The Daily Shot: 27-Feb-23

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

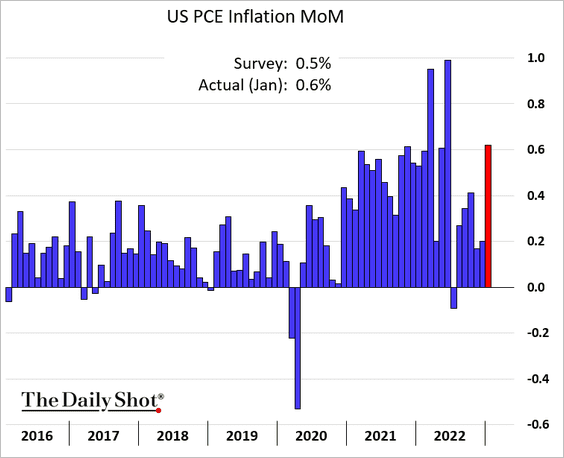

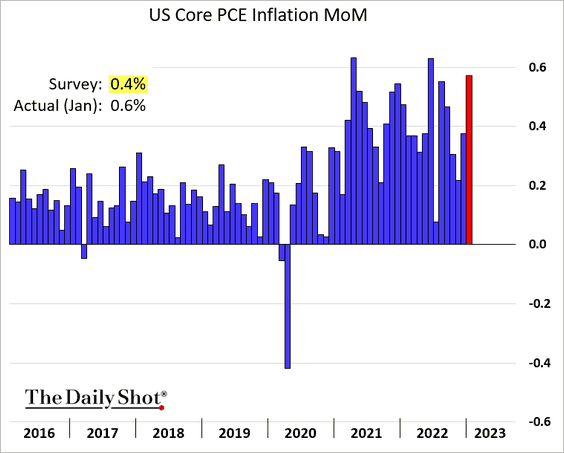

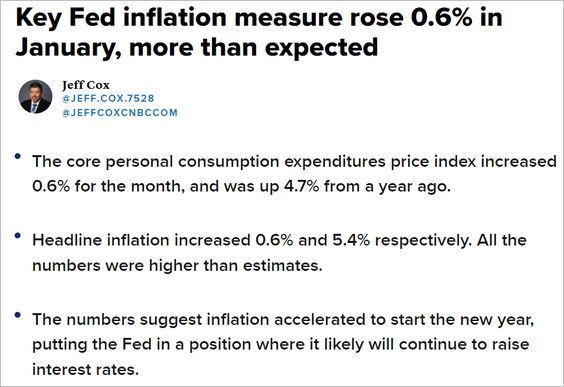

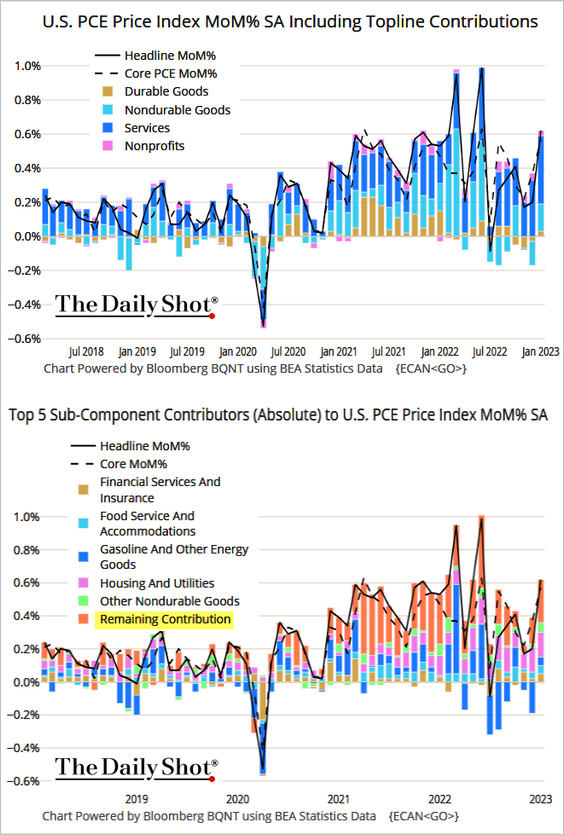

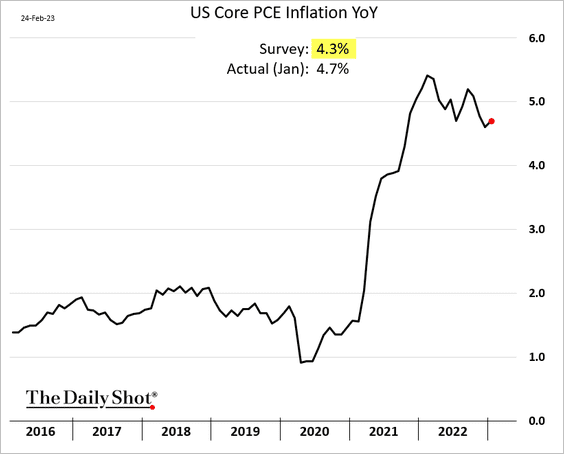

1. The January PCE inflation measure topped expectations, …

… particularly the core index. US inflation continues to run hot.

Source: CNBC Read full article

Source: CNBC Read full article

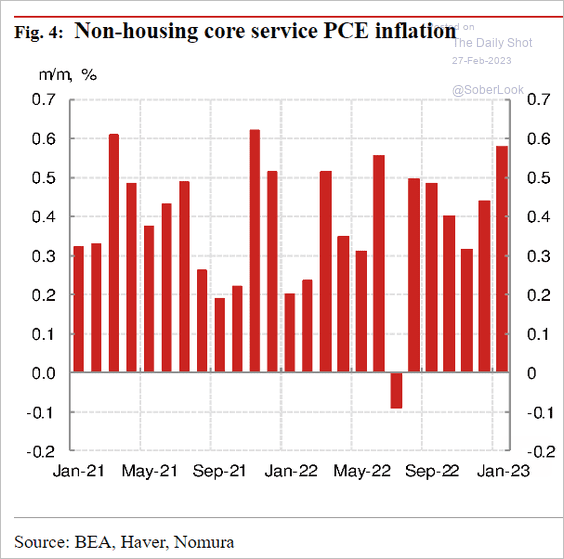

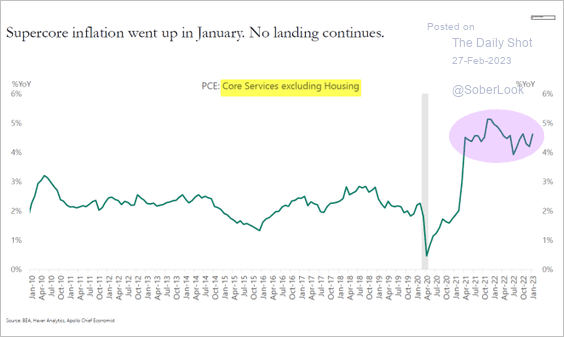

• The FOMC is very focused on the non-housing core services PCE inflation (“supercore”), which registered its biggest monthly increase in over a year.

Source: Nomura Securities

Source: Nomura Securities

• Inflation pressures remain broad.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here are the core and “supercore” PCE indices on a year-over-year basis.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

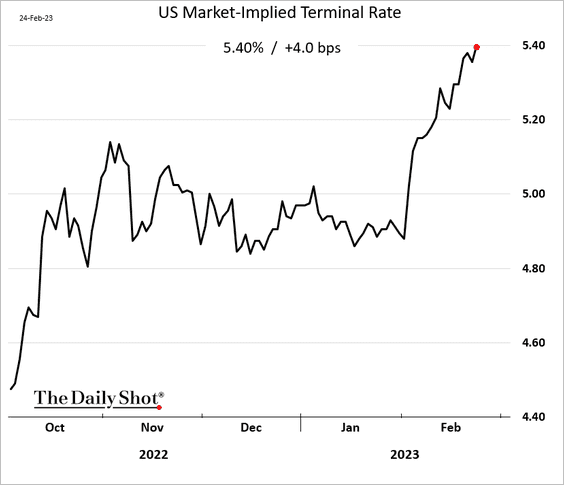

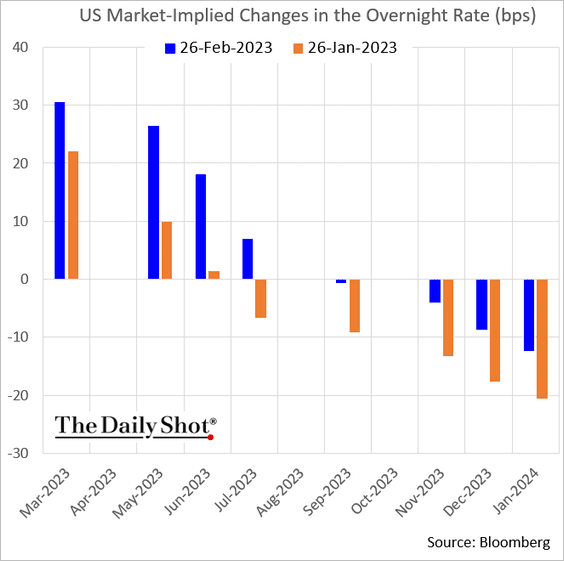

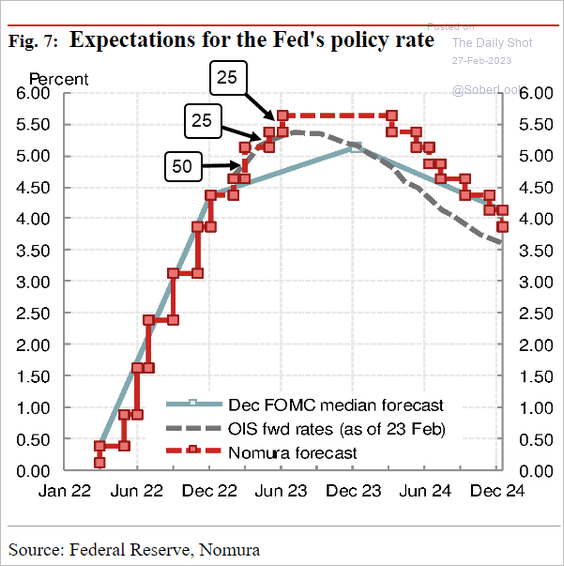

2. The implied terminal rate reached 5.4% in response to the upside PCE inflation surprise.

• The market expects at least three more 25 bps hikes.

• Nomura projects the terminal rate to rise even higher, with a 50 bps rate hike in March, followed by two 25 bps increases.

Source: Nomura Securities

Source: Nomura Securities

——————–

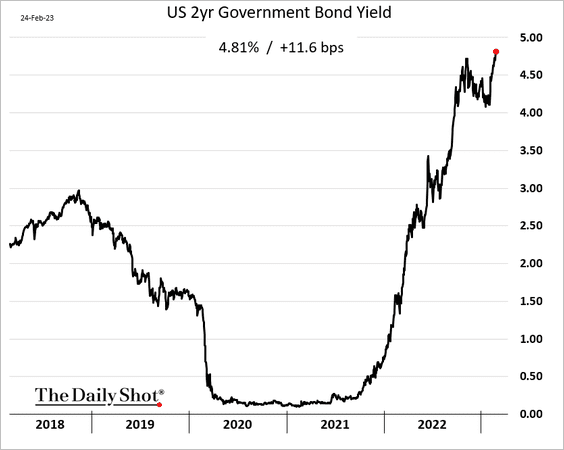

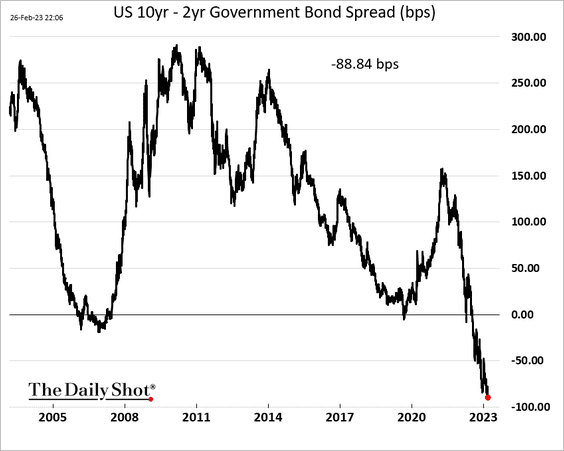

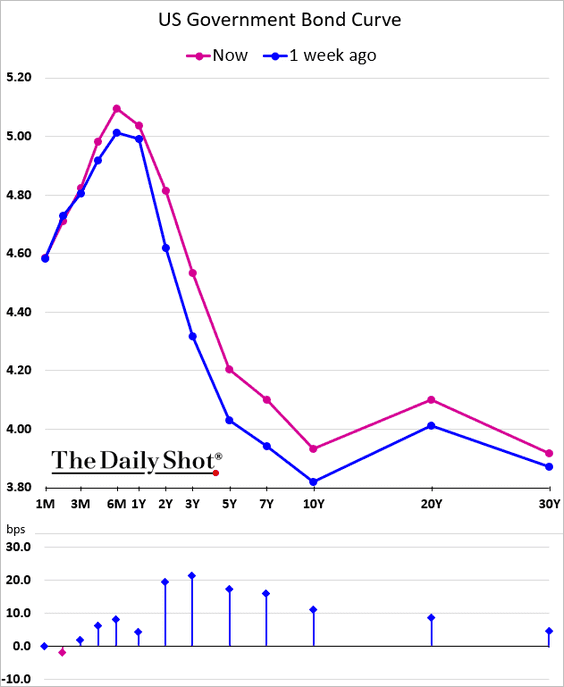

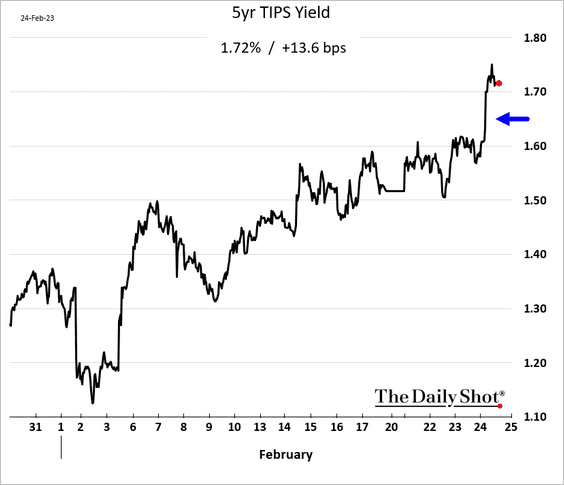

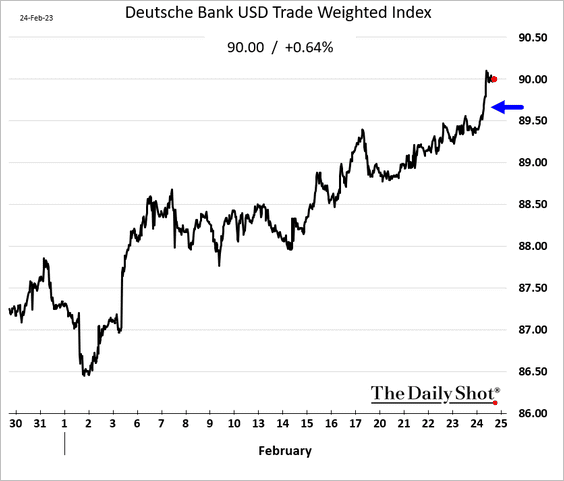

3. Treasury yields jumped, …

… and the curve inverted further after the PCE inflation report (2 charts).

• Real rates and the US dollar climbed as well, both of which tend to pose headwinds for stocks.

——————–

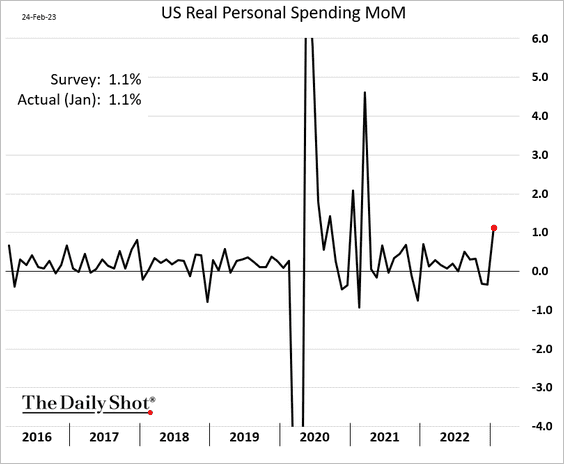

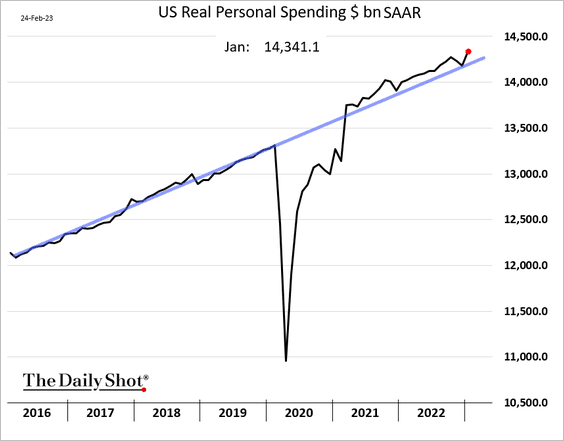

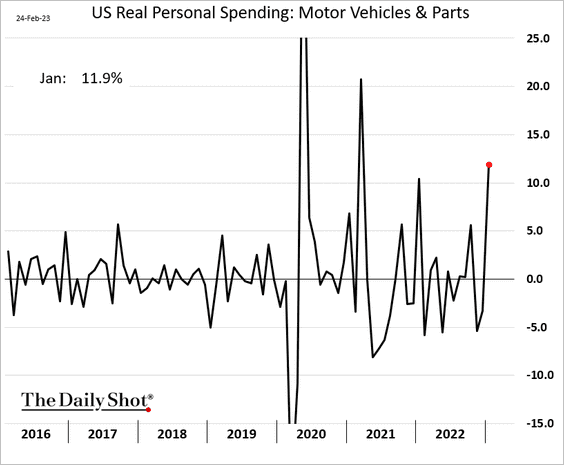

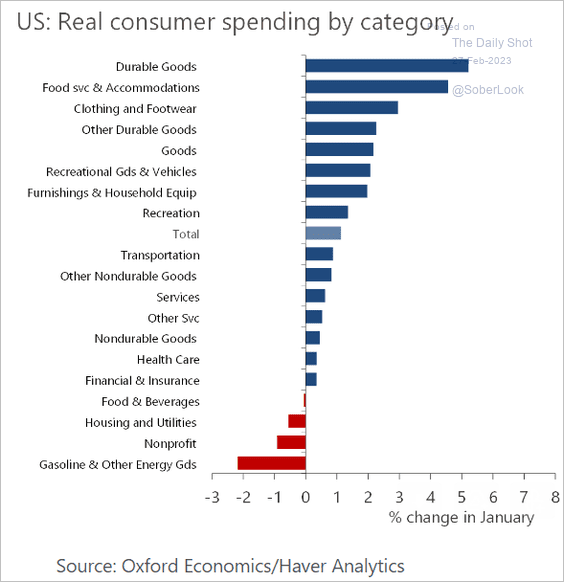

4. Consumer spending was strong in January.

– Automobile purchases jumped.

– Here is real spending by category.

Source: Oxford Economics

Source: Oxford Economics

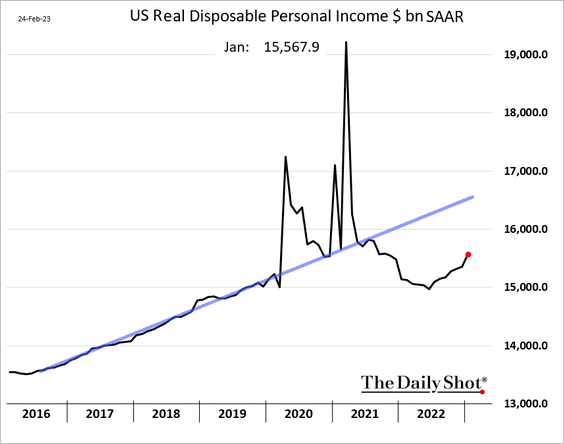

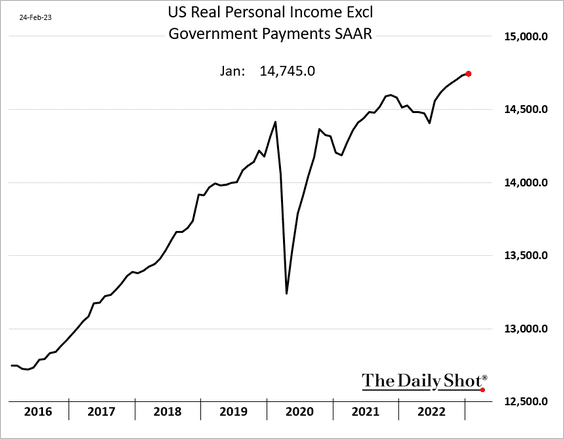

5. US real disposable income has been rebounding from recent lows.

This chart shows US real personal income without including government payments.

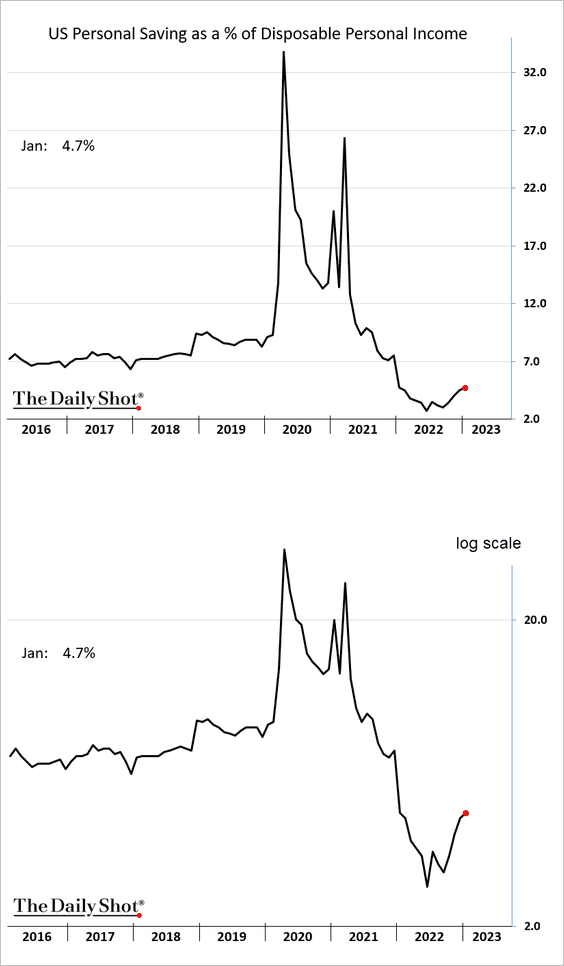

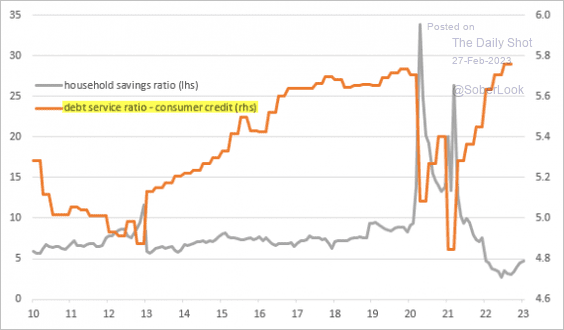

• Savings as a share of disposable income edged higher.

Households are facing difficulties in saving money because they are allocating a significant portion of their income toward debt related to consumer credit (excluding mortgages).

Source: ING

Source: ING

——————–

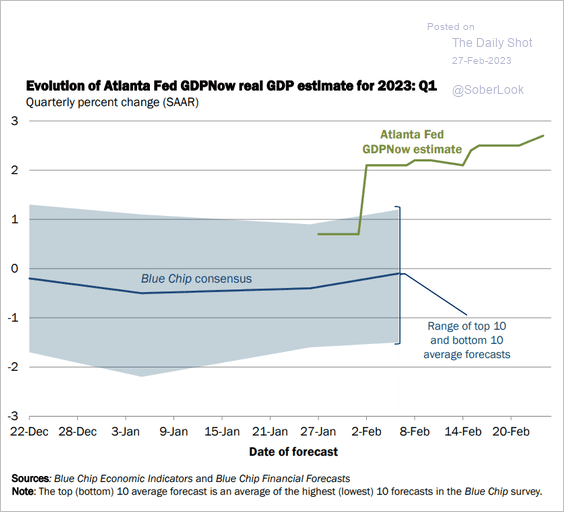

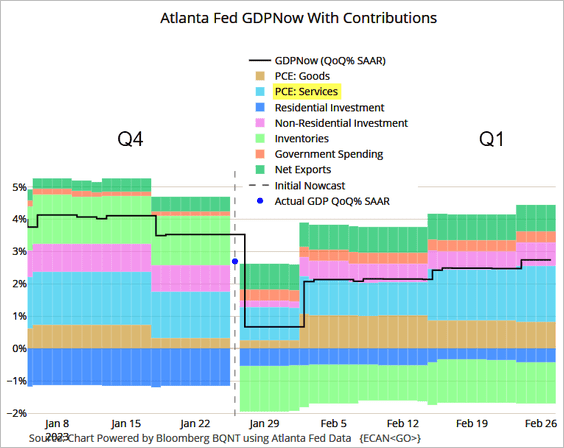

6. The GDPNow estimate for the Q1 economic growth climbed in response to the consumer spending report, …

Source: @AtlantaFed

Source: @AtlantaFed

… boosted by spending on services.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

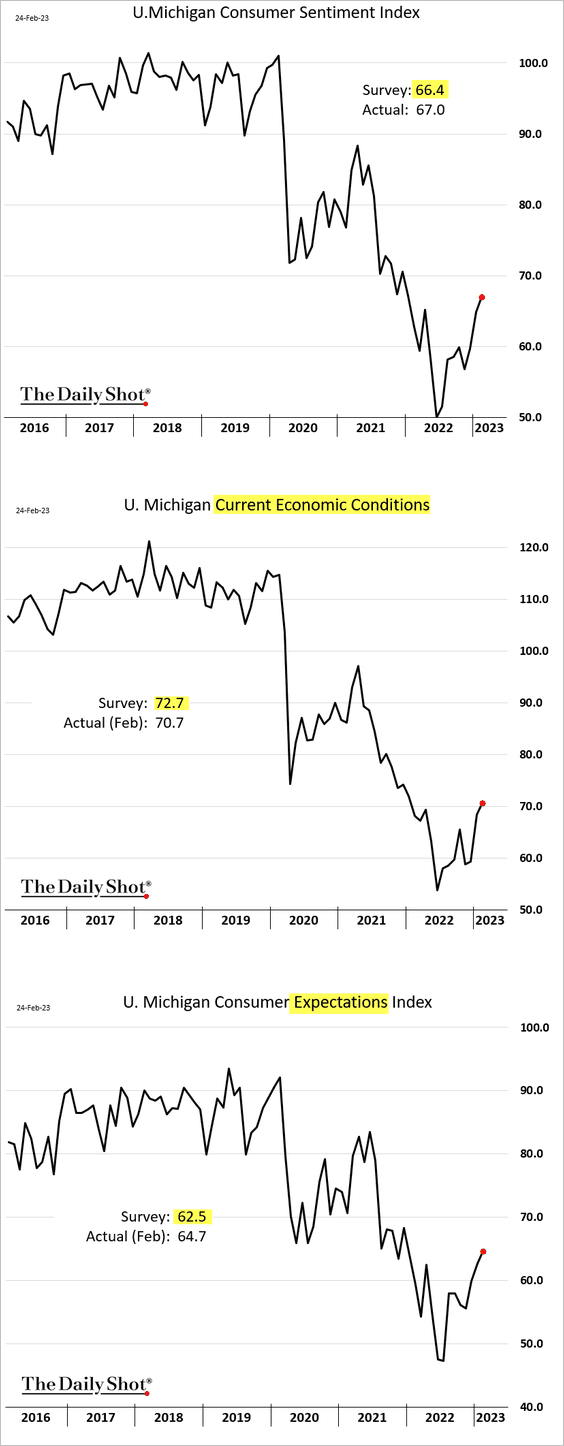

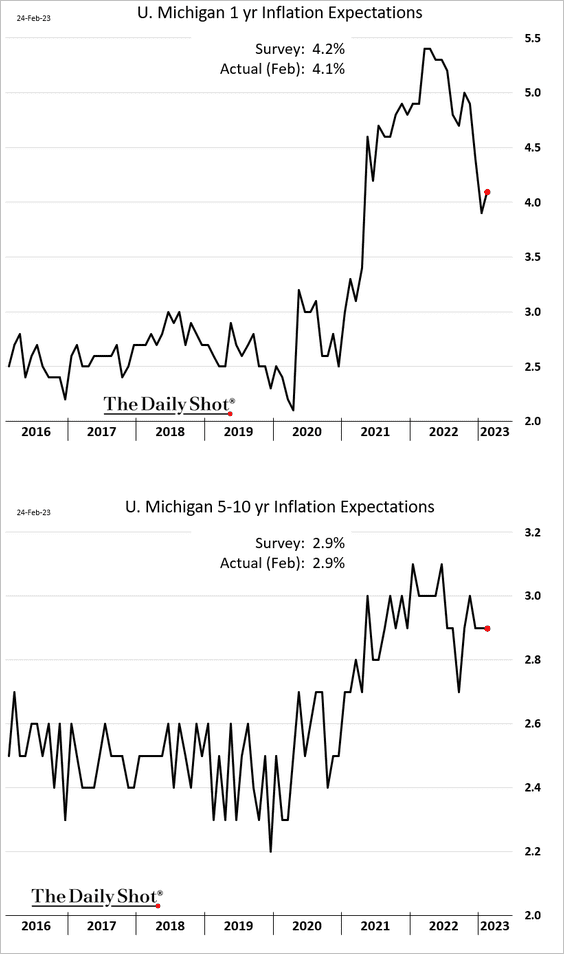

7. The final U. Michigan sentiment index showed stronger consumer expectations.

Inflation expectations were roughly unchanged from the earlier result.

——————–

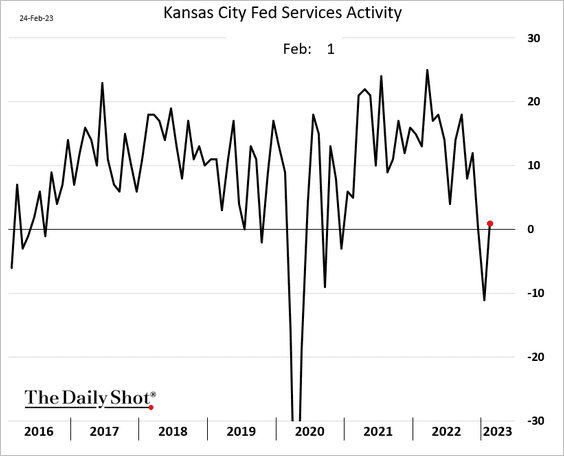

8. As with other service-sector surveys, the Kansas City Fed’s index showed an improvement this month.

Back to Index

The Eurozone

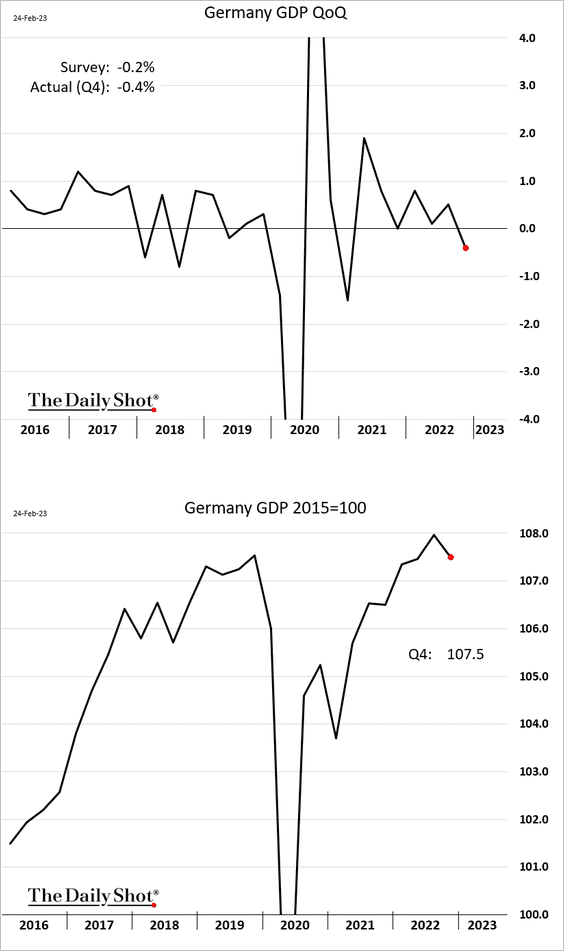

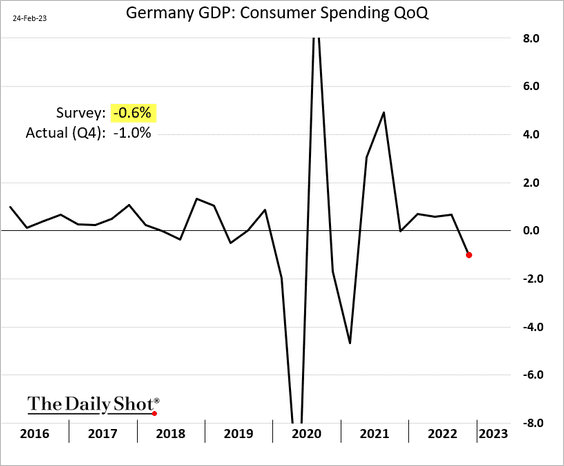

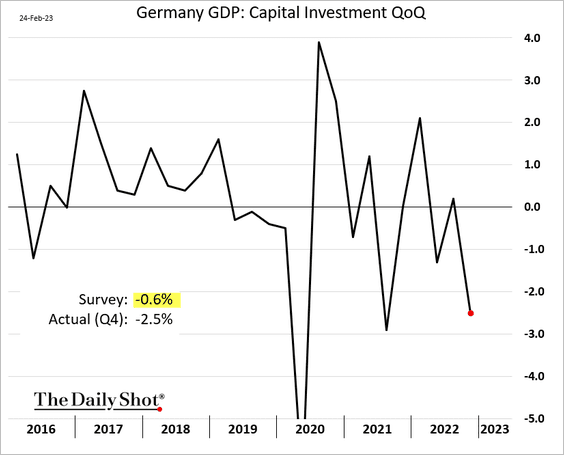

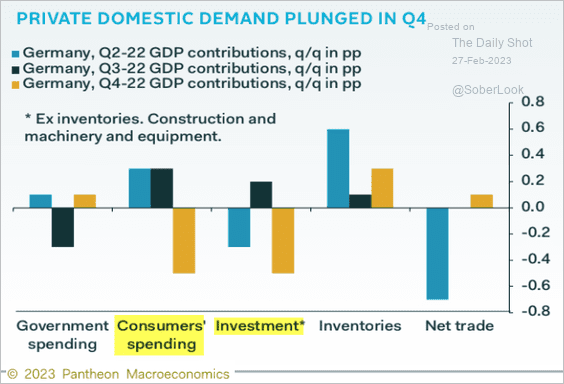

1. Germany’s revised Q4 GDP report was ugly.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Consumer spending and business investment slumped.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

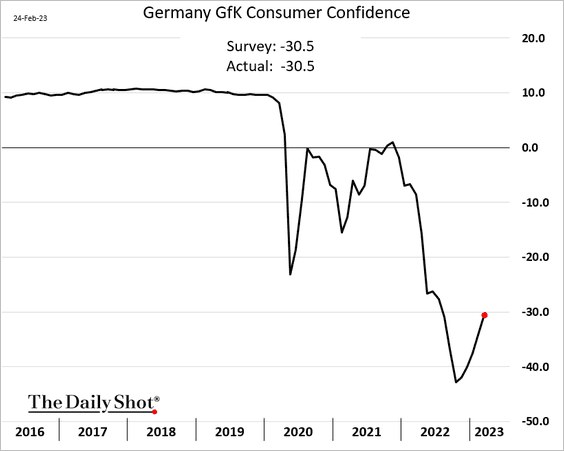

Separately, Germany’s consumer sentiment continues to recover from the lows.

——————–

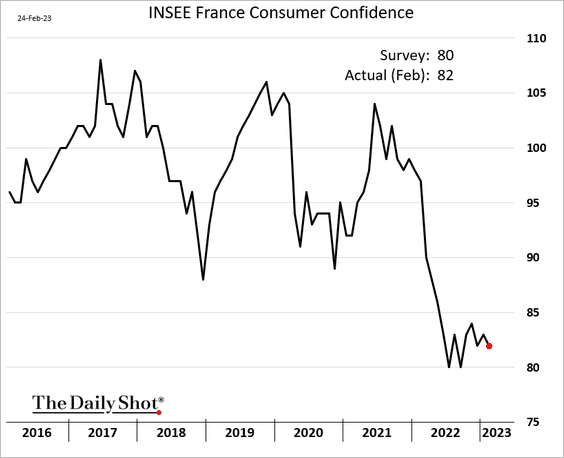

2. French consumer sentiment remains depressed.

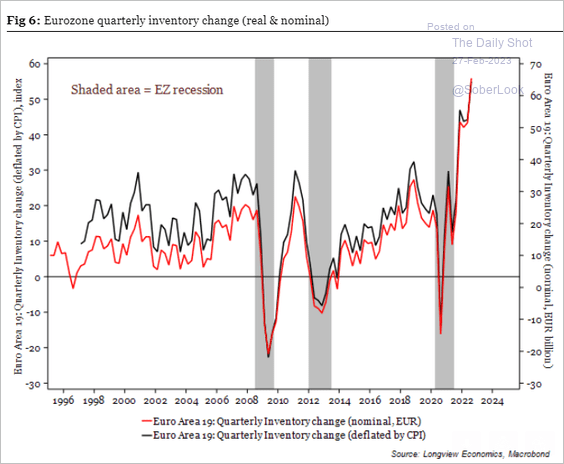

3. Euro-area inventories have been rising quickly.

Source: Longview Economics

Source: Longview Economics

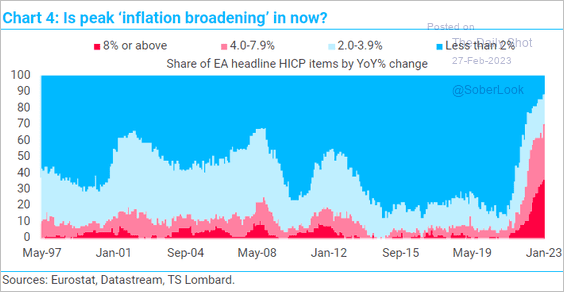

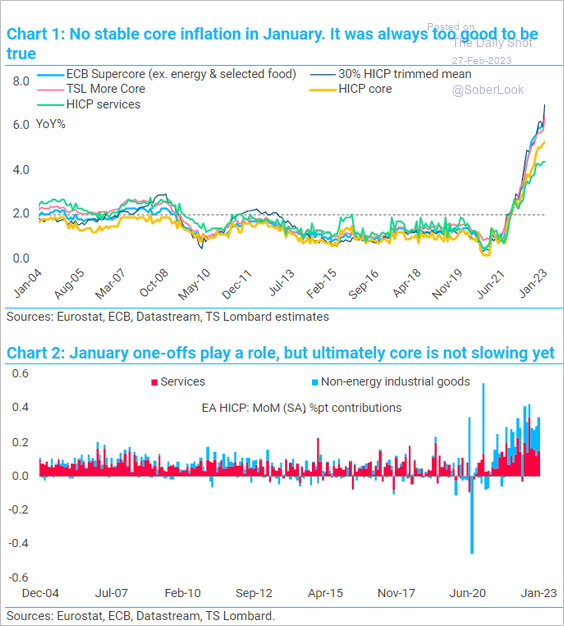

4. Inflation has been broadening, …

Source: TS Lombard

Source: TS Lombard

… with the core CPI running hot.

Source: TS Lombard

Source: TS Lombard

——————–

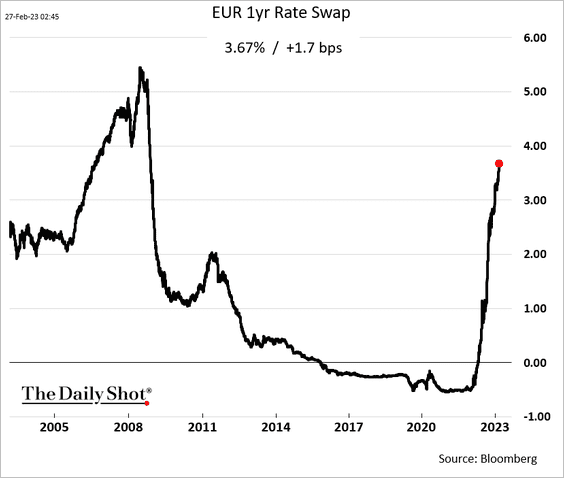

5. Short-term rates keep climbing as the market boosts ECB rate hike expectations.

Back to Index

Europe

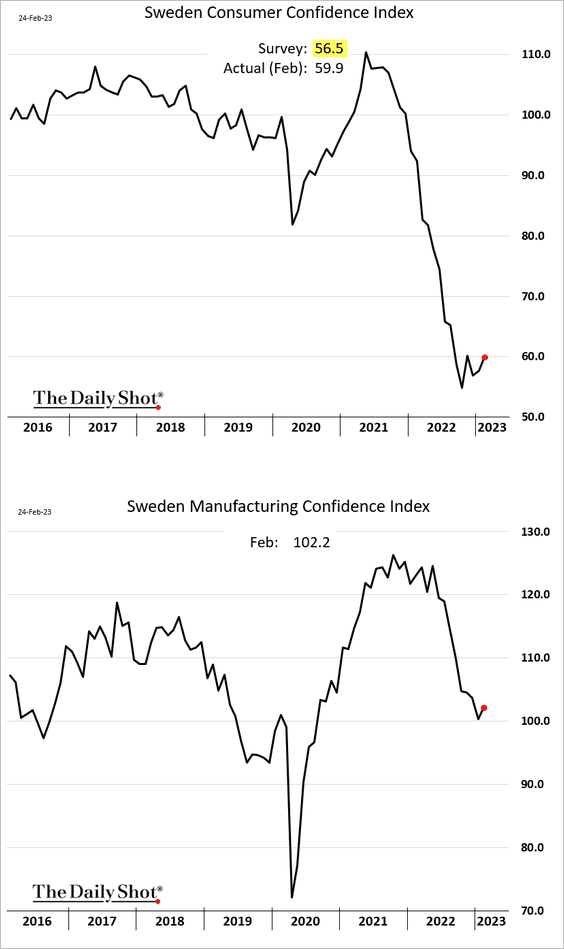

1. Sweden’s sentiment indices appear to have bottomed.

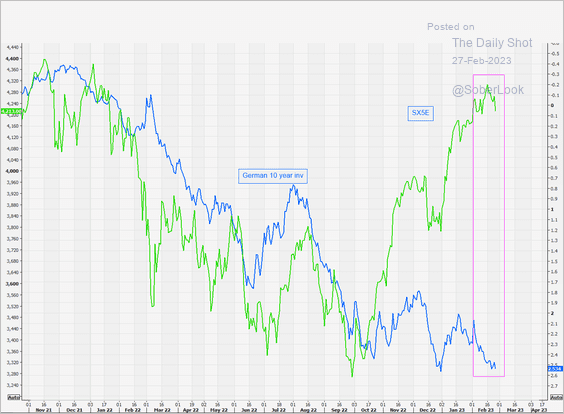

2. Stocks have been climbing despite higher bond yields.

Source: @themarketear

Source: @themarketear

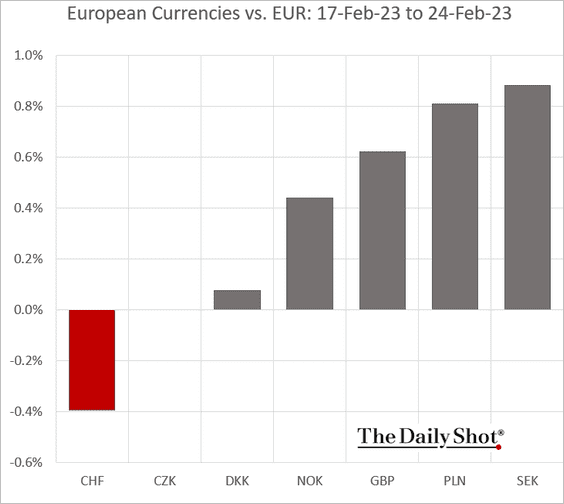

3. This chart shows how some European currencies performed against the euro last week.

Back to Index

Asia – Pacific

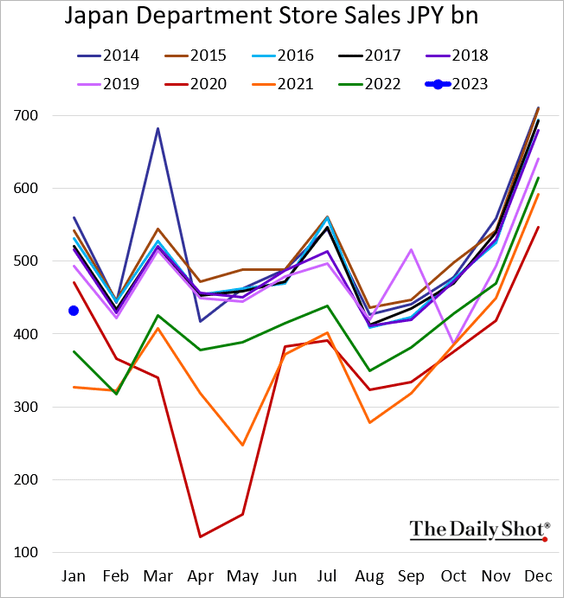

1. Japan’s department store sales were well above last year’s levels in January.

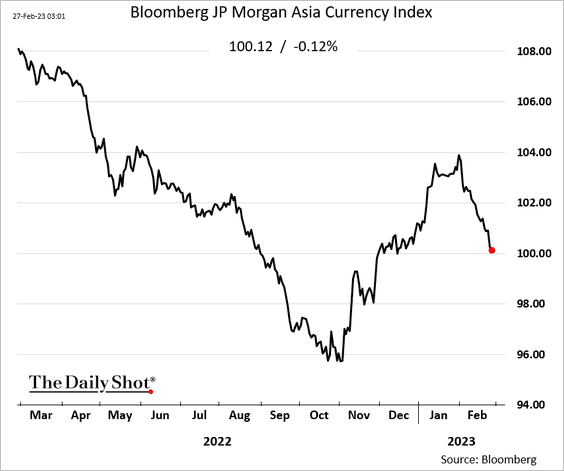

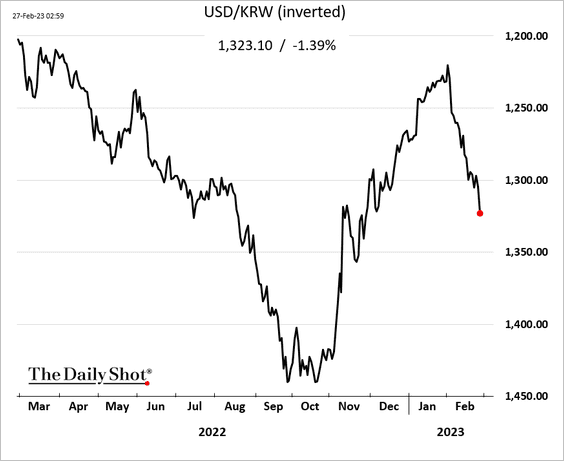

2. Asian currencies have been weakening vs. USD.

Here is the South Korean won.

Back to Index

Emerging Markets

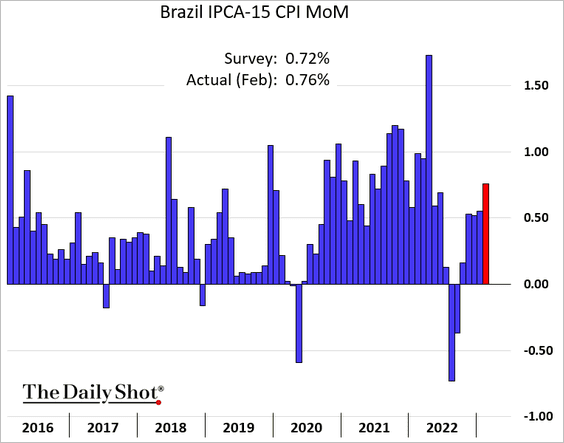

1. Brazil’s inflation has accelerated again.

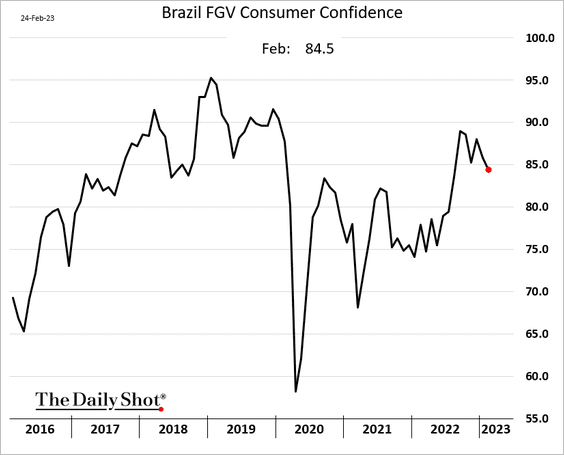

Consumer confidence is rolling over.

——————–

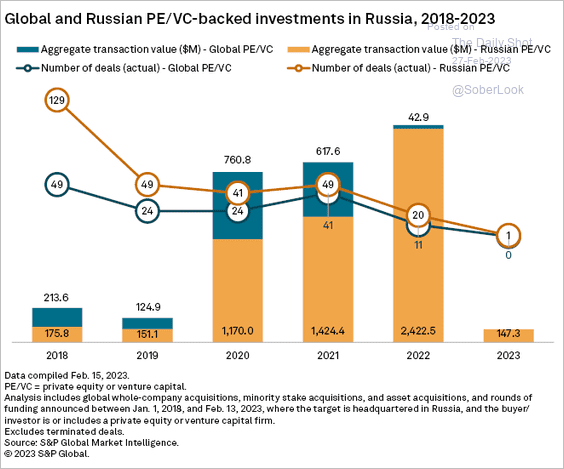

2. This chart shows PE/VC-backed investments in Russia.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

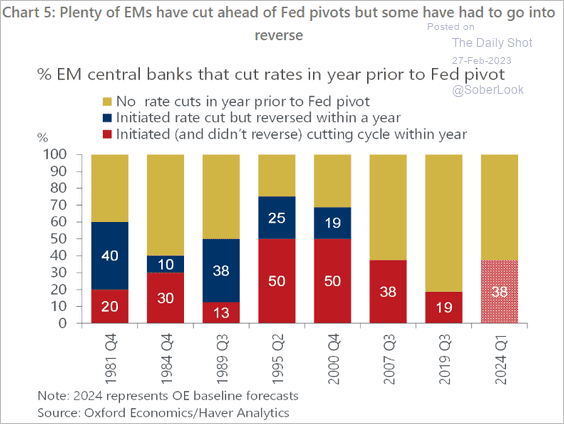

3. Which central banks cut rates ahead of the Fed’s pivot in the past?

Source: Oxford Economics

Source: Oxford Economics

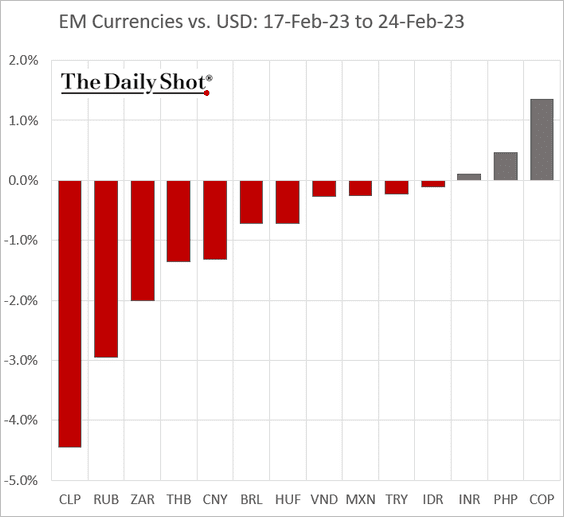

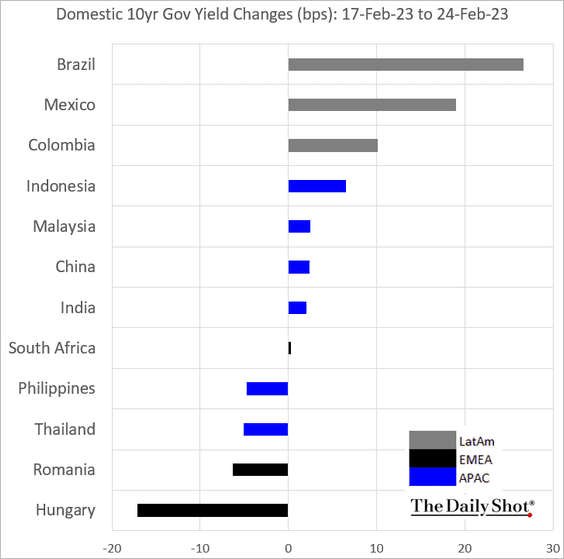

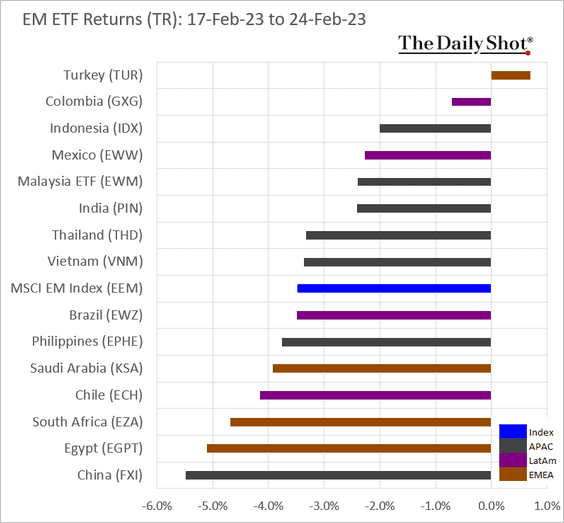

4. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

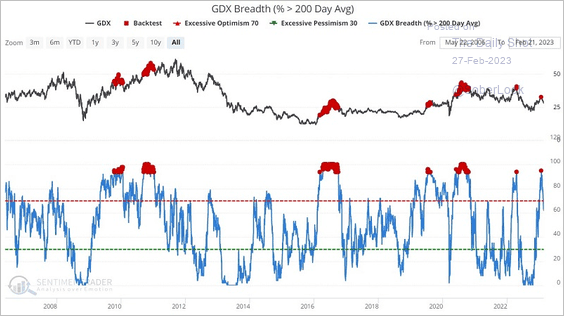

1. Gold mining stocks registered a sharp rise in breadth over the past month, signaling overbought conditions.

Source: SentimenTrader

Source: SentimenTrader

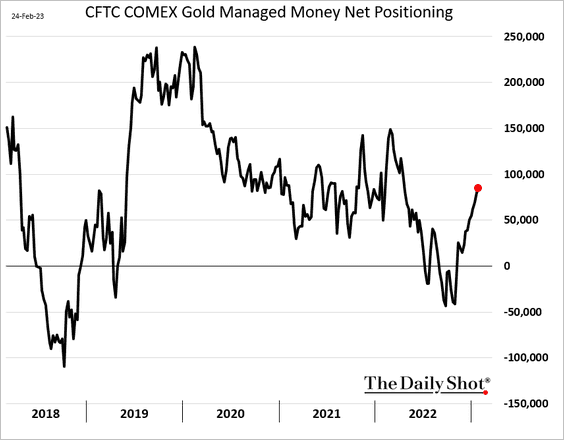

Funds have been boosting their long bets on gold futures.

——————–

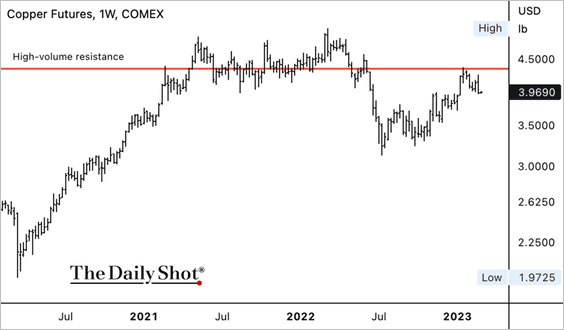

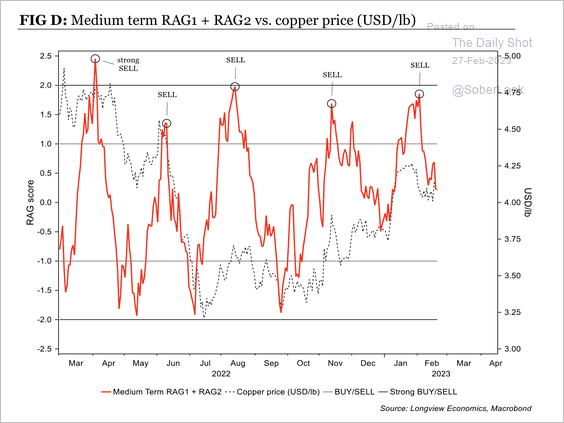

2. Copper futures are declining from long-term resistance, coinciding with large levels of selling interest. Support around $3.50 could stabilize the pullback. (2 charts)

Source: Longview Economics

Source: Longview Economics

——————–

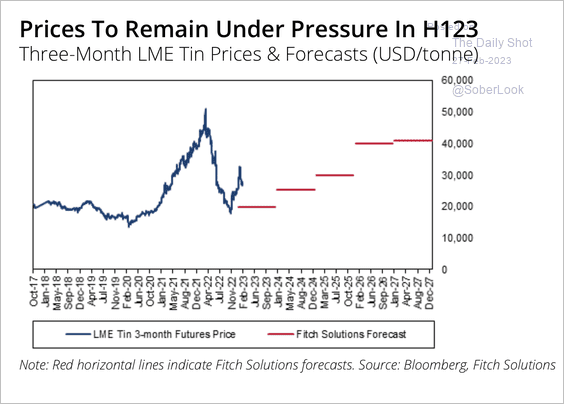

3. Fitch expects tin prices to decline this year, before gradually recovering over the next few years. Higher supply and weaker consumer electronic spending could be an immediate headwind.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

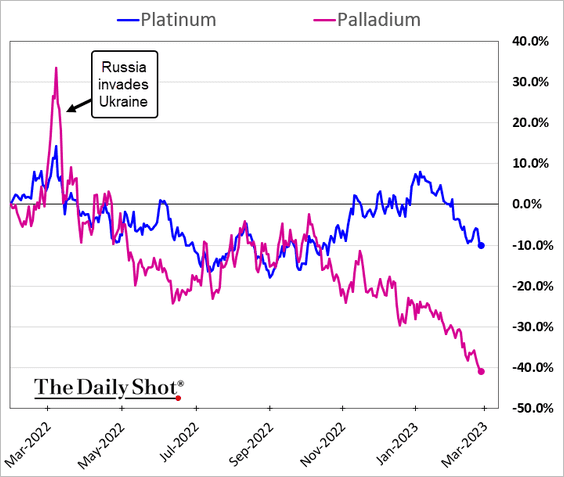

4. Palladium prices are now down over 40% vs. 12 months ago.

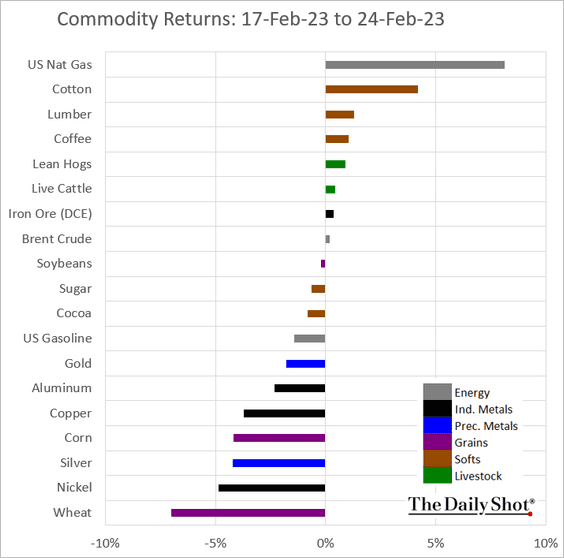

5. Finally, we have last week’s returns across key commodity markets.

Back to Index

Energy

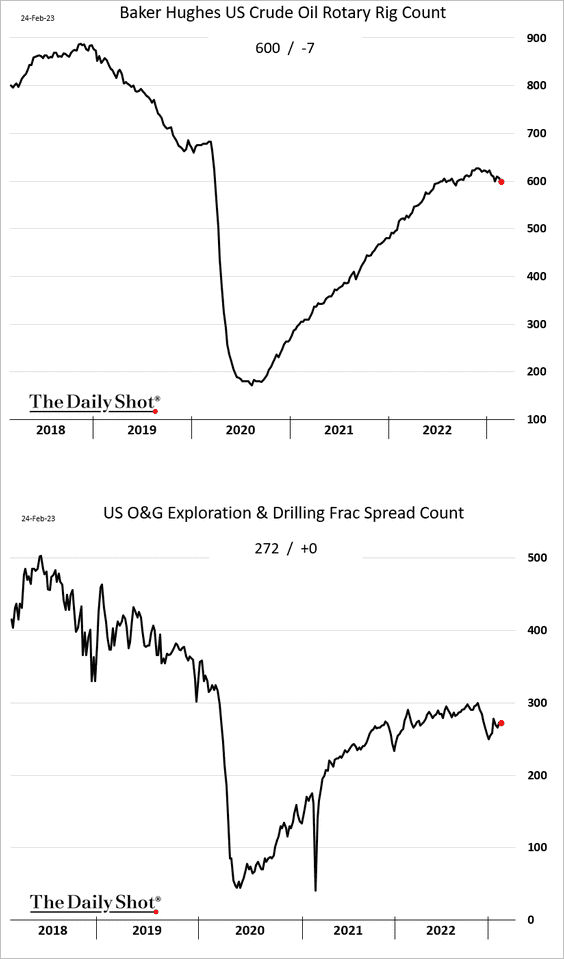

1. US drilling activity remains stalled.

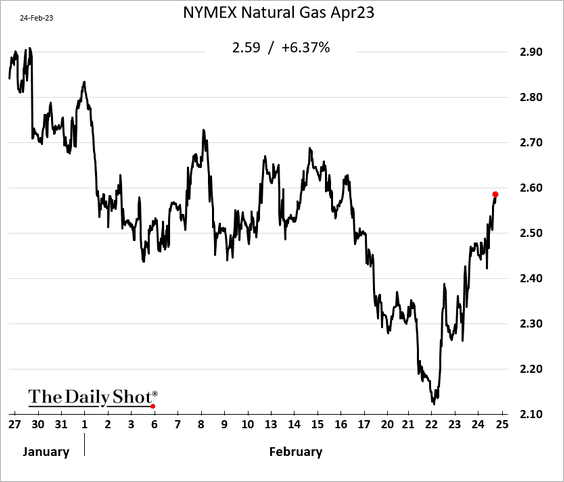

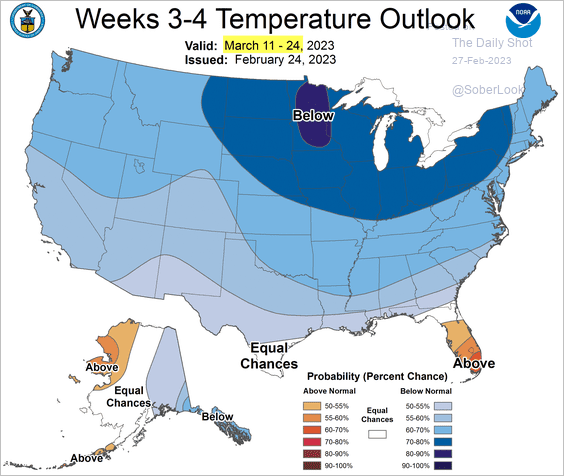

2. US natural gas futures are rebounding, …

… boosted by expectations of a cold March.

Source: NOAA

Source: NOAA

——————–

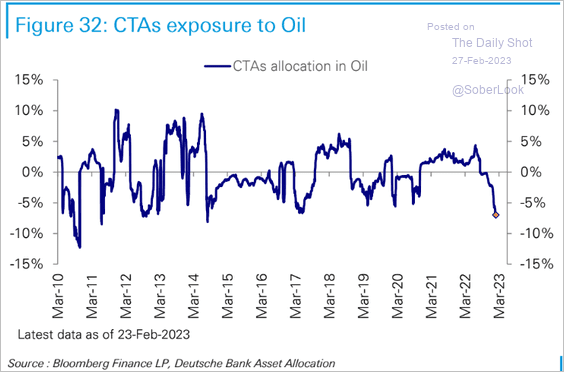

3. CTAs have been increasingly bearish on crude oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

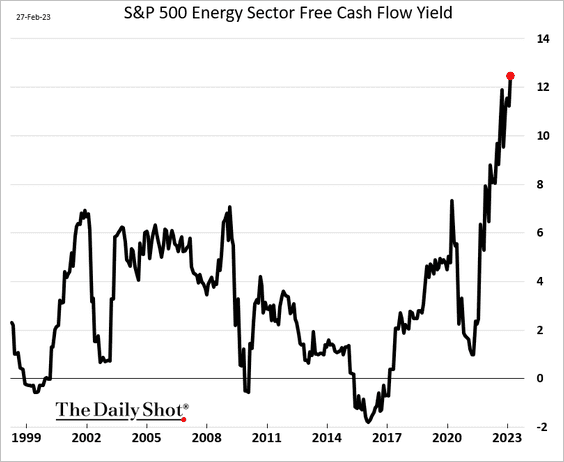

4. Energy sector free cash flow yield surged to multi-decade highs in recent quarters.

Back to Index

Equities

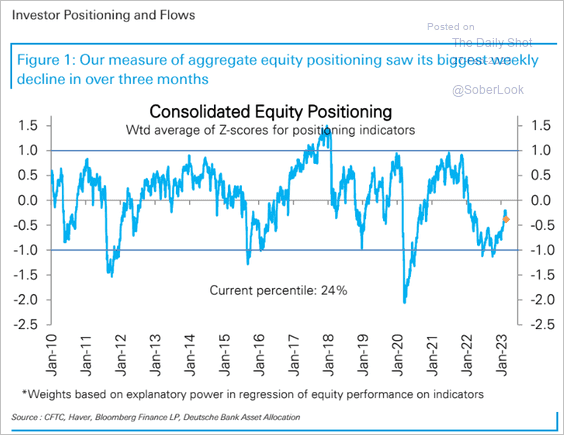

1. Deutsche Bank’s positioning index pulled back last week.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

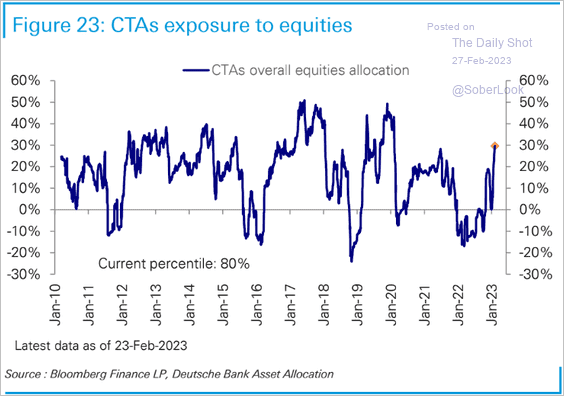

But CTAs continue to boost their exposure.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

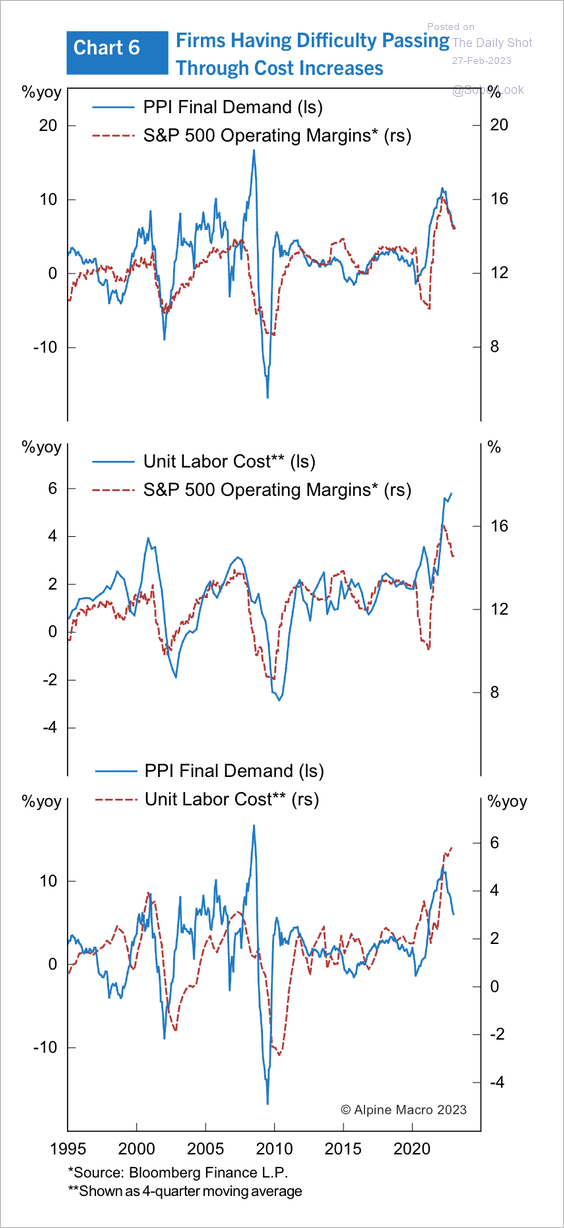

2. Narrowing corporate profit margins suggest firms are having difficulties passing through rising labor costs.

Source: Alpine Macro

Source: Alpine Macro

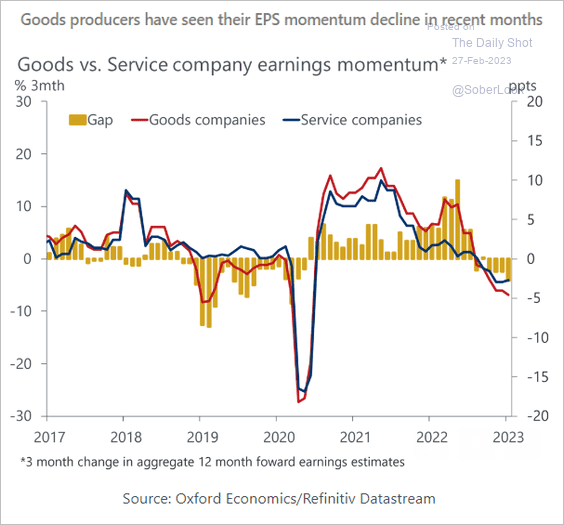

3. Service companies’ earnings momentum is outpacing goods-producing businesses.

Source: Oxford Economics

Source: Oxford Economics

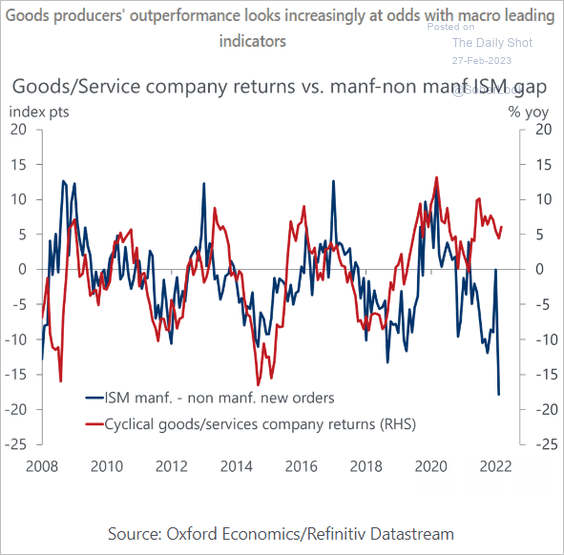

The spread between ISM manufacturing and non-manufacturing orders indices signals underperformance ahead for goods-producing companies.

Source: Oxford Economics

Source: Oxford Economics

——————–

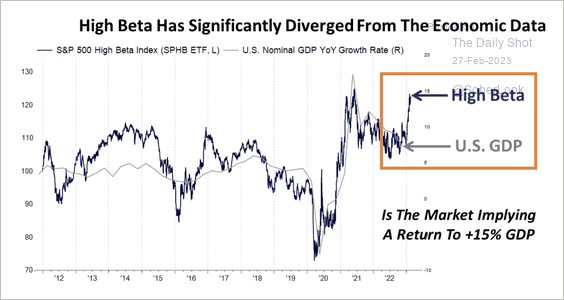

4. S&P 500 high-beta stocks have significantly diverged from economic data …

Source: Piper Sandler

Source: Piper Sandler

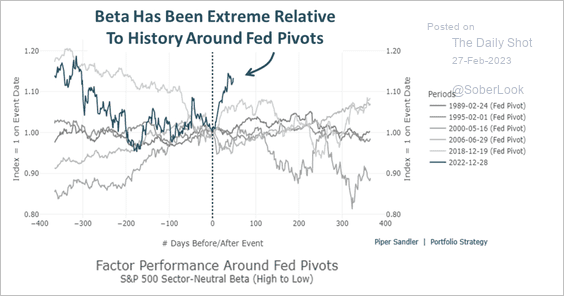

…and outpacing past Fed pivots by a wide margin.

Source: Piper Sandler

Source: Piper Sandler

——————–

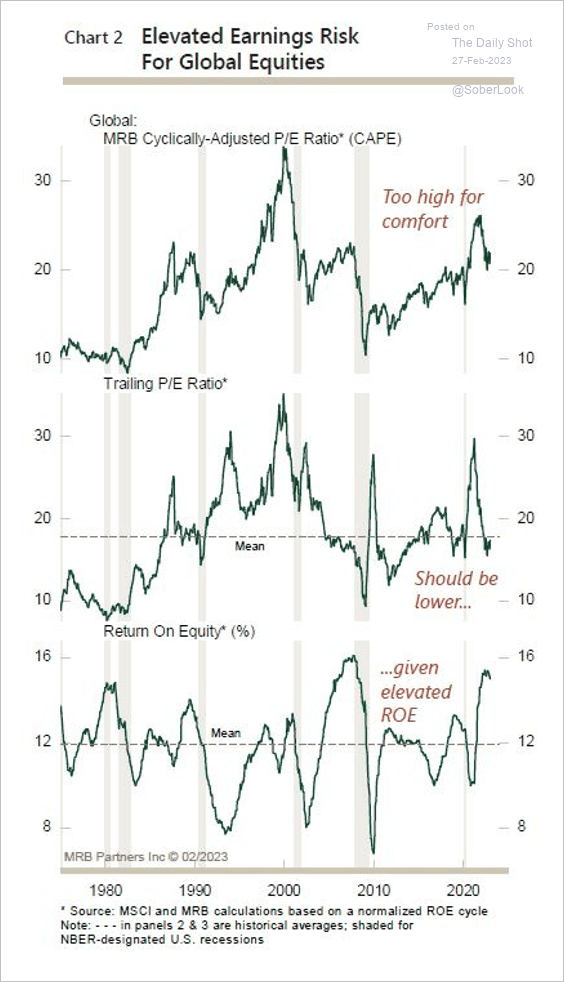

5. Global equity valuations are still relatively high, which typically occurs during the late-cycle phase.

Source: MRB Partners

Source: MRB Partners

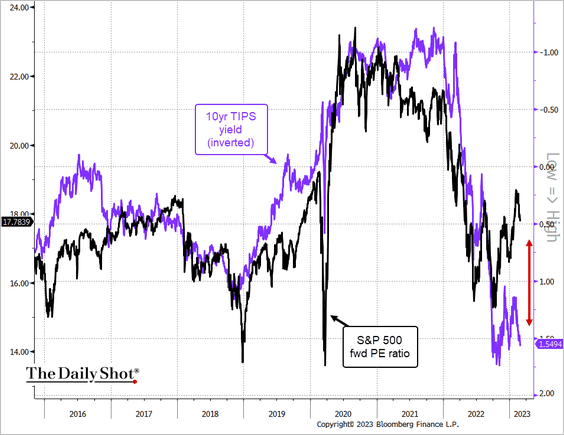

6. S&P 500 valuations need to adjust lower to keep up with rising real yields.

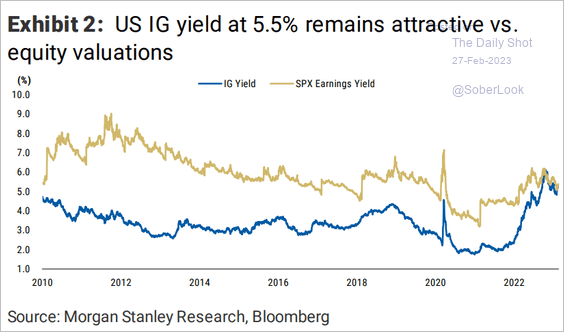

7. Stocks increasingly look unattractive relative to fixed-income products.

• S&P earnings yield vs. investment-grade bonds:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• S&P earnings yield vs. Treasury bills:

——————–

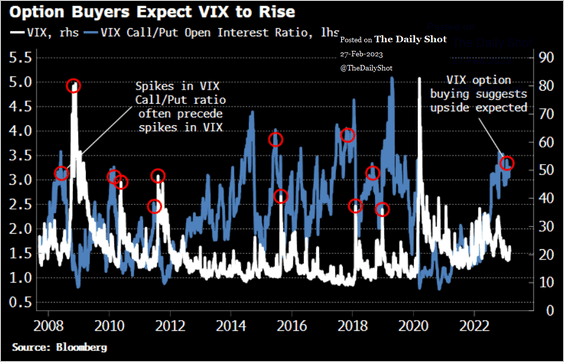

8. Demand for VIX call options remains elevated, signaling persistent concerns about stock market downside risks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

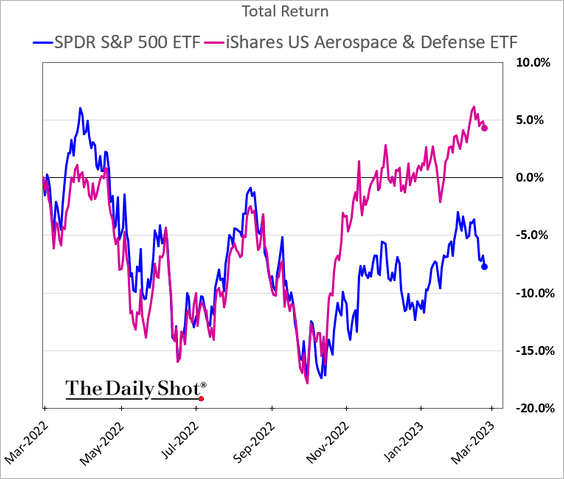

9. Defense companies have been outperforming as weapons demand surges.

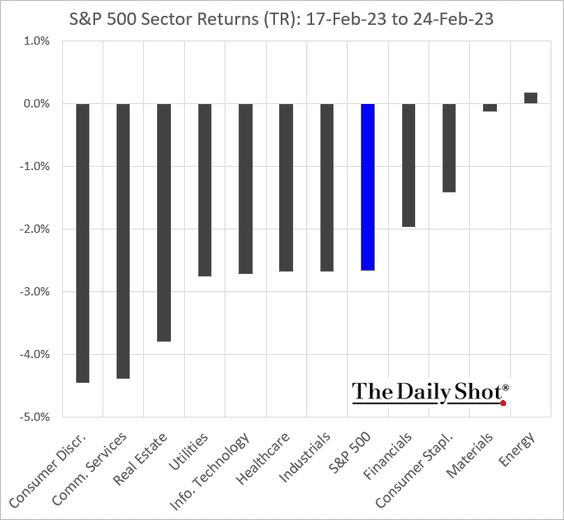

10. Finally, we have some performance data from last week.

• Sectors:

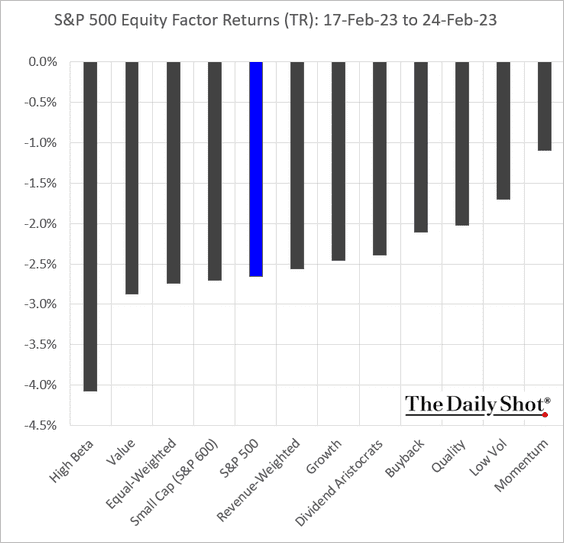

• Equity factors:

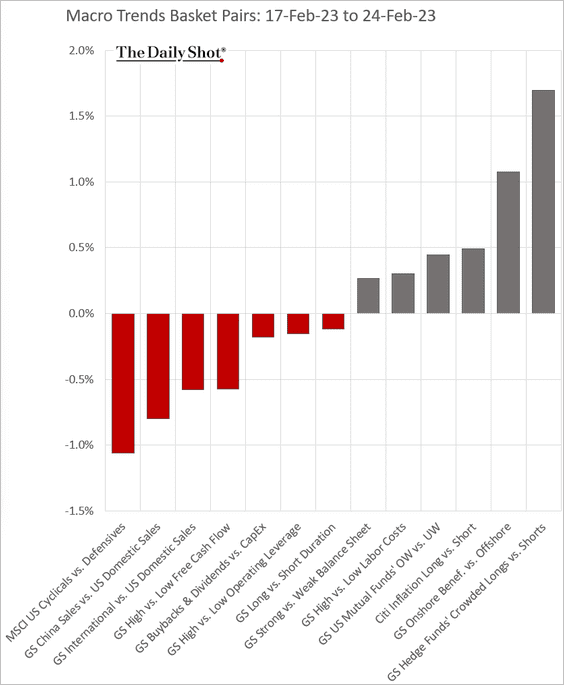

• Macro basket pairs:

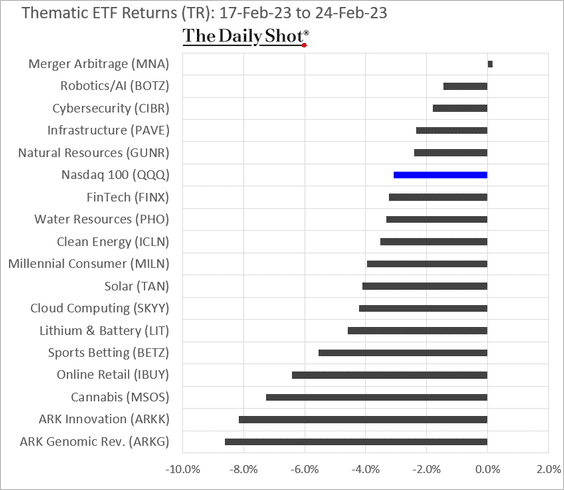

• Thematic ETFs:

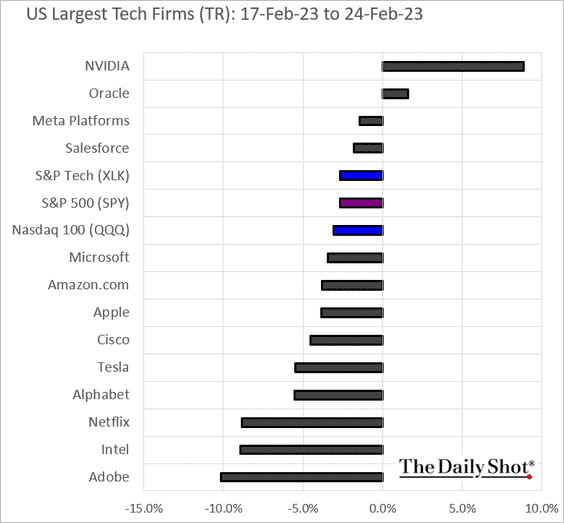

• Largest US tech firms:

Back to Index

Credit

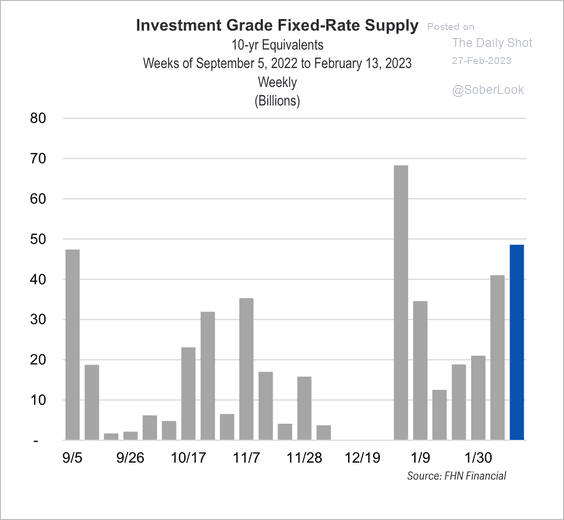

1. US investment-grade bond supply has been rising.

Source: FHN Financial

Source: FHN Financial

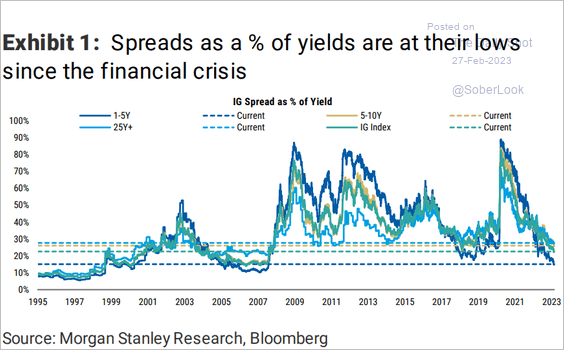

2. Investment-grade spreads are low as a share of yields.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

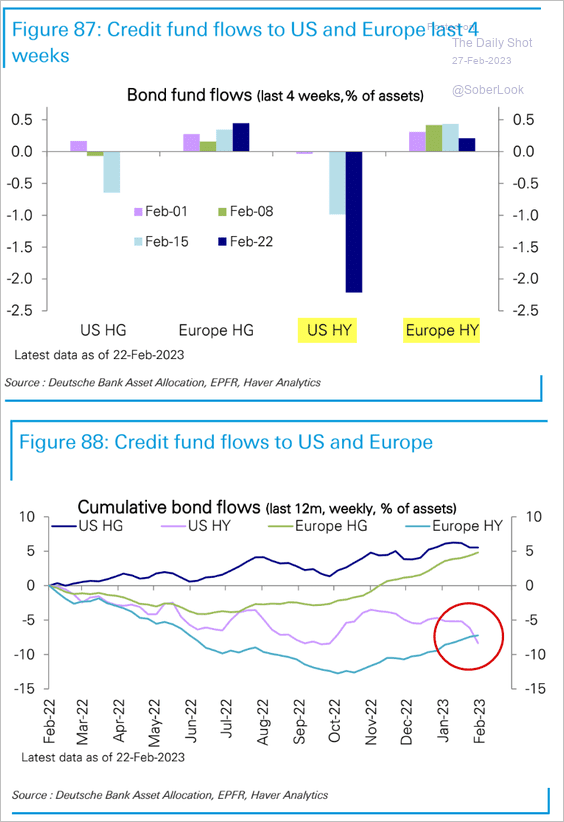

3. US and European high-yield fund flows have diverged.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

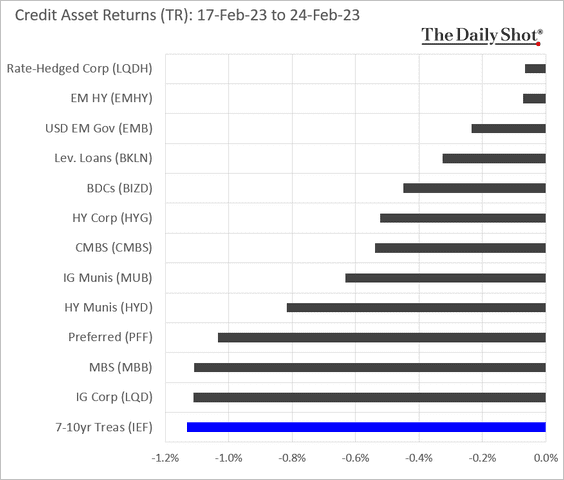

4. Here is last week’s performance by asset class.

Back to Index

Rates

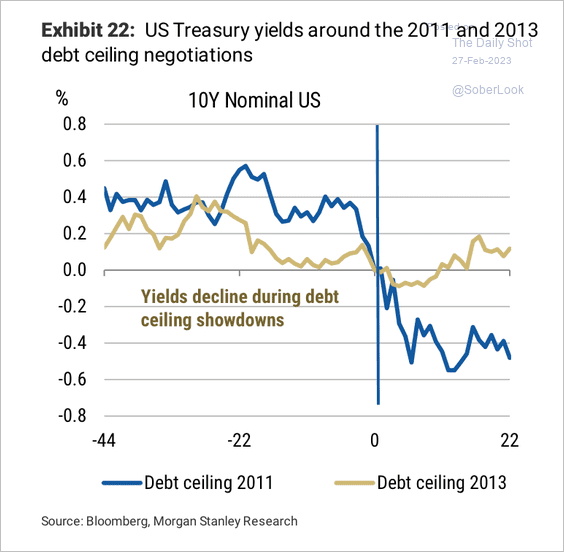

The 10-year yield declined during the 2011 and 2013 debt ceiling negotiations.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

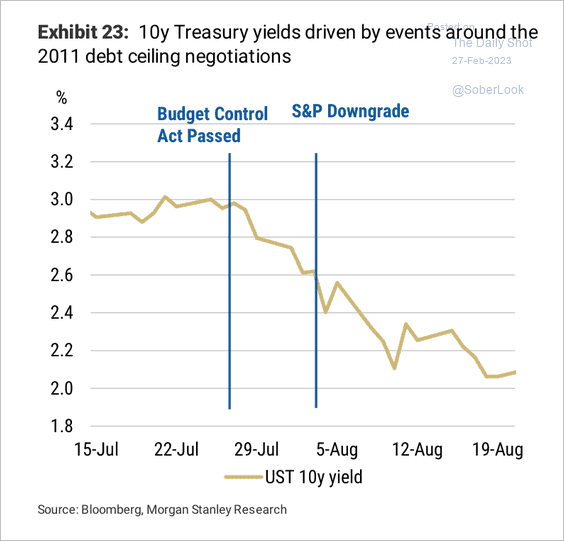

The 2011 decline accelerated after S&P downgraded the US credit rating.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Global Developments

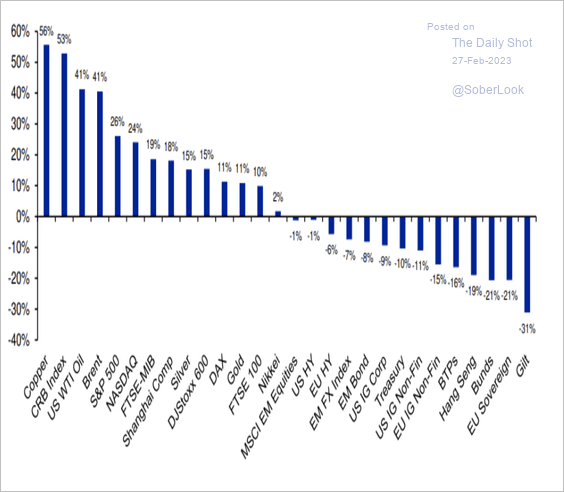

1. This chart shows total returns of major assets in the last three years since the first COVID-19 sell-off. Returns reflect a massive reflation trade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

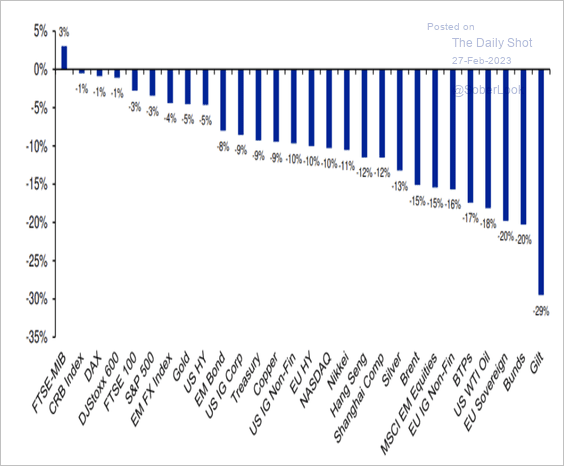

Here is a look at total returns one year since the start of the Russia/Ukraine war. Bonds sold off as central banks hiked rates to combat rising inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

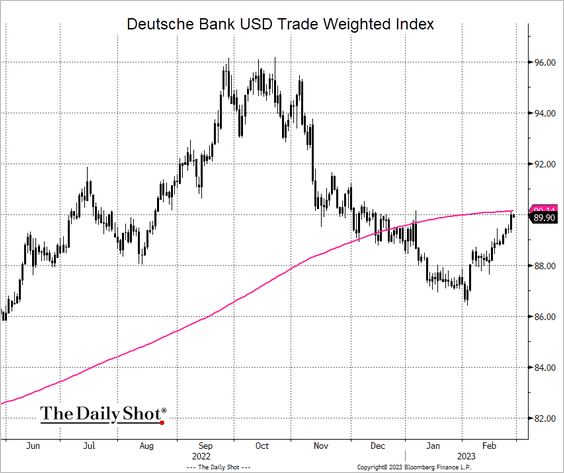

2. The US dollar trade-weighted index is testing resistance at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

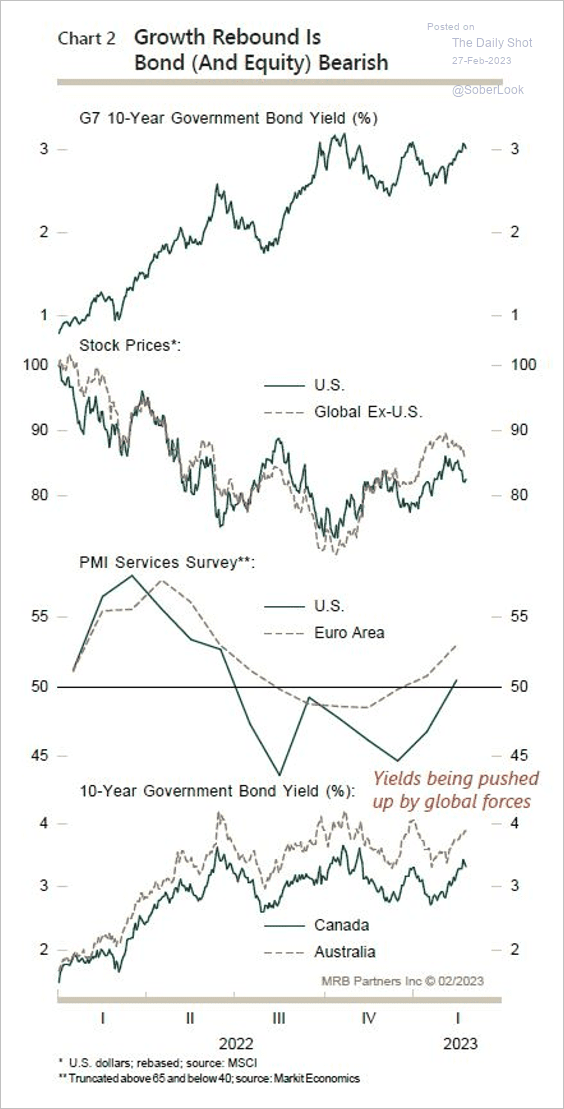

3. The improvement in US and euro-area economic growth has weighed on equity and bond prices. Markets are anticipating “higher for longer” interest rates.

Source: MRB Partners

Source: MRB Partners

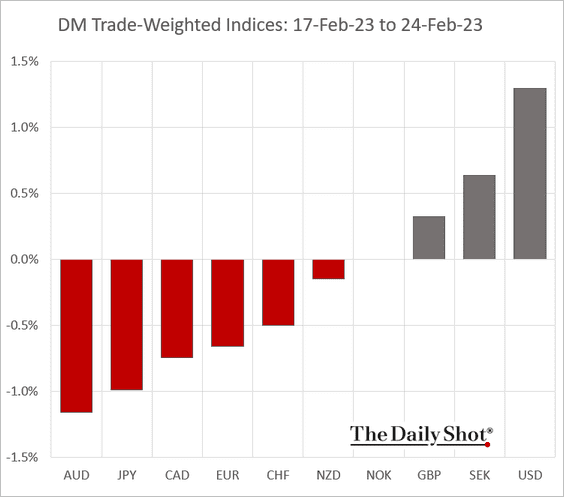

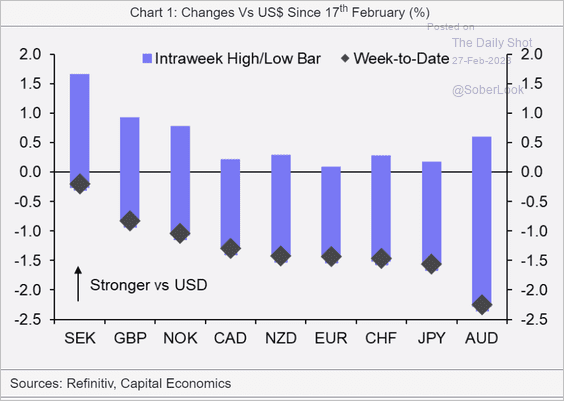

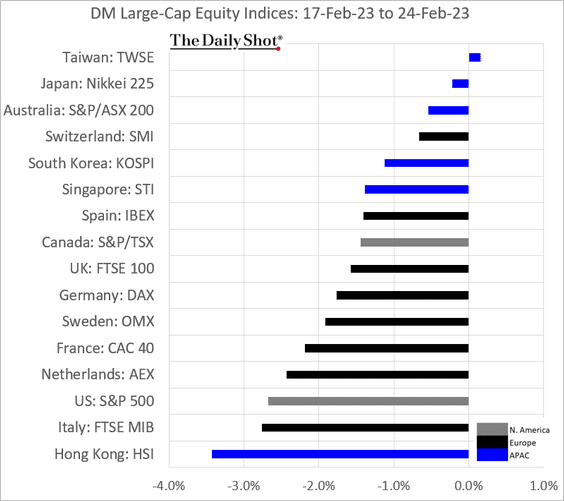

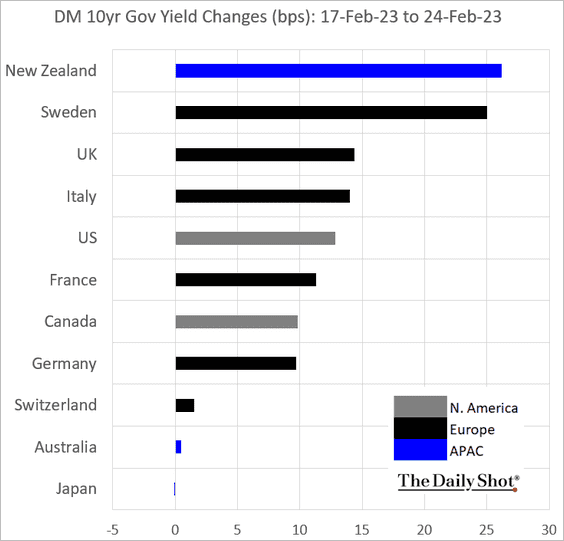

4. Finally, we have some DM performance data from last week.

• Trade-weighted currency indices:

– DM currencies vs. USD:

Source: Capital Economics

Source: Capital Economics

• Large-cap equity indices:

• Bond yields:

——————–

Food for Thought

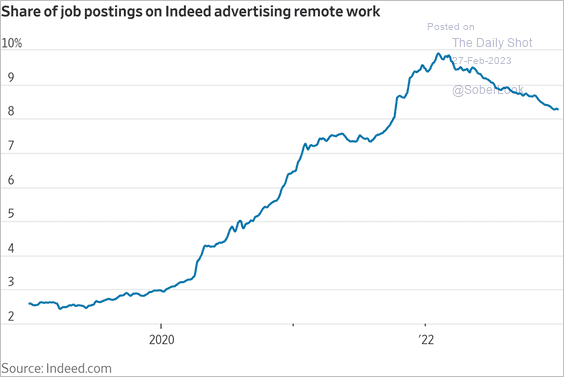

1. Remote work share of postings on Indeed:

Source: @WSJ Read full article

Source: @WSJ Read full article

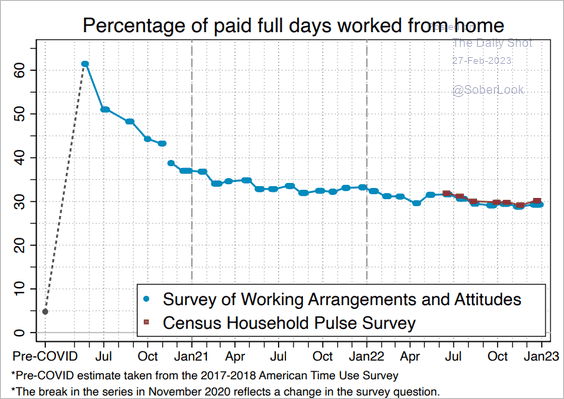

2. Paid days worked from home (holding at 30%):

Source: WFH Research Read full article

Source: WFH Research Read full article

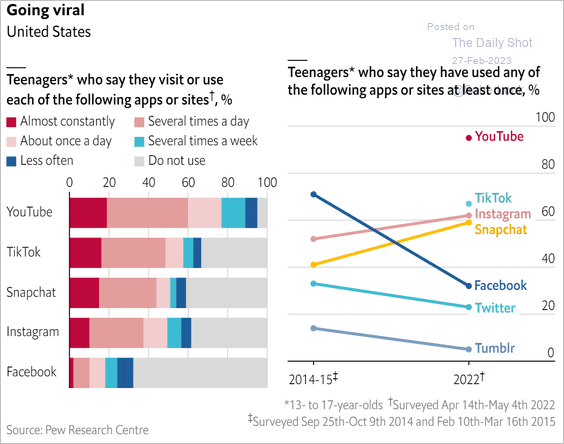

3. Teens on social media:

Source: The Economist Read full article

Source: The Economist Read full article

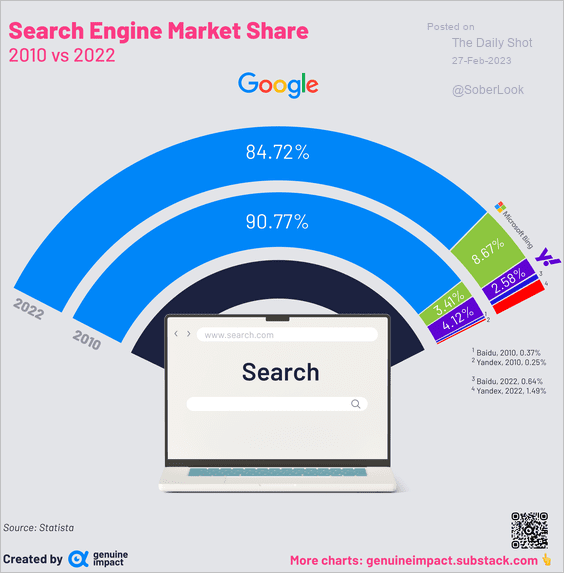

4. Search engine market share:

Source: @genuine_impact

Source: @genuine_impact

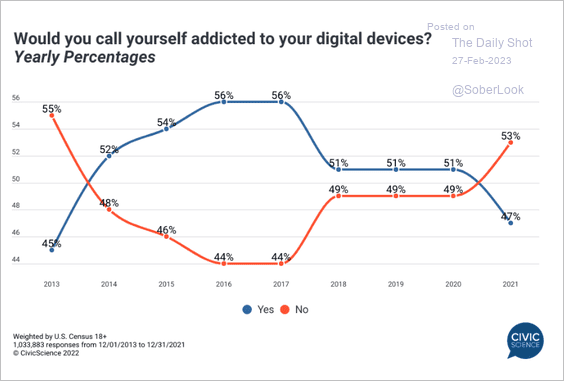

5. Are you addicted to digital devices?

Source: @CivicScience

Source: @CivicScience

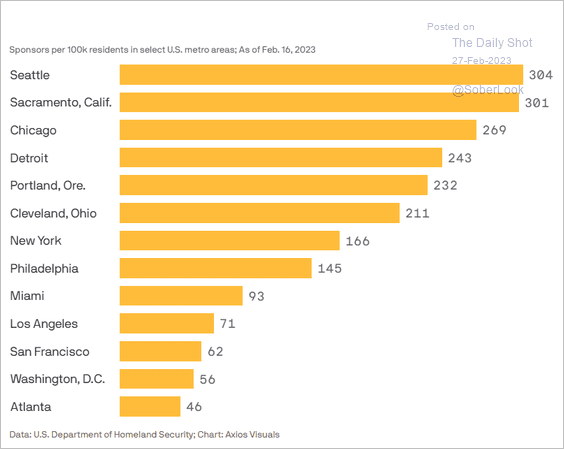

6. US requests to sponsor Ukrainian refugees, per capita:

Source: @axios Read full article

Source: @axios Read full article

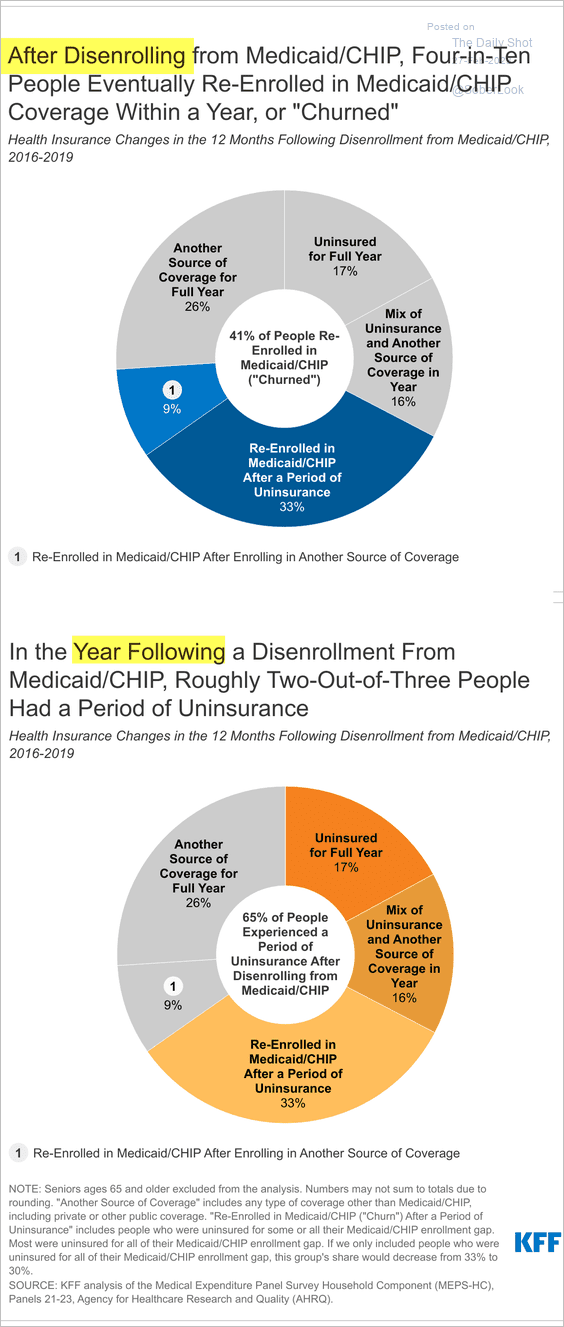

7. What happens after Americans lose Medicaid coverage?

Source: KFF Read full article

Source: KFF Read full article

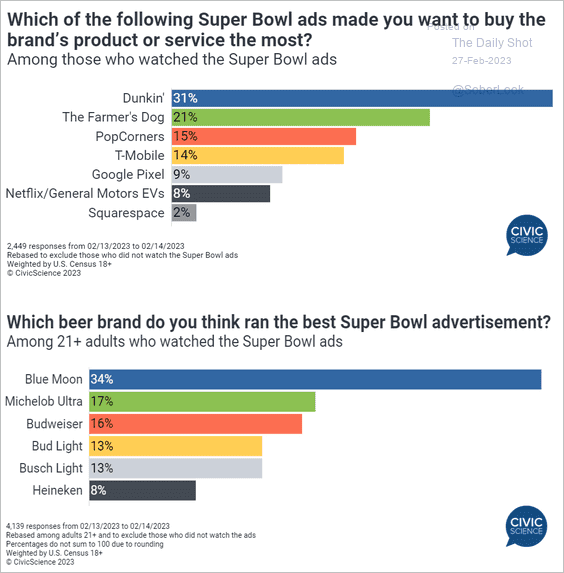

8. Views on Super Bowl ads:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index