The Daily Shot: 02-May-23

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

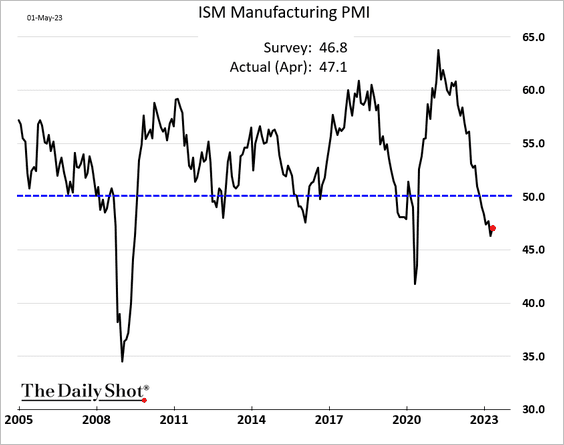

1. US manufacturing activity continued to contract in April, but the pace of declines eased slightly.

Source: Reuters Read full article

Source: Reuters Read full article

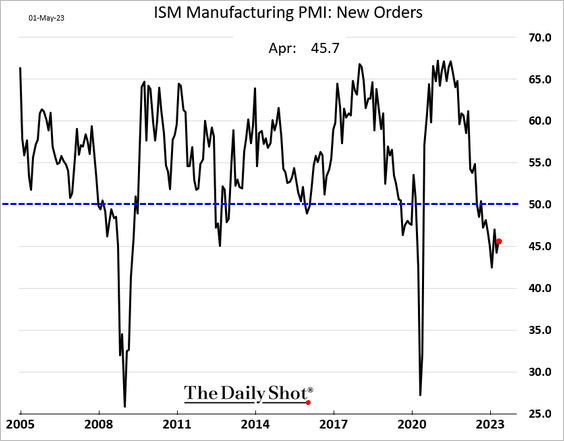

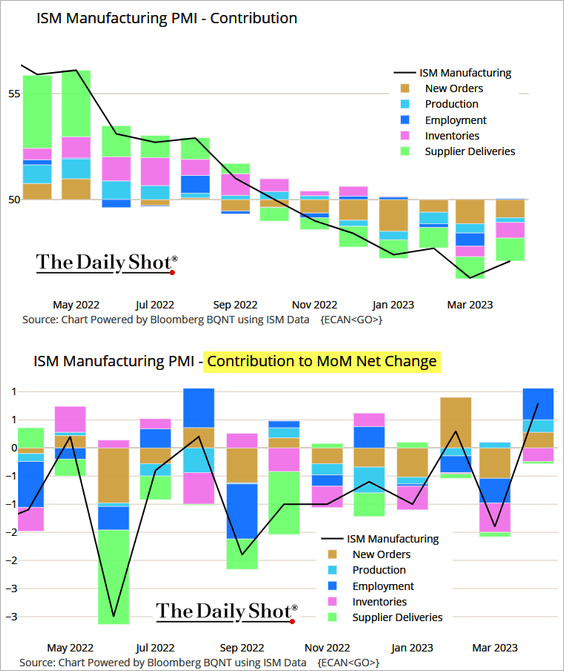

• Demand keeps weakening.

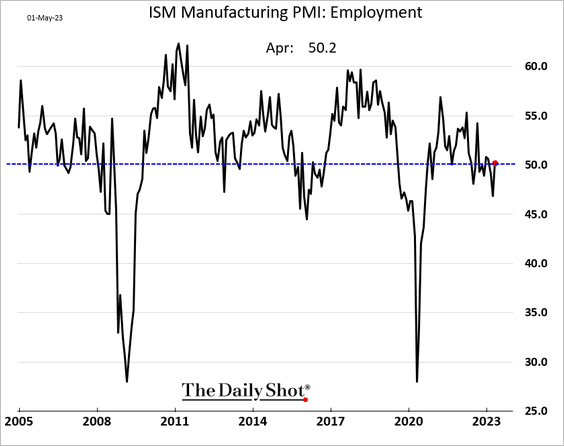

• Manufacturing employment stabilized last month.

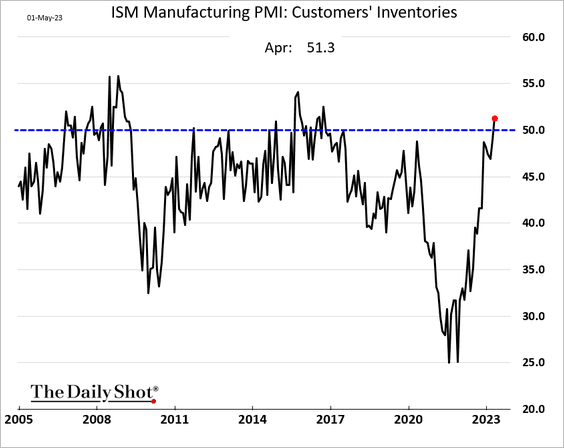

• Manufacturers now perceive customers’ inventory levels as increasing.

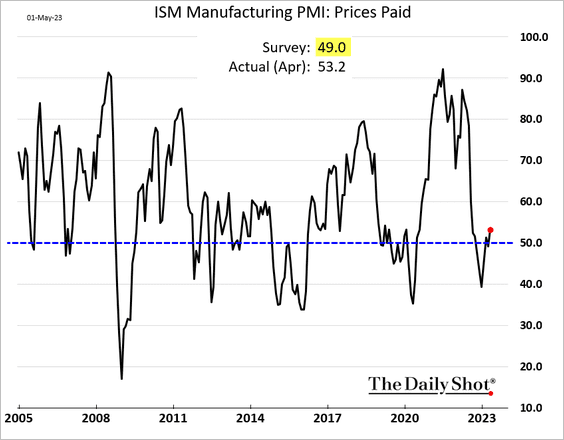

• Costs are rising again.

• Here are the contributions to the ISM level (1st panel) and monthly changes (2nd panel).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

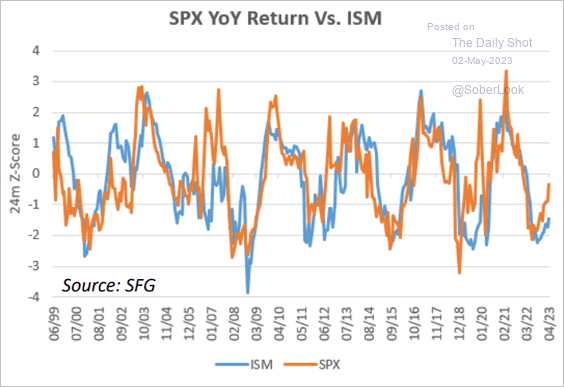

• The stock market points to improvements ahead for US manufacturing.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

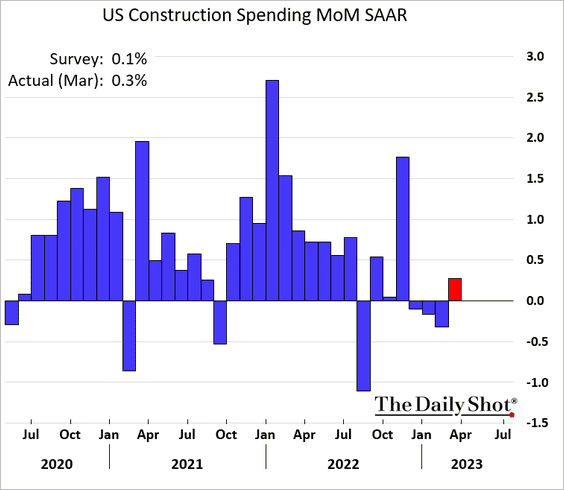

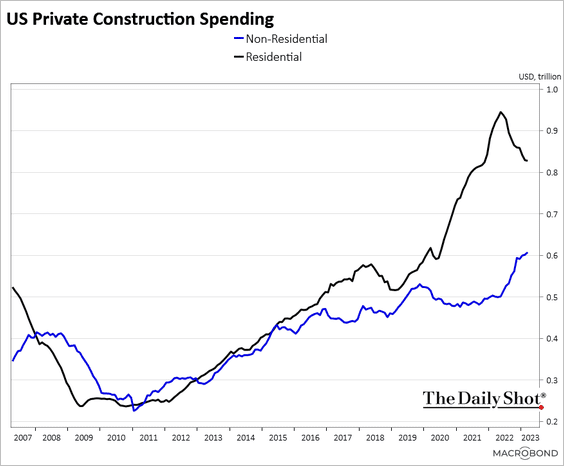

2. After three months of declines, construction spending increased in March.

• Private nonresidential construction spending continues to grind higher as residential expenditures slow.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

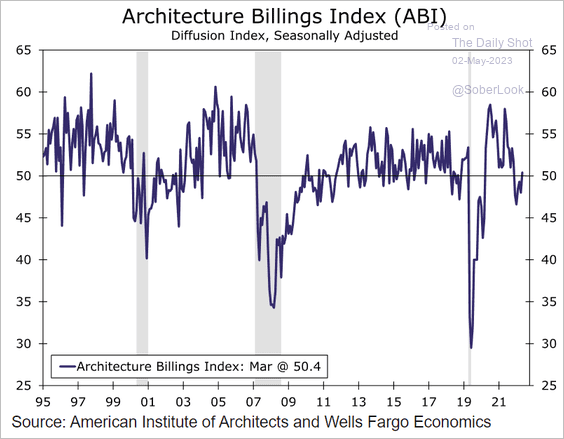

• Architecture billings have stabilized.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

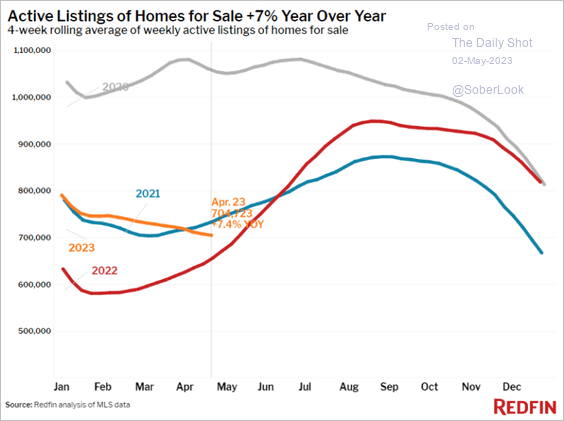

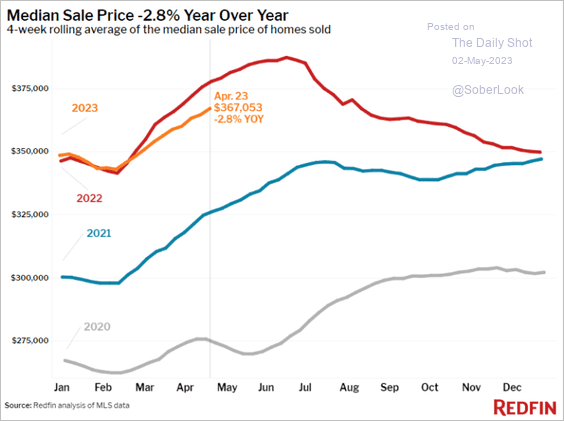

3. Listings of homes for sale are falling quickly and may soon dip below last year’s levels.

Source: Redfin

Source: Redfin

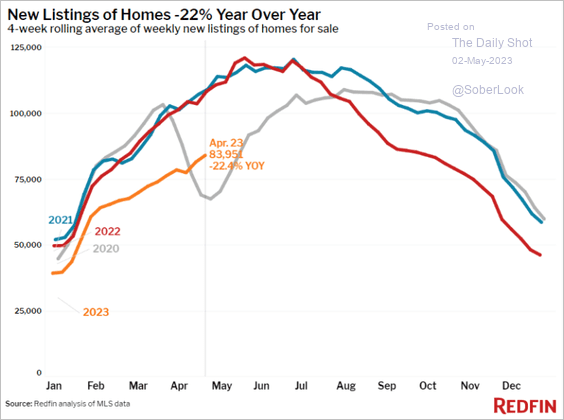

New listings are down 22.4% vs. 2022.

Source: Redfin

Source: Redfin

The median price is currently only 2.8% lower than what we observed in 2022.

Source: Redfin

Source: Redfin

——————–

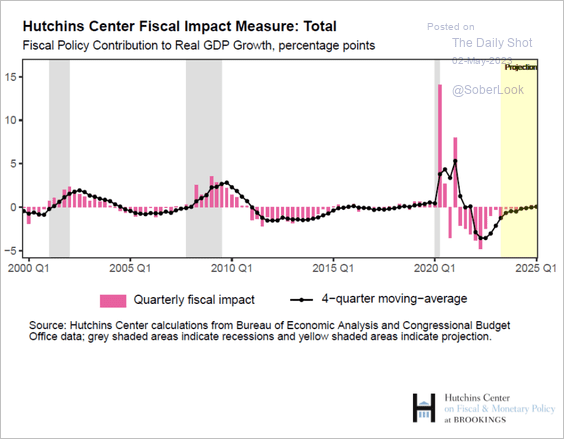

4. The fiscal policy drag that has been slowing the economy is about to disappear.

Source: Brookings Read full article

Source: Brookings Read full article

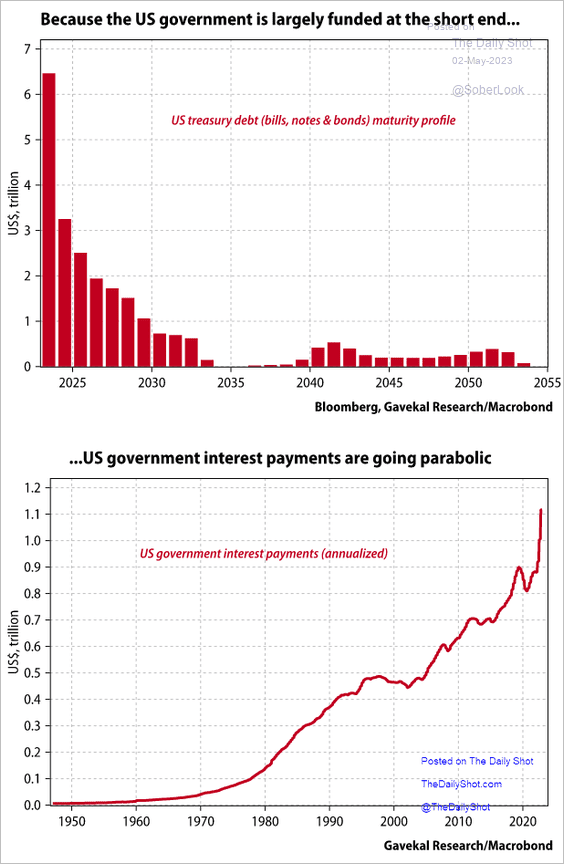

5. The federal government missed out on locking in low long-term rates in recent years, causing interest payments to surge.

Source: Gavekal Research

Source: Gavekal Research

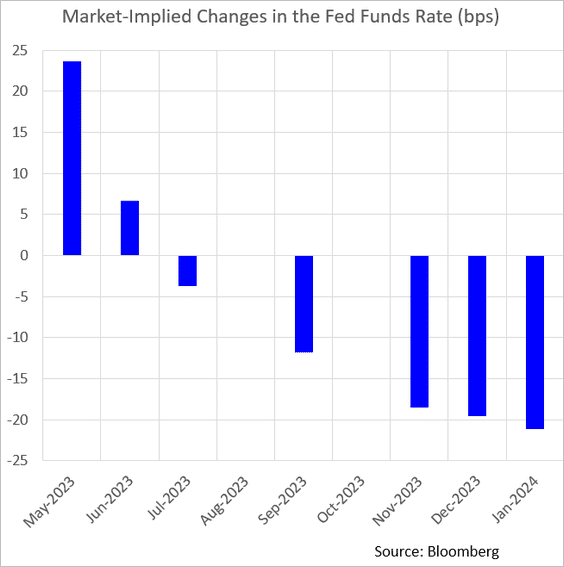

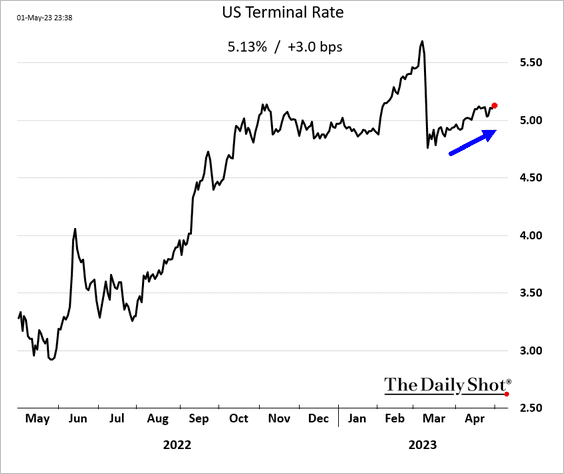

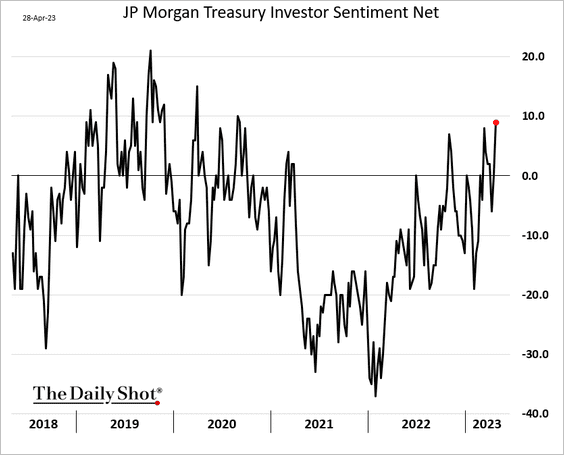

6. A 25 bps Fed rate hike this week is baked in. The US central bank is likely to pause from there until the debt ceiling situation is resolved.

The expected terminal rate continues to grind higher, with the peak fed funds rate now firmly above 5%.

Back to Index

Canada

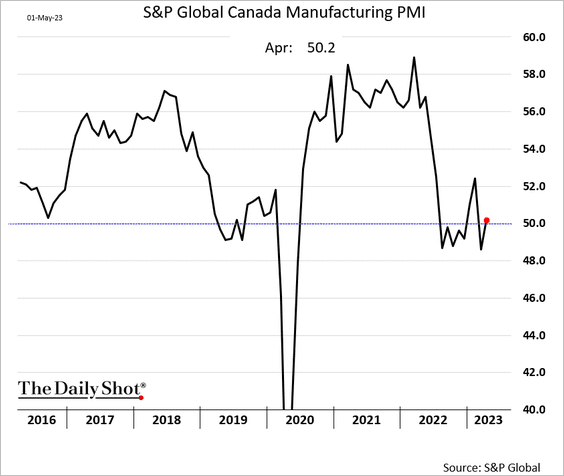

1. Factory activity stabilized in April, showing modest growth.

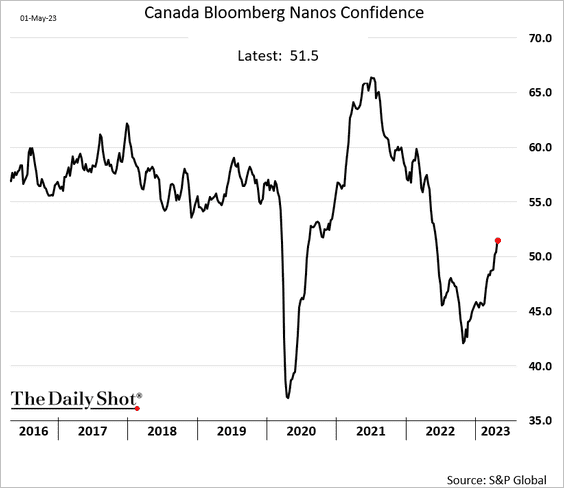

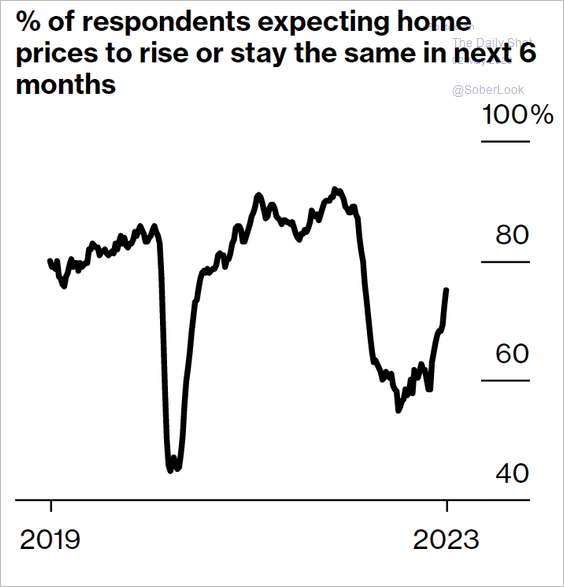

2. Consumer confidence is rebounding, …

… boosted by improved housing market sentiment.

Source: @ErikHertzberg, @economics Read full article

Source: @ErikHertzberg, @economics Read full article

——————–

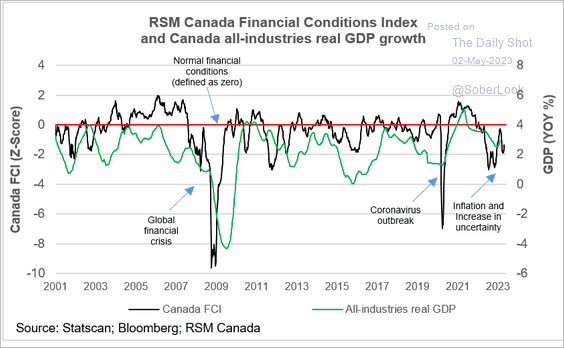

3. Financial conditions are still restrictive.

Source: The Real Economy Blog Read full article

Source: The Real Economy Blog Read full article

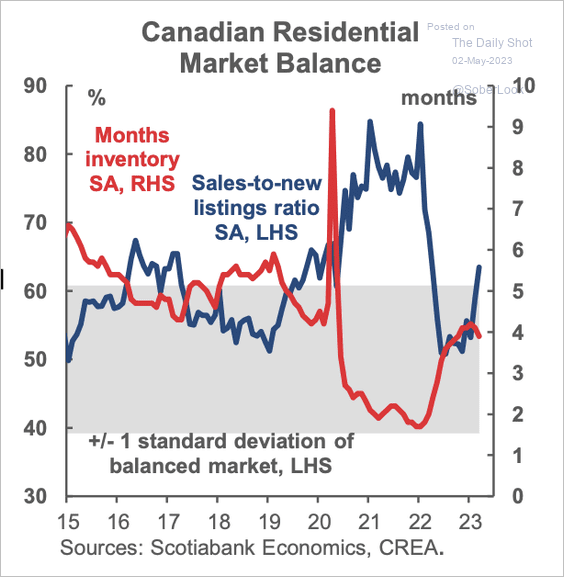

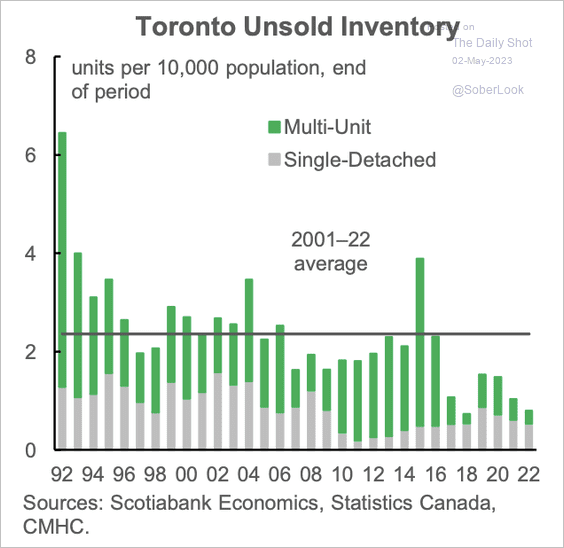

4. The housing market remains tight. (2 charts)

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

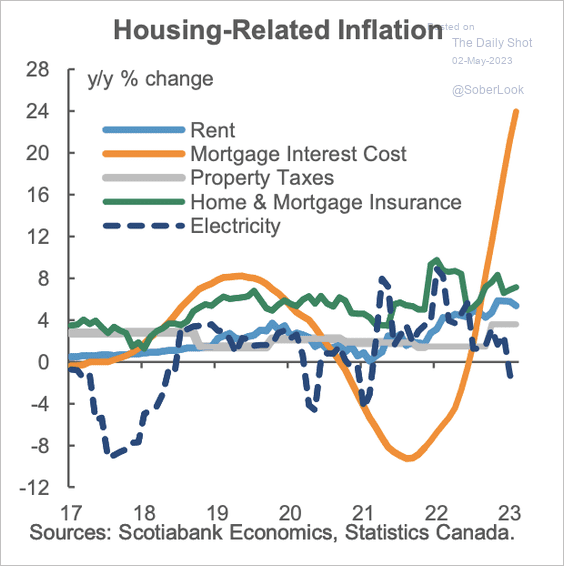

Mortgage interest costs have accelerated along with rising rent and insurance rates.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The Eurozone

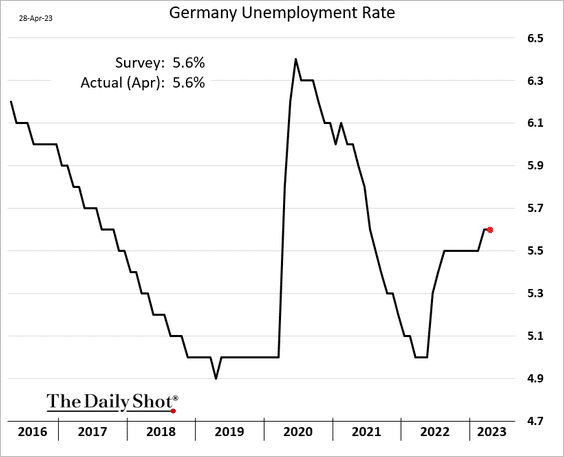

1. Germany’s unemployment rate held steady in April.

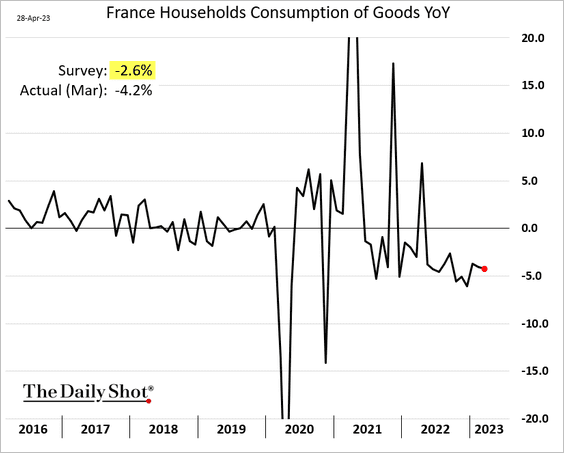

2. French consumer spending on goods has been weakening, with the March print below expectations.

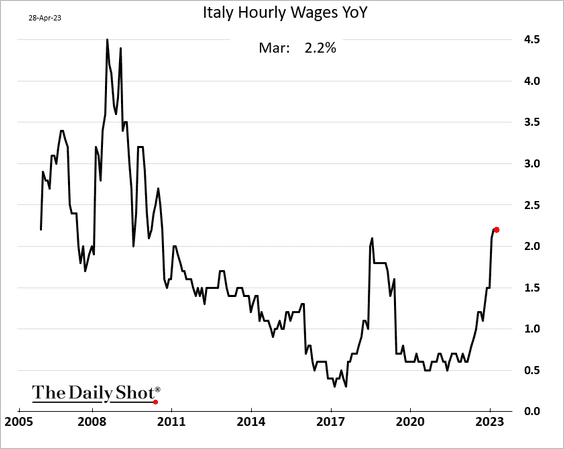

3. Italian wage growth hit a multi-year high.

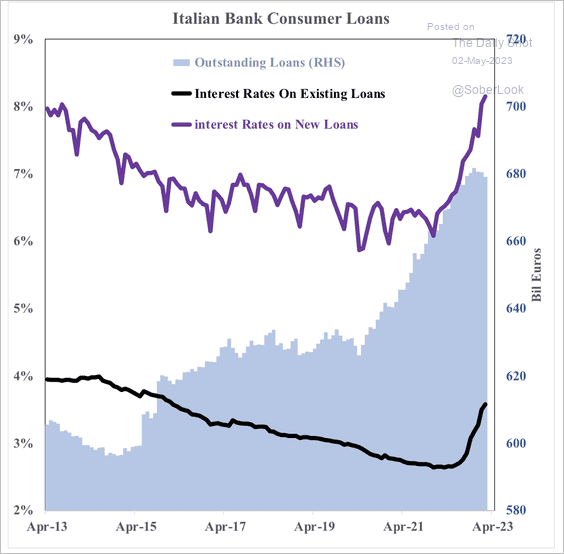

Separately, higher yields from new loan originations could help Italian bank earnings.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

——————–

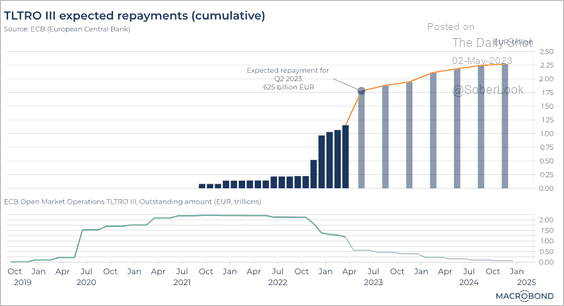

4. This summer, substantial TLTRO repayments are due, which could be viewed as a type of quantitative tightening.

Source: Macrobond

Source: Macrobond

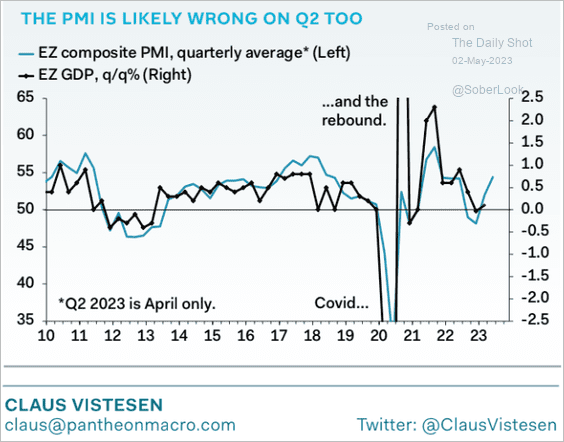

5. Are the PMI indicators signaling a GDP rebound?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

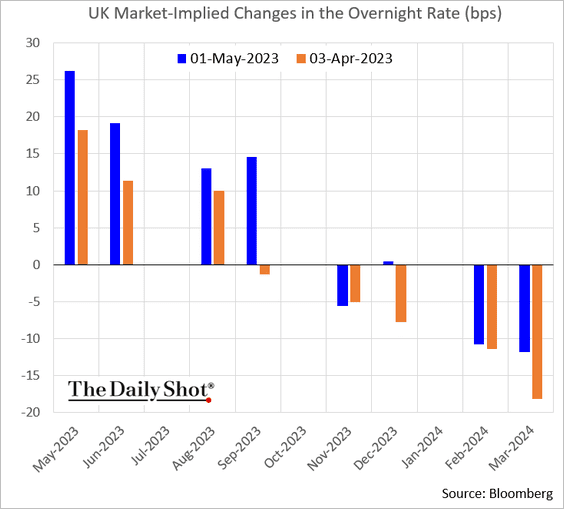

1. The market sees a 25 bps BoE rate hike this month and potentially another increase in June.

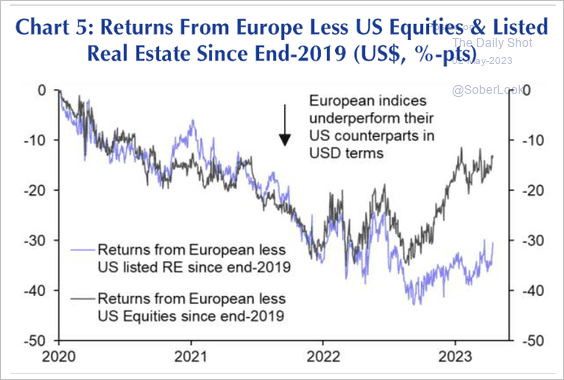

2. There is a wide relative performance gap between European real estate and US REITs.

Source: Capital Economics

Source: Capital Economics

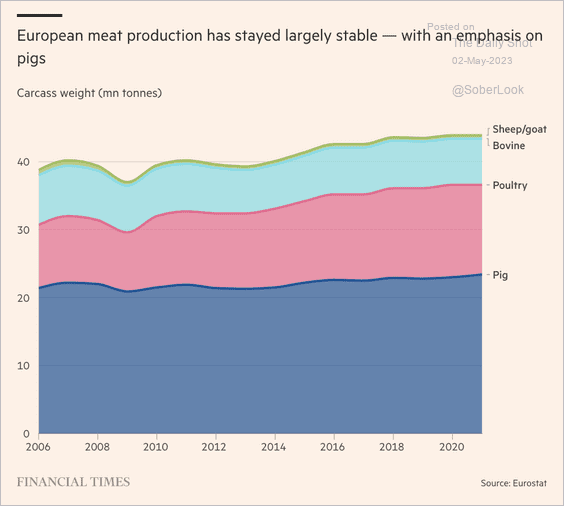

3. This chart shows European meat production over time.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

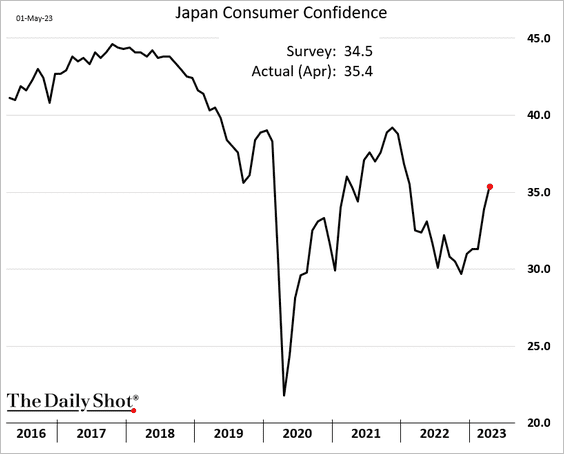

Japan

1. Consumer confidence is rebounding rapidly.

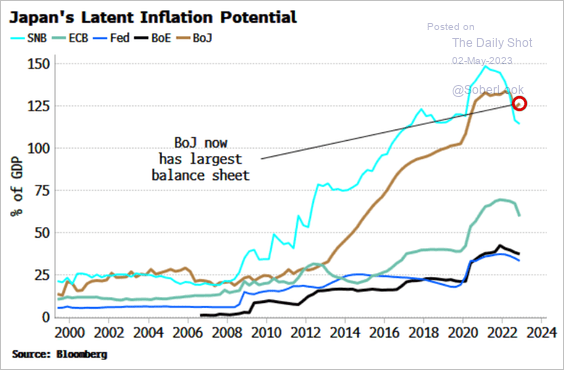

2. The BoJ’s balance sheet as a share of GDP is now the largest among major central banks.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

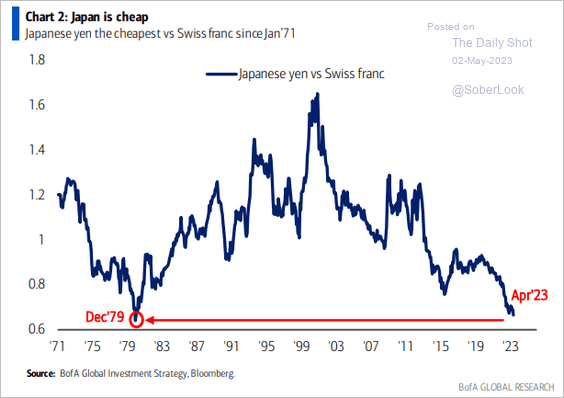

3. The yen is cheap relative to the Swiss franc.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Asia-Pacific

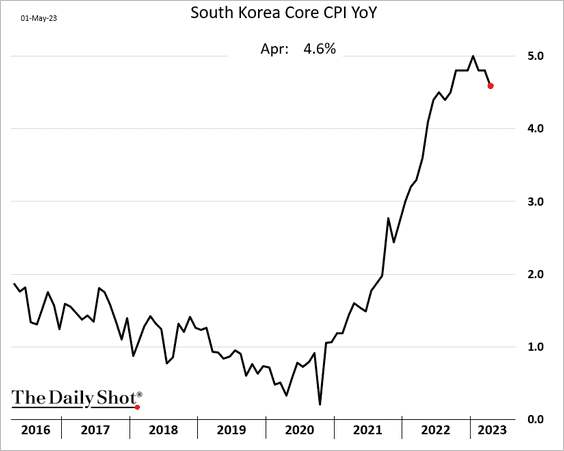

1. South Korea’s core inflation has finally peaked.

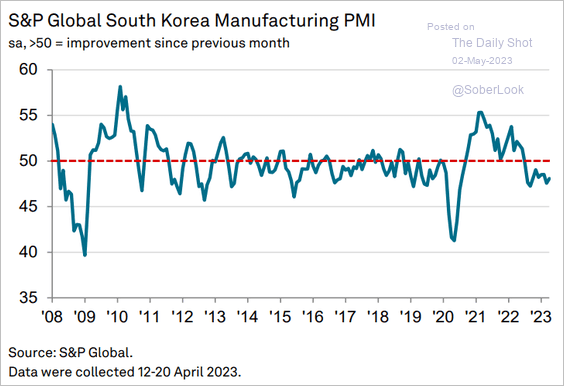

Factory activity continues to contract.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

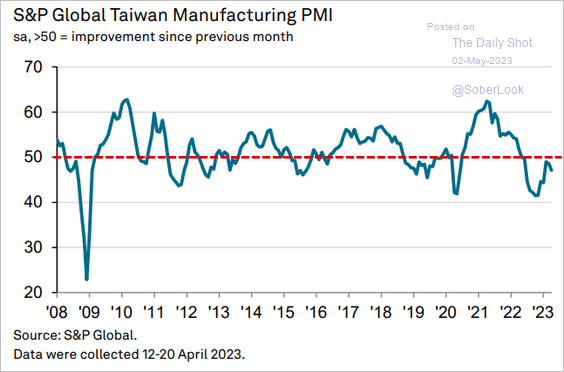

2. Taiwan’s manufacturing activity weakened in April.

Source: S&P Global PMI

Source: S&P Global PMI

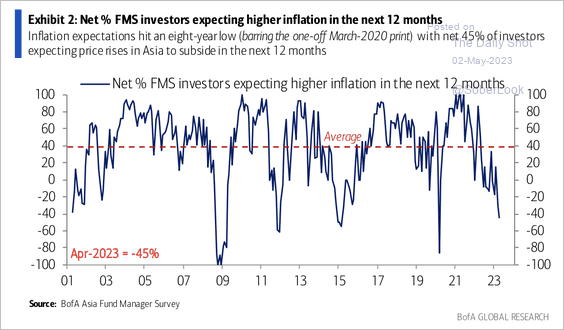

3. Investors’ inflation expectations for Asia hit an eight-year low, according to a survey by BofA.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

China

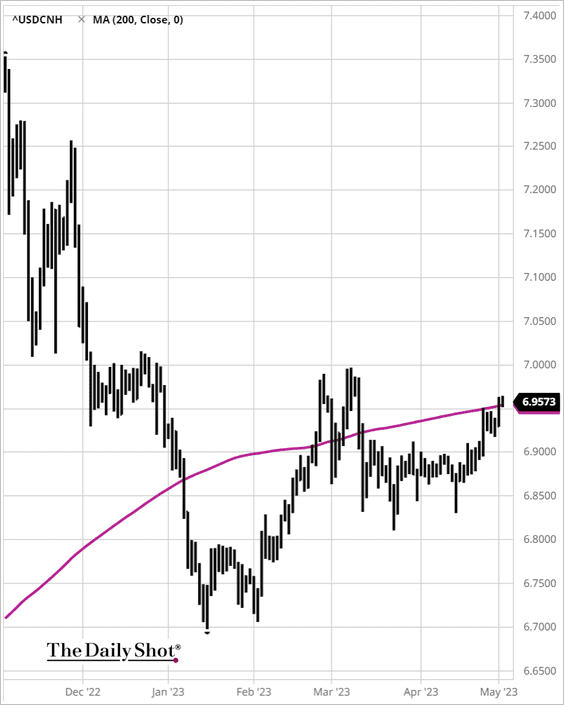

1. USD/CNH (offshore yuan) is at the 200-day moving average resistance (CNH is weakening against the dollar).

Source: barchart.com

Source: barchart.com

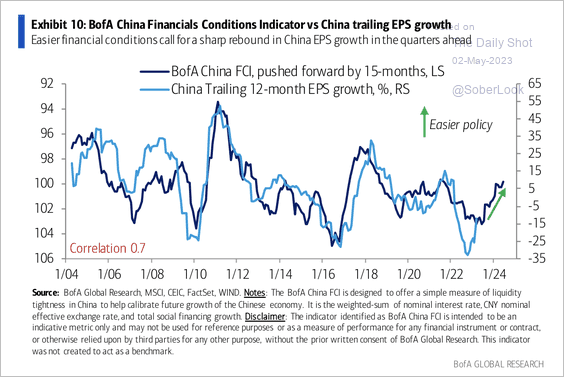

2. Easing financial conditions could benefit earnings growth.

Source: BofA Global Research

Source: BofA Global Research

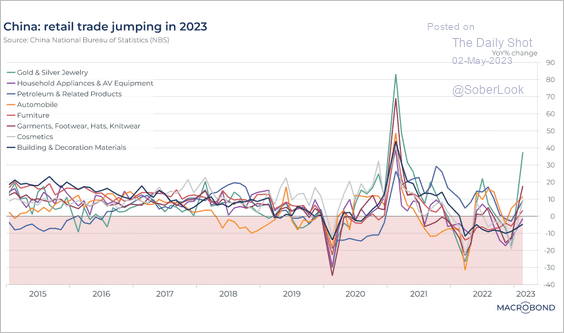

3. Chinese consumers have been shopping.

Source: Macrobond

Source: Macrobond

Back to Index

Cryptocurrency

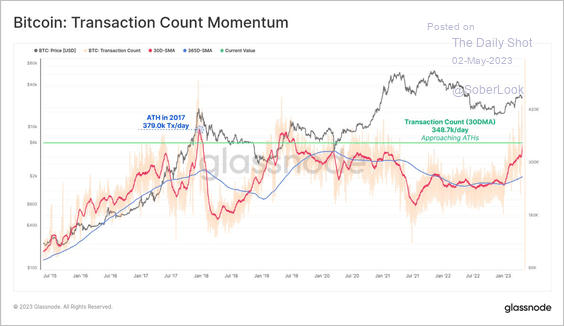

1. Bitcoin’s daily transaction counts are approaching all-time highs.

Source: @glassnode

Source: @glassnode

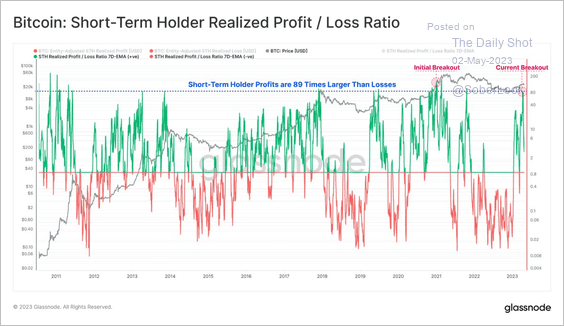

2. Short-term bitcoin holders experienced some of the most profitable days on record during the latest crypto rally.

Source: @glassnode

Source: @glassnode

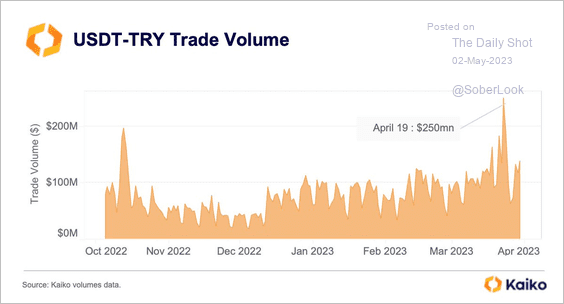

3. Demand for Tether’s USDT stablecoin on Turkish markets spiked.

Source: @KaikoData

Source: @KaikoData

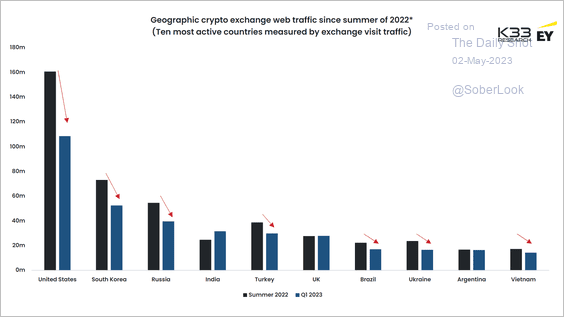

4. Crypto exchange web traffic has declined since last summer, although India remained active.

Source: @K33Research

Source: @K33Research

Back to Index

Commodities

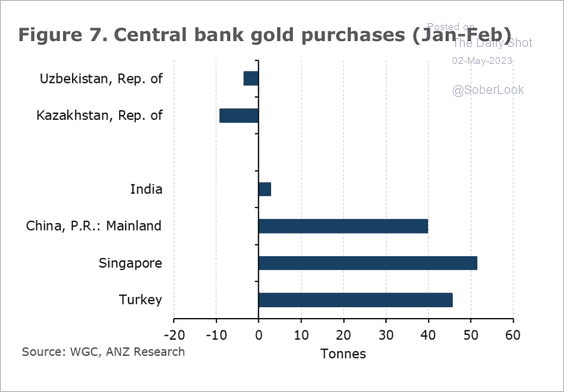

1. Central banks in Turkey, China, and India were the top buyers of gold in January and February.

Source: @ANZ_Research

Source: @ANZ_Research

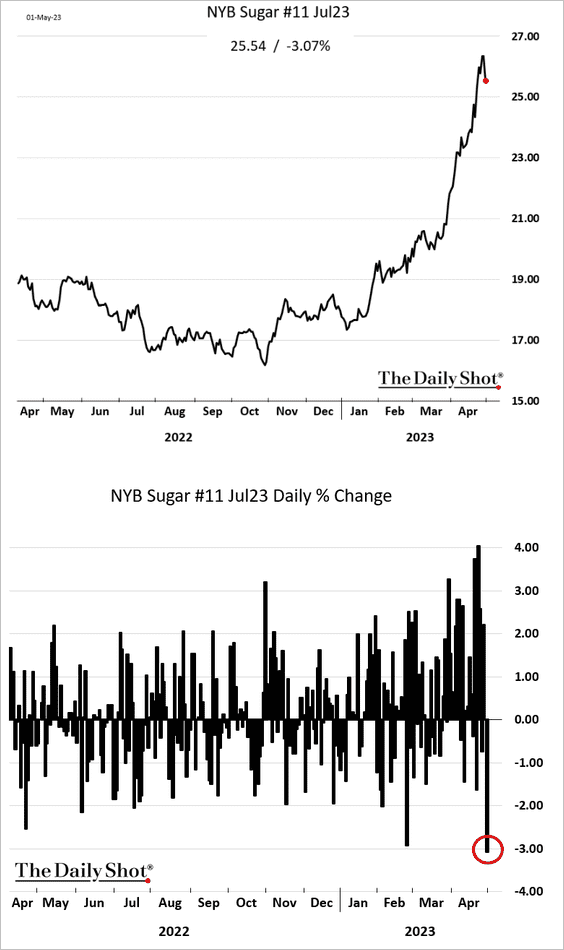

2. New York sugar futures fell from an 11-year high on Monday.

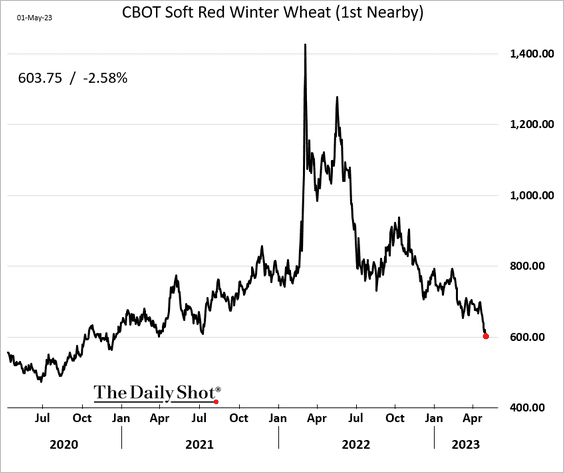

3. Wheat prices remain under pressure.

Source: barchart.com Read full article

Source: barchart.com Read full article

——————–

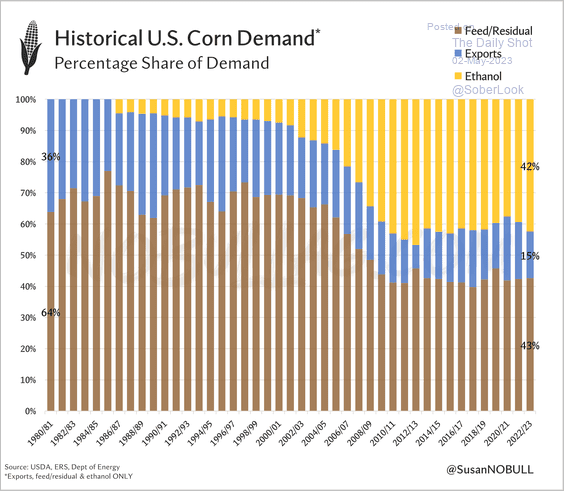

4. This chart shows the drivers of US corn demand.

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

Back to Index

Equities

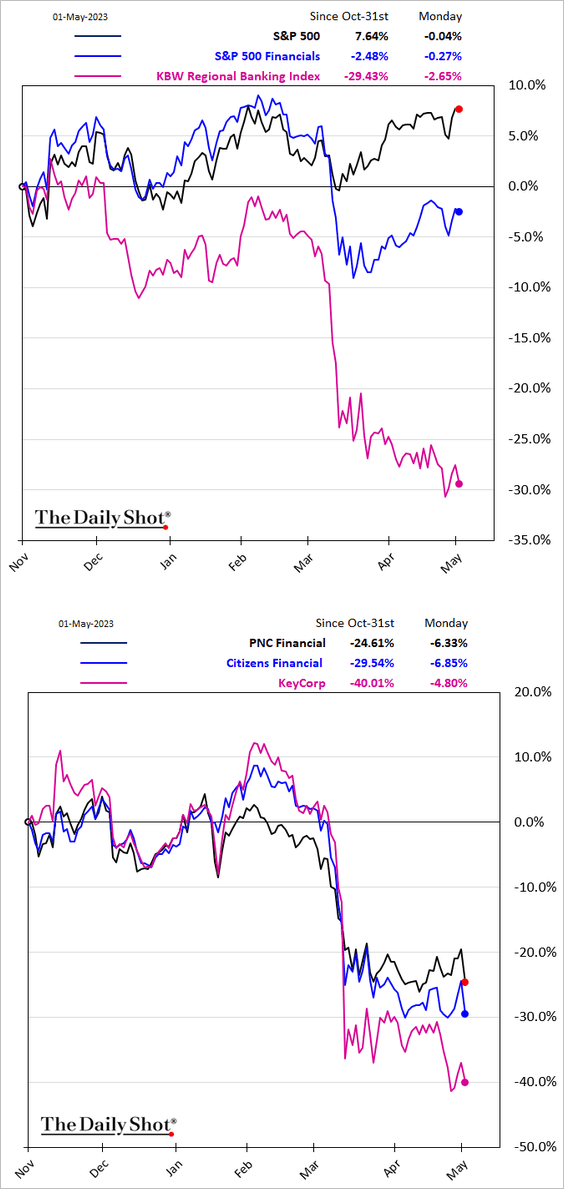

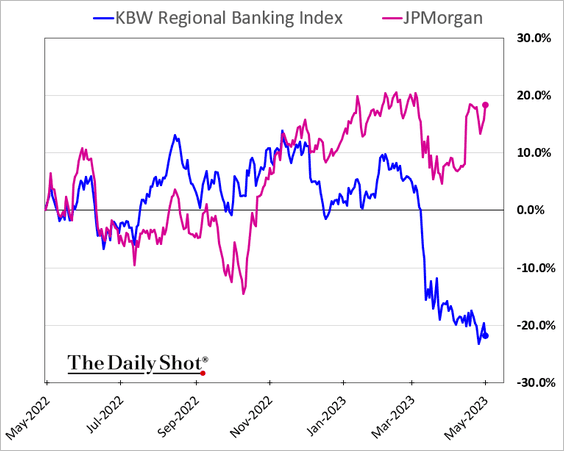

1. Banks getting snuffed out of existence in a single weekend is putting pressure on the regional banking sector.

But the largest banks are performing well.

——————–

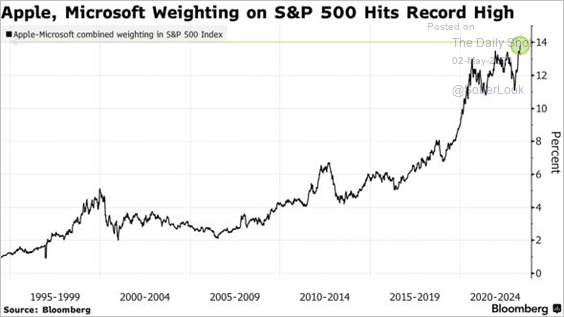

2. Apple’s and Microsoft’s combined weight in the S&P 500 hit a record high.

Source: @Subrat_Patnaik, @technology Read full article

Source: @Subrat_Patnaik, @technology Read full article

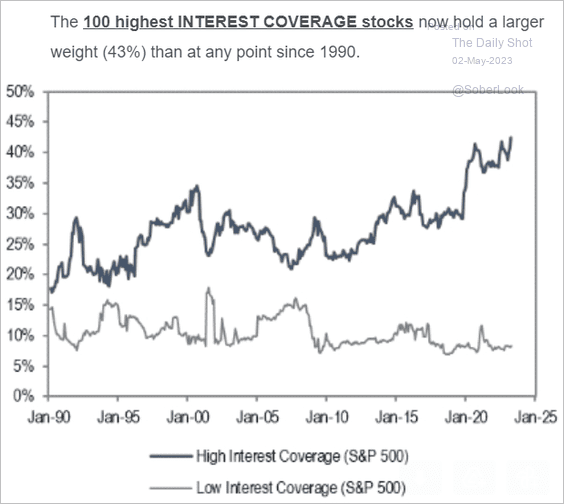

3. Stocks with the highest interest coverage are increasingly dominant in the S&P 500.

Source: Piper Sandler

Source: Piper Sandler

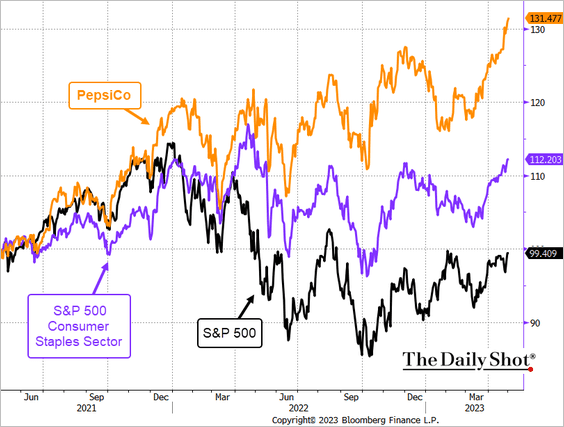

4. Consumer Staples shares held up well over the past couple of years.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

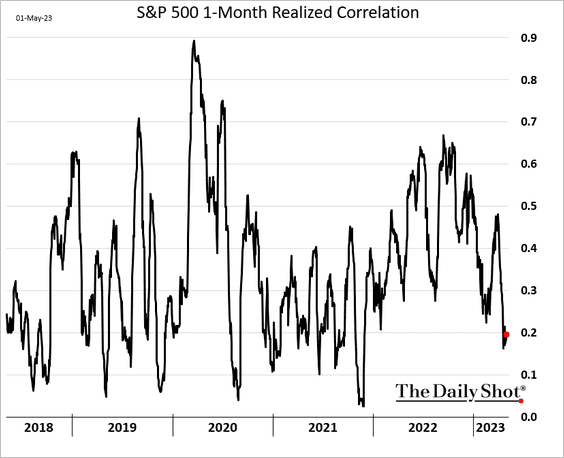

5. Declining correlation among S&P 500 members lowered the overall index volatility.

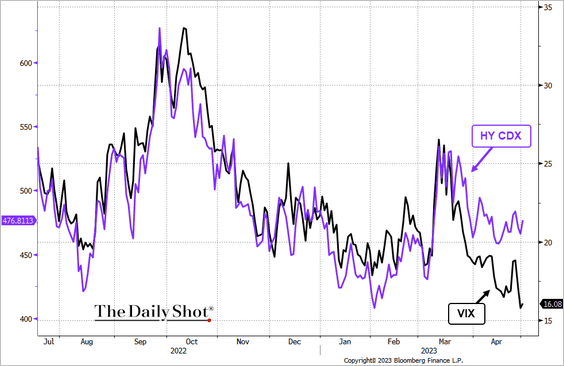

6. Equity implied volatility is too low, given elevated credit spreads.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

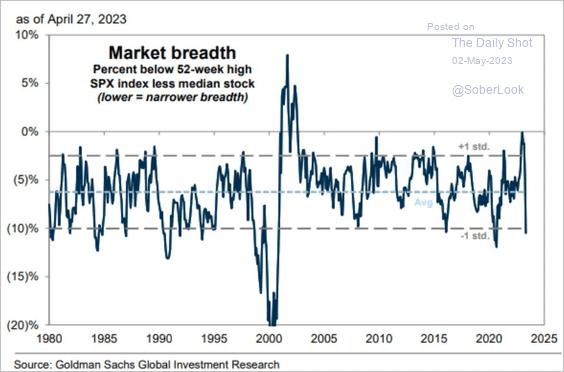

7. Market breadth has deteriorated.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

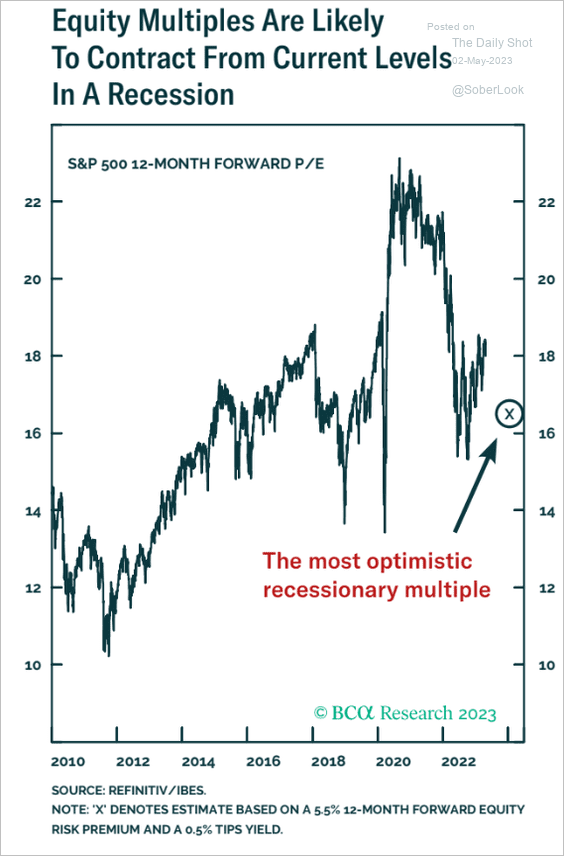

8. Valuation multiples are likely to contract in a recession.

Source: BCA Research

Source: BCA Research

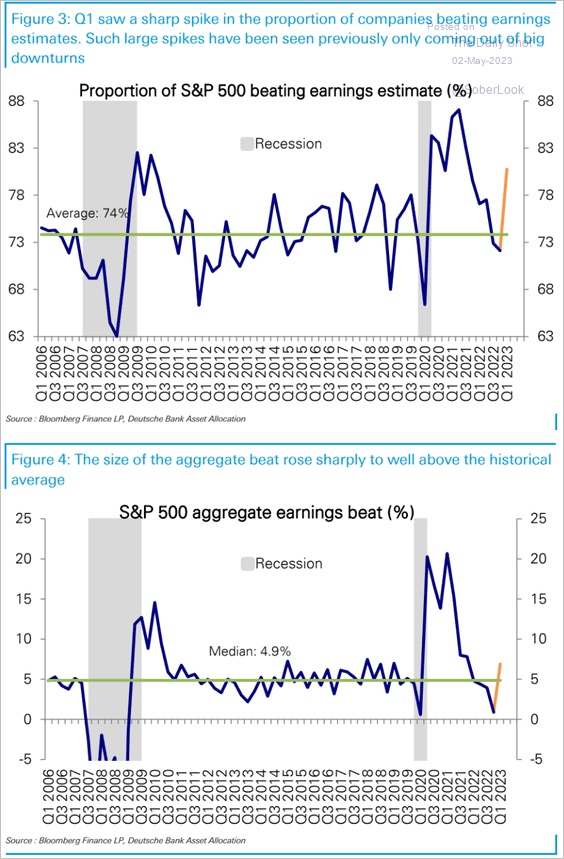

9. The breadth as well as the size of earnings beats bounced in the current earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

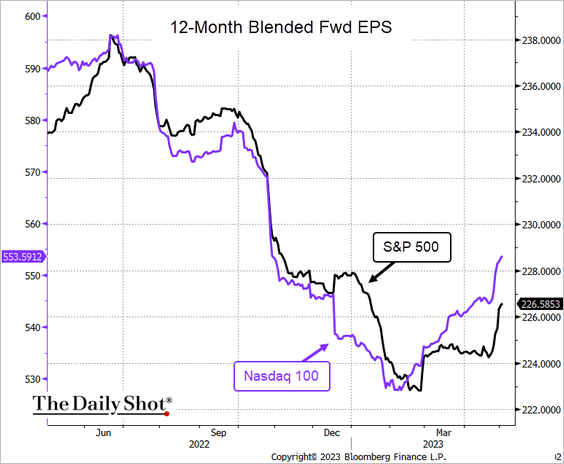

The 12-month forward earnings expectations jumped.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

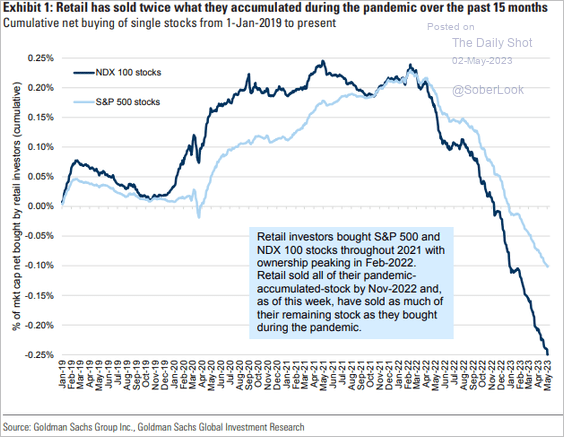

10. Retail investors seem to have capitulated (bought high and sold low.)

Source: Goldman Sachs; @SethCL, h/t @chartrdaily

Source: Goldman Sachs; @SethCL, h/t @chartrdaily

Back to Index

Credit

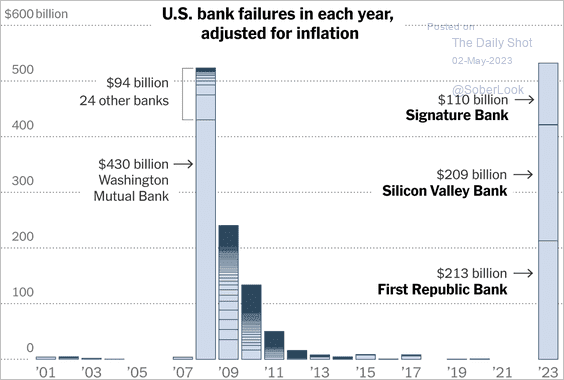

1. Let’s start with the chart of US bank failures.

Source: The New York Times Read full article

Source: The New York Times Read full article

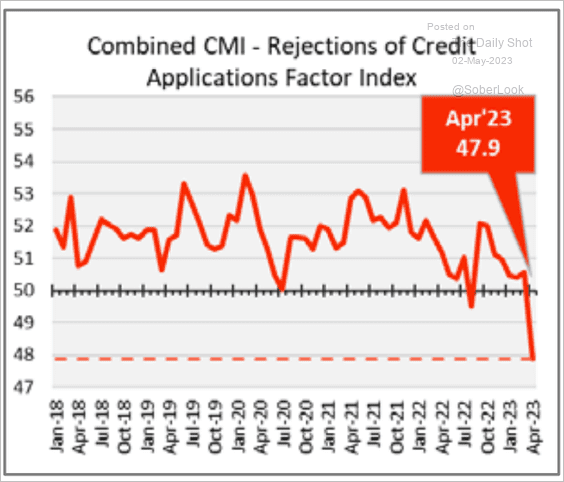

2. Rejections of credit applications spiked last month, according to NACM.

Source: NACM

Source: NACM

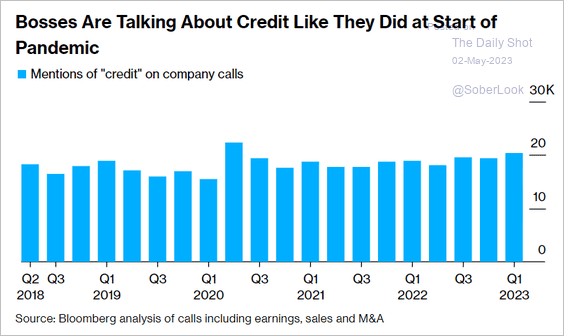

3. More companies are talking about credit on earnings calls.

Source: @ncallanan, @markets Read full article

Source: @ncallanan, @markets Read full article

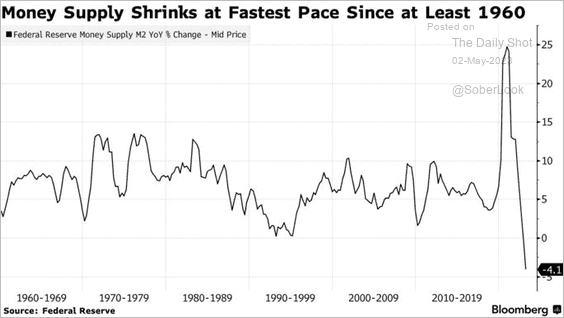

4. The money supply continues to shrink.

Source: @ncallanan, @markets Read full article

Source: @ncallanan, @markets Read full article

Back to Index

Rates

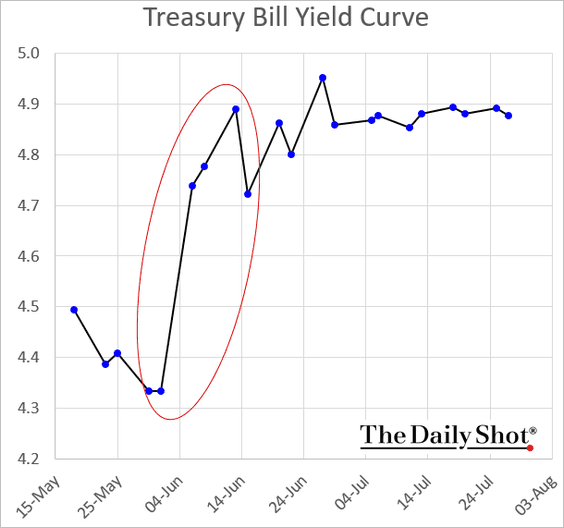

1. The Treasury bill curve remains distorted amid the debt ceiling “game of chicken.”

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

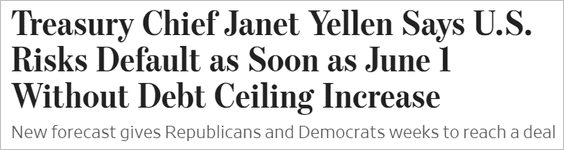

2. Bets on long-term Treasuries jumped before the FOMC meeting.

Source: @WSJ Read full article

Source: @WSJ Read full article

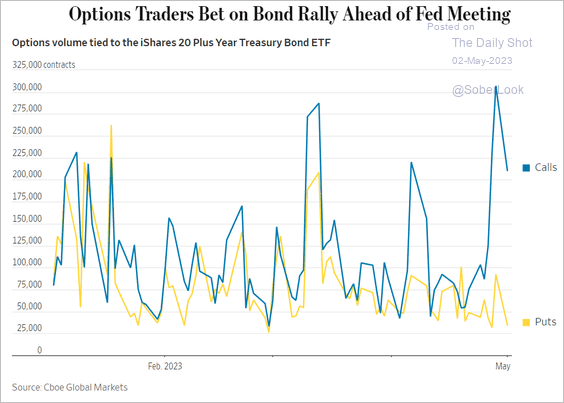

3. JP Morgan’s clients are increasingly bullish on Treasuries.

——————–

Food for Thought

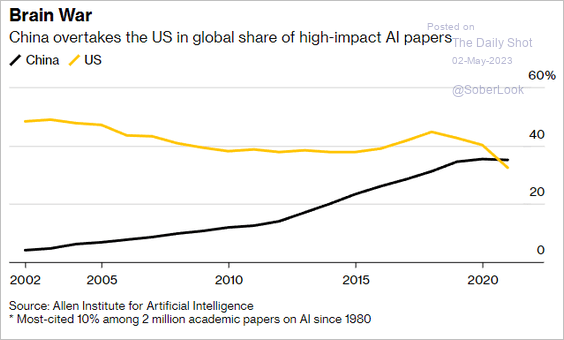

1. AI-related publications in the US and China:

Source: @business Read full article

Source: @business Read full article

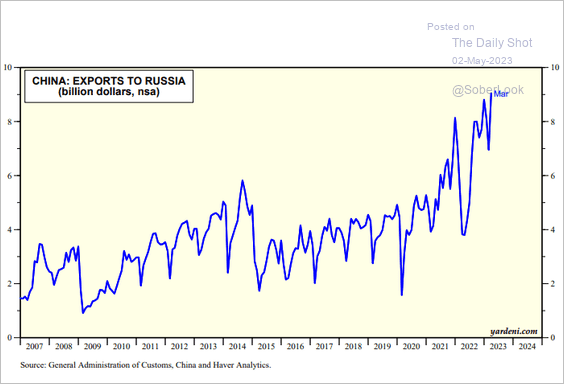

2. China’s exports to Russia:

Source: Yardeni Research

Source: Yardeni Research

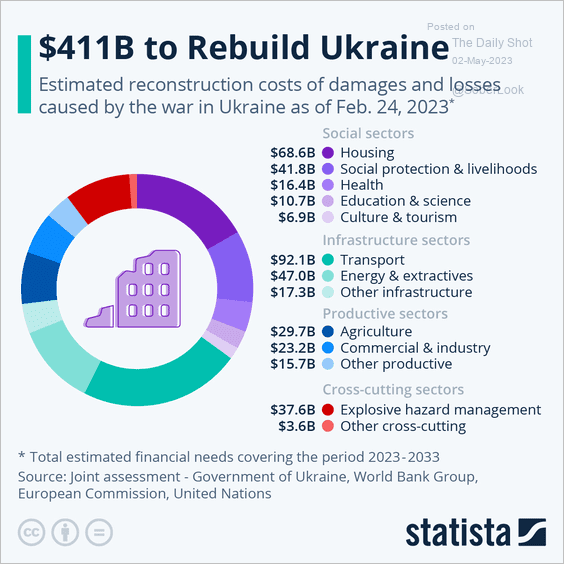

3. Ukraine’s reconstruction costs:

Source: Statista

Source: Statista

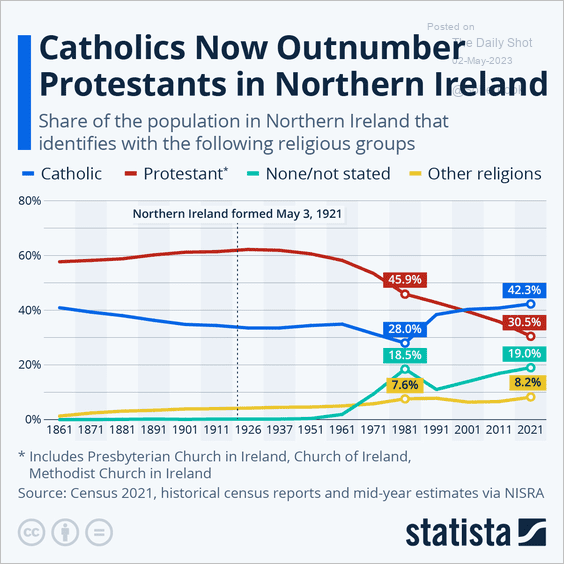

4. Religious affiliations in Northern Ireland:

Source: Statista

Source: Statista

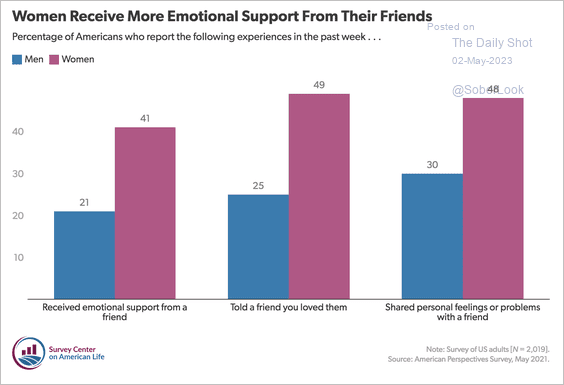

5. Emotional support from friends:

Source: Survey Center on American Life Read full article

Source: Survey Center on American Life Read full article

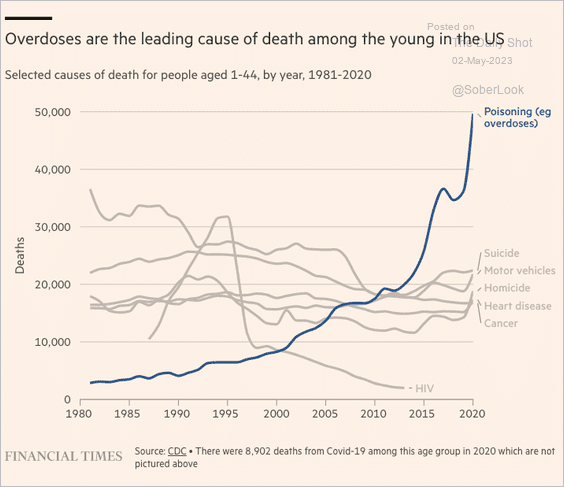

6. Drug overdoses among young Americans (mostly due to fentanyl):

Source: @financialtimes Read full article

Source: @financialtimes Read full article

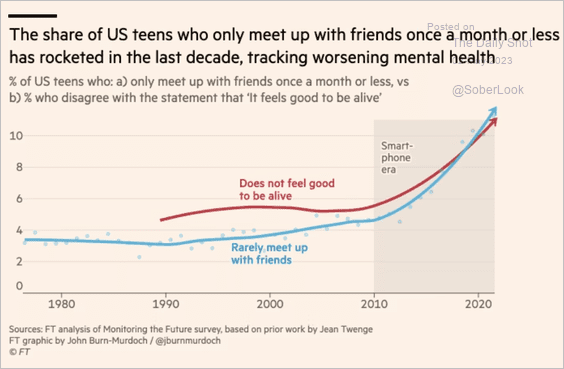

7. Teens who rarely meet with friends:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

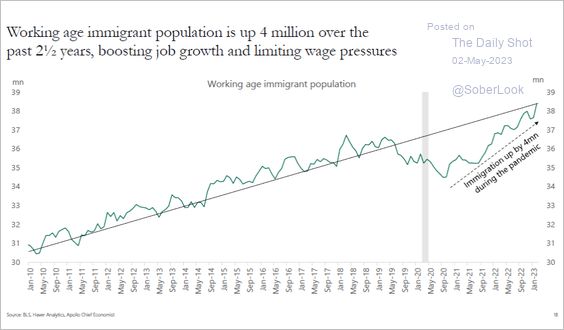

8. Working-age immigrant population:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

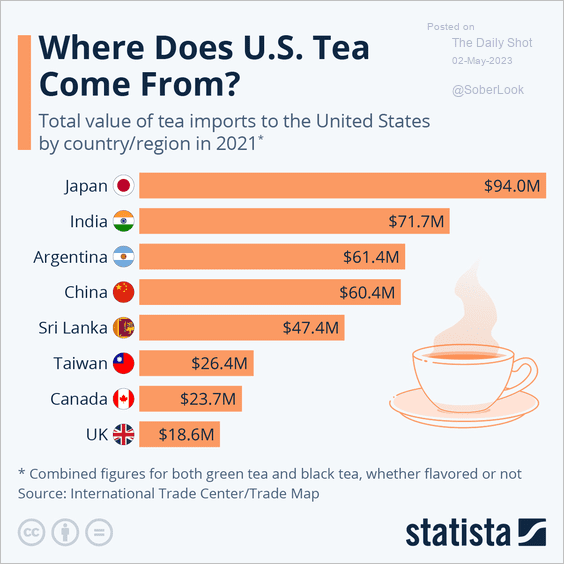

9. US tea imports:

Source: Statista

Source: Statista

——————–

Back to Index