The Daily Shot: 21-Apr-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

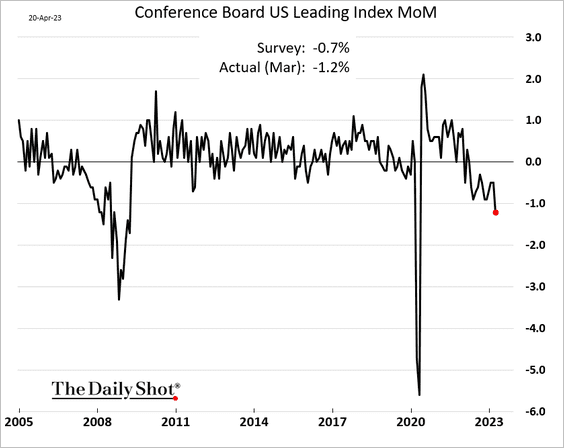

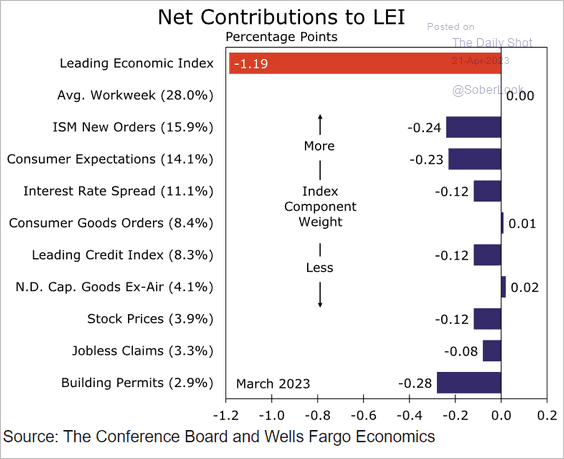

1. The Conference Board’s index of leading economic indicators looks increasingly recessionary.

• Here are the components for March.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

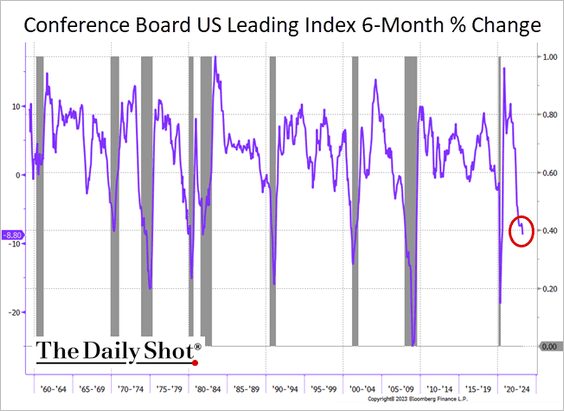

• The leading index has never declined this much in six months without a recession, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

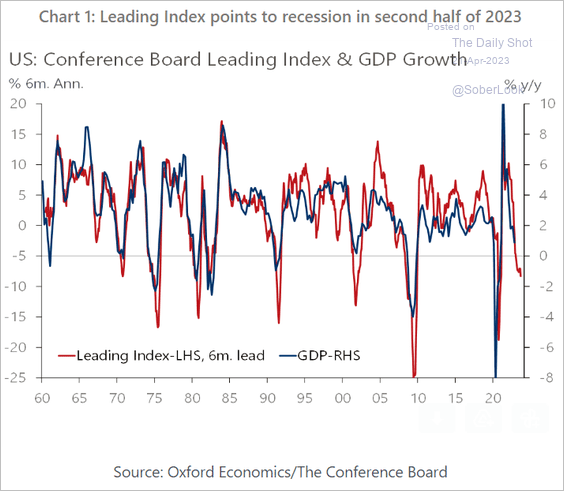

… which looks increasingly likely in the second half of the year.

Source: Oxford Economics

Source: Oxford Economics

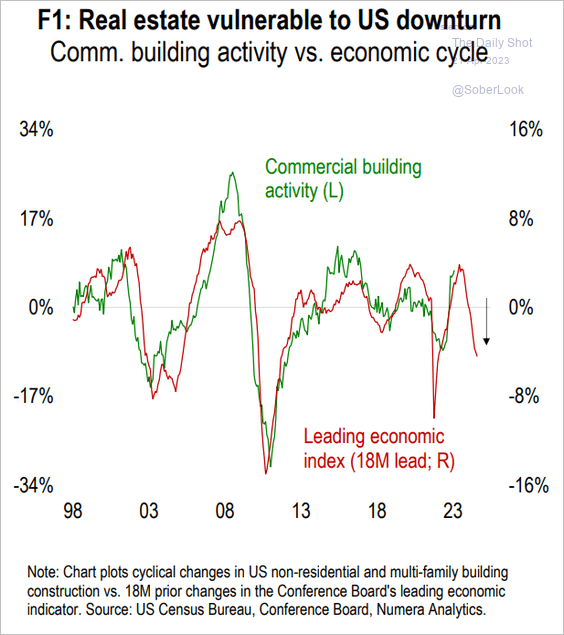

• What does the leading index tell us about commercial real estate building activity?

Source: Nomura Securities

Source: Nomura Securities

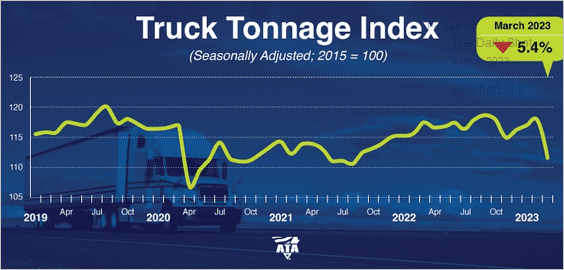

• Speaking of leading indicators, here is the US truck tonnage.

Source: ATA; h/t @dailychartbook Read full article

Source: ATA; h/t @dailychartbook Read full article

——————–

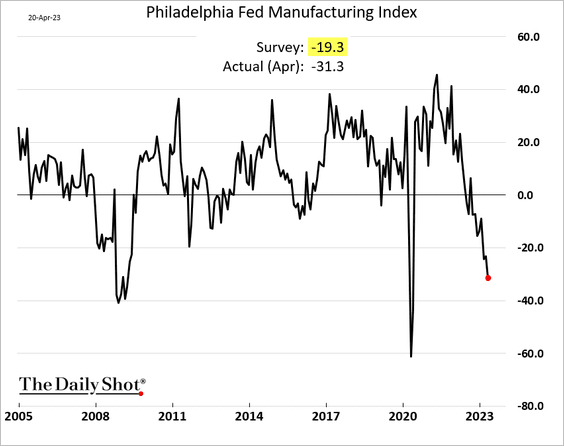

2. In contrast to the report from the NY Fed, the Philly Fed’s manufacturing index tumbled further this month.

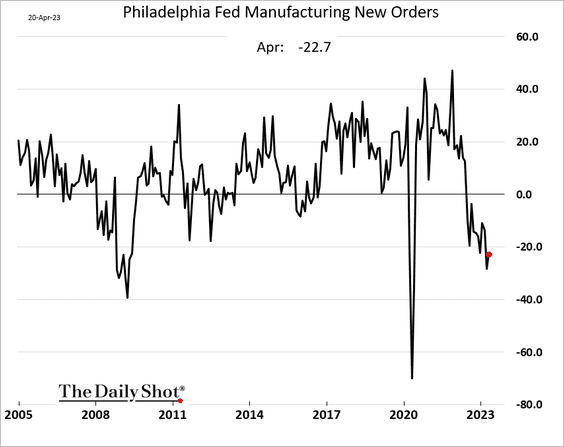

• New orders continue to decline.

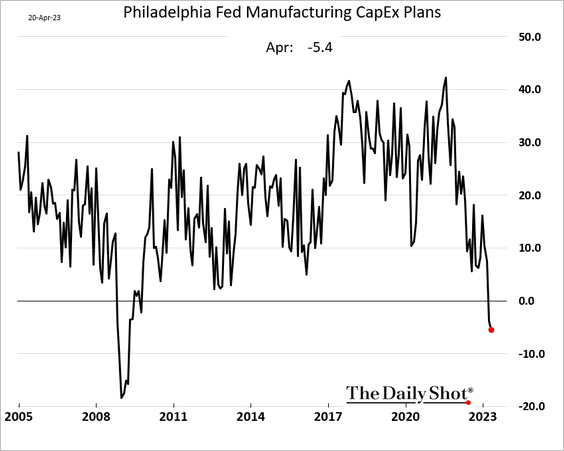

• Factories are cutting their CapEx plans.

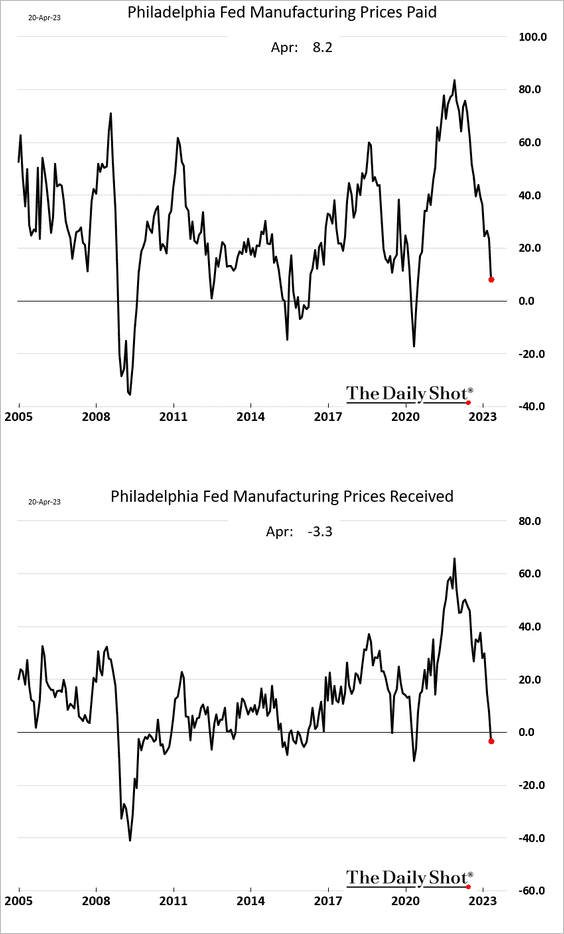

• Manufacturers are now reducing their selling prices (2nd panel).

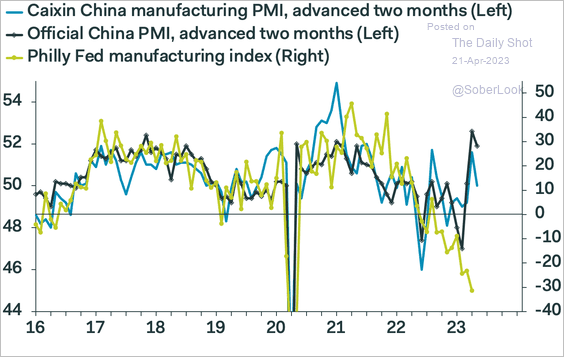

• The Philly Fed’s index has diverged from factory activity in China (post-reopening).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

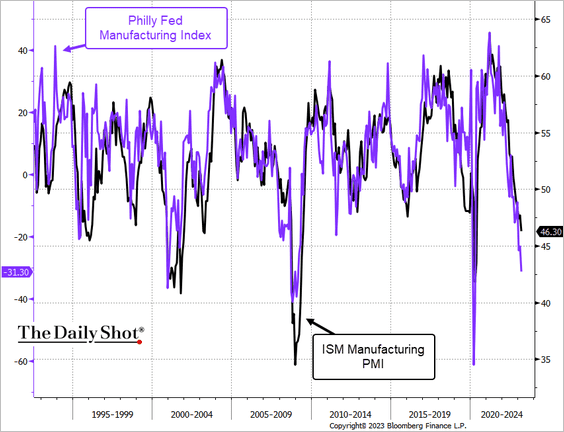

• What does it tell us about manufacturing at the national level?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

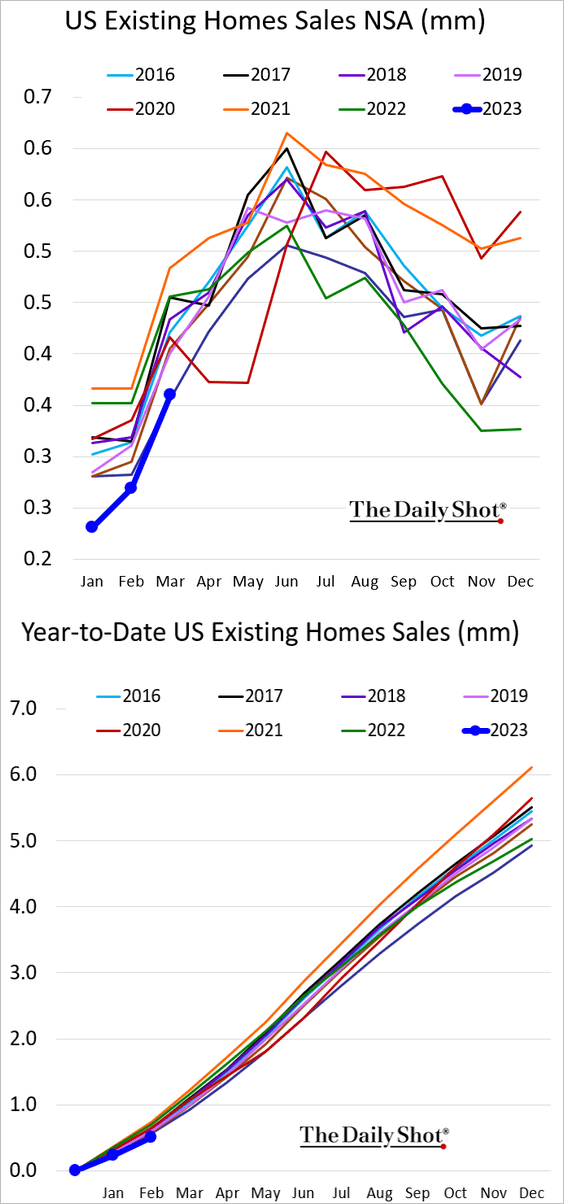

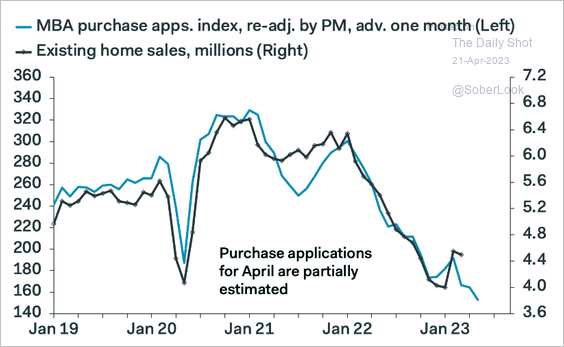

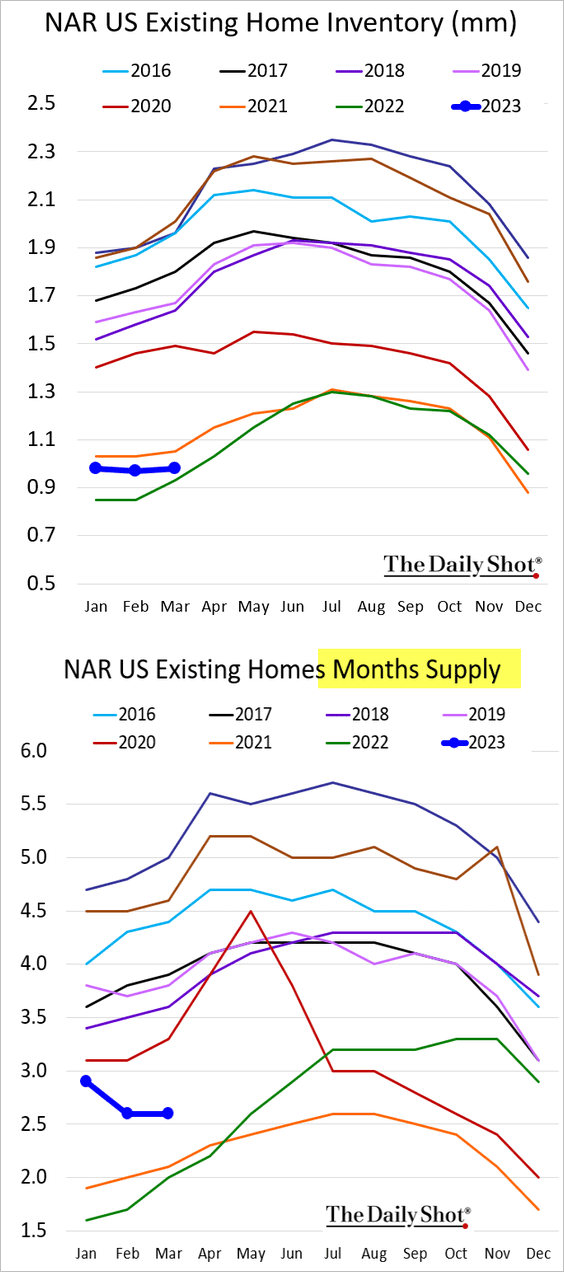

3. Existing home sales were below expectations last month.

And soft mortgage applications point to further weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

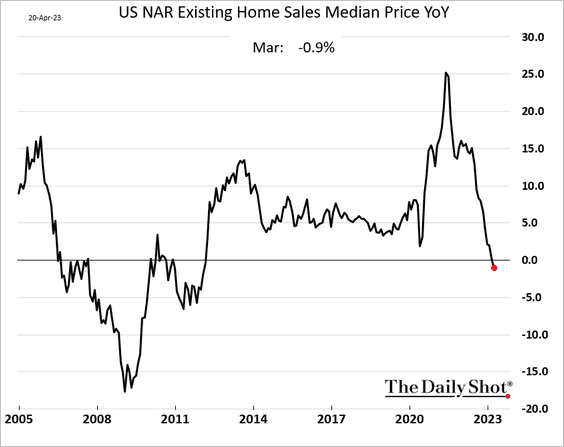

The median sales price is now down on a year-over-year basis.

Persistently tight inventories have prevented home prices from declining more rapidly.

——————–

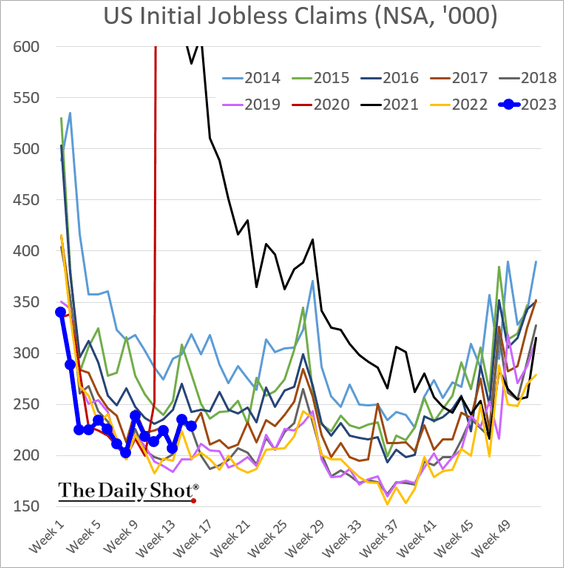

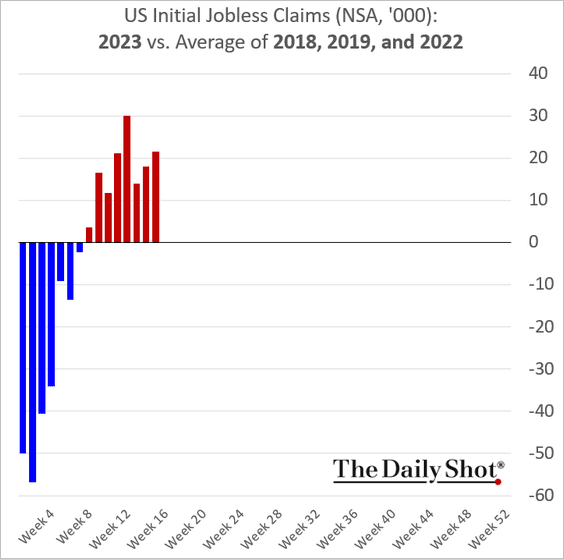

4. Initial jobless claims are grinding higher.

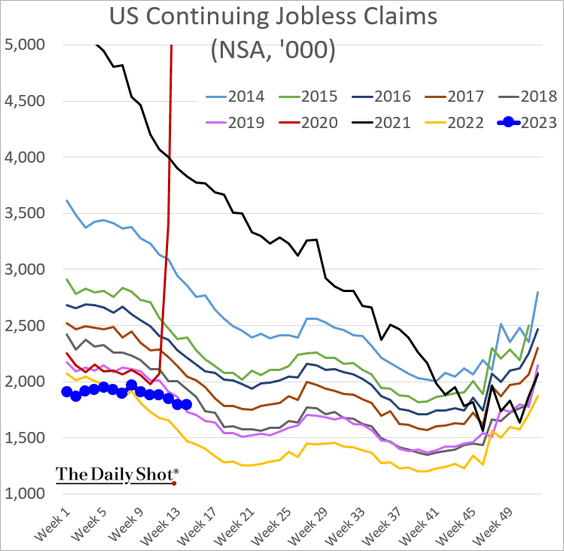

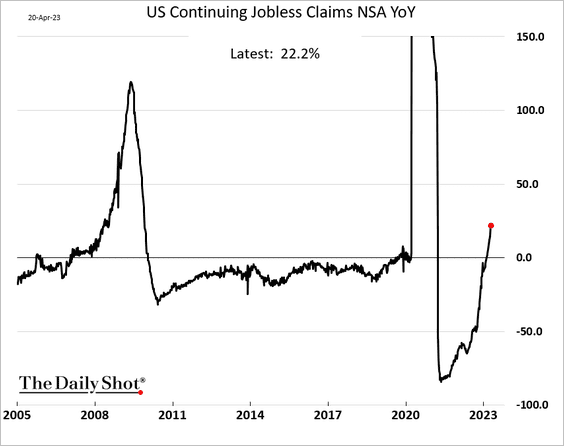

Continuing claims are now up 22% versus last year.

——————–

5. Unlike in previous downturns, the decline in job openings from the peak has not been followed by higher unemployment (for now).

Source: BCA Research

Source: BCA Research

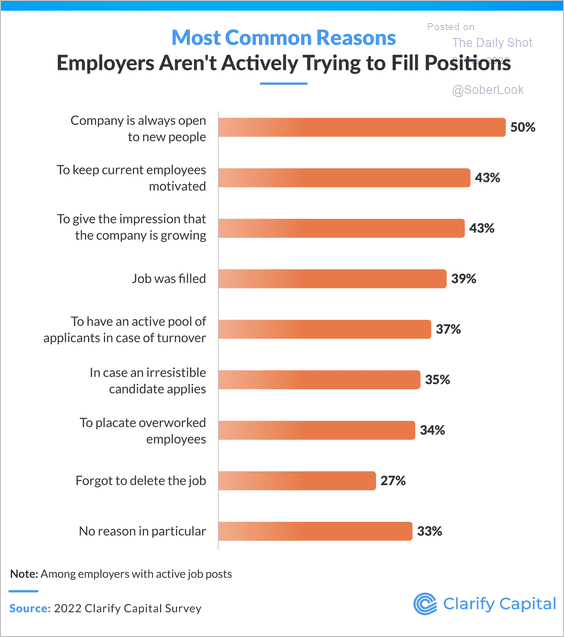

• Why do some companies post “ghost jobs”?

Source: Clarify Capital

Source: Clarify Capital

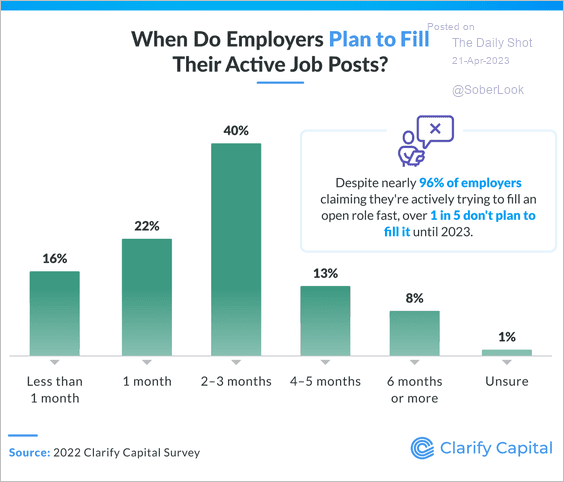

Some firms are not in a rush to fill their job openings.

Source: Clarify Capital

Source: Clarify Capital

——————–

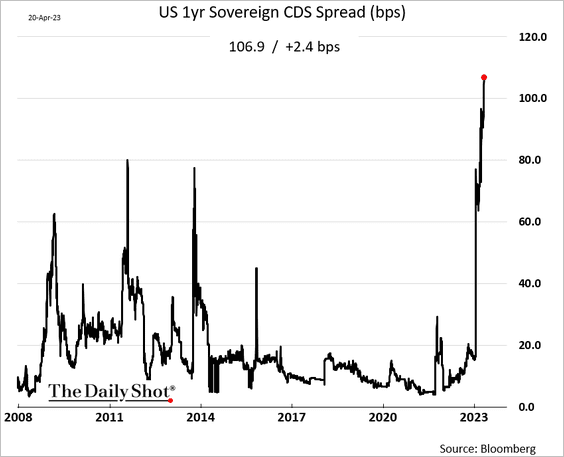

6. Demand for protection against a US default this year keeps climbing.

Back to Index

The United Kingdom

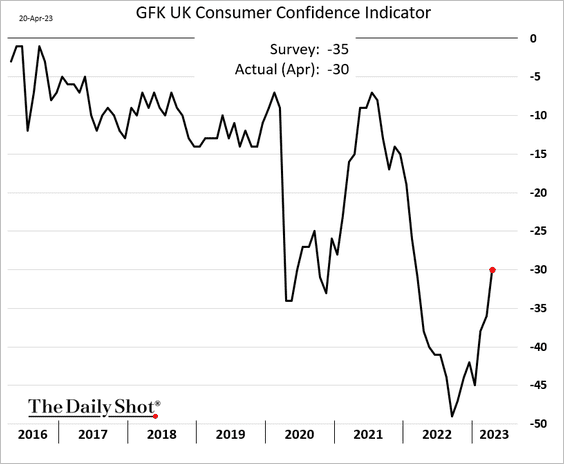

1. Consumer confidence is rebounding.

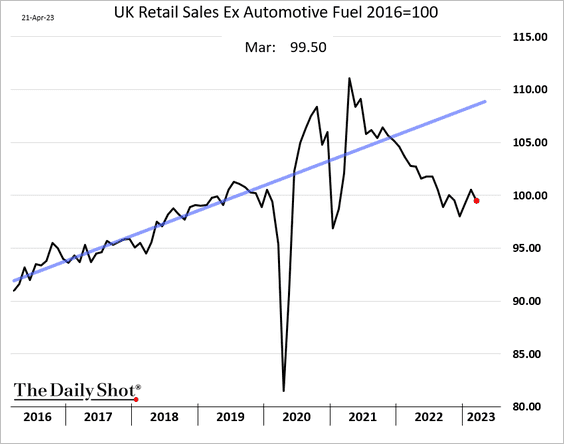

2. Retail sales declined in March.

Back to Index

The Eurozone

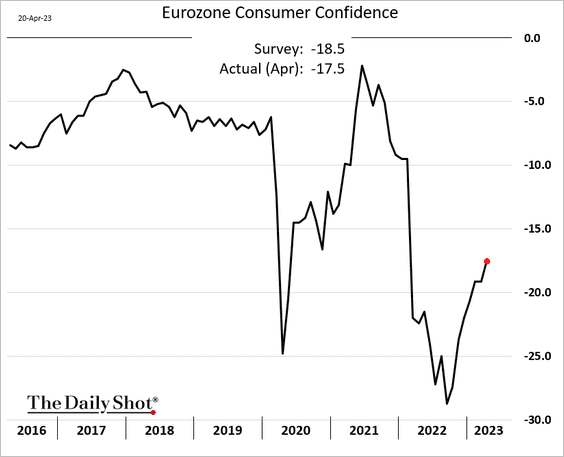

1. Consumer confidence continues to move higher.

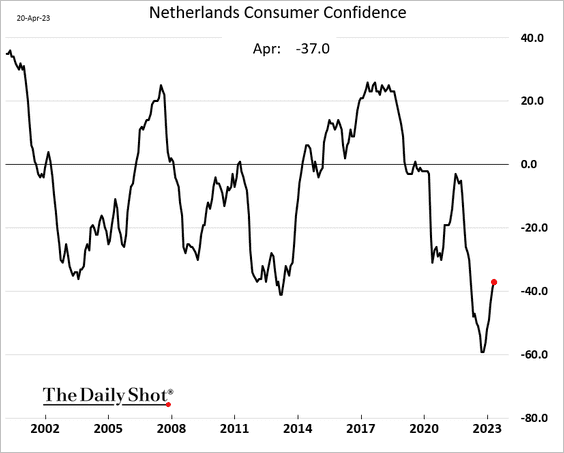

Here is Dutch consumer confidence.

——————–

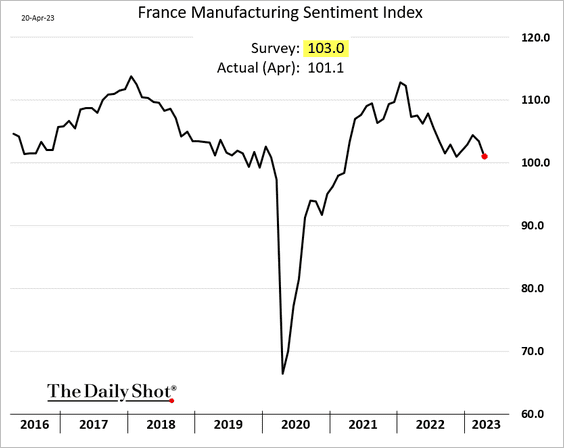

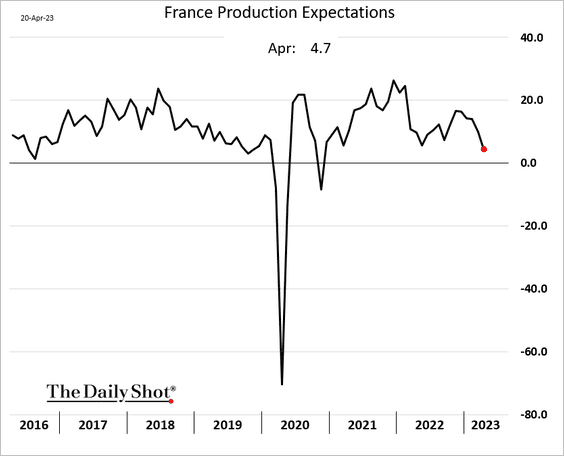

2. French manufacturing sentiment declined this month.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

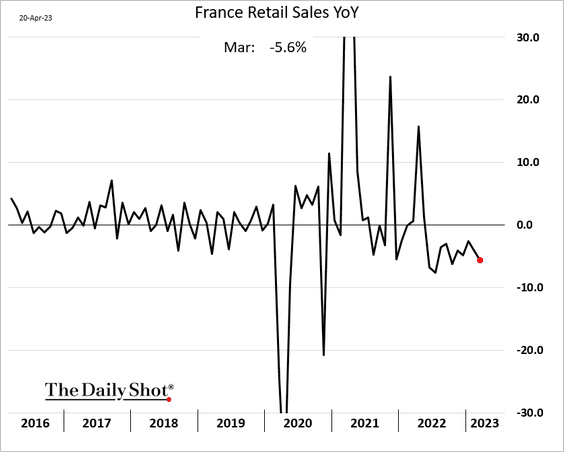

Separately, French retail sales were down 5.6% on a year-over-year basis in March.

——————–

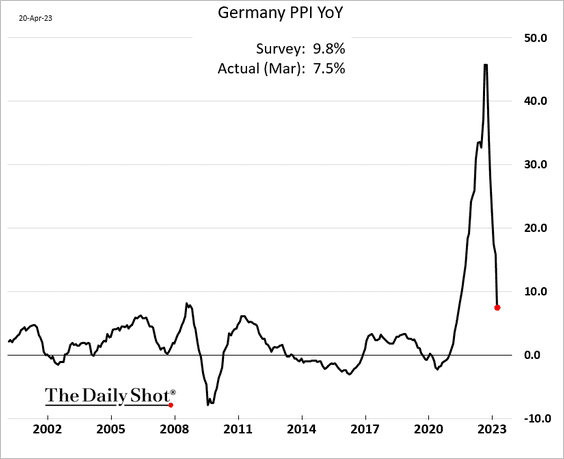

3. Germany’s PPI is crashing.

Here is Portugal’s PPI.

——————–

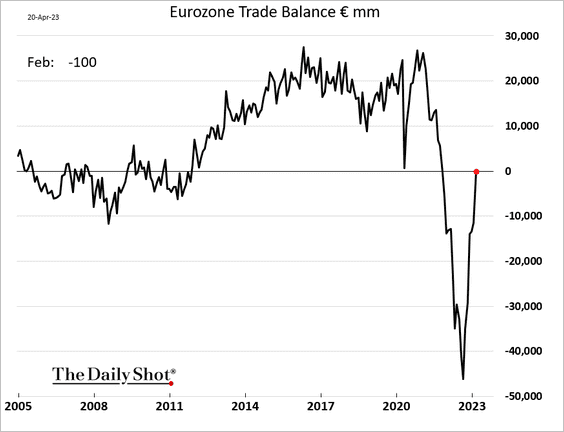

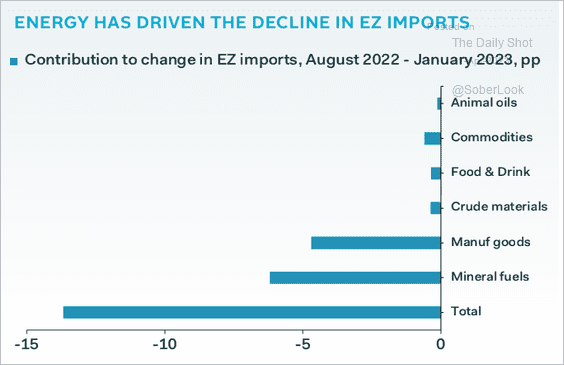

4. The euro-area trade balance is returning to surplus, …

… as energy imports decline.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

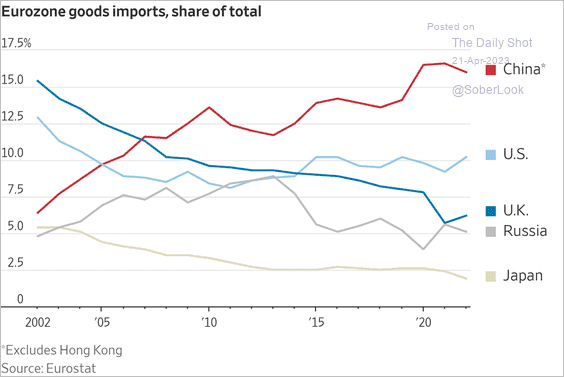

This chart shows euro-area goods imports by source.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Europe

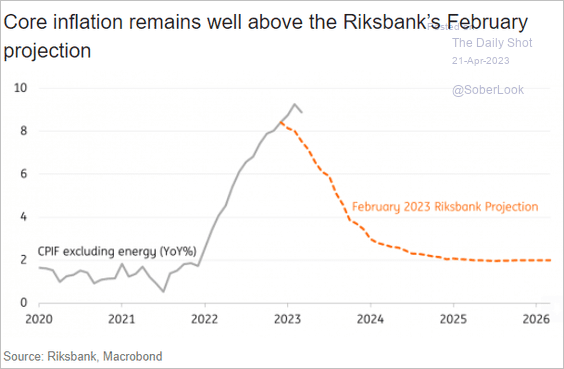

1. Will Sweden’s Riksbank boost rates by 50 bps amid persistent inflation?

Source: ING

Source: ING

Here is a forecast from ING.

Source: ING

Source: ING

——————–

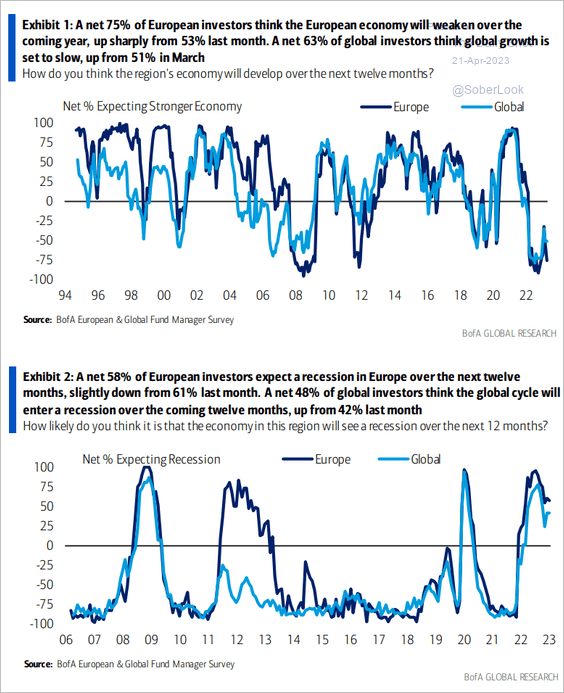

2. Fund managers are not optimistic about the European economy.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Japan

1. Core inflation surprised to the upside again.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

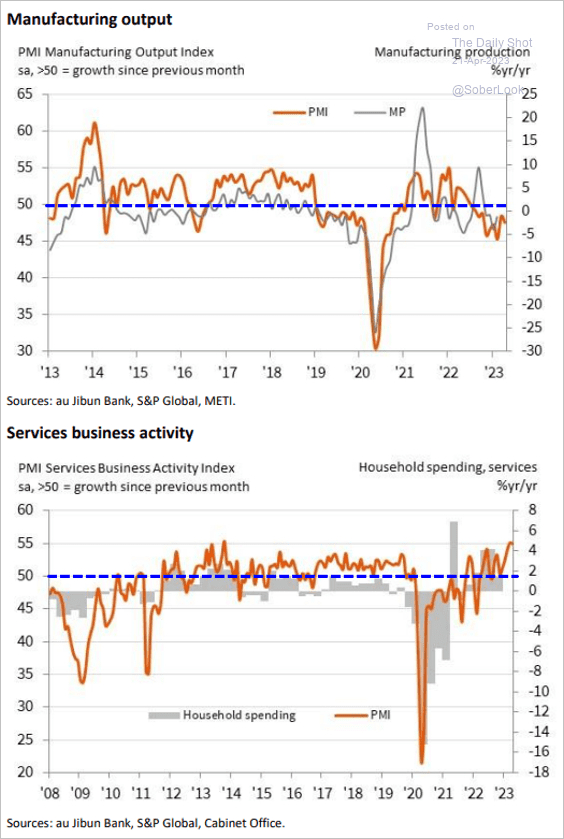

2. Stronger services are offsetting soft manufacturing activity. Here are the PMI output indices through April.

Source: S&P Global PMI

Source: S&P Global PMI

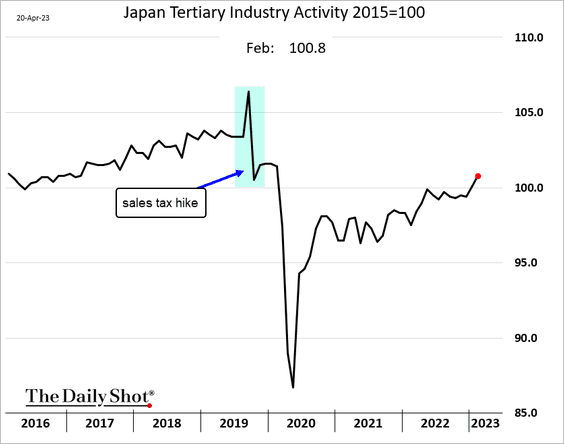

Below is the actual services output index through February.

——————–

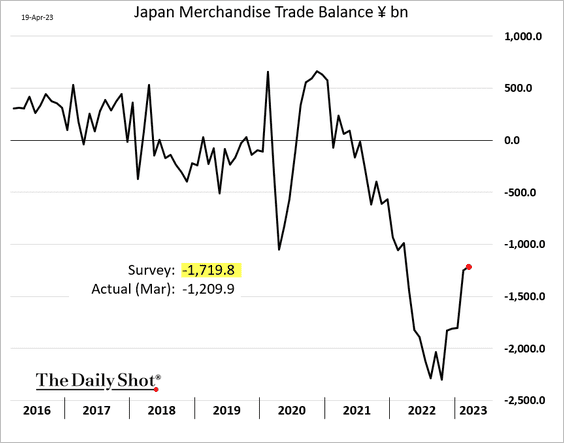

3. The trade deficit was narrower than expected in March.

Back to Index

Asia – Pacific

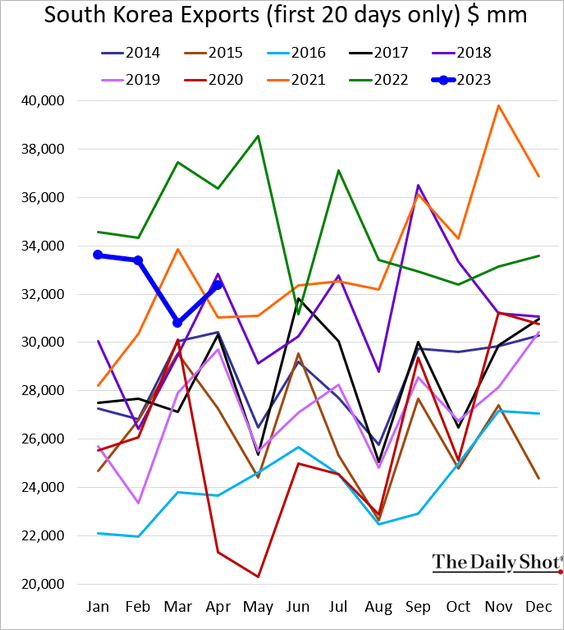

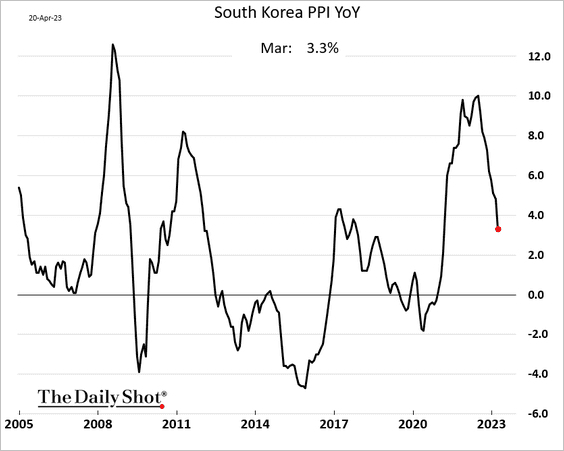

1. South Korean exports remain well below last year’s levels.

The nation’s PPI continues to moderate.

——————–

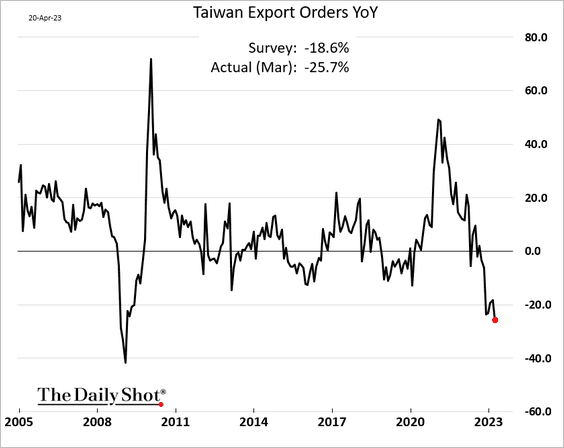

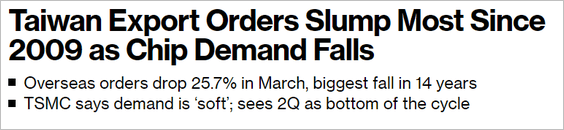

2. Taiwan’s export orders are crashing.

Source: @samsonellis, @WanChienHua1, @economics Read full article

Source: @samsonellis, @WanChienHua1, @economics Read full article

——————–

3. Australia’s services sector is back in growth mode this month, but the contraction in manufacturing has accelerated.

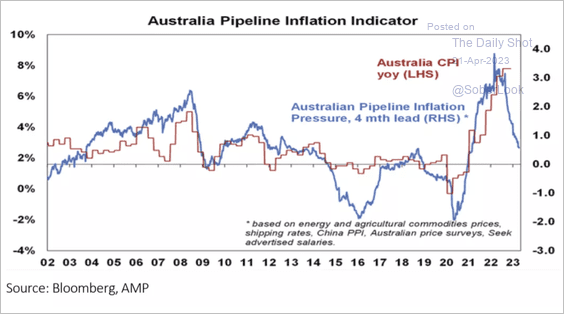

Australia’s CPI should begin to moderate rapidly.

Source: Livewire Markets Read full article

Source: Livewire Markets Read full article

Back to Index

China

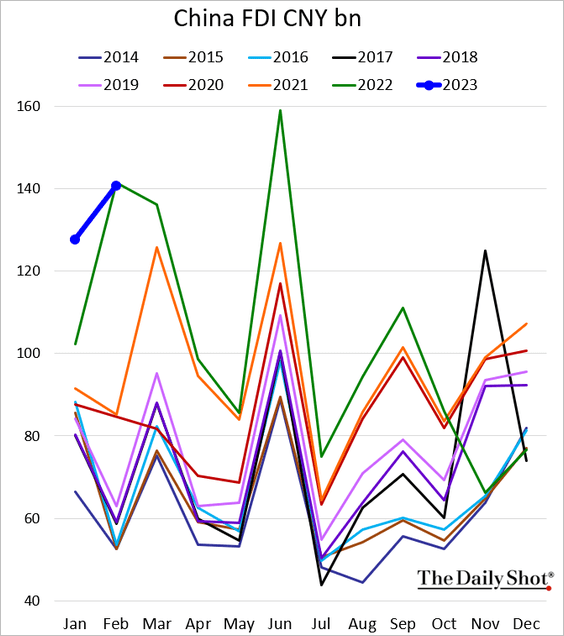

1. Foreign direct investment is back at last year’s levels.

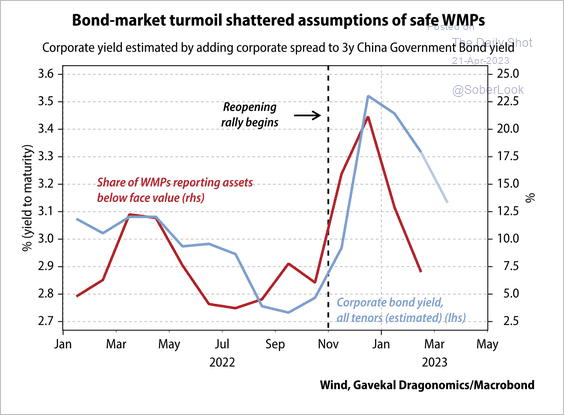

2. More than a fifth of wealth management products (WMPs) reported assets worth less than their face value during the market rout in December 2022, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

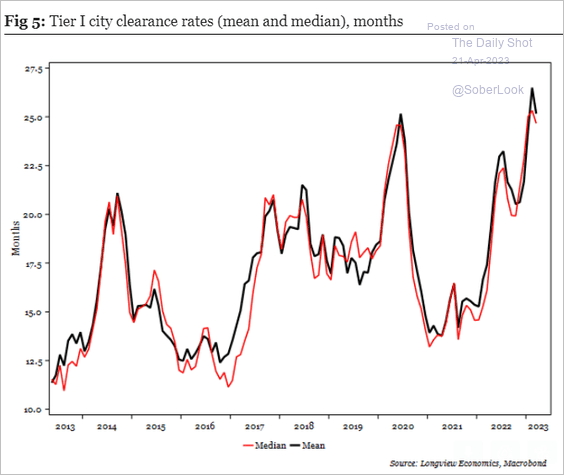

3. It’s been taking longer to sell properties.

Source: Longview Economics

Source: Longview Economics

Back to Index

Cryptocurrency

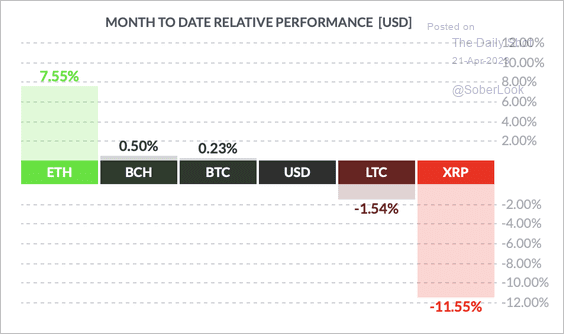

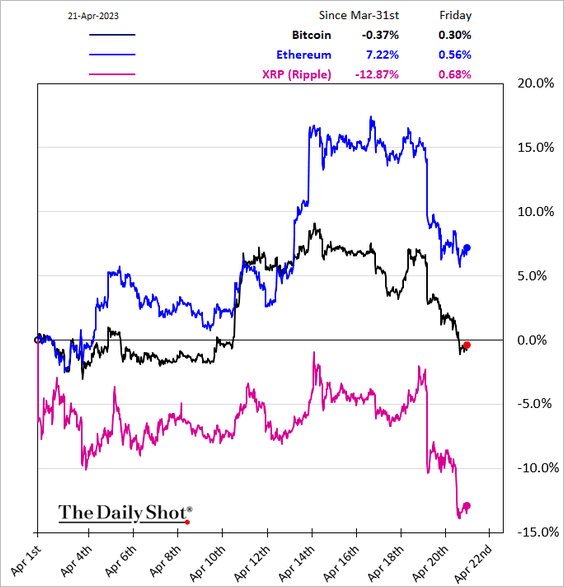

1. It’s been a mixed month so far with ether (ETH) outperforming and XRP underperforming select crypto peers.

Source: FinViz

Source: FinViz

——————–

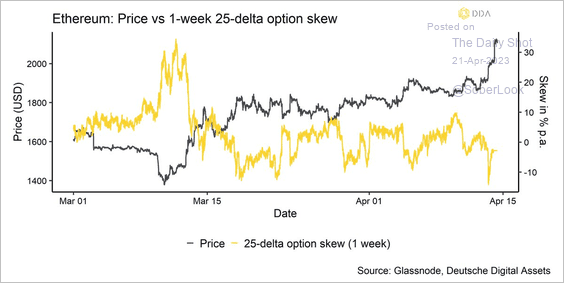

2. The drop in ETH option skews suggests traders were unwinding their downside hedges ahead of the Ethereum network upgrade.

Source: @DDA_GmbH

Source: @DDA_GmbH

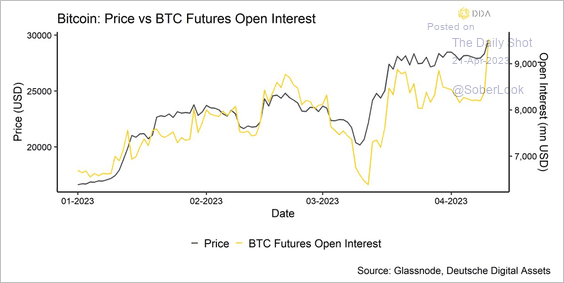

3. Open interest in bitcoin’s futures market ticked higher this month.

Source: @DDA_GmbH

Source: @DDA_GmbH

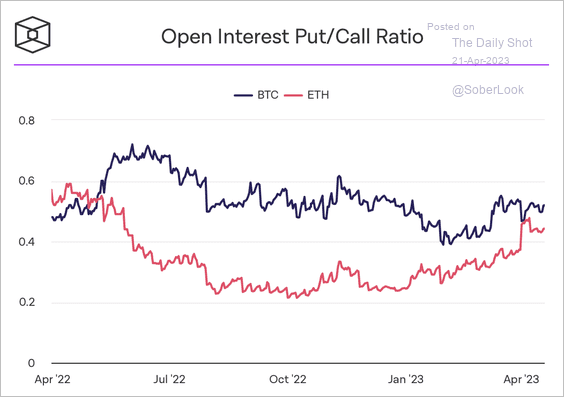

4. The decline in BTC’s put/call ratio has stabilized, while ETH’s put/call ratio is starting to trend higher.

Source: The Block Research

Source: The Block Research

Back to Index

Energy

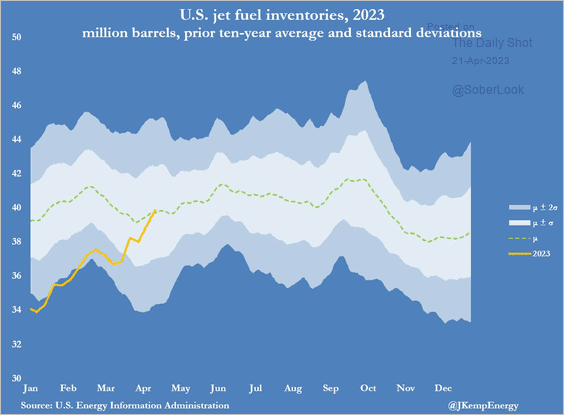

1. US jet fuel inventories have rebounded.

Source: @JKempEnergy

Source: @JKempEnergy

2. US LNG capacity could surge during this decade.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Equities

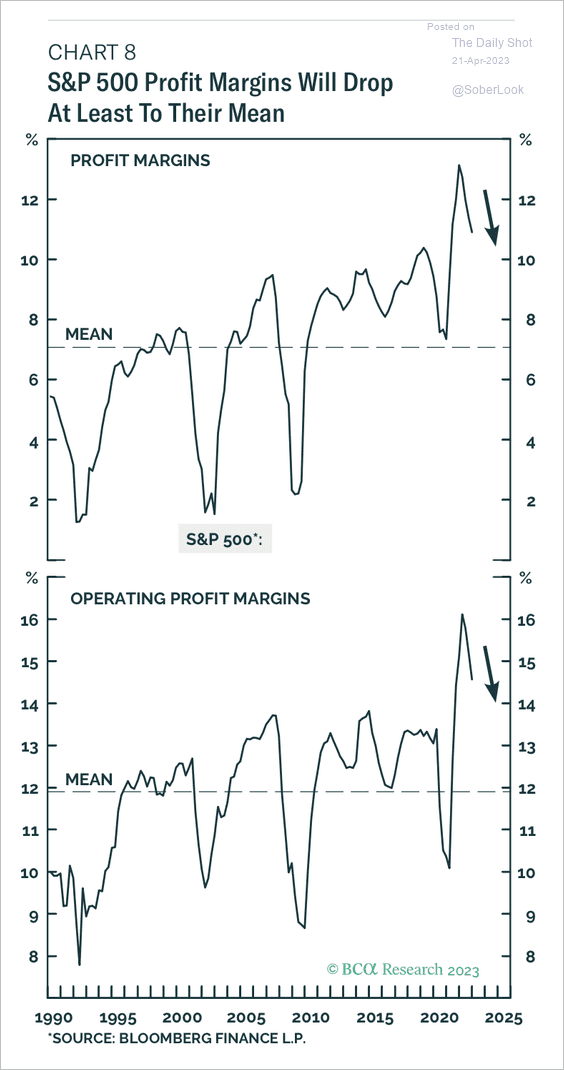

1. S&P 500 profit margins will see further declines toward average levels.

Source: BCA Research

Source: BCA Research

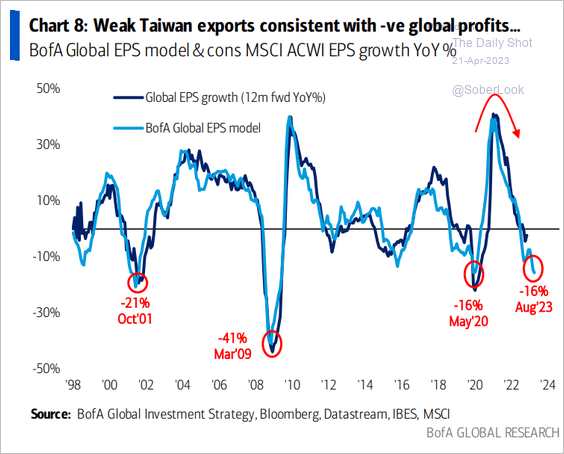

2. Weak leading indicators, such as Taiwan’s exports, signal deep declines in global corporate earnings.

Source: BofA Global Research

Source: BofA Global Research

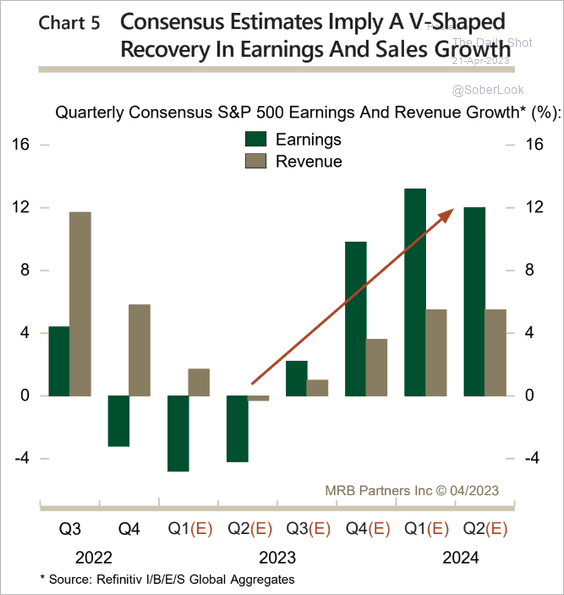

And yet, the market expects a v-shaped recovery in earnings and sales growth.

Source: MRB Partners

Source: MRB Partners

——————–

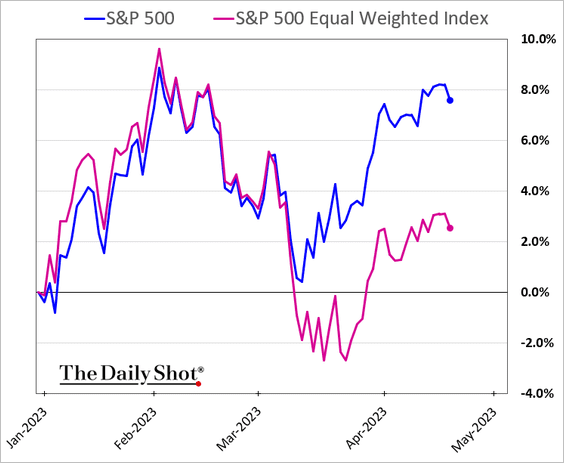

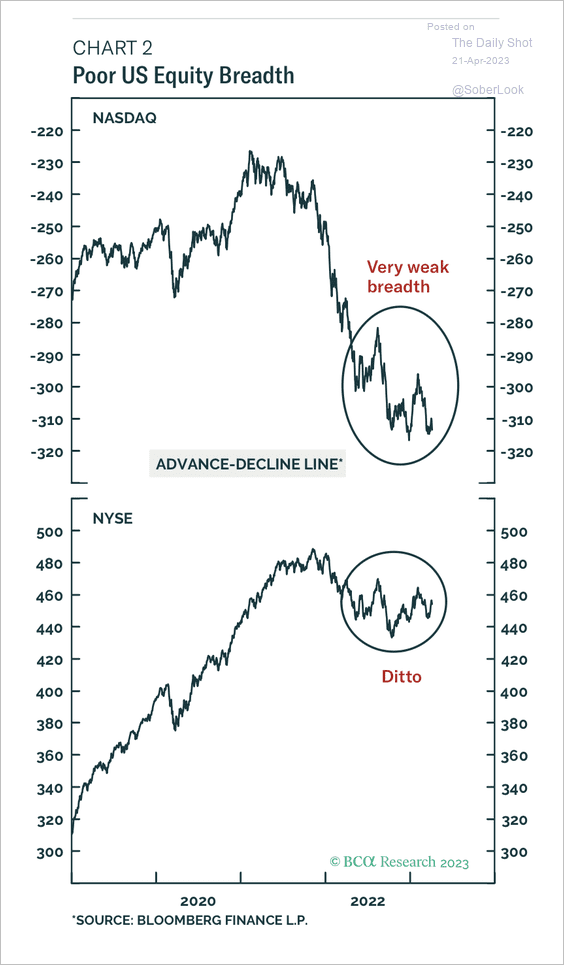

3. The S&P 500 equal-weight index has underperformed sharply over the past couple of months. The divergence has been driven by tech mega-caps’ massive outperformance over financials.

Here is a look at the equal-weigh index distribution of weights vs. the S&P 500.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

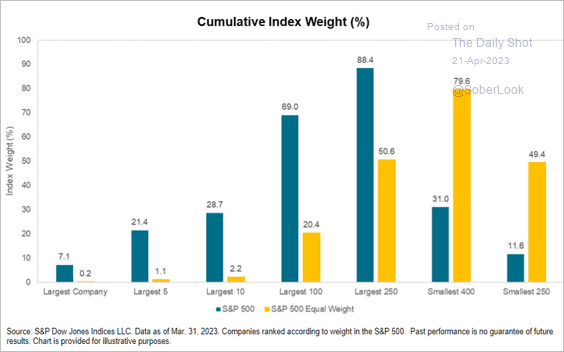

4. Fund managers see long tech mega-caps as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

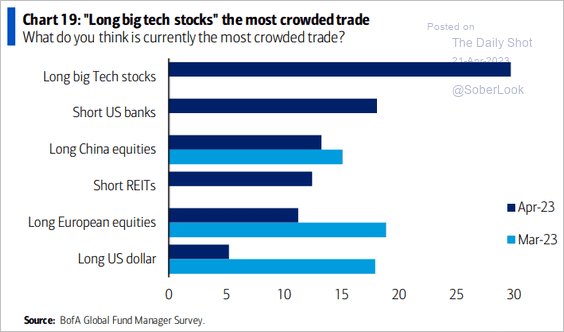

5. Market breadth remains weak. Eventually, more advances and breakouts in stocks could confirm a shift in trend.

Source: BCA Research

Source: BCA Research

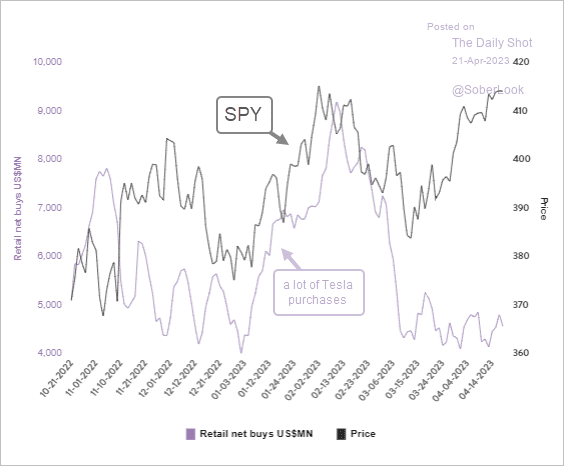

6. Retail net stock purchases remain relatively subdued.

Source: Vanda Research

Source: Vanda Research

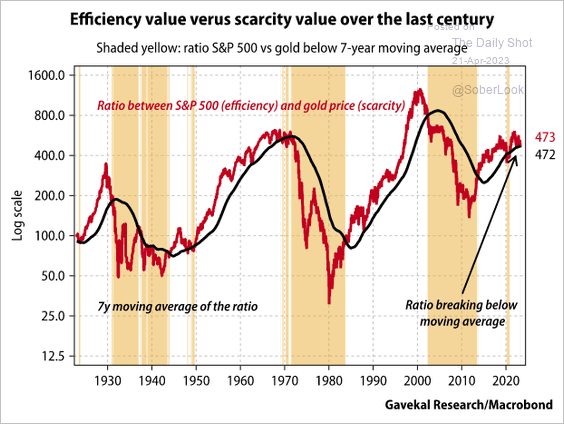

7. The S&P 500/gold ratio is breaking below the 7-year moving average, which tends to signal a recession.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Credit

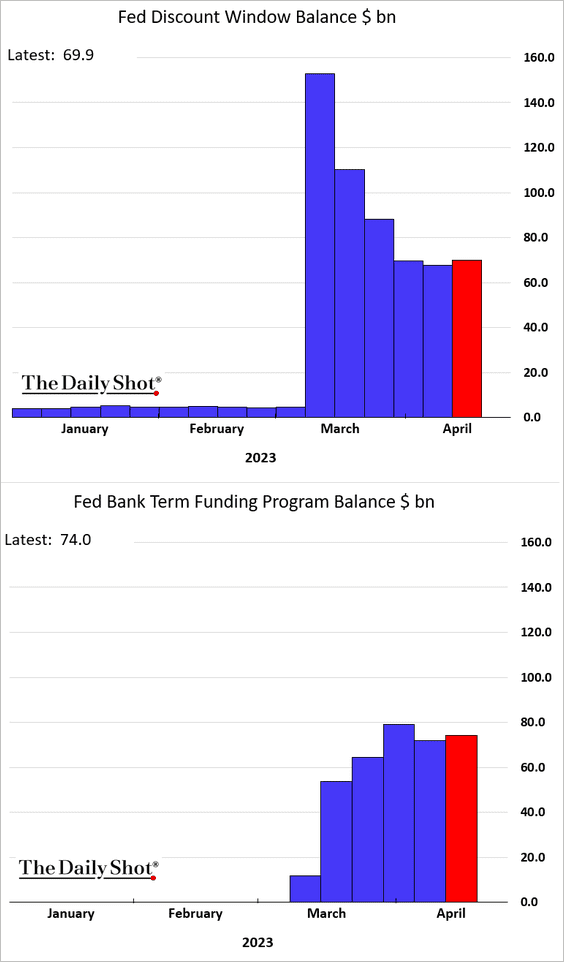

1. Balances on the Fed’s emergency funding facilities (for banks) increased in recent days.

Source: @boes_, @markets Read full article

Source: @boes_, @markets Read full article

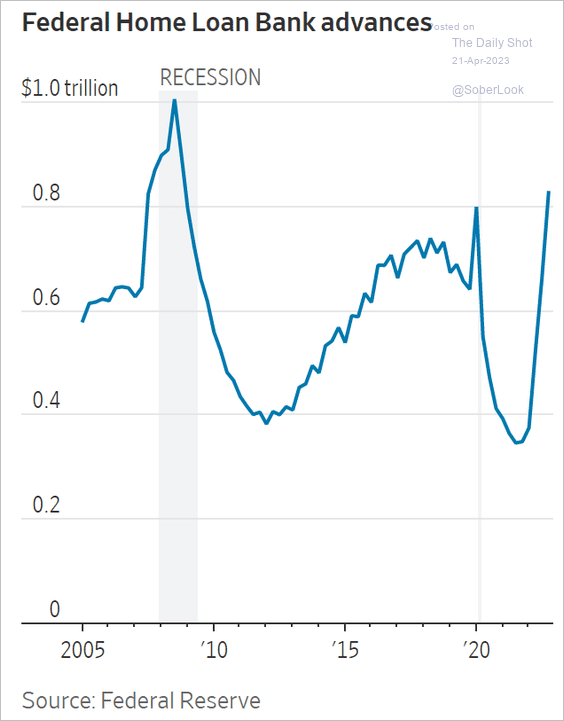

Banks have also borrowed heavily from FHLBs.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

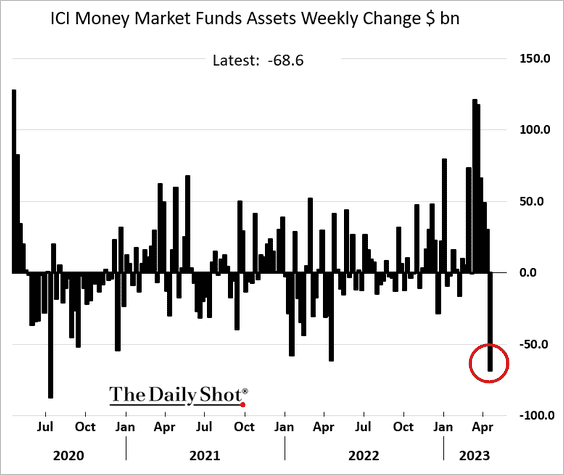

2. Money market funds saw substantial outflows in recent days.

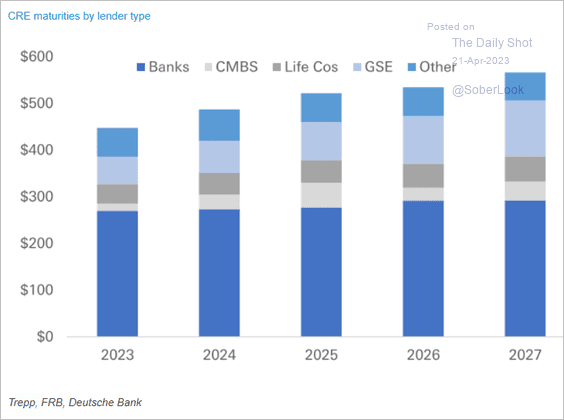

3. Here is a look at commercial real estate debt maturities by lender type.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

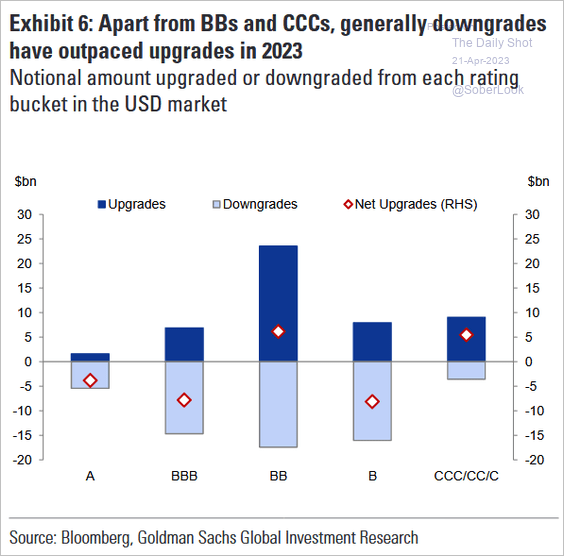

4. Next, we have USD corporate bond upgrades and downgrades by rating.

Source: Goldman Sachs

Source: Goldman Sachs

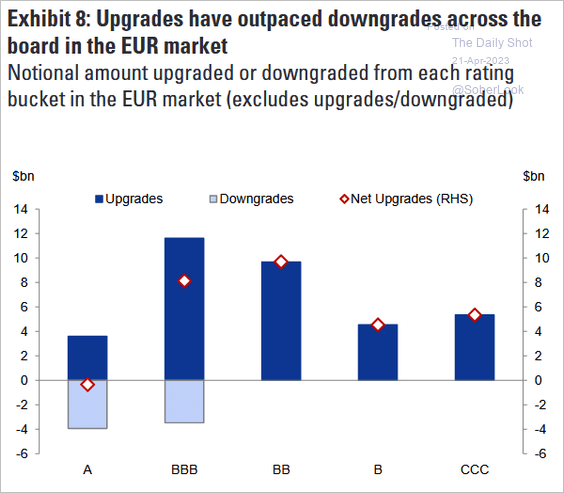

And here is the same chart for euro-denominated debt.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

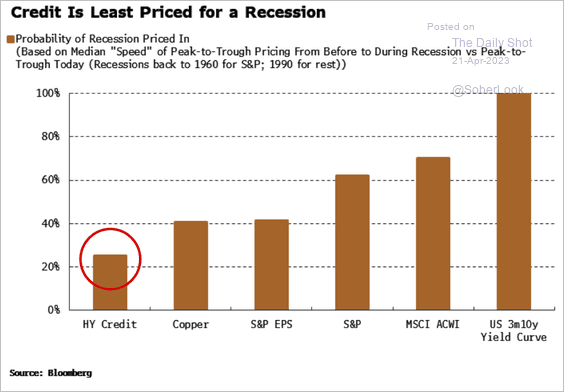

5. Credit is still not pricing a recession.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

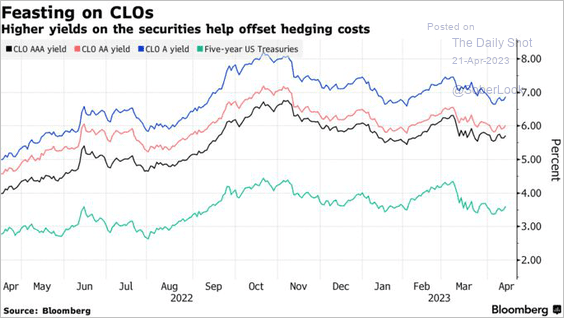

6. CLO yields remain elevated.

Source: @ArroyoNieto, @jillrshah, @markets Read full article

Source: @ArroyoNieto, @jillrshah, @markets Read full article

Back to Index

Rates

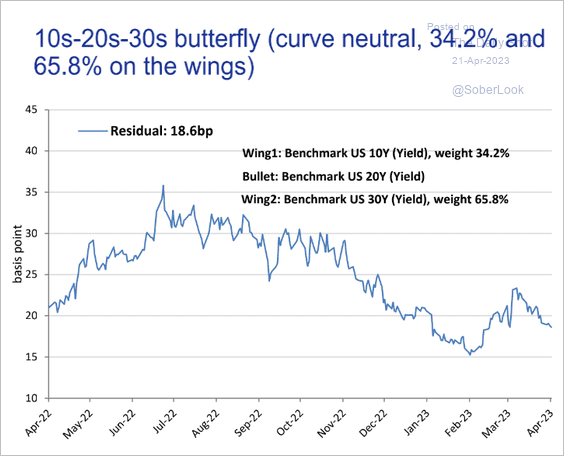

1. The 20-year Treasury continues to trade at a discount vs. the curve.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Yen-based investors have little use for Treasuries, as hedging pushes the 10-year yield toward -2%.

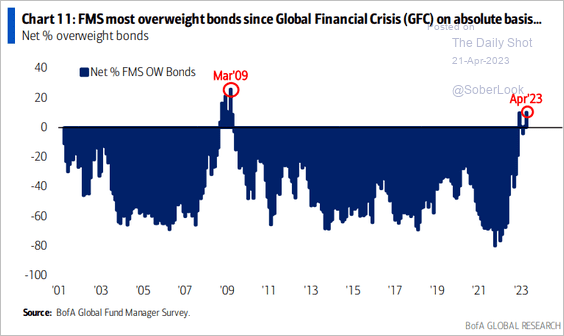

3. Fund managers are overweight bonds.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

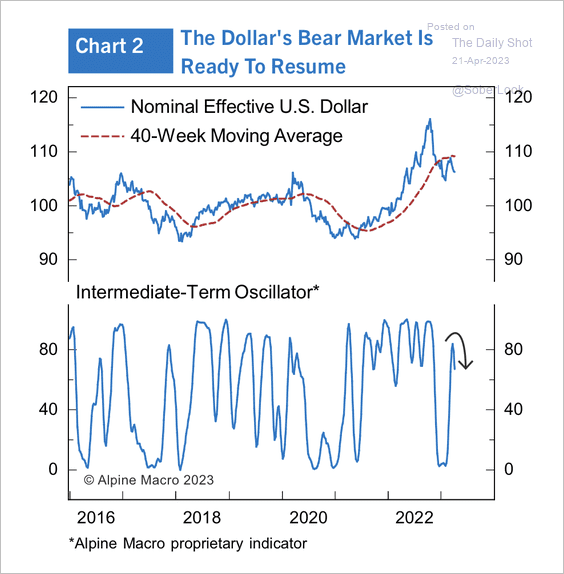

1. The dollar remains stuck below its 40-week moving average.

Source: Alpine Macro

Source: Alpine Macro

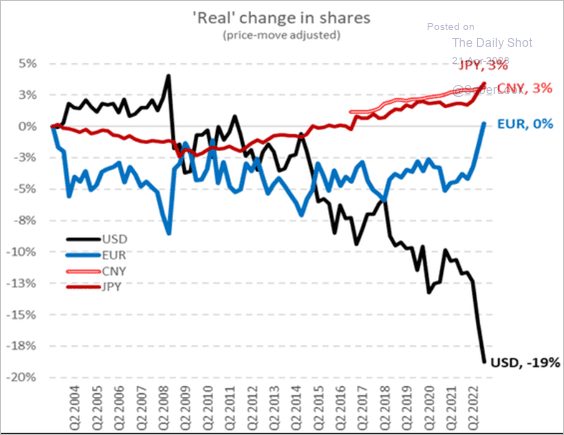

2. The decline in the US dollar’s share in global reserves has accelerated.

Source: BNN Bloomberg Read full article

Source: BNN Bloomberg Read full article

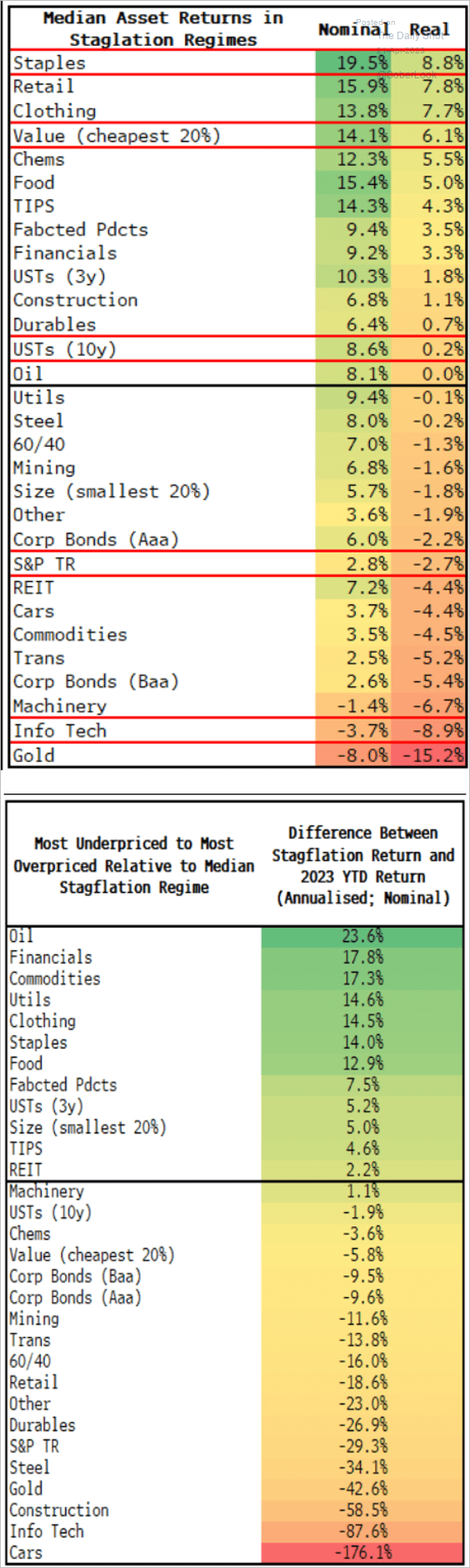

3. How did various assets perform during stagflation periods and how do their returns in 2023 compare?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

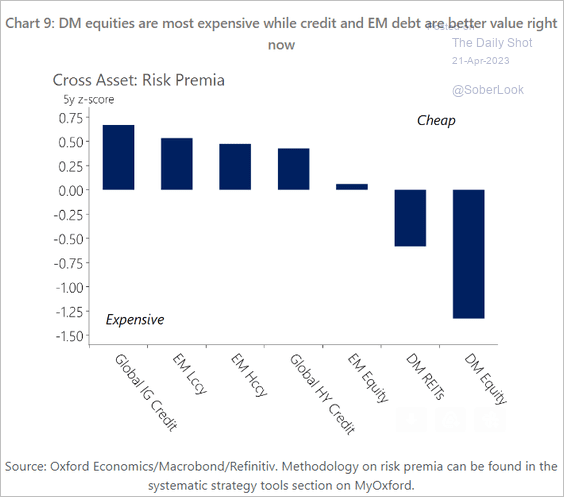

4. This chart shows cross-asset risk premia, a measure of relative value.

Source: Oxford Economics

Source: Oxford Economics

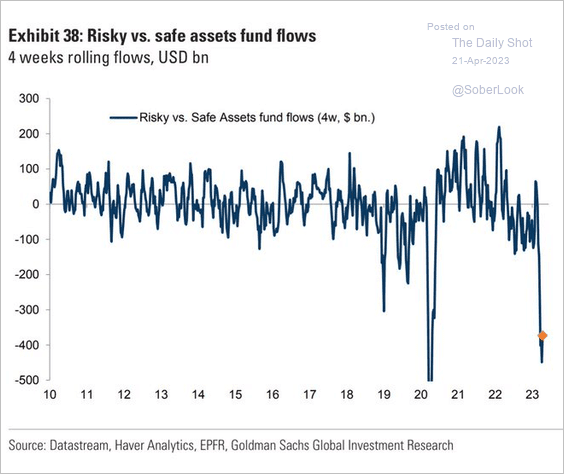

5. Risky asset fund flows remain depressed relative to safe assets.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

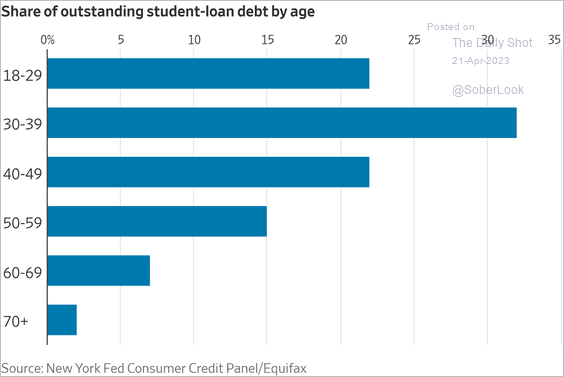

1. Student loan debt by age:

Source: @WSJ Read full article

Source: @WSJ Read full article

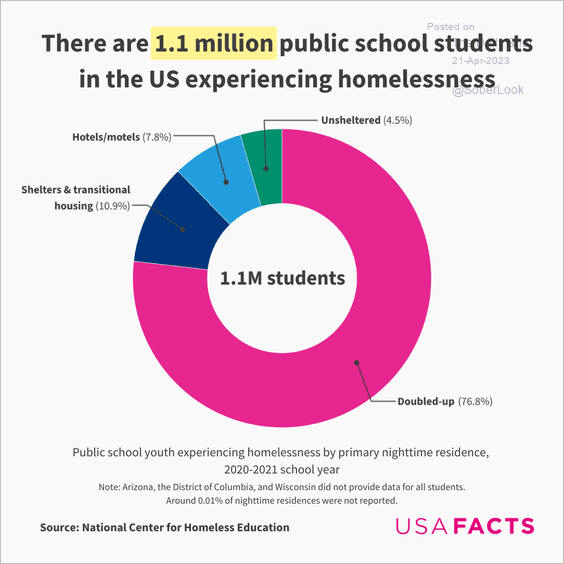

2. Homeless public school students:

Source: USAFacts

Source: USAFacts

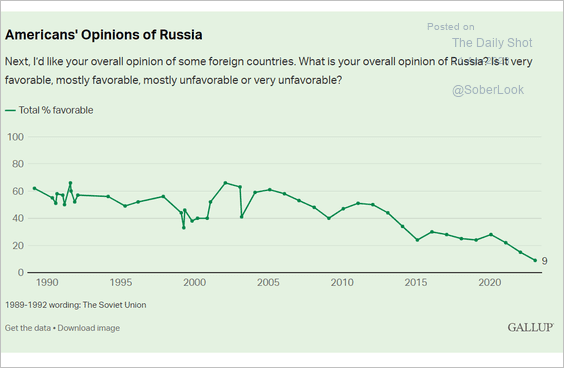

3. Americans’ opinion of Russia:

Source: Gallup Read full article

Source: Gallup Read full article

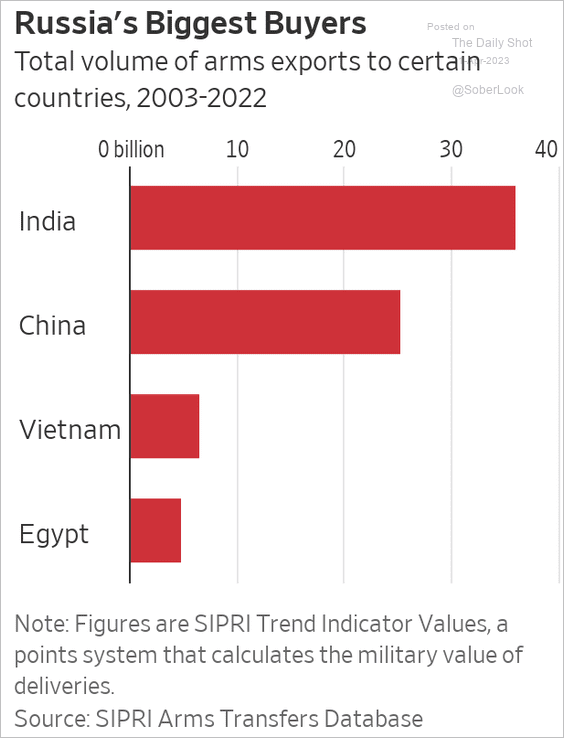

4. Buyers of Russian weapons:

Source: @WSJ Read full article

Source: @WSJ Read full article

5. China’s solar panel production dominance:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

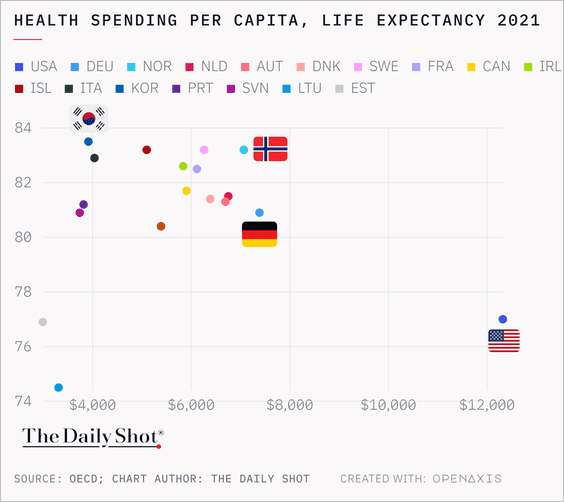

6. Health spending and life expectancy:

Source: @TheDailyShot

Source: @TheDailyShot

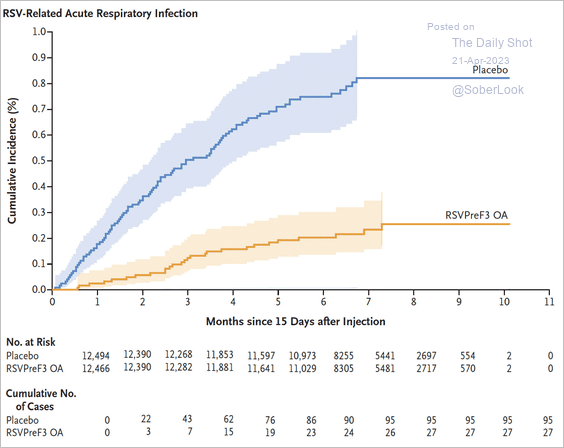

7. mRNA vaccines have been highly effective.

Source: Eric Topol Read full article

Source: Eric Topol Read full article

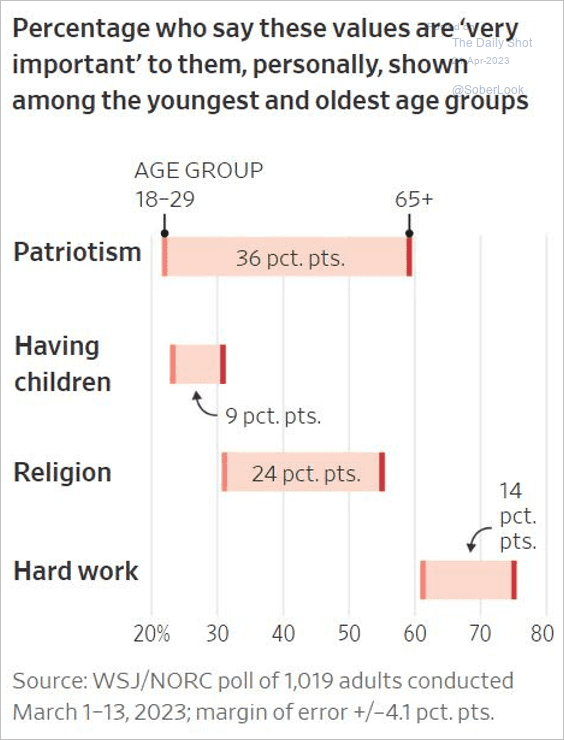

8. The generational value gap:

Source: @austenhufford, @WSJ

Source: @austenhufford, @WSJ

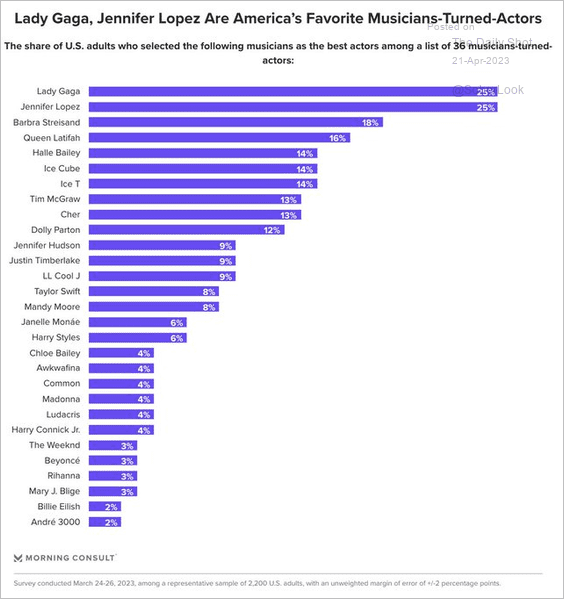

9. Favorite musicians-turned-actors:

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

——————–

Have a great weekend!

Back to Index