The Daily Shot: 20-Apr-23

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities.

• Credit

• Food for Thought

Administrative Update

• As a reminder, if you have any technical questions or concerns about your account, please don’t hesitate to contact us at [email protected]. More information is available here.

• If you have content-related questions, please email [email protected].

• We request that you refrain from replying to this email because you may not receive a response.

Back to Index

The United States

1. Let’s begin with the housing market.

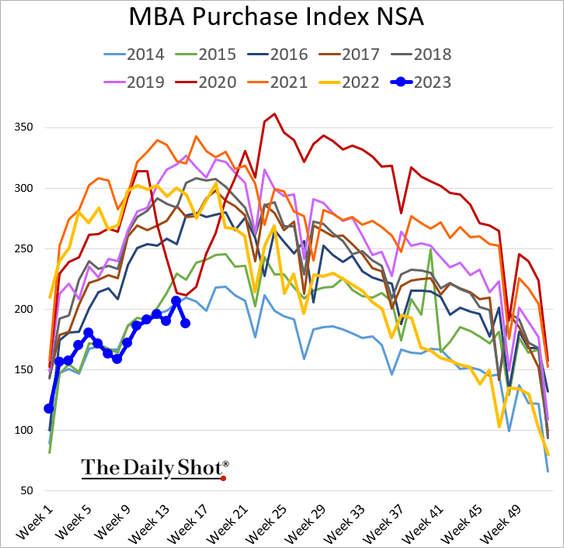

• Mortgage applications hit a multi-year low last week.

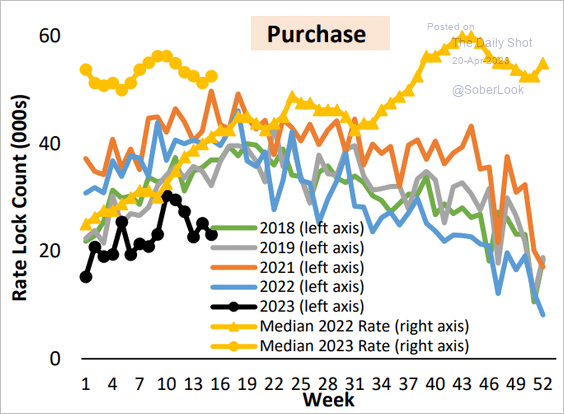

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

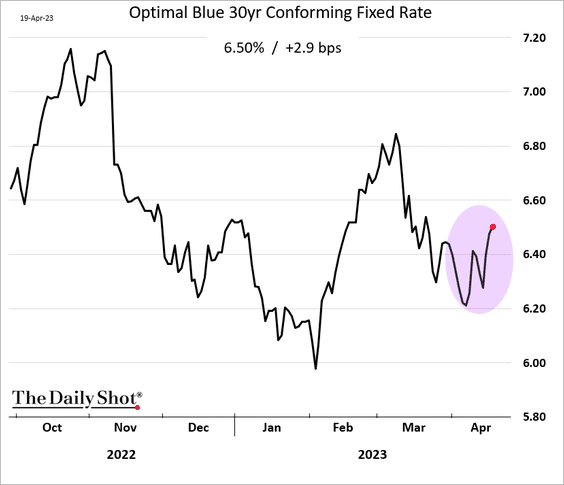

• Mortgage rates have been moving higher.

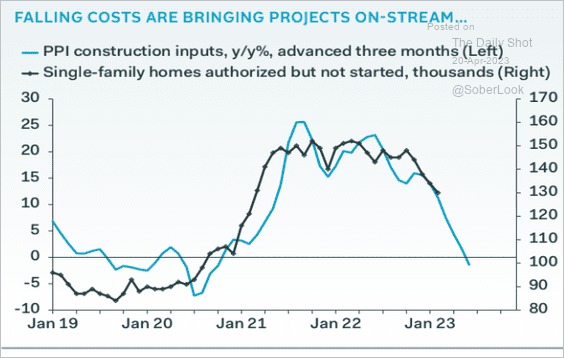

• Falling construction costs and easing supply issues are helping to get projects completed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

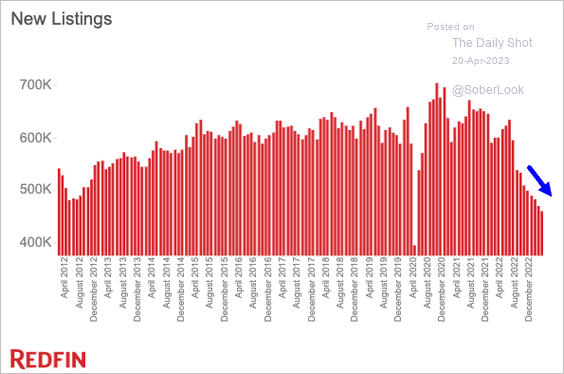

• The number of new home listings keeps falling.

Source: Redfin

Source: Redfin

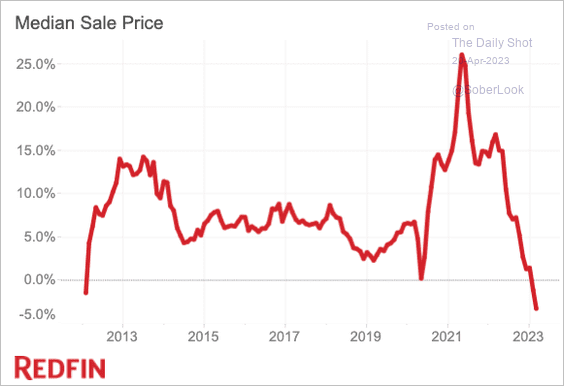

• The median sale price continues to decline, partially due to a higher proportion of lower-priced homes being sold.

Source: Redfin

Source: Redfin

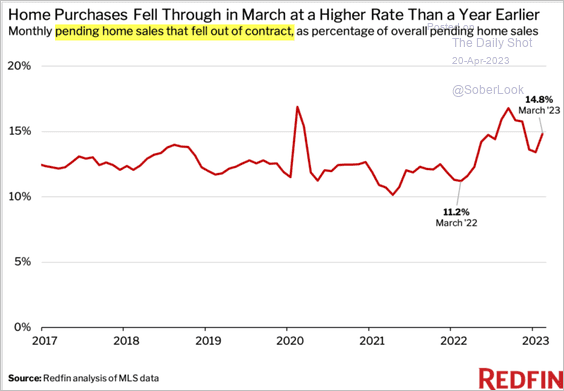

• The proportion of pending home sales that fail to close remains elevated.

Source: Redfin

Source: Redfin

——————–

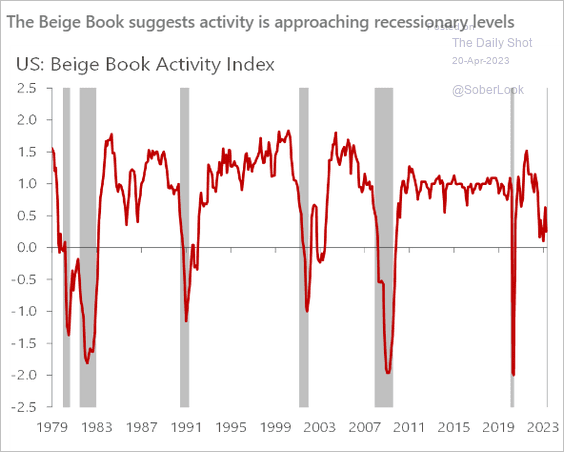

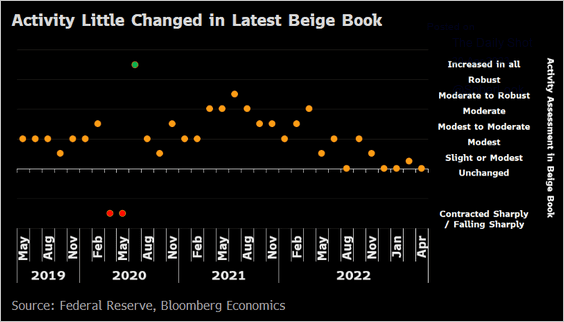

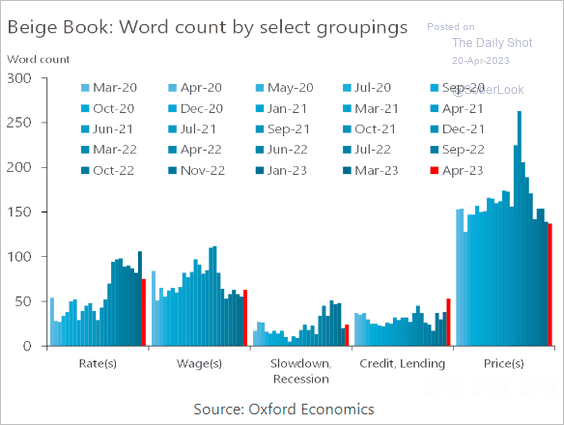

2. The Fed’s Beige Book activity indicators were roughly unchanged this month.

• Oxford Economics:

Source: Oxford Economics

Source: Oxford Economics

• Bloomberg Economics:

Source: @WingerEliza, @economics Read full article

Source: @WingerEliza, @economics Read full article

There were increases in comments related to wages, recession, and credit.

Source: Oxford Economics

Source: Oxford Economics

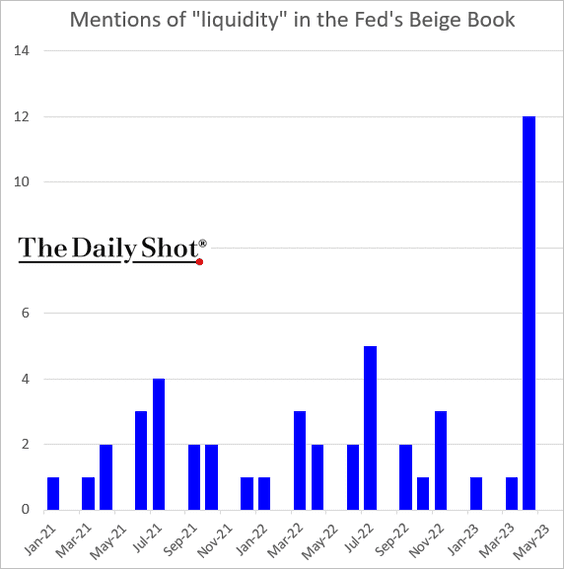

The biggest increase, however, was in reference to liquidity (related to concerns about the banking turmoil).

Beige Book: – Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity.

——————–

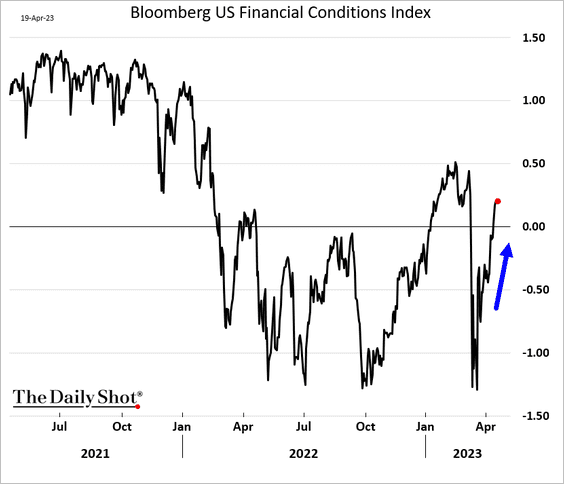

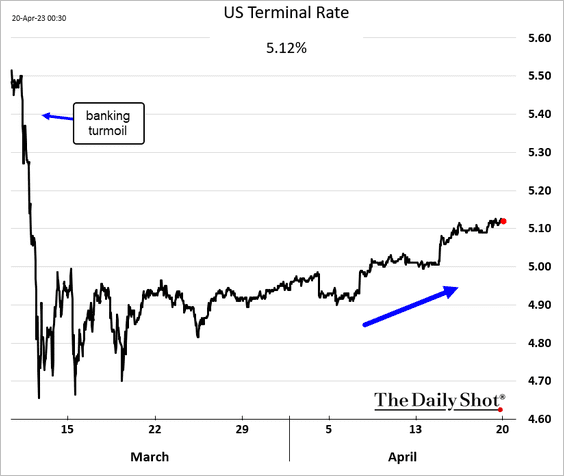

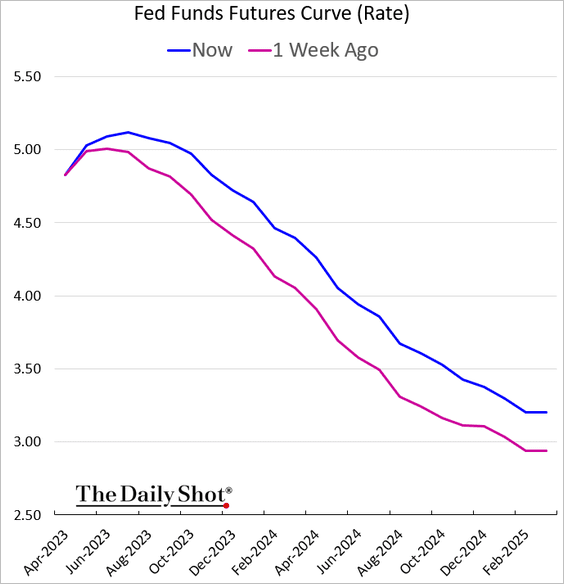

3. Fed officials want to raise rates in May, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… as financial conditions ease.

The terminal rate continues to grind higher.

——————–

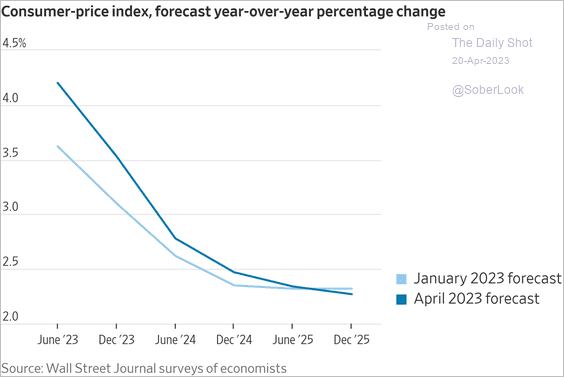

4. Next, we have some updates on inflation.

• Inflation has been more persistent than economists expected.

Source: @WSJ Read full article

Source: @WSJ Read full article

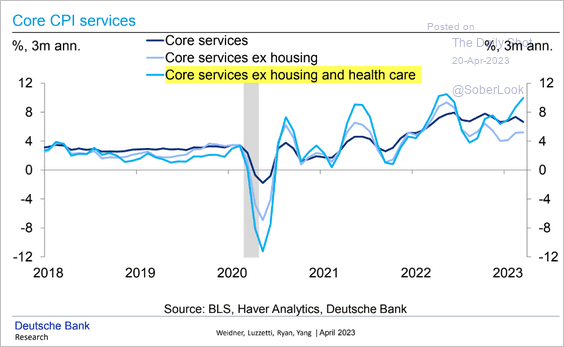

• Here is the supercore CPI excluding healthcare.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

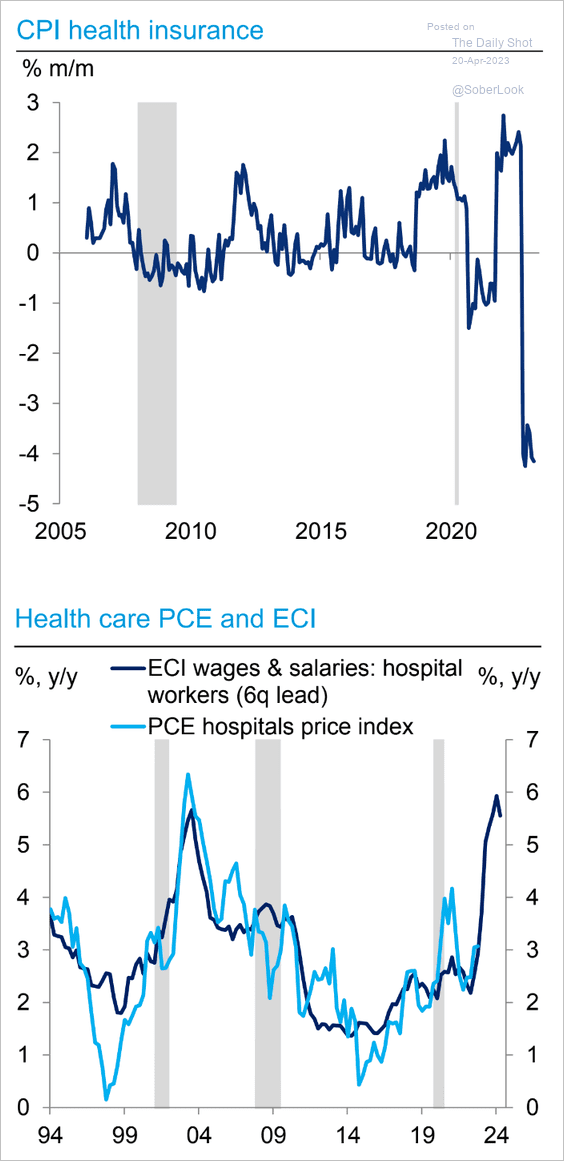

• Although health insurance has been a drag on the healthcare services CPI, the recent strong wage gains are expected to exert upward pressure on hospital costs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

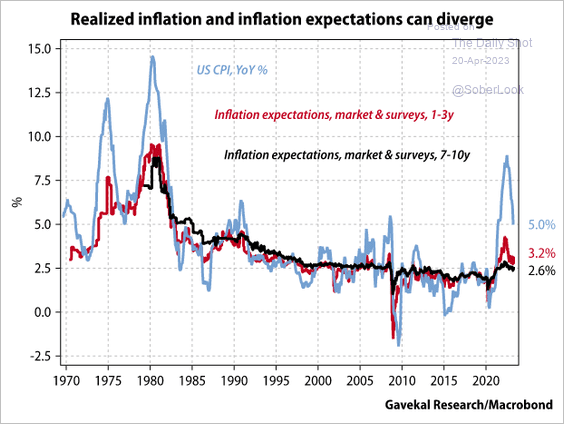

• Inflation tends to revert to inflation expectations.

Source: Gavekal Research

Source: Gavekal Research

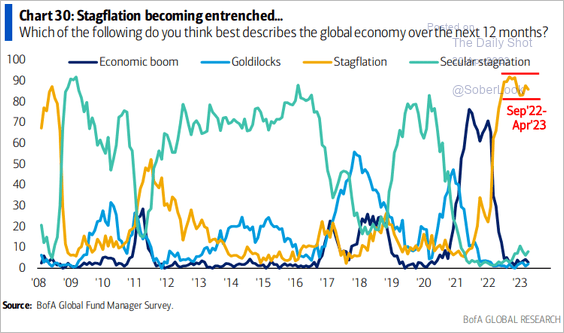

• Investors expect to see stagflation in the next 12 months.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Canada

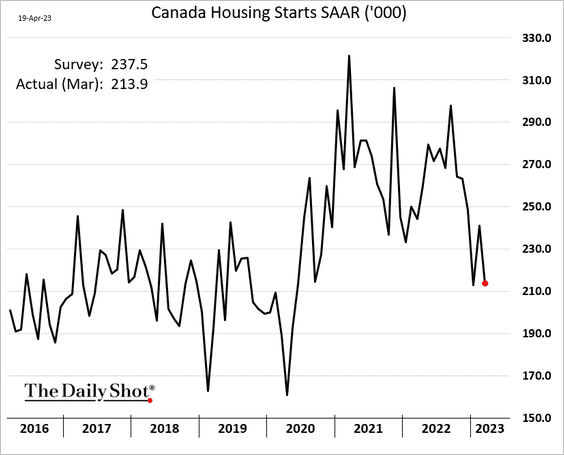

1. Housing starts were lower than expected in March.

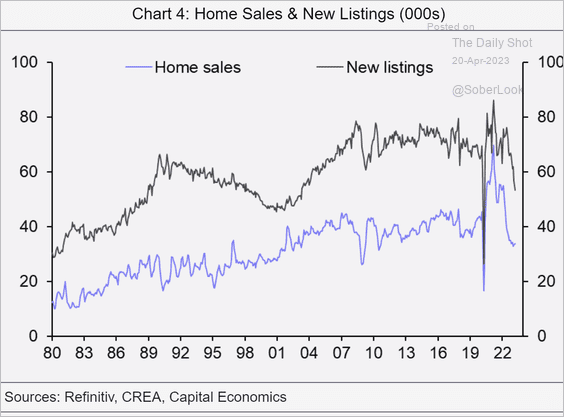

2. Are home sales bottoming?

Source: Capital Economics

Source: Capital Economics

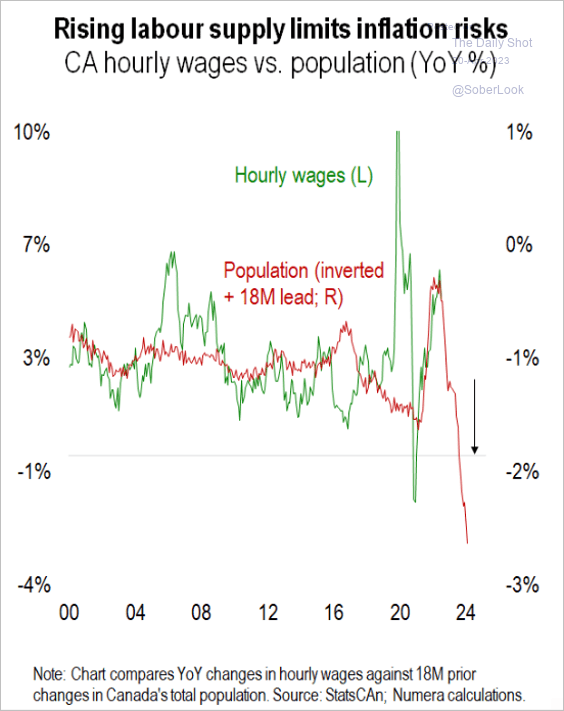

3. Robust labor force growth due to immigration reduces inflation risks by limiting wage growth.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

Back to Index

The United Kingdom

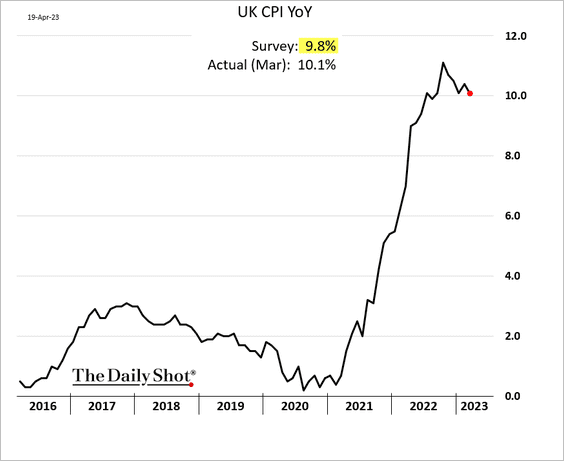

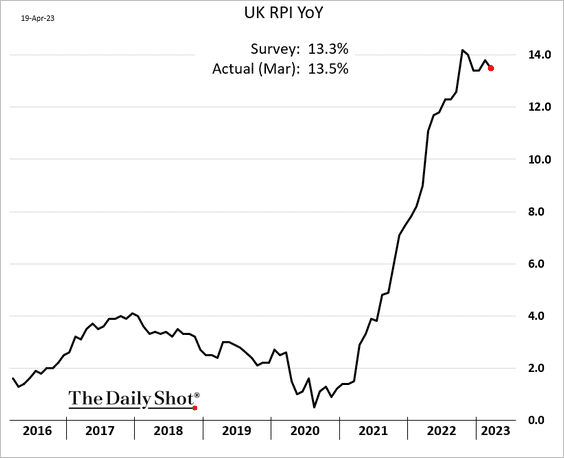

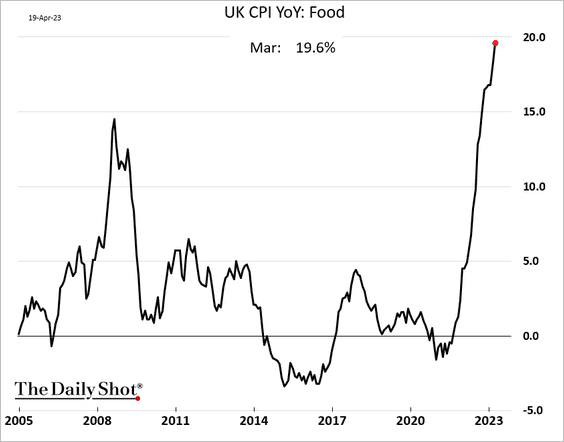

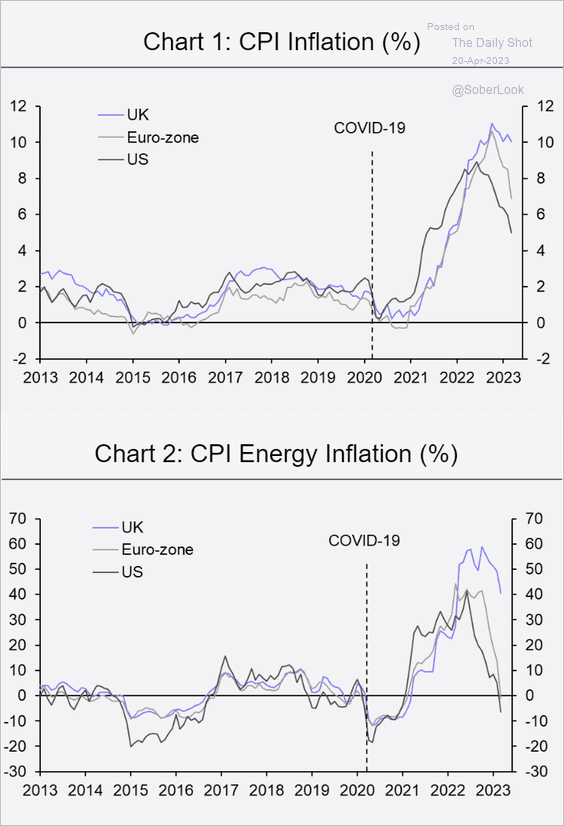

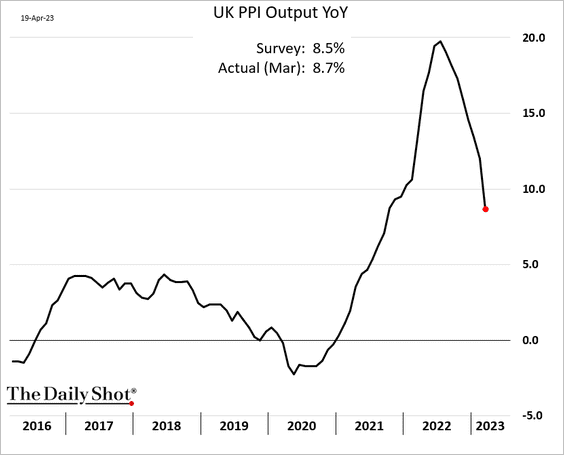

1. Inflation continues to run hot, with the CPI report surprising to the upside again.

Source: CNBC Read full article

Source: CNBC Read full article

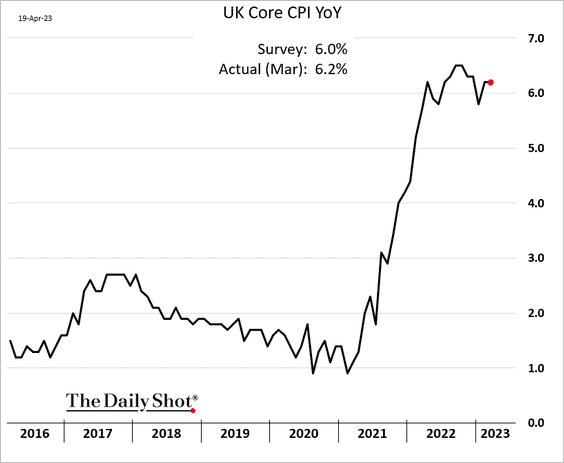

• Here is the core CPI.

• Retail price gains have been stubbornly high.

• Food inflation is nearing 20%.

• One reason the UK CPI has been outpacing that of the Eurozone and the US is elevated energy inflation.

Source: Capital Economics

Source: Capital Economics

• The PPI continues to ease.

——————–

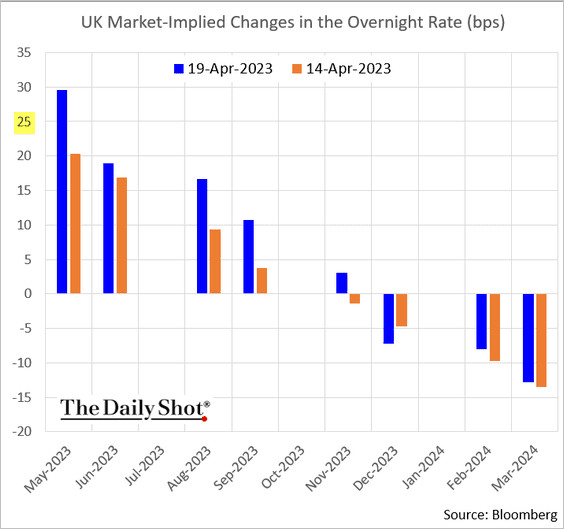

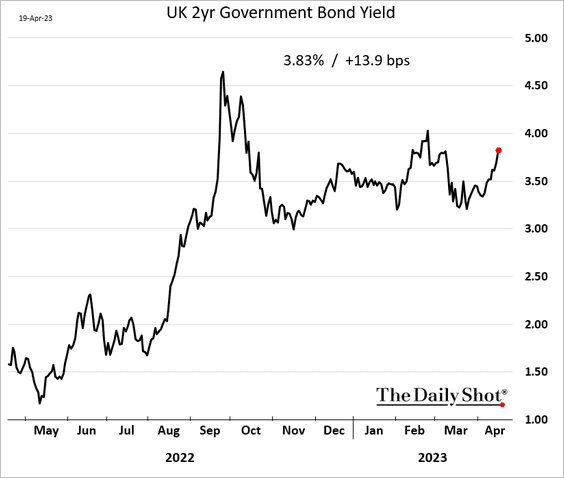

2. Surprises in both inflation and wage growth have raised market expectations for the May BoE rate hike to above 25 bps. The market is now factoring in the probability of a 50 bps rate increase.

Here is the 2-year yield.

——————–

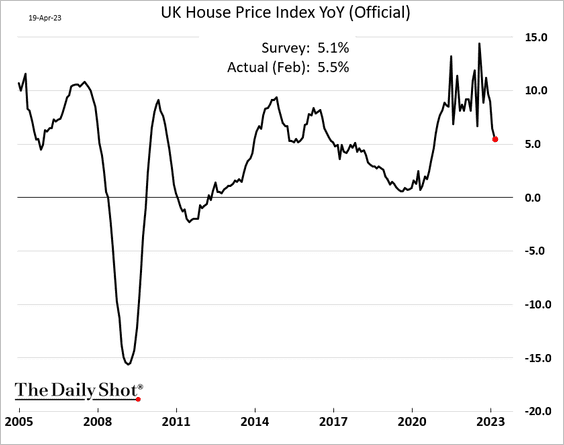

3. Although home price appreciation has been decelerating, it has not been as rapid as anticipated.

Back to Index

The Eurozone

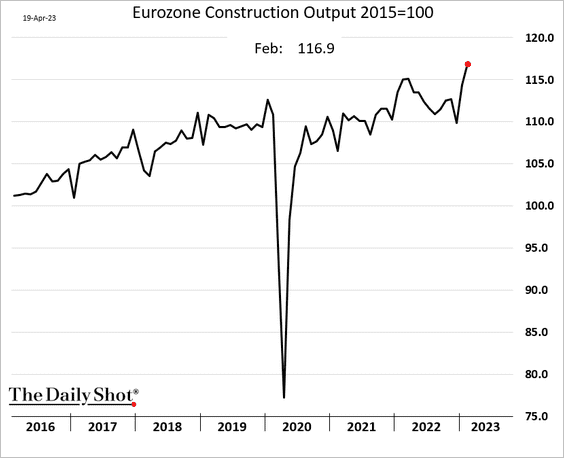

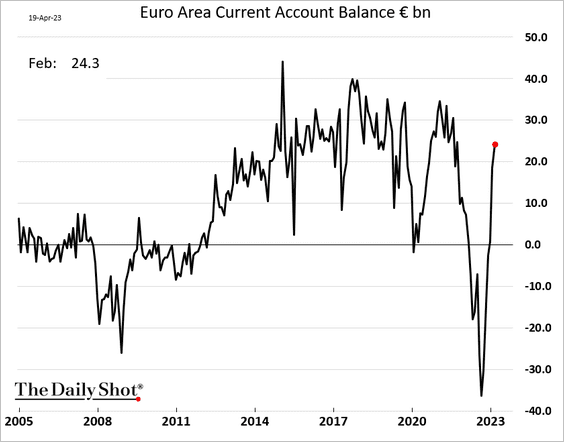

1. Construction output has been surging.

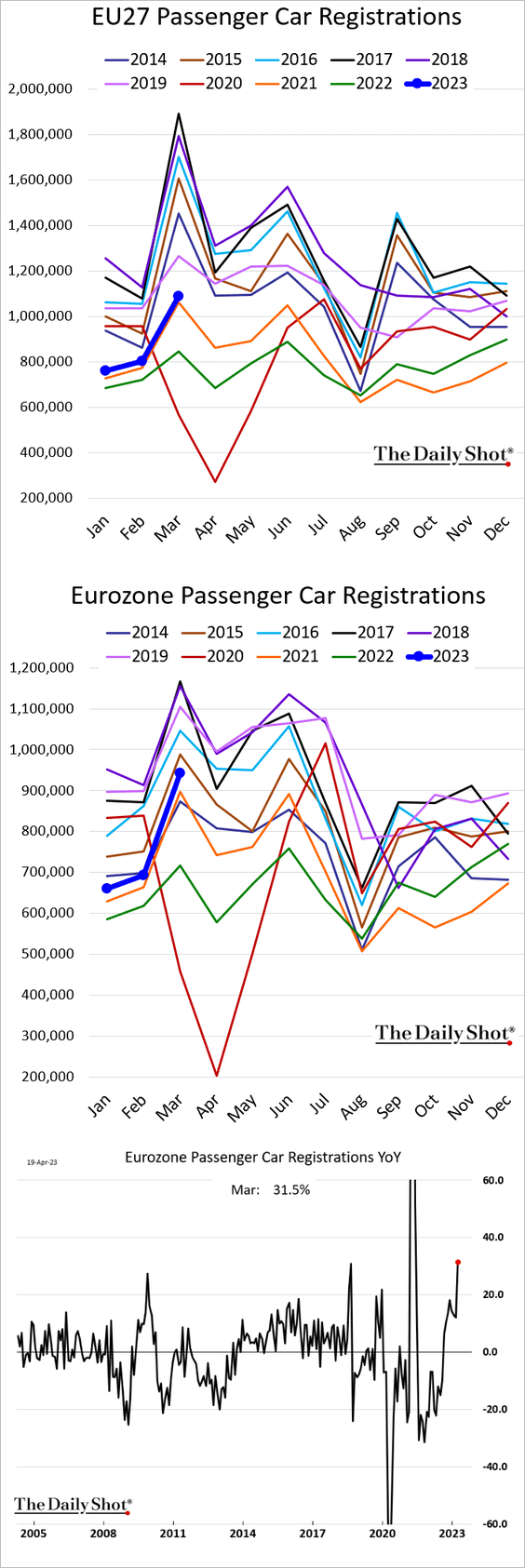

2. The current account surplus is reverting to more typical levels as energy costs ease.

3. New car registrations are rebounding as the supply chain bottlenecks ease.

Source: @eckldorna, @business Read full article

Source: @eckldorna, @business Read full article

Back to Index

Asia – Pacific

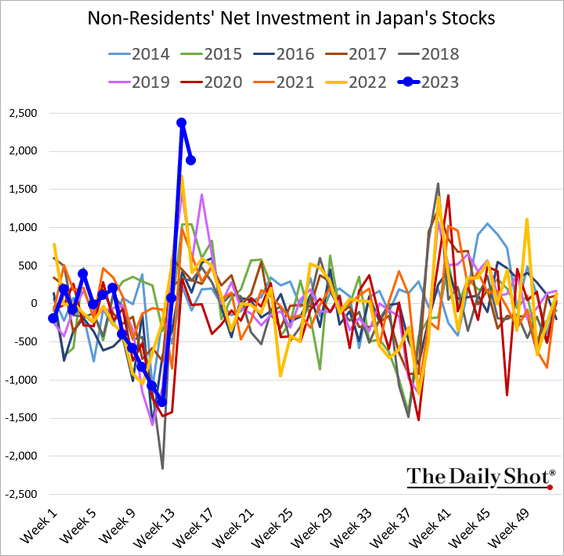

1. Foreign investors continued to plow into Japan’s equities last week.

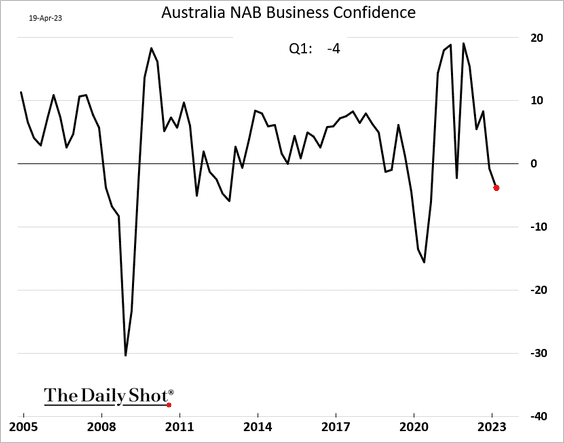

2. Australia’s business confidence worsened in Q1.

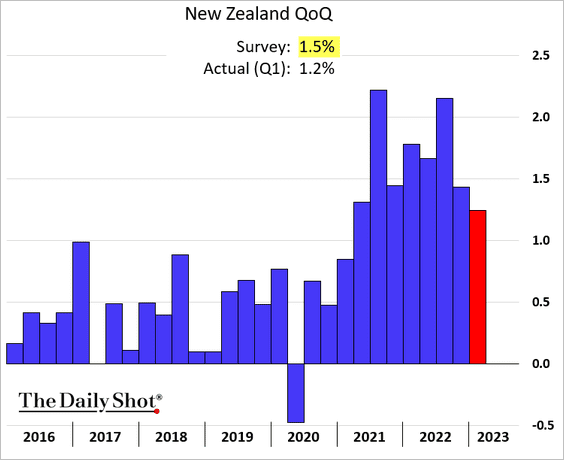

3. New Zealand’s Q1 CPI surprised to the downside. The RBNZ is still expected to hike rates.

Back to Index

China

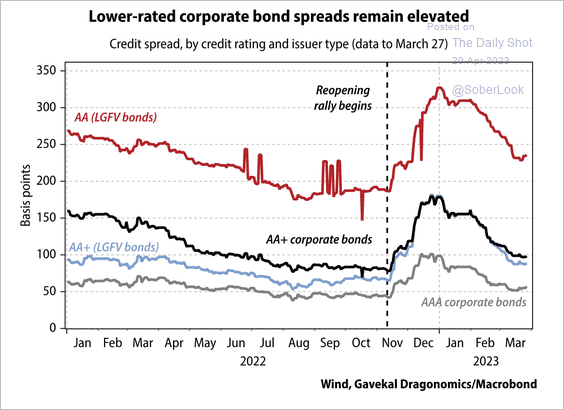

1. Credit spreads on lower-rated corporate bonds and local government financing vehicles (LGFV) remain elevated. LGFV’s account for a large share of bond issuance.

Source: Gavekal Research

Source: Gavekal Research

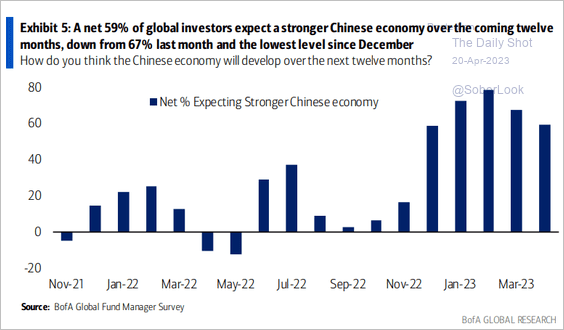

2. Investor optimism about the Chinese economy is moderating.

Source: BofA Global Research

Source: BofA Global Research

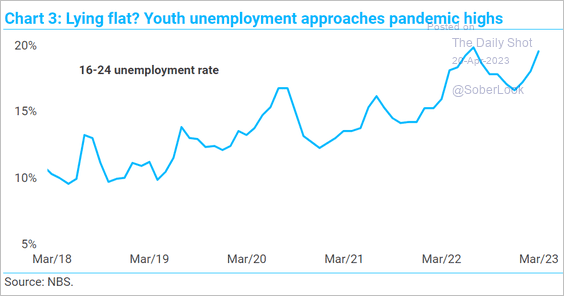

3. Youth unemployment has been climbing.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

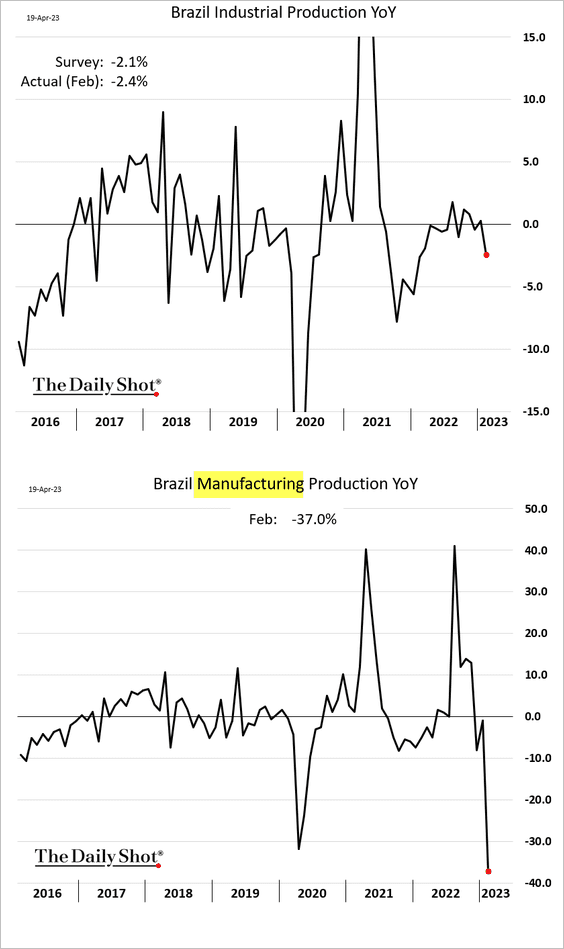

1. Brazil’s industrial output slowed in February due to weak food production.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

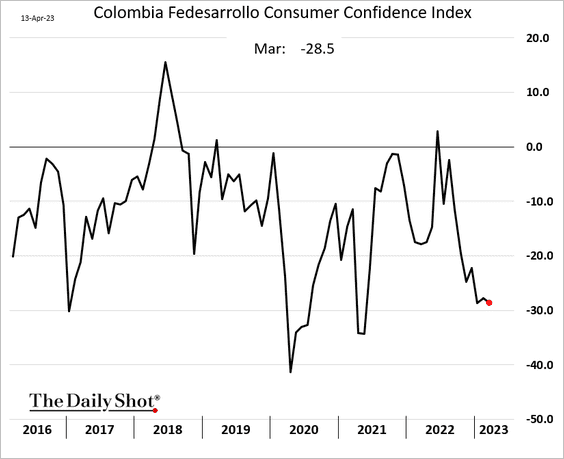

2. Colombia’s consumer confidence remains depressed.

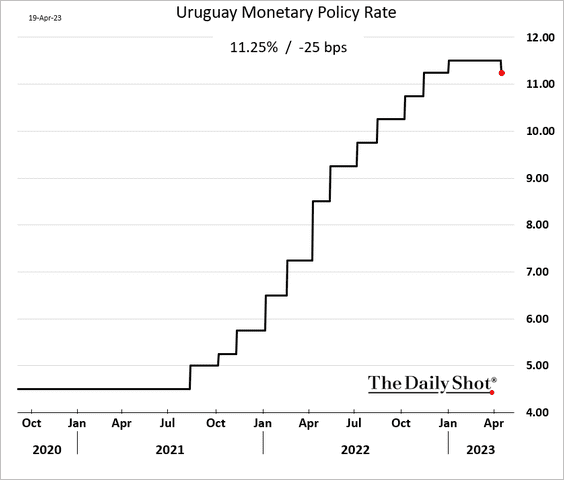

3. Uruguay’s central bank cut its benchmark interest rate by 25 basis points on Wednesday. This was the first rate cut in Latin America since the start of the COVID-19 pandemic.

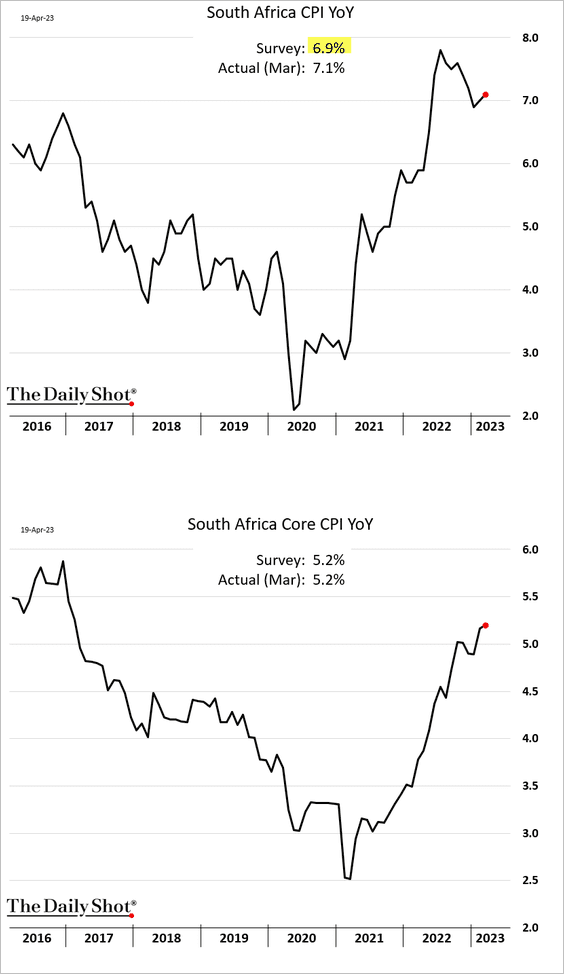

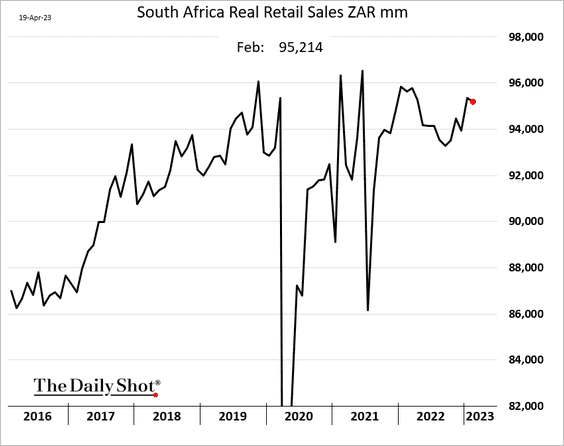

4. South Africa’s inflation surprised to the upside. The SARB is expected to continue raising interest rates in an effort to bring inflation under control.

Retail sales inched lower in February but remained strong.

——————–

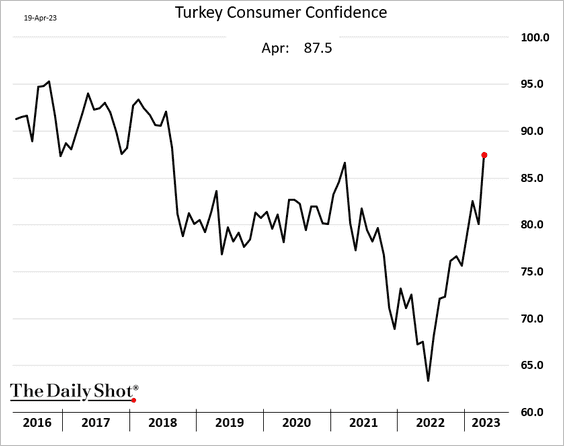

5. Turkey’s consumer confidence is surging.

Back to Index

Commodities

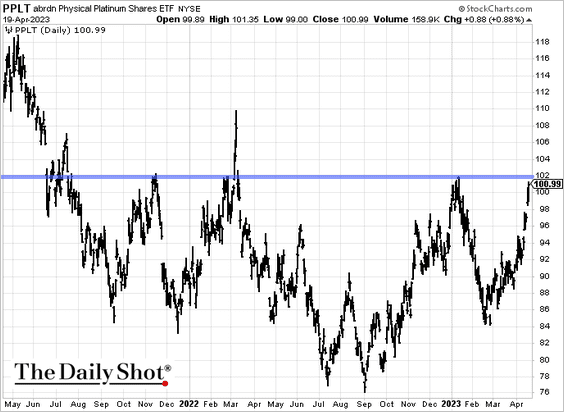

Platinum has been rallying, with PPLT (physical platinum ETF) hitting resistance.

Back to Index

Energy

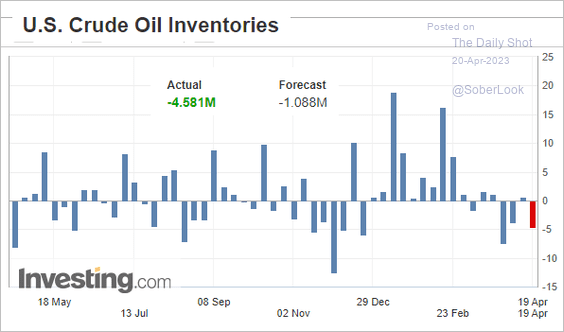

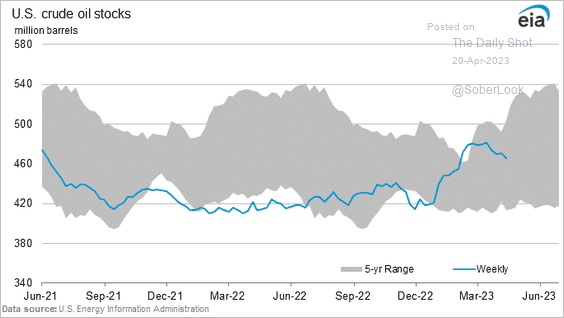

1. US oil inventories declined last week.

• Weekly change:

• Level:

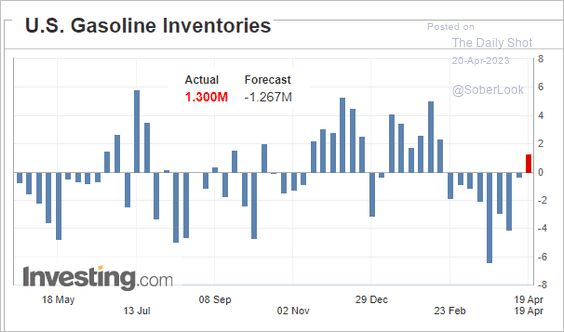

2. But gasoline inventories unexpectedly jumped, …

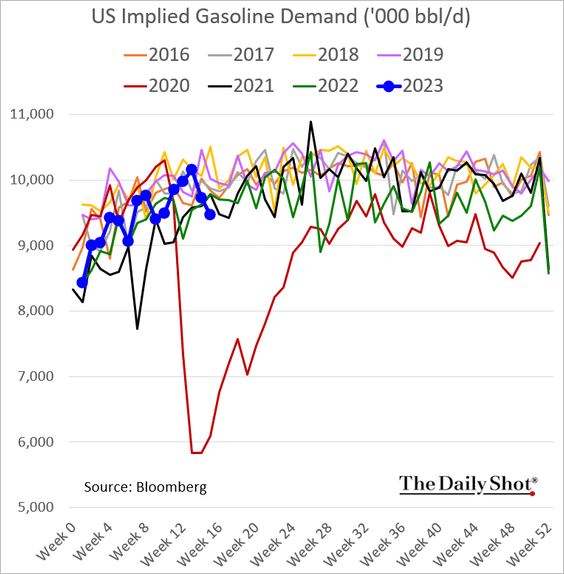

… as demand slumps.

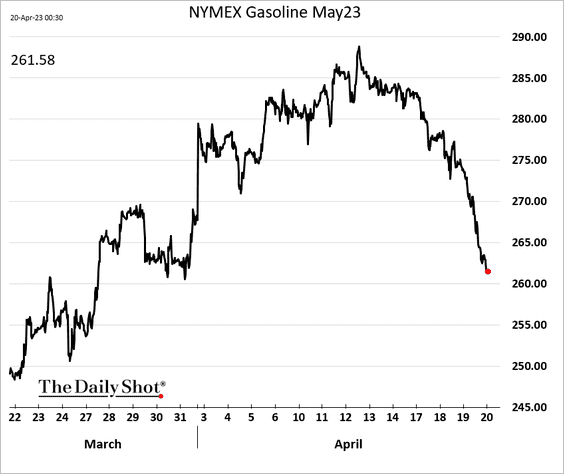

Gasoline futures have been tumbling.

——————–

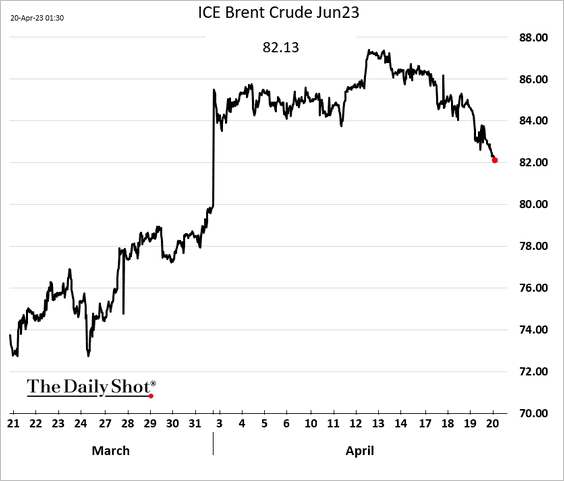

3. With the Fed expected to push rates higher and oil sanctions against Russia not working, …

Source: Markets Insider Read full article

Source: Markets Insider Read full article

… crude oil prices are moving lower.

——————–

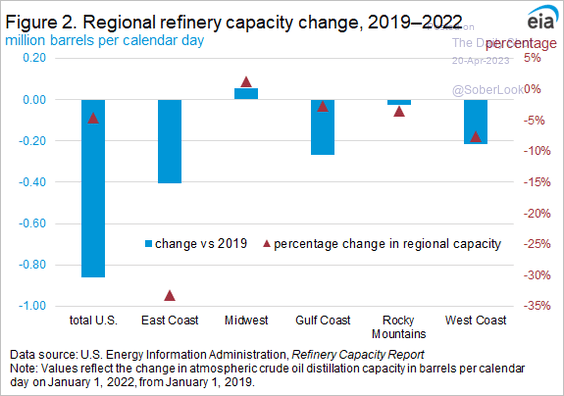

4. This chart shows the decline in US refinery capacity.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities.

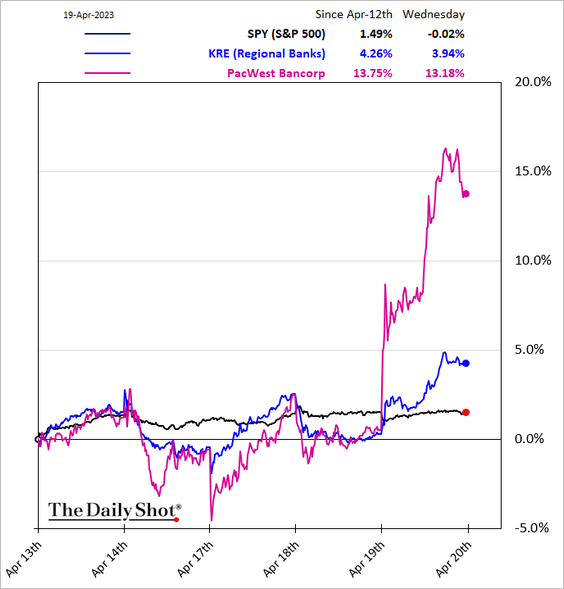

1. US regional banks are seeing some tailwinds.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

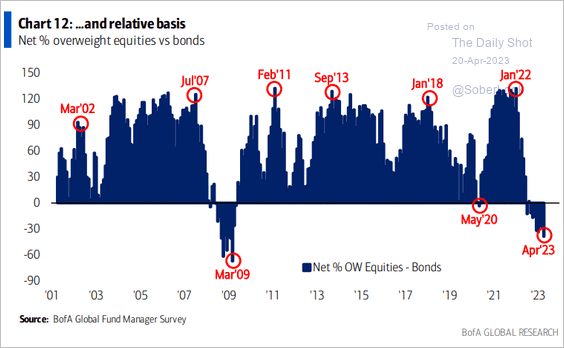

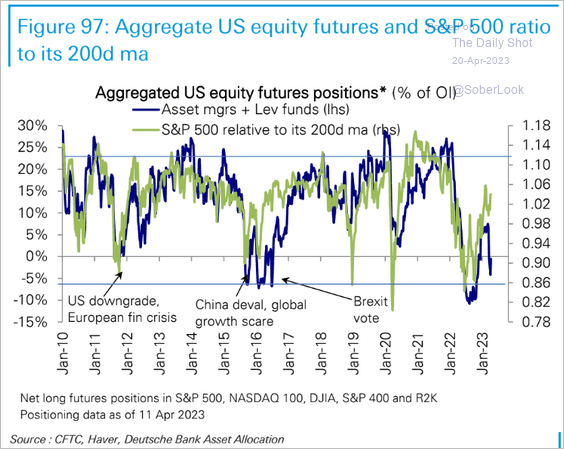

2. Fund managers are heavily underweight equities relative to bonds.

Source: BofA Global Research

Source: BofA Global Research

Asset managers and leveraged funds remain cautious on stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

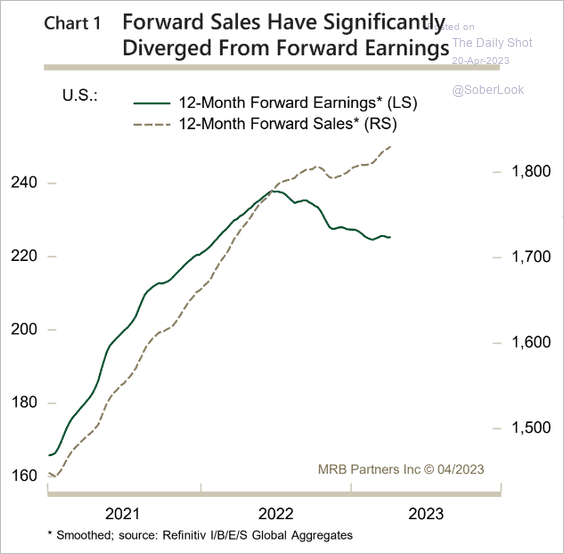

3. Forward sales expectations have diverged from projected earnings as profit margins sink.

Source: MRB Partners

Source: MRB Partners

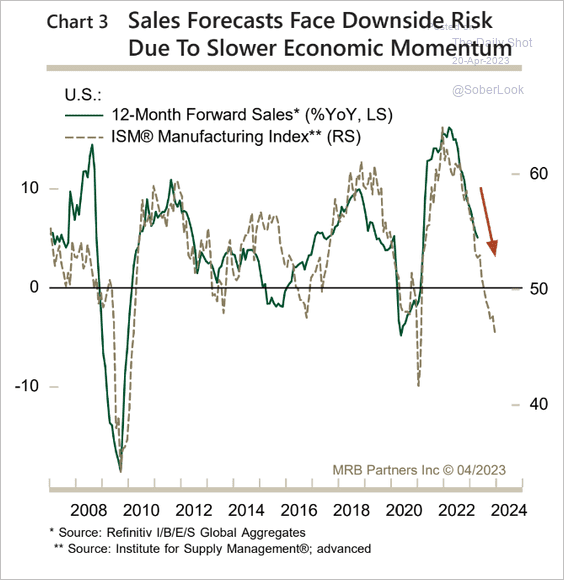

Leading indicators signal weakness ahead for corporate sales.

Source: MRB Partners

Source: MRB Partners

——————–

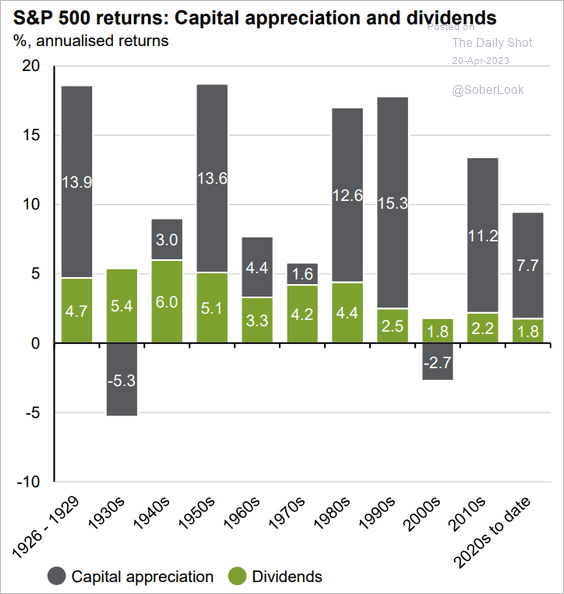

4. This chart shows the S&P 500 return attribution by decade, broken down into capital appreciation and dividends.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

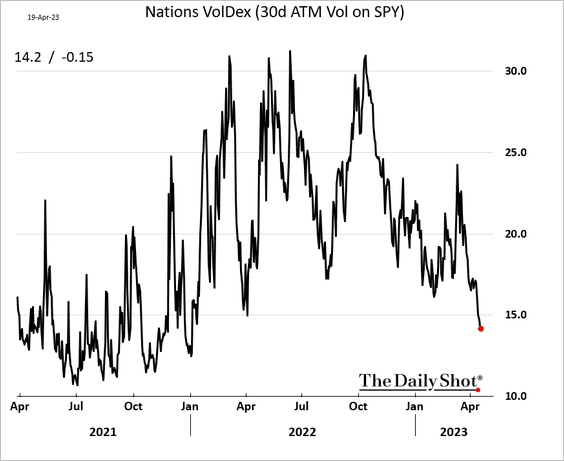

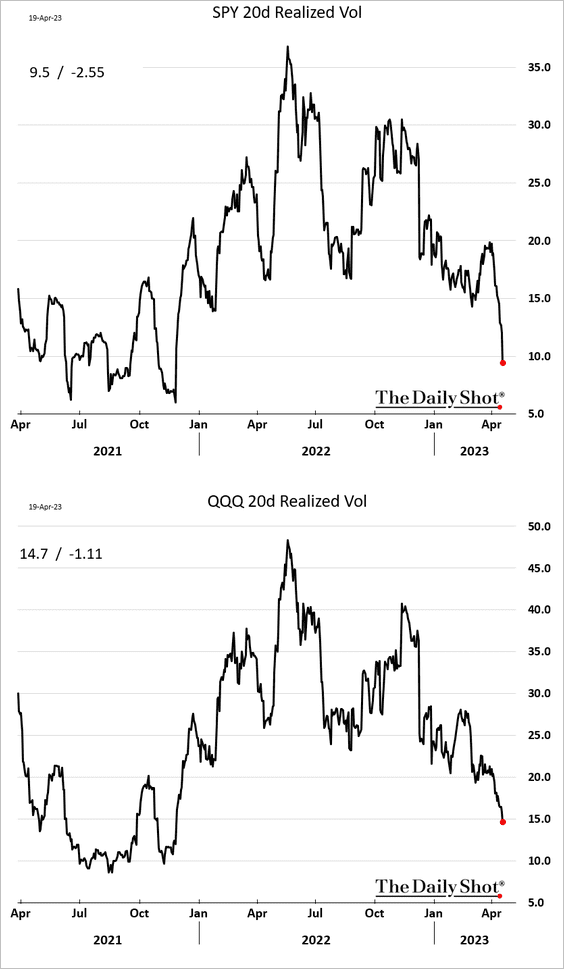

5. Volatility continues to crash.

• Implied vol:

• Realized vol:

——————–

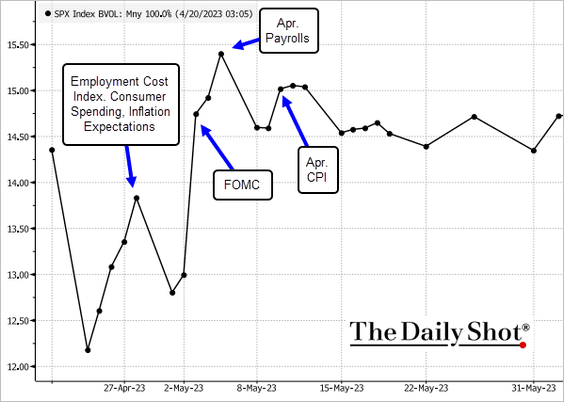

6. What are the primary macroeconomic concerns for equity volatility traders? Take a look at the term structure of the S&P 500 implied volatility.

Back to Index

Credit

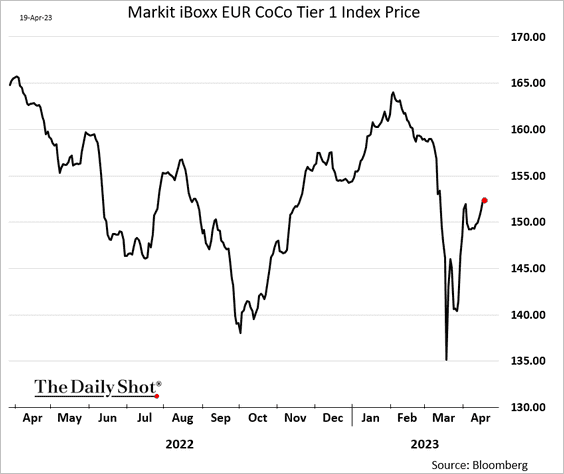

1. The CoCo market is coming back after the Credit Suisse wipeout.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

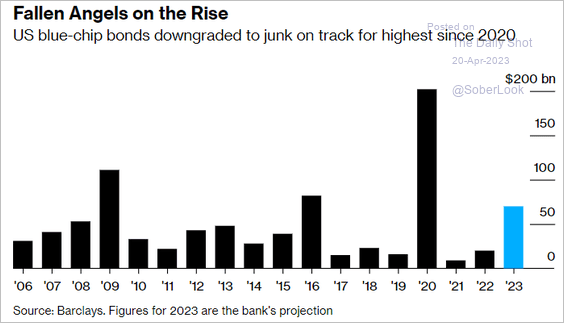

2. There are a lot of fallen angels this year.

Source: @LivRaiReports, @markets Read full article

Source: @LivRaiReports, @markets Read full article

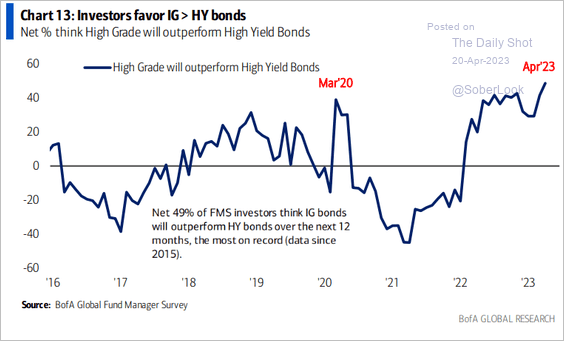

3. Fund managers increasingly see investment-grade bonds outperforming high-yield.

Source: BofA Global Research

Source: BofA Global Research

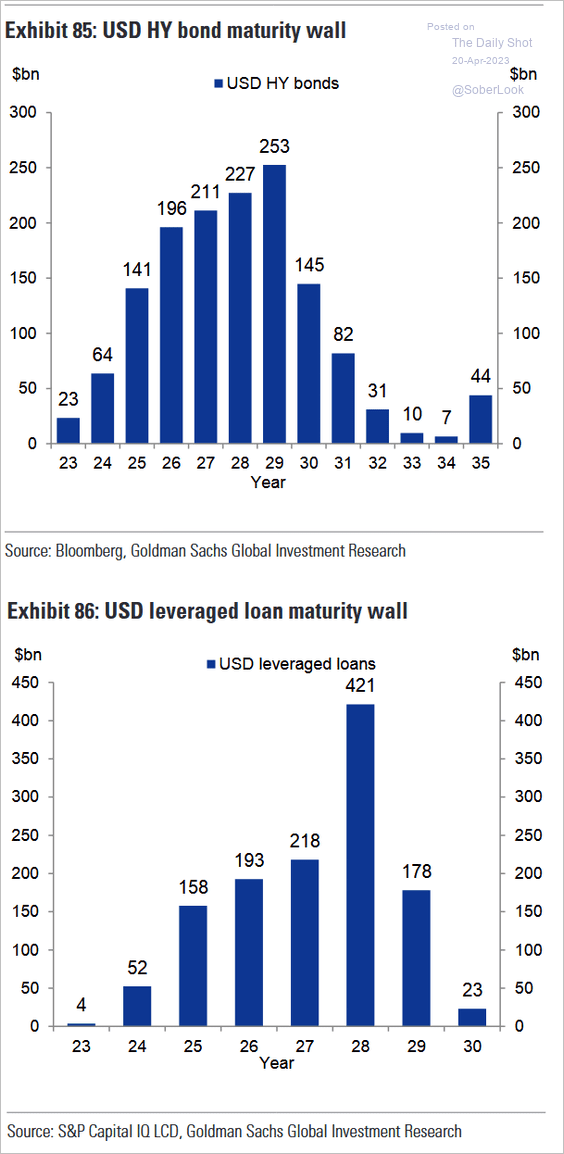

4. Here is the USD high-yield debt maturity wall.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

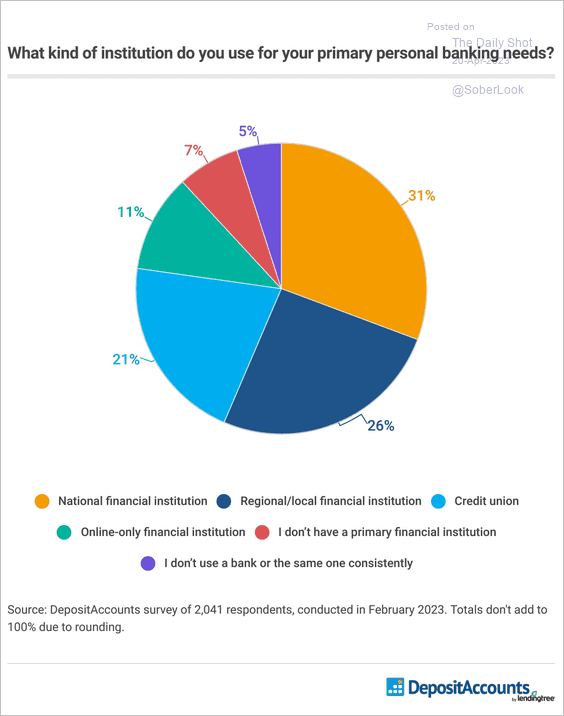

1. Primary personal banking institutions:

Source: Deposit Accounts Read full article

Source: Deposit Accounts Read full article

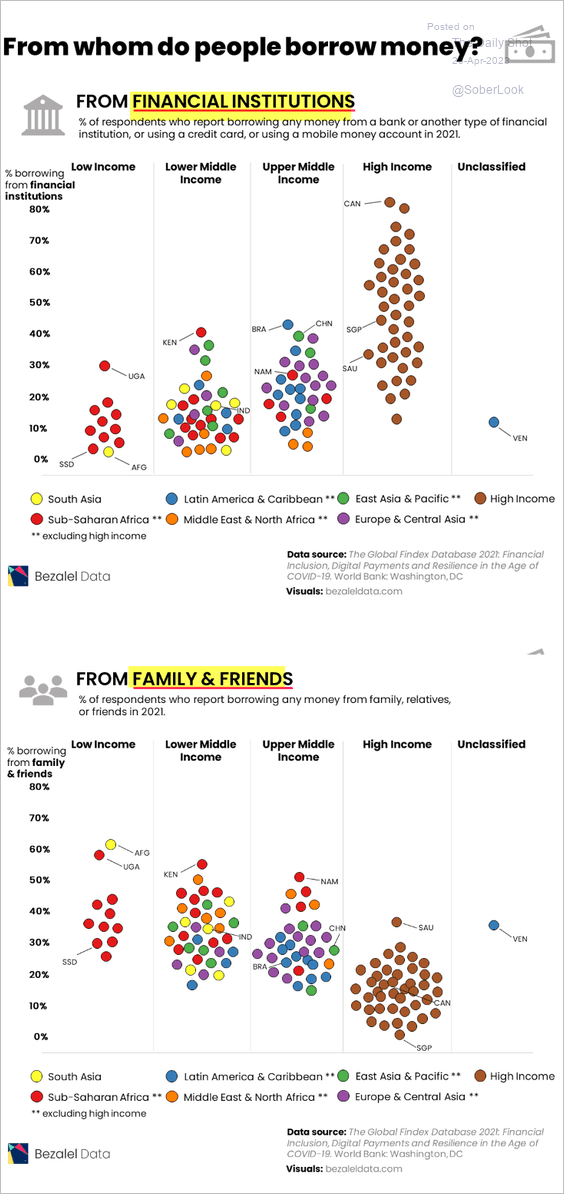

2. Borrowing money around the world:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

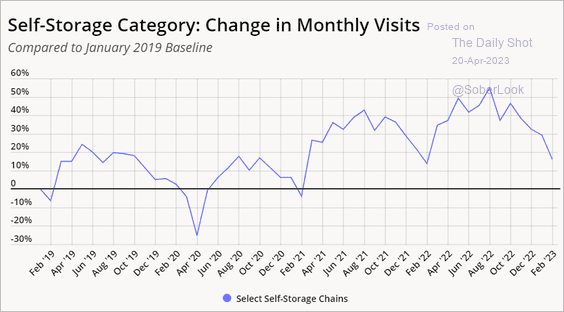

3. Self-storage visits:

Source: Placer.ai Read full article

Source: Placer.ai Read full article

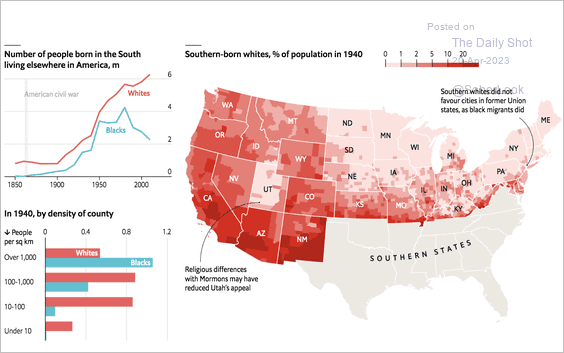

4. Migration from the South:

Source: The Economist Read full article

Source: The Economist Read full article

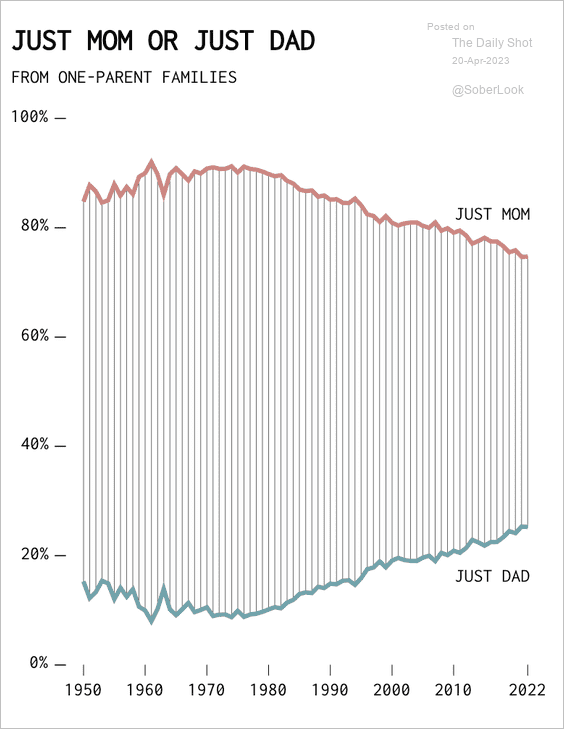

5. One-parent families:

Source: FlowingData

Source: FlowingData

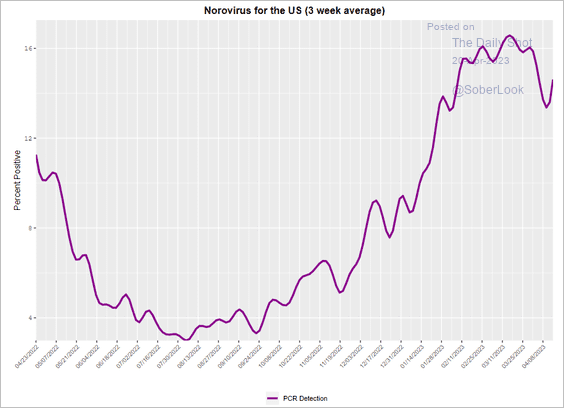

6. Norovirus cases:

Source: CDC

Source: CDC

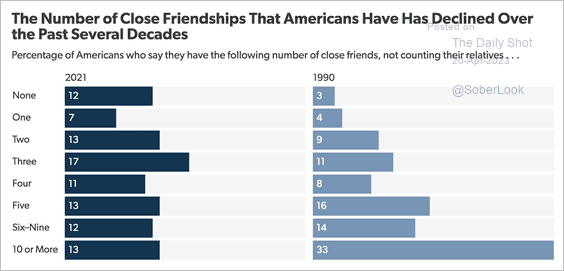

7. Number of close friends:

Source: Survey Center on American Life Read full article

Source: Survey Center on American Life Read full article

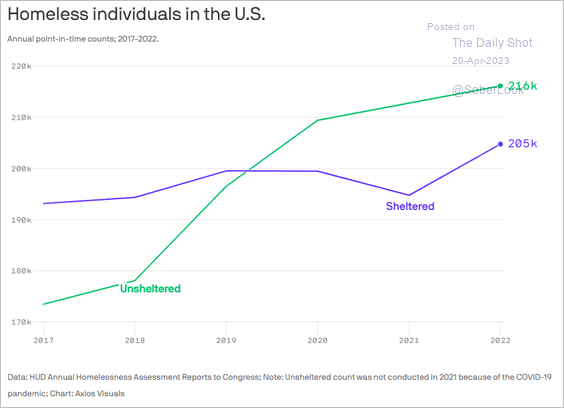

8. Sheltered and unsheltered homeless population in the US:

Source: @axios Read full article

Source: @axios Read full article

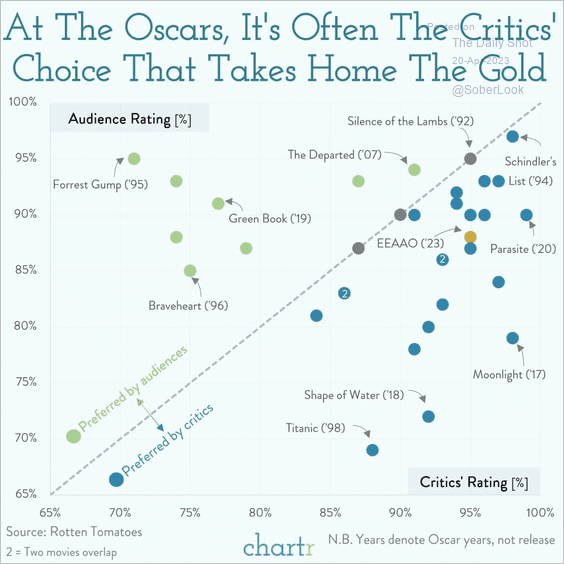

9. Audience vs. critics’ ratings of Oscar winners:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index