The Daily Shot: 03-May-23

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Food for Thought

The United States

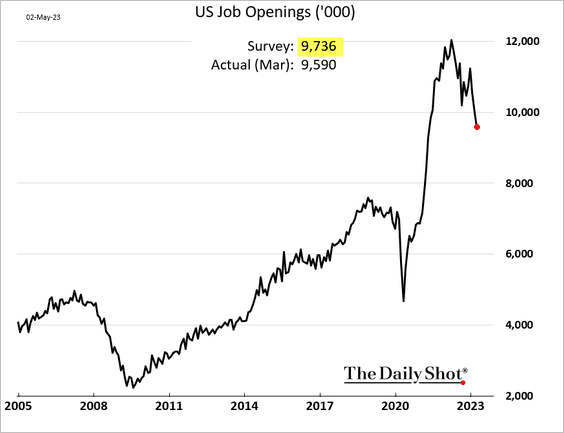

1. Job openings declined sharply in March.

Source: ABC News Read full article

Source: ABC News Read full article

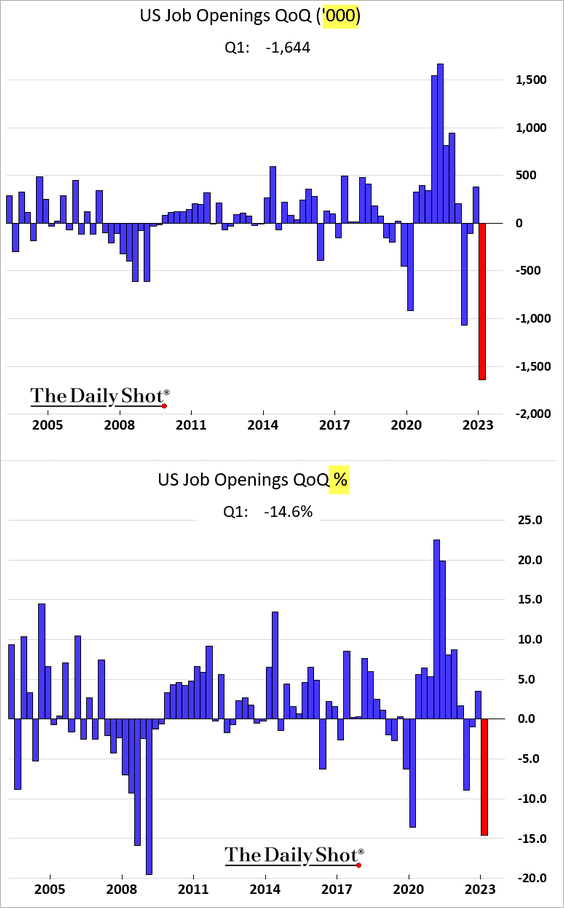

Here are the quarterly changes in job openings (absolute level and percentage).

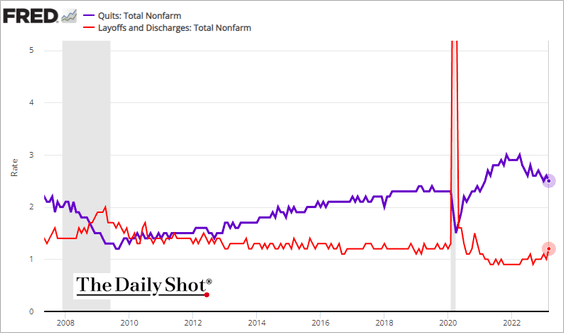

• Voluntary resignations slowed further while layoffs increased.

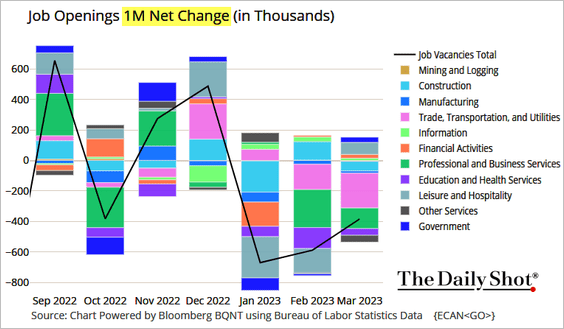

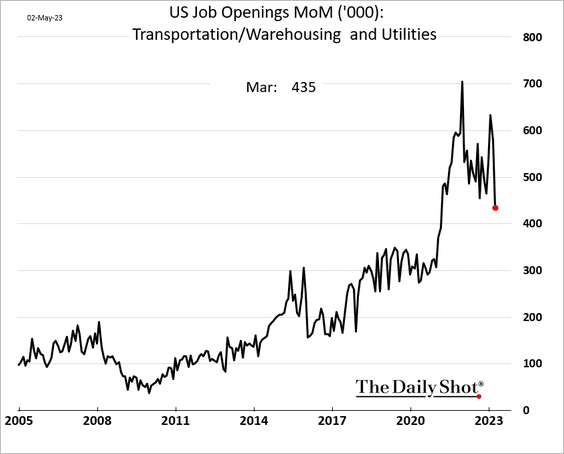

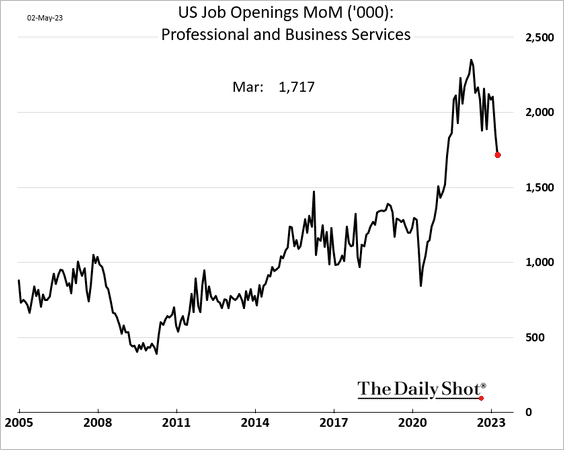

• Logistics and business services saw significant declines (3 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

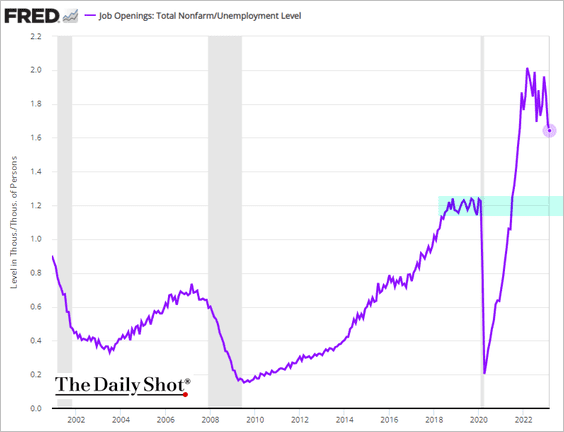

• The number of job openings per unemployed American is still well above pre-COVID levels.

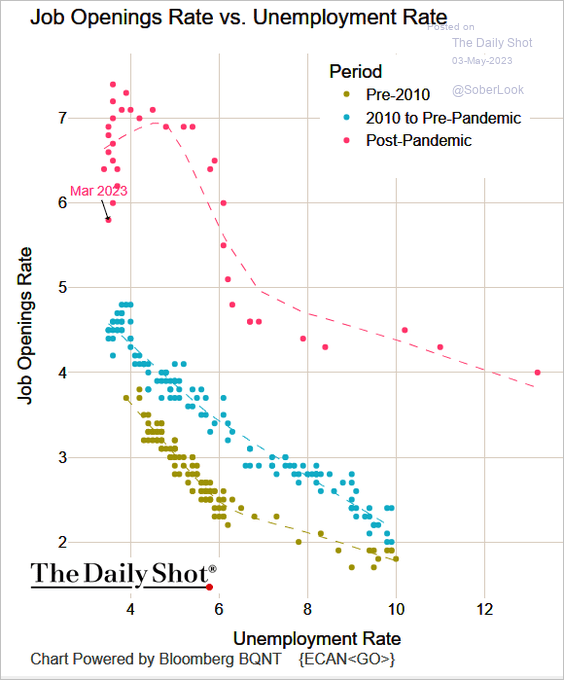

• Here is the Beveridge curve.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

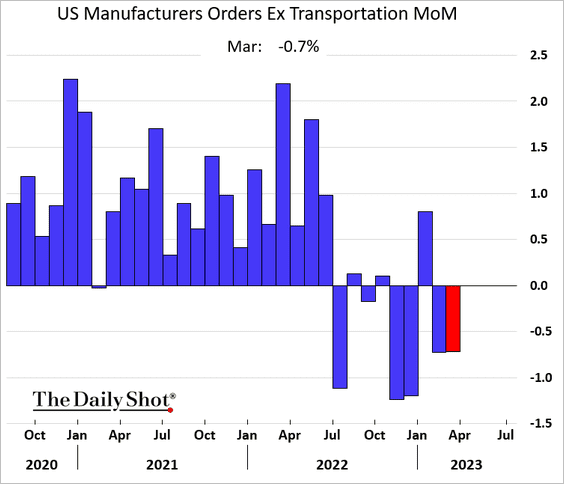

2. Factory orders declined again in March.

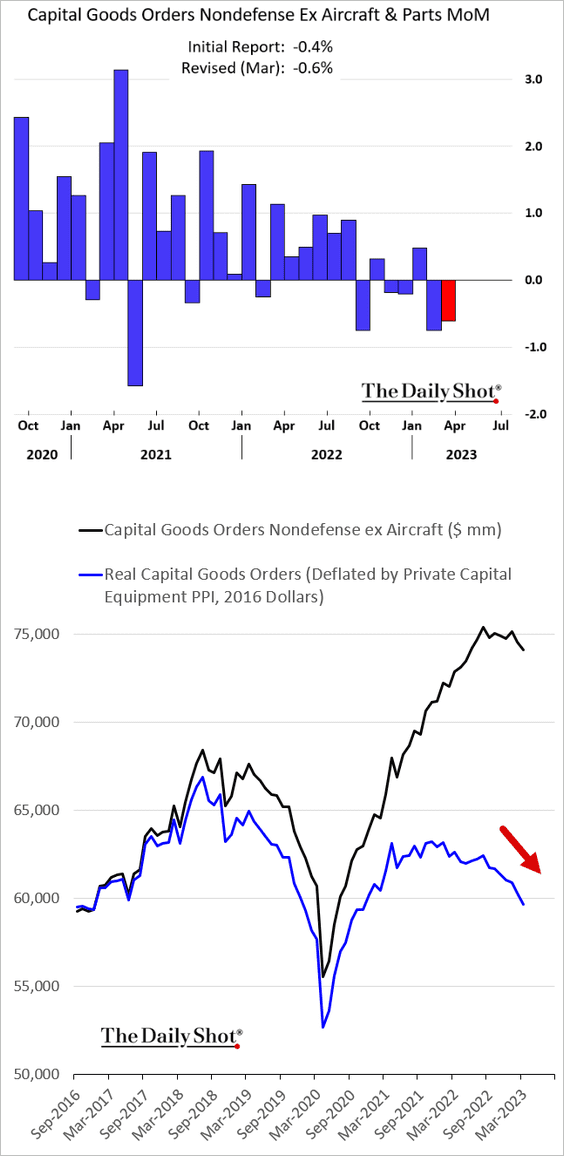

• March capital goods orders were revised lower, pointing to weakening business investment.

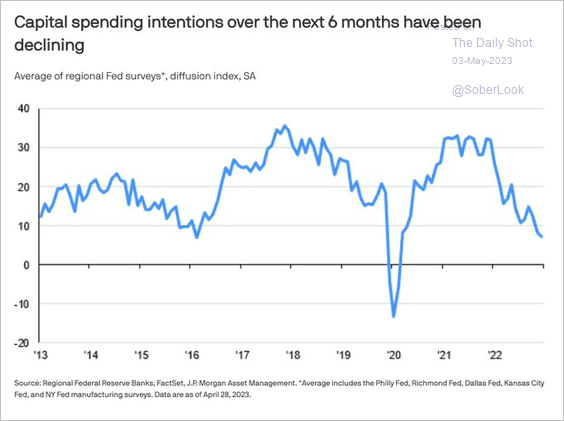

• Regional Fed manufacturing surveys signal a further CapEx slowdown ahead.

Source: @acemaxx, @JPMorganAM

Source: @acemaxx, @JPMorganAM

——————–

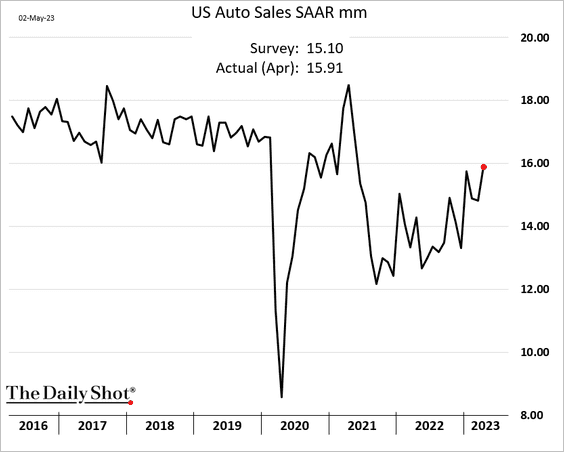

3. Automobile sales are rebounding as supply bottlenecks fade.

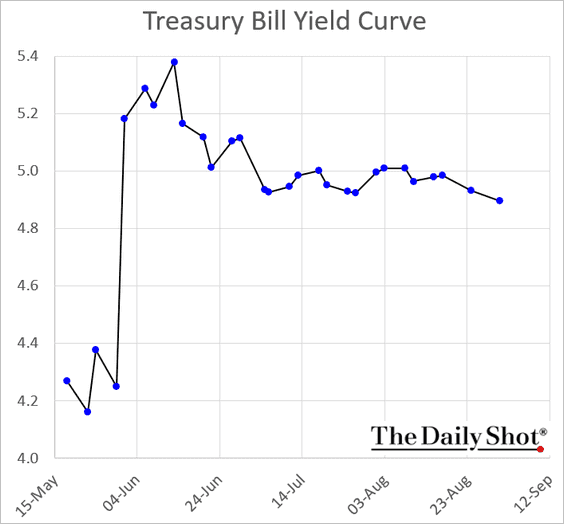

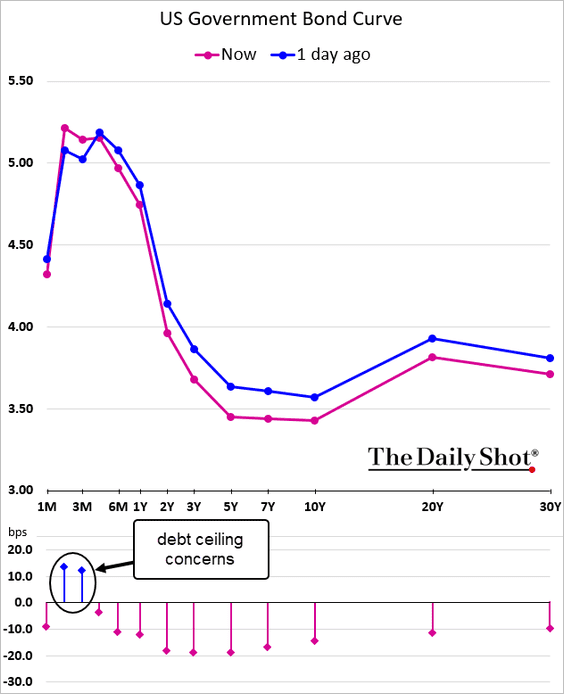

4. The Treasury bill market is increasingly signaling concerns about a US default this summer. Here is the T-bill yield curve.

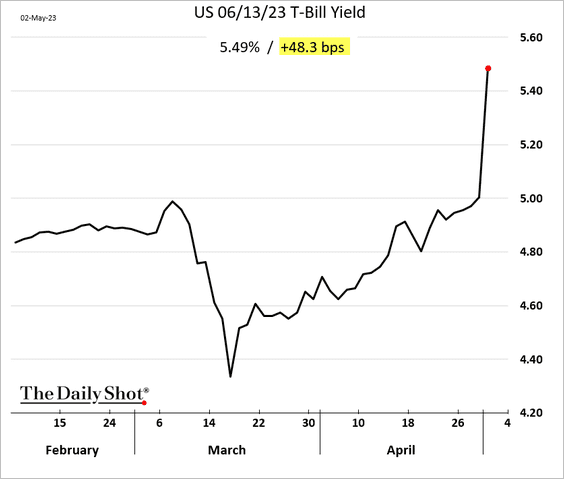

The June 13th T-bill yield jumped by 48 basis points on Tuesday.

——————–

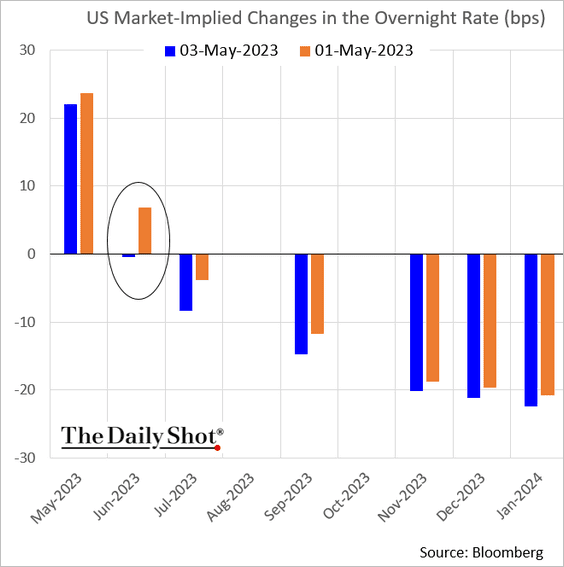

5. The combination of banking jitters and the debt ceiling took a June Fed rate hike off the table.

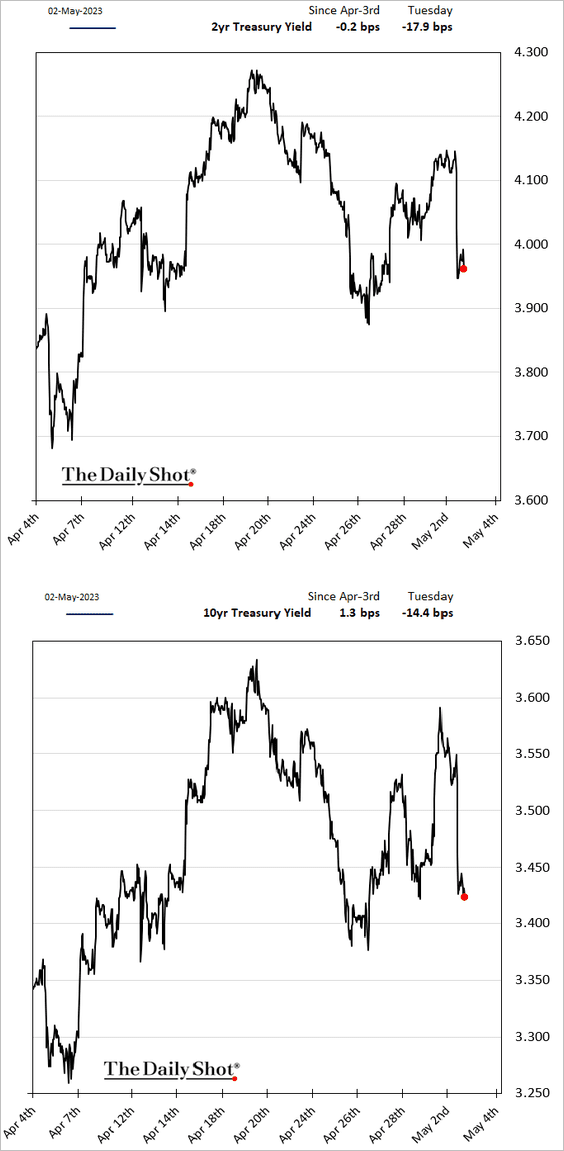

• Treasury yields dropped sharply.

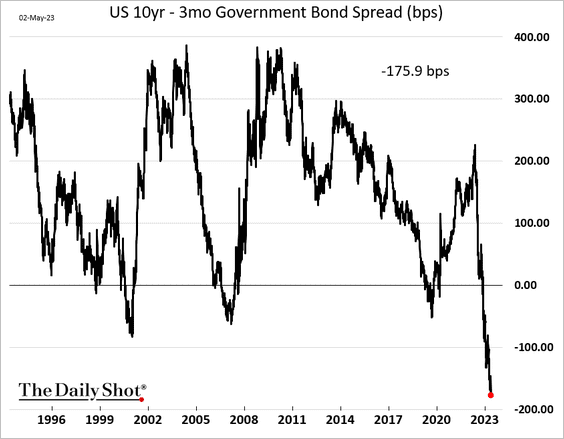

• The yield curve inverted further.

– Here is the 10-year – 3-month Treasury spread.

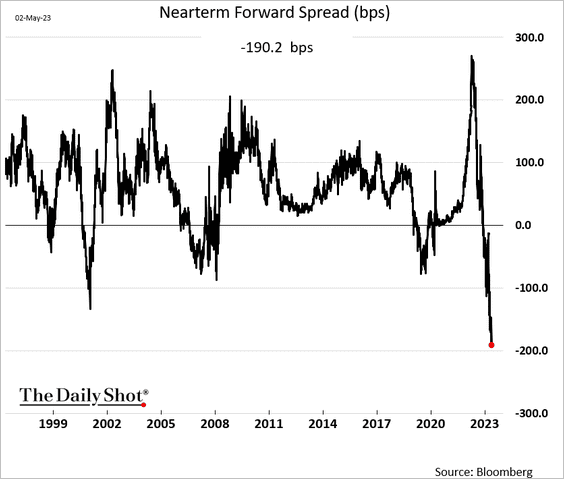

– The spread between the forward rate on Treasury bills 18 months from now and the current yield on a three-month Treasury bill, which is the Federal Reserve’s preferred bond market signal, has reached a new low.

Back to Index

The United Kingdom

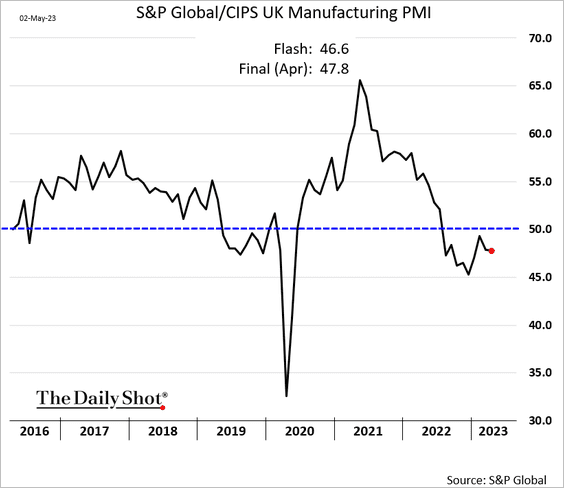

1. The final April manufacturing PMI showed a slower decline than the flash report.

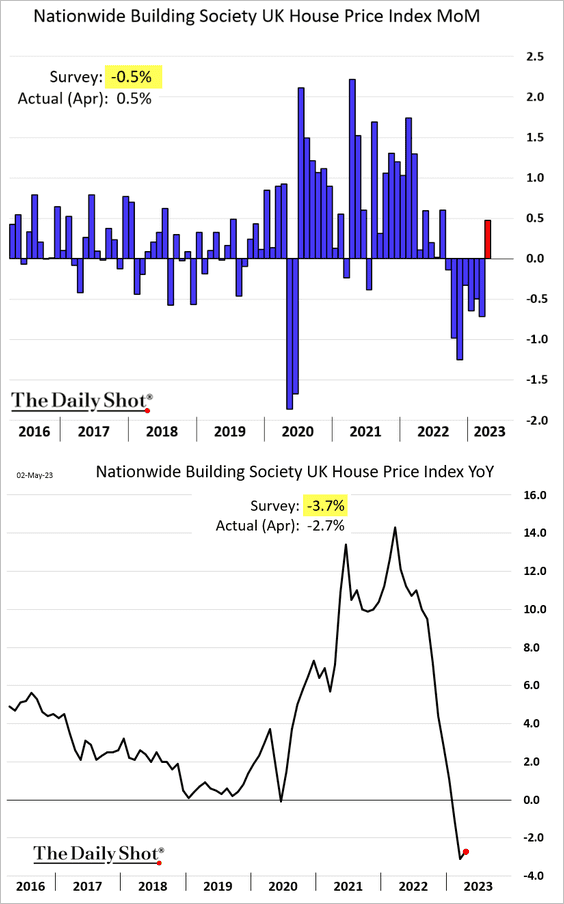

2. Home prices unexpectedly jumped in April.

Back to Index

The Eurozone

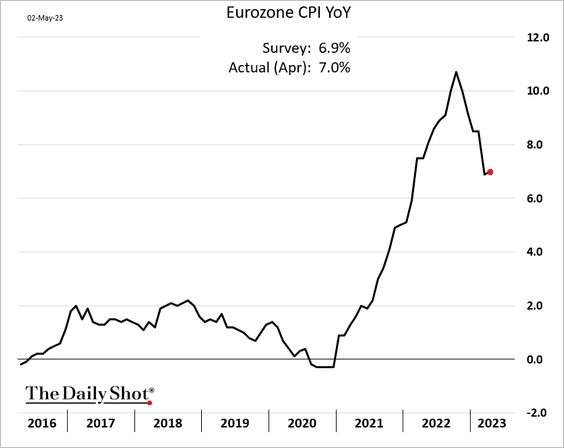

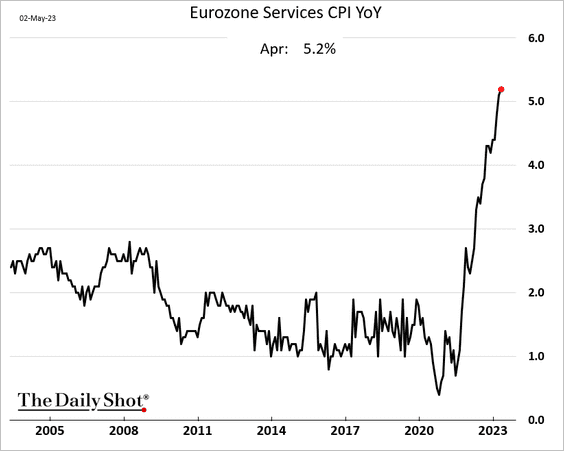

1. Inflation picked up again in April.

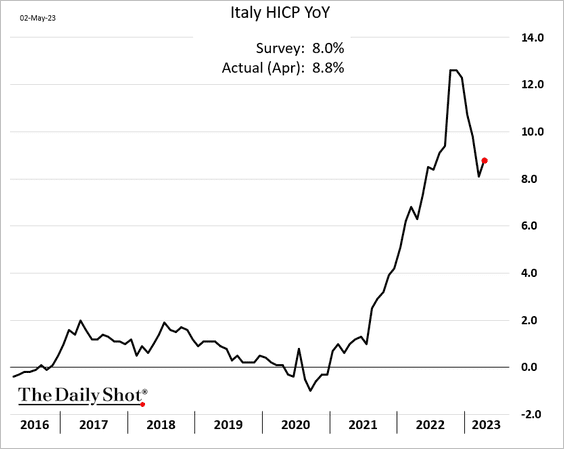

Here is Italy’s CPI.

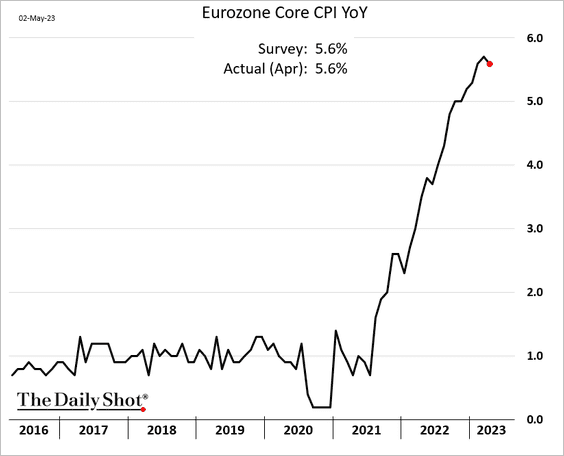

• The core CPI appears to have finally peaked at an elevated level.

• Services CPI hit a record high.

But the ECB is expected to deliver a smaller rate hike this week.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

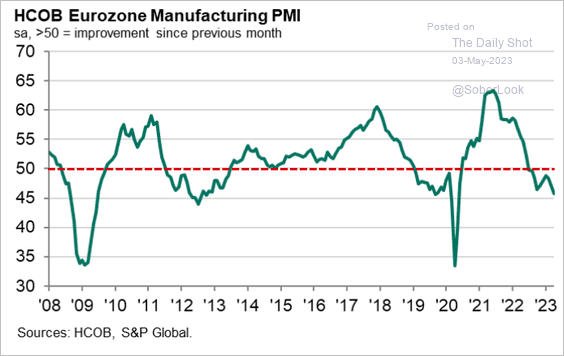

2. Next, we have some manufacturing PMI data.

• Factory activity continued to contract in April, although the decline was a bit slower than seen in the flash report.

Source: Reuters Read full article

Source: Reuters Read full article

Source: S&P Global PMI

Source: S&P Global PMI

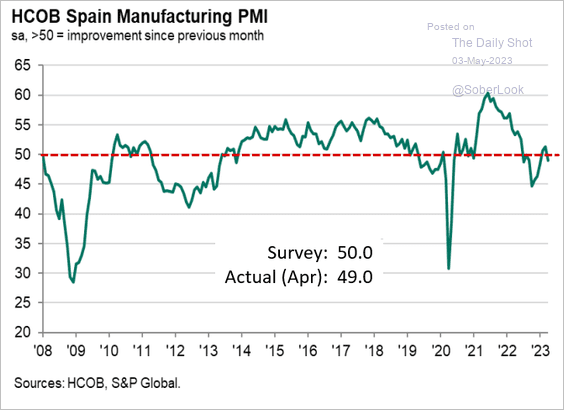

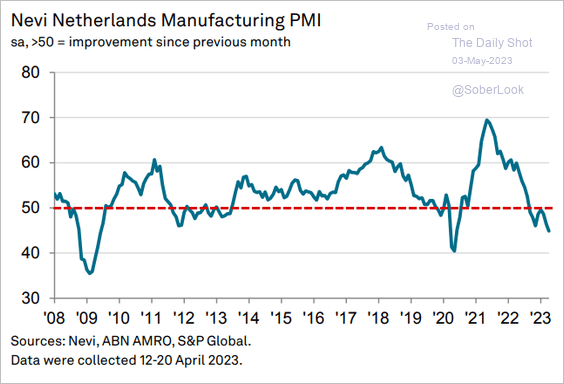

• Here are some PMI trends.

– Spain (back in contraction):

Source: S&P Global PMI

Source: S&P Global PMI

– The Netherlands (accelerating contraction):

Source: S&P Global PMI

Source: S&P Global PMI

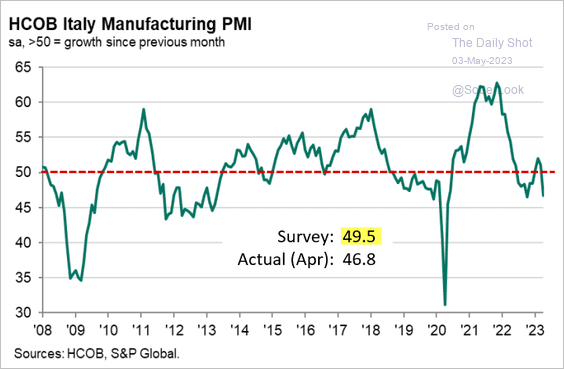

– Italy (well below expectations):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

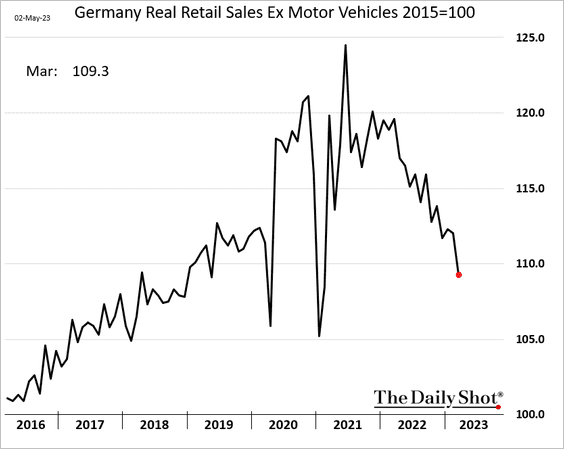

2. Germany’s retail sales continued to crash in March.

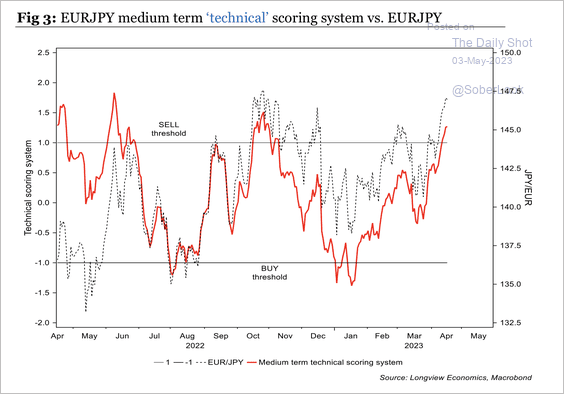

3. The rally in EUR/JPY appears overbought …

Source: Longview Economics

Source: Longview Economics

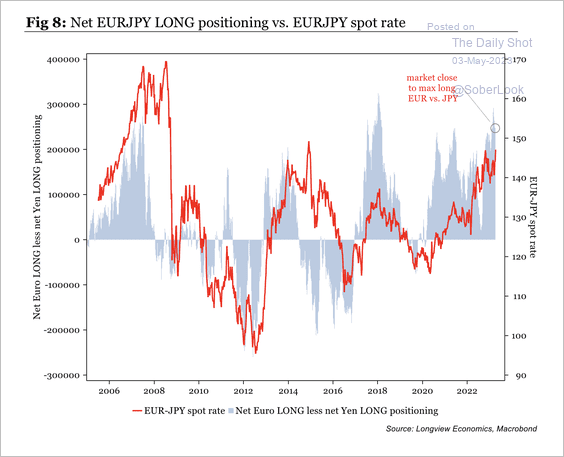

… and speculative long positioning is stretched.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

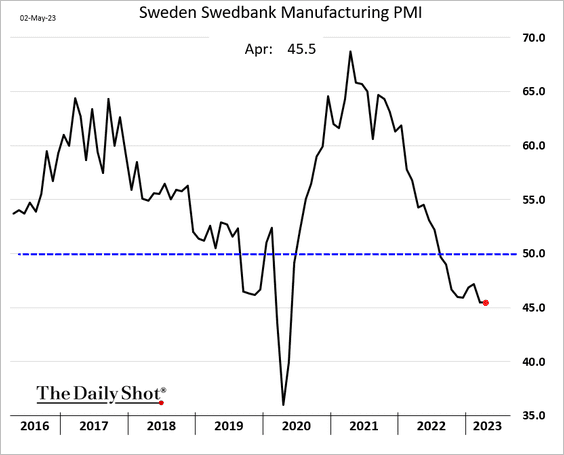

1. Sweden’s manufacturing sector continues to contract.

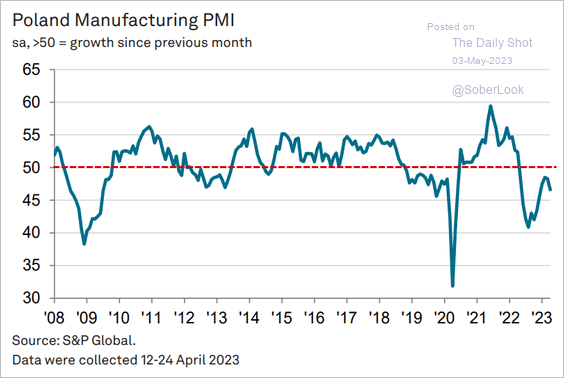

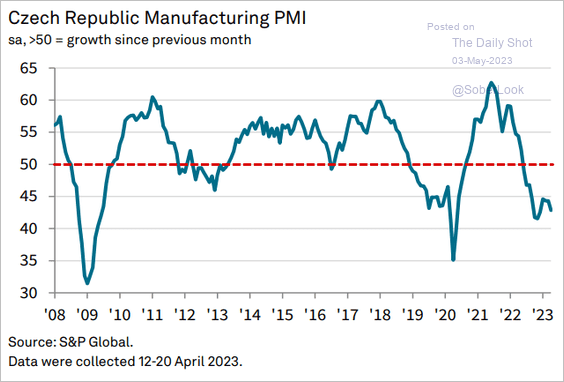

2. Central European manufacturing hubs are also struggling.

• Poland:

Source: S&P Global PMI

Source: S&P Global PMI

• Czech Republic:

Source: S&P Global PMI

Source: S&P Global PMI

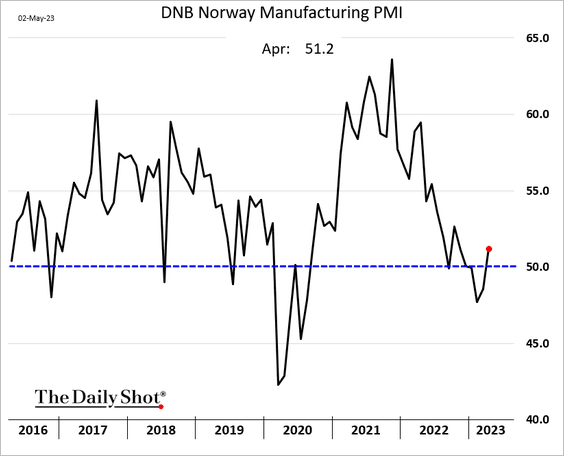

3. But Norway’s factory activity is back in growth mode.

——————–

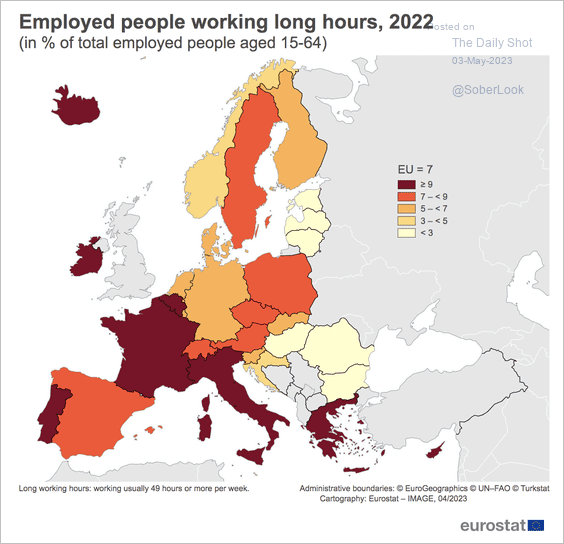

4. Who works long hours?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

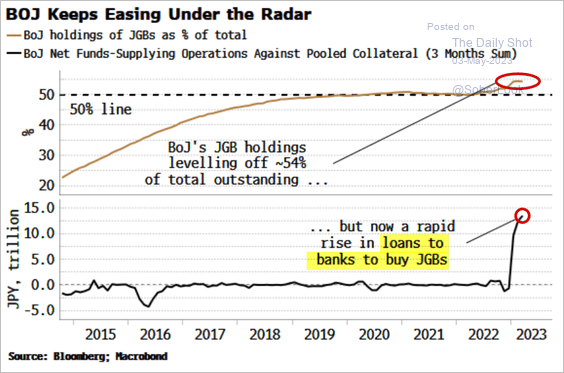

1. The BoJ has been encouraging banks to buy JGBs (stealth QE).

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

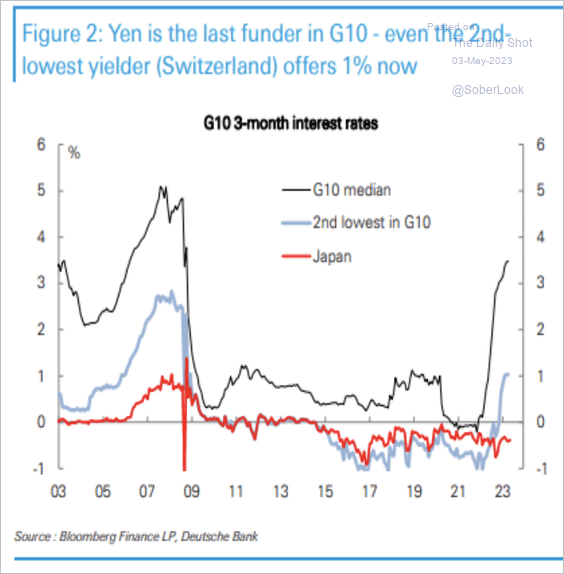

2. The yen is the lowest-yielding currency among G10 nations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

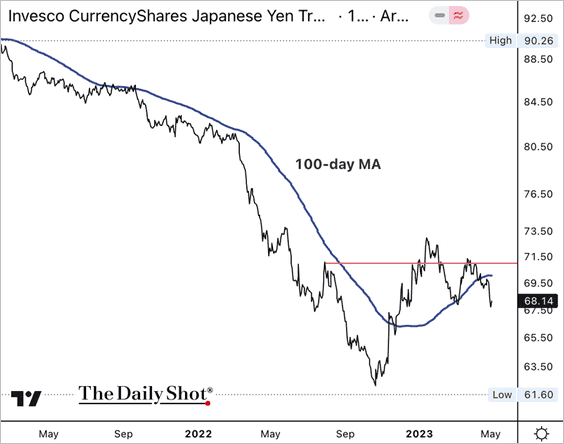

• The Invesco Japanese Yen ETF (FXY) dipped below its 100-day moving average, reversing nearly half of its uptrend from the October 2022 low.

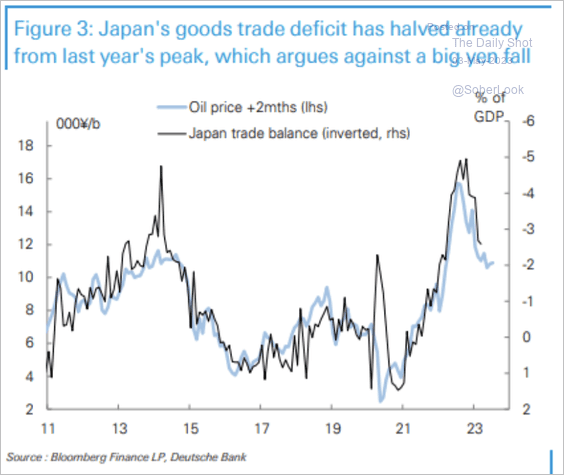

However, Japan’s terms of trade have improved, which could support the yen.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia-Pacific

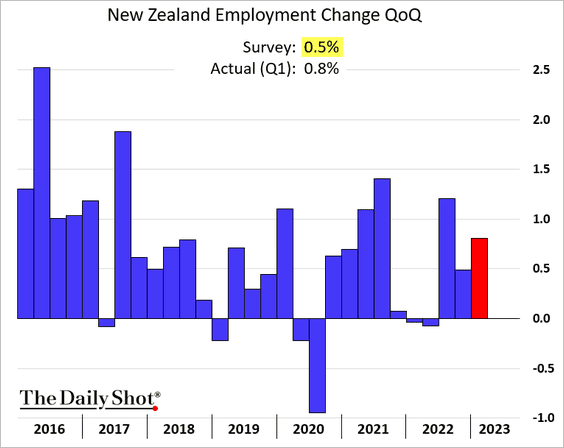

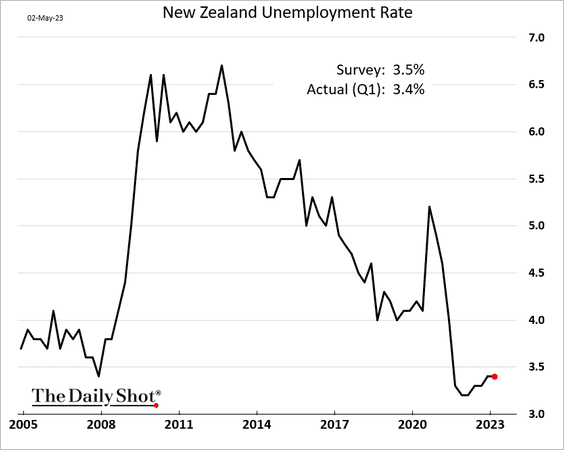

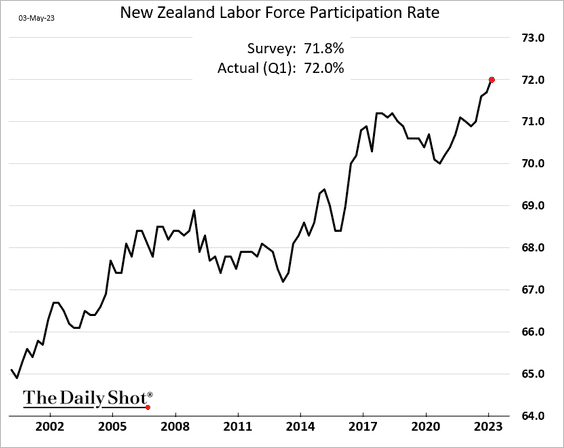

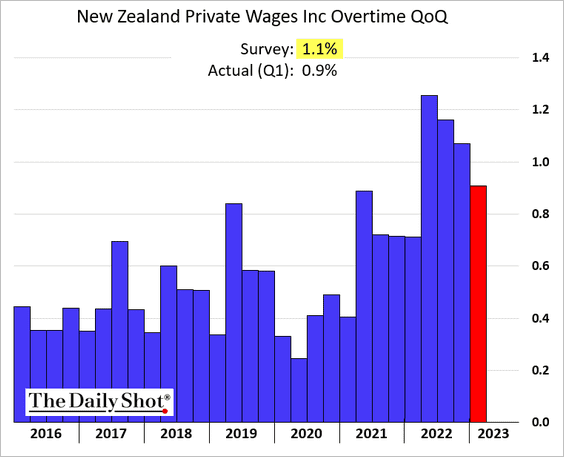

1. New Zealand’s labor market remained very strong in Q1.

• Employment gains (well above expectations):

• The unemployment rate:

• Labor force participation (remarkable):

• Growth in labor costs eased in Q1.

——————–

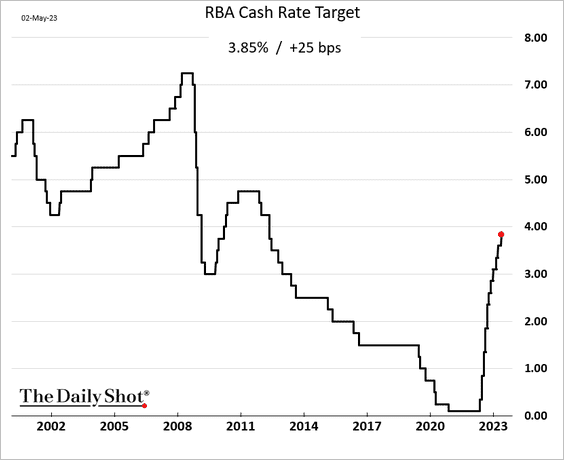

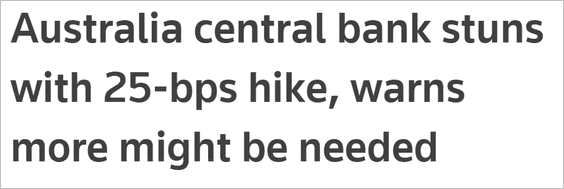

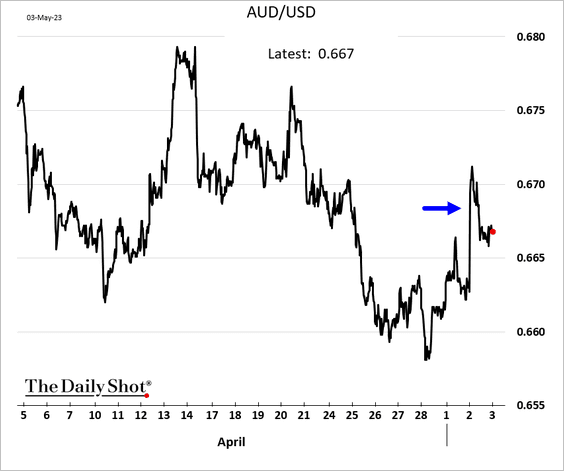

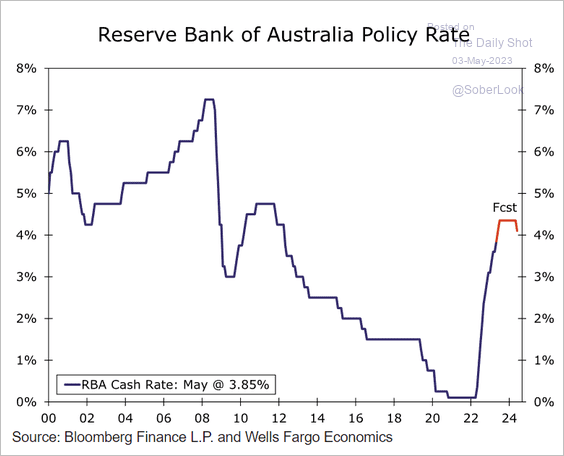

2. The RBA delivered a surprise rate hike.

Source: Reuters Read full article

Source: Reuters Read full article

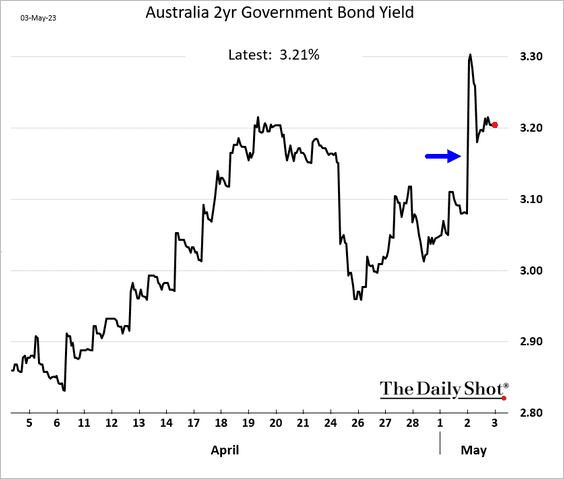

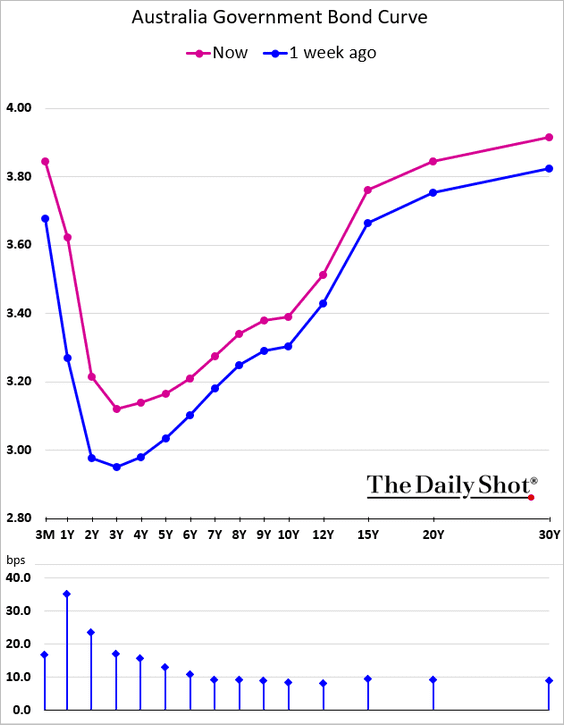

• The Aussie dollar and bond yields climbed.

Here is the yield curve.

• Wells Fargo sees more rate hikes ahead.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Emerging Markets

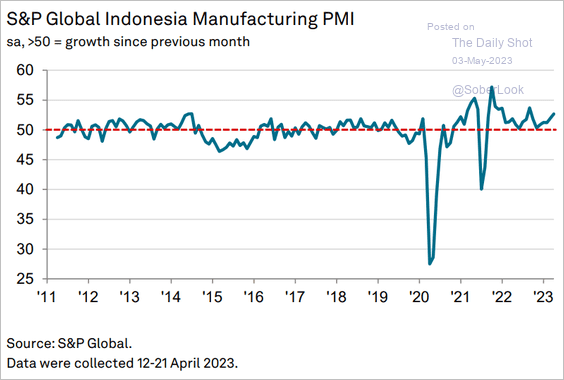

1. Let’s run through some April manufacturing PMI reports.

• Indonesia (strengthening):

Source: S&P Global PMI

Source: S&P Global PMI

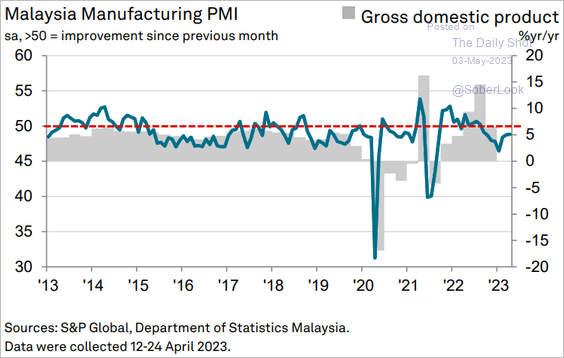

• Malaysia (still contracting):

Source: S&P Global PMI

Source: S&P Global PMI

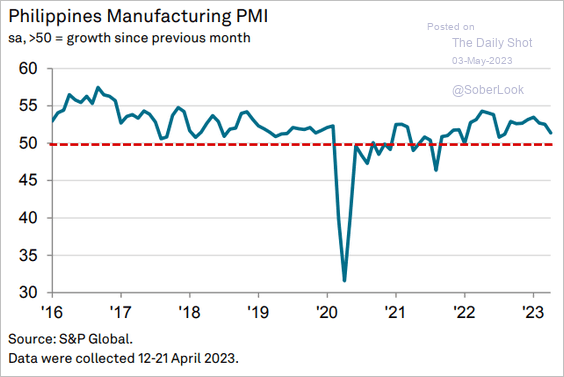

• The Philippines (slower growth):

Source: S&P Global PMI

Source: S&P Global PMI

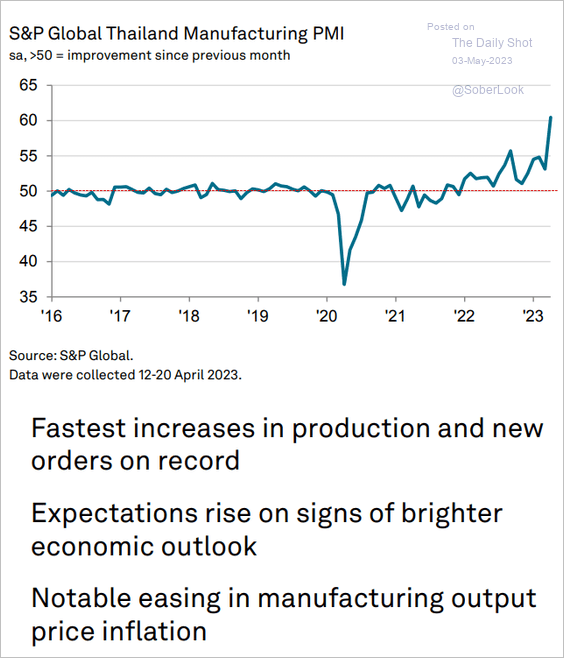

• Thailand (record-high PMI):

Source: S&P Global PMI

Source: S&P Global PMI

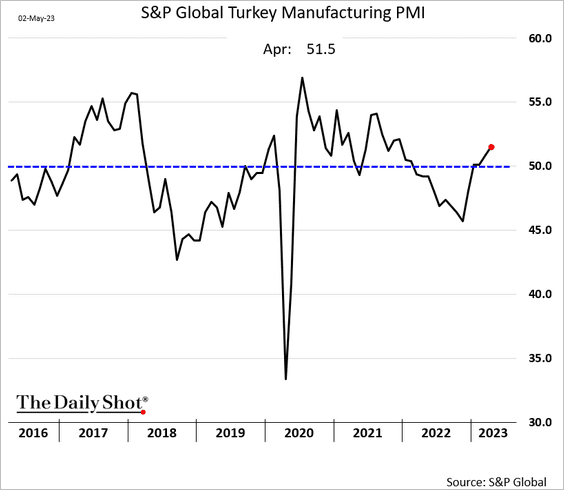

• Turkey (back in growth territory):

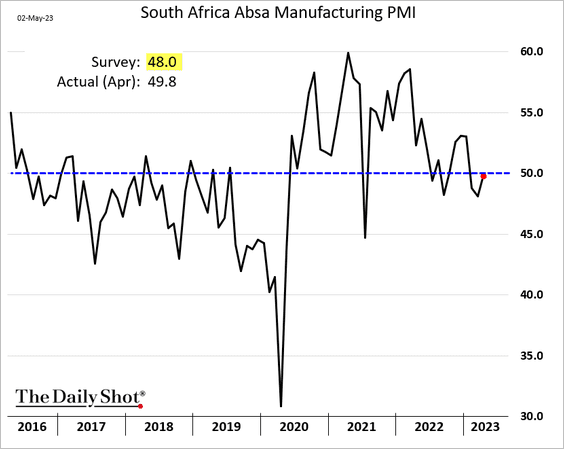

• South Africa (stabilizing):

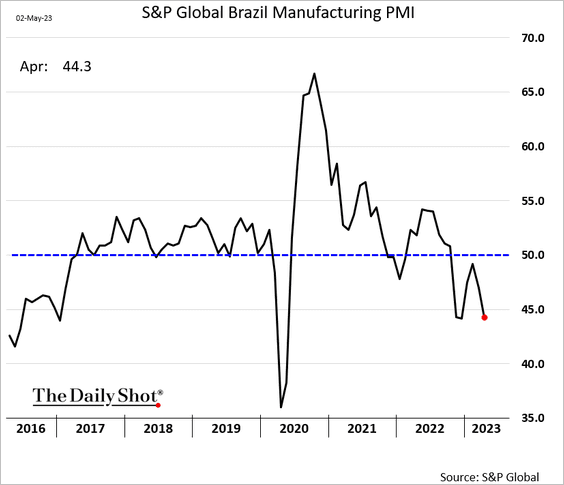

• Brazil (faster contraction):

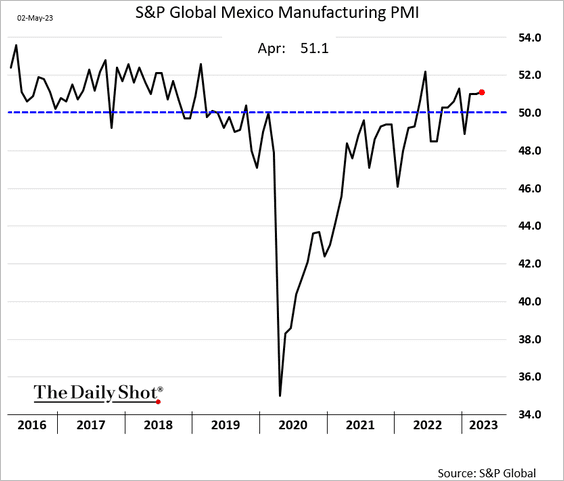

• Mexico (ongoing growth):

——————–

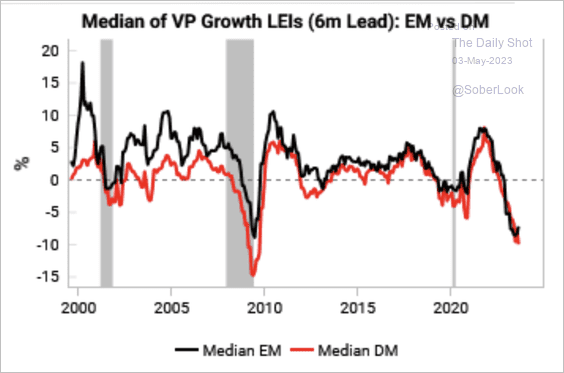

2. Leading indicators for EM inflation are falling, which could pressure central banks to cut rates early.

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

1. Bitcoin is testing resistance near $28.5K.

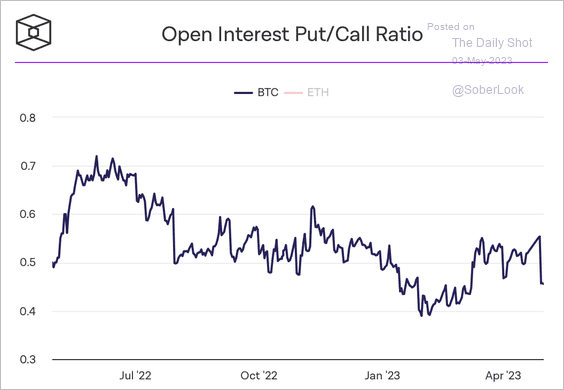

2. Bitcoin’s put/call ratio ticked lower over the past week.

Source: The Block Research

Source: The Block Research

3. The ETH/BTC price ratio continues to decline as traders favored bitcoin during the recent rally.

4. Bitcoin’s market cap relative to the total crypto market cap, or dominance ratio, broke above resistance. If confirmed, a trend shift could keep BTC in the lead versus other cryptos.

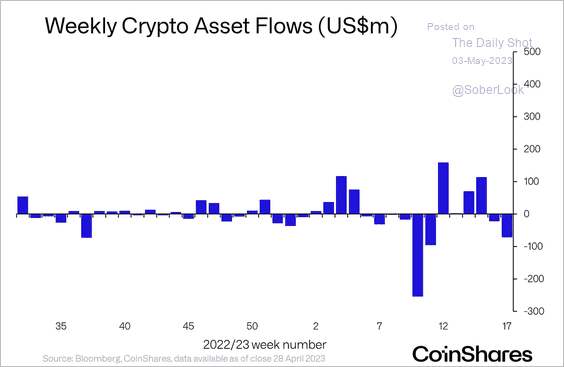

5. Crypto funds saw two consecutive weeks of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

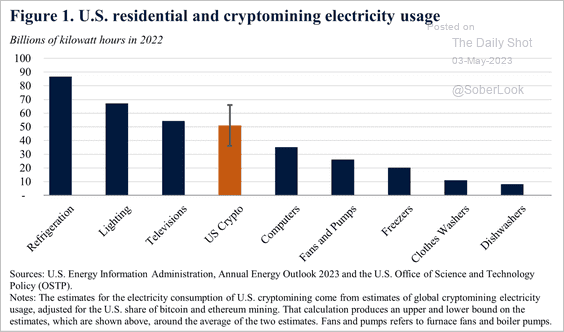

6. US crypto mining firms could face a 30% tax on electricity usage.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: The White House Read full article

Source: The White House Read full article

Back to Index

Commodities

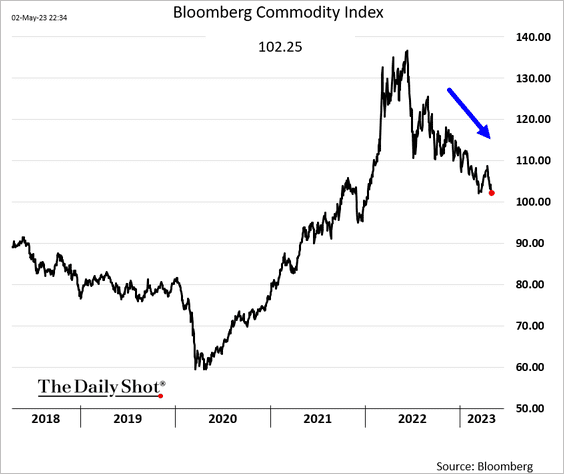

1. Bloomberg’s broad commodity index is trending lower.

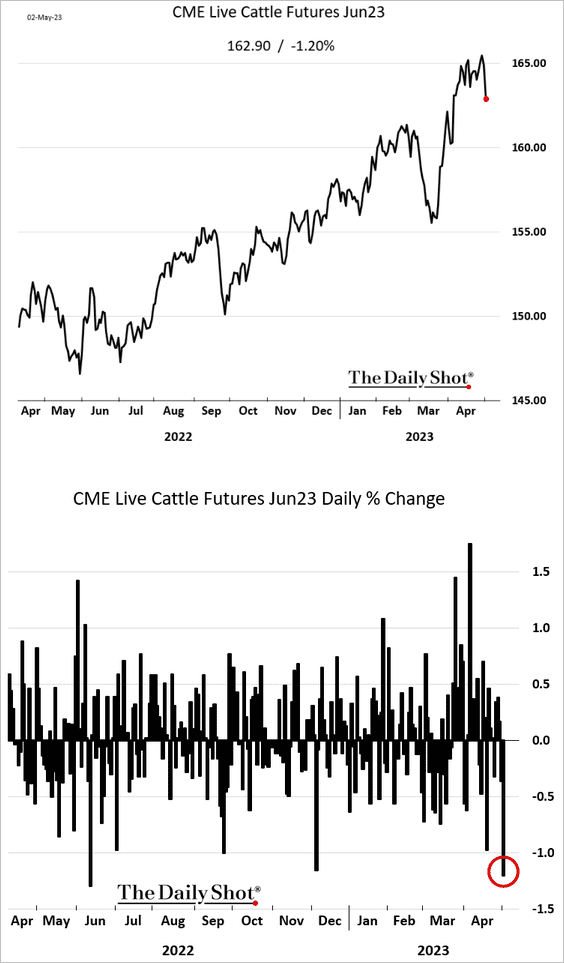

2. US cattle futures appear to have peaked as the cash market becomes better supplied.

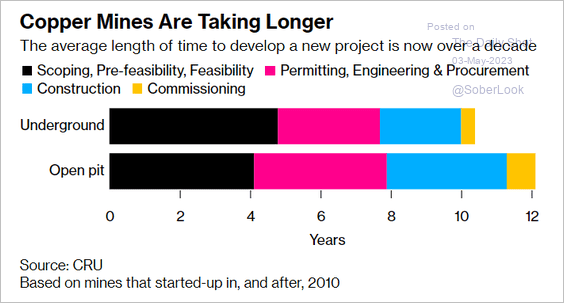

3. Copper mining projects take longer to develop.

Source: @business Read full article

Source: @business Read full article

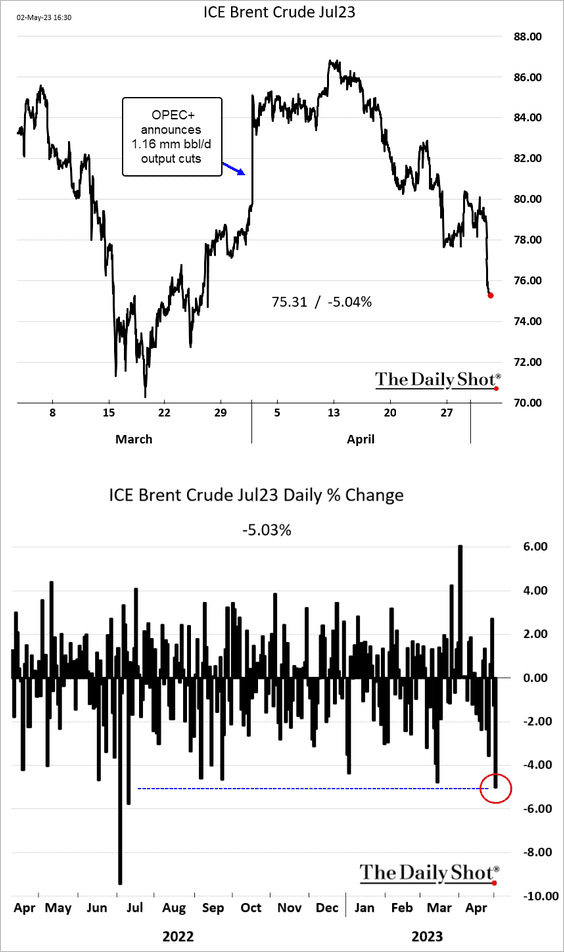

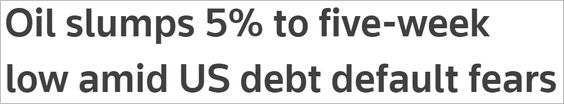

4. Crude oil tumbled 5% on demand concerns.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

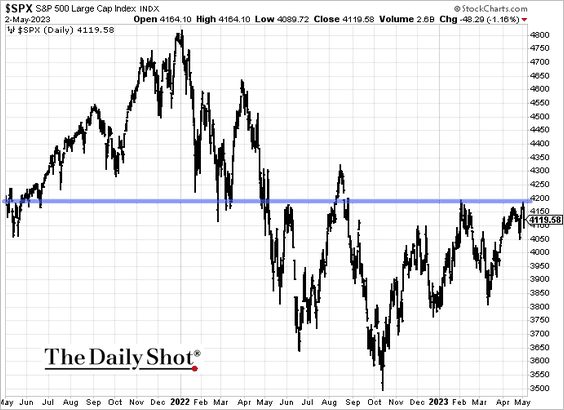

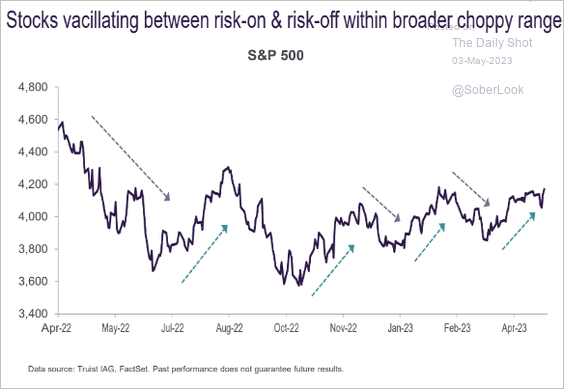

1. The S&P 500 resistance is holding for now.

Back to risk-off?

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

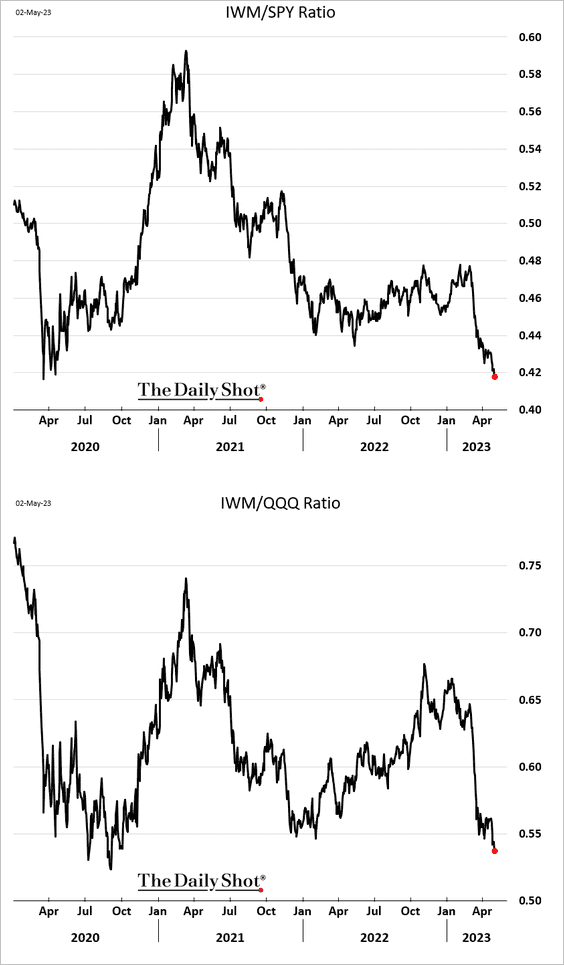

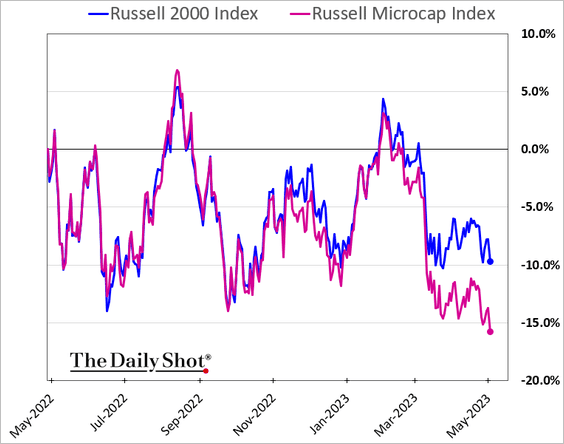

2. Small caps continue to widen their underperformance due to bank jitters (see the credit section).

• The Russell 2000 relative to the S&P 500 and the Nasdaq 100:

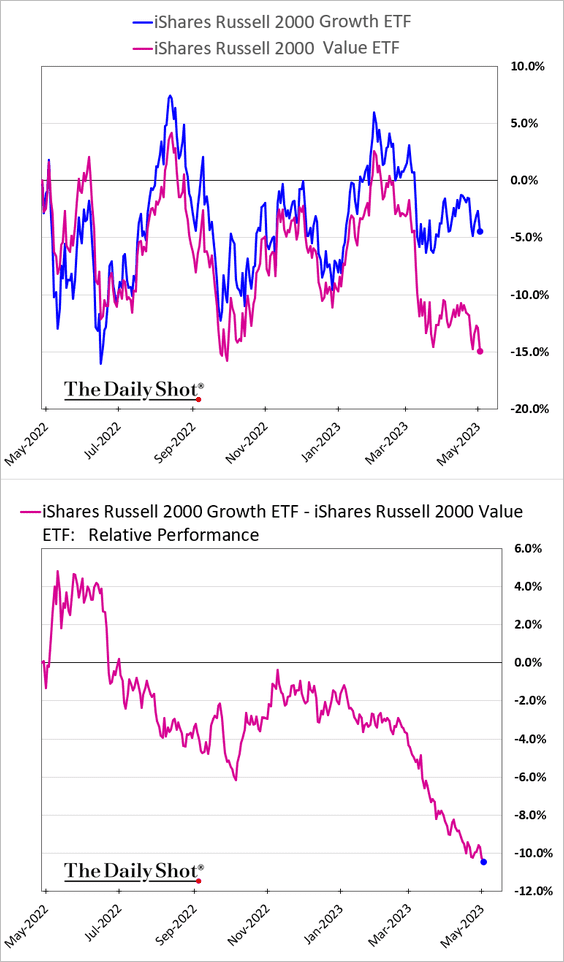

• The Russell 2000 growth vs. value (banks dragging value lower):

• Microcaps:

——————–

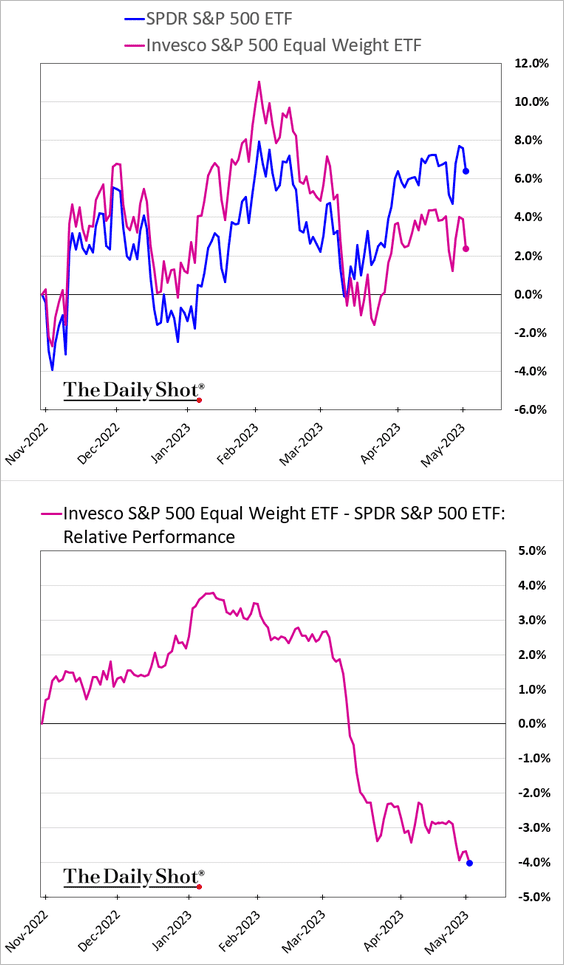

3. The equal-weight S&P 500 index continues to underperform.

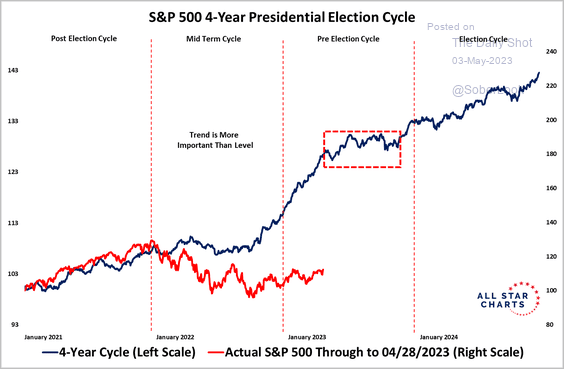

4. The S&P 500 typically moves sideways mid-way through a pre-election year.

Source: @granthawkridge

Source: @granthawkridge

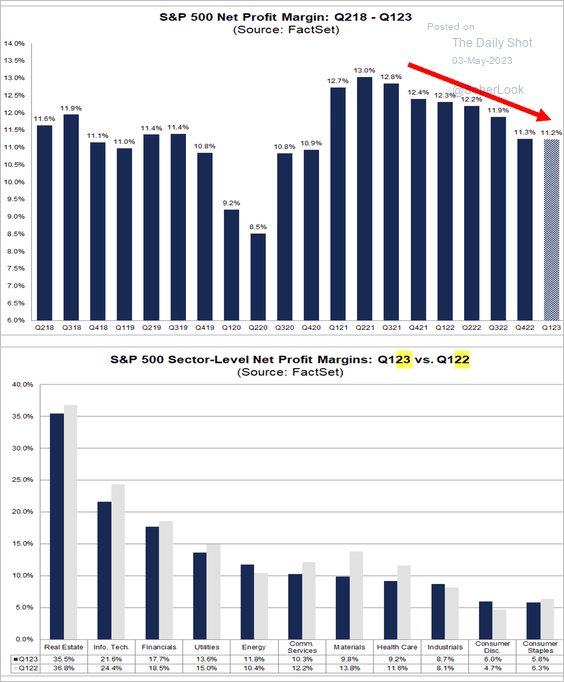

5. Profit margins continue to trend lower.

Source: @FactSet Read full article

Source: @FactSet Read full article

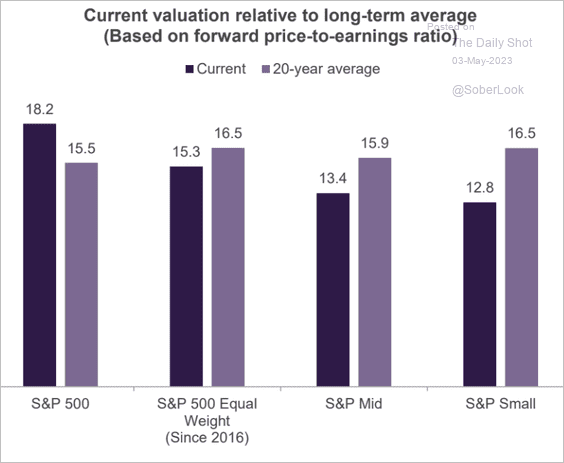

6. This chart shows US valuations by size (relative to historical averages).

Source: Truist Advisory Services

Source: Truist Advisory Services

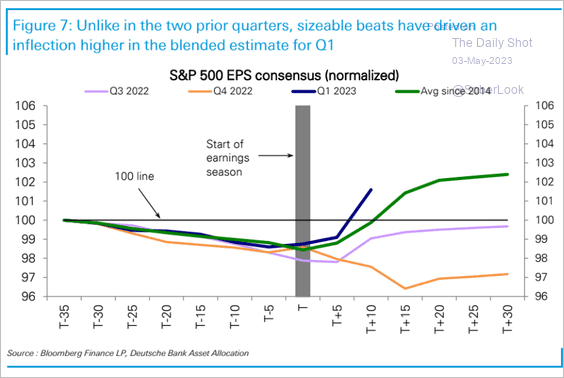

• The Q1 EPS consensus estimate increased more than in previous years as earnings beat.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

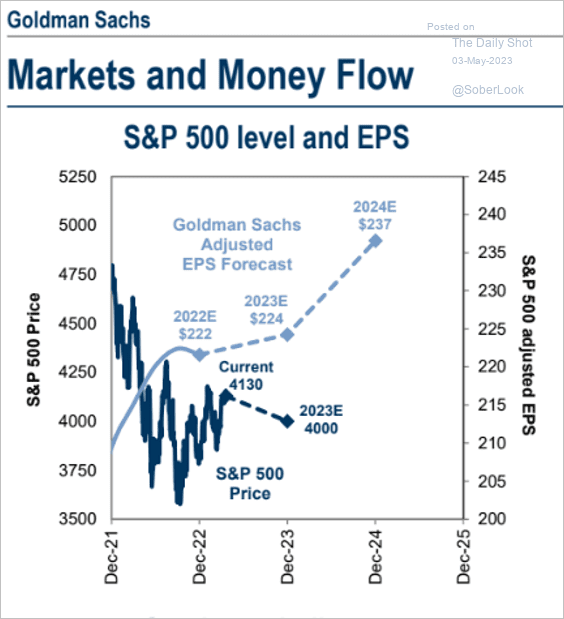

• What does Goldman expect for earnings and prices at the end of 2023?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

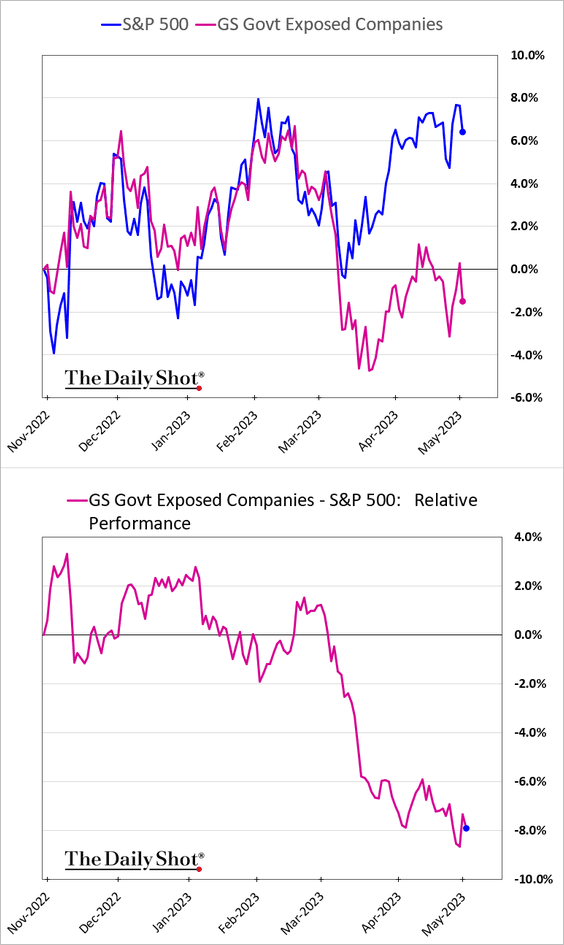

7. The debt ceiling risks are pressuring companies exposed to the federal government.

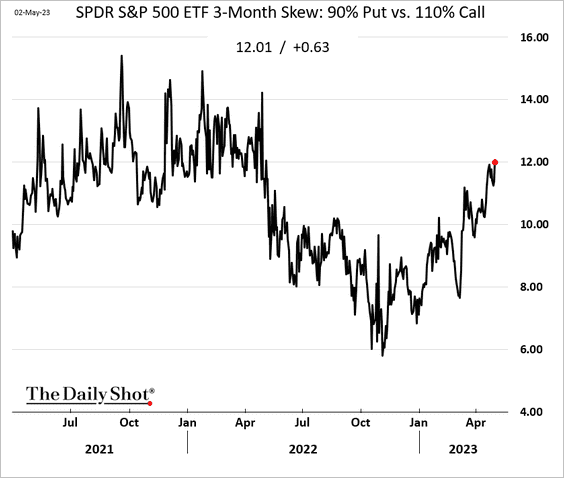

8. The volatility skew continues to climb (higher demand for downside protection).

Back to Index

Credit

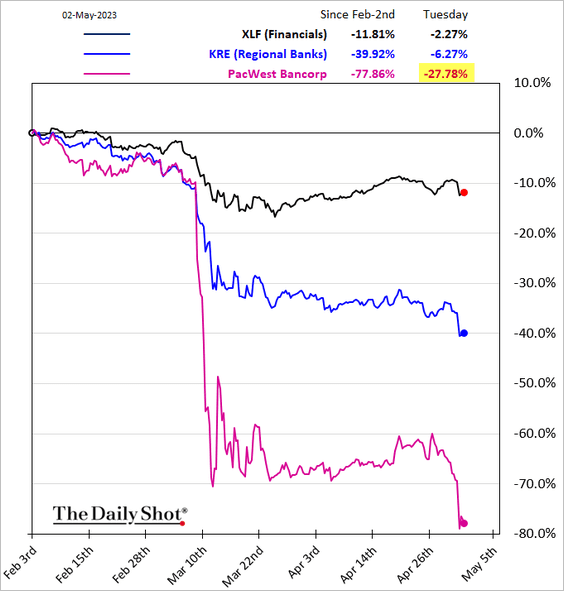

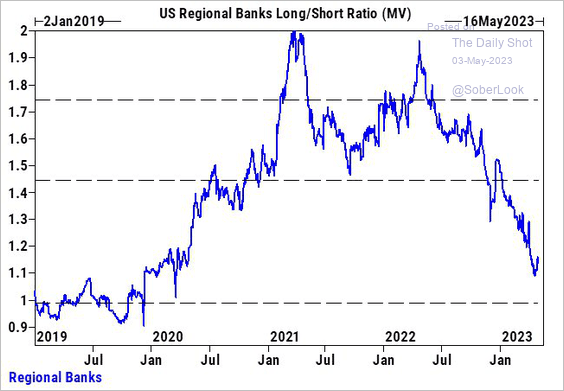

1. Regional banks are hurting.

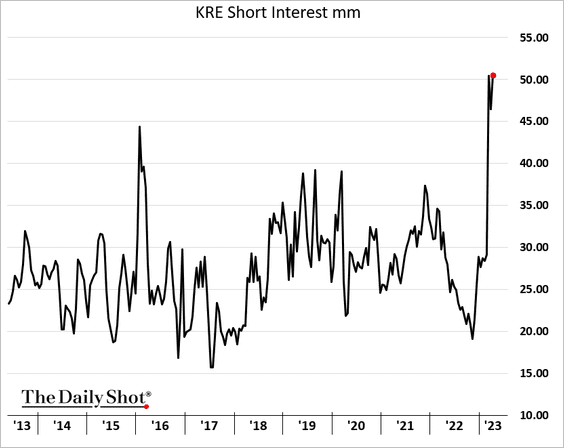

But how much of this is credit risk versus hedge funds trying to push these shares lower? Short interest has risen substantially.

• Regional banks ETF short interest:

• Hedge funds’ regional banks long/short ratio:

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

——————–

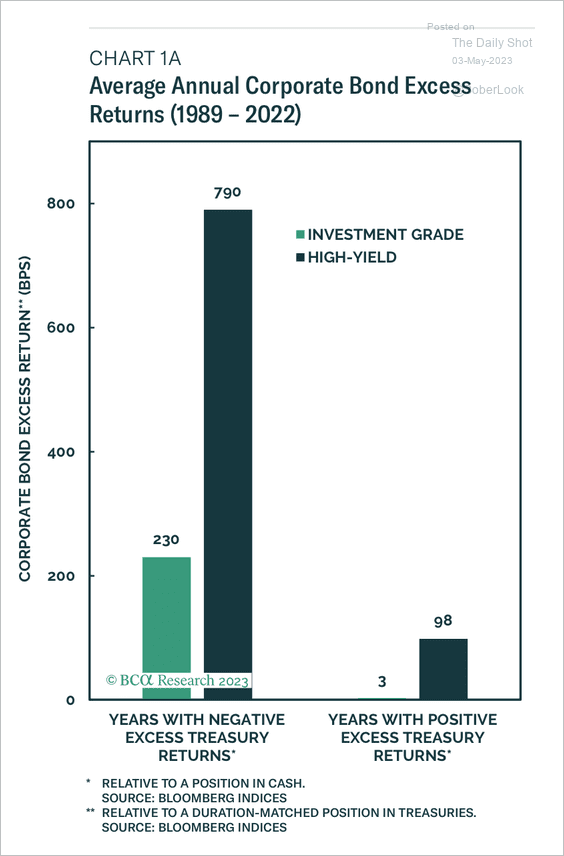

2. Corporate bonds deliver strong excess returns in years when Treasuries perform poorly.

Source: BCA Research

Source: BCA Research

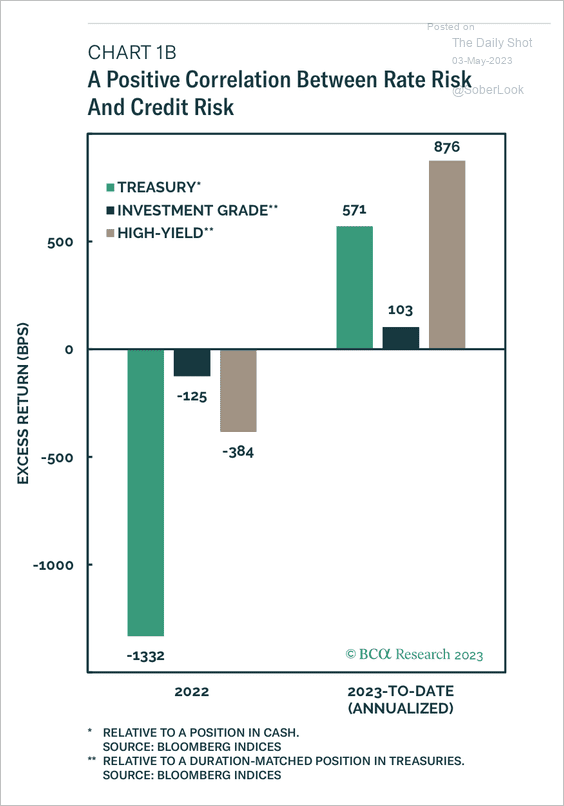

The traditional correlation between rate risk and credit risk flipped last year. Both are performing better this year.

Source: BCA Research

Source: BCA Research

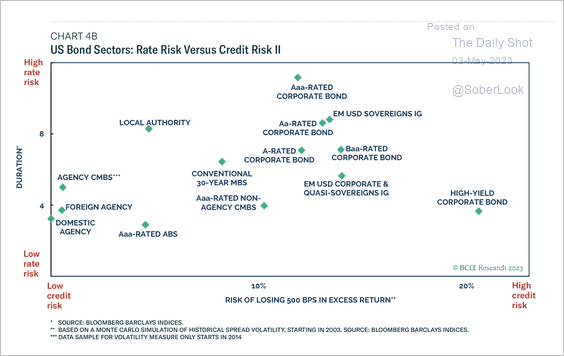

This chart shows rate risk versus credit risk across US bond sectors.

Source: BCA Research

Source: BCA Research

<-<>

Back to Index

Food for Thought

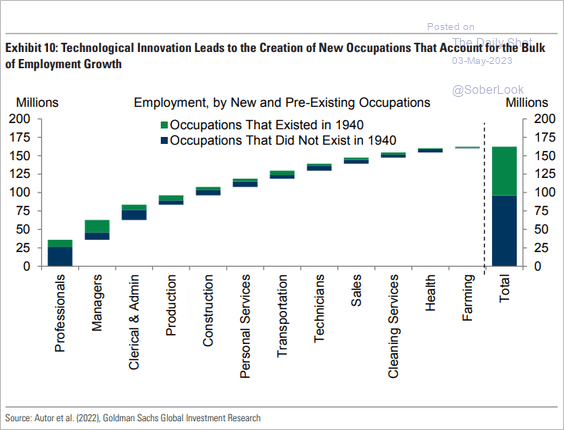

1. New and pre-existing occupations in post-1940 employment growth:

Source: Goldman Sachs

Source: Goldman Sachs

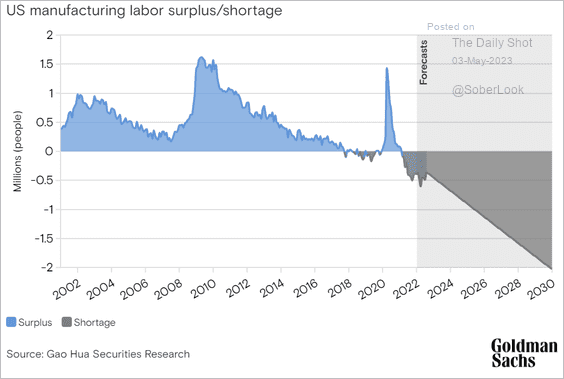

2. Manufacturing labor shortages:

Source: Goldman Sachs

Source: Goldman Sachs

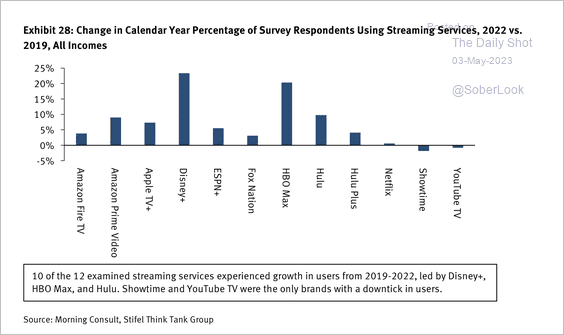

3. Use of streaming services:

Source: Stifel Think Tank Group

Source: Stifel Think Tank Group

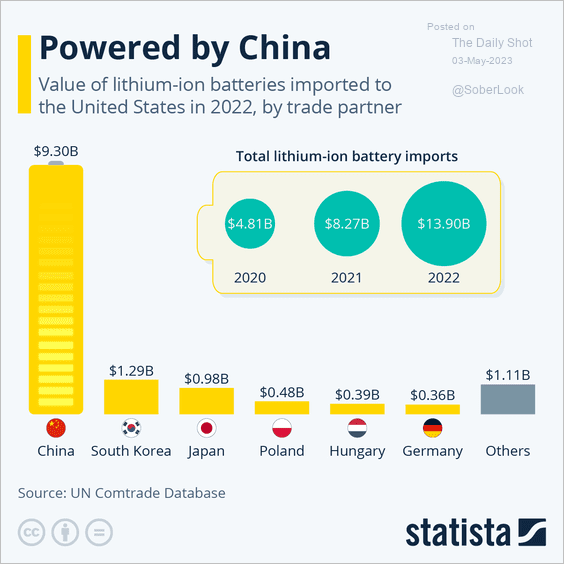

4. US imports of lithium-ion batteries:

Source: Statista

Source: Statista

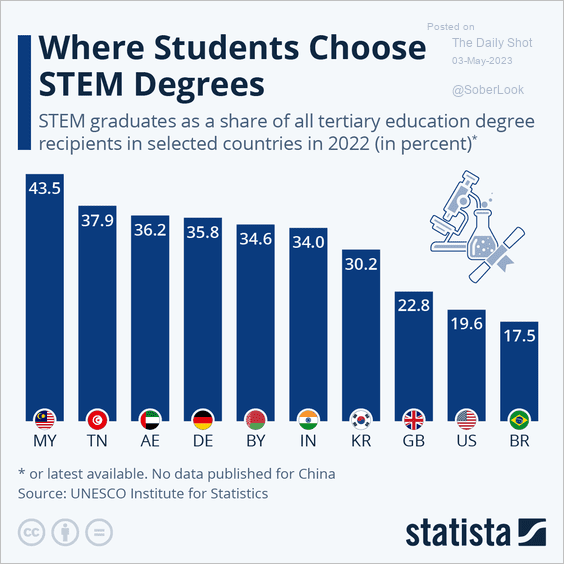

5. Preferences for STEM degrees:

Source: Statista

Source: Statista

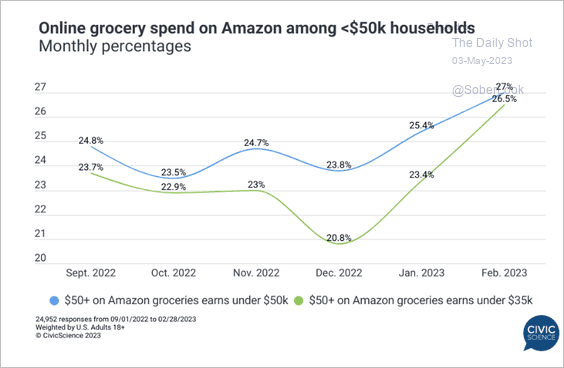

6. Online grocery spending among lower-income households:

Source: @CivicScience

Source: @CivicScience

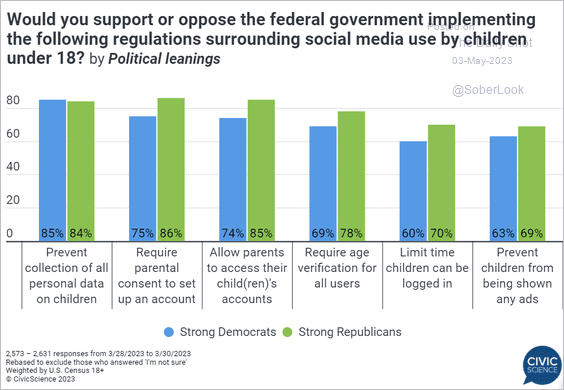

7. Support for federal regulations surrounding social media use by children:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

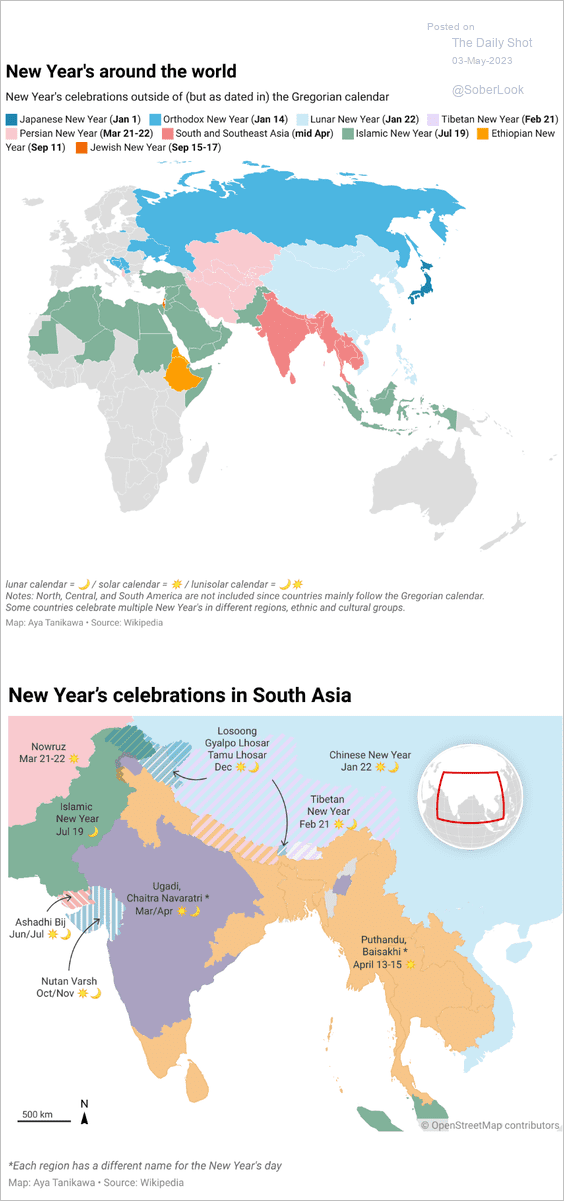

8. New Year’s around the world:

Source: Datawrapper

Source: Datawrapper

——————–

Back to Index