The Daily Shot: 27-Mar-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

The United States

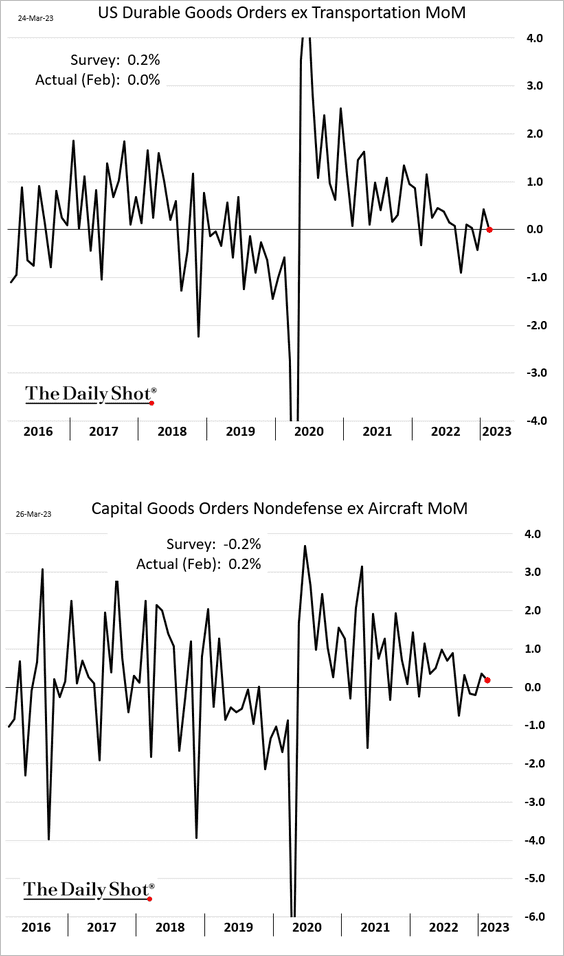

1. Durable goods orders, excluding transportation, were flat last month. But capital goods orders edged higher (2nd panel).

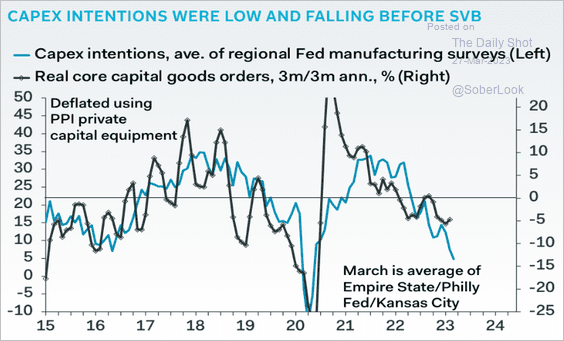

• Survey indicators point to weakness ahead for capital goods orders (falling business investment).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

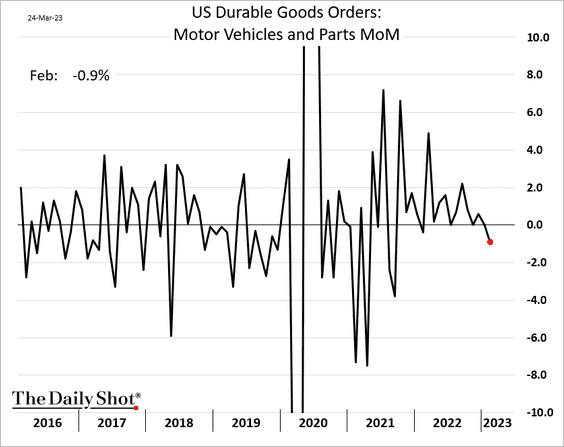

• Orders for automobiles declined.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

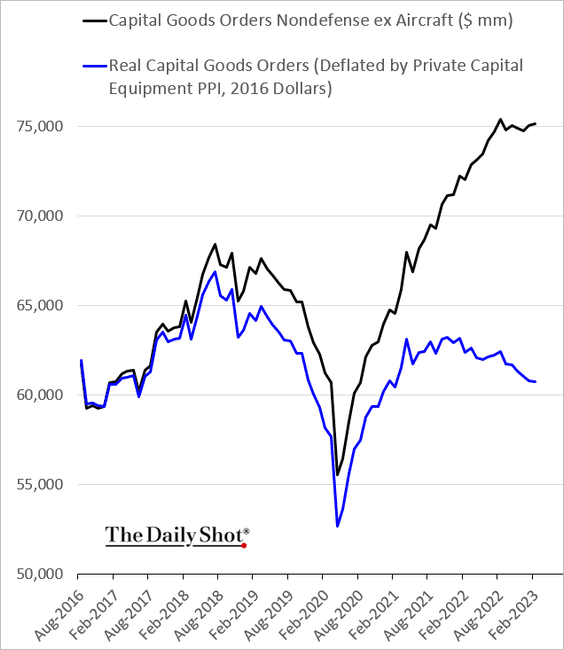

• Real capital goods orders were lower again.

——————–

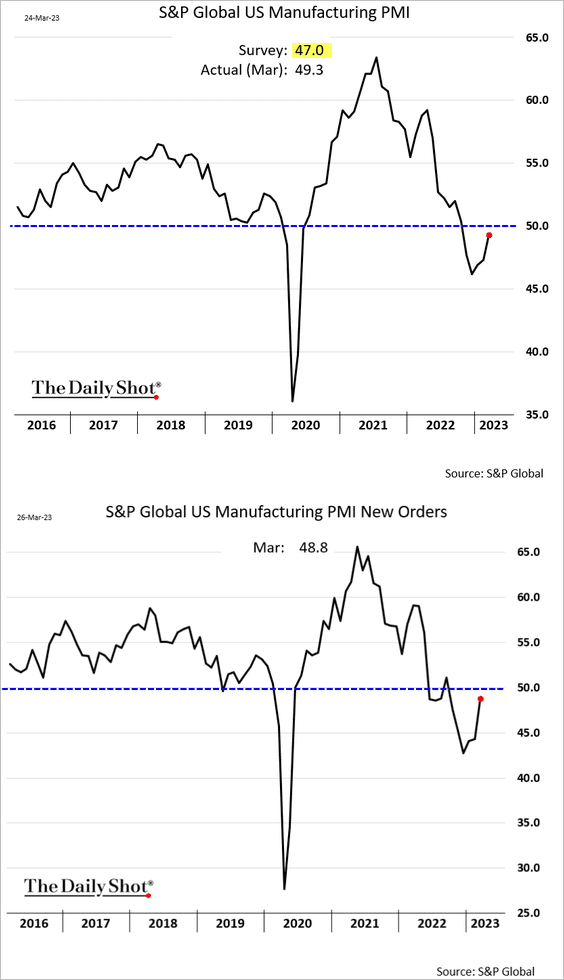

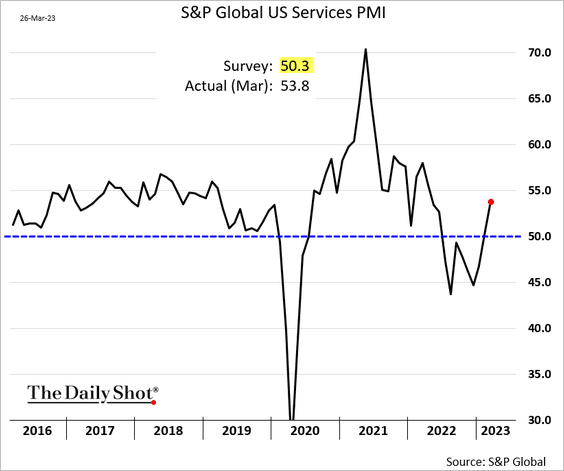

2. The PMI report from S&P Global points to a slower contraction in the US manufacturing sector.

Service firms reported faster growth this month.

——————–

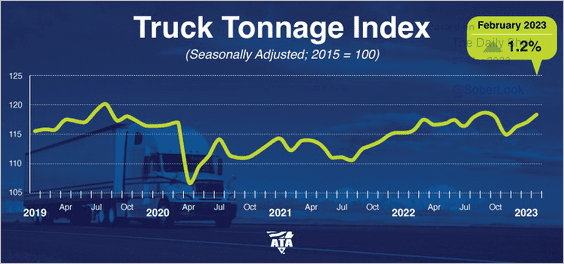

3. Truck tonnage has been rebounding.

Source: American Trucking Associations; h/t @dailychartbook

Source: American Trucking Associations; h/t @dailychartbook

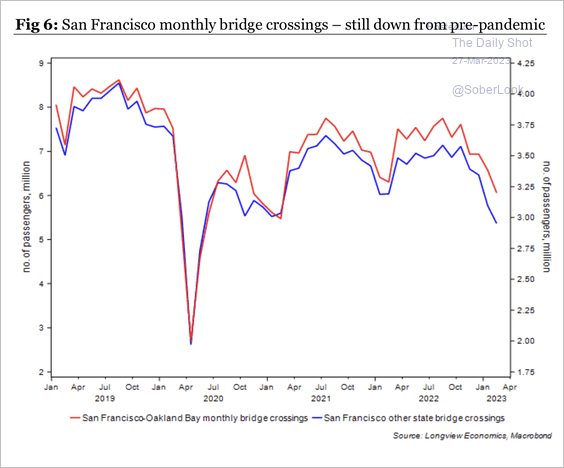

4. Office vacancy rates are near record highs.

Source: Longview Economics

Source: Longview Economics

As an example, San Francisco bridge crossings remain below pre-pandemic levels.

Source: Longview Economics

Source: Longview Economics

——————–

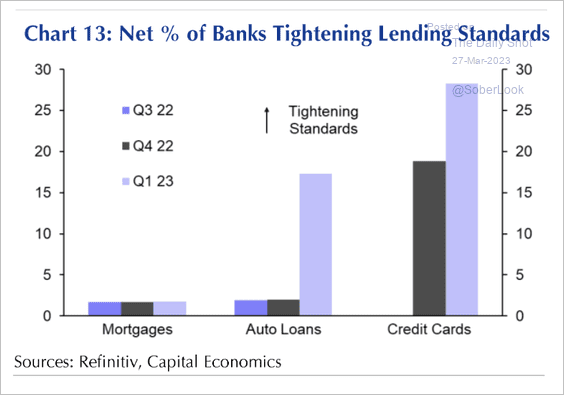

5. US banks have tightened lending standards in autos and credit cards this quarter, which will weigh on consumers’ ability to spend.

Source: Capital Economics

Source: Capital Economics

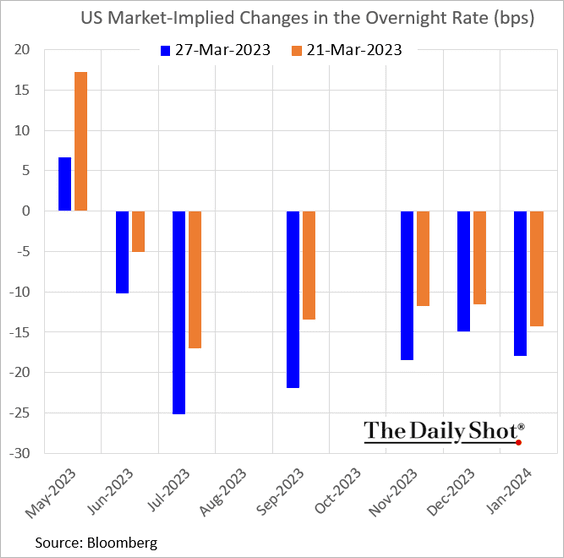

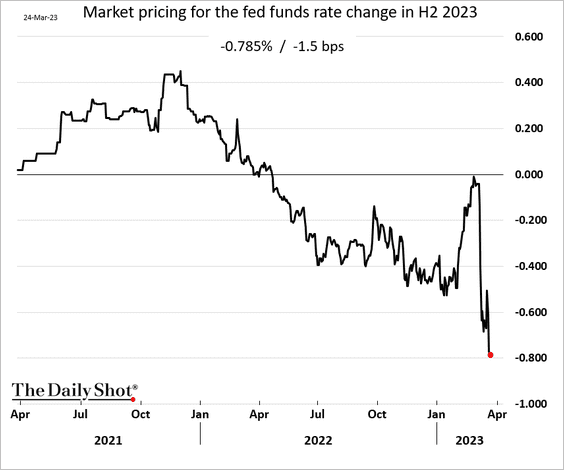

6. The market is increasingly unsure about another Fed rate hike in May, …

… and is pricing in almost 80 bps of rate cuts later this year.

——————–

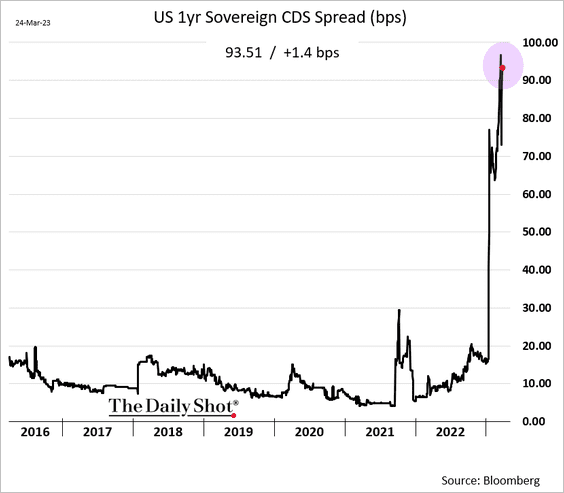

7. Concerns over a US government (“technical”) default this summer remain elevated.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The United Kingdom

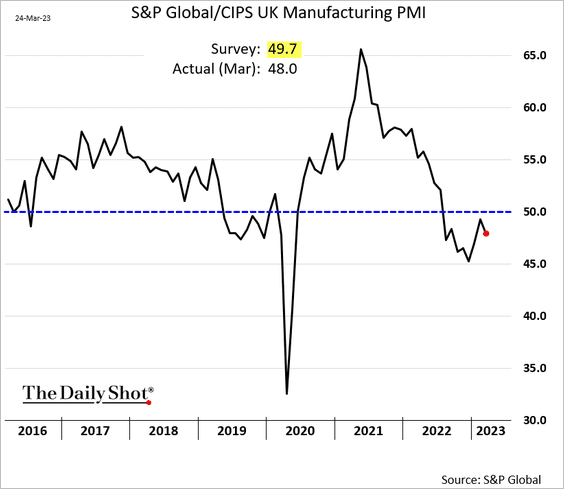

1. Manufacturing activity unexpectedly slowed this month, …

… but orders have stabilized.

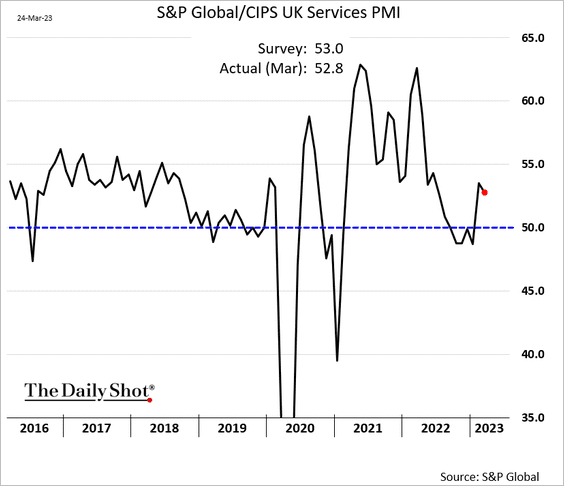

• Service firms continue to report growth.

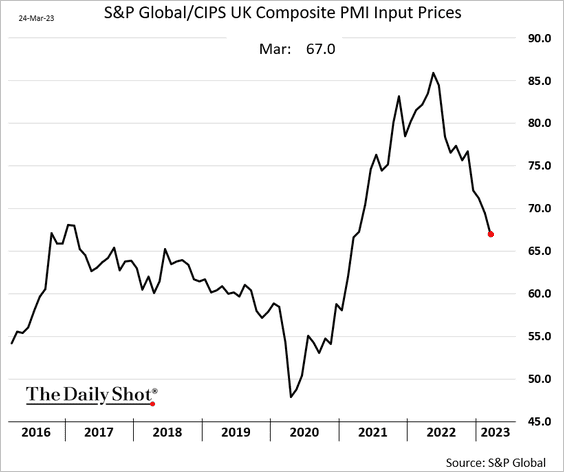

• Price pressures have been easing.

——————–

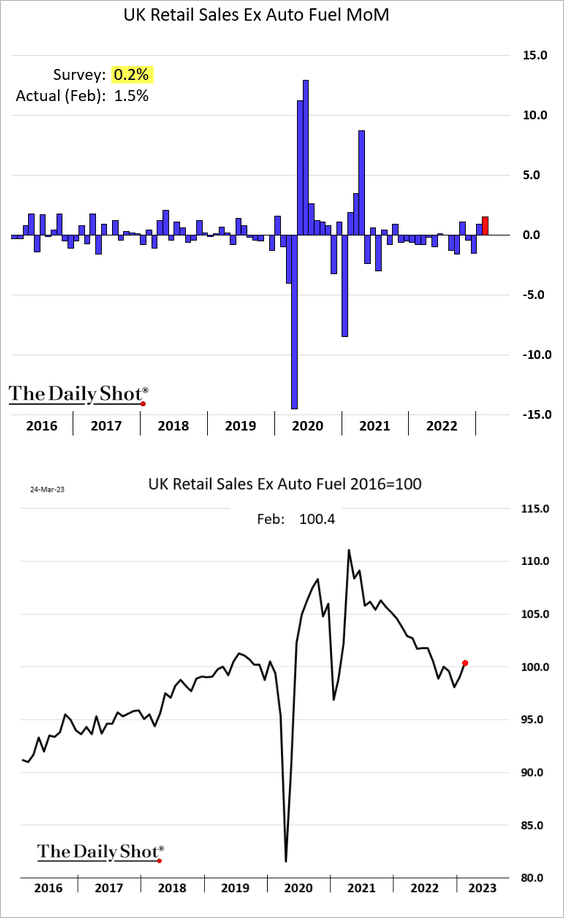

2. Last month’s real retail sales topped expectations.

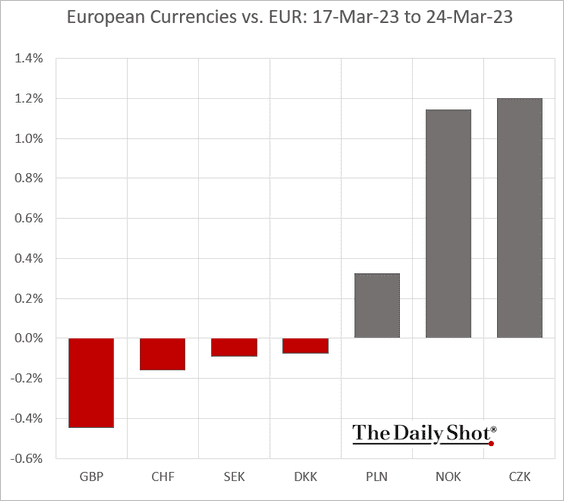

3. The pound underperformed last week.

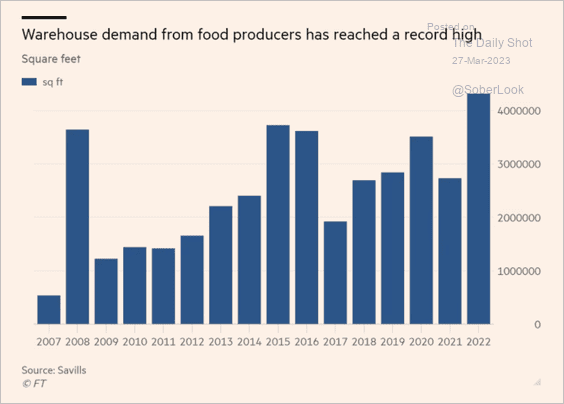

4. UK food producers are trying to prevent shortages.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

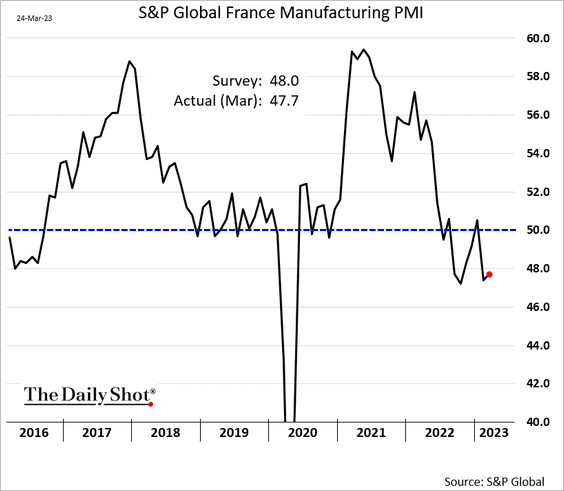

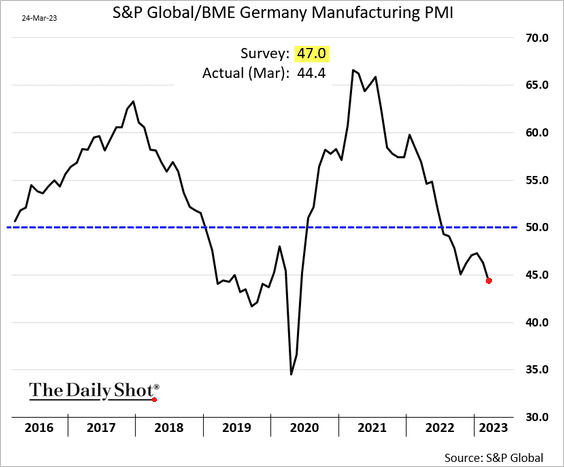

1. Factories reported further contraction this month.

– France:

– Germany:

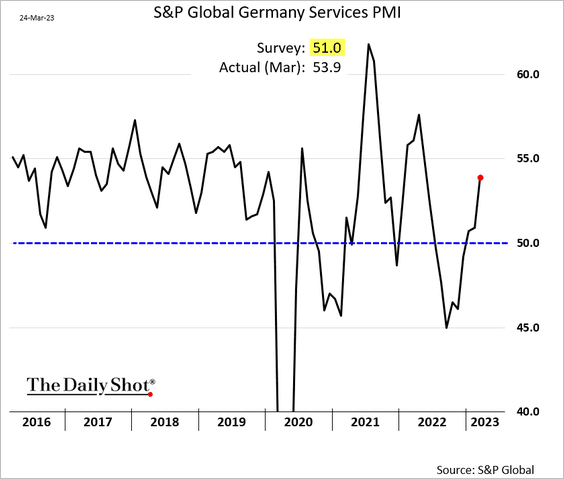

• But service companies showed accelerating growth.

– France:

– Germany:

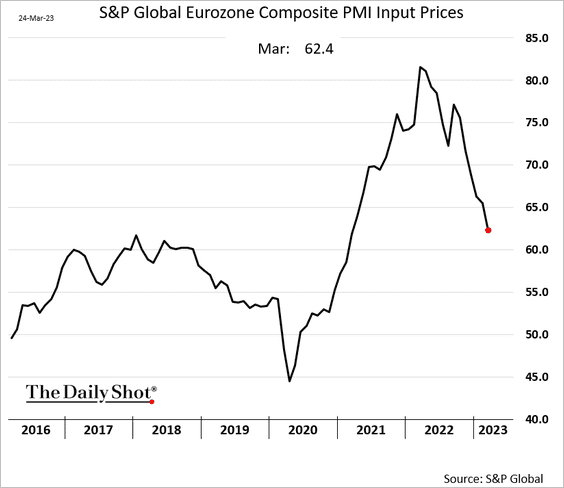

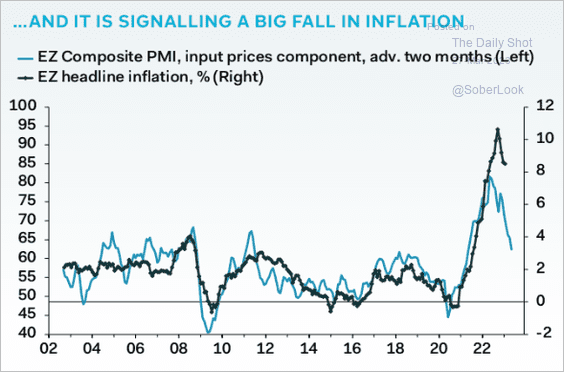

• Price pressures continue to ease, which should pull inflation lower (2nd chart).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

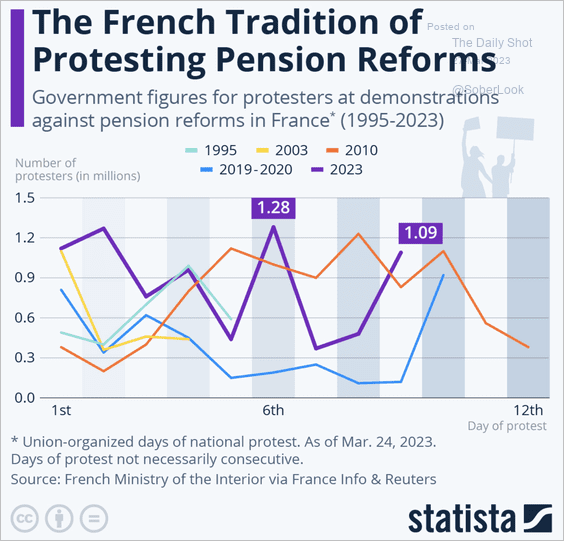

2. This chart shows protests against pension reforms in France.

Source: Statista

Source: Statista

Back to Index

Europe

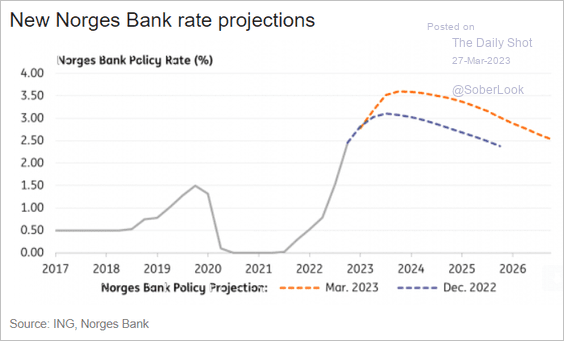

1. More hikes ahead for Norway’s central bank?

Source: ING

Source: ING

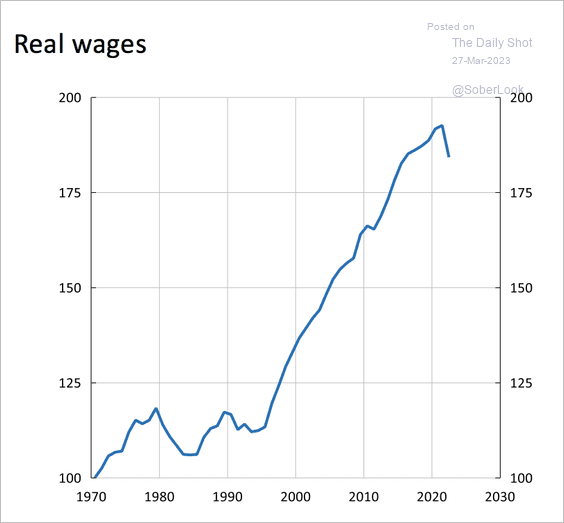

2. Have Sweden’s real wages peaked for now?

Source: Riksbank Read full article

Source: Riksbank Read full article

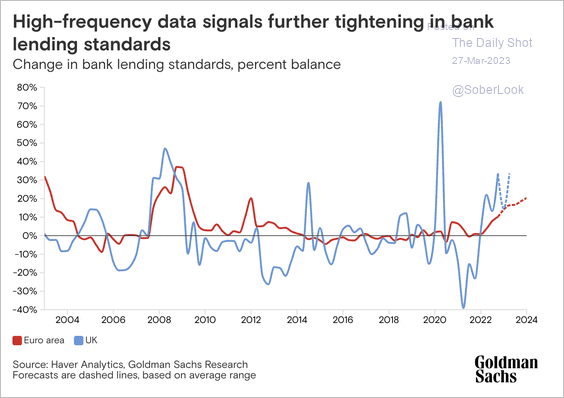

3. Goldman sees further credit tightening ahead for Europe.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Asia – Pacific

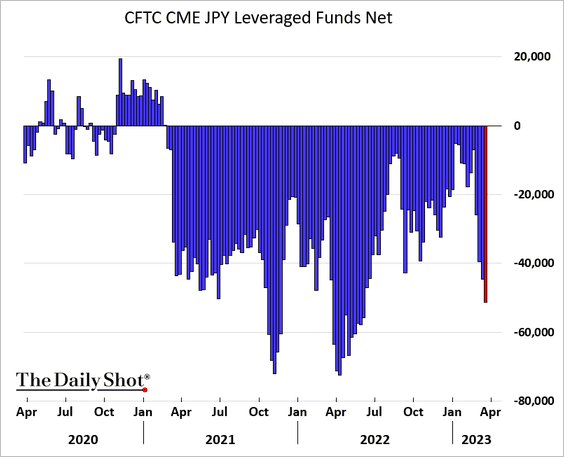

1. Hedge funds are boosting their bets against the yen.

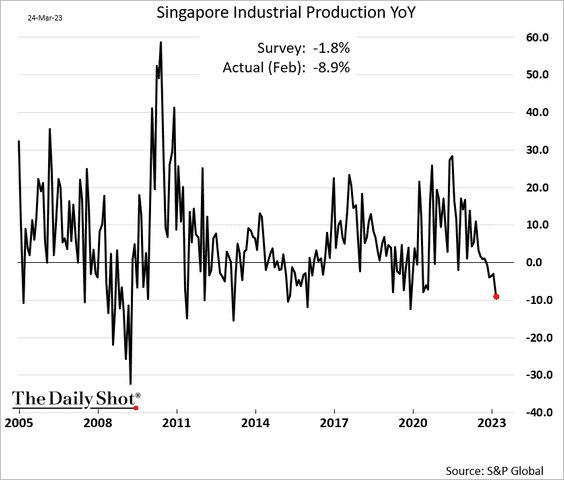

2. Singapore’s industrial production is down sharply on a year-over-year basis.

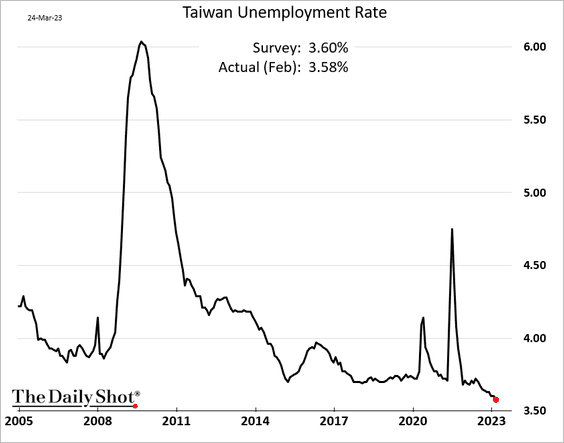

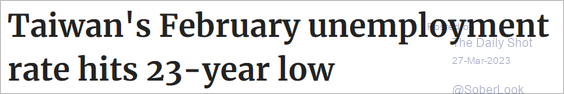

3. Taiwan’s unemployment rate hit a multi-year low.

Source: Focus Taiwan Read full article

Source: Focus Taiwan Read full article

Back to Index

Emerging Markets

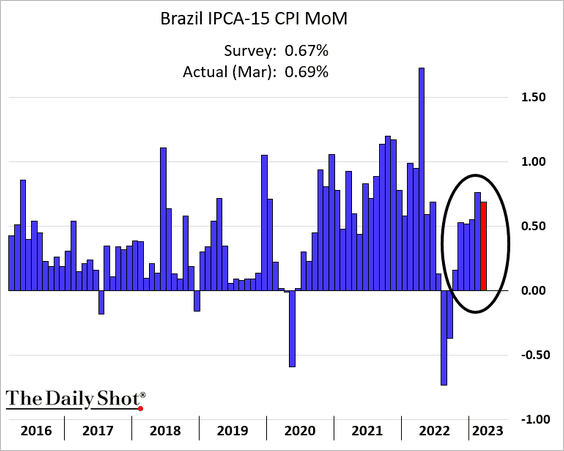

1. Brazil’s inflation remains stubbornly high.

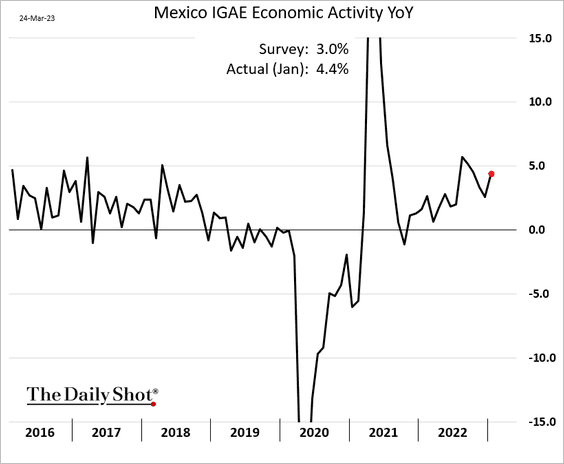

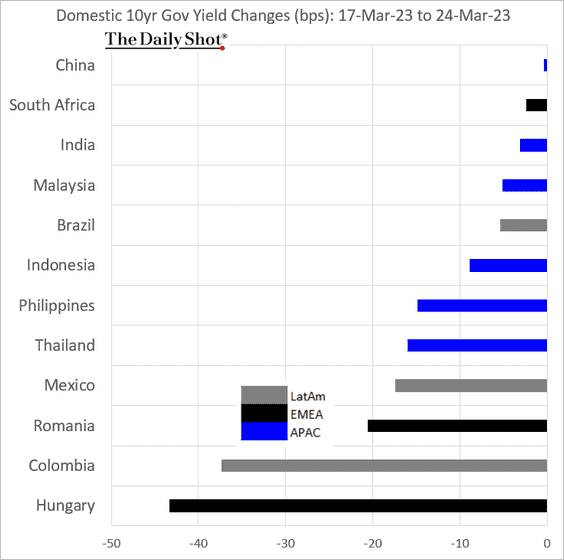

2. Mexico’s economic activity jumped in January, topping expectations.

Source: @JPSpinetto, @economics Read full article

Source: @JPSpinetto, @economics Read full article

——————–

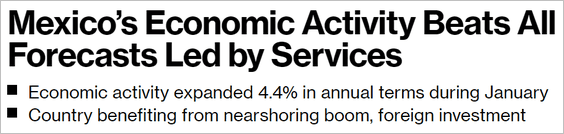

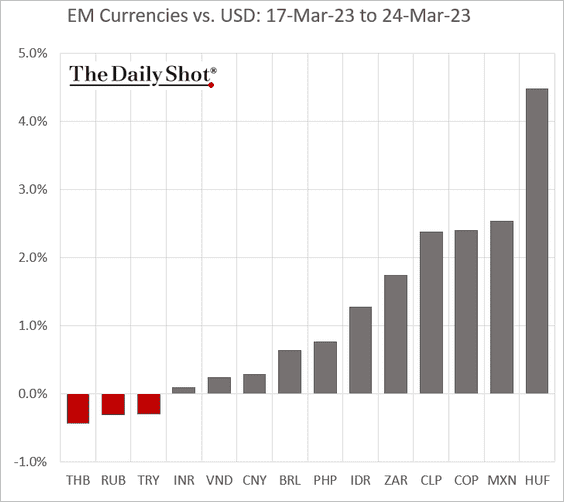

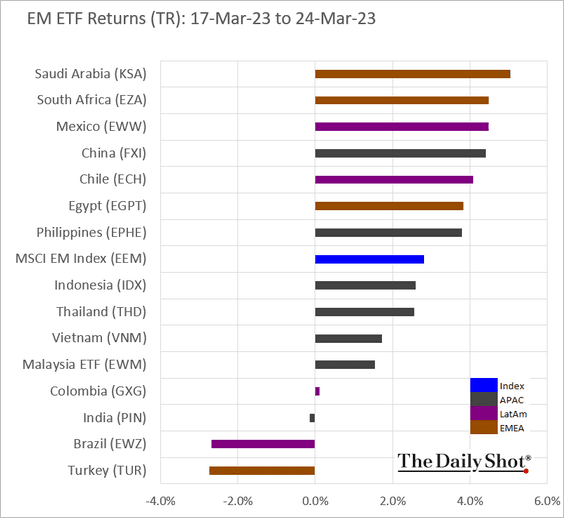

3. Now let’s take a look at some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

——————–

Commodities

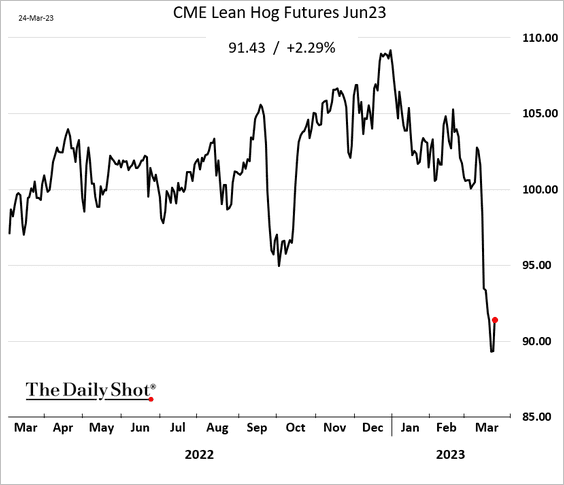

1. Chicago hog futures bounced from the lows on Friday, with weakness driven by demand concerns.

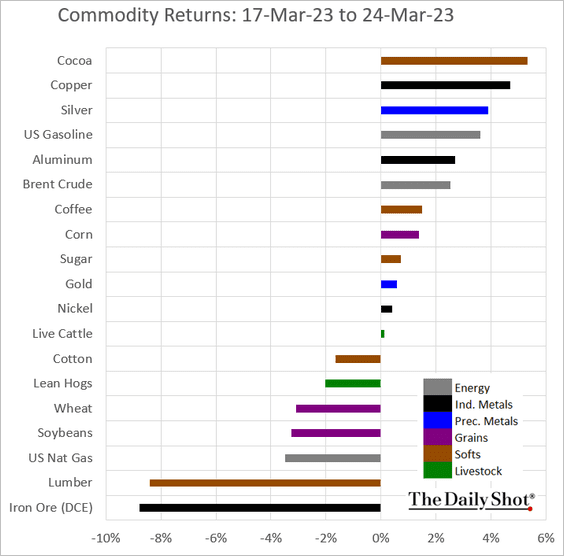

2. Here is last week’s performance across key commodity markets.

Back to Index

Energy

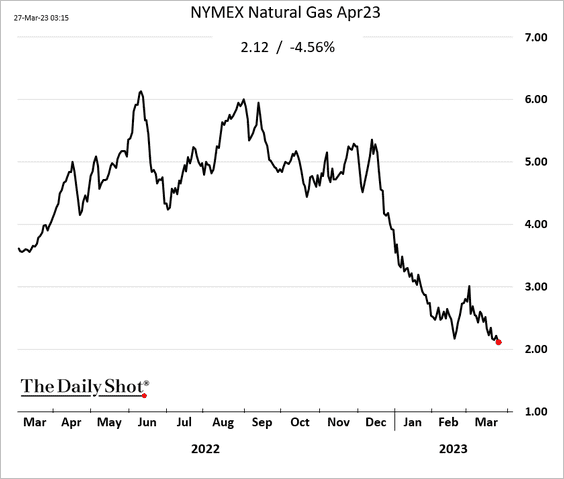

1. US natural gas futures remain under pressure amid robust production and elevated inventories.

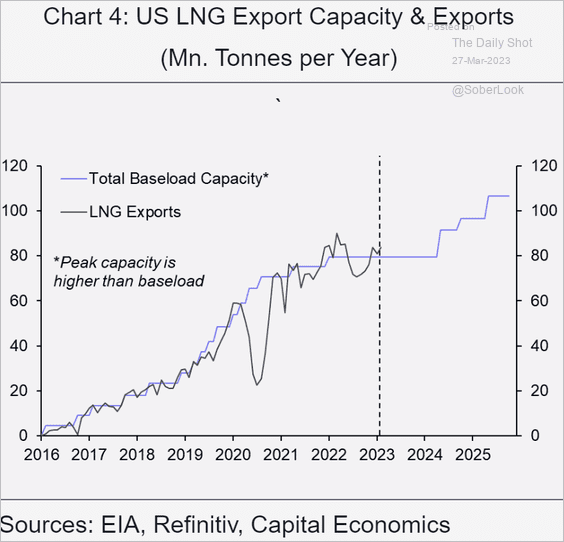

2. US LNG exports will pick up in 2024 and 2025 with capacity additions.

Source: Capital Economics

Source: Capital Economics

Back to Index

Equities

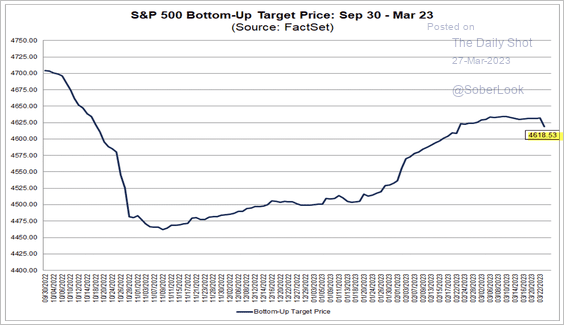

1. Where do analysts see the S&P 500 over the next 12 months? Right now, the target is about 16% above the current level.

Source: @FactSet Read full article

Source: @FactSet Read full article

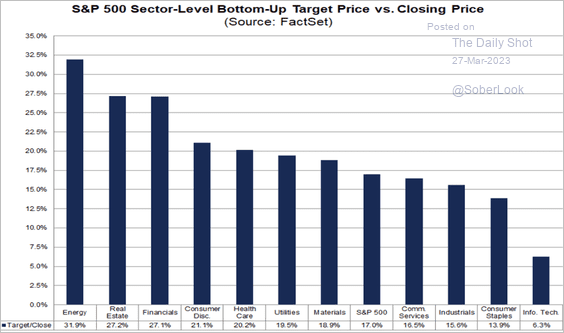

Here are the return targets by sector.

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

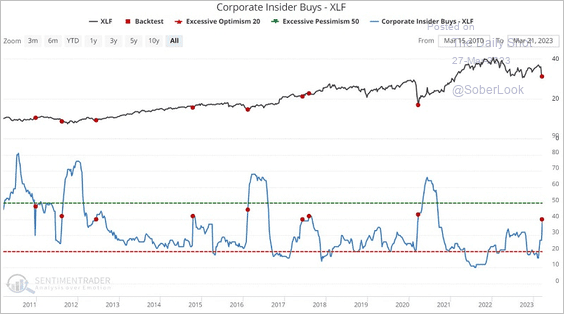

2. Corporate insiders have been buying financial stocks over the past two weeks.

Source: SentimenTrader

Source: SentimenTrader

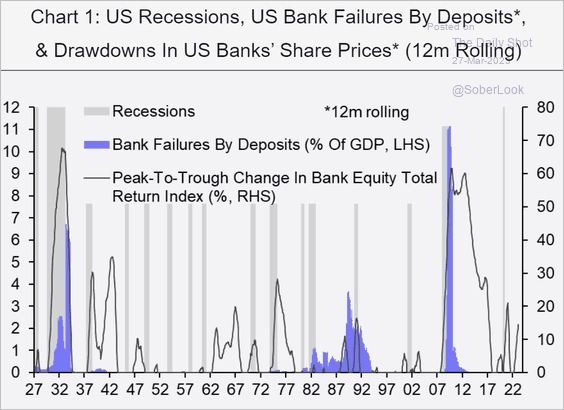

• This chart shows bank failures and drawdowns in banks’ share prices.

Source: Capital Economics

Source: Capital Economics

——————–

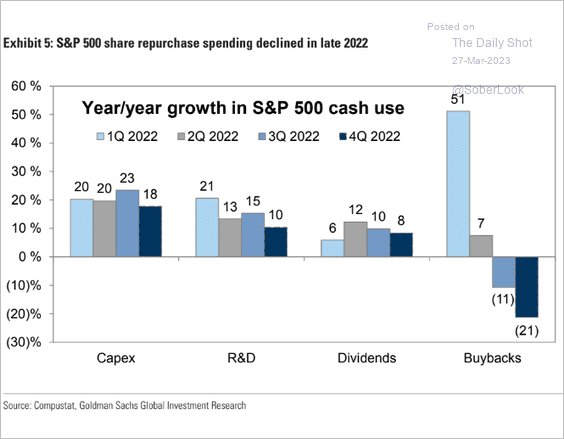

3. Spending on share buybacks slowed last quarter.

Source: Goldman Sachs

Source: Goldman Sachs

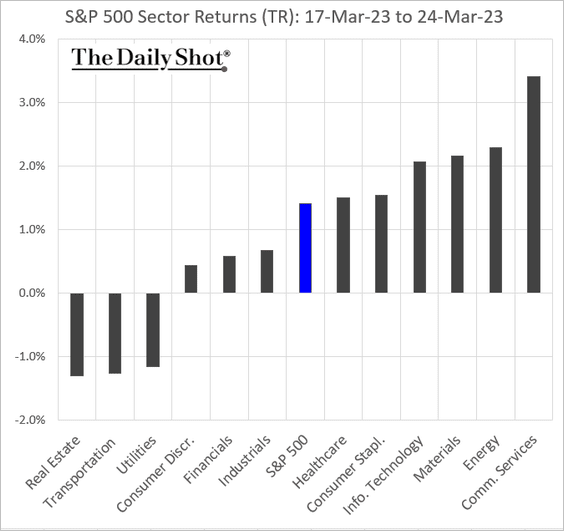

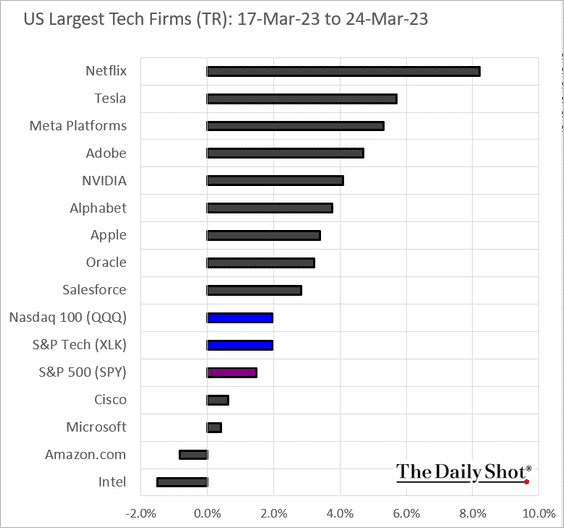

4. Next, we have some performance data from last week.

• Sectors:

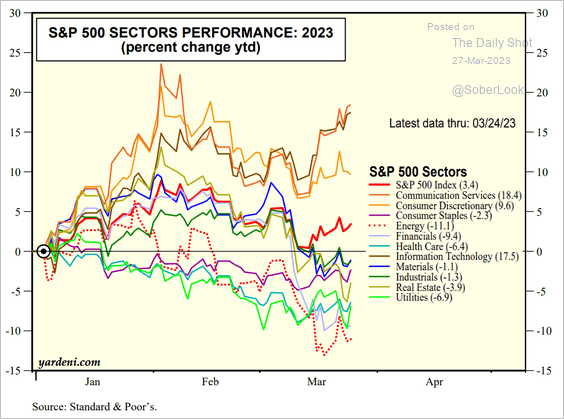

– Sectors year-to-date:

Source: Yardeni Research

Source: Yardeni Research

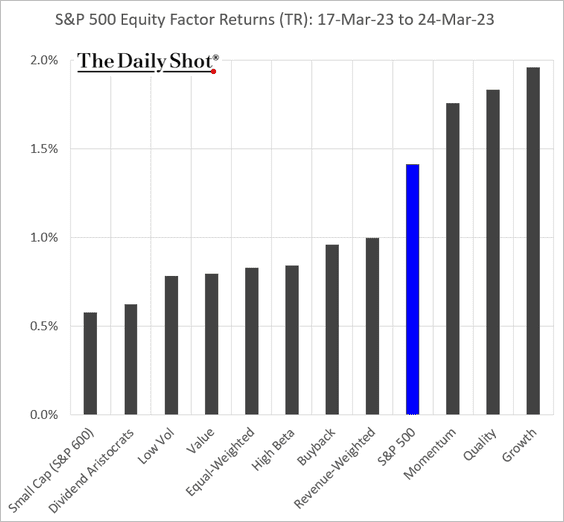

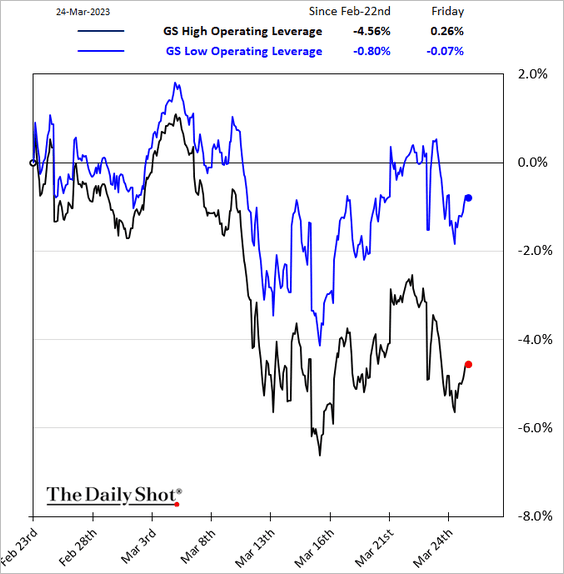

• Equity factors:

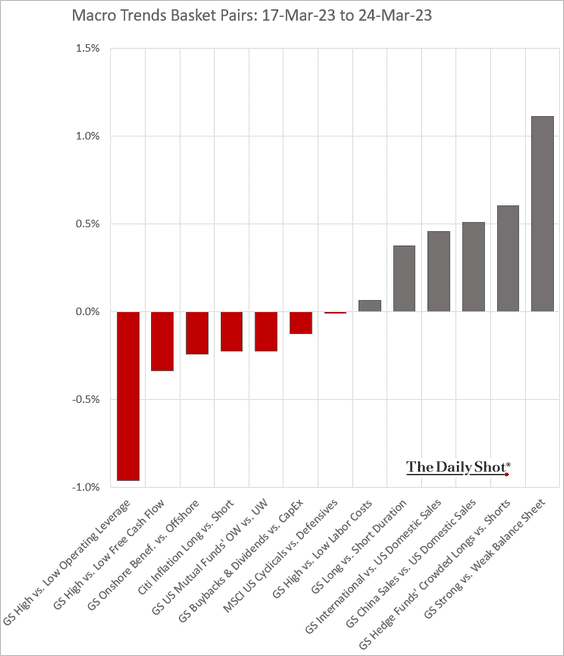

• Macro basket pairs:

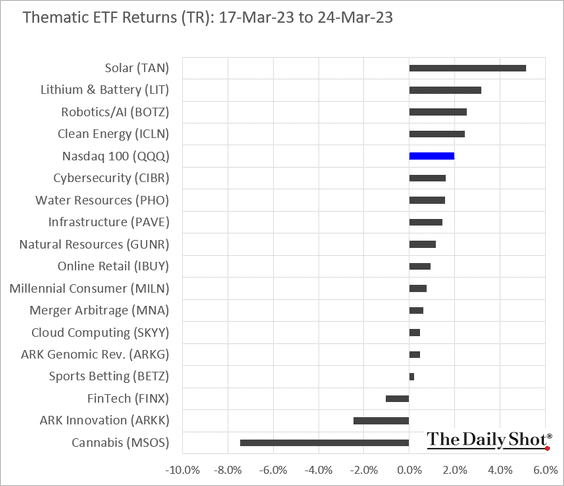

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

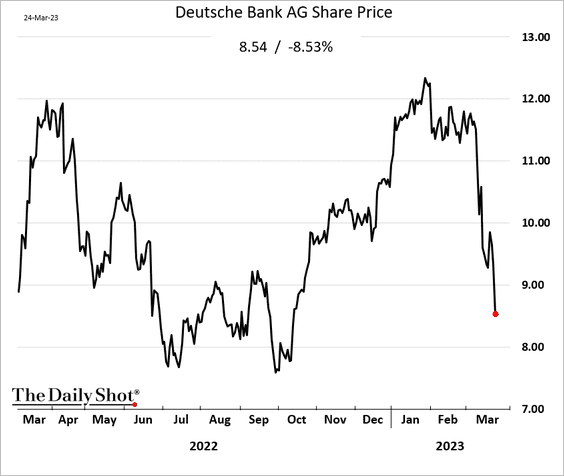

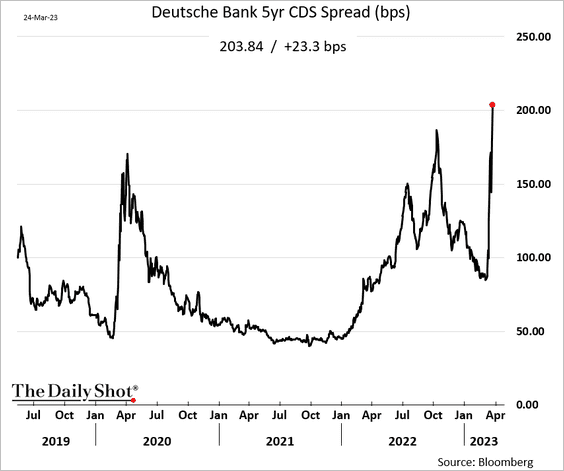

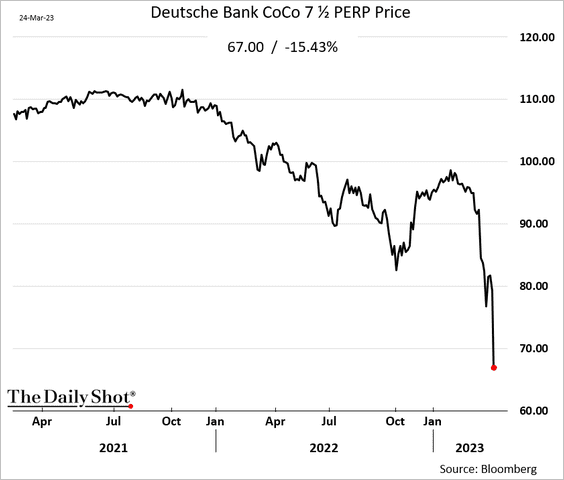

1. Deutsche Bank’s stock and bonds came under pressure last week, as hedge funds look for the next weak link in the financial sector.

• Stock price:

• CDS spread:

• CoCo price:

But unlike CS, Deutsche Bank is profitable and is not bleeding assets.

Source: @gmorpurgo, @lauralevfinance, @markets Read full article

Source: @gmorpurgo, @lauralevfinance, @markets Read full article

——————–

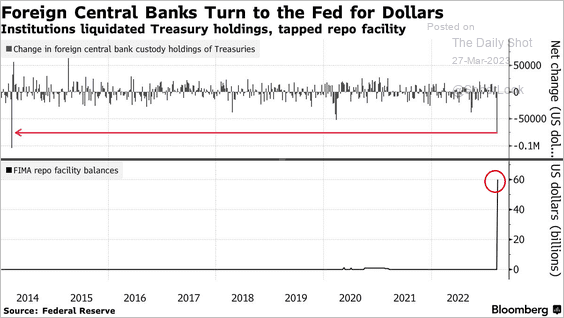

2. Swiss authorities borrowed dollars from the Fed as they work through the UBS/CS merger.

Source: @LibbyCherry98, @greg_ritchie, @markets Read full article

Source: @LibbyCherry98, @greg_ritchie, @markets Read full article

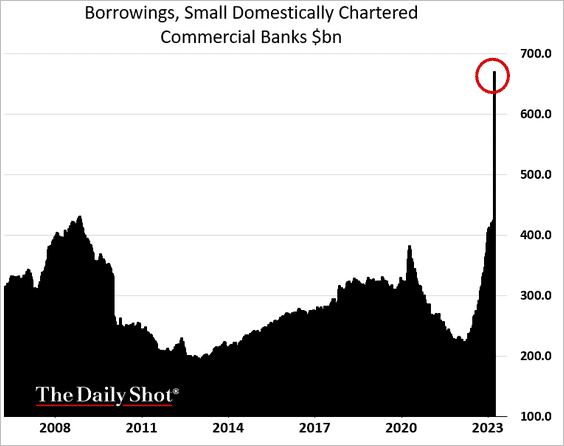

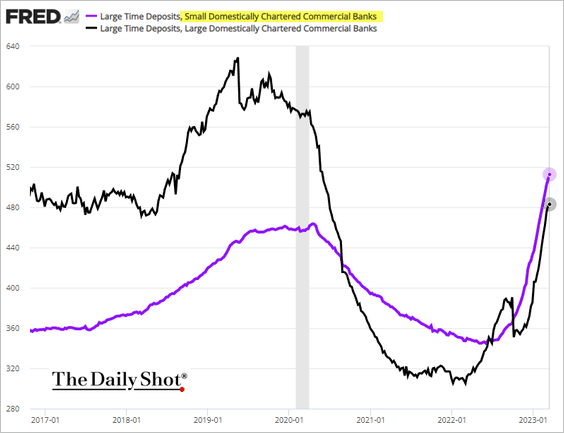

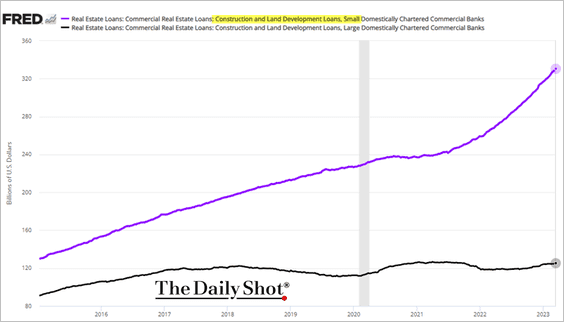

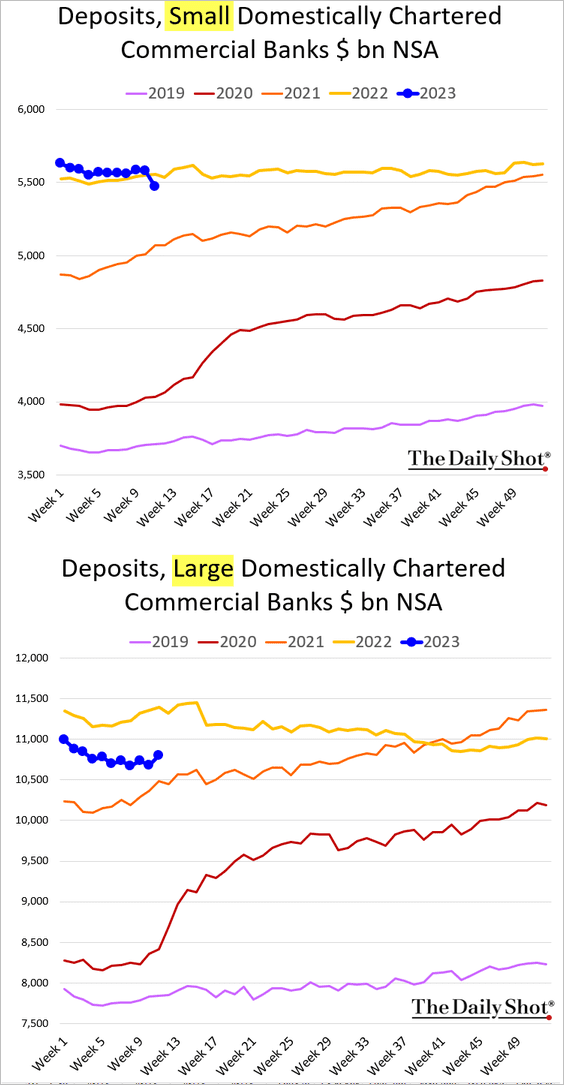

3. Next, let’s take a look at some trends in US small banks.

• Borrowing surged after the SVB collapse.

• Small banks have been selling high-yielding jumbo CDs to compensate for deposit losses.

• Small banks have been dominating commercial construction and development lending.

• As of the 15th, the overall rotation in deposits from small to large banks was not dramatic.

——————–

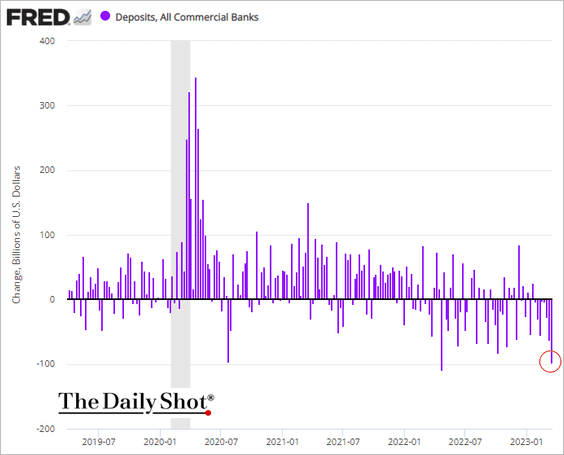

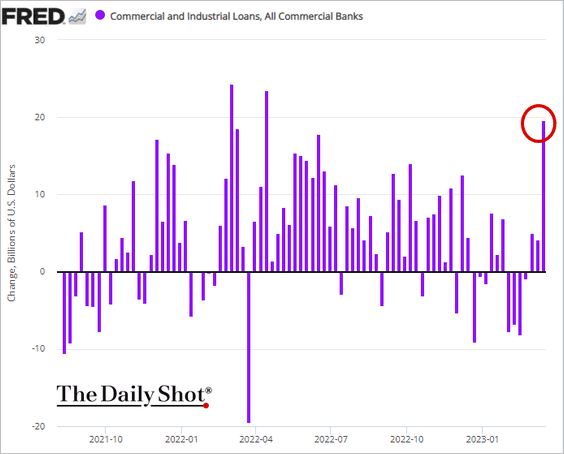

4. Deposits in the banking system as a whole declined over the week ending on the 15th.

Business loans jumped as companies tapped revolving facilities.

——————–

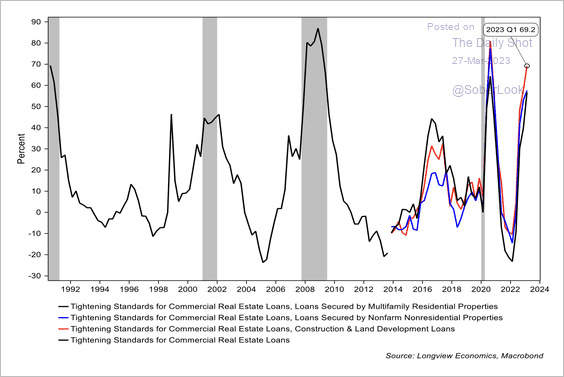

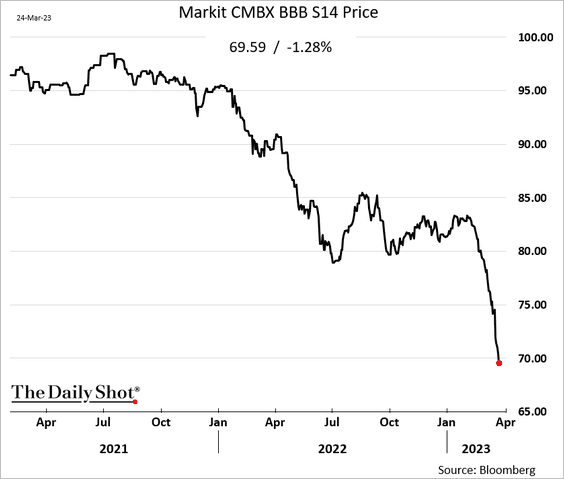

5. US banks have tightened lending standards for commercial real estate loans.

Source: Longview Economics

Source: Longview Economics

• Exposure to office properties sent CMBX BBB price sharply lower.

——————–

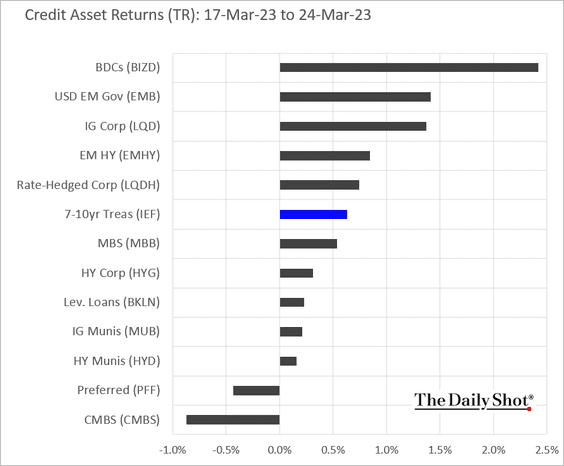

6. Finally, we have last week’s performance by asset class.

Back to Index

Global Developments

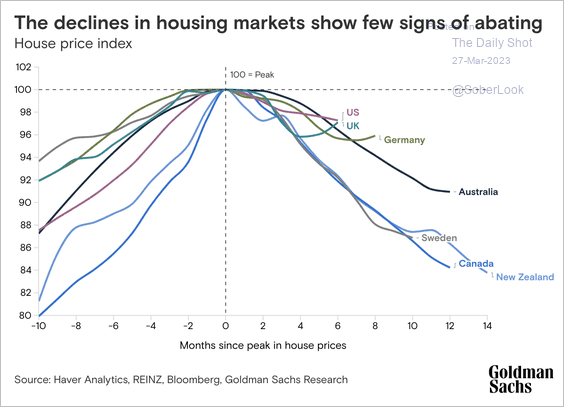

1. This chart shows housing market declines in advanced economies.

Source: Goldman Sachs

Source: Goldman Sachs

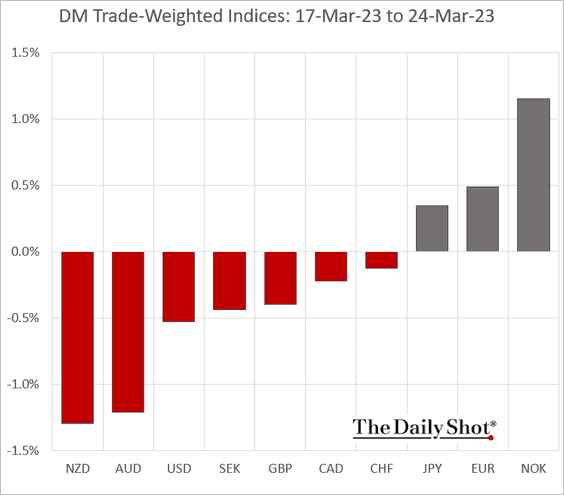

2. Finally, we have last week’s performance data for advanced economies.

• Currency indices:

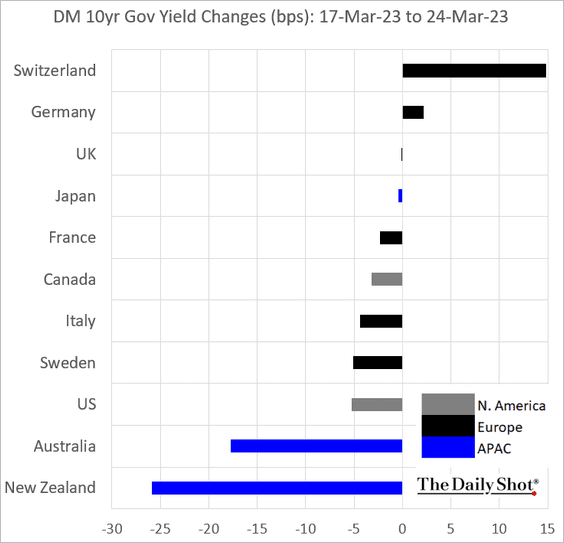

• Bond yields:

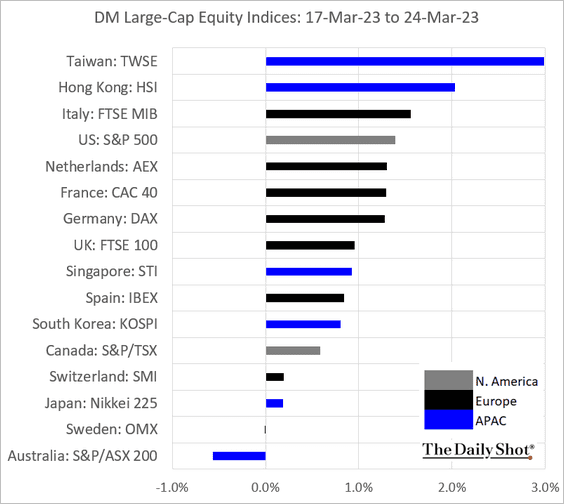

• Large-cap equities:

——————–

Food for Thought

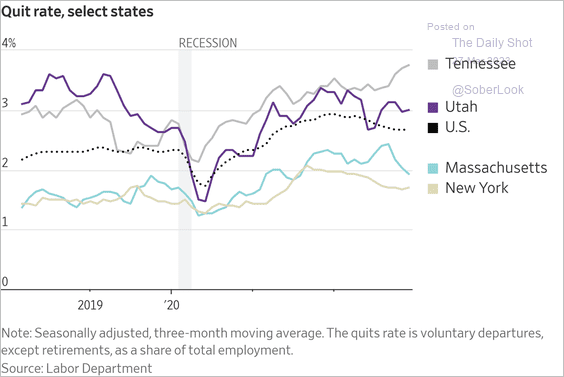

1. Quit rates (voluntary resignations) in select states:

Source: @WSJ Read full article

Source: @WSJ Read full article

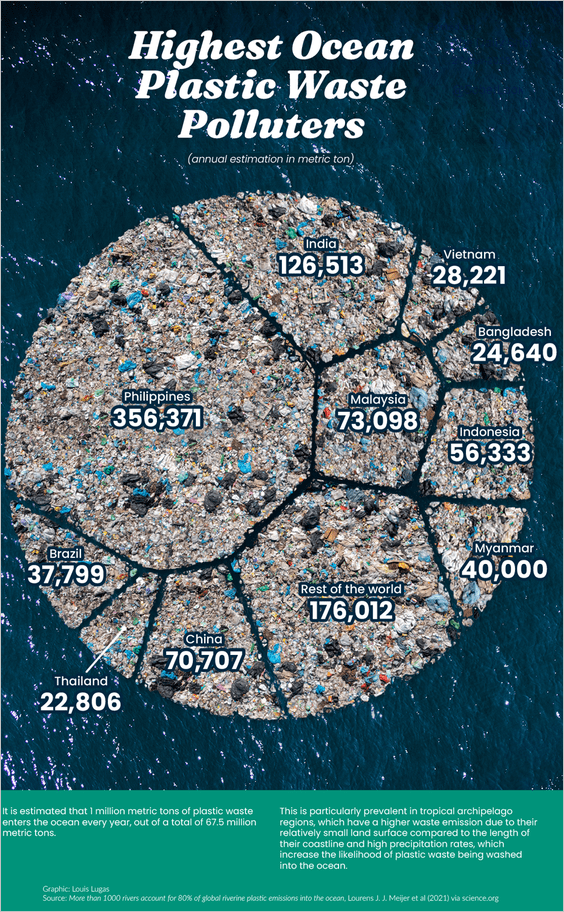

2. Ocean plastic waste pollution by country:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

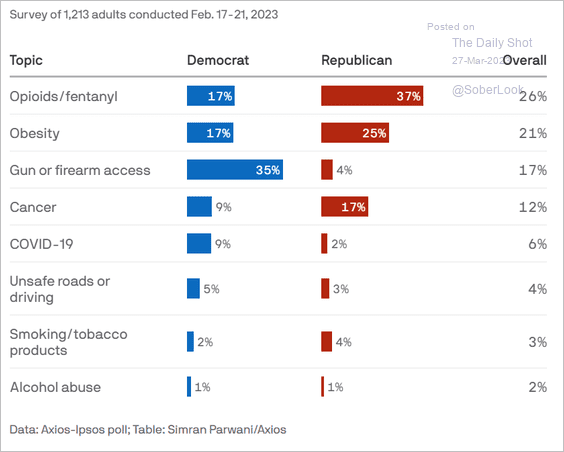

3. The greatest threat to US public health:

Source: @axios Read full article

Source: @axios Read full article

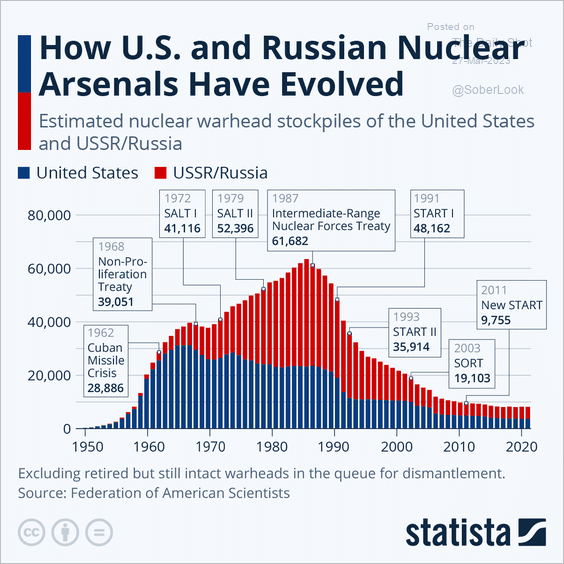

4. US and Russian nuclear arsenals:

Source: Statista

Source: Statista

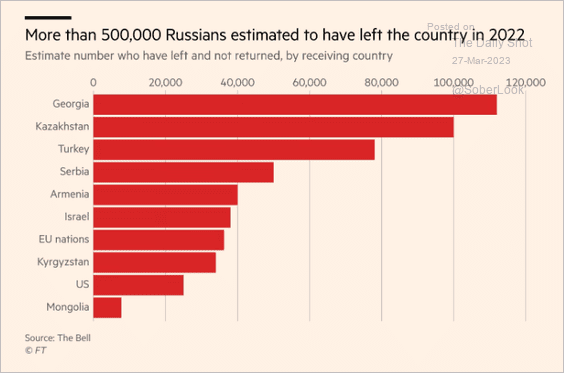

5. The number of people who left Russia in 2022, by destination:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

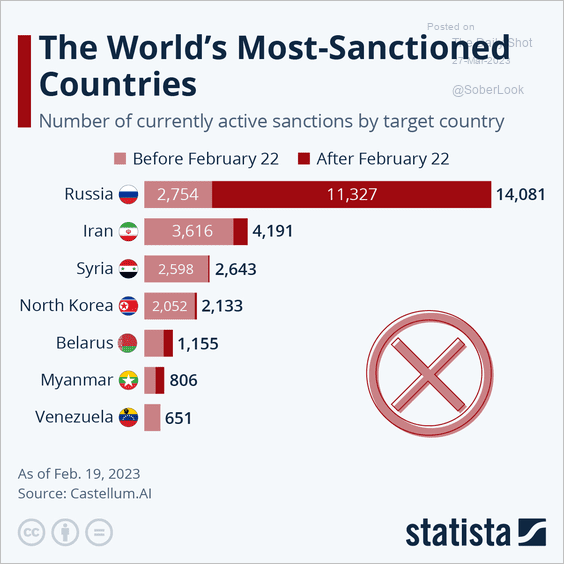

6. Most-sanctioned countries:

Source: Statista

Source: Statista

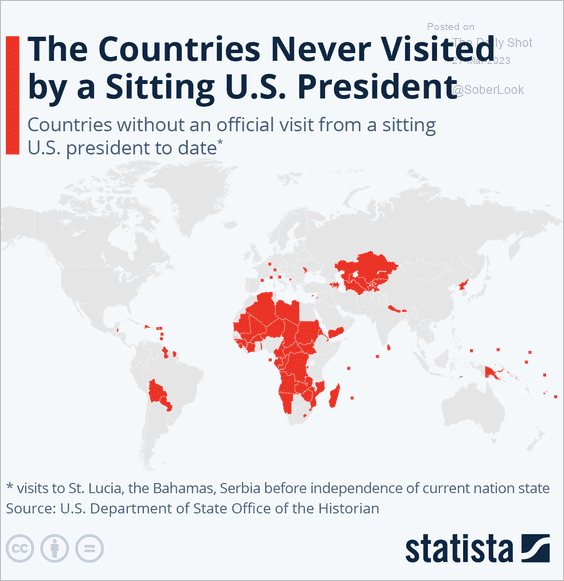

7. The countries never visited by a sitting US president:

Source: Statista

Source: Statista

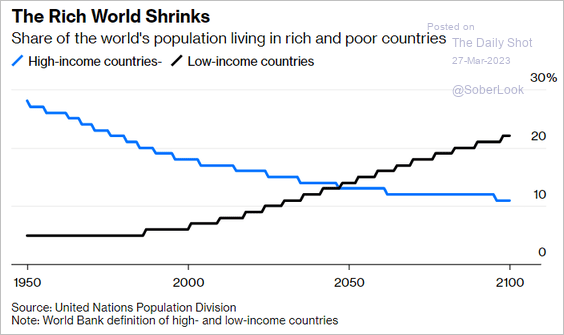

8. Population of rich vs. poor countries:

Source: @portereduardo, @opinion Read full article

Source: @portereduardo, @opinion Read full article

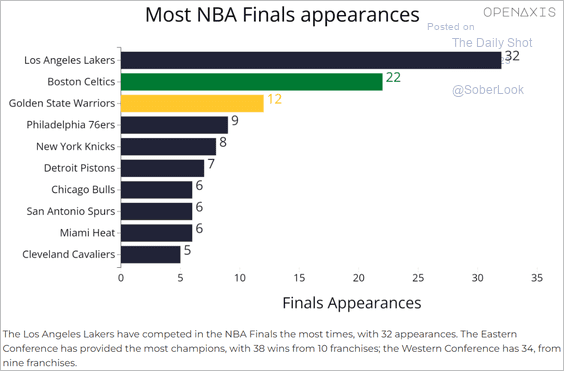

9. Most NBA finals appearances:

Source: OpenAxis

Source: OpenAxis

——————–

Back to Index