The Daily Shot: 01-Mar-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

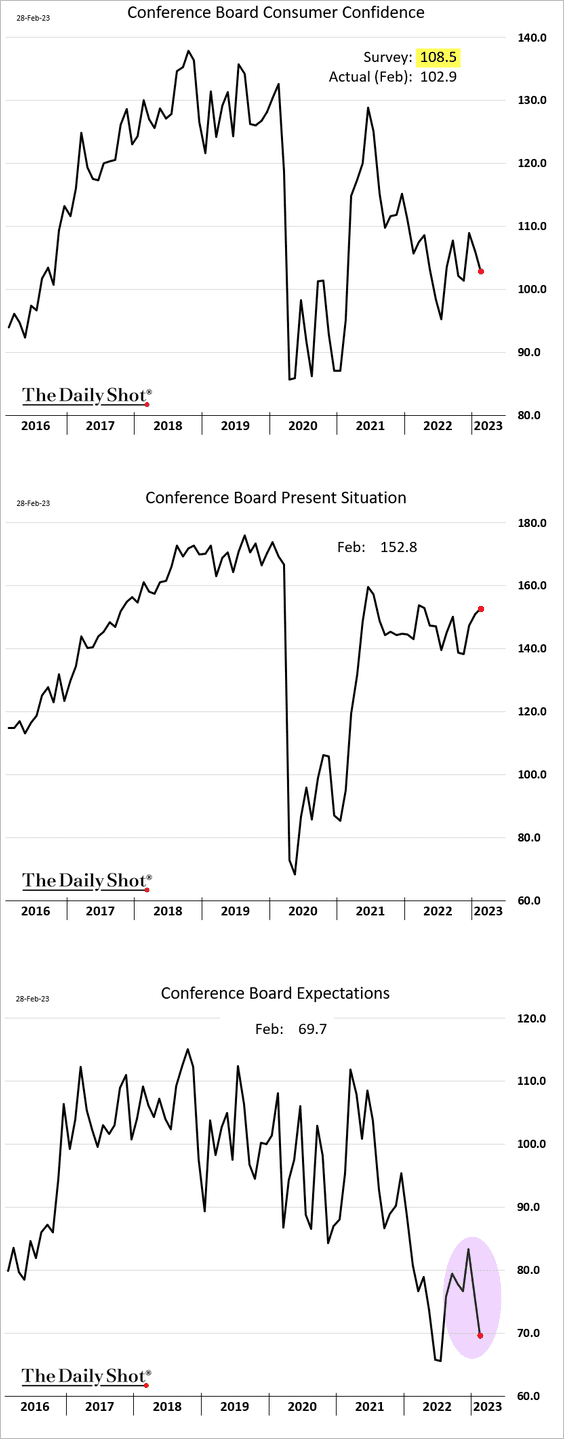

1. The Conference Board’s consumer confidence indicator surprised to the downside, as the expectations component slumped.

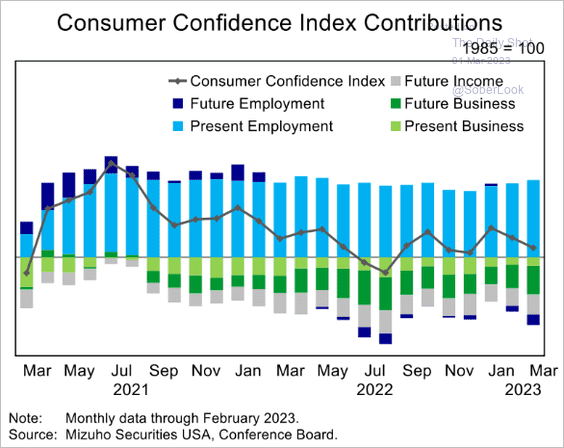

• Here are the contributions.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

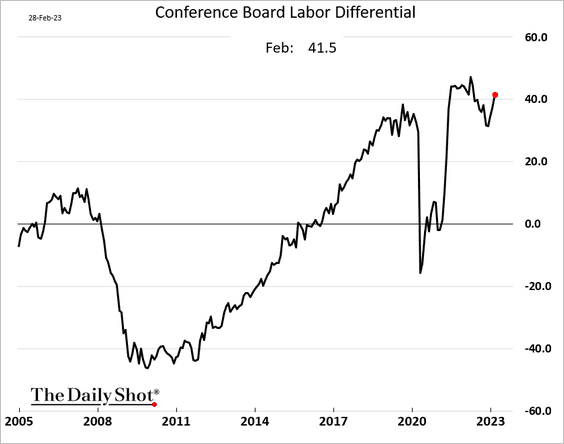

• The labor differential (“jobs plentiful” – “jobs hard to get”) once again points to a tight labor market.

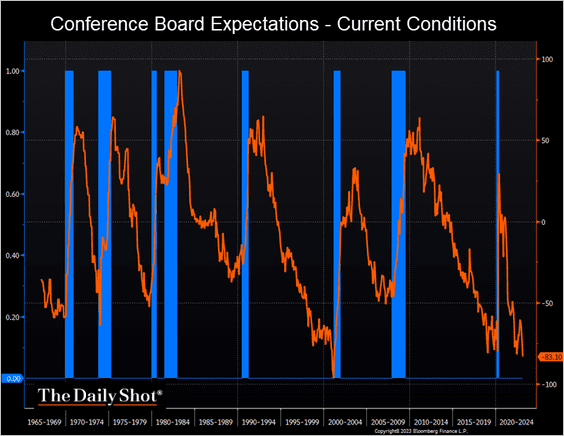

• The spread between expectations and current conditions continues to signal a recession ahead.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

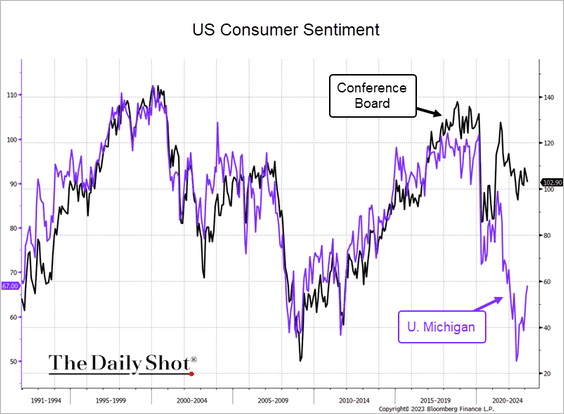

• The Conference Board – U. Michigan sentiment index gap persists.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

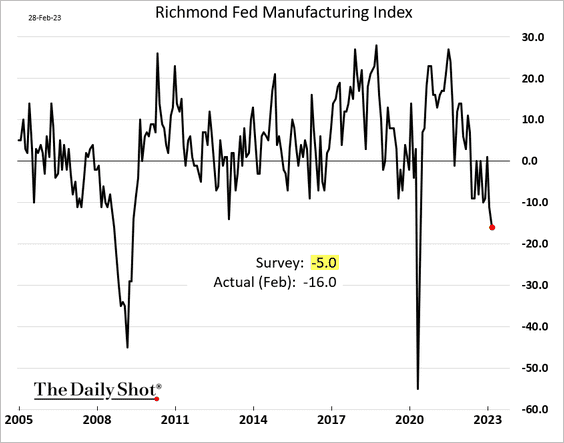

2. The Richmond Fed’s manufacturing index showed severe deterioration in the region’s business activity.

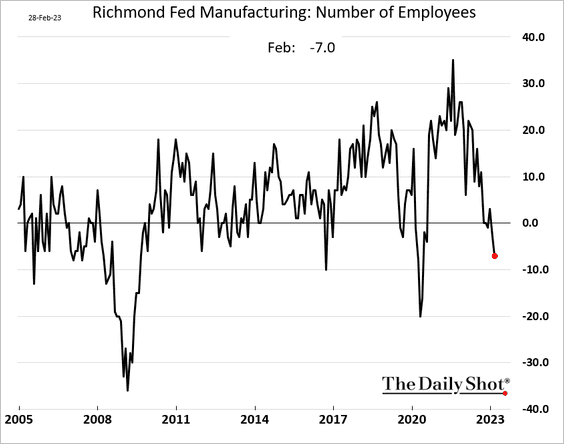

• Manufacturers reduced their workforce in February.

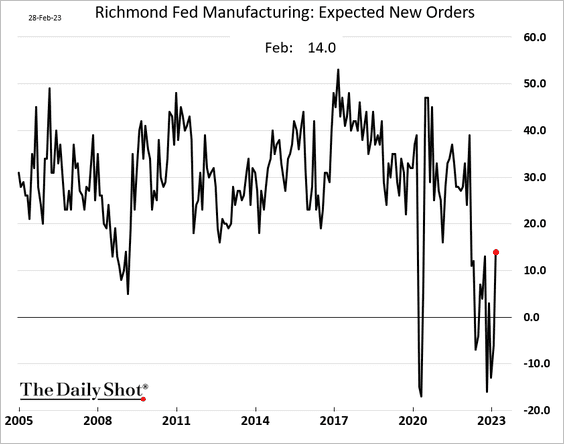

• Manufacturers are somewhat more upbeat about the future.

——————–

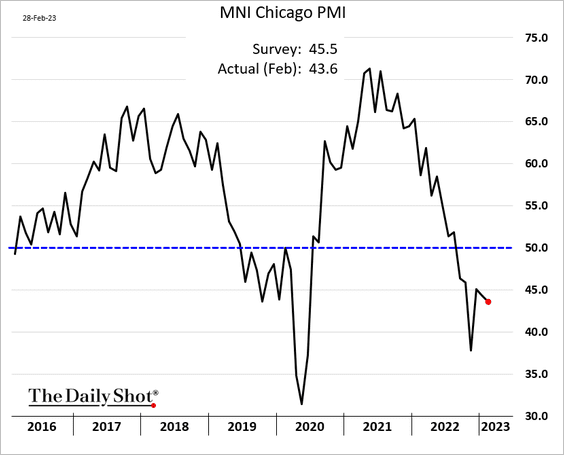

3. The MNI Chicago PMI points to factory activity weakness in the Midwest region.

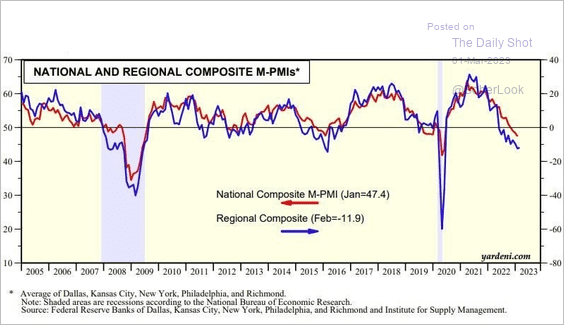

4. Regional indicators continue to signal weakness at the national level (ISM).

Source: Yardeni Research

Source: Yardeni Research

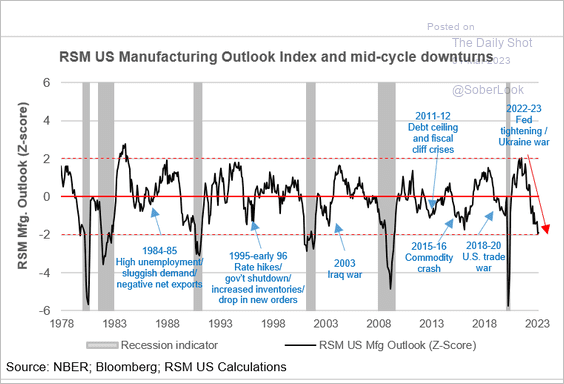

• Here is the aggregate manufacturing index from RSM.

Source: RSM Read full article

Source: RSM Read full article

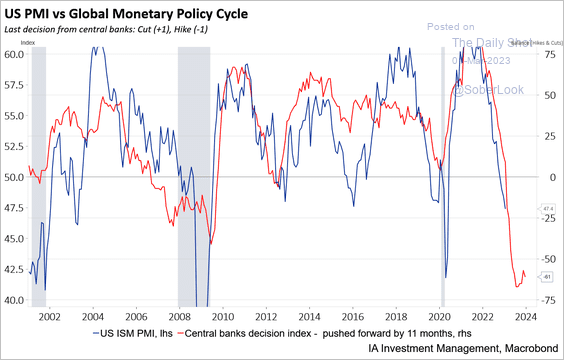

• Global monetary tightening has also been a headwind for US manufacturing.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

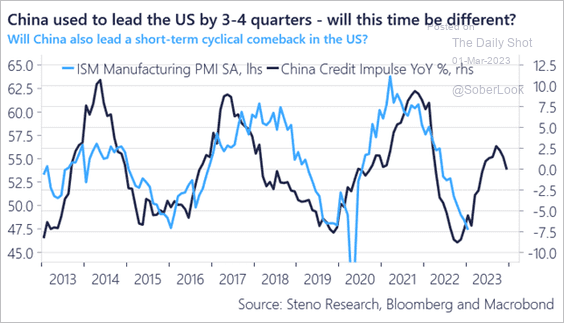

• But China’s recovery could support US factory activity.

Source: @AndreasSteno

Source: @AndreasSteno

——————–

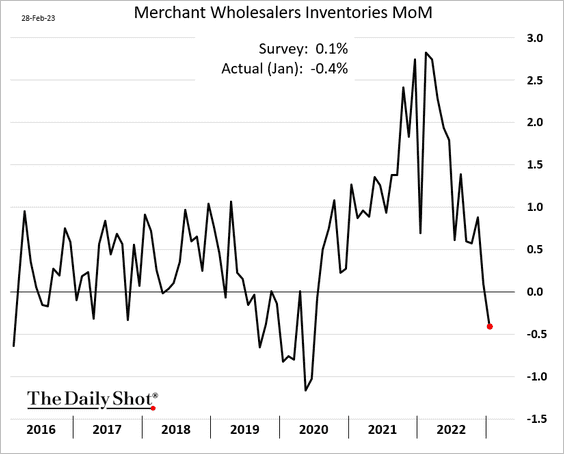

5. Wholesale inventories unexpectedly declined in January.

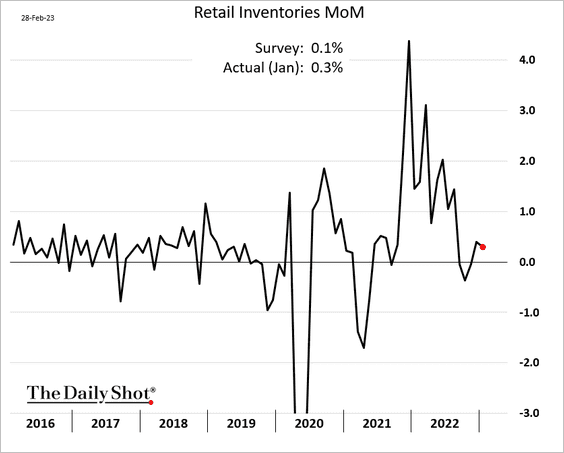

But retail inventories continue to climb.

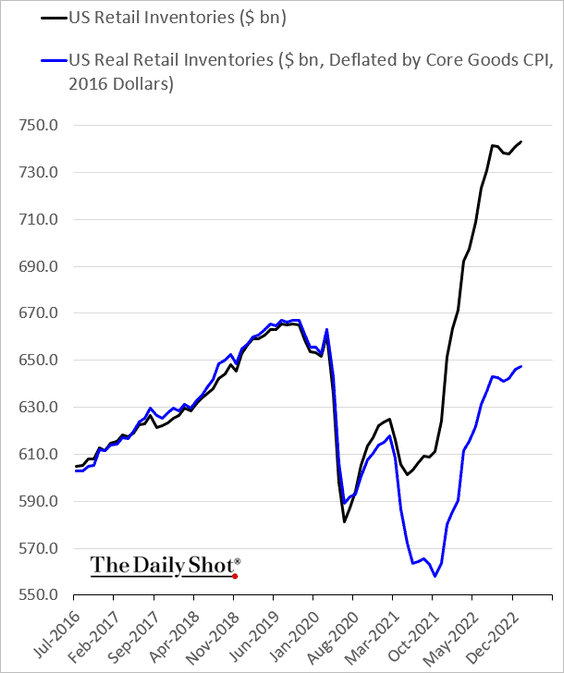

This chart shows nominal and real retail inventories (level).

——————–

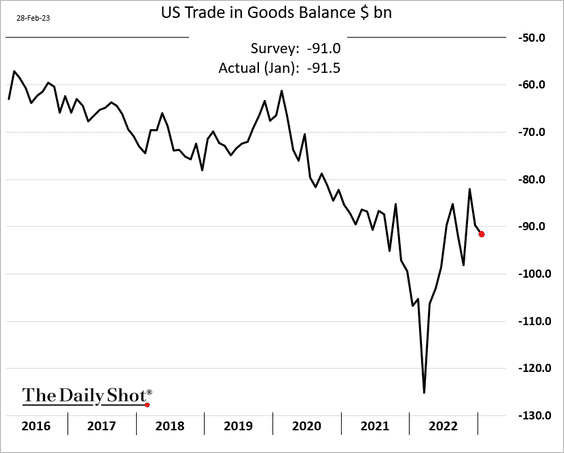

6. The US trade deficit in goods widened in January, …

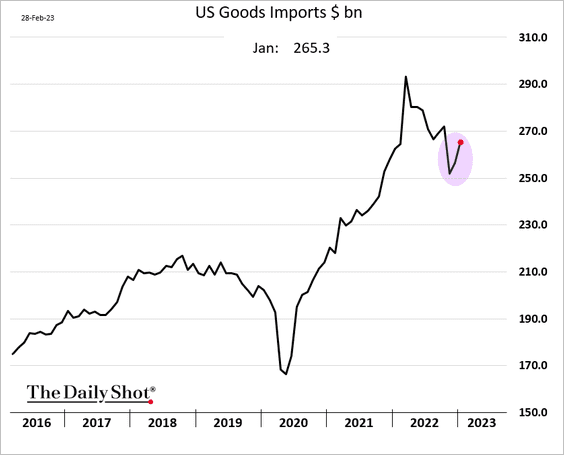

… as imports strengthened.

——————–

7. Next, we have some updates on the housing market.

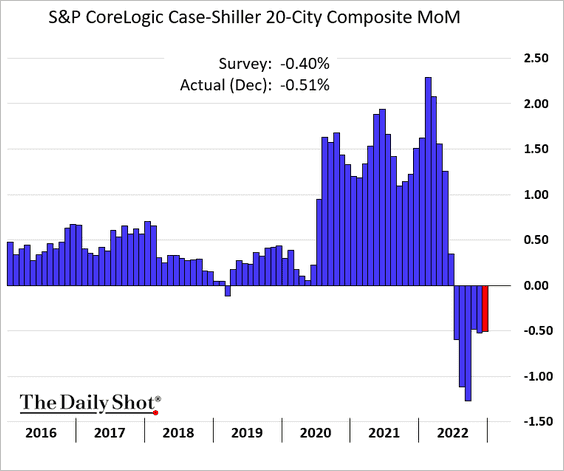

• Home prices declined for the sixth month in a row in December.

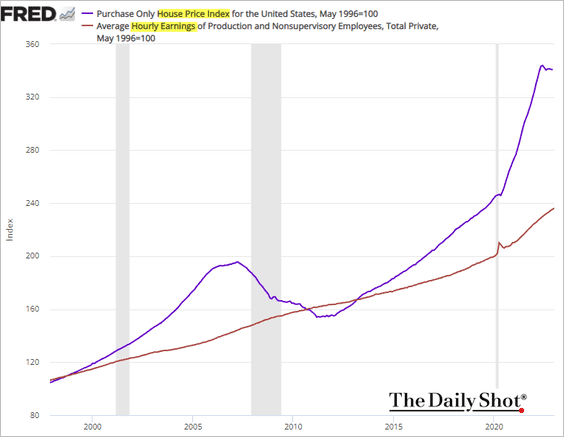

• Home price declines have hardly made a dent in the wage/price gap.

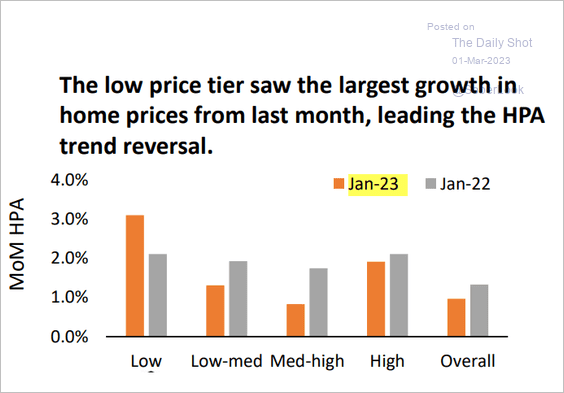

• Moreover, home prices increased in January, led by the low-price tier.

Source: AEI Housing Center

Source: AEI Housing Center

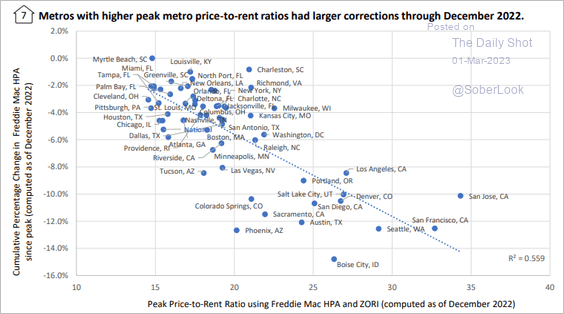

• Housing markets with higher valuations saw bigger corrections through December.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

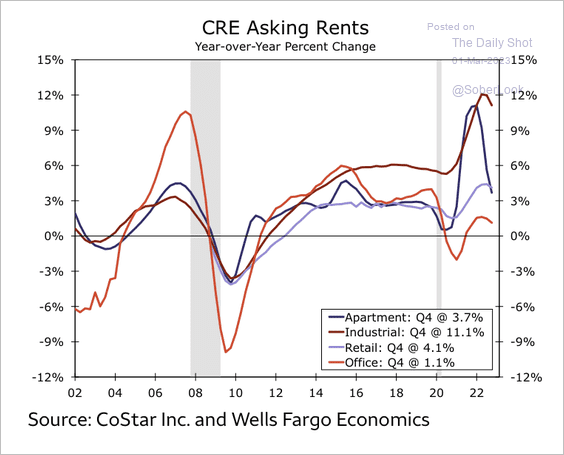

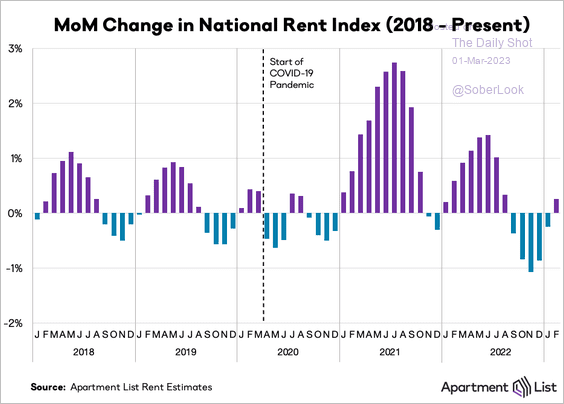

8. Finally, let’s take a look at some trends impacting inflation.

• Apartment rents have slowed considerably versus other property types, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

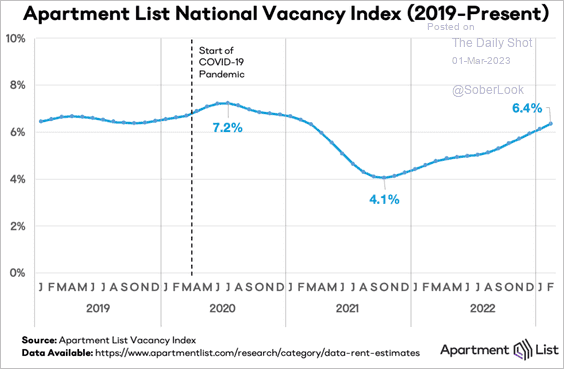

… as vacancies increased.

Source: Apartment List

Source: Apartment List

However, after five months of declines, apartment rental costs increased in February.

Source: Apartment List

Source: Apartment List

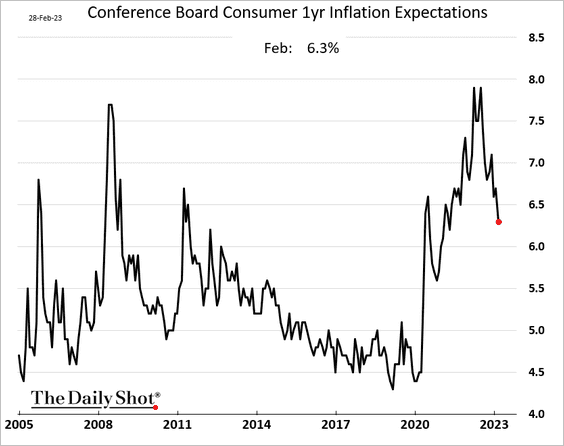

• According to the Conference Board, consumer inflation expectations continue to ease.

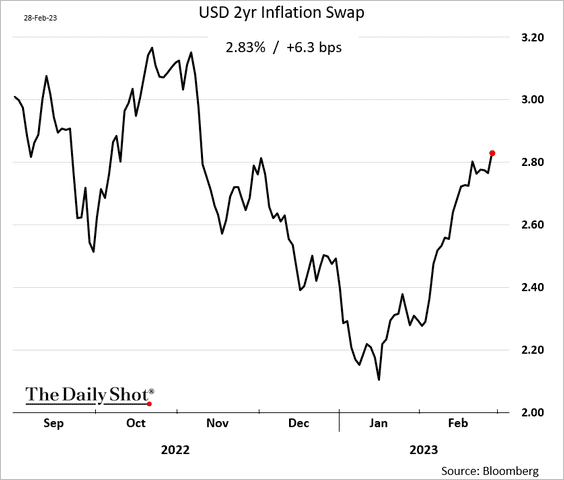

However, the market is pricing higher inflation over the next couple of years.

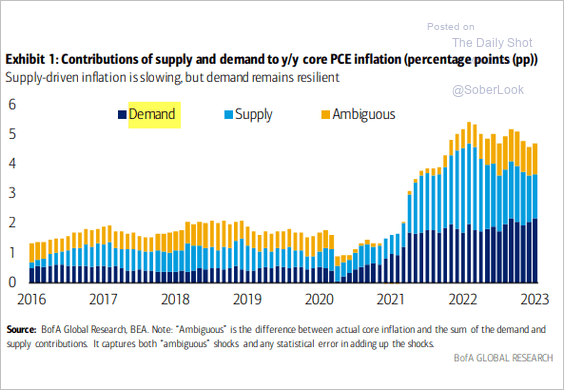

• As supply bottlenecks ease, inflation is increasingly driven by demand.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

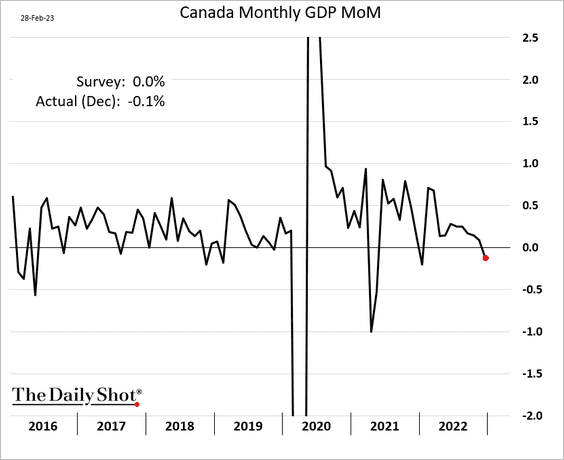

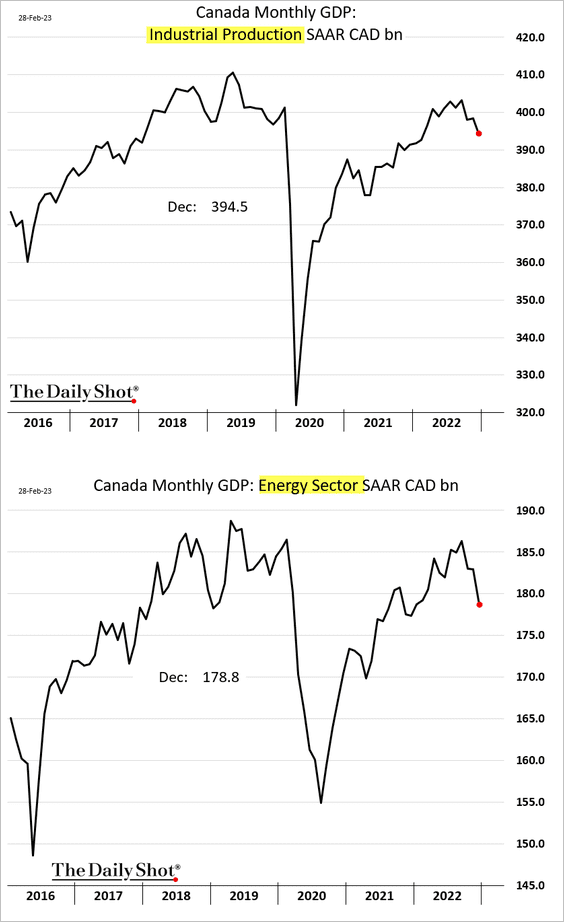

1. The monthly GDP estimate unexpectedly showed an economic contraction in December, …

… with manufacturing and energy output slowing.

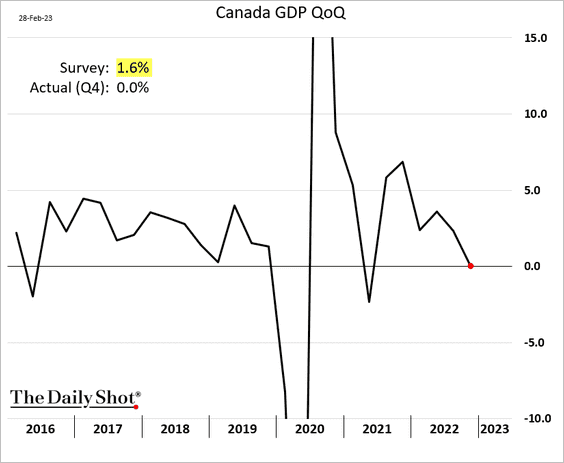

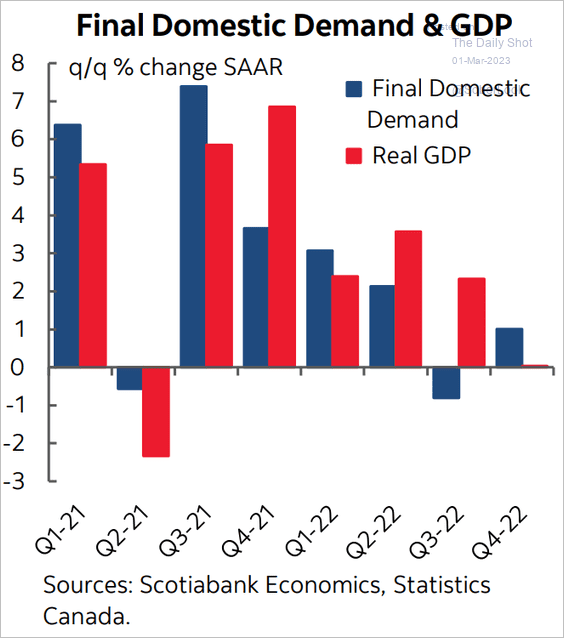

• The quarterly GDP was flat (the market expected a 1.6% annualized expansion).

• However, the “core” GDP showed growth, …

Source: Scotiabank Economics

Source: Scotiabank Economics

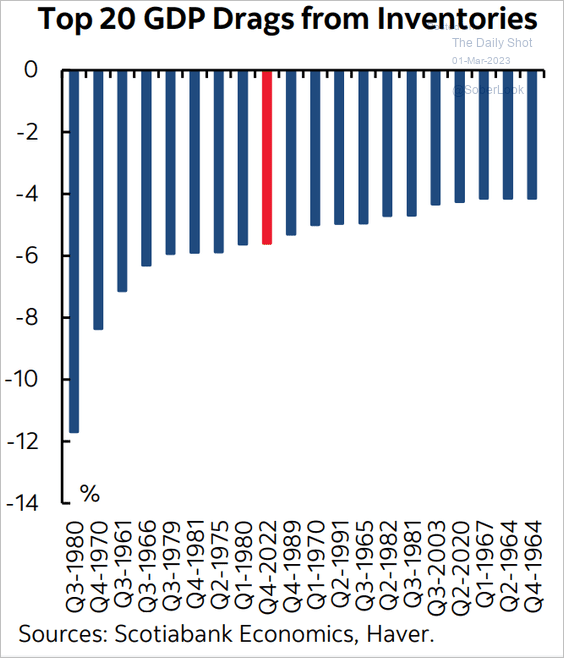

… with weakness driven by inventories.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

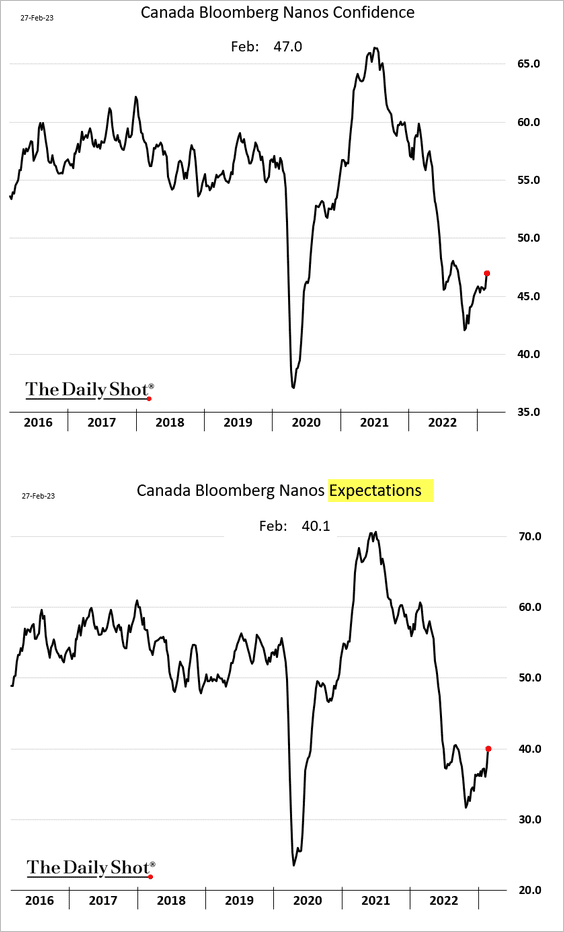

2. Consumer confidence is gradually improving.

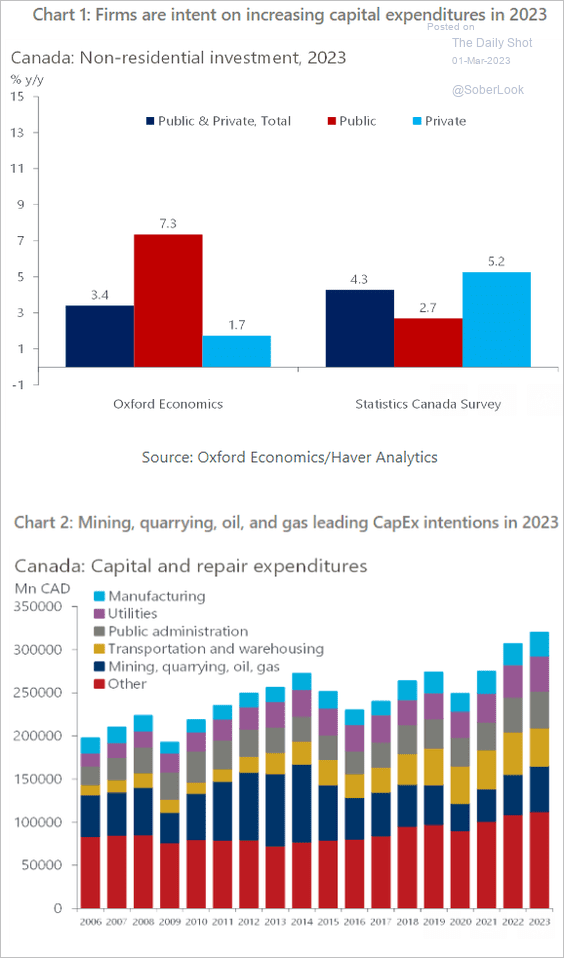

3. Canadian firms expect to grow business investment.

Source: Oxford Economics

Source: Oxford Economics

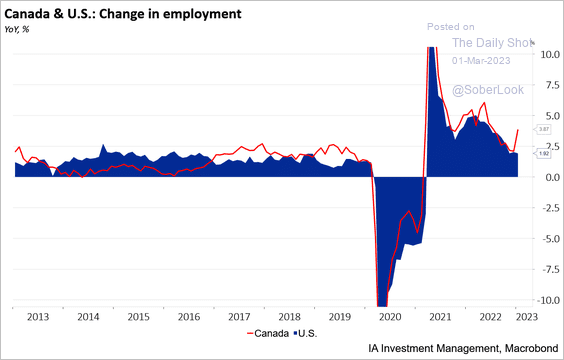

4. Canada’s employment growth has been outpacing the US.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

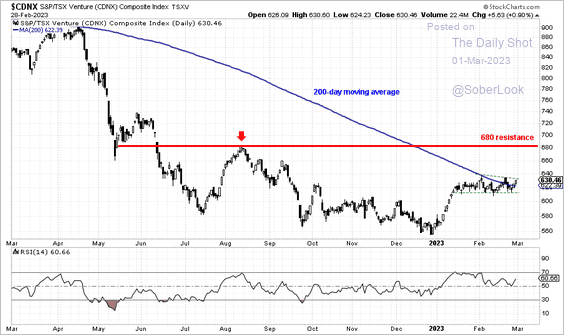

5. The TSX Venture Index (micro-cap stocks) is breaking above its 200-day moving average.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

The United Kingdom

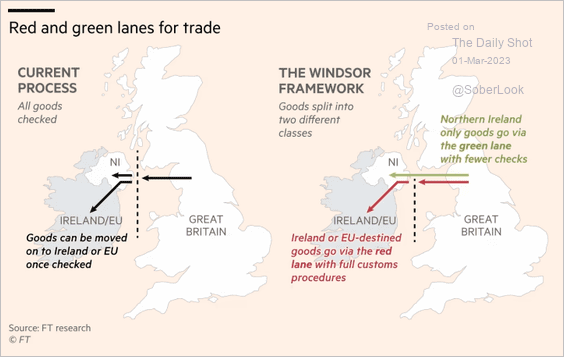

1. This graphic illustrates the “two-lane” UK/EU trade framework.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

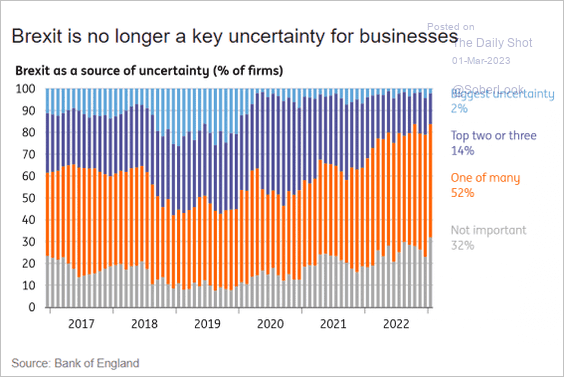

Brexit uncertainty has been less of a concern for businesses.

Source: ING

Source: ING

——————–

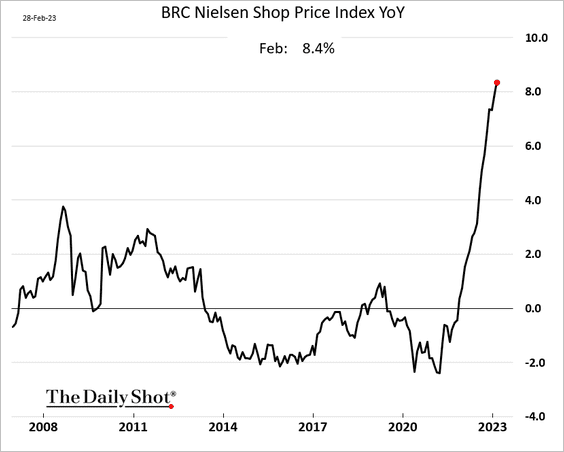

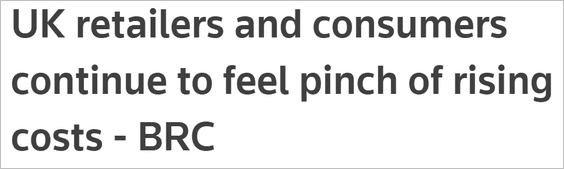

2. Shop prices continue to surge.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

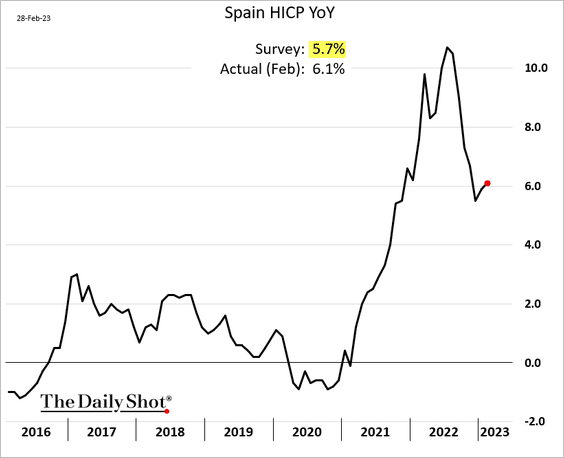

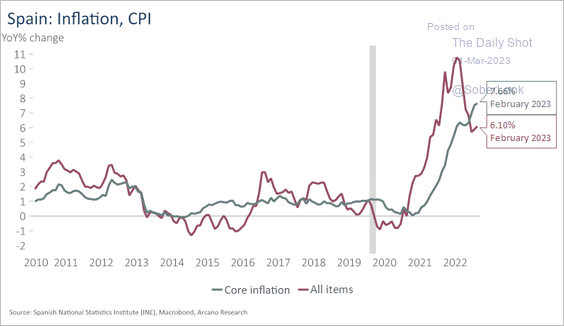

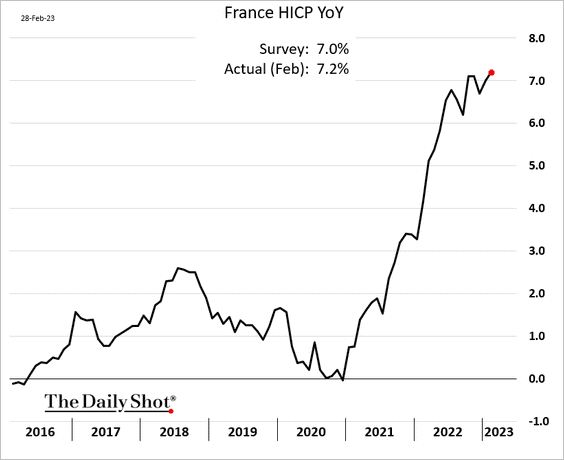

1. The first releases of February inflation measures topped expectations. Euro-area inflation is still running hot.

Source: Reuters Read full article

Source: Reuters Read full article

• Spain:

Here is Spain’s core inflation, which continues to hit multi-year highs.

Source: Arcano Economics

Source: Arcano Economics

• France:

——————–

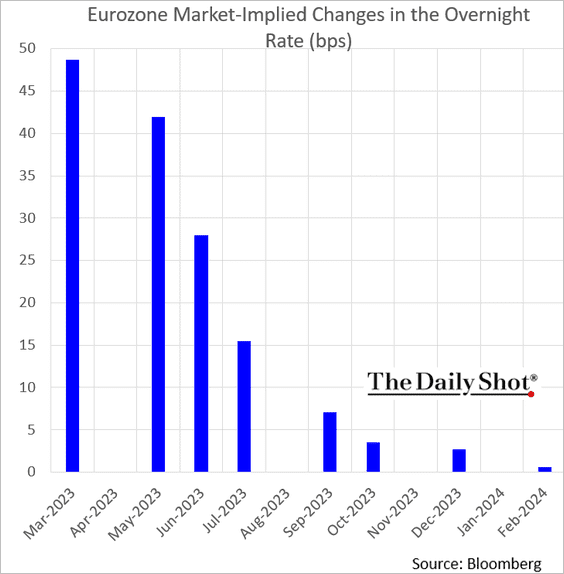

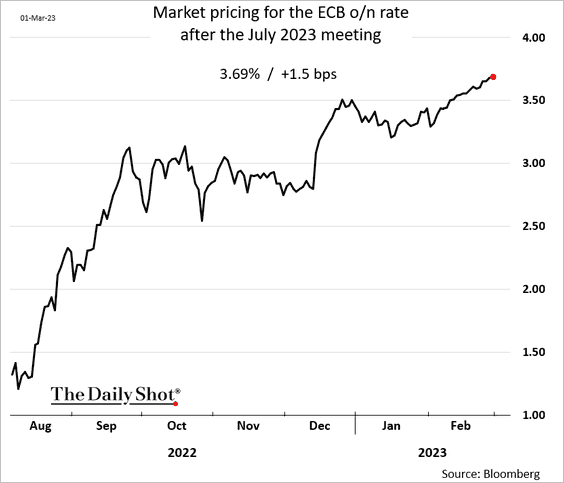

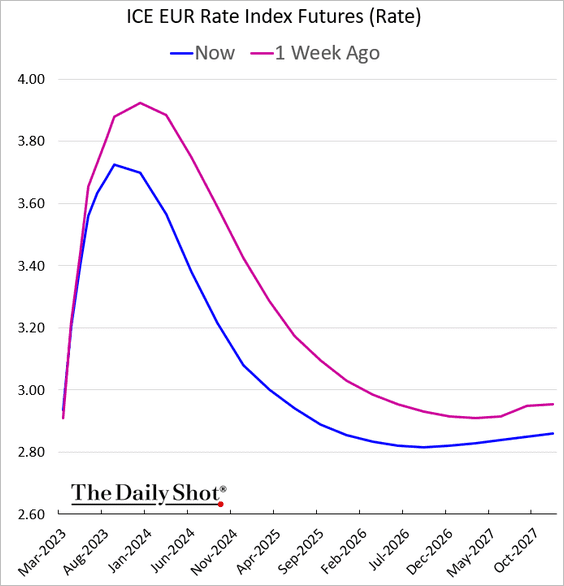

2. Market expectations for ECB rate hikes climbed further.

• The terminal rate is nearing 4%.

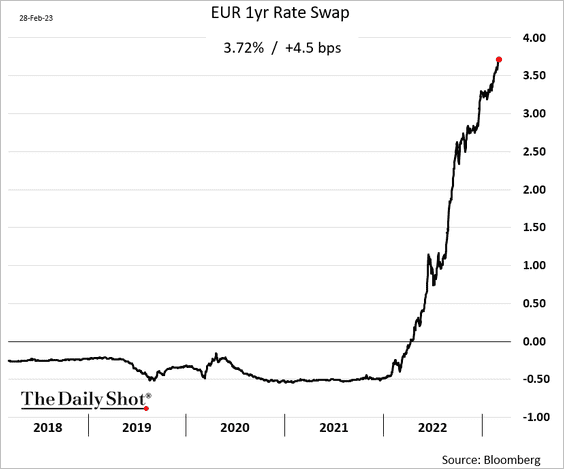

• Short-term rates continue to surge.

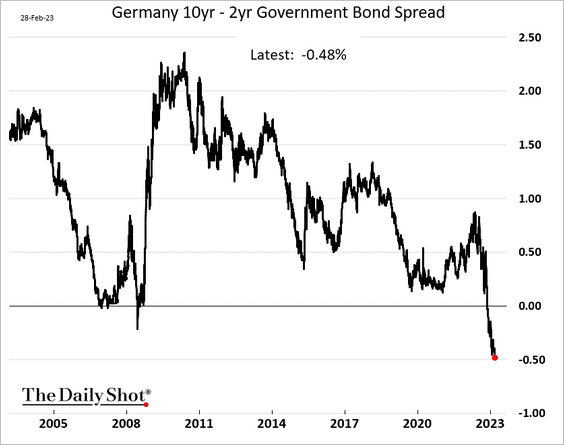

• The Bund curve is increasingly inverted.

——————–

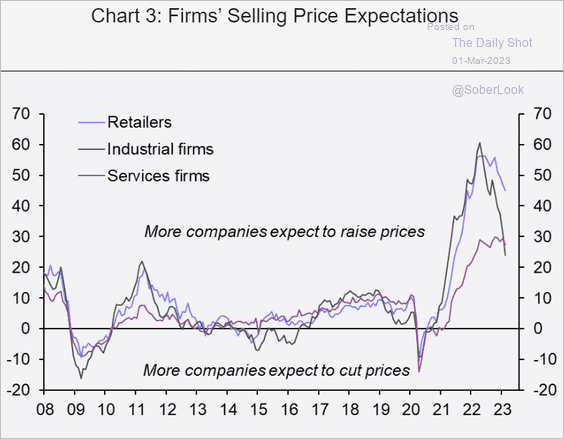

3. Many companies plan to keep boosting prices.

Source: Capital Economics

Source: Capital Economics

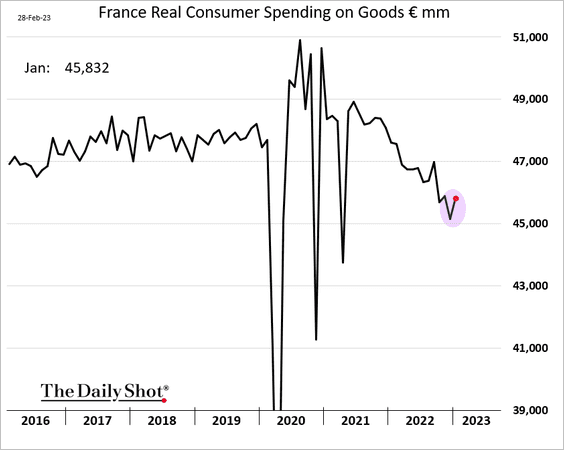

4. French consumer spending improved in January.

Back to Index

Europe

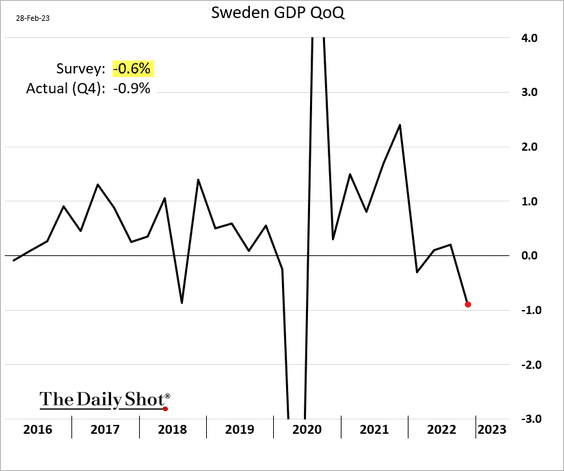

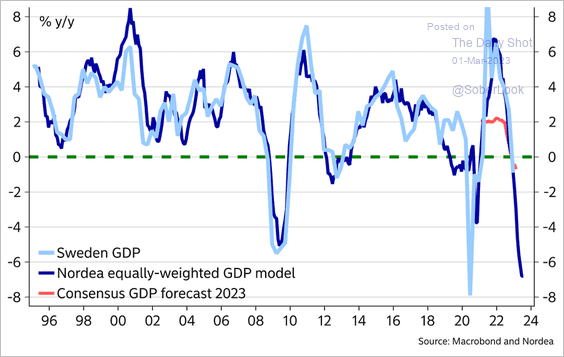

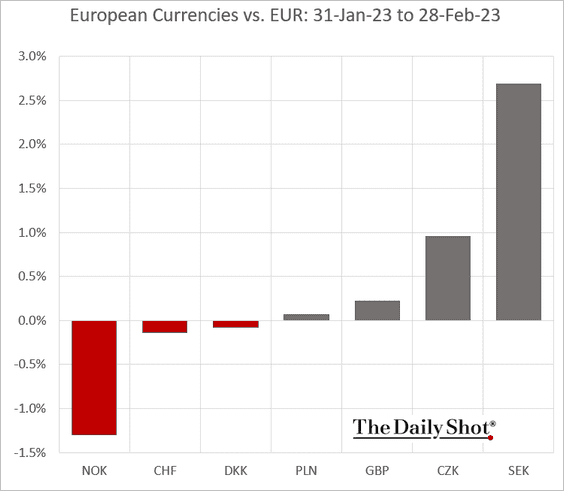

1. Sweden’s Q4 GDP report was ugly.

More pain ahead?

Source: @MikaelSarwe

Source: @MikaelSarwe

The Swedish krona outperformed in February.

——————–

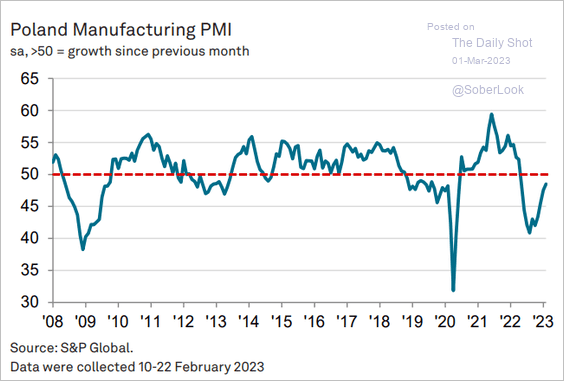

2. The contraction in Poland’s factory activity is slowing.

Source: World Economics

Source: World Economics

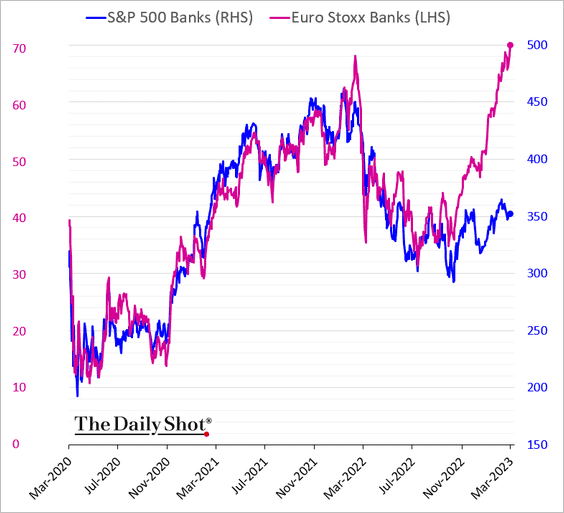

3. European bank shares have massively outperformed their US peers in recent months.

Back to Index

Asia – Pacific

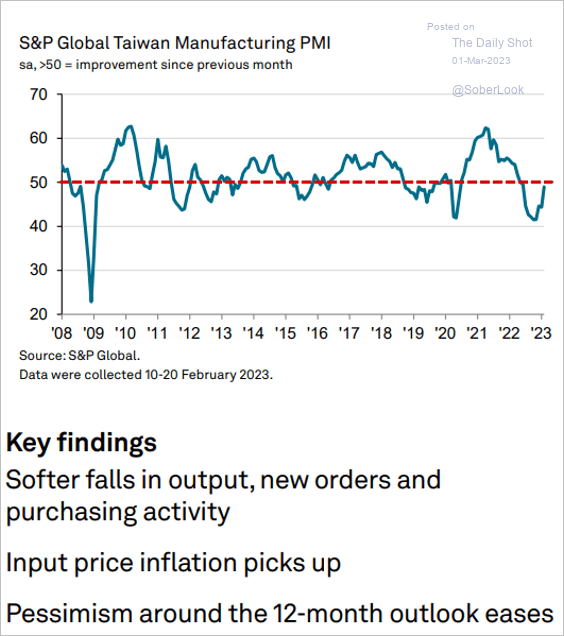

1. Taiwan’s manufacturing sector contraction is almost over.

Source: S&P Global PMI

Source: S&P Global PMI

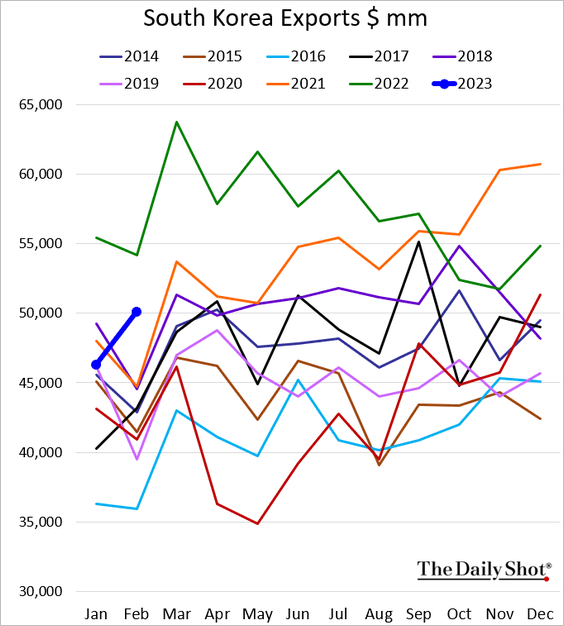

2. South Korea’s exports were relatively strong in February.

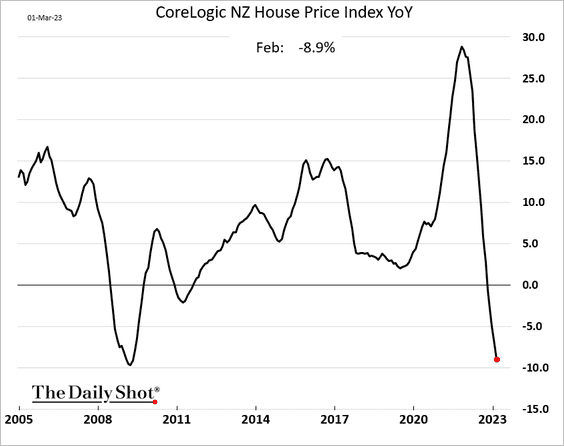

3. New Zealand’s home prices continue to fall.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

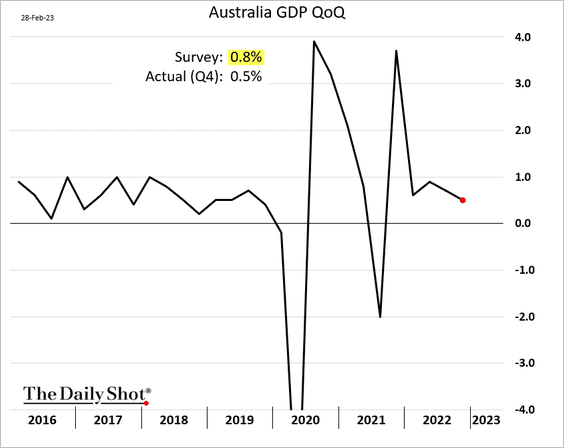

4. Next, we have some updates on Australia.

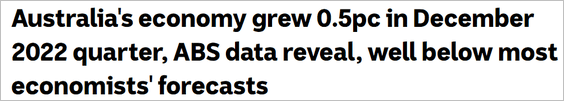

• The Q4 GDP report was disappointing.

Source: ABC News Read full article

Source: ABC News Read full article

• The monthly inflation index appears to have peaked on a year-over-year basis.

Source: The Guardian Read full article

Source: The Guardian Read full article

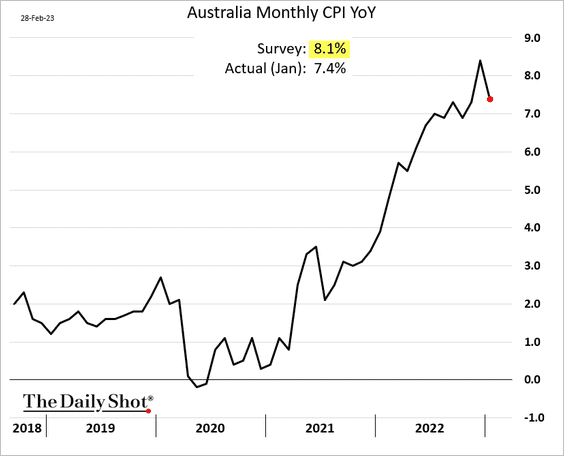

• Australia’s labor force participation is well above the level implied by the nation’s demographics.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

China

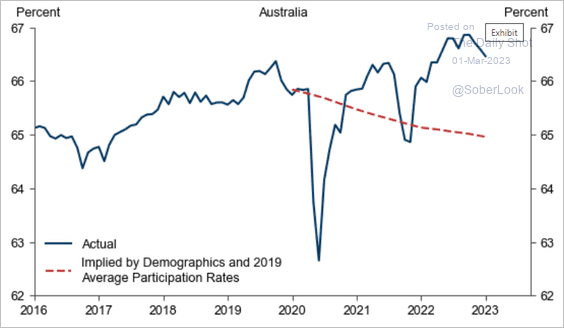

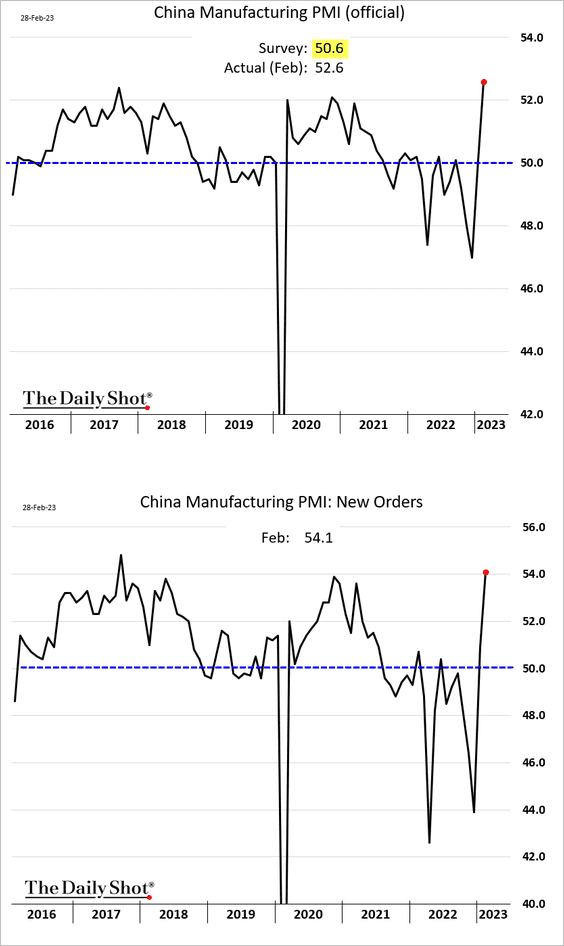

1. The official manufacturing PMI showed a massive factory activity surge in February.

Source: Reuters Read full article

Source: Reuters Read full article

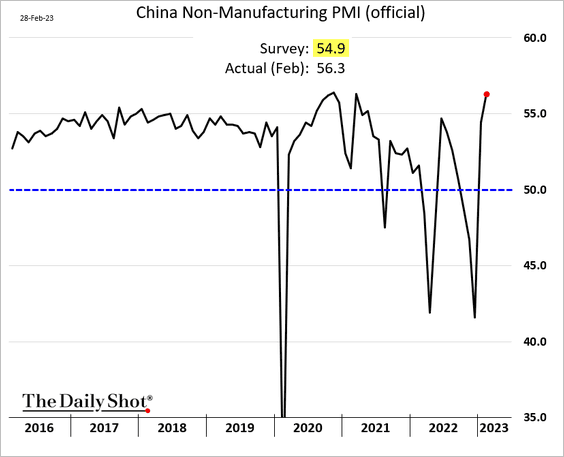

The non-manufacturing index is also very strong, topping expectations.

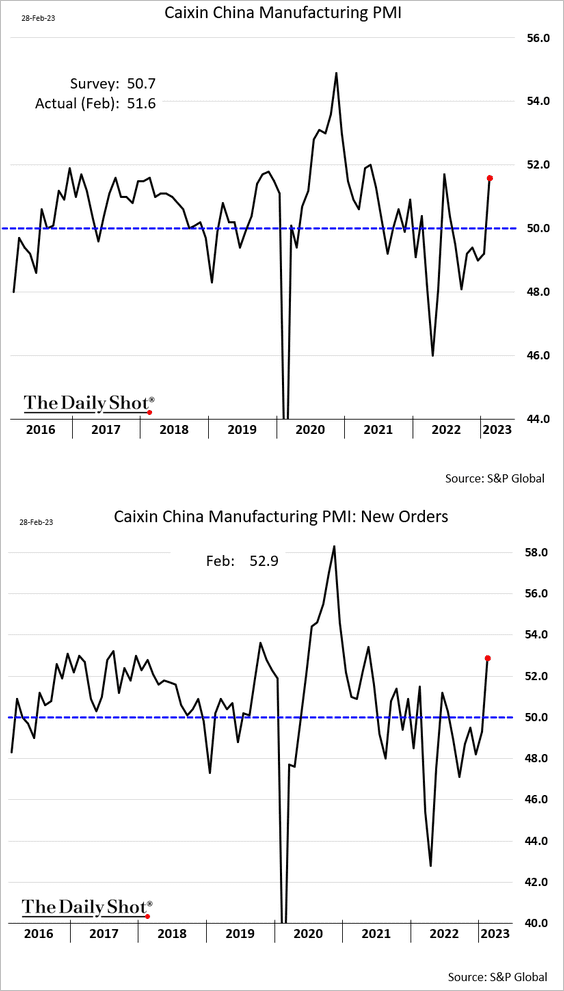

The private PMI index from S&P Global was less upbeat but also showed an acceleration in growth.

——————–

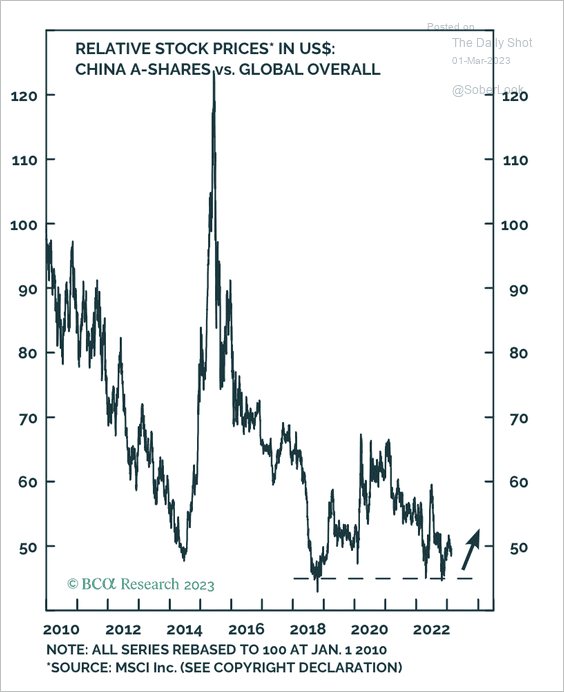

2. Chinese A-shares are holding long-term support relative to global stocks.

Source: BCA Research

Source: BCA Research

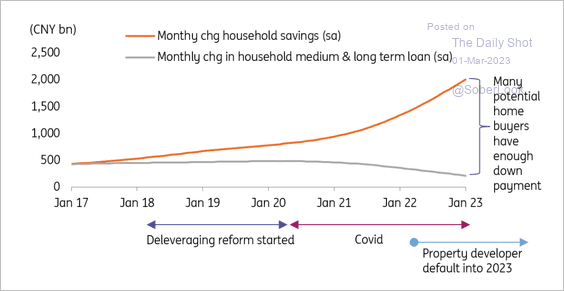

3. Potential homebuyers have saved enough for down payments.

Source: ING

Source: ING

Back to Index

Emerging Markets

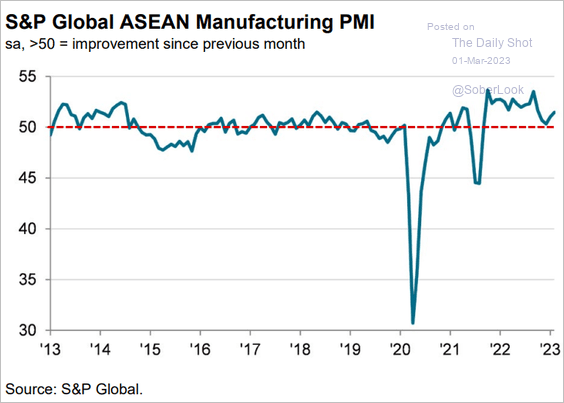

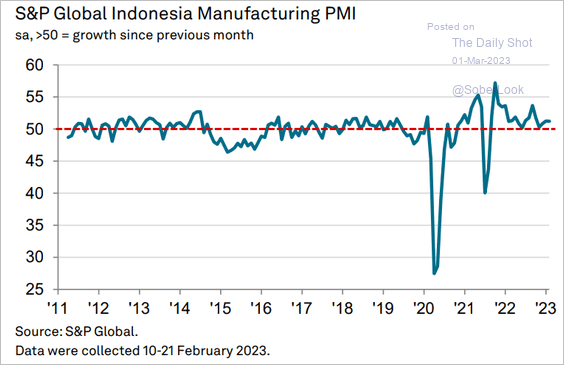

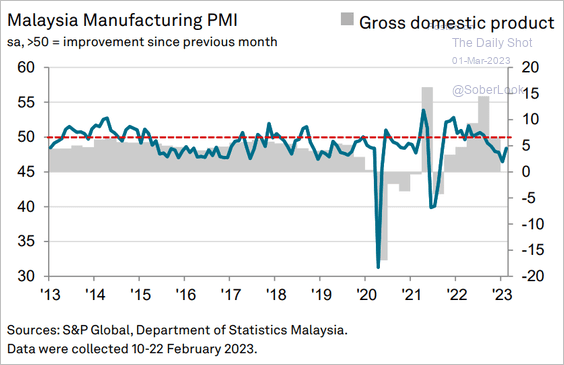

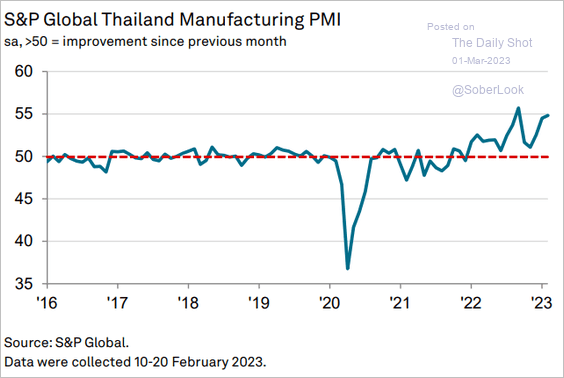

1. Let’s run through the Asian PMI data.

• ASEAN (improved growth):

Source: S&P Global PMI

Source: S&P Global PMI

• Indonesia:

Source: S&P Global PMI

Source: S&P Global PMI

• Malaysia (still contracting):

Source: S&P Global PMI

Source: S&P Global PMI

• Thailand (very strong):

Source: S&P Global PMI

Source: S&P Global PMI

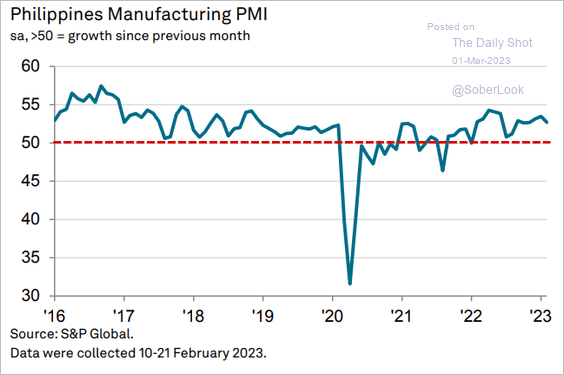

• The Philippines (still solid):

Source: S&P Global PMI

Source: S&P Global PMI

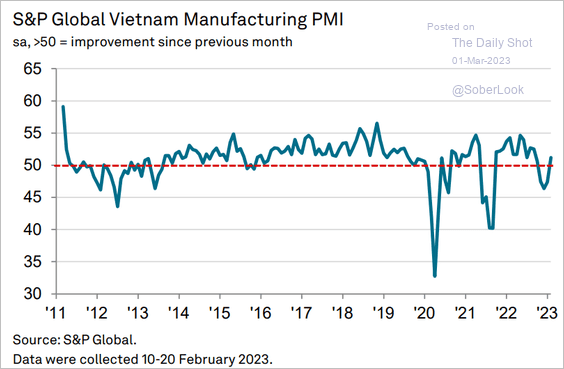

• Vietnam (back in growth territory):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

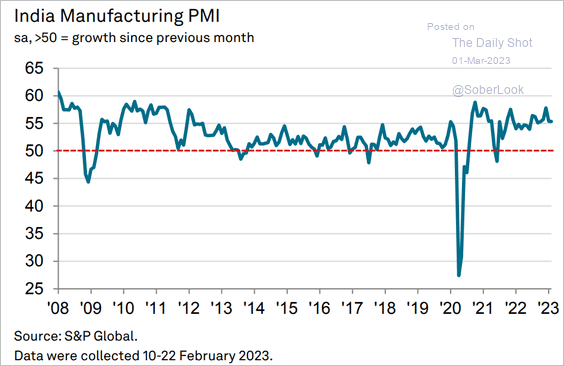

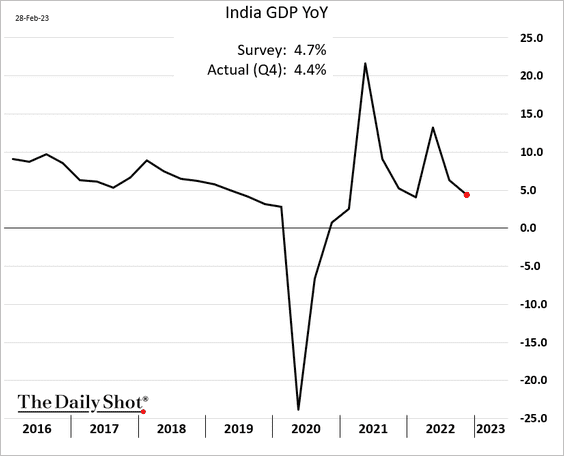

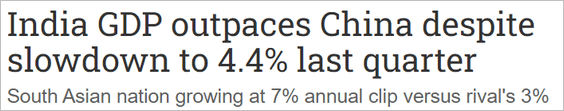

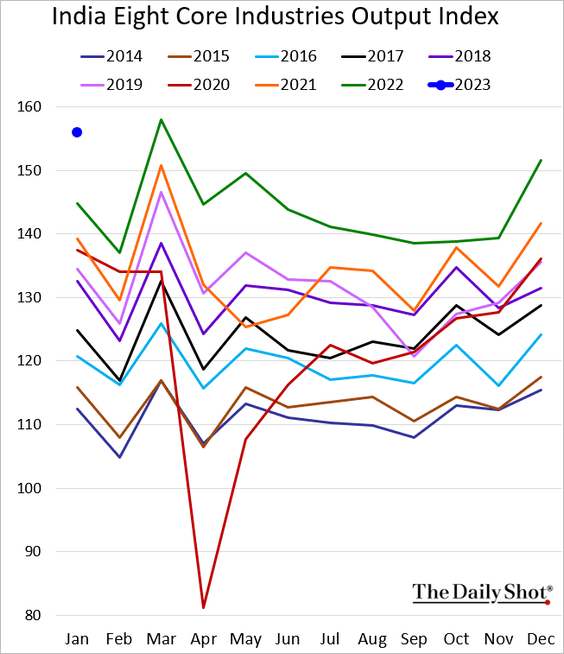

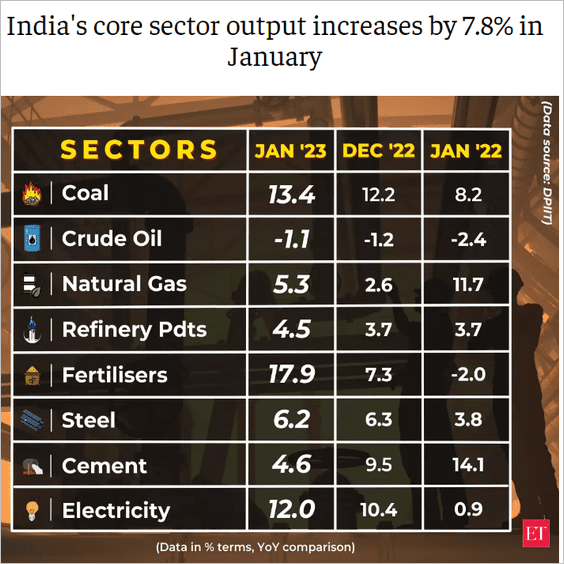

2. Next, we have some updates on India.

• Manufacturing growth is holding up well.

Source: World Economics

Source: World Economics

• The GDP report was softer than expected.

Source: @WSJ Read full article

Source: @WSJ Read full article

But India still outpaced China.

Source: NIKKEI Asia Read full article

Source: NIKKEI Asia Read full article

• Core industries’ output was robust in January.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

• Government spending remains strong.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

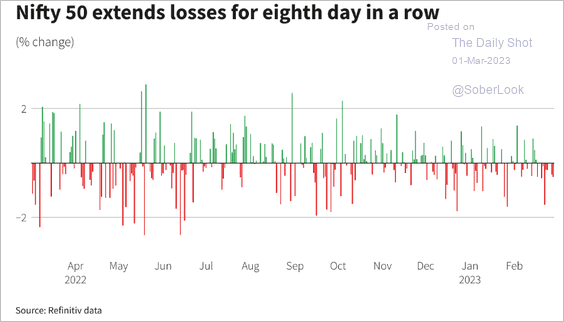

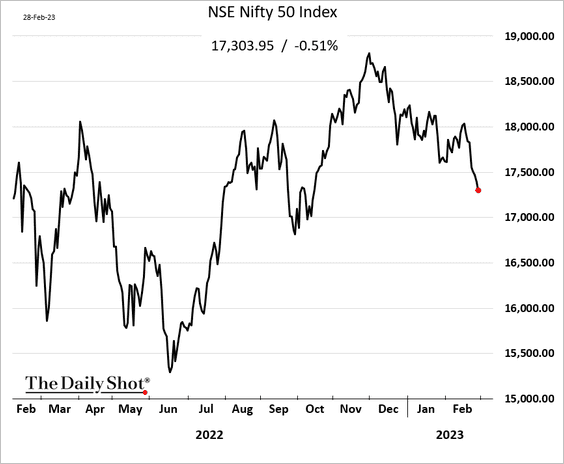

• The stock market has been struggling.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

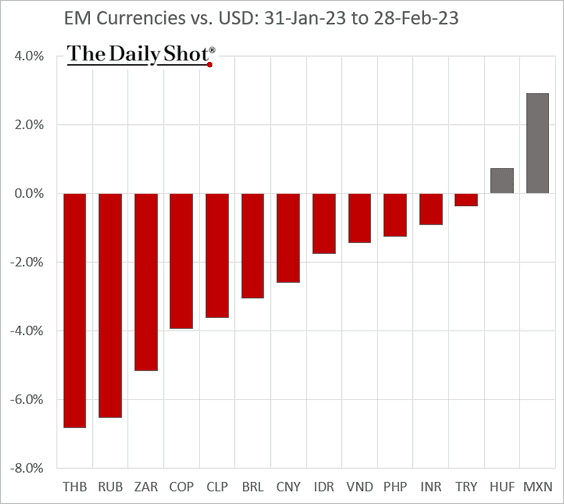

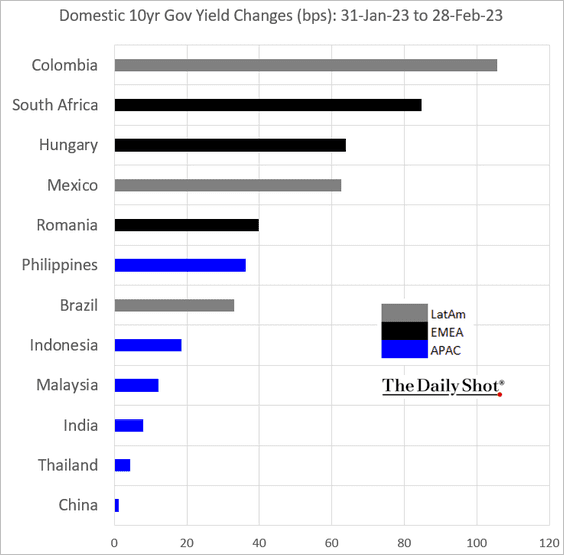

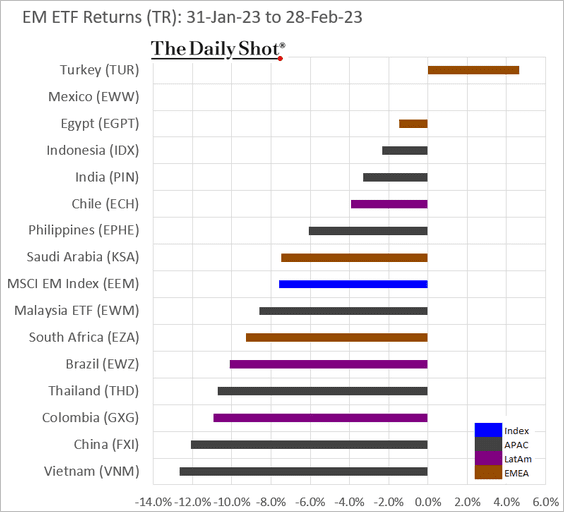

3. Finally, we have some performance data for February.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

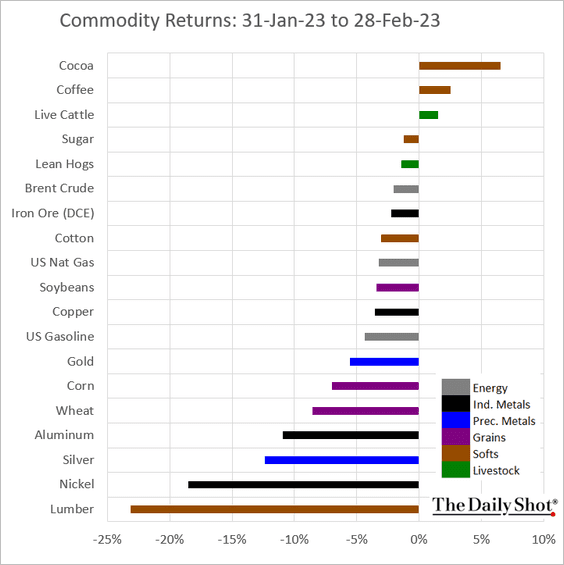

Commodities

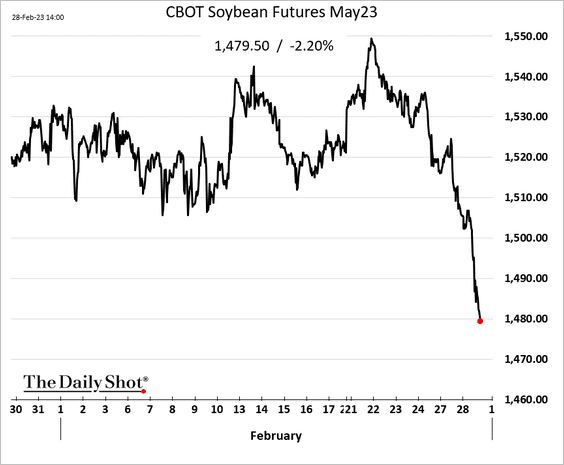

1. US soybean futures ended the month on a soft note.

Source: Meredith Read full article

Source: Meredith Read full article

——————–

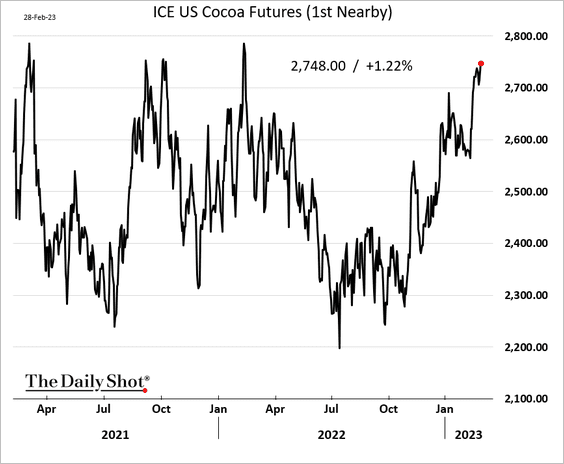

2. Cocoa futures have been rallying.

3. Here is the February performance across key commodity markets.

Back to Index

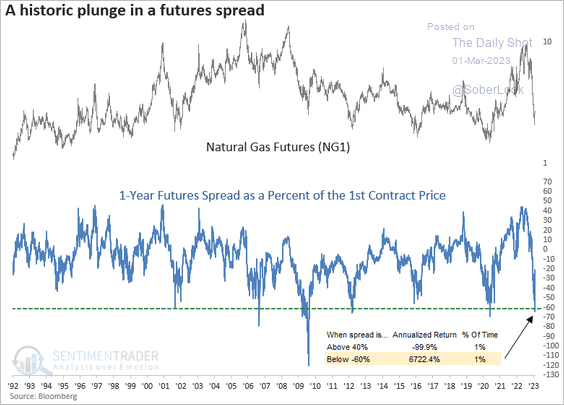

Energy

1. The one-year futures spread for Henry Hub Natural Gas plummeted below -60% and then reversed. Historically, natural gas has rallied after similar spread reversals.

Source: SentimenTrader

Source: SentimenTrader

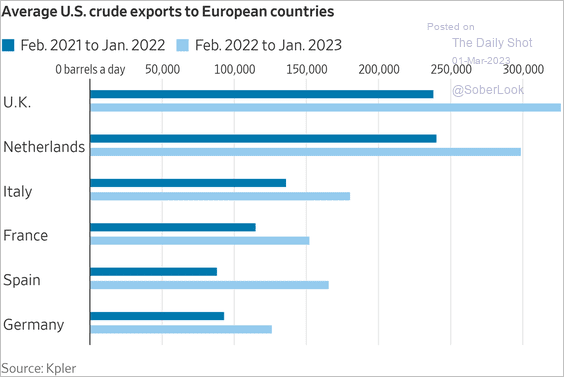

2. US crude oil exports to Europe increased substantially over the past 12 months.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

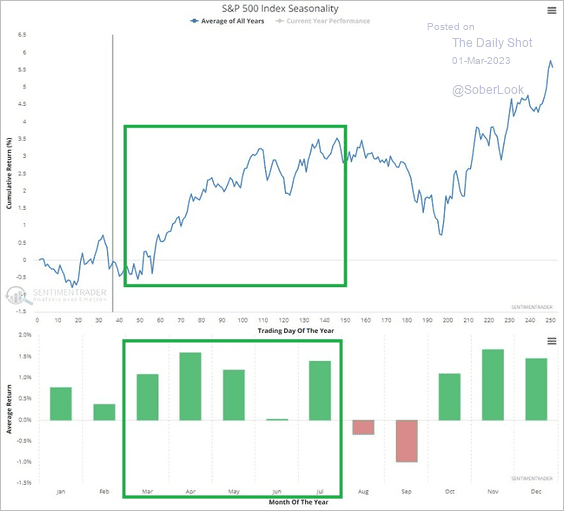

Equities

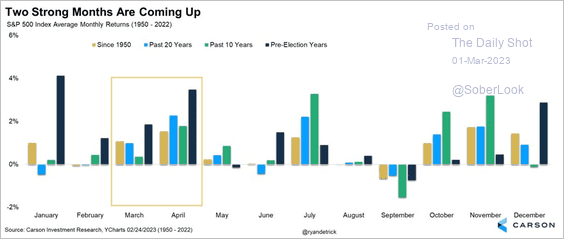

1. The S&P 500 is entering a seasonally strong period. (2 charts)

Source: SentimenTrader

Source: SentimenTrader

Source: @RyanDetrick

Source: @RyanDetrick

——————–

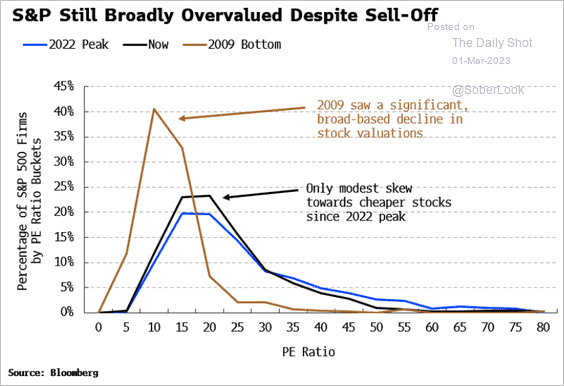

2. Stocks still look overvalued. Here is the distribution of P/E ratios for the S&P 500.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

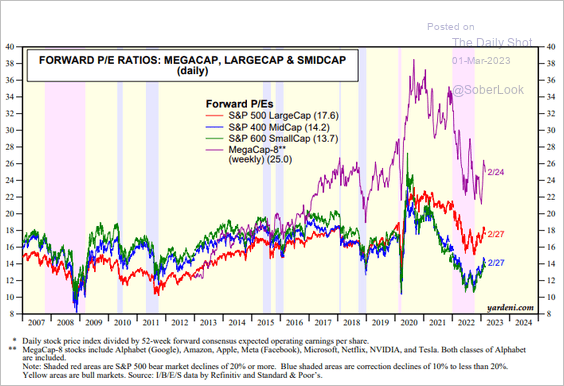

3. This chart shows P/E ratios for tech mega-caps, large caps, mid-caps, and small caps.

Source: Yardeni Research

Source: Yardeni Research

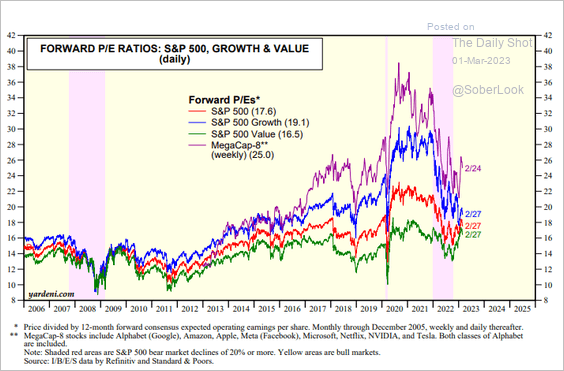

And here are the P/E ratios for growth and value factors.

Source: Yardeni Research

Source: Yardeni Research

——————–

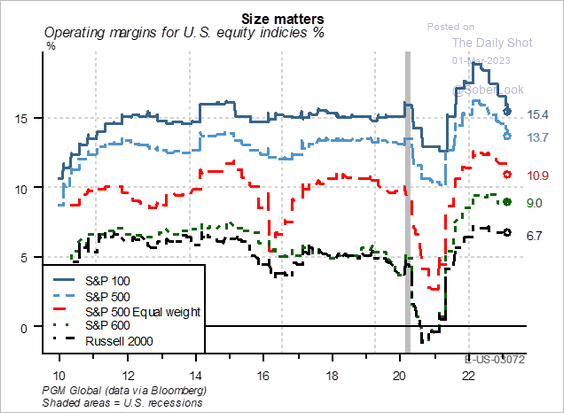

4. Larger firms have been running higher operating margins.

Source: PGM Global

Source: PGM Global

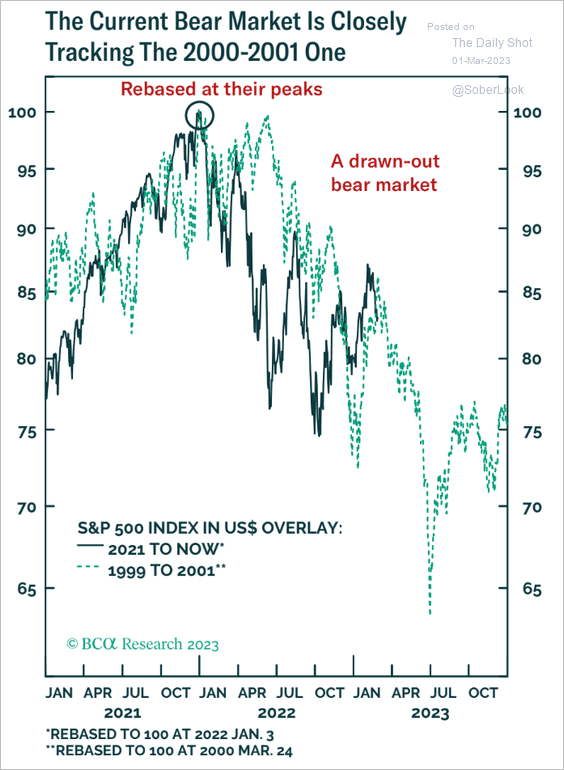

5. The dot-com analog remains in play.

Source: BCA Research

Source: BCA Research

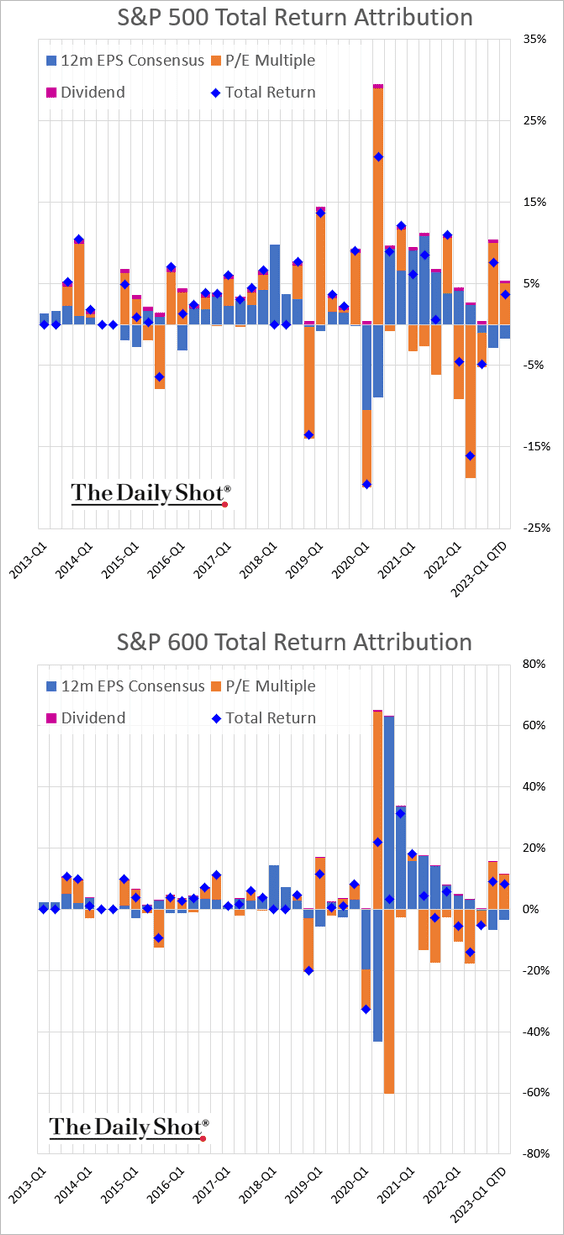

6. Here is the quarterly performance attribution for US large and small caps (through the end of February).

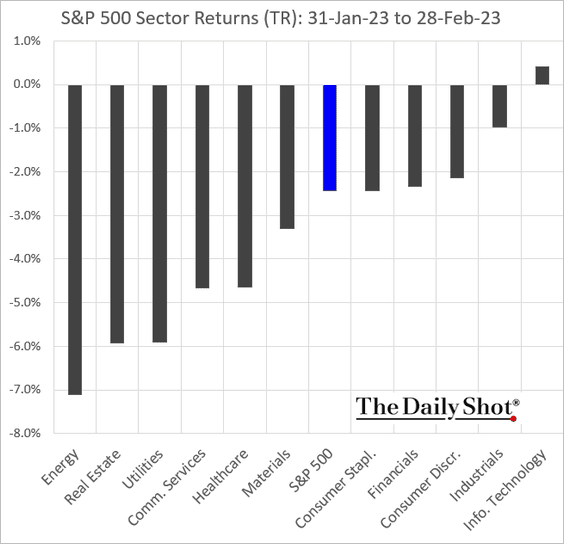

7. Finally, we have performance metrics for the month of February.

• Sectors:

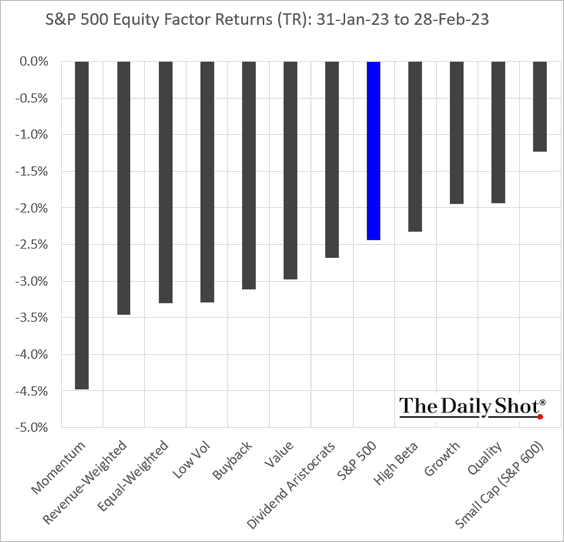

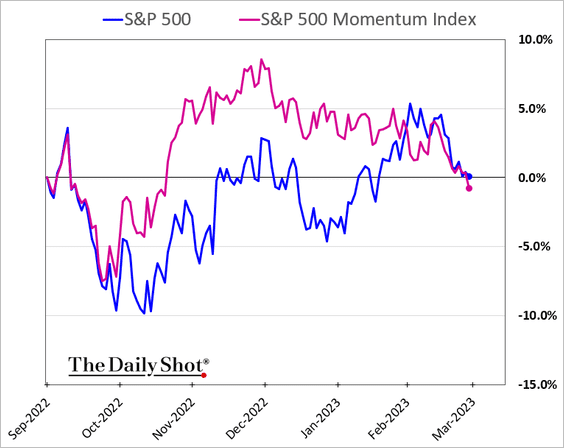

• Equity factors:

The momentum factor has given up its recent outperformance.

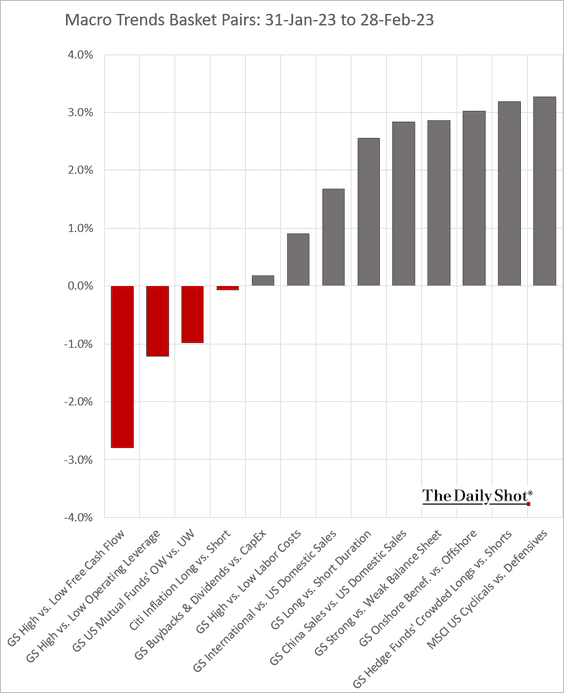

• Macro basket pairs:

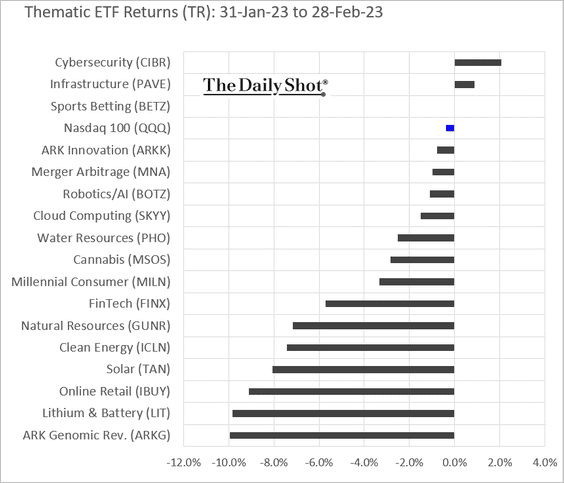

• Thematic ETFs:

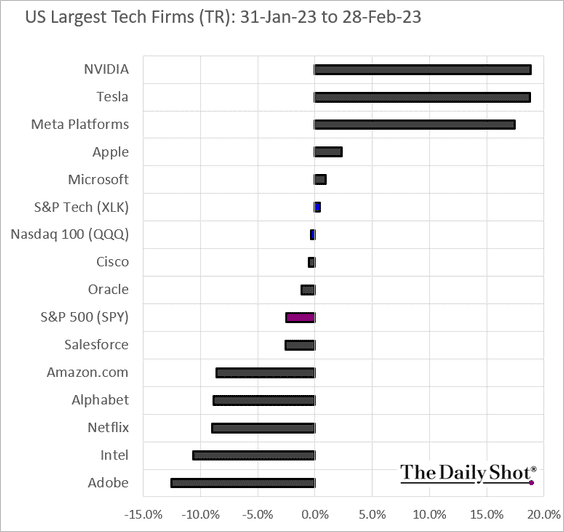

• Largest US tech firms:

Back to Index

Credit

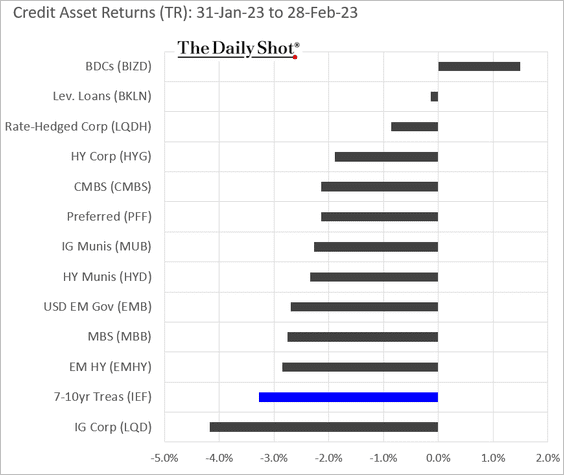

This chart shows credit performance by asset class in February. The weakness was driven by higher Treasury yields.

Back to Index

Rates

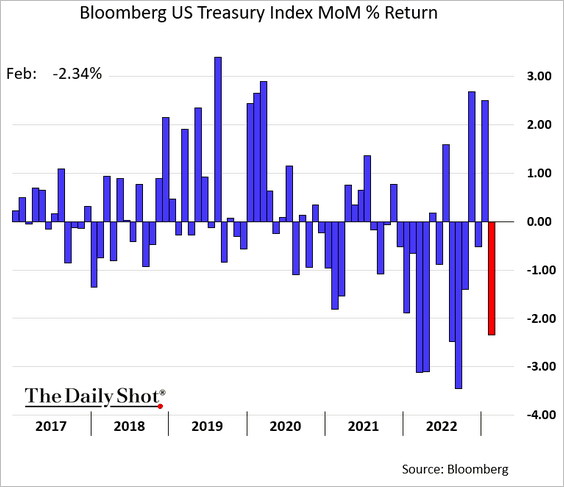

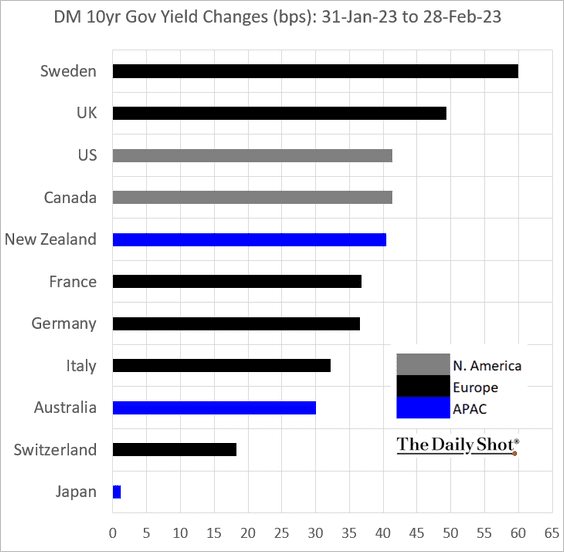

1. With inflation still running hot, Treasuries tumbled in February.

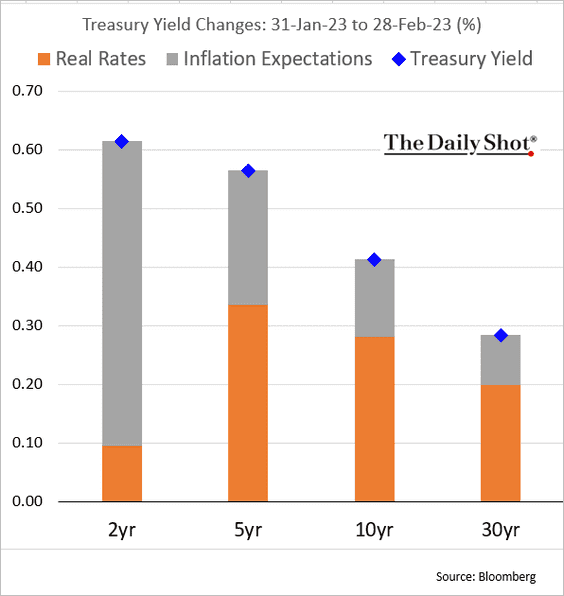

Here is the attribution of yield changes.

——————–

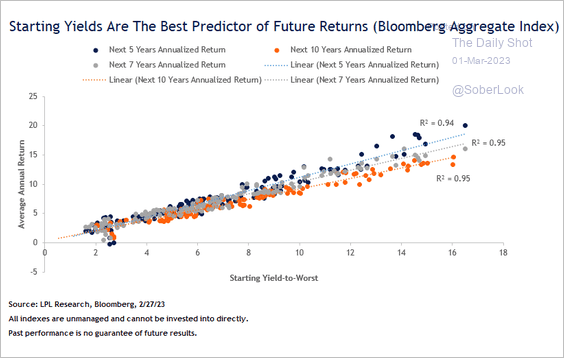

2. Starting yields are a good predictor of longer-term bond returns.

Source: LPL Research

Source: LPL Research

Back to Index

Global Developments

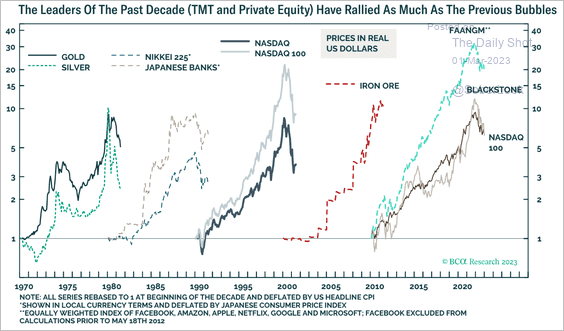

1. This chart shows “bubble” leaders in each cycle.

Source: BCA Research

Source: BCA Research

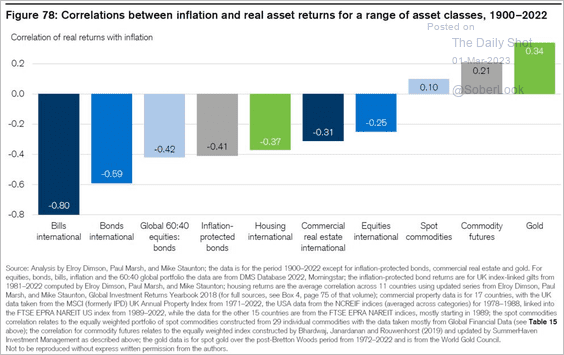

2. How correlated are real long-term asset returns to inflation?

Source: @jessefelder, @johnauthers Read full article

Source: @jessefelder, @johnauthers Read full article

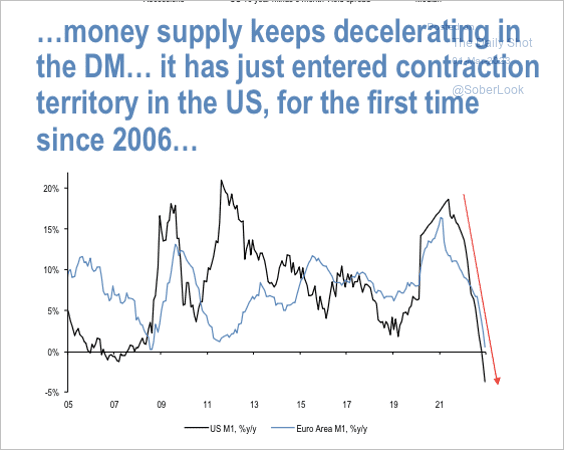

3. Money supply keeps decelerating in the US and euro area.

Source: JP Morgan Research

Source: JP Morgan Research

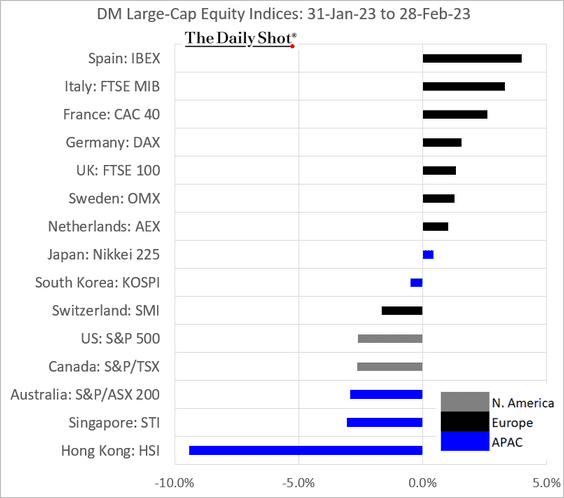

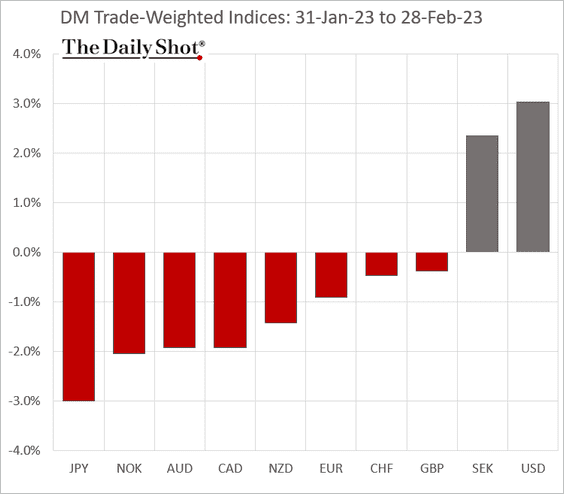

4. Next, we have some DM performance data for February.

• Large-cap equity indices:

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

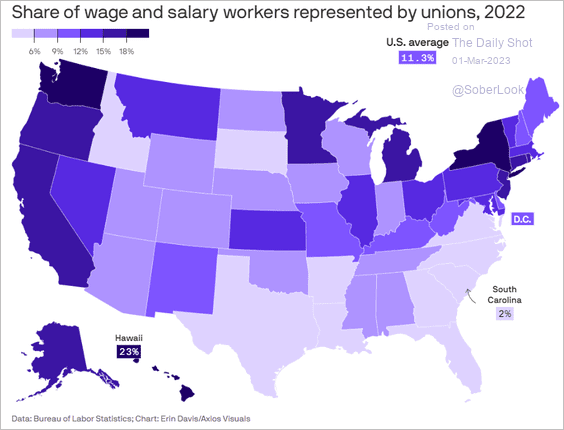

1. Union membership by state:

Source: @axios Read full article

Source: @axios Read full article

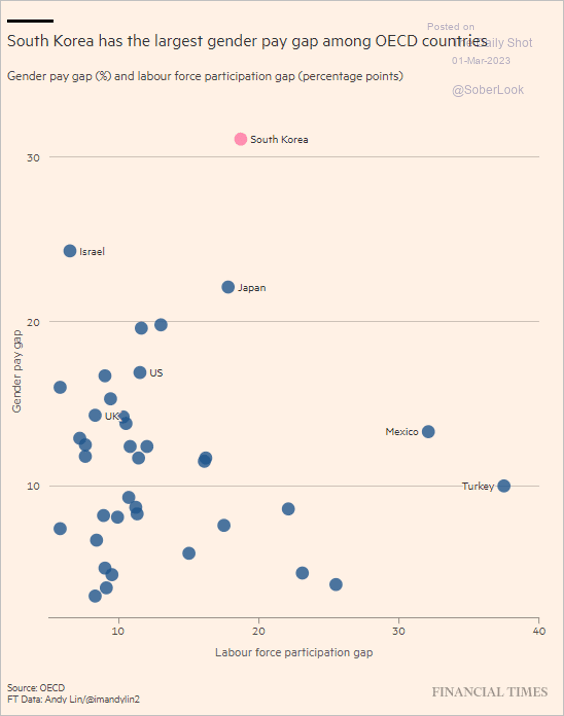

2. Gender pay and labor force participation gaps globally:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

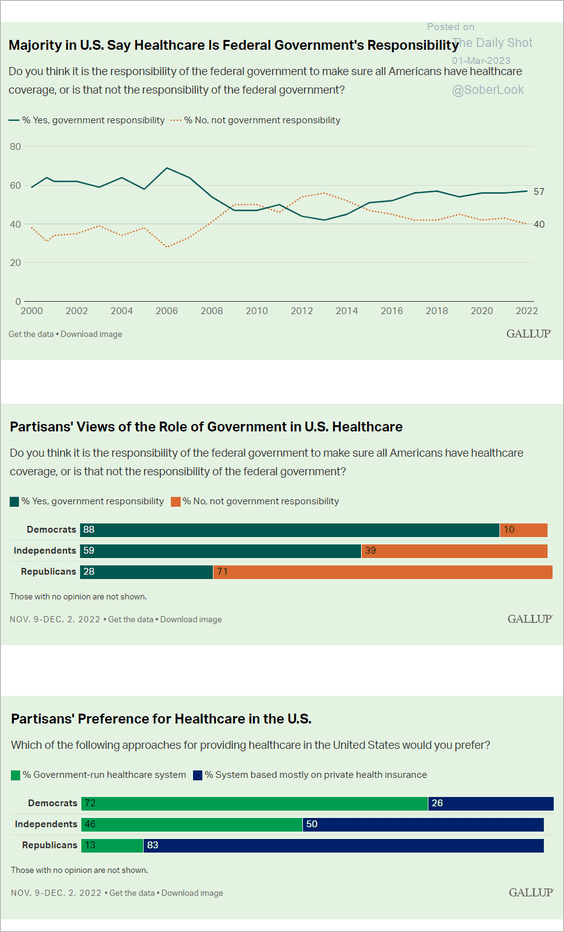

3. Views on US government’s role in healthcare:

Source: Gallup Read full article

Source: Gallup Read full article

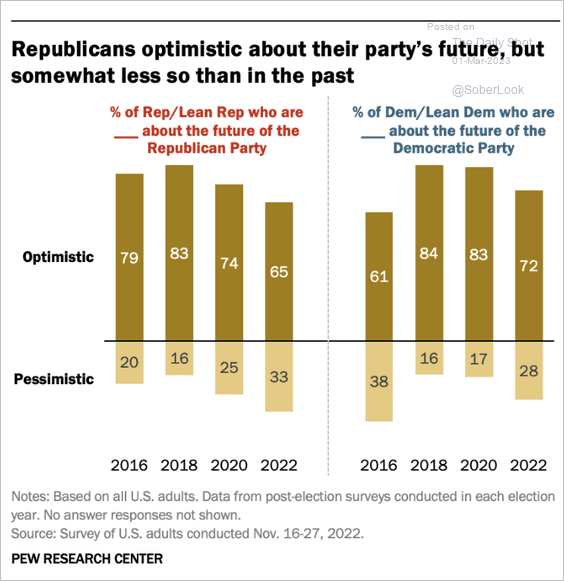

4. Americans’ views on their political party’s future:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

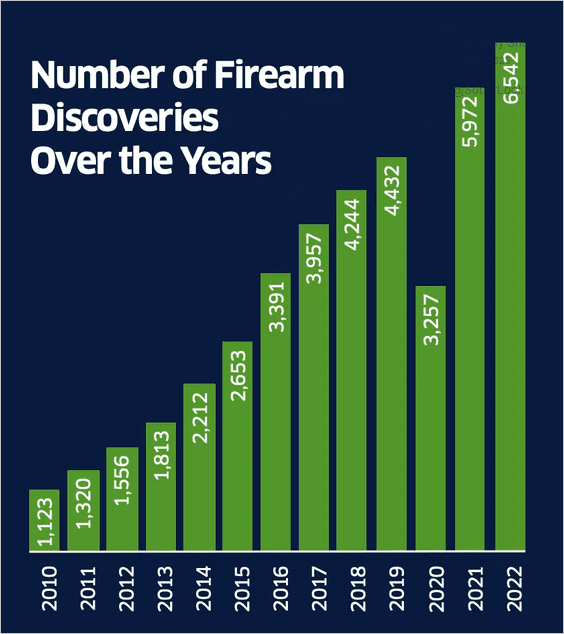

5. TSA firearm discoveries at security checkpoints:

Source: @axios Read full article

Source: @axios Read full article

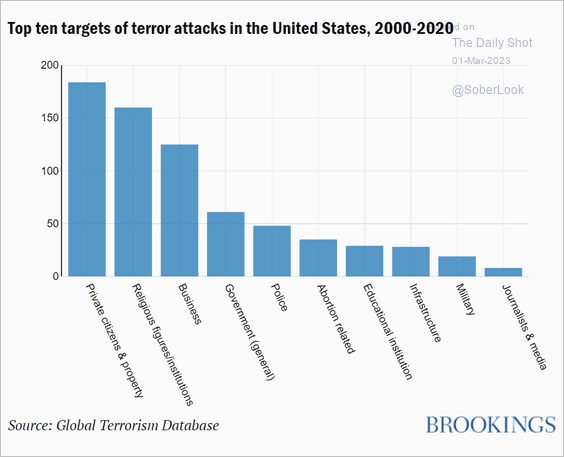

6. Targets of terror attacks:

Source: Brookings Read full article

Source: Brookings Read full article

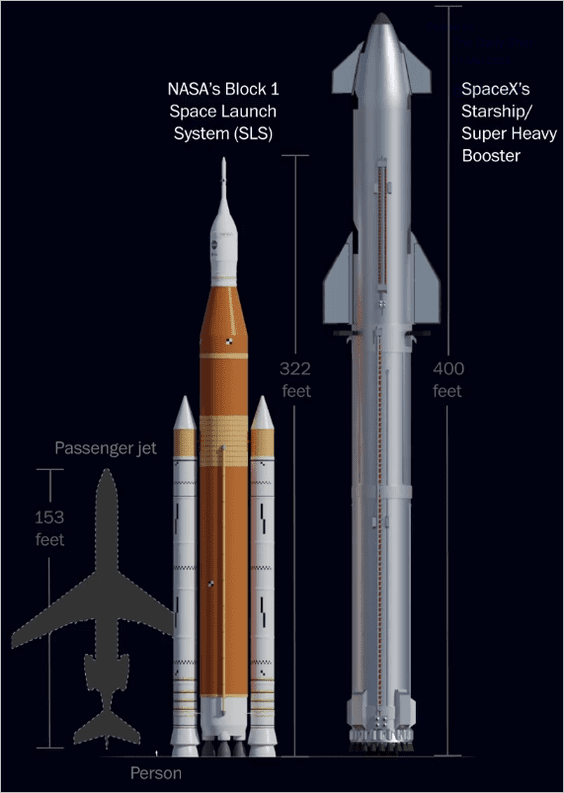

7. Rockets that NASA and SpaceX plan to send to the moon:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Back to Index