The Daily Shot: 10-Feb-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Rates

• Food for Thought

The United States

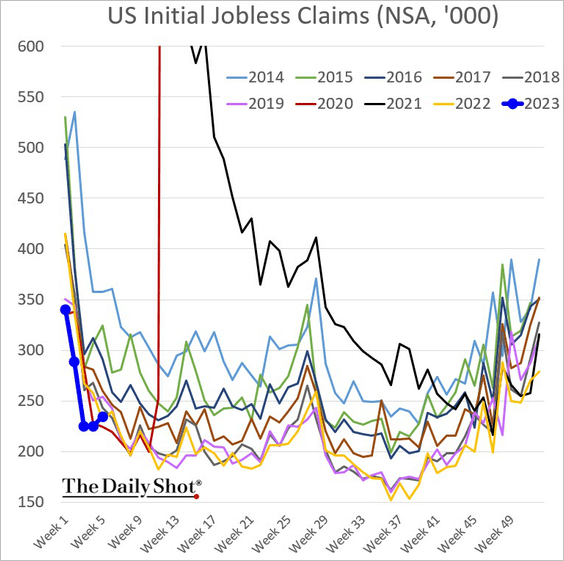

1. Let’s begin with the labor market.

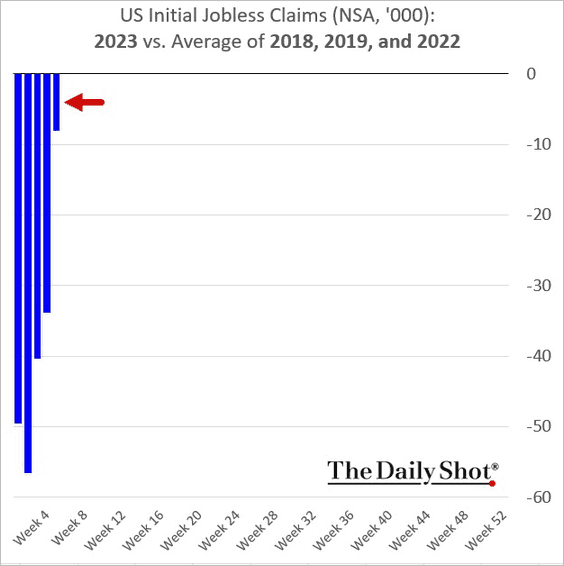

• Initial unemployment applications increased last week, …

… but remain below the average of 2018, 2019, and 2022 levels. The labor market is still tight.

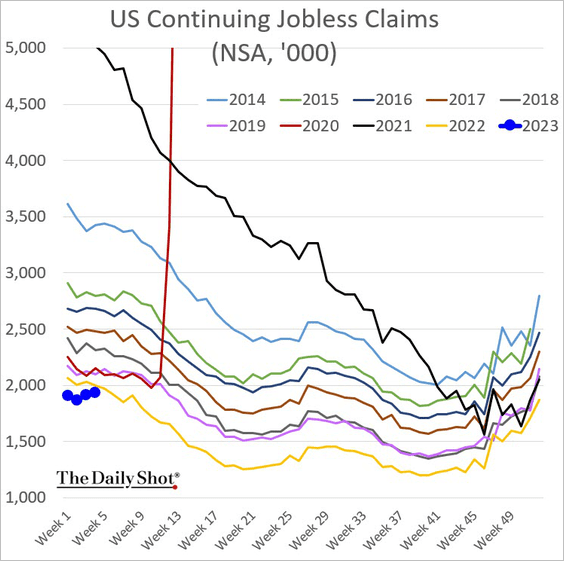

Continuing unemployment claims have been edging higher.

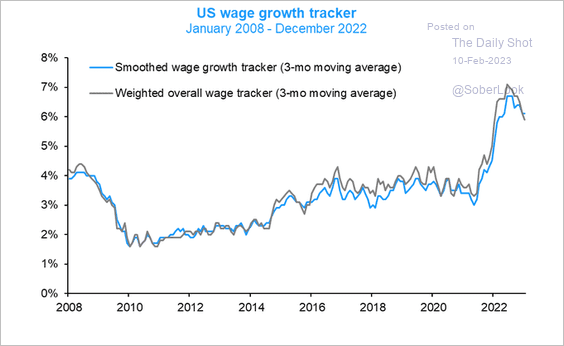

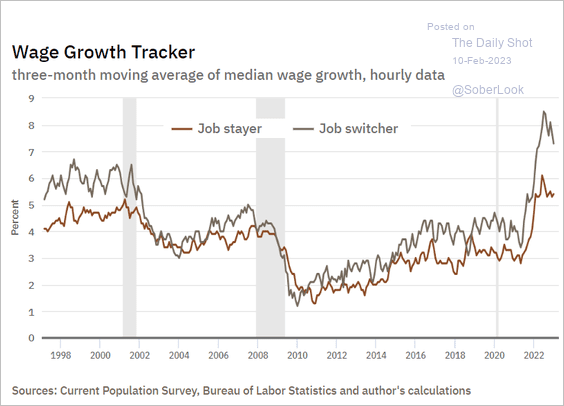

• The Atlanta Fed’s wage growth tracker shows some moderation in pay increases.

Source: @GregDaco, @AtlantaFed

Source: @GregDaco, @AtlantaFed

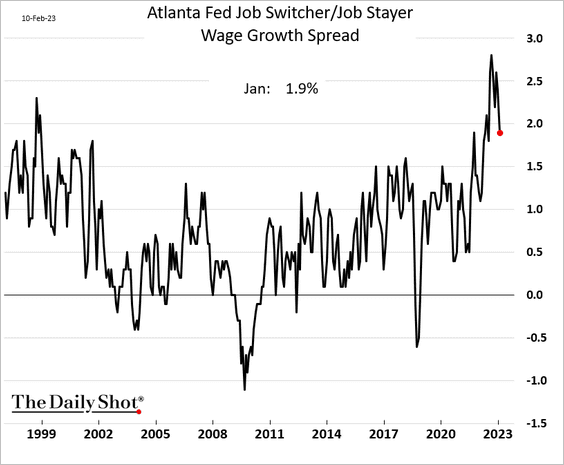

The spread between wage growth of job switchers and job stayers has started to tighten, suggesting that labor demand has peaked (2 charts).

Source: @AtlantaFed

Source: @AtlantaFed

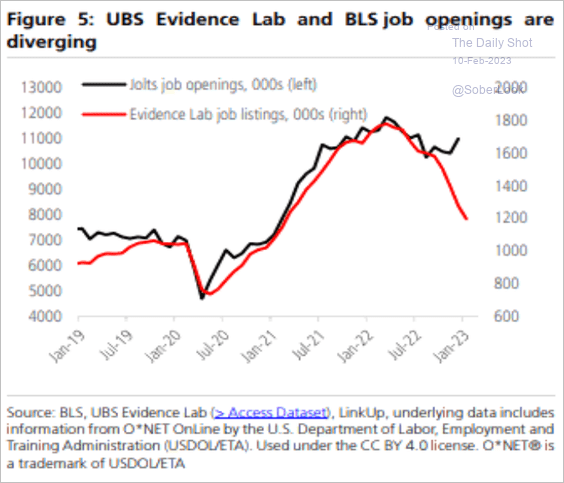

• Job openings should ease going forward.

Source: UBS Research; III Capital Management

Source: UBS Research; III Capital Management

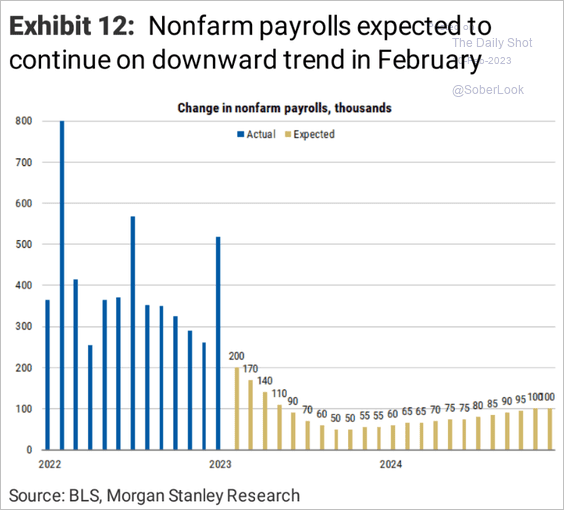

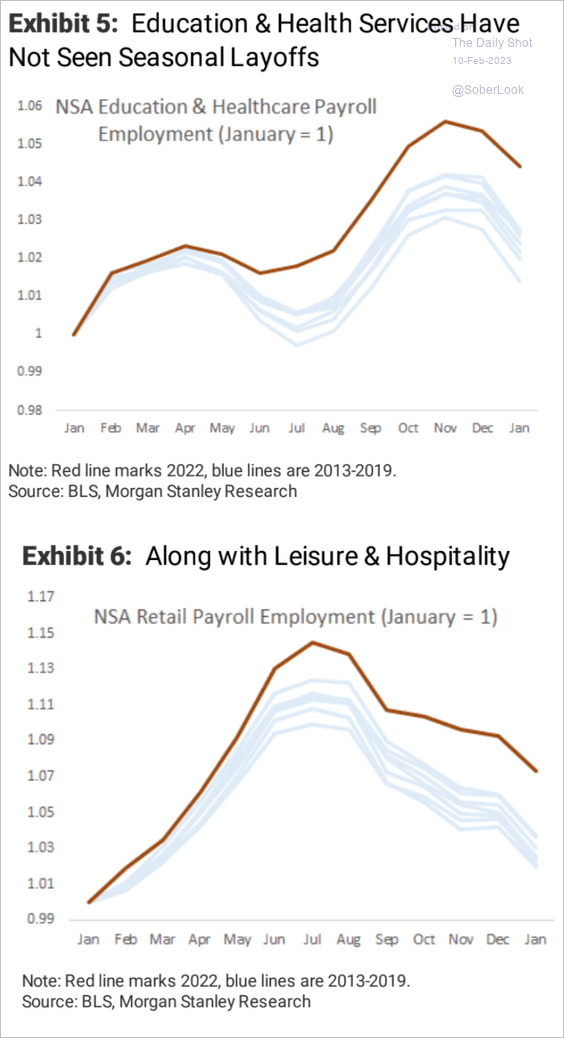

• Payrolls growth will resume its slowing trend, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

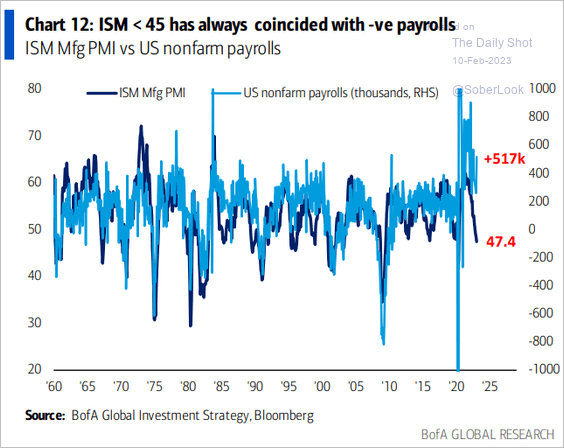

• The ISM Manufacturing PMI signals job losses ahead.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

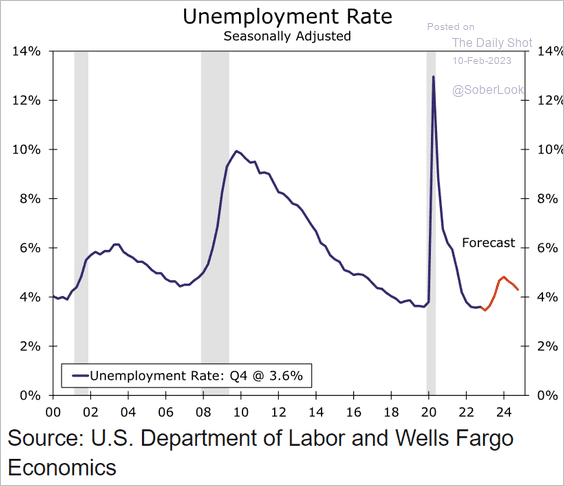

• Wells Fargo sees the unemployment rate peaking just below 5% this year (averaged over each quarter).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

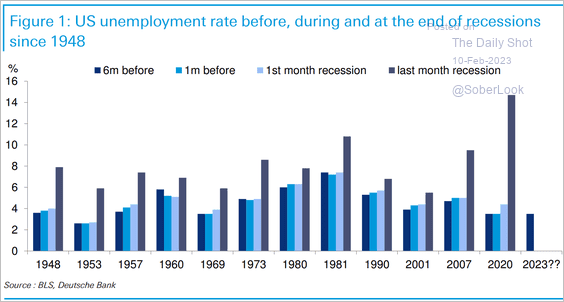

• This chart shows unemployment around recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Some sectors have been “labor hoarding,” with no typical seasonal layoffs. That behavior has contributed to tight labor markets.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

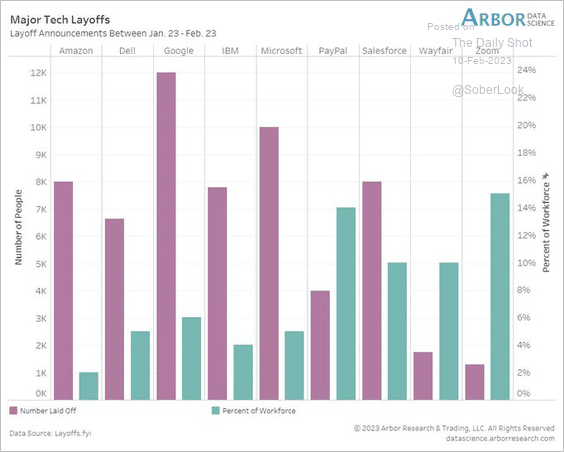

• Next, we have tech layoffs as a percentage of each company’s workforce.

Source: @LizAnnSonders, @DataArbor, @Layoffsfyi

Source: @LizAnnSonders, @DataArbor, @Layoffsfyi

——————–

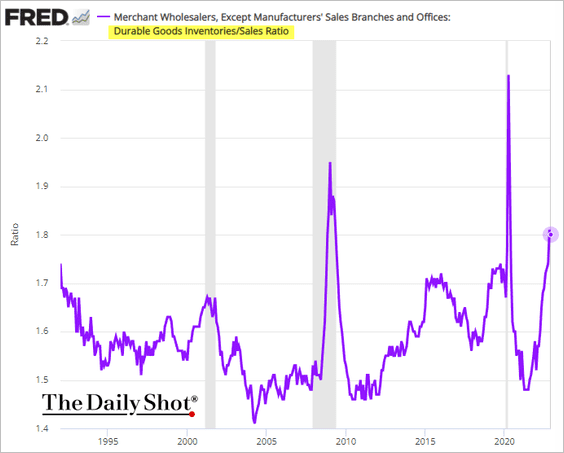

2. The wholesale durable goods inventories-to-sales ratio is now well above pre-COVID levels, which should help ease inflation. The inventory overhang will also put downward pressure on margins.

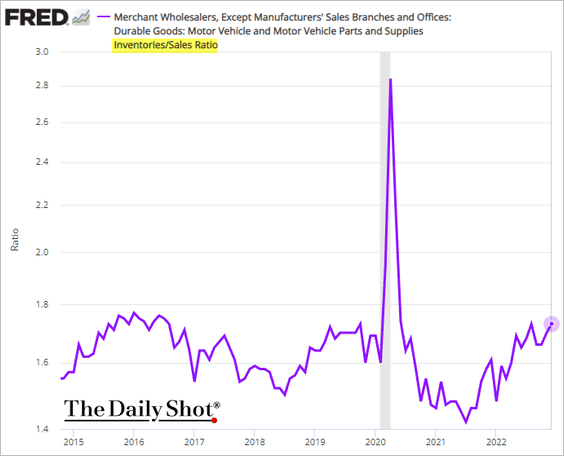

The vehicle inventories-to-sales ratio is at pre-COVID levels.

——————–

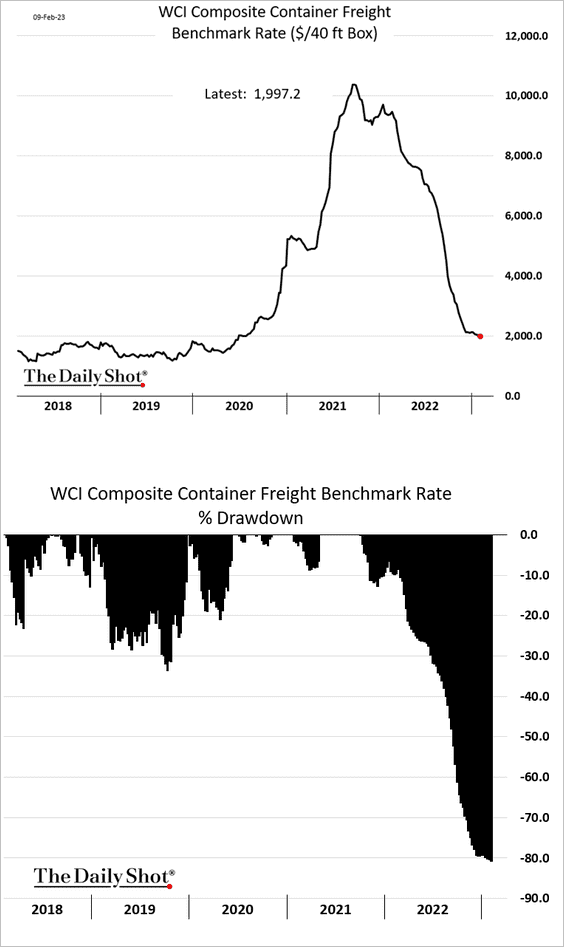

3. The WCI Container Freight Rate dipped below $2k for the first time since mid-2020, down over 80% from the peak.

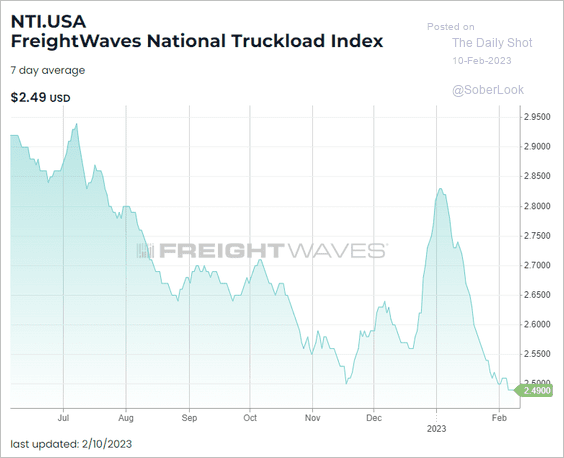

Trucking rates continue to fall as demand slows.

Source: FreightWaves SONAR

Source: FreightWaves SONAR

Back to Index

The United Kingdom

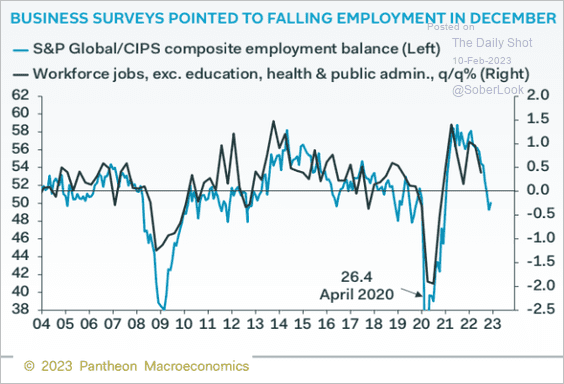

1. Employment losses ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

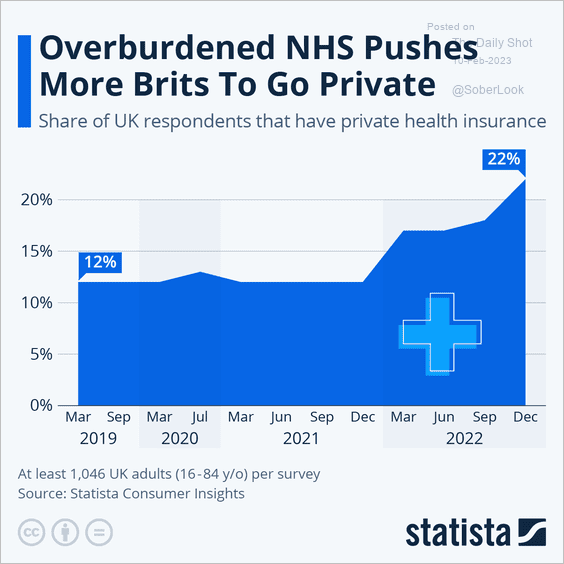

2. More Britons are switching to private health insurance.

Source: Statista

Source: Statista

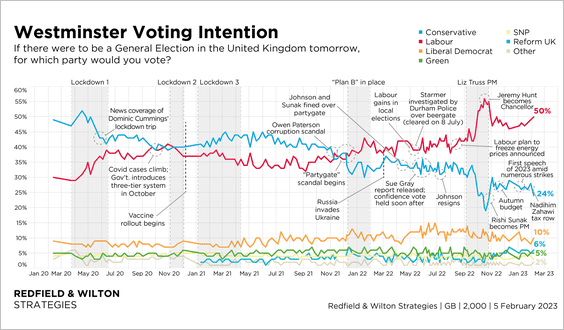

3. This chart shows the latest voting intentions polls.

Source: @RedfieldWilton Read full article

Source: @RedfieldWilton Read full article

Back to Index

The Eurozone

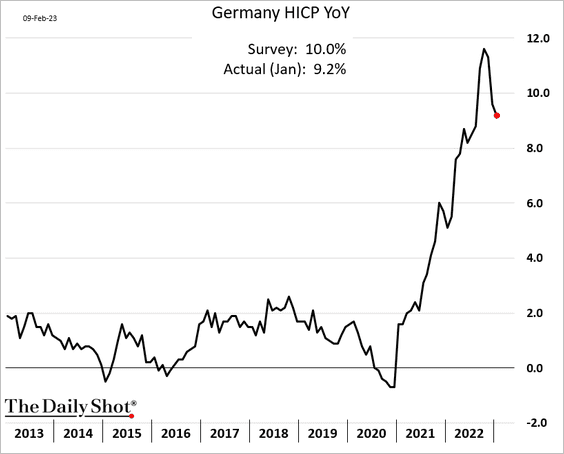

1. German inflation continued to ease in January.

Source: @jrandow, @economics Read full article

Source: @jrandow, @economics Read full article

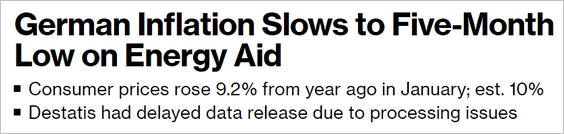

Separately, Sweden’s Industrial weakness signals more headwinds for German factories.

Source: Gavekal Research

Source: Gavekal Research

——————–

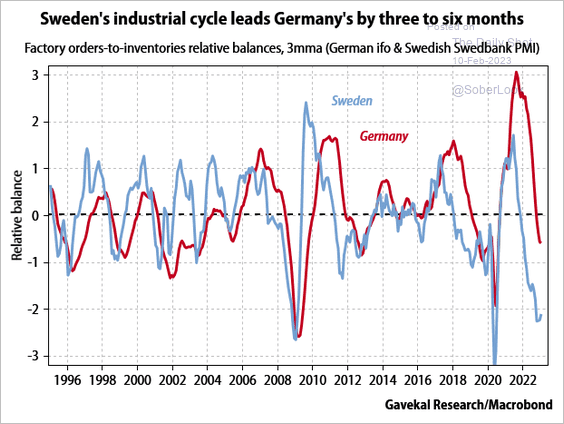

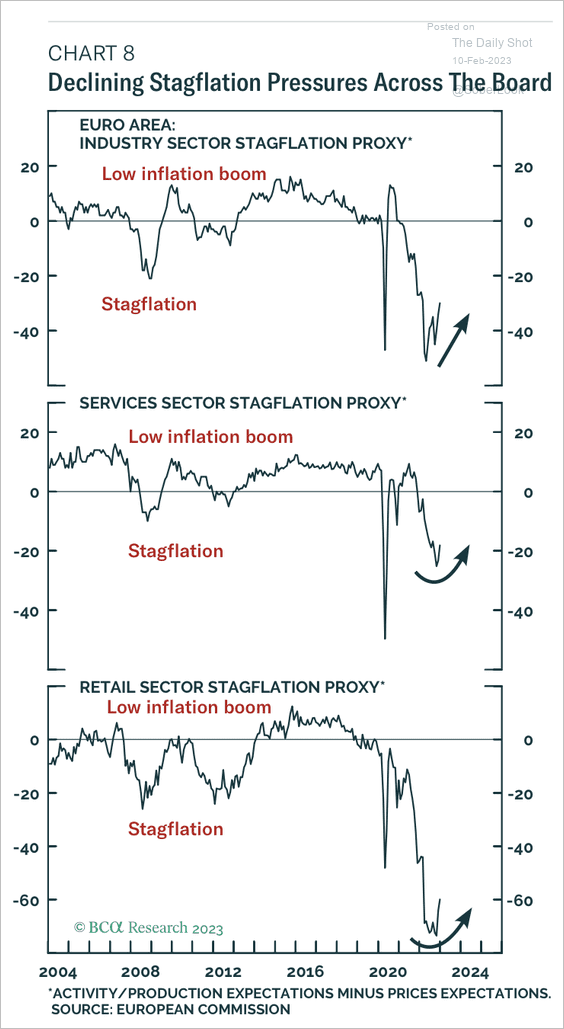

2. Euro-area stagflation conditions are expected to dissipate over the coming months.

Source: BCA Research

Source: BCA Research

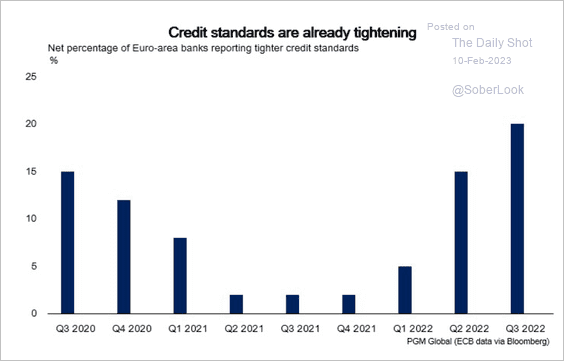

3. More Euro-area banks have tightened lending standards.

Source: PGM Global

Source: PGM Global

Back to Index

Europe

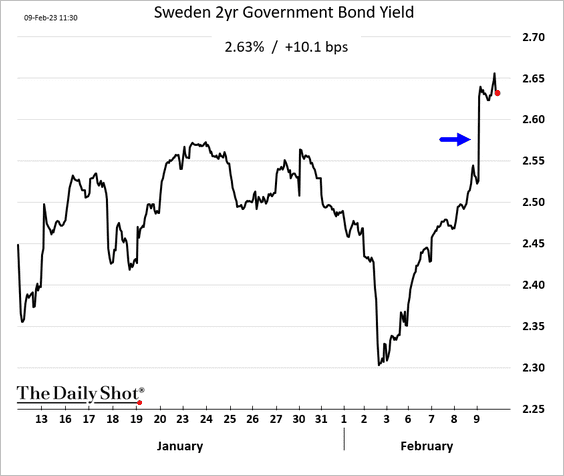

1. Let’s begin with Sweden.

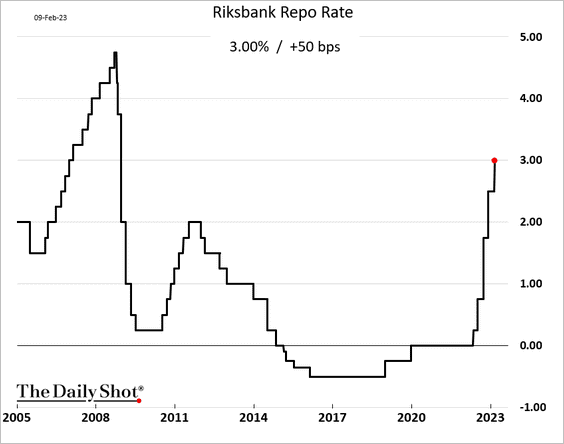

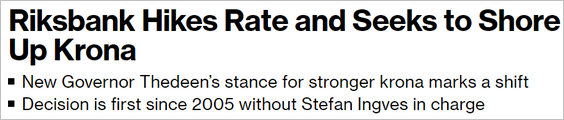

• Riksbank delivered a hawkish rate hike, signaling a willingness to boost the krona.

Source: @nicrolander, @economics Read full article

Source: @nicrolander, @economics Read full article

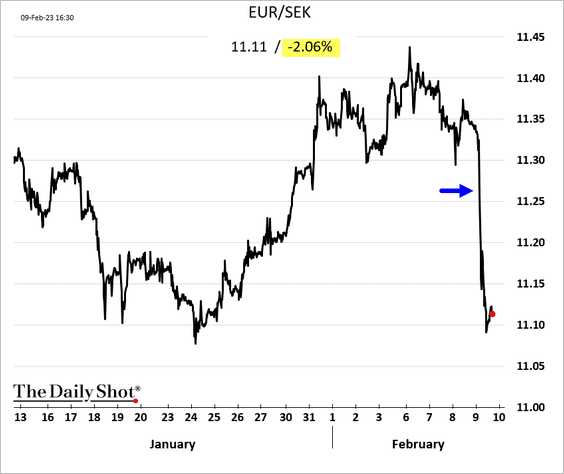

• The krona surged 2% vs. the euro.

Bond yields jumped.

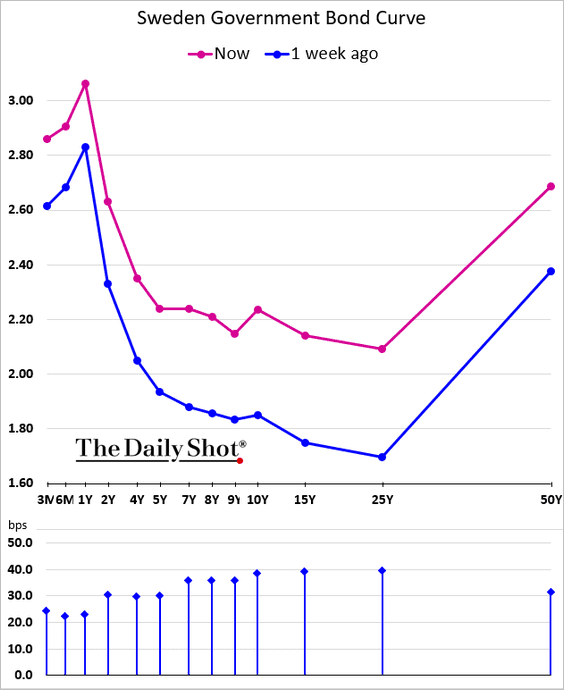

• Here is the yield curve.

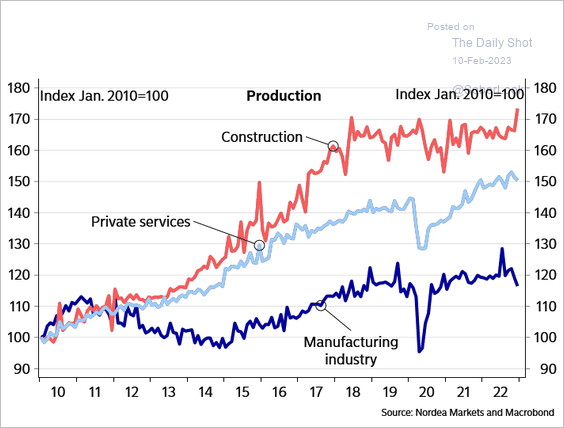

• Sweden’s construction activity remains robust.

Source: Nordea Markets

Source: Nordea Markets

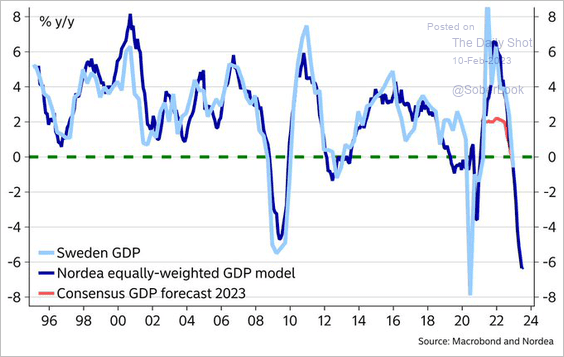

• Models point to a recession.

Source: @AndreasSteno, @MikaelSarwe

Source: @AndreasSteno, @MikaelSarwe

——————–

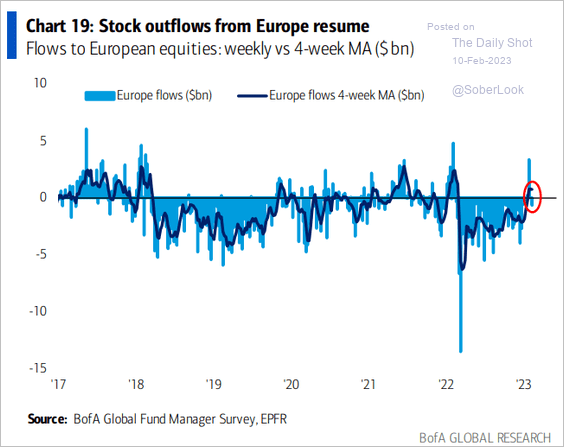

2. European stock funds see outflows again.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

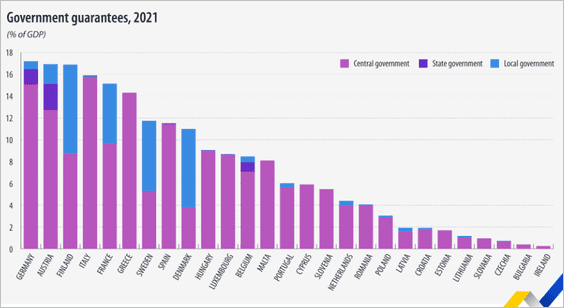

3. This chart shows government guarantees by country.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

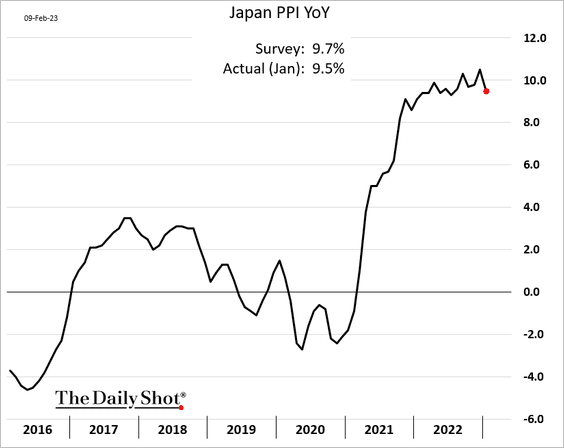

1. Japan’s PPI is back below 10%.

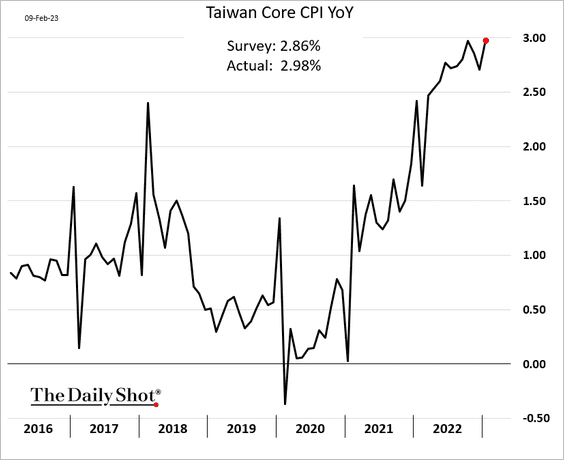

2. Taiwan’s core CPI is near 3% again, surpassing expectations.

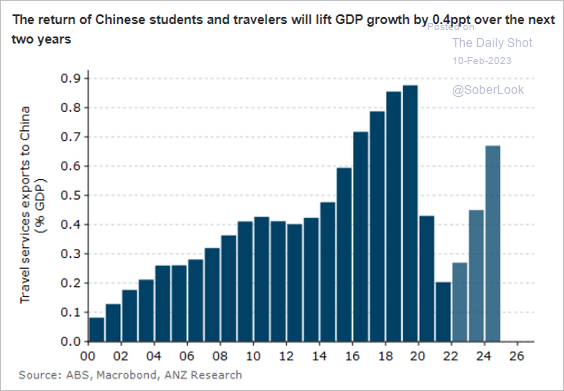

3. The rebound in visitors from China will boost Australia’s GDP growth.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

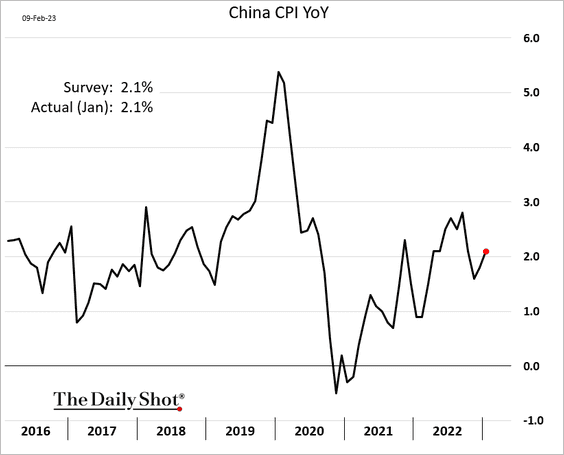

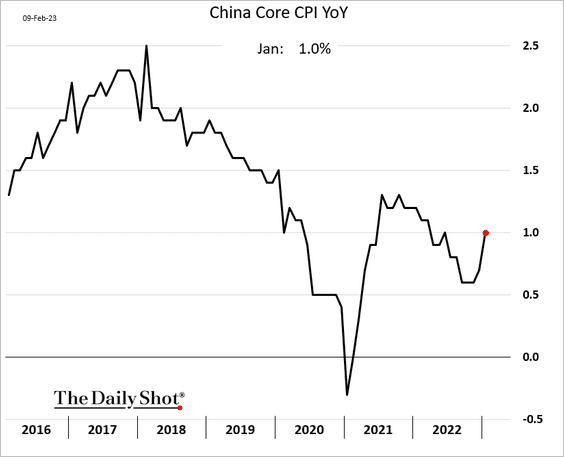

1. Consumer inflation climbed last month.

• Headline CPI:

• Core CPI:

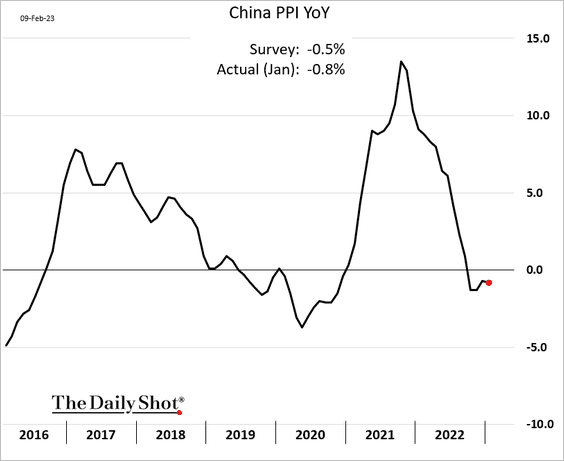

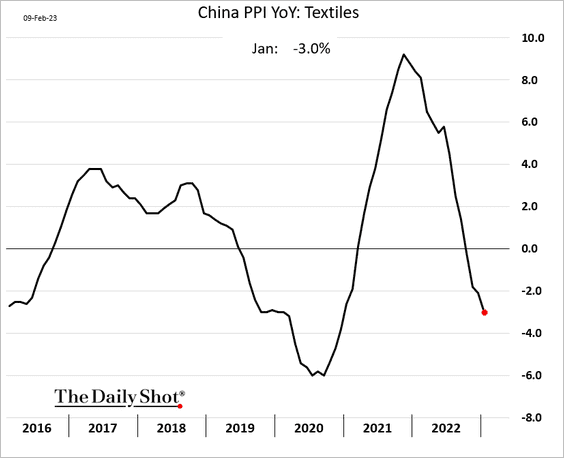

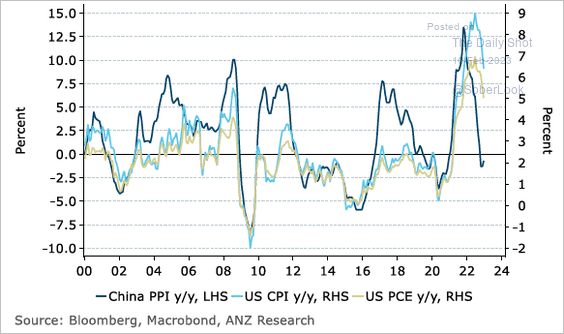

2. The PPI surprised to the downside.

This is good news for US inflation.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

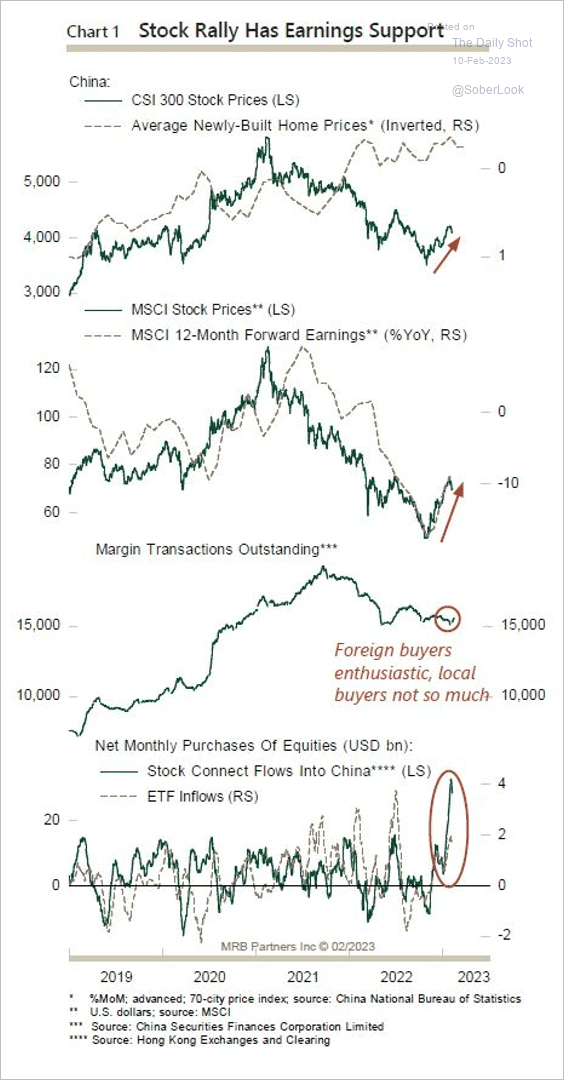

3. Chinese stocks have rallied alongside improving earnings momentum and inflows.

Source: MRB Partners

Source: MRB Partners

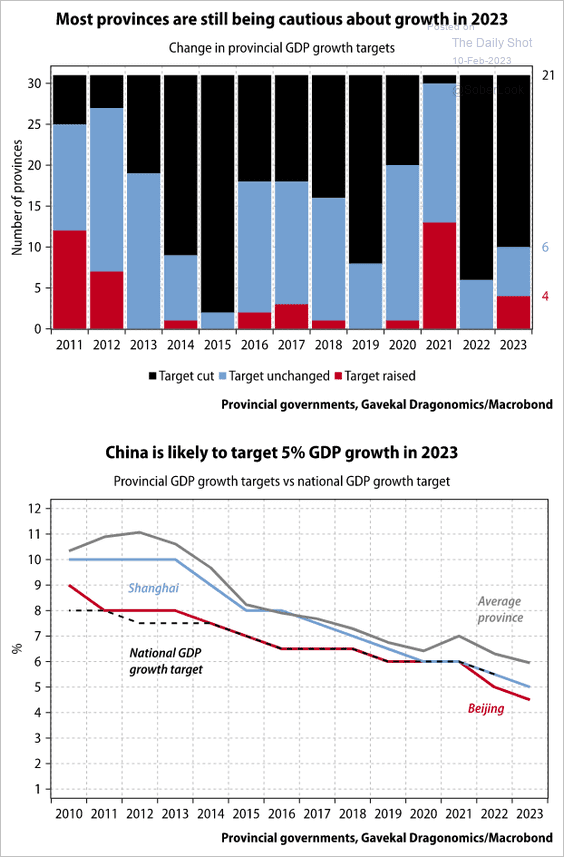

4. Most provinces cut their growth targets for 2023.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

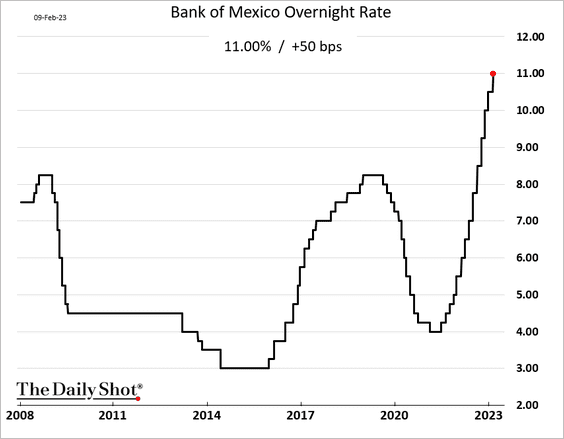

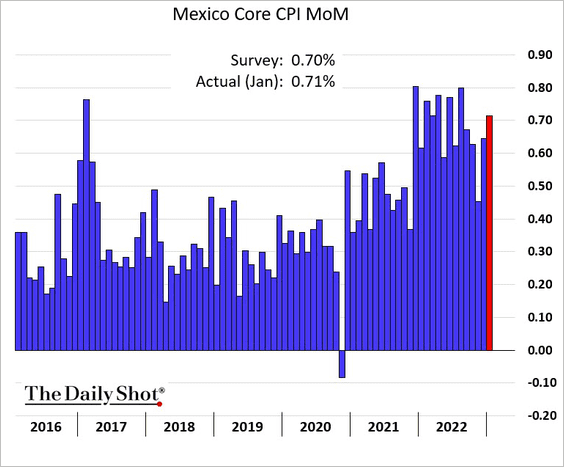

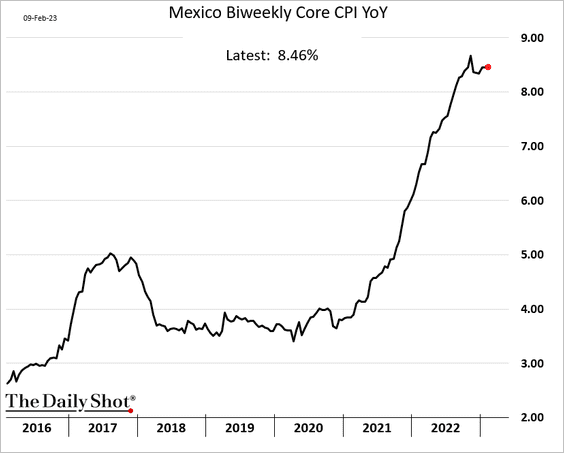

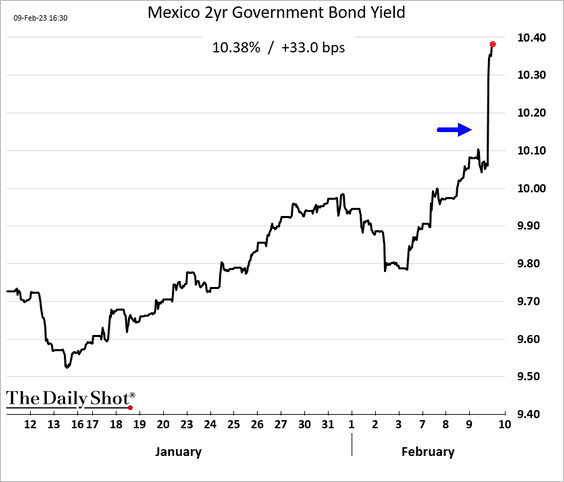

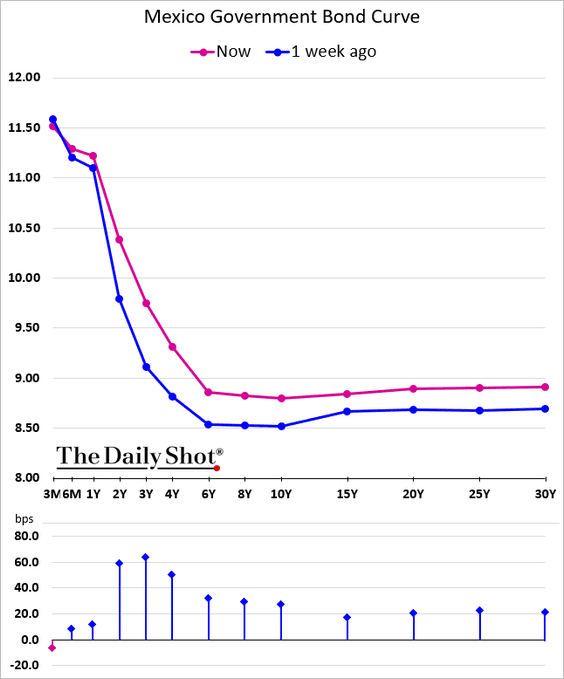

1. Banxico surprised the markets with a 50 bps rate hike amid persistently elevated core inflation (2nd and 3rd charts below). Based on the Fed’s decision, the market expected a 25 bps increase.

Further reading

Further reading

Source: @MddeH, @economics Read full article

Source: @MddeH, @economics Read full article

– Core CPI (month over month):

– Biweekly core CPI (year over year):

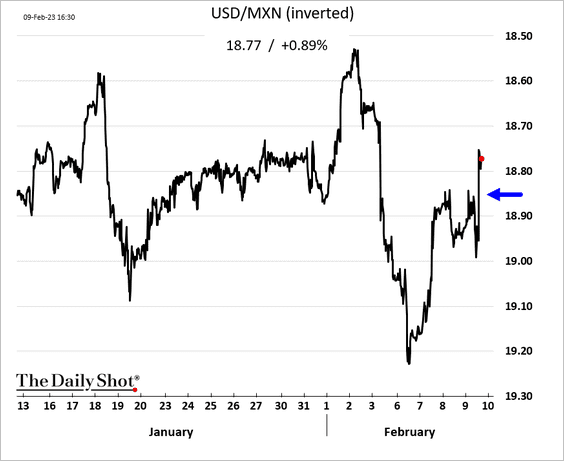

• The peso and bond yields jumped.

Here is the yield curve.

——————–

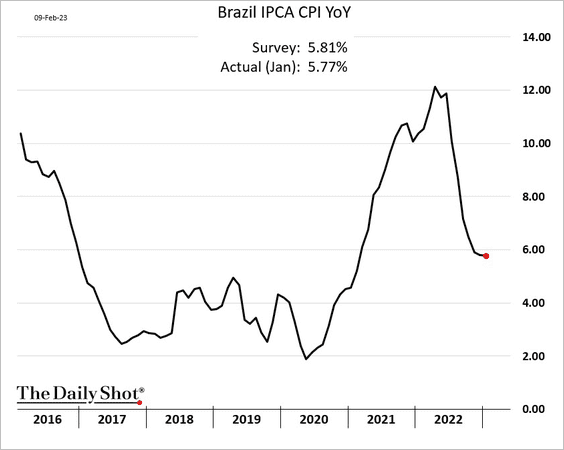

2. Brazil’s inflation continues to moderate.

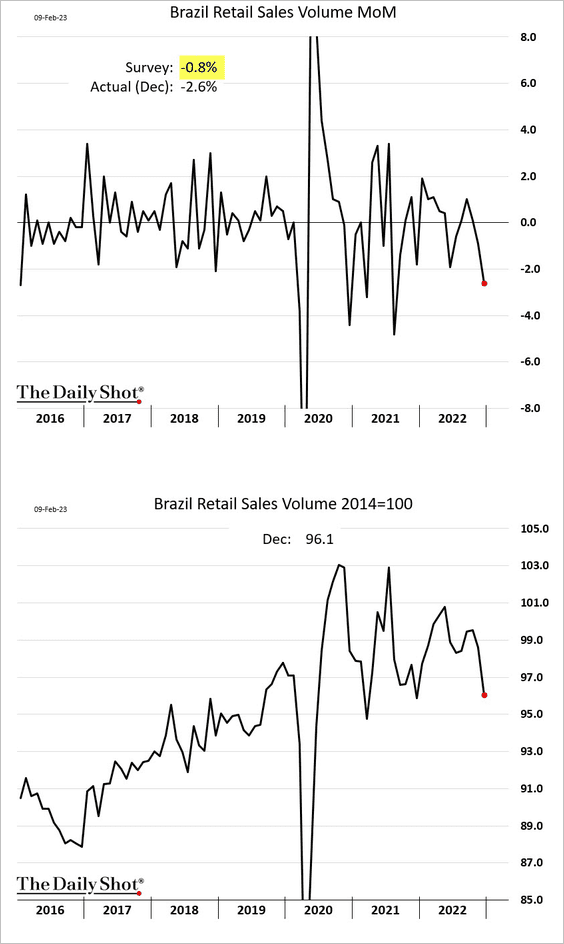

December retail sales surprised to the downside.

——————–

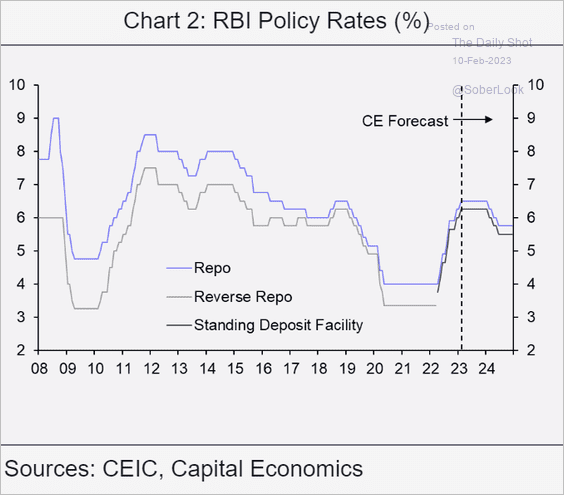

3. Is India’s central bank done raising rates?

Source: Capital Economics

Source: Capital Economics

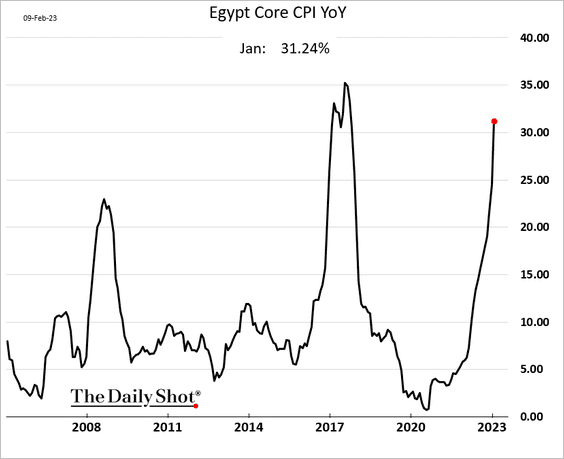

4. Egypt’s inflation climbed above 30% after the recent devaluation. More CPI gains ahead?

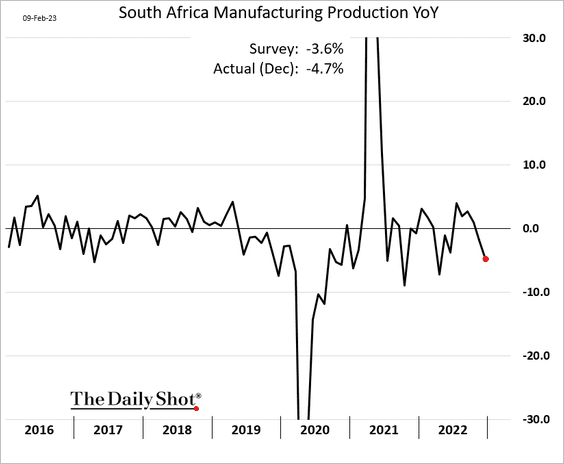

5. South Africa’s manufacturing output declined more than expected on a year-over-year basis.

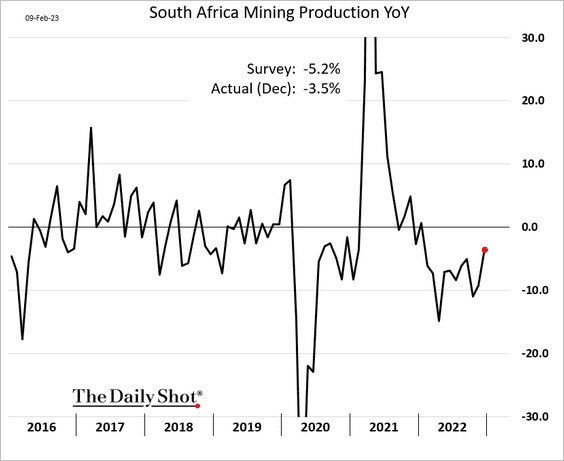

But mining production showed some improvement.

——————–

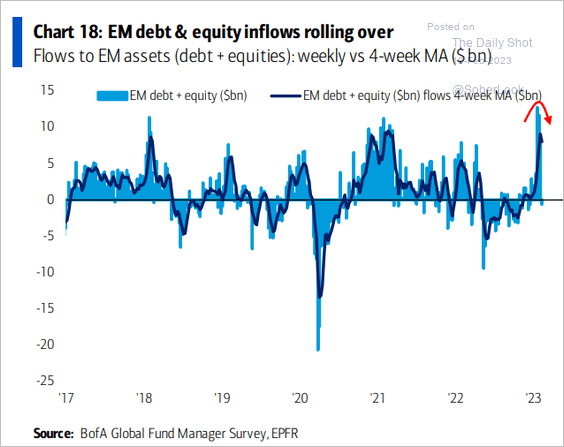

6. EM equity fund inflows are rolling over.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

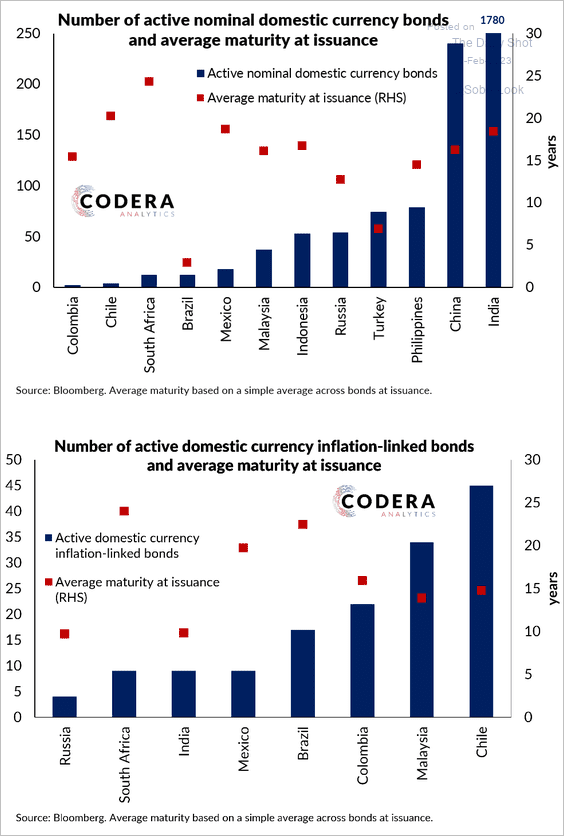

7. This chart shows the number of domestic nominal and inflation-linked bonds by country and average maturity at issuance.

Source: Codera Analytics Further reading

Source: Codera Analytics Further reading

Back to Index

Cryptocurrency

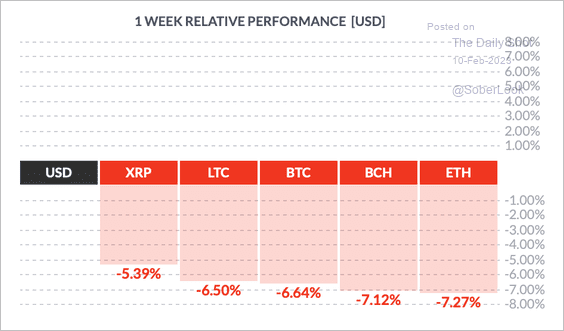

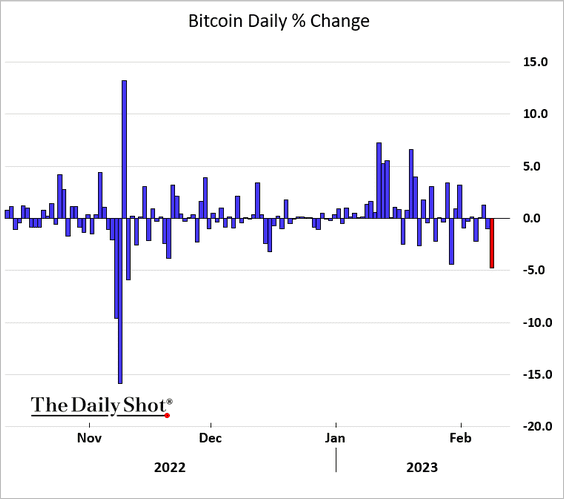

1. The crypto rally stalled over the past week, with ether (ETH) underperforming large-cap peers.

Source: FinViz

Source: FinViz

Bitcoin was down almost 5% on Thursday.

——————–

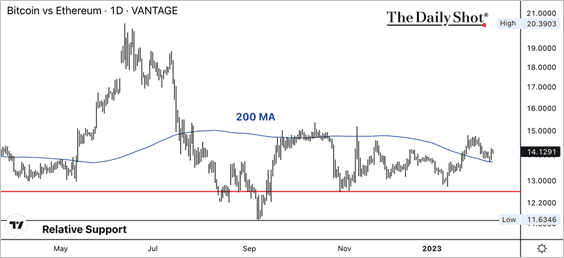

2. The BTC/ETH price ratio is holding support above its 200-day moving average. A sustained rise in this ratio typically signals risk-off conditions.

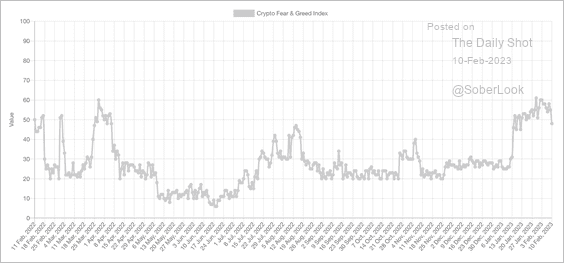

3. The Crypto Fear & Greed Index declined from “greed” territory and returned to “neutral” over the past week.

Source: Alternative.me

Source: Alternative.me

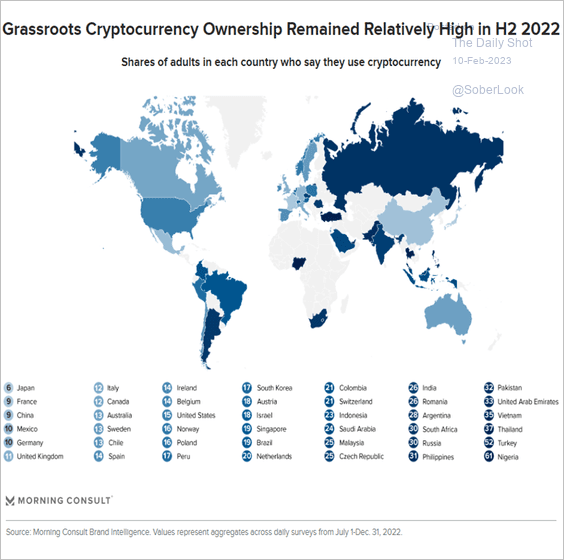

4. Finally, we have “grassroots” crypto ownership by country.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Commodities

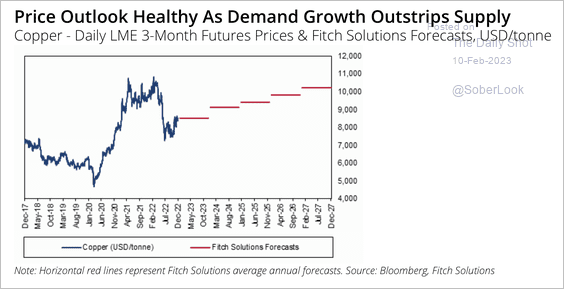

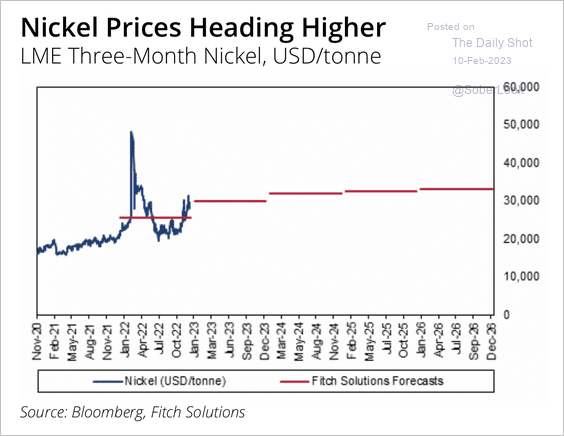

Fitch expects higher copper and nickel prices as demand outstrips supply, especially with China’s reopening. (2 charts)

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Equities

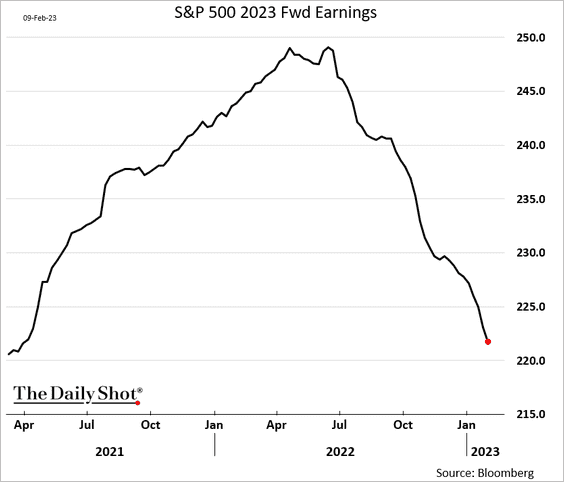

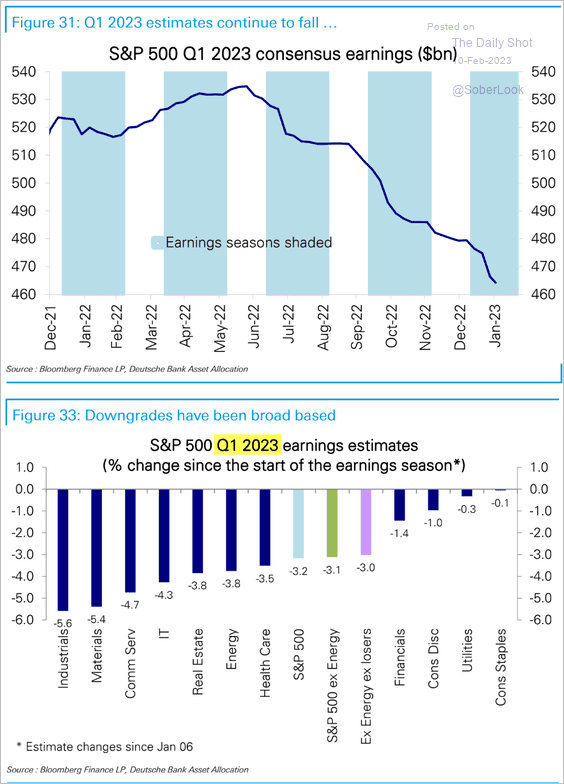

1. Analysts’ 2023 S&P 500 earnings forecasts are down 11% from the peak. More downgrades ahead?

• Here is the evolution of earnings estimates for the current quarter, with industrials and materials taking the biggest hit.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

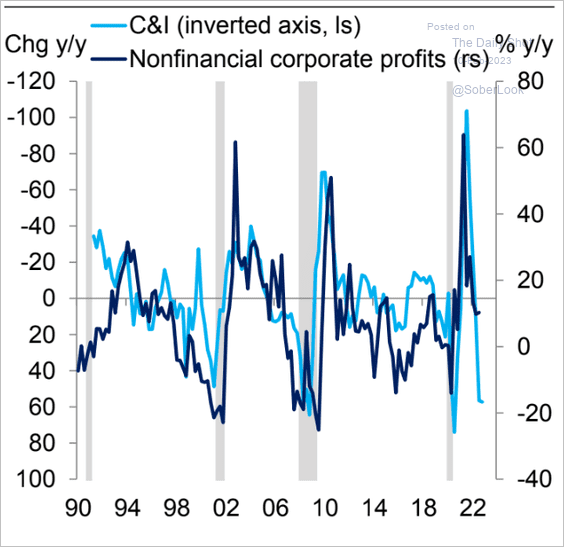

• Tighter credit conditions point to further weakness in profits.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

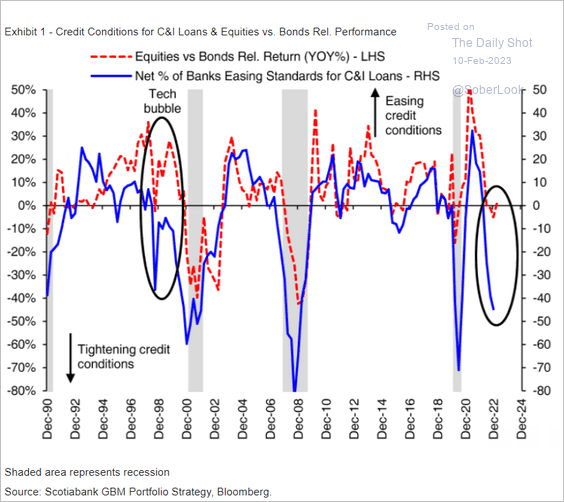

2. Tighter credit conditions also suggest that equities will underperform bonds.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

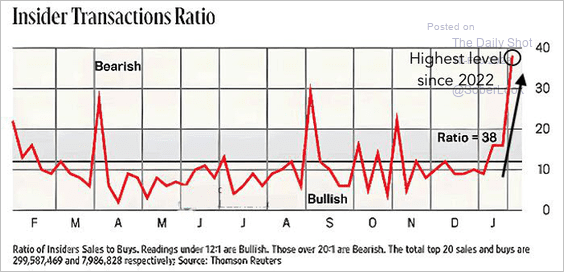

3. The Insider Transaction Ratio signals bearish sentiment.

Source: Thomson Reuters, Barron’s

Source: Thomson Reuters, Barron’s

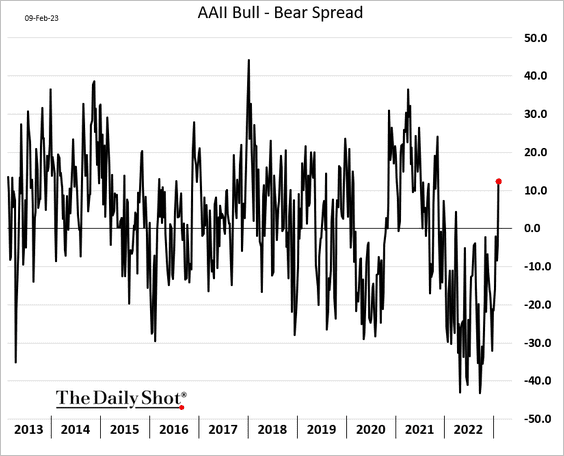

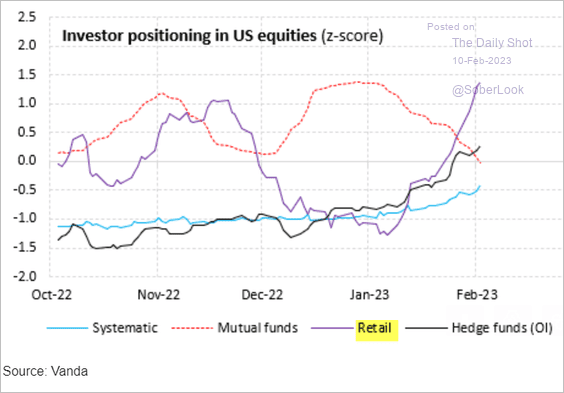

But retail investors have turned bullish (2 charts).

Source: @BTLipschultz, @markets Read full article

Source: @BTLipschultz, @markets Read full article

Source: Vanda Research

Source: Vanda Research

——————–

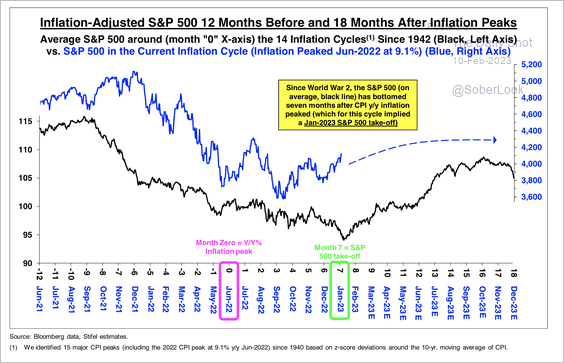

4. The S&P 500 typically bottoms about seven months after inflation peaks.

Source: Stifel

Source: Stifel

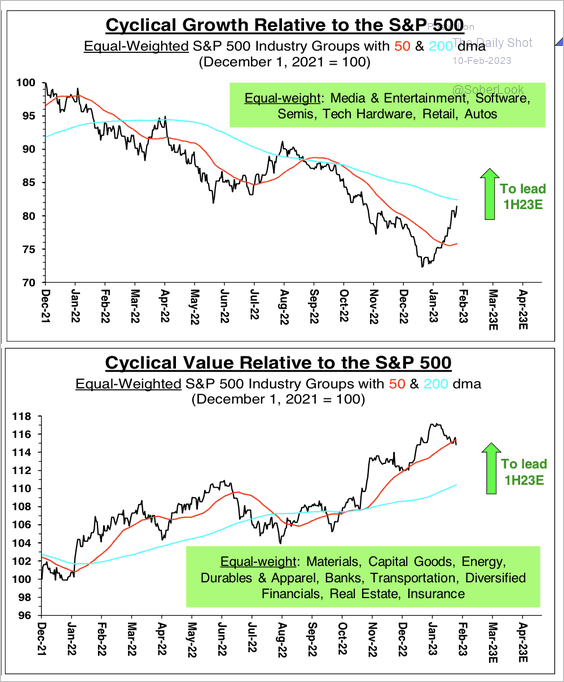

Declining inflation has benefitted cyclical growth relative to cyclical value.

Source: Stifel

Source: Stifel

——————–

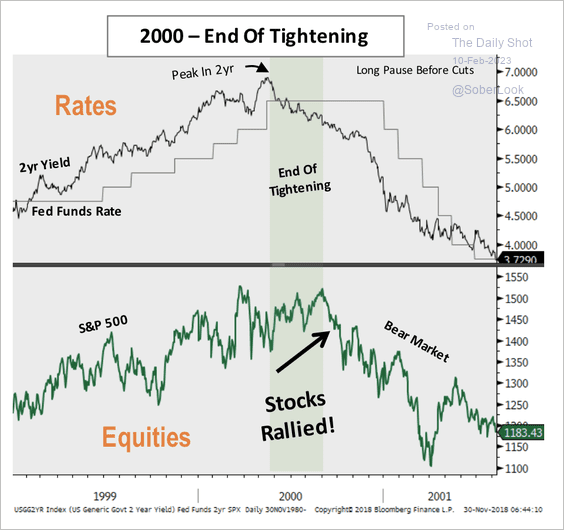

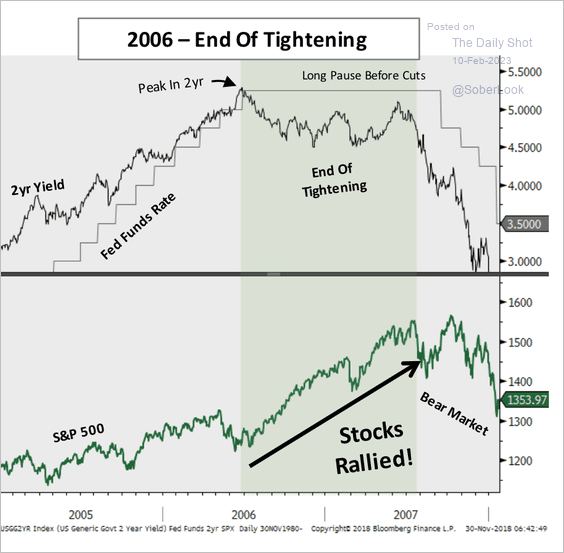

5. Historically, stocks have rallied around the peak of the Fed hiking cycle, but immediate gains have been short-lived if the economy enters a recession. This time, however, drawdowns have been more severe during the start of the hiking phase. (2 charts)

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

——————–

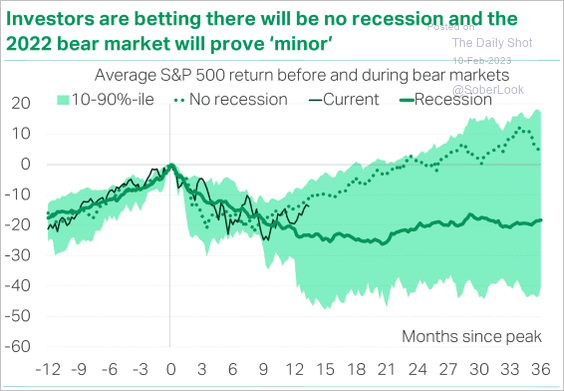

6. Is the market pricing in a no-recession scenario?

Source: TS Lombard

Source: TS Lombard

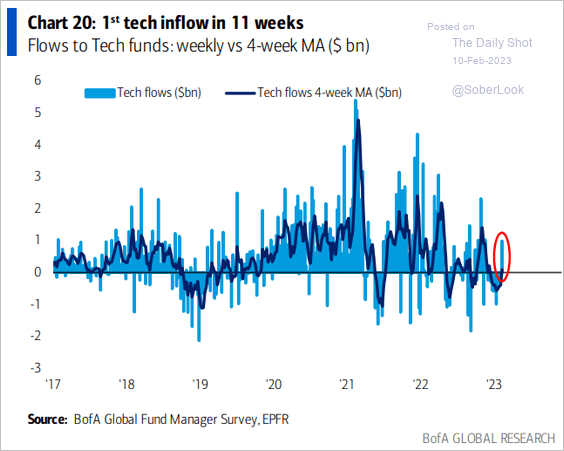

7. Tech stocks finally saw some inflows.

Source: BofA Global Research

Source: BofA Global Research

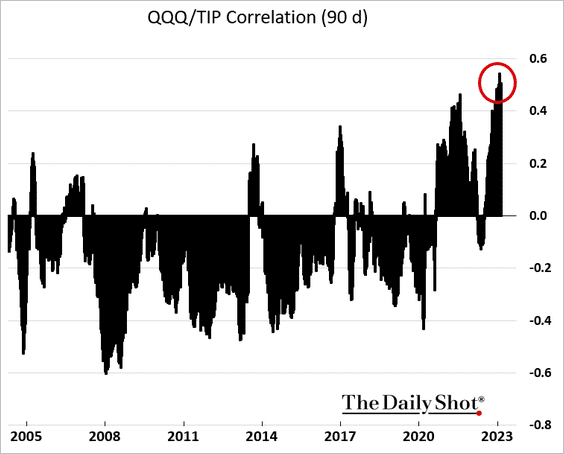

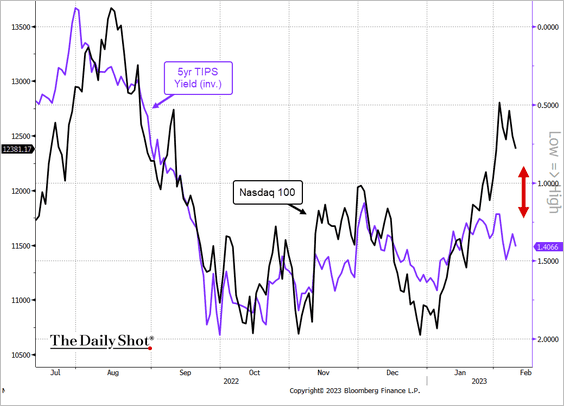

8. The Nasdaq 100 has been highly correlated with inflation-linked Treasuries (TIPS) over the past 90 days (inversely correlated to real yields).

So what should we make of this recent divergence?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

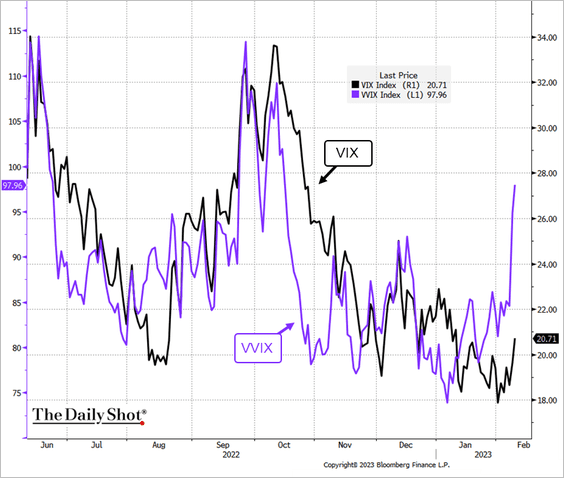

9. VVIX (vol of vol) has diverged from VIX, pointing to surging demand for VIX call options (downside protection for stocks).

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @themarketear

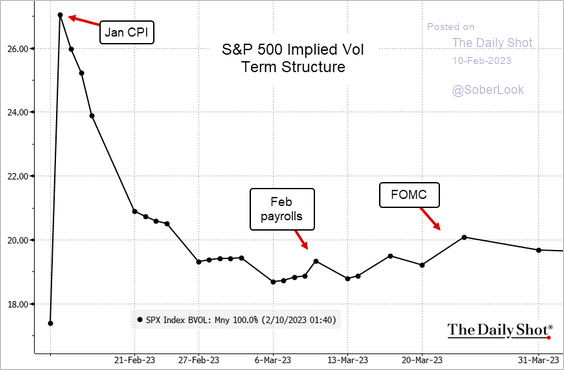

10. All eyes are on next week’s CPI report.

Back to Index

Rates

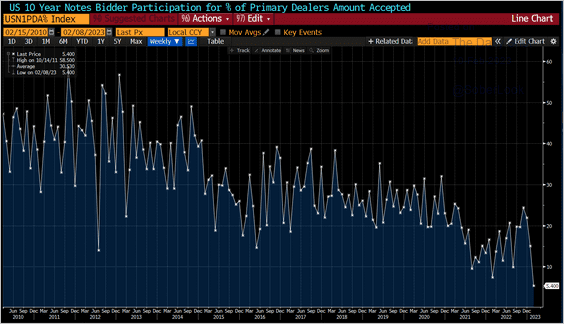

1. The 10-year Treasury auction showed robust demand, with dealers taking down the smallest share of notes on record. That indicates demand from a broad array of investors.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

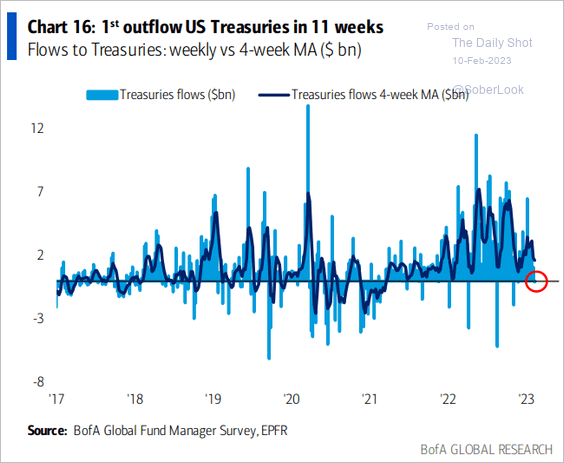

2. Treasury funds saw some outflows.

Source: BofA Global Research Read full article

Source: BofA Global Research Read full article

——————–

Food for Thought

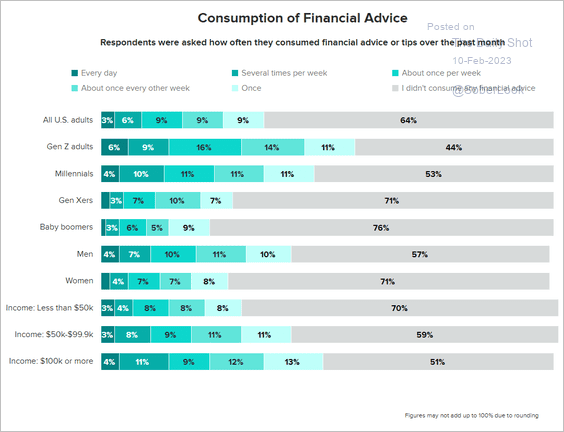

1. Consumption of financial advice:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

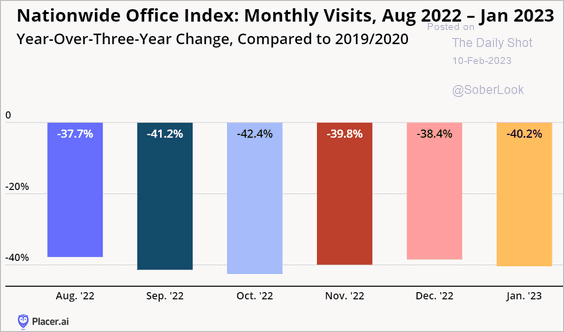

2. US office visits (still down 40% from pre-COVID levels):

Source: Placer.ai

Source: Placer.ai

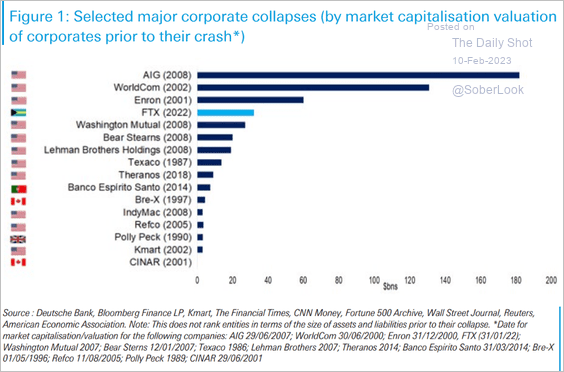

3. Major corporate collapses since 1987:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

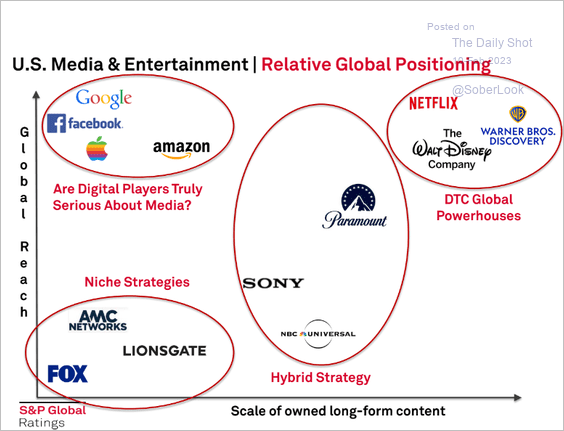

4. Media companies’ global reach vs. content ownership:

Source: S&P Global Ratings

Source: S&P Global Ratings

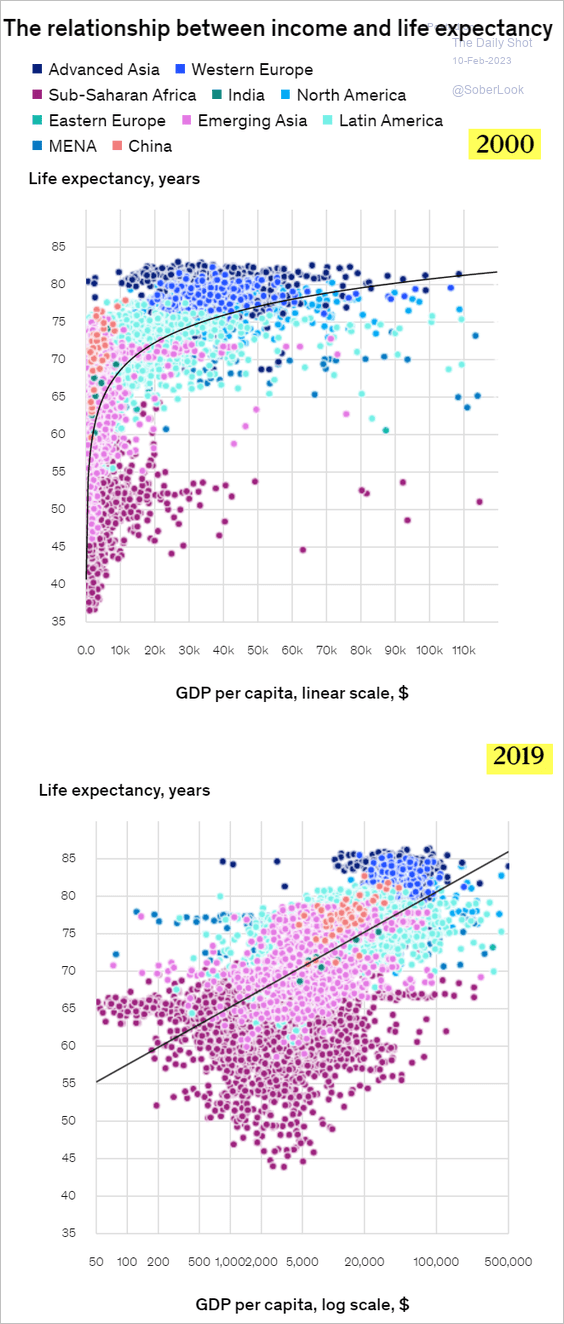

5. Life expectancy and GDP per capita:

Source: McKinsey & Company, h/t Walter Read full article

Source: McKinsey & Company, h/t Walter Read full article

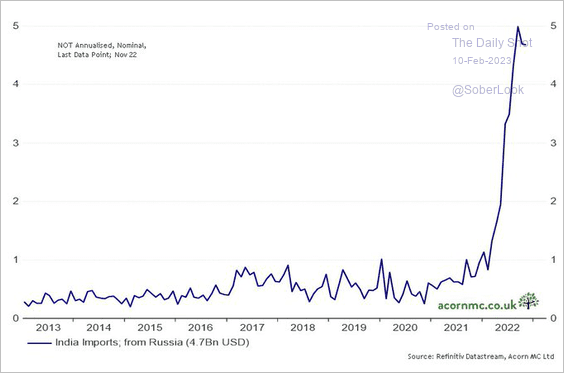

6. India’s imports from Russia:

Source: @RichardDias_CFA

Source: @RichardDias_CFA

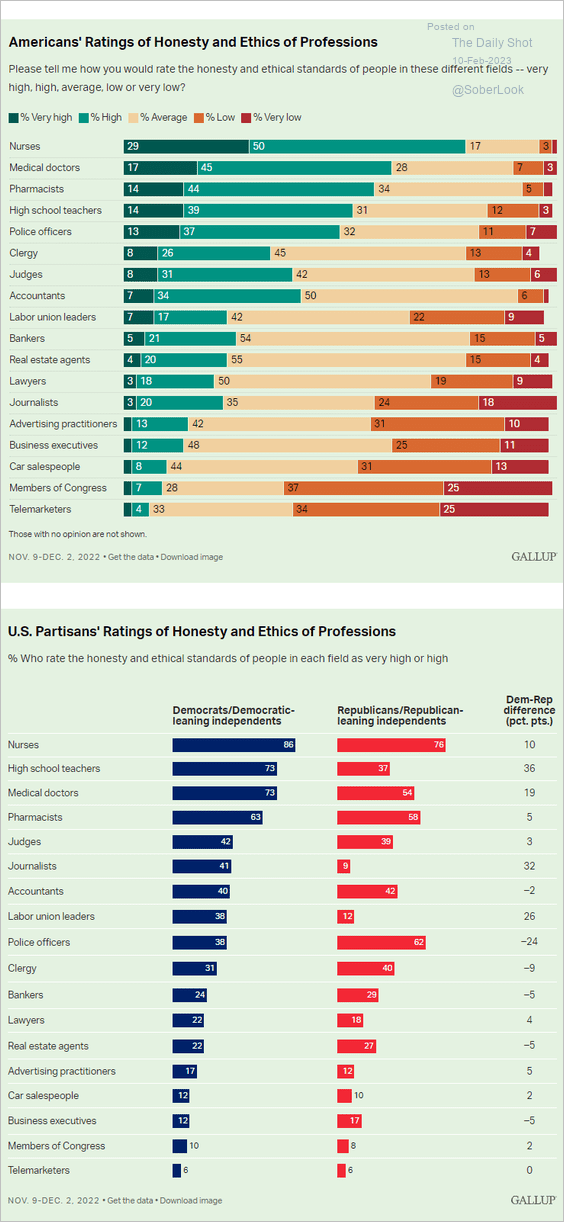

7. Honesty and ethics ratings by profession:

Source: Gallup Read full article

Source: Gallup Read full article

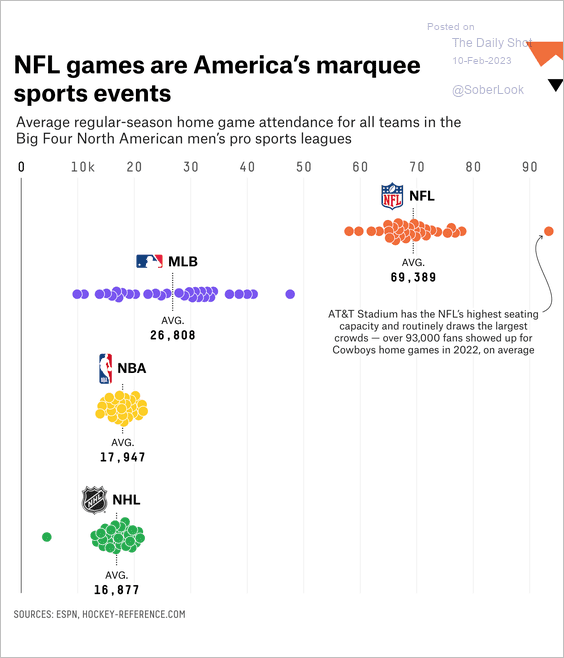

8. Home game attendance in North American men’s pro sports leagues:

Source: @FiveThirtyEight Read full article

Source: @FiveThirtyEight Read full article

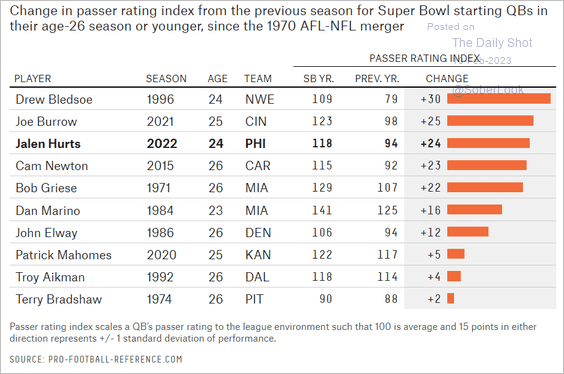

• Super Bowl’s most improved QBs:

Source: @neil_paine, @friscojosh, FiveThirtyEight Read full article

Source: @neil_paine, @friscojosh, FiveThirtyEight Read full article

——————–

Have a great weekend!

Back to Index