The Daily Shot: 20-Mar-23

• Credit

• Equities

• Energy

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• Europe

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Credit

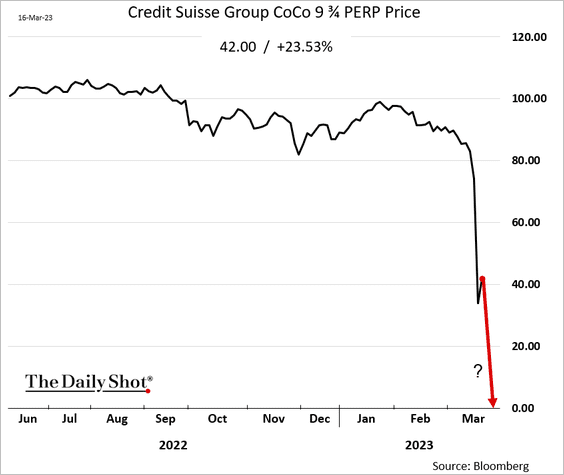

1. Swiss regulators strongarmed UBS to take over Credit Suisse over the weekend to stem the banking crisis.

Source: CNBC Read full article

Source: CNBC Read full article

It appears that the Credit Suisse AT1 securities will get wiped out. That’s a sizable hit to the CoCo market and will make it challenging for other banks to issue these securities.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Reuters Read full article

Source: Reuters Read full article

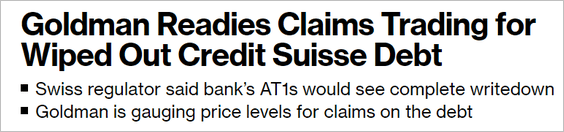

Of course, the CoCo holders are not going to take this lying down.

Source: @ArroyoNieto, @markets Read full article

Source: @ArroyoNieto, @markets Read full article

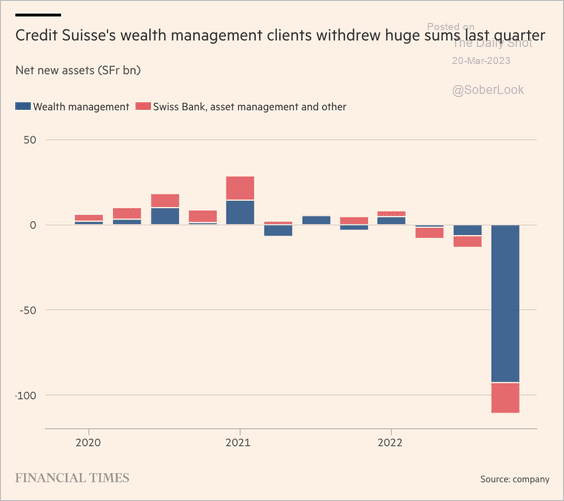

Separately, this chart shows Credit Suisse wealth management clients running for the exits.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

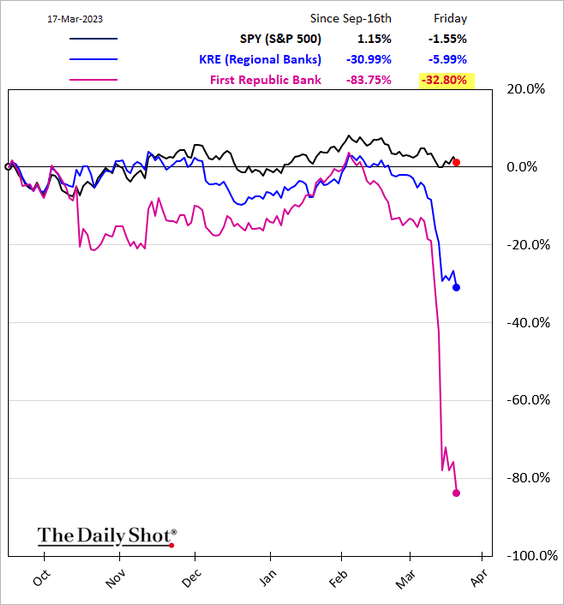

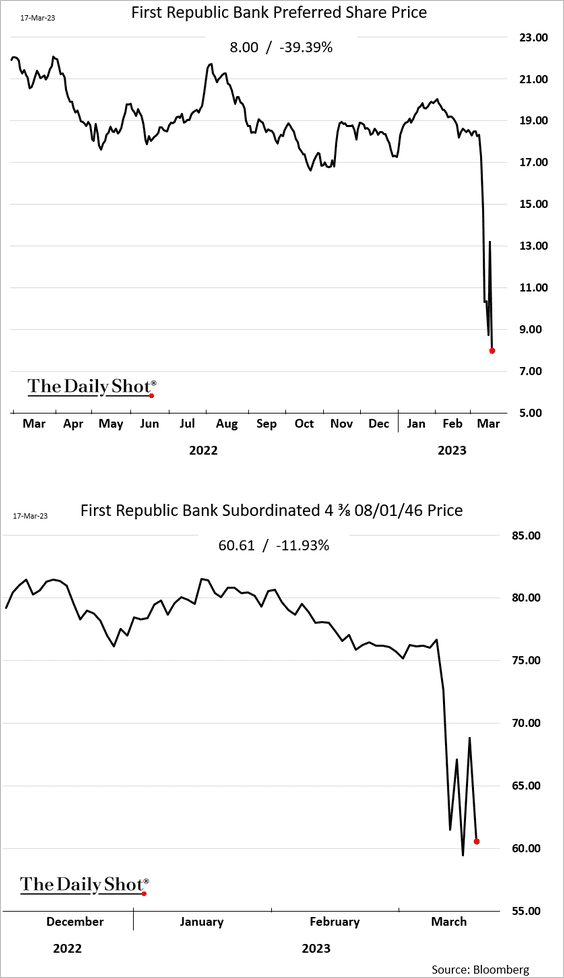

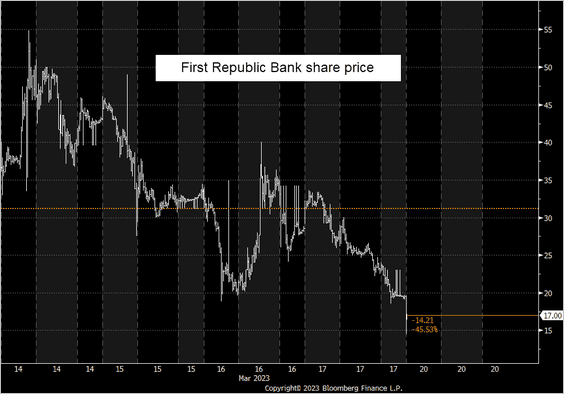

2. In the US, First Republic Bank shares remain under pressure.

Here are the preferreds and sub-debt.

Shares are down again this morning.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

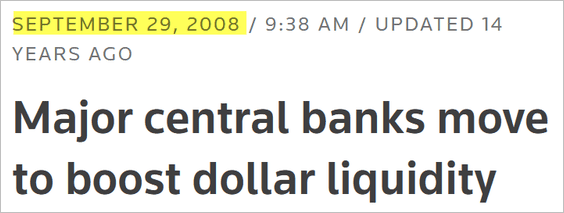

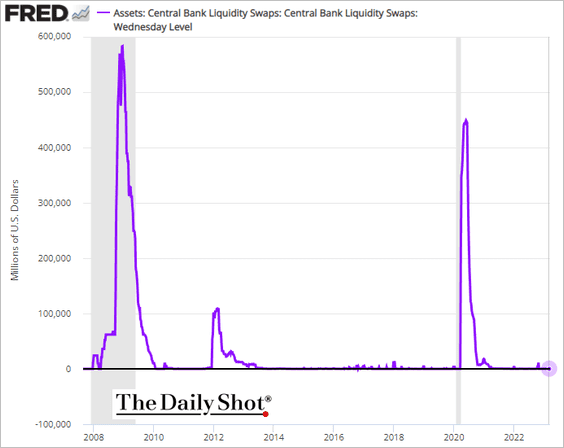

3. The Fed moved to boost dollar funding capability for other central banks.

Source: @ctorresreporter, @markets Read full article

Source: @ctorresreporter, @markets Read full article

This brings back memories of 2008.

Source: Reuters Read full article

Source: Reuters Read full article

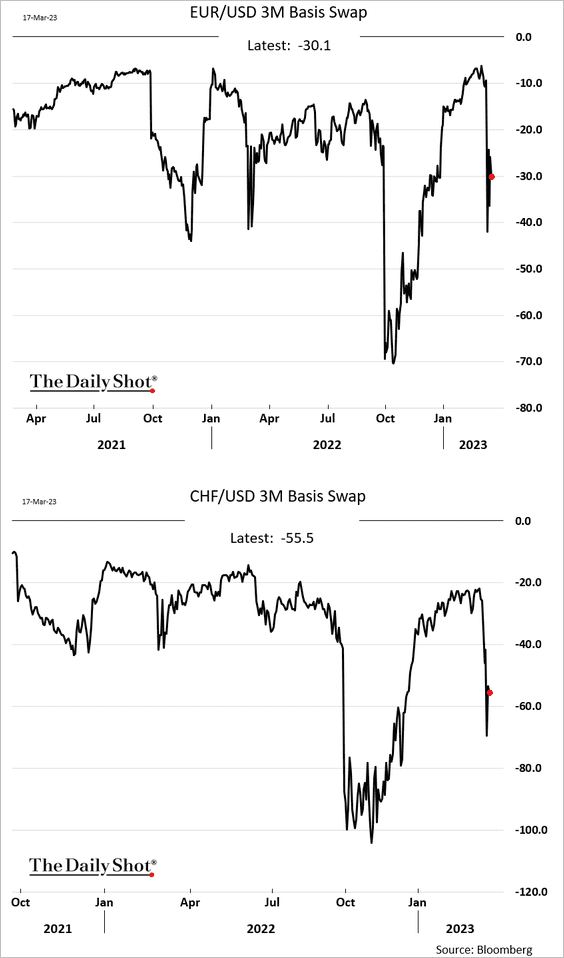

The use of the Fed’s international swap lines spikes during severe risk-off episodes when there is a shortage of dollar liquidity.

For now, basis swaps are not signaling severe shortages of US dollar funding.

——————–

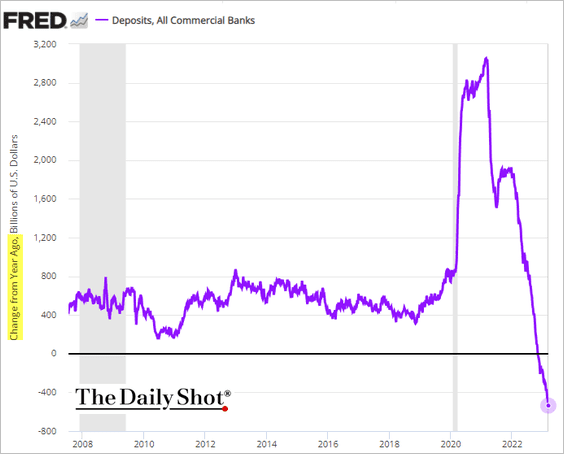

4. US deposits continued to shrink going into the SVB default week, driven mostly by the Fed’s QT.

——————–

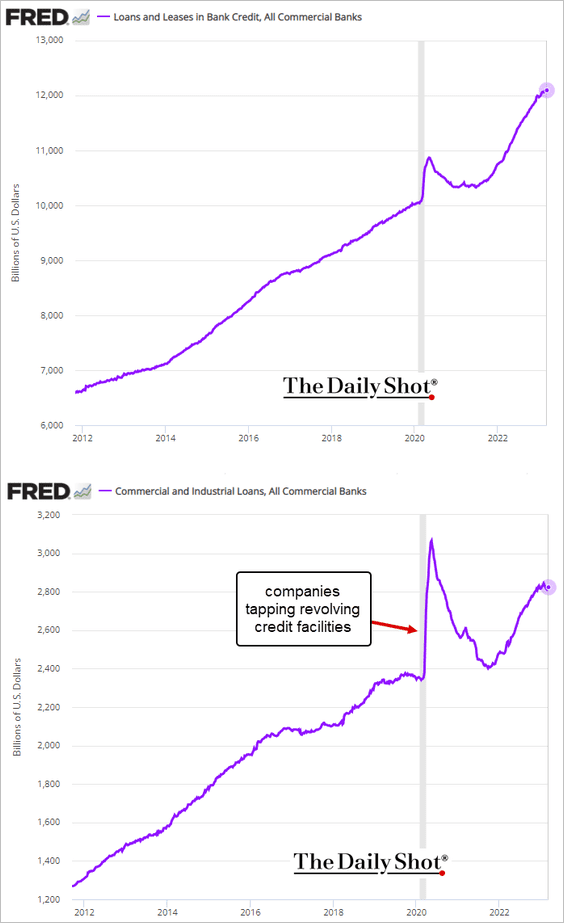

5. Is US loan growth about to peak?

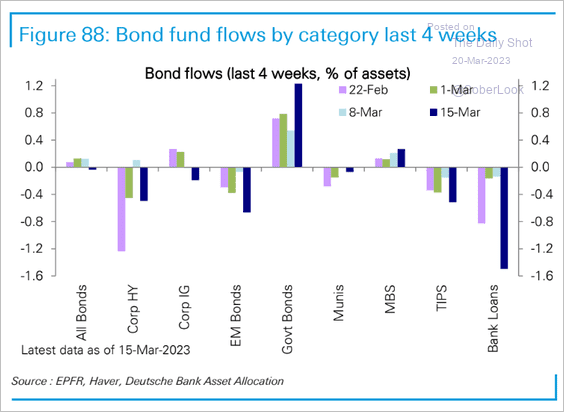

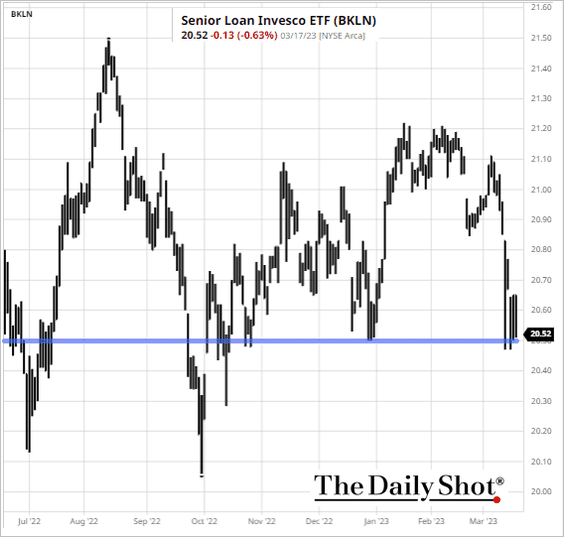

6. Leveraged loans continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

BKLN, the largest loan ETF, is testing support.

Source: barchart.com

Source: barchart.com

——————–

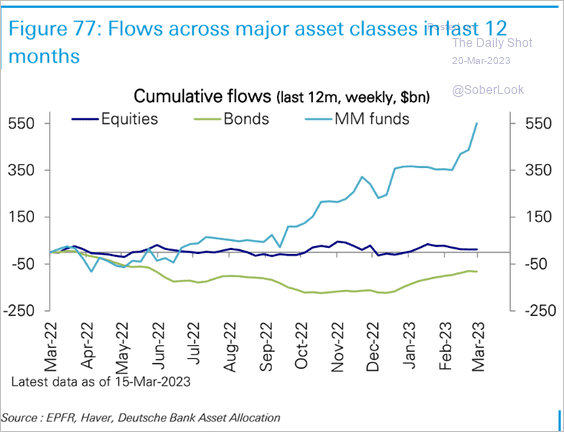

7. Flows into money market funds have accelerated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

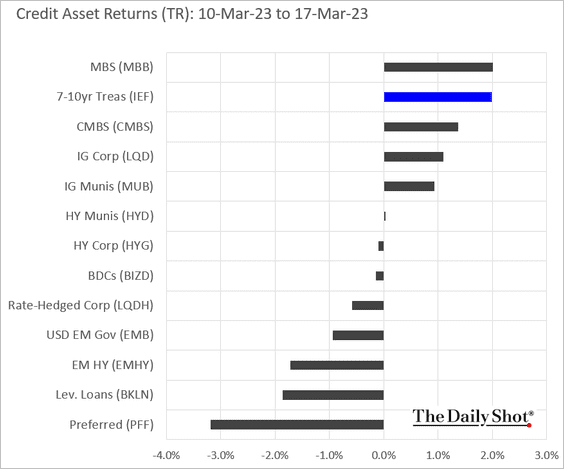

8. Here is last week’s performance by credit asset class.

Back to Index

Equities

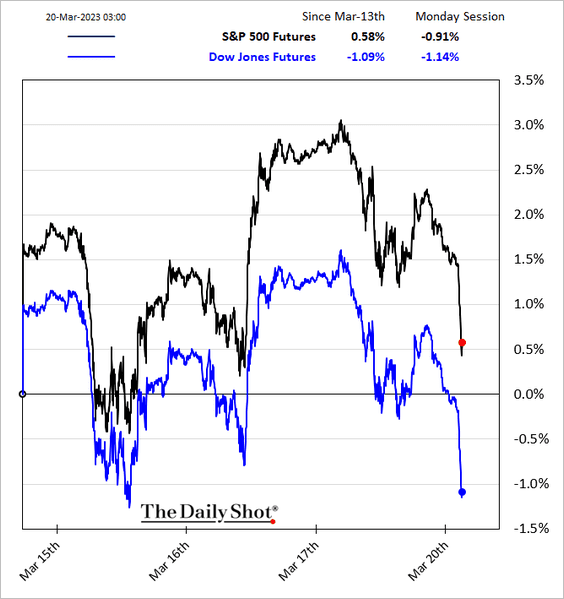

1. Stock futures in the US and Europe are under pressure after the Credit Suisse deal.

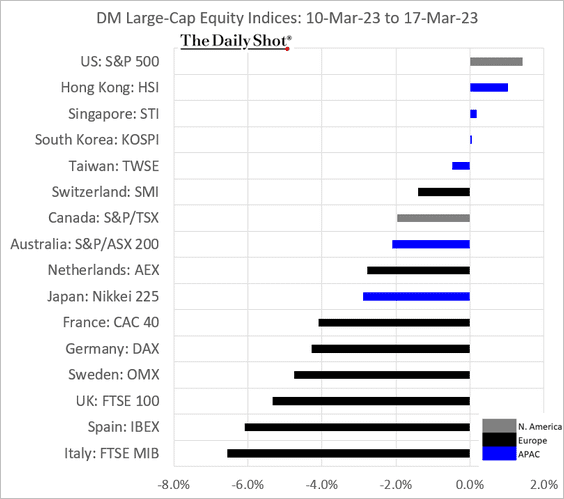

2. The S&P 500 outperformed other DM large-cap indices last week, …

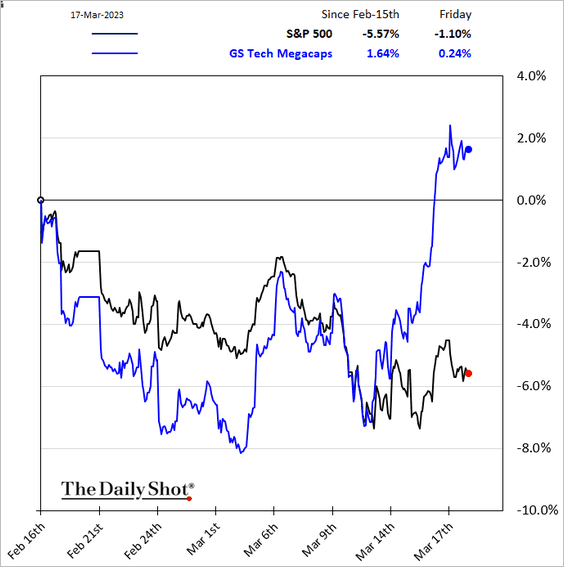

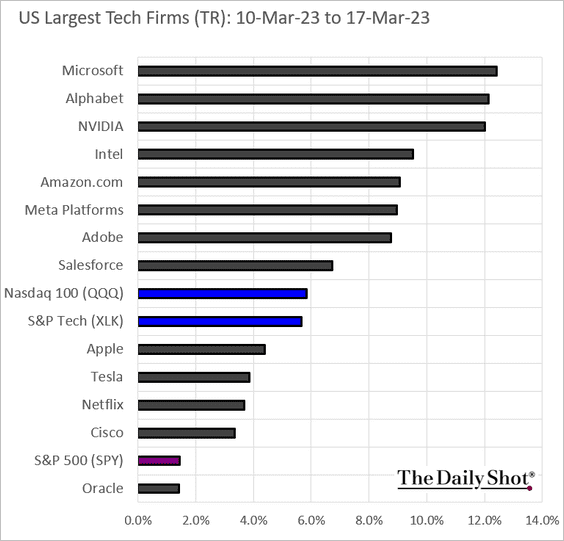

… boosted by tech mega-caps.

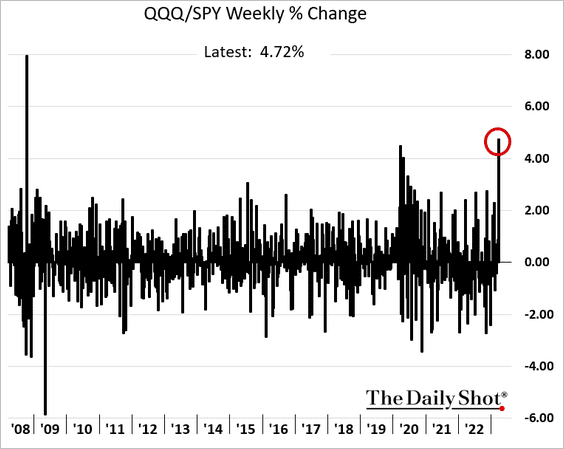

3. The Nasdaq 100 had the best week vs. the S&P 500 since 2008.

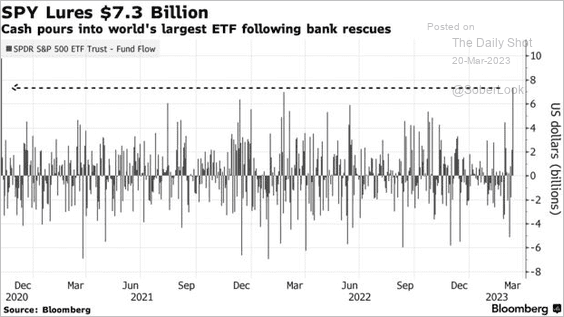

4. SPY, the largest ETF, saw substantial inflows.

Source: @SamJPotter, @markets Read full article

Source: @SamJPotter, @markets Read full article

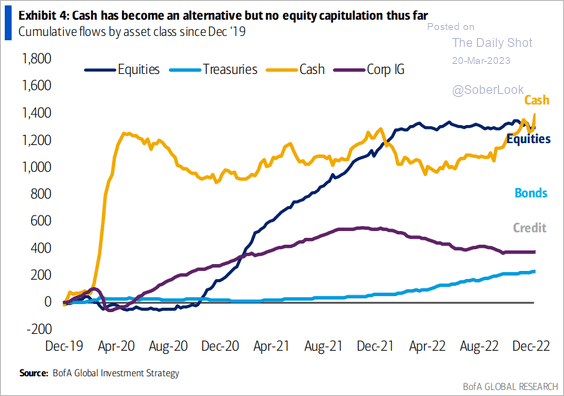

We are yet to see meaningful outflows from equity funds.

Source: BofA Global Research

Source: BofA Global Research

——————–

6. Next, let’s take a look at financials.

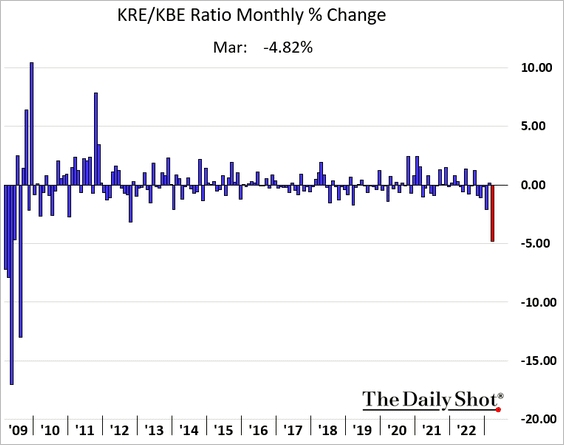

• It’s been a rough month for regional banks relative to the overall banking sector.

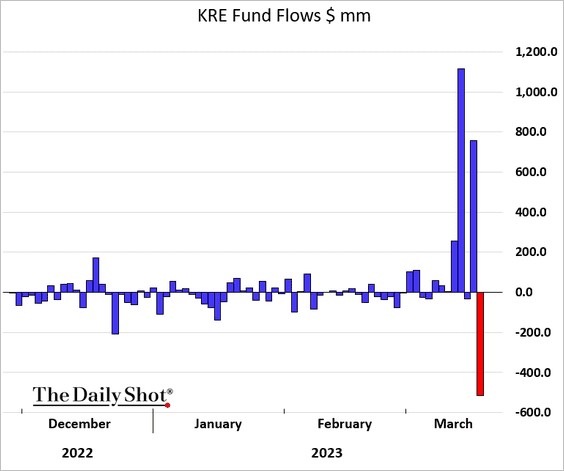

• After massive inflows, the regional banking ETF saw outflows on Friday.

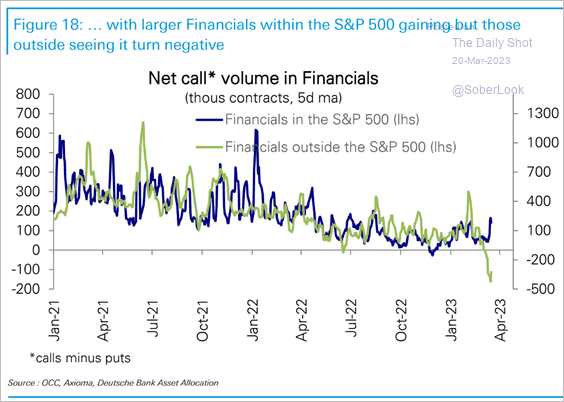

• Demand for call options on smaller financials has crumbled.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

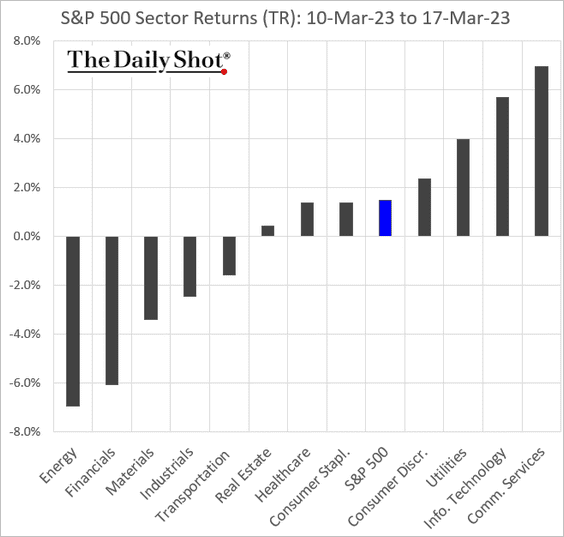

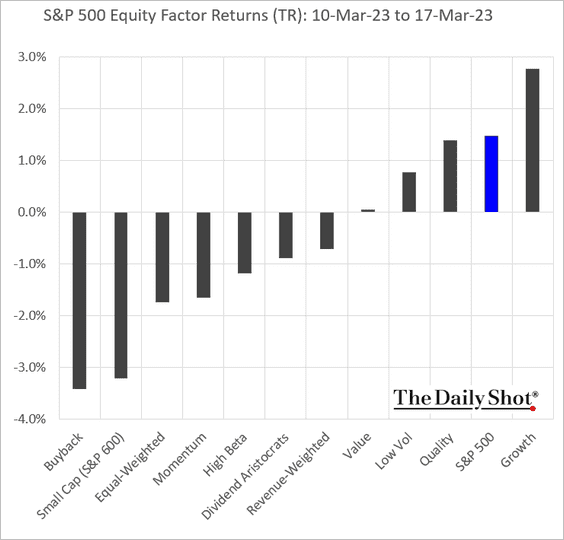

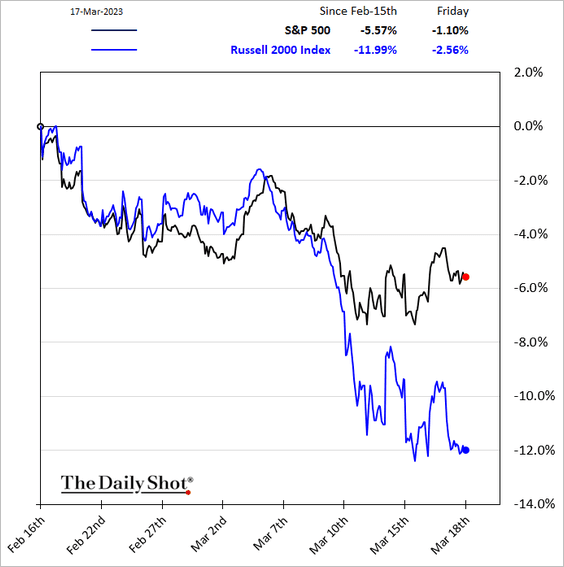

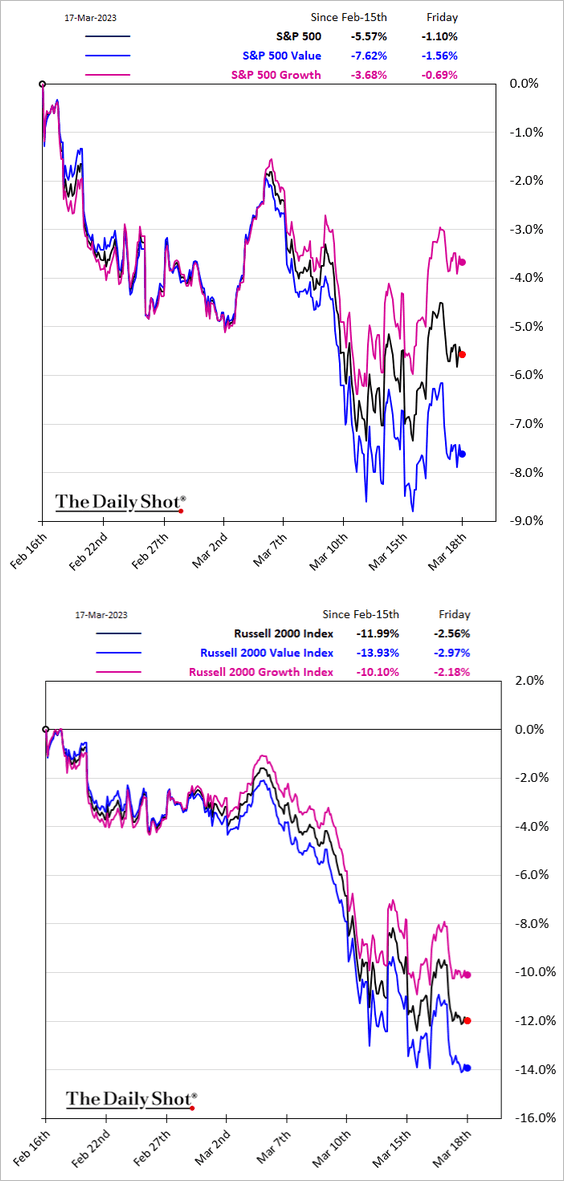

7. Now, let’s take a look at last week’s performance.

• Sectors:

• Equity factors:

– Small caps:

– Growth vs. value for large- and small-cap stocks:

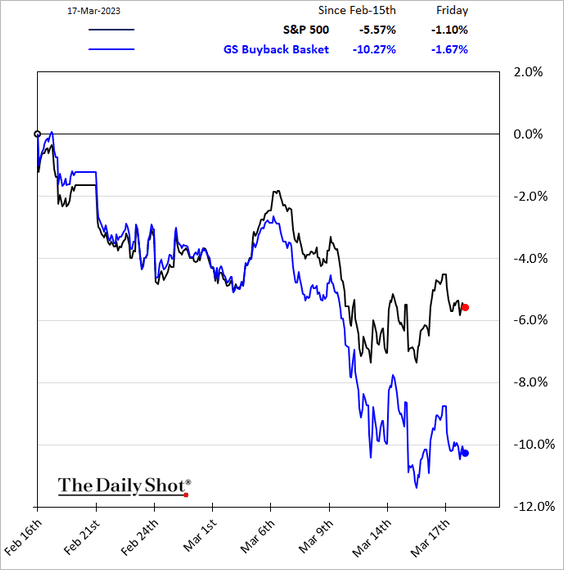

– The buyback index (companies known for buying back their shares):

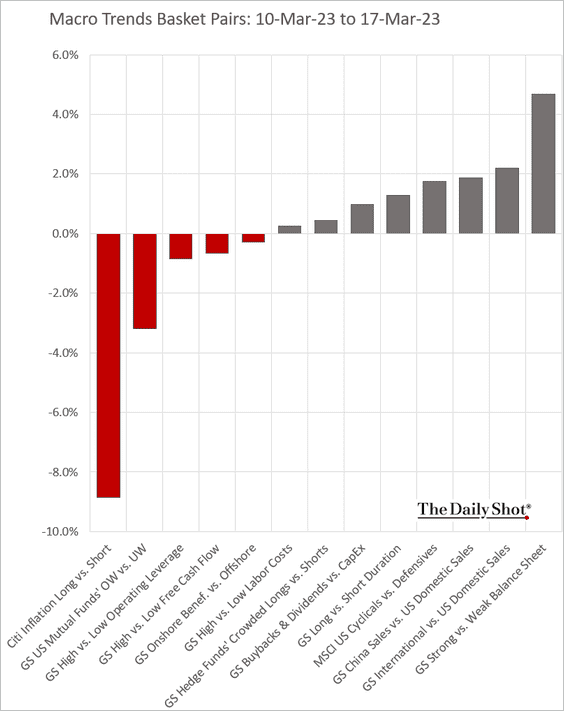

• Macro basket pairs relative performance:

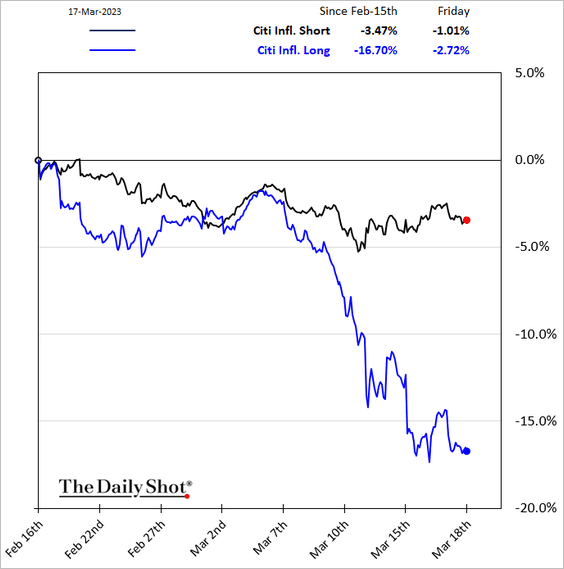

– Inflation long vs. inflation short:

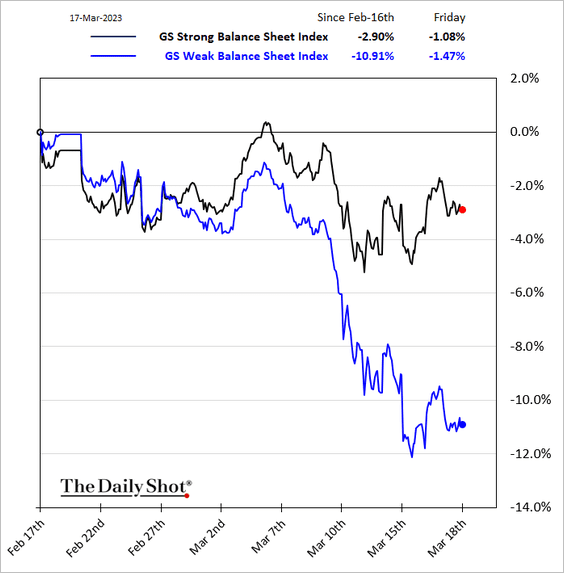

– Strong vs. weak balance sheet:

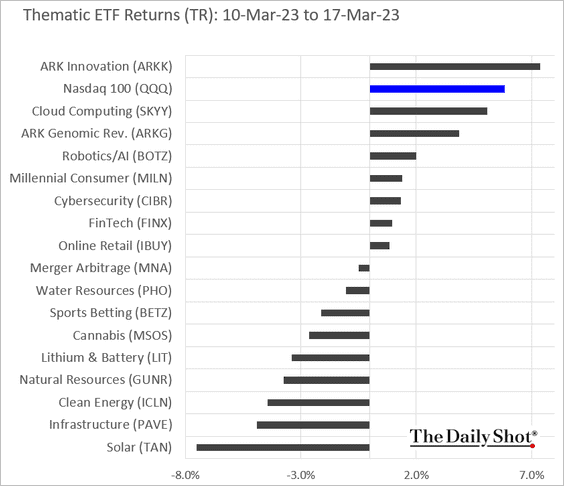

• Thematic ETFs:

• Largest tech firms:

Back to Index

Energy

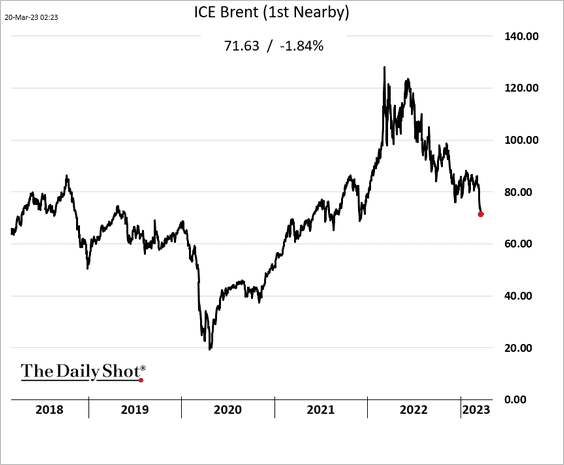

1. Brent crude is approaching $70/bbl.

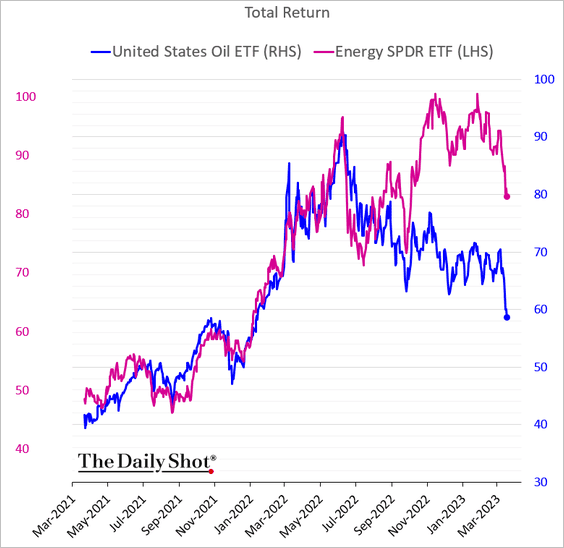

2. Will energy shares close their outperformance vs. crude oil?

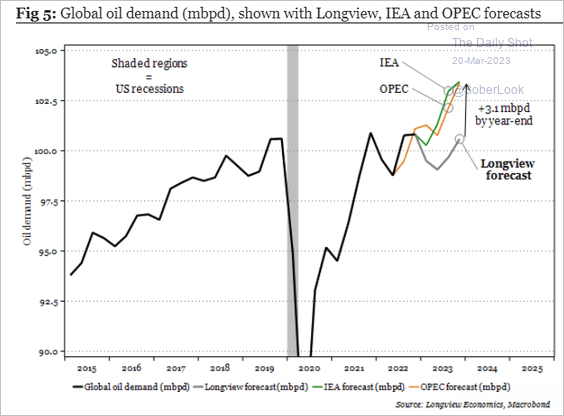

3. Are OPEC and IEA overestimating global oil demand for this year?

Source: Longview Economics

Source: Longview Economics

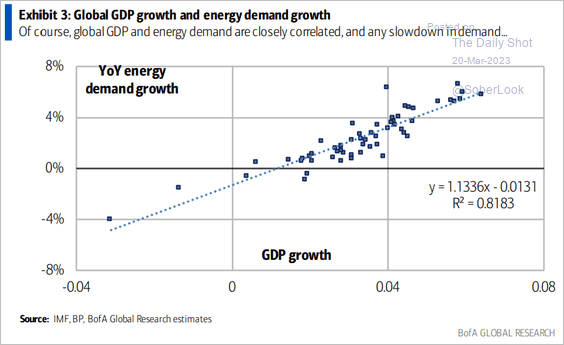

Oil demand is highly correlated to GDP growth.

Source: BofA Global Research

Source: BofA Global Research

——————–

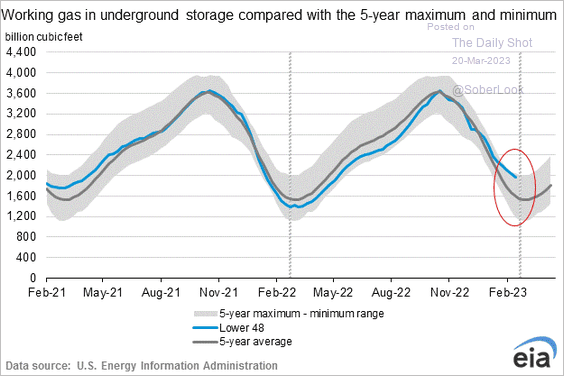

4. US natural gas levels in storage remain elevated.

Back to Index

Commodities

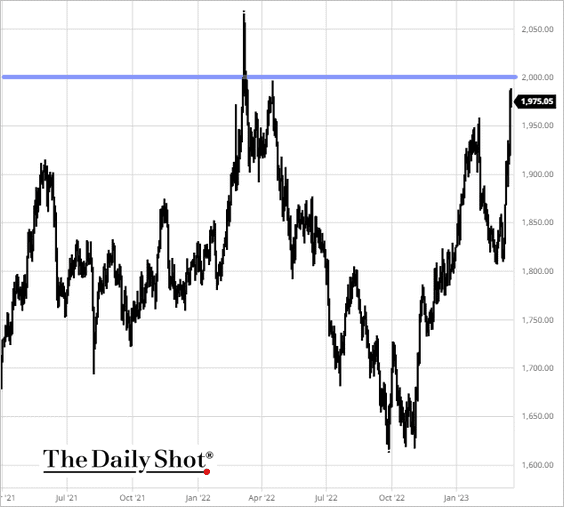

1. Will gold test resistance at $2,000?

Source: barchart.com

Source: barchart.com

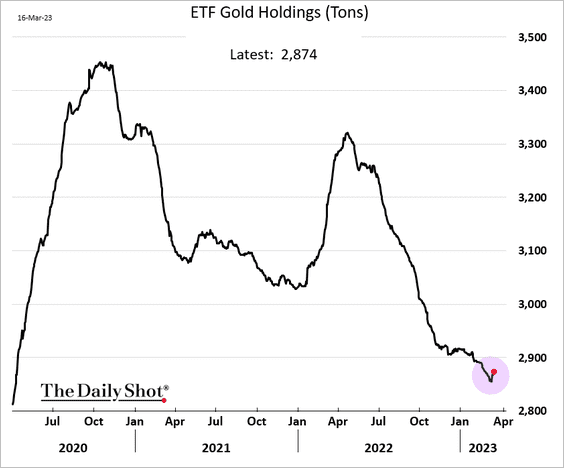

• ETF gold holdings have bottomed.

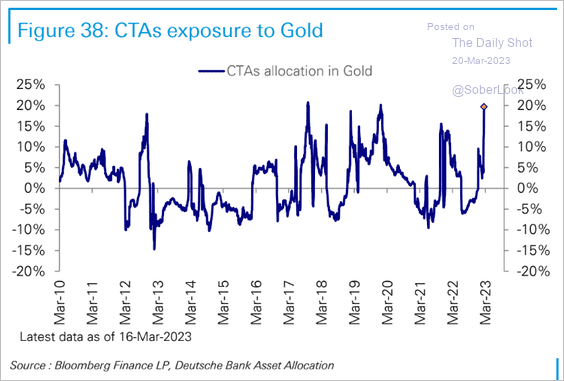

• CTOs massively boosted exposure to gold.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

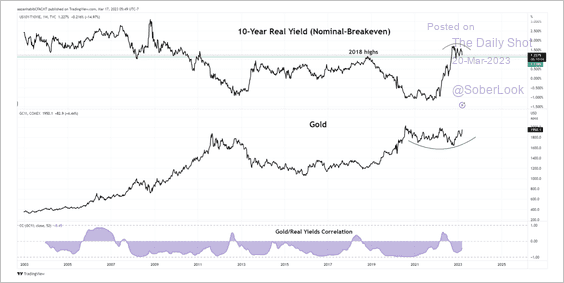

• Gold’s rally is supported by a pullback in real yields.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

——————–

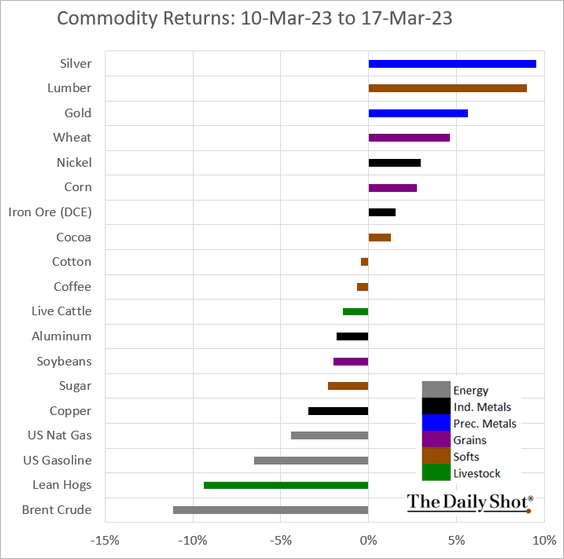

2. Here is last week’s performance across key commodity markets.

Back to Index

Cryptocurrency

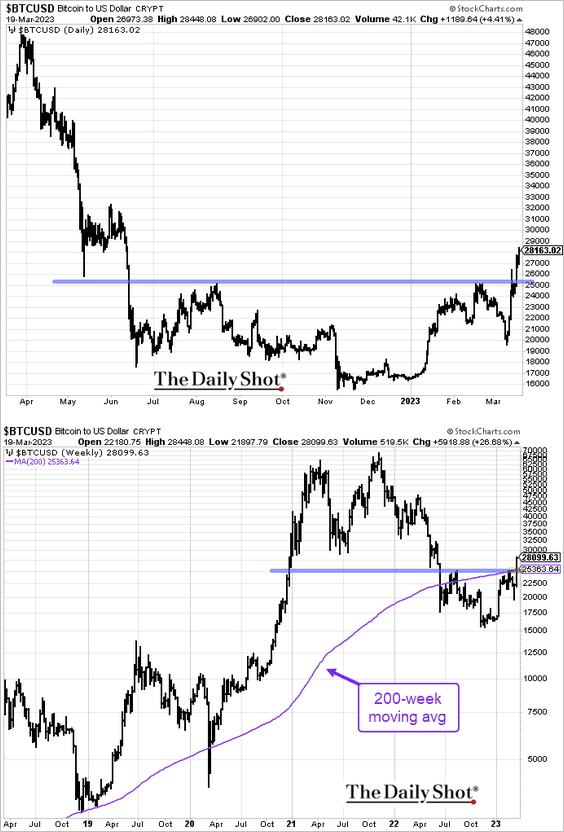

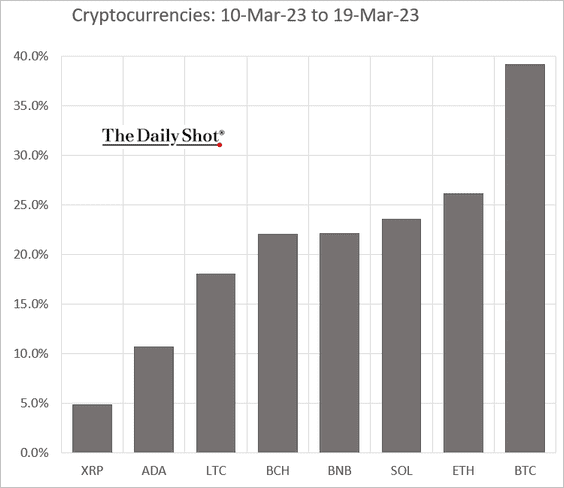

Bitcoin broke through a key resistance level.

The cryptocurrency was up almost 40% over the past week sharply outperforming other cryptos.

Back to Index

Emerging Markets

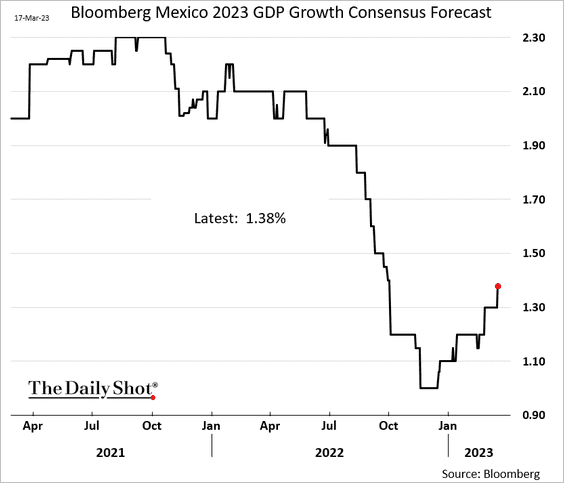

1. Economists have been upgrading Mexico’s GDP growth forecasts for 2023.

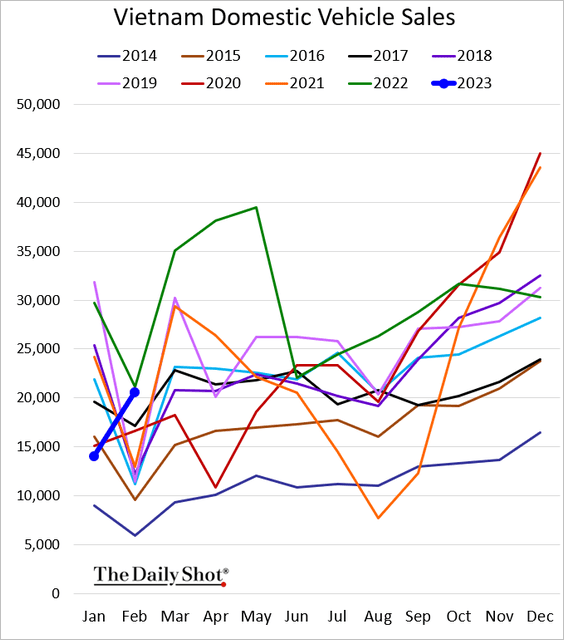

2. Vietnam’s vehicle sales bounced from recent lows.

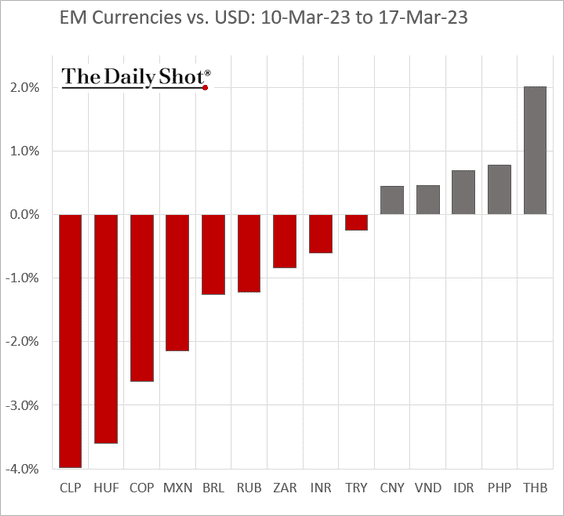

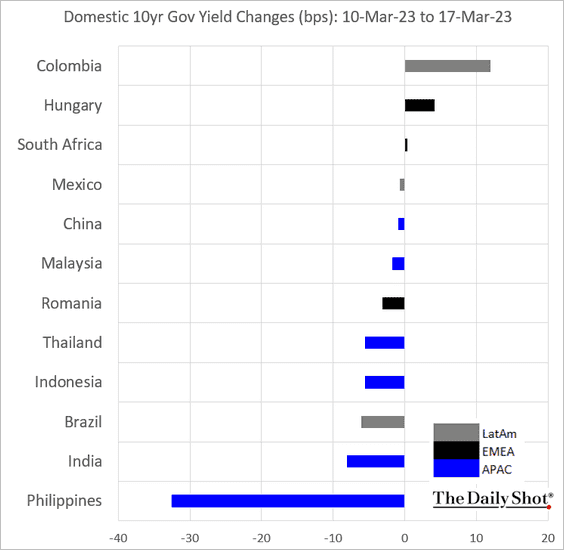

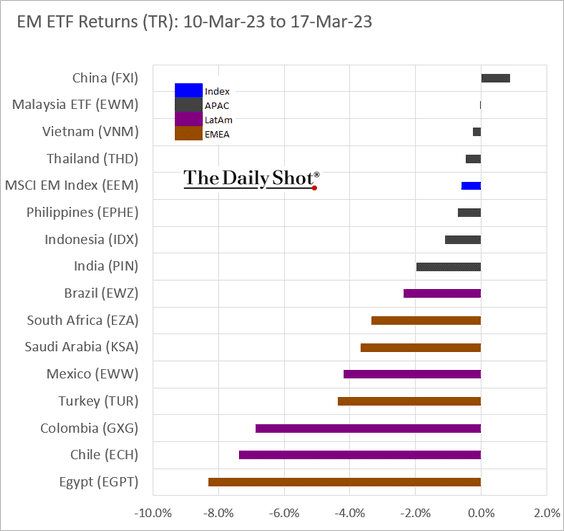

3. Next, we have some performance data.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

China

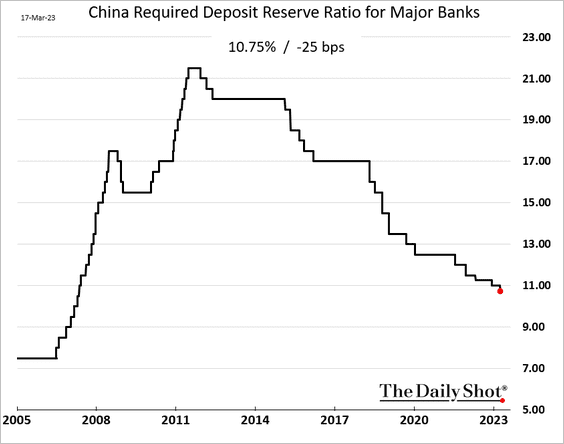

1. The PBoC eased monetary policy again via the RRR.

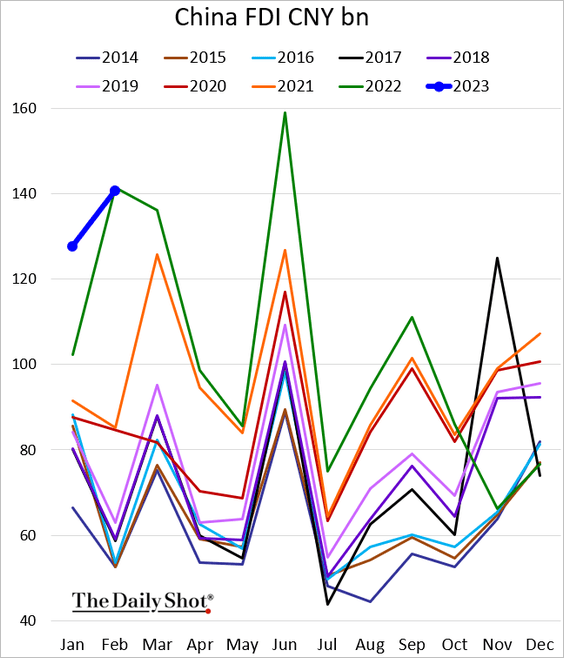

2. Foreign direct investment was at 2022 levels in February.

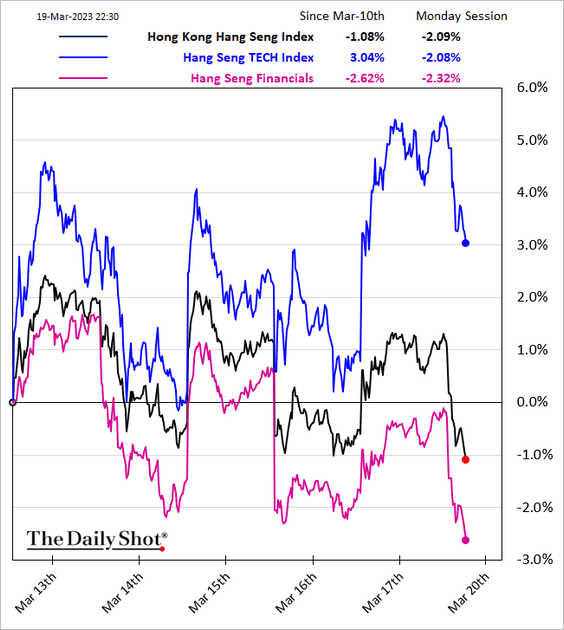

3. Hong Kong stocks are down sharply.

Back to Index

Europe

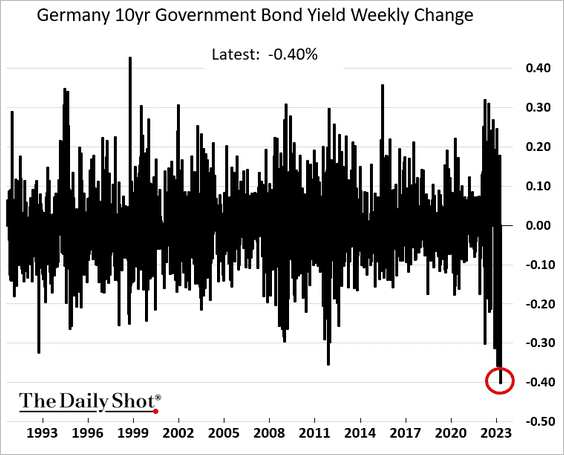

1. Bund yields saw the biggest weekly decline in decades.

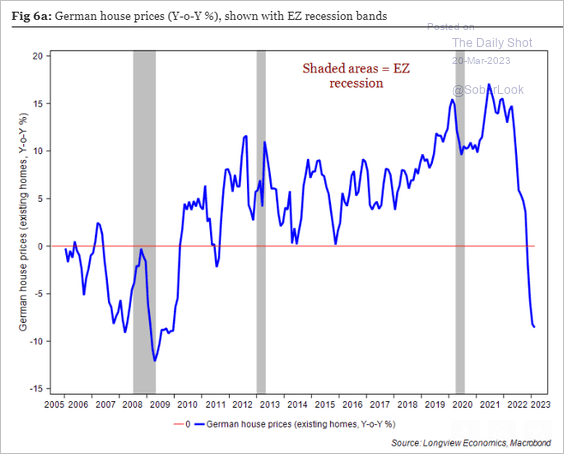

2. German home prices have been falling.

Source: Longview Economics

Source: Longview Economics

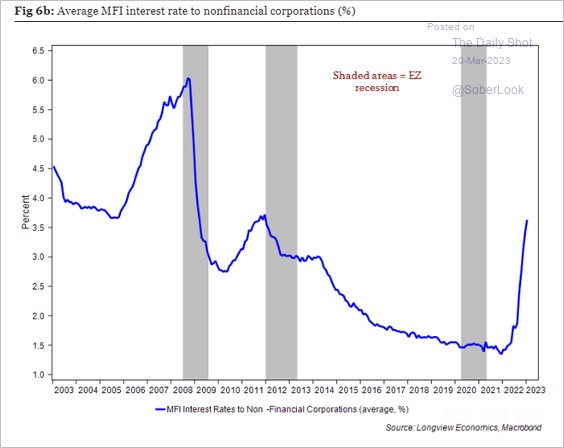

3. Here is the rate shock to the euro-area corporate sector.

Source: Longview Economics

Source: Longview Economics

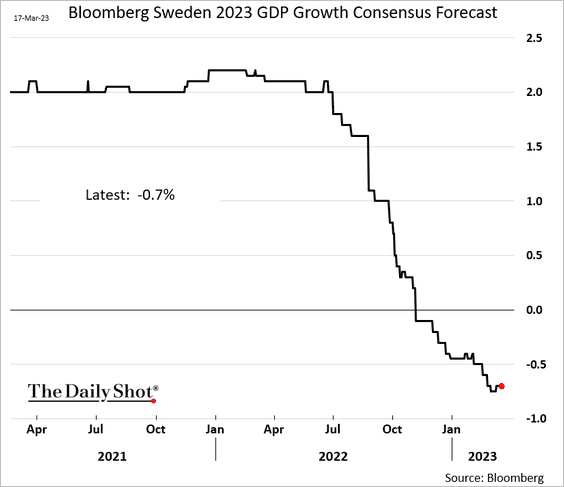

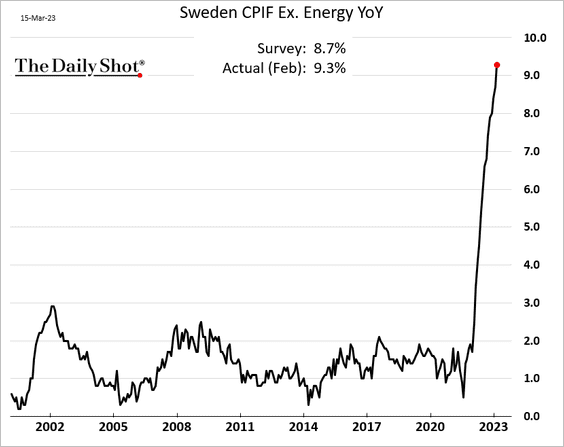

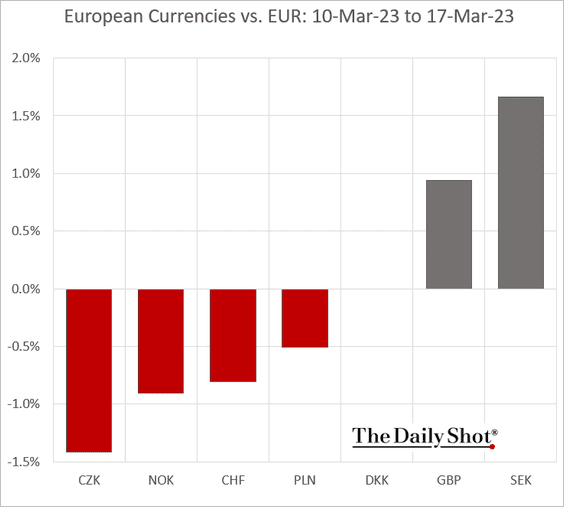

4. Next, we have some updates on Sweden.

• GDP growth forecasts:

• Inflation:

• The krona:

Source: Pound Sterling Live Read full article

Source: Pound Sterling Live Read full article

Back to Index

The United Kingdom

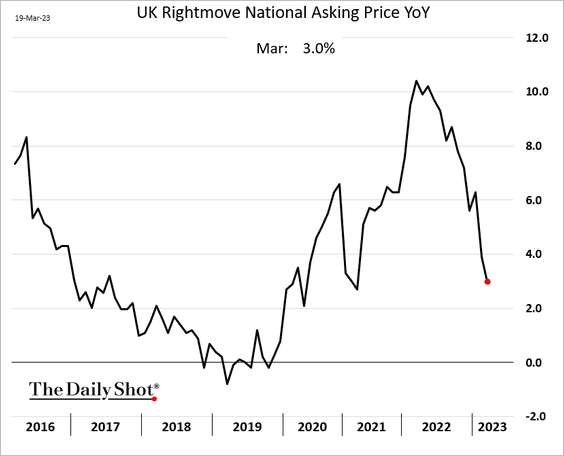

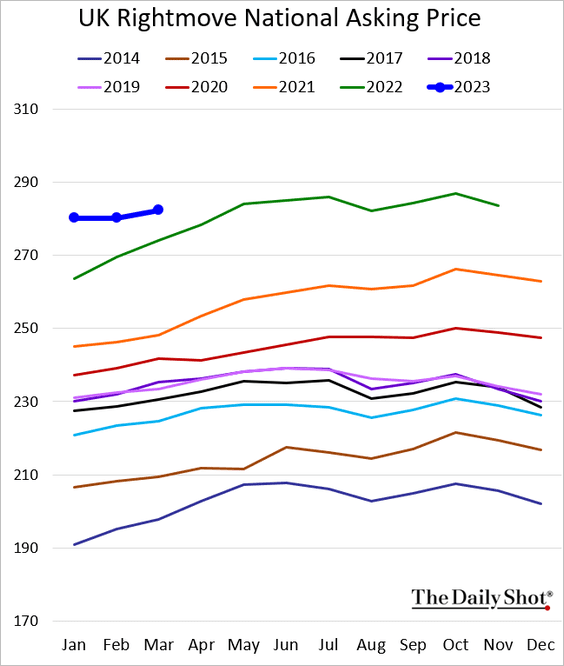

1. There are signs of home prices stabilizing.

——————–

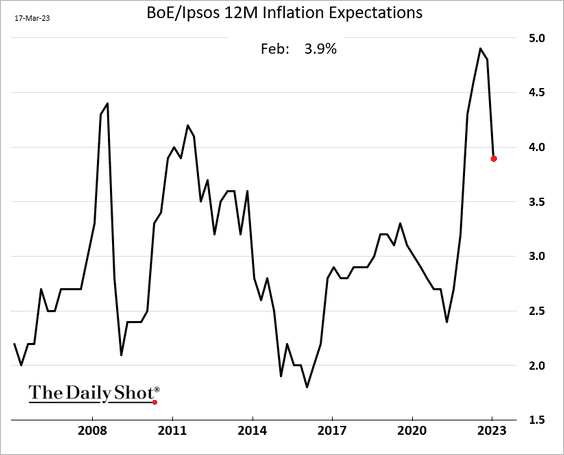

2. Inflation expectations are easing.

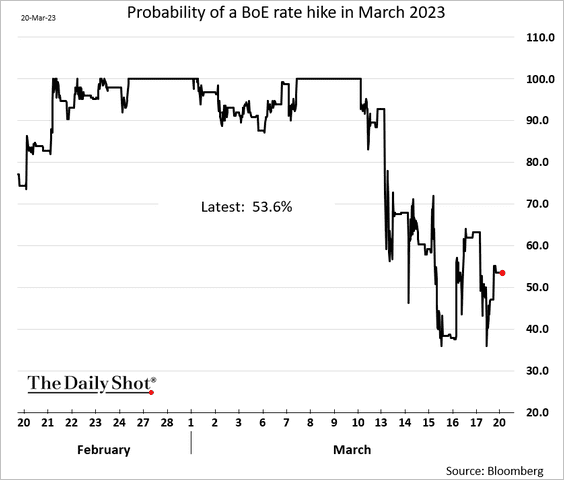

3. The chance of a BoE rate hike this week is just above 50%, according to the rates markets.

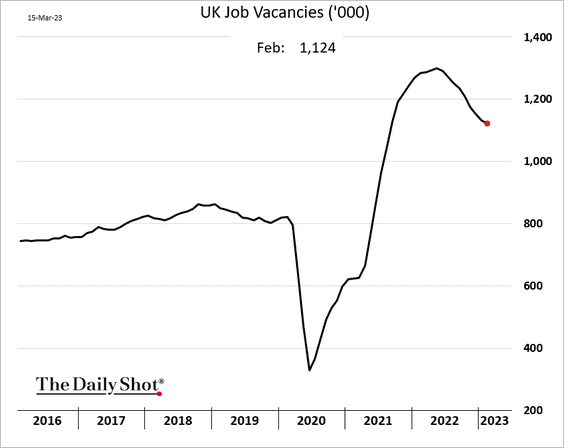

4. Job vacancies are drifting lower.

Back to Index

The United States

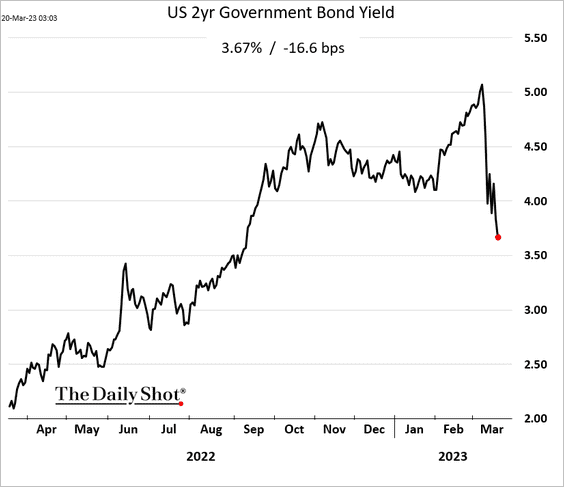

1. The 2-year Treasury yield plunged further this morning after the announcement of UBS taking over Credit Suisse.

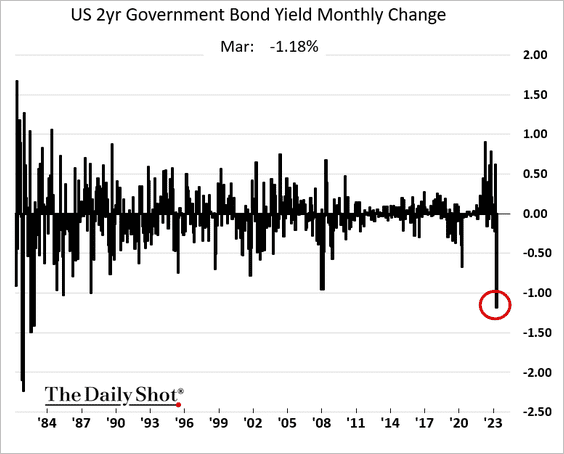

The month-to-date decline has been the biggest since the early 1980s.

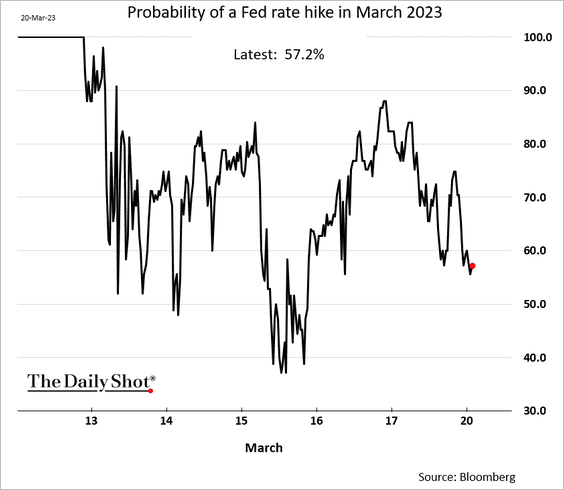

• The market is unsure if the Fed will hike rates this month.

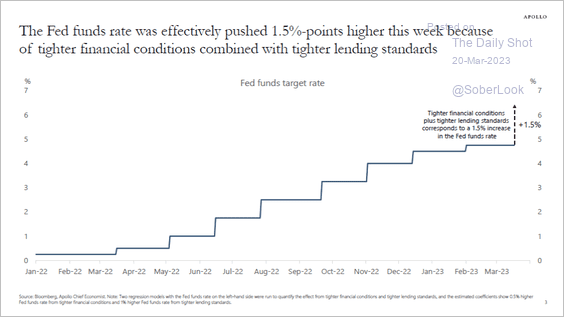

Tightening financial conditions over the past few days are equivalent to a significant rate hike.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

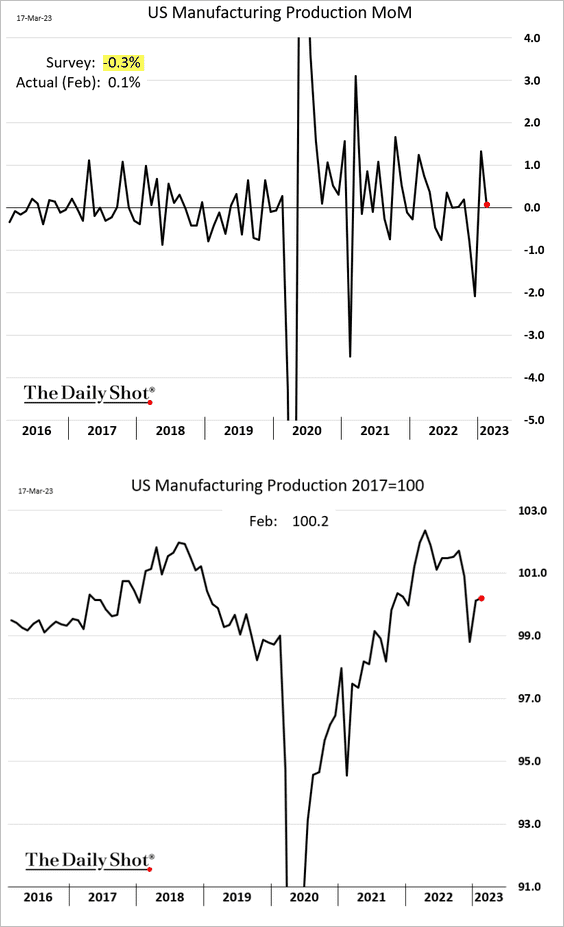

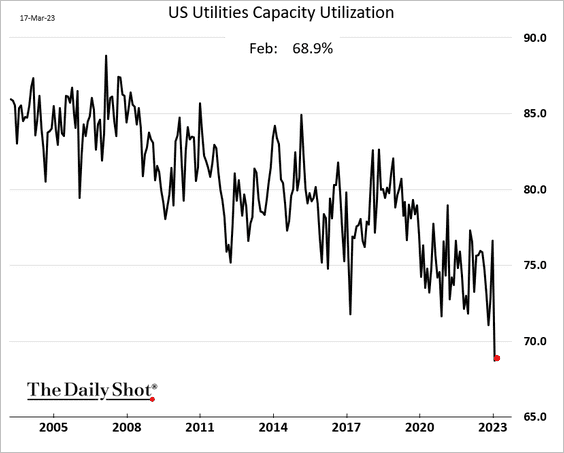

2. US manufacturing output unexpectedly increased (slightly) last month.

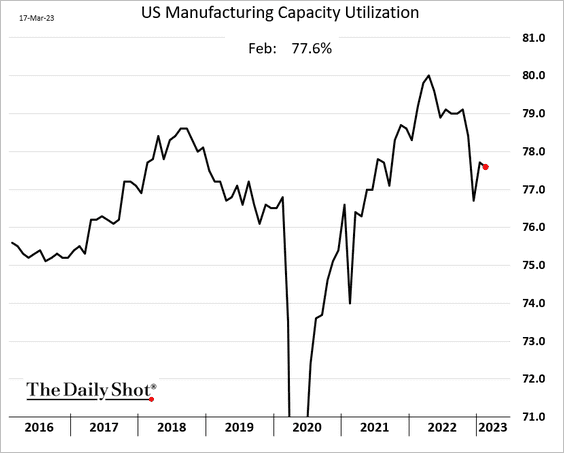

Capacity utilization eased.

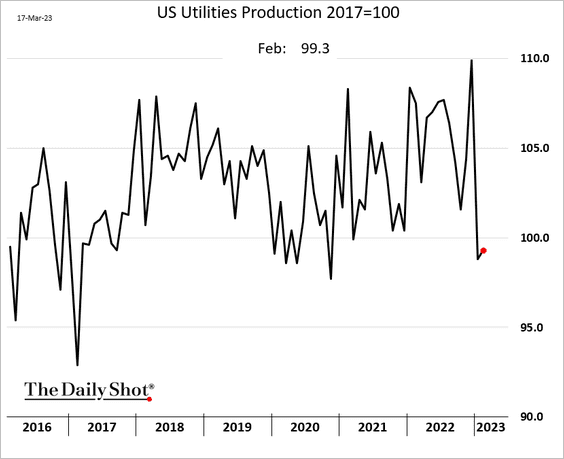

Utilities’ output has been soft, …

… with capacity utilization near multi-year lows.

——————–

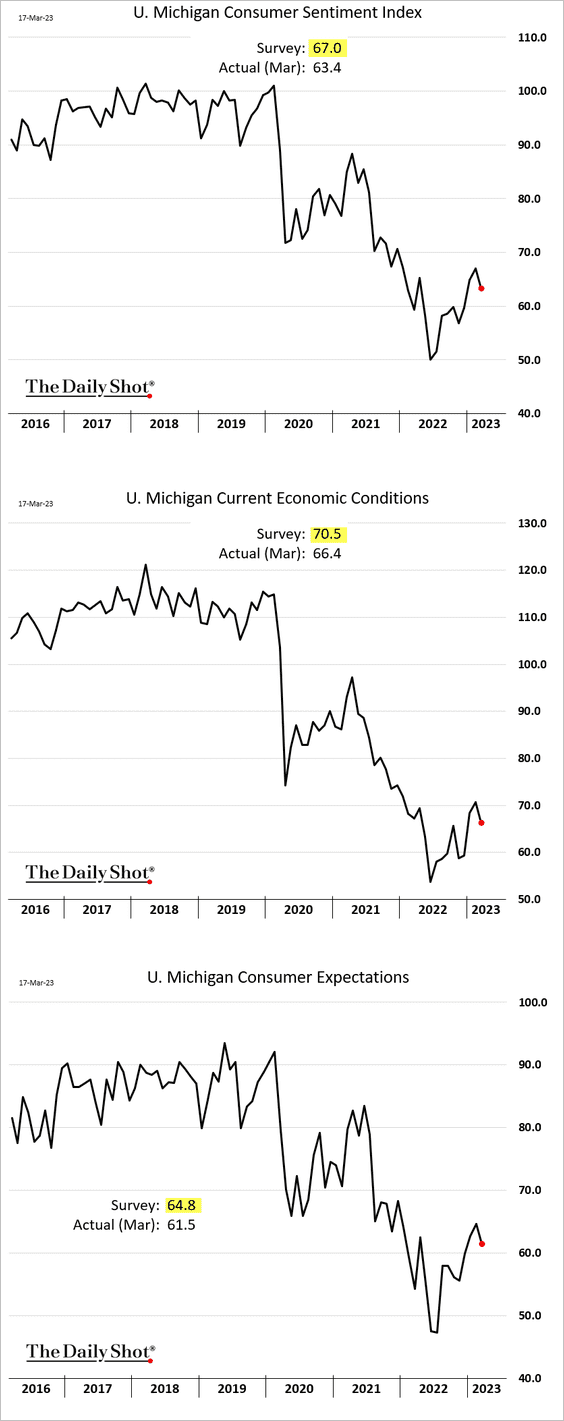

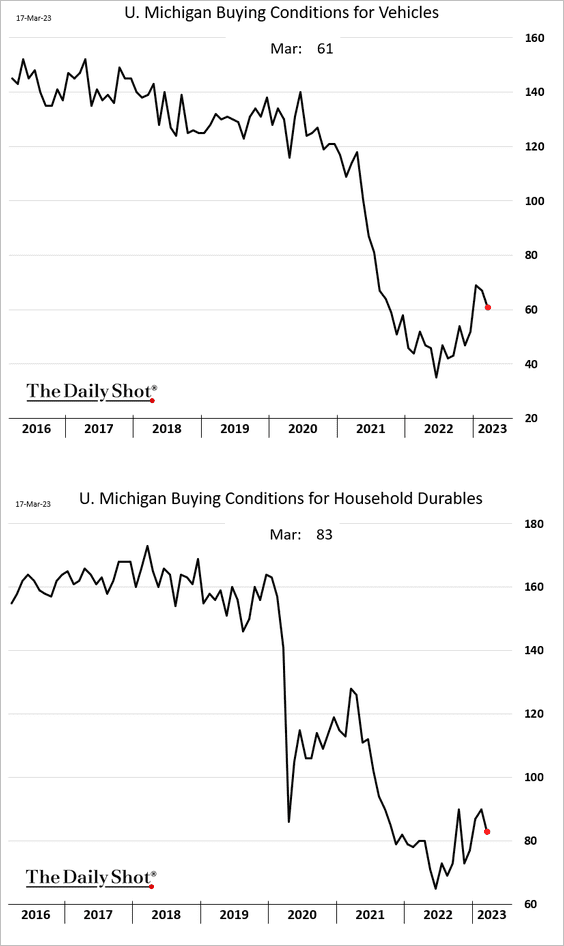

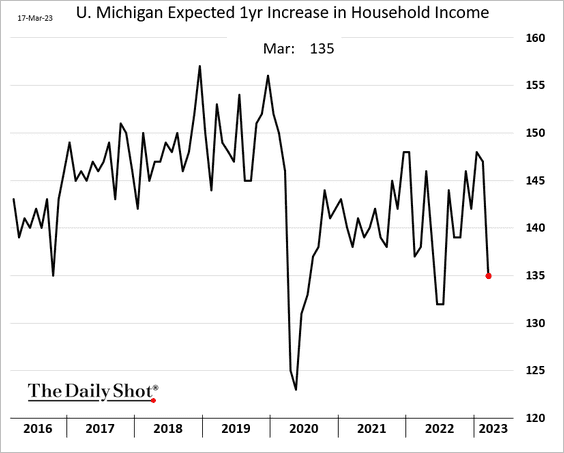

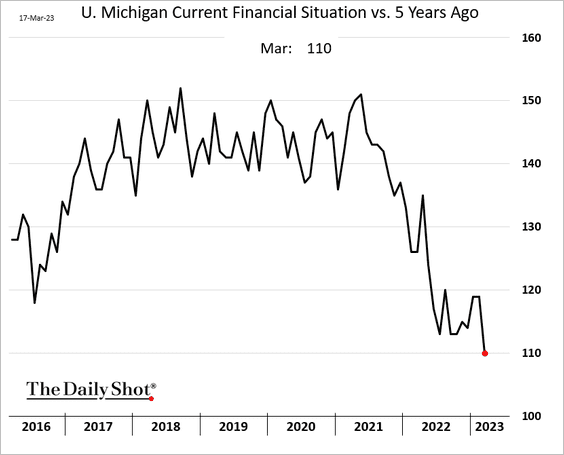

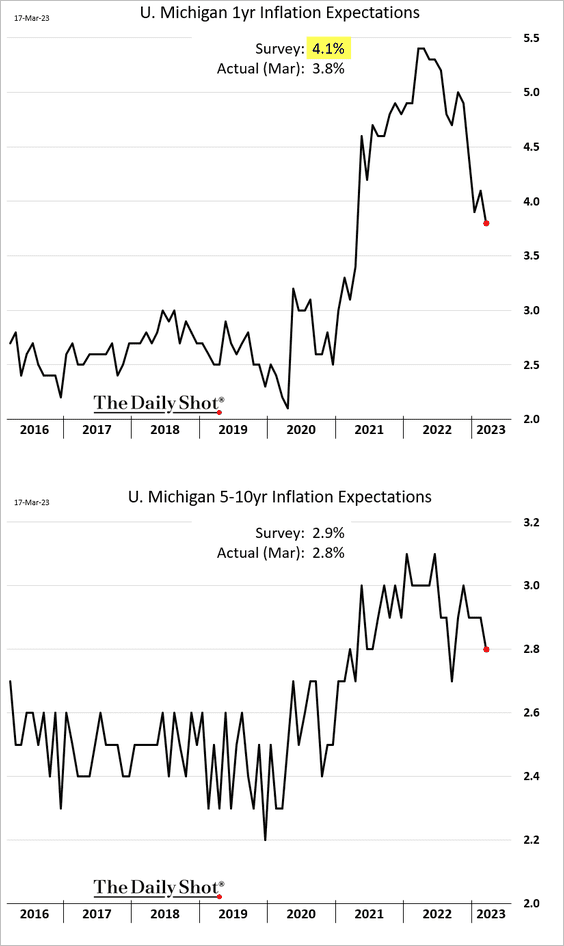

3. The U. Michigan consumer sentiment index declined this month.

• Buying conditions:

• Income expectations:

• Financial situation:

Inflation expectations eased.

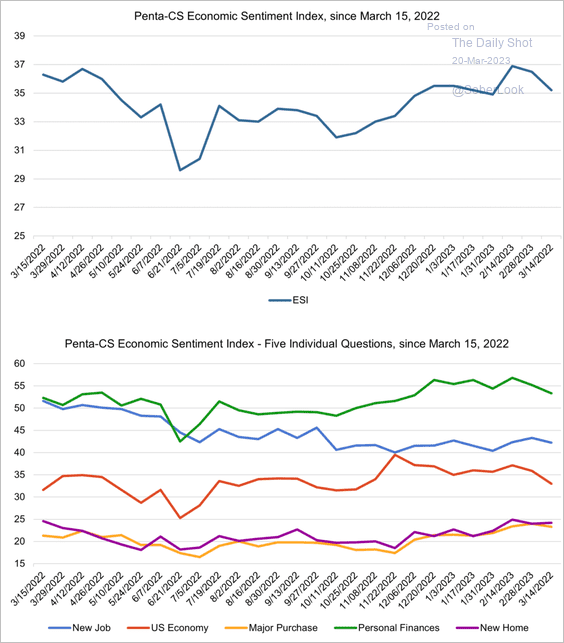

A separate survey from Penta and Civic Science also declined.

Source: @CS_Penta, @Pentagrp, @CivicScience

Source: @CS_Penta, @Pentagrp, @CivicScience

——————–

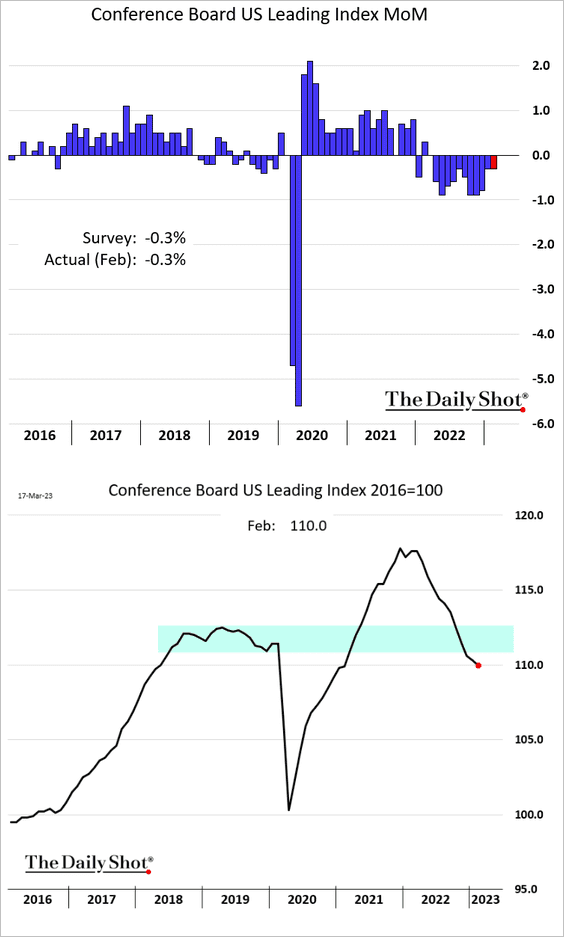

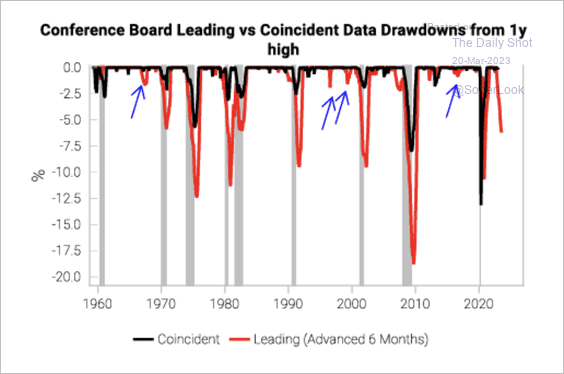

4. The Conference Board’s leading index is down 11 months in a row.

Coincident indicators have not yet fallen despite the sharp drop in leading indicators, possibly delaying the shift to recession.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Global Developments

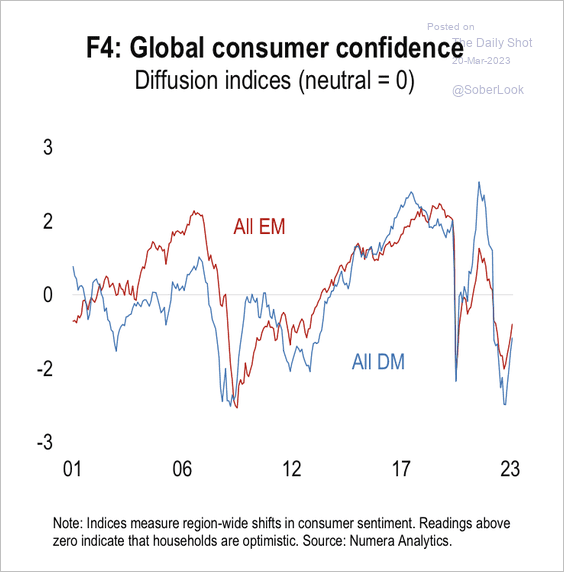

1. Global consumer confidence has been rising from the lowest levels since the financial crisis.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

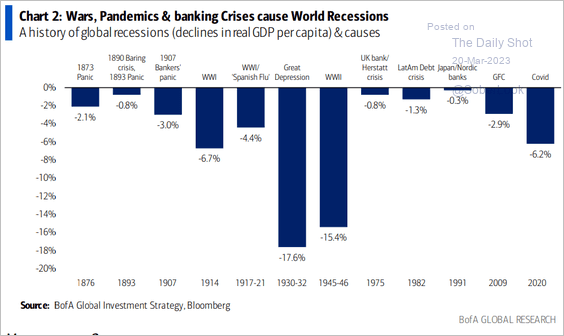

2. Here are some of the causes of global recessions.

Source: BofA Global Research

Source: BofA Global Research

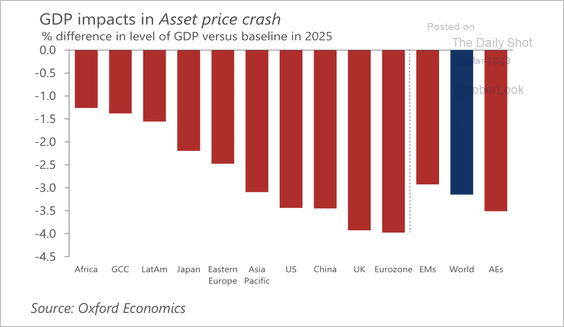

3. Economies with the most overvalued asset prices and those that rely relatively more on bank financing would likely suffer the greatest GDP decline during a major repricing of risk, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

4. Next, we have some market performance data.

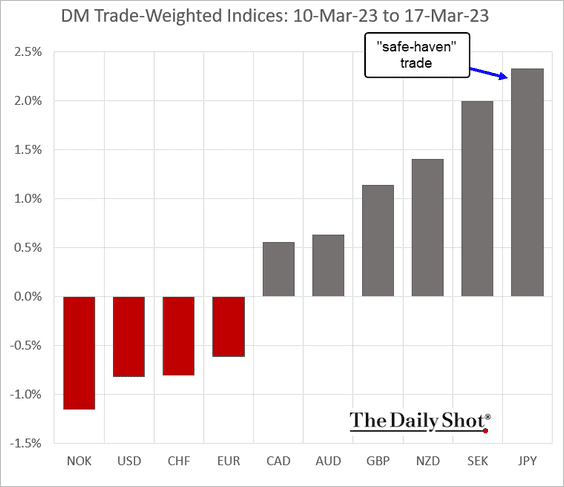

• Currencies:

• Bond yields:

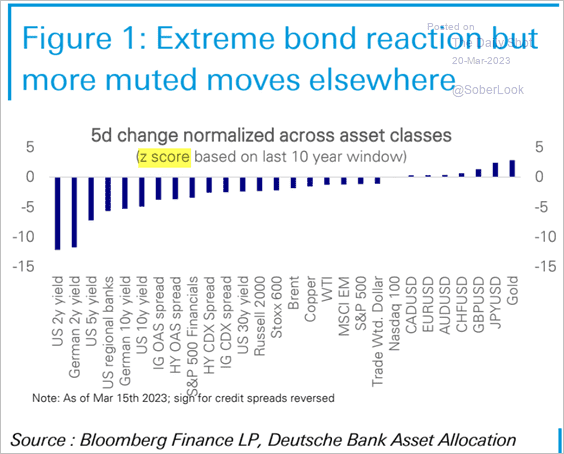

• Market movements across different asset classes:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

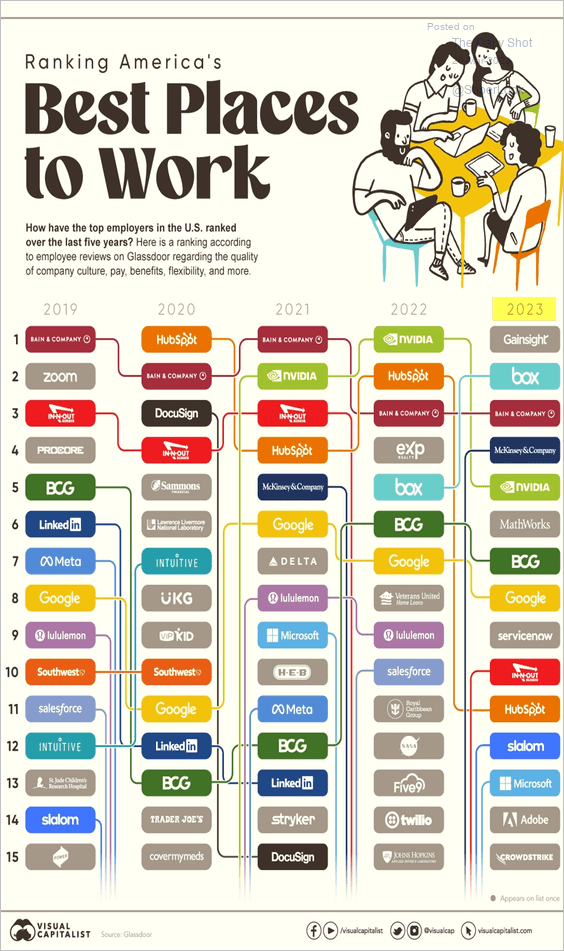

1. Best places to work:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

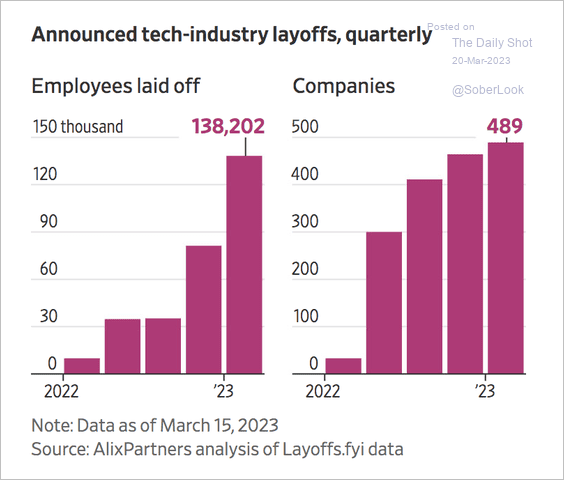

2. Tech layoffs:

Source: @WSJ Read full article

Source: @WSJ Read full article

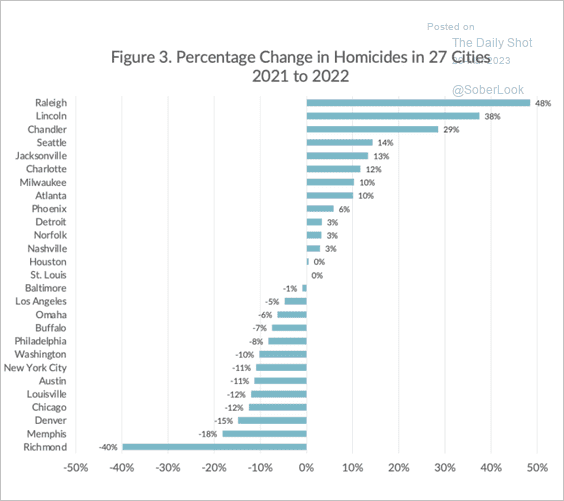

3. Changes in homicides by city (2022 vs. 2021):

Source: Council on Criminal Justice

Source: Council on Criminal Justice

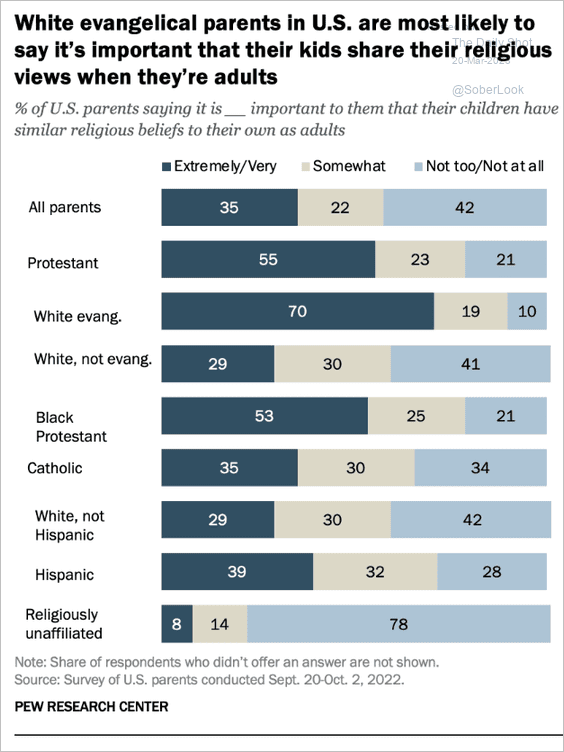

4. Importance of children having similar religious beliefs to their parents:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

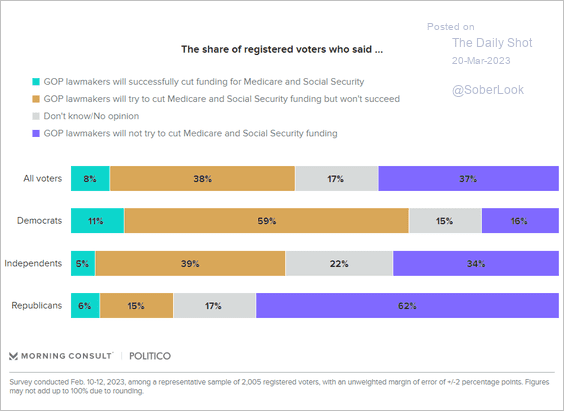

5. Will GOP lawmakers cut Social Security and Medicare?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

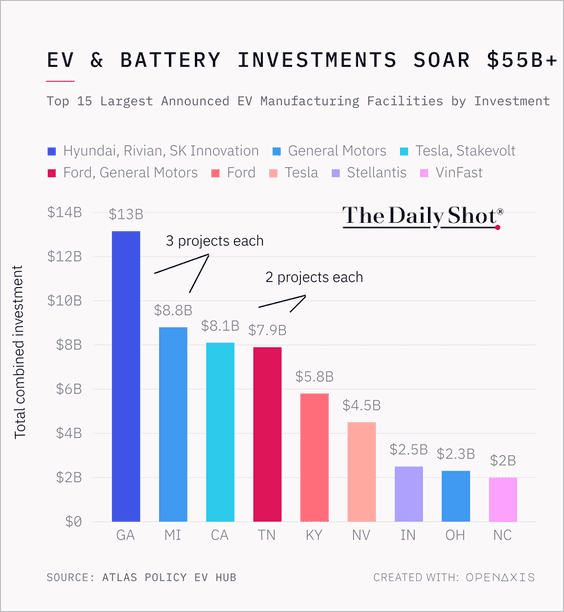

6. EV and battery investments:

Source: @OpenAxisHQ

Source: @OpenAxisHQ

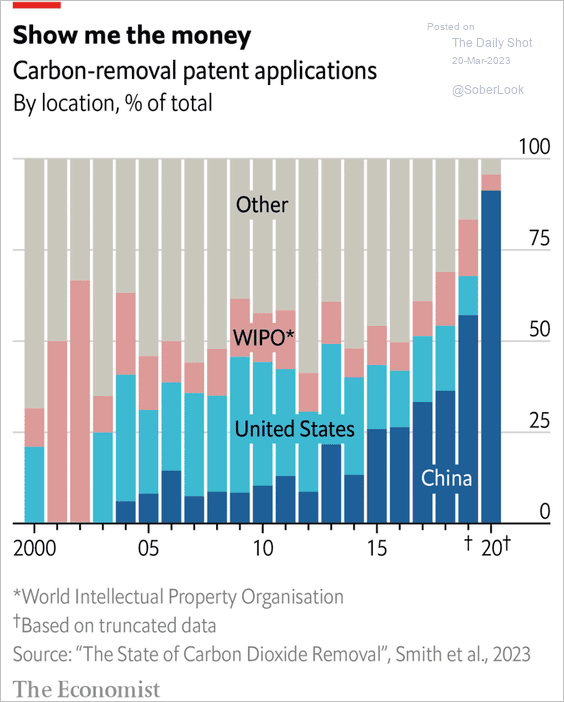

7. Carbon-removal patent applications:

Source: The Economist Read full article

Source: The Economist Read full article

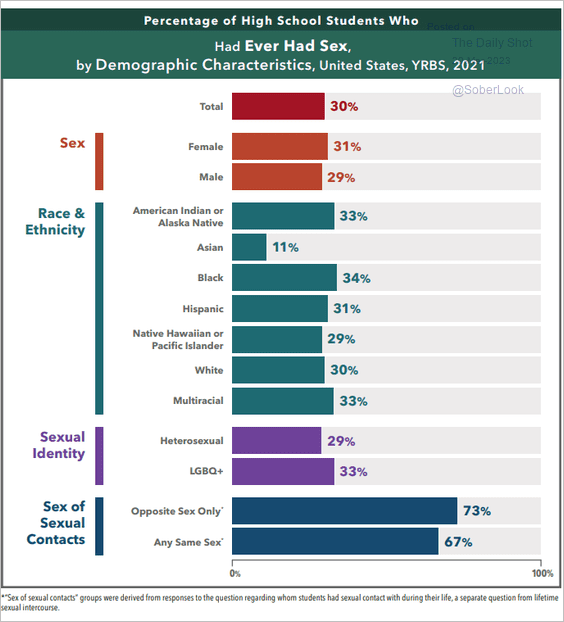

8. Percentage of high school students who had ever had sex:

Source: CDC Read full article

Source: CDC Read full article

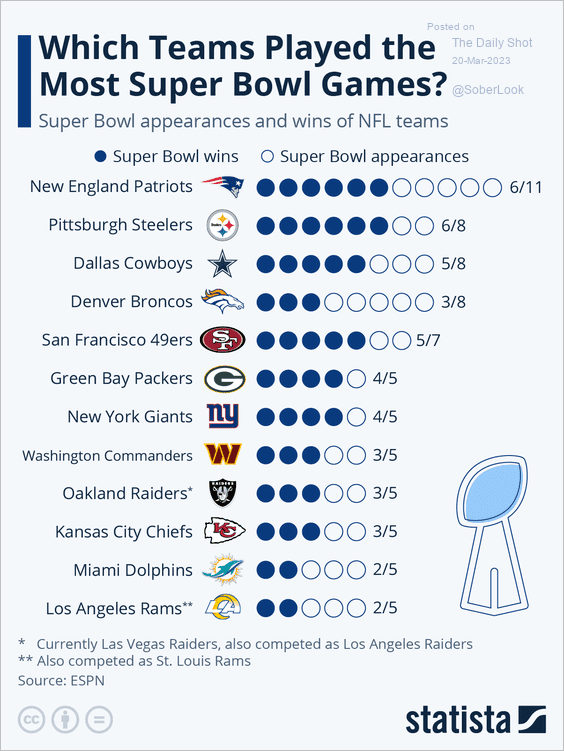

9. Which teams played the most Super Bowl games?

Source: Statista

Source: Statista

——————–

Back to Index