The Daily Shot: 24-Apr-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

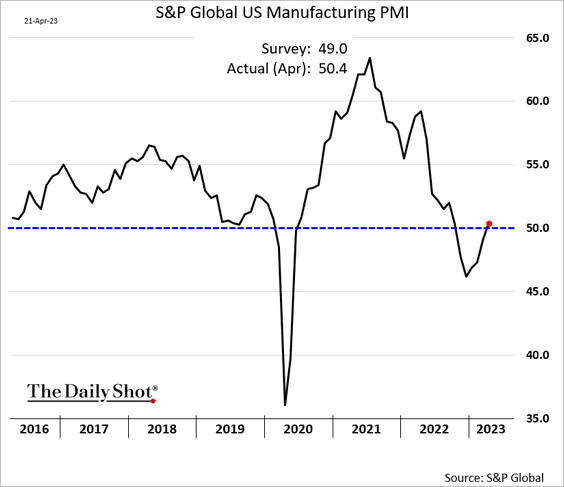

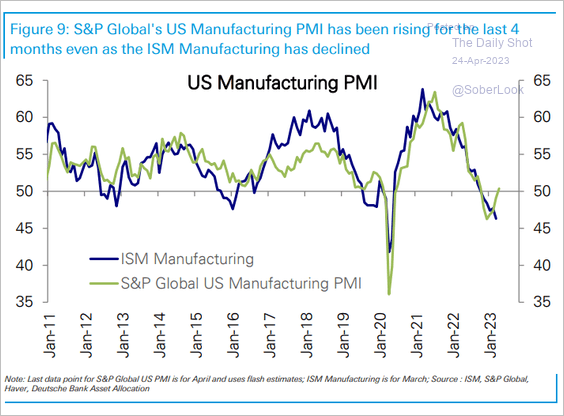

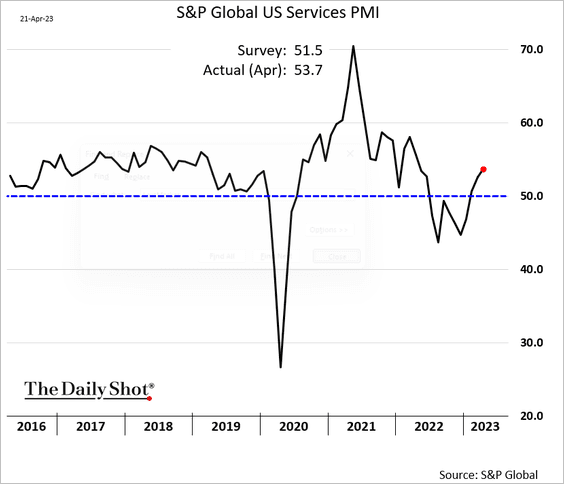

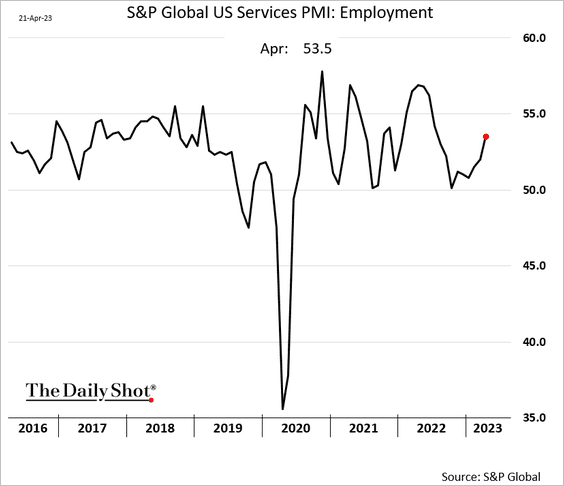

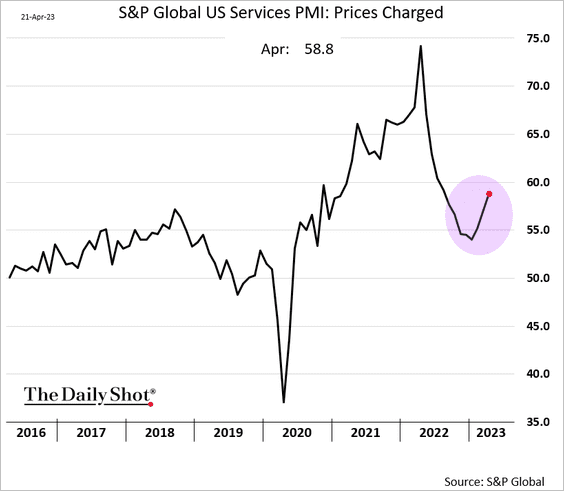

1. The PMI indices from S&P Global point to a rebound in US business activity. The report further boosts the odds of a Fed rate hike in May.

• Manufacturing is growing again (PMI > 0).

– Will we also see a bounce in the ISM Manufacturing PMI this month?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

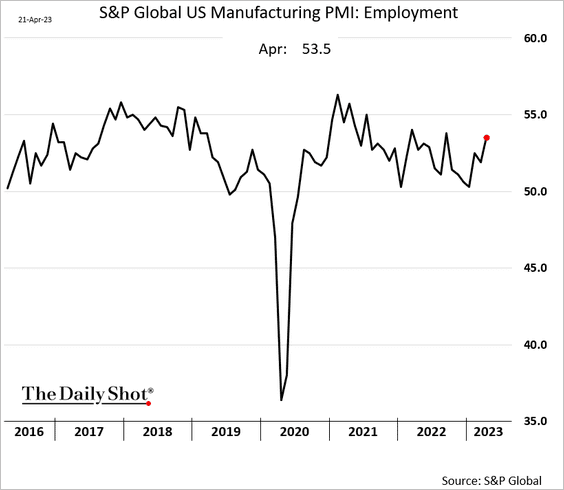

– Hiring in the manufacturing sector has picked up.

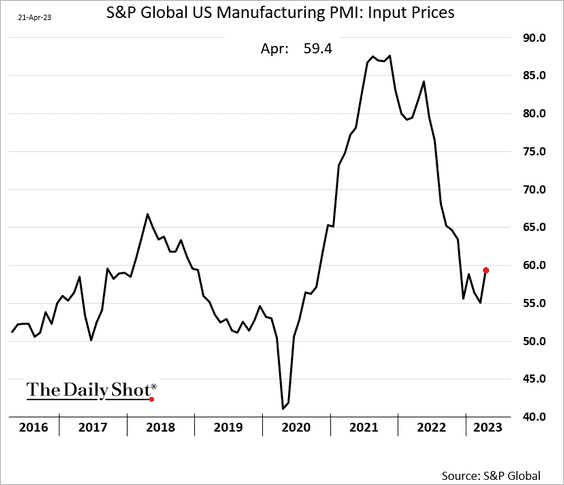

– More firms saw an increase in input prices.

• Service sector activity accelerated this month.

– Service firms have been doing more hiring.

– Service firms have picked up the pace of price increases.

——————–

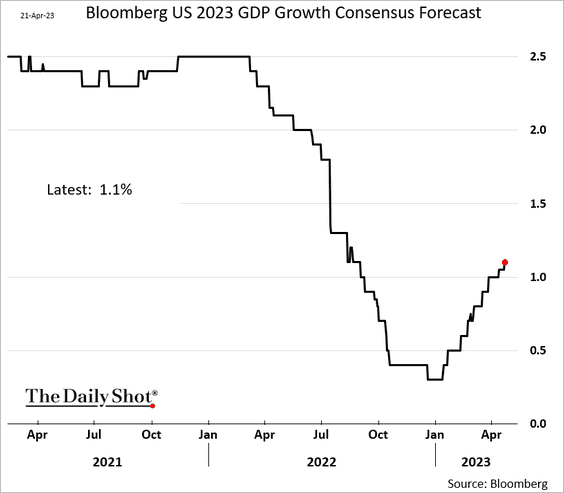

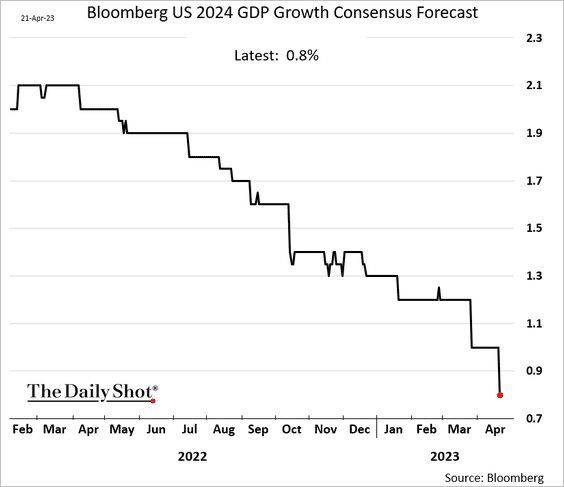

2. Economists continue to boost their forecasts for the 2023 GDP growth.

At the same time, they are trimming growth expectations for 2024.

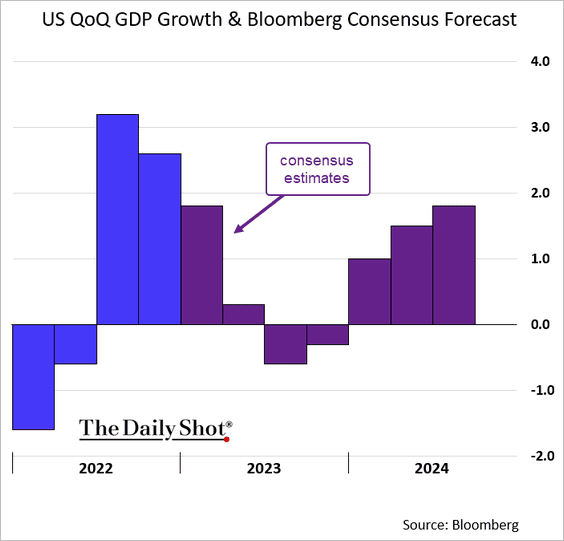

Here are the quarterly forecasts.

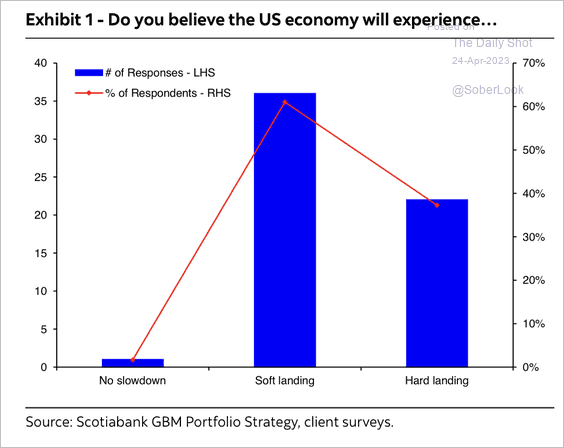

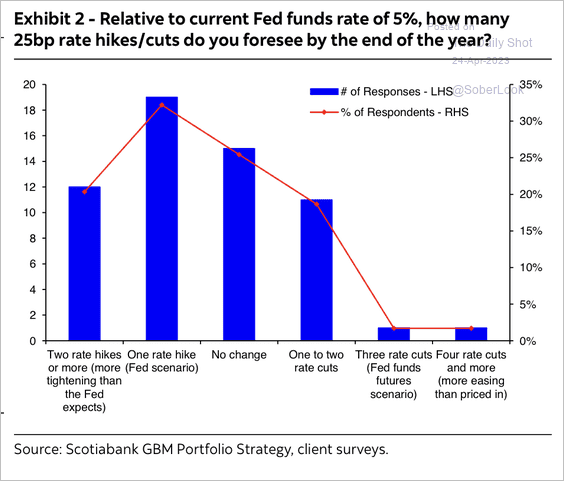

• The US could experience a soft economic landing with just one more rate hike this year, according to a Scotiabank survey of institutional investors. (2 charts)

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

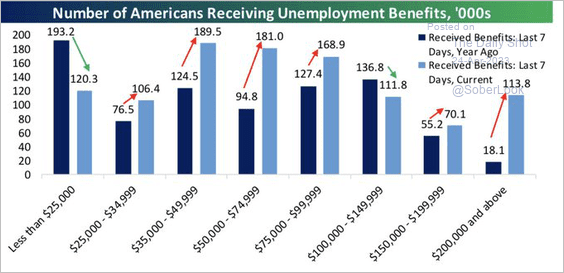

3. Who is receiving unemployment benefits?

Source: @bespokeinvest

Source: @bespokeinvest

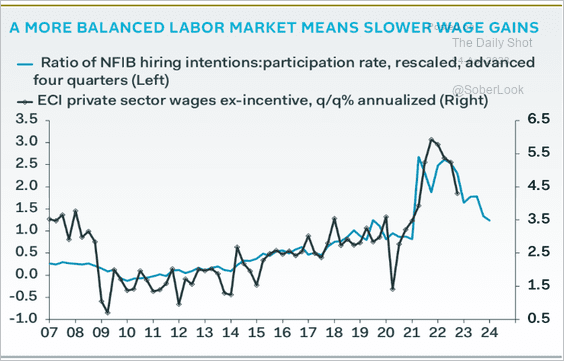

4. Will we see further moderation in wage growth?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

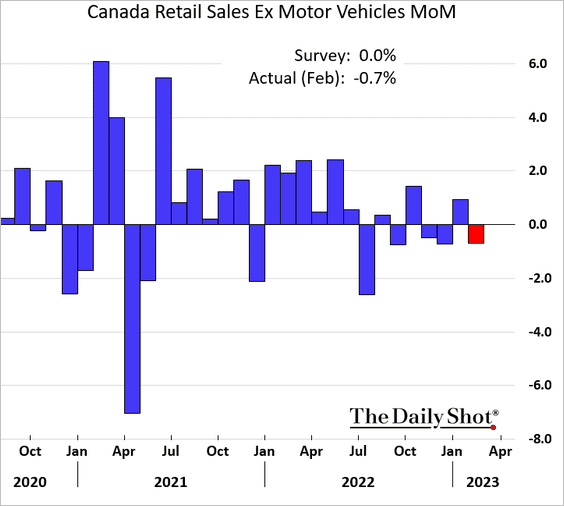

1. Retail sales declined in February, …

… and are estiamted to fall further in March.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

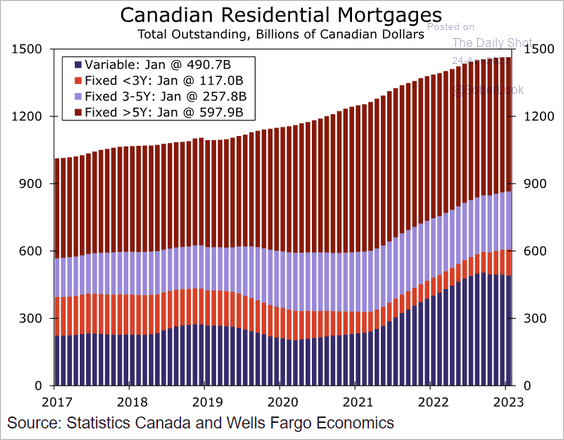

2. This chart shows the distribution of mortgages by rate exposure.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

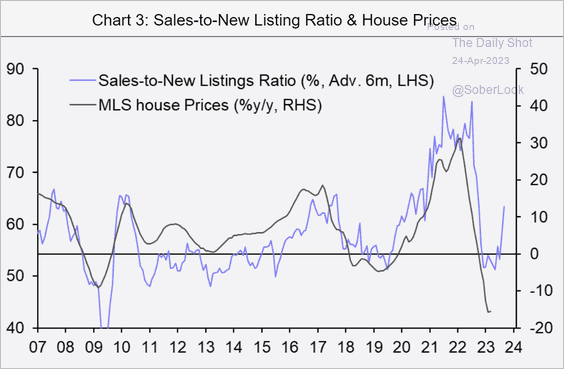

3. Home price declines are slowing.

Source: Capital Economics

Source: Capital Economics

Back to Index

The United Kingdom

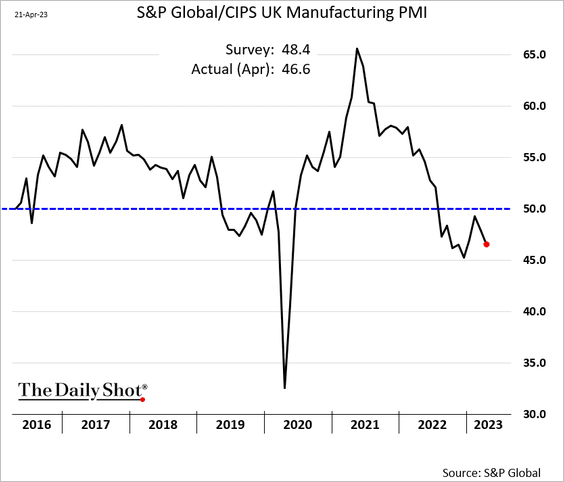

1. Factory activity slowed this month, …

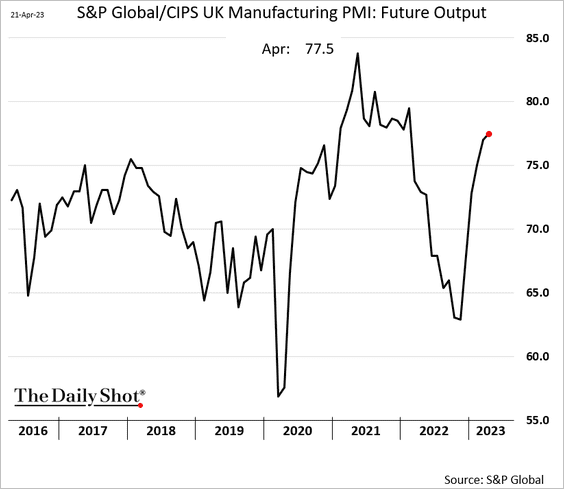

… but manufacturers remain upbeat.

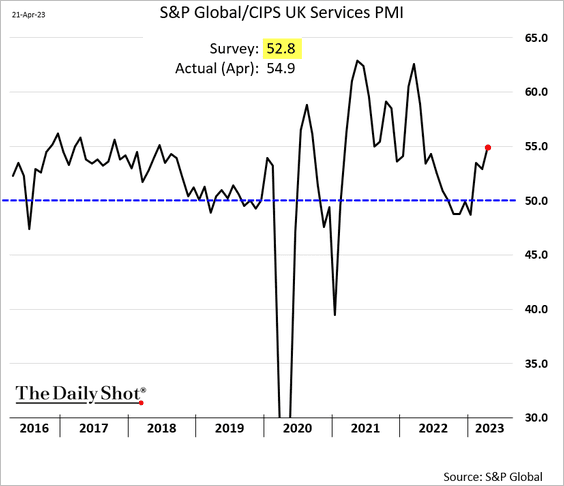

• Service-sector activity accelerated in April, topping expectations.

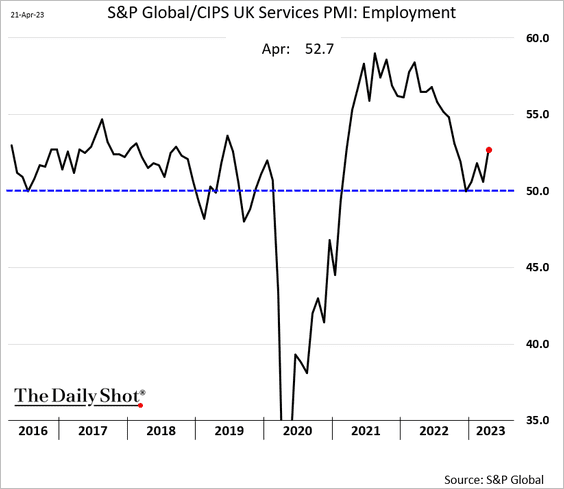

Services employment strengthened.

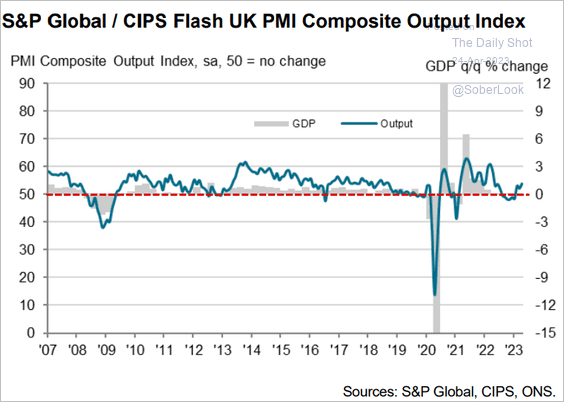

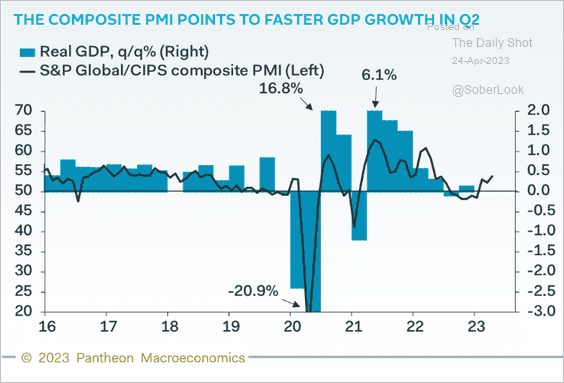

• The composite PMI (manufacturing + services) is now firmly in growth territory, …

Source: S&P Global PMI

Source: S&P Global PMI

… pointing to an economic expansion in Q2.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Reuters Read full article

Source: Reuters Read full article

——————–

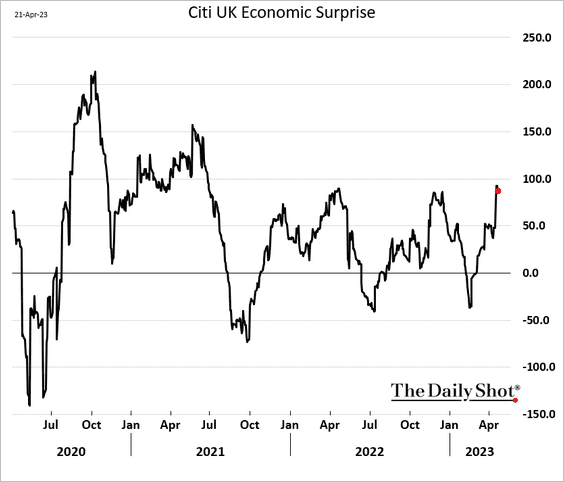

2. UK economic data have been surprising to the upside.

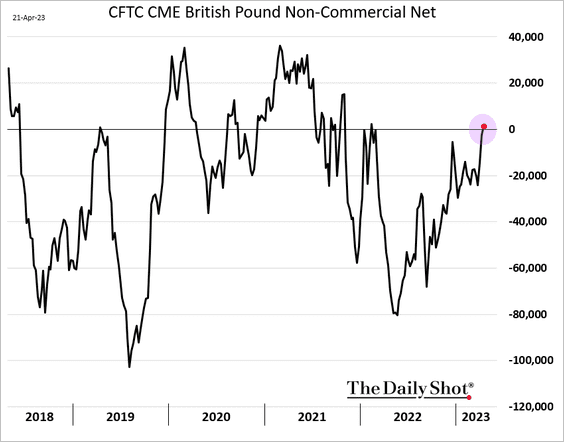

3. Speculative accounts are now net long GBP futures.

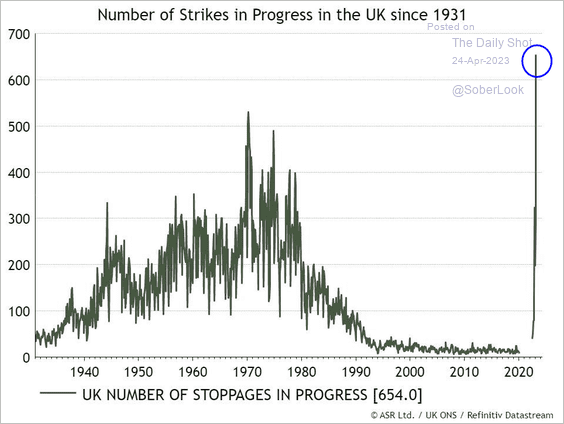

4. Labor disputes remain elevated.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

Back to Index

The Eurozone

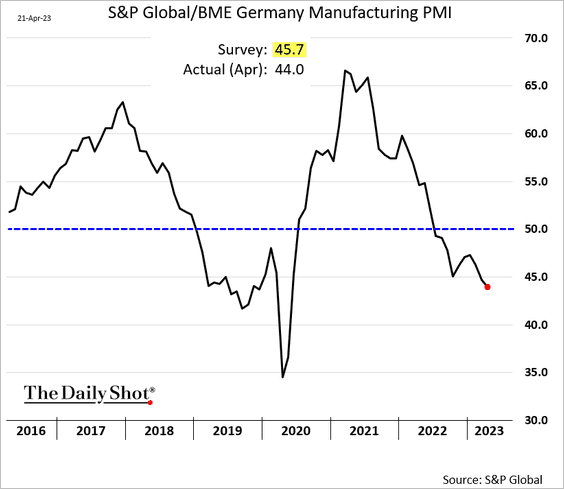

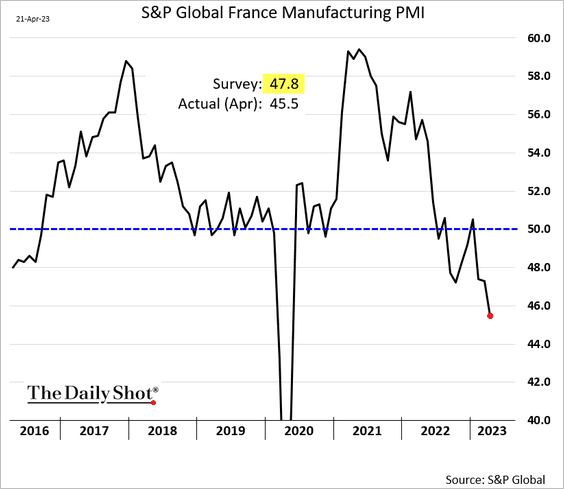

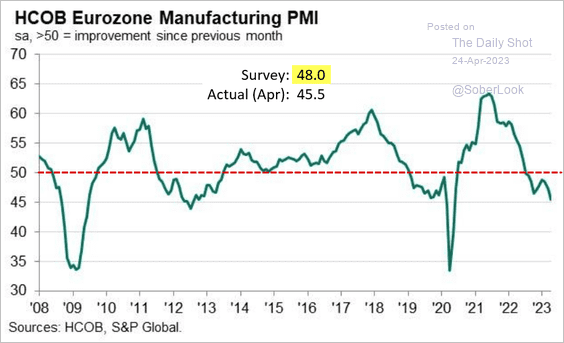

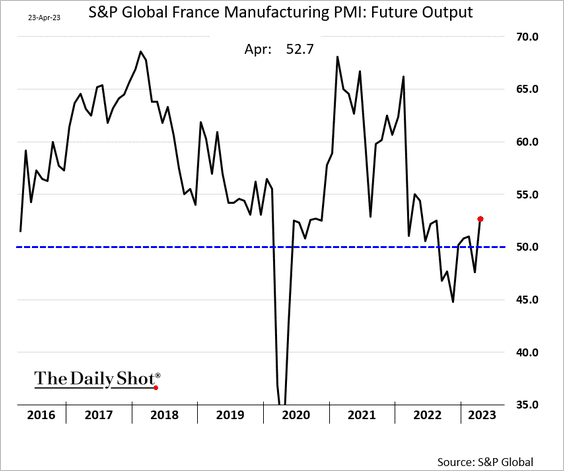

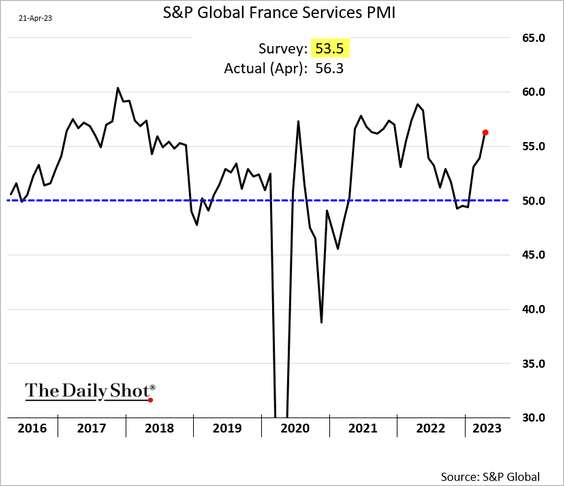

1. Similar to the UK, euro-area manufacturing activity slumped in April.

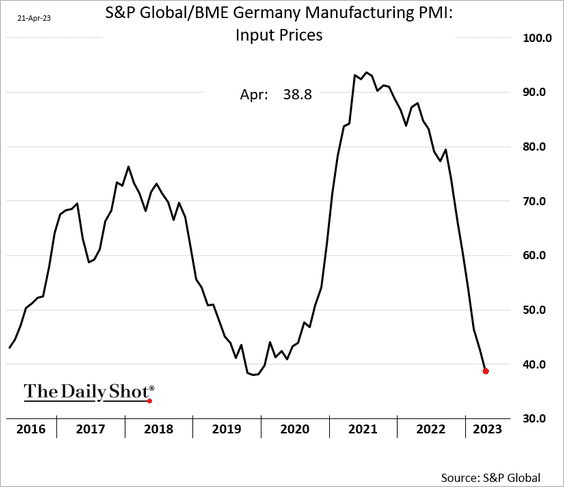

– Germany:

– France:

– The Eurozone:

Source: S&P Global PMI

Source: S&P Global PMI

However, more businesses are upbeat about the future, …

… as input prices sink.

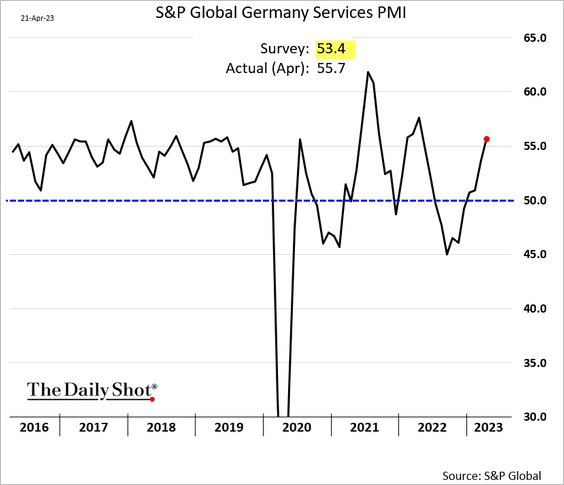

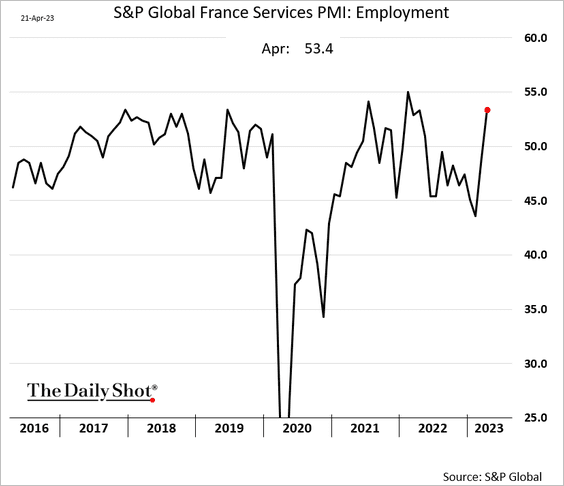

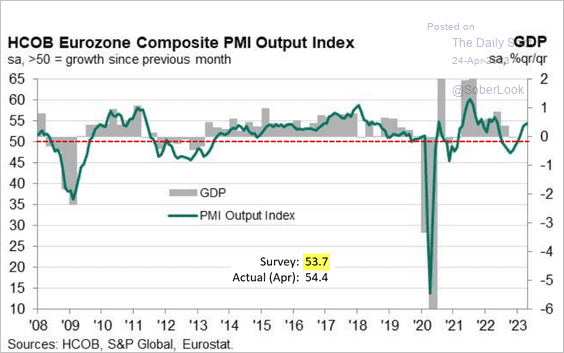

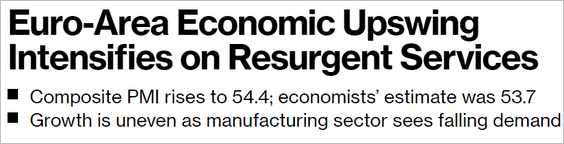

• On the other hand, service companies reported robust growth, topping expectations.

– Germany:

– France:

• Here is the composite indicator, with services driving growth.

Source: S&P Global PMI

Source: S&P Global PMI

Source: @WeberAlexander, @economics Read full article

Source: @WeberAlexander, @economics Read full article

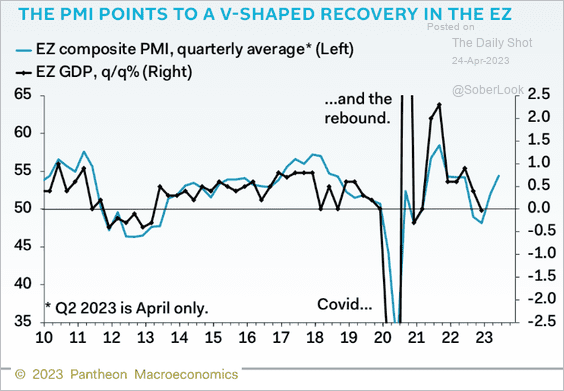

• The PMI report points to a GDP rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

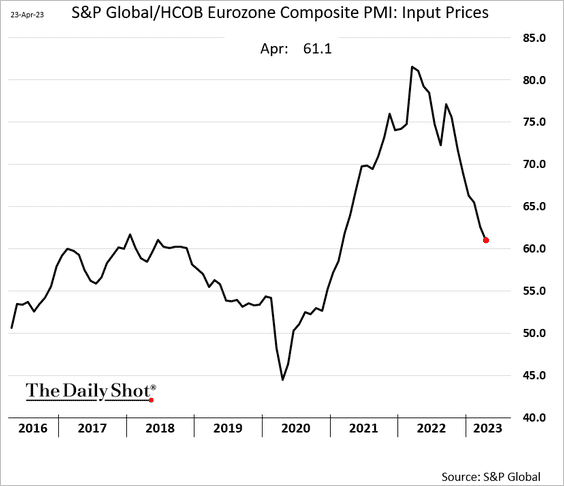

• Price pressures continue to moderate.

——————–

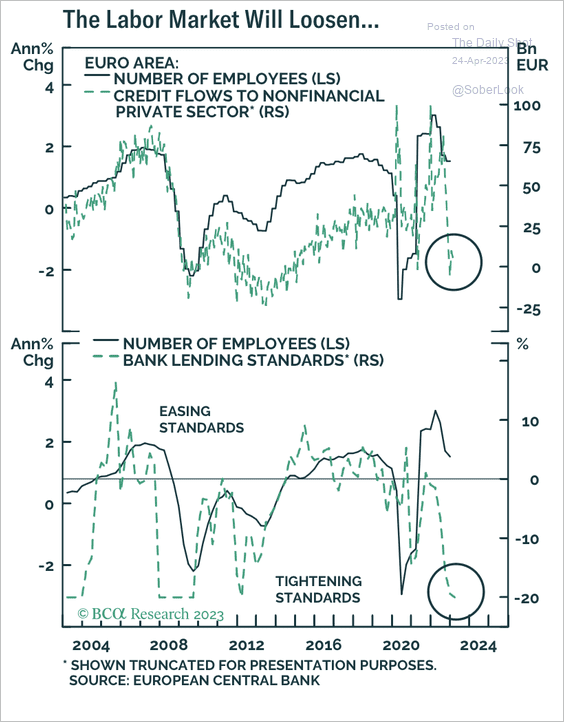

2. Employment growth should weaken in response to the decline in credit flows.

Source: BCA Research

Source: BCA Research

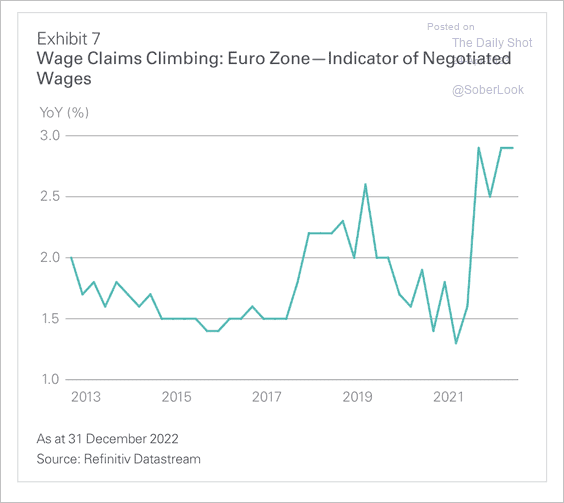

3. Workers have been demanding higher wages to counter real income losses.

Source: Lazard Asset Management

Source: Lazard Asset Management

Back to Index

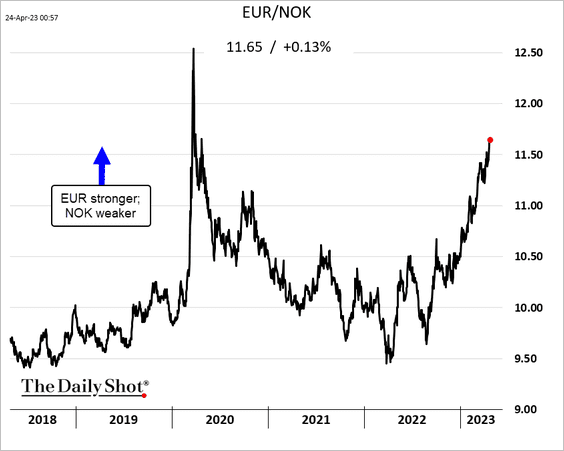

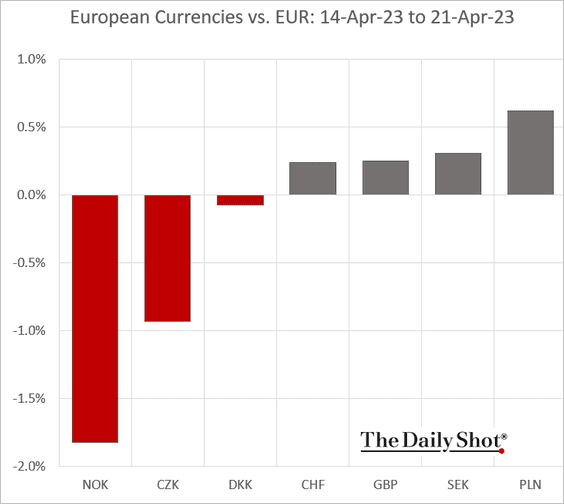

Europe

1. The Norwegian krone continues to weaken.

——————–

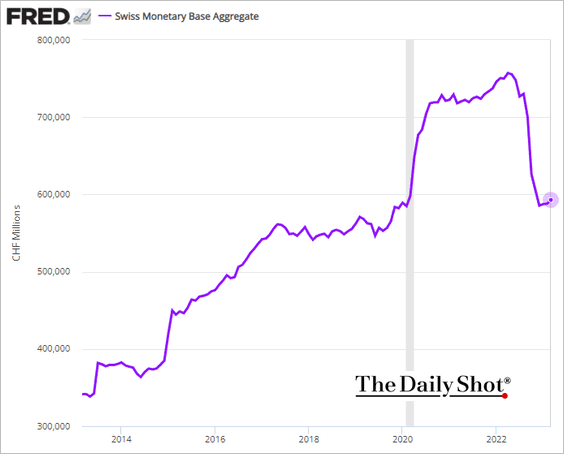

2. The Swiss monetary base has stabilized near pre-COVID levels.

Back to Index

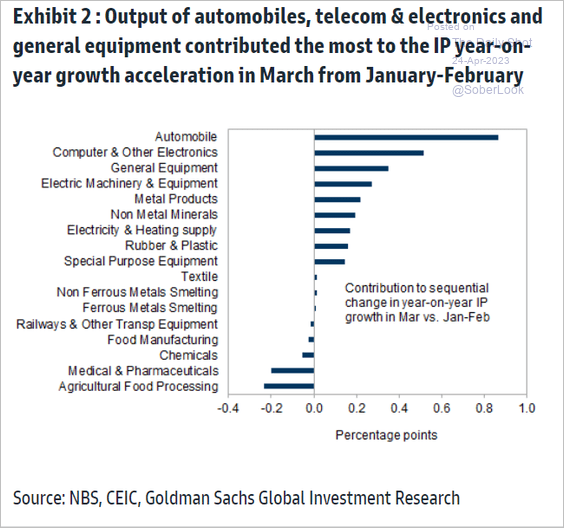

China

1. This chart shows the drivers of gains in March industrial production.

Source: Goldman Sachs

Source: Goldman Sachs

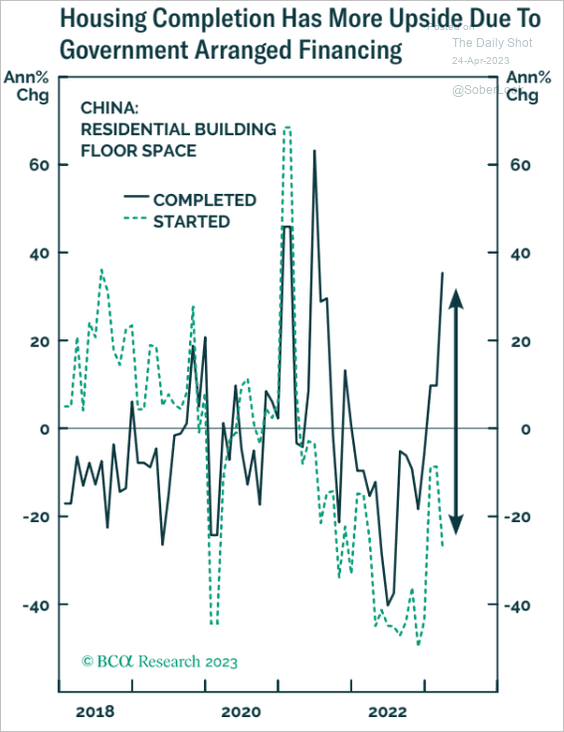

2. There are a lot of construction projects to complete as Beijing provides financing.

Source: BCA Research

Source: BCA Research

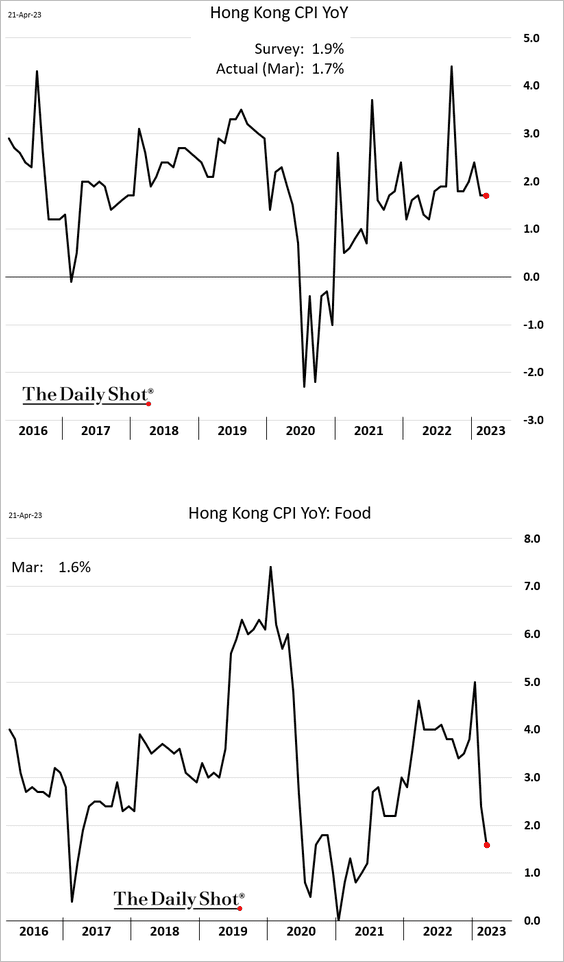

3. Hong Kong’s CPI was lower than expected in March.

Back to Index

Emerging Markets

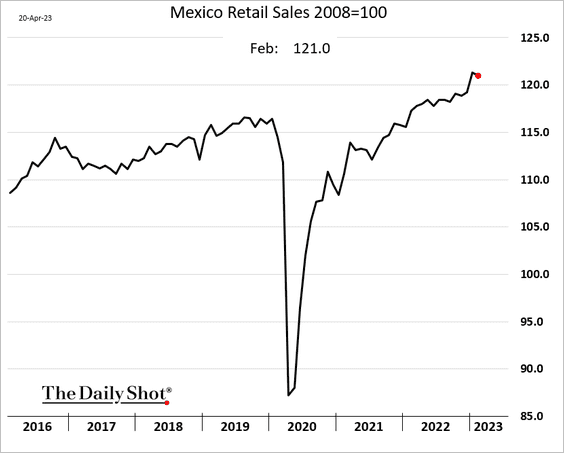

1. Mexico’s retail sales eased in February but remained elevated.

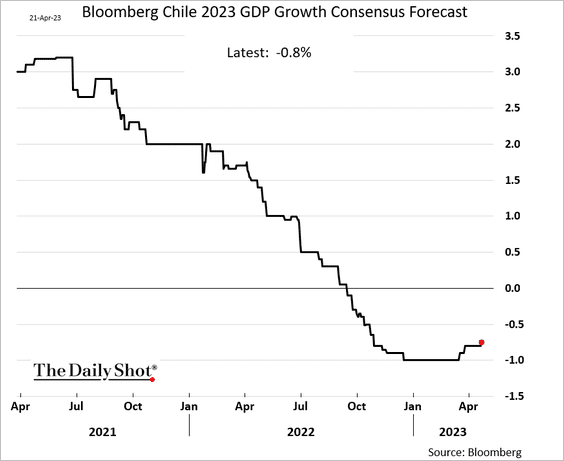

2. Economists continue to boost Chile’s GDP forecast, but a 2023 recession remains in the cards.

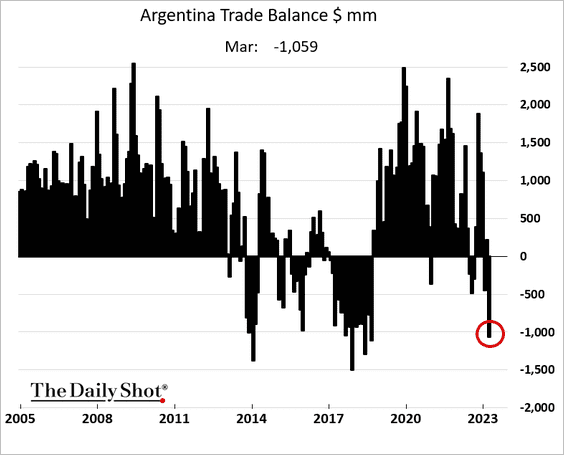

3. Argenitna’s trade deficit hit a multi-year high in March.

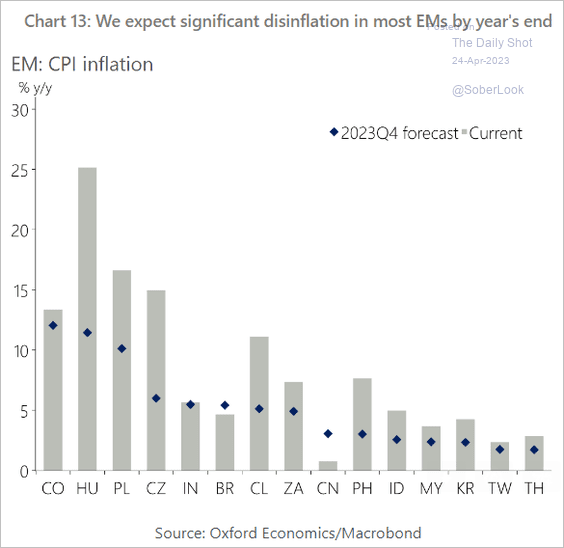

4. This chart shows 2023 CPI forecasts from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

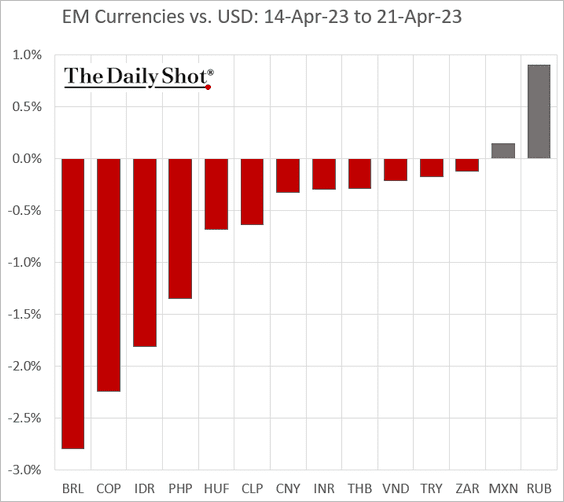

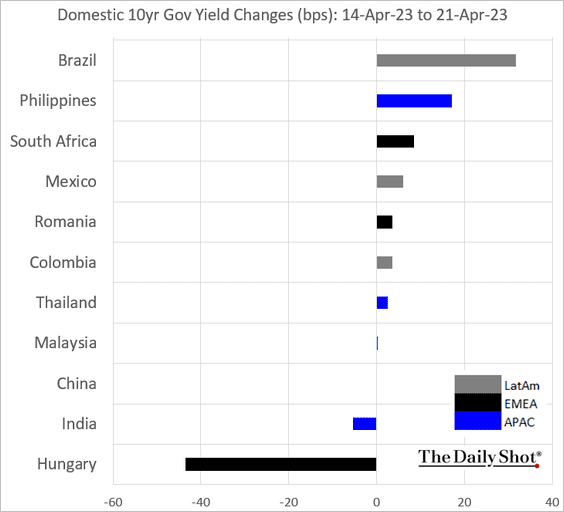

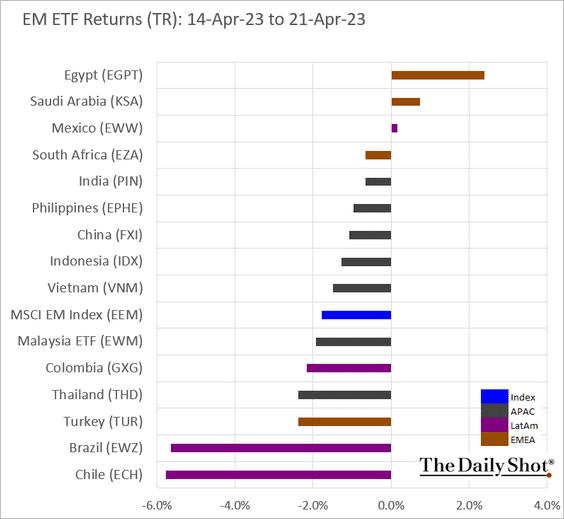

5. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

Commodities

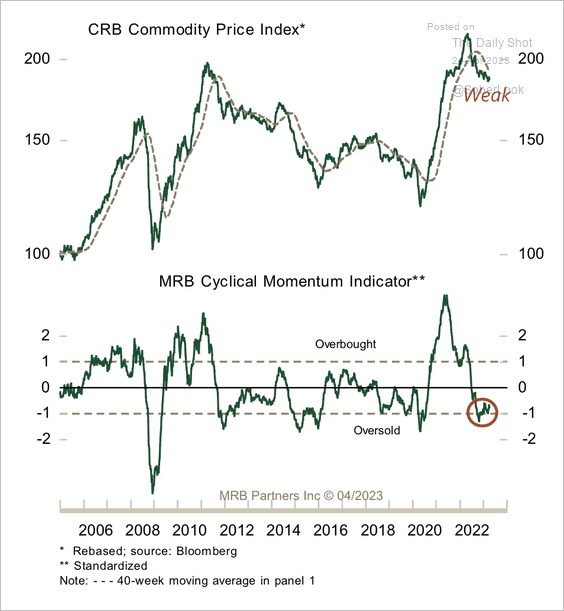

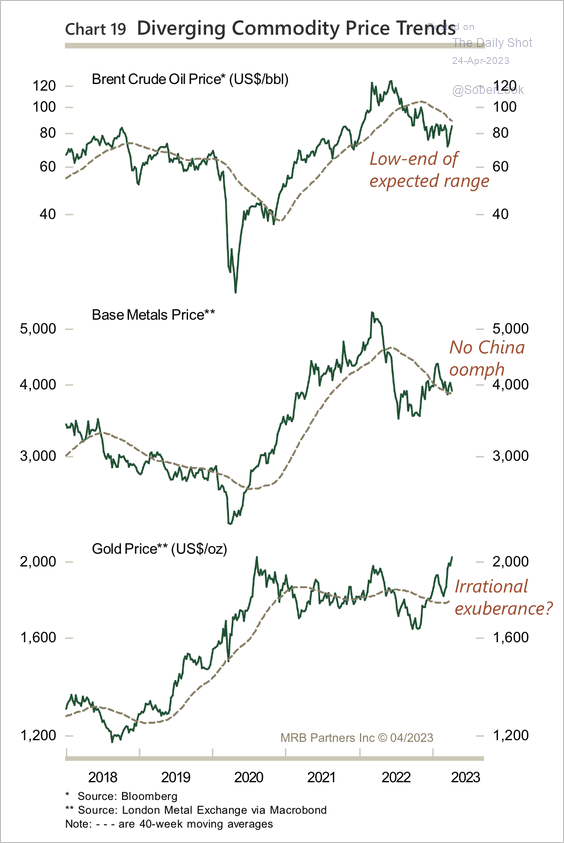

1. The CRB Commodity Price Index appears oversold, although underlying trends have diverged. (2 charts)

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

——————–

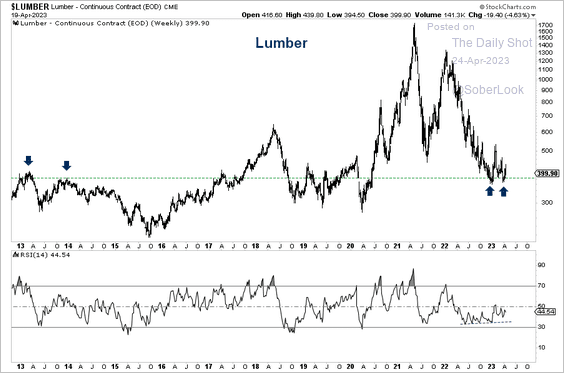

2. The lumber futures price is testing support.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

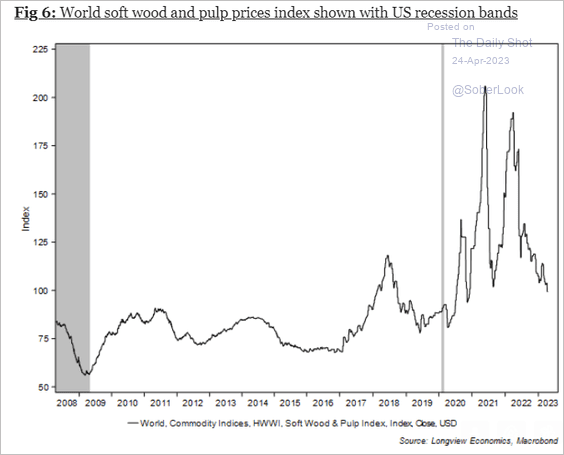

This chart shows the wood & pulp price index.

Source: Longview Economics

Source: Longview Economics

——————–

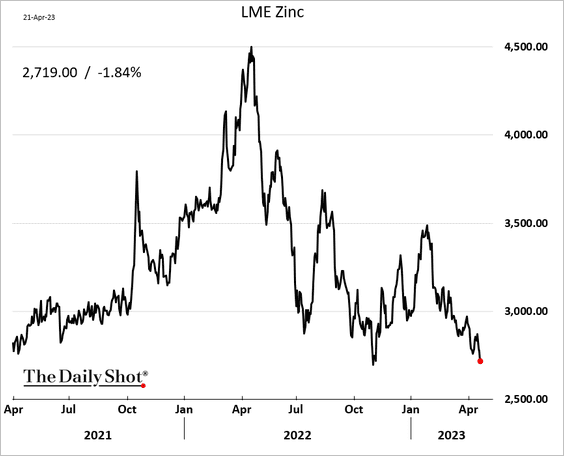

3. Zinc prices have been falling.

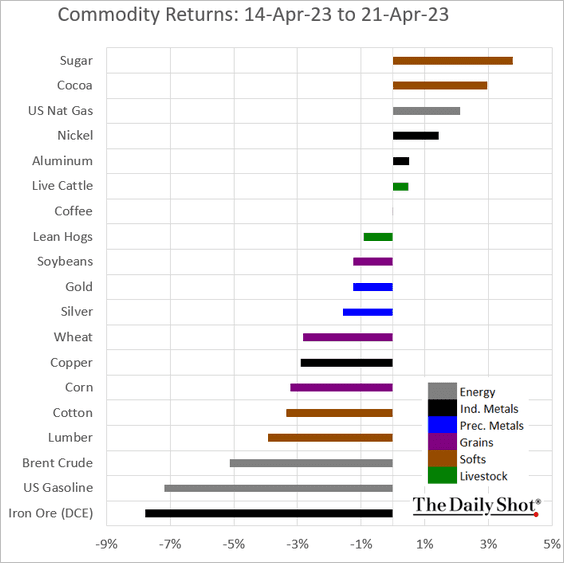

4. Here is last week’s performance across key commodity markets.

Back to Index

Equities

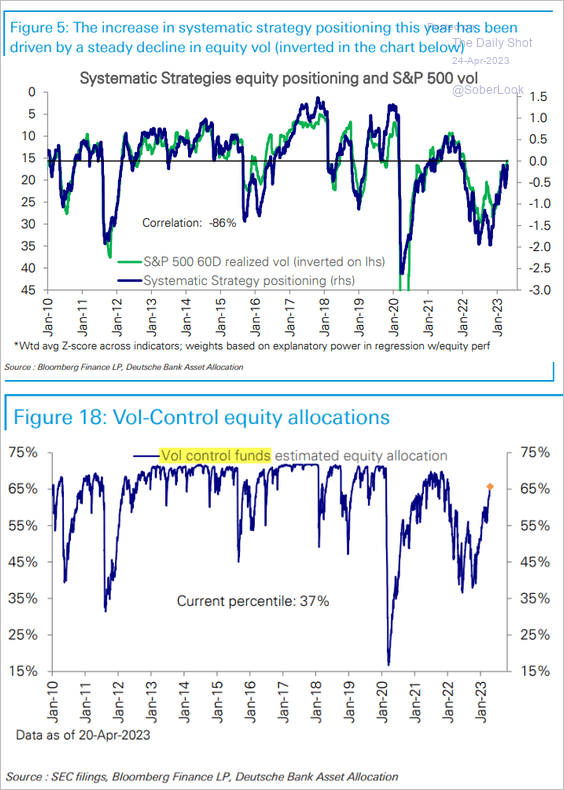

1. Reduced market volatility has been increasing systematic strategies’ positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

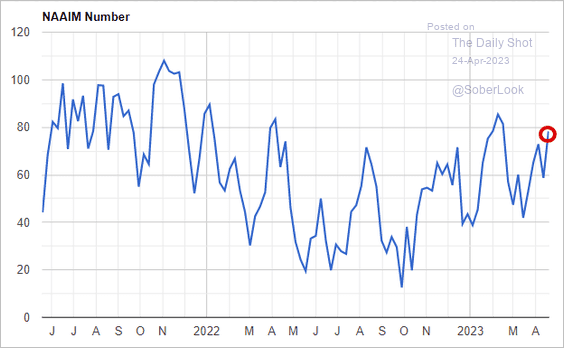

2. Investment managers have been boosting exposure to stocks.

Source: NAAIM

Source: NAAIM

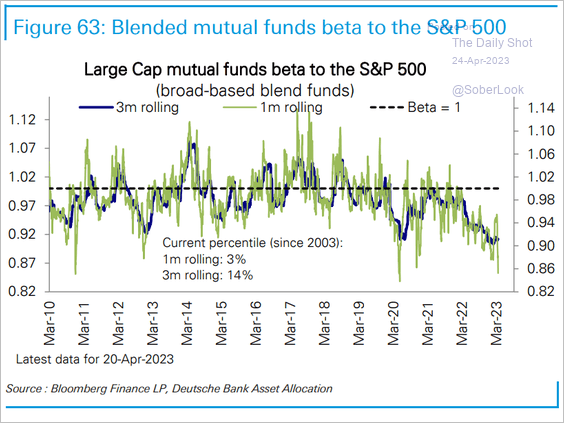

Large-cap mutual funds remain cautious.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

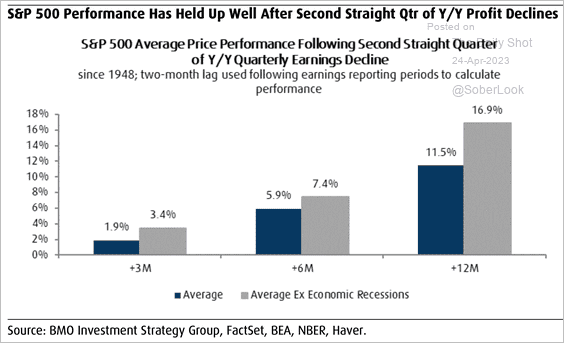

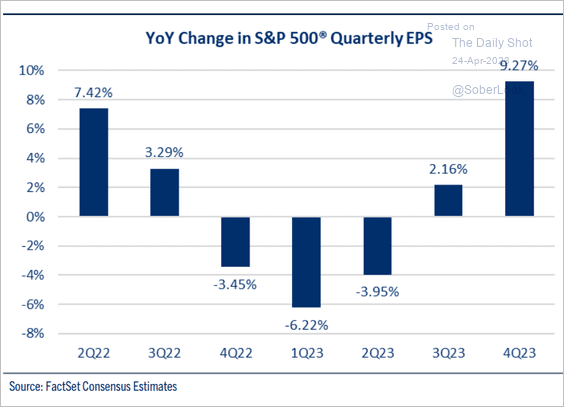

3. A second straight quarter of year-over-year profit declines is not necessarily a headwind for stock prices.

Source: BMO; @SamRo, @TKerLLC

Source: BMO; @SamRo, @TKerLLC

What about a third down quarter?

Source: Comerica Wealth Management

Source: Comerica Wealth Management

——————–

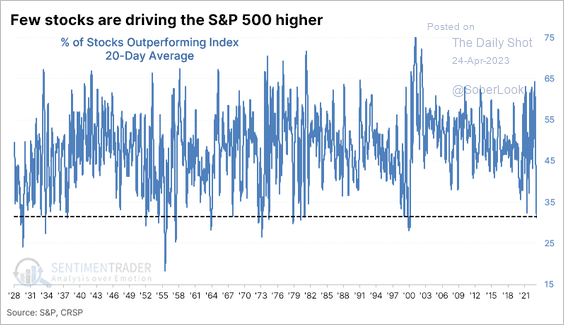

4. Market breadth has been weak. On average, only 30% of stocks have outperformed the S&P 500 over the past 20 days, the lowest reading since 1999.

Source: SentimenTrader

Source: SentimenTrader

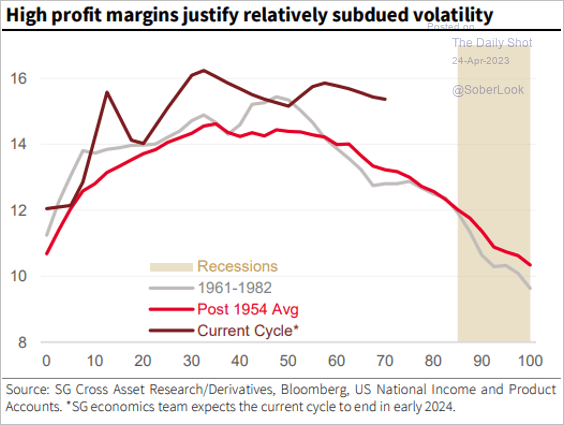

5. Do elevated profit margins justify lower volatility?

Source: SocGen; @GunjanJS; h/t @dailychartbook

Source: SocGen; @GunjanJS; h/t @dailychartbook

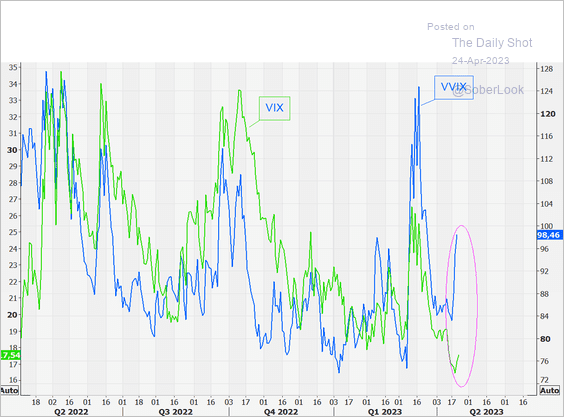

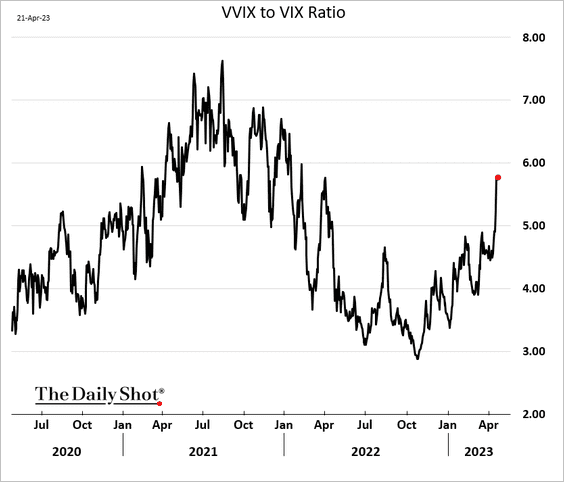

6. VVIX (implied volatility index of VIX options) has risen even as VIX declines. It indicates increased demand for VIX call options.

Source: @themarketear

Source: @themarketear

——————–

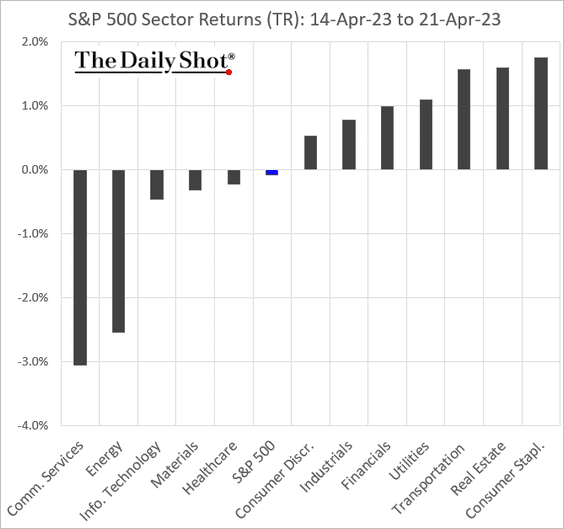

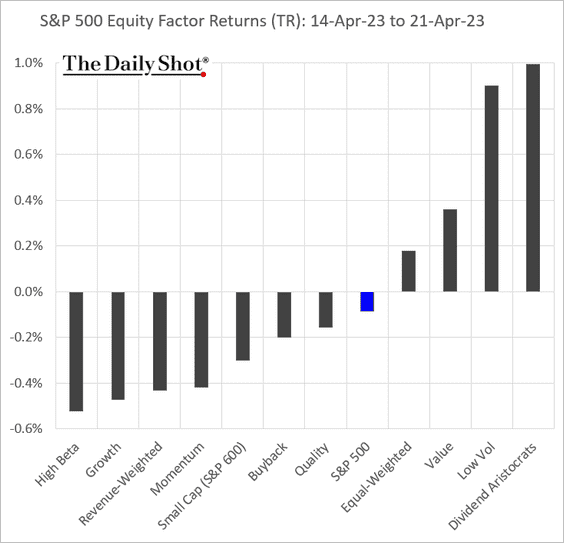

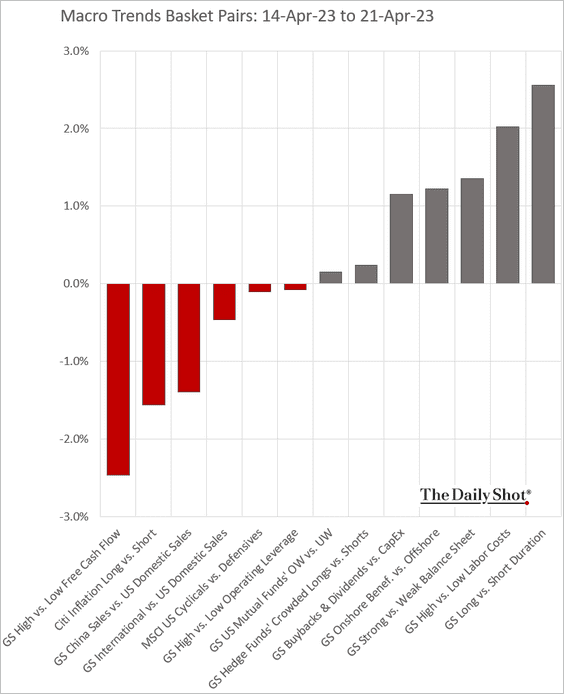

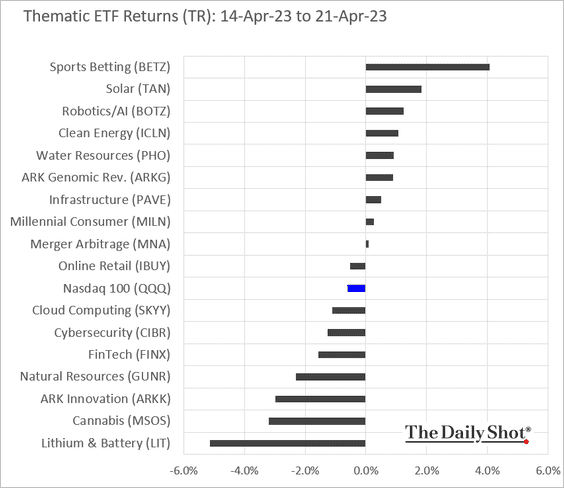

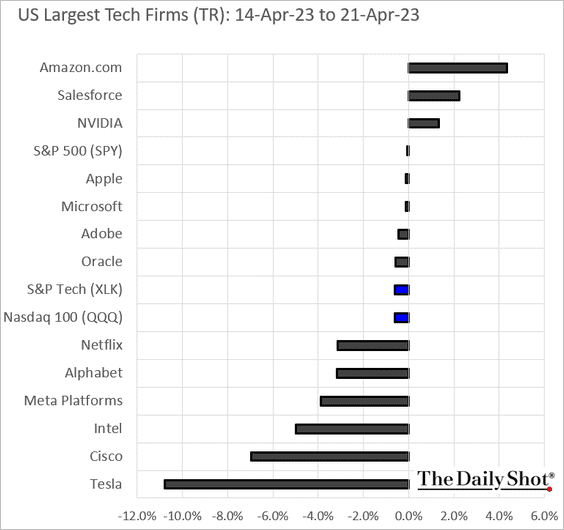

7. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

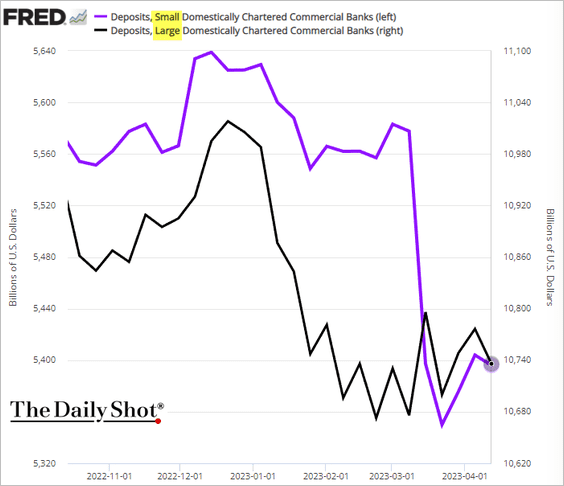

1. Bank deposits declined during the week ending on the 12th.

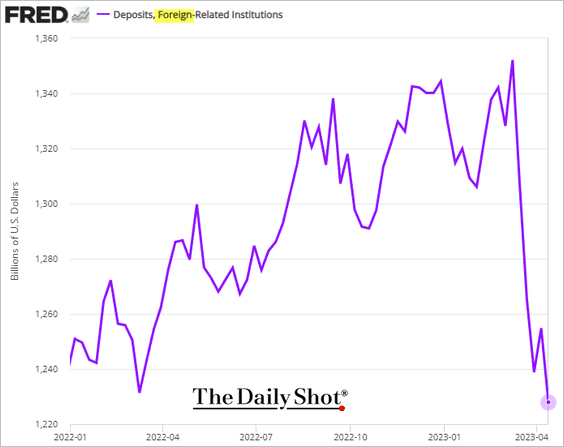

This chart shows foreign banks’ USD deposits.

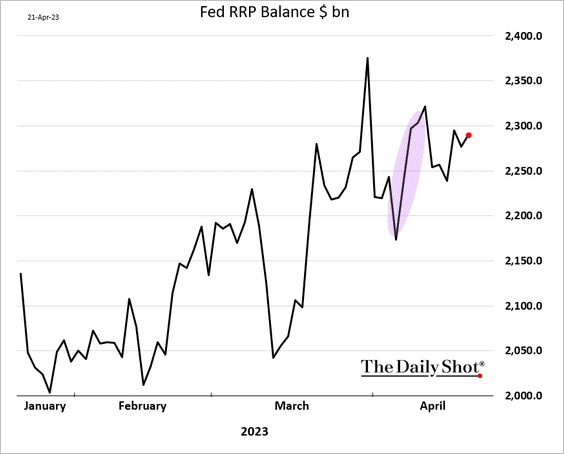

The decline was driven by an increase in the Fed’s RRP facility usage (highlighted).

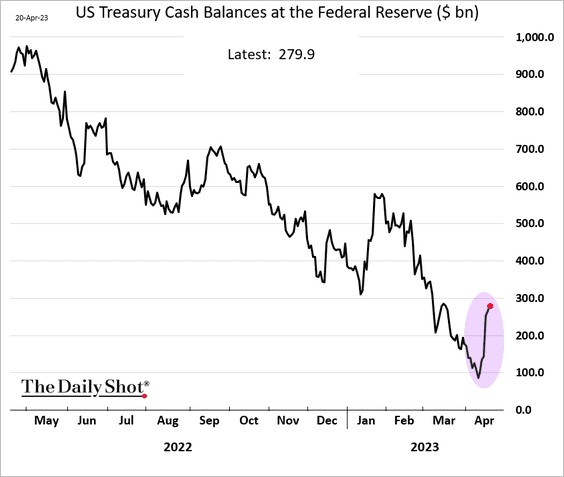

Another trend that will put downward pressure on bank deposits is the increase in the Treasury’s cash balance at the Fed (due to tax receipts).

——————–

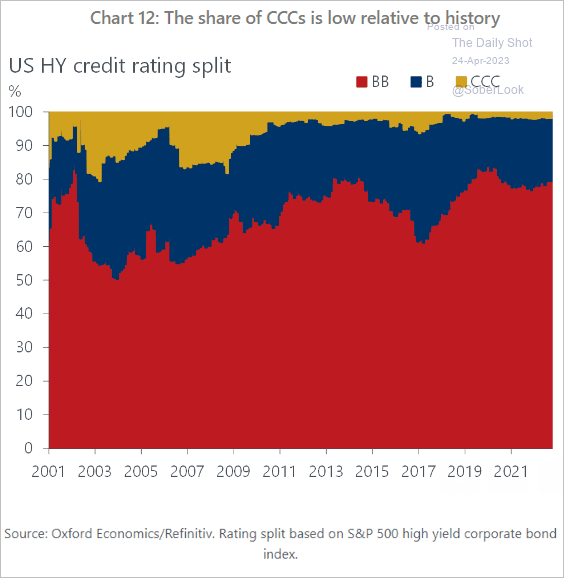

2. Next, we have the high-yield market by rating.

Source: Oxford Economics

Source: Oxford Economics

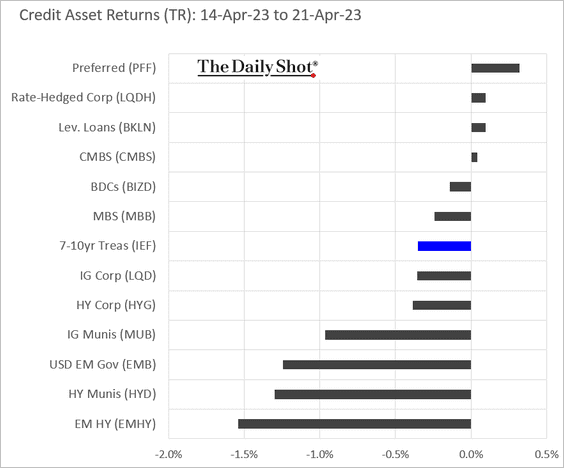

3. Here is last week’s performance by asset class.

Back to Index

Rates

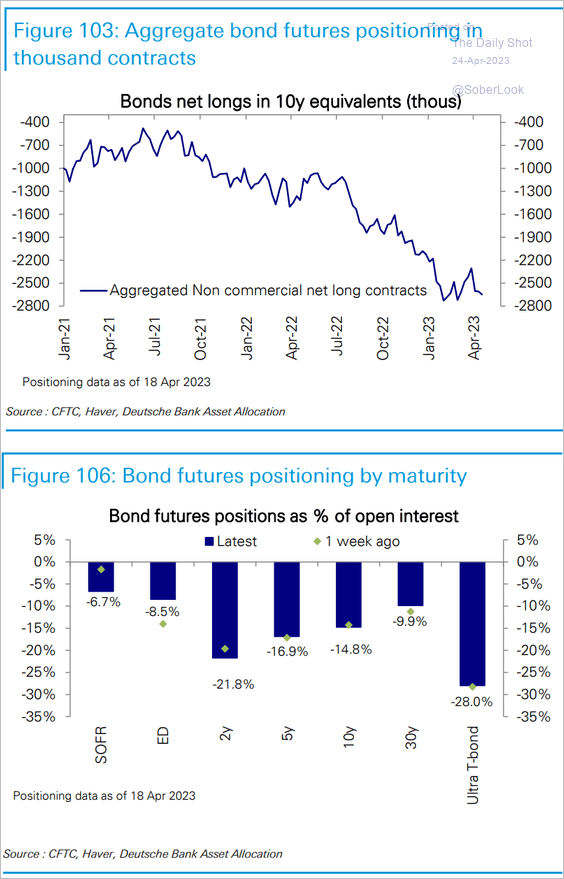

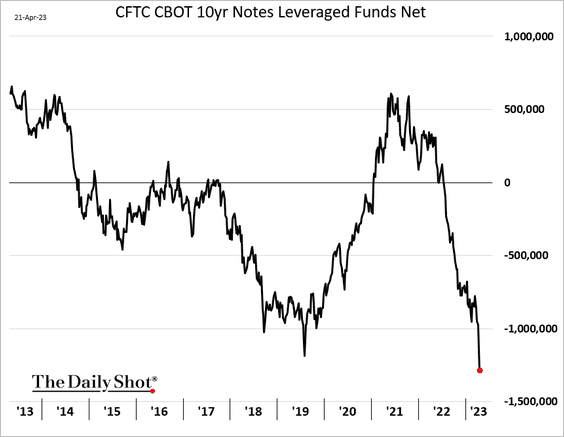

1. Speculative investors’ net-short positioning in interest rate futures is still near extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Here is the positioning in the 10yr note futures.

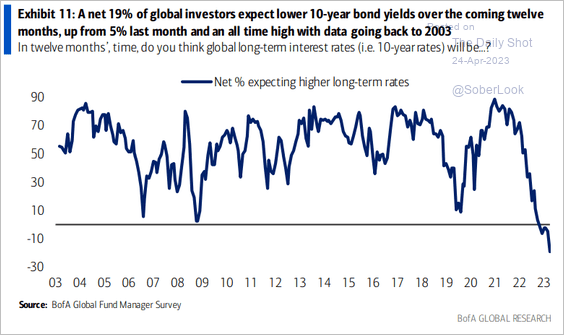

2. However, investors expect longer rates to decline, …

Source: BofA Global Research

Source: BofA Global Research

… with fixed-income portfolio managers becoming bullish on bonds (target durations exceeding actuals).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

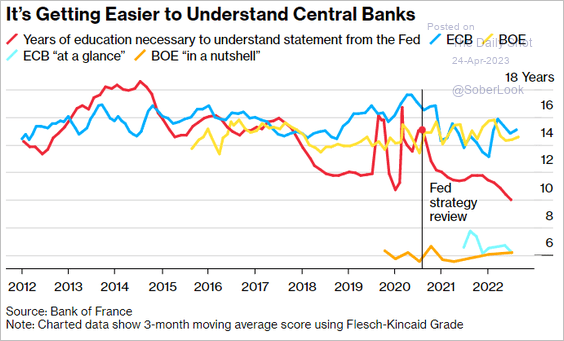

3. Fed statements have become easier to understand.

Source: @WHorobin, @economics Read full article

Source: @WHorobin, @economics Read full article

Back to Index

Global Developments

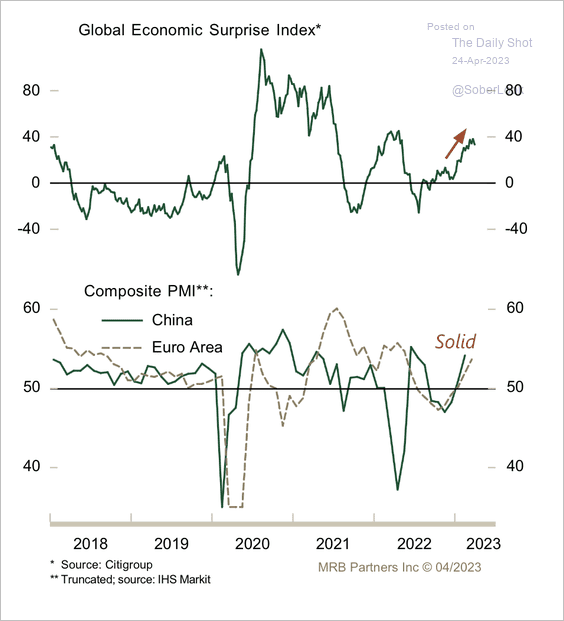

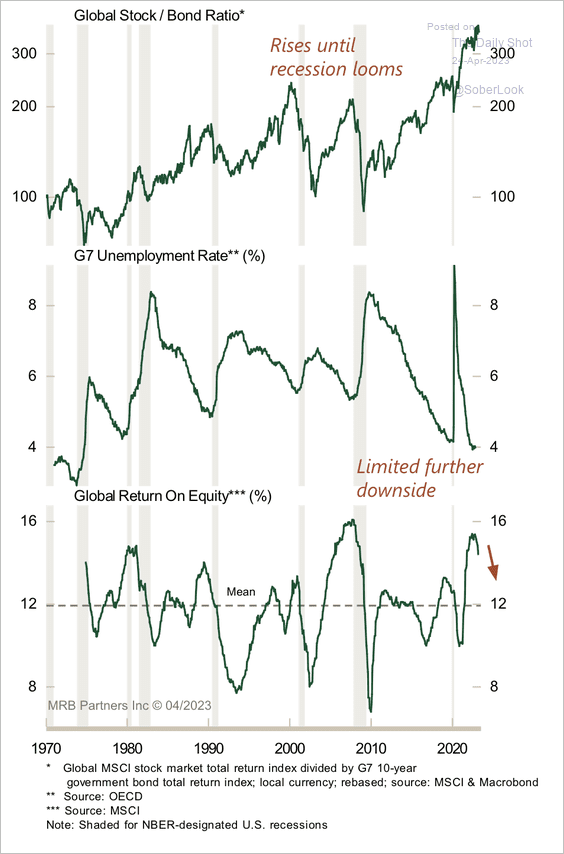

1. Global economic momentum remains solid, …

Source: MRB Partners

Source: MRB Partners

… although some indicators suggest late-cycle/recessionary conditions.

Source: MRB Partners

Source: MRB Partners

——————–

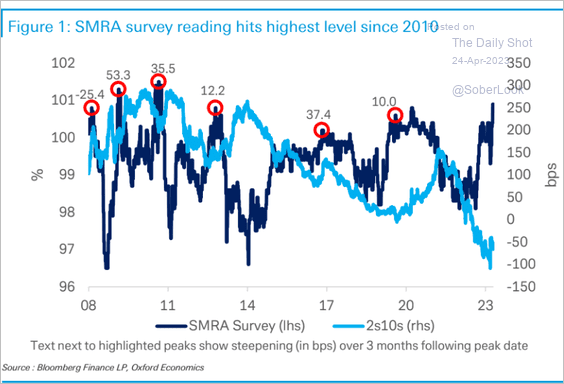

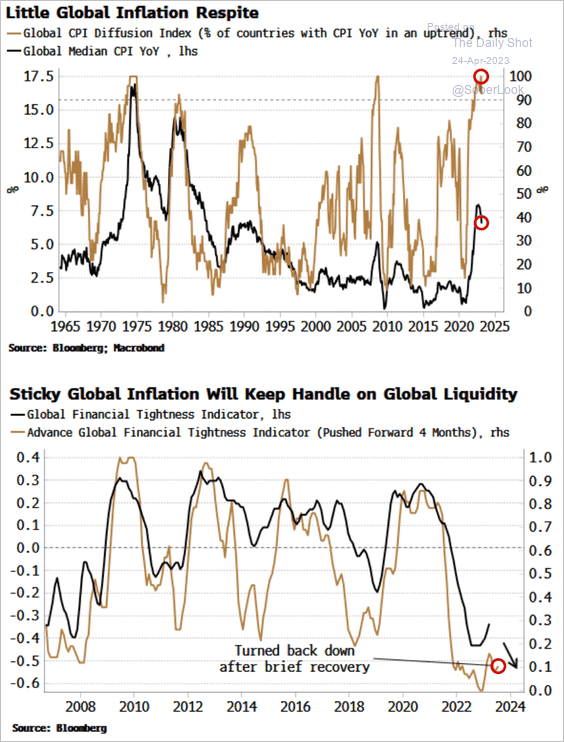

2. Persistently high inflation is compelling central banks to maintain tight liquidity.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

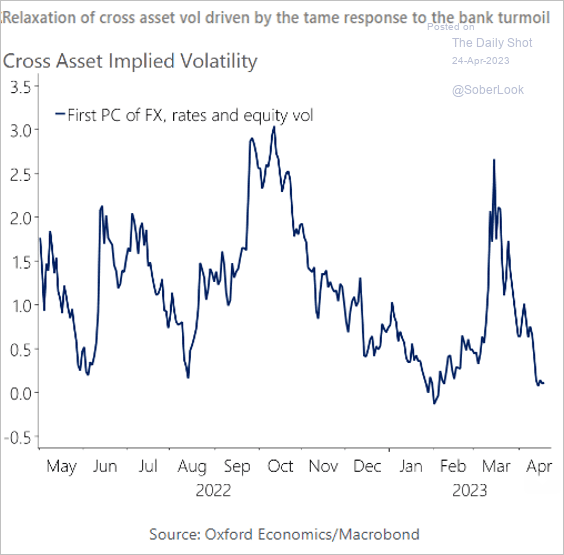

3. Volatility is down across major asset classes.

Source: Oxford Economics

Source: Oxford Economics

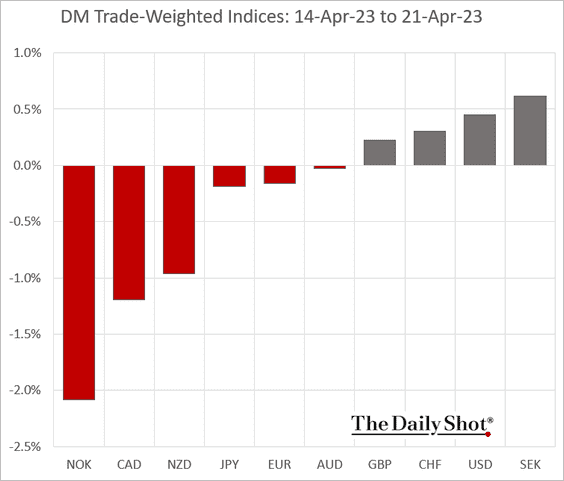

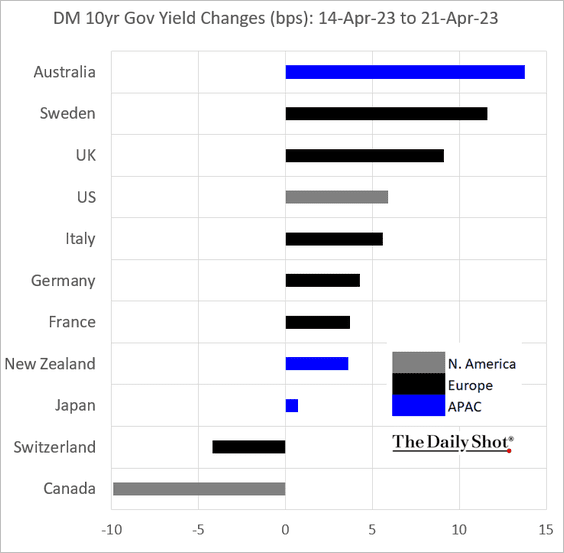

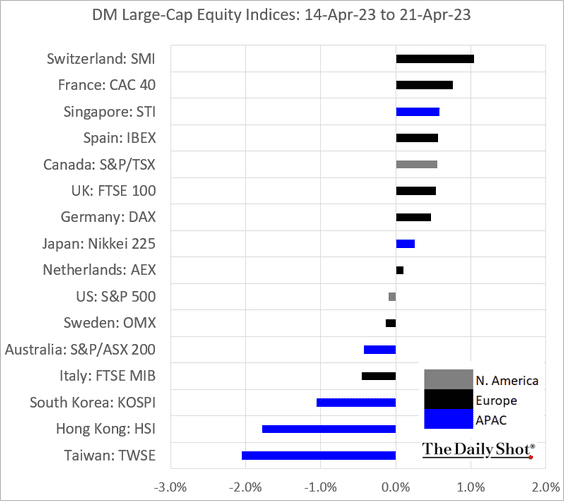

4. Here is last week’s market performance in select advanced economies.

• Currency indices:

• Bond yields:

• Large-cap equity indices:

——————–

Food for Thought

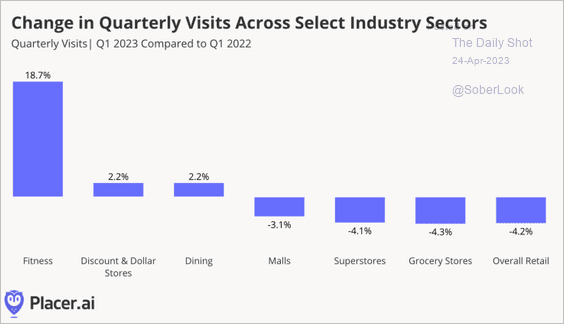

1. Year-on-year changes in visits to retail and services establishments:

Source: Placer.ai

Source: Placer.ai

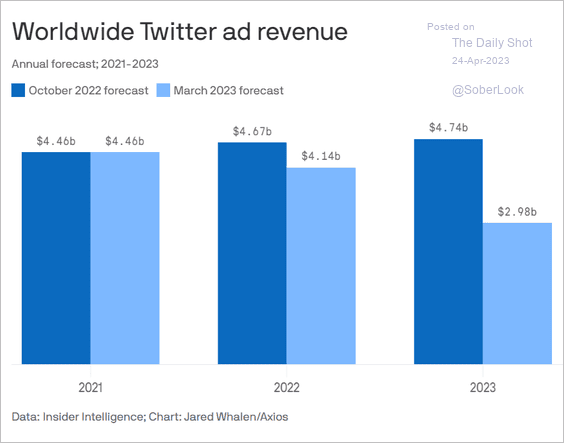

2. Twitter ad revenue:

Source: @axios Read full article

Source: @axios Read full article

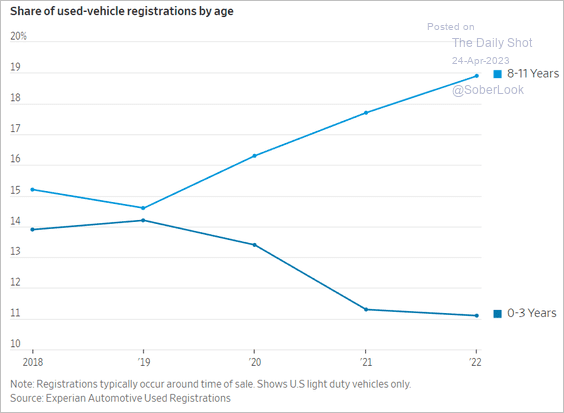

3. Aging used-car fleet in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

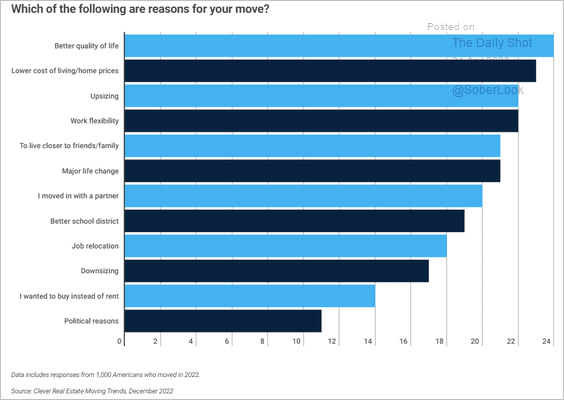

4. Reasons for moving:

Source: Home Bay; h/t Walter Read full article

Source: Home Bay; h/t Walter Read full article

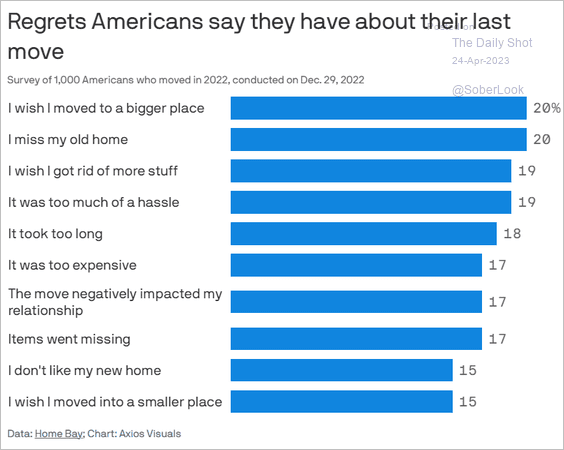

Regrets about moving:

Source: @axios Read full article

Source: @axios Read full article

——————–

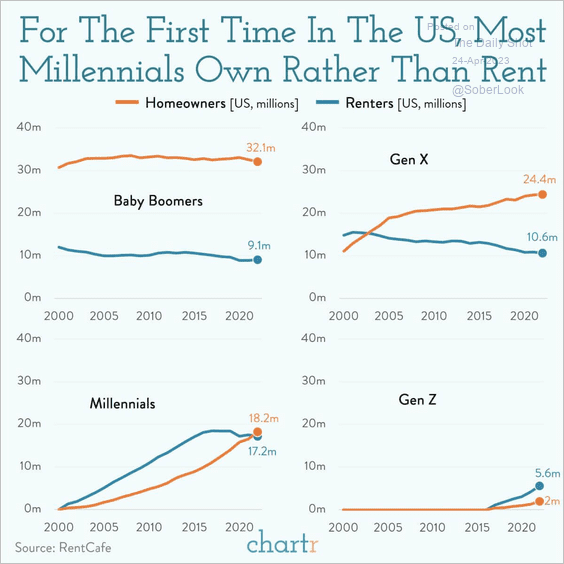

5. Homeowners vs. renters:

Source: @chartrdaily

Source: @chartrdaily

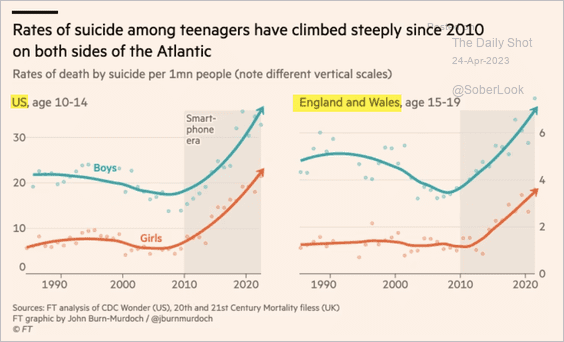

6. Teen suicide rates:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

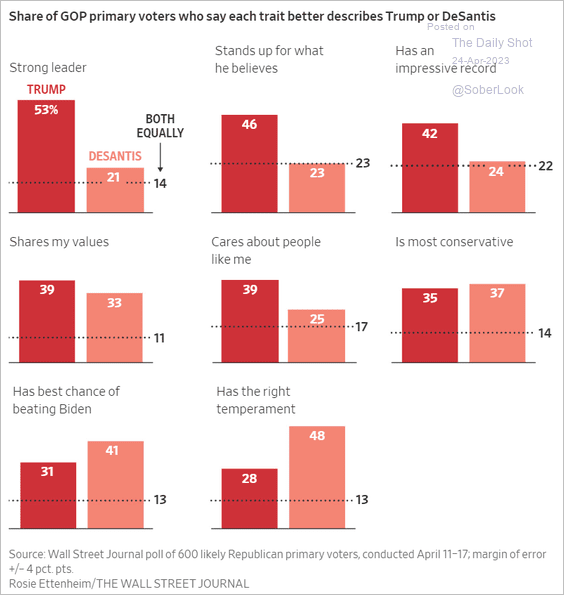

7. GOP primary voters’ views on Trump and DeSantis:

Source: @WSJ Read full article

Source: @WSJ Read full article

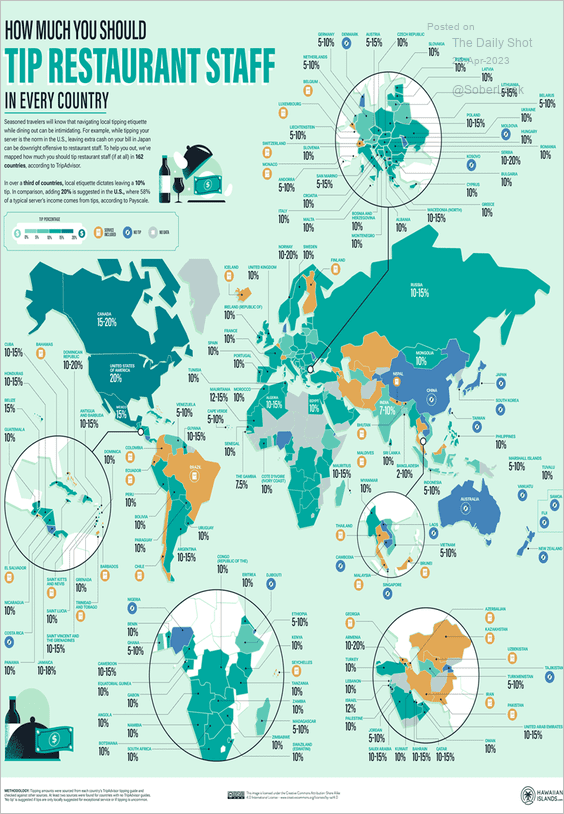

8. How much should you tip In each country?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index