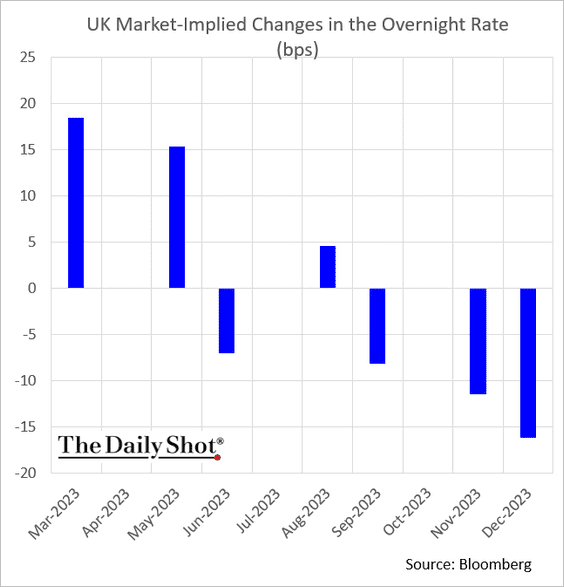

1. The post-BoE rally in gilts held on Friday.

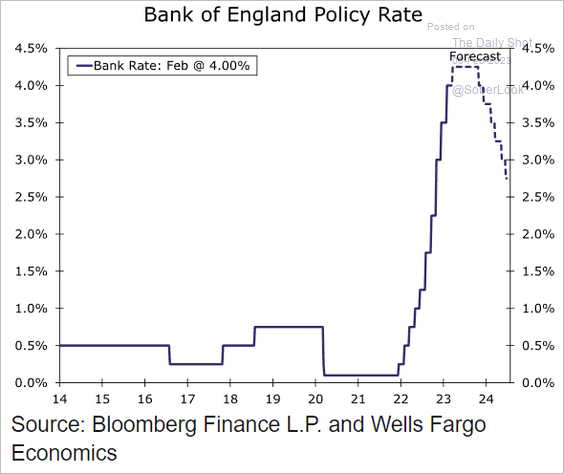

One or two more rate hikes?

Wells Fargo sees juts one.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

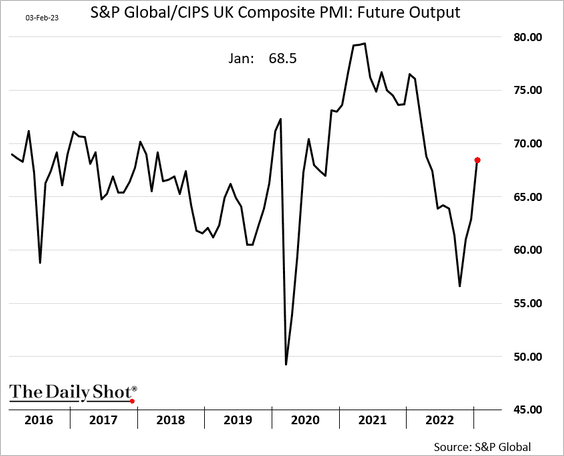

2. The S&P Global PMI report shows businesses becoming more upbeat about the future.

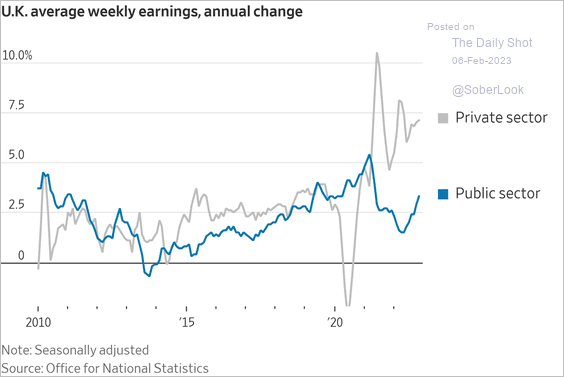

3. Public employee wage growth has been lagging.

Source: @WSJ Read full article

Source: @WSJ Read full article

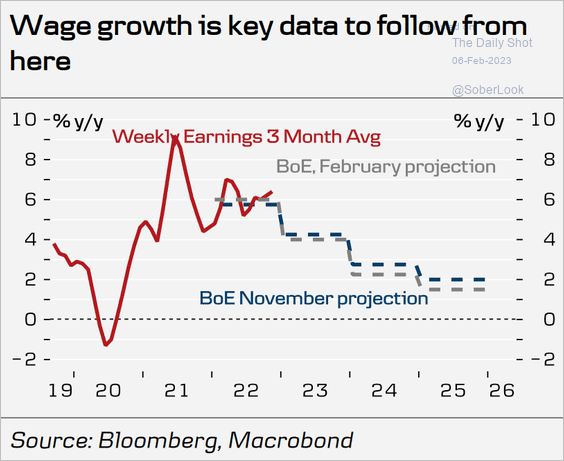

The BoE sees wage growth moderating over the next couple of years.

Source: Danske Bank

Source: Danske Bank

Back to Index

The Eurozone

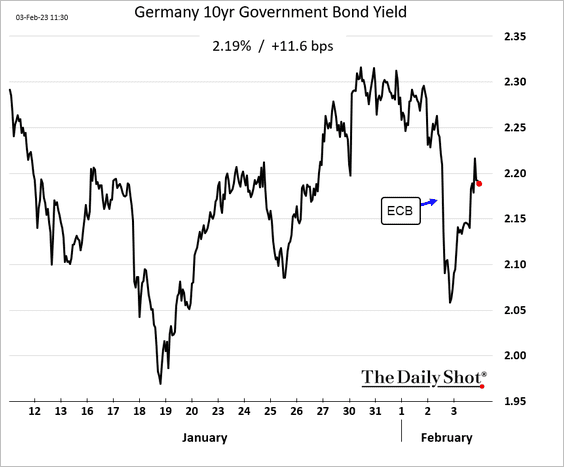

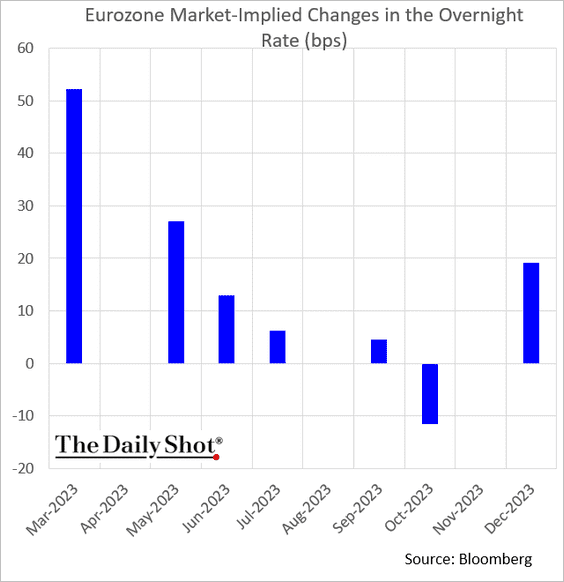

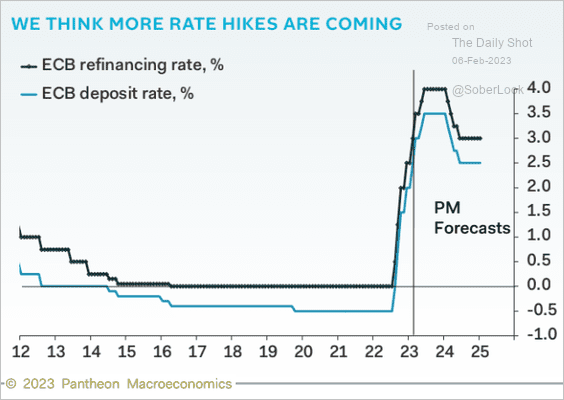

1. The post-ECB euphoria subsided after the realization that there was no dovish message from the central bank. The US employment shocker exacerbated the bond market gloom.

• The market sees another 50 bps increase followed by one or two 25 bps hikes.

Here is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

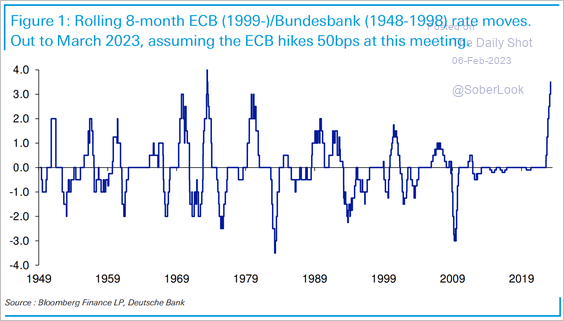

• Combining the ECB’s rate changes with that of the Bundesbank (prior to the euro) makes the current tightening the second highest over an eight-month period.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

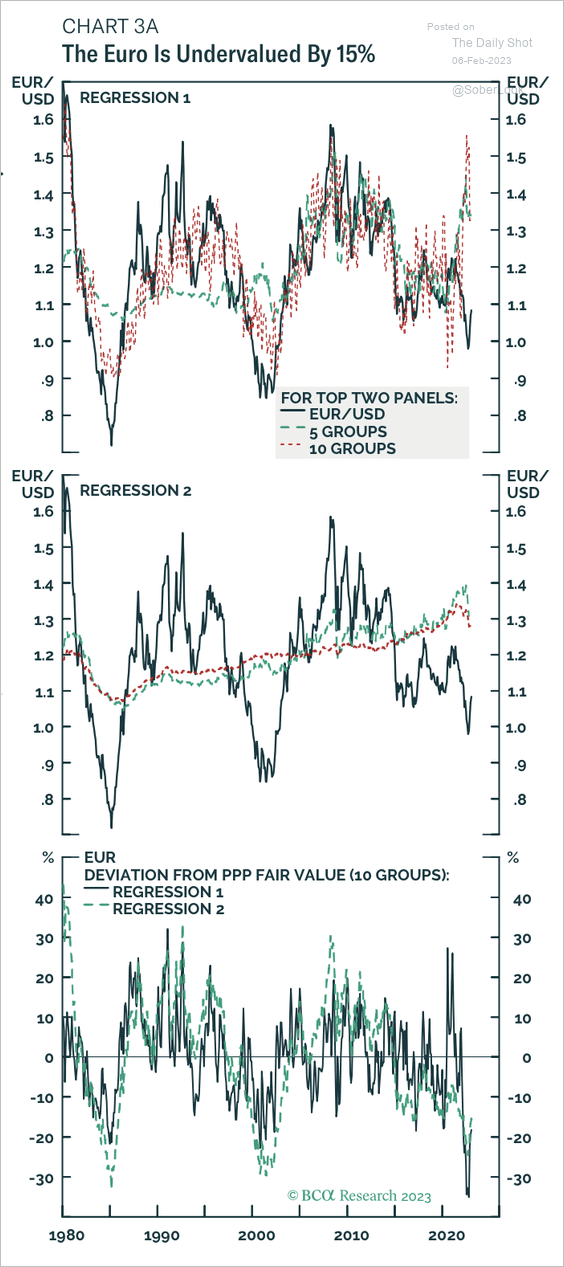

2. Despite its recent rally, the euro is still undervalued by about 15%.

Source: BCA Research

Source: BCA Research

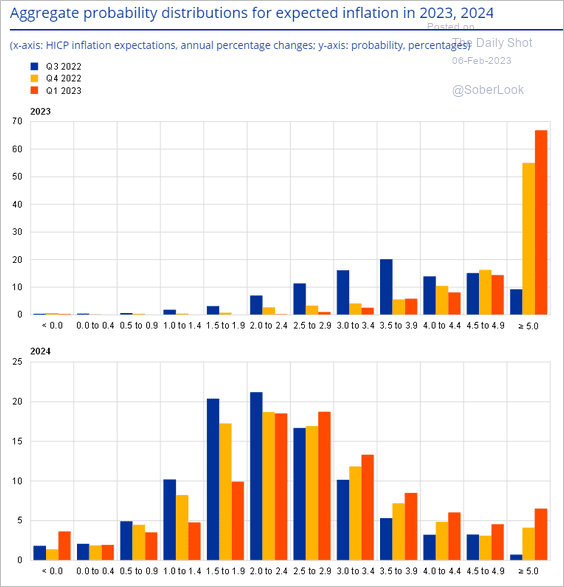

3. Professional forecasters boosted their inflation estimates for 2023 and 2024.

Source: ECB

Source: ECB

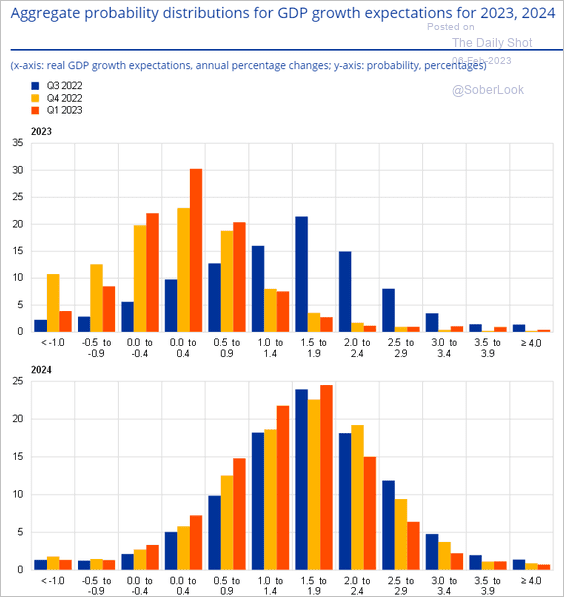

They also increased their 2023 growth projections relative to the previous survey, amid a pullback in energy prices.

Source: ECB

Source: ECB

——————–

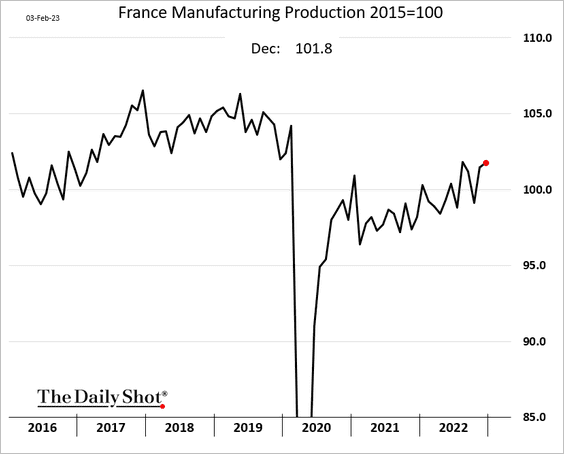

4. French manufacturing output continues to trend higher.

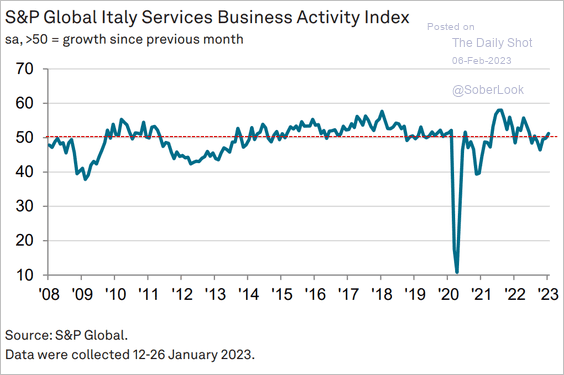

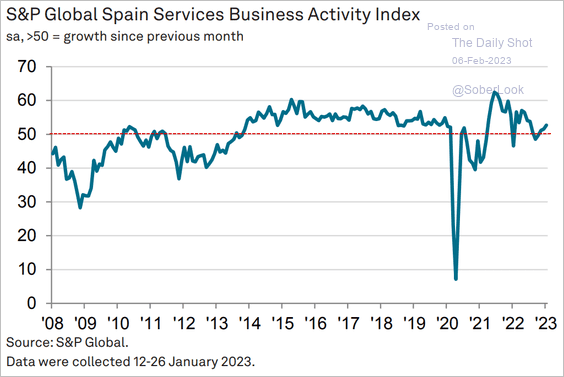

5. Service industries reported an improvement last month, with Italy and Spain now in growth territory.

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

——————–

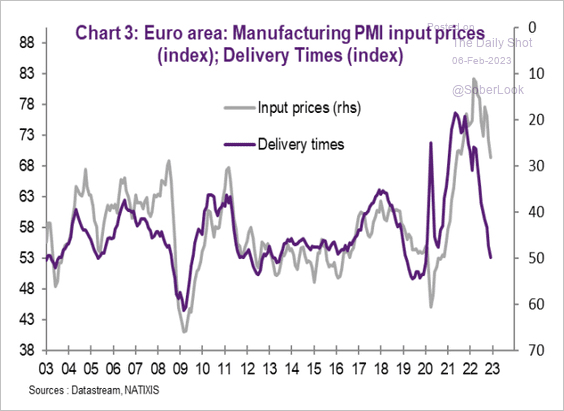

6. Input price pressures should moderate further as supply chain stress eases.

Source: Natixis

Source: Natixis

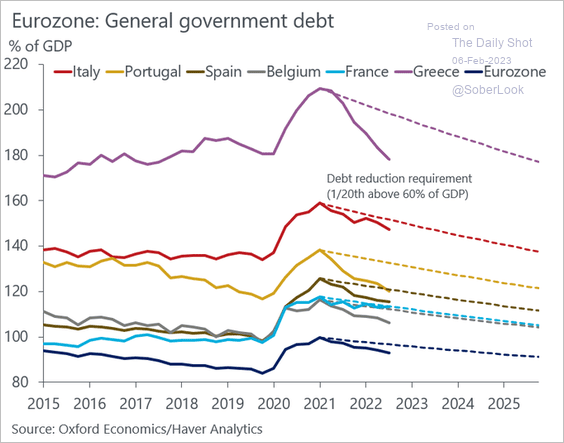

7. Public debt reductions have been exceeding the pace required by current fiscal rules.

Source: @DanielKral1

Source: @DanielKral1

Back to Index

Europe

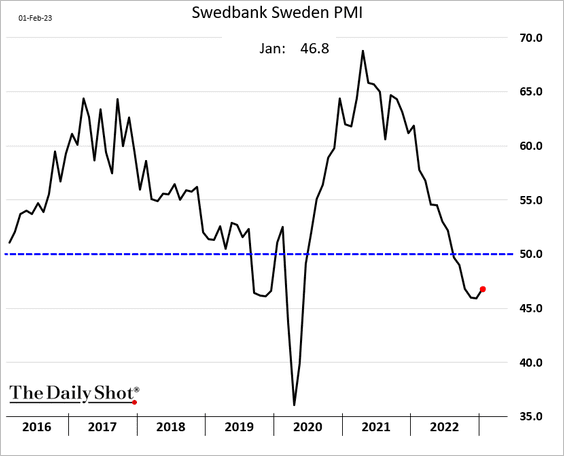

1. Sweden’s manufacturing activity continued to contract last month.

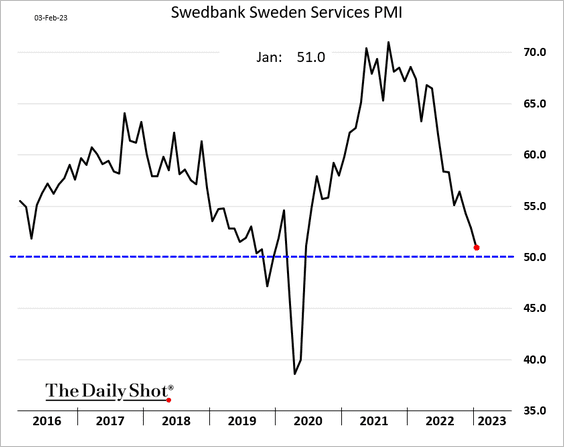

And services growth has slowed markedly.

——————–

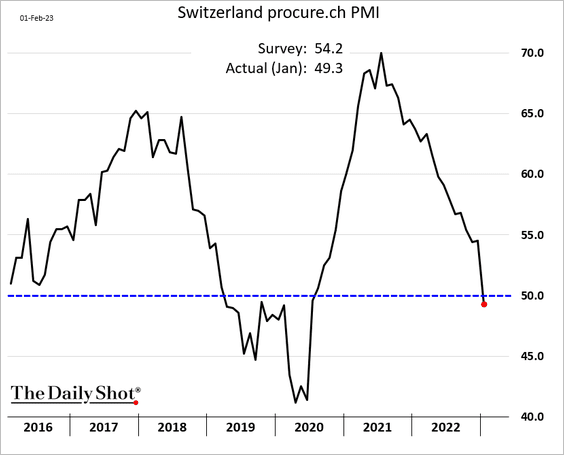

2. Swiss manufacturing is shrinking for the first time since 2020.

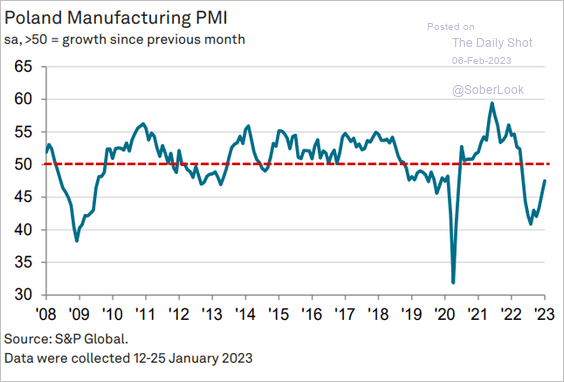

3. Poland’s manufacturing contraction is slowing.

Source: S&P Global PMI

Source: S&P Global PMI

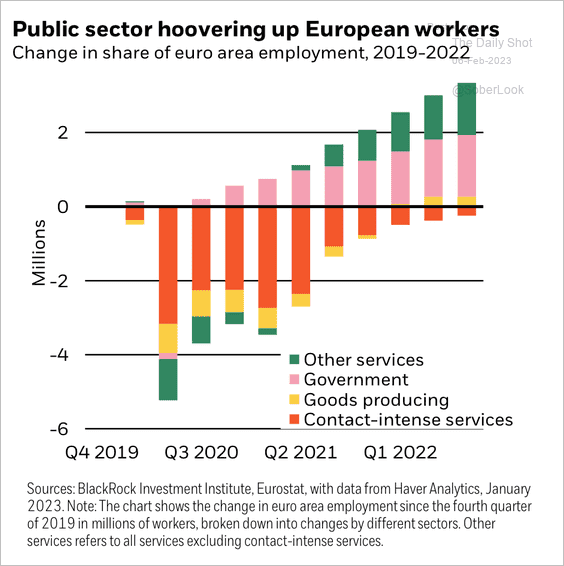

4. Public sector hiring advanced in recent years.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

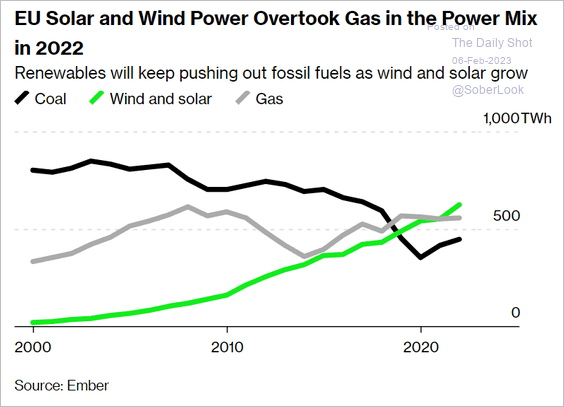

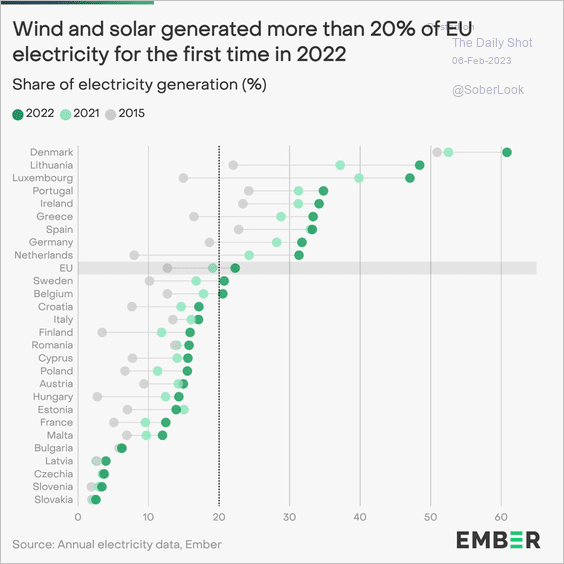

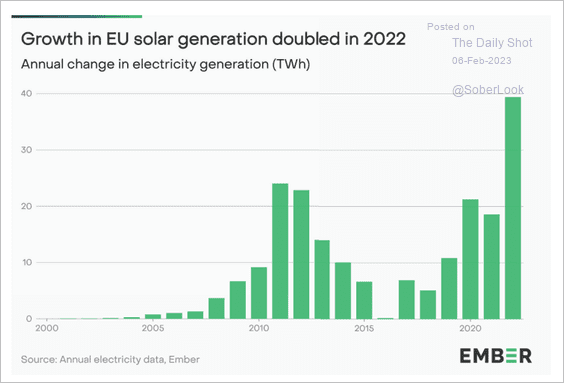

5. Next, we have data on the EU’s renewables situation.

• Renewables overtaking natural gas:

Source: @MathisWilliam, @business Read full article

Source: @MathisWilliam, @business Read full article

• Wind and solar by country:

Source: @EmberClimate Read full article

Source: @EmberClimate Read full article

• Solar growth:

Source: @EmberClimate Read full article

Source: @EmberClimate Read full article

——————–

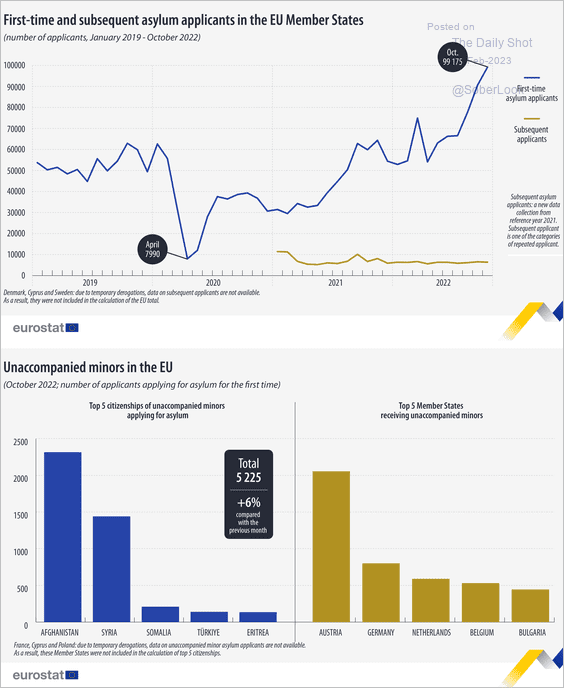

6. Below are some trends in asylum applications.

Source: Eurostat Read full article

Source: Eurostat Read full article

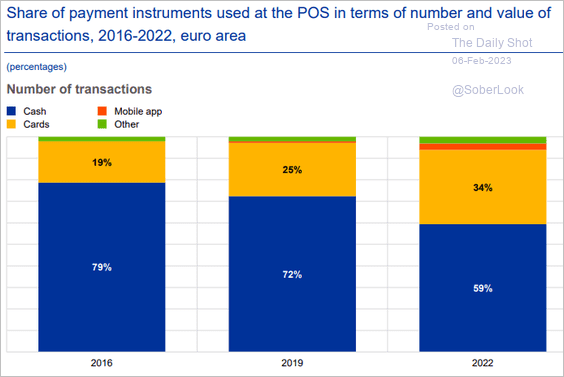

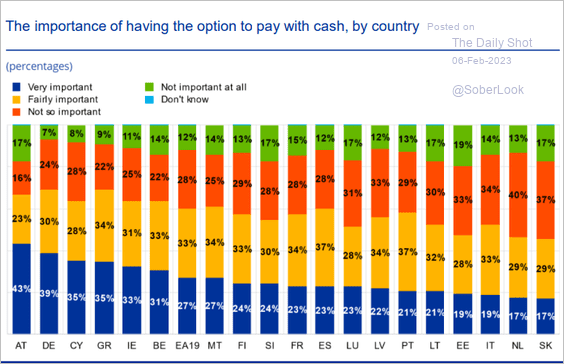

7. Finally, here is a look at cash usage.

• Cash usage has declined since the start of the pandemic.

Source: ECB Read full article

Source: ECB Read full article

• How do different countries view the importance of having cash as a payment option?

Source: ECB Read full article

Source: ECB Read full article

Back to Index

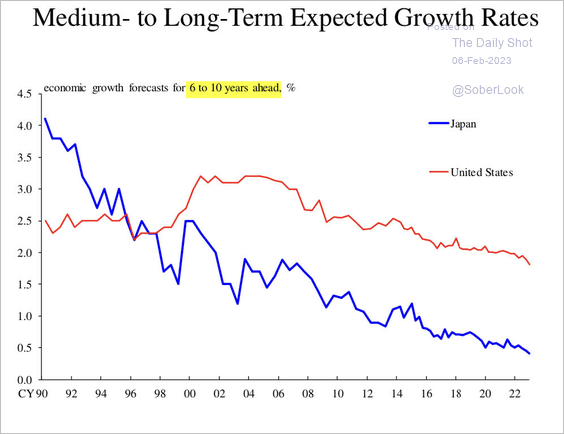

Japan

1. Long-term growth forecasts continue to move lower.

Source: BoJ

Source: BoJ

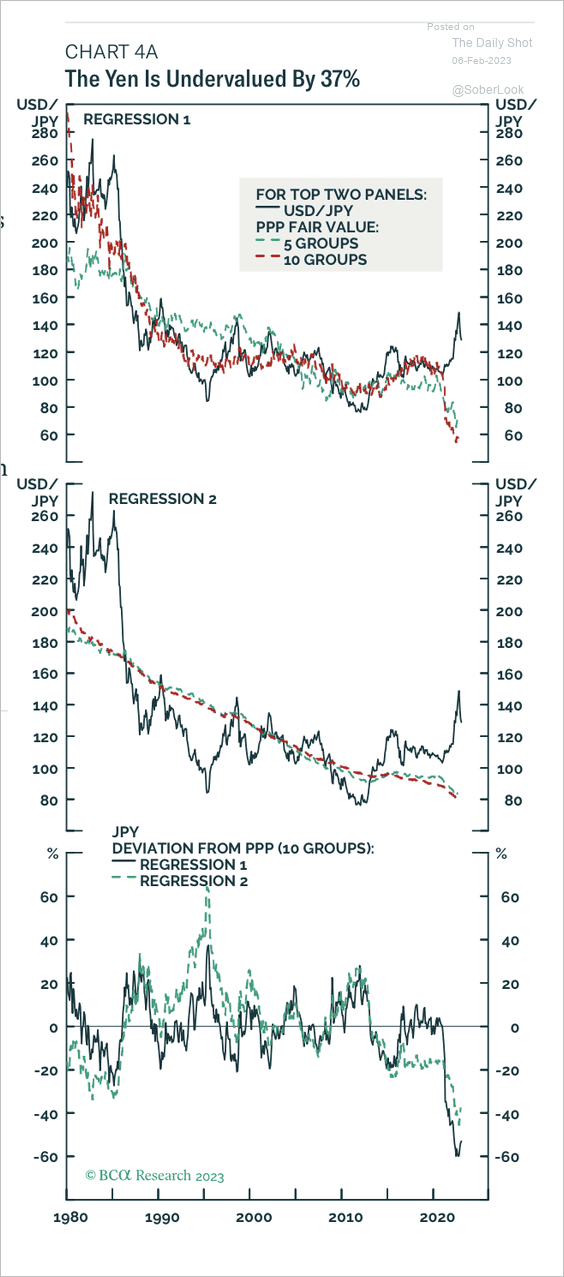

2. The yen is significantly undervalued.

Source: BCA Research

Source: BCA Research

Back to Index

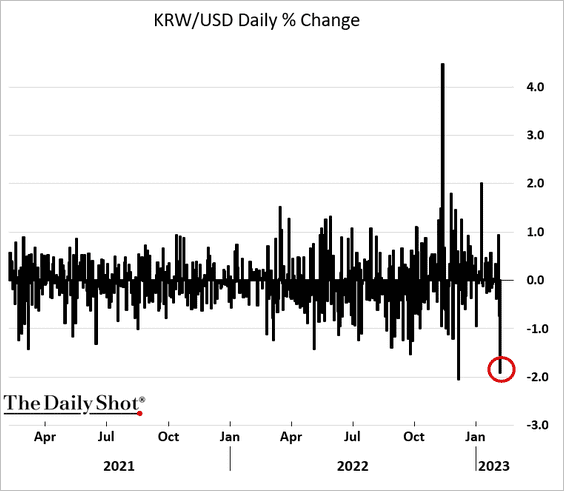

Asia – Pacific

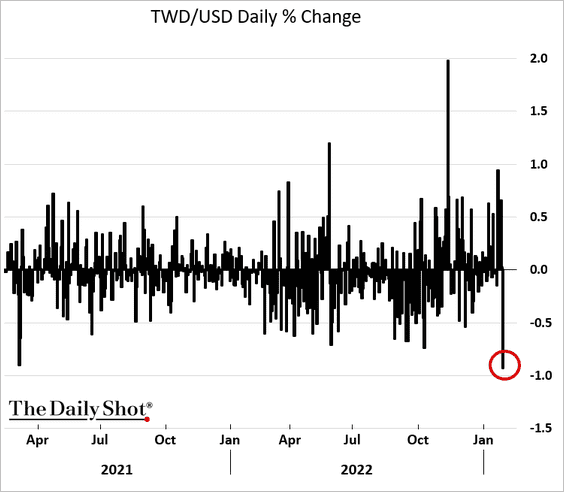

1. Asian currencies declined sharply in response to the US jobs report shocker.

• The South Korean won:

• The Taiwan dollar:

——————–

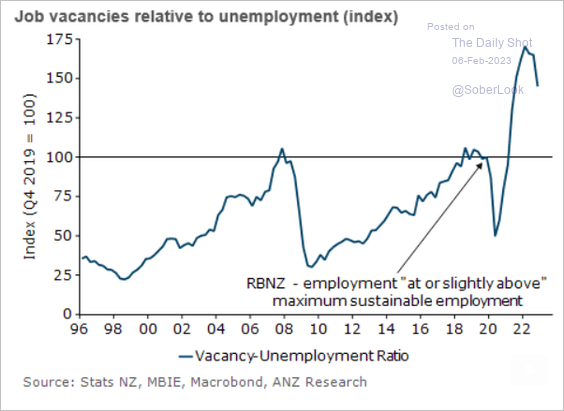

2. New Zealand’s labor market imbalance remains severe.

Source: @ANZ_Research

Source: @ANZ_Research

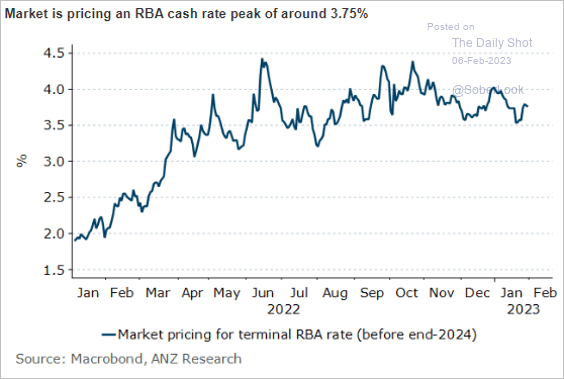

3. The RBA terminal rate is priced at around 3.75%.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

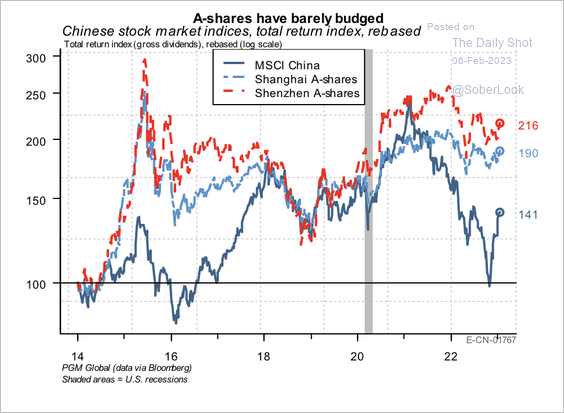

1. The rise in A-shares has been relatively mild, possibly indicating subdued mainland sentiment relative to foreign sentiment.

Source: PGM Global

Source: PGM Global

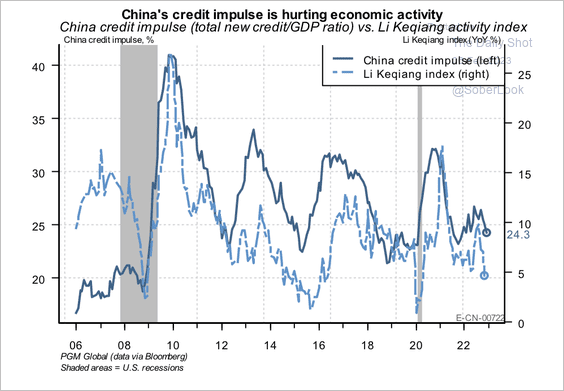

2. The credit impulse remains weak, which could stall a meaningful economic recovery.

Source: PGM Global

Source: PGM Global

Back to Index

Emerging Markets

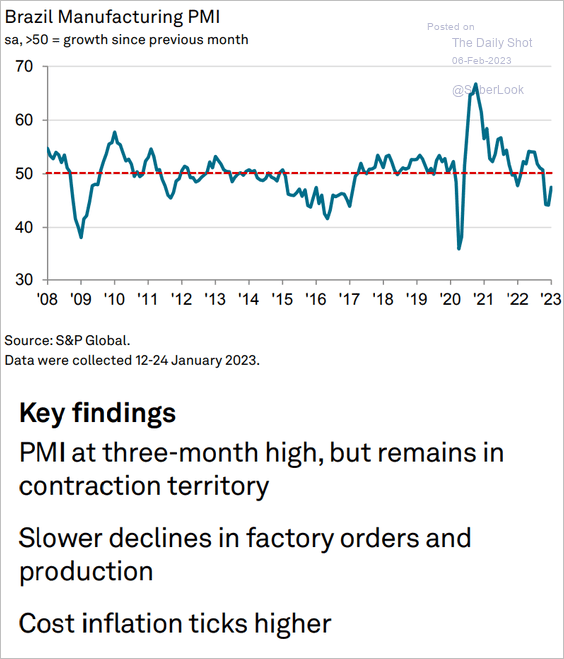

1. Let’s begin with Brazil.

• Manufacturing (still in contraction mode):

Source: S&P Global PMI

Source: S&P Global PMI

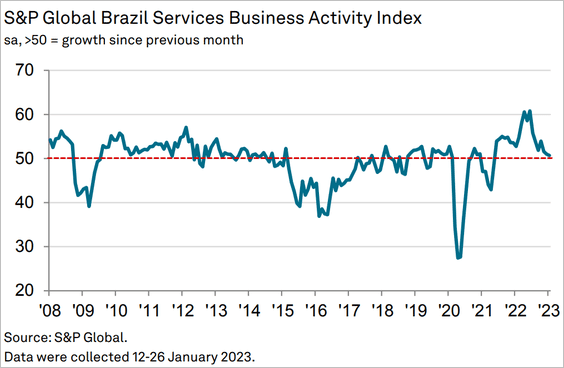

• Services PMI (growth stalling):

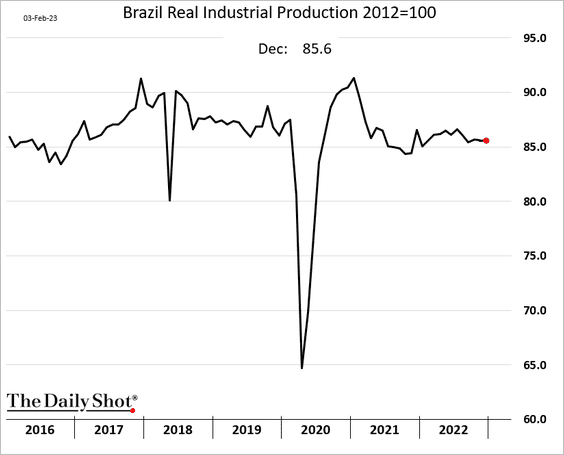

• Industrial production (holding steady, despite weak signals from the PMI data):

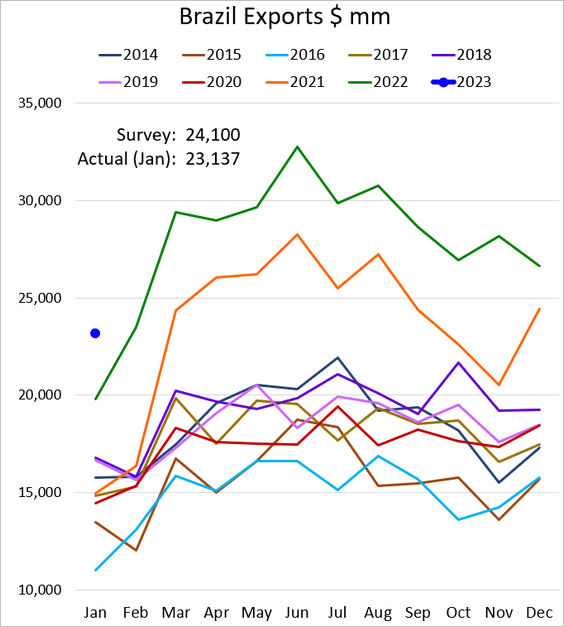

• Exports (strong start):

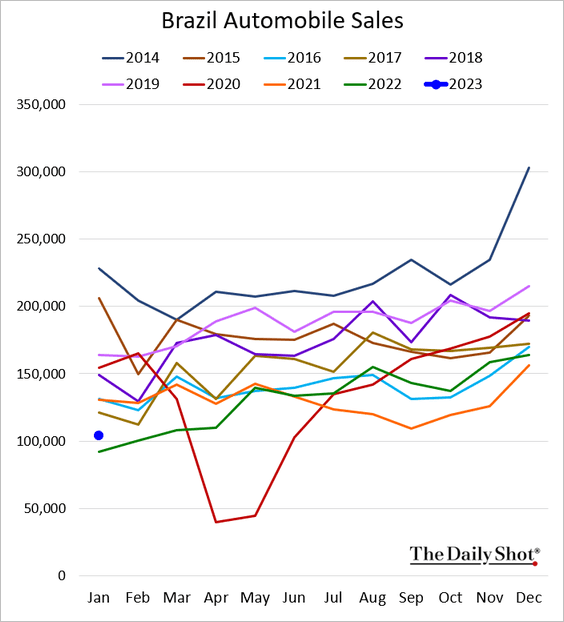

• Auto sales (above last year’s level but still soft):

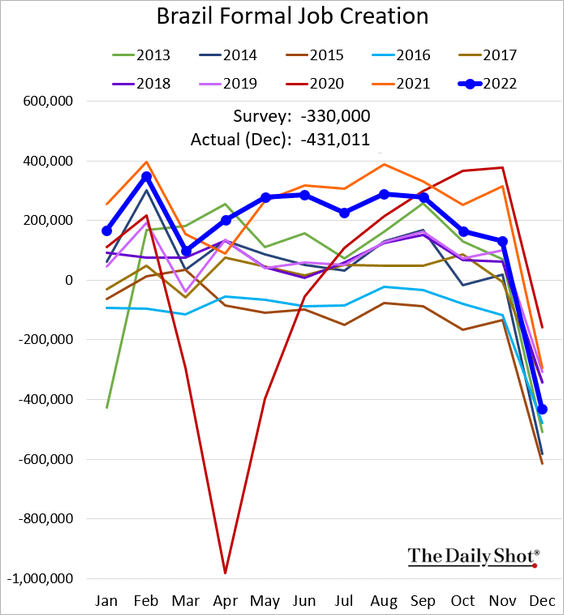

• Formal job creation:

——————–

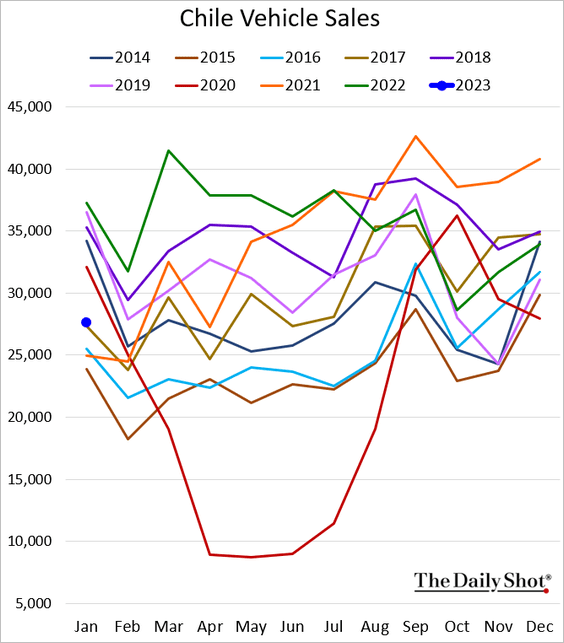

2. Chile’s vehicle sales were well below 2022 levels last month.

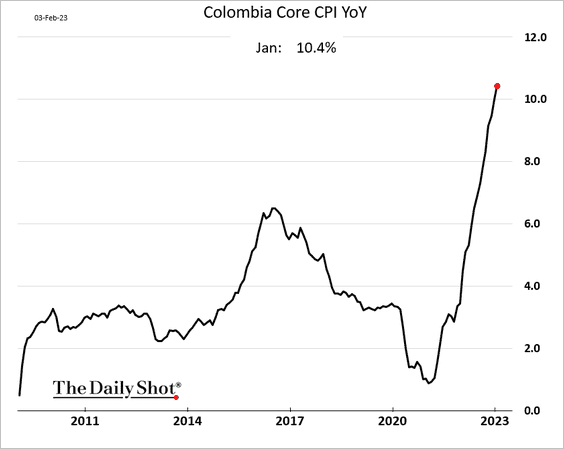

3. Colombia’s core CPI continues to surge.

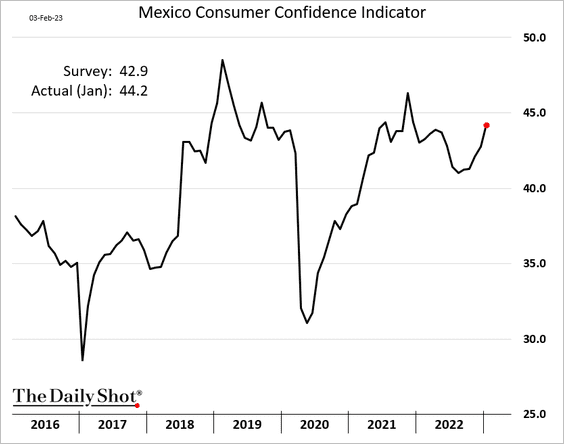

4. Mexico’s consumer confidence keeps rising.

——————–

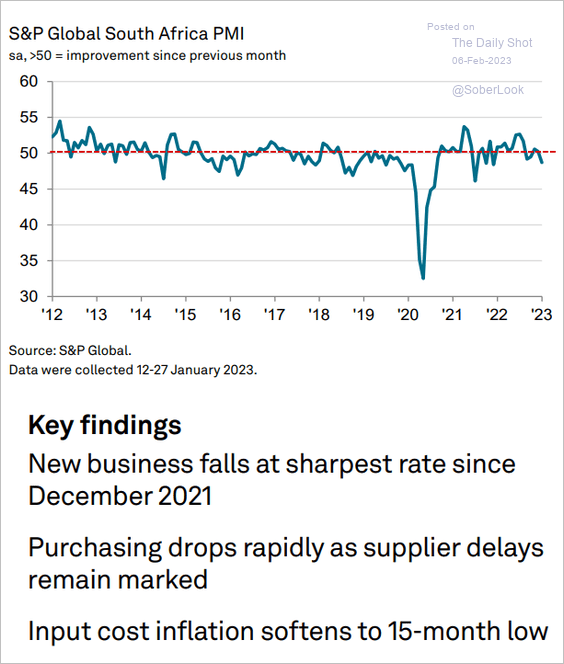

5. South Africa’s business activity slipped into contraction, according to S&P Global.

Source: S&P Global PMI

Source: S&P Global PMI

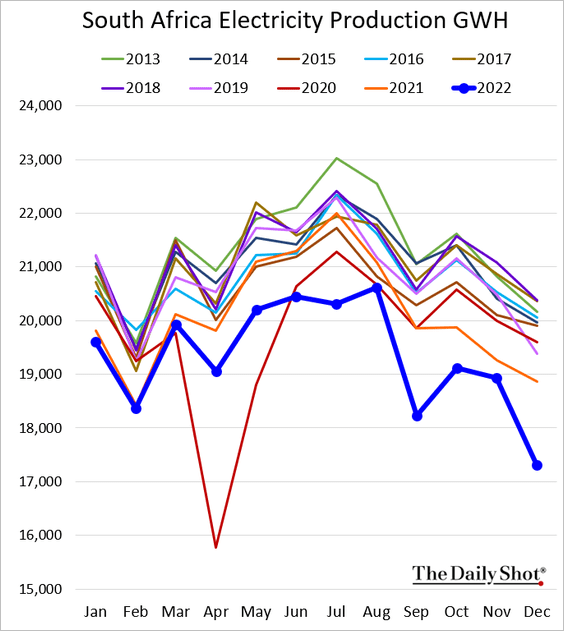

Electricity output tumbled in December.

——————–

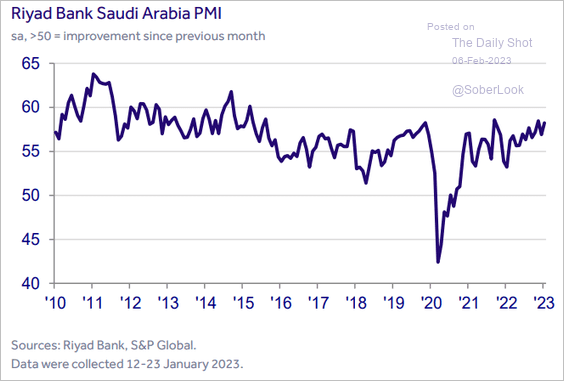

6. Saudi business activity is surging amid elevated energy prices.

Source: S&P Global PMI

Source: S&P Global PMI

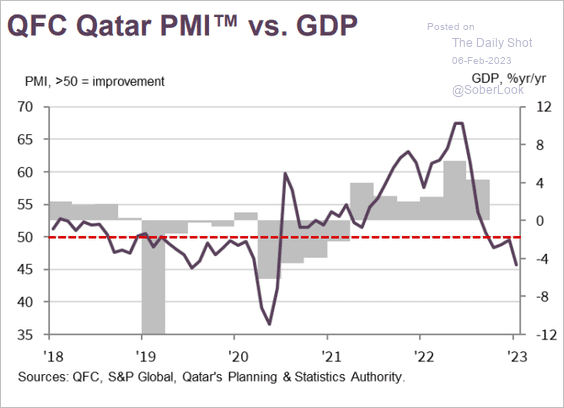

7. Qatar’s business activity slows as the FIFA World Cup boost wanes.

Source: S&P Global PMI

Source: S&P Global PMI

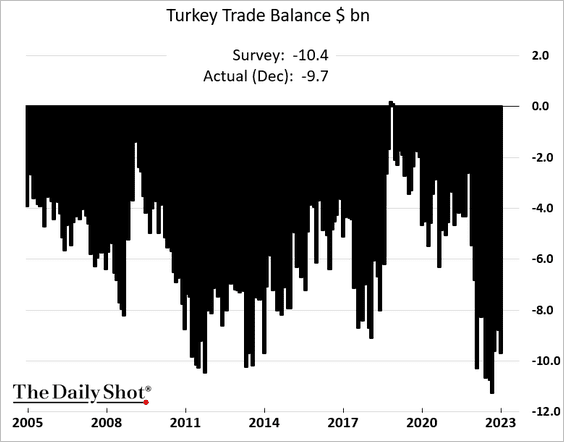

8. Turkey’s trade deficit remains wide.

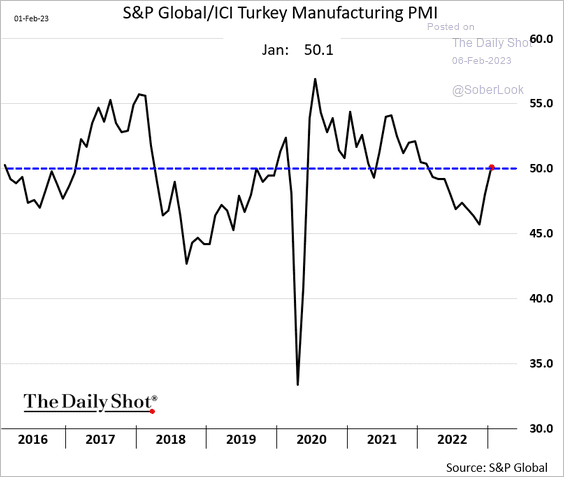

• Manufacturing has returned to growth.

Source: S&P Global PMI

Source: S&P Global PMI

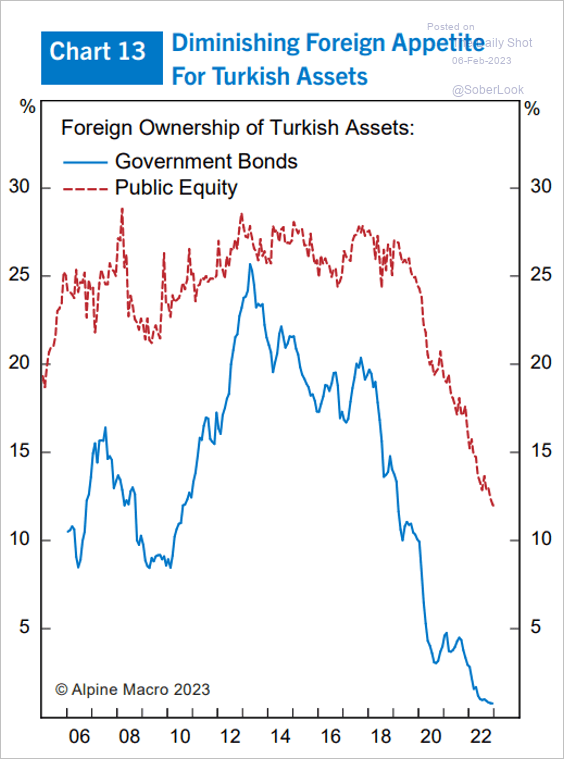

• This chart shows foreign ownership of Turkish assets.

Source: Alpine Macro

Source: Alpine Macro

——————–

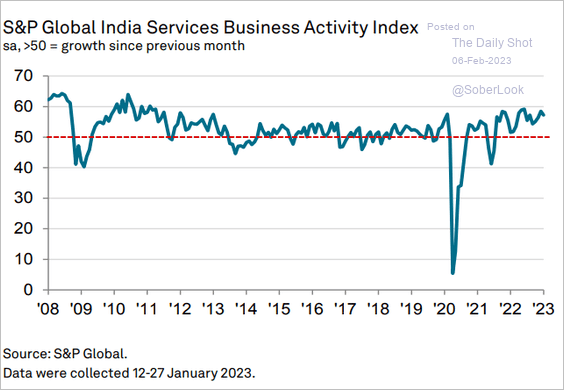

9. India’s service sector growth remains robust.

Source: S&P Global PMI

Source: S&P Global PMI

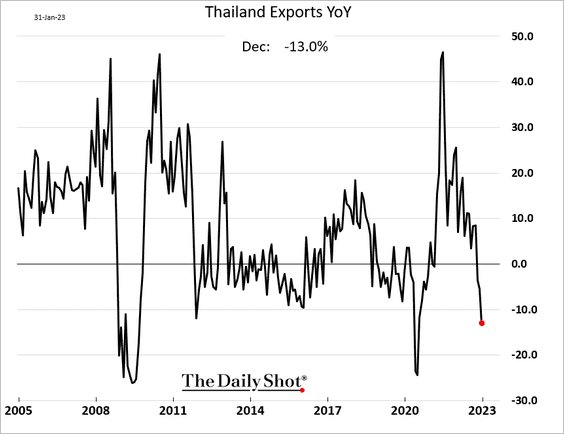

10. Thai exports declined further in December on a year-over-year basis.

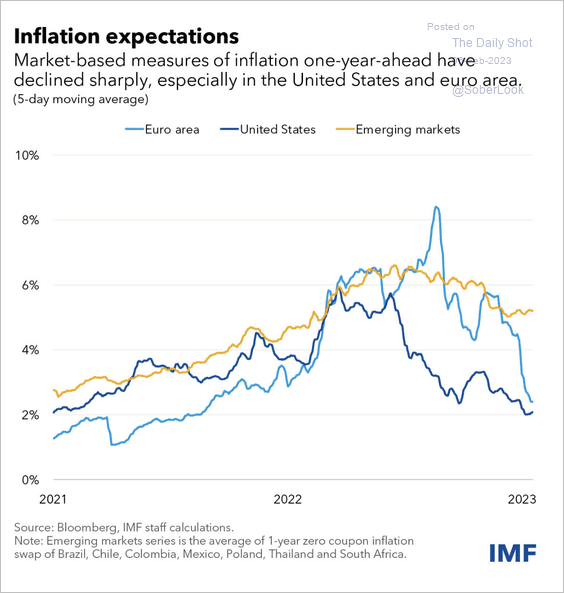

11. EM market-based inflation expectations remain elevated relative to DM.

Source: IMF

Source: IMF

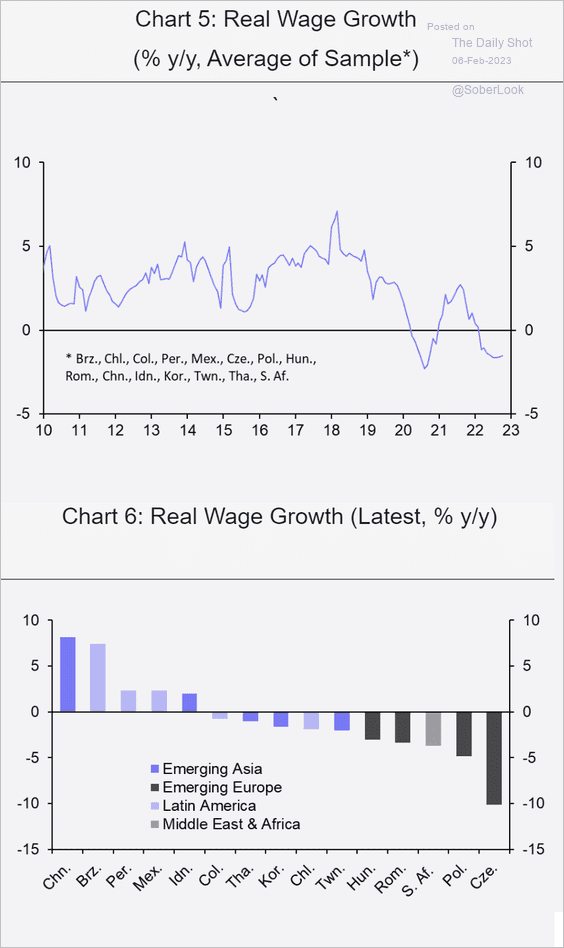

12. Real wage growth has been negative in many EM economies.

Source: Capital Economics

Source: Capital Economics

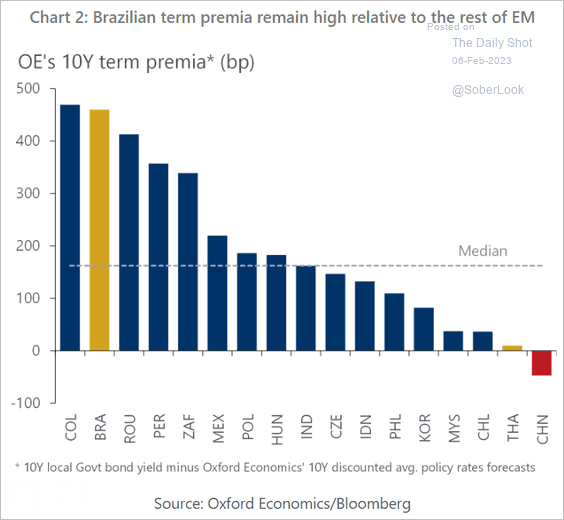

13. This chart shows 10-year bond term premia in select economies.

Source: Oxford Economics

Source: Oxford Economics

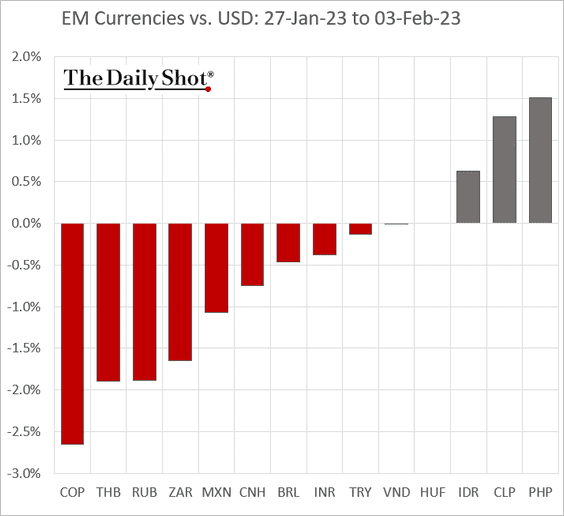

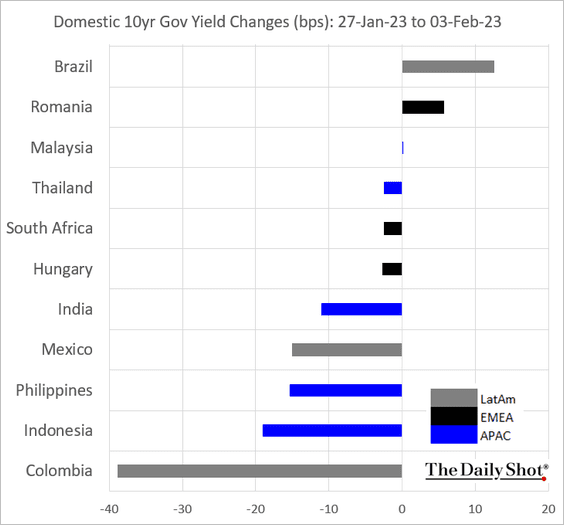

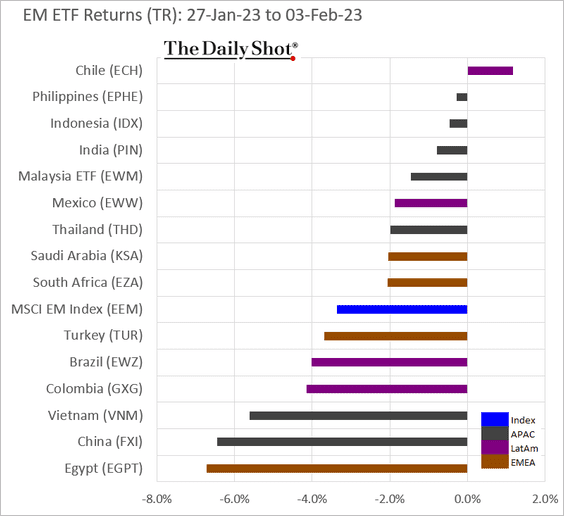

14. Finally, we have last week’s performance.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

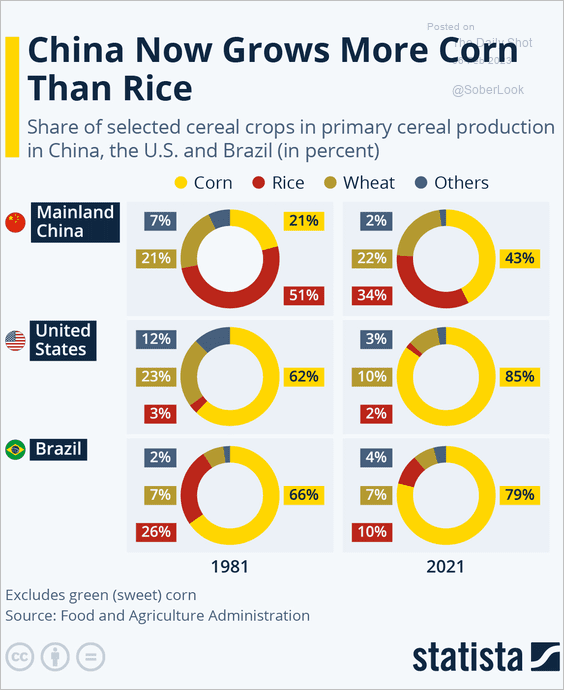

1. This chart shows the cereal crop production mix changes since 1981.

Source: Statista

Source: Statista

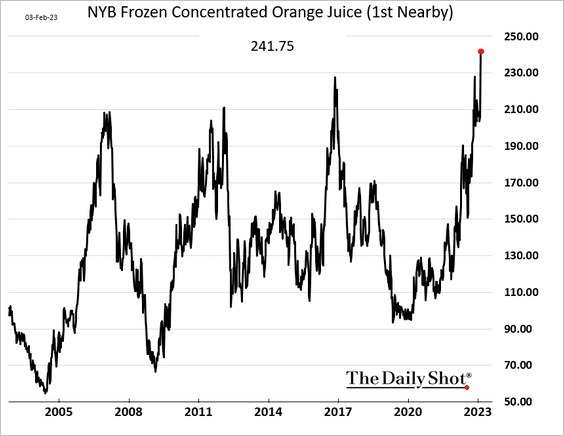

2. US orange juice futures hit a record high.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

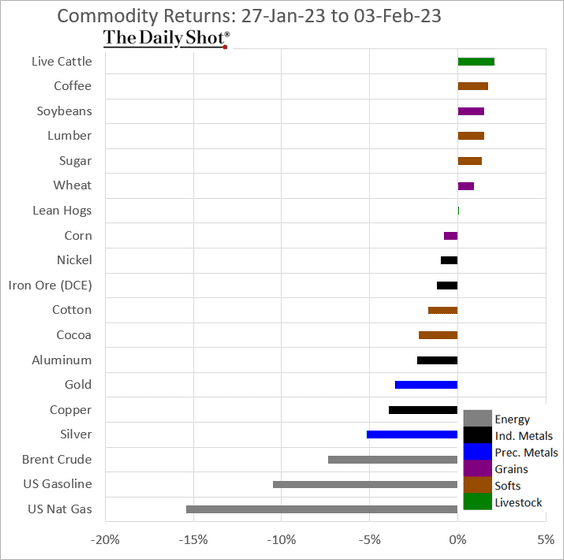

3. Here is last week’s performance across key commodity markets.

Back to Index

Energy

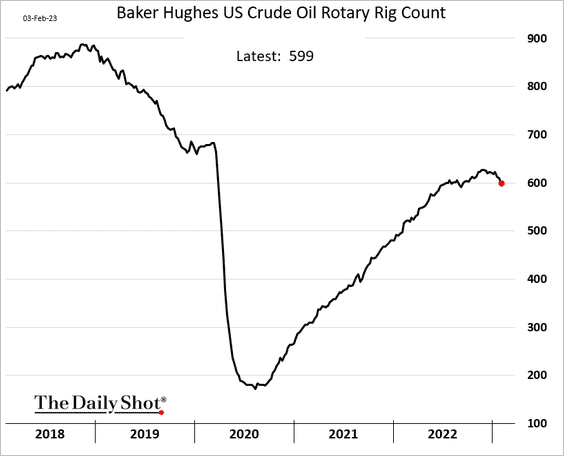

1. The US oil rig count dipped back below 600 last week.

Source: Reuters Read full article

Source: Reuters Read full article

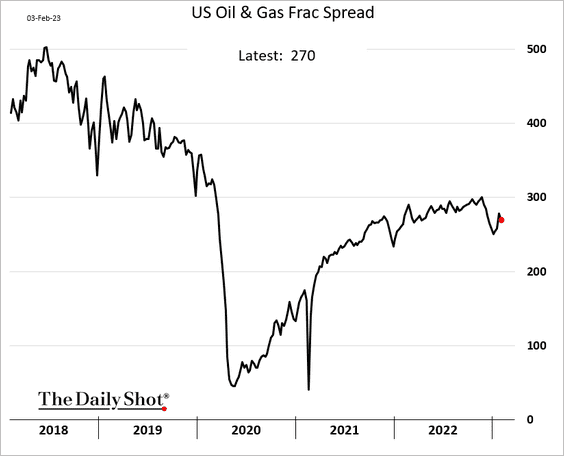

Fracking activity remains well below the 2022 peak.

——————–

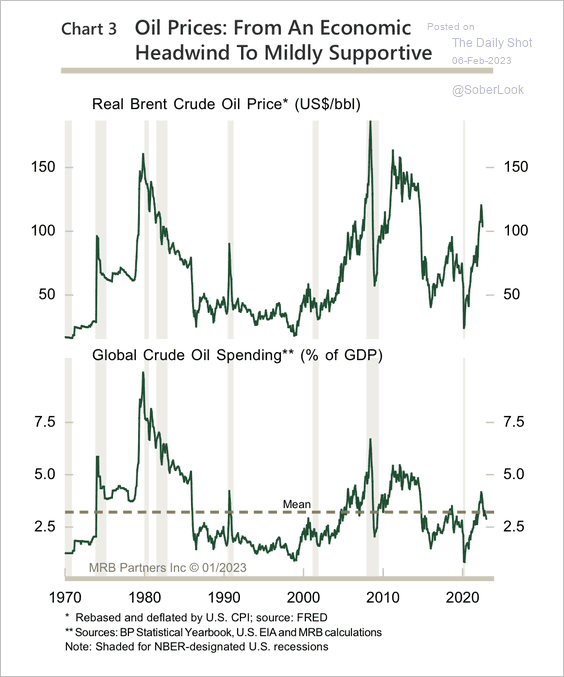

2. Global crude oil spending dipped below its long-term average during the recent price drop. Spending has been relatively weak during this cycle.

Source: MRB Partners

Source: MRB Partners

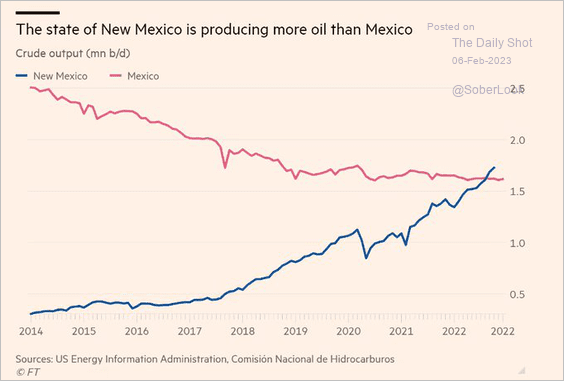

3. The state of New Mexico produces more oil than Mexico.

Source: @OilSheppard, @FR Read full article

Source: @OilSheppard, @FR Read full article

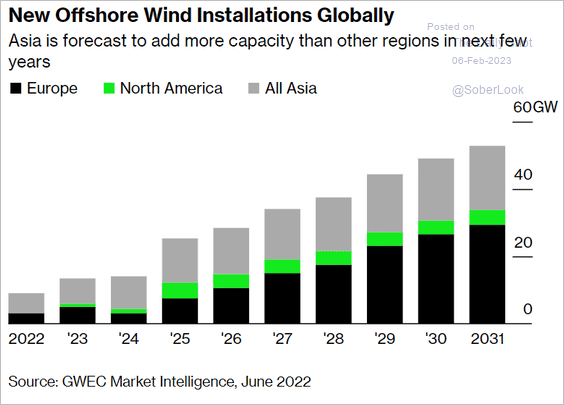

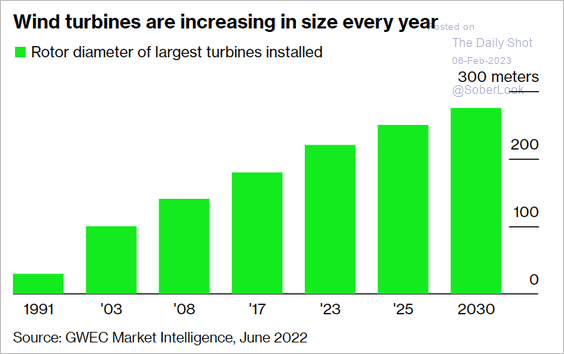

4. Next, we have some updates on renewable energy.

• Offshore wind installations:

Source: @messageannkoh, @business Read full article

Source: @messageannkoh, @business Read full article

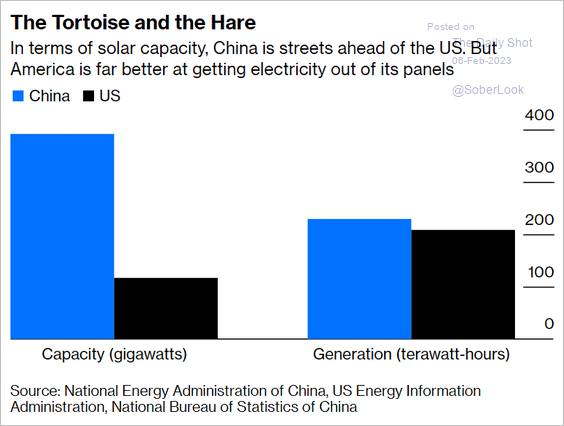

• Solar capacity vs. solar generation in the US and China:

Source: @davidfickling, @opinion Read full article

Source: @davidfickling, @opinion Read full article

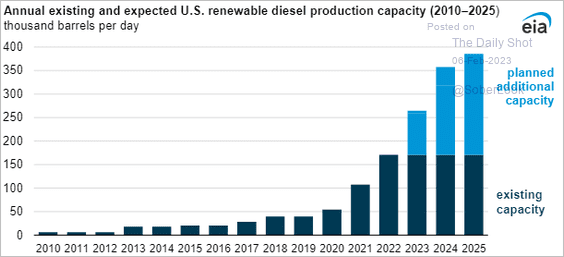

• US renewable diesel capacity projections:

Source: @EIAgov

Source: @EIAgov

• Wind turbines’ rotor diameter:

Source: @messageannkoh, @business Read full article

Source: @messageannkoh, @business Read full article

Back to Index

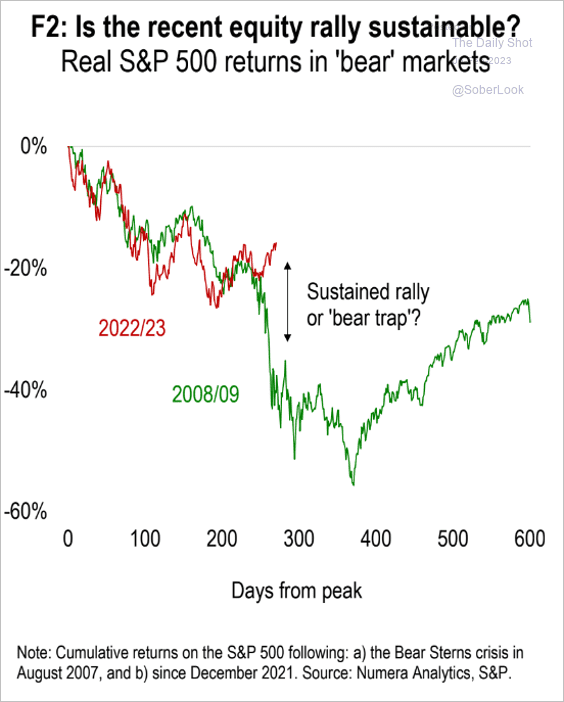

Equities

1. It’s decision time with respect to the 2008 analog.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

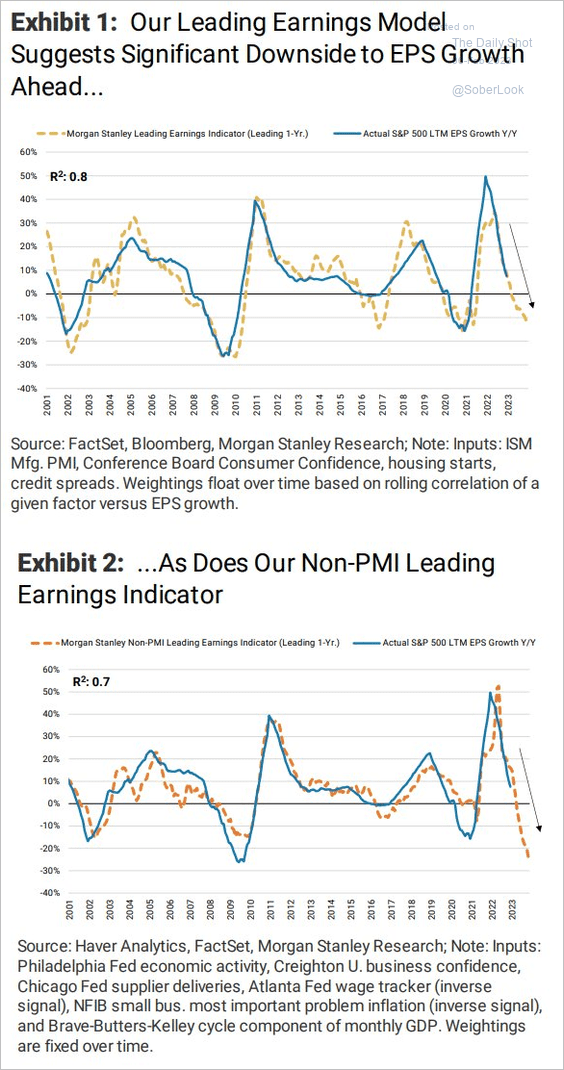

2. Morgan Stanley’s model points to a deep earnings recession.

Source: Morgan Stanley Research; @dlacalle_IA

Source: Morgan Stanley Research; @dlacalle_IA

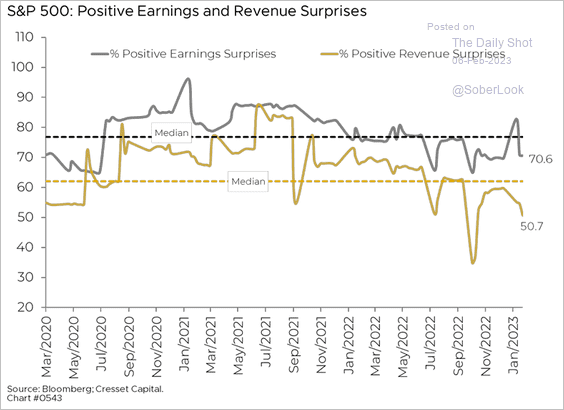

3. Net revenue surprises have been low relative to historical levels.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

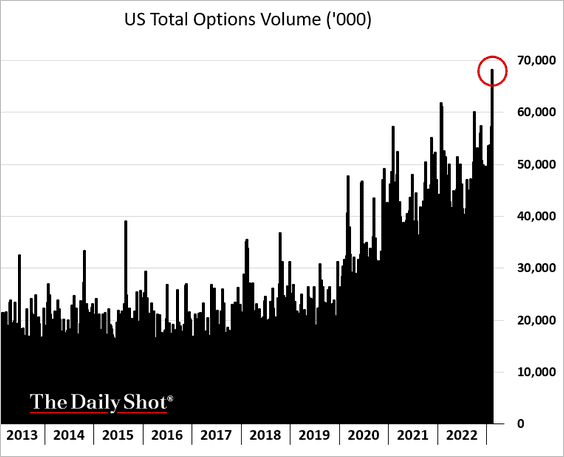

4. Options volume surged at the end of last week.

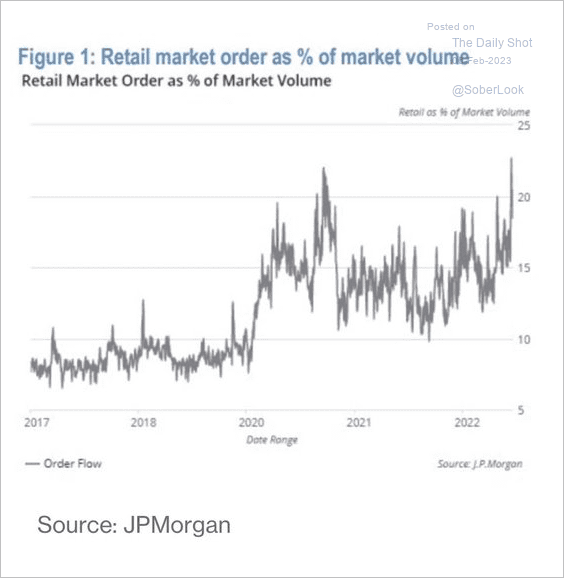

5. It was a strong week for retail market orders.

Source: JP Morgan Research; @business, @luwangnyc Read full article

Source: JP Morgan Research; @business, @luwangnyc Read full article

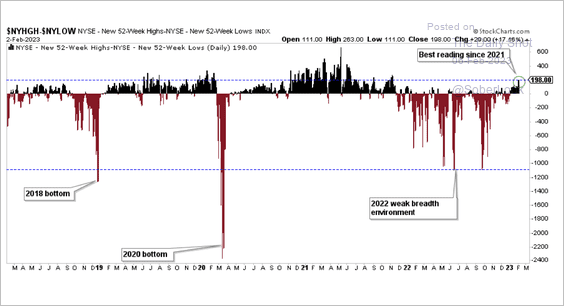

6. The NYSE New Highs/New Lows indicator reached its best reading since 2021.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

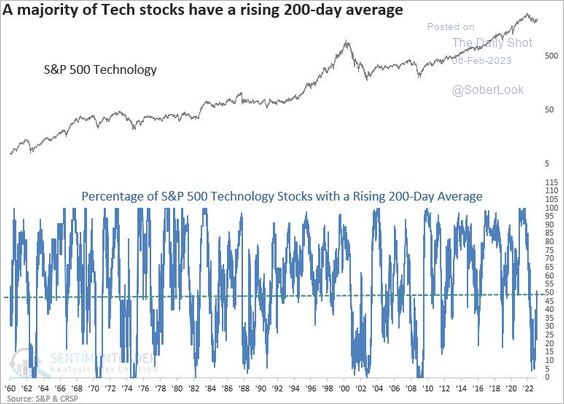

7. A majority of S&P 500 tech stocks are trading above their 200-day moving average.

Source: @DeanChristians

Source: @DeanChristians

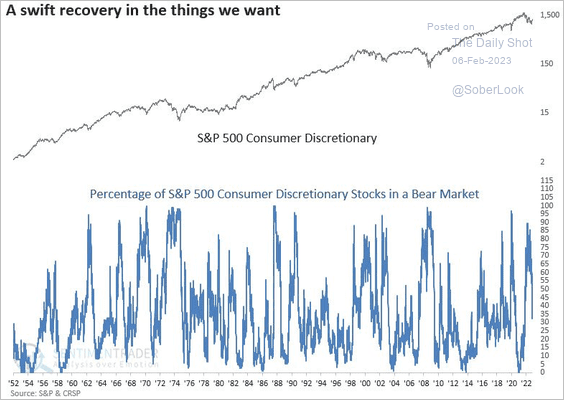

• Most S&P 500 consumer discretionary stocks are no longer in a bear market.

Source: @DeanChristians

Source: @DeanChristians

——————–

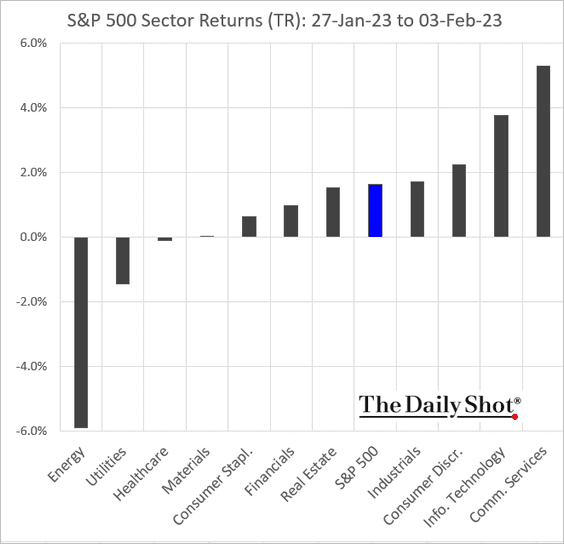

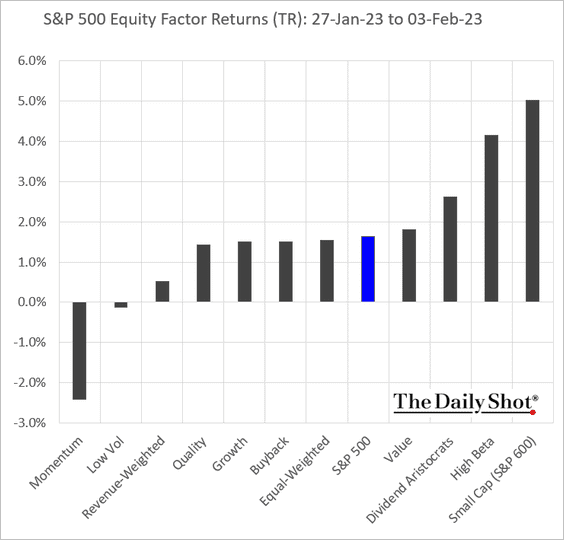

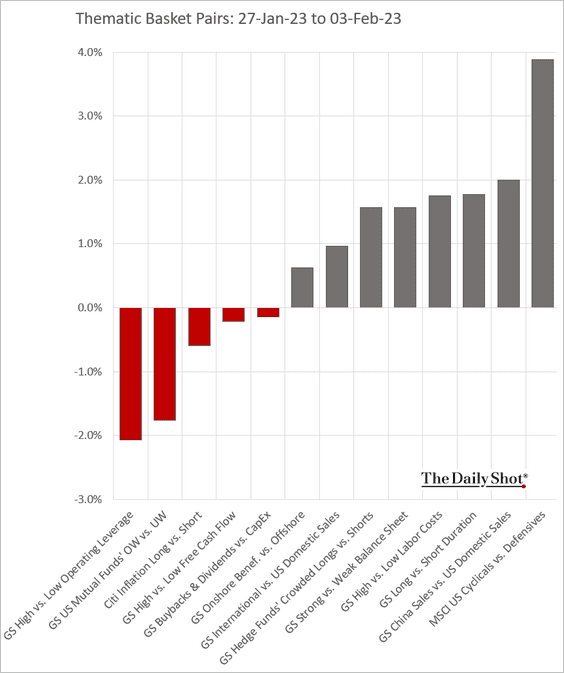

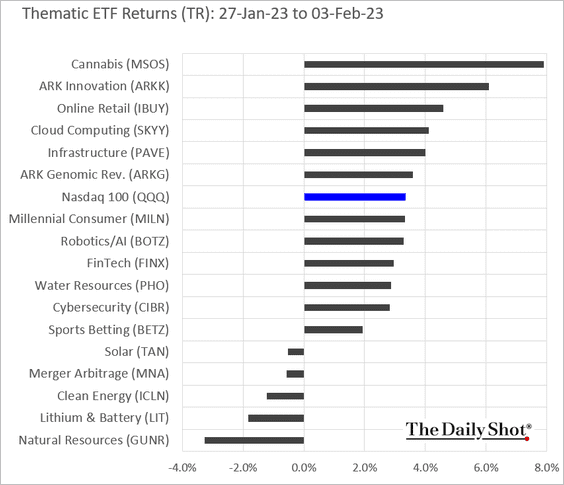

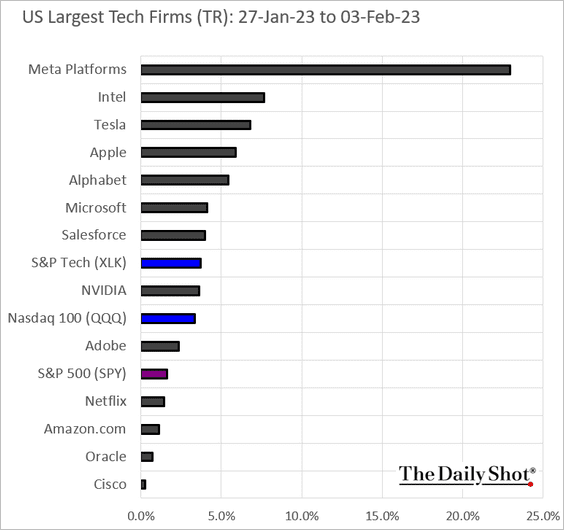

9. Finally, we have some performance data from last week.

• Sectors:

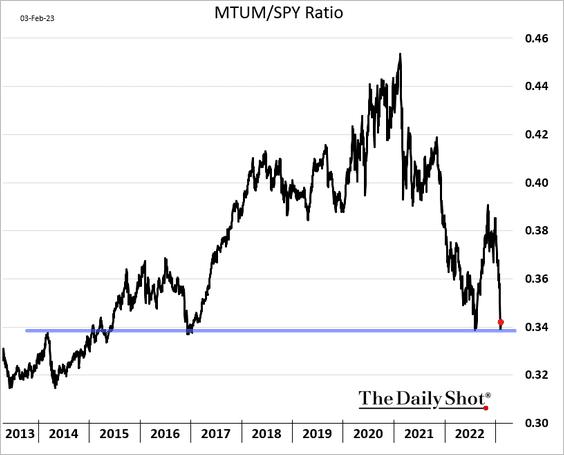

• Equity factors:

Has the momentum factor found support relative to the S&P 500?

• Macro basket pairs:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

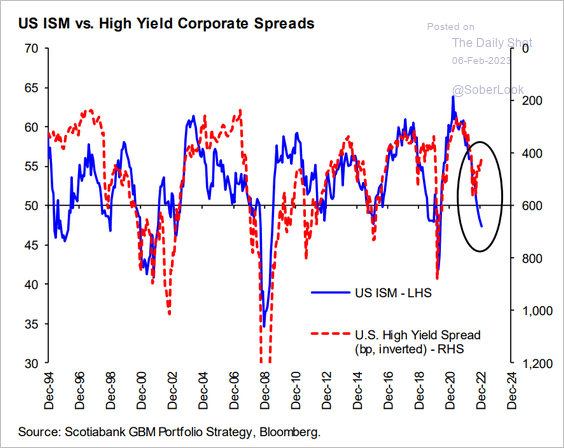

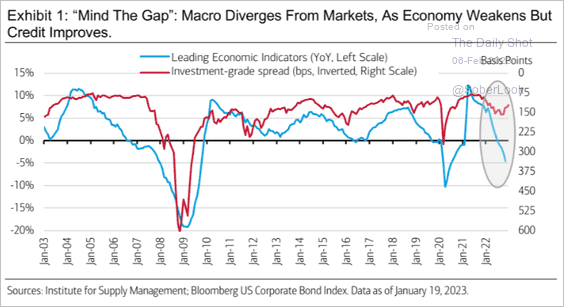

1. Key economic indicators continue to flash warning signals for credit.

• ISM vs. high-yield:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• The leading index vs. investment-grade:

Source: Merrill Lynch

Source: Merrill Lynch

——————–

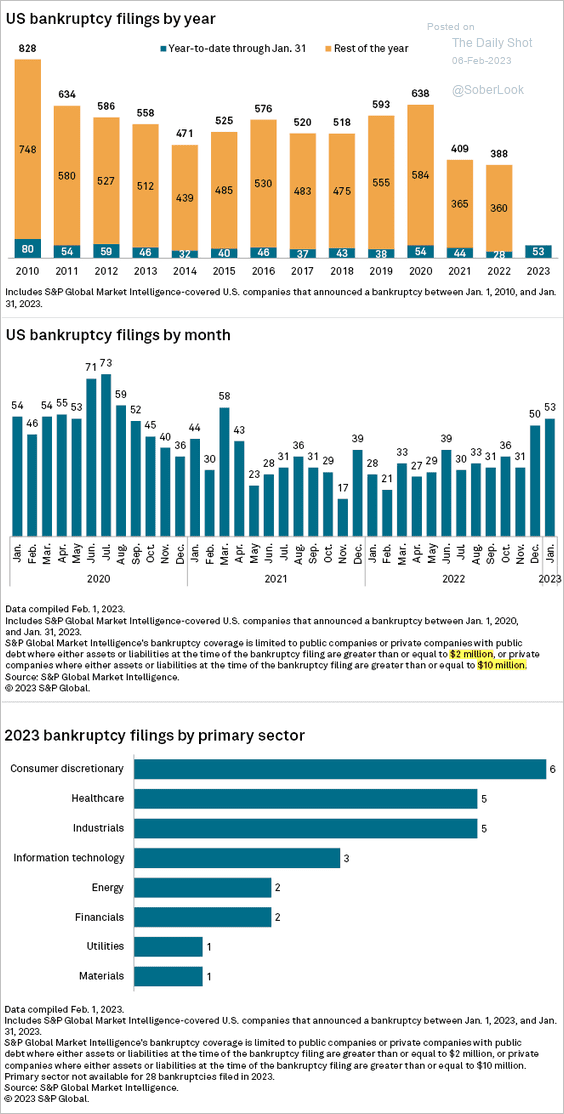

2. Bankraptices picked up in January.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

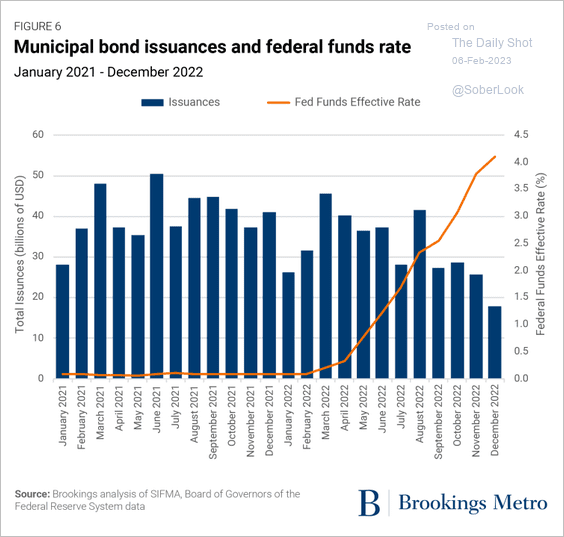

3. Muni issuance slowed at the end of last year.

Source: Brookings Read full article

Source: Brookings Read full article

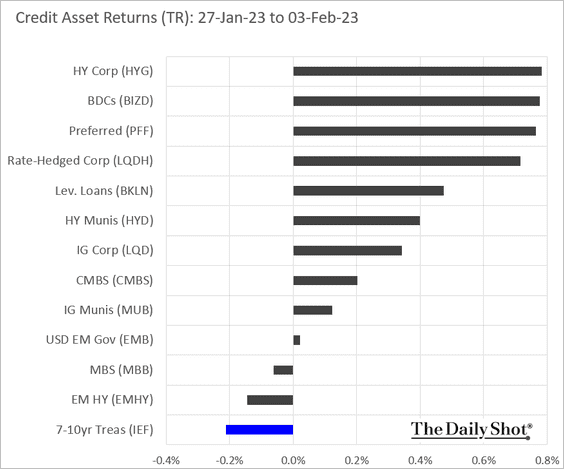

4. This chart shows last week’s performance by asset class.

Back to Index

Global Developments

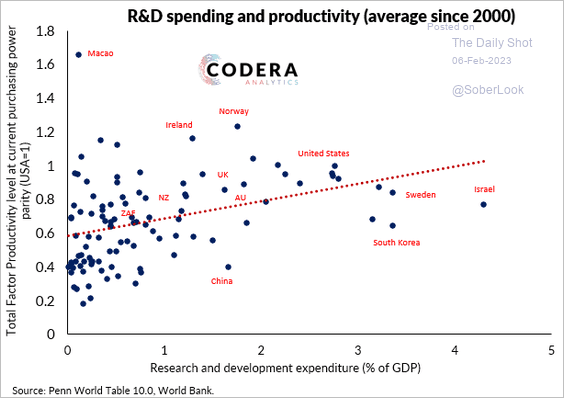

1. There is a positive relationship between R&D and long-term productivity growth, although the magnitude of the productivity gains is a topic of debate amongst economists.

Source: Codera Analytics

Source: Codera Analytics

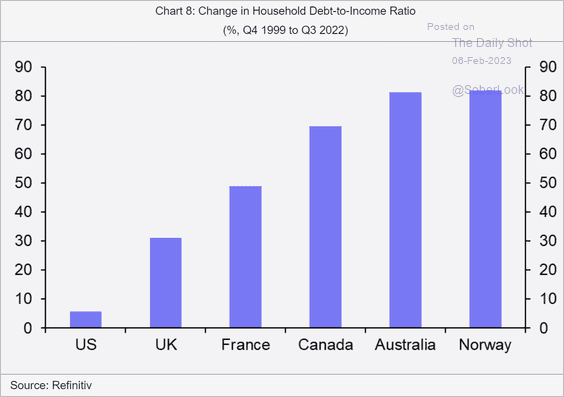

2. Here is the increase in household leverage since 1999 in select economies.

Source: Capital Economics

Source: Capital Economics

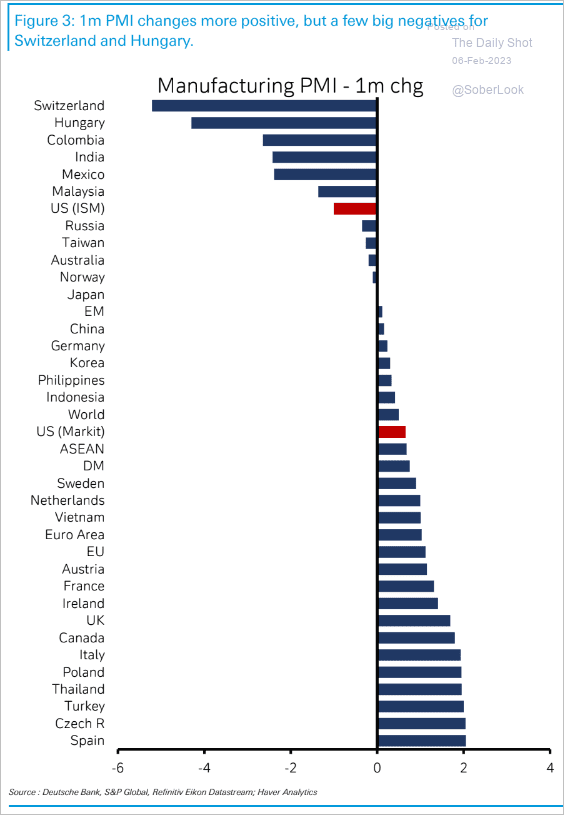

3. How did the manufacturing PMIs change over the past month?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

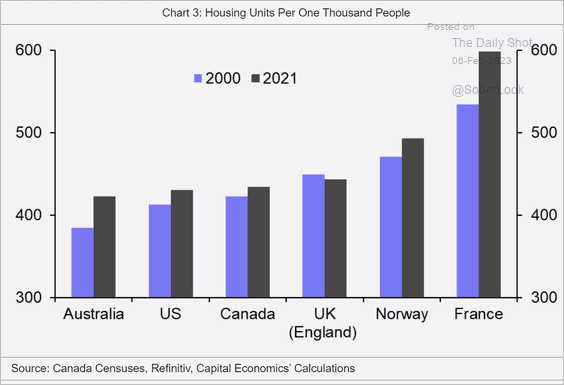

4. This chart shows the number of housing units per one thousand people in select economies.

Source: Capital Economics

Source: Capital Economics

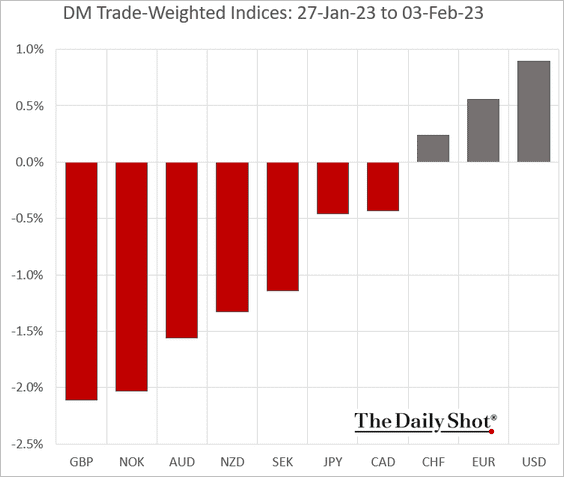

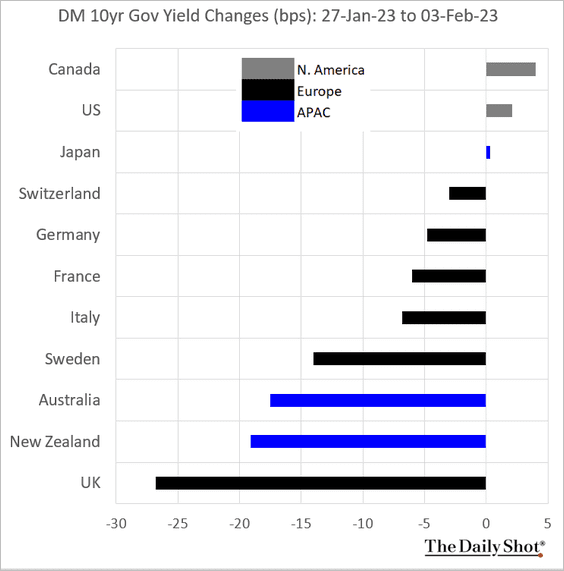

5. Finally, we have some performance data for advanced economies.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

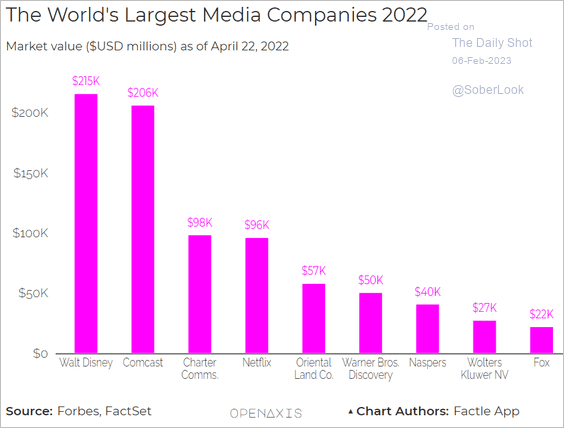

1. Largest media companies:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

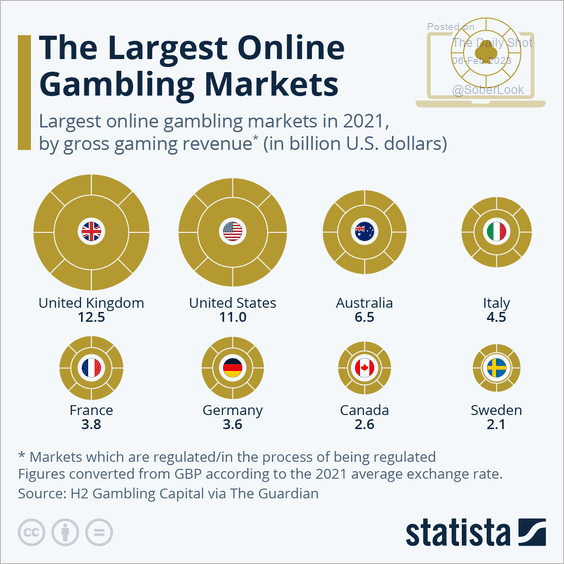

2. Online gambling markets:

Source: Statista

Source: Statista

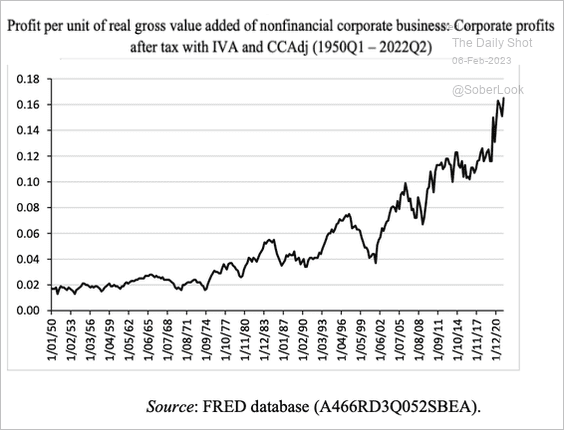

3. US corporate profit margins since 1950:

Source: @heimbergecon

Source: @heimbergecon

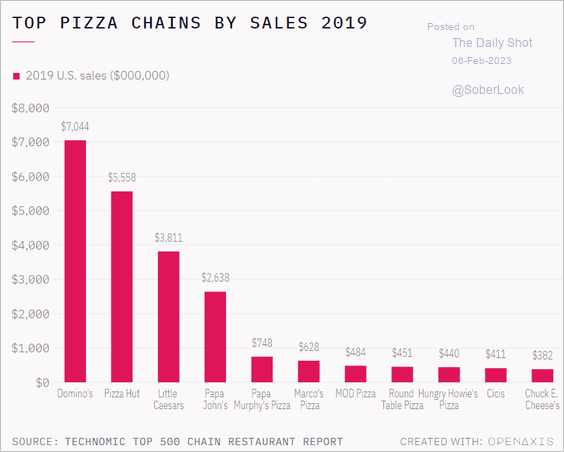

4. Top pizza chains:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

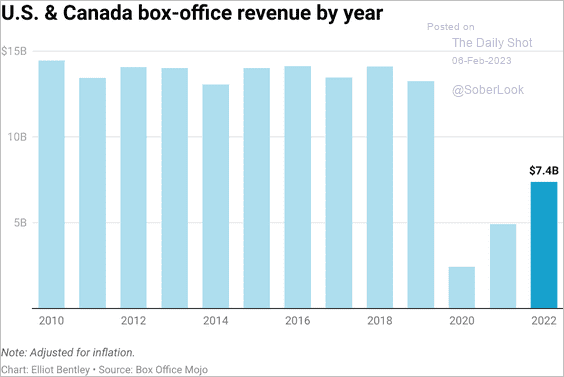

5. Box-office revenue in the US and Canada:

Source: @Datawrapper, @elliot_bentley

Source: @Datawrapper, @elliot_bentley

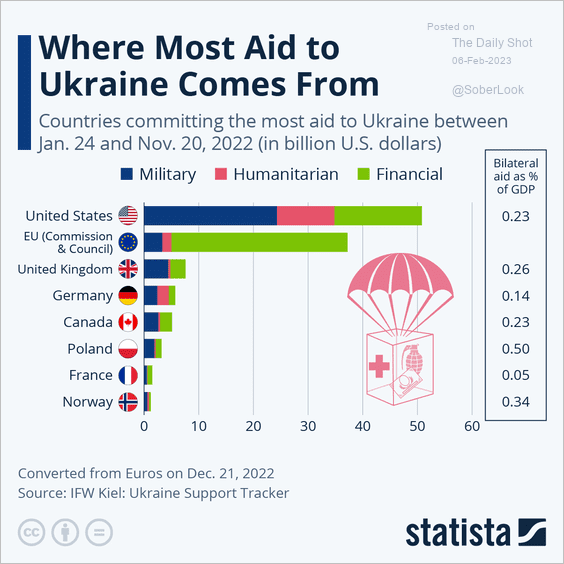

6. Aid to Ukraine:

Source: Statista

Source: Statista

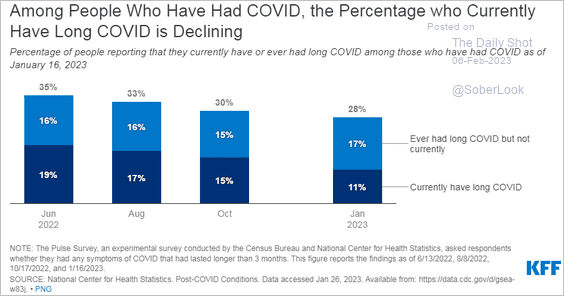

7. Long COVID:

Source: KFF Read full article

Source: KFF Read full article

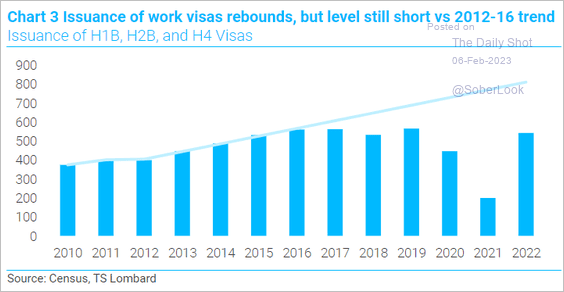

8. US issuance of work visas:

Source: TS Lombard

Source: TS Lombard

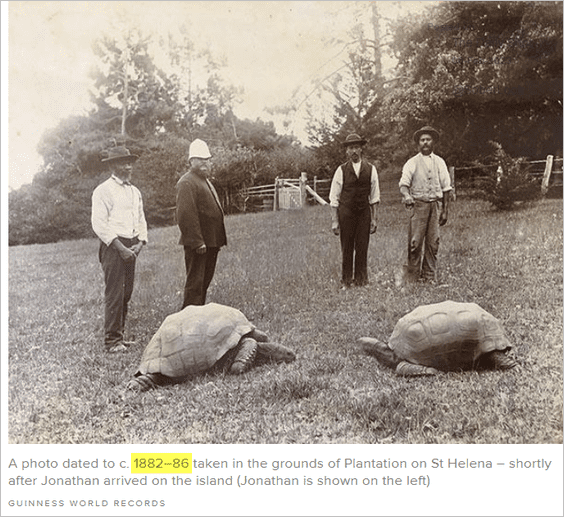

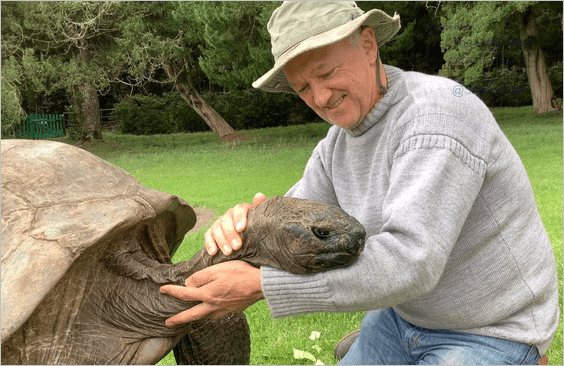

9. Jonathan, the world’s oldest known land animal (190 years old):

Source: CBS News Read full article

Source: CBS News Read full article

Source: St Helena Tourism Read full article

Source: St Helena Tourism Read full article

——————–

Back to Index