The Daily Shot: 21-Feb-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

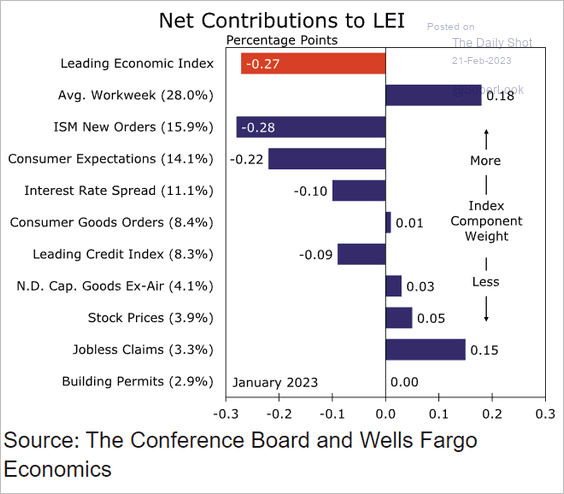

1. The Conference Board’s leading index declined again last month.

• Here are the drivers of the index in January.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

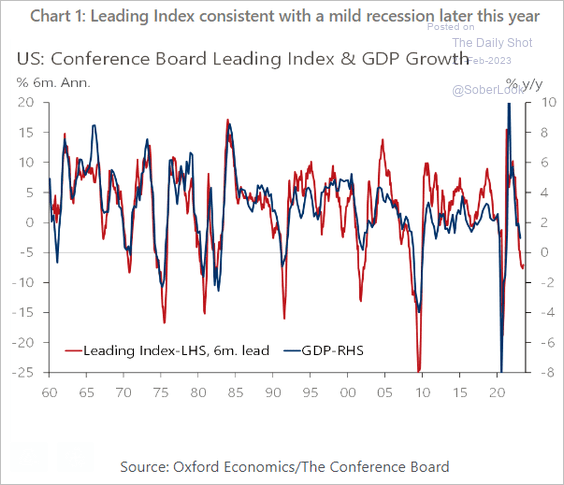

• The leading index continues to signal a mild recession ahead, …

Source: Oxford Economics

Source: Oxford Economics

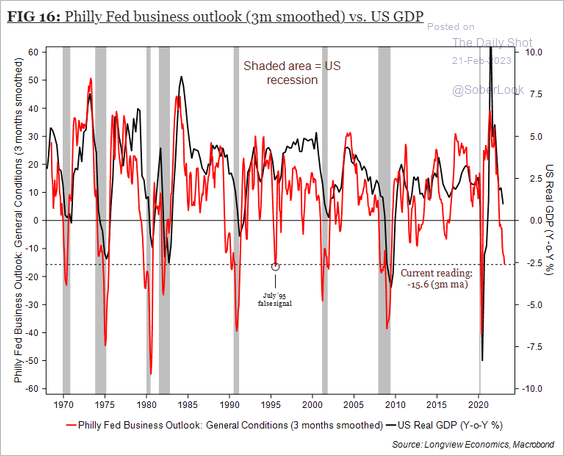

… which is consistent with the February Philly Fed’s regional manufacturing outlook indicator.

Source: Longview Economics

Source: Longview Economics

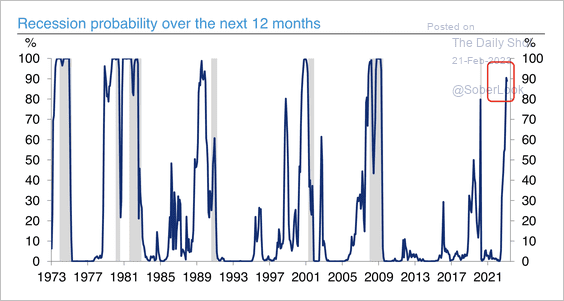

• Deutsche Bank’s model shows a 90% chance of recession over the next 12 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

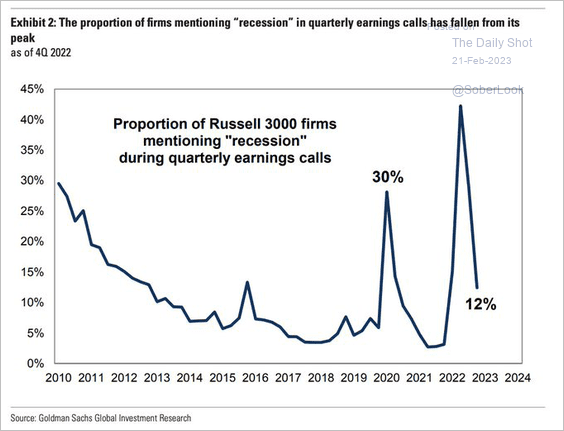

• However, fewer firms are mentioning “recession” on earnings calls.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

——————–

2. The World Economics SMI report shows US business activity returning to growth this month.

Source: World Economics

Source: World Economics

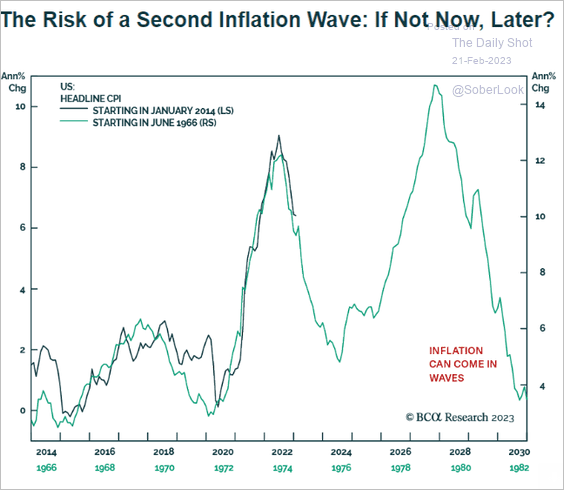

3. Next, we have some updates on inflation.

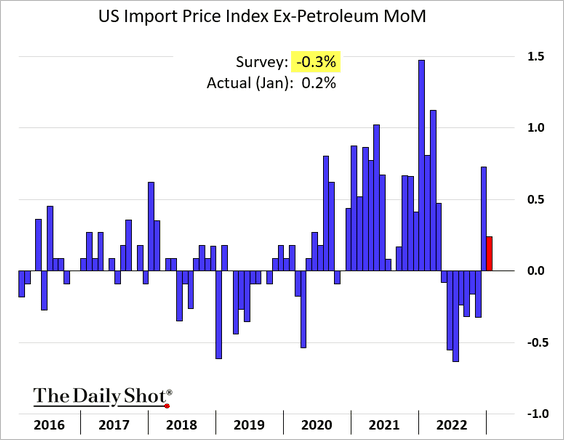

• Import prices (excluding petroleum) unexpectedly climbed in January.

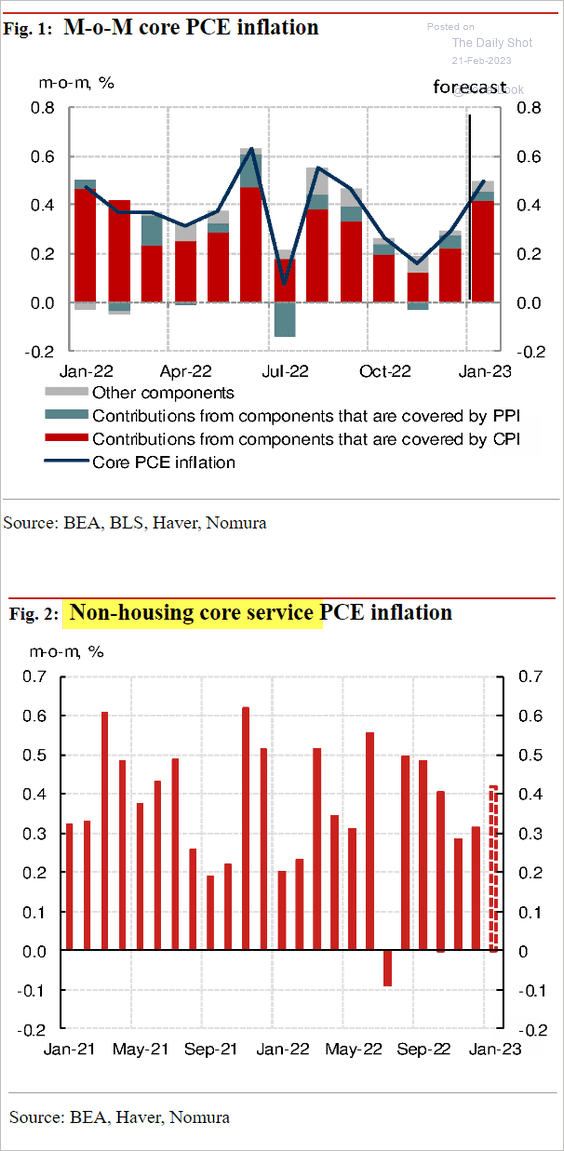

• Based on the CPI and PPI reports, Nomura estimates a jump in the core PCE inflation in January.

Source: Nomura Securities

Source: Nomura Securities

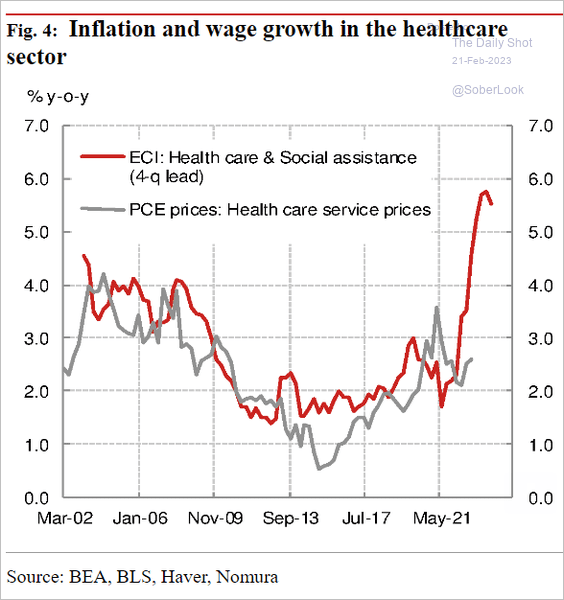

• The recent surge in healthcare wage growth signals higher inflation in the sector.

Source: Nomura Securities

Source: Nomura Securities

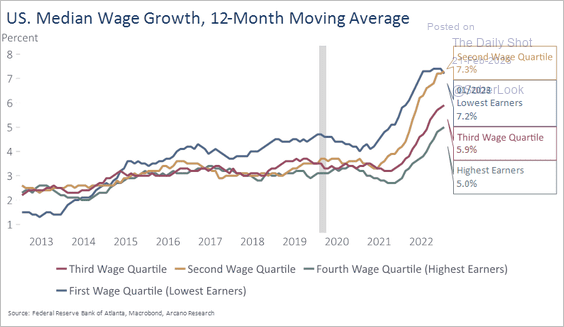

• This chart shows US wage growth by wage quartile.

Source: Arcano Economics

Source: Arcano Economics

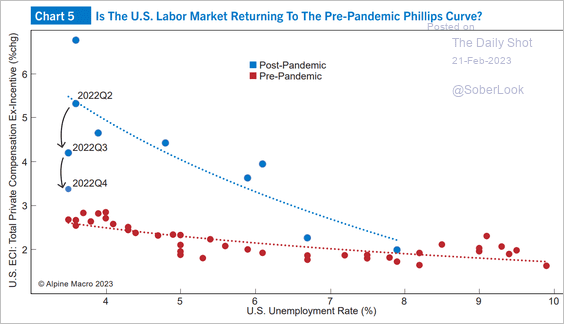

• Back to the old Phillips Curve?

Source: Alpine Macro

Source: Alpine Macro

——————–

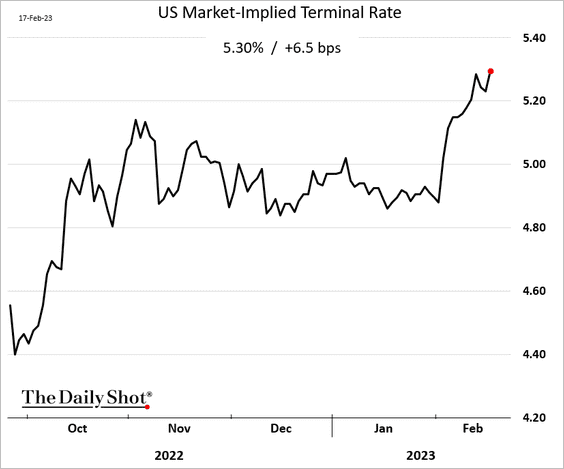

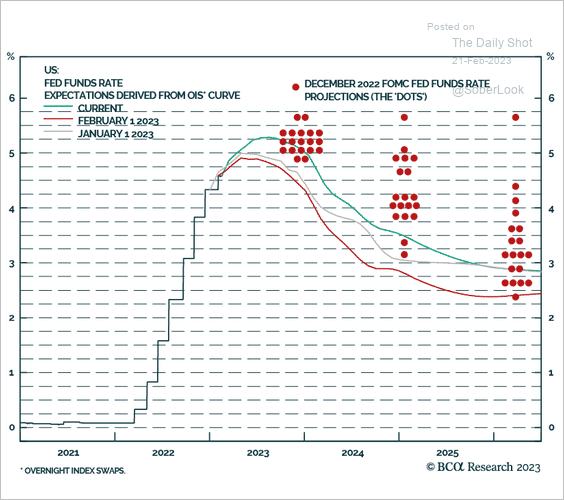

4. The market-implied terminal rate is up some 40 basis points this month. It’s surprising to see the stock market barely responding to this repricing in rate hike expectations.

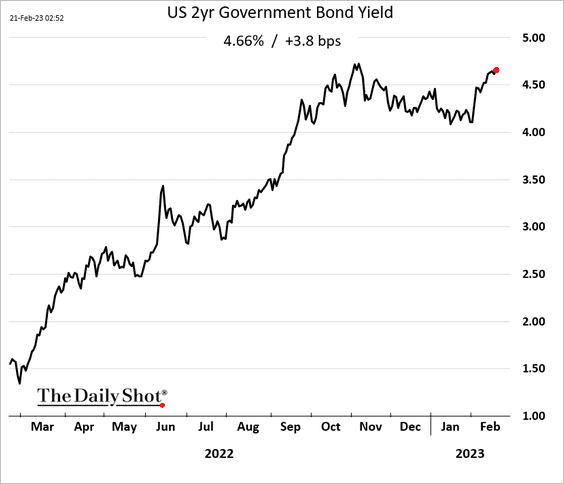

• The 2-year Treasury yield is nearing last year’s peak.

• Deutsche Bank expects an even higher terminal rate than the market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The market is now more in line with the 2023 dot-plot, but there is a disagreement between the market and FOMC projections on rate cuts next year.

Source: BCA Research

Source: BCA Research

• Here is why the Fed is less likely to cut rates, even amid soft economic activity.

Source: BCA Research

Source: BCA Research

——————–

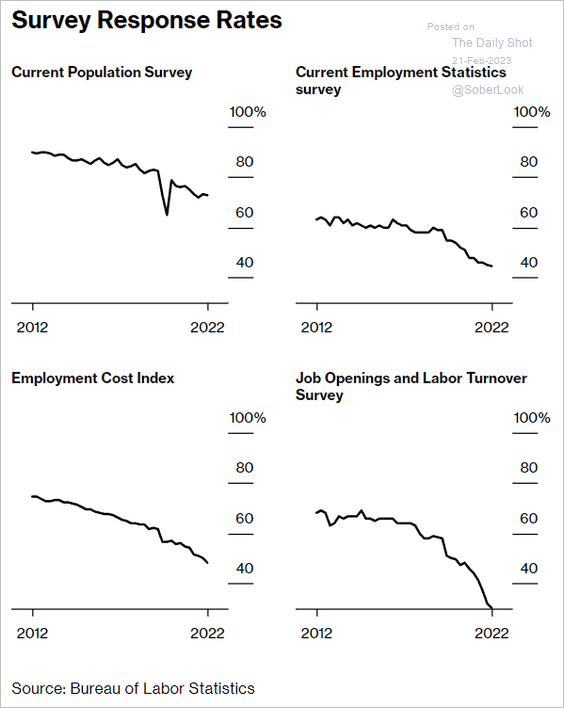

5. Participation rates in key US economic data surveys have been falling.

Source: @readep, @BW Read full article

Source: @readep, @BW Read full article

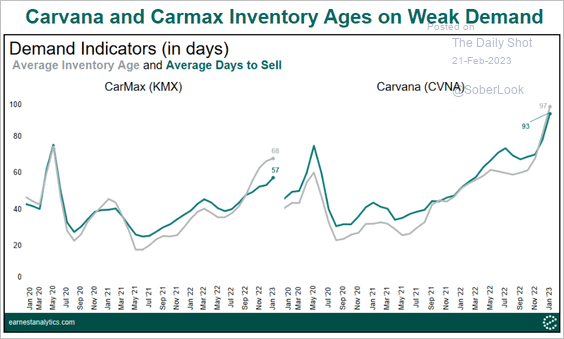

6. Used cars are taking longer to sell.

Source: @earnestinsights

Source: @earnestinsights

Back to Index

The United Kingdom

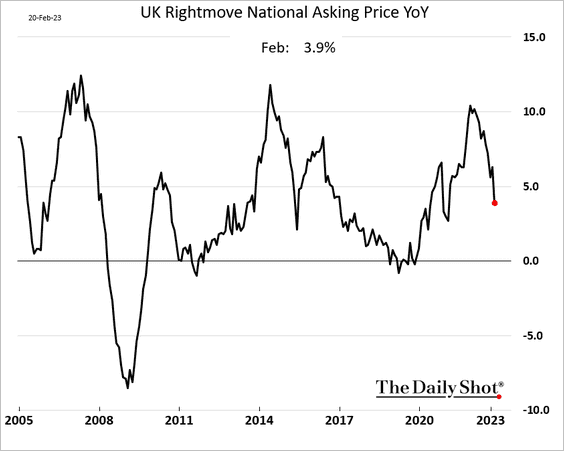

1. Home price appreciation continues to slow.

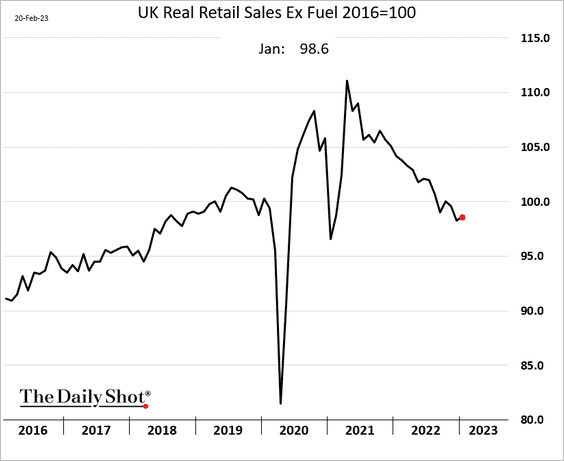

2. Retail sales edged up last month.

3. Tighter consumer credit conditions ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

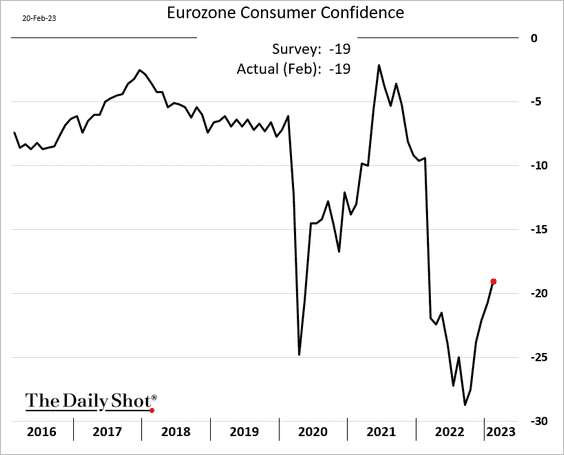

1. Consumer confidence continues to rebound.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

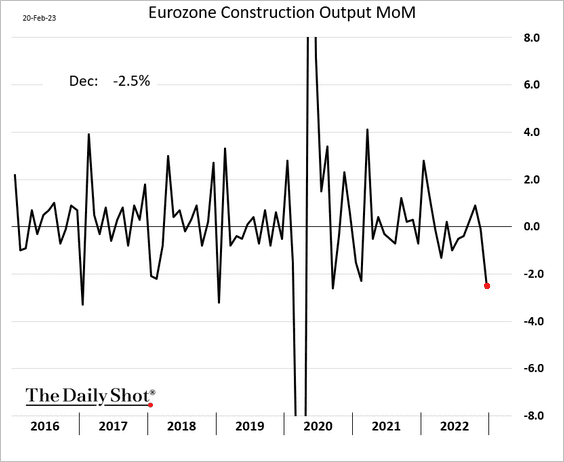

2. Construction output tumbled in December.

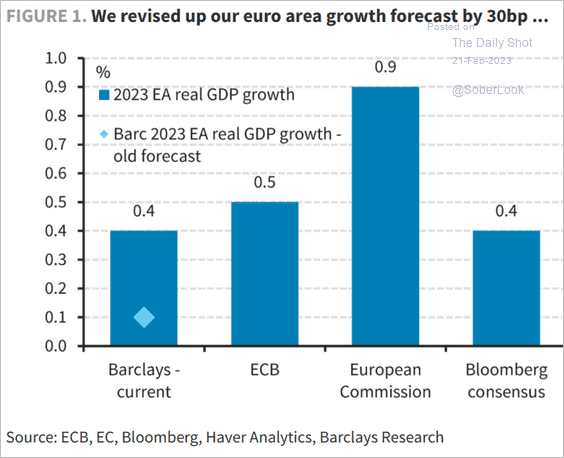

3. Barclays upgraded their 2023 GDP forecast for the euro area.

Source: Barclays Research

Source: Barclays Research

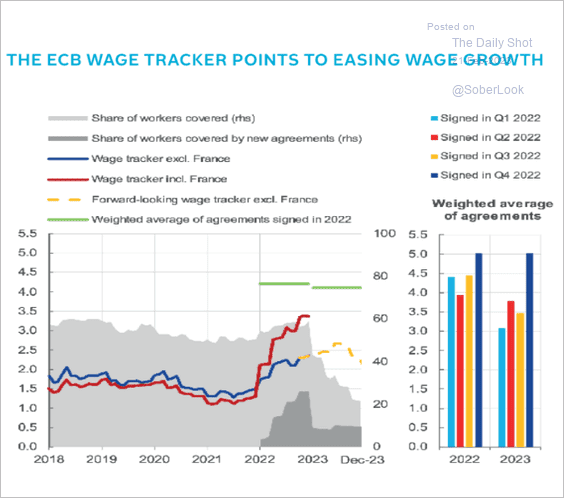

4. Will wage growth slow down later this year?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

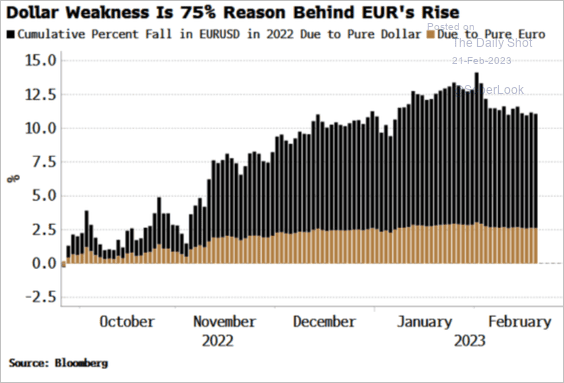

5. Much of the euro’s recent strength has been due to the dollar’s weakness.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Europe

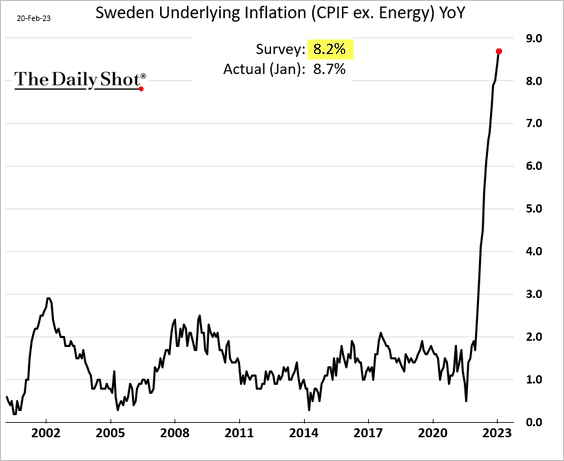

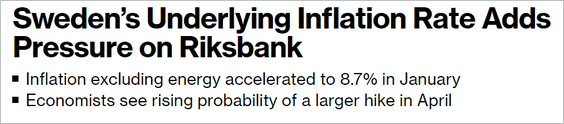

1. Sweden’s underlying inflation print was a shocker.

Source: @nicrolander, @economics Read full article

Source: @nicrolander, @economics Read full article

• Price gains were driven by services.

Source: Nordea Markets

Source: Nordea Markets

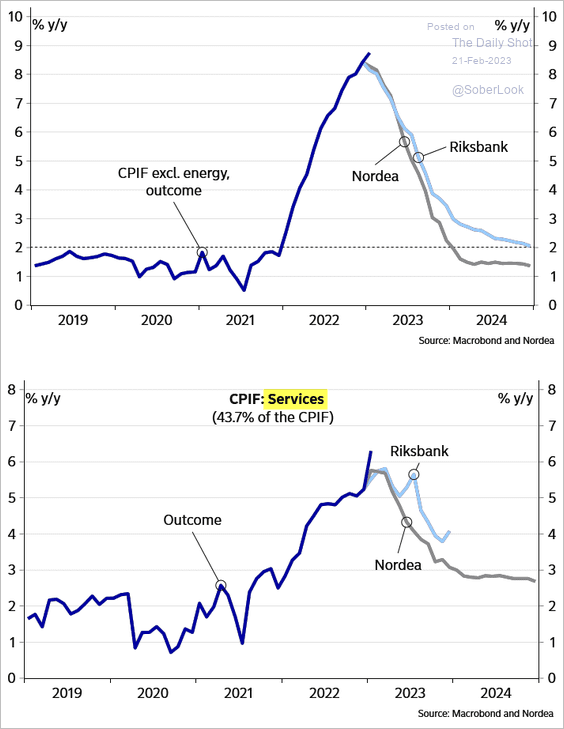

• The 2-year yield is above 3% for the first time since 2008.

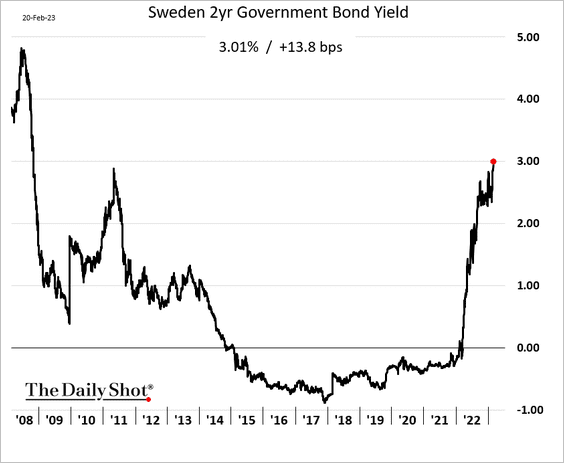

Here is the yield curve.

——————–

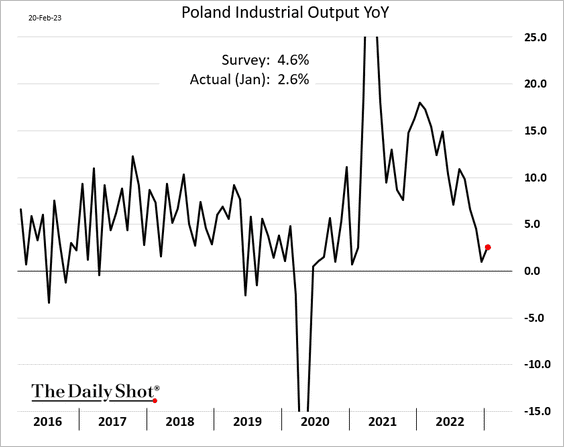

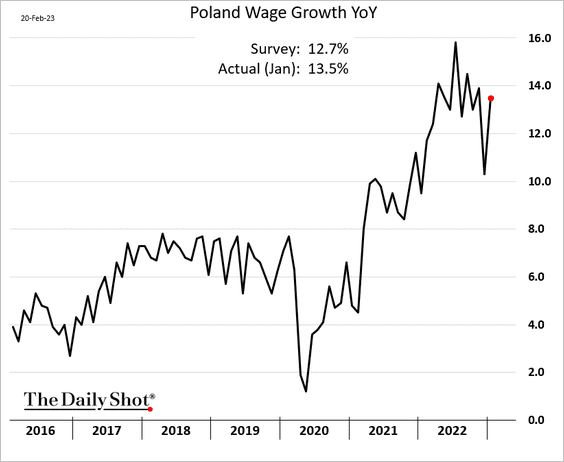

2. Poland’s January industrial production was disappointing.

But wage growth topped expectations.

——————–

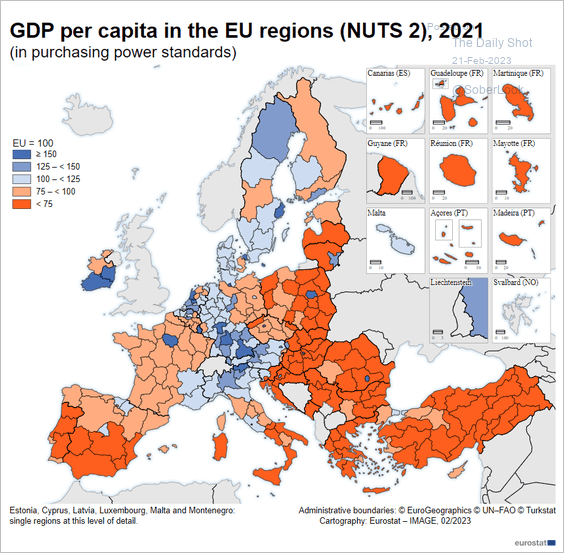

3. This map shows the regional GDP per capita in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

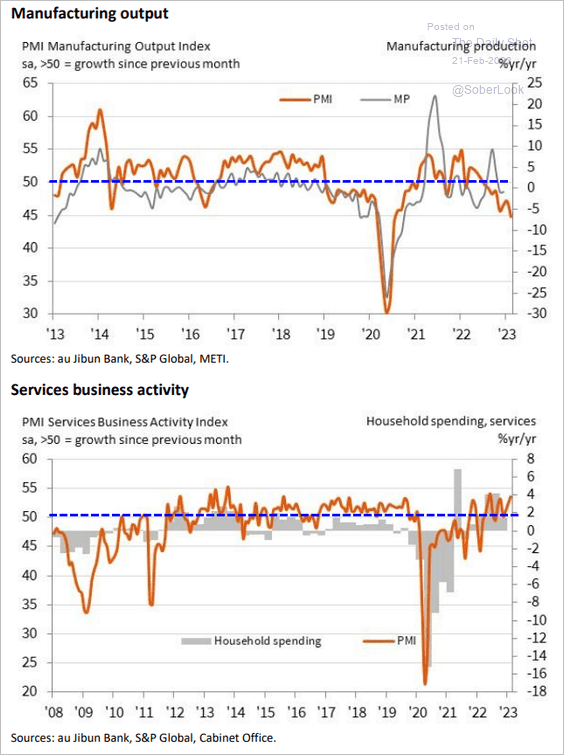

1. Manufacturing and services activity (PMI) indicators have diverged.

Source: S&P Global PMI

Source: S&P Global PMI

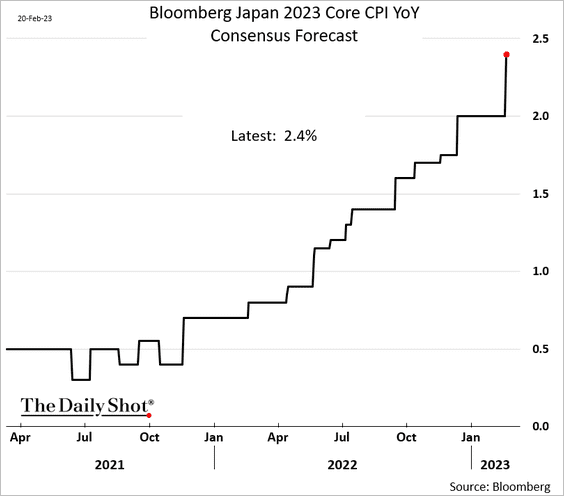

2. Bloomberg’s survey shows economists boosting their core CPI forecasts for 2023.

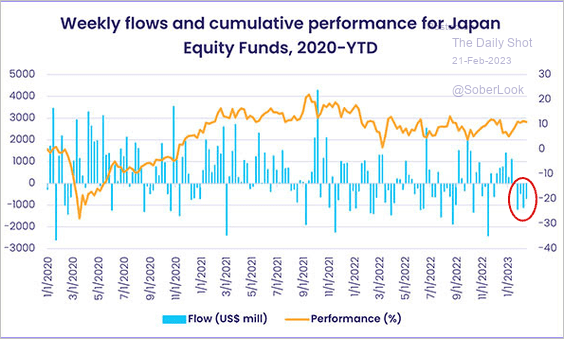

3. Japan-focused funds are seeing some outflows.

Source: EPFR

Source: EPFR

Back to Index

Asia-Pacific

1. South Korea’s consumer confidence remains in the doldrums.

2. Taiwan’s January export orders topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

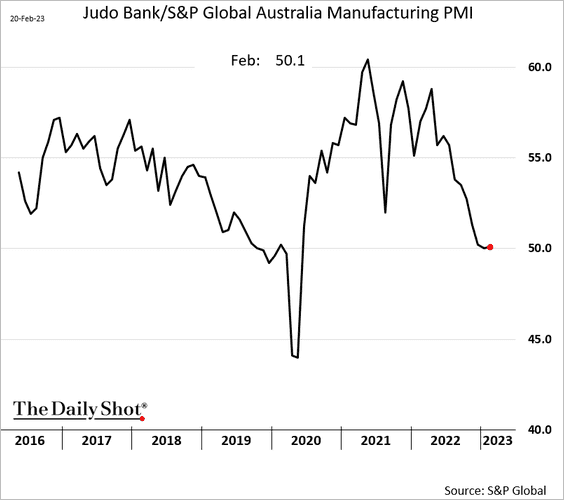

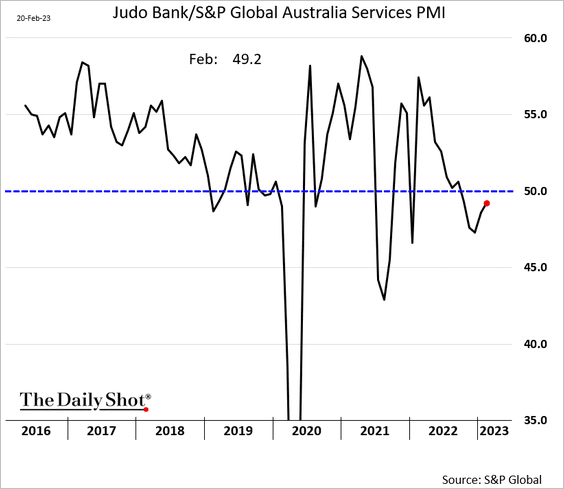

3. S&P Global’s PMI report showed improvement in Australia’s business activity this month.

• Manufacturing (modest growth):

• Services (slower contraction):

Back to Index

China

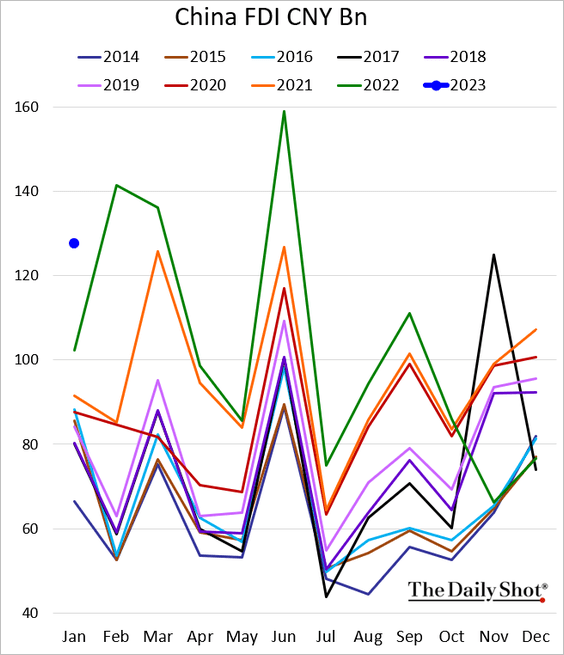

1. Foreign direct investment was very strong in January.

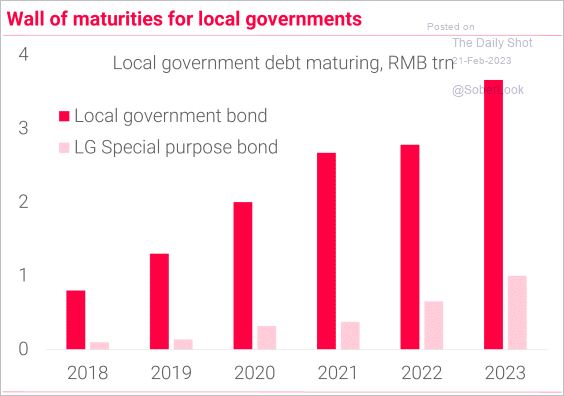

2. There is a lot of local government debt maturing this year.

Source: TS Lombard

Source: TS Lombard

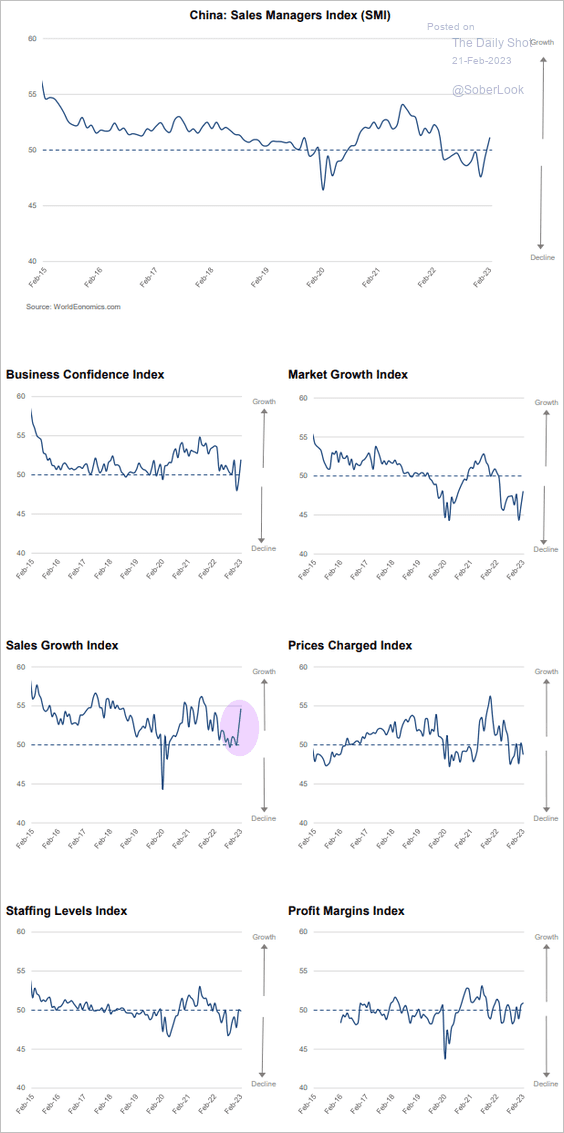

3. The World Economics SMI report shows a rebound in business activity this month.

Source: World Economics

Source: World Economics

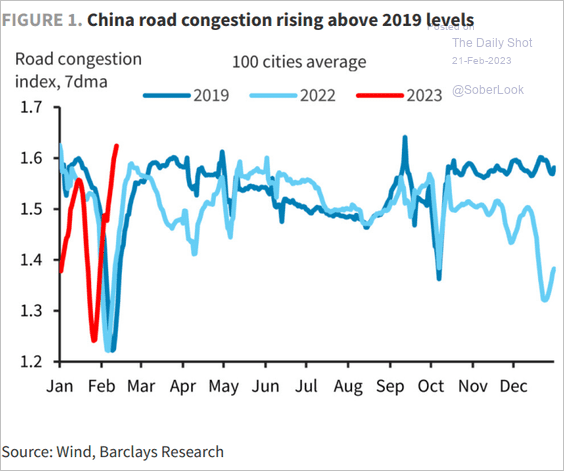

4. Road congestion surged as the country reopened.

Source: Barclays Research

Source: Barclays Research

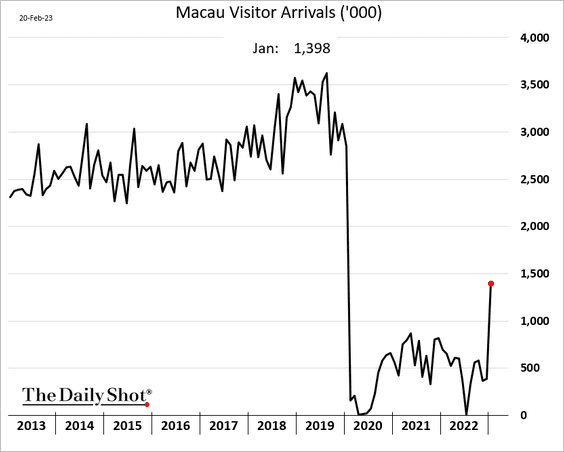

5. Macau visitor arrivals are finally recovering.

6. China’s CSI 300 stock market benchmark is at support.

Source: @SashaAndo, @markets Read full article

Source: @SashaAndo, @markets Read full article

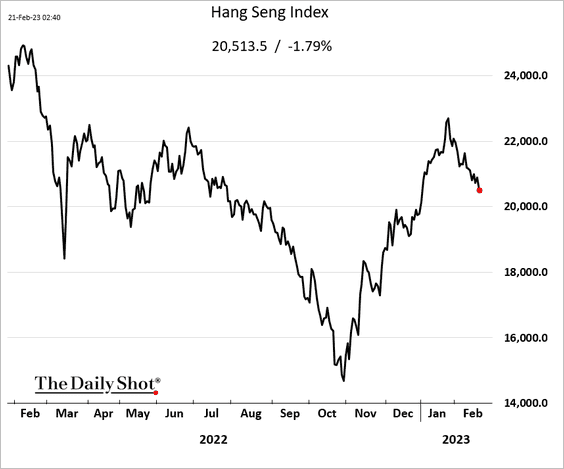

Hong Kong stocks are rolling over.

Back to Index

Emerging Markets

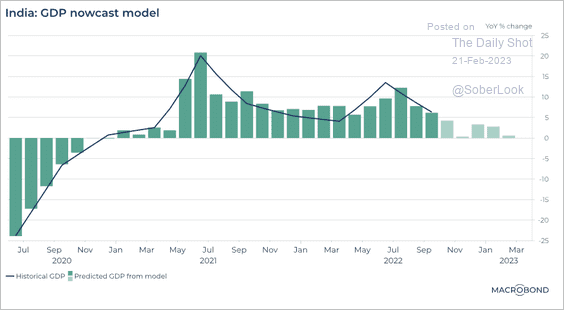

1. Macrobond’s India GDP nowcast model points to a growth slowdown.

Source: @MacrobondF

Source: @MacrobondF

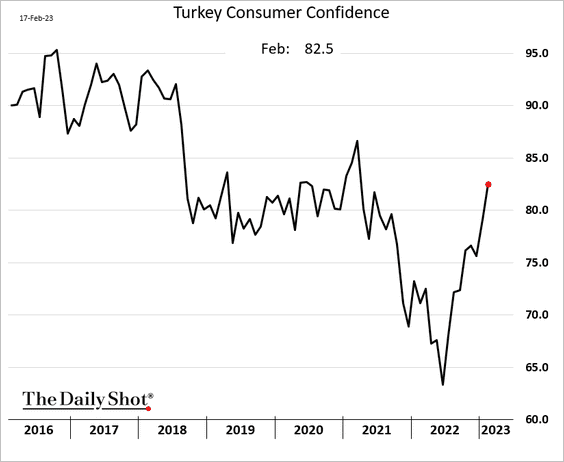

2. Turkey’s consumer confidence is rebounding sharply (similar to the Eurozone).

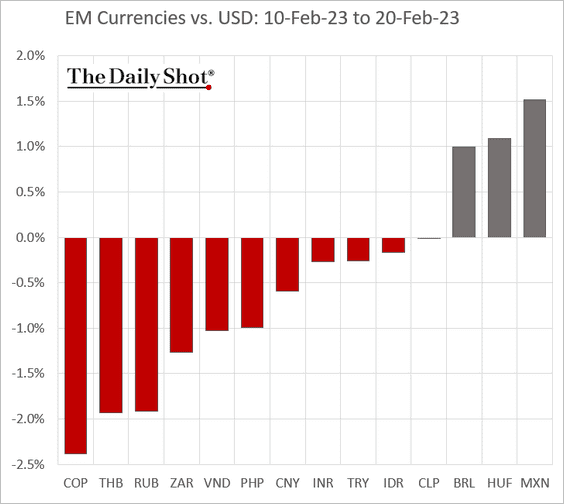

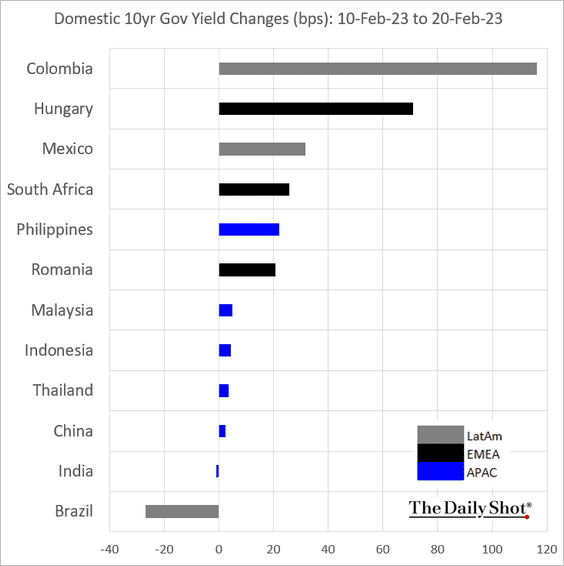

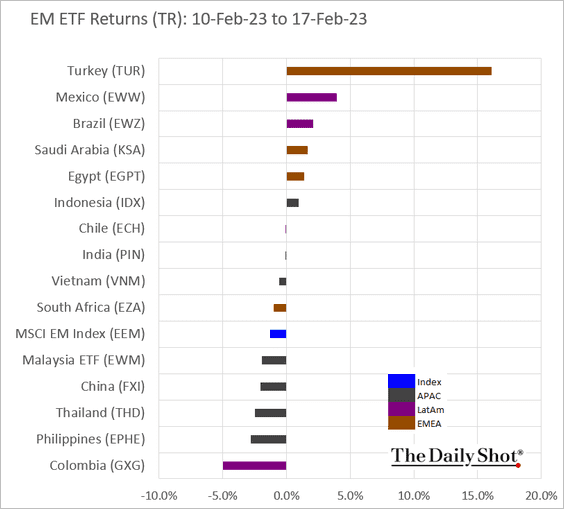

3. Below are some performance updates since February 10th.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

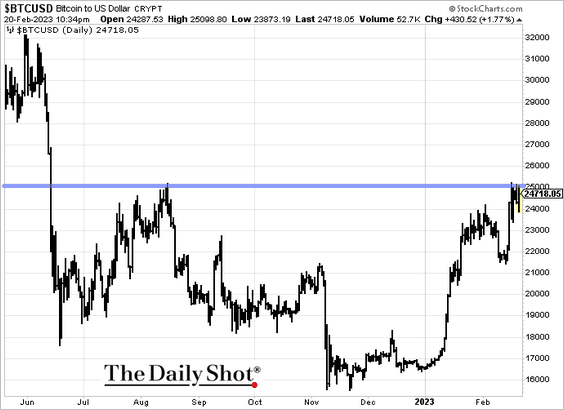

Cryptocurrency

1. Bitcoin is holding resistance at 25k.

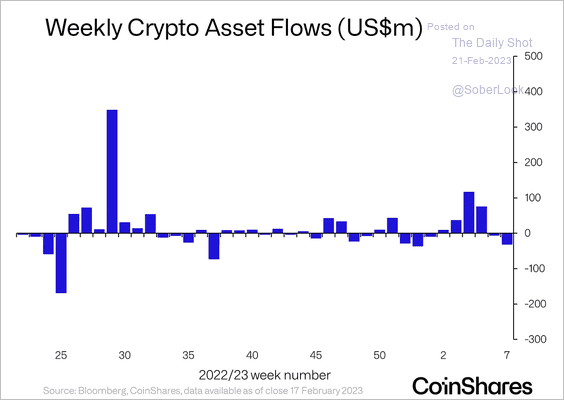

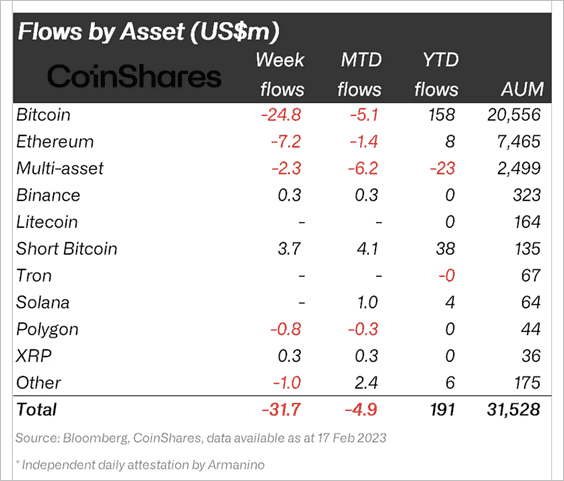

2. Last week, crypto funds saw the largest outflows since December 2022.

Source: CoinShares Read full article

Source: CoinShares Read full article

Long-bitcoin funds accounted for most outflows last week, while investors rotated to short-bitcoin funds.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

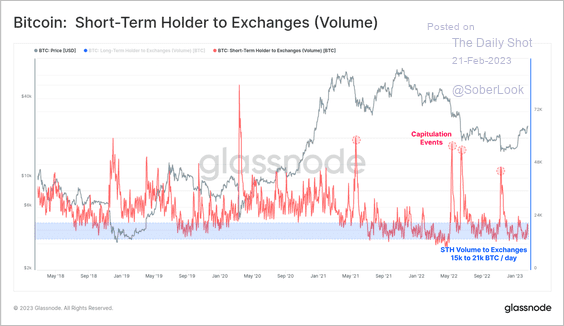

3. Short-term bitcoin holders are not heavy sellers to exchanges just yet (possibly keeping tokens in storage/wallets). In contrast, offloading tokens for sale on exchanges could signal capitulation.

Source: Glassnode Read full article

Source: Glassnode Read full article

Back to Index

Commodities

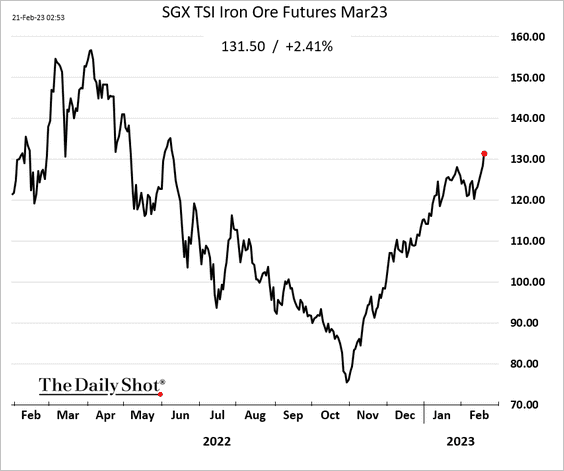

1. Iron ore continues to surge on China reopening.

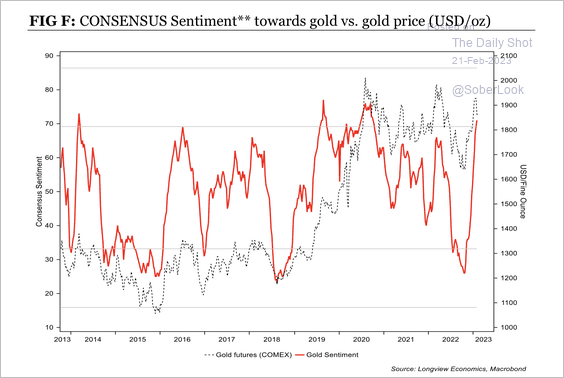

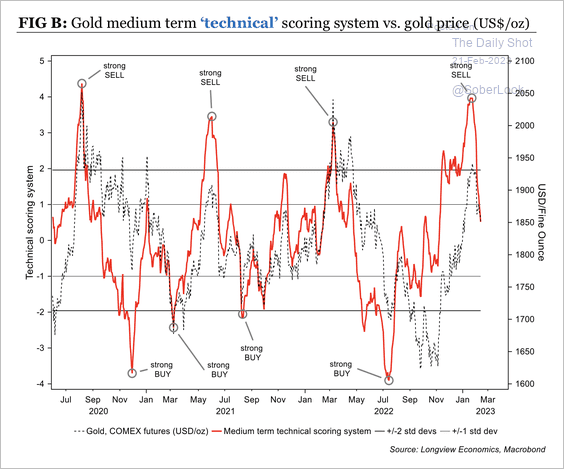

2. Technicals suggest gold is overbought, especially as bullish sentiment appears stretched. (2 charts)

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

——————–

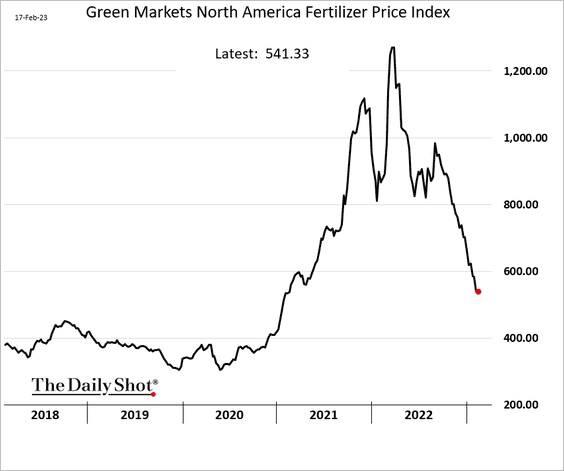

3. Fertilizer prices are down massively from the 2022 peak.

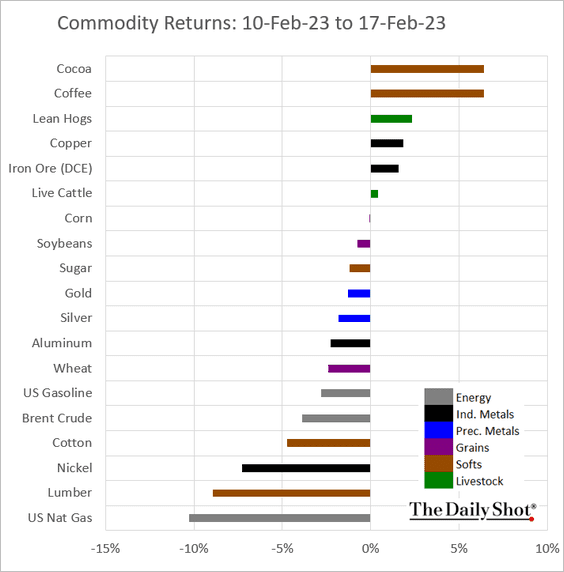

4. Finally, we have last week’s performance across key commodity markets.

Back to Index

Energy

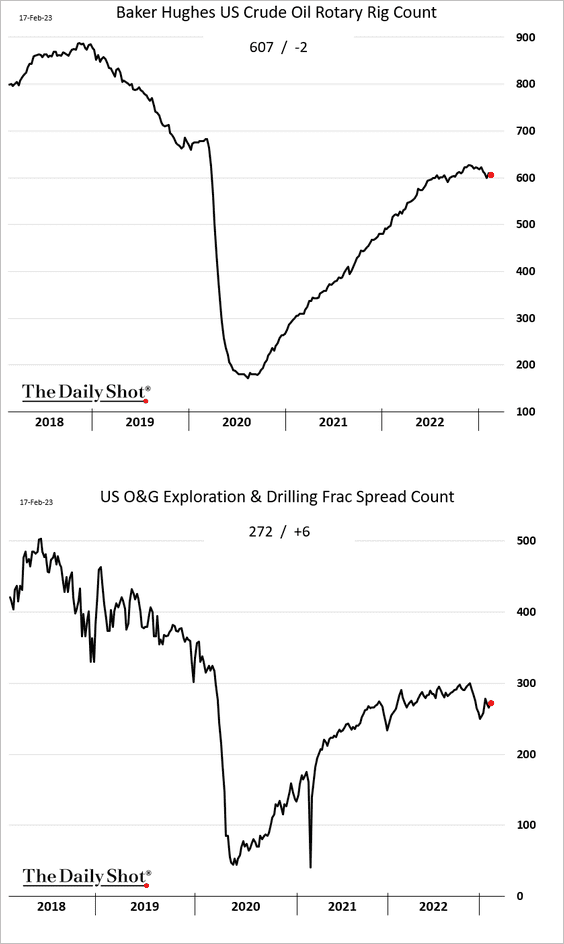

1. Growth in US drilling activity has stalled.

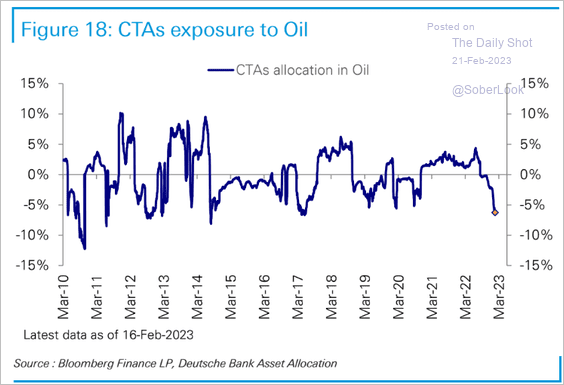

2. CTAs have been increasingly bearish on oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

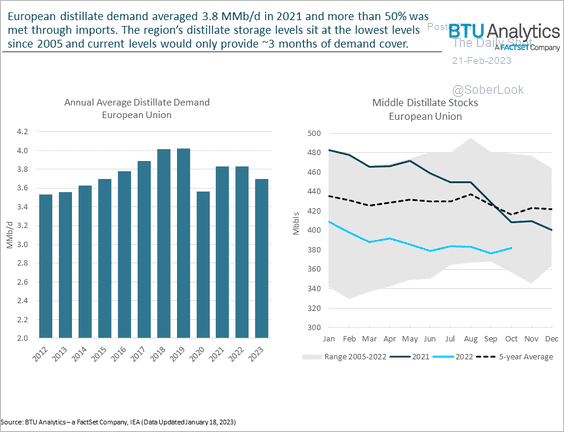

3. EU distillates inventories are tight.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Equities

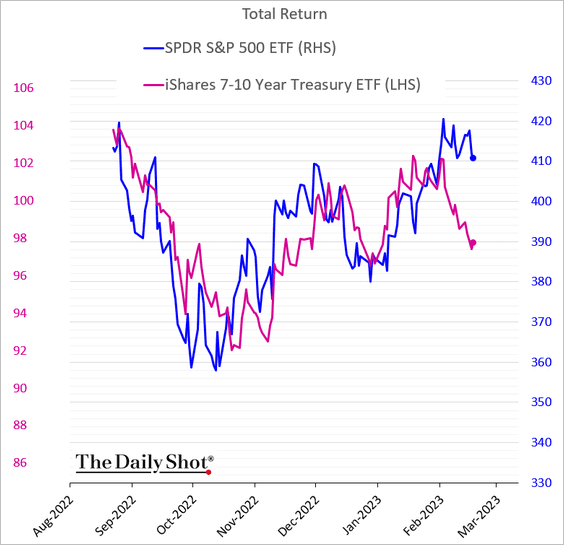

1. Is the decoupling of stocks and bonds sustainable?

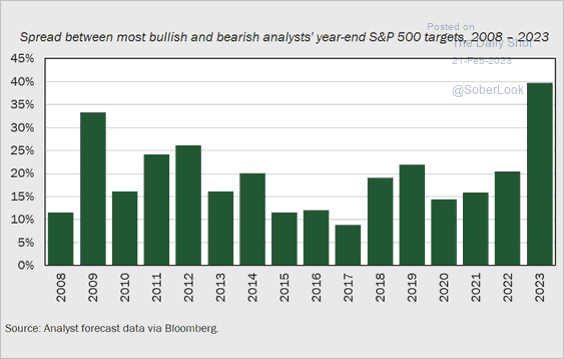

2. There is a lot of uncertainty about the stock market trajectory this year.

Source: @HendersonRowe; h/t @TopdownCharts

Source: @HendersonRowe; h/t @TopdownCharts

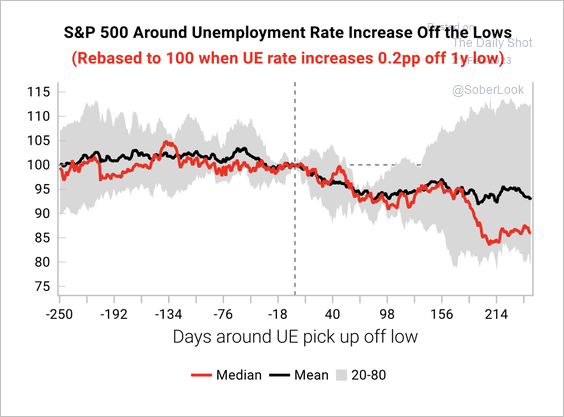

3. A rising unemployment rate off the lows typically signals the final leg of risk-asset drawdowns in recessions, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

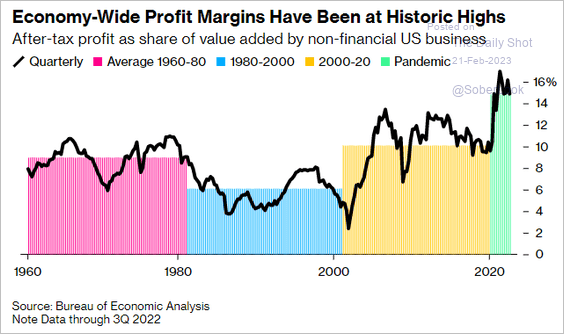

4. Profit margins have been at historic highs in the pandemic era.

Source: @katiadmi, @business Read full article

Source: @katiadmi, @business Read full article

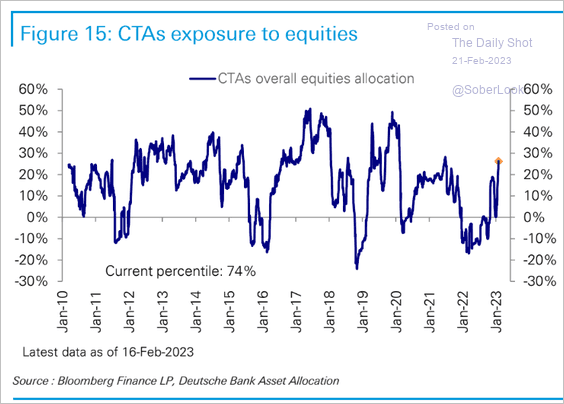

5. CTAs have been boosting their equity exposure.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

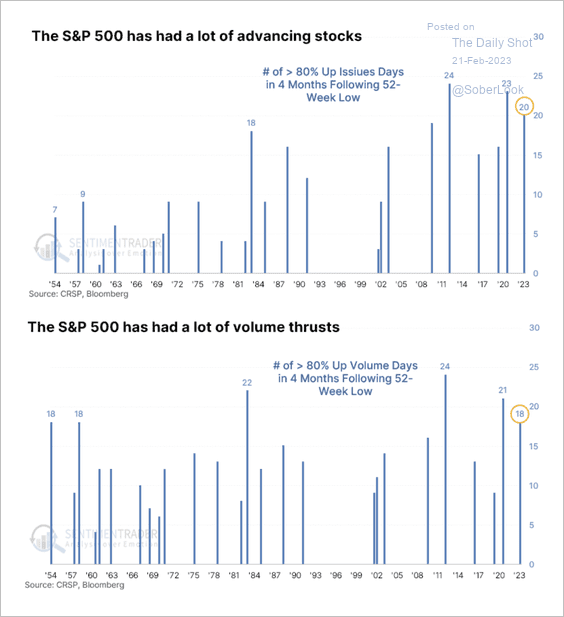

6. The latest market rally occurred with strong breadth and underlying volume. Previous advances signaled further gains in the months ahead, according to SentimenTrader.

Source: @sentimentrader

Source: @sentimentrader

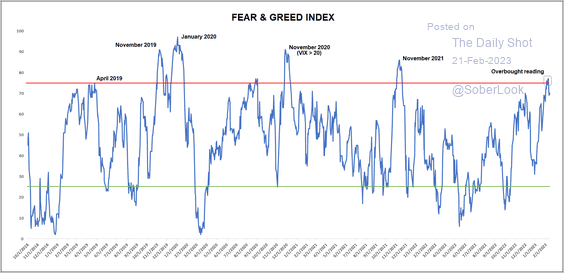

7. Bullish sentiment appears stretched.

Source: @StocktonKatie

Source: @StocktonKatie

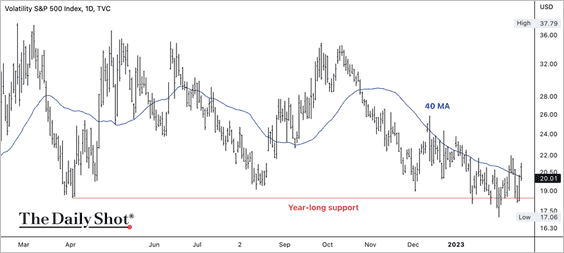

8. VIX is holding support above 18.50 (and broke above its 40-week moving average).

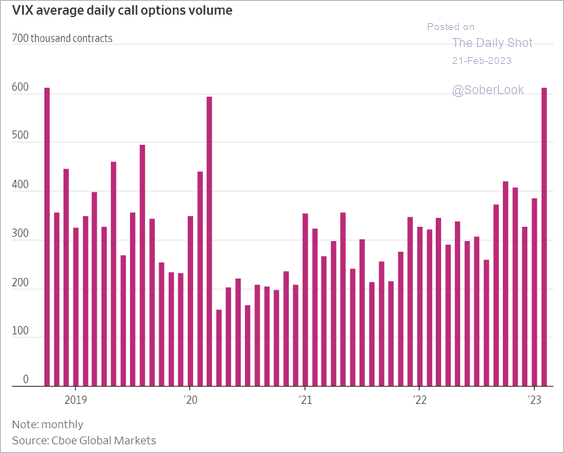

9. There has been quite a bit of interest in VIX call options (used as a hedge against market declines).

Source: @WSJ Read full article

Source: @WSJ Read full article

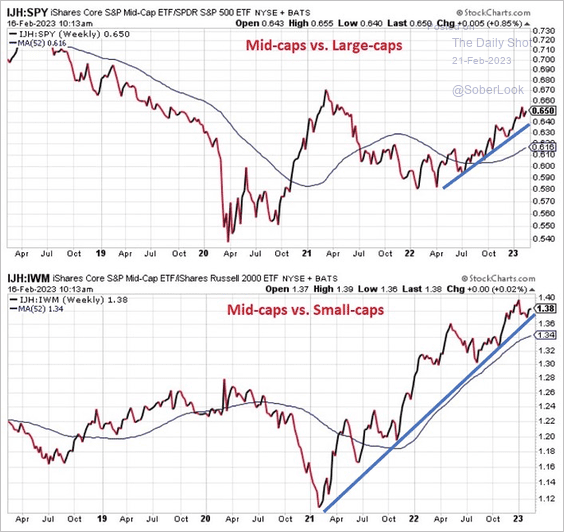

10. Mid-cap stocks have been outperforming small and large-cap stocks.

Source: @jaykaeppel

Source: @jaykaeppel

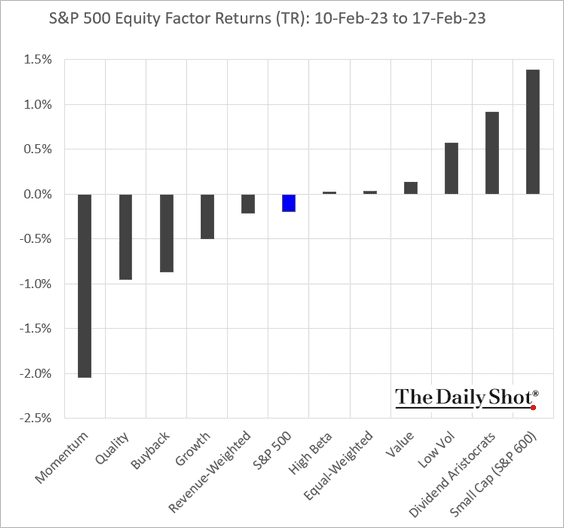

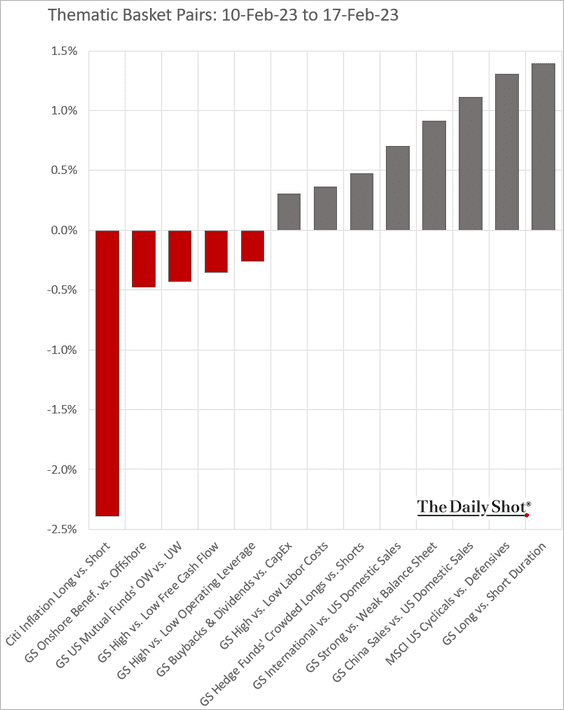

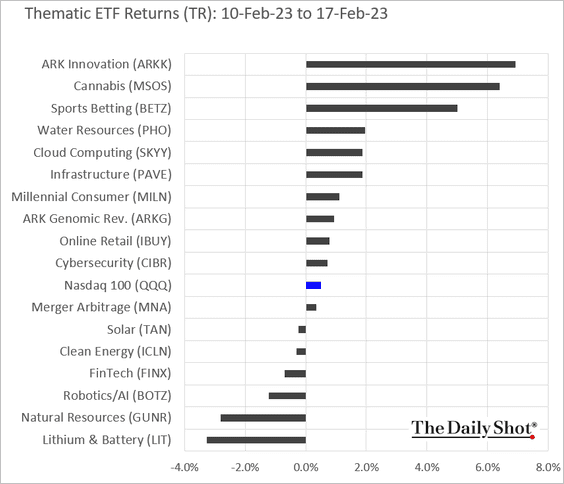

11. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

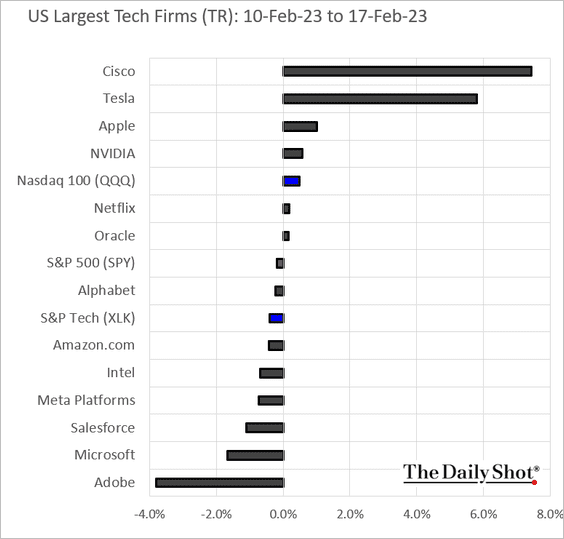

• Largest US tech stocks:

Back to Index

Credit

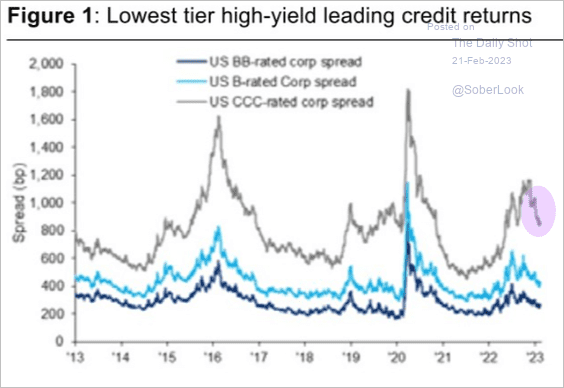

1. CCC-rated bonds have been leading the rally in credit.

Source: Citi Private Bank

Source: Citi Private Bank

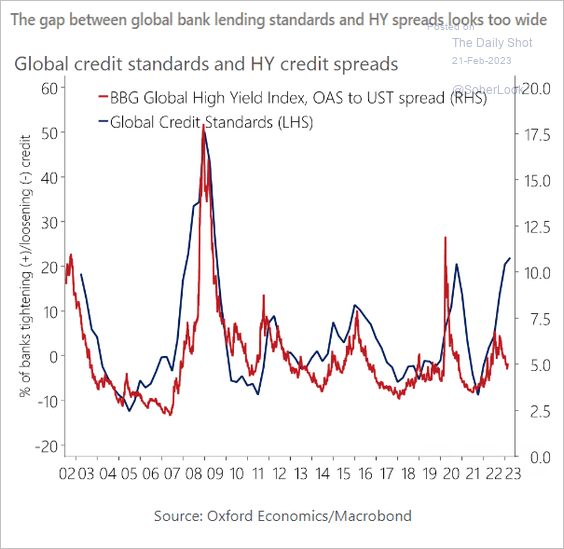

2. Global high-yield bond spreads are too tight.

Source: Oxford Economics

Source: Oxford Economics

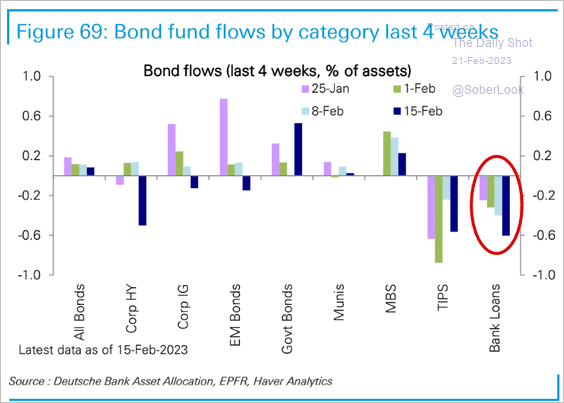

3. Leveraged loan funds continue to see outflows. Inflation-linked Treasury funds are also losing capital.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

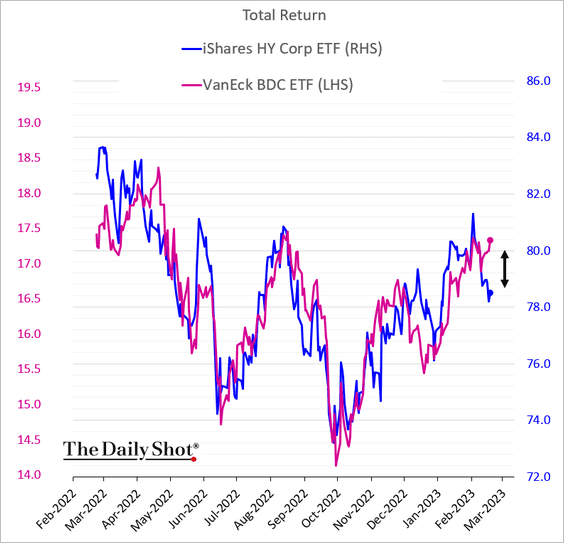

4. Divergence episodes between BDCs and HY bonds generally don’t last long.

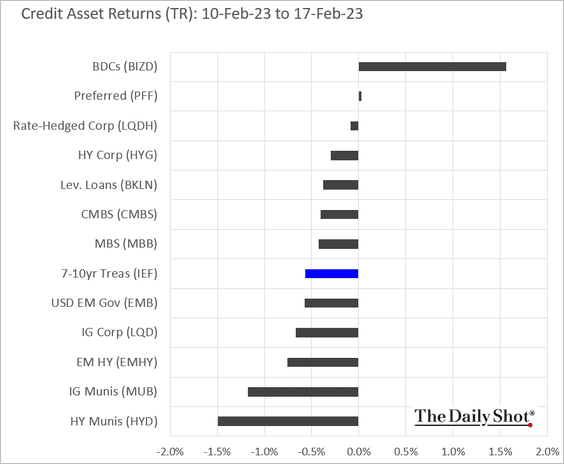

5. This chart shows last week’s performance by asset class.

Back to Index

Rates

1. As #3 in the credit section (above) shows, inflation-linked Treasury (TIPS) funds continue to see substantial outflows.

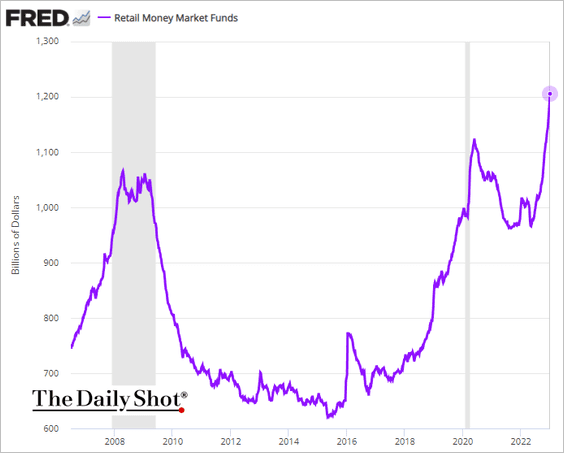

2. Retail money market fund balances have been surging as yields improve, creating competition for banks.

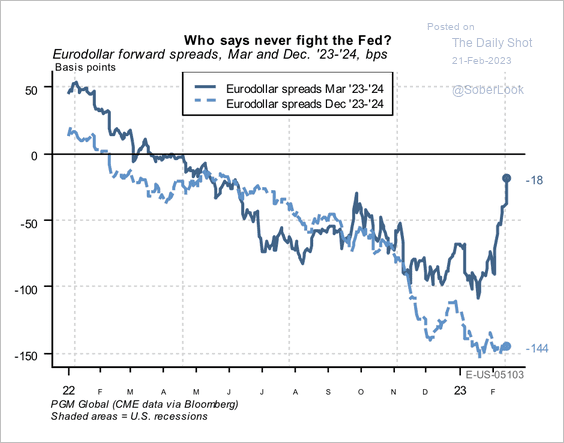

3. Eurodollar 23/24 spreads point to widespread expectations of Fed rate cuts next year.

Source: PGM Global

Source: PGM Global

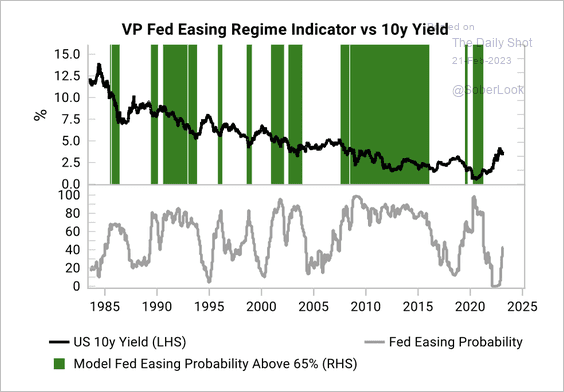

4. Variant Perception’s “Fed easing” probability indicator is rising, although not quite signaling a reversal in yields.

Source: Variant Perception

Source: Variant Perception

Back to Index

Global Developments

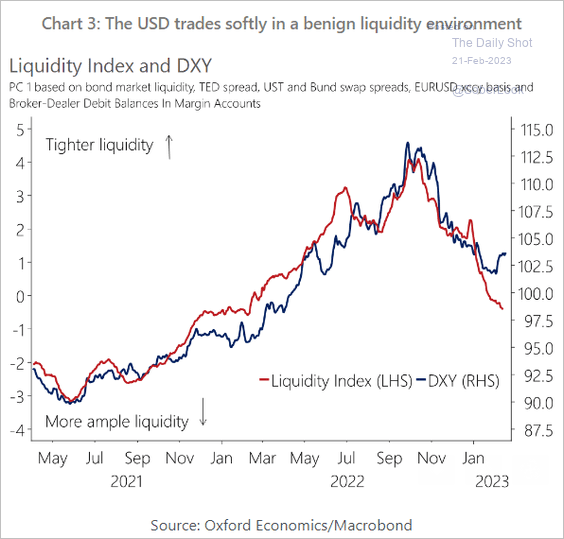

1. Will improving global liquidity pressure the US dollar?

Source: Oxford Economics

Source: Oxford Economics

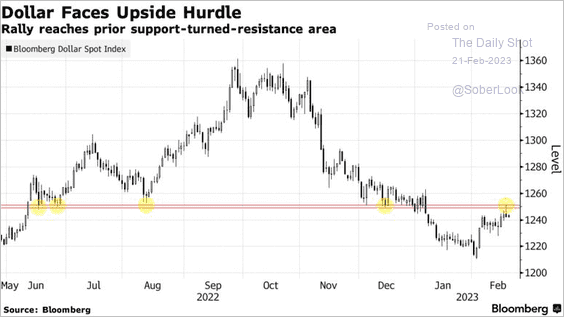

• Bloomberg’s US dollar index is at resistance.

Source: @SriniSivabalan, @markets Read full article

Source: @SriniSivabalan, @markets Read full article

——————–

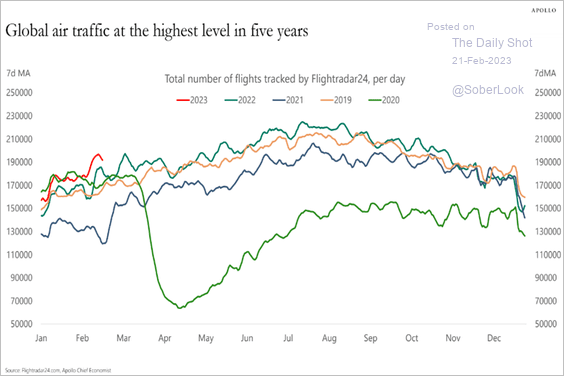

2. Global air traffic is at multi-year highs for this time of the year.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

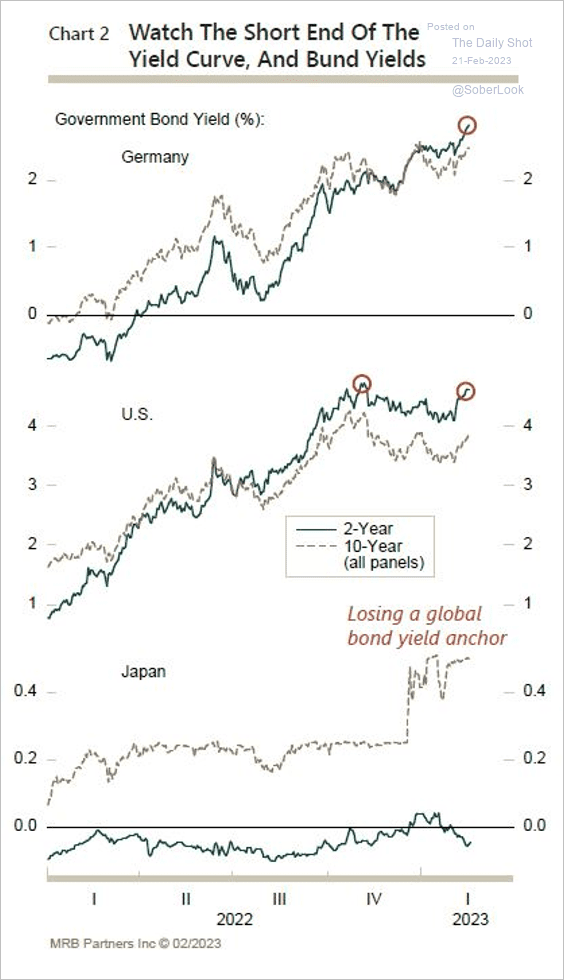

3. Will a breakout in sovereign bond yields trigger another risk-off phase?

Source: MRB Partners

Source: MRB Partners

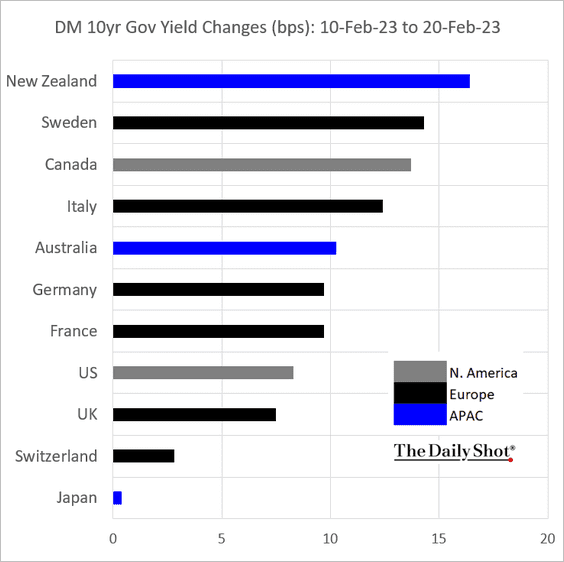

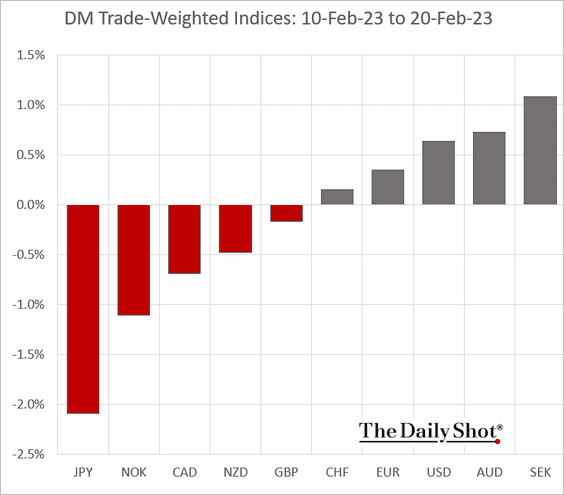

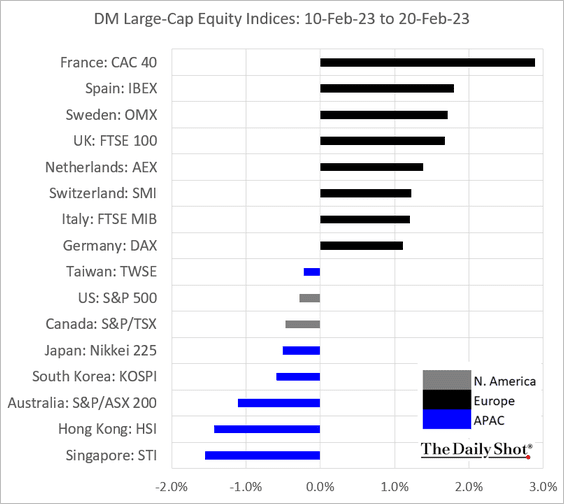

4. Next, we have some performance data since February 10th.

• Bond yields:

• Trade-weighted currency indices:

• Large-cap equity indices:

——————–

Food for Thought

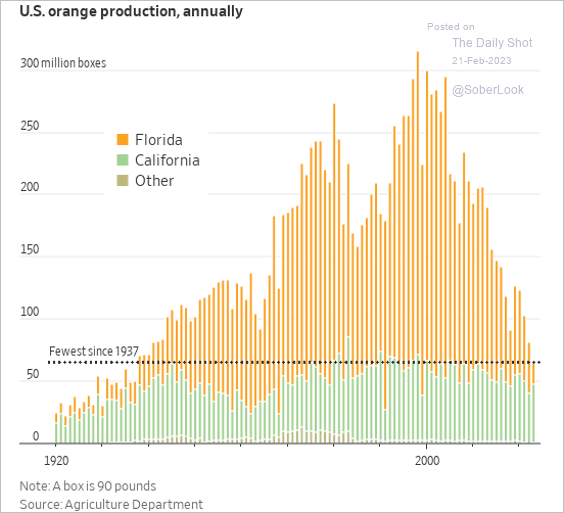

1. Orange production in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

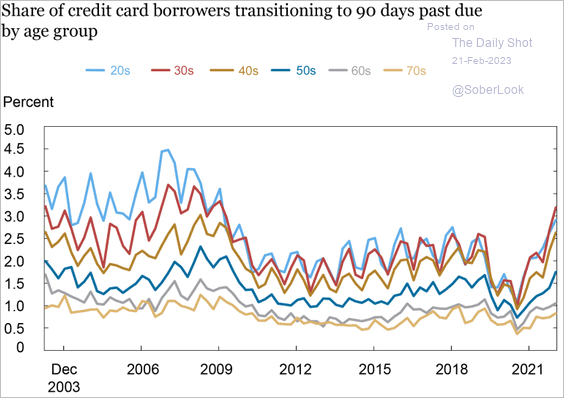

2. Credit card delinquency rates by age:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

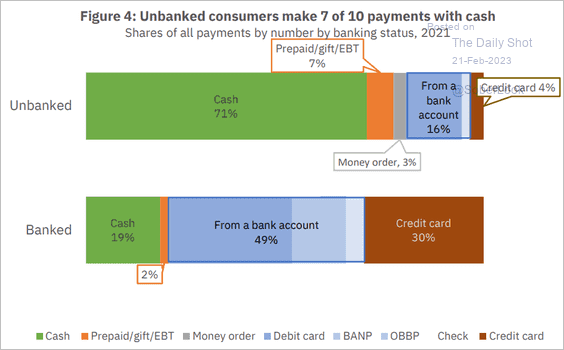

3. Payments by banked vs. unbanked consumers:

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

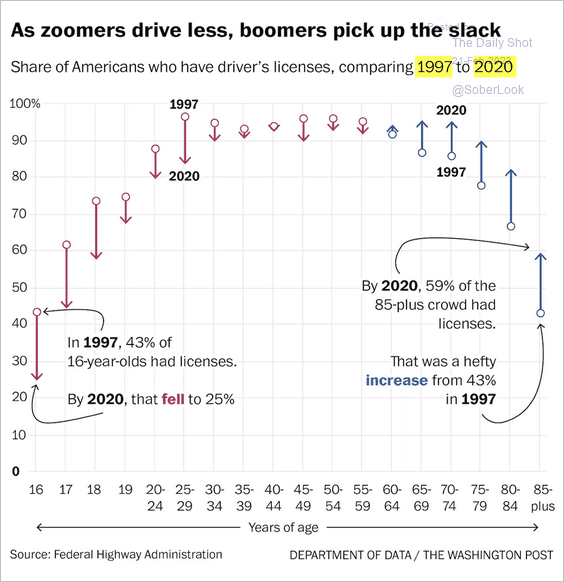

4. The shift in US drivers’ demographics:

Source: @byHeatherLong, @andrewvandam Read full article

Source: @byHeatherLong, @andrewvandam Read full article

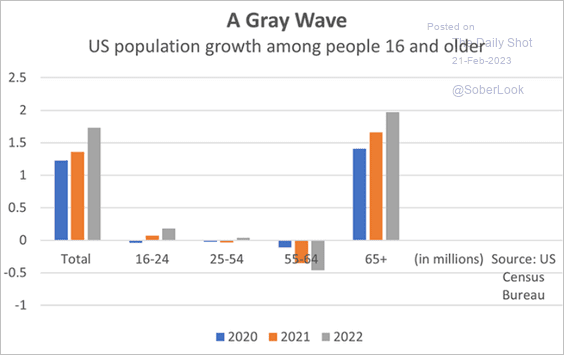

5. US adult population growth by age:

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

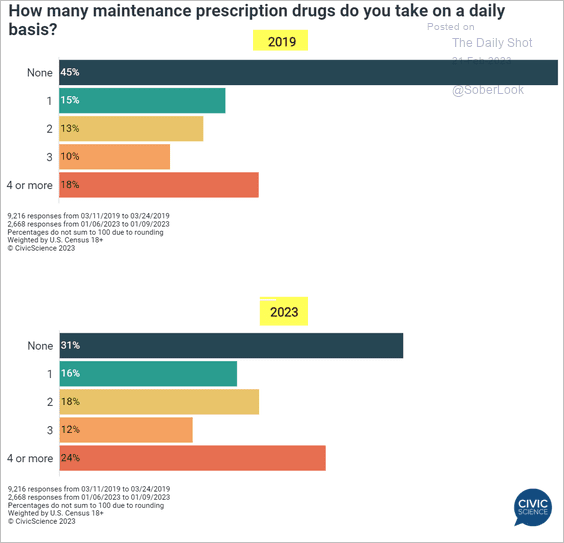

6. Prescription medications:

Source: @CivicScience

Source: @CivicScience

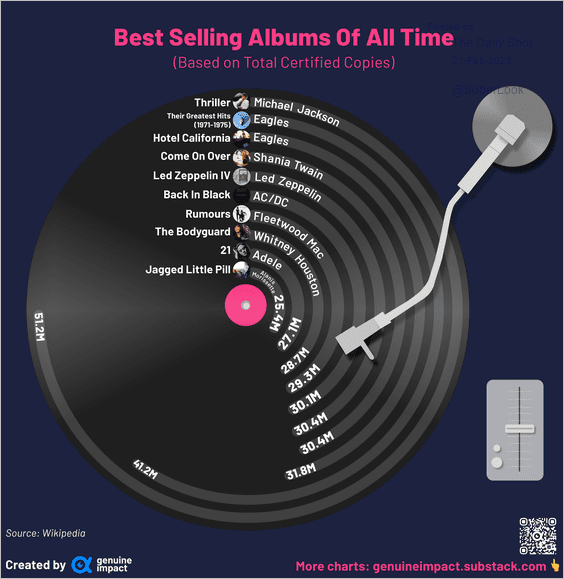

7. Best-selling albums of all times:

Source: @genuine_impact

Source: @genuine_impact

——————–

Back to Index