The Daily Shot: 23-Feb-23

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

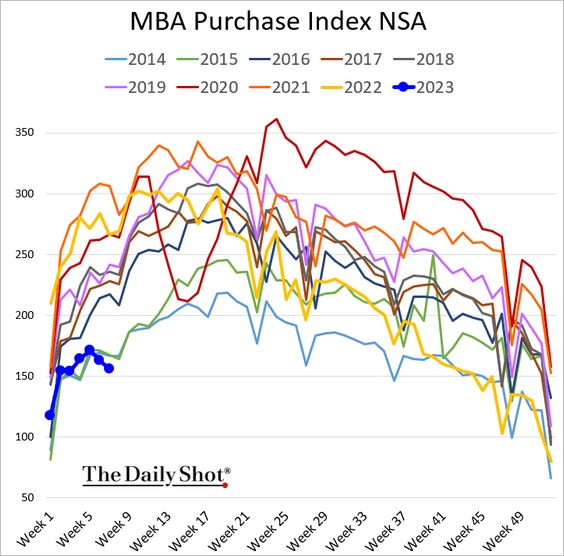

1. Mortgage applications continued to sink last week, …

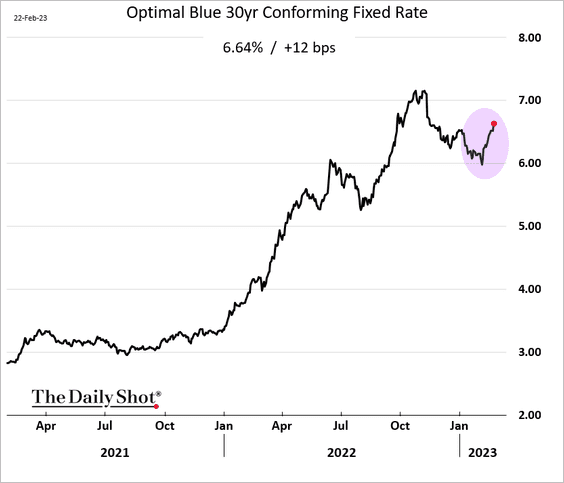

… as mortgage rates climb back toward 7%.

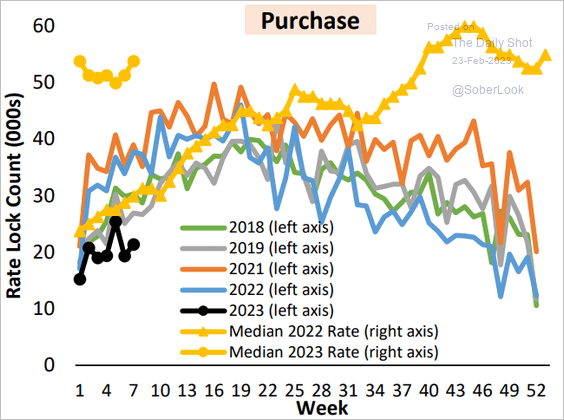

Rate locks were also at multi-year lows.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

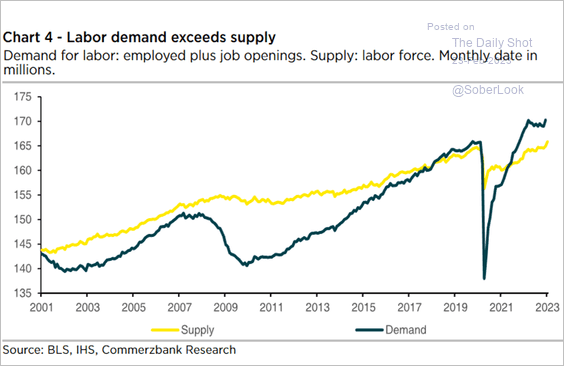

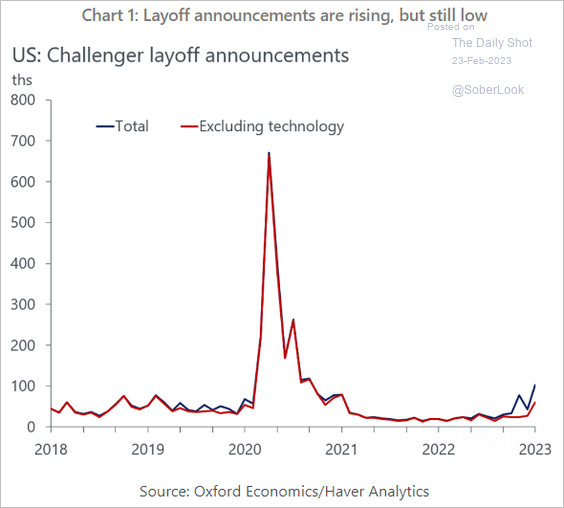

2. Next, we have some updates on the labor market.

• Labor demand still exceeds supply.

Source: Commerzbank Research

Source: Commerzbank Research

• The declining quits rate points to a slowdown in wage growth.

Source: Alpine Macro

Source: Alpine Macro

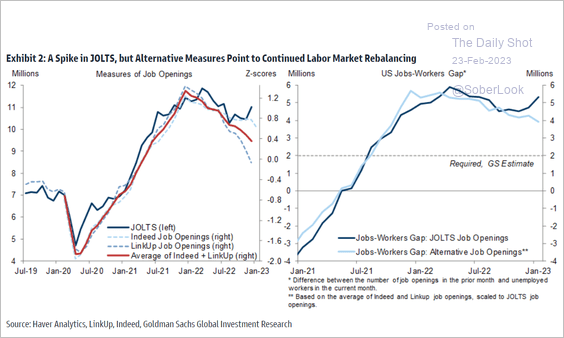

• Job openings are falling, which should soon be reflected in the official JOLTS figures.

Source: Goldman Sachs

Source: Goldman Sachs

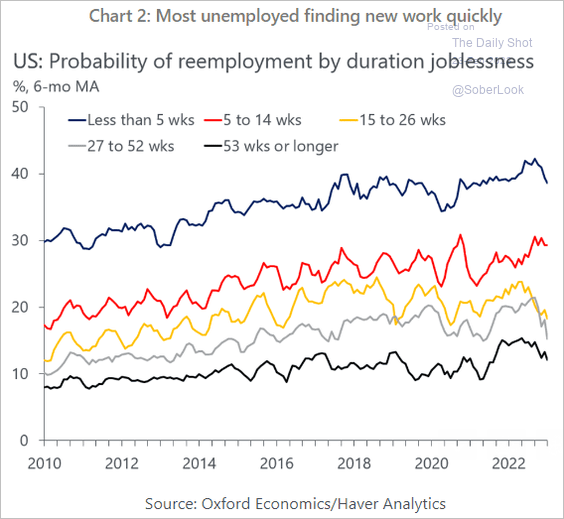

• Most US unemployed are still finding work quickly, …

Source: Oxford Economics

Source: Oxford Economics

… especially tech workers.

Source: Oxford Economics

Source: Oxford Economics

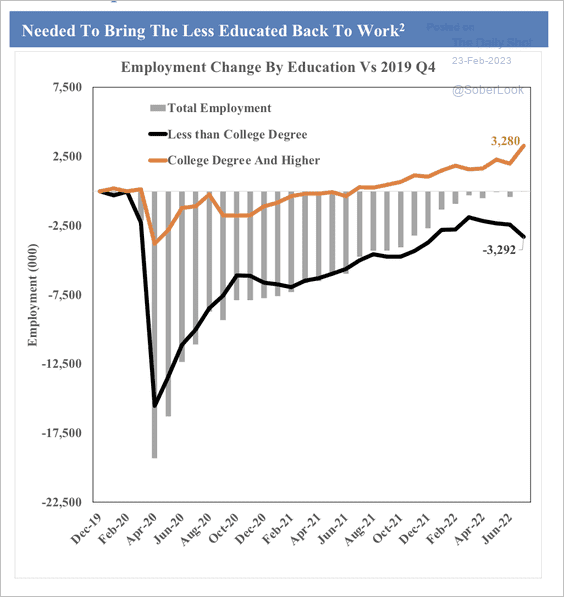

• The employment change for workers without a college degree remains below pre-COVID levels.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

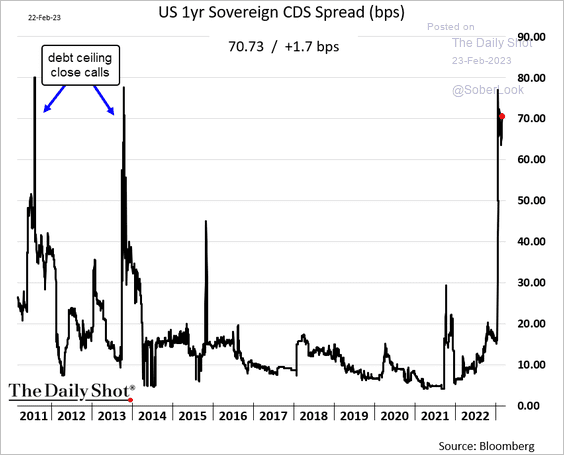

• Market jitters around US debt default risks persist as the x-date approaches. The Treasury is expected to run out of emergency funds in late summer. Here is the US one-year sovereign CDS spread.

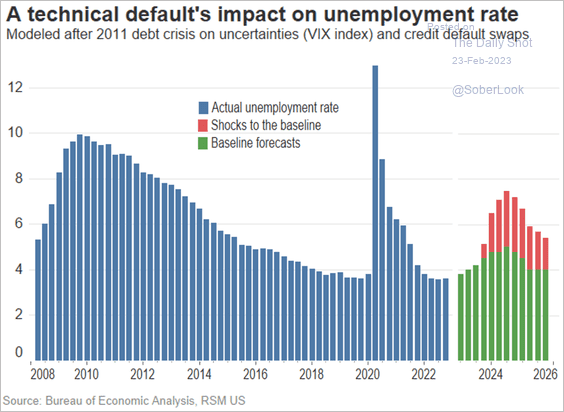

How much will a US technical default impact the unemployment rate?

Source: RSM Read full article

Source: RSM Read full article

——————–

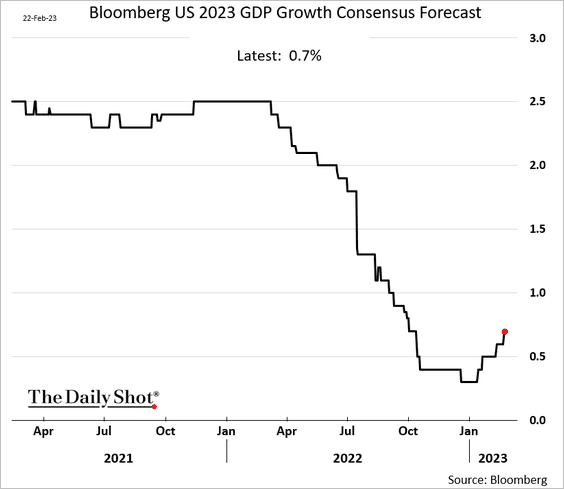

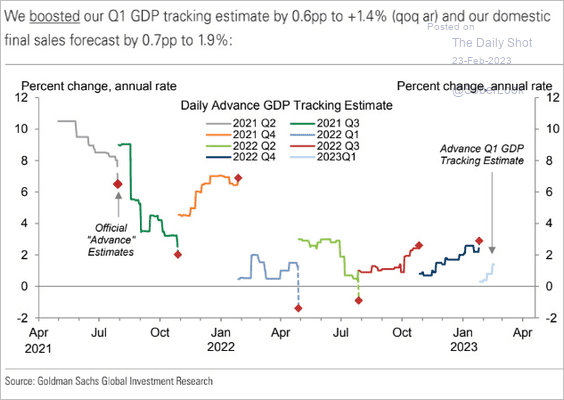

3. Economists have been upgrading their GDP growth forecasts for 2023, …

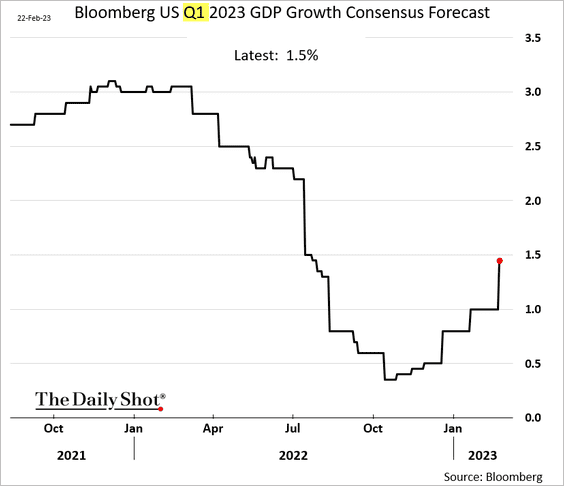

… especially the current quarter.

Here is Goldman’s GDP tracker.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

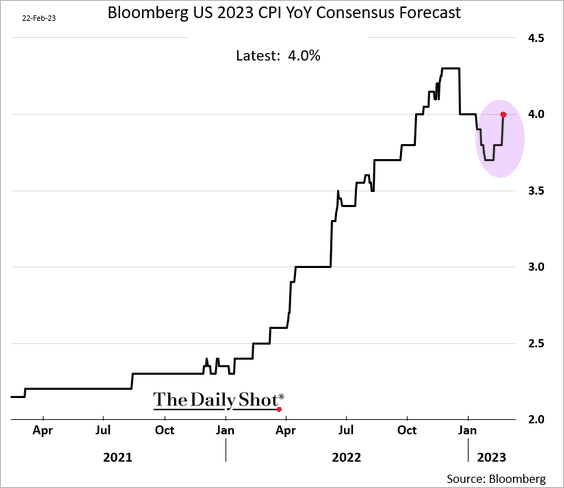

• Economists are also reversing their lowered projections for inflation in 2023.

——————–

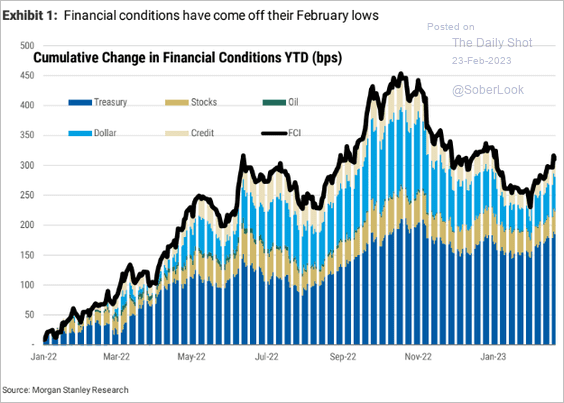

4. Financial conditions are tightening again, according to Morgan Stanley’s model.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

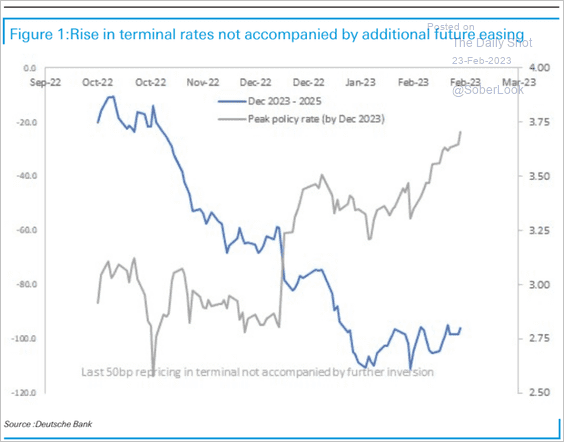

The market is coming to terms with “higher for longer.” The surge in US terminal rate was not followed by steeper rate cut expectations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

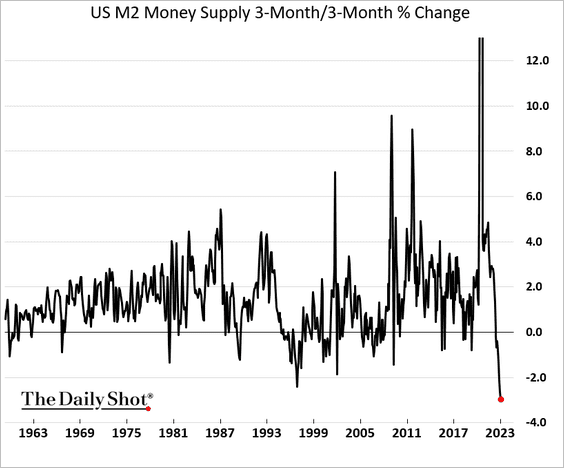

5. The recent decline in the money supply has been unprecedented.

Back to Index

The Eurozone

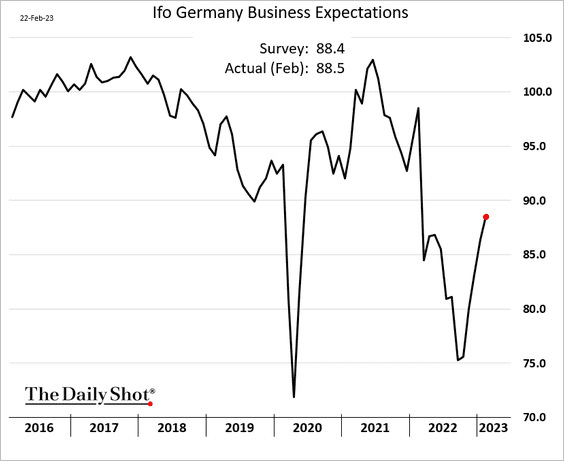

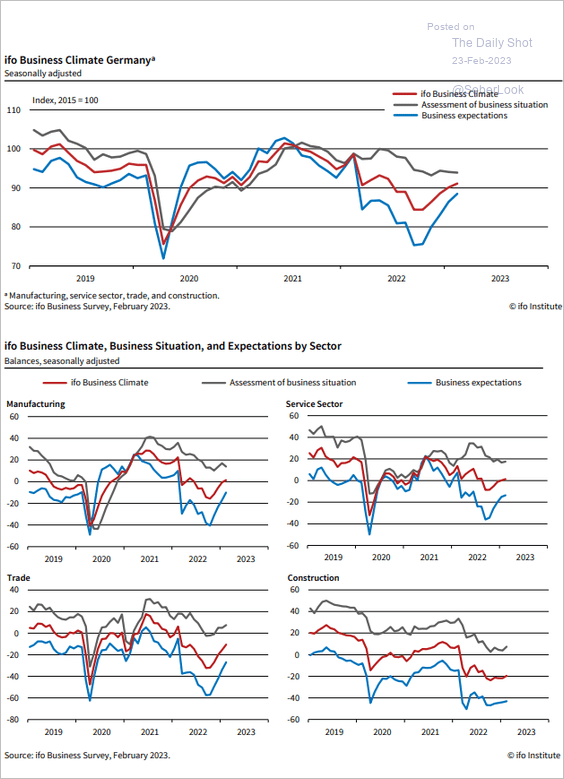

1. Germany’s Ifo expectations index continues to recover.

Source: ifo Institute

Source: ifo Institute

——————–

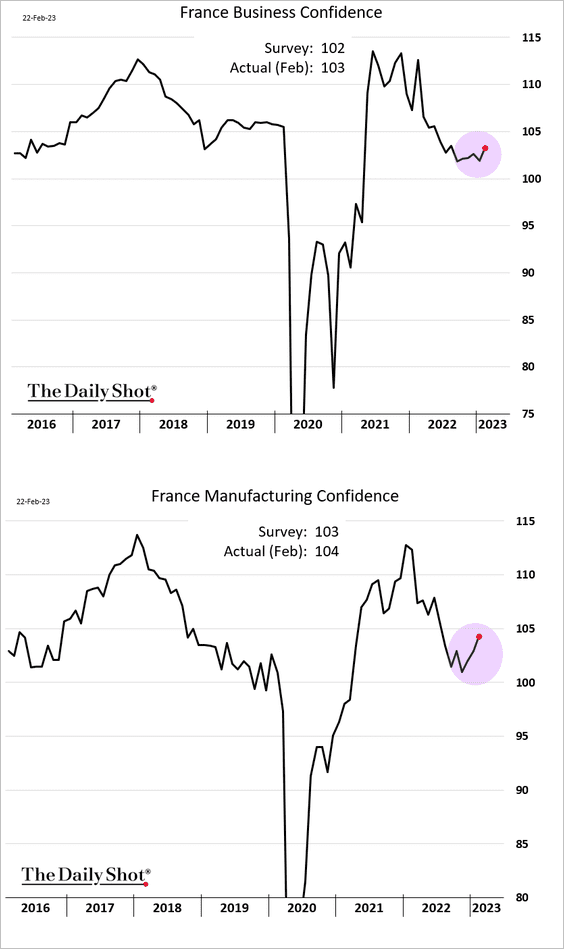

2. French business confidence is also turning higher.

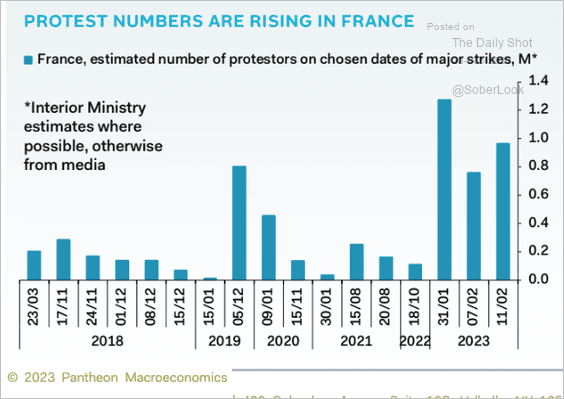

Separately, France saw a lot of protests this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

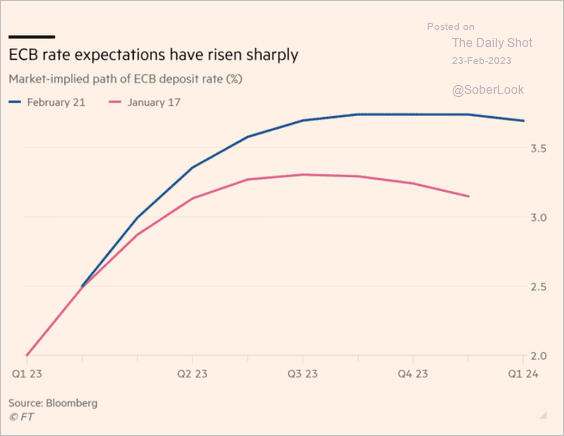

3. ECB rate hike expectations have repriced sharply over the past month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

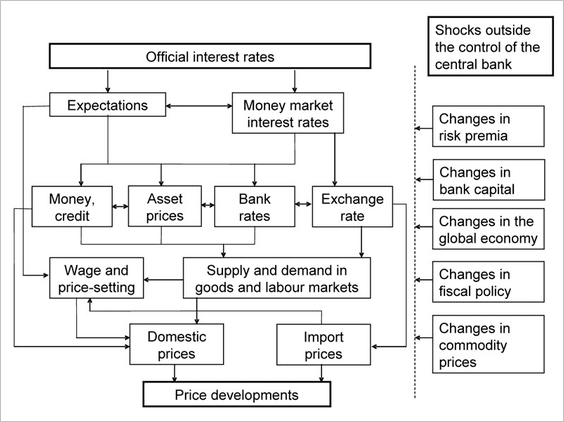

4. Here is how the ECB models the transmission mechanism of its monetary policy.

Source: ECB Read full article

Source: ECB Read full article

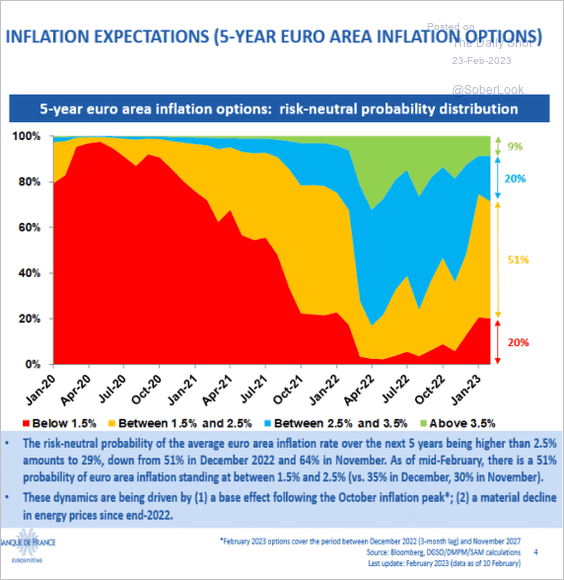

5. This chart shows the 5-year inflation expectations distribution based on inflation options.

Source: La Banque de France

Source: La Banque de France

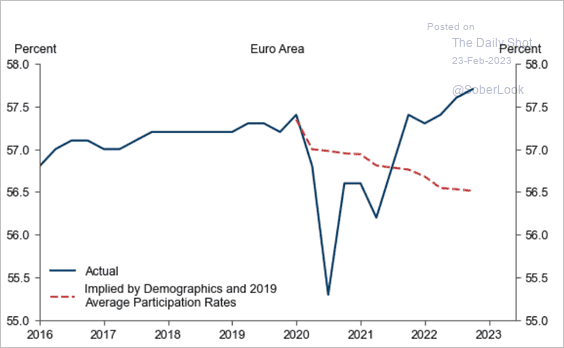

6. Labor force participation is well above the levels implied by demographics.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Europe

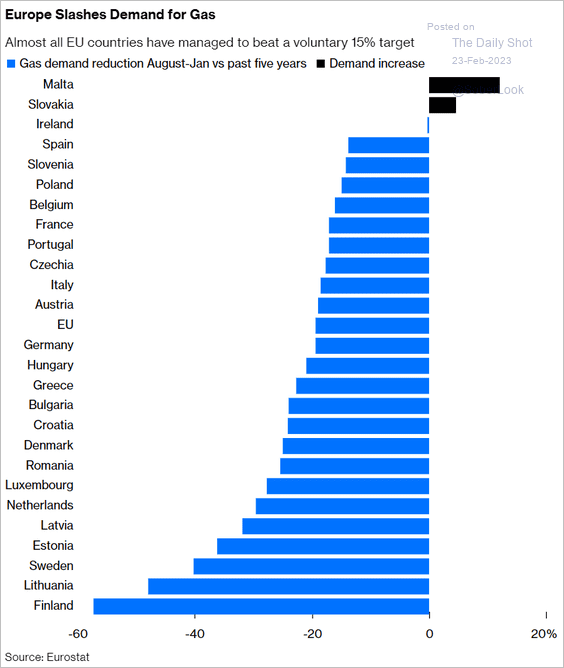

1. Here is the reduction in natural gas demand across the EU between August and January.

Source: @JLeeEnergy, @opinion Read full article

Source: @JLeeEnergy, @opinion Read full article

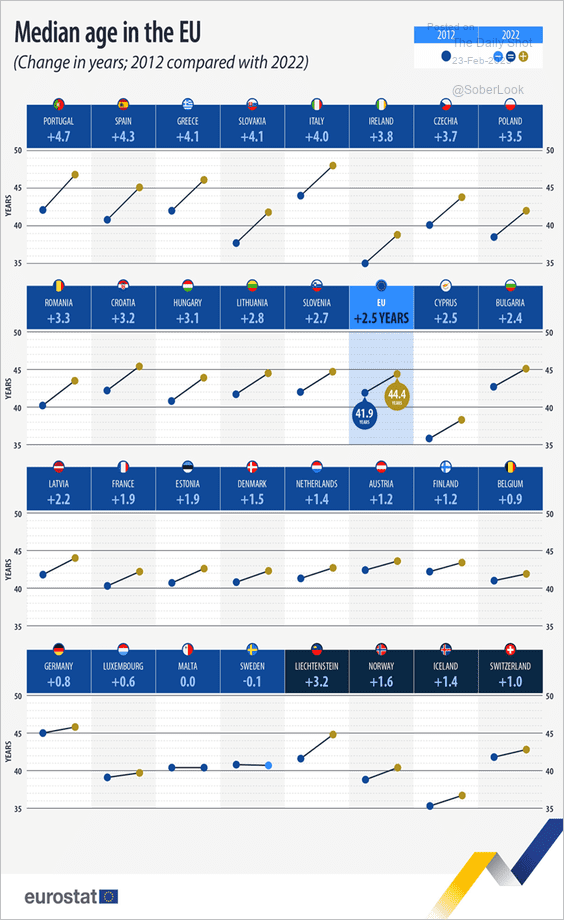

2. How has the median age changed across the EU over the past decade?

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

Back to Index

Asia – Pacific

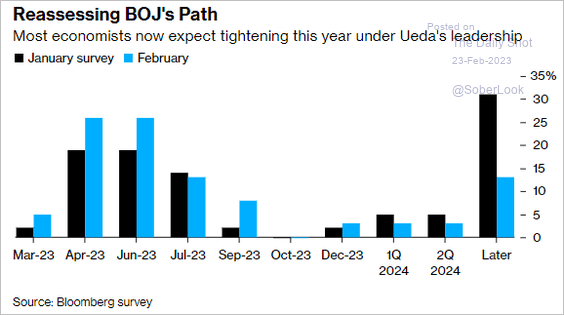

1. Economists expect the BoJ to tighten policy this year under new leadership.

Source: @GregDaco, @economics Read full article

Source: @GregDaco, @economics Read full article

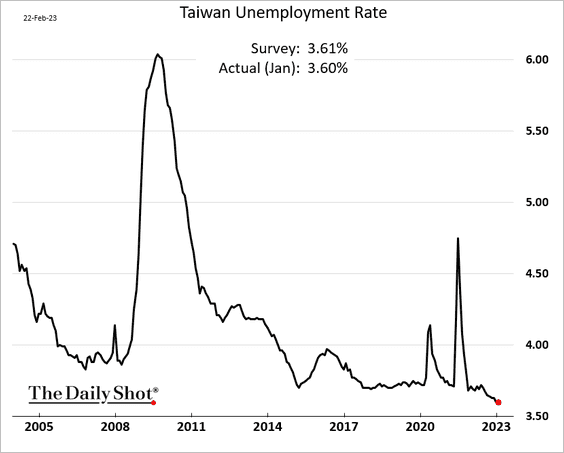

2. Taiwan’s unemployment rate is at multi-decade lows.

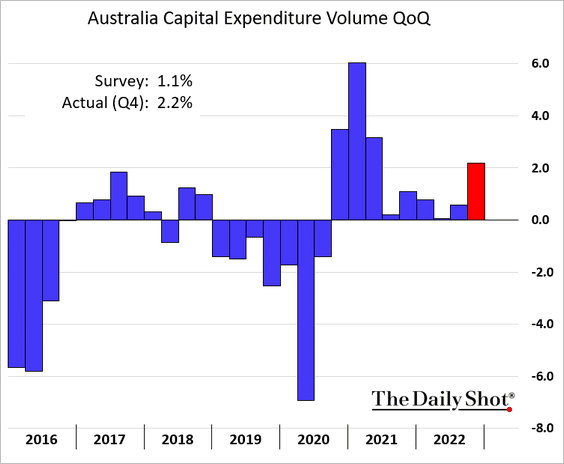

3. Australia’s business investment strengthened last quarter.

Back to Index

China

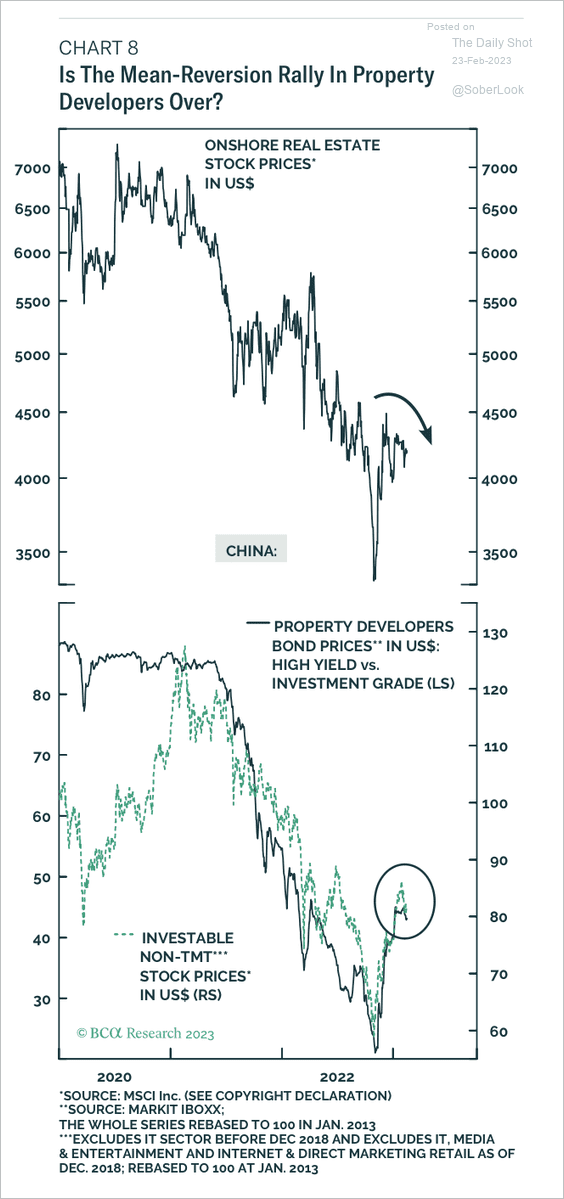

1. The bounce in property developer stocks and bonds is starting to fade.

Source: BCA Research

Source: BCA Research

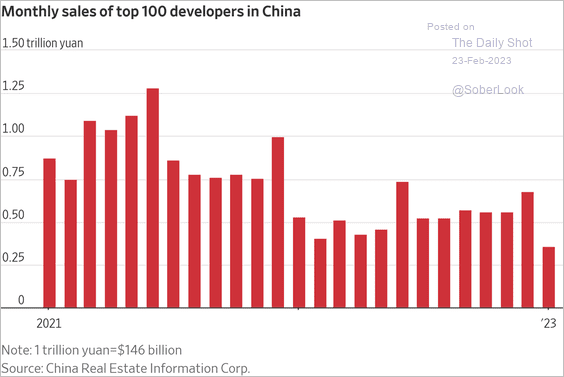

Developers’ sales sagged this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

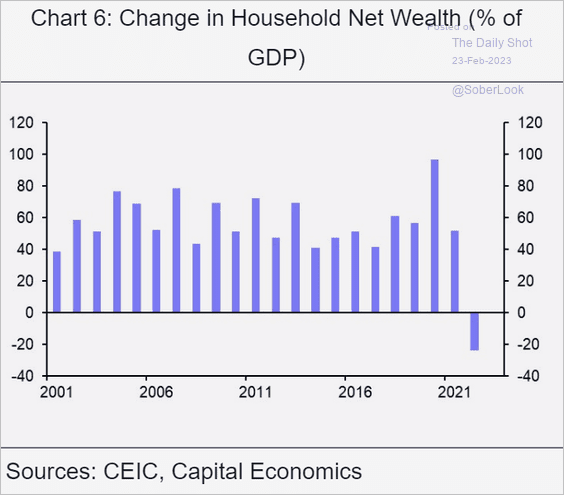

2. China’s households’ wealth declined for the first time in decades last year.

Source: Capital Economics

Source: Capital Economics

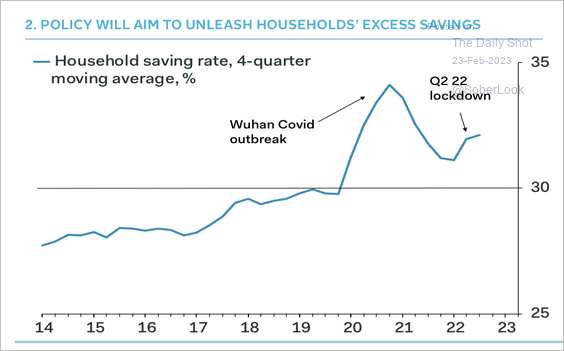

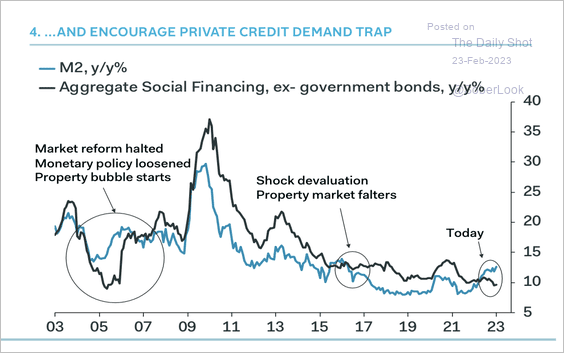

3. Household savings have risen amid weak credit demand. But regulators have asked lenders to front-load lending. (2 charts)

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

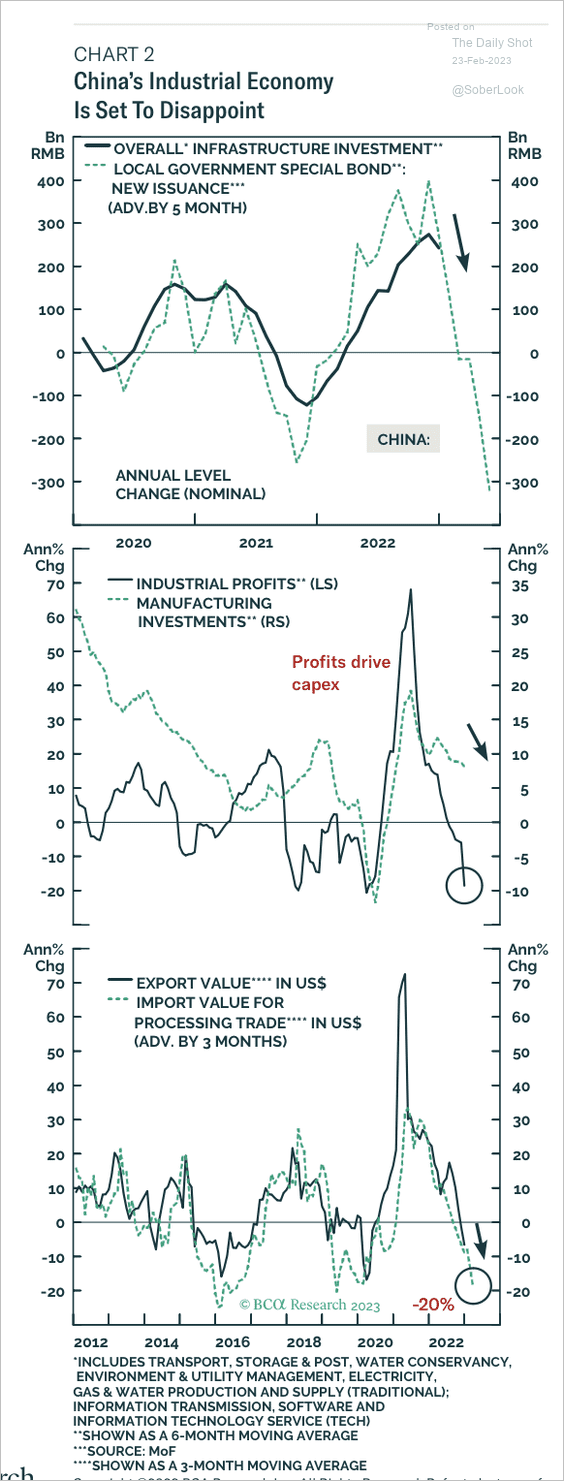

4. Could we see further weakness in China’s industrial activity?

Source: BCA Research

Source: BCA Research

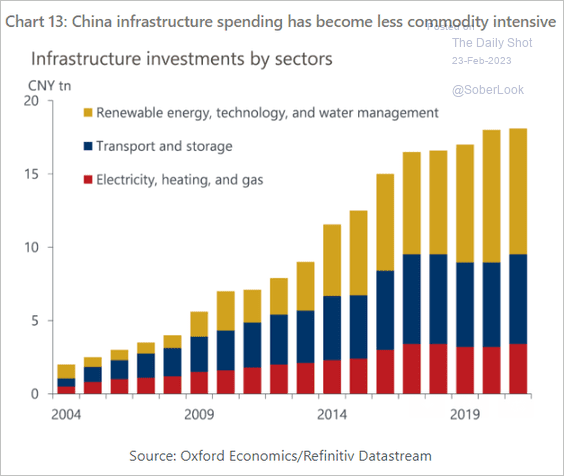

5. Here are the components of China’s infrastructure investment.

Source: Oxford Economics

Source: Oxford Economics

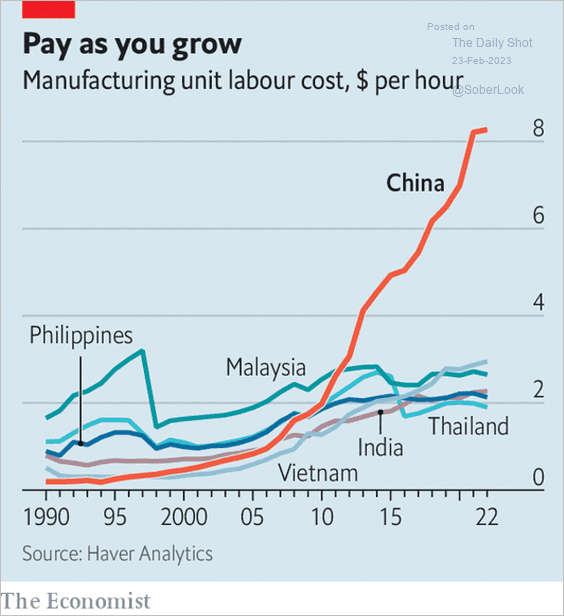

6. China’s labor costs have risen sharply over the past decade.

Source: @jessefelder; The Economist Read full article

Source: @jessefelder; The Economist Read full article

Back to Index

Emerging Markets

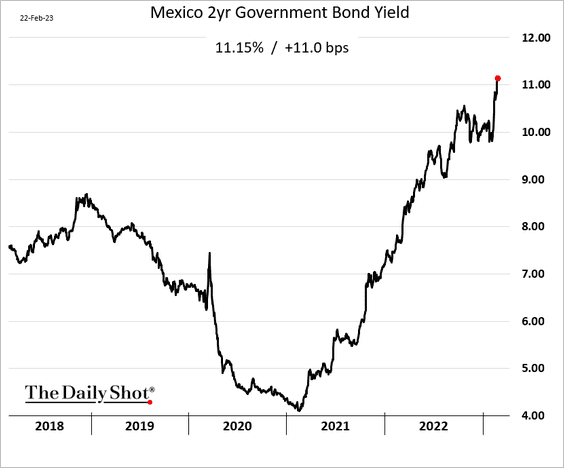

1. Mexico’s 2-year yield is now firmly above 11% amid persistent inflationary pressures.

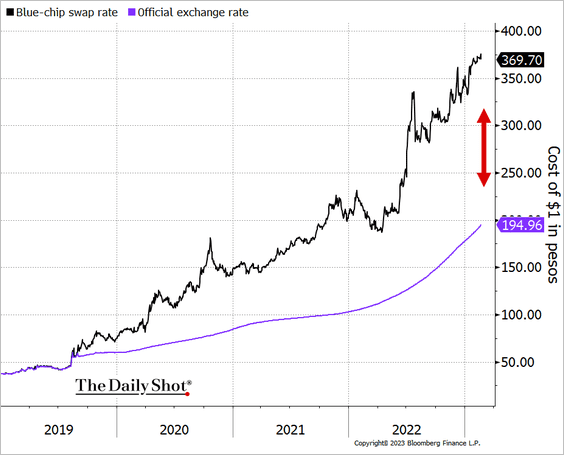

2. Argentina’s official currency devaluation is not keeping up with the market.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

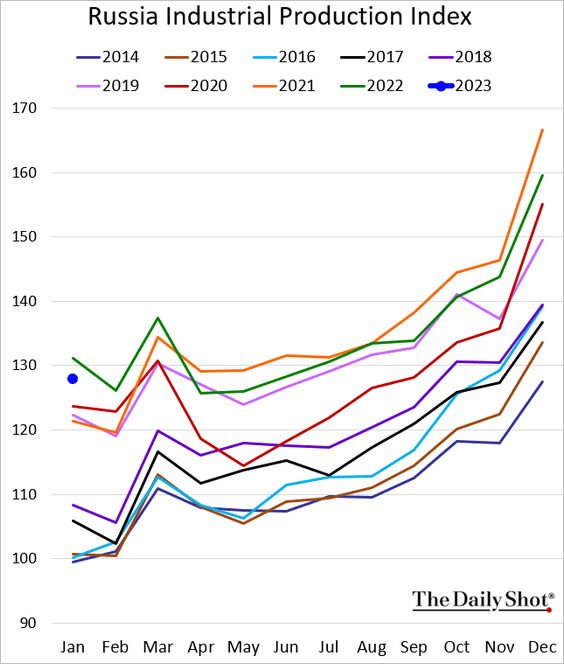

3. Here is Russia’s industrial production index (as reported by the government).

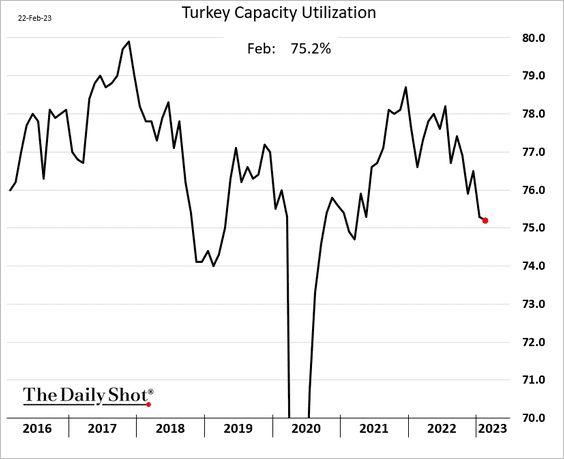

4. Turkey’s capacity utilization continues to sink.

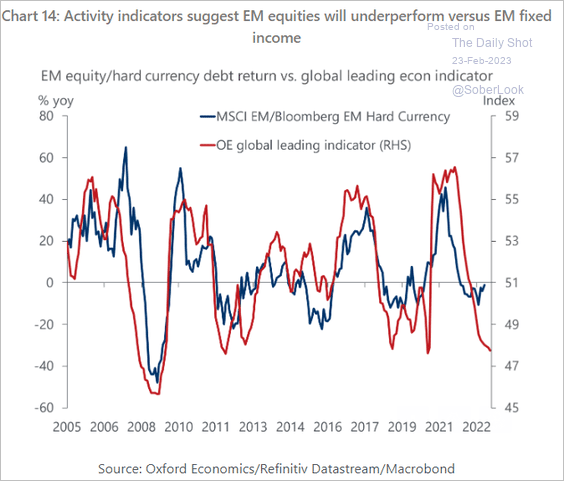

5. A leading indicator from Oxford Economics suggests that EM stocks will underperform bonds.

Source: Oxford Economics

Source: Oxford Economics

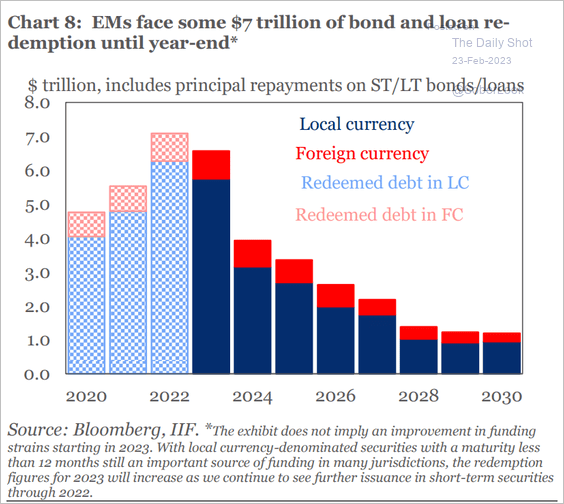

6. Here is the EM debt maturity wall.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

1. Bitcoin’s $25k resistance is holding.

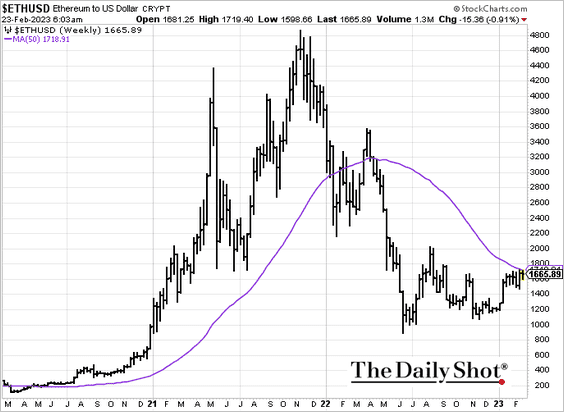

2. Ether is testing resistance at the 50-week moving average.

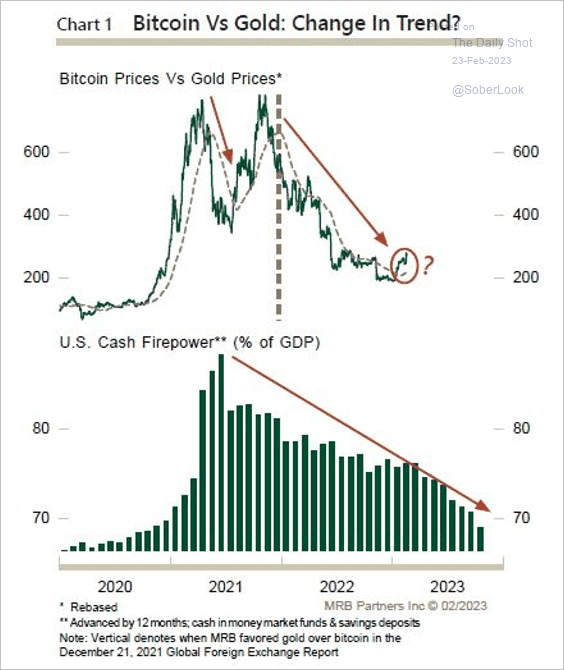

3. So far, bitcoin has improved relative to gold this year as investors embraced risk-on conditions.

Source: MRB Partners

Source: MRB Partners

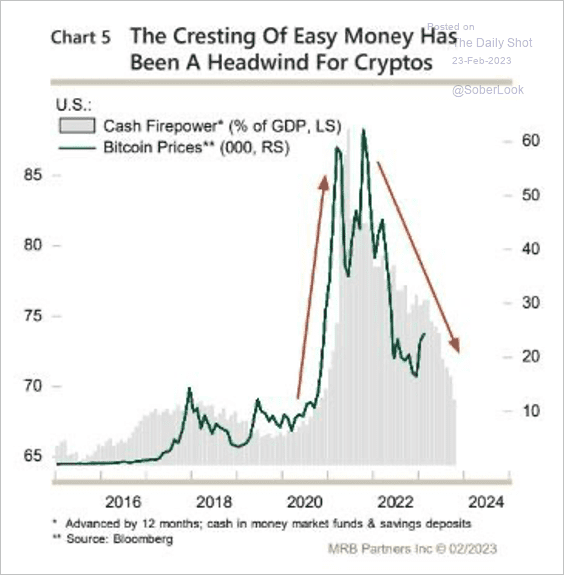

4. The slowdown in excess cash and savings has been a headwind for bitcoin over the past year.

Source: MRB Partners

Source: MRB Partners

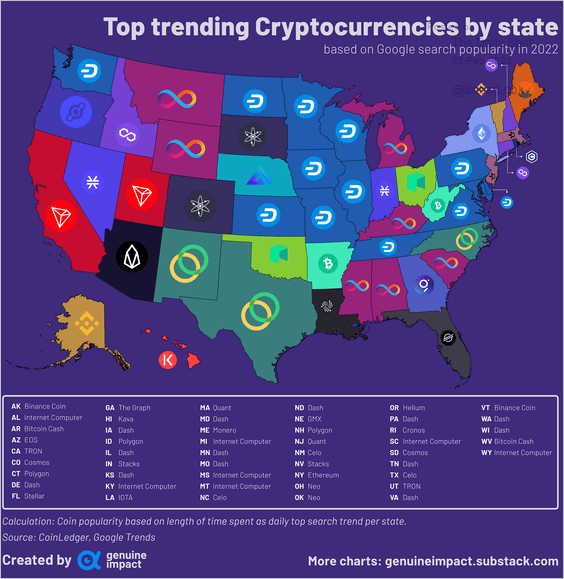

5. This map shows the most searched tokens by state.

Source: @genuine_impact

Source: @genuine_impact

Back to Index

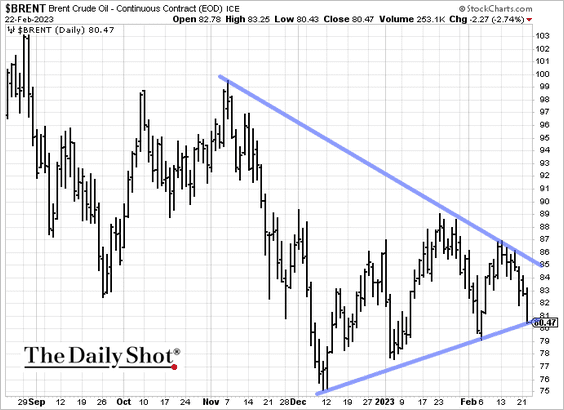

Energy

1. Crude oil has been under pressure this week amid demand concerns.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

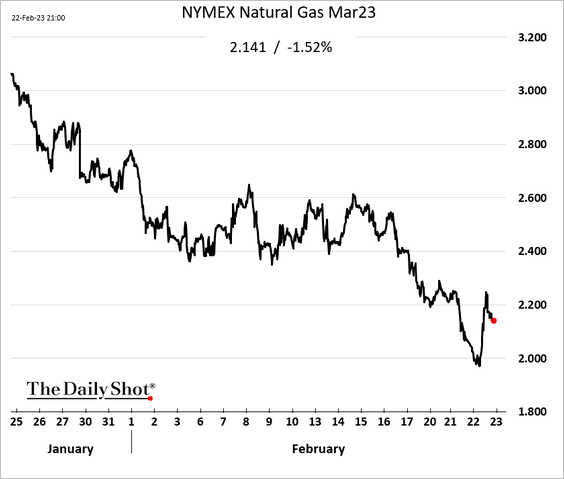

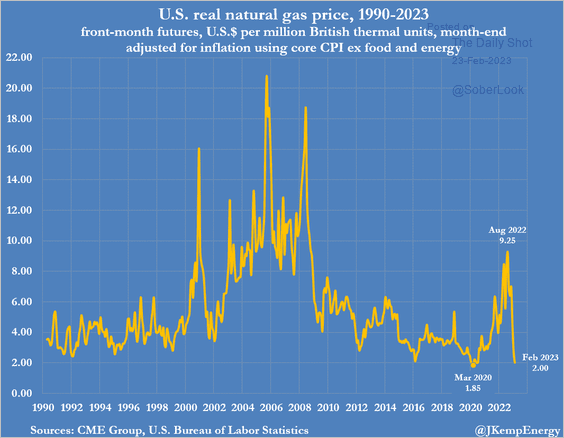

2. US natural gas futures dipped below $2/mmbtu for the first time since 2020, before rebounding.

• Will natural gas test record lows?

Source: @JKempEnergy

Source: @JKempEnergy

• Will we see lower production ahead?

Source: Reuters Read full article

Source: Reuters Read full article

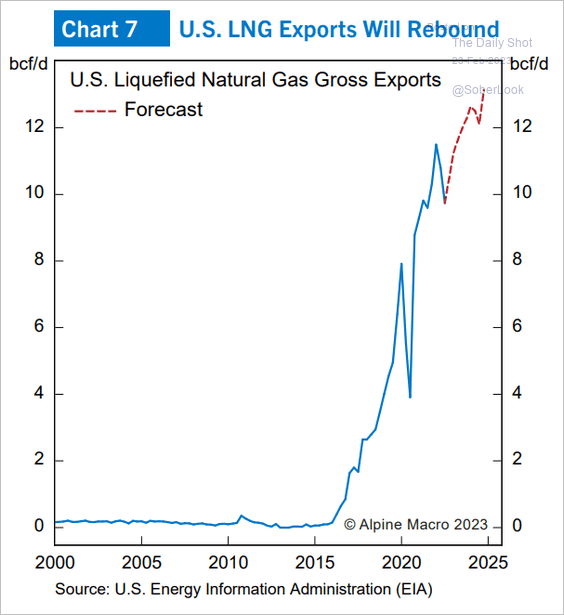

• US LNG exports are expected to keep surging.

Source: Alpine Macro

Source: Alpine Macro

——————–

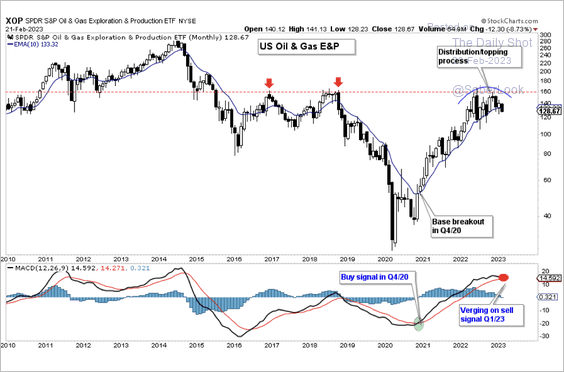

3. The SPDR Oil & Gas Exploration & Production ETF (XOP) is testing long-term resistance.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Equities

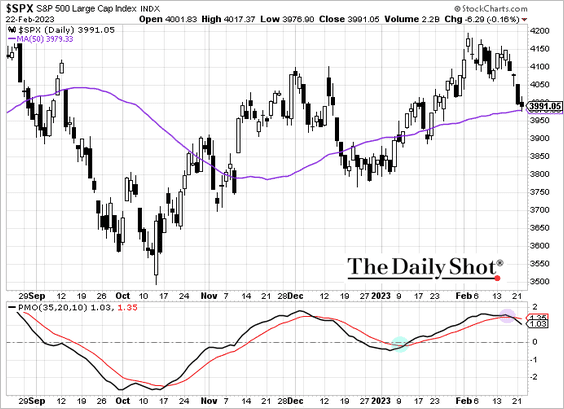

1. The S&P 500 is testing initial support near its 50-day moving average, although short-term momentum is negative.

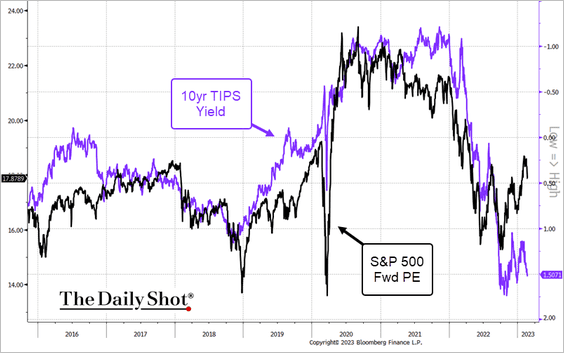

2. Elevated real yields suggest that stocks are too expensive.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

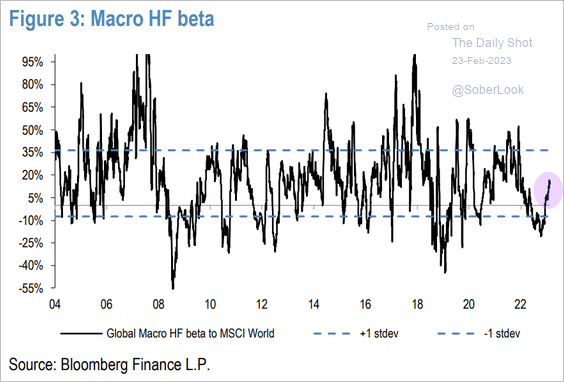

3. Macro hedge funds have been boosting their exposure to stocks.

Source: JP Morgan Research

Source: JP Morgan Research

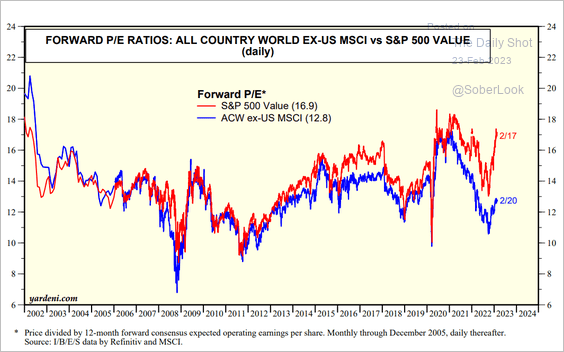

4. US value stocks trade at a substantial premium to non-US large-caps.

Source: Yardeni Research

Source: Yardeni Research

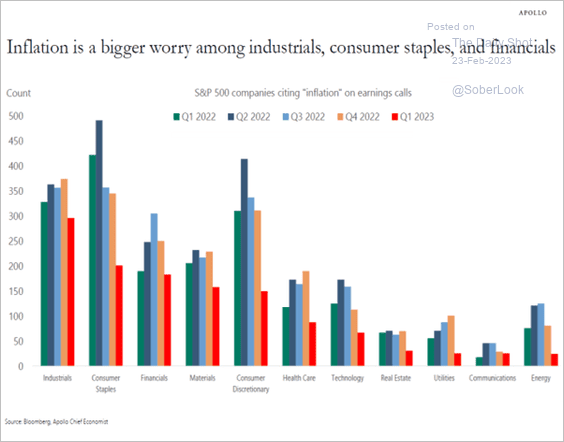

5. Which industries are most concerned about inflation?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

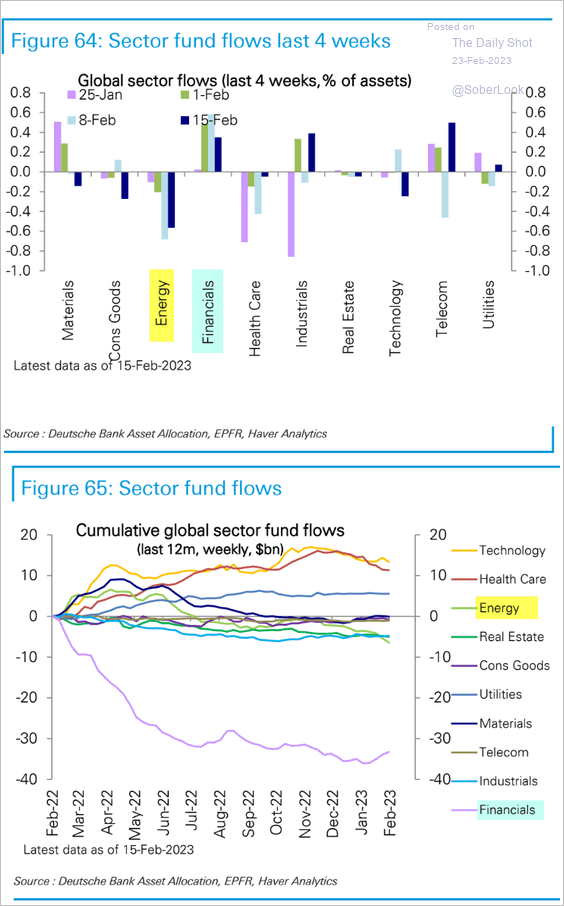

6. Fund flows into financials are recovering after massive withdrawals last year. Energy-sector funds are seeing outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

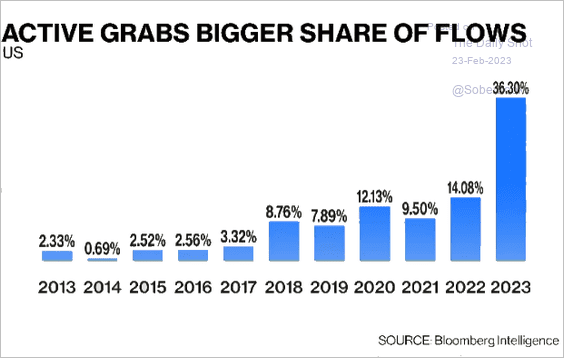

7. Active ETFs’ share of fund flows surged this year.

Source: @BloombergTV

Source: @BloombergTV

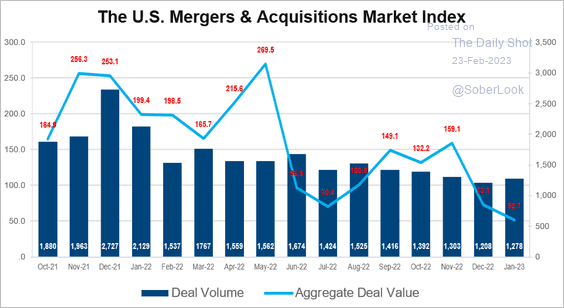

8. M&A spending (deal value) has been trending lower.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Alternatives

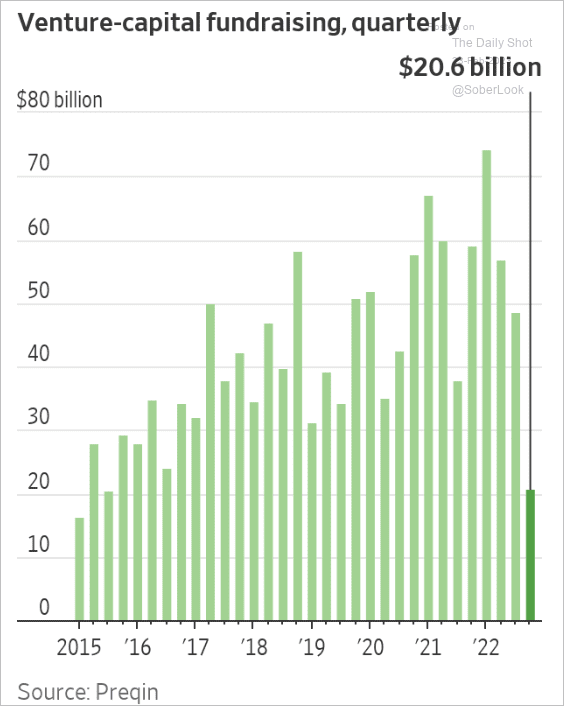

1. VC fundraising hit a nine-year low.

Source: @WSJ Read full article

Source: @WSJ Read full article

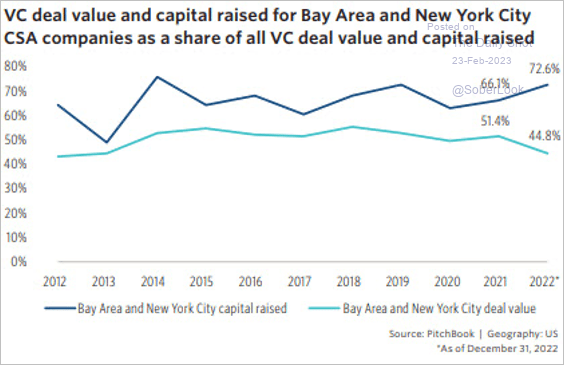

2. 73% of venture capital commitments in 2022 went to Bay Area or NYC firms.

Source: PitchBook

Source: PitchBook

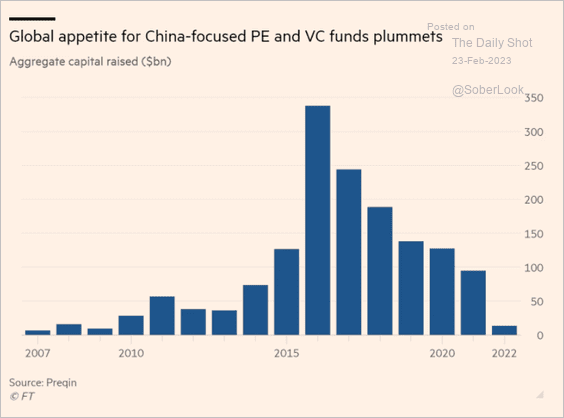

3. China-focused PE and VC funds didn’t get much love last year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Credit

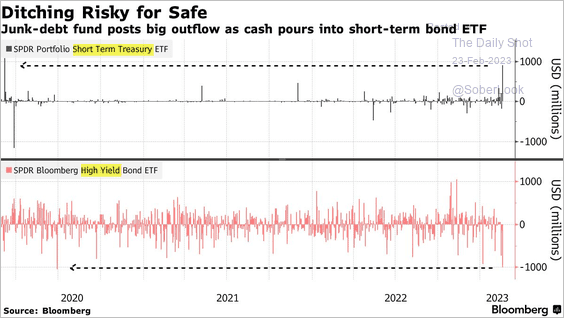

1. ETF investors have been dumping HY bonds and moving into cash.

Source: @SamJPotter, @markets Read full article

Source: @SamJPotter, @markets Read full article

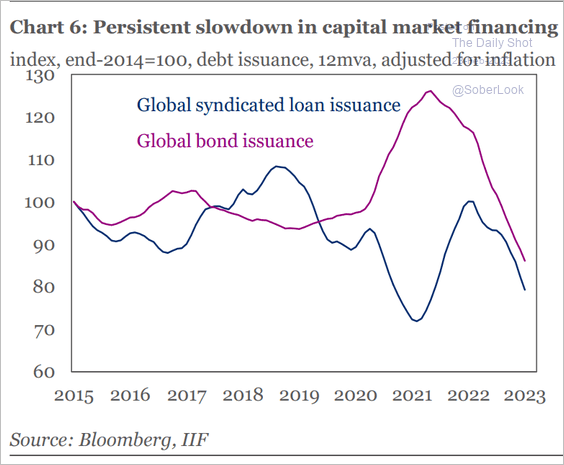

3. Capital markets financing slowed sharply last year.

Source: IIF

Source: IIF

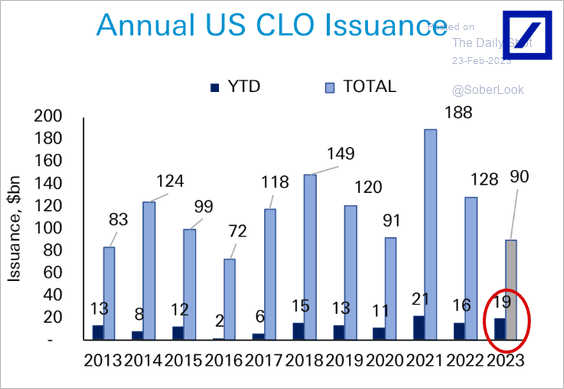

4. CLO issuance has been robust year-to-date.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

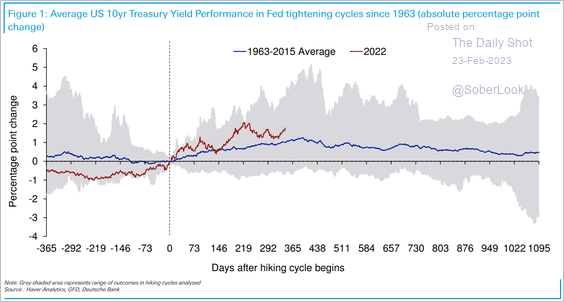

1. The 10-year Treasury yield has risen above average levels during previous hiking cycles.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

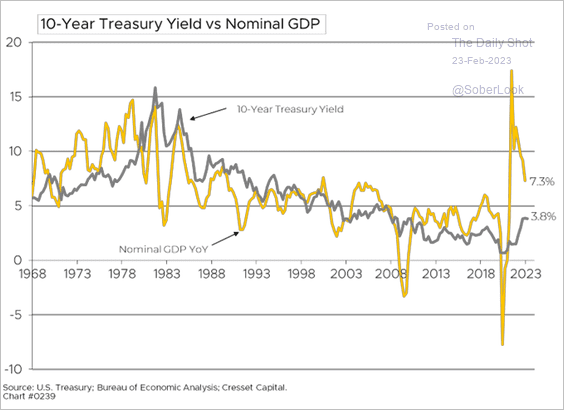

2. Over the long run, the 10-year Treasury yield tends to track US nominal GDP growth.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

Back to Index

Global Developments

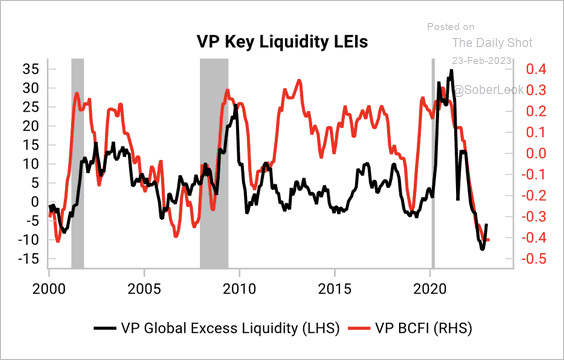

1. Excess liquidity ticked up off very low levels, largely reflecting the dollar’s sell-off since October 2022.

Source: Variant Perception

Source: Variant Perception

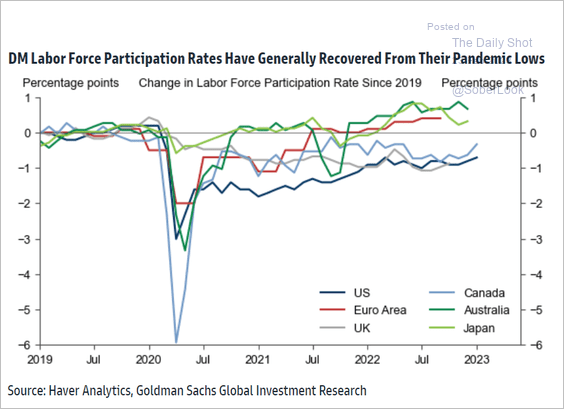

2. This chart shows labor force participation rates in advanced economies.

Source: Goldman Sachs

Source: Goldman Sachs

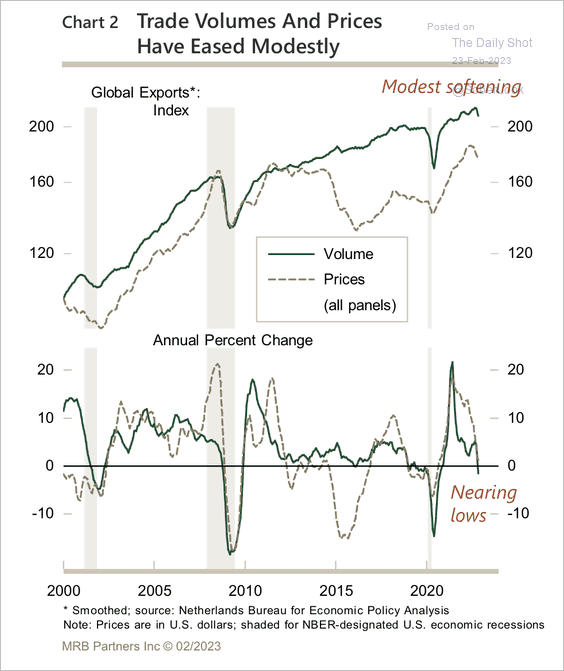

3. Global trade volumes and prices have eased.

Source: MRB Partners

Source: MRB Partners

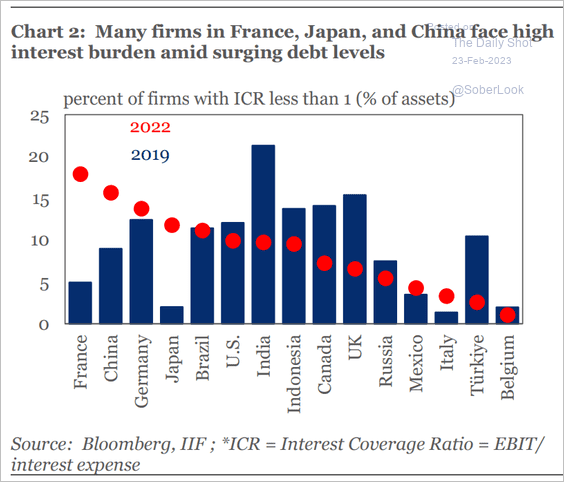

4. Which countries have the most firms with low interest coverage ratios?

Source: IIF

Source: IIF

——————–

Food for Thought

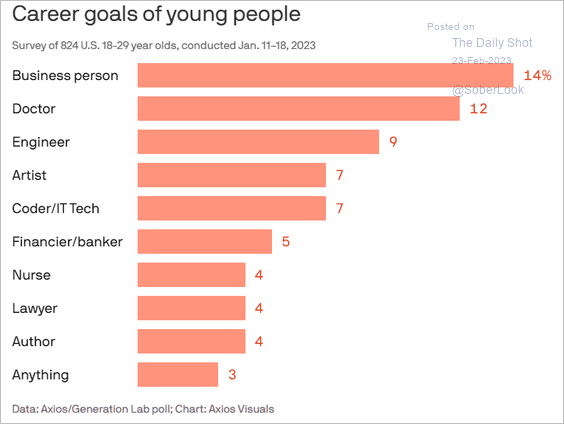

1. Gen-Z career goals:

Source: @axios Read full article

Source: @axios Read full article

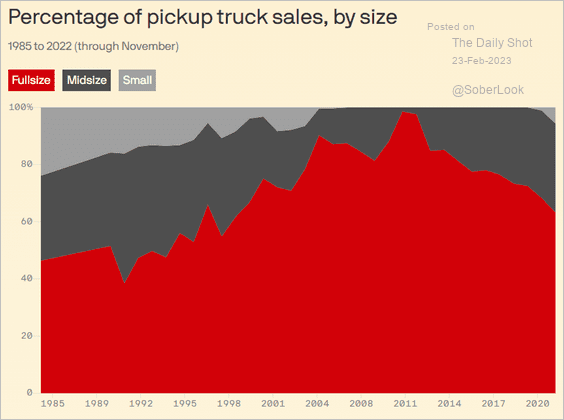

2. US pickup truck sales by size:

Source: @axios Read full article

Source: @axios Read full article

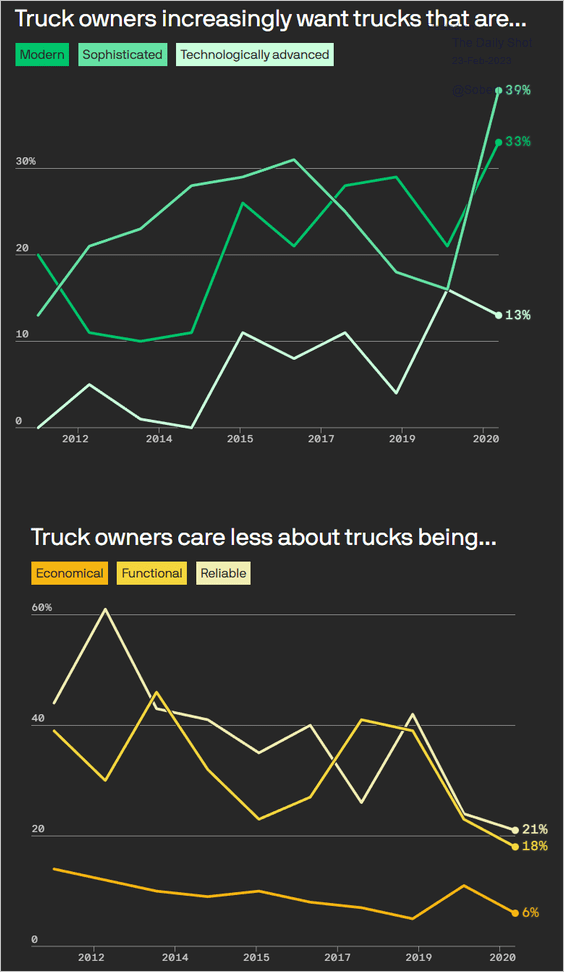

What do truck buyers care about?

Source: @axios Read full article

Source: @axios Read full article

——————–

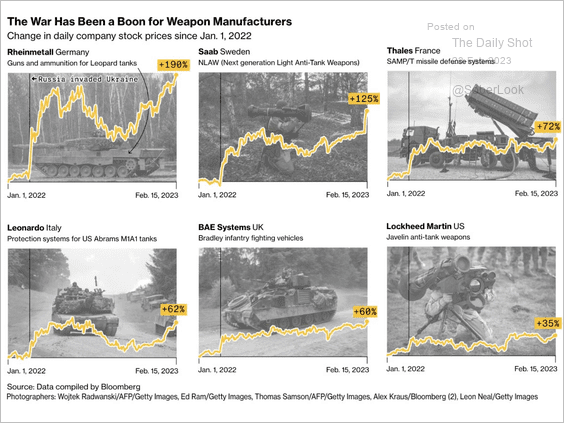

3. Weapons manufacturers’ share prices:

Source: @pogkas, @BBGVisualData, @bpolitics Read full article

Source: @pogkas, @BBGVisualData, @bpolitics Read full article

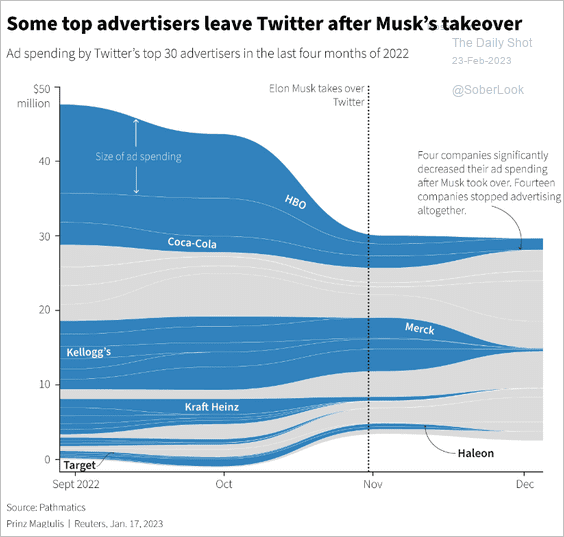

4. Twitter’s advertising revenue loss:

Source: Reuters Read full article

Source: Reuters Read full article

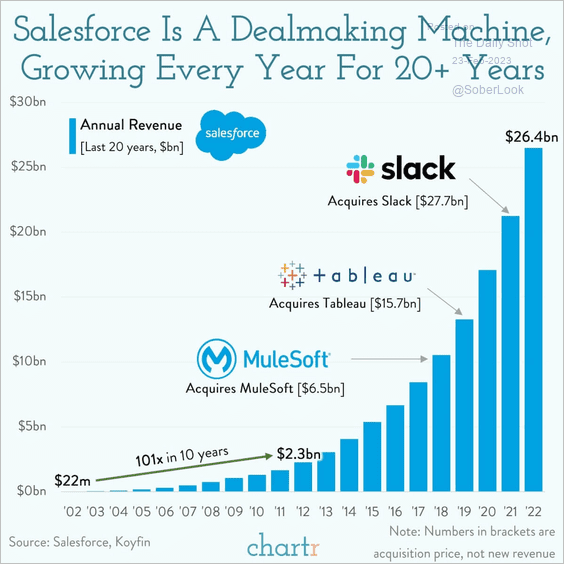

5. Salesforce revenue growth:

Source: @chartrdaily

Source: @chartrdaily

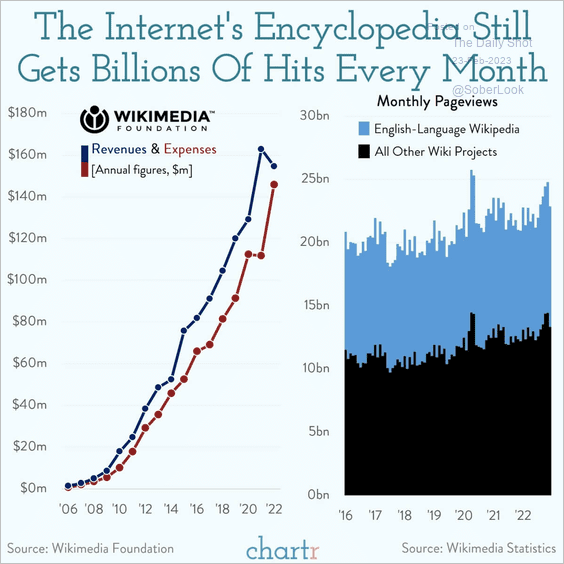

6. The Wikimedia Foundation:

Source: @chartrdaily

Source: @chartrdaily

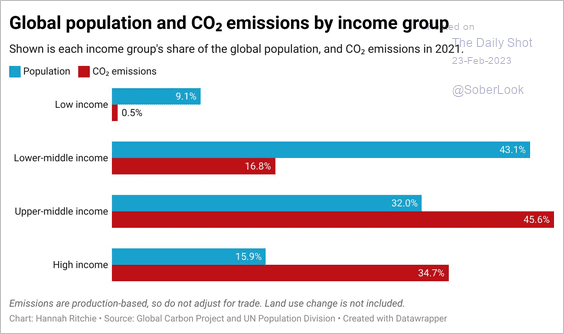

7. CO2 emissions by income group:

Source: @_HannahRitchie

Source: @_HannahRitchie

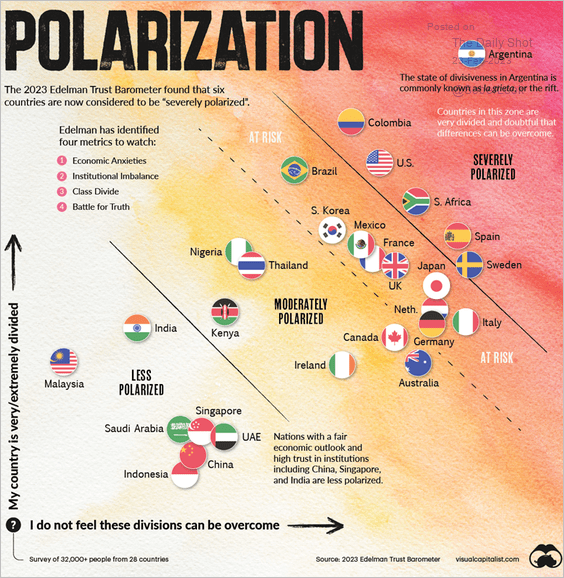

8. Political polarization globally:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

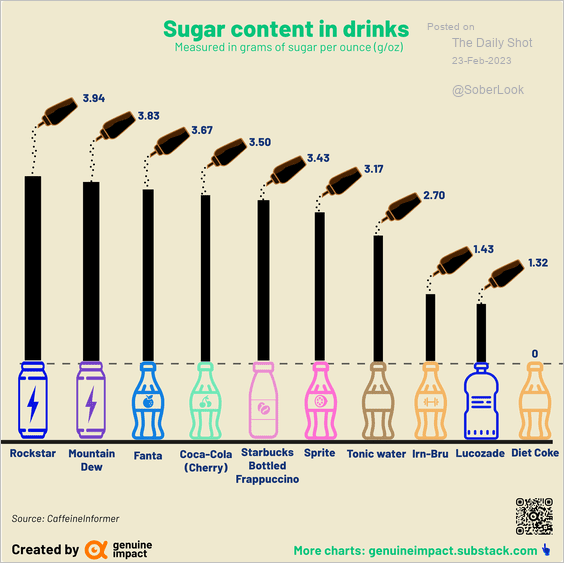

9. The amount of sugar per ounce in select drinks:

Source: @genuine_impact

Source: @genuine_impact

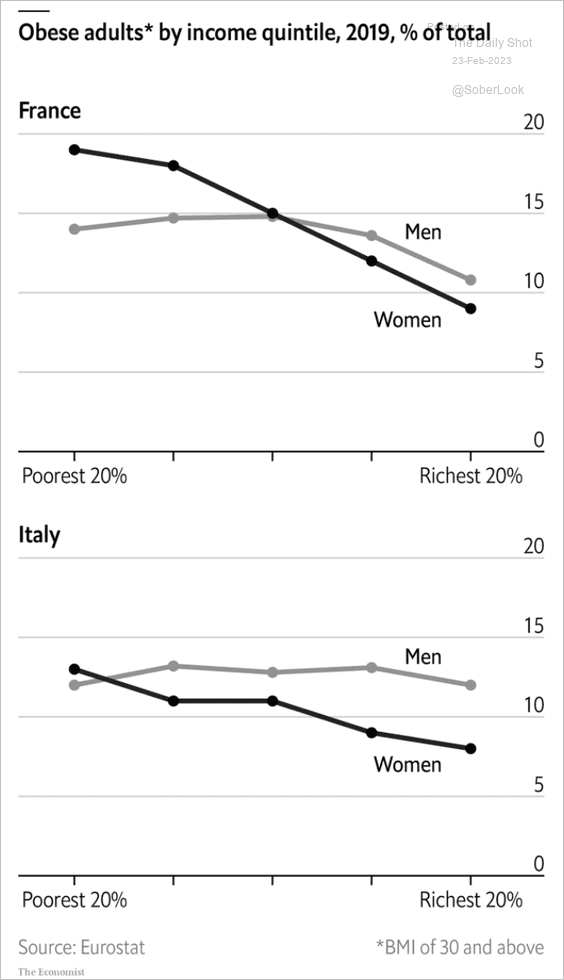

10. Share of obese adults by income quintile in France and Italy:

Source: The Economist Read full article

Source: The Economist Read full article

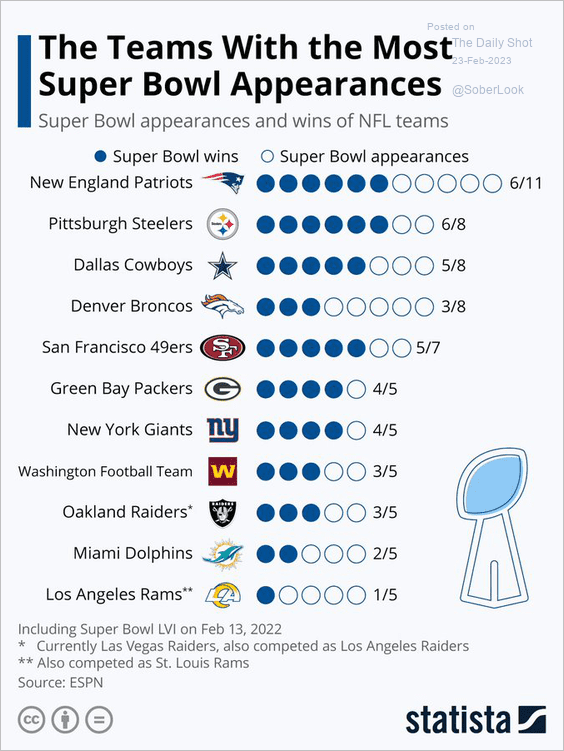

11. Most Super Bowl appearances:

Source: Statista

Source: Statista

——————–

Back to Index