The Daily Shot: 28-Apr-23

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Food for Thought

The United States

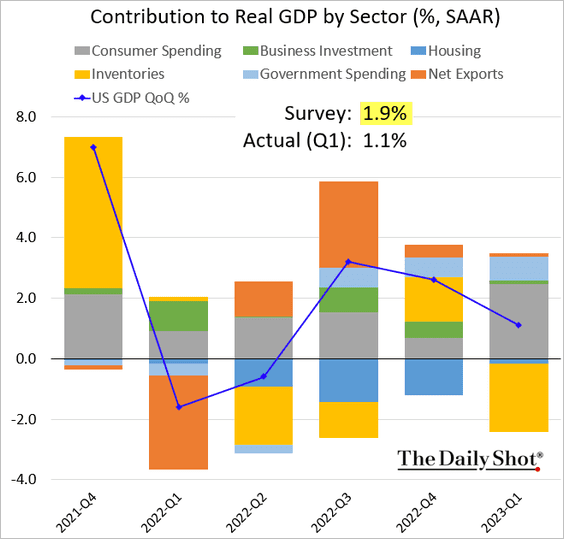

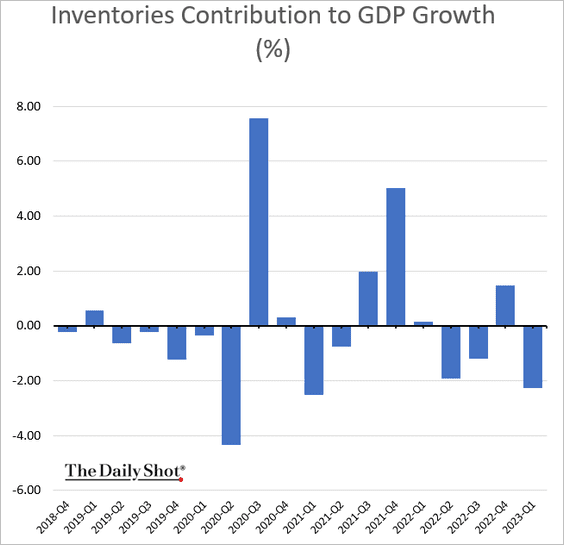

1. The first-quarter GDP report fell short of expectations, as inventory reductions contributed to a slowdown in economic growth.

Source: Reuters Read full article

Source: Reuters Read full article

• Boosted by stronger consumer spending, …

… real final sales to private domestic purchasers (sometimes called the “core GDP”) rebounded.

• Business investment decelerated but remained positive.

• The drag from weak housing investment slowed.

• The GDP-GDI gap has been closed.

——————–

2. Inflation continues to run hot. Here are the quarterly changes in the PCE price index.

We are still on track for a 25 bps rate hike in May.

——————–

3. Initial jobless claims have risen this year but are not surging yet.

• Continuing claims are 22.5% above last year’s levels.

• More states have experienced a rise in jobless claims compared to last year.

Source: Variant Perception

Source: Variant Perception

• Given the recent trend, the labor market imbalance could be gone soon.

Source: BCA Research

Source: BCA Research

——————–

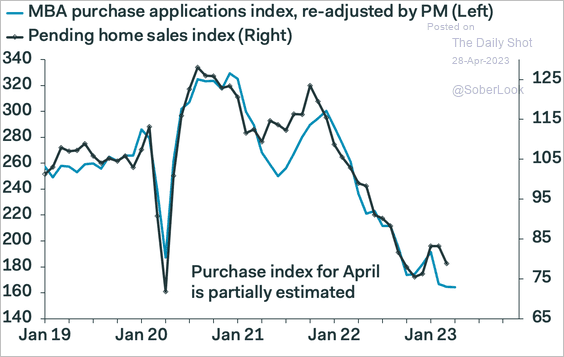

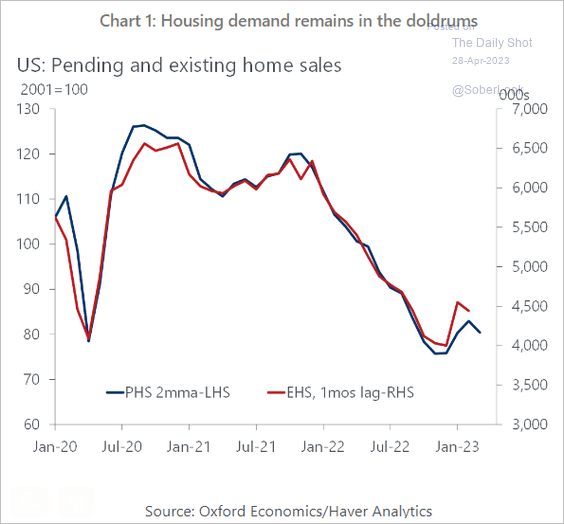

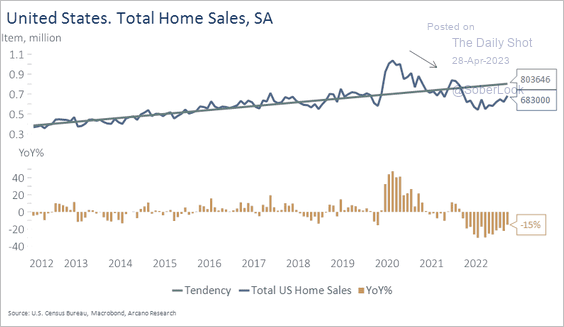

4. In March, pending home sales were 23% lower than the previous year’s levels, underperforming expectations.

Source: Reuters Read full article

Source: Reuters Read full article

• Mortgage applications point to further weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Existing home sales should follow.

Source: Oxford Economics

Source: Oxford Economics

• This chart shows total home sales relative to the long-term trend (seasonally adjusted).

Source: Arcano Economics

Source: Arcano Economics

——————–

5. The Kansas City Fed’s manufacturing index declined sharply this month as demand softened further.

The employment index dipped into negative territory for the first time since 2020.

——————–

6. The US goods trade deficit narrowed last month.

——————–

7. Next, we have some updates on the debt ceiling situation.

• Tax collections are running well below last year’s levels.

Source: Oxford Economics

Source: Oxford Economics

According to Oxford Economics, “June is off the table for a debt limit crisis, but July is not.”

Source: Oxford Economics

Source: Oxford Economics

{*) The US sovereign CDS spread continues to widen, reflecting an escalating risk of potential default.

• Who will be blamed?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Canada

1. The CFIB small-business activity index edged higher this month.

The charts below show the index level and monthly changes by sector.

——————–

2. What money market rates are available to Canadians?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

1. The CBI retail sales index showed an improvement this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. The Lloyds Busines Barometer edged higher.

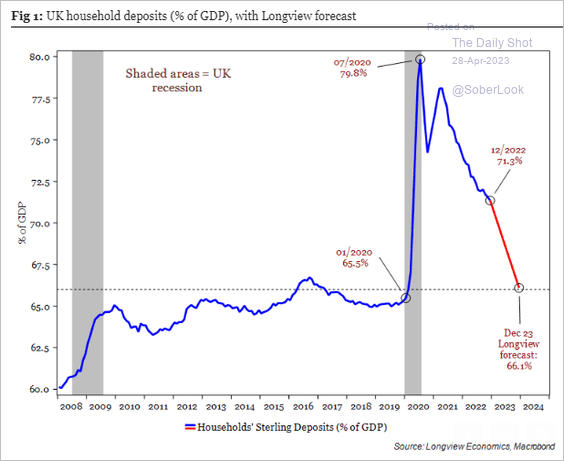

3. How quickly will “excess” household deposits be depleted?

Source: Longview Economics

Source: Longview Economics

Back to Index

The Eurozone

1. Italian consumer sentiment ticked higher this month, …

… but the manufacturing confidence index declined.

——————–

2. Here are the sentiment indicators at the Eurozone level.

• Manufacturing:

• Services (the divergence between services and manufacturing is also seen in the PMI report):

• Economic sentiment (including consumer sentiment):

——————–

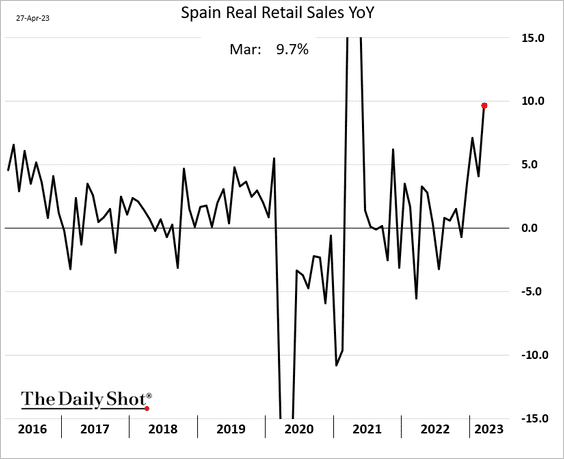

3. Spain’s retail sales have been surging.

4. This chart shows commercial real estate loan levels and default rates in the Eurozone and the US.

Source: Natixis

Source: Natixis

Back to Index

Japan

1. Ueda’s BoJ debut left policy unchanged. The market expected some signs of a policy shift.

Source: @markets Read full article

Source: @markets Read full article

The yen tumbled (the chart shows the US dollar rallying against the yen).

JGB yields declined.

——————–

2. The Tokyo CPI report for this month showed inflation running hot, topping expectations.

• Here are some trends from the report.

• Below is a long-term chart showing the percentage of CPI components rising.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

• Wage growth is accelerating.

Source: Natixis

Source: Natixis

——————–

3. The labor market has been softening.

Source: Nippon Read full article

Source: Nippon Read full article

Back to Index

Asia – Pacific

1. South Korea’s industrial production jumped in March.

2. Will we see rate cuts in Taiwan next year?

Source: ING

Source: ING

3. Similar to business confidence, New Zealand’s consumer sentiment remains depressed.

4. Australia’s credit growth continues to slow.

Back to Index

Emerging Markets

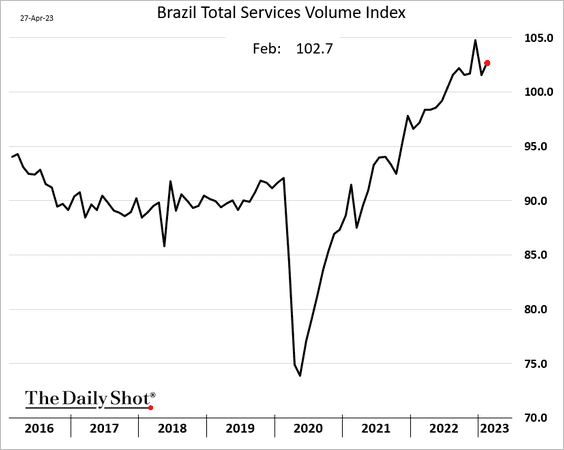

1. Brazil’s services output improved in February.

The nation’s formal job creation hit a multi-year high, topping expectations.

——————–

2. Mexico’s trade balance unexpectedly swung into surplus, …

… as exports hit a record high.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

3. Turkey’s economic confidence jumped in April.

Separately, here are the latest poll results.

Source: @pollofpolls_EU

Source: @pollofpolls_EU

Back to Index

Commodities

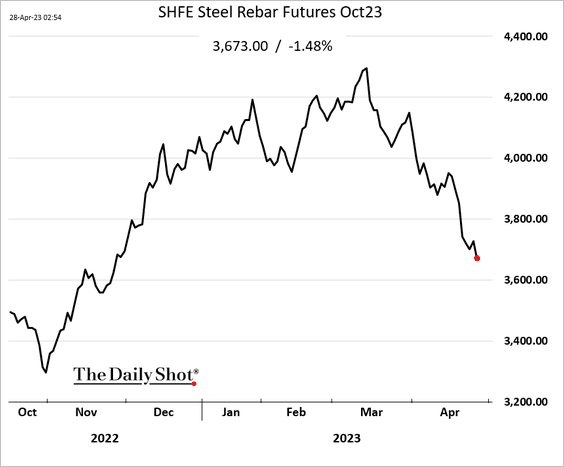

1. Steel prices continue to sink in China, …

… dragging down metallurgical coal futures.

——————–

2. Gold improves risk-adjusted performance during periods of stagflation.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

3. US corn futures keep sinking after China canceled a 233K metric ton order.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

1. Brent oil is trading at a roughly $15/bbl premium to “fair value.”

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

2. The recent rise in oil prices diverged from US inflation expectations.

Source: FHN Financial

Source: FHN Financial

3. Some clean energy stocks are under pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

1. Stocks rallied on tech earnings, but futures are down this morning.

2. With mega-caps outpacing the rest of the market, equal-weight indices have underperformed sharply this week.

• Here is the 2-day relative performance of the Nasdaq 100 equal-weight index.

• What percentage of S&P 500 members are outperforming the index?

Source: Jefferies; @Mayhem4Markets; h/t @chartrdaily

Source: Jefferies; @Mayhem4Markets; h/t @chartrdaily

——————–

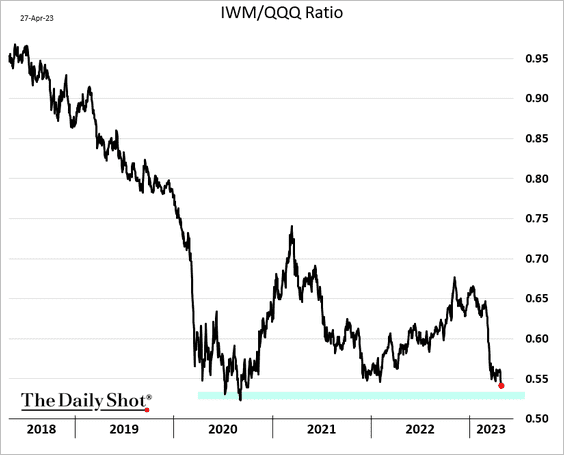

3. Small caps are struggling relative to the Nasdaq 100, dragged lower by bank shares.

4. Tech funds have been seeing some inflows in recent days.

Source: BofA Global Research

Source: BofA Global Research

5. Tech shares’ valuation premium is widening again.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

6. Tighter credit points to weaker revenue growth.

Source: Merrill Lynch

Source: Merrill Lynch

7. Share buyback activity has been robust so far this year.

Source: Goldman Sachs

Source: Goldman Sachs

8. Burned by Tesla, retail investors remain cautious, particularly with single-stock purchases.

Source: Vanda Research

Source: Vanda Research

Separately, retail investors tend to lose money on 0DTE (less than 24 hr) options, especially after fees.

Source: Beckmeyer, Branger, Gayda Read full article

Source: Beckmeyer, Branger, Gayda Read full article

——————–

9. Worried about commercial real estate, BofA’s private clients continue to dump REITs.

Source: BofA Global Research

Source: BofA Global Research

Office properties keep widening their underperformance.

——————–

Food for Thought

1. ChatGPT 4.0 vs. 3.5:

Source: Statista

Source: Statista

2. Cross-border collaborations on AI projects:

Source: Stanford University Read full article

Source: Stanford University Read full article

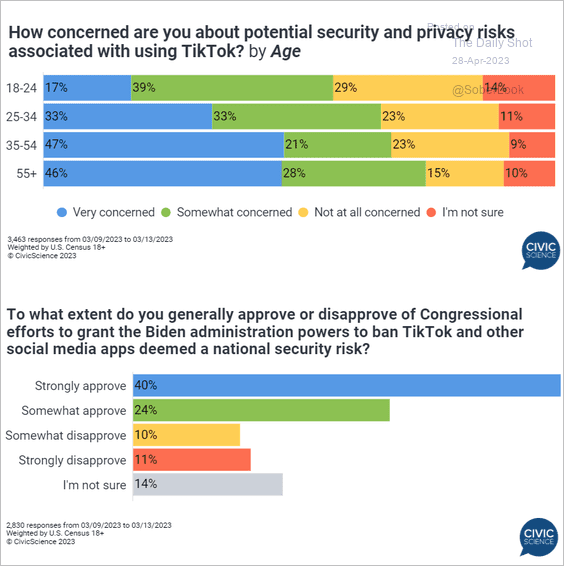

3. Concerns about TikTok:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

4. App store revenue growth:

Source: Semafor

Source: Semafor

5. US Latinos’ religious affiliation over time:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

6. Who is boosting coal capacity?

Source: Statista

Source: Statista

7. New York City’s least snowy winters:

Source: The New York Times Read full article

Source: The New York Times Read full article

8. Trust in allergy medicines:

Source: @CivicScience

Source: @CivicScience

9. Changes in life expectancy:

Source: The Economist Read full article

Source: The Economist Read full article

10. Average movie length:

Source: EOM

Source: EOM

——————–

Have a great weekend!

Back to Index