The Daily Shot: 18-Apr-23

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

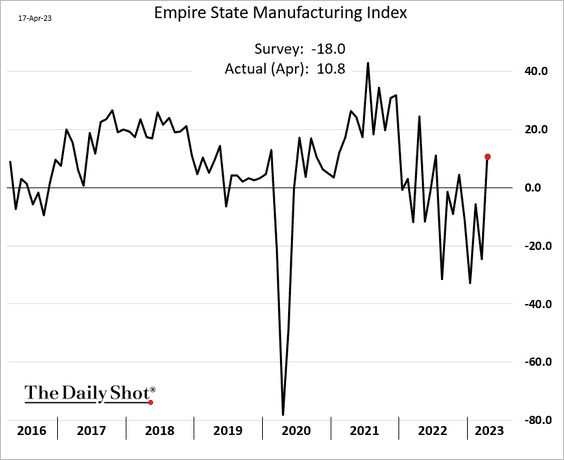

1. The NY Fed’s Empire Manufacturing Index, the first regional factory report of the month, was remarkably strong.

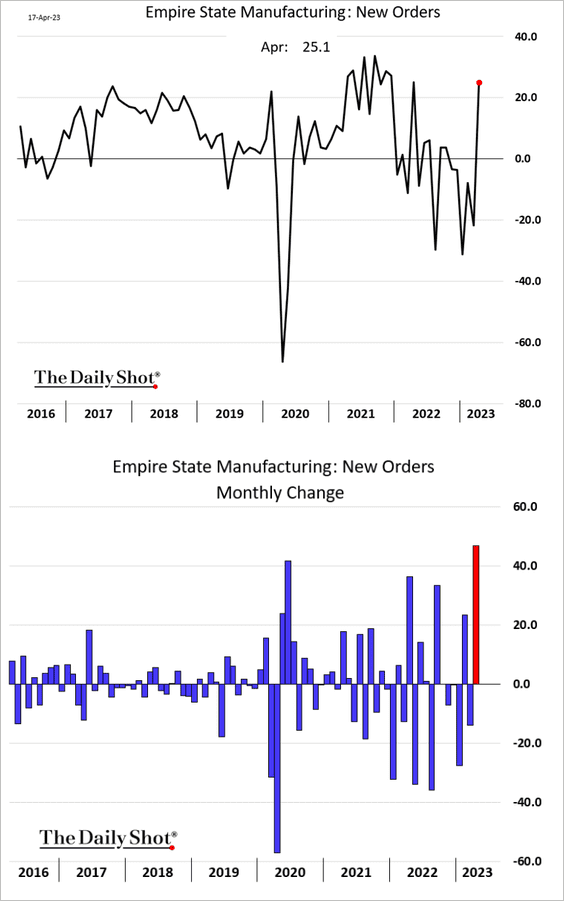

• The index of new orders soared.

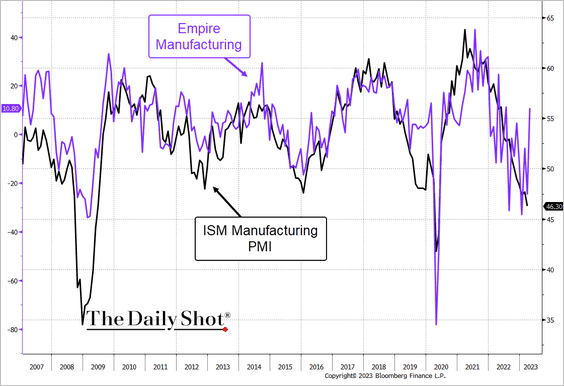

• The Empire index points to a rebound in factory activity at the national level.

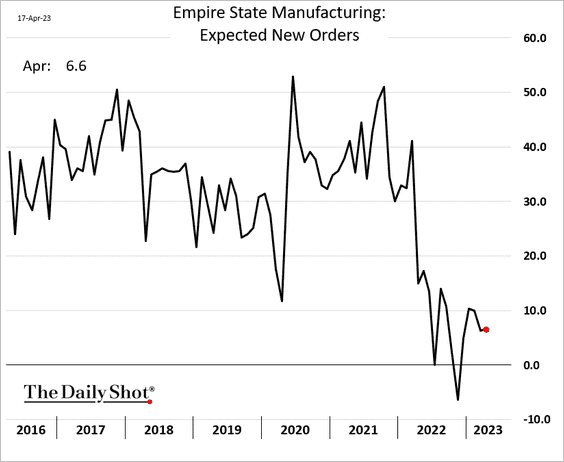

• However, it is important to exercise caution in interpreting this positive surprise. The current upswing in performance may prove to be transitory, given that the outlook for new orders remains subdued.

• Cost pressures in the region have been moderating.

——————–

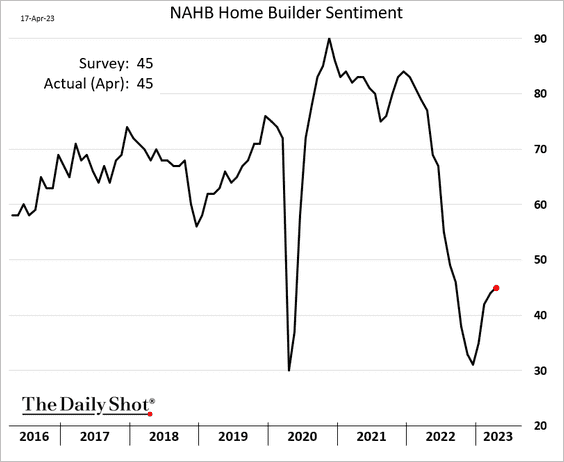

2. Homebuilder sentiment inched higher this month, …

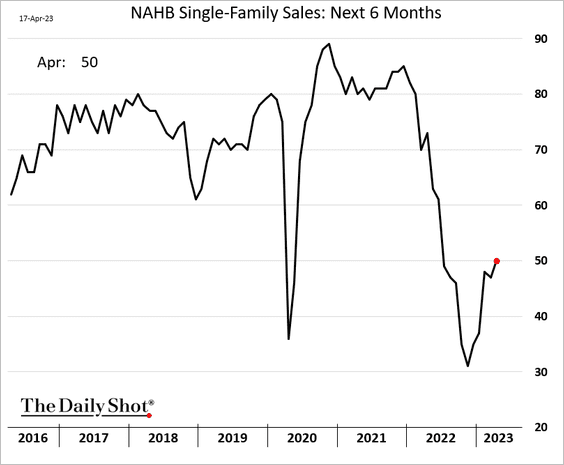

… as sales expectations improve.

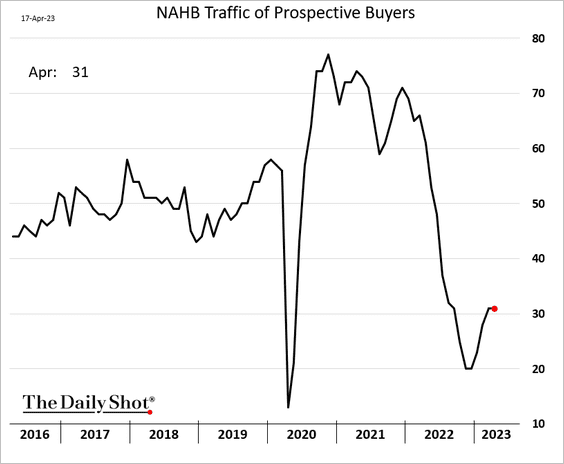

• Prospective buyer traffic showed no improvement.

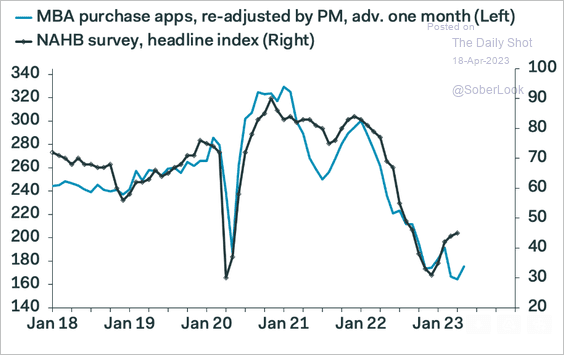

• Softer mortgage applications point to downside risks for builder sentiment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

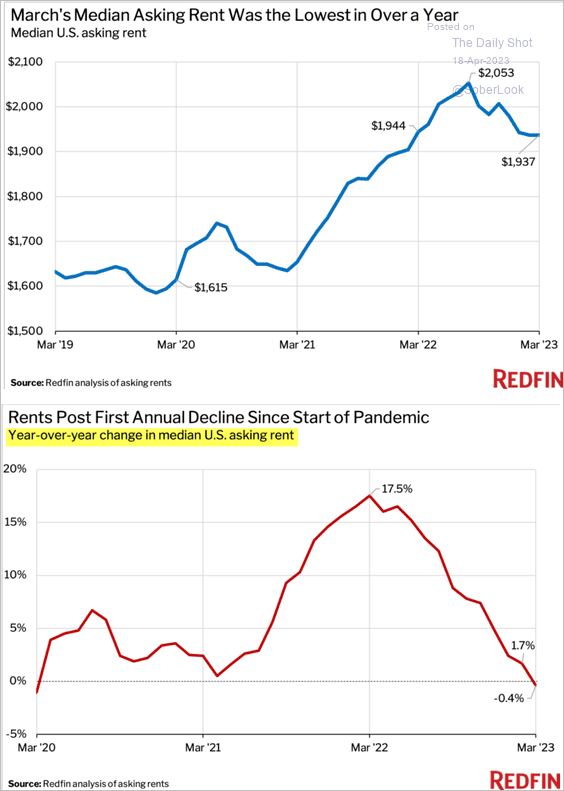

3. Rents are down on a year-over-year basis for the first time since the COVID shock, according to Redfin.

Source: Redfin

Source: Redfin

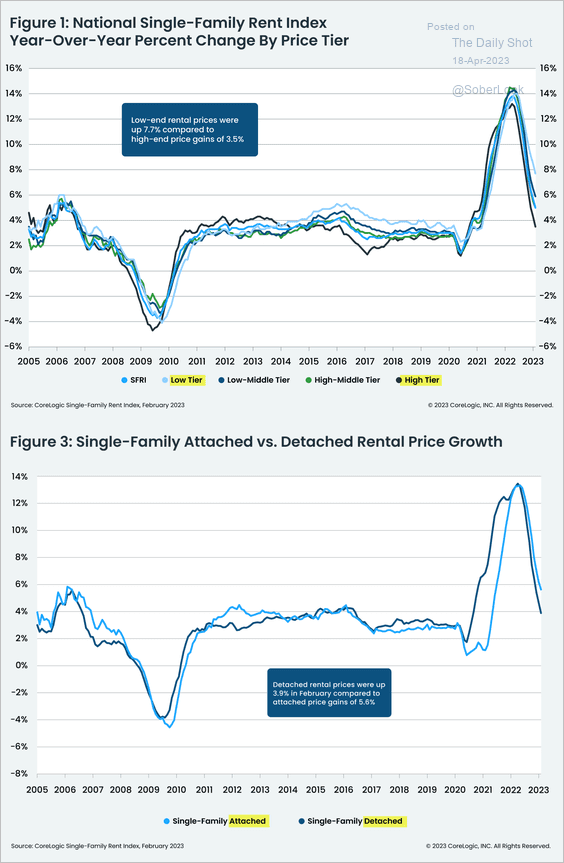

According to CoreLogic, single-family housing rent inflation is slowing rapidly, led by higher-price detached properties,

Source: CoreLogic

Source: CoreLogic

——————–

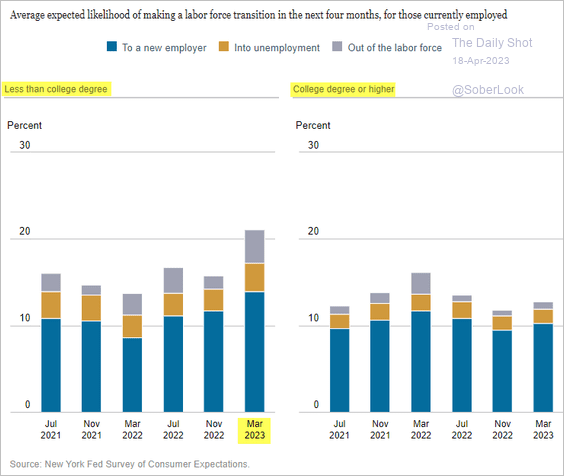

4. More workers without a college degree expect to be switching jobs or retiring.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

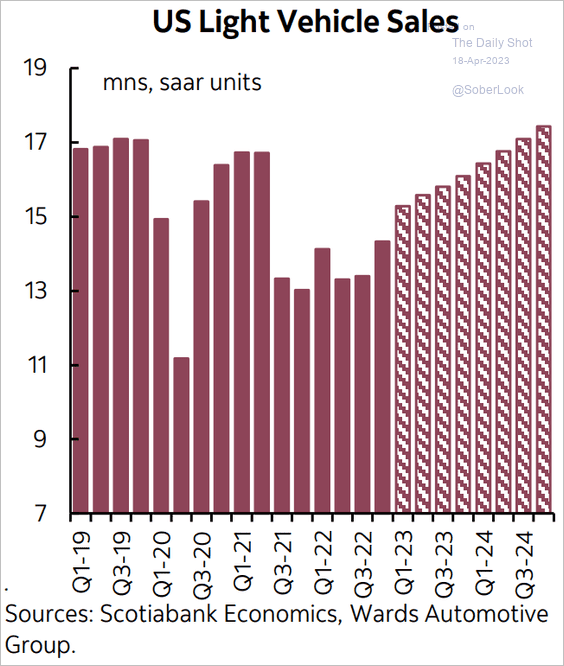

5. Scotiabank Economics expects vehicle sales to keep climbing over the next few quarters.

Source: Scotiabank Economics

Source: Scotiabank Economics

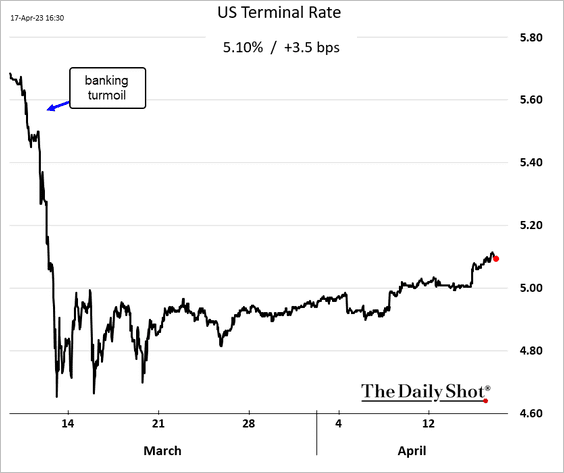

6. The terminal rate continues to rise, …

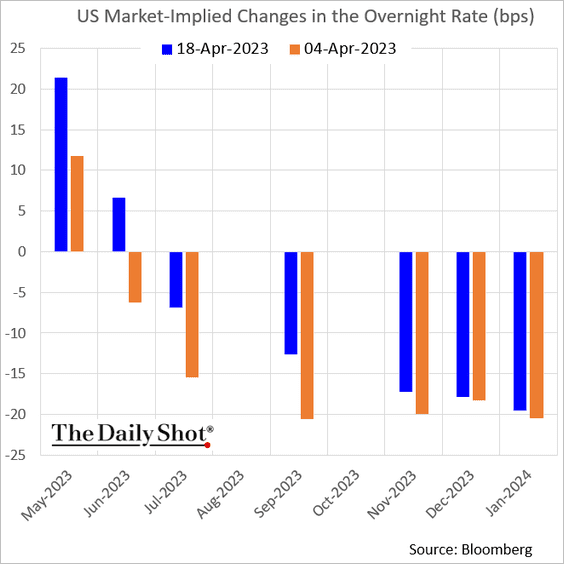

… as the market assigns a small probability to a June rate hike.

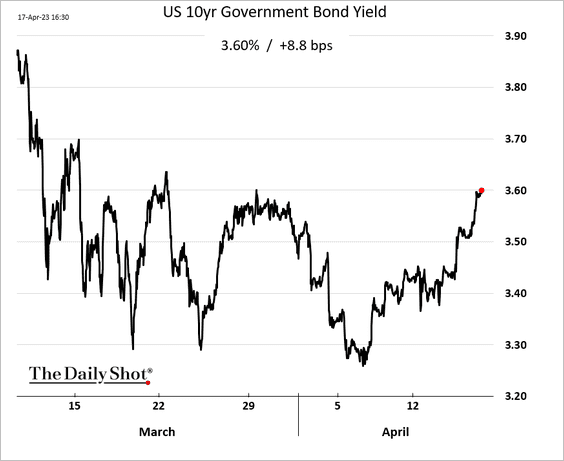

• Treasury yields have been climbing.

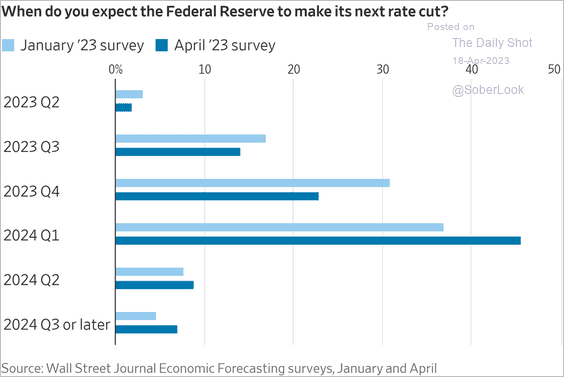

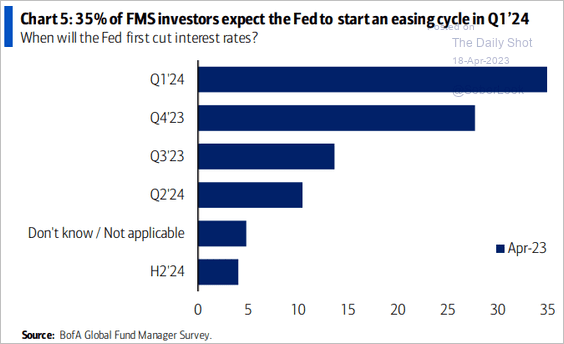

• When will the Fed start an easing cycle?

– WSJ survey:

Source: @WSJ Read full article

Source: @WSJ Read full article

– BofA survey of fund managers:

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

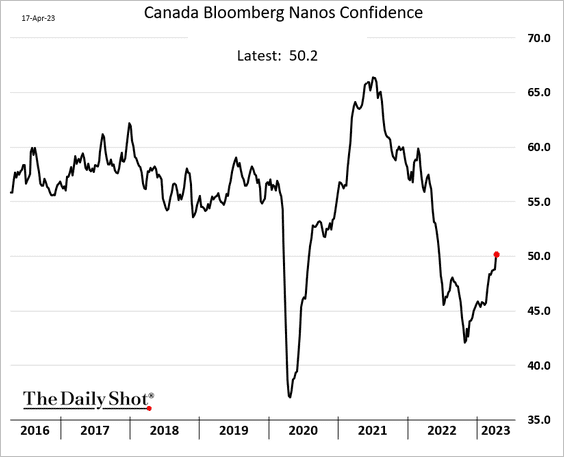

1. Consumer confidence continues to recover.

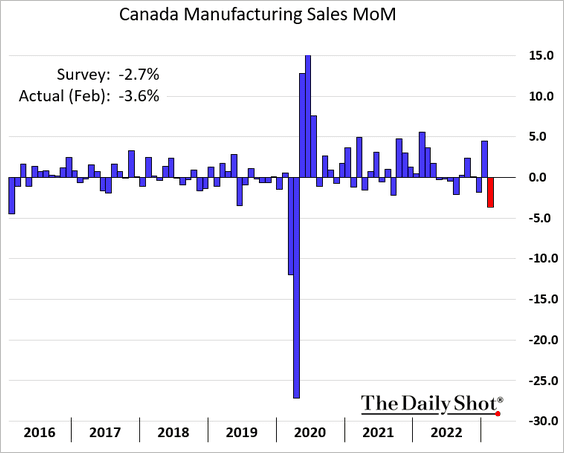

2. Manufacturing sales declined more than expected in February.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

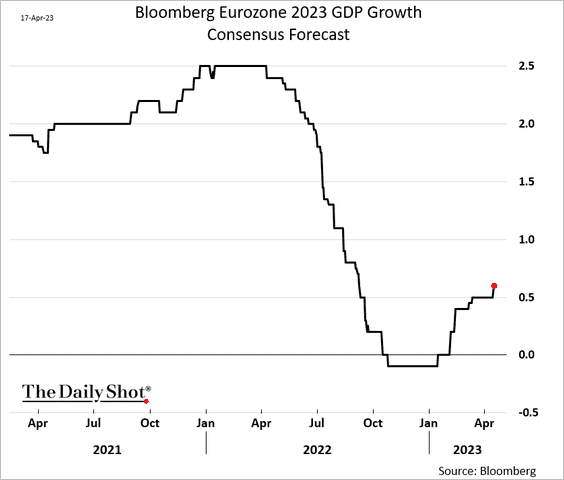

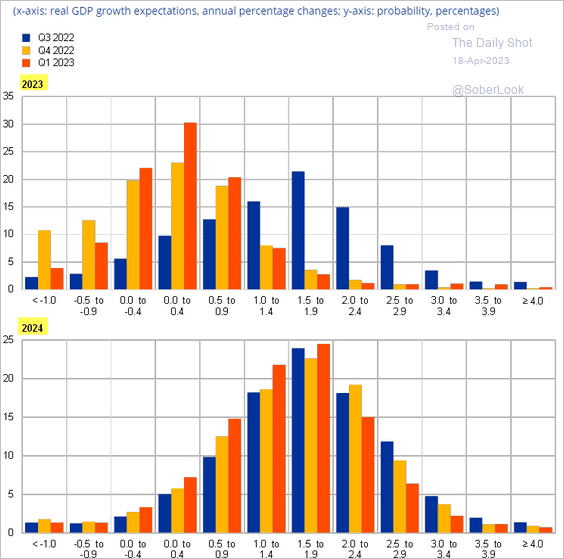

Economists are boosting their forecasts for the currency bloc’s economic growth.

Here is the ECB’s survey of professional forecasters.

Source: ECB

Source: ECB

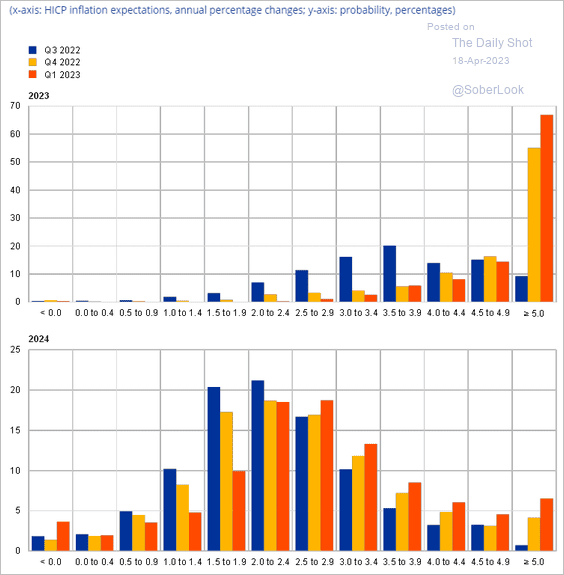

• Economists have raised their inflation forecasts for 2023 and 2024 (vs. the Q4 forecast).

Source: ECB

Source: ECB

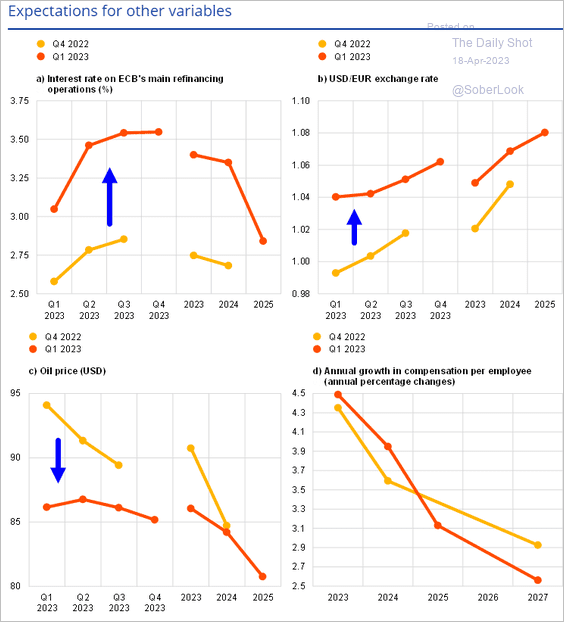

• Projections for interest rates and the euro are up.

Source: ECB

Source: ECB

Back to Index

Asia – Pacific

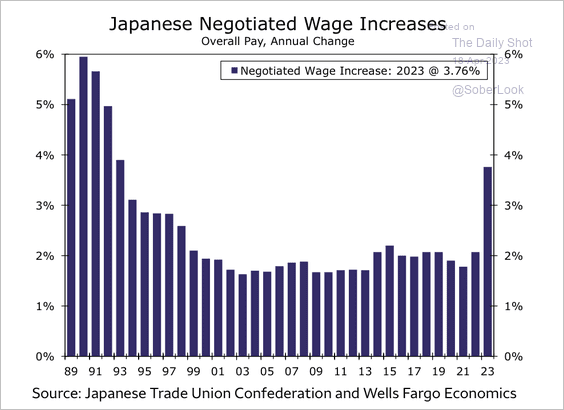

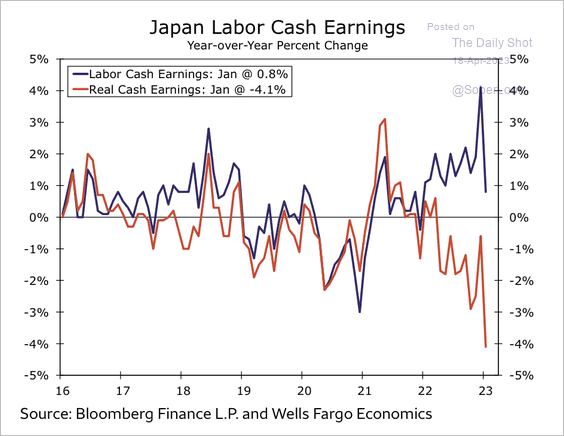

1. Japan’s unions negotiated the largest wage hike in 30 years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

However, real cash earnings remain very weak.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

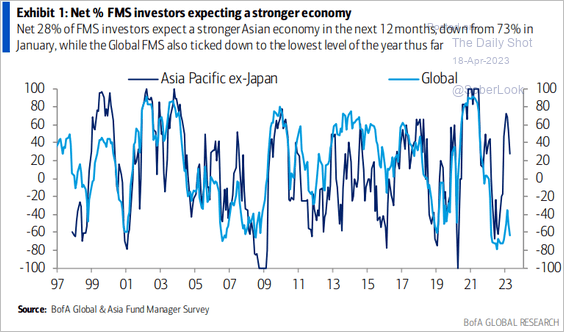

2. Investors see a sharp divergence between Asian and global economic growth.

Source: BofA Global Research

Source: BofA Global Research

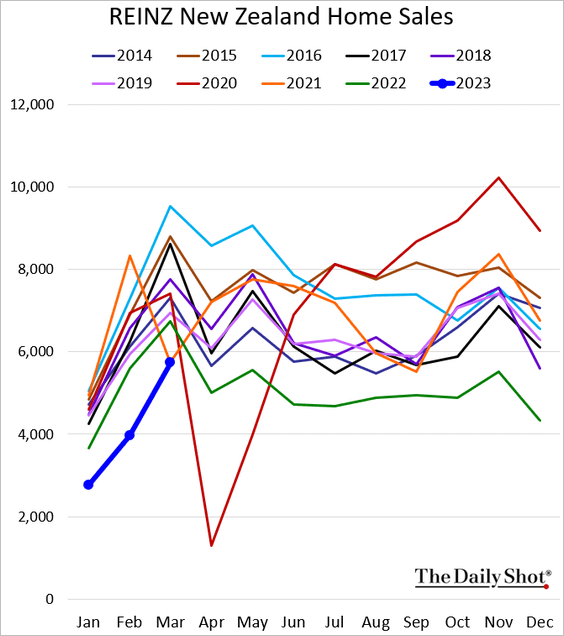

3. New Zealand’s home sales remain depressed for this time of the year.

Back to Index

China

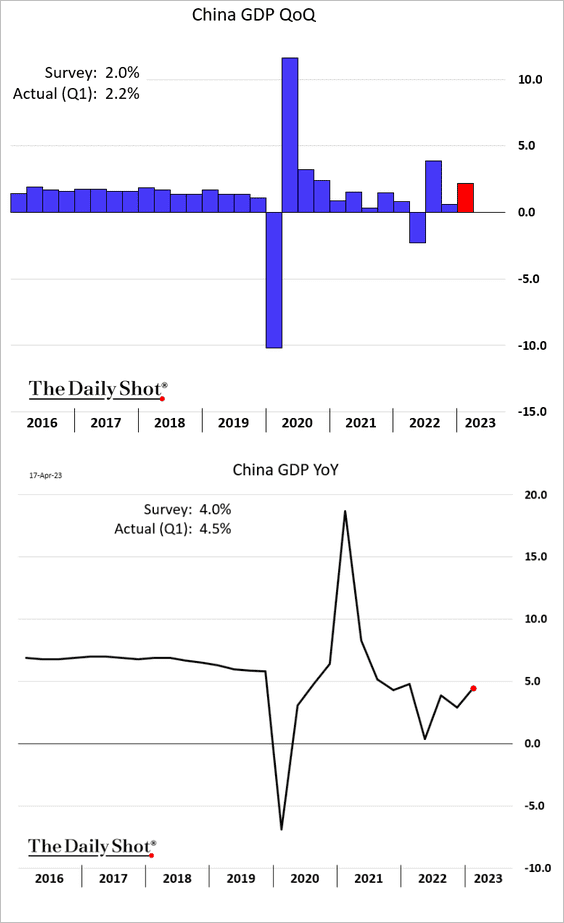

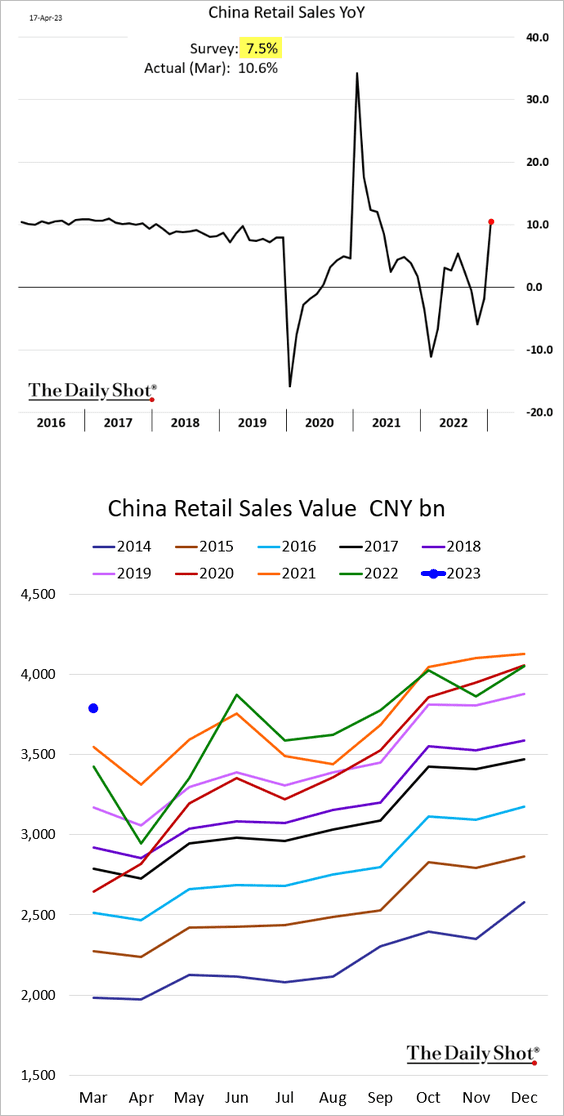

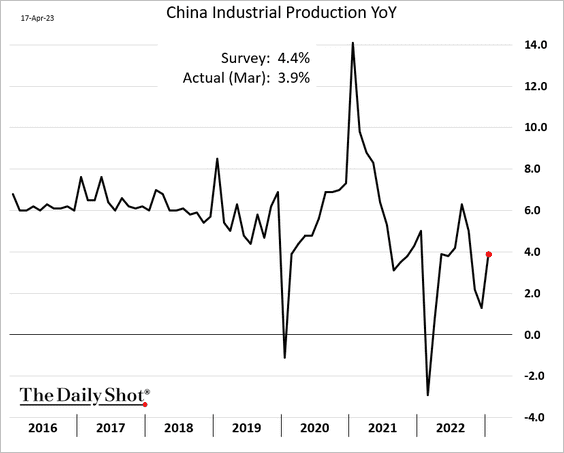

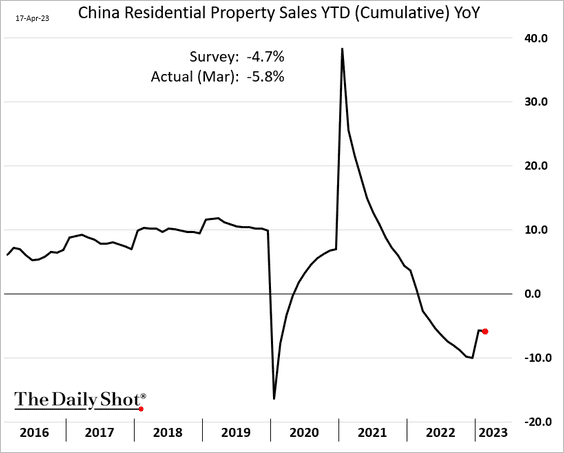

1. China’s Q1 GDP growth was slightly higher than expected, …

… boosted by a surge in consumption.

Source: ABC News Read full article

Source: ABC News Read full article

• Industrial production also improved.

• Residential property investment remains depressed.

——————–

2. China’s steel output has been surging, …

Source: @markets Read full article

Source: @markets Read full article

… but Beijing wants to cap the nation’s steel production.

Source: Caixin Read full article

Source: Caixin Read full article

——————–

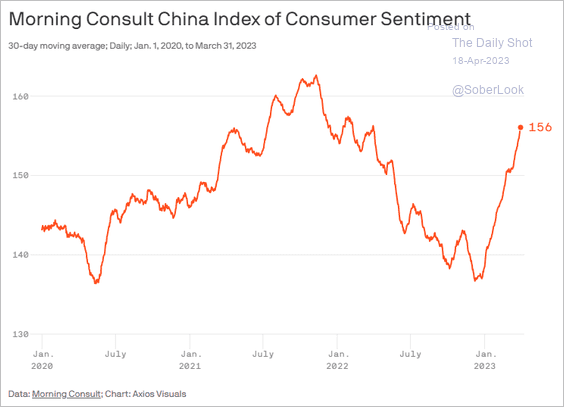

3. Consumer confidence has been rebounding this year.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Emerging Markets

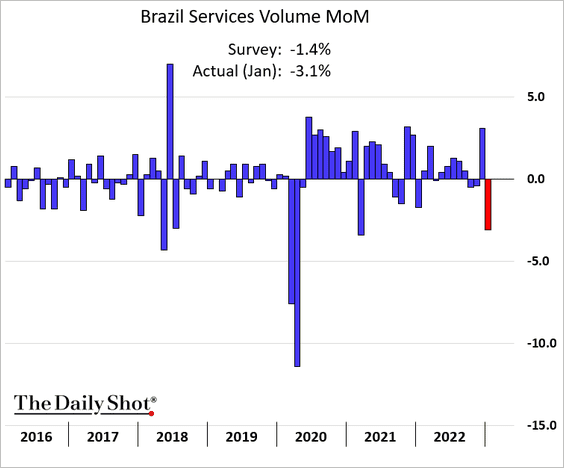

1. Brazil’s service sector output was down more than expected in January.

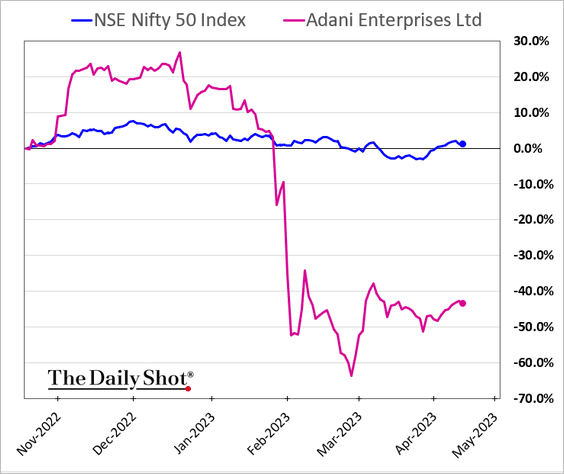

2. Shares of India’s Adani have stabilized.

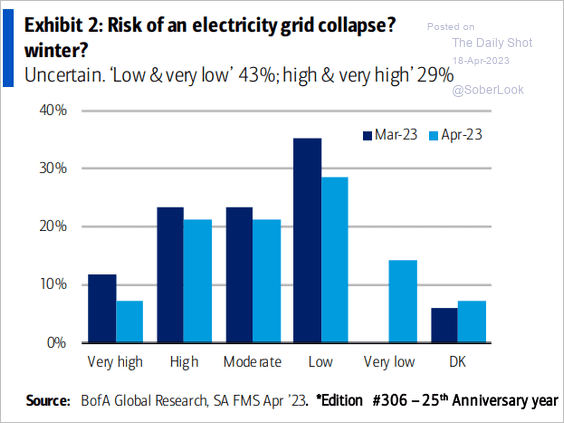

3. Investors are becoming more concerned about South Africa’s electricity grid.

Source: BofA Global Research

Source: BofA Global Research

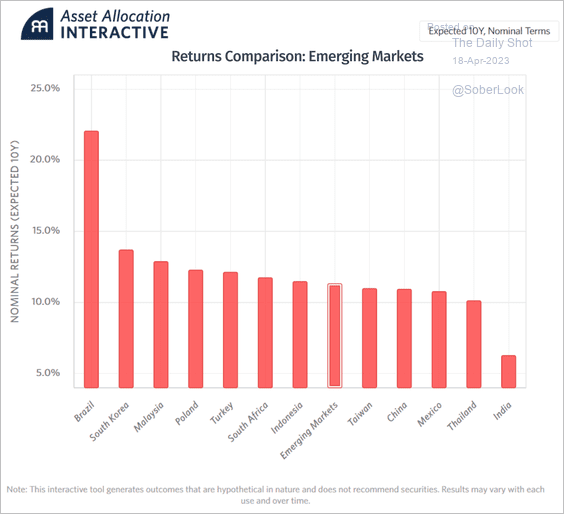

4. This chart shows expected annualized returns across select EM equity indices over the next decade. Brazil is forecasted to lead, while India’s high starting valuation is relatively unfavorable.

Source: Research Affiliates

Source: Research Affiliates

Back to Index

Cryptocurrency

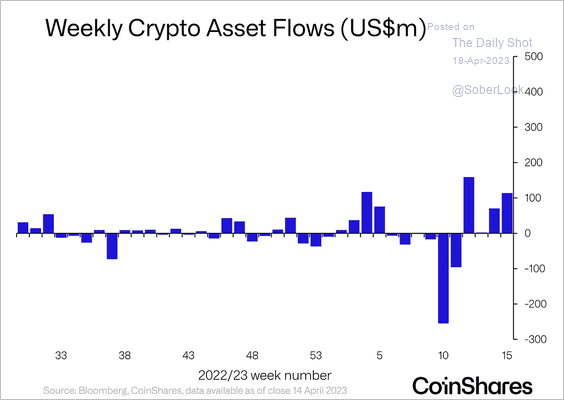

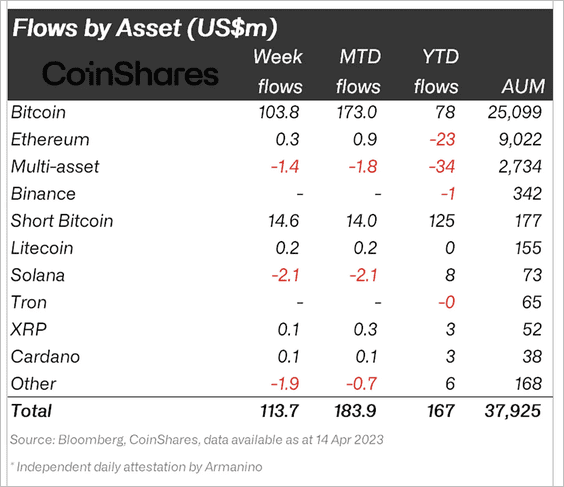

1. Crypto funds have seen an improvement in inflows in recent weeks.

Source: CoinShares Read full article

Source: CoinShares Read full article

Long-bitcoin funds accounted for most inflows last week. However, investors also added to short-bitcoin funds and continued to exit multi-asset products.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

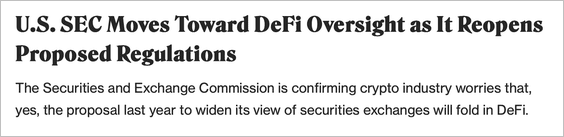

2. The SEC could include decentralized finance (DeFi) in its widening definition of regulated exchanges.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

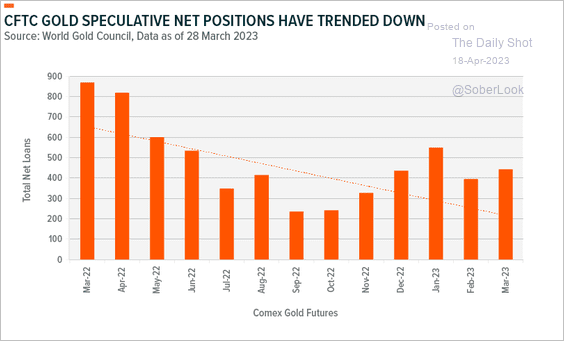

1. Speculative net-long gold positioning has trended lower over the past year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

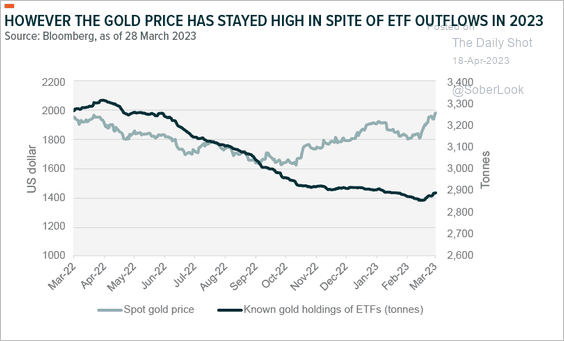

• Gold prices have risen despite recent ETF outflows.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

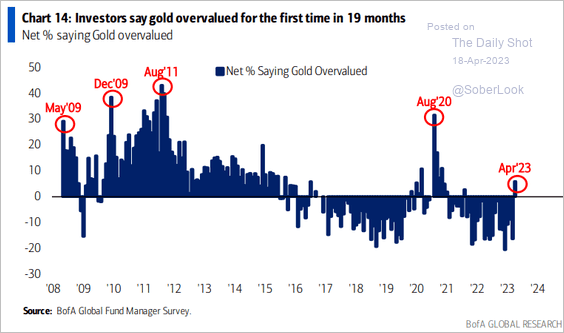

• Global fund managers now see gold as overvalued.

Source: BofA Global Research

Source: BofA Global Research

——————–

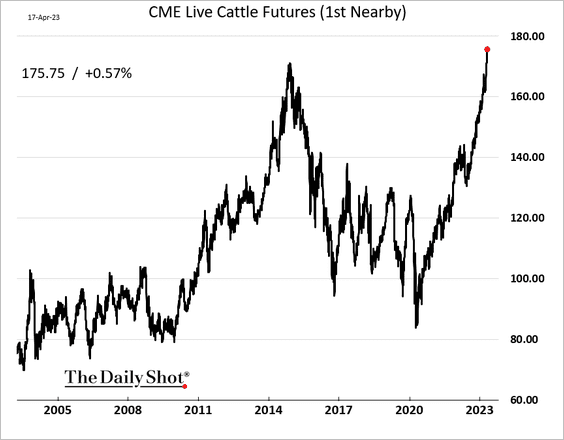

2. CME live cattle futures hit a record high due to a tighter cash market.

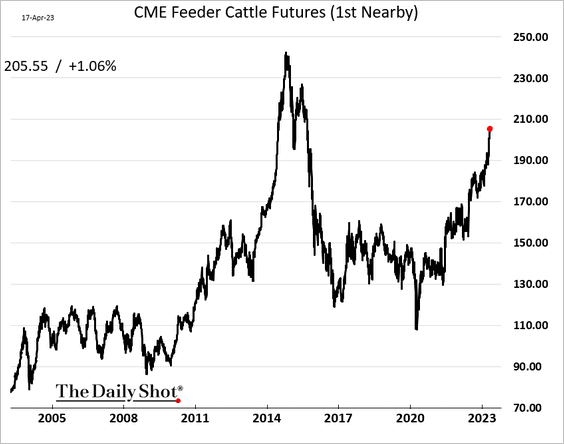

Feeder cattle futures are also surging.

Back to Index

Energy

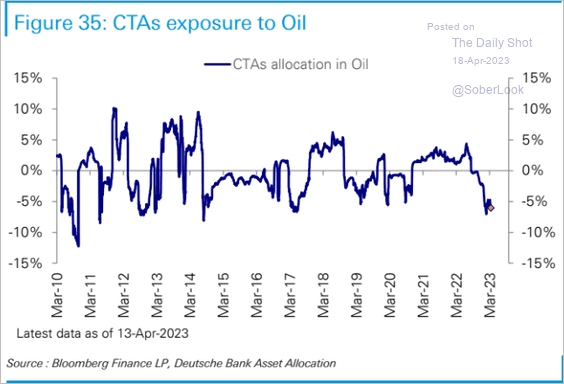

1. CTAs remain bearish on crude oil.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

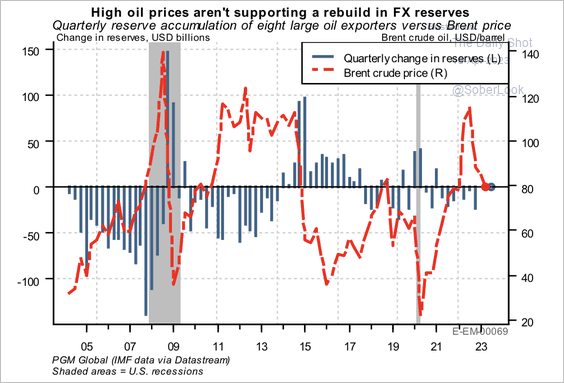

2. Over the past decade, rising oil prices have not supported a rebuild in foreign exchange reserves of major oil exporters.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

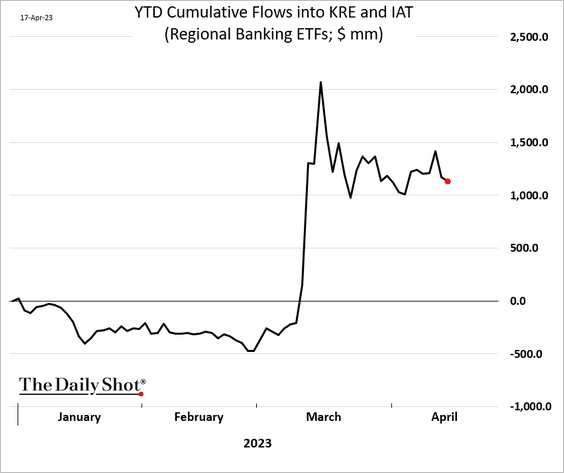

1. The buy-the-dip crowd has largely retained their purchases of regional bank ETFs.

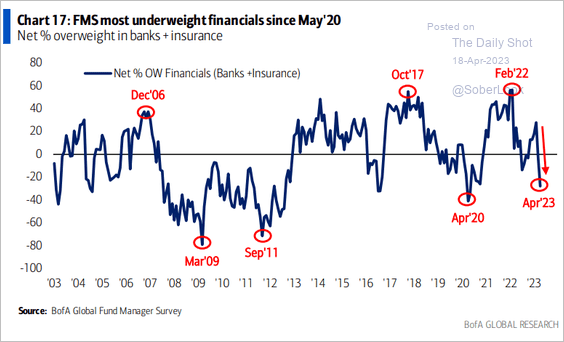

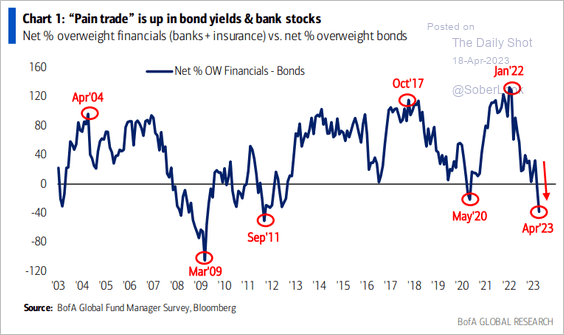

2. Fund managers are underweight financials, …

Source: BofA Global Research

Source: BofA Global Research

… particularly relative to bonds.

Source: BofA Global Research

Source: BofA Global Research

——————–

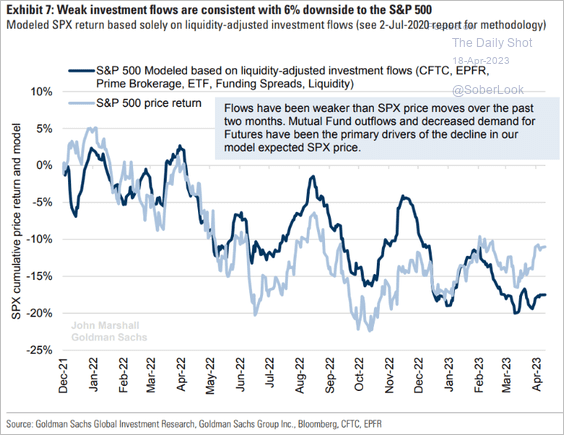

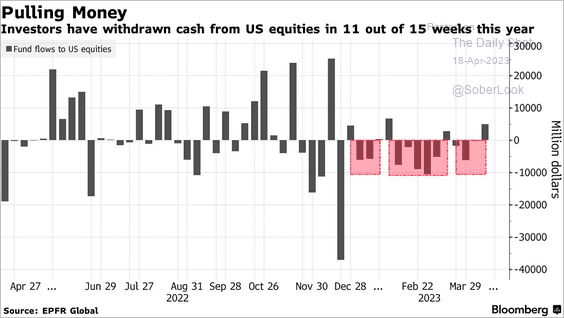

3. Fund flows suggest that the S&P 500 should be lower.

Source: Goldman Sachs; @VildanaHajric, @markets Read full article

Source: Goldman Sachs; @VildanaHajric, @markets Read full article

Source: @JessicaMenton, @lena_popina, @markets Read full article

Source: @JessicaMenton, @lena_popina, @markets Read full article

——————–

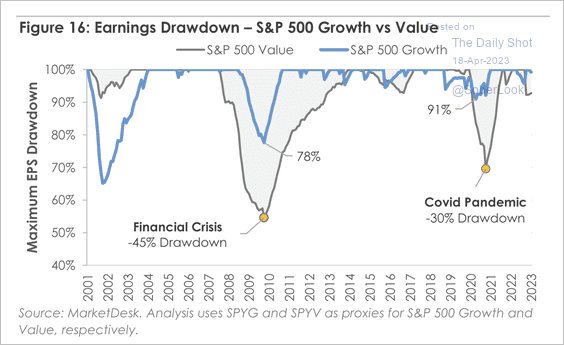

4. During recent recessions, the earnings drawdown of US growth stocks has been less severe than value stocks.

Source: MarketDesk Research

Source: MarketDesk Research

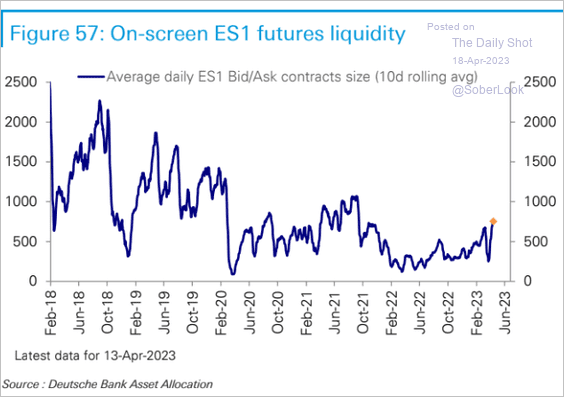

5. S&P 500 futures liquidity has improved over the past couple of weeks

Source: Deutsche Bank Research

Source: Deutsche Bank Research

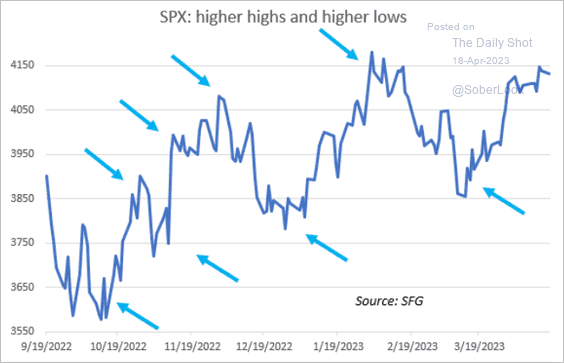

6. Higher highs and higher lows?

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

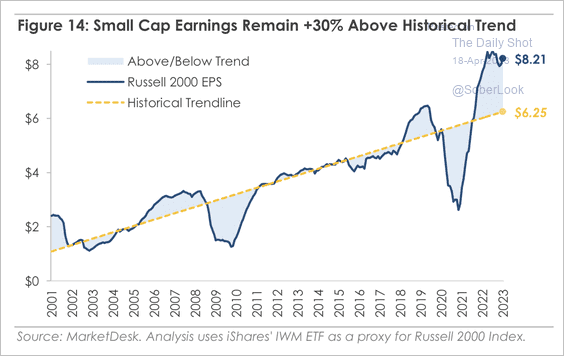

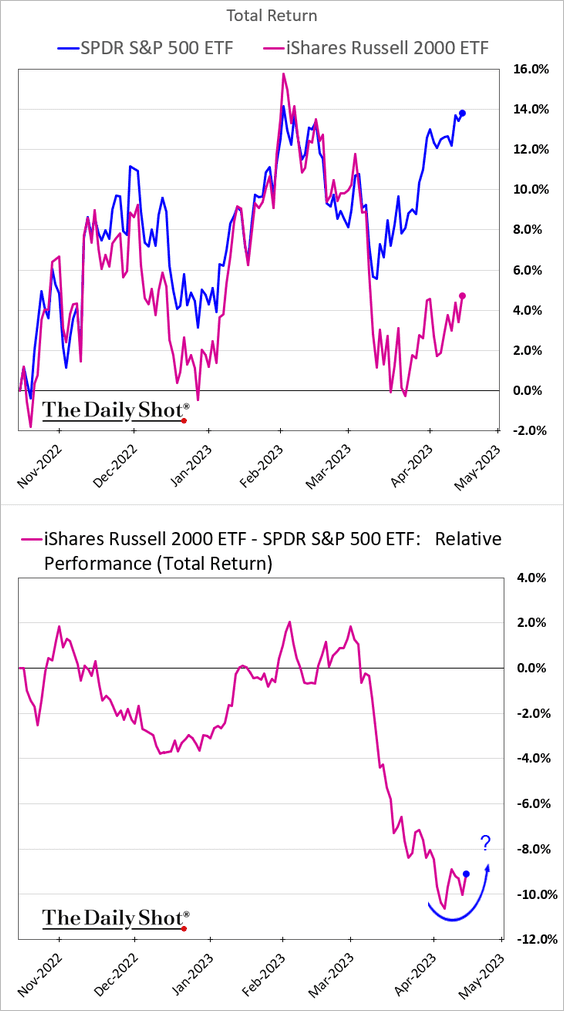

7. US small-cap earnings are significantly above their pre-pandemic trend.

Source: MarketDesk Research

Source: MarketDesk Research

Is small-cap underperformance over?

——————–

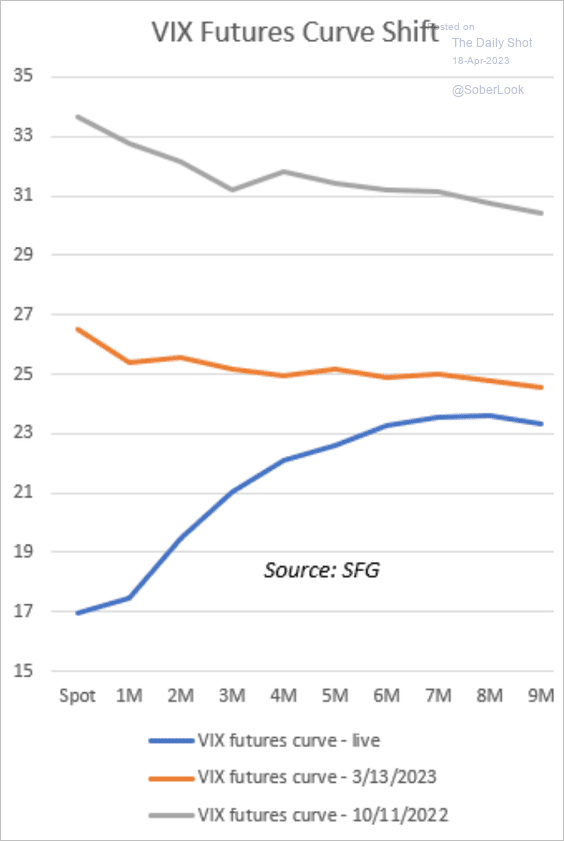

8. The VIX curve is in contango.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

Back to Index

Credit

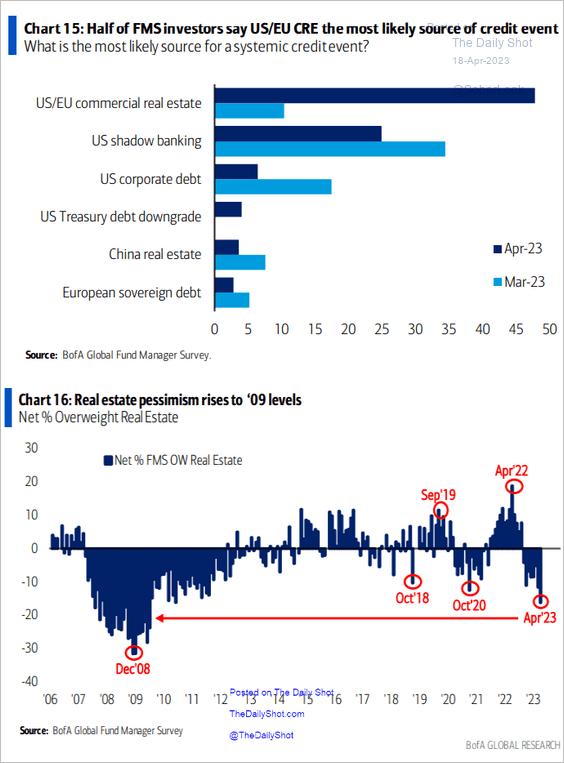

1. Fund managers see commercial real estate as the most likely source for a systemic credit event.

Source: BofA Global Research

Source: BofA Global Research

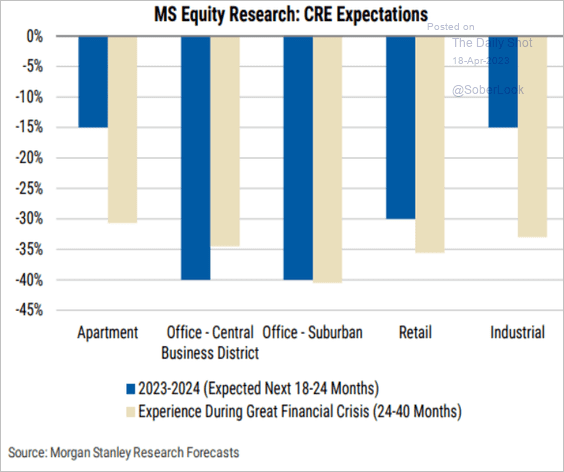

• Here is how the expected drawdowns in commercial property prices compare to the GFC?

Source: Morgan Stanley Research; III Capital Management

Source: Morgan Stanley Research; III Capital Management

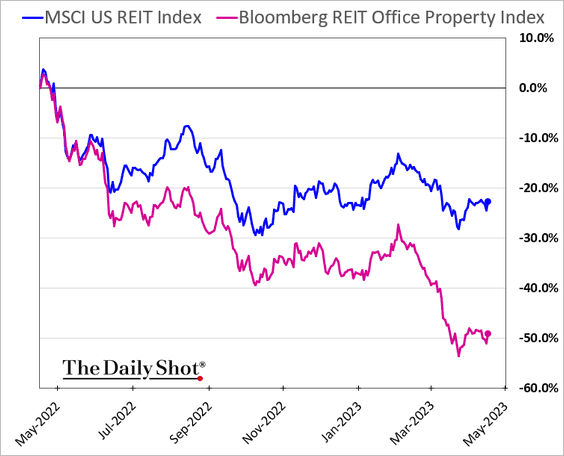

• Office REITs continue to struggle.

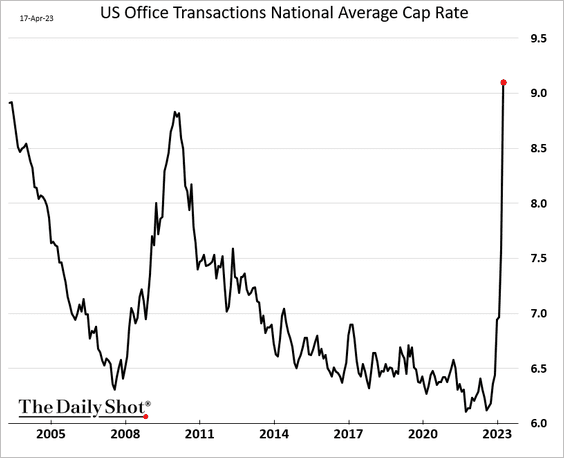

• US office properties’ cap rate has been surging.

LPL Research: … capitalization (cap) rates, which are used to estimate the return on investment for properties, have climbed to over 9% for the office space segment, marking nearly a 3.0% increase since 2021

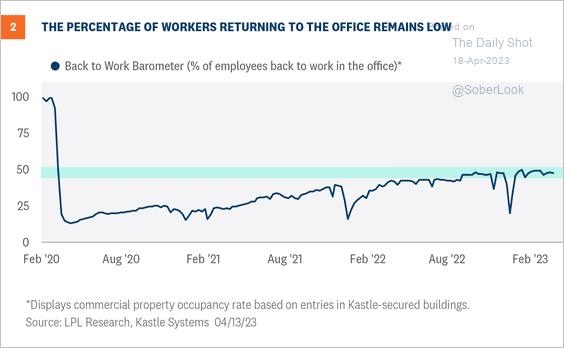

• The percentage of workers returning to the office has stalled.

Source: LPL Research

Source: LPL Research

——————–

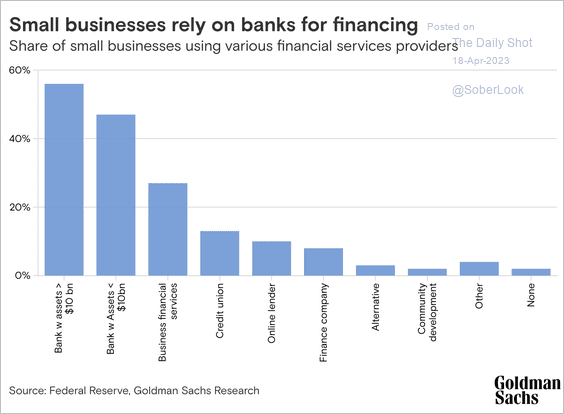

2. This chart shows the sources of credit for small businesses.

Source: Goldman Sachs

Source: Goldman Sachs

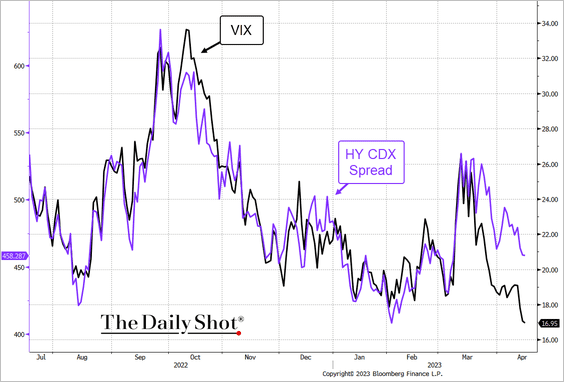

3. High-yield spreads are elevated relative to VIX.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

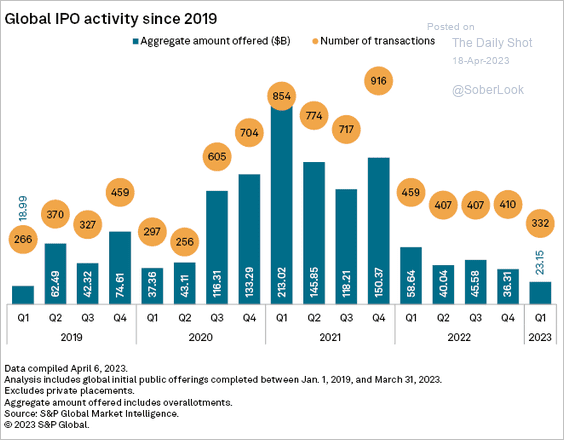

1. IPO activity slowed sharply in Q1.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

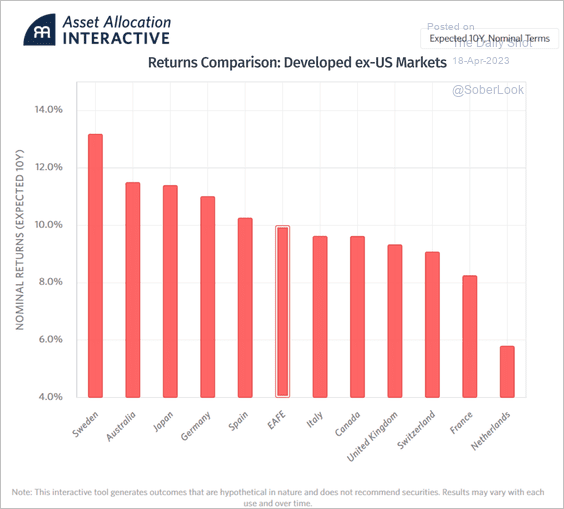

2. Developed ex-US equities are expected to deliver annualized returns of 10% over the next decade, led by Sweden, Australia, and Japan.

Source: Research Affiliates

Source: Research Affiliates

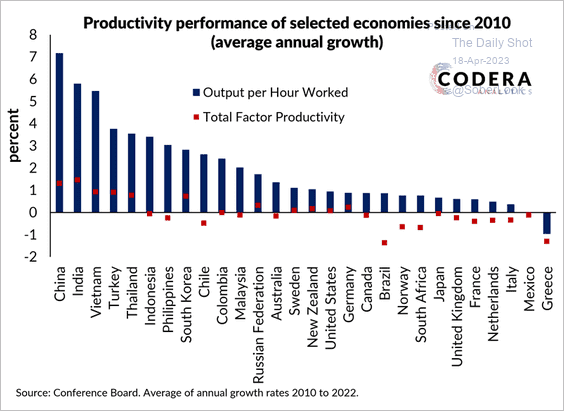

3. The next chart shows productivity growth since 2010.

Source: Codera Analytics

Source: Codera Analytics

——————–

Food for Thought

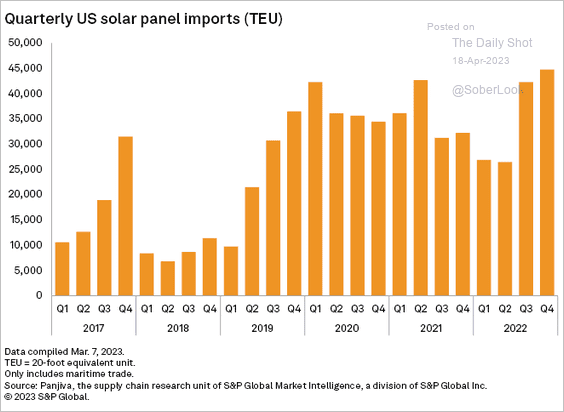

1. US solar panel imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

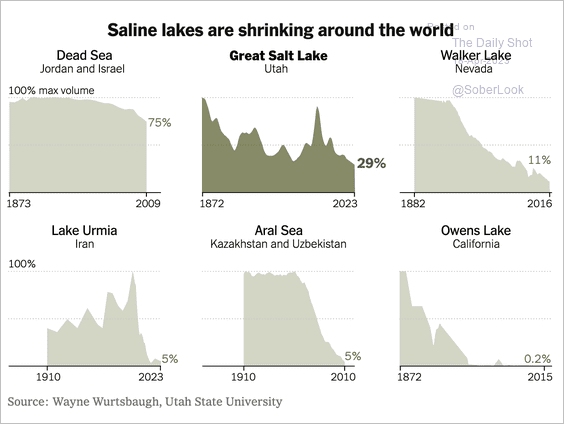

2. Shrinking salt lakes:

Source: The New York Times Read full article

Source: The New York Times Read full article

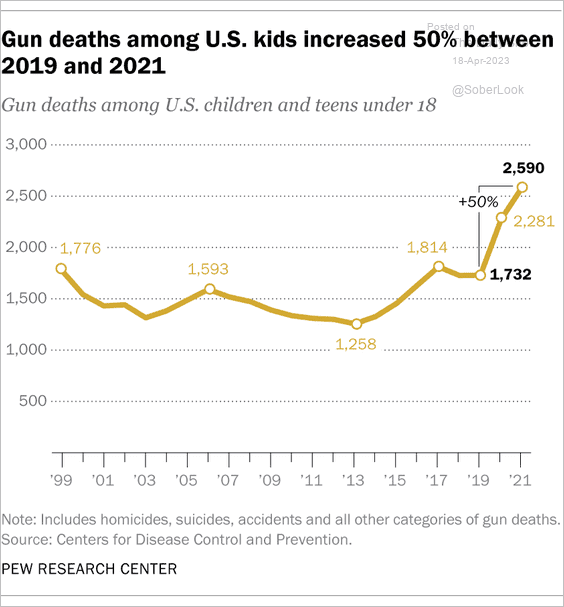

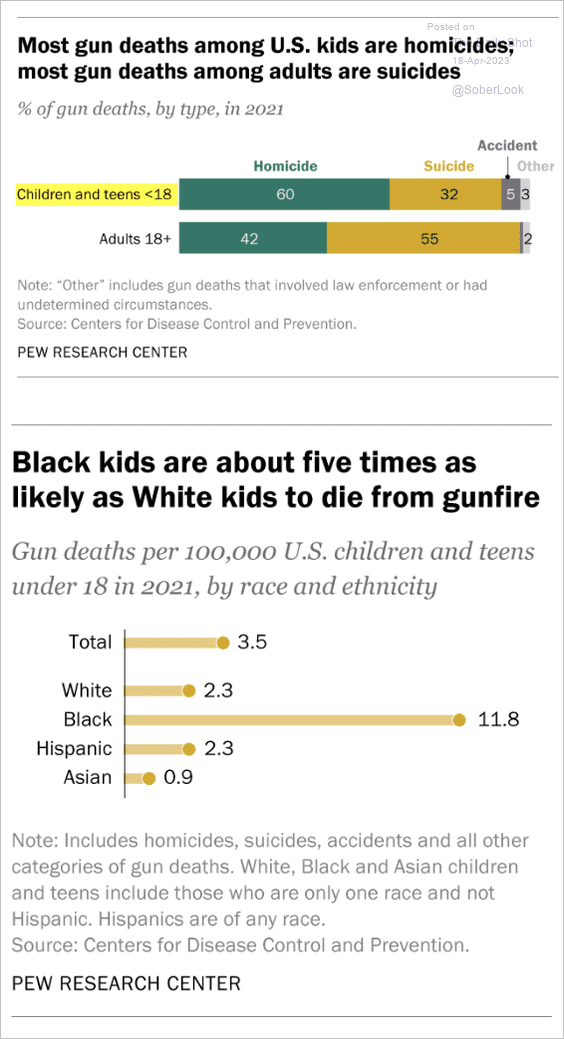

3. Gun deaths among US children and teens:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

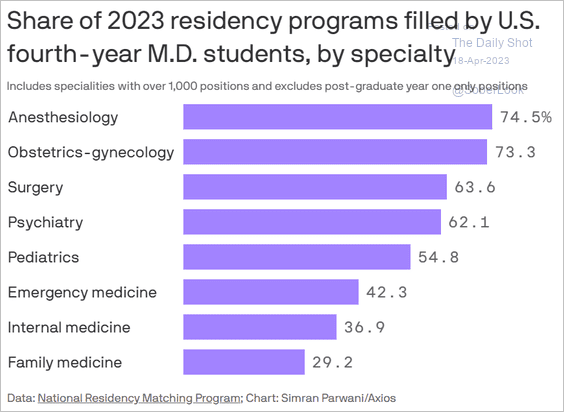

4. M.D. residency programs by specialty:

Source: @axios Read full article

Source: @axios Read full article

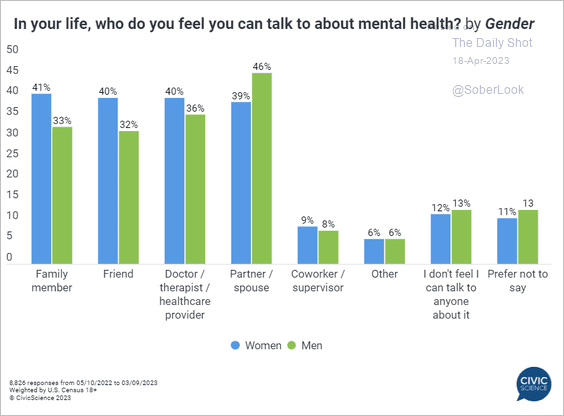

5. Talking about mental health:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

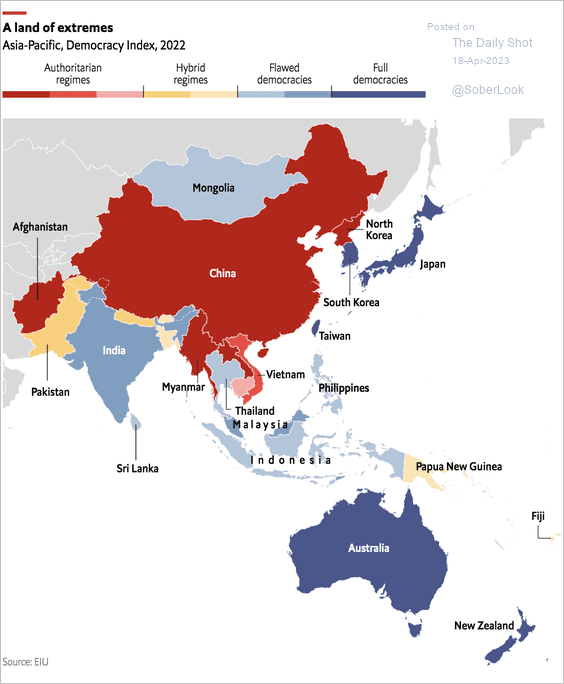

6. The Democracy Index across Asia:

Source: The Economist Read full article

Source: The Economist Read full article

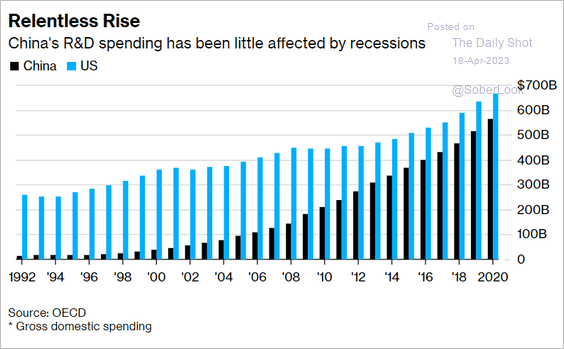

7. US vs. China R&D spending:

Source: @business Read full article

Source: @business Read full article

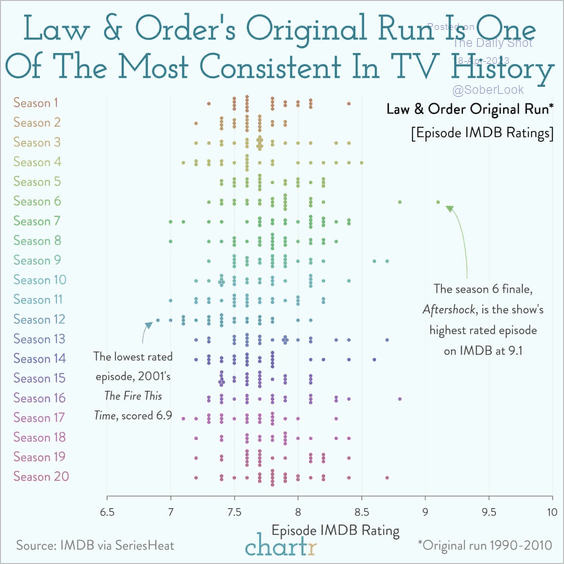

8. Law & Order’s ratings over time:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index