The Daily Shot: 25-Apr-23

• The United States

• The Eurozone

• Europe

• Asia -Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

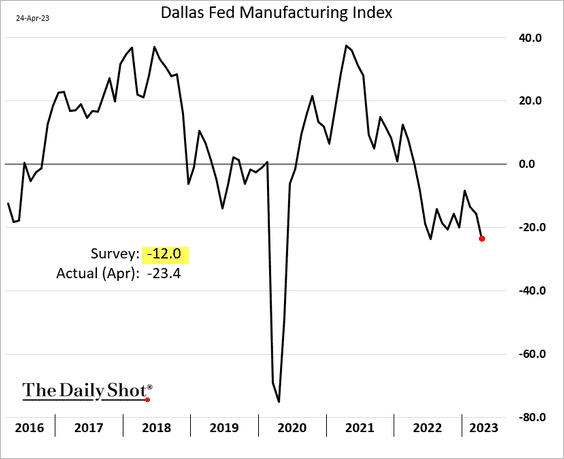

1. The Dallas Fed’s regional manufacturing index moved deeper into contraction territory this month.

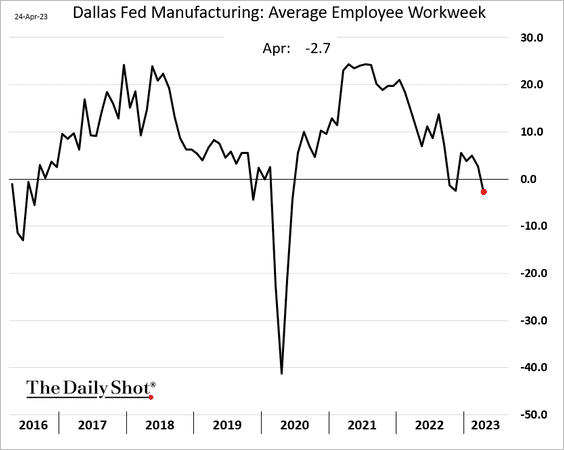

• Factories are once again reducing workers’ hours.

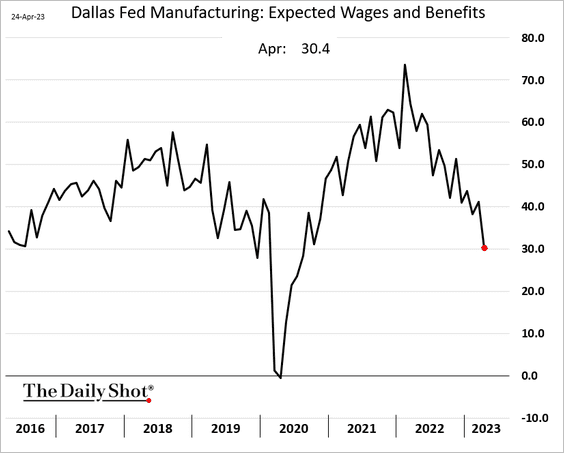

• Fewer companies expect to be raising wages.

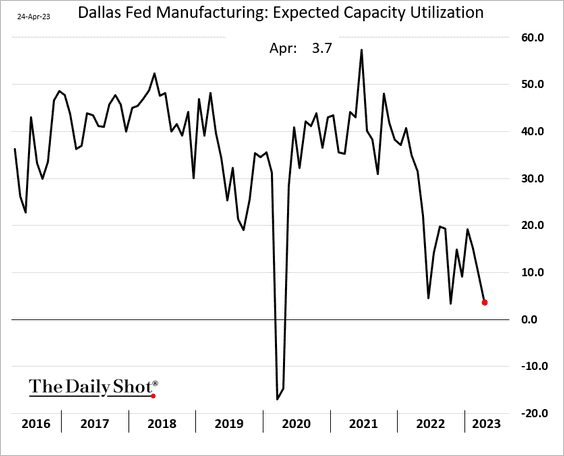

• Very few firms expect an increase in capacity utilization.

——————–

2. Next, we have some updates on the US consumer.

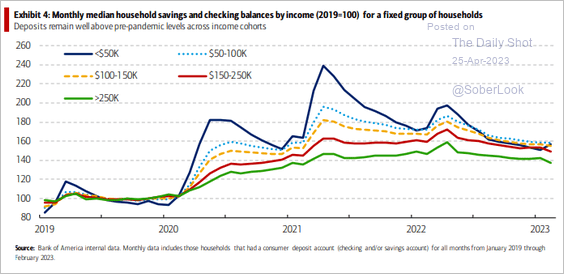

• Consumer deposit balances remain elevated, according to BofA data.

Source: BofA Global Research

Source: BofA Global Research

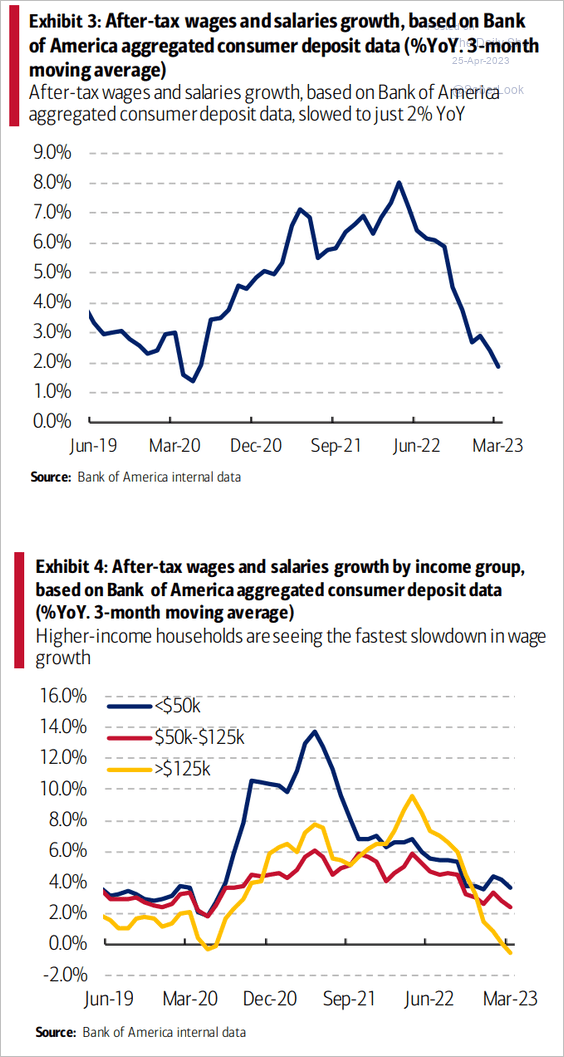

• BofA bank deposits signal slower wage growth.

Source: BofA Global Research

Source: BofA Global Research

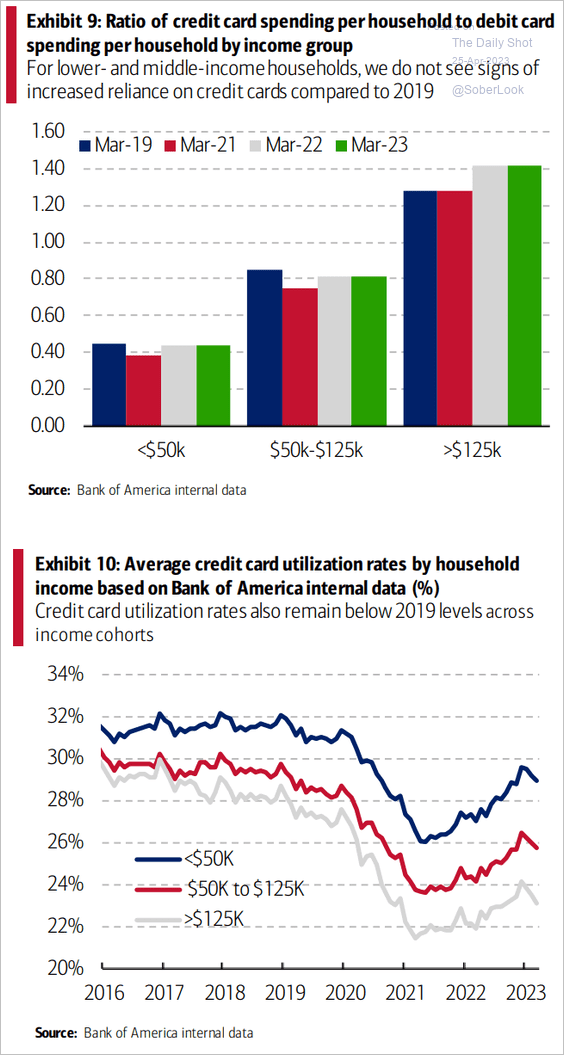

• Reliance on credit cards hasn’t increased much (despite the media hype).

Source: BofA Global Research

Source: BofA Global Research

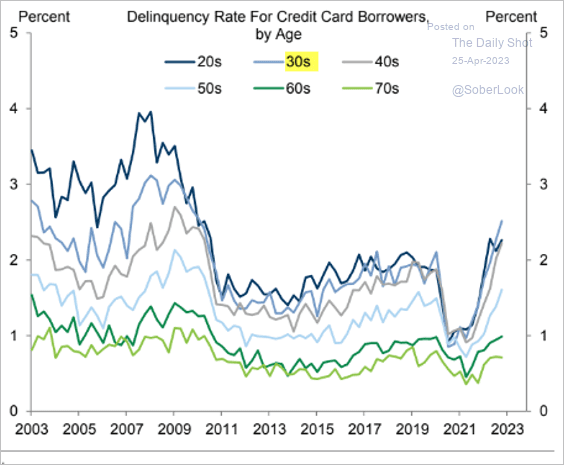

• But credit card delinquencies are rising.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

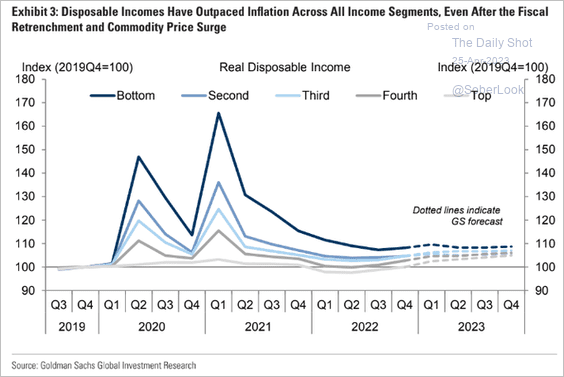

• Disposable incomes are outpacing inflation.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

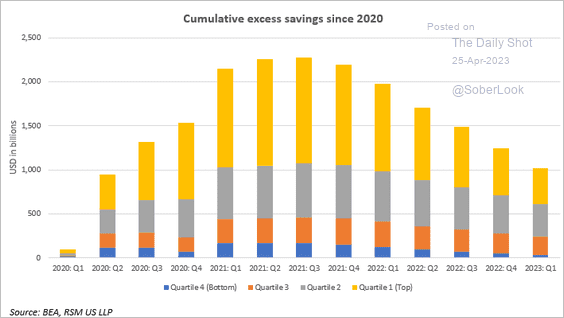

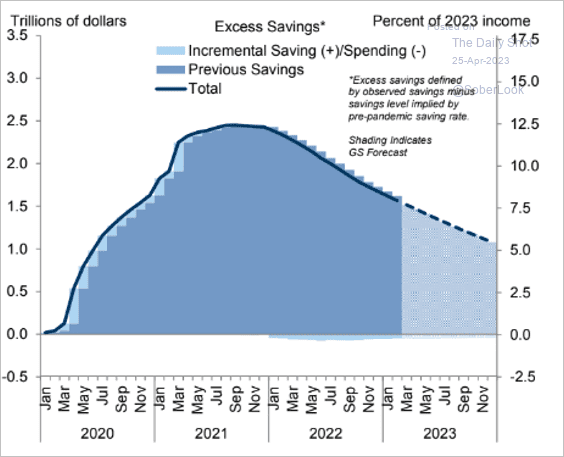

• Here are a couple of updates on excess savings.

Source: The Real Economy Blog

Source: The Real Economy Blog

Source: Goldman Sachs

Source: Goldman Sachs

——————–

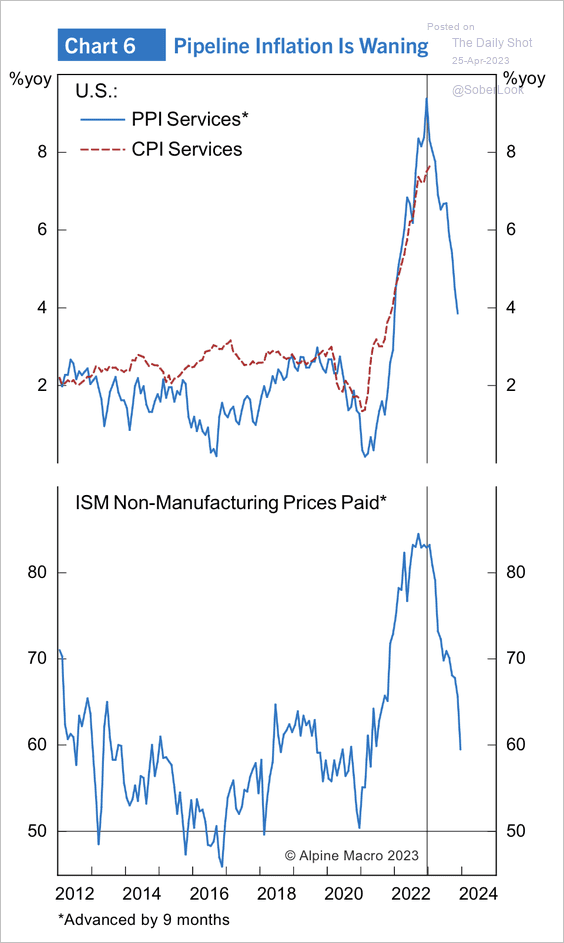

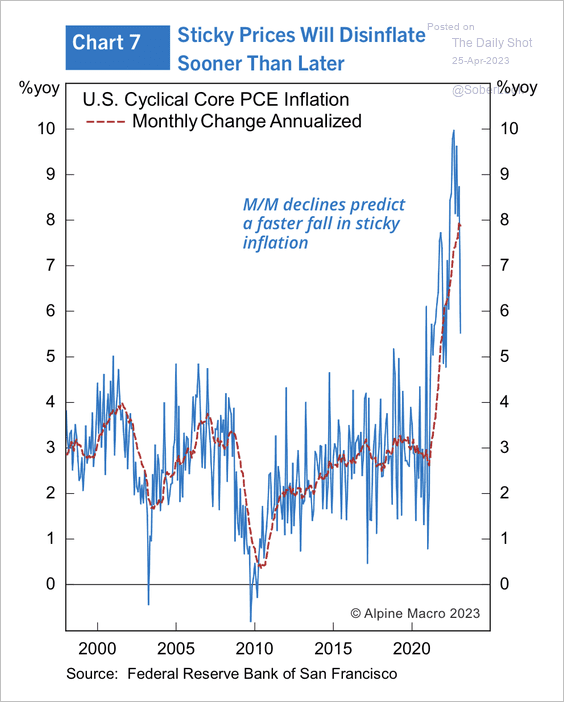

3. Inflationary pressures continue to ease. (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

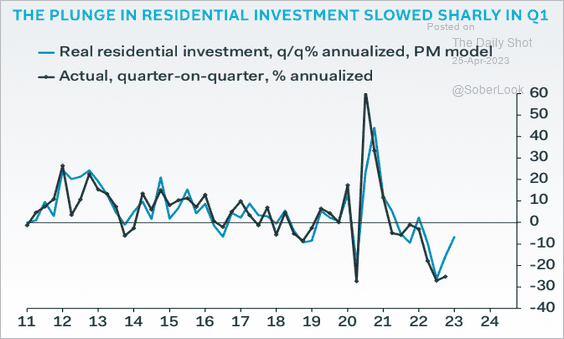

4. Pantheon Macroeconomics sees slower declines in residential investment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

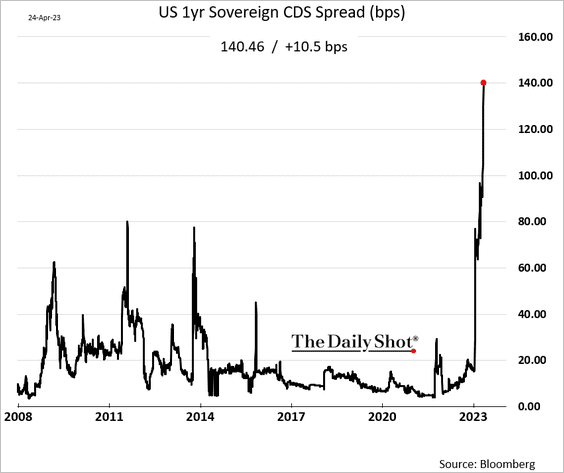

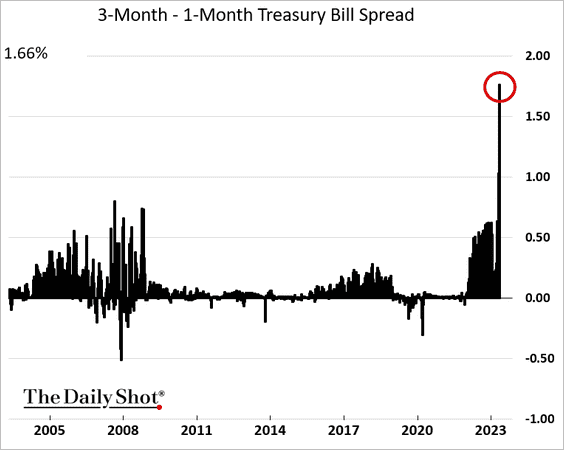

5. Investors are becoming increasingly uneasy with the debt ceiling impasse.

Source: @WSJ Read full article

Source: @WSJ Read full article

The 1-year US sovereign credit default swap spread hit another record high.

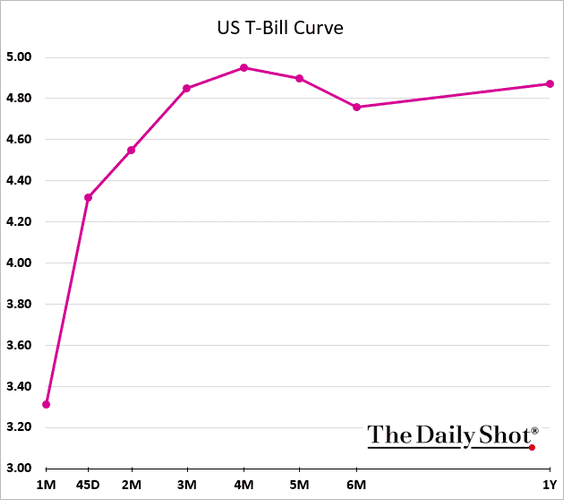

The Treasury bill curve is highly distorted.

Here is the spread between the 3-month and the 1-month bills.

Back to Index

The Eurozone

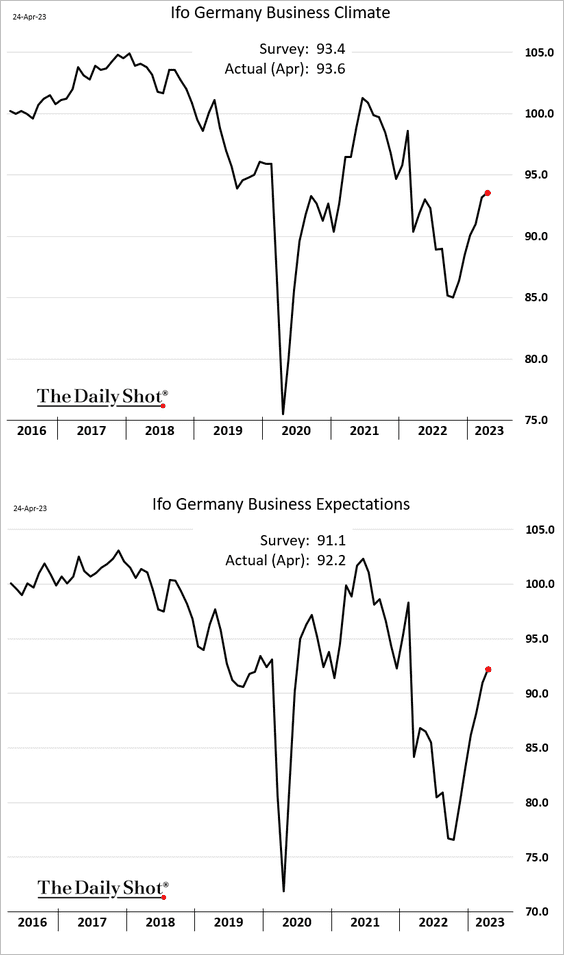

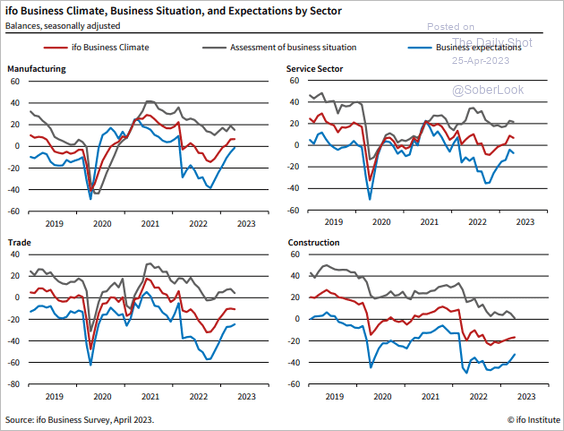

1. Germany’s Ifo Business Expectations index showed further improvement.

Here is the breakdown by sector.

Source: ifo Institute

Source: ifo Institute

——————–

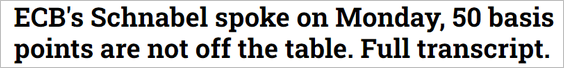

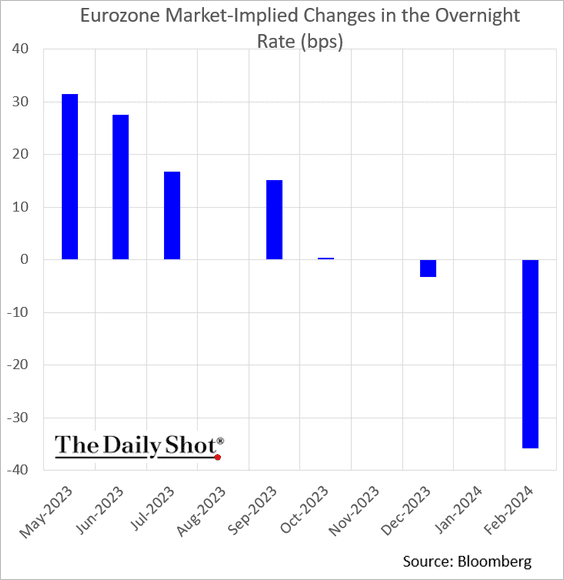

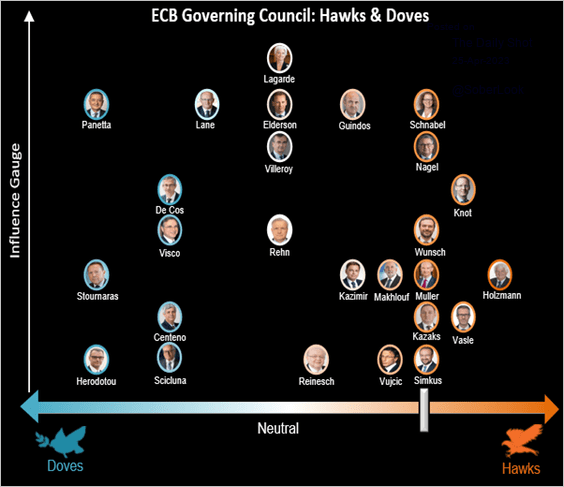

2. Another 50 bps rate hike from the ECB?

Source: ForexLive Read full article

Source: ForexLive Read full article

The market is pricing in a 60-65% probability of such an outcome.

Here is the Governing Council’s dove/hawk spectrum from Bloomberg Economics.

Source: @WeberAlexander, @economics Read full article

Source: @WeberAlexander, @economics Read full article

——————–

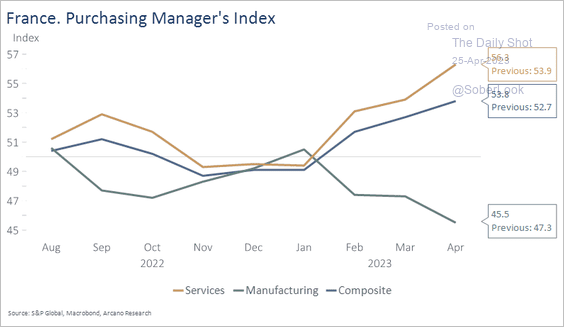

3. This chart illustrates the manufacturing/services PMI divergence in the Eurozone.

Source: Arcano Economics

Source: Arcano Economics

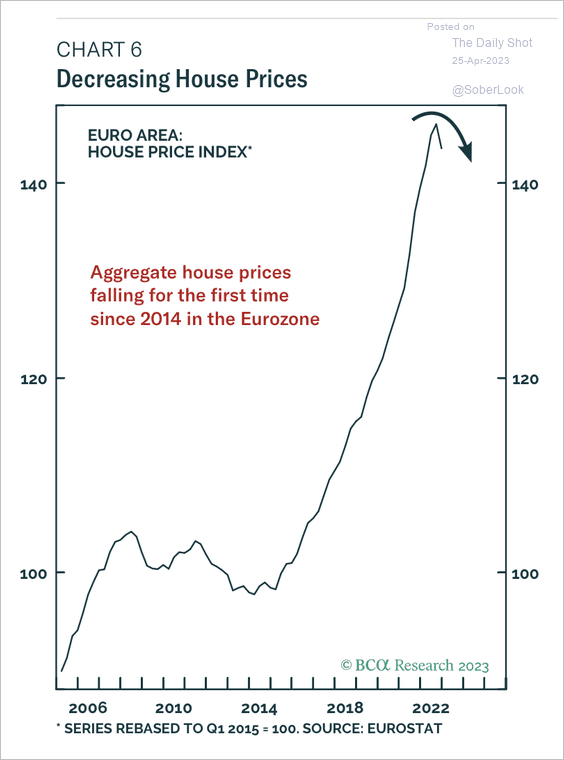

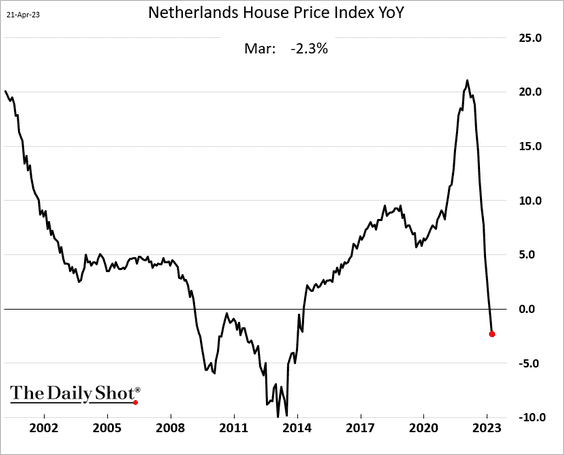

4. Housing prices have peaked, which could cool inflationary forces.

Source: BCA Research

Source: BCA Research

Dutch home prices are now down on a year-over-year basis.

Back to Index

Europe

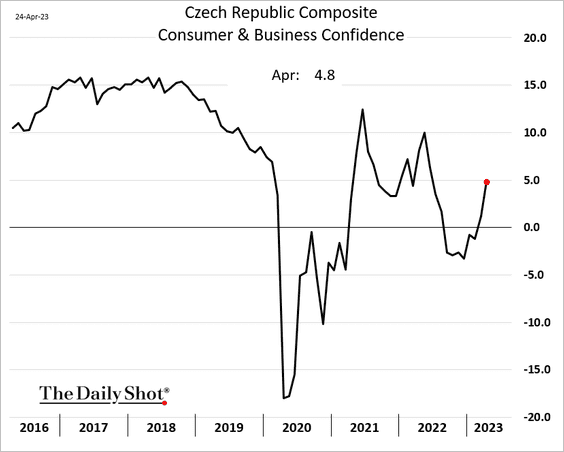

1. Czech Republic’s economic confidence is rebounding.

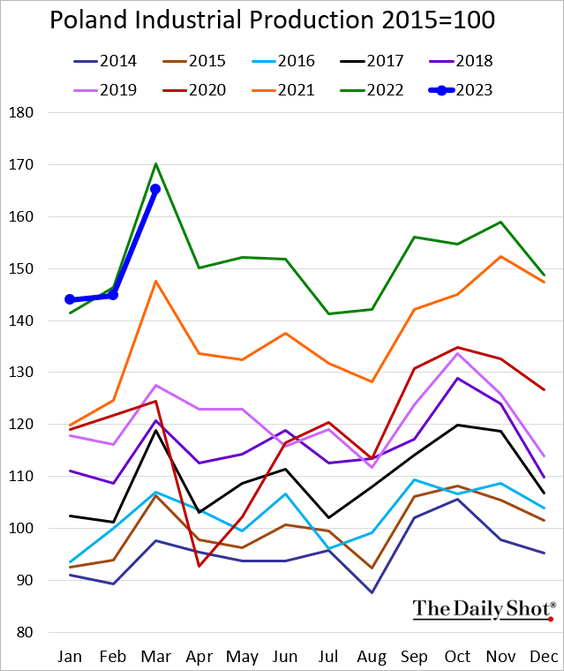

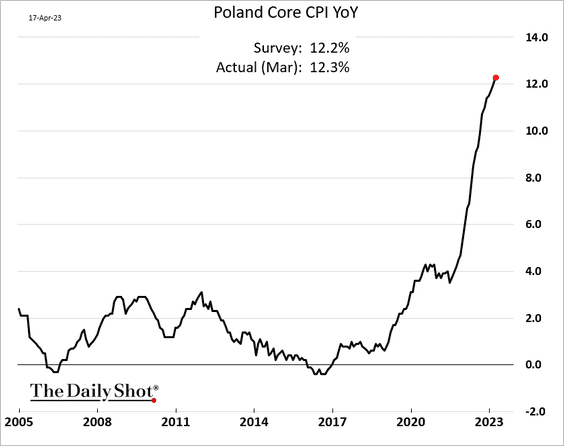

2. Poland’s industrial production dipped below last year’s levels.

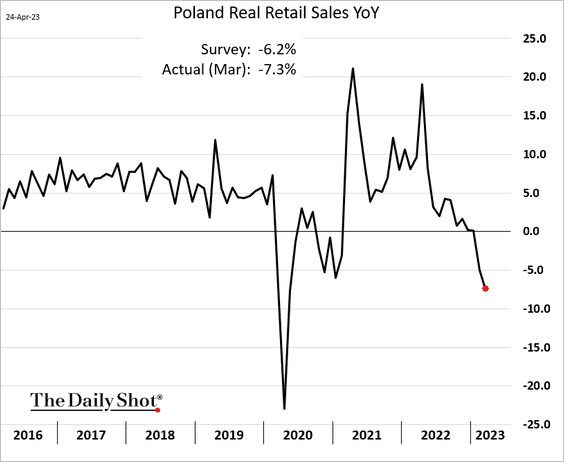

• Poland’s real retail sales are down sharply year-over-year.

• The core CPI continues to climb.

——————–

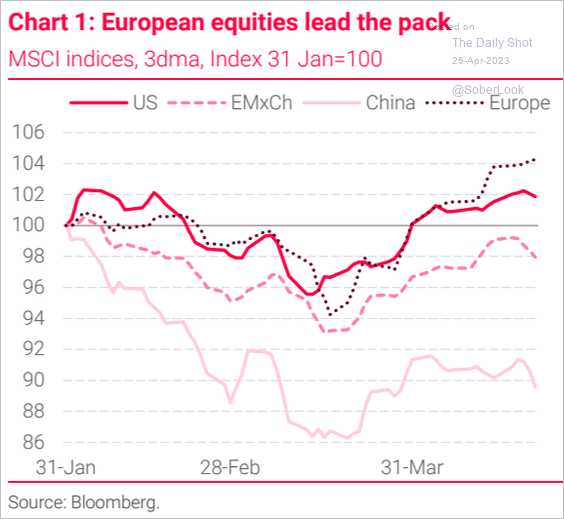

3. European stocks keep outperforming.

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia -Pacific

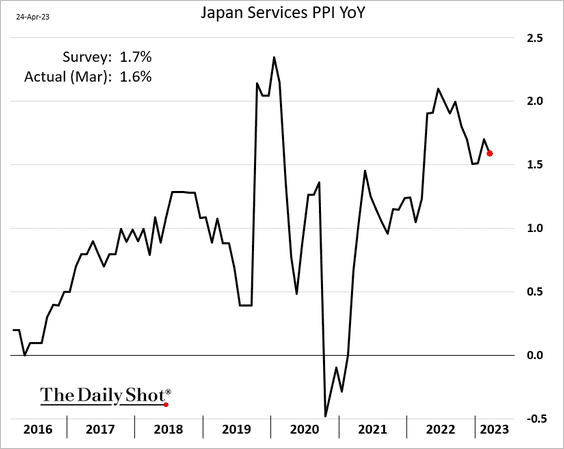

1. Japan’s services PPI declined in March.

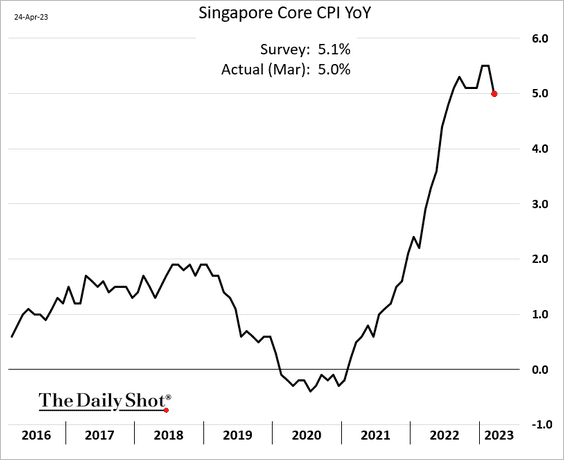

2. Singapore’s core inflation has finally peaked.

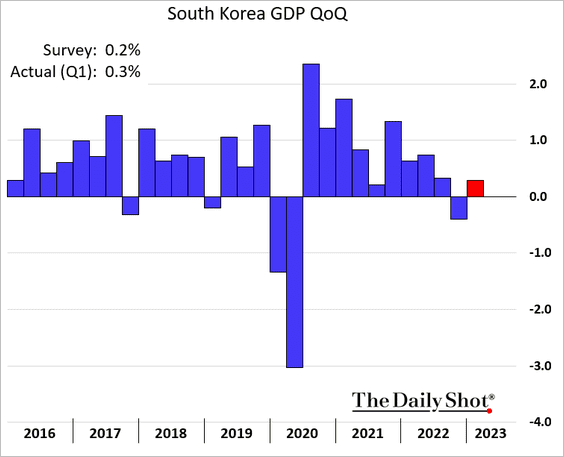

3. South Korea’s Q1 GDP growth was higher than expected.

Source: @markets Read full article

Source: @markets Read full article

——————–

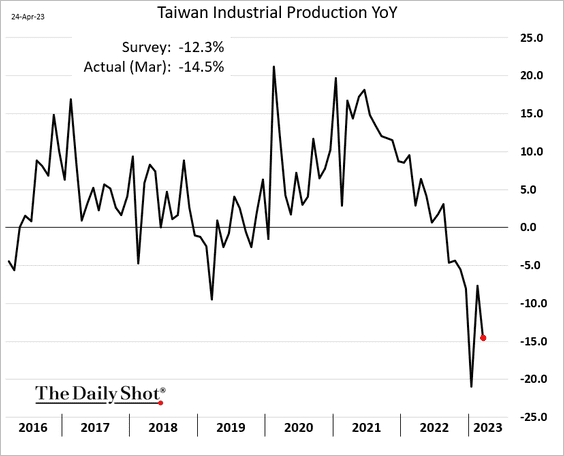

4. Taiwan’s industrial production remains depressed relative to last year.

Back to Index

China

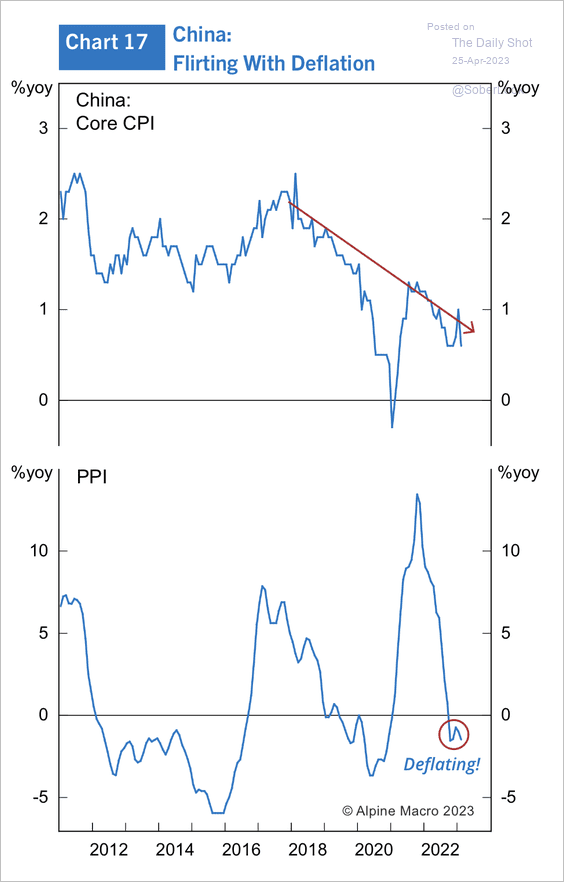

1. Unlike the US and Europe, China’s core CPI remains low while the PPI is deflating.

Source: Alpine Macro

Source: Alpine Macro

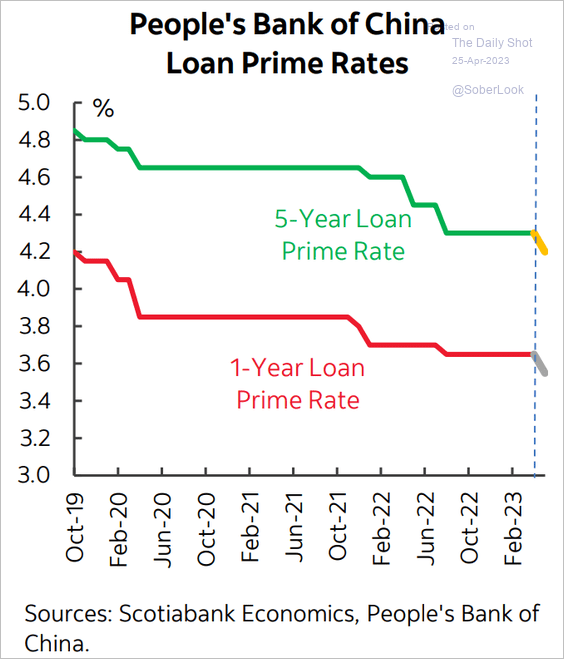

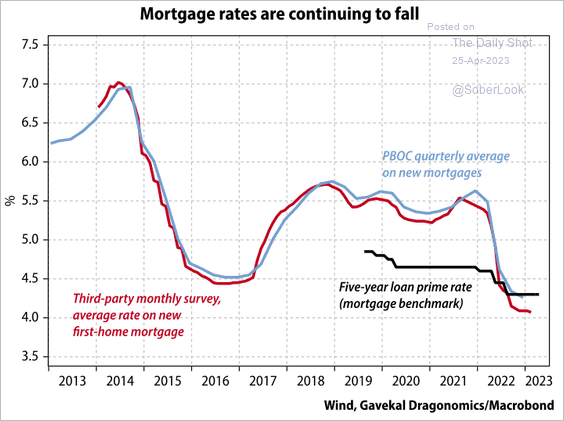

2. Rate cuts ahead?

Source: Scotiabank Economics

Source: Scotiabank Economics

Mortgage rates continue to trend lower.

Source: Gavekal Research

Source: Gavekal Research

——————–

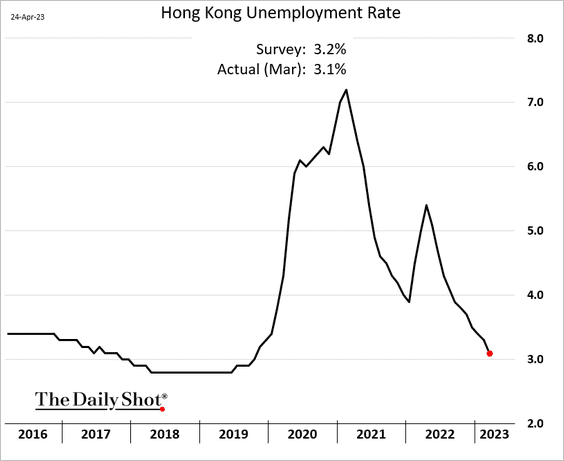

3. Hong Kong’s unemployment keeps falling.

Back to Index

Emerging Markets

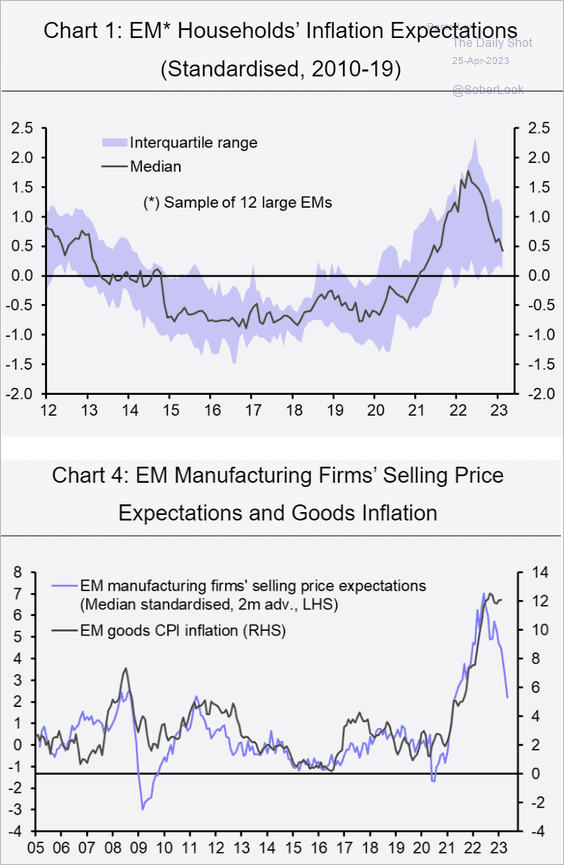

1. Inflation expectations are easing across EM economies.

Source: Capital Economics

Source: Capital Economics

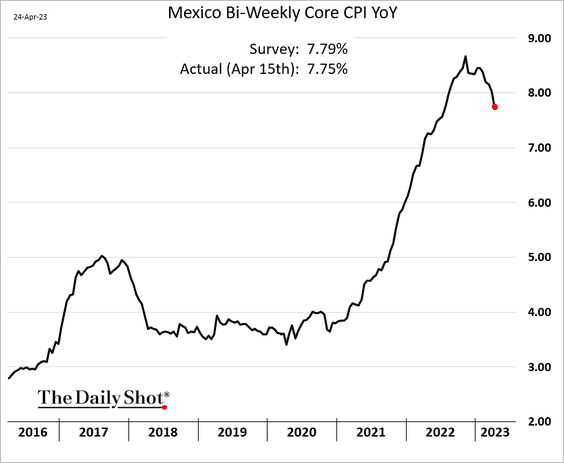

2. Mexico’s core inflation is finally slowing.

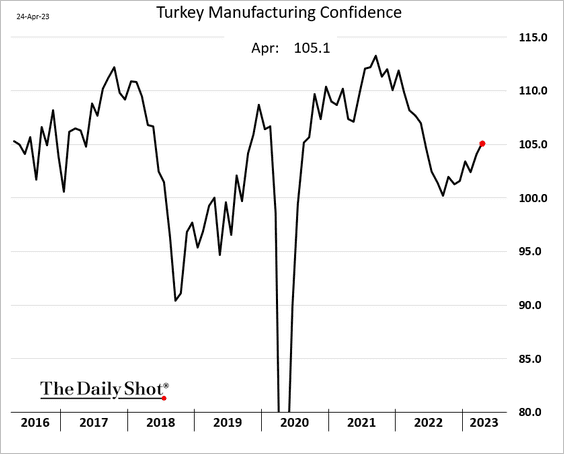

3. Turkey’s manufacturing confidence is rebounding.

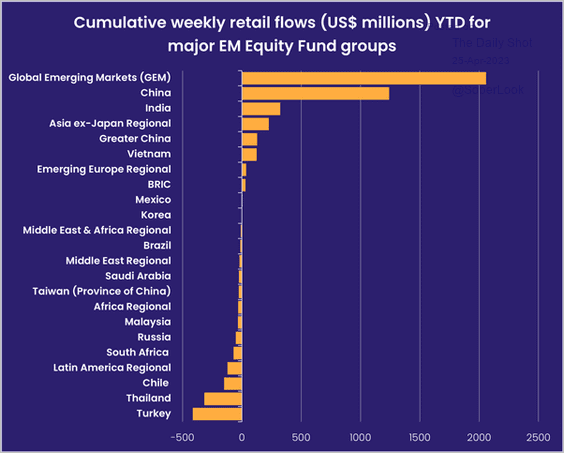

4. This chart shows year-to-date EM fund flows from retail investors.

Source: EPFR

Source: EPFR

Back to Index

Cryptocurrency

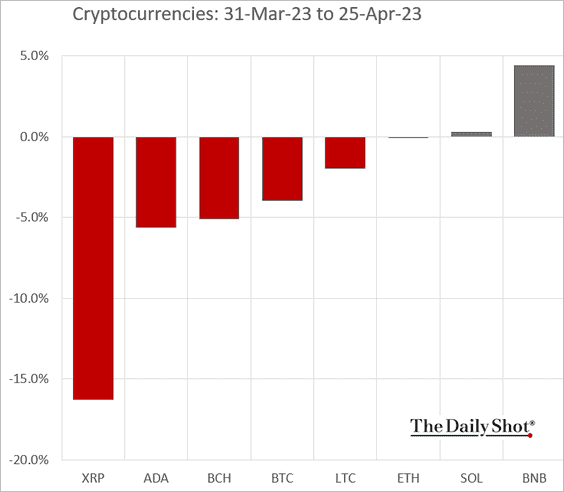

1. Here is the month-to-date performance of selected cryptocurrencies.

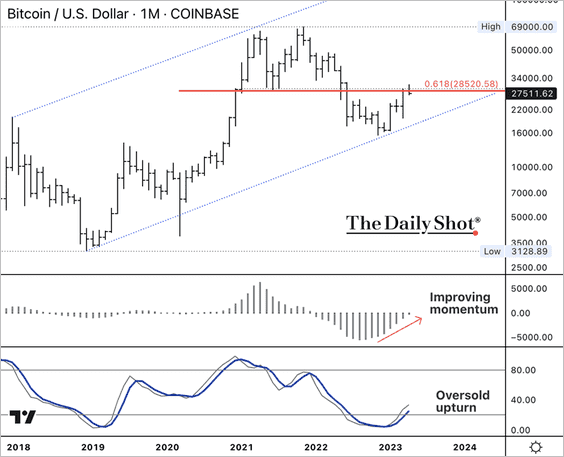

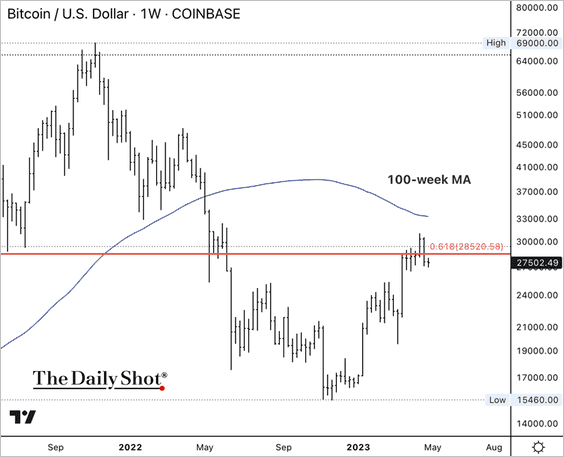

2. Bitcoin’s long-term momentum has improved, which could solidify its broad uptrend this year.

For now, a pullback is likely given strong resistance at the 100-week moving average.

——————–

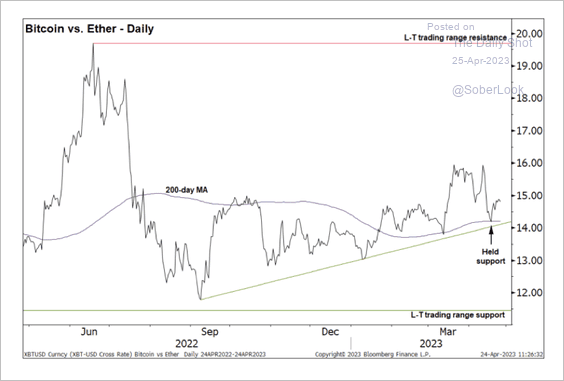

3. The BTC/ETH price ratio is holding support, favoring bitcoin in the months ahead.

Source: @StocktonKatie

Source: @StocktonKatie

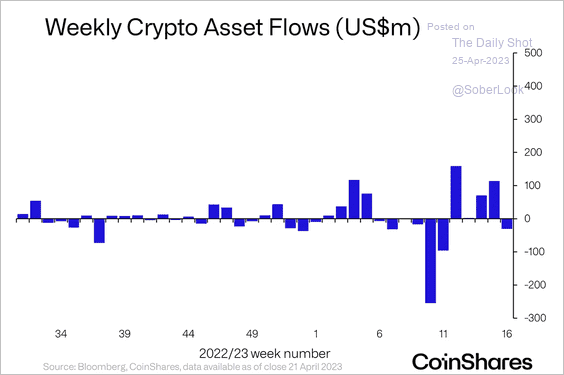

4. Crypto funds saw minor outflows last week, ending a six-week run of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

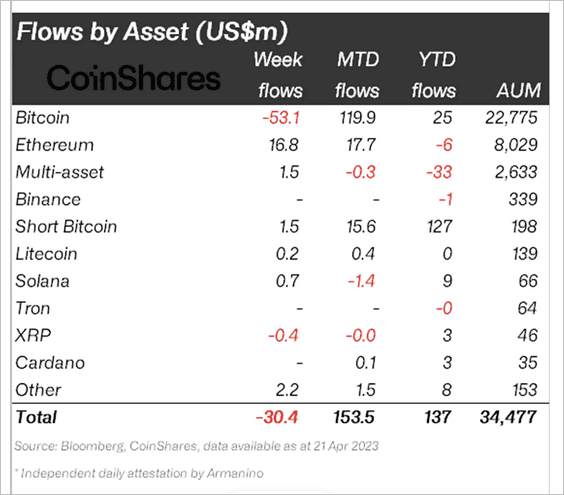

Bitcoin funds accounted for most inflows last week, while Ethereum-focused funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

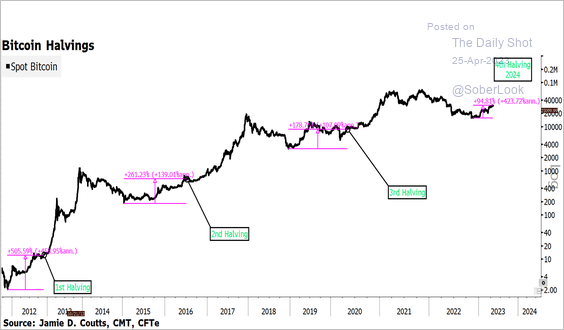

5. Bitcoin halvings tend to boost prices.

Source: @sidcoins, @markets Read full article

Source: @sidcoins, @markets Read full article

Source: BeInNews Read full article

Source: BeInNews Read full article

Back to Index

Commodities

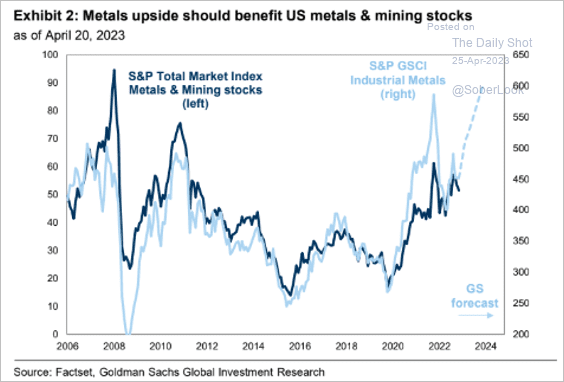

1. Goldman sees a substantial upside for industrial metals.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

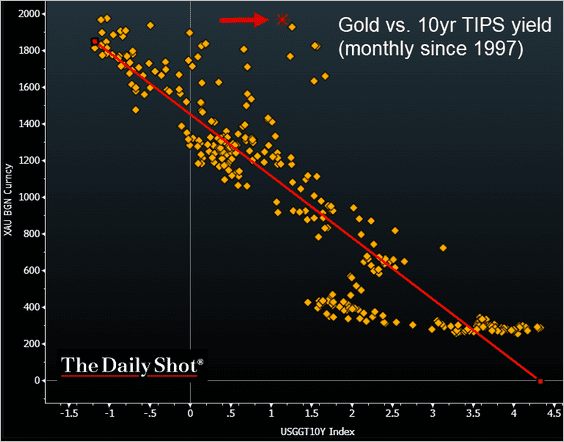

2. The dislocation of gold prices from real yields looks extreme.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Walter, @FT

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Walter, @FT

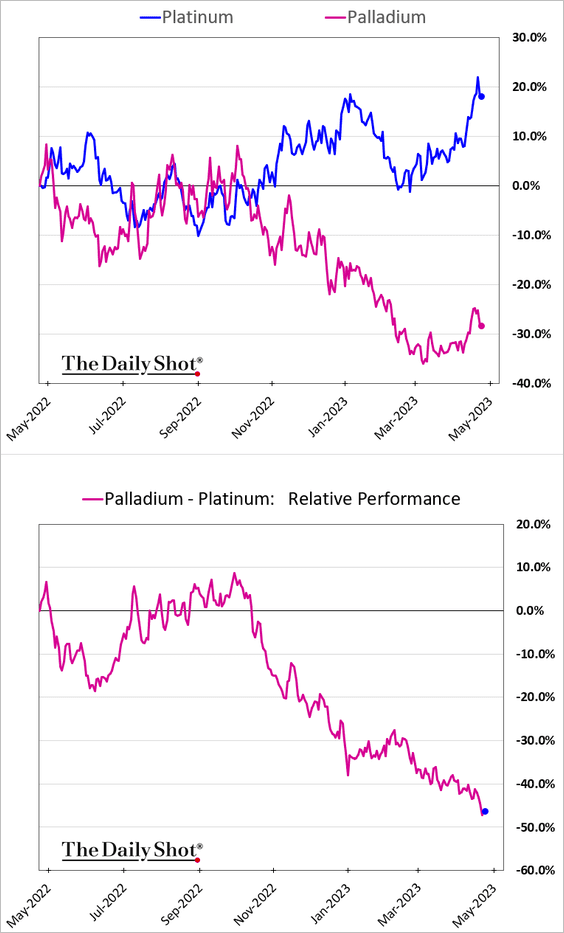

3. The platinum-palladium performance gap continues to widen.

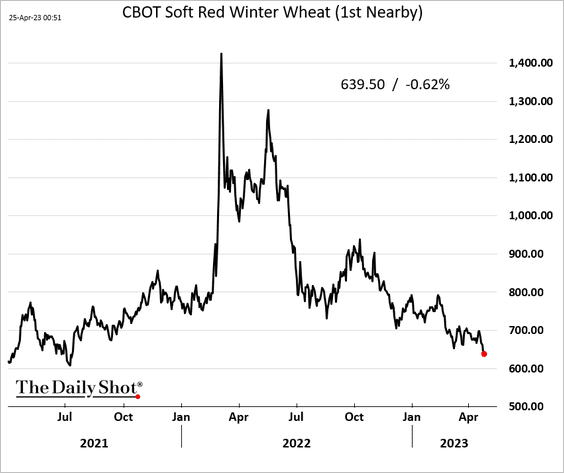

4. US wheat futures remain under pressure.

Back to Index

Equities

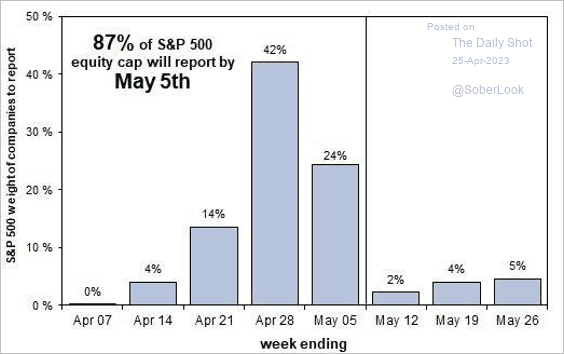

1. It will be a busy few days for earnings reports.

Source: Goldman Sachs

Source: Goldman Sachs

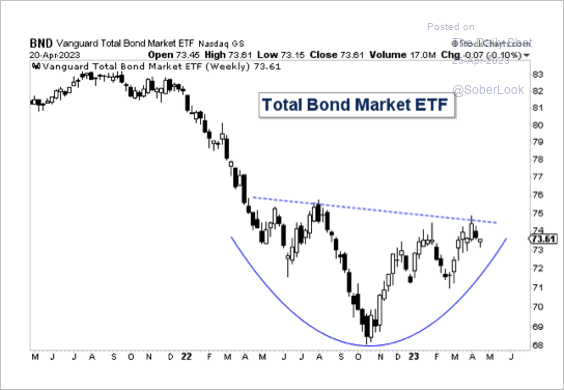

2. The decline in bonds versus stocks appears to be bottoming, which typically happens during shifts in the economic cycle.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

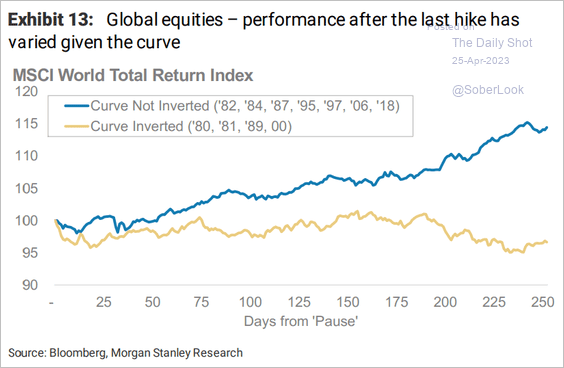

3. Curve inversion plays a role in equity performance after the last rate hike.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

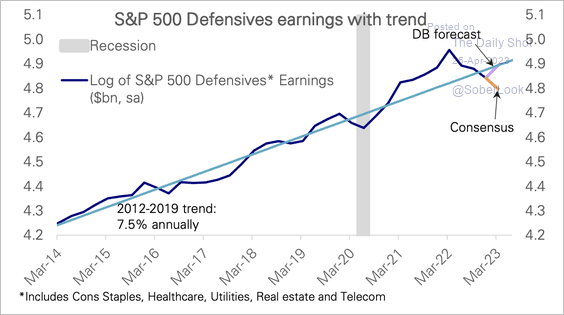

4. Deutsche Bank expects S&P 500 defensive sector earnings to return toward trend, which is typical during recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

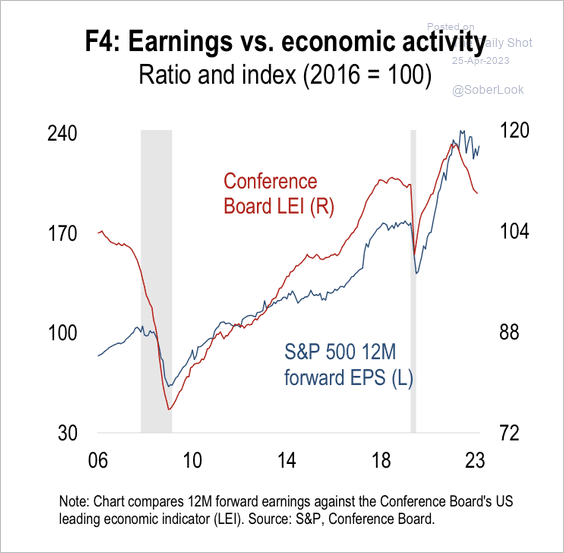

5. The decline in US leading indicators points to lower earnings ahead.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

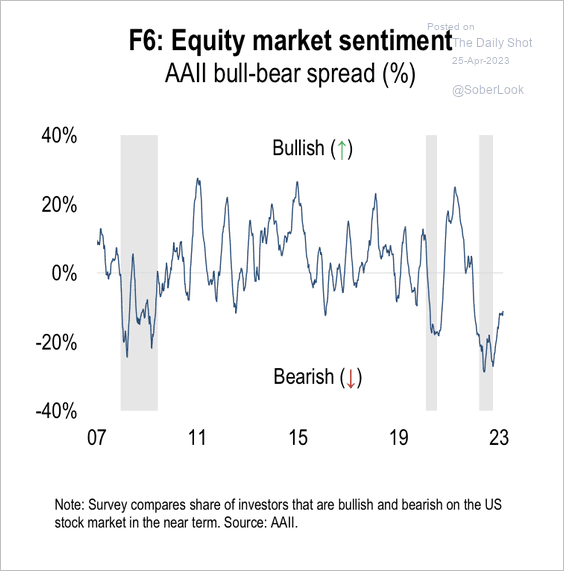

But equity market sentiment is improving from extreme bearish levels. Have markets priced in a recession?

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

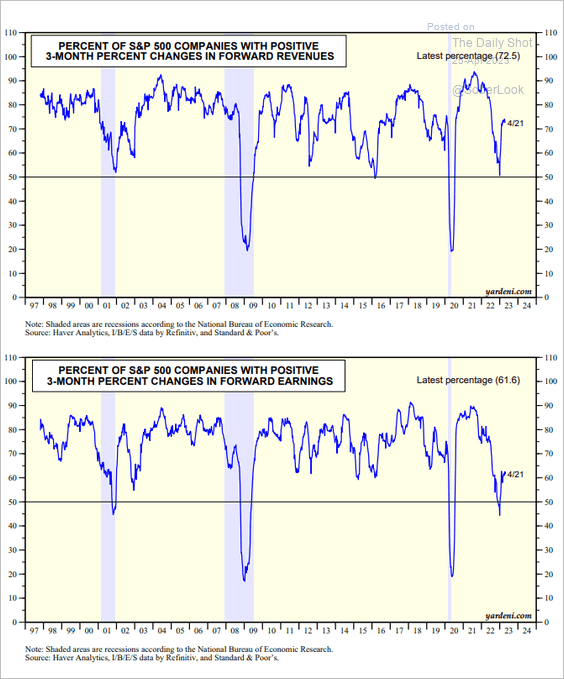

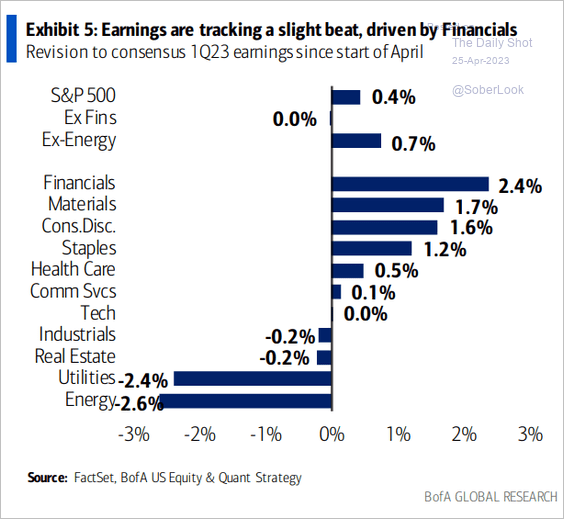

• More companies are seeing improvements in projected revenues and earnings.

Source: Yardeni Research

Source: Yardeni Research

Here are the month-to-date revisions.

Source: BofA Global Research; @alexandraandnyc, @markets Read full article

Source: BofA Global Research; @alexandraandnyc, @markets Read full article

——————–

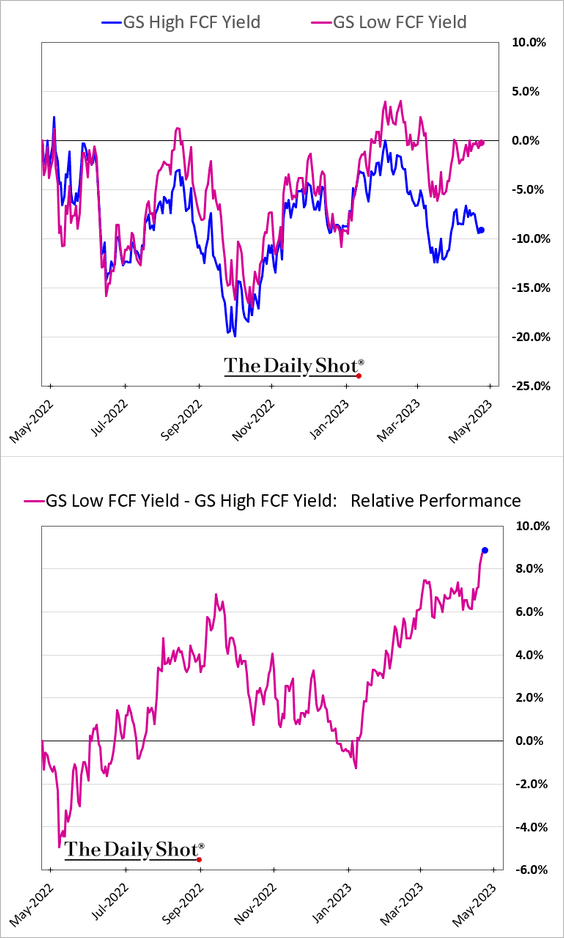

6. Companies with low free-cash-flow yields have been outperforming.

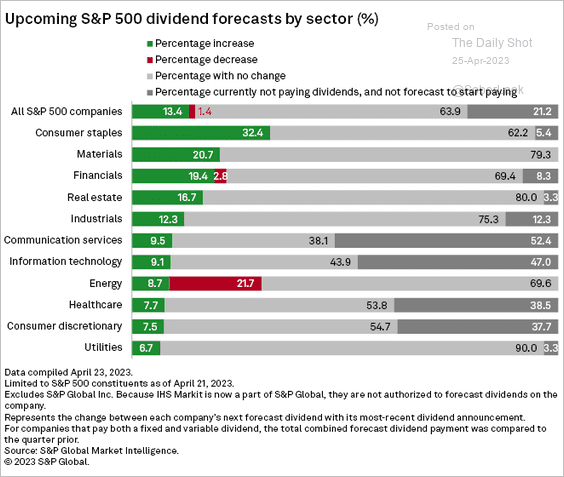

7. This chart shows dividend forecasts by sector from S&P Global Market Intelligence.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

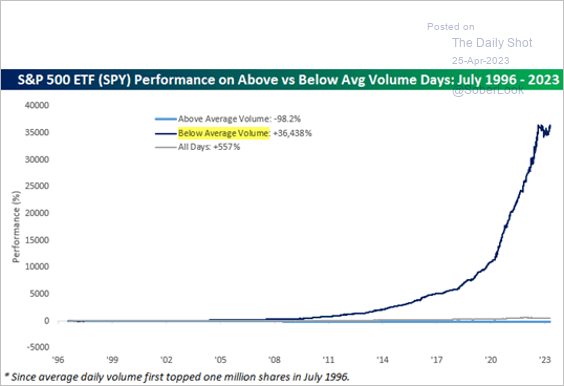

8. Here are the cumulative performance results for SPY on days with above- or below-average trading volume.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

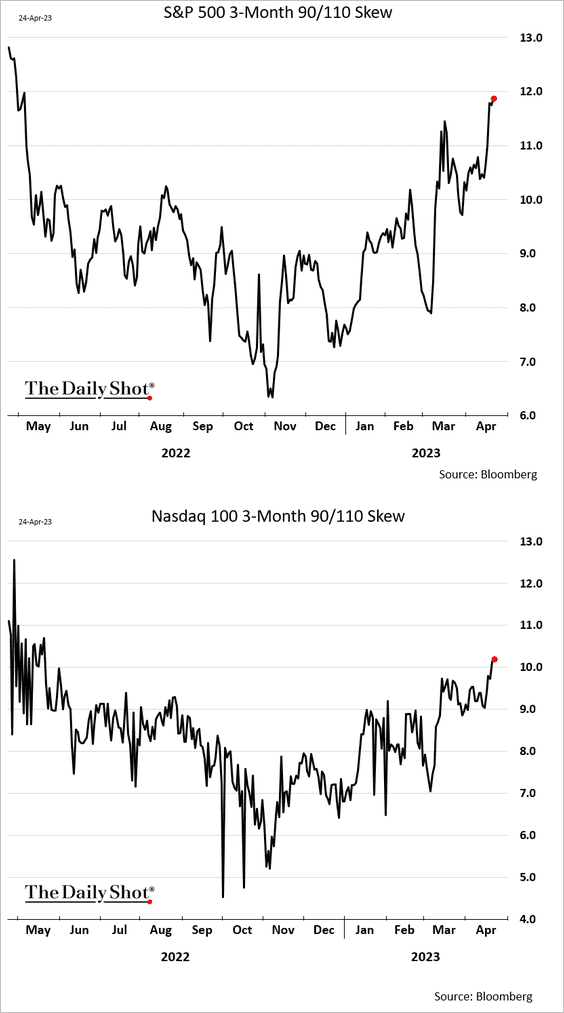

9. Demand for put options relative to calls continues to climb.

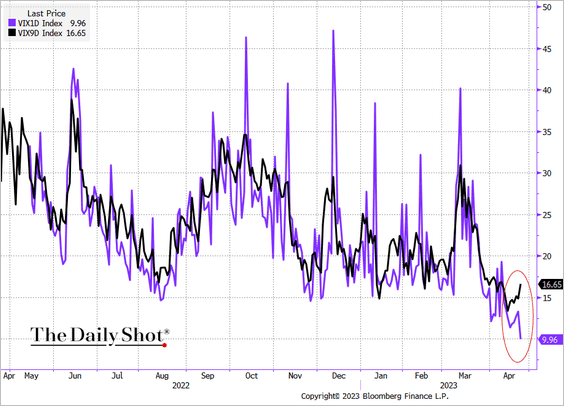

10. The newly-launched index of 1-day implied volatility has diverged from the longer-term indicators (purple = 1-day index, black = 9-day index).

Source: @luwangnyc, @markets Read full article

Source: @luwangnyc, @markets Read full article

Back to Index

Credit

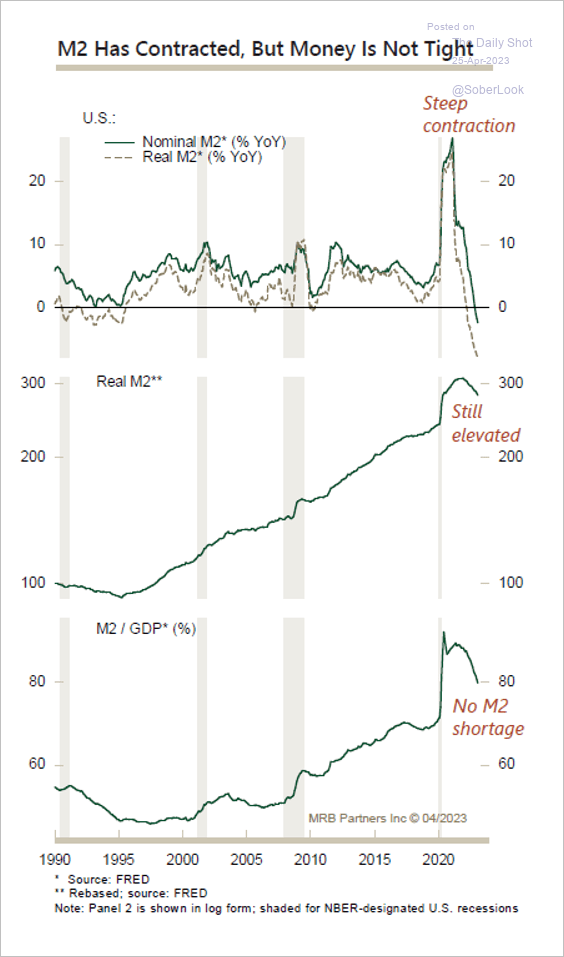

1. Money supply is contracting but remains elevated in real terms and as a percentage of GDP.

Source: MRB Partners

Source: MRB Partners

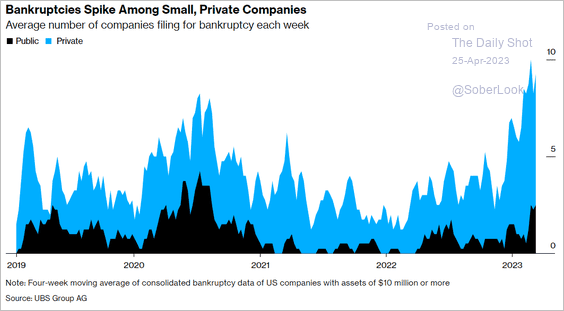

2. Bankruptcies among small private firms have risen sharply.

Source: @business Read full article

Source: @business Read full article

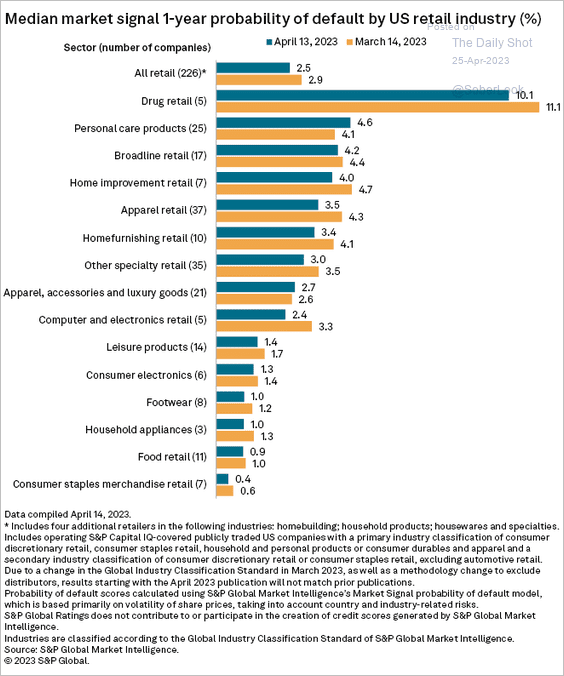

Which retail establishments are most vulnerable?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

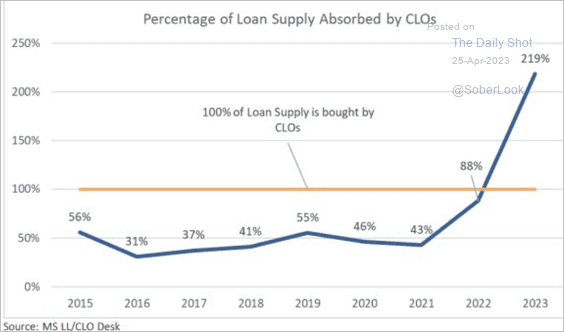

3. CLOs are absorbing all of the new leveraged loan supply plus a big portion of the secondary market.

Source: Morgan Stanley Research; III Capital Management

Source: Morgan Stanley Research; III Capital Management

Back to Index

Rates

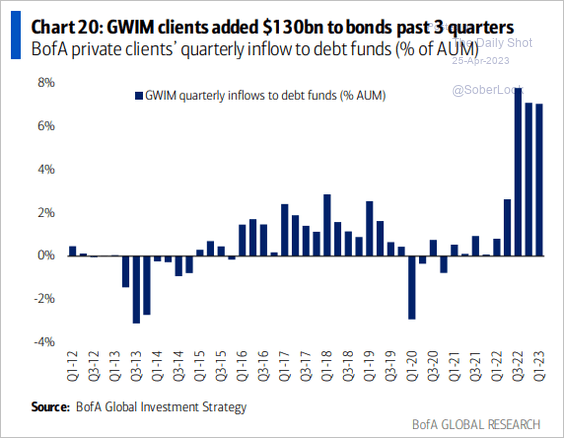

1. BofA private clients continue to buy bonds.

Source: BofA Global Research

Source: BofA Global Research

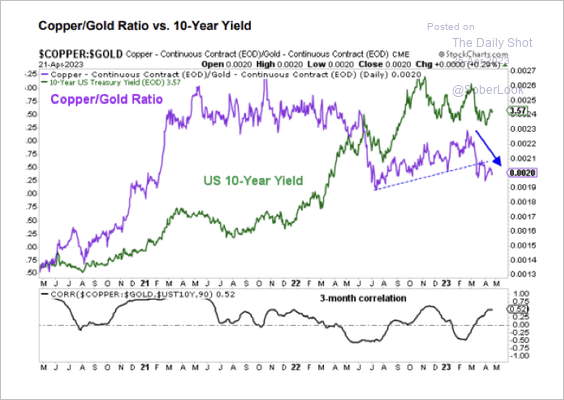

2. The breakdown in the copper/gold ratio points to lower Treasury yields.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

Global Developments

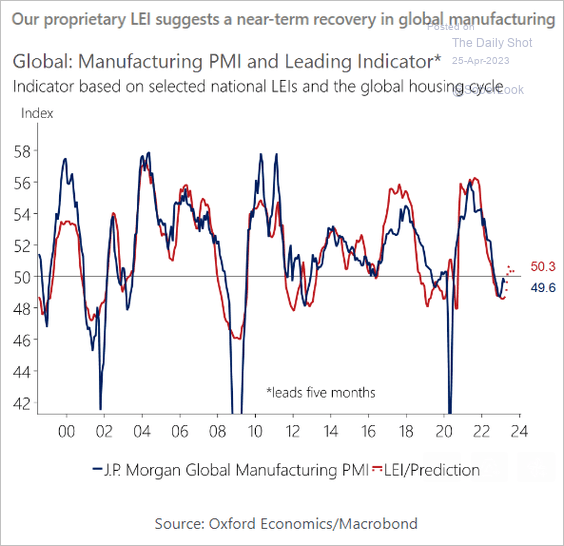

1. The Oxford Economics leading indicator signals a rebound in global manufacturing.

Source: Oxford Economics

Source: Oxford Economics

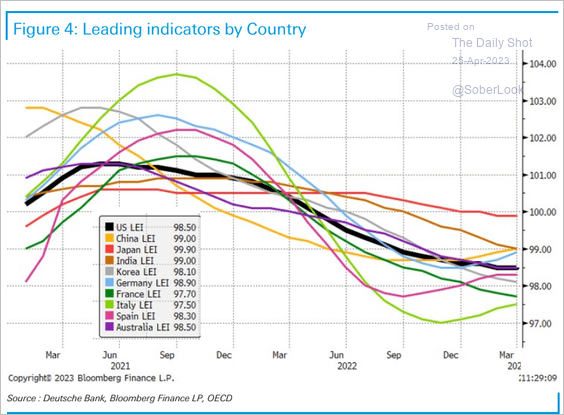

2. This chart shows leading indicators in selected economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

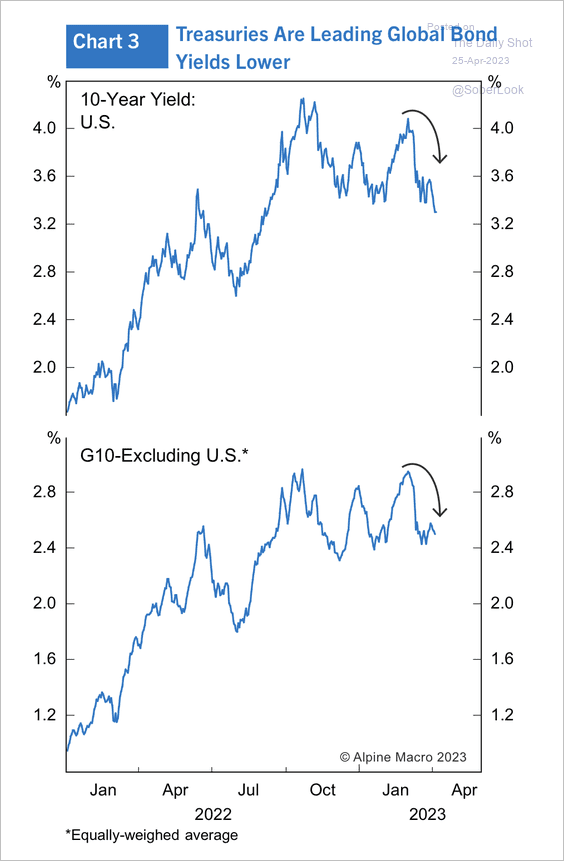

3. Sovereign bond yields have declined across G10 nations, led by Treasuries. Weaker interest rate differentials could weigh on the dollar.

Source: Alpine Macro

Source: Alpine Macro

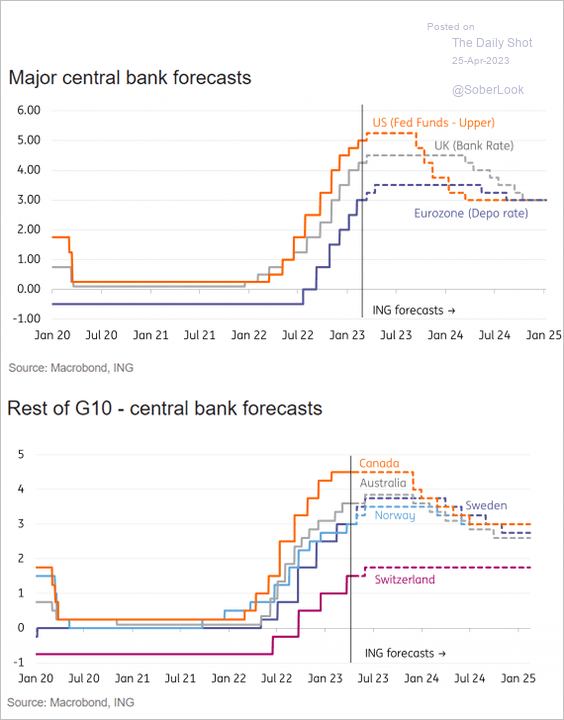

4. Here are ING’s forecasts for DM central banks’ policy rates.

Source: ING

Source: ING

——————–

Food for Thought

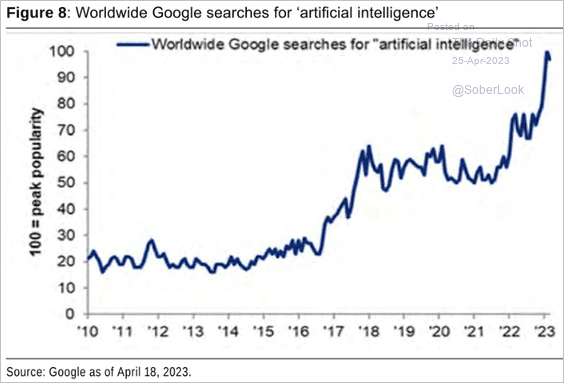

1. Google search activity for “artificial intelligence”:

Source: Citi Private Bank

Source: Citi Private Bank

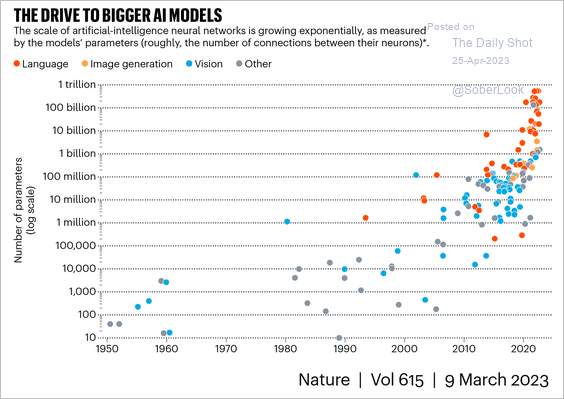

2. AI neural net complexity over time:

Source: Anil Ananthaswamy, Nature

Source: Anil Ananthaswamy, Nature

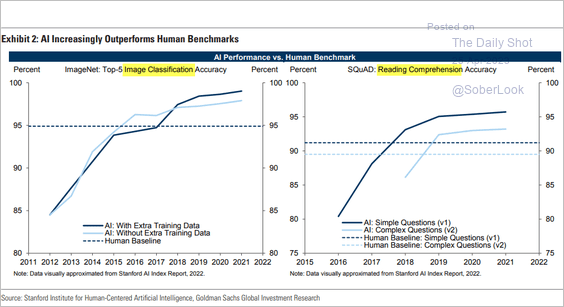

3. AI outperforming human benchmarks:

Source: Goldman Sachs

Source: Goldman Sachs

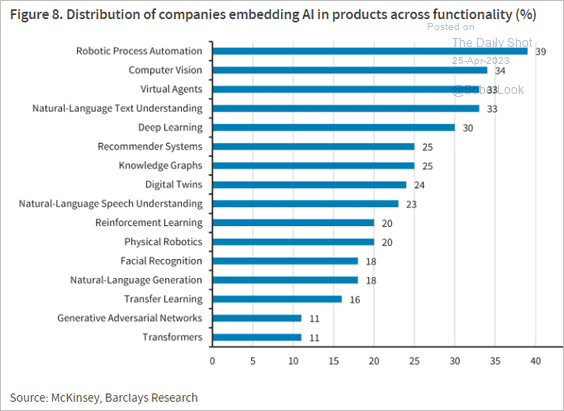

4. Companies embedding AI in products and processes:

Source: Barclays Research

Source: Barclays Research

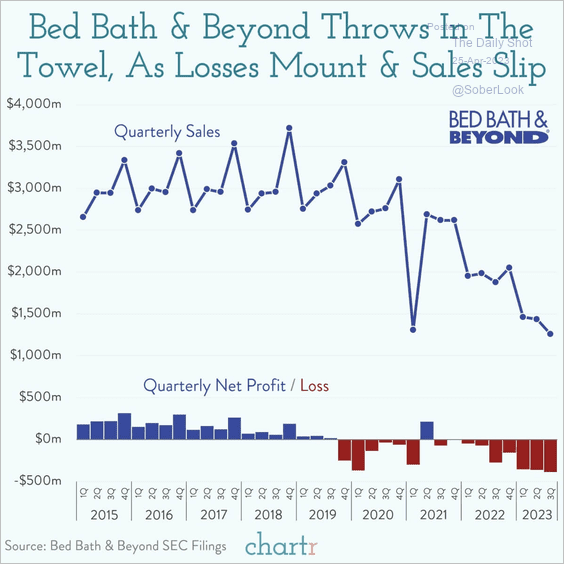

5. The end of Bed Bath & Beyond:

Source: @chartrdaily

Source: @chartrdaily

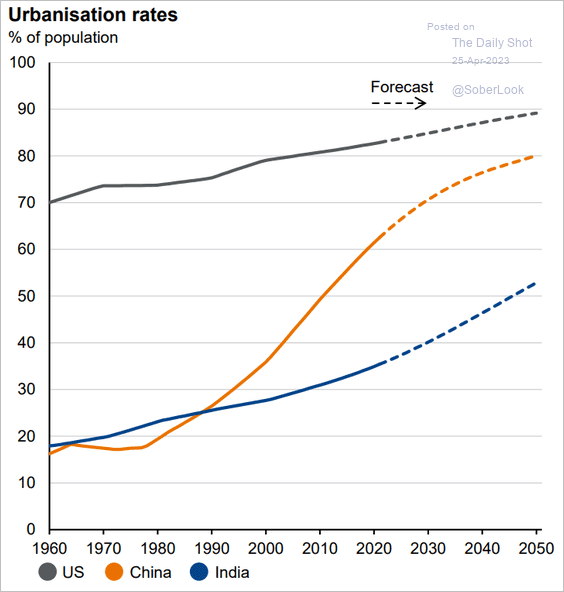

6. Urbanization rates:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

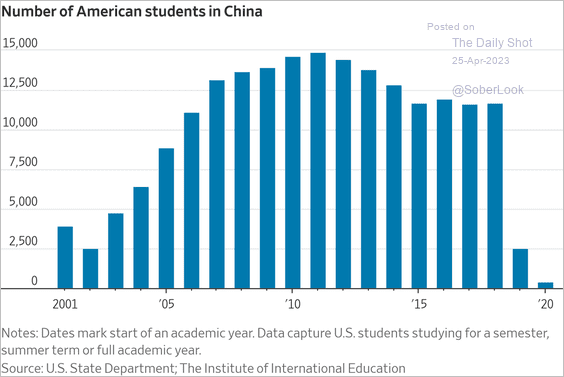

7. Will American students return to China?

Source: @WSJ Read full article

Source: @WSJ Read full article

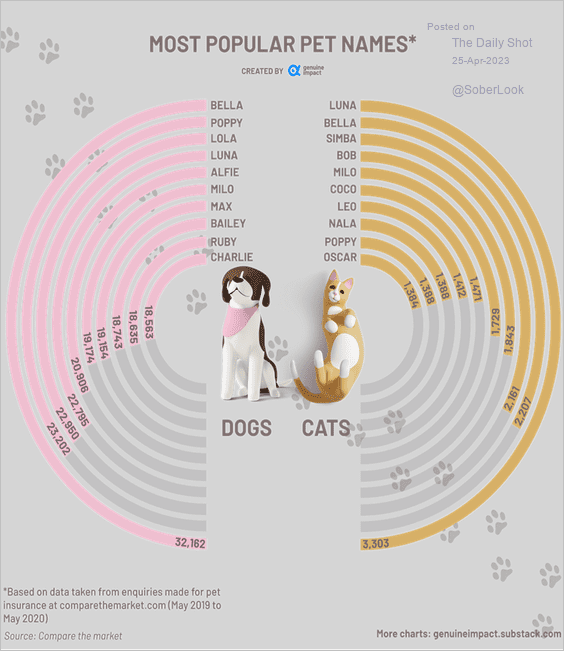

8. Most popular pet names:

Source: Genuine Impact

Source: Genuine Impact

——————–

Back to Index