The Daily Shot: 16-Mar-23

• Credit

• Equities

• Energy

• Commodities

• Emerging Markets

• China

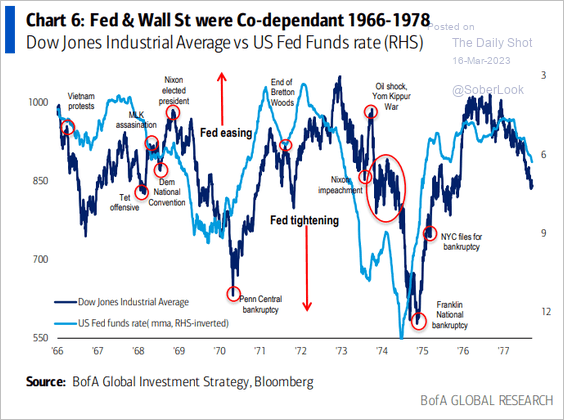

• Asia – Pacific

• Japan

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Credit

1. Let’s start with Credit Suisse. The chronology of events over the past 24 hours is laid out in the headlines below.

• Starting point:

Source: Reuters Read full article

Source: Reuters Read full article

• Market reaction:

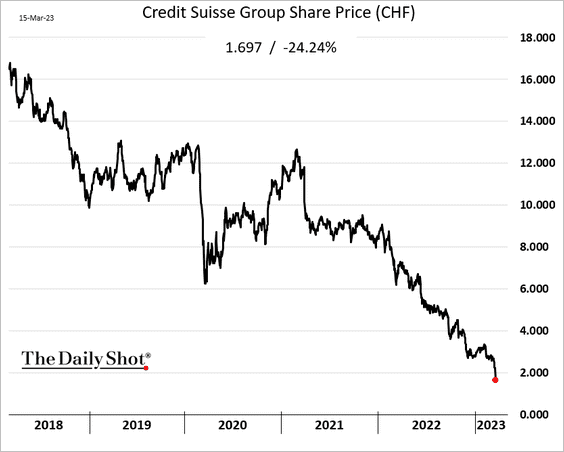

– Stock price:

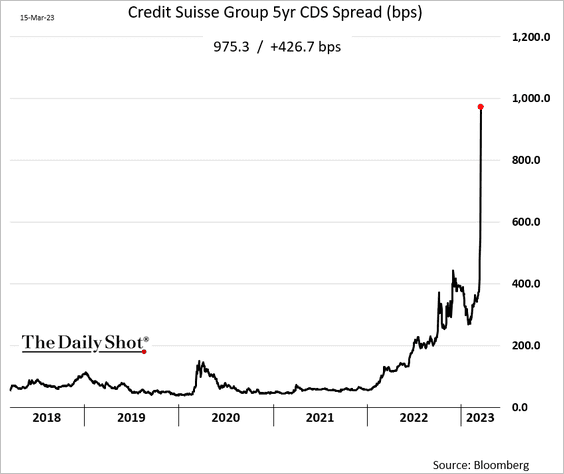

– CDS spread (nearing 1000 bps):

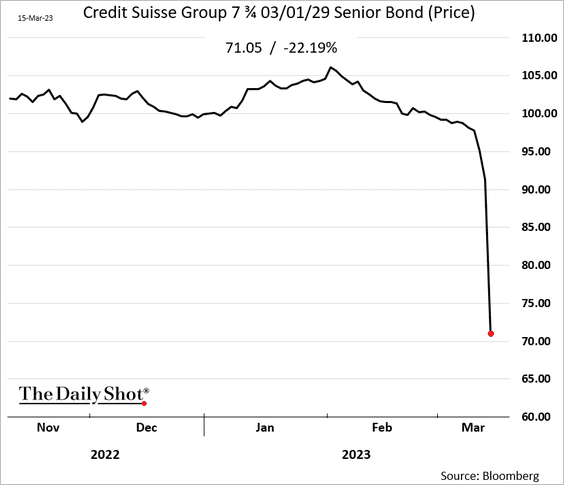

– Senior bond price:

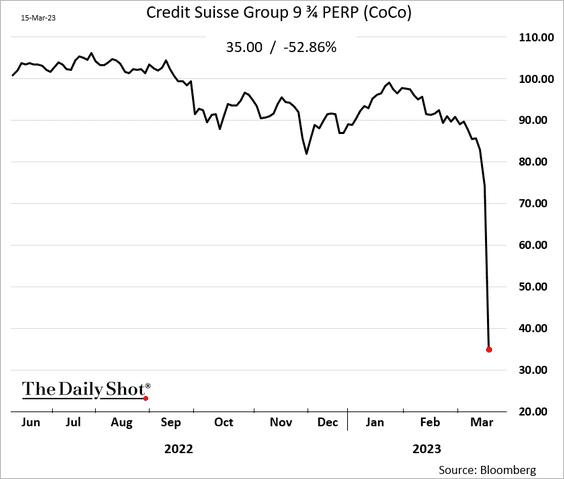

– CoCo price:

• Counterparty fears:

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

• The request:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• The response:

Source: @WSJ Read full article

Source: @WSJ Read full article

• The rescue:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

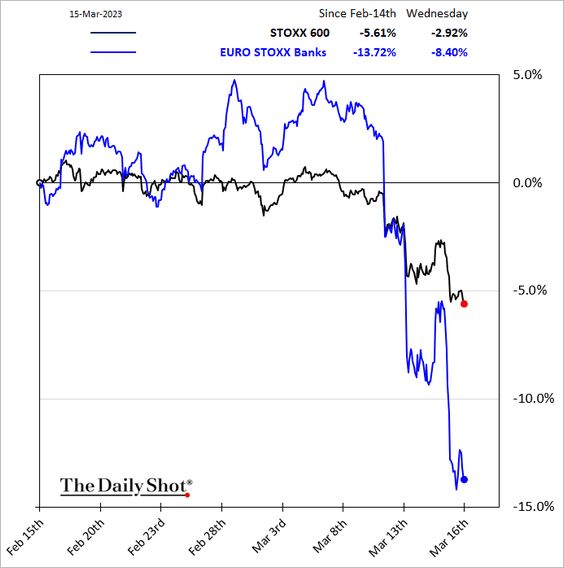

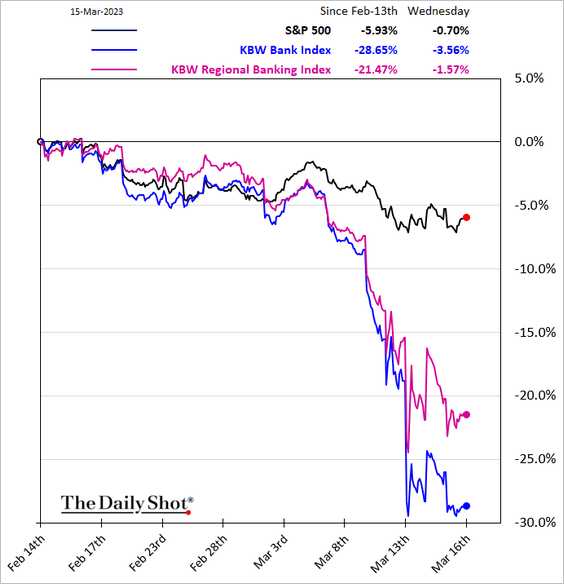

2. Other European banks’ shares tumbled, …

Source: TS Lombard

Source: TS Lombard

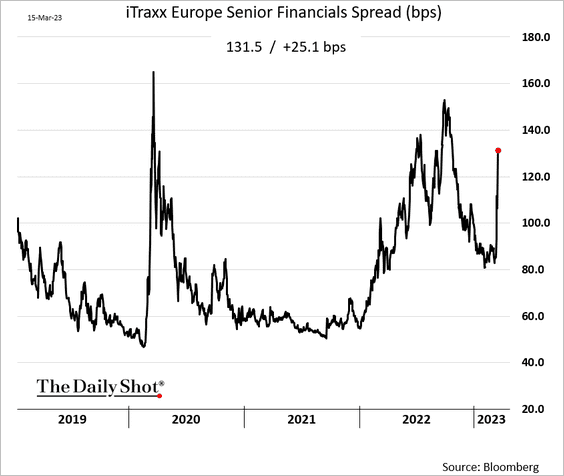

• Credit default swap spreads have widened, but there is no panic.

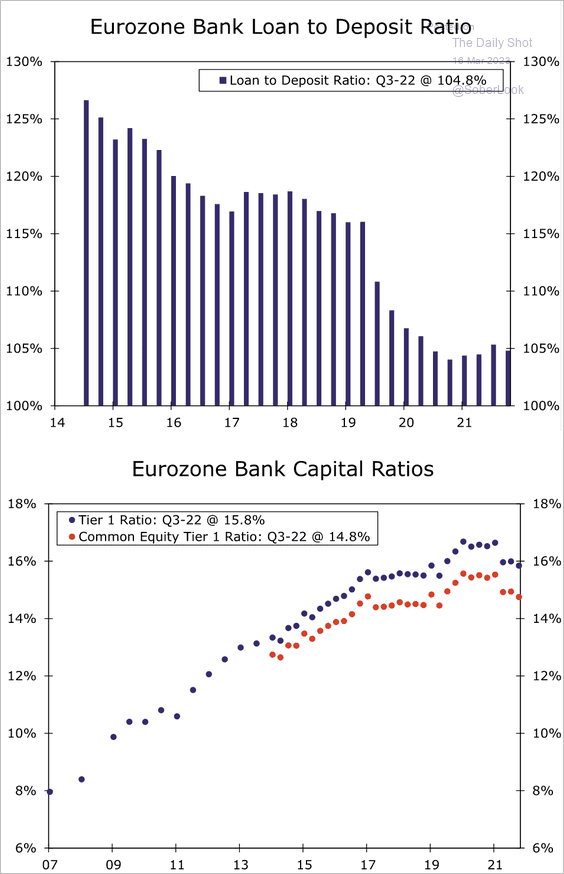

• European banks are generally in good shape.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

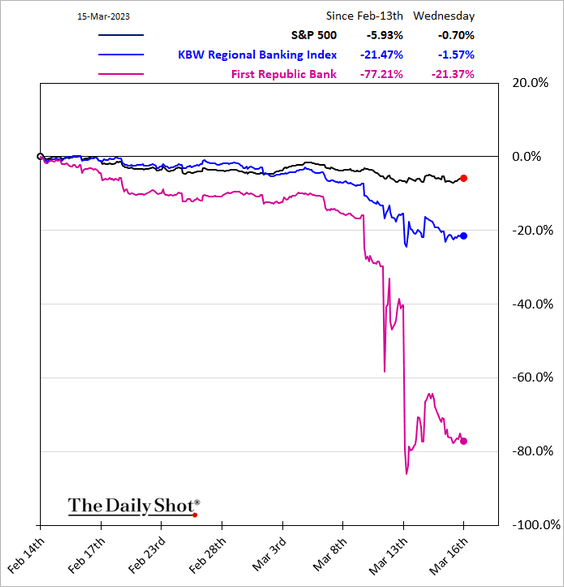

3. With Credit Suisse in trouble, attention turned to large banks in the US.

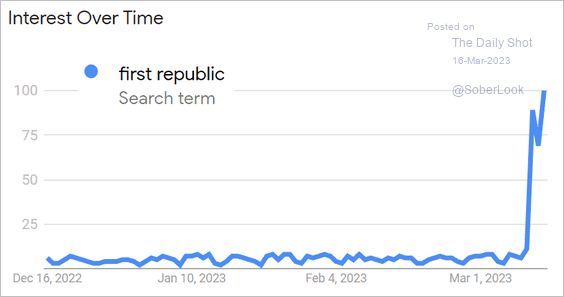

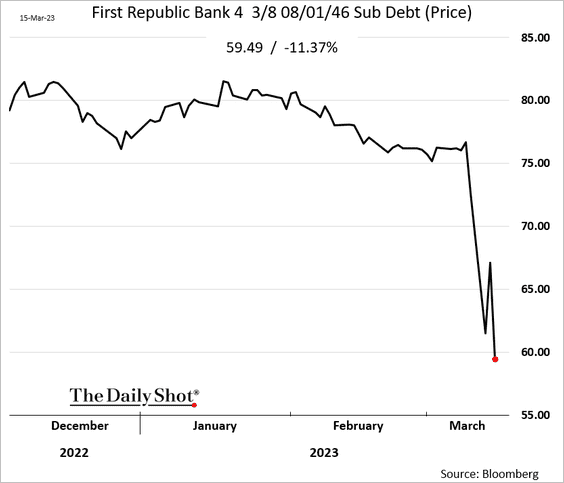

• However, one regional US bank spooking investors is First Republic Bank.

– This chart shows Google search activity for “First Republic.”

Source: Google Trends

Source: Google Trends

• Debt was downgraded to junk.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

– Here is the bond price.

• What to do?

Source: @GillianTan, @MattMonks123, @business Read full article

Source: @GillianTan, @MattMonks123, @business Read full article

——————–

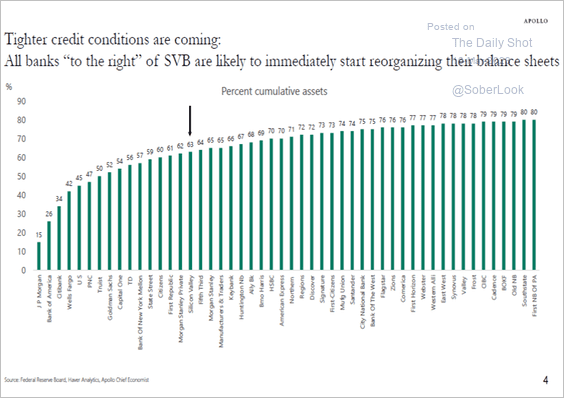

4. In the wake of SVB, smaller banks will be reorganizing their balance sheets, leading to tighter credit conditions in the US. This development makes a recession much more likely.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

Back to Index

Equities

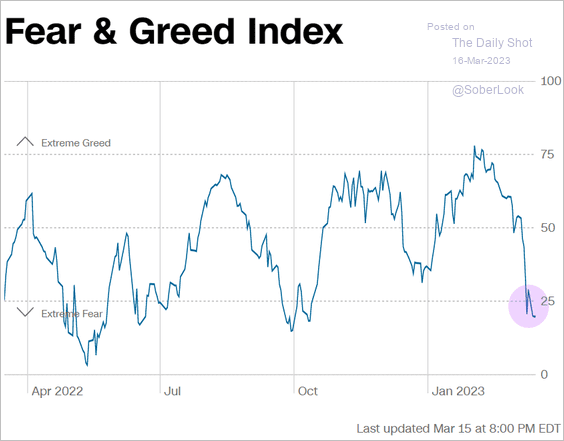

1. The Fear & Greed index is in “extreme fear” territory, which tightens financial conditions.

Source: CNN Business

Source: CNN Business

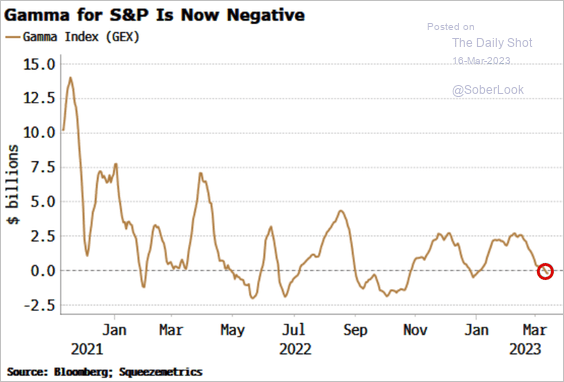

2. Dealer gamma is negative, which could exacerbate volatility.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

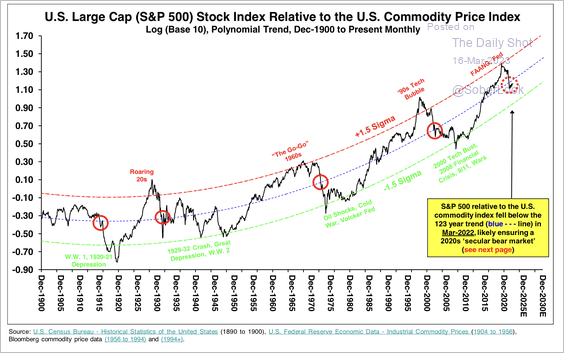

3. Stifel expects a secular bear market in stocks versus commodities, which typically occurs after major market tops.

Source: Stifel

Source: Stifel

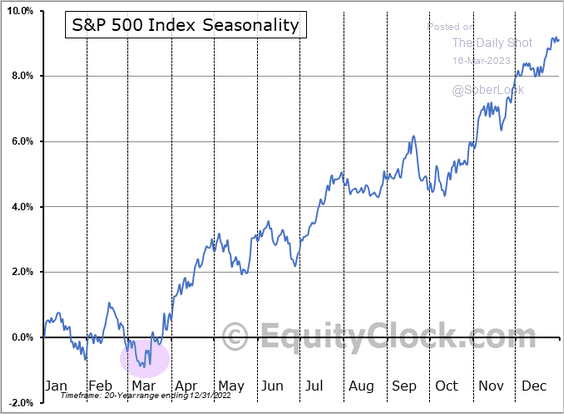

4. Stocks tend to bottom in March.

Source: Equity Clock

Source: Equity Clock

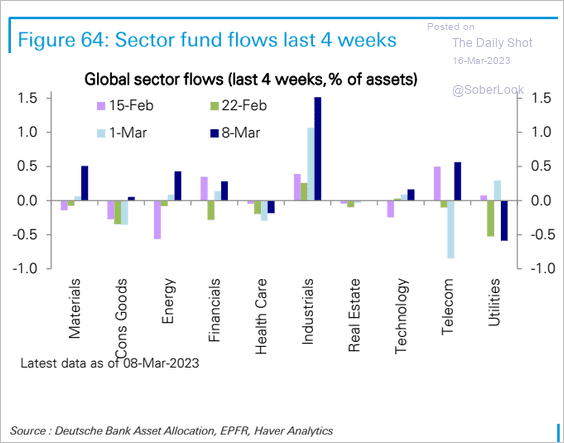

5. Industrials have been seeing inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

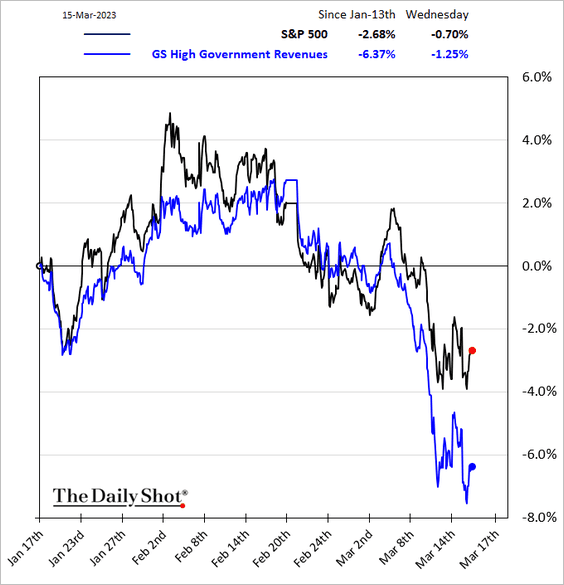

6. Companies exposed to the US government are underperforming.

7. The stock market was tightly linked to the US monetary policy between 1966 and 1978.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

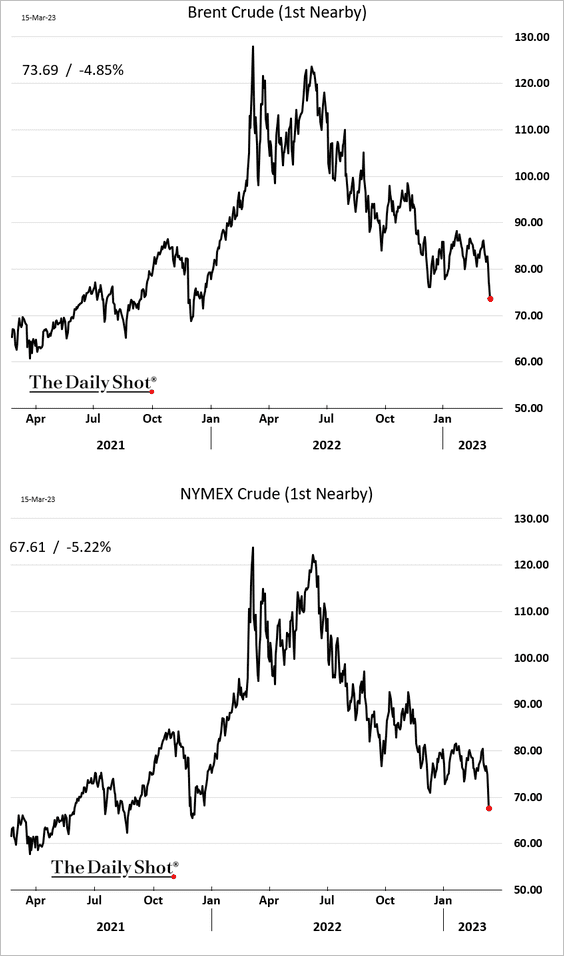

Energy

1. Crude oil has been under pressure amid bank crisis fears.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

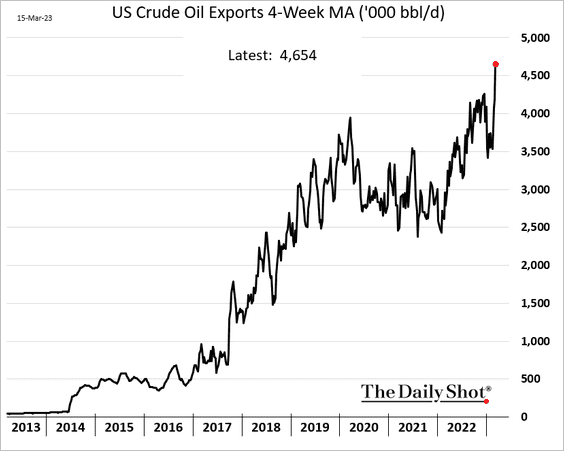

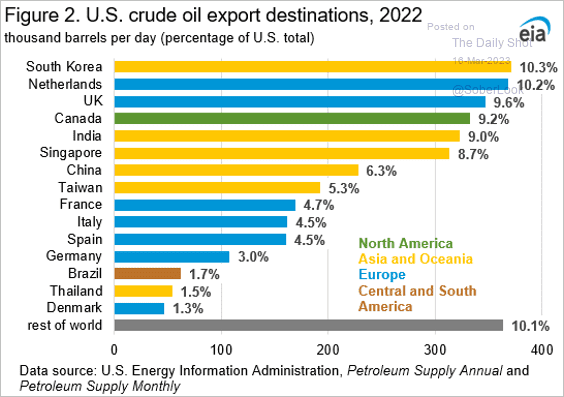

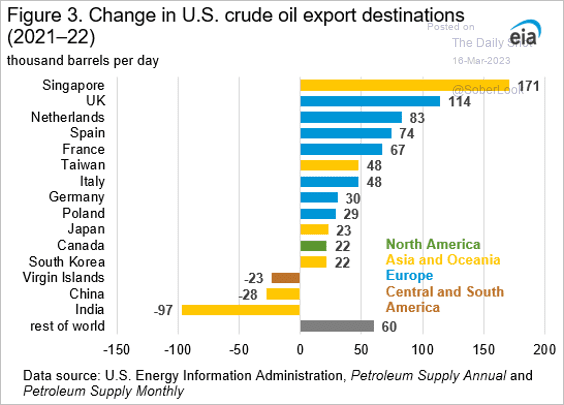

2. US gross crude oil exports are near record levels.

Below, we have some data on the destinations of US oil exports (2 charts).

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

Source: @EIAgov

——————–

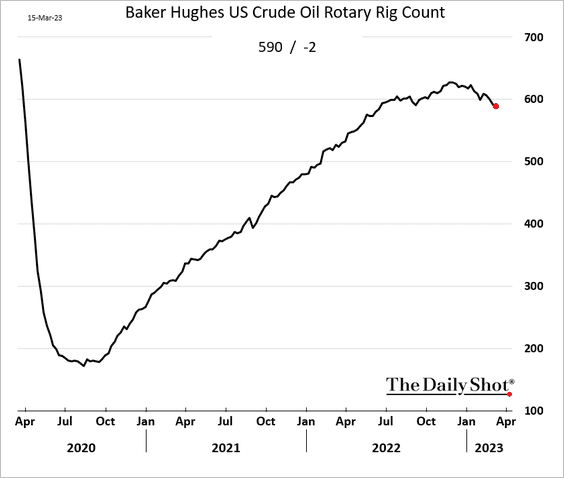

3. The US rig count declined again last week.

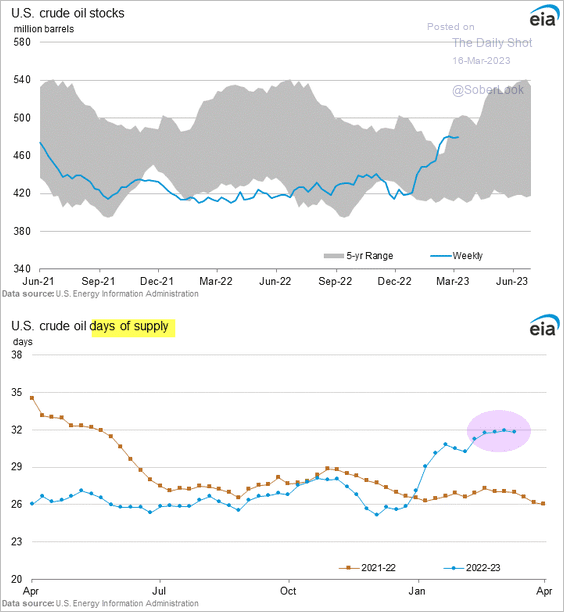

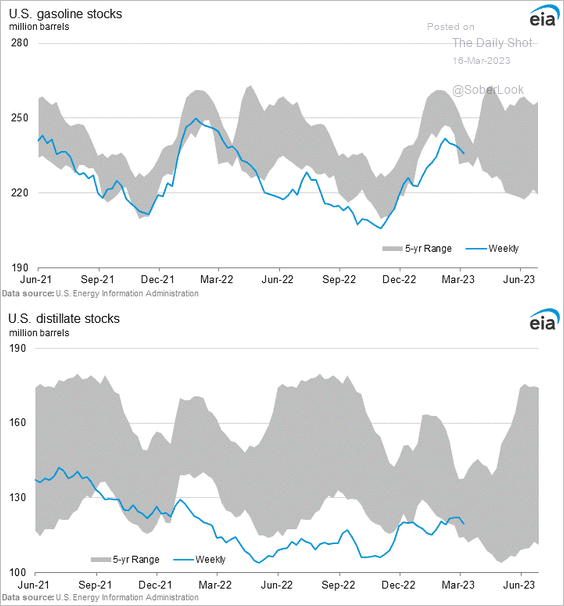

4. US crude oil inventories remain elevated.

• Product inventories are inside the 5-year range.

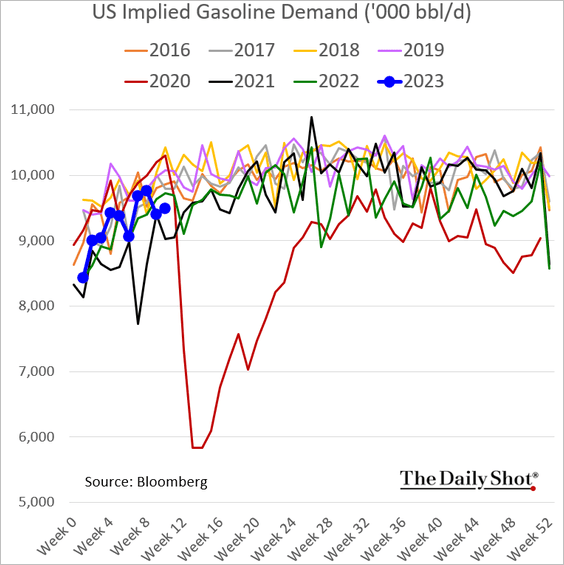

• Gasoline demand is still relatively soft.

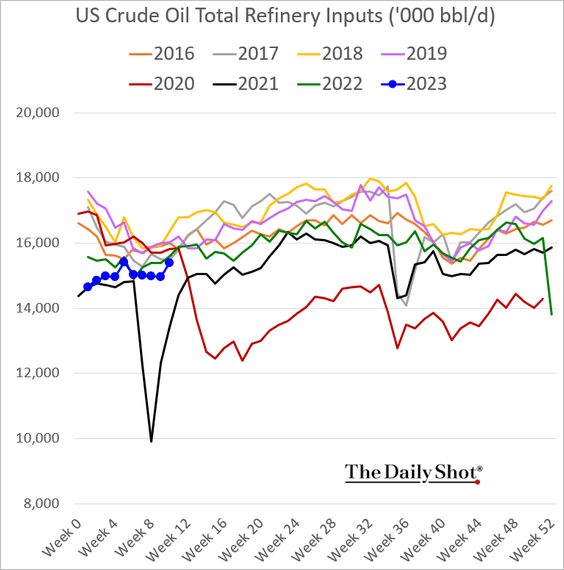

• Refinery runs improved last week.

——————–

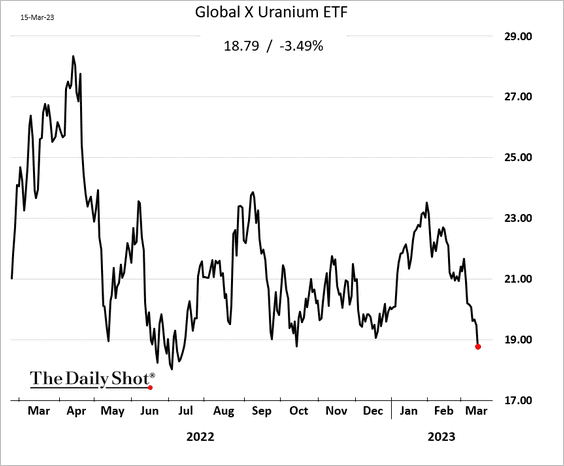

5. The Global X Uranium ETF has been selling off.

Back to Index

Commodities

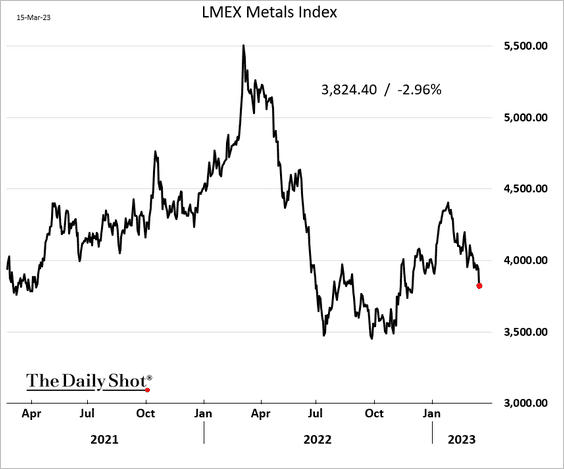

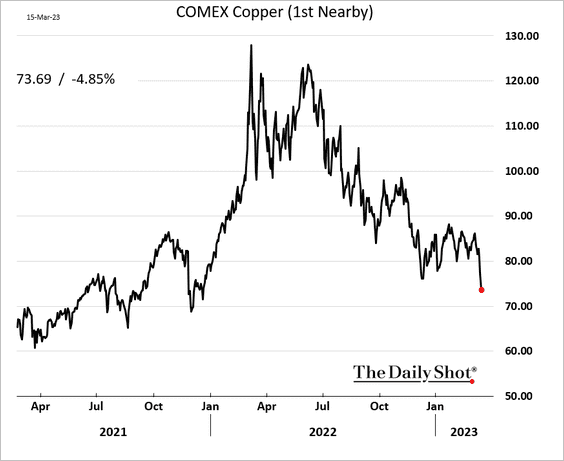

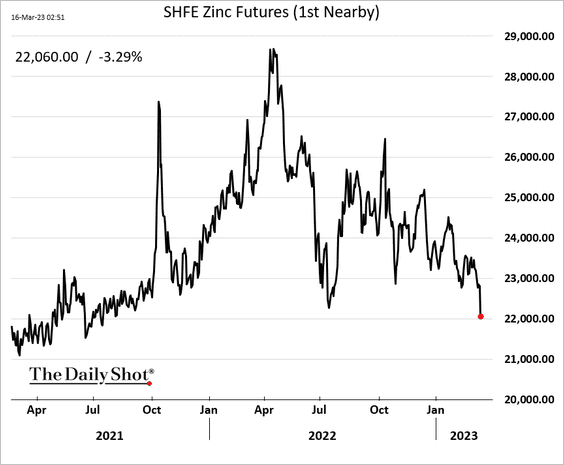

1. Industrial metals prices took a hit.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

• The LME metals index:

• Copper:

• Zinc

——————–

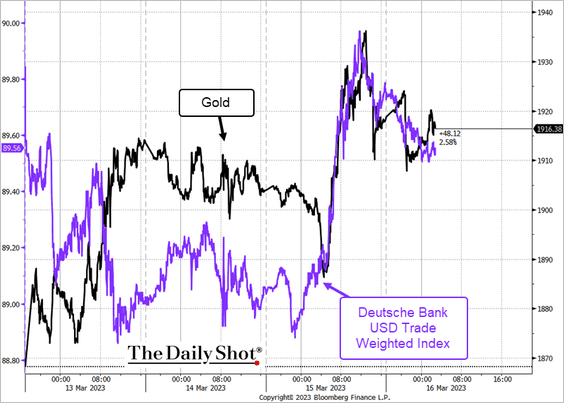

2. Gold has been rallying …

Source: Reuters Read full article

Source: Reuters Read full article

… together with the US dollar. That’s highly unusual, indicating a rush into “safe-haven” assets.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

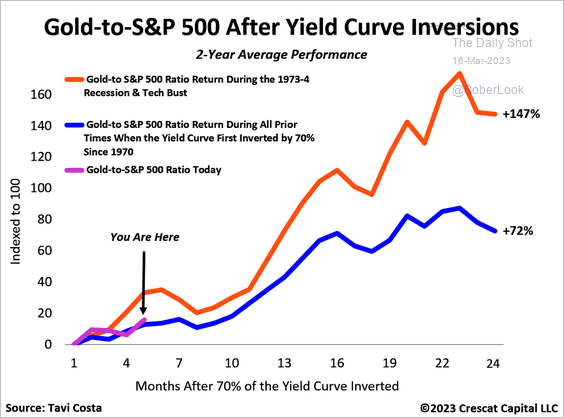

• Gold tends to outperform the S&P 500 after yield curve inversions.

Source: @TaviCosta

Source: @TaviCosta

——————–

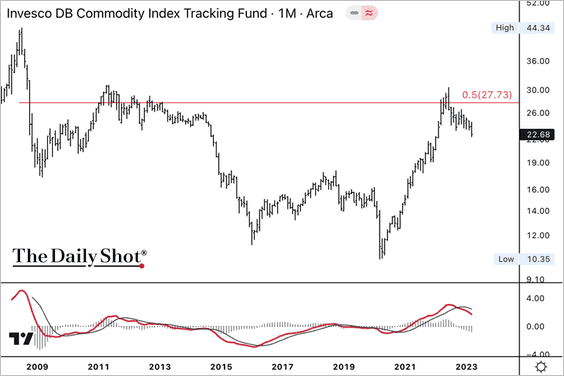

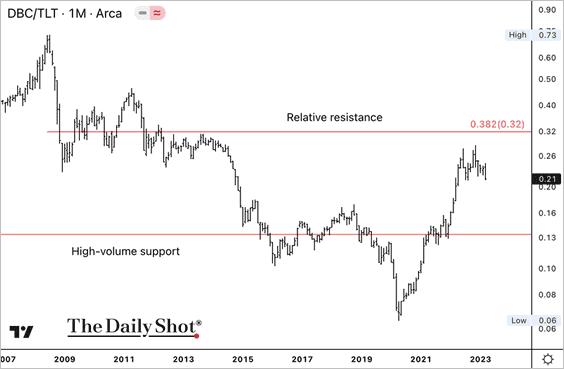

3. The Invesco Commodity Index ETF (DBC) is declining from long-term resistance.

The DBC/TLT price ratio is also declining, reflecting commodity weakness relative to Treasuries.

Back to Index

Emerging Markets

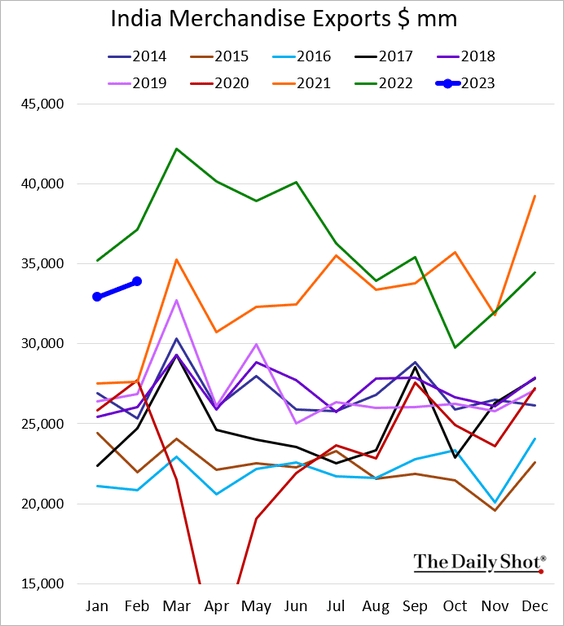

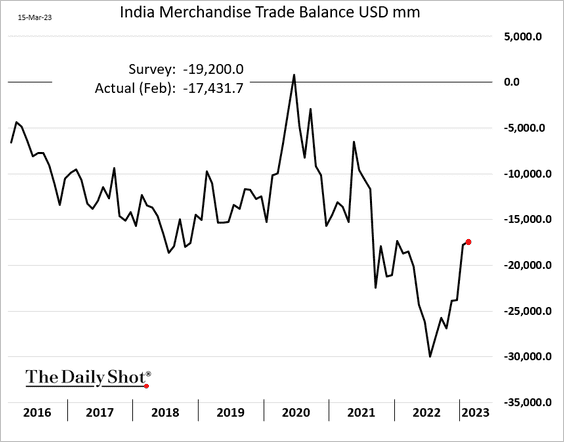

1. India’s exports are holding up well.

The trade deficit was lower than expected last month.

——————–

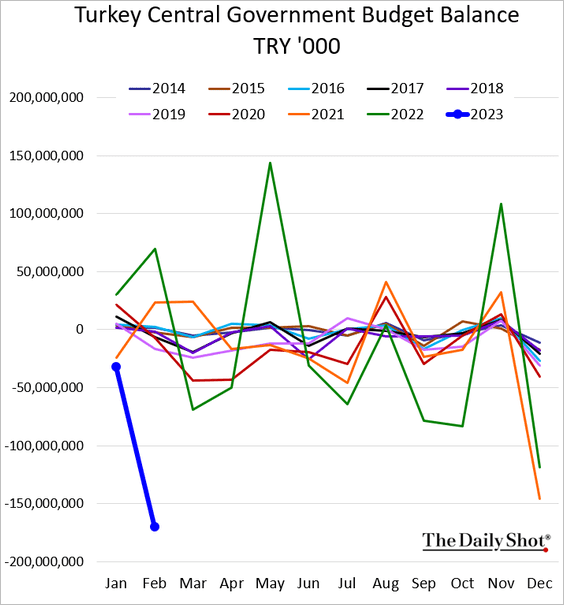

2. Turkey’s government deficit has blown out.

Source: Bloomberg Tax Read full article

Source: Bloomberg Tax Read full article

——————–

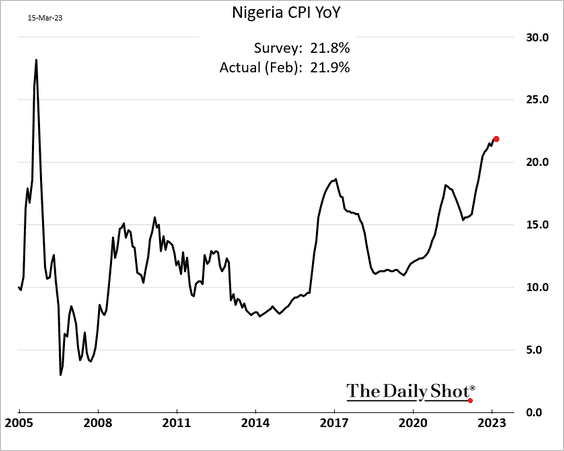

3. The Nigerian CPI continues to surge, even amid the scarcity of the naira (due to the currency “redesign” policy).

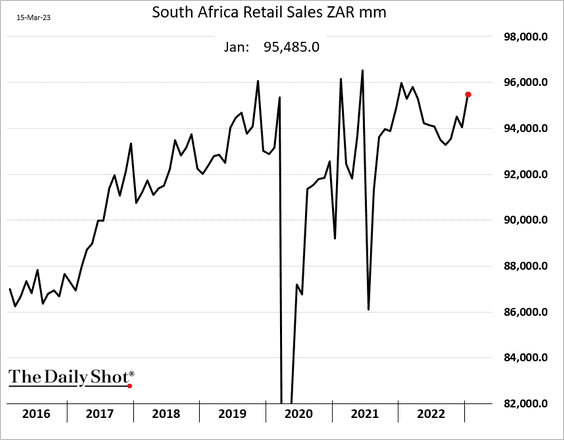

4. South Africa’s retail sales have been strengthening.

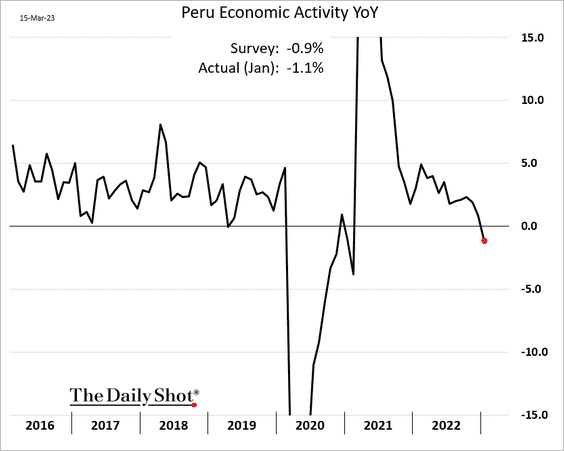

5. Peru’s economic activity deteriorated in January.

Back to Index

China

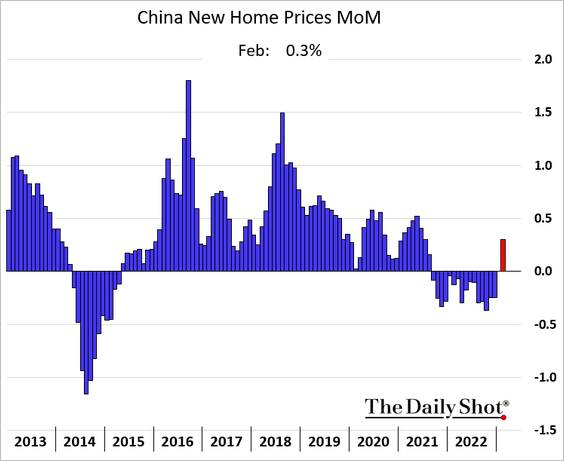

1. After months of declines China’s new home prices jumped in February.

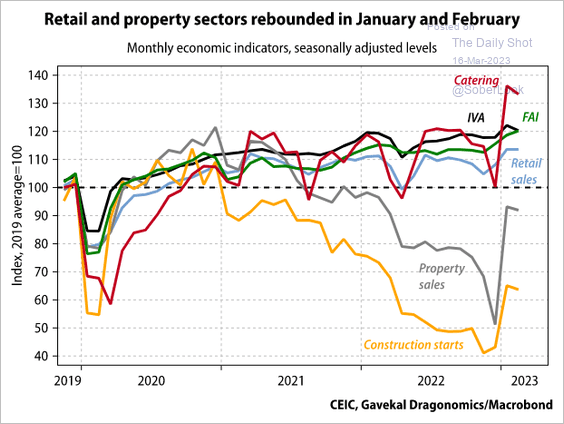

2. Here are the key economic indicators.

Source: Gavekal Research

Source: Gavekal Research

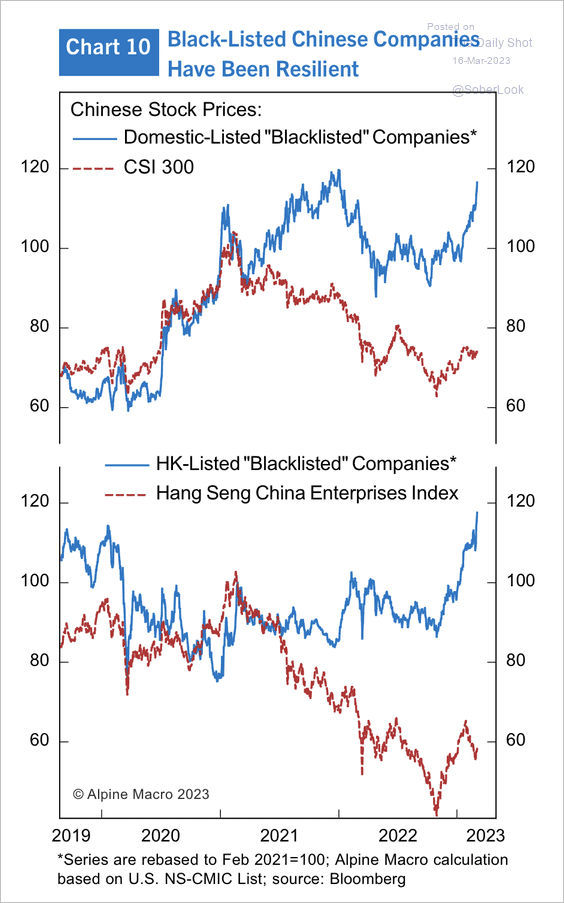

3. Companies on the US “Entity List” have outperformed over the past two years.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Asia – Pacific

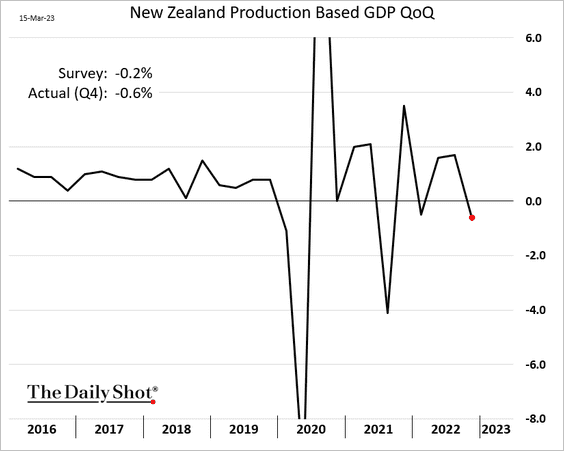

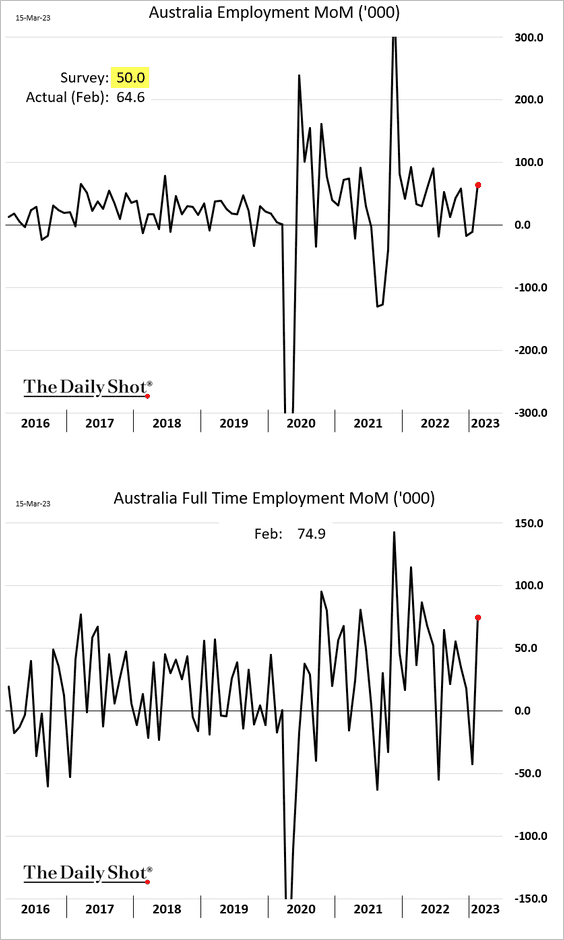

1. New Zealand’s GDP declined more than expected last quarter, …

… after a strong run.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

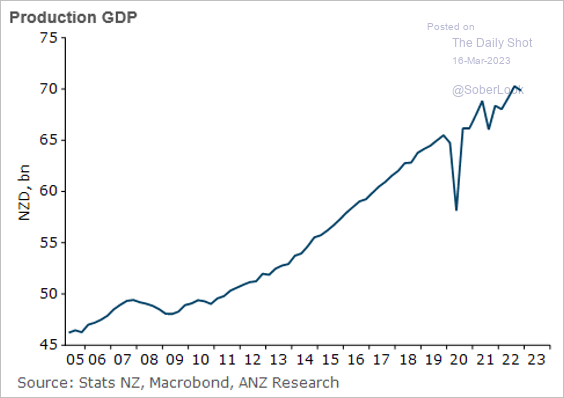

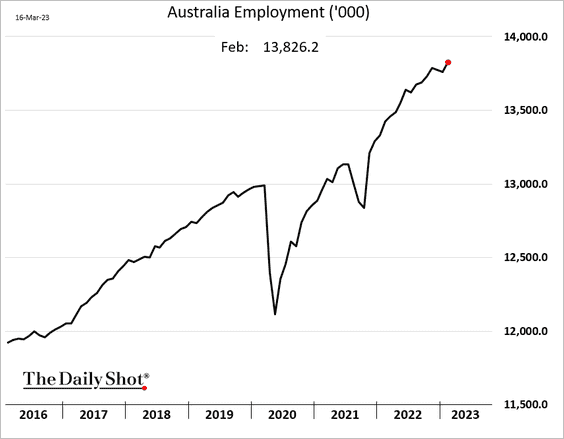

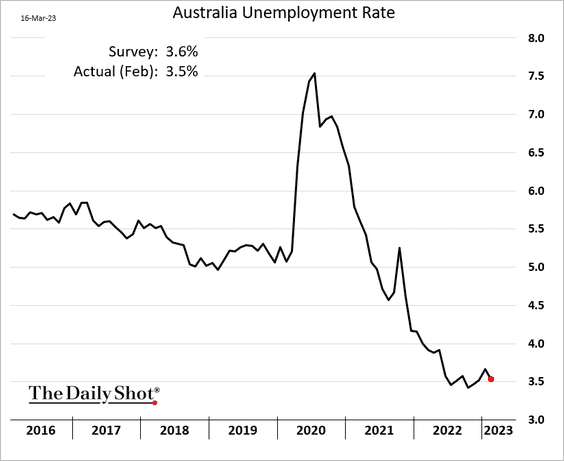

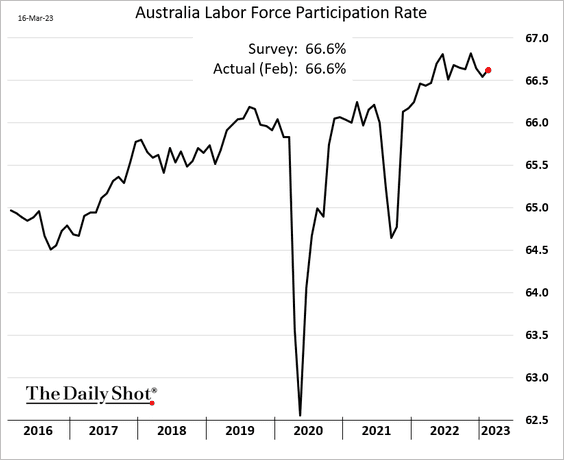

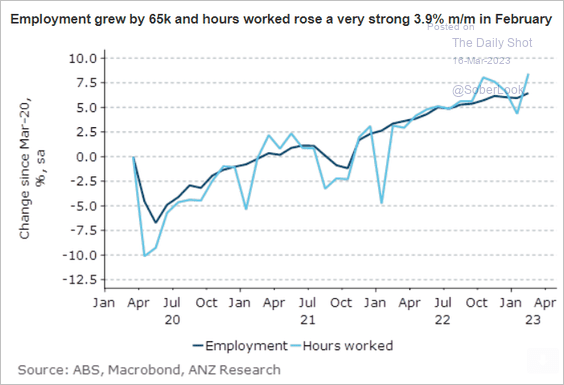

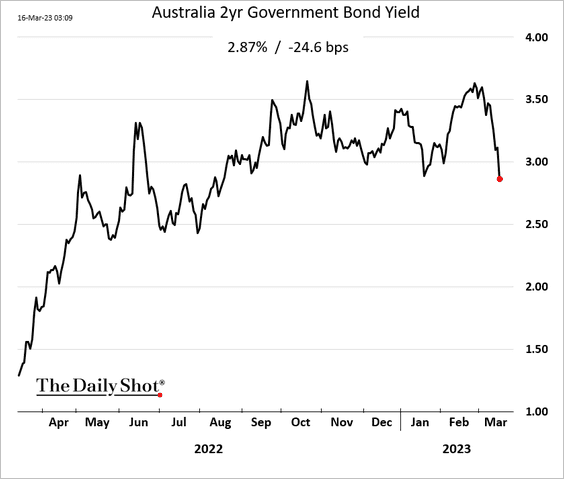

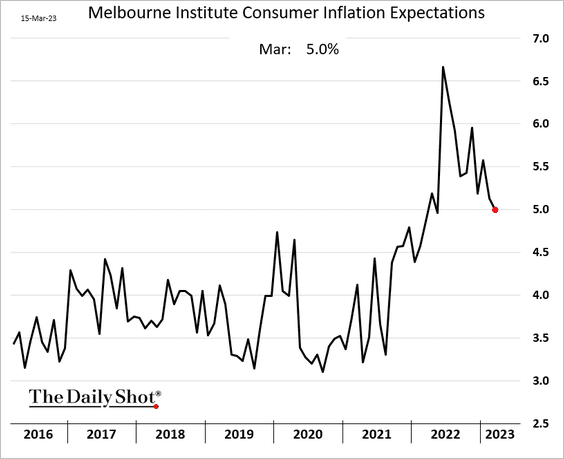

2. Next, we have some updates on Australia.

• The jobs market rebounded last month, topping expectations. An RBA rate hike ahead?

– The unemployment rate dropped.

Source: Reuters Read full article

Source: Reuters Read full article

– The participation rate edged higher.

– Hours worked continue to climb.

Source: @ANZ_Research

Source: @ANZ_Research

• Despite the robust jobs data, bond yields are sharply lower.

• Inflation expectations are moderating.

Back to Index

Japan

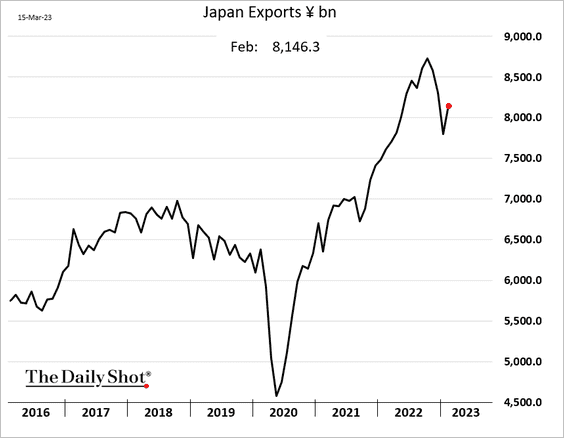

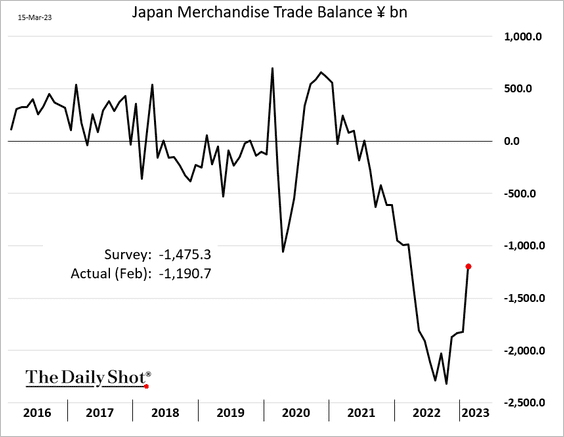

1. Exports strengthened last month.

The trade deficit narrowed more than expected.

——————–

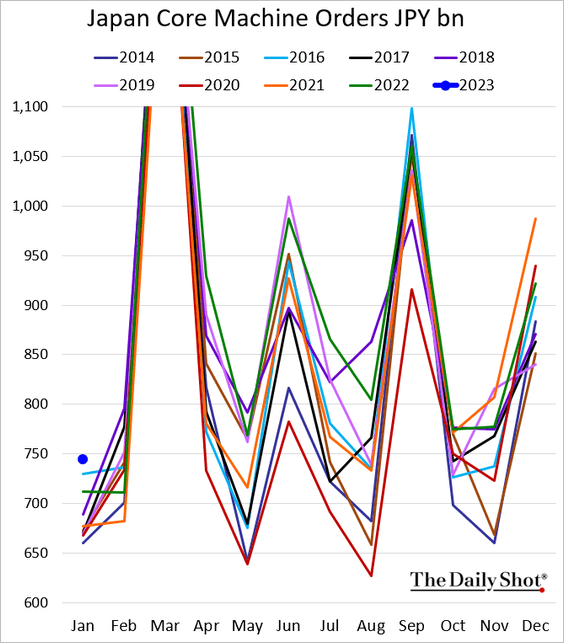

2. Core machinery orders jumped in January.

Source: RTT News Read full article

Source: RTT News Read full article

Back to Index

The Eurozone

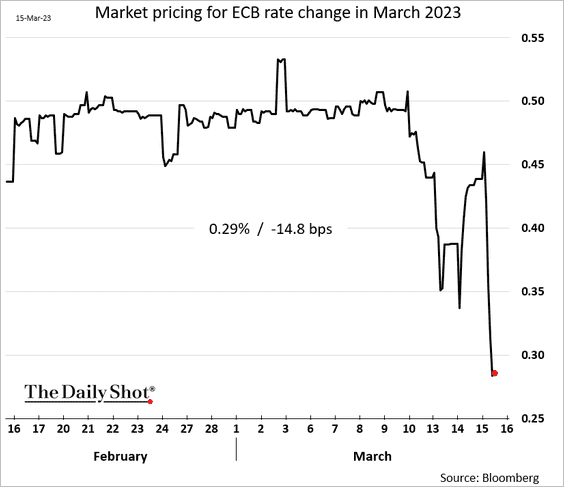

1. The market no longer sees a 50 bps rate hike.

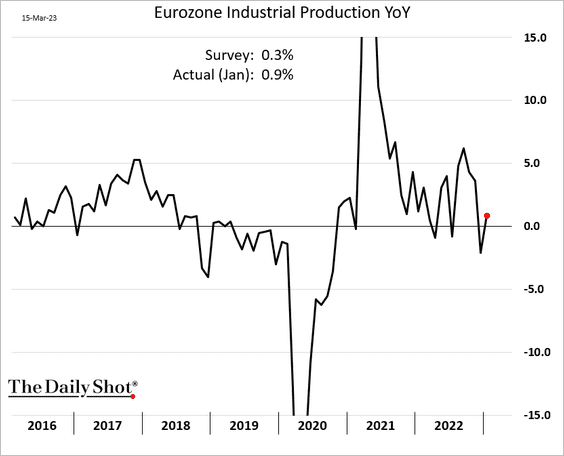

2. Industrial production strengthened in January.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

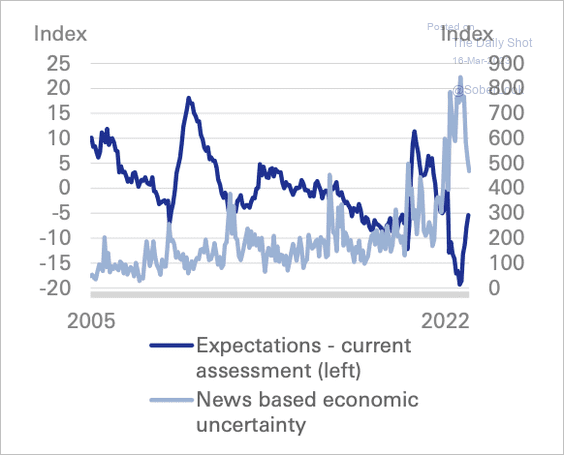

3. News-based economic uncertainty in Germany receded but remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

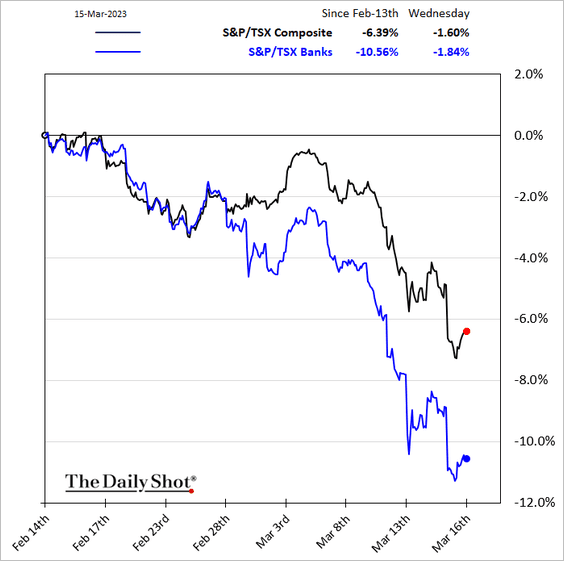

1. Bank shares remain under pressure.

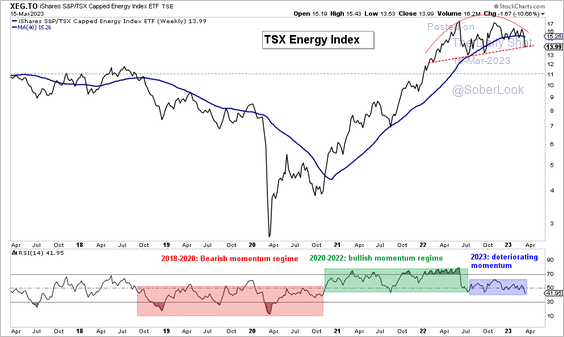

2. The uptrend in Canadian energy stocks is weakening.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

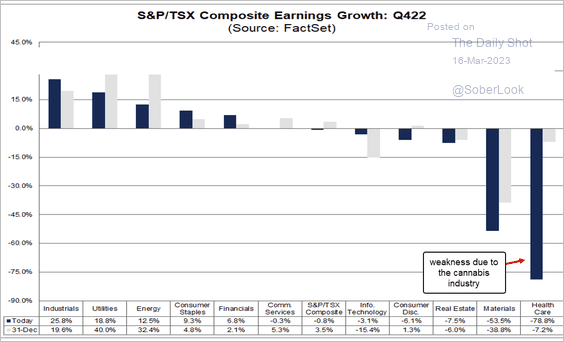

3. This chart shows the Q4 earnings growth by sector.

Source: @FactSet Read full article

Source: @FactSet Read full article

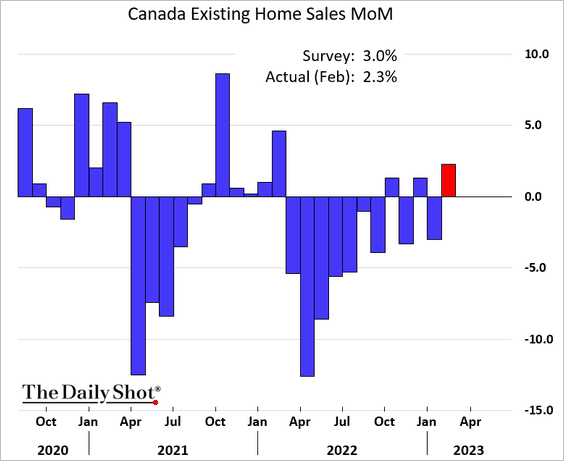

4. Existing home sales increased last month.

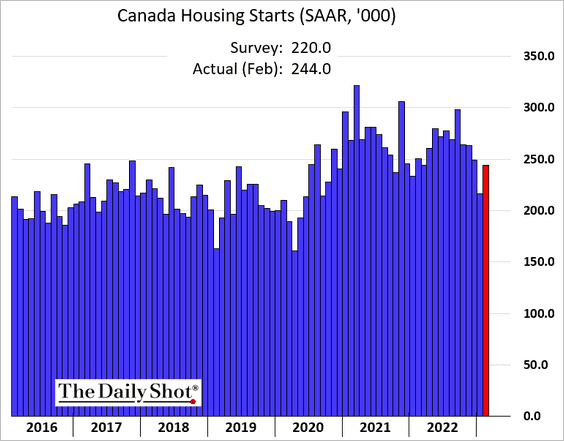

• Housing starts surprised to the upside.

• Home price declines are slowing. Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United States

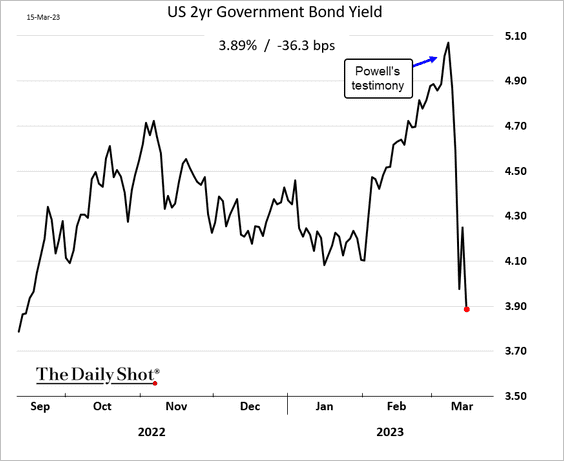

1. The 2-year Treasury yield is down 118 bps from the peak.

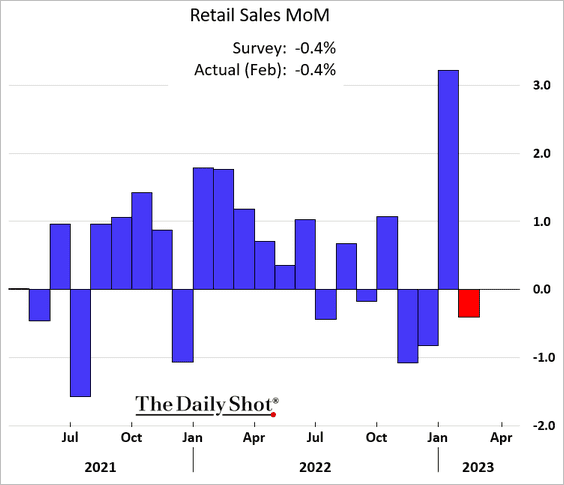

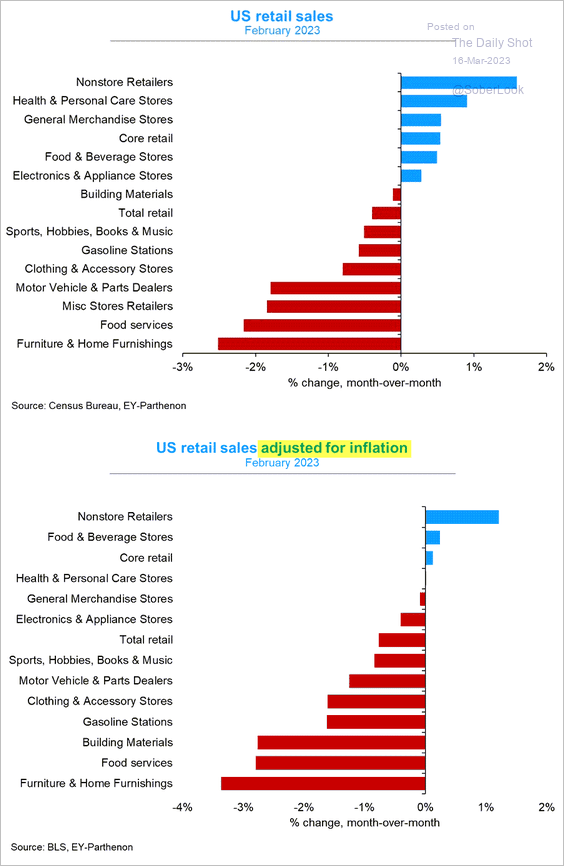

2. Retail sales declined last month.

– Nominal monthly changes:

– Contributions:

Source: @GregDaco

Source: @GregDaco

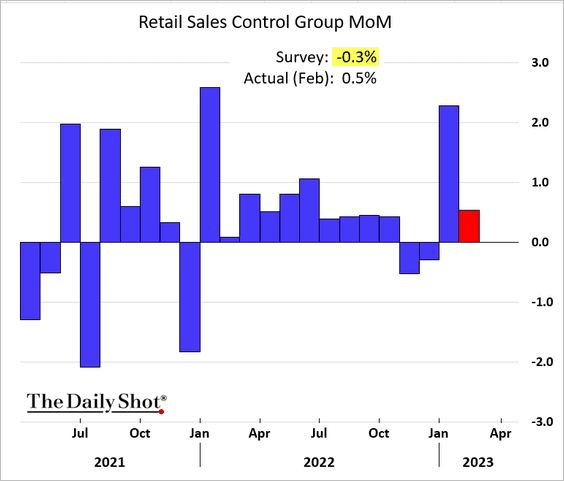

• However, the “core” retail sales (control group) unexpectedly increased.

Source: Reuters Read full article

Source: Reuters Read full article

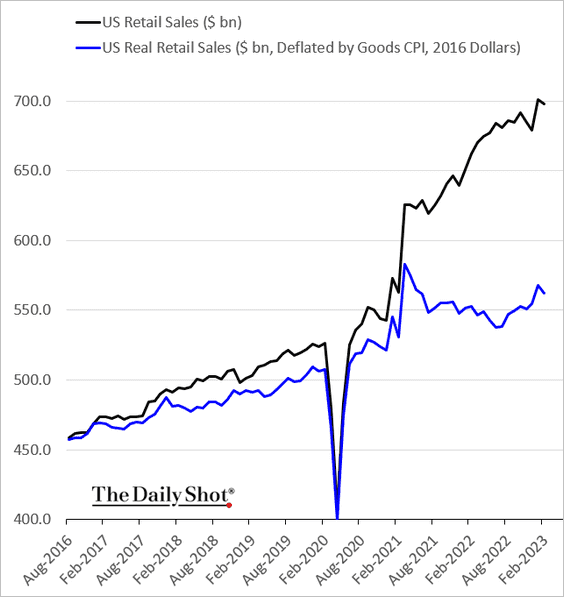

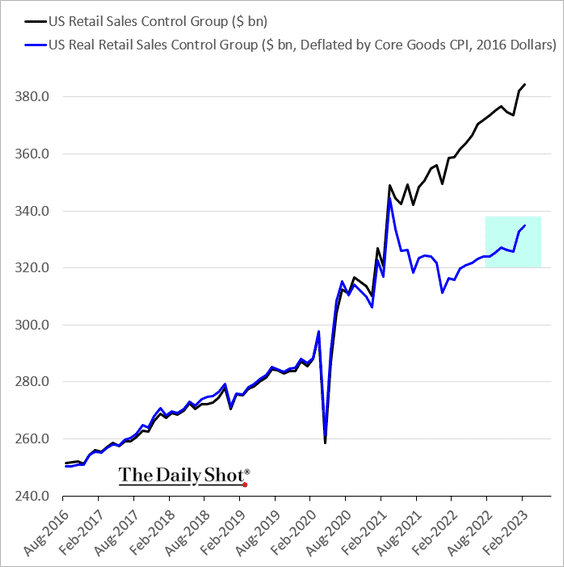

• Below are the retail sales levels – nominal and real.

– Headline retail sales:

– Core retail sales:

——————–

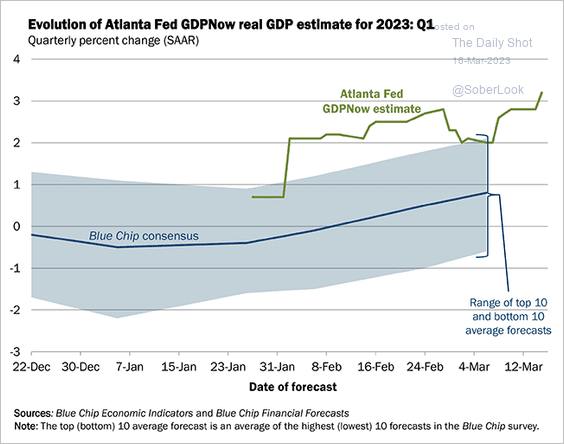

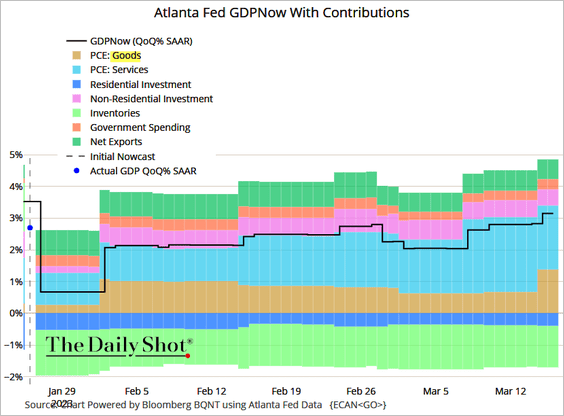

3. The Atlanta Fed’s Q1 GDP growth tracker climbed to 3.2%, …

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

… driven by stronger spending on goods.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

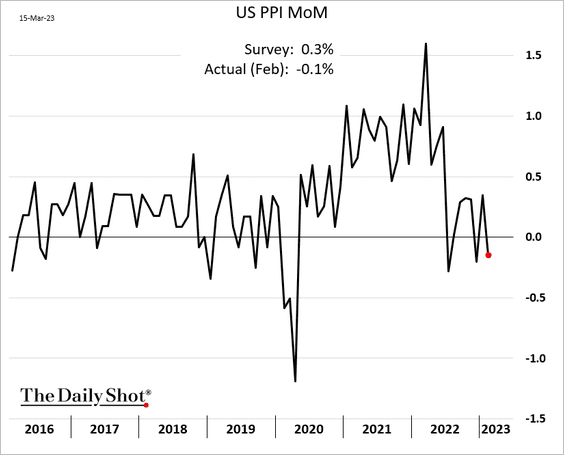

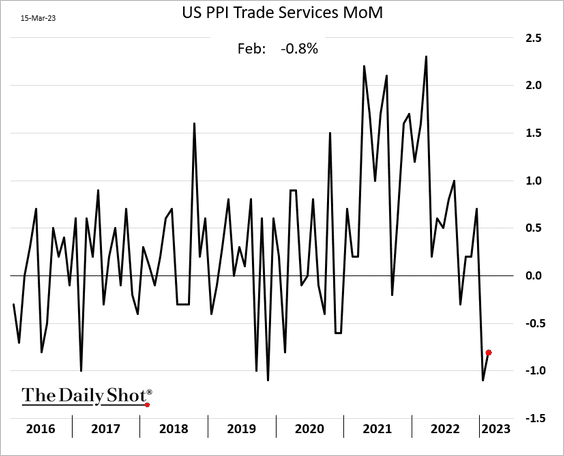

4. The PPI unexpectedly declined in February.

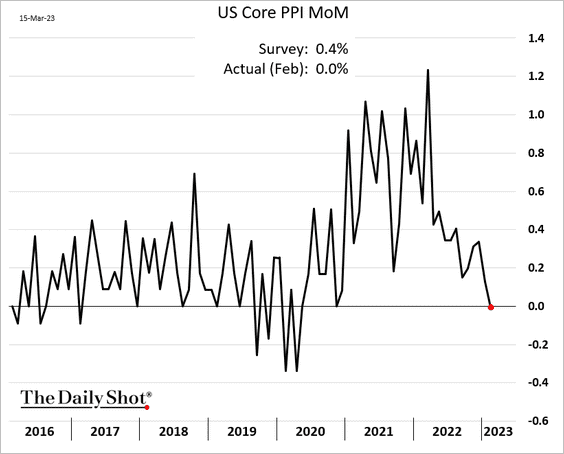

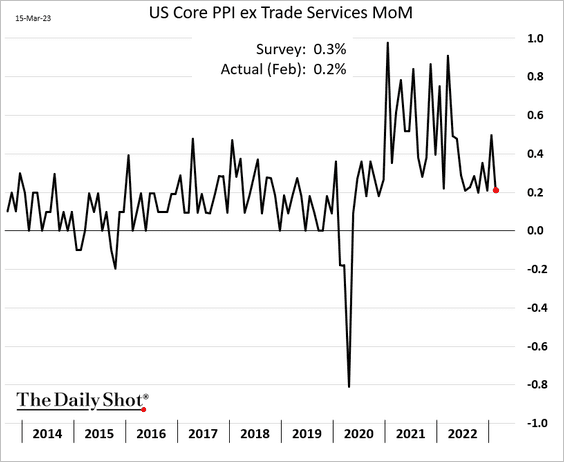

• The core PPI was flat.

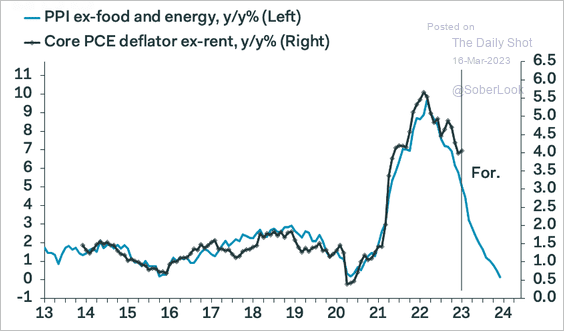

• Softer core PPI signals slower CPI ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The weakness in the core PPI was driven, in part, by trade services (business markups). Shrinking margins represent good news for the Fed, but not so much for the stock market.

• Here is the core PPI excluding trade services.

——————–

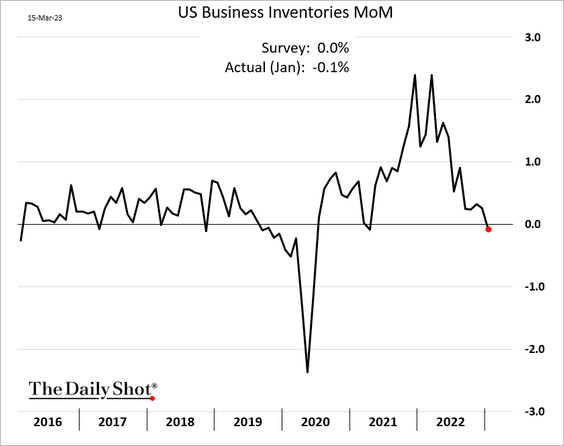

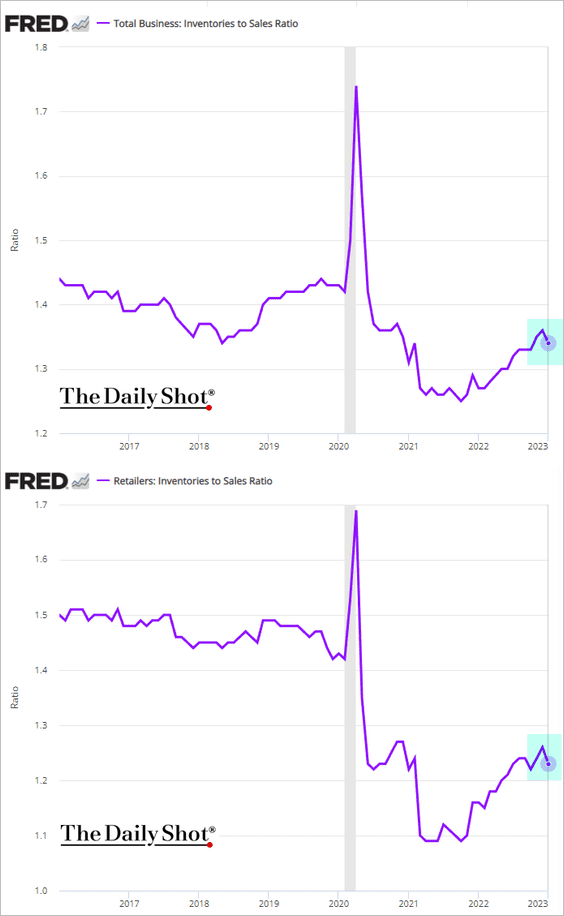

5. Business inventories declined in January.

Inventory-to-sales ratios were lower.

——————–

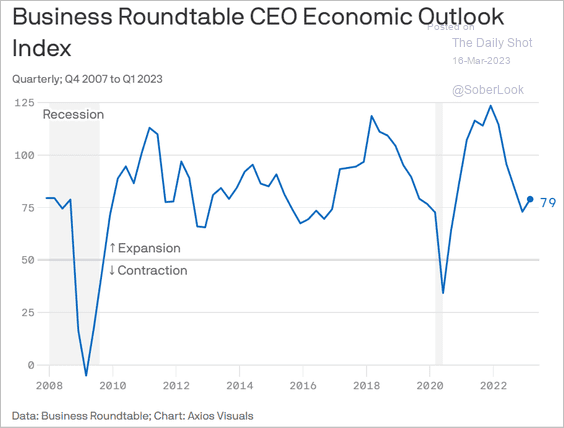

6. CEO outlook improved this quarter (before the banking crisis).

Source: @axios Read full article

Source: @axios Read full article

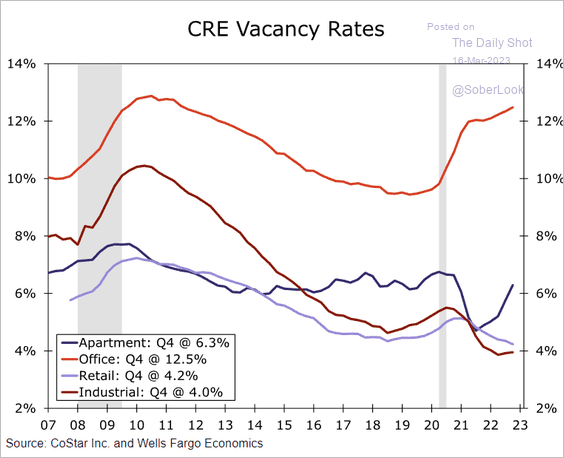

7. This chart shows commercial real estate vacancy rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Global Developments

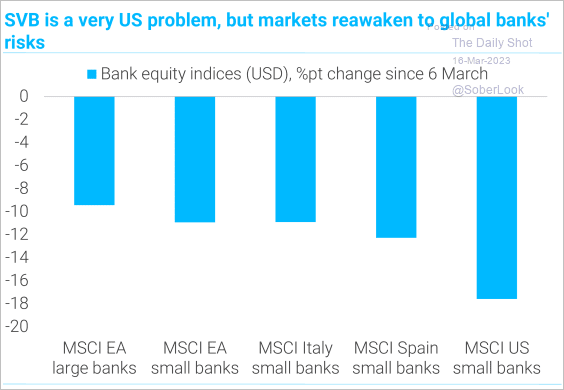

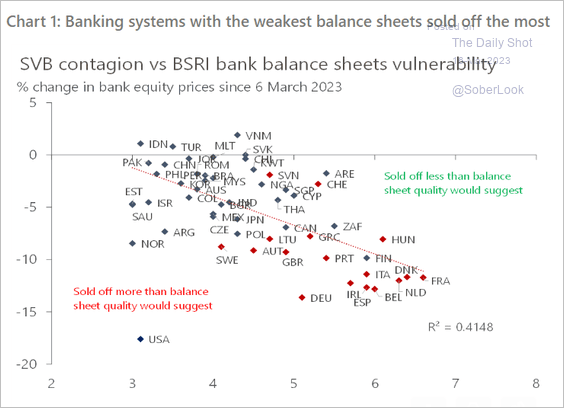

1. Which banking sectors sold off the most in recent days?

Source: Oxford Economics

Source: Oxford Economics

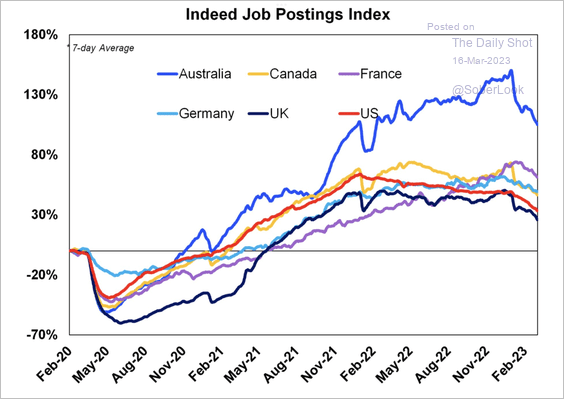

2. Job postings on Indeed are slowing, especially in Australia.

Source: @ShaneOliverAMP

Source: @ShaneOliverAMP

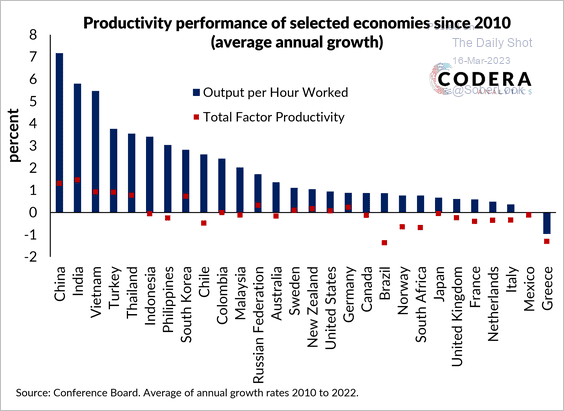

3. Since 2010, productivity growth has been the fastest in countries such as China, India, and Vietnam.

Source: Codera Analytics Read full article

Source: Codera Analytics Read full article

——————–

Food for Thought

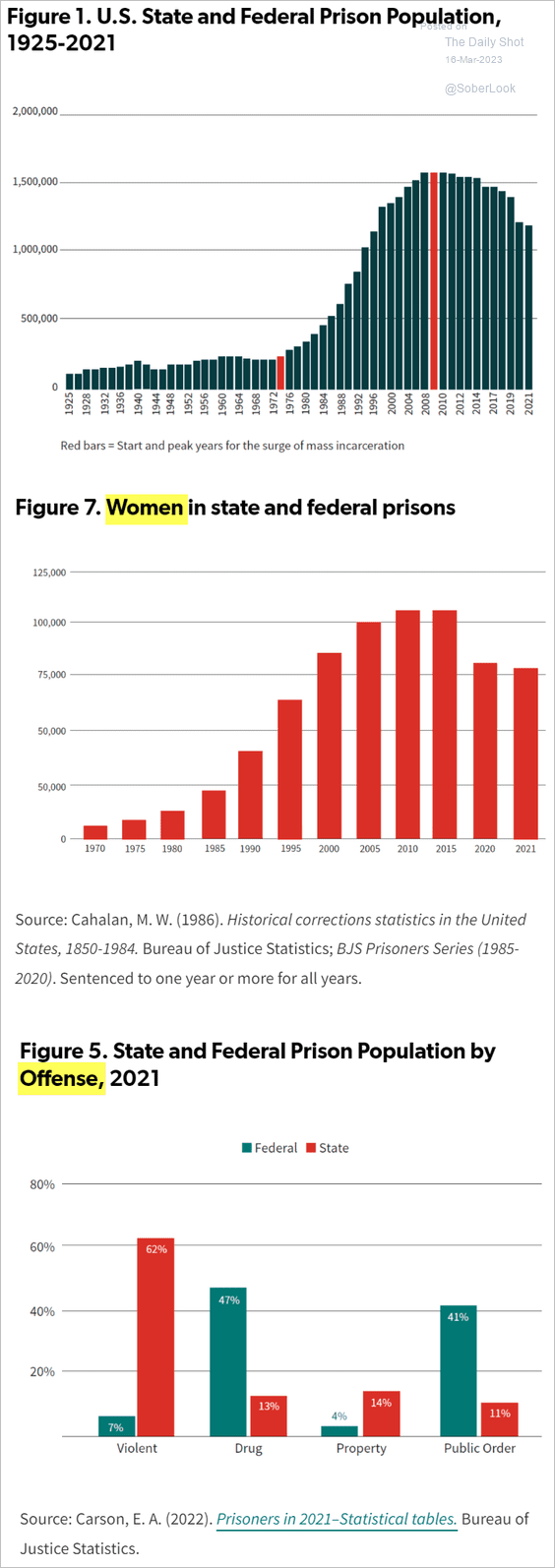

1. US state and federal prison population:

Source: The Sentencing Project

Source: The Sentencing Project

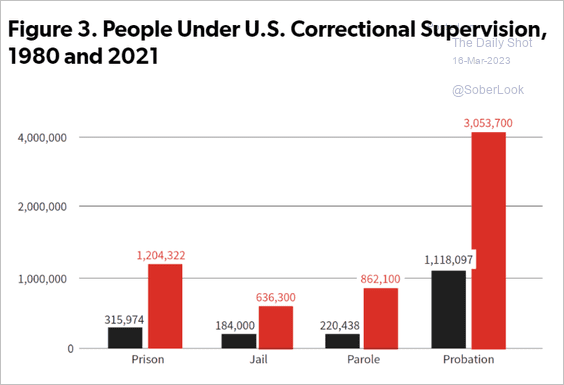

2. People under US correctional supervision:

Source: The Sentencing Project

Source: The Sentencing Project

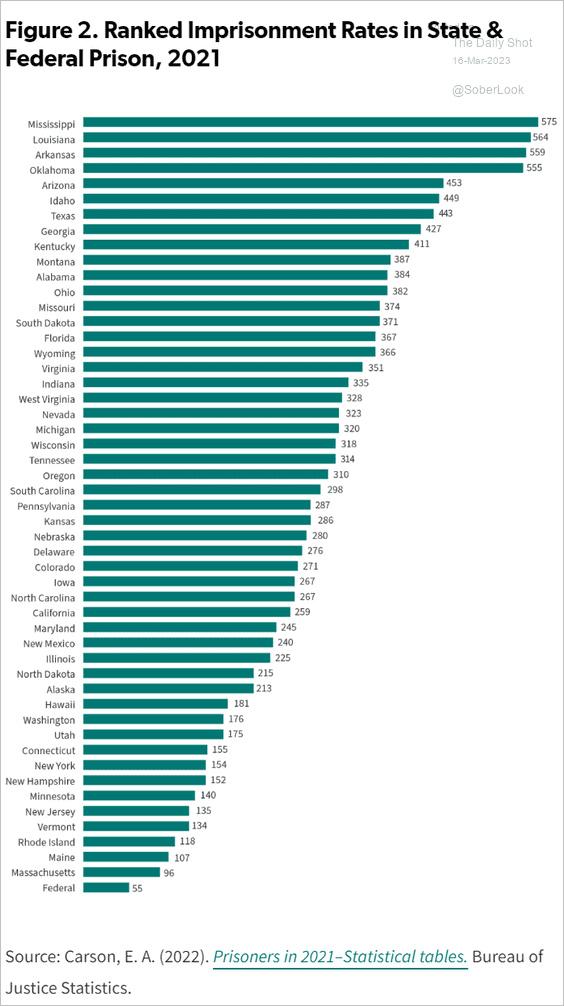

3. Imprisonment rates by state:

Source: The Sentencing Project

Source: The Sentencing Project

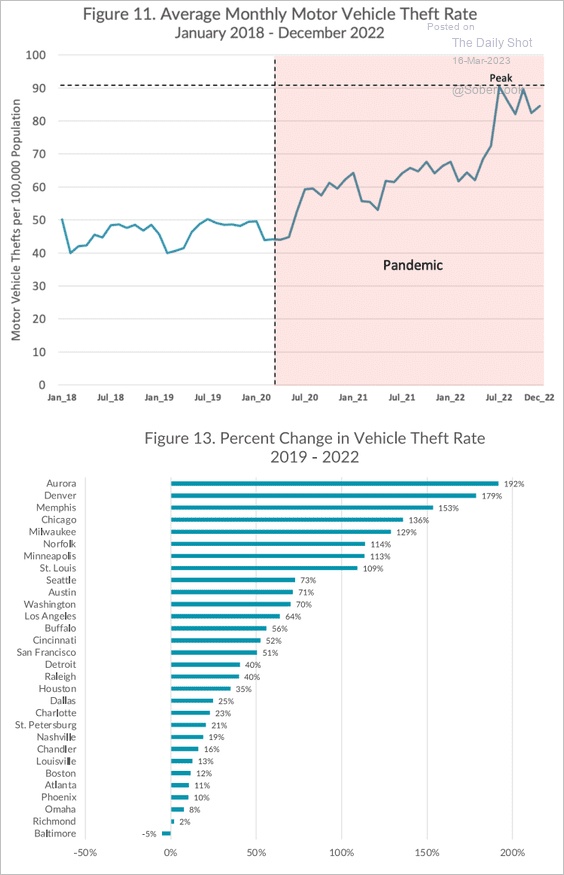

4. Vehicle theft in the 30 US cities with available data:

Source: Council on Criminal Justice

Source: Council on Criminal Justice

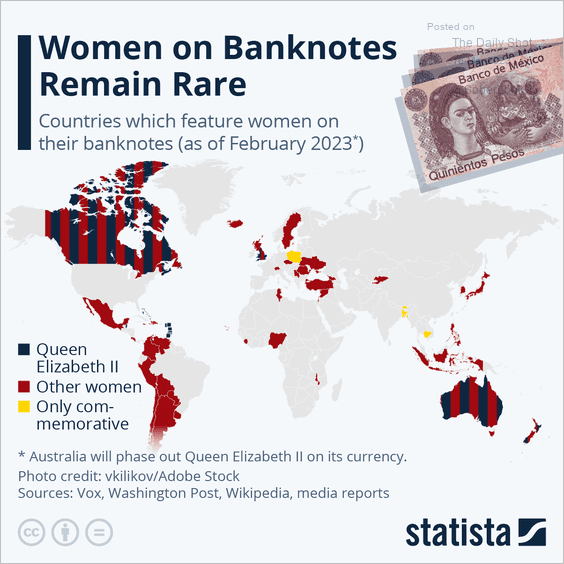

5. Women on banknotes:

Source: Statista

Source: Statista

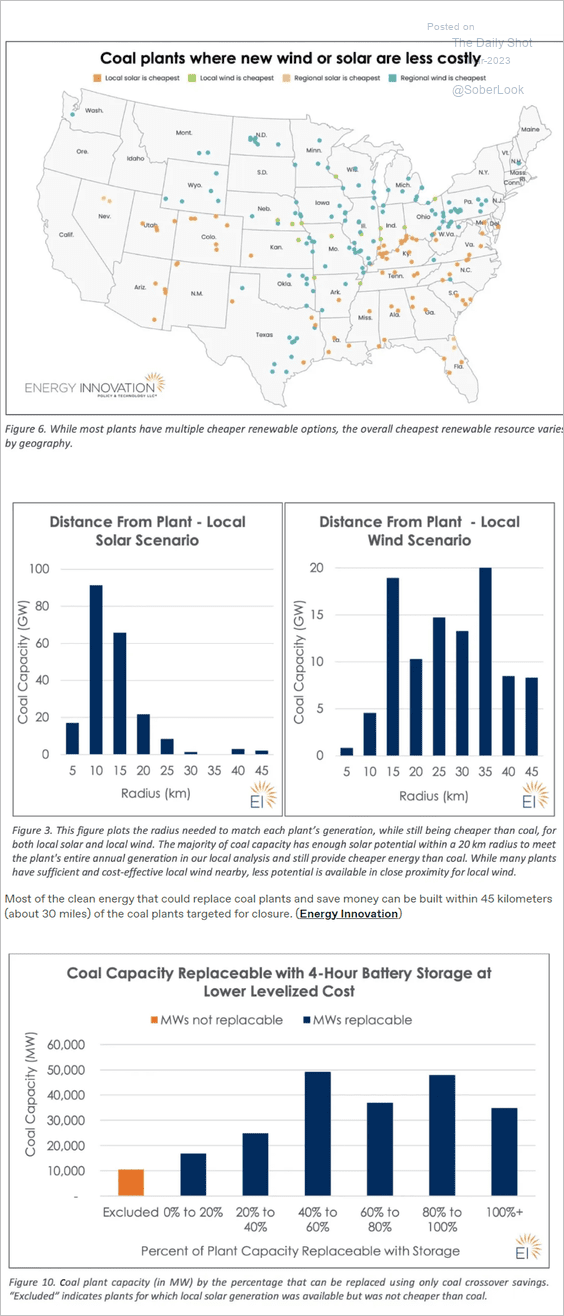

6. Replacing coal capacity:

Source: Canary Media Read full article

Source: Canary Media Read full article

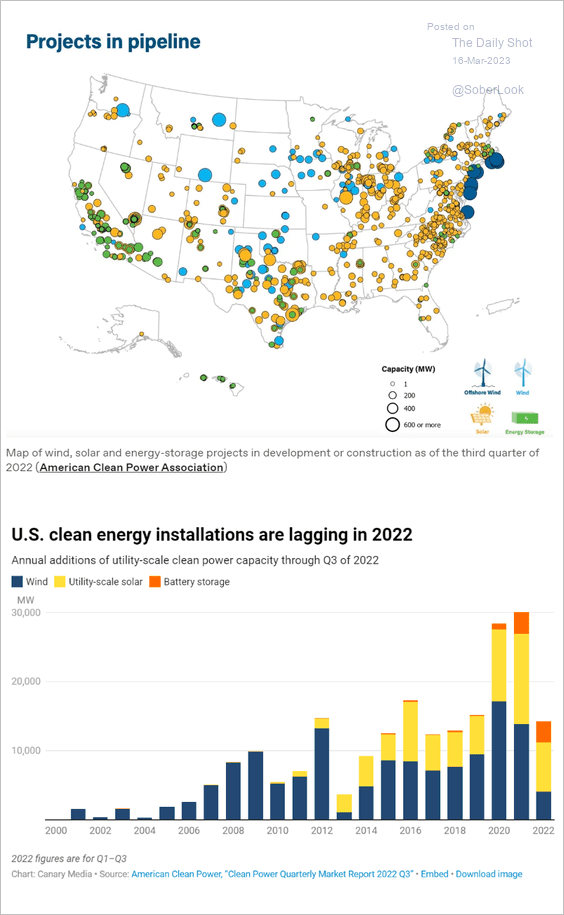

7. Clean energy projects:

Source: Canary Media Read full article

Source: Canary Media Read full article

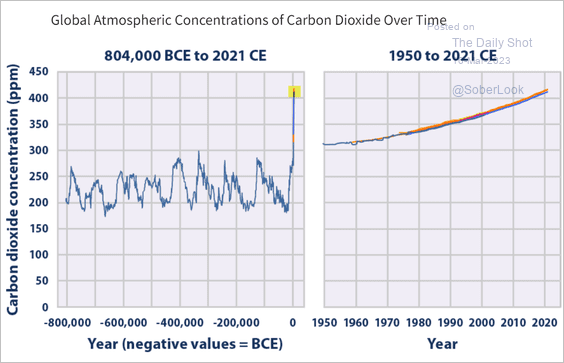

8. Atmospheric concentrations of CO2 over time:

Source: EPA Read full article

Source: EPA Read full article

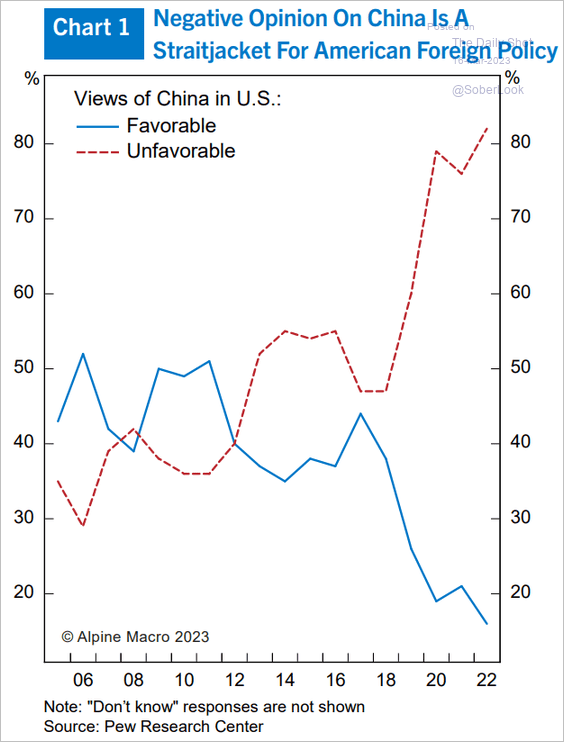

9. Views on China in the US:

Source: Alpine Macro

Source: Alpine Macro

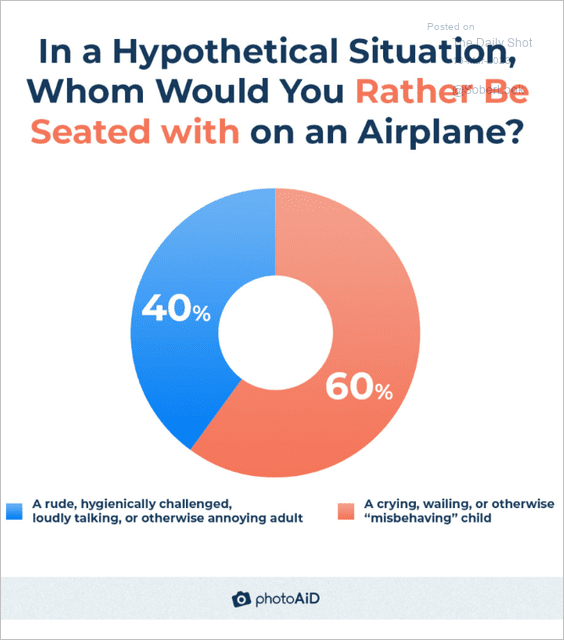

10. An annoying adult or a misbehaving child?

Source: PhotoAiD Read full article

Source: PhotoAiD Read full article

——————–

Back to Index