The Daily Shot: 08-Feb-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

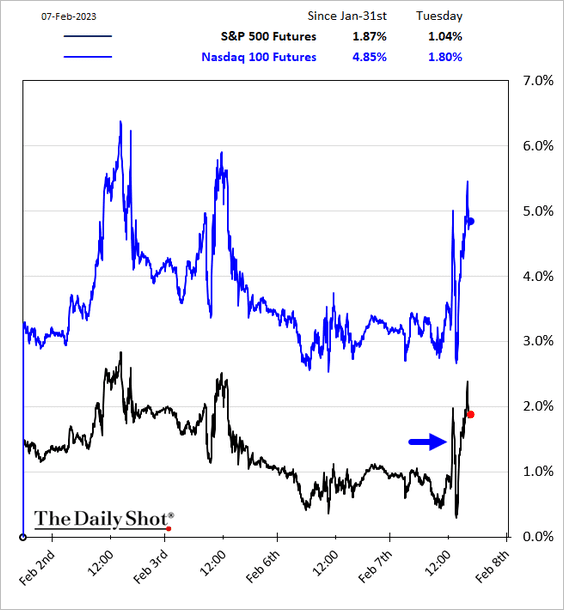

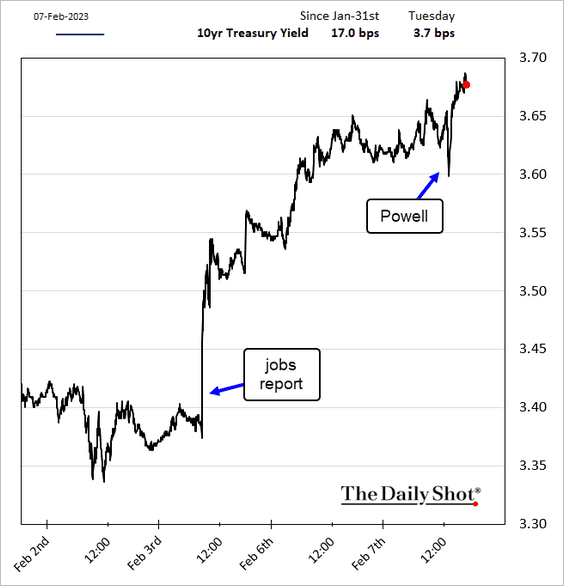

1. In his speech, Chair Powell commented on the robust January jobs report, suggesting that the Fed has much more work ahead to get inflation under control.

It kind of shows you why we think this will be a process that takes a significant period of time.

The stock market saw the speech as sufficiently “benign” to send share prices higher.

But bond yields edged up.

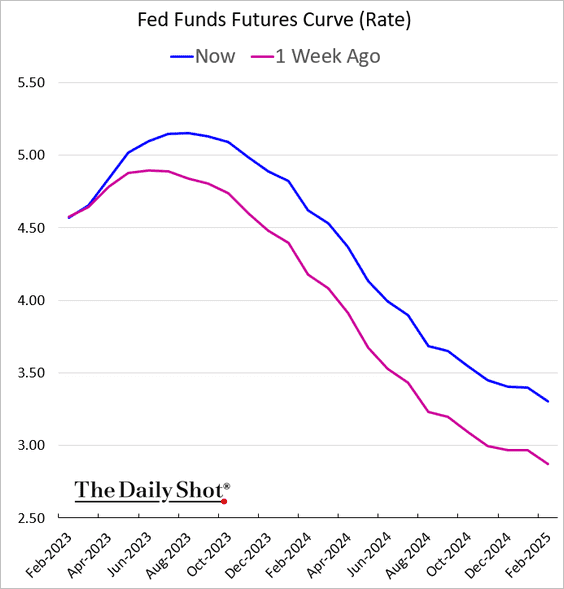

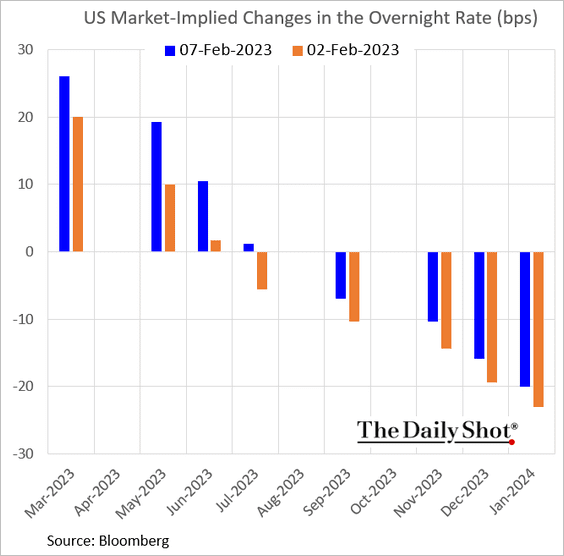

The market has sharply repriced the fed funds rate trajectory over the past few days, …

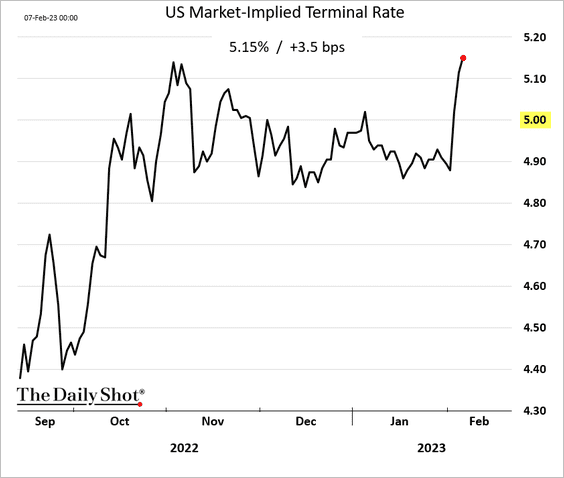

… sending the terminal rate to a new high. That’s why the equity market’s upbeat response was a surprise.

This chart shows the changes in rate hike expectations since last Thursday.

——————–

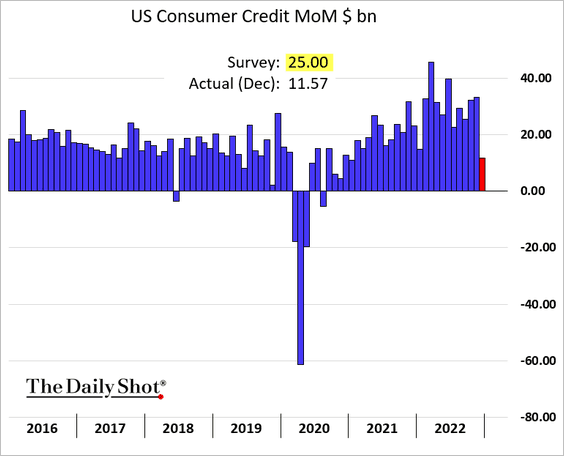

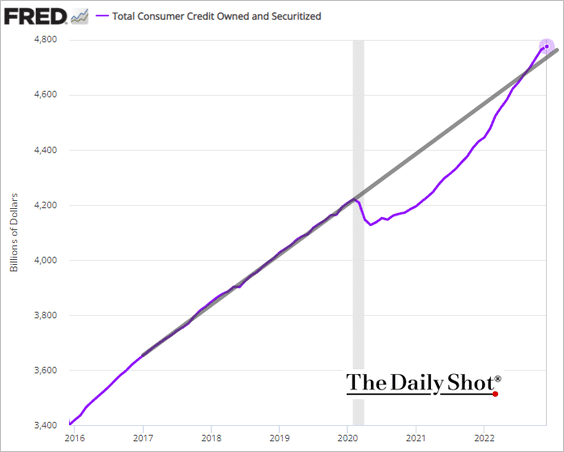

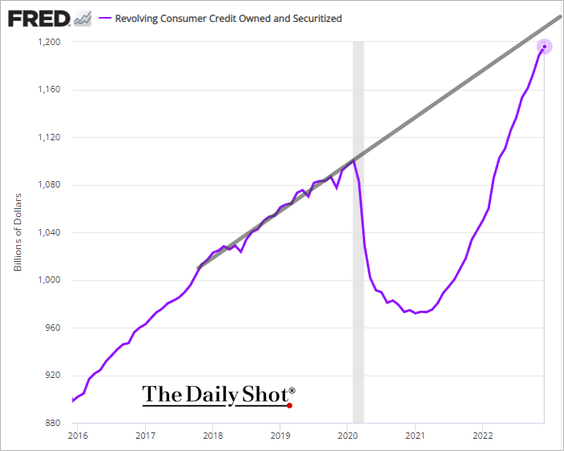

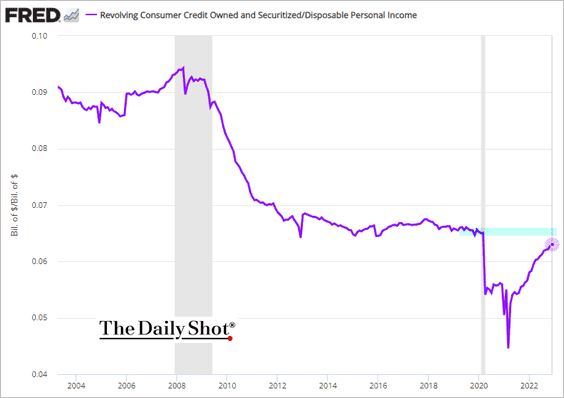

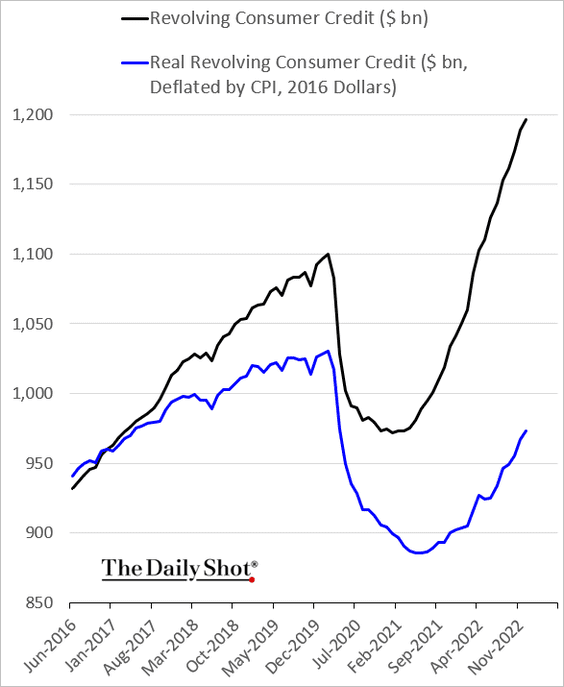

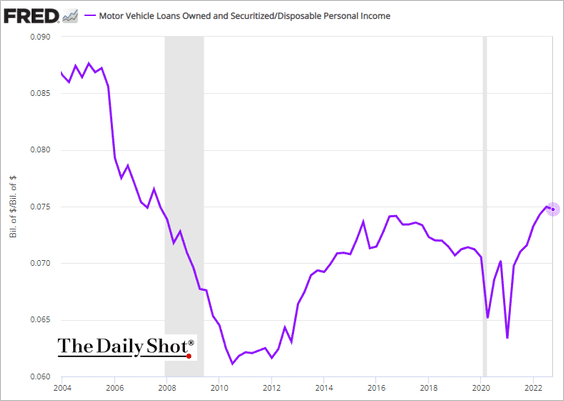

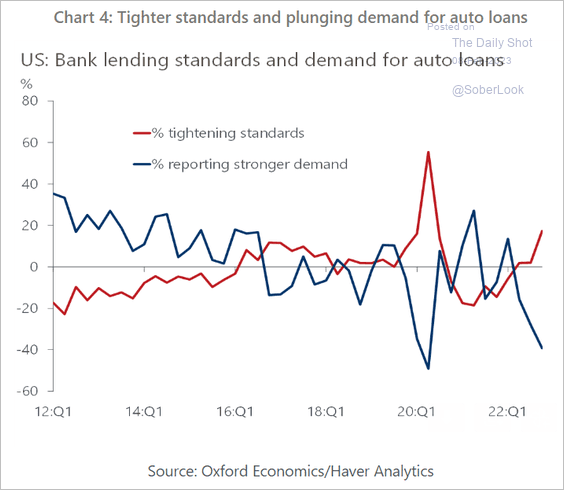

2. Next, we have some updates on consumer credit.

• Growth in total consumer credit slowed in December.

• The level remains above the pre-COVID trend.

• Credit card debt continues to climb.

– Credit card debt as a share of disposable personal income remains below pre-COVID levels.

– Borrowed cash doesn’t go very far when we take price gains into account.

• Auto loans as a share of disposable income are well above pre-COVID levels.

– Auto loan demand has been waning as banks tighten lending standards.

Source: Oxford Economics

Source: Oxford Economics

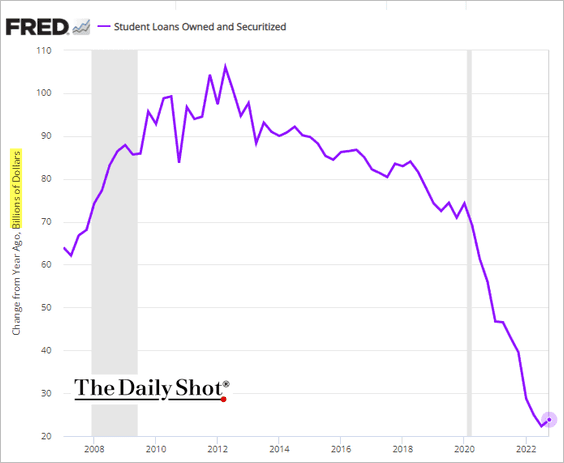

• Student loan growth slowed substantially since the start of the pandemic.

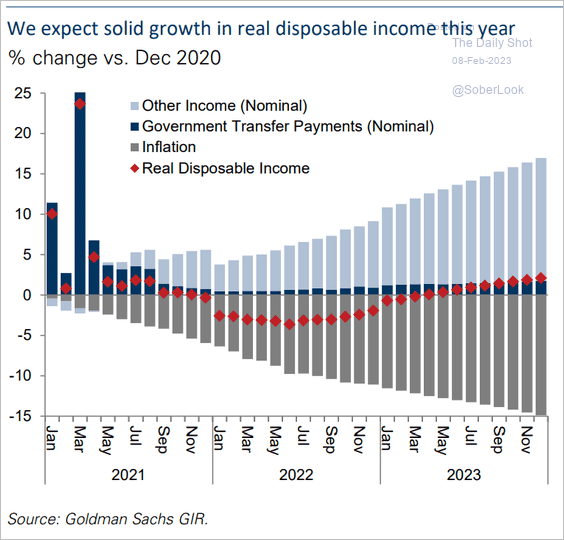

• Goldman expects real disposable income to grow this year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

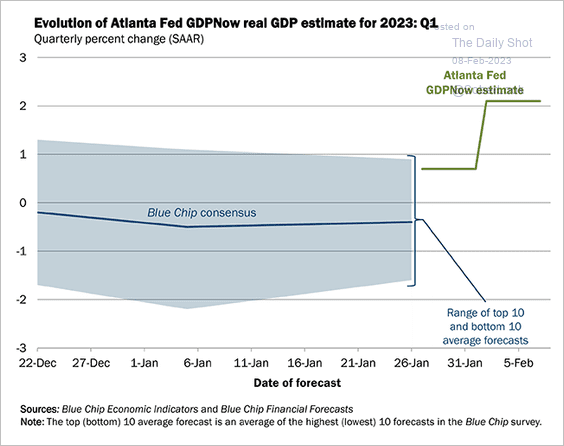

3. The Atalanta Fed’s GDPNow model forecast for Q1 growth is holding above 2% (annualized), …

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

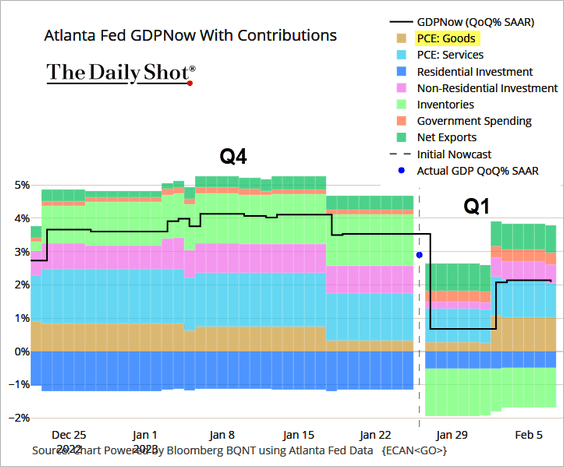

… boosted by expectations of robust consumer spending on goods.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

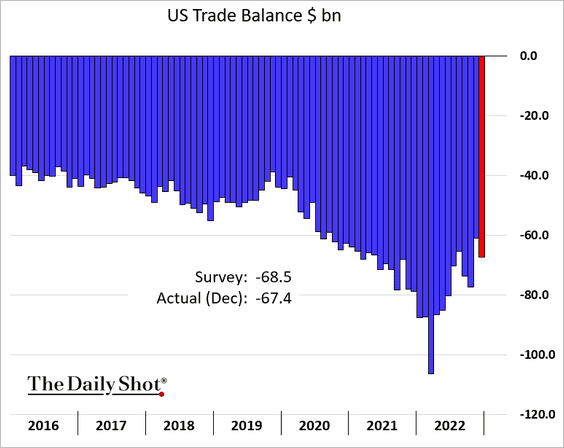

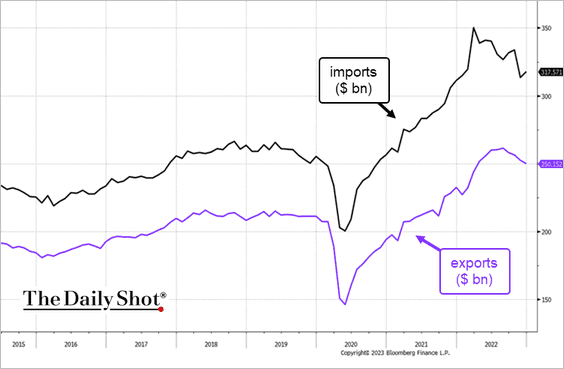

4. The trade deficit widened in December, …

… as imports edged higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

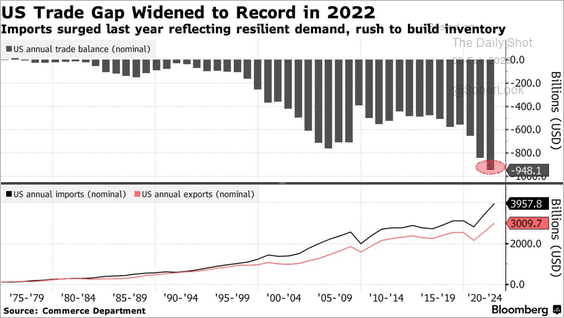

On a yearly basis, the trade gap hit a new record in 2022.

Source: @gutavsaraiva, @economics Read full article

Source: @gutavsaraiva, @economics Read full article

——————–

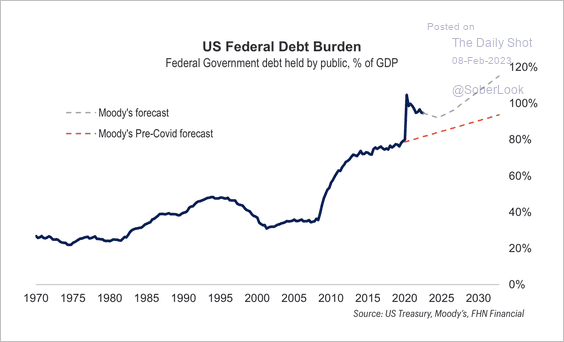

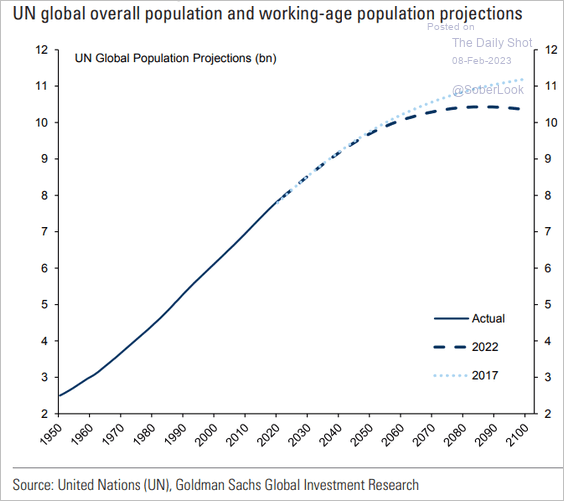

5. Moody’s projects the federal debt burden to grow from rising entitlement liabilities and slowing working-age population growth over the next decade.

Source: FHN Financial

Source: FHN Financial

Back to Index

Canada

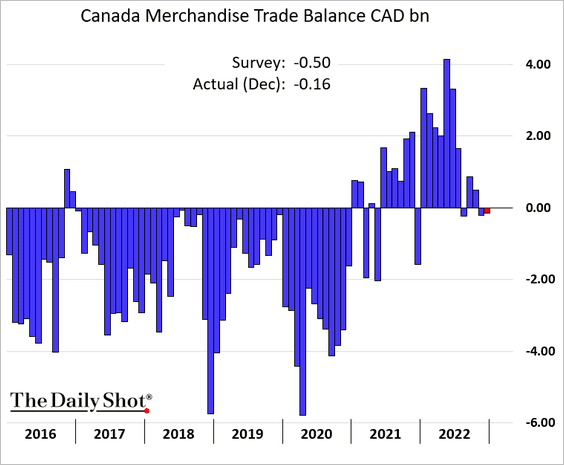

1. The trade gap was narrower than expected in December.

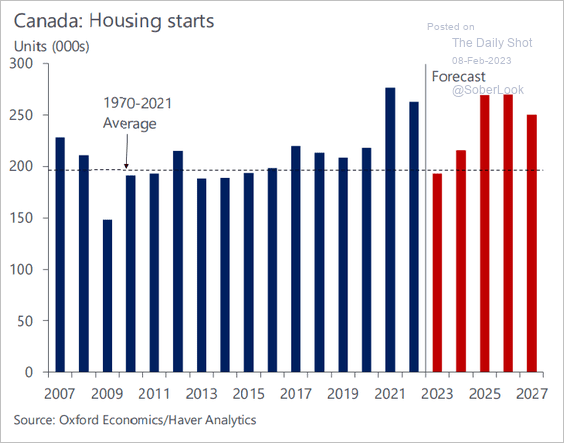

2. According to Oxford Economics, residential construction will dip to the lowest level since 2014 this year.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

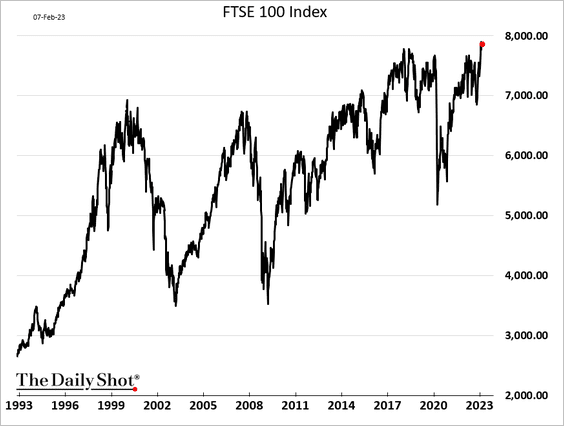

1. UK large caps are trading near record highs.

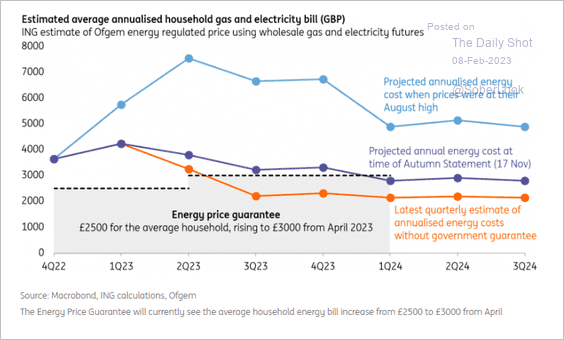

2. This chart shows household energy costs as projected in November as well as estimates based on current wholesale prices.

Source: ING

Source: ING

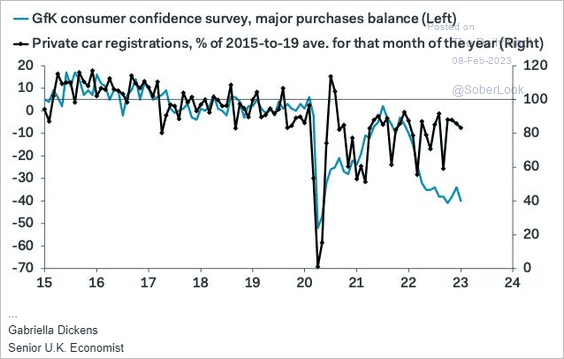

3. Will soft consumer confidence put pressure on car sales?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

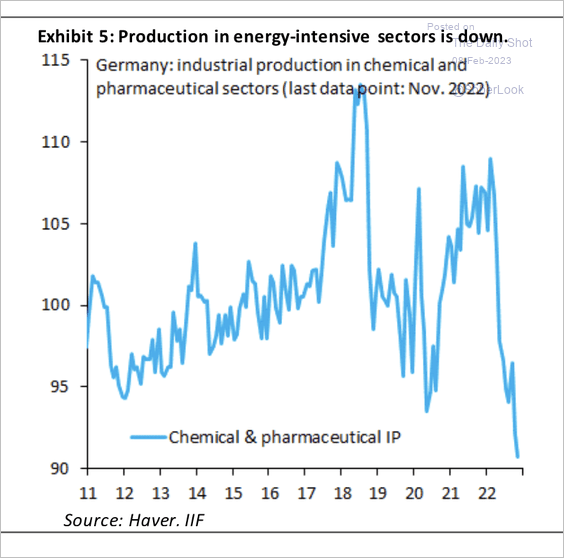

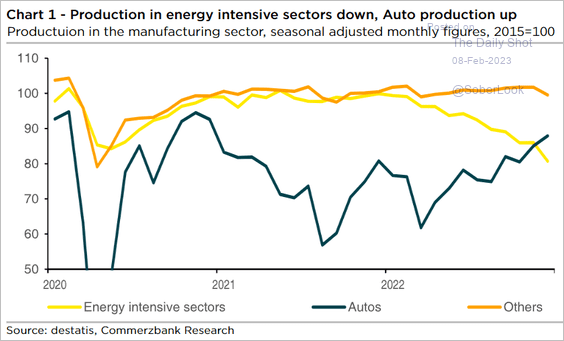

1. German industrial production in energy-intensive sectors is sharply lower, which helped ease the demand for natural gas.

Source: IIF

Source: IIF

Source: Commerzbank Research

Source: Commerzbank Research

——————–

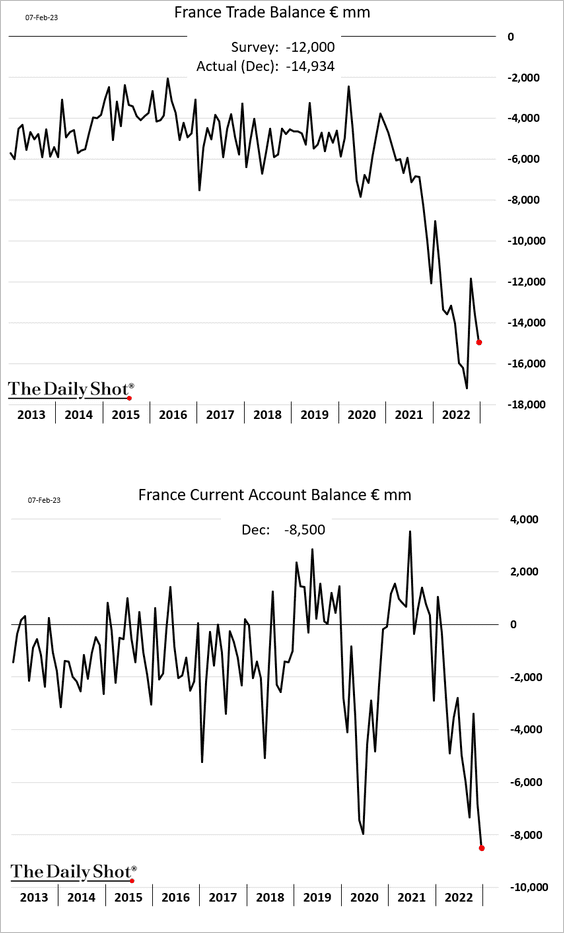

2. French current account deficit hit a record high, driven by deep trade deficit.

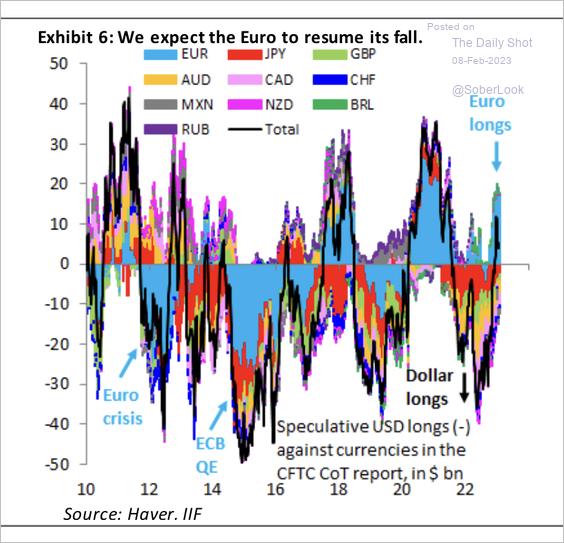

3. Speculators boosted net-long euro positions. However, IIF expects EUR/USD to return to parity as ECB rate hikes will be hard to justify during a recession.

Source: IIF

Source: IIF

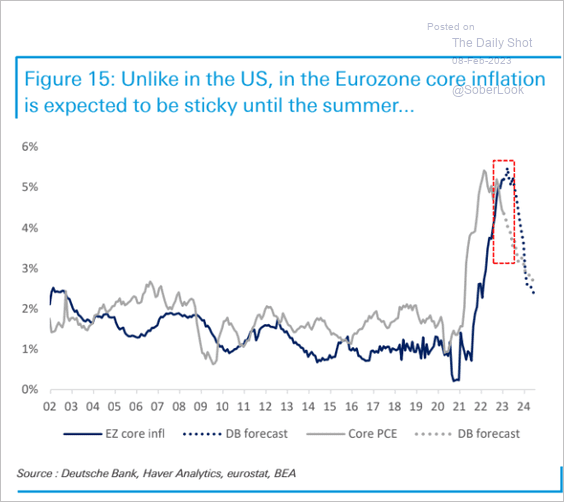

4. Euro-area core inflation is expected to be more persistent than in the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

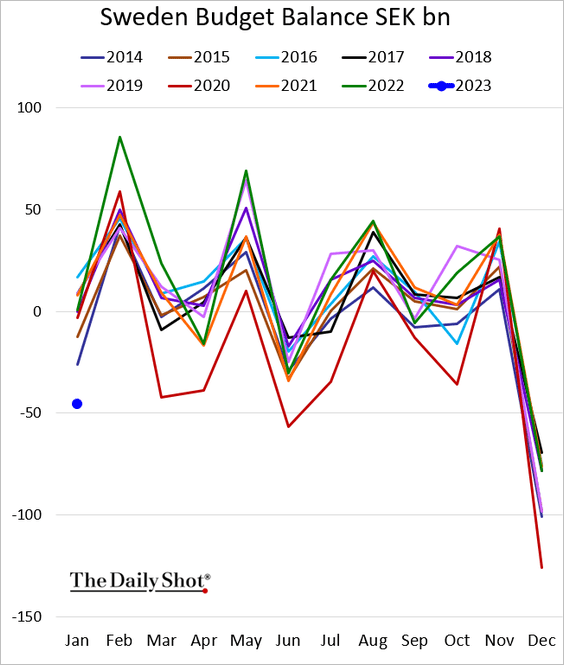

1. Sweden’s budget deficit hit a multi-year high (for January).

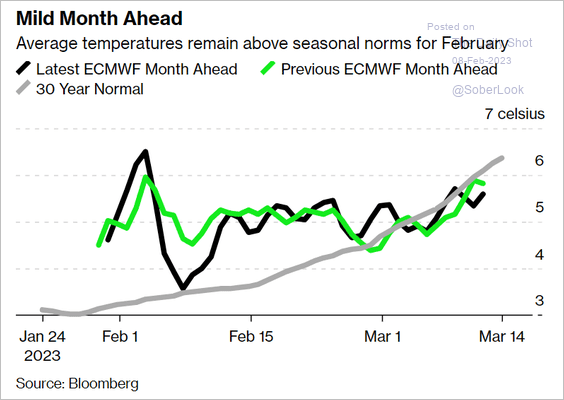

2. Warm temperatures ahead?

Source: @CeliaBergin, @josefinefokuhl, @business Read full article

Source: @CeliaBergin, @josefinefokuhl, @business Read full article

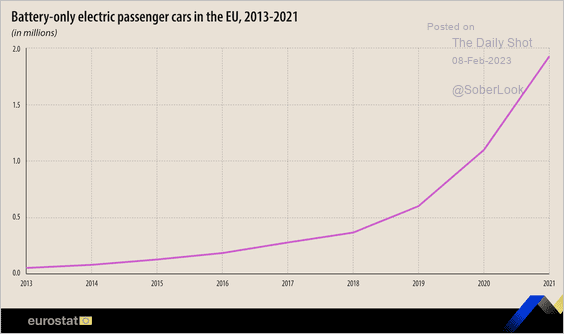

3. Battery-only EVs keep rising.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

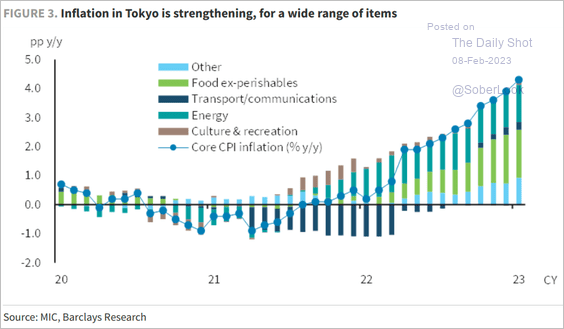

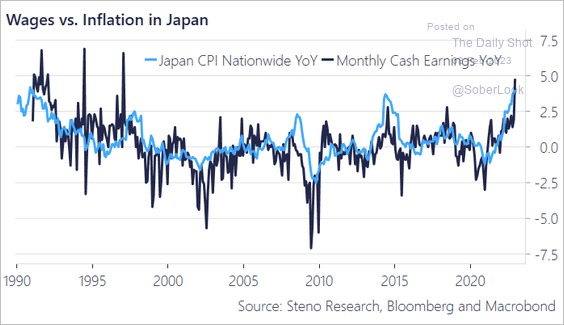

1. Will the BoJ continue to ignore Japan’s inflation problem? (2 charts)

Source: Barclays Research

Source: Barclays Research

Source: @AndreasSteno

Source: @AndreasSteno

——————–

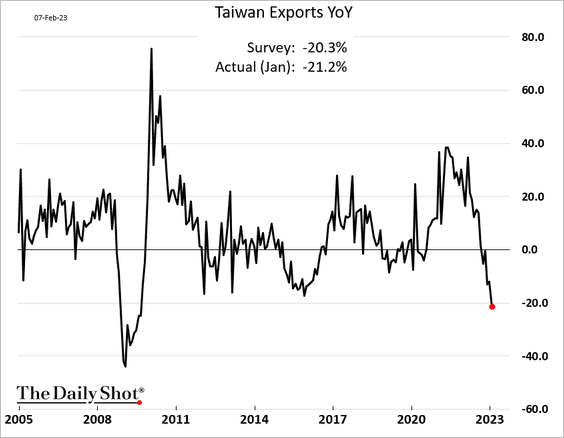

2. Taiwan’s exports were down 21% last month on a year-over-year basis.

Back to Index

China

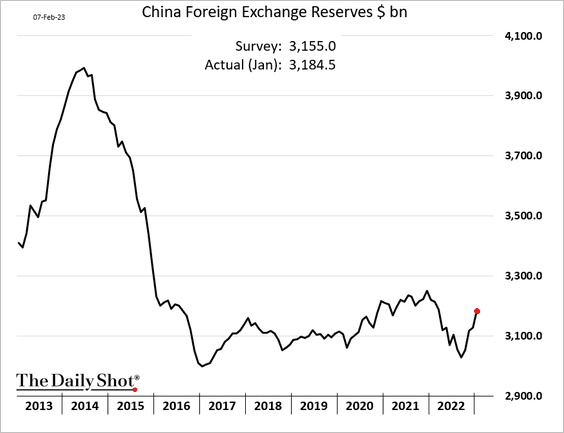

1. F/X reserves are rebounding.

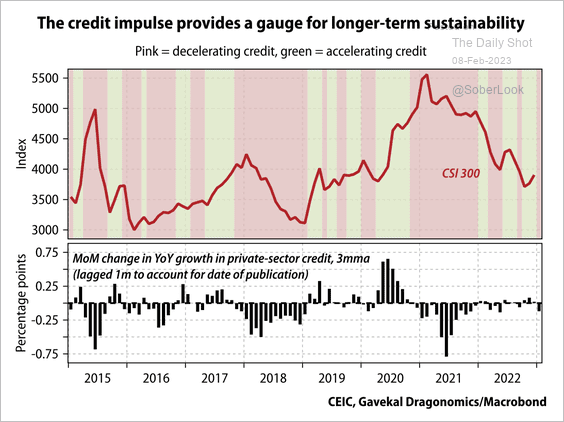

2. A rise in China’s credit impulse is needed to sustain the market recovery.

Source: Gavekal Research

Source: Gavekal Research

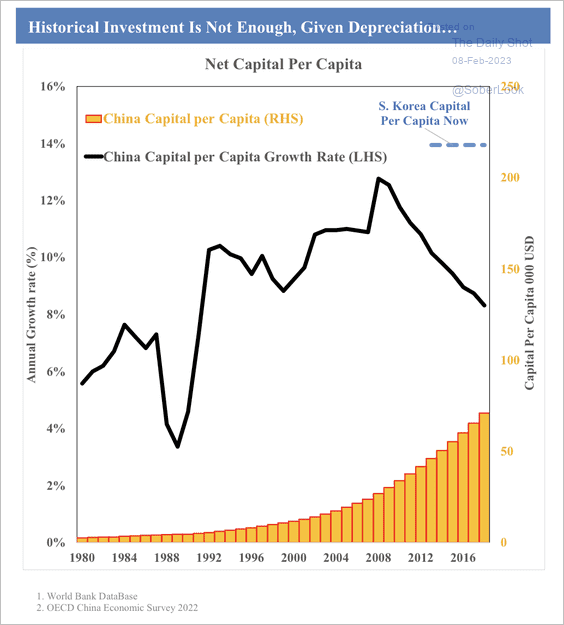

3. China’s net capital per capita growth rate has declined over the past 20 years.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

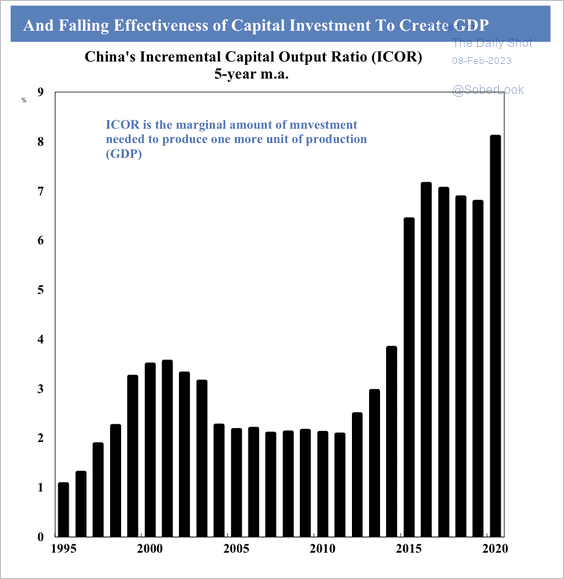

More capital is required to boost production.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

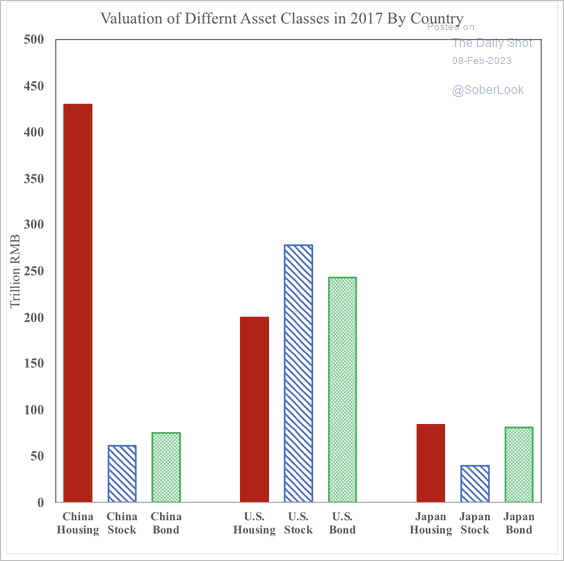

4. Housing investment dwarfs traditional asset investment.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

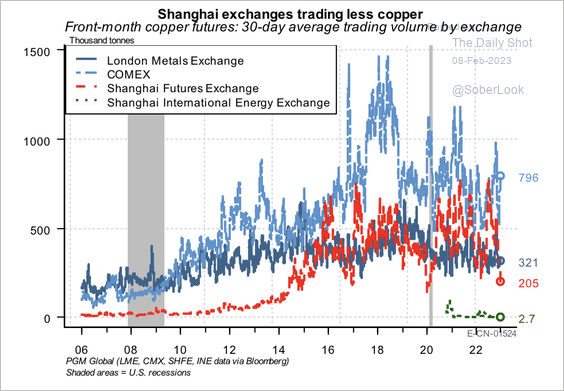

5. Chinese investors are trading less copper futures in Shanghai, while copper prices are trading at premiums in Chicago and London.

Source: PGM Global

Source: PGM Global

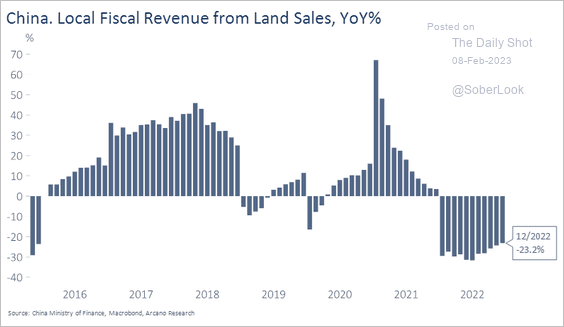

6. Local government revenues from land sales remain depressed.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Emerging Markets

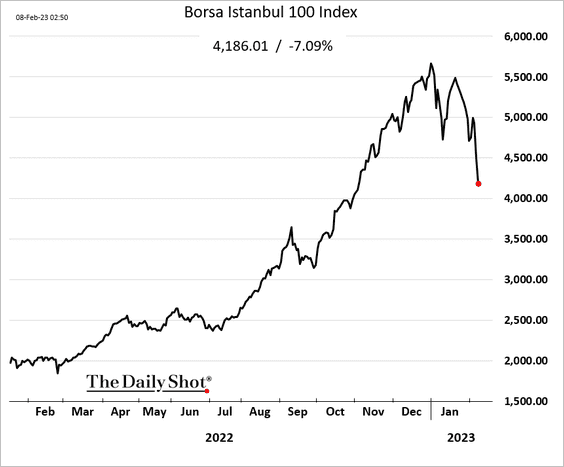

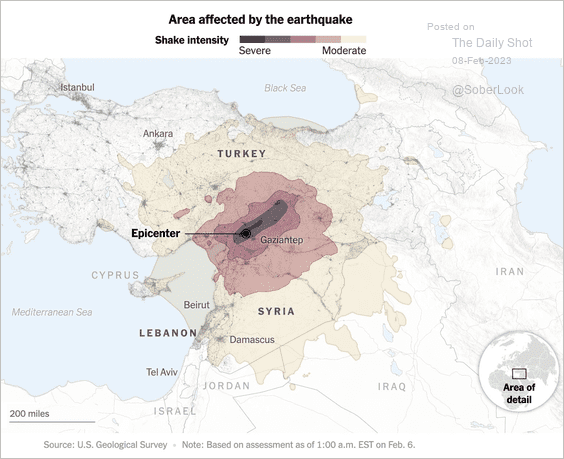

1. Turkish stocks are in bear market after the devastating earthquake.

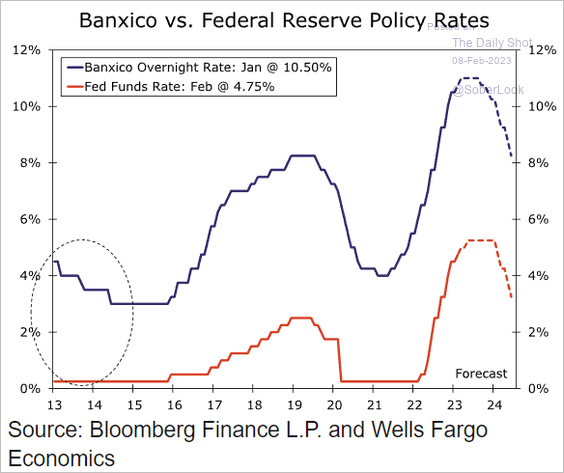

2. Banxico will begin easing before the Fed, according to Wells Fargo, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

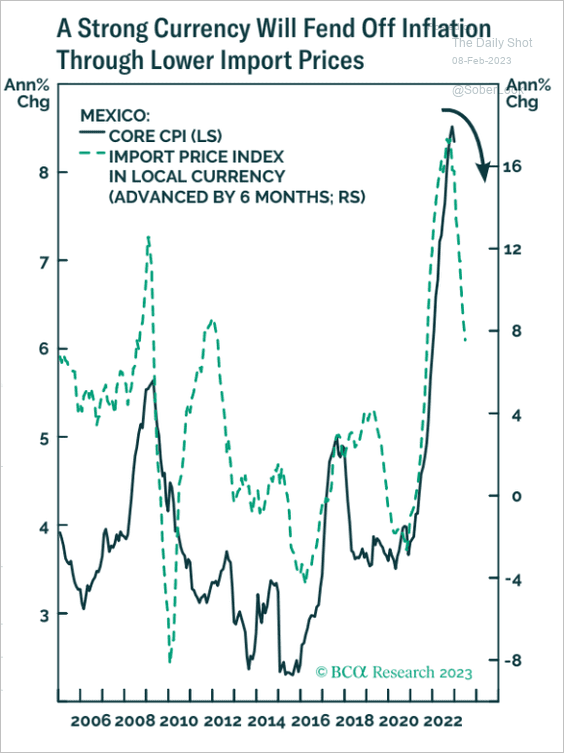

… as inflation slows.

Source: BCA Research

Source: BCA Research

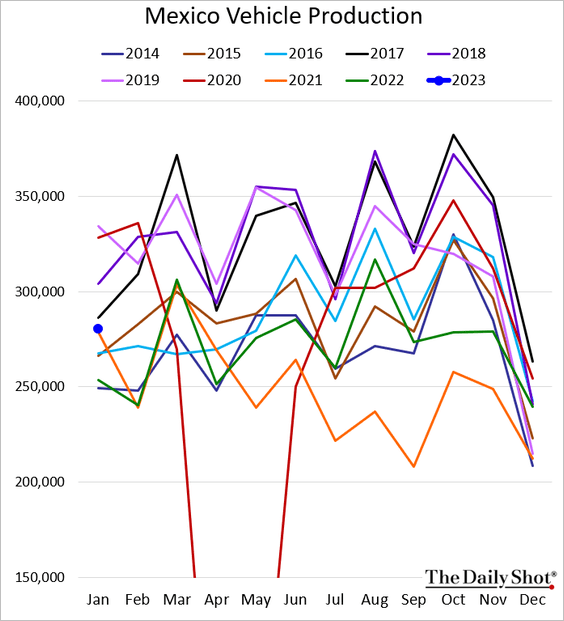

Separately, Mexican vehicle production was well above last year’s levels in January.

——————–

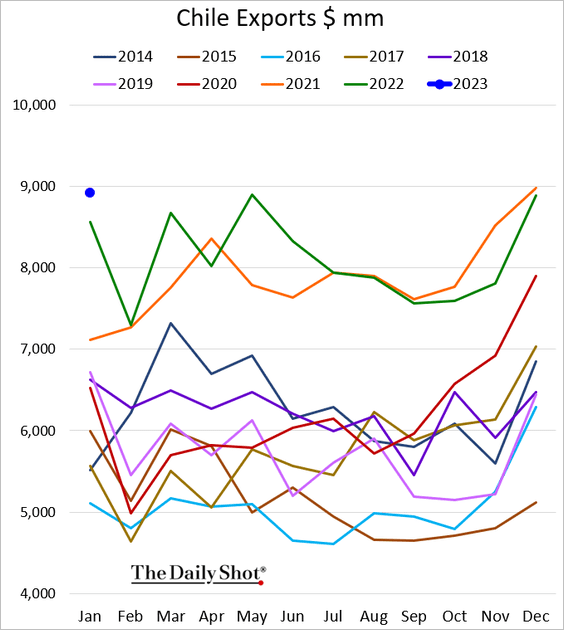

3. Chile’s exports hit a new high (for January).

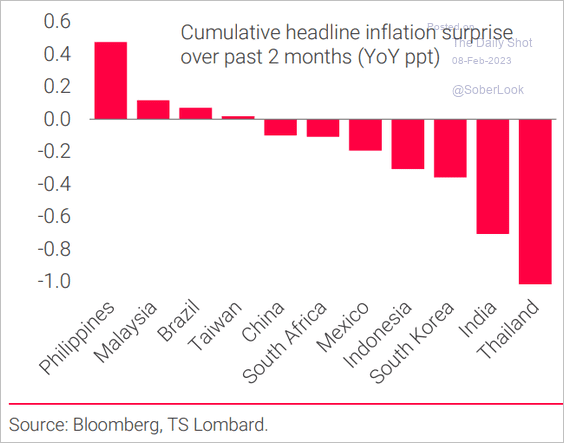

4. EM inflation surprises have been fading.

Source: TS Lombard

Source: TS Lombard

Back to Index

Commodities

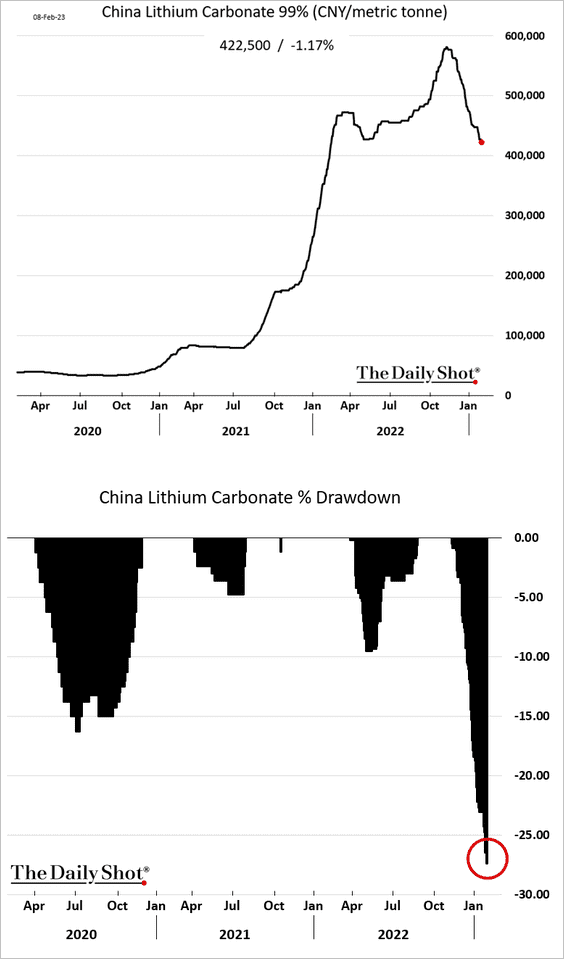

1. Lithium prices are down sharply from the peak.

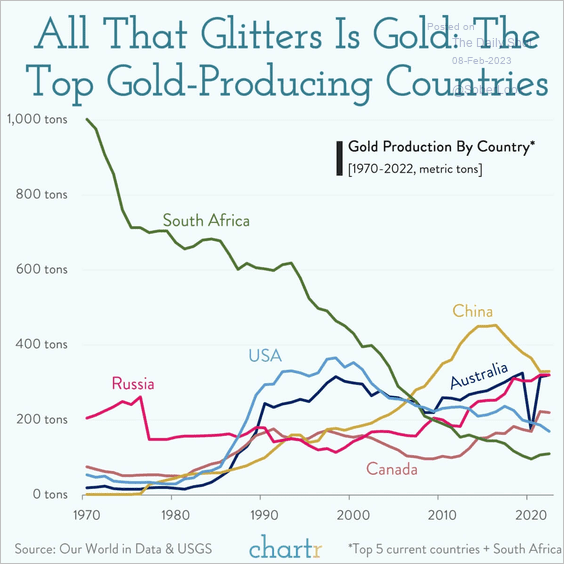

2. This chart shows the evolution of gold production by country.

Source: @chartrdaily

Source: @chartrdaily

Back to Index

Energy

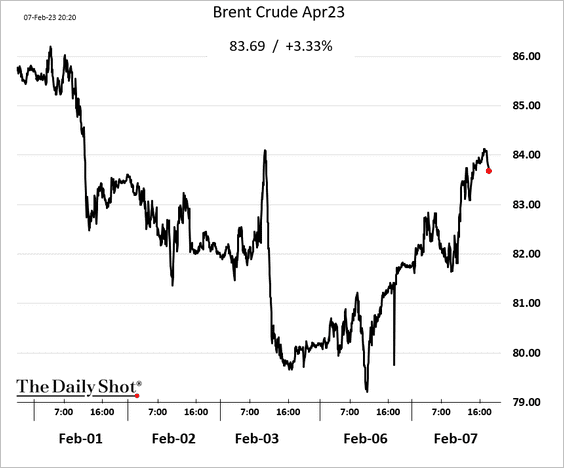

1. Oil prices jumped this week.

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

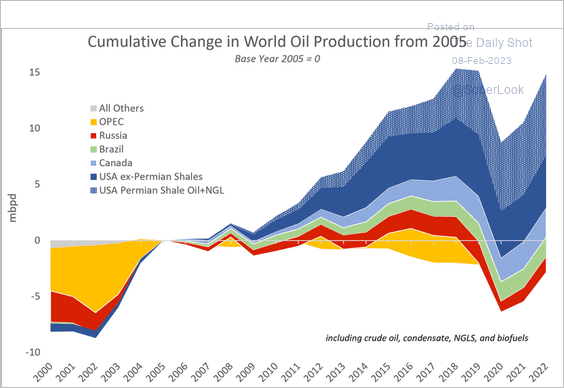

2. This chart shows the contributions to cumulative changes in global oil production since 2005.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Equities

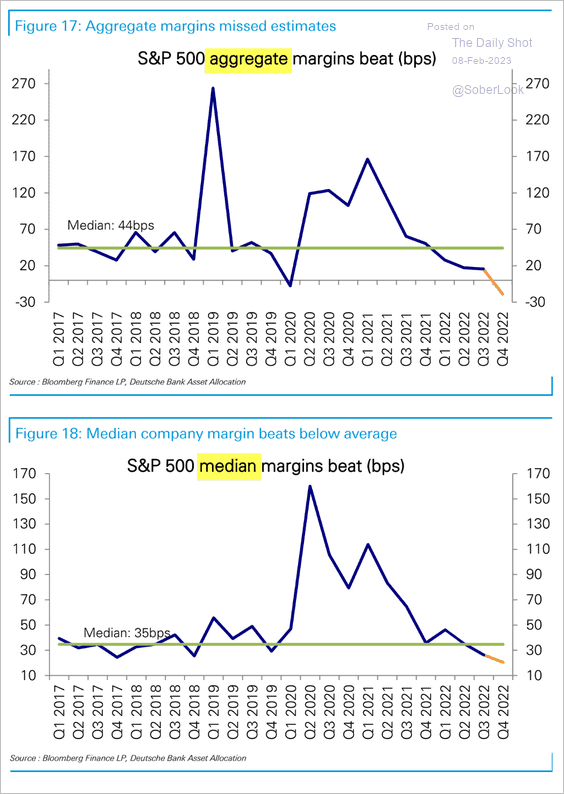

1. Q4 margins were less than stellar relative to expectations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

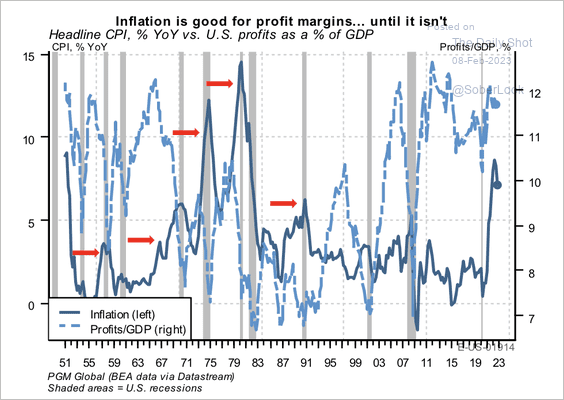

Rising prices initially boost top-line revenue growth and margins, but eventually, cost inflation reduces profit growth, especially when sales growth slows.

Source: PGM Global

Source: PGM Global

——————–

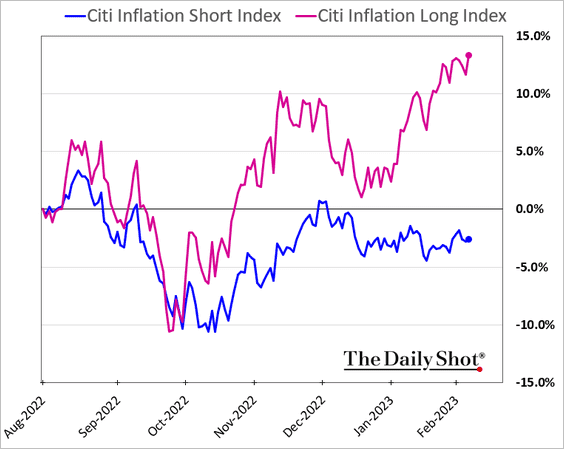

2. Despite slowing inflation, companies that benefit from higher prices have been outperforming.

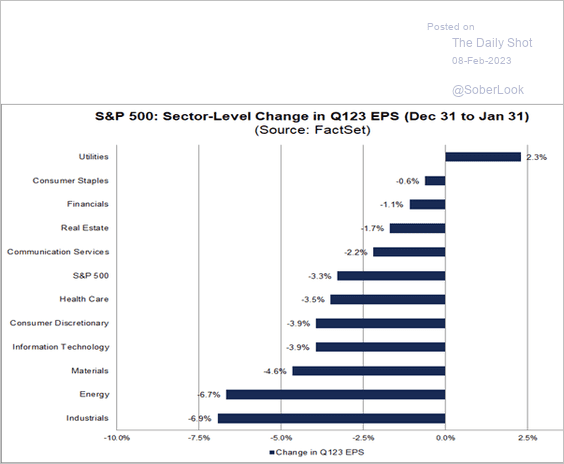

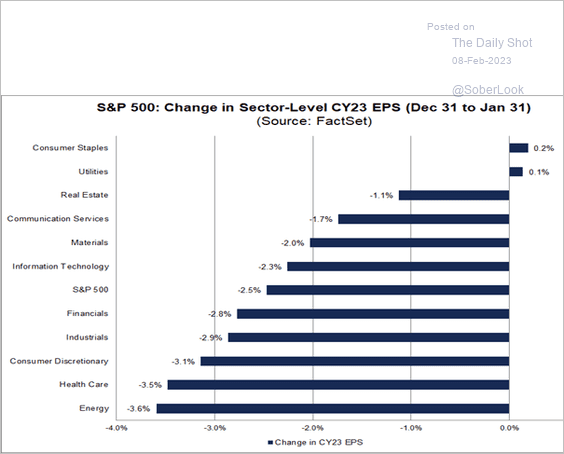

3. Which sectors saw the largest earnings downgrades in January?

• Q1:

Source: @FactSet Read full article

Source: @FactSet Read full article

• Calendar-year 2023:

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

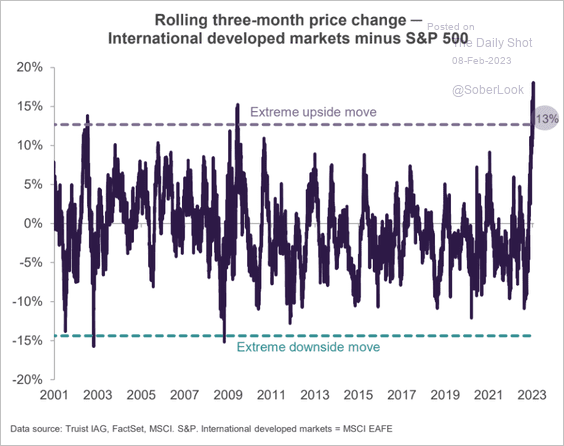

4. The recent developed-markets non-US share outperformance has been remarkable.

Source: Truist Advisory Services

Source: Truist Advisory Services

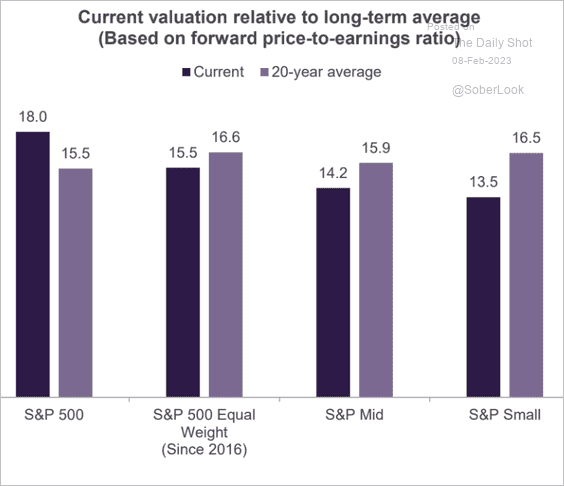

5. S&P 500 valuations remain above their long-term average.

Source: Truist Advisory Services

Source: Truist Advisory Services

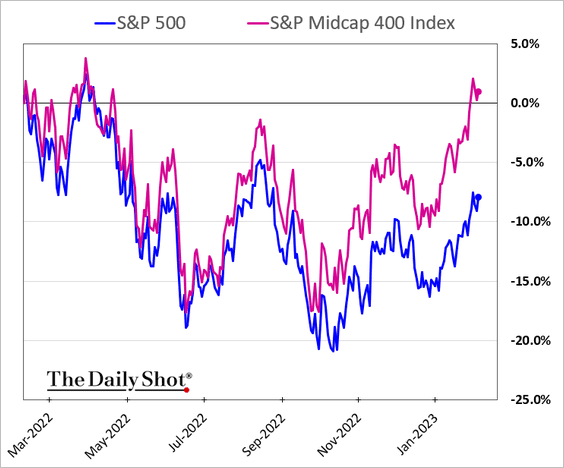

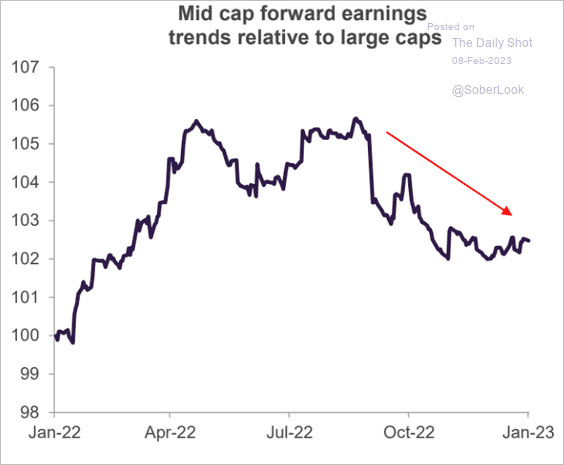

6. Mid-cap shares have been outperforming, …

… amid improved valuations.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

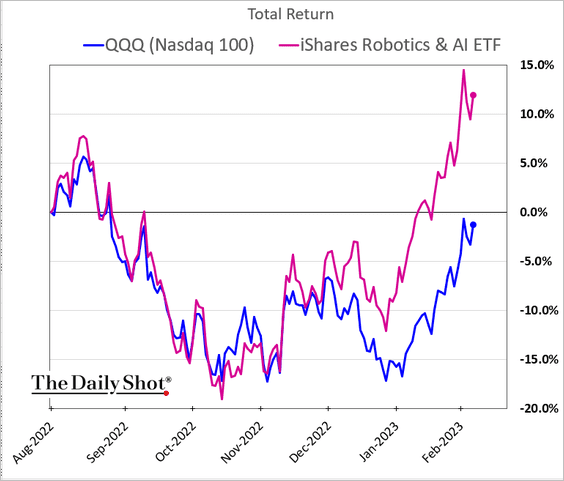

7. AI and robotics stocks have been rallying.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

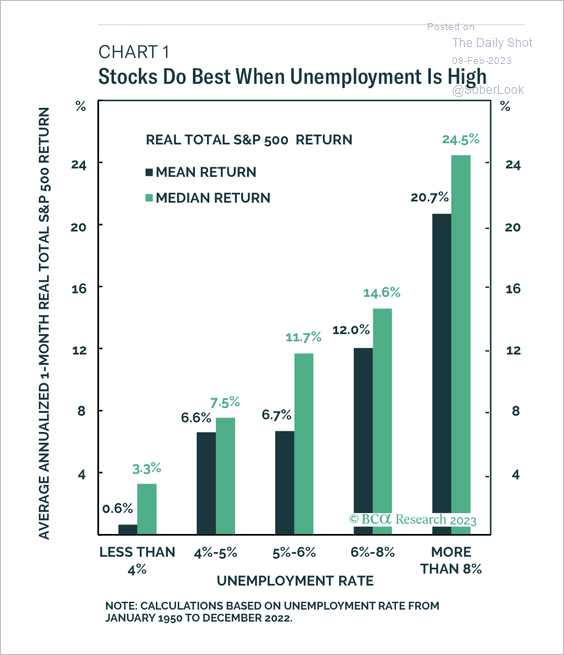

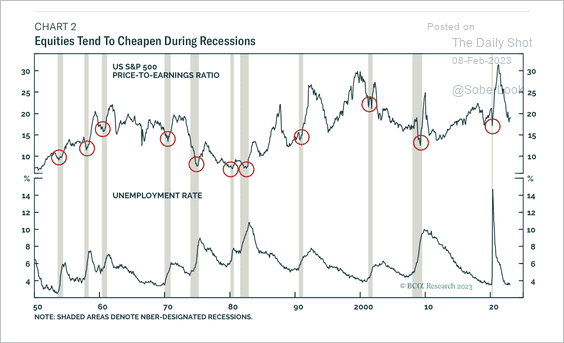

8. Stocks tend to do best when the unemployment rate is high. This is possibly due to the mean reverting nature of the unemployment rate and lower valuations during recessions. (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Back to Index

Alternatives

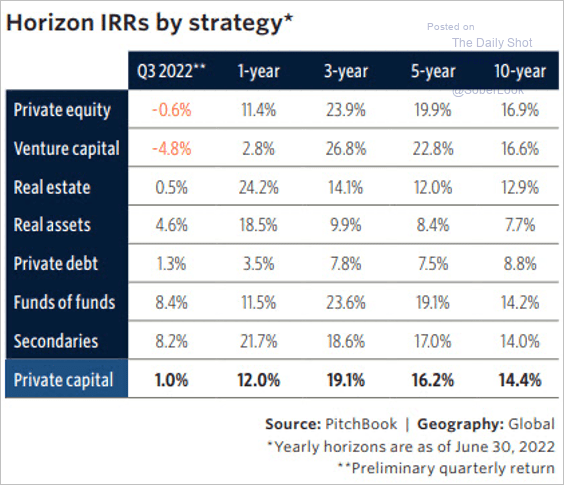

1. Preliminary Q3 2022 data shows US private equity and venture capital performance in the red.

Source: PitchBook

Source: PitchBook

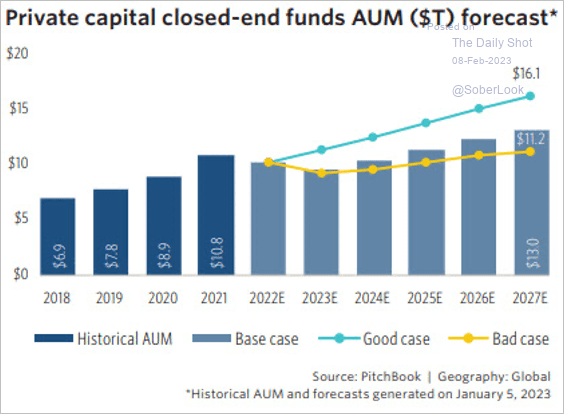

2. Pitchbook expects private capital assets under management to decline this year before gradually recovering.

Source: PitchBook

Source: PitchBook

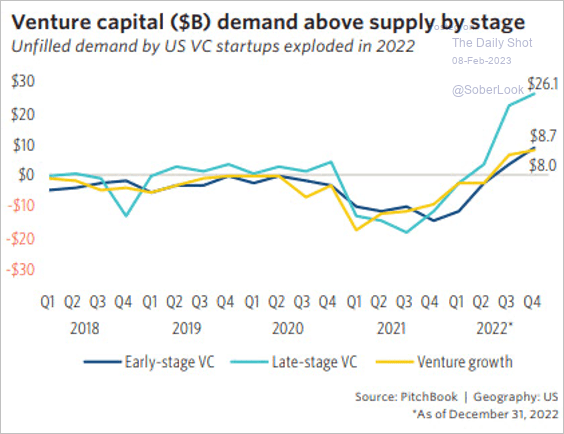

3. US startups demanded more than twice as much capital as venture capitalists supplied last quarter. The imbalance is especially extended in later stage deals.

Source: PitchBook

Source: PitchBook

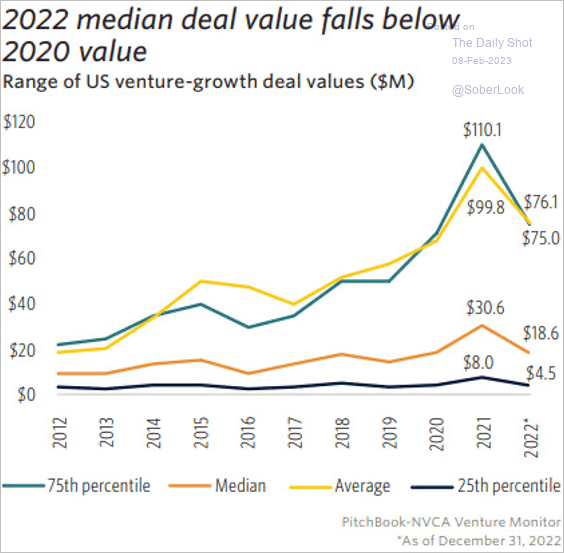

US venture-growth deal values fell below 2020 levels.

Source: PitchBook

Source: PitchBook

——————–

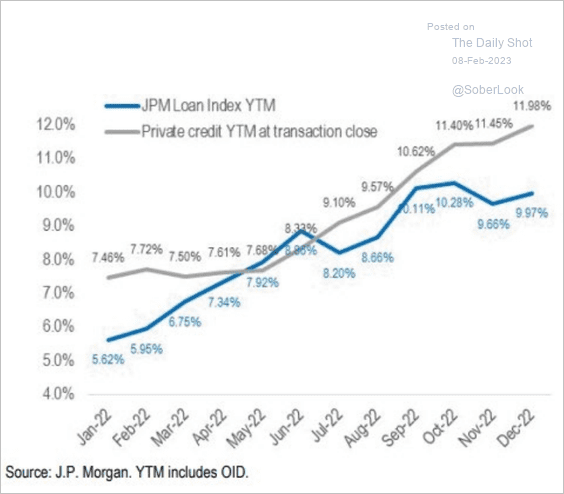

4. Private credit yields are attractive relative to broadly syndicated loans.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

Back to Index

Credit

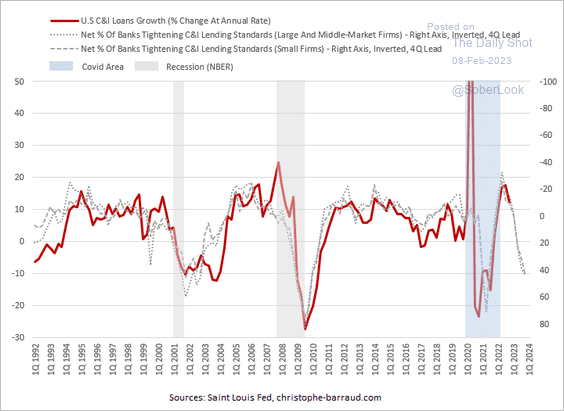

1. Tighter business lending standards signal slower loan growth ahead …

Source: @C_Barraud Read full article

Source: @C_Barraud Read full article

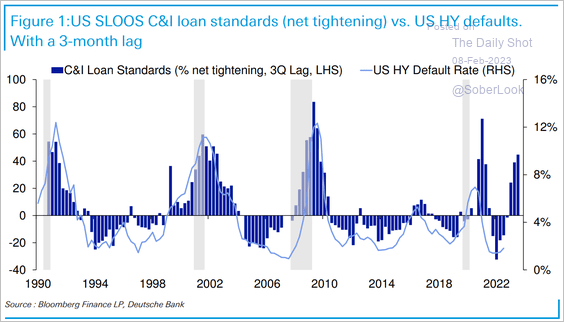

… and an increase in US high-yield defaults, which typically occurs during recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

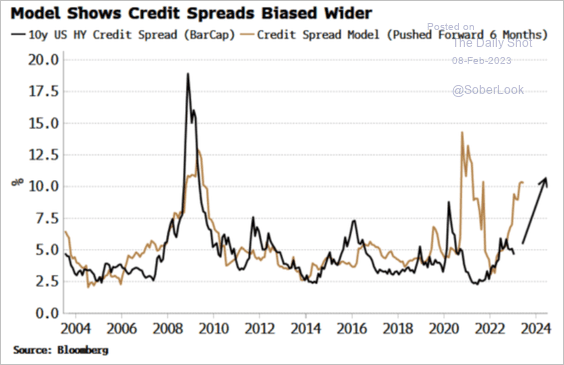

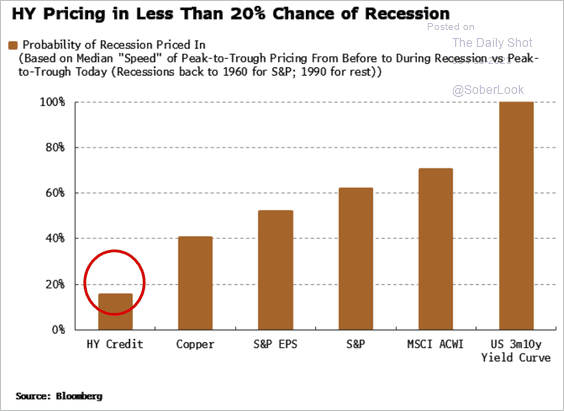

2. The high yield market appears to be mispriced, …

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

… with only negligible recession risk priced in.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

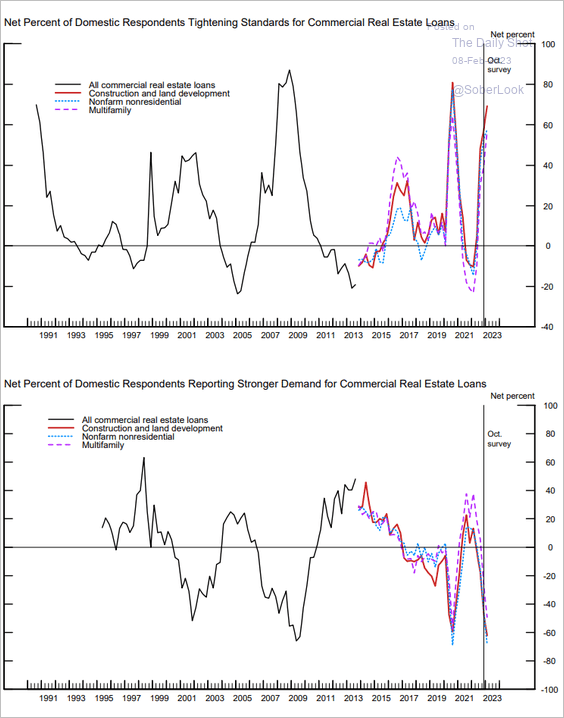

3. Banks are tightening lending standards on commercial rel estate loans, while demand for credit deteriorates.

Source: FRB

Source: FRB

Back to Index

Rates

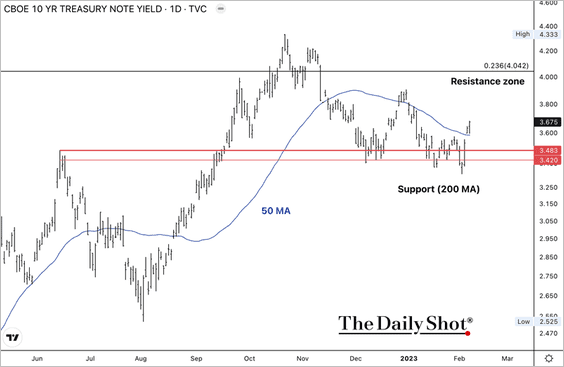

1. The 10-year Treasury yield held support at 3.3% and returned above its 50-day moving average. Resistance is around 4%.

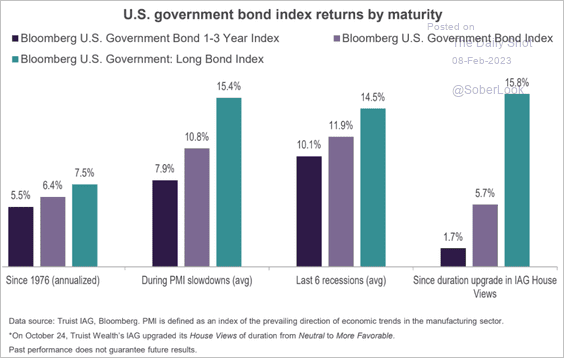

2. This chart shows Treasury returns during different economic regimes.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Global Developments

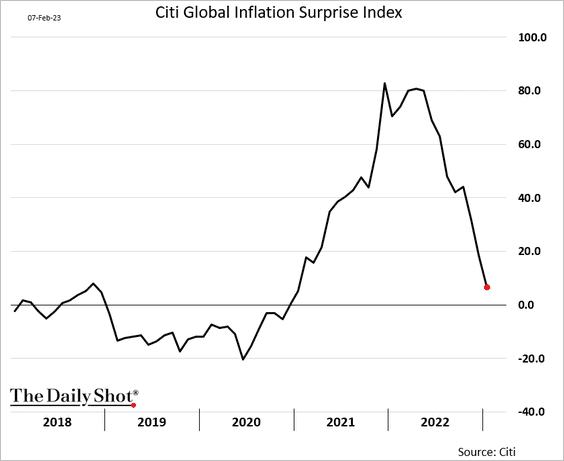

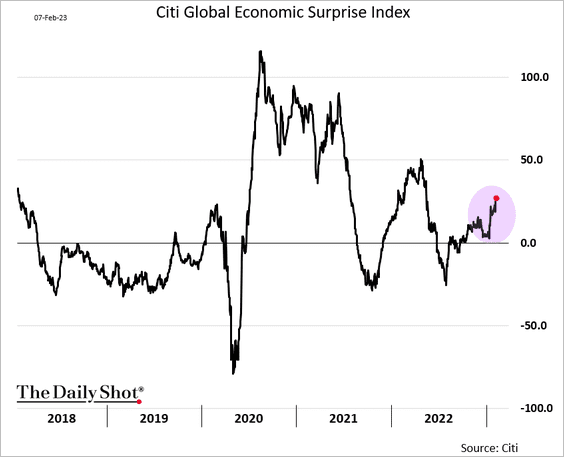

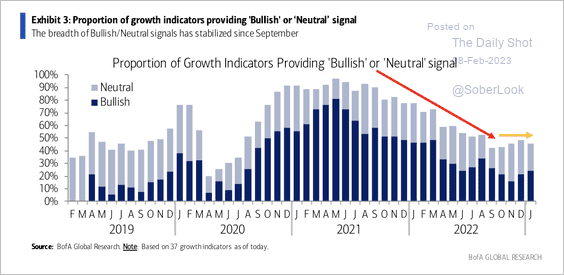

1. Inflation surprises have declined while economic surprises increased. (2 charts)

However, global growth indicators are mostly neutral.

Source: BofA Global Research

Source: BofA Global Research

——————–

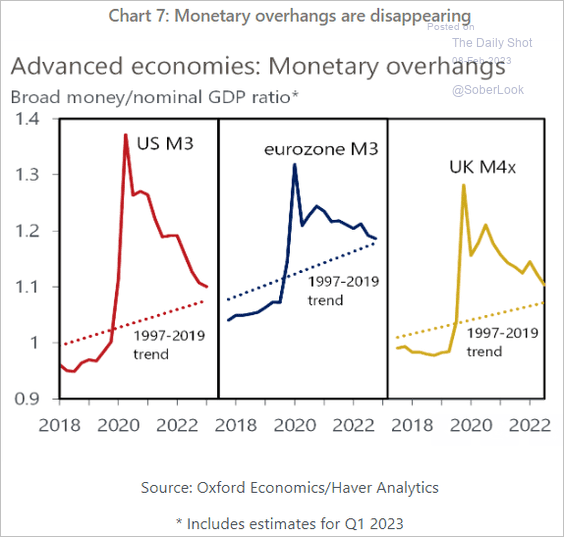

2. Here is a look at monetary overhangs in the US, the Eurozone, and the UK.

Source: Oxford Economics

Source: Oxford Economics

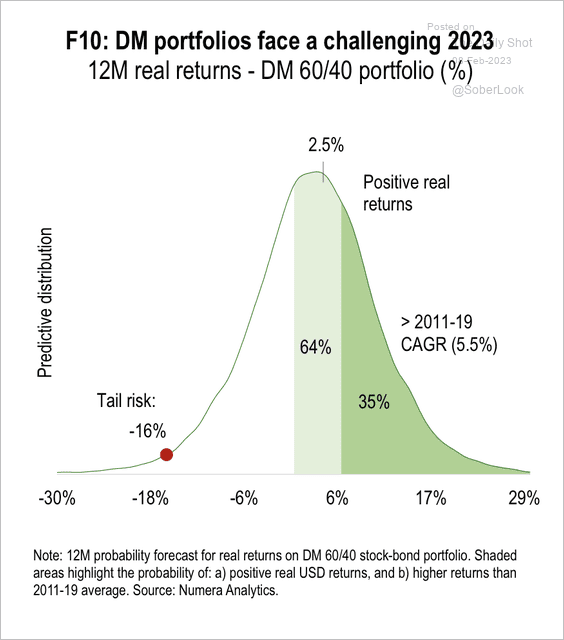

3. Numera Analytics sees a 35% chance of above-average returns in a 60% stock/40% bond portfolio during a stagflation environment this year.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

——————–

Food for Thought

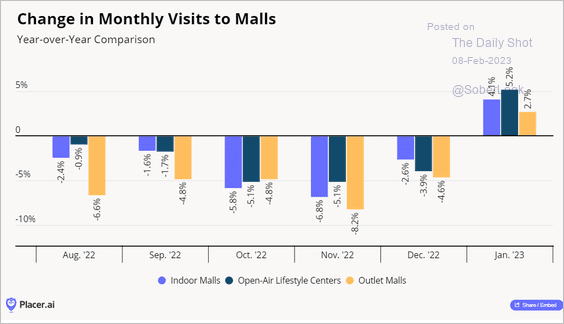

1. A rebound in mall visits?

Source: Placer.ai

Source: Placer.ai

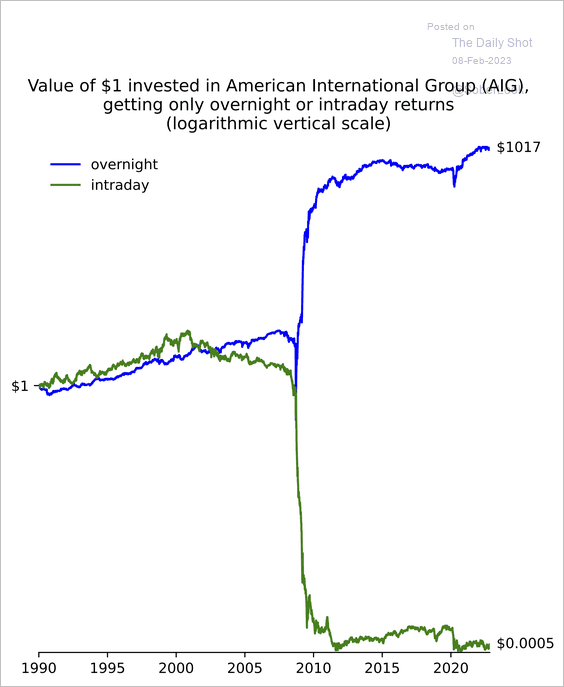

2. AIG shares’ overnight vs. intraday cumulative returns since 1990:

Source: Statistical Modeling, Causal Inference, and Social Science Read full article

Source: Statistical Modeling, Causal Inference, and Social Science Read full article

3. Global population growth projections made in 2017 and 2022:

Source: Goldman Sachs

Source: Goldman Sachs

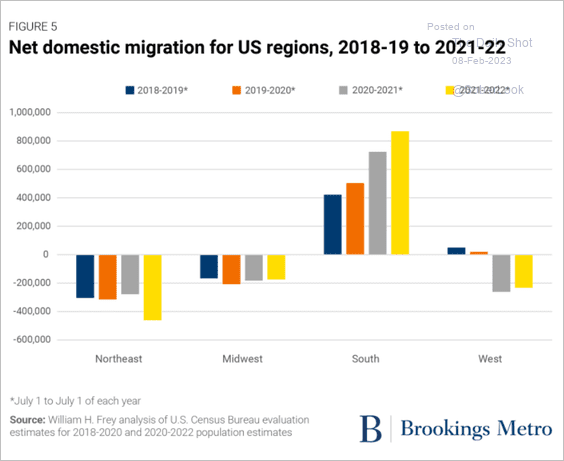

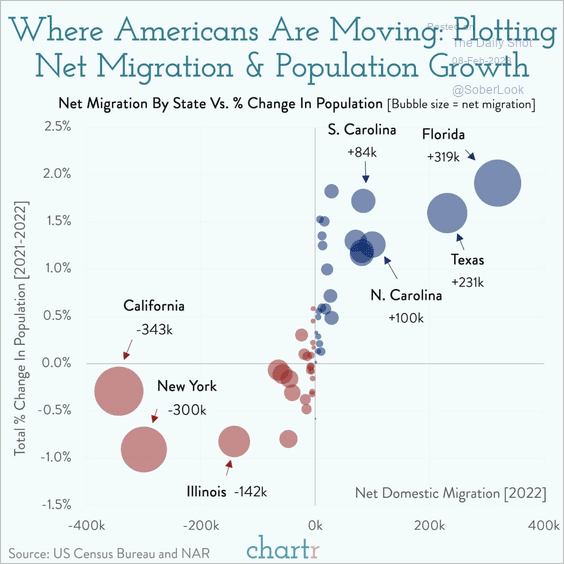

4. US net domestic migration (2 charts):

Source: Brookings Read full article

Source: Brookings Read full article

Source: @chartrdaily

Source: @chartrdaily

——————–

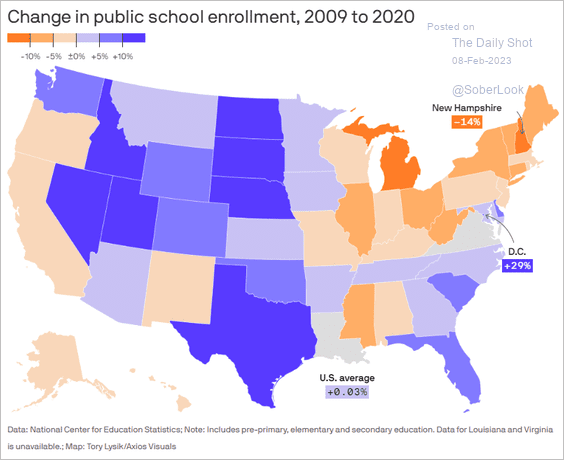

5. Changes in public-school enrollment:

Source: @axios Read full article

Source: @axios Read full article

6. Areas affected by the earthquake in Turkey and Syria:

Source: The New York Times Read full article

Source: The New York Times Read full article

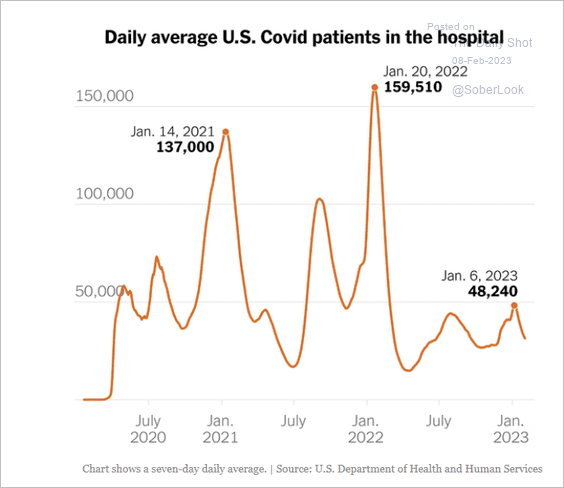

7. Hospitalized COVID patients:

Source: The New York Times Read full article

Source: The New York Times Read full article

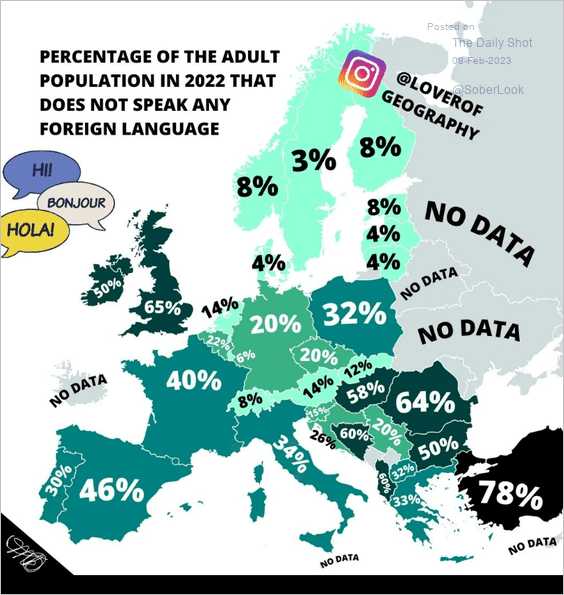

8. Percent of the adult European population that does not speak a foreign language:

Source: @loverofgeography

Source: @loverofgeography

——————–

Back to Index