The Daily Shot: 08-Mar-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Chair Powell struck a hawkish tone on Tuesday.

– Faster rate hikes:

Powell: – If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

– Higher terminal rate:

Powell: – The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.

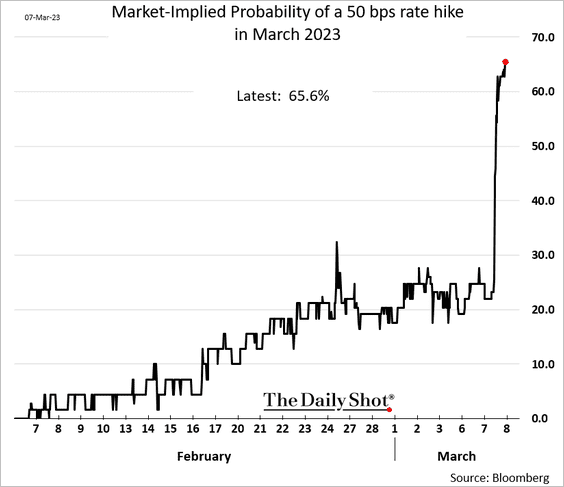

• The probability of a 50 bps hike this month surged.

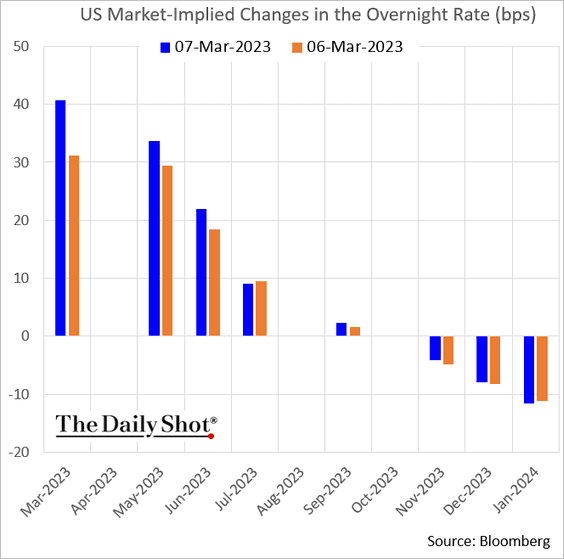

• Here are the market expectations for the fed funds rate changes on FOMC days.

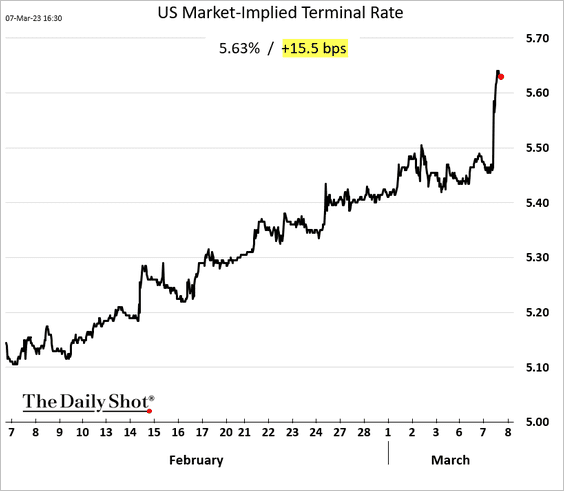

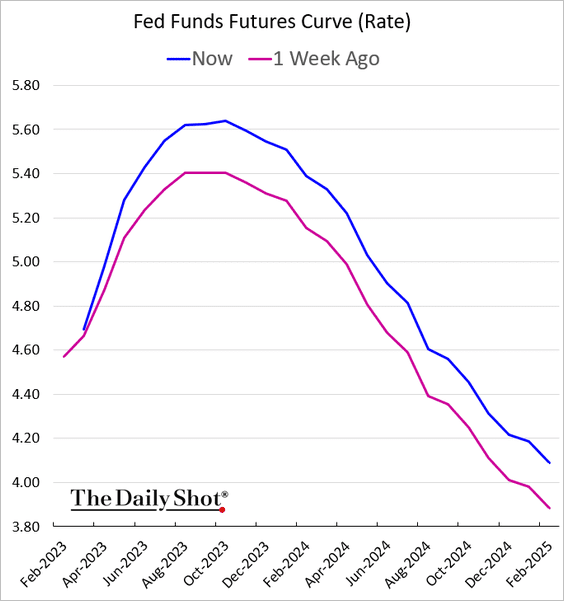

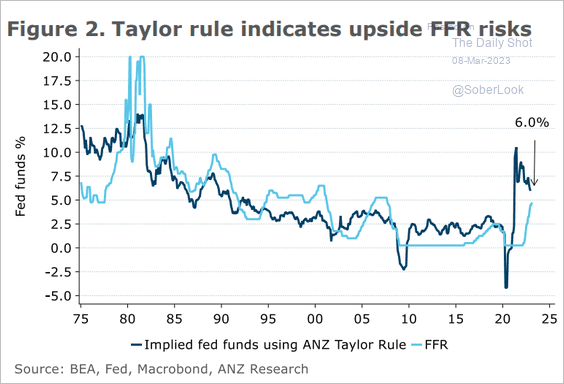

• The implied terminal rate climbed above 5.6%. Are we headed for 6%?

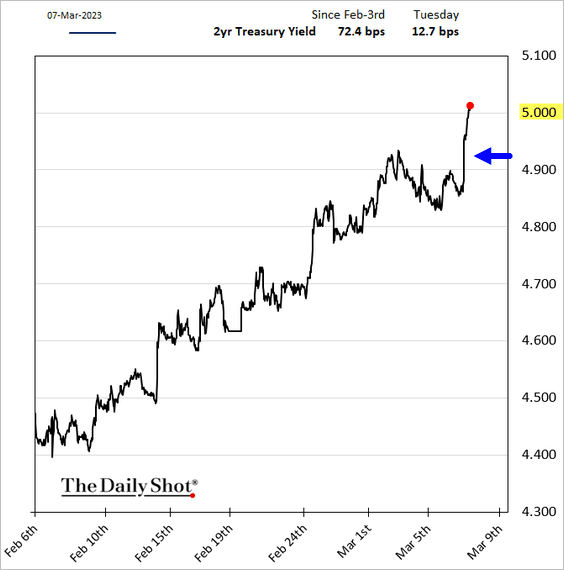

• The 2-year Treasury yield rose above 5%, …

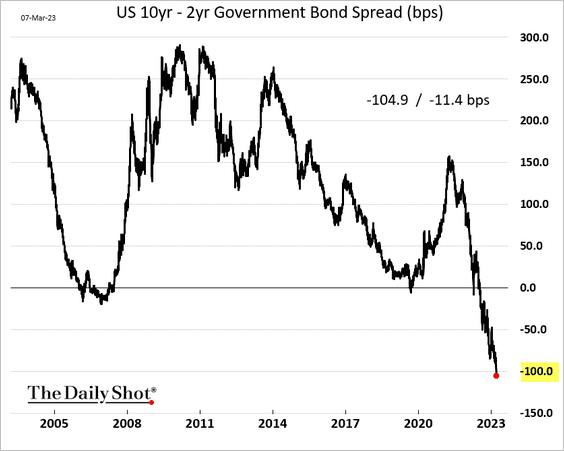

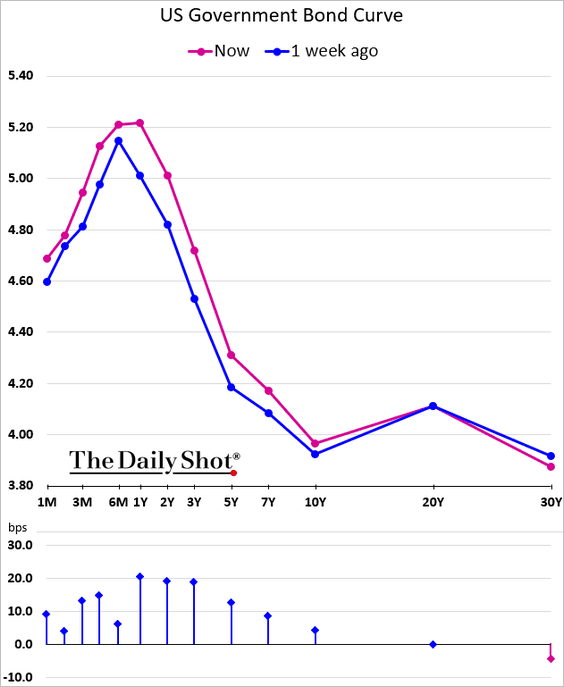

… and the Treasury curve moved deeper into inversion territory.

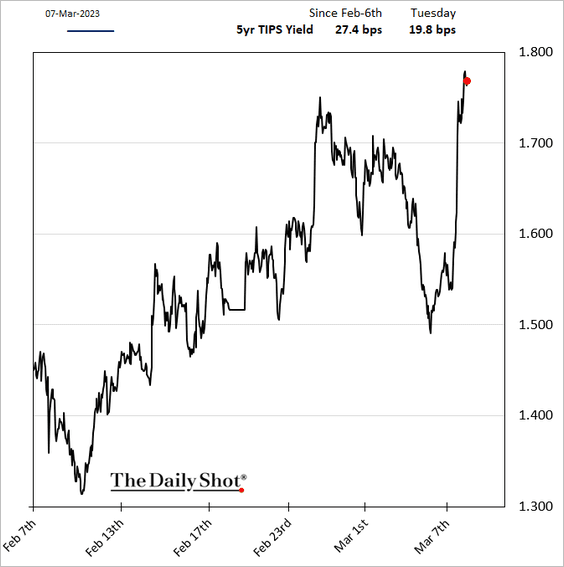

• Real yields jumped.

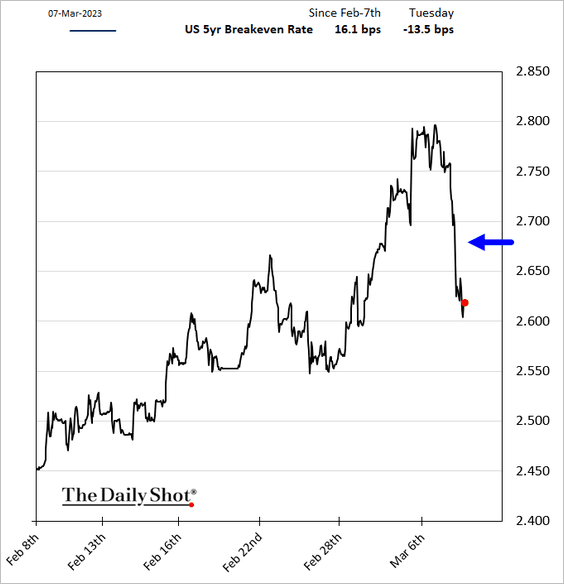

• Market-based inflation expectations moved lower.

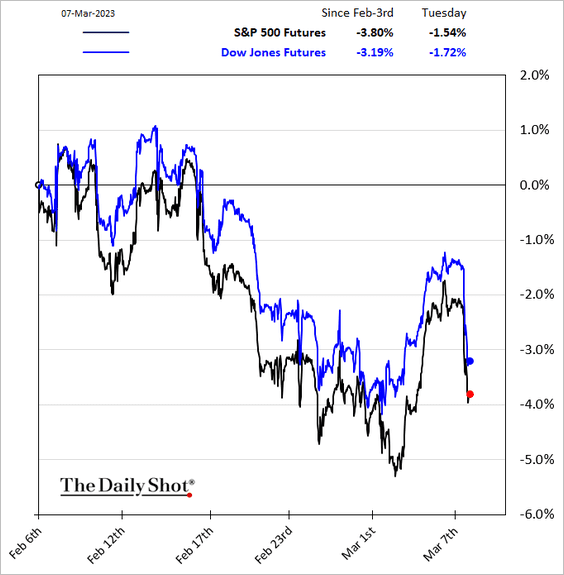

• Stocks retreated.

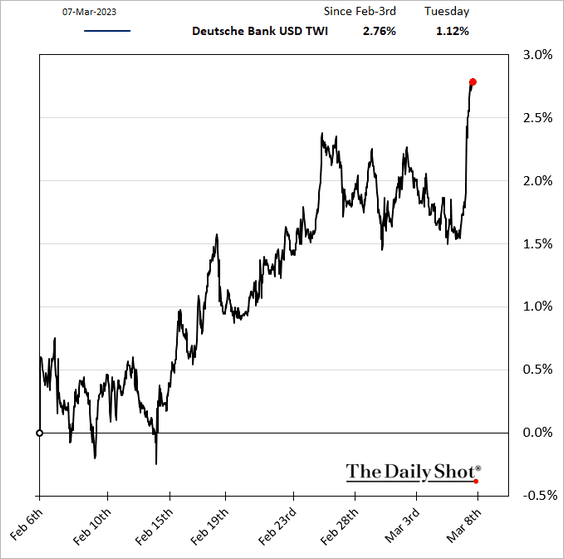

• The dollar surged.

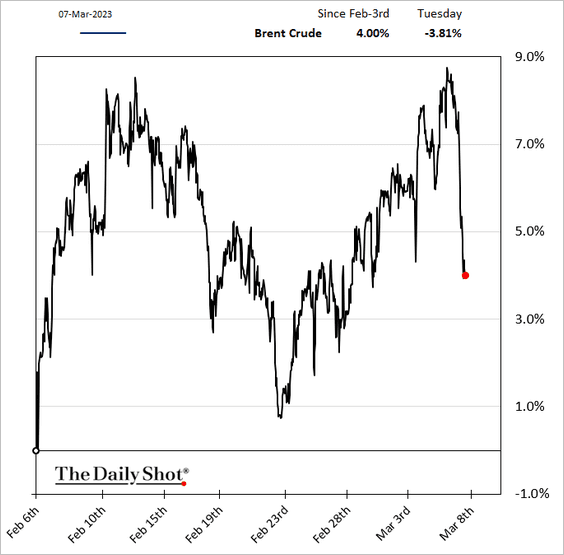

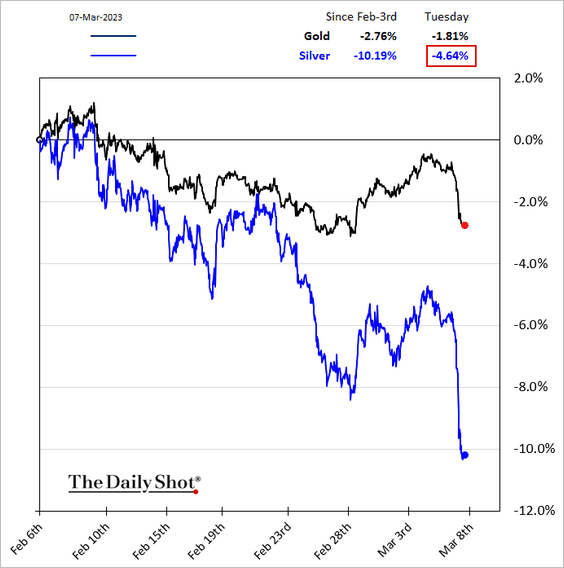

• Commodities came under pressure.

——————–

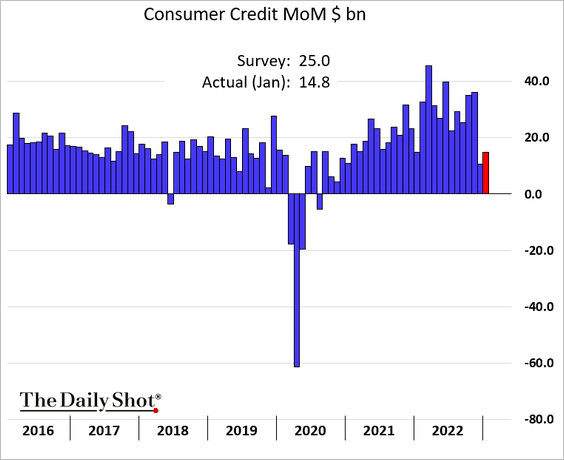

2. Consumer credit increased less than expected in January.

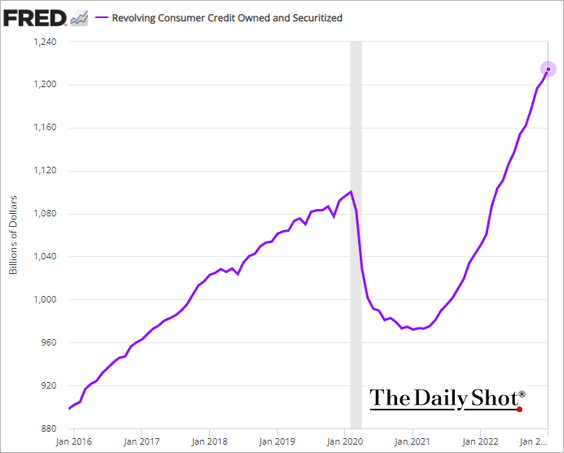

Credit card debt continues to rise.

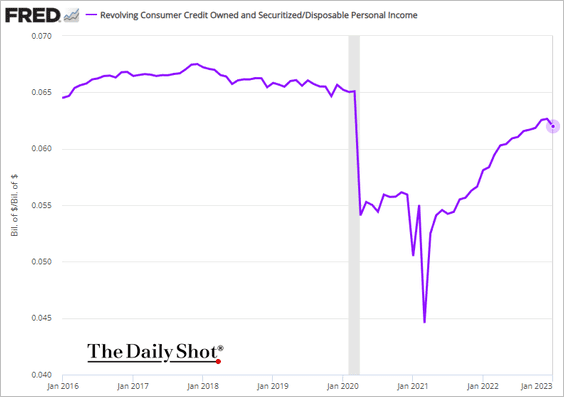

But it declined in January as a share of disposable personal income.

——————–

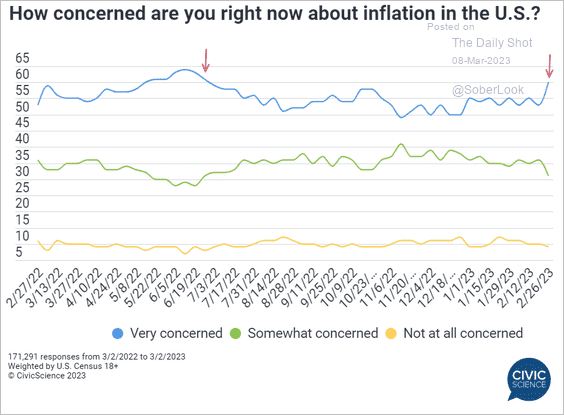

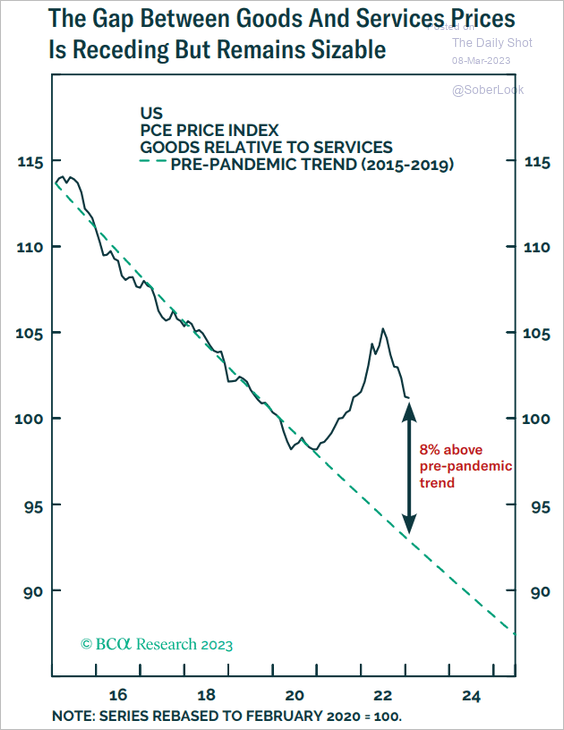

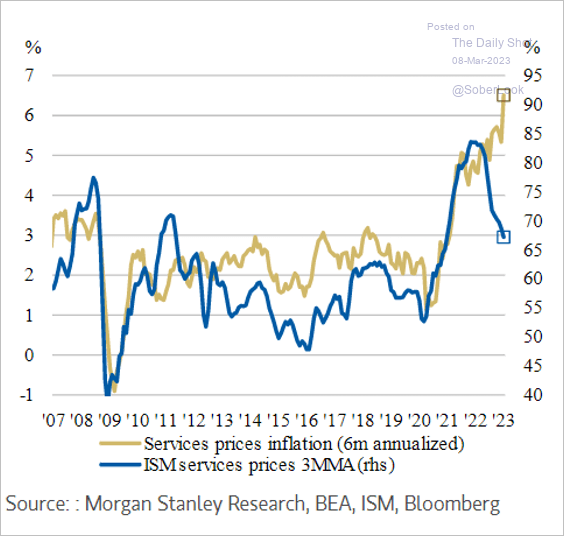

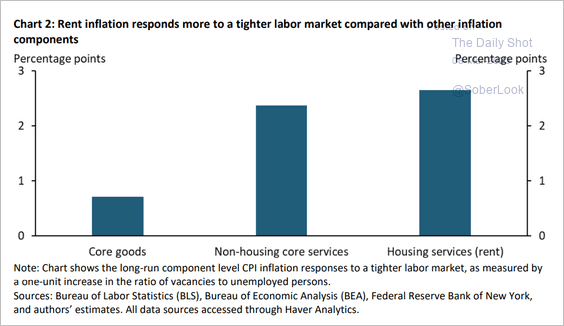

3. Next, we have some updates on inflation.

• Consumer concerns about inflation have risen in recent weeks.

Source: @CivicScience

Source: @CivicScience

• The gap between goods and services prices remains elevated.

Source: BCA Research

Source: BCA Research

• The ISM report has been pointing to lower services inflation.

Source: Morgan Stanley Research; @Marcomadness

Source: Morgan Stanley Research; @Marcomadness

• Rent inflation is sensitive to tight labor markets.

Source: Kansas City Fed; h/t Torsten Slok, Apollo Read full article

Source: Kansas City Fed; h/t Torsten Slok, Apollo Read full article

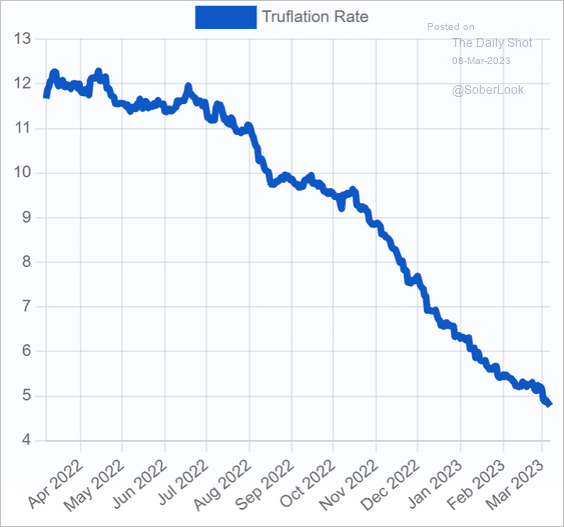

• This chart shows the truflation rate, which takes into account the changes in the quality of goods and services over time.

Source: truflation, @t1alpha Further reading

Source: truflation, @t1alpha Further reading

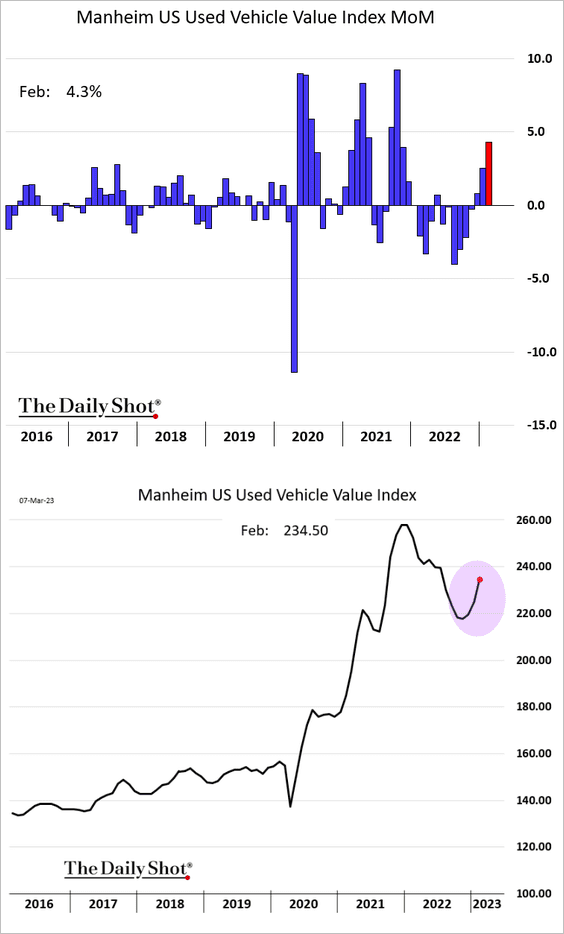

• Wholesale used automobile prices are rising again.

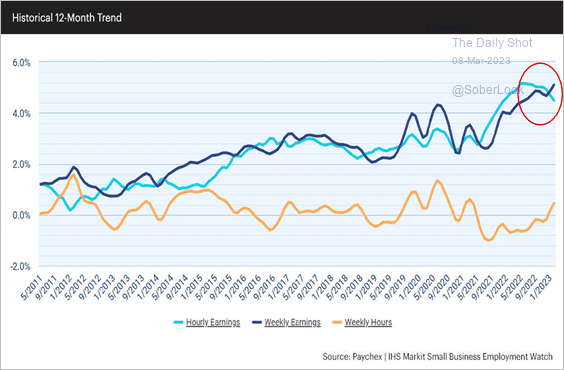

• Small business hourly wage growth slowed last month, but weekly pay gains hit a multi-year high.

Source: Paychex, IHS Markit

Source: Paychex, IHS Markit

Back to Index

Canada

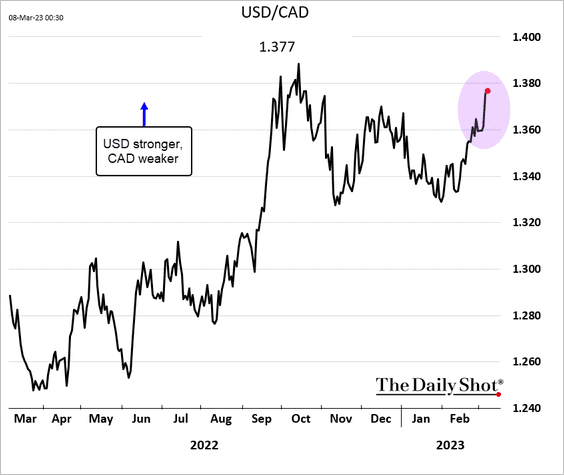

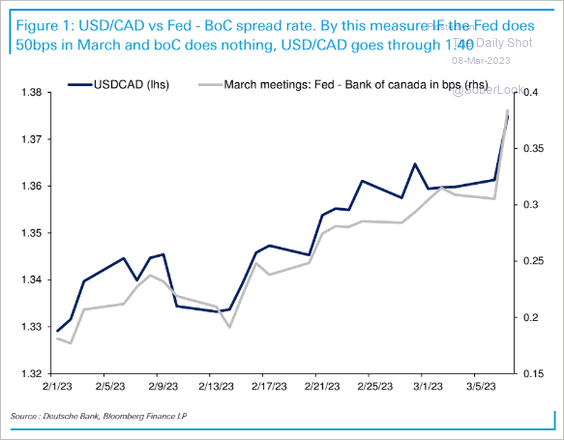

1. The loonie tumbled on Powell’s comments.

Canada’s currency could be in further trouble if the BoC doesn’t hike rates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

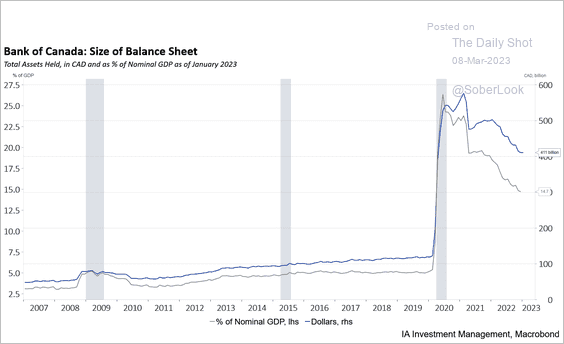

2. This chart shows the BoC’s balance sheet over time.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

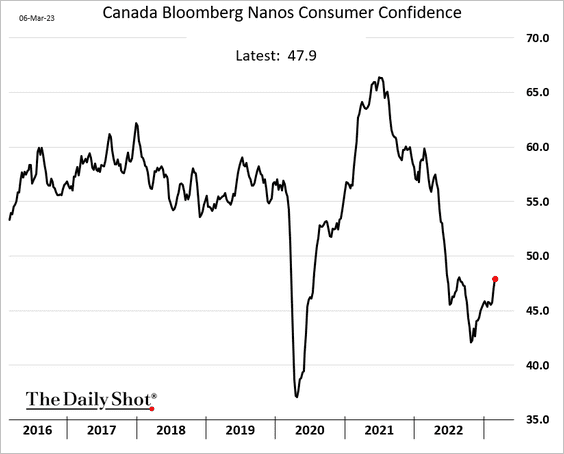

3. Consumer confidence is off the lows.

Back to Index

The United Kingdom

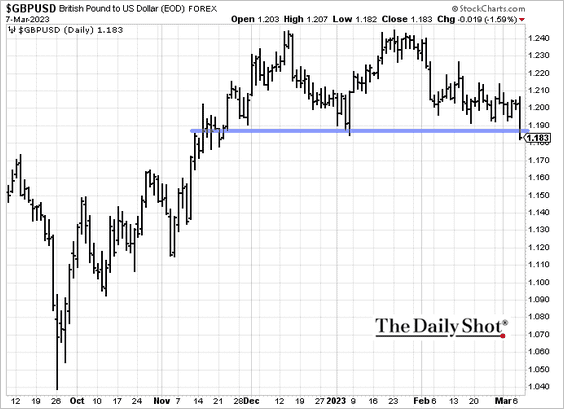

1. The pound is breaking below support.

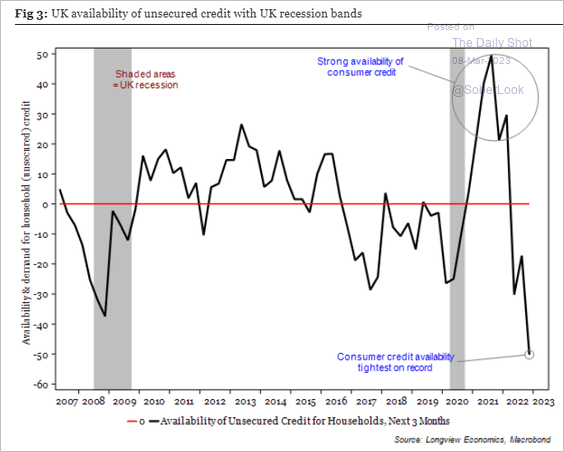

2. Consumer credit has been tight.

Source: Longview Economics

Source: Longview Economics

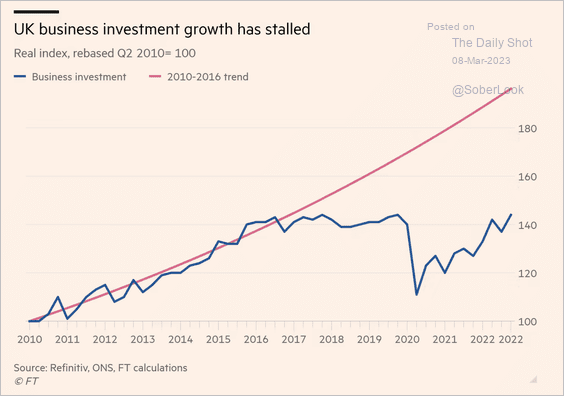

3. Business investment has been running well below the pre-2016 trend.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

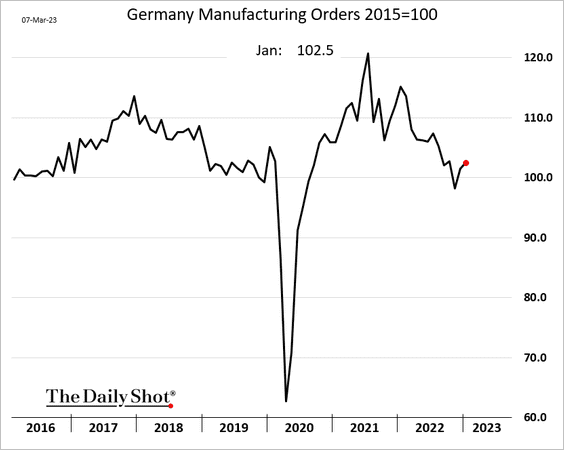

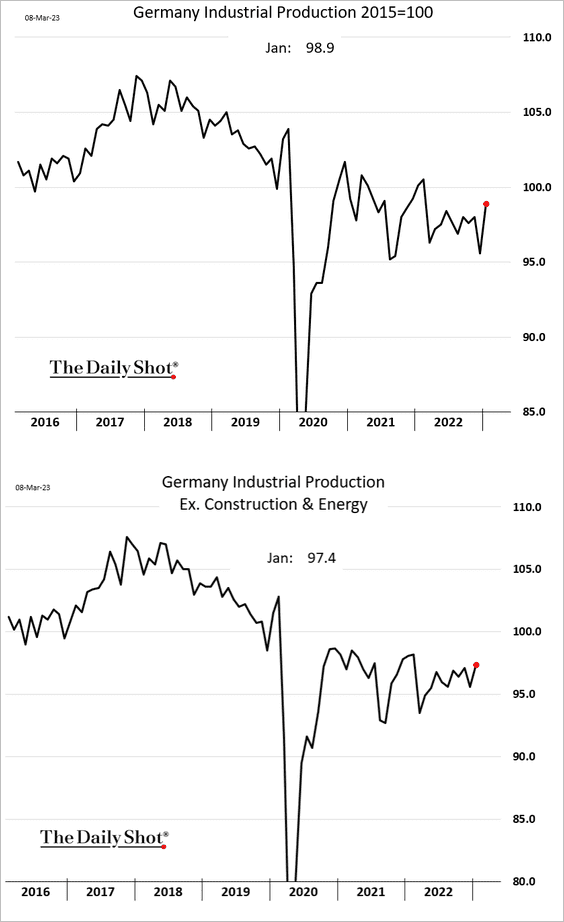

1. Germany’s January factory orders and industrial production topped expectations.

Source: @ZSchneeweiss, @economics Read full article

Source: @ZSchneeweiss, @economics Read full article

Source: MarketWatch Read full article

Source: MarketWatch Read full article

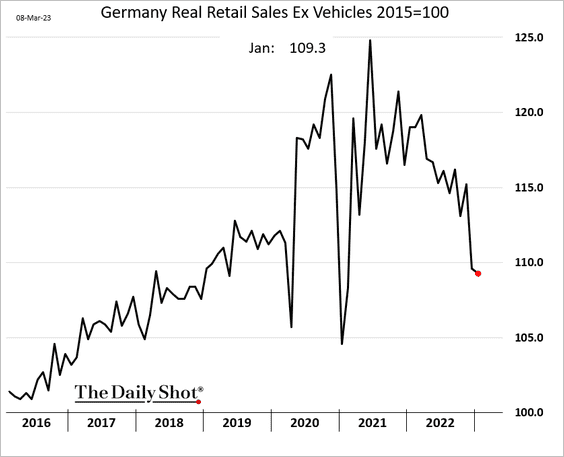

• Retail sales remained soft.

——————–

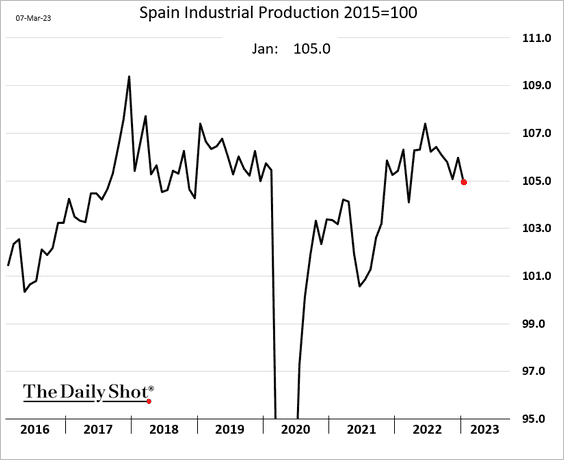

2. Spain’s industrial production hit the lowest level in a year.

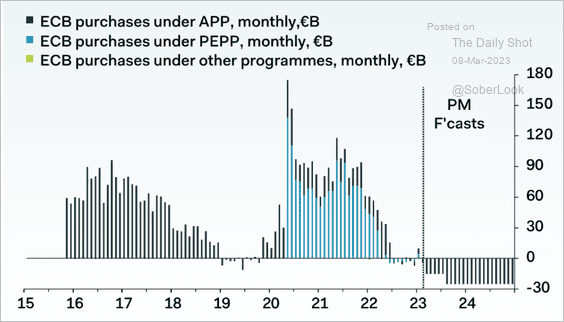

3. Pantheon Macroeconomics sees the ECB ramping up QT later this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

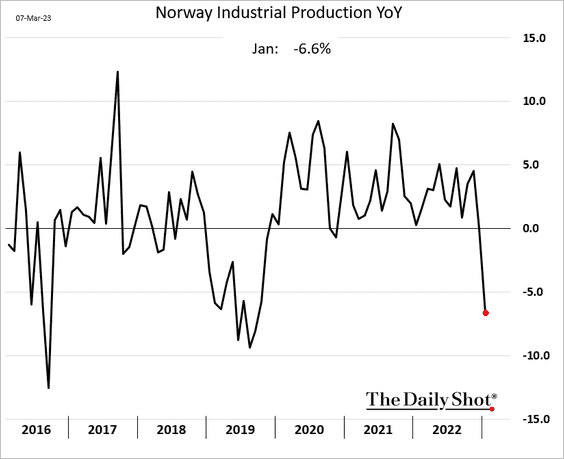

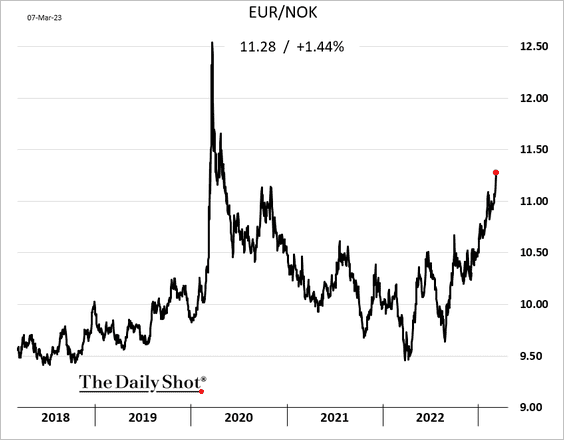

1. Norway’s industrial production took a hit in January.

The Norwegian krone hit the lowest level (vs. EUR) in nearly three years.

——————–

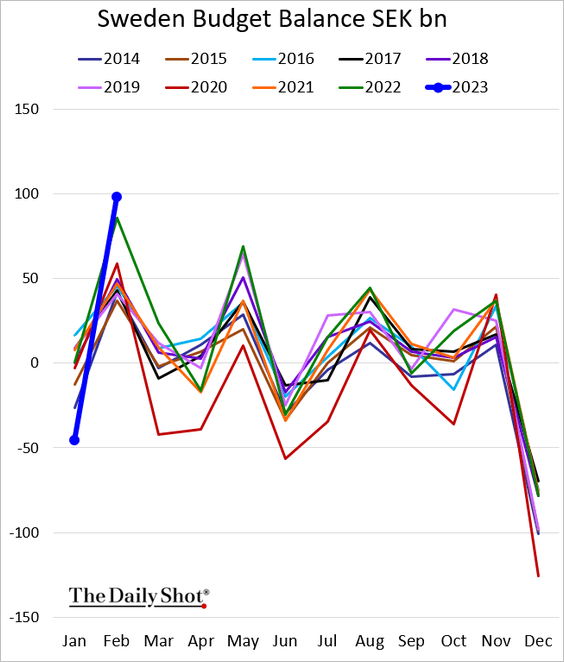

2. Sweden’s budget surplus exceeded last year’s levels in February.

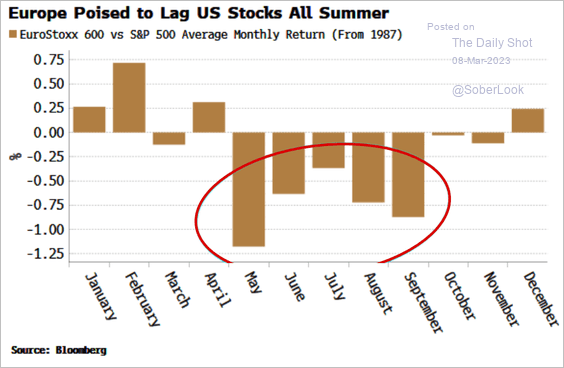

3. Historically, European shares have demonstrated weaker performance compared to the S&P 500 between May and September.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Asia – Pacific

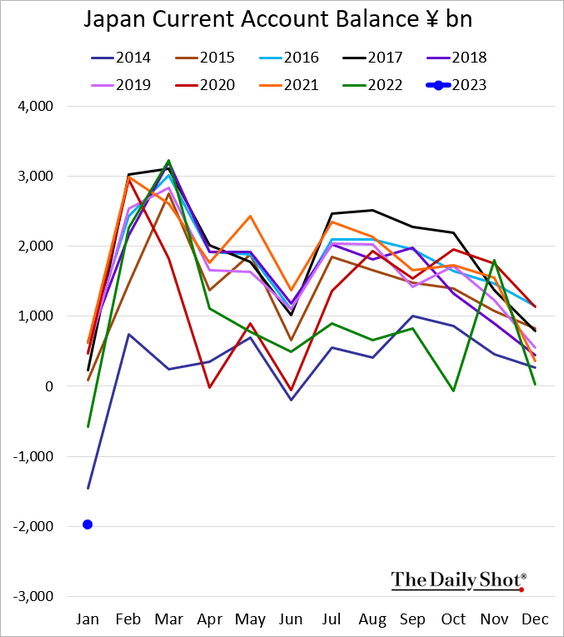

1. Japan’s current account deficit hit a record in January.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

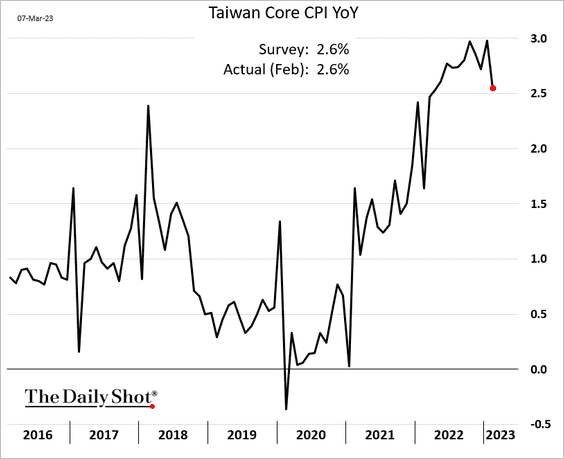

2. Taiwan’s core CPI appears to be peaking.

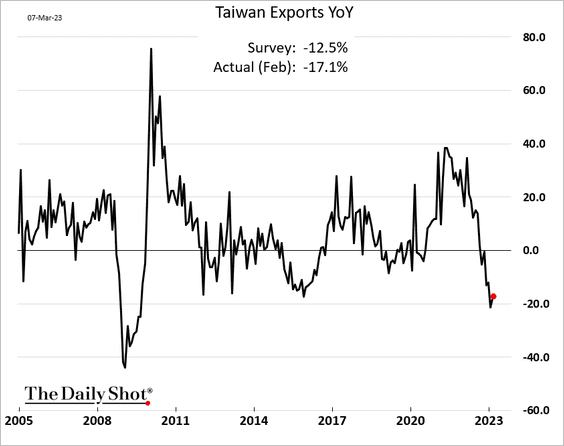

• Taiwan’s exports were lower than expected last month.

Source: SCMP Read full article

Source: SCMP Read full article

Back to Index

China

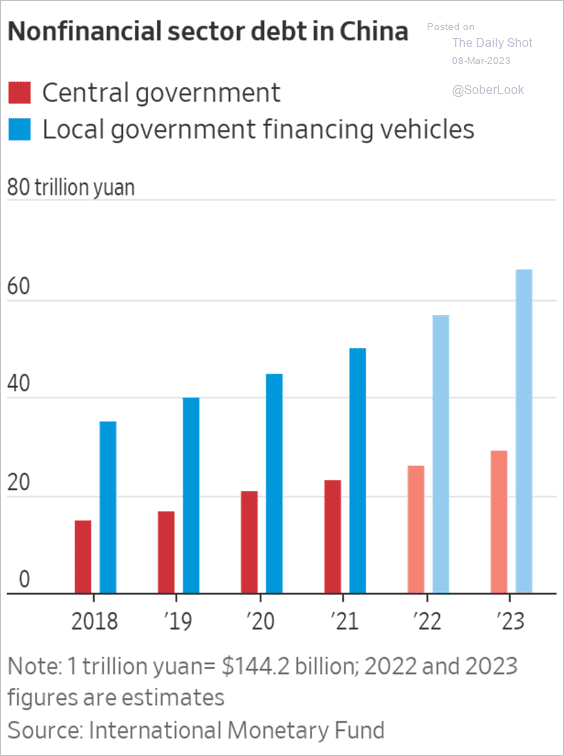

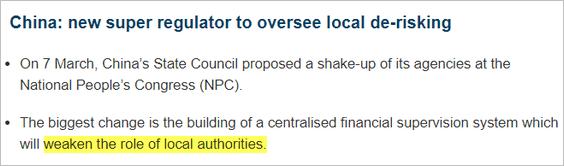

1. Local government debt is massive, …

Source: @WSJ Read full article

Source: @WSJ Read full article

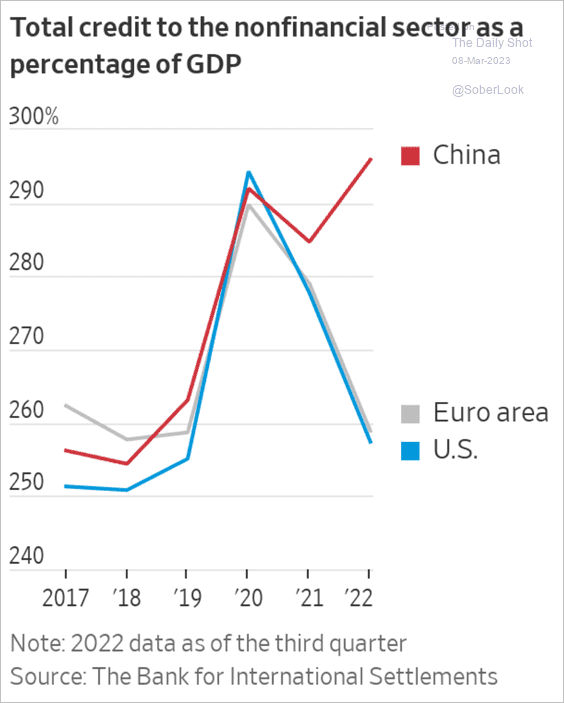

… pushing the total debt-to-GDP ratio well above that of the US and the Eurozone.

Source: @WSJ Read full article

Source: @WSJ Read full article

Beijing wants to get the situation under control.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

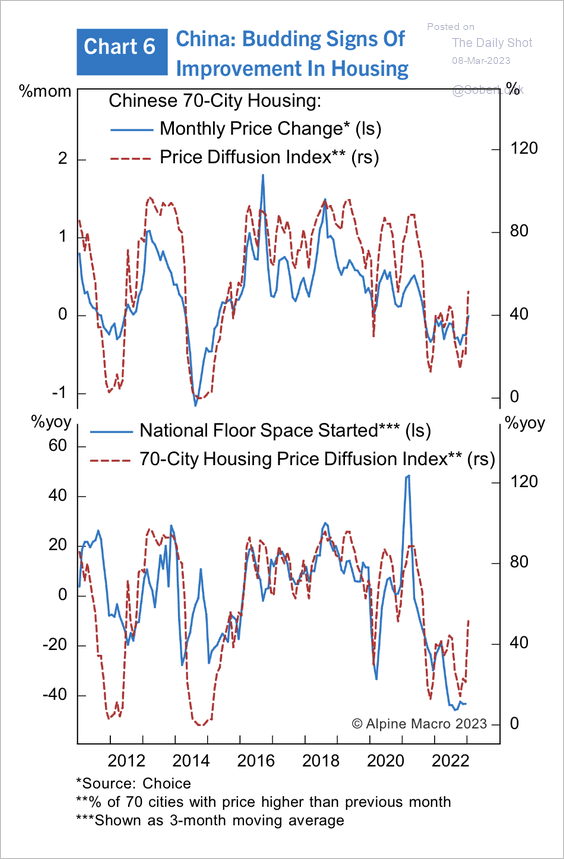

2. The percentage of cities with rising real estate prices is picking up.

Source: Alpine Macro

Source: Alpine Macro

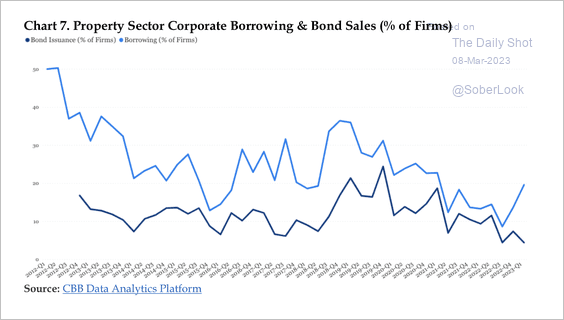

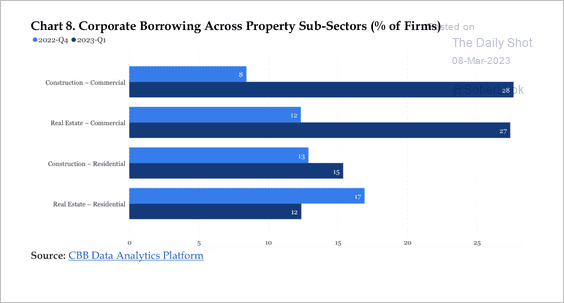

Property sector borrowing is rebounding, mostly in commercial real estate. (2 charts)

Source: China Beige Book

Source: China Beige Book

Source: China Beige Book

Source: China Beige Book

——————–

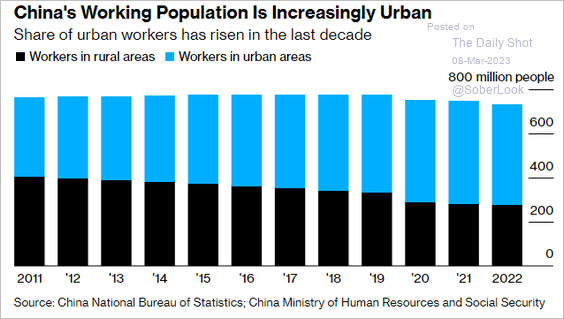

3. The share of urban workers has been rising.

Source: @hancocktom, @business Read full article

Source: @hancocktom, @business Read full article

Back to Index

Emerging Markets

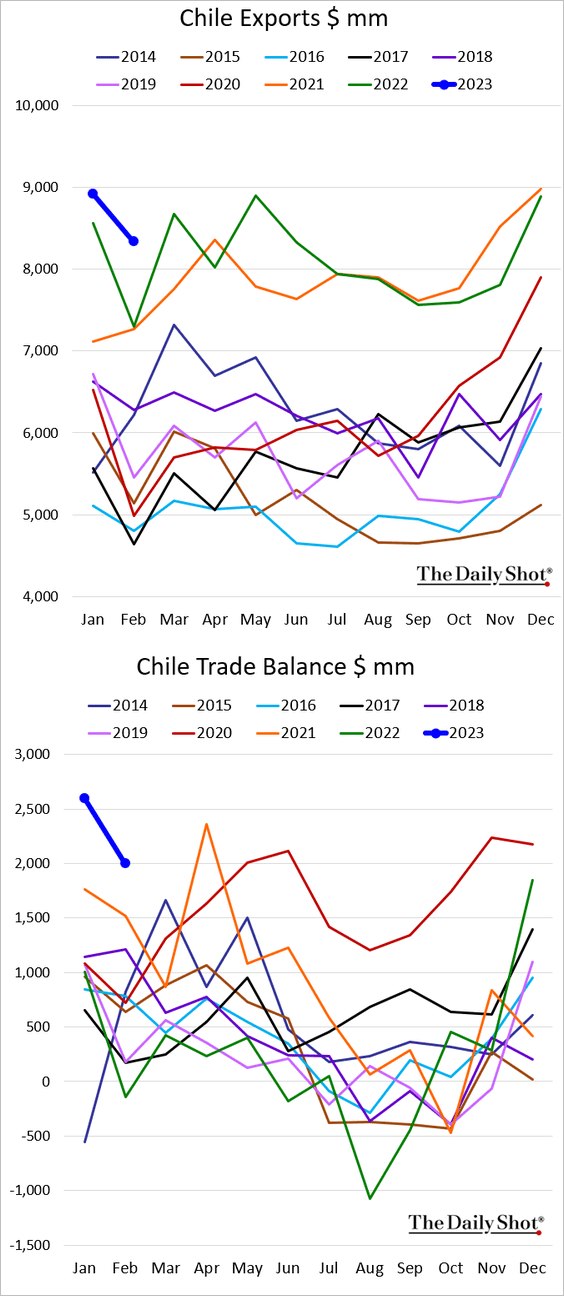

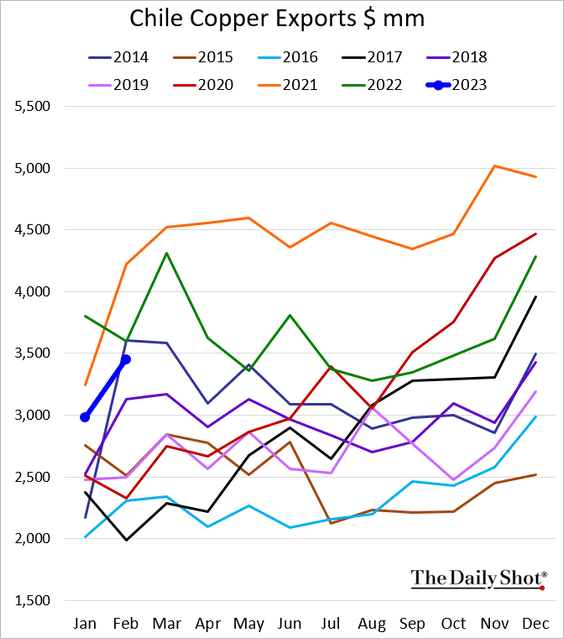

1. Chile’s exports remain robust.

Copper exports are still below last year’s level in dollar terms.

——————–

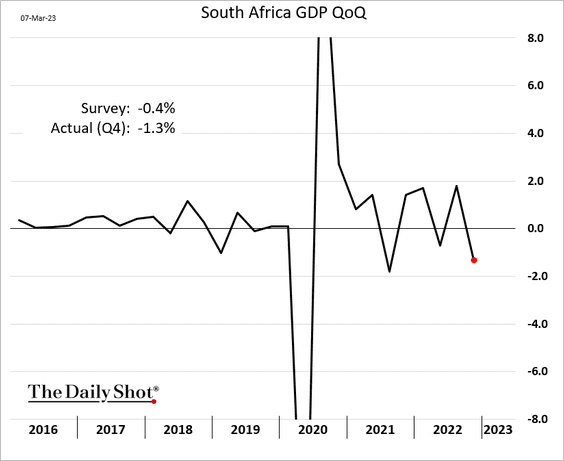

2. South Africa’s GDP declined more than expected in Q4.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

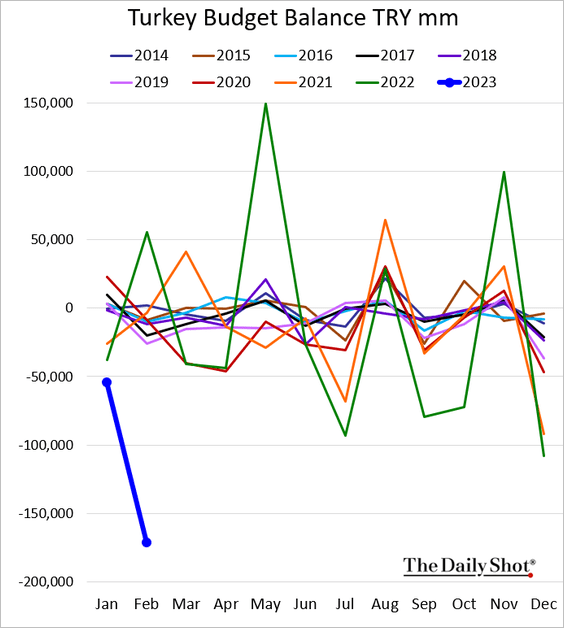

3. Turkey’s government budget hit a record deficit last month.

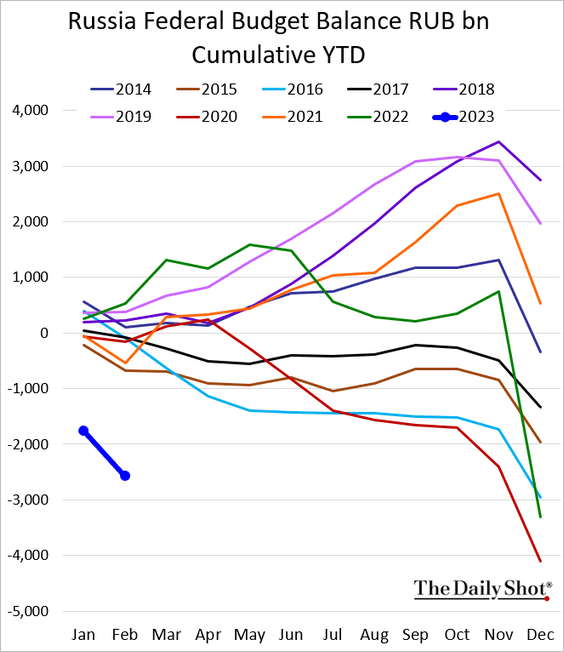

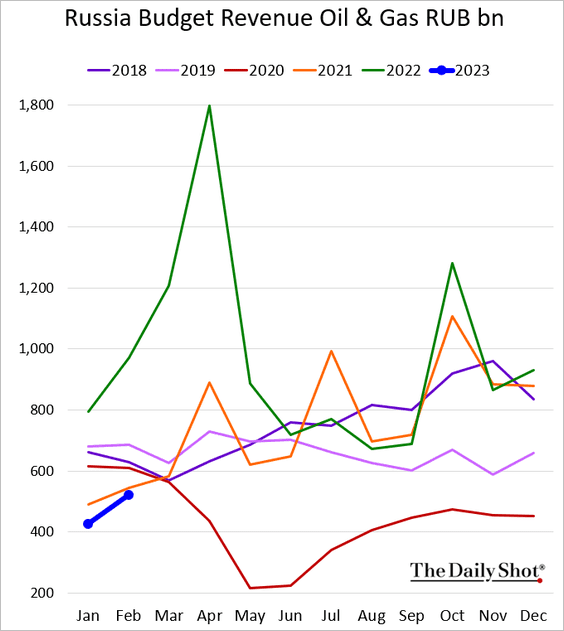

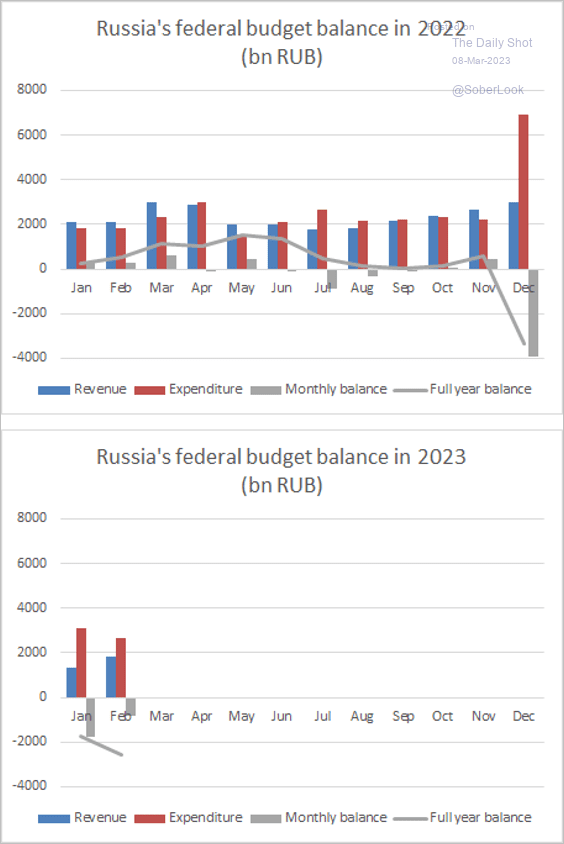

4. Next, we have some updates on Russia.

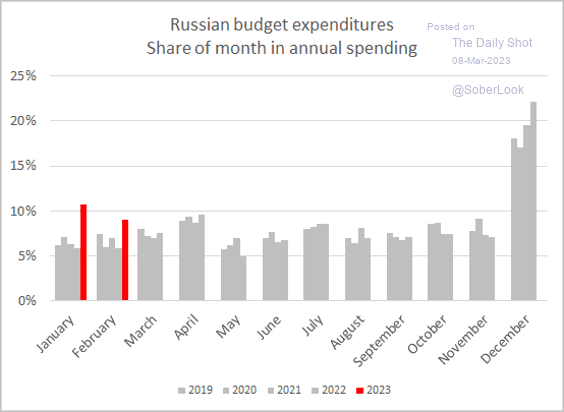

• The budget deficit worsened in February, according to government data.

Source: @WSJ Read full article

Source: @WSJ Read full article

– Oil & gas revenues:

Source: Reuters Read full article

Source: Reuters Read full article

– Monthly revenue and expenditures:

Source: @jakluge

Source: @jakluge

Source: @jakluge

Source: @jakluge

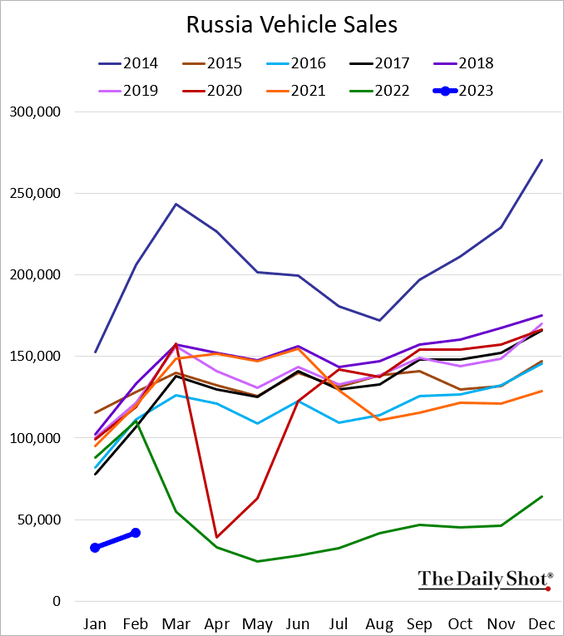

• Car sales remain soft.

——————–

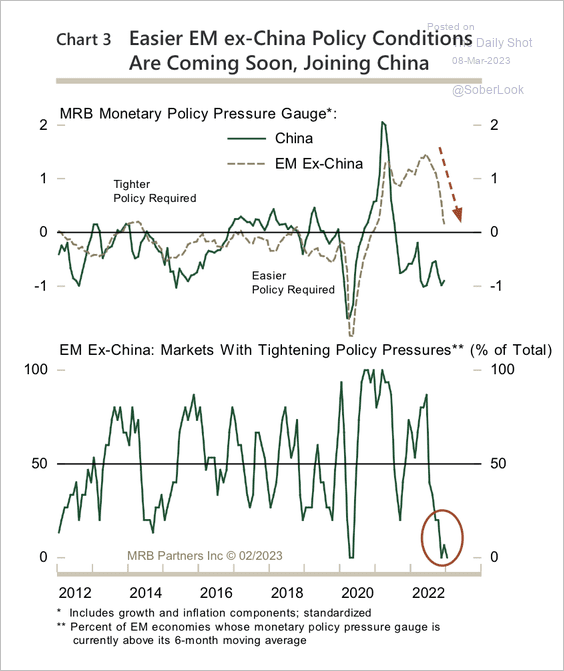

5. EM central banks are closer to the point of easing monetary policy, joining China.

Source: MRB Partners

Source: MRB Partners

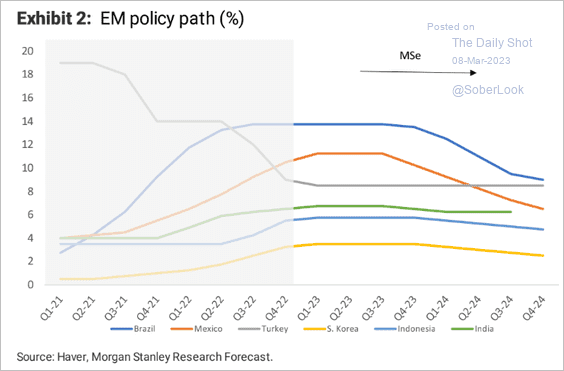

Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

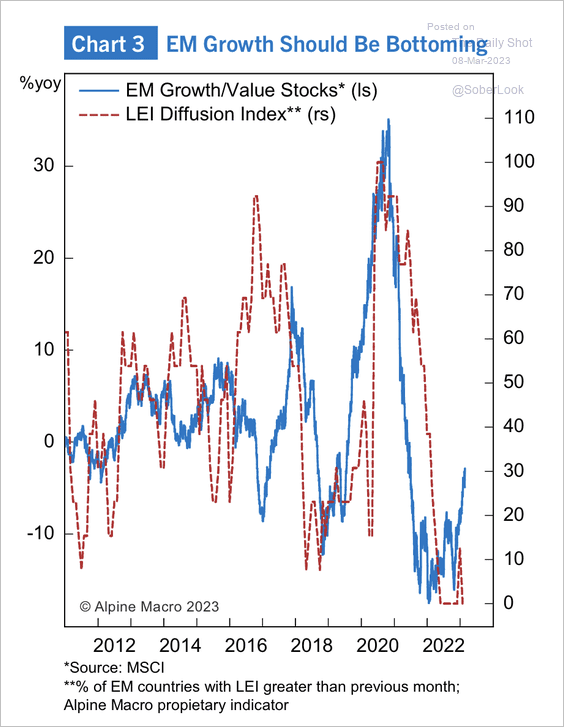

6. The rise in EM growth versus value stocks points to a recovery in leading economic indicators.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

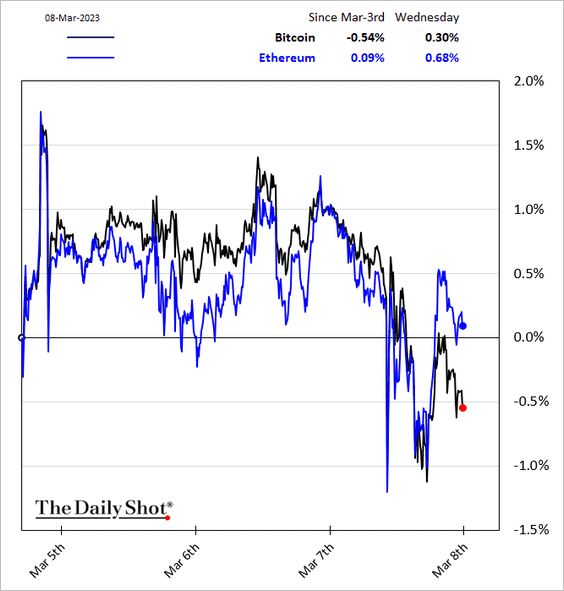

1. Ether held up better than bitcoin after Powell’s hawkish comments.

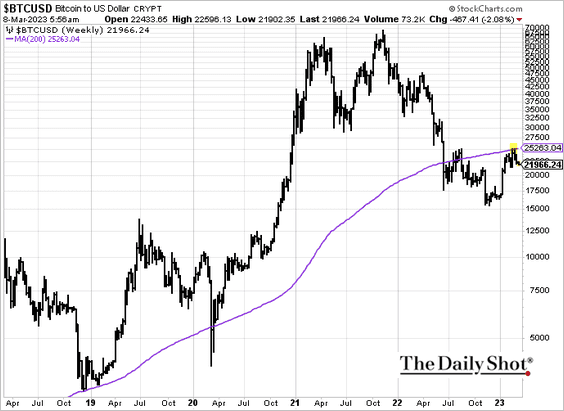

2. Bitcoin held resistance at the 200-week moving average.

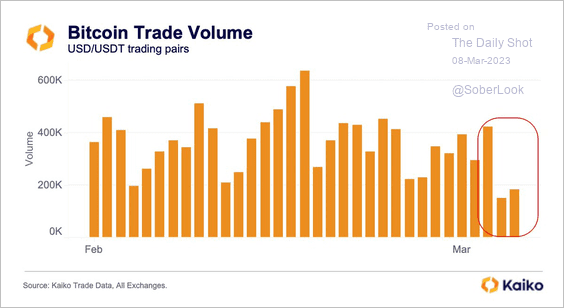

3. Bitcoin’s trading volume over the past weekend fell to its lowest level in months.

Source: @KaikoData

Source: @KaikoData

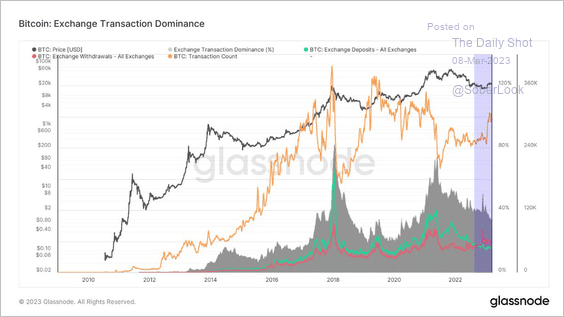

4. Bitcoin’s transaction count ticked higher as exchange withdrawals exceed deposits. This is partly the result of the FTX collapse.

Source: @jimmyvs24

Source: @jimmyvs24

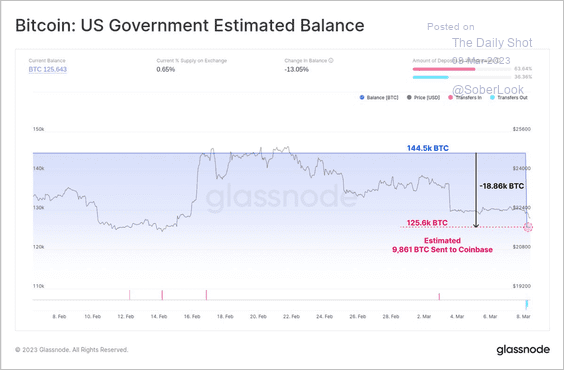

5. Approximately $40K BTC from wallets associated with US government law enforcement seizures are on the move, possibly held in custody at exchanges such as Coinbase.

Source: @glassnode

Source: @glassnode

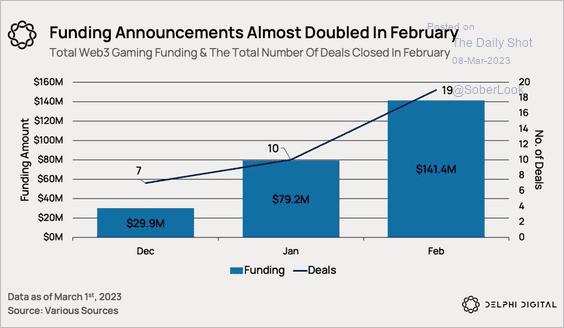

6. Fundraising in crypto gaming jumped 79% over the past two months.

Source: @DelphiDigital

Source: @DelphiDigital

Back to Index

Commodities

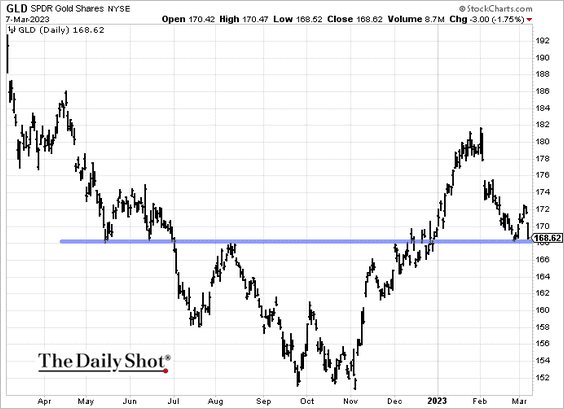

1. The SPDR gold ETF is at support.

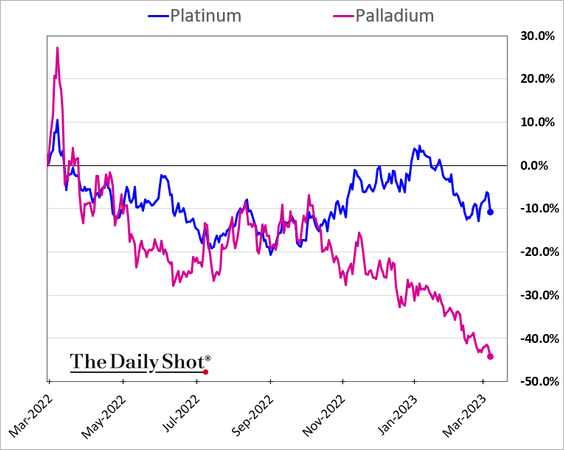

2. Palladium prices continue to sink.

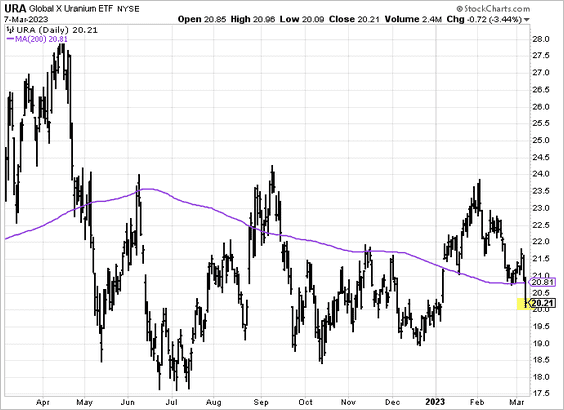

3. The Global X Uranium ETF broke below support at the 200-day moving average.

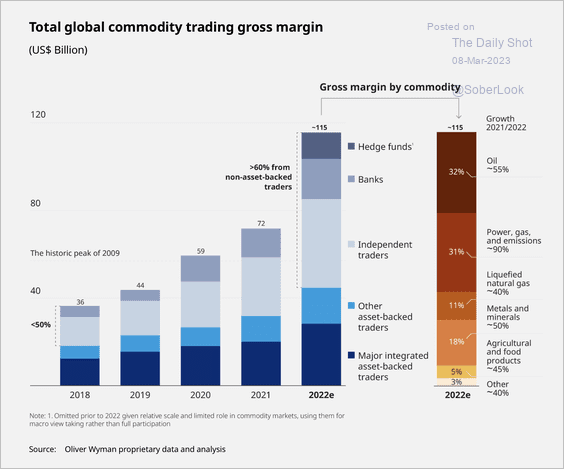

4. Commodity trading companies had a profitable year in 2022.

Source: Oliver Wyman Read full article

Source: Oliver Wyman Read full article

Back to Index

Equities

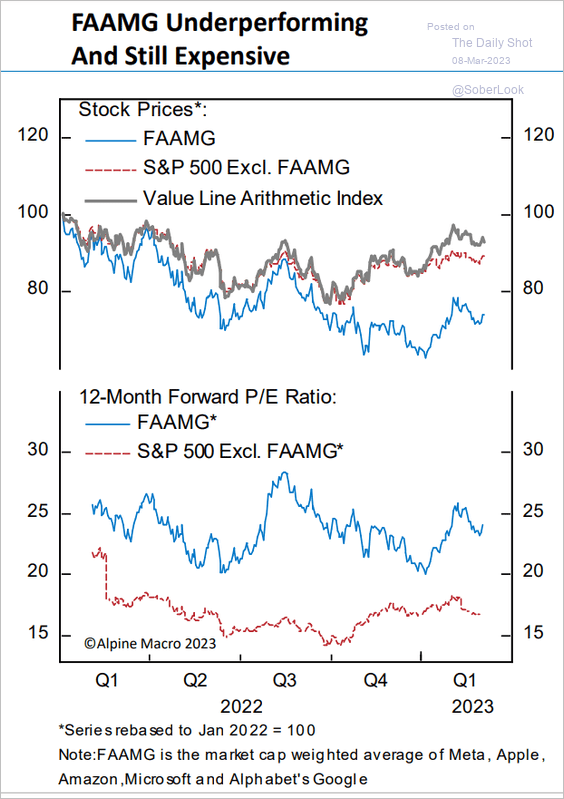

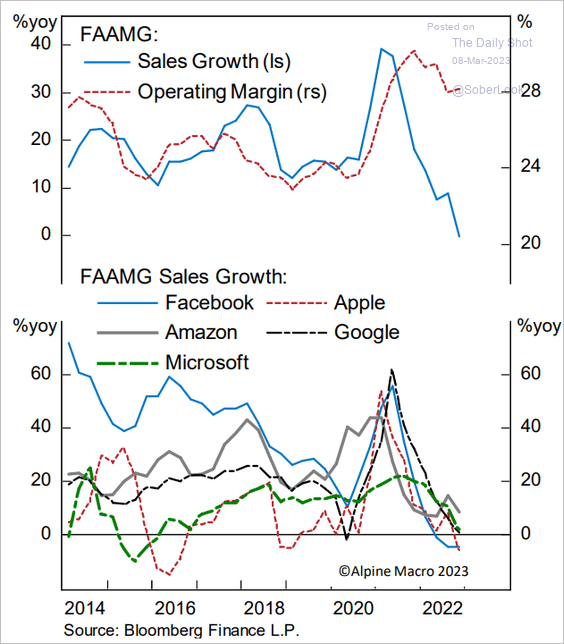

1. Despite recent underperformance, tech mega-caps are still expensive.

Source: Alpine Macro

Source: Alpine Macro

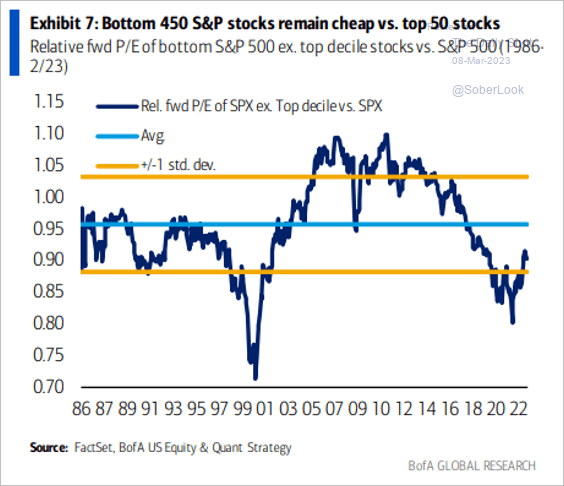

• The top 50 stocks in the S&P 500 remain expensive relative to the rest of the index.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

• Weak sales growth signals lower margins for tech mega-caps.

Source: Alpine Macro

Source: Alpine Macro

——————–

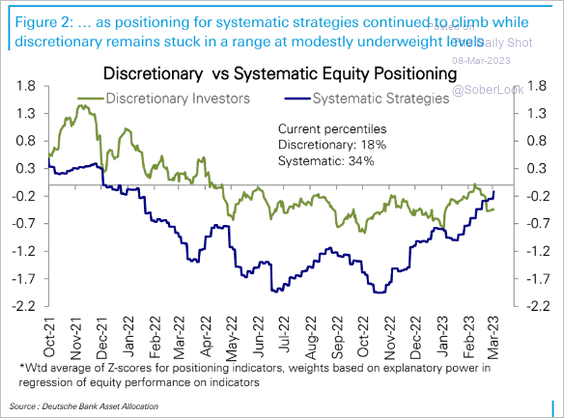

2. The positioning of systematic strategies is now above that of discretionary ones.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

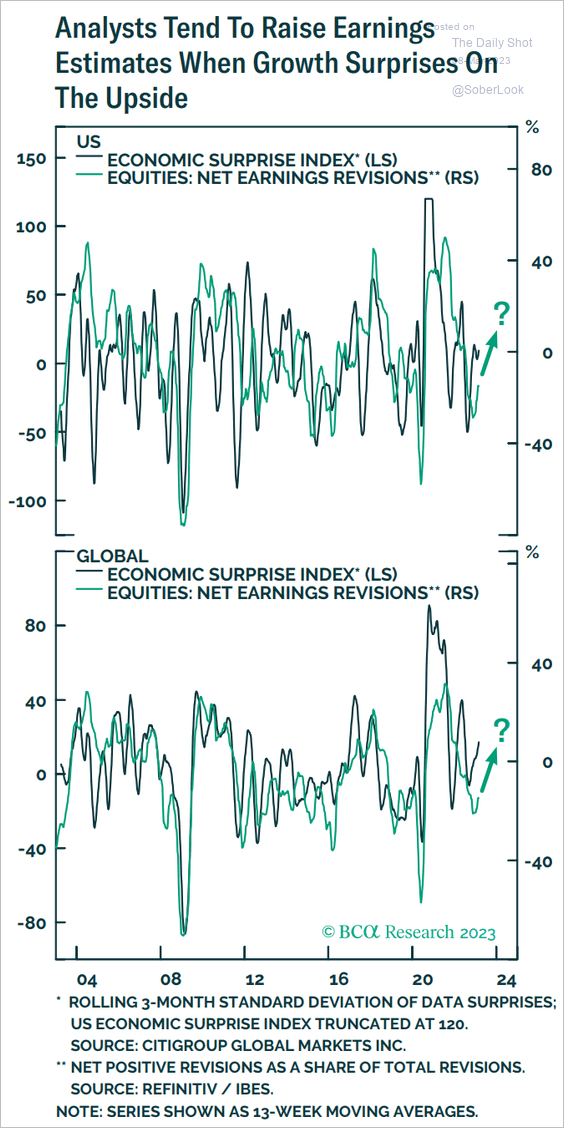

3. Will analysts upgrade their earnings forecasts if economic data surprises remain positive?

Source: BCA Research

Source: BCA Research

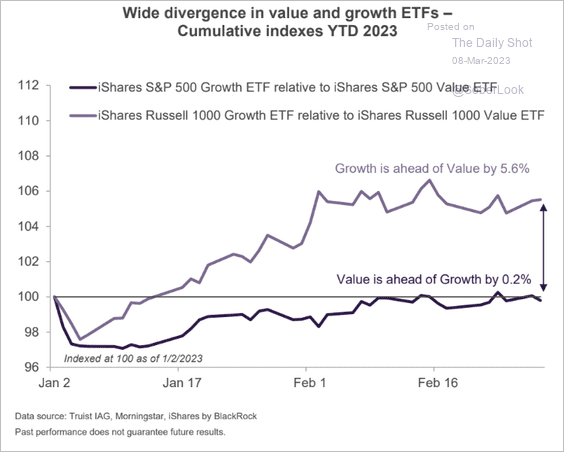

4. Growth vs. value relative performance looks very different for the S&P 500 vs. the Russell 1000 indices.

Source: Truist Advisory Services

Source: Truist Advisory Services

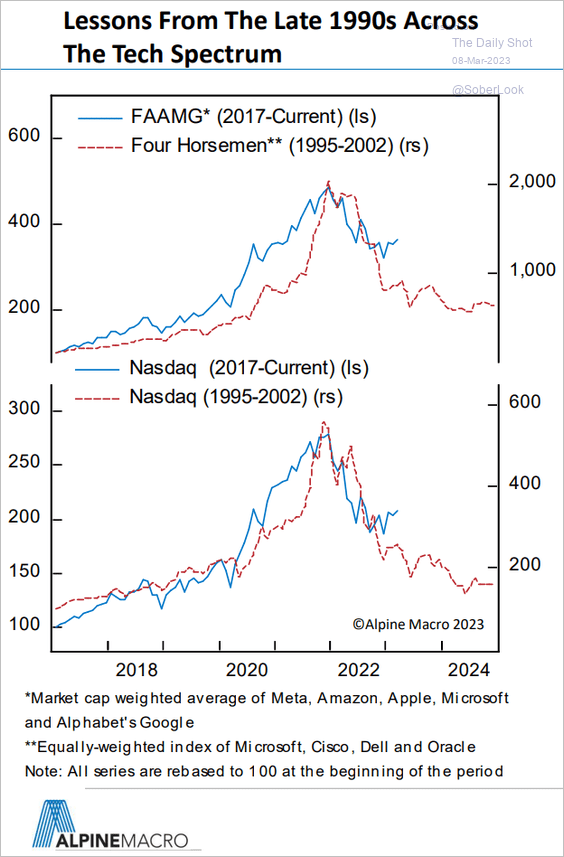

5. Should we continue to pay attention to the dot-com analog?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Credit

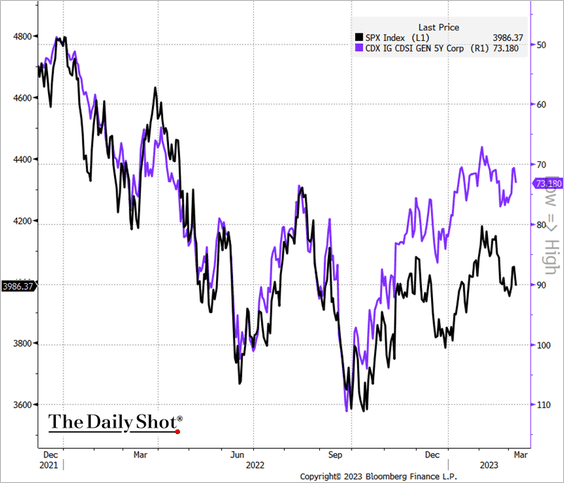

1. Are stocks pointing to wider credit spreads?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

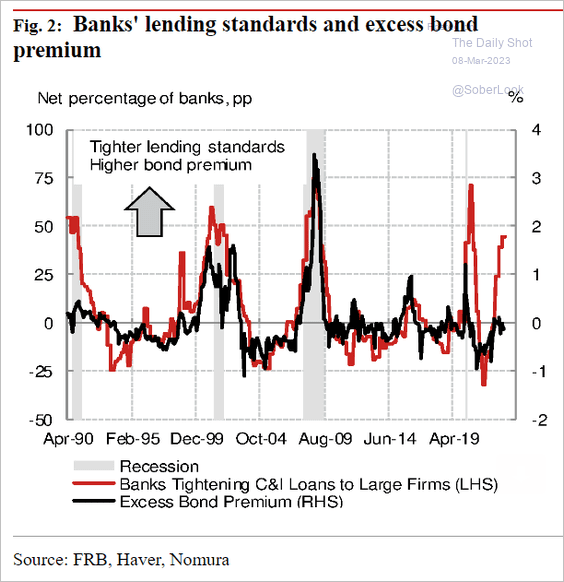

2. Bank lending standards signal higher corporate bond premiums (spreads adjusted for expected default rates).

Source: Nomura Securities

Source: Nomura Securities

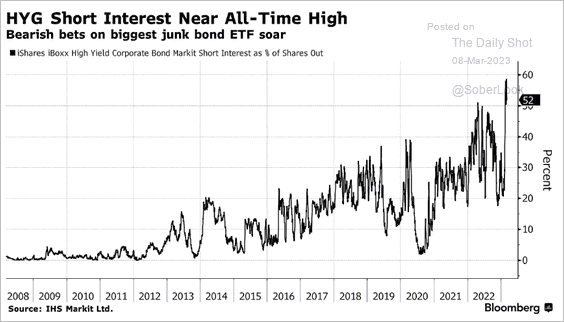

3. Investors have been shorting HYG.

Source: @BLaw Read full article

Source: @BLaw Read full article

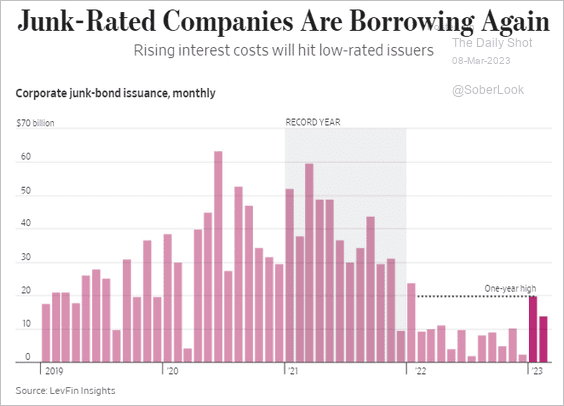

4. High-yield borrowing increased this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

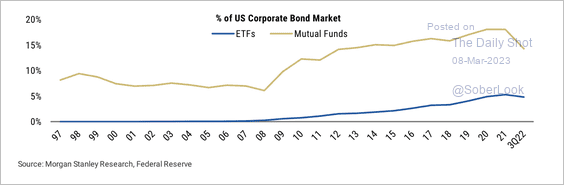

5. Mutual fund ownership of US corporate credit has risen sharply since the financial crisis. ETFs have picked up market share over the past few years.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

6. Demand for private credit remains robust (one has to love that 50% PIK).

Source: @LisaLeereporter, @dscigliuzzo, @PSeligson, @jillrshah, @markets Read full article

Source: @LisaLeereporter, @dscigliuzzo, @PSeligson, @jillrshah, @markets Read full article

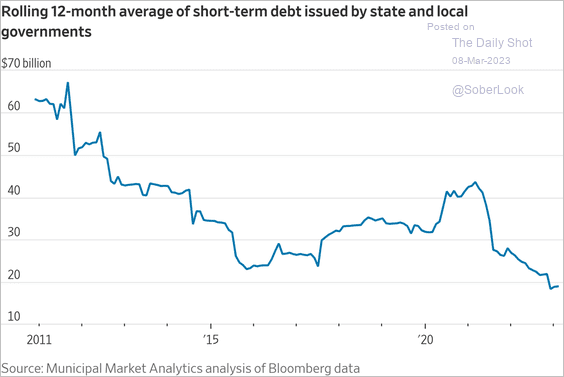

7. Short-term muni debt issuance has been falling as rates surge.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

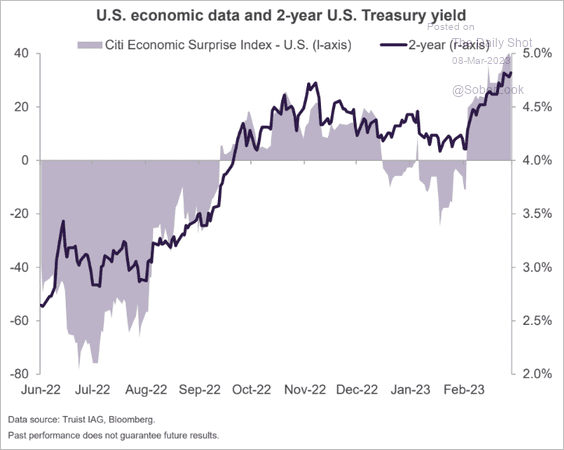

1. The 2-year Treasury yield has been following the Citi Economic Surprise Index.

Source: Truist Advisory Services

Source: Truist Advisory Services

2. The Taylor rule says the terminal rate should be 6%.

Source: @ANZ_Research

Source: @ANZ_Research

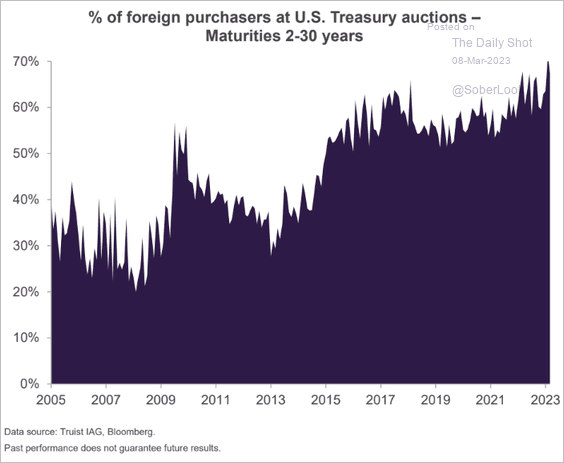

3. Foreign demand for Treasury notes and bonds has been robust.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Global Developments

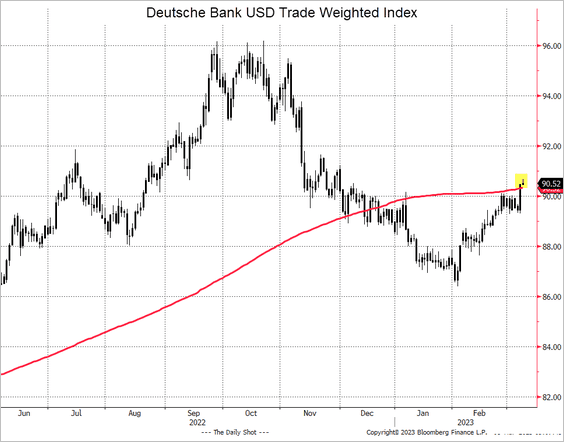

1. The US dollar index is breaking above its 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

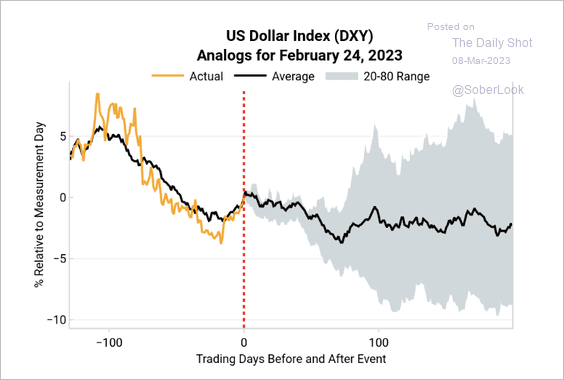

The dollar is trading in line with previous similar macro regimes. The recessionary flight to safety already happened last year, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

——————–

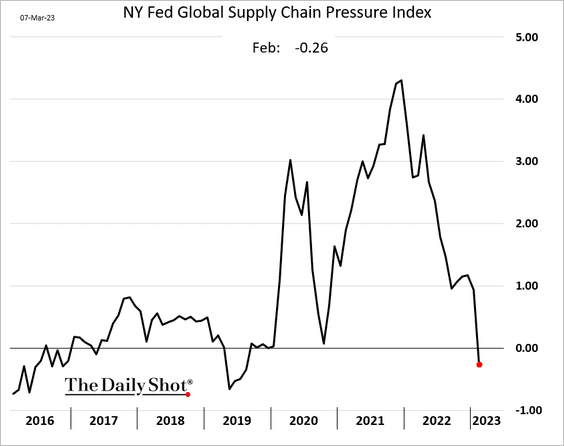

2. The NY Fed’s global index of supply bottlenecks is in negative territory for the first time since 2019.

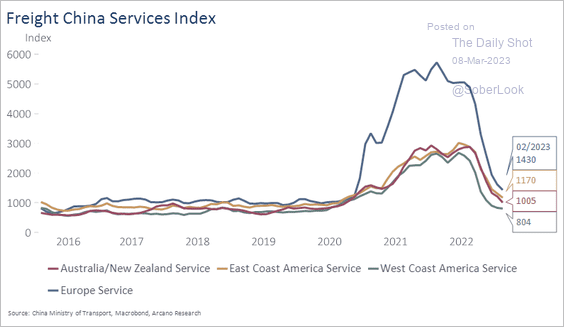

Container shipping costs continue to move lower.

Source: Arcano Economics

Source: Arcano Economics

——————–

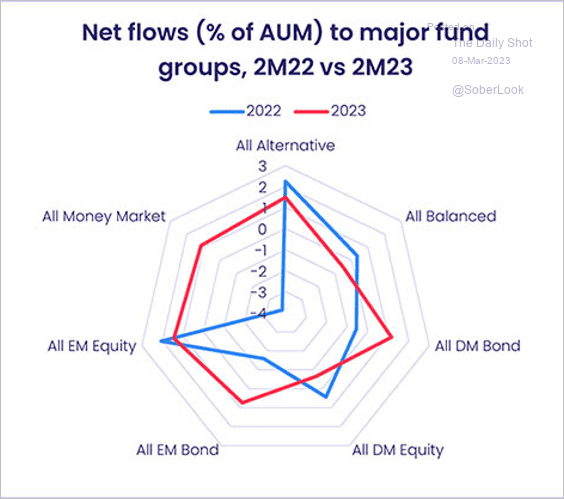

3. Next, we have fund flows by broad category in the first two months of 2022 and 2023.

Source: EPFR

Source: EPFR

——————–

Food for Thought

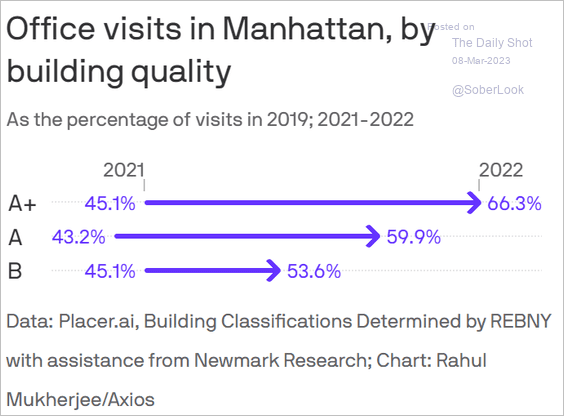

1. Back to the office? Only if it’s a nice building …

Source: @axios Read full article

Source: @axios Read full article

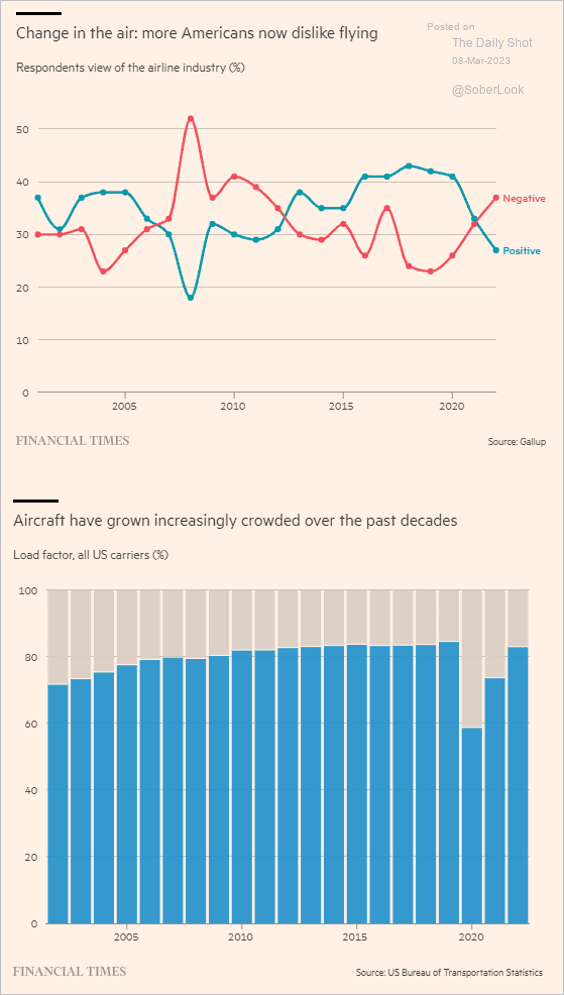

2. Who likes flying?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

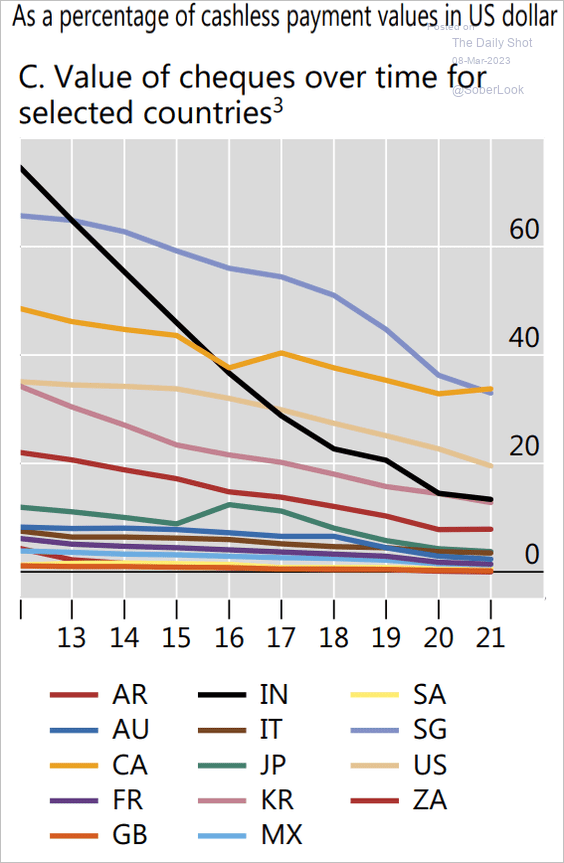

3. Using checks to make payments:

Source: BIS Read full article

Source: BIS Read full article

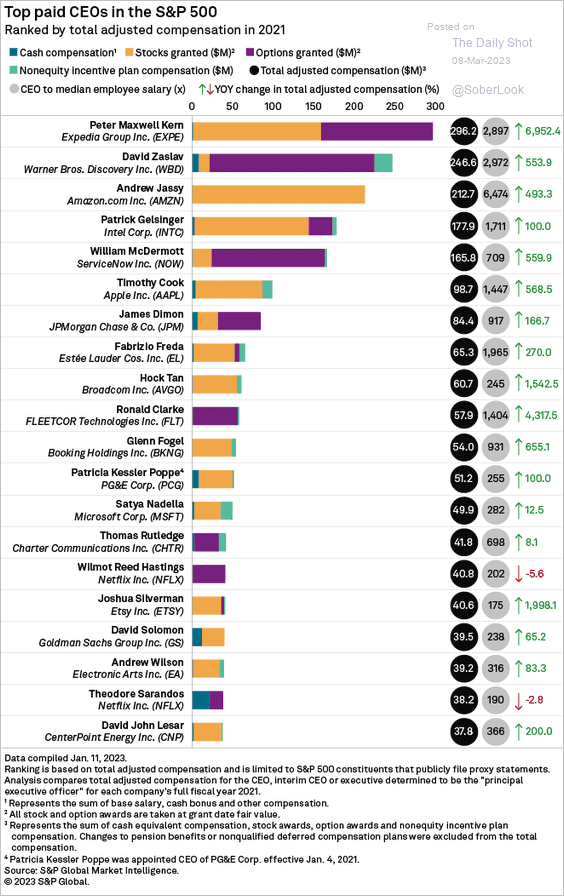

4. Top-paid US CEOs:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

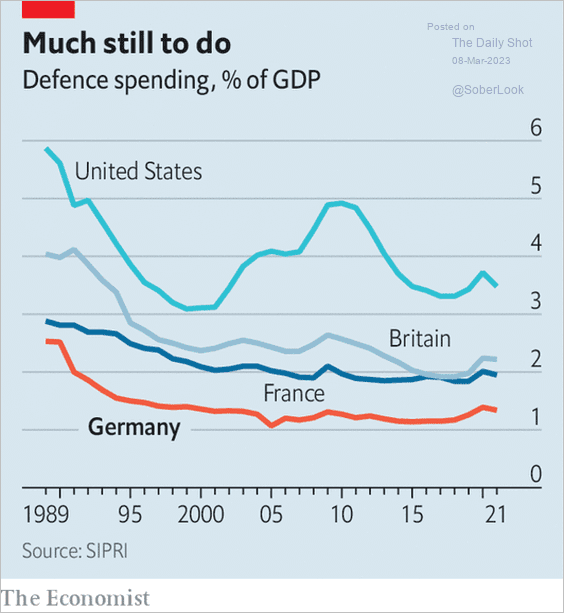

5. US and European defense spending:

Source: The Economist Read full article

Source: The Economist Read full article

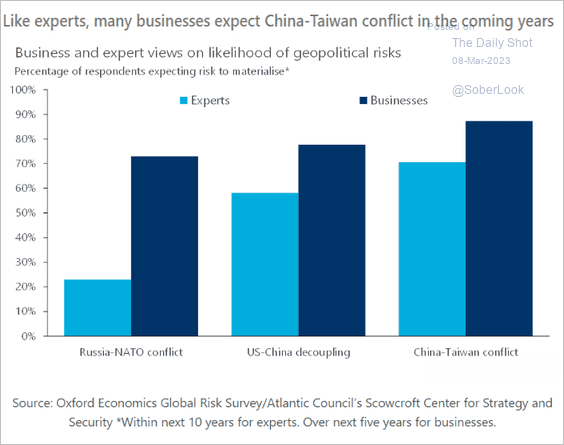

6. Views on geopolitical risks:

Source: Oxford Economics

Source: Oxford Economics

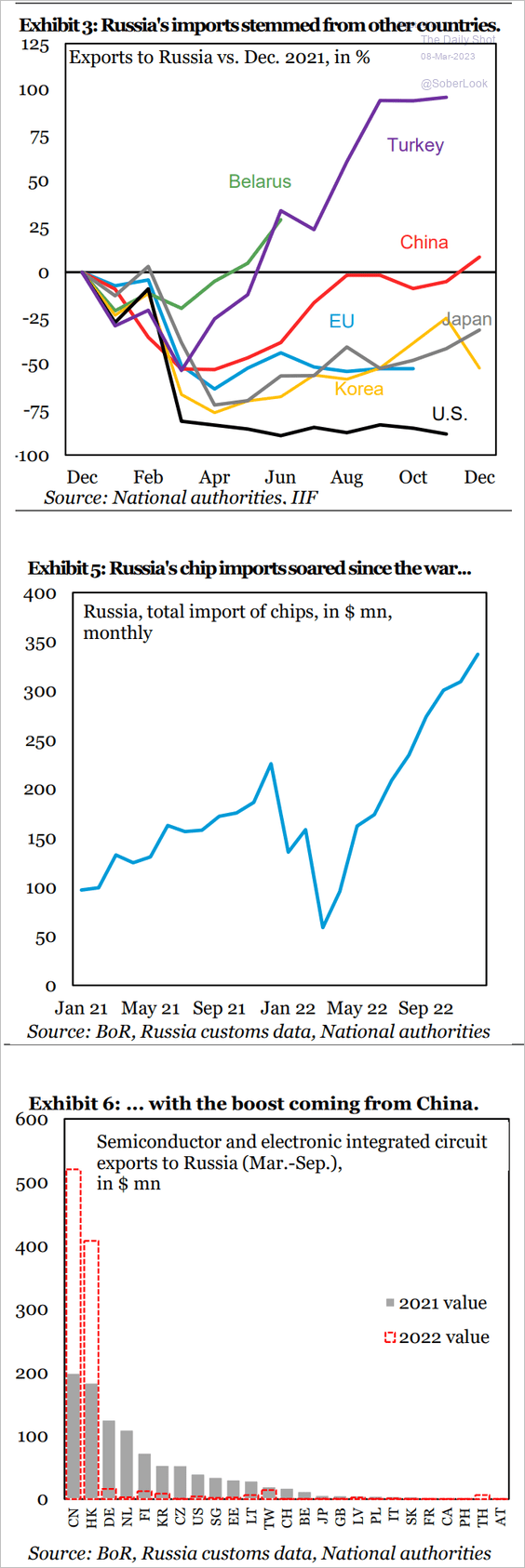

7. Who is supplying Russia?

Source: IIF

Source: IIF

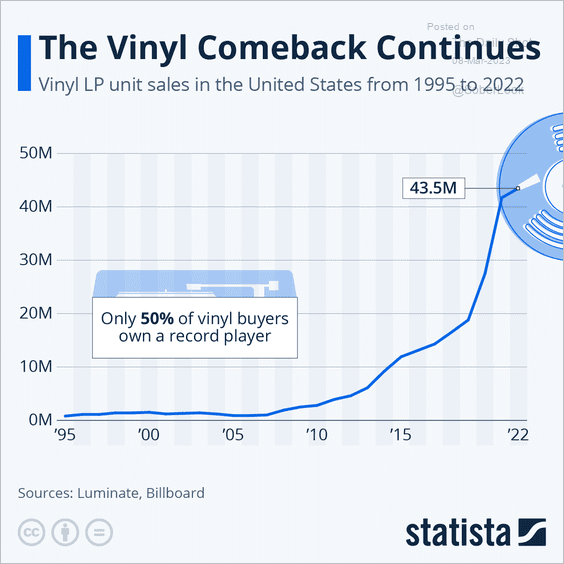

8. The vinyl comeback:

Source: Statista

Source: Statista

——————–

Back to Index