The Daily Shot: 09-Mar-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

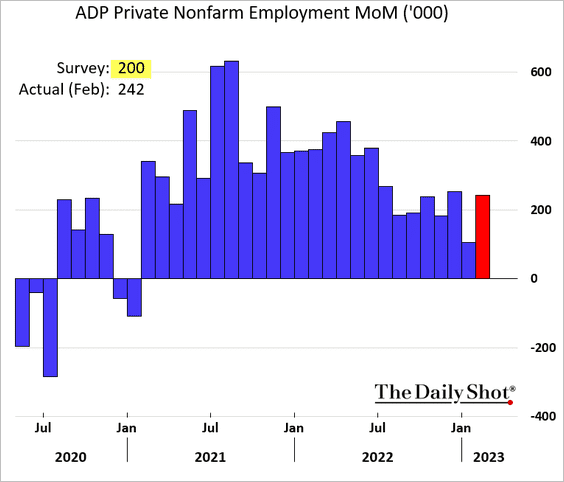

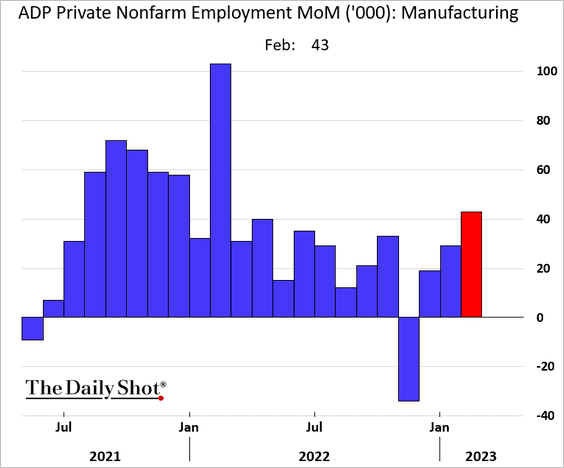

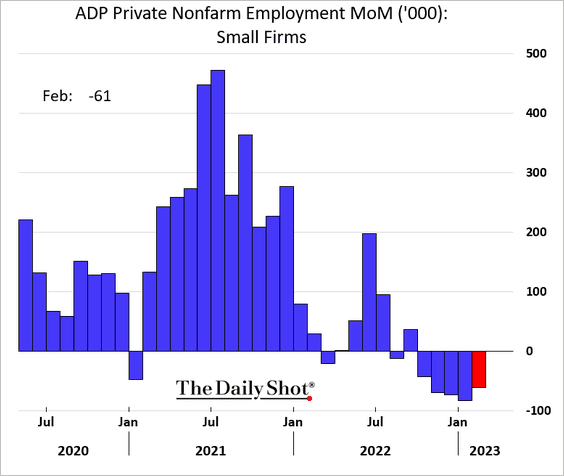

1. The February ADP private payrolls index topped expectations.

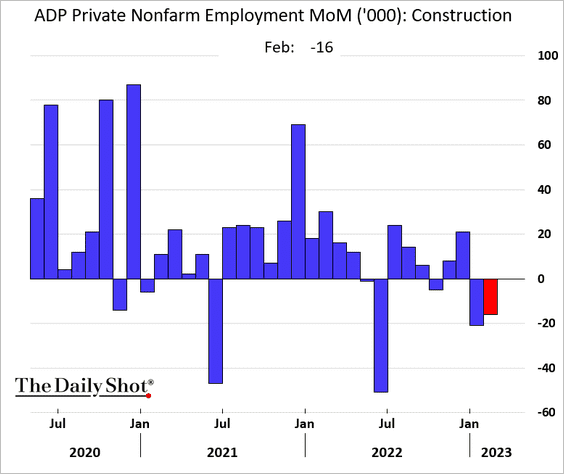

• We are starting to see some pain in the construction sector.

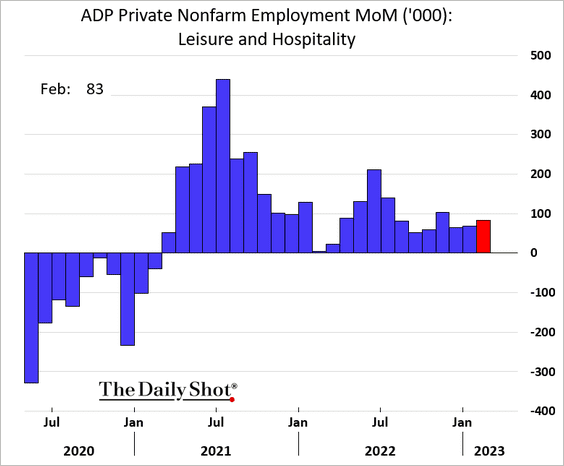

• Hotels and restaurants/bars continue to add jobs.

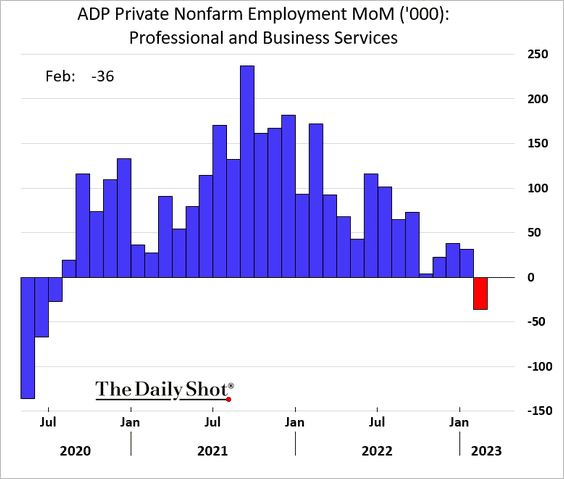

• Professional and business services experienced a loss in payrolls for the first time since the COVID shock.

• Factories continue to hire.

• Small businesses have been shedding jobs for five months in a row.

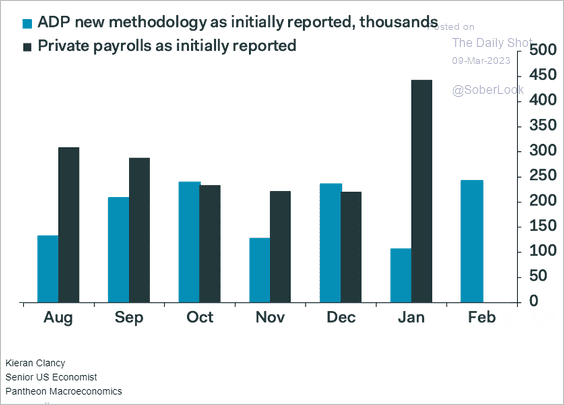

• By the way, the ADP report is not a good predictor of the official payrolls figures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

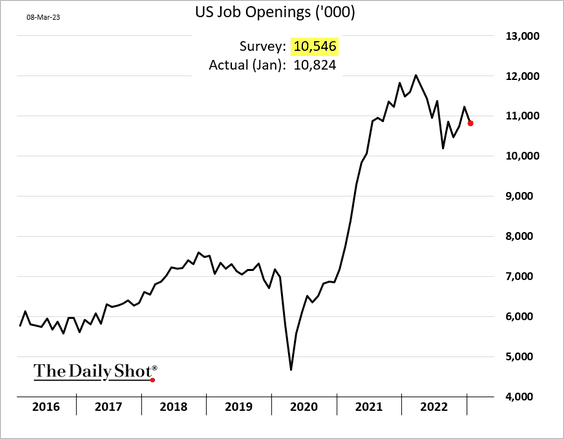

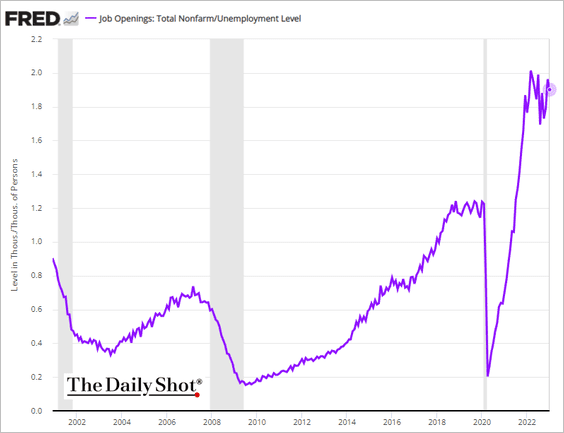

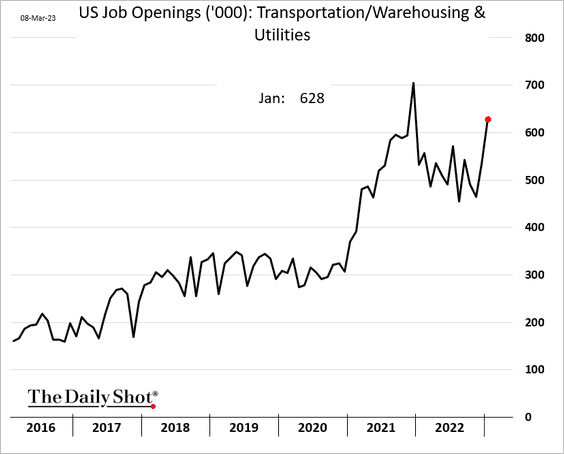

2. Job openings also surprised to the upside, with labor demand remaining robust in January.

• This is not the trend the Federal Reserve wants to see. There were 1.9 job openings per unemployed American. The labor market imbalances persist.

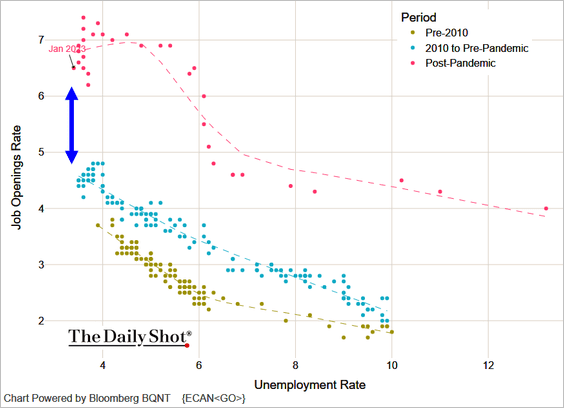

The Beveridge Curve also points to an imbalance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

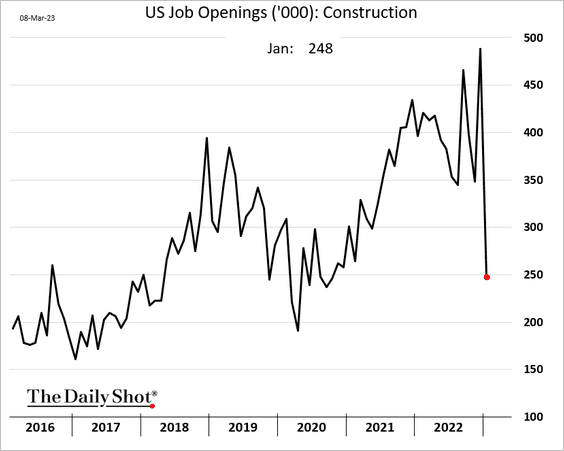

– As we saw in the ADP report, the housing market rout is starting to take a toll on construction jobs.

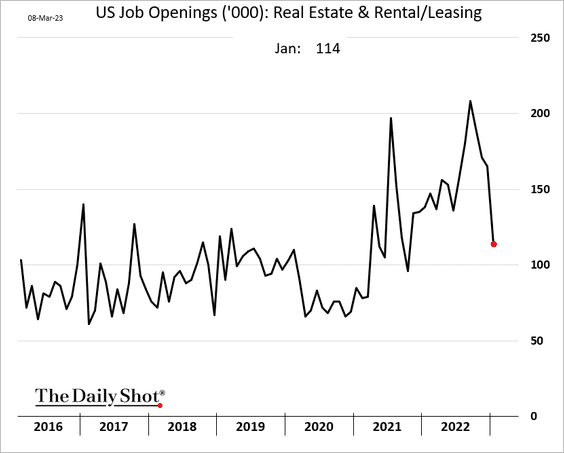

Real estate services also saw a decline in demand.

– But logistics job openings strengthened.

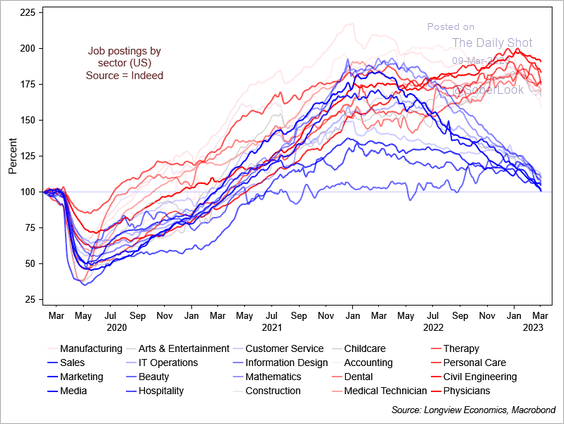

• Job openings have become bifurcated.

Source: @Lvieweconomics

Source: @Lvieweconomics

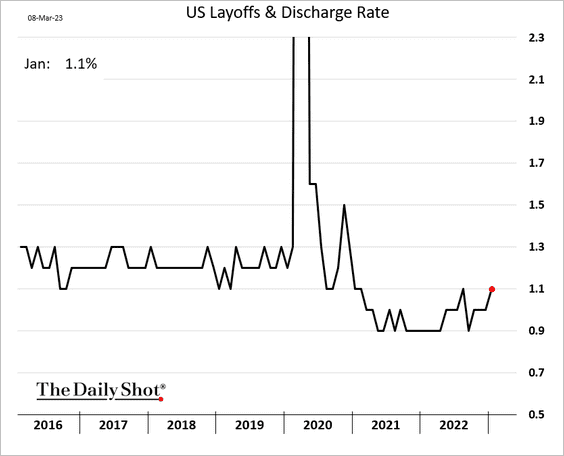

• Layoffs remain below pre-COVID levels.

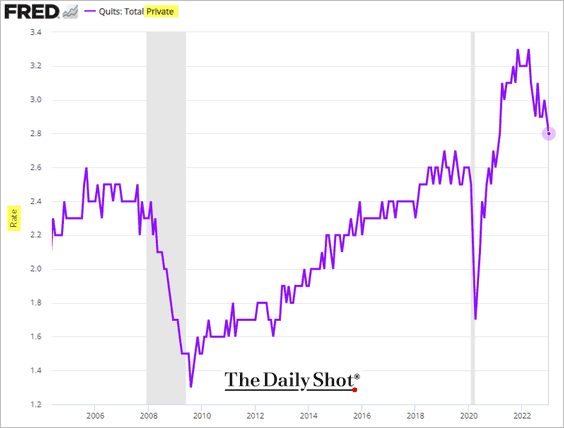

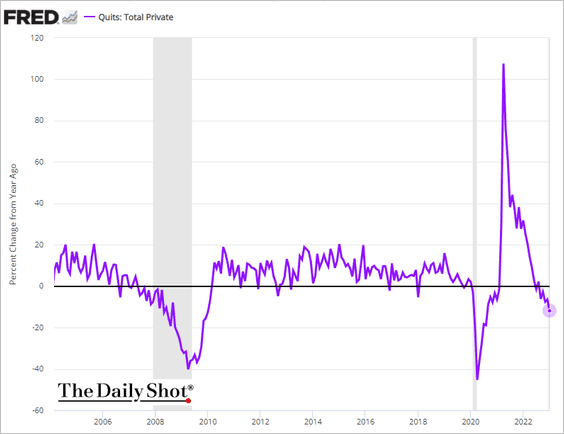

• The Great Resignation is slowing, with the quits rate rolling over (but still above pre-COVID levels).

– Below is the year-over-year change in the resignations level.

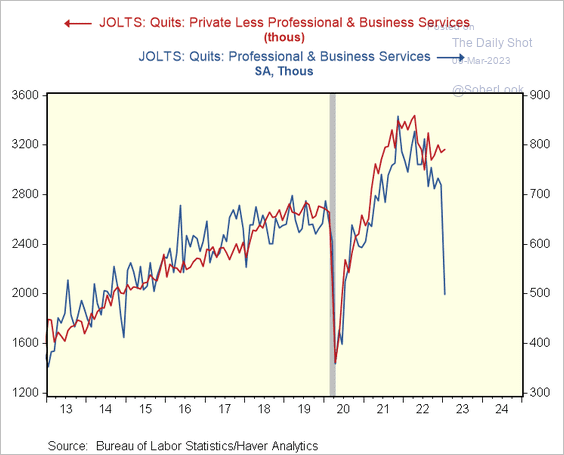

– The significant decrease in resignations within professional and business services may indicate potential decreases in resignations in other industries.

Source: @RenMacLLC

Source: @RenMacLLC

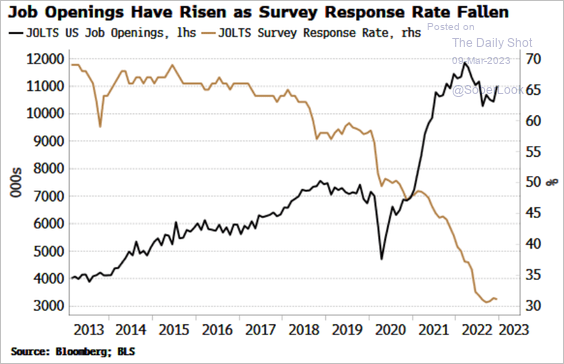

• It’s worth noting that the participation rate in the jobs openings survey has been trending down.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

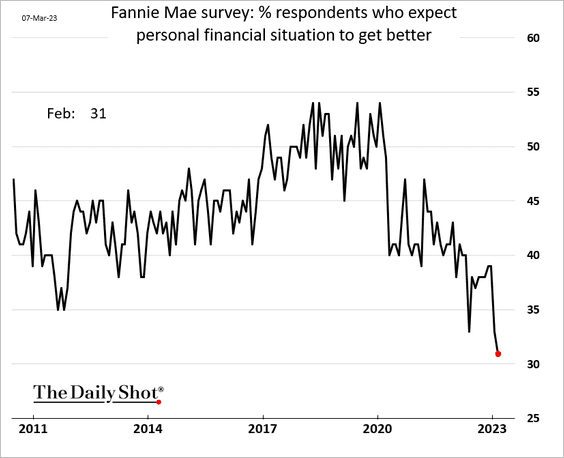

3. Americans are increasingly uneasy about personal finances.

Source: @atanzi, @wealth Read full article

Source: @atanzi, @wealth Read full article

——————–

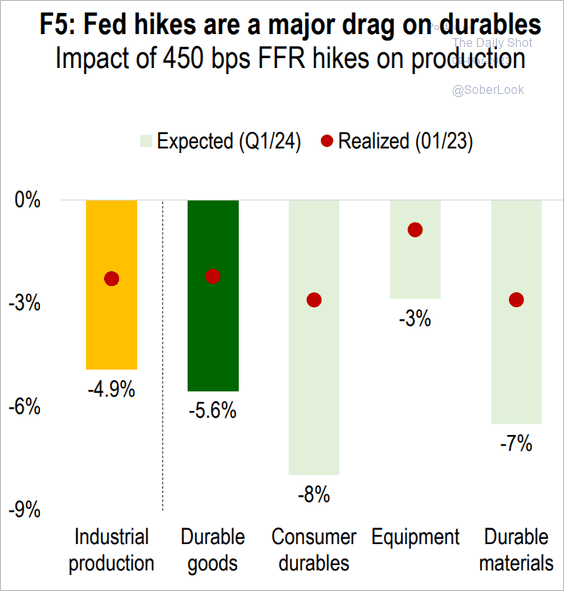

4. The full impact of Fed’s rate hikes on US industrial output is yet to be felt.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

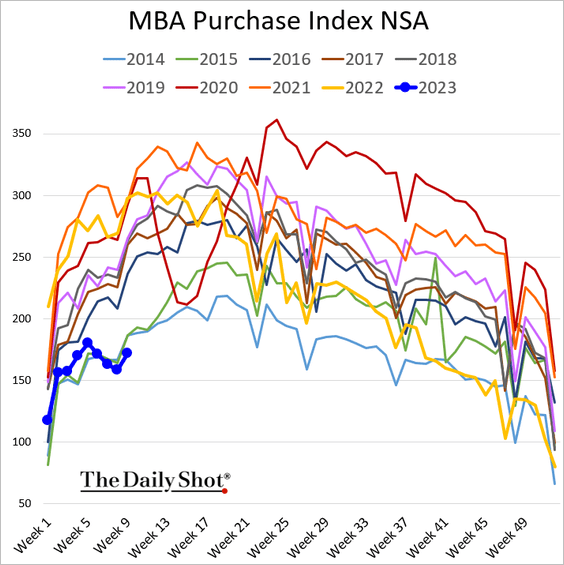

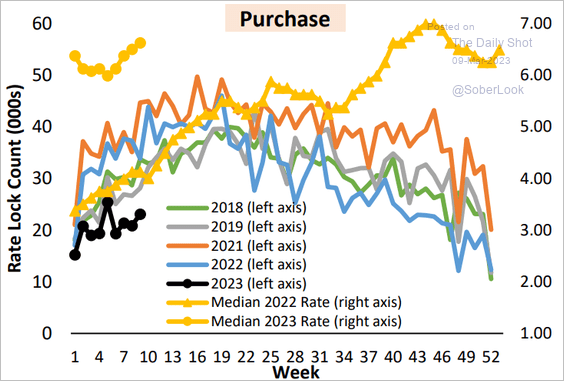

5. Mortgage applications remain at multi-year lows.

Here is the rate lock index.

Source: AEI Housing Center

Source: AEI Housing Center

Back to Index

Canada

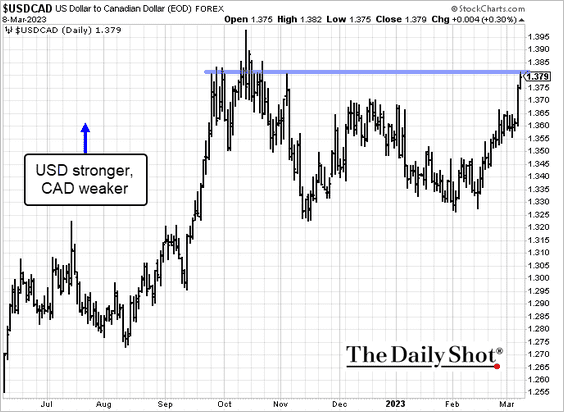

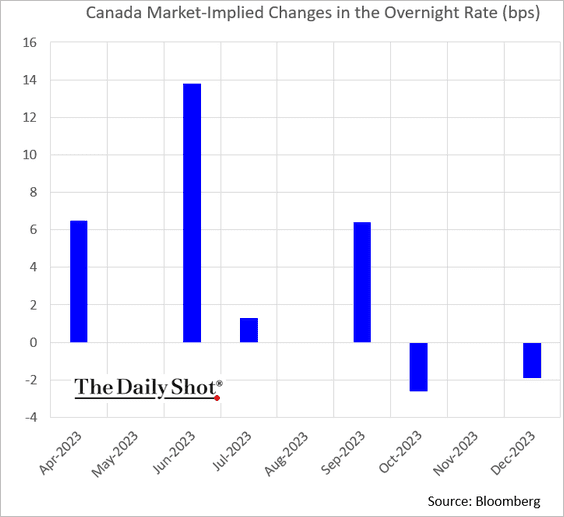

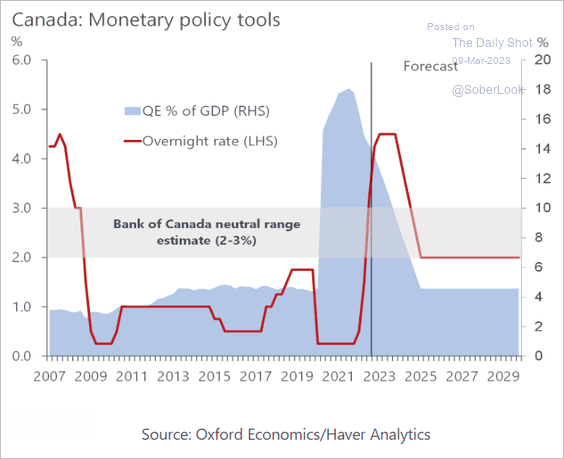

1. The loonie is under pressure as the BoC leaves rates unchanged.

Source: Reuters Read full article

Source: Reuters Read full article

• The market still expects at least one rate hike.

• Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

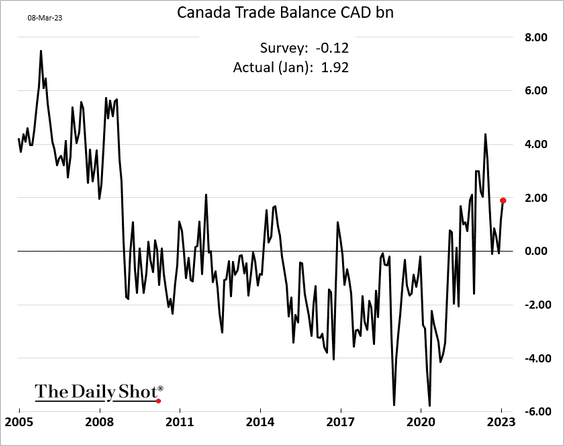

2. The January trade balance topped expectations.

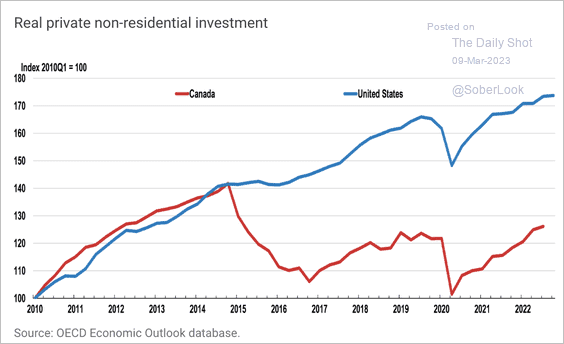

3. The lower level of business investment in Canada compared to the US is negatively impacting productivity.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

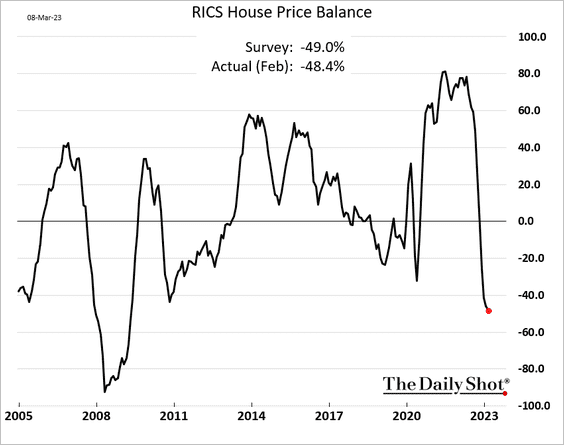

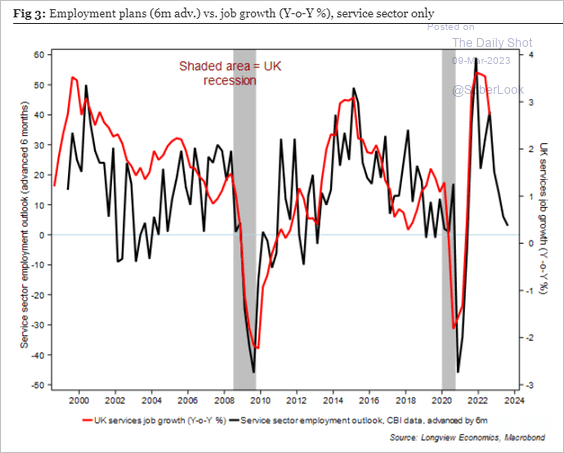

The United Kingdom

1. The RICS housing index shows ongoing price declines.

2. Business employment plans signal slower job gains ahead.

Source: Longview Economics

Source: Longview Economics

Back to Index

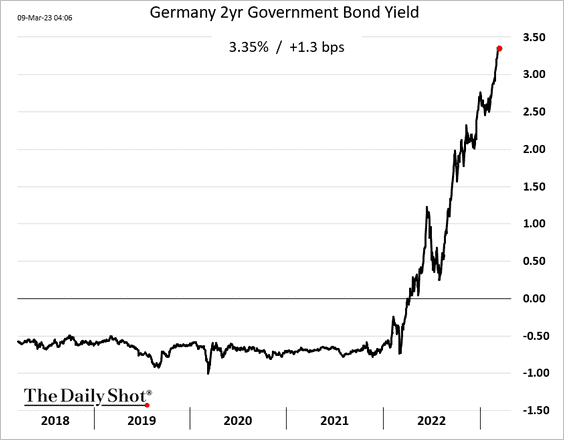

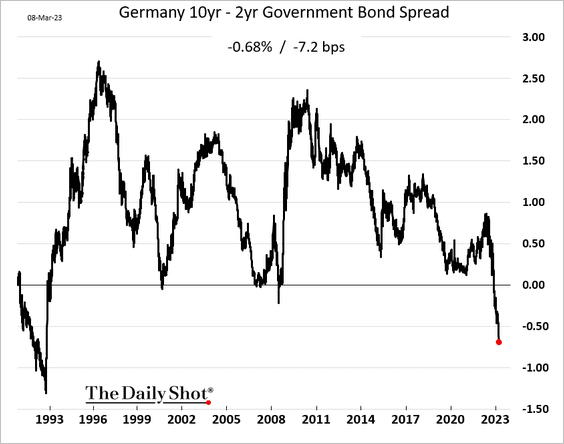

The Eurozone

1. Short-term Bund yields continue to climb, …

… with the yield curve moving deeper into inversion territory.

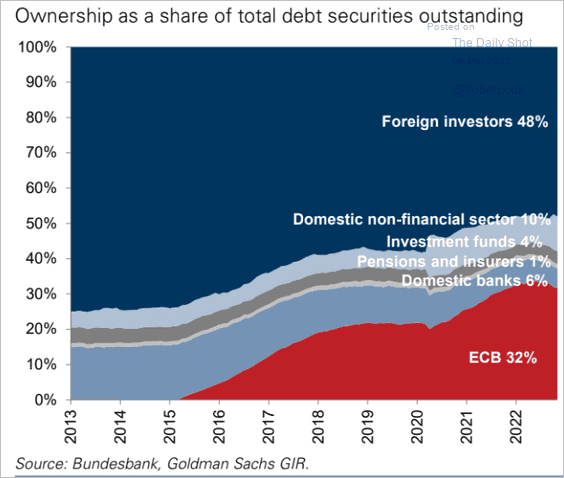

By the way, who owns Bunds?

Source: Goldman Sachs

Source: Goldman Sachs

——————–

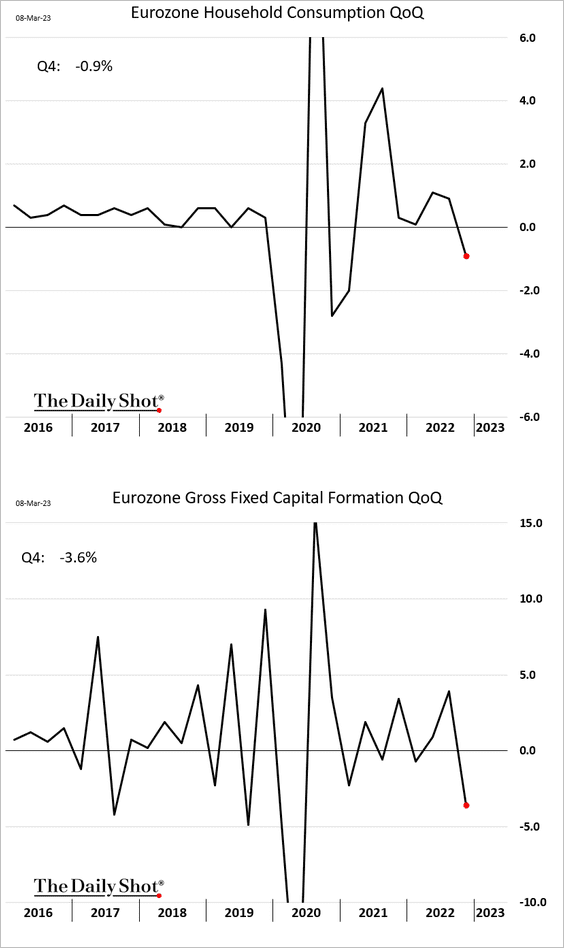

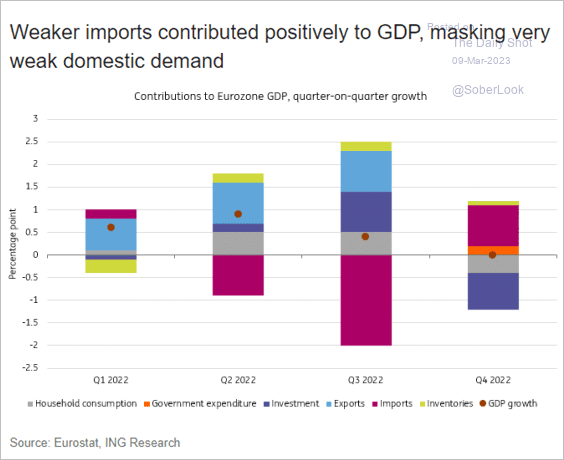

2. Q4 was a tough quarter for the Eurozone with both consumer and business spending contracting.

• Slowing imports kept the GDP from bigger declines.

Source: ING

Source: ING

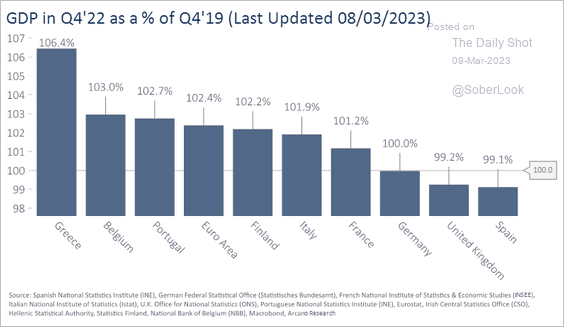

• This chart shows each country’s GDP compared to pre-COVID levels.

Source: Arcano Economics

Source: Arcano Economics

——————–

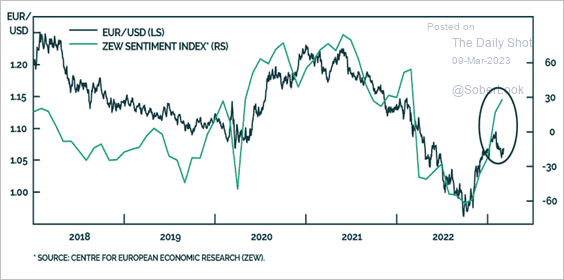

3. The euro has decoupled from sentiment.

Source: BCA Research

Source: BCA Research

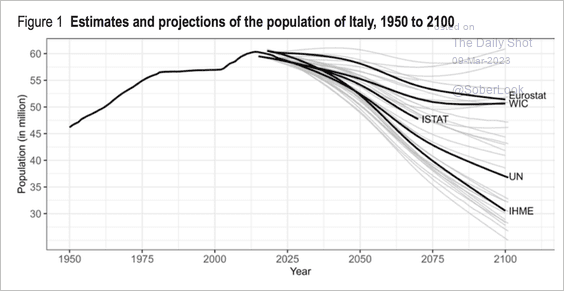

4. How quickly will Italy’s population decline?

Source: Fondata da Mario Arcelli

Source: Fondata da Mario Arcelli

Back to Index

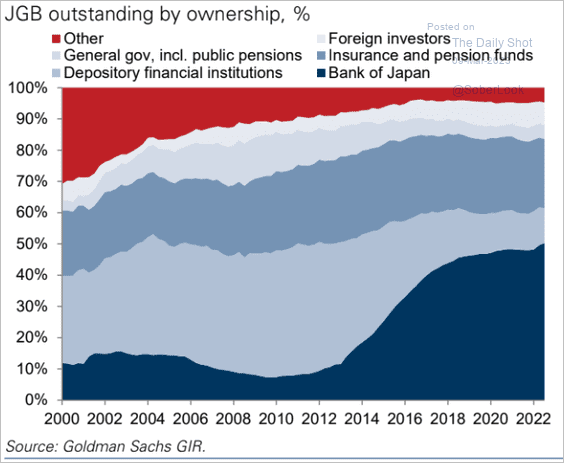

Japan

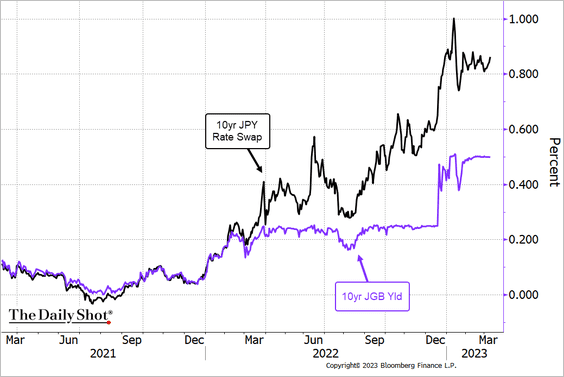

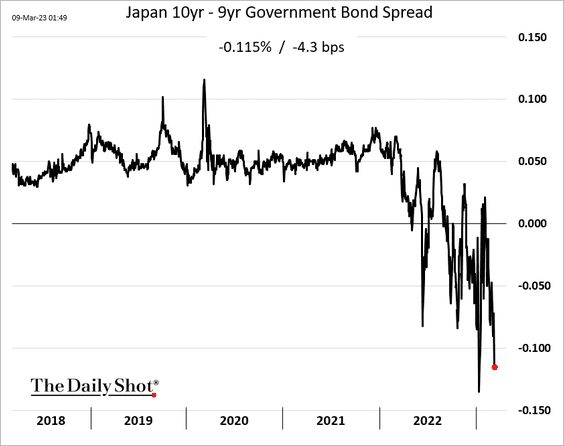

1. The pressure on the 10-year JGB remains extreme.

• Rate swaps vs. JGBs:

• The spread between the 10-year and the 9-year JGB yield (the curve is inverted here):

• The BoJ owns roughly half the JGB market.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

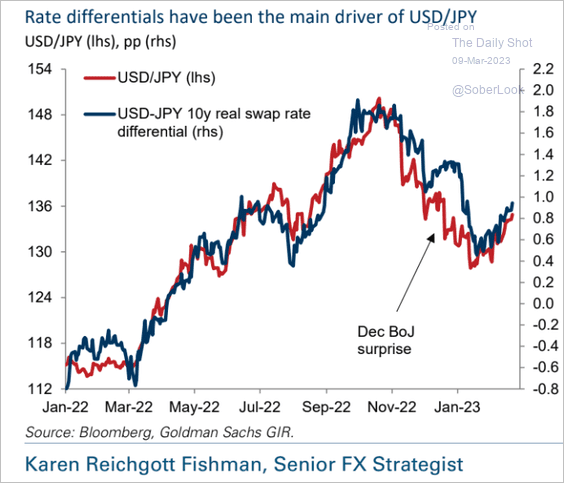

2. Rate differentials drive the USD/JPY exchange rate.

Source: Goldman Sachs

Source: Goldman Sachs

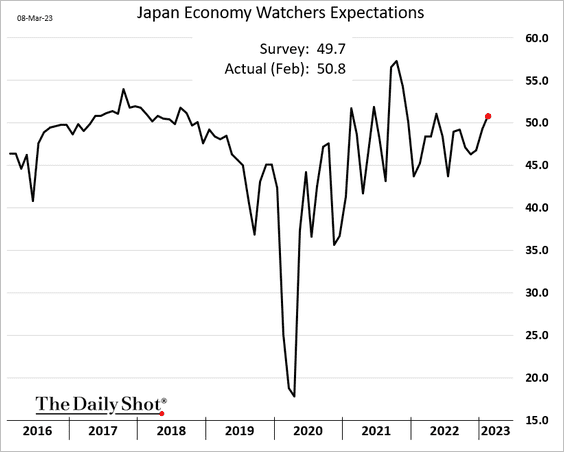

3. Service-sector workers are showing improved confidence as tourism returns.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

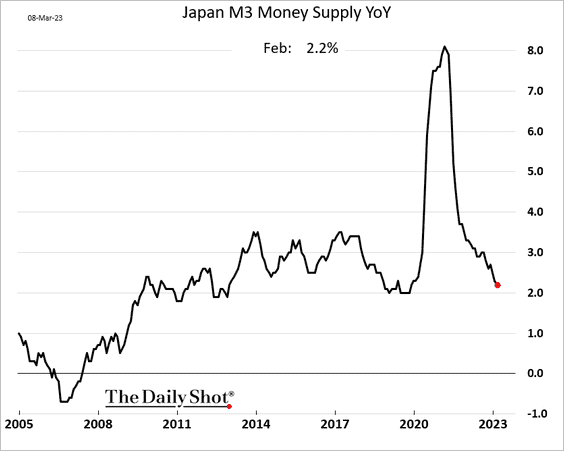

4. The broad money supply growth continues to slow.

Back to Index

China

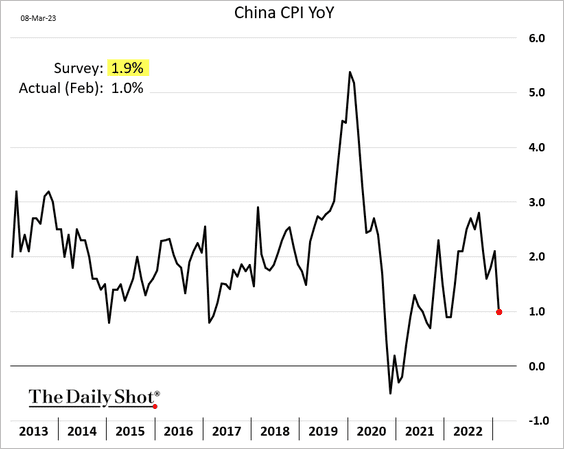

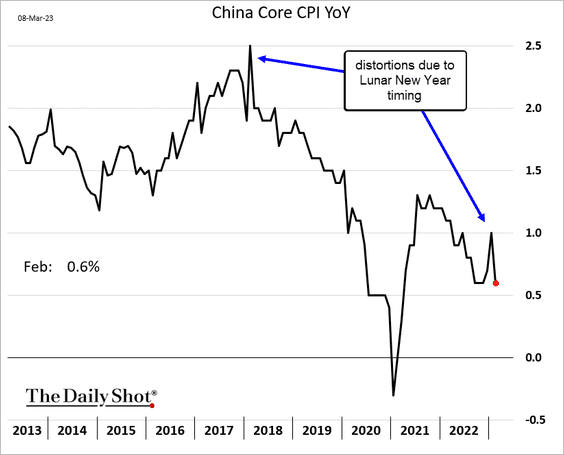

1. The CPI surprised to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

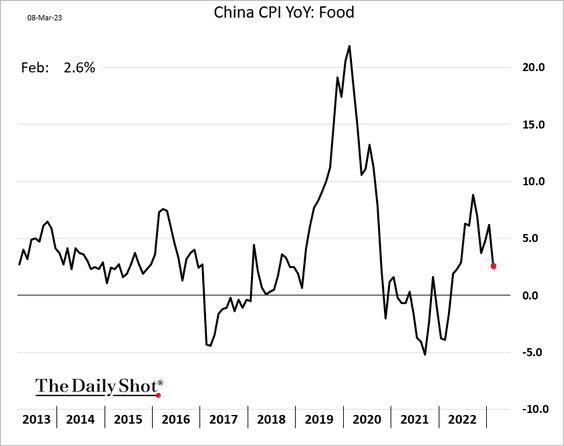

• Food inflation declined.

• Below is the core CPI. The spikes are due to the timing of the Lunar New Year.

——————–

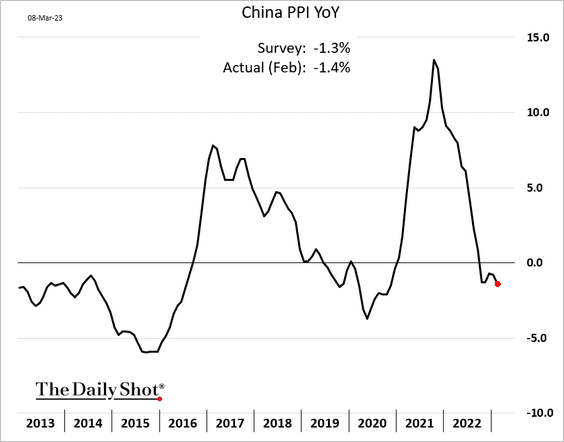

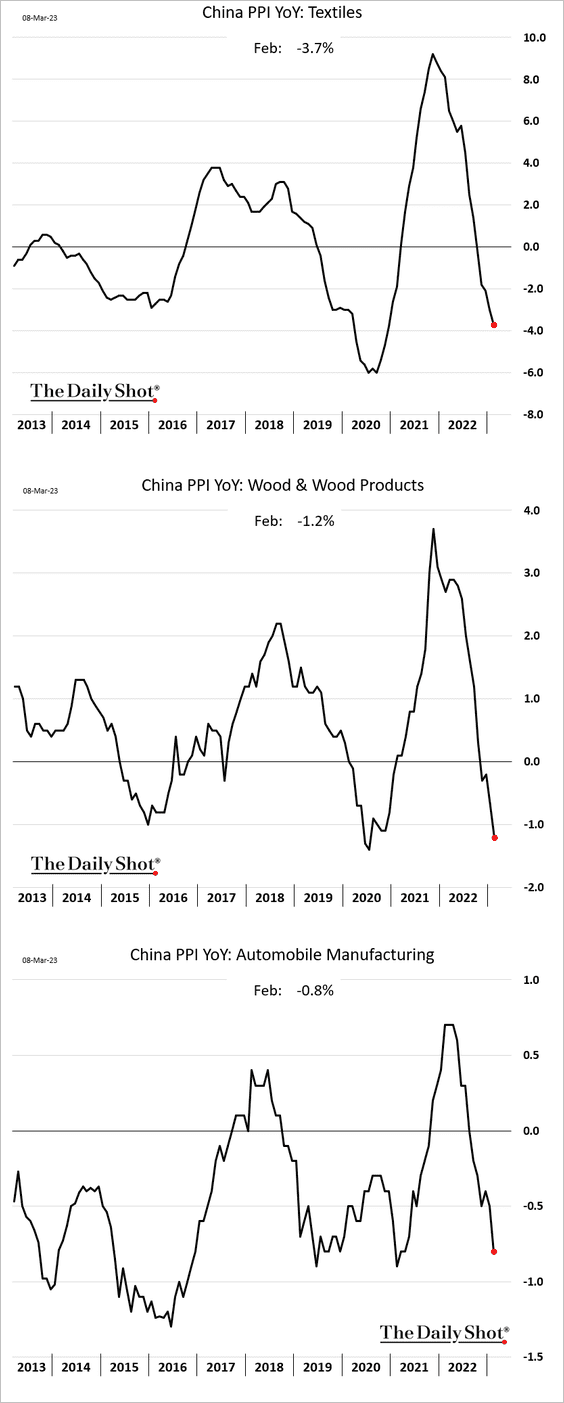

2. The PPI moved deeper into negative territory. This is good news for inflation in the US.

Below are some examples of the downward pressure on the PPI.

——————–

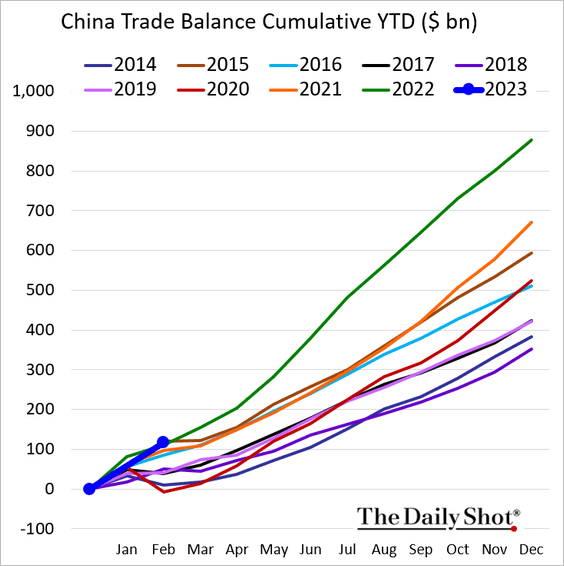

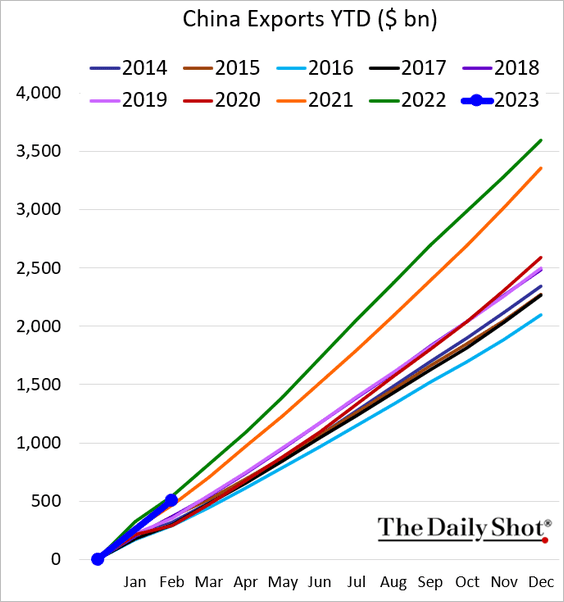

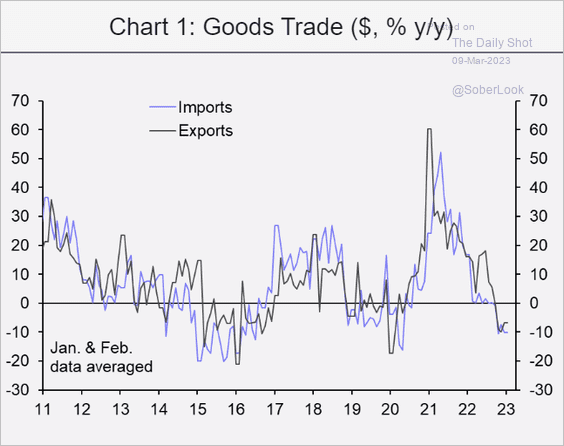

3. The trade surplus was a touch higher than last year’s levels.

But exports in the first two months of 2023 showed weaker performance than in the same period of 2022.

Source: Capital Economics

Source: Capital Economics

——————–

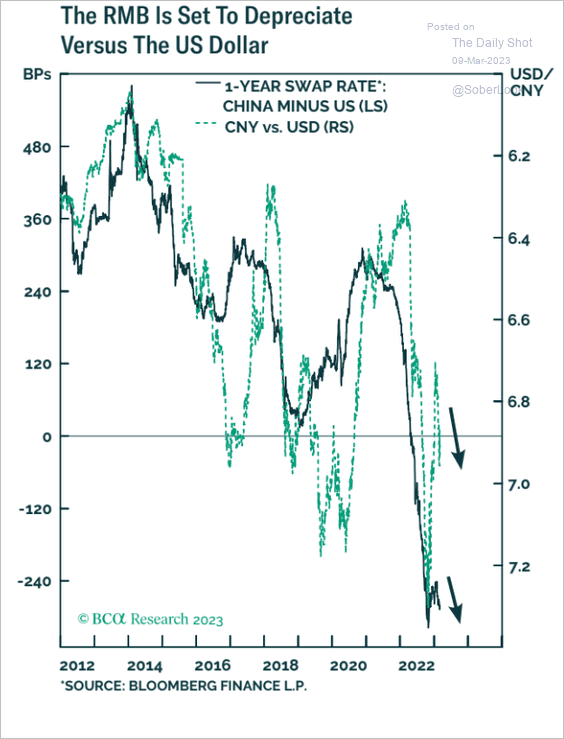

4. Rate differentials with the US pose downside risks for the renminbi.

Source: BCA Research

Source: BCA Research

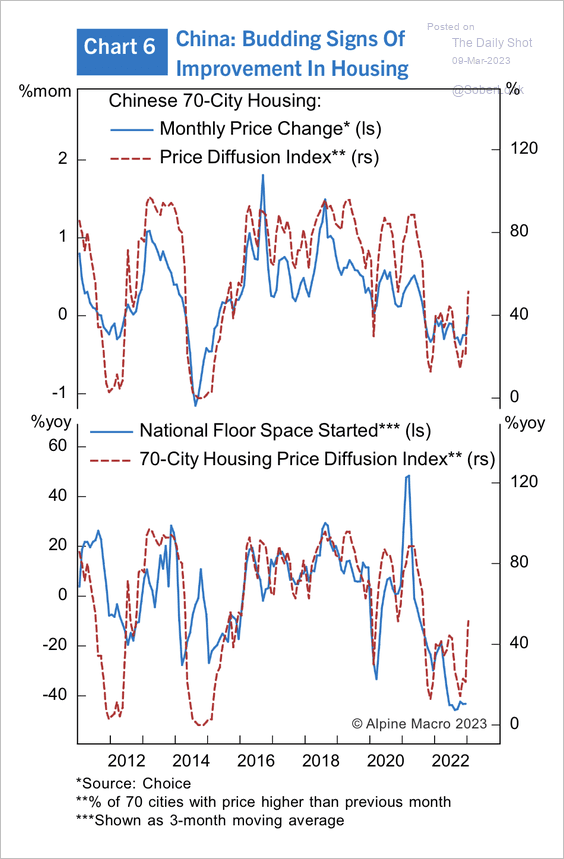

5. The profit cycle could be bottoming.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

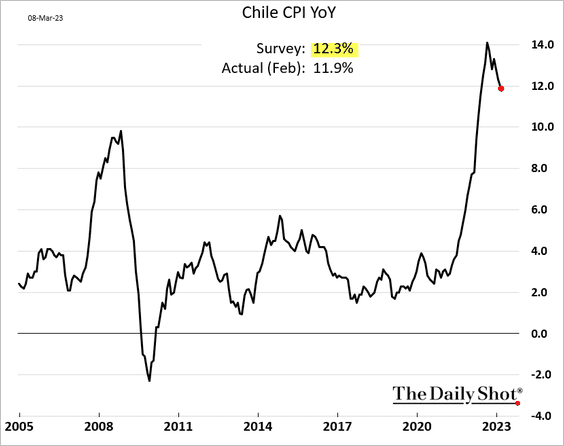

1. Chile’s CPI is starting to roll over.

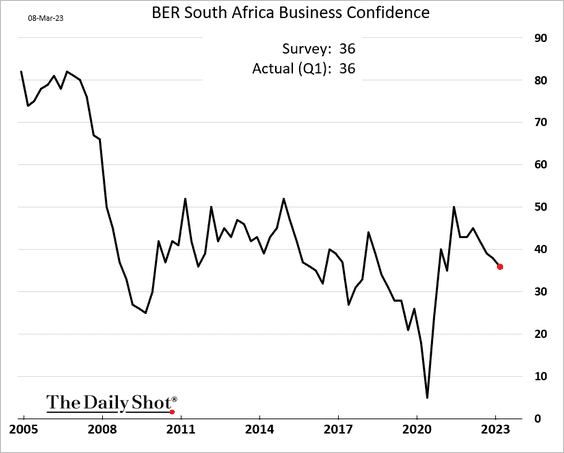

2. South Africa’s business confidence is trending down.

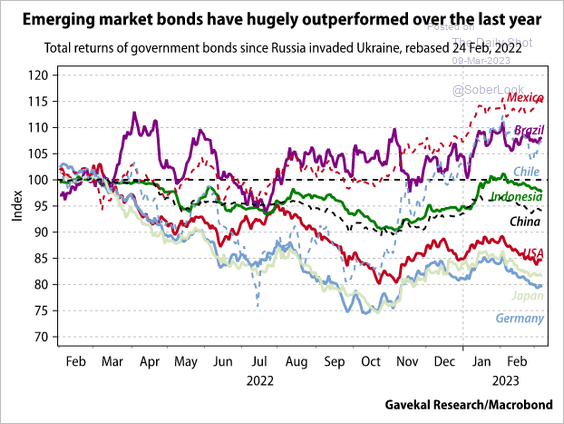

3. EM bonds have outperformed advanced economies.

Source: Gavekal Research

Source: Gavekal Research

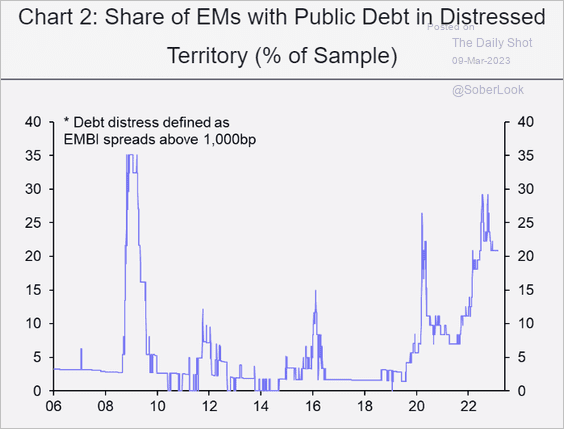

Nonetheless, here is the share of emerging economies with distressed public debt.

Source: Capital Economics

Source: Capital Economics

Back to Index

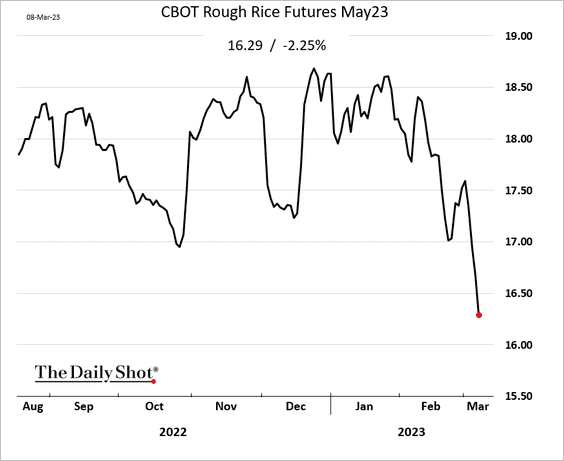

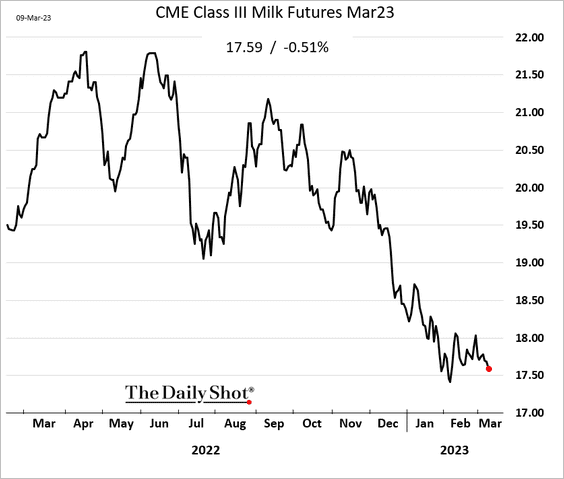

Commodities

1. Rough rice futures have taken a hit in recent days.

2. US milk futures remain under pressure.

Source: Farm Journal Read full article

Source: Farm Journal Read full article

Back to Index

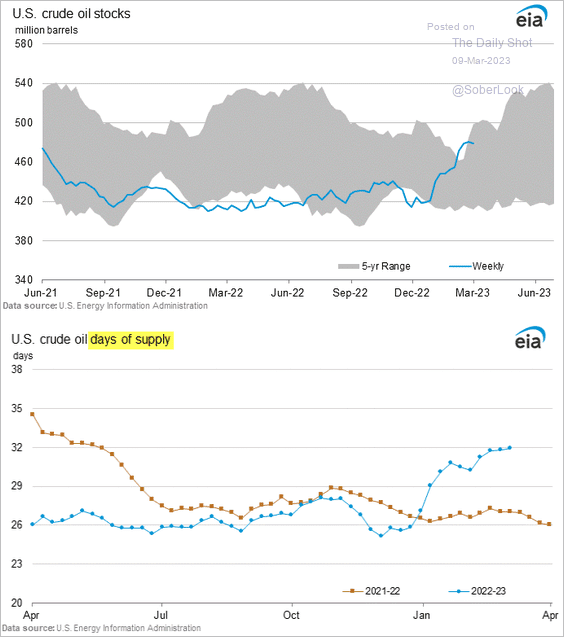

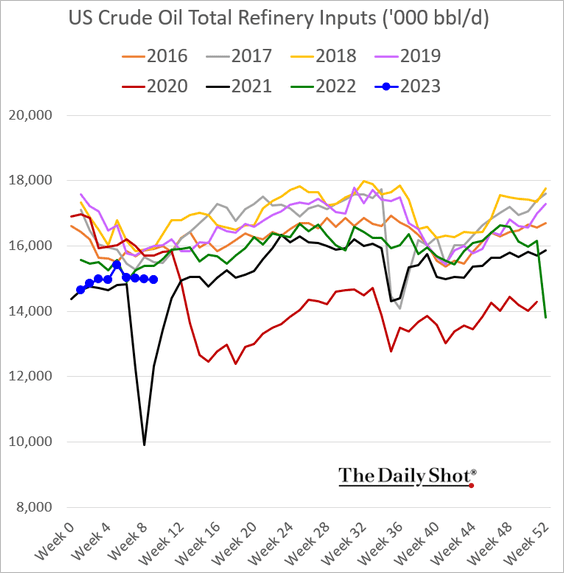

Energy

1. US crude oil inventories edged lower last week (back inside the 5-year range). But there was an increase in the number of days of supply, …

… as refinery demand remains soft.

——————–

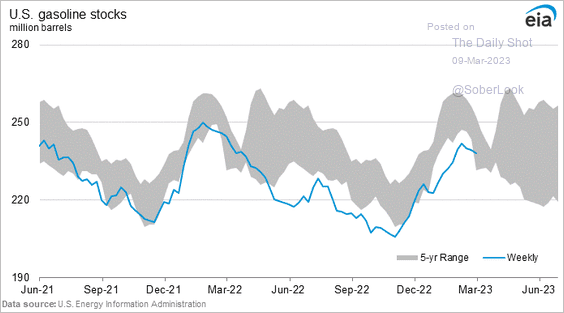

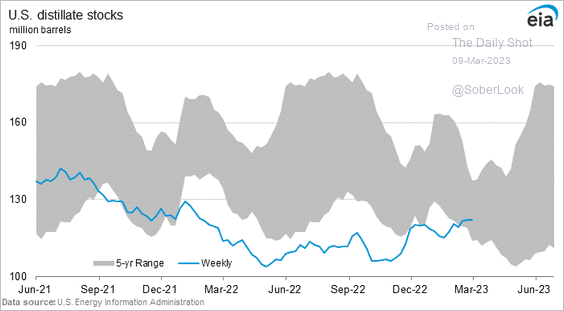

2. Refined product inventories are inside the 5-year range.

——————–

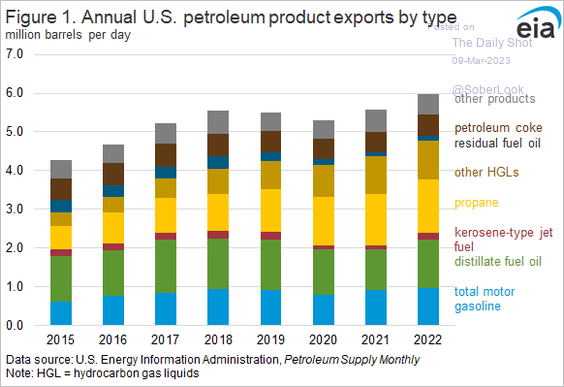

3. US refined product exports have been rising.

Source: @EIAgov

Source: @EIAgov

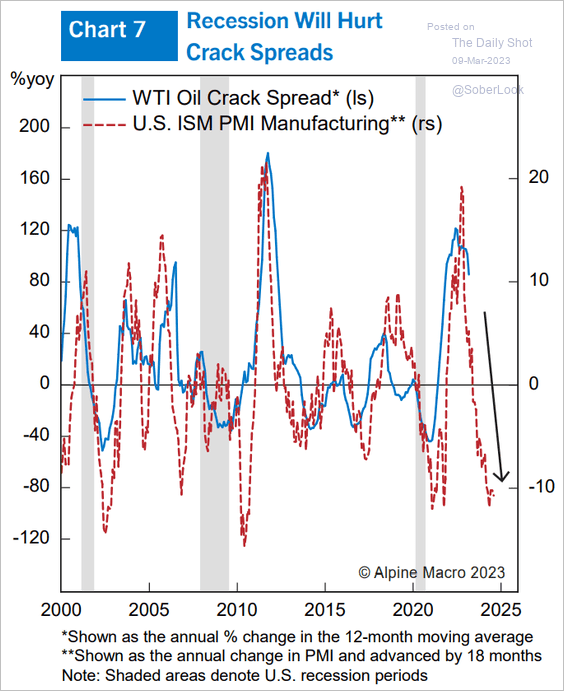

4. Refinery margins face downside risks in a recession scenario.

Source: Alpine Macro

Source: Alpine Macro

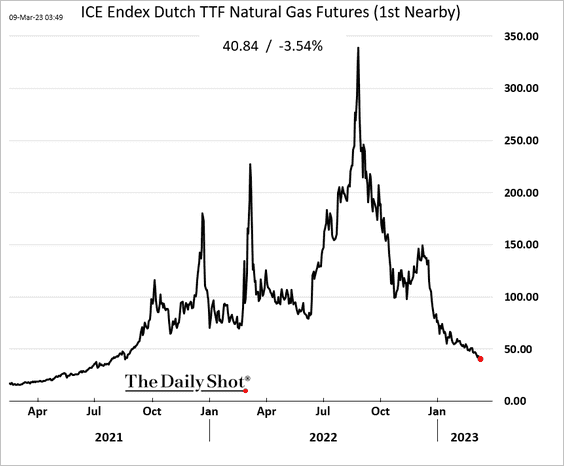

5. European natural gas prices keep moving lower.

Back to Index

Equities

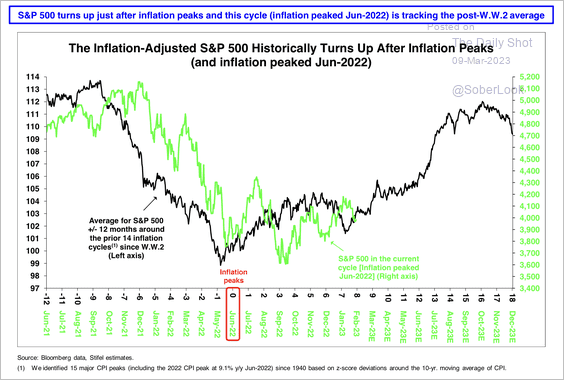

1. Will peak inflation spark a recovery for the S&P 500?

Source: Stifel

Source: Stifel

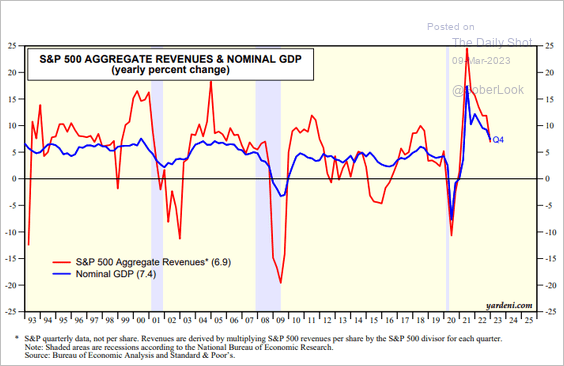

2. As of Q4, the S&P 500 revenue growth was in line with the nominal GDP expansion.

Source: Yardeni Research

Source: Yardeni Research

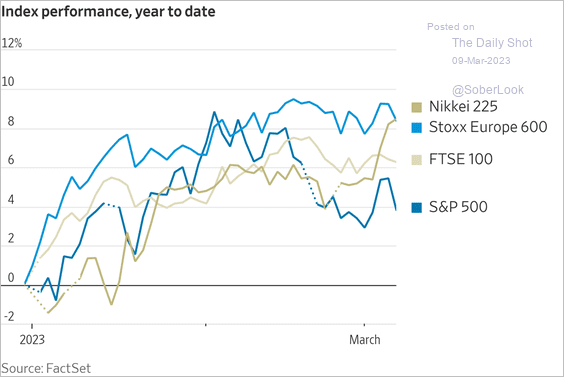

3. The S&P 500 has been underperforming other DM indices.

Source: @WSJ Read full article

Source: @WSJ Read full article

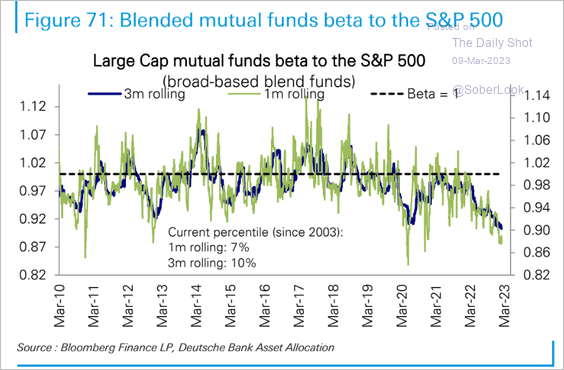

4. Mutual funds’ beta to the S&P 500 continues to sink. Many funds have been overweight in defensive shares while maintaining larger-than-normal cash levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

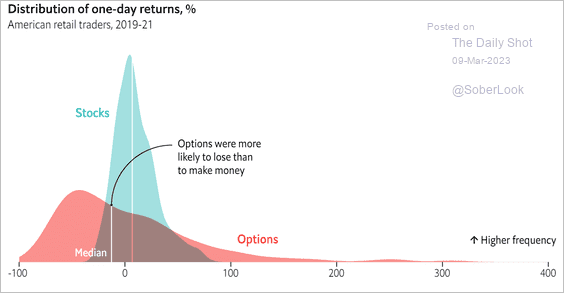

5. The bulk of retail options trades result in losses.

Source: The Economist Read full article

Source: The Economist Read full article

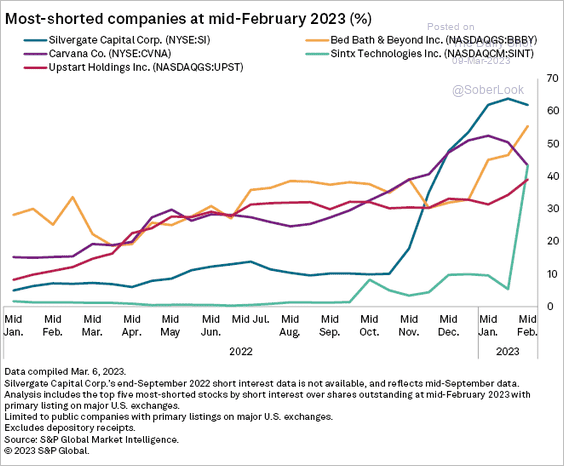

6. Here are the most shorted companies last month.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

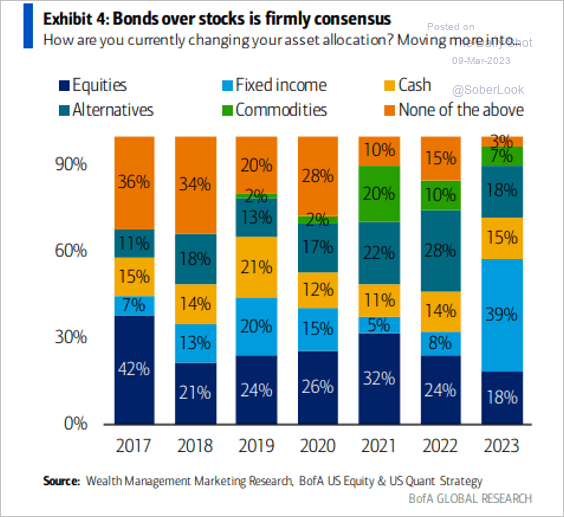

7. BofA’s Global Wealth & Investment Management Survey shows a massive preference for bonds over equities.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

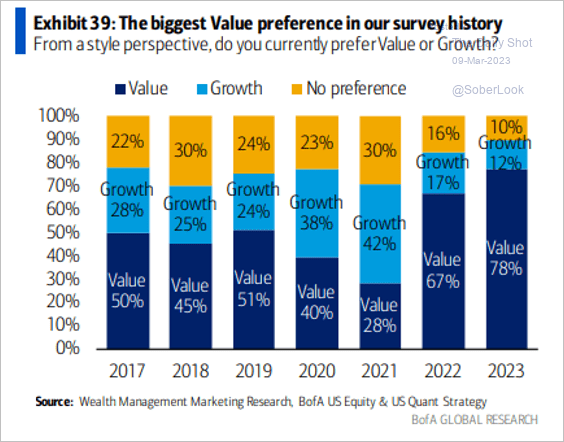

Moreover, investors are showing a stronger preference for value stocks compared to growth stocks, significantly more so than in previous years.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Credit

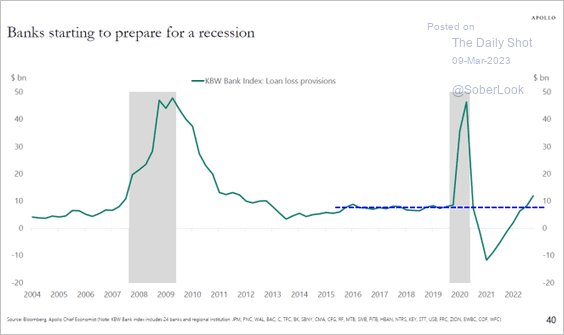

1. Banks’ loan loss provisions are now above pre-COVID levels.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

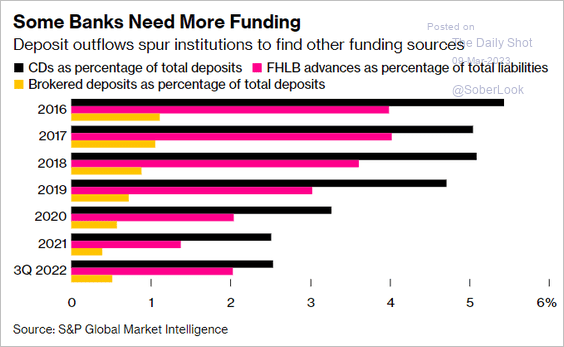

• Some banks need more funding, forcing them to pay higher rates on CDs.

Source: @CalMutua, @PaigeSmithNews, @business Read full article

Source: @CalMutua, @PaigeSmithNews, @business Read full article

——————–

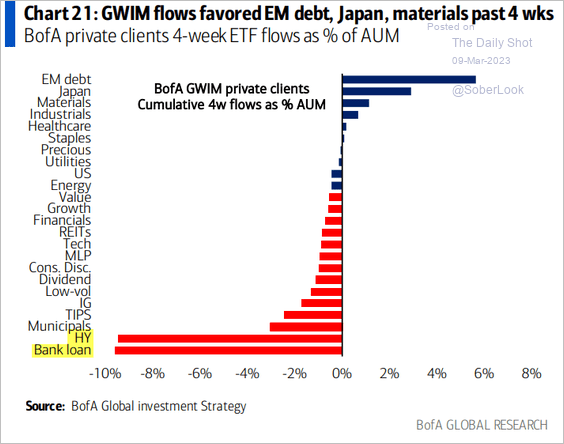

2. Merrill Lynch’s private clients have been dumping leveraged finance assets.

Source: BofA Global Research

Source: BofA Global Research

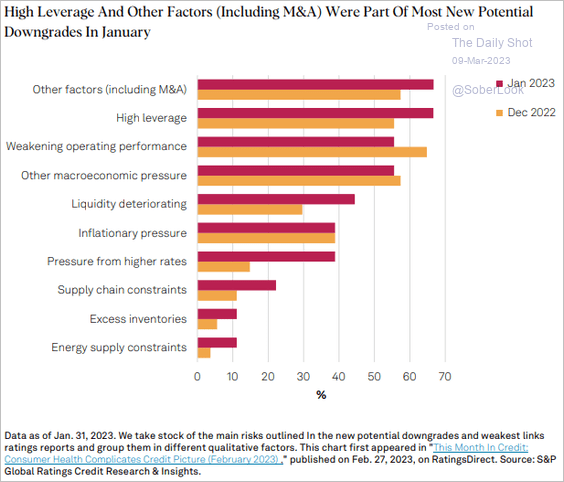

3. This chart shows S&P’s reasons for potential credit downgrades.

Source: S&P Global Ratings

Source: S&P Global Ratings

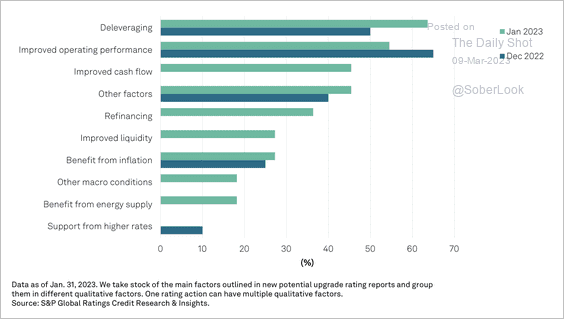

Most new potential upgrades in January showed lower leverage and improved operating performance.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Rates

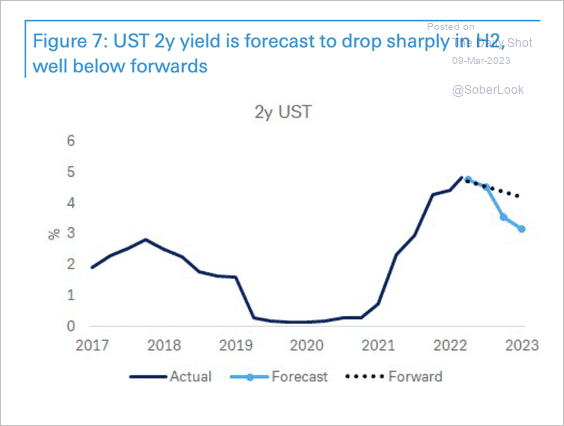

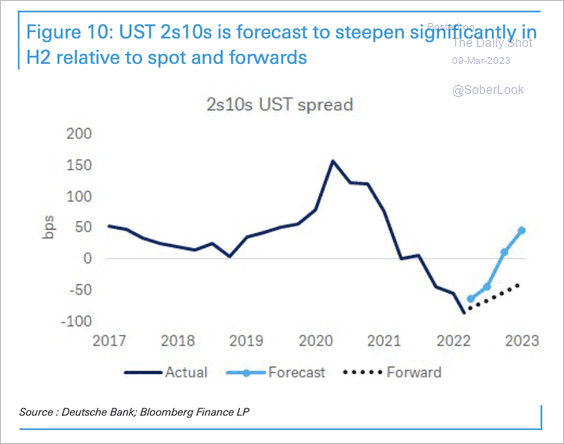

1. Deutsche Bank forecasts a sharp decline in front-end Treasury rates and curve steepening in the second half of the year as recession pricing dominates. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

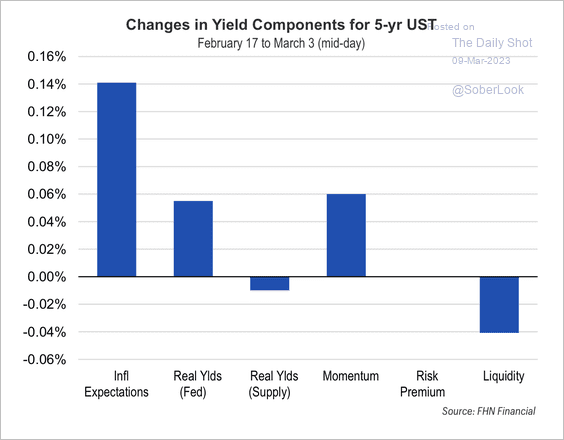

2. Inflation expectations have driven recent changes in the 5-year Treasury yield.

Source: FHN Financial

Source: FHN Financial

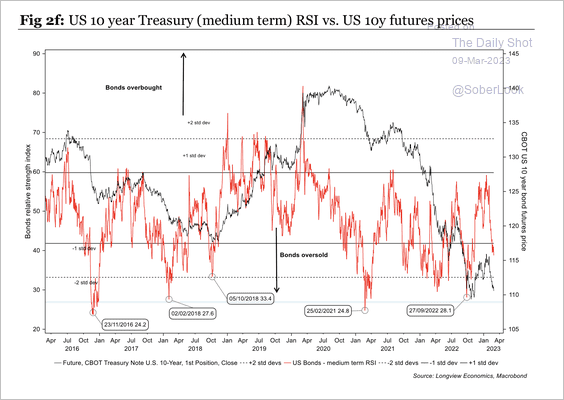

3. The 10-year Treasury note appears oversold.

Source: Longview Economics

Source: Longview Economics

Back to Index

Global Developments

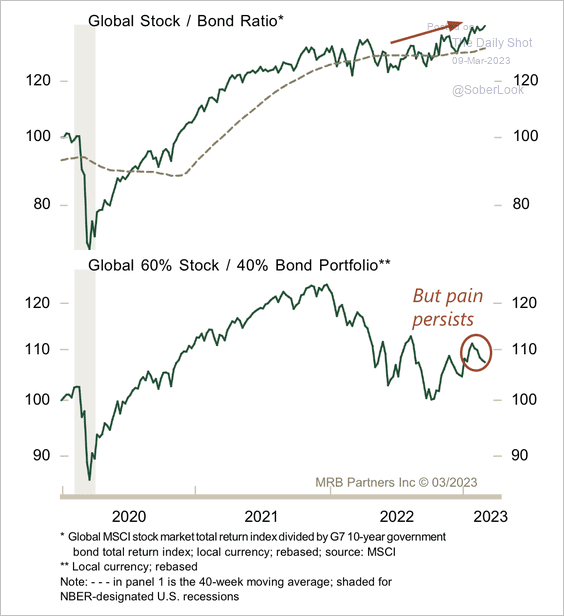

1. The global stock/bond ratio is edging higher, although the traditional 60/40 stock/bond portfolio remains challenged.

Source: MRB Partners

Source: MRB Partners

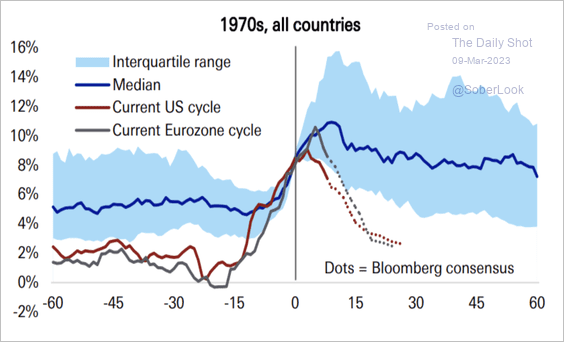

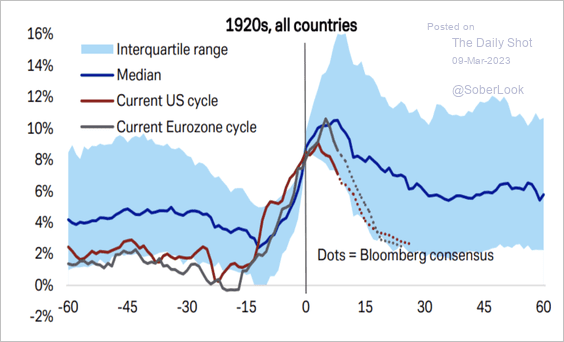

2. Inflation typically remains elevated for a few years after a spike above 8%. (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

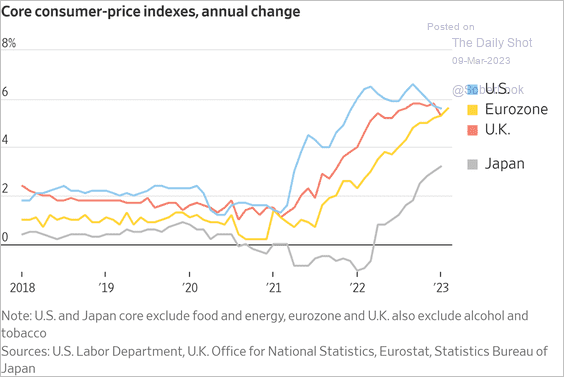

3. This chart shows core inflation trends in select economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

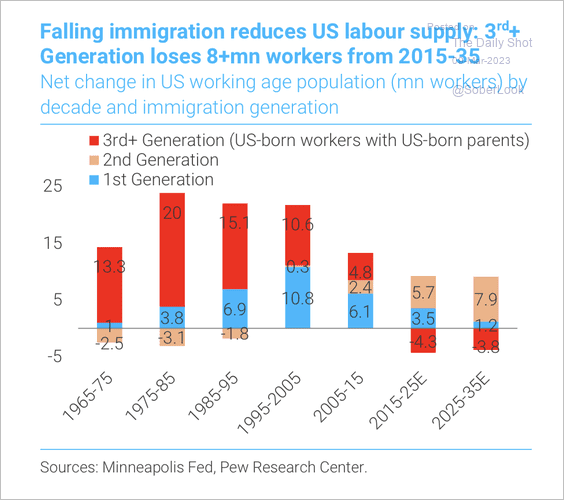

1. The US faces further labor shortages ahead.

Source: TS Lombard

Source: TS Lombard

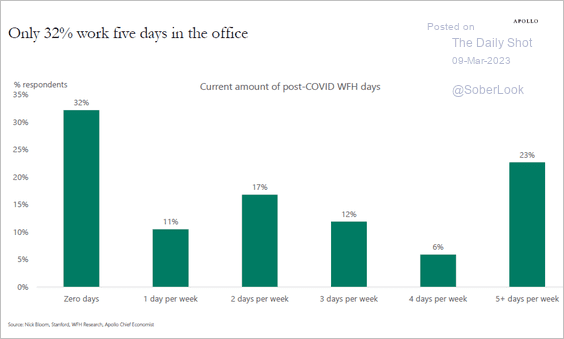

2. Working from home:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

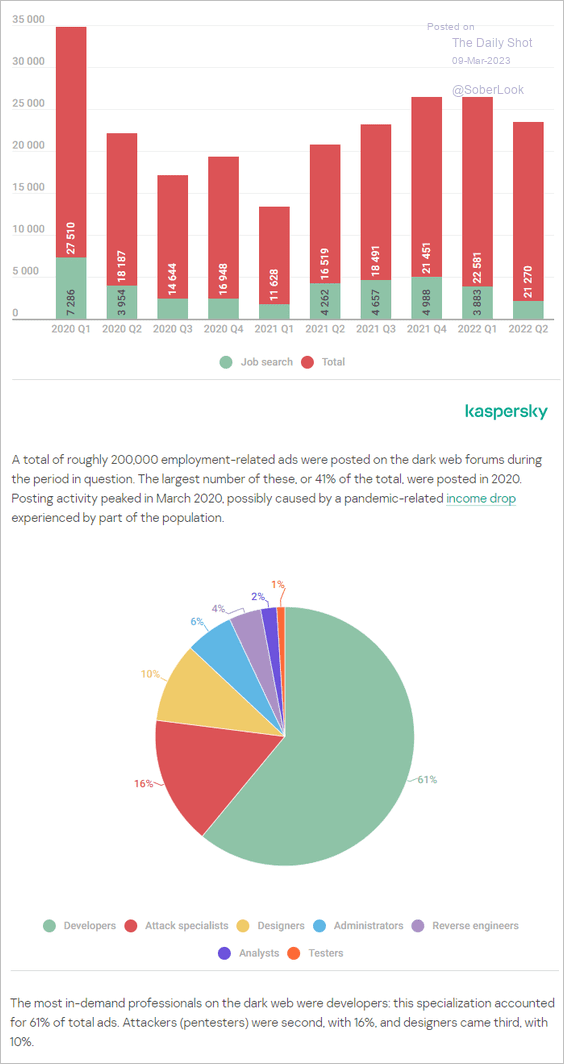

3. Jobs posted on the dark web:

Source: Kaspersky Read full article

Source: Kaspersky Read full article

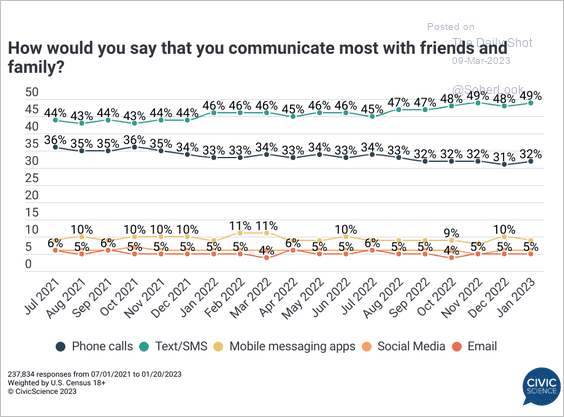

4. Communicating with friends and family:

Source: @CivicScience

Source: @CivicScience

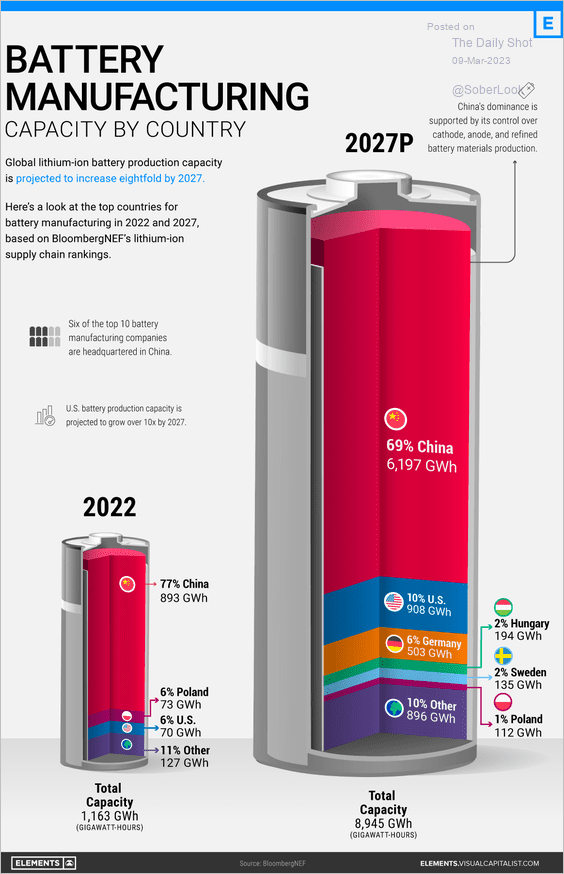

5. Battery manufacturing forecasts:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

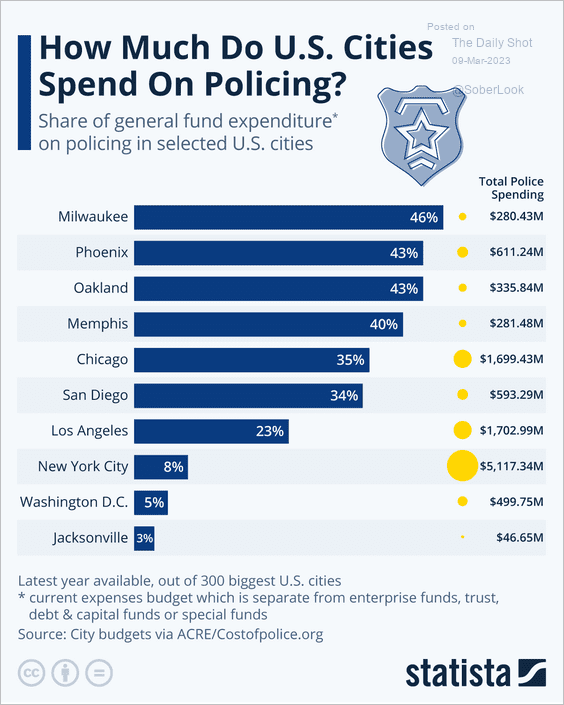

6. Policing-related expenditures:

Source: Statista

Source: Statista

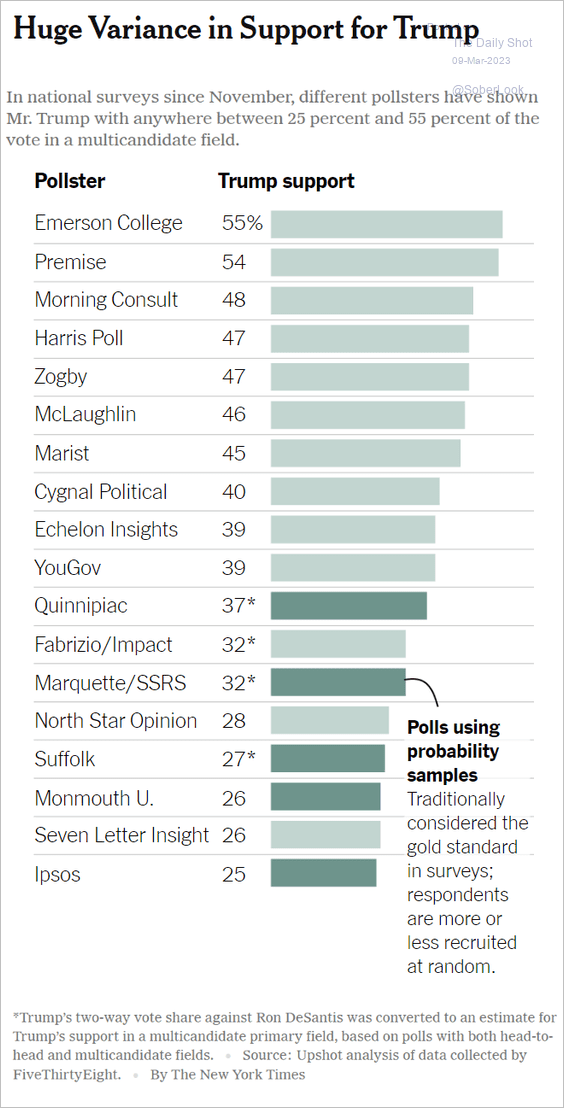

7. Support for Trump:

Source: The New York Times Read full article

Source: The New York Times Read full article

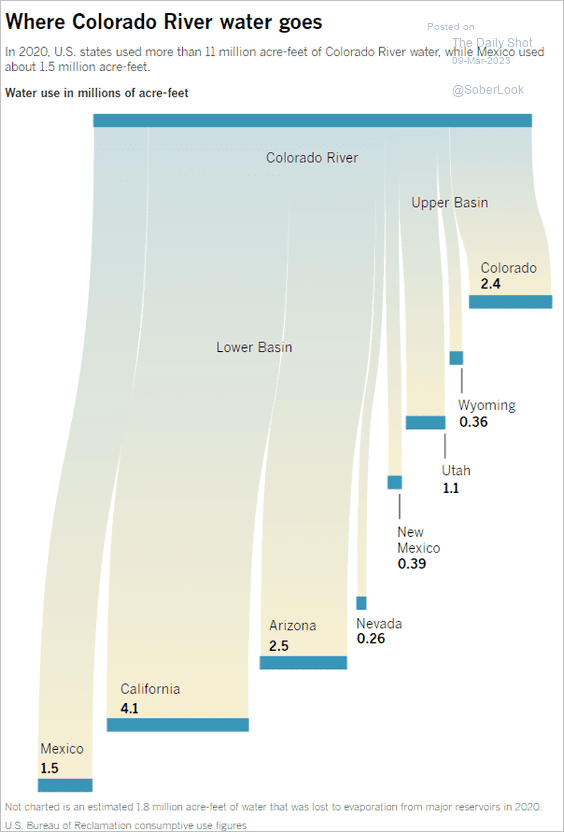

8. Water from the Colorado River:

Source: LA Times Read full article

Source: LA Times Read full article

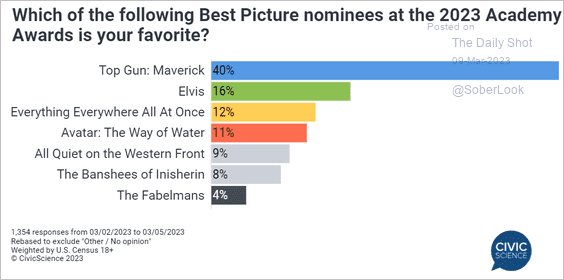

9. Favorite Best Picture nominees:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index